©2015 Backstop Solutions Group, LLC

BUC: Handout – BUC: Backstop User Conference 2015 | page 1

Reporting Workshop for Investor Relations & Marketing – Part 1 & 2

Become a Backstop reporting rock star! These back-to-back, primarily workshop-style, sessions will work through multiple

reporting scenarios (some common, some more challenging) for investor relations and marketing users, using combinations

of the Report Builder and the Excel Toolkit.

Workshop Resources

Handouts and Sample Reports: https://support.backstopsolutions.com/buc15 (see name badge for login info).

Excel Toolkit Download and Resources: https://support.backstopsolutions.com/etk

Workshop Format

These two sessions are workshop-style and we assume prior knowledge of Report Builder. If you have any questions during

these sessions, please do not hesitate to ask or raise your hand, and a Backstop rep will assist.

Tip: Check out these Support Site resources, regarding reporting: https://support.backstopsolutions.com/um_toc#reports.

Workshop Scenarios Overview

In these two sessions, we will be launching a mock Product (Westeros Flagship Fund, LP) for our firm, Seven Kingdoms

Capital, utilizing Backstop Report Builder, in conjunction with our Excel Toolkit. We will cover using these resources to identify

promising prospective investors (both current investors and prospects), managing our team as they market the fund, and

touching base with our investors once the fund has been established.

Scenario 1: Identifying Potential Investors for our Fund

Our firm has been utilizing a custom layout on contacts (i.e. People and Organizations) to track the likelihood of future

investments from current and prospective investors. Tip: Check out our Study Hall: Custom Layouts,

https://support.backstopsolutions.com/ssh#customlU and our Custom Layouts: User Guide,

https://support.backstopsolutions.com/um_toc#customLO.

We will be using these custom data points in conjunction with data in Backstop-standard fields to determine who may be a

good fit for our new fund. Our first report checks for current investors (see Figure 1).

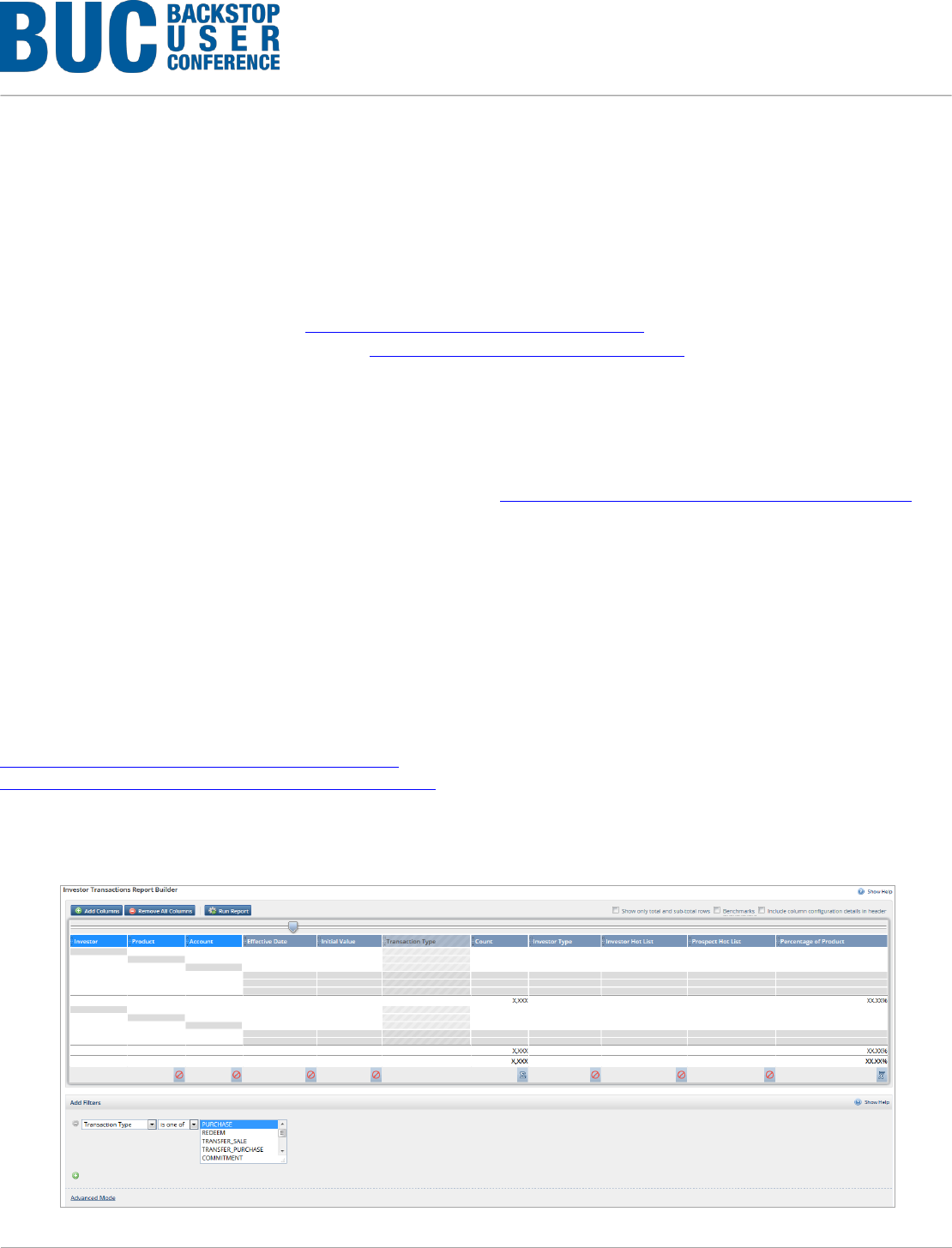

Figure 1 - Quick Links: Report Center > Shared Reports: RWIRM – Subscriptions by Investor

©2015 Backstop Solutions Group, LLC

BUC: Handout – BUC: Backstop User Conference 2015 | page 2

Specifically, we are interested in our contacts that have invested multiple times (signified by having multiple accounts or

multiple subscriptions within their accounts). This is accomplished using our Investor Transactions Report Builder (see Figure

1 and navigate to Quick Links: Report Center > Shared Reports: RWIRM – Subscriptions by Investor).

This report breaks down our subscriptions by Investor and Account, including a “Count” column, so we get a quick snapshot

of which investors are investing with us the most. Note: We have also utilized a simple People and Organizations report to pull

prospective organizations in particular categories and their Prospect Hot List Ranking (one of our aforementioned custom

fields).

This data is, of course, very useful on its own, but we have also built an Excel workbook that utilizes pivot tables to help us

visualize this data in a more immediate and configurable manner.

For this, we have pulled our above reports into an Excel workbook using Backstop’s Excel Toolkit and pulled the

named ranges for those reports into PivotTables.

o This ensures that, should the reports expand or contract for any reason (data changes, etc), these

PivotTables are faithfully pulling all of the data we want to tie in. The PivotTable functionality will allow us to

see our totals for certain Investor Types and individual investors, in terms of both the potential amount of

money invested and number of investments made to other funds from our firm thus far.

o We can then add various report filters so we can view the information in whichever way we please, whether it

be by Product or one of our custom field values. We can pull similar information for our prospects, based on

potential investment amount rather than current investment.

Please refer to the available Fund Launch Dashboard Excel document for both the finished version and the

template, to play around with our data. The steps below cover the areas we covered:

PivotTables:

o By selecting the data we wish to see in our 3 PivotTables for “BSG_Subscriptions by Investor”, we then

navigated to the “Insert” ribbon within Excel and selected PivotTable. We added the tables at cells B10, F10,

and I10 in our “Current Investors (FINISHED)” worksheet.

o Within the PivotTable process, we added in 3 filters (top-right box when creating a PivotTable):

Product

Investor Hot List (the priority level of our current investors)

Prospect Hot List (the level in which the prospect might be interested in investing)

o For the “Top 10” tables, we created these by clicking on the arrow drop-down for the Investor column header,

and hovered over “Value Filters” and then chose “Top 10.” This filtering options allows us to see the top 10

results within the data set, which we can then sort further (we sorted ours by largest to smallest amount).

Conditional Formatting:

o Each of our PivotTables on this dashboard have conditional formatting to visually give us a better

understanding of how much the investors have given us.

When using conditional formatting and filters, you will first want to make sure all data rows within the

PivotTables are un-filtered to then be able to see the formatting continue down when we select a

specific filtering option (i.e. Product = Backstop Partners LP).

This means:

Since we have the Top 10 PivotTables essentially shortened, we’ll want to expand the

filtering option to show the entire list, use our conditional formatting all the way down (except

Grand Total), and then collapse back into the Top 10 filtering.

©2015 Backstop Solutions Group, LLC

BUC: Handout – BUC: Backstop User Conference 2015 | page 3

For our conditional formatting example, we selected our data we wish to format, and then within the

Home ribbon, selected “Conditional Formatting.” We have several options to choose from, but we

used the data bars > gradiant fill.

Scenario 2: Managing our Team

While we are in the process of launching our fund and gathering investors for this fund, it’s important that leadership is able to

track their team’s activity and progress on prospective and current investors.

We can do this via several reports, which we have assembled in Backstop:

An Opportunities Report Builder that pulls opportunity and prospect information. This also includes our last contact

with the prospect and our days since that last contact (a Formula field that subtracts the last contact date from the

current date).

o Report Center: Shared Reports > RWIRM – Opportunity Report

An Activity Report Builder that pulls in Meetings and Calls, who the activity is regarding, and the Author/Rep for the

activity.

o Report Center: Shared Reports > RWIRM – Activity Report

An additional Opportunities Report Builder that includes further information about our most recent contact.

o Report Center: Shared Reports > RWIRM – Prospects to Call

Again, these reports are of course useful on their own, but we want to work smarter, not harder. Since we

have done all of this work up front, we can easily use the methods described in the first scenario to pull a

useful pipeline and activity dashboard, which can be updated with fresh data at the click of a button, and

thus displays all of the pertinent information in these reports in a convenient dashboard.

The dashboard we looked at for this example is, “Managing Our Team.” We already have our PivotTables available

in this dashboard, but now we have added in some pretty graphs and other ways to take our data to the next level.

Things like: having a “values as of date” available to let us know how current our data is helps us stay within our

processes. Also, by utilizing functional formulas, such as VLookup and Countifs, aids us in pulling data that’s

connected to PivotTable output.

o To create these, we simply added columns to the right of our PivotTable rows, and copied over the formulas

listed in our Formulas worksheet of the Excel document. That way, our PivotTables will update once we

refresh, and we will also see refreshed data that connects to those rows from the reports in Backstop.

o We also created some functional PivotCharts that connect to PivotTables added to the “Tables” worksheet in

the workbook. By using PivotCharts, we only need to refresh all charts in the workbook (after refreshing the

data in Backstop via the Excel Toolkit) and our charts will automatically update.

When using PivotCharts, there will be some buttons that are added to the chart, and if you don’t

require or need those, you can right-click on one of the buttons to either hide all buttons or just those

that relate to horizontal or vertical axis’.

o And lastly, we added our values as of date to cell D3 with the formula: =BSG_AsOfDate() and made sure to

update the values as of date available within the Backstop ribbon.

Tip: For more information about Vlookup, check out the VLookup in Excel guide on the Support Site:

https://support.backstopsolutions.com/um_toc#reports.

©2015 Backstop Solutions Group, LLC

BUC: Handout – BUC: Backstop User Conference 2015 | page 4

Scenario 3: Investor Outreach, Post Launch

Our fund has been launched for more than a year now and we are looking to retain and expand the investments that made

this fund’s launch possible. Of course, a major part of this effort involves investor outreach. There are a number of factors that

may contribute to how and when we reach out to our investors.

Common situations we hear of are upcoming liquidity on investments and longer gaps in outreach. Also, our outreach efforts

can certainly be affected by the percentage of capital a given investor has in our fund. Per these examples, we have built out

three reports:

An Investor Transactions Report Builder that looks at “Next Notice Dates” for the Accounts in Westeros Flagship

Fund, LP that are within the next few months. This gives us the ability to preemptively reach out to our investors

before they start thinking about redeeming capital.

o Report Center: Shared Reports > RWIRM – Accounts w/Upcoming Notice

An Accounts Report Builder that includes “days since last contact” (described above) and performance information on

the Accounts in our Fund. This allows us to see which investors we may not have reached out to one-on-one in some

time and gives us a quick snapshot of their Account’s performance (so we can brag about it, of course).

o Report Center: Shared Reports > RWIRM – Investor Outreach: Westeros

An additional Accounts Report Builder that looks at our investor rankings and includes additional account information,

namely earnings and returns (expanding on the other accounts report without creating too massive of a dataset).

o Report Center: Shared Reports > RWIRM – Investor Rankings: Westeros

Again, all of these reports are very nice to have on their own, and dynamically adjusted as time goes on (both the Notice

report and the report with Days Since Last Contact utilize the current date, so we don’t have to worry about adjusting the

reports). But again, it would be very useful to have all of this information in a format that we can share easily across

users/colleagues in one place, which can be refreshed with the click of a button. The Excel document we looked at is entitled

“Investor Relations Dashboard.”

Since we have already added in the PivotTables, conditional formatting, and graphs with our previous scenarios, we

are now ready to learn some beneficial formulas and how to create a slicer to filter our entire dashboard by each

Investor.

o To create a slicer, we must first have our PivotTables created (which are all housed in our Tables worksheet

within our workbook).

o Once we have the PivotTables, we will click into one of the PivotTables we wish to connect, and in PivotTable

options, select “Insert Slicer.” With this, we used the PivotTable within cell G1 (PivotTable 8).

A pop-up will appear and we will select the field(s) we wish to use as a filtering option.

For this case, we’re going to use the Investor Name since we want to see an entire dashboard for

each investor and their information.

o Once we have this created, we’ll cut and paste it to our main dashboard.

o Now, we have it connected to one of the PivotTables (the one we added it to), but what if we have multiple

PivotTables that our dashboard data is coming from?

Well, we can easily connect the slicer to multiple PivotTables from the same worksheet. To do this,

we’ll click into the slicer and we’ll see a new ribbon appear.

We’ll click “options” under that ribbon and then select “PivotTable Connections.” A pop-up

with all PivotTables within the workbook will show up and we can select all that apply.

However, if we want to connect multiple PivotTables from different worksheets, we will have to add

some background developer VBA code, which we’ve added here to allow us to do just that.

To view this code, you will have to turn-on the Developer ribbon, which can be done by going

to: File > Options > Customize Ribbon > and checking the box for “Developer” on the right.

©2015 Backstop Solutions Group, LLC

BUC: Handout – BUC: Backstop User Conference 2015 | page 5

Once you have this ribbon enabled, you can click on the ribbon at the top, and clicking

“Visual Basic” on the left of the ribbon.

o This pop-out window looks daunting, but once you double-click on Sheet4 (Tables),

you’ll notice that we have added an IF code to update PivotTable8 if PivotTable7 (cell

P1) changes. If you make any changes to this code, simply click “Save” and then exit

the window.

o We also have formulas that we’ll be using within this document, which are available in the Formulas tab of the

workbook. These formulas all serve a different purpose, but in terms of the BSG_GetRefreshableCell, we can

use this in place of a Vlookup when needing to reference a specific data point but not a specific cell.

We are using this type of formula within the Investor Profiles tab in the “Upcoming Notices” section

because, if our RWIRM – Upcoming Notice report happens to change, the data being pulled will

remain the same since we’re not referencing a specific cell (which would need to happen with a

Vlookup formula).

We have one more tip and trick for you, which aids us in completing our tasks efficiently in Excel.

o Let’s say, a colleague of ours built this lovely dashboard and also created the Backstop reports, which are

pulled in via the Excel Toolkit. However, when working around the document, we noticed that one of the

reports did not include the “Investor Type” field. As long as this field is available in another report pulled into

the same Excel document, we can easily add it by using the same BSG_GetRefreshableCell formula.

Within this same Excel dashboard, we directed to the tab “BSG_RWIRM – Upcoming Notice” and

noticed that the Investor Type column is not present in this report. To add this:

We clicked into cell, J2 and added the following formula:

=BSG_GetRefreshableCell("BSG_Subj_RWIRM___Investor_Rankings__Westeros",[@[Acco

unt Name]],"Investor Type","*")

o This might look a bit different from a Vlookup. This is because, instead of locating to

a specific Excel worksheet and column/cell, we are using the quotations to direct to

that particular worksheet and column header.

o Also, the final part of the formula can either be left blank or have something within

quotations (whichever your preference) if there is no value.

Once we have this formula completed, we’ll click enter and see that the entire column has

been updated.

This is beneficial to us if we need to see certain information all in one place, but especially if we don’t

want to get lost in background VBA within Excel. We previously mentioned why we’d need to use

background VBA, but if we want to create multiple PivotTables from one data source, and need more

data added to that data source, this will be the easiest solution.

Additional Questions

If you have any questions following this workshop, see us at the BackChat Bar or the Excel Toolkit room. If you have

questions after the conference, feel free to visit our Support site (https://support.backstopsolutions.com/), or reach out to

Support: +1-312-277-7702 (support@backstopsolutions.com).

Additional Resources

Check out the Support Site (https://support.backstopsolutions.com) for additional resources, in particular:

Reporting Guides - https://support.backstopsolutions.com/um_toc#reports

Custom Layouts and Uploads Study Hall Video - https://support.backstopsolutions.com/ssh#customlU

Reporting Study Hall Videos - https://support.backstopsolutions.com/ssh#rbB

Custom Layouts User Guide: https://support.backstopsolutions.com/um_toc#customLO

Excel Toolkit Download and Resources - https://support.backstopsolutions.com/etk