ARAB INTERNATIONAL HOTELS COMPANY

PUBLIC SHAREHOLDING COMPANY

FINANCIAL STATEMENTS

31 DECEMBER 2020

INDEPENDENT AUDITOR’S REPORT

To the Shareholders of Arab International Hotels Company Public Shareholding Company

Amman – Jordan

Report on the Audit of the Financial Statements

Opinion

We have audited the financial statements of Arab International Hotels Company Public

Shareholding Company (the Company), which comprise the statement of financial position as at

31 December 2020, and the statement of income, the statement of comprehensive income,

statement of changes in equity and statement of cash flows for the year then ended, and notes to

the financial statements, including a summary of significant accounting policies.

In our opinion, the accompanying financial statements present fairly, in all material respects, the

financial position of the Company as at 31 December 2020, and its financial performance and its

cash flows for the year then ended in accordance with International Financial Reporting Standards

(IFRSs).

Basis for Opinion

We conducted our audit in accordance with International Standards on Auditing (ISAs). Our

responsibilities under those standards, are further described in the Auditor’s Responsibilities for

the Audit of the Financial Statements section of our report. We are independent of the Company

in accordance with the International Code of Ethics for Professional Accountants (IESBA Code)

together with the ethical requirements that are relevant to our audit of the financial statements in

Jordan, and we have fulfilled our other ethical responsibilities in accordance with these

requirements and the IESBA Code. We believe that the audit evidence we have obtained is

sufficient and appropriate to provide a basis for our opinion.

Emphasis of a Matter

Without qualifying our openion, we draw attention to note (28) to the financial statements, which

describes the potential effect of COVID-19 pandemic on the Company’s operating environment.

Ernst & Young Jordan

P.O. Box 1140

Amman 11118

Jordan

Tel: 00 962 6580 0777\ 00 962 6552 6111

Fax:00 962 6553 8300

ey.com/me

Key Audit Matters

Key audit matters are those matters that, in our professional judgment, were of most significance

in our audit of the financial statements for the current year. These matters were addressed in the

context of our audit of the financial statements as a whole, and in forming our opinion thereon,

and we do not provide a separate opinion on these matters. For each matter below, our

description of how our audit addressed the matter provided in that context.

We have fulfilled the responsibilities described in the Auditor’s responsibilities for the audit of the

financial statements section of our report, including in relation to these matters. Accordingly, our

audit included the performance of procedures designed to respond to our assessment of the risks

of material misstatement of the financial statements. The results of our audit procedures, including

the procedures performed to address the matters below, provide the basis for our audit opinion

on the accompanying financial statements.

Revenue recognition

How the key audit matter was addressed

Our audit procedures include considering the

appropriateness of the Company’s revenue

recognition accounting policies and assessed

compliance with the policies in terms of

applicable International Financial Reporting

Standards. We tested the Company’s controls

around revenue recognition and key controls

in the revenue cycle. We performed analytical

procedures for the gross margin for rooms

and food and beverages departments.

We performed also analytical procedures that

was based on building expectations about the

revenue figures for the year using financial

and non-financial information. We selected

and tested a sample of journal entries on

revenue accounts.

Refer to note (25) to the financial statements

for more details about revenues and note (5)

for significant accounting policies applicable

to revenue account.

Key Audit Matter

We have considered revenue recognition as

key audit matter as there is a risk of

misstatement of revenue due to high volume

of revenues with low value transactions. In

addition, we focus on this area because there

is a risk that billing to guests and customers

may be done for services that are not

rendered or services rendered but not billed

or recorded and hence may result in an

overstatement or understatement of revenue.

The Company focuses on revenue as a key

performance measure, which may create an

incentive for revenue to be recognized before

rendering the service.

Other information included in the Company’s 2020 annual report.

Other information consists of the information included in the annual report, other than the financial

statements and our auditor’s report thereon. Management is responsible for the other information.

Our opinion on the financial statements does not cover the other information and we do not

express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other

information and, in doing so, consider whether the other information is materially inconsistent with

the financial statements or our knowledge obtained in the audit or otherwise appears to be

materially misstated. If, based on the work we have performed, we conclude that there is a

material misstatement of this other information; we are required to report that fact. We have

nothing to report in this regard.

Responsibilities of Management and Those Charged with Governance for the Financial

Statements

Management is responsible for the preparation and fair presentation of the financial statements

in accordance with IFRSs, and for such internal control as management determines is necessary

to enable the preparation of financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the Company’s

ability to continue as a going concern, disclosing, as applicable, matters related to going concern

and using the going concern basis of accounting unless management either intends to liquidate

the Company or to cease operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Company’s financial reporting

process.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a

whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s

report that includes our opinion.

Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted

in accordance with ISAs will always detect a material misstatement when it exist. Misstatements

can arise from fraud or error and are considered material if, individually or in the aggregate, they

could reasonably be expected to influence the economic decisions of users taken on the basis of

these financial statements.

As part of an audit in accordance with ISAs, we exercise professional judgment and maintain

professional skepticism throughout the audit. We also:

• Identify and assess the risks of material misstatement of the financial statements, whether

due to fraud or error, design and perform audit procedures responsive to those risks, and

obtain audit evidence that is sufficient and appropriate to provide a basis for our opinion. The

risk of not detecting a material misstatement resulting from fraud is higher than for one

resulting from error, as fraud may involve collusion, forgery, intentional omissions,

misrepresentations, or the override of internal control.

• Obtain an understanding of internal control relevant to the audit in order to design audit

procedures that are appropriate in the circumstances, but not for the purpose of expressing

an opinion on the effectiveness of the Company’s internal control.

• Evaluate the appropriateness of accounting policies used and the reasonableness of

accounting estimates and related disclosures made by management.

• Conclude on the appropriateness of management’s use of the going concern basis of

accounting and, based on the audit evidence obtained, whether a material uncertainty exists

related to events or conditions that may cast significant doubt on the Company’s ability to

continue as a going concern. If we conclude that a material uncertainty exist, we are required

to draw attention in our auditor’s report to the related disclosures in the financial statements

or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on

the audit evidence obtained up to the date of our auditor’s report. However future events or

conditions may cause the Company to cease to continue as a going concern.

• Evaluate the overall presentation, structure and content of the financial statements, including

the disclosures, and whether the financial statements represent the underlying transactions

and events in a manner that achieves fair presentation.

We communicate with those charged with governance regarding, among other matters, the

planned scope and timing of the audit and significant audit findings, including any significant

deficiencies in internal control that we identify during our audit.

We also provide those charged with governance with a statement that we have complied with

relevant ethical requirements regarding independence, and to communicate with them all

relationships and other matters that may reasonably be thought to bear on our independence,

and where applicable, actions taken to eliminate threats or related safeguards.

From the matters communicated with those charged with governance, we determine those

matters that were of most significance in the audit of the financial statements of the current period,

and are therefore the key audit matters. We describe these matters in our auditor’s report, unless

law or regulation precludes public disclosure about the matter or when, in extremely rare

circumstances, we determine that a matter should not be communicated in our report because

the adverse consequences of doing so would reasonable be expected to outweigh the public

interest benefits of such communication.

Report on Other Legal and Regulatory Requirements

The Company maintains proper books of accounts which are in agreement with the financial

statements.

The partner in charge of the audit resulting in this auditor’s report was Waddah Issam Barqawi;

license number 591.

Amman – Jordan

28 February 2021

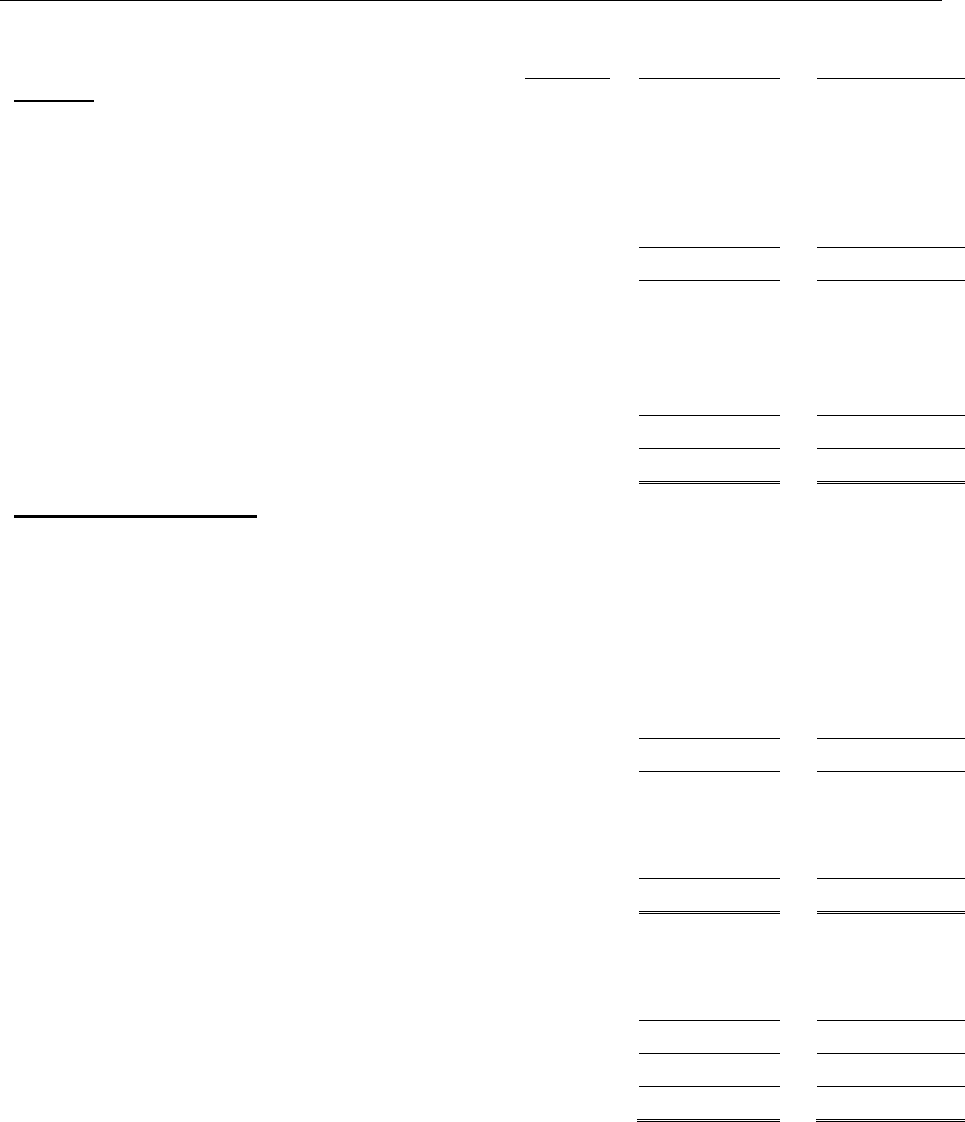

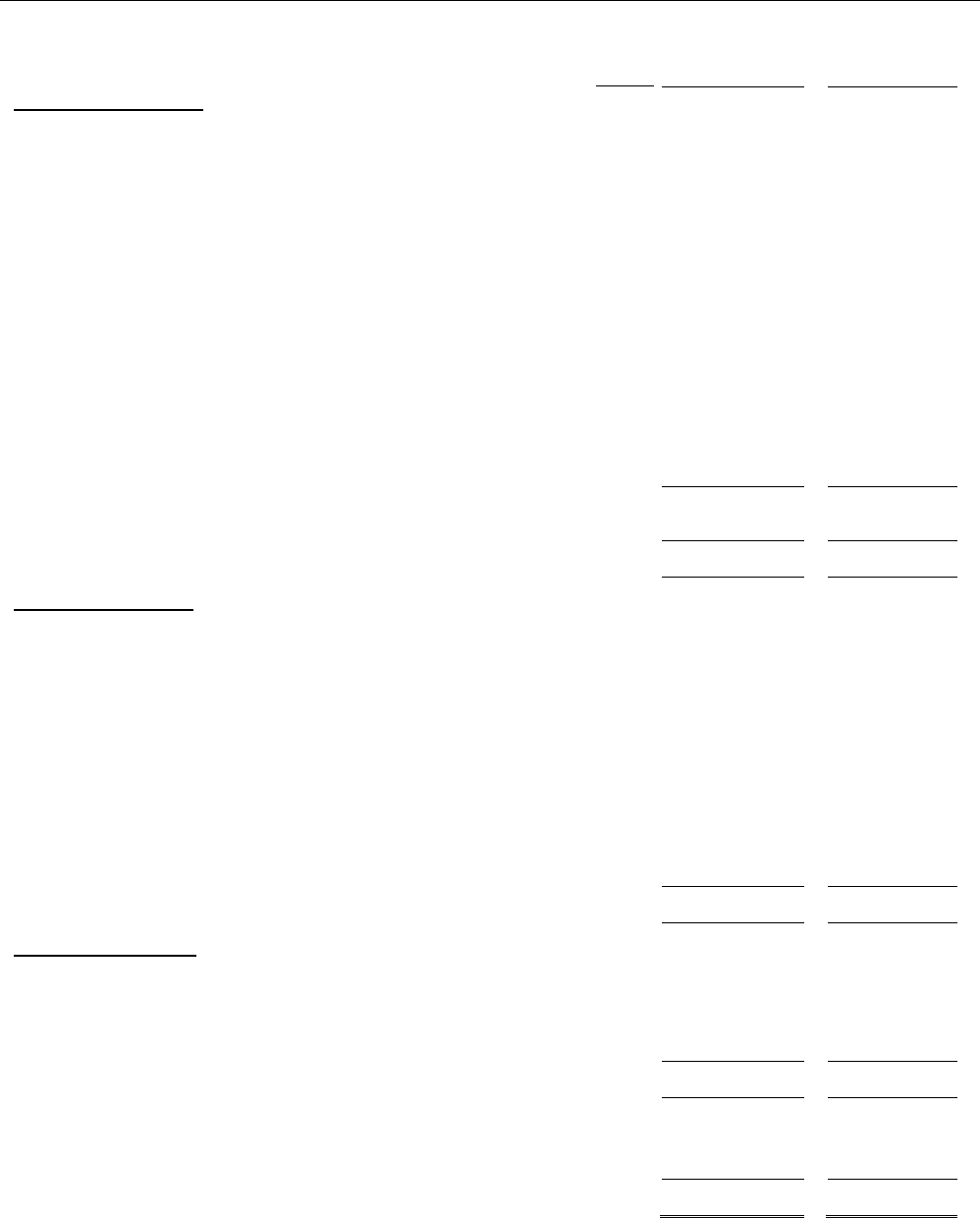

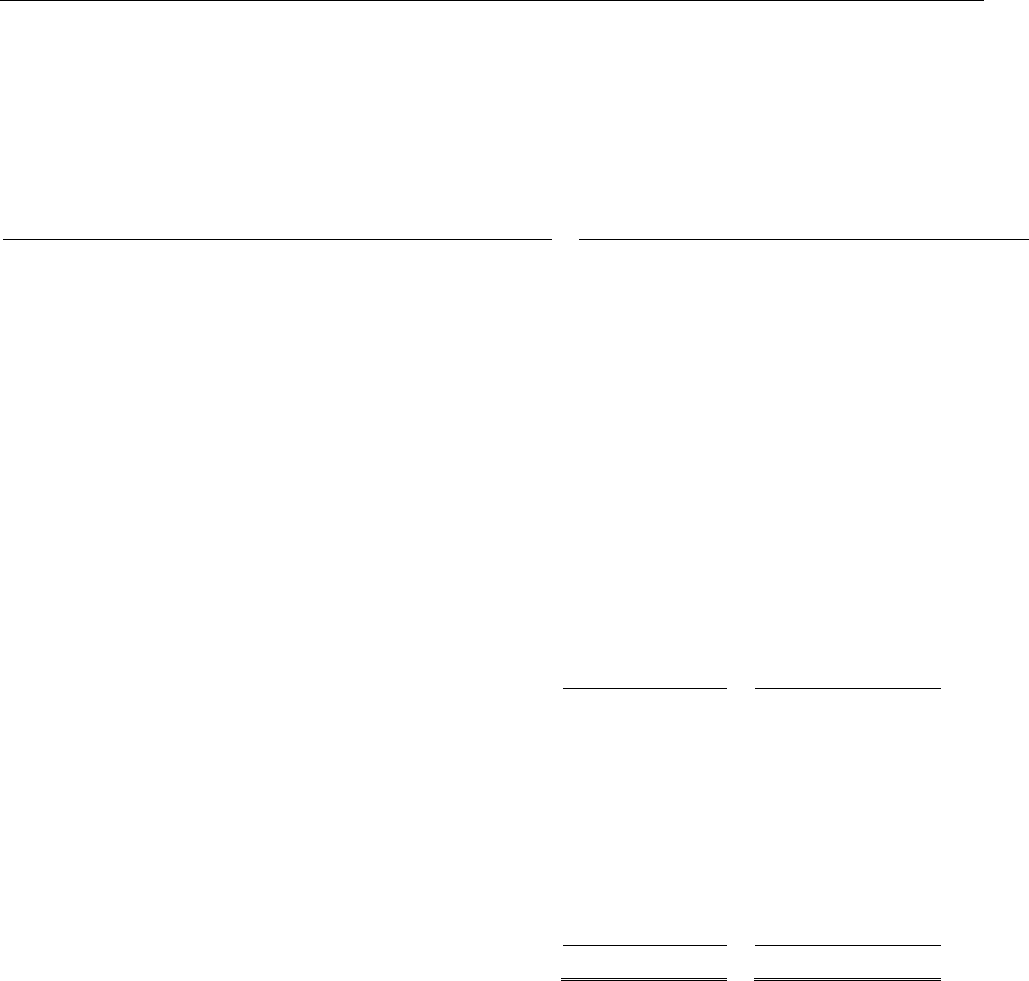

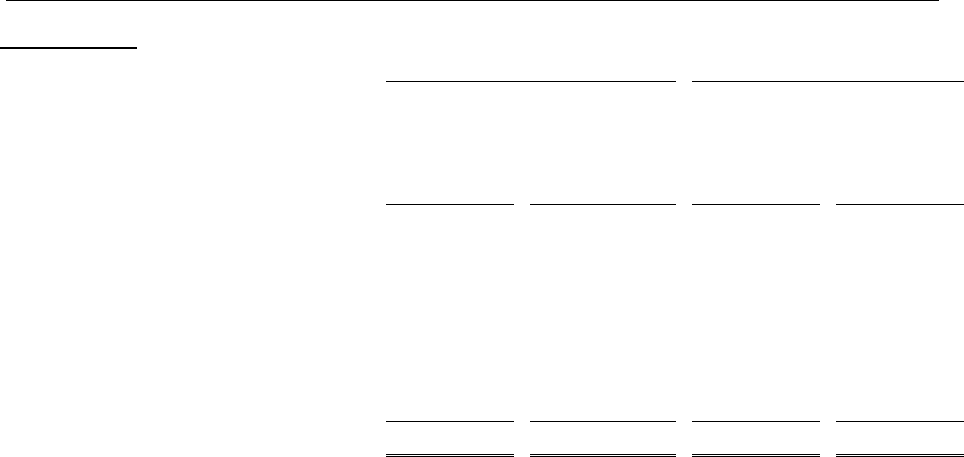

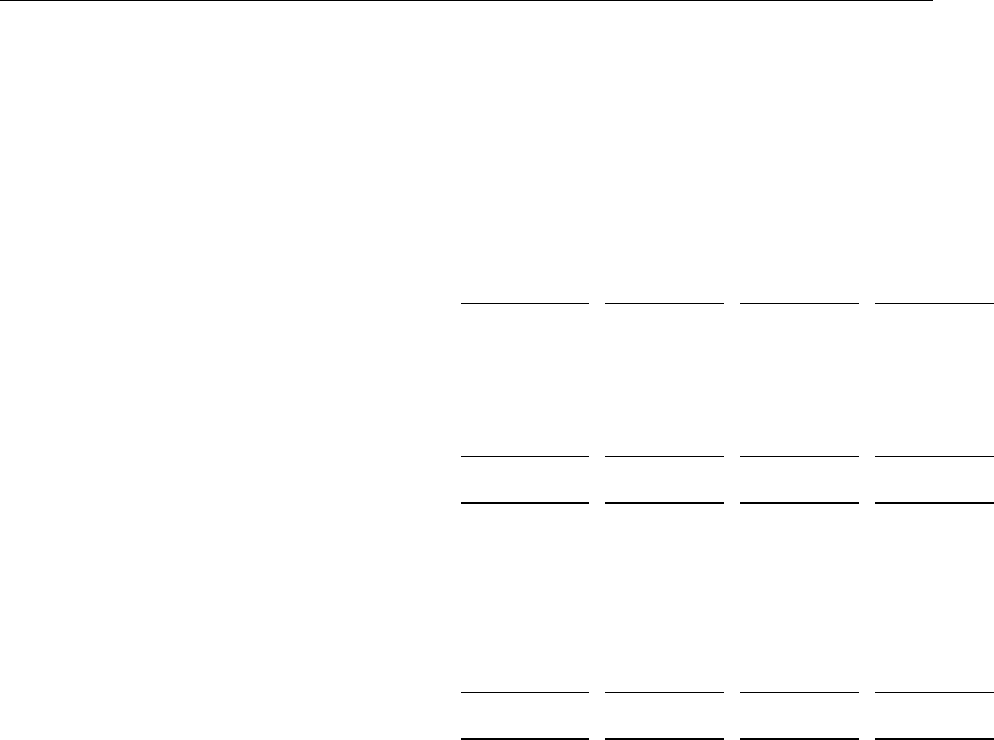

ARAB INTERNATIONAL HOTELS COMPANY PLC

STATEMENT OF FINANCIAL POSITION

AS AT 31 DECEMBER 2020

The accompanying notes from 1 to 28 form part of these financial statements

Notes

2020

2019

ASSETS

JD

JD

Non-current assets -

Property and equipment

6

13,583,901

14,503,310

Financial assets at fair value through other

comprehensive income

7

4,359,067

5,202,367

Investments in associates

8

42,770,137

49,038,537

Deferred tax assets

18

418,409

-

61,131,514

68,744,214

Current assets -

Inventories

359,786

384,553

Accounts receivable and other current assets

11

1,009,848

4,584,180

Financial assets at amortized cost

9

1,500,000

1,500,000

Cash and short term deposits

12

4,365,716

2,736,877

7,235,350

9,205,610

Total Assets

68,366,864

77,949,824

EQUITY AND LIABILITIES

EQUITY-

Paid-in capital

13

32,000,000

32,000,000

Share premium

13

3,644,693

3,644,693

Statutory reserve

13

8,000,000

8,000,000

Voluntary reserve

13

8,000,000

8,000,000

Fair value reserve

7

(4,314,265)

(3,469,552)

Company’s share of the fair value reserve / investments

in associates

(3,678,657)

(2,487,136)

Retained earnings

2,566,762

10,651,397

Total Equity

46,218,533

56,339,402

Non-current liabilities -

Long-term loans

15

8,456,878

7,656,301

Bonds payable

10

10,000,000

10,000,000

18,456,878

17,656,301

Current liabilities -

Current portion of long- term loans

15

2,422,534

1,484,310

Accounts payable

448,167

877,390

Provisions and other current liabilities

16

820,752

1,592,421

3,691,453

3,954,121

Total Liabilities

22,148,331

21,610,422

Total Equity and Liabilities

68,366,864

77,949,824

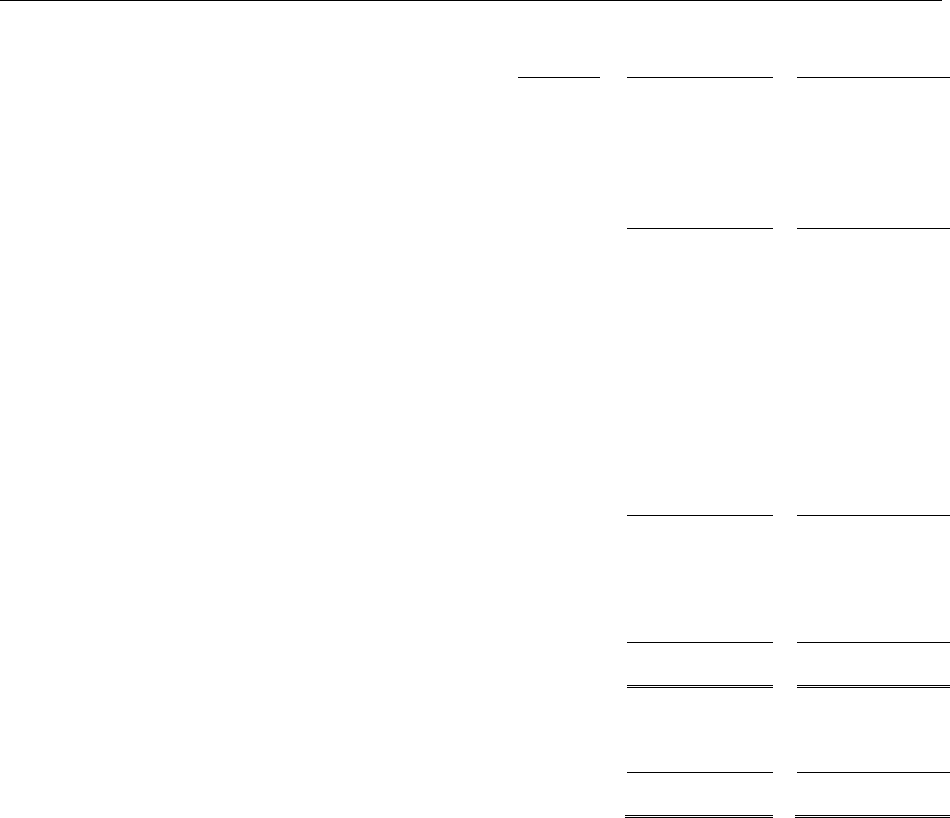

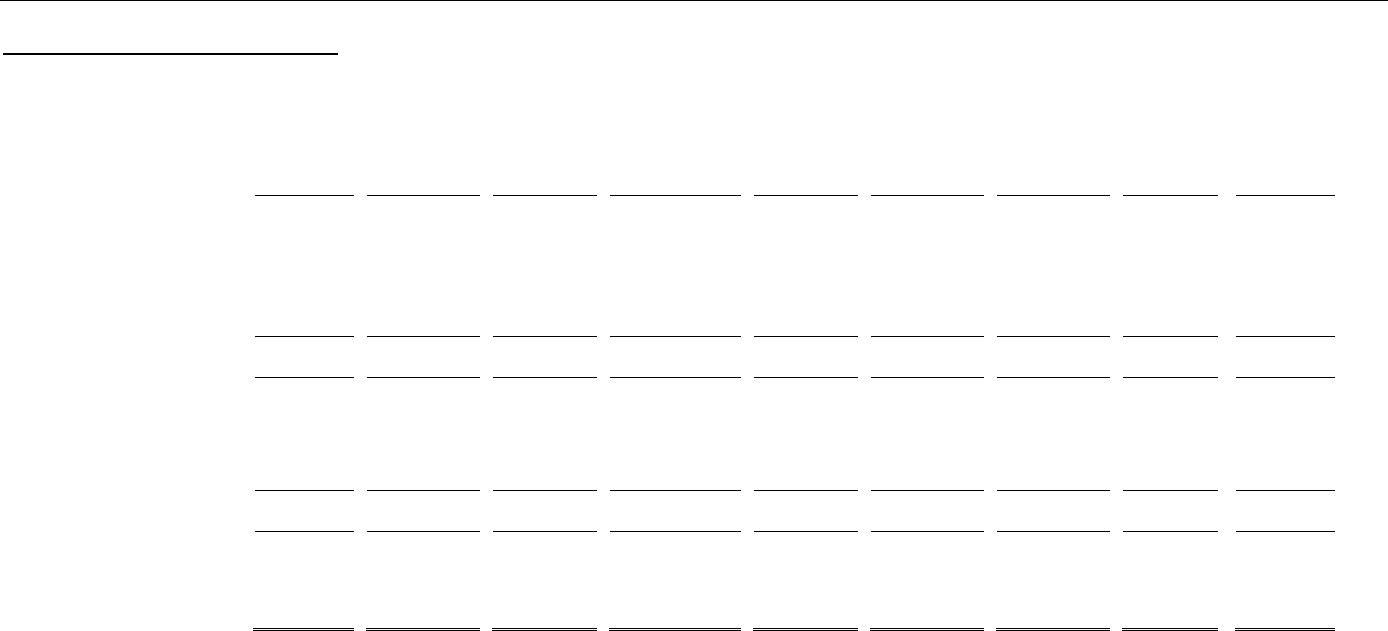

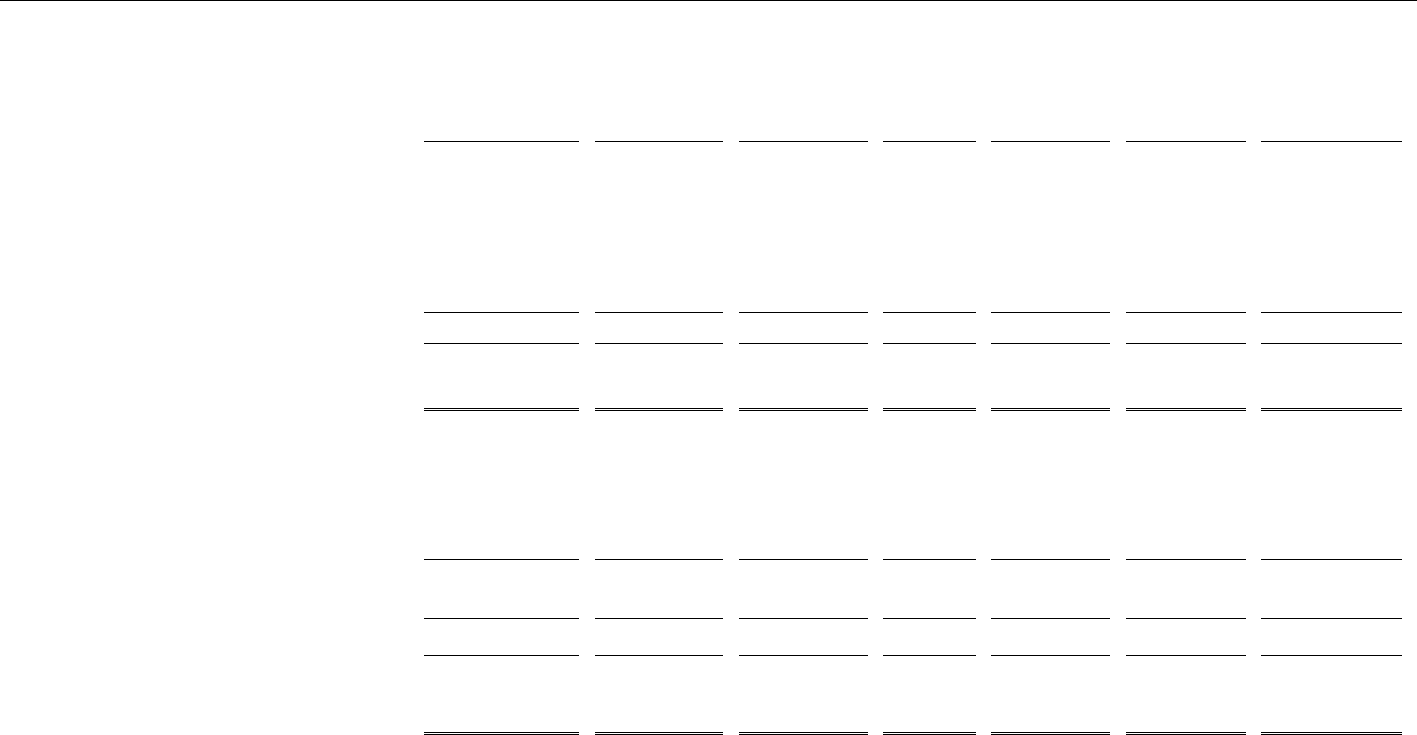

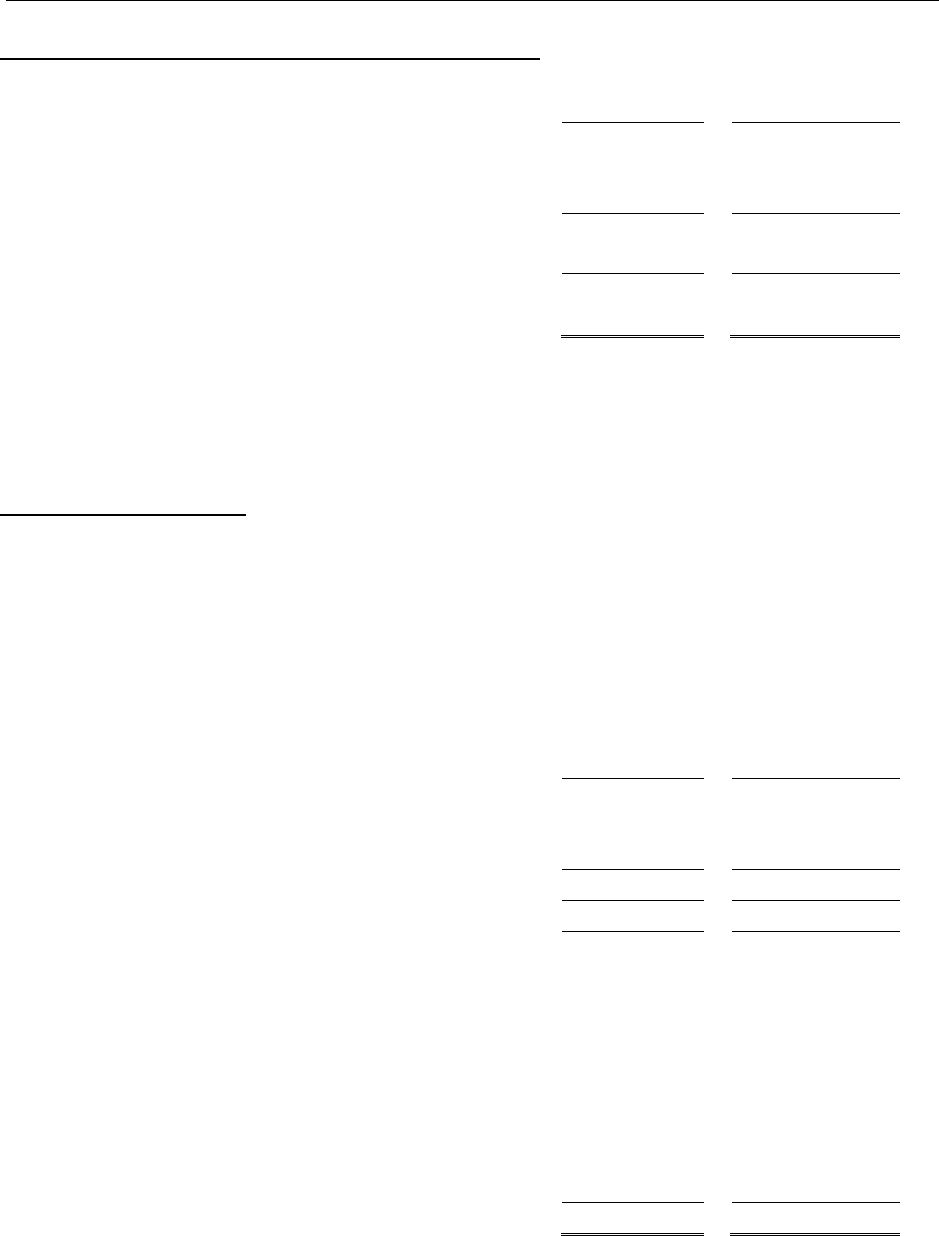

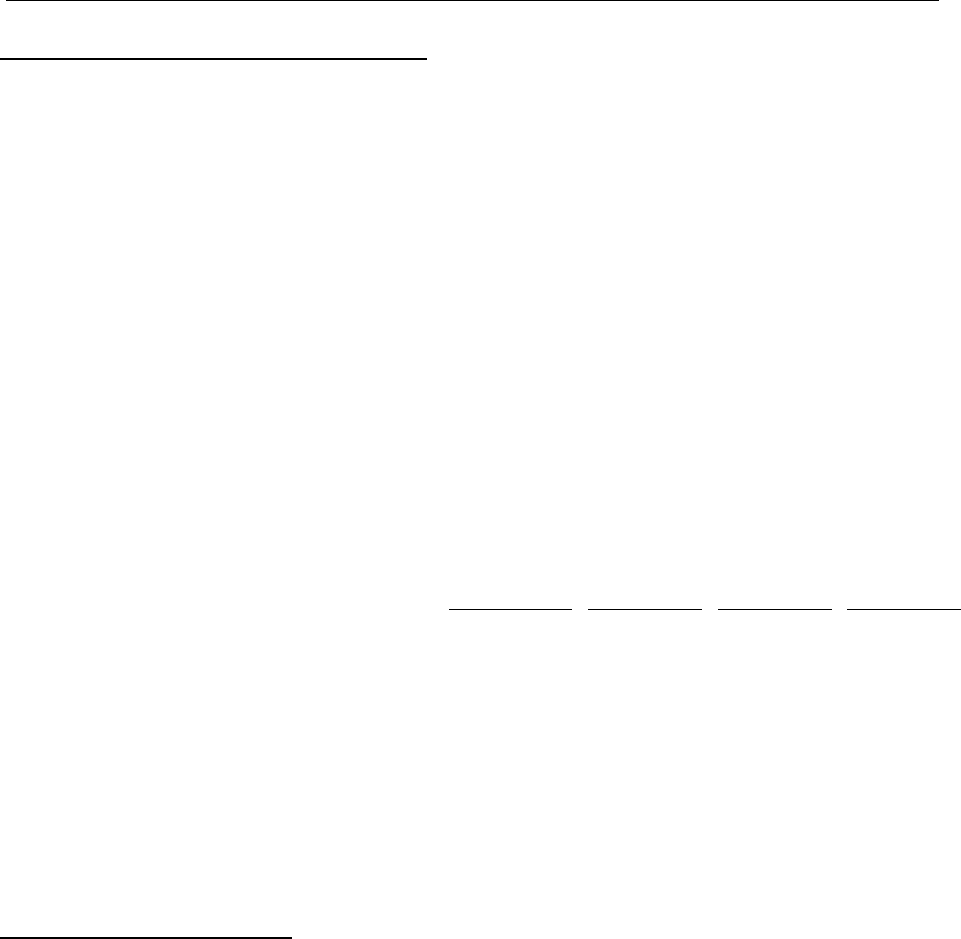

ARAB INTERNATIONAL HOTELS COMPANY PLC

STATEMENT OF PROFIT OR LOSS

FOR THE YEAR ENDED 31 DECEMBER 2020

The accompanying notes from 1 to 28 form part of these financial statements

Notes

2020

2019

JD

JD

Operational revenues from Amman Marriott Hotel

3,170,300

10,822,183

Operational costs from Amman Marriott Hotel

(4,069,601)

(8,183,363)

Depreciation of property and equipment

6

(1,170,121)

(1,328,015)

Operational (loss) profits from the hotel

(2,069,422)

1,310,805

Share of (losses) profits from associates

8

(3,315,414)

4,441,755

Interest income

234,581

154,857

Finance costs

(966,228)

(1,044,148)

Dividends income

162,732

371,543

Other income

184,655

50,684

Depreciation of property and equipment

6

(29,120)

(34,095)

Administrative expenses

17

(784,828)

(894,136)

(Loss) profit before income tax

(6,583,044)

4,357,265

Income tax (expense) surplus

18

418,409

(140,776)

National contribution tax

-

(7,039)

(Loss) profit for the year

(6,164,635)

4,209,450

JD / Fils

JD / Fils

Basic and diluted (loss) earnings per share

19

(0/193)

0/132

ARAB INTERNATIONAL HOTELS COMPANY PLC

STATEMENT OF OTHER COMPREHENSIVE INCOME

FOR THE YEAR ENDED 31 DECEMBER 2020

The accompanying notes from 1 to 28 form part of these financial statements

Notes

2020

2019

JD

JD

(Loss) profit for the year

(6,164,635)

4,209,450

Add: Other comprehensive income items not to be

reclassified to profit or loss in subsequent

periods:

Net change in fair value reserve

7

(844,713)

(761,630)

Company’s share of the net change in fair value reserve

from the investments in associates

8

(1,191,521)

(1,054,051)

Total comprehensive (loss) income for the year

(8,200,869)

2,393,769

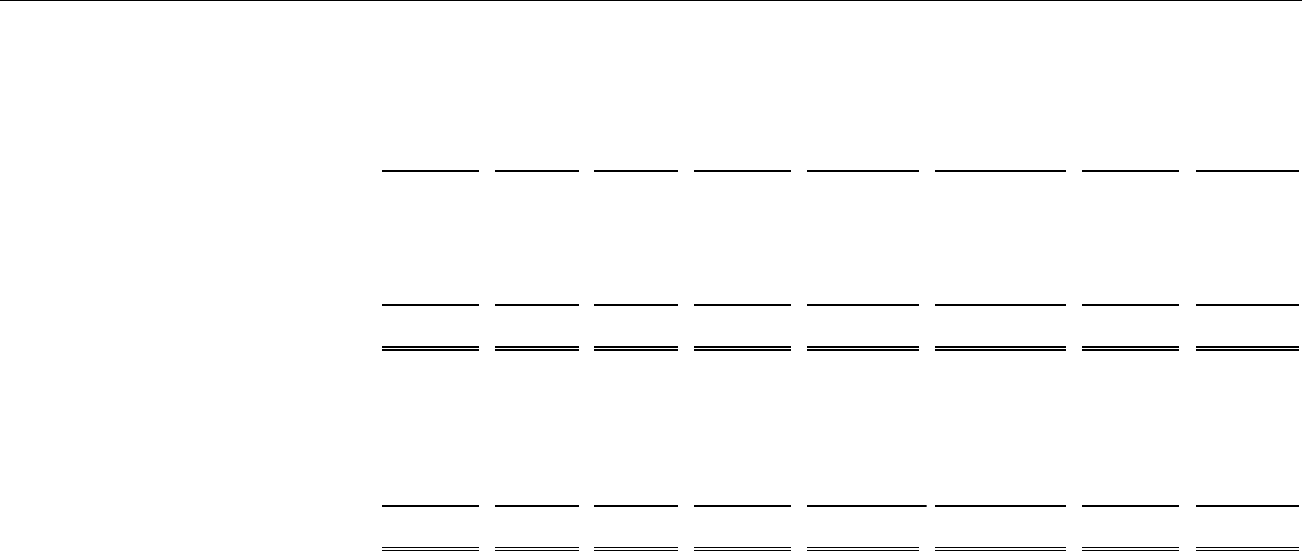

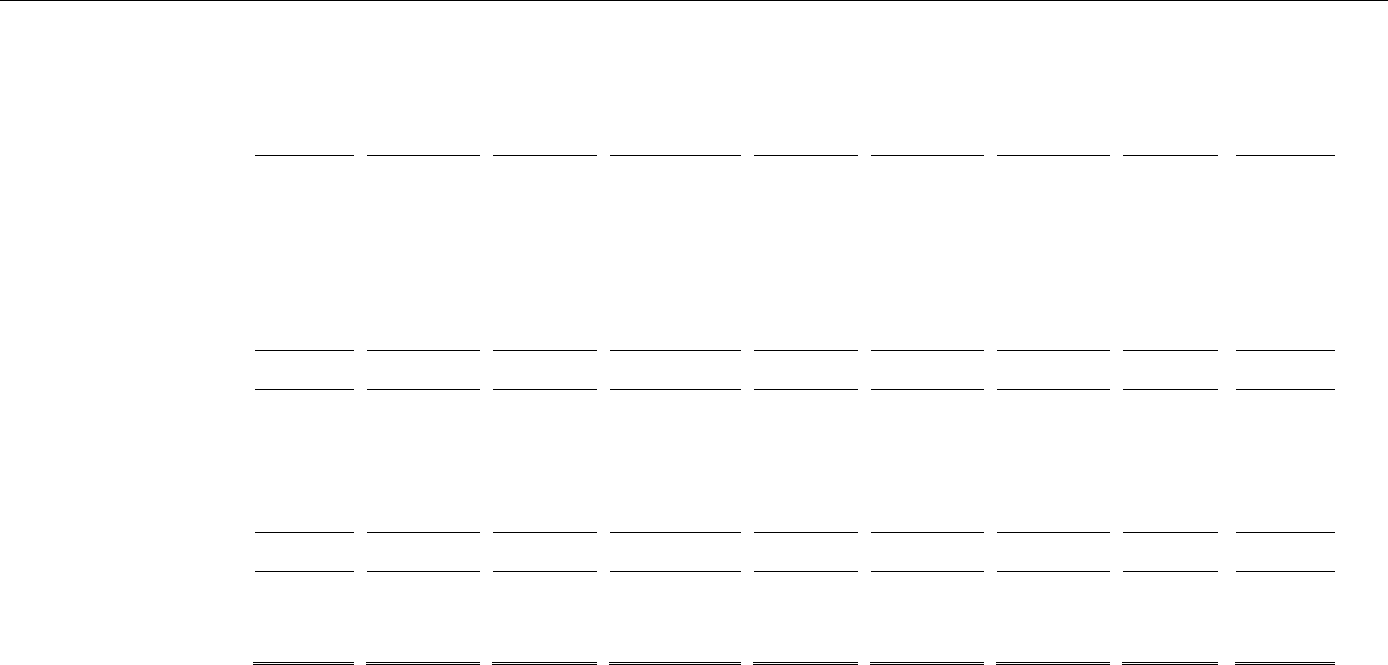

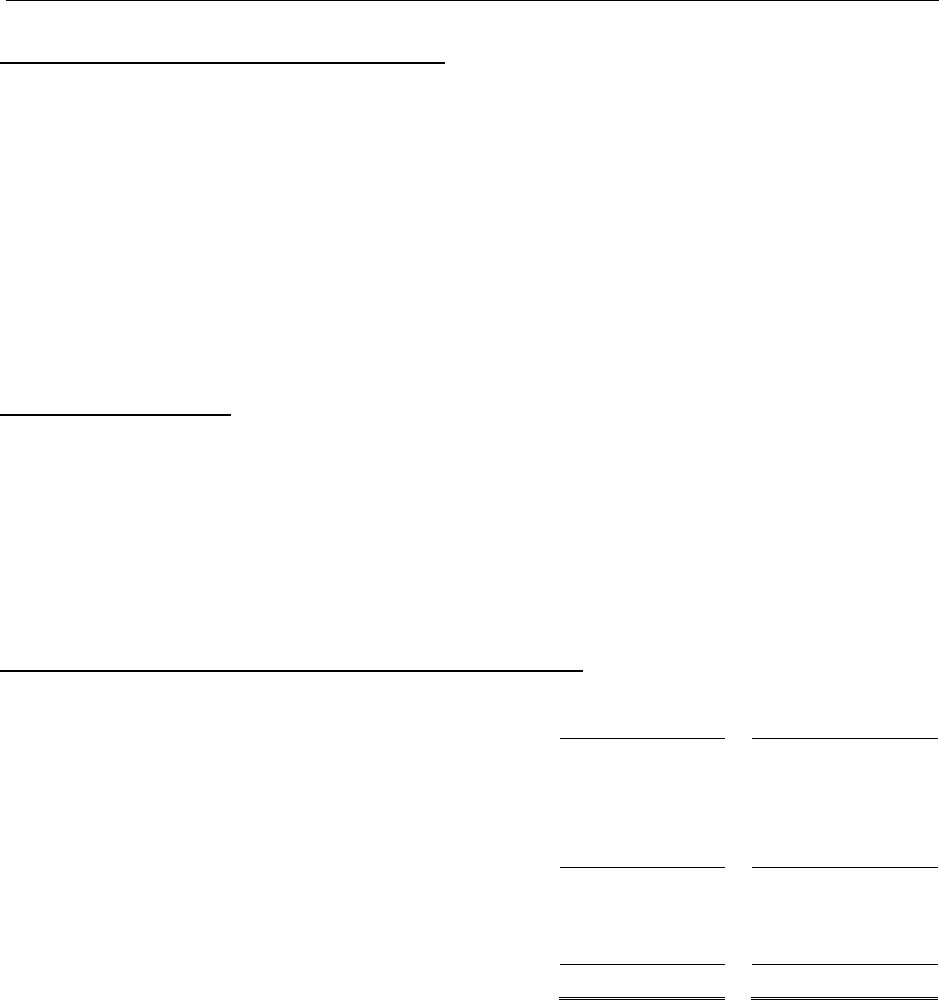

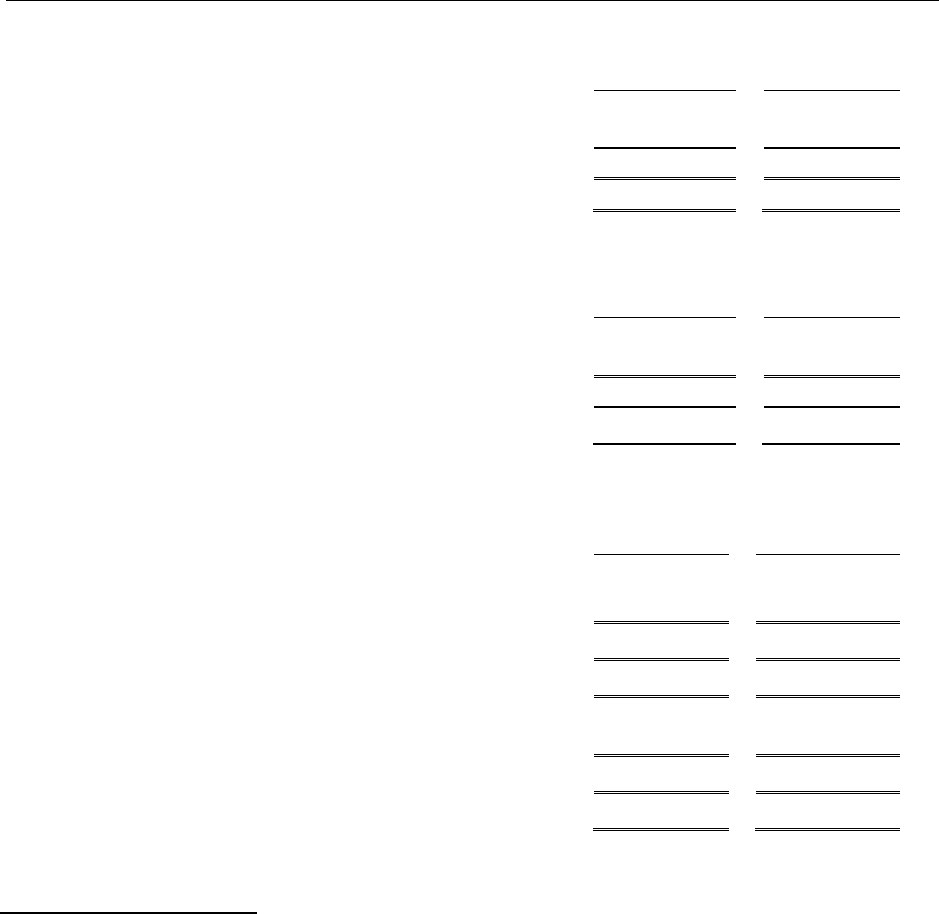

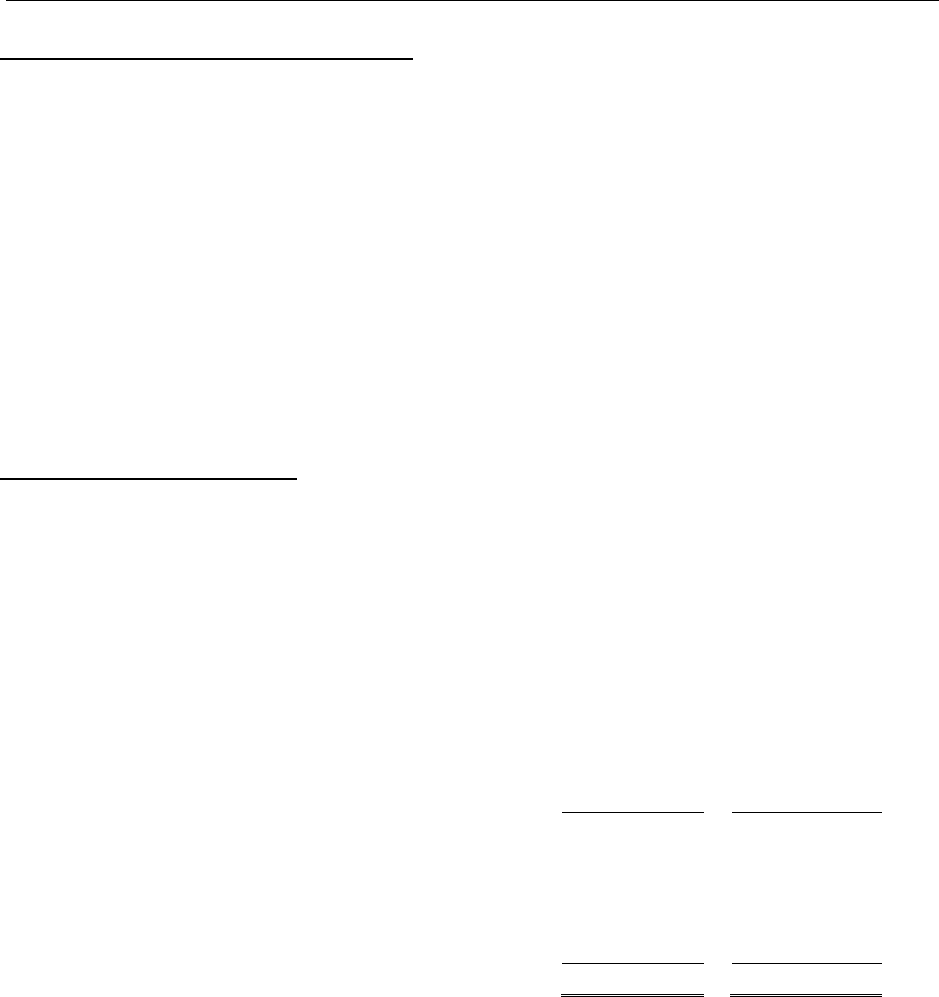

ARAB INTERNATIONAL HOTELS COMPANY PLC

STATEMENT OF CHANGE IN EQUITY

FOR THE YEAR ENDED 31 DECEMBER 2020

The accompanying notes from 1 to 28 form part of these financial statements

Paid-in

capital

Share

premium

Statutory

reserve

Voluntary

reserve

Fair value

reserve*

Company’s share

from the fair

value reserve /of

the investment in

associates*

Retained

earnings

Total

JD

JD

JD

JD

JD

JD

JD

JD

2020 -

Balance at 1 January 2020

32,000,000

3,644,693

8,000,000

8,000,000

(3,469,552)

(2,487,136)

10,651,397

56,339,402

Total comprehensive loss for the year

-

-

-

-

(844,713)

(1,191,521)

(6,164,635)

(8,200,869)

Dividends (note 14)

-

-

-

-

-

-

(1,920,000)

(1,920,000)

Balance at 31 December 2020

32,000,000

3,644,693

8,000,000

8,000,000

(4,314,265)

(3,678,657)

2,566,762

46,218,533

2019 -

Balance at 1 January 2019

32,000,000

3,644,693

8,000,000

13,000,000

(2,707,922)

(1,433,085)

3,361,947

55,865,633

Total comprehensive loss for the year

-

-

-

-

(761,630)

(1,054,051)

4,209,450

2,393,769

Transfers

-

-

-

(5,000,000)

-

-

5,000,000

-

Dividends (note 14)

-

-

-

-

-

-

(1,920,000)

(1,920,000)

Balance at 31 December 2019

32,000,000

3,644,693

8,000,000

8,000,000

(3,469,552)

(2,487,136)

10,651,397

56,339,402

* It is restricted to use an amount of JD 7,992,922 from retained earnings as at 31 December 2020, which represents the total negative balance

of the fair value reserve and Company’s share of fair value reserve / investment in associates.

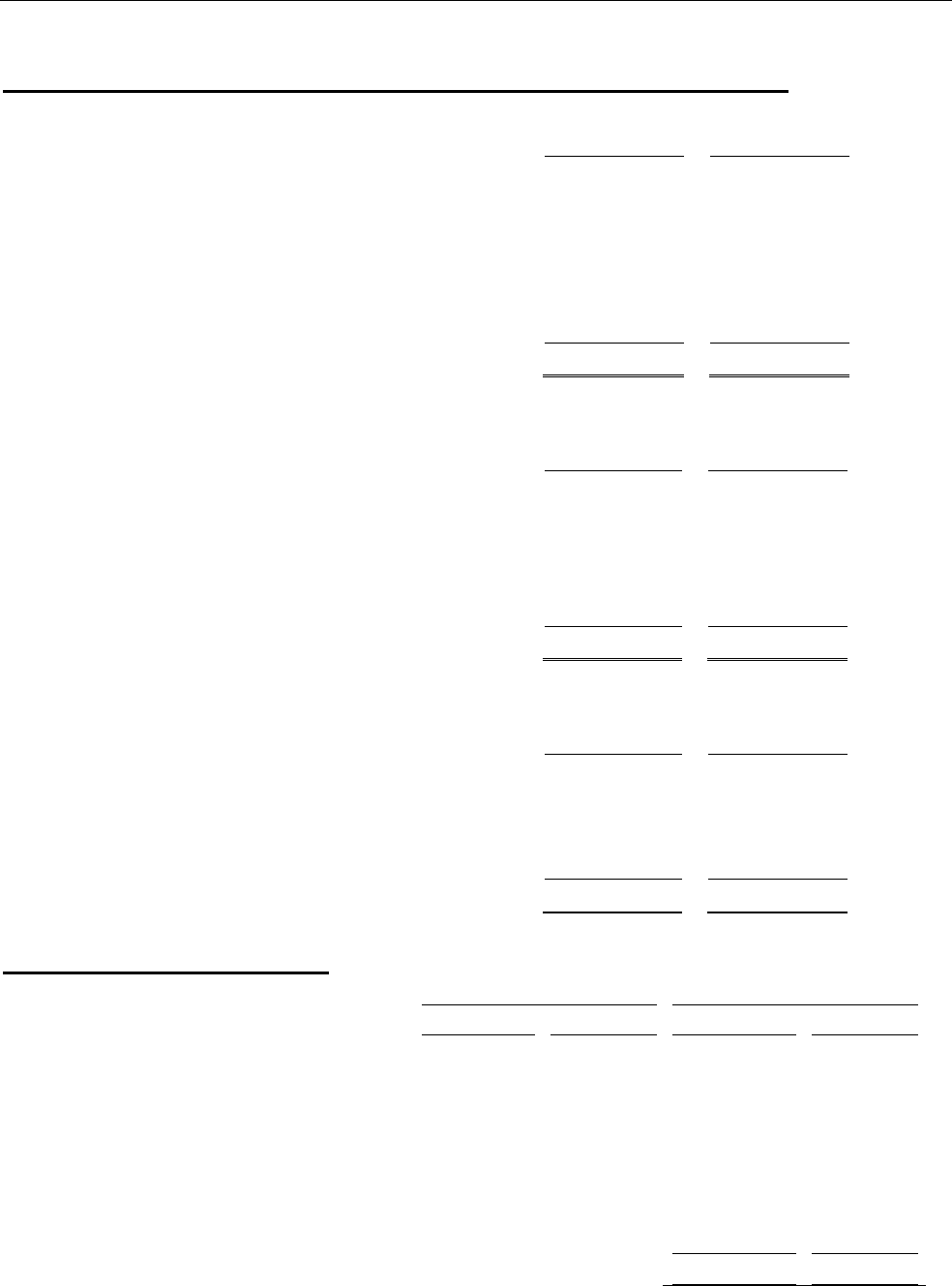

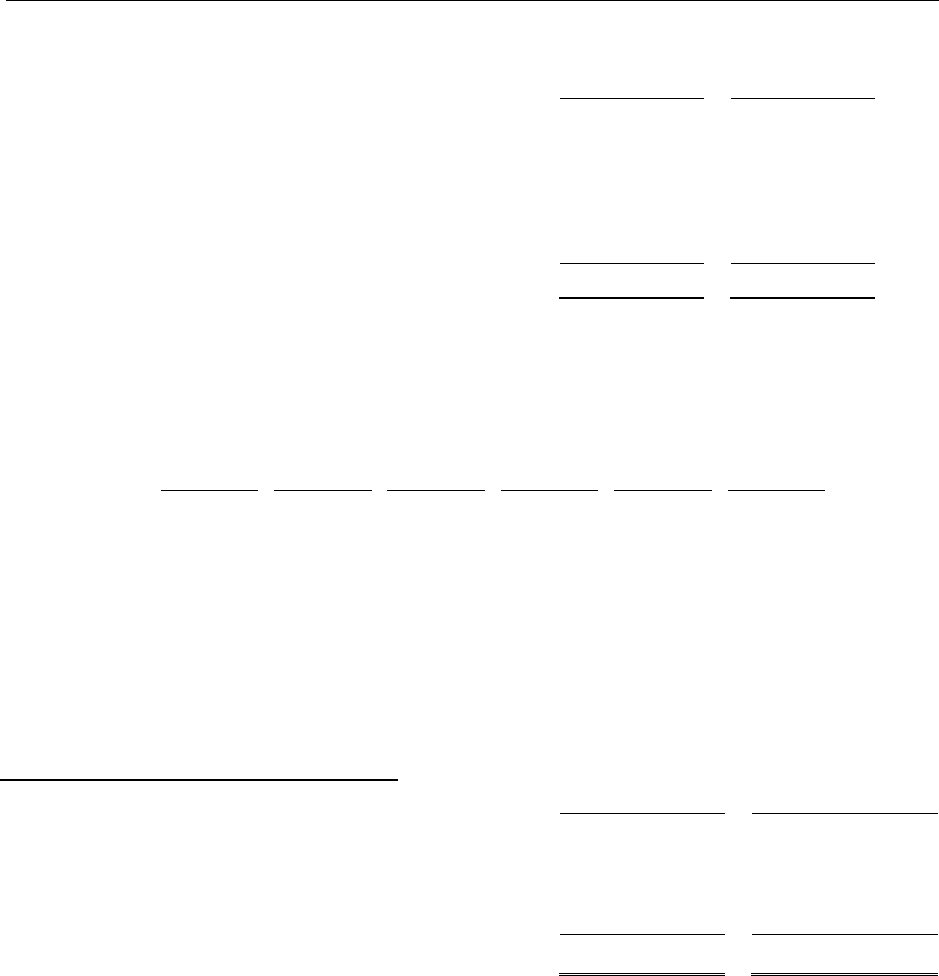

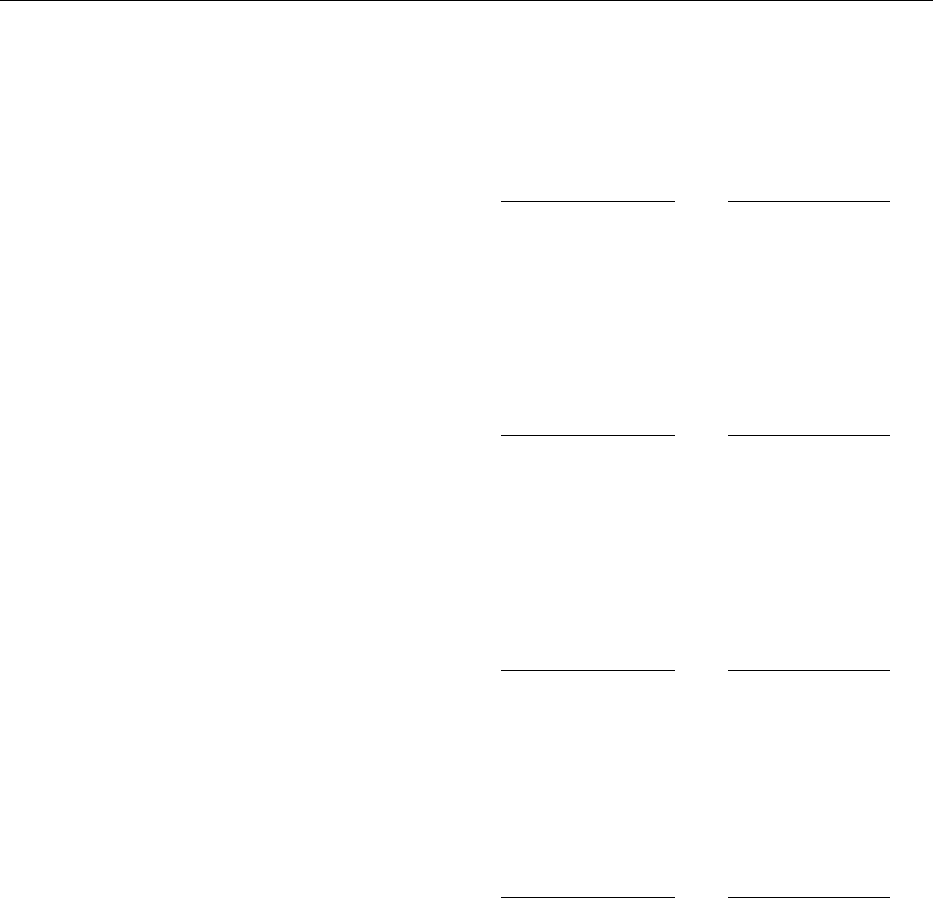

ARAB INTERNATIONAL HOTELS COMPANY PLC

STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED 31 DECEMBER 2020

The accompanying notes from 1 to 28 form part of these financial statements

Notes

2020

2019

OPERATING ACTIVITIES

JD

JD

(Loss) profit before income tax

(6,583,044)

4,357,265

Adjustments for:

Depreciation on property and equipment

6

1,199,241

1,362,110

Gain on sale of property and equipment

-

(46,412)

Recovered from expected credit losses

(6,002)

-

Finance costs

966,228

1,044,148

Interest income

(234,581)

(154,857)

Share of loss (profit) from associates

8

3,315,414

(4,441,755)

Dividends income

(162,732)

(371,543)

Changes in working capital:

Inventories

24,767

13,114

Accounts receivable and other current assets

(130,778)

(3,487,786)

Accounts payable

(429,223)

(6,353)

Provisions and other current liabilities

(771,669)

(204,332)

(2,812,379)

(1,936,401)

Income tax paid

18

(186,831)

(80,113)

Net cash flows used in operating activities

(2,999,210)

(2,016,514)

INVESTING ACTIVITIES

Purchase of property and equipment

6

(279,832)

(1,019,608)

Purchase of financial assets at fair value through other

comprehensive income

-

(1,926)

Decrease in associate capital (note 8)

2,474,080

-

Dividends received from associates

8

163,904

4,268,109

Interest income received

234,581

154,857

Dividends received

-

371,543

Related parties – Beaches Company for Hotels and Resorts

receivable

3,711,112

-

Purchase of shares in associates

8

(876,519)

-

Proceed from sale of property and equipment

-

54,723

Net cash flows from investing activities

5,427,326

3,827,698

FINANCING ACTIVITIES

Dividends paid

14

(1,920,000)

(1,920,000)

Repayments of loans

15

-

(2,193,310)

Proceeds from loans

1,738,801

4,254,000

Finance costs paid

(618,078)

(1,044,148)

Net cash flows used in financing activities

(799,277)

(903,458)

Net increase (decrease) in cash and cash equivalents

1,628,839

907,726

Cash and cash equivalents on 1 January

2,736,877

1,829,151

Cash and cash equivalents on 31 December

12

4,365,716

2,736,877

ARAB INTERNATIONAL HOTELS COMPANY PLC

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-1-

(1) GENERAL

The Arab International Hotels Company (the “Company”) was registered as a Public Shareholding

Company in 1975 with a paid-in capital of JD 3,000,000. The paid in capital was increased several

times throughout the years to become JD 32,000,000 with par value of JD 1 per share .

The Company owns Amman Marriott Hotel which commenced its operations during 1982. The

Hotel is managed by Marriott International Corporation in accordance with a management

agreement signed during 1976 and its subsequent amendments the latest of which was in 2014

and is valid until 2041 .

The financial statements were approved by the Company’s Board of Directors on 9 February

2021. These financial statements require the approval of the General Assembly of the

shareholders of the Company.

(2) BASIS OF FINANCIAL STATEMENTS PREPARATION

(2-1) BASIS OF PREPARATION

The financial statements are prepared under the historical cost convention except for the financial

assets at fair value through other comprehensive income which are presented at fair value as at

the date of the financial statements.

The financial statements have been prepared in accordance with International Financial Reporting

Standards.

The financial statements have been presented in Jordanian Dinar, which is the functional currency

of the Company.

(2-2) CONCEPTUAL ACCOUNTING CONCEPTS

Due to the spread of Corona virus (COID-19) as disclosed in note (28) which may cast significant

doubt on the Company’s ability to continue as a going concern. The Company’s management

believes that it is appropriate to use the going concern basis for the financial statements based

on the future business of the Company, in addition to its ability to obtain or reschedule banking

facilities.

ARAB INTERNATIONAL HOTELS COMPANY PLC

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-2-

(3) CHANGES IN ACCOUNTING POLICIES

The accounting policies used in the preparation of the financial statements are consistent with

those used in the preparation of the annual financial statements for the year ended 31 December

2019 except for the adoption of new standards effective as of 1 January 2020 shown below:

Amendments to IFRS 3: Definition of a Business

The amendment to IFRS 3 Business Combinations clarifies that to be considered a business, an

integrated set of activities and assets must include, at a minimum, an input and a substantive

process that, together, significantly contribute to the ability to create output. Furthermore, it

clarifies that a business can exist without including all of the inputs and processes needed to

create outputs.

The amendments have been applied to transactions that are either a business merger or the

acquisition of assets which its acquisition date is on or after the beginning of the first annual

reporting period that began on or after January 1, 2020. Consequently, the company did not have

to reconsider these transactions that occurred on Earlier periods. Early application is permitted

and must be disclosed.

These amendments had no impact on the financial statements of the Company.

Amendments to IAS 1 and IAS 8: Definition of “Material”

The IASB issued amendments to IAS 1 Presentation of Financial Statements and IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors to align the definition of

‘material’ across the standards and to clarify certain aspects of the definition. The new definition

states that, ’Information is material if omitting, misstating or obscuring it could reasonably be

expected to influence decisions that the primary users of general-purpose financial statements

make on the basis of those financial statements, which provide financial information about a

specific reporting entity.

These amendments had no impact on the financial statements of the Company.

Amendments to IFRS 7, IFRS 9 and IAS 39 Interest Rate Benchmark Reform

Interest Rate Benchmark Reform Amendments to IFRS 9 and IFRS 7 includes a number of reliefs,

which apply to all hedging relationships that are directly affected by interest rate benchmark

reform. A hedging relationship is affected if the reform gives rise to uncertainties about the timing

and or amount of benchmark-based cash flows of the hedged item or the hedging instrument.

These amendments have no impact on the financial statements of the Company.

ARAB INTERNATIONAL HOTELS COMPANY PLC

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-3-

Amendments to IFRS 16 Covid-19 Related Rent Concessions

On 28 May 2020, the IASB issued Covid-19-Related Rent Concessions - amendment to IFRS 16

Leases. The amendments provide relief to lessees from applying IFRS 16 guidance on lease

modification accounting for rent concessions arising as a direct consequence of the Covid-19

pandemic. This relates to any reduction in lease payments which are originally due on or before

30 June 2021. As a practical expedient, a lessee may elect not to assess whether a Covid-19

related rent concession from a lessor is a lease modification.

The amendment applies to annual reporting periods beginning on or after 1 June 2020. Earlier

application is permitted.

The amendment s did not have a material impact on the financial statements of the company.

(4) USE OF ESTIMATES

The preparation of the financial statements requires management to make estimates and

assumptions that affect the reported amounts of financial assets and liabilities and disclosure of

contingent liabilities. These estimates and assumptions also affect the revenues and expenses and

the resultant provisions. In particular, considerable judgment by management is required in the

estimation of the amount and timing of future cash flows when determining the level of provisions

required. Such estimates are necessarily based on assumptions about several factors involving

varying degrees of judgment and uncertainty and actual results may differ resulting in future

changes in such provisions.

Allowance for expected credit losses : Allowance for expected credit loss on receivables is reviewed

and under the principles and assumptions approved by the Company’s management to estimate

the allowance amount and in accordance with IFRS requirements.

Income Tax provision: The fiscal year shall be charged in respect of the income tax expense in

accordance with the regulations, laws and accounting standards. The needed income tax provision

is calculated accordingly.

Useful life of properties and equipment : The Company’s management estimates the useful life for

its tangible assets for the purpose of calculating depreciation by depending on the expected useful

life of these assets. Impairment loss is recorded in the statement of income (if any).

Legal Provision: To meet any legal obligations, provisions are made for these obligations based on

the opinion of the Company's legal advisor.

ARAB INTERNATIONAL HOTELS COMPANY PLC

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-4-

(5) SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Property and equipment

Property and equipment is stated at cost, net of accumulated depreciation and accumulated

impairment losses (except lands).

Property and equipment depreciation is calculated using the straight-line method over their

estimated useful lives using the following annual depreciation rates:

%

Hotel’s building, renovations, and improvements 2-20

Furniture and fixture 8-12

Machinery and equipment 6-20

Vehicles 15

Fire extinguishing system 4

Solar System 5

The assets carrying values of property and equipment are reviewed whenever indications arise

or events incur that indicates that the carrying value is non recoverable. The asset’s carrying

amount is written down to its recoverable amount if the asset’s carrying amount is greater than its

estimated recoverable amount.

Expenditure incurred to replace a component of an item of property and equipment that is accounted

for separately is capitalised and the carrying amount of the component that is replaced is written

off. Other subsequent expenditure is capitalised only when it increases the future economic benefits

of the related item of property and equipment. All other expenditures are recognised in the statement

of profit or loss as the expense is incurred.

Financial assets at fair value through other comprehensive income

These assets represent investments in equity instruments for the purpose of maintaining them

over the long term.

Financial assets at fair value through other comprehensive income are recorded at fair value plus

acquisition costs at the date of acquisition and subsequently measured at fair value. Changes in

fair value are reported as a separate component in the statement of other comprehensive income

and in the statement of equity including the change in fair value resulting from conversion

differences of non-cash items of assets at foreign currencies. In case of sale of such assets or

part of it, the gains or losses is recorded at the statement of comprehensive income and in the

statement of equity and the valuation reserve balance for sold assets will be transferred directly

to retained earnings and not through statement of income. These assets are not subject to

impairment testing and dividends received are recognized in the statement of profit and loss when

declared.

ARAB INTERNATIONAL HOTELS COMPANY PLC

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-5-

Financial assets at amortized cost

Financial assets at amortized cost are the financial assets that the Company's management, in

accordance with its business model, intends to maintain in order to collect contractual cash flows

which consist of payments of principal and interest on the outstanding debt balance.

These assets are recognized at cost, plus acquisition costs, and the allowance / discount is

amortized using the effective interest method, restricted or credited to the interest, and any

impairment charge is removed and the original or part of the asset cannot be recovered. Their

value in the statement of income.

The amount of impairment in value of these assets represents the difference between the carrying

value of the records and the present value of the expected cash flows discounted at the original

effective interest rate.

Investments in associates

An associate is an entity in which the Company has significant influence on the financial and

operating decision-making (the Company does not control) which the company owns 20% to 50%

from the voting rights. The Company’s investments in its associates are accounted for using the

equity method.

Income and expenses resulting from transactions between the Company and the associate are

eliminated to the extent of the interest in the associate.

Accounts receivable

Accounts receivable are stated at original invoice amount less provision expected credit losses.

The Company applies the simplified approach in calculating the expected credit loss in

accordance with the international financial accounting standard number (9).

Inventories

Inventories are valued at cost (weighted average costing) or net realizable value whichever is

lower.

Cash and cash equivalents

For the purpose of the statement of cash flows, cash and cash equivalents consist of cash and

short-term deposits with maturities of three months or less, net of outstanding bank overdrafts.

ARAB INTERNATIONAL HOTELS COMPANY PLC

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-6-

Fair value

The Company measures financial instruments such as financial assets at fair value through other

comprehensive income at fair value on the date of the financial statements as disclosed in

(note 22).

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement date. The fair value

measurement is based on the presumption that the transaction to sell the asset or transfer the

liability takes place either:

- In the principal market for the asset or liability, or

- In the absence of a principal market, in the most advantageous market for the asset or liability

The principal or the most advantageous market must be accessible to by the Company.

The fair value of an asset or a liability is measured using the assumptions that market participants

would use when pricing the asset or liability, assuming that market participants act in their

economic best interest.

A fair value measurement of a non-financial asset takes into account a market participant's ability

to generate economic benefits by using the asset in its highest and best use or by selling it to

another market participant that would use the asset in its highest and best use.

The Company uses valuation techniques that are appropriate in the circumstances and for which

sufficient data are available to measure fair value, maximising the use of relevant observable

inputs and minimising the use of unobservable inputs.

All assets and liabilities for which fair value is measured or disclosed in the financial statements

are categorised within the fair value hierarchy, described as follows, based on the lowest level

input that is significant to the fair value measurement as a whole:

Level 1 - Quoted (unadjusted) market prices in active markets for identical assets or liabilities

Level 2 - Valuation techniques for which the lowest level input that is significant to the fair value

measurement is directly or indirectly observable

Level 3 - Valuation techniques for which the lowest level input that is significant to the fair value

measurement is unobservable

ARAB INTERNATIONAL HOTELS COMPANY PLC

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-7-

Loans and borrowings

After initial recognition, interest bearing loans and borrowings are subsequently measured at

amortized cost using the effective interest rate method.

Provisions

Provisions are recognized when the Company has a present obligation (legal or constructive)

arising from a past event and the cost to settle the obligation is both probable and able to be reliably

measured.

Segment reporting

A business segment is a group of assets and operations engaged in providing products or services

that are subject to risks and returns that are different from those of other business segments which

are measured based on the reporting to management and the decision makers in the Company.

A geographical segment is engaged in providing products or services within a particular economic

environment that are subject to risks and return that are different from those of segments operating

in other economic environments.

The Company's activity consists of three economic sectors the revenues and expenses of the

Marriott Amman Hotel, investments in financial assets through other comprehensive income and

investments in associates.

Revenue and expenses recognition

Revenue is recognized based on the five-step model framework derived from the international

financial reporting standard number (15) which includes the identification of the contract, price,

allocating the contract price to the performance obligation in the contract and recognizing revenue

when the company satisfies the performance obligation. Whereby revenue is recognized when

selling goods to the customers and issuing the invoice to the customer at a point in time.

Interest revenue is recognised on accrual basis using effective interest rate.

Profits of associates is recognised by using the equity method when the associates declare their

results.

Other income is recognised on accrual basis.

Expenses are recognised on accrual basis.

ARAB INTERNATIONAL HOTELS COMPANY PLC

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-8-

Foreign currency

Foreign currency transactions during the year are recorded using exchange rates that are in effect

at the dates of the transactions. Assets and liabilities denominated in foreign currencies are

translated to Jordanian Dinars using the prevailing exchange rates at year end. Foreign exchange

gains or losses are reflected in the statement of income.

Income Taxes

Income tax is accounted for in accordance with the Income Tax Law No. (34) of 2014 and

International Accounting Standard No. (12) which states that deferred tax is provided for

temporary differences, at each reporting date, between the tax basis of assets and liabilities and

their carrying amounts for financial reporting purposes.

Current tax is calculated based on taxable profits, which may differ from accounting profits

appearing in the statement of profit or loss. Accounting profits may include non-taxable profits or

expenses which may not be tax deductible in the current but in subsequent applicable years.

Deferred Tax Assets

Deferred tax assets are recognized for all deductible temporary differences such as unused tax

expenses and losses to the extent that it is probable that taxable profit will be available against

which the loses can be utilized. Management judgment is required to determine the amount of

deferred tax assets that can be recognized, based upon the likely timing and the level of future

taxable profits.

ARAB INTERNATIONAL HOTELS COMPANY PLC

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-9-

(6) PROPERTY AND EQUIPMENT

Lands

Hotel’s

building and

renovations

and

improvements

Furniture

and fixtures

Machinery and

equipment

Vehicles

Fire

extinguishing

system

Work in

progress*

Solar

system

Solar

System

Total

2020-

JD

JD

JD

JD

JD

JD

JD

JD

JD

Cost

At 1 January 2020

2,094,168

17,497,244

8,789,331

7,512,299

352,175

424,782

1,630,831

2,620,208

40,921,038

Additions

-

17,664

83,563

132,204

-

-

25,980

20,421

279,832

Transfers

-

1,495,205

16,800

124,627

-

-

(1,636,632)

-

-

At 31 December 2020

2,094,168

19,010,113

8,889,694

7,769,130

352,175

424,782

20,179

2,640,629

41,200,870

Accumulated depreciation

At 1 January 2020

-

11,994,009

7,683,996

5,897,381

219,142

424,782

-

198,418

26,417,728

Depreciation for the year

-

366,305

266,087

403,371

31,772

-

-

131,706

1,199,241

At 31 December 2020

-

12,360,314

7,950,083

6,300,752

250,914

424,782

-

330,124

27,616,969

Net book value

At 31 December 2020

2,094,168

6,649,799

939,611

1,468,378

101,261

-

20,179

2,310,505

13,583,901

* The estimated cost to complete the projects as at 31 December 2020 is approximately JD 80,000, and it is expected to complete these

projects during the year 2021.

** The total cost of fully depreciated assets as at 31 December 2020 is JD 12,178,425 (2019: JD 9,605,357).

*** The depreciation expenses at 31 December 2020 is divided between depreciation of operating property and equipment (JD 1,170,212) and

depreciation of general and administrative property and equipment (JD 29,120).

ARAB INTERNATIONAL HOTELS COMPANY PLC

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-10-

Lands

Hotel’s

building and

renovations

and

improvements

Furniture

and fixtures

Machinery and

equipment

Vehicles

Fire

extinguishing

system

Work in

progress*

Solar

system

Solar

System

Total

2019-

JD

JD

JD

JD

JD

JD

JD

JD

JD

Cost

At 1 January 2019

2,094,168

16,926,786

8,721,333

7,603,209

409,550

424,782

2,134,590

2,437,715

40,752,133

Additions

-

-

67,864

363,369

80,235

-

416,152

91,988

1,019,608

Transfers

-

570,458

-

-

-

-

(570,458)

-

-

Returns from contractors

-

-

-

-

-

-

-

(437,210)

(437,210)

Disposals

-

-

-

(275,883)

(137,610)

-

-

-

(413,493)

At 31 December 2019

2,094,168

17,497,244

8,789,197

7,690,695

352,175

424,782

1,980,284

2,092,493

40,921,038

Accumulated depreciation

At 1 January 2019

-

11,646,688

7,248,269

5,770,698

319,373

420,944

-

54,828

25,460,800

Depreciation for the year

-

347,320

437,112

401,167

29,084

3,838

-

143,589

1,362,110

Disposal

-

-

-

(275,882)

(129,300)

-

-

-

(405,182)

At 31 December 2019

-

11,994,008

7,685,381

5,895,983

219,157

424,782

-

198,417

26,417,728

Net book value

At 31 December 2019

2,094,168

5,503,236

1,103,816

1,794,712

133,018

-

1,980,284

1,894,076

14,503,310

ARAB INTERNATIONAL HOTELS COMPANY PLC

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-11-

(7) FINANCIAL ASSETS AT FAIR VALUE THROUGH OTHER COMPREHENSIVE INCOME

2020

2019

JD

JD

Investment in companies’ shares – quoted in Amman

Stock Exchange

4,182,067

5,025,367

Investment in companies’ shares– unquoted in Amman

Stock Exchange

177,000

177,000

4,359,067

5,202,367

Movement on the financial assets at fair value is as follows:

2020

2019

JD

JD

At 1 January

5,202,367

5,962,071

Investment during the year

1,413

1,926

Change in fair value

(844,713)

(761,630)

At 31 December

4,359,067

5,202,367

Movement on fair value reserve is as follows:

2020

2019

JD

JD

At 1 January

(3,469,552)

(2,707,922)

Change in fair value

(844,713)

(761,630)

At 31 December 2020

(4,314,265)

(3,469,552)

(8) INVESTMENT IN ASSOCIATES

Percentage of ownership

Value

2020

2019

2020

2019

%

%

JD

JD

Business Tourism Company

35.516

35.516

16,802,918

18,393,353

Al Dawliyah for Hotels and Malls Company

26.91

26.91

12,701,929

13,790,409

Interior Design Studio Company

25

25

-

-

Beaches Company for Hotels and Resorts*

48.89

30.93

763,192

2,503,328

Jordan Investor Center Company

49.34

49.34

10,986,524

12,836,044

Arab International Real Estate Company

42.35

42.35

1,515,574

1,515,403

42,770,137

49,038,537

ARAB INTERNATIONAL HOTELS COMPANY PLC

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-12-

* The General Assembly approved in their extraordinary meeting held on 28 June 2020 on merging the

Company with its associate “Beaches Company for Hotels and Resorts“. The legal procedures were

not completed until the date of preparing these condensed financial statements.

The schedule below includes a summary of the associates main operations:

Company

Main operation

Business Tourism Company – private shareholding

Owning company of Jordan Valley Marriot and

Petra Marriott Hotels

Al Dawliyah for Hotels and Malls Company - PLC

Owning company of Sheraton Amman Hotel

Interior Design Studio Company LLC.

Interior designs projects for hotels

Beaches Company for Hotels and Resorts – private

shareholding

Owning company of Marriot Aqaba Hotel

Jordan Investor Center Company – private shareholding

Investments in stocks and companies

Arab International Real Estate Company – private

shareholding

Investments in lands and real estate

Movement on investment in associates is as follows:

2020

2019

JD

JD

Balance at 1 January

49,038,537

49,918,942

Decrease in associate capital

(2,474,080)

-

Dividends paid

(163,904)

(4,268,109)

Share of (loss) profit from associates

(3,315,414)

4,441,755

Share of change in fair value reserve

(1,191,521)

(1,054,051)

Purchase of additional shares in associate*

876,519

-

42,770,137

49,038,537

* During 2020 the Company purchased 876,519 shares from Beaches Company for Hotels and

Resorts – private shareholding.

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-13-

Al Dawliyah for

Hotels and Malls

Company

Business

Tourism

Company

Jordan

Investor

Center

Company

Interior

Design

Studio

Company

Beaches

Company

for Hotels

and Resorts

Arab

International

Real Estate

Company

Total

2020 -

JD

JD

JD

JD

JD

JD

JD

Investment in associates

Current assets

1,712,941

3,164,608

1,310,631

-

4,791,868

93,991

11,074,039

Non-current assets

58,563,453

54,628,713

24,114,666

-

-

3,482,598

140,789,430

Current liabilities

(6,008,612)

(3,509,818)

(7,270,106)

-

-

(1,759)

(16,790,295)

Non-current liabilities

(4,260,463)

(3,245,960)

-

-

(3,020)

-

(7,509,443)

Equity

(50,007,319)

(51,037,543)

(18,155,191)

-

(4,788,848)

(3,574,830)

(127,563,731)

Ownership %

26.91

35.516

49.34

25

48.89

42.35

-

Investment carrying amount

12,701,929

16,802,918

10,986,524

-

763,192

1,515,574

42,770,137

Revenues

Operating (losses) Revenues

(2,386,696)

(3,012,005)

(910,633)

-

161,390

1,439

(6,146,505)

Administrative expenses

(727,566)

(599,268)

(262,708)

(98,636)

(397,412)

(926)

(2,086,516)

Finance costs

(264,840)

(201,289)

(670,166)

-

-

-

(1,136,295)

(Loss) Income before tax

(3,379,102)

(3,812,562)

(1,843,507)

(98,636)

(236,022)

513

(9,369,316)

Income tax expense

-

-

-

-

-

(108)

(108)

(Loss) profit for the year

(3,379,102)

(3,812,562)

(1,843,507)

(98,636)

(236,022)

405

(9,369,424)

The Company’s share of (loss) profit for

the year

(909,316)

(1,354,070)

(909,623)

(24,659)

(117,574)

(172)

(3,315,414)

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-14-

Al Dawliyah for

Hotels and Malls

Company

Business

Tourism

Company

Jordan

Investor

Center

Company

Interior

Design

Studio

Company

Beaches

Company for

Hotels and

Resorts

Arab

Internation

al Real

Estate

Company

Total

2019 -

JD

JD

JD

JD

JD

JD

JD

Investment in associates

Current assets

2,469,140

6,691,889

9,619,902

310,897

26,445,896

95,001

45,632,725

Non-current assets

61,052,267

56,543,069

25,234,079

14,553

2,600,000

3,482,598

148,926,566

Current liabilities

(5,778,067)

(1,989,189)

(11,177,016)

(285,904)

(13,416,039)

-

(32,646,215)

Non-current liabilities

(3,438,017)

(6,056,188)

-

(90,430)

-

(1,988)

(9,586,623)

Equity

54,305,323

55,189,581

23,676,965

(50,883)

15,629,857

3,575,611

152,326,453

Ownership %

26,91

35,516

49,342

25

30,926

42,353

Investment carrying amount

13,790,409

18,393,353

12,836,044

-

2,503,328

1,515,403

49,038,537

Revenues

Operating Revenues

11,439,137

18,239,116

2,572,425

377,458

19,519,106

2,732

52,149,974

Administrative expenses

(10,578,867)

(15,578,499)

(1,320,996)

(573,180)

(6,057,084)

(110)

(34,108,736)

Finance costs

(274,619)

(315,242)

(816,936)

(16,242)

-

-

(1,423,039)

Income (loss) before tax

585,651

2,345,375

434,493

(211,964)

13,462,022

2,622

16,618,199

Income tax expense

(95,571)

(160,000)

-

-

-

-

(255,571)

Profit (loss) for the year

490,080

2,185,375

434,493

(211,964)

13,462,022

2,622

16,362,628

The Company’s share of profit (loss) for

the year

131,880

776,158

214,388

(40,970)

3,359,189

1,110

4,441,755

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-15-

(9) FINANCIAL ASSETS AT AMORTIZED COST

On 12 October 2017, Arab International Hotels Company purchased 15 bonds from Jordan Ahli

Bank (sister company) with a variable interest rate where the interest rate at the beginning of each

period equals to the discount rate of the Central Bank of Jordan plus 2% margin which amounted

to 6.75% at issuance date. The interest at year end was 7.5% and the interest is paid semi-

annually. The Bond is due in one instalment on 12 October 2023. In October 2018 the Board of

Directors decided to sell Jordan Ahli Bank bonds, thus the bonds were classified as current

assets.

(10) BONDS PAYABLE

On 22 January 2017, Arab International Hotels Company Public Shareholding Company issued

a 10,000 bonds through Jordan Ahli Bank with a par value of JD 1,000 and a total value of JD

10,000,000 for five years at a fixed interest rate of 5.5%. paid semi-annually. The bond principal

is due in one instalment on 22 January 2022.

(11) ACCOUNTS RECEIVABLE AND OTHER CURRENT ASSETS

2020

2019

JD

JD

Trade receivables

363,842

525,163

Provision for expected credit losses

(33,288)

(39,290)

330,554

485,873

Amounts due from related parties (note 20)

23,299

3,799,907

Other current assets

655,995

298,400

1,009,848

4,584,180

Expected credit losses provision amounted to JD 33,288 as at 31 December 2020 (2019: JD

39,290).

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-16-

Movement on expected credit losses provision is as follows:

2020

2019

JD

JD

Balance as at 1 January

39,290

38,977

Provision of the year

-

313

Recovered from expected credit losses

(6,002)

-

Balance as at 31 December

33,288

39,290

As at 31 December, the ageing of unimpaired receivables net of expected credit losses provision

is as follows:

1 - 30

31 – 60

61 – 90

91 – 120

>120

days

days

days

days

days

Total

JD

JD

JD

JD

JD

JD

2020

261,269

39,930

4,561

6,000

18,794

330,554

2019

287,005

155,870

12,295

5,703

25,000

485,873

The management expects to collect all unimpaired receivables balances. It is not the practice of

the Company to obtain collateral against the receivable, therefore they are unsecured.

(12) CASH AND SHORT TERM DEPOSITS

2020

2019

JD

JD

Short-term deposits*

2,939,233

689,458

Cash on hands and at banks

1,426,483

2,047,419

4,365,716

2,736,877

* Short term deposits represent deposits held with local banks in Jordanian Dinar with maturities

of three months or less, bearing an interest rate 4%.

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-17-

(13) EQUITY

Paid-in capital

The Company authorized paid-in capital amounted to JD 32,000,000 divided to 32,000,000

shares with par value of JD 1 per share as at 31 December 2020.

Share premium

The amount accumulated in this account represents the difference between the proceeds of share

issuances and the par value of the issued shares.

Statutory reserve

The accumulated amounts in this account represent cumulative appropriations of 10% of the profit

before income tax. The statutory reserve is not available for distribution to the shareholders. The

Company is allowed to stop the transfer to this account when the reserve amount reaches 25%

of the share capital.in reference to that the Company decided not to transfer any additional

amounts to the statutory reserve.

Voluntary reserve

The accumulated amounts in this account represent cumulative appropriations of 20% of the profit

before income tax. The statutory reserve is available for distribution to the shareholders. At its

meeting held on 22 April 2019, the General Assembly approved the transfer of JD 5,000,000 from

voluntary reserve to retained earnings.

(14) Dividends

The General Assembly approved in its meeting held on 28 April 2020, the distribution of cash

dividends amounted to JD 1,920,000 representing 6% of the paid in capital as a result of 2019’s

operations (2019: JD1,920,000).

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-18-

(15) Loans

2020

2019

Current

portion of

long- term

loans

Long term

loans

Current

portion of

long- term

loans

Long term

loans

JD

JD

JD

JD

Jordan Ahli Bank – USD (1)

709,000

-

709,000

-

Jordan Ahli Bank – USD (2)

330,866

1,985,204

330,866

1,985,204

Jordan Ahli Bank – JD (3)

531,868

1,329,673

444,444

1,417,097

Jordan Ahli Bank – USD (4)

Jordan Ahli Bank – JD (5)

850,800

-

3,403,200

1,738,801

-

-

4,254,000

-

2,422,534

8,456,878

1,484,310

7,656,301

Jordan Ahli Bank – USD (1)

This represents Jordan Ahli Bank loan amounting to USD 10,000,000 (JD 7,090,000). The

Company signed an agreement with Jordan Ahli Bank on 6 August 2015 for a loan which was

granted against the Company’s guarantee and with an interest rate of 4.10%. The loan will be

repaid in 10 equal semi- annual instalments. The first instalment was due on 30 September 2015,

and the interest will be paid every 6 months. During the period ended 31 December 2020, the

loan was rescheduled, as the due dates for the instalments of the year 2020 were postponed until

the end of the loan life in 31 March 2021.

Jordan Ahli Bank – USD (2)

This balance represents Jordan Ahli Bank loan amounting to USD 4,200,000 (JD 2,977,800). The

Company signed an agreement with Jordan Ahli Bank on 15 April 2015. this loan was granted

against the Company’s guarantee and with an interest rate of 4%. The loan will be paid in 18

equal semi- annual instalments. The first instalment was due on 30 September 2017, and the

interest will be paid every 6 months. The loan instalments for the years 2018 and 2017 were

rescheduled to 2025 and 2026 while the interest will be paid every 6 months. During the period

ended 31 December 2020, the loan was rescheduled, as the due dates for the instalments of the

year 2020 were postponed until the end of the loan life on October 2027.

Jordan Ahli Bank – JD (3)

On 4 November 2015 the Company signed an energy loan agreement with Jordan Ahli Bank with

a ceiling of JD 4,000,000 with an annual interest rate of 4% on utilized balance. The loan will be

paid in 18 semi annual instalments, the first instalment was due on 1 November 2017. The last

instalment will be due on 1 May 2025. During the period ended 31 December 2020, the loan was

rescheduled, as the due dates for the instalments of the year 2020 were postponed until the end

of the loan life on May 2024.

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-19-

Jordan Ahli Bank – USD (4)

This balance represents Jordan Ahli Bank loan amounting to USD 6,000,000 (JD 4,254,000). The

Company signed an agreement with Jordan Ahli Bank on 26 March 2019 for a loan which was

granted against the Company’s guarantee and with an interest equivalent to LIBOR 2.5% and

minimum 5%. The loan will be paid in 10 equal semi - annual instalments. The first instalment

was due on 28 February 2021, and the interest will be paid monthly.

Jordan Ahli Bank – JD (5)

On 15 June 2020 the Company signed a funding operating expenses and salaries agreement

with Jordan Ahli Bank with a ceiling of JD 3,000,000 with an annual interest rate of 3% on utilized

balance. The loan will be paid in 16 semi annual instalments, the first instalment will be due on

30 June 2022. The last instalment will be due on 31 December 2028. The Company utilized an

amount of JD1,738,801 as of 31 December 2020.

These loans were granted against the Company’s guarantee.

Movement on the loans is as follows:

2020

2019

JD

JD

Balance as at 1 January

9,140,611

7,079,921

Proceeds from loans

1,738,801

4,254,000

Loans repayments

-

(2,193,310)

10,879,412

9,140,611

- The amount of annual payments and maturities of the loans are as follows:

Year

JD

2021

2,422,534

2022

1,565,767

2023

1,850,320

2024 - 2028

5,040,791

10,879,412

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-20-

(16) PROVISIONS AND OTHER CURRENT LIABILITIES

2020

2019

JD

JD

Due to share holders and dividends payable

358,660

337,278

Board of Directors’ benefits

-

65,000

Accrued expenses

462,092

653,506

Income tax provision (note 18)

-

186,831

Other credit balances

-

342,767

National contribution taxes provision

-

7,039

820,752

1,592,421

(17) ADMINISTRATIVE EXPENSES

2020

2019

JD

JD

Salaries, wages and other benefits

315,314

405,280

Prior years income tax

43,167

-

Social security

11,863

14,660

Board of Directors travel and transportation expenses

97,293

101,682

Chairman office expenses

5,171

5,208

BOD remuneration

-

65,000

Insurance expenses

56,726

74,141

Governmental fees

27,420

26,747

Donations

19,200

19,200

Rent

19,350

19,350

Professional fees

12,950

10,000

Advertisement expenses

3,296

6,910

Vehicles expenses

13,977

17,900

Bank expenses

20,313

23,629

Property tax expenses

45,724

46,368

Stationery and publications

6,483

8,715

Hospitality expenses

3,263

6,175

Solar System expenses

69,337

33,266

Others

13,981

9,905

784,828

894,136

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-21-

(18) INCOME TAX

The income tax for the years ended 31 December 2020 has not been calculated due to the excess

in expenses over taxable income in accordance with income tax law no (38) of 2018.

The income tax for the year ended 31 December 2019 is calculated in accordance with the

Income Tax Law No. (38) of 2018.

The Company submitted its tax declarations to the Income Tax and Sales Tax departments up to

the year 2019.

The Company obtained clearance from the Income Tax Department up to the year 2018.

A- The movement on income tax provision is as follow:

2020

2019

JD

JD

Balance as at 1 January

186,831

126,168

Income tax expense for the year

-

140,776

Income tax paid

(186,831)

(80,113)

Balance as at 31 December

-

186,831

B- The reconciliation between the accounting profit and taxable income is as follows:

2020

2019

JD

JD

Accounting (loss) profit

(6,583,044)

4,357,265

Non-taxable income

3,478,146

(4,813,299)

Non-deductible expenses

1,012,856

1,159,913

Taxable (loss) income

(2,092,042)

703,879

Income tax expense for the year

-

140,776

Statutory income tax rate

20%

20%

Effective income tax rate

-

3.23%

The income tax expense at it appears on the statement of profit and loss is as follows:

2020

2019

JD

JD

Current year income tax expense

-

(140,776)

Deferred tax assets

418,409

-

Income tax surplus (expense)

418,409

(140,776)

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-22-

(19) BASIC AND DILUTED (LOSS) EARNINGS PER SHARE

2020

2019

(Loss) Profit for the year (JD)

(6,164,635)

4,209,450

Weighted average number of shares (share)

32,000,000

32,000,000

JD/ Fils

JD/ Fils

Basic (loss) earnings per share

(0/193)

0/132

The diluted earnings per share of the (loss) profit for the year to shareholders of the Company is

equal to the basic earnings per share of (loss) profit for the year.

(20) RELATED PARTIES

Related parties represent associated companies, sister companies, major shareholders, directors

and key management personnel of the Company, and entities controlled, jointly controlled or

significantly influenced by such parties. Pricing policies and terms of these transactions are

approved by the Company’s management.

Related parties balances included in the statement of financial position is as follow:

2020

2019

JD

JD

Assets

Bank deposit - Jordan Ahli Bank

2,939,233

689,458

Current account at Jordan Ahli Bank

1,295,098

2,025,919

Financial assets at amortized cost (note 9)

1,500,000

1,500,000

The other debit balances includes due from related

parties broken down as follows:

Due from Interior Design Studio Company Partner

23,299

23,299

Petra Marriott Hotel

-

16,494

Jordan Valley Marriott Hotel

-

40,195

Due from Business Tourism Company

-

1,000

Due from Al Dawliyeh for hotels and malls

-

4,582

Due from Beaches Company for Hotel and Resorts

-

3,711,112

Due from Jordan investor company

-

3,225

23,299

3,799,907

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-23-

Liabilities:

2020

2019

JD

JD

Loans granted by Jordan Ahli Bank

10,879,412

9,140,611

Due to banks - Jordan Ahli Bank

-

-

Bonds payable (note 10)

7,300,000

7,300,000

Financial assets at fair value through other comprehensive income:

2020

2019

JD

JD

The Joradan Worsted Mills Company

1,854,410

2,079,347

El Zay Ready Wear Manufacturing Company

145,396

176,006

Jordan Ahli Bank

1,216,813

1,501,263

Transactions with related parties included in the statement of income are as follows:

2020

2019

JD

JD

Interest income on deposits - Jordan Ahli Bank

21,721

46,501

Dividends income

162,732

294,584

Interest income on financial assets at amortized cost

90,134

113,250

Key management salaries and benefits and Board of

Directors remuneration

302,698

347,630

Finance costs – Jordan Ahli Bank

414,708

494,148

Finance costs bonds – related parties

401,500

401,500

(21) RISK MANAGEMENT

Interest rate risk

The Company is exposed to interest rate risk on its interest bearing assets and liabilities such as

bank deposits and bank overdraft and term loans. There is no interest rate risk associated with

interest rate on bonds as it bears fixed interest rates.

The sensitivity of the statement of income is the effect of the assumed changes in interest rates

on the Company’s profit for one year, based on the floating rate financial assets and financial

liabilities held at 31 December.

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-24-

The following table demonstrates the sensitivity of the statement of income to reasonably possible

changes in interest rates as 31 December, with all other variables held constant.

2020-

Increase

in basis points

Effect on

profit

for the year

Currency

JD

JD

100

(65,396)

USD

100

(72,791)

Decrease

in basis points

Effect on

profit

for the year

Currency

JD

JD

100

65,396

USD

100

72,791

2019-

Increase

in basis points

Effect on

profit for the

year

Currency

JD

JD

100

(11,721)

USD

100

(72,791)

Decrease

in basis points

Effect on

profit for the

year

Currency

JD

JD

100

11,721

USD

100

72,791

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-25-

Equity price risk

The following table demonstrates the sensitivity of the fair value reserve to reasonably possible

changes in equity prices, with all other variables held constant.

2020-

Change in

equity price

Effect on

equity

Equity price

%

JD

Amman Stock Exchange

5

(5)

217,953

(271,953)

2019 -

Change in

equity price

Effect on

equity

Equity price

%

JD

Amman Stock Exchange

5

260,118

(5)

(260,118)

Credit risk

Credit risk is the risk that one party to a financial instrument will fail to discharge an obligation and

cause the other party to incur a financial loss.

The Company seeks to limit its credit risk with respect to customers by setting credit limits for

individual customers and monitoring outstanding receivables. The Company seeks to limit its

credit risk with respect to banks by only dealing with reputable banks.

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-26-

Liquidity risk

The Company limits its liquidity risk by ensuring bank facilities are available.

The table below summarises the maturities of the Company’s (undiscounted) financial liabilities

at 31 December, based on contractual payment dates and current market interest rates.

31 December 2020

Less than

3 months

3 to 12

months

1 to 5

years

Total

JD

JD

JD

JD

Bonds payable

-

550,000

11,100,000

11,650,000

Accounts payable and other current liabilities

1,268,919

-

-

1,268,919

Loans

820,313

1,647,224

9,820,116

12,287,653

Total

2,089,232

2,197,224

20,920,116

25,206,572

31 December 2019

Bonds payable

-

550,000

11,100,000

11,650,000

Accounts payable and other current liabilities

2,469,811

-

-

2,469,811

Loans

820,313

1,094,406

8,634,133

10,548,852

Total

3,290,124

1,644,406

19,734,133

24,668,663

Currency risk

Most of the Company’s transactions are in Jordanian Dinars and US Dollar. The Jordanian Dinar

is fixed against US Dollar (1.41 USD / 1JD). Accordingly, the effect of currency risk is not material

to the financial statements.

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-27-

(22) FAIR VALUE FINANCIAL INSTRUMENTS

Financial instruments comprise of financial assets and liabilities.

Financial assets consists of cash on hand and at banks, account receivable, and some other debit

balances. Financial liabilities consist of accounts payable, due to banks, loans, and some other

current liabilities.

The Company uses the following hierarchy for determining and disclosing the fair value of financial

instruments by valuation technique:

Level 1: Quoted prices in active markets for identical assets or liabilities.

Level 2: Other techniques for which all inputs that have a significant effect on the recorded fair value

are observable, either directly or indirectly.

Level 3: Techniques that use inputs that have a significant effect on the recorded fair value that are

not based on observable market data.

Assets measured at fair value

2020-

Level 1

Level 2

Level 3

Total

JD

JD

JD

JD

Financial assets at fair value through other

comprehensive income

4,182,067

-

177,000

4,359,067

2019-

Financial assets at fair value through other

comprehensive income

5,025,367

-

177,000

5,202,367

(23) CAPITAL MANAGEMENT

The primary objective of the Company's capital management is to ensure that it maintains healthy

capital ratios in order to support its business and maximize shareholder value.

The Company manages its capital structure and makes adjustments to it in light of changes in

business conditions. No changes were made in the objectives, policies, or processes for the

current year and previous year.

Capital comprises of paid-in capital, share premium, statutory reserve, voluntary reserve , change

in fair value reserve, company’s share from change in fair value reserve /from investment in

associates, and retained earnings and is measured at JD 46,218,533 as of 31 December 2020

(2019: JD 56,339,402).

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-28-

(24) CONTINGENCIES AND COMMITMENTS

Lawsuits

The Company is a defendant in a number of lawsuits amounting JD 6,634 representing legal

claims related to its activities (2019: JD 43,385).

The Company filed a number of lawsuits amounting JD 29,459 representing legal claims related

to its activities.

Capital commitments

Expected cost to complete the projects in progress as of 31 December 2019 is approximately JD

5,000,000 and it is expected to complete such projects during the year 2021.

(25) SEGMENT INFORMATION

A business segment is the Company’s assets and operations engaged in providing products

together or are subject to risks and returns services differ from those of other business segments.

Geographical segment is associated in providing products or services in a particular economic

environment subject to risks and rewards that are different from those in other segments operating

in other economic environments. Segment results are as follows:

The following table represent Marriott Amman operating revenues:

2020

2019

JD

JD

Rooms Revenues

1,594,033

6,470,310

F&B Revenues

1,330,082

4,013,850

Other Revenues

246,185

338,023

3,170,300

10,822,183

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-29-

The following table summarizes the Segment results:

Hotel

sector

Investment

in financial

assets

Total

31 December 2020 -

JD

JD

JD

Revenues

1,488,882

(1,052,028)

436,854

Segment results -

(Loss) profit before income tax

(5,531,016)

(1,052,028)

(6,583,044)

Income tax surplus

418,409

-

418,409

National contribution tax

-

-

-

Loss for the year

(5,112,607)

(1,052,028)

(6,164,635)

Other Segment Information

Capital expenditure

279,832

-

279,832

Depreciation

1,199,241

-

1,199,241

31 December 2019 -

Revenues

15,181,700

659,322

15,841,022

Segment results -

Profit before income tax

3,697,943

659,322

4,357,265

Income tax expense

(119,474)

(21,302)

(140,776)

National contribution tax

(7,039)

-

(7,039)

Profit for the year

3,571,430

638,020

4,209,450

Other Segment Information

Capital expenditure

1,019,608

-

1,019,608

Depreciation

1,362,110

-

1,362,110

Assets and Liabilities

31 December 2020

Assets segment

48,824,098

19,124,357

68,366,864

Liabilities segment

22,148,331

-

1,362,110

31 December 2019

Assets segment

54,392,682

23,557,142

77,949,824

Liabilities segment

21,610,422

-

21,610,422

The Company share from associates (losses) profits amounted to 3,315,414 JD for the year

ended 31 December 2020 (2019: JD 4,441,755).

ARAB INTERNATIONAL HOTELS COMPANY

NOTES TO THE FINANCIAL STATEMENTS

31 DECEMBER 2020

-30-

(26) STANDARDS ISSUED BUT NOT YET EFFECTIVE