Genworth Life Insurance Company

Address: 6620 West Broad Street, Richmond, VA 23230

Company NAIC No: 70025

Actuarial Memorandum

June 2020

PUBLIC

Choice 2 & 2.1 1 | Page

Policy Forms 7042MD, 7044MD, 7042MD Rev, 7044MD Rev

1. Scope of this Filing

This filing applies to the referenced policy forms issued in Maryland between November 2004 and August

2012. Forms 7042 and 7044 are also referred to by Genworth Life Insurance Company (“GLIC”) as

“Choice 2”; forms 7042 Rev and 7044 Rev are also referred to by GLIC as “Choice 2.1”. Forms 7042 and

7042 Rev were marketed by the name “Classic Select” and the 7044 and 7044 Rev forms were marketed

under the name “Privileged Choice”. Privileged Choice policies have many features built into the base

policy that were only available as riders for Classic Select policies. These forms are no longer being sold.

Note that at the time of our last filing, policies sold to AARP members (“AARP Policies”) were subject to

contractual agreements with AARP governing rate increases. These contractual agreements placed

certain limitations on rate increases for a period of years, that did not apply to policies sold through other

channels (“Non-AARP Polices”). As a result, AARP Policies were filed separately from Non-AARP

Policies.

Starting from our 2018 filing, however, the limitations of the AARP contractual agreements no longer

apply. Additionally, since like policies (both Non-AARP and AARP) under Choice 2 & 2.1 policy forms

sold in Maryland have identical rates and there have not been material differences in the administration

of premiums and premium increases, GLIC has decided to submit all forms under the same single filing.

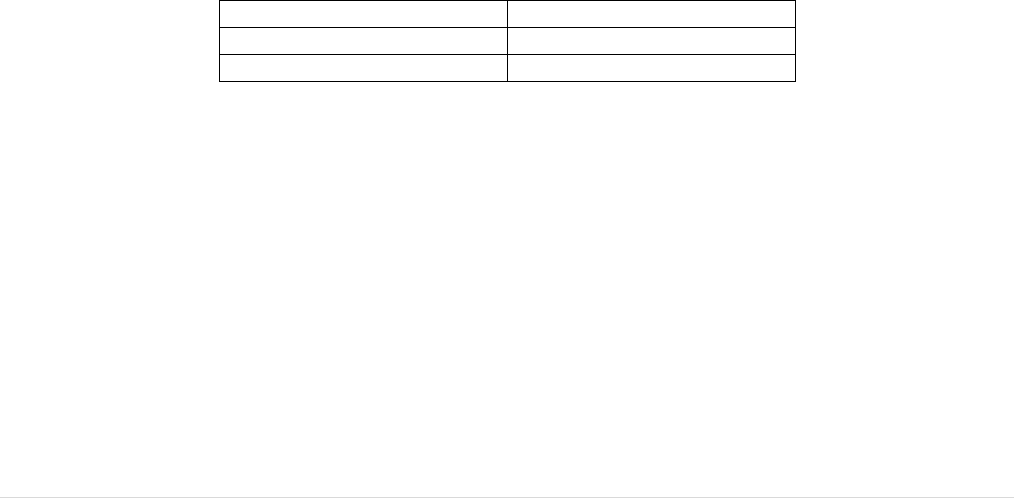

For all the policies issued in Maryland to which the current filing applies, the following table shows the

number of exposed lives by policies issued and policies inforce as of December 31, 2019.

Total Lives

Issued Lives

12,044

Inforce Lives

10,227

2. Purpose of this Filing

This actuarial memorandum has been prepared to request and support the approval of a premium rate

increase in your state.

In our prior filing we stated our intention to seek the remainder of the requested rate increase if it was not

approved in full. Since Maryland has not approved the prior requested rate increase in full as justified by

our experience, GLIC submits this premium rate increase filing to pursue the balance of the rate increase

that was previously not approved. In addition, GLIC has made material changes to actuarial assumptions

since the prior filing, which has further increased the rate increase request.

In this filing, GLIC requests a premium rate increase of 97.5%, applicable to the base rates and

associated riders of all inforce policies referenced in Section 1 of this actuarial memorandum.

Genworth Life Insurance Company

Address: 6620 West Broad Street, Richmond, VA 23230

Company NAIC No: 70025

Actuarial Memorandum

June 2020

PUBLIC

Choice 2 & 2.1 2 | Page

GLIC acknowledges Maryland regulation COMAR 31.14.01.04(5) and would be willing to achieve the

same lifetime loss ratio by implementing the requested rate increase over a 6-year period, phased as

follows: (15%, 15%, 15%, 15%, 15%, 14.8%).

We demonstrate that the proposed premium rate increase satisfies the minimum requirements of

Maryland and the Rate Stability regulation. This actuarial memorandum may not be suitable for other

purposes.

3. Justification of the Premium Rate Increase

Redacted pursuant to section 16, below.

4. Marketing Method and Underwriting Description

Policies were sold by captive independent agents, independent agents working through broker general

agencies, financial advisors, and agents working through financial institutions.

The underwriting process included an assessment of functional and cognitive abilities at issue ages

considered by GLIC to be appropriate. Various underwriting tools were used in accordance with our

underwriting requirements, including an application, medical records, an attending physician’s statement,

telephone interview and/or face-to-face assessment.

5. Description of Benefits

These are federally tax-qualified, individually underwritten policies that provide comprehensive long-term

care coverage. They cover the reimbursement of expenses incurred by the insured(s) subject to the

amount of coverage purchased. Premium payments are waived after the elimination period has been

satisfied.

The Privileged Choice (7044 and 7044 Rev) policy forms pay benefits on a monthly basis and include a

10-year survivorship benefit. The 10-year survivorship benefit waives future premium payments upon the

death of one spouse if both spouses are insured and have met certain requirements. It also includes a

waiver of elimination period for home health care benefits, and home health care service days are applied

to the facility elimination period. The optional nonforfeiture benefit, restoration of benefit, 7-year

survivorship benefit and return of premium riders were available for purchase for an additional premium.

The Classic Select (7042 and 7042 Rev) policy forms are comprehensive products with benefits payable

on a daily basis. Riders include 7-year and 10-year survivorship, waiver of elimination period for home

health care benefits, monthly maximum benefit (as opposed to daily), restoration of benefits and

nonforfeiture benefits.

Genworth Life Insurance Company

Address: 6620 West Broad Street, Richmond, VA 23230

Company NAIC No: 70025

Actuarial Memorandum

June 2020

PUBLIC

Choice 2 & 2.1 3 | Page

These policy forms can cover an individual or a couple (joint policy). The joint policy operates as two

individual policies, except that the two insureds draw from one shared policy benefit pool.

These forms require an insured to meet benefit eligibility requirements that are triggered by Activities of

Daily Living (“ADL”) deficiencies or cognitive impairment. The daily or monthly benefit, benefit period and

elimination period are selected at issue.

In addition, a Benefit Increase Option (BIO) can be selected at issue. The simple BIO increases the

original daily maximum by 5% each year starting with the second policy year and continuing for the life

of the policy, unless terminated earlier by the insured. The compound BIO increases the prior year’s daily

maximum by 3% or 5% each year starting with the second policy year and continuing for the life of the

policy, unless terminated earlier by the insured. The 3% compound BIO was only made available on the

Choice 2.1 (7042 Rev and 7044 Rev) versions of these policy forms.

6. Alternatives to the Proposed Rate Increase

GLIC will offer insureds impacted by rate filings several options for mitigating the impact of the rate

increase. These options will be provided in the policyholder notification letter. In addition, policyholders

will have the ability to call a dedicated team of customer service representatives that can assist with

providing customized quotes for any number of other benefit adjustments

Reduced Benefit Options. As with prior rate increases, insureds can change any number of benefit

features or coverage limits in order to maintain reasonably equivalent pre- and post-rate increase

premium levels, and the optimal balance of coverage and cost based on their specific needs. The

available benefit and rate combinations are consistent with the combinations presented in the rate tables

approved by the Department as part of the original filing. To balance coverage and cost considerations,

GLIC will offer policyholders, subject to rate increases on their long term care policies, customized options

to adjust their benefits, which may include any of the following options (where available):

1. Reduction in Daily/Monthly/Lifetime Maximum amount;

2. Reduction in Benefit Period;

3. Reduction or elimination of the BIO;

4. Increases in Elimination Period; and

5. Elimination of policy riders.

If a policyholder elects to reduce or eliminate the BIO, they would retain any prior increases to their daily

or monthly payment maximums. In addition, the company plans to offer, and has included as part of this

filing, a new BIO of 1% compound, which will be available for policyholders who wish to reduce their BIO

from a higher level.

Flexible Benefit Option (FBO). GLIC has developed a new alternative to mitigate the proposed premium

increase while still providing meaningful protection.

Genworth Life Insurance Company

Address: 6620 West Broad Street, Richmond, VA 23230

Company NAIC No: 70025

Actuarial Memorandum

June 2020

PUBLIC

Choice 2 & 2.1 4 | Page

The option features the following:

1. A premium rate guarantee until at least January 1, 2025;

2. $250,000 benefit pool for non-shared, $400,000 benefit pool for shared;

3. Monthly indemnity payments that vary by type of benefit. For each full month of qualification, the

benefit amounts for each type of benefit are as follows:

- Nursing Home Benefit - monthly payments are 100% of the monthly maximum. Payments are

designed to last three years if the policyholder is in a nursing home for the entire time and would

be calculated by dividing the claimant’s benefit pool by 36 months;

- Assisted Care Facility Benefit - monthly payments are 75% of the monthly maximum and are for

care in an assisted care facility; and

- Flexible Care Benefit – monthly payments are 50% of the monthly maximum and are for other types

of care, such as home care.

4. GLIC will adjust monthly payment amounts when the insured qualifies for benefits for only part of a

month;

5. GLIC will pay only one benefit in a calendar month. If more than one benefit could apply in a calendar

month, then GLIC will pay the benefit (Nursing Home Benefit, Assisted Care Facility Benefit, or the

Flexible Care Benefit) with the most days of qualification in that month;

6. A 180 day elimination period applies for the Nursing Home and Assisted Care Facility Benefits, and

a 90 day elimination period applies to the Flexible Care Benefit; and

7. The benefit pool and monthly maximum will remain fixed, unless the 1% compound BIO is elected. If

1% compound BIO is elected, the benefit pool and monthly maximum will inflate by 1% compounded

annually.

The FBO is not available for policies that currently have a benefit pool (net of past claims) less than

$250,000 for non-shared, $400,000 for shared.

The combination of the benefits presented with this option is supported by a 2016 PwC study of industry

data which found that the average duration for an LTC event is about three years, and that approximately

75%-80% of all LTC events cost less than $250,000

[1]

. Under this new option, policyholders with non-

shared policies will have a benefit pool of $250,000, with monthly payments designed to last three years

in a nursing home situs (longer in other situses), and the option of 1% benefit inflation on the benefit pool

and monthly maximum. The monthly payment also provides the policyholder more flexibility in managing

their long term care event, and a simpler process for receiving benefit payments.

Other options. GLIC will continue to offer the applicable nonforfeiture option to each policyholder.

Policyholders that are eligible for the Contingent Nonforfeiture Option will be presented with that as an

option in their notification letter. Policyholders that have a nonforfeiture (NFO) rider with their policy may

elect that option. For those policyholders that do not have either the Contingent Nonforfeiture or NFO

rider available, GLIC will continue to offer its Optional Limited Benefit, which provides a paid-up benefit

equal to the total of premium paid, less any claims paid.

[1]

The formal cost of long-term care services: How can society meet a growing need? The referenced study, initially made available in October

2016 and then formally published on their website in 2018, is based on data for the time period 2000-2015 and reports figures in 2016 dollars

Genworth Life Insurance Company

Address: 6620 West Broad Street, Richmond, VA 23230

Company NAIC No: 70025

Actuarial Memorandum

June 2020

PUBLIC

Choice 2 & 2.1 5 | Page

7. Premiums

7.1 Renewability

These policies are guaranteed renewable for life, subject to policy terms and conditions.

7.2 Area Factors

Geographic area factors are not used in rating these policies.

7.3 Premium Classes

Premium rates are unisex, level (with the exception of approved rate increases) and payable for life

(except for 399 inforce policies with limited pay premium on these forms in your state). Premiums

generally vary by issue age, daily benefit, benefit period, elimination period, BIO, and any applicable

riders selected.

Certain underwriting discounts may have been applied to the premium rates. A preferred risk discount of

10% or 20% may have been provided to applicants in response to specified health underwriting criteria

specified on the application. Where the criteria for a couple’s discount were met, a discount of 40% was

provided to both individuals when both submitted valid applications and both were issued coverage. If

only one member of a couple was approved, the discount was reduced to 25%. Where a shared policy

was issued, a couple’s discount was factored into the shared policy form rates. If only one member of a

couple applying for shared coverage was approved, an individual policy was issued and the couple’s

discount was reduced to 25%.

7.4 Modalization Rules

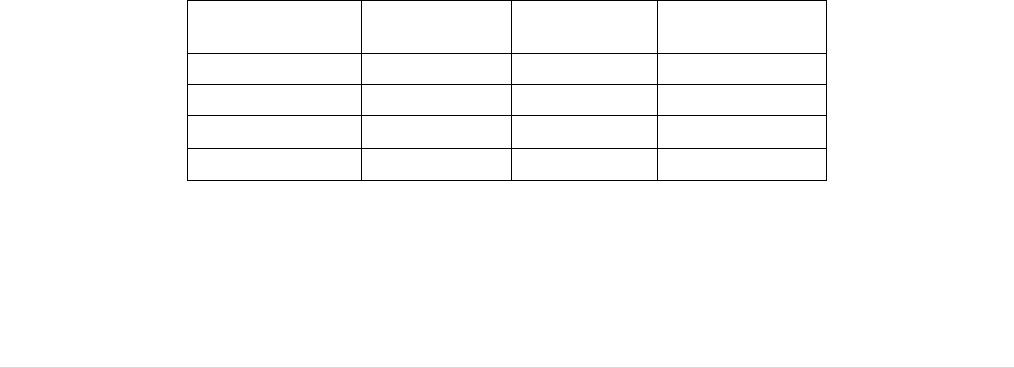

The following table shows the modal factors that are applied to the annual premium for policies, and the

percentage of insureds selecting each premium mode.

Premium

Mode

Modal

Factor

State

Distribution

Nationwide

Distribution

Annual

1

62.8%

64.0%

Semi-Annual

0.51

7.9%

6.6%

Quarterly

0.26

18.9%

15.3%

Monthly

0.09

10.5%

14.0%

7.5 History of Previous Rate Revisions

A 12.8% rate increase was accepted in Maryland on 5/27/2014.

A 15% rate increase was accepted in Maryland on 1/23/2017.

A 19.9% rate increase was accepted in Maryland on 9/26/2018.

Genworth Life Insurance Company

Address: 6620 West Broad Street, Richmond, VA 23230

Company NAIC No: 70025

Actuarial Memorandum

June 2020

PUBLIC

Choice 2 & 2.1 6 | Page

A cumulative rate increase of 55.5% has been approved in your state.

7.6 Rate Schedule

Current rate tables reflecting any prior approved rate increase have been included in Appendix A.

Corresponding rate tables reflecting any prior approved and the proposed rate increase have been

included in Appendix B, attached separately. Please note that actual rates implemented may vary slightly

from those set forth in Appendices A and B due to implementation rounding algorithms.

Rate tables for the FBO presented in Section 6 are included in Appendix C.

Rate tables for the 1% compound BIO are included in Appendix D.

7.7 Proposed Effective Date

This rate increase will apply to policies on their billing anniversary date, following a 60 day policyholder

notification period.

GLIC will not implement any of the rate increases sought in this filing until we fully implement all previously

dispositioned filings.

8. Actuarial Assumptions

Redacted pursuant to section 16, below.

9. Development of the Proposed Rate Increase

In developing the proposed premium rate increase, the following has been considered:

a) Policy design, underwriting, and claims adjudication practices have been considered;

b) In order to ensure maximum credibility, exhibits are based on GLIC nationwide experience through

December 31, 2019, for all the forms affected by this filing. Projected earned premiums and incurred

claims are based on the assumptions described in Section 8 of this actuarial memorandum;

c) The nationwide premium has been restated at Maryland level, only reflecting your state’s approved

rate increases, in order to avoid subsidization among states;

d) One of the main purposes of MAE is to stabilize Long-Term Care premiums. The experience has

deteriorated year after year such that it has been necessary for GLIC to request rate increases of

higher amounts and more frequently than desired. To help avoid such frequent rate increases, GLIC

is increasing the current 10% MAE to 15%;

Genworth Life Insurance Company

Address: 6620 West Broad Street, Richmond, VA 23230

Company NAIC No: 70025

Actuarial Memorandum

June 2020

PUBLIC

Choice 2 & 2.1 7 | Page

e) The proposed rate increase has been assumed to be implemented on August 1, 2021. Our objective

is to get closer to the acceptable maximum lifetime loss ratio of 64.3%. The justified rate increase

was calculated to bring the lifetime loss ratio with the current assumption and new provision for MAE

(15%) closer to the acceptable maximum lifetime loss ratio, in compliance with the 58%/85% premium

test defined in the Rate Stability regulation;

f) Lifetime projections of earned premiums and incurred claims reflecting all the prior approved rate

increases in Maryland are set forth in Exhibit I. Lifetime projections of earned premiums and incurred

claims reflecting all the prior approved rate increases in Maryland and the proposed rate increase are

set forth in Exhibit II;

g) Compliance of the 58%/85% premium test defined in the Rate Stability regulation has been verified,

as demonstrated in Exhibit III;

h) Historical and projected earned premiums and incurred claims include provisions for waiver of

premium; and

i) The majority of policies are eligible for contingent benefit upon lapse. For this reason, we have

provided Additional Exhibits I and II in accordance with the Maryland Regulation, COMAR

31.14.02.06.H.

9.1 New Business Premium Rate Comparison

GLIC has compared premium rates on the referenced policy forms to the new business rates where the

policy characteristics are similar. There are significant differences in benefits, underwriting and other

product features between the Choice 2 and 2.1 products and the product form series GLIC currently

offers for sale, Policy Form Number 8000R1. Where possible, adjustments have been made so that new

business comparisons are meaningful. These differences affect the rate comparison in the following

ways:

Benefit Differences: Several benefits, available in prior product generations, including Choice 2 and 2.1,

are not offered in Policy Form Number 8000R1, including benefit periods of eight (8) years or longer,

elimination period of zero (0) days, and limited premium payment options (none of these benefits are

currently marketed). Policies with these benefit differences are not considered to exceed new business

rates.

Survivorship Benefit: All 7044 and 7044Rev policies have a survivorship benefit. The current product

does not have this feature, but GLIC did have a product that had this feature available as a rider. These

rider rates were added to the currently marketed product rates, which enabled these policies to be part

of the new business rate comparison.

Underwriting: Product Form Number 8000R1 is subject to several underwriting enhancements that did

not apply to Choice 2 and 2.1. While these underwriting enhancements are not directly reflected in

benefits, they impact both original and new business pricing. In addition, Product Form Number 8000R1

has four underwriting categories (Standard, Select, Preferred, and Best), while Choice 2 and 2.1 had only

two such categories (Standard and Preferred). GLIC recently made the decision to discontinue sales of

Preferred and Best. Ignoring Preferred policies would limit the comparison significantly. GLIC has made

Genworth Life Insurance Company

Address: 6620 West Broad Street, Richmond, VA 23230

Company NAIC No: 70025

Actuarial Memorandum

June 2020

PUBLIC

Choice 2 & 2.1 8 | Page

a good faith effort to compare these policies and map the two underwriting categories of Choice 2 and

2.1 to the four underwriting categories of Policy Form Number 8000R1 despite the differences.

Issue Ages: Current marketing limits issue ages to between 40 and 75. Policyholders with issue ages

outside of this range are not considered to exceed new business rates.

Policies with 50% Home Health Care: Due to the small number of inforce policies with this benefit, these

policies have not been included in the comparison and are not considered to exceed new business rates.

Gender Based Pricing: Product Form Number 8000R1 was priced on a gender-specific basis, as opposed

to the unisex basis applicable to Choice 2 and 2.1. A blend of female/male rates based on pricing

assumptions was used to develop approximate unisex rates.

Informal Home Care: Product Form Number 8000R1 covers services provided by informal caregivers to

policyholders receiving care at home, but requires caregivers to be registered, and reimburses that care

only up to 50% of the available nursing home benefit. Choice 2 and 2.1 covers services provided by

informal caregivers to policyholders receiving care at home, but does not require caregivers to be

registered, and reimburses that care up to 100% of the available nursing home benefit. An adjustment to

rates for this difference could not be approximated.

Claims Offset: Product Form Number 8000R1 reduces available benefit by claims paid before benefit

increases are calculated. Choice 2 and 2.1 products reduce available benefits by claims paid after benefit

increases are calculated. An adjustment to rates for this difference could not be approximated.

Marketing and Distribution: Choice 2 and 2.1 were sold during the peak years of LTC production when

sales and distribution channels were in a growing stage; the current environment is the exact opposite,

with decreasing sales and distribution outlets. In 2004-2009 sales were conducted 66% by Independent

Agents and Financial Advisors and 33% by Career Agents. Choice 2.1 was sold also through AARP.

GLIC’s lower ratings today also impact the current distribution and the amount of production of the

currently marketed product is an insignificant fraction of the Choice 2 and 2.1 business sold.

Delay in Approvals and Unapproved Amounts: The rate comparison is sensitive to the approval timing

and amounts of prior rate increase request. Delays in approval of the full proposed rate increase result

in higher percentage future premium rate increases and increases the likelihood of proposed rate levels

exceeding the new business rates.

In accordance with the Rate Stability regulation and the Long-Term Care Rate Stability Practice Note

issued by the American Academy of Actuaries in 2012, we believe the differences noted above sufficiently

justify a rate level greater than the new business rates for some of the Choice 2 and 2.1 inforce policies

in your State. Since GLIC prioritizes rate sufficiency and company solvency, the greater rate level is

required in order to certify that, if experience emerges as expected, no further rate increases are

anticipated.

Genworth Life Insurance Company

Address: 6620 West Broad Street, Richmond, VA 23230

Company NAIC No: 70025

Actuarial Memorandum

June 2020

PUBLIC

Choice 2 & 2.1 9 | Page

10. Active Life Reserves and Claim Liability Reserves

Active life reserves have not been used in this rate increase analysis. Claim reserves as of December

31, 2019, have been discounted to the date of incurral of each respective claim and included in historical

incurred claims. Incurred but not reported reserve balances as of December 31, 2019, have been

allocated to a calendar year of incurral and included in historic incurred claims. Discounting occurs at

4.12%.

11. Trend Assumptions

As this is not medical insurance, we have not included any explicit medical cost trends in the projections.

12. Future Rate Increases

Policies to which this premium rate increase filing applies may also be subject to future additional rate

increases if the full amount of the rate increase requested in this filing is not approved or if underlying

assumptions are not realized and the future experience exceeds a 15% MAE. We defined “exceeds a

15% margin” as any change that results in a lifetime loss ratio greater than projected in Exhibit II of this

memorandum.

Genworth Life Insurance Company

Address: 6620 West Broad Street, Richmond, VA 23230

Company NAIC No: 70025

Actuarial Memorandum

June 2020

PUBLIC

Choice 2 & 2.1 10 | Page

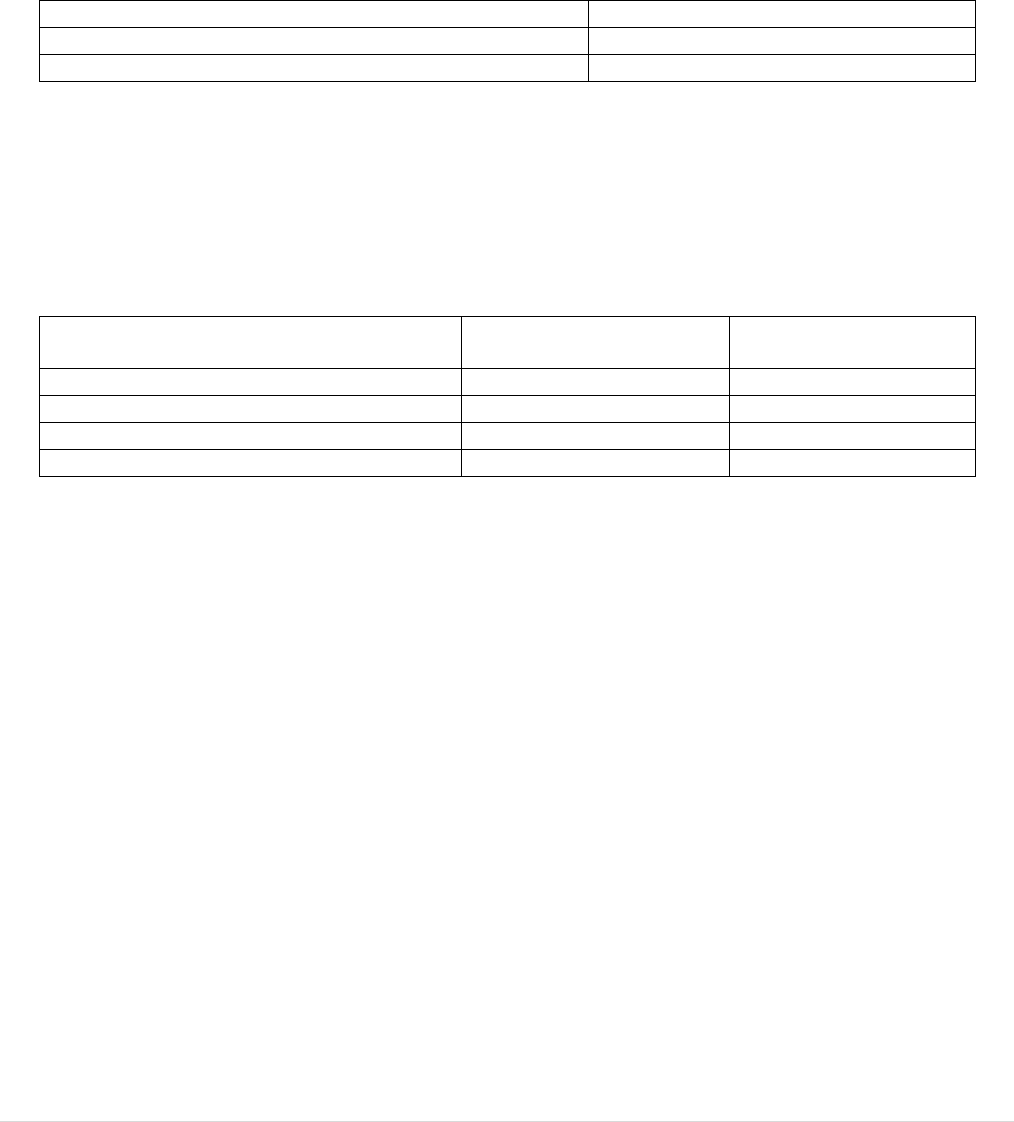

13. State Average Annual Premium Based on Exposed Lives

Average Premium

Before Proposed Rate Increase

$2,673

After Proposed Rate Increase

$5,279

14. State and GLIC Nationwide Distribution of Business as of December 31, 2019 (Based on

Exposed Lives)

Redacted pursuant to section 16, below.

15. State and GLIC Nationwide Lives, Premiums and Average Age

State Nationwide

Number of Exposed Lives

10,227

364,057

Inforce Annualized Premium

$27,337,352

$882,617,906

Average Issue Age

57

58

Average Attained Age

69

70

^ Paid-up policies are included in the number of Exposed Lives

16. Confidentiality

Pursuant to Md. Code Ann., Gen. Provis. § 4-301, et seq., (the “Public Records Law”) and, specifically,

Md. Gen. Provis. § 4-335, GLIC respectfully requests that the following portions of this Actuarial

Memorandum be maintained by the Administration as confidential:

Sections 3, 8, 14, Exhibit I, Exhibit II and Exhibit III of the Actuarial Memorandum and Additional Exhibits

I-IV.

The materials sought to be maintained as confidential are collectively referred to as the “GLIC

Confidential Materials” herein. GLIC respectfully requests that the GLIC Confidential Materials be

maintained as confidential and not subject to disclosure under the Public Records Law. See Md. Code

Ann., Gen. Provis. § 4-335 (“A custodian shall deny inspection of the part of a public record that contains

any of the following information provided by or obtained from any person…: (1) a trade secret; (2)

confidential commercial information; (3) confidential financial information….”) (emphasis added); Md.

Code Ann., Ins. § 11-703 (“A carrier may request a finding by the Commissioner that certain information

filed with the Commissioner be considered confidential commercial information under § 4-335 . . . and

not subject to public inspection.”).

Genworth Life Insurance Company

Address: 6620 West Broad Street, Richmond, VA 23230

Company NAIC No: 70025

Actuarial Memorandum

June 2020

PUBLIC

Choice 2 & 2.1 11 | Page

Maryland’s Uniform Trade Secrets Act, Md. Code Ann., Com. Law § 11-1201 (the “Trade Secrets Act”)

defines “trade secret” as information, including a formula, pattern, compilation, program, device, method,

technique, or process, that:

(1) Derives independent economic value, actual or potential, from not being generally known to, and

not being readily ascertainable by proper means by, other persons who can obtain economic value from

its disclosure or use; and

(2) Is the subject of efforts that are reasonable under the circumstances to maintain its secrecy.

See Md. Code Ann., Com. Law § 11-1201. The GLIC Confidential Materials contain GLIC’s confidential

trade secrets, including, but not limited to, actuarial formulas, statistics and/or assumptions, which are

not generally known to, or ascertainable by proper means by, persons or entities other than GLIC who

could obtain economic value from their disclosure or use.

The GLIC Confidential materials must be kept confidential by a record custodian under the Public

Records Law because they constitute trade secrets, confidential commercial information, and/or

confidential financial information. See Md. Code Ann., Gen. Provis. §§ 4-328, 335. Furthermore, Md.

Code Ann., Ins. § 11-703 specifically permits long-term care insurance companies to seek confidential

treatment of premium rate information filed with the Department.

The GLIC Confidential Materials fall squarely within the above definition of trade secrets and also

constitute confidential commercial / financial information. GLIC and its predecessors have been providing

long-term care insurance coverage to policyholders for more than 35 years. GLIC’s lengthy experience

in the long-term care insurance business has placed it in a unique position in the long-term care insurance

marketplace, in that no other long-term care insurance carrier has as much experience in that line of

business as GLIC and its predecessors. Because GLIC has been marketing long-term care insurance

products longer than its competitors, it has been able to accumulate experience-related data that its

competitors have not been able to gather. Among other things, GLIC’s confidential, experience-related

data is used to price GLIC’s long-term care insurance products and manage its existing policies, providing

economic value to GLIC, and if it was released, would provide economic value to GLIC’s competitors.

Additionally, the GLIC Confidential Materials are held and maintained as confidential by GLIC. The data

in GLIC Confidential Materials is not generally known to, or ascertainable by proper means by, persons

or entities other than GLIC who could obtain economic value from their disclosure or use. GLIC takes

active measures to maintain the secrecy of the information in the GLIC Confidential Materials. Among

other measures, GLIC obtains non-disclosure agreements with potential reinsurers before providing

those potential reinsurers with any experience-related data. Furthermore, access to the data is limited

and available only to employees of GLIC who are deemed likely to need the information in the course of

their duties; those employees are subject to non- disclosure agreements under which they agree not to

share the information except in furtherance of the business of GLIC. Thus, the GLIC Confidential

Materials are plainly information that “is the subject of efforts that are reasonable under the circumstances

to maintain its secrecy,” and “derives independent economic value, actual or potential, from not being

generally known to, and not being readily ascertainable by proper means by the public or any other

Genworth Life Insurance Company

Address: 6620 West Broad Street, Richmond, VA 23230

Company NAIC No: 70025

Actuarial Memorandum

June 2020

PUBLIC

Choice 2 & 2.1 12 | Page

person who can obtain economic value from its disclosure or use.” See Md. Code Ann., Gen. Provis. §

4-335.

If disclosed, the GLIC Confidential Materials would permit GLIC’s competitors to exploit GLIC’s

confidential, proprietary, trade secret information for their own benefit, and to GLIC’s competitive and

economic disadvantage. GLIC’s hard-earned information should be kept confidential so that others

cannot gain from GLIC’s experience in order to more effectively compete with GLIC in the long- term care

insurance marketplace. The GLIC Confidential Materials include, among other things, compilations of

information regarding GLIC’s assumptions in pricing certain long-term care products, GLIC’s proprietary

persistency and incurred claims data, and GLIC’s policy demographics. None of this information is

available to GLIC’s competitors or to the public generally, and it is plainly protectable under Md. Code

Ann., Gen. Provis. § 4-335.

This submission contains the publicly available version of this Actuarial Memorandum and other exhibits

referenced above, which redacts the GLIC Confidential Materials. A complete, unredacted, confidential

version of GLIC’s Actuarial Memorandum has been filed separately.

Genworth Life Insurance Company

Address: 6620 West Broad Street, Richmond, VA 23230

Company NAIC No: 70025

Actuarial Memorandum

June 2020

PUBLIC

Choice 2 & 2.1 13 | Page

17. Actuarial Certification

I am a Fellow of the Society of Actuaries and a Member of the American Academy of Actuaries, and I

meet the American Academy of Actuaries’ qualification standards for rendering this opinion and am

familiar with the requirements for filing for increases in long-term care insurance premiums.

This memorandum has been prepared in conformity with all applicable Actuarial Standards of Practice,

including ASOP No. 8, 18, 23, 25 and 41.

I have relied on historical cash flows and projections completed by GLIC’s Inforce Actuarial Infrastructure

team. All future projections included in this memorandum, while based on GLIC’s best estimates, are

uncertain and may not emerge as expected.

I have relied on the IFA Analytics team for the pricing, methodology and design of the FBO and the 1%

compound BIO.

I have relied on statutory valuations as of December 31, 2019, for Claim Reserves (i.e., Disabled Life

Reserves, Pending Claims reserves, Incurred But Not Reported reserves, and Dead But Not Reported

reserves) provided by GLIC’s Long Term Care Valuation team.

I have also relied on assumptions developed by GLIC’s Long Term Care Experience Studies team in

collaboration with other GLIC actuaries, which assumptions were approved by Genworth’s Assumption

Review Committee. The assumptions present the actuary’s best judgement and are consistent with the

issuer’s business plan at the time of the filing.

I hereby certify that, to the best of my knowledge and judgment, this rate submission is in compliance

with the applicable laws and regulations of Maryland and the Long-Term Care Insurance regulation. If

the requested premium rate schedule increase is implemented and the underlying assumptions, which

reflect moderately adverse conditions, are realized, no further premium rate schedule increases are

anticipated. In my opinion, the rates are not excessive or unfairly discriminatory.

________________________________

Susan Lin, F.S.A., M.A.A.A.

Senior Pricing Actuary

Genworth Life Insurance Company

June 2020

Genworth Life Insurance Company

Address: 6620 West Broad Street, Richmond, VA 23230

Company NAIC No: 70025

Actuarial Memorandum

June 2020

PUBLIC

Choice 2 & 2.1 14 | Page

Exhibit I: Choice 2 & Choice 2.1 Policy Forms - Nationwide Experience

With Maryland Approved Rate Increase* without MAE

Redacted pursuant to Section 16, above.

Exhibit II: Choice 2 & Choice 2.1 Policy Forms - Nationwide Experience

With Requested 97.5% Rate Increase* with MAE

Redacted pursuant to Section 16, above.

Exhibit III: Choice 2 & Choice 2.1 Policy Forms - Nationwide Experience

With Requested 97.5% Rate Increase with MAE 58/85 Test

Redacted pursuant to Section 16, above.