Report on the Internal Controls for

Private Wealth Management Custody

Services of Morgan Stanley Wealth

Management Australia Pty Ltd

ASAE 3402 report for the period 1 July 2019 to

30 June 2020

2

Table of contents

I. Executive Summary

3

II. Statement by the Service Organisation

8

III. Description of the System accompanying the Statement by

the Service Organisation

11

IV. Independent Service Auditor's Assurance Report on the

Description of Controls, their Design and Operating

Effectiveness

23

V. Overview of Work Performed

27

VI. Control Objectives, Control Activities, Testing of Design and

Implementation and Operating Effectiveness

32

VII. Other Information Provided by the Service Organisation that

does not form part of our Opinion

77

3

Section I:

Executive Summary

4

Section I: Executive Summary

Overview

This report has been prepared to provide clients (or “users”) of Morgan Stanley Wealth Management

Australia Pty Ltd (“MSWM”)’s Private Wealth Management (“PWM”) custody services with a description of its

system of internal controls. The system, or internal control environment, is an essential component of an

organisation’s governance structure. The objectives of an internal control system are to provide reasonable,

but not absolute assurance as to the integrity and reliability of the financial information, the protection of

assets from unauthorised use, and that transactions are valid. The management of MSWM have established

and maintained an internal control system that monitors compliance with established policies and

procedures.

This report will be provided to relevant users and their auditors, who have a sufficient understanding to

consider it, along with other information including information about controls operated by users themselves,

so they may assess the risks of material misstatements of users’ financial reports. It may be provided to

others as authorised by MSWM and Deloitte Touche Tohmatsu (“Deloitte”).

Scope

The scope of this report includes the description of MSWM’s PWM custody services throughout the period

from 1 July 2019 to 30 June 2020 (the description), and on the design and operating effectiveness of controls

related to the control objectives stated in the description.

This report has been prepared in accordance with Australian Standard on Assurance Engagements 3402

Assurance Reports on Controls at a Service Organisation (“ASAE 3402”). ASAE 3402 conforms with the

International Standard for Assurance Engagements 3402 Assurance Reports on Controls at a Service

Organization (“ISAE 3402”).

The control objectives in this report are directly referenced from Guidance Statement GS 007 Audit

Implications of the Use of Service Organisations for Investment Management Services (“GS 007” or “the

Guidance Statement”), issued by the Auditing and Assurance Standards Board in Australia.

The specific controls set out in Section VI of the report have been designed to achieve each of the control

objectives. The controls have been in place throughout the period from 1 July 2019 to 30 June 2020 unless

otherwise indicated.

Specifically excluded from the scope of the report are complementary user entity controls, that is, controls

assumed to be implemented by customers for stated control objectives to be met. Also excluded from the

scope are other services provided by us not described in the description of the system and control activities.

This report includes controls operated by internal affiliates of MSWM who perform functions to support the

custody services MSWM provides to its PWM clients.

This report does not include (carved out) controls at external sub-service organisations of MSWM. The

effectiveness of controls performed by users and their service providers should also be considered as part

of the overall system of controls.

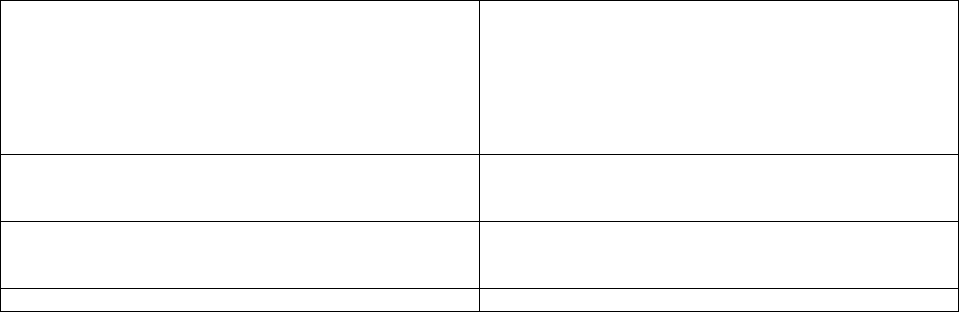

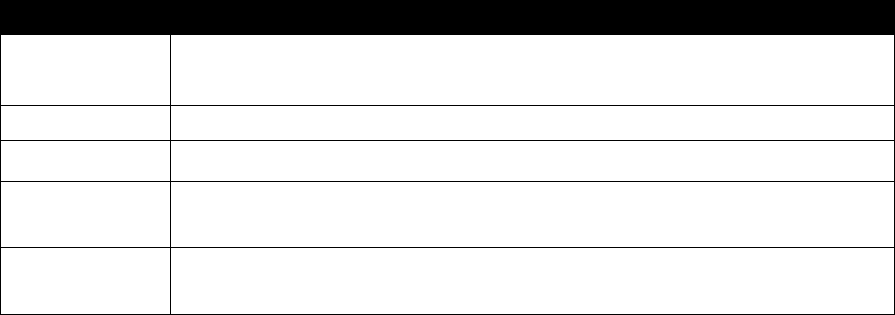

Summary of results

Below is a summary of the service auditor’s results and conclusions, by control objective. This summary of

results does not provide all details relevant for users and their auditors and should be read in conjunction

with the entire report. The details of the specific controls tested, and the nature, timing and extent of

those tests, are listed in Section VI.

5

Control Objective

Number of

controls

effectively

designed and

operated

Number of

controls per

control

objective

Results

Conclusion (in

all material

respects)

A.1 New accounts are set up

completely and accurately in

accordance with client agreements

and any applicable regulations.

2

2

No deviations

noted

Control objective

met

A.2 Complete and authorised client

agreements are established prior to

initiating custody activity.

1

1

No deviations

noted

Control objective

met

A.3 Investment and related cash and

foreign exchange transactions are

authorised and recorded completely,

accurately and on a timely basis in

accordance with client instructions.

4

4

No deviations

noted

Control objective

met

A.4 Investment and related cash and

foreign exchange transactions are

settled completely, accurately and

on a timely basis and failures are

resolved in a timely manner.

2

2

No deviations

noted

Control objective

met

A.5 Corporate actions are identified,

actioned, processed and recorded on

a timely basis.

4

4

No deviations

noted

Control objective

met

A.6 Cash receipts and payments are

authorised, processed and recorded

completely, accurately and on a

timely basis

2

2

No deviations

noted

Control objective

met

A.7 Securities lending programs are

authorised and loan initiation,

maintenance and termination are

recorded on an accurate and timely

basis.

N/A – MSWM does not provide its PWM clients securities lending services

A.8 Loans are collateralised in

accordance with the lender’s

agreement and the collateral

together with its related income is

recorded completely, accurately and

on a timely basis.

N/A – MSWM does not provide its PWM clients loan services

A.9 Collateral is completely and

accurately invested in accordance

with the lender’s agreement.

N/A – MSWM does not obtain collateral from its PWM clients

A.10 Accounts are administered in

accordance with client agreements

and any applicable regulations.

3

3

No deviations

noted

Control objective

met

A.11 Changes to non-monetary

static data (for example, address

changes and changes in allocation

instructions) are authorised and

correctly recorded on a timely basis.

2

2

No deviations

noted

Control objective

met

A.12 Investment income and related

tax reclaims are collected and

recorded accurately and on a timely

basis.

4

4

No deviations

noted

Control objective

met

A.13 Asset positions for securities

held by third parties such as sub

custodians and depositories are

accurately recorded and regularly

reconciled.

2

2

No deviations

noted

Control objective

met

A.14 Assets held (including

investments held with depositories,

cash and physically held assets) are

safeguarded from loss,

misappropriation and unauthorised

use.

4

4

No deviations

noted

Control objective

met

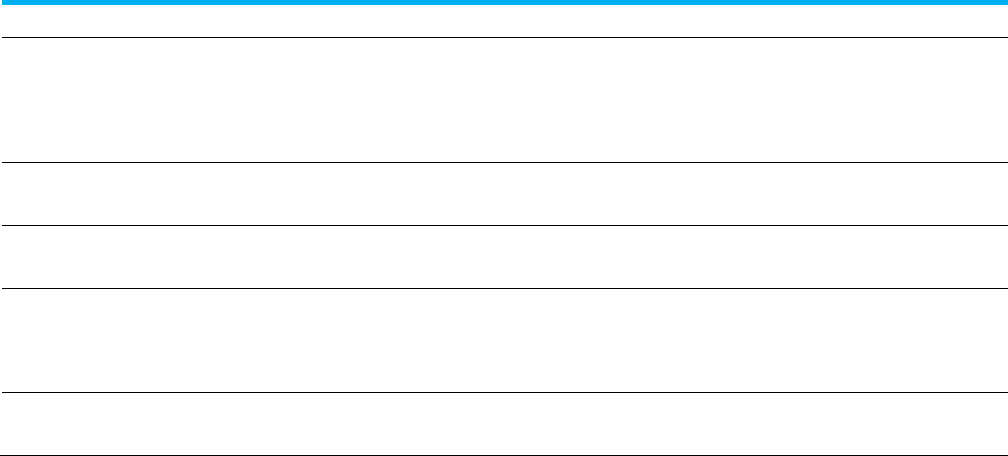

6

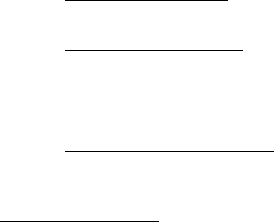

Control Objective

Number of

controls

effectively

designed and

operated

Number of

controls per

control

objective

Results

Conclusion (in

all material

respects)

A.15 Assets held are appropriately

registered and client money is

segregated.

Refer A.14

Refer A.14

No deviations

noted

Control objective

met

A.16 Transaction errors are rectified

promptly.

3

3

No deviations

noted

Control objective

met

A.17 Appointments of subservice

organisations, including sub-

custodians, are approved, subservice

organisations are managed in

accordance with the requirements of

the client agreement and their

activities are adequately monitored.

4

4

No deviations

noted

Control objective

met

A.18 Client reporting in respect of

client asset holdings is complete and

accurate and provided within

required timescales.

3

3

No deviations

noted

Control objective

met

A.19 Asset positions and details of

securities lent (including collateral)

are reported to interested parties

accurately and within the required

time scale.

N/A – MSWM does not provide its PWM clients securities lending services

G.1 Physical access to computer

networks, equipment, storage media

and program documentation is

restricted to authorised individuals.

1

1

No deviations

noted

Control objective

met

G.2 Logical access to computer

systems, programs, master data,

client data, transaction data and

parameters, including access by

administrators to applications,

databases, systems and networks, is

restricted to authorised individuals

via information security tools and

techniques.

4

4

No deviations

noted

Control objective

met

G.3 Segregation of incompatible

duties is defined, implemented and

enforced by logical security controls

in accordance with job roles.

7

7

No deviations

noted

Control objective

met

G.4 IT processing is authorised and

scheduled appropriately and

deviations are identified and

resolved in a timely manner.

6

6

No deviations

noted

Control objective

met

G.5 Appropriate measures, including

firewalls and anti-virus software, are

implemented to counter the threat

from malicious electronic attack.

1

1

No deviations

noted

Control objective

met

G.6 The physical IT equipment is

maintained in a controlled

environment.

1

1

No deviations

noted

Control objective

met

G.7 Development and

implementation of new systems,

applications and software, and

changes to existing systems,

applications and

Software, are authorised, tested,

approved, implemented and

documented.

8

7

Deviation noted.

Refer Section VI

G.7

Control objective

met

G.8 Data migration or modification is

authorised, tested and, once

performed, reconciled back to the

source data.

2

2

No deviations

noted

Control objective

met

7

Control Objective

Number of

controls

effectively

designed and

operated

Number of

controls per

control

objective

Results

Conclusion (in

all material

respects)

G.9 Data and systems are backed up

regularly offsite and regularly tested

for recoverability on a periodic basis.

1

1

No deviations

noted

Control objective

met

G.10 IT hardware and software

issues are monitored and resolved in

a timely manner.

1

1

No deviations

noted

Control objective

met

G.11 Business and information

systems recovery plans are

documented, approved, tested and

maintained.

2

2

No deviations

noted

Control objective

met

G.12 Information Technology

services provided to clients are

approved, managed and

performance thresholds met in

accordance with the requirements of

the client agreement.

N/A – MSWM does not provide IT services to its PWM clients.

G.13 Appointment of sub-service

organisations, including those

providing IT services, are approved,

subservice organisations are

managed in accordance with the

requirements of the client

agreement and their activities are

adequately monitored.

1

1

No deviations

noted

Control objective

met

8

Section II:

Statement by the Service

Organisation

9

Section II: Statement by Morgan Stanley

Wealth Management Australia Pty Ltd

The accompanying description has been prepared for customers who have used the Private Wealth

Management (“PWM”) custody services and their auditors who have a sufficient understanding to consider

the description, along with other information including information about controls operated by customers

themselves, when assessing the risks of material misstatements of customers’ financial

reports/statements. Morgan Stanley Wealth Management Australia Pty Ltd (“MSWM”) confirms that:

(a) The accompanying description in Section III which includes control objectives and control activities

included in Section V fairly presents the PWM custody services throughout the period 1 July 2019

to 30 June 2020. The criteria used in making this statement were that the accompanying

description:

i. Presents how the system was designed and implemented, including:

• The types of services provided, including, as appropriate, classes of transactions

processed.

• The procedures, within both information technology and manual systems, by which

those transactions were initiated, recorded, processed, corrected as necessary, and

transferred to the reports prepared for customers.

• The related accounting records, supporting information and specific accounts that

were used to initiate, record, process and report transactions; this includes the

correction of incorrect information and how information was transferred to the

reports prepared for customers.

• How the system dealt with significant events and conditions, other than transactions

including the impact of COVID-19 as detailed in the “COVID-19 impact” section in

the description.

• The process used to prepare reports for customers.

• Relevant control objectives and controls designed to achieve those objectives.

• Controls that we assumed, in the design of the system, would be implemented by

customers, and which, if necessary, to achieve control objectives stated in the

accompanying description, are identified in the description along with the specific

control objectives that cannot be achieved by ourselves alone.

• Other aspects of our control environment, risk assessment process, information

system (including the related business processes) and communication, control

activities and monitoring controls that were relevant to processing and reporting

customers’ transactions.

ii. Includes relevant details of changes to MSWM’s system during the period 1 July 2019 to 30

June 2020.

10

iii. Does not omit or distort information relevant to the scope of the system being described,

while acknowledging that the description is prepared to meet the common needs of a

broad range of customers and their auditors and may not, therefore, include every aspect

of the system that each individual customer may consider important in its own particular

environment

(b) The controls related to the control objectives stated in the accompanying description were suitably

designed and operated effectively throughout the period 1 July 2019 to 30 June 2020. The criteria

used in making this statement were that:

i. The risks that threatened achievement of the control objectives stated in the description

were identified;

ii. The identified controls would, if operated as described, provide reasonable assurance that

those risks did not prevent the stated control objectives from being achieved; and

iii. The controls were consistently applied as designed, including that manual controls were

applied by individuals who have the appropriate competence and authority, throughout the

period 1 July 2019 to 30 June 2020.

Signed on behalf of Management of MSWM.

Astrid Ullmann

Chief Operating Officer

Morgan Stanley Wealth Management

23 October 2020

11

Section III:

Description of the System

accompanying the Statement by

the Service Organisation

12

Section III: Description of the System

accompanying the Statement by the

Service Organisation

Introduction

This report is designed to provide information to be used for financial reporting purposes by the clients of

Morgan Stanley Wealth Management Australia Pty Ltd (“MSWM”), their independent auditors and other

persons authorised by MSWM and Deloitte. The information in this report is prepared with reference to the

guidance in Standard on Assurance Engagements ASAE 3402 Assurance Reports on Controls at a Service

Organisation May 2017, and with reference to the guidelines contained in Guidance Statement GS 007 Audit

Implications of the Use of Service Organisations for Investment Services October 2011 (“GS 007” or “the

Guidance Statement”), issued by the Auditing and Assurance Standards Board (AUASB).

1 Overview of Operations and Applicability of Report

MSWM offers financial planning services, investment advice and stock broking services to Australian and

overseas residents (generally high net worth) who wish to invest locally and internationally.

MSWM’s international platform, known as ‘Private Wealth Management’ (“PWM”) provides clients with access

to a broad range of product offerings, including but not limited to international equities, fixed income

products, foreign exchange products, listed options, over-the-counter derivatives, structured products,

managed funds and other forms of offshore collective investment vehicles. Only clients that meet the

Wholesale Client test under the Corporations Act 2001 (Cth) are able to access the PWM platform.

1.1 General Overview of MSWM

MSWM’s immediate parent undertaking is Morgan Stanley Domestic Holdings Inc. MSWM’s ultimate

parent undertaking and controlling entity is Morgan Stanley & Co LLC (“MSCL”) which, together with

MSWM and Morgan Stanley’s other subsidiary undertakings, form the Morgan Stanley Group. MSWM

is:

a) a registered Australian proprietary company (ACN 009 145 555);

b) the holder of an Australian Financial Service Licence (AFSL) (Licence Number 240813) issued

by the Australian Securities & Investments Commission (ASIC);

c) a market participant of the financial market operated by the ASX Limited (ASX);

d) a clearing participant of ASX Clear Pty Limited; and

e) a settlement participant of ASX Settlement Pty Limited.

MSWM is also a member of the Australian Financial Markets Association.

13

1.2 Structure of PWM

In respect of MSWM’s PWM platform, MSWM acts as the introducing broker to a Morgan Stanley

affiliate in the United Kingdom, Morgan Stanley & Co International plc (MSIP). That is, MSWM has a

direct relationship with the clients of the PWM platform and provides financial advice and certain

administrative services to those clients, but MSIP is responsible for certain other functions, including

the provision of custody services.

MSIP (FCA registration number 165935) is authorised by the Prudential Regulatory Authority (“PRA”)

and regulated by the PRA and the Financial Conduct Authority (“FCA”) in the United Kingdom (“UK”).

MSIP is subject to the rules of the FCA (“FCA Rules”) with respect to holding of client assets, which

supplement common law principles of trust. The FCA Rules exist to protect client assets held with an

investment firm. FCA regulated financial services firms that hold client assets and client money are

subject to the Client Asset Sourcebook section of the FCA Rules (“CASS”), which sets out the

requirements relating to holding client assets and client money.

MSIP is exempt from the requirement in Australia to hold an AFSL under the Corporations Act 2001

(Cth) in respect of the provision of certain financial services. When providing financial services to

Australian wholesale clients, MSIP does so through reliance on ASIC Corporations (Repeal and

Transitional) Instrument 2016/396.

MSIP is registered as a foreign company in Australia (ARBN 613 032 705).

As noted above, MSIP is responsible for the provision of custody services in relation to assets held on

the PWM platform. MSIP does not accept orders or instructions directly from PWM clients – all

instructions are placed through MSWM. MSWM is responsible for:

(a) accepting and transmitting orders and instructions regarding investments;

(b) approving, opening and monitoring PWM accounts including obtaining, verifying and retaining

client account information and documents;

(c) determining whether persons placing instructions for the PWM accounts are authorised to do so;

(d) investigating and responding to any questions or client complaints related to the PWM accounts;

(e) maintaining the required books and records with respect to the functions it performs; and

(f) providing discretionary investment services in certain circumstances.

1.3 Applicability of Report

This report relates only to the PWM custody services provided to MSWM PWM clients. This report is

intended to provide an understanding of the description of the custody controls related to transactions

in equities, fixed income, cash, mutual funds, alternative investments, foreign exchange products,

listed options, over-the-counter derivatives, structured products, managed funds and other forms of

offshore collective investment vehicles. The control functions are located in Sydney, London, Hong

Kong, Singapore, India and the United States.

The report covers controls over the following areas with regard to accounts on the PWM platform:

• Account set-up and account modification

o Open new accounts, maintain existing accounts and update client account information, as

required, and in accordance with internal processes

• Trading, trade support and settlement

o Execution, booking and settlement of all trades executed through the MSIP platform

• Cash management

o Manage deposits and payments for all clients on the PWM platform

• Security transfers

o Process incoming and outgoing security transfers

• Errors handling

o Manage all errors in a timely manner and in accordance within defined Risk procedures

• Investment income and corporate income

o Process all investment related income directly to the client account

• Reconciliation

o Reconcile all positions and ensure all positions are accurately reflected on client accounts

• Custody

o Maintain client assets through agent Custodians and Sub-Custodians in different countries

and monitor the network of Custodians through an ongoing review process

14

• Client reporting

o Report all positions held in Custody and provide monthly reporting to all clients on the

PWM platform

• Information system security

o Maintain information security to the highest standards to protect business information from

modification and disruption

• Information system operations

o Internal systems used to process day-to-day transactions on the PWM platform

• Application development and maintenance, and

o Develop and maintain internal applications to ensure systems are up-to-date and software

product development is maintained effectively.

• Business continuity management.

o Global Business Continuity management plan that ensures the Firm is prepared in advance

for potential business-impacting incidents

For the above mentioned areas the operational and technology controls are the responsibility of MSWM

however many are operated by MSWM internal affiliates. Controls at internal affiliates MSIP, MSCL and

Morgan Stanley Institutional Securities Group (MSISG) are included in scope of this report to the extent

they relate to custody services provided to MSWM PWM clients. Refer to Section VI for these relevant

controls.

With regards to the custody process, MSIP may outsource certain functions to sub-custodians as part of

Morgan Stanley’s global custody network. These outsourced functions are controlled by Morgan Stanley’s

Global Network Management department. The report does not extend to the controls at sub-custodians.

Some MSWM clients have the custody service provided outside of Morgan Stanley by third party service

providers. This occurs in some circumstances for specific products (e.g. hedge funds). For these client

relationships, the activities handled by third party service providers are outside the scope of this report.

2 Business Structure

MSWM is dedicated to serving clients through a relationship based on advice, integrity and mutual trust.

When a new client comes to MSWM, the relationship begins with a discovery process; an in-depth dialogue

to identify all the factors surrounding and defining the client’s wealth. This includes the client’s short and

long-term goals and concerns, the structure of his or her holdings, and the client’s exposure to, and

tolerance for, risk.

The client’s dedicated team, along with Morgan Stanley’s wealth management specialists, then work with

the client to construct, implement and monitor a service that will help the client achieve his or her

objectives.

The MSWM business is divided in two key functions and responsibilities:

(a) Financial Advisers

Financial advisers are the client’s primary point of contact. They work closely with clients to devise the

appropriate investment approach. This may include developing and implementing a strategic asset

allocation and risk management solution. Thereafter, financial advisers work with the client to meet their

needs on a day-to-day basis. They ensure that any change in financial circumstances or risk profile is

reflected in the construction of the portfolio. The financial advisers also provide access to Morgan Stanley’s

global research and trading franchise and can provide additional investment solutions on an advisory

basis.

(b) Administration, risk management, technology and support

MSWM provides financial advisers and their clients support through a number of business activities

including the provision of investment research and products, holistic financial planning services and

portfolio administration activities. On a day-to-day basis, risk management controls assist financial

advisers to ensure that portfolios are being structured within agreed client risk tolerances. Oversight of the

business is conducted at multiple layers by risk management, business management and autonomous

compliance, legal and audit teams.

Through the Morgan Stanley’s PWM platform clients can receive real-time access to their portfolios via a

client web portal, called Matrix, as well as access to Morgan Stanley’s published research.

15

3 Control environment and risk management

The control environment is an essential component of an organisation’s governance structure and includes

the control consciousness of its people. It is the foundation for all other components of internal control,

providing discipline and structure. The objectives of an internal control structure is to provide reasonable,

but not absolute, assurance as to the integrity and reliability of the financial information, the protection of

assets from unauthorised use or disposition, and that transactions are executed in accordance with

management’s authorisation and client instructions. The management of MSWM have established and

maintained an internal control structure that monitors compliance with established policies and

procedures.

MSWM’s executive management are accountable to the Board of Directors of MSWM for monitoring the

system of internal control within the business. MSWM’s executive management have implemented an

internal control system designed to facilitate effective and efficient operations. The control environment

has been designed to enable management to respond appropriately to significant business, operational,

financial, compliance and other risks. The system of internal control contributes to ensuring adequate

control of internal and external reporting and compliance with applicable laws and regulations.

MSWM regards its internal control environment as fundamental to its business strategy. All business

development initiatives are required to adhere to stringent control standards.

The control objectives and related controls activities are described in more detail in Section VI. In

determining the controls and control objectives we took into account the following criteria:

• The risks that threatened achievement of the control objectives stated in the description were

identified;

• The identified controls would, if operated as described, provide reasonable assurance that those

risks did not prevent the stated control objectives from being achieved; and

• The description of the controls and control environment does not omit relevant information.

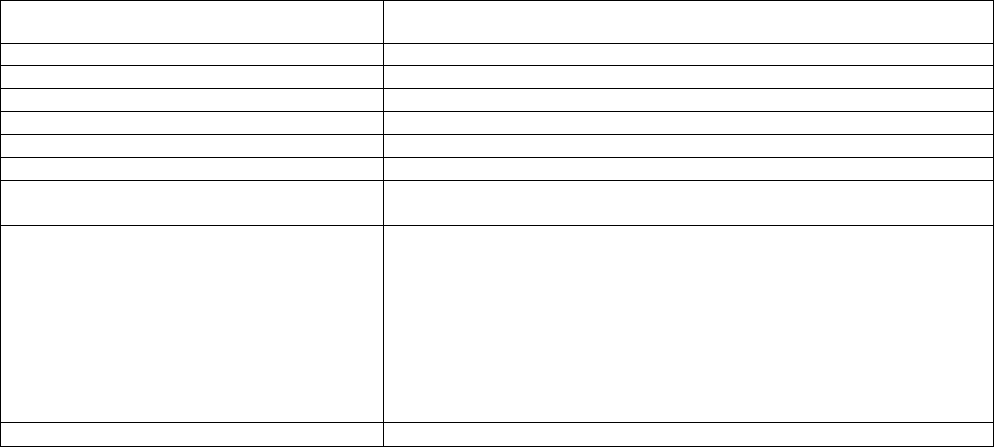

3.1 Organisational Structure

MSWM’s organisational structure provides a framework within which its business activities are planned,

executed, controlled and monitored. A significant aspect of the set structure is defining key areas of

authority and responsibility and establishing appropriate lines of reporting.

Organisational Chart

The organisational chart for the senior management of MSWM as at 30 June 2020 is shown below:

Functional Groups

The functional groups and their key responsibilities for areas in scope for this report are:

Group

Function

Branch Administration

Account set-up and modification

Errors handling

Risk Management

Risk monitoring

Business Continuity Management

Operations

New account set up

Client reporting

Head of MSWM

Ian Chambers

MSWM COO

Astrid

Ullmann

Investment

Platforms

Matthew

Nicholls

Research

Nathan Lim

Financial

Planning

Lisa Houlford

Marketing

Michael

Bortolotti

Risk

Management

Gordon

Davies

Legal

Jennifer Cho

Compliance

Katrina

Hillman

16

Trade support and settlement

Deposit and payments

Security transfers

Reconciliation

Investment income and corporate income

Corporate actions

Information Technology

Information system security

Information system operations

System development and maintenance

Sales & Marketing

Client interface

Trading

Cash management

Legal Entity Group

AML checks

3.2 Communication and Enforcement of Integrity and Ethical Values

For MSWM, maintaining an environment that demands integrity and ethical values is critical for the

establishment and maintenance of an effectively controlled organisation. The effectiveness of internal

controls cannot rise above the integrity and ethical values of the people who create, administer and

monitor them. Therefore MSWM Board and Management promote integrity and ethical values.

MSWM as well as the whole of Morgan Stanley focuses on recruiting only high quality individuals for

each position. MSWM provides specific rules, procedures and training for employees to fulfil the given

tasks in the best interest of the organisation.

MSWM adheres to the Morgan Stanley codes and policies (such as Code of Conduct, Non-

discrimination, and Anti-harassment policy) by requiring employees to read and acknowledge the

codes and policies. Morgan Stanley conducts regular training and education sessions that are

mandatory for employees. MSWM’s management expect employees to maintain high moral and ethical

standards.

Employees of MSWM have pre-clearance and reporting obligations with regards to employee securities

accounts, personal securities transactions, outside activities, private placements, gifts and

entertainment.

3.3 Assignment of Authority and Responsibility

The control environment is greatly influenced by the extent to which individuals recognise that they

are held accountable. MSWM encourages individuals and teams to use initiative in addressing issues

and solving problems. Management communicates, through various means (such as emails and

meetings), its policies describing appropriate business practices to the staff.

MSWM has developed departmental responsibilities and reporting structures to ensure that there is

adequate segregation of functions and duties throughout the business.

Key functions and duties are appropriately segregated as follows

• The front office (trade execution and processing) function must be segregated from the back-office

function (setting up new client accounts, reconciliation process and financial reporting);

• Compliance, legal and audit are separate functions and provides compliance and monitoring oversight

across the business.

3.4 Internal Audit Reviews

MSWM’s risks and controls are reviewed by Morgan Stanley’s Internal Audit department. Internal Audit

evaluates the adequacy and effectiveness of controls over MSWM’s governance, operations, and

information systems. Audit reports, which carry an audit rating and outline the degree to which

unacceptable risk exposures were identified, are presented to senior management. The audit reporting

process actively considers and recommends ways in which control weakness may be corrected or risks

may be mitigated. Management is required to respond to audit findings and to indicate target dates as

to when appropriate corrective action will be completed.

17

3.5 Risk Management

Risk Management is responsible for the supervision and oversight of all aspects of MSWM risk,

including market and non-market risks, and ensures that risks assumed are identified, understood and

appropriately managed. Key risks facing the MSWM business are:

• Credit Risk: the most significant credit risk is that MSWM does not get paid back margin loans

granted to clients (including risks associated with managing the collateral lodged by clients).

• Client Suitability Risk: the risk that MSWM faces financial loss as a result of selling products to

clients for which they are not suitable (considered on both an upfront and ongoing basis).

• Product Suitability Risk the risk that MSWM faces financial loss as a result of Morgan Stanley

doing insufficient due diligence on the products which it distributes to clients.

• Operational Risk: The risk that MSWM faces losses arising from failed or inadequate internal

processes, systems or people, or from external events.

Additionally, MSWM has the following in place to reduce risk:

• Insurance Policies - MSMW maintains adequate levels of insurance and is review on a yearly

basis.

• Business Continuity Plans - Business continuity involves infrastructure solutions that have been

implemented to provide full application redundancy whilst simplifying business continuity

arrangements so that they are either initiated automatically or can be actioned by staff in a

timely manner.

• Disaster Recovery Plan - MSWM has disaster recovery plans in place. Testing is done annually

for work area recovery (WAR) site and plans are updated annually.

COVID-19 impact

The outbreak of COVID-19 and the global response to reduce the spread of the virus has resulted in

the implementation of unprecedented social distancing and people movement restrictions and a

contraction in global economic activity. The timing and trajectory of the economic recovery remains

uncertain.

The impact on business operations have been assessed and reflected in the description of the Morgan

Stanley Wealth Management systems and controls.

Risk Assessment

Risk assessment approach and conclusions have been reviewed to ensure that they are appropriately

responsive to the changes in the organisation that have occurred since the outbreak of COVID-19 and

include the following key areas:

– offices being closed or access is limited;

– technology and other infrastructure disruption including risk of cyber attack;

– processes that are manual or reliant on key employees;

– access to relevant data that is used to prepare certain financial information and reports;

– delays in processing of transactions due to employee constraints;

– assessment of the fraud risk and any changes to the control environment;

– assessment of subservice organisations’ ability to reliably execute their processes and controls;

and

– impact on the design, implementation and operating effectiveness of controls throughout the

period due to the working from home arrangements.

Review of controls

Review of controls which needed adjustment (as well as appropriate documentation of the adjustment

maintained) to compensate for changes in risk, or contingency plans put in place. Our consideration

focused on the following key areas:

– reviewing policies and control design, including the review of any manual controls;

– invoking the business continuity plan (BCP) and review and update of the BCP;

– remote working arrangements changing how a control traditionally operated or how consistently

the control operated;

– review and contacting subservices organisations to understand and assess any risk from changes

to their services; and ensuring monitoring activities cover any newly implemented controls or

processes

18

Invoking BCP

In response to advice issued by Australian government authorities regarding COVID-19 and to support

the health and wellbeing of our staff, clients and communities, Morgan Stanley Wealth Management

Australia invoked its BCP on 16 March 2020 and required all staff to work from home until further notice,

with core staff allowed to come to the office in a Team A/B split format on a weekly rotation. Over the

past couple of months the arrangements have been adjusted for each state individually, in line with the

respective local COVID situation. As at the date of this report all staff is allowed back to the offices on

a voluntary basis in Adelaide, Perth, Brisbane and Sydney, however Melbourne staff continue to work

from home.

Remote access arrangements were, prior to the BCP being invoked in response to COVID-19, in place

for all staff and operated in line with internal requirements and technology solutions. Established

systems and processes enabled continuity of Wealth Management Services to clients throughout the

working from home period. In terms of business activities:

– investment management and monitoring of portfolio assets continued in accordance with the

established investment management framework;

– trading and advice activity continued with the increased market volatility in particular around

March/April providing for an increase in trading volumes;

– reporting and compliance requirements continued to be satisfied, operating in accordance with

established procedures and processes;

– the operational risk committee continued to operate as usual with members available to meet on

an as required basis; and

– the board continued to operate as usual with directors available to meet on an as required basis.

3.6 Information and Communication

Information and communication is integral to the continual competitiveness of an organisation. Morgan

Stanley’s management has policies and procedures in place to initiate, record, process, and report

entity transactions and to effectively communicate and distribute relevant information timely. Both

management and operations personnel are provided with an understanding of their individual roles

and responsibilities pertaining to internal controls.

MSWM management encourage individuals and teams to use initiative in addressing issues and solving

problems. Employees are made aware of changes to policies and procedures, significant business

events and other major announcements by written communication (such as email). General Morgan

Stanley announcements are communicated either through email or via Morgan Stanley’s intranet.

The employees are obligated to safeguard and prevent disclosure of sensitive, proprietary,

confidential, privileged, or secret information. MSWM has various policies in place governing this.

3.7 Monitoring

An important management responsibility is to establish and maintain internal controls and to monitor

business developments on an ongoing basis. MSWM management reviews such areas through various

metric figures, reviews and committees.

MSWM’s policies and procedures are subject an annual review by the Executive Committee, MSWM

BOARD, Audit Committee and Legal and Compliance Division (LCD).

These included:

• Compliance Monitoring – MSWM’s compliance team performs the independent checking and

observing of each business or function’s adherence to relevant rules and/or policies and

procedures (e.g. through sample-based re-performance, review of possible exceptions flagged

via detection scenarios, and trends analysis of first-line compliance activities, or through other

methods)

• Conflict of interest – MSWM manages conflicts of interest via the implementation of internal

control policies, processes and procedures, including standards of conduct; disclosure;

avoidance; and monitoring.

• Breach reporting – MSWM maintains a breach register for internal and external breaches. This

is monitored and reported to the Board.

19

3.8 Complimentary User Entity Controls

MSWM’s services were designed with the assumption that certain controls would be placed in operation

at user entities. This section describes controls that should be in operation at user entities to

complement the controls at MSWM.

Specifically, controls should be established to validate that:

• User entity instructions and information provided to MSWM should be in accordance with the

provisions of the client agreement or other applicable governing agreements or documents in

effect between MSWM and the client

• The user entity should have sufficient controls to ensure that proper instructions are authorised,

timely and in accordance with regulatory requirements. User entities should have effective

controls over the authorisation, periodic review and removal of access rights for their staff to

access systems.

• User entities should provide proper instructions and information to MSWM using data

transmission delivery methods in accordance with MSWM security standards. Instructions and

information provided to MSWM using methods not in accordance with the security standards

may be less secure. The user entity should have sufficient controls to ensure that the set-up of

new accounts on applicable systems or changes to existing accounts are authorised, approved

and implemented.

• User entities should provide MSWM with timely written notification regarding changes to those

individuals authorised to instruct on behalf of client activities.

• User entities should periodically review standing instructions provided to MSWM

• User entities should establish, monitor and maintain effective controls over physical and logical

access to their computer systems via PCs at client locations.

• User entities should perform a timely review of reports provided for holdings and cash balances

and related activity and provide written notice of any discrepancies.

• User entities should provide timely tax information to MSWM to ensure the efficient completion

of year-end reporting

This list does not represent a comprehensive set of all the controls to be employed by user entities. Other

controls may be required at user entities, depending upon each individual circumstance.

4 Operations and infrastructure support model – affiliates controls

MSWM relies in part on Morgan Stanley’s support infrastructure to conduct its business through the

outsourcing of some services and systems.

Services that are provided to MSWM by MSIP (and other entities of the Morgan Stanley Group) include:

• information technology

• operations

• legal and compliance

• risk management

• tax

• financial and regulatory controls, and

• treasury

As part of the delegated operations services, certain activities to support the delivery of custody services

such as the handling of corporate actions and dividends/income, and the segregation of assets are

delegated to Morgan Stanley’s ISG Operations (MSISG) as outlined below:

• MSISG handles for MSWM’s PWM customers the receipt and distribution of dividends and other

distributions, the processing of exchange offers, right offerings, warrants, tender offers, exercises,

calls, redemptions and sales and transfers of shares subject to any applicable restriction, other

corporate actions and such other functions

• MSISG ensures the segregation of client assets and firm assets in line with FCA regulations. The

Operations team protects positions by keeping client assets in a segregated safekeeping account.

20

Key Third Party / External Subservice Organisations

MSWM uses the services of third-party service providers in some operations with Service Level agreements

in place. Monitoring of service providers is overseen by Management, with compliance undertaking periodic

monitoring to ensure that counterparties are complying with reporting and other contractual obligations.

MSWMs key external subservice provider relevant to supporting custody services for MSWM PWM clients is

Clearstream, in the provision of investor statement reporting. This report does not include controls at

Clearstream or any other external sub-service organisation.

The effectiveness of controls performed by users and their service providers should also be considered as

part of the overall system of controls.

5 IT systems

5.1 Network and Infrastructure

MSWM PWM utilises both mainframe and distributed technology. The key system platforms are

standardized on z/OS, Linux and Windows operating systems. Morgan Stanley owns and operates the

Data Centres located in Somerset, New Jersey, Piscataway, New Jersey, and Ashburn, Virginia.

5.2 Information Technology Organisation

Morgan Stanley IT is divided into the business units with a New York based IT Senior Manager heading

up PWM IT from a global perspective while global functional heads report to the New York based IT

Senior Manager. Some of the functional heads also have a regional responsibility, in which case they

also report to local business heads in their regional offices. Staff working on global projects will have a

link, organized by function, to the functional area that is leading and managing that project.

Morgan Stanley’s Enterprise Infrastructure Group (“EI”) is responsible for each business line’s server

management and deployment needs, providing adherence to Morgan Stanley IT standards. PWM is a

business line under the responsibility of the Engineering/service account manager for PWM. While the

responsibility is centralized, the specialized support groups are resident in each location. Specialized

groups include Network, UNIX, Windows and database support. The IT functions generally operate based

on firm wide standards. There are policies and procedures for many functions set by Quality Assurance

and Production Management (QAPM).

Production Management is responsible for supporting PWM applications and ensuring the stability of the

IT environment. Responsibilities include application support, software turnovers/deployments and

monitoring of overnight batch processes. ASG personnel are located across several regions which

ensures that there is coverage throughout the day and night. Refer below to Section III 5.4 In Scope

Application for further details.

In-bound instructions to Clearstream are received electronically via Webstreme - a secure order

management system developed by Clearstream. An ASAE 3402 Assurance Report on Controls at a

Service Organisation has been received from Clearstream which is referred to as "Report on the Internal

Controls for Custody, Investment Administration and Related Information Technology Services".

5.3 BCM/DRP

Morgan Stanley maintains global programs for business continuity management and technology disaster

recovery that facilitate activities designed to protect the Firm during a business continuity event. A

business continuity event is an interruption with potential impact to normal business activity of the Firm’s

people, operations, technology, suppliers, and/or facilities.

The business continuity program’s core functions are business continuity planning (with associated

testing) and crisis management. The Firm has dedicated Business Continuity Management staff

responsible for coordination of the program governed by the Business Continuity Governance Committee

and a Risk Oversight Committee. In addition, a Committee of the Board of Directors (the “Board

Committee”) and senior management oversee the program. BCM reports to the Board Committee at

least annually on the status of program components such as business continuity events and business

continuity testing results.

BCM facilitates the exchange of information within the Firm during an incident. BCM works with partners

in Technology, Security, and Corporate Services to assess incidents for the level of impact to businesses

and, as appropriate, escalate them accordingly. BCM provides 24/7 global coverage to monitor and

manage incidents.

21

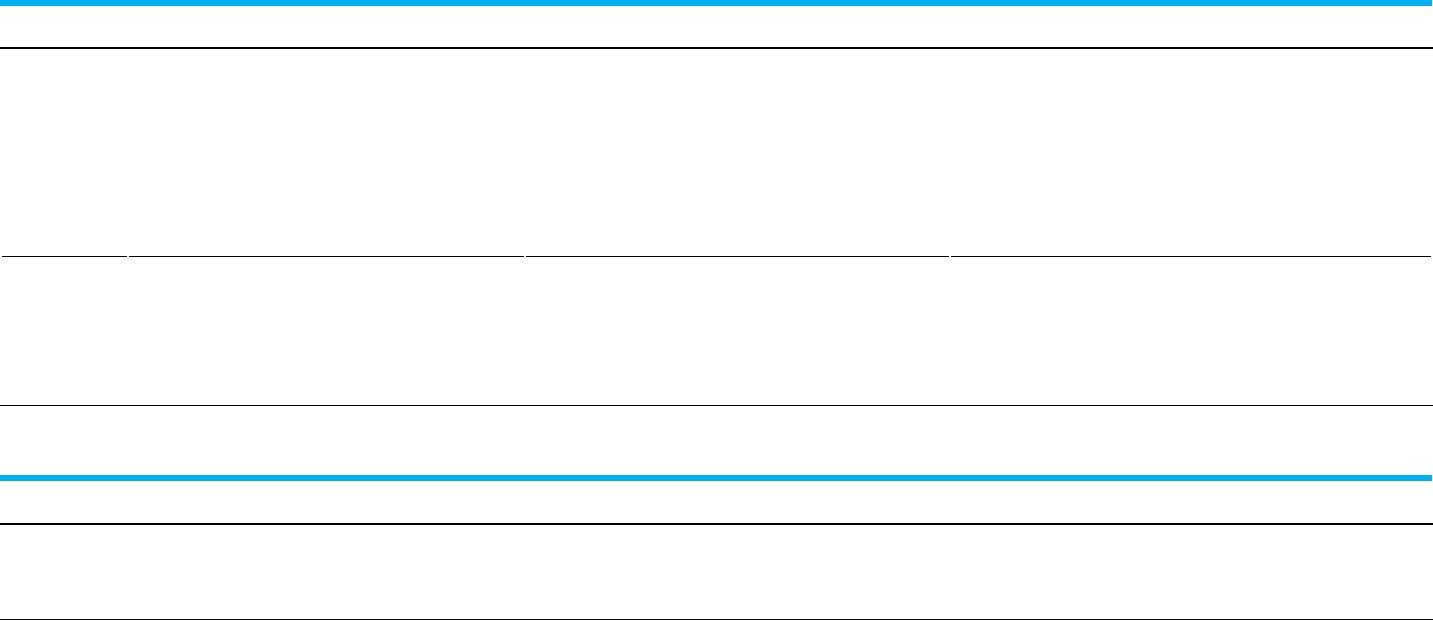

5.4 In Scope Applications

The following applications are applicable to the delivery of custody services to MSWM PWM clients.

Application

Description

AQUA

US Aqua coverage includes but is not limited to (1) daily SEC 15c3-3 customer

reserve; (2) daily and monthly SEC 15c3-1 securities haircuts; (3) monthly

SEC 15c3-1 FOCUS reporting. UK Aqua calculates the daily client money

lockup required by the FCA.

CashForecasting

CashForecasting automates the process of forecasting cash requirements in

various currencies and generating fx spot, money market, fiduciary and bank

deposit orders, as appropriate and electronically transmit to the relevant

execution and processing systems.

IWM Client

Management

Strategic project for IWM to create a centralized client data repository.

FC3

FC3 is a Client trade confirmation system that delivers trade confirmations.

Confirms are delivered to clients based in incoming trade messages matching

rules that are managed by client service in Operations. This platform is

responsible for intra-day confirmation of client trading to custodians and

clients globally, supporting both industry standard and client specific formats

to meet internal, external and regulatory requirements.

Intellimatch

(Ops Control

Apps)

Intellimatch is a generic reconciliation system that receives data from a

variety of both internal and external data sources to carry out reconciliations

for multiple internal customers. Data from the Intellimatch system is

downloaded to a number of risk tracking and management reporting

functions.

QWEST

QWEST (Query Workflow Exceptions Services Technology) is an Enterprise-

wide application that consolidates information from many underlying data

sources into one portal.

SAFE Global

Settlements

SAFE is Morgan Stanley's in-house settlement system. SAFE ensures that the

contract agreed between two trading parties is fulfilled. In its simplest form,

SAFE facilitates the transfer of securities and cash as per the agreement on

the trade contract and notes exceptions.

Scorpio

Covers the Scorpio application for calculation of entitlements arising from

corporate actions and dividends and processing elections of those entitlements

STP

Workstation

PWM STP Workstation is a PWM Proprietary order entry and order

management system. It supports Equities, Options, OTC's, Mutual Funds and

Fixed Income products. It performs order capture, pre-trade checks,

execution and client side booking support.

T2

T2 is a trade capture and lifecycle management system for Equity OTC

derivative trades and positions and their hedges. For listed equity derivatives

and cash equities, it also provides the ability to move positions between

internal firm accounts and to capture off-exchange trades with external

brokers.

LiveWire

LiveWire GUI enables maintenance & tracking of deals, rates and clients in

Wire, track charges in Global Billing System and create overrides in RBC

system.

ASRV

This is the renovated platform for Asset Services applications.

Presto

Presto is a strategic solution to automate critical manual processes and

replace the EUCs and tactical applications in the Firm. Presto is best fit for: 1)

Control reporting - reports/alerts to facilitate users to perform

control/monitoring functions 2) Data integration - data exchange between MS

and external system in a variety of data formats 3) Data integrity check -

detect data integrity issue before further user or downstream processing.

Client

Suitability

Engine (CSE)

Web application and middle tier services, that will be used for assessing the

client Suitability and Eligibility - for pre and post trade checks (PRR checks for

example) for Asia and Australia Clients.

FC0

FCO Overnight regulatory confirmation system FCO is a Client trade

confirmation system that delivers overnight official trade confirmations for

Equity, Fixed Income, PWM and Prime Brokerage. It is a close relation to the

FC3 system which delivers real time confirms for the same trades.

22

Application

Description

EPS (Expert

Payment

System)

Assessment system used to analyze cash payments leaving the Firm.

CMI

CMI is the cash management instruction system.

GIM2

PWM portfolio accounting system front end applications and database.

Client RefData

Mgmt

(CRD/PIPE)

Client RefData Mgmt (CRD/PIPE) supports the creation of new accounts and

parties, including regulatory tasks for the on-boarding process.

Libra

Libra is the TAPS Position & Balance subledger. Libra contains the P&B data

and the journal audit trail forming this data. Libra also contains the JEMS

(Renovated Manual Journal System).

23

Section IV:

Independent Service Auditor's

Assurance Report on the

Description of Controls, their

Design and Operating

Effectiveness

24

Deloitte Touche Tohmatsu

A.C.N. 74 490 121 060

Grosvenor Place

225 George Street

Sydney NSW 2000

PO Box N250 Grosvenor Place

Sydney NSW 1217 Australia

DX 10307SSE

Tel: +61 (0) 2 9322 7000

Fax: +61 (0) 2 9322 7001

www.deloitte.com.au

Independent Service Auditor's Assurance Report on the Description of Controls, their

Design and Operating Effectiveness

To the Directors of Morgan Stanley Wealth Management Pty Ltd (“MSWM”)

Opinion

We have been engaged to report on MSWM’s description in Section III of its internal controls over Private

Wealth Management’s (“PWM”) custody services system and on the design and operation of controls related

to the control objectives stated in the Section VI throughout the period from 1 July 2019 to 30 June 2020

(the description).

In our opinion, in all material respects, based on the criteria in Section II:

(a) The description fairly presents the PWM’s custody services system as designed and implemented

throughout the period from 1 July 2019 to 30 June 2020;

(b) The controls related to the control objectives stated in Section VI were suitably designed throughout

the period from 1 July 2019 to 30 June 2020; and

(c) The controls tested, which were those necessary to provide reasonable assurance that the control

objectives stated in Section VI were achieved, operated effectively throughout the period from 1

July 2019 to 30 June 2020.

Basis of Opinion

We conducted our engagement in accordance with Standard on Assurance Engagements ASAE 3402

Assurance Reports on Controls at a Service Organisation, and with reference to Guidance Statement GS 007

Audit Implications of the Use of Service Organisations for Investment Management Services, issued by the

Auditing and Assurance Standards Board. That standard requires that we plan and perform our procedures

to obtain reasonable assurance about whether, in all material respects, the description is fairly presented

and the controls are suitably designed and operating effectively.

We have not evaluated the suitability of design or operating effectiveness of complementary user entity

controls. The control objectives stated in the service organisation’s description of its system can be achieved

only if complementary user entity controls are suitably designed or operating effectively, along with the

controls at the service organisation.

The following internal affiliates perform functions to support the custody services MSWM’s provides to its

PWM clients:

• MSIP – in the provision of custody services

• MSISG – in the provision of custody operations

• MSCL - in the provision of IT services

The inclusive method has been used in relation to the above, meaning MSWM’s description of its PWM

custody services system includes control objectives and related controls at the abovenamed internal

affiliates. Our procedures extended to controls at the abovenamed internal affiliates to the extent they

related to the custodial services.

Clearstream is an external subservice organisation who perform functions on behalf of MSWM’s custody

services provided to PWM clients in relation to investor statement reporting. The carve-out method has been

used in relation to Clearstream. MSWM’s description of its PWM custody services system excludes control

objectives and related controls at Clearstream, consequently our procedures did not extend to controls at

Clearstream.

Liability limited by a scheme approved under Professional Standards Legislation

Member of Deloitte Asia Pacific Limited and the Deloitte Organisation

25

Our opinion has been formed on the basis of the matters outlined in this report.

We believe that the evidence we have obtained is sufficient and appropriate to provide a basis for our

opinion.

MSWM’s Responsibilities

MSWM is responsible for: preparing the description and accompanying statement in Section II, including the

completeness, accuracy and method of presentation of the description and statement; providing the services

covered by the description; stating the control objectives; and designing, implementing and effectively

operating controls to achieve the stated control objectives.

Our Independence and Quality Control

We have complied with independence and other relevant ethical requirements relating to assurance

engagements, and apply Auditing Standard ASQC 1 Quality Control for Firms that Perform Audits and

Reviews of Financial Reports and Other Financial Information, Other Assurance Engagements and Related

Services Engagements in undertaking this assurance engagement.

Service Auditor’s Responsibilities

Our responsibility is to express an opinion on MSWM’s PWM custody services system description and on the

design and operation of controls related to the control objectives stated in that description, based on our

procedures.

An assurance engagement to report on the description, design and operating effectiveness of controls at a

service organisation involves performing procedures to obtain evidence about the disclosures in the service

organisation’s description of its system, and the design and operating effectiveness of controls. The

procedures selected depend on our judgement, including the assessment of the risks that the description is

not fairly presented, and that controls are not suitably designed or operating effectively. Our procedures

included testing the operating effectiveness of those controls that we consider necessary to provide

reasonable assurance that the control objectives stated in Section VI were achieved. An assurance

engagement of this type also includes evaluating the overall presentation of the description, the suitability

of the objectives stated therein, and the suitability of the criteria specified by the service organisation

(MSWM) and described in Section II.

In evaluating the suitability of the objectives stated in the description, we have determined whether each of

the minimum control objectives provided in GS 007 for custody services is included, or, if any of them are

omitted or amended, that the reason for the omission or amendment is adequately disclosed in the

description.

Limitations of Controls at a Service Organisation

MSWM’s description is prepared to meet the common needs of a broad range of customers and their auditors

and may not, therefore, include every aspect of the system that each individual customer may consider

important in its own particular environment. Also, because of their nature, controls at a service organisation

may not prevent or detect all errors or omissions in processing or reporting transactions. Also, the projection

of any evaluation of effectiveness to future periods is subject to the risk that controls at a service organisation

may become inadequate or fail.

Description of Tests of Controls

The specific controls tested and the nature, timing and results of those tests are listed in Section VI.

Other Information

Management is responsible for the other information. The other information comprises the information

included in Sections I and VII.

Our opinion on the description in Section III and on the design and operation of controls related to the

control objectives stated in Section VI does not cover the other information and we do not express any form

of assurance conclusion thereon.

Liability limited by a scheme approved under Professional Standards Legislation

Member of Deloitte Asia Pacific Limited and the Deloitte Organisation

26

In connection with our assurance engagement, our responsibility is to read the other information and, in

doing so, consider whether the other information is materially inconsistent with the description in Section

III or our knowledge obtained during the assurance engagement, or otherwise appears to be materially

inconsistent or contains a material misstatement of fact. If, based on the work we have performed, we

conclude that there is a material inconsistency or a material misstatement of fact of this other information,

we are required to report that fact. We have nothing to report in this regard.

Intended Users and Purpose

This report and the description of tests of controls in Section VI are intended only for customers who have

used MSWM’s PWM custody services and related information system, and their auditors, who have a

sufficient understanding to consider it, along with other information including information about controls

operated by customers themselves, when assessing the risks of material misstatements of customers’

financial reports/statements.

Restriction of distribution and use

We disclaim any assumption of responsibility for any reliance on this report to any person other than the

MSWM’s clients and their auditors or for any purpose other than that for which it was prepared. This report

is not intended to and should not be used or relied upon by anyone else and we accept no duty of care to

any other person or entity.

Deloitte Touche Tohmatsu

Vincent Sita

Partner

Chartered Accountant

Sydney, 23 October 2020

Liability limited by a scheme approved under Professional Standards Legislation

Member of Deloitte Asia Pacific Limited and the Deloitte Organisation

27

Section V:

Overview of the Work Performed

28

Section V: Overview of the Work

Performed

Introduction

This report on the description of the system is intended to provide customers and their auditors with

information for their evaluation of the effect of a service organisation on a customer’s internal control

relating to MSWM’s internal controls over Private Wealth Management’s (“PWM”) custody services

system throughout the period 1 July 2019 to 30 June 2020.

Deloitte Touche Tohmatsu’s engagement was conducted in accordance with the Standard on Assurance

Engagements 3402, Assurance Reports on Controls at a Service Organisation, issued by the Auditing

and Assurance Standards Board. Testing of MSWM’s PWM controls was restricted to the control

objectives and related control activities listed in Section VI and was not extended to controls that may

be in effect at user organisations.

Deloitte Touche Tohmatsu’s work was carried out remotely using virtual tools and technologies in

Sydney as well as across Asia, the US and UK. The scope of work was based on criteria (control

objectives) agreed with management of MSWM prior to the commencement of work.

Control environment elements

The control environment sets the tone of an organisation, influencing the control consciousness of its

people. It is the foundation for other components of internal control, providing discipline and structure.

In addition to the tests of design, implementation, and operating effectiveness of controls identified

by MSWM, Deloitte Touche Tohmatsu’s procedures included tests of the relevant elements of MSWM’s

control environment as outlined in Section III.

Such tests included inquiry of the appropriate management, supervisory, and staff personnel;

observation of MSWM’s activities and operations, inspection of MSWM’s documents and records, and

re-performance of the application of MSWM’s controls. The results of these tests were considered in

planning the nature, timing, and extent of testing of the control activities described in Section VI.

Obtaining Evidence Regarding the Description

Deloitte Touche Tohmatsu obtained and read the service organisation’s description of its system in

Section III, and evaluated whether those aspects of the description included in the scope of the

engagement are fairly presented, including whether:

a) Control objectives stated in the service organisation’s description of its system are reasonable

in the circumstances;

b) Controls identified in that description were implemented;

c) Complementary user entity controls, if any, are adequately described; and

d) Services performed by a subservice organisation, if any, are adequately described, including

whether the inclusive method or the carve-out method has been used in relation to them.

Obtaining Evidence Regarding Design of Controls

In determining which of the controls at the service organisation are necessary to achieve the control

objectives stated in the service organisation’s description of its system, Deloitte Touche Tohmatsu

assessed whether those controls were suitably designed. This included:

a) Identifying the risks that threaten the achievement of the control objectives stated in the

service organisation’s description of its system; and

b) Evaluating the linkage of controls identified in the service organisation’s description of its

system with those risks. Some of the considerations Deloitte Touche Tohmatsu took into

account included:

• Appropriateness of the purpose of the control and its correlation to the risk/assertion

29

• Competence and authority of the person(s) performing the control

• Frequency and consistency with which the control is performed

• Level of aggregation and predictability

• Criteria for investigation (i.e. threshold) and process for follow-Up

Tests of operating effectiveness

Deloitte Touche Tohmatsu’s tests of the controls were designed to cover a representative number of

transactions throughout the period from 1 July 2019 to 30 June 2020. In determining the nature,

timing and extent of tests we considered the following:

a) Nature and frequency of the controls being tested

b) Types of available evidential matter

c) Nature of the control objectives to be achieved

d) Assessed level of control risk

e) Expected effectiveness of the test, and

f) Results of tests of the control environment.

Testing the accuracy and completeness of information provided by MSWM is also part of the testing

procedures performed. Information we utilised as evidence may have included, but was not limited

to:

• Standard “out of the box” reports as configured within the system

• Parameter-driven reports generated by MSWM’s systems

• Custom-developed reports that are not standard to the application such as scripts,

report writers, and queries

• Spreadsheets that include relevant information utilized for the performance or testing

of a control

• MSWM prepared analyses, schedules, or other evidence manually prepared and utilised

by MSWM.

While these procedures may not be specifically called out in the test procedures listed in Section VI,

they may be completed as a component of testing to support the evaluation of whether or not the

information is sufficiently precise and detailed for purposes of fully testing the controls identified by

MSWM.

Description of testing procedures performed

Deloitte performed a variety of tests relating to the controls listed in Section VI throughout the period

from 1 July 2019 to 30 June 2020. The tests were performed on controls as they existed during this

period and were applied to those controls relating to control objectives specified by MSWM.

Tests performed for the purpose of this report may have included, but were not limited to those

described below:

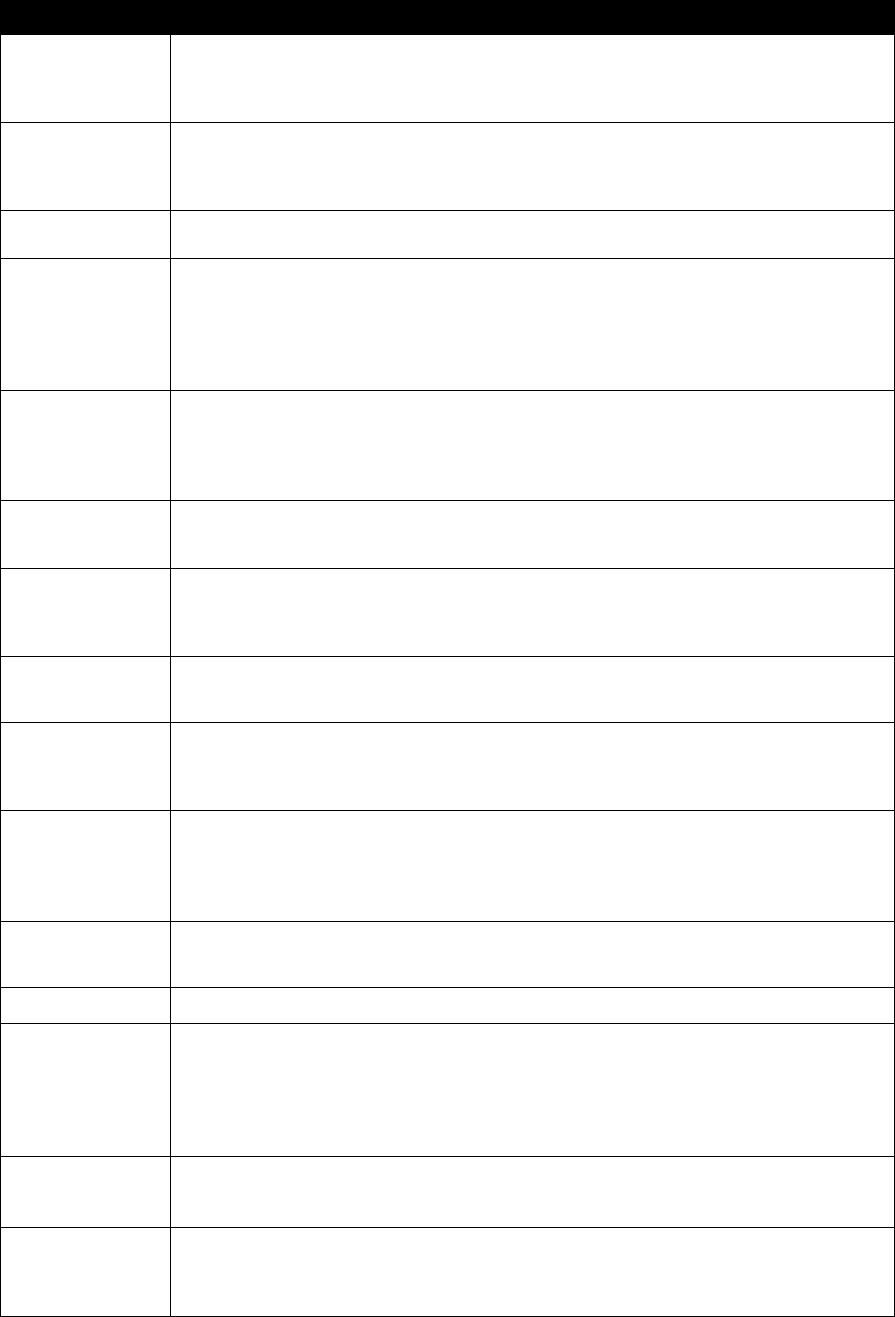

Test

Description

Inquiry

Conducted detailed interviews with relevant

personnel to obtain evidence that the control was in

operation during the report period and is

accompanied by other procedures noted below that

are necessary to corroborate the information

derived from the inquiry.

Observation

Observed the performance of the control multiple

times throughout the report period to evidence

application of the specific control activity.

Inspection of documentation

If the performance of the control is documented,

inspected documents and reports indicating

performance of the control.

Reperformance of monitoring

activities or manual controls

Obtained documents used in the monitoring activity

or manual control activity and independently

reperformed the procedures. Compared any

deviation items identified with those identified by

the responsible control owner.

Reperformance of programmed

processing

Input test data, manually calculated expected

results, and compared actual results of processing

to expectations.

30

Sampling Methodology

In terms of frequency of the performance of the control by MSWM, we consider the following guidance

when planning the extent of tests of control for specific types of control.

a) The purpose of the procedure and the characteristics of the population from which the sample

will be drawn when designing the sample;

b) Determine a sample size sufficient to reduce sampling risk to an appropriately low level;

c) Select items for the sample in such a way that each sampling unit in the population has a

chance of selection;

d) If a designed procedure is not applicable to a selected item, perform the procedure on a

replacement item; and

e) If unable to apply the designed procedures, or suitable alternative procedures, to a selected

item, treat that item as a deviation.

The following guidelines are at a minimum followed in performing the test of controls:

Frequency of control

activity

Minimum sample size

Annual

1

Quarterly

2

Monthly

2

Weekly

5

Daily

15

Many times per day

25

Automated Controls

Test one instance of each automated

control.

Indirect Controls (e.g.,

indirect entity-level

controls, general IT

controls)

For those indirect entity-level controls that

do not themselves directly address risks of

material misstatement, the above is the

suggested minimum sample size for the test

of operating effectiveness.

In the event that the indirect control is

directly responsive to the control objective,

the above is the minimum sample size for

the test of operating effectiveness.

The table assumes zero deviations.

The nature and cause of deviations identified (if any), were evaluated to conclude on whether the

deviations are material individually or in combination.

Reporting on results of testing

In most instances, controls are performed in the same manner and with the same degree of intensity

for all clients. For this reason, samples were chosen from the whole population of MSWM transactions.

Deloitte Touche Tohmatsu does not have the ability to determine whether a deviation will be relevant

to a particular user, consequently all deviations are reported.

Results of testing

The concept of effectiveness of the operation of controls recognises that some deviations in the way

controls are applied by MSWM may occur. Deviations from prescribed controls may be caused by such

factors as changes in key personnel, significant seasonal fluctuations volume of transactions and

human error.

We use judgement in considering the overall operating effectiveness of the control by considering the

number of deviations detected, the potential significance of the financial statement effect, as well as

other qualitative aspects of the deviations such as the cause of the deviation.

When we identify a deviation for a periodic or automated control, we consider whether other controls

/ mitigating controls may provide the evidence we require.

If we find a single deviation in the initial sample for a recurring manual control operating multiple

times per day, when we did not expect to find control deviations, we consider whether the deviation

is representative of systematic or intentional deviations.

31

If control deviations are found in tests of controls which operate daily or less frequently, the sample

size cannot be extended and we assess such controls as ineffective.

32

Section VI:

Control Objectives, Control

Activities, Testing of Design

and Implementation and

Operating Effectiveness

33

Section VI:

Control Objectives, Control

Activities, Testing of Design and

Implementation and Operating

Effectiveness

Introduction

This section presents the following information provided by MSWM:

• The control objectives specified by the management of MSWM.