BBVA México

S.A.

Financial Report and

Achievements

January-September 2021

2

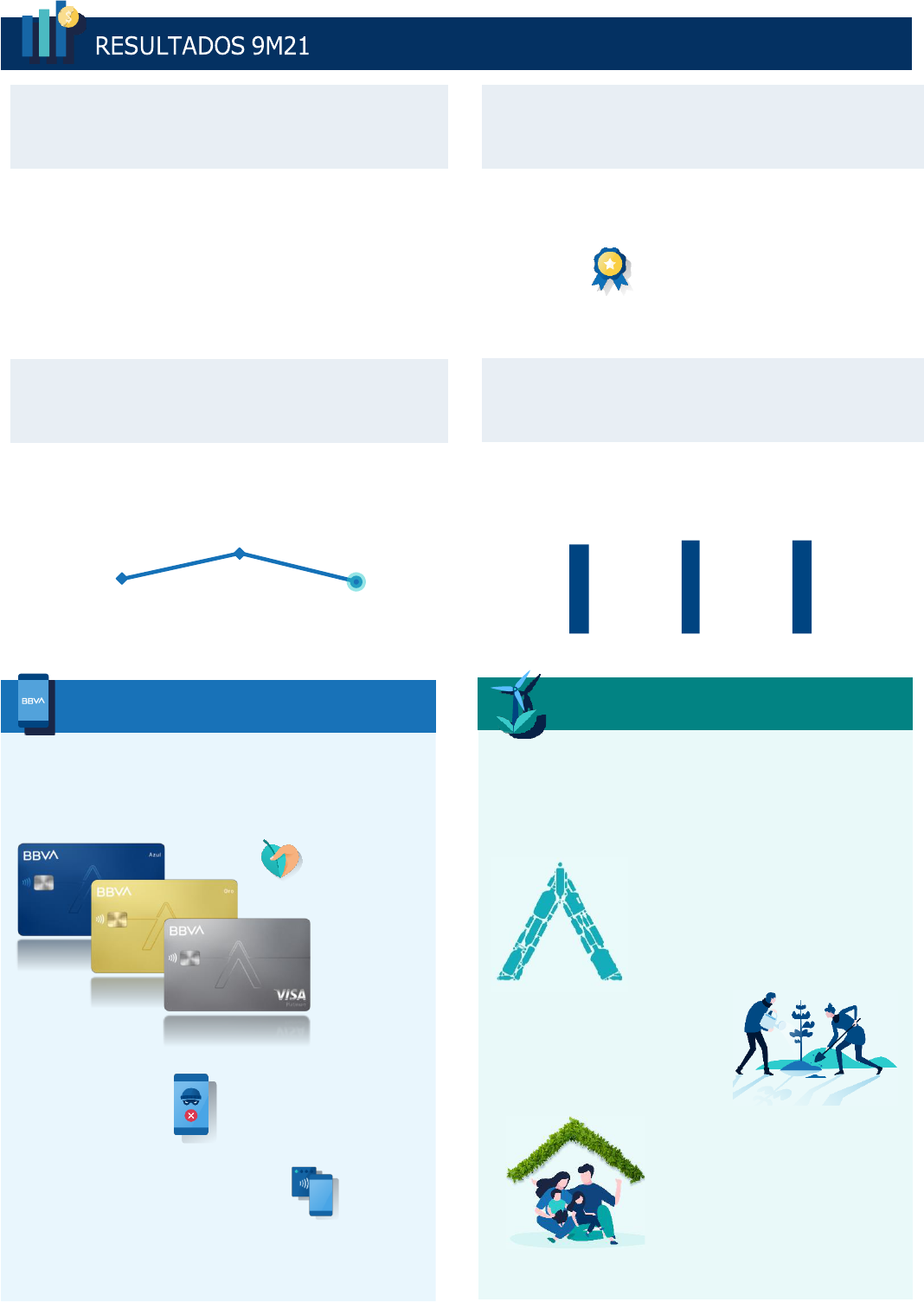

Total Income*

+7.5%

vs.9M20 (mp)

*Financial Margin + net commissions + trading income + other income

Efficiency ratio

37.8%

Past Due Loan Ratio (%) Capitalization Index (%)

Adequate asset

quality

High capital levels

Positive behavior in

recurrent income

Operational excellence

2.0

3.0

1.9

Sep.20 Dic.20 Sep.21

16.8

17.5

18.1

Sep.20 Dic.20 Sep.21

TRANSFORMATION

SUSTAINABILITY

Without visible

numbers

Recycled

Plastic

Contactless

Continuous investment in

innovation

Committed with the environment

Help our clients’ transition to a

sustainable future

We grant green loans to

companies and support them

in their debt issuances

Our clients obtain benefits on

their loans for sustainable

goods

New Aqua Card

Index

Relevant Information ............................................................................................................................4

Digital Development .............................................................................................................................5

Responsible Banking ............................................................................................................................7

Analysis and Discussion of Results ..................................................................................................... 10

Main Magnitudes .................................................................................................................................11

Commercial Activity..................................................................................................................... 12

Performing Loans ........................................................................................................................ 12

Asset quality ................................................................................................................................ 14

Non-Performing Loans ................................................................................................................ 14

Non-Performing Loans Movements ............................................................................................. 15

Loan Portfolio Credit Quality Classification.................................................................................. 15

Deposits ...................................................................................................................................... 16

Results ........................................................................................................................................ 17

Net Interest Income ..................................................................................................................... 18

Fees and Commissions................................................................................................................ 18

Trading income............................................................................................................................ 19

Non-Interest Expenses ............................................................................................................... 20

Capital and Liquidity ........................................................................................................................... 21

BBVA Mexico estimated capitalization index ............................................................................... 21

Financial Indicators ............................................................................................................................22

Ratings ...............................................................................................................................................24

Issuances ...........................................................................................................................................25

Financial Statements ......................................................................................................................... 26

Balance Sheet ............................................................................................................................ 26

Assets ........................................................................................................................................ 26

Liabilities & Stockholders’ Equity................................................................................................ 27

Memorandum accounts ............................................................................................................. 28

P&L (Last 5 quarters) ................................................................................................................. 29

Cash Flow Statement ................................................................................................................. 30

Changes in Stakeholder’s Equity ................................................................................................. 31

Regulatory accounting pronouncements recently issued ............................................................32

4

Relevant Information

Decree and distribution of dividends

During the third quarter of 2021, no decree or dividend payments was made, regarding the dividends

that were approved for distribution at the General Ordinary Shareholders' Meeting of BBVA México, SA,

Institución de Banca Múltiple, Grupo Financiero BBVA México (BBVA Mexico or the Institution) dated

February 26, 2021, corresponding to the profits for the year 2020.

The foregoing in accordance to the recommendation of the National Banking and Securities

Commission (CNBV), applicable to fiscal years 2019 and 2020 for credit institutions dated April 16,

2021, by means of official letter No. P083 / 2021, on the payment of dividends, shares repurchase and

any other mechanism or act that implies a capital transfer to the, which left without effect the one dated

March 30, 2020.

Expiration of the Bank Stock Certificate

During September 2021, the Stock Certificate BACOMER 18V expired and was liquidated; the issuance

date was September 2018 for an amount of 3,500 million pesos (mp).

Change in Company Name

As part of the unified identity of Grupo BBVA globally, as well as the rebranding at the local level, the

financial entities that form Grupo BBVA Mexico changed their corporate names. In the case of the bank,

the Group's main subsidiary, the new name is established as BBVA México, SA, Institución de Banca

Múltiple, Grupo Financiero BBVA México, which will replace the previous name, BBVA Bancomer, SA,

Institución de Banca Múltiple, BBVA Bancomer Financial Group.

5

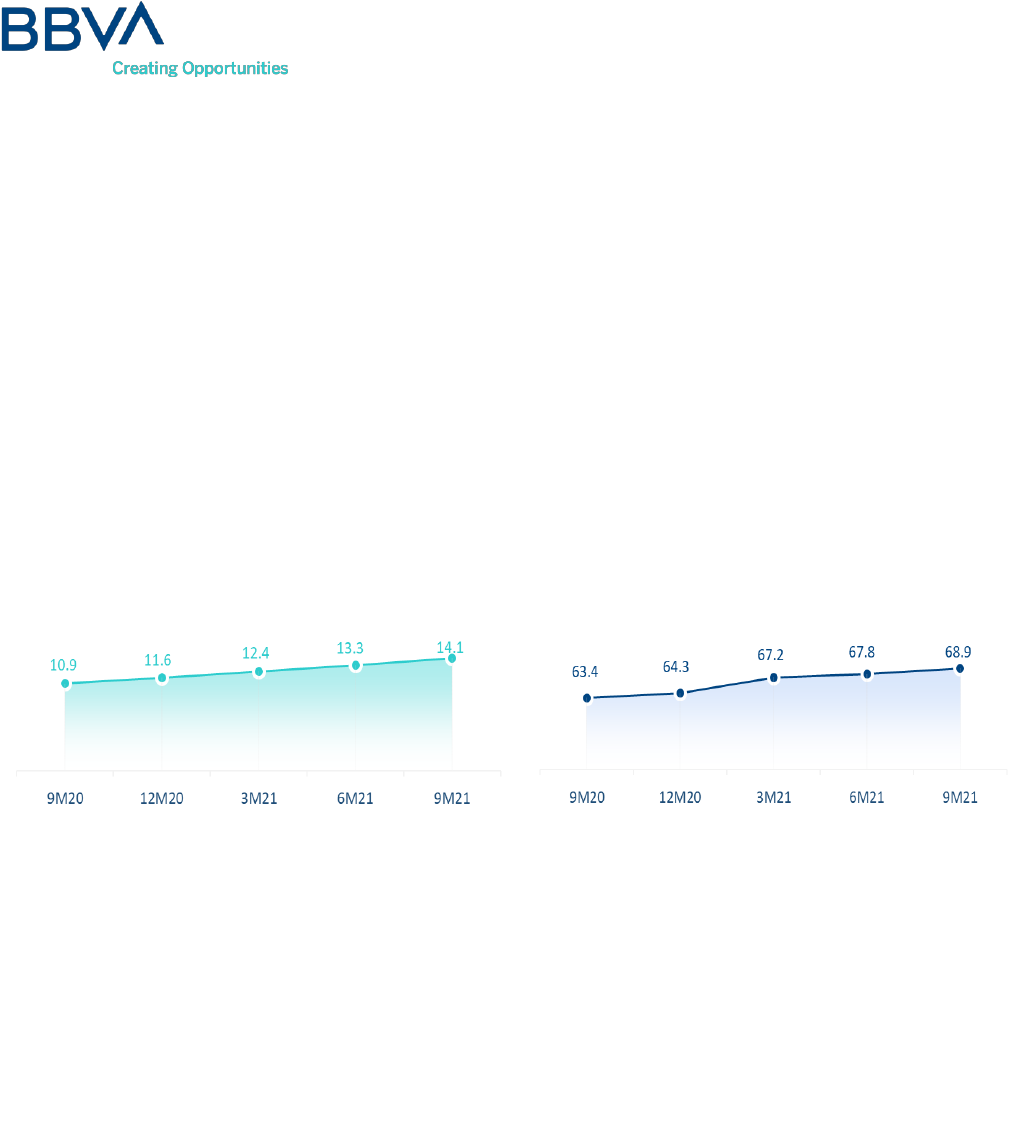

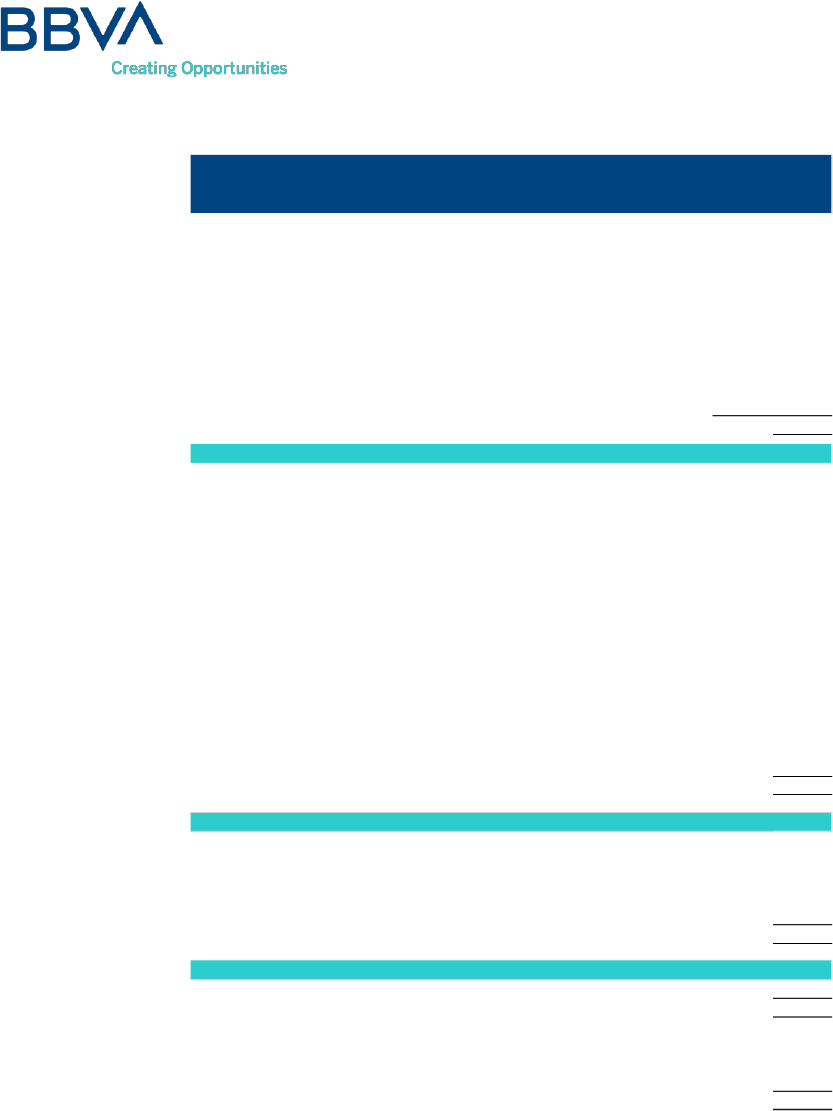

Digital Development

DIGITAL STRATEGY

As a result of our continuous investment in innovation and development of new products and services

to offer our customers through our Apps, we continue to see a growth in the number of customers

using digital channels. As of today, we reached a total of 14.1 million of Mobile Clients at the end of

September 2021, which represents 60% of total customer base, being 30% higher than the previous

year.

Constant boost in the use of digital channels is reflected in the percentage of digital sales (measured in

units), which during the first nine months of the year reached 69% of total sales done in BBVA Mexico.

Mobile Clients (millones)

Digital Sales (% total sales, units)

Financial transactions carried out by our clients in the first nine months of the year totaled 1,676 million,

which represented an increase of 32% compared to last year. In this sense, the continuous

implementation of our digital strategy, reflected in the number of transactions carried out within our

mobile and web channels, representing 53% of the total (compared to 43% in 9M20) and growing by

64% in the last twelve months. This allows our customers to access our services and products more

easily, reducing waiting time and in a safe environment, complying with the most robust and

sophisticated standards in the industry.

DIGITAL DEVELOPMENT & INNOVATION

BBVA INVEST

BBVA Mexico recently made available the BBVA Invest service to its clients, an innovative experience

of digital personalized advice. Based on an objective and using programmed investment, this service

offers investment fund portfolios for each of our clients. BBVA Invest is a tool for clients who are not

familiar with the investment world, having access to have high quality and personalized digital advice.

INSURANCE “TU MÉDICO PARTICULAR” (your own doctor)

In order to promote the culture of health insurance and help to protect financial health of Mexicans,

BBVA Seguros Salud México, S.A. de CV, Grupo Financiero BBVA México and Bupa Seguros México

6

launched a insurance product called 'Tu Médico particular', a product that offers consultations, video

consultations, medicines and a doctor at home, as well as diagnostic analysis and medical

emergencies, in case of needed. The insurance, which can be hired digitally and / or in BBVA Mexico

branches, is aimed on being a complement to a public or private insurance, in addition to having

financial support for people who do not have Access to a health service.

7

Responsible Banking

REPUTATION MANAGEMENT AT BBVA MEXICO

This topic is becoming more and more relevant since it is one of the most valuable and important

resources to maintain and create value for institutions, it also serves to mitigate risks and identify

opportunities that ensure the sustainability of organizations.

At BBVA Mexico, we have set out to be the company with the best reputation, generating value for

society and responding to the needs of clients and employees.

Today we are close to our goal, since we are currently number four in the Merco ranking of the 100 best

companies (the first place in the financial sector) and our CEO is number five in the Leaders ranking , for

the first time we have a ranking within Top 5 in both of these rankings.

The challenge continues and for this, BBVA Mexico implemented a robust governance model that

mitigates potential reputational risks. The main processes within our governance model are:

prevention, reputation management, response to events and damage control, communication and

monitoring.

There are seven dimensions by which we currently measure reputation:

• Offer of products and services

• Ethics and Integrity

• Society and Environment

• Leadership

• Finance

• Innovation

• Job

This helps us identify the needs that have the greatest impact for the perception of our stakeholders

and act accordingly. We will continue working to improve internal and external processes to become

the company with the best reputation in the country.

8

SUSTAINABLE STRATEGY

BBVA Mexico is aware of the important role banking institutions’ play in the transition to a sustainable

world through its financial activity, as demanded by society. In addition, this is one of our strategic

priorities "to help our clients transition towards a sustainable future", inspired by the Sustainable

Development Goals (SDG) adopted by the United Nations (UN), with a focus on climate change, and

inclusive and sustainable social development.

BBVA Mexico has a local sustainable office that coordinates twelve work groups specifically designed

to develop sustainable solutions for clients and promote responsible communication and marketing

practices directed at them. In addition, we have strategies that favor the creation of sustainable

markets.

BBVA Mexico has a sustainable local office that coordinates twelve work groups specifically designed

to develop sustainable solutions for clients and promote responsible communication and marketing

practices directed at them. In addition, we have strategies that favor the creation of sustainable

markets.

BBVA Mexico aims to enhance a positive impact through financial instruments, aligning itself with

initiatives such as:

• Financial Initiative of the United Nations Environment Program (UNEP FI)

• Equator Principles

• Principles of Responsible Investment (PRI)

• Principles of Responsible Banking (PRB)

• UN Global Pact

• Carbon Disclosure Project (CDP)

• Green Finance Advisory Council (CCFV, by its acronym in Spanish)

Finally, in 2020 Grupo BBVA and BBVA Mexico took an additional step forward with two very relevant

announcements: First, the commitment to reduce its exposure to carbon-related activities to zero by

2030 in developed countries and by 2040 in the rest of the world. Second, it has made a commitment

to be greenhouse gas neutral (zero carbon portfolio) by 2050, also taking into account the emissions

of clients financed. This is a very important milestone, which means aligning with the most ambitious

scenario of the Paris Agreement.

SUSTAINABLE FINANCING

Credit Products

The range of credit products handled by BBVA Mexico have significant benefits for clients such as

preferential rates. The main goal is to make these products more attractive in the market.

Individuals: financing for the

acquisition of hybrid and

electric cars, financing for

solar panels and green

mortgages, among others.

Companies: green financing

for companies, letters of

credit, leases and green

bonds, among others.

*Preliminary figures

Insurance: we are initiating

the green insurance offering

(hybrid and electric cars).

January – September 2021

38,887 mp*

January - September 2021

2,467 mp

Green and social bonds issuance in the Mexican market

Beyond just promoting sustainable financing, at BBVA Mexico we promote a new Sustainable Banking

model. For this reason, we have actively participated in numerous initiatives and are always in close

collaboration with all interest groups such as the industry itself, regulators, supervisors, investors and

civil society organizations to continue advancing and promoting the world’s transition towards a

sustainable development.

The total of green and social bonds in which we participated as an intermediary placement agent in the

first nine months of the year was for 19,400 million pesos.

10

Analysis and Discussion of Results

Executive Summary

We continue to provide opportunities to our clients and boost the country's

economic activity, reflected in the performance of the consumer and housing loan

portfolio, growing 1.7% and 8.3% in annual terms, respectively (4.1% and 6.5% vs.

Dec-20).

The loan portfolio remained at similar levels to that of the third quarter of 2020

(+3.3% vs. Dec-20), the annual comparison shows the effect of the use of credit lines in

2020 from companies and corporates to face the pandemic, which have been prepaid

during 2021.

As such, we maintain our leadership in the loan portfolio, with a market share of

23.7% in August 2021, according to figures published by the CNBV.

The continuous promotion of savings among our clients is shown in the evolution of our

bank deposits (demand deposits + total term), with an annual growth of 4.2% (4.1%

vs. Dec-20). This has led us to increase our bank deposit market share in the last

twelve months by 47 basis points (bp) to 23.1% in August 2021 (figures from the

CNBV).

Net income for the first months of the year totaled 42,459 million pesos, driven

by a recovery in the financial margin, higher commissions resulting from the opening of

non-essential activities during the year, and the continuous search for internal

efficiencies focused on maintaining our operational excellence.

Our solid risk models are reflected in a continuous improvement of the asset quality

indicators with an NPL ratio that improved to 1.9%.

We continue to have solvency and liquidity ratios above the minimum required,

with a total capital ratio (ICAP) of 18.1% and a liquidity coverage ratio of 216.69%

(minimum required of 12% and 100%, respectively).

11

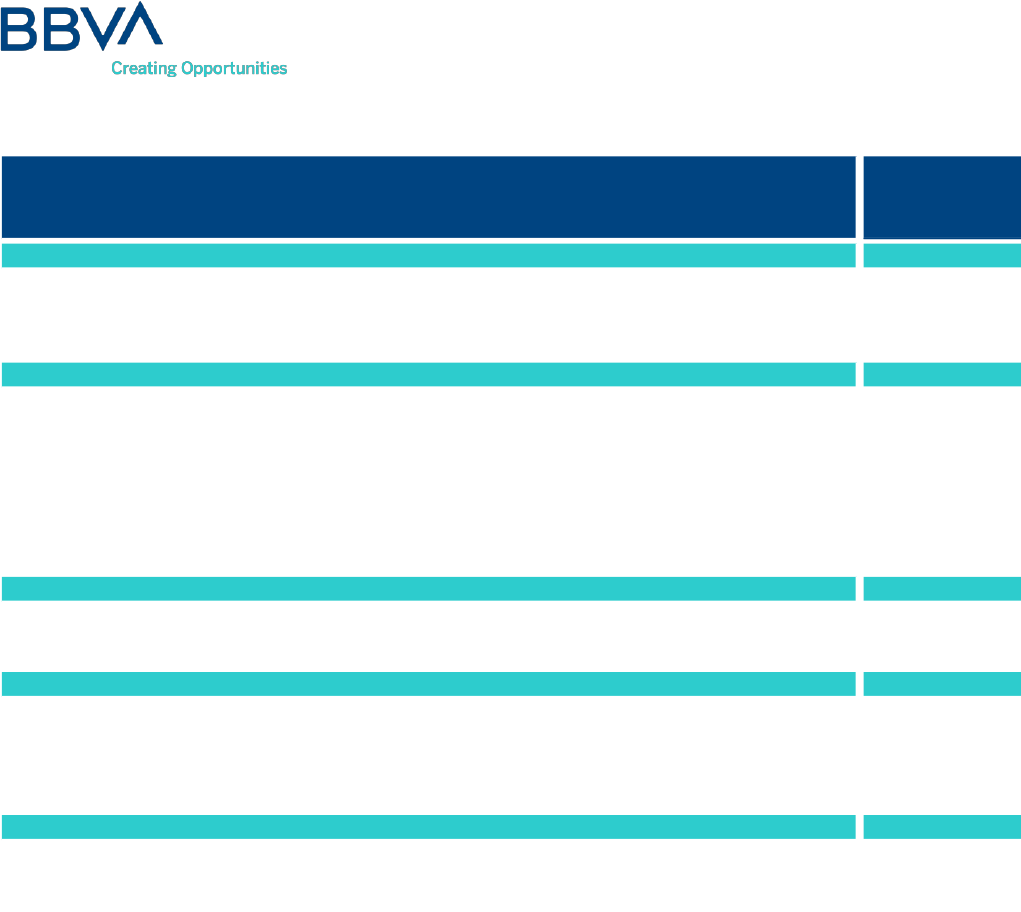

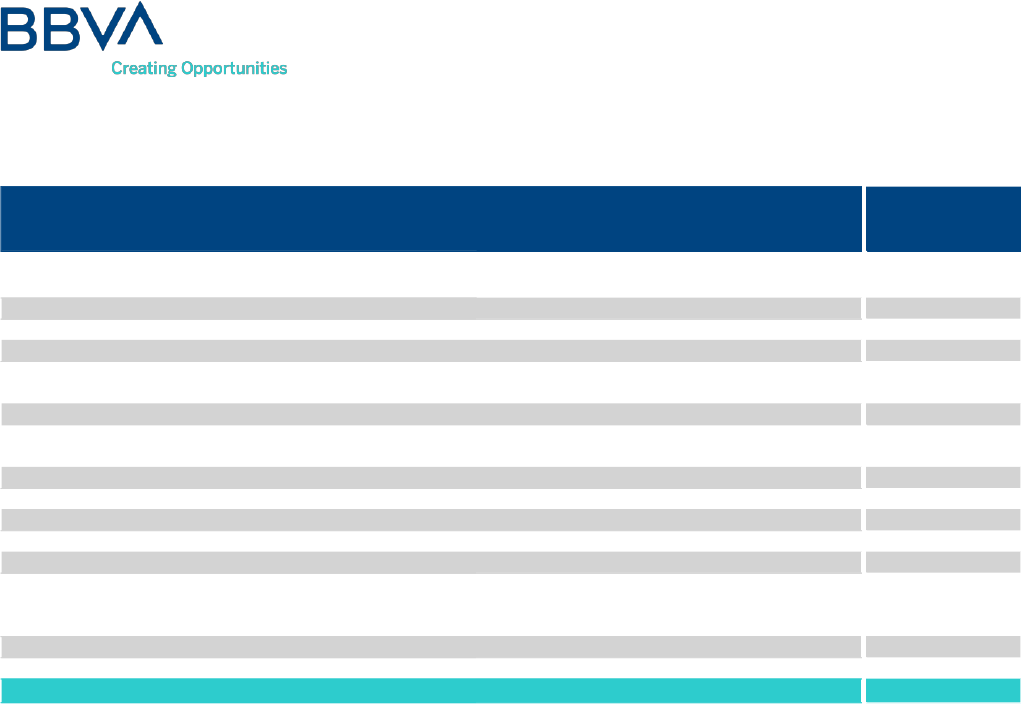

Main Magnitudes

Information as September 2021

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

% %

Main Magnitudes 3Q 4Q 1Q 2Q 3Q 9M 9M

M illion pesos

2020 2020 2021 2021 2021 2020 2021

Balance Sheet

Assets 2,452,564 2,442,870 2,413,308 2,494,873 2,510,737 0.6 2,452,564 2,510,737 2.4

Performing Loans 1,250,968 1,209,449 1,226,893 1,233,847 1,249,918 1.3 1,250,968 1,249,918 (0.1)

Liabilities 2,218,878 2,200,636 2,166,430 2,246,110 2,243,802 (0.1) 2,218,878 2,243,802 1.1

Bank Deposits* 1,326,707 1,328,063 1,359,680 1,361,633 1,382,046 1.5 1,326,707 1,382,046 4.2

Equity 233,686 242,234 246,878 248,763 266,935 7.3 233,686 266,935 14.2

Results

Net Interest Income 31,965 32,835 32,498 32,586 34,375 5.5 92,693 99,459 7.3

Total Operating Income 41,376 43,168 40,853 43,535 43,949 1.0 119,359 128,337 7.5

Expenses (15,969) (16,638) (17,135) (17,646) (13,733) (22.2) (48,399) (48,514) 0.2

Income Before Tax 18,438 10,290 13,291 19,444 25,605 31.7 40,149 58,340 45.3

Net Income 12,663 7,587 9,702 13,349 19,408 45.4 28,580 42,459 48.6

Indicators in %

3Q 4Q 1Q 2Q 3Q 9M 9M

2020 2020 2021 2021 2021 QoQ (bp) 2020 2021 YoY (bp)

Profitability and Asset Quality

ROE 22.3 12.8 15.9 21.5 30.1 856 17.0 22.2 525

Efficiency 38.6 38.5 41.9 40.5 31.2 (928) 40.5 37.8 (275)

NPL ratio 2.0 3.0 2.6 2.4 1.9 (46) 2.0 1.9 (11)

Coverage ratio 159.8 128.7 137.4 141.5 149.8 834 159.8 149.8 (1,004)

Solvency and Liquidity

Total Capital Ratio 16.8 17.5 17.7 17.5 18.1 61 16.8 18.1 129

Core Equity Tier 1 Ratio

13.5 14.4 14.6 14.5 15.5 100 13.5 15.5 205

CCL** 185.24 190.49 203.12 206.89 216.69 980 185.24 216.69 3,145

Leverage Ratio

9.8 10.3 10.3 9.6 10.2 54 9.8 10.2 36

Figures in units (#)

3Q 4Q 1Q 2Q 3Q 9M 9M

2020 2020 2021 2021 2021 QoQ (#) 2020 2021 YoY (#)

Infraestructure

Employees 33,347 33,313 33,759 33,525 37,889 4,364 33,347 37,889 4,542

Branches 1,814 1,746 1,728 1,725 1,721 (4) 1,814 1,721 (93)

ATMs 12,923 12,950 12,957 13,014 13,139 125 12,923 13,139 216

* Demand + time deposits

** LCR level quarterly average. Preliminary figure

Q-o-Q

Y-o-Y

12

Commercial Activity

Performing Loans

The loan portfolio remained at similar levels than that of the third quarter of 2020, while in the

first nine months of 2021 grew by 3.3%. The annual comparison shows the effect of credit line

used by companies and corporations to face the pandemic in 2020, and that were later

prepaid; while compared to 2020, the result benefits from a favorable recovery in the demand

of consumer and mortgage loans.

As a result of the continuous recovery in the country's economic activity, driven largely by a

pickup in private consumption, we have observed an acceleration in loan demand mainly to

individuals, which grew 4.7% in annual terms (+5.2% vs. Dec-20). By segment, the mortgage

portfolio continues to show a favorable performance growing 8.3% annually (6.5% vs. Dec-

20); while consumer and credit card loans have accelerated their growth trend in recent

months increasing 1.7% in annual terms (4.1% vs. Dec-20), highlighting a positive

performance in payroll loans and credit cards.

The commercial portfolio decreased 3.7% in annual terms (+1.9% vs. Dec-20). By segment,

business loans have been impacted by the effect of prepayments; as well as the appreciation

of the peso against the dollar. The result in the first nine months of the year is explained by a

positive behavior in government loans (+1.5%), explained by our strategy based on complete

solutions, as well as by higher demand for loans to companies, growing 3.3% in the period.

We maintain our leadership as a result of a continuous loan offer to our clients, registering a

market share of 23.7% as of August 2021, an increase of 51 bp compared to 2020 and

according to figures published by the CNBV.

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

Performing Loans 9M 6M 9M %

Million pesos 2020 2021 2021 Q-o-Q Y-o-Y

Businesses 534,926 499,068 505,222 1.2 (5.6)

Financial entities 26,762 24,156 22,065 (8.7) (17.6)

Government 155,953 166,593 164,105 (1.5) 5.2

Government loans 100,179 112,504 114,629 1.9 14.4

State-owned entities 55,774 54,089 49,476 (8.5) (11.3)

Commercial loans 717,641 689,817 691,392 0.2 (3.7)

Consumer 288,427 285,434 293,398 2.8 1.7

Mortgage 244,900 258,596 265,128 2.5 8.3

Total Performing Loans 1,250,968 1,233,847 1,249,918 1.3 (0.1)

13

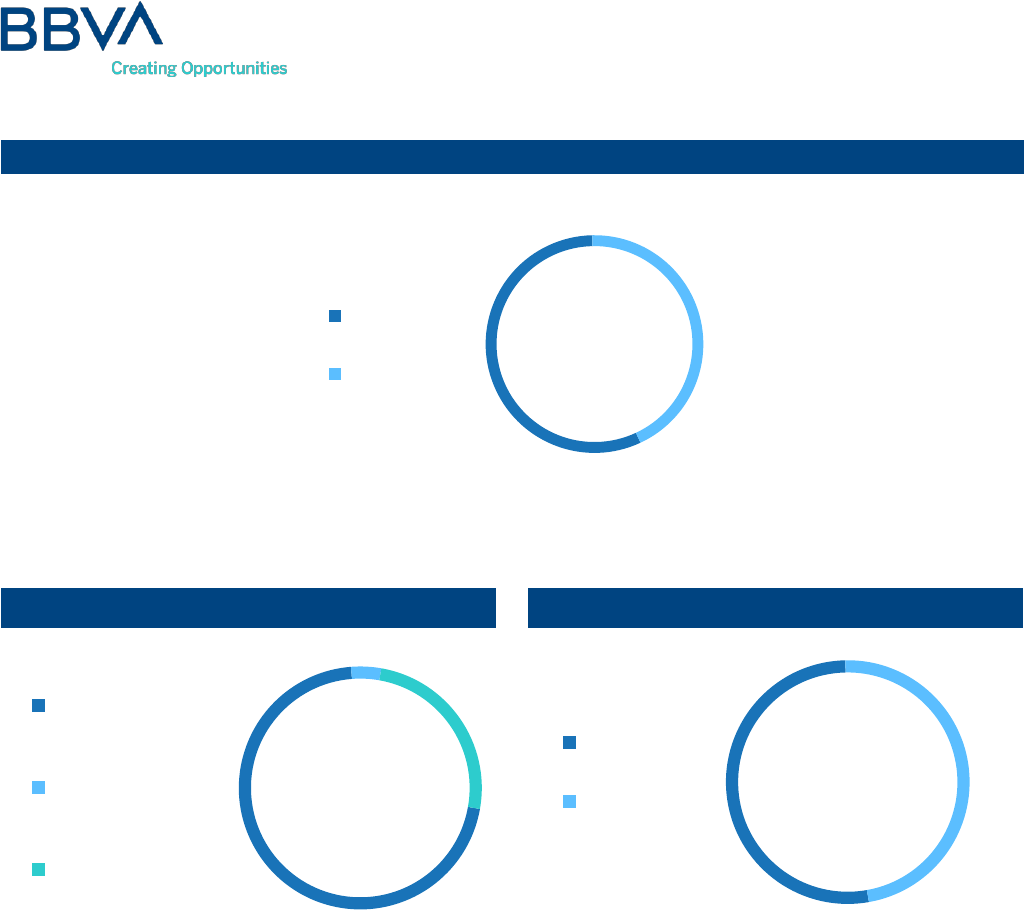

Performing Loans mix (%)

Commercial Loans mix (%)

Retail Lending mix (%)

55%

45%

Commercial

Retail

73%

3%

24%

Businesses

Financial

entities

Government

53%

47%

Consumer

Mortgage

14

Asset quality

Non-Performing Loans

The past-due loan portfolio shows an annual decline of 5.5%, explained by our strict internal

risk models, helping us achieve during this quarter a past due loan portfolio in better levels

than those we had previous to the 2020 crisis. Reflected in a reduction of 11 bp in Non-

Performing Loan (NPL) ratio, closing September 2021 in 1.9%.

Compared to the end of December 2020, there is also a positive performance of the past-due

portfolio with a decline of 34.6%, explained by our strict risk model and constant monitoring

of the payment evolution of the customers who required additional support.

The coverage of the past due loan portfolio in 3Q21 was 149.81%.

NPL and Coverage ratio (%)

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

Non Performing Loans 9M 6M 9M

Million pesos 2020 2021 2021 Q-o-Q Y-o-Y

Businesses 9,932 12,375 8,098 (34.6) (18.5)

Financial entities 0 0 0 0 0

Government entities 0 11 0 0 0

Commercial loans 9,932 12,386 8,098 (34.6) (18.5)

Consumer 7,778 8,837 8,184 (7.4) 5.2

Mortgage 8,230 8,877 8,237 (7.2) 0.1

Total Non Performing Loans 25,940 30,100 24,519 (18.5) (5.5)

%

159.8

149.8

2.0

1.9

1.0

2.0

3.0

4.0

5.0

6.0

7.0

8.0

Sep.20 Sep.21

Coverage

ratio

NPL ratio

15

Non-Performing Loans Movements

Loan Portfolio Credit Quality Classification

Around 80% of the portfolio was classified with the minimum risk level, which implies a sound

asset quality.

Credit Card for Businesses and letters of credit are included in commercial.

In mortgage, the securitization consolidated by BACOMCB 09 is considered.

NON-PERFORMING LOANS MOVEMENTS SEPTEMBER 2021

BBVA México, S.A., Institución de Banca Múltiple, Grupo

Financiero BBVA México

Businesses

and financial

entities

Mortgages Consumer Total

Non-Performing Loans movements

Million pesos

Final Balance (December 2020) 11,983 9,354 16,147 37,484

Inputs: 5,741 6,658 22,653 35,052

Transfer to current loans and reestructured 4,928 5,827 21,895 32,650

Reestructurados 813 831 758 2,402

Outputs: (9,626) (7,775) (30,616) (48,017)

Transfer to current loans (678) (5,198) (3,055) (8,931)

Cash settlements (1,661) (342) (2,233) (4,236)

Restructured (Cash settlements) (187) (348) (127) (662)

Settlement and/or adjudication (131) (61) 0 (192)

Write-offs (695) (156) (1,774) (2,625)

Financial penalties (6,274) (1,670) (23,427) (31,371)

Final Balance (September 2021) 8,098 8,237 8,184 24,519

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

Performing Loan Rating Commercial Mortgage Consumer Credit Card TOTAL

September 2021 Balance Provision Balance Provision Balance Provision Balance Provision Balance Provision

Million pesos

Risk Level

A1

646,255 1,651 226,125 247 56,458 519 53,565

944

982,403

3361

A2

67,720 777 1,445 9 14,107 357 15,360 602 98,632 1,745

B1

12,817 210 6,827 61 59,451 1,978 8,891 511 87,986 2,760

B2

8,940 202 15,439 181 30,206 1,378 7,904 573 62,489 2,334

B3

15,232 489 2,579 41 7,674 428 7,905 704 33,390 1,662

C1

10,632 727 8,394 262 5,134 374 8,437 1,006 32,597 2,369

C2

2,649 180 4,158 304 4,125 412 9,516 2,259 20,448 3,155

D

2,804 814 4,480 1,254 2,294 528 1,542 767 11,120 3,363

E

8,040 5,061 3,916 1,968 7,302 4,955 1,700 1,469 20,958 13,453

Adicional

2,529

Total required 775,089 10,111 273,363 4,327 186,751 10,929 114,820 8,835 1,350,023 36,731

16

Deposits

The continuous promotion of savings among our clients benefitted the evolution of the bank’s

deposits (demand deposits + total term) with an annual growth of 4.2% (4.1% vs. Dec-20).

This, has led us to increase the bank’s market share by 47 bp. during the last 12 months to

23.1% in August 2021 (according to the CNBV figures).

Demand deposits registered a positive behavior with an annual increase of 10.0% (6.3% vs.

Dec-20), due to the preference of our clients to maintain their resources available in a scenario

of uncertainty. On the other hand, time deposits decreased 17.7% in annual terms (-5.9% vs.

Dec-20). This evolution has allowed us to register a favorable mix in bank deposits with an 83%

of the relative weight in low-cost deposits.

*Bank Deposits (mp)

Bank Deposits Mix (%)

*Bank deposits includes demand deposits and time deposits

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

Deposits 9M 6M 9M

Million pesos 2020 2021 2021 Q-o-Q Y-o-Y

Demand deposits 1,047,863 1,132,151 1,152,512 1.8 10.0

Time Deposits 278,844 229,482 229,534 0.0 (17.7)

Customer Deposits 258,218 223,838 225,064 0.5 (12.8)

Money Market 20,626 5,644 4,470 (20.8) (78.3)

Bonds 89,006 87,743 88,170 0.5 (0.9)

Deposits global account without movements 4,929 5,278 5,161 (2.2) 4.7

Total Deposits 1,420,642 1,454,654 1,475,377 1.4 3.9

%

83%

17%

Demand

Time

1,327

1,362

1,382

Sep.20 Jun.21 Sep.21

+4.2%

17

Results

As a result of the recovery in private consumption and economic activity in the country, which

was impacted in 2020 by the closure of non-essential activities derived from the pandemic, a

positive performance is observed in the results of the first nine months of 2021. Thus, net

income in this period totaled 42,459 million pesos, a 48.6% increase compared to the same

period of the previous year.

This result can be explained by a recovery in the financial margin, which in 2020 was negatively

impacted by the application of support programs, an increase in commissions derived from

the opening of non-essential activities during the year, and the continuous search of internal

efficiencies focused on maintaining our operational excellence.

NIM (total assets, %)

1

ROE (%)

1

Net Interest Margin (NIM) on total assets.

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

Income Statement 3Q 2Q 3Q % 9M 9M %

Million pesos 2020 2021 2021 Q-o-Q Y-o-Y 2020 3021 Y-o-Y

Net interest income 31,965 32,586 34,375 5.5 7.5 92,693 99,459 7.3

Provisions for loan losses

(6,987) (6,471) (4,624) (28.5) (33.8) (30,833) (21,540) (30.1)

Net interest income after provisions for loan losses 24,978 26,115 29,751 13.9 19.1 61,860 77,919 26.0

Total Fees & Commissions

6,906 7,415 7,476 0.8 8.3 19,713 22,116 12.2

Trading income

1,898 2,241 2,133 (4.8) 12.4 6,693 5,222 (22.0)

Other operating income

607 1,293 (35) NA NA 260 1,540 NA

Total operating revenues 34,389 37,064 39,325 6.1 14.4 88,526 106,797 20.6

Non-interest expense

(15,969) (17,646) (13,733) (22.2) (14.0) (48,399) (48,514) 0.2

Net operating income 18,420 19,418 25,592 31.8 38.9 40,127 58,283 45.2

Income before income tax and profit sharing 18,438 19,444 25,605 31.7 38.9 40,149 58,340 45.3

Net Income 12,663 13,349 19,408 45.4 53.3 28,580 42,459 48.6

5.4

5.4

9M20 9M21

17.0

22.2

9M20 9M21

18

Net Interest Income

In the first nine months of 2021 there was a positive evolution of the financial margin with an

annual growth of 7.3%. This is explained by the recovery of the loan activity this year, an

improvement in the portfolio mix of loans and deposits compared to the previous year and a

negative impact that occurred in 2020 related to the application of support programs to our

clients.

Noteworthy to remember, in the 1Q20 additional reserves were created for 6,544 million pesos

to face the crisis caused by the pandemic, of which 2,953 million pesos were released in this

quarter and 1,548 million pesos in 2Q21. Resulting from this, the item of provisions for loan

losses decreased 30.1% in annual terms. The financial margin adjusted for provisions was

77,919 million pesos in the first nine months of the year 26.0% higher than the previous year.

Fees and Commissions

Driven by the opening of non-essential economic activities, which have contributed to an

acceleration in the economic recovery, net fees and commissions increased by 12.2%. This is

mainly explained by higher acquiring billing in credit and debit cards boosted by a higher level

of transactions; as well as an increase in bank fees mainly related to the recovery of credit

activity.

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

%

Net Interest Income 3Q 2Q 3Q 9M 9M

Million pesos 2020 2021 2021 2020 2021

Interest income

43,559 42,066 44,345

5.4 1.8 136,172 128,594 (5.6)

Interest expenses

(12,071) (9,948) (10,440)

4.9 (13.5) (44,960) (30,612) (31.9)

Margin fees

477 468 470

0.4 (1.5) 1,481 1,477 (0.3)

Net interest income

31,965 32,586 34,375 5.5 7.5 92,693 99,459 7.3

Provisions for loan losses

(6,987) (6,471) (4,624)

(28.5) (33.8) (30,833) (21,540) (30.1)

Net interest income after provisions 24,978 26,115 29,751 13.9 19.1 61,860 77,919 26.0

%

Q-o-Q

Y-o-Y

Y-o-Y

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

Fees & Commissions 3Q 2Q 3Q 9M 9M %

Million pesos 2020 2021 2021 Q-o-Q Y-o-Y

2020 2021 Y-o-Y

Bank fees 1,758 1,801 1,845 2.4 4.9 5,073 5,293 4.3

Credit and debit card

3,483 4,216 4,232

0.4 21.5 9,966 12,247 22.9

Investment funds

1,161 1,183 1,122

(5.2) (3.4) 3,381 3,443 1.8

Others

504 215 277

28.8 (45.0) 1,293 1,133 (12.4)

Commissions and fee income 6,906 7,415 7,476 0.8 8.3 19,713 22,116 12.2

%

19

Trading income

The volatility observed in the equity and fixed income markets has resulted in lower trading

income from purchases and sales this year. This, together with a negative valuation in foreign

currency due to derivative operations, makes this item show a decline of 22% in the first nine

months of the year compared to the same period of 2020.

Other income (expenses) of the operation

The positive result in other operating income is explained by the extraordinary income derived

from the sale in 2Q21 of affiliated companies, and income generated from the implementation

of initiatives aimed at transforming the production model.

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

Trading income 3Q 2Q 3Q 9M 9M %

Million pesos

2020 2021 2021 Q-o-Q Y-o-Y 2020 2021 Y-o-Y

Variable income 15 (1) (2) 100.0 (113.3) (12) (39) 225.0

Fixed income and repos (1,439) (189) 463 (345.0) (132.2) (1,426) (1,325) (7.1)

Securities (1,424) (190) 461 (342.6) (132.4) (1,438) (1,364) (5.1)

FX 6,881 (5,849) (1,042) (82.2) (115.1) (2,138) (10,089) 371.9

Derivatives (7,803) (4,524) (949) (79.0) (87.8) (4,388) 2,399 (154.7)

Results from valuation (2,346) (10,563) (1,530) (85.5) (34.8) (7,964) (9,054) 13.7

Variable income 221 2 (8) (500.0) (103.6) (811) 97 (112.0)

Fixed income and repos 1,963 (386) (800) 107.3 (140.8) 3,151 862 (72.6)

Securities 2,184 (384) (808) 110.4 (137.0) 2,340 959 (59.0)

FX 1,507 1,796 2,056 14.5 36.4 4,564 5,280 15.7

Derivatives 553 11,392 2,415 (78.8) 336.7 7,753 8,037 3.7

Results from trading 4,244 12,804 3,663 (71.4) (13.7) 14,657 14,276 (2.6)

Trading income 1,898 2,241 2,133 (4.8) 12.4 6,693 5,222 (22.0)

%

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México %

Other Income (Expenses) 3Q 2Q 3Q 9M 9M

Million pesos 2020 2021 2021 2020 2021

Result of operation of foreclosed assets 475 297 256

(13.8) (46.1)

830 724

(12.8)

Interest of loans to employees

207 215 214

(0.5) 3.4

614 636 3.6

Bank Correspondents

38 45 46 2.2

21.1

95 142 49.5

Recovery of warranty payments

56 43 79 83.7 41.1 201 136 (32.3)

Sales and recoveries of loan portfolio

123 44 49 11.4 (60.2) 166 93 (44.0)

Reorganization plans

(589) - - NA NA (589) - NA

Write-offs

(42) (96) (163) 69.8 288.1 (326) (275) (15.6)

Legal and labor contingencies

(99) (70) (280)

300.0

182.8 (238) (314) 31.9

Donations

(131) (155) (246)

58.7

87.8 (591) (574) (2.9)

Other Income

569 970 10

(99.0)

(98.2) 98 972 891.8

Other operating income 607 1,293 (35) NA NA 260 1,540 492.3

Q-o-Q

Y-o-Y

Y-o-Y

%

20

Non-Interest Expenses

Non-Interest expenses had a marginal increase of 0.2%, explained by the evolution of

personnel expenses, which show an annual drop. This, explained by the entry of the

subcontracting labor reform law, which has a specific impact in personnel expenses given the

payment of employees participation in the company’s profit (PTU by its acronym in Spanish).

The efficiency ratio (measured as expenses divided by revenues) was 37.8% at the end of

September 2021, it was 275 bp lower than the previous year.

However, we maintain a strong physical infrastructure network with 1,721 branches and 13,139

ATMs, in addition to a wide range of digital applications and services to meet the current and

future needs of our growing customer base.

Operating revenues, expenses and efficiency (%)

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

%

Non-Interest Expenses

3Q 2Q 3Q 9M 9M

Million pesos

2020 2021 2021 2020 2021

Administrative and operating expenses

10,310 11,649 8,147 (30.1) (21.0) 31,322 30,949 (1.2)

Rents

1,494 1,679 1,743 3.8 16.7 4,550 5,121 12.5

Depreciation and amortization

1,467 1,477 1,488 0.7 1.4 4,381 4,419 0.9

Taxes

1,107 1,284 752 (41.4) (32.1) 3,450 3,301 (4.3)

Deposit guarantee fund (IPAB)

1,591 1,557 1,603 3.0 0.8 4,696 4,724 0.6

Administrative and promotional expenses 15,969 17,646 13,733 (22.2) (14.0) 48,399 48,514 0.2

Y-o-Y

%

Q-o-Q

Y-o-Y

119,359

128,337

48,399

48,514

40.55

37.80

30

35

40

45

50

55

60

65

70

75

80

9M20 9M21

Operating

revenues

Expenses

Efficiency

21

Capital and Liquidity

BBVA Mexico estimated capitalization index stood at 18.1% at the end of September 2021,

composed by 15.52% of Tier 1 capital and 2.58% of Tier 2 capital a 129 bp increase in the index

compared with the previous year.

BBVA Mexico fully covers the minimum capital requirements. Derived from the additional

allocation of capital after being classified as a domestic systemically important financial

institution (Grade IV), it is necessary to cover with an additional buffer of 1.5%, which implies

maintaining a minimum requirement of 12.0% for the total capital ratio.

BBVA Mexico estimated capitalization index

*Preliminary information. The figures are under review by authorities.

Despite the complex environment, BBVA Mexico maintains favorable liquidity levels to

continue growing. The regulatory liquidity ratio, defined as Liquid assets / Liquid liabilities,

stood at 68.7%. The Coeficient Coverage Ratio (Local LCR) stood at 216.69%.

Regulatory Liquidity Ratio (%)

Local LCR (%)

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

Capitalization

Million pesos

Tier 1 capital 225,935 240,847 256,067

Tier 2 capital 56,086 49,328 42,625

Net capital 282,021 290,175 298,693

Credit Market, Operative Credit

Market, Operative

Credit

Market, Operative

Risk & Credit Risk Risk & Credit Risk Risk & Credit Risk

Risk-weighted assets

1,142,508 1,677,328 1,096,289 1,658,890 1,081,691 1,650,203

Tier 1 as % of risk-weighted assets

19.78% 13.47% 21.97% 14.52% 23.67% 15.52%

Tier 2 as % of risk-weighted assets

4.91% 3.34% 4.50% 2.97% 3.94% 2.58%

Total capital ratio

24.69% 16.81% 26.47% 17.49% 27.61% 18.10%

September

2020

September

2021

June

2021

66.9

72.7

68.7

Sep.20 Jun.21 Sep.21

185.24

206.89

216.69

Sep.20 Jun.21 Sep.21

22

Financial Indicators

INFRASTRUCTURE

ATMs: Include those that have activity during the quarter.

PROFITABILITY

a) Net Interest Margin adjusted (NIM adjusted): Financial margin after provisions for loan losses (annualized) /

Average productive assets

Average productive assets: Cash + Securities + Repo debtors + securities lending + derivatives + performing

loans + Receivable benefits from securitization transactions + Valuation adjustments derived from hedges

of financial assets.

b) Net Interest Margin (NIM): Net interest income (annualized) / Average total assets.

c) Operating efficiency: Expenses (annualized) / Average total assets.

d) Efficiency index: Administrative and promotional expenses / Net interest income + commissions and fee

income + trading income + other operating income (expense).

e) Productivity Index: Commissions and fees, net / Promotion and administrative expenses.

f) Return on equity (ROE): Net income (annualized) / Average capital.

g) Return on assets (ROA): Net income (annualized) / Average total assets.

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

3Q 4Q 1Q 2Q 3Q 9M 9M

2020 2020 2021 2021 2021 2020 2021

Infrastructure Indicators (#)

Branches 1,814 1,746 1,728 1,725 1,721 1,814 1,721

ATMs 12,923 12,950 12,957 13,014 13,139 12,923 13,139

Employees 33,347 33,313 33,759 33,525 37,889 33,347 37,889

Profitability Indicators (%)

a) NIM adjusted (interest bearing assets) 4.4 2.9 4.0 4.6 5.2 3.9 4.6

b) NIM (total assets) 5.2 5.4 5.4 5.3 5.5 5.4 5.4

c) Operating efficiency 2.6 2.7 2.8 2.9 2.2 2.8 2.6

d) Efficiency (cost to income) 38.6 38.5 41.9 40.5 31.2 40.5 37.8

e) Productivity index 43.2 46.8 42.2 42.0 54.4 40.7 45.6

f) ROE 22.3 12.8 15.9 21.5 30.1 17.0 22.2

g) ROA 2.1 1.24 1.60 2.18 3.10 1.7 2.3

Asset Quality Indicators (%)

h) NPL ratio 2.0 3.0 2.6 2.4 1.9 2.0 1.9

i) Coverage ratio 159.8 128.7 137.4 141.5 149.8 159.8 149.8

Solvency Indicators (%)

j) Core equity tier 1 ratio 13.5 14.4 14.6 14.5 15.5 13.5 15.5

k) Tier 1 ratio 13.5 14.4 14.6 14.5 15.5 13.5 15.5

l) Total capital ratio 16.8 17.5 17.7 17.5 18.1 16.8 18.1

m) Leverage ratio 9.8 10.3 10.3 9.6 10.2 9.8 10.2

Liquidity Indicators (%)

n) Liquidity ratio (CNBV requirement) 66.9 65.7 67.0 72.7 68.7 66.9 68.7

o) Liquidity ratio (Loans / Deposits) 93.9 90.7 89.9 90.3 90.1 93.9 90.1

p) Liquidity Coverage Coefficient (Local LCR) 185.24 190.49 203.12 206.89 216.69 185.24 216.69

23

ASSET QUALITY

h) NPL ratio: Non performing loans / Total loan portfolio.

i) Coverage Ratio: Allowance for loan losses / Non performing loans.

SOLVENCY

j) Core Equity Tier 1 Ratio: CET1 Capital / Risk Weighted Assets to credit risk, market and operational (applied

in Mexico since January 2013).

k) Tier 1 Ratio: Tier 1 Capital / Risk Weighted Assets to credit risk, market and operational (applied in Mexico

since January 2013).

l) Total Capital Ratio: Net Capital / Risk Weighted Assets to credit risk, market and operational (applied in

Mexico since January 2013).

m) Leverage Ratio: Risk Capital / Exposure.

LIQUIDITY

n) Liquidity Ratio: Liquid assets / Liquid liabilities.

Liquid Assets: Cash and cash equivalents + Trading (securities) + Available for sale (securities).

Liquid Liabilities: Demand deposits + Interbank loans and loans from other entities payable on

demand + Interbank loans and loans from other entities short term.

o) Loans / Deposits: Performing loans / Core deposits (demand + time).

p) Liquidity Coverage Ratio (Local LCR): Computable Liquid Assets / 30-day stressed Net Outflows (BBVA

Mexico information). Quarterly average. Preliminary figure

24

Ratings

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México Ratings

Long Term Short Term Outlook

Standard and Poor's

Issuer Credit Rating - Foreign Currency

BBB A-2 Negative

Issuer Credit Rating - Local Currency

BBB A-2 Negative

National Scale

mxAAA mxA-1+ Stable

Stand Alone Credit Profile (SACP)

bbb+

Moody's

Bank Deposits - Foreign Currency

Baa1 P-2 Negative

Bank Deposits - Domestic Currency

Baa1 P-2 Negative

National Scale Rating Bank Deposits

Aaa.mx MX-1

Baseline Credit Assessment (BCA)

baa1

Fitch

Issuer Default Rating - Foreign Currency

BBB F2 Stable

Issuer Default Rating - Local Currency

BBB F2 Stable

National Scale Rating

AAA(mex) F1+(mex) Stable

Viability Rating (VR)

bbb

25

Issuances

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

Issuances

Instruments Amount

Original

Currency

Issue Date Due Date Call Date

Term

(years)

Rate

Senior Debt S&P Moody's Fitch

BACOMER 07U 2,240 UDIS 30-ene-07 09-jul-26 19.4 4.36% Baa1/Aaa.mx AAA(mex)

BACOMER 22224 1,000 MXN 07-jun-12 26-may-22 10.0 TIIE28 + 85 Baa1/Aaa.mx AAA(mex)

Senior Notes Dlls 2024 750 USD 03-abr-14 10-abr-24 10.0 4.375% Baa1 BBB

Senior Notes Dlls 2025 500 USD 15-sep-20 18-sep-25 5.0 1.875% Baa1 BBB

BACOMER 17-2 1,858 MXN 26-may-17 20-may-22 5.0 TIIE28 + 35 Baa1/Aaa.mx AAA(mex)

BACOMER 18 3,500 MXN 27-sep-18 21-sep-23 5.0 TIIE28 + 19 Baa1/Aaa.mx AAA(mex)

BACOMER 19 5,000 MXN 21-jun-19 17-jun-22 3.0 TIIE + 7 Baa1/Aaa.mx AAA(mex)

BACOMER 19-2 5,000 MXN 21-jun-19 11-jun-27 8.0 8.49% Baa1/Aaa.mx AAA(mex)

BACOMER 20 7,123 MXN 10-feb-20 08-feb-23 3.0 TIIE28 + 5 Baa1/Aaa.mx AAA(mex)

BACOMER 20-2 6,000 MXN 10-feb-20 05-feb-25 5.0 TIIE28 + 15 Baa1/Aaa.mx AAA(mex)

BACOMER 20D 100 USD 10-feb-20 27-ene-23 3.0 Libor3M + 49 Baa1/Aaa.mx AAA(mex)

Subordinated Debt

Subordinated Debentures Tier 2 2022 1,500 USD 19-jul-12 30-sep-22 10.2 6.75% Baa2 BB

Subordinated Debentures Tier 2 15NC10 2029 200 USD 06-nov-14 12-nov-29 12-nov-24 15NC10 5.35% BB Baa3 BB

Subordinated Debentures Tier 2 15NC10 2033 1,000 USD 17-ene-18 18-ene-33 18-ene-28 15NC10 5.125% BB BB

Subordinated Debentures Tier 2 15NC10 2034 750 USD 05-sep-19 13-sep-34 19-sep-29 15NC10 5.875% Baa3 BB

Mortgage Securitization

BACOMCB 09-3 3,616 MXN 07-ago-09 24-may-29 19.8 10.48% mxAAA AAA(mex)

Ratings

26

Financial Statements

Balance Sheet

Assets

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

Assets Sep Dec Mar Jun Sep

Million pesos 2020 2020 2021 2021 2021

CASH AND CASH EQUIVALENTS 217,933 223,219 255,662 309,541 326,891

Margin call accounts 26,005 32,261 19,360 15,187 11,914

SECURITIES 569,595 574,938 578,229 587,175 539,003

Trading

295,390 281,920 267,039 289,679 242,830

Available for sale

192,538 211,788 229,436 228,254 226,623

Held to maturity

81,667 81,230 81,754 69,242 69,550

Debtors from repurchase agreement 3,060 15,123 44 38 33

Derivatives 228,687 213,927 156,947 145,882 144,328

Trading

208,343 197,606 143,297 132,680 131,037

Hedging Transactions

20,344 16,321 13,650 13,202 13,291

Valuation adjustments derived from hedges of financial assets 2,129 2,488 1,097 1,102 723

PERFORMING LOANS 1,250,968 1,209,449 1,226,893 1,233,847 1,249,918

Commercial loans 717,641 678,572 694,679 689,817 691,392

Business or commercial activity

534,926 488,878 496,702 499,068 505,222

Financial entities

26,762 28,079 24,558 24,156 22,065

Government entities

155,953 161,615 173,419 166,593 164,105

Consumer 288,427 281,968 279,195 285,434 293,398

Mortgage 244,900 248,909 253,019 258,596 265,128

Residential Mortgages

237,505 241,968 246,255 252,158 258,998

Social Housing

7,395 6,941 6,764 6,438 6,130

NON PERFORMING LOANS 25,940 37,484 32,980 30,100 24,519

Commercial loans 9,932 11,983 12,131 12,386 8,098

Business or commercial activity

9,932 11,983 12,131 12,375 8,098

Government entities

0 0 0 11 0

Consumer 7,778 16,147 11,614 8,837 8,184

Mortgage 8,230 9,354 9,235 8,877 8,237

Residential Mortgages

7,729 8,824 8,747 8,448 7,847

Social Housing

501 530 488 429 390

TOTAL LOANS 1,276,908 1,246,933 1,259,873 1,263,947 1,274,437

Allowance for loan losses (41,463) (48,236) (45,301) (42,581) (36,731)

TOTAL LOANS, NET 1,235,445 1,198,697 1,214,572 1,221,366 1,237,706

Other accounts receivable, net 97,219 106,527 118,277 146,908 179,780

Repossessed assets, net 1,415 1,317 1,241 1,188 1,033

Property, furniture and equipment, net 36,170 36,293 35,556 35,155 34,974

Equity investments 1,121 1,135 1,153 1,086 1,089

Deferred taxes, net 21,352 22,416 23,609 23,322 26,201

Other assets 12,433 14,529 7,561 6,923 7,062

Deferred charges, prepaid expenses and intangibles 12,433 14,529 7,561 6,923 7,062

TOTAL ASSETS 2,452,564 2,442,870 2,413,308 2,494,873 2,510,737

27

Liabilities & Stockholders’ Equity

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

Liabilities & Stockholders' Equity Sep Dec Mar Jun Sep

Million pesos 2020 2020 2021 2021 2021

TOTAL DEPOSITS

1,420,642 1,417,071 1,450,011 1,454,654 1,475,377

Demand deposits

1,047,863 1,084,227 1,116,008 1,132,151 1,152,512

Time Deposits

278,844 243,836 243,672 229,482 229,534

Customer deposits

258,218 229,974 237,622 223,838 225,064

Money market

20,626 13,862 6,050 5,644 4,470

Bonds

89,006 84,052 85,296 87,743 88,170

Deposits global account without movements

4,929 4,956 5,035 5,278 5,161

INTER BANK LOANS AND LOANS FROM OTHER ENTITIES

19,374 17,861 30,885 30,456 31,639

Payable on demand

0 0 0 0 1,000

Short- term

7,757 6,985 6,070 6,171 5,984

Long- term

11,617 10,876 24,815 24,285 24,655

Creditors from repurchase agreements 246,458 263,716 256,581 309,491 264,775

Securities creditors 1 5 3 1 4

COLLATERALS SOLD OR DELIVERED IN GUARANTEE

49,932 63,841 64,413 53,068 51,695

Repurchase

0 0 19,963 12,591 7,321

Securities lending

49,932 63,841 44,450 40,477 44,374

DERIVATIVES

244,304 223,841 162,609 152,846 156,876

Trading

229,061 210,971 155,273 146,775 150,510

Hedge transactions

15,243 12,870 7,336 6,071 6,366

Valuation adjustments derived from hedges of financial liabilities 9,659 7,915 4,796 4,742 4,168

OTHER PAYAB LES

127,689 113,665 118,659 163,370 180,531

Profit taxes payable

0 0 0 1,726 3,700

Employee profit sharing (PTU) payable

2 59 57 57 2,004

Transaction settlement creditors

78,298 55,312 62,515 68,465 68,930

Creditors and margin accounts

0 1,179 348 348 0

Creditors from collaterals received in cash

24,937 19,762 21,444 15,975 17,279

Accrued liabilities and other

24,452 37,353 34,295 76,799 88,618

Subordinated debt 93,446 85,181 70,869 69,943 71,293

Deferred credits and advanced collections 7,373 7,540 7,604 7,539 7,444

TOTAL LIABILITIES 2,218,878 2,200,636 2,166,430 2,246,110 2,243,802

SUBSCRIBED CAPITAL

40,003 40,003 40,003 40,003 40,003

Paid- in capital

24,143 24,143 24,143 24,143 24,143

Share premium

15,860 15,860 15,860 15,860 15,860

EARNED CAPITAL

193,645 202,194 206,837 208,718 226,885

Capital reserves

6,901 6,901 6,901 6,901 6,901

Results of prior years

160,008 160,008 196,175 185,095 185,095

Unrealized gain on available- for- sale securities

707 2,820 (1,998) (3,332) (4,649)

Result from valuation of cash flow hedging instruments

283 (96) (430) (562) (595)

Accummulated effect by conversion

440 440 440 0 0

Redefined benefits to employees

(3,274) (4,046) (3,953) (2,435) (2,326)

Net income

28,580 36,167 9,702 23,051 42,459

MAJORITY STOCKHOLDERS' EQUITY

233,648 242,197 246,840 248,721 266,888

Non- controlling interest in consolidated subsidiaries 38 37 38 42 47

TOTAL STOCKHOLDERS EQUITY 233,686 242,234 246,878 248,763 266,935

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 2,452,564 2,442,870 2,413,308 2,494,873 2,510,737

28

Memorandum accounts

“The historical balance of the capital stock as of September 30, 2021 is 4,248 million pesos.

This consolidated balance sheet is prepared in accordance with the Accounting Criteria for Credit Institutions issued by the National Banking

and Securities Commission, based on the Articles 99, 101 and 102 of the Mexican Credit Institutions Law, of general and compulsory

observance, consistently applied, reflecting the operations conducted by the Bank up to the above date, which were realized and valued in

accordance with sound banking practices and applicable legal and administrative disposals.

The Board of Directors under the responsibility of the managers who subscribe it approved this consolidated financial statement.”

Eduardo Osuna Osuna

Luis Ignacio De La Luz Dávalos

Adolfo Arcos González

Ana Luisa Miriam Ordorica Amezcua

CEO

CFO

Head of Internal Audit

Head of Accounting

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

Memorandum accounts Sep Dec Mar Jun Sep

Million pesos 2020 2020 2021 2021 2021

Contingent assets and liabilities 771 805 904 942 1,022

Credit commitments 642,252 638,851 626,480 632,070 652,357

In trusts 434,569 429,883 426,344 430,298 470,220

Under mandate 212 223 227 233 196

Assets in trust or under mandate 434,781 430,106 426,571 430,531 470,416

Assets in custody or under administration 212,083 203,467 196,519 225,194 243,036

Collaterals received by the institution 79,341 131,586 110,591 92,679 96,369

Collaterals received and sold or pledged as collateral by the institution 67,135 106,906 91,892 83,089 78,748

Investment banking transactions on behalf of third parties, net 1,528,642 1,604,841 1,695,175 1,808,667 1,904,929

Accrued interest on non- performing loans 3,344 3,524 3,312 3,424 2,465

Other record accounts 3,436,271 3,336,242 3,423,140 3,464,835 3,562,232

29

P&L (Last 5 quarters)

“This consolidated income statement is prepared in accordance with the Accounting Criteria for Credit Institutions issued by the National

Banking and Securities Commission, based on the Articles 99, 101 and 102 of the Mexican Credit Institutions Law, of general and compulsory

observance, consistently applied, reflecting the operations conducted by the Bank up to the above date, which were realized and valued in

accordance with sound banking practices and applicable legal and administrative disposals.

The Board of Directors under the responsibility of the managers who subscribe it approved this consolidated financial statement.”

Eduardo Osuna Osuna

Luis Ignacio De La Luz Dávalos

Adolfo Arcos González

Ana Luisa Miriam Ordorica Amezcua

CEO

CFO

Head of Internal Audit

Head of Accounting

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

Income Statement 3Q 4Q 1Q 2Q 3Q 9M 9M

Million pesos 2020 2020 2021 2021 2021 2020 3021

interest income 44,036 43,523 42,722 42,534 44,815 137,653 130,071

interest expenses (12,071) (10,688) (10,224) (9,948) (10,440) (44,960) (30,612)

Net interest income 31,965 32,835 32,498 32,586 34,375 92,693 99,459

Provisions for loan losses

(6,987) (16,257) (10,445) (6,471) (4,624) (30,833) (21,540)

Net interest income after provisions for loan losses 24,978 16,578 22,053 26,115 29,751 61,860 77,919

Commissions and fees charged 10,847 12,433 11,568 12,429 12,715 31,663 36,712

Commissions and fees paid (3,941) (4,643) (4,343) (5,014) (5,239) (11,950) (14,596)

Total Fees & Commissions

6,906 7,790 7,225 7,415 7,476 19,713 22,116

Trading income

1,898 1,740 848 2,241 2,133 6,693 5,222

Other operating income

607 803 282 1,293 (35) 260 1,540

Total operating revenues 34,389 26,911 30,408 37,064 39,325 88,526 106,797

Non-interest expense

(15,969) (16,638) (17,135) (17,646) (13,733) (48,399) (48,514)

Net operating income 18,420 10,273 13,273 19,418 25,592 40,127 58,283

Share in net income of unconsolidated subsidiaries and affiliates

18 17 18 26 13 22 57

Income before income tax and profit sharing 18,438 10,290 13,291 19,444 25,605 40,149 58,340

Tax incurred (7,255) (4,384) (2,591) (5,424) (4,950) (12,393) (12,965)

Deferred taxes 1,481 1,680 (997) (667) (1,242) 824 (2,906)

Net Taxes

(5,774) (2,704) (3,588) (6,091) (6,192) (11,569) (15,871)

Income before non-controlling interest 12,664 7,586 9,703 13,353 19,413 28,580 42,469

Non-controlling interest

(1) 1 (1) (4) (5) 0 (10)

Net Income 12,663 7,587 9,702 13,349 19,408 28,580 42,459

30

Cash Flow Statement

“This consolidated cash flow statement is prepared in accordance with the Accounting Criteria for Credit Institutions issued by the National

Banking and Securities Commission, based on the Articles 99, 101 and 102 of the Mexican Credit Institutions Law, of general and compulsory

observance, consistently applied, reflecting the operations conducted by the Bank up to the above date, which were realized and valued in

accordance with sound banking practices and applicable legal and administrative disposals.

The Board of Directors under the responsibility of the managers who subscribe it approved this consolidated financial statemen t.”

Eduardo Osuna Osuna

Luis Ignacio De La Luz Dávalos

Adolfo Arcos González

Ana Luisa Miriam Ordorica Amezcua

CEO

CFO

Head of Internal Audit

Head of Accounting

BBVA México, S.A., Institución de Banca Múltiple, Grupo Financiero BBVA México

Cash Flow Statement (from January 1st to September 30th 2021)

Million pesos

Net income 42,459

Adjustments derived from items not involving cash flow

Profit or loss derived from the valuation of investment and financing activities

Depreciation of property, furniture and fixtures 1,760

Amortization of installation expenses 1,377

Amortization of intangible assets 1,281

Provisions 3,995

(440)

Income taxes 15,871

Share in net income of unconsolidated subsidiaries and affiliated companies (57)

Noncontrolling interest 10 23,797

66,256

Operating activities

Change in margin call accounts 20,595

Change in investments in securities 26,393

Change in debtors from repurchase agreement 15,091

Change in derivatives (assets) 66,569

Change in loan portfolio (net) (33,927)

Change in repossessed assets 283

Change in other operating assets (77,331)

Change in deposits 50,942

Change in interbank loans and other loans from other entities 13,661

Change in creditors from repurchase agreements 1,059

Change in securities lending (1)

Change in collaterals sold or delivered in guarantee (12,147)

Change in derivatives (liabilities) (60,462)

Change in subordinated obligations with liability characteristics (16,155)

Change in other operating liabilities

64,664

Change in hedging instruments (of hedge items related to operation activities)

(6,308)

Income taxes payment

(6,024)

Net cash flows used in operating activities

46,902

Investment activities

Proceeds from the disposal of property, furniture and fixtures 50

Payments for the acquisition of property furniture and fixtures (1,868)

103

Proceeds from cash dividends 1

Payments for acquisition of intangible assets (890)

Net cash flows used in investment activities (2,604)

Financing activities

Cash dividends paid (11,080)

Net cash flows used in financing activities (11,080)

Net increase or decrease in cash and cash equivalents 99,474

Effects of changes in cash and cash equivalents 4,198

Cash and cash equivalents at the beginning of the year 223,219

Cash and cash equivalents at the end of the year 326,891

Changes in Stakeholder’s Equity

“This consolidated variation in stakeholders’ equity statement is prepared in accordance with the Accounting Criteria for Credit Institutions issued by the National Banking and Securities

Commission, based on the Articles 99, 101 and 102 of the Mexican Credit Institutions Law, of general and compulsory observance, consistently applied, reflecting the operations conducted by

the Bank up to the above date, which were realized and valued in accordance with sound banking practices and applicable legal and administrative disposals.

The Board of Directors under the responsibility of the managers who subscribe it approved this consolidated financial statement.”

Eduardo Osuna Osuna

Luis Ignacio De La Luz Dávalos

Adolfo Arcos González

Ana Luisa Miriam Ordorica Amezcua

CEO

CFO

Head of Internal Audit

Head of Accounting

BBVA México, S.A., Institución de Banca Múltiple, Grupo

Financiero BBVA México

Subscribed

Capital

Earned

Capital

Million pesos

Paid in Capital

Share

Premium

Capital

Reserves

Results of

prior years

Unrealized Gain on

Available for Sale

Securities

Result from

Valuation of Cash

Flow Hedging

Instruments

Result from

Conversion of

Foreign

Subsidiaries

Redefined

benefits to

employees

Net Income

Balances as of December 31st, 2020 24,143 15,860 6,901 160,008 2,820 (96) 440 (4,046) 36,167 242,197 37 242,234

HOLDERS' MOVEMENTS IN LINE WITH STOCKHOLDERS

Subscription of shares ( Hipotecaria Nacional merger) 183 183

Transfer from net income to results of prior years 36,167 (36,167) 0

Decree of dividends (11,080) (11,080) (11,080)

Total 0 0 0 25,087 0 0 0 0 (36,167) (11,080) 0 (11,080)

HOLDERS MOVEMENTS IN RECOGNITION TO THE REVENUES

Net income 42,459 42,459 10 42,469

Result from valuation of securities available for sale (7,469) (7,469) (7,469)

Result from valuations of Cash Flow Hedging (499) (499) (499)

Recognition in the preventive estimation for credit risks due to a

change in rating methodology

(440) (440) (440)

Redefined benefits to employees 1,720 1,720 1,720

Total 0 0 0 0 (7,469) (499) (440) 1,720 42,459 35,771 10 35,781

Balances as of September 30th, 2021 24,143 15,860 6,901 185,095 (4,649) (595) 0 (2,326) 42,459 266,888 47 266,935

Majority

Stockholder´s

Equity

Non Controlling

Interest in

Consolidated

Subsidiaries

Total

Stockholder´s

Equity

Regulatory accounting pronouncements recently issued

I. Adoption of international standard

a. According to the Resolution that modifies the general provisions applicable to credit

institutions, published in the Diario Oficial de la Federación (DOF) on December 4, 2020,

the CNBV has resolved to adopt the IFRS 9, for which it is necessary to update the

accounting criteria applicable to credit institutions, to make them consistent with the

financial and international reporting standards contained in this resolution, which will allow

having transparent and comparable financial information with other countries, with its

entry into force on January 1, 2022.

BBVA Mexico’s administration is in the process of determining the effects of the adoption of

these modifications to the accounting criteria applicable to credit institutions.

b. In accordance with the amendments that modifies the general provisions applicable to

credit institutions, published in the DOF on December 4, 2020, the CNBV has resolved to

modify the following Financial Reporting Standards (FRS), which had previously been

published in the DOF of December 27, 2017; and this will be effective as of January 1, 2022

rather than on January 1

st

, 2019.

The following is a brief description of the main changes with application as of January 1, 2022:

Mexican FRS B-17 “Fair Value Determination”- It defines fair value as the exit price that

would be received for selling an asset, or paid to transfer a liability in an orderly transaction

between market participants at the valuation date. It is mentioned that fair value is a market-

based determination and not on a specific value of an asset or a liability and that, when

determining the fair value, the entity should use assumptions that market participants would

use when setting the price of an asset or a liability under current market conditions as of a

specific date, including assumptions about risk. As a result, the entity’s intention to hold or

liquidate an asset, or otherwise satisfy a liability, is not relevant in determining fair value.

Mexican FRS C-3 “Accounts receivable”- Main changes issued for this FRS are shown

below:

It leaves the Bulletin C-3 “Accounts receivable” without effect.

Specifies that accounts receivable based on a contract represent a financial instrument,

while some of the other accounts receivable generated by a legal or fiscal provision may

have certain characteristics of a financial instrument, such as generating interest, but

they are not considered as a financial instrument.

It establishes that the provisions for loan losses for commercial accounts payable is

recognized from the moment the income is accrued, based on expected credit losses.

33

It establishes that, from the initial recognition, the value of money over time must be

considered, so if the effect of the present value of the account receivable is important in

view of its term, it must be adjusted based on its present value. The effect of the present

value is relevant when the payment of the account receivable is agreed, in whole or in

part, for a term greater than one year, since in these cases a financing operation exists.

The accounting changes that arise must be recognized retrospectively, however, the valuation

effects can be recognized prospectively.

Mexican FRS C-9 “Provisions, contingencies and commitments”- It leaves without effect

the Bulletin C-9 “Liabilities, provisions, contingent assets and liabilities and commitments”, its

scope is reduced by relocating the issue related to the accounting treatment of financial

liabilities in FRS C-19 “Financial instruments payable” and it modifies the definition of a liability

as “virtually unavoidable” and including the term “likely”. First time adoption of this Mexican

FRS does not generate accounting changes in the financial statements of the entities.

Mexican FRS C-16 “Impairment of Financial Instruments Receivable (FIR)”- It indicates

that, to determine the recognition of the expected loss, the historical experience that the entity

has in credit losses should be considered; as well as, current conditions ; as well as, reasonable

and sustainable forecasts for the different measurable future events that could affect the

amount of future cash flows to be recovered from the FIR.

It also notes that the expected loss should be recognized when, having increased credit risk, it

is concluded that a portion of the FIR future cash flows will not be recovered. Any accounting

changes that arise should be recognized retrospectively.

Mexican FRS C-19 “Financial instruments payable”- The main characteristics issued for

this FRS are shown below:

The possibility of valuing certain financial liabilities at their fair value is established when

certain conditions are met.

Value long-term liabilities at their present value at initial recognition.

When restructuring a liability, without substantially modifying the future cash flows to

settle it, the costs and commissions disbursed in this process will affect the amount of

the liability and will be amortized using a modified effective interest rate, instead of

directly affecting the net income or loss.

It incorporates the provisions in IFRIC 19 “Extinction of Financial Liabilities with Capital

Instruments”, an issue that was not included in the existing regulations.

The effect of extinguishing a financial liability must be presented as a financial result in

the comprehensive income statement.

It introduces the concepts of amortized cost to value financial liabilities and the effective

interest method, based on the effective interest rate.

34

Any accounting changes that arise must be recognized retrospectively.

Mexican FRS C-20 “Financial instruments to collect principal and interest”- The main

characteristics issued for this FRS are shown below:

The way of classifying the financial instruments as assets is modified, since the concept of

intention to acquire and hold them to determine their classification is discarded, instead the

adoption of the concept business model of the administration.

The classification includes financial instruments whose objective is to collect the

contractual cash flows and obtain a gain on the contractual interest they generate,

having characteristics of a loan.

They include both financial instruments generated by sales of goods or services,

financial leases or loans, as well as those acquired in the market.

Mexican FRS D-1 “Revenues from clients’ contracts” - The main changes issued for this

FRS are shown below:

Control transfer, based on the opportunity to recognize income.

Identify the obligations to be complied with in a contractual agreement.

The allocation of the transaction price among the complied obligations based on the

independent sales price.

The introduction of the concept of conditioned account receivable.

The recognition of collection rights.

The valuation of income.

Mexican FRS D-2 “Revenue, costs from contracts with clients” – The main change in this

rule is the separation of the regulations regarding the recognition of revenue from contracts

with clients from the regulations for the recognition of costs for contracts with clients.

Mexican FRS D-5 “Leasing”- Effective from January 1, 2022. Its early application is allowed

for those who use FRS D-1 “Revenue from contracts with clients” and FRS D-2 “Costs from

contracts with clients”, before the date of initial application of this FRS. It leaves without effect

the Bulletin D-5 “Leases”. The application for the first time of this FRS generates accounting

changes in the financial statements mainly for the lessee and grants different options for

recognition. Among the main changes are the following:

Eliminates the classification of leases as operational or capitalizable for a lessee, and

the latter must recognize a liability for leasing at the present value of the payments and

an asset for use of rights for the same amount, of all leases with a duration greater than

12 months, unless the underlying asset is of low value.

An expense for depreciation or amortization of the right-of-use assets and an interest

expense on the lease liabilities are recognized.

35

It modifies the presentation of related cash flows, as cash outflows from operating

activities are reduced, with an increase in outflows of cash flows from financing

activities.

It modifies the recognition of the gain or loss when a seller-lessee transfers an asset to

another entity and leases that asset in return.

The accounting recognition by the lessor has no changes in relation to the previous

Bulletin D-5, and only some disclosure requirements are added.

c. New Standard Pronouncements issued by CINIF

In December 2020, the CINIF issued a document titled “Improvements to Mexican FRS 2021”,

which contains specific amendments to some existing Mexican FRS. The main amendments

that generate accounting changes are the following:

Mexican FRS B-1 “Accounting changes and error corrections”- To converge with FRS 8 of

IFRS, prospective application is incorporated when it is impractical to determine the

accumulated effects of an accounting change or the correction of an error . In those cases, the

entity should recognize the effects of the change in the error correction in the current

accounting period.

The amendment to this FRS comes into force for the years beginning on January 1, 2021;

allowing its early application for fiscal year 2020. The accounting changes that arise must be

recognized through prospective application.

Mexican FRS C-19 “Financial instruments payable” - Establishes that now the proceeds

from forgiveness received or granted should be presented within the results related to

operating activities, instead of being presented in comprehensive income.

The amendment to this FRS comes into force for the years beginning on January 1, 2021;

allowing its early application for fiscal year 2020. The accounting changes that arise must be

recognized based on the provisions of FRS B-1.

Mexican FRS C-20 “Financial instruments to collect principal and interest” - Establishes

that now the effects of the renegotiation of an IFCPI must be presented within the results

related to operating activities, instead of being presented in comprehensive income.

The amendment to this FRS comes into force for the years beginning on January 1, 2021;

allowing its early application for fiscal year 2020. The accounting changes that arise must be

recognized based on the provisions of FRS B-1.

Mexican FRS D-5 “Leasing” - 1) establishes that the mandatory disclosures of the expense

related to short-term and low-value leases for which the right-of-use asset has not been

recognized, separately. 2) It incorporates the method to determine the proportion that

36

corresponds to the rights of use retained by the seller-lessee, as well as their accounting

recognition.

The Institution's Management is in the process of determining the effects of adopting the new

Financial Reporting Standards and the improvements to the FRS in the financial statements.

* * *