How Amazon Exploits and

Undermines Small Businesses,

and Why Breaking It Up Would

Revive American Entrepreneurship

Most Americans believe that Amazon’s outsized power is dangerous and must be

reined in. A recent poll found that nearly 80 percent of voters believe Amazon

should be subject to greater regulation, and more than half support breaking it up.

1

By Stacy Mitchell and Ron Knox, June 2021

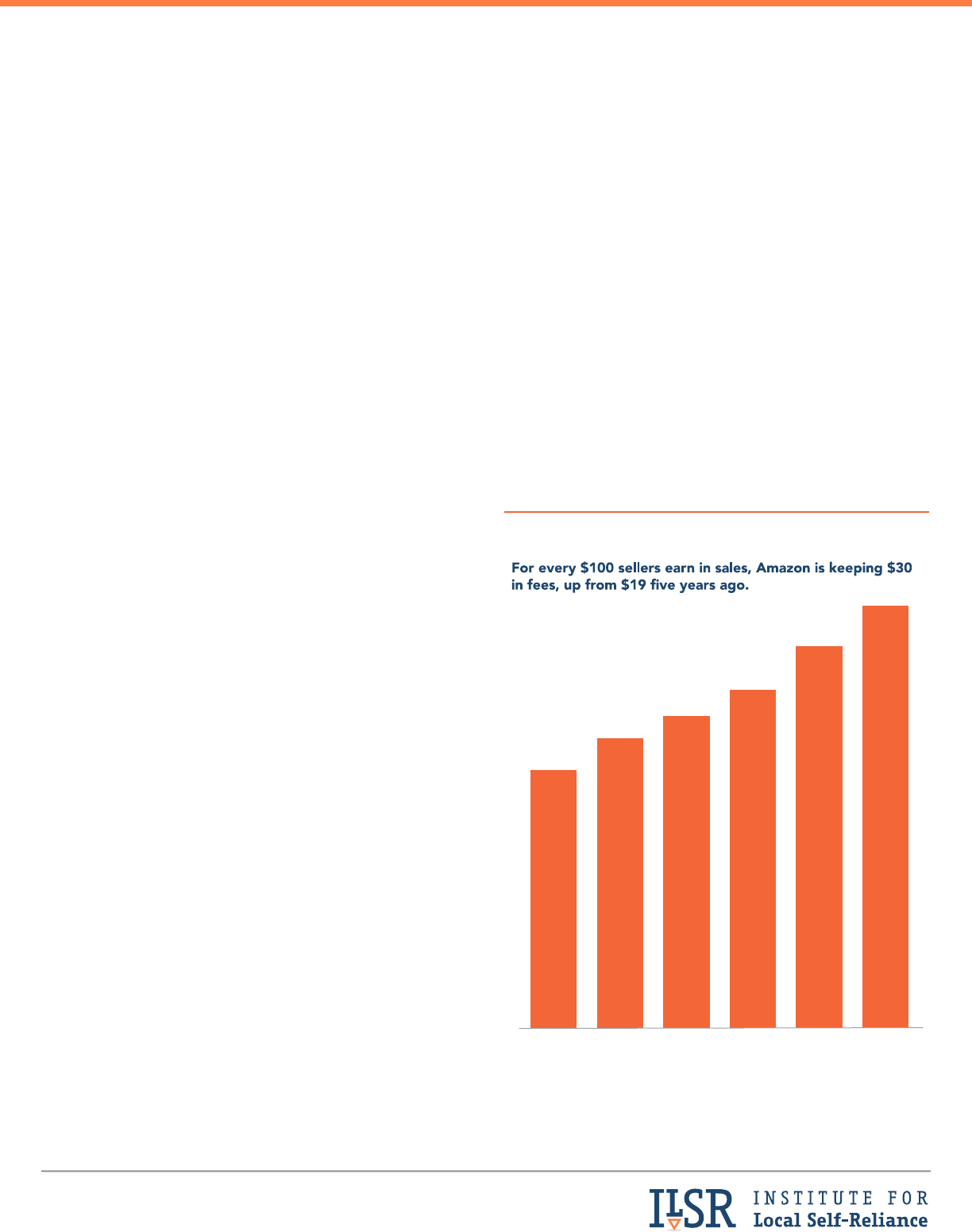

Amazon’s Cut of Sellers’ Revenue

2019

30%

2018

28%

2017

24%

2016

23%

2015

21%

2014

19%

Notes: Amazon’s nancials break out revenue from third-party seller fees, but do not include seller

payments for product advertising. ILSR has estimated those fees and included them here. The esti-

mates are based on data from eMarketer and information from Amazon’s nancials.

Sources: Amazon’s 10-K lings; eMarketer.

A growing number of lawmakers are moving to do just

that.

2

A 15-month investigation by the House Judiciary

Committee concluded that Amazon “has monopoly power

over many small- and medium-sized businesses.”

3

It called

for breaking up the company by separating its major

business lines into stand-alone rms and regulating its

online marketplace to ensure that sellers are treated fairly.

Both Democrats and Republicans have voiced support for

these measures.

4

As lawmakers have grown increasingly serious about

addressing Amazon’s harms, Amazon has sought to portray

itself as benecial to independent small businesses.

5

In

splashy campaigns, press releases, and lobbying at the

Capitol, Amazon contends that it has “a mutually benecial

relationship” with the small businesses that depend on its

platform, that these businesses are “thriving,” and that “our

interests are well aligned.”

6

Small business owners themselves tell a very different

story. In a 2019 survey, three-quarters of independent

retailers ranked Amazon’s dominance as a major threat to

their survival, and only 11 percent of those selling on its

site described their experience as successful.

7

It’s not only

retailers; small consumer product manufacturers, book

publishers, and other creators are also imperiled. All of

Amazon Small Business Fact Sheet

2

WWW.ILSR.ORG

Amazon Small Business Fact Sheet

“When you are small,

someone else that is bigger can

always come along and take away

what you have.”

— JEFF BEZOS, FOUNDER AND CEO OF AMAZON

14

v Amazon steals independent businesses’ best ideas and

innovations.

While Amazon touts sellers as “partners” in public, within the

company, it refers to them as “internal competitors.”

15

Both

the House investigation and reporting by the Wall Street

Journal have found that Amazon has spied on sellers and

appropriated data about their sales, costs, and suppliers.

It’s then used this information to create its own competing

versions of their products, often giving its versions superior

placement in the search results.

16

Amazon has also been

caught using its venture capital fund to invest in startups,

only to steal those startups’ ideas and create rival products

and services. In some cases, “Amazon’s decision to launch

a competing product devastated the business in which

it invested.”

17

these small businesses are trapped in Amazon’s monopoly

gambit: the tech giant controls access to the online market,

which leaves them little choice but to sell on its platform. Yet

doing so allows Amazon, also their competitor, to exploit

and undermine them.

As Amazon has grown, the number of independent

businesses has fallen. Between 2007 and 2017, the number

of small retailers fell by 65,000.

8

About 40 percent of the

nation’s small apparel, toy, and sporting goods makers

disappeared, along with about one-third of small book

publishers.

9

(Small is dened here as under 500 employees.)

This factsheet details the specic ways in which Amazon

abuses its market dominance to hurt smaller competitors.

v Amazon has cornered the online market, impeding the

ability of small businesses to operate independently

and blocking them from having direct relationships

with their customers.

A majority of shoppers looking to buy something online

begin their search on Amazon, and its site captures about

50 percent of online spending in the U.S.

10

This dominance

allows Amazon to function as a gatekeeper: retailers and

brands must sell on its site to reach much of the online market.

This dependence is risky and leaves many businesses living

in fear. Changes to Amazon’s search algorithms or selling

terms can cause their sales to evaporate overnight. Amazon

also makes it hard for sellers to reduce their dependence

on its platform, in part by making their brand identity

almost invisible to shoppers and preventing them from

building relationships with their customers. Amazon strictly

limits contact between sellers and customers.

11

In April

2021, it implemented a new policy that blocks most sellers

from even seeing the names and addresses of the people

buying their products.

12

“If the customer is on Amazon,

as a small business you have to say,

‘That is where I have to go.‘ Otherwise,

we are going to close our doors.”

— CHRIS LAMPEN-CROWELL, OWNER OF

GAZELLE SPORTS IN GRAND RAPIDS, MICHIGAN

13

The Institute for Local Self-Reliance is a national research

and advocacy organization working to reverse the

concentration of corporate power and build thriving,

equitable communities.

SIGN UP FOR OUR NEWSLETTER:

hometownadvantage.org

3

Amazon Small Business Fact Sheet

WWW.ILSR.ORG

“It’s not a comfortable feeling knowing that

[Amazon has] people internally specically

looking at us to compete with us.”

– TRAVIS KILLIAN, CEO OF UPPER ECHELON, A HOME GOODS

MANUFACTURER IN AUSTIN, TEXAS, THAT SELLS ON AMAZON’S SITE

18

v Amazon compels sellers to buy its warehousing and

shipping services, even though many would get a better

deal from other delivery providers.

Amazon has made a seller’s ability to generate sales on its

site largely contingent on purchasing its warehousing and

shipping services (“Fulllment By Amazon” or FBA). Sellers

who subscribe to FBA are favored by Amazon in two ways:

they’re allowed to add the Prime badge to their products

and they’re signicantly more likely to be chosen by the

site’s algorithm as the default seller of a product (known

as “winning the buy box”).

19

Both are crucial to generating

sales. By making FBA all but mandatory, Amazon has built

a massive logistics business on the backs of independent

businesses who would, in many cases, prefer to use another

carrier. “I’d recommend Amazon if they were really good

on price, but they’re not. If it weren’t for the algorithm…

FBA wouldn’t be attractive,” according to Matthew White, a

logistics consultant for e-commerce companies.

20

If you “actually add up all the ways

Amazon nickels and dimes you…

you can’t make money.”

— DOUG MRDEZA, FOUNDER OF TOP SHELF BRANDS,

AN E-COMMERCE SELLER IN MICHIGAN

21

v Amazon imposes high fees on sellers, putting them at

risk of going under.

Through the fees it charges sellers, Amazon keeps an

average of 30 percent of each sale independent businesses

make on its site, up from 19 percent in 2014.

22

Amazon has

extracted more from sellers in part by making it harder for

them to generate sales unless they purchase additional

Amazon services, including shipping and advertising.

Amazon’s revenue from seller fees soared to $60 billion

in 2019 and has grown so large that “sellers are effectively

cross-subsidizing Amazon’s retail division.”

23

These high

fees make it nearly impossible to sustain a protable

business. Because of the rising cost of these monopoly tolls,

“the vast majority of those who start selling on Amazon’s site

fail within a few years.”

24

v Amazon blocks independent businesses from offering

lower prices on other sites.

Under scrutiny from members of Congress, Amazon in 2019

eliminated clauses in its contracts that barred third-party

sellers from offering their goods for less on rival shopping

sites.

25

But Amazon continues to indirectly enforce this

rule through its “Fair Pricing Policy.”

26

If Amazon’s pricing

bots detect that a seller is offering a lower price elsewhere,

Amazon suppresses the seller’s sales by demoting the item

in search results, so that customers are unlikely to see it,

or making the seller ineligible to win the buy box.

27

These

actions invariably cause sales to crater. As a result, even

though it may cost less to sell on competing sites, sellers

can’t lower their prices below Amazon’s, on any platform.

This insulates Amazon from competition and preserves its

dominance.

v Amazon shuts down small businesses without due process.

Despite small businesses’ reliance on Amazon’s platform

to reach customers, Amazon routinely suspends sellers’

accounts and seizes their inventory and cash balances.

28

These actions are often abrupt and arbitrary, and can

be catastrophic, costing sellers enormous sums in lost

merchandise and receivables. Sellers have little recourse.

It can take weeks or months for Amazon to respond to

complaints of mistaken or inappropriate suspensions.

29

Sellers who attempt to recover their losses or get their

accounts reinstated must go through an arbitration process;

4

Amazon Small Business Fact Sheet

WWW.ILSR.ORG

Amazon’s standard contract bars them from pursuing legal

action. As the House Judiciary Committee’s investigation

found, “the [arbitration] process is unfair and unlikely to

result in a meaningful remedy.”

30

Evidence collected during

the investigation showed that “Amazon’s poor treatment of

sellers is far from an isolated incident.”

31

“I paid that bribe [to Amazon]

and the books reappeared.”

— DENNIS JOHNSON, CO-OWNER OF MELVILLE HOUSE,

A BOOK PUBLISHER IN BROOKLYN, N.Y.

32

v Amazon sells goods and services below cost to harm

rivals and take market share.

Amazon has consistently engaged in predatory pricing

— selling products and services below cost to kill off

competitors and expand its market share.

33

During its

rst six years, Amazon lost billions of dollars selling books

below cost, a strategy that drove many bookstores out

of business.

34

Amazon has also used predatory pricing

to eliminate e-commerce rivals. It reportedly lost $150

million selling shoes below cost in a successful bid to

compel Zappos to agree to a merger.

35

Similarly, it clocked

hundreds of millions of dollars in losses selling diapers

below cost to destabilize Diapers.com and force it into a

merger.

36

Amazon has also incurred strategic losses to keep

customers locked into Prime and thus wed to its shopping

platform. It has lost as much as $700 million a year on

Prime Video, for example.

37

Amazon initially nanced its

predatory pricing schemes through a tacit agreement with

investors, who accepted little or no prot in exchange for

rapid market share growth.

38

More recently, it’s been able to

cross-subsidize losses by tapping into the high prots of its

cloud division, Amazon Web Services. In 2020, 59 percent

of Amazon’s operating income came from AWS.

39

v Amazon strong-arms small brands, destabilizing their

businesses and making it harder for them to grow and

develop new products.

As Amazon muscles competing retailers out of the market,

small manufacturers are left with fewer channels through

which to market and sell their products. This gives Amazon

even more leverage to extract price concessions and

special terms from them. Those who do not comply can

face ruinous retaliation. When the book publisher Melville

House declined Amazon’s demand for steeper discounts,

for example, Amazon removed the buy button from all of

its titles, causing a devastating drop in sales.

40

Similarly, the

phone accessory-maker PopSockets reported having to

buy nearly $2 million in advertising from Amazon before

the tech giant would rid its platform of counterfeit versions

of PopSockets’ products.

41

As Amazon eeces producers,

these companies are left with less revenue to invest in

developing new products and growing their businesses.

“If you can’t make any money, it takes away invention and

innovation,” an executive at a sporting goods company

explained.

42

“There’s a whole class of businesses out

there who live in fear of going out of

business as a result of the at of Amazon

and their algorithms.”

— AN ANONYMOUS THIRD-PARTY SELLER IN AN

INTERVIEW WITH THE SEATTLE TIMES

43

Credit: Marie Donahue

5

Amazon Small Business Fact Sheet

WWW.ILSR.ORG

Congress Needs to Break Up

Amazon Along Business Lines and

Set Standards of Fair Dealing for

Its Marketplace

Congress shouldn’t let Amazon dictate whether and how

small businesses can compete online. If policymakers

do not act to check Amazon’s outsized power, they’re

effectively allowing Amazon to be a private regulator of

the online market, deciding which businesses may reach

customers and the price they must pay to do so.

To restore an open, competitive online market,

policymakers must:

1. Break up Amazon along its major lines of business.

Amazon derives much of its power to bully and exploit

independent businesses from its integration across busi-

ness lines and the fact that it plays multiple roles in markets.

This allows it to leverage its dominance in one area to

gain an advantage in others: It uses its power as an online

marketplace to grow its logistics business, force conc-

essions from suppliers to its retail division, and appropriate

seller data to inform development of its own products.

“Market participants that depend on Amazon’s retail

platform are effectively forced to accept its demands —

even in markets where Amazon would otherwise lack the

power to set the terms of commerce,” the House Judiciary

Committee’s investigation concluded.

44

In its report, the

committee called for breaking up the dominant tech rms

along business lines. By separating Amazon’s third-party

marketplace from its retail division, and spinning off its

cloud services and other major divisions into stand-alone

companies, policymakers could remove the incentive and

ability for Amazon to exploit its gatekeeper status to favor

its own interests and harm competition.

If policymakers do not act to check

Amazon’s outsized power, they’re effectively

allowing Amazon to be a private regulator

of the online market, deciding which

businesses may reach customers and the

price they must pay to do so.

2. Require dominant digital platforms to deal fairly with

the independent businesses that rely on them.

Breaking up Amazon and separating its major divisions into

new companies is essential to removing the underlying

conicts of interest and incentives to self-deal that drive

its anti-competitive and abusive behavior. But even as

stand-alone companies, dominant digital platforms, such

as Amazon’s retail marketplace, will still serve as critical

infrastructure for other businesses, much like railroad

and telephone lines. As such, these platforms should be

regulated in a similar fashion. Congress should enact

legislation requiring them to treat all sellers fairly and

on equal terms. Congress should also nullify contract

provisions that force sellers to accept mandatory arbitration

or other coercive terms for adjudicating disputes.

3. Block Amazon from engaging in abusive tactics by

making our antitrust laws stronger and easier to enforce.

In the 1980s, federal antitrust enforcement agencies and

the courts began to radically reinterpret our antitrust laws.

Judges set aside the concerns about outsized power that

had led Congress to pass these laws in the rst place and

instead oriented antitrust enforcement around the goal

of maximizing efciency. Under this framework, the courts

began to look favorably on consolidation and, through a

series of misguided rulings, made many antitrust violations

very difcult to prove. This fundamental shift allowed

Amazon to amass market power by engaging in anti-

competitive tactics, such as predatory pricing, that would

have been blocked in an earlier period. Congress should

restore the antitrust laws to their original strength and

purpose by enacting legislation that claries the intent of

these laws and sets clear, bright-line rules that prohibit anti-

competitive behavior and don’t allow judges to rewrite the

law. Doing so will make antitrust enforcement simpler, less

expensive, and more effective.

6

Amazon Small Business Fact Sheet

WWW.ILSR.ORG

1. “Public Support for Regulation of Big Tech: Analysis of Survey Findings,”

Lake Research Partners, Feb. 2021.

2. “Congress Is Leaning Towards a Big Tech Breakup,” Hal Singer, ProMarket,

Mar. 9, 2021.

3. “Investigation of Competition in Digital Markets,” U.S. House of

Representatives, Subcommittee on Antitrust, Commercial and

Administrative Law of the Committee on the Judiciary, 2020, at 15

[hereinafter, House Investigation].

4. For example, earlier this year, Republican Rep. Ken Buck, who is the

ranking member on the House Antitrust Subcommittee, speaking at

the Conservative Political Action Conference, said if “we break these

companies up,” it would help ensure that “Amazon can’t create a product

and compete with the company that is actually using Amazon.” (“Antitrust

at CPAC: Conservatives Debate Breaking Up Big Tech,” Jana Kasperkevic,

ProMarket, Mar. 2, 2021.) Similarly, the chair of the Subcommittee,

Democratic Rep. David Cicilline, speaking at a forum on antitrust policy,

said "How Amazon is working creates a tremendous amount of unfairness.

It fosters anticompetitive behavior, favors self-preferencing for their own

products. I think you either need to be a seller of goods and services

or you can control the marketplace — you cannot do both." ("Reining in

Monopoly Power: Small Businesses and the Push to Strengthen Antitrust

Laws,” event hosted by the Institute for Local Self-Reliance, Feb. 22, 2021).

5. “Making Ends Meet,” Politico (Amazon-sponsored advertorial), Nov. 20,

2020.

6. “Fringe Notions On Antitrust Would Destroy Small Businesses and Hurt

Consumers,” Politico (Amazon-sponsored advertorial), Oct. 2020.

7. “2019 Independent Business Survey,” Institute for Local Self Reliance, July

2019.

8. Data is from the U.S. Economic Census.

9. Ibid.

10. House Investigation at 254 and 256.

11. “Communication Guidelines,” Amazon Seller Central, https://sellercentral.

amazon.com/gp/help/external/G1701 (last visited May 12, 2021).

12. “Amazon-Fullled Shipments Report,” Amazon Seller Central, https://

sellercentral.amazon.com/gp/help/external/200453120 (last visited May

12, 2021).

13. “Amazon Doesn’t Just Want to Dominate the Market, It Wants to Become

the Market,” Stacy Mitchell, The Nation, Feb. 15, 2018.

14. The Everything Store: Jeff Bezos and the Age of Amazon, Brad Stone, New

York, N.Y.: Little Brown, 2013, at 52.

15. House Investigation at 16.

16. House Investigation at 274-282; “Amazon Scooped Up Data From Its Own

Sellers to Launch Competing Products,” Dana Mattioli, The Wall Street

Journal, April 23, 2020.

17. “Amazon Met With Startups About Investing, Then Launched Competing

Products,” Dana Mattioli and Cara Lombardo, The Wall Street Journal, July

23, 2020.

18. Op cit. “Amazon Scooped Up Data From Its Own Sellers to Launch

Competing Products.”.

19. “Amazon’s Monopoly Tollbooth,” Stacy Mitchell, Ron Knox and Zach

Freed, ILSR, July 28, 2020; “How Amazon Rigs Its Shopping Algorithm,”

Stacy Mitchell and Shaoul Sussman, ProMarket, Nov. 6, 2019; “How

Amazon Used the Pandemic to Amass More Monopoly Power,” Ron Knox

and Shaoul Sussman, The Nation, June 26, 2020.

20. Ibid at 8.

21. Ibid at 5.

22. Ibid at 3.

23. Ibid at 6.

24. Ibid at 3.

25. “Amazon silently ends controversial pricing agreements with sellers,”

Makena Kelly, The Verge, March 11, 2019. European regulators have also

concluded that Amazon’s “Most Favored Nation” pricing policies are

anti-competitive. See “Case AT.40153, E-Book MFNs and related matters

(Amazon),” Antitrust Procedure, European Commission Directorate

General for Competition, May 4, 2017.

26. “Amazon Marketplace Fair Pricing Policy,” available at https://sellercentral.

amazon.com/gp/help/external/G5TUVJKZHUVMN77V (last visited May

12, 2021).

27. “Amazon Squeezes Sellers That Offer Better Prices on Walmart,” Spencer

Soper, Bloomberg, Aug. 5, 2019; House Investigation at 295.

28. Statement of Stacy F. Mitchell, Co-Director, Institute for Local Self-Reliance,

Subcommittee on Antitrust, Commercial and Administrative Law of the

Committee on the Judiciary hearing on Innovation and Entrepreneurship,

July 16, 2019.

29. “Prime and Punishment: Dirty Dealing in the $175 Billion Amazon

Marketplace,” Josh Dzieza, The Verge, Dec. 19, 2018.

30. House Investigation at 272-273.

31. House Investigation at 271.

32. Op cit. “Cheap Words: Amazon is good for customers. But is it good for

books?”.

33. “Amazon’s Antitrust Paradox,” Lina Khan, Yale Law Journal, 2017.

34. “Amazon’s Stranglehold: How the Company’s Tightening Grip on the

Economy is Stiing Competition, Eroding Jobs, and Threatening

Communities,” Stacy Mitchell and Olivia Lavecchia, Institute for Local Self-

Reliance, at 15.

35. Op cit. “Amazon Doesn’t Just Want to Dominate the Market, It Wants to

Become the Market.”

36. House Investigation at 263.

37. “Amazon Prime Instant Video Is A Huge Loss Leader,” Adam Levy, The

Motley Fool, Feb. 22, 2017.

38. Op cit. “Amazon’s Antitrust Paradox.”

39. Amazon’s Annual Report, 2020.

40. “Cheap Words: Amazon is good for customers. But is it good for books?”

George Packer, The New Yorker, Feb. 17, 2014.

41. Testimony of David Barnett, founder and CEO of PopSockets LLC, to

House Judiciary Committee, Field Hearing on Online Platforms and

Market Power, Part 5, conducted January 17, 2020.

42. Op cit. “Amazon’s Stranglehold” at 28.

43. “Third-party sellers giving Amazon a huge boost,” Ángel González, Seattle

Times, May 31, 2016.

44. House Investigation at 379.

Notes