United States Patent and Trademark Office

Fiscal Year 2025 Congressional Submission

March 2024

This Page Is Intentionally Left Blank.

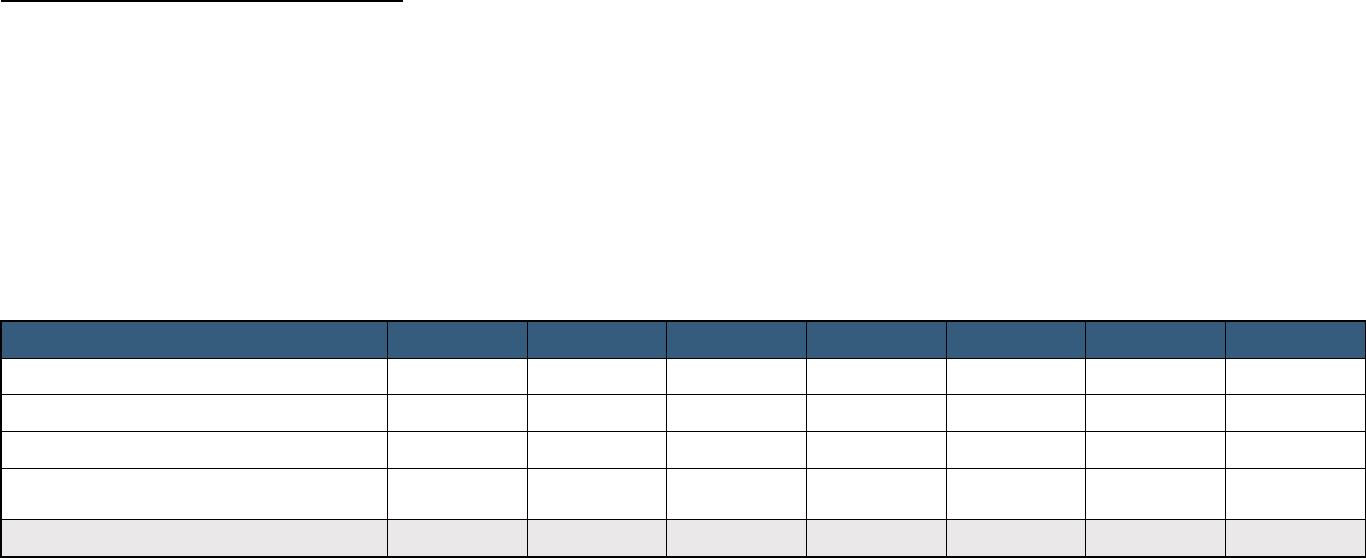

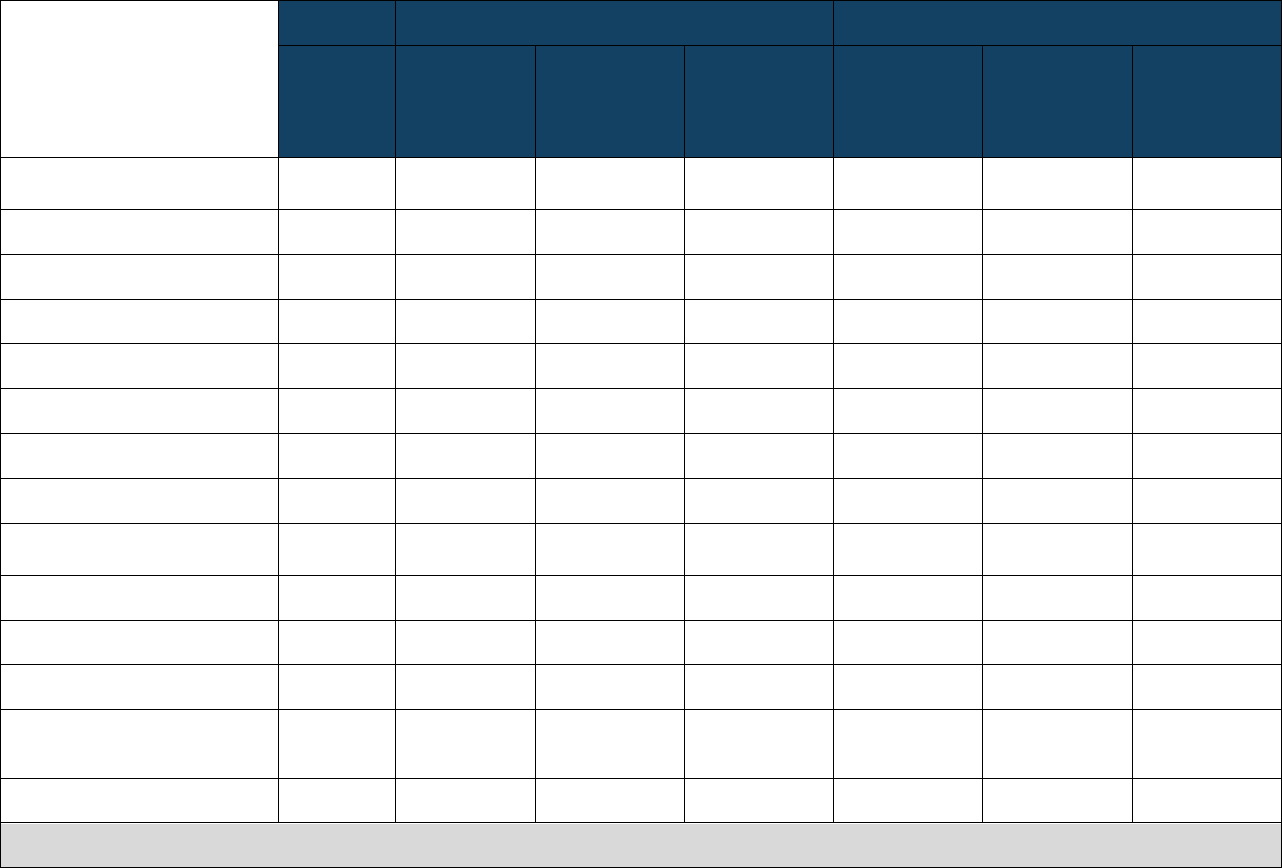

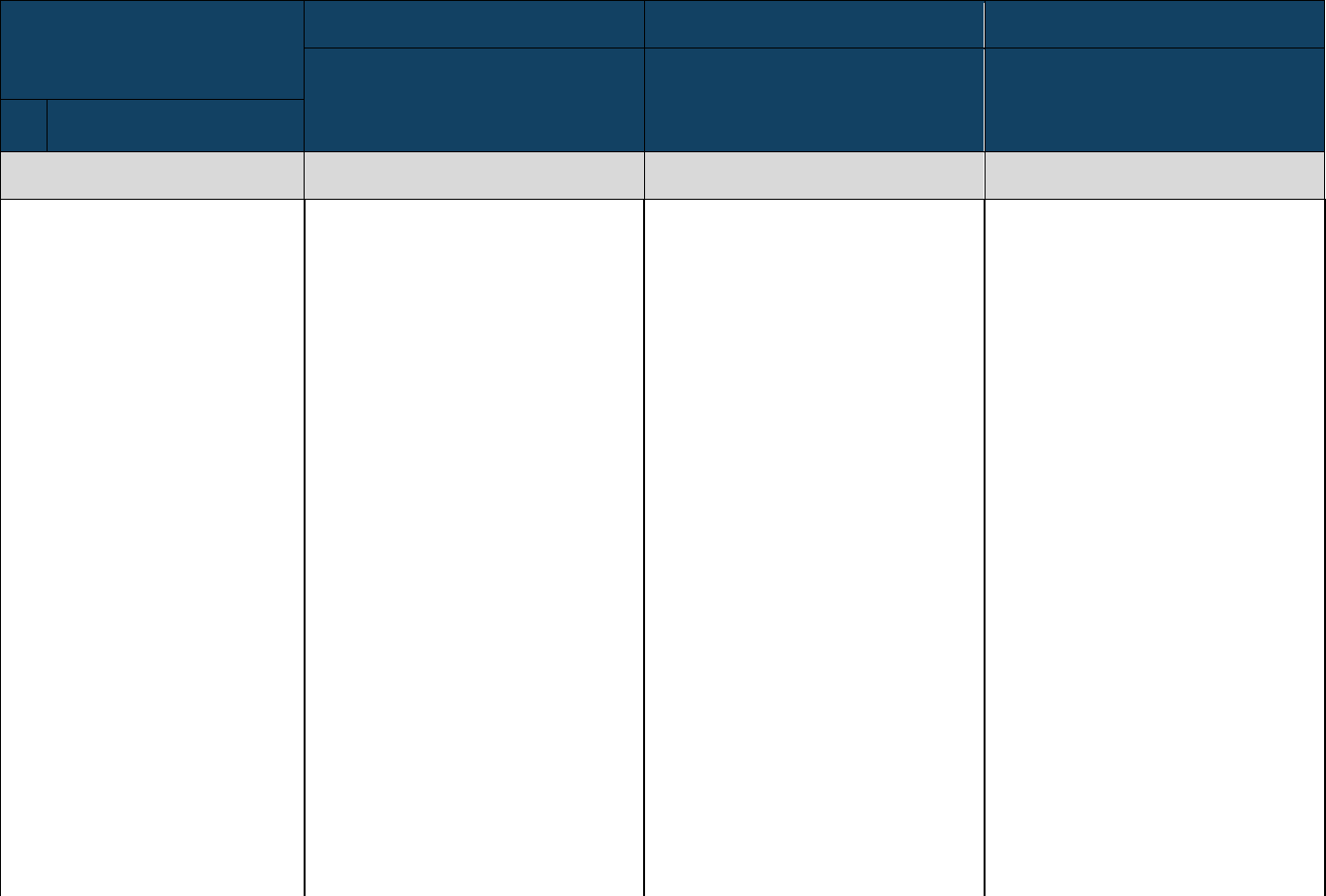

Transfer Summary Table

Exhibit 1

DEPARTMENT OF COMMERCE

UNITED STATES PATENT AND TRADEMARK OFFICE

Budget Estimates, Fiscal Year 2025

Congressional Submission

Table of Contents

Exhibit Number Exhibit Page Number

2

Organizational Chart

USPTO – 2

3

Executive Summary

USPTO – 3

4

Priority Rank of 2025 Program Changes

USPTO – 9

4A

Program Increases/Decreases/Terminations

USPTO – 10

4T

Transfer Summary Table

USPTO – 12

5

Summary of Resource Requirements

USPTO – 13

7

Summary of Financing

USPTO – 15

8

Adjustments to Base

USPTO – 16

Patent Program

10

Program and Performance: Direct Obligations

USPTO – 19

12

Justification of Program and Performance

USPTO – 20

13

Program Changes for 2025

USPTO – 27

14

Program Change Personnel Detail

USPTO – 35

15

Program Change Detail by Object Class

USPTO – 36

Trademark Program

10

Program and Performance: Direct Obligations

USPTO – 39

12

Justification of Program and Performance

USPTO – 40

13

Program Changes for 2025

USPTO – 46

14

Program Change Personnel Detail

USPTO – 51

15

Program Change Detail by Object Class

USPTO – 53

Cross-Cutting Functions Program

10

Program and Performance: Direct Obligations

USPTO – 56

12

Justification of Program and Performance

USPTO – 58

13

Program Change for 2025

USPTO – 66

14

Program Change Personnel Detail

USPTO – 75

15

Program Change Detail by Object Class

USPTO – 77

Exhibits 16-36

16

Summary of Requirements by Object Class

USPTO – 80

Exhibit 1

16A

Select Activities by Object Class

USPTO – 81

32

Justification of Proposed Language Changes

USPTO – 83

33

Appropriations Language and Code Citation

USPTO – 84

34

Advisory and Assistance Services

USPTO – 86

35

Periodicals, Pamphlets, and Audiovisual Services

USPTO – 87

36

Average Grade and Salaries

USPTO – 88

41

Implementation Status of GAO and OIG Recommendations

USPTO – 89

Appendices

Appendix I

Patent and Trademark Programs Five-Year Outlook

USPTO – 107

Appendix II

Allocation of Budgetary Requirements to the Patent and Trademark Programs

USPTO – 117

Appendix III

USPTO IT Portfolio

USPTO – 119

Appendix IV

Multiyear Planning by Program

USPTO – 123

Appendix V

USPTO Fee Estimate Changes from FY 2024 PB to FY 2025 PB

USPTO – 128

Appendix VI

USPTO Estimates and Actual Fees and Assumptions

USPTO – 134

Appendix VII

FY 2023 Fee Report

USPTO – 138

Appendix VIII

USPTO 2022-2026 Strategic Plan Framework

USPTO – 161

Appendix IX

FY 2024/2025 Annual Performance Plan and Report

USPTO – 163

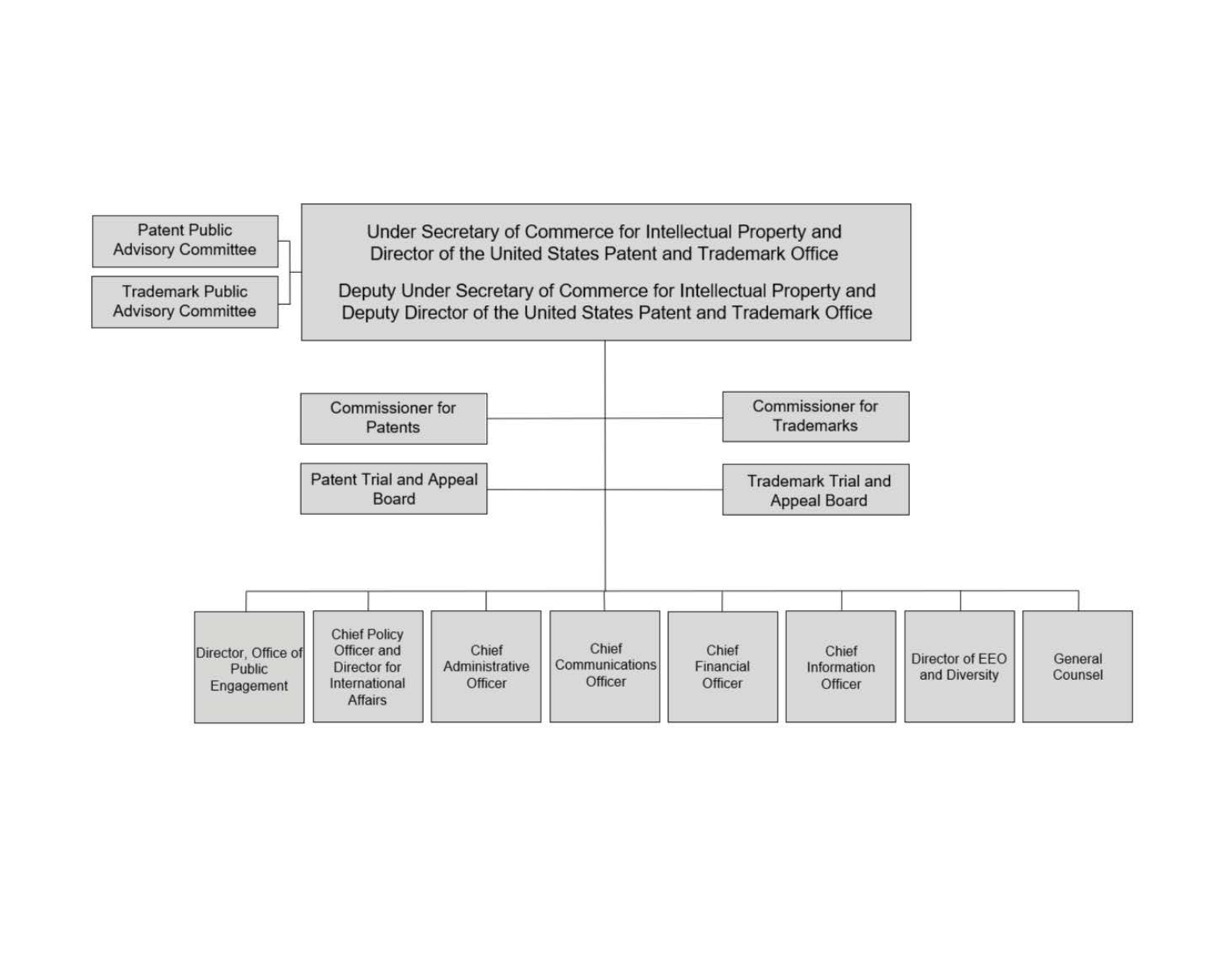

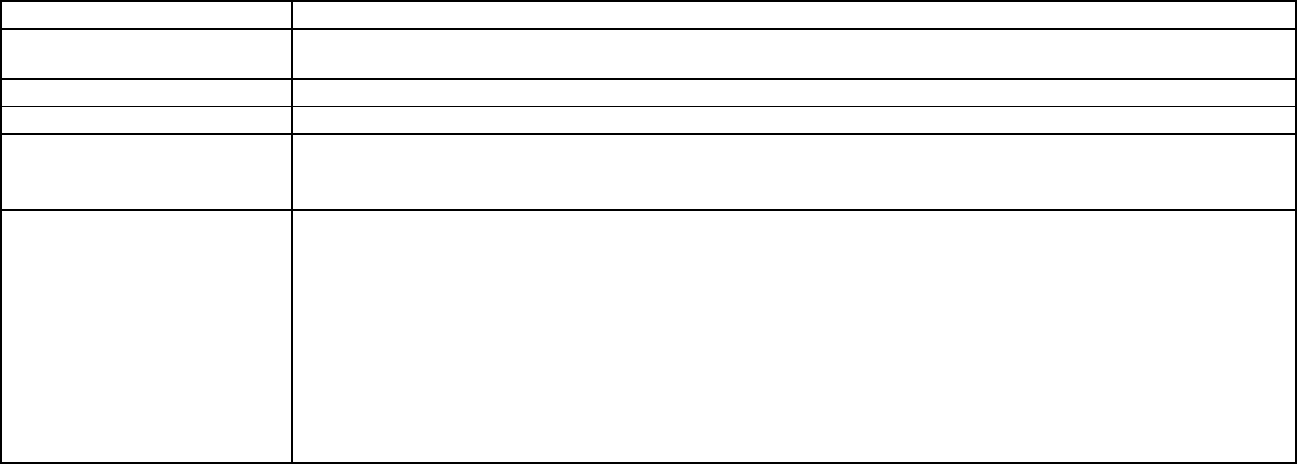

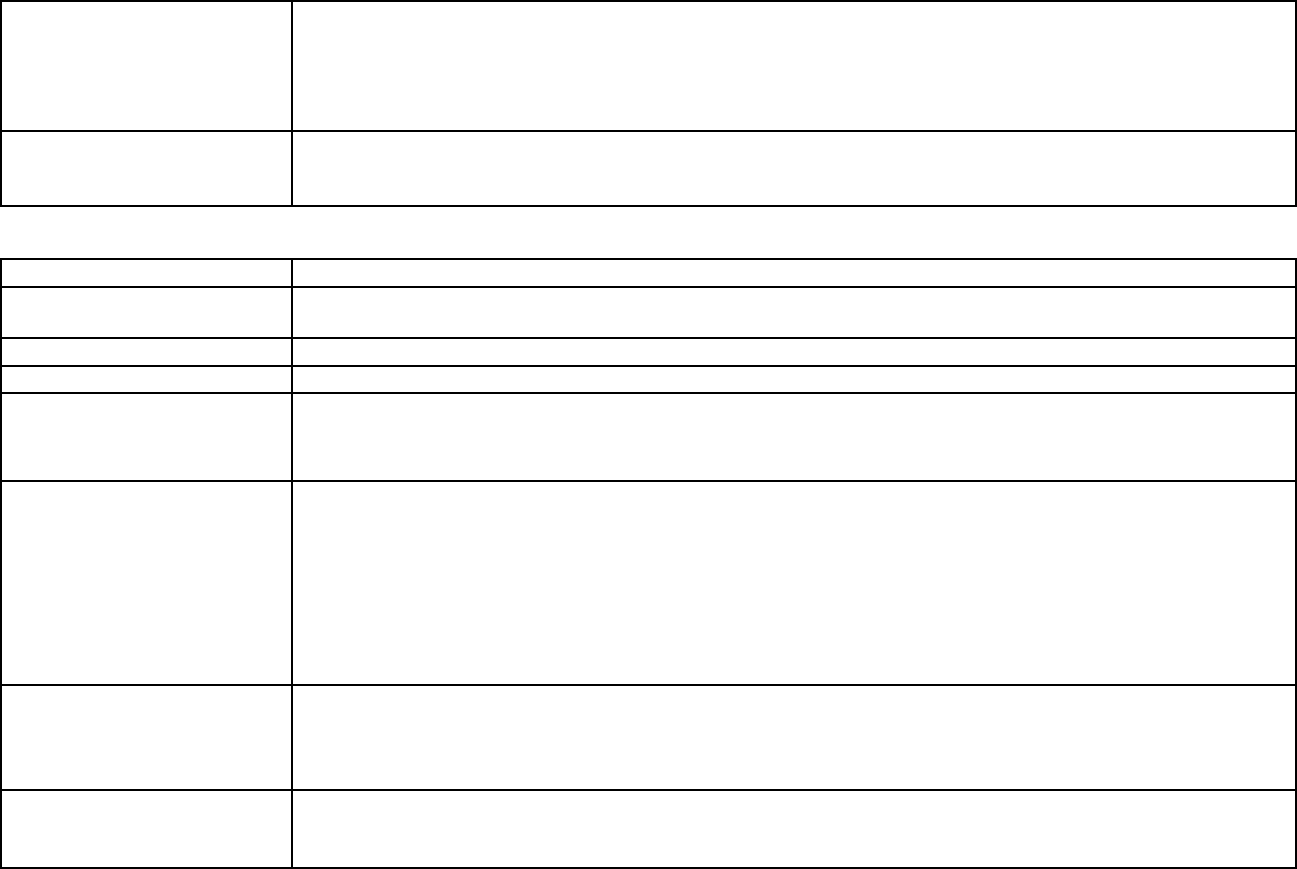

Description/Scope of Responsibilities

The United States Patent and Trademark Office (USPTO) is an agency within the U.S. Department of Commerce (DOC). The Under

Secretary of Commerce for Intellectual Property and Director of the USPTO leads the agency and consults the Patent Public Advisory

Committee (PPAC) and the Trademark Public Advisory Committee (TPAC) on agency policies, goals, performance, budgets, and user fees.

The Commissioner for Patents oversees the Patents organization, and the Commissioner for Trademarks oversees the Trademarks

organization. The Commissioners, whom the Secretary of Commerce appoints, enter into annual performance agreements with the

Secretary that describe their measurable organizational goals.

The USPTO’s mission is to drive U.S. innovation, inclusive capitalism, and global competitiveness. The USPTO will deliver on its mission

through two distinct programs, Patents and Trademarks, that administer patent and trademark laws to enable and protect intellectual

property (IP). The USPTO is a demand-driven, fee-funded, performance-based agency committed to delivering balanced IP protection and

information to all its stakeholders, including inventors, entrepreneurs, businesses, IP organizations, and international entities.

The USPTO estimates that it will employ 14,933 federal employees, including patent examiners, trademark examining attorneys, information

technology (IT) specialists, attorneys, and other administrative staff, in fiscal year (FY) 2025. The USPTO’s employees perform the

inherently governmental functions of issuing patents and registering trademarks, as well as providing domestic and global leadership on IP

issues. Third-party contractors perform several mission support activities that are not inherently governmental.

A core component of the USPTO’s business strategy is a nationwide workforce with extensive remote work and telework options to employ,

engage, and retain employees. The USPTO has successfully managed organizational performance and organizational health under this

operating model. The USPTO is headquartered in Alexandria, Virginia, and has four regional offices in Detroit, Michigan; Denver, Colorado;

San Jose, California; and Dallas, Texas. The agency also maintains an Eastern Regional Outreach Office based at USPTO headquarters.

The USPTO is implementing the provisions of the Unleashing American Innovators Act of 2022 (UAIA) (Pub. L. 117-328), enacted on

December 29, 2022, and, accordingly, will open a new regional office in the Atlanta, Georgia, metropolitan area serving innovators in the

Southeast region, and a new community outreach office in Strafford County, New Hampshire, serving innovators in the New England region.

The USPTO continues to evaluate locations for three additional community outreach offices across the United States.

Exhibits 32 and 33 contain the USPTO’s legislative authorities.

Disclaimer

Due to rounding, the numbers presented in tables throughout this document may not add up precisely to the totals provided, and

percentages may not precisely reflect absolute figures.

USPTO - 1

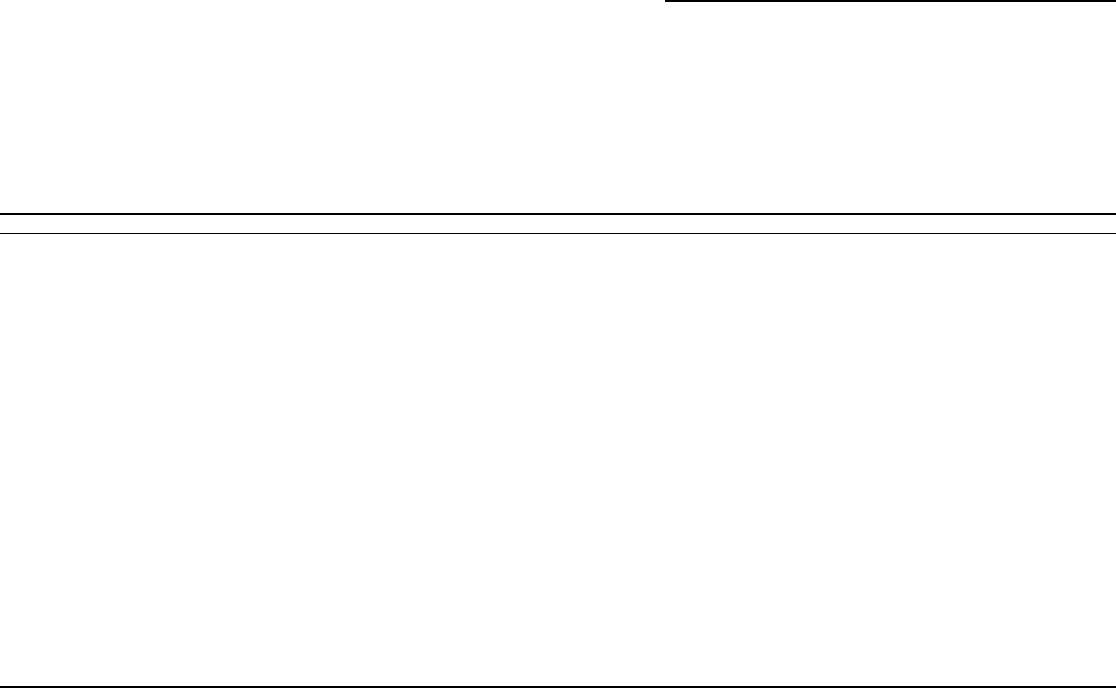

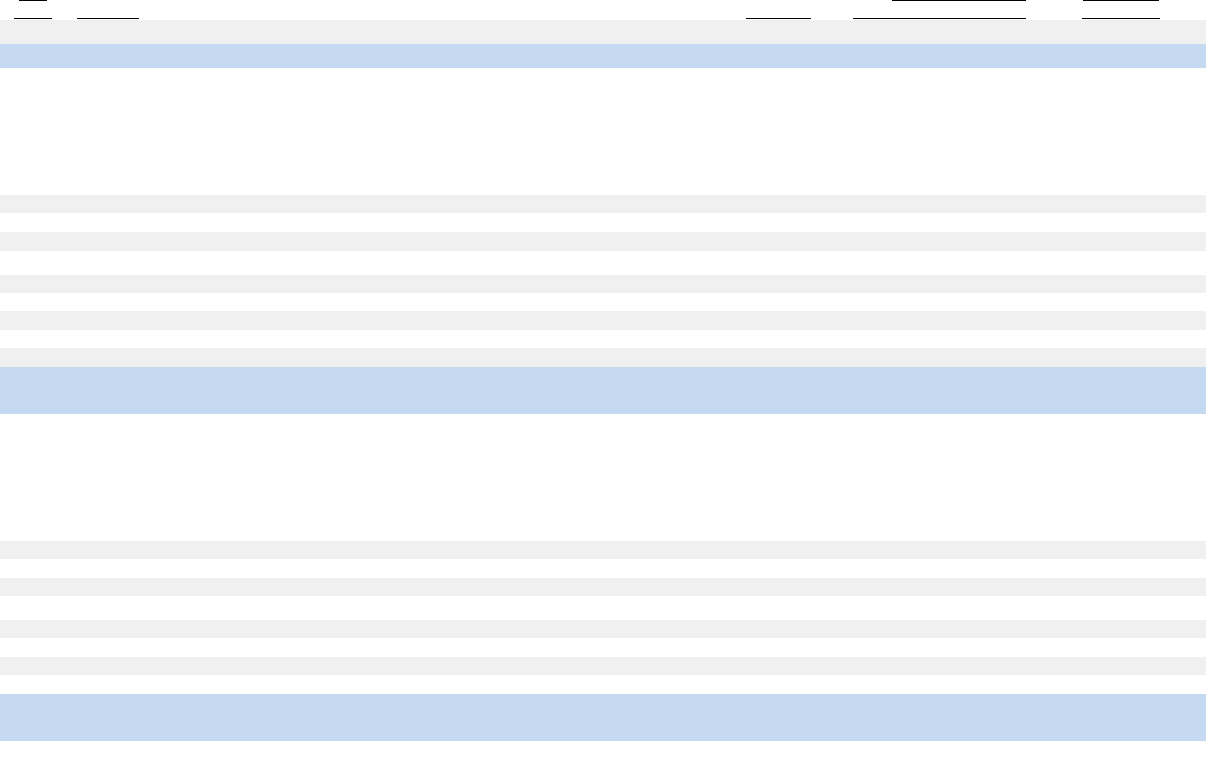

Exhibit 2

D

epartment of Commerce

United States Patent and Trademark Office

Patent

Public

Advisory

Committee

Trademark

Public

Advisory

Committee

Und

er

Secretary

of

Co

mm

erce for Intellectual Property and

Director

of

the United States Patent and Trademark Office

-

-

Deputy Under Secretary

of

Co

mmer

ce

for Intellectual Property and

Deputy Director

of

the United States Patent and Trademark Office

-

Commissioner

for

Patents

Commissioner

for

Trademarks

Patent

Trial

and

Appeal

Board

Trademark

Trial

and

Appeal

Board

I I I I I

Director, Office ol

Pu

blic

Eng

a

gemen

t

Chief Policy

Officer

and

Director for

International

Affairs

Chief

Administrative

Officer

Chief

Commun

ications

Officer

Chief

Financi

al

Officer

Chief

In

formation

Officer

Director of

EEO

and

Di

v

ersi

ty

Gener

al

Counsel

USPTO - 2

Exhibit 3

Department of Commerce

U.S. Patent and Trademark Office

Budget Estimates, FY 2025

Executive Summary

The USPTO’s FY 2025 Budget (Budget)

estimates agency fee collections of $4,555

million, consisting of $3,972 million in patent

fees and $583 million in trademark fees. The

USPTO also expects to collect $60 million in

other income (i.e., reimbursements). Estimated

spending is $4,569 million, consisting of $3,975

million in Patents spending and $594 million in

Trademarks spending, which supports 14,933

positions. During FY 2025, the USPTO will add

a net of $47 million to the combined operating

reserves (ORs). The patent OR will increase by

$48 million, and the trademark OR will decrease

by $1 million. The agency requests appropriation authority to spend the full fee collection estimate of $4,555 million to offset budgetary

requirements (estimated spending and OR deposits); under this request, the USPTO’s FY 2025 net appropriation is $0.

USPTO Operating Levels for FY 2025

Dollars in millions

Patents

Trademarks

Total

Estimated fee collections (Appropriation/Authority) $3,972 $583 $4,555

Other income $50

$10

$60

Operating reserve, beginning of year $793 $86 $878

Total estimated funds available

$4,815 $679

$5,494

Estimated spending

($3,975)

($594)

($4,569)

Total operating reserve and Patent and Trademark Fee

Reserve Fund (PTFRF), end of year

$840

$85

$925

Authorized positions

13,195

1,738

14,933

The Budget anticipates the USPTO will implement changes to both the patent and trademark fee schedules during FY 2025. Accordingly, FY

2025 estimated fee collections and the appropriation request level include these changes. New aggregate fee collections will meet

budgetary requirements to address increased workloads and inflationary pay raises, offset aggregate fee discounts enacted in the UAIA,

update the patent examiner special rate table

1

, and establish a regional office and four community outreach offices in accordance with the

UAIA. Reducing spending requirements through divesting leased space in Northern Virginia and moderately reducing overall IT spending

partially offsets new budgetary requirements.

The USPTO is a fee-funded agency and must periodically assess and adjust fee rates to ensure aggregate fee collections finance the

aggregate costs necessary to issue robust and reliable patents and to register and maintain accurate and reliable trademarks. Recent

comprehensive patent and trademark fee reviews concluded that fee adjustments are necessary to increase aggregate revenue (fee

collections) and to refine certain fees to finance ongoing operations. For purposes of estimating fee collections, the Budget assumes revised

USPTO - 3

1

The patent examiner special rate table applies to job series 1220, 1222, 1223, 1224, and 1226.

Exhibit 3

trademark fee rates will take effect on November 23, 2024, and revised patent fee rates will take effect on January 8, 2025. These dates, as

well as the proposals, may change as the agency goes through the process of publishing notices of proposed rulemaking (NPRMs),

incorporating public feedback received during the comment periods, and drafting and publishing final rules. Combined, the agency projects

these new fee rates will increase fee collections by approximately $437.9 million during FY 2025.

The Budget is predicated on workload and fee collection estimates derived from agency production and workload models, as well as

relevant indicators of economic and IP activity. In FY 2025, the USPTO estimates that the growth rate for serialized (original) patent

applications will increase by 1.5% over projected FY 2024 application filing levels, and that trademark applications will increase by 4.6%.

These forecasts are inherently uncertain; actual demand for patent and trademark services could be higher or lower than projected based on

changing economic conditions. The USPTO must spend fee collections to meet the actual demand for services.

To mitigate the risk of uncertain demand, the USPTO maintains two ORs (i.e., patent and trademark). The ORs are a U.S. Government

Accountability Office (GAO) best practice for user fee-funded government agencies like the USPTO. The ORs enable the USPTO to align

fees and costs over a longer horizon and to improve its preparation for, and adjustment to, fluctuations in actual fee collections, demand,

and spending. Depositing a portion of annual fee collections into the ORs, such that the balance is available to finance USPTO operations in

the event of unexpected economic fluctuations, is a USPTO budgetary requirement. With the proposed fee adjustments in FY 2025, the

agency projects the patent OR will remain above minimum levels for all years through FY 2029, under current economic assumptions. The

USPTO expects the trademark OR will be slightly below minimum OR levels in FYs 2024-2026 and above minimum levels in FYs 2027-2029

under current economic assumptions. For additional information, including annual estimates for FYs 2025-2029, please see Appendix I.

The USPTO is committed to fiscal responsibility. It makes prudent decisions to align spending priorities with fee collection projections to

meet workload requirements and maintain sufficient OR levels. The fee setting authority authorized in the 2011 Leahy-Smith America

Invents Act (AIA) (Pub. L. 112-29) and extended in the Study of Underrepresented Classes Chasing Engineering and Science Success Act

(SUCCESS Act) of 2018 (Pub. L. 115-273) provides the USPTO the authority to set and adjust fees to align with costs. The AIA also created

a successful framework to provide the USPTO full access to all fees it collects. This authority to adjust both patent and trademark user fees

via the regulatory process enables the USPTO to set fees at the appropriate level to recover the aggregate costs of its operations, including

investments in strategic agency goals, and to respond to changing legislative requirements and market needs. Since the enactment of the

AIA, the agency has adjusted patent and trademark fees via rulemaking three times, and the fee collection estimates in this Budget include

proposals that would represent a fourth rulemaking adjustment for both patent and trademark fees. Fee estimates included in this Budget

reflect the change in small and micro entity discounts included in section 107 of the UAIA. Absent congressional action, the agency’s AIA fee

setting authority will expire on September 15, 2026.

The USPTO is requesting administrative approval to update and adjust the patent examiner special rate table (table) for the first time since

2007. The objective of the table update is to provide competitive compensation to patent examiners, thereby reducing attrition and

enhancing the recruitment of qualified employees needed to examine increasingly complex IP applications. This Budget includes an

estimated compensation increase for the Patents organization that is contingent on final approval. The USPTO will include additional details

in future budget submissions pending finalization and approval of the table proposal.

USPTO - 4

Exhibit 3

This Budget also assigns resources to substantially fund provisions of the UAIA. Specifically, it includes requirements in FY 2024 to

establish a New England Community Outreach Office in Strafford County, New Hampshire, and a Southeast Regional Office in the Atlanta,

Georgia, metropolitan area, including anticipated leased space build-out and IT infrastructure costs. The Budget also includes requirements

to establish three additional community outreach offices and to conduct a study to determine whether additional offices are required to

achieve AIA mandates and increase the participation of underrepresented inventors in the patent system in accordance with the UAIA. For

more detailed information, please see Appendix I.

The UAIA directed the USPTO to promote inclusive innovation by expanding its national footprint and establishing and expanding

stakeholder programs that increase access to the U.S. innovation ecosystem. As a result, the Budget funds the establishment of a new

office—tentatively titled the Office of Public Engagement (OPE)—to operationalize UAIA requirements. The OPE will consolidate outreach,

education, customer experience (CX), and customer engagement functions from across the agency to deliver a greater impact to more

innovators and reach newer audiences.

Budget Highlights

The USPTO’s FY 2025 estimated spending is $4,569 million. This figure is a $122 million net increase from the agency’s FY 2024 estimated

spending of $4,447 million. The net increase includes a $224 million upward adjustment for prescribed inflation and other adjustments to

base, and a $102 million downward adjustment in program spending and other realized efficiencies. This aggregate spending level allows for

the USPTO to hire 850 patent examiners (approximately 360 over estimated attrition levels) and 80 trademark examining attorneys

(approximately 50 over estimated attrition levels), as well as implement sufficient production support capabilities to match the agency’s

examination capacity with its expected workload. Furthermore, the Budget funds additional examination capacity to improve patent reliability,

maintain patent term adjustment (PTA) compliance rates, maintain trademark quality, and improve trademark processing times to match

demand and reduce the backlog of unexamined inventory (resulting from unprecedented demand during 2021). Additionally, the Budget

supports the following major USPTO strategic initiatives: the Council for Inclusive Innovation (CI

2

); emerging technologies like artificial

intelligence (AI); the Women’s Entrepreneurship (WE) initiative; military community-focused entrepreneurship resources; the White House

Cancer Moonshot initiative; enhanced collaboration between the USPTO and the U.S. Food and Drug Administration (FDA); support for

international cooperation on IP rights to advance global competitiveness and improve enforcement, capacity building, and legislative reform;

engagement with domestic and global partners to incentivize, protect, and commercialize green tech, climate-related innovation, and

sustainability; and the provision of equal opportunity for people of all backgrounds to become innovators through inclusive innovation. The

Budget builds on the $40 million in real estate savings assumed in the FY 2024 President’s Budget (PB), to include additional annual cost

savings of $12 million through leased space reductions in Northern Virginia. The combined reduction in campus space amounts to estimated

annual cost savings of approximately $52 million.

Performance

For current Government Performance and Results Act targets, please see Appendix IX.

USPTO - 5

Exhibit 3

Adjustments

Inflationary adjustments

The USPTO’s FY 2025 base includes a total of $4,668 million and 14,023 full-time equivalents (FTEs)/14,459 positions. The agency

calculated inflationary adjustments to current programs for USPTO activities from these levels. These adjustments include the estimated

2.0% civilian pay raise planned in FY 2025 and inflationary increases for labor and nonlabor activities such as benefits, service contracts,

utilities, and lease payments.

USPTO - 6

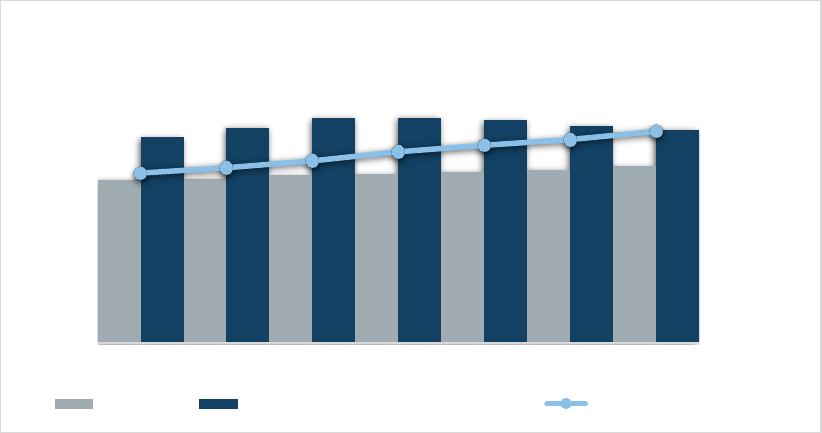

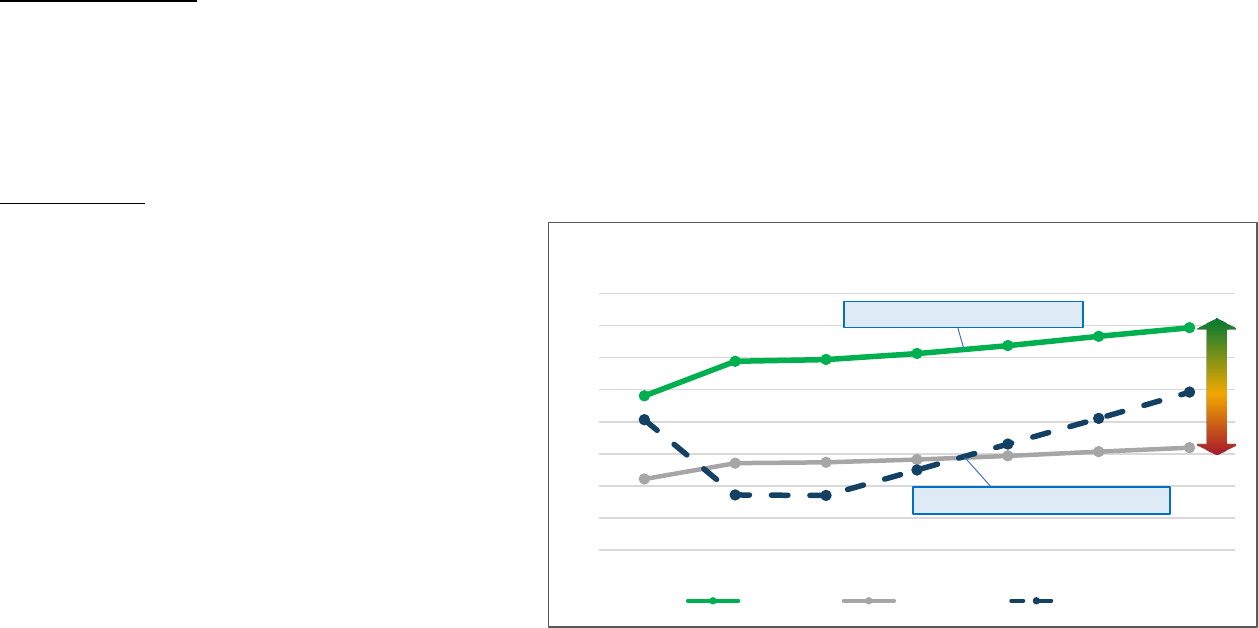

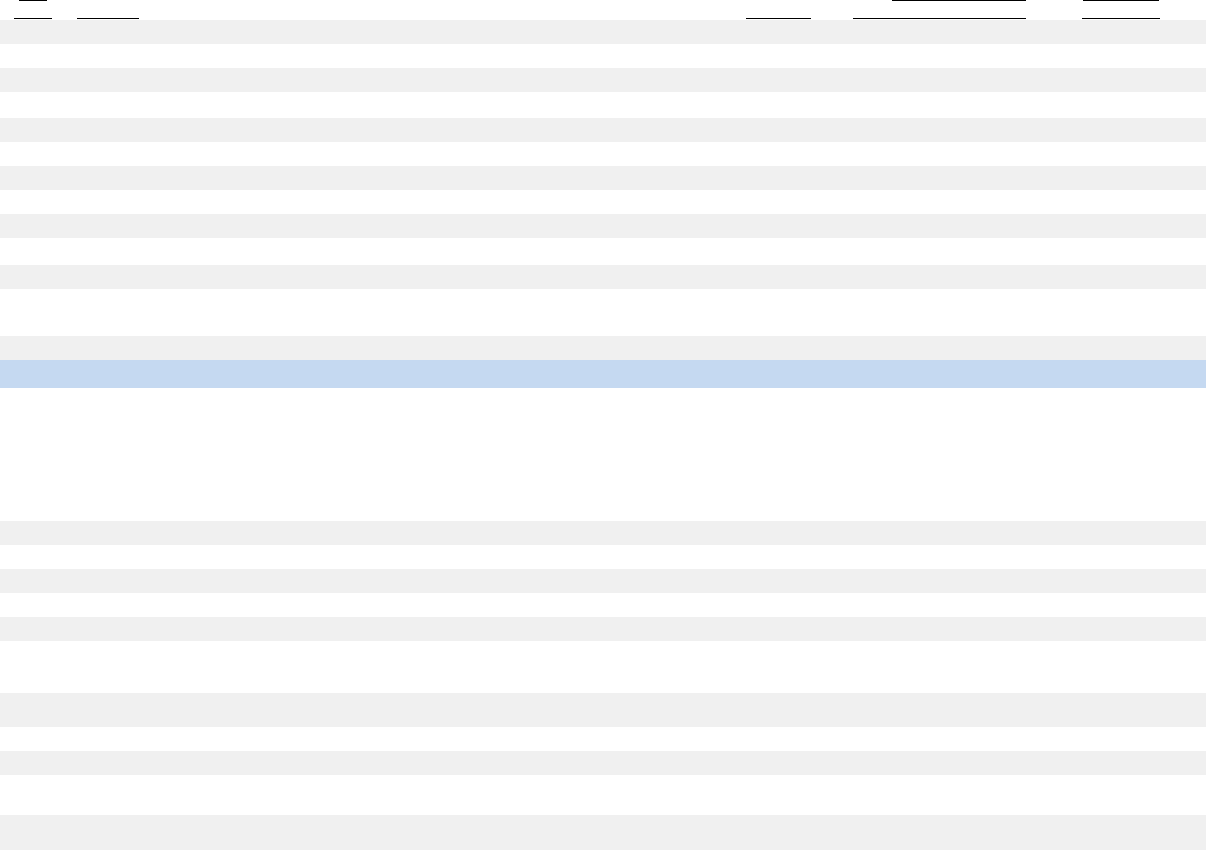

TOTAL BUDGET AND FINANCING

USPTO - 7

This Page Is Intentionally Left Blank.

USPTO - 8

Exhibit 4

Department of Commerce

U.S. Patent and Trademark Office

PRIORITY RANK OF 2025 PROGRAM CHANGES

(Dollar amounts in thousands)

Page No.

Activity/Sub activity

Item

Positions

Budget

Authority

USPTO–29

Patent Program

Patent Examining

392

13,339

USPTO–70

Cross Cutting Functions

Human Resources Management and

Administrative Services

9

2,906

USPTO–49

Trademark Program

Trademark Trial and Appeals

4

1,090

USPTO–69

Cross Cutting Functions

Executive Direction and Communications

5

488

USPTO–70

Cross Cutting Functions

Financial Management Services

13

107

USPTO–32

Patent Program

Patent Trial and Appeals

-

(22)

USPTO–68

Cross Cutting Functions

Global Intellectual Property Academy

(GIPA)

-

(31)

USPTO–48

Trademark Program

Trademark Examining

44

(32)

USPTO–71

Cross Cutting Functions

Legal Services

-

(101)

USPTO–68

Cross Cutting Functions

Policy, External Affairs and Administrative

Support

-

(171)

USPTO–68

Cross Cutting Functions

IPR Attaché Program

-

(330)

USPTO–71

Cross Cutting Functions

Cross Cutting Functions Information

Resources

-

(3,421)

USPTO–33

Patent Program

Patent Information Resources

6

(4,029)

USPTO–72

Cross Cutting Functions

IT Infrastructure and IT Support Services

-

(9,005)

USPTO–49

Trademark Program

Trademark Information Resources

1

(10,626)

USPTO–73

Cross Cutting Functions

Miscellaneous General Expense (MGE)

-

(99,324)

Total, Program Changes

474

(109,162)

USPTO - 9

Exhibit 4A

Department of Commerce

U.S. Patent and Trademark Office

FY 2025 PROGRAM INCREASES / DECREAS

ES / TERMINATIONS

(Dollar amounts in thousands)

(By Appropriation, Largest to Smallest)

Increases

Page No. Appropriations Budget Program Title of Increase Positions Budget Authority

USPTO–29

Salaries and Expenses

Patent Program

Patent Examining

392

13,339

USPTO–70 Salaries and Expenses Cross Cutting Functions Human Resources

Management and

Administrative Services

9 2,906

USPTO–49

Salaries and Expenses

Trademark Program

Trademark Trial and Appeals

4

1,090

USPTO–69

Salaries and Expenses

Cross Cutting Functions

Executive Direction and

Communications

5

488

USPTO–70

Salaries and Expenses

Cross Cutting Functions

Financial Management

Services

13

107

Subtotal, Increases 423 17,930

USPTO - 10

Exhibit 4A

Decreases

Page No. Appropriations Budget Program Title of Decrease Positions Budget Authority

USPTO–73

Salaries and Expenses

Cross Cutting Functions

Miscellaneous General

Expense (MGE)

-

(99,324)

USPTO–49 Salaries and Expenses Trademark Program Trademark Information

Resources

1 (10,626)

USPTO–72

Salaries and Expenses

Cross Cutting Functions

IT Infrastructure and IT

Support Services

-

(9,005)

USPTO–33 Salaries

and Expenses Patent Program Patent Information Resources 6

(4,029)

USPTO–71

Salaries and Expenses

Cross Cutting Functions

Cross Cutting Functions

Information Resources

-

(3,421)

USPTO–68 Salaries and Expenses Cross Cutting Functions IPR Attaché Program - (330)

USPTO–68

Salaries and Expenses

Cross Cutting Functions

Policy, External Affairs and

Administrative Support

-

(171)

USPTO–71 Salaries and Expenses Cross Cutting Functions Legal Services - (101)

USPTO–48

Salaries and Expenses

Trademark Program

Trademark Examining

44

(32)

USPTO–68

Salaries and Expenses

Cross Cutting Functions

Global Intellectual Property

Academy (GIPA)

-

(31)

USPTO–32 Salaries and Expenses Patent Program Patent Trial and Appeals - (22)

Subtotal, Decreases

51

(127,092)

USPTO - 11

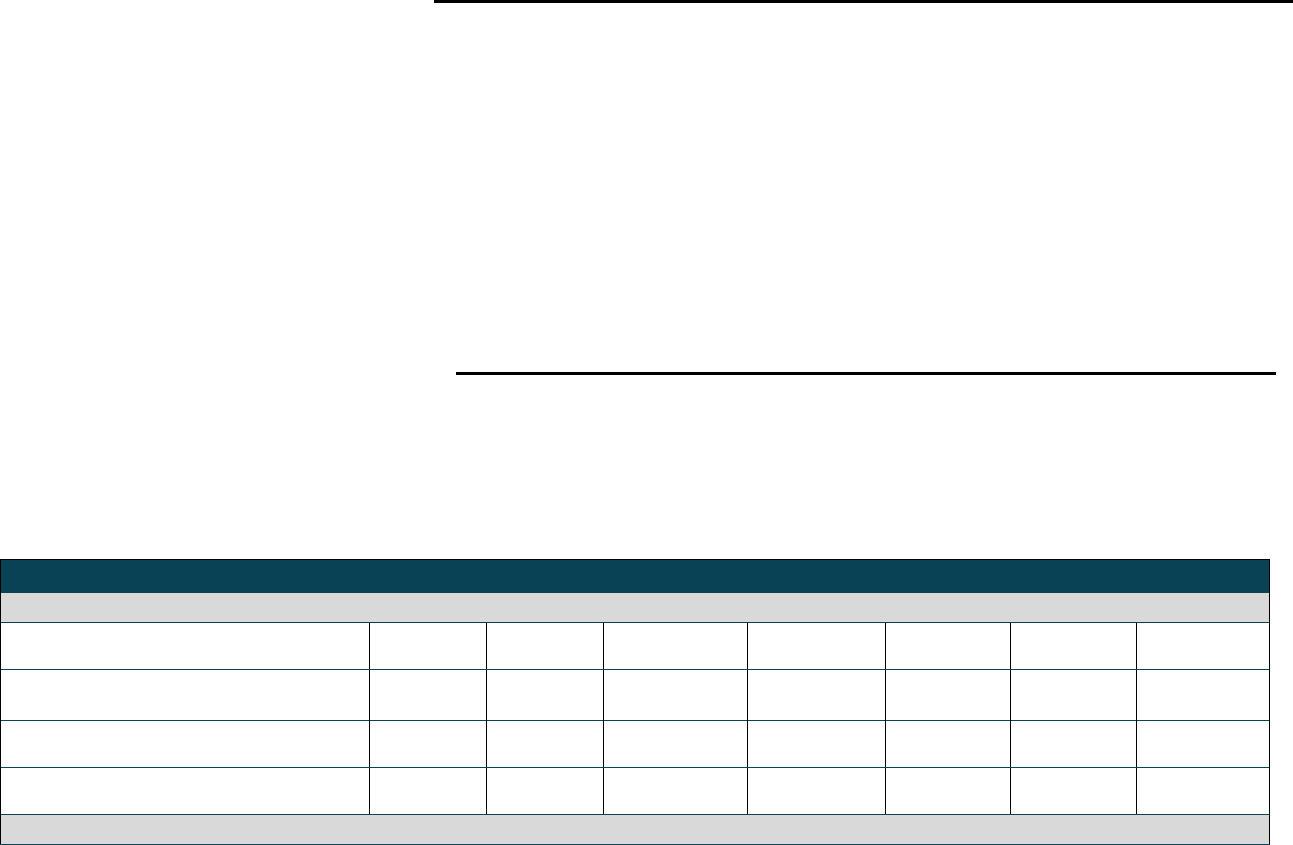

Exhibit 4T

Department of Commerce

U.S. Patent and Trademark Office

FY 2025 TRANSFER SUMM

ARY TABLE

(Dollar amounts in thousands)

Transfers

Page No.

Appropriations

Budget Program

Title of Transfer Positions Budget Authority

USPTO– 72 Salaries an

d Expenses

Cross Cutting Functions Program

Transfer to the DOC OIG

-

(2,450)

Total, Transfers

- (2,450)

USPTO - 12

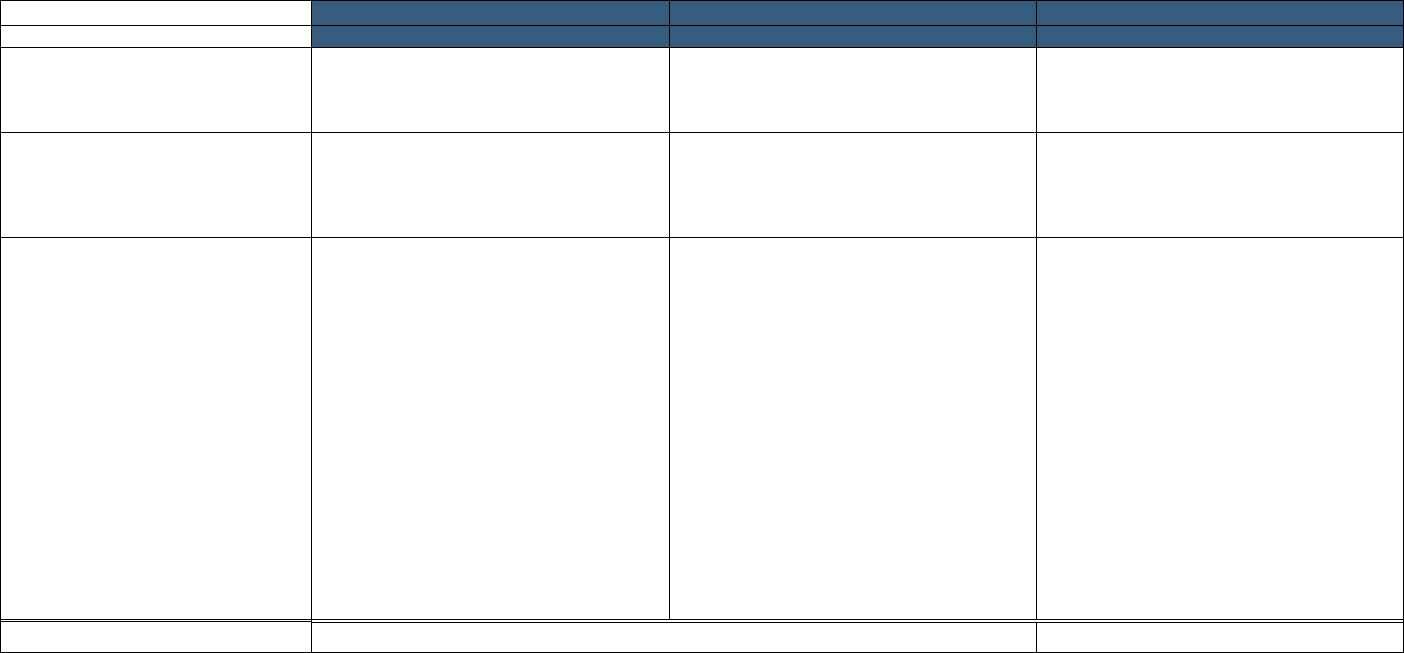

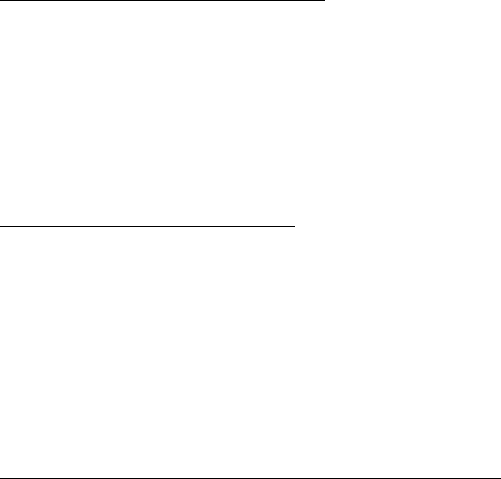

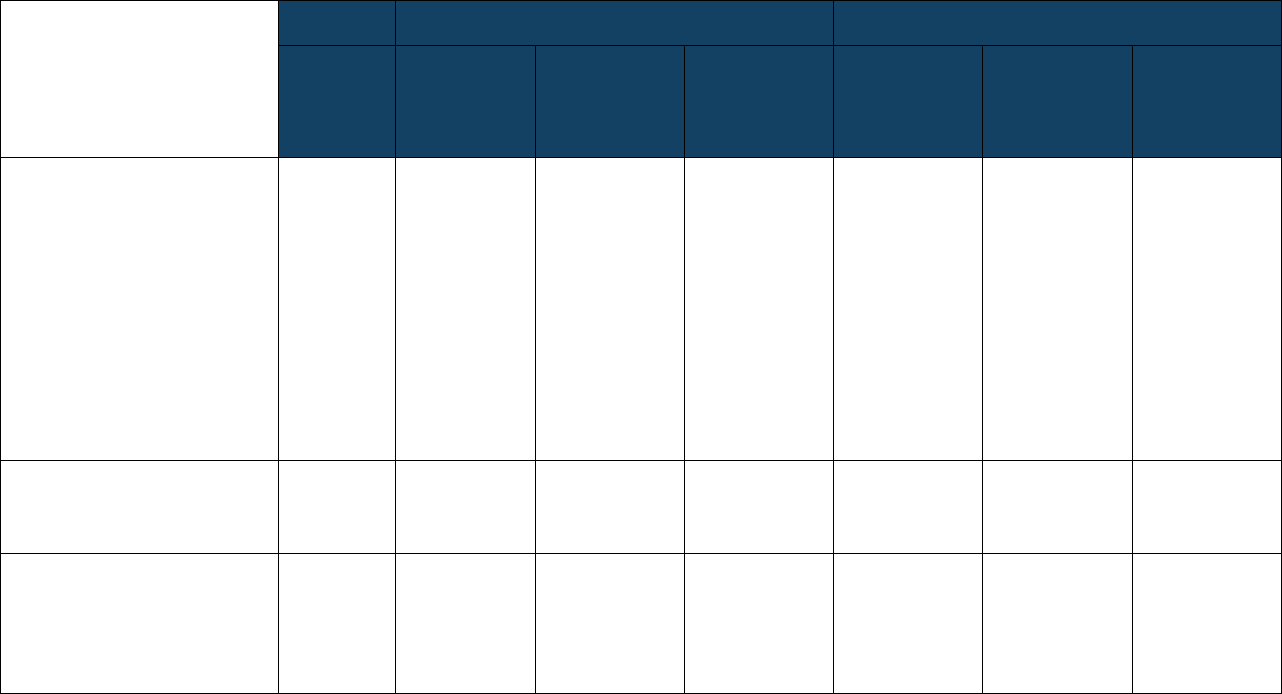

Exhibit 5

Department of Commerce

U.S. Patent and Trademark Office

Salaries and Expenses

SUMM

ARY OF RESOURCE REQUIREMENTS

(Dollar amounts in thousands)

Positions

FTE

Budget

Authority

Total

Obligations

2024 Current Plan

14,459

13,749

4,444,508

2025 Adjustments to base:

Plus: Restoration of recoveries/unobligated balances

Plus: Inflationary adjustments to base

-

274

230,826

2025 Base

14,459

14,023

4,675,334

plus: 2025 Program changes

474

200

(109,162)

F2025 Estimate

14,933

14,223

4,566,172

Comparison by activity /subactivity

with totals by activity

2023

Actual

2024

Estimate

2025

Base

2025

Estimate

Increase/(Decrease)

from 2025 Base

Personnel

Amount

Personnel

Amount

Personnel

Amount

Personnel

Amount

Personnel

Amount

Patents

Pos./Obl.

12,458

3,487,888

12,774

3,856,716

12,774

4,061,257

13,195

3,972,511

421

(88,745)

FTE

11,338

12,118

12,373

12,527

154

Trademarks

Pos./Obl.

1,649

480,205

1,685

587,792

1,685

614,077

1,738

593,660

53

(20,417)

FTE

1,344

1,631

1,650

1,696

46

Total

Pos./Obl.

14,107

3,968,093

14,459

4,444,508

14,459

4,668,321

14,933

4,566,172

474

(109,162)

FTE

12,682

13,749

14,023

14,223

200

-

Adjustments for:

Offsetting Fee Collections

(4,040,161)

(4,119,306)

(4,554,940)

(4,554,940)

-

Other Income / Recoveries

(60,467)

(60,467)

(60,467)

(60,467)

-

Unobligated balance, start of year:

Operating Reserve Balance

(983,741)

(1,145,459)

(878,273)

(878,273)

PTFRF Balance

(31,633)

-

-

-

Unobligated balance, end of year:

Operating Reserve Balance

1,145,459

878,273

815,896

925,058

109,162

PTFRF Balance

-

-

-

-

-

Total Budget Authority

(2,450)

(2,450)

(2,450)

(2,450)

-

Financing from transfers

Transfer from other accounts (-)

-

-

-

-

-

Transfer to other accounts (+)

2,450

2,450

2,450

2,450

-

Appropriation

0

0

0

0

-

USPTO - 13

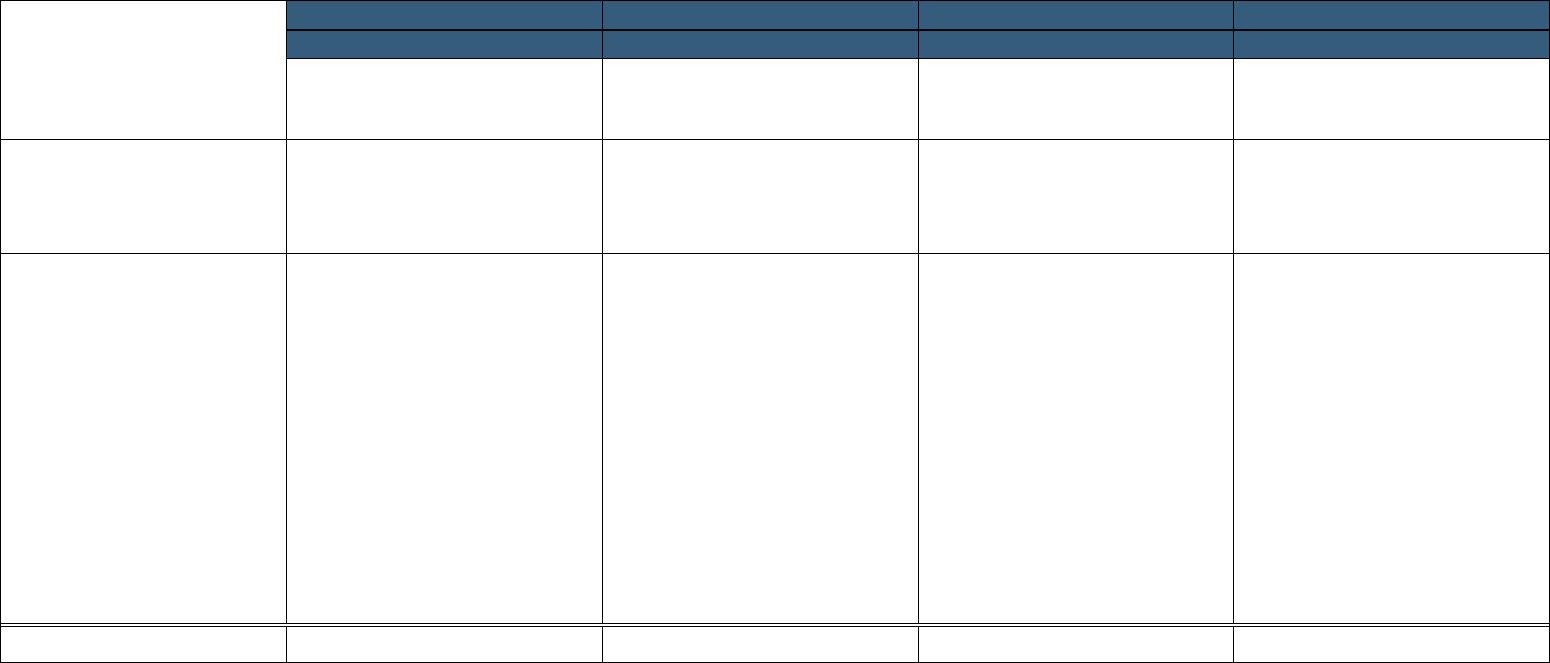

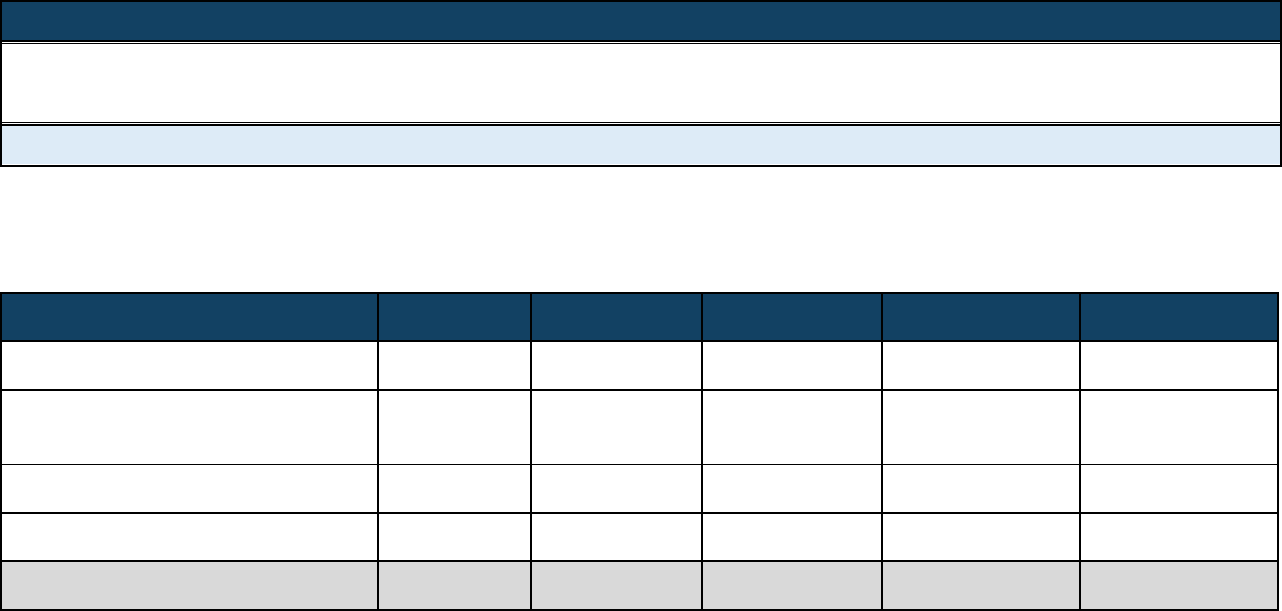

Department of Commerce

U.S. Patent and Trademark Office

SUMMARY OF RESOURCE REQUIREMENTS

(Doll

ar amounts in thousands)

Comparison by activity:

2025

Estimate

2026

Estimate

2027

Estimate

2028

Estimate

2029

Estimate

Exhibit 5

Personnel

Amount

Personnel

Amount

Personnel

Amount

Personnel

Amount

Personnel

Amount

Patents

Pos./Obl. 13,195

3,972,511

13,685 4,099,398 14,034 4,265,508 14,327

4,428,374

14,609

4,598,132

FTE

12,527

12,906

13,371

13,675

14,004

Trademarks

Pos./Obl. 1,738

593,660

1,808

610,349

1,864

634,879

1,919

663,647

1,970

690,143

FTE

1,696

1,774

1,820

1,869

1,920

Total Obligations Pos./Obl. 14,933 4,566,172 15,493 4,709,747 15,898 4,900,387 16,246 5,092,021 16,579 5,288,275

FTE

14,223

14,681

15,191

15,543

15,925

Adjustments for:

Offsetting Fee Collections (4,554,940) (4,878,801) (5,003,718) (4,999,192) (5,035,091)

Other Income / Recoveries

Unobligated balance, start of year:

(60,467) (60,467) (60,467) (60,467) (60,467)

Operating Reserve Balance (878,273) (925,058) (1,152,128) (1,313,476) (1,278,663)

PTFRF Balance - - - - -

Unobligated balance, end of year:

Operating Reserve Balance 925,058 1,152,128 1,313,476 1,278,663 1,083,497

PTFRF Balance - - - - -

Total Budget Authority

(2,450)

(2,450)

(2,450)

(2,450)

(2,450)

Financing from transfers

Transfer from other accounts (-) - - - - -

Transfer to other accounts (+)

2,450 2,450 2,450 2,450 2,450

Appropriation

0

0

0

0

0

USPTO - 14

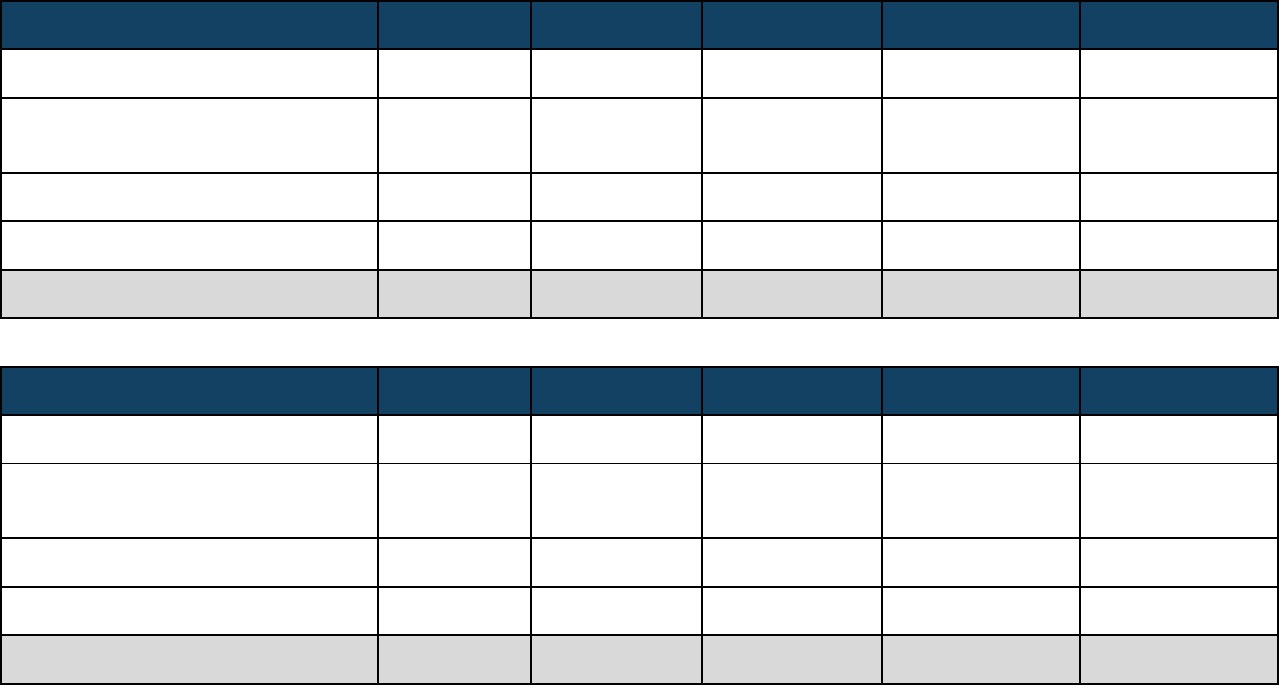

Exhibit 7

Department of Commerce

U.S. Patent and Trademark Office

Salaries and Expenses

SUMMARY

OF FINANCING

(Dollar amounts in thousands)

FY 2023

Actual

FY 2024

Current

FY 2025

Base

FY 2025

Estimate

Increase / Decrease

from 2025 Base

Total Obligations

3,968,093

4,444,508

4,675,334

4,566,172

(109,162)

Offsetting collections from:

Federal funds - - - - -

Trust funds - - - - -

Non-Federal sources (User Fee Collections) (4,040,161) (4,119,306) (4,554,940

) (4,554,940) -

Other Income

(5,085)

(5,085)

(5,085)

(5,085)

-

Recoveries

(55,382)

(55,382)

(55,382)

(55,382)

-

Unobligated balance, start of year (1,015,374) (1,145,459) (878,273) (878,273) -

Unobligated balance, transferred - - - - -

Unobligated balance, end of year 1,145,459 878,27

3 815,896 925,058 109,162

Unobligated balance, expiring - - - - -

Budget Authority

(2,450)

(2,450)

(2,450)

(2,450)

0

Financing:

Transfer from other accounts (-)

- - - - -

Transfer to other accounts (+) 2,450 2,450 2,450 2,450 -

Appropriation

0

0

0

0

0

USPTO - 15

Exhibit 8

Department of Commerce

U.S. Patent and Trademark Office

Salaries and Expenses

ADJUSTMENTS TO BASE

(Dollar amounts in thousands)

FTE Amount

Technical Transfer to Departmental Management Salary and Expenses

-

-

Adjustments

-

-

Financing

- -

-

Other Changes:

-

-

2024 Pay raise 30,039

2025 Pay raise 34,098

Full-year cost in 2025 of positions financed for part-year in 2024 274 33,490

Other Compensation Adjustments (amounts include the annualization of the projected

implementation of the Patent Examiner Special Table increase) 94,086

Change in compensable days

-

Civil Service Retirement

System (CSRS)

-

Federal Employees Retire

ment System (FERS) (384)

Thrift Savings Plan (TSP)

-

Federal Insurance Contribution Act (FIC

A) - OASDI 3,619

Health insurance 3,095

Employee Compensation Fund 145

Post-Retirement Benefits to OPM 6,074

-

-

-

Travel 261

Rental payments to GSA 1,775

GSA Furniture and IT Program (FIT) (3)

Postage 34

Working Capital Fund, Departmental Management (882)

Cyber Security WCF 1,483

National Archives and Records Administration (NARA) 40

General Pricing Level Adjustment 24,738

Telecommunications Services – Enterprise Infrastructure Services (EIS) (912)

Enterprise Services

-

HCHB Utilities

-

Commerce Business System (C

BS)

-

Federal Protective Se

rvice 29

Subtotal, other changes 274

230,826

Total, adjustments to base 274

230,826

-

-

-

USPTO - 16

PATENT PROGRAM

USPTO - 17

This Page Is Intentionally Left Blank.

USPTO - 18

Exhibit 10

Department of Commerce

U.S. Patent and Trademark Office

Salaries and Expenses

PROGRAM AND PERF

ORMANCE: DIRECT OBLIGATIONS

(Dollar amounts in thousands)

Activity: Patent Program

2023

Actual

2024

Current

2025

Base

2025

Estimate

Increase/Decrease

from 2025 Base

Sub-Activity:

Personnel

Amount

Personnel

Amount

Personnel

Amount

Personnel

Amount

Personnel

Amount

Patent Examining

Pos./Obl 10,594

2,420,722

10,864

2,655,077

10,864

2,821,933

11,256

2,835,271

392

13,339

FTE

9,861

10,395

10,615

10,743

128

Patent Trial and Appeals

Pos./Obl 413

83,425

413

90,828

413

89,644

413

89,622

-

(22)

FTE

356

354

352

352

-

Patent Information Resources

Pos./Obl 209

148,646

178

156,998

178

162,612

184

158,582

6

(4,029)

FTE

151

167

170

175

5

Subtotal Direct Pos./Obl 11,216 2,652,793 11,455 2,902,904 11,455 3,074,189 11,853 3,083,476 398 9,287

FTE 10,368 10,917 11,137 11,270 133

Cross Cutting Functions

-

Allocated Pos./Obl 1,241

835,095

1,319

953,812

1,319

987,068

1,342

889,036

23

(98,032)

FTE

970

1,202

1,236

1,257

20

Total

Pos./Obl 12,458

3,487,888

12,774

3,856,716

12,774

4,061,257

13,195

3,972,511

421

(88,745)

FTE

11,338

12,118

12,373

12,527

154

USPTO - 19

Exhibit 12

Department of Commerce

U.S. Patent and Trademark Office

Salaries and Expenses

JUSTIFICATION OF PROGRAM A

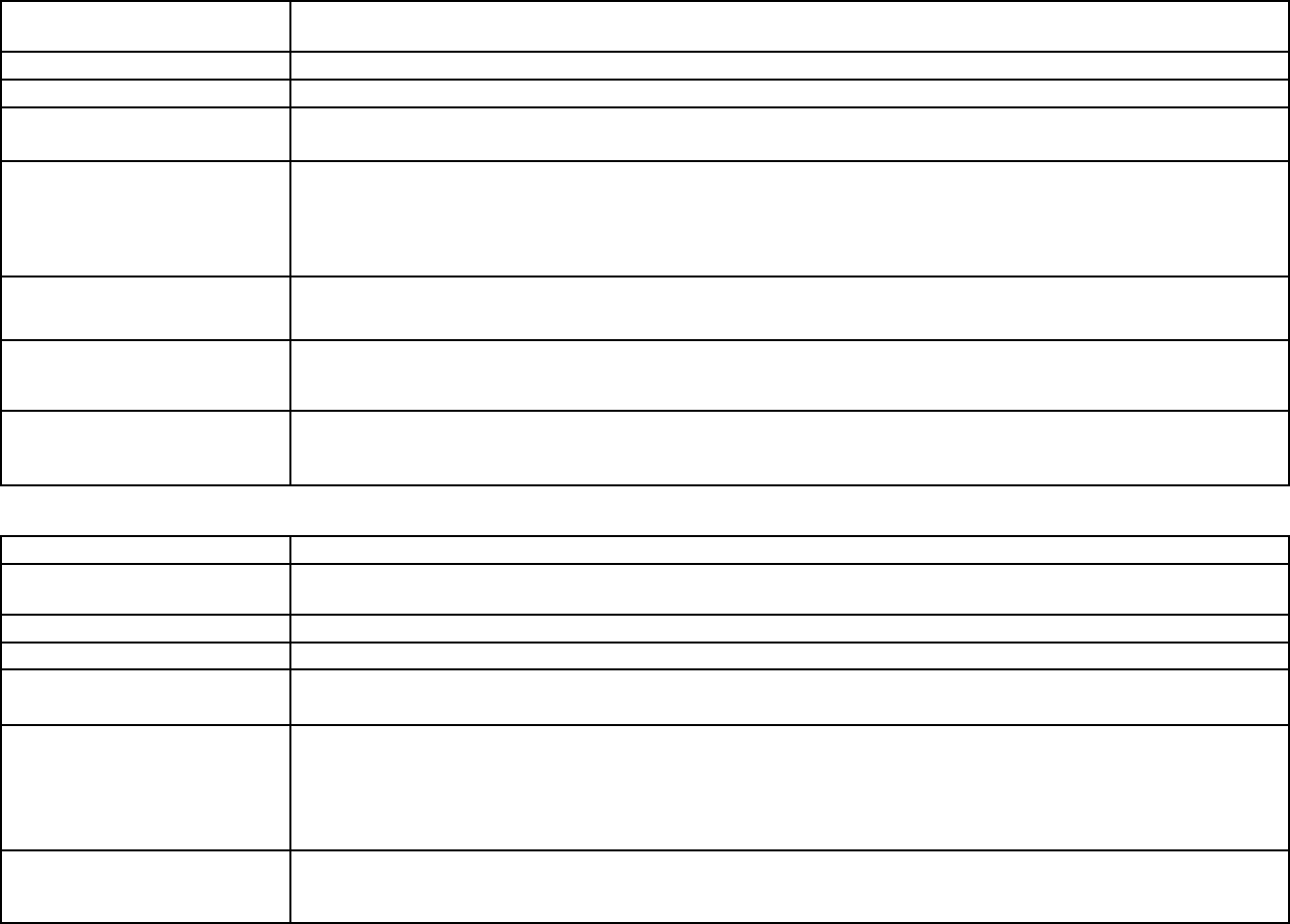

ND PERFORMANCE

(Dollar amounts in thousands)

Activity: Patent Program

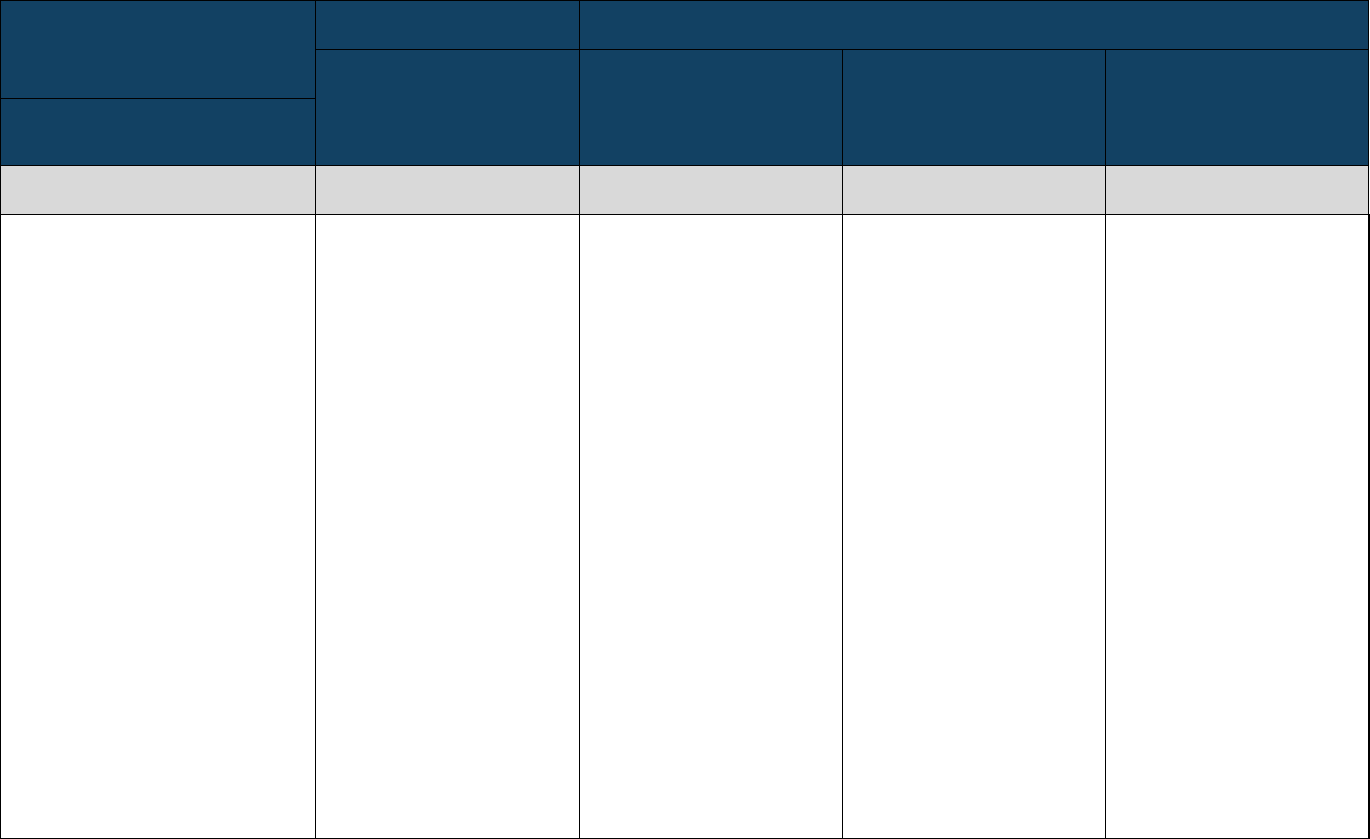

Goal Statement

The Patent Program carries out the USPTO’s mission by delivering patent services that promote inclusive innovation and by partnering

domestically and globally to educate and advise on ways to deter IP violations in accordance with laws, regulations, and practices.

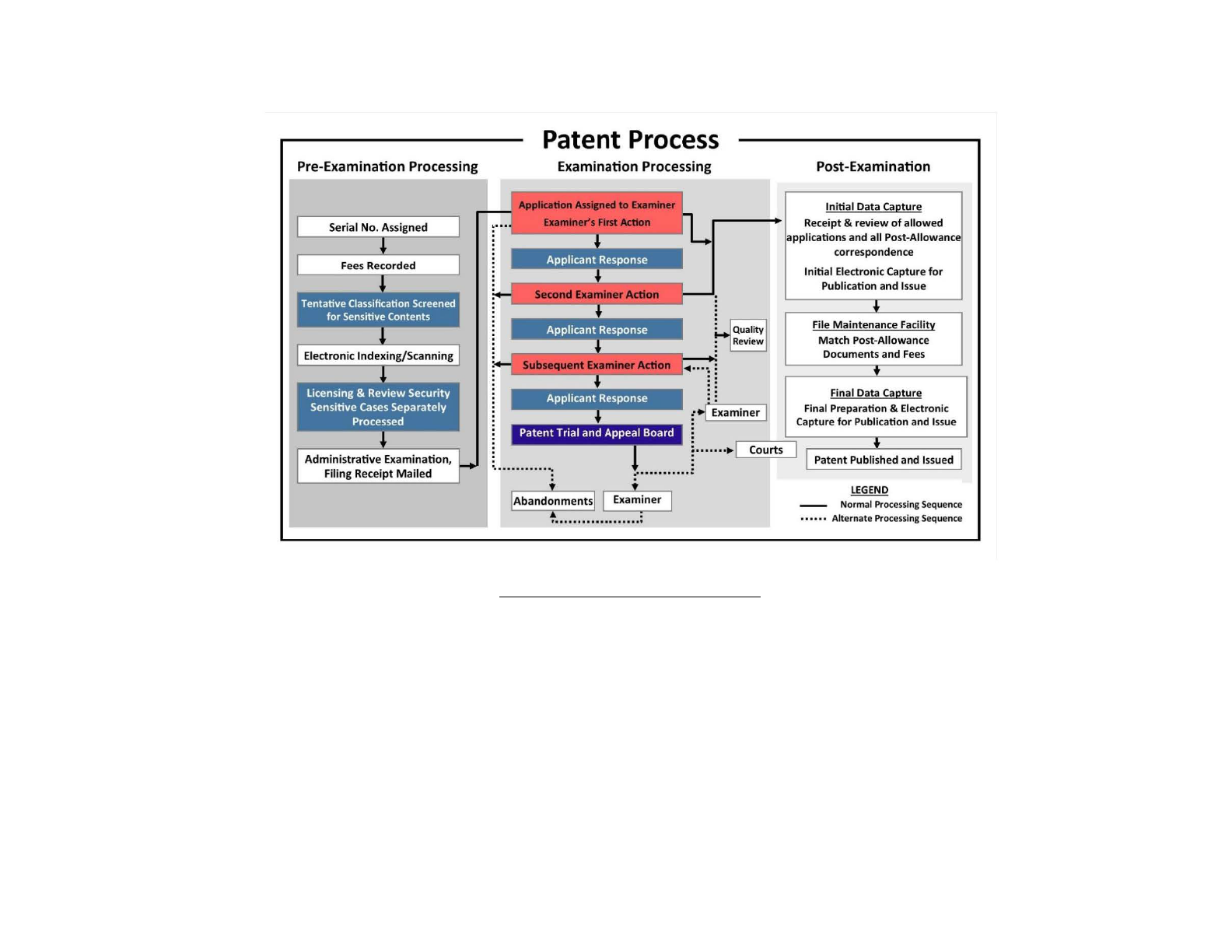

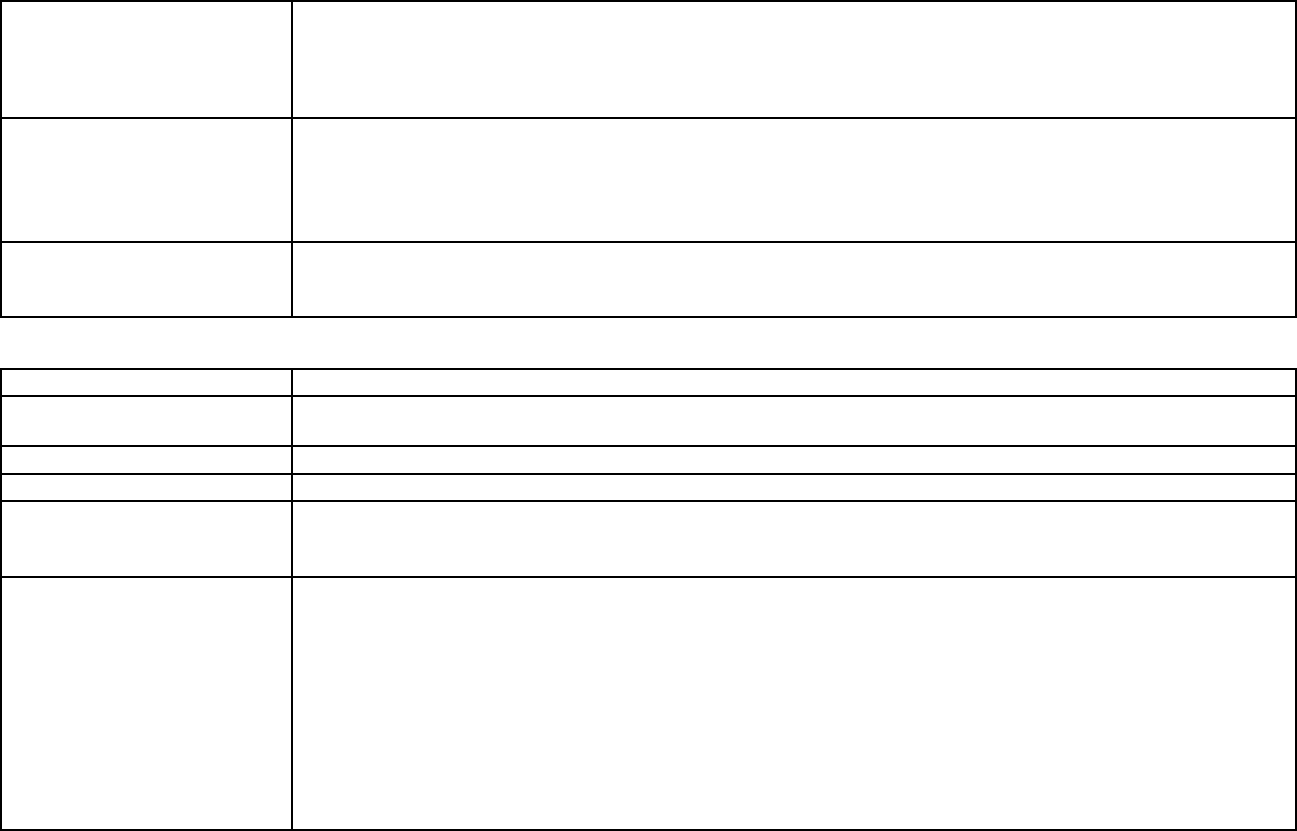

Base Program

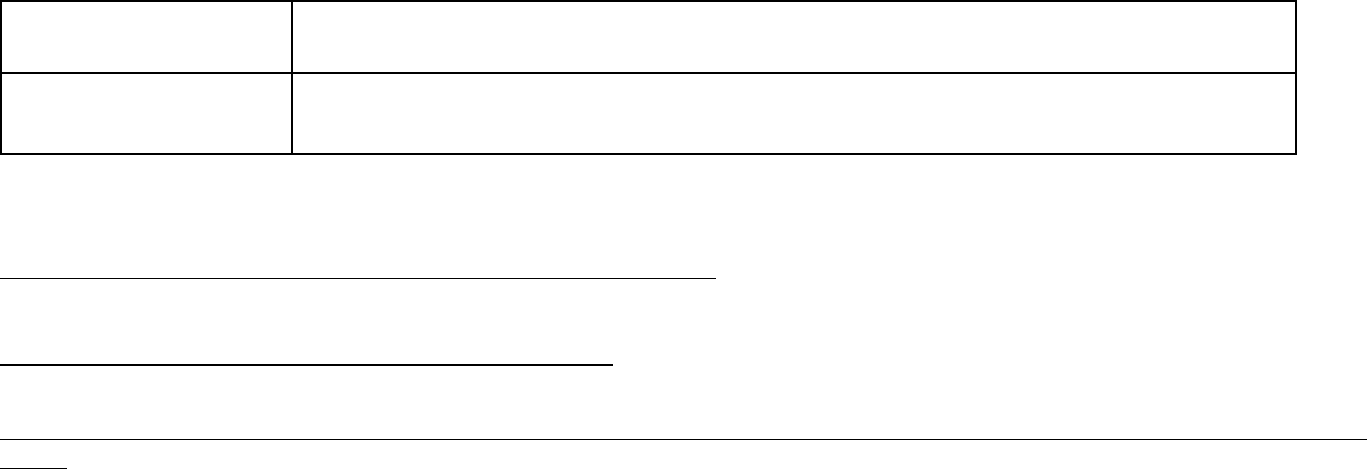

The Patent Program consists of the activities of the patent examination function and the Patent Trial and Appeal Board (PTAB), with

support from the Patent Information Resources function, which provides the tools and resources to carry out the Patent Program’s

mission-critical activities. The functions of the Patent Program are primarily demand-driven. Thus, the USPTO derived a majority of the

requirements for the FY 2025 base program from production-based workload modeling. The base resources needed to carry out the

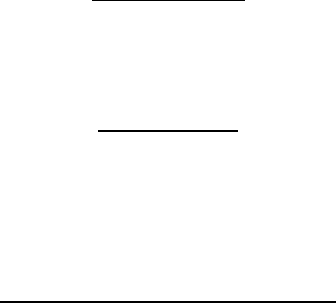

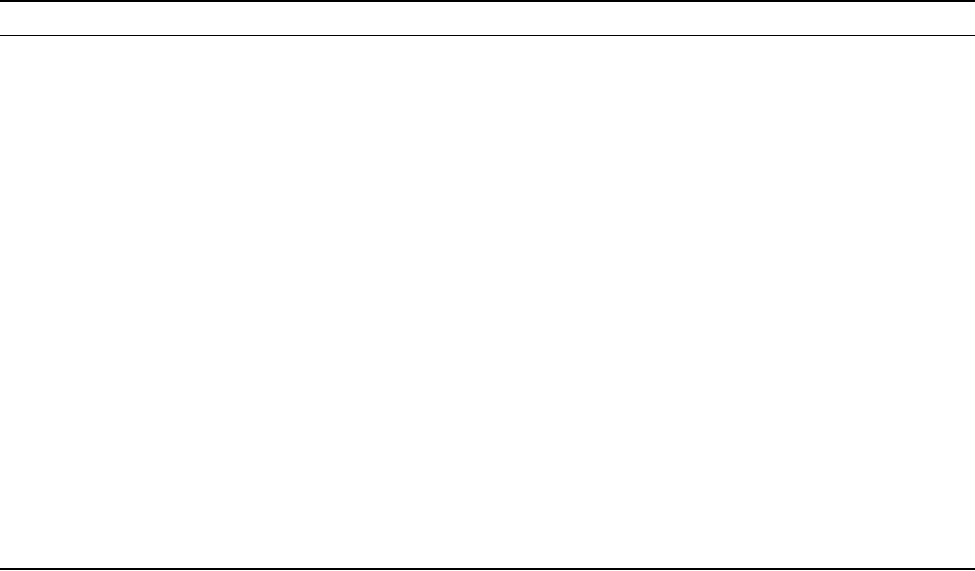

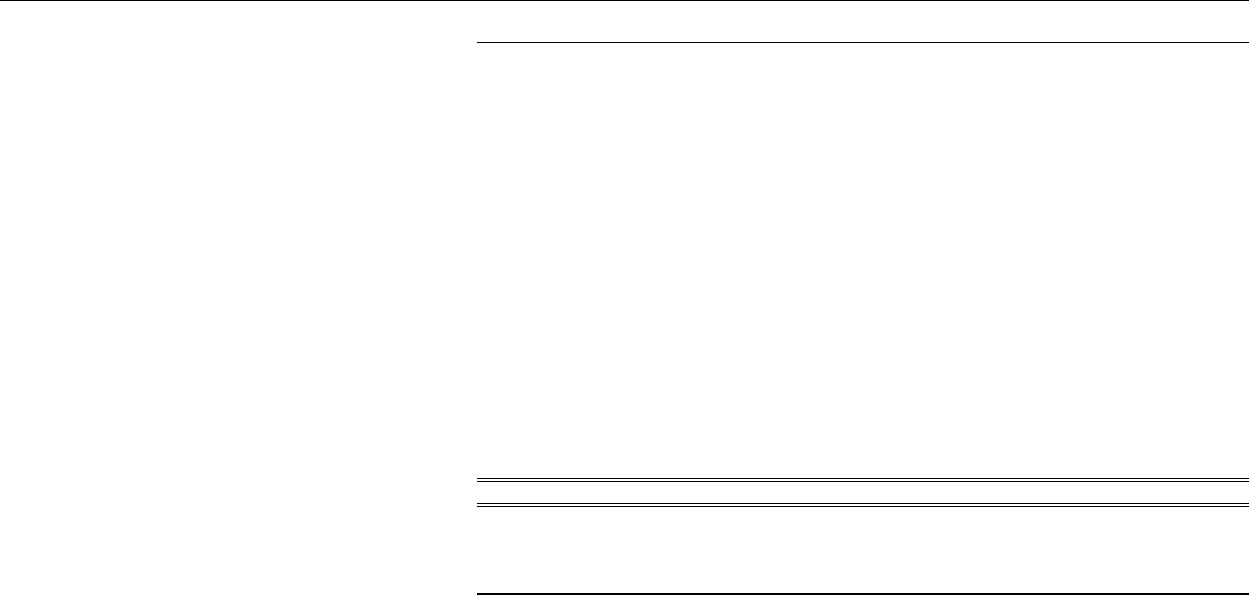

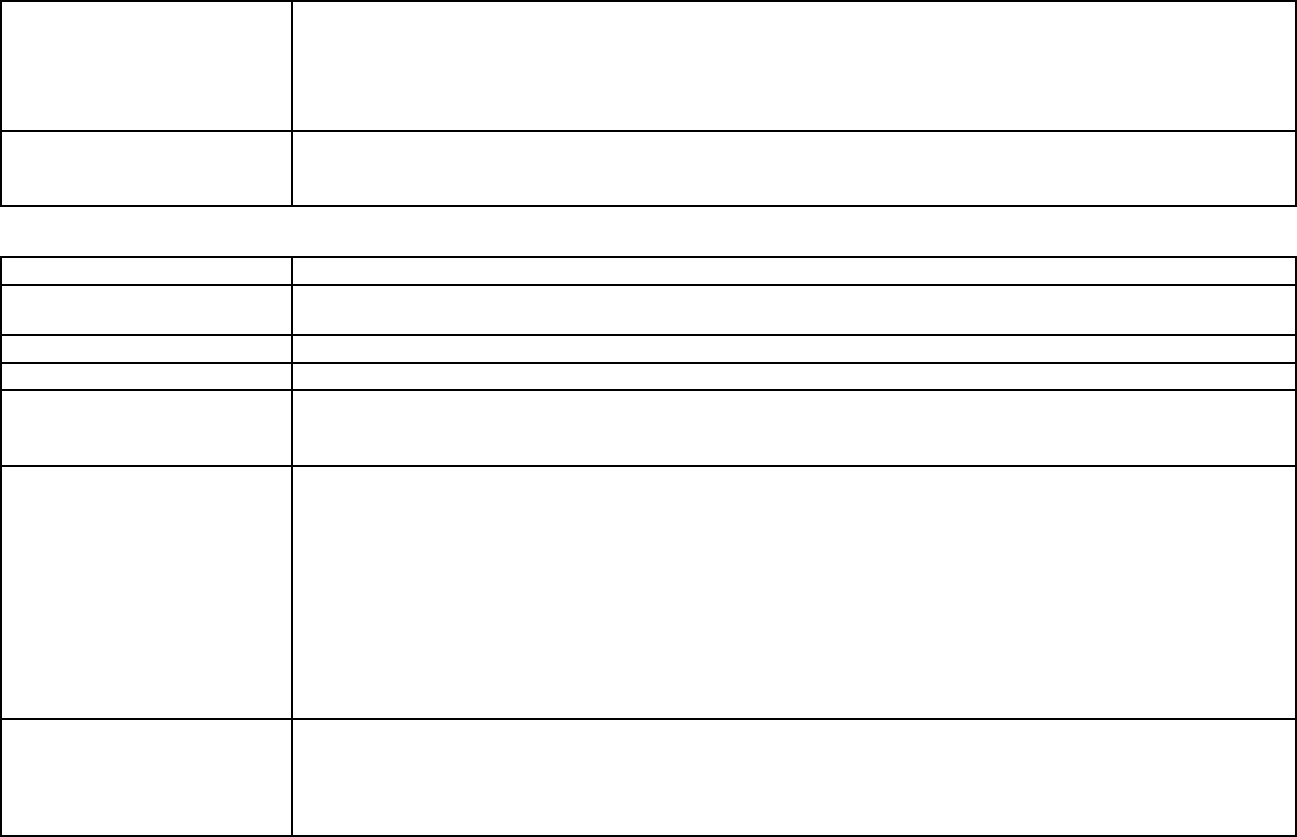

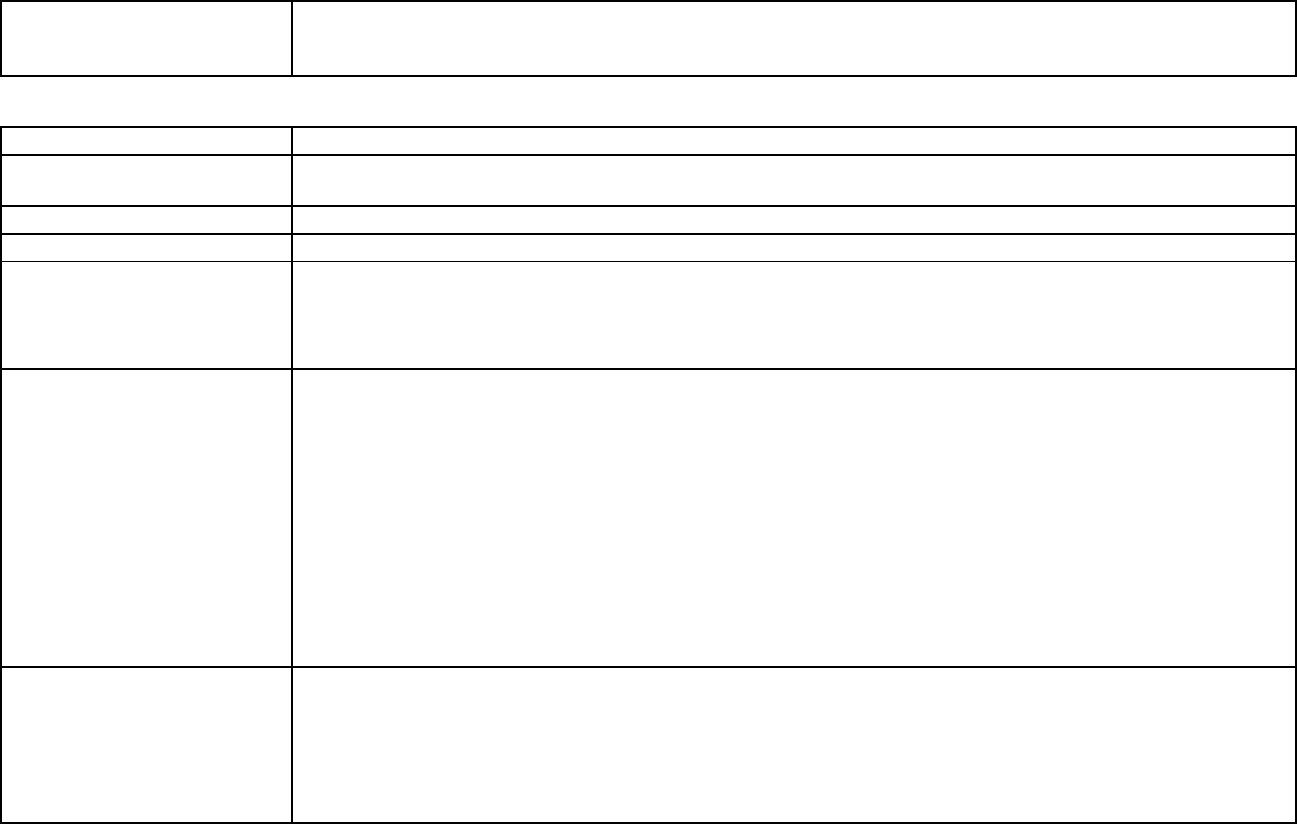

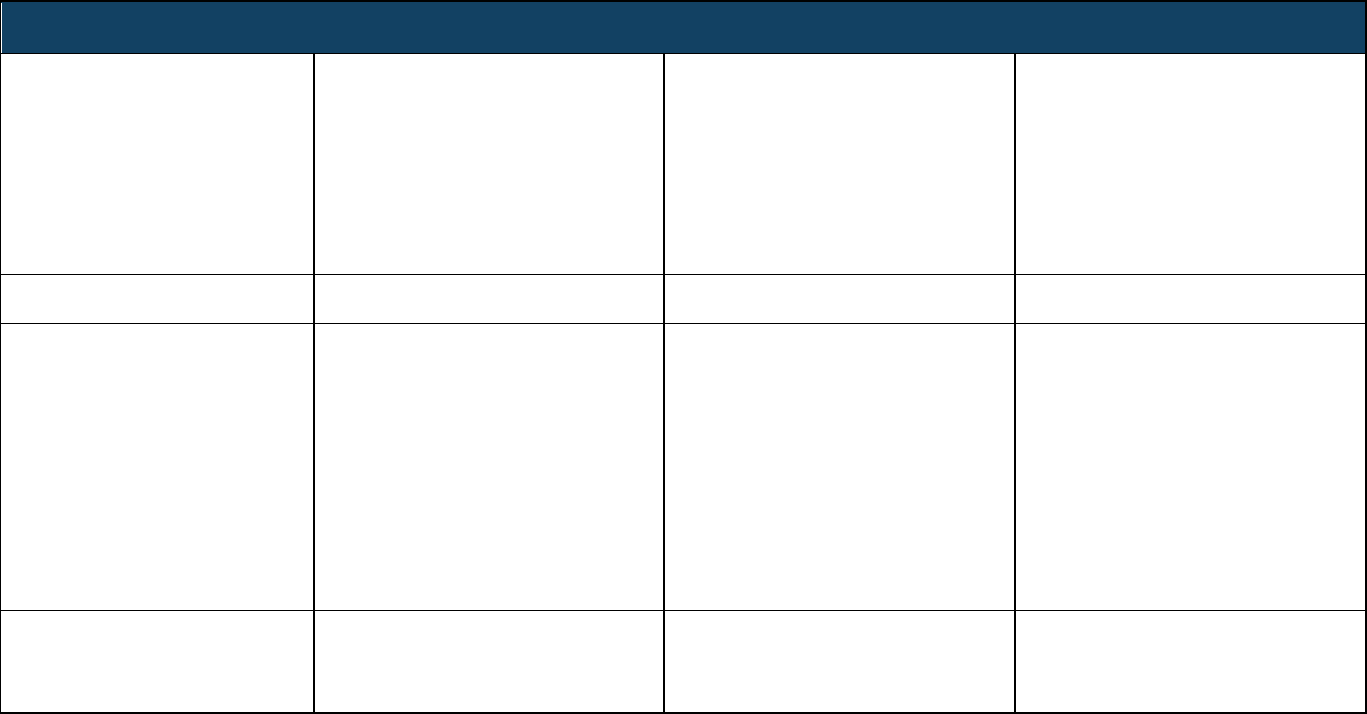

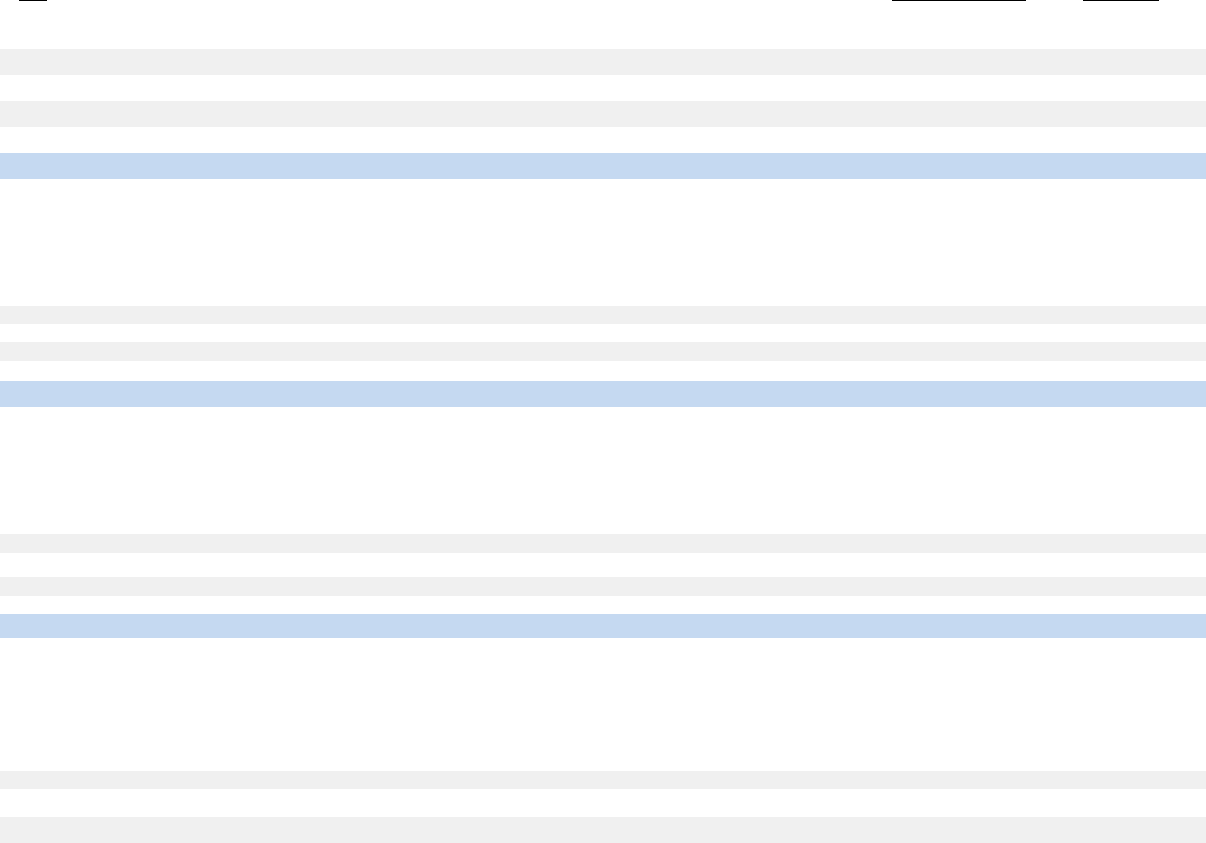

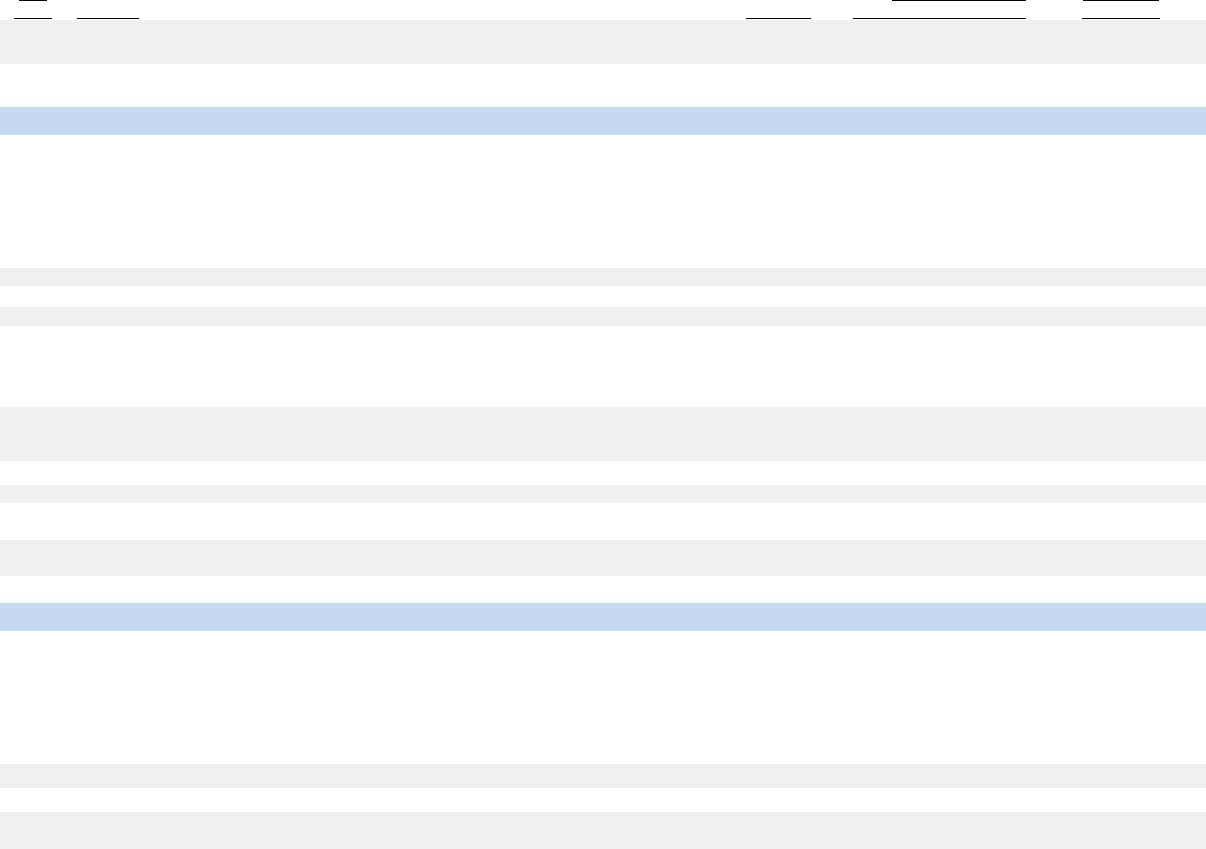

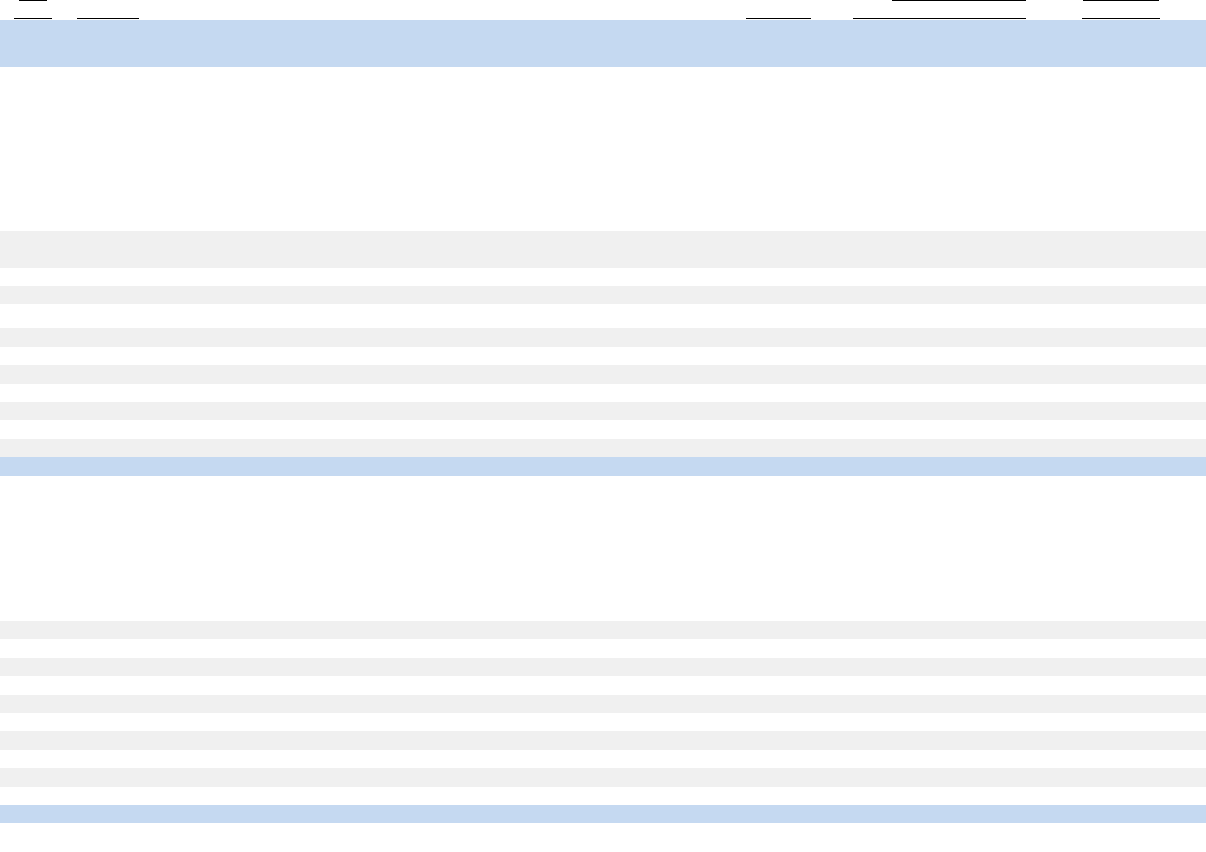

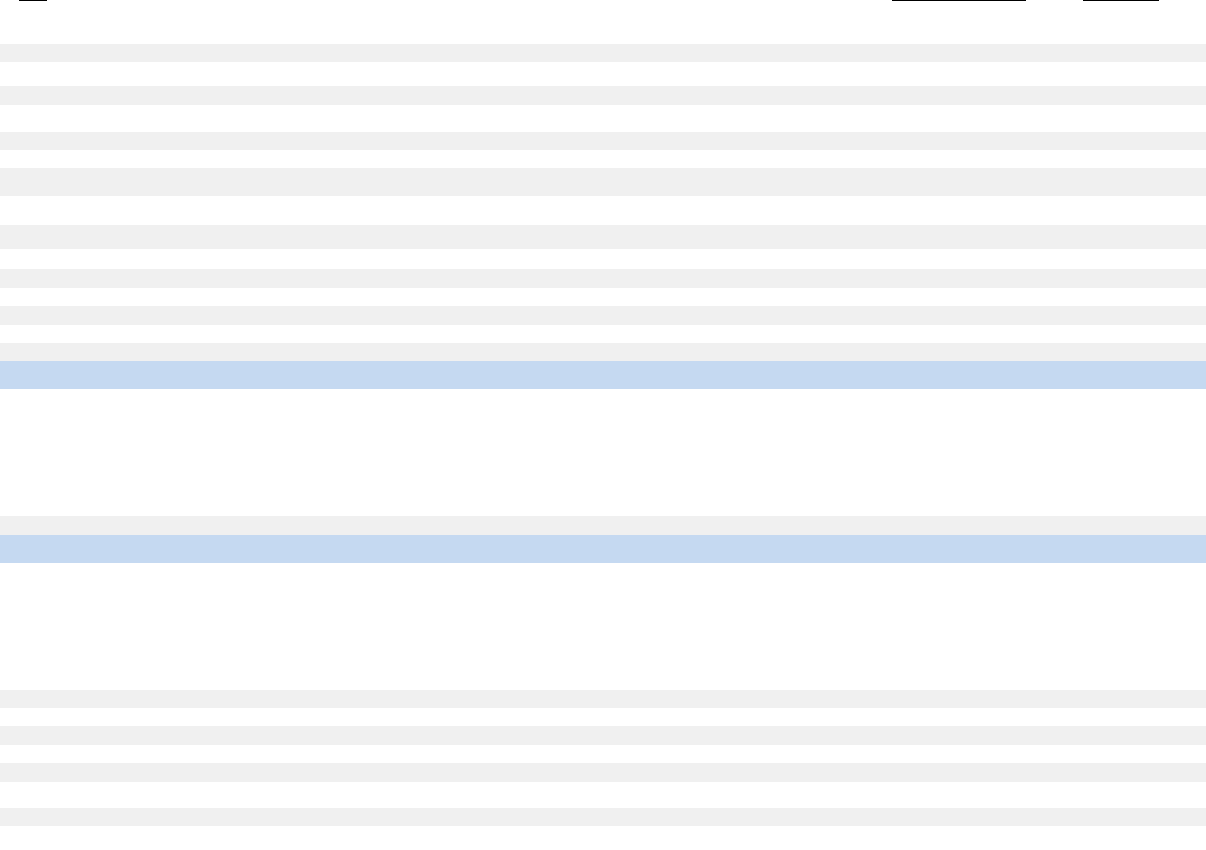

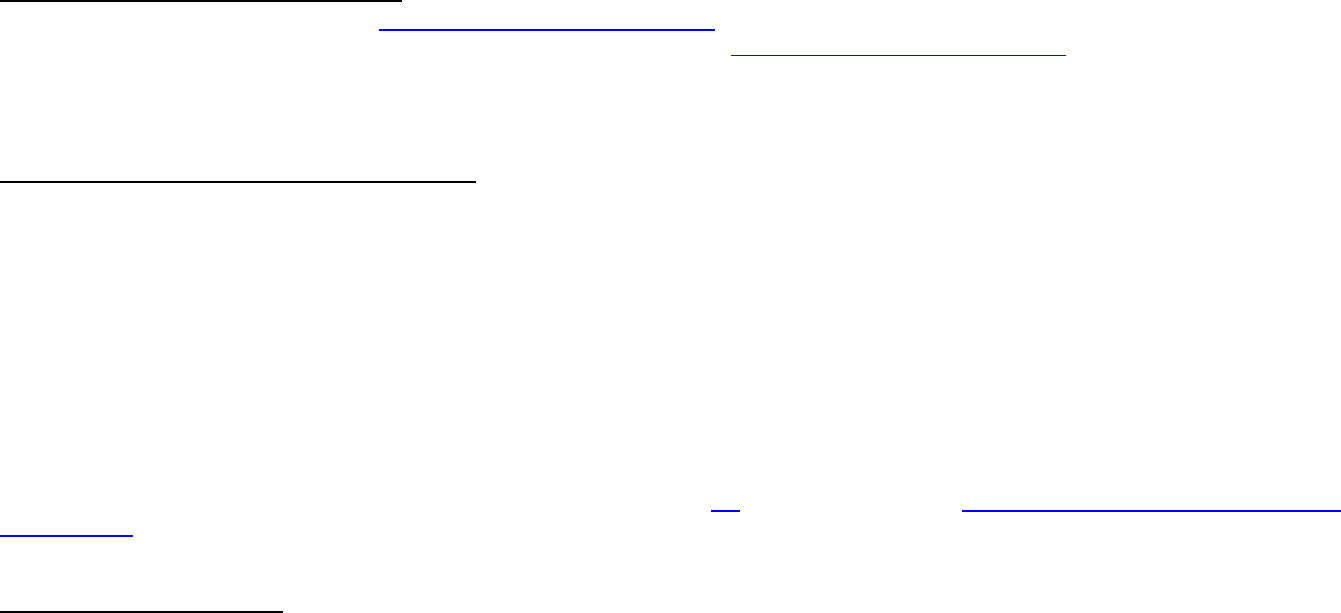

agency’s mission include training, production incentive programs, and investments in IT solutions. The patent examination process

drives most of the Patent Program requirements. It consists of the activities shown in the following schematic as well as the major

functions described below. The USPTO allocates the budget estimates for line items according to processing functions.

USPTO - 20

Patent

Process

Pre-Examination

Processing

Serial

No.

Assigned

licensing

& Review Security

Sensitive

Cases

Separately

Processed

Administrative

Examination,

Filing Receipt

Mailed

Examination

Processing

'lpp

l

Clltlon

Alllp.i

llO

ExllmNr

Elalmlner's

Flnt Adlon

Applicant

Response

Applicant

Response

subsequent

ED"*-

Action

Abandonment

s

Examiner

...

.

..

Examiner

....

~~~

~

·'muH+r•·

.......

~

I

Courts

.

..

...

.

......

.

. .

Post-Examination

Ini

tia

l Data Capture

Receipt

& review

of

allowed

applications and all Post-Allowance

correspondence

Initial Electronic Capture

for

Publication and I

ss

ue

File Maintenance

Faci

li

ty

Match

Post-Allowance

Documents and

Fees

Final Data Capture

Final Preparation & Electronic

Capture

for

Publication and Is

su

e

Patent Published and Issued

L

EGEND

No

rm

al

Process

in

g Se

qu

ence

• • • • • • Alt e

rn

a

te

Proce

ss

in

g

Se

qu

ence

Exhibit 12

Statement of Operating Objectives

The objectives of the Patent Program align with the USPTO’s focus on enhancing the country’s innovation ecosystem and providing strong,

reliable, and predictable IP rights. Patents and the PTAB are meeting the USPTO’s strategic goals by achieving the following objectives and

corresponding initiatives. The Patent Program’s objectives include:

• Issue and maintain robust and reliable patents.

• Improve patent application pendency.

• Optimize the patent application process to enable efficiencies for applicants and other stakeholders.

• Enhance internal processes to prevent fraudulent and abusive behaviors that do not embody the USPTO’s mission.

USPTO - 21

Exhibit 12

Explanation and Justification

Line Item

2023

Actual

2024

Current

2025

Base

Personnel

Amount

Personnel

Amount

Personnel

Amount

Patent Examining

Pos./Obl.

10,594

2,420,722

10,864

2,655,077

10,864

2,821,933

FTE

9,861

10,395

10,615

Patent Trial and Appeals

Pos./Obl.

413

83,425

413

90,828

413

89,644

FTE

356

354

352

Patent Information

Resources

Pos./Obl. 209 148,646 178 156,998 178 162,612

FTE

151 167 170

Cross Cutting Functions -

Allocated

Pos./Obl. 1,241 835,095 1,319 953,812 1,319 987,068

FTE

970 1,202 1,236

Total

Pos./Obl. 12,458 3,487,888 12,774 3,856,716 12,774 4,061,257

FTE

11,338 12,118 12,373

Patent Program

For FY 2025, the USPTO base totals $4,061 million and 12,373 FTEs/12,774 positions for the Patent Program.

Proposed Patent Fee Adjustments

The USPTO is a fully fee-funded agency and must periodically assess and adjust fee rates to ensure aggregate fee collections finance

the aggregate costs necessary to issue robust and reliable patents. The agency recently completed a comprehensive patent fee review,

with the conclusion that fee adjustments are necessary to increase aggregate revenue (fee collections) and to refine certain fees to

finance ongoing operations efficiently.

As part of the patent fee review, the USPTO evaluated the financial outlook under the existing fee schedule and conducted significant

research on and analysis of proposed revisions to certain fees. The UAIA, signed into law on December 29, 2022, reduced barriers to

entering the patent system by increasing small and micro entity discounts. As a consequence of new, higher discounts, the USPTO

estimates its annual fee collections will be approximately $100 million less per year than previous estimates. Additionally, the broader

U.S. economy has experienced higher-than-expected inflation over the last two years and, in turn, increased USPTO operating costs.

The USPTO is also proposing to increase the patent special rate table, which will directly impact spending for the Patent Program

USPTO - 22

Exhibit 12

beginning in FY 2024. Consequently, the agency projects aggregate operating costs will exceed aggregate fee revenues for the Patent

Program. The USPTO will finance this operating shortfall using existing OR balances until the agency implements a new fee schedule

that realigns aggregate fee collections with aggregate costs.

Patent fee collection estimates included in this Budget are based on proposed patent fee adjustments presented in a May 2023 public

hearing, with an assumed effective date of January 8, 2025. The proposed fee rates will increase projected fee collections by

approximately $437.9 million in FY 2025, once fully implemented.

Patent Examining

Continued investment in patent examination remains a priority. The USPTO employs nearly 9,500 patent examiners and other patent

employees covered by a patent special pay rate table. In 2007, the table exceeded the Washington, D.C., area General Schedule (GS)

locality pay table by 11.4–31.4%, depending on employee grade, with lower grades receiving the higher end of the supplement. The

differential above the GS has diminished over the years. In 2024, five localities, including Washington, D.C., had GS locality pay tables

that exceeded the special rate table for covered employees grade 12 and above. This has resulted in nearly 50% of the covered

employees no longer receiving a specialized supplement above the GS counterparts. In 2007, the agency set rates above the federal GS

pay table because patent-related job fields require a highly educated and technical science, technology, engineering, and mathematics

(STEM) workforce. This specialization has historically posed recruitment challenges for the agency, and the increased pay rates kept the

USPTO competitive with private sector compensation opportunities. Absent this increase, the special rate table will become obsolete,

further reducing the USPTO’s competitive edge among the private sector and other federal agencies. As such, the USPTO is facing

rising turnover in the patent field and, in response, in accordance with 5 CFR 530.304, has submitted a special salary rate to increase

the patent special rate table during FY 2024. This increase in patent special pay is an agency priority, and the USPTO considers it critical

to the continuation of quality patent examination. The Budget assumes the requested increase will be approved and the funding of the

increase is included in the compensation projections through the budget horizon. The requested increase is subject to the federal

mandated pay caps, incorporated in the estimates herein. Estimates are subject to change pending formal approval and final

implementation dates. This Budget also includes funding for recruitment incentives for certain incoming hires in the patent examination

corps. These compensation investments will assist the USPTO in meeting hiring goals and retaining the tenured examination workforce

necessary to keep pace with performance demands, while continuing to attract and retain qualified candidates in the highly competitive

STEM job market.

These investments in patent examination also include funding for application readiness, continuation practice, prior art and searching,

training, prosecution changes, and enhancements to improve patent durability. Budgeted requirements for FY 2025 comprise necessary

funding for the Patent Program’s priorities, including mission-critical, multivendor contract support.

The patent application process begins when the USPTO receives the application. This marks the onset of the pre-examination stage.

Patent anticipates receiving 609,400 utility, plant, and reissue (UPR) applications in FY 2025, including 477,000 serialized applications.

These estimates represent a 2.1% growth in UPR applications and a 1.5% growth in serialized applications over the previous year.

USPTO - 23

Exhibit 12

Resources for the pre-examination function allow the agency to conduct an administrative review, determining applications’ compliance

with requirements for form, content, adequacy, and payment of appropriate fees for paper and electronic filings. Paper filings, which

represent about 1% of new applications, require additional resources for the agency to convert the files to electronic images. This

process includes assigning the official filing date and patent application tracking number and entering the patent bibliographic data (e.g.,

filing date, priority date, and inventor(s) title(s)) into the Patent Data Portal (PDP). Patent pre-examination resources also support the

pre-grant publication process for applicable filings.

The examination stage is critical to the USPTO achieving many of its strategic and performance goals. Patent uses funding to support a

highly educated and specialized workforce that produces the office actions needed to process patent applications. The USPTO will

require resources to support the 557,000 UPR production units estimated for FY 2025. A staff of over 8,800 patent examiners, supported

by management and contractors, IT tools, legal and policy resources, and training and quality investments, generates these units to

maintain the USPTO’s standards of excellence in patent examination.

The USPTO remains committed to emphasizing quality and training, enabling a continued focus on issuing reliable and predictable

patents. The terms “reliable” and “predictable” apply to patents the USPTO issues in compliance with all the requirements of title 35 of

the U.S. Code (U.S.C.) as well as the relevant case law at the time of issuance. The USPTO continues to develop patent examining staff

by investing in a range of opportunities for technical and legal training. These opportunities include training on subjects related to 35

U.S.C. section 101, 35 U.S.C. section 102, 35 U.S.C. section 103, 35 U.S.C. section 112, and search. The USPTO continues to run

programs to train stakeholders on USPTO practices and procedures to improve applicant submissions, including initial filings and

USPTO action responses, as well as collaboration between applicants and examiners. The USPTO’s quality assurance program remains

the agency’s foundation for assessing its multiple efforts to improve reliability and consistency. Under this program, the USPTO reviews

a random sample of patent examiners’ work products to provide timely, reliable, and meaningful indicators of examination quality.

Patents needs resources to continue the activities required for post-examination processing, which takes place after examiners have

allowed applications and issue fees have been paid. These resources will support the current FY 2025 estimate of 330,600 patents being

prepared by the USPTO for issuance, printing, and publication in a weekly edition of the electronic Official Gazette for dissemination to

the public. Post-issue activities also include reissues, reexaminations, certificates of correction, the processing of withdrawals, and

assignments.

Council for Inclusive Innovation

The USPTO established the CI

2

to support all future American innovators. The council, which comprises representatives from industry,

academia, and government, helps to guide the USPTO in developing a comprehensive national strategy for building a more diverse and

inclusive innovation ecosystem by encouraging participation demographically, geographically, and economically.

USPTO - 24

Exhibit 12

Patent Trials and Appeals

The USPTO’s PTAB manages dual jurisdictions, adjudicating ex parte appeals of examiners’ final rejections and conducting AIA trial

proceedings (inter partes reviews, post-grant reviews, the transitional program for covered business method patents, and derivation

proceedings). The PTAB is an administrative tribunal that consists of administrative patent judges (APJs) whose work contributes

significantly to the issuance of reliable and predictable patents. The PTAB projects it will receive approximately 5,140 appeals in FY

2025. The FY 2025 base resources fund the legal staffing and support the PTAB needs to meet statutory requirements, aligning capacity

with projected workloads to meet objectives continuously. These base resources enable the PTAB to reach and maintain pendency for

three activities:

• The AIA trials which, by statute, must have a decision on whether to institute trial within three months of the patent owner filing a

preliminary response and which the PTAB must adjudicate within one year of instituting a trial;

• Reexamination appeals which, by statute, must be completed with “special dispatch”; and

• Ex parte appeals. Although ex parte appeals do not have a timeliness requirement, the PTAB remains committed to reducing the

inventory of open cases and remains committed to maintaining a strategic inventory level, hiring APJs as needed to support

workload projections, clearing the oldest cases, and reassigning judges according to the greatest need.

The PTAB strives to issue reliable and timely decisions by using these resources for judicial and legal staffs, systematic training, data

analytics, and trial-related studies. The PTAB is focused on enhancing decisional quality and educating and engaging stakeholders.

The base program also supports the PTAB Pro Bono Program, which the PTAB Bar Association administers and which matches under-

resourced inventors with volunteer patent practitioners for free legal assistance with ex parte appeal matters. The USPTO fully launched

the program in FY 2022, and the PTAB plans to expand the PTAB Pro Bono Program to cover AIA trial matters. PTAB proceedings are

often intimidating for under-resourced or inexperienced inventors and can place a hefty burden on their ability to practice their inventions.

The USPTO aims to provide equity in all aspects of the IP system and prioritizes expanding pro bono legal resources to appeals and

post-grant matters.

Patent Information Resources

This activity includes funding for the Patent Information Resources function, which supports the USPTO’s enterprise technology objective

of achieving world-class resiliency. Patent Information Resources also supports the following Patents product line key objectives:

• Improve the patent filing experience;

• Increase patent data quality;

• Increase access to prior art;

• Improve business operational efficiency through cloud migration; and

• Expand the availability and improve the quality of PTAB data to mitigate operational and reputational risk.

USPTO - 25

Exhibit 12

Cross-Cutting Functions – Allocated

This sub-activity represents cross-cutting management and support activities that enable the Patent Program to accomplish its goals.

These activities can be directly related to Patents, such as Office of Human Resources activities dedicated to recruiting patent examiners

and APJs, or cross-cutting functions dedicated to overall USPTO activities, such as IP policy or financial management. The Budget

describes these activities in the Cross-Cutting Functions section. The USPTO allocates these costs to the Patent Program based on the

agency’s Activity Based Information (ABI) analysis and results.

USPTO - 26

Exhibit 13

Department of Commerce

U.S. Patent and Trademark Office

Salaries and Expenses

PATENT PROGRAM

PROGRAM CHANGES FOR 2025

(Dollar amounts in thousands)

2025 Base 2025 Estimate

Increase/Decrease

from 2025 base

Personnel Amount Personn

el Amount Personnel Amount

Patent Examining

Pos./Obl. 10,864 2,821,933 11,256 2,835,271 392 13,339

FTE 10,615 10,743 128

Patent Examiner New Hires Pos./Obl. 10,864 2,288,211 11,256 2,288,744 392 533

FTE 10,615 10,743 128

Overtime / Production Incentives Pos./Obl. 157,763 168,828 - 11,065

FTE -

Workload Processing Contracts Pos./Obl. 375,959 377,699

- 1,740

FTE

-

Patent Trial and Appeals

Pos./

Obl.

413 89,644 413 89,622 - (22)

FTE

352 352 -

Patent Information Resources

Pos./Obl.

178 162,612 184 158,582 6 (4,029)

FTE 170 175 5

Direct Total, Patent Program Pos./

Obl.

11,455 3,074,189 11,853 3,083,476 398 9,287

FTE 11,137 11,270 133

USPTO - 27

Department of Commerce

U.S. Patent and Trademark Office

Salaries and Expenses

PATENT PROGRAM

Exhibit 13

PROGRAM CHANGES FOR 2025–2029

(Dollar amounts in thousands)

2025

Increase/Decrease

2026

Increase/Decrease

2027

Increase/Decrease

2028

Increase/Decrease

2029

Increase/Decrease

Personnel

Amount

Personnel

Amount

Personnel

Amount

Personnel

Amount

Personnel

Amount

Patent Examining

Pos./Obl. 392

13,339

888

51,139

1,237

100,773

1,529

147,958

1,811

199,617

FTE

128

500

975

1,278

1,611

Patent Examiner New Hires Pos./Obl. 392 533 888 35,610 1,237 81,065 1,529 121,300 1,811 164,795

FTE 128 500 975 1,278 1,611

Overtime / Production

Incentives

Pos./Obl.

11,065

16,159

23,983

30,488

37,216

FTE

Workload Processing Contracts

Pos./Obl.

1,740

(630)

(4,276)

(3,830)

(2,394)

FTE

Patent Trial and Appeals

Pos./Obl. -

(22)

-

(61)

-

(114)

-

(168)

-

(223)

FTE

-

-

-

-

-

6 6 6 6 6

Patent Information Resources

Pos./Obl.

(4,029)

(9,702)

(13,345)

(17,026)

(20,747)

FTE

5

6

6

6

6

398 894 1,243 1,535 1,817

Direct Total, Patent Program

Pos./Obl.

9,287

41,377

87,314

130,764

178,647

FTE

133

506

981

1,284

1,617

USPTO - 28

(percent)

Exhibit 13

Sub-Activity: Patent Examining

Patent Examining ($13.3 Million and +128 FTEs/392 Positions): In FY 2025, the Patent Examining program change and base resources

will provide funding to ensure the high-quality and timely examination of patent applications, leading to the USPTO issuing reliable and

predictable patents. The requirements will also enhance the CX by ensuring the accuracy, consistency, and reliability of patent

examination, thereby increasing the value of the patent to the inventor. The requirements also support the DOC’s strategic objective of

promoting accessible, strong, and effective IP rights to advance innovation, creativity, and entrepreneurship.

The USPTO remains committed to processing patent applications promptly and has established patent timeliness goals based on PTA

time frames. Reducing the number of patents that receive PTAs provides consistently shorter pendency for all applications and gives

applicants greater certainty of the timeliness of their own cases. These resources will allow the USPTO to process incoming work for

which fees have been paid.

Assuming Patents successfully executes planned hiring, workload, and productivity levels in FY 2024 and FY 2025, these program

requirements collectively will enable Patents to:

• Address 477,000 new serialized applications (609,400 UPR applications are expected to be filed in FY 2025), 1.5% above the

projected FY 2024 level;

• Hold the current unexamined UPR inventory at approximately 817,900 by the end of FY 2025;

• Continue to provide timely examination of patent applications by maintaining total PTA compliance for all mailed actions at 80% in

FY 2025; and

• Maintain total PTA compliance for all remaining inventory at 81% in FY 2025.

Performance Measures

2025

2026

2027

2028

2029

Total PTA Compliance – all mailed actions (percent)

80

80

80

80

80

Total PTA Compliance – remaining inventory

81

80

80

80

81

remaining inventory

Without Funding:

Total PTA Compliance – all mailed actions (percent)

79

78

77

76

76

Total PTA Compliance – remaining inventory

80

79

77

76

74

(percent)

Outyear Costs:

Direct Obligations

13,339

51,139

100,773

147,958

199,617

FTE

128

500

975

1,278

1,611

Positions

392

888

1,237

1,529

1,811

USPTO - 29

Exhibit 13

Patent Examiner New Hires: In FY 2025, the USPTO will continue to calibrate the size of the patent examining staff with projected

application filings and desired performance results, as documented by patent production modeling. The USPTO projects serialized

patent application filings will increase by 1.5% in FY 2025 and, beginning in FY 2026, remain consistent at 1.0% annually through the

budget horizon. The USPTO plans to hire 850 UPR patent examiners in FY 2025 and 700–900 patent examiners annually from FY 2026

through FY 2029. Approximately 400 attritions offset these hires annually. The increased workforce is based on filing trends and planned

investments in enhanced quality—particularly, the issuance of reliable and predictable patents. The patent examiner corps comprises a

highly technical workforce, and the Patent Program changes will also fund the USPTO’s continued investment in competitive examiner

compensation and recruitment incentives through the budget horizon. These continued investments will help the USPTO to meet

expanded examination capacity needs while combating an increasingly competitive STEM job market. This funding will allow the USPTO

to continue to connect a diverse, elite STEM talent pool with fulfilling federal careers to meet the growing demand for reliable patent

services.

The production model considers this revised incoming work as well as the revised output of examiners. The careful calibration of quality,

workload, and hires will enable the USPTO to continue making progress on its PTA targets while enabling continued financial

sustainability.

2025

2026

2027

2028

2029

Outyear Costs:

Direct Obligations

533

35,610

81,065

121,300

164,795

Budget Authority

533

35,610

81,065

121,300

164,795

FTE

128

500

975

1,278

1,611

Positions

392

888

1,237

1,529

1,811

Council for Inclusive Innovation (CI

2

): In FY 2025, the USPTO will fund programming that expands on the efforts to increase

participation in the innovation ecosystem by encouraging, empowering, and supporting all future innovators, including women and other

underrepresented groups. This program change will support the USPTO’s CI2 objective by expanding the programming for IP community

outreach campaigns. This program change will also leverage the USPTO’s nationwide workforce as a powerful tool for educating local

communities on the importance of IP as well as achieving the goal of increasing IP literacy and participation in the innovation ecosystem

across our nation’s population. USPTO IP ambassadors will engage with new audiences on the importance of protecting ideas and

brands to help to foster new businesses and economic activity. In addition, this funding will support a laptop reuse partnership initiative

and paid internship programs for community college and four-year college students to broaden the inclusion of underrepresented groups

by providing a curriculum that will encourage students to seek full-time employment in the IP and innovation ecosystem.

USPTO - 30

Exhibit 13

Overtime/Production Incentives: The USPTO uses overtime and production incentives to continue to align production with workload

demand. Each overtime hour worked ties directly to production output, as do production incentives. As such, overtime has proven to be

more efficient on a per-hour basis than equivalent regular-time hours, which must also incorporate the costs of training, employee leave,

and other employee benefits. Funding the full amount of examiner overtime and other production incentives is essential to achieving PTA

and inventory goals. The inherent flexibility of overtime allows Patents to expand its production capacity easily while also maintaining

optimal staffing levels.

2025

2026

2027

2028

2029

Outyear Costs:

Direct Obligations 11,065 16,159 23,983 30,488 37,216

Budget Authority 11,065 16,159 23,983 30,488 37,216

FTE 0 0 0 0

0

Positions 0 0 0 0 0

Workload Processing Contracts: Patents uses contractor support to manage the application and issuance processes. The contract

costs are based on the number of applications, examiner production, and granted patents. Specifically, Patents uses these contracts for:

• Front-end processing of newly filed applications, incoming documents, and outgoing documents and quality assurance of

electronic filings based on the increase in electronically filed applications and the number of pages per application;

• Data capture of applications subject to publication at 18 months as a pre-grant publication;

• Pre-grant publication and initial classification services whereby a contractor classifies all incoming applications once they have

been through the initial security review; and

• Patent publication, which includes capturing granted patents data and generating both a text-searchable file and an image file for

electronic dissemination.

Additionally, Patents will use funding for information security system officers to support the workload contracts, establish security and

privacy policies, and protect information.

USPTO - 31

Exhibit 13

2025

2026

2027

2028

2029

Outyear Costs:

Direct Obligations

1,740

(630)

(4,276)

(3,830)

(2,394)

Budget Authority

1,740

(630)

(4,276)

(3,830)

(2,394)

FTE

0

0

0

0

0

Positions

0

0

0

0

0

Sub-Activity: Patent Trials and Appeals

PTAB Production and AIA Workload (-$22.0 Thousand and 0 FTEs/0 Positions): For FY 2025 through FY 2029, the PTAB projects that

costs will decrease slightly due to efficiencies found in savings via non-compensation that are below the allowed inflationary adjustments.

2025

2026

2027

2028

2029

Outyear Costs:

Direct Obligations

(22)

(61)

(114)

(168)

(223)

Budget Authority

(22)

(61)

(114)

(168)

(223)

FTE

0

0

0

0

0

Positions

0

0

0

0

0

FY 2023

FY 2024

FY 2025

FY 2026

FY 2027

FY 2028

FY 2029

APPEALS

Incoming appeals

(Ex parte appeals)

4,413

4,501

4,569

4,615

4,661

4,708

4,755

Appeals disposed

4,785

4,680

4,757

4,566

4,511

4,511

4,511

Appeal inventory/backlog

(Ex parte appeals)

4,231

4,052

3,864

3,913

4,063

4,260

4,504

Board months of inventory

12

11

10

10

10

11

11

AIA TRIAL

USPTO - 32

Exhibit 13

FY 2023

FY 2024

FY 2025

FY 2026

FY 2027

FY 2028

FY 2029

AIA petitions filed

1,246

1,271

1,290

1,303

1,316

1,329

1,342

AIA petitions disposed

1,390

1,314

1,288

1,289

1,305

1,317

1,330

ADMINISTRATIVE PATENT JUDGES

Total APJs and PAs

(incl. executive APJs and vacancies)

301

301

301

301

301

301

301

Sub-Activity: Patent Information Resources

Patents Product Line (-$4.0 Million and 5 FTEs/6 Positions): The Patents product line will focus on the following objectives:

• Improve the Patent Filing Experience: Based on customer feedback, modernizing the USPTO’s patent filing system by using

new technologies, new filing capabilities (e.g., DOCX application types), and filing assistance promotes a better user experience

for agency stakeholders.

• Increase Patent Data Quality: Improving patent data quality through the full patent application life cycle will reduce operational

costs over time and improve the timeliness and quality of published grants.

• Increase Access to Prior Art: Providing search stakeholders with new technologies, including AI, increased prior art collections,

and automation efficiencies, will improve the CX.

• Improve Business Operational Efficiency through Cloud Migration: Leveraging cloud infrastructure for the Patents product

line will improve resiliency and system performance across the patent application life cycle, reduce operational disruptions, and

improve security posture.

• Expand the Availability and Improve the Quality of PTAB Data to Mitigate Operational and Reputational Risk: Providing

increased access to complete, accurate case data and promoting more case decision transparency and consistency will increase

operational efficiency and better communicate PTAB case outcomes and statistics.

Appendix III to this Budget contains additional information about Patents’ planned IT activities.

2025

2026

2027

2028

2029

Outyear Costs:

Direct Obligations

(4,029)

(9,702)

(13,345)

(17,026)

(20,747)

Budget Authority

(4,029)

(9,702)

(13,345)

(17,026)

(20,747)

FTE

5

6

6

6

6

Positions

6

6

6

6

6

USPTO - 33

Exhibit 14

Department of Commerce

U.S. Patent and Trademark Office

Salaries and Expenses

PROGR

AM CHANGE PERSONNEL DETAIL

Activity:

Patents

Subactivity:

Program Change:

Full-time permanent

Annual

Total

Title:

Grade

Number

Salary

Salaries

Patent Examiner

7

460

86,658

39,862,680

Patent Examiner

9

340

90,774

30,863,160

Patent Examiner

11

85

97,360

8,275,600

Patent Attritions

Various

(507)

139,163

(70,555,478)

Patent Examiner Support Positions

Various

14

101,344

1,418,815

IT Specialists

Various

6

168,129

1,008,773

Total

398

10,873,550

Less lapse

66%

(264)

(10,896,137)

Total full-time permanent (FTE)

133

(22,587)

2025 Pay Adjustment (2%)

22,753

Total

166

Personnel Data Summary

Full-Time Equivalent Employment

Full-time permanent

133

Other than full-time permanent

-

Total

133

Authorized Positions:

Full-time permanent

398

Other than full-time permanent

-

Total

398

USPTO - 35

Exhibit 15

Department of Commerce

U.S. Patent and Trademark Office

Salaries and Expenses

PROGRAM CHANGE DETAIL BY OBJECT CLASS

(Direct Obligations amounts in thousands)

Activity: Patent Program

Object Class

2023

Actual

2024

Current

2025

Base

2025

Estimate

2025

Increase/Decrease

from 2025 base

11

Personnel compensation

11.1

Full-time permanent

1,456,152

1,601,404

1,719,182

1,719,348

166

11.3

Other than full-time permanent

-

-

-

-

-

11.5

Other personnel compensation

136,378

160,151

162,448

173,514

11,065

11.8

Special personnel services payments

-

-

-

-

-

11.9

Total personnel compensation

1,592,530

1,761,555

1,881,630

1,892,861

11,231

12

Civilian personnel benefits

551,557

623,513

664,366

664,733

367

13

Benefits for former personnel

-

-

-

-

-

21

Travel and transportation of persons

1,460

7,204

7,349

7,398

50

22

Transportation of things

2

13

13

13

0

23.1

Rental payments to GSA

-

-

-

-

-

23.2

Rental payments to others

26

-

-

-

-

23.3

Communications, utilities and miscellaneous charges

288

301

307

305

(2)

24

Printing and reproduction

198,180

183,055

186,716

186,359

(357)

25.1

Advisory and assistance services

50,812

55,744

56,859

56,622

(237)

25.2

Other services

87,437

80,685

82,298

83,356

1,058

25.3

Purchases of goods & services from Gov't accounts

173

100

102

100

(2)

25.4

Operation and maintenance of facilities

-

-

-

-

-

25.5

Research and development contracts

-

-

-

-

-

25.6

Medical Care

-

-

-

-

-

25.7

Operation and maintenance of equipment

57,628

139,139

141,923

138,154

(3,769)

25.8

Subsistence and support of persons

-

-

-

-

-

26

Supplies and materials

45,602

48,538

49,509

50,463

954

31

Equipment

64,412

606

618

612

(6)

32

Lands and structures

-

-

-

-

-

33

Investments and loans

-

-

-

-

-

41

Grants, subsidies and contributions

-

-

-

-

-

42

Insurance claims and indemnities

437

-

-

-

-

43

Interest and dividends

-

2

2

2

(0)

44

Refunds

2,248

2,448

2,497

2,497

0

99

Total obligations

2,652,793

2,902,904

3,074,189

3,083,476

9,287

USPTO - 36

TRADEMARK PROGRAM

USPTO - 37

This Page Is Intentionally Left Blank.

USPTO - 38

Exhibit 10

Department of Commerce

U.S. Patent and Trademark Office

Salaries and Expenses

PROGRAM AND PERFORMANCE: DIRECT OBLIGATIONS

(Dollar amounts in thousands)

Activity: Trademark Program

2023

Actual

2024

Current

2025

Base

2025

Estimate

Increase/Decrease

from 2025 Base

Line Item

Personnel

Amount

Personnel

Amount

Personnel

Amount

Personnel

Amount

Personnel

Amount

Trademark Examining

Pos./Obl

1,164

219,295

1,180

276,021

1,180

293,215

1,224

293,183

44

(32)

FTE

961

1,158

1,172

1,210

38

Trademark Appeals and

Inter Partes Proceedings

Pos./Obl

91

16,605

96

22,950

96

23,367

100

24,457

4

1,090

FTE

71

96

96

100

4

Trademark Information

Resources

Pos./Obl

73

59,199

83

59,373

83

60,958

84

50,332

1

(10,626)

FTE

54

78

76

77

1

Subtotal Direct

Pos./Obl

1,328

295,100

1,359

358,344

1,359

377,539

1,408

367,972

49

(9,567)

FTE

1,087

1,331

1,344

1,387

42

Cross Cutting Functions -

Allocated

Pos./Obl

322

185,105

327

229,448

327

236,538

331

225,688

4

(10,850)

FTE

257

299

305

309

4

Total

Pos./Obl

1,649

480,205

1,685

587,792

1,685

614,077

1,738

593,660

53

(20,417)

FTE

1,344

1,631

1,650

1,696

46

USPTO - 39

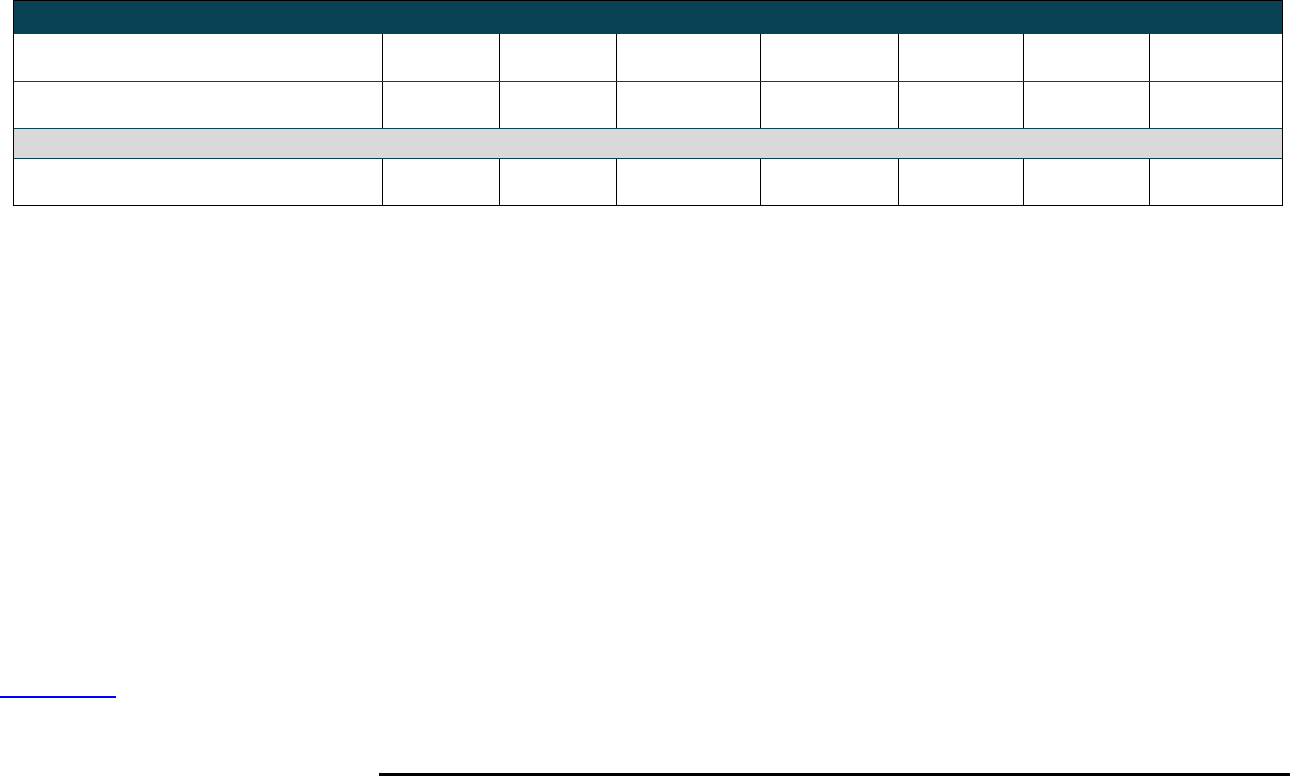

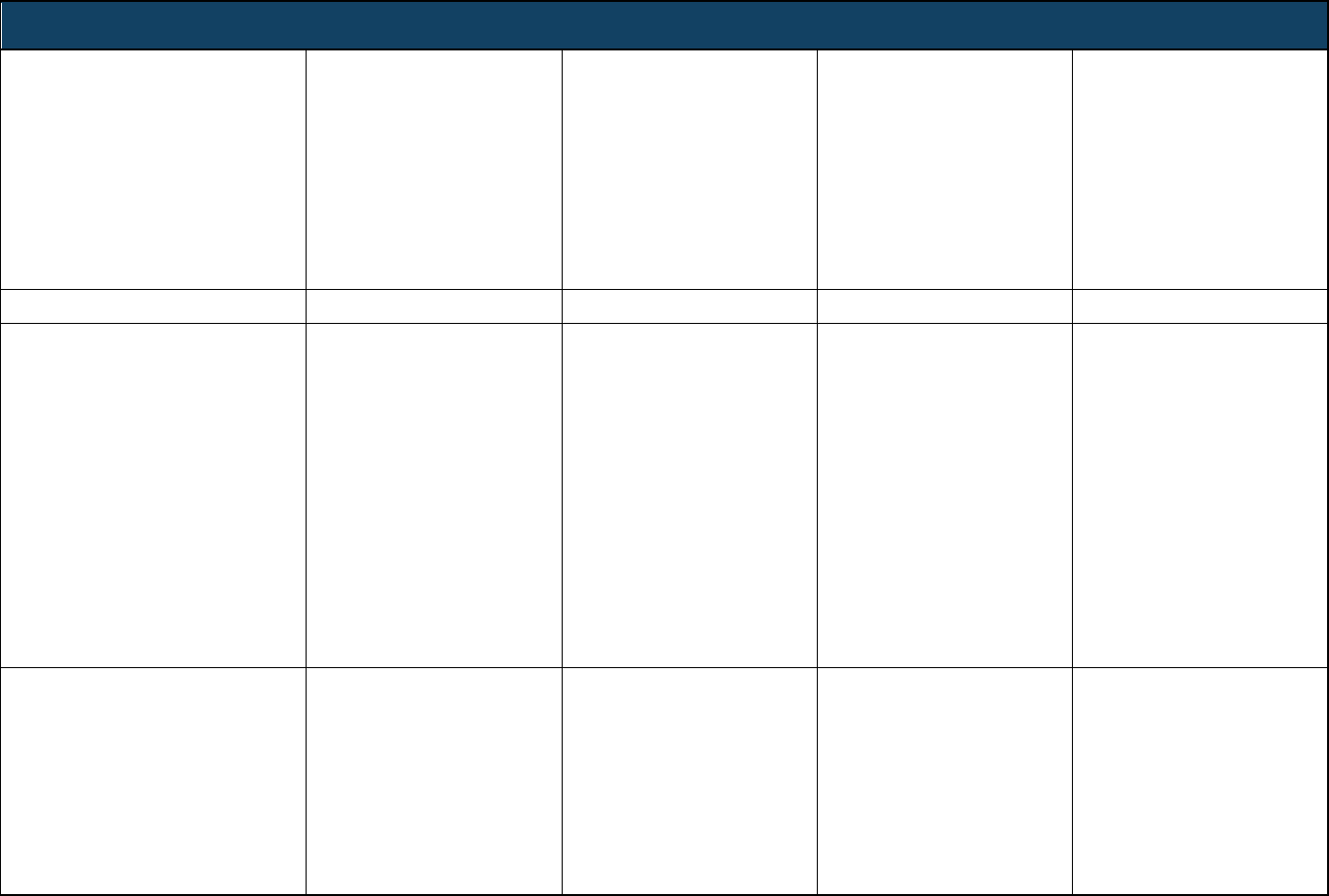

Department of Commerce

U.S. Patent and Trademark Office

Salaries and Expenses

Exhibit 12

JUSTIFICATION OF PROGRAM AND PERFORMANCE

(Dollar amounts in thousands)

Activity: Trademark Program

Goal Statement

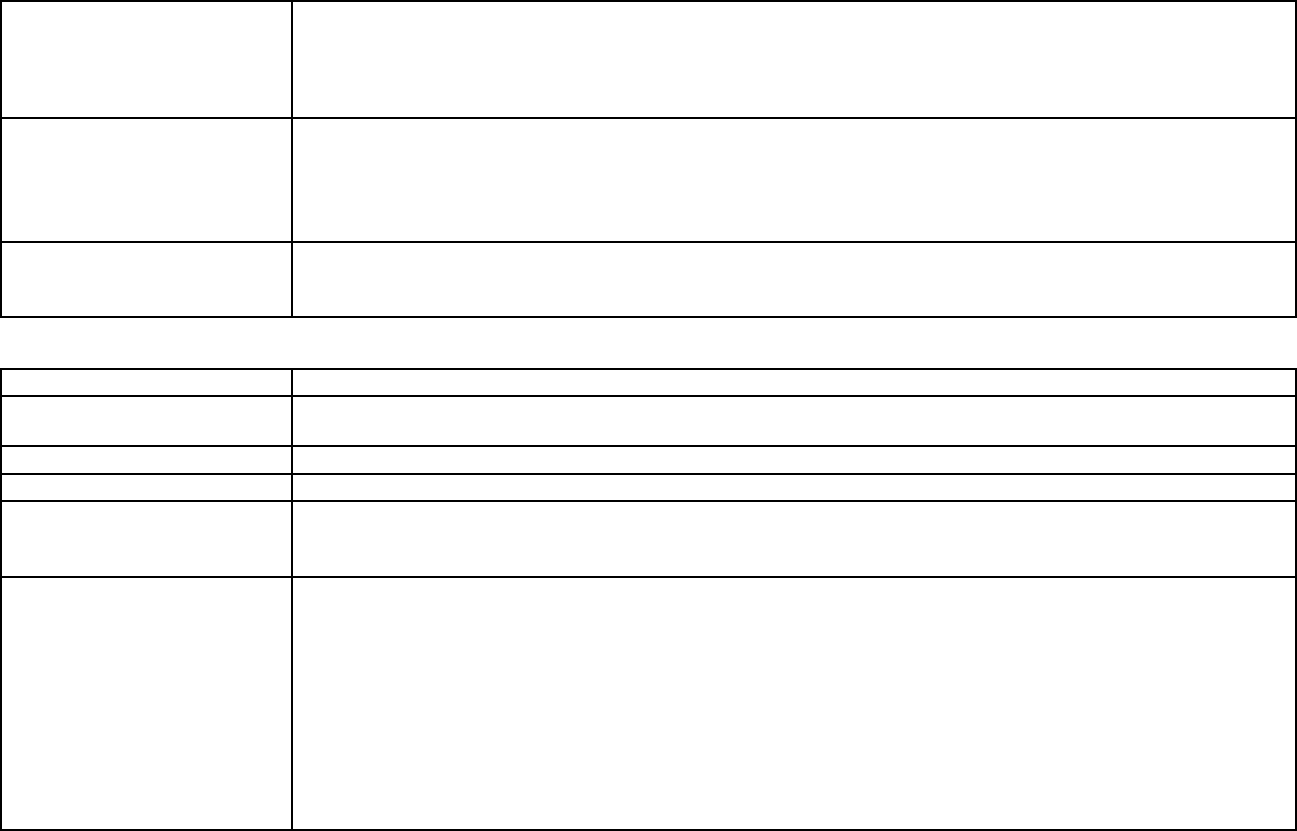

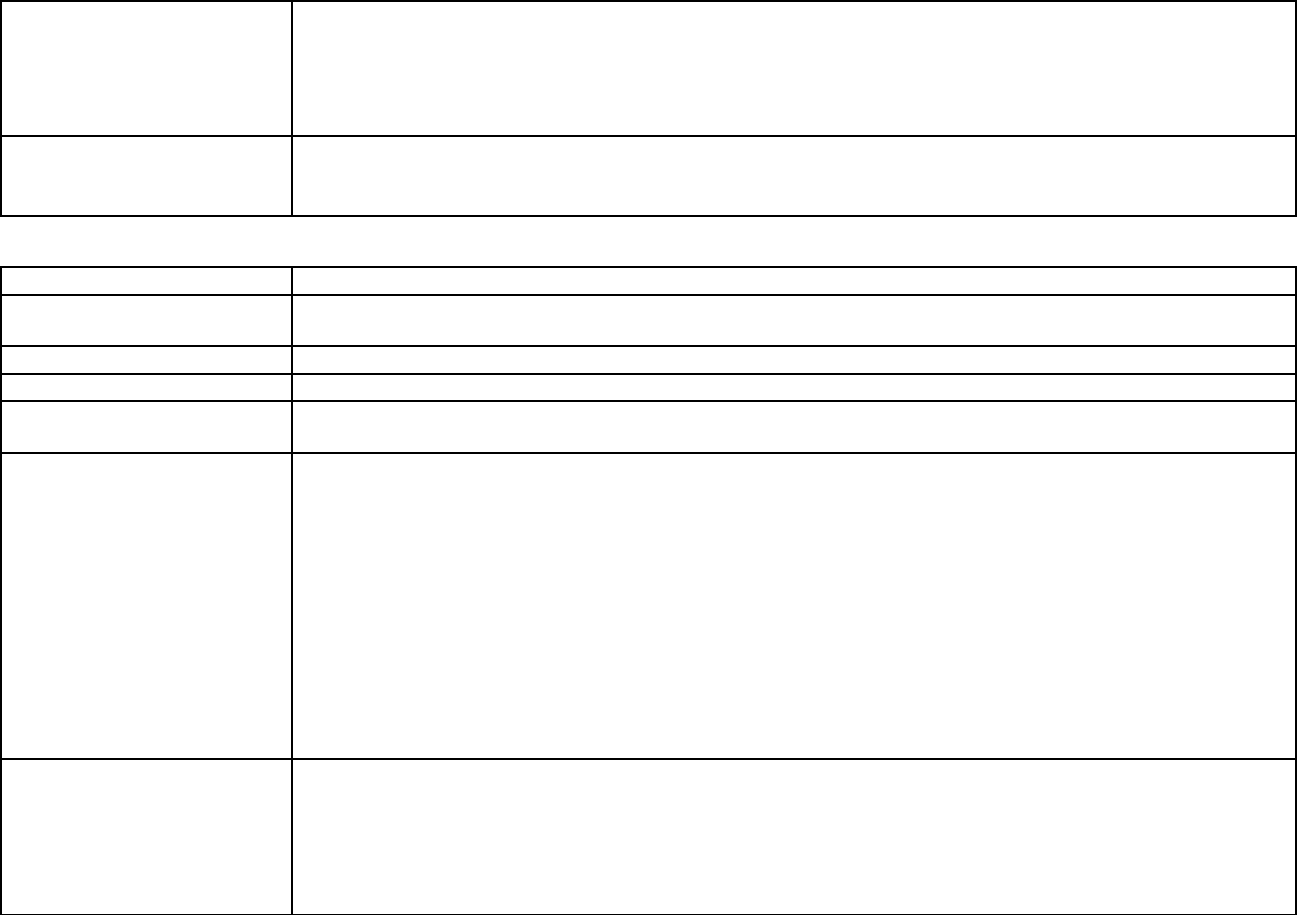

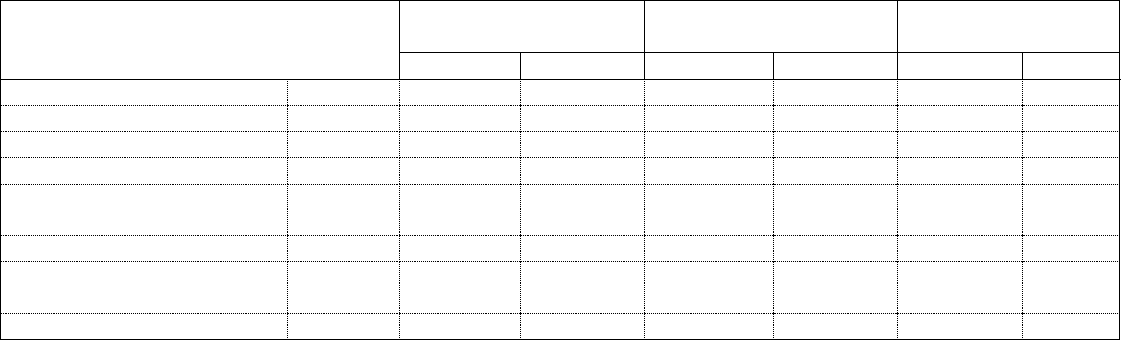

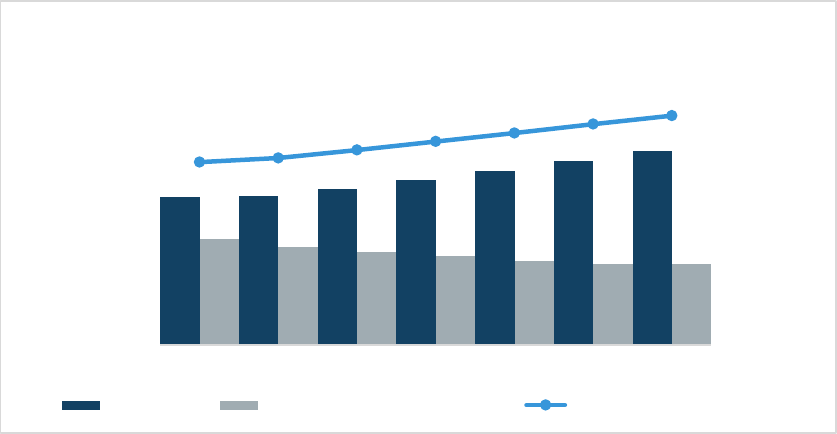

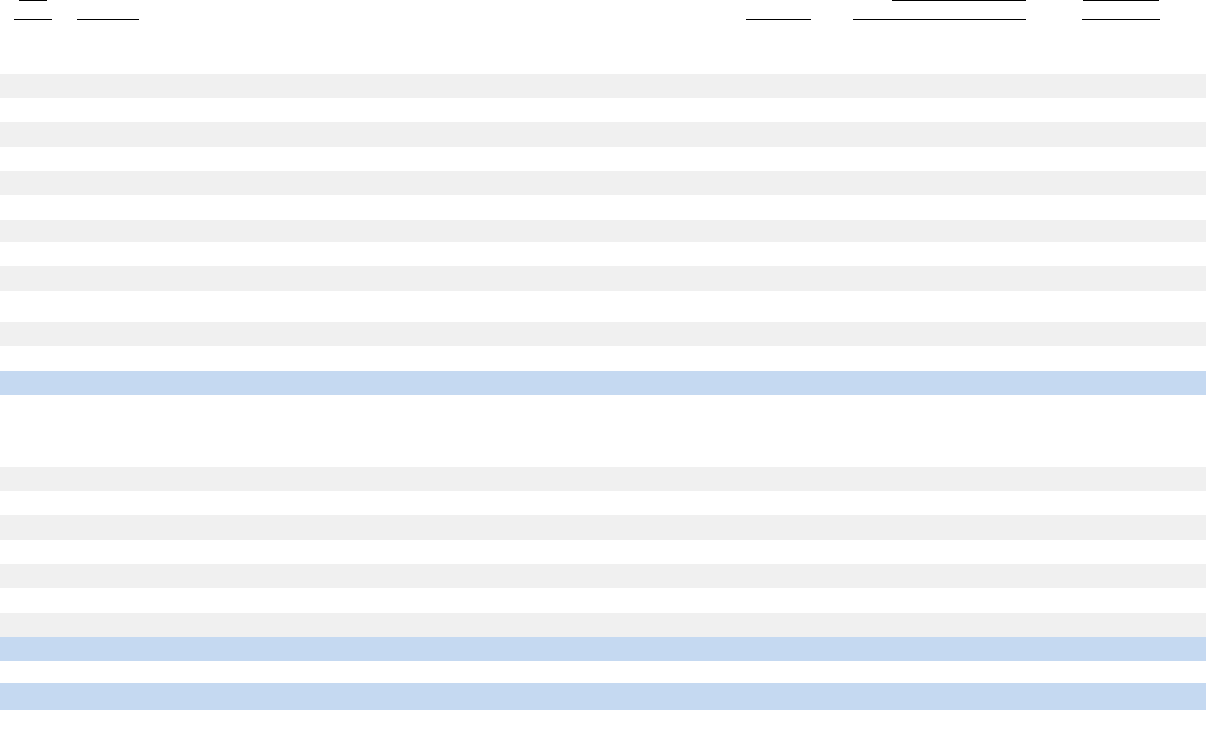

The USPTO’s Trademark Program carries out the USPTO’s mission by delivering trademark services that promote inclusive innovation

and by partnering domestically and globally to educate and advise on ways to deter IP violations and fraudulent behavior in accordance

with laws, regulations, and practices.

Base Program

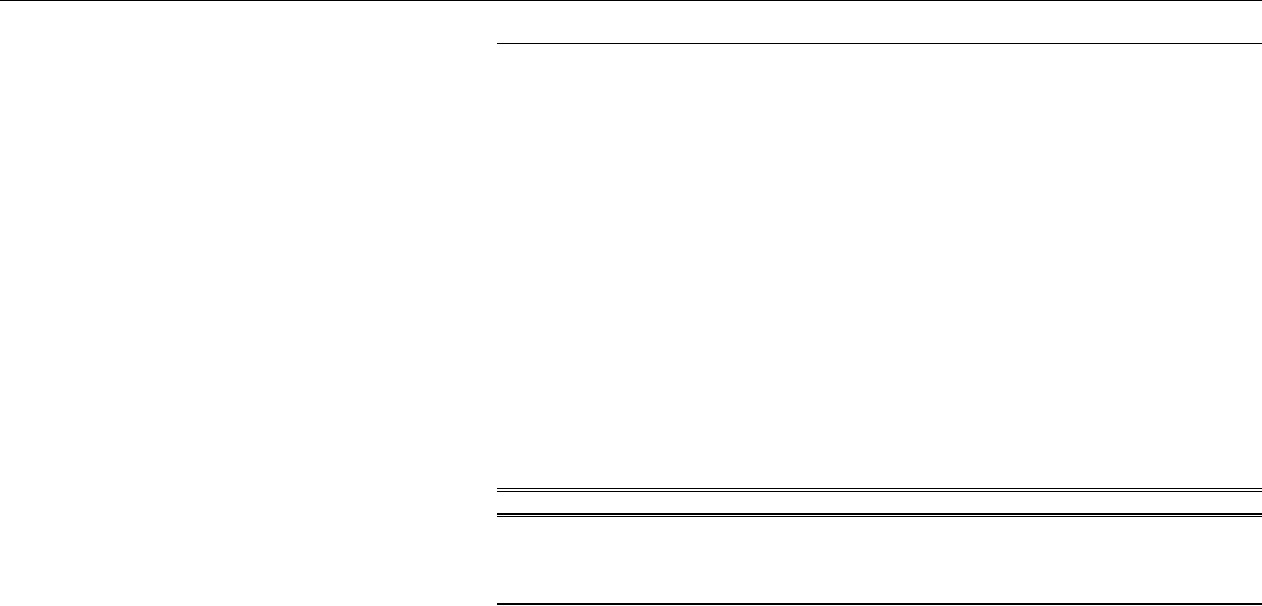

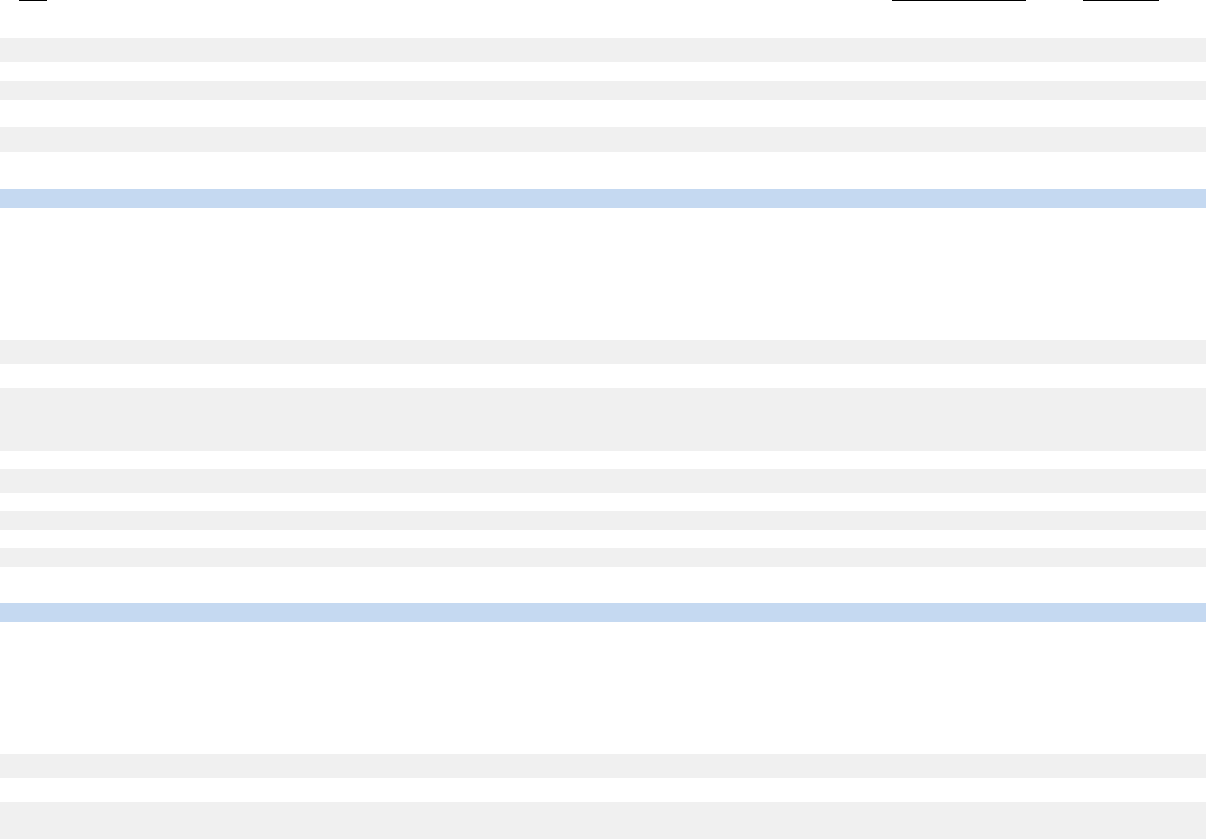

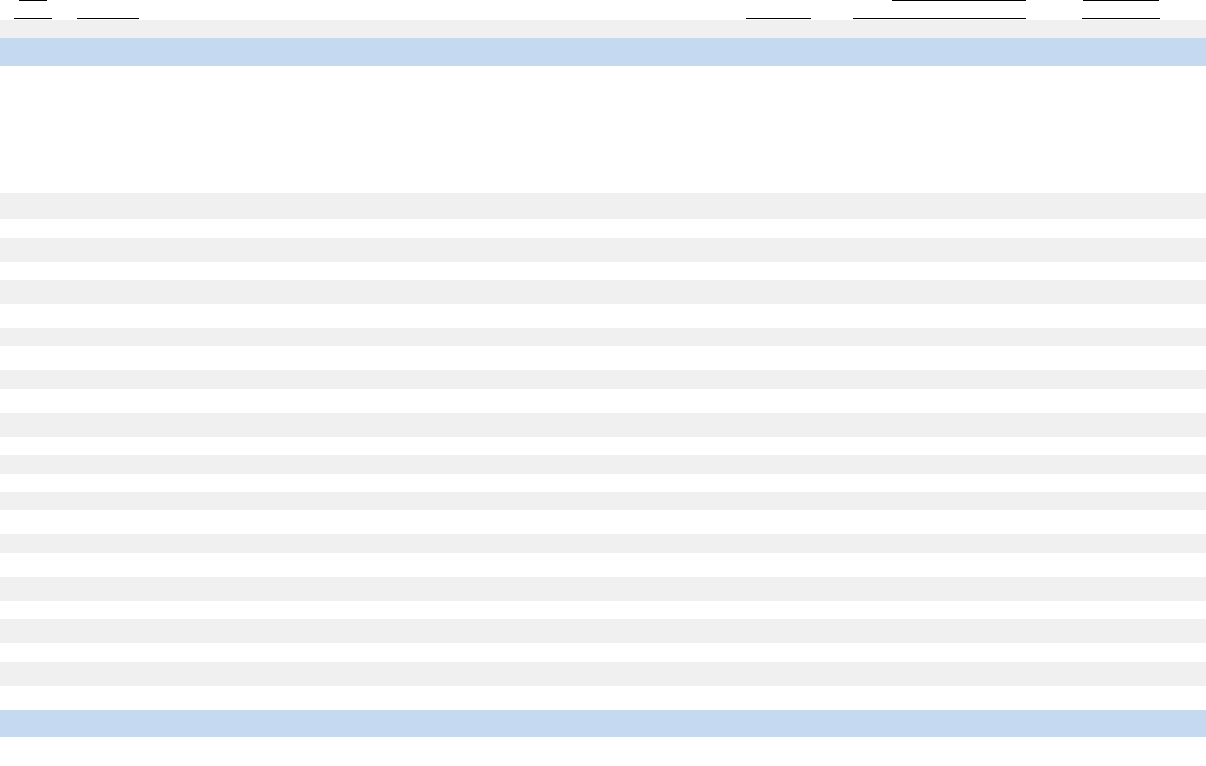

The Trademark Program performs a valuable function by identifying the source of products and services and serving as a reliable

indicator of quality to the consumer. By registering trademarks, the USPTO has a significant role in protecting consumers, as well as in

providing important benefits to American businesses by allowing them to strengthen and safeguard their brands and related investments.

Examining trademark applications consists of the activities shown in the following schematic and the major functions described below.

Statement of Operating Objectives

Some of the Trademark Program’s major objectives are:

• Protect the integrity of the Trademark Register.

• Improve trademark application pendency.

• Optimize trademark application processes to enable efficiencies for applicants and other stakeholders.

USPTO - 40

Exhibit 12

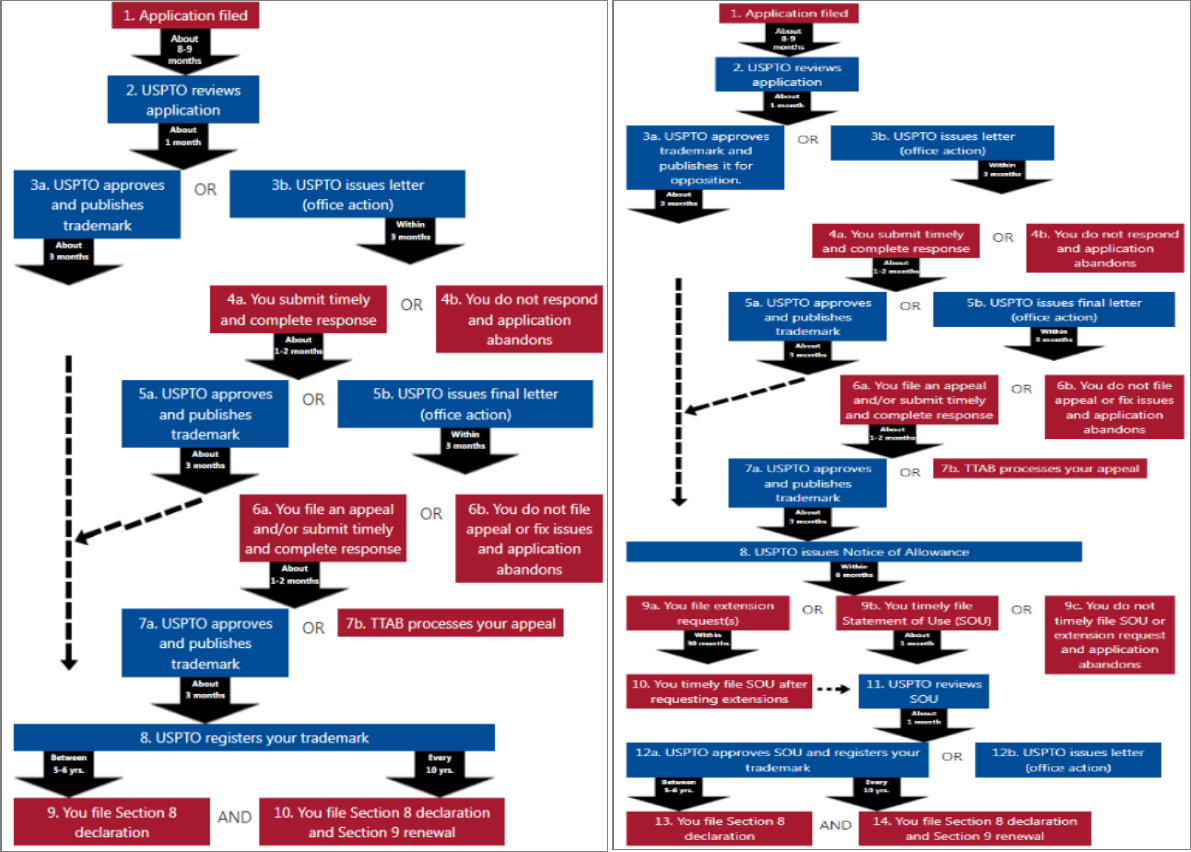

Trademark Process

Section 1a. Timeline: Application based on use in commerce Section 1b. Timeline: Application based on intent to use

USPTO - 41

Exhibit 12

Explanation and Justification

Line Item

2023

Actual

2024

Current

2025

Base

Personnel

Amount

Personnel

Amount

Personnel

Amount

Trademark Examining

Pos./Obl. 1,164 219,295 1,180

276,021 1,180 293,215

FTE

961

1,158

1,172

Trademark Trial and

Pos./Obl.

91

16,605

96 22,950 96 23,367

Appeals

FTE

71

96 96

Trademark Information

Pos./Obl. 73 59,199 83 59,373 83 60,958

Resources FTE

54

78 76

Cross Cutting

Pos./Obl. 322 185,105 327 229,448 327 236,538

Functions - Allocated FTE

257

299 305

Total

Pos./Obl.

1,649

480,205 1,685 587,792 1,685 614,077

FTE 1,344 1,631 1,650

Trademark Program

For FY 2025, the USPTO base totals $614 million and 1,650 FTEs/1,685 positions for the Trademark Program.

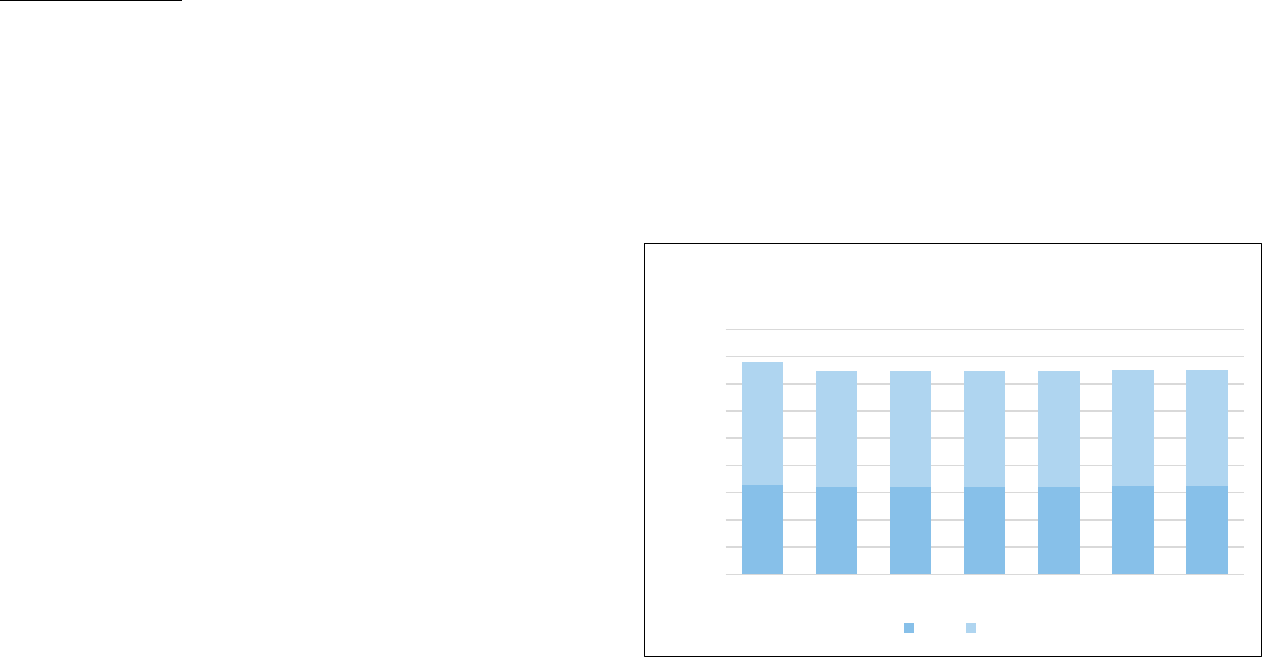

Proposed Trademark Fee Adjustments

As a fully fee-funded agency, the USPTO must periodically assess and adjust fee rates to ensure aggregate fee collections finance the

aggregate costs necessary to maintain accurate and reliable trademarks. The agency recently completed a comprehensive trademark

fee review, with the conclusion that fee adjustments are necessary to increase aggregate revenue (fee collections) and to refine certain

fees to finance ongoing operations efficiently.

As part of the trademark fee review, the USPTO evaluated the financial outlook under the existing fee schedule and conducted

significant research on and analysis of proposed revisions to certain fees. The financial outlook has two principal themes. First, forecasts