1

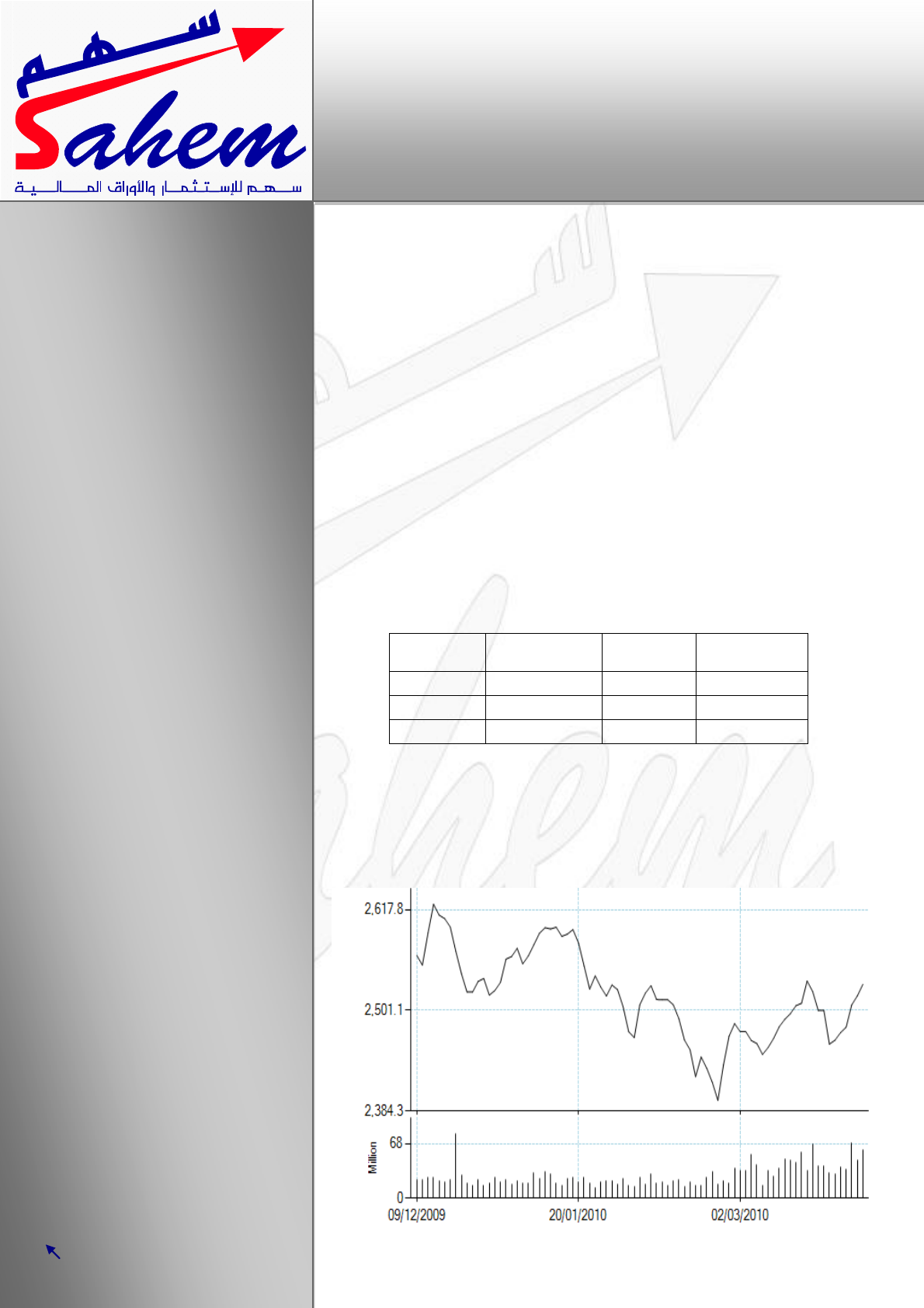

Trading value for Sunday 4/4/2010 reached JD(54.3) million. (63.5) million

shares were traded through (12351) transactions.

The shares price index closed at (2533) point, an increase of (0.08%).

The shares of (158) companies were traded, the shares prices of (69)

companies rose, and the shares prices of (51) declined.

The top five gainers were, the National Steel Industry by (5.00%),

Comprehensive Leasing by (4.97%), Premier Business And Projects by

(4.86%), Nopar For Trading And Investment by (4.85%), and Bindar Trading

& Investment by (4.83%).

The top five losers were, the Al Barakah Takaful by (4.98%), Al Ahlia

Enterprises by (4.82%), Al-nisr Al-arabi Insurance by (4.75%), Ittihad Schools

by (4.55%), and Al-dawliyah For Hotels & Malls by (4.39%).

Index %Change

Value

(JD)

Change in

Points

Financial 0.36 41,102,376 3073

Services -0.43 5,746,686 2076

Industrial 0.12 7,409,095 2706

ASE Index

The ASE General Index rose by 1.96 points closing at 2533.14 points,

resulting in a slightly increase of 0.08%.

Amman Stock Exchange Daily

Summar

y

April 4

th

, 2010

Sahem Trading and Investment

Co.

Ramallah-Gaza-Khan Younis

Tel : +970 2 2965710

P.O.Box 2187

www.Sahem-inv.com

2

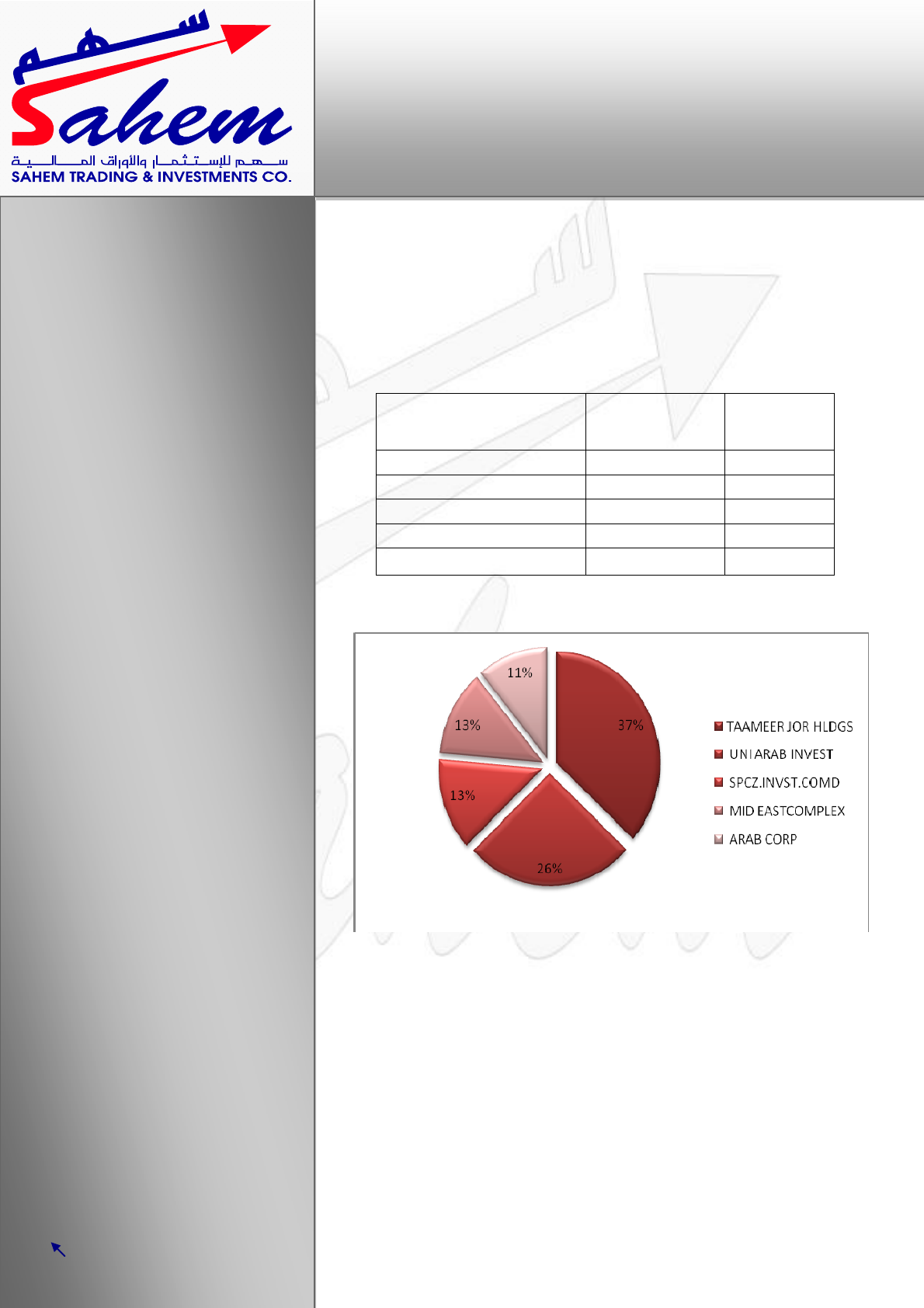

Most Active Shares

Stock

Volume

(JD)

Change to

total

market%

TAAMEER JOR HLDGS 12,001,513 22.1

UNI ARAB INVEST 8,573,800 15.8

SPCZ.INVST.COMD 4,330,028 8.0

MID EASTCOMPLEX 4,107,594 7.6

ARAB CORP 3,614,931 6.7

Amman Stock Exchange Daily

Summar

y

April 4

th

, 2010

Sahem Trading and Investment

Co.

Ramallah-Gaza-Khan Younis

Tel : +970 2 2965710

P.O.Box 2187

www.Sahem-inv.com

3

This document has been issued by Sahem Co. for informational purposes only. This document is not and should

not be construed as an offer or the solicitation of an offer to purchase or subscribe or sell any investment or

subscribe to any investment management or advisory service. This document is not intended as investment

advice as to the value of any securities or as to the advisability of investing in, purchasing, or selling any security.

Sahem Co. has based this document on information obtained from sources it believes to be reliable. It makes no

guarantee, representation or warranty as to its accuracy or completeness and accepts no responsibility or liability

in respect thereof or for any reliance placed by any person on such information. All opinions expressed herein are

subject to change without notice. This document may not be reproduced or circulated without the prior written

consent of Sahem Co.