Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 1 of 23

UIN: LIBTGDP22171V012122

Optional Travel Insurance for E-ticket passengers- IRCTC

Liberty General Insurance Limited (“the Company, We, Our, or Us”), having received a Proposal from the

Proposer, along with declaration(s), reports and such other documents as may be required, upon receipt of such

proposal and upon occurrence of the Insured event(s) agree to pay the compensation having become payable

under Part 2 of this Policy, i.e. that the Sum Insured/ appropriate benefit (s), subject however to the terms,

conditions, provisos, exclusions contained herein or endorsed or otherwise expressed herein.

Part I: Definitions

The following words and terms shall have the meaning as described herein, wherever they appear in this Policy.

The references to singular or masculine will include references to plural and female wherever the context permits

and vice versa.

1. “Accident” - An Accident means sudden, unforeseen and involuntary event caused by external, visible and

violent means.

(a) When in the course of working a railway, an accident occurs, being either a collision between trains of

which one is a train, carrying passengers or the derailment of or other accident to a train or any part of a

train carrying passenger.

(b) When in the course of working a railway an untoward incident occurs, in the train carrying passengers

(any part of the train) or at the actual departure from the originating station to actual arrival of train at

the destination station.

2. “Act of terrorism”- means the calculated use of violence (or the threat of violence) against civilians, harmful

to human life, tangible or intangible property or infrastructure in order to attain goals that are political,

economical, religious or racial interests; this is done through intimidation or coercion or instilling fear.

Terrorism shall also include any act which is verified or recognized by the relevant Government as an act of

Terrorism.

3. “Age”– means age of the Insured person on last birthday as on date of commencement of the Policy.

4. “Condition Precedent” - means a Policy term or condition upon which the Company’s liability under the

Policy is conditional upon.

5. “Congenital Anomaly” - refers to a condition(s) which is present since birth, and which is abnormal with

reference to form, structure or position.

a) “Internal Congenital Anomaly” - Congenital anomaly which is not in the visible and accessible parts

of the body.

b) “External Congenital Anomaly” - Congenital anomaly which is in the visible and accessible parts of

the body.

6. “Day Care Centre” - means any institution established for day care treatment of disease/ injuries or a medical

setup within a hospital and which has been registered with the local authorities, wherever applicable, and is

i) Conditions precedent to the contract

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 2 of 23

UIN: LIBTGDP22171V012122

under the supervision of a registered and qualified medical practitioner AND must comply with all minimum

criteria as under:

i. has qualified nursing staff under its employment;

ii. has qualified medical practitioner (s) in charge;

iii. has a fully equipped operation theatre of its own where surgical procedures are carried out

iv. maintains daily records of patients and shall make these accessible to the Company’s authorized

personnel.

7. “Day Care Treatment” - means medical treatment, and/or surgical procedure which is:

i. undertaken under General or Local Anesthesia in a hospital/Day Care Centre in less than twenty four

(24) hours because of technological advancement, and

ii. which would have otherwise required a hospitalization of more than twenty four (24) hours.

Treatment normally taken on an out-patient basis is not included in the scope of this definition.

8. “Deductible”- Deductible means a cost-sharing requirement under a health insurance policy that provides

that the Insurer will not be liable for a specified rupee amount in case of indemnity policies and for a specified

number of days/hours in case of hospital cash policies which will apply before any benefits are payable by

the Insurer. A deductible does not reduce the sum insured. Deductible will be applicable for each event

claimed by the Insured.

9. “Declaration”–means explicitly written or verbal statement/ information provided by the Insured during

the course of Insurance, which forms the basis of this contract.

10. “Dental Treatment” - Dental treatment means a treatment related to teeth or structures supporting teeth

including examinations, fillings (where appropriate), crowns, extractions and surgery.

11. “Disclosure to information norm” - The Policy shall be void and all premium paid hereon shall be forfeited

to the Company, in the event of misrepresentation, mis-description or non-disclosure of any material fact.

12. “Doctor/Physician/Medical practitioner”- means a person who holds a valid registration from the

Medical Council of any state or Medical Council of India or Council for Indian Medicine or for Homeopathy

set up by the Government of India or a State Government and is thereby entitled to practice medicine within

its jurisdiction; and is acting within the scope and jurisdiction of his licence provided that this person is not a

member of the Insured Person's family.

13. “Emergency Care” - Emergency care means management for an illness or injury which results in symptoms

which occur suddenly and unexpectedly, and requires immediate care by a Medical Practitioner to prevent

death or serious long term impairment of the Insured Person’s health.

14. “Geographical Scope” - The geographical scope of this Policy will be India and the claims shall be settled

in India in Indian rupees only. The laws of India shall govern the construction, interpretation and meaning of

the provisions of this Policy for the time being in force. The parties hereto unconditionally submit to the

jurisdiction of the courts in India.

15. “Group”-A group shall mean and include the customers of IRCTC holding a valid e-travel ticket.

16. “Hospital”- A hospital means any institution established for in- patient care and day care treatment of

illness and / or injuries and which has been registered as a hospital with the local authorities under the

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 3 of 23

UIN: LIBTGDP22171V012122

Clinical Establishments (Registration and Regulation) Act, 2010 or under the enactments specified under the

Schedule of Section 56(1) of the said Act OR complies with all minimum criteria as under:,

- has qualified nursing staff under its employment round the clock;

- has at least ten inpatient beds, in towns having a population of less than ten lakh and fifteen inpatient

beds in all other places;

- has qualified Medical Practitioner (s) in charge round the clock;

- has a fully equipped operation theatre of its own where surgical procedures are carried out

- Maintains daily records of patients and make these accessible to the Insurance Company’s authorized

personnel.

17. “Hospitalization” - Means admission in a Hospital for a minimum period of twenty four (24) consecutive

‘In- patient Care’ hours except for specified procedures/ treatments, where such admission could be for a

period of less than twenty four (24) consecutive hours.

18. “ICU (Intensive Care Unit) Charges” - means the amount charged by a Hospital towards ICU expenses

on a per day basis which shall include the expenses for ICU bed, general medical support services provided

to any ICU patient including monitoring devices, critical care nursing and intensivist charges

19. “Illness”- means a sickness or a disease or pathological condition leading to the impairment of normal

physiological function which manifests itself during the policy period and requires medical treatment.

a) Acute Condition - Acute condition is a disease, illness or injury that is likely to respond quickly to

treatment which aims to return the person to his or her state of health immediately before suffering the

disease/illness/injury which leads to full recovery.

b) Chronic Condition - A chronic condition is defined as a disease, illness or injury that has one or more

of the following characteristics:

1. it needs ongoing or long term monitoring through consultations, examinations, check-ups, and/or

tests.

2. it needs ongoing or long term control or relief of symptoms.

3. it requires rehabilitation for the patient or for the patient to be special trained to cope with it

4. it continues indefinitely.

5. it recurs or is likely to recur.

20. “Immediate family member” – means Insured’s spouse, children, parents, siblings, children in law, parents

in law, siblings in law, grandchildren, grandparents, legal guardian who reside in India

21. “Injury” - Injury means accidental physical bodily harm excluding illness or disease solely and directly caused

by external, violent and visible and evident means which is verified and certified by a Medical Practitioner.

22. “Inpatient Care” - Inpatient care means treatment for which the Insured person has to stay in a hospital for

more than twenty four (24) hours for a covered event.

23. “Intensive Care Unit” - means an identified section, ward or wing of a hospital which is under the constant

supervision of a dedicated medical practitioner(s), and which is specially equipped for the continuous

monitoring and treatment of patients who are in a critical condition, or require life support facilities and where

the level of care and supervision is considerably more sophisticated and intensive than in the ordinary and

other wards

24. “Insured/ You/ Your/ Yourself” - means a Group Policyholder on whose name the Policy is issued.

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 4 of 23

UIN: LIBTGDP22171V012122

25. “Insured Person (s)” - Insured Person/s or Insured Beneficiary means the persons, or his Family members,

named in the Schedule travelling by Indian Railway of all class who book the e-ticket through IRCTC site and

opt for this insurance cover by paying an appropriate premium, irrespective of the class of the ticket and the

benefit will be only against the accident and untoward incident that takes place during actual departure to

actual arrival of the train. including ‘process of entraining ‘ and ‘process of detraining the train’ and Vikalp

train, short termination and diverted route.

26. “Insured Journey / Journey” - means a one-way journey and/or return journey during the Policy Period to

a destination within India.

27. “Limb” - means the hand above the wrist joint or foot above the ankle joint.

28. “Limit of Indemnity” - means the amount stated in the Schedule against each relevant Section, which shall

be Our maximum liability under this Policy (regardless of number of Claims made) for any one claim and in

the aggregate for all claims under such Section subject to deductible specified in the Policy Schedule.

29. “Medical Advise” - Medical Advice means any consultation or advice from a Medical Practitioner including

the issue of any prescription or follow-up prescription.

30. “Medical Expenses” - Medical Expenses means those expenses that an Insured Person has necessarily and

actually incurred for medical treatment on account of Illness or Accident on the advice of a Medical

Practitioner, as long as these are no more than would have been payable if the Insured Person had not been

Insured and no more than other hospitals or doctors in the same locality would have charged for the same

medical treatment.

31. “Medically Necessary Treatment” - Medically necessary treatment means any treatment, tests,

medication, or stay in hospital or part of a stay in hospital which

- is required for the medical management of the illness or injury suffered by the Insured;

- must not exceed the level of care necessary to provide safe, adequate and appropriate medical care in

scope, duration, or intensity;

- must have been prescribed by a Medical Practitioner,

- must conform to the professional standards widely accepted in international medical practice or by the

medical community in India.

32. “Nominee” - means the person named in the Proposal or Schedule to whom the benefits under the Policy

is nominated by the Insured Person.

33. “Notification of Claim” - Notification of claim means the process of intimating a claim to the Insurer or

TPA through any of the recognized modes of communication.

34. “Out-Patient (OPD) Treatment” - means treatment in which the insured visits a clinic / hospital or

associated facility like a consultation room for diagnosis and treatment based on the advice of a medical

practitioner. The insured is not admitted as a day care or in-patient.

35. “Passenger” -means a traveller travelling against a confirmed e-ticket on a train managed by IRCTC.

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 5 of 23

UIN: LIBTGDP22171V012122

36. “Permanent Partial Disability” - means an accidental Injury caused by accident, which as a direct

consequence thereof, disables any part of the limbs or organs of the body of the Insured person and which

falls into one of the categories listed in the Table of Benefits.

37. “Permanent Total Disablement” - means Doctor certified total, continuous and permanent physical or

functional loss of body parts as a result of accidental bodily injury.

38. “Policy”– means this document of Policy describing the terms and conditions of this contract of insurance

including the Company’s covering letter to the Insured if any, the Schedule attached to and forming part of

this Policy, the Insured’s declarations made at proposal of Insurance and any applicable endorsement

attaching to and forming part thereof either at inception or during the period of insurance.

39. “Policy Period” - means the period between and including actual departure time to actual arrival time of the

train including ‘process of entraining‘ and ‘process of detraining’ the train and Vikalp train, short termination

and diverted route.

40. “Policy Schedule” - means the Policy Schedule attached to and forming part of the Policy.

41. “Proposal and Declaration Form” - means any initial or subsequent declaration made by the Insured/

Insured Person/s and is deemed to be attached and forming part of this Policy.

42. “Qualified Nurse” - means a person who holds a valid registration from the Nursing Council of India or

the Nursing Council of any state in India.

43. “Reasonable and Customary Charges” – Reasonable and customary charges means the charges for

services or supplies, which are the standard charges for the specific provider and consistent with the prevailing

charges in the geographical area for identical or similar services, taking into account the nature of the illness

/ injury involved.

44. “Room rent” - Room Rent means the amount charged by a Hospital towards Room and Boarding expenses

and shall include the associated medical expenses

45. “Surgery” or “Surgical Procedure” Surgery or Surgical Procedure means manual and / or operative

procedure (s) required for treatment of an illness or injury, correction of deformities and defects, diagnosis

and cure of diseases, relief from suffering and prolongation of life, performed in a hospital or day care center

by a medical practitioner.

46. “Train Accident” is as defined under section 123 read with Sections 124 and 124A of the Railways Act, 1989

subject to the qualification that the coverage will be valid from the actual departure of train from the originating

station to actual arrival of train at the destination station including ‘process of entraining’ and ‘process of

detraining’ the train.

47. “Trip” - shall mean a travel or journey undertaken by the Insured Person (s) travelling with a valid train e-

ticket booked from IRCTC, from the date and time of actual boarding the train to the date of time of actual

arrival of the train at the destination station as mentioned in the Policy schedule including ‘process of

entraining’ and ‘process of detraining’ the train.

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 6 of 23

UIN: LIBTGDP22171V012122

48. “Trip Duration”- means the time period commencing from the date & time when the Insured Person (s)

boards the train and ending on the date & time of arrival at the destination station as mentioned in the Policy

schedule including ‘process of entraining’ and ‘process of detraining’ as specifically mentioned in the Policy

Schedule for the journey undertaken within the Policy period.

49. “Unproven/Experimental treatment” - Unproven/Experimental treatment means the treatment including

drug Experimental therapy, which is not based on established medical practice in India, is treatment

experimental or unproven.

50. “Untoward incident”- means

(a) The commission of a terrorist act within the meaning of sub-section (1) of section 3 of the Terrorist and

Disruptive Activities (Prevention) Act, 1987(28 of 1987), or

(b) The making of a violent attack or the commission of robbery or dacoity; or

(c) The indulging in rioting, shoot-out or arson, by any person in or any train carrying passengers or, from

the actual departure from originating station to actual arrival of train at destination station including

‘process of entraining ‘and ‘process of detraining the train’ and Vikalp train, short termination and

diverted route

(d) The accident falling of any passenger from a train carrying passengers.

51. “War” – means Open and declared conflict between the armed forces of two or more states or nations to

achieve economic, geographic, nationalistic, political, racial, religious or other ends.

52. “We, Us, Our, Company” – means Liberty General Insurance Limited.

Part II: Scope of Cover

Section 1- Accidental Death

In case of Death due to accident 100% of sum insured will be paid by the Insurance Company.

Coverage:

The Insurance Company shall compensate the nominee or their legal heirs as the case may be for any injury (whilst

on a trip covered in the policy) solely and directly caused by accident occurring during the period of insurance

resulting death within12 calendar months of occurrence of the accident. The sum insured as specified above shall

be limit per passengers per policy period payable only to the nominee/ insured person's legal heirs.

Special Conditions

A. If the Insured Person dies as a result of the Accident within 12 months of its occurrence, or thereafter for any

other covered reason, and a claim for permanent impairment had been made prior to the death, then payment will

be made of the Sum Insured less any sum paid for the permanent impairment, and any sum that was due to be

paid for the permanent impairment shall not be paid.

B. If the Insured Person is not found within 7 years of the disappearance, sinking or wrecking of the Scheduled

Railway Carrier in which he was travelling as a fare paying passenger, the Insured Person will be presumed to have

died as a result of the Accident.

ii) Conditions applicable during the contract

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 7 of 23

UIN: LIBTGDP22171V012122

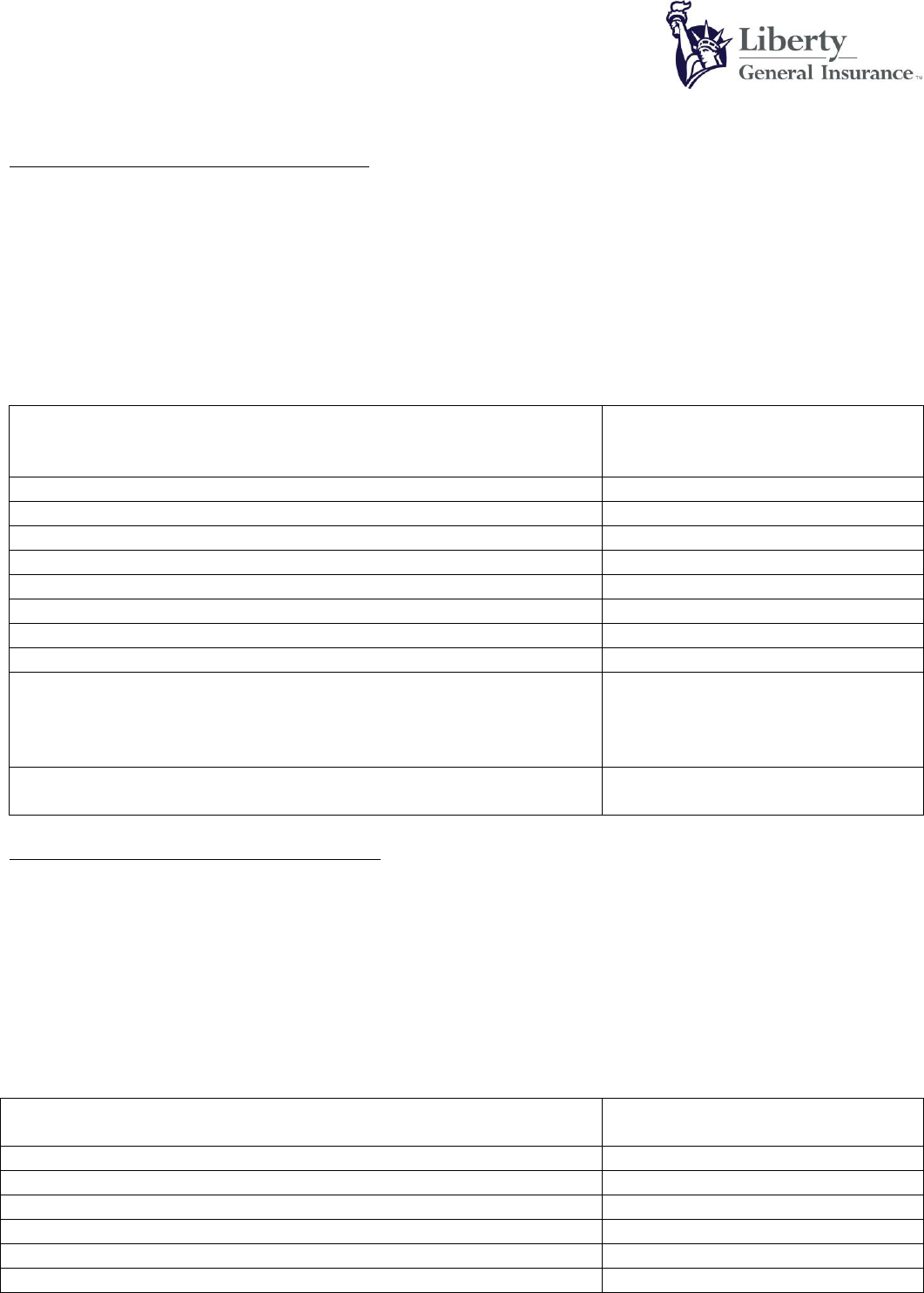

Section 2- Permanent Total Disablement

In case of Permanent total disability the 100% of sum insured will be paid by the Insurance Company.

If during the policy period, the insured person sustains Accidental Bodily injury which directly and independently

of all other causes results in permanent total disability within 12 months from the date of accident. For the purpose

of this cover, Permanent total disability shall mean either of the following and compensation will be paid as per

table below.

Permanent Total Disability Sum Insured Rs. 10,00,000/-

The Disablement

Compensation Expressed as a

Percentage of Total Sum Insured

1. Permanent Total Disablement

100%

2. Permanent and incurable insanity

100%

3. Permanent Total Loss of two Limbs

100%

4. Permanent Total Loss of Sight in both eyes

100%

5. Permanent Total Loss of Sight of one eye and one Limb

100%

6. Permanent Total Loss of Speech

100%

7. Complete removal of the lower jaw

100%

8. Permanent Total Loss of Mastication

100%

9. Permanent Total Loss of the central nervous system or the thorax

and all abdominal organs resulting in the complete inability to engage in

any job and the inability to carry out Daily Activities essential to life

without full time assistance

100%

10. Permanent disablement not otherwise provided for under above

Items inclusive up to a maximum of Sum Insured.

100%

Section 3- Permanent Partial Disablement

In case of Permanent partial disability the 75% of sum insured will be paid by the Insurance Company.

If during the policy period, the insured person sustains Accidental Bodily injury which directly and independently

of all other causes results in permanent partial disability within 12 months from the date of accident. For the

purpose of this cover, Permanent partial disability shall mean either of the following and compensation will be

paid as per table below.

Permanent Partial Disability Sum Insured upto Rs. 7,50,000/-

The Disablement

Compensation Expressed as a

Percentage of Total Sum Insured

1. Permanent Total Loss of Hearing in both ears

100%

2. Permanent Total Loss of one Limb

67%

3. Permanent Total Loss of Sight of one eye

67%

4. Permanent Total Loss of Hearing in one ear

20%

5. Permanent Total Loss of the lens in one eye

33%

6. Permanent Total Loss of use of four fingers and thumb of either hand

53%

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 8 of 23

UIN: LIBTGDP22171V012122

7. Permanent Total Loss of use of four fingers of either hand

27%

8. Permanent Total Loss of use of one thumb of either hand

27%

9. Permanent Total Loss of one finger of either hand

7%

10. Permanent Total Loss of use of toes

20%

11. Established non-union of fractured leg or kneecap

13%

12. Shortening of leg by at least 5 cms.

10%

13. Any loss is of the elbow, hip or knee

27%

14. Any other Permanent Partial not included in above items.

% as assessed by Doctor.

Specific Condition

1) The total amount payable in respect of more than one disablement due to the same Accident is arrived at by

adding together the various percentages shown in the Table of Benefits, shall not exceed the Total Sum

Insured.

2) If an Insured Person dies as the result of the Bodily Injury any amount claimed and paid to an Insured under

the Permanent Disablement Section will be deducted from any payment under the Accidental Death and/or

Permanent Total Disablement Section.

Section 4 – Hospitalization Expenses for Injury

The Company shall indemnify the Insured Person for the expenses upto Rs. 2 lakhs, incurred by the Insured

Person for hospitalization and medical treatment, taken on account of any injury sustained by the Insured person

whilst on a trip during the period of Insurance.

The Medical Expenses incurred for hospitalization treatment during the risk period for:

a) Room rent, boarding expenses (Room rent to be capped at 2% of the sum insured and ICU/CCU to be capped

at 4% of the sum insured)

b) Nursing

c) Intensive care unit

d) Medical practitioner

e) Anesthesia, blood, oxygen, operation theatre charges, surgical appliances

f) Medicines, drugs and consumables

g) Diagnostic procedures

h) The cost of prosthetic and other devices or equipment if implanted internally during a surgical procedure.

i) Medical expenses incurred as out-patient are not covered. However, procedures followed under day care stands

covered.

j) No OPD charges to be covered. However, procedures followed under day care shall also be covered.

k) In case happening of an accident, initial treatment be taken from nearest hospital of accident site and upon

written referral of this hospital, treatment be taken from any specialized hospital

Section 5- Transportation of Mortal Remains

If the Insured Person dies during the Risk Period, then the Company will reimburse INR 10,000/- as the cost of

either transporting his mortal remains to his usual place of residence or to a cremation or burial ground subject to

a valid claim admissible under Section 1- Accidental Death.

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 9 of 23

UIN: LIBTGDP22171V012122

COMPANY’S MAXIMUM LIABILITY

Any payment in case of more than one claim in respect of any Insured Person under this Policy during any one

Period of Insurance should not exceed the Sum Insured applicable to such Insured Person. However, the

amount relating to carriage of dead body of the Insured Person and medical expenses would be payable in

addition, if applicable.

Part III: Exclusions applicable to all the Sections

The Company shall not be liable to make any payment under this benefit in respect of the following:

General Exclusions:

1. Accident while crossing the Railway tracks

2. Accident due to breach of law with criminal intent.

3. Damage of health caused by curative measures, radiations, infection, poisoning except where arise from

the accident.

4. From intentional self-injury, suicide or attempted suicide.

5. Whilst engaging in any sort or form of adventurous sport.

6. Committing any breach of law with criminal intent.

7. Influence of intoxication, liquor or drugs.

8. Directly or indirectly caused or contributed by congenital anomaly, venereal disease, or insanity caused

by, contributed to or aggravated or prolonged by child birth or from pregnancy

9. Any natural cause or disease or medical or surgical treatment unless such treatment becomes necessary

due to injury caused by the said untoward incident.

10. War (whether declared or not), civil war, invasion, act of foreign enemies, rebellion, revolution,

insurrection, mutiny, military or usurped power, seizure, capture, arrest, restraint or detainment,

confiscation or nationalization or requisition of or damage by or under the order of any government or

public local authority.

11. Nuclear energy, radiation.

12. Claim on account of injury due accident prior to the date & time of journey & post the date & time of

journey would be excluded from the scope of the policy, however any delay in the time of departure &

arrival of the respective train would be taken into consideration

13. Claim in instances wherein ticket was booked by the insured; however the train was not boarded. This is

irrespective of whether the train ticket was cancelled or not.

14. Claim in instances wherein ticket was booked by the insured; however the ticket was not confirmed but

still the passenger boarded the train.

Exclusion for hospital expenses:

1. The treatment of any illness even if caused by the Accident suffered by the Insured Person except any

caused by Accident and requiring immediate medical treatment in order to maintain life or relieve

immediate pain or distress.

2. Any medical treatment which was not medically necessary.

3. Plastic or cosmetic surgery unless this is certified by the attending Medical Practitioner to be medically

necessary for reconstruction following an Accident.

4. Dental treatment or surgery of any kind, unless to sound natural teeth and necessitated by an Accident.

5. Any health check-ups or examinations or measures primarily carried out for diagnostic or investigative

reasons for any purpose other than treatment related to an Accident

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 10 of 23

UIN: LIBTGDP22171V012122

6. Any costs relating to physiotherapy unless undertaken while the Insured Person is hospitalized.

7. Any costs or periods of residence incurred in connection with rest cures or recuperation at spas or health

resorts, sanatorium, convalescence homes or any similar institution.

8.

9. Any costs relating to the Insured Person’s pregnancy, childbirth or the consequences of either.

10. Any congenital internal or external diseases, defects or anomalies.

Part IV: General Conditions Applicable to all Sections

A. Declaration

The Company shall have no liability towards any claim arising under this Policy if Insured Person makes any false/

incorrect declaration/information while proposing for insurance, which is material for accepting the risk and

offering the cover under the Policy.

B. Transfer of Interest

The insurance Policy forms a Contract between the Company and the Insured Person. The Person under the

Policy is not eligible to transfer, assign, alienate or in any way pass the benefits and/or liabilities to any other

person, Institution, Hospital, Company or Corporate without specific prior approval in writing from the

authorized officer of the Company. However, if the Insured Person is permanently incapacitated or deceased, the

legal heirs of the Insured may represent him in respect of Claim under the Policy.

C. Arbitration

In the event any dispute arises between the Parties out of or in connection with this Agreement, including the

validity thereof, the Parties hereto shall endeavor to settle such dispute amicably in the first instance. The attempt

to bring about an amicable settlement shall be treated as having failed as soon as one of the Parties hereto, after

reasonable attempts, which shall continue for not less than 30 days, gives a notice to this effect, to the other party

in writing. In case of any dispute, controversy or claim arising out of or relating to this Agreement, the Services or

any matter or issue arising there from (‘Dispute’) shall be resolved in accordance with Arbitration and conciliation

Act 1996. Such dispute, controversy, or claim shall be referred to the Sole Arbitrator to be mutually appointed by

the parties as per the provisions of “The Arbitration and Conciliation Act-1996’.In case, the parties fail to appoint

Sole Arbitrator within 30 days, the event shall be referred to a three member Arbitral tribunal. One member each

shall be appointed by both the parties. They shall, within 30 days of their appointment, mutually decide on the

name of the third arbitrator. Arbitration proceedings shall be deemed to commence only on the first date of

meeting of all the three arbitrators. The award of the arbitrator shall be final and binding on the parties to this

contract. The venue of the Arbitration shall be New Delhi. The fees and expenses of the Arbitration Tribunal all

other expenses of the Arbitration shall be borne jointly by the Parties in equal proportion and shall be governed

by Circular No. 2011/IRCTC/Co/Legal/App. Arbitrator dated 18.10.2019 The Parties submit to the exclusive

jurisdiction of the Courts of Delhi. This Agreement shall be interpreted in accordance with Indian law.

D. Electronic Transaction

The Insured agrees to adhere to and comply with all such terms and conditions as the Company may prescribe

from time to time, and hereby agrees and validates that all transactions effected by or through facilities for

conducting remote transactions including the Internet, World Wide Web, electronic data interchange, call centers,

teleservice operations (whether voice, video, data or combination thereof) or by means of electronic, computer,

automated machines network or through other means of telecommunication, established by or on behalf of the

Company, for and in respect of the Policy or its terms, or the Company’s other products and services, has his

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 11 of 23

UIN: LIBTGDP22171V012122

concurrence and full understanding of the terms and conditions affecting this Contract and shall constitute legally

binding and valid transactions when done in adherence to and in compliance with the Company’s terms and

conditions for such facilities, as may be prescribed from time to time. The Company may exchange, share or part

with any information to or with other group companies or any other person in connection with the Policy, as may

be determined by the Company and shall not hold the Company liable for such use/application when done so

after agreement with Insured.

E. Cancellation/Termination of the Policy

This Policy will terminate at the expiration of the period for which premium has been paid or on the Expiration

Date shown in Policy Schedule.

Cancellation by Insured/Insured Person:

No cancellation of the policy by the insured will be allowed in case the insured has reported and received payment

for a claim under any of the covers of this Policy prior to the date of notice of cancellation.

In case of ticket cancellation, Policy Schedule issued to Insured Person may be cancelled by the Insured Person

within 10 days from the policy period end date, by intimation in writing to the Company as long as the Insured

Person is able to establish to the Company’s satisfaction that the Insured Person’s Trip has not commenced. In

this case we will process refund of premium after deduction of administration charges @ 20% of the premium.

F. Notifications & Declarations

The Insured/Insured Person needs to send any and all notices and declarations to the Company in writing only.

Any and all notices and declarations for the attention of the Company shall be sent to the address specified in the

Policy Schedule.

G. Fraud

If any claim made by the insured person, is in any respect fraudulent, or if any false statement, or declaration is

made or used in support thereof, or if any fraudulent means or devices are used by the insured person or anyone

acting on his/her behalf to obtain any benefit under this policy, all benefits under this policy shall be forfeited.

Any amount already paid against claims which are found fraudulent later under this policy shall be repaid by all

person(s) named in the policy schedule, who shall be jointly and severally liable for such repayment.

For the purpose of this clause, the expression "fraud" means any of the following acts committed by the Insured

Person or by his agent, with intent to deceive the insurer or to induce the insurer to issue a insurance Policy:

(a) the suggestion ,as a fact of that which is not true and which the Insured Person does not believe to be true;

(b) the active concealment of a fact by the Insured Person having knowledge or belief of the fact;

(c) any other act fitted to deceive; and

(d) any such act or omission as the law specially declares to be fraudulent

The company shall not repudiate the policy on the ground of fraud, if the insured person / beneficiary can prove

that the misstatement was true to the best of his knowledge and there was no deliberate intention to suppress the

fact or that such mis-statement of or suppression of material fact are within the knowledge of the insurer. Onus

of disproving is upon the policyholder, if alive, or beneficiaries.

H. Governing Law

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 12 of 23

UIN: LIBTGDP22171V012122

The construction, interpretation and meaning of the provisions of this Policy shall be determined in accordance

with the laws of India. The section headings of this Policy are included for descriptive purposes only and do not

form part of this Policy for the purpose of its construction or interpretation. The terms of this Policy shall not be

waived or changed except by endorsement issued by the Company.

I. Eligibility

The scheme is applicable to those who book their e-ticket through IRCTC website. It will be an optional cover

however the coverage will be compulsory for all passengers booked under one PNR number if the option is to be

exercised.

In case of children below 5 years travelling with passengers, the required details should be entered in the reservation

form [online form] and accordingly travel insurance premium will be added to the total amount payable, if detail

not filled then the travel insurance cover will not be applicable for the children below 5 years.

J. Entire Contract

The Policy constitutes the complete contract of insurance. No change or alteration in this Policy shall be valid or

effective unless approved in writing by the Company, which approval shall be evidenced by an endorsement on

the Policy. No agent shall or has the authority to change in any respect whatsoever any term and conditions and

exclusions under this Policy or waive off any of its provisions.

K. Nomination

The policyholder is required at the inception of the policy to make a nomination for the purpose of payment

of claims under the policy in the event of death of the policyholder. Any change of nomination shall be

communicated to the company in writing and such change shall be effective only when an endorsement on

the policy is made. For Claim settlement under reimbursement, the Company will pay the policyholder. In

the event of death of the policyholder, the Company will pay the nominee {as named in the Policy

Schedule/Policy Certificate/Endorsement (if any)} and in case there is no subsisting nominee, to the legal

heirs or legal representatives of the Policyholder whose discharge shall be treated as full and final discharge

of its liability under the Policy.

L. Notification of Claims

Upon the happening of any event giving rise or likely to give rise to a claim under this Policy, the Insured/Insured

Person(s) shall give immediate notice to Us but not later than 4 months after the event has taken place through

on-line module or calling toll-free number or in writing to the address as shown in the Schedule with Particulars

below:

i. PNR no.

ii. Policy Number/ Certificate No.

iii. Type of claim

iv. Name of the Insured Person availing treatment

v. Details of injury

vi. Name and address of the Hospital

vii. Any other relevant information

iii) Conditions when a claim arises

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 13 of 23

UIN: LIBTGDP22171V012122

The Company’s liability under this Policy will be subject to the following provisos, upon the happening of any

event giving rise to or likely to give rise to a Claim under any Section of this Policy,

i) An immediate notification is made to the Insurance Company in respect of any Claim under Medical expenses

and disability or train delay, by the Insured Person or, if deceased, his legal or other representative or

immediate family member, and provided with the name of the treating Physician, the name and telephone

number of the hospital at which treatment is being obtained, and the fact or matter giving rise to the need for

medical treatment, all the original bills, receipts and documentation or information as mentioned in Annexure

‘A’- Claim Documents Checklist or any other documents or information that might be required or

requested by the Company for assessment of the claim.

ii) The Insured Person/Claimant need to fill in the claim form (including online form) and forward the same to

the Company along with all the bills, receipts and other supporting documentation or additional information

requested by the Company for assessment of the claim.

M. Assessment of Claim & Payment

Reimbursement Claims - Notice of claim with particulars relating to Policy numbers, Policy schedule no, name

of the Insured Person in respect of whom claim is made, nature of injury and name and address of the attending

Medical Practitioner/ Hospital/ Nursing Home should be given to Us immediately on hospitalization due to

injury/ death, failing which admission of claim would be based on the merits of the case as per the board approved

underwriting policy of the Company. The Insured Person shall after intimation as aforesaid, further submit

documents as per Annexure A at his/her own expense to Us within 15 days of discharge from the hospital.

The Insured Person/s shall at any time as may be required authorize and permit the Company to obtain any further

information or records from the Hospital, Medical Practitioner, Lab or other agency, in connection with the

treatment relating to the claim. The Company may call for additional documents/information and/or carry out

verification on a case to case basis to ascertain the facts/collect additional information/documents of the case to

determine the extent of loss. Verification carried out will be done by professional Investigators or a member of

the Service Provider and costs for such investigations shall be borne by the Company.

The Company may accept claims where documents have been provided after a delayed interval in case such delay

is proved to be for reasons beyond the control of the Insured/ Insured Person (s). The Insured shall tender to the

Company all reasonable information, assistance and proofs in connection with any claim hereunder.

No person other than the Insured /Insured Person(s) and/ or nominees declared at proposal can claim under this

Policy.

Payment of Claim

i. We will make payment to Insured Person or Insured Person’s Nominee. If there is no Nominee and Insured

Person are incapacitated or deceased, We will pay Insured Person’s heir, executor or validly appointed legal

representative and any payment We make in this way will be a complete and final discharge of our liability to

make payment.

ii. On receipt of all the documents as mentioned under Annexure ‘A’- Claim Documents Checklist as provided

hereunder and on being satisfied with regards to admissibility of the claims as per Policy terms and conditions,

We shall settle the claim within 15 days of the receipt of the documents in accordance with the provisions of

‘Protection of Policyholders’ Interest Regulations, 2017’ as amended from time to time.

iii. The Policy - excludes the List of excluded items - attached in the Policy document.

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 14 of 23

UIN: LIBTGDP22171V012122

iv. The following will apply specifically in respect of a Claim under Accidental Hospitalization:

The Insured Person shall present himself for medical examination by a Medical Advisor as considered

necessary by the Company at his expense and the Insured Person agrees that the Company may approach

anyone who may have treated the Insured Person for information and/or documentation in respect of the

Claim.

N. Withdrawal of Product

In the likelihood of this product being withdrawn in future, the Company will intimate the insured person about

the same 90 days prior to expiry of the policy.

Insured Person will have the option to migrate to similar health insurance product available with the Company at

the time of renewal with all the accrued continuity benefits such as cumulative bonus, waiver of waiting period. as

per IRDAI guidelines, provided the policy has been maintained without a break..

O. Due Observance

The due observance of and compliance with the terms, provision, warranties and conditions of this Policy in so

far as they relate to anything to be done or complied with by the Insured shall be a condition precedent to the

Company’s liability under this Policy.

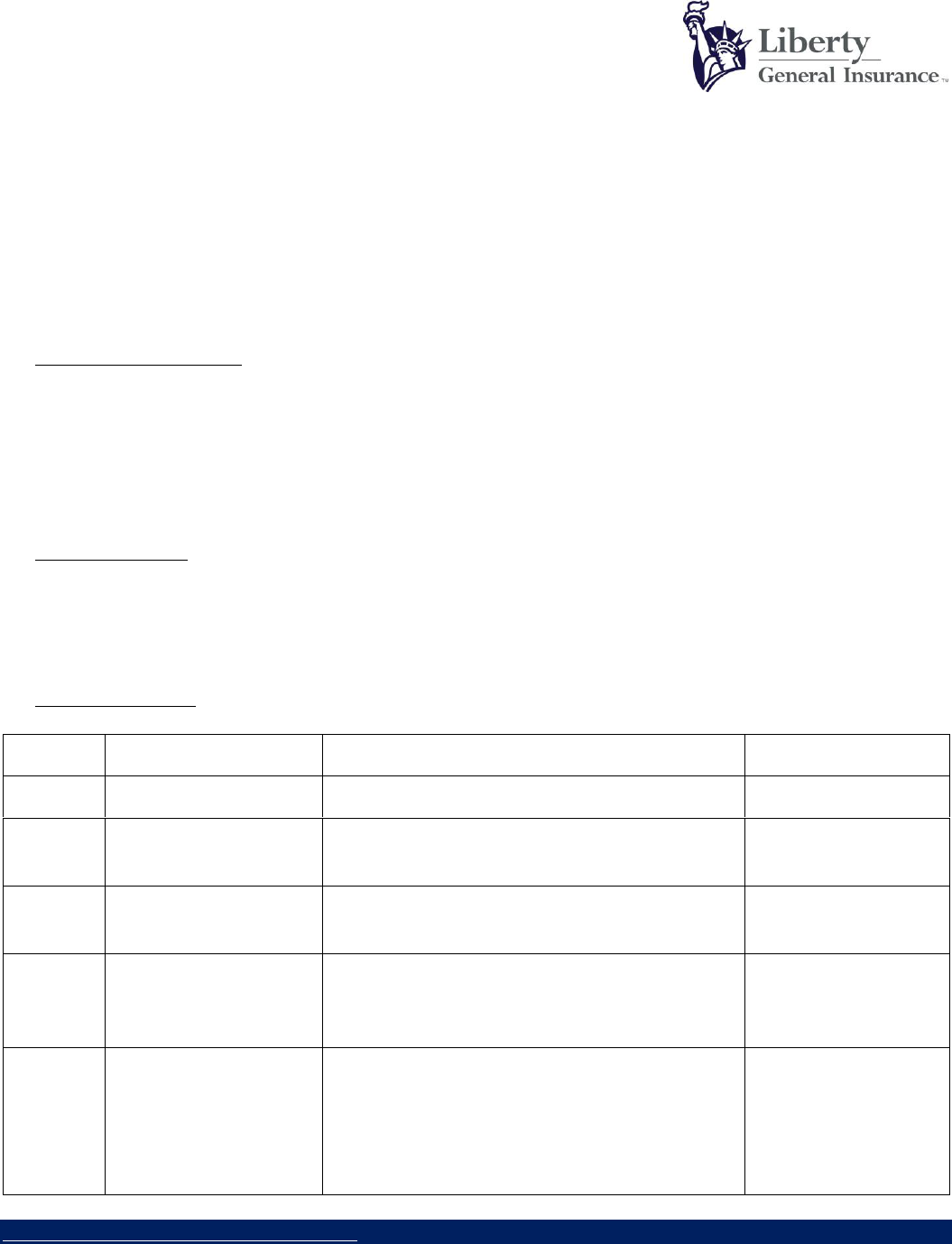

P. Benefit Schedule:

Sections

Scope of Cover

Description

Sum Insured-INR

Section 1

Accidental Death

Covers death due to an accident during the trip.

10,00,000

Section 2

Permanent Total

Disablement

Covers Permanent Total Disability caused due

to an accident during the trip.

10,00,000

Section 3

Permanent Partial

Disablement

Covers Permanent Partial Disability caused due

to an accident during the trip.

Max Upto 7,50,000

Section 4

Emergency Accidental

Hospitalization

Covers medical expenses incurred towards

hospitalization on account of accidental injury

occurring during the trip.

Max upto 2,00,000

Section 5

Transportation of

Mortal Remains

Covers cost of transportation of mortal remains

or equivalent amount for burial or cremation of

the Insured at the location where death has

occurred, in case of death on account of

accidental injury during the trip.

Max upto 10,000

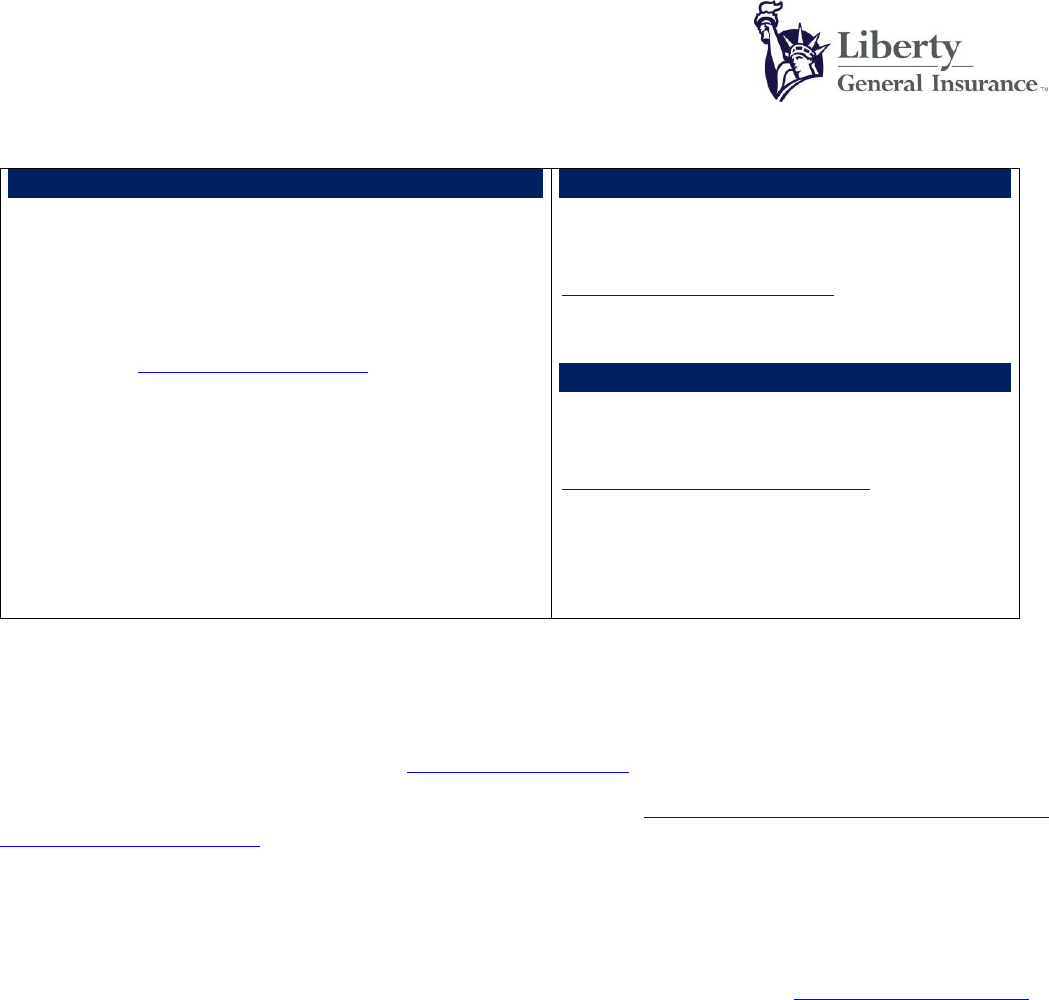

Part V: Grievance Redressal Procedure

We are concerned about You and are committed to extend the best possible services. In case You are not

satisfied with our services or resolutions, please follow the below steps for redressal.

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 15 of 23

UIN: LIBTGDP22171V012122

Step 1

Call us on Toll free number: 1800-266-5844

(8:00 AM to 8:00 PM, 7 days of the week)

or

Email us at: [email protected]

or

Write to us at:

Customer Service

Liberty General Insurance Ltd.

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai 400 013

Step 2

If our response or resolution does not meet

Your expectations, You can escalate at

Step 3

If You are still not satisfied with the resolution

provided, You can further escalate at

Insured person may also approach the grievance cell at any time of the Company’s branches with the details of

the grievance.

If the insured person is not satisfied with the redressal of the grievance through one of the above methods, insured

person may contact the grievance officer at [email protected].

For updated details of grievance officer kindly refer https://www.libertyinsurance.in/customer-

support/grievance-redressal

If Insured person is not satisfied with the redressal of grievance through above methods, the insured person may

also approach the office of Insurance Ombudsman of the respective area/region for redressal of grievance. The

contact details of the Insurance Ombudsman offices have been provided as Annexure-B

Grievance may also be lodged at IRDAI Integrated Grievance Management System - https://igms.irda.gov.in/

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 16 of 23

UIN: LIBTGDP22171V012122

Annexure A- Claim Documents Checklist

Following is the indicative document list for reimbursement claims:

1. In case of Death Claim:

Submit the duly filled in claim form signed by nominee/legal heir along with the NEFT mandate details and

cancelled cheque with the following documents:

• Report of the Railway Authority confirming the accident of the train.

• Report of the Railway Authority carrying the details of the passengers declared dead.

• Duly Completed Personal Accident Claim Form signed by Nominee / Legal Heir along with the NEFT

mandate details & cancelled cheque

• Photo identity proof of nominee

• For Death Claims, claim will be settled only to nominee declared at the time of buying insurance through

IRCTC portal

• In absence of nominee, claim will be paid to Legal Heir only –as per Legal Heir / Succession Certificate

2. Permanent Total Disablement & Permanent Partial Disablement:

• Report of the Railway Authority confirming the accident of the train.

• Report of attending doctor confirming the extent of disability.

• Medical bills corresponding to doctor’s prescription.

• Duly Completed Personal Accident Claim Form signed by insured / Nominee

• Attested copy of disability certificate from Civil Surgeon of that Hospital in which the treatment has

undergone stating percentage of disability.

• Attested copy of FIR.

• All X-Ray / Investigation reports and films supporting to disablement.

• Claim form with NEFT details & cancelled cheque of the beneficiary

• Photograph before & after disability

3. In case of Hospitalization Expenses for Injury

• Report of the Railway Authority confirming the accident of the train.

• Medical bills corresponding to doctor’s prescription

• Duly completed personal accident claim form signed by the Insured Person/Nominee

4. In case of Transportation of mortal remains

• Report of the Railway Authority confirming the accident of the train.

• Report of the Railway Authority carrying the details of the passengers declared dead

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 17 of 23

UIN: LIBTGDP22171V012122

• Photo identity proof of nominee.

• In absence of nominee, claim will be paid to Legal Heir only – as per Legal Heir / Succession Certificate.

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 18 of 23

UIN: LIBTGDP22171V012122

Annexure-B

The contact details of the

Insurance Ombudsman

offices are as below-

Areas of

Jurisdiction

Office of the Insurance

Ombudsman

Gujarat , UT of Dadra

and Nagar Haveli,

Daman and Diu

AHMEDABAD - Shri Kuldip Singh

Office of the Insurance Ombudsman,

Jeevan Prakash Building, 6th floor,

Tilak Marg, Relief Road,

Ahmedabad – 380 001.

Tel.: 079 - 25501201/02/05/06

Email: bimalokpal.ahmedabad@cioins.co

.in

Karnataka

BENGALURU -

Office of the Insurance Ombudsman,

Jeevan Soudha Building,PID No. 57-27-

N-19

Ground Floor, 19/19, 24th Main Road,

JP Nagar, Ist Phase,

Bengaluru – 560 078.

Tel.: 080 - 26652048 / 26652049

Email: bimalokpal.be[email protected]

n

Madhya Pradesh and

Chhattisgarh

BHOPAL -

Office of the Insurance Ombudsman,

Janak Vihar Complex, 2nd Floor,

6, Malviya Nagar, Opp. Airtel Office,

Near New Market,

Bhopal – 462 003.

Tel.: 0755 - 2769201 / 2769202

Fax: 0755 - 2769203

Email: bimalokpal.bhopal@cioins.co.in

Orissa

BHUBANESHWAR - Shri Suresh

Chandra Panda

Office of the Insurance Ombudsman,

62, Forest park,

Bhubneshwar – 751 009.

Tel.: 0674 - 2596461 /2596455

Fax: 0674 - 2596429

Email: bimalokpal.bhubaneswar@cioins.

co.in

Punjab,

Haryana(excluding

Gurugram, Faridabad,

Sonepat and

Bahadurgarh)

Himachal Pradesh,

Union Territories of

Jammu & Kashmir,

Ladakh & Chandigarh.

CHANDIGARH -

Office of the Insurance Ombudsman,

S.C.O. No. 101, 102 & 103, 2nd Floor,

Batra Building, Sector 17 – D,

Chandigarh – 160 017.

Tel.: 0172 - 2706196 / 2706468

Fax: 0172 - 2708274

Email: bimalokpal.c[email protected]o.

in

Tamil Nadu,

Tamil Nadu

Puducherry Town and

Karaikal (which are

part of Puducherry).

CHENNAI -

Office of the Insurance Ombudsman,

Fatima Akhtar Court, 4th Floor, 453,

Anna Salai, Teynampet,

CHENNAI – 600 018.

Tel.: 044 - 24333668 / 24335284

Fax: 044 - 24333664

Email: bimalokpal.chennai@cioins.co.in

Delhi &

Following Districts of

Haryana - Gurugram,

Faridabad, Sonepat &

Bahadurgarh.

DELHI - Shri Sudhir Krishna

Office of the Insurance Ombudsman,

2/2 A, Universal Insurance Building,

Asaf Ali Road,

New Delhi – 110 002.

Tel.: 011 - 23232481/23213504

Email: bimalokpal.de[email protected]

Assam,

Meghalaya,

Manipur,

Mizoram,

Arunachal Pradesh,

Nagaland and Tripura.

GUWAHATI -

Office of the Insurance Ombudsman,

Jeevan Nivesh, 5th Floor,

Nr. Panbazar over bridge, S.S. Road,

Guwahati – 781001(ASSAM).

Tel.: 0361 - 2632204 / 2602205

Email: bimalokpal.g[email protected]

Andhra Pradesh,

Telangana,

Yanam and

part of Union

Territory of

Puducherry.

HYDERABAD -

Office of the Insurance Ombudsman,

6-2-46, 1st floor, "Moin Court",

Lane Opp. Saleem Function Palace,

A. C. Guards, Lakdi-Ka-Pool,

Hyderabad - 500 004.

Tel.: 040 - 23312122

Fax: 040 - 23376599

Email: bimalokpal.hyderabad@cioins.co.i

n

Rajasthan

JAIPUR -

Office of the Insurance Ombudsman,

Jeevan Nidhi – II Bldg., Gr. Floor,

Bhawani Singh Marg,

Jaipur - 302 005.

Tel.: 0141 - 2740363

Email: bimalokpal.ja[email protected]

Kerala,

Lakshadweep,

Mahe-a part of Union

Territory of

Puducherry.

ERNAKULAM - Ms. Poonam Bodra

Office of the Insurance Ombudsman,

2nd Floor, Pulinat Bldg.,

Opp. Cochin Shipyard, M. G. Road,

Ernakulam - 682 015.

Tel.: 0484 - 2358759 / 2359338

Fax: 0484 - 2359336

Email: bimalokpal.ernakulam@cioins.co.

in

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 19 of 23

UIN: LIBTGDP22171V012122

West Bengal,

Sikkim,

Andaman & Nicobar

Islands.

KOLKATA - Shri P. K. Rath

Office of the Insurance Ombudsman,

Hindustan Bldg. Annexe, 4th Floor,

4, C.R. Avenue,

KOLKATA - 700 072.

Tel.: 033 - 22124339 / 22124340

Fax : 033 - 22124341

Email: bimalokpal.kolka[email protected]

Districts of Uttar

Pradesh :

Lalitpur, Jhansi,

Mahoba, Hamirpur,

Banda, Chitrakoot,

Allahabad, Mirzapur,

Sonbhabdra, Fatehpur,

Pratapgarh,

Jaunpur,Varanasi,

Gazipur, Jalaun,

Kanpur, Lucknow,

Unnao, Sitapur,

Lakhimpur, Bahraich,

Barabanki, Raebareli,

Sravasti, Gonda,

Faizabad, Amethi,

Kaushambi,

Balrampur, Basti,

Ambedkarnagar,

Sultanpur,

Maharajgang,

Santkabirnagar,

Azamgarh,

Kushinagar,

Gorkhpur, Deoria,

Mau, Ghazipur,

Chandauli, Ballia,

Sidharathnagar.

LUCKNOW -Shri Justice Anil Kumar

Srivastava

Office of the Insurance Ombudsman,

6th Floor, Jeevan Bhawan, Phase-II,

Nawal Kishore Road, Hazratganj,

Lucknow - 226 001.

Tel.: 0522 - 2231330 / 2231331

Fax: 0522 - 2231310

Email: bimalokpal.lucknow@cioins.co.in

Goa, Mumbai

Metropolitan Region

excluding Navi

Mumbai & Thane

MUMBAI -

Office of the Insurance Ombudsman,

3rd Floor, Jeevan Seva Annexe,

S. V. Road, Santacruz (W),

Mumbai - 400 054.

Tel.:

69038821/23/24/25/26/27/28/28/29/

State of Uttaranchal

and the following

Districts of Uttar

Pradesh:

Agra, Aligarh, Bagpat,

Bareilly, Bijnor,

Budaun,

Bulandshehar, Etah,

Kanooj, Mainpuri,

Mathura, Meerut,

Moradabad,

Muzaffarnagar,

Oraiyya, Pilibhit,

Etawah, Farrukhabad,

Firozbad,

Gautambodhanagar,

Ghaziabad, Hardoi,

Shahjahanpur, Hapur,

Shamli, Rampur,

Kashganj, Sambhal,

Amroha, Hathras,

Kanshiramnagar,

Saharanpur.

NOIDA - Shri Chandra Shekhar

Prasad

Office of the Insurance Ombudsman,

Bhagwan Sahai Palace

4th Floor, Main Road,

Naya Bans, Sector 15,

Distt: Gautam Buddh Nagar,

U.P-201301.

Tel.: 0120-2514252 / 2514253

Email: bimalokpal.noida@cioins.co.in

Bihar,

Jharkhand.

PATNA - Shri N. K. Singh

Office of the Insurance Ombudsman,

2nd Floor, Lalit Bhawan,

Bailey Road,

Patna 800 001.

Tel.: 0612-2547068

Email: bimalokpal.pa[email protected]

Maharashtra,

Area of Navi Mumbai

and Thane excluding

Mumbai

Metropolitan Region

PUNE - Shri Vinay Sah

Office of the Insurance Ombudsman,

Jeevan Darshan Bldg., 3rd Floor,

C.T.S. No.s. 195 to 198,

N.C. Kelkar Road, Narayan Peth,

Pune – 411 030.

Tel.: 020-41312555

Email: bimalokpal.pune@cioins.co.in

For updated details of Insurance Ombudsman Offices You may visit Council of Insurance Ombudsmen website

at https://www.cioins.co.in//ombudsman.html or our website at https://www.libertyinsurance.in/customer-

support/grievance-redressal

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 20 of 23

UIN: LIBTGDP22171V012122

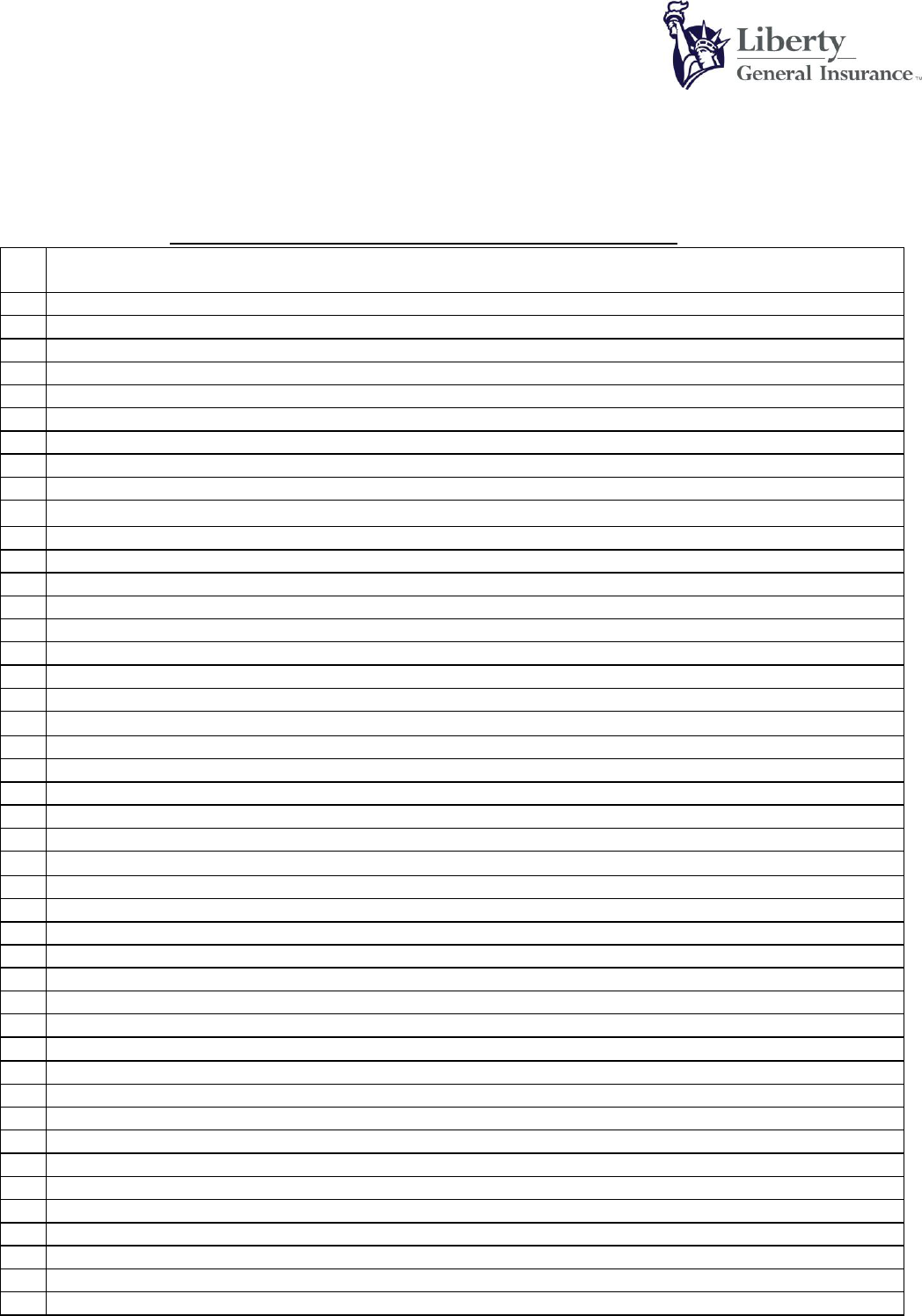

LIST OF EXCLUDED ITEMS

(Applicable for Claim under Accidental Hospitalization only)

List I – Items for which coverage is not available in the policy

Sl

No

Item

1

BABY FOOD

2

BABY UTILITIES CHARGES

3

BEAUTY SERVICES

4

BELTS/ BRACES

5

BUDS

6

COLD PACK/HOT PACK

7

CARRY BAGS

8

EMAIL / INTERNET CHARGES

9

FOOD CHARGES (OTHER THAN PATIENT's DIET PROVIDED BY HOSPITAL)

10

LEGGINGS

11

LAUNDRY CHARGES

12

MINERAL WATER

13

SANITARY PAD

14

TELEPHONE CHARGES

15

GUEST SERVICES

16

CREPE BANDAGE

17

DIAPER OF ANY TYPE

18

EYELET COLLAR

19

SLINGS

20

BLOOD GROUPING AND CROSS MATCHING OF DONORS SAMPLES

21

SERVICE CHARGES WHERE NURSING CHARGE ALSO CHARGED

22

Television Charges

23

SURCHARGES

24

ATTENDANT CHARGES

25

EXTRA DIET OF PATIENT (OTHER THAN THAT WHICH FORMS PART OF BED CHARGE)

26

BIRTH CERTIFICATE

27

CERTIFICATE CHARGES

28

COURIER CHARGES

29

CONVEYANCE CHARGES

30

MEDICAL CERTIFICATE

31

MEDICAL RECORDS

32

PHOTOCOPIES CHARGES

33

MORTUARY CHARGES

34

WALKING AIDS CHARGES

35

OXYGEN CYLINDER (FOR USAGE OUTSIDE THE HOSPITAL)

36

SPACER

37

SPIROMETRE

38

NEBULIZER KIT

39

STEAM INHALER

40

ARMSLING

41

THERMOMETER

42

CERVICAL COLLAR

43

SPLINT

44

DIABETIC FOOT WEAR

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 21 of 23

UIN: LIBTGDP22171V012122

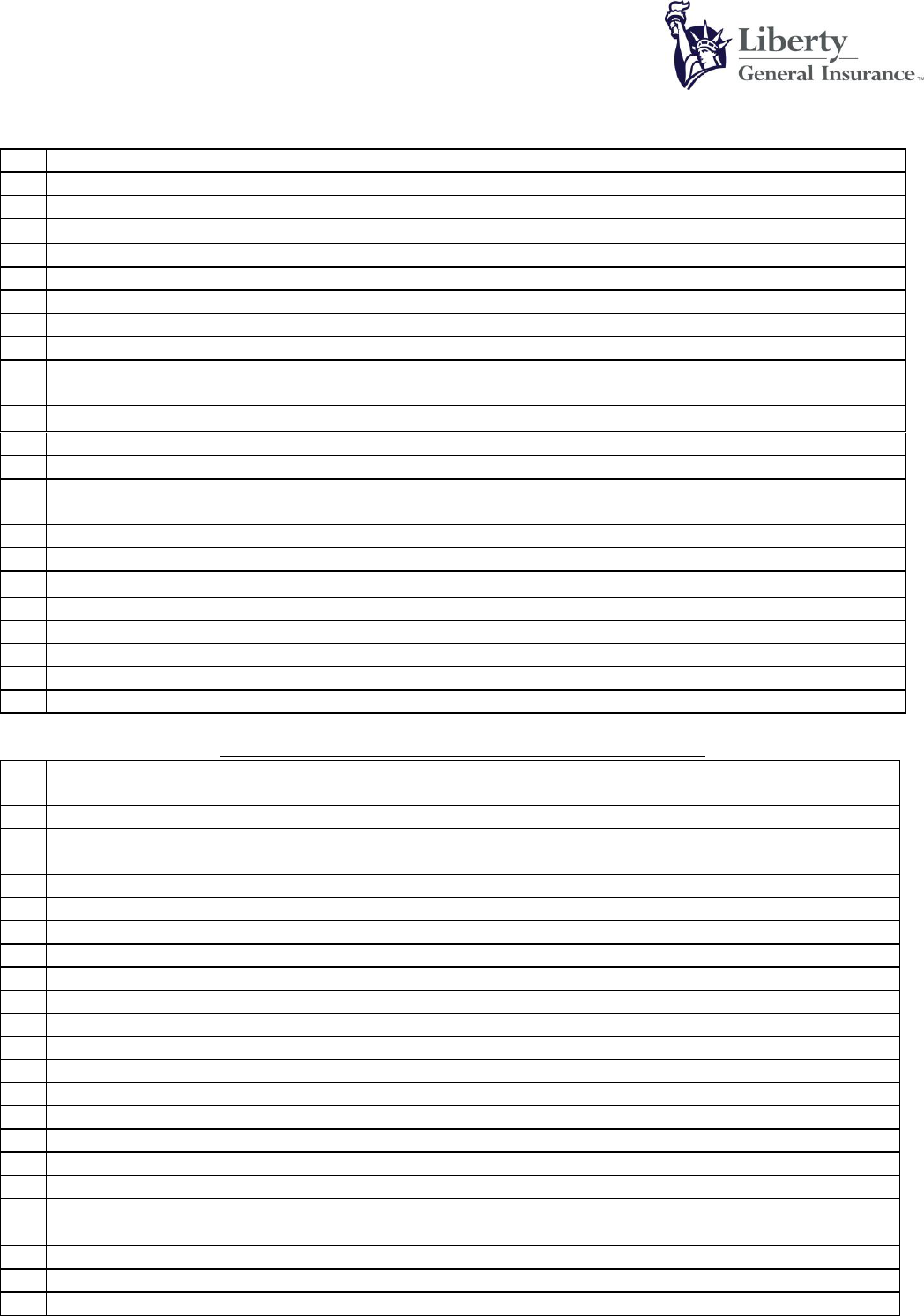

List II – Items that are to be subsumed into Room Charges

45

KNEE BRACES (LONG/ SHORT/ HINGED)

46

KNEE IMMOBILIZER/SHOULDER IMMOBILIZER

47

LUMBO SACRAL BELT

48

NIMBUS BED OR WATER OR AIR BED CHARGES

49

AMBULANCE COLLAR

50

AMBULANCE EQUIPMENT

51

ABDOMINAL BINDER

52

PRIVATE NURSES CHARGES- SPECIAL NURSING CHARGES

53

SUGAR FREE Tablets

54

CREAMS POWDERS LOTIONS (Toiletries are not payable, only prescribed medical pharmaceuticals payable)

55

ECG ELECTRODES

56

GLOVES

57

NEBULISATION KIT

58

ANY KIT WITH NO DETAILS MENTIONED [DELIVERY KIT, ORTHOKIT, RECOVERY KIT, ETC]

59

KIDNEY TRAY

60

MASK

61

OUNCE GLASS

62

OXYGEN MASK

63

PELVIC TRACTION BELT

64

PAN CAN

65

TROLLY COVER

66

UROMETER, URINE JUG

67

AMBULANCE

68

VASOFIX SAFETY

Sl

No

Item

1

BABY CHARGES (UNLESS SPECIFIED/INDICATED)

2

HAND WASH

3

SHOE COVER

4

CAPS

5

CRADLE CHARGES

6

COMB

7

EAU-DE-COLOGNE / ROOM FRESHNERS

8

FOOT COVER

9

GOWN

10

SLIPPERS

11

TISSUE PAPER

12

TOOTH PASTE

13

TOOTH BRUSH

14

BED PAN

15

FACE MASK

16

FLEXI MASK

17

HAND HOLDER

18

SPUTUM CUP

19

DISINFECTANT LOTIONS

20

LUXURY TAX

21

HVAC

22

HOUSE KEEPING CHARGES

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 22 of 23

UIN: LIBTGDP22171V012122

List III – Items that are to be subsumed into Procedure Charges

List IV – Items that are to be subsumed into costs of treatment

23

AIR CONDITIONER CHARGES

24

IM IV INJECTION CHARGES

25

CLEAN SHEET

26

BLANKET/WARMER BLANKET

27

ADMISSION KIT

28

DIABETIC CHART CHARGES

29

DOCUMENTATION CHARGES / ADMINISTRATIVE EXPENSES

30

DISCHARGE PROCEDURE CHARGES

31

DAILY CHART CHARGES

32

ENTRANCE PASS / VISITORS PASS CHARGES

33

EXPENSES RELATED TO PRESCRIPTION ON DISCHARGE

34

FILE OPENING CHARGES

35

INCIDENTAL EXPENSES / MISC. CHARGES (NOT EXPLAINED)

36

PATIENT IDENTIFICATION BAND / NAME TAG

37

PULSEOXYMETER CHARGES

Sl

No.

Item

1

HAIR REMOVAL CREAM

2

DISPOSABLES RAZORS CHARGES (for site preparations)

3

EYE PAD

4

EYE SHEILD

5

CAMERA COVER

6

DVD, CD CHARGES

7

GAUSE SOFT

8

GAUZE

9

WARD AND THEATRE BOOKING CHARGES

10

ARTHROSCOPY AND ENDOSCOPY INSTRUMENTS

11

MICROSCOPE COVER

12

SURGICAL BLADES, HARMONICSCALPEL,SHAVER

13

SURGICAL DRILL

14

EYE KIT

15

EYE DRAPE

16

X-RAY FILM

17

BOYLES APPARATUS CHARGES

18

COTTON

19

COTTON BANDAGE

20

SURGICAL TAPE

21

APRON

22

TORNIQUET

23

ORTHOBUNDLE, GYNAEC BUNDLE

Sl

No.

Item

1

ADMISSION/REGISTRATION CHARGES

2

HOSPITALISATION FOR EVALUATION/ DIAGNOSTIC PURPOSE

3

URINE CONTAINER

4

BLOOD RESERVATION CHARGES AND ANTE NATAL BOOKING CHARGES

Liberty General Insurance Limited

10

th

Floor, Tower A, Peninsula Business Park,

Ganpatrao Kadam Marg, Lower Parel, Mumbai – 400 013

Phone: +91 22 6700 1313 Fax: +91 22 6700 1606

Email: care@libertyinsurance.in

IRDA registration number: 150 • CIN: U66000MH2010PLC209656

Optional Travel Insurance for E-ticket passengers - IRCTC Page 23 of 23

UIN: LIBTGDP22171V012122

5

BIPAP MACHINE

6

CPAP/ CAPD EQUIPMENTS

7

INFUSION PUMP– COST

8

HYDROGEN PEROXIDE\SPIRIT\ DISINFECTANTS ETC

9

NUTRITION PLANNING CHARGES - DIETICIAN CHARGES- DIET CHARGES

10

HIV KIT

11

ANTISEPTIC MOUTHWASH

12

LOZENGES

13

MOUTH PAINT

14

VACCINATION CHARGES

15

ALCOHOL SWABES

16

SCRUB SOLUTION/STERILLIUM

17

GLUCOMETER& STRIPS

18

URINE BAG