Update on financial reporting requirements for Australian Financial Services Licensees

Impact of the Australian Accounting Standards Board’s financial reporting reforms for for-profit entities

for years ending 30 June 2022 and beyond

Introduction

This fact sheet has been prepared by Chartered Accountants Australia and New Zealand (CA ANZ) and CPA Australia to assist members understand how the statutory

financial reporting requirements of Australian Financial Services Licensees (AFSLs) have been impacted by the Australian Accounting Standards Board (AASB) financial

reporting reforms for for-profit entities. These reforms impact the requirements for AFSLs to prepare financial reports under:

• Chapter 2M of the Corporations Act 2001 (the Act), and

• Chapter 7 of the Act as a result of the consequential changes introduced by the Australian Securities and Investments Commission (ASIC) to Form FS70 Australian

financial services licensee profit and loss statement and balance sheet (July 2022) (Form FS70).

Impacted AFSLs include entities regulated by the Australian Prudential Regulation Authority (APRA) but do not include self-managed superannuation funds (SMSFs). In

addition, this fact sheet does not consider AFSLs that are foreign companies as they are subject to different statutory reporting requirements.

The fact sheet uses flowcharts to assist members identify the key decision points involved in implementing the financial reporting reforms and the implications of those

decisions. However, readers should not rely on this fact sheet alone but refer to the relevant legal requirements in the Act and Australian Accounting Standards (AAS) as the

final determinants of an AFSL’s statutory reporting obligations.

This fact sheet assumes knowledge of the AASB’s financial reporting reforms and more details surrounding these reforms can be found in our joint publication Can I still

prepare special purpose financial statements? It also assumes an understanding of the statutory financial reporting requirements applicable to AFSLs and, in addition to its

recently revised Form FS70, ASIC has issued a supporting media release (22-128MR) and FAQs, which should be read in conjunction with this fact sheet.

Understanding the AASB financial reporting reforms

The amendments to remove the ability of certain for-profit entities to prepare special purpose financial statements (SPFS) arising from the AASB’s reforms are set out in:

• SAC 1 Definition of the Reporting Entity (SAC 1), as amended by AASB 2020-2 Removal of Special Purpose Financial Statements for Certain For-Profit Private Sector

Entities (limiting the scope of SAC 1 for some for-profit entities)

• AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2 Entities (introducing the Simplified Disclosure Regime

(SDS) replacing the Reduced Disclosure Regime (RDR) set out in AASB 1053 Application of Tiers of Australian Accounting Standards)

As noted above, these changes affect AFSL’s reporting under Chapter 2M of the Act due to their requirement to comply with AAS in section 296, and Chapter 7 of the Act due

to their requirements to lodge financial reports prepared in accordance with AAS as required by Form FS70, which has the force of law (see “financial statements” on page 7,

Guide to Form FS70). Depending on its legal structure an AFSL reports either under Chapter 7 (generally, AFSLs that are not companies) or under both Chapter 2M and 7

(generally, AFSLs that are companies).

Update on financial reporting requirements for Australian Financial Services Licensees

Impact of the Australian Accounting Standards Board’s financial reporting reforms for for-profit entities

for years ending 30 June 2022 and beyond

Application of the AASB financial reporting reforms to AFSLs

Under the AASB’s reforms, for-profit entities with statutory financial reporting requirements that require them to prepare and lodge financial statements in accordance with AAS

can no longer prepare and lodge SPFS but must transition to preparing either Tier 1 or Tier 2 general purpose financial statements (GPFS). The preparation of Tier 1 or Tier 2

GPFS depends on the assessment of the entity’s “public accountability” status under AASB 1053 Application of Tiers of Australian Accounting Standards (subject to certain

entities deemed by ASIC as having “public accountability”, see below).

AASB 1053 Appendix A and B defines an entity as having “public accountability” where:

• its debt or equity instruments are traded in a public market, or it is in the process of issuing such instruments for trading in a public market (a domestic or foreign stock

exchange or an over-the-counter market, including local and regional markets); or

• it holds assets in a fiduciary capacity for a broad group of outsiders as one of its primary businesses (this would include AFSLs that hold client monies).

In addition to this definition, ASIC has also deemed certain AFSL licence categories as always having “public accountability” for the purposes of complying with their statutory

financial reporting obligations (see section 11 of Form FS70). ASIC has taken this approach in order to avoid doubt about the status of particular AFSLs, and/or to recognise

the significance of certain AFSLs to their markets. AFSLs that are deemed to have “public accountability” must prepare and lodge Tier 1 GPFS (see paragraph 11(a) of Form

FS70 and also ASIC media release (22-128MR) while all other AFSLs that are not deemed to have “public accountability” must, as a minimum, prepare and lodge Tier 2

GPFS.

AFSLs that ASIC has deemed to have “public accountability” are those which are:

• regulated by the APRA

• participants in a licensed market

• participants in a clearing and settlement facility

• retail over-the-counter derivative issuers

• wholesale electricity dealers

• corporate advisors that deal in financial products

• over-the-counter derivative traders

• wholesale trustees

• responsible entities of a registered scheme

• corporate directors of a corporate collective investment vehicle

• providers of a custodial or depository service

• operators of an investor directed portfolio service.

Transitional provisions

To assist AFSLs with their transition from preparing SPFS to preparing either Tier 1 or Tier 2 GPFS, ASIC has also provided some transitional relief which is detailed in section

11 of Form FS70. The relief recognises that some of the new requirements have only been put in place immediately before they are due to apply. It provides AFSLs preparing

financial reports only under Chapter 7 of the Act with an additional one year to transition to the new requirements and relief from the presentation of comparative disclosures

that comply with the new requirements in the first and second years of transition provided that they are not a “reporting entity” (as defined by AASB 1057 Application of

Update on financial reporting requirements for Australian Financial Services Licensees

Impact of the Australian Accounting Standards Board’s financial reporting reforms for for-profit entities

for years ending 30 June 2022 and beyond

Australian Accounting Standards (AASB 1057)) and prepared a SPFS in the immediately preceding financial year. For more details see the flowcharts below, Form FS70 and

ASIC’s FAQs.

Consequences of utilising ASIC transitional provisions around comparatives

The transitional relief offered by ASIC is not provided by AAS and therefore financial statements prepared under the requirements of Chapter 2M that make use of ASIC’s

transitional relief cannot state that they “comply with Australian Accounting Standards” because AAS require comparative information for all amounts reported in the current

period financial statements (see paragraph 38 of AASB 101 Presentation of Financial Statements). However, the transitional relief is available to financial reports prepared

under the requirements arising from Chapter 7 of the Act since this relief is contained in FS70. Accordingly, ASIC has engaged with the AASB and the Australian Auditing and

Assurance Standards Board (AUASB) and has included in its FAQs, guidance on what should be included in the “basis of preparation” note to the financial statements and the

auditor’s report in these circumstances.

Consolidation

AFSLs with subsidiaries preparing financial reports under Chapter 2M of the Act are required to prepare consolidated Tier 1 or Tier 2 GPFS in accordance with AAS unless the

entity is an intermediate parent that is eligible for consolidation relief under AASB 10 Consolidated Financial Statements. Also, in accordance with s295(2)(b) of the Act, the

financial report is only required to present consolidated financial statements (with no requirement to separately present the parent entity financial statements). However, AFSLs

with subsidiaries preparing financial reports under Chapter 7 of the Act must present the full separate parent entity financial statements together with the consolidated financial

statements.

Natural persons

Where a natural person is an AFSL, the financial reports covering the licensee’s activities must be prepared as Tier 1 or Tier 2 GPFS. However, the financial reports do not

need to include revenue and expenses that relate to the licensee’s personal activities, or their non AFSL business interests, provided this exclusion is noted in the financial

reports (see Form FS70, certification paragraph 11B).

Self-managed superannuation funds (SMSFs)

SMSFs are required to prepare financial reports under the Superannuation Industry (Supervision) Act 1993 (the SISA). The SISA reporting requirements (with some exceptions

specified in the accompanying regulations to the SISA) are for the preparation of a statement of financial position and an operating statement (see section 35B of the SISA).

These requirements do not mandate compliance with “accounting standards” or “Australian Accounting Standards” and are therefore outside the scope of the AASB financial

reporting reforms. However, it is also important to check the reporting requirements contained in the SMSF’s trust deed as these could impose more specific requirements that

could bring them within the scope of the AASB reforms.

Update on financial reporting requirements for Australian Financial Services Licensees

Impact of the Australian Accounting Standards Board’s financial reporting reforms for for-profit entities

for years ending 30 June 2022 and beyond

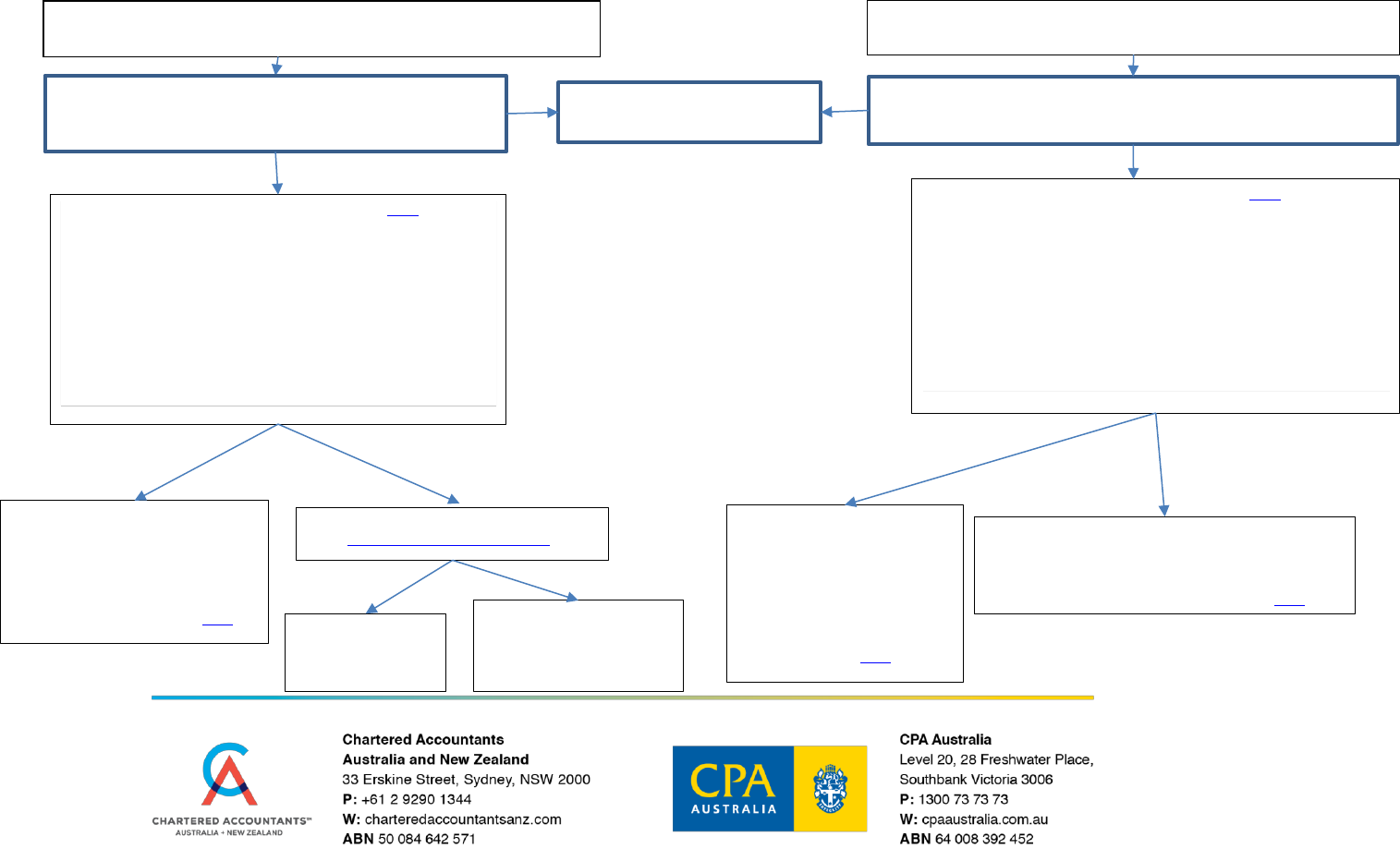

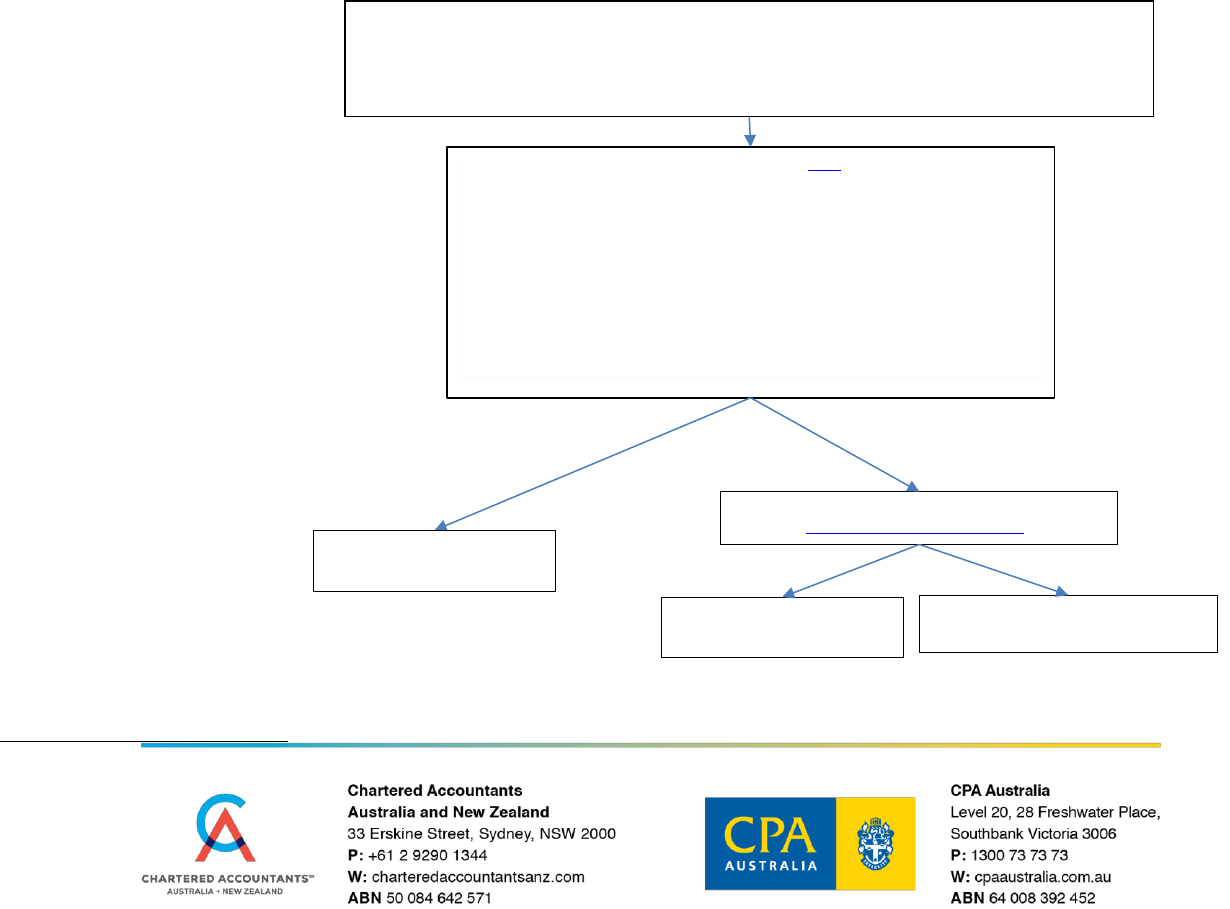

FLOWCHART 1 – AFSLs previously preparing Special Purpose Financial Statements

YES

NO

YES

NO

NO

YES

AFSLs reporting only under Chapter 7 of the Act

(Including small proprietary companies and natural persons)

May continue to prepare SPFS for 30 June 2022 and then

transition to Tier 2 GPFS (applying AASB 1060) by 30 June

2023 (extra 1 year transition window). ASIC transitional

provisions provide relief from comparatives for any new

disclosures in those initial Tier 2 GPFS (see FS70)

May continue to prepare SPFS for

30 June 2022 and then transition to

preparing Tier 1 GPFS by 30 June

2023 (extra 1 year transition

window). ASIC transitional

provisions provide relief from

comparatives for any new

disclosures in those initial Tier 1

GPFS (see FS70)

Did you prepare SPFS in the previous year ended 30 June 2021 and continue to

assess to not be a “reporting entity” (as per AASB 1057 and SAC 1) for the year ended

30 June 2022?

Are you one of the following types of AFSLs? (see Form FS70)

• regulated by the Australian Prudential Regulatory Authority

• participants in a licensed market

• participants in a clearing and settlement facility

• retail over-the-counter derivative issuers

• wholesale electricity dealers

• corporate advisors that deal in financial products

• over-the-counter derivative traders

• wholesale trustees

• responsible entities of a registered scheme

• corporate directors of a corporate collective investment vehicle

• providers of a custodial or depository service

• operators of an investor directed portfolio service.

NO

NO

YES

AFSLs reporting under both Chapter 2M and Chapter 7 of the Act

(Including large proprietary companies, registered schemes and disclosing entities)

Do you have “public accountability” as defined in

Appendices A and B of AASB 1053?

Must prepare Tier 1

GPFS for 30 June

2022 and beyond

Must prepare (as a minimum) Tier 2

GPFS (applying AASB 1060) for 30 June

2022 and then transition to Tier 1 GPFS

by 30 June 2023. ASIC’s transitional

provisions provide relief from

comparatives for any new disclosures in

those initial Tier 1 SPFS (see FS70)

Must prepare (as a minimum)

Tier 2 GPFS (applying AASB

1060) for 30 June 2022 and

beyond

Did you prepare SPFS in the previous year ended 30 June 2021 and

continue to assess to not be a “reporting entity” (as per AASB 1057 and

SAC 1) for the year ended 30 June 2022?

Are you one of the following types of AFSLs? (see Form FS70)

• regulated by the Australian Prudential Regulatory Authority

• participants in a licensed market

• participants in a clearing and settlement facility

• retail over-the-counter derivative issuers

• wholesale electricity dealers

• corporate advisors that deal in financial products

• over-the-counter derivative traders

• wholesale trustees

• responsible entities of a registered scheme

• corporate directors of a corporate collective investment vehicle

• providers of a custodial or depository service

• operators of an investor directed portfolio service.

YES

Go to FLOWCHART 2

Update on financial reporting requirements for Australian Financial Services Licensees

Impact of the Australian Accounting Standards Board’s financial reporting reforms for for-profit entities

for years ending 30 June 2022 and beyond

FLOWCHART 2 – AFSLs previously preparing General Purpose Financial Statements

(or who assess as a reporting entity

1

for the year ended 30 June 2022)

1

As per AASB 1057 Application of Australian Accounting Standards and Statement of Accounting Concept 1 (SAC 1) Definition of the Reporting Entity

Do you have “public accountability” as defined in

Appendices A and B of AASB 1053?

YES

NO

AFSLs reporting under:

• both Chapter 2M and Chapter 7 of the Act (Including large proprietary companies, registered schemes and

disclosing entities)

• AFSLs reporting only under Chapter 7 of the Act (Including small proprietary companies and natural persons)

Are you one of the following types of AFSLs? (see form FS70)

• regulated by the Australian Prudential Regulatory Authority

• participants in a licensed market

• participants in a clearing and settlement facility

• retail over-the-counter derivative issuers

• wholesale electricity dealers

• corporate advisors that deal in financial products

• over-the-counter derivative traders

• wholesale trustees

• responsible entities of a registered scheme

• corporate directors of a corporate collective investment vehicle

• providers of a custodial or depository service

• operators of an investor directed portfolio service.

Must prepare Tier 1 GPFS for 30

June 2022 and beyond

Must prepare Tier 2 GPFS (applying AASB

1060) for 30 June 2022 and beyond

YES

NO

Must prepare Tier 1 GPFS for 30

June 2022 and beyond

Update on financial reporting requirements for Australian Financial Services Licensees

Impact of the Australian Accounting Standards Board’s financial reporting reforms for for-profit entities

for years ending 30 June 2022 and beyond

Disclaimer

This fact sheet was prepared by CPA Australia ABN 64 008 392 452 (CPAA) and Chartered Accountants Australia and New Zealand ABN 50 084 642 571 (CA ANZ). This fact sheet has been prepared for use by members of

CA ANZ and CPAA in Australia only. It is not intended for use by any person who is not a CA ANZ or CPAA member and/or does not have appropriate expertise in the factsheet's subject matter. The fact sheet is intended to

provide general information and is not intended to provide or substitute legal or professional advice on a specific matter. Laws, practices and regulations may have changed since publication of this fact sheet. You should make

your own enquiries as to the currency of relevant laws, practices and regulations.

No warranty is given as to the correctness of the information contained in this fact sheet, or of their suitability for use by you. To the fullest extent permitted by law, CA ANZ and CPAA are not liable for any statement or opinion,

or for any error or omission contained in these FAQs and disclaim all warranties with regard to the information contained in it, including, without limitation, all implied warranties of merchantability and fitness for a particular

purpose. CA ANZ and CPAA are not liable for any direct, indirect, special or consequential losses or damages of any kind, or loss of profit, loss or corruption of data, business interruption or indirect costs, arising out of or in

connection with the use of this publication or the information contained in it, whether such loss or damage arises in contract, negligence, tort, under statute, or otherwise.

Copyright Notice

© 2022 Chartered Accountants Australia and New Zealand and CPA Australia

Copyright Use Statement

This fact sheet is protected by copyright. Other than for the purposes of and in accordance with the Copyright Act 1968 (Cth), this fact sheet may only be reproduced for internal business purposes, and may not otherwise be

reproduced, adapted, published, stored in a retrieval system or communicated in whole or in part by any means without express prior written permission.