This is page i

Printer: Opaque

t

Solution M anual

G am e T heory: A n In trodu ction

Steve Tadelis

Jan uary 31, 2013

Th is is page ii

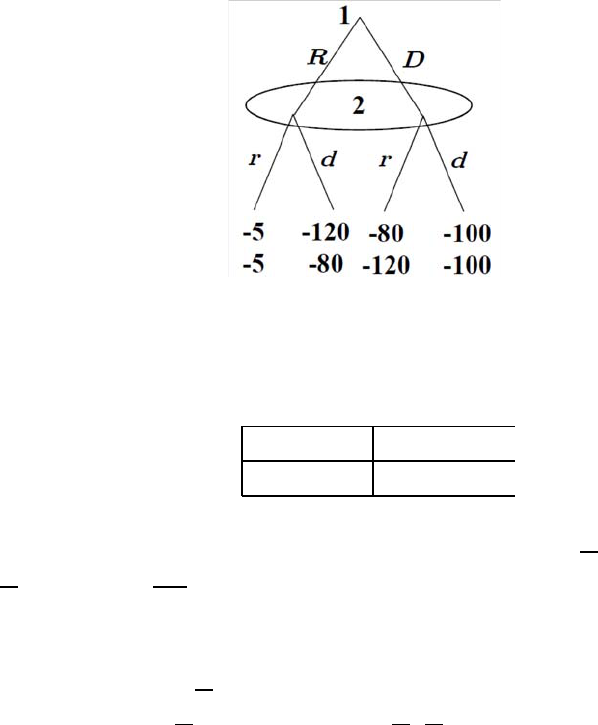

Printer: Opaque

t

ABSTRACT This Slution Manual is incomplete. It will be updated every 2-3 weeks

to add the solutions to problems as they become available. A complete version is

expected by March 15, 2013.

Th is is page iii

Printer: Opaque

t

C on ten ts

I R a tio n a l De c isio n Mak in g 2

1 The Single-P erson Decision Problem 3

2 Introducing Uncertain ty and T ime 13

II Static G ames of Complete Information 44

3Preliminaries 45

4 R a tio n a lity and Com mon Knowledge 51

5 P in n in g Down Beliefs: Nash Equ ilibrium 61

6 Mixed Strategies 95

Contents 1

III Dynamic Games of Complete Information 113

7 Preliminaries 115

8 Credibility and Sequen tial Rationalit y 133

9 M ulti-Stage Games 163

10 Repeated G am es 179

11 Strategic B argaining 197

IV Static Gam es of Incomplete Information 206

12 Ba yesian Game s 207

13 Auctions and Com petitiv e Bidding 215

14 Mechanism Design 221

V Dynamic Gam es of Incomplete Information 222

15 Sequen tial Rationalit y with Incomplete Information 223

16 Signaling Games 231

17 Building a Reputation 239

18 Information Transm ission and Cheap Talk 243

Part I

R ational De cision M aking

2

This is page 3

Printer: Opaque

t

1

The Single-P erson D ecision P roblem

1. Think of a simple decision y ou face regularly and formalize it as a decision

problem , carefully listing the actions and outcomes withou t the preference

relation. Then, assign payoffs to the outcom es, and dra w the decision tree.

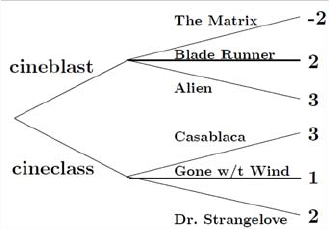

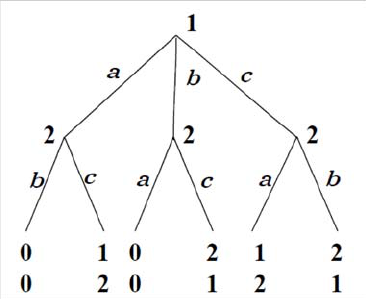

2. Going to the Movies: There are two movie theatres in you r neighbor-

hood: Cineclass, which is located one mile from yo ur home, and Cineblast,

located 3 miles from you r home, eac h showing three films.Cineclassisshow-

ing Casablanca, Gone with the Wind and Dr. Str angelove, while Cineblast

is show ing The Matrix, Blade Runner and Aliens. Your problem is to decide

which movie to go to.

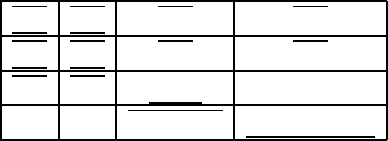

(a) Dra w a decision tree tha t represents this problem without assigning

pa y off values.

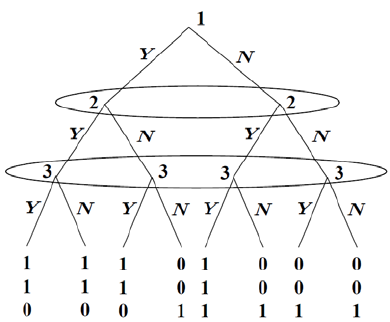

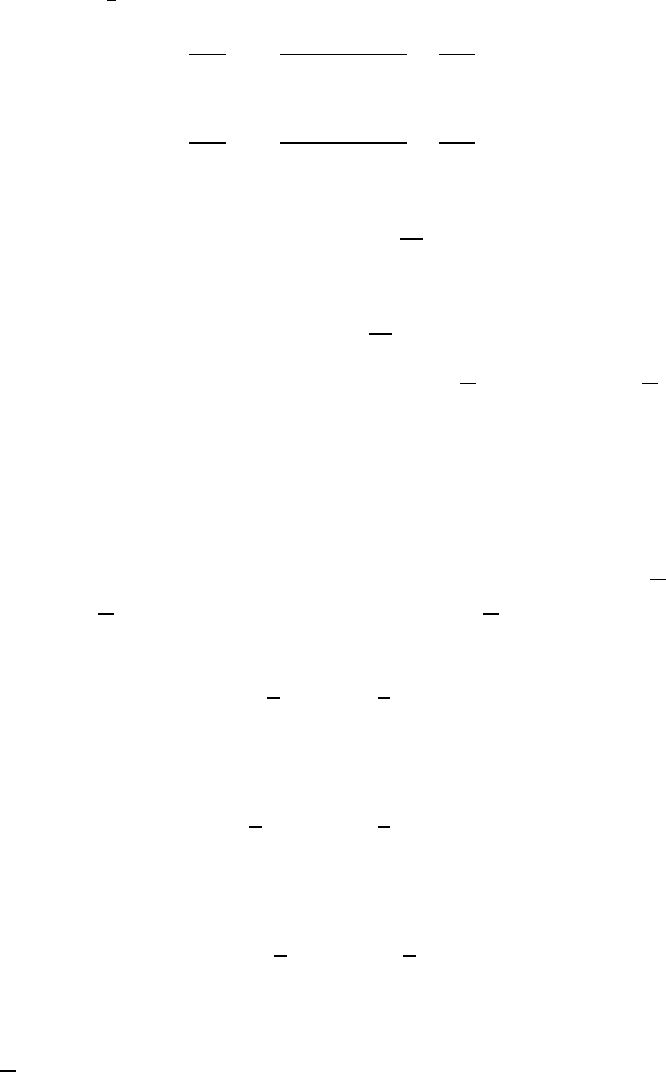

Answ er:

4 1. The Single-Person Decision Problem

¥

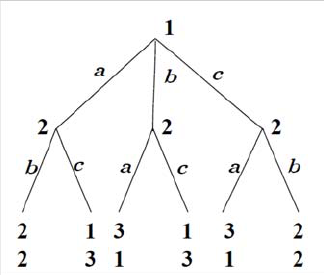

(b) Imagine that you don’t care about distance and that y our preferences

for movies is alphabetic (i.e., y ou like Aliens the most and The Matrix

the least.) U sin g payoff values 1 throug h 6 complete th e decision tree

y ou drew in part (a). What option wou ld y ou choose?

Answ er:

¥

(c) Now ima gin e tha t you r car is in the shop , and the cost of walk in g each

mile is equal to one unit of pay off.Updatethepayoffs in the decision

tree. Would y our c hoice change?

Answ er:

1. The Single-Person Decision Problem 5

¥

3. Fruit or Candy: A banana costs $050 and a candy costs $025 at the local

cafeteria. You have $1.25 in your pocket and y ou value money. The money-

equivalent value (payoff) you get from eating y our first banana is $1.20, and

that of each additiona l banana is half the previous one (the second banana

gives y ou a value of $0.60, the third 0.30, etc.). Similarly, the pa y off you get

from eating your first candy is $0.40, and that of eac h additional candy is

half the previous one ($0.20, 0.10, etc.). Your value from eating bananas is

not affected by ho w ma ny candies you eat and vice v ersa.

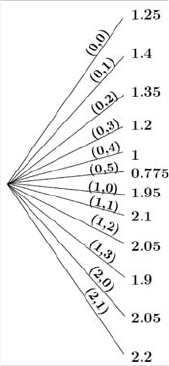

(a) What is the set of possible actions you can tak e given your budget of

$1.25?

Answ er: You can buy any combination of bananas and candies that

sum up to no more than $1.25. If we denote by ( ) the choice to buy

bananas and cand ies, then the set of possible actions is

= {(0 0) (0 1) (0 2) (0 3) (0 4) (0 5) (1 0) (1 1) (1 2) (1 3) (2 0) (2 1)}

¥

(b) Dra w the decision tree that is associated with this decision problem.

Answ er: For each c hoice you need to calculate the final net value. For

example, if y ou buy one banana and 2 candies then y ou get 1.2 w orth

from the banana, 0.4 from the first candy an d 0.2 from the second which

totals 1.8. To this w e need to add the $0.25 you ha ve left (the cost was

only $1) so the net final v alue you hav e is 2.05.

6 1. The Single-Person Decision Problem

¥

(c) Should you spend all yo ur money at the cafeteria? Justify y our answ er

with a rational choice argum en t.

Answ er: Yes. The highest net final value if from buying two bananas

and one candy. ¥

(d) No w imagine that the price of a candy increased to $030.Howmany

possible actions do you have? Does your answer to (c) above chan ge?

Answ er: Of the 12 options above, three are no longer possible: (0 5) (1 3)

and (2 1).Also,thenetfinal values change because each candy is 5

cen ts more expensive. The highest net final value is 2.05 whic h can be

obtained from one of two choices: (1 1) and (2 0), both lea ving some

money in the decision maker’s poc ket. ¥

4. Alcohol Consumption: Recall the examp le in which you needed to choose

ho w m uc h to drink. Imagine that your payoff function is given by − 4

2

,

where is a parameter that depends on yo ur ph ysique. Ev ery person m ay

ha v e a different value of , and it is known that in th e population ()the

smallest is 02;() the largest is 6;and()largerpeoplehavehigher’s

than smaller people.

1. The Single-Person Decision Problem 7

(a) Can you find an am ount of drinking that no person should drink?

Answ er: The utilit y from drinkin g 0 is equal to 0. If a decision maker

drinks =2then, if he has the largest =6,hispayoff is =6× 2 −

4 × (2)

2

= −4 and it is easy to see th at decision m akers w ith smaller

values of will obtain an even more negativ e payoff from consuming

=2. Hence, no person should choose =2. ¥

(b) How much should y ou drink if yo u r =1?If =4?

Answ er: The optimal solu t i on is ob t ained b y maxi mizing the p ay off

function ()= − 4

2

.Thefir st-order maximization condition is

− 8 =0implyin g that =

8

is the optimal solution. For =1the

solution is =

1

8

and for =4it is =

1

2

. ¥

(c) Sho w tha t in general, smaller people should drink less than larger people.

Answ er: This fo llows from the so lution in part (b) a bo ve. For ev e ry

type of person , the solution is ()=

8

which is increasing in ,and

larger people ha ve higher values of ¥

(d) Should an y person drink more than one bottle of wine?

Answ er: N o. Ev en the largest type of person with =6should only

consume =

3

4

of a bottle of wine. ¥

5. Buying a Car: Youplanonbuyingausedcar.Youhave$12,000,andyou

arenoteligibleforanyloans.Thepricesofavailablecarsonthelotaregiven

as follo ws:

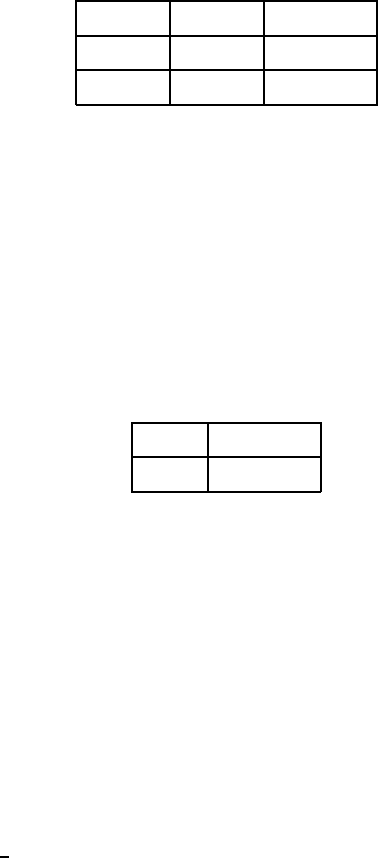

Make, Model & Year Price

To yota Corolla 2002 $9,350

Toyota Camry 2001 $10,500

Buick LeSabre 2001 $8,825

Honda Civic 2000 $9,215

Subaru Impreza 2000 $9,690

For any given year, you prefer a Ca m ry to an Impreza , an Im preza to a

Corolla, a Corolla to a Civic and a Civic to a LeSabre. For any given ye ar,

8 1. The Single-Person Decision Problem

you are willing to pay up to $999 to move form a car to the next preferred

car. For example, if the price of a Corolla is $, then you are willing to buy

it over a Civic if the Civic costs mo r e that $( − 999) but you w ould prefer

buy ing the Civic if it costs less than this amo u nt. Similarly, you prefer the

Civic at $ to a Corolla that costs more than $( + 1000) but y ou prefer the

Corolla if it costs less. For any given c ar,youarewillingtomovetoamodel

a year older if it is chea per b y at least $500 For example, if the price of a

2003 Civic is $, then you are willing to buy it o ver a 200 2 Civic if the 2002

Civic costs more that $( −500) but you would prefer buying the 2002 Civic

ifitcostslessthanthisamount.

(a) What is y our set of possible alternatives?

Answ er: Given that you have $12,000, w hich is m ore than the price

of any car, y ou have six alternativ es: any one of the five cars or buying

nothing. ¥

(b) Whatisyourpreferencerelationbetweenthealternativesin(a)above?

Answ er: To answer this we need use the information on willingness to

pay giv en in the question, together with the prices. The least valued

car w ould be a 2000 LeSabre. Assum e that the value of ow ning that car

is given by . From the information above, a 2000 Civic is valued at

+999, a 2000 Corolla is valued at +1 998,andsoonuptoa2000

Camry valued at +3 996. Similarly, eac h of these ca rs for the year

2001 is valued at 500 m ore than the 2000 model, and the 20 02 model

is valued at 1,000 more than the 2000 model. Hence, w e can write the

tableofvaluesasfollows:

Make and Model year 2000 y ear 2001 year 2002

Toyota Camry +3 996 +4 496 +4 996

Subaru Impreza +2 997 +3 497 +3 997

Toyota Corolla

+1 998 +2 498 +2 998

Hond a Civic +999 +1 499 +1 999

Buick LeSabre +0 +500 +1 000

1. The Single-Person Decision Problem 9

Now, to see what the net value from eac h purchase would be w e must

deduct the price of the car from the value. Using the five prices given

aboveandthevalueswejustcalculatedwehavenetpayoffsas(e.g.,for

the 2002 Corolla, the net pa yoff is +2 998 − 9 350 = − 6 352),

Make, Model & Year Price

Toyota Corolla 2002 − 6 352

Toyota Camry 2001 − 6 004

Buick LeSabre 2001 − 8 325

Honda Civic 2000 − 8 216

Subaru Impreza 2000 − 6 693

Assum ing that is large enough to wan t to buy any car, the ranking

of the alternativ es is, Toyota Camry 2001, followed b y To yota Corolla

2002, followed by Subaru Impreza 2000, followed by Honda Civic 2000

and last being the Buic k LeSab re 2001. ¥

(c) Dra w a decision tree an assign payoffs to the terminal nodes associated

with the possible alternativ es. Wh at would y o u c h oose?

Answ er: This follow s directly from th e analy sis in (b) abo ve: you shou ld

c hoose the Toyota Camry 2001 (with six branches, including no pur-

chase.) ¥

(d) Can you dra w a decision tree with different pa yoffs that represents the

same pro blem ?

Answ er: Because w e left as undetermined, w e can find many v alues

of that will represen t this problem. Notice that if is small enough

(less than 6,004) then the best choice w o uld be not to buy a car. ¥

6. Fruit Trees: You h ave room for up to t wo fruit bearing trees in your gar de n.

The fruit trees that can grow in y our garden are either apple, orange or pear.

The cost of maintenance is $100 for an ap ple tree, $70 for an orange tree and

$120 for a pear tree. Your food bill w ill be reduced b y $130 for each apple

tree you plant, b y $145 for each pear tree you plan t and b y $90 for eac h

10 1. The Single-Person Decision Problem

orange tree you plant. You care only about your total expenditure in makin g

any planting decisions.

(a) What is the set of possible actions and related outcomes?

Answ er: Youhavetwo“slots”thatcanbeleftempty,orhaveoneof3

possible trees plan ted in eac h slot. Hence, you have 10 possible c h oices.

1

Theoutcomeswilljustbethechoicesofwhattoplant.¥

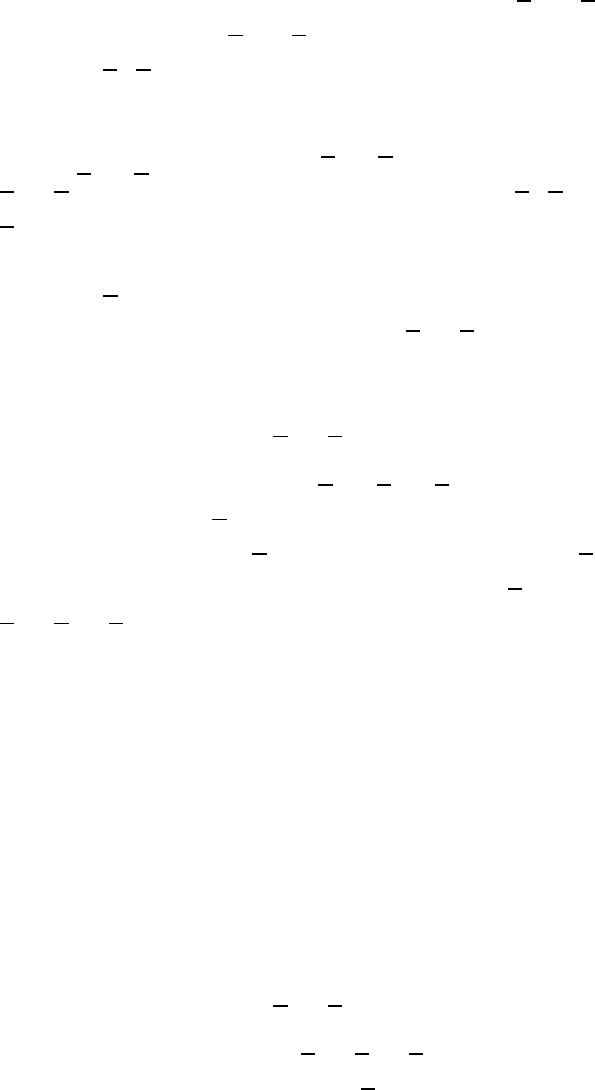

(b) What is the pa yoff of eac h action/outcome?

Answ er: To calculate the pay offsfromeachchoiceitisconvenientto

useatableasfollows:

Choice cost food sa vings net pa yoff

nothing 00 0

one apple tree 100 130 30

one orange tree 70 90 20

one pear tree 120 145 25

t wo ap ple trees 200 260 60

t wo orange trees 140 180 40

t wo pear trees 240 290 50

apple and orange 170 220 50

apple and pear 220 275 55

pear and orange 190 235 45

(c) Which actions are dom ina ted?

Answ er: All but choosing t wo apple trees are dominated. ¥

(d) Dra w the associated decision tree. What will a rational play er choose?

Answ er: Thetreewillhavetenbrancheswiththepayoffs associated

with the table abo ve, and the optim al c ho ice is two apple trees. ¥

1

Th is is a pro be m o f cho o sing 2 items out of 4 poss ib i litie s wit h rep la ce ment, wh ich i s equ a l to

4+2−1

2

=

(4+2−1)!

2!(4−1)!

=

5×4

2

=10.

1. The Single-Person Decision Problem 11

(e) Nowimaginethatthefoodbillreductionishalfforthesecondtreeof

thesamekind(youlikevariety).Thatis,thefirst apple still reduces

y o u r food bill by $130, but if y o u plan t t wo apple trees y o u r food bill

will be reduced b y $130 + $65 = $195. (Similarly for pear and orange

trees.) What will a rational player choose now?

Answ er: An ap ple tree is still the best ch oice for the first tree, but no w

thesecondtreeshouldbeapeartree.¥

7. City P arks: A city’s mayor has to decide how much money to spend on

parks and recreation. City codes restrict this spending to be no more than

5% of the budget, and the yearly budget of the city is $20,000,0 00. He wants

to please his constituen ts who ha v e diminishing returns from parks. The

money-equivalen t benefitfromspending$ on parks is ()=

√

400 −

1

80

.

(a) What is the action set of the city’s mayor?

Answ er: The lim it on spendin g is $1 million, so the actions set is

∈ [0 1000000]. ¥

(b) Ho w m uch should the mayor spend?

Answ er: The maximizat ion prob lem is

max

∈[01000000]

√

400 −

1

80

and taking the der ivativ e for the first-order condition we obtain,

10

√

−

1

80

=0,

or =$640 000. T he second order d erivative is −5

−

3

2

0 so this is

indeed a maximum. ¥

(c) The mo vie A n Inc onvenient Truth has shifted public opinion and no w

people are mor e willing to pay for parks. The new pr eferences of the

people are giv en by ()=

√

1600 −

1

80

.Whatnowistheactionset

12 1. The Single-Person Decision Problem

of the ma yor, and ho w much spending should he choose to cater to his

constituents?

Answ er: The first-ord er condition is now,

20

√

−

1

80

=0,

or =$2 560 000. This exceeds the budget and hence the optim al

solution is to spend $1 million. ¥

This is page 13

Printer: Opaque

t

2

Introdu cing U ncerta in t y a nd T im e

1. Getting an MB A : Recall the decision problem in Section 2.3.1, and now

assum e that the probabilit y of a strong labor market is ,ofanaveragelabor

marketis0.5andofaweaklabormarketis05 −. All the other values are

the same.

(a) For which values of willyoudecidenottogetanMBA?

Answ er: The expected pay offsfromeachchoicearegivenby,

(Get MBA)= × 22 + 05 × 6+(05 − ) × 2=20 +4

(Don’t get MBA)= × 12 + 05 × 8+(05 − ) × 4=8 +6

which imp lies that getting an MBA is worthw hile if and only if

20 +4≥ 8 +6

or, ≥

1

6

¥

(b) If =04, what is the highest price the univ ersity can charge for you

to be willing to go ahead and get an MB A ?

14 2. Introducing Uncertainty and Time

Answ er: If =04 then the pa yoffsare,

(Get MBA)=04 × 22 + 05 × 6+01 × 2=12

(Don’t get MBA)=04 × 12 + 05 × 8+01 × 4=92

which implies that an extra charge of up to 2.8 can be c h arged by the

university and y ou wo uld still be willing to get an MB A . ¥

2. Recreation Ch oices: A player has three possible ven ues to c hoose from:

going to a football game, going to a bo xing mat ch, or going for a hik e.

The pay off from each of these alternatives will depend on the weather. Th e

following table gives the agent’s pa yoff in eac h of the two re levant w ea ther

ev ents:

Alternative pay off if R ain payoff if Shine

Football game 1 2

Bo xing Match 3 0

Hike 0 1

For Let denote the probability of rain.

(a) Is there an alternative that a rational pla yer will nev e r take regardless

of ? (i.e., it is dom ina ted for any ∈ [0 1].)

Answ er: For this decision maker c hoosing the hike is always w orse

(dominated) by going to the football game, and he should never go on

ahike.¥

(b) What is the optima l decision, or best response, as a function of .

Answ er: The expected payoffs from eac h of the remain ing two c h oices

are giv en by,

(Football)= × 1+(1− ) × 2=2−

(Boxing)= × 3+(1− ) × 0=3

which implies that football is a better choic e if and only if

2 − ≥ 3

2. Introducing Uncertainty and Time 15

or, ≤

1

2

, and boxin g is better otherwise. ¥

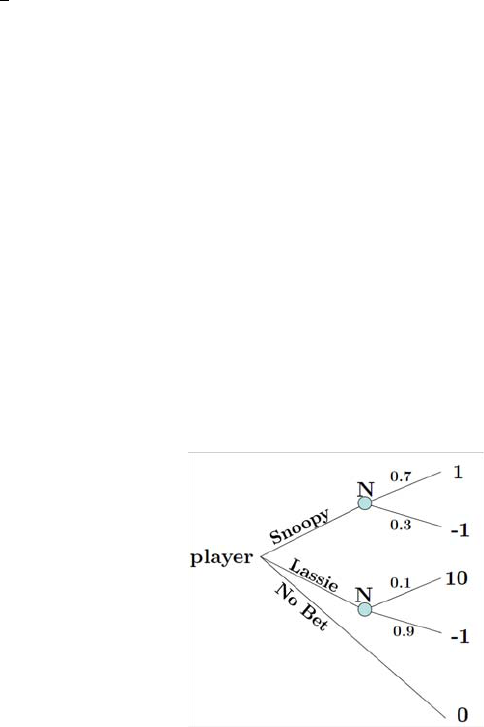

3. At the Dog Races: You’re in Las Vegas, and you can decide what to do at

the dog-racing bet room. You can c hoose not to participate, or you bet on

one of t wo dogs as follo w s. Betting on Snoopy costs $1, and y ou will be paid

$2 if he wins. Betting on Lassie costs $1, and you will be paid $11 if she wins.

You believe that Snoop y has probab ility 0.7 of winnin g and that Lassie has

proba bility 0.1 of winn ing (there are other dogs that you are not considerin g

betting on). Your goal is to maximize the expected monetary return of your

action.

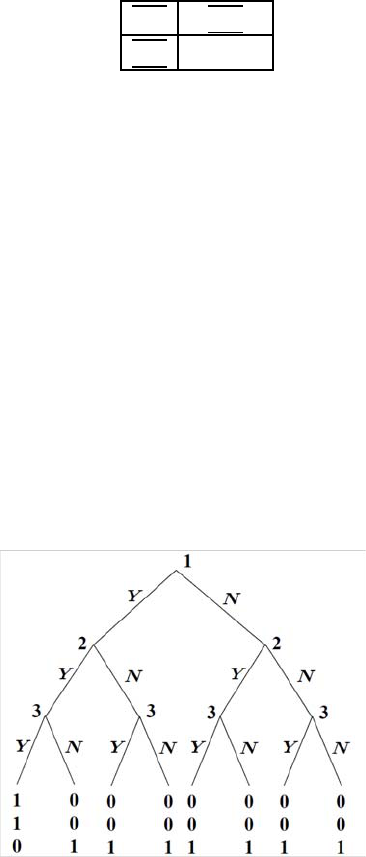

(a) Dra w the decision tree of this problem.

Answ er:

(b) What is your best course of action, and wh at is your expected value?

Answ er: The expected payoff from betting on Snoopy is 07−03=04

while betting on Lassie yields 1 −09=01, so betting on Snoop y is the

best action. ¥

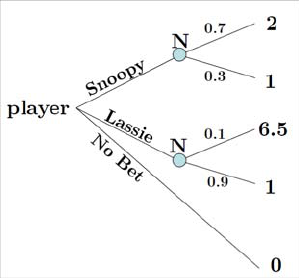

(c) Someone com es an d offersyougambler’santi-insurancetowhichyou

can agree or not. If you agree to it, you get paid $2 up front and y ou

agree to pa y back 50% of any winnings you receive. Draw the new de-

cision tree, and find the optimal action.

16 2. Introducing Uncertainty and Time

Answ er:

The best action is still to bet on Snoopy with an expected payoff of 1.7

v e rsu s 1.55 from betting on Lassie. ¥

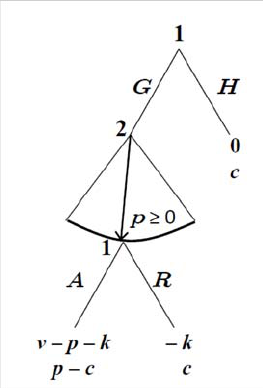

4. Dr illin g for Oil: An oil dr illing com p any m u st decide whether or not t o

engag e in a new drilling activit y before regulators pass a la w tha t bans drillin g

at that site. The cost of drilling is $1,000,000. After drilling is complet ed and

the drilling costs are incurred, then the com pa ny will learn if there is oil or

not. If there is oil, operating profits generated are estimated at $4,000,000.

If there is no oil, there will be no future profits.

(a) Using to denot e the likelihood that drilling results in oil, dra w th e

decision tree of this problem.

Answ er: Two decision br a nches: drill or n ot drill. Following drilling,

Nature c hooses oil with probabilit y ,withthepayoff of $3 million (4

minus the initial investment). With p rob ab ility 1 − Nature ch ooses

no-oil with a pa y off $ − 1 million. ¥

(b) The company estima tes that =06. What is the expected value of

drilling? Sho u ld the comp any go ahead and drill?

Answ er: The expected pa yoff (in millio ns ) from drilling is × 3 −(1 −

) × 1=4 − 1=06, which means that the company should drill. ¥

(c) To be on the safe side, the company hires a specialist to come up with a

more accurate estimate of . What is the minimum vale of for wh ich

2. Introducing Uncertainty and Time 17

it w ou ld be the company’s best response to go ahead and drill?

Answ er: Th e minimum value of for whic h drilling causes no expected

loss is calculate d by solving × 3 − (1 − ) × 1 ≥ 0,or ≥

1

4

¥

5. Discount Prices: A local department store puts out products at an initial

price, and ev ery week the product goes unsold, its price is discoun ted by

25% of the origin al pr ice. If it is not sold a fte r 4 w ee ks, it is sent bac k t o

the r egiona l wa rehou se. There is a set of bu tcher kniv es that was just put

out for the price of $200. Your willingness to pa y for the knives (your dollar

value) is $180, so if you buy them at a price ,yourpayoff is =180− .

If you don’t buy the knives, the c han ces that they are sold to someo ne else

conditio nal on not selling in the week before are giv en in the follo w in g table:

week 1 0.2

week 2 0.4

week 3 0.6

week 4 0.8

For example, if y ou do not buy it during the first t wo weeks, the likelihood

that it is a vailable at the beginning of the third w eek is the likelih ood that

it does not sell in either weeks 1 and 2, which is 08 × 06=048.

(a) Drawyourdecisiontreeforthe4weeksaftertheknivesareputoutfor

sale.

Answ er: We can draw each week as having nature mo ve first to deter-

mine whether someone else bought the kniv es, and if they did not, then

our pla yer can buy or w ait. The tree therefore will be,

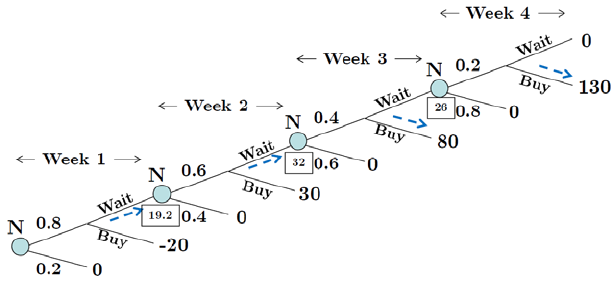

18 2. Introducing Uncertainty and Time

where the numbers in the squares next to Nature’s nodes mark the ex-

pected value from c h oosing w ait before tha t node. ¥

(b) A t the beginning of which w eek, if any, should you run to buy the

knives?

Answ er: We solve this bac kward. In week 4 the player will buy the

knives of they are there. Waiting in w eek 3 gives an expected payoff

of only 02 × (180 − 50) = 26, while buying in w eek 3 gives a pa yoff of

180−100 = 80 26, so buying in w eek 3 beats wa iting. Moving back to

week 2, waiting giv es an expected payoff of 04 × 80 = 32 while buying

yields 180−150 = 30 32 so waiting beats buying, and moving back to

w eek 1 mak es waiting ev en more valuable compared to buying (buying

in w e e k 1 is dominated by not bu y ing. Hence, the player will wai t till

week 3 and then try to buy the kniv e s. ¥

(c) Find a willingn ess to pay for the knives tha t w o u ld make it optim al to

buy at the beginning of the first week.

Answ er: Waiting is risky so intuitively, to make an early p u rchase

valuable, the willingn ess to pay must be very high. Set the willingness

to pa y at 1000. In week 4 the pla yer will buy the kniv es. Waiting in w eek

3yields02 × (1000 − 50) = 190, while buying in week 3 give s a payoff

of 1000 − 100 = 900 190, so buying in w eek 3 beats w aiting. Mo ving

back to w eek 2, waiting gives an expected payoff of 04×190 = 76 while

buying yields 1000 − 150 = 850 76 so buying beats w aiting. Moving

2. Introducing Uncertainty and Time 19

back to week 1, w aiting gives an expected pa yoff of 06 × 850 = 510

wh ile buying yields 1000 −200 = 800 510 so buying in the first w eek

is the optim a l decision. ¥

(d) Find a willingn ess to pay that would make it optima l to buy at the

beginning of the fourth w eek.

Answ er: Similarlyto(c)above,tomakealatepurchasevaluable,the

willing nes s to pay m ust be quite lo w. Set the willingn ess to pa y at 100.

In any wee k but we ek 4 the price is above the willingne ss to pay, so the

optim al decision is to wait for we ek 4 and then buy the kniv es if they

are a vailable. ¥

6. Real Estate Developm ent: A real estate dev eloper wishes to build a new

dev elopment. Regulations impose an en vironmen tal impact study that will

yield an “imp act score,” whic h is an index n umber based on the impact the

developm e nt will likely have on traffic, air qualit y, sew age and water usage,

etc. The developer, w ho has lots of experience, knows that the score will

be no less than 40, and no m ore than 70. Furthermore, he knows th at any

score between 40 and 70 is as likely as any other score bet ween 40 and 70

(use continuous values ). The local go vernment’s past behavior implies that

there is a 35% chance that it will approve the development if the impact

score is less than 50, a 5% chance that it will approve the dev elopmen t if

the score is bet ween 50 and 55, and if the score is greater than 55 then the

project will surely be halted. The v alue of the developmen t to the devel-

oper is $20,000,000. Assuming that the developer is risk neutral, what is the

maxim u m cost of the impact study suc h that it is still w orth while for the

dev eloper to have it conducted?

Answ er: Observ e that there is a

1

3

probability of getting a score between

40 and 50 giv en that 40 to 50 is one-th ird of the range 40 to 70. There is

a

1

6

proba bility of getting a score bet ween 50 and 55 giv en that 50 to 55 is

one-sixth of the range 40 to 70. Hence, the expected value of doing a study

20 2. Introducing Uncertainty and Time

is

1

3

× 35 × $20 000 000 +

1

6

× 05 × $20 000 000 +

1

2

× 0 × $20 000 000

=$2 500 000

Hence, the most the dev eloper should pa y for the study is $2,500,000. ¥

7. Toys: WakTek is a renowned man ufactu rer of electronic to ys, with a spe-

cialty in r emote-controlle d (RC) miniature vehicles. WakTek is consid erin g

the introduction of a new product, an R C Ho vercraft called WakA tak. Pre-

liminary designs ha v e already been produced at a cost of $2 million. To

introduce a marketable product requires the building of a dedicated product

lineatacostof$12 million. Also, before the product can be launc hed a pro-

tot y pe need s to be built and tested for safety. The prototy pe can be crafted

ev en in the absence of a production line, at a cost of $05 million, but if the

prototype is built after the production line then its cost is negligible.

1

There

is uncertaint y over what safety rating WakAtak will get. This could have a

large impact on demand, as a lower safet y-rating will increase the minimum

age required from users. The safety-testing costs $1 million. The outcome of

the safet y-test is estimated to ha ve a 65% c h ance of resulting in a minimum

age of 8 years, a 30% c han ce of m inimum age 15 years, and a 5% chance of

being declared unsafe in whic h case it could not be sold at all. (The cost of

improving the safety status of a finished design is deem ed prohibitive.) Af-

ter successful safety-testing the product could be launched at a cost of $15

million .

There is also uncertaint y o ver demand, which will have a crucial impact on

the ev entual profits. Currently the best estimate is that the finished product,

if available to the 8 − 14 demographic, has a 50 − 50 c han ce of resulting in

profits of either $10 million or $5 million from that demographic. Similarly

there is a 50−50 ch ance of either $14 million or $6 million profitfromthe15-

or-above demo grap hic. These dem an d outcom e s are independent across the

demographics. The profits do not take into account the costs defined abo v e;

1

“Negligible” mean s you can treat it as zero.

2. Introducing Uncertainty and Time 21

they are measured in expected present-value terms so they are directly com-

parable with the costs.

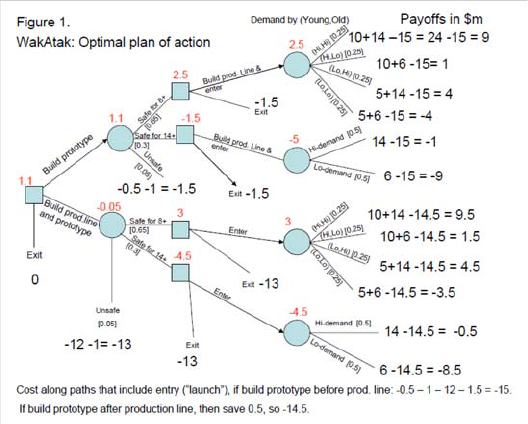

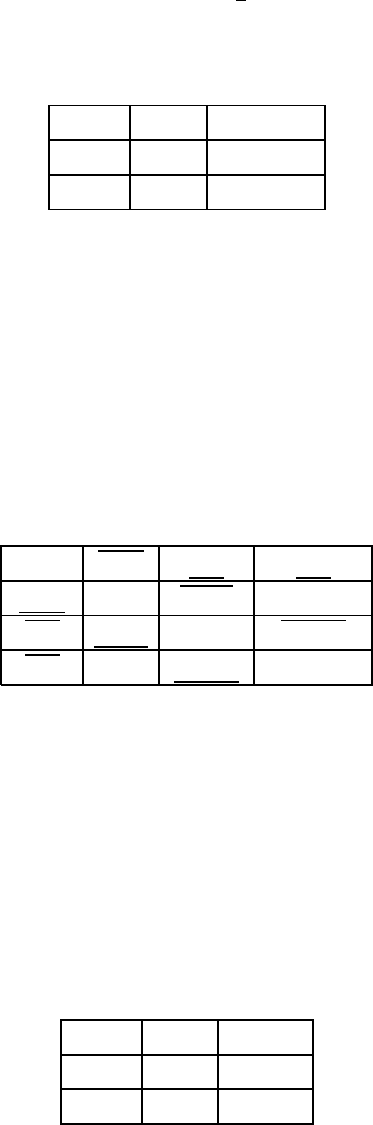

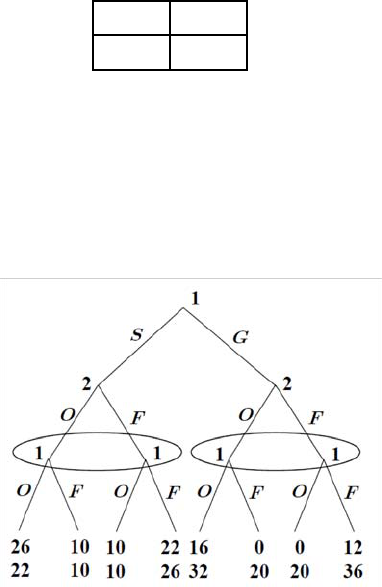

(a) What is the optimal plan of actio n for WakTek? W ha t is currently the

expected economic value of the WakAtak project?

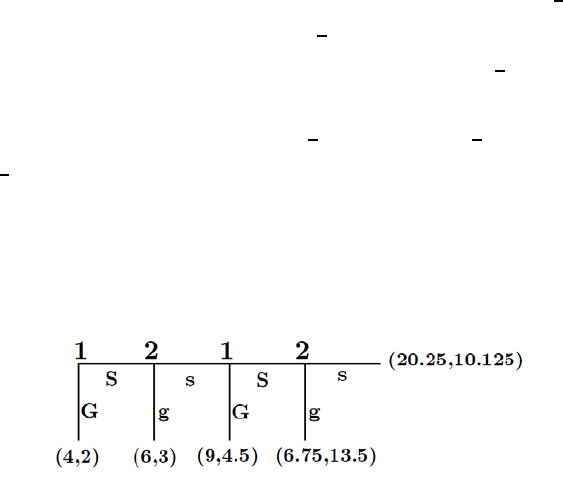

Answ er: The optim al plan is to build the prototype first and then do

the safety test, then build the production line and launch the product

only if the safet y test results in the “safe for 8 years and above” status.

The expected economic profits from this plan are $1.1 million. For jus-

tification of this answer, consider the follow ing decision tree:

Notice that the cost of the prelim inar y design is sunk (cannot be recov-

ered) and should be ignored. ¥

(b) Suddenly it turns out that the original estimate of the cost of safet y-

testing w as incorrect. Analyze the sensitivit y of WakTek’s optima l plan

of action to the cost of safet y-testing.

Answ er: If the cost of safety-testing is too high, then the expected

value becomes negativ e and the optimal plan is to exit the project. To

find out the threshold cost of safety-testing abov e which exit becomes

optim al, notice that the cost of safet y-testing is incurred for sure under

22 2. Introducing Uncertainty and Time

the optimal plan of action which brings expected profits of $1.1 million.

Therefor e, if the cost of safety-testing is increased by $1.1 million or

more (bringing it to $2.1 million or more) then the decision should be

c hanged to “exit.” ¥

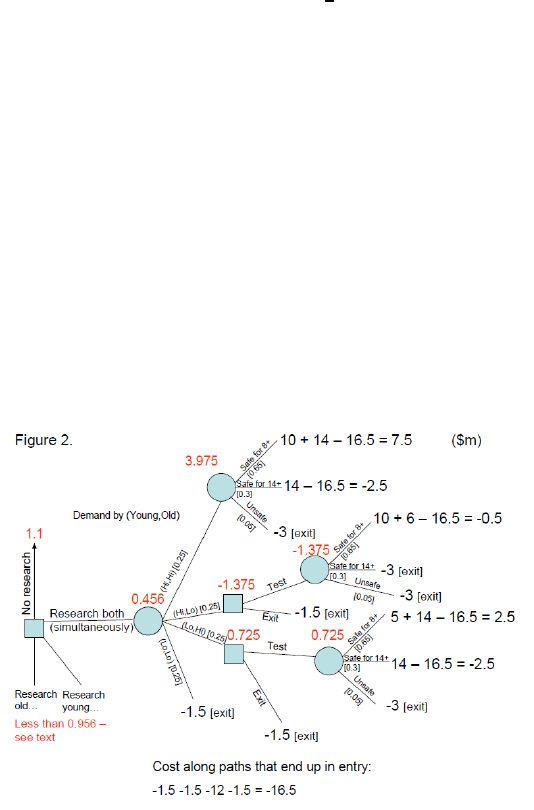

(c) Suppose WakTek has also the possibility of conducting a market surv ey,

which would tell exactly wh ich dem and scenario is true. This m a rket

researc h costs $15 million if done simu ltaneo usly for both demograph -

ics, and $1 million if done for one demogr ap hic only. How, if at all, is

theanswertoparta)affected?

Answ er: Firstexaminethedecisiontreefromparta)toseewhether

we can simplify the effect of the market research, b y elimina ting som e

logically possible alternativ e s. Which alternatives to eliminate from the

tree as “ob viously irrelevan t” is partly a matter of taste. For example,

there are poin ts in the tree where the opportunit y to exit is irrelevan t

(e.g.afterwe’vefoundoutthatdemandishighforthe“young”

2

)be-

cause the profits will clearly be higher by not exiting. You can alwa ys

just include all alternativ e s, although that can lead to a v ery large tree;

the final answer is of course unaffected. Elim inations that are not obvi-

ous but that were used in simplifying the decision trees are justified b y

logic as follow s:

(i) We can com plet ely ignore the possibility of building a production line

before the safety test. We already established in part (a) that doing the

safety test first achiev es expected profits that are (11−(−005) = 115)

million higher than doing the production line first. The only poten tial

benefitofdoingtheproductionlinefirst is the sa ved $0.5 million pr o-

totype cost. Thus no information could ever c hange the differ ence in

pa y offs to the advantage of a “production line first” plan b y more than

this $0.5 million. Since research always costs at least $1 million, “prod.

line first” can not become optim al due to the possibilit y of doing market

2

For b revity, th e 8-14 dem og raphic is henceforth referred to as the “young,” and th e 14+ dem ograp hic as the

“old.”

2. Introducing Uncertainty and Time 23

researc h.

(ii) It is never profitable to do researc h after the safety test. If the re-

sult w e re “safe for both groups” then the only case where info is useful

(i.e. ch a nges the decision to ente r into exit) is if both groups have low

demand. (See Figure 1: exiting payoff −15 is better than the −4 of Low-

Low demand scenario, but less than the payoff under the other three de-

man d scenarios). This demand scenario could be ruled out b y researc h -

ing either group. The expected payoff would be

1

4

(9+1+4−15)−1 25,

i.e., not worth it after pa y ing for the cost of research. Research after find-

ing out that WakAtak is only “safe for old” is obviously not profitable,

since even if the information caused the decision to c ha ng e (from “exit”

to “enter,” if demand is high) this results only in a pa yoff of −1 before

the researc h cost, w hile exit guarantees −15; since r esea rch is mo re

costly than the 0:5 difference it canno t be w or thwhile.

(iii) The potential benefit of researc h is that it allow s WakTek to sa ve

the cost of production line under unfavorable demand conditions, so

there w ou ld be no point in plans of action where research is conducted

after the production line is built.

Consider a plan where both groups are researched sim u ltaneously.

This would lead to e xpected value of $0.456 million, so not doing re-

24 2. Introducing Uncertainty and Time

search is better than researching both simultan eously. We can now de-

duce that researching only one of the group s cannot be optimal either.

The reason is th at it is less inform ative than researching both, so th e

expected payoff could not be higher than $0.456 million for any other

reason than the fact that it is cheaper by $(15 −1=05) million. This

means that the expected value (EV ) of a plan where only one group is

researc h ed must be lower than ($0456 + $05=$0956) million. Thus

the $1.1 million value from no research is still the highest. Similar ly,

consider the possibilit y of researc hing both groups sequentially. This is,

at best, equally infor m ative as researchin g both groups simultan eously.

It offers the added option of stopping the research after finding out

the results for one group, and thu s potentially a saving of $0.5 million

comp ared to the cost of researc hin g both sim u lta neou sly. Again, this

cost-saving could not increase the EV to abo ve $0.956, so the optimal

plan of action for part a) is not affected.

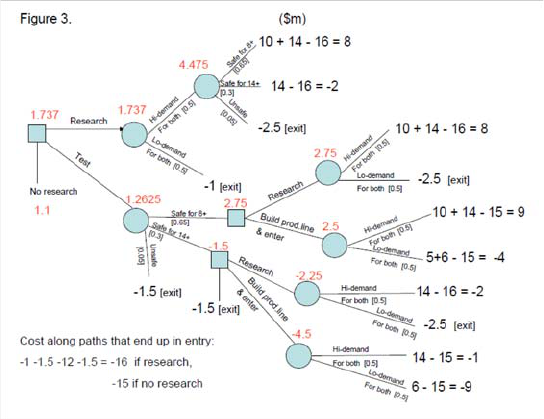

(d) Suppose that demand is not independen t across demographics after all,

but instead is perfectly correlated (i.e., if deman d is high in one dem o-

graphic , then it is for sure high in the oth er one as w ell). How, if at all,

w ould that change y our answer to part c)?

Answ er: Now researc h ing either one of the demog raphic groups is

just as in formative as resea rching both (bu t c h ea per, at $1 million);

it tells WakTek whether the dem a nd is high for both groups or low for

both groups. In this case the optimal decision w o uld be to research one

(doesn’t matter which) group, and do the safety testing if the dema nd

is high for both group s, then build the production line and launch the

product unless deemed unsafe; This results in EV of $1.7375 million.

The follow ing figure show s the decision tree.

3

3

Note that exp ected values are not directly axoected by the correlation so the E V of no research is still 1.1.

However, the correlation of dem ands is goo d for WakTek, not just b ecause it m akes m arket research cheap er.

For example, compared to the case (in part c) w here WakTek researches b oth groups simultaneously, one ad ded

benefit here is that WakTek will n ever have to “waste” the cost of safety-testing in the event where the result

turns out to be “safe for old only,” which leads to exit.

2. Introducing Uncertainty and Time 25

8. Juice: Bozoni is a reno w n ed Swiss ma ker of fruit and vegeta ble juice, w hose

products are sold at specialty stores around Western Europe. Bozoni is con-

sidering whether to add c her imoya juice to its line of products. “It w ou ld

be one of our more difficult varieties to produce and distribute,” observ es

Johann Ziffenboeffel, Bozoni’s CEO. “The cherim oya would be flowninfrom

New Zealand in firm , unripe form , and it w ou ld need its o w n dedicated ripen-

ing facility her e in Europe.” Three succ essful steps are absolute ly necessary

for the new c herimo ya variety to be worth producing. The industrial ripen-

ing process must be shown to allow the delicate flavors of the cherimoya

to be preserved; the testin g of the ripening process requires th e building

of a small-sc ale ripening facilit y. M arket research in selected small regions

around Europe must sho w that there is sufficien t demand am ong consumers

for cherimo ya juice. And cherimo y a juice m ust be sho wn to withstand the

existing tin y gaps in the cold chain bet ween the Bozoni plan t and the end

consumers (these gaps would be prohibitively expensive to fix). Once these

three steps have been completed , there are about 2,500,000 worth of ex-

penses in lau nching the new variety of juice. A successful new variet y w ill

then yield profits, in expected presen t-value terms, of 42.5 m illion.

26 2. Introducing Uncertainty and Time

The three absolutely necessary steps can be done in parallel or sequentially

in any order. Data about these three steps is given in Table 1. “Prob ability

of success” refers to how lik ely it is that the step will be successful. If it is not

successful, then that means that cherim oya juice cannot be sold at a profit.

All pro babilities are ind ependent of each other (i.e., whether a giv en step is

successful or not does not affect the probabilities that the other steps will be

successful). “Cost” refers to the cost of doing this step (regardless of whether

it is successful or not).

(a) Suppose Mr. Ziffen boeffel calls y ou and asks y ou r advice about the

project. In particular, he wants to know (i) should he do the three

necessary steps in parallel (i.e., all a t once) or should he do them se-

quentially; and (ii) if sequentially, w hat’s the righ t order for the steps

to be done? What answers do y ou give him?

Answ er: Bo zoni should do the steps sequentially in this order: first test

the cold cha in, then the ripening process, then do the test-marketing.

The expected value of profits is 1.84 million. Observe that it wo uld not

be profitable to launc h the product if Bozoni had to do all the steps

simultane ou sly. This is an exam ple of real options– by sequencin g the

steps, Bozoni creates options to switc h out of a doomed project before

too much money gets spen t. ¥

(b) Mr. Ziffenboeffel calls you back. Since Table 1 wa s produced (see below ),

Bozoni has found a small research firm that can perform the necessary

tests for the r ipening process at a lower cost than Bozoni’s in-house

researc h department.

Table 1: D ata on launching the Ch erimoya juice

Step Pr o b a bility of succes s Cost

Ripening process 0.7 1,000,000

Test marketing 0.3 5,000,000

Cold chain 0.6 500,000

At the same time, th e EU has raised the criteria for getting approval

for new food producing facilities, which raises the costs of these tests.

2. Introducing Uncertainty and Time 27

Mr. Ziffenboeffel would, therefore, like to kno w how your answe r to (a)

c h ang es as a function of the cost of the ripening test. What do you tell

him?

Answ er: This is sensitivit y analysis for the cost of testing the ripening

process. This can be done by varying the cost for ripening, and seeing

which expected payoff (highlig hted y ellow) is highest for which values of

the cost. For example, whenever w e set the cost below 375,000 it turns

out that the pa yoff from the sequence → → giv es the highest

pa y off among the six possible sequences. (Excel’s GoalSeek is a partic-

ularly handy wa y for finding the threshold v alues quic k ly).

Specifically, the optimal sequence is

i) → → if the cost of ≤ 375 000

ii) → → if the cost of 375 000 ≤ ≤ 2 142 857

iii) → → if the cost of 2 142 857 ≤ ≤ 8 640 000

iv) don’t launch if costsmorethan8 640 000

where “” stands for th e ripening process, “” stands for the cold

c hain, and “ ” stands for test marketing. ¥

(c) Mr. Ziffenboeff

el calls you back y et again. The good news is the EU

regulations and the ou tsourcing of the ripening tests “ balan ce” eac h

other out, so the cost of the test rem ains 1,000,000. No w the problem

is that his marketing department is suggesting that the probabilit y that

the market researc h will result in good news about the deman d could

be differen t in light of some recen t data on the sales of other subtropical

fruit products. He would, therefore, like to kno w how your answer to

(a) c ha nges as a functio n of the probability of a positiv e result from the

market researc h. What do you tell him?

Answ er: This can be found b y varying th e probability of success for

test mark eting (highlighted by blue in the excel sheet) bet ween 0 and

1. The optimal sequence turns out to be

28 2. Introducing Uncertainty and Time

i) don’t launch if ≤ 01905

ii) → → if 01905

where is the probability that the test marketing will be successful.

¥

9. Steel: AK Steel Hold ing Corporation is a producer of flat-rolled carbon,

stainless and electrical steels and tubular products through its wholly o w ned

subsidiary, AK Steel Corporation. The recent surge in the demand for steel

significan tly increased AK ’s profits,

4

and it is no w engaged in a research

project to improve its production of rolled steel. The research involves three

distinct steps, eac h of whic h must be successfully completed before the firm

can implement the cost-sa ving new production process. If the research is

completed successfully, it will save the firm $4 million. Unfortunately, there

is a c ha nce that one or more of the research steps might fail, in which case

the project is worth less. The three steps are done sequen tially, so that the

firm knows whether one step w as successful before it has to in vest in the next

step.Eachstephasa08 probabilit y of success and eac h step costs $500 000.

The risks of failure in the three steps are uncor relate d with one another. AK

Steel is a risk neutral company. (In case you are worried about such things,

the interest rate is zero).

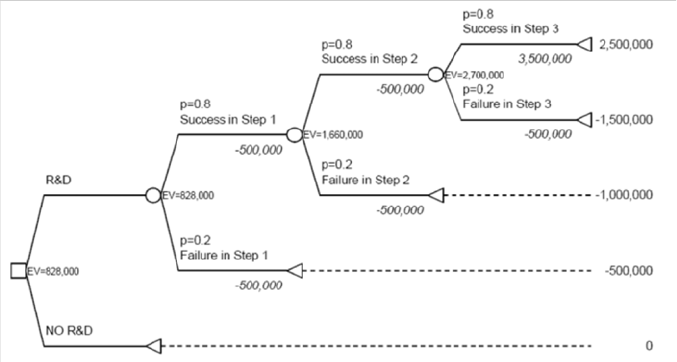

(a) Dra w the decision tree for the firm.

Answ er:

4

See “Demand Send s A K Steel ProfitUp32%,”New York Time, 07/23/2008.

http://www.nytimes.com/2008/07/23/business/23steel.html?partner=rssnyt&emc=rss

2. Introducing Uncertainty and Time 29

¥

(b) If the firm proceeds with this project, what is the probabilit y that it

will succeed in implementing the new production process?

Answ er: For the project to be successful, each of the three independen t

steps must be complet ed. Since the probability of success in eac h stage

is 0.8 and the probabilities are independen t, the probabilit y of three

successes is =08 · 08 · 08=08

3

=0512, just over one-half. ¥

(c) If the researc h were costless, what would be the firm ’s expected gain

from it before the project began?

Answ er: E[]=0512 · $4 000 000 + 0488 · 0=$2 048 000¥

(d) Should the firm begin the researc h , given that each step costs $500 000?

Answ er: The expected cost of the project is

02·$500 000+08·02·$1 000 000+08·08·$1 500 000 = $1 220 000

The first term is the probability times cost of a failure in the fir st step.

The second term is the probabilit y times cost of success in the first step

and failure in the second step. The third term is the probability times

cost of success in the first step and success in the second step (success

or failure in the third step does not affect the cost of the project, just

30 2. Introducing Uncertainty and Time

the gain from it). The expected cost is less than the expected gain (b y

$828,000). Since the company is not risk averse, it shou ld begin the

project. Note that this is not the only way to do the calculation. An

alternate approach w o uld be to aggregate the costs and benefits of each

possible outcom e:

08 · 08 · 08 · (4 000 000 − 500 000 − 500 000 − 500 000)

+08 · 08 · 02(−500 000 − 500 000 − 500 000)

+08 · 02(−500 000 − 500 000) + 02(−500 000)

=$828 000

Either way, the expected net gain is $828 000. ¥

(e) Once the researc h has begun, should the firm quit at any poin t ev en if

it has had no failures? should it ever continue the researc h ev en if it has

had a failure?

Answ er: NO to both. Obviously, if one stage fails, then the project

cannot be com pleted successfully, so any mo re expenditures on it are a

waste. If no stage has failed a nd at lea st one h as succeeded, then th e

benefit/cost comp arison of going forward with the project is even more

favorable than when the project began. ¥

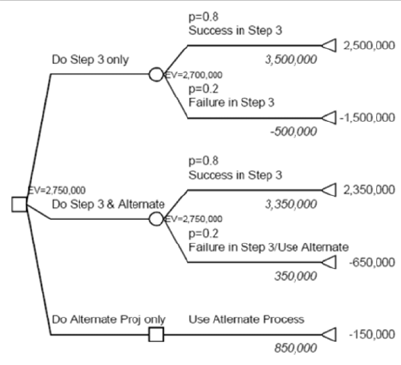

After the

firm has successfully completed steps one and t wo, it discov-

ers an alternate production process that w ould cost $150 000 and would

lo wer production costs b y $1 000 000 with certainty. This process, how-

ever, is a substitute for the three-step cost-saving process; they cannot

be used sim ulta neously. Furthermor e, to have this process available, the

firm m ust spend the $150 000 before it know s if it will successfully

comp lete step three of the three-step research project.

(f) Draw the augmented decision tree that includes the possibility of pur-

suing this alternate production process.

Answ er:

2. Introducing Uncertainty and Time 31

(g) If the firm continues the three-step project, what is the cha nce it would

get any value from also developing the alternate production process?

Answ er: Th e alt erna te process would be used only if step three of the

current project failed, which has a 0.2 probab ility. ¥

(h) If dev eloping the alternate production process wer e costless and if the

firm con tinues the three-step project, w hat is the expected value that

it would get from ha ving the alternate production process available (at

the beginning of researc h step 3)? (This is known as the option value of

ha ving this process a vailable.)

Answ er: There is a 0.2 probabilit y that the alternate process would be

used and a $1,000,000 value if it is used, so the option value of having

thealternateprocessavailableis$200,000.¥

(i) Should the firm:

i. Pursue only the third step of the three-step project

ii. Pursue only alternate production process

iii. Pursue both the third step of the three-step project and the alter-

nate process

32 2. Introducing Uncertainty and Time

Answ er: Since the option value of the alternate process is greater

than the cost of having this option, the alternate process should

be developed if one con tinues with the three-step project. The net

value of developing this option is $200 000 − $150 000 = $50 000.

Of course, the alternate process wo uld also be developed if the

three-step project w ere unavailable, since it will be used with cer-

taint y and the net value of the altern ate process would then be

$850,00 0. The remainin g question is whether AK should drop the

three-step project rather than attempting the third step. Giv en

that the alternate process will be developed, the extra (or mar-

ginal ) value of successfully completing the three-step project wo u ld

be $3,000,000, because it w ou ld save $3,000,000 more than the al-

ternate process. The expected value of attemp ting the third step

is then 08 · $3 000 000 = $2 400 000. This is greater than the

$500,000 cost of the third step, so AK should p roceed with th e

three-step project as well as the alternate process, i.e., tak e strat-

egy (iii). ¥

(j) If the firm had kno wn of the alternate production process before it began

the three-step research project, what should it have done?

Answ er: We know that AK should p ursue the alternate process: It

was wo rth doing after successful completion of steps one and two (see

(i)) and wo uld ha ve g rea ter expected value if th e p roba bility of the

three-step project failing were high er . In fact, the option value of the

alternative process declines with each step of success in the three-step

project. At the beginning of step three A K would pay up to $200,000

for the alternate process. Con vin ce yo urself that it w o uld be willing to

pay up to $360,000 for the alternate process at the beginning of step

t wo and up to $488,000 for the alternate process at the beginning of

step one, assuming in each case that it cou ldn’t wait to develop the

alternate later. In fact, the option to wait un til the beginning of the

third period to develop the alternate process could itself be valuab le,

but it isn’t in this case, w h en the process costs $150,000. The other

2. Introducing Uncertainty and Time 33

question is whether AK should pursue the three-step project given that

it will ha ve the alternate process available with certain ty. As in (i), the

marg inal value of successfully completing the three-step project wou ld

be $3,000,000, because it w ould sav e $3,000,000 more than the alternate

process. The expected value of attempting the three-step project is then

0512 · $3 000 000 = $1 536 000. Th is is greater than the the expected

cost of pursuing the three-step project, which is 02 · 500 000 + 08 · 02 ·

1 000 000 + 08 · 08 · 1 500 000 = 1 220 000, so AK should proceed

with the three-step project as w ell as the alternate process. This is the

same calculation as in (c) and (d) except the benefit of success is no w

$3,000,000 instead of $4,000,000. ¥

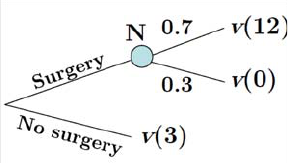

10. Surgery: A patient is very sick, and will die in 6 months if he goes un trea ted.

The only available treatment is risky surgery. The patien t is expected to live

for 12 months if the surgery is successful, but the probability that the surgery

fails and the patient dies immed ia tely is 0.3.

(a) Dra w a decision tree for this decision problem .

Answ er: Using () to denote the value of living more months, the

follow ing is the decision tree:

¥

(b) Let () be the patien t’s pa yoff function, where is the n umber of

mon ths till death. Assuming that (12) = 1 and (0) = 0,whatisthe

lowest payoff thepatientcanhaveforliving3monthssothathaving

surgery is a best response?

Answ er: The expected value of the surgery giv en the pa yoffsaboveis

[(surgery)] = 07(12) + 03(0) = 07

34 2. Introducing Uncertainty and Time

which implies that if (3) 07 then the surgery should be performed. ¥

For the rest of the problem , assume that (3) = 08.

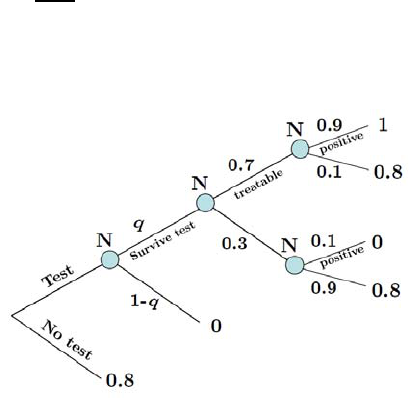

(c) A test is a vailable that will provid e some informatio n that predicts

wheth er or not surgery will be successful. A positive test implies an

increased likelihood that the patient will survive the surgery as follows:

True- p ositive rate: Th e probab ility that the results of this test will

be positive if surgery is to be successful is 0.90.

False-positive rate: The probability that the results of this test will

be positive if the patient will not survive the operation is 0.10.

W ha t is the prob ab ility of a successful surgery if the test is positive ?

Answ er: The easiest way to think about this is to imagine that the

original 0.7 probability of success is true because for 70% of the sic k

populatio n, call these the “treatable” patients, the surgery is success-

ful, while for the other 30% (“untreatab le”) it is not, and previously

the patient did not know which population he belongs to. The test can

be though t of as detecting which population the patien t belongs to.

The abo ve description means th at if the patient is treatable then the

test will claim he is treata b le with proba bility 0.9, while if the patie nt

is un trea ta ble then the test will claim he is treatable with probability

0.1. Hence, 63% of the population are treatable and detected as such

(0.7×09), while 3% of the population are untre atable but are detected

as treatable (0.3×01). Hence, of the population of people for whom the

test is positive, the probability of successful surgery is

63

63+3

=0955 ¥

(d) Assuming that the patient has the test done, at no cost, and the result

is positiv e, should surgery be performed?

Answ er: The value from not having surgery is (3) = 08, and a positive

test updates the probability of success to 0955 with the expected payoff

being 0955 × 1 so the patient should ha ve surgery done. ¥

2. Introducing Uncertainty and Time 35

(e) It turns out that the test may ha v e some fatal complications, i.e., the

patient ma y die durin g the test. D raw a d ecision tree for this revised

problem.

Answ er: Given the data above, we kno w that without taking the test

thepatientwillnothavesurgerybecausetheexpectedvalueofsurgery

is 0.7 while the value of living 3 months is 0.8. Also, we showed abo ve

that after a positive test the patient will choose to have surgery, and it

is easy to sho w that after a negative test he won’t (the probability of

a successful outcome is

7

7+27

=0206) Hence, the decision tree can be

collapsed as follow s 9the decision to have surg ery ha ve been collapsed

to the relevant payoffs):

¥

(f) If the proba bility of death during the test is 0.005, should the patient

opt to have the test prior to deciding on the operation?

Answ er: From the decision tree in part (e), the expected value con di-

tional on surviving the test is equal to

07(09 × 1+01 × 08) + 03(01 × 0+09 × 08) = 0902

which implies that if the test succeeds with probabilit y 0.995 then the

expected pa yoff from taking the test is

0995 × 0902 + 0005 × 0=0897

36 2. Introducing Uncertainty and Time

which implies that the test should be tak en because 0897 08. ¥

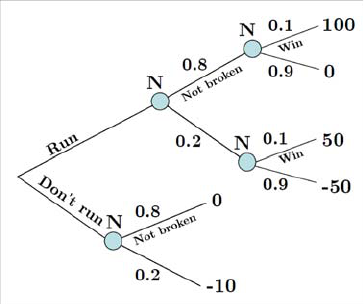

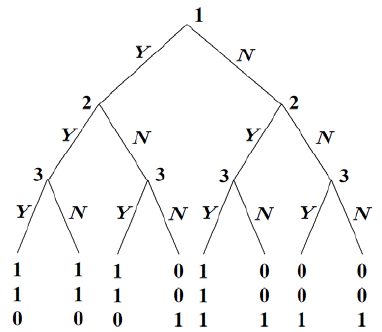

11. To Run or not to Run: You’re a sprinter, and in practice toda y y ou fell

and h u rt y o ur leg. A n x-ray suggests that it’s broken with probabilit y 0.2.

Your problem is whether you should participate in next week’s tournamen t.

If you run, you think you ’ll win w ith probability 0.1. If you r leg is b roken

and y ou run, then it will be further damaged and y our payoffs are as follo w s:

+100 if you win the race and y ou r leg isn’t br oken;

+50 if y o u win and y ou r leg is broken;

0 if you lose and your leg isn’t broken;

−50 if you lose and your leg is broken;

−10 if you don’t run and if y our leg is brok en;

0 if you don’t run and your leg isn’t brok en.

(a) Dra w the decision tree for this problem.

Answ er:

¥

(b) What is your best c h oice of action and its expected pa yoff?

Answ er: The expected pay off from not running is

[(not run)] = 08 × 0+02(−10) = −2

and the expected pa yoff from running is

[(run)] = 08×(01×100+09×0)+02×(01×50+09×(−50)) = 0

2. Introducing Uncertainty and Time 37

so the best c h oice is to run and have an expected payoff of 0. ¥

You can gather some more inform a tion by having more tests, and y ou

can gather more information about whether y ou ’ll win the race b y talk-

ingtoyourcoach.

(c) What is the value of perfect inform ation about the state of yo ur leg?

Answ er: If you knew you r leg is broken then running yields an expected

pa y off of 01×50+09×(−50) = −40 while not running yields a pay off

of −10,soyouwouldnotrunandget−10.Ifyouknewyourlegisnot

broken then the expected payoff from runnin g is 01×100+09×0=10,

while the pay off from not running is 0, and hence you would run and

get 10. Before getting the information you know your leg is broken

with proba b ility 0.2, so before getting the perfect inform ation , your

expected pa yoff from being able to then act on the perfect inform a tion

is 02(−10) + 08 × 10 = 6. Recall from (b) that the expected payoff of

not ha vin g perfect information is 0, so the value of being able to obtain

the perfect inform ation is 6 − 0=6. ¥

(d) What is the value of perfect information about whether you’ll win the

tournam ent?

Answ er: In this case we know that you will run if y ou know y o u will

win and y ou will not if you know you will lose. Hence, with probability

01 yo u will learn that you’ll win and your expected payoff (depending

on the state of yo ur leg) is 02 × 100 + 08

× 50 = 60Similarly, with

probab ility 0.9 you learn that you’ll lose in wh ich case you r expected

pa y off is 02 × (−10)+ 08 × 0=−2. Before getting the information y ou

know you will win with probab ility 0.1, so before getting the perfect

information, y our expected pa yoff frombeingabletothenactonthe

perfect information is 01 × 60+ 09(−2) = 42.Recallfrom(b)thatthe

expected payoff of not ha v in g perfec t informa tio n is 0,sothevalueof

beingabletoobtaintheperfectinformationis42 − 0=42. ¥

38 2. Introducing Uncertainty and Time

(e) As stated above, the probabilit y that your leg is broken and the proba-

bilit y that y ou will win the tournamen t are independent. Can y ou use a

decision tree in the case that the probability that you will win the race

depends on whether y our leg is broken?

Answ er: Yes. All you need to do is have different proba bilities of win-

ning that depend on whether or not y our leg is brok en. ¥

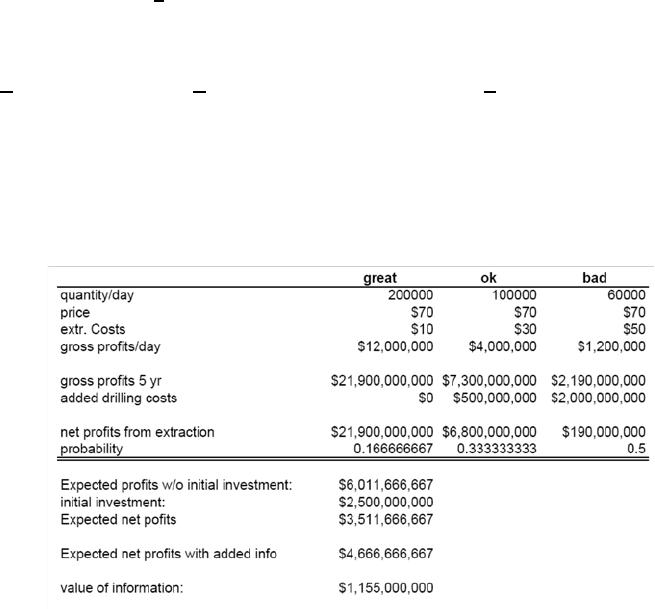

12. Mo re O il: Ch evron, the No. 2 US oil company, is facing a tough decision.

The new oil project dubbed “Tahiti” is sch eduled to produce its first comm er-

cial oil in mid-2008, ye t it is still unclear how productiv e it will be. “Tahiti

is one of Chevron’s fiv e big projects,” told Peter Robertson, vice ch airm an

of the compan y’s board to the Wall Str eet Journal.

5

Still, it was unclear

wheth er the project will result in the blockb u ster success Chevron is hop ing

for. As of June 2007, $4-billion has been in vested in the high-tec h deep sea

platform, w hic h suffices to perform early w ell tests. Aside from offering in-

formation on the type of reservoir, the tests will produce enough oil to just

co ver the incremental costs of the testing (beyond the $4 billion investm ent).

Follo win g the test we lls, Chevron predicts one of three possible scenarios.

The optim istic one is that Tahiti sits on one giant, easily accessible oil reser-

voir, in whic h case the compa ny expects to extract 200,000 barrels a da y

after expending another $5 billion in platform setup costs, with a cost of

extraction at about $10 a barrel. This will continue for 10 years, after whic h

the field will have no more econom ically recoverable oil. Chevron believes

this scenario has a 1 in 6 c h an ce of occurring. A less rosy scen ario, that is

twice as lik ely as th e optim istic one, is that Chev ro n wo uld ha ve to drill

t wo more w e lls at an additional cost of $0.5 billion each (above and beyo nd

the $5 billion set-up costs), and in w hich case production will be around

100,000 barrels a day with a cost of extraction at about $30 a barrel, and

the field will still be depleted after 10 years. The worst case scenario in volves

5

“C h e v ron’s Tahiti Facility Bets Bi g on G u lf O il Boo m.” Jun 2 7, 20 0 7 . pg. B 5 C.

http://proquest.umi.com/pqdweb?did=1295308671& sid=1&Fmt=3&clientId=1566&RQT=309&V Name= PQD

2. Introducing Uncertainty and Time 39

the oil tucked awa y in n um ero us poc kets, requiring expensive water injection

tec h n ique s which w o uld include up-front costs of another $4 billion (abo ve

and bey on d the $5 billion set-up costs), extraction costs of $50 a barre l, and

production is estimated to be at about 60,000 barr els a day, for 10 y ea rs.

Bill Varnado, Tahiti’s project manag er, was quoted giving this least desir-

able outcome odds of 50-50.

The curren t price of oil is $70 a barrel. For simplicity, assum e that the price

of oil and all costs will remain constant (adjusted for inflation) and that

Chevr on’s faces a 0% cost of capital (also adjusted for inflation).

(a) If the test-wells w o uld not produce information about whic h one of three

possible scenarios will result, should Ch evron invest the set-up costs of

$5 billion to be prepared to produce at wh atever scenario is realized?

Answ er: We start b y noticing that the $2 billion that were in vested are

a sunk cost and hence irrelevant. Also, since the cost of capital is just

about the same as the projected increase in oil prices, w e do not need to

discount future oil reven ues to get the net present value (NPV) sine the

two effects (price increase and tim e discounting) will cancel each other

out. If the com p any in vests the $2 .5 billion dollar s, then they will be

prepared to a ct upon whatev e r scenario arises (great with probabilit y

1

6

, ok with pro bability

1

3

or bad w ith probabilit y

1

2

). N otice from the

table belo w that in eac h scenario the added costs of extraction that

Chevron need s to invest (once it becomes clear whic h scenario it is) is

worthwhile (e.g., even in the bad scenario, the profits are $2.19 billion,

which covers the added drilling costs of $2 billion in this case.) Hence,

Chevron wou ld proceed to drill in eac h of the three scenarios, and the

expected profits inclu din g the init ia l $2.5 billion investm e nt would be,

=

1

6

×($21)+

1

3

×($73−$05)+

1

2

×($219−$2)−$25 =$3 511 666 667

(b) If the test-w ells do produce accura te info rm ation about which of three

possible scenarios is true, what is the added value of performing these

40 2. Introducing Uncertainty and Time

tests?

Answ er: Now, if the test drilling will revea l the scenario ahead of time,

then in the event of the bad scena rio the revenues w ou ld not cover the

total in vestment of $4.5 billion ($2.5 billion initially, a nd another $2

billion for the bad scenario.) In the great and ok scenarios, ho wever,

the revenues cover all the costs. Hence, with the inform atio n Chevron

would not p roceed with the investm ents at all when the bad scenario

happens (probability

1

2

), and proceed only when the scenario is great or

ok, yielding an expected profitof

=

1

6

×($21−25)+

1

3

×($73−$25−$05)+

1

2

×0=$4 666 666 667

Hence, the added value of perfor m ing the tests is,

info

=$4 666 666 667 − $3 511 666 667 = $1 155 000 000

¥

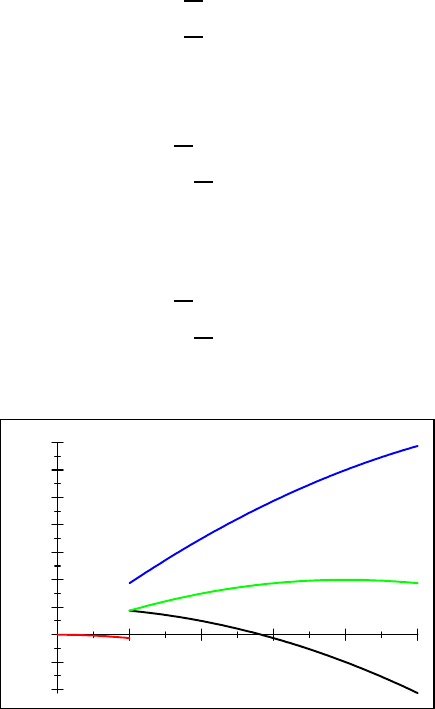

13. To day, Tomorrow or the Day after: Aplayerhas$100 toda y that need

to be consum ed o ver the next three periods, =1 2 3. The utility over

consuming $

in period is given by the utility funct ion ()=ln(),and

at period =1, the player valu es his net presen t value from all consum p tion

as (

1

)+(

2

)+

2

(

3

),where =09

2. Introducing Uncertainty and Time 41

(a) How w ill the player plan to spend the $100 over the three periods of

consumption?

Answ er: The player will max imize

max

1

2

ln(

1

)+ ln(

2

)+

2

ln(100 −

1

−

2

)

which yield s the followin g two first-order equations:

1

1

−

2

100 −

1

−

2

=0

2

−

2

100 −

1

−

2

=0

From these two equation s conclude that

1

1

=

2

or

2

=

1

. We can then then substitute

2

with

1

in the first equa-

tion above to obtain,

1

1

−

2

100 −

1

−

1

=0

or

100 −

1

−

1

−

2

1

=0

and the solution is

1

=

100

+

2

+1

and in turn

2

=

100

+

2

+1

,and

3

=

2

100

+

2

+1

. ¥

(b) Imagine that the pla yer know s that in period =2he will receiv e an

additional gift of $20 How will he ch oose to allocate his original $100

initially, and how will he spend the extra $20?

42 2. Introducing Uncertainty and Time

Answ er: After spending

1

≤ 100, the player has 100 −

1

+20in the

beginnin g of the second period. We can now solv e this backward and

assume that the pla yer has 100 −

1

+20in the beginning of period 2

and has to choose between

2

and

3

so that he solv e,

max

2

ln(

2

)+ ln(120 −

1

−

2

)

with the first order condition

1

2

−

120 −

1

−

2

=0

which yields,

2

=

120 −

1

1+

and

3

=

(120 −

1

)

1+

Now we can step back to the first period and solve the optimal c h o ice

of

1

given the w a y

2

and

3

will be chosen later. The pla y er solves,

max

1

2

ln(

1

)+ ln(

120 −

1

1+

)+

2

ln(

(120 −

1

)

1+

)

and the first order condition is,

1

1

−

(1 + )

120 −

1

×

1

1+

−

2

(1 + )

120 −

1

×

1

1+

=0

or

1

=

120

1+ +

2

.

Notice, howev er, that as drops,

1

increases, and for a small enough

this equation will call for

1

100. In particular, the value of for

which

1

=100canbesolvedasfollows,

100 =

120

1+ +

2

or, =

3

10

√

5 −

1

2

≈ 017. Ho wever,

1

100 is not possible, so the

solution is,

1

=

120

1++

2

if ≥ 017

100 if 017

2. Introducing Uncertainty and Time 43

and from the calculations earlier,

2

=

120 −

1

1+

and

3

=

(120 −

1

)

1+

¥

Part II

Static Gam es of Com plete

Information

44

This is page 45

Printer: Opaque

t

3

P r elimina r ies

1. eBa y: Hund red s of millions of people bid on eBa y auctions to purchase goods

from all over th e world. Despite being done online, in spirit these a uction s

are similar to those conducted cen turies ago. Is an auction a game? W h y or

wh y not?

Answ er: An auction is indeed a game. A bidder’s payoff depends on his bid

and on the bid of other bidders, and hence there are players, actions (whic h

are bids) and pa yoffs that depend on all the bids. Th e winner gets the item

andpaystheprice(whichoneBayisthesecondhighestbidplustheauction

increm ent), while the losers all pay nothing and get nothing. ¥

2. Pena lty Kicks: Imagine a kick er and a goalie who confron t each other in a

penalty kic k that will determine the outcom e of the gam e. The kicker can kick

theballleftorright,whilethegoaliecanchoosetojumpleftorright.Because

of the speed of the kick, the decision s need to be made simultaneously. If the

goalie jumps in the same direction as the kick, then the goalie wins and the

kic ker loses. If the goalie jumps in the opposite direction of the kick then the

kic ker wins and the goalie loses. M odel this as a normal form game and write

down the matrix that represents the game yo u modeled.

46 3. Preliminaries

Answ er: There are two pla yers, 1 (kic ker) and 2 (goalie). Each has two

actions,

∈ { } to denote left or right. The kicker wins when they

c h oose opposite directions while the goalie wins if they ch oose the same

direction. Using 1 to denote a win and −1 to denote a loss, w e can w rite

1

( )=

1

( )=

2

( )=

2

( )=1and

1

( )=

1

( )=

2

( )=

2

( )=−1. The matrix is therefore,

Play er 1

Player 2

−1 1 1 −1

1 −1 −1 1

¥

3. Meeting Up: Tw o old friends plan to meet at a conference in San Francisco,

and agreed to m eet by the to wer. When arriving in tow n , each realizes that

there a re two natural choices: Sutro To wer or C oit Tower. Not having cell

phones, eac h m ust c hoose independently which tower to go to. Eac h pla y er

prefers meeting up to not meeting up, and neither cares w her e this would

happen. Model this as a normal form came, and write dow n the matrix form

of the game.

Answ er: There are t w o play ers, 1 and 2.Eachhastwoactions,

∈ { }

to denote Sutro or Coit. Both players are happ y if they choose the same

to wer and unhapp y if they don’t. Using 1 to denote happ y and 0 to denote

unhapp y, we can write

( )=

( )=1and

( )=

( )=0

for ∈ {1 2}. The matrix is therefor e,

Player 1

Player 2

1 1 −1 −1

−1 −1 1 1

¥

3. Preliminaries 47

4. Hunting: Two hunters, players 1 and 2 can eac h ch oose to h u nt a stag,

which provides a rather large and tasty meal, or h unt a hare, also tast y, but

much less filling . Hun t in g stags is c hallen gin g and requires m ut ua l coopera-

tion. If either hunts a stag alone, then the stag will get away, while h u nting

the stag together guarantees that the stag is caught. Hun ting hares is an

individualistic enterprise that is not done in pairs, and whoever c hooses to

hunt a hare will catch one. The payoff from hunting a hare is 1, while the

pa y off to each from hu nting a stag together is 3. The pa yoff from an unsuc-

cessful stag-h u nt is 0.Representthisgameasamatrix.

Answ er: This is the fam ous “stag hunt” game. Using for stag and for

hare, the matrix is,

Player 1

Player 2

3 3 0 1

1 0 1 1

¥

5. Matc hing P ennies: Players 1 and 2 both put a penny on a table sim ul-

taneously. If the t wo pennies come up the same side (heads or tails) then

play er 1 gets both pennies, otherwise pla yer 2 gets both pennies. Represent

this game as a matrix.

Answer: Letting denote a c hoice of heads and a c ho ice of tails, and

letting winning giv e a pa y off of 1 while losing gives −1, the m atrix is ther e-

fore,

Play er 1

Player 2

1 −1 −1 1

−1 1 1 −1

¥

6. Price Com petition: Imagine a market with dem an d ()=100−.There

are t wo firms, 1 and 2, and each firm has to sim ultaneously choose it’s price

48 3. Preliminaries

.If

,thenfirm gets all of the m ark et while no one demands the

good of firm . If the prices are the same then both firm s equally split the

mark et demand. Imagine that there are no costs to produce any quantit y

of the good. (These are two large dairy farms, and the product is man ure.)

Write do w n the norm al form of this game.

Answ er: The players are = {1 2} and the strategy sets are

=[0 ∞]

for ∈ {1 2} and firms choose prices

∈

.Tocalculatepayoffs, we need

to kno w what the qua ntities will be for eac h firm giv en prices (

1

2

).Given

the assump tion on ties, the quantities are given by,

(

)=

⎧

⎪

⎨

⎪

⎩

100 −

if

0 if

100−

2

if

=

whichinturnmeansthatthepayoff function is given by quantit y times price

(there are no costs):

(

)=

⎧

⎪

⎨

⎪

⎩

(100 −

)

if

0 if

100−

2

if

=

¥

7. Pu blic Good Co ntribution: Three pla y ers live in a town and eac h can

c h oose to contribu te to fund a street lamp. T h e value of having the street

lam p is 3 for eac h player and the value of not having one is 0.TheMayor

asks eac h pla yer to either contrib ute 1 or nothing. If at least two pla yers

con trib ute then the lam p will be erected. If one or less people con tribu te

then the lamp will not be erected, in which case an y person wh o contribu ted

will not get their money back. Write dow n the normal form of this game.

Answ er: The set of players is = {1 2 3} and eac h h as an strategy set

= {0 1} where 0 is not to con tribute and 1 is to contribu te. The payoffs

3. Preliminaries 49

of player fro m a profile of strategies (

1

2

3

) is given by,

(

1

2

3

)=

⎧

⎪

⎪

⎪

⎨

⎪

⎪

⎪

⎩

0 if

=0and

=0for some 6=

3 if

=0and

=1for both 6=

−1 if

=1and

=0for both 6=

2 if

=1and

=1for some 6=

¥

50 3. Preliminaries

This is page 51

Printer: Opaque

t

4

Rat io n ality a n d C o mm o n Knowled g e

1. Prove Proposition ??:IfthegameΓ = h{

}

=1

{

}

=1

i has a strictly

dominan t strategy equilibrium

,then

is the unique dominant strateg y

equilibrium .

Answ er: Assume not. That is, there is some other strategy profile

∗

6=

that is also a strictly dominant strategy equilibrium . But this implies that

for ev ery ,

∗

, which contradicts that

is a strictly dominant strategy

equilibrium . ¥

2. Weak dominance. We call the strategy profile

∈ is a weakly domi-

nant strategy equilibriu m if

∈

is a wea kly dominant strategy for all

∈ .Thatisif

(

−

) ≥

(

0

−

) for all

0

∈

and for all

−

∈

−

.

(a) Provide an example of a game in whic h there is no weakly dominan t

strategy equilibrium.

Answ er:

Player 1

Play er 2

1 −1 −1 1

−1 1 1 −1

52 4. Rationality and Common Knowledge

¥

(b) Pro vide an exam ple of a game in whic h there is more than one we akly

dom inant strategy equilibrium .

Answ er: In the follow ing gam e each pla yer is indifferent between his

strategies and so each one is weakly dominated by the other. This means

that an y outc om e is a weakly dom ina nt strategy equilibrium.

Player 1

Play er 2

1 1 1 1

1 1 1 1

¥

3. Discrete first-price auction: An item is up for auction. Player 1 values

the item at 3 while player 2 values the item at 5 Eac h player can bid either

0 1 or 2.Ifplayer bids more than player then win’s the good and pays

his bid, while the loser does not pay. If both pla y ers bid the same amoun t

then a coin is tossed to determine who the winner is, who gets the good and

pa ys his bid while the loser pays nothing.

(a) Write dow n the game in matrix form.

Answ er: We need to determine what the pa y offs are if the bidders

tie. The one who wins the coin toss bids his bid and the loser gets

and pays nothing. Hence, w e can just calculate the expected payoff as a

50:50 lottery betw een getting nothing and winning. For example, if both

pla yers bid 2 then pla yer 1 gets 3 −2=1unit of pa y off with probability

1

2

and pla yer 2 gets 5 − 2=3units of payoff with prob a bility

1

2

,sothe

4. Rationality and Common Kno wledge 53

pair of pa y offsis(

1

2

3

2

)

Player 1

Player 2

012

0

3

2

5

2

0 4 0 3

1 2 0 1 2 0 3

2 1 0 1 0

1

2

3

2

(b) Does an y pla yer have a strictly dominated strategy?

Answ er: Yes-forplayer2bidding0 is strictly dominated b y bidding

2. ¥

(c) Which strategies survive IESDS?

Answ er: After removing the strategy 0 of pla yer 2, pla yer 1’s strategy

of 0 is dominated by 2, so we can rem ove that too. But then, in the

remain ing 2 × 2 game where both pla yers can choose 1 or 2, bidding

1 is strictly dominated by bidding 2 for play e r 2, and after this roun d,

bidding 1 is strictly domina ted by bid ding 2 forplayer1.Hence,the

unique strategy that survives IESD S is (2 2) yielding expected payoffs

of (

1

2

3

2

). ¥

4. eBa y’s recommendation: It is hard to imagine that an yon e is not familia r

with eBay

c

°

, the m ost popular auction website by far. The wa y a typical

eBa y auction w orks is that a good is placed for sale, and each bidder places

a“proxybid”,whicheBaykeepsinmemory.Ifyouenteraproxybidthat

is lo wer than the current highest bid, then y our bid is ignored. If, however,

it is higher, then the curren t bid increases up to one incremen t (say, 1 cent)