SaaS Sales

Compensation

Policies & Practices

Report

January 2021

Introduction

Plan Designs

Sales Crediting

Policy

Demographics

About Us

Caps

Accelerators

Multi-Year

SPIFFs

Front Line Managers

Recognition & Timing

Splits

Early Renewals

Non-Recurring Revenue

New Logos

Tools

Mega Deals

New Hire Ramp

Contents

It’s not about going

back; it’s about preparing

for the future.

3

Introduction

Many SaaS organizations have closed out

their year and have recently gone through

compensation planning for this scal year.

Nearly every organization will evaluate their

sales compensation programs as a part of

this process. As organizations evaluate their

design, they’ll likely focus on the performance

metrics, accelerator tables, quotas, and pay

levels. All of which are important design

elements, and each with many available

industry benchmarks. However, many

organizations will not address the policies

and practices that govern the overall

compensation plan.

Policies and practices are often the toughest

questions related to the plan design. They’re

situational. They can be specic to your

industry sector. They were likely put in place

by legacy team members. They don’t often

change every year. It can be difcult to know

if your company even needs certain policies.

But your plan’s policies and practices can

have a huge impact on the behavior and

performance of your sales team.

Specically, our research addressed the most

common questions we received related to:

• Sales Crediting

• Mega Deals

• Accelerators

• New Hire Compensation

• And of course, Spiffs

The goal of our research is to help your

organization drive smarter decisions around

these policies and practices. Simply put, we

want to capture better insights on these

questions with answers that typically start

with “it depends…”.

68%

67%

49%

have no policy governing

‘Mega Deals’

utilize Spiffs in their

compensation Plan

of respondents don’t have

a mechanism in place to

compensate deals that are

renewed early

4

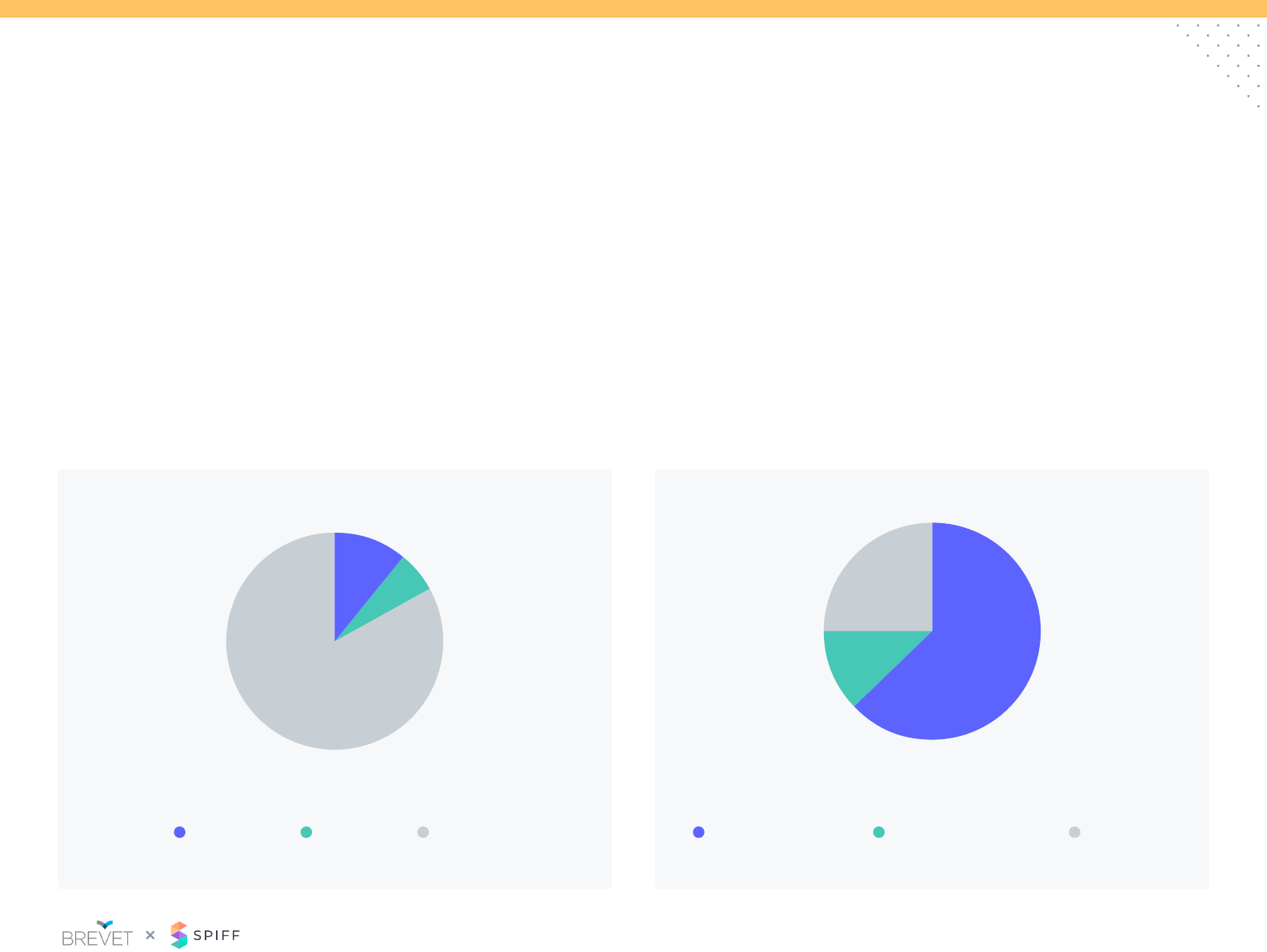

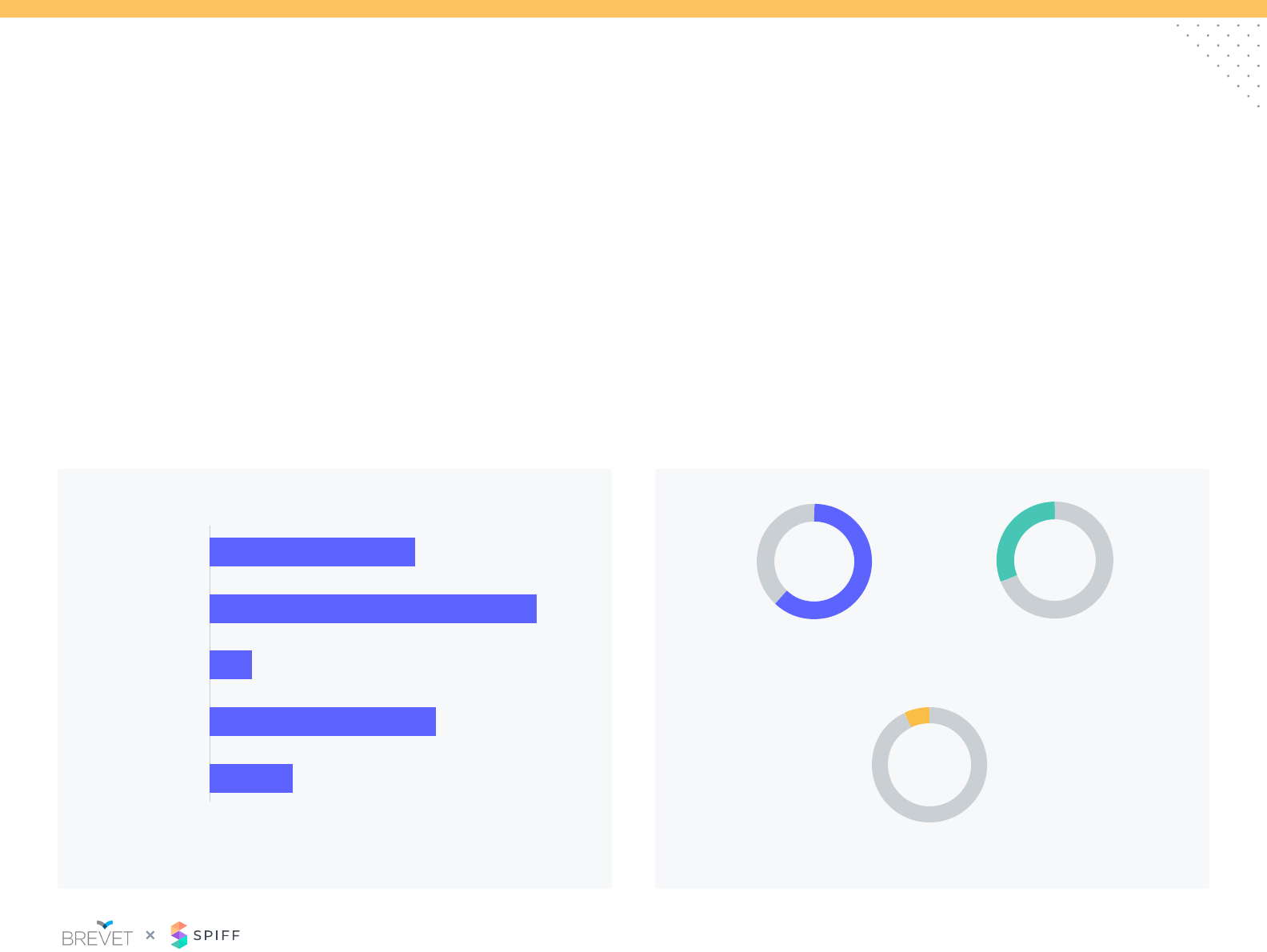

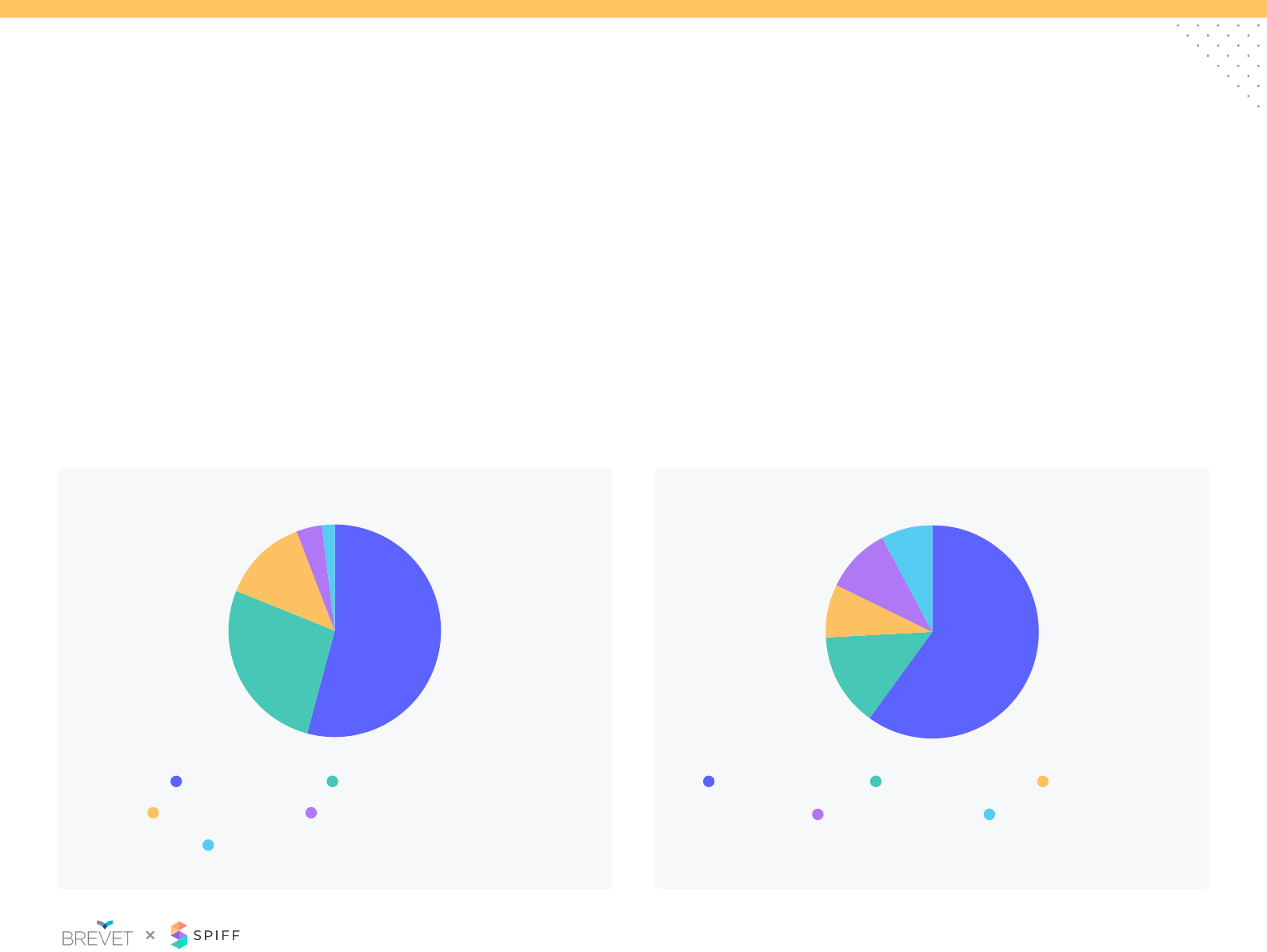

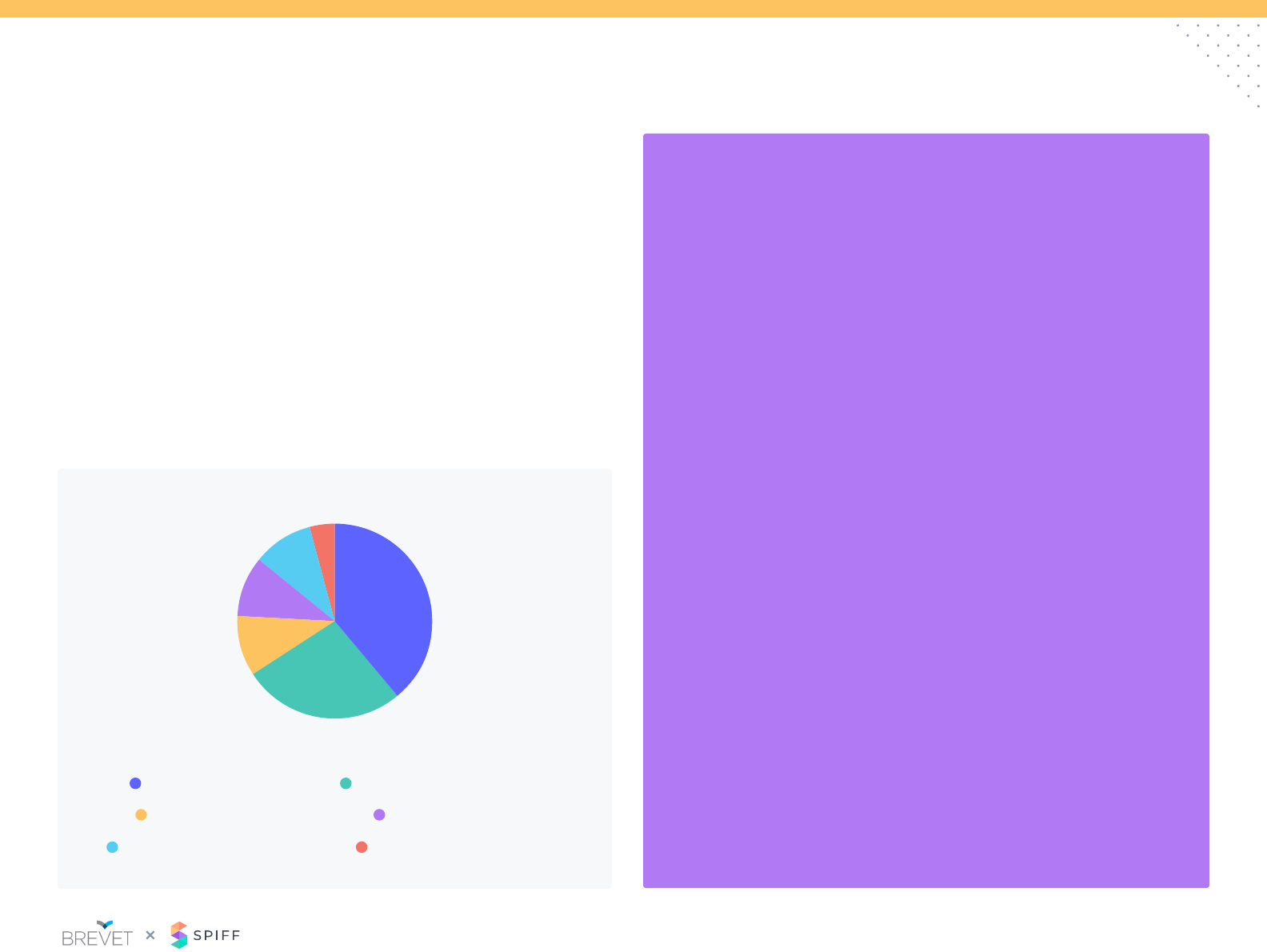

Plan Design: Caps

Caps are not a widely used practice in SaaS sales compensation,

especially for companies with smaller ACVs.

While companies with larger ACVs ($50k+) are 2x more likely to use

caps than companies with smaller ACVs, only 25% of companies with

larger ACVs have caps.

The hard cap limits upside versus the soft cap that pays a lower rate

at a certain performance level.

Does your plan have a cap? What is your cap based on?

The most common practice of caps is to limit the performance

to goal (i.e. at 200% of goal paid reduced/no amount) versus

performance to variable (i.e. 3x target variable).

11%

25%

63%

12%

6%

83%

Hard Cap Performance to goal

Reects SaaS participants

who use caps

Performance to variable Per Deal Cap Soft Cap No Cap

5

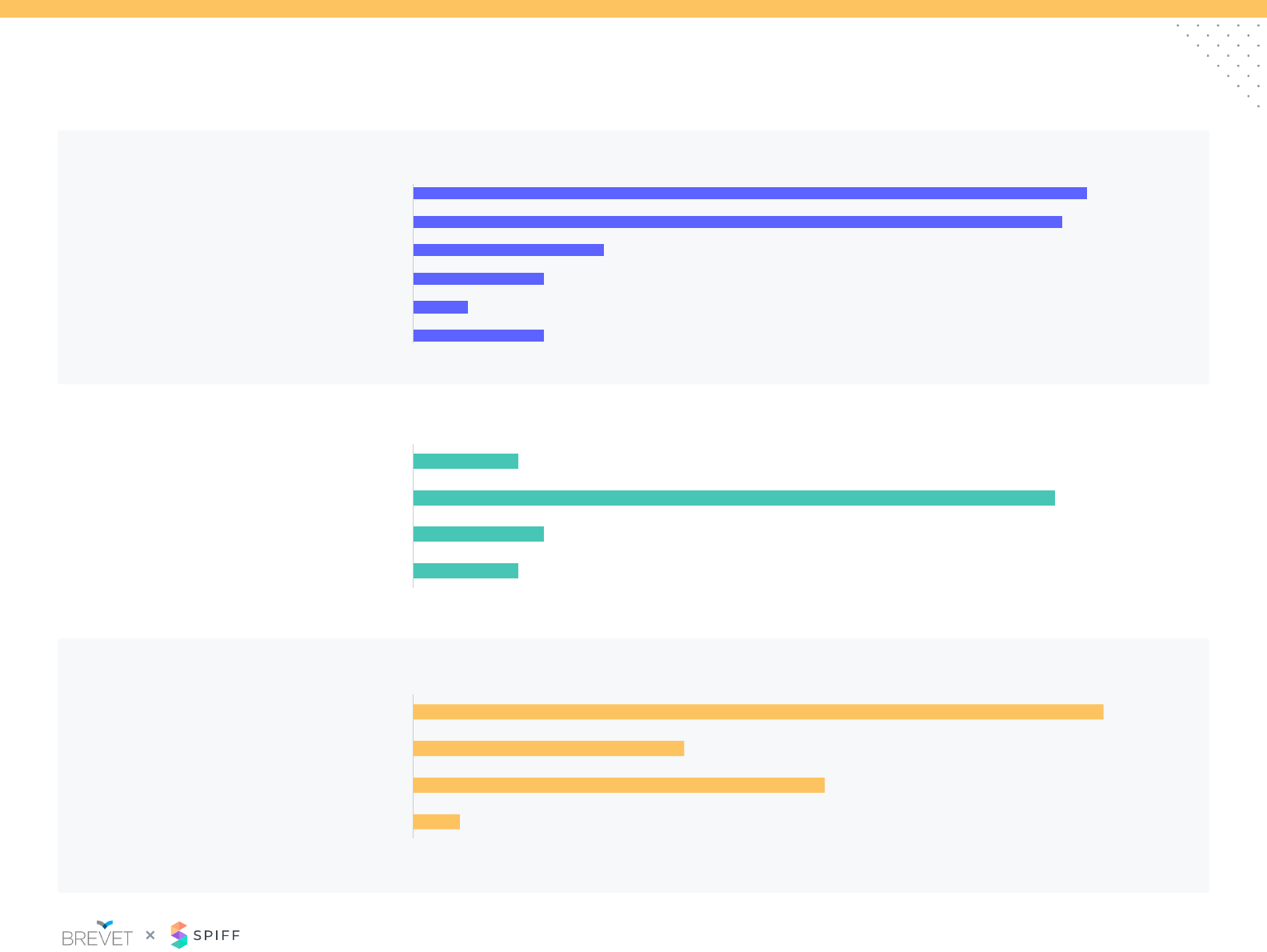

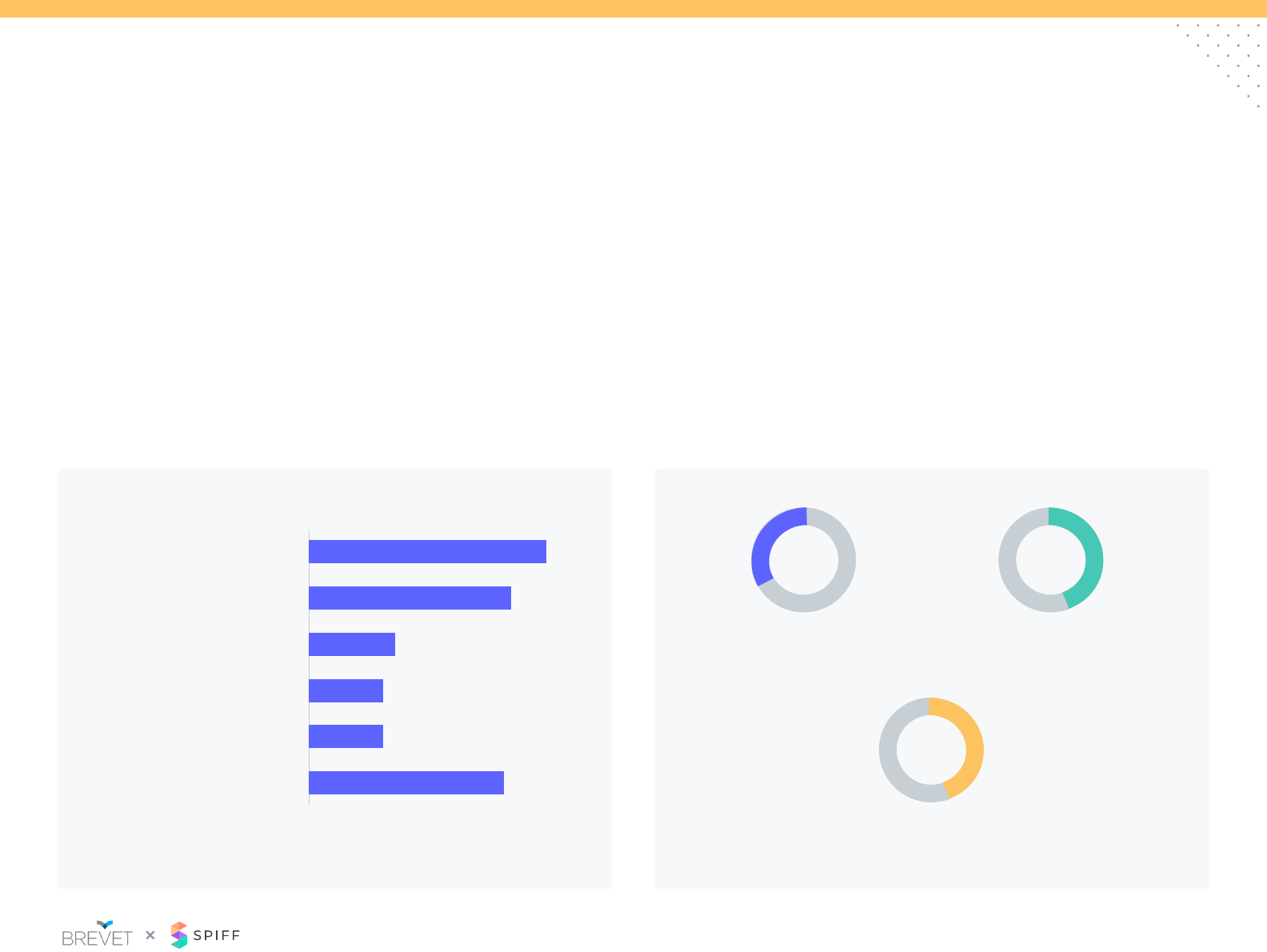

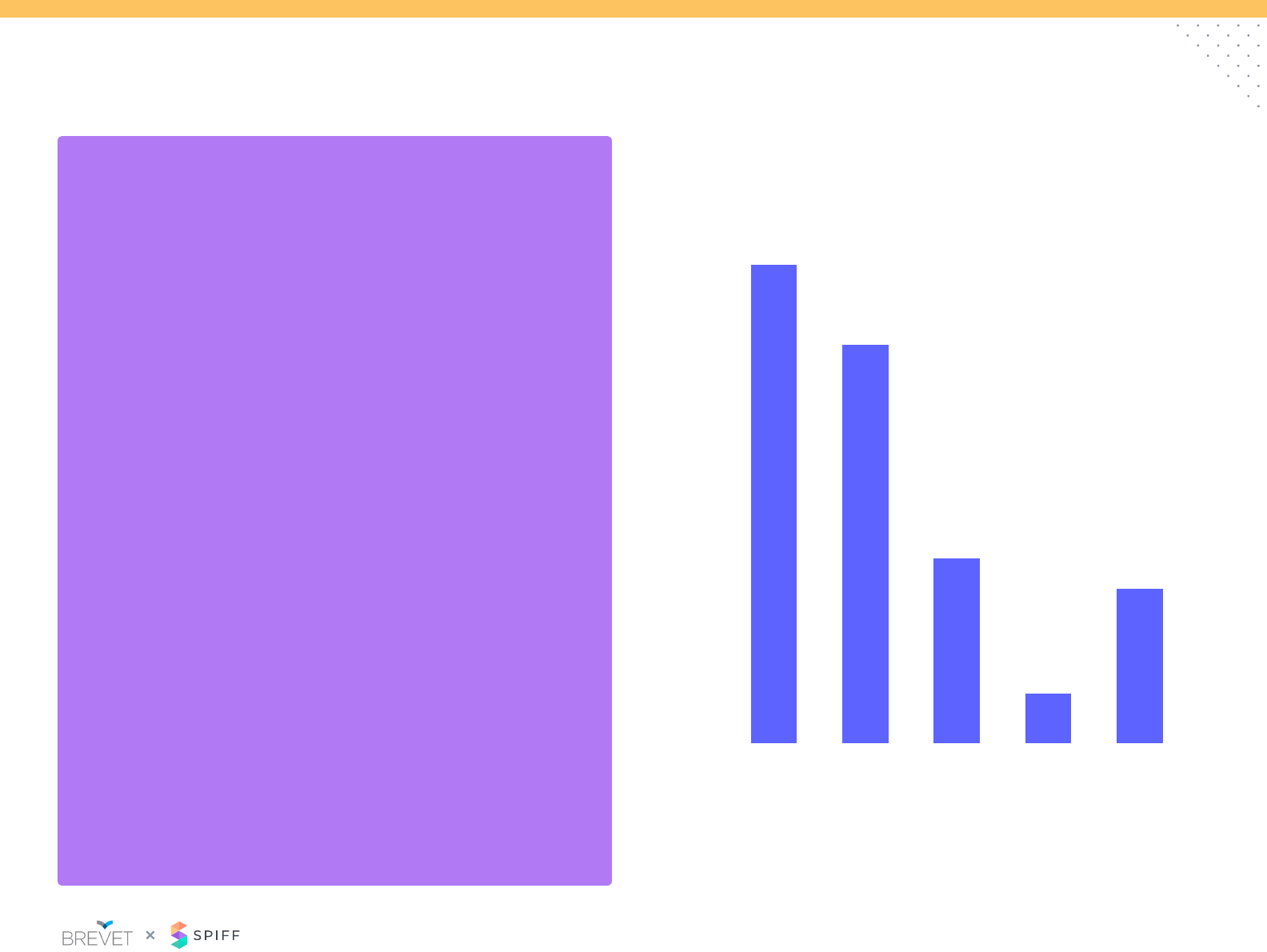

Plan Design: Multipliers

Multipliers are often used in incentive plans (60%) to accelerate quota

retirement and/or accelerate incentives.

75% of companies with ACVs greater than $25k use multipliers in

some fashion in their compensation plans.

Does your sales incentive plan use multipliers to

accelerate quota retirement or incentives?

What do you pay multipliers on? (Check all that apply)

The most common strategic reasons to use multipliers is to extend

contract length, obtain new accounts/markets, or promote new/

strategic products.

The practice of multipliers needs to be reassessed on regular basis as

it adds complexity to the sales incentive plan.

30%

40%

30%

20%

10%

30%

40%

50%

Deal

duration

Net New

accounts

Certain

products

Spiff Up-sell /

Cross-sell

Growth

year

Renewals Other

44%

34%

25%

22%

19%

15%

9% 9%

0%

Multipliers accelerate quota retirement

Multipliers accelerate incentives or SPIFFs Multipliers not used

6

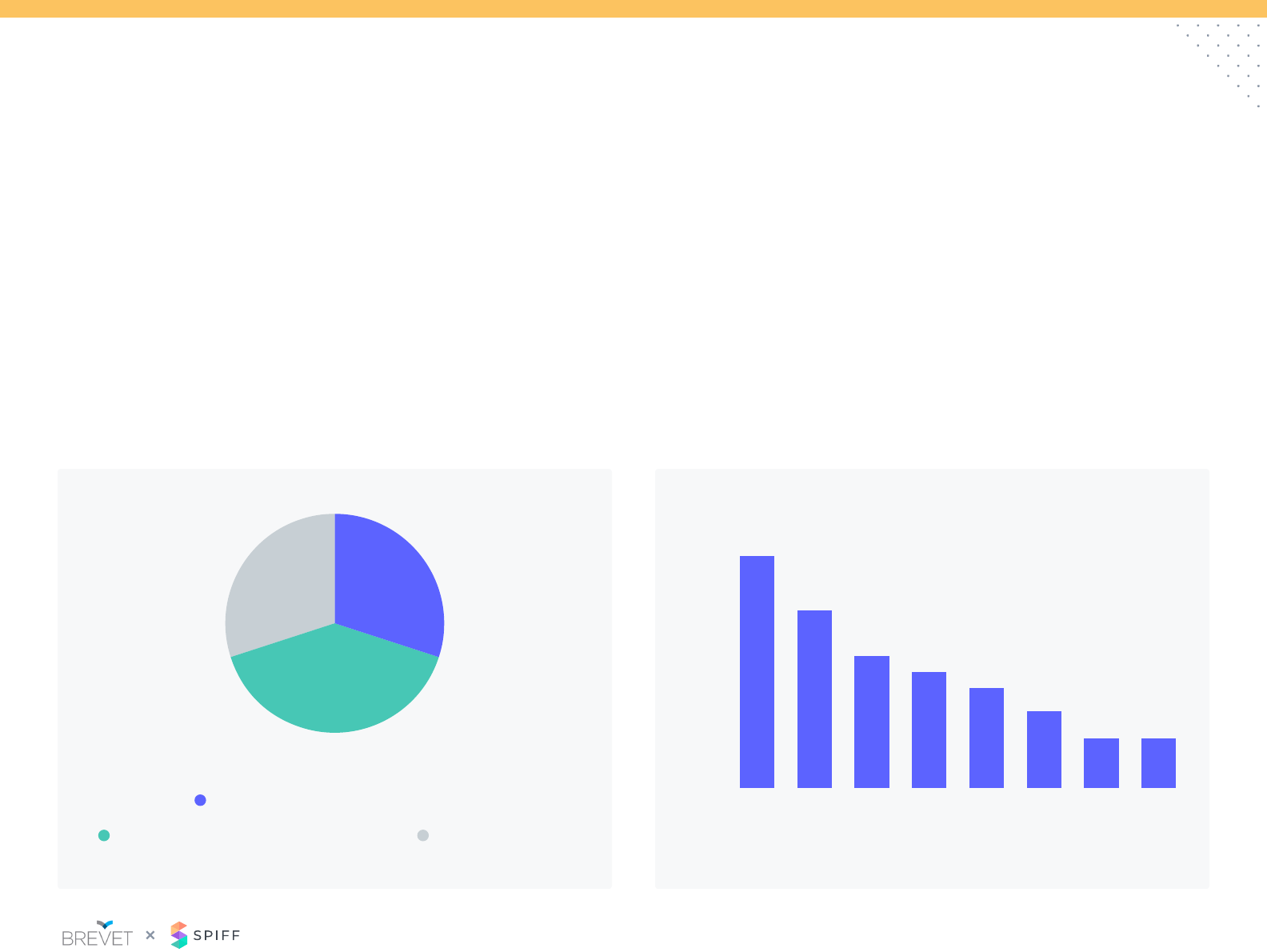

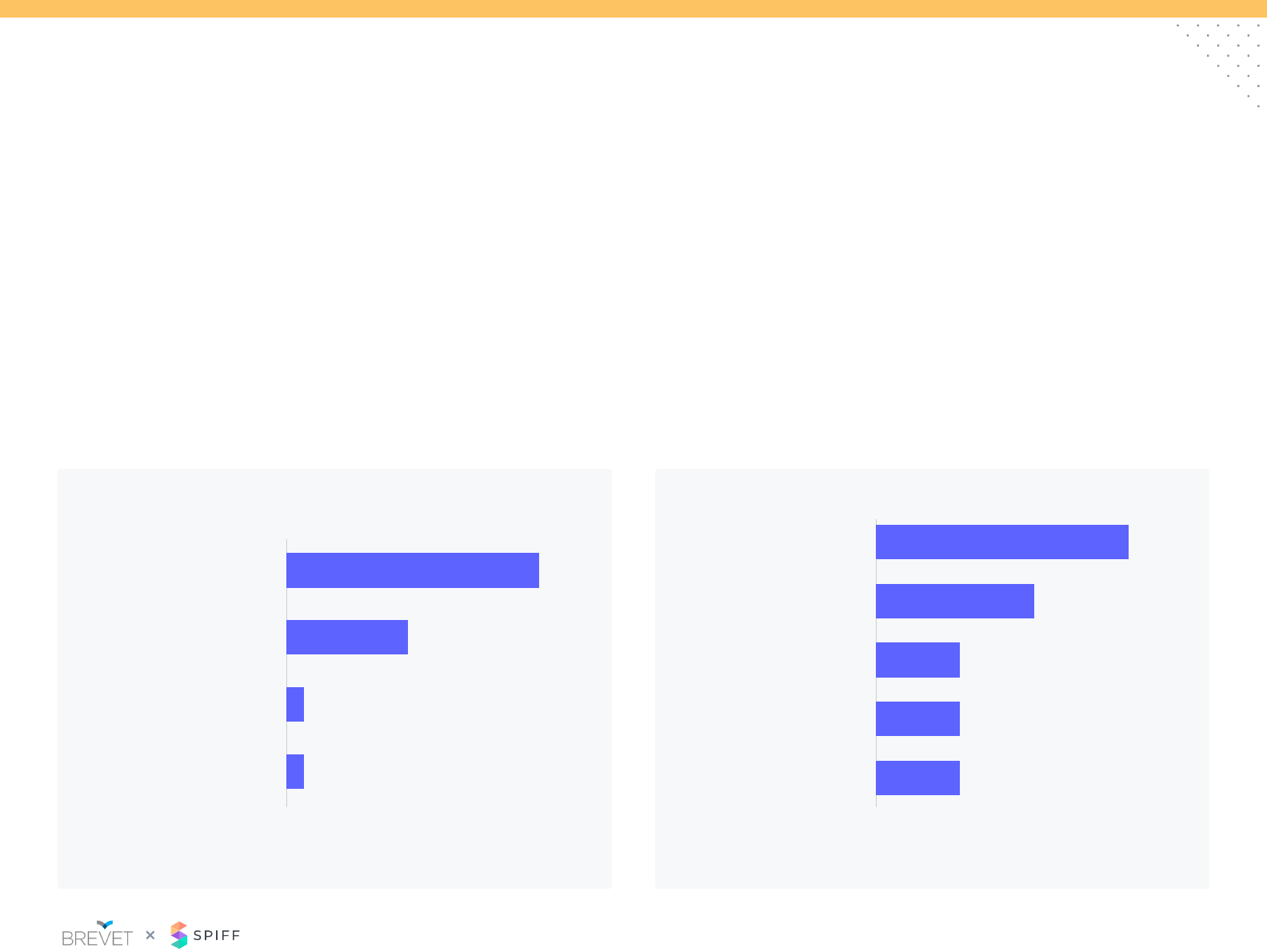

Plan Design: Accelerators

Sellers are eligible for accelerated rates of incentive on varying time

frames. Quarterly is the most common approach as it aligns with the

sales cycle and compensation payout.

How are accelerators paid?Accelerator Frequency

The most common approach to applying accelerators is through a

tiered structure. This allows for only net dollars above a specic goal

to be eligible for the higher rate.

Only 1/3 of companies apply the acceleration on the full amount.

Tiered structure, accelerators only

applied to amount over goal

Quarterly

Semi-Annually

Annually

No Accelerators

Monthly

Other

Retroactive, accelerators

applied to all revenue generated

62% 31%

7%

0% 10% 20% 30% 40%

23%

37%

5%

26%

9%

7

Plan Design: Multi-Year Deal Compensation

20%

10%

30%

40%

50% 48%

26%

11%

9%

7%

Annual

Contract

Value

Annual Contract

Value Multiplier

based on length

of contract

Total Contract

Value

Bonus (Flat or %)

paid for

multi-year

No

compensation

paid

0%

76%

1.5x

<40%

use ACV in some capacity to determine

compensation on multi-year deals

is average multiplier on contracts

>12 months. Multipliers on multi-years

range from 1.15x – 1.75x on two-year deals

and 1.1x – 2.5x on three-year deals

contracts signed are greater than

12 months

8

Plan Design: SPIFFS

Sales of specied product

Monthly

1-2%

Achievement of individual goal

Quarterly

3-4%

Multiple SPIFF targets

Semi-Annually

5-10%

Achievement of team goal

Annually

10%+

Maintain pricing / not discounting

Other

0%

0%

0%

10%

18%

13%

20%

35%

25%

Why SPIFFs?

SPIFF Frequency

Percentage of Total Incentive Budget for SPIFFs

37%

11%

48%

19%

30%

4%

64%

11%

14%

35%

11%

7%

7%

3%

30%

53%

38%

40%

70%

50%

9

Plan Design: Front Line Managers

65%

32%

17%

Sales incentive based

Have managers with

Hybrid teams^

Mix of sales and

non-sales incentive

compensation

Which of the following best describes your front-line sales

manager plan?

68%

3%

18%

13%

Team’s roll up performance

Other

Mix of overall and specic targets*

Mix of revenue targets and KPIs

10

Sales Credit: Recognition & Payout Period

More than half of respondents pay for the sale at booking, leaving the

company at risk if the invoice is not paid. Yet only 39% of respondents

issue claw backs in their incentive plans

Over the past 2 years, there has been a shift to credit upon payment

receipt (27%). This policy works more effectively for shorter revenue

cycles.

When do you process the payment of incentives? When do you credit quota retirement for the sale?

Processing incentive payments within 30 days has become the norm

and expectation.

Delaying incentive payments longer than 60 days can lead to a

disconnect between work and reward.

54% 60%

14%

8%

10%

8%

27%

13%

4%

2%

100% at booking 30 days in arrears

90 days in arrears Other

45 days in arrears 60 days in arrears

Split at booking and at invoicing

Following testing and client acceptance

100% at payment receipt

100% at invoicing

11

Sales Credit: Splits

Almost 1/3 of participants do not split sales credit and/or have no split

policy.

Splitting credit is commonplace, who gets the split credit is not. For

those participants, that do split credits it is primarily due to territory

and/or account changes as relationships transition. There is an

increase in splits for collaborative sales between reps.

How are splits determined? (Check all that apply) When do you split sales credit? (Check all that apply)

Very few SaaS participants have a specic criterion to determine

splits. Most respondents determine splits on a situational basis.

Allowing the involved reps negotiate splits allows management to

stay unbiased but can lead to awkward situations where imbalances

of seniority and negotiation skills can create tension.

Dened rates based on role,

contribution or % quota assigned

Dened rates based on role,

contribution or % quota assigned

Negotiated splits

between involved roles

Reects SaaS participants who have split policy

33% 42%

42%

Territory or account transitions

Sellers in the same role

Seller and specialist*

Manager and seller

Pod structure – AE, SDR, CSM

Don’t split credit

0% 10% 20% 30% 40%

37%

33%

31%

14%

12%

12%

12

Sales Credit: Early Renewals

The policy on handling early renewals has received a lot of attention

in the last few years. There is mixed reaction on recognizing early

renewals.

Surprisingly, the majority of participants do not recognize early

renewals at this time and/or treat early renewal the same as standard

renewal. For those companies that do recognize early renewals, the

AE and assigned CSM are most likely to receive credit.

How is early renewal credit determined?Who Receives Credit for Early Renewals?

For the participants that have specic early renewals policies, the

amount of credit is split between new contract only vs. the net of

the new contract and original contract. In some cases, the quota is

adjusted to incorporate the new contract.

New Contract Only New Contract Less

Remaining Contract

52% 48%

No credit for early renewal 50%

14%

12%

8%

8%

4%

4%

AE receives credit

CSM rep receives credit

AM receives credit

Multi-credit between roles (AE and CSM)

CSM team receives credit

Other

Reects SaaS participants who recognize/pay for early renewals only

13

Sales Credit/Comp: Non-Recurring Revenue

Paid at lower rate than

licensed revenue

Paid at same rate as

licensed revenue

Paid at higher rate than

licensed revenue

Separate services quota retired

Commission isn’t paid

Other

0% 13% 25% 38% 50%

44%

24%

4%

4%

18%

6%

As SaaS companies continue to expand their product offerings, the

question of how to compensate non-recurring offerings such as

professional services, implementation fees.

Similar to renewals, non-recurring review is often paid at a lower

commission rate then recurring revenue.

Commission on Services Revenue

82%

of respondents recognize and incent

for non-recurring revenue, such as

services or implementation fees

14

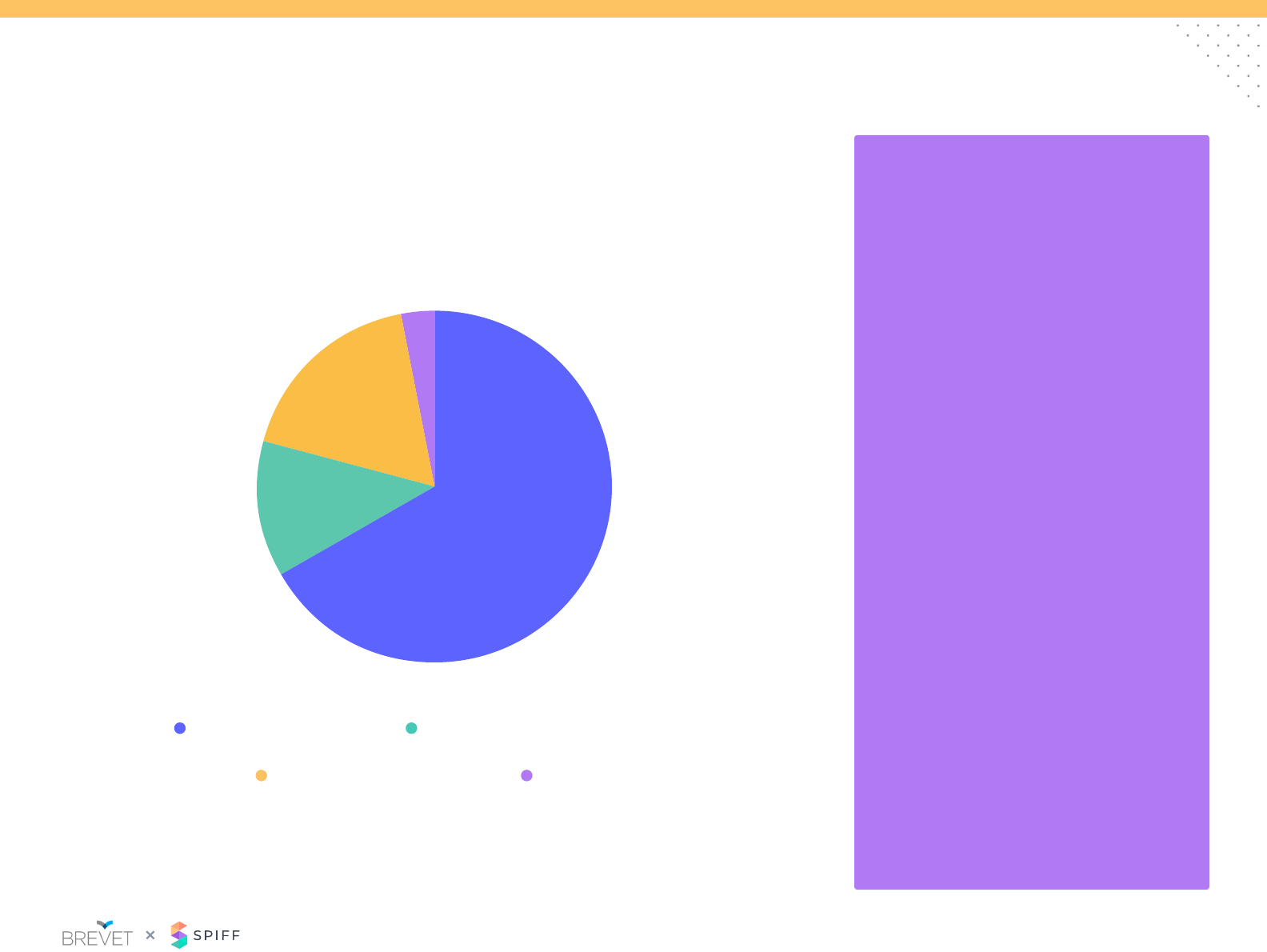

Sales Credit: New Logos

83%

31%

of respondents with >$100k ACV offer no

additional compensation for new logos

of respondents with <$25k ACV offer no

additional compensation for new logos

Almost 40% of Account Executives do not receive any additional

recognition for new customer logos (a $ of revenue is the same

regardless the type of customer).

New Logo Sales Credit

27%

39%

10%

10%

10%

4%

No additional recognition Separate new business quota

A multiplier is applied

Credit against a SPIFF program AE only focuses on new logos

A separate bonus is provided

15

Sales Crediting: Tools

Excel and CRM easily

outpace any other workow tool

to capture sales crediting, likely due

to familiarity and legacy

of companies with a sales

force <200 use Excel or CRM to

administer sales crediting

75%

20%

10%

30%

40%

38%

32%

15%

11%

4%

Excel CRM Incentive

management

software

Payroll / HR

software

Other

0%

16

Policy: Mega Deals

The denition of Mega Deal varies from company to company.

Companies with >$50k ACV deals are signicantly more likely to have

an established Mega Deal policy. .

If you use specic criteria, what criteria makes a

Mega Deal?

How do you pay on Mega Deals?

Those companies with have dened criteria often consider a Mega

Deal as % of individual’s quota (i.e. 50+%) or a deal with a specic

dollar amount (>$500K ACV)

We do not have a policy for

Mega Deals (large deals)

Deals over certain % quota

Deals over certain $ value

Deals over certain % OTE

Other

Deals that drive certain

incentive value

Formulaic scale and/or

specic criteria

Management discretion

Relative contribution from

the broader sales team

(SDR, AE, SC, CSM)

0% 0%18% 10%35% 20%53% 30%70% 40%

68%

38%

25%

12%

12%

12%

19%

9%

4%

4%

17

Policy: New Hire Ramp

Lower quota expectations

Guarantee OTE for a period of time

Guarantee less than OTE for a period of time

Incentives for completing on-boarding activities

Best of guaranteed pay or actual earnings

Other

0% 13% 25%

New hire compensation adjustment

Quota adjustment period Compensation adjustment period

45%

32%

11%

5%

5%

3%

38% 50%

1-3 months <1 month 3-6 months 1-3 months

9-12 months 6-9 months Not applicable 9-12 months Not applicable

6-9 months 3-6 months

26%

3%

38%

38%

3%

3%

15%

44%

10%

5%

15%

18

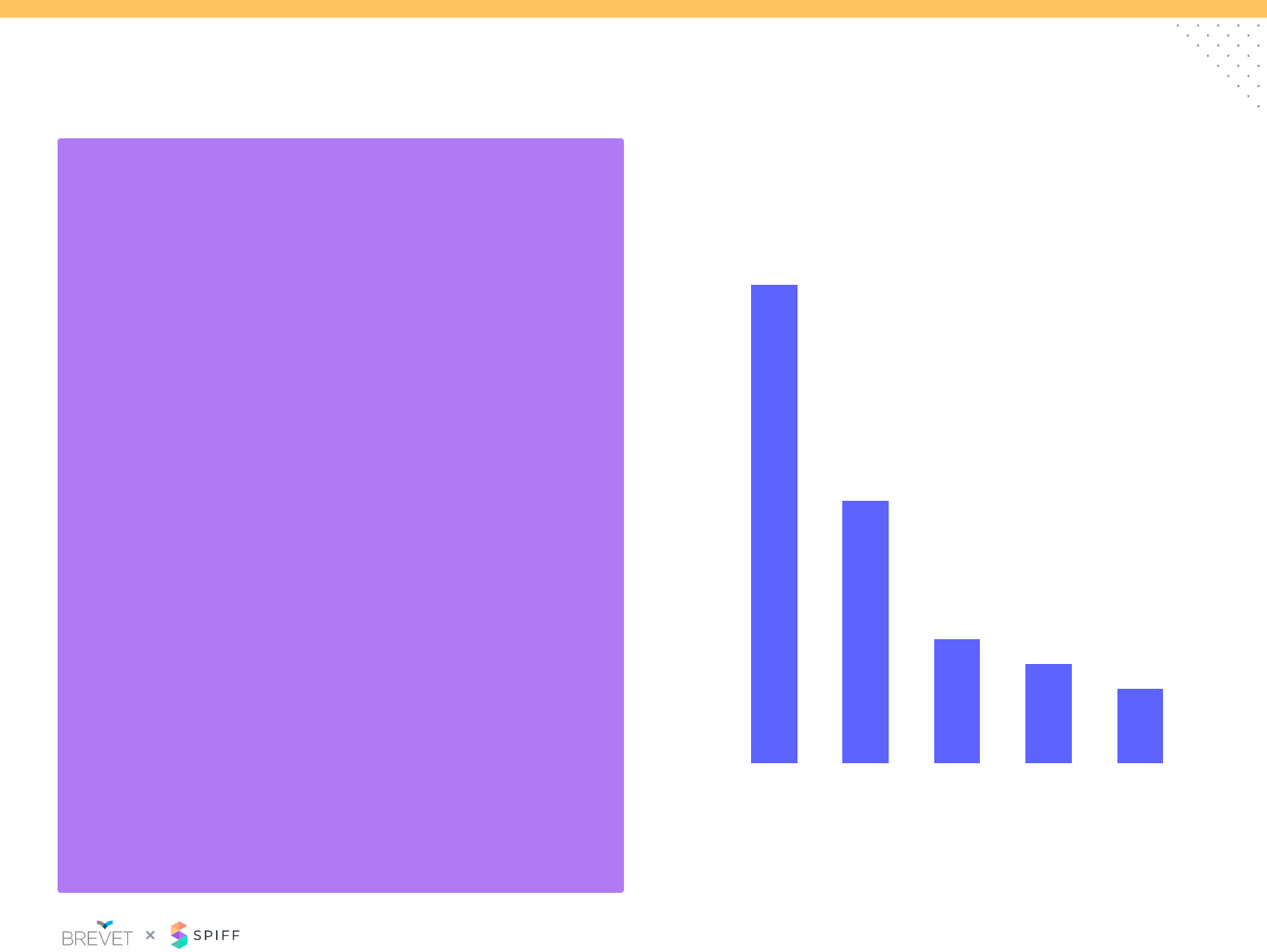

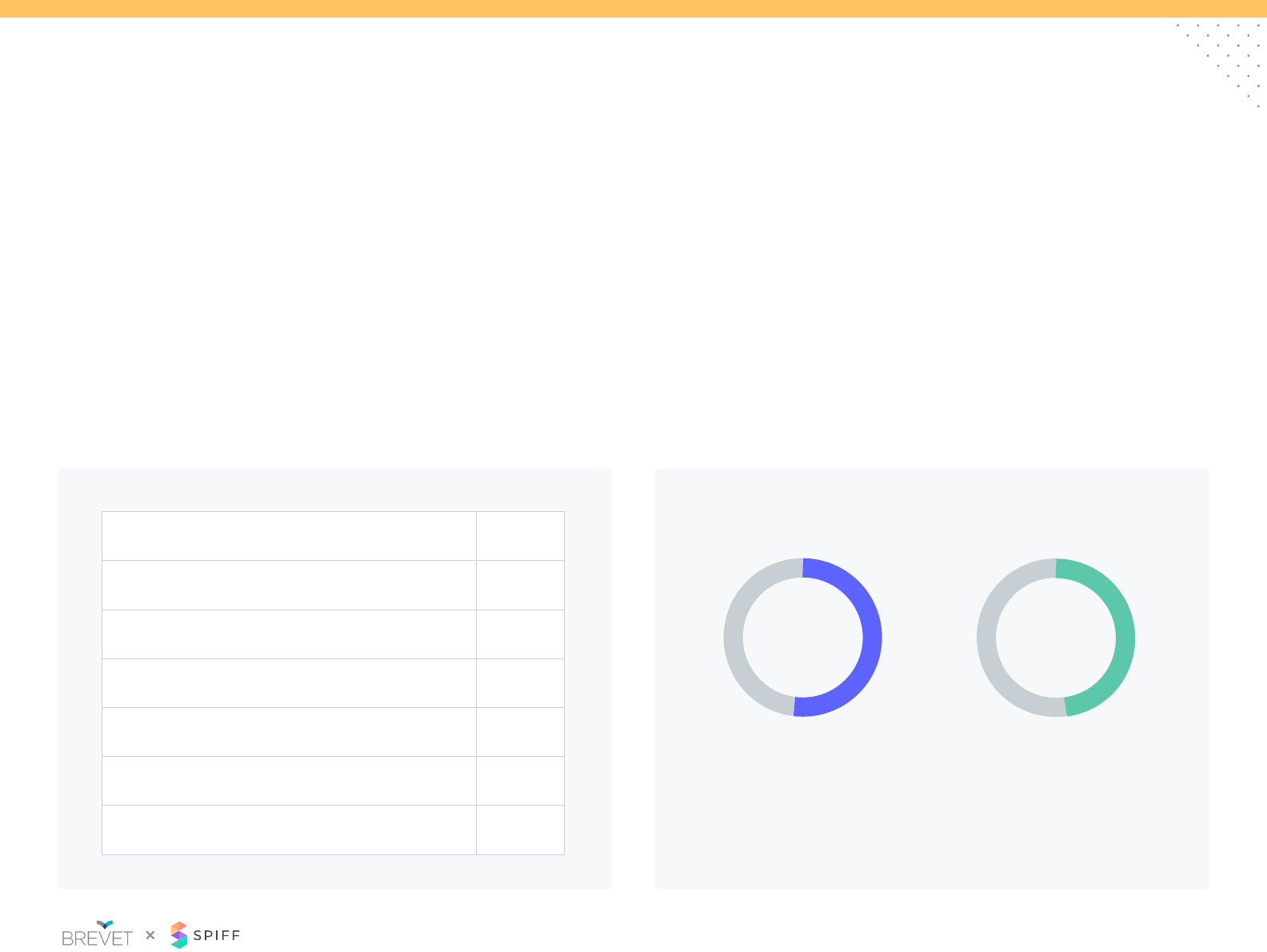

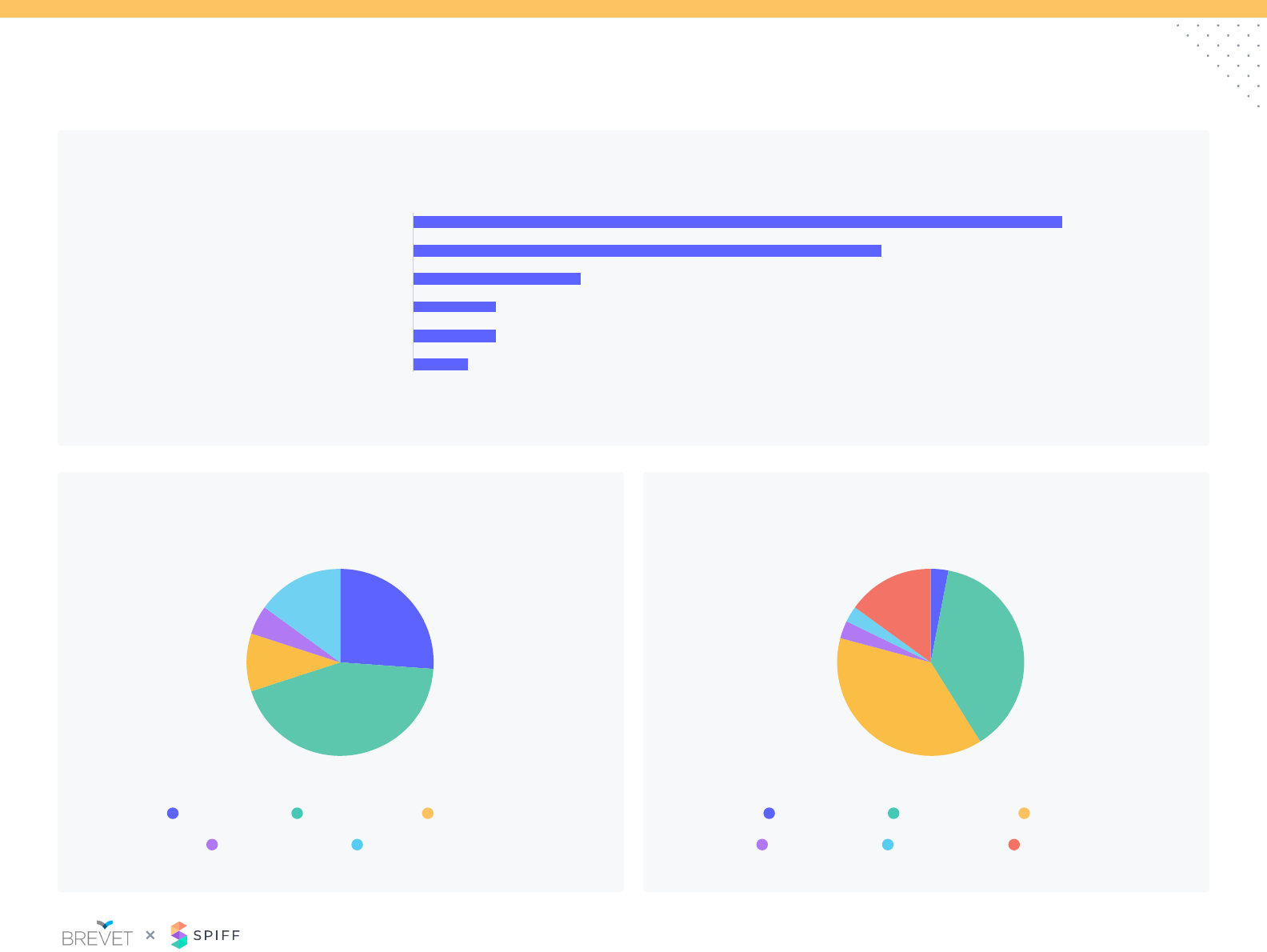

Participant Demographics

• Survey was conducted in December 2020 via online survey tool

• 93 participants from broad spectrum of companies

ACV Size of Sales Team Annual Revenue

<$5k <10 <$5M

$5-25k

11-50

$5-

20M

$25-50k 101-200

$50-

100M

51-100

$20-

50M

$50-100k

501-1,000

$250-

500M

201-500

$100-

250M

$100k+ 1,001+ $500M+

0% 0% 0%10% 10% 7%20% 20% 13%30% 30% 20%40% 40% 26%

8% 27% 11%

24%

14%

19%

16%

8%

8%

32%

11%

16%

5%

5%

3%

38%

14%

24%

16%

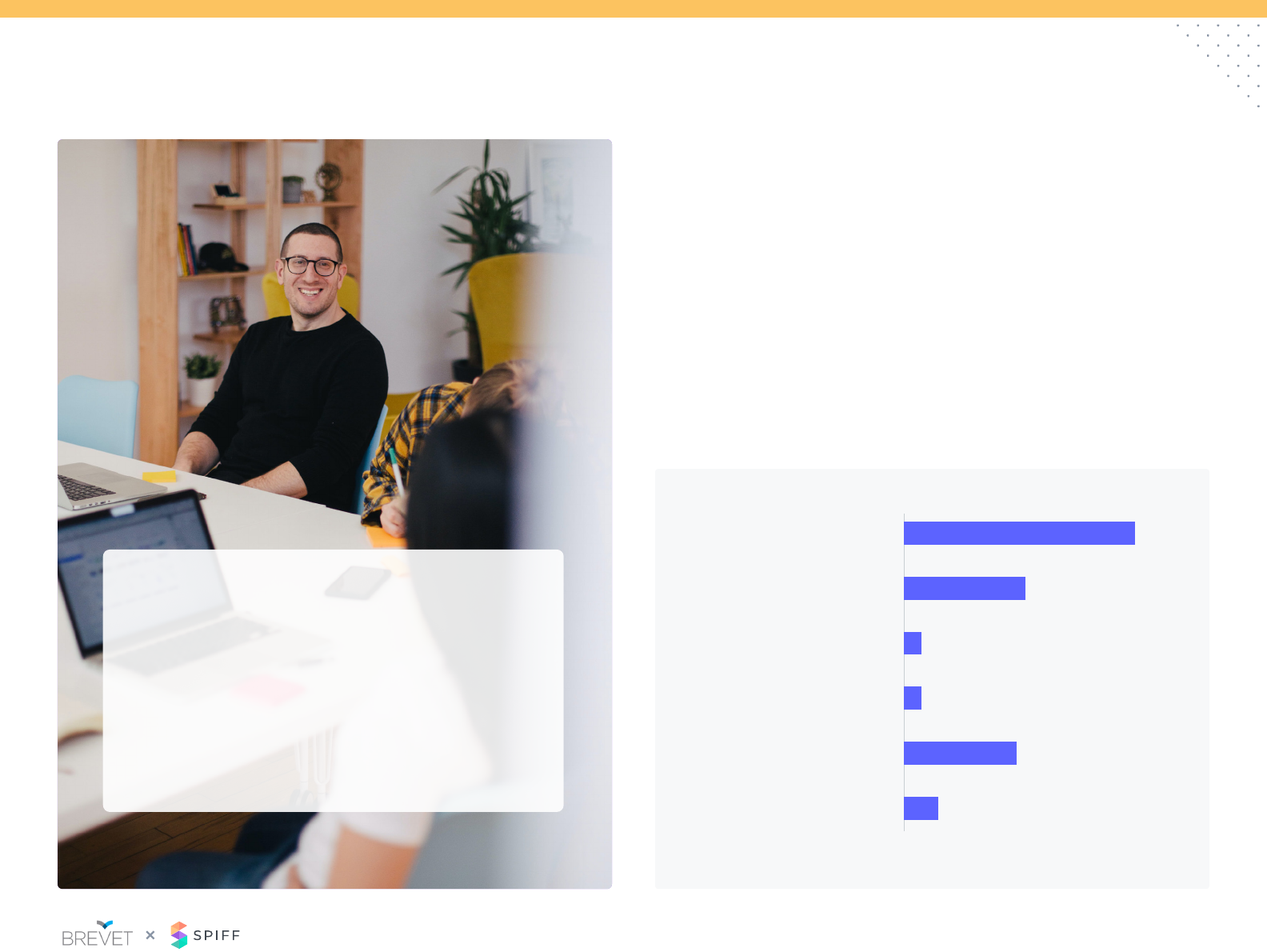

COVID has had a direct

impact on SaaS sales practices

The pandemic and the shift to virtual selling has highlighted so

many challenges for organizations and is forcing a reckoning. For

many teams, COVID has put a new spotlight on known, but long-

ignored gaps in their sales compensation.

SaaS companies are no longer waiting for their annual review to

tweak their compensation plans and policies. Questions continue

to arise about plan design, sales crediting, and quota setting.

The Brevet Group and SPIFF are having these conversations every

day within the industry and are here to help you design and

formalize your sales compensation plans and policies. We also

have a network of your counterparts, who are looking to share

ideas with you.

www.thebrevetgroup.com

Info@thebrevetgroup.com

If you’re inexible or

resistant to change,

2020 isn’t the year

for you.

Contact Us: