Investor

Presentation

2024

Disclaimers

Forward-Looking Statements

This presentation contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In some cases, you can identify

forward-looking statements by terms such as “anticipate,” “believe,” “can,” “continue,” “could,” “estimate,” “expect,” “explore,” “intend,” “long-term model,” “may,” “might” “outlook,” “plan,” “potential,” “predict,” “project,” “should,” “strategy,” “target,”

“will,” “would,” or the negative of these terms, and similar expressions intended to identify forward-looking statements. However, not all forward-looking statements contain these identifying words. These statements may relate to our market size

and growth strategy, our estimated and projected costs, margins, revenue, expenditures and customer and financial growth rates, our Q1 2024, 2024, medium term, and long-term financial outlook and performance against our multi-year financial

framework, our plans and objectives for future operations, growth, initiatives or strategies, including our investments in research and development. By their nature, these statements are subject to numerous uncertainties and risks, including factors

beyond our control, that could cause actual results, performance or achievement to differ materially and adversely from those anticipated or implied in the forward-looking statements. These assumptions, uncertainties and risks include that, among

others: our rapid growth and limited history with our current pricing and platform features makes it difficult to evaluate our prospects and future operating results; we may not be able to sustain our revenue and customer growth rate in the future;

price increases have and may continue to negatively impact demand for our products, customer acquisition and retention and reduce the total number of customers or customer additions; our business would be harmed by any significant

interruptions, delays or outages in services from our platform, our API providers, or certain social media platforms; if we are unable to attract potential customers through unpaid channels, convert this traffic to free trials or convert free trials to paid

subscriptions, our business and results of operations may be adversely affected; we may be unable to successfully enter new markets, manage our international expansion and comply with any applicable international laws and regulations; we may

be unable to integrate acquired businesses or technologies successfully or achieve the expected benefits of such acquisitions and investments; unstable market and economic conditions, such as recession risks, effects of inflation, labor shortages,

supply chain issues, high interest rates, and the impacts of current and potential future bank failures and ongoing overseas conflicts, could adversely impact our business and that of our existing and prospective customers, which may result in

reduced demand for our products; we may not be able to generate sufficient cash to service our indebtedness; covenants in our credit agreement may restrict our operations, and if we do not effectively manage our business to comply with these

covenants, our financial condition could be adversely impacted; any cybersecurity-related attack, significant data breach or disruption of the information technology systems or networks on which we rely could negatively affect our business; and

changing regulations relating to privacy, information security and data protection could increase our costs, affect or limit how we collect and use personal information and harm our brand. Additional risks and uncertainties that could cause actual

outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the caption “Risk Factors” and elsewhere in our filings with the Securities and Exchange Commission (the “SEC”), including our

Annual Report on Form 10-K for the year ended December 31, 2022 filed with the SEC on February 22, 2023, as supplemented by our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 filed November 3, 2023, and our

Annual Report on Form 10-K for the year ended December 31, 2023 to be filed with the SEC, as well as any future reports that we file with the SEC. Moreover, you should interpret many of the risks identified in those reports as being heightened as a

result of the ongoing and current instability in market and economic conditions. Forward-looking statements speak only as of the date the statements are made and are based on information available to Sprout Social at the time those statements are

made and/or management's good faith belief as of that time with respect to future events. Sprout Social assumes no obligation to update forward-looking statements to reflect events or circumstances after the date they were made, except as

required by law.

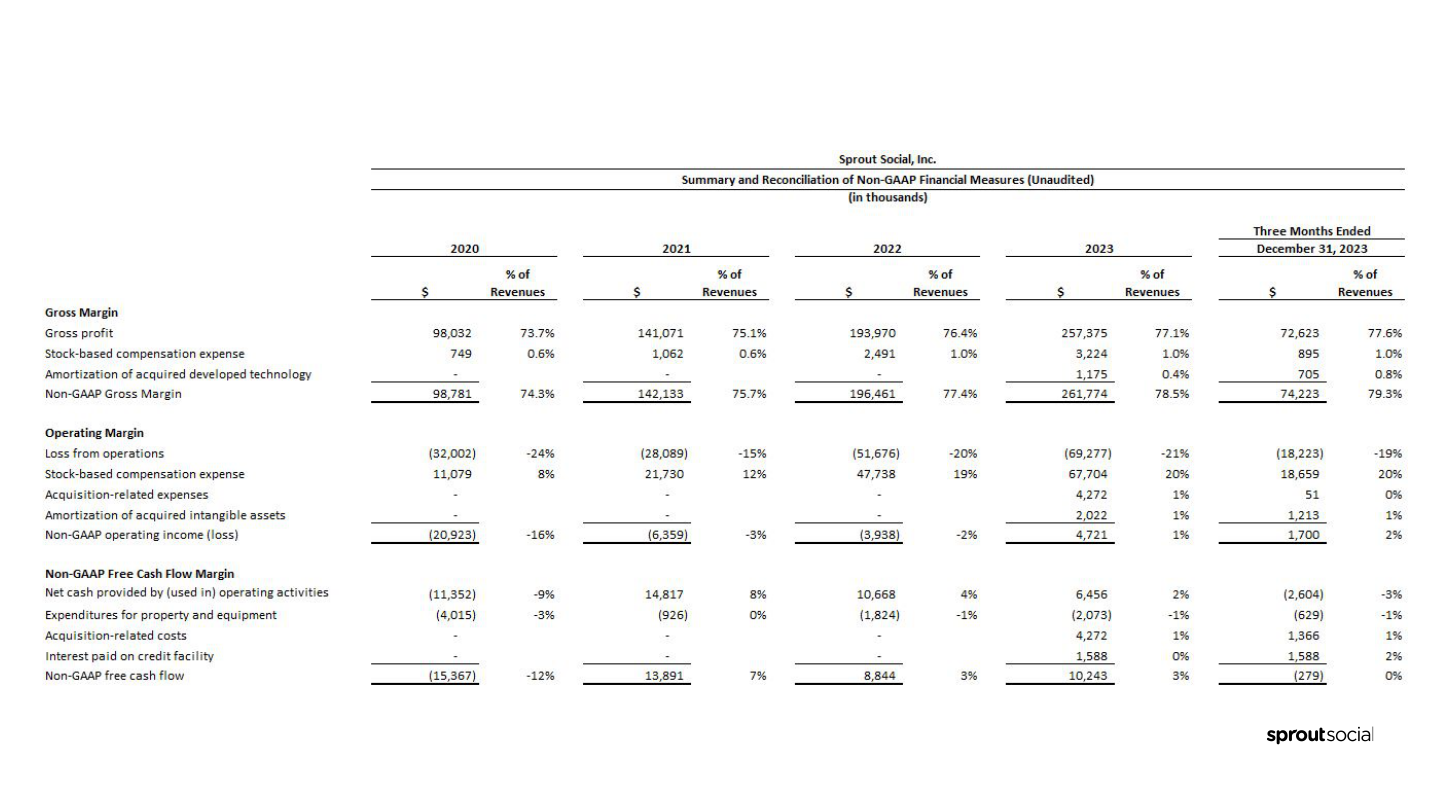

Use of Non-GAAP Financial Measures

We have provided in this presentation certain financial information that has not been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”). Our management uses these non-GAAP financial measures

internally in analyzing our financial results and believes that use of these non-GAAP financial measures is useful to investors as an additional tool to evaluate ongoing operating results and trends and in comparing our financial results with other

companies in our industry, many of which present similar non-GAAP financial measures. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable financial measures prepared in accordance with

GAAP and should be read only in conjunction with our consolidated financial statements prepared in accordance with GAAP. A reconciliation of our historical non-GAAP financial measures to the most directly comparable GAAP measures has been

provided in the financial statement tables included at the end of this presentation, and investors are encouraged to review these reconciliations. The Company cannot provide reconciliations between its forecasted non-GAAP measures and the most

comparable GAAP measures without unreasonable effort due to the unavailability of reliable estimates for certain items. These items are not within the Company’s control and may vary greatly between periods and could significantly impact future

financial results.

Customer Metrics and Market Data

This presentation includes useful customer metrics and other data, which are defined at the back of this presentation. Unless otherwise noted, information in this presentation concerning our industry, including industry statistics and forecasts,

competitive position and the markets in which we operate is based on information from independent industry and research organizations, other third-party sources and management estimates. Management estimates are derived from publicly

available information released by independent industry analysts and other third party sources, as well as data from our internal research, and are based on assumptions made by us upon reviewing such data, and our experience in, and knowledge

of, such industry and markets, which we believe to be reasonable. Projections, forecasts, assumptions and estimates of the future performance of the industry in which we operate and our future performance are necessarily subject to uncertainty

and risk due to a variety of factors. We have not independently verified the accuracy or completeness of the information provided by independent industry and research organizations, other third parties or other publicly available information.

Accordingly, we make no representations as to the accuracy or completeness of that information nor do we undertake to update such information after the date of this presentation.

2023 Investor Presentation

*All financial metrics are as of or for the quarter ended 12/31/23. Revenue

growth represents year-over-year growth of Q4 2023 over Q4 2022.

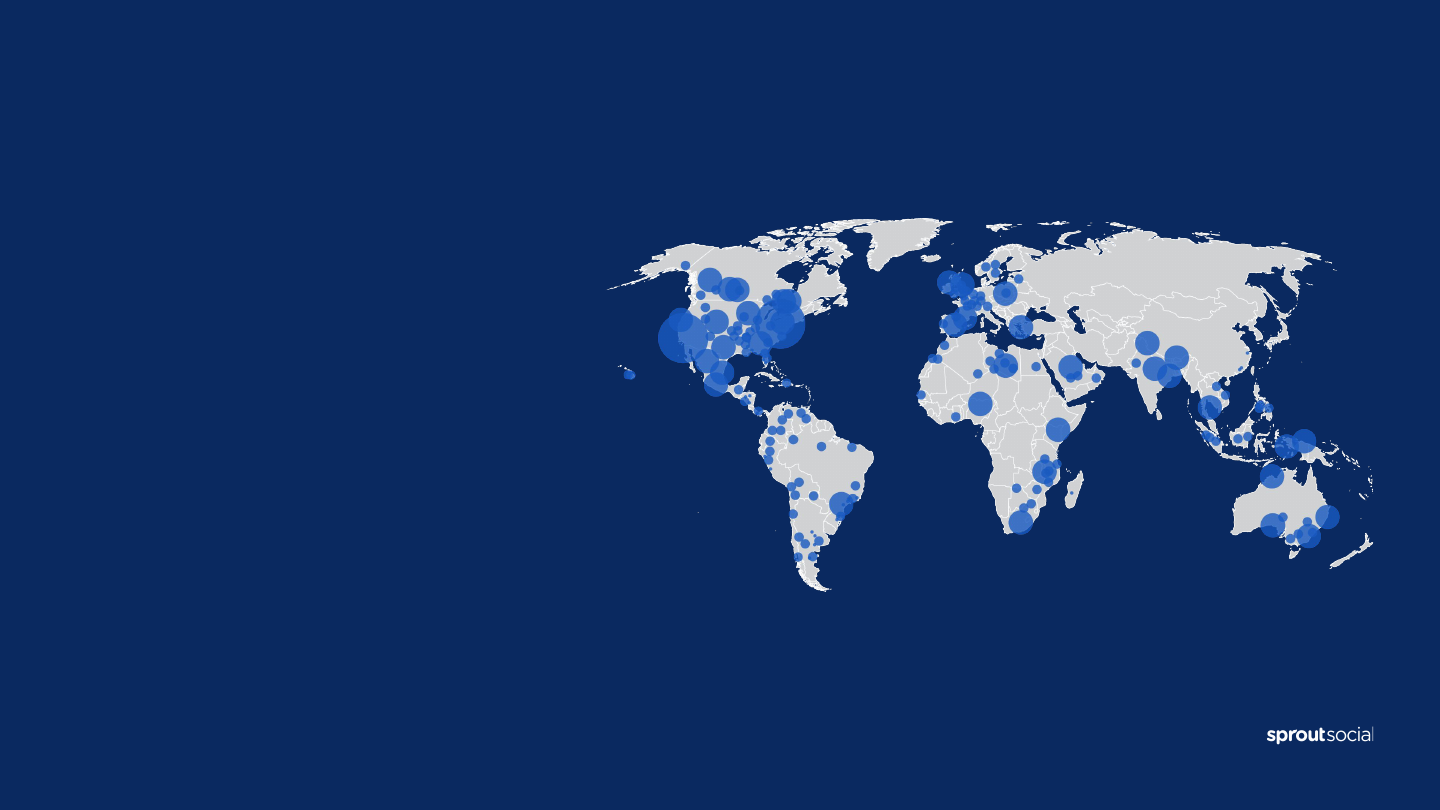

30,000+

Customers in 100+ countries

78%

Gross Profit

34%

Revenue Growth

99%

Subscription

Revenue

$385M

Annual Recurring

Revenue

Empowering

businesses to

operationalize social

Disruptive product

led model and fast

time to value

Recurring SaaS model

(99% subscription)

Durable moats and

barriers to entry

Investment highlights

Social system of

record, intelligence

and action

Highly scalable

single code base

Founder-led

leadership team and

exceptional culture

Large and rapidly

growing TAM

Our history

Sprout was built on the premise that social media

would change the way the world communicates and

how virtually every aspect of business operates.

2011

Sprout platform

introduced

2010

Founded

company

2013

Hired 100th

employee

2017

First business

acquisition

2018

Opened Dublin office

Launched first add-on

module (Listening)

2019

Became a public

company

Launched Reviews

add-on

2020

Sprout Design Refresh

Launched Premium

Analytics add-on

2021

Launched Social

Commerce

2016

Series C

funding

2022

Strategic

platform

changes

2023

Acquired Influencer

Marketing leader,

Tagger

Acquired AI/ML

leader, Repustate

Social media has

fundamentally

transformed the way

consumers connect

with brands

Total Global Social Media Users per Statista, January 31, 2024

With more than

consumers using social media

5.04 billion

Businesses must adapt or risk becoming irrelevant

to nearly half of the world’s population. The ways

that business attract, acquire, sell to and service

customers is being completely transformed.

And changed the entire customer experience,

across the enterprise

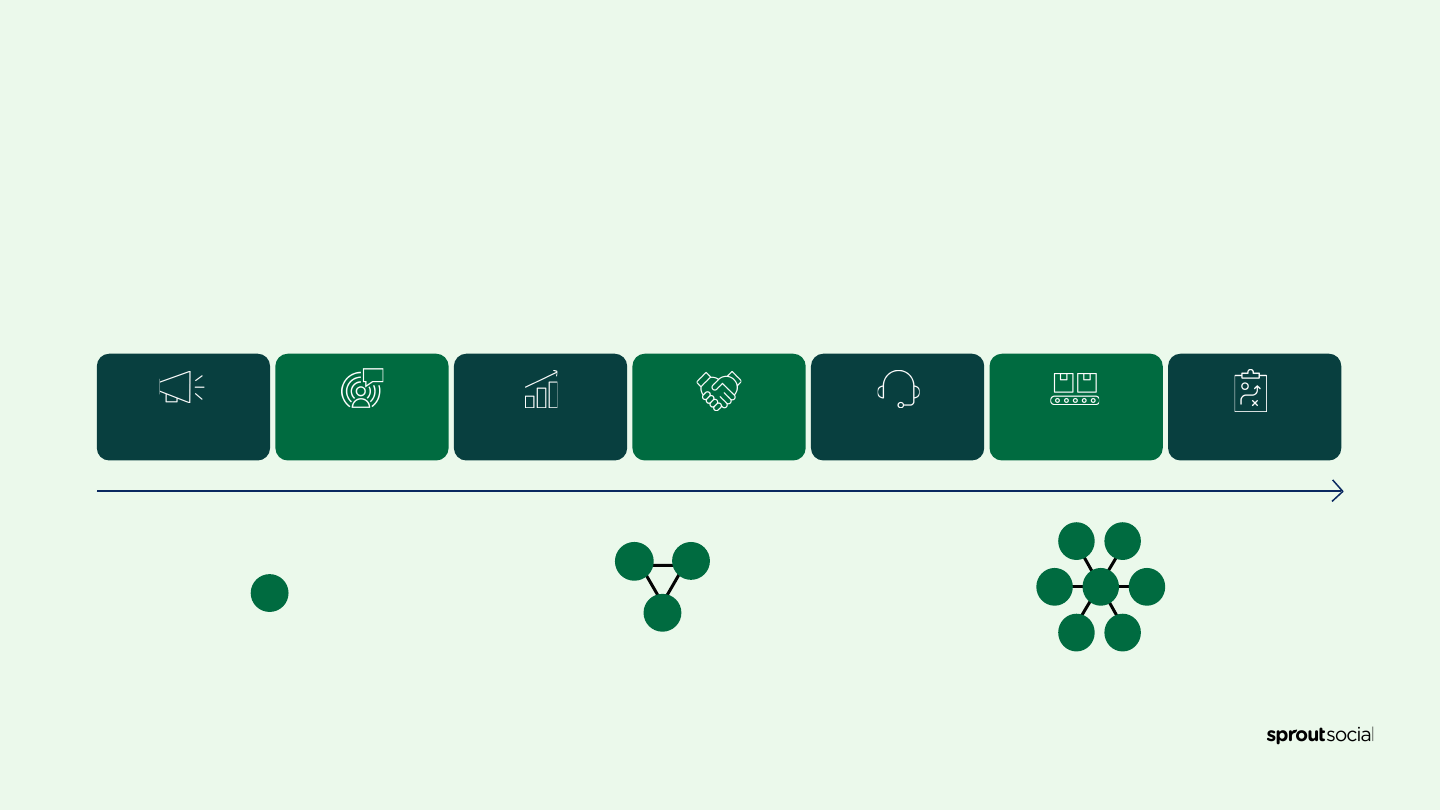

Social is a horizontal technology that has tangible benefits to nearly every department within a

modern business; businesses must adapt and re-tool to harness the power of social and maximize

the value of social data.

Social is strategic to

every business

Social media

marketer

Social team

Product

Influence

Marketing

Sales Success Support Strategy

Marketing

Sales Support Success Product Strategy

Commerce

Advocacy

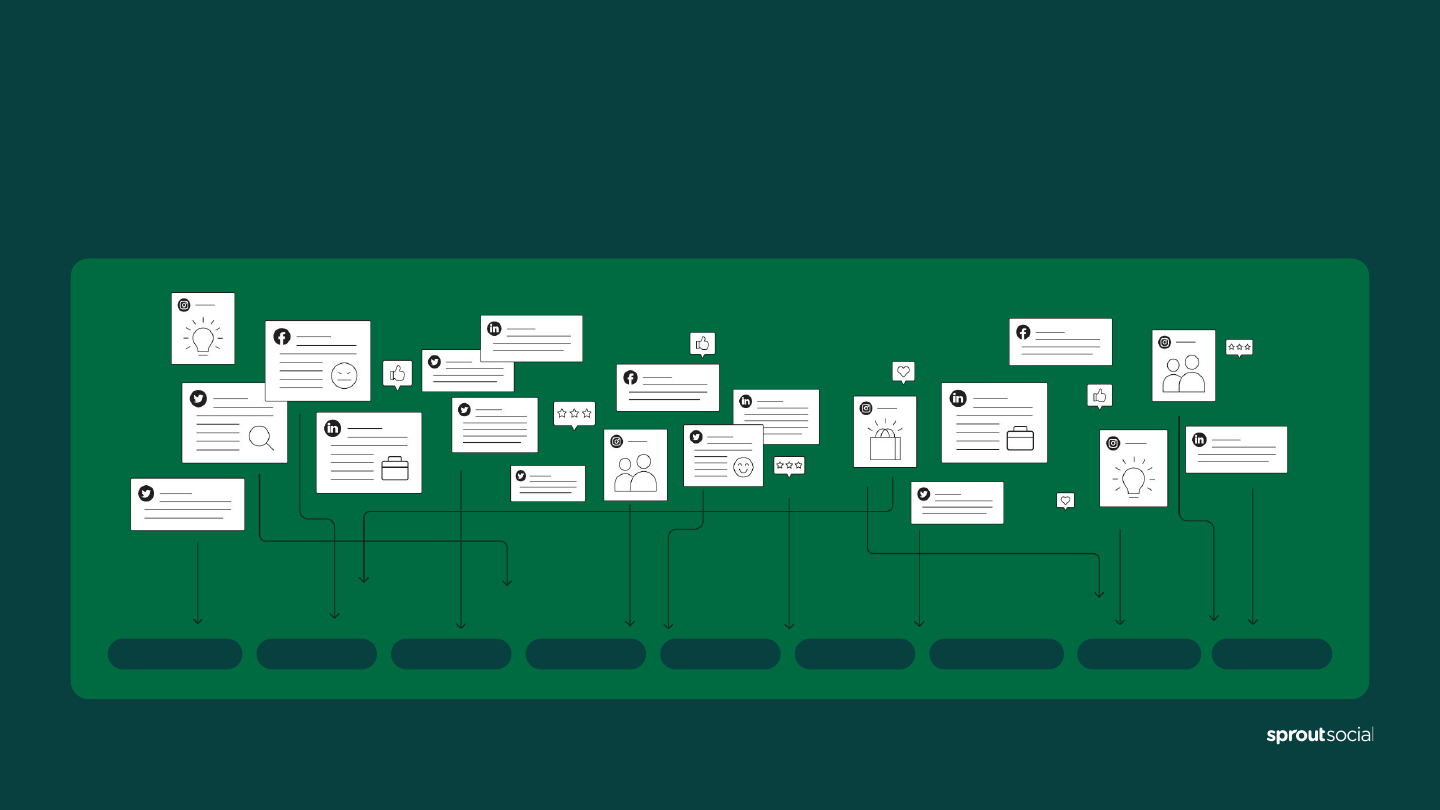

Requiring an entirely new system of record

Social media is massive, scattered, multi-purpose and does not conform to our existing business

systems. A centralized platform is critical to creating strategic business value.

Influencer

Marketing

Sales Support Success Product Strategy

Commerce

Advocacy

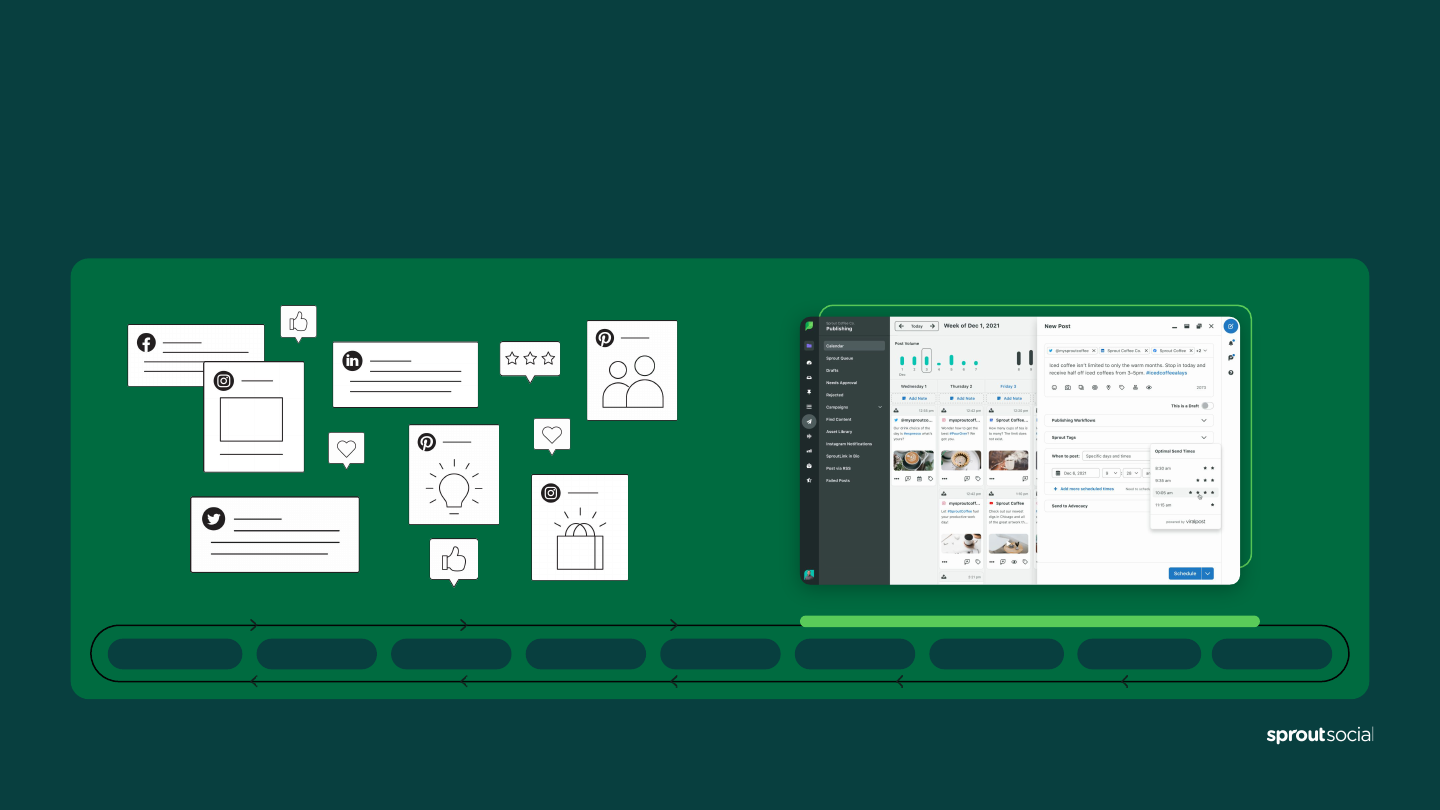

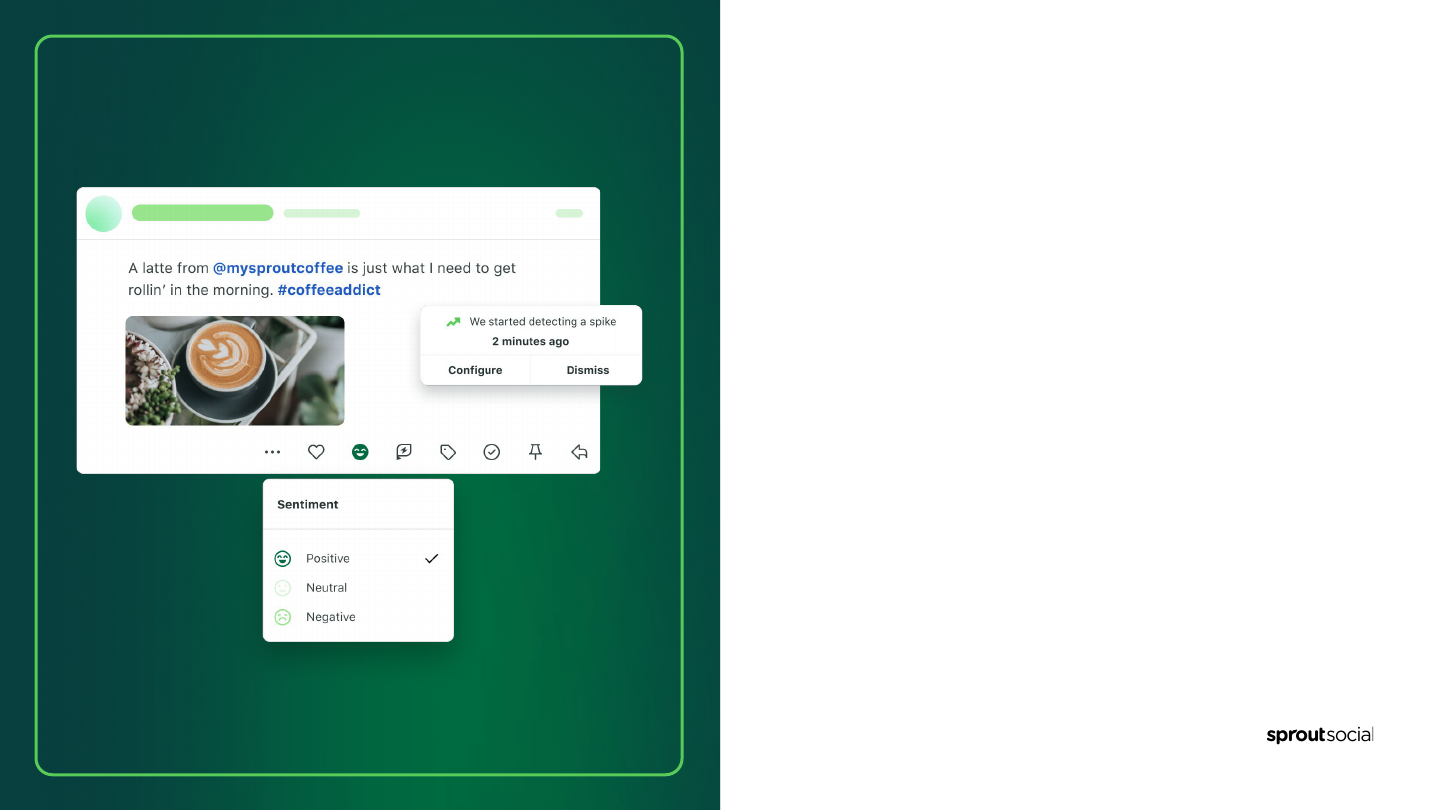

Sprout is the platform solution

Sprout consolidates the complexity of social channels into a powerful, elegant and seamlessly

integrated platform that can be leveraged across an organization.

Influencer

Influencer category expansion via August 2023 acquisition of Tagger. This product has not been fully integrated yet into Sprout.

Sprout Social

has become

mission-critical

for more than

30,000 customers

globally

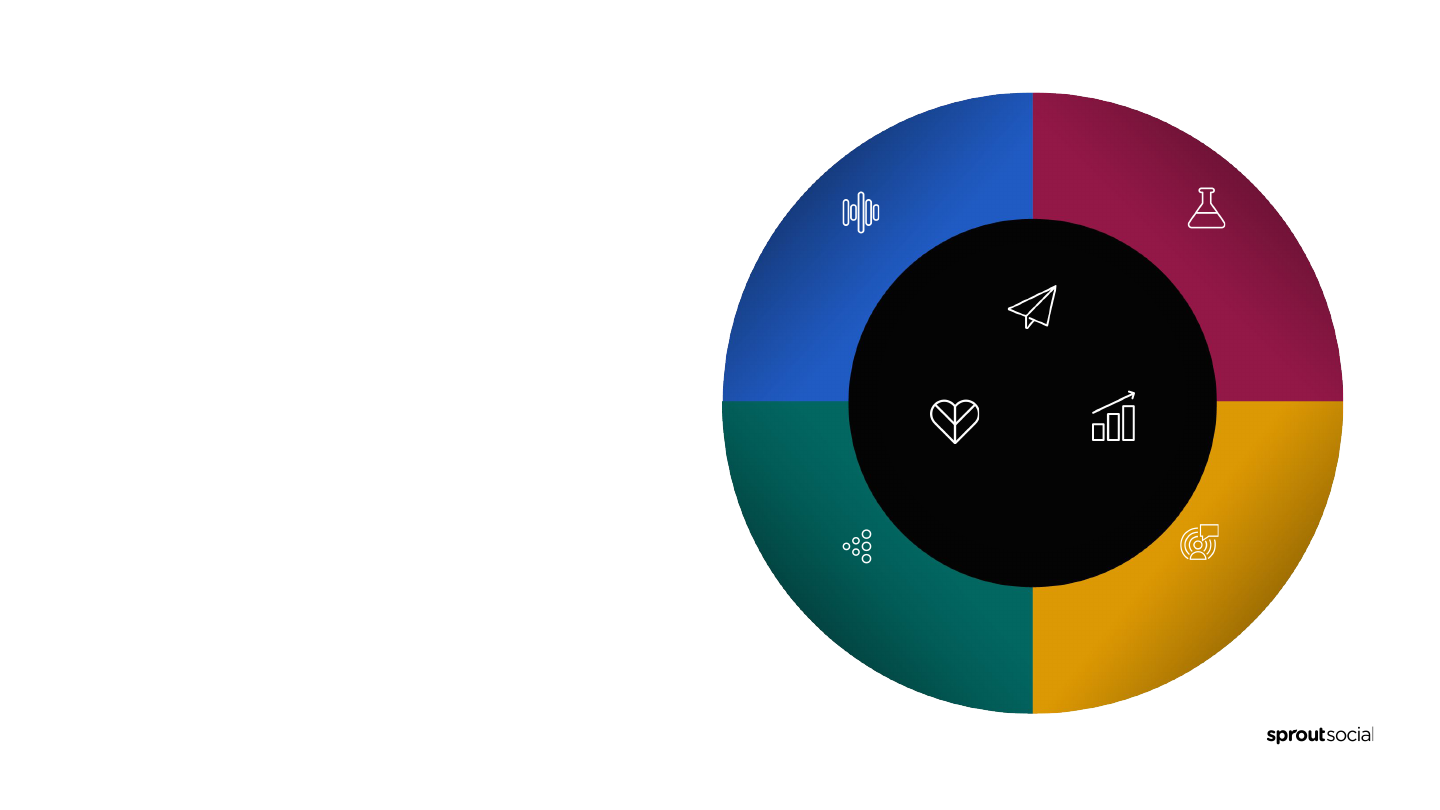

Analytics

Engagement

Listening

Influencer

Marketing

Publishing

Advocacy

A powerful,

fully integrated

platform

Our core platform was built to facilitate

social communication. We’ve expanded

our capabilities to handle new use-cases

as more of the customer experience has

shifted to social, and as businesses mature

in their standardization of social.

Reporting

Providing real-time

insights for brands

across billions

of data points

Social data is an unprecedented source of

business intelligence — allowing businesses

to better understand their customers,

markets, competitors and to shape their

strategy based on real-time global insights

from billions of consumers.

With

compounding

competitive

advantages

Our core platform was built to

facilitate social communication.

We’ve expanded our capabilities

to meet new use-cases as more

of the customer experience shifts

to social over time.

Data scale

Single code

base

Seamless,

unified

platform

Deep,

integrated

network

partnerships

Dynamic

innovation

Direct competitors

Specialized & lack integration

Platform / technology limitations

Disparate systems that are hard to

get value from

Custom & services heavy

Other software vendors

Social is horizontal and can’t be

compartmentalized

Built on common, unique ID

Anonymized data / GDPR Issues

Partnering with Sprout

Meaningful barriers to entry

We are well positioned to lead our market. Our primary competitors have taken a different approach; other software

vendors have been unable to adapt effectively to social and are leaning in to social partnerships with Sprout.

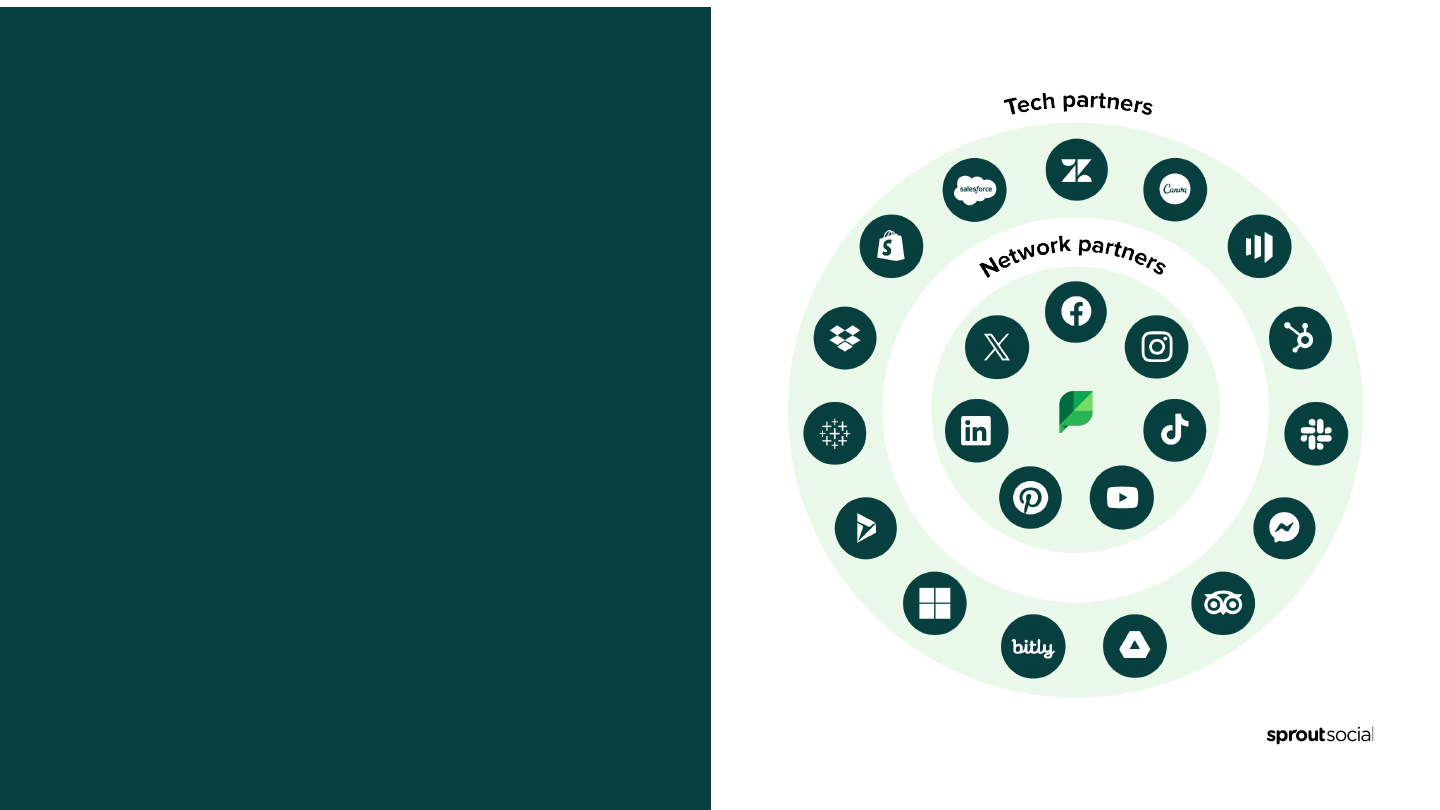

Entrenched

network &

integration

ecosystem

We have deep, integrated and differentiated

network & technology partner relationships

that are increasingly hard to replicate; our

expanding ecosystem is growing the value of

our social system of record.

Top customer-rated platform

Sprout was named the #1 Best Software Product by G2’s 2024 Best Software Awards. We are the top rated platform

in our category for virtually every customer satisfaction dimension.

*Ratings reflect Sprout Social’s rating and the ratings of its primary competitors by G2 as of January 30, 2024

Ease of use Admin

Product

direction

Support

Performance

& reliability

Ease of setup Focus

8.9 9.1 9.1 8.8 9.0 9.1 Social-First

A 8.5 8.5 8.0 8.2 8.5 8.6 Consumer, SMB

B 7.5 7.2 8.6 7.7 8.1 7.4 Enterprise

C 7.4 7.3 7.8 7.7 8.2 6.3 Large Enterprise

Our market is early

90% <5%

Executives agree: social will soon

become their primary channel for

connecting with customers

Have adopted a social media

management platform

Data from “The 2023 State of Social Media: AI & Data Take Center Stage.” Harris Poll, Commissioned by Sprout Social, 2023.

>$55B current SAM*

2023 Estimate; influencer marketing represents

additional SAM and category expansion

<5% current penetration*

Sprout and all of our direct competitors combined

today serve a small fraction of our SAM

>$120B 2025 TAM forecast*

>25% Annual Growth; influencer marketing represents

additional TAM and faster growth

*See Appendix for detailed calculation

And rapidly growing

Sprout’s entrance into the influencer marketing category will expand ACV and SAM opportunity

SMB

Enterprise

Agency

Mid-Market

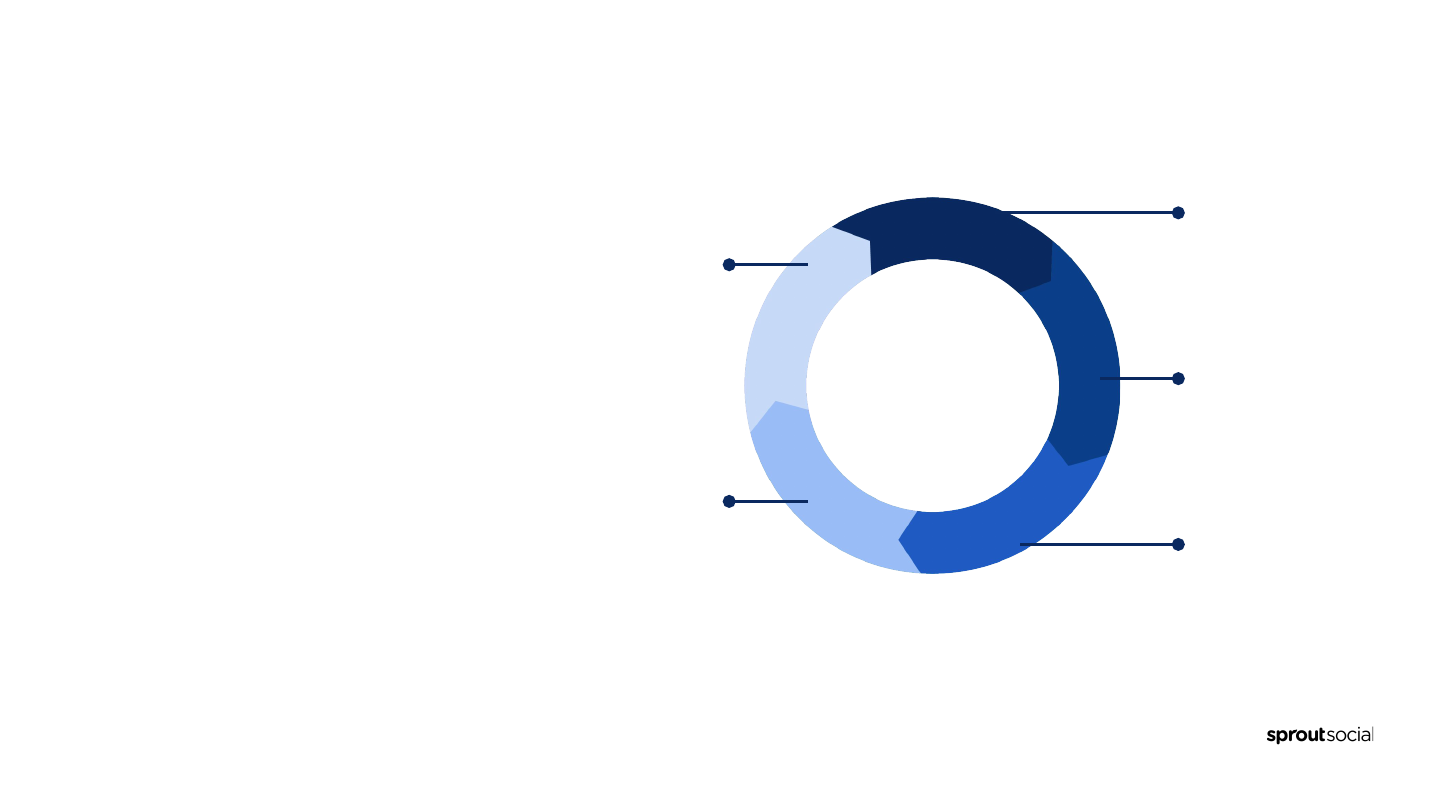

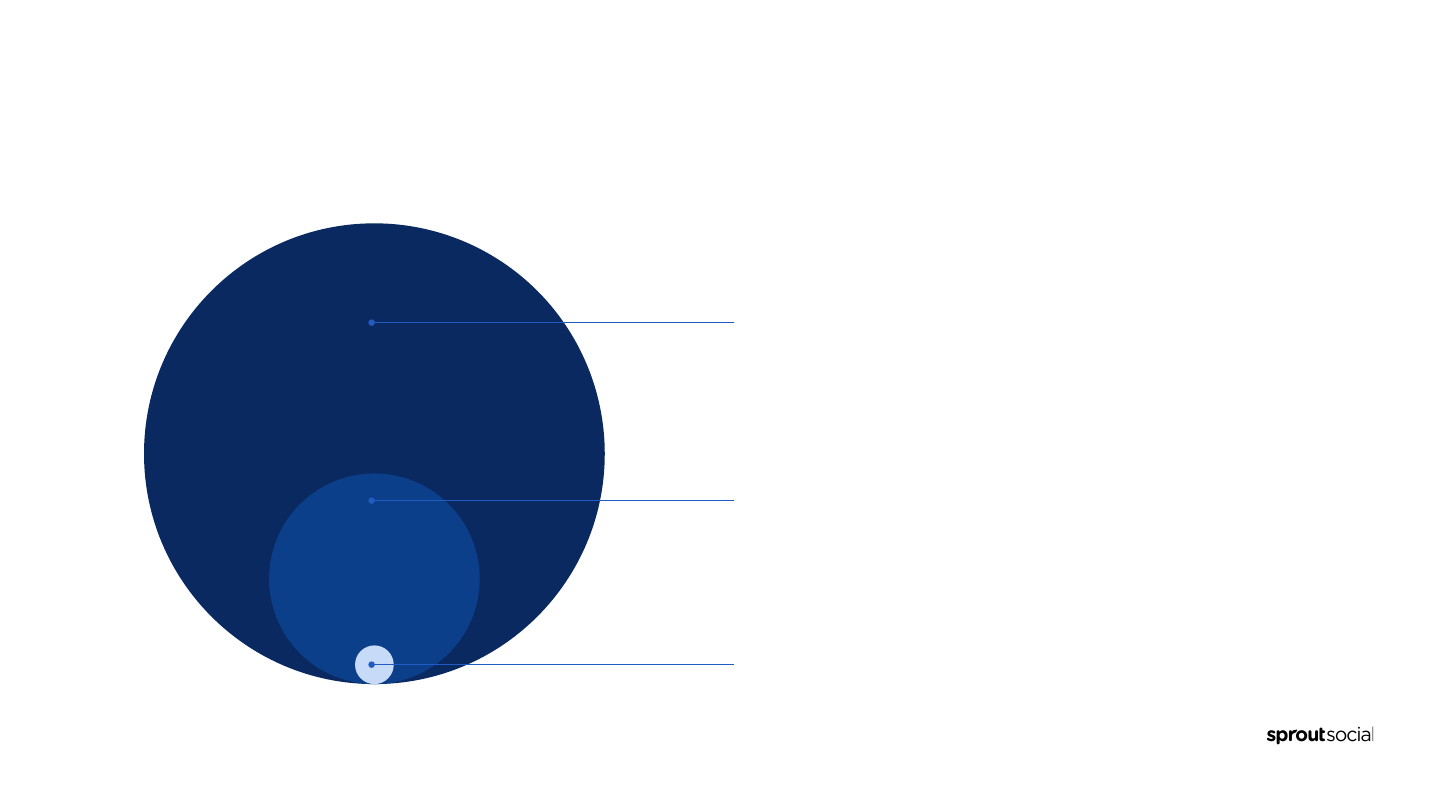

*As of 12/31/2023. Visual reflects ARR distribution by segment as of 12/31/2023.

With a strategically diversied customer base

Our product, go to market and success strategies are aligned around the most productive customers in

our market. We’re positioned to capture customers as they mature into our sweet spot over time.

● >6:1 overall LTV:CAC Ratio*

● Highly diverse customer base with no

revenue concentration

● Broad perspective. Our smallest

segment has 5,000+ customers

● Every segment served from a single

code-base and distribution model

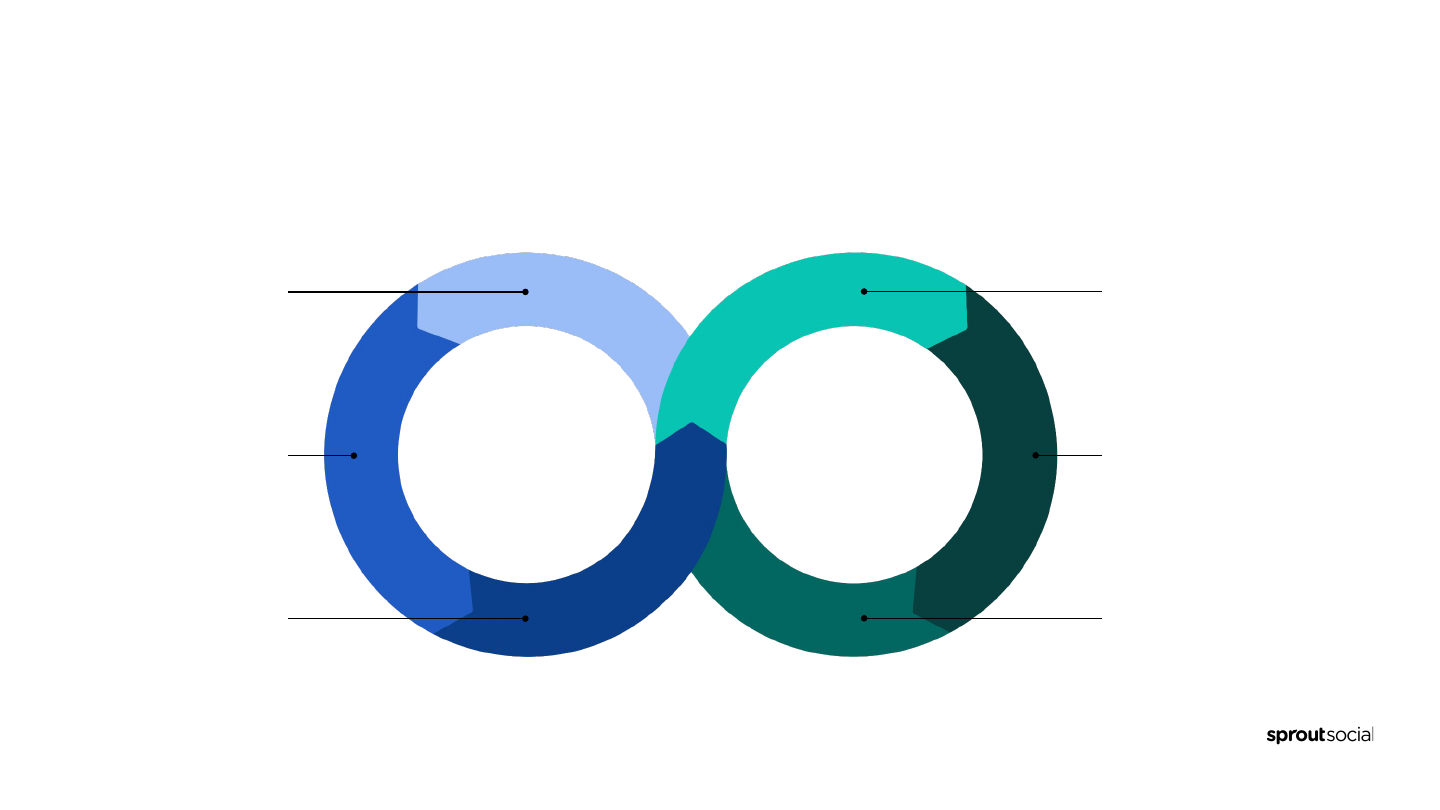

Disruptive and durable GTM model

Success & Support

Community,

content & customer

marketing

Customer

on-boarding

Retention

Inbound trials

Sales

development

SEO, content,

partnerships

& brand

Acquisition

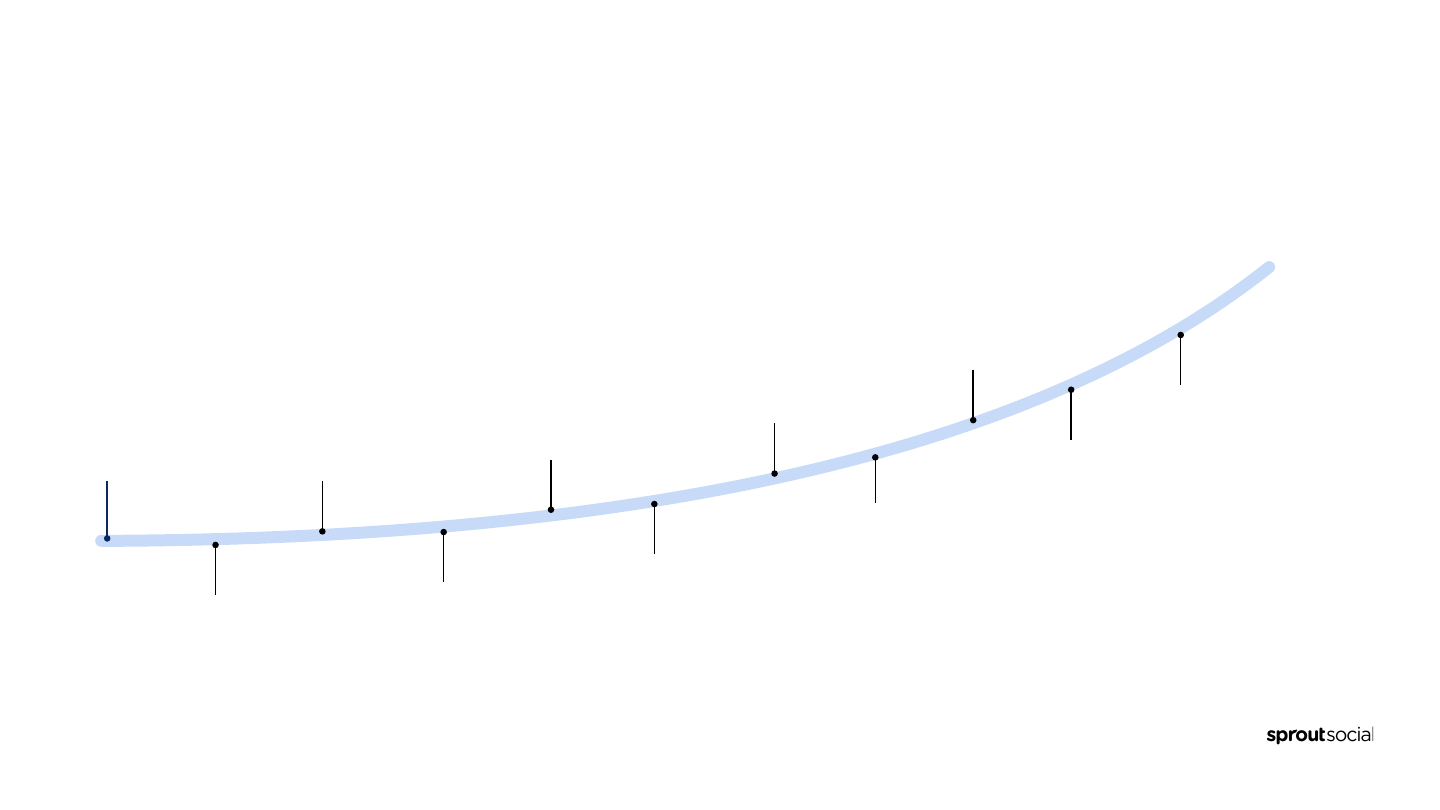

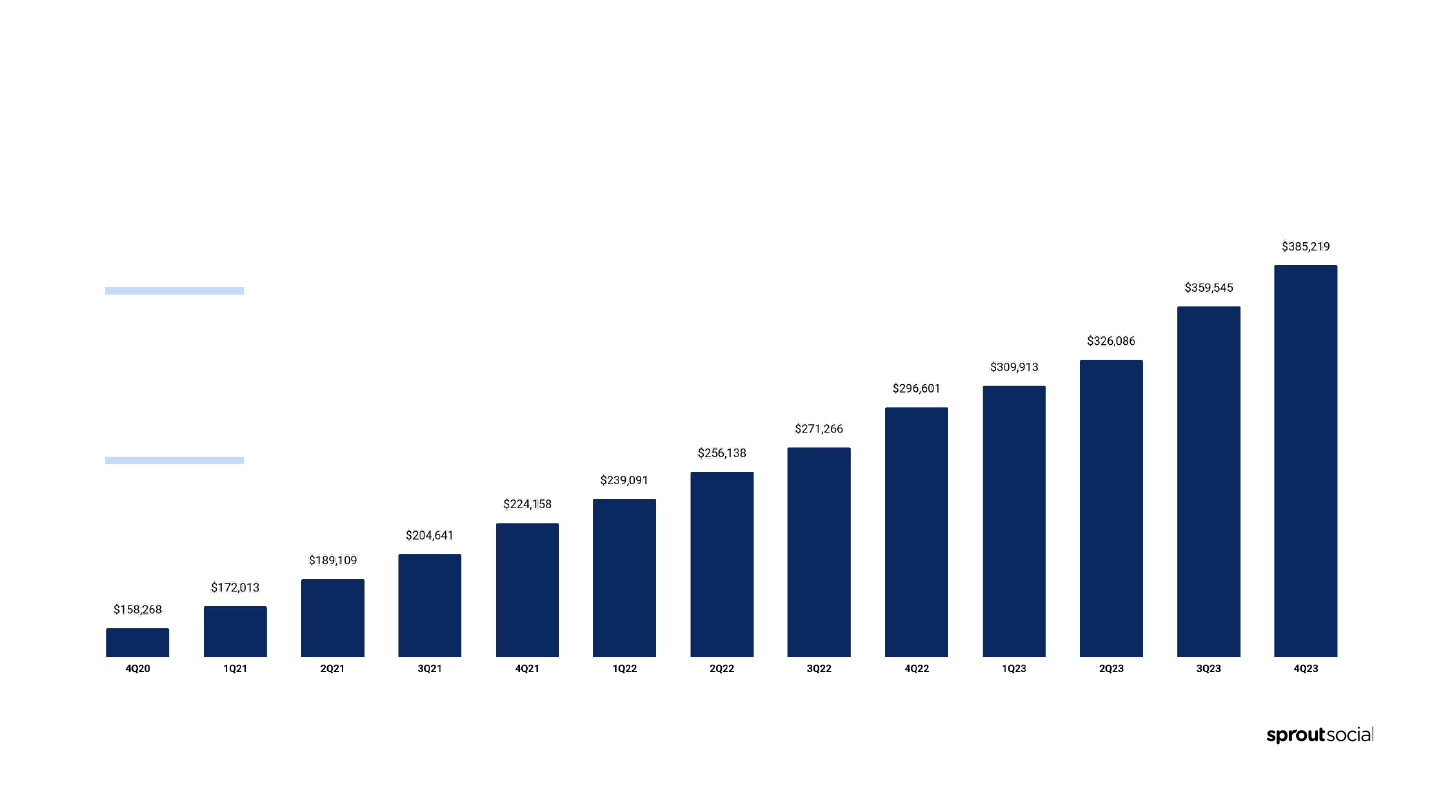

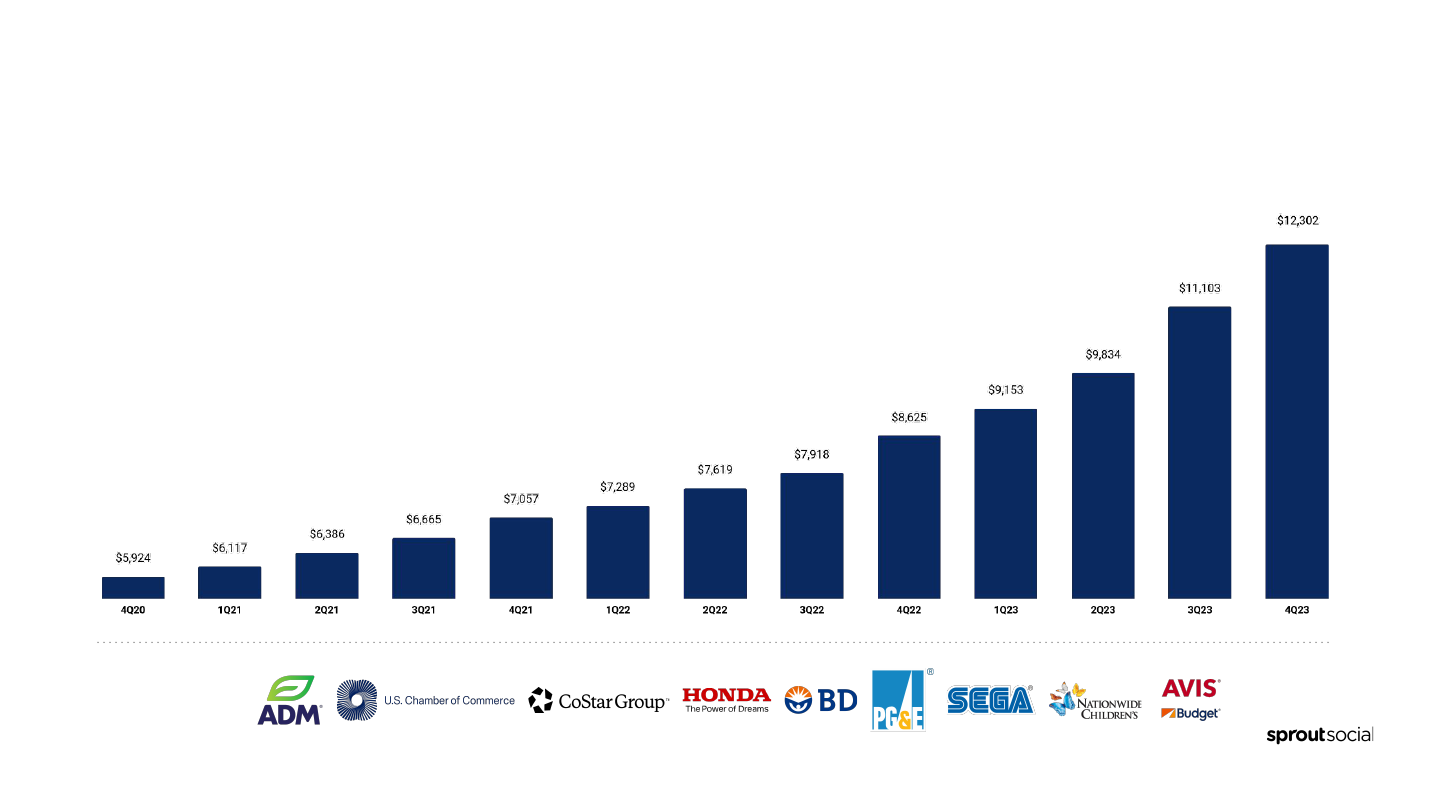

Compound Average Growth Rate (CAGR) measured over the trailing 3 year period 4Q20 to 4Q23

35%

ARR CAGR

Durable ARR growth

Our ARR growth has consistently compounded over time driven by rapidly

growing initial deal sizes and steady customer expansion.

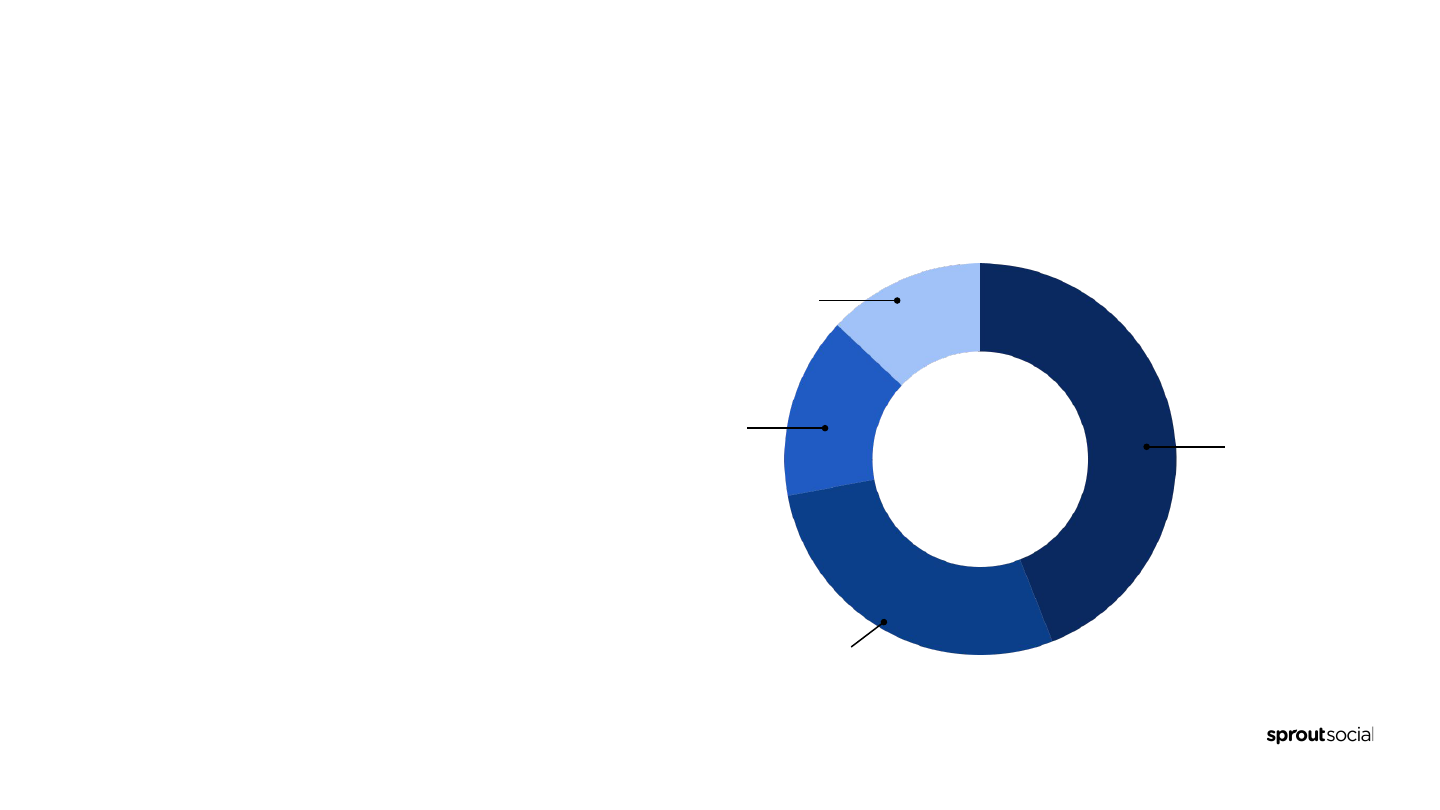

Customers who

have not adopted a

premium product

Customers who

have adopted one

premium product

Two or more premium

products

Platform adoption is early

We’re building the unified platform for all social workflow. We have a large opportunity to make social listening,

advocacy, reporting and influencer marketing core to every customer.

Recent Customer

Highlights

ACV calculated as ending quarter ARR divided by ending quarter total customer count

Accelerating multi-year ACV growth

We are scaling with high quality, social-first customers. This is

resulting in larger initial lands, more valuable existing customers,

and broader penetration of larger accounts, all compounding to

deliver multi-year ACV growth.

As we accelerate growth with our largest customers, we are establishing

ourselves as the social system of record, intelligence and action.

Recent Customer

Highlights

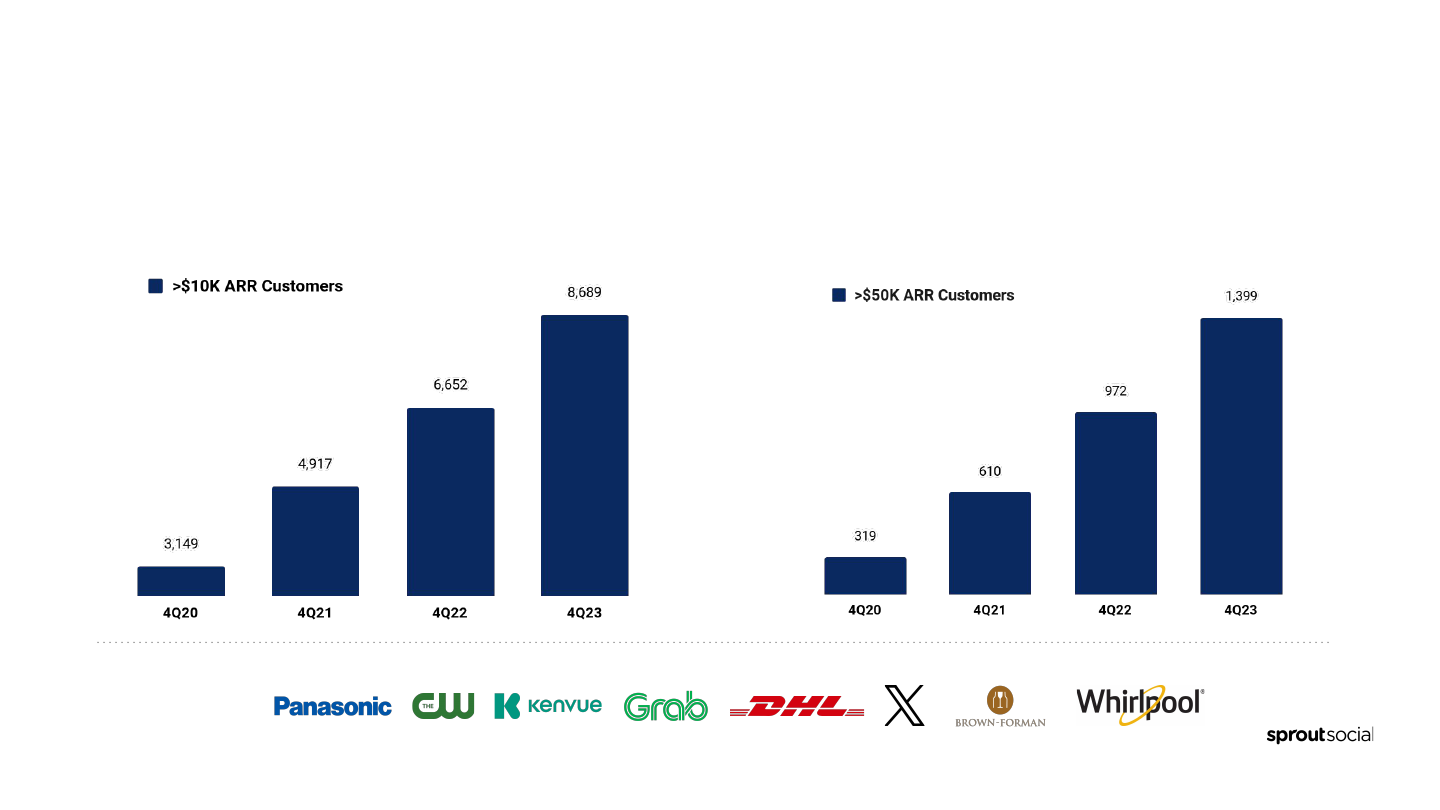

Broadening customer adoption

Strong economics, optimized for growth

Attractive returns on growth investments and a strong competitive position reinforce

investments to support long duration growth

ARR, Non-GAAP Gross Margin, Non-GAAP Operating Margin and Non-GAAP FCF Margin are Non-GAAP financial metrics. See appendix for

reconciliations of these measures to their closest comparable GAAP measure and definitions to these Non-GAAP measures.

2020 2021 2022 2023 2028 Target

Revenue 36% 41% 35% 31% >$1B

ARR 36% 42% 32% 30%

Non-GAAP

Gross Margin

74% 76% 77% 78% >80%

Non-GAAP

Operating Margin

-16% -3% -2% 1% >20%

Non-GAAP FCF

Margin

-12% 7% 3% 3% 20-22%

● Lead Nascent TAM

● Account Expansion

● Platform Expansion

● International Expansion

● Category Expansion

Our growth

strategy

We are early in our journey with multiple

levers to sustain durable medium term growth

Culture as a

business strategy

We’re building an enduring company centered

on amazing people, amazing products and

over-delivering for our customers.

2017, 2018,

2020, 2021,

2022, 2023

2019, 2020,

2021, 2022,

2023

Driven by a

world-class

executive

leadership

team

Joe Del Preto

CFO

Justyn Howard

CEO

Ryan Barretto

President

Rachael Pfenning

SVP, Operations

Heidi Jonas

General Counsel

Alan Boyce

CTO

Team background:

Scott Morris

CMO

Creating value for all of our stakeholders

Attractive unit economics

and durable long term

growth

Sustainable competitive

advantages

Industry leading

platform

Social is disruptive and

mission critical

Strategic technology partner

in secularly advantaged

growth market

Top rated culture

and team

Sprout Social, Inc.

Summary and Reconciliation of Non-GAAP Financial Measures (Unaudited) (in thousands, except per share data)

Reconciliation of Non-GAAP Financial Measures

Three Months Ended 12/31,

2023 2022

Reconciliation of Non-GAAP operating income (loss)

Loss from operations $(18,223) $(13,149)

Stock-based compensation expense $18,659 $13,708

Acquisition-related expenses $51 $-

Amortization of acquired intangible assets $1,213 $-

Non-GAAP operating income $1,700 $559

Reconciliation of Non-GAAP net income (loss)

Net loss $(20,077) $(11,942)

Stock-based compensation expense $18,659 $13,708

Acquisition-related expenses $51 $-

Amortization of acquired intangible assets $1,213 $-

Tax expense due to change in valuation allowance from business acquisition $1,134 $-

Non-GAAP net income $980 $1,766

Reconciliation of Non-GAAP net income (loss) per share

Net loss per share attributable to common shareholders, basic and diluted $(0.36) $(0.22)

Stock-based compensation expense per share $0.34 $0.25

Acquisition-related expenses $- $-

Amortization of acquired intangible assets $0.02 $-

Tax expense due to change in valuation allowance from business acquisition $0.02 $-

Non-GAAP net income per share $0.02 $0.03

Summary of Non-GAAP Financial Measures

Three Months Ended 12/31

2023 2022

Non-GAAP operating income $1,700 $559

Non-GAAP net income $980 $1,766

Non-GAAP net income per share $0.02 $0.03

Non-GAAP free cash flow $(279) $2,555

Reconciliation of Non-GAAP Financial Measures

Three Months Ended 12/31,

2023 2022

Reconciliation of Non-GAAP free cash flow

Net cash provided by (used in) operating activities $(2,604) $2,952

Expenditures for property and equipment $(629) $(397)

Acquisition-related costs $1,366 $-

Interest paid on credit facility $1,588 $-

Non-GAAP free cash flow $(279) $2,555

Appendix

Appendix

Annual Recurring Revenue (“ARR”). We define ARR as the annualized revenue run-rate of subscription agreements from all customers as of the last date of the specified period. We believe ARR is an indicator of the scale of our entire platform while mitigating fluctuations due to seasonality and contract term.

Non-GAAP gross profit: We define non-GAAP gross profit as GAAP gross profit, excluding stock-based compensation expense and amortization expense associated with the acquired developed technology from the Tagger Media, Inc. acquisition. We believe non-GAAP gross profit provides our management and investors

consistency and comparability with our past financial performance and facilitates period-to-period comparisons of operations, as it eliminates the effect of stock-based compensation and amortization expense, which are often unrelated to overall operating performance. In 2023, we revised our definition of non-GAAP

gross profit to exclude amortization expense associated with the acquired developed technology from the Tagger acquisition.

Non-GAAP gross margin.We define non-GAAP gross margin as non-GAAP gross profit as a percentage of revenue.

Non-GAAP operating income (loss).We define non-GAAP operating income (loss) as GAAP loss from operations, excluding stock-based compensation expense, acquisition-related expenses and amortization expense associated with the acquired intangible assets from the Tagger acquisition. We believe non-GAAP

operating income (loss) provides our management and investors consistency and comparability with our past financial performance and facilitates period-to-period comparisons of operations, as this non-GAAP financial measure eliminates the effect of stock-based compensation, acquisition-related expenses and

amortization expense, which are often unrelated to overall operating performance. In 2023, we revised our definition of non-GAAP operating income (loss) to exclude acquisition-related expenses in connection with our acquisition of Tagger and amortization expense associated with the acquired intangible assets from the

Tagger acquisition.

Non-GAAP operating margin. We defined non-GAAP operating margin as non-GAAP operating income (loss) as a percentage of revenue.

Non-GAAP net income (loss).We define non-GAAP net income (loss) as GAAP net loss, excluding stock-based compensation expense, acquisition-related expenses, amortization expense associated with the acquired intangible assets from the Tagger acquisition and tax expense due to changes in the valuation

allowance from the Tagger acquisition. We believe non-GAAP net income (loss) provides our management and investors consistency and comparability with our past financial performance and facilitates period-to-period comparisons of operations, as this non-GAAP financial measure eliminates the effect of stock-based

compensation, acquisition-related expenses and amortization expense and tax expense due to changes in valuation allowances, which are often unrelated to overall operating performance. In 2023, we revised our definition of non-GAAP net income (loss) to exclude acquisition-related expenses in connection with our

acquisition of Tagger, amortization expense associated with the acquired intangible assets from the Tagger acquisition and tax expense due to changes in the valuation allowance from the Tagger acquisition.

Non-GAAP net income (loss) per share.We define non-GAAP net income (loss) per share as GAAP net loss per share attributable to common shareholders, basic and diluted, excluding stock-based compensation expense, acquisition-related expenses, amortization expense associated with the acquired intangible assets

from the Tagger acquisition and tax expense due to changes in the valuation allowance from the Tagger acquisition. We believe non-GAAP net income (loss) per share provides our management and investors consistency and comparability with our past financial performance and facilitates period-to-period comparisons of

operations, as this non-GAAP financial measure eliminates the effect of stock-based compensation, acquisition-related expenses, amortization expense and tax expense due to changes in valuation allowances, which are often unrelated to overall operating performance. In 2023, we revised our definition of non-GAAP net

income (loss) per share to exclude acquisition-related expenses in connection with our acquisition of Tagger, amortization expense associated with the acquired intangible assets from the Tagger acquisition and tax expense due to changes in the valuation allowance from the Tagger acquisition.

Non-GAAP free cash flow.Non-GAAP free cash flow is a non-GAAP financial measure that we define as net cash provided by (used in) operating activities less expenditures for property and equipment, acquisition-related costs and interest. Non-GAAP free cash flow does not reflect our future contractual obligations or

represent the total increase or decrease in our cash balance for a given period. We believe non-GAAP free cash flow is a useful indicator of liquidity that provides information to management and investors about the amount of cash used in our core operations that, after expenditures for property and equipment,

acquisition-related costs and interest, is not available for strategic initiatives. In 2023, we revised our definition of non-GAAP free cash flow to exclude payments related to acquisition-related costs associated with our acquisition of Tagger and cash paid for interest on our revolving line of credit.

Non-GAAP free cash flow margin (Non-GAAP FCF Margin).We define non-GAAP free cash flow margin as non-GAAP free cash flow as a percentage of revenue.

Dollar-based net retention rate. We calculate dollar-based net retention rate by dividing the organic ARR from our customers as of December 31st in the reported year by the organic ARR from those same customers as of December 31st in the previous year. This calculation is net of upsells, contraction, cancellation or

expansion during the period but excludes organic ARR from new customers. We use dollar-based net retention to evaluate the long-term value of our customer relationships, because we believe this metric reflects our ability to retain and expand subscription revenue generated from our existing customers.

Average Contract Value (ACV). We define ACV as the ending period total ARR divided by the ending period total customer count.

LTV:CAC. We calculate the lifetime value of our customers and associated customer acquisition costs for a particular year by comparing (i) gross profit from net new ARR for the year divided by oneminusthe estimated subscription renewal rate to (ii) total sales and marketing expense incurred in the preceding year.

Number of customers.We define a customer as a unique account, multiple accounts containing a common non-personal email domain, or multiple accounts governed by a single agreement or entity. We believe that the number of customers using our platform is an indicator of our market penetration.

Number of customers contributing more than $10,000 in ARR.We define number of customers contributing more than $10,000 in ARR as those on a paid subscription plan that had more than $10,000 in ARR as of a period end. We view the number of customers that contribute more than $10,000 in ARR as a measure of

our ability to scale with our customers. We believe this represents potential for future growth, including expanding within our current customer base.

Number of customers contributing more than $50,000 in ARR. We define number of customers contributing more than $50,000 in ARR as those on a paid subscription plan that had more than $50,000 in ARR as of a period end. We view the number of customers that contribute more than $50,000 in ARR as a measure

of our ability to scale with large customers and attract sophisticated organizations. We believe this represents potential for future growth, including expanding within our current customer base.

We calculated our current >$55B Served Addressable Market estimate as follows: (i) utilized data from The US SBA, The US Census Bureau, The OECD and Statista to estimate the total number of businesses in the United States and globally in each of our served market segments (Enterprise, Mid-Market, SMB); (ii)

utilized internal data and third party estimates to estimate of the number of such businesses that require a social media management platform (the “Target Businesses”); (iii) calculated the average of our ACV and our estimate of our direct competitors’ ACVs in each segment; and (iv) multiplied the estimated average

segment ACVs by the estimated number of Target Businesses in each applicable segment.

We calculated our >$120B Total Addressable Market estimate using the methodology above. We then used internal estimates informed by research from the Harris Poll to determine the projected business presence on social media in 2025 that will require

a social media management platform, multiplied by our internal projected average segment ACVs in 2025 for Sprout Social and its direct competitors in the applicable segment.

Current Penetration of our Served Addressable Market. We estimate the current total revenue of SPT and each of our primary competitors and divide by our current SAM to determine current market penetration.

Appendix