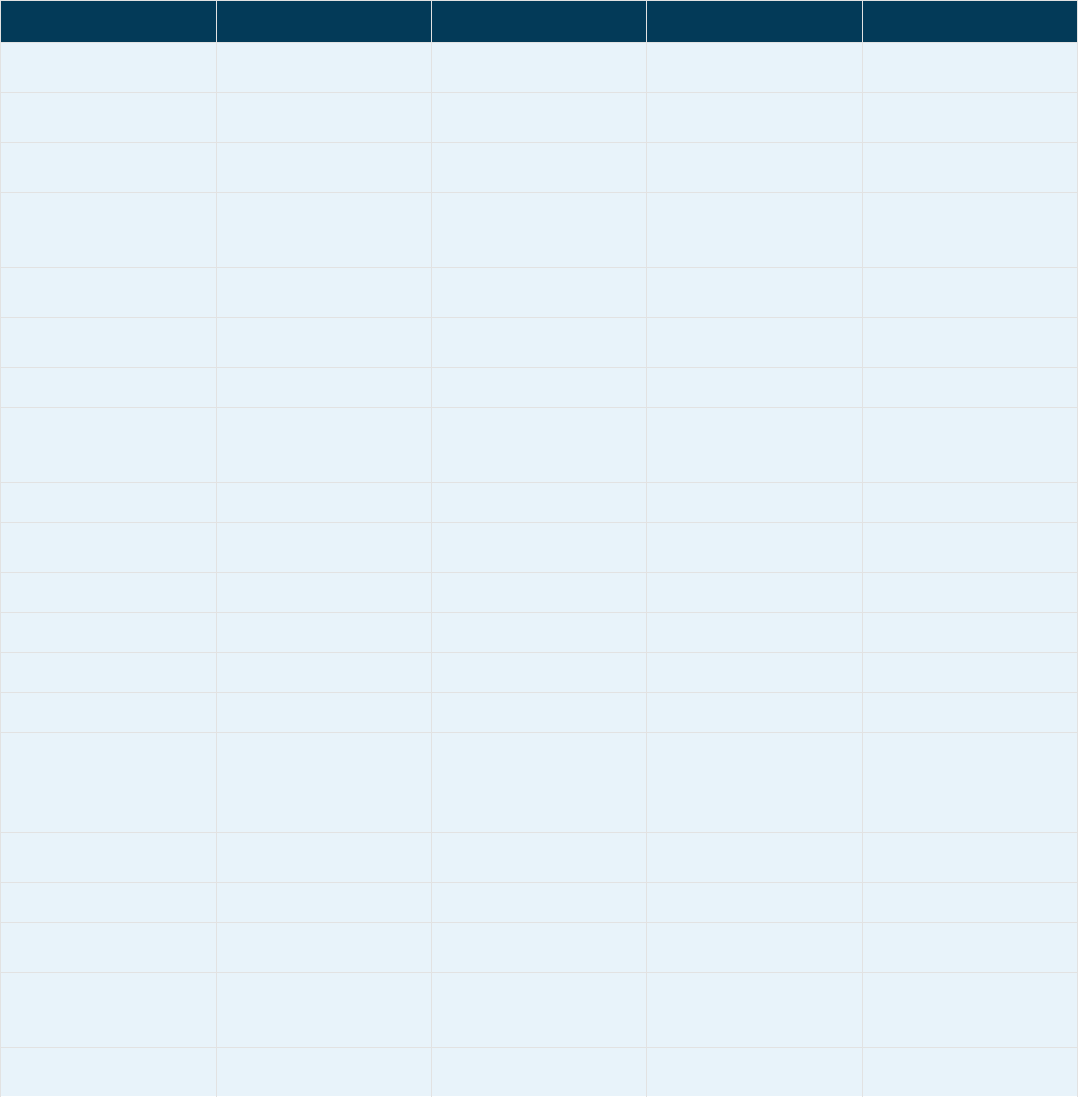

Constituents

ASEGI Sample for the Third Quarter 2024

Company's code Symbol code Company's Name Factor Weight

111001 JOIB JORDAN ISLAMIC

BANK

0.30 7.75

111002 JOKB JORDAN KUWAIT

BANK

0.25 3.00

111003 JCBK JORDAN

COMMERCIAL BANK

0.05 0.18

111004 THBK THE HOUSING BANK

FOR TRADE AND

FINANCE

0.05 1.73

111005 AJIB ARAB JORDAN

INVESTMENT BANK

0.30 1.83

111006 SIBK SAFWA ISLAMIC

BANK

0.20 1.44

111007 UBSI BANK AL ETIHAD 0.35 4.00

111009 ABCO ARAB BANKING

CORPORATION

/(JORDAN)

0.15 0.35

111014 INVB INVEST BANK 0.55 2.61

111017 CAPL CAPITAL BANK OF

JORDAN

0.50 8.32

111021 CABK CAIRO AMMAN BANK 0.45 3.52

111022 BOJX BANK OF JORDAN 0.50 6.97

111033 AHLI JORDAN AHLI BANK 0.65 4.38

113023 ARBK ARAB BANK 0.1063 9.50

121022 JIJC JORDAN

INTE

RNATION

AL INSURANCE

0.45 0.14

121025 TIIC THE ISLAMIC

INSURANCE

0.40 0.35

121034 FINS FIRST INSURANCE 0.25 0.16

131004 JOEP JORDAN ELECTRIC

POWER

0.75 5.09

131005 AIHO ARAB

INTERNATIONAL

HOTELS

0.30 0.25

131010 IREL IRBID DISTRICT 0.15 0.72

Company's code Symbol code Company's Name Factor Weight

ELECTRICITY

131012 SHIP JORDAN NATIONAL

SHIPPING LINES

0.30 0.32

131017 JDPC JORDAN DECAPOLIS

PROPERTIES

0.15 0.06

131019 TAJM AL-TAJAMOUAT FOR

TOURISTIC

PROJECTS CO PLC

0.30 0.45

131022 JDFS JORDANIAN DUTY

FREE SHOPS

0.20 1.05

131025 JEIH JORDANIAN

EXPATRIATES

INVESTMENT

HOLDING

0.45 0.12

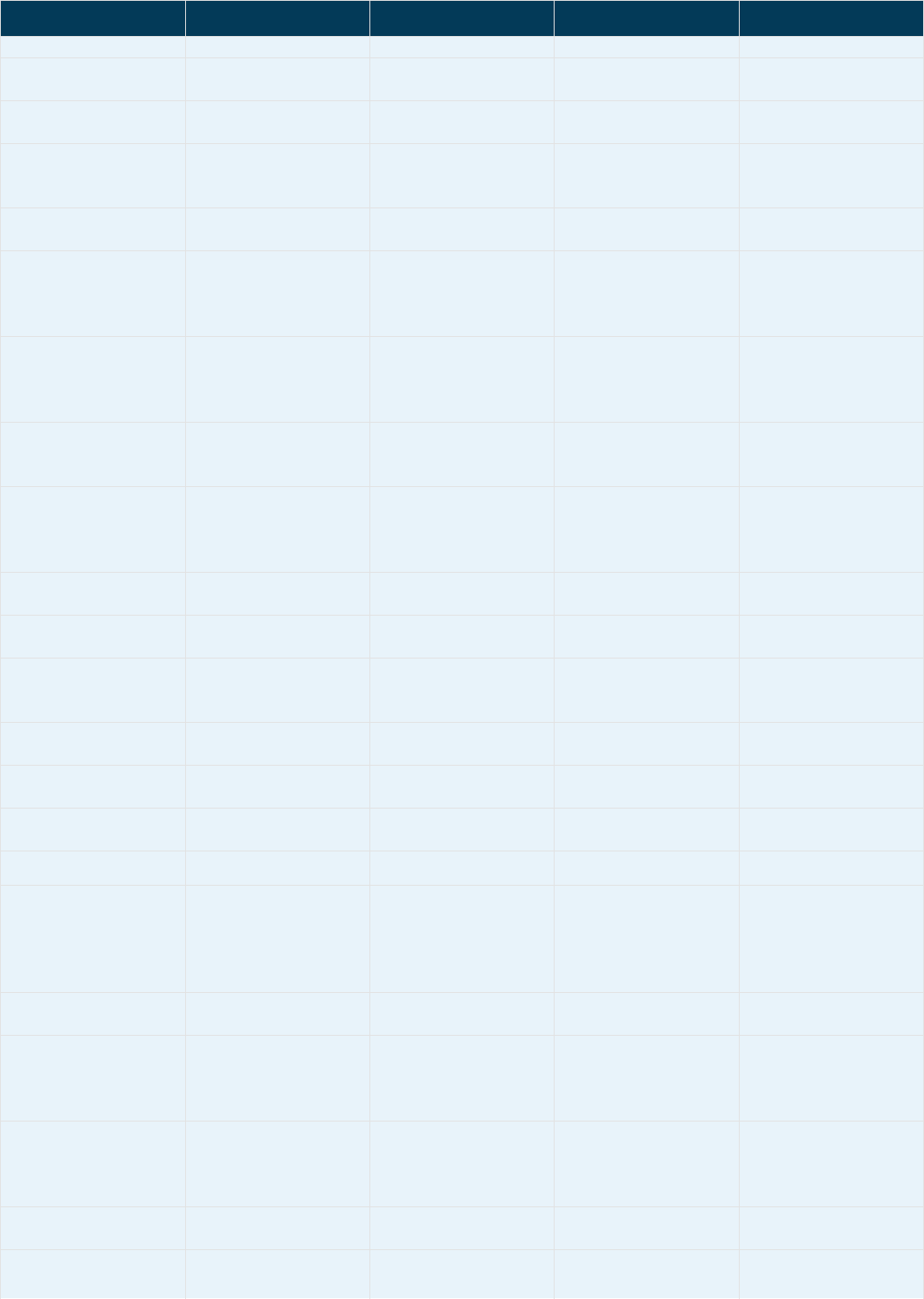

131034 SITT SALAM

INTERNATIONL

TRANSPORT &

TRADING

0.30 0.18

131051 ZEIC AL-ZARQA

EDUCATIONAL &

INVESTMENT

0.25 0.38

131052 AIEI THE ARAB

INTERNATIONL

FOR EDUCATION &

INVESTMENT.

0.45 1.36

131065 DMAN ALDAMAN FOR

INVESTMENTS

0.05 0.01

131069 UINV UNION INVESTMENT

CORPORATION

0.75 0.18

131080 JETT JORDAN EXPRESS

TOURIST

TRANSPORT

0.35 0.21

131082 AEIV ARAB EAST

INVESTMENT

0.45 0.69

131087 REDV REAL ESTATE

DEVELOPMENT

0.10 0.10

131098 MALL AL-DAWLIYAH FOR

HOTELS & MALLS

0.35 0.19

131206 JTEL JORDAN TELECOM 0.15 2.62

131222 PIEC PHILADELPHIA

INTERNATIONAL

EDUCATIONAL

INVESTMENT

COMPANY

0.80 0.67

131228 OFTC OFFTEC HOLDING

GROUP PLC

0.20 0.07

131229 JRCD JORDANIAN

REALESTATE

COMPANY FOR

DEVELOPMENT

0.50 0.28

131232 CEBC AL-FARIS NATIONAL

COMPANY FOR

INVESTMENT &

EXPORT

0.25 0.07

131239 PHNX ARAB PHOENIX

HOLDINGS

0.50 0.18

131243 MSFT MASAFAT FOR

SPECIALISED

0.55 0.23

Company's code Symbol code Company's Name Factor Weight

TRANSPORT

131249 SANA AL SANABEL

INTERNATIONAL FOR

ISLAMIC INVESTMENT

S(HOLDING) PLC. CO.

0.40 0.21

131251 FFCO FIRST FINANCE 0.40 0.22

131255 DERA DEERA INVESTMENT

& REAL ESTATE

DEVELOPMENT CO

0.20 0.14

131256 ABUS COMPREHENSIVE

MULTIPLE

TRANSPORTATIONS

CO.

0.10 0.09

131258 FUTR FUTURE ARAB

INVESTMENT

COMPANY

0.60 0.14

131269 FRST FIRST JORDAN

INVESTMENT

COMPANY PLC

0.25 0.18

131270 PROF THE PROFESSIONAL

COMPANY FOR REAL

ESTATE INVESTMENT

AND HOUSING

0.65 0.28

131286 MANE AFAQ FOR ENERGY

CO. P.L.C

0.10 0.63

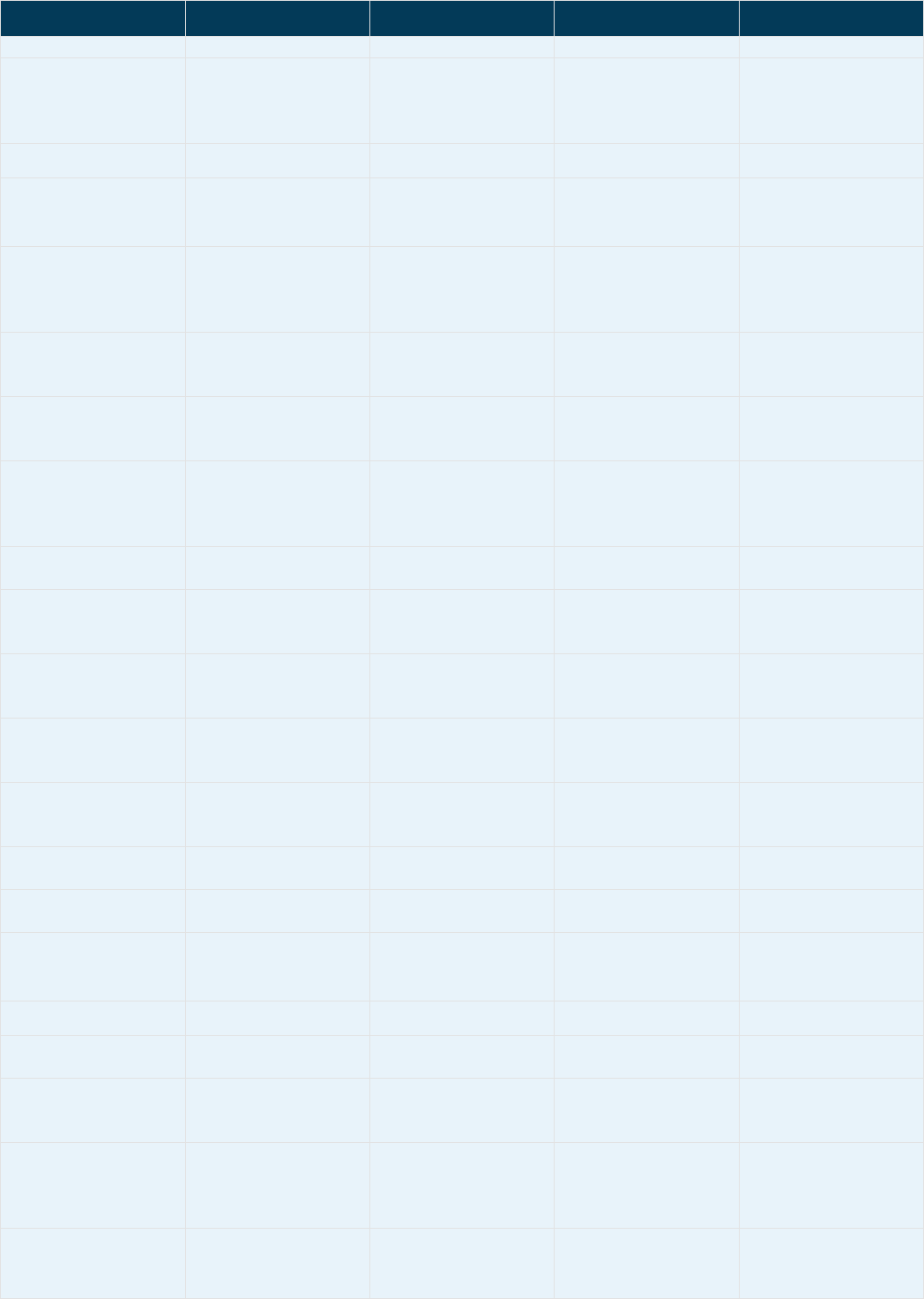

141002 JPPC JORDAN POULTRY

PROCESSING &

MARKETING

0.40 0.11

141006 AALU ARAB

ALUMINIU

M INDUSTRY /ARAL

0.35 0.18

141009 ICAG THE INDUSTRIAL

COMMERCIAL &

AGRICULTURAL

0.25 0.11

141012 DADI DAR AL DAWA

DEVELOPMENT &

INVESTMENT

0.60 0.89

141014 JOWM THE JORDAN

WORSTED MILLS

0.40 0.40

141018 JOPH JORDAN PHOSPHATE

MINES

0.10 9.05

141036 ATTA COMPREHENSIVE

LAND DEVELOPMENT

AND INVESTMENT

0.15 0.04

141043 APOT THE ARAB POTASH 0.05 3.50

141052 UMIC UNIVERSAL MODERN

INDUSTRIES

0.50 0.19

141058 ATCO INJAZ FOR

DEVELOPMENT &

PROJECTS

0.40 0.14

141065 RMCC READY MIX

CONCRETE AND

CONSTRUCTION

SUPPLIES

0.45 0.44

141094 NDAR NUTRI DAR 0.10 0.03

Company's code Symbol code Company's Name Factor Weight

141098 ASPMM ARABIAN STEEL

PIPES

MANUFACTURING

0.25 0.09

141106 IDMC AD-DULAYL

INDUSTRIAL PARK &

REAL ESTATE

COMPANY P.L.C

0.70 0.36

141208 AQRM AL-QUDS READY MIX 0.35 0.10

141209 MBED THE ARAB

PESTICIDES &

VETERINARY DRUGS

MFG. CO.

0.65 0.79

141210 HPIC HAYAT

PHARMACEUTICAL

INDUSTRIES CO.

0.35 0.27

141215 UCIC UNITED CABLE

INDUSTRIES

0.50 0.23

142041 JOPT JORDAN PETROLEUM

REFINERY

0.6017 9.50

The Amman Stock Exchange calculates a price index weighted by the market capitalization of free-

float shares. The market capitalization of each company included in the index is calculated by

multiplying its total number of listed shares with the last close price and then by a number called

“factor ". The calculation of this factor depends on the company's free-float ratio that represents the

total listed shares minus the shares owned by the board of directors, investors who own more than

5% and any government ownership, and then this factor is multiplied with adjusted weight factor

which depends on the weight of company before and after capping. The ASE changes the value of

this factor at the time of the index re-balancing. The weight of each individual company is capped at

(10%) in order to prevent the index from being dominated by individual companies. Therefore, the

factor value is reduced for any company which weighs more than (10%) of the market capitalization

of the index.

Source URl:

https://www.ase.com.jo/en/print/pdf/node/50

Powered by TCPDF (www.tcpdf.org)