www.saas-capital.com

PAGE 1

RESEARCH BRIEF 28: RETENTION

ϭϬϬй

ϭϬϮй

ϭϬϯй

ϭϬϱй

ϭϬϳй

ϭϭϬй

ϵϬй ϵϬй

ϵϮй

ϵϯй ϵϯй ϵϯй

ϴϱй

ϵϬй

ϵϱй

ϭϬϬй

ϭϬϱй

ϭϭϬй

ϭϭϱй

>ĞƐƐƚŚĂŶ

ΨϭϮŬ

ΨϭϮŬƚŽ

ΨϮϱŬ

ΨϮϱŬƚŽ

ΨϱϬŬ

ΨϱϬŬƚŽ

ΨϭϬϬŬ

ΨϭϬϬŬƚŽ

ΨϮϱϬŬ

DŽƌĞƚŚĂŶ

ΨϮϱϬŬ

DĞĚŝĂŶZĞƚĞŶƚŝŽŶ

s

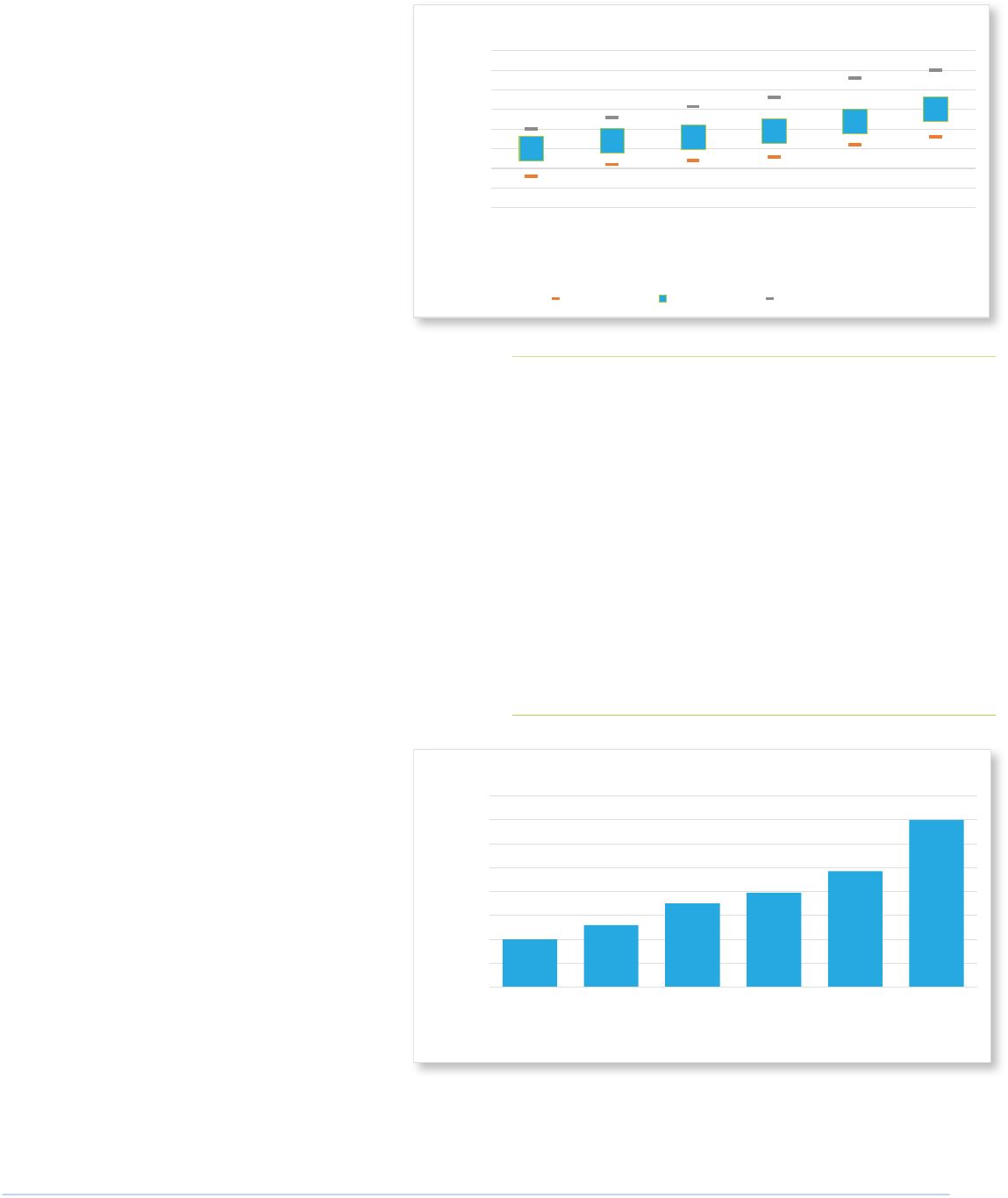

DĞĚŝĂŶEĞƚĂŶĚ'ƌŽƐƐZĞǀĞŶƵĞZĞƚĞŶƚŝŽŶďLJs

EĞƚZĞǀĞŶƵĞZĞƚĞŶƚŝŽŶ 'ƌŽƐƐZĞǀĞŶƵĞZĞƚĞŶƚŝŽŶ

ΞϮϬϮϯͲ ^ĂĂ^ĂƉŝƚĂů

Figure 1

Excludes Companies with less than $1M ARR

In Q1 of each year, SaaS Capital conducts a survey of B2B SaaS company metrics. This year’s study marked our 12th annual survey, with more than 1,500

private B2B SaaS companies responding, making it the largest survey of its kind. Below are our ndings on retention.

2023 B2B SAAS RETENTION BENCHMARKS

As we have noted for many years, revenue retention

is one of the most important metrics for ensuring

medium- to long-term business health due to its

compounding eect on growth.

The relationship of new sale bookings to revenue

retention is the SaaS version of “oense wins games,

defense wins championships.” Below is our most

recent survey data cross-referenced against other

important gures like growth rate, funding, and scale.

Denitions and formulas for key terms are at the end

of the report.

Retention by AnnuAl ContRACt VAlue

Figure 1 shows median net revenue retention (NRR)

and median gross revenue retention (GRR) across a

range of annual contract values (ACVs). For retention, benchmarking by ACV is the best starting point. More than by company

age, revenue level, or industry, companies that share a similar selling price have the most in common. They will be organized

similarly, go to market similarly, and support customers similarly. The opposite is true of two companies selling a $19.99/month

product versus a $250,000/year product.

While ACV is the best starting point for benchmarking retention, it’s worth

noting that the relationship has evolved over time. Prior to our 2020 survey,

higher gross retention was directly correlated with higher ACVs while net

retention was fairly consistent across all ACVs. Beginning with the 2020

survey, the data showed that while the companies with the very highest

ACVs still had the highest gross retention, higher net retention was starting

to correlate with higher ACVs. This year’s survey clearly illustrates the

relationship with median net revenue retention rising as ACVs increase.

Companies with ACVs above $25,000 show median gross revenue retention

of ~93%, while companies below $25,000 show 90% median gross revenue

retention. This relationship makes intuitive sense. Higher-priced solutions

often involve a longer sales cycle, in-depth scoping and implementation,

and dedicated support and account management, all of which yield a

stickier product.

“For retention, benchmarking

by ACV is the best starting

point. More than by company

age, revenue level, or

industry, companies that

share a similar selling price

have the most in common.”

www.saas-capital.com

PAGE 2

net ReVenue QuARtiles

Digging deeper into the net revenue benchmarks,

Figure 2 shows NRR broken into quartiles for the same

ACV categories. Companies with ACVs above $25,000

show median net revenue retention of at least 103%.

However, as the chart shows, even the 25th percentile

for these companies report NRR of 97% to 103%. Top-

quartile companies with ACVs north of $100,000 report

NRR of 118% to 120%.

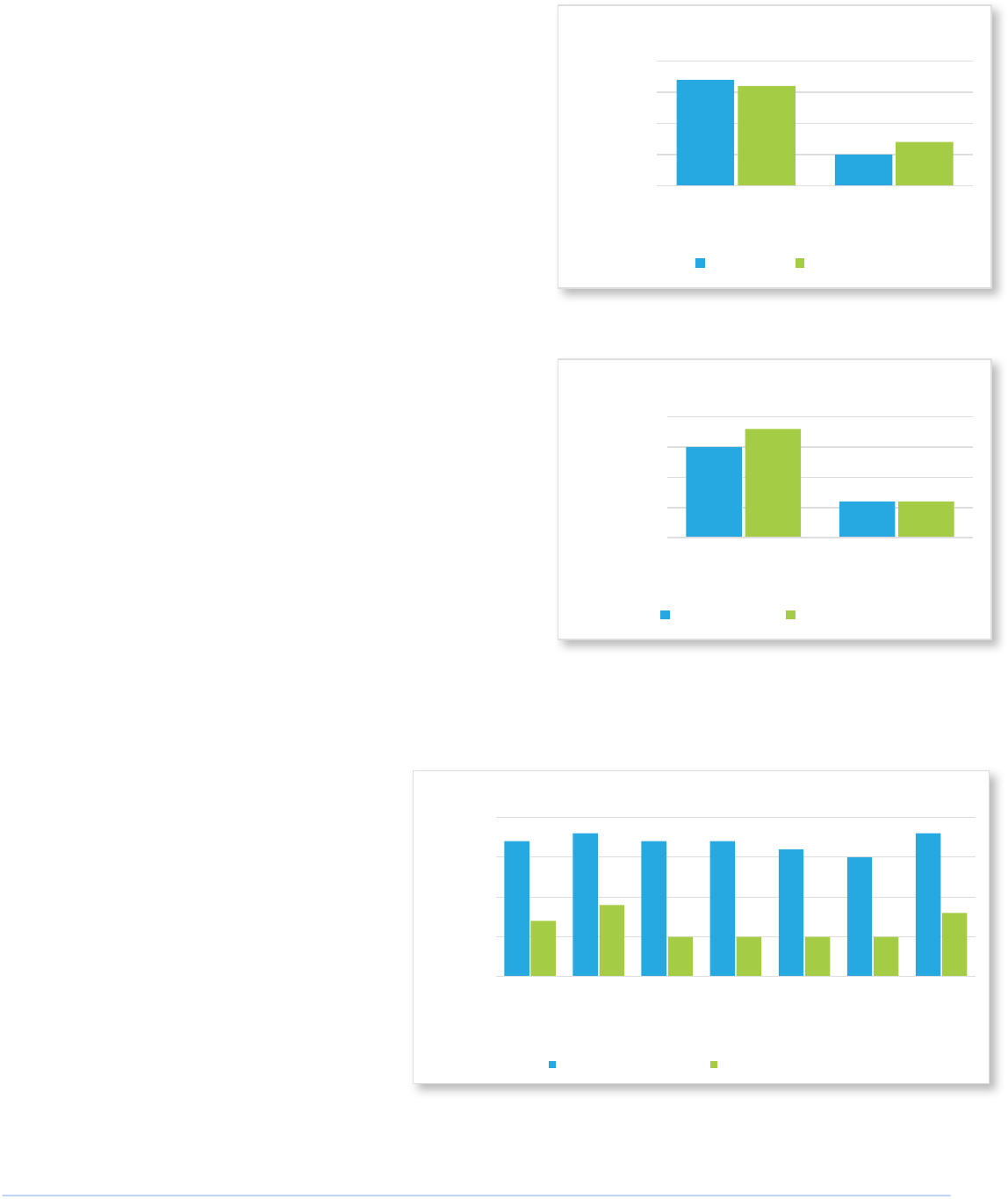

Retention And GRowth RAte

Generally speaking, higher growth is associated with

higher retention and vice versa. This is the “leaky

bucket” metaphor. The higher your retention, the

easier it is to grow that much faster because you don’t

have to rst rell the bucket before adding to it. The impact of

retention is also cumulative as it repeats and expands on itself year

after year. The opposite is also true.

There is a strong and exponential correlation between net revenue

retention and growth. The correlation between growth and NRR is

intuitive, as net retention includes what are essentially new “sales”

in the form of price increases, upgrades, upsells, and cross-sells,

all of which help grow revenue year-over-year. The cumulative

compounding nature of NRR is clearly evident in the chart.

Across the entire survey sample of companies with more than $1

million in annual recurring revenue (ARR)

1

, the median growth rate

was 34%.

The growth rates for groups of companies with NRR of

at least 110% were higher than the population median,

and the growth rate for companies with NRR below

100% was lower than the population median.

Figure 3 shows that increasing NRR from the 90% to

100% range to the 100% to 110% range improves

growth rate by 9 percentage points.

Companies with the highest NRR report median

growth that is double the population median. This is a

rare example of increasing returns from investment in

upsells and cross-sells.

The relationship between gross revenue retention and

growth is not as direct and is more binary. Companies

with gross retention below 90% reported growth

below the population median of 34%.

ϮϬй

Ϯϲй

ϯϱй

ϰϬй

ϰϵй

ϳϬй

Ϭй

ϭϬй

ϮϬй

ϯϬй

ϰϬй

ϱϬй

ϲϬй

ϳϬй

ϴϬй

ĞůŽǁ

ϵϬй

ϵϬйƚŽ

ϭϬϬй

ϭϬϬйƚŽ

ϭϭϬй

ϭϭϬйƚŽ

ϭϮϬй

ϭϮϬйƚŽ

ϭϯϬй

ďŽǀĞ

ϭϯϬй

DĞĚŝĂŶ'ƌŽǁƚŚZĂƚĞ

EĞƚZĞǀĞŶƵĞZĞƚĞŶƚŝŽŶ

'ƌŽǁƚŚZĂƚĞďLJDĞĚŝĂŶEĞƚZĞǀĞŶƵĞZĞƚĞŶƚŝŽŶ

ΞϮϬϮϯͲ ^ĂĂ^ĂƉŝƚĂů

Figure 3

Excludes Companies with less than $1M ARR

“The growth rates for groups

of companies with NRR of at

least 110% was higher than the

population median, and the

growth rate for companies with

NRR below 100% was lower than

the population median.”

ϵϯй

ϵϲй

ϵϳй

ϵϴй

ϭϬϭй

ϭϬϯй

ϭϬϬй

ϭϬϮй

ϭϬϯй

ϭϬϱй

ϭϬϳй

ϭϭϬй

ϭϬϱй

ϭϬϴй

ϭϭϭй

ϭϭϯй

ϭϭϴй

ϭϮϬй

ϴϱй

ϵϬй

ϵϱй

ϭϬϬй

ϭϬϱй

ϭϭϬй

ϭϭϱй

ϭϮϬй

ϭϮϱй

>ĞƐƐƚŚĂŶ

ΨϭϮŬ

ΨϭϮŬƚŽ

ΨϮϱŬ

ΨϮϱŬƚŽ

ΨϱϬŬ

ΨϱϬŬƚŽ

ΨϭϬϬŬ

ΨϭϬϬŬƚŽ

ΨϮϱϬŬ

DŽƌĞƚŚĂŶ

ΨϮϱϬŬ

EĞƚZĞǀĞŶƵĞZĞƚĞŶƚŝŽŶ

s

EĞƚZĞǀĞŶƵĞZĞƚĞŶƚŝŽŶďLJYƵĂƌƚŝůĞďLJs

ϮϱƚŚWĞƌĐĞŶƚŝůĞ ϱϬƚŚWĞƌĐĞŶƚŝůĞ ϳϱƚŚWĞƌĐĞŶƚŝůĞ

ΞϮϬϮϯͲ ^ĂĂ^ĂƉŝƚĂů

Figure 2

Excludes Companies with less than $1M ARR

1

We frequently exclude data from companies with less than $1 mill in ARR because of the small revenue

denominator in growth rate calculations.

www.saas-capital.com

PAGE 3

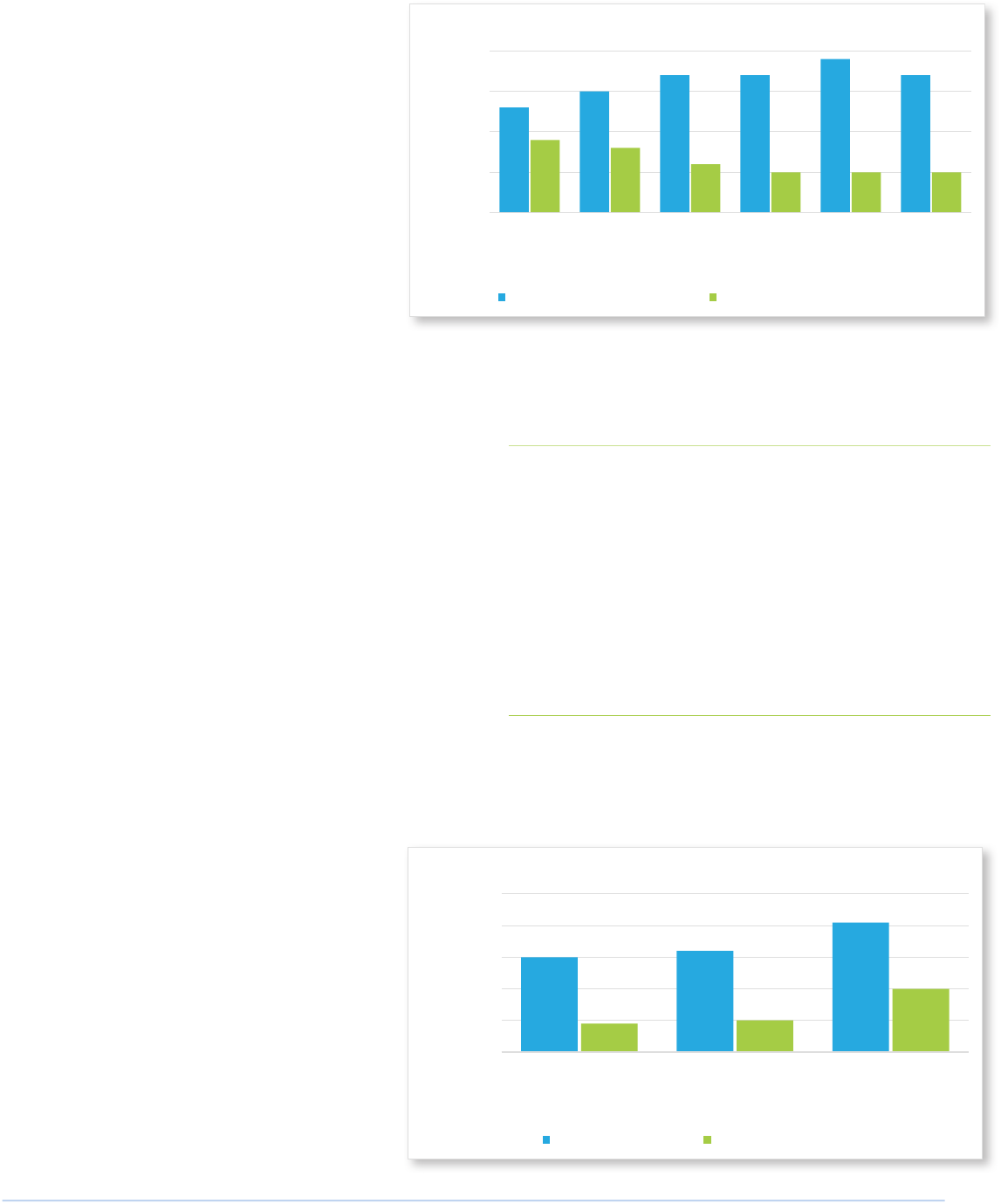

Retention foR hoRizontAl Vs. VeRtiCAl solutions

Looking at whether a company sells a vertically focused product (e.g.,

dental oce management software) versus a horizontal product (e.g.,

new hire applicant tracking) reveals only minor, and mixed, dierences.

During the pandemic, we saw that vertically focused companies

reported better retention than horizontally focused companies but that

relationship has faded.

Figure 4 shows median net revenue retention is slightly higher for

horizontally focused companies while vertically focused companies

show slightly higher median gross retention.

Retention in VC-bACked Vs. bootstRApped CompAnies

The dynamic between bootstrapped companies and equity-backed

companies has also evolved over time. Historically we had seen that

equity-backed companies showed markedly higher net and gross

retention.

Figure 5 shows equity-backed companies are reporting slightly higher

NRR while there is no dierence in GRR.

The erosion of the previous pattern of equity-backed companies

reporting notably higher NRR and GRR suggests that best practices

in customer success are now fully disseminated throughout the SaaS

industry.

Whereas previously, customer success was a niche concept advocated

by experienced executives-turned-venture capitalists advising their

portfolio companies or only seen as a nice-to-have employed by

externally funded companies and not worth bootstrapped companies

allocating money toward. Whatever the reason, CS is now clearly a SaaS

best practice in 2023.

Retention by CompAny AGe

For the most part, company age isn’t a factor in

retention, especially net retention. However, there is

an important exception related to gross retention. A

point we have made in the past is that younger SaaS

companies tend to show inated gross retention

numbers because their customers haven’t yet had a

chance to churn.

Figure 6 illustrates this point. Companies less than 5

years old report median gross retention of 92% to

94%. As they enter their “scale-up” and growth phases,

retention slips and eventually stabilizes around 90%.

It is important for management teams and boards to

understand this retention “lifecycle” as SaaS companies

scale.

ϭϬϮй

ϵϬй

ϭϬϭй

ϵϮй

ϴϱй

ϵϬй

ϵϱй

ϭϬϬй

ϭϬϱй

EĞƚZĞǀĞŶƵĞ

ZĞƚĞŶƚŝŽŶ

'ƌŽƐƐZĞǀĞŶƵĞ

ZĞƚĞŶƚŝŽŶ

DĞĚŝĂŶZĞƚĞŶƚŝŽŶ

ZĞƚĞŶƚŝŽŶďLJsĞƌƚŝĐĂůǀƐ͘,ŽƌŝnjŽŶƚĂů

,ŽƌŝnjŽŶƚĂů sĞƌƚŝĐĂů

ΞϮϬϮϯ Ͳ ^ĂĂ^ĂƉŝƚĂů

Figure 4

Excludes Companies with less than $1M ARR

ϭϬϮй

ϭϬϯй

ϭϬϮй ϭϬϮй

ϭϬϭй

ϭϬϬй

ϭϬϯй

ϵϮй

ϵϰй

ϵϬй ϵϬй ϵϬй ϵϬй

ϵϯй

ϴϱй

ϵϬй

ϵϱй

ϭϬϬй

ϭϬϱй

>ĞƐƐƚŚĂŶ

ϯzĞĂƌƐ

ϯƚŽϱ

zĞĂƌƐ

ϲƚŽϴ

zĞĂƌƐ

ϵƚŽϭϭ

zĞĂƌƐ

ϭϮƚŽϭϰ

zĞĂƌƐ

ϭϱƚŽϭϳ

zĞĂƌƐ

KǀĞƌϭϳ

zĞĂƌƐ

DĞĚŝĂŶZĞƚĞŶƚŝŽŶ

ŽŵƉĂŶLJŐĞ

ZĞƚĞŶƚŝŽŶďLJŽŵƉĂŶLJŐĞ

EĞƚZĞǀĞŶƵĞZĞƚĞŶƚŝŽŶ 'ƌŽƐƐZĞǀĞŶƵĞZĞƚĞŶƚŝŽŶ

ΞϮϬϮϯͲ ^ĂĂ^ĂƉŝƚĂů

Figure 6

Excludes Companies with less than $1M ARR

ϭϬϬй

ϵϭй

ϭϬϯй

ϵϭй

ϴϱй

ϵϬй

ϵϱй

ϭϬϬй

ϭϬϱй

EĞƚZĞǀĞŶƵĞ

ZĞƚĞŶƚŝŽŶ

'ƌŽƐƐZĞǀĞŶƵĞ

ZĞƚĞŶƚŝŽŶ

DĞĚŝĂŶZĞƚĞŶƚŝŽŶ

ZĞƚĞŶƚŝŽŶďLJ&ƵŶĚŝŶŐdLJƉĞ

ŽŽƚƐƚƌĂƉƉĞĚ ƋƵŝƚLJͲĂĐŬĞĚ

ΞϮϬϮϯͲ ^ĂĂ^ĂƉŝƚĂů

Figure 5

Excludes Companies with less than $1M ARR

www.saas-capital.com

PAGE 4

Retention by ARR

Following the point about company age, another

way to measure maturity is by the size of a company.

Figure 7 shows both median net revenue retention

and median gross retention by ARR.

Gross revenue retention by ARR echoes the data in

Figure 6. We know from other analysis that it typically

takes a company on average six years to reach $1

million in ARR, so the curve here is consistent with

companies having slightly overstated GRR until year

ve or six and ARR of $3 to $5 million, before entering

their scale phase.

Note that in both Figure 6 and Figure 7 the dierences

between each cohort are slight, but we have seen a

similar shape to the data for numerous years. The positively correlated relationship between median net revenue retention and

ARR is one that emerged in our 2022 survey. Historically, net revenue retention was largely the same across all company sizes. We

now see an emerging pattern of NRR increasing as companies scale.

A possible explanation for this could be the convergence of two

points noted above. First, net retention has a strong, cumulative,

and compounding impact on growth year-on-year-on-year.

Second, data elsewhere in this analysis indicates companies are

now fully embracing customer success as a table-stakes SaaS

strategy, with positive results.

Retention by ContRACtinG lenGth

A frequently asked question is whether contract length impacts

retention. It makes intuitive sense that longer-term contracts

would reduce churn.

Figure 8 shows companies that primarily use month-to-month terms and annual contracts show median net revenue retention

and median gross revenue retention that is essentially the same at 100% and ~90%, respectively.

Companies primarily utilizing multi-year contracts

show higher median net revenue retention and

median gross revenue retention, which seems

to support the idea that long-term contracts are

conducive to reducing churn.

However, it should be noted that this is not a

relationship that has been consistent in previous

survey results. Historically, net revenue retention

showed little correlation with contract length while

the 2022 survey was the rst year to show higher

gross revenue retention with multi-year contracts.

Given the economic slowdown in 2022, this might

be a situation where multi-year contracts haven’t yet

come up for renewal and therefore had a chance to

churn.

ϵϴй

ϭϬϬй

ϭϬϮй ϭϬϮй

ϭϬϰй

ϭϬϮй

ϵϰй

ϵϯй

ϵϭй

ϵϬй ϵϬй ϵϬй

ϴϱй

ϵϬй

ϵϱй

ϭϬϬй

ϭϬϱй

>ĞƐƐƚŚĂŶΨϭ

DŝůůŝŽŶ

ΨϭͲΨϯDŝůůŝŽŶ ΨϯͲΨϱDŝůůŝŽŶ ΨϱͲΨϭϬ

DŝůůŝŽŶ

ΨϭϬͲΨϮϬ

DŝůůŝŽŶ

DŽƌĞƚŚĂŶΨϮϬ

DŝůůŝŽŶ

DĞĚŝĂŶZĞƚĞŶƚŝŽŶ

ZZ

DĞĚŝĂŶEĞƚĂŶĚ'ƌŽƐƐZĞǀĞŶƵĞZĞƚĞŶƚŝŽŶďLJZZ

DĞĚŝĂŶEĞƚZĞǀĞŶƵĞZĞƚĞŶƚŝŽŶ DĞĚŝĂŶ'ƌŽƐƐZĞǀĞŶƵĞZĞƚĞŶƚŝŽŶ

ΞϮϬϮϯͲ ^ĂĂ^ĂƉŝƚĂů

Figure 7

“Historically, net revenue retention

was largely the same across

all company sizes. We now see

an emerging pattern of NRR

increasing as companies scale.”

ϭϬϬ͘Ϭй

ϭϬϭ͘Ϭй

ϭϬϱ͘ϱй

ϴϵ͘ϱй

ϵϬ͘Ϭй

ϵϱ͘Ϭй

ϴϱ͘Ϭй

ϵϬ͘Ϭй

ϵϱ͘Ϭй

ϭϬϬ͘Ϭй

ϭϬϱ͘Ϭй

ϭϭϬ͘Ϭй

EŽĐŽŶƚƌĂĐƚƐŽƌŵŽŶƚŚͲƚŽͲ

ŵŽŶƚŚ

ŶŶƵĂů DƵůƚŝͲLJĞĂƌ

DĞĚŝĂŶZĞƚĞŶƚŝŽŶ

WƌŝŵĂƌLJ/ŶŝƚŝĂůŽŶƚƌĂĐƚ>ĞŶŐƚŚ

ZĞƚĞŶƚŝŽŶďLJŽŶƚƌĂĐƚ>ĞŶŐƚŚ

EĞƚZĞǀĞŶƵĞZĞƚĞŶƚŝŽŶ 'ƌŽƐƐZĞǀĞŶƵĞZĞƚĞŶƚŝŽŶ

ΞϮϬϮϯͲ ^ĂĂ^ĂƉŝƚĂů

Figure 8

www.saas-capital.com

PAGE 5

ConClusions And tAkeAwAys

• Across all SaaS companies, the 2023 median net

retention is 102%, which is unchanged from 2022.

Median gross retention is 91%, also unchanged from

the previous year’s survey.

• One of the biggest takeaways this year is the

evolving relationship between median net revenue

retention and ACVs. Historically, the data showed

little correlation. Over the last few years, we have seen

signs that the highest ACVs showed higher median

net revenue retention. This year’s data showed a

direct, positive relationship with median net revenue

retention rising as ACVs increase.

• Higher-ACV products show higher net and gross

retention. For companies with ACVs below $25k, 90% gross retention is the norm. Higher ACV companies should

benchmark to 93%.

• Growth rate continues to be positively and exponentially correlated with net revenue retention, while gross revenue

retention is a “table stakes” benchmark – to have a shot at performance parity with your peers, GRR must be at least 90%.

• While the median NRR is 102% across the entire survey, the benchmark to target for median growth rate of 34% is NRR of

at least 100%.

• Gross retention during the rst 5 years of a company’s life may be articially elevated until customers have had enough

time to churn. GRR by ARR corroborates this point, and, while the changes are slight, GRR declines as companies reach $3

million of ARR, then stablizes.

• Equity-backed companies report slightly higher net revenue retention than bootstrapped companies while there was no

reported dierence in gross retention. Historically, VC-backed companies have had higher retention across both metrics

and the erosion of that relationship suggests that best practices in customer success are now fully disseminated.

• Whether a company sells a vertically focused product or a horizontal product shows only minor, and mixed, dierences.

• Contracting length shows a potentially developing relationship where multi-year contracts show higher median net

revenue retention and median gross revenue retention.

Retention definitions And foRmulAs

We asked companies to report their net and gross annual revenue retention data. Customer account retention may be a useful

metric for you to track, but our focus in the survey, and generally the retention metric we think is the most important, is based on

dollars of revenue. We dene net retention as:

(Monthly Recurring Revenue in December of 2022 only from customers who were customers in December 2021)

÷

(Total MRR in December 2021)

This number can be anything from 0% to well above 100%, as it includes upsells, new product cross-sells, and price increases.

Annual gross retention is the same formula, excluding the upsells, cross-sells, and price increases. (For easy calculation, set each

customer’s 2021 MRR to be less than or equal to their 2021 MRR.) For this reason, gross retention cannot exceed 100%.

“Growth rate is positively and

exponentially correlated with net

revenue retention, while gross

revenue retention is a “table stakes”

benchmark – to have a shot at

performance parity with your peers,

GRR must be at least 90%.”

www.saas-capital.com

PAGE 6

SaaS Capital is the leading provider of growth debt designed explicitly for B2B SaaS companies. SaaS Capital’s growth debt is

structured to provide a signicant source of committed funding, deployment exibility, and lower overall cost of capital, all while

avoiding the loss of control associated with selling equity. SaaS Capital was the rst to oer lending alternatives to SaaS businesses

based on their future recurring revenue. Since 2007, SaaS Capital has committed more than $375 million in growth debt facilities to

deliver better outcomes for our 110+ clients, resulting in more than $2 billion in total enterprise value created.

Benets of SaaS Capital’s unique, SaaS-focused approach:

• Higher advance rates - Capital availability is based on a multiple of your

monthly recurring revenue (MRR) – typically 5x to 8x MRR

• Capital availability that grows with your business - The amount of

capital that you can draw increases automatically as your revenue grows

• Long-term source of capital - The capital is drawn down over 2 years

under the committed line of credit, and then either renewed, or repaid

over the following 3 to 4 years

• Ecient use of capital - Capital is drawn down only as your business

needs it, thereby reducing your interest expense

• Cost is simple and transparent - Interest rate of 12% to 14%, a 1.0% to

1.5% commitment fee, and a nominal penny warrant

• Flexibility - No balance sheet covenants or cash reserve requirements

SaaS Capital is best able to assist companies with the following

attributes:

• Sell a SaaS-based solution

• Seeking $2M to $20M in growth capital

• $250,000, or above, in MRR

• Have a minimum of 85% retention

• Registered and principally banked in the U.S., Canada, or UK

• Revenue growth above 15% per year

Your business does NOT need to be:

• Venture Backed

• Protable

• Billing your customers monthly

Visit www.saas-capital.com to learn more.

1311 VINE STREET | CINCINNATI, OH, 45202

7900 E GREENLAKE DRIVE NE, SUITE 206 | SEATTLE, WA 98103

WWW.SAASCAPITAL.COM

ROB BELCHER | MANAGING DIRECTOR | RBELCHERSAASCAPITAL.COM | 3038709529

STEVE JAFFEE | MANAGING DIRECTOR | SJAFFEESAASCAPITAL.COM | 6145062770

RANDALL LUCAS | MANAGING DIRECTOR | RLUCASSAASCAPITAL.COM | 6179057467

STEPHANIE FORTENER | MANAGING DIRECTOR| SFORTENERSAASCAPITAL.COM | 6144256519

About SaaS Capital