August 3, 2017

Future of Finance

Payment Ecosystems

Equity Research

What happens when the world shifts online?

Payments: The next battleground in the online revolution

The world is pivoting online faster than ever—payments are no exception.

Amazon is breaking barriers between online and offline, forcing traditional

retailers to adapt to survive. The payments transformation is accelerating

as challengers Stripe, Alipay, and Adyen become online juggernauts. Huge

new online markets are being created – including B2B payments and the

sharing economy. We see $28 trillion in online spending growing to $51

trillion over 10 years, driving $200 billion in new payments fee revenue.

What will the future hold? Addressing top investor questions

As battle lines are drawn in these emerging online markets, we give our

views and supporting analysis on top investor questions including:

* Is PayPal’s growth sustainable? We take a look back at what has driven

PayPal’s formula for success, and whether it can maintain its relevance.

* How could Visa and Mastercard be disrupted? We lay out the case for

how Alipay and Tenpay could export China’s payment systems overseas.

* Could payments be the next industry that Amazon takes on? We assess

Amazon’s payments strategy, and how it could seek to upend incumbents.

* What’s the outlook for M&A in payments? We survey the payment

processor landscape in search of potential consolidation opportunities.

Startups: Profiling the most innovative global online players

We see few obstacles to slow the momentum of emerging companies that

are achieving scale, and we profile the leading private online payment

companies globally. Adyen has established itself as an international force,

crossing from online to offline. Stripe leads the sharing economy and is

building a presence in B2B payments. Alipay and Tenpay are dominant

names in China and could seek to expand overseas, while PayU and Paytm

build new ecosystems amid the digitalization of cash in emerging markets.

Affirm and Klarna have the potential to transform consumer credit online.

We interview Adyen’s CEO and Stripe’s CFO for their insights.

Incumbents: Can they be disrupted? Look overseas for clues

We tackle the question of disruption risk for Visa, Mastercard, and PayPal –

and if China’s payments model can be imported to the US. We think these

risks are real. However, incumbents are expanding to new opportunities.

PayPal should sustain mid-teens volume growth to 2025 as it diversifies to

online bill pay, B2B, and sharing economy. We think Visa and Mastercard

can sustain their growth rates driven by B2B, a new $40 trillion market.

Wirecard is

p

oised to build u

p

on its success as an online-first leader.

James Schneider, Ph.D.

(917) 343-3149 james.schneider@gs.com

Goldman Sachs & Co. LLC

Lara Fourman, CFA

(917) 343-7293 lara.fourman@gs.com

Goldman Sachs & Co. LLC

Heath P. Terry, CFA

(212) 357-1849 heath[email protected]m

Goldman Sachs & Co. LLC

Piyush Mubayi

+852-2978-1677 piyush.mub[email protected]

Goldman Sachs (Asia) L.L.C.

Mohammed Moawalla

+44(20)7774-1726 mohammed.moawalla@gs.com

Goldman Sachs International

Ryan M. Nash, CFA

(212) 902-8963 ryan.na[email protected]

Goldman Sachs & Co. LLC

Julia McCrimlisk

(917) 343-2456 julia.mccrimlisk@gs.com

Goldman Sachs & Co. LLC

Goldman Sachs does and seeks to do business with companies covered in its research reports. As a result, investors

should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors

should consider this report as only a single factor in making their investment decision. For Reg AC certification and other

important disclosures, see the Disclosure Appendix, or go to www.gs.com/research/hedge.html. Analysts employed by

non-US affiliates are not registered/qualified as research analysts with FINRA in the U.S.

The Goldman Sachs Group, Inc. Global Investment Research

More on the

Future of Finance

This report is the latest in our series

exploring the technology, new business

models and regulation reshaping

finance. See inside for more.

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 2

Table of Contents

Payment ecosystems: What happens when the world moves online? 3

Online payments: Overview and industry roadmap 7

Q1: Can PayPal sustain its growth trajectory? 14

Q2: How could Visa and Mastercard be disrupted? 21

Q3: Is Amazon Payments a threat to the existing ecosystem? 30

Q4: What are the most promising & disruptive payments startups? 37

Interview with … Pieter van der Does, CEO of Adyen 38

Interview with … Will Gaybrick, CFO of Stripe 42

Q5: How are Visa and Mastercard positioned for the move online? 52

Q6: Can payment processors still grow as the market shifts online? 59

Q7: How is e-commerce changing the consumer credit landscape? 65

Q8: What role will mobile wallets like Apple Pay play in the emerging online payments landscape? 68

Q9: Why does C2C matter, and will it ever make money? 73

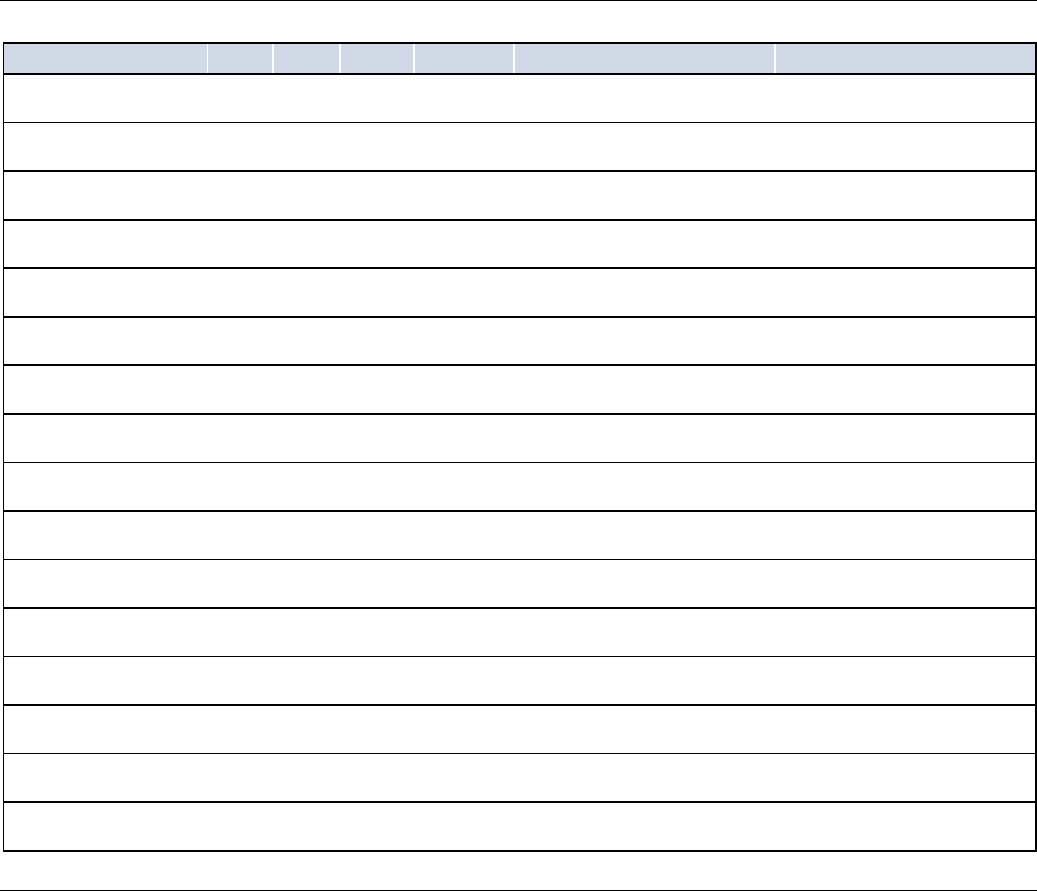

Appendix I: Index of global emerging payments companies 79

Appendix II: Model assumptions and price targets 80

Disclosure Appendix 84

Payments Internet Int'l Payments/Financials Financials Consumer

James Schneider, Ph.D. Heath P. Terry, CF

A

Mohammed Mowalla Ryan M. Nash, CF

A

Matthew J. Fassler

james.schneider@gs.com heath.terry@gs.com mohammed.mowalla@gs.com ryan.nash@gs.com matt.fassl[email protected]m

(917) 343-3149 (212) 357-1849 +44(20)7774-1726 (212) 902-8963 (212) 902-6740

Goldman Sachs & Co. LLC Goldman Sachs & Co. LLC Goldman Sachs International Goldman Sachs & Co. LLC Goldman Sachs & Co. LLC

Lara Fourman, CF

A

Piyush Mubayi Mancy Sun Richard Ramsden

(917) 343-7293 +852 2978-1677 +852 2978-6072 (212) 357-9981

Goldman Sachs & Co. LLC Goldman Sachs (Asia) L.L.C. Goldman Sachs (Asia) L.L.C. Goldman Sachs & Co. LLC

Julia McCrimlis

k

Daniel Powell Stanley Tian Will Nance

(917) 343-2456 (917) 343-4120 +852 2978-1945 (212) 357-7438

Goldman Sachs & Co. LLC Goldman Sachs & Co. LLC Goldman Sachs (Asia) L.L.C. Goldman Sachs & Co. LLC

Derek Taylor Adam Hotchkiss

derek.ta[email protected]om adam.hotchkiss@gs.com

(801) 884-4434 (212) 902-3941

Goldman Sachs & Co. LLC Goldman Sachs & Co. LLC

Technology, regulation and new business models are changing the shape of finance. From shadow banks to new tech

platforms, an evolving class of competitors is emerging to go after the profit pools of traditional lenders and institutions.

In a series of reports on the Future of Finance, we explore what these trends mean for how companies and consumers

bank, lend, borrow and pay.

The Rise of the New Shadow Bank, March 3, 2015

Redefining the ‘Way We Pay’ in the Next Decade, March 10, 2015

The Socialization of Finance, March 13, 2015

Profiles in Innovation: Blockchain—Putting Theory into Practice, May 24, 2016

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 3

Payment ecosystems: What happens when the world moves online?

Background: Setting the stage

The world is pivoting online, and the payments industry is no exception. We estimate

there will be over $50 trillion in online payment volume by 2026, with $23 trillion

shifting online over the next 10 years, driving $200 billion in new fees the payments

industry can capture. We think investors underestimate the disruption of online

payments outside e-commerce, and we estimate that other segments – notably B2B

payments, bill payments, and the sharing economy – will drive 50% of that growth.

The battle for payments dominance will play out globally, and we expect competing

ecosystems of consumers and businesses – from banks to PayPal to Amazon to

Alipay – to compete based on the scale and scope of market power they represent. In

this report we lay out our answers to the most common investor questions on who

could be disrupted, highlighting the most promising new companies on the horizon.

Top investment conclusions

PayPal (Buy-CL) – We believe PayPal still has a long runway for success and can

maintain volume growth of about 15% over the next 10 years.

We think investors

often see PayPal’s market simply as e-commerce, but we think PayPal is positioned to

seed growth in new markets. To be sure, this growth is not without execution risk. But

we believe the biggest driver of PayPal’s success – its base of over 200mn users – will

prove critical as it markets next-generation payments services to millennials and others.

Visa (Buy-CL) and Mastercard (Buy) – The networks face threats, but are also

positioned to open new avenues of growth.

The card networks face real threats

from China and elsewhere (Alipay, Tenpay), and will need to invest and partner

aggressively (Apple, Square, Klarna) to ensure that faster payments stay on their rails.

But they are positioning themselves to capture substantial share in greenfield markets

like B2B payments, allowing them to sustain their growth rates over the next decade.

Payment processors – Changing of the online guard: Stripe and Adyen lead while

traditional acquirers consolidate.

Online-first companies, both incumbents (PayPal,

Wirecard, and startups (Stripe, Adyen) are growing unimpeded, while offerings from

traditional acquirers have struggled to keep pace.

We believe Wirecard (Buy-CL) is

positioned to sustain growth

as an online-first leader. We think merchant acquirers

will consolidate further

to mitigate price pressure and sustain stock multiples. Global

Payments (GPN, Buy) is our preferred name

given its M&A execution. Square (SQ,

Buy)

is positioned to grow profitability by expanding its TAM to software and services.

Private companies: We profile the most promising private companies in payments

including

Adyen, Stripe, Ant Financial, Tenpay, Paytm, Affirm, Klarna, and PayU.

Top 9 investor questions addressed in this report

Question #1: Can PayPal sustain its growth trajectory?

In our analysis, we break down PayPal’s opportunity by market segment and find

PayPal has meaningful room to grow as it taps into new markets including the sharing

economy, bill payment, and B2B payments. We believe this is a key point often missed

by investors who expect PayPal’s growth trajectory to come under pressure as Amazon

consolidates the e-commerce market (estimated under 40% of PayPal volume by 2026).

Question #2: How could Visa and Mastercard be disrupted?

Emerging markets, including China and India, have developed alternative ecosystems

to those in the United States and Europe. We evaluate how the Chinese model – Alipay

and Tenpay – can be exported to the United States and potentially disrupt incumbents

including Visa and Mastercard. We also consider “moonshots” – such as blockchain

and artificial intelligence – and the long-term impacts they could have on the payments

industry.

We interview Adyen’s

CEO and Stripe’s CFO

(pp. 38 and 42)

We estimate traditional

e-commerce will be

under 40% of PayPal’s

volume by 2026 (p. 14)

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 4

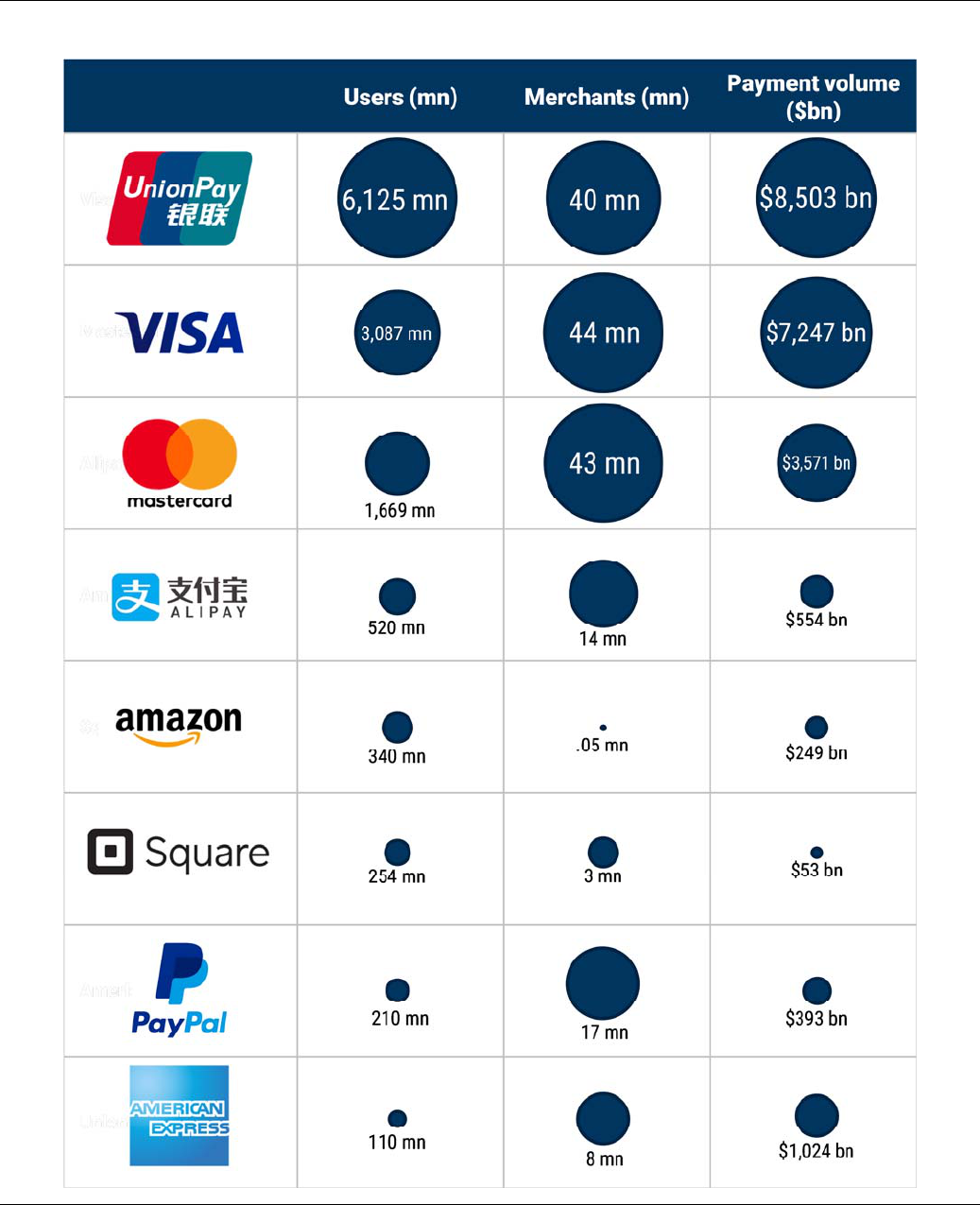

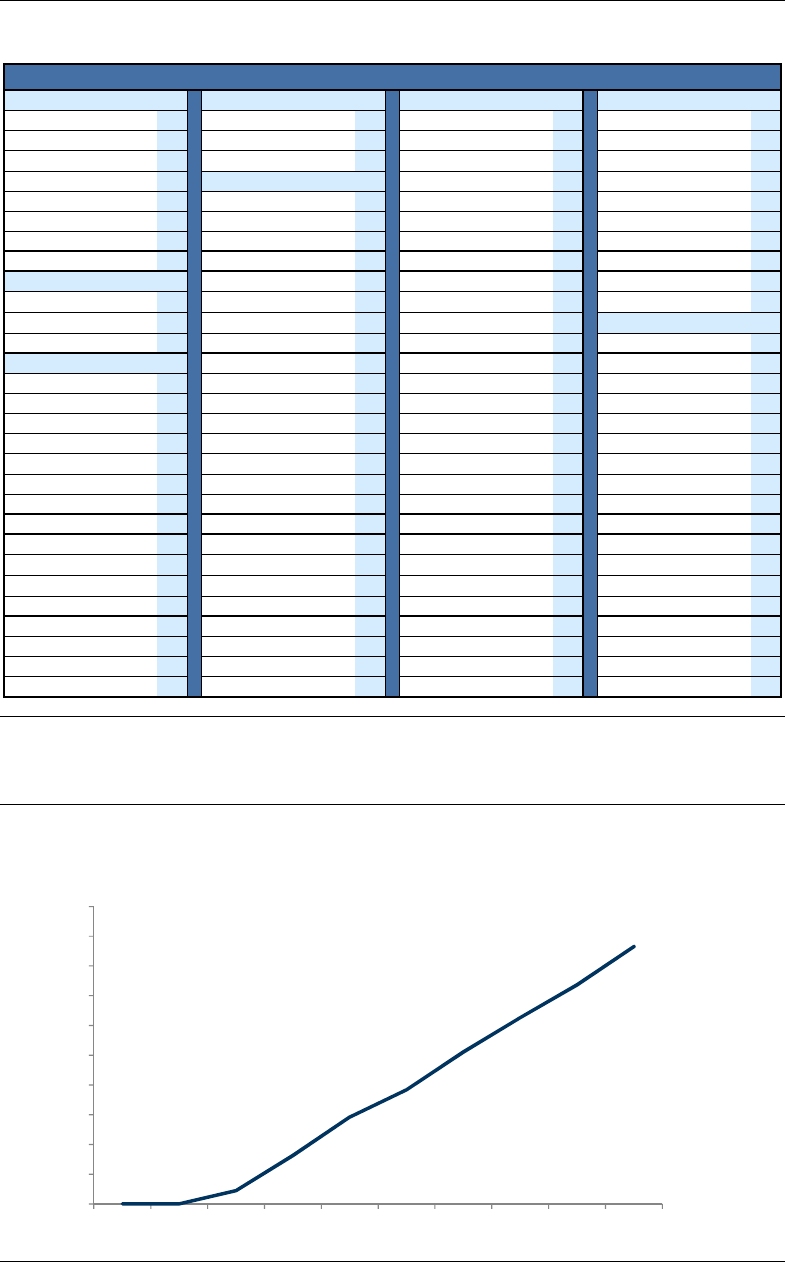

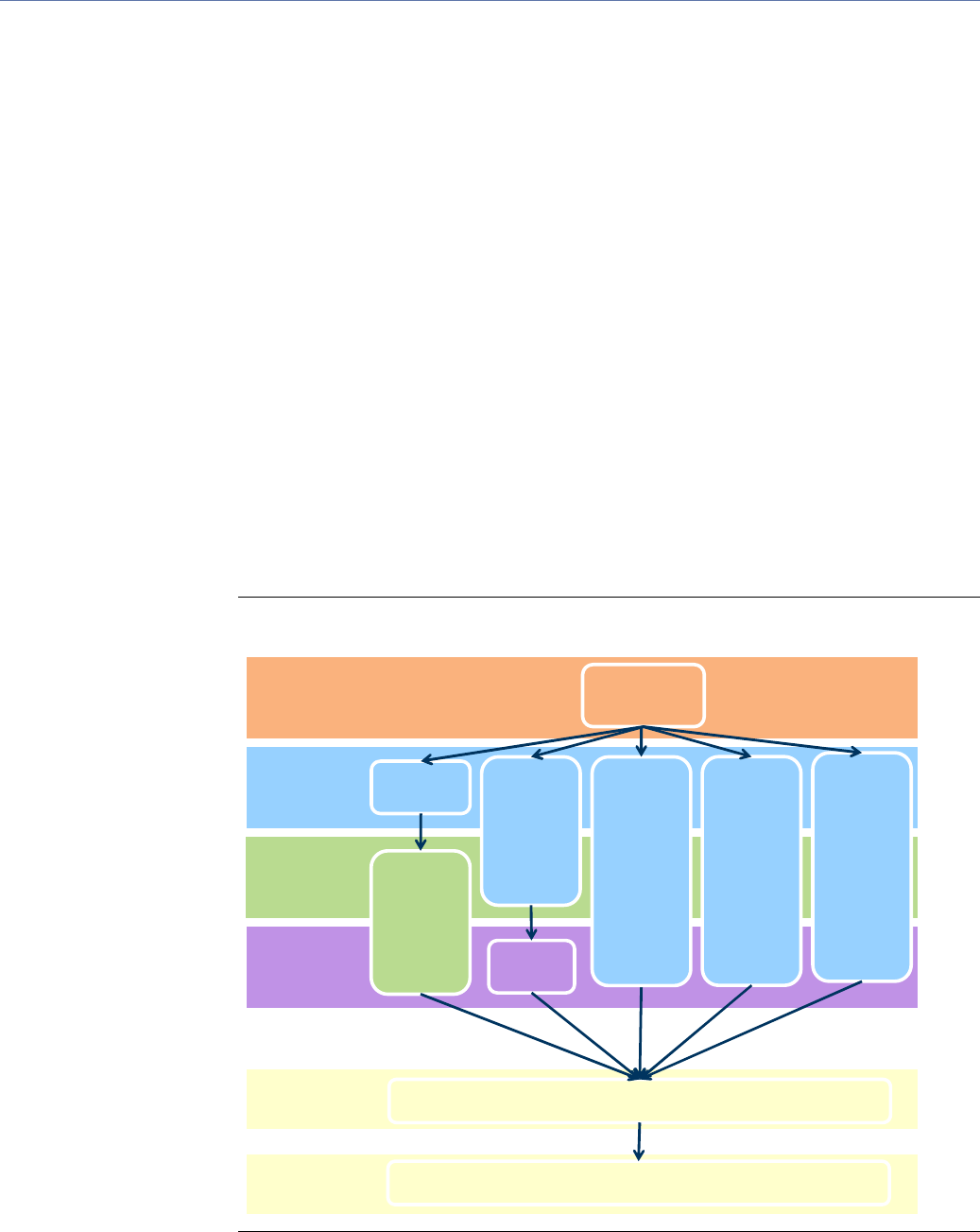

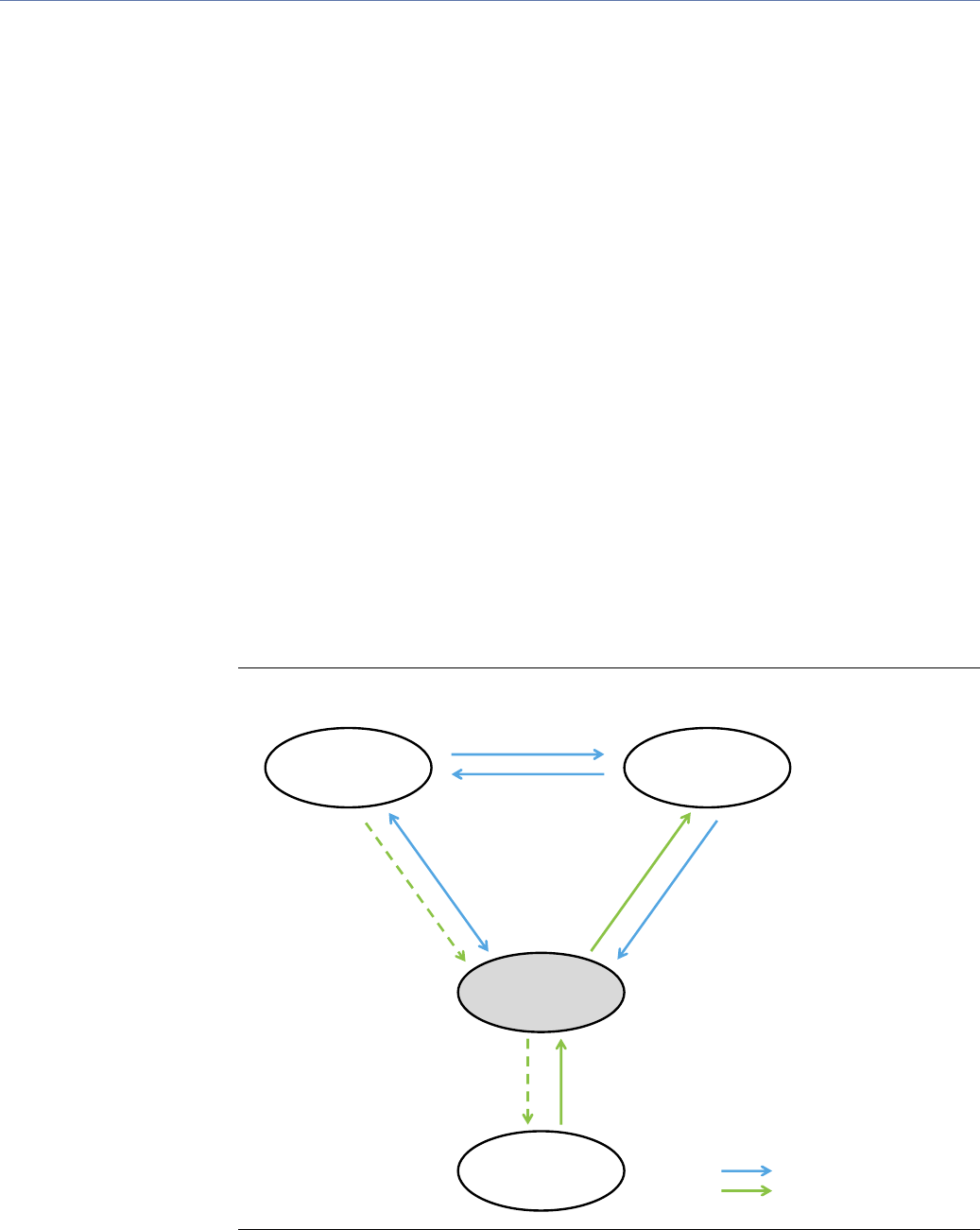

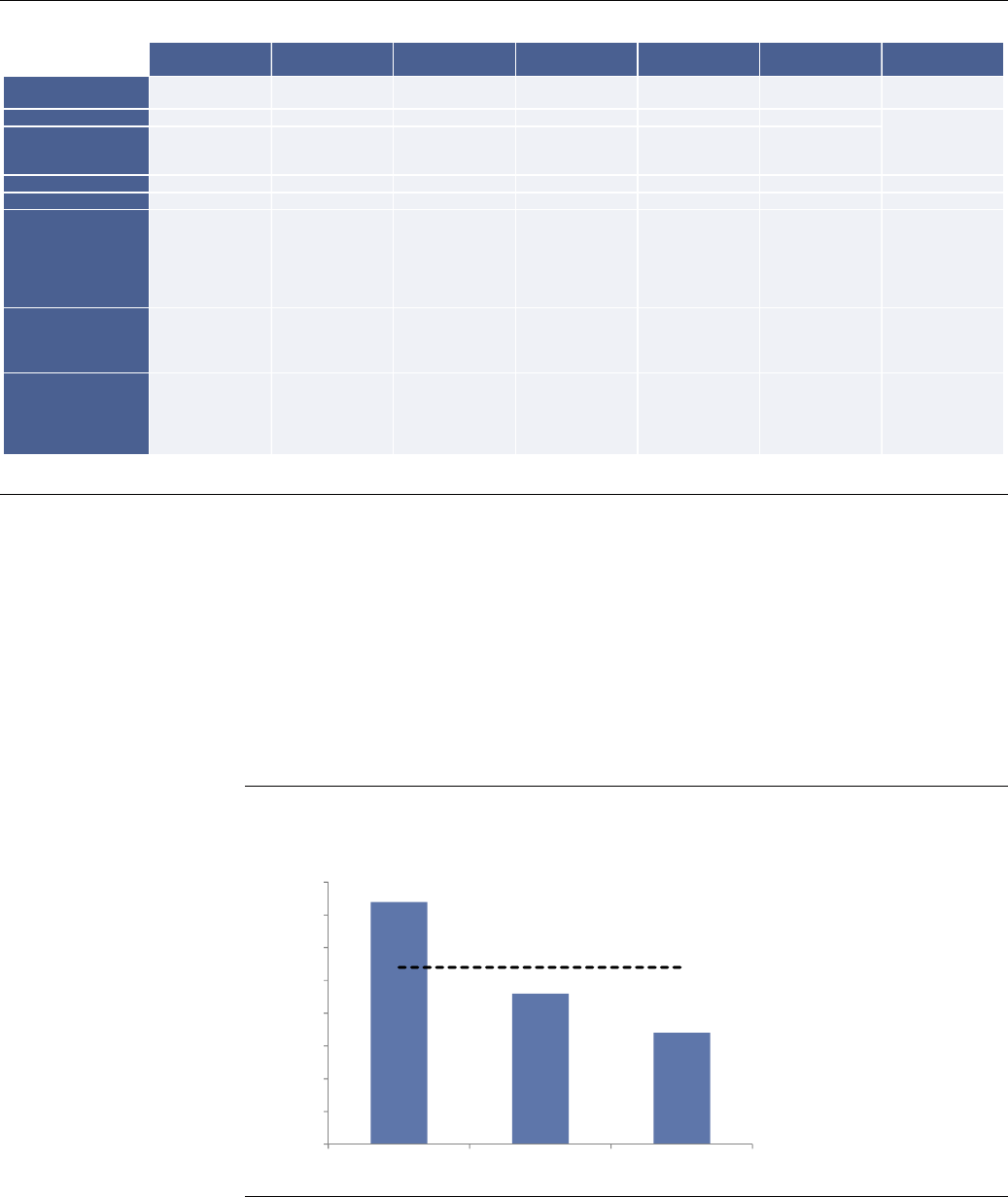

Exhibit 1: Battle of the payment ecosystems

Top global payments providers, arranged by number of users (or cards), merchants on platform, and purchase volume

Source: Company data, Goldman Sachs Global Investment Research.

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 5

Question #3: Is Amazon Payments a threat to incumbent payment ecosystems?

After several unsuccessful attempts, Amazon is seeing more traction with Amazon

Payments (after its re-launch in 2013), which allows third-party merchants to improve

checkout rates by letting shoppers pay with their Amazon account. We think Amazon

can substantially expand its reach by signing new merchants. However, we do not see

Amazon as an imminent threat to PayPal or the card networks. While Amazon has a

large and growing base of consumers, we believe it still has substantial work to do in

order to prove it can develop a broader ecosystem of merchants on par with PayPal.

Question #4: What are the most promising and disruptive startups in payments?

The term “frictionless payments” has long been used to describe a seamless and

convenient user experience. E-commerce and the complexity of merchant websites

have created new pain points in the payments experience that many companies have

tried to remove. We highlight six payments innovators—Adyen, Stripe, Alipay, Tencent,

Paytm, and PayU—that have scaled quickly, as their superior merchant and consumer

experience has driven adoption. We also interview the CEO of Adyen and CFO of Stripe.

Question #5: How are Visa and Mastercard positioned for the move online?

The advent of traditional e-commerce has accelerated the structural shift to electronic

payments, and e-commerce is a tailwind to volume growth for the networks. We

believe Visa and Mastercard are positioned to capture substantial share of the

untapped $45 trillion opportunity we see in B2B payments, bill payments, and other

emerging areas. We see the networks maneuvering to become essential names, with

partnerships to capture the next generation of online payments over the next10 years.

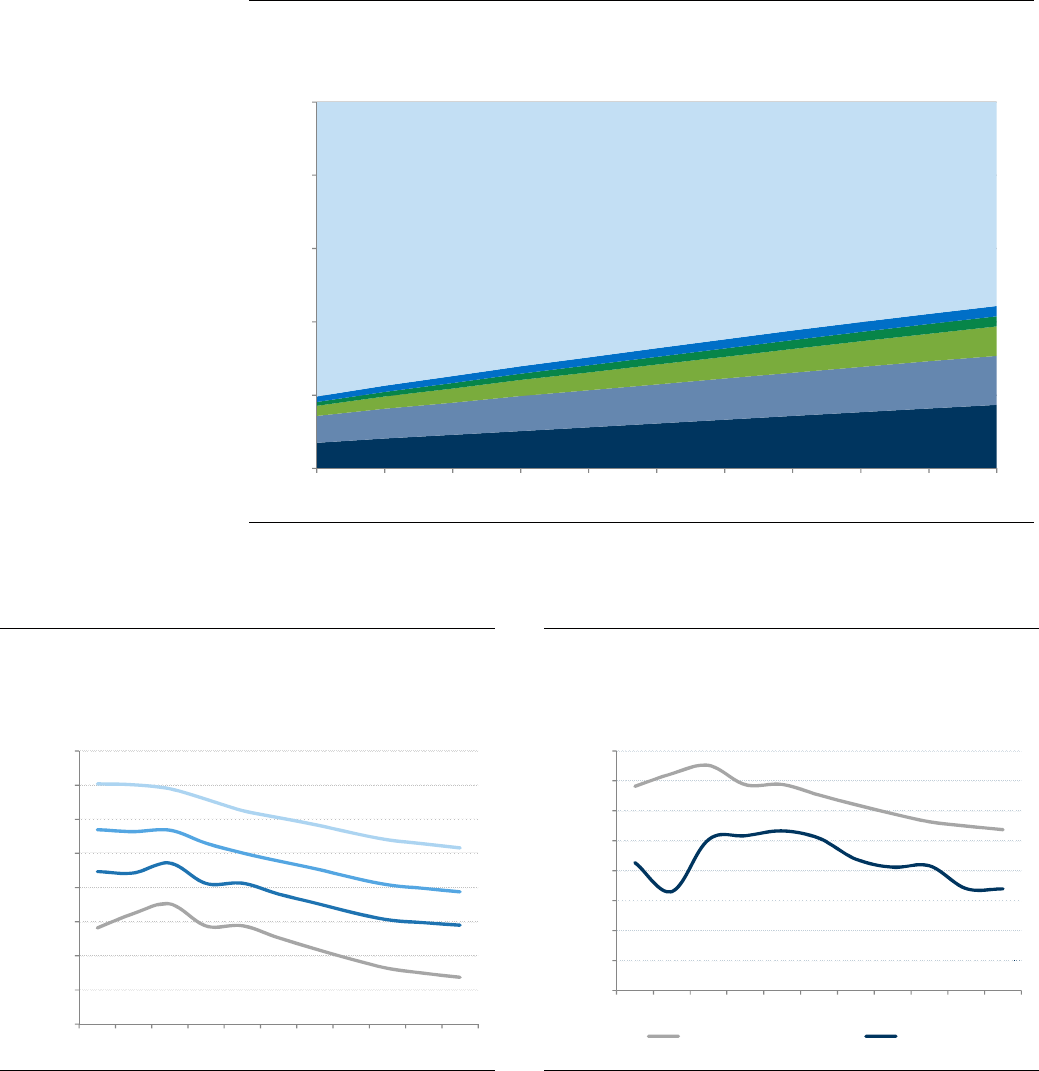

Question #6: Can payment processors still grow as the market shifts online?

We believe traditional merchant acquirers will lose online payments share to acquirers

like PayPal, Adyen, Stripe, and Wirecard who have more advanced technology

solutions and who serve more online-first merchants. While this phenomenon is not

new and has been impacting the growth of acquirers for years, we see an increasingly

narrow path to success for this group. We believe merchant acquirers will continue

consolidating in order to mitigate pricing pressure and sustain stock multiples.

Question #7: How is e-commerce changing the consumer credit landscape?

Payments companies have always aimed to tackle one of two core issues in order to

drive increased consumer spending: (1) make the payment experience more

convenient; (2) expand consumer spending capacity. The past five years has witnessed

the rise of online point of sale (POS) credit facilities – and we examine how startups

like Affirm and Klarna are seeking to reduce friction and transform retail lending online.

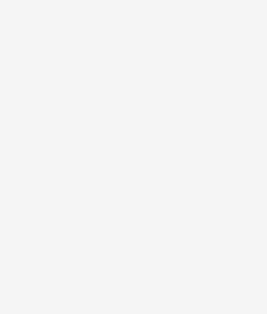

Question #8: What role will mobile wallets play in the emerging landscape?

Mobile wallet adoption has been underwhelming to date. Apple Pay and Samsung Pay

do not disintermediate the existing payment system, but instead reinforce it by relying

on enhanced security technology provided by the card networks. We think mobile

wallets stand a good chance of gaining traction in the long run, but expect adoption to

be slow because of a lack of uniform acceptance, ease of use, and rewards.

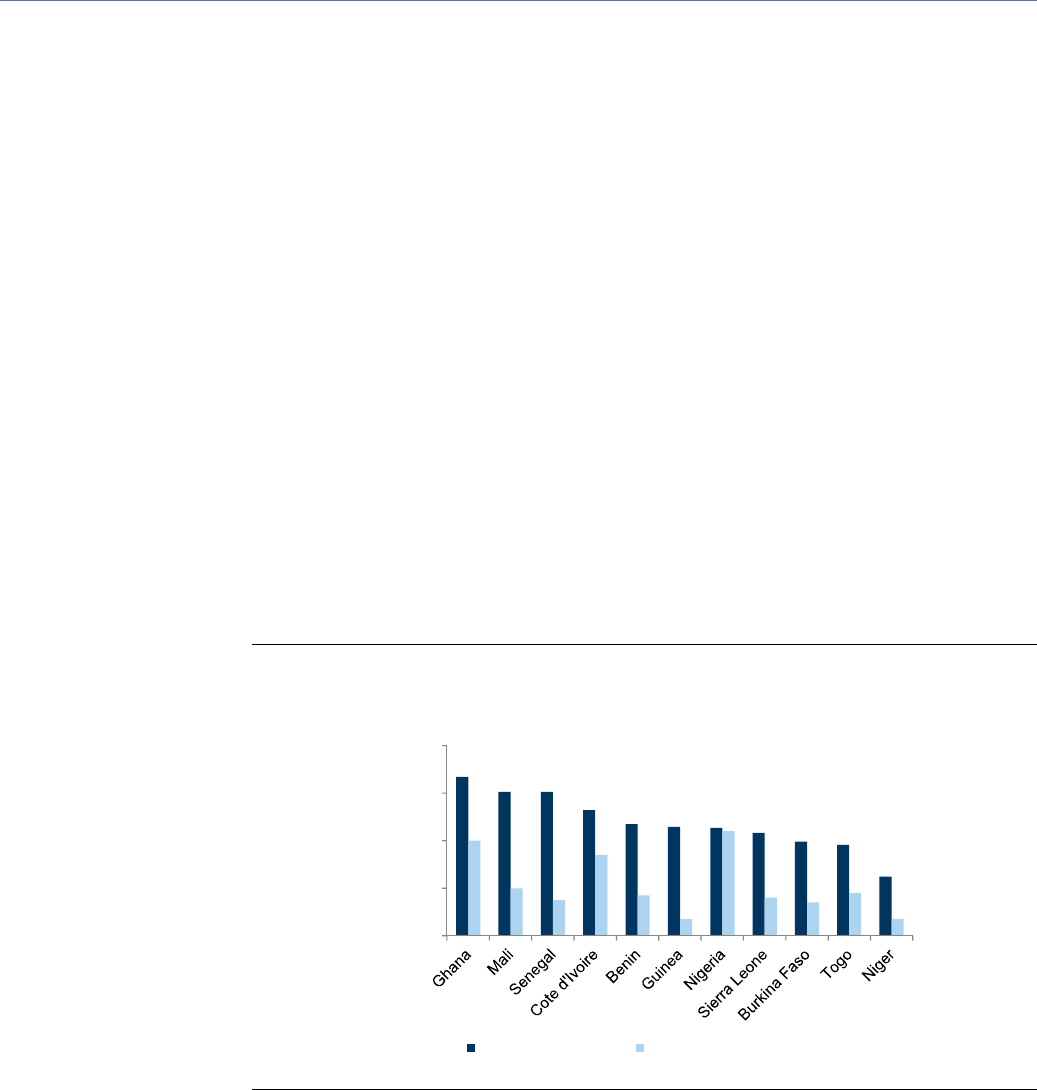

Question #9: Why does C2C matter, and will it ever make money?

We believe scaling a presence in peer-to-peer (C2C) payments will be of greatest value

in emerging markets given a large under-banked population and lack of tech-enabled

banking, as it can establish a user base upon which a larger payment presence can be

built. We have seen this play out with mobile money transfers in the past 10 years, and

believe China and India are well down this road. In the United States, Venmo has

successfully built a loyal millennial user base that can be monetized in the future.

We analyze over 100

Amazon Payments

merchants and find

that 90% also accept

PayPal (p. 32)

We expect merchant

acquirer consolidation

to continue (p. 62)

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 6

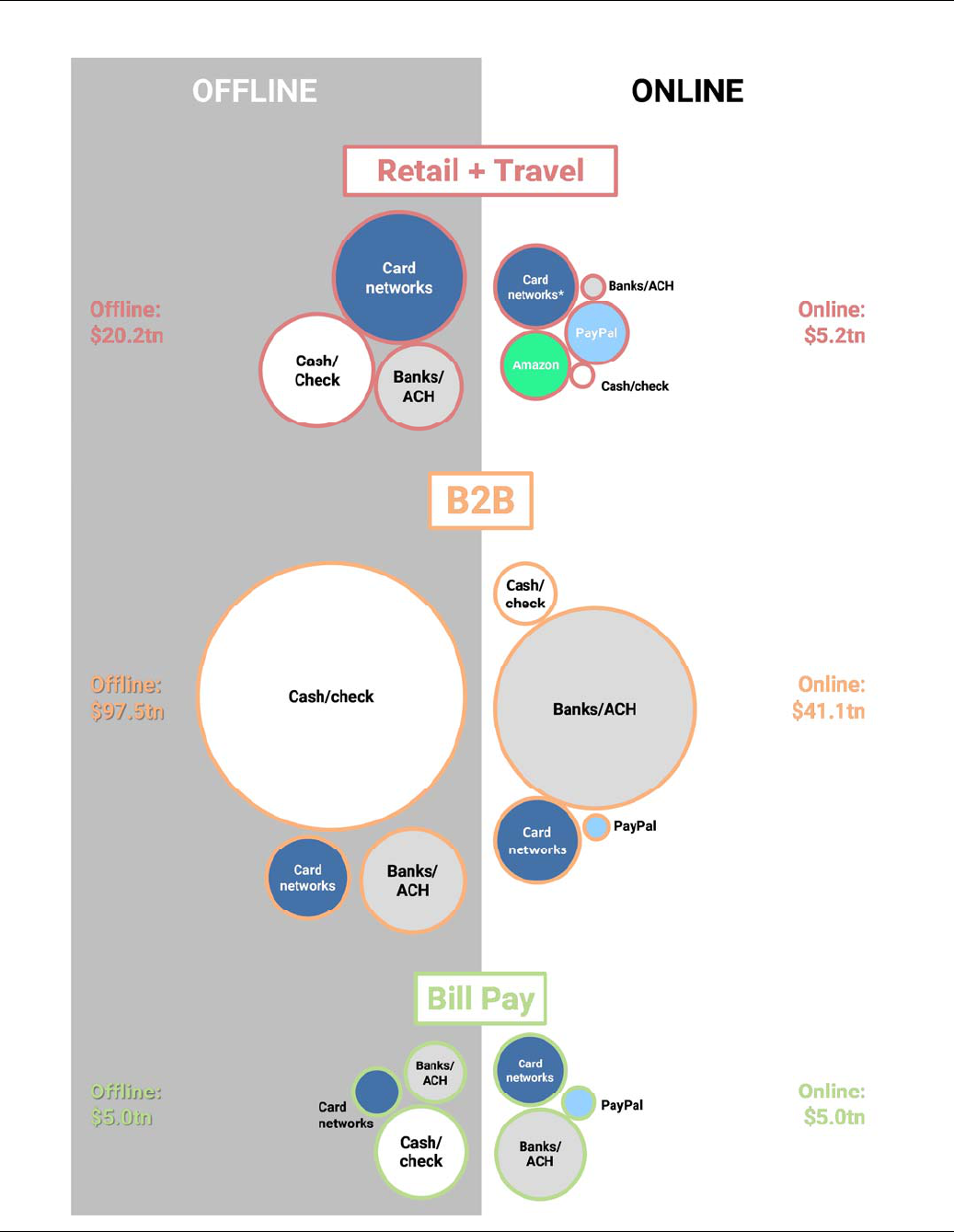

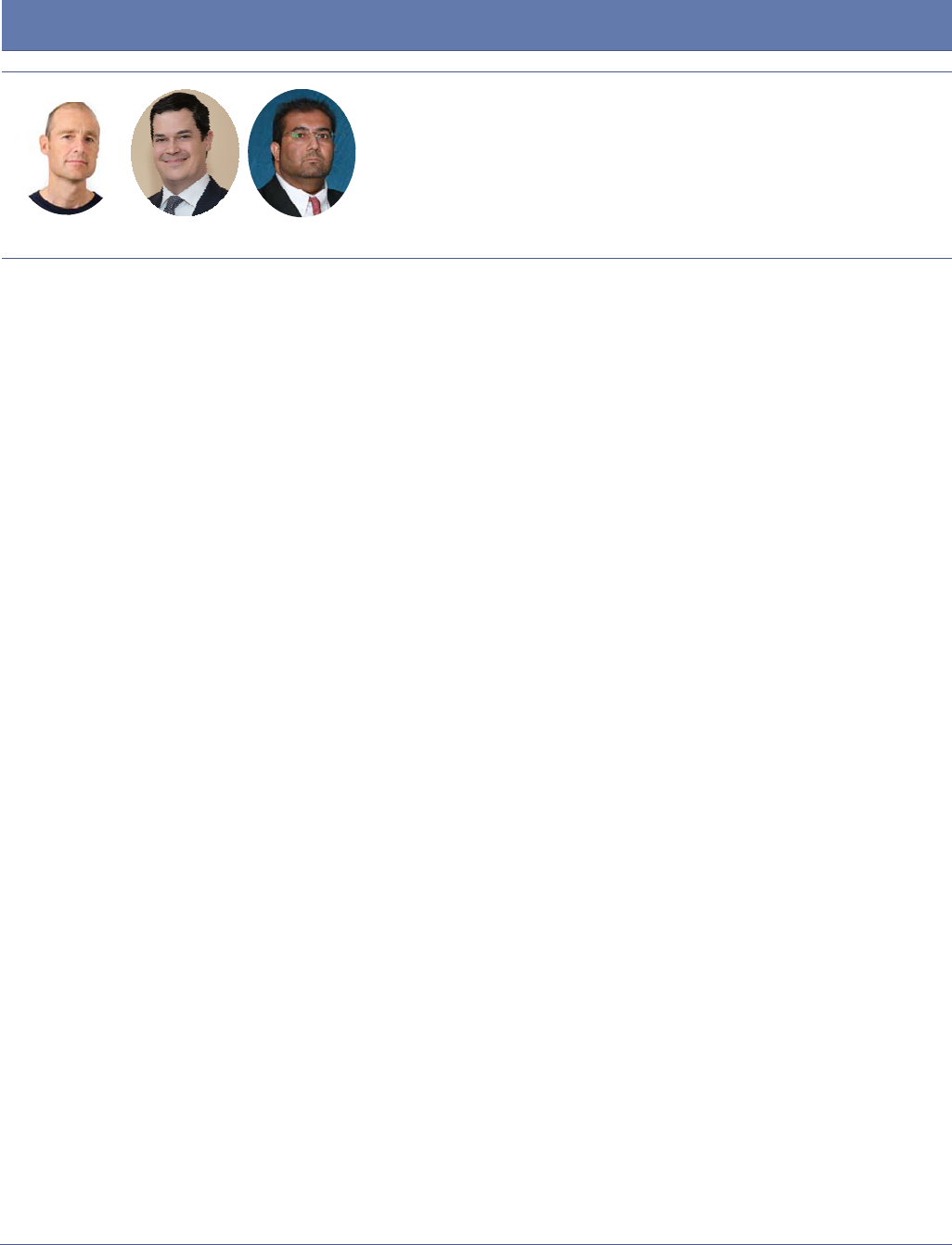

Exhibit 2: Mapping the online payment landscape

Global market opportunity and major industry players: retail and travel, B2B payments, bill payment

Source: Company data, Goldman Sachs Global Investment Research.

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 7

Online payments: Overview and industry roadmap

In this section, we define the online payments market and map out 10 distinct sub-

segments – many of which are untapped opportunities today – and we also discuss

current and potential profit pools tied to each segment. We briefly review the

ecosystem of providers involved in the online world, and how this system contrasts

with the offline world. Using this foundation, the rest of the report is organized as a

series of common investor questions that tie back to the market roadmap presented

here.

What do we mean by online payments? The sum of 10 markets

Any treatment of online payments begins with a clear definition of the market. We find that

many investors conflate online payments with e-commerce, for understandable reasons: e-

commerce dominates the news flow around public companies, it is a key point of investor

debate, and industry/government data have sized the e-commerce retail market (but the

broader online payments market remains largely undefined). Our view is that traditional e-

commerce (goods and services solid online through Amazon, Walmart.com, etc.)

represents only a small piece of the online opportunity today, and could be even less in the

future:

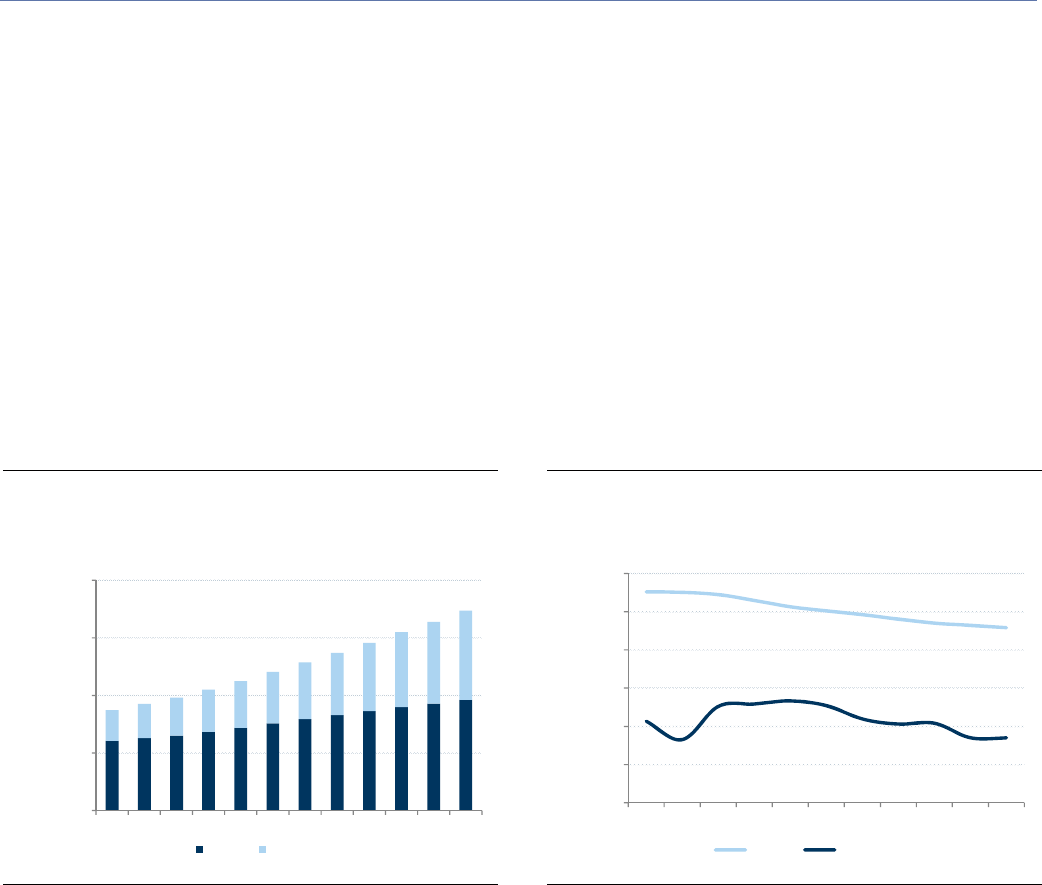

We estimate traditional e-commerce makes up only about 4% of global online

payment volume and 38% of global payment processing fees today.

We estimate that $28tn of payment volumes are transacted online today and that this will

nearly double by 2026. We estimate online payments generate $84bn in fees today, which

based on current rates we project to grow at a 9.2% 10-year CAGR to $202bn in 2026. Our

definition of the online payments market is comprised of the 10 different sub-segments

outlined in Exhibit 3:

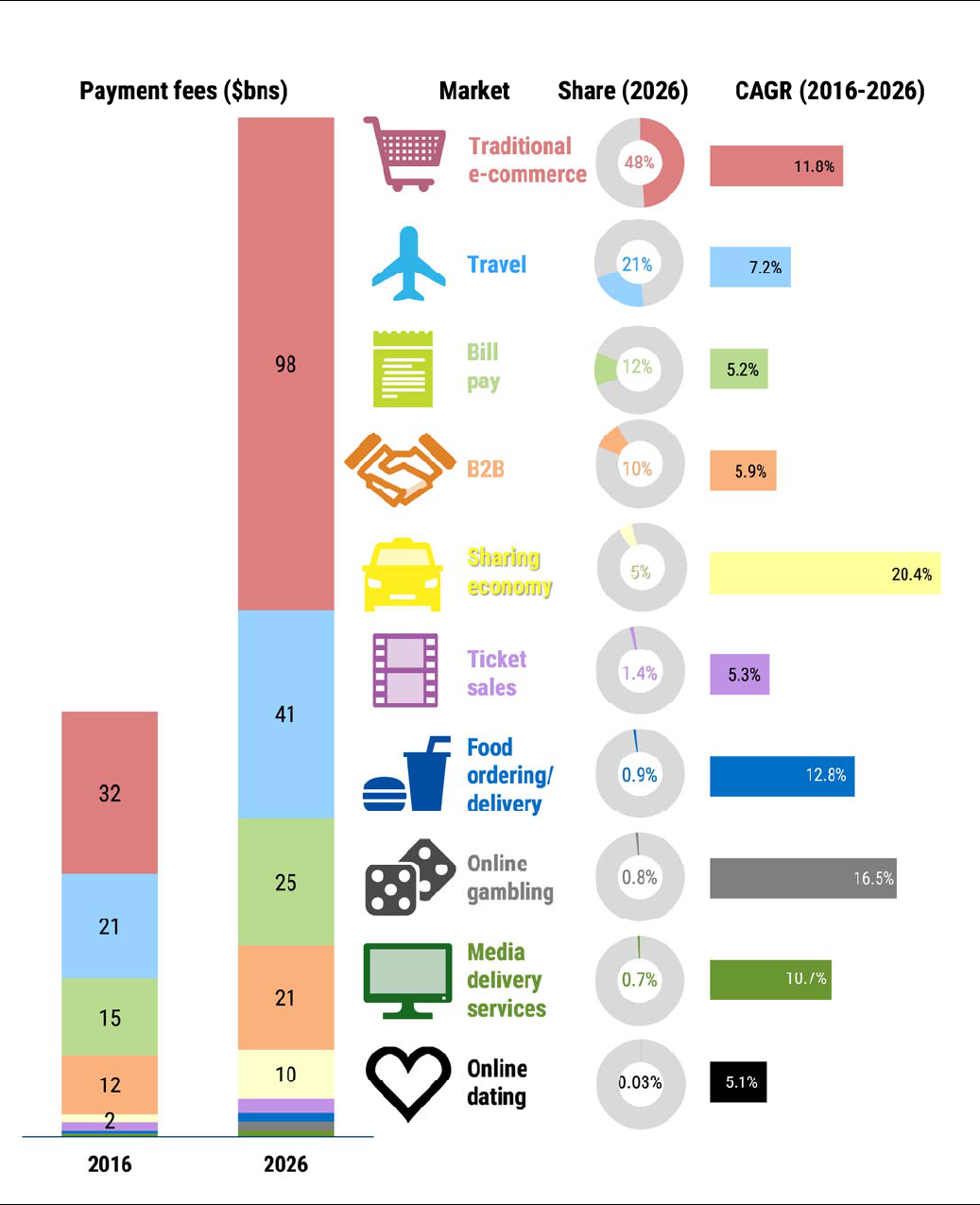

(1)

Traditional e-commerce ($3.3tn in volume, $98bn in fees by 2026): This familiar

category of consumers shopping for goods online is comprised of three major

segments: pure online names (Amazon), omni-channel retail (Walmart.com), and

specialized online retailers (Etsy). The majority of traditional e-commerce payments

today (we estimate about 80%) are made with credit or debit cards. Given the higher

yields associated with card-not-present payments, traditional e-commerce comprises a

much larger share of payment processing fees relative to payment volumes (38% vs.

4%). We estimate that $32bn in payment fees are generated in processing traditional e-

commerce volumes globally today (ex-China), and that this market will grow at an

11.8% CAGR over the next 10 years.

(2)

Travel ($1.4tn in volume, $41bn in fees by 2026): Travel booking was one of the first

markets to move online, as evidenced by the IPOs of Expedia and Priceline in 1999.

Whether booking travel through an online travel agent or directly on a vendor’s

website (delta.com, hilton.com), the Internet has become a major booking engine for

airlines, hotels, and car rental. We estimate that $21bn in payment fees are generated

in processing online travel volumes globally today (ex-China), and this market will

grow at a 7.2% CAGR over the next 10 years.

(3)

Bill payment ($5.0tn in volume, $25bn in fees by 2026): Bill payment is a large

market opportunity for online payments—with utility, insurance, and mortgage

payments increasingly moving online. These non-retail categories are part of PCE

(personal consumption expenditure), and have historically been the domain of checks

– but are poised to benefit payment processors as more payments shift online.

According to Aite, 50% of US bill volume is paid online in the United States today, with

30% paid through a bank’s website and 70% paid directly on biller websites. We

estimate $15bn in payment fees are generated in processing online bill payments

globally today (ex-China), and that this market will grow at a 5.2% CAGR over the next

10 years.

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 8

Exhibit 3: We estimate online payment fees are a $200bn opportunity by 2026, growing at a 10-year CAGR of 9.2%

Online payment fees by market segment

Source: Company data, World Bank, Euromonitor, eMarketer, Adyen, Aite Group, NACHA, Visa, Nilson Report, Goldman Sachs Global Investment Research.

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 9

(4) B2B payments ($41tn in volume, $21bn in fees in 2026): We believe the B2B

payments market is a large and relatively untapped online opportunity (albeit at lower

yields for payment processors). We believe online penetration in B2B payments is

around 25% today, driven primarily by accounts payable transactions via Automated

Clearing House (ACH). We estimate credit and debit cards comprise a very small share

of both online and offline B2B payments today (less than 5%), and most of these

volumes are associated with travel-related corporate expenses. We believe the

industry transition to instant B2B payments—whether instant ACH or push payments

through Visa Direct and Mastercard Send—will fuel a significant new market

opportunity over the next decade. We estimate that $12bn in payment fees are

generated in processing online B2B payments globally today (ex-China), and that this

market will grow at a 5.9% CAGR over the next 10 years.

The “last 10%” of online payment fees: Smaller markets, but at higher yields

(5) Sharing economy ($325bn in volume, $10bn in fees in 2026): The sharing economy

is a market that has emerged over the last few years. Payment volumes are dominated

by Uber and AirBnB, plus other ride-hailing and travel competitors. Given the novelty

of the space, we expect the sharing economy to be the fastest-growing market within

online payments, as existing players scale rapidly and de novo businesses enter the

market, and our payment volume estimate could surprise to the upside. We estimate

that $1.5bn in payment fees are generated in processing sharing economy payments

globally today (ex-China), and that this market will grow at a 20.4% CAGR over the next

10 years, after nearly doubling in 2016.

(6)

Ticket sales ($91bn in volume, $3bn in fees in 2026): This online payments category

combines slower-growing primary ticket sales (generally those sold by event providers

such as Ticketmaster and Live Nation) and the secondary ticket market (re-sold through

sites such as StubHub). We estimate that $1.6bn in payment fees are generated in

processing online ticket sale payments globally today (ex-China), and that this market

will grow at a 5.3% CAGR over the next ten years.

(7)

Food ordering/delivery ($57bn in volume, $1.7bn in fees in 2026): Online takeout is

a growing and competitive market, and we believe less than 10% of restaurant takeout

in the United States is online today. Our food delivery segment includes online

ordering models such as GrubHub and Seamless. We estimate that $0.5bn in payment

fees are generated in processing online food ordering/delivery payments globally

today (ex-China), and that this market will grow at a 12.8% CAGR over 10 years.

(8)

Online gambling ($56bn in volume, $1.7bn in fees in 2026): Online gambling is a

highly regulated market and is legal today in only three US states (Delaware, New

Jersey, and Nevada). We estimate that $0.4bn in payment fees are generated in

processing online gambling payments globally today (ex-China), and that this market

will grow at a 16.5% CAGR over the next 10 years.

(9)

Media delivery services ($48bn in volume, $1.4bn in fees in 2026): This segment

combines popular consumer offerings like Netflix, Hulu, Pandora, and Spotify (but

does not include single downloads from iTunes or Amazon). We estimate that $0.5bn

in payment fees are generated in processing online media payments globally today

(ex-China), and that this market will grow at a 10.7% CAGR over the next 10 years.

(10)

Online dating ($2bn in volume, $0.1bn in fees in 2026): Online dating includes sites

operated by Match Group (match.com, OkCupid) and Spark Networks. We estimate

that $0.04bn in payment fees are generated by online dating payments globally today

(ex-China), and that this market will grow at a 5.1% CAGR over the next ten years.

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 10

Defining the major consumer and business payment segments

We believe online payments is a $28tn global payments opportunity (ex-China) today

growing at a 6.2% CAGR over the next ten years. We see the market as split across

consumer-driven payments (B2C and C2C) and business-related payments (B2B):

Consumer payments (B2C):

o Online payment penetration: We estimate $4.9tn in payment volume

was online by consumers globally (ex-China) in 2016, 19% of total spend.

o

Card penetration: We estimate 36% of total consumer spend (both online

and offline) is transacted with a credit or debit card today. Card

penetration is higher online: we estimate 52% of total consumer online

spending is transacted with a card today.

o Percentage of card volume done online: We estimate 28% of total

consumer card payment volumes occur online.

Business payments (B2B):

o Online payment penetration: We estimate $23tn in payment volume was

online by businesses globally (ex-China) in 2016, or 25% of total spend.

o

Card penetration: We estimate 3% of total business spend (both online

and offline) is transacted with a credit or debit card today. Checks are still

the dominant form of payment, comprising 70% of B2B volume. Card

penetration is only 5% of total business online spending today.

o

Percentage of card volume done online: We estimate 47% of total

business card payment volumes occur online.

Peer-to-peer payments (C2C): Our definition of online payments does not include

consumer remittances, but we see it as an important related topic. We discuss the

potential for monetization of digital peer-to-peer payments on p. 73 of our report:

o

Online payment volume: We estimate just under $1tn of online peer-to-

peer payment volume was transacted globally (ex-China) in 2016.

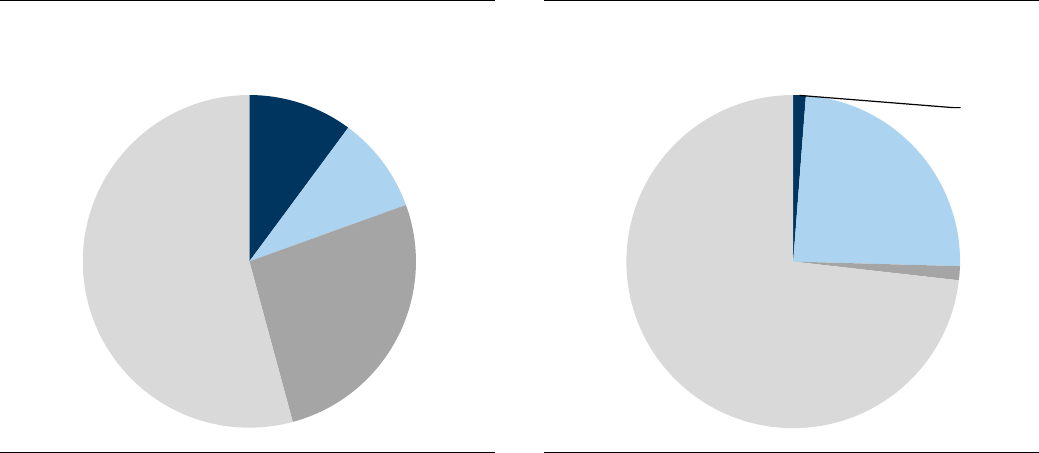

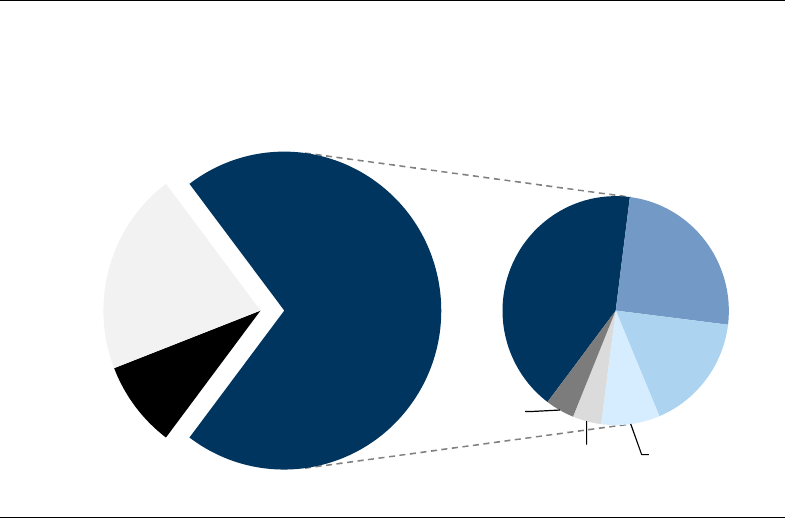

Exhibit 4: We estimate about 20% of B2C card volumes

are online payments

2016 consumer (B2C) payment volume, in $tn

Exhibit 5: Check still dominates offline B2B payments

today, and ACH is the dominant mode of payment online

2016 business (B2B) payment volume, in $tn

Source: Company data, World Bank, Euromonitor, eMarketer, Adyen, Aite

Group, NACHA, Nilson Report, Goldman Sachs Global Investment Research.

Source: NACHA, Visa, Nilson Report, Goldman Sachs Global Investment

Research.

Card

online,

$2.6

Non-card

online,

$2.4

Card

offline,

$6.7

Non-card

offline,

$13.8

Card

online,

$1.1

Non-card

online,

$22.1

Card

offline,

$1.2

Non-card

offline,

$66.9

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 11

Who are the major competitors?

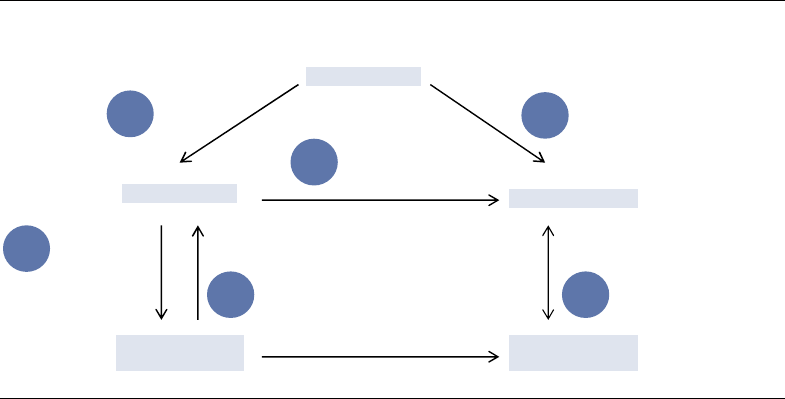

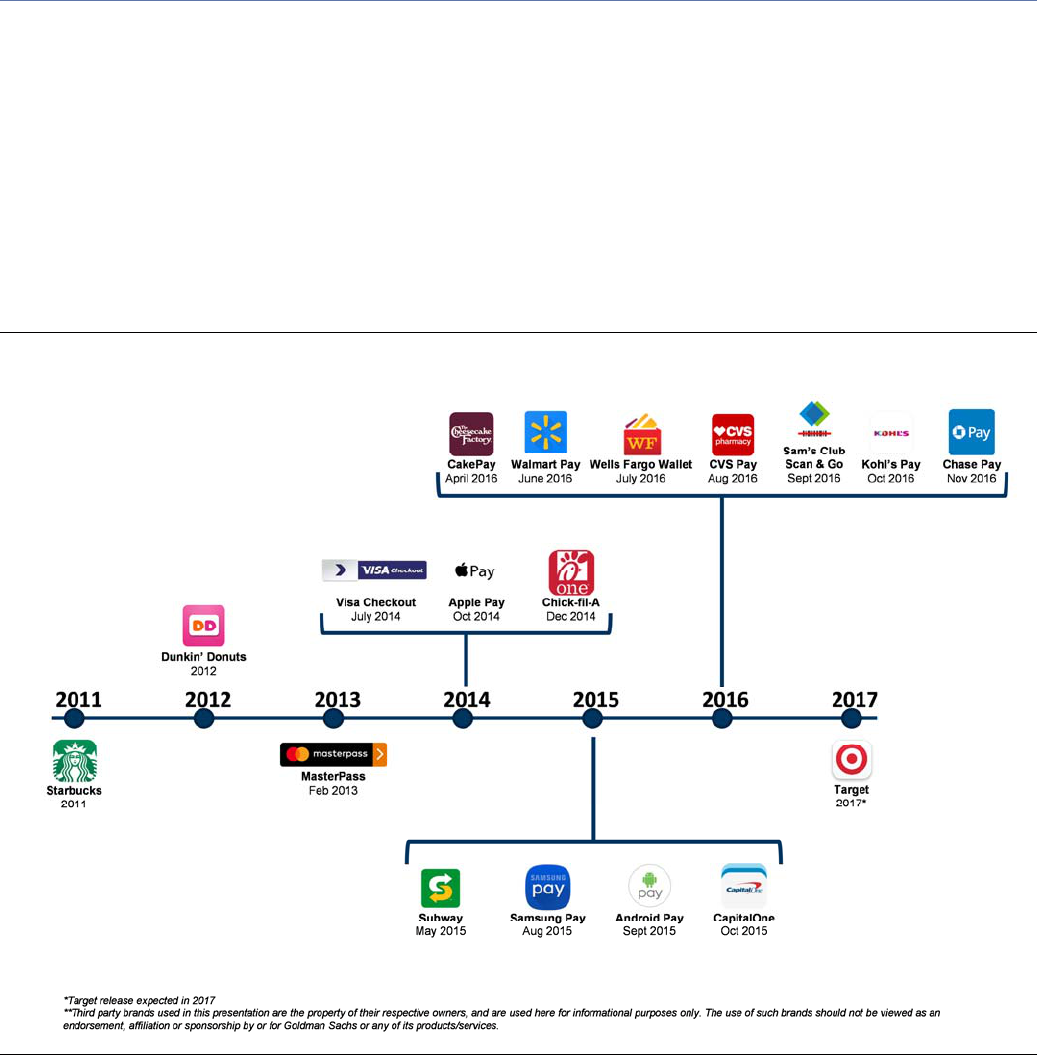

The offline card payment ecosystem in the United States, Europe, and LatAm is complex,

with a number of middlemen—merchant acquirers, card networks, and issuing banks—

interacting with each other to enable consumer payments. We summarize the traditional

“four-party system” in Exhibit 6.

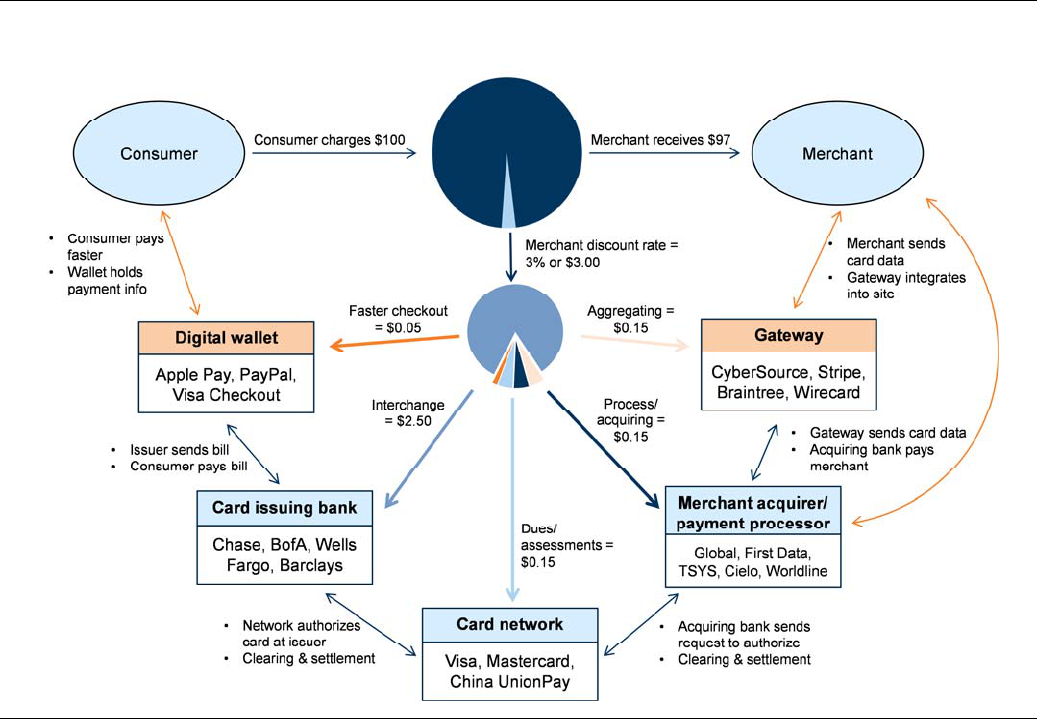

The online card payment ecosystem introduces two new participants that have

innovated on the front end of online payment processing to make the transaction more

seamless:

(1) the digital wallet, so the consumer can easily input his payment information

on the merchant’s site; and

(2) the gateway, so the merchant can easily accept the

consumer’s payment information. We summarize the online system in Exhibit 7.

The digital wallet

is effectively a token representing user payment and personal

information, obviating the need to re-enter this information on every website and thus

increasing conversion rates for online payments. Digital wallets include Apple Pay,

Walmart Pay, Visa Checkout, Amazon Payments, and PayPal. All of these wallets make the

consumer experience more seamless, although digital wallet providers have different

motivations for capturing market share. PayPal and Visa claim online payment success/

conversion rates 50% higher than transactions for which information is entered manually.

The gateway can be thought of as an online “point of sale”— a payment terminal for the

Internet. With a gateway, web developers have a single point of communication to collect

payment information on their websites. Gateways have become more sophisticated over

time, with sleeker application programming interfaces (APIs) like Adyen, Stripe, Braintree

(owned by PayPal), and Wirecard reducing the gateway implementation time (from months

to hours), eliminating the need to change the user interfaces to accommodate payments.

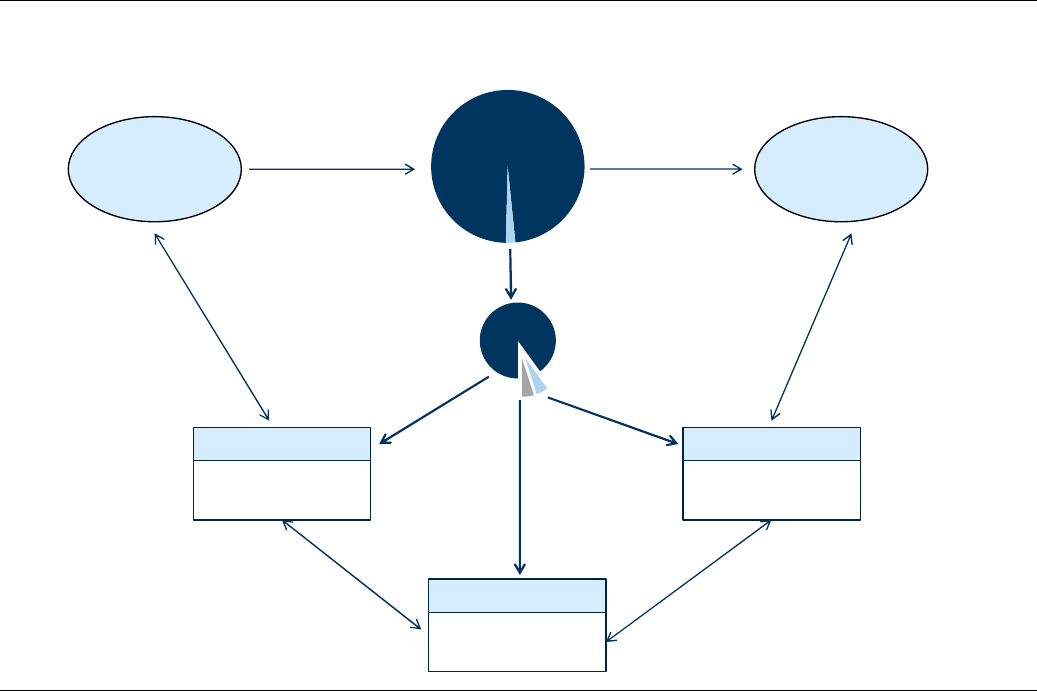

Exhibit 6: The “four-party system” is the dominant bank-driven system used across US, Europe, and LatAm

US offline card payment ecosystem

Source: Goldman Sachs Global Investment Research.

Consumer Merchant

Card issuing bank

Chase, BofA, Wells

Fargo, Barclays

Merchant acquirer

Global, First Data,

TSYS, Cielo, Worldline

Card network

Visa, Mastercard,

China UnionPay

Consumer charges $100 Merchant receives $98

Merchant discount rate =

2% or $2.00

Process/acquiring =

$0.10

Dues/assessments

= $0.10

Interchange

= $1.80

• Merchant sends

card data

• Acquiring bank

pays merchant

• Acquiring bank sends

request to authorize

• Clearing & settlement

• Network authorizes

card at issuer

• Clearing & settlement

• Issuer sends bill

• Consumer pays bill

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 12

Exhibit 7: Online card payments introduce new players, gateways and digital wallets

US online card payment ecosystem

Source: Goldman Sachs Global Investment Research.

We highlight two important online impacts on the payment ecosystem:

1) The back-end interaction between merchant acquirers, card networks, and issuing

banks to complete the transaction remains unchanged.

2) Newer companies (PayPal, Stripe, Adyen) have entered the fray: these entrants believe

they can address the pain points of online payments better than incumbents. These

companies have heightened the competitive landscape among gateways and merchant

acquirers, which is illustrated in Exhibit 8.

New online payment methods are inventing new ways to pay

In traditional payments, any consumer not paying with a card had paid with cash, check, or

bank transfer. We are seeing wholly new online payments methods emerge that bypass

much – if not all – of this payments infrastructure.

Affirm/Klarna:

Affirm and Klarna are online point of sale credit facilities. These companies

can offer installment loans to consumers at online checkout, in lieu of traditional credit card

lending. Affirm in particular was founded with the intention of providing credit-averse

millennials with a credit card alternative. Affirm and Klarna do not circumvent the card

networks entirely—both companies accept debit cards, as well as bank transfers, for loan

repayment.

Alipay:

Alipay can process payments directly from a depository account or through a

linked bank card. By offering depository accounts in China, Alipay can compete directly

against card networks (i.e., China UnionPay) for volume.

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 13

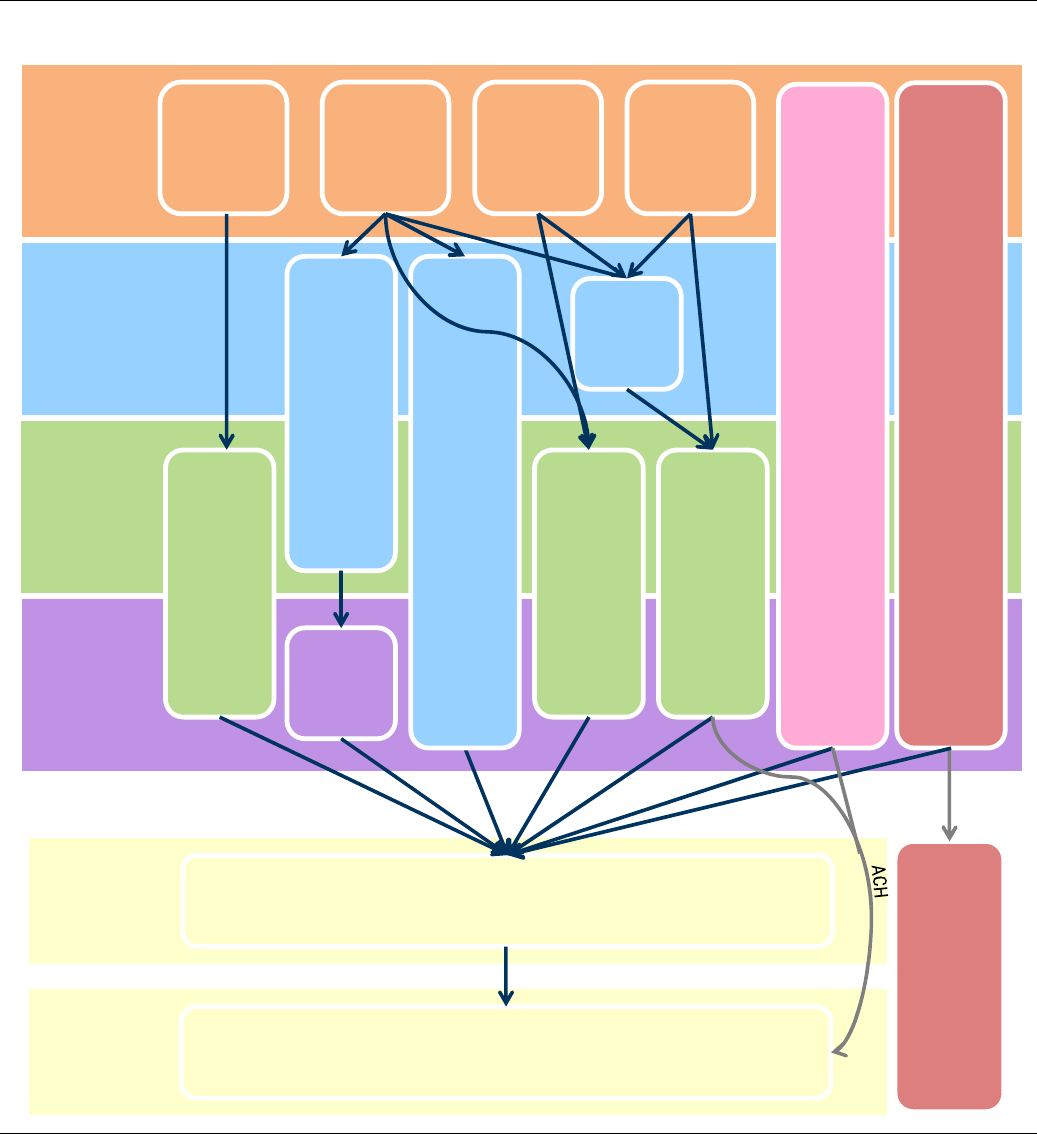

Exhibit 8: Payment flows in online payments: we see greatest competition among gateways and merchant acquirers

Flow chart of payment methods

Source: Goldman Sachs Global Investment Research.

BACK END

GATEWAY

MERCHANT

ACQUIRER

PAYMENT

PROCESSOR

ISSUER

NETWORK

Visa / MasterCard / China UnionPay

Consumer’s bank

Credit/

debit card

(manual

input)

Apple Pay/

Samsung

Pay

PayPal

Merchant

acquirer

(e.g., First

Data, Global

Payments)

PayPal

FRONT END

PAYMENT

METHOD

Stripe/

Square

Bank

processor

Braintree

Adyen/

Wirecard

Alipay

Affirm/

Klarna

Alipay

deposit

account

Amazon

Payments

Amazon’s

merchant

acquirer

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 14

Q1: Can PayPal sustain its growth trajectory?

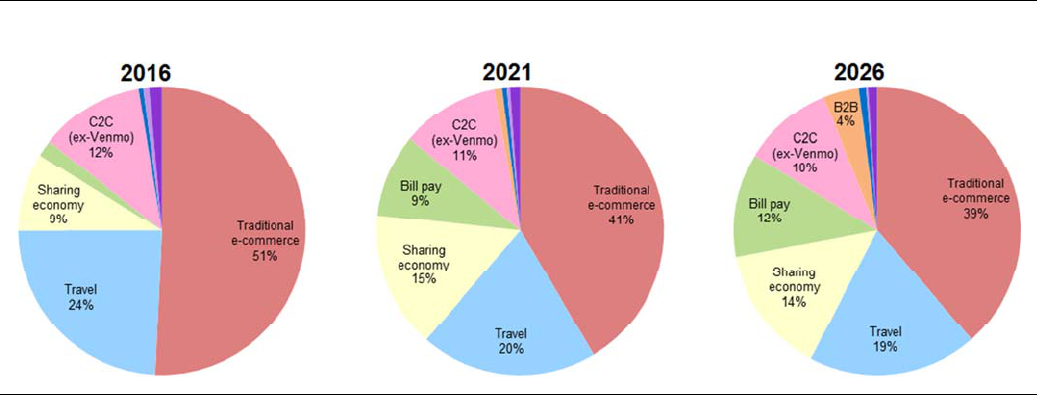

In our new analysis, we break down PayPal’s total payment volume (TPV) by market

segment and find that PayPal has meaningful room to grow as it taps into new

markets including the sharing economy, bill payment, and B2B payments. We believe

this is a key point often missed by some investors who expect PayPal’s growth

trajectory to come under pressure as Amazon consolidates the market. Traditional e-

commerce is only one of PayPal’s markets, and we estimate it comprises about 50%

of PayPal’s volume (TPV) and 40% of its TPV growth today.

We think PayPal can sustain ~15% volume growth over 10 years

In our volume analysis, we adjust PayPal’s TPV to exclude PayPal Credit and Venmo in

order to better understand PayPal’s core transaction fee-generating volume.

We estimate PayPal’s TPV (excluding PayPal Credit and Venmo) will grow at a 15% CAGR

over the next decade, totaling $1.5tn in 2027, compared to $328bn in 2016 (Exhibit 9). We

expect PayPal will grow about 1000bps faster than the overall market as it leverages

strategic partnerships, its two-sided network of merchants and consumers, and its

international footprint (Exhibit 10). We note that, if we were to include PayPal Credit and

Venmo, PayPal’s TPV would grow about 300bps faster (18% CAGR) over the next decade.

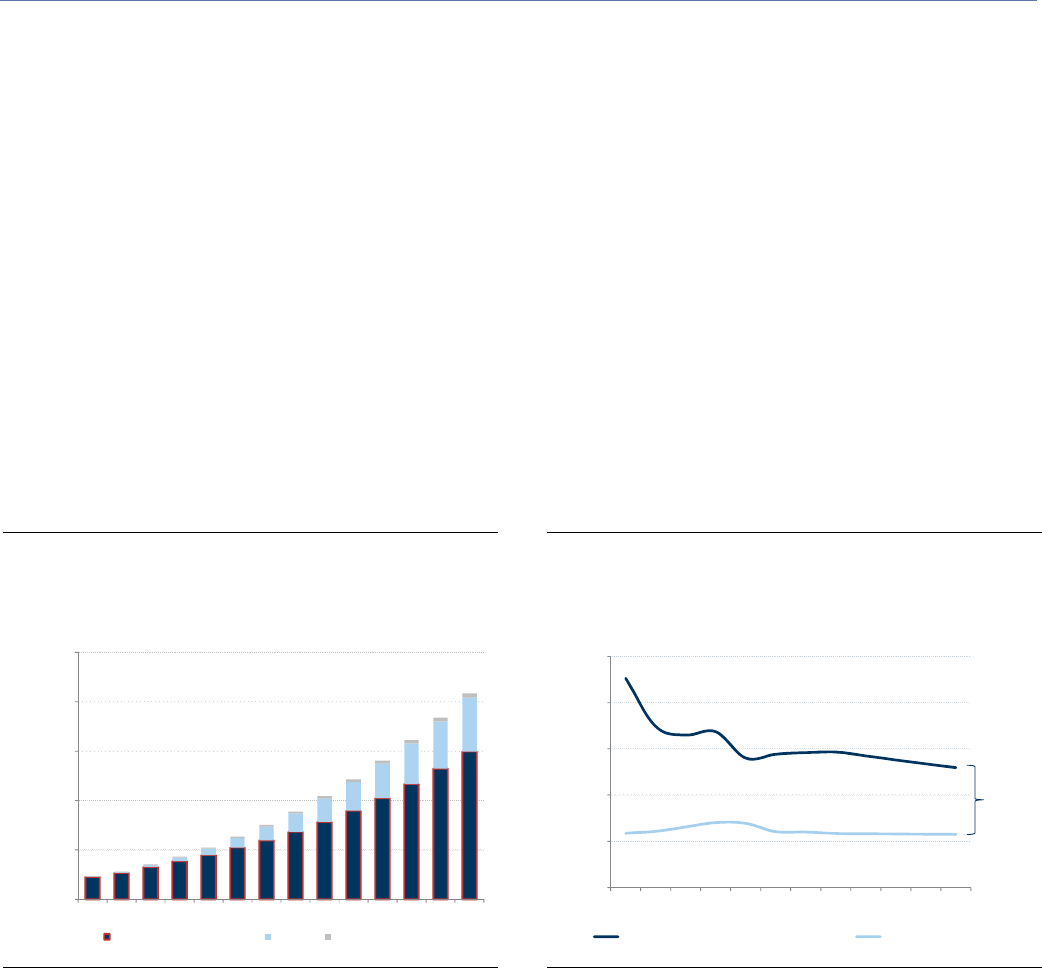

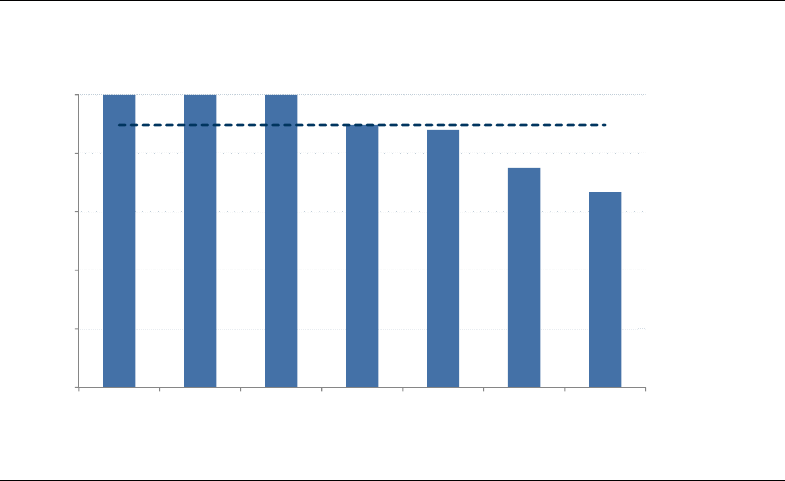

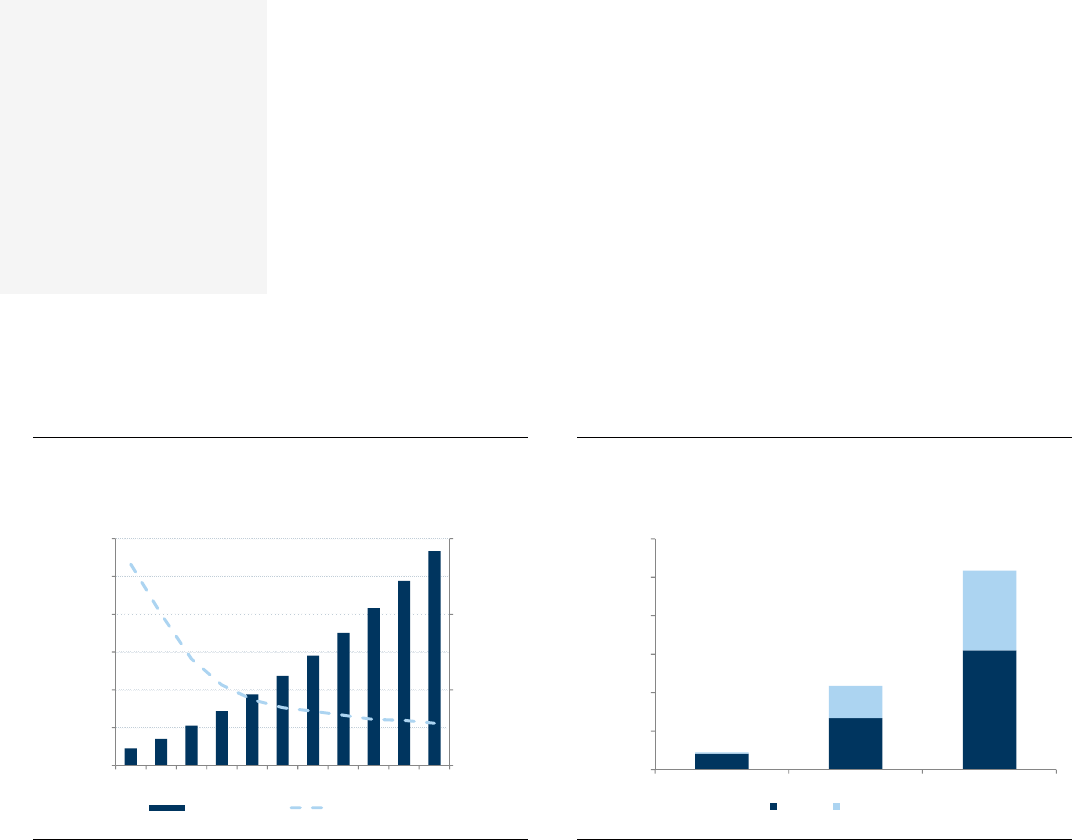

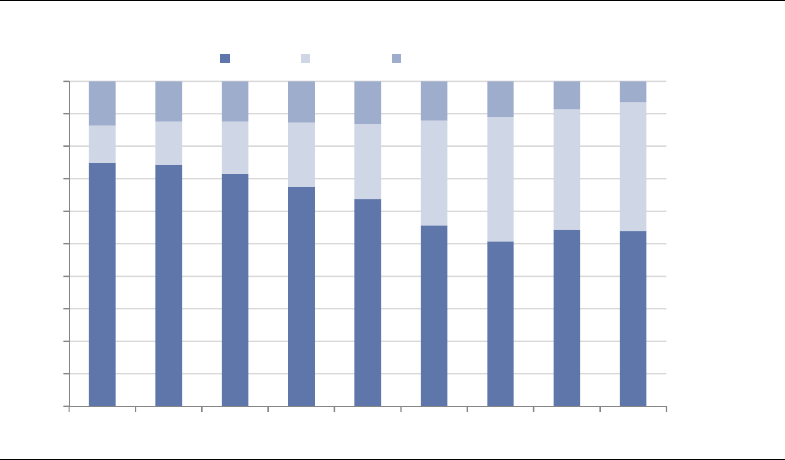

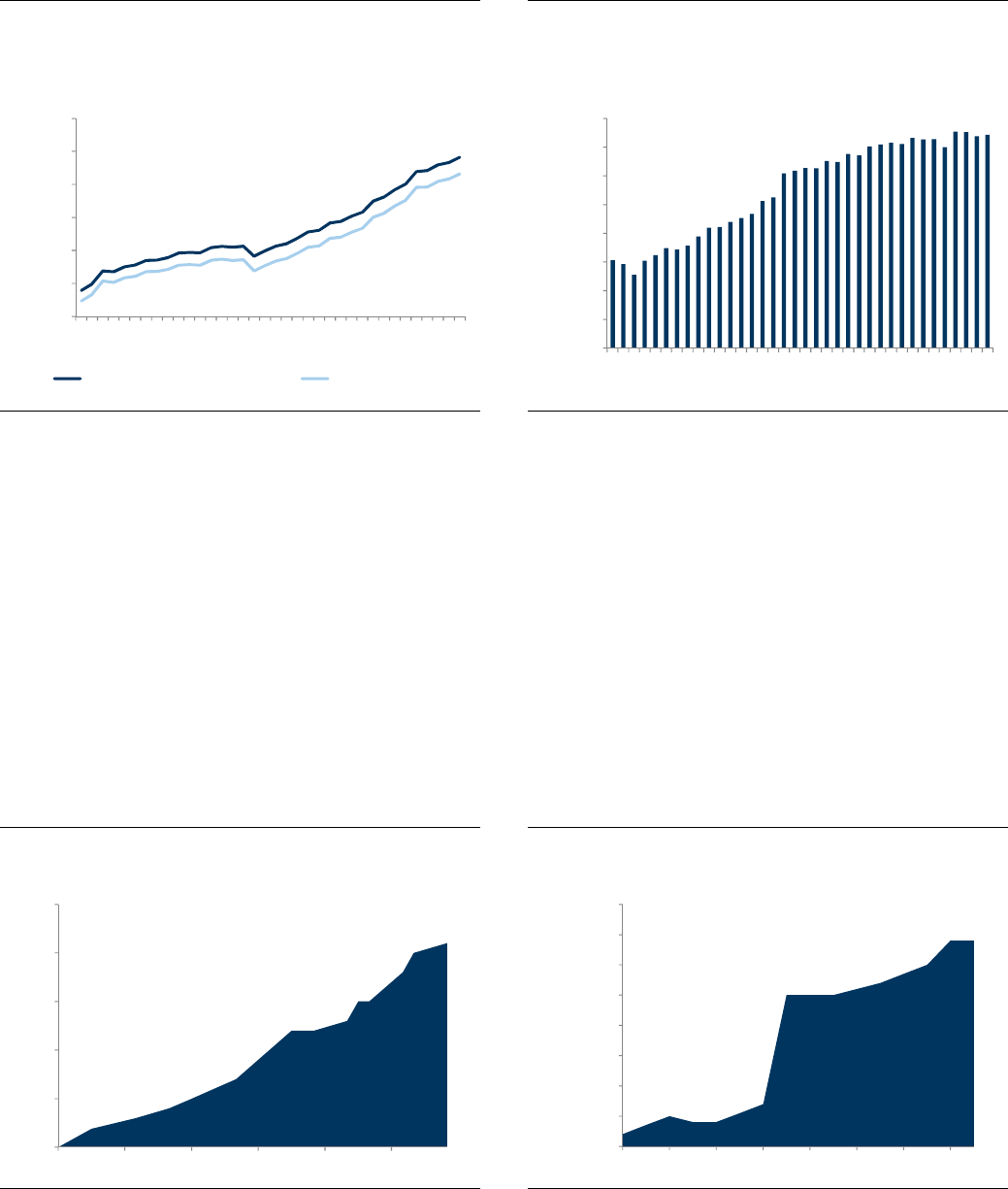

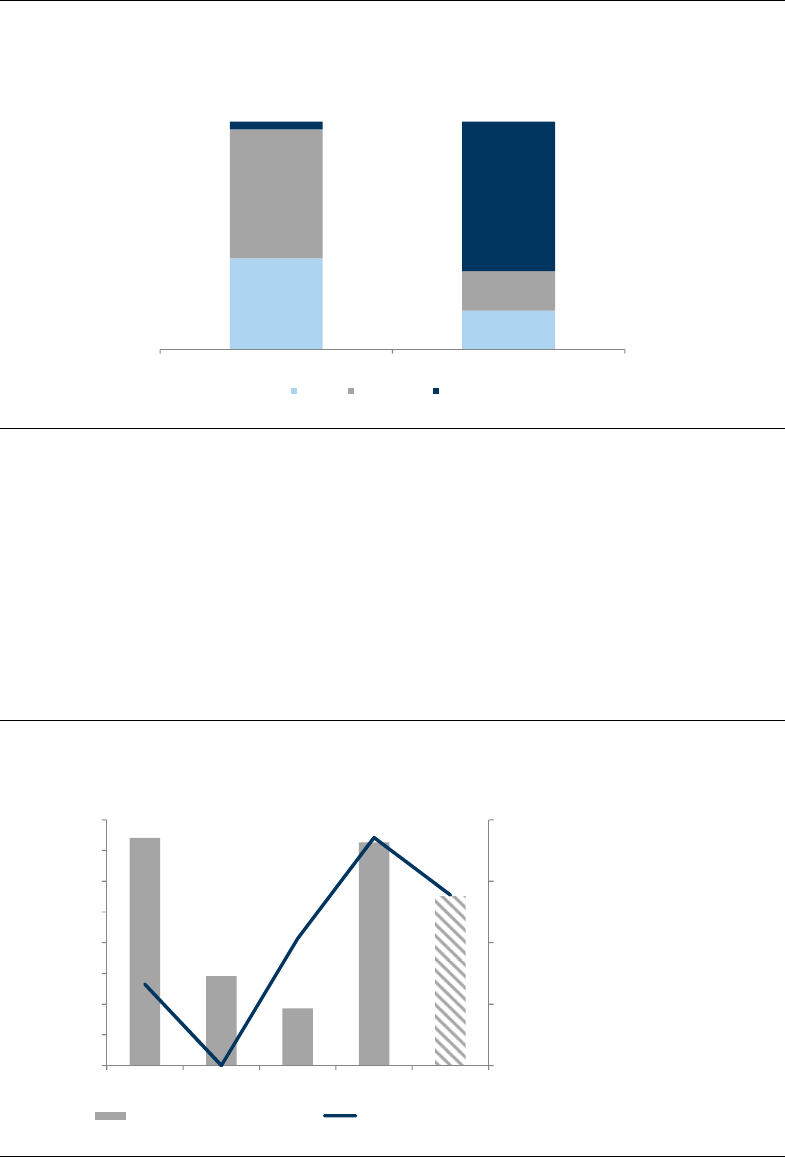

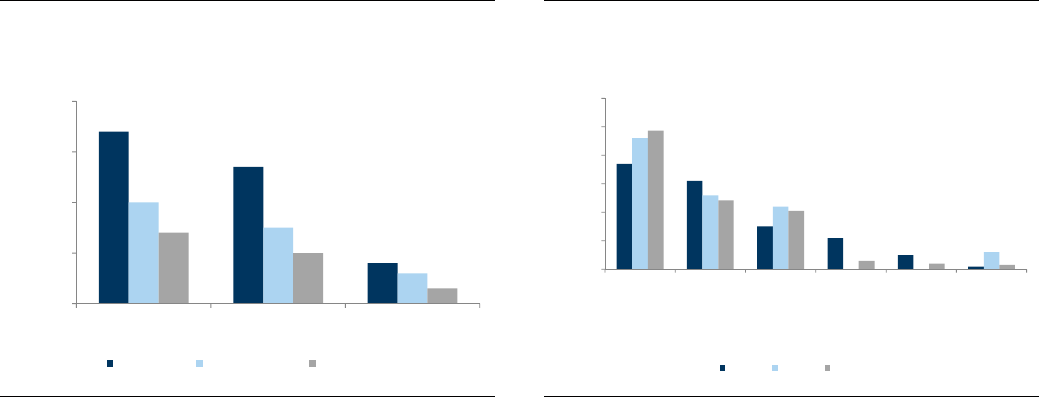

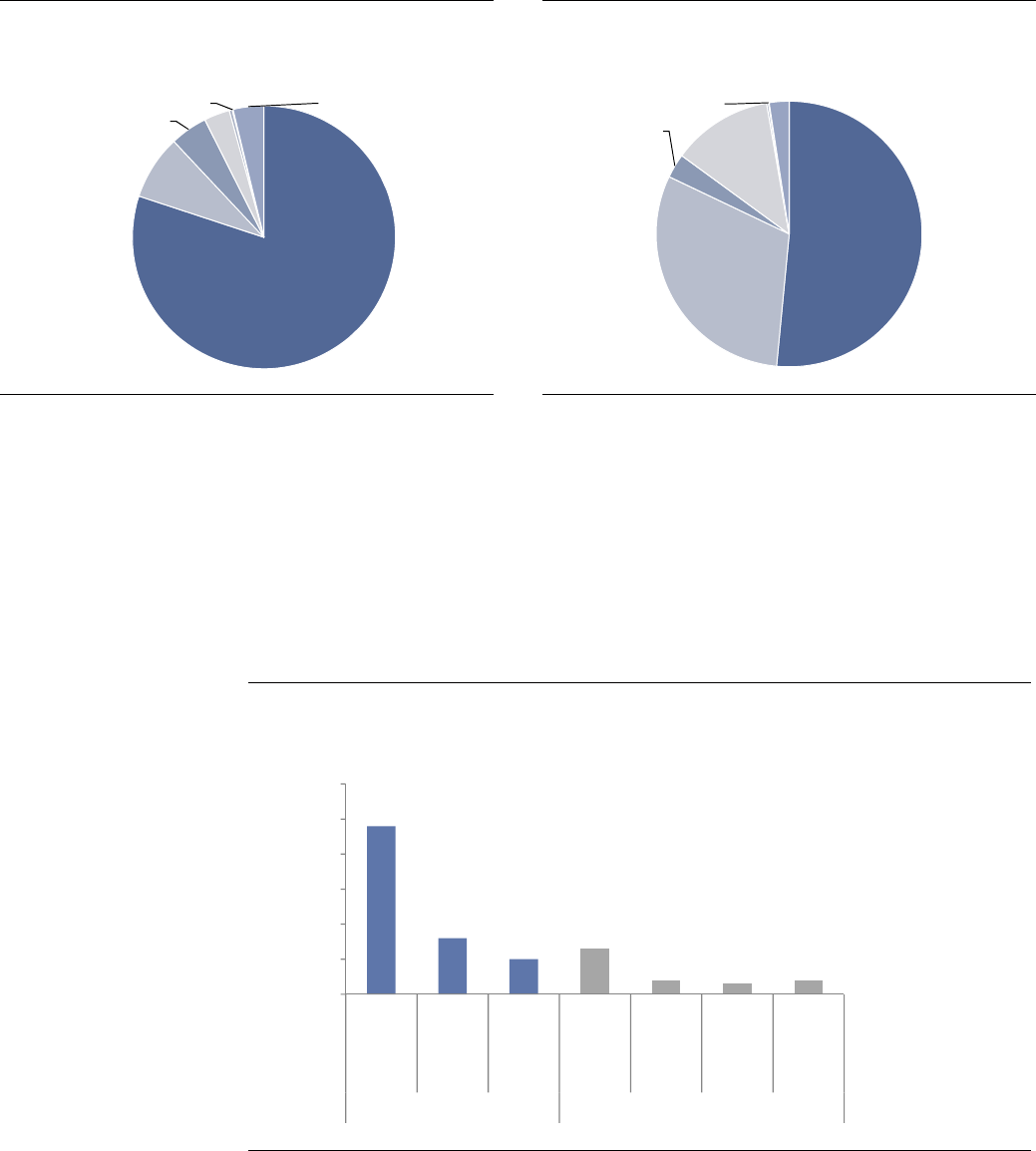

Exhibit 9: We expect TPV ex-Credit and Venmo to grow

to $1.5tn in 2026 from $328bn in 2016

PayPal Total Payment Volume (TPV)

Exhibit 10: We expect PayPal to drive outsized payment

volume growth over the next decade

PayPal TPV growth (ex-PayPal Credit and Venmo) vs. global

online payments growth

Source: Company data, Goldman Sachs Global Investment Research.

Source: Company data, World Bank, Euromonitor, eMarketer, Adyen, Aite

Group, NACHA, Visa, Nilson Report, Goldman Sachs Global Investment

Research.

We see several points that give us confidence in PayPal’s growth trajectory.

First, PayPal is not just about e-commerce. We estimate that today, about 50% of

PayPal’s volume (TPV) and 40% of its TPV growth (ex-PayPal Credit and Venmo) comes

from “traditional” e-commerce, which we define as the direct sale of goods online (Exhibit

11). We see traditional e-commerce as comprised of three major segments: pure online

retail (eBay), omni-channel retail (Walmart.com), and specialized online retailers (Etsy) (see

the Online payments overview section on page 7 for the segment details).

In many of our client conversations, investors express concerns around PayPal’s growth

runway by assuming that nearly all of PayPal’s TPV comes from traditional e-commerce

(i.e., online retail sales). By this math, PayPal (ex-PayPal Credit and Venmo) and Amazon

$0

$500

$1,000

$1,500

$2,000

$2,500

2014 2016 2018 2020 2022 2024 2026

Total Payment Volume ($bn)

TPV less Credit and Venmo Venmo PayPal Credit

0%

5%

10%

15%

20%

25%

2016 2018 2020 2022 2024 2026

Payment volume growth

PayPal TPV (ex-PayPal Credit and Venmo) Global online payments

10%

higher

growth

Note: We exclude

PayPal Credit and

Venmo from PayPal’s

TPV in our segment

analysis in this section

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 15

would have 31% and 23% market share in traditional e-commerce in 2016, respectively,

leaving less than half the market remaining (and assuming PayPal does not convert

Amazon as a customer). However, we estimate PayPal’s penetration rate in traditional e-

commerce is significantly lower—at about 16%—as roughly 50% of its volumes come from

other areas such as travel and the sharing economy (Exhibit 12).

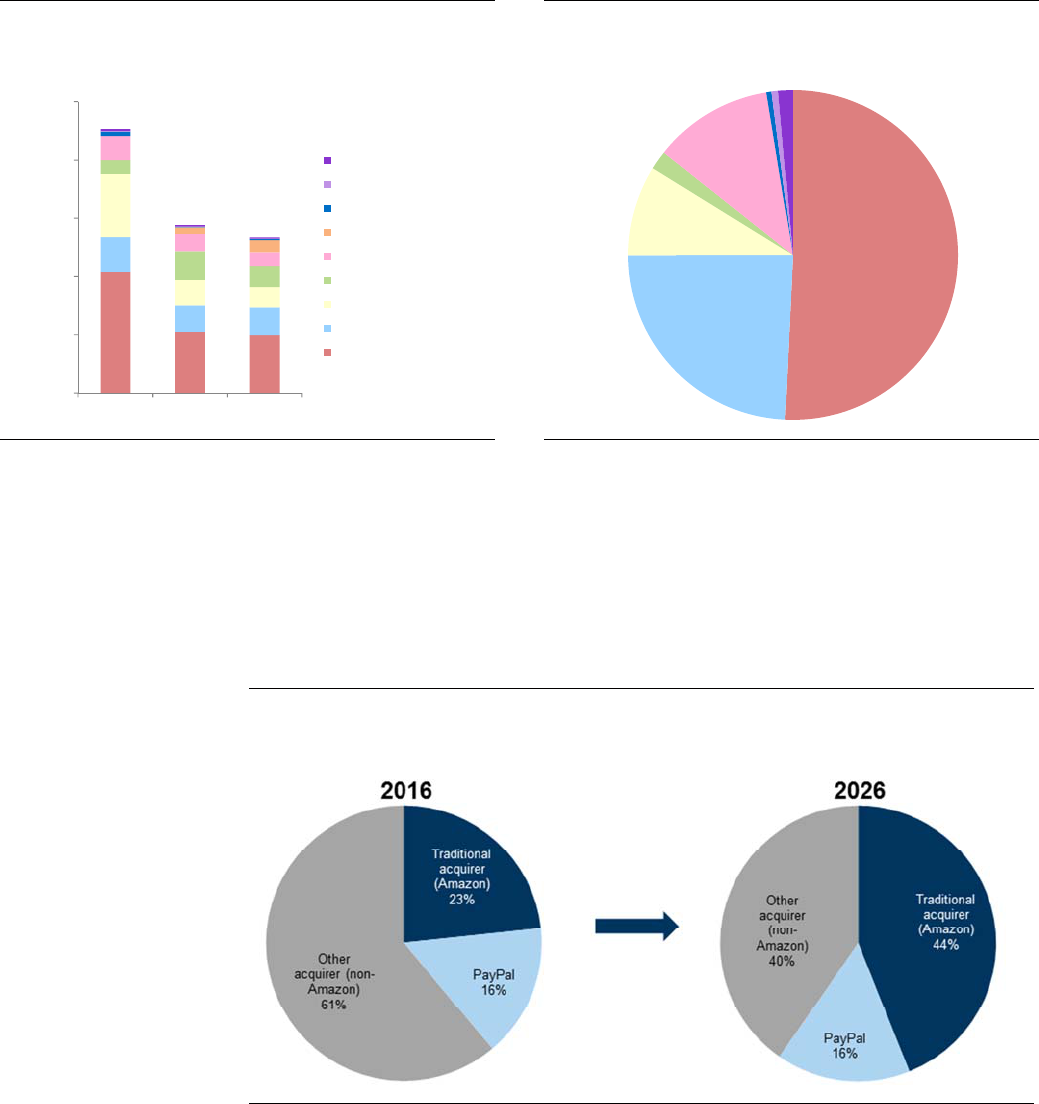

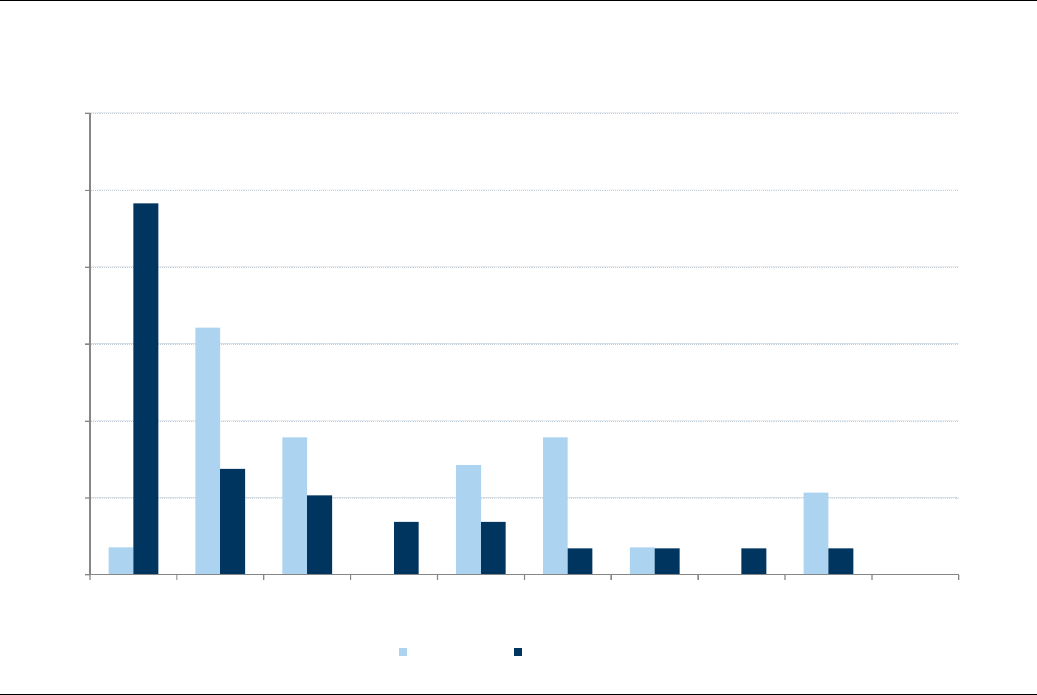

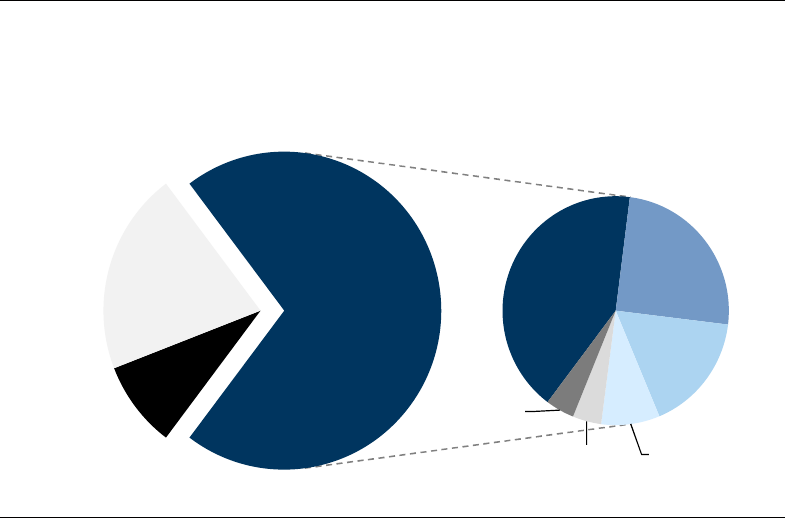

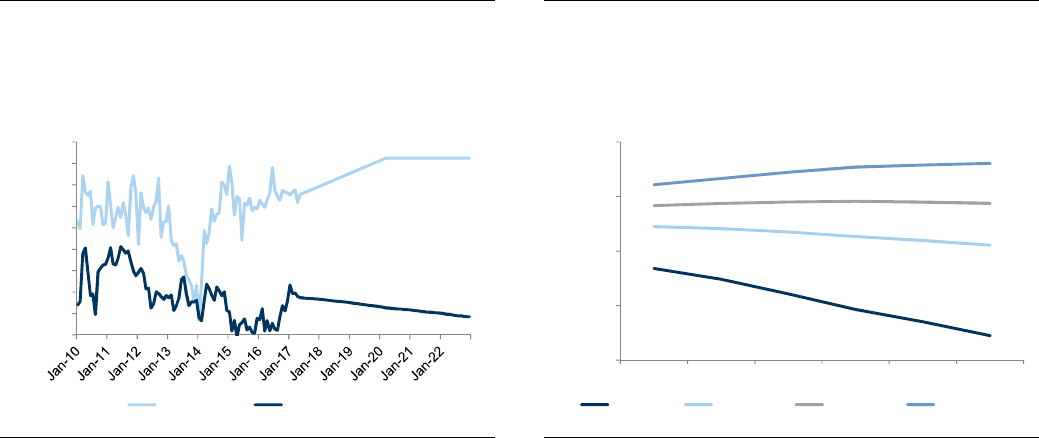

Exhibit 11: About 40% of PayPal’s growth comes from

traditional e-commerce today

PayPal TPV growth (ex-PayPal Credit and Venmo) by market

Exhibit 12: About 50% of PayPal’s TPV comes from

traditional e-commerce in 2016

2016 PayPal TPV volume (ex-PayPal Credit and Venmo)

Source: Company data, World Bank, Euromonitor, eMarketer, Adyen, Aite

Group, NACHA, Visa, Nilson Report, Goldman Sachs Global Investment

Research.

Source: Company data, World Bank, Euromonitor, eMarketer, Adyen, Aite

Group, NACHA, Visa, Nilson Report, Goldman Sachs Global Investment

Research.

Second, we expect PayPal’s traditional e-commerce TPV to grow with the overall

market while gaining share excluding Amazon.

We expect PayPal’s traditional e-

commerce share to stay roughly stable over the next decade, even as Amazon gains

meaningful share (Exhibit 13). Excluding Amazon purchase volumes, we expect PayPal to

grow about 350bps faster than traditional e-commerce retail sales (11.9% vs. 8.3%) over the

next decade (Exhibit 14), as it leverages its two-sided network of merchants and consumers.

Exhibit 13: We estimate PayPal’s market share in traditional e-commerce should remain

roughly stable over the next decade as Amazon gains share

Global traditional e-commerce (ex-China) market share

Source: Company data, World Bank, Euromonitor, eMarketer, Adyen, Aite Group, NACHA, Visa, Nilson Report, Goldman

Sachs Global Investment Research.

0%

5%

10%

15%

20%

25%

2016 2021 2026

PayPal TPV growth build

Secondary ticket sales

Primary ticket sales

Food delivery

B2B

C2C (ex-Venmo)

Bill pay

Sharing economy

Travel

Traditional e-commerce

Traditional

e-commerce

51%

Travel

24%

Sharing

economy

9%

C2C

(ex-Venmo)

12%

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 16

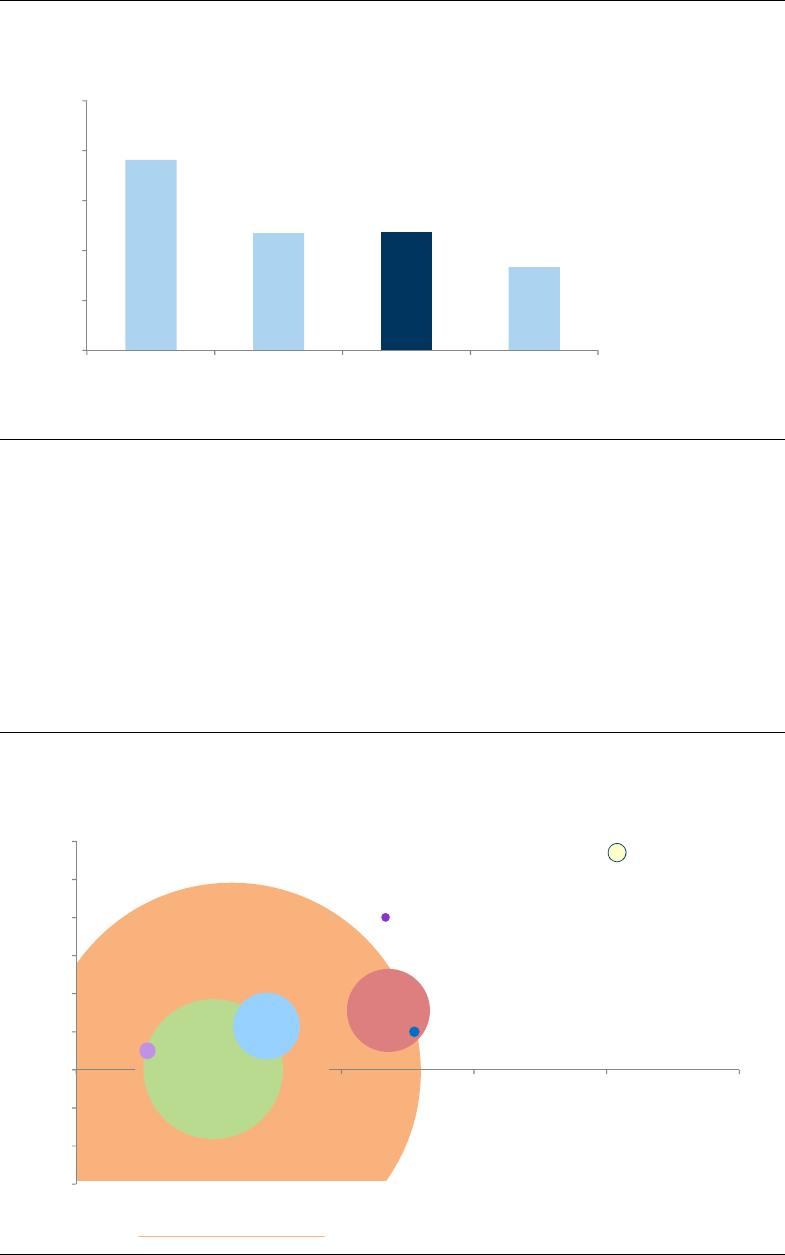

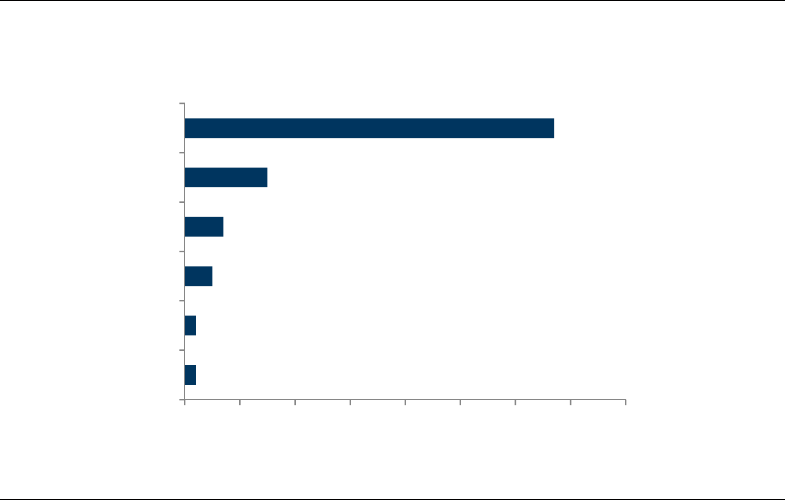

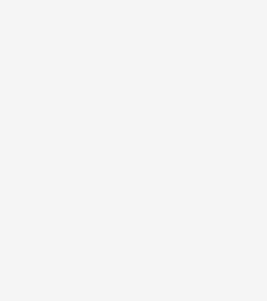

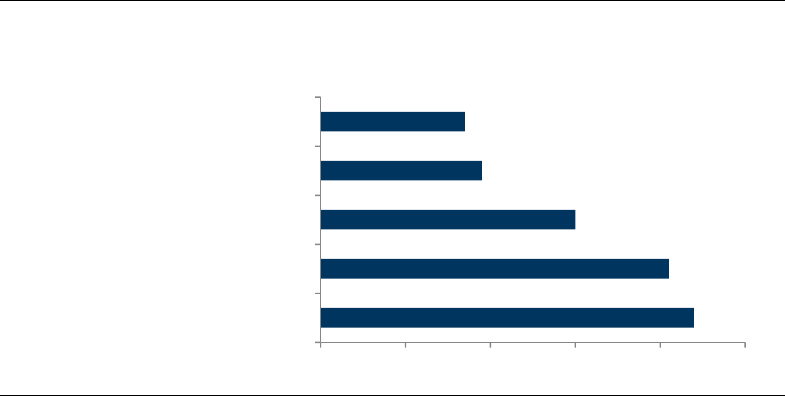

Exhibit 14: We expect PayPal’s traditional e-commerce volumes to grow in line with the

industry

Traditional e-commerce retail sales growth CAGR, 2016-2026

Source: Company data, World Bank, Euromonitor, eMarketer, Adyen, Aite Group, NACHA, Visa, Nilson Report, Goldman

Sachs Global Investment Research.

Third, we believe PayPal has substantial room to tap into large, underpenetrated

markets, including bill payment and B2B (Exhibit 15).

By diversifying its TPV volume,

we expect PayPal (ex-PayPal Credit and Venmo) can maintain 15% TPV growth. As a result,

we estimate traditional e-commerce will comprise 39% of TPV (ex-PayPal Credit and

Venmo) in 2026, compared to 51% in 2016 (Exhibit 16). We view the underlying growth in

broader online payments is healthy, with volume growing at about a 6% CAGR over the

next decade.

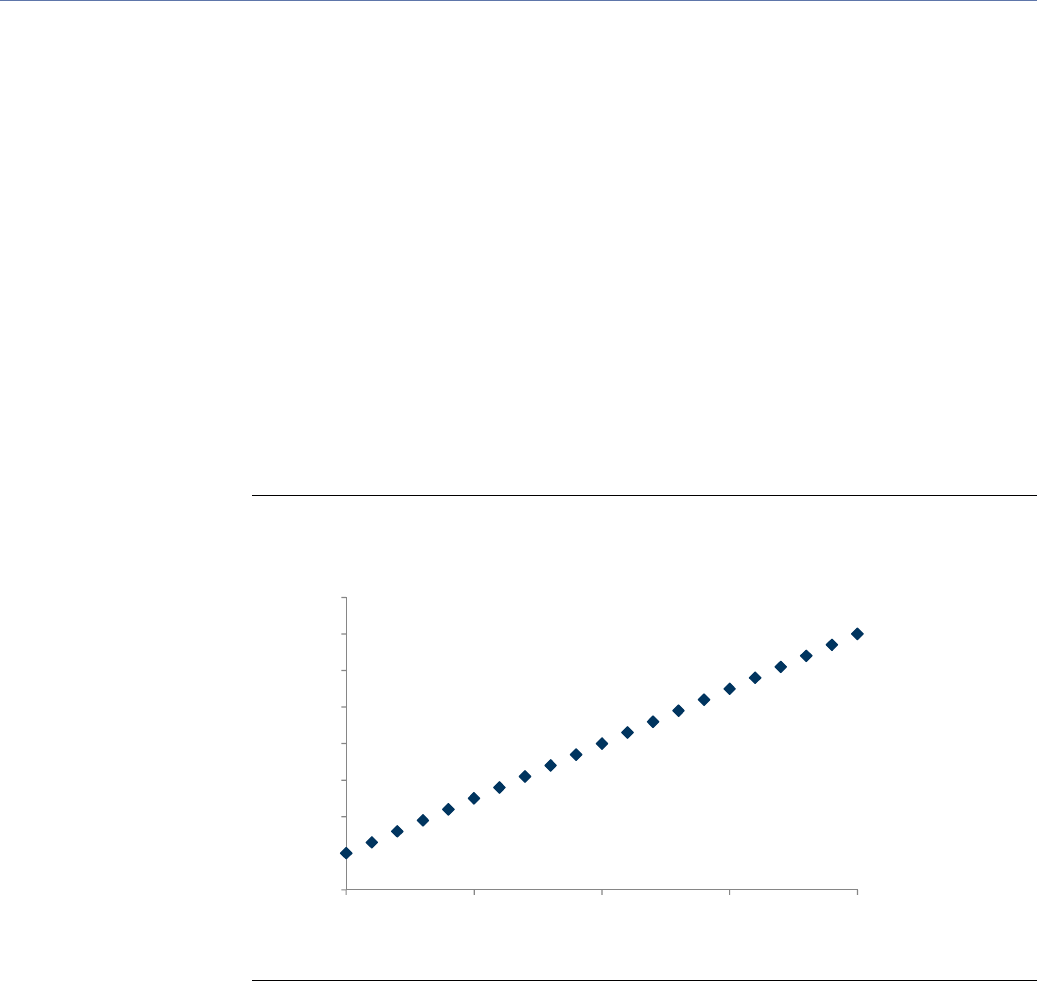

Exhibit 15: PayPal remains underpenetrated in larger markets, leaving room for growth

vertical-axis: PayPal market penetration as of 2016; horizontal-axis: market growth CAGR from

2016-2026; circles are scaled to industry market size in 2016

Source: Company data, World Bank, Euromonitor, eMarketer, Adyen, Aite Group, NACHA, Visa, Nilson Report, Goldman

Sachs Global Investment Research.

19.1%

11.8%

11.9%

8.3%

0%

5%

10%

15%

20%

25%

Amazon Traditional

e-commerce

PayPal traditional

e-commerce

Traditional

e-commerce

(ex-Amazon)

Traditional e-commerce growth

B2B

Bill

pay

Traditional

e-commerce

Travel

Primary

ticket sales

Secondary

ticket sales

Food delivery

Sharing economy

-30%

-20%

-10%

0%

10%

20%

30%

40%

50%

60%

0% 5% 10% 15% 20% 25%

Market penetration

Market growth rate

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 17

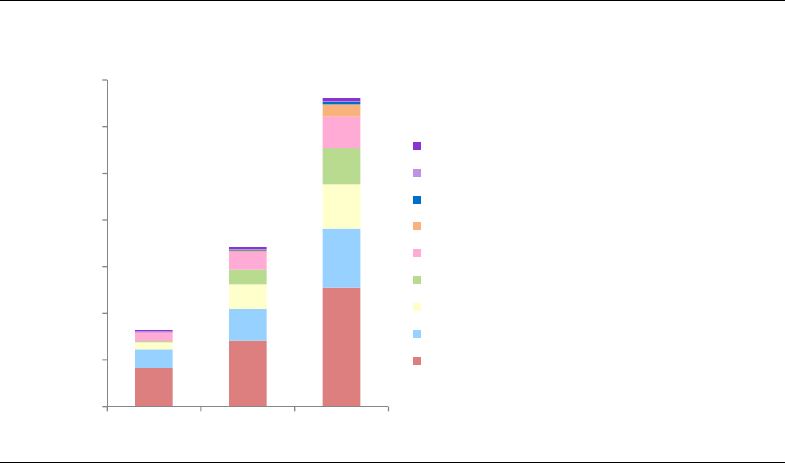

Exhibit 16: We expect PayPal’s expansion into new markets to drive continued growth

PayPal TPV (ex-PayPal Credit and Venmo) by market

Source: Company data, World Bank, Euromonitor, eMarketer, Adyen, Aite Group, NACHA, Visa, Nilson Report, Goldman

Sachs Global Investment Research.

We detail PayPal’s positioning and opportunities by market (Exhibit 18)

(references to PayPal’s TPV exclude PayPal Credit and Venmo):

Online travel: Although the travel market is fairly penetrated by traditional acquirers,

we believe the shift to online bookings from agent-driven models has created an

opportunity for companies like PayPal to gain share, as many airlines have adopted the

company’s PayPal button on their websites. We estimate online travel to be a $690bn

volume opportunity globally in 2016, and we expect this to grow at a 7% CAGR over

the next ten years. Given the ease of integrating PayPal’s offerings, we anticipate

modest share gains (from 12% in 2016 to 18% in 2026) in the online travel segment.

We expect online travel to be PayPal’s second-largest market in 2026 at 19% of

TPV (ex-PayPal Credit and Venmo), compared to 24% of volumes in 2016.

Sharing economy:

The sharing economy is the fastest-growing online payments

market in our analysis, growing at a 20% CAGR over the next ten years by our

estimates. PayPal capitalized on the sharing economy trend through its acquisition of

payment gateway provider Braintree in 2013, which services the two largest sharing

economy companies, Uber and AirBnB. By processing these two businesses (as well as

several smaller businesses like TaskRabbit), our model assumes that PayPal processes

nearly 60% of global sharing economy payments today. We expect this dominant

position to remain fairly stable over the next decade, but note the loss of key clients

(Uber or AirBnB) as a risk.

We expect the sharing economy will be PayPal’s third-

largest market in 2026 at 14% of TPV (ex-PayPal Credit and Venmo), compared to

9% of volumes in 2016.

Online bill payment:

About $1.5tn in bill payments are paid online in the United States

today, according to the Aite Group, and PayPal has started to pursue this large market

opportunity. PayPal acquired online bill payment company TIO Networks in 2017 for

$233mn. The company processed about $7bn in volume in 2016, and we expect PayPal

to leverage this acquisition to grow its footprint quickly. Our model assumes PayPal is

able to gain about 30bps of bill payment market share per year over the next 10 years,

and that PayPal will have just over 3% market share of online bill payments in 2026.

We expect bill payment will be PayPal’s fourth-largest market in 2026 at 12% of

TPV (ex-PayPal Credit and Venmo), despite having negligible volumes today.

-

200

400

600

800

1,000

1,200

1,400

2016 2021 2026

PayPal TPV ($bns)

Secondary ticket sales

Primary ticket sales

Food delivery

B2B

C2C (ex-Venmo)

Bill pay

Sharing economy

Travel

Traditional e-commerce

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 18

We consider a scenario in which PayPal is able to successfully roll out a bill payment

offering to its consumer base of 210mn, and the implications this would have on the

company’s TPV. We make simplified underlying assumptions, with the company

driving 5% incremental adoption among its user base in the first three years of launch,

applying a 2019 penetration rate of 15%. A user paying $500 in bills on average per

year using this service would yield $5bn in TPV in the first year (assuming a 2017

launch), building up to $20bn in 2019 as the company increases its penetration rate

and user base (Exhibit 17). Therefore, a simple bill payment tool with a relatively low

penetration could add over 1.5% to TPV growth in each of the next three years.

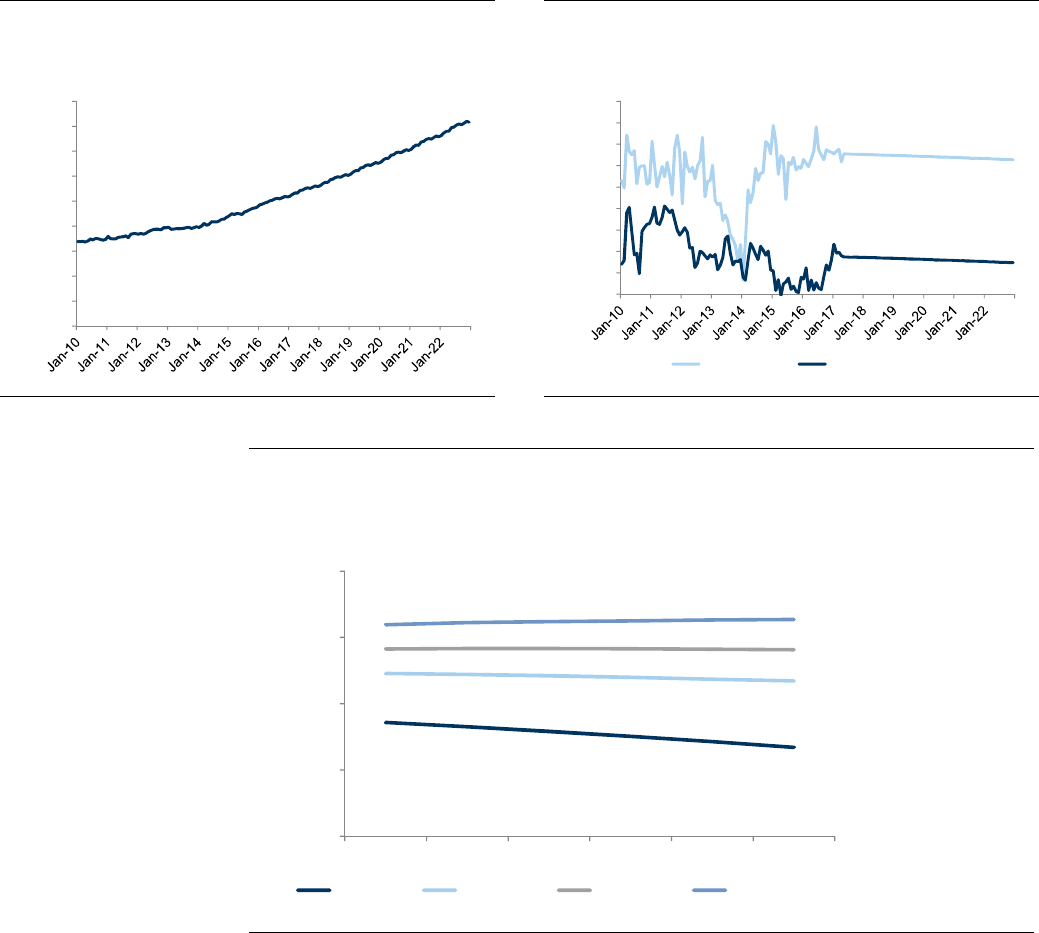

Exhibit 17: Given the company’s large customer base, a new product can drive meaningful

incremental TPV

New bill payment TPV assuming 5% penetration per year and $500 in annual payments

Source: Company data, Goldman Sachs Global Investment Research.

C2C (ex-Venmo): Our C2C (ex-Venmo) segment includes fee-generating C2C

payments made through the PayPal wallet and Xoom. We exclude Venmo in our

analysis in order to highlight the revenue impact of fee-generating volume on PayPal’s

growth. The remittance market has been slow to evolve, with the majority of

remittances still occurring through informal channels. A smaller share of remittances

are transmitted through banks or money remittance companies like Western Union

and MoneyGram, which largely rely on a vast network of retail partner locations to

complete the money transfer. PayPal processes C2C payments through its core PayPal

wallet feature (we estimate $30bn in 2016) and through Xoom (we estimate $8bn in

2016), which was acquired by PayPal in 2015 for $890mn. While C2C remittances could

be a compelling opportunity for PayPal, we see larger competitors like Western Union

have compelling digital offerings with a larger geographic reach.

We expect online

C2C (excluding Venmo) to be PayPal’s fifth-largest market in 2026 at 10% of TPV

(ex-PayPal Credit and Venmo), compared to 12% of volumes in 2016.

Online B2B payments:

The B2B payments space has seen significant M&A and

partnership activity as larger payments companies begin to penetrate the market. Visa

and Mastercard have gained exposure to the space, with offerings including Visa Direct,

the Chain Inc. partnership, the VocaLink acquisition, and the AvidXchange partnership.

Payment processors have also engaged in significant deal activity, with FleetCor’s

announced acquisition of Cambridge Global Payments in May 2017. PayPal also

announced a partnership with B2B e-commerce platform provider Oro in March 2017.

We estimate the online B2B payments market represents a $23tn volume opportunity

globally today, and expect this to grow at a 5.9% CAGR to $41tn over the next ten

0%

1%

2%

3%

4%

5%

$0

$5

$10

$15

$20

$25

2017 2018 2019

% of total TPV

New product TPV ($bns)

New product TPV ($bn) % of total TPV

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 19

years as businesses transform their back-end infrastructure to adopt more efficient

payment methods. Our model assumes PayPal had no B2B exposure in 2016, and

ultimately anticipate the company can achieve just under 0.15% market share of online

B2B spend in 2026.

We expect online B2B payments to be PayPal’s sixth-largest

market in 2026 at 4% of TPV (ex-PayPal Credit and Venmo), despite having

negligible volumes today.

Exhibit 18: We expect PayPal to diversify into new markets over the next ten years, particularly bill payment and B2B

PayPal TPV (ex-PayPal Credit and Venmo) by market segment, 2016, 2021, 2026

Source: Company data, World Bank, Euromonitor, eMarketer, Adyen, Aite Group, NACHA, Visa, Nilson Report, Goldman Sachs Global Investment Research.

Upside and downside risks to PayPal’s growth

Our TPV segment analysis estimates the composition of PayPal’s TPV today and its ability

to maintain growth. We briefly touch on some other upside and downside risks below:

Upside potential:

Venmo monetization:

We exclude Venmo and PayPal Credit from our TPV segment

analysis, and currently expect Venmo-related revenues to be negligible in our forecasts.

We note that Venmo has started testing merchant acceptance with several websites,

including Munchery, ParkingPanda, and Poshmark, and we will follow its merchant

acceptance closely.

Offline payment penetration:

Our TPV analysis assumes PayPal can maintain 15%

TPV growth without making progress in offline payments. Therefore, offline payment

penetration would be entirely incremental to our estimates. Given the limited traction

of mobile wallets in the offline space, we expect PayPal to gain minimal offline traction

in the medium term – but this could occur over time.

Powerful track record:

PayPal has grown in the face of competition and countless

new entrants (Exhibit 19). While the status quo can change—especially among

technology companies—we find PayPal’s track record and scale reassuring. With

partnerships with 14 of the largest 20 US merchants (Exhibit 20) and direct access to a

large base of consumers and merchants, we believe PayPal is well-positioned to

compete against new entrants.

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 20

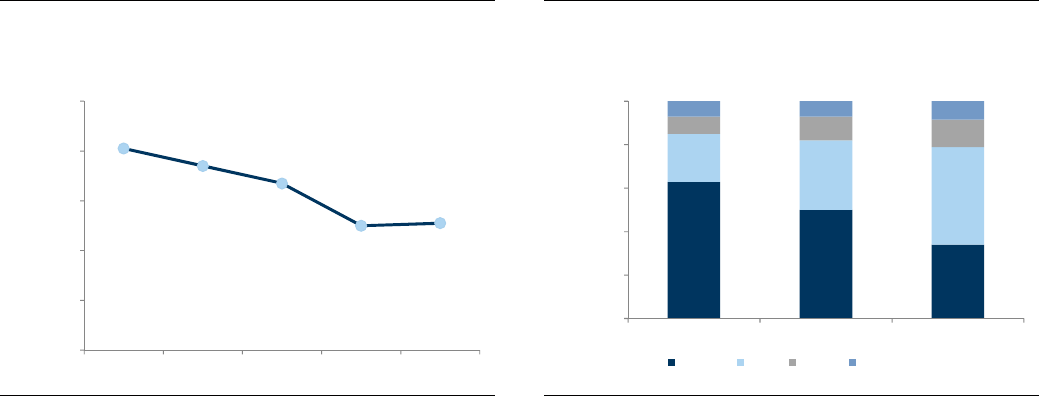

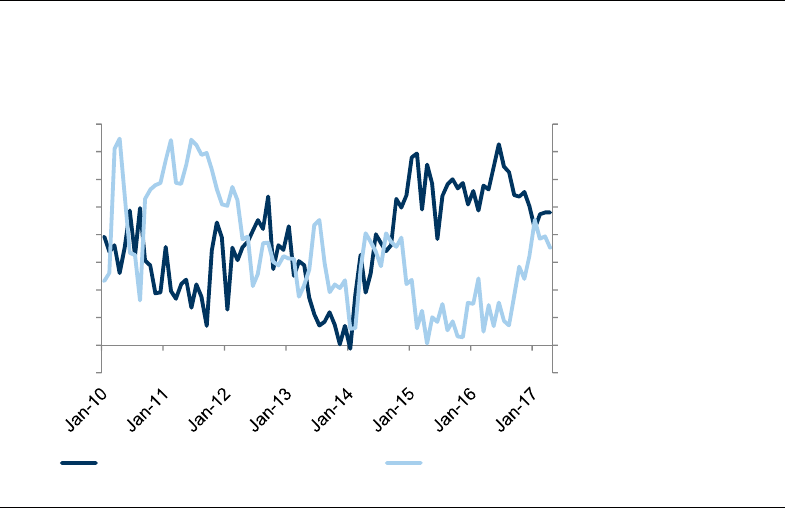

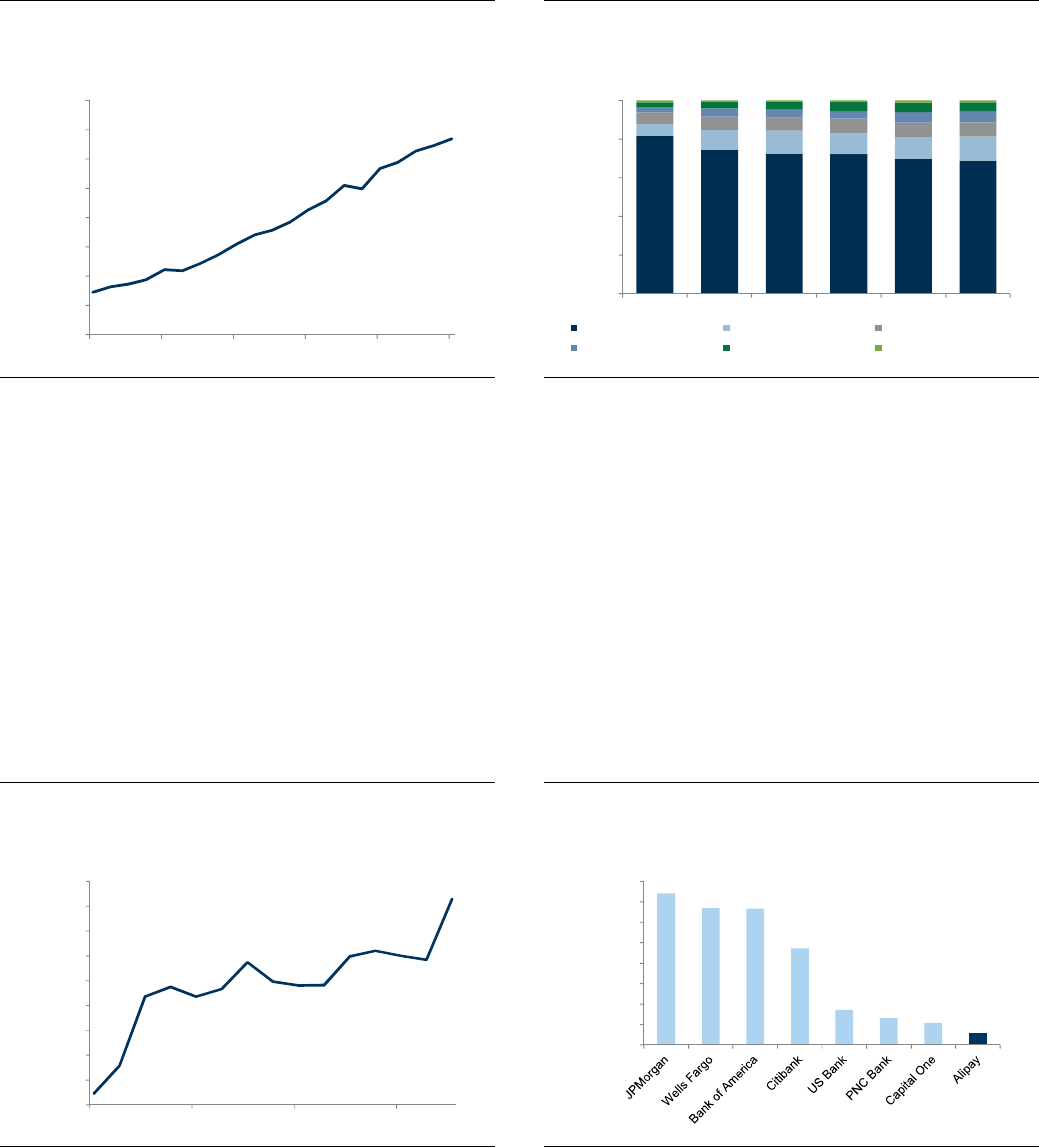

Exhibit 19: PayPal has successfully grown TPV despite

persistent market competition

PayPal TPV vs. competitive entrants

Exhibit 20: PayPal is accepted at 14 of the top 20 online

merchants in the US

PayPal acceptance among top 20 US merchants

Source: Company data, Goldman Sachs Global Investment Research.

Source: Euromonitor, company data, Goldman Sachs Global Investment

Research.

Downside risks:

Need for increased investment in growth: Technology companies cannot rest on

their laurels, especially in a space as dynamic and innovative as online payments. As

we see with the rise of Stripe against incumbent gateways like CyberSource,

companies can gain and cede market share quickly. PayPal must continue investing in

its growth—both organically to ensure its technology is best-in-class and easy to use

and inorganically to gain a foothold in new markets, as demonstrated by PayPal’s

acquisitions of Braintree (gateway/sharing economy), Xoom (C2C remittance), and TIO

Networks (bill pay) over the last few years.

Margin pressure: There are risks to PayPal’s model beyond volume, notably on

margins. Margin compression could come on two fronts: (1) take rate compression:

PayPal’s take rate can come under pressure, either by virtue of mix toward lower-

yielding segments or price pressure. However, with offerings like Amazon Payments

and Stripe with comparable pricing to PayPal, plus healthy growth in cross-border

online payments at richer fees, we expect PayPal’s take rate (excluding Venmo) to

remain fairly stable and see modest erosion over the next few years; (2) transaction

expense growth: with a greater share of PayPal’s volumes on credit and debit cards

(we estimate 78% in 2021, compared to 68% in 2016), fees paid to Visa and Mastercard

will continue to increase. We believe PayPal can offset these higher transaction

expenses and expand margins over this period by recognizing efficiencies in SG&A

and other operating expenses.

Security risk: A key premise underlying the success of PayPal—and online payments

in general—is security and trust. If PayPal were subject to a security breach, this could

limit customer use and merchant acceptance.

$0

$10

$20

$30

$40

$50

$60

$70

$80

$90

$100

1Q05

3Q05

1Q06

3Q06

1Q07

3Q07

1Q08

3Q08

1Q09

3Q09

1Q10

3Q10

1Q11

3Q11

1Q12

3Q12

1Q13

3Q13

1Q14

3Q14

1Q15

3Q15

1Q16

3Q16

1Q17

Total payment volume ($bns)

Google

Checkout

June 2006

ISIS

demo

Oct.

2012

V.Me by

Visa Nov.

2012

Amazon

Payments

Aug. 2007

Square

June

2010

Google Wallet,

Stripe

Sept. 2011

Facebook Credits

Jan. 2011

Amex Serve

Mar. 2011

Amazon

Payments

relaunch

Oct. 2013

Apple

Pay

Oct. 2014

Visa

Checkout

July 2014

Facebook Messenger

Payments

June 2015

Merchant

V

olume ($mn) PayPal accepted?

1

Amazon.com Inc 102,843 No

2 Wal-Mart Stores Inc 24,339 Yes

3 eBay Inc 22,993 Yes

4 Apple Inc 14,821 Yes

5 Valve Corp 5,702 Yes

6 Macys Inc 4,967 Yes

7 Home Depot Inc, The 4,465 Yes

8

Liberty Interactive Corp 4,379 No

9

Sears Holdings Corp 3,917 Yes

10

Best Buy Co Inc 3,782 Yes

11

Target Corp 3,699 Yes

12

Kohl's Corp 3,683 No

13

Wayfair LLC 3,484 Yes

14

Costco Wholesale Corp 3,289 No

15

Williams - Sonoma Inc 2,513 No

16

Nordstrom Inc 2,425 Yes

17

Office Depot Inc 2,382 Yes

18

Newegg.com Inc 2,368 Yes

19

Gap Inc, The 1,858 No

20

HSN Inc 1,830 Yes

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 21

Q2: How could Visa and Mastercard be disrupted?

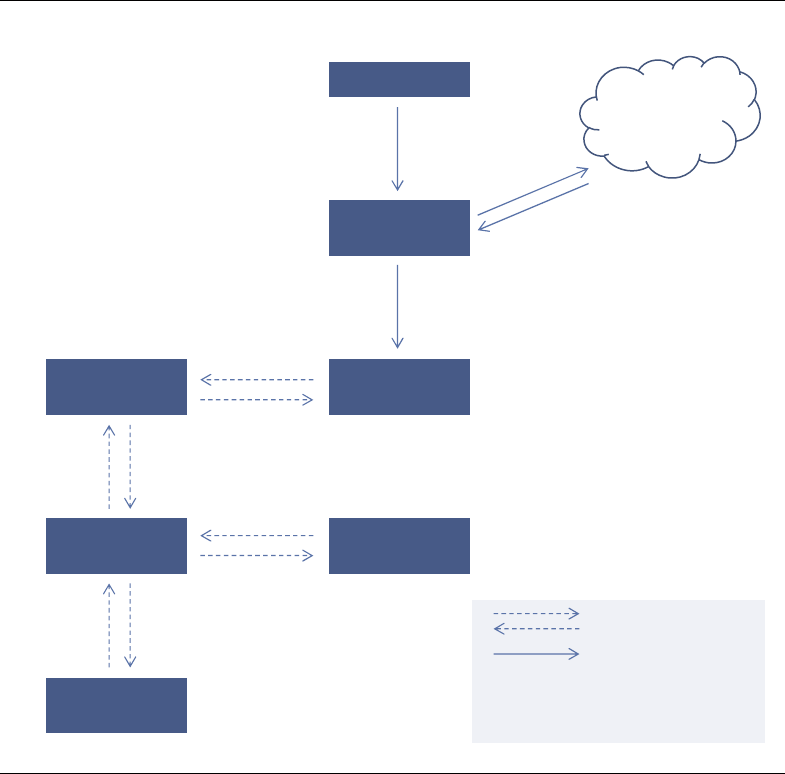

We consider the potential for incumbent payment ecosystems to be disrupted. We

examine the core elements needed to build a consumer payment ecosystem, and

specifically look at how certain emerging markets like China have developed

alternative ecosystems to those in the United States and Europe. We evaluate how

the Chinese third-party payments model – specifically Alipay and Tenpay – can be

exported to the United States and potentially disrupt the ecosystem of incumbents.

Finally, we consider “moonshots” – new technologies like blockchain and artificial

intelligence – and the long-term impacts they could have on the payments industry.

Building a disruptive payment ecosystem in three “easy” steps:

A successful payments system requires two basic ingredients: consumer adoption

and merchant acceptance. Consumers must perceive clear value (such as easy credit

financing for large purchases, better convenience, rewards) and merchants must be

compelled to accept a payment type (such as fear of missing a sale, higher ticket

consumer spending, lower cost of acceptance). Building consumer adoption has

always been a pre-condition for merchant acceptance. In the United States and

Europe, a new ecosystem aimed at disrupting incumbents will need to provide

superior solutions capable of changing both consumer and merchant behavior:

(1)

Build critical mass with consumers: We see financial incentives and improved

convenience as the two main avenues for driving consumer adoption of new payment

methods. Payment cards are ubiquitous in the United States and Europe due to their

convenience and direct links to consumer bank accounts and services (such as

revolving credit lines). As we discuss elsewhere in this report, mobile payment

methods offer similar or slightly higher levels of consumer convenience (similar in-

store experience, without the need to carry physical cards) – but these have failed to

gain significant traction thus far. Starbucks is the main exception to this trend,

achieving 29% adoption with its mobile payments app, which has been driven in large

part by the company’s attractive 10% rewards program. Thus, we expect any

successful disruptive competitor would need to provide substantially greater

convenience, significantly greater financial incentives or rewards, or both, in order to

gain widespread consumer adoption.

(2)

Gain widespread merchant adoption: Every merchant is motivated to maximize sales

and minimize costs, and payments are no exception. Historically, merchants have

accepted credit cards (even higher-cost cards like AmEx) as a way of driving higher

sales conversion, more large-ticket sales, and higher spending levels. Merchant

acceptance tends to be driven by consumer demographics—that is, they accept new

payment methods only after a critical mass of consumers wants to use one. However,

we believe it is also possible for merchant acceptance to be stimulated by either

significantly lower acceptance cost or direct subsidies by payment providers.

(3)

Drive a “virtuous cycle”: Once a minimum critical mass of consumers and merchants

is achieved, adoption rates can be increased over time by payment providers. To

increase consumer adoption, the payment provider can offer ancillary services on the

platform such as other financial services or concierge service that appeal to a wider

demographic range. To expand the merchant base, the provider can offer merchants

incentives for new signups or exclusivity.

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 22

How could Chinese payments models disrupt the US and Europe?

Over the past five years, a number of potential threats to the incumbent payment

ecosystems in the United States and Europe have surfaced, including Apple Pay,

Google Wallet, MCX (Merchant Customer Exchange), and others. Thus far, these

methods have failed to gain widespread adoption because of either modest

consumer adoption or merchant acceptance. However, in China, “third-party”

payment methods Alipay and Tenpay have been growing at over a 40% CAGR and

comprise $2tn in payment volume today. Here, we build the case for how they could

disrupt the incumbent payment systems outside of China.

Background: Growing fast by winning users and merchants.

“Third party” payment

methods such as Alipay and Tenpay allow consumers to pay either directly through linked

bank cards (removing the role of the acquiring bank and the card network) or with an e-

wallet balance (removing the role of the acquiring bank, the card network, and the issuing

bank). As a result, third-party payment providers play multiple roles in a transaction and

dis-intermediate portions of the payments value chain (Exhibit 21).

We believe the lack of domestic competition provided a clear opening for third-party

payment providers in China to gain a strong foothold among consumers and expand

rapidly. China UnionPay, the only bank-linked network in China, had failed to develop (1) e-

commerce technology capability for processing online transactions, instead partnering

with Alipay and Tenpay; and (2) mobile payment technology for consumers to pay with

smartphones.

Exhibit 21: Third party payment companies can replace more than one traditional payment value chain player

Value chain of traditional bank card and third-party payment transactions

Source: Goldman Sachs Global Investment Research.

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 23

Below we examine how these systems have succeeded in China, and how this could be

applied elsewhere:

(1) Building the consumer base:

We believe Alipay and Tenpay will need to provide a

payment offering that is as convenient and has better incentives than incumbents:

Replacing the bank by attracting deposits and cross-selling financial services:

Ant Financial launched Yu’e Bao (Chinese for “leftover treasure”) in 2013, which

provides interest-bearing depository accounts to both banked and underbanked

individuals. By offering cash returns up to twice as high as interest-bearing

accounts offered by Chinese banks (about 6% vs. about 3%, although rates have

receded in recent years), Ant Financial has successfully drawn substantial deposit

share away from the banks and is now the world’s largest money market fund (per

Financial Times) with Rmb1.4 trillion ($208 bn) in AUM. We believe these

incentives were critical in driving consumers to the Alipay platform and have

effectively helped create a viable substitute to Chinese banks (Exhibit 22). The

addition of other financial services such as insurance and consumer loans has

further diversified Ant’s portfolio. We believe Chinese third-party payment services

could potentially gain users in the United States and Europe if they are able to

offer significantly higher deposit rates, along with a broad array of financial

services – provided they can overcome regulatory obstacles (see below).

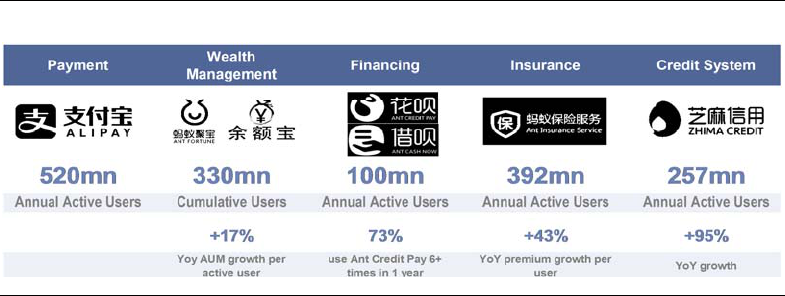

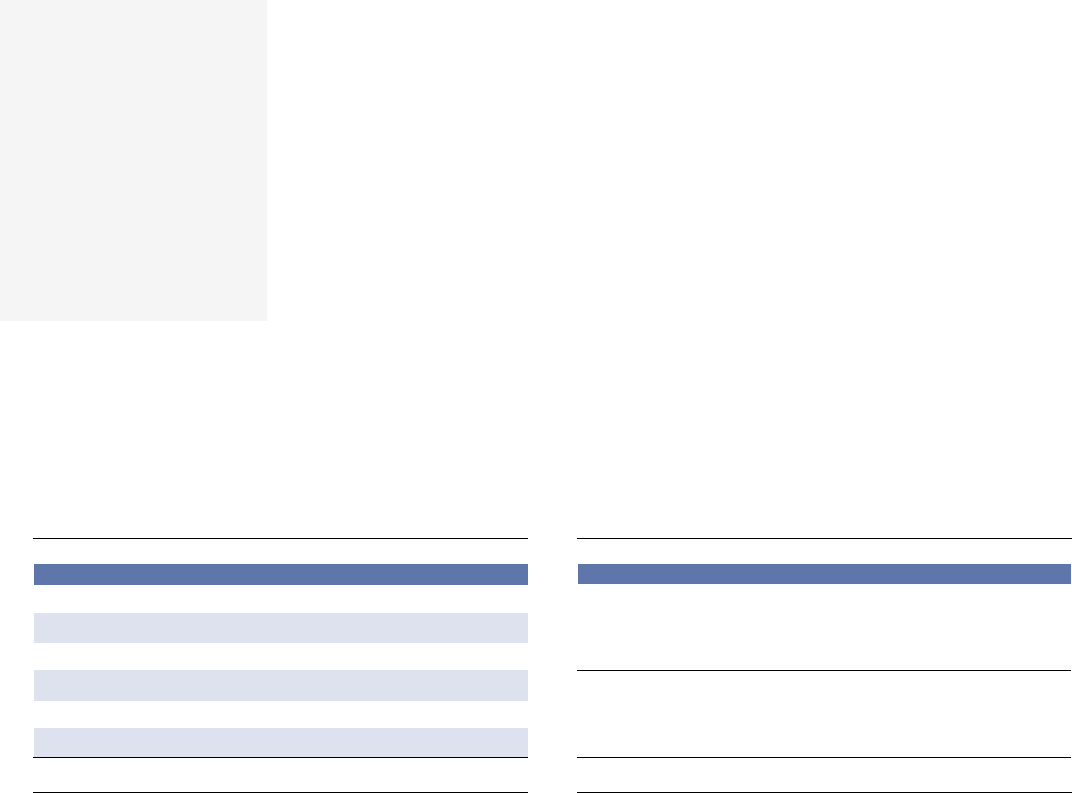

Exhibit 22: Ant Financial’s leading breadth and scale

Source: Company data.

Improving convenience with a one-touch mobile experience:

Alipay and

Tenpay succeeded in bringing an easy-to-use mobile experience to both

consumers and merchants. To pay, the consumer launches the appropriate

payment app, which generates an on-screen QR code (similar to a bar code) which

is then scanned by the merchant at the point of sale. While technically simple and

lacking in security, the consumer experience is at least as easy as Apple Pay and

requires no new equipment investment by the merchant.

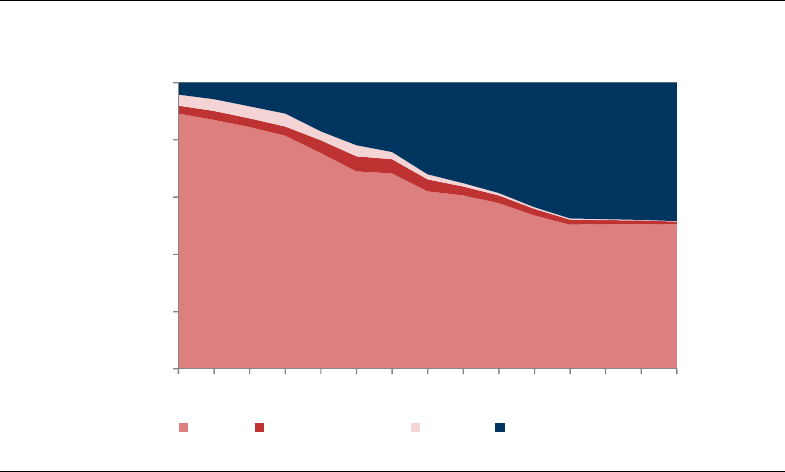

Filling an unmet need for the underbanked:

Many Chinese consumers were not

historically served by banks, providing an opening for FinTech disruptors. Just 15

years ago, China was virtually an all-cash economy (Exhibit 23). Chinese

consumers quickly evolved and became more sophisticated with their payment

methods, and cards and eWallets make up roughly 50% of consumer spending

today. Bank penetration has also increased rapidly, with 79% of individuals over 15

years old having a bank account as of 2014, up from 64% in 2011, according to the

World Bank. We believe the large number of unbanked and underbanked

consumers in China has provided a fertile environment for Alipay and Tenpay to

introduce new payment and financial services. We believe a similar market

opportunity exists in developed markets as well – and we would point to Ant

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 24

Financial’s proposed acquisition of US-based remittance provider MoneyGram as

an attempt by Ant to gain a foothold with this demographic in the United States.

Exhibit 23: Cards/eWallets have meaningfully scaled over the last 15 years

Payment volume mix in China, 2002-2016

Source: Euromonitor.

(2) Building merchant acceptance at scale: While Chinese third-party payment providers

will likely need to first drive consumer adoption, we believe they are already taking

important steps to build a global footprint of merchant acceptance:

Forging partnerships to drive merchant acceptance. Alipay and WeChat Pay

(Tencent’s payments platform) are leveraging their existing Chinese consumer

base to gain merchant acceptance outside of China by forging global partnerships.

They have announced several partnerships over the last year with Verifone (Alipay

in October 2016), Citcon (WeChat Pay in February 2017), and First Data (Alipay in

May 2017) to build international merchant acceptance. These services are available

in 28 countries outside of China for Chinese tourists (Exhibit 24). We expect this

initial merchant base will be a useful baseline for rolling out local Alipay and

WeChat Pay offerings to North American and European consumers. The larger and

more penetrated the consumer base, the more merchants will be convinced to

offer the payment method in their stores.

Lowering the cost of acceptance: As we have written previously (see our July 7,

2014 report, Resume on Payments), we believe there is a long-term trend toward

lower merchant acceptance fees, mainly as a result of regulation (which has

already been executed in the United States, Europe, and Australia). Today, we

estimate that third-party payment transaction costs in China are slightly higher

than debit fees in the United States and in Europe for in-store transactions (about

40bps) and online transactions (about 60bps) (Exhibits 25 and 26). However, US

credit card fees remain significantly higher than third-party payment fees (which

do not offer a direct credit option). We highlight that debit spreads for Alipay and

Tenpay (8-28bps) are richer than those for Visa and Mastercard (5-10bps). Recent

EU interchange cuts implemented in December 2015 demonstrate that pricing can

impact merchant acceptance. Aldi and Lidl, the Germany-based supermarket

chains that together represent about 25% of German retail sales, announced that

their stores now accept credit cards after the interchange cuts took effect, and we

0%

20%

40%

60%

80%

100%

2002 2004 2006 2008 2010 2012 2014 2016

% of payments

Cash Electronic/ACH Check Card/eWallet

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 25

expect small merchants to follow. We believe charging comparable or lower fees

relative to merchants will be necessary to gain widespread merchant acceptance.

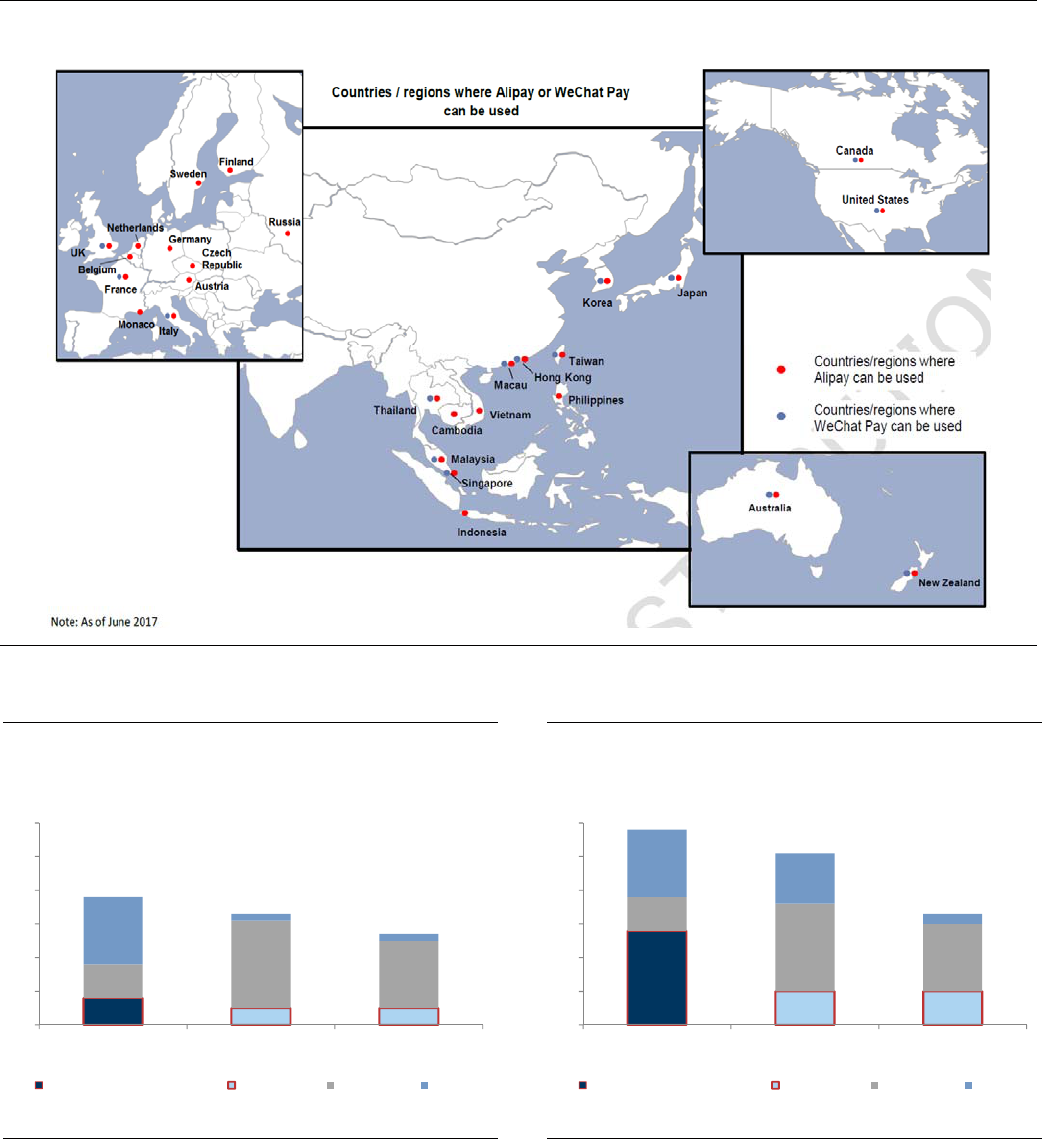

Exhibit 24: Alipay and WeChat Pay are available in 28 countries / regions outside of Mainland China

Countries and regions where Alipay or WeChat Pay can be used

Source: Company data, Caixin, Goldman Sachs Global Investment Research.

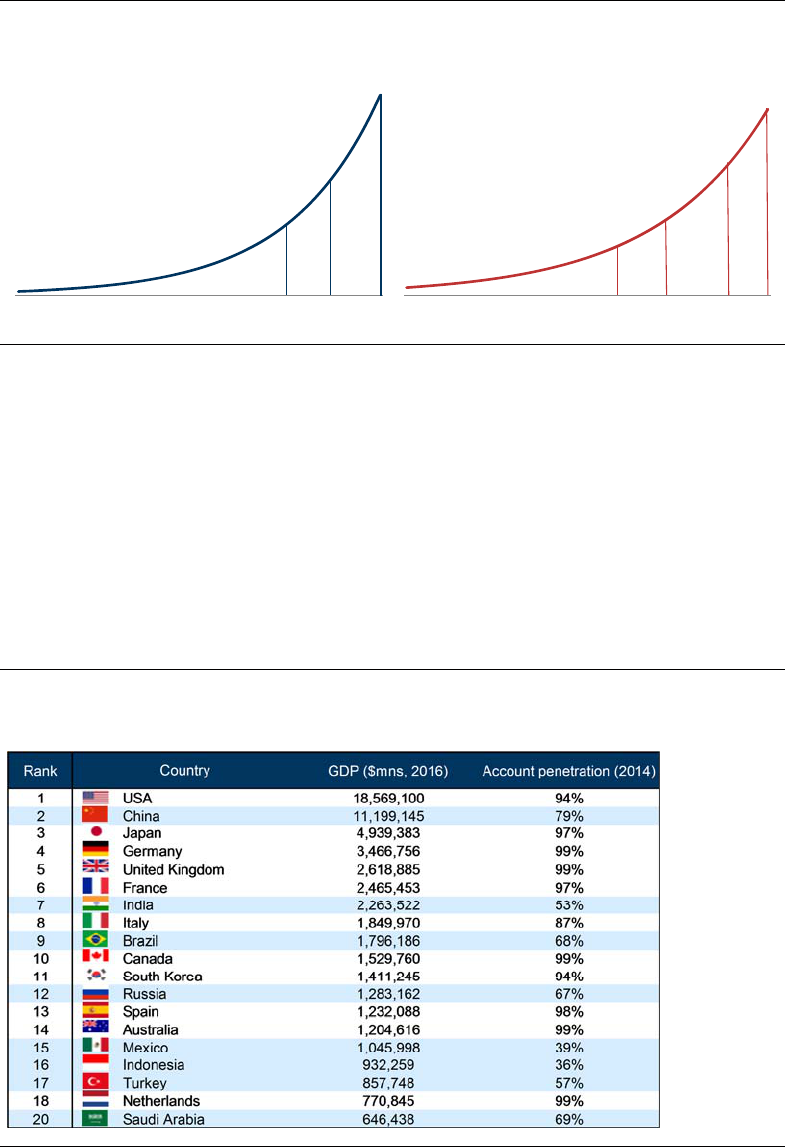

Exhibit 25: China third party payment fees are slightly

higher than other regions for instore transactions…

Estimated instore transaction fees

Exhibit 26: …and for online transactions

Estimated online transaction fees

*Other includes merchant acquirers, payment aggregators, gateways, etc.

*Other includes merchant acquirers, payment aggregators, gateways, etc.

Source: Company data, Goldman Sachs Global Investment Research.

Source: Company data, Goldman Sachs Global Investment Research.

0

10

20

30

40

50

60

China third party

payment

US debit Europe debit

Third party payment provider Card network Issuing bank Other*

0

10

20

30

40

50

60

China third party

payment

US debit Europe debit

Third party payment provider Card network Issuing bank Other*

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 26

What could go wrong? Obstacles to exporting China’s third party model

While we have outlined a path for China’s third-party payments model to expand overseas

and challenge incumbent ecosystems in the United States, Europe, and elsewhere, it is

important to recognize that there are substantial challenges (regulatory, competitive, and

demographic) associated with success outside China, including:

(1)

Stricter regulatory regimes: China’s FinTech industry grew with few regulatory

constraints in the early days. However, there are stricter regulations governing

financial institutions (particularly broad financial service providers) in the United States

and Europe. If building an integrated platform tied to depository (interest-bearing)

accounts is important to building scale, Chinese third-party payment companies would

need to apply for bank licenses and comply with broad banking regulations, which

could slow their growth and introduce more complexity.

We believe the bar to becoming a bank is lower in Europe. For example, PayPal has a

bank license in Europe (and is issuing debit cards in partnership with Visa), but it does

not have an equivalent license in the United States. There is also precedent for non-

financial institutions (such as retailers Tesco and Sainsbury’s) to become banks in

Europe. Wal-Mart’s efforts to obtain a special banking charter in the United States were

stymied before the financial crisis. While it might be easier to obtain a license in

Europe, we note the path forward is not easy – and we would point out that online-only

“challenger banks” in the United Kingdom such as Atom Bank and Revolut have

gained limited market traction in recent years.

In the United States, if the OCC were to issue Special Purpose National Bank Charters

(as discussed in the next section), that could offer the opportunity for China’s FinTechs

to receive a bank license. However, there is significant uncertainty around whether

these bank charters will be introduced, what the definition of them will be, and if they

would be issued to non-US institutions.

(2)

Stiffer competition, with powerful incumbents backed by US banks: Simply put,

payment industry incumbents in the United States and Europe are substantially

stronger than their counterparts in China. Credit cards in the United States offer rich

reward plans (often with 2% or better rewards programs which directly benefit

consumers and drive loyalty), and card usage in the United States and Europe is

already widespread among consumers with ubiquitous merchant acceptance (Exhibit

27). In our view, this dominant market position is the main reason why tech companies

like Apple and Google partnered with the card networks and banks when launching

their digital wallets, rather than attempting to disintermediate them. Importantly,

payments companies have driven significant technology innovations – as the core

security technology underlying mobile payment services such as Apple Pay and

Google Wallet was developed by Visa and Mastercard.

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 27

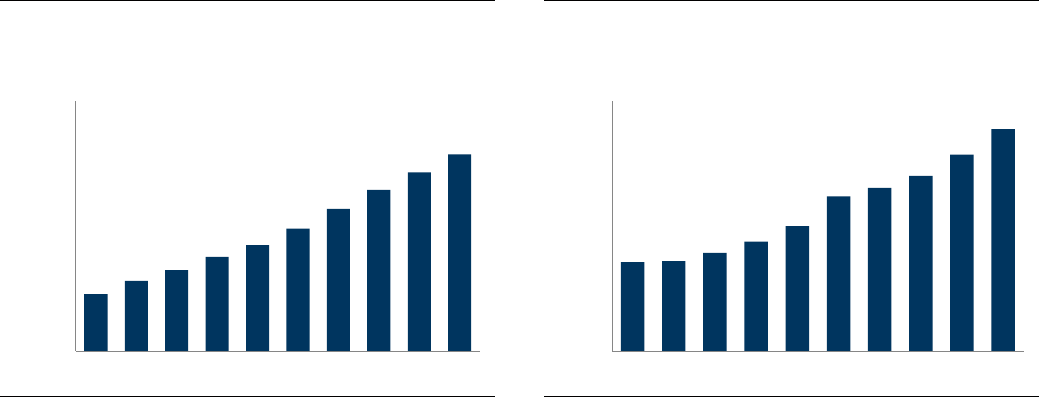

Exhibit 27: Visa’s user base grew in tandem with merchant acceptance

Visa cards and merchant locations, 1958-2016

Source: Company data.

(3)

“High inertia” consumer base:

Consumers in the United States and Europe are

arguably more widely served by existing financial institutions than Chinese consumers,

with bank account penetration of about 95% (Exhibit 28). Consumers in these

developed markets are slow to change their current payment method. Consumer

adoption of new technologies such as Apple Pay has been disappointing over the last

three years – in large part due to a lack of clear advantages in terms of convenience or

rewards. At its core, we believe consumer payment is a fundamentally high-inertia

market, and most consumers do not actively re-evaluate the cost-benefit of their

payment choices.

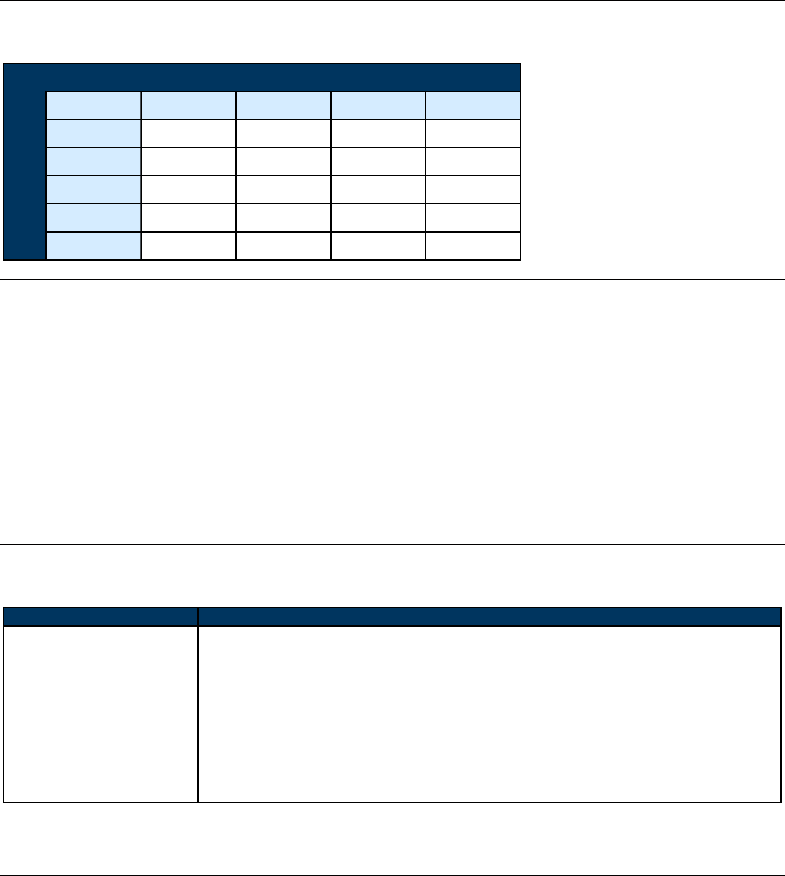

Exhibit 28: China has lower bank account penetration than other large economies

GDP and bank account penetration for top 20 largest economies; countries with less than 80%

bank account penetration highlighted in blue

Source: World Bank, Goldman Sachs Global Investment Research.

OCC’s Special Purpose Bank Charter: Advancing FinTech breadth

In December 2016, the US Office of the Comptroller of the Currency (OCC) published and

solicited comments on a paper considering whether FinTech companies should be granted

Special Purpose National Bank Charters. The OCC currently grants Special Purpose

National Bank Charters to trust banks and credit card issuing banks. The OCC provided

'58 '01 '08 '16

Visa Cards

1bn

2bn

3bn

'58 '92 '00 '10 '16

Visa Merchant Locations

10mn

20mn

30mn

44mn

August 3, 2017 Global: Technology

Goldman Sachs Global Investment Research 28

three reasons for why this may be in the public interest: (1) FinTech companies and banks

will operate in the same “safe and sound manner”; (2) the OCC can provide consistency in

the application of law and regulation across the country for FinTech companies and banks;

and (3) the federal banking system could strengthen, as FinTechs could explore new ways

to promote fair access, financial inclusion, and innovation.

There is ongoing debate as to whether these charters would be beneficial for FinTech

innovation, especially for smaller companies. Some argue that smaller FinTechs would

benefit from a national charter because it would provide consistent national FinTech

regulation, rather than state-by-state laws. Others argue that smaller FinTechs would

struggle to gain the scale necessary to apply for a national charter, ensuring a wider

competitive moat around larger FinTech companies. Other opponents are concerned that

OCC oversight could slow down innovation—because the pace of regulatory change is

slower than the pace of technological change.

Potential risks to Visa and Mastercard: In the existing payment ecosystem, the banks

and card networks work in tandem. Therefore, Visa and Mastercard have two competitive

moats: (1) the card network moat, whereby Visa and Mastercard have achieved a level of

convenience and ubiquity in most developed markets that is difficult to disrupt; and (2) the

bank moat, whereby FinTechs struggle to disrupt the role of banks as credit facilities

(although there have been efforts—see our discussion on point of sale credit (p. 65)), and

Visa and Mastercard have deep partnerships with the banks. If FinTechs are granted

Special Purpose National Bank Charters, it could give rise to a business model that offers a

greater breadth of offerings (similar to those of an Alipay or Tenpay) that has the potential

to disintermediate banks and eliminate one of these competitive advantages. However,

with consumers satisfied with their current payment method, we believe it could be

challenging to uproot the status quo without offering the same scale, convenience, and

incentives as the card networks.

Blockchain: Limited use cases consumer payments; opportunities in

cross-border

Blockchain has captured the imagination of Silicon Valley and Wall Street alike over the

past few years, and is in the early stages of being tested across different industries, such as

security, capital markets, and compliance. It is fundamentally a new type of database

technology that is optimized to tackle a unique set of challenges. Blockchain is a shared,

distributed database of transactions among parties that is designed to increase

transparency, security, and efficiency.

We believe blockchain technology will have limited use cases in traditional payments

(i.e., retail sales, bill pay, etc.).

We think Visa and Mastercard are too cheap and too

convenient to be displaced for conventional debit transactions. From a cost perspective, we

estimate that Visa and Mastercard break even at about 2bps of transaction value when

processing a transaction on their debit rails; with Bitcoin, we estimate it costs 450-500bps

as it is computationally intensive. On convenience, Visa and Mastercard can authorize

transactions in 20ms, compared to 18 hours of verification on the public Bitcoin network

today.

Blockchain offers an enticing opportunity in cross-border payment settlement, an

estimated $25tn addressable market (according to Ripple).

Cross-border FX settlement

currently takes several days, and near real-time cross-border payment and FX settlement

systems can reduce working capital needs, maximize liquidity, and minimize settlement

risk. Ripple is a promising innovator in this field and uses customized protocols based on

blockchain technology and transactional ledger technology that is bilateral in nature to

provide real-time cross-border payment functionality. Similar to SMTP (Simple Mail