©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are

trademarks used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved

under Professional Standards Legislation. 1

Example Simplified Disclosures Proprietary Limited 30 June 2022

A single Simplified Disclosures standard to replace Reduced Disclosure Requirements

AASB 1053 Application of Tiers of Australian Accounting Standards requires preparers to assess whether the

entity is publicly accountable to determine if it qualifies for the preparation of Tier 2 general purpose financial

statements under the differential reporting regime.

AASB 1060 General Purpose Financial Statements – Simplified Disclosures for For-Profit and Not-for-Profit Tier 2

Entities, replaces the current suite of Reduced Disclosure Requirements (RDR) disclosures. AASB 1060 is a new

single general purpose financial statements (GPFS)-Tier 2 Simplified Disclosures (SD) standard. It is principally

based on the disclosures included in the IFRS for SMEs

®

Standard, with some adjustment for the Australian

context. It will apply to all entities (both for-profit and not-for-profit) preparing financial statements under Tier 2,

both those currently reporting under the existing RDR framework and those that will be required to stop preparing

special purpose financial statements (SPFS) and be required to prepare GPFS.

AASB 1060 works in conjunction with AASB 2020-2 Amendments to Australian Accounting Standards – Removal

of Special Purpose Financial Statements for Certain For-Profit Private Sector Entities – the Australian Accounting

Standard (AAS) that removed the ability of certain for-profit private sector entities to prepare SPFS.

Key features

• Entities preparing GPFS-Tier 2 SD must comply with all recognition and measurement (R&M) requirements of

AAS, i.e. there is no impact on existing R&M requirements of AAS.

• AASB 1060 is a single standard containing all the required disclosures for an entity preparing GPFS-Tier 2 SD.

Thi

s means that those AAS only dealing with presentation and disclosure (including AASB 7 Financial

Instruments: Disclosures, AASB 12 Disclosure of Interests in Other Entities, AASB 101 Presentation of

Financial Statements, AASB 107 Statement of Cash Flows and AASB 124 Related Party Disclosures) hav

e

been

incorporated into AASB 1060 – but without all the additional guidance contained in those standards.

AASB 1060 instructs entities to refer to these presentation and disclosure standards for guidance w

hen

need

ed.

• Entities that comply with AASB 1060 are exempt from the disclosure requirements in specified paragraphs in

other AAS.

• There is an option – where specific conditions are met – for an entity not to present a statement of changes in

equ

ity, which if elected would result in a presentation difference to GPFS-Tier 1.

• The Standard applies whether consolidated or separate financial statements are presented.

While AASB 1060 includes certain presentation requirements, these do not result in presentations or

classifications that are different to those required for Tier 1 entities. The only exceptions are:

• the option not to include a separate statement of changes in equity in certain circumstances; and

• no requirement to separate the share of other comprehensive income of associates and joint ventures

accounted for by the equity method between items that will not be reclassified subsequently to profit or loss,

and those that will.

Effective date and transition

AASB 1060, together with AASB 2020-2 apply for financial reporting periods beginning on or after 1 July 2021.Both

standards need to be applied at the same time. Comparative disclosures are required for all disclosures.

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are

trademarks used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved

under Professional Standards Legislation. 2

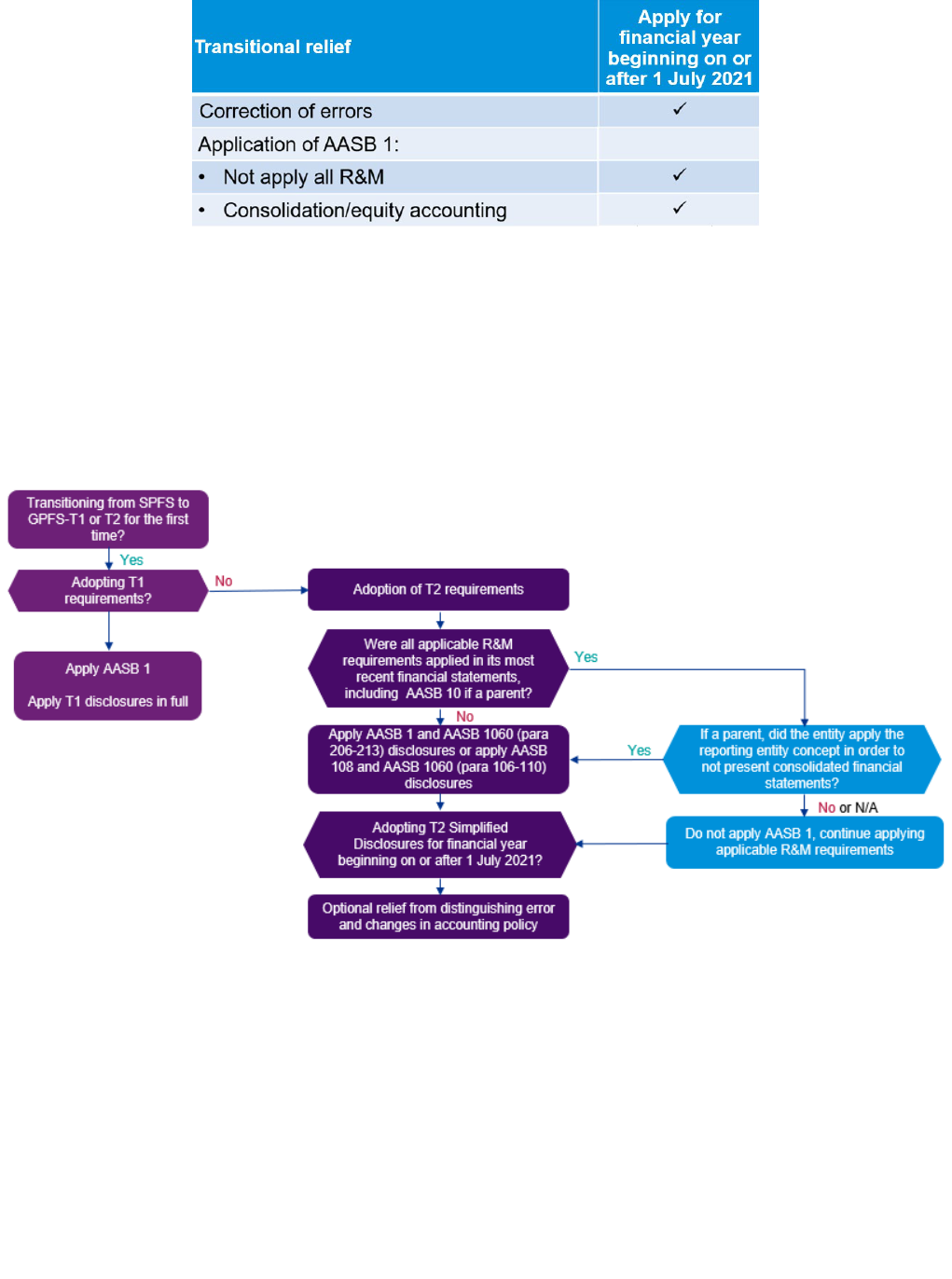

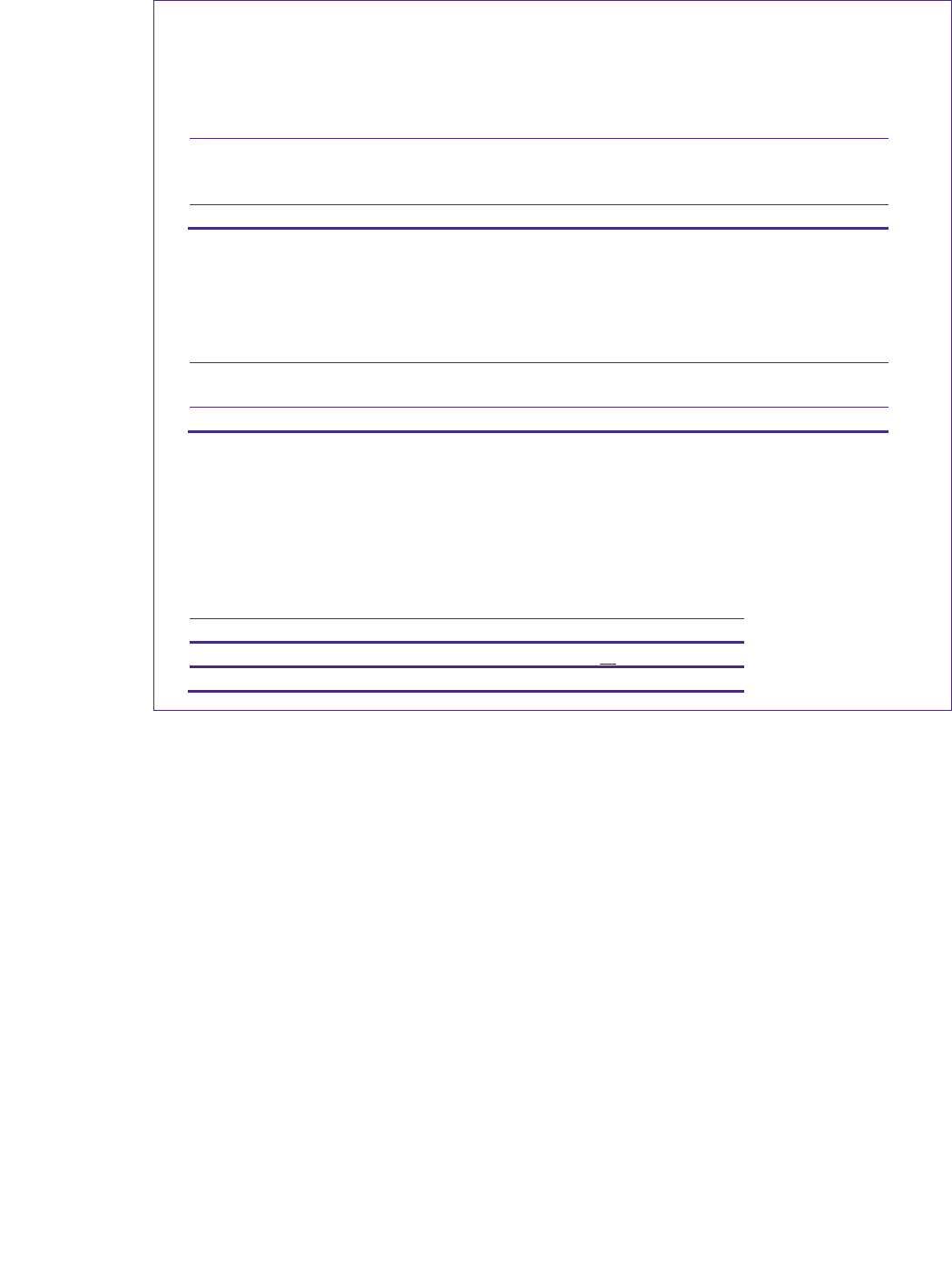

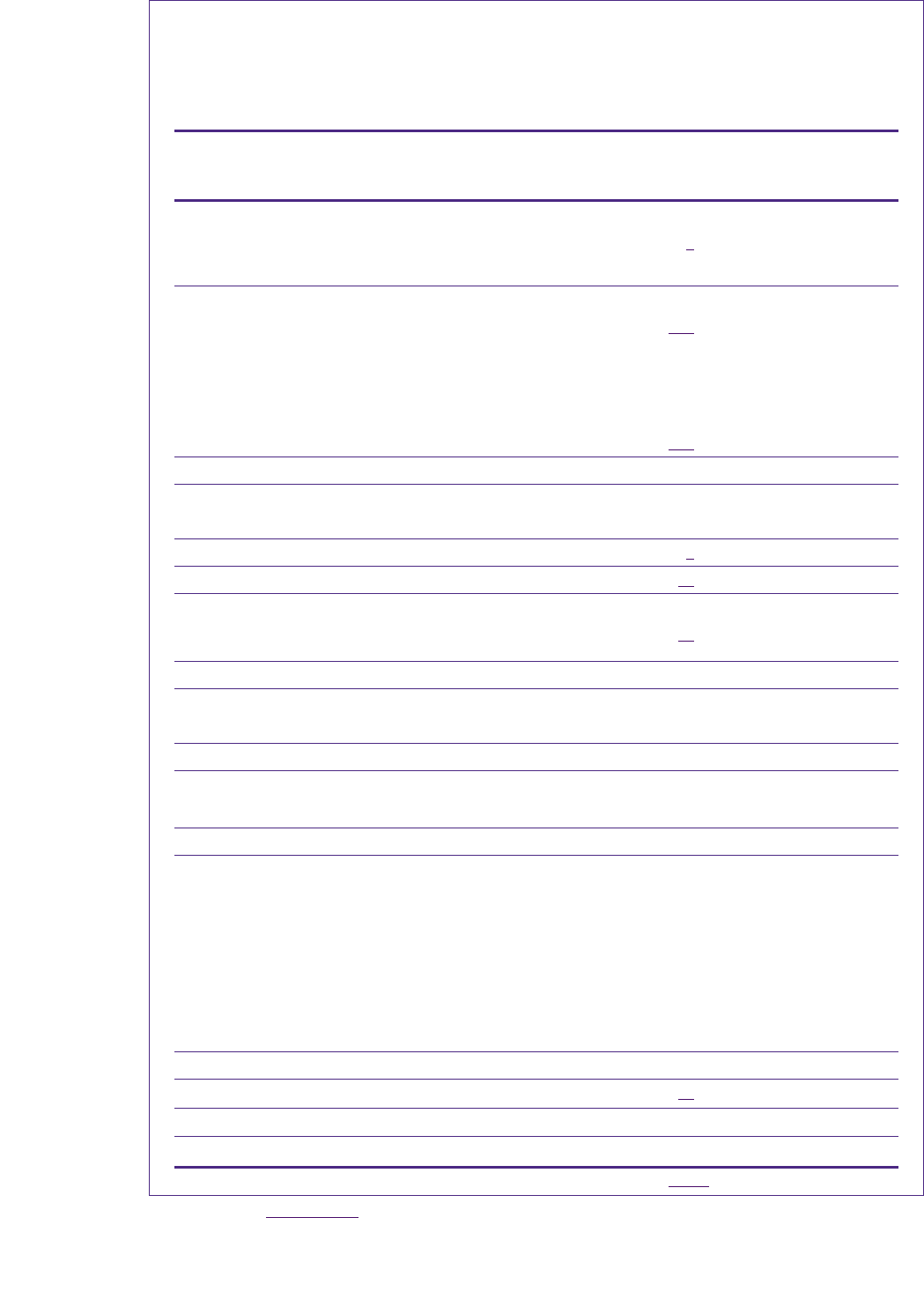

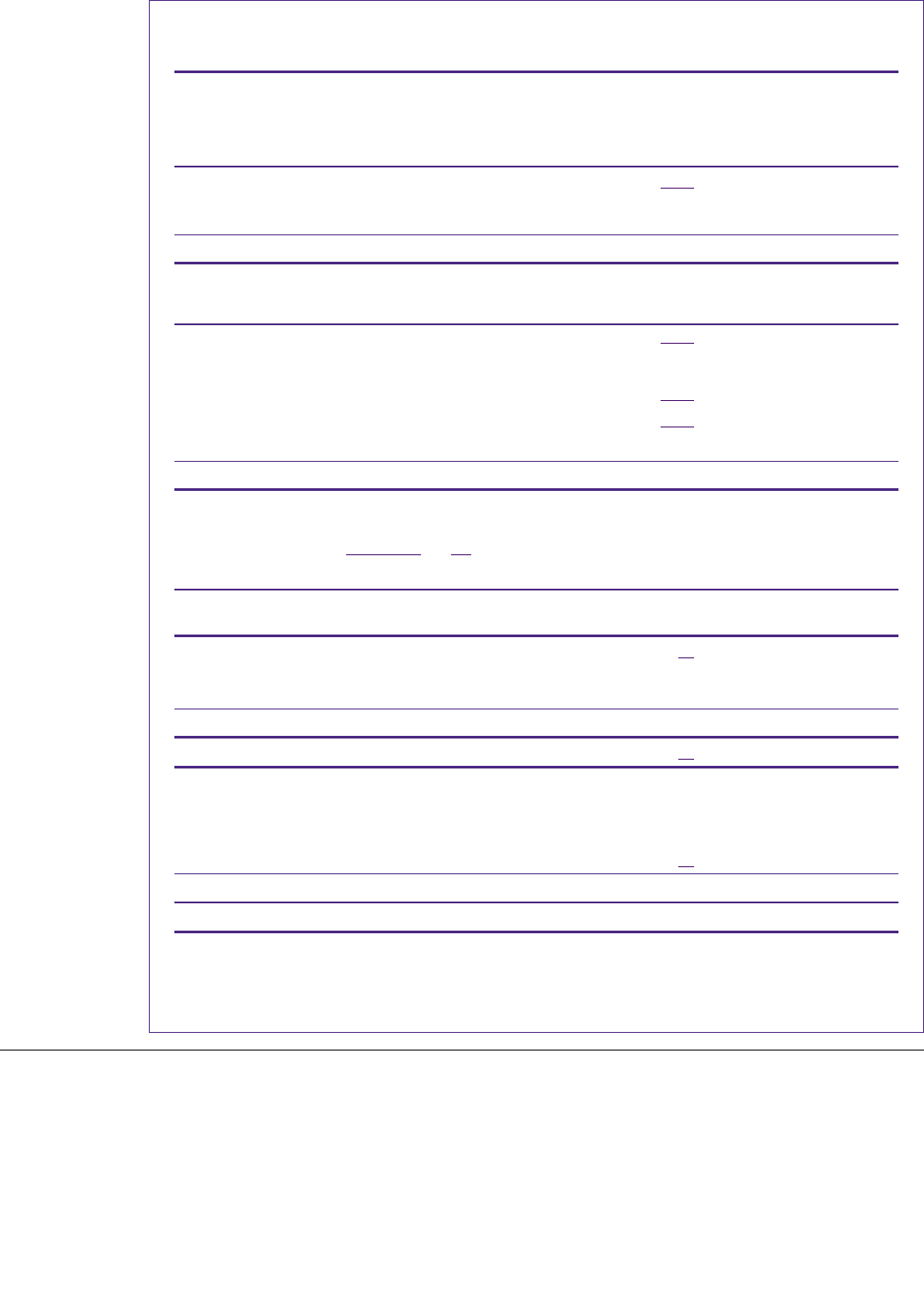

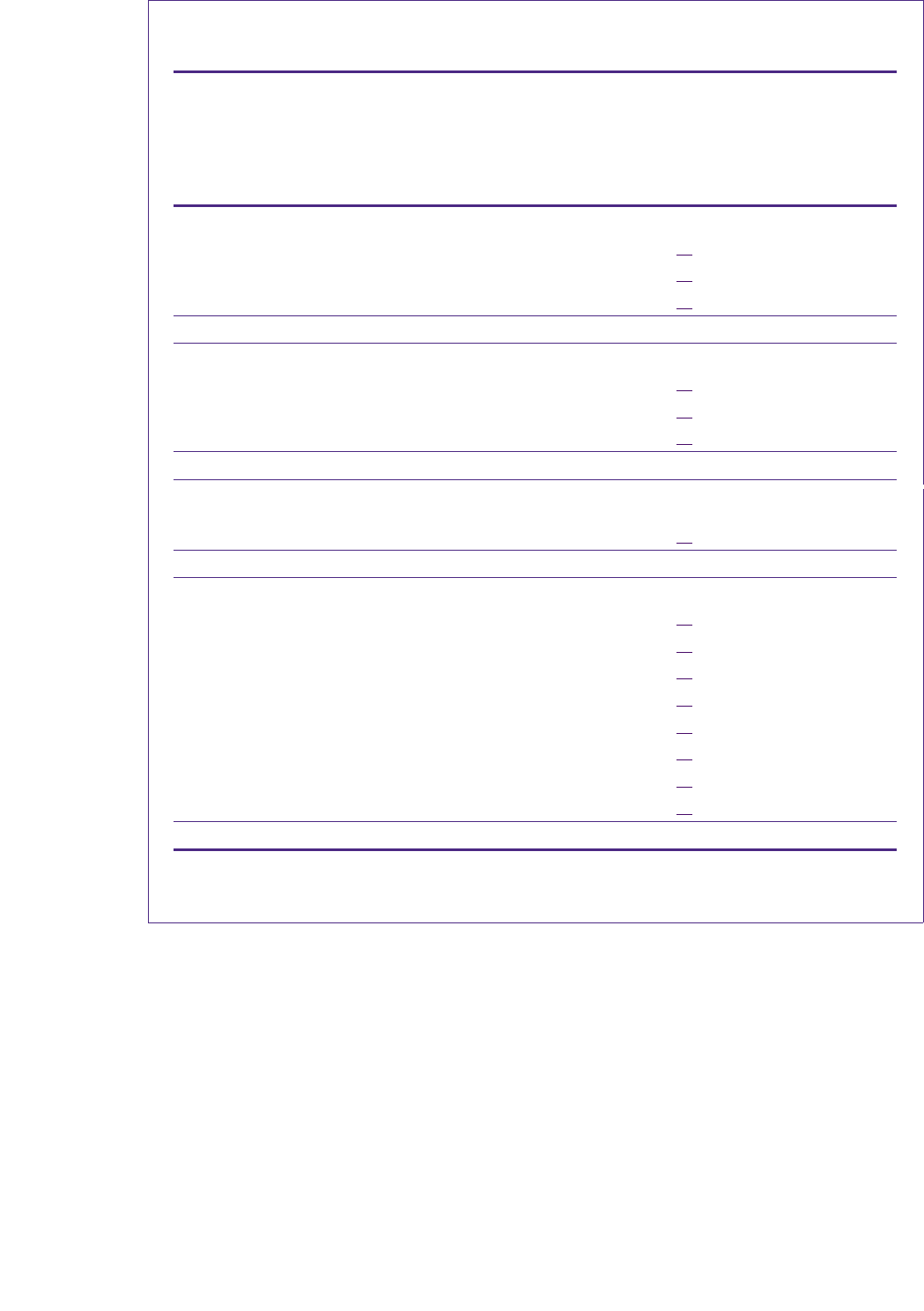

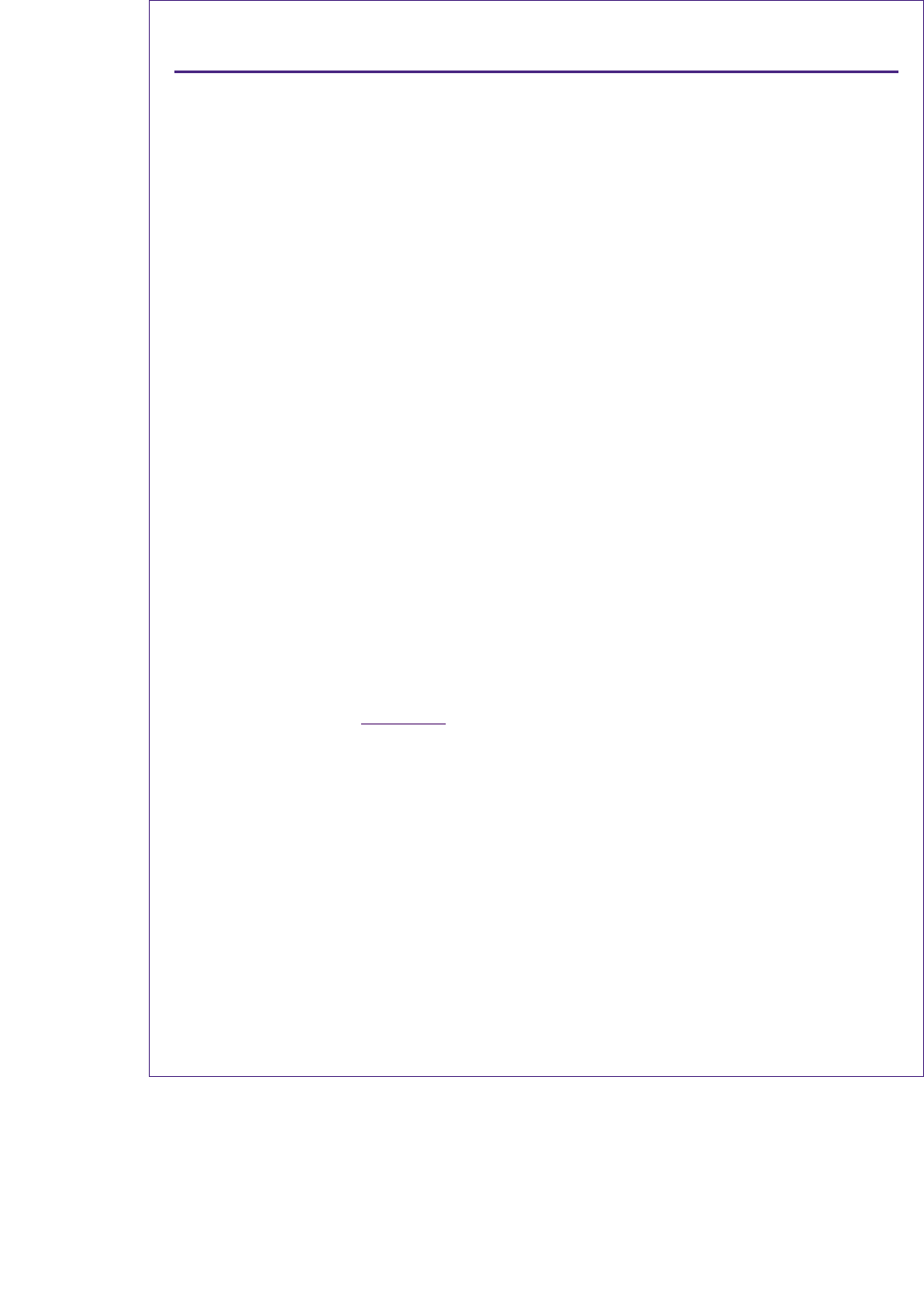

The table below sets out the available transitional relief for entities applying the standards for the first time in years

beginning on or after 1 July 2021.

The transition provisions are included in the amendments to AASB 1053 Application of Tiers of Australian Accounting

Standards. An entity need not apply the transitional relief – in which case it will apply a fully retrospective transition in

accordance with AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors.

Transitional relief explained

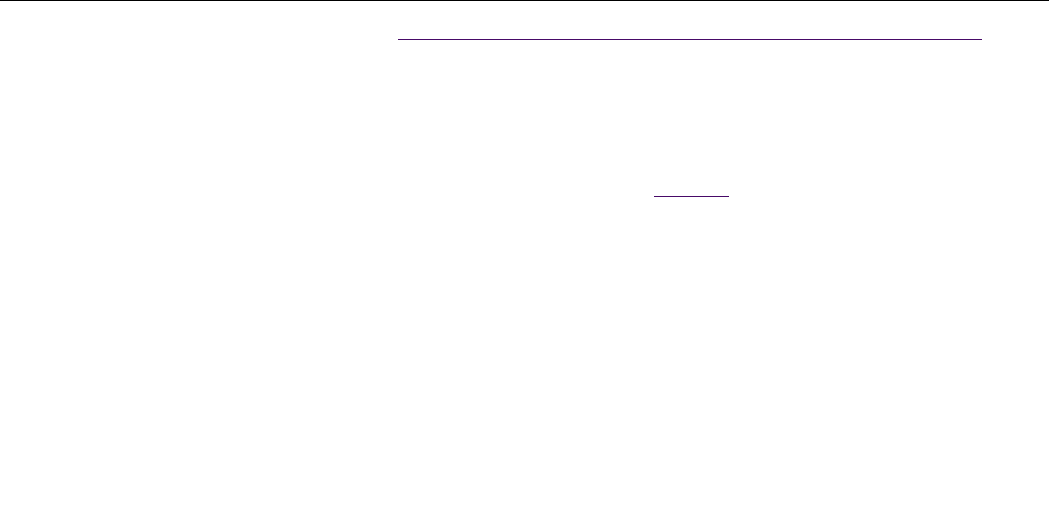

The transitional provisions explained below must be considered in the context of the table above. The flow

diagram below illustrates the transitional relief available depending on an entity’s circumstances.

C

orrection of errors

For entities moving from SPFS and applying GPFS-Tier 2 SD reporting requirements for the first time there is no

requirement to distinguish between the correction of errors and changes in accounting policies if the entity

becomes aware of errors made in its most recent previous SPFS.

This means that an entity that discovered an error in its previous SPFS does not need to separately address this in

its first GPFS-Tier 2 SD financial statements and is able to apply the transitional relief in AASB 1 First-time

Adoption of Australian Accounting Standards or elect to apply AASB 108 (i.e. fully retrospectively).

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are

trademarks used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved

under Professional Standards Legislation. 3

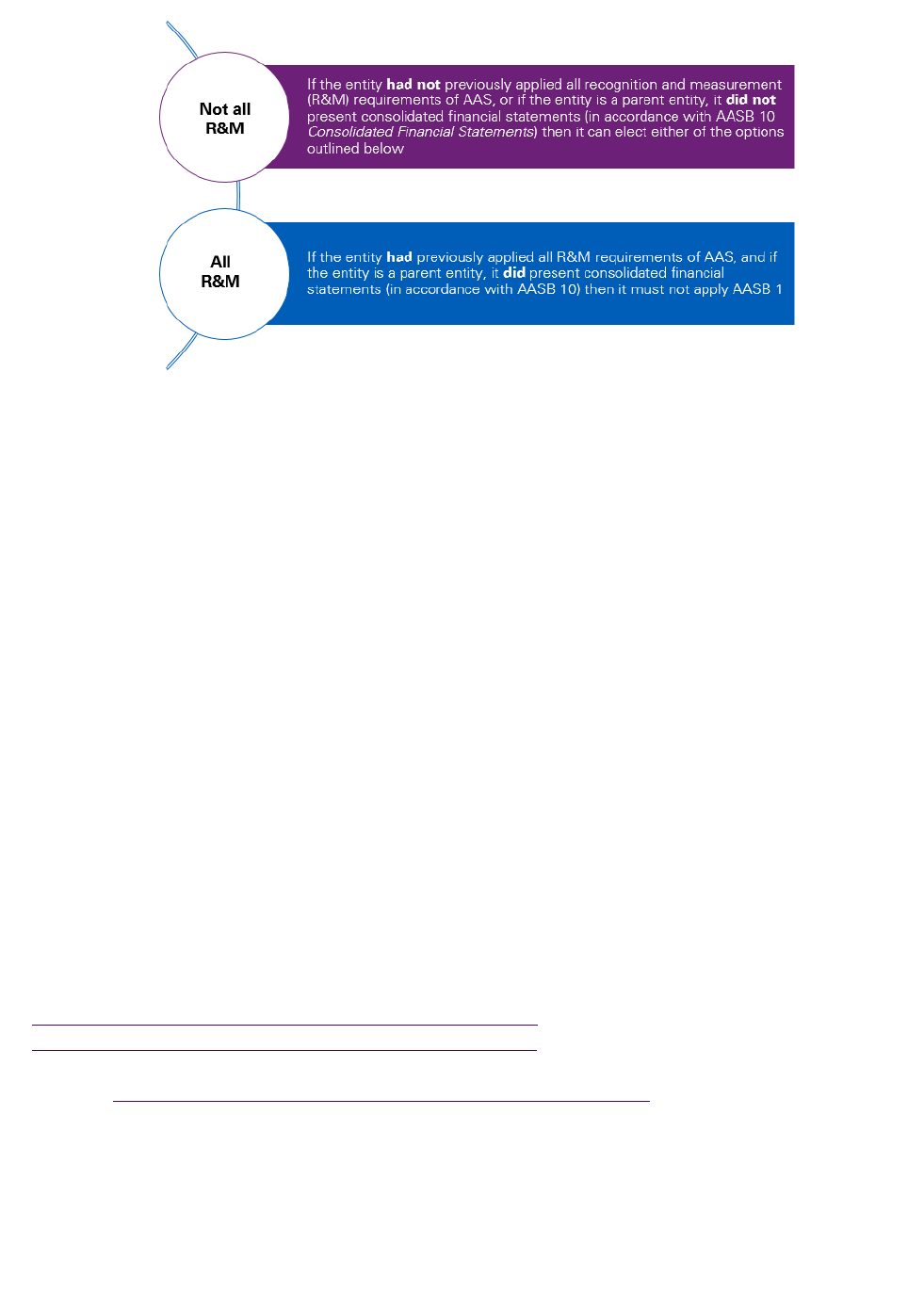

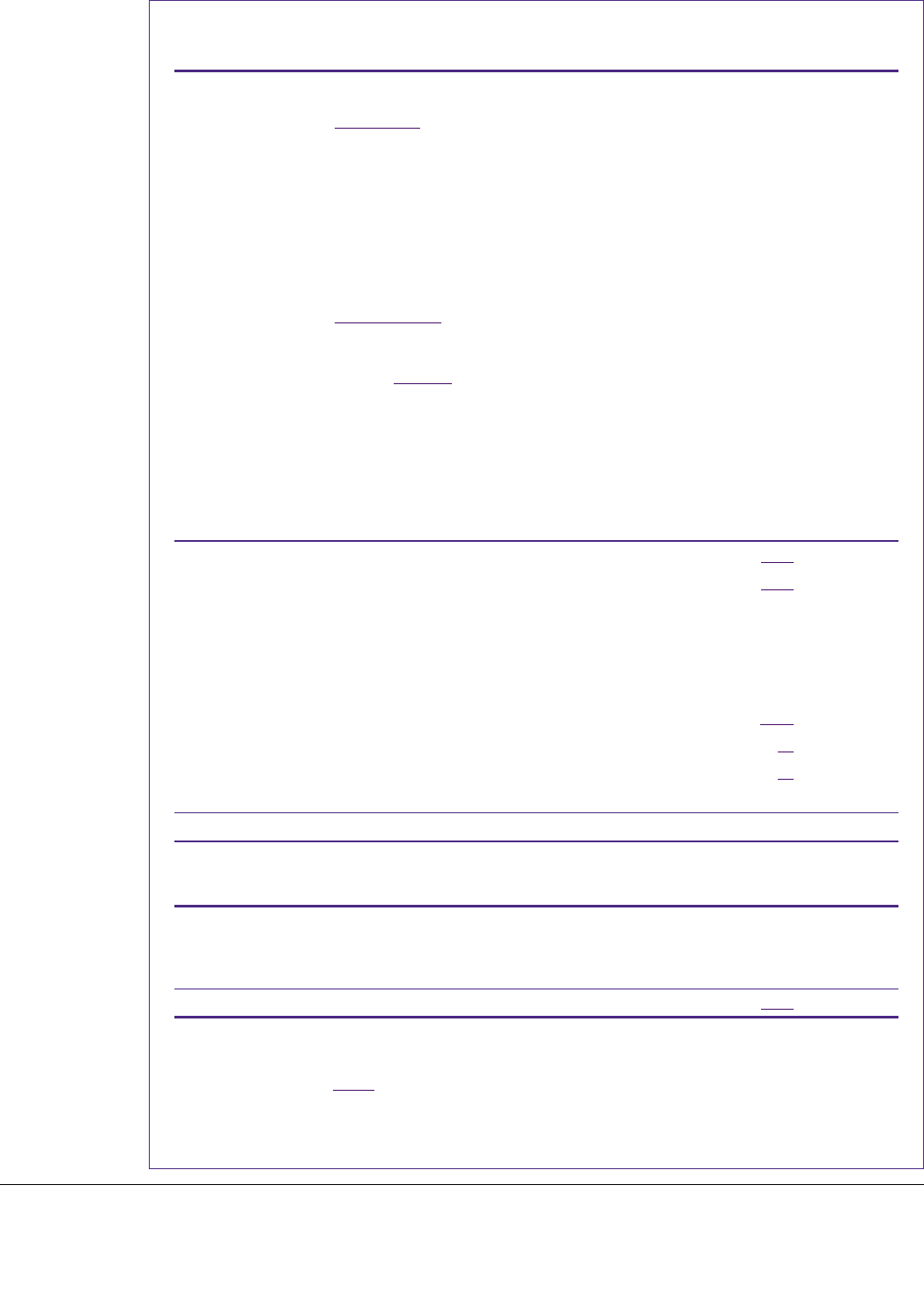

Application of AASB 1

When applying GPFS-Tier 2 SD reporting requirements for the first time (i.e. the entity prepared its most recent

previous financial statements in the form of SPFS):

Options – Not all R&M

The entity applies either:

• all relevant requirements of AASB 1 (i.e. provides some relief from full retrospective application), or

• GPFS-Tier 2 SD reporting requirements directly using the requirements of AASB 108 (i.e. full retrospective

application).

All R&M

For entities preparing SPFS that are already complying with the R&M requirements in AAS, and consolidating

subsidiaries and equity accounting investments in associates and joint ventures (if applicable), the transition from

SPFS to GPFS-Tier 2 SD will be limited to the provision of additional disclosures.

Transition from GPFS-Tier 2 RDR to GPFS-Tier 2 SD

While applying GPFS-Tier 2 RDR all R&M requirements will have been complied with – as such if an entity

transitions from GPFS-Tier 2 RDR to GPFS-Tier 2 SD, neither AASB 1 nor AASB 108 have to be applied as there

will not be any adjustments.

What will change are the disclosures in the first GPFS-Tier 2 SD financial statements – they will need to align to

AASB 1060.

Further resources

The following resources provide further details and discussion on the changes to the Australian Financial Reporting

Framework, and the transition to GPFS-Tier 2 SD:

• 20RU-006 Farewell SPFS… Welcome Simplified Disclosures

• KPMG’s Australian Financial Reporting Framework webpage

• Transition publication: moving from SPFS to GPFS – coming soon

• Webinar: The impacts of the new Australian financial reporting framework

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are

trademarks used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved

under Professional Standards Legislation. 4

How to use Example Simplified Disclosures Proprietary Limited 30 June

2022

The purpose of Example Simplified Disclosures Proprietary Limited is to assist in the preparation of an entity’s

annual financial report in accordance with Australian Accounting Standards – Simplified Disclosures, and that also

meet statutory requirements under the Corporations Act 2001 for financial years ending on or after 30 June

2022. Example Simplified Disclosures Proprietary Limited is a for-profit entity preparing consolidated financial

statements.

In addition, Example Simplified Disclosures Proprietary Limited is adopting AASB 1060 for the first time, applying

GPFS-Tier 2 SD, having previously applied GPFS-Tier 2 RDR. Appendix 2

provides illustrative disclosures for a for-

profit entity adopting GPFS-Tier 2 SD for the first time having prepared special purpose financial statements in its

most recent financial statements. Appendix

2 includes disclosures where neither consolidation nor equity

accounting was previously applied and the entity applies AASB 1 First-time Adoption of Australian Accounting

Standards on transition to GPFS-Tier 2 SD.

This publication illustrates one possible format for Tier 2 statutory general purpose financial statements, based on

a fictitious corporation involved in general business. Accordingly, a number of notes are not applicable to

Example Simplified Disclosures Proprietary Limited and have not been included in the main body of the financial

report. However, Appendix 3

includes illustrations of additional notes if they were to be prepared under Tier 2

requirements.

This publication should not be used as a boiler plate template. The preparation of financial statements requires

judgement, in terms of the choice of accounting policies, how the disclosures should be tailored to reflect the

entity’s specific circumstances, and the materiality of disclosures in the context of the entity.

This publication reflects Australian Accounting Standards – Simplified Disclosures on issue as at 31 August 2021

that must be applied by an entity with an annual period beginning on 1 July 2021 (“currently effective”

requirements), including AASB 2020-2 and AASB 1060. All other Australian Accounting Standards that are

effective for annual periods beginning on or after 1 July 2022 (“forthcoming” requirements) have not been early

adopted.

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are

trademarks used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved

under Professional Standards Legislation. 5

Example Simplified

Disclosures Proprietary

Limited

30 June 2022

Example Simplified Disclosures Proprietary Limited

Directors’ report

For the year ended 30 June 2022

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 6

S292(1), S298(1),

S299(2)

The directors present their report together with the consolidated financial statements of the Group

comprising Example Simplified Disclosures Proprietary Limited (the Company), and its subsidiaries

for the financial year ended 30 June 2022 and the auditor’s report thereon.

S300(1)(c)

1. Directors

The directors of the Company at any time during or since the end of the financial year are:

[Director_name]

Appointed [date]

and if applicable resigned [date]

[Director_name]

Appointed [date]

and if applicable resigned [date]

[Director_name]

Appointed [date]

and if applicable resigned [date]

[Director_name]

Appointed [date]

and if applicable resigned [date]

S300(1)(ca)

S9

2. Officers who were previously partners of the audit firm

The following persons were officers of the Company during the financial year and were previously

partners of the current audit firm, KPMG, at a time when KPMG undertook an audit of the Group:

[insert names if applicable]

S299(1)(f)

RG68

3. Environmental regulation

The Group’s operations are subject to significant environmental regulation under both

Commonwealth and State legislation in relation to its [insert details if relevant].

S299(1)(c)

4. Principal activities

The principal activities of the Group during the course of the financial year were the manufacture

and sale of paper and paper-related products.

There were no other significant changes in the nature of the activities of the Group during the year.

Objectives

The Group’s objectives are to:

[insert details].

Example Simplified Disclosures Proprietary Limited

Directors’ report

For the year ended 30 June 2022

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 7

S299(1)(a)

RG230

5. Review of operations and results of those operations

Overview of the Group

These consolidated financial statements are the first general purpose financial statements prepared

in accordance with Australian Accounting Standards – Simplified Disclosures. In the prior year, the

consolidated financial statements were general purpose financial statements prepared in

accordance with Australian Accounting Standards – Reduced Disclosure Requirements.

There was no impact on the amounts recognised, measured and classified in the statements of

financial position, financial performance and cash flows of the Group as a result of the change in

basis of preparation.

a

[insert details]

Review of [insert details]

Products

[Insert details]

Market

[Insert details]

Operating results

[Insert details]

Commentary on operating results

[Insert details]

Strategy and future performance

[Insert details]

S299(1)(b)

6. Significant changes in the state of affairs

In August 2021, the Group sold its entire packaging line of business. The Group was committed to

a plan to sell this division due to a strategic decision to change the direction of the Group in late

2021.

On 30 September 2021, the Group acquired 75% of the shares and voting interests in Papyrus for

a total cash consideration of $2,935 thousand. As a result, the Group’s equity interest in Papyrus

increased from 25 to 100%, granting it control of Papyrus.

Taking control of Papyrus will enable the Group to modernise its production process through

access to Papyrus’s patented technology. The acquisition is also expected to provide the Group

with an increased share of the standard paper market through access to Papyrus’s customer base.

The Group also expects to reduce costs through economies of scale.

In 2022, a majority of the Company’s shares were acquired by Cameron Paper Co from Brown

Products Corporation. As a result, the new ultimate controlling party of the Group is AJ

Pennypacker. The previous ultimate controlling party was Sigma Australia Investment Holdings.

a.

Directors are not required to make this disclosure in the Directors’ report, but may choose to do so.

Example Simplified Disclosures Proprietary Limited

Directors’ report

For the year ended 30 June 2022

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 8

S300(1)(a)-(b)

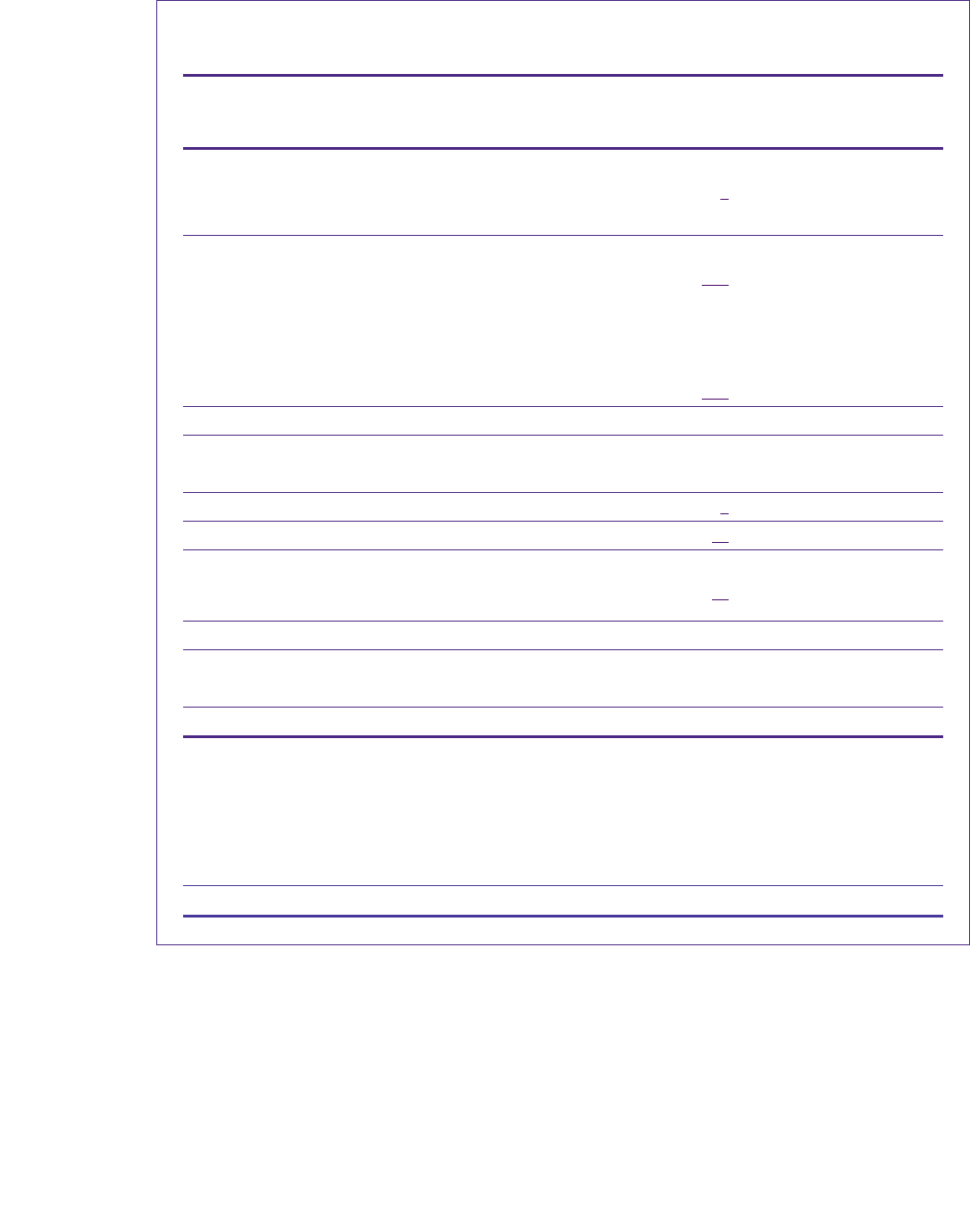

7. Dividends

Dividends paid or declared by the Company to members since the end of the previous financial year

were:

Cents per

share

Total amount

$000

Date of payment

Declared and paid during the year 2022

Final 2021 ordinary

25.97

805

[ ]

Final 2021 preference

25.03

438

[ ]

Total amount

1,243

Declared after end of year

After the reporting date the following dividends were proposed by the directors. The dividends have

not been provided and there are no income tax consequences.

Cents per

share

Total amount

$000

Date of payment

Final ordinary

27.97

892

[ ]

Final preference

25.03

438

[ ]

Total amount

1,330

The financial effect of these dividends has not been brought to account in the consolidated financial

statements for the year ended 30 June 2022 and will be recognised in subsequent financial reports.

Preference shares are classified as a liability and distributions paid are recognised as interest

expense.

Dividends have been dealt with in the financial report as:

Note

Total amount

$000

- Dividends

1,243

- Interest expense

20

51

- Noted as a subsequent event

1,330

Example Simplified Disclosures Proprietary Limited

Directors’ report

For the year ended 30 June 2022

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 9

S299(1)(d)

S299(1)(e)

S299(3)

S608, S609, RG 5

S300(1)(d)-(f)

S300(5)-(7)

8. Events subsequent to reporting date

At the end of July 2022, the Group a

nnounced its intention to implement a cost-reduction

programme and to take further measures to reduce costs. Additionally, to enable the Group to

adapt its size to current market conditions, it intends to reduce the Group’s workforce by 400

positions worldwide by the end of 2022/23, by means of non-replacement whenever possible. The

Group expects the restructuring associated with the reduction in positions to cost between $600

thousand and $850 thousand in 2023 and 2024.

Subsequent to 30 June 2022, one of the Group’s major trade customers went into liquidation

following a natural disaster in August 2022 that damaged its operating plant. Of the $100 thousand

owed by the customer, the Group expects to recover less than $10 thousand. No additional

allowance for impair

ment has been made in these consolidated financial statements.

On 10 July 2022, one

of the premises of the Group’s material subsidiary, having a carrying amount

of $220 thousand, was seriously damaged by fire. Surveyors are in the process of assessing the

extent of the loss, following which t

he Group will file a claim for reimbursement with the insurance

company. The Group

is unable to estimate the incremental costs relating to refurbishment and

temporary shift of production to other locations (in excess of the reimbursement expected).

As reported in the condensed interim financial statements on 22 January 2022, the Group

announced its intention to acquire all of the shares of ABC Company for $6,500 thousand. On 4

July 2022, the Group’s shareholders approved the transaction and the Group is now awaiting

approval from regulatory authorities before proceeding with the acquisition. Management

anticipates that this approval will be received by October 2022.

Subsequent to 30 June 2022, the loan covenant maximum leverage ratio (calculated as debt to

quarterly revenue for continuing operations) related to a secured bank loan was revised from 2.5 to

3

.5 times.

O

ther than the matters discussed above, there has not arisen in the interval between the end of

the financial year and the date of this report any item, transaction or event of a material and

unusual nature likely, in the opinion of the directors of the Group, to affect significantly the

operations of the Group, the results of those operations, or the state of affairs of the Group, in

future financial years.

9. Likely developments

T

he Group will continue to pursue its policy of increasing the profitability and market share of its

major business sectors during the next financial year. This will require further investment in areas

such as manufacturing and sale of paper, which have performed well over recent years and offer

sound opportunities for future development.

Further information about likely developments in the operations of the Group and the expected

results of those operations in future financial years has not been included in this report because

disclosure of the information would be likely to result in unreasonable prejudice to the Group.

10. Directors’ interests and share options

[

This heading and associated disclosure is not necessary if directors do not have interests in the

company and there are no options on issue. Refer to sections 11 and 12 of the Directors’ Report in

Example Public Company Limited – Illustrative disclosures 2021-22 for example disclosures if

re

levant].

Example Simplified Disclosures Proprietary Limited

Directors’ report

For the year ended 30 June 2022

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 10

S300(1)(g), (8)-(9)

S199A-199B

11. Indemnification and insurance of officers and auditors

Indemnification

Since the end of the previous financial year, the Company has not indemnified or made a relevant

agreement for indemnifying against a liability any person who is or has been an officer or auditor of

the Group.

Insurance premiums

During the financial year the Company has paid premiums in respect of directors’ and officers’

liability and legal expenses insurance contracts for the year ended 30 June 2022 and since the

financial year, the Company has paid premiums in respect of such insurance contracts for the year

ending 30 June 2022. Such insurance contracts insure against certain liability (subject to specific

exclusions) persons who are or have been directors or executive officers of the Group.

The directors have not included details of the nature of the liabilities covered or the amount of the

premiums paid in respect of the directors’ and officers’ liability and legal expenses insurance

contracts, as such disclosure is prohibited under the terms of the contract.

S298(1A)

12. True and fair view

[Details of the directors’ reasons for disclosing the additional information and reference to where

this information is disclosed should be inserted here, when applicable].

S300(14)-(15)

13. Proceedings on behalf of the Company

[Details of any proceedings should be inserted here, when applicable].

S307C

14. Lead auditor’s independence declaration

The Lead auditor’s independence declaration is set out on page [xxx] and forms part of the

directors’ report for the financial year ended 30 June 2022.

ASIC Instrument

2016/191

15. Rounding off

[[Include if relevant ] The Group is of a kind referred to in ASIC Corporations (Rounding in

Financial/Directors’ Reports) Instrument 2016/191 and in accordance with that instrument, amounts

in the consolidated financial report and directors’ report have been rounded off to the nearest

thousand dollars, unless otherwise stated.]

This report is made out in accordance with a resolution of the directors:

____________________________

[Director_name]

Dated at …...................……… [City] this ……… day of …………………… 2022

Example Simplified Disclosures Proprietary Ltd

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 11

AASB 1060.25(a), 30

Consolidated statement of financial position

a,b

AASB 1060.20-21, 28-29,

31(c)-(d), 36, 42, 92

In thousands of dollars

Note

30 June 2022

30 June 2021

Assets

AASB 1060.35(a)

Cash and cash equivalents

13

1,504

1,849

AASB 1060.35(b), 44(b)

Trade and other receivables

12

34,119

24,307

AASB 1060.35(c)

Other financial assets

18

662

1,032

AASB 1060.35(d)

Inventories

11

12,148

12,119

AASB 1060.35(m)

Current tax assets

34

60

AASB 1060.35(r),

AASB 5.38, 40,

Assets held for sale

14

14,400

-

AASB 1060.37

Current assets

62,867

39,367

AASB 1060.35(c)

Other financial assets

18

2,672

2,497

AASB 1060.35(e)

Property, plant and equipment

c

15

29,090

33,230

AASB 1060.35(g)

Intangible assets

16

6,226

4,661

AASB 1060.35(i), 125(b)

Investments in associates

17

272

900

AASB 1060.35(n)

Deferred tax assets

10

1,987

1,954

AASB 1060.37

Non-current assets

40,247

43,242

Total assets

103,114

82,609

Liabilities

Bank overdraft

13

334

282

AASB 1060.35(k)

Trade and other payables

21

23,976

21,708

AASB 1060.35(l)

Other financial liabilities

20

2,283

5,546

AASB 1060.35(m)

Current tax liabilities

4,751

1,693

AASB 1060.35(o)

Provisions

23

680

1,548

AASB 1060.35(s),

AASB 5.38, 40

Liabilities held for sale

14

4,410

-

AASB 1060.37

Current liabilities

36,434

30,777

AASB 1060.35(k)

Trade and other payables

21

440

-

AASB 1060.35(l)

Other financial liabilities

20

17,622

9,831

AASB 1060.35(n)

Deferred tax liabilities

10

251

337

AASB 1060.35(o)

Provisions

23

1,197

173

Deferred income

22

1,424

1,462

AASB 1060.37

Non-current liabilities

20,934

11,803

Total liabilities

57,368

42,580

Net assets

45,746

40,029

Equity

d

AASB 1060.44(f)

Share capital

19,600

18,050

AASB 1060.44(f)

Reserves

22,424

12,974

AASB 1060.44(f)

Retained earnings

3,722

9,005

AASB 1060.35(q)

Equity attributable to owners of the Company

19

45,746

40,029

The notes on pages 18 to 67 are an integral part of these consolidated financial statements.

Example Simplified Disclosures Proprietary Ltd

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 12

AASB 1060.30, 42-43

a.

An entity may also use other titles – e.g. ‘balance sheet’ – as long as the meaning is clear and the title not misleading. There is no

prescribed sequence or format in which items are to be presented in the statement of financial position. Additional line items may

be included when the size, nature or function of an item or aggregation of similar items is such that separate presentation is

relevant to an understanding of the entity’s financial position. The descriptions used and the sequencing of items or aggregation

of similar items may be amended according to the nature of the entity and its transactions, to provide information that is relevant

to an understanding of the entity’s financial position. The judgement of whether additional line items are presented separately is

based on the assessment of the amounts, nature and liquidity of assets and liabilities, and the function of assets within the entity.

AASB 1060.35, 44

b.

AASB 1060 sets out the minimum line items to be included in the statement of financial position. Further sub-classifications of the

line items presented, classified in a manner appropriate to the entity’s operations, may be disclosed either in the statement of

financial position or in the notes.

AASB 16.47(a)

c.

The Group has presented right-of-use assets within ‘property, plant and equipment’ – i.e. the same line item in which it presents

underlying assets of the same nature that it owns. Alternatively, an entity may choose to present right-of-use assets separately in

the statement of financial position.

AASB 1060.44(f), 45

d.

Although it is not specifically required, the Group has presented in the statement of financial position line items related to

classification of equity into share capital, retained earnings and reserves.

The Group has presented in the statement of changes in equity and in the notes further information about each class of share

capital and each reserve within equity.

Example Simplified Disclosures Proprietary Ltd

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 13

AASB 1060.25(b)(i), 30

Consolidated statement of profit or loss and

other comprehensive income

a,b,c

AASB 1060.31(c)

For the year ended 30 June

AASB 1060.20-21, 28-29,

31(d), 49(a), 51, 56, 92

In thousands of dollars

Note

2022

2021*

Continuing operations

AASB 1060.52(a)

Revenue

6

102,400

96,417

AASB 1060.58(b)

Cost of sales

d

(57,461)

(56,186)

Gross profit

44,939

40,231

Other income

7(A)

264

16

AASB 1060.58(b)

Selling and distribution expenses

d

(18,322)

(15,865)

AASB 1060.58(b)

Administrative expenses

d

(17,732)

(14,428)

AASB 1060.58(b), 139

Research and development expenses

d

(1,109)

(697)

AASB 1060.58(b)

Other expenses

7(B)

(870)

(190)

Operating profit

7,170

9,067

Finance income

1,034

369

AASB 1060.52(b)

Finance costs

(1,867)

(1,616)

Net finance costs

8

(833)

(1,247)

AASB 1060.52(c)

Share of profit of associates, net of tax

17

(49)

315

Profit before tax

6,288

8,135

AASB 1060.52(d),

AASB 112.77

Income tax expense

10

(1,837)

(2,223)

Profit from continuing operations

4,451

5,912

Discontinued operation

AASB 1060.52(e)

Profit (loss) from discontinued operation, net of tax

379

(422)

AASB 1060.52(f), 53(a)(ii)

Profit for the period

4,830

5,490

AASB 1060.51(b)

Other comprehensive income

AASB 1060.52(g)(i)

Items that will not be reclassified to profit or loss, net of tax

e

-

-

AASB 1060.52(g)(ii)

Items that are or will be reclassified to profit or loss when

specific conditions are met, net of tax

AASB 1060.180(b)

Foreign operations – foreign currency translation differences

680

471

AASB 1060.122(c)

Net investment hedge – net loss

(3)

(8)

AASB 1060.122(c)

Cash flow hedges – effective portion of changes in fair value

(19)

71

AASB 1060.122(d)

Cash flow hedges – reclassified to profit or loss

(16)

(6)

AASB 1060.180(b)

Reclassification of foreign currency differences on loss of

significant influence

(20)

-

622

528

AASB 1060.52(h)

Share of OCI of associates

f

17

(159)

(169)

Other comprehensive income for the period, net of tax

463

359

AASB 1060.52(i), 53(b)(ii)

Total comprehensive income

g

for the period

5,293

5,849

* Comparative information has been re-presented due to a discontinued operation. See Note 5.

The notes on pages 18 to 67 are an integral part of these consolidated financial statements.

Example Simplified Disclosures Proprietary Ltd

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 14

AASB 1060.25(b)

a.

The Group has elected to present comprehensive income using a ‘single-statement’ approach. For an illustration of the alternative

‘two-statement’ approach, see Example Public Company Limited: Guide to annual reports – illustrative disclosures 2021-2022

[Appendix 2].

AASB 1060.50

b.

If an entity changes its presentation of total comprehensive income for the period from the single-statement approach to the two-

statement approach, or vice versa, it has to apply AASB 108 Accounting Policies, Changes in Accounting Estimates and Errors to a

change in accounting policy.

AASB 1060.26

c.

If the only changes to equity during the periods for which financial statements are presented arise from profit or loss, payment of

dividends, corrections of prior period errors, and changes in accounting policy, the entity may present a single statement of

income and retained earnings in place of the statement of comprehensive income and statement of changes in equity. For an

illustration of the single statement of income and retained earnings, see Appendix 1.

AASB 1060.58

d.

The Group has elected to analyse expenses recognised in profit or loss based on functions within the Group. Alternatively, an

entity may present the analysis based on nature if this presentation provides information that is reliable and more relevant. The

analysis may also be presented in the notes.

AASB 1060.52(g)(i)

e.

No items of OCI that will not be reclassified subsequently to profit or loss have arisen in the current or prior periods. When they

arise, an entity presents each such item of OCI classified by nature and group them accordingly. This sub-heading may be omitted

where there are no such items.

AASB 1060.52(g)-(h)

f.

The share of OCI of associates and joint ventures accounted for under the equity method is not disclosed separately by items that

will not subsequently be reclassified to profit or loss and those that will,

AASB 1060.52(i)

g.

If an entity has no items of OCI, another term, such as profit or loss, may be used instead of total comprehensive income.

Example Simplified Disclosures Proprietary Ltd

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 15

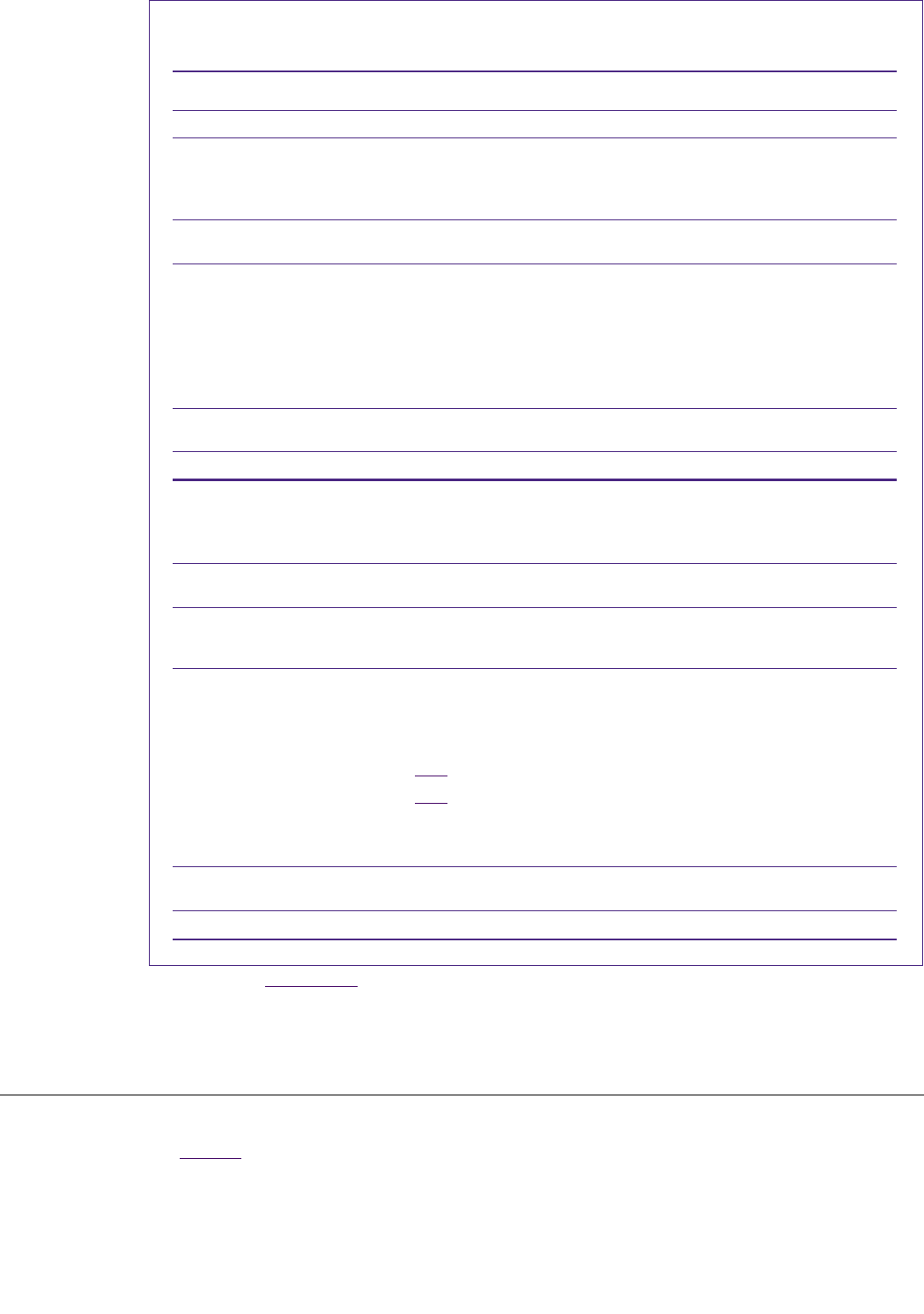

AASB 1060.25(c), 30

Consolidated statement of changes in equity

a

AASB 1060.20-21, 28-29,

31(d), 92

In thousands of dollars

Note

Share

capital

Translation

reserve

Hedging

reserve

Profits

reserve

Convert-

ible notes

Retained

earnings

Total

equity

AASB 1060.61(c)

Balance at 1 July 2020

18,050

(119)

399

3,521

-

12,900

34,751

Total comprehensive income

AASB 1060.61(c)(i)

Profit for the period

-

-

-

-

5,490

5,490

AASB 1060.61(c)(ii)

OCI for the period

-

297

65

-

(3)

359

AASB 1060.61(a)

Total comprehensive income

for the period

-

297

65

-

5,487

5,849

Transactions with owners of

the Company

AASB 1060.61(c)(iii)

Contributions and

distributions

Transfer to profits reserve

b

-

-

-

9,382

-

(9,382)

-

Dividends

-

-

-

(571)

-

-

(571)

Total transactions with

owners of the Company

-

-

-

8,811

-

(9,382)

(571)

AASB 1060.61(c)

Balance at 30 June 2021

18,050

178

464

12,332

-

9,005

40,029

Total comprehensive income

AASB 1060.61(c)(i)

Profit for the period

-

-

-

-

4,830

4,830

AASB 1060.61(c)(ii)

OCI for the period

-

485

(35)

-

13

463

AASB 1060.61(a)

Total comprehensive income

for the period

-

485

(35)

-

4,843

5,293

Hedging gains and losses and

costs of hedging transferred

to the cost of inventory

-

-

8

-

-

8

Transactions with owners of

the Company

AASB 1060.61(c)(iii)

Contributions and

distributions

Issue of ordinary shares

19(A)

1,550

-

-

-

-

1,550

Issue of convertible notes

20(C)

-

-

-

109

-

109

Transfer to profits reserve

a

-

-

-

10,126

-

(10,126)

-

Dividends

-

-

-

(1,243)

-

-

(1,243)

Total transactions with

owners of the Company

1,550

-

-

8,883

109

(10,126)

416

AASB 1060.61(c)

Balance at 30 June 2022

19,600

663

437

21,215

109

3,722

45,746

The notes on pages 18 to 67 are an integral part of these consolidated financial statements.

AASB 1060.26

a.

If the only changes to equity during the periods for which financial statements are presented arise from profit or loss, payment of

dividends, corrections of prior period errors, and changes in accounting policy, the entity may present a single statement of

income and retained earnings in place of the statement of comprehensive income and statement of changes in equity. Refer to

Appendix 1 for the illustrative consolidated statement of income and retained earnings.

Reporting Update

12RU-005

b.

Amounts transferred to the profits reserve characterise profits available for distribution as dividends in future years and reflects

the amounts transferred by individuals in the Group and is therefore not necessarily equivalent to the consolidated Group profit for

the year.

Example Simplified Disclosures Proprietary Ltd

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 16

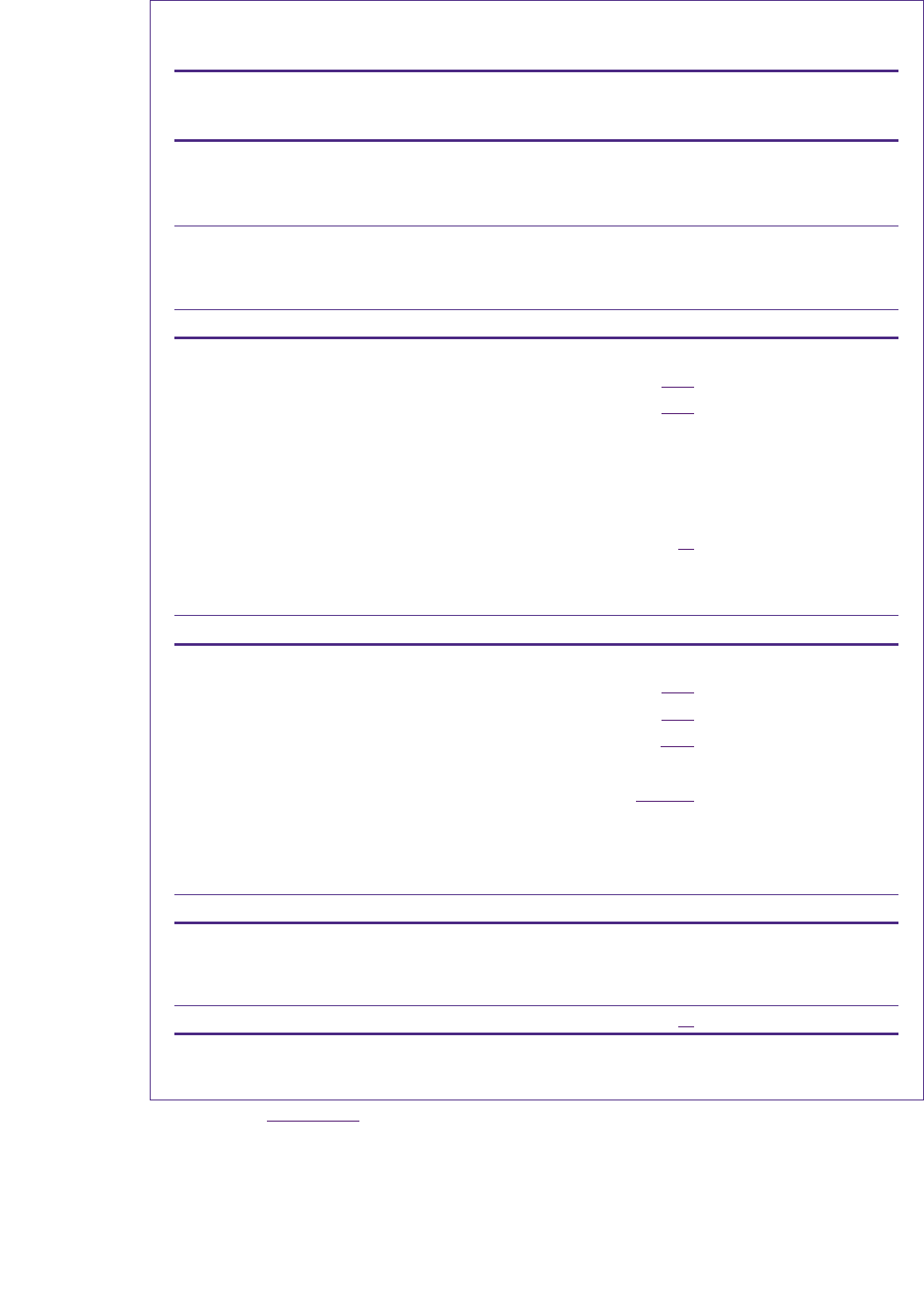

AASB 1060.25(d), 30

Consolidated statement of cash flows

AASB 1060.31(c)

For the year ended 30 June

AASB 1060.20-21, 28-29,

31(d), 66, 92

In thousands of dollars

Note

2022

2021

AASB 1060.70(a)

Cash flows from operating activities

a

Cash receipts from customers

94,352

97,996

Cash paid to suppliers and employees

(90,377)

(94,149)

Cash generated from operating activities

3,975

3,847

AASB 1060.82-83

Interest paid

b, c

(1,609)

(1,289)

AASB 1060.85

Income taxes paid

(400)

(1,913)

AASB 1060.71

Net cash from operating activities

1,966

645

AASB 1060.74, 86

Cash flows from investing activities

AASB 1060.68(a)

Acquisition of property, plant and equipment

15(A)

(15,657)

(2,228)

AASB 1060.68(a)

Development expenditure

16(A)

(1,235)

(503)

AASB 1060.68(b)

Proceeds from sale of property, plant and equipment

3,085

397

Disposal of discontinued operation, net of cash disposed of

10,890

-

AASB 1060.68(c), (g)

Acquisition of other investments

(359)

(363)

AASB 1060.68(d), (h)

Proceeds from sale of investments

1,476

534

AASB 1060.74

Acquisition of subsidiary, net of cash acquired

26

(2,560)

-

AASB 1060.82-83

Interest received

c

6

19

AASB 1060.82-83

Dividends received

c

26

32

Net cash used in investing activities

(4,328)

(2,112)

AASB 1060.74, 86

Cash flows from financing activities

AASB 1060.69(a)

Proceeds from issue of share capital

19(A)

1,550

-

AASB 1060.69(c)

Proceeds from issue of convertible notes

20(C)

5,000

-

AASB 1060.69(c)

Proceeds from issue of redeemable preference shares

20(D)

2,000

-

AASB 1060.69(c)

Proceeds from loans and borrowings

591

4,439

Transaction costs related to loans and borrowings

20(C)–(D)

(311)

-

AASB 1060.69(d)

Repayment of borrowings

(5,055)

(2,445)

AASB 1060.69(e)

Payment of lease liabilities

b

(554)

(590)

AASB 1060.82, 84

Dividends paid

c

(1,243)

(571)

Net cash from financing activities

1,978

833

Net decrease in cash and cash equivalents

(384)

(634)

AASB 1060.88

Cash and cash equivalents at 1 July*

1,567

2,226

AASB 1060.81

Effect of movements in exchange rates on cash held

(13)

(25)

AASB 1060.88

Cash and cash equivalents at 30 June*

13

1,170

1,567

AASB 1060.65

* Cash and cash equivalents includes bank overdrafts that are repayable on demand and form an integral part of the Group’s

cash management.

The notes on pages 18 to 67 are an integral part of these consolidated financial statements.

Example Simplified Disclosures Proprietary Ltd

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 17

AASB 1060.70

a.

The Group has elected to present cash flows from operating activities using the direct method. Alternatively, an entity may

present operating cash flows using the indirect method, whereby profit or loss is adjusted for the effects of non-cash transactions

(see Example Public Company Limited: Guide to annual reports – illustrative disclosures 2021-2022 for example presentation).

AASB 1060.69(e),

AASB 16.50

b.

The Group has classified:

–

cash payments for the principal portion of lease payments as financing activities;

–

cash payments for the interest portion of lease liabilities as operating activities consistent with the presentation of interest

payments chosen by the Group (see footnote (c) below); and

–

short-term lease payments and payments for leases of low-value assets as operating activities.

AASB 1060.82-84,

Insights 2.3.50.10-20

c.

AASB 1060 requires cash flows from interest and dividends received and paid to be disclosed separately. In our view, such

disclosure is required in the statement of cash flows, rather than in the notes. In the absence of specific guidance in the

Standards, an entity chooses an accounting policy, to be applied consistently, for classifying interest and dividends paid as either

operating or financing activities, and interest and dividends received as either operating or investing activities. The Group has

elected to classify cash flows from interest paid as operating activities, cash flows from interest received and dividends received

as investing activities, and cash flows from dividends paid as financing activities.

Interest paid includes the interest portion of the lease liabilities. See footnote (b) above.

Example Simplified Disclosures Proprietary Ltd

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 18

AASB 1060.25(e), 28-30,

91–94

Notes to the consolidated financial statements

a

1. Reporting entity

AASB 1060.31(a), 32(a)

Example Proprietary Limited (the ‘Company’) is domiciled in Australia. The Company’s registered office is at

[address].

AASB 1060.31(b), 104(a)

These consolidated financial statements comprise the Company and its subsidiaries (together referred to as the

‘Group’).

AASB 1060.11(b), 32(b)

The Group is a for-profit entity and is primarily involved in manufacturing paper and paper-related products.

2. Basis of preparation

AASB 1060.10, 11(a),

104(a),

Corporations Act 2001

Sect 296-297

These consolidated financial statements are general purpose financial statements for distribution to the members

and for the purpose of fulfilling the requirements of the Corporations Act 2001. They have been prepared in

accordance with Australian Accounting Standards – Simplified Disclosures made by the Australian Accounting

Standards Board and the Corporations Act 2001.

AASB 1060.208

AASB 1053.E4

These consolidated financial statements are the first general purpose financial statements prepared in accordance

with Australian Accounting Standards – Simplified Disclosures. In the prior year the consolidated financial

statements were general purpose financial statements prepared in accordance with Australian Accounting

Standards – Reduced Disclosure Requirements. There was no impact on the recognition and measurement of

amounts recognised in the statements of financial position, profit and loss and other comprehensive income and

cash flows of the Group as a result of the change in the basis of preparation.

b,c

AASB 1060.186

These consolidated financial statements were authorised for issue by the Company’s board of directors on [date].

AASB 91(a), 94

Details of the Group’s accounting policies are included in Note 35.

3. Functional and presentation currency and rounding

AASB 1060.31(d)-(e),

181,

ASIC Instrument

2016/191

These consolidated financial statements are presented in Australian dollars, which is the Company’s functional

currency. The Group is of a kind referred to in ASIC Corporations (Rounding in Financial/Directors’ Reports)

Instrument 2016/191 and in accordance with that instrument, amounts in the consolidated financial statements

and directors’ report have been rounded to the nearest thousand, unless otherwise indicated.

d

AASB 1060.92–93

a.

Notes are presented, to the extent practicable, in a systematic order and are cross-referred to/from items in the primary

statements. In determining a systematic manner of presentation, an entity considers the effect on the understandability and

comparability of the financial statements. The Group has applied judgement in presenting related information together in a manner

that it considers to be most relevant to an understanding of its financial performance and financial position. The order presented is

only illustrative and entities need to tailor the organisation of the notes to fit their specific circumstances.

AASB 1060.26

b.

While AASB 1060 includes certain presentation requirements, these do not result in presentations or classifications that are

different to those required for Tier 1 entities. Entities are permitted to refer to other Standards for guidance on the requirements

in AASB 1060. The only exception is the option not to include a separate statement of changes in equity in certain circumstances,

as set out below.

If an entity elects to present a single statement of income and retained earnings in place of the statement of comprehensive

income and statement of changes in equity, this should be disclosed. The appropriate wording would be:

“The only changes to equity during the periods for which the financial statements are presented arise from [profit or loss,

payment of dividends, corrections of prior period errors, and changes in accounting policy] [delete those items that are not

applicable]. In accordance with the options available in the accounting standards, the Group has elected to present a single

statement of income and retained earnings in place of the statement of comprehensive income and statement of changes in

equity.”

c.

Where prior to AASB 1060 all recognition and measurement requirements of Australian Accounting Standards (including

consolidation and equity accounting) were not applied, refer to

Appendix 2 for disclosures.

ASIC Instrument

2016/191

d.

Where an entity applies the rounding relief available in ASIC Instrument 2016/191, certain amounts are required to be rounded to

a lower level. ASIC Instrument 2016/191 specifies those amounts with reference to particular disclosure paragraphs in AAS (e.g.

AASB 2.50, AASB 124.17). The ASIC Instrument has not been updated for the equivalent paragraphs in AASB 1060 where an

entity applies Tier 2 – Simplified Disclosures. This guide applies the requirements in the legislative instrument as if it refers to the

corresponding disclosure requirements in AASB 1060.

Example Simplified Disclosures Proprietary Ltd

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 19

Notes to the consolidated financial statements (continued)

4. Use of judgements and estimates

In preparing these consolidated financial statements, management has made judgements and estimates that

affect the application of the Group’s accounting policies and the reported amounts of assets, liabilities, income

and expenses. Actual results may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing basis. Revisions to estimates are recognised

prospectively.

AASB 1060.96

A. Judgements

Information about judgements made in applying accounting policies that have the most significant effects on the

amounts recognised in the financial statements is included in the following notes:

–

Note 17 – investments in associates: whether the Group has significant influence over an associate;

–

Note 27(A

) – lease term: whether the Group is reasonably certain to exercise extension options;

–

Note 35(D)

– revenue recognition: whether revenue from made-to-order paper products is recognised over

time or at a point in time.

AASB 1060.97

B. Assumptions and estimation uncertainties

a

Information about assumptions and estimation uncertainties at 30 June 2022 that have a significant risk of

resulting in a material adjustment to the carrying amounts of assets and liabilities in the next financial year is

included in the following notes:

–

Note 10(F) – recognition of deferred tax assets: availability of future taxable profit against which deductible

temporary differences and tax losses carried forward can be utilised;

–

Note 12(B)

– measurement of ECL allowances for trade receivables and contract assets: determining loss

rates;

–

Note 16(C)

– impairment test of intangible assets and goodwill: key assumptions underlying recoverable

amounts; and

–

Notes 23 and 29

– recognition and measurement of provisions and contingencies: key assumptions about the

likelihood and magnitude of an outflow of resources.

5. Discontinued operation

b

See accounting policy in Note 35(C).

AASB 1060.91(c)

In August 2021, the Group sold its entire packaging line of business. Management committed to a plan to sell this

business in mid-2021, following a strategic decision to place greater focus on the Group’s key competencies – i.e.

the manufacture of paper used in the printing industry and forestry.

The packaging business was not previously classified as held-for-sale or as a discontinued operation. The

comparative consolidated statement of profit or loss and OCI has been re-presented to show the discontinued

operation separately from continuing operations.

Subsequent to the disposal, the Group has continued to purchase packaging from the discontinued operation.

Although intra-group transactions have been fully eliminated in the consolidated financial results, management

has elected to attribute the elimination of transactions between the continuing operations and the discontinued

operation before the disposal in a way that reflects the continuance of these transactions subsequent to the

disposal, because management believes this is useful to the users of the financial statements.

To achieve this presentation, management has eliminated from the results of the discontinued operation the inter-

company sales (and costs thereof, less unrealised profits) made before its disposal. Because purchases from the

discontinued operation will continue after the disposal, inter-company purchases made by the continuing

operations before the disposal are retained in continuing operations.

AASB 1060.97

a.

An entity discloses information about the key assumptions concerning the future, and other key sources of information

uncertainty at the reporting date, that have a significant risk of causing a material adjustment to the carrying amount of assets and

liabilities within the next financial year

b.

AASB 1060 only requires the impact of a discontinued operation on the financial performance of the entity to be disclosed. No

other specific disclosures are required. The Group has disclosed information relating to the discontinued operation to provide

users of the financial statements with an understanding of the transactions that occurred during the financial year.

Example Simplified Disclosures Proprietary Ltd

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 20

Notes to the consolidated financial statements (continued)

6. Revenue

See accounting policy in Note 35(D).

The Group generates revenue primarily from sale of paper and provision of forestry services to its customers.

Other sources of revenue include immaterial amounts related to hedge accounting and hedging gains.

AASB 1060.157(b)

In the following table, revenue from contracts with customers (excluding revenue related to a discontinued

operation) is disaggregated by primary geographical market, major products and service lines and timing of

revenue recognition.

a

For the year ended 30 June

Total

In thousands of dollars

2022

2021

Primary geographical markets

Australia and New Zealand

81,903

78,098

United States

20,491

18,323

102,394

96,421

Major products/service lines

Standard paper products

70,855

66,862

Made-to-order paper products

23,618

22,287

Forestry services

3,967

3,483

Other

3,954

3,789

102,394

96,421

Timing of revenue recognition

Products transferred at a point in time

74,386

70,205

Products and services transferred over time

28,008

26,216

Revenue from contracts with customers

102,394

96,421

Other revenue

6

(4)

External revenue

102,400

96,417

AASB 15.B87–B89

a.

The extent to which an entity’s revenue is disaggregated for the purposes of this disclosure depends on the facts and

circumstances of the entity’s contracts with customers.

In determining the appropriate categories, an entity considers how revenue is disaggregated in:

–

disclosures presented outside the financial statements;

–

information reviewed by the chief operating decision maker for evaluating the financial performance of operating segments;

and

–

other similar information that is used by the entity or users of the entity’s financial statements to evaluate performance or

make resource allocation decisions.

Examples of categories that might be appropriate in disclosing disaggregated revenue include, but are not limited to, the

following.

Type of category

Example

Type of good or service

Major product lines

Geographic region

Country or region

Market or type of customer

Government and non-government customers

Type of contract

Fixed-price and time-and-materials contracts

Contract duration

Short-term and long-term contracts

Timing of transfer of goods or services

Goods or services transferred to customers:

–

at a point in time

–

over time

Sales channels

Goods or services sold:

–

directly to consumers

–

through intermediaries

Example Simplified Disclosures Proprietary Ltd

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 21

Notes to the consolidated financial statements (continued)

7. Income and expenses

a

A. Other income

In thousands of dollars

Note

2022

2021

AASB 1060.160(a),

AASB 120.29

Government grants

22(A)

238

-

Gain on sale of property, plant and equipment

26

16

264

16

AASB 1060.91(c)

B. Other expenses

b

In thousands of dollars

Note

2022

2021

Impairment loss on goodwill

c

16(C)

116

-

Impairment loss on remeasurement of disposal group

35

-

Impairment loss on trade receivables and contract assets

12(B)

200

190

Onerous contract charge

23(D)

160

-

Earthquake-related expenses

359

-

870

190

8. Net finance costs

See accounting policies in Notes 35(G) and (L).

In thousands of dollars

Note

2022

2021

AASB 1060.119(b)

Finance income under the effective interest method on

financial assets not measured at FVTPL

202

124

Remeasurement to fair value of pre-existing interest in an

acquiree

26

250

-

AASB 1060.119(a)(i)

Financial assets at FVTPL – net change in fair value

582

245

Finance income – other

832

245

AASB 1060.119(c)

Finance costs – impairment loss on debt securities

18

(62)

(13)

AASB 1060.119(a)(iv)

Financial liabilities at amortised cost – interest expense

(1,523)

(1,299)

AASB 1060.180(a)

Net foreign exchange loss

(239)

(266)

AASB 1060.122(d)

Cash flow hedges – reclassified from OCI

17

12

Unwind of discount on site restoration provision

23

(60)

(50)

Finance costs – other

(1,805)

(1,603)

Net finance costs recognised in profit or loss

(833)

(1,247)

AASB 1060.162

The Group has capitalised $231 thousand (2021: $12 thousand) of borrowing costs related to the acquisition of

land, the construction of the factory and the development of a new process in one of the factories.

AASB 1060.BC81

a.

Entities applying AASB 1060 are still expected to disclose information that is not presented elsewhere but that is relevant to an

understanding of the financial statement in accordance with paragraph 91(c). This would include information about individually

material items of income and expense where information about these items is necessary to assess the entity’s financial

performance.

Insights 4.1.30.10–40

b.

There is no guidance in the Standards on how specific expenses are allocated to functions. An entity establishes its own

definitions of functions. In our view, cost of sales includes only expenses directly or indirectly attributable to the production

process. Only expenses that cannot be allocated to a specific function are classified as ‘other expenses’.

AASB 1060.169-170,

Insights 3.10.410.20

c.

The Group has classified expenses by function and has therefore allocated the impairment loss to the appropriate function, where

possible. In our view, in the rare case that an impairment loss cannot be allocated to a function, it should be included in ‘other

expenses’ as a separate line item if it is significant (e.g. impairment of goodwill), with additional information given in a note.

Example Simplified Disclosures Proprietary Ltd

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 22

Notes to the consolidated financial statements (continued)

9. Share-based payment arrangements

a

See accounting policy in Note 35(E)(ii).

AASB 1060.164(a)

At 30 June 2022, the Group had only one type of share-based payment arrangements

b,c

– cash-settled share

appreciation rights (SARs).

On 1 July 2016 and 1 July 2021, the Group granted 100,000 and 300,000 SARs, respectively, to employees that

entitle them to a cash payment after three years of service. The SARs expire at the end of a five-year period after

grant date. The amount of the cash payment is determined based on the increase in the share price of the

Company between grant date and the time of exercise.

Details of the liabilities arising from the SARs were as follows.

In dollars

Note

2022

2021

AASB 1060.168(b)

Total carrying amount of liabilities for SARs

439,950

379,500

AASB 1060.166,

AASB 2.33A

The fair value of the SARs has been measured using the Black-Scholes formula. Service and non-market

performance conditions attached to the arrangements were not taken into account in measuring fair value.

AASB 1060.168(a)

The Group has recognised in profit or loss the share-based expense of $439,950 (2021: $5,850).

10. Income taxes

d

See accounting policy in Note 35(H).

A. Amounts recognised in profit or loss

In thousands of dollars

2022

2021

Current tax expense

AASB 1060.177(a)

Current year

1,707

3,352

AASB 1060.177(b)

Changes in estimates related to prior years

116

(34)

1,823

3,318

Deferred tax expense

AASB 1060.177(c)

Origination and reversal of temporary differences

77

(865)

AASB 1060.177(e)

Recognition of previously unrecognised tax losses

(50)

(240)

AASB 1060.177(e)

Recognition of previously unrecognised (derecognition of

previously recognised) deductible temporary differences

(13)

10

14

(1,095)

Tax expense on continuing operations

1,837

2,223

ASIC Instrument

2016/191

a.

Where an entity applies the rounding relief available in ASIC Instrument 2016/191, certain amounts are required to be rounded to

a lower level. ASIC Instrument 2016/191 specifies those amounts with reference to particular disclosure paragraphs in AAS (e.g.

AASB 2.50, AASB 124.17). The ASIC Instrument has not been updated for the equivalent paragraphs in AASB 1060 where an

entity applies Tier 2 – Simplified Disclosures. This guide applies the requirements in the legislative instrument as if it refers to the

corresponding disclosure requirements in AASB 1060.

AASB 1060.164(b)

b.

Where an entity has share options, it discloses the number and weighted average exercise prices for each of the following groups

of options:

–

outstanding at the beginning of the period;

–

granted during the period;

–

forfeited during the period;

–

exercised during the period;

–

expired during the period;

–

outstanding at the end of the period; and

–

exercisable at the end of the period.

AASB 1060.165

c.

Where an entity has equity-settled share-based payment arrangements, it discloses how it measured the fair value of goods or

services received or the value of equity instruments granted. If a valuation methodology was used, the entity discloses the

method and its reason for choosing it.

d.

The changes in tax laws and the tax rates disclosed or applied throughout this guide to calculate the tax impact amounts are for

illustrative purposes only and do not reflect actual changes in tax laws or corporate tax rates in the respective jurisdictions. In

practice, the applicable changes in tax laws need to be considered. All tax impacts are calculated using the tax rate of 33%.

Example Simplified Disclosures Proprietary Ltd

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 23

Notes to the consolidated financial statements (continued)

10. Income taxes

(continued)

B. Amounts recognised in OCI and equity

In thousands of dollars

2022

2021

Tax expense (benefit)

AASB 1060.178(a)

Items recognised in OCI

(16)

29

AASB 1060.178(b)

Items recognised directly in equity

54

-

C. Reconciliation of effective tax rate

a

In thousands of dollars

2022

2022

2021

2021

AASB 1060.178(c)

Profit before tax from continuing operations

6,288

8,135

Tax using the Company’s domestic tax rate

33.00%

2,075

33.00%

2,685

Effect of tax rates in foreign jurisdictions

b

(1.06%)

(88)

(0.66%)

(54)

Tax effect of:

- Share of profit of associates, net of tax

4.53%

(377)

2.38%

(194)

- Non-deductible expenses

2.95%

245

0.44%

36

- Tax-exempt income

(0.29%)

(24)

(0.61%)

(50)

- Tax incentives

(1.06%)

(88)

(0.77%)

(63)

- Current-year losses for which no deferred tax asset is

recognised

0.49%

41

1.56%

127

Recognition of previously unrecognised tax losses

(0.60%)

(50)

(2.95%)

(240)

Recognition of previously unrecognised (derecognition of

previously recognised) deductible temporary differences

(0.16%)

(13)

0.12%

10

Changes in estimates related to prior years

1.39%

116

(0.42%)

(34)

32.06%

1,837

26.82%

2,223

AASB 1060.178(c)

a.

Rather than presenting either a numerical reconciliation between total tax expense and the product of accounting profit multiplied

by the applicable tax rates, or a numerical reconciliation between the average effective tax rate and the applicable tax rate, the

Group has elected to present both. Only one form is required to be presented.

b.

The Group’s reconciliation of the effective tax rate is based on its domestic tax rate, with a reconciling item in respect of tax rates

applied by Group companies in other jurisdictions. The reconciliation of the effective tax rate is based on an applicable tax rate that

pr

ovides the most meaningful information to users. In some cases, it might be more meaningful to aggregate separat

e

reconciliations prepared using the domestic tax rate in each individual jurisdiction.

Example Simplified Disclosures Proprietary Ltd

©2021 KPMG, an Australian partnership and a member firm of the KPMG global organisation of independent member firms affiliated with

KPMG International Limited, a private English company limited by guarantee. All rights reserved. The KPMG name and logo are trademarks

used under license by the independent member firms of the KPMG global organisation. Liability limited by a scheme approved under

Professional Standards Legislation. 24

Notes to the consolidated financial statements (continued)

10. Income taxes (continued)

AASB 1060.178(e)

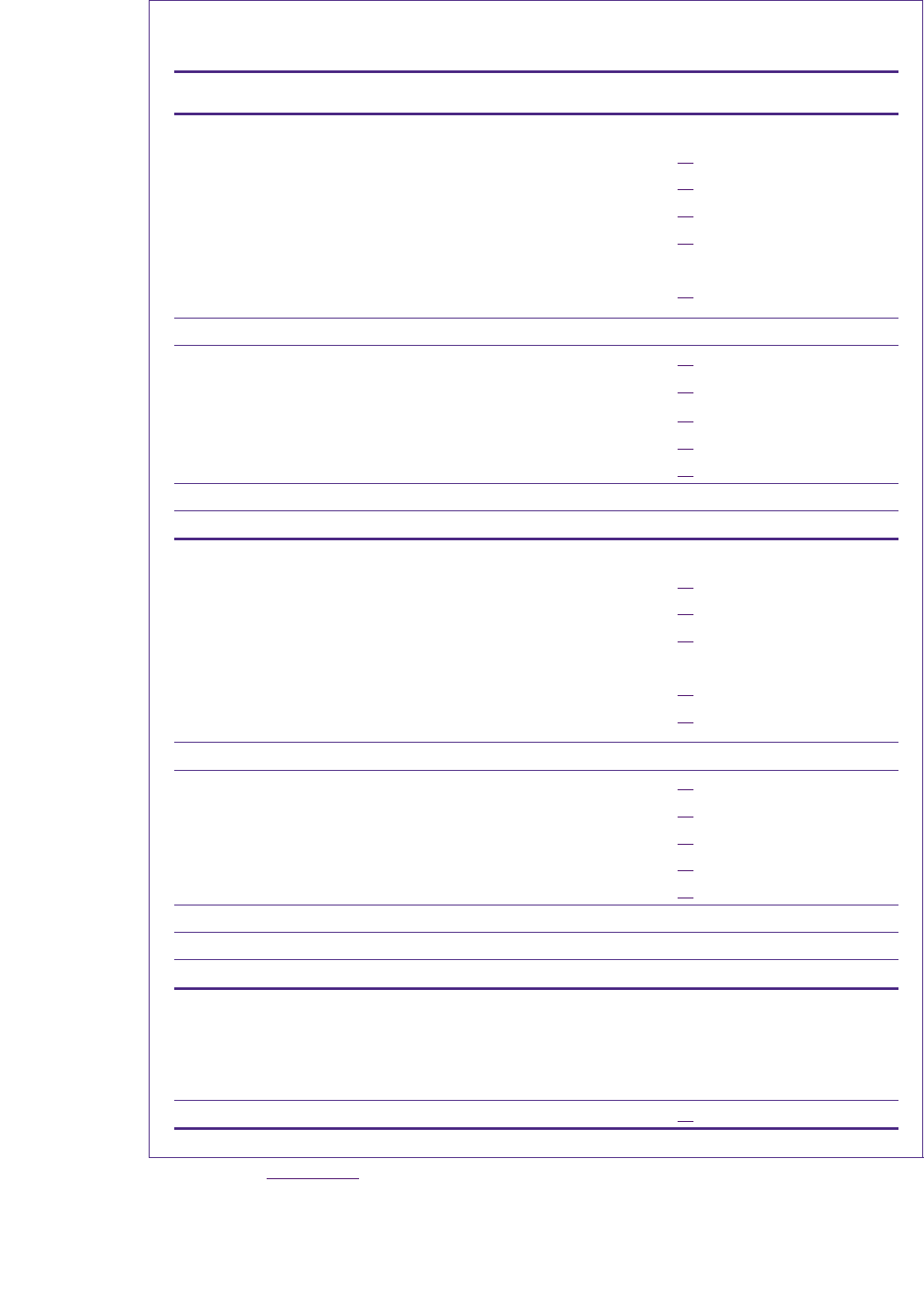

D. Movement in deferred tax balances

Balance at 30 June

In thousands of dollars

Net

balance

at 1 July

Recogn.

in profit

or loss

Recogn.

in OCI

Recogn.

directly

in equity

Acquired

in bus.

comb.

Other

Net

Deferred

tax

assets

Deferred

tax

liabilities

2022

Property, plant and

equipment

443

(241)

-

-

(35)

210

377

553

(176)

Leases

132

54

-

-

-

-

186

186

-

Intangible assets

56

4

-

-

(38)

-

22

98

(76)

Investment in securities

38

(7)

24

-

-

-

55

82

(27)

Trade and other receivables

53

17

-

-

-

-

70

70

-

Derivatives

(40)

(5)

16

-

-

-

(29)

2

(31)

Inventories

64

96

-

-

(3)

40

197

197

-

Loans and borrowings

-

-

-

(54)

(9)

-

(63)

-

(63)

Provisions

417

8

(24)

-

6

-

407

661

(254)

Deferred income

54

(15)

-

-

-

-

39

39

-

Other items

14

25

-

-

-

39

50

(11)

Tax losses carried forward

386

50

-

-

-

-

436

436

-

Tax assets (liabilities)

before set-off

1,617

(14)

16

(54)

(79)

250

1,736

2,374

(638)

Set-off of tax

-

(387)

387

Net tax assets (liabilities)

1,736

1,987

(251)

2021

Property, plant and

equipment

84

359

-

-

-

-

443

526

(83)

Leases

125

7

-

-

-

-

132

132

-

Intangible assets

(38)

94

-

-

-

-

56

94

(38)

Investment in securities

(18)

61

(5)

-

-

-

38

92

(54)

Trade and other receivables

-

53

-

-

-

-

53

53

-

Derivatives

(12)

1

(29)

-

-

-

(40)

3

(43)