Michael H. Fine

Chief Executive Ocer

Central Unied

School District

Fiscal and Human

Resources Review

May 17, 2023

Michael H. Fine • Chief Executive Ocer

1300 17th Street – City Centre, Bakersfield, CA 93301-4533 • Tel. 661-636-4611 • Fax 661-636-4647

www.fcmat.org

May 17, 2023

Ketti Davis, Superintendent

Central Unified School District

4605 N. Polk Avenue

Fresno, CA 93722

Dear Superintendent Davis:

In October 2022, the Central Unified School District and the Fiscal Crisis and Management Assistance

Team (FCMAT) entered into an agreement for FCMAT to conduct a review of the district’s fiscal services

and human resources departments. The agreement stated that FCMAT would perform the following:

1.

Review operational processes and procedures in the fiscal services department and make

recommendations for improved eciency, if any, in the following areas:

•

Budget development

•

Budget monitoring

•

Position control

•

Accounts payable

•

Accounts receivable

•

Payroll

2.

Review operational processes and procedures in the human resources department and

make recommendations for improved eciency, if any.

3.

Evaluate the current workflow and distribution of functions within and between the above

departments and make recommendations for improved eciencies, if any.

4.

Conduct an organizational and stang review of the above departments and make

recommendations for stang improvements and organizational restructuring, if any.

This final report contains the study team’s findings and recommendations.

FCMAT appreciates the opportunity to serve the Central Unified School District and extends thanks to all

the sta for their assistance during fieldwork.

Sincerely,

Michael H. Fine

Chief Executive Ocer

Table of Contents

About FCMAT ..................................................................................................iii

Introduction .......................................................................................................v

Background ............................................................................................................................ v

Study and Report Guidelines ............................................................................................. v

Study Team ............................................................................................................................. v

Executive Summary ........................................................................................ 1

Findings and Recommendations................................................................ 3

Organizational Structure and Stang ................................................................. 3

District Organizational Charts ............................................................................................ 4

Job Descriptions ....................................................................................................................4

Job Classifications and Functional Duties ...................................................................... 5

Stang Comparison .............................................................................................................6

Interdepartmental Considerations ....................................................................... 11

Internal Controls ................................................................................................................... 11

Policies and Procedural Manuals .................................................................................... 12

Software Systems ............................................................................................................... 12

Organizational Culture, Collaboration, and Communication ................................... 13

Fiscal Services .........................................................................................................16

Structure and Stang ........................................................................................................ 16

Processes and Procedures .............................................................................................. 20

Budget Development and Monitoring .......................................................................... 20

Position Control .................................................................................................................. 25

Accounts Payable ............................................................................................................... 28

Fiscal Crisis and Management Assistance Team Central Unified School District i

T C

Accounts Receivable ......................................................................................................... 35

Payroll .................................................................................................................................... 39

Department Morale and Customer Service ................................................................ 43

Human Resources .................................................................................................. 45

Structure and Stang ....................................................................................................... 45

Processes and Procedures .............................................................................................. 50

Board Approval for Personnel Actions ......................................................................... 50

Employee Recruitment and Selection .......................................................................... 50

Employee Absences and Leaves .................................................................................... 51

Employee Handbook ........................................................................................................ 52

Appendices .................................................................................................... 54

Appendix A ..............................................................................................................55

Hotel/Motel Transient Occupancy Tax Waiver ........................................................... 55

Appendix B ..............................................................................................................57

Study Agreement ................................................................................................................57

Fiscal Crisis and Management Assistance Team Central Unified School District ii

T C

About FCMAT

FCMAT’s primary mission is to assist California’s local TK-14 educational agencies to identify, prevent, and

resolve financial, human resources and data management challenges. FCMAT provides fiscal and data

management assistance, professional development training, product development and other related school

business and data services. FCMAT’s fiscal and management assistance services are used not just to help

avert fiscal crisis, but to promote sound financial practices, support the training and development of chief

business ocials and help to create ecient organizational operations. FCMAT’s data management ser-

vices are used to help local educational agencies (LEAs) meet state reporting responsibilities, improve data

quality, and inform instructional program decisions.

FCMAT may be requested to provide fiscal crisis or management assistance by a school district, charter

school, community college, county oce of education, the state superintendent of public instruction, or the

Legislature.

When a request or assignment is received, FCMAT assembles a study team that works closely with the LEA

to define the scope of work, conduct on-site fieldwork and provide a written report with findings and

recommendations to help resolve issues, overcome challenges and plan for the future.

FCMAT has continued to make adjustments in the types of support provided based on the changing

dynamics of TK-14 LEAs and the implementation of major educational reforms. FCMAT also develops and

provides numerous publications, software tools, workshops and professional learning opportunities to

help LEAs operate more eectively and fulfill their fiscal oversight and data management responsibilities.

The California School Information Services (CSIS) division of FCMAT assists the California Department

of Education with the implementation of the California Longitudinal Pupil Achievement Data System

(CALPADS). CSIS also hosts and maintains the Ed-Data website (www.ed-data.org) and provides technical

expertise to the Ed-Data partnership: the California Department of Education, EdSource and FCMAT.

FCMAT was created by Assembly Bill (AB) 1200 in 1992 to assist LEAs to meet and sustain their financial

obligations. AB 107 in 1997 charged FCMAT with responsibility for CSIS and its statewide data management

work. AB 1115 in 1999 codified CSIS’ mission.

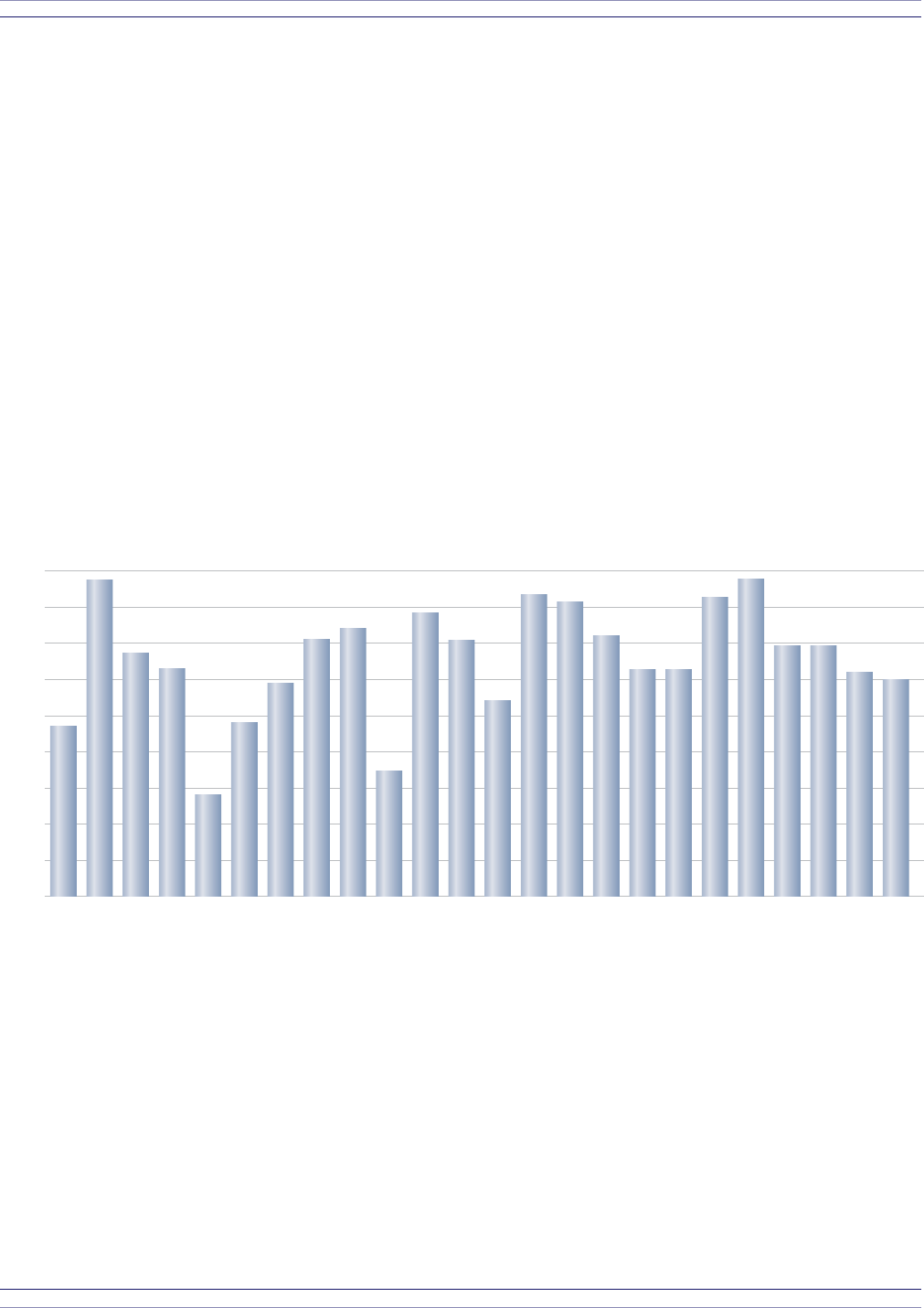

90

80

70

60

50

40

30

20

10

0

Number of Studies

98/99 99/00 00/01 01/02 02/03 03/04 04/05 05/06 06/07 07/08 08/09 09/10 10/11 11/12 12/13 13/14 14/15 15/16 16/17 17/18 18/19 19/20 20/21 21/22

Studies by Fiscal Year

Fiscal Crisis and Management Assistance Team Central Unified School District iii

A FCMAT

AB 1200 is also a statewide plan for county oces of education and school districts to work together locally

to improve fiscal procedures and accountability standards. AB 2756 (2004) provides specific responsibili-

ties to FCMAT with regard to districts that have received emergency state loans.

In January 2006, Senate Bill 430 (charter schools) and AB 1366 (community colleges) became law and

expanded FCMAT’s services to those types of LEAs.

On September 17, 2018 AB 1840 was signed into law. This legislation changed how fiscally insolvent dis-

tricts are administered once an emergency appropriation has been made, shifting the former state-centric

system to be more consistent with the principles of local control, and providing new responsibilities to

FCMAT associated with the process.

Since 1992, FCMAT has been engaged to perform more than 1,400 reviews for LEAs, including school

districts, county oces of education, charter schools and community colleges. The Kern County

Superintendent of Schools is the administrative agent for FCMAT. The team is led by Michael H. Fine, Chief

Executive Ocer, with funding derived through appropriations in the state budget and a modest fee sched-

ule for charges to requesting agencies.

Fiscal Crisis and Management Assistance Team Central Unified School District iv

A FCMAT

Introduction

Background

Located in Fresno County, the Central Unified School District has a seven-member governing board

and serves preschool through adult students at 14 elementary schools, three middle schools, three high

schools, three alternative educational programs and one adult school. According to data from the California

Department of Education (CDE), the district’s student enrollment increased steadily over the last two

decades; total transitional kindergarten through grade 12 (TK-12) enrollment peaked at 15,893 in 2017-18

and has remained flat or declined slightly to 15,742 in 2022-23. As of the 2022-23 first principal apportion-

ment certification (the latest data available), the district’s unduplicated count of English learner, socioeco-

nomically disadvantaged and foster youth students was 81.3% of enrollment.

Study and Report Guidelines

In October 2022, the Central Unified School District and the Fiscal Crisis and Management Assistance

Team (FCMAT) entered into an agreement for FCMAT to conduct a review of the district’s Fiscal Services

and Human Resources departments.

FCMAT visited the district in person on December 5-7, and 14 and virtually on December 12, 2022 to con-

duct interviews with district and school site sta, collect data and review documents. Following fieldwork,

FCMAT continued to review and analyze documents. This report is the result of those activities.

FCMAT’s reports focus on systems and processes that may need improvement. Those that may be func-

tioning well are generally not commented on in FCMAT’s reports. In writing its reports, FCMAT uses the

Associated Press Stylebook, a comprehensive guide to usage and accepted style that emphasizes con-

ciseness and clarity. In addition, this guide emphasizes plain language, discourages the use of jargon and

capitalizes relatively few terms.

Study Team

The study team was composed of the following members:

Erin Lillibridge, CFE Diane Branham

FCMAT Intervention Specialist FCMAT Chief Analyst

Rita Sierra Beyers John Lotze

FCMAT Consultant FCMAT Technical Writer

Each team member reviewed the draft report to confirm accuracy and achieve consensus on the final

recommendations.

Fiscal Crisis and Management Assistance Team Central Unified School District v

I

Executive Summary

Over the last two decades, the district has experienced significant growth due to rapid development in the

communities it serves. To meet its organizational needs, the district’s stang and operational procedures,

particularly those in the Fiscal Services and Human Resources departments, need to be adjusted in align-

ment with its enrollment.

School districts should be staed according to the basic theories of organizational structure and the stan-

dards used by other local educational agencies (LEAs) of similar size and type. A review of comparable

LEAs and interviews with sta indicate that the Fiscal Services and Human Resources departments are

understaed by up to 4.0 and 3.0 full-time equivalent (FTE) positions, respectively. It may be beneficial to

assign some tasks performed by human resources and fiscal services to other departments. Additionally,

some fiscal services and human resources positions provide services that are performed by dierent posi-

tions in other districts.

The division of labor among some sta members may not be equitable, and some duties may need to be

reassigned. The district would benefit from a desk audit in which sta complete a one-month time analy-

sis of daily job duties. The district is planning to complete a job classification study. The information from

this report, desk audit and/or job classification study should provide the district with the data necessary

to address stang needs and improve workload eciencies. Training should be provided when duties are

transferred between departments or employees.

A review of fiscal services’ processes and procedures indicates the following areas could benefit from

additional support: risk management, purchasing, associated student bodies (ASBs), attendance, position

control, and budgeting. Human resources could improve eciencies by reclassifying some of its positions,

restructuring its chain of command, and adding at least 1.0 FTE position. In addition, it may benefit the

district to consider reassigning certain duties, such as Aordable Care Act compliance and budget account

coding, from human resources to fiscal services.

Organizational charts are important graphical representations of the roles, responsibilities, and relation-

ships between positions within a district; they identify the chain of command and the functional areas for

which each sta member is responsible. The district needs to update its organizational charts to include all

positions, the correct title for each position, accurate lines of authority, and the governing board’s approval

date. It also needs to review, revise and update its job descriptions at least annually to ensure their

accuracy.

Internal controls are the foundation of sound fiscal management; they ensure ecient operations, reli-

able financial information and legal compliance. Internal controls also protect the district from material

weaknesses, serious errors and fraud. The district needs to implement several changes to its purchasing,

accounts payable, accounts receivable, payroll, position control and human resources processes, as dis-

cussed in this report, to improve its internal controls. It must also ensure it has accurate written policies and

procedures for key functional areas, as well as desk manuals that include step-by-step procedures for each

job duty.

The district uses multiple software systems to support its fiscal and human resources functions. The Fresno

County Oce of Education manages and supports Everest, the district’s primary system of record for all

financial and personnel data, including purchasing, payroll, accounting and budgeting. The district uses

Digital Schools, an independent, third-party software system, for its position control system. To be eec-

tive, the position control system must be integrated with other financial modules, such as budget and pay-

roll. Because these functions do not integrate automatically, the district needs to establish procedures to

manually reconcile position control to budget and payroll. Position control functions must also be separated

Fiscal Crisis and Management Assistance Team Central Unified School District 1

E S

to improve internal controls; such internal controls ensure that only board-authorized positions are entered

in the systems, that human resources hires only for authorized positions, and that payroll pays only employ-

ees in authorized positions.

School district budgets change throughout the year as new information becomes available. The district

should develop comprehensive budget development and monitoring procedures including a budget cal-

endar and processes for the following: input from the executive cabinet, schools and department leaders;

position control updates; sta assignments for categorical program monitoring, and coordination and

preparation of multiyear financial planning by resource code (the funding source). Enrollment and atten-

dance projections need to be based on historical trends, while stang projections need to be based

on board-approved ratios. Funds must be used according to board-approved expenditure plans, with

restricted funds expended before unrestricted funds. The district needs to revise its chart of accounts to

facilitate the use of these best practices.

If there is insucient time to process payments through the accounts payable or payroll processes (e.g.,

when an employee has not been paid or has been paid incorrectly), the district can use revolving cash

funds to make immediate payments. The district needs to revise its board policies to establish a standard

revolving cash fund and increase it to the maximum amount allowed per Education Code (EC) 42800.

The district has established core values and beliefs to guide its operations according to its mission and

goals; district leaders should ensure they model these guiding principles and that all sta uphold them.

The Fiscal Services and Human Resources departments need to establish regular sta meetings for their

departments, as well as continue to meet monthly together to strengthen procedures related to payroll,

budget and position control. The payroll and human resources sta may also benefit from establishing

regular meetings to review and resolve common issues that lead to payroll errors. The directors of both

departments need to be held accountable for establishing and managing these meetings to ensure their

productivity, and they should include other departments, such as educational services, when necessary.

Eective collaboration is challenging for the Fiscal Services and Human Resources departments, in part

because their oces are located on two dierent sites. Consequently, most communication occurs via

email or telephone. The district needs to establish a standard of one business day for responses to email

and telephone inquiries, and hold employees accountable for following it. In addition, the district should

continue its plans to relocate the fiscal services sta to its main district oce, where the human resources

oce is also located, to improve collaboration between the two departments.

To improve the eciency of its hiring practices, the district should allow new hires to begin working once

appropriately cleared, and revise the hiring process to have the governing board routinely ratify candidates

for hire. Human resources should develop a new way to organize requests for positions and track key steps

in the recruitment and selection process, to improve communication with hiring managers and increase

eciencies. Finally, the district should establish a districtwide process for entering employee absences,

and enforce procedures and deadlines to ensure payroll overpayments are minimized. The district uses

Digital Management Systems (DMS) and SmartFind to record and/or track employee leaves and absences.

Because these systems do not interface with one another, the district should reconcile the information in

these systems routinely to ensure the accuracy of its data, reduce payroll errors, and support the overall

eectiveness of the departments’ work.

Fiscal Crisis and Management Assistance Team Central Unified School District 2

E S

Findings and Recommendations

Organizational Structure and Stang

Organizational structure establishes the framework an institution, such as a school district, uses to define

leadership roles and delegate specific duties and responsibilities to all sta members. It is normal and best

practice for district leaders to manage this structure to maximize resources and achieve identified goals,

and to adapt it as needed as a district’s enrollment increases or declines.

The purpose of organizational structure is to help management make key decisions to facilitate student

learning while balancing stang and financial resources. An eective organizational design outlines the

management process and its specific links to the district’s formal system of communication, authority and

responsibility. Authority in a public school district originates with the elected governing board, which hires

a superintendent to oversee the organization. Through the superintendent, authority and responsibility are

delegated to the district’s administration and sta.

A district should be staed and structured according to generally accepted theories of organizational

structure and the standards used in public school agencies of comparable size and type. As discussed in

Principles of School Business Management, by Craig R. Wood, David C. Thompson, and Lawrence O. Picus,

the most common of these theories are span of control, chain of command, and line and sta authority.

Span of Control

Span of control refers to the number of subordinates who report directly to a supervisor. Although there is

no agreed upon ideal number of subordinates for span of control, the span can be larger at lower levels of

an organization than at higher levels because subordinates at lower levels typically perform routine duties

that are easier to supervise.

Chain of Command

Chain of command refers to the flow of authority in an organization. Chain of command is characterized by

two significant principles: unity of command, in which a subordinate is accountable to only one supervisor,

thus eliminating the potential for conflicting direction from multiple supervisors; and the scalar principle,

in which authority and responsibility should flow in a direct vertical line from top management to the lower

levels. The result is a hierarchical division of labor.

Line and Sta Authority

School district organizational structure has both line and sta authority. Line authority is the relationship

between supervisors and subordinates and refers to the direct line in the chain of command. For example,

in the Central Unified School District, the superintendent has direct line authority over the assistant super-

intendent/human resources, and the assistant superintendent has direct line authority over the director of

human resources. In contrast, sta authority is advisory in nature. Sta personnel do not have the authority

to make and implement decisions, but act in support of supervisors who have line authority.

Management positions are responsible for supervising employees and the work of their respective depart-

ments. They must ensure sta members understand all district policies and procedures and perform

duties in a timely and accurate manner. A manager also serves as the liaison between their department

Fiscal Crisis and Management Assistance Team Central Unified School District 3

F R

Organizational Structure and Stang

and others to identify and resolve problems and design and modify processes and procedures as needed.

Management positions are typically not responsible for routine daily functions; these activities are best

assigned to department sta.

District Organizational Charts

Organizational charts are useful graphic representations of the roles, responsibilities, and relationships

between positions within an organization and can depict the structure of an organization as a whole or

broken down by departments or units. Organizational charts typically delineate the organization’s chain of

command. A chain of command benefits an organization by increasing eciency, supporting all employees,

simplifying delegation, creating and clarifying accountability, and standardizing communication.

The district’s organizational chart dated September 2022 shows the assistant superintendent/human

resources oversees the director of human resources, who has direct line authority over the supervisor of

student support services, who has direct line authority over the director of athletics. However, information

collected during fieldwork and the human resources organizational chart indicated the assistant superinten-

dent/human resources supervises all three positions, as well as the student information systems manager.

The district also provided FCMAT with organizational charts for the Fiscal Services and Human Resources

departments. These documents are not dated, and some information is missing or incorrect. For example,

the fiscal services organizational chart does not include the executive secretary II position, and the title

for the senior accounting manager is incorrect; the human resources organizational chart does not include

accurate reporting lines for most positions.

In interviews, district sta, particularly those in human resources, could not clearly articulate who their

direct supervisors were. They frequently knew who had completed their latest evaluations but that was not

always the person they identified as their supervisor. Others stated one person was their direct supervi-

sor, a dierent person supervised their day-to-day work, and a third person completed their evaluation. In

addition, the information provided by interviewees on supervision did not align with that contained in the

organizational chart or job descriptions.

The lack of alignment between the district’s organizational charts and chain of command results in an

informal structure that diers from the formal structure; this dierence has led to workflow ineciencies

and confusion regarding employee supervision. An organizational chart is important because it shows the

structure and the relationship of all positions to one another. This document is also necessary to identify

the chain of command and the functional areas for which each sta member is responsible. For clarity and

consistency, position titles on organizational charts should match those on approved job descriptions; and

all charts should be dated and revised as often as needed to ensure their accuracy.

Job Descriptions

Job descriptions should be updated regularly to reflect the changing requirements of each position. The

Society for Human Resource Management recommends updating job descriptions annually or when there

is a meaningful change in job responsibilities.

The district provided FCMAT with job descriptions for positions in the Fiscal Services and Human

Resources departments. Most of the documents are more than eight years old; for example, all fiscal ser-

vices job descriptions (except for the purchasing/fiscal analyst) are dated prior to August 2013. Some job

descriptions are undated, so it is unclear when they were developed or updated (e.g., human resources

coordinator, COVID-19 response technician, and secretary-receptionist district oce). The best practice is

Fiscal Crisis and Management Assistance Team Central Unified School District 4

F R

Organizational Structure and Stang

for human resources to include on the job description the date developed and the last date reviewed and/

or revised, and to review job descriptions annually and present them to the governing board for approval if

changes are needed.

The district’s job descriptions are insucient to establish key areas of authority and responsibility between

the two departments and positions; they also contain some inaccuracies. For example, the district has

a generic account clerk III job description for five positions in fiscal services covering accounts payable,

accounts receivable and purchasing functions. While general responsibilities may have been sucient in

prior years, the district’s growth in size and stang necessitates increased specificity in job descriptions,

which could require changes to job classifications. In many cases, the job description duties and/or position

title do not match the current employee’s responsibilities (e.g., human resources benefit technician); and in

one case, the job description title did not match the organizational chart or the salary schedule (i.e., human

resources specialist/oce manager). Finally, as discussed in the previous section, the job descriptions,

especially in human resources, often do not accurately state the position’s direct supervisor.

Current job descriptions that accurately describe position responsibilities are crucial to 1) develop job post-

ings and support recruiting; 2) support wage and hour classifications; 3) manage employee performance;

4) respond to Americans with Disabilities Act accommodations; and 5) respond to workers’ compensation

and light duty accommodations. In collaboration with other department managers, the Human Resources

Department is responsible for ensuring that job descriptions are accurate, and that job classifications are

adequate to support the district’s operational needs.

Job Classifications and Functional Duties

Over the last two decades, the district has experienced significant growth due to rapid development in the

communities it serves. Several interviewees stated that, in their opinion, the district oce has not grown

with the school sites but instead has maintained its small district practices, which no longer serve it well.

Support services, such as those provided by the Fiscal Services and Human Resources departments, have

not strategically made the necessary changes to stang and systems to adequately meet the needs of the

district’s current size.

Observations indicated that the division of labor among some support sta members may not be equita-

ble and that some duties may need to be reallocated. To get a better understanding of the amount of time

required for the tasks assigned to each position, the district should consider assigning the sta members

in each department to complete a one-month time analysis of daily job duties. This often is referred to as a

desk audit and can be completed in a few minutes at the end of each day during which sta members write

down the tasks worked on that day and the time spent on each major responsibility. This provides a method

for analyzing workloads, eciency of tasks, and prioritization, as necessary. Once desk audits are complete

and analyzed, sta should be provided with a clear designation of duties and responsibilities.

Interviews with sta revealed that some tasks may be more appropriately accomplished by others,

and some positions provide services that are performed by a dierent position in many district oces.

Following are some examples, and others are discussed elsewhere in this report:

•

Student support services – is overseen by human resources but is commonly overseen by

educational services.

•

Processing requests for student transcripts and records – is done by fiscal services but is

commonly done by educational services.

Fiscal Crisis and Management Assistance Team Central Unified School District 5

F R

Organizational Structure and Stang

•

Purchase orders – are signed by the assistant superintendent/chief business ocer (CBO)

but more commonly signed by the purchasing manager or director of fiscal services.

•

Placing orders with vendors – is done by schools and departments, but such purchasing

duties are commonly centralized in the Purchasing Department.

•

Receptionist duties – are performed by an accounts payable position but are commonly

performed by a district oce receptionist or department secretary. This issue may be

resolved when the fiscal services oce is moved to the district oce location.

Duties may be reassigned because they do not match a position’s responsibilities, the division of labor is

disproportionate, or stronger internal controls are needed. Redistributing duties among sta will help share

workloads and allow for cross-training to provide better customer service.

During interviews, FCMAT learned the district is considering a job classification study. Such a study typi-

cally involves a desk audit as described above. Once job duties are determined by the study and/or desk

audit, the district should reassign duties and update job classifications and descriptions as needed.

Government Code Section 3513 is part of the Rodda Act that governs collective bargaining in education.

Management and confidential employees are prohibited by the Rodda Act from being members of any

bargaining unit. Government Code Section 3513 (e) defines management positions as having significant

responsibilities for formulating district policies or administering district programs. Government Code

Section 3513 (f) defines a confidential employee as “any employee who is required to develop or present

management positions with respect to employer-employee relations or whose duties normally require

access to confidential information contributing significantly to the development of management positions.”

Based on sta interviews and job descriptions, the following confidential sta in the Fiscal Services and

Human Resources departments are not involved in the collective bargaining process, and therefore the

positions do not appear to meet the Government Code definition for confidential employees: administrative

secretary I, purchasing/fiscal analyst, COVID-19 response technician, human resources benefit technician,

payroll specialist, and benefits specialist. Additionally, the human resources coordinator is classified as a

management position, but does not appear to manage any employees or have responsibilities consistent

with the Government Code’s definition of a “managerial employee.”

Districts commonly make the mistake of assuming that a position is confidential because it has access to

information that the public cannot or should not see, such as some portions of personnel files. However, to

meet the legal definition of confidential employee, the position needs to be involved in employer-employee

relations as indicated in the Government Code. Examples of confidential support to negotiations include

taking or maintaining notes in bargaining sessions or strategy sessions, assisting in costing out proposals,

or typing and maintaining drafts of bargaining positions.

Stang Comparison

Data for a comparison of the Fiscal Services and Human Resources departments’ stang was obtained

from five California unified school districts: four with student enrollments similar to that of Central and one,

which was the closest in size to Central, taken from the list of districts that Central uses for other compari-

son purposes. The comparison districts surveyed were Alhambra, Norwalk-La Mirada, Tracy, Ventura, and

Sanger unified school districts.

Although comparative information is useful, it should not be considered the only measure of appropriate

stang levels. School districts are complex and vary widely in demographics and resources. Careful evalu-

ation is recommended because generalizations can be misleading if unique circumstances are not consid-

Fiscal Crisis and Management Assistance Team Central Unified School District 6

F R

Organizational Structure and Stang

ered. FCMAT considered district type, student enrollment, unduplicated pupil percentage, and general fund

revenues per student in choosing the comparison districts. Data for the following comparison was taken

from the Education Data Partnership (Ed-Data) website, and department stang information was obtained

directly from the comparison districts.

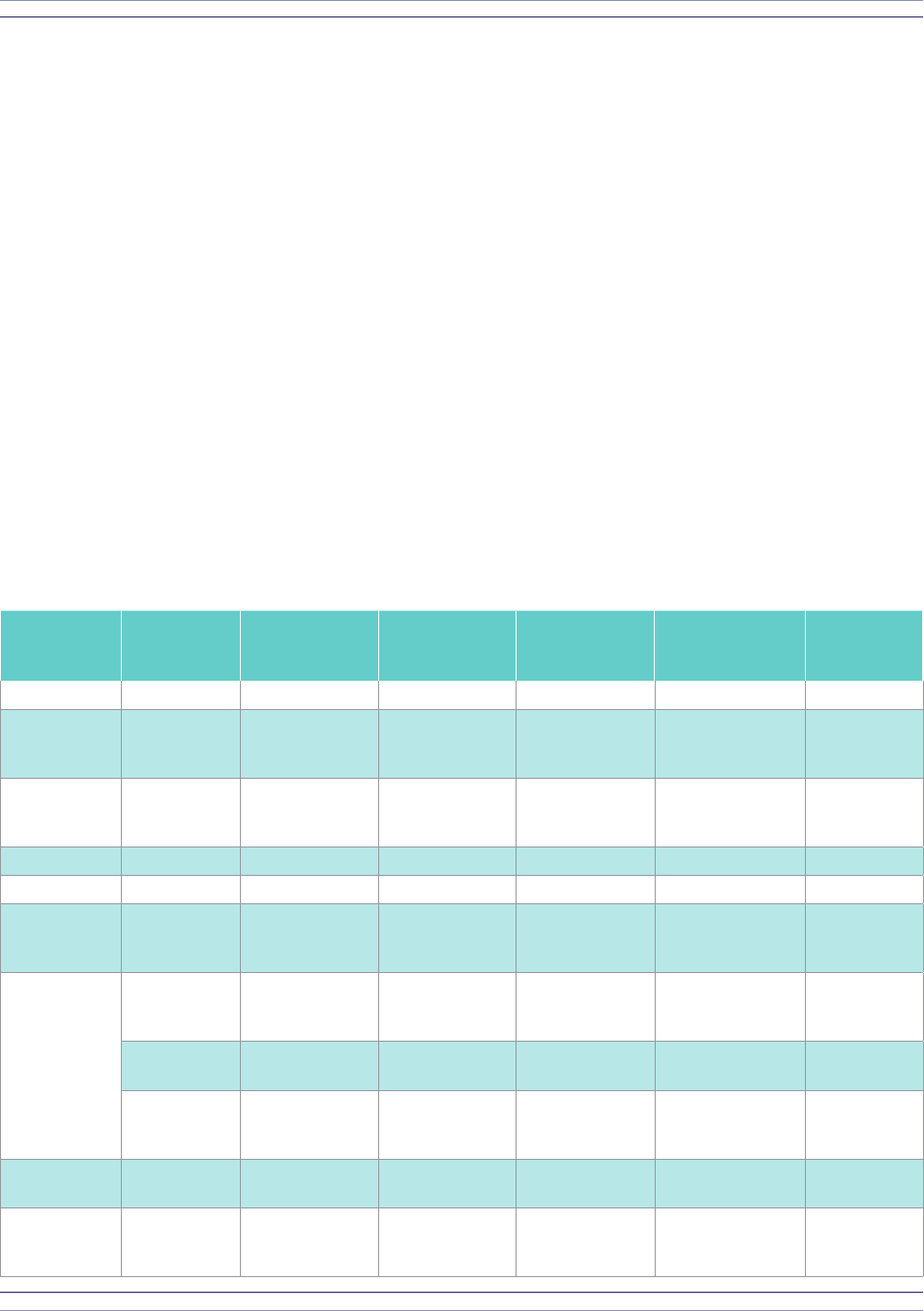

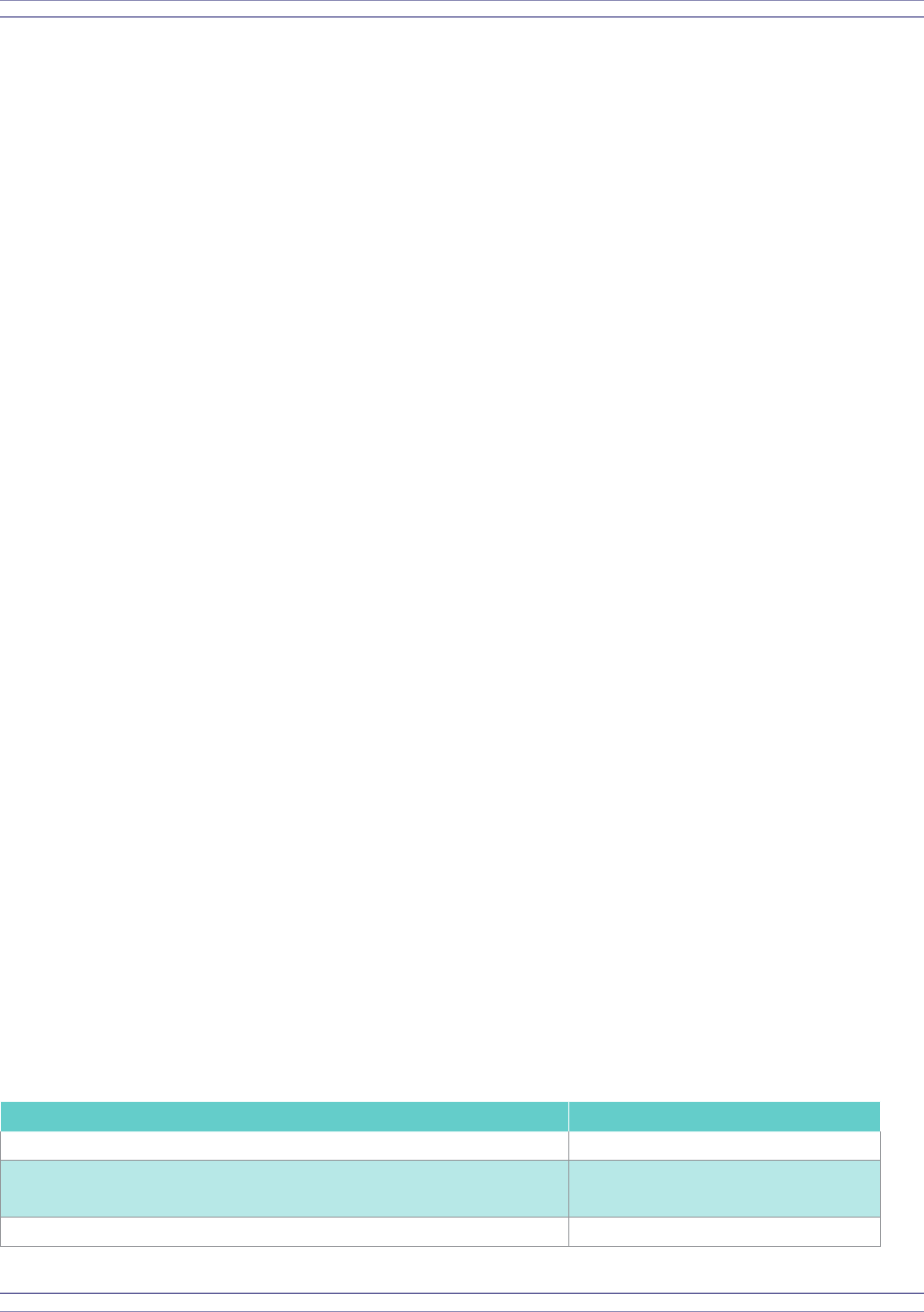

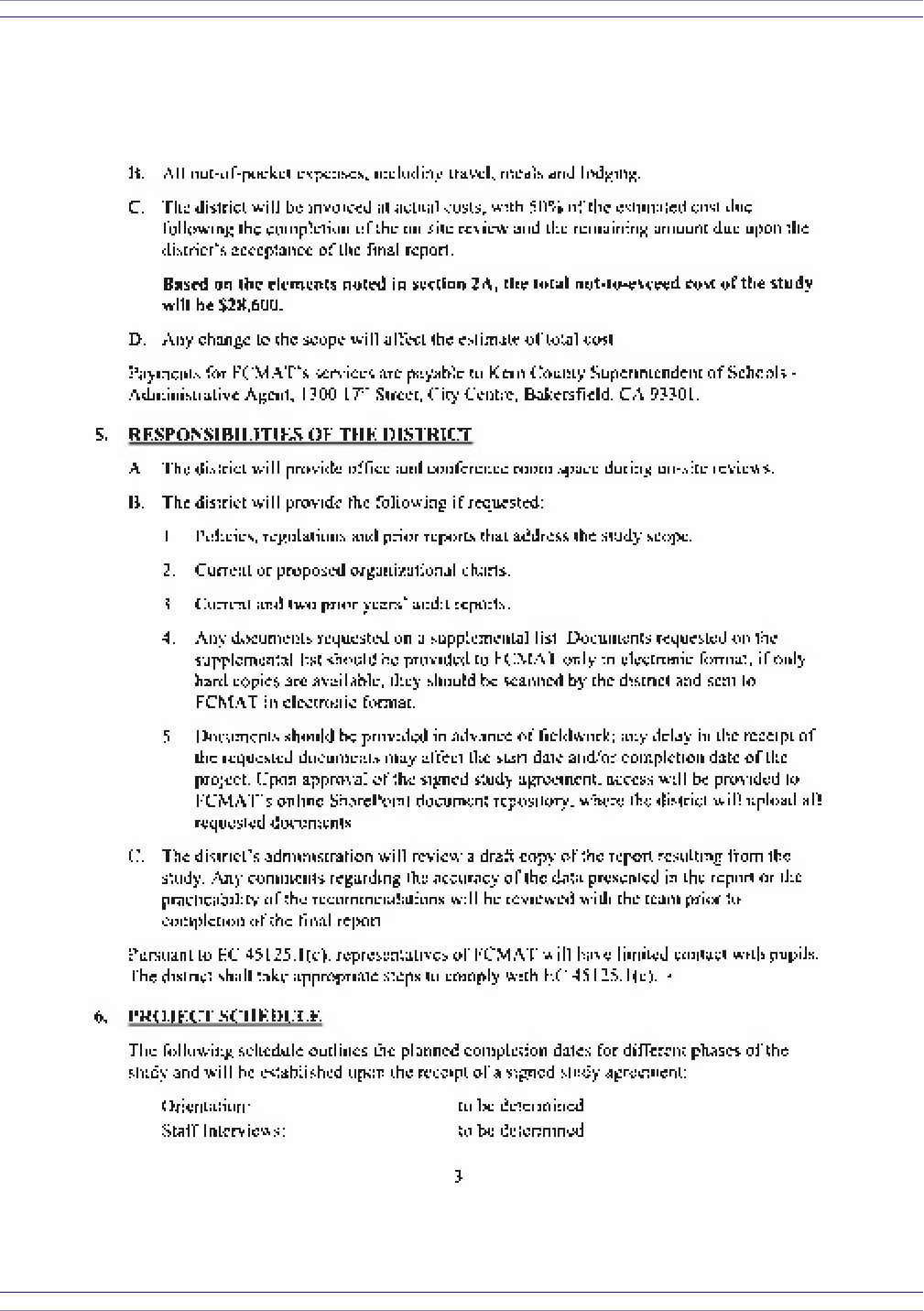

The data in the table below indicates that the five comparison districts have an average of 22.0 FTE in their

fiscal services or equivalent departments, and an average of 12.0 FTE in their human resources or equiva-

lent departments. By contrast, Central Unified has 18.0 FTE and 9.2 FTE in those departments, respectively,

which means it is understaed by approximately 4.0 FTE in fiscal services and approximately 3.0 FTE in

human resources.

Based on the information in this report, a completed desk audit and/or job classification study, the district

needs to consider increasing its Fiscal Services and Human Resources departments’ sta and/or centraliz-

ing and reassigning duties.

As discussed elsewhere in this report, the district uses the Everest financial software system, the Digital

Schools software system and various other software programs for some fiscal services and human

resources functions. In many instances, this creates a duplication of work. Interviews indicated that the use

of multiple systems requires more sta time to process transactions including those for budget, position

control, and payroll. This merits further analysis and inclusion in the district’s decision when determining

stang needs.

Comparison of Fiscal Services and Human Resources Stafng in Selected California Unied School

Districts

District

(County)

Central

(Fresno)

Alhambra

(Los Angeles)

Norwalk-La

Mirada

(Los Angeles)

Tracy

(San Joaquin)

Ventura

(Ventura)

Sanger

(Fresno)

Enrollment* 15,729 15,262 15,582 15,398 15,359 13,087

Unduplicated

Pupil

Percentage* 64.57% 63.01% 67. 9 0% 52.24% 56.55% 63.91%

General Fund

Revenues Per

Student** $14,923 $14,973 $15,434 $13,249 $14,070 $15,556

Employees 1,884 1,851 2,282 1,635 1,804 1,460

Chief Business

Ofcial (CBO)

Assistant

Superintendent/

CBO

Assistant

Superintendent,

Business Svcs

Assistant

Superintendent,

Business Svcs

Associate

Superintendent,

Business Svcs

Assistant

Superintendent,

Business/Finance

Chief Financial

Ofcer (CFO)

Fiscal Services

Support Staff

(includes

accounting,

budget, payroll,

purchasing

and risk

management)

Executive

Secretary II

Condential

Administrative

Secretary

Administrative

Assistant

Administrative

Secretary Executive Assistant

Executive

Assistant (0.1)

Director, Fiscal

Services

Director, Fiscal

Services

Director, Fiscal

Services

Director, Financial

Services

Director, Fiscal

Services

Accounting

Supervisor (2.0)

Fiscal Analyst

Administrative

Secretary, Fiscal

Services

Fiscal Control

Technician/

Secretary Budget Analyst Fiscal Specialist

Accounting

Specialist

Senior

Administrative

Secretary I Accountant (3.0)

Sr. Budget Advisor/

Analyst Budget Technician Senior Accountant

Accounting

Specialist (3.0)

Senior

Accounting

Manager

Account Clerk

Technician (5.0) Financial Analyst Payroll Specialist Accountant (3.0)

Payroll

Supervisor

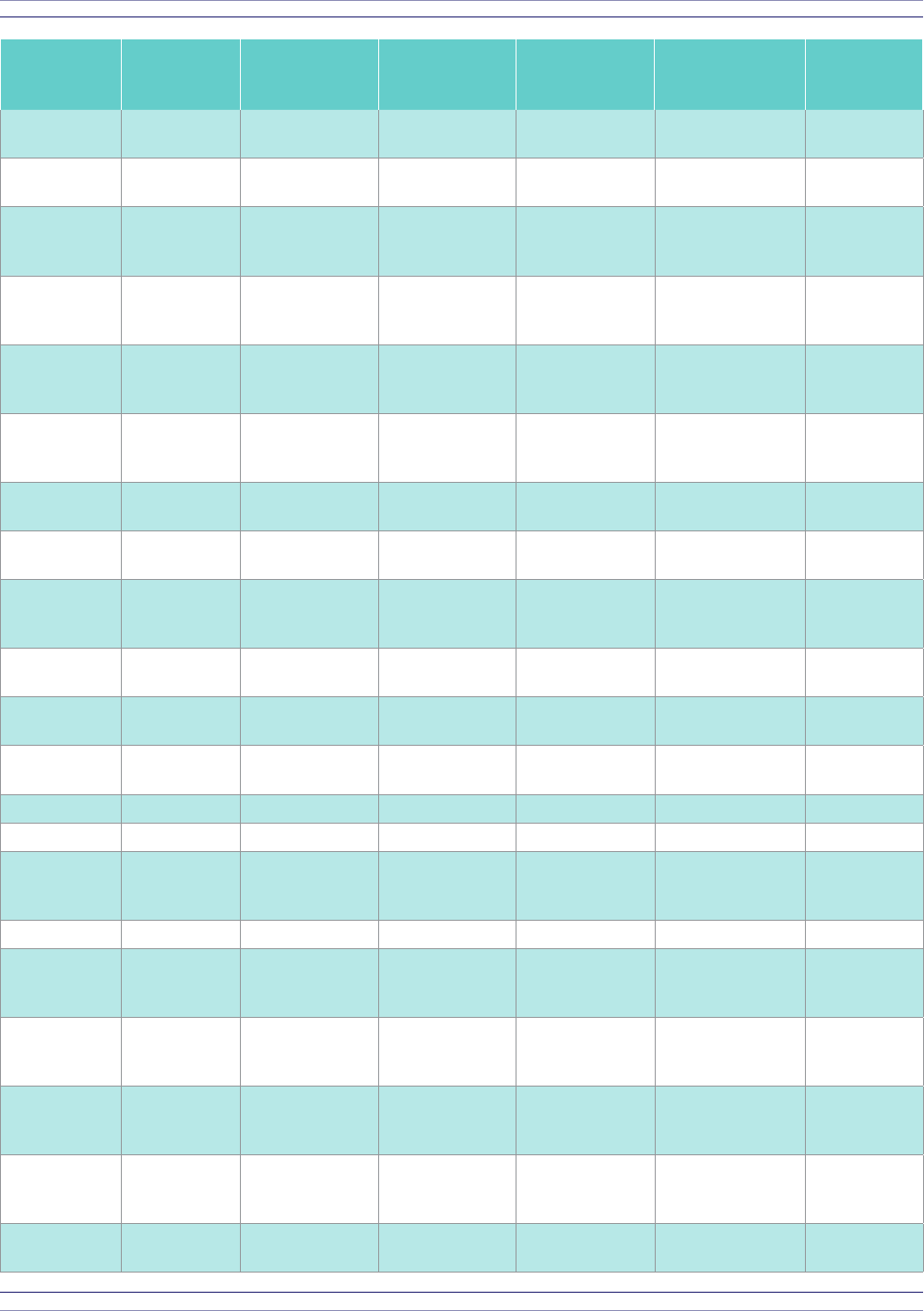

Fiscal Crisis and Management Assistance Team Central Unified School District 7

F R

Organizational Structure and Stang

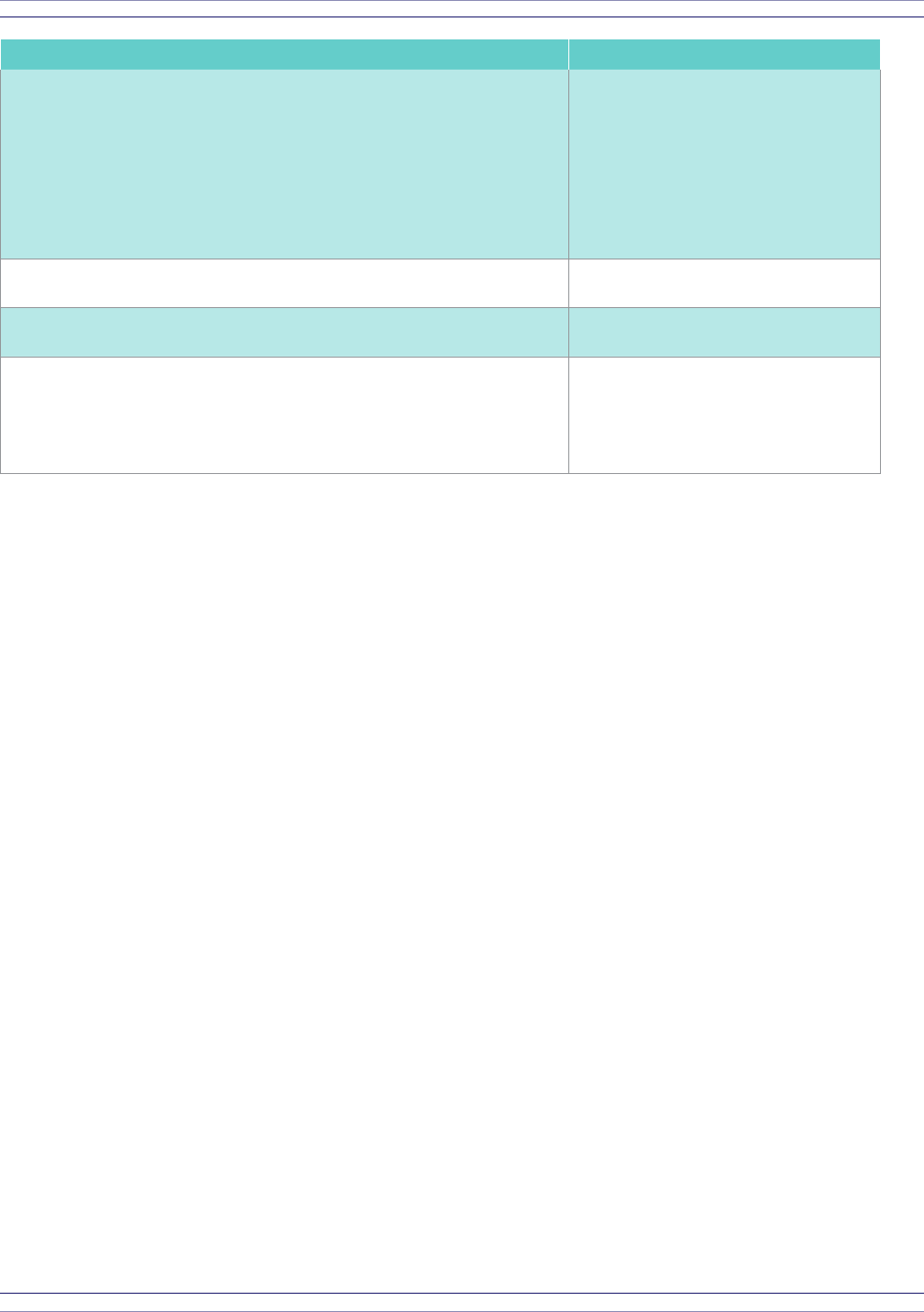

District

(County)

Central

(Fresno)

Alhambra

(Los Angeles)

Norwalk-La

Mirada

(Los Angeles)

Tracy

(San Joaquin)

Ventura

(Ventura)

Sanger

(Fresno)

Payroll

Specialist (3.0)

Project Technician

- Construction

Lead Accounting

Technician (2.0)

Coordinator,

Financial Services

Accounting

Supervisor

Payroll

Technician (3.0)

Benets

Specialist Payroll Manager

Account Clerk

Senior (4.0)

Accounting

Supervisor

Fiscal Technician I

(3.0) Ofce Assistant

Budgets

and Finance

Manager

Payroll Technician

(3.0) Payroll Supervisor Account Clerk (4.0)

Fiscal Technician II

(4.0)

Purchasing

Agent

Accounts

Payable III (3.0)

Purchasing

Manager

Lead Payroll/

Retirement

Technician

Payroll Technician

(5.0)

Purchasing

Supervisor

Purchasing

Technician

Account Clerk

III (2.0) Senior Buyer (2.0)

Payroll Clerk III

(3.0)

Director, School

Business/

Purchasing

Purchasing

Specialist

Fixed Assets

Technician

Purchasing/

Warehouse

Manager Buyer

Director,

Purchasing/

Warehouse

Purchasing

Technician

Director, Risk

Management

Director,

Support Svcs -

Risk Mgt

Purchasing/

Fiscal Analyst

Administrative

Clerk I

Purchasing Clerk

III (2.0)

Risk Management

Specialist

Ofce

Technician

Administrative

Clerk II Purchasing Clerk II

Director I, Risk

Management

Director,

Risk/Safety

Management

Administrative

Clerk II Secretary

Administrative

Clerk I

Benets

Technician (2.0)

Employee Benets

Specialist

Medi-Cal Account

Clerk

Claims Coordinator

Total

Business Ofce

Staff 18.0 FTE 28.0 FTE 26.0 FTE 19.0 FTE 20.0 FTE 17.10 FTE

Human

Resources

Administrator

Assistant

Superintendent,

HR

Assistant

Superintendent,

HR

Assistant

Superintendent,

HR

Associate

Superintendent,

HR

Assistant

Superintendent, HR

Assistant

Superintendent,

HR

Human

Resources

Support Staff

Executive

Secretary

HR Administrative

Secretary (2.0)

Administrative

Secretary II Secretary Executive Assistant

Program

Administrator

Director, HR Director, HR Director, HR

Director, HR

and Employee

Relations

HR Manager,

Certicated HR Supervisor

HR Specialist HR Analyst HR Coordinator HR Coordinator

Director, Classied

HR

Director,

Classied HR

(.8)

HR Coordinator

(2.0) HR Analyst II Credential Analyst Clerk HR Supervisor

HR Specialist

(2.0)

Fiscal Crisis and Management Assistance Team Central Unified School District 8

F R

Organizational Structure and Stang

District

(County)

Central

(Fresno)

Alhambra

(Los Angeles)

Norwalk-La

Mirada

(Los Angeles)

Tracy

(San Joaquin)

Ventura

(Ventura)

Sanger

(Fresno)

HR Benets

Technician

HR Technician

(4.0) HR Analyst (2.0) Credentials Analyst HR Analyst

HR Technician

(2.0)

Administrative

Secretary (2.0) HR Specialist (7.0)

Workers' Comp/

Safety Technician HR Specialist (5.0)

HR Ofce

Assistant (1.75)

Secretary-

Receptionist (.2)

LiveScan

Technician HR Technician

Personnel

Technician (5.0)

Talent Acquisition

Specialist

Total Human

Resources Staff 9.2 FTE 10.0 FTE 14.0 FTE 13.0 FTE 13.0 FTE 9.55 FTE

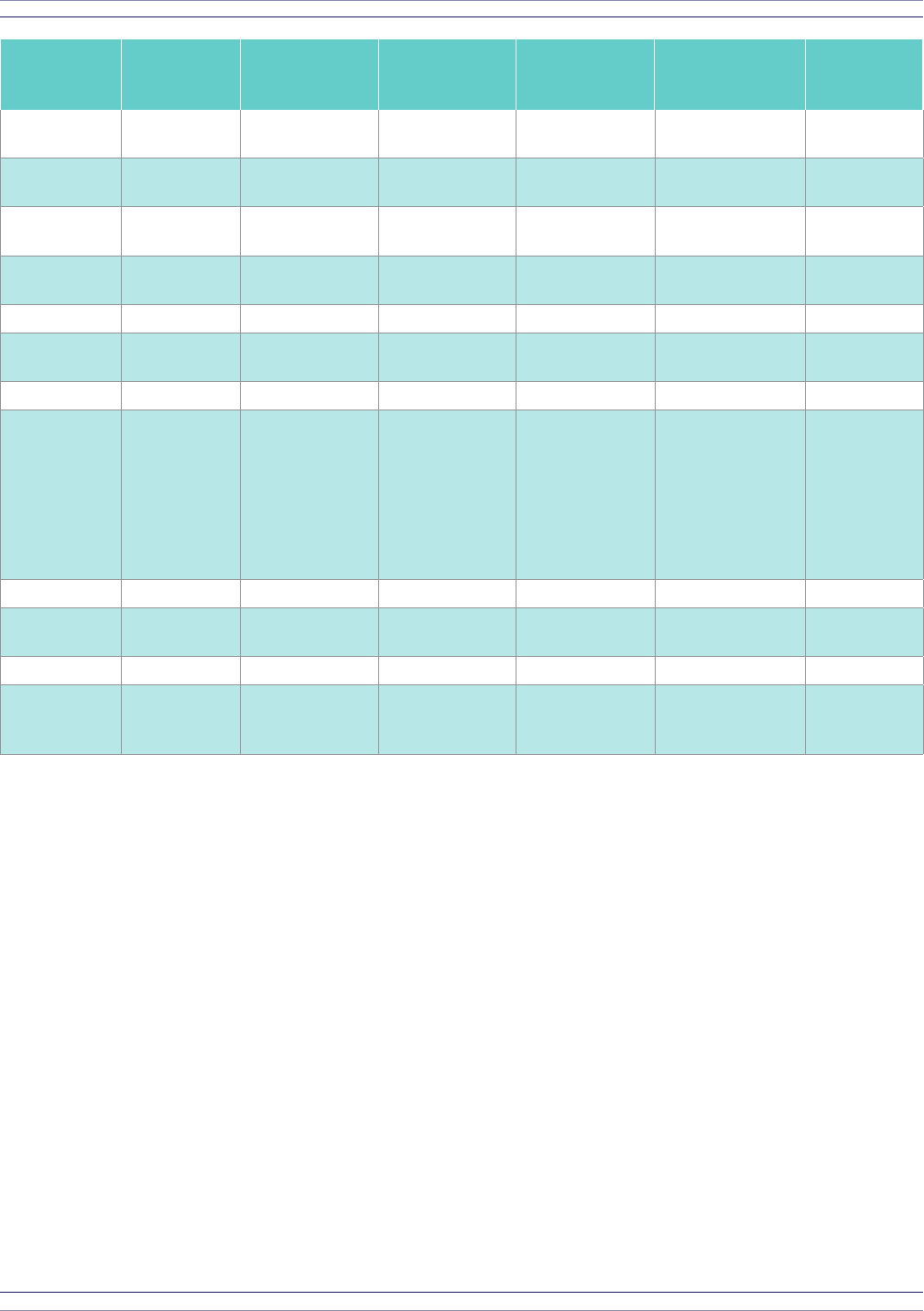

District

Receptionist

HR Department

oversees

Position

includes some

HR duties

(.2 FTE is

included above

in HR staff)

District has a

security desk

rather than a

receptionist

HR Department

oversees

Position does not

include HR duties

Superintendent

oversees

HR Department

oversees

Position does not

include HR duties

Deputy

superintendent

oversees

Assists

departments as

time allows

Reprographics

Fiscal Services

oversees

No reprographics

department

Educational

Services oversees

No reprographics

department

Fiscal Services

oversees

Purchasing

oversees

Warehouse

Fiscal Services

oversees

Purchasing

oversees

Purchasing/

Warehouse

oversees

Purchasing

oversees

Fiscal Services

oversees

Purchasing

oversees

Alhambra - educational services oversees Technology Department, site athletic directors, and CALPADS; educational services completes and

CBO reviews state student attendance reports; superintendent oversees student support services; student support services oversees requests

for student transcripts/records; financial system - BEST; purchase orders are signed by the purchasing manager; Purchasing Department places

orders with vendors; HR Department completes employment verifications and obtains substitutes for teacher positions not filled by the online

system and for campus supervisor and clerical positions; district is self-insured for health/welfare, workers’ comp; passed GO bond and has large

construction projects; has not authorized any charter schools.

Norwalk-La Mirada - fiscally accountable district; superintendent oversees technology services; educational services oversees instructional

technology, student & family services, athletic director, and requests for student transcripts/records; fiscal services completes state student

attendance reports, and instructional technology oversees CALPADS; CBO oversees School Safety Department; financial system - QCC; pur-

chase orders are signed by the director of purchasing; Purchasing Department places orders with vendors; HR Department and payroll complete

employment verifications; sites/departments obtain substitutes for positions not filled by the online system; district is self-insured for workers’

comp; passed GO bond and has large construction projects; has not authorized any charter schools.

Tracy - educational services oversees Technology Department, student services, athletic director and requests for student transcripts/records;

financial services completes state student attendance reports, and Technology Department oversees CALPADS; HR Department oversees work-

ers’ compensation portion of risk management; financial system - Escape; purchase orders are signed by the director of purchasing; Purchasing

Department places orders with vendors; HR Department completes employment verifications and obtains substitutes for teacher and parapro-

fessional positions not filled by the online system; district is not self-insured; has no major construction projects at this time; has authorized one

district-operated and three independent charter schools.

Ventura - merit system district; business services oversees Technology Department; educational services oversees student support services

and requests for student transcripts/records; athletic director at each high school reports to site principal who reports to educational services;

fiscal services completes state student attendance reports, and Technology Department oversees CALPADS; financial system - Escape; pur-

chase orders are signed by director of fiscal services, CBO signs for capital acquisition and construction purchases; Purchasing Department

places orders with vendors; payroll completes employment verifications; sites/departments obtain substitutes for positions not filled by the

online system; district is not self-insured; passed GO bond in 2022, large construction projects have not yet started; has not authorized any

charter schools.

Fiscal Crisis and Management Assistance Team Central Unified School District 9

F R

Organizational Structure and Stang

Sanger - merit system district; CFO oversees finance, payroll, purchasing; chief operating ocer oversees child nutrition, facilities/bond over-

sight, maintenance and operations, risk management/security, transportation; educational services oversees Technology Department, student

support services, athletic director and requests for student transcripts/records; Finance Department completes state student attendance reports

and educational services oversees CALPADS; financial system - Everest; purchase orders are signed by the CFO; Purchasing Department places

orders with vendors; HR Department completes employment verifications and obtains substitutes for positions not filled by the online system;

district is not self-insured; passed GO bond and has large construction projects; has authorized three dependent charter schools.

* Source:Ed-Data 2021-22

** Source: Ed-Data 2020-21 (most recent financial comparison data available)

Recommendations

The district should:

1.

Update its organizational charts to ensure they include all positions, the correct title of

each position, accurate lines of authority, and the governing board’s approval date.

2.

Ensure employee evaluations are completed by direct supervisors.

3.

Review, revise and update job descriptions annually and as needed, and present them to

the governing board for approval; ensure approval and revision dates are included on all

job descriptions.

4.

Ensure human resources personnel are involved in developing all job descriptions.

5.

Review all fiscal services and human resources job descriptions to ensure they describe

key areas of responsibility.

6.

Assign district oce support sta to perform a one-month desk audit, or collect the

information as part of a districtwide job classification study.

7.

Consider reassigning and/or centralizing duties that are typically performed in other

departments to the applicable employee or department.

8.

Ensure that similar or identical work functions are assigned to the same classification and

included in the job description.

9.

Evaluate the need for additional job classifications based on results of the desk audit and/

or job classification study.

10.

Update job descriptions as needed based on any changes made to job duties, and provide

training as needed for duties that are transferred from one employee to another.

11.

Review and adjust duties as appropriate and/or reclassify positions, including those in

fiscal services and human resources, to comply with the government code definitions for

management and confidential employees.

12.

Consider increasing fiscal services sta based on further analysis and information in this

report, including stang comparisons indicating the department is understaed by up to

4.0 FTE.

13.

Consider increasing human resources sta based on further analysis and information in this

report, including stang comparisons indicating the department is understaed by up to

3.0 FTE.

14.

Consider the time needed to process transactions in both Everest and Digital Schools

when determining sta needs.

Fiscal Crisis and Management Assistance Team Central Unified School District 10

F R

Organizational Structure and Stang

Interdepartmental Considerations

Internal Controls

Internal controls are the foundation of sound fiscal management and allow organizations to fulfill their

mission while helping to ensure ecient operations, reliable financial information, and legal compliance.

Internal controls also protect a district from material weaknesses, serious errors and fraud.

All LEAs need to have internal control procedures to do the following: 1) prevent management and sta

from overriding internal controls, 2) ensure ongoing state and federal compliance, 3) provide assurance to

management that the internal control system is sound, 4) help identify and correct inecient processes,

and 5) ensure that employees are aware of proper internal control expectations. To build an eective

internal control structure, organizations need to apply concepts and have procedures for transactions and

reporting including, but not limited to, the following:

•

System of checks and balances – Formal procedures should be implemented to initiate,

approve, execute, record, and reconcile transactions. The procedures should identify the

employee responsible for each step and time for completion. Key areas of checks and bal-

ances include purchasing, accounts payable, cash receipts and payroll.

•

Separation of duties – Adequate internal control accounting procedures should be imple-

mented, and changes made as needed to separate job duties to protect the organization’s

assets. No one employee should handle a transaction from initiation to reconciliation or

have custody of an asset (such as cash or inventory) and maintain the records of related

transactions.

•

Sta cross-training – More than one employee should be able to perform each job. All

sta members should be required to use accrued vacation time, and another sta member

should be able to perform those duties. Inadequate cross-training is a frequent problem,

even in larger organizations.

•

Use of prenumbered documents – Checks, sales and cash receipts, purchase orders,

receiving reports, and event tickets should be preprinted. Physical controls should be main-

tained over check stock, cash, receipt books, and tickets. It is not sucient to simply use

prenumbered documents; a log of the documents and numbers should be maintained, and

reconciliations performed periodically.

•

Asset security – Cash should be deposited according to adopted procedures (at least

weekly), computer equipment secured, and access to supplies/stores, food stock, tools,

and gasoline restricted to designated employees.

•

Timely reconciliations – An employee not involved in the original transaction and recording

process should reconcile bank statements and account balances monthly. For example, the

employee who reconciles the revolving check account should not maintain the check stock.

An internal control system should include both hard controls (e.g., separation of duties, management review

and approval, and reconciliations) and soft controls (management tone, performance evaluations, and train-

ing programs) to provide reasonable assurance that the organization is achieving its goals and objectives.

The district lacks some of these elements, as explained in further detail later in this report.

FCMAT has created a comprehensive list of management standards for school districts. These standards

address key functional areas in personnel and financial management, including leadership and organiza-

Fiscal Crisis and Management Assistance Team Central Unified School District 11

F R

Interdepartmental Considerations

tional capacity; planning; employee recruitment/selection; induction and professional learning; operational

procedures; compliance practices; evaluation; employee services; employer/employee relations; internal

control; budget policy and procedures; financial management; bell schedule and attendance accounting;

projections; technology and information systems; ASBs; and charter schools. The district would benefit

from reviewing these standards to ensure it develops and supports best practices to meet them.

Policies and Procedural Manuals

Policies and procedural manuals give an organization the ability to plan and diagram internal controls and

written standards for schools and district departments to follow. They allow readers to see where their

duties fit into a process, who provides the information that comes to them, and where the information they

generate goes. Policies and procedures standardize processes, and ensure the most accurate and ecient

method is used to accomplish a task. Desk manuals provide information and step-by-step processes that

sta members use to do their jobs. A written desk manual can guide and help a back-up employee in the

event of employee absences and turnover.

The district’s Human Resources and Fiscal Services departments do not have desk manuals, and their

policies and procedures manuals are outdated. For example, the Human Resources Department provided

FCMAT with a detailed department handbook, but it was last updated in April 2015 and appeared to be in

draft form with pending changes and out-of-date information (e.g., the section on maintaining application

files includes information on walk-in applications, which are no longer allowed). The district’s purchasing

handbook, last updated in February 2017, gives employees general information about procurement policies

and procedures but also includes outdated information (e.g., bid limits). The district also has an accounts

payable guide dated November 13, 2022, which gives schools and departments general information about

vendor payments and procedures for tracking orders. No other district-authored policies and procedural

manuals for fiscal services were provided to FCMAT. When asked, some sta in both departments stated

there were no written desk manuals or policies and procedures manuals.

Managers need to ensure accurate and sucient written policies and procedures manuals are in place

to direct their department’s work and provide useful guidance for schools and other district departments

to follow. Sta members need to create written step-by-step procedures for each of their tasks and have

another sta member perform the procedure to determine if revisions are needed. These procedures

should be updated as needed and stored on a shared drive for all support personnel to access as needed.

To help complete both policies and procedures manuals and desk manuals, the district could consider

using a third party to prepare them. This would help ensure the manuals are consistent in format cross all

sections of a department and would not detract from time sta spend on assigned duties.

Software Systems

The district has various software systems for its personnel and fiscal management processes. For its

financial system, the district uses Everest, which is provided and managed by the Fresno County Oce of

Education; it is used to record all general ledger and budget transactions, make purchases, pay vendors

and employees, and track personnel information.

According to interviews with district sta, the Everest system is limited in its ability to eectively inte-

grate data for payroll, budget, and position control. Consequently, the district has implemented a sepa-

rate system, Digital Schools, to manage its position control. The district uses DMS to manage employee

absences, and recently implemented BenefitSolver to manage its employee health benefits program.

Fiscal Crisis and Management Assistance Team Central Unified School District 12

F R

Interdepartmental Considerations

Both the Human Resources and Fiscal Services departments also report using other software systems for

specific tasks, including Droplet in purchasing, and EdJoin, Aeries, Talent Ed, Public School Works, and

SmartFind in human resources.

These systems do not interface with or transfer data easily to one another; therefore, sta, especially in

human resources, must enter the same data into multiple systems. For example, new employee information

is required in three systems: Digital Schools, Everest, and Aeries (the district’s student data system). Each

time data is entered manually, the risk of errors increases and the time available for other duties decreases.

Information missed in one system or not entered in another in a timely manner can create confusion about

the accuracy and validity of district data.

The Everest system, the primary system of record for all financial and personnel management transactions,

does not automatically populate data between its modules, and requires the district to perform consider-

able manual input in payroll and budget. For example, labor distribution/payroll screens do not populate

from human resources data; therefore, payroll sta must input all employee pay data, except name and

position number, in Everest. Manual entry often results in errors; therefore, timely reconciliation, super-

visory reviews, and written procedures are essential internal controls to protect the district from material

weaknesses, serious errors and fraud.

Organizational Culture, Collaboration, and

Communication

Organizational culture is broadly defined as the customs, rituals and values shared within an organization.

Every school district has a unique culture shaped over time through leaders’ decisions and actions, both

formal and informal, that influence behaviors and shape the professional learning community. The district

has codified its cultural values in a formal written statement titled Central Unified School District Guiding

Principles, which is posted on its website. The guiding principles include the following core values and

beliefs to support its mission to “embrace diversity to educate our youth, ensure academic success, and

empower tomorrow’s leaders”:

Core values: Communication, Achievement, Resilience, Empathy, and Service.

Beliefs: We believe in excellence and high expectations. We believe in equity and access. We

believe in collaboration and community.

District leaders, including the superintendent, executive cabinet, and governing board, set the tone of a

district’s organizational culture. Sta need to see the district’s leaders model its guiding principles if they

are to trust and adopt the core values and beliefs it describes.

The district has recently attempted to establish monthly interdepartmental meetings for fiscal services and

human resources sta to review procedures related to payroll, budget, and position control. Educational

services sta who oversee state and federal programs have also been invited to attend. These monthly

meetings have exposed a lack of trust between departments. Department managers with decision-making

authority initially attended the meetings, but some no longer attend; without their leadership, the meetings

are unproductive. In addition, without a clear understanding of each department’s responsibilities, it is di-

cult for sta to create and maintain processes that work for all.

The best practice is for managers to determine each department’s responsibilities and clearly communicate

that information to their respective sta. The monthly meetings can then focus on establishing interde-

partmental practices. The meetings should not be used to transfer responsibilities from one department to

another or to discuss how one department completes its responsibilities. Proposed changes to a depart-

Fiscal Crisis and Management Assistance Team Central Unified School District 13

F R

Interdepartmental Considerations

ment’s responsibilities or an individual’s workload need to be reviewed and approved through that depart-

ment’s chain of command.

During interviews, district sta called attention to behavior contrary to the district’s core values and beliefs,

specifically ongoing tension between the Fiscal Services and Human Resources departments. Interpersonal

conflicts, confusion regarding each department’s authority and responsibilities, and a lack of customer

service and leadership accountability have negatively aected the district’s employees (e.g., errors in

employee pay). The payroll and human resources sta do not have a functioning process to meet regularly

to review and resolve common issues related to employee leaves, resignations, salary placement, dier-

ential pay, and other related subjects. Regular meetings are needed to provide valuable time for the two

departments to collaborate on specific employee situations that may not occur regularly.

The Human Resources Department is at the district oce, and the Fiscal Services Department is at another

location approximately half a mile away. This physical separation has resulted in almost entirely email and

telephone communications between the two departments, which has hindered relationship building and

collaboration. The district states it is planning to move the fiscal services sta to the site where the human

resources oce is located. District sta overwhelmingly expressed support for this move and believed it

would help improve communication and collaboration between the two departments.

The district has no districtwide standard for responding to telephone or email messages. In interviews,

district sta indicated that the Fiscal Services and Human Resources departments do not respond in a

timely manner to telephone and email messages, and department sta communicated varying expectations

regarding response times (e.g., 24 hours versus 48 hours). Delayed responses have resulted in school and

department sta having to escalate routine issues to the district’s area administrators, assistant superin-

tendents, and in some cases, superintendent. Communication is a key factor in any district’s success in

achieving is mission and goals. Telephone and email response standards hold employees accountable for

performing their duties; a standard response time of one business day would ensure significant issues are

addressed in time.

Recommendations

The district should:

1.

Review FCMAT’s comprehensive standards for personnel and fiscal management functions

and ensure it is meeting them.

2.

Update the Human Resources Department handbook to reflect current practices and

procedures.

3.

Update its purchasing handbook, and create a written policies and procedural manual for

all key functional areas of the Fiscal Services Department.

4.

Assign sta members to complete written and clearly-defined step-by-step procedures for

all their job duties, update them as necessary, and store them on a shared drive.

5.

Consider using a third party to prepare the manuals.

6.

Review and revise policies and procedures manuals and desk manuals periodically, but not

less than annually.

7.

Evaluate the need for each software system, and eliminate and/or consolidate them if

possible to improve operational eciencies.

Fiscal Crisis and Management Assistance Team Central Unified School District 14

F R

Interdepartmental Considerations

8.

Ensure it has adequate controls to maintain and reconcile its systems, especially Everest,

Digital Schools, and BenefitSolver.

9.

Prepare and revise as needed clear written policies and procedures documenting the use

and maintenance of all software systems supporting fiscal services and human resources.

10.

Ensure that the assistant superintendent/human resources and assistant superintendent/

CBO work together to develop strong communication and collaboration between their

departments.

11.

Hold managers responsible for modeling the district’s core values and beliefs; ensure the

fiscal services and human resources directors meet regularly to establish and maintain

each department’s respective duties.

12.

Require fiscal services and human resources personnel to meet monthly to improve

communication; consider including other departments, such as educational services, as

needed to further increase collaboration. Consider having the director of fiscal services

initiate these meetings, prepare and distribute a written draft agenda before each meeting,

and allow sta to propose agenda items in advance.

13.

Establish regular meetings of payroll and human resources sta to discuss ongoing issues,

develop solutions to common problems, and improve communication.

14.

Continue planning for and taking all actions needed to move fiscal services sta to the

district oce site.

15.

Establish a districtwide standard for responding to telephone and email messages, and

hold all employees accountable for meeting it.

Fiscal Crisis and Management Assistance Team Central Unified School District 15

F R

Interdepartmental Considerations

Fiscal Services

Structure and Stang

The district’s Fiscal Services Department is responsible for student attendance accounting, accounts pay-

able, accounts receivable, budget, purchasing, payroll, health benefits, risk management, warehouse, dupli-

cation, and student records and transcripts. The department is overseen by the assistant superintendent/

CBO, who had worked in the position for three years at the time of FCMAT’s fieldwork (soon after FCMAT’s

fieldwork, the assistant superintendent/CBO resigned, and the district is recruiting to fill the position). The

assistant superintendent/CBO position also oversees the following departments, which are outside of the

scope of this study: Child Nutrition, Facilities Planning, Technology Services, and Maintenance, Operations

and Transportation.

The department includes the following full-time manager, confidential, and support sta positions:

Director of Fiscal Services (1.0 FTE)

The department is managed by the director of fiscal services, who reports to the assistant superintendent/

CBO and has worked in the position for 10 years. The director position is responsible for planning, man-

aging, and directing all department functions. The director’s job duties include much of the routine work

associated with budget development and monitoring, including preparation of enrollment and attendance

projections, interim and budget financial reports, multiyear financial and cash flow projections, and state

and federal program reporting.

The position’s job description is dated November 2004 and indicates it reports to a “department

administrator.”

Senior Accounting Manager (1.0 FTE)

The senior accounting manager position reports to the director of fiscal services and oversees the payroll

and benefits specialists. The manager’s job duties include all bank reconciliations and various accounting

functions related to the cash clearing account, capital assets and depreciation, food service, and self-insur-

ance funds. This position also serves as the primary point of contact and support for the district’s 21 ASBs.

The job description is dated November 2012 and has a position title that does not match the organizational

chart. In interviews, the employee in this position did not describe any responsibility for the job descrip-

tion’s listed duties in the areas of position control, budgeting, and cash flow.

Payroll Specialist (3.0 FTE)

This position reports to the senior accounting manager and performs all functions related to certificated

and classified payrolls. The position also completes employment verifications, reconciles payroll general

ledger holding accounts, processes state disability insurance payments, reviews and approves position

status changes, and prepares and maintains payroll-related vendor databases.

The job description for this position is not dated, and although the three payroll positions are staed as

payroll specialists, the organizational chart shows two of the three positions as payroll technicians. The job

description also incorrectly indicates the position reports to the director of fiscal services rather than the

senior accounting manager.

Fiscal Crisis and Management Assistance Team Central Unified School District 16

F R

Fiscal Services

Benefits Specialist (1.0 FTE)

This position reports to the senior accounting manager and performs all functions related to the district’s

employee health and welfare benefit programs.

The job description, dated March 2000, indicates the position reports to a “department administrator,” and

is responsible for supporting the district’s workers’ compensation and property and liability insurance pro-

grams. In interviews, district sta indicated that the district recently implemented new employee benefits

software, BenefitSolver, that employee benefits duties occupy all the position’s time, and that duties related

to workers’ compensation and property/liability claims have shifted to the executive secretary II position.

Budget and Finance Manager (1.0 FTE)

This position reports to the director of fiscal services and oversees account clerk III positions in accounts

payable and accounts receivable. The manager’s job duties include categorical and school budget develop-

ment and monitoring in collaboration with the directors of fiscal services, and state and federal programs.

This position also oversees a duplication manager and production specialist, whose duties are outside of

this study’s scope.

The job description for this position is not dated. It specifies responsibilities in general terms and includes

various duties not reported by the employee in interviews as areas of responsibility, such as payroll, ASBs,

student attendance accounting, purchasing, and administration of financial systems.

Account Clerk III (5.0 FTE)

Three accounts payable clerks and one accounts receivable clerk report to the budget and finance man-

ager, and a purchasing account clerk reports to the purchasing/warehouse manager. These positions are

primarily responsible for day-to-day activities related to accounts payable, accounts receivable, and pur-

chasing. One of the accounts payable clerks also serves as the department’s receptionist.

The accounts payable clerks pay vendor invoices and employee reimbursements. The accounts receivable

clerk reviews and finalizes school and department budget revisions, and processes journal entries from var-

ious departments, including the district’s due to and due from transactions. This is in addition to accounts

receivable activities such as generating invoices, monitoring receipts, and counting cash. The purchasing

clerk is responsible for the district’s student attendance reporting and various purchasing support func-

tions, such as scanning and indexing purchase orders and creating and maintaining vendor records in the

purchasing system.

The job description is dated March 2000 and indicates the position reports to a “site administrator.” It also

refers to supervision “as assigned by the director of business and finance.” Rather than specifying position

responsibilities in each functional area, such as accounts payable, accounts receivable and purchasing,

the description is written in general terms to include accounting clerical work related to the maintenance

of district accounts. In addition, the department’s organizational chart shows the position title as “accounts

payable III” for those assigned to accounts payable duties.

Purchasing/Warehouse Manager (1.0 FTE)