Management’s Discussion and Analysis

and

Consolidated Financial Statements

June 30, 2016

Page 2

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

June 30, 2016

Contents

Page

I

Executive Summary .................................................................................................................. 4

II Client Services .......................................................................................................................... 8

III Liquid Assets .......................................................................................................................... 15

IV Funding Resources ................................................................................................................ 16

V Risk Management ................................................................................................................... 18

VI Critical Accounting Policies .................................................................................................... 26

VII Results of Operations ............................................................................................................. 28

VIII Governance and Control ........................................................................................................ 37

Page 3

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

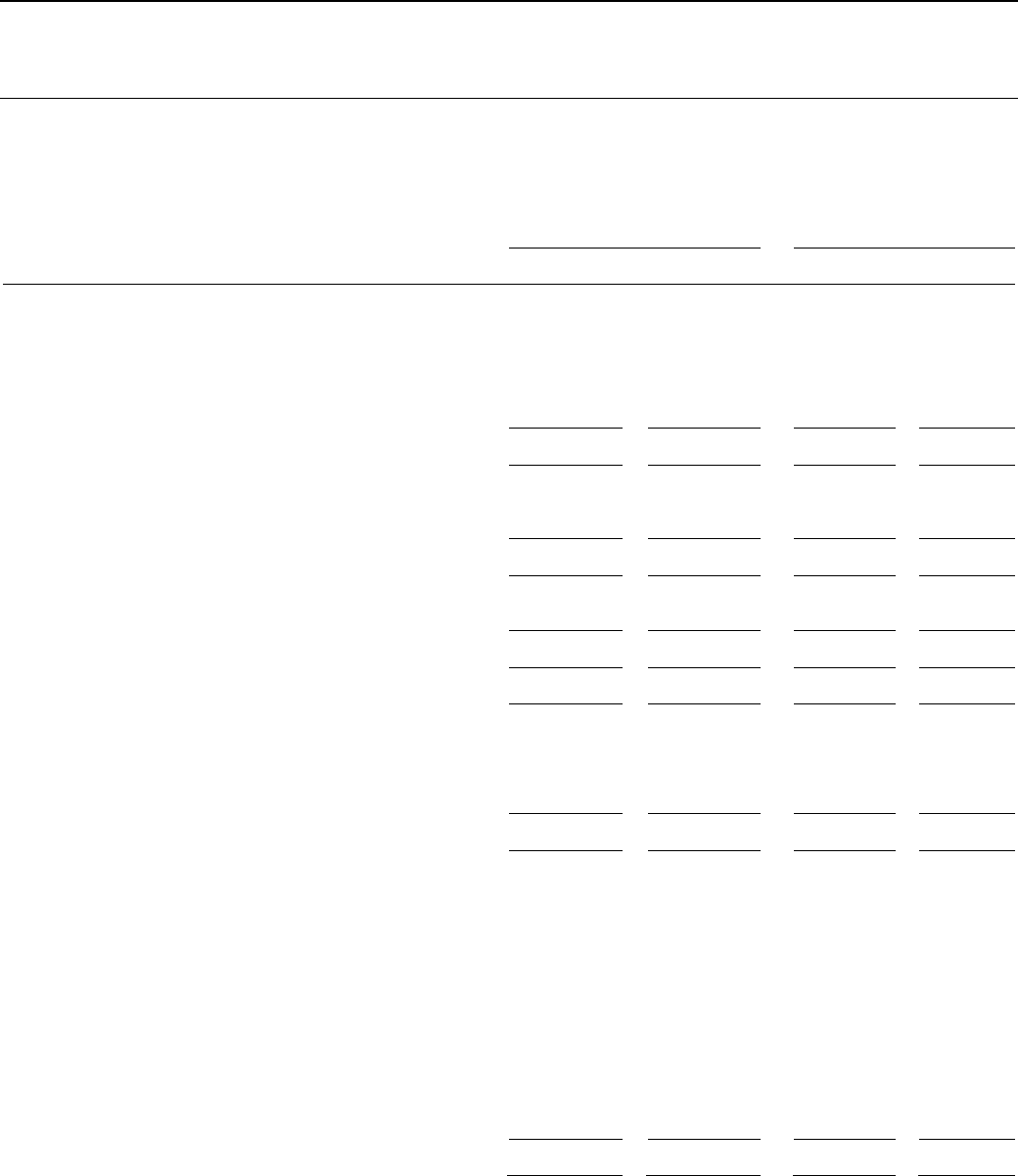

LIST OF TABLES Page

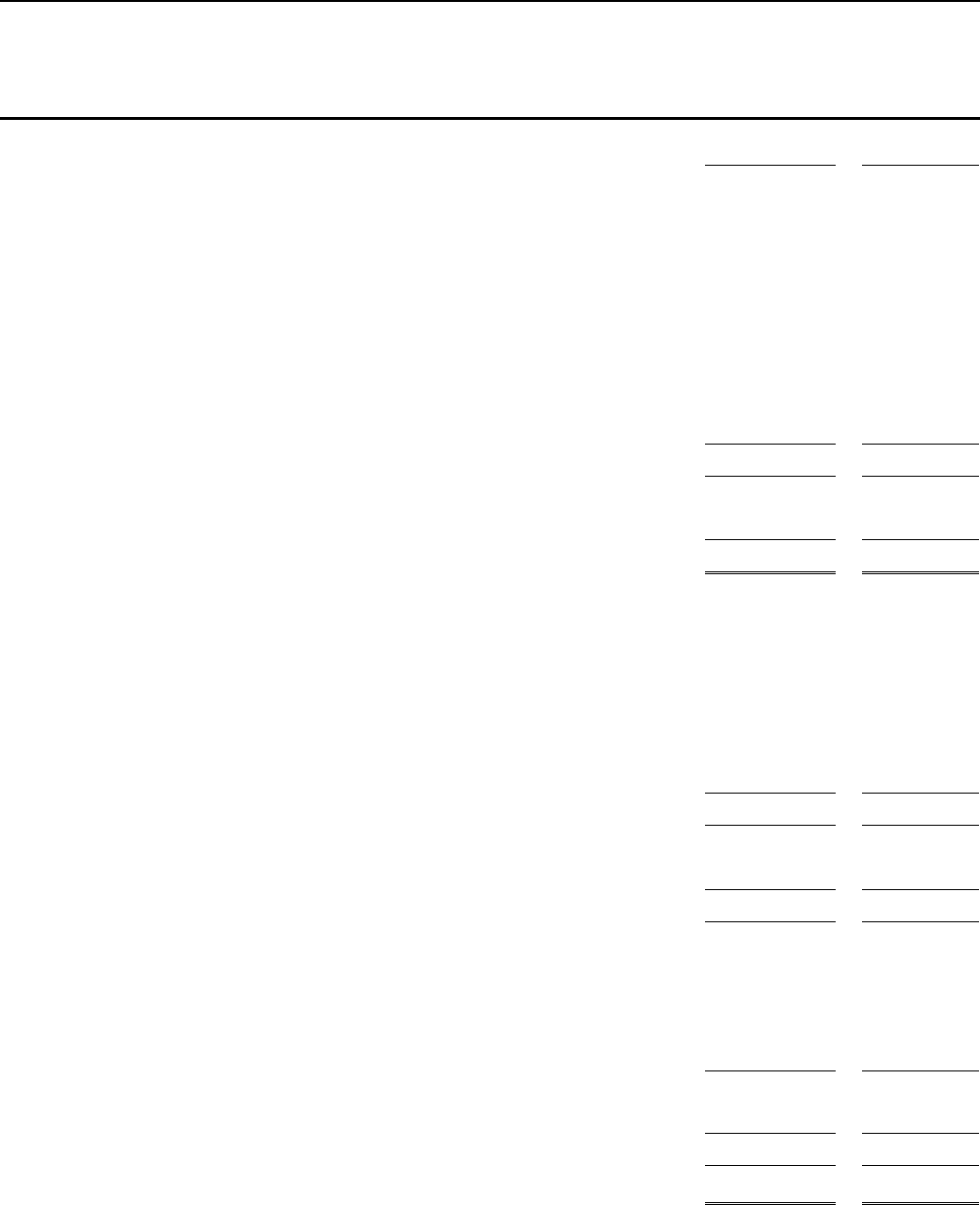

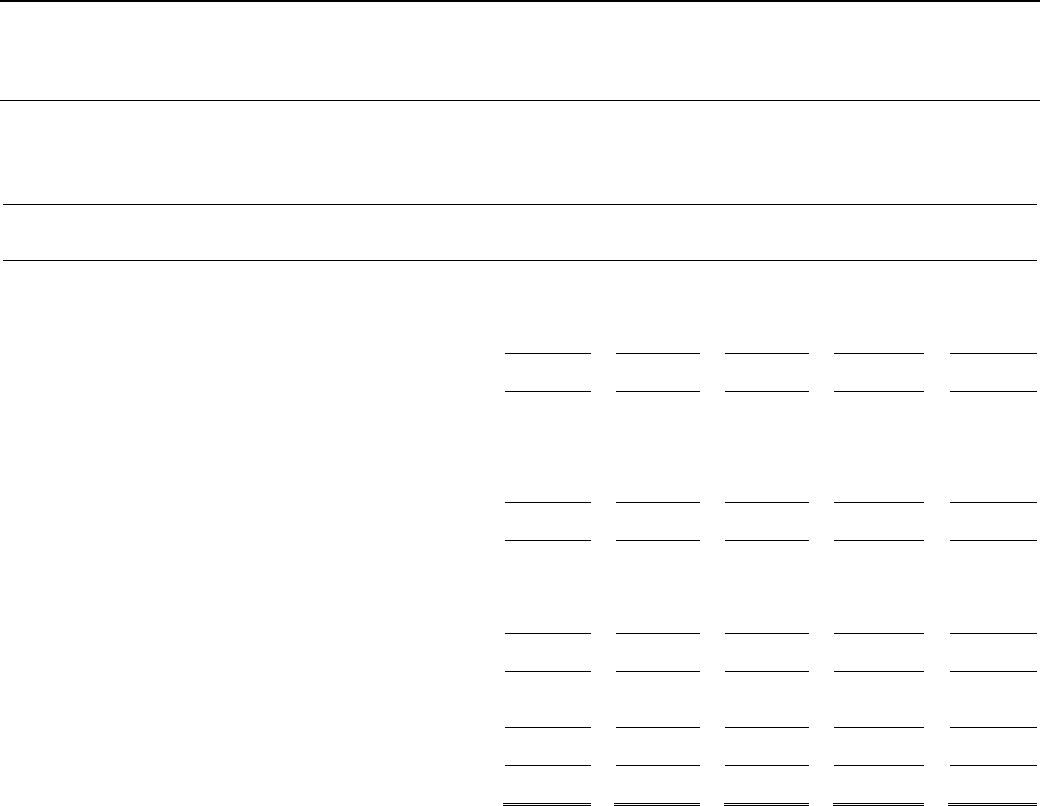

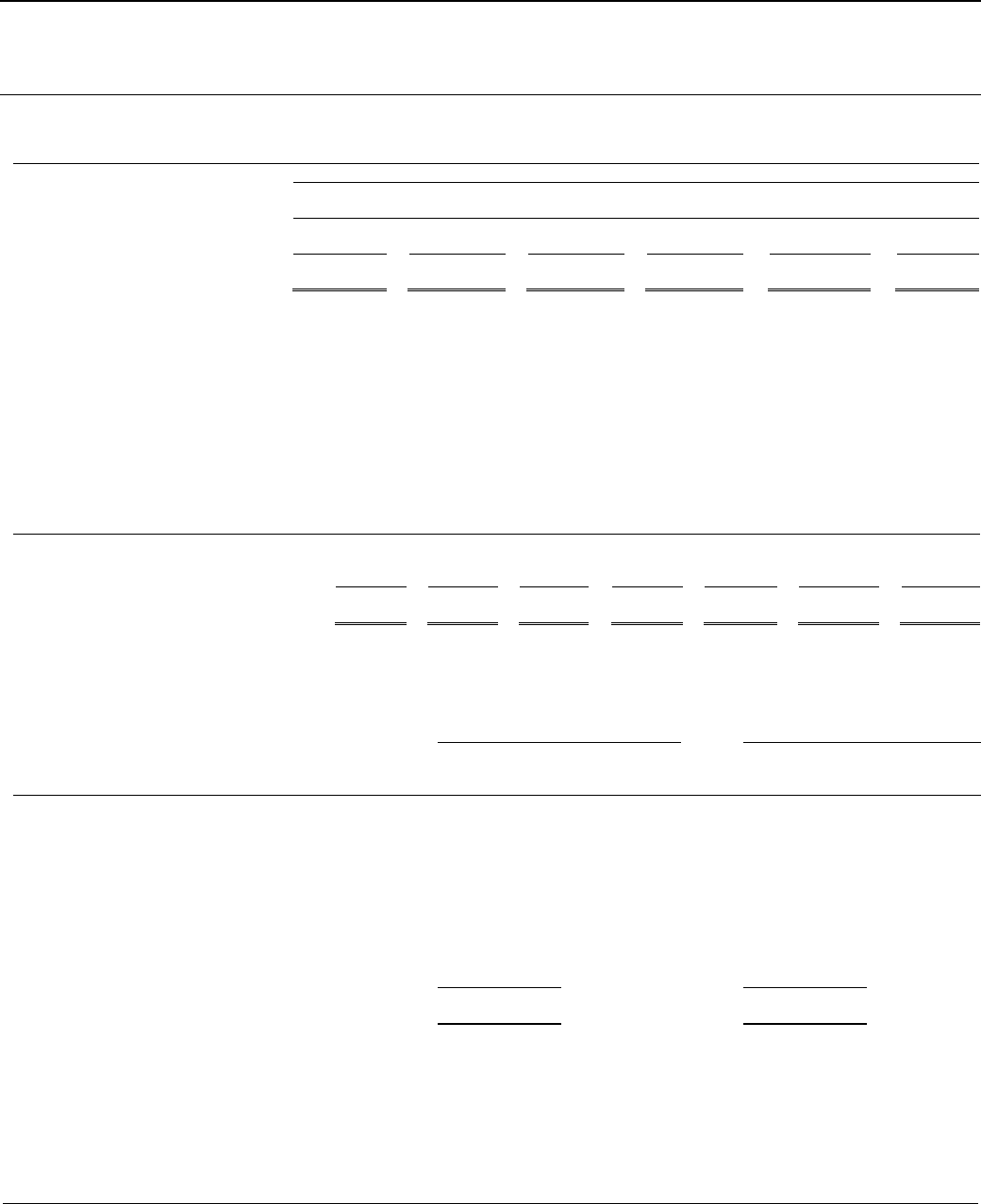

Table 1: Reconciliation of reported Net Income to Allocable Income for Designations ......................... 5

Table 2a: Change in Income before Net Unrealized Gains and Losses on Non-Trading

Financial Instruments Accounted for at Fair Value, Grants to IDA and Net Gains

and Losses attributable to Non-Controlling Interests FY16 vs FY15 ....................................... 5

Table 2b: Change in Income before Net Unrealized Gains and Losses on Non-Trading

Financial Instruments Accounted for at Fair Value, Grants to IDA and Net Gains

and Losses attributable to Non-Controlling Interests FY15 vs FY14 ....................................... 6

Table 3: Selected Financial data as of and for the last Five Fiscal Years .............................................. 6

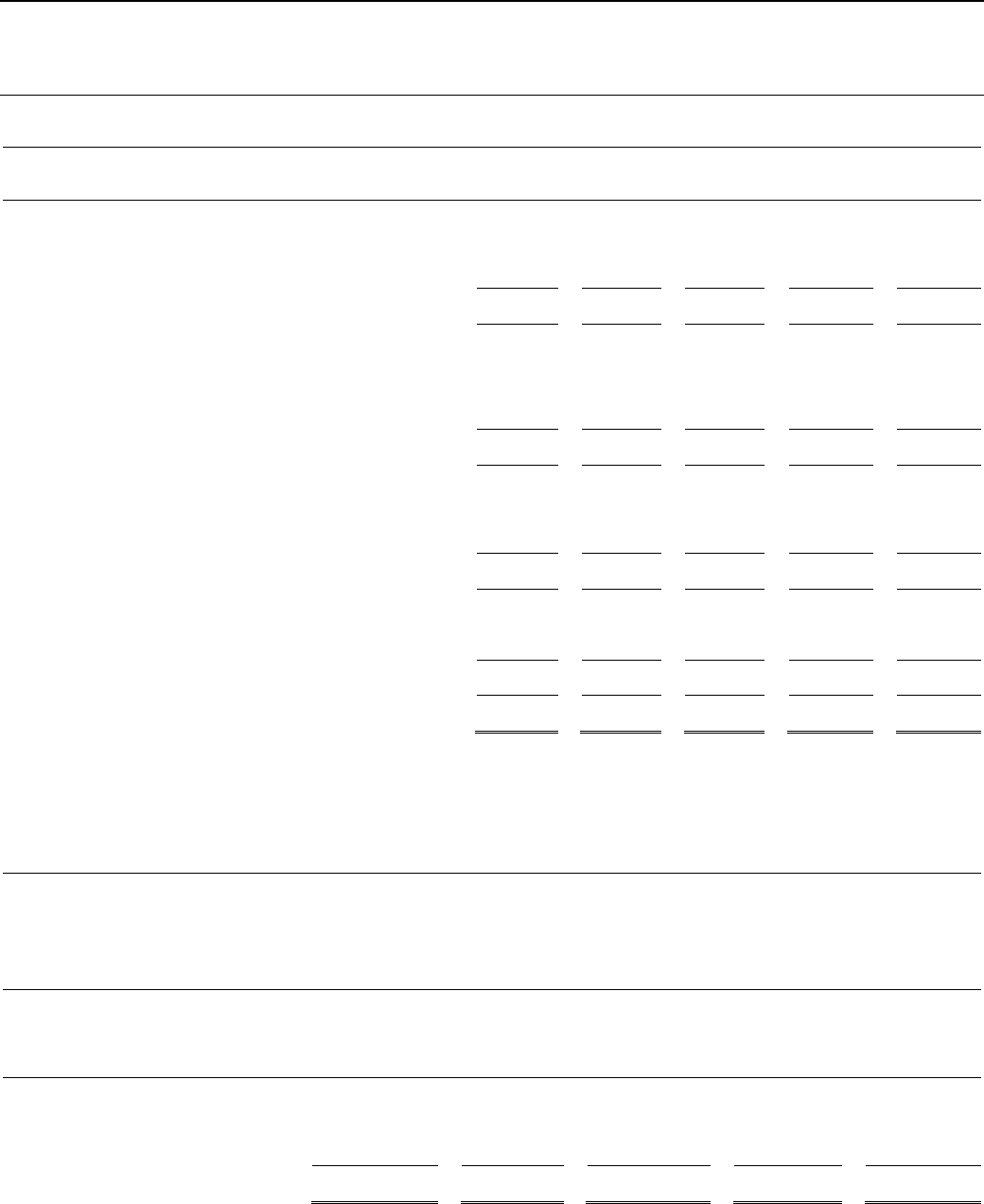

Table 4: Key Financial Ratios ................................................................................................................. 7

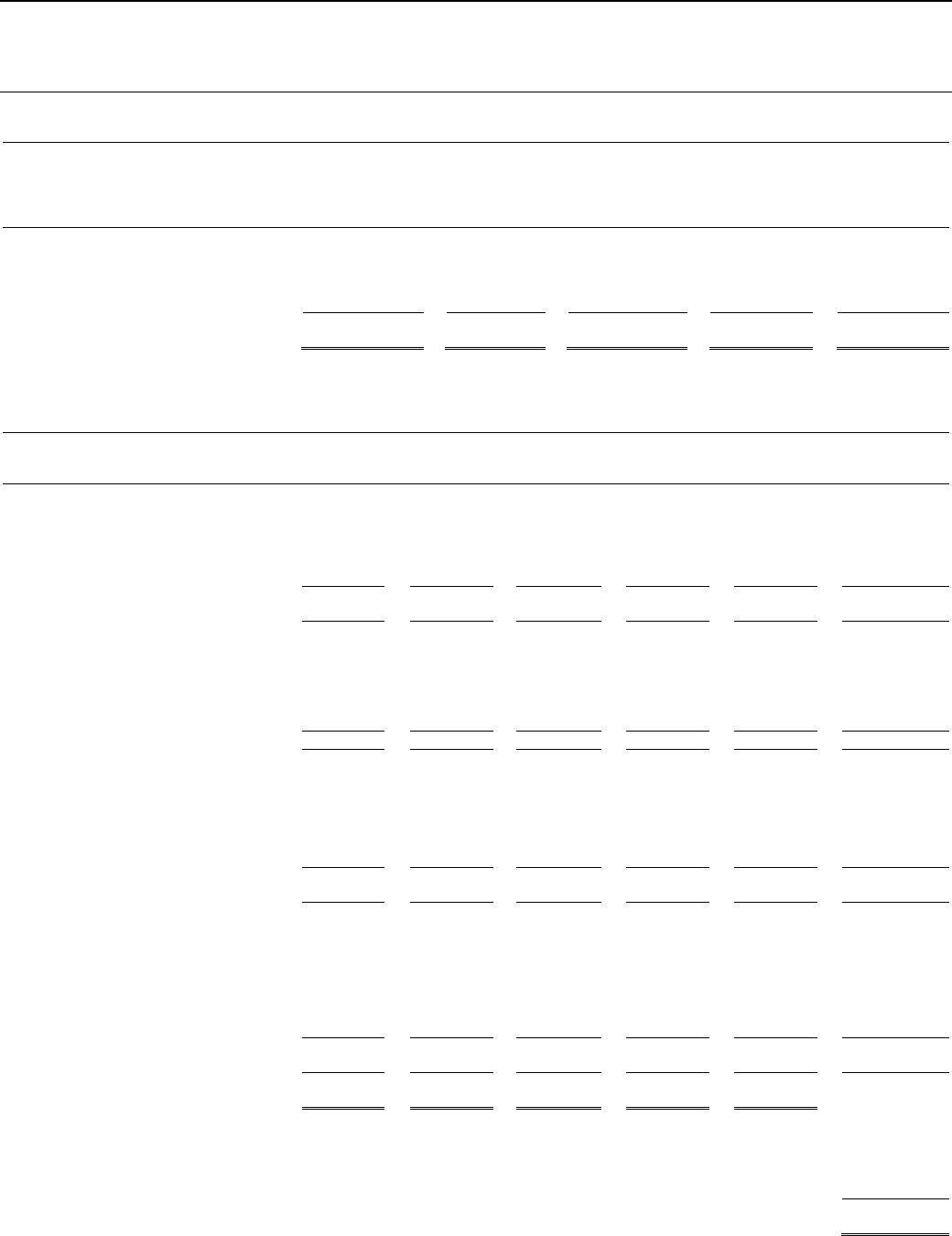

Table 5: FY16 and FY15 Long-Term Finance and Core Mobilization .................................................. 10

Table 6: IFC Advisory Services Portfolio - Program Expenditures by Region for FY16 vs

FY15 ....................................................................................................................................... 13

Table 7: IFC Advisory Services Portfolio - Program Expenditures by Area for FY16 vs FY15 ............ 14

Table 8: List of Funds Managed by AMC ............................................................................................. 14

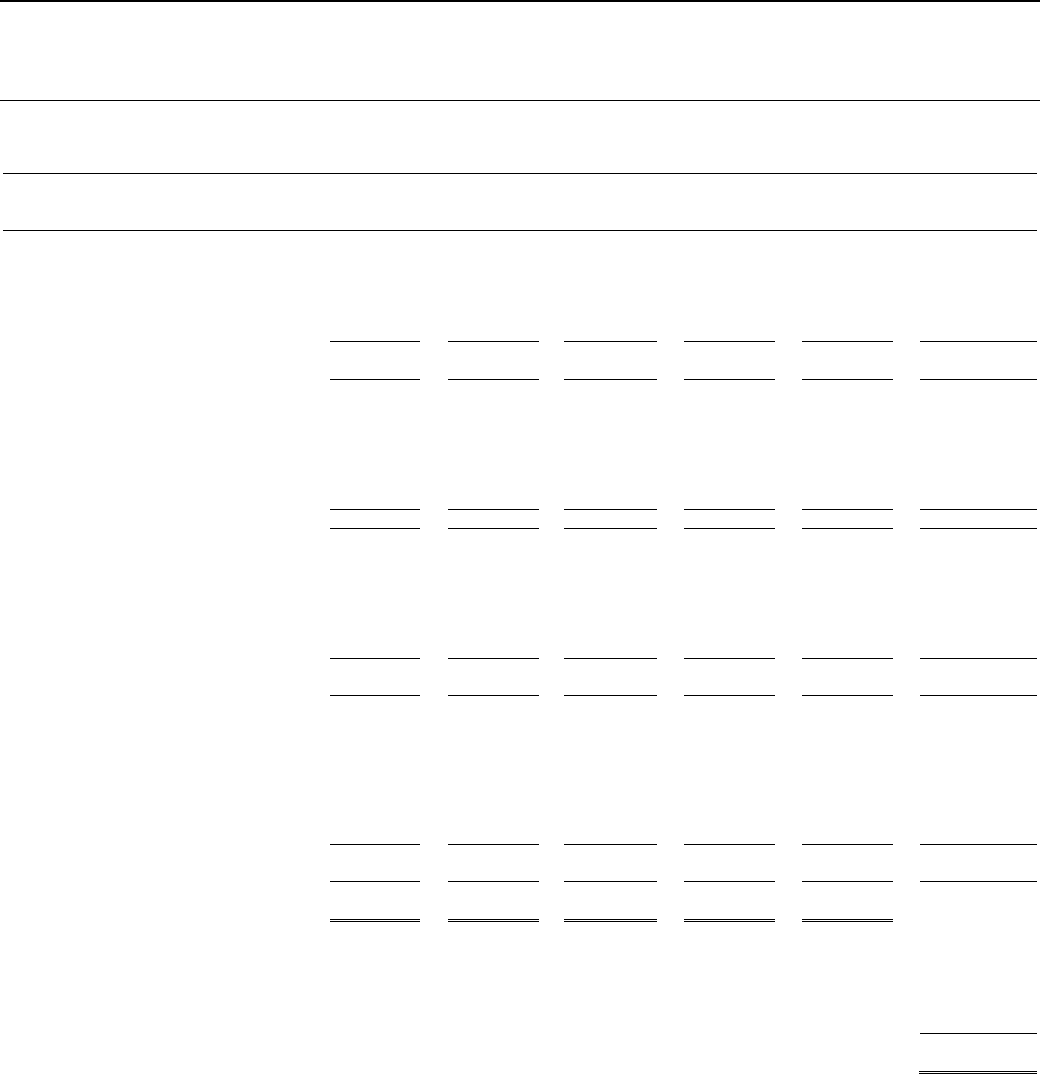

Table 9: Activities of the Funds Managed by AMC FY16 vs FY15 ...................................................... 15

Table 10: IFC's Capital ........................................................................................................................... 17

Table 11: IFC's Retained Earnings ......................................................................................................... 17

Table 12: IFC Loan Portfolio Credit Risk Indicators ............................................................................... 22

Table 13: Main Elements of Net Income (Loss) and Comprehensive Income (Loss) ............................ 28

Table 14: Change in Net Income FY16 vs FY15 .................................................................................... 29

Table 15: FY16 Change in Income from Loans and Guarantees, including Realized Gains

and Losses on Loans and Associated Derivatives ................................................................. 30

Table 16: Net Unrealized Gains and Losses on Non-Trading Financial Instruments FY16 vs

FY15 ....................................................................................................................................... 32

Table 17: Change in Other Comprehensive Income (Loss) - Unrealized Gains and Losses on

Equity Investments and Debt Securities FY16 vs FY15 .......................................................... 33

Table 18: Change in Net Income FY15 vs FY14 .................................................................................... 33

Table 19: FY15 Change in Income from Loans and Guarantees, including Realized Gains

and Losses on Loans and Associated Derivatives ................................................................. 34

Table 20: Net Unrealized Gains and Losses on Non-Trading Financial Instruments FY15 vs

FY14 ....................................................................................................................................... 36

Table 21: Change in Other Comprehensive Income (Loss) - Unrealized Gains and Losses on

Equity Investments and Debt Securities FY15 vs FY14 ..........................................................

37

Figures

Figure 1:

Disbursed Investment Portfolio-Distribution by Region .......................................................... 11

Figure 2: Disbursed Investment Portfolio-Distribution by Sector ........................................................... 11

Figure 3: Currency position of the Disbursed Loan Portfolio ................................................................. 12

Figure 4: IFC's Funding Resources ....................................................................................................... 16

Figure 5: IFC's Enterprise Risk Management Framework ..................................................................... 19

Figure 6: NPLs as Percentage of Disbursed Loan Portfolio .................................................................. 22

Figure 7: Environment and Social Risk .................................................................................................. 25

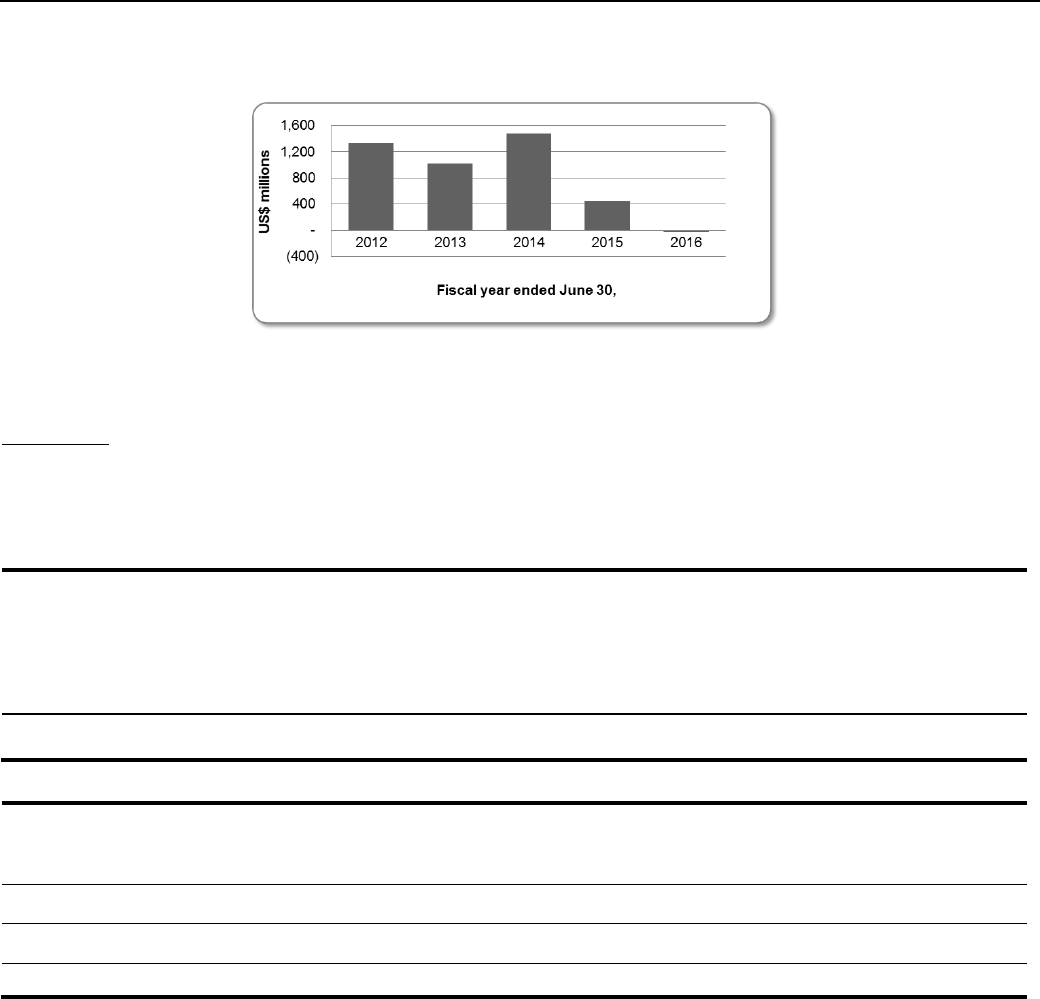

Figure 8: IFC's Net (Loss) Income, Fiscal Years 2012-2016 ................................................................. 29

Page 4

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

I. EXECUTIVE SUMMARY

International Finance Corporation (IFC or the Corporation) is the largest global development institution focused on the private sector in

developing countries. Established in 1956, IFC is owned by 184 member countries, a group that collectively determines its policies. IFC

is a member of the World Bank Group (WBG)

1

but is a legal entity separate and distinct from IBRD, IDA, MIGA, and ICSID, with its own

Articles of Agreement, share capital, financial structure, management, and staff. Membership in IFC is open only to member countries of

IBRD.

The mission of the WBG is defined by two goals:

•

To end extreme poverty by reducing the percentage of people living on less than $1.90 a day to no more than 3% globally b

y

203

0; and

•

To promote shared prosperity in a sustainable manner by fostering income growth for the bottom 40% of the population of ever

y

dev

eloping country.

In the year ended June 30, 2016 (FY16), WBG, together with the international community, agreed to support a more ambitious and broader

development agenda, including the Sustainable Development Goals (SDGs), the climate change goals at the 21

st

Conference of Parties

(COP21), and the Addis Ababa Action Agenda agreed at the Financing for Development (FfD) conference in Ethiopia.

IFC’s overall strategy remains focused on contributing to the WBG strategy and goals.

IFC helps developing countries achieve sustainable growth by financing private sector investment, mobilizing capital in international

financial markets, and providing advisory services to businesses and governments. IFC’s principal investment products are loans and

equity investments, with smaller debt securities and guarantee portfolios. IFC also plays an active and direct role in mobilizing additional

funding from other investors and lenders through a variety of means. Such means principally comprise: loan participations, parallel loans,

sales of loans, the non-IFC portion of structured finance transactions which meet core mobilization criteria, the non-IFC portion of

commitments in IFC’s initiatives, and the non-IFC investment portion of commitments in funds managed by IFC’s wholly owned subsidiary,

IFC Asset Management Company LLC (AMC), (collectively Core Mobilization). Unlike most other development institutions, IFC does not

accept host government guarantees of its exposures. IFC raises virtually all of the funds for its lending activities through the issuance of

debt obligations in the international capital markets, while maintaining a small borrowing window with IBRD. Equity investments are funded

from capital (or net worth).

IFC’s capital base and its assets and liabilities, other than its equity investments, are primarily denominated in US dollars ($ or US$) or

swapped into US dollars but it has a growing portion of debt issuances denominated in currencies other than USD and which are invested

in such currencies. Overall, IFC seeks to minimize foreign exchange and interest rate risks arising from its loans and liquid assets by

closely matching the currency and rate bases of its assets in various currencies with liabilities having the same characteristics. IFC

generally manages non-equity investment related and certain lending related residual currency and interest rate risks by utilizing currency

and interest rate swaps and other derivative instruments.

The Management’s Discussion and Analysis contains forward looking statements which may be identified by such terms as “anticipates,”

“believes,” “expects,” “intends,” “plans” or words of similar meaning. Such statements involve a number of assumptions and estimates that

are based on current expectations, which are subject to risks and uncertainties beyond IFC’s control. Consequently, actual future results

could differ materially from those currently anticipated.

BASIS OF PREPARATION OF IFC’S CONSOLIDATED FINANCIAL STATEMENTS

The accounting and reporting policies of IFC conform to accounting principles generally accepted in the United States (GAAP). IFC’s

accounting policies are discussed in more detail in Section VI, Critical Accounting Policies, and in Note A to IFC’s Consolidated Financial

Statements as of and for the year ended June 30, 2016 (FY16 Consolidated Financial Statements).

Management uses income available for designations (Allocable Income) (a non-GAAP measure) as a basis for designations of retained

earnings. Allocable Income generally comprises net income excluding net unrealized gains and losses on equity investments and net

unrealized gains and losses on non-trading financial instruments accounted for at fair value, income from consolidated entities other than

AMC, and expenses reported in net income related to prior year designations

.

FINANCIAL PERFORMANCE SUMMARY

From year to year, IFC’s net income is affected by a number of factors that can result in volatile financial performance.

Global equity markets in emerging economies were volatile in the years ended June 30, 2016 (FY16) and June 30, 2015 (FY15).

Additionally, there was further depreciation of certain of IFC’s major investment currencies against IFC’s reporting currency, the US$,

particularly in the Latin America and Caribbean region in the first six months of FY16, continuing the trend experienced throughout much

of FY15. The second half of FY16 saw a partial reversal of the recent trend as certain of IFC’s major investment currencies appreciated

against the US$. FY16 also saw a continuation of lower commodities prices. Collectively, these factors negatively impacted the valuation

of many of IFC’s investments in FY16.

The above factors, together with some adverse project-specific developments, have put downward pressure on IFC’s investment portfolio

returns in FY16, resulting in continuing high other-than-temporary impairments on equity investments and debt securities, albeit marginally

lower than in FY15, along with higher provisions for losses on loans when compared to FY15. Partially offsetting these negative impacts

on the investment portfolio, IFC realized robust capital gains on equity investment sales, the largest of which occurred in the three months

1

The other institutions of the World Bank Group are the International Bank for Reconstruction and Development (IBRD), the International Development Association

(IDA), the Multilateral Investment Guaranty Agency (MIGA), and the International Centre for Settlement of Investment Disputes (ICSID).

Page 5

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

ended September 30, 2015 (FY16 Q1). Realized gains were concentrated in FY16, with six investments accounting for 56% of the realized

gains.

Capital markets were particularly turbulent in FY16 Q4 with credit spreads widening significantly. By the end of FY16, however, markets

had largely recovered and IFC ultimately recorded stronger liquid asset income in the second half of FY16 than in the first half of FY16,

although gross income from liquid assets in FY16 remained lower than in FY15.

IFC’s financial performance is detailed more fully in Section VII - Results of Operations.

IFC has reported income before net unrealized gains and losses on non-trading financial instruments accounted for at fair value and grants

to IDA of $500 million in FY16, $355 million lower than FY15 ($855 million) and $1,282 million lower than FY14 ($1,782 million).

Income Available for Designations (a non-GAAP measure)

2

was $770 million, 42% lower than in FY15 ($1,327 million) and 52% lower

than in FY14 ($1,614 million).

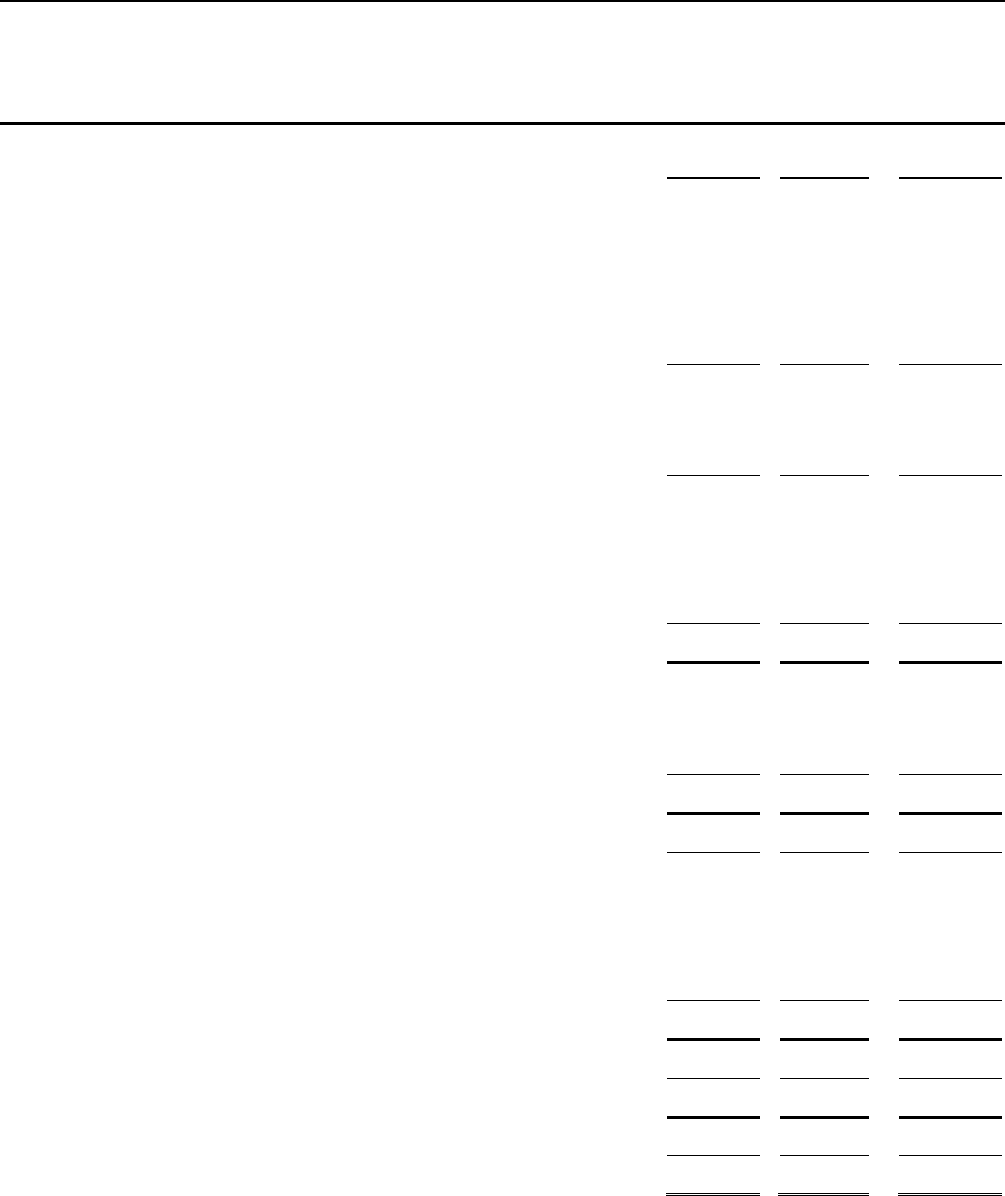

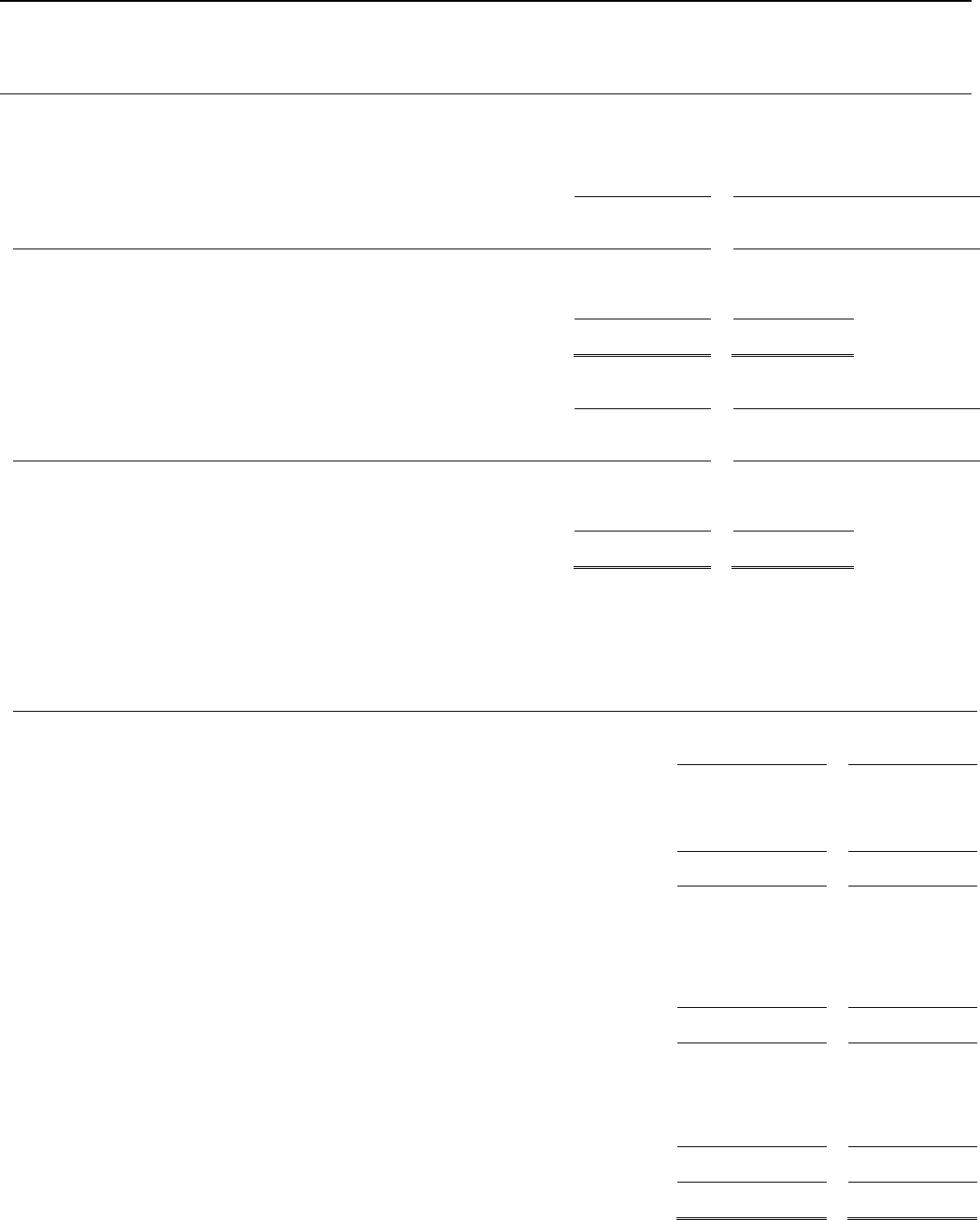

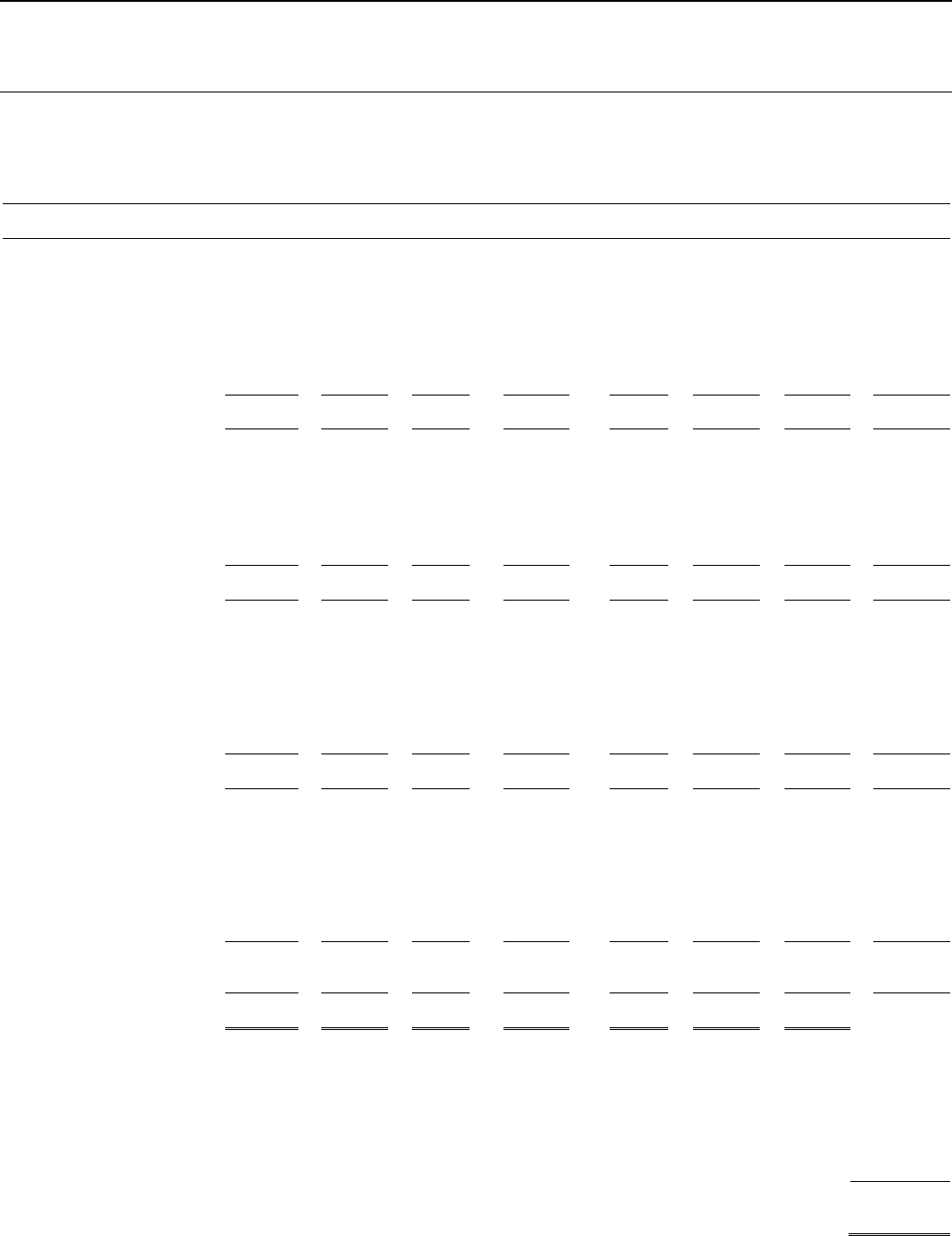

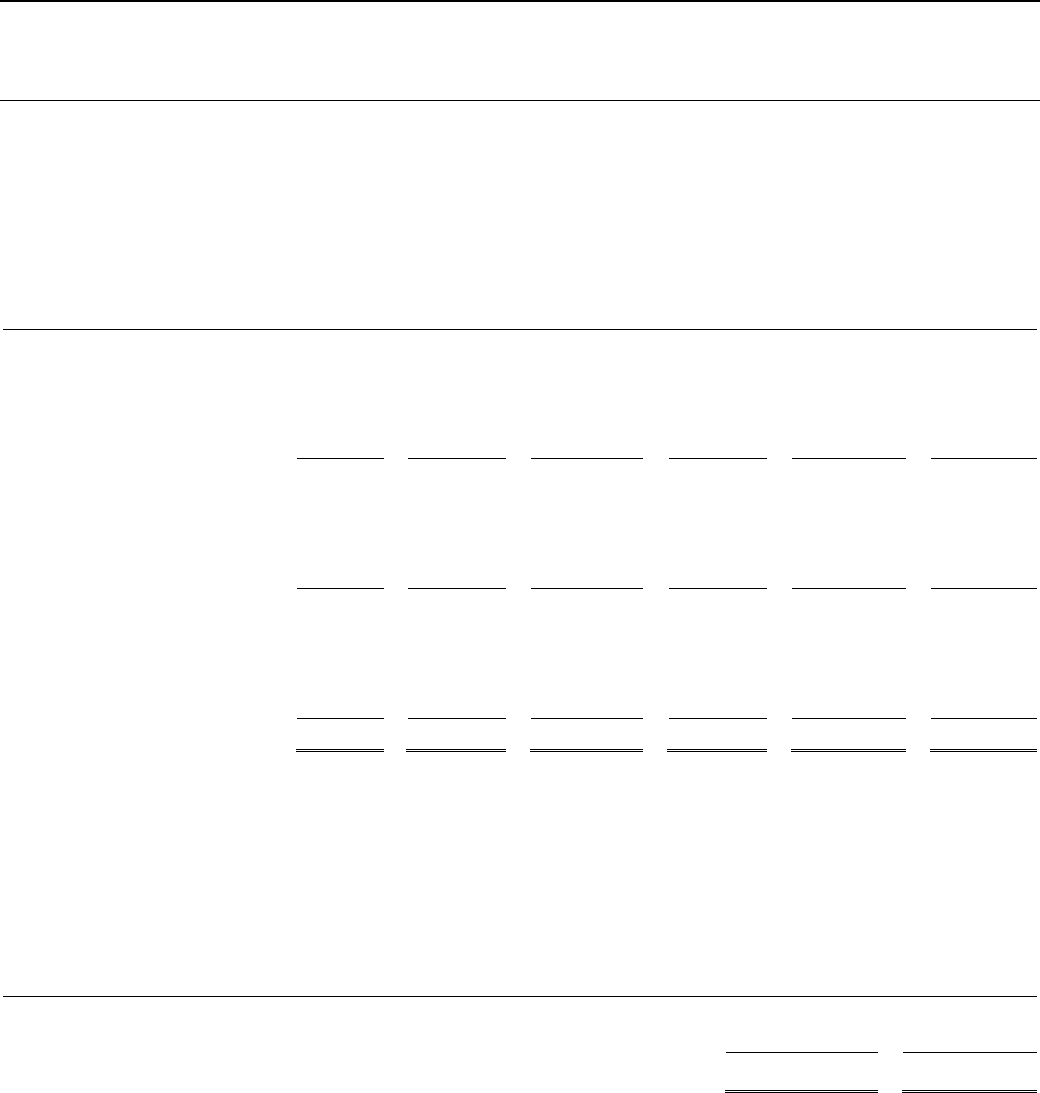

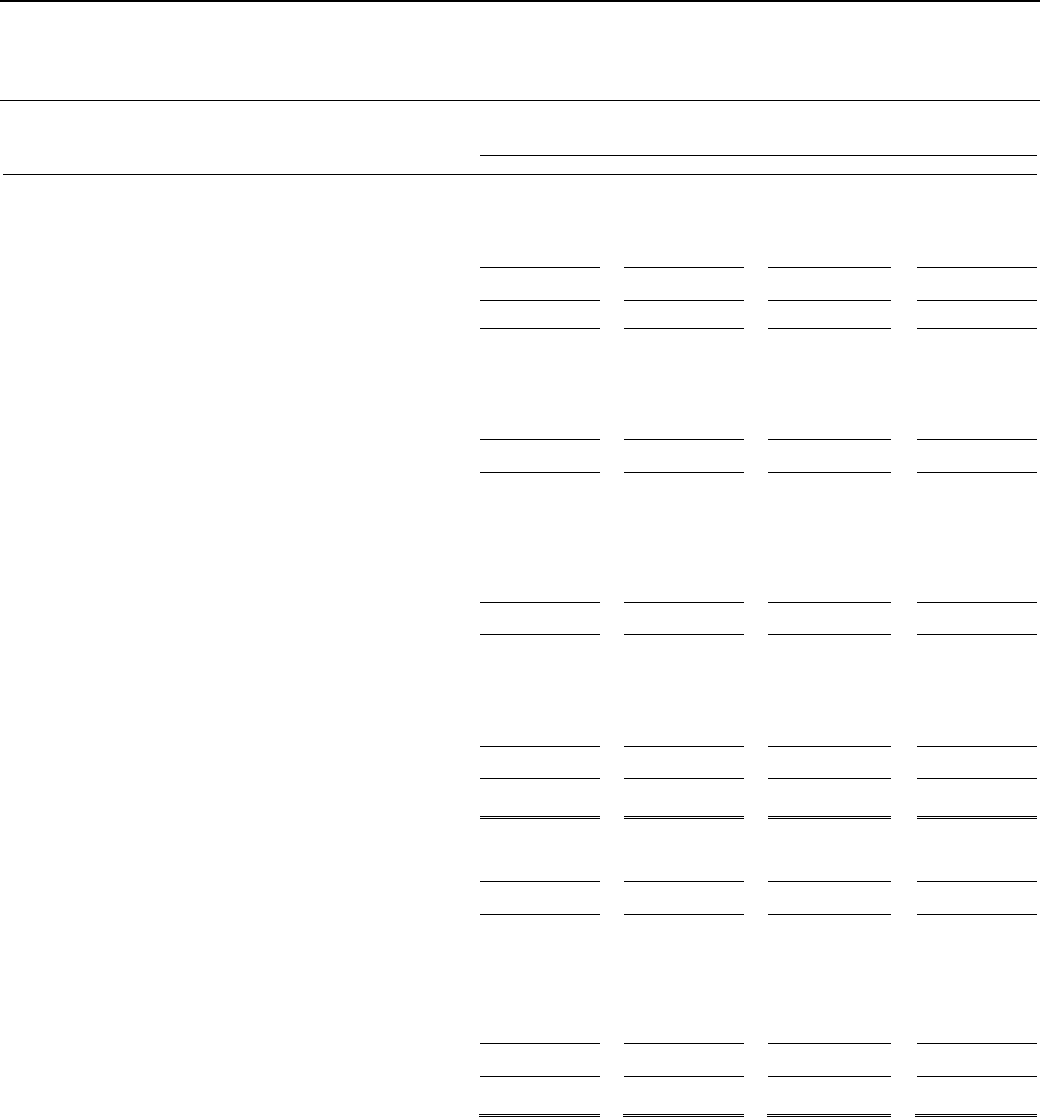

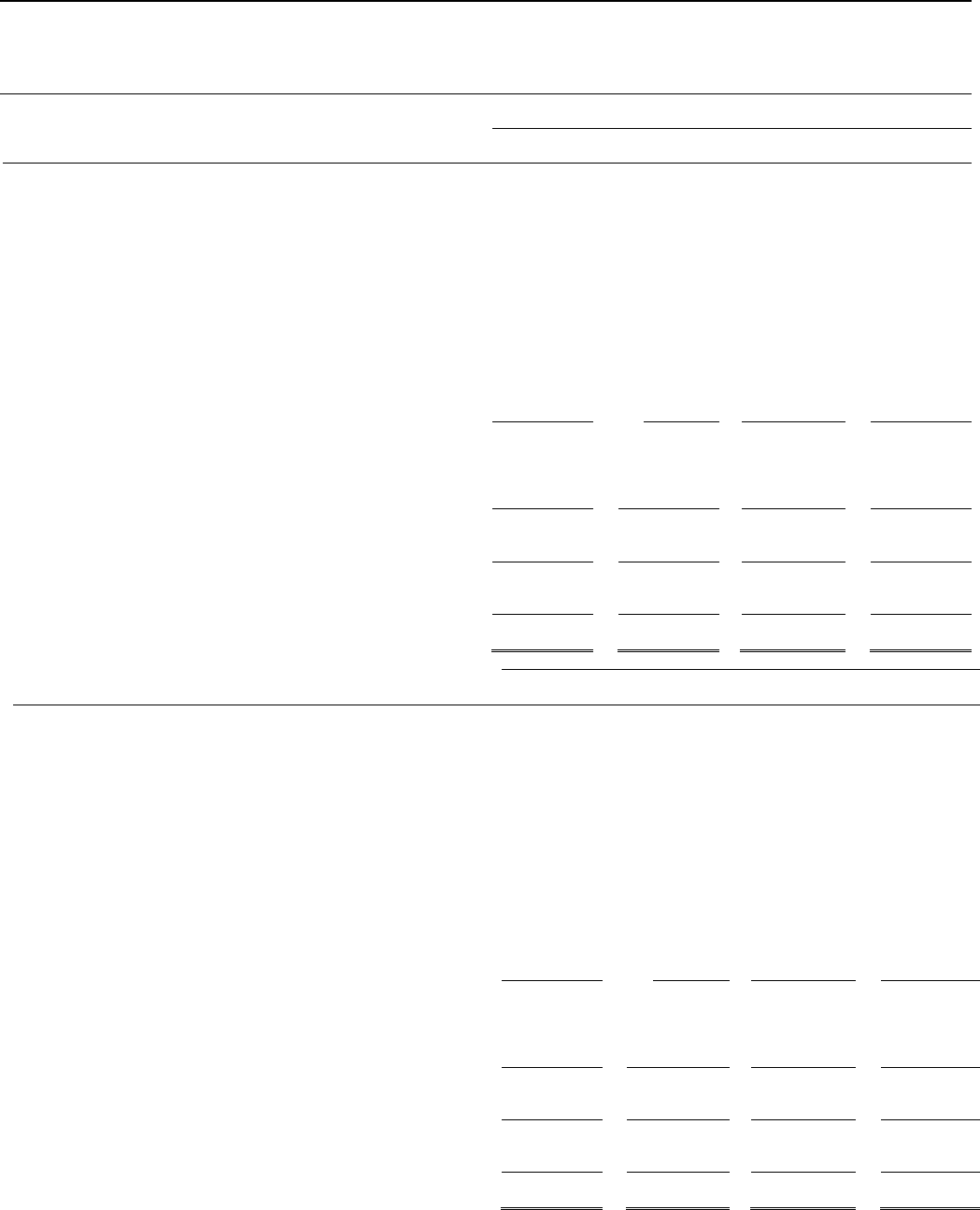

Table 1: Reconciliation of reported Net Income to Income Available for Designations

FY16

FY15

FY14

Net (loss) income attributable to IFC

$

(33)

$

445

$

1,483

Add: Net losses (gains) attributable to non-controlling interests

(1)

(36)

5

Net (loss) income

$

(34)

$

409

$

1,488

Adjustments to reconcile net income to Income Available for Designations

Grants to IDA from prior year designations

330

340

251

Unrealized gains and losses on investments

470

456

(287)

Unrealized gains and losses on borrowings

(62)

52

74

Advisory Services Expenses from prior year designations

57

59

79

Other

9

11

9

Income Available for Designations

$

770

$

1,327

$

1,614

Based on the distribution policy approved by IFC’s Board of Directors, the maximum amount available for designation relating to FY16 would

be $161 million. On August 4, 2016, the Board of Directors approved a designation of $101 million of IFC’s retained earnings for grants to

IDA and a designation of $60 million of IFC’s retained earnings for Advisory Services. These designations are expected to be noted with

approval by the Board of Governors, and thereby concluded, in FY17.

Table 2a: Change in Income before Net Unrealized Gains and Losses on Non-Trading Financial Instruments Accounted for at

Fair Value, Grants to IDA and Net Gains and Losses Attributable to Non-Controlling Interests FY16 vs FY15 (US$ millions)

Increase

(decrease)

FY16 vs FY15

Higher provisions for losses on loans, guarantees and other receivables

$

(188)

Higher charges on borrowings

(151)

Higher foreign currency transaction losses on non-trading activities

(99)

Lower realized gains on equity investments and associated derivatives, net

(71)

Higher other-than-temporary impairments on equity investments and debt securities

(24)

Lower unrealized losses on equity investments and associated derivatives, net

198

Other, net

(20)

Change in income before net unrealized gains and losses on non-trading financial instruments accounted

for at fair value, grants to IDA and net gains and losses attributable to non-controlling interests

$

(355)

2

Income available for designations generally comprises net income excluding unrealized gains and losses on investments and unrealized gains and losses on other

non-trading financial instruments, income from consolidated VIEs, and expenses reported in net income related to prior year designations.

Page 6

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

Table 2b: Change in Income before Net Unrealized Gains and Losses on Non-Trading Financial Instruments Accounted for at

Fair Value, Grants to IDA and Net Gains and Losses Attributable to Non-Controlling Interests FY15 vs FY14 (US$ millions)

Increase

(decrease)

FY15 vs FY14

Higher unrealized losses on equity investments and associated derivatives, net

$

(658)

Higher other-than-temporary impairments on equity investments and debt securities

(484)

Lower income from liquid asset trading activities

(132)

Higher provisions for losses on loans, guarantees and other receivables

(83)

Higher income from loans and guarantees, realized gains and losses on loans and associated derivatives

58

Higher foreign currency transaction gains on non-trading activities

72

Higher realized gains on equity investments and associated derivatives, net

275

Other, net

25

Change in income before net unrealized gains and losses on non-trading financial instruments accounted

for at fair value, grants to IDA and net gains and losses attributable to non-controlling interests

$

(927)

T

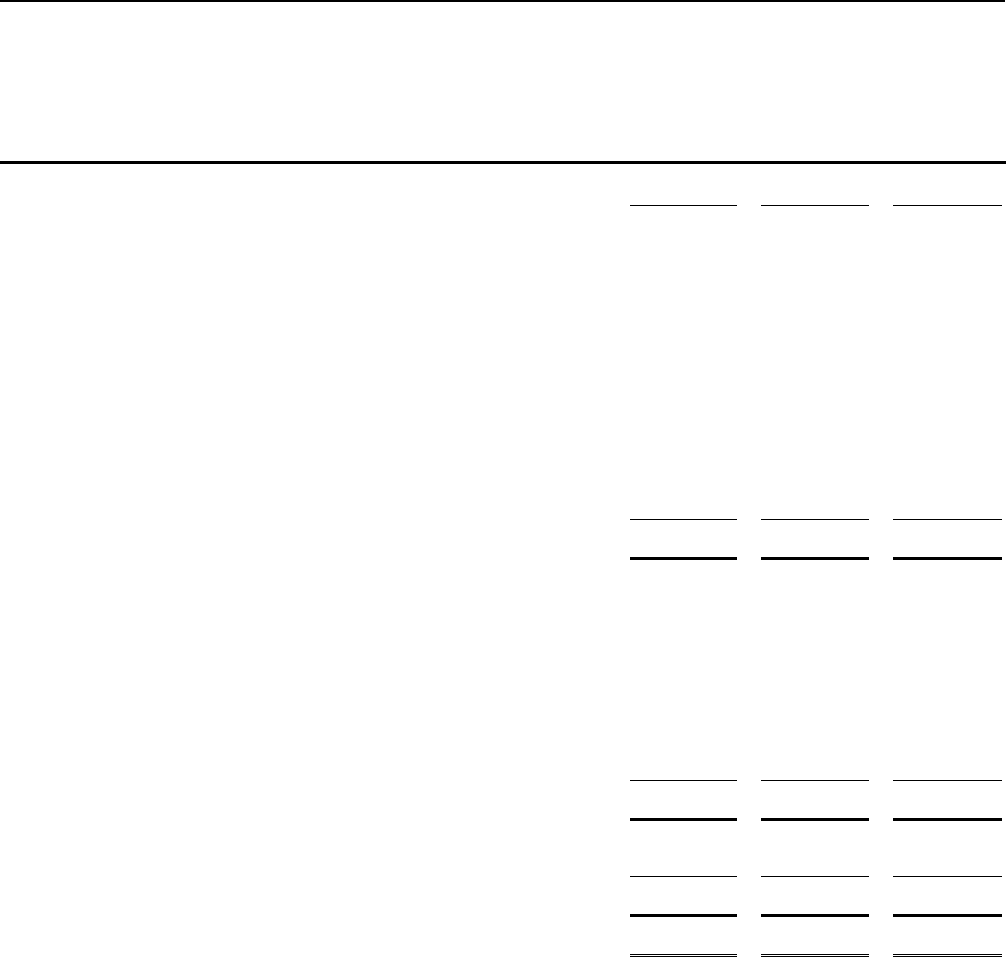

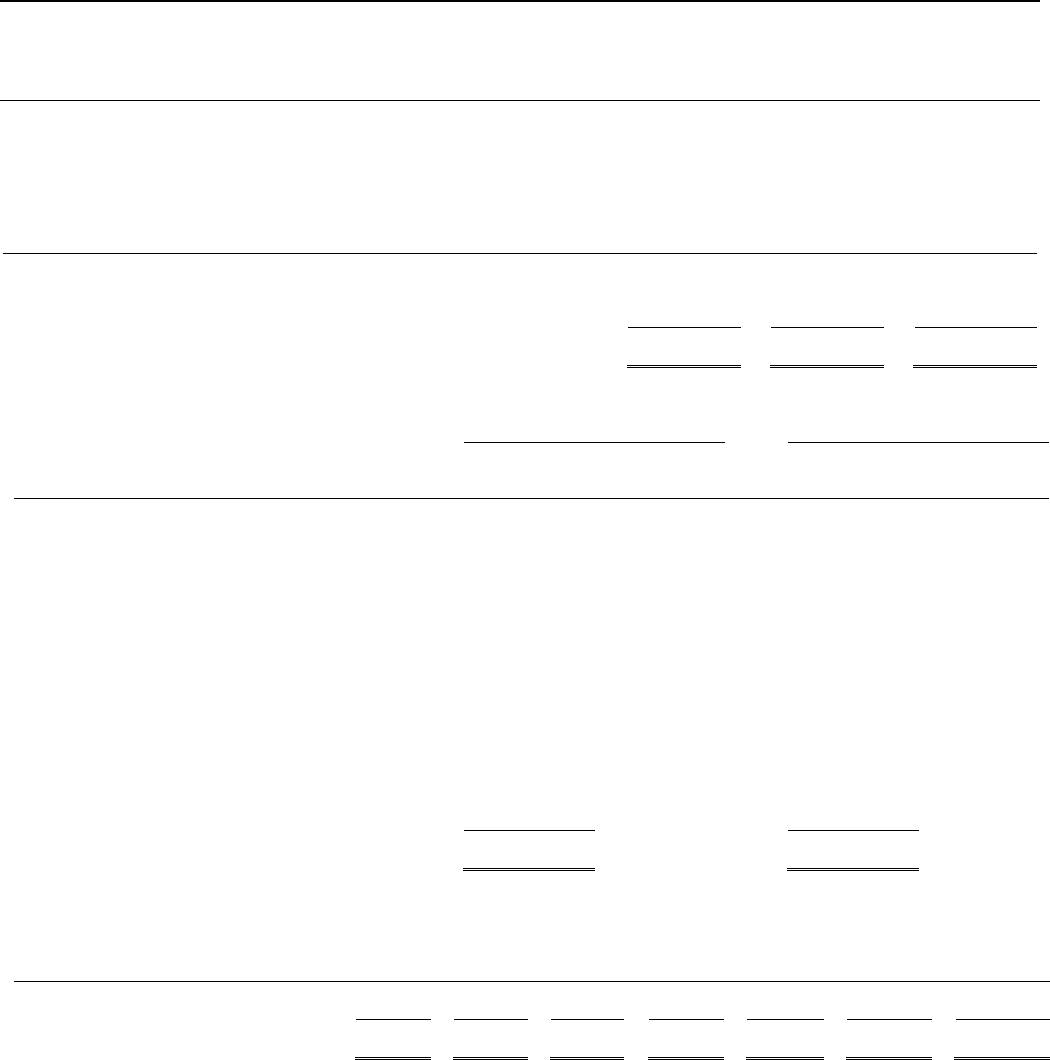

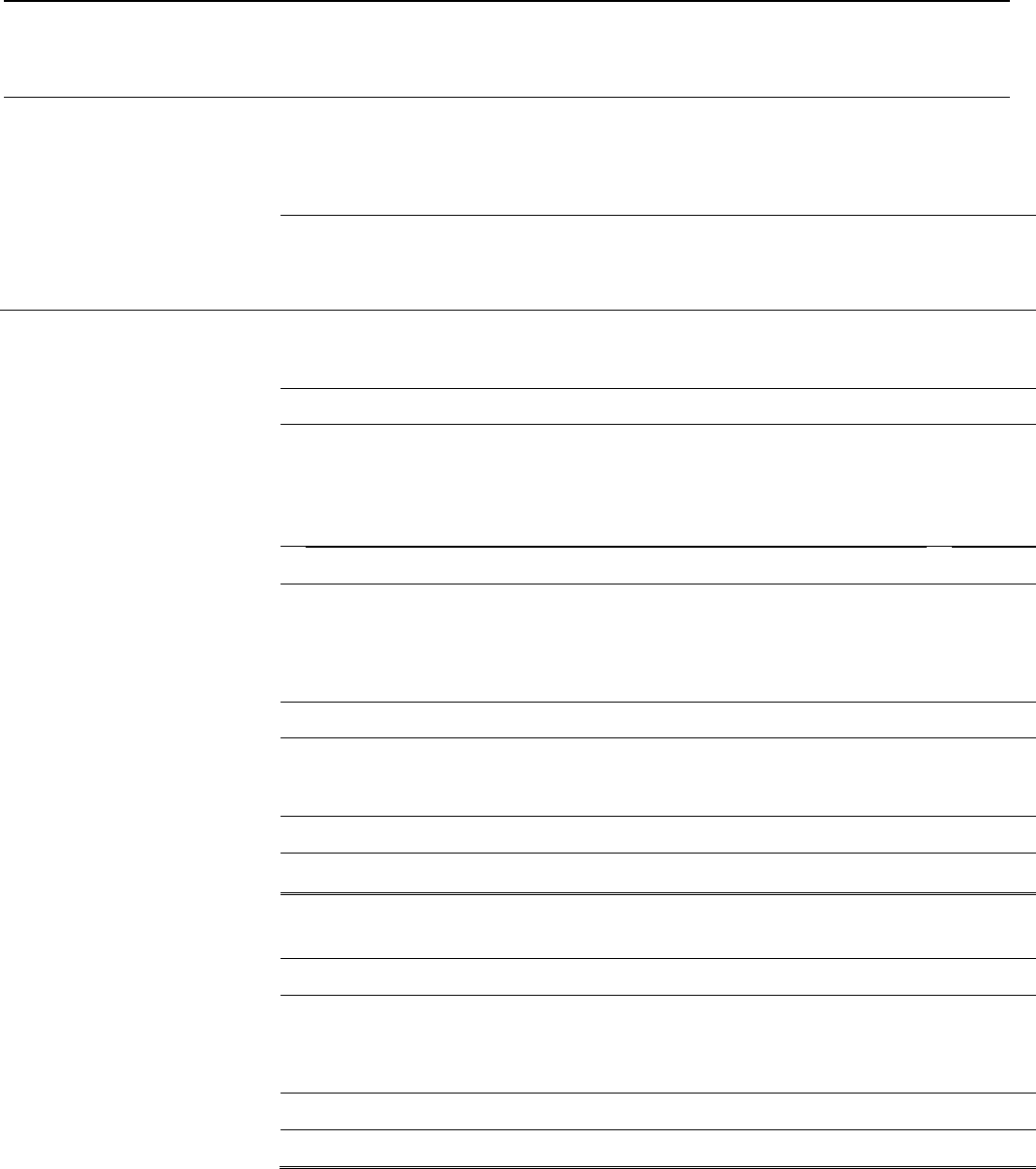

able 3: Selected Financial data as of and for the last Five Fiscal Years (US$ millions)

AS OF AND FOR THE YEARS ENDED JUNE 30

2016

2015

2014

2013

2012

Consolidated income highlights:

Income from loans and guarantees, including realized gains and

losses on loans and associated derivatives

$

1,126

$

1,123

$

1,065

$

996

$

993

Provision for losses on loans, guarantees and other receivables

(359)

(171)

(88)

(243)

(117)

Income from equity investments and associated derivatives

518

427

1,289

732

1,548

Income from debt securities, including realized gains and losses

on debt securities and associated derivatives

129

132

89

69

71

Income from liquid asset trading activities

504

467

599

500

313

Charges on borrowings

(409)

(258)

(196)

(220)

(181)

Other income

501

505

461

441

448

Other expenses

(1,464)

(1,423)

(1,418)

(1,401)

(1,207)

Foreign currency transaction gains and losses on non-trading

activities

(46)

53

(19)

35

145

Income before net unrealized gains and losses on non-trading

financial instruments accounted for at fair value and grants

to IDA

500

855

1,782

909

2,013

Net unrealized gains and losses on non-trading financial

instruments accounted for at fair value

(204)

(106)

(43)

441

(355)

Income before grants to IDA

296

749

1,739

1,350

1,658

Grants to IDA

(330)

(340)

(251)

(340)

(330)

Net (loss) income

(34)

409

1,488

1,010

1,328

Less: Net losses (gains) attributable to non-controlling interests

1

36

(5)

8

-

Net (loss) income attributable to IFC

$

(33)

$

445

$

1,483

$

1,018

$

1,328

AS OF AND FOR THE YEARS ENDED JUNE 30

2016

2015

2014

2013

2012

Consolidated balance sheet highlights:

Total assets

$

90,434

$

87,548

$

84,130

$

77,525

$

75,761

Liquid assets, net of associated derivatives

41,373

39,475

33,738

31,237

29,721

Investments

37,356

37,578

38,176

34,677

31,438

Borrowings outstanding, including fair value adjustments

55,142

51,265

49,481

44,869

44,665

Total capital

$

22,766

$

24,426

$

23,990

$

22,275

$

20,580

of which

Undesignated retained earnings

$

20,475

$

20,457

$

20,002

$

18,435

$

17,373

Designated retained earnings

133

184

194

278

322

Capital stock

2,566

2,566

2,502

2,403

2,372

Accumulated other comprehensive (loss) income (AOCI)

(431)

1,197

1,239

1,121

513

Non-controlling interests

23

22

53

38

-

Page 7

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

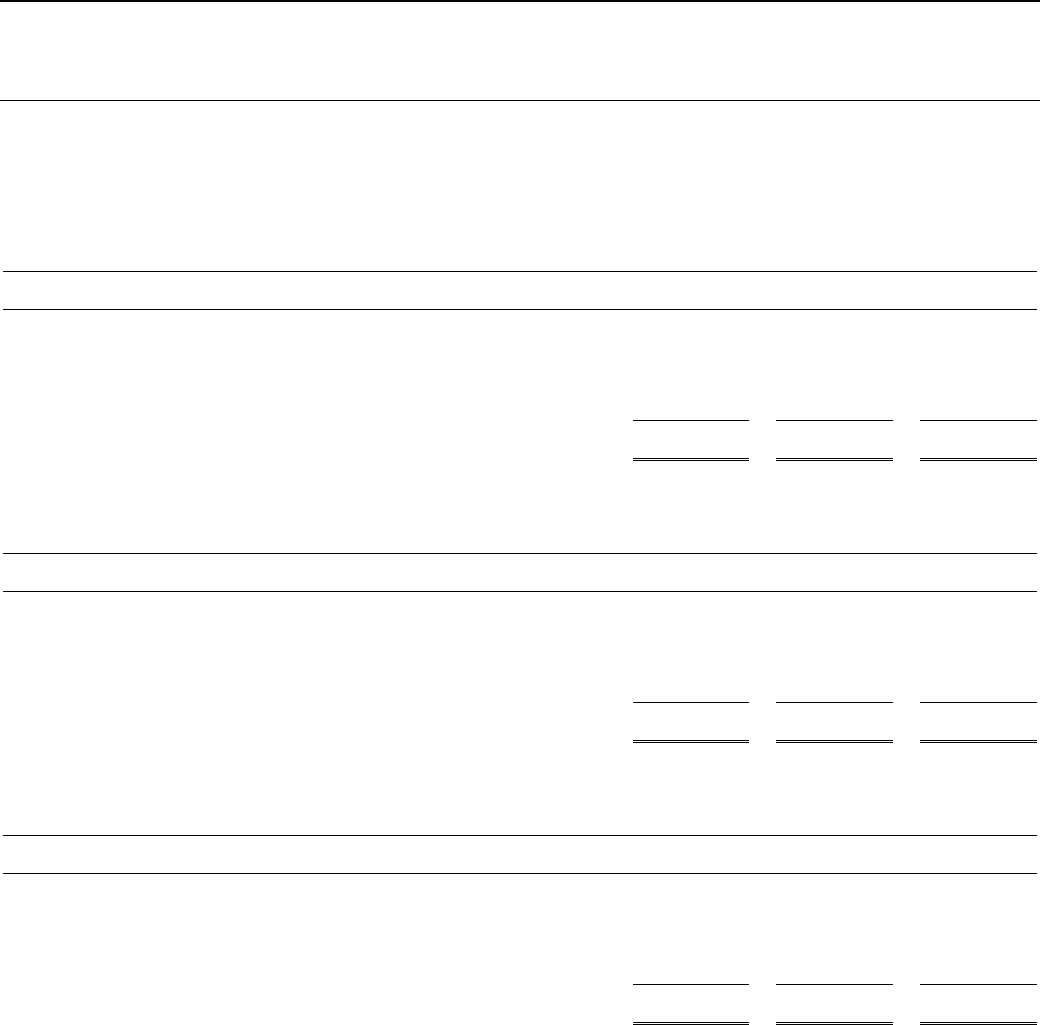

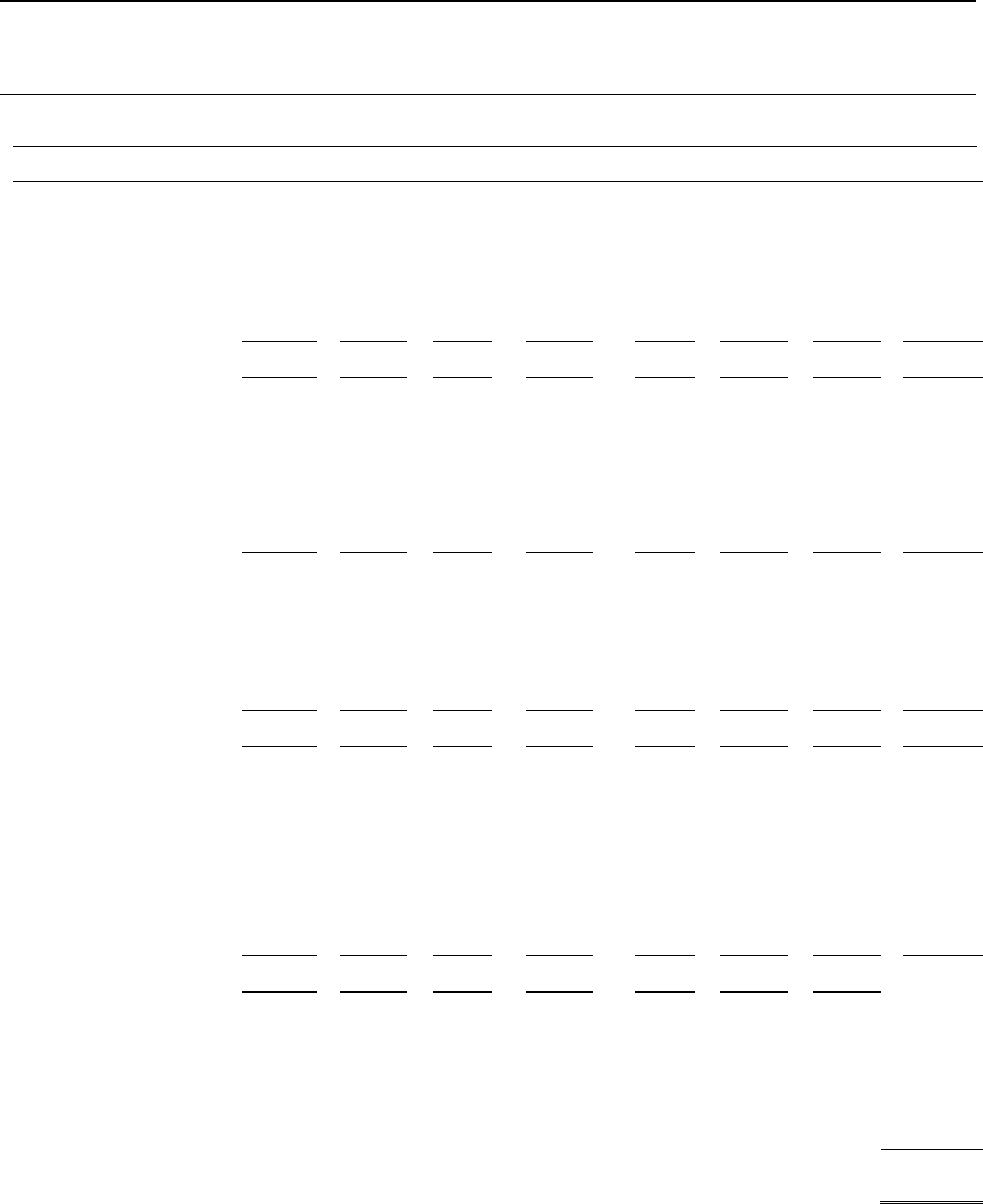

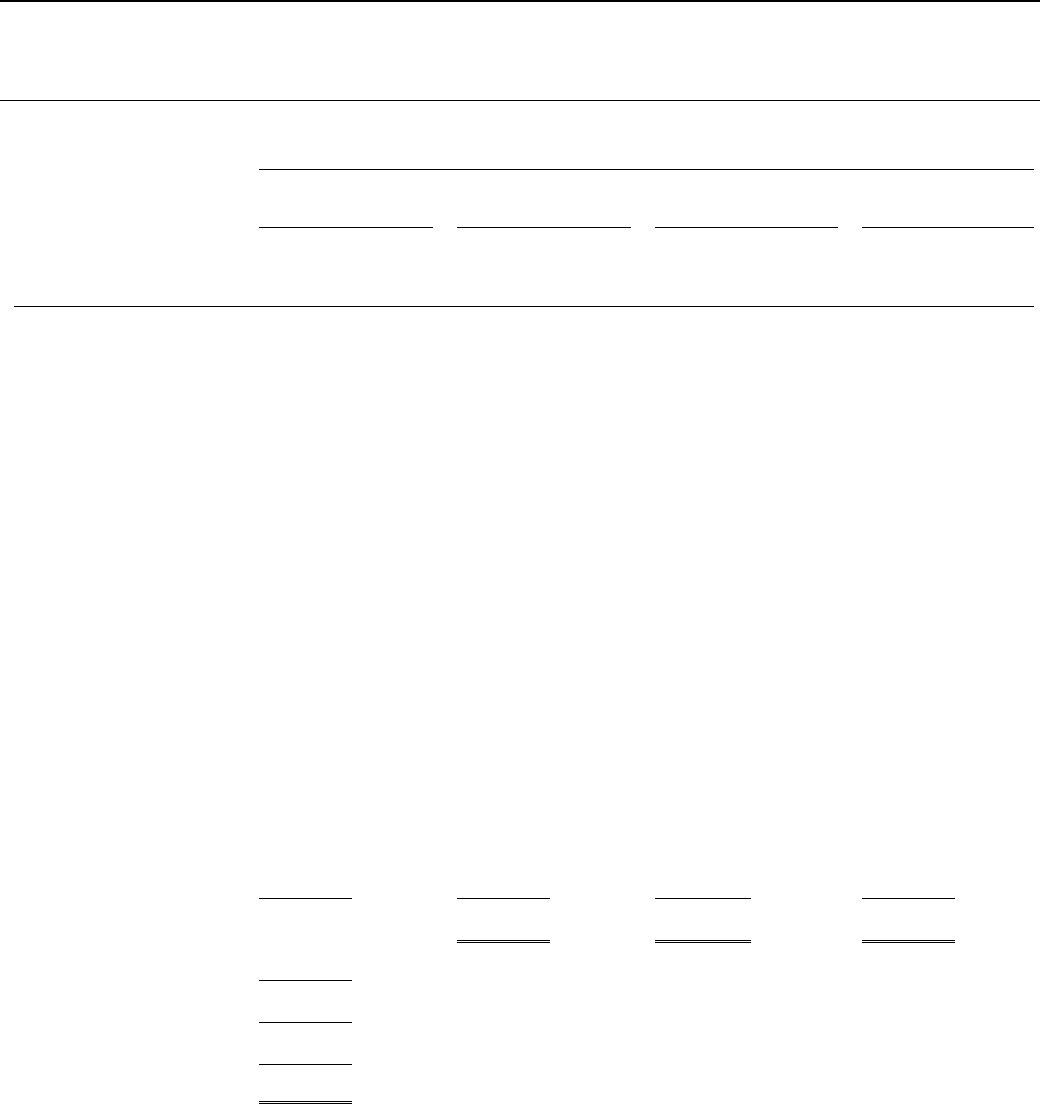

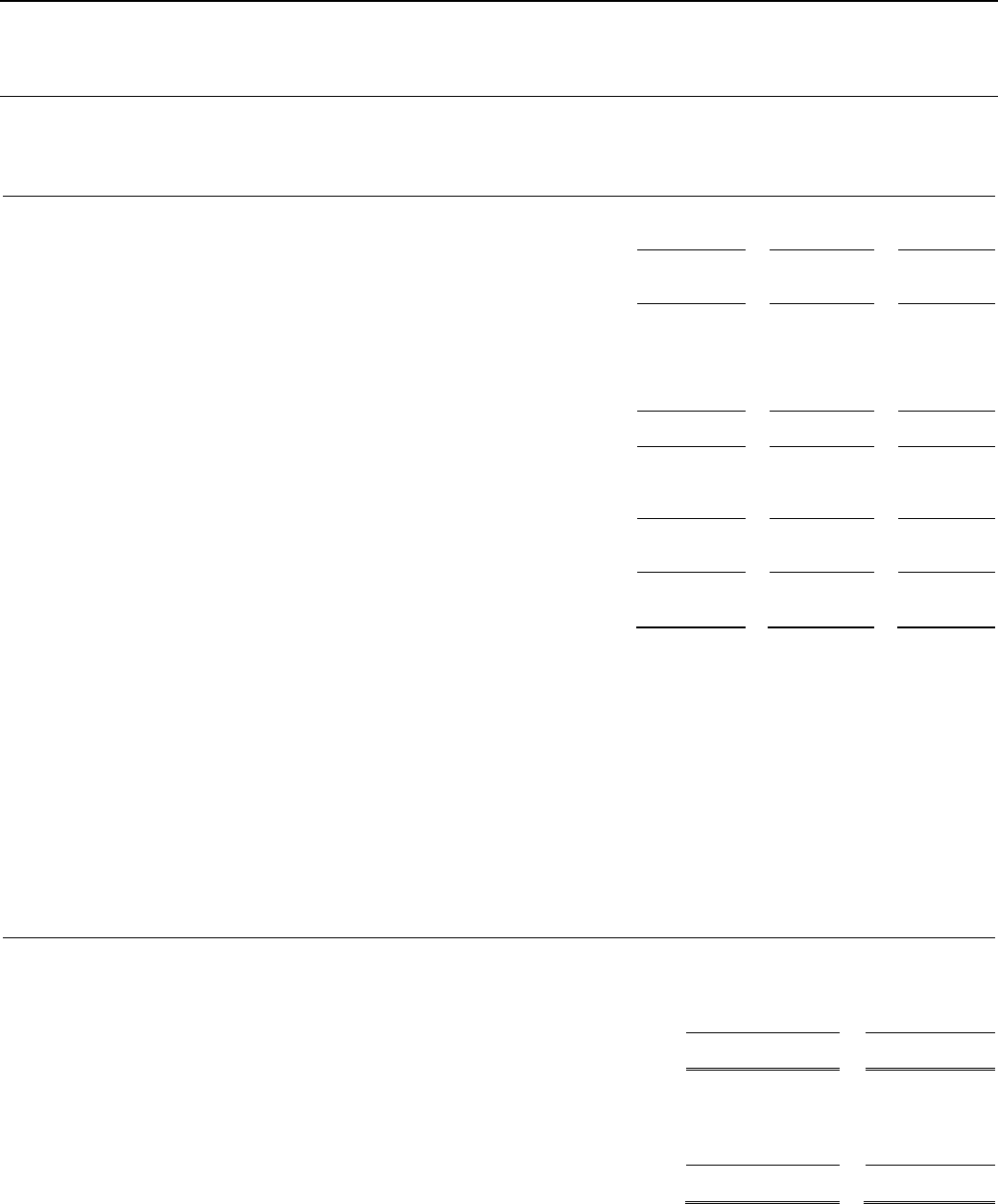

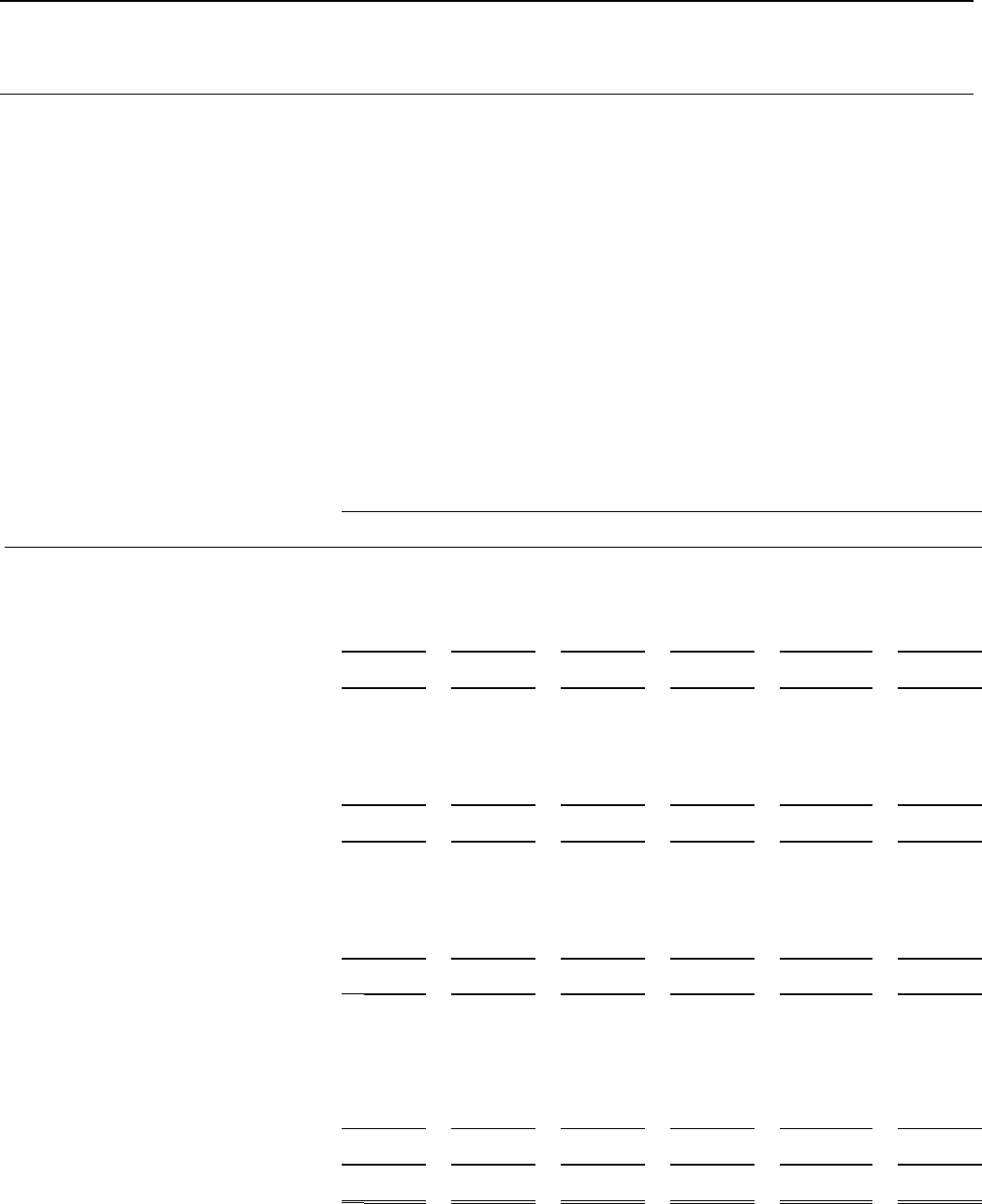

Table 4: Key Financial Ratios

2016

2015

2014

2013

2012

Financial ratios:

a

Return on average assets (GAAP basis)

b

0.0%

0.5%

1.8%

1.3%

1.8%

Return on average assets (non-GAAP basis)

c

0.5%

1.3%

1.8%

0.9%

2.8%

Return on average capital (GAAP basis)

d

(0.1)%

1.8%

6.4%

4.8%

6.5%

Return on average capital (non-GAAP basis)

e

1.8%

4.6%

6.5%

3.1%

9.9%

Overall liquidity ratio

f

85%

81%

78%

77%

77%

External funding liquidity level

504%

494%

359%

309%

327%

Debt to equity ratio

g

2.8:1

2.6:1

2.7:1

2.6:1

2.7:1

Total reserves against losses on loans to total disbursed portfolio

h

7.4%

7.5%

6.9%

7.2%

6.6%

Capital measures:

Total Resources Required ($ billions)

i

19.2

19.2

18.0

16.8

15.5

Total Resources Available ($ billions)

j

22.5

22.6

21.6

20.5

19.2

Strategic Capital

k

3.3

3.4

3.6

3.8

3.7

Deployable Strategic Capital

l

1.0

1.1

1.4

1.7

1.8

Deployable Strategic Capital as a percentage of Total

Resources Available

4%

5%

7%

8%

9%

a. C

ertain financial ratios, as described below, are calculated excluding the effects of unrealized gains and losses on investments, other

non-trading financial instruments, AOCI, and impacts from consolidated Variable Interest Entities (VIEs).

b. Net income for the fiscal year as a percentage of the average of total assets at the end of such fiscal year and the previous fiscal year.

c. Return on average assets is defined as Net income, excluding unrealized gains/losses on investments accounted for at fair value, income from

consolidated VIEs and net gains/losses on non-trading financial investments, as a percentage of total disbursed loan and equity investments

(net of reserves), liquid assets net of repos, and other assets averaged for the current and previous fiscal year.

d. Net income for the fiscal year as a percentage of the average of total capital (excluding payments on account of pending subscriptions) at the end

o

f such fiscal year and the previous fiscal year.

e. Return on average capital is defined as Net income, excluding unrealized gains/losses on investments accounted for at fair value, income from

consolidated VIEs and net gains/losses on non-trading financial investments, as percentage of the paid-in share capital and accumulated

earnings (before certain unrealized gains/losses and excluding cumulative designations not yet expensed) averaged for the current and

previous fiscal year.

f. Overall Liquidity Policy states that IFC would at all times maintain a minimum level of liquidity, plus undrawn borrowing commitments from

the IBRD, that would cover at least 45% of the next three years’ estimated net cash requirements (target range of 65-95%).

g. Leverage (Debt/equity) ratio is defined as the number of times outstanding borrowings plus outstanding guarantees cover paid-in capital and

accumulated earnings (net of retained earnings designations and certain unrealized gains/losses).

h. Total reserves against losses on loans to total disbursed loan portfolio is defined as reserve against losses on loans as a percentage of the total

disbursed.

i. Total resources required (TRR) is the minimum capital required to cover the expected and unexpected loss on IFC’s portfolio, calibrated t

o

m

aintain IFC’s triple-A rating. TRR is the sum of the economic capital requirements for IFC’s different assets, and it is determined by the

absolute size of the committed portfolio, the product mix (equity, loans, short-term finance, and Treasury portfolio assets), and by operational

and other risks.

j. Total resources available (TRA) is the total capital of the Corporation, consisting of (i) paid-in capital; (ii) retained earnings net of designations

and some unrealized gains and losses; and (iii) total loan loss reserves. TRA grows based on retained earnings (profit minus distributions) and

increases in reserves.

k. Total resources available less total resources required.

l. 90% of total resources available less total resources required.

Page 8

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

II. CLIENT SERVICES

BUSINESS OVERVIEW

IFC fosters sustainable economic growth in developing countries by financing private sector investment, mobilizing capital in the

international financial markets, and providing advisory services to businesses and governments.

For all new investments, IFC articulates the expected impact on sustainable development, and, as the projects mature, IFC assesses the

quality of the development benefits realized.

IFC’s strategic focus areas are aligned to advance the World Bank Group’s global priorities.

INVESTMENT SERVICES

IFC’s investments are normally made in its developing member countries. The Articles of Agreement mandate that IFC shall invest in

productive private enterprise. The requirement for private ownership does not disqualify enterprises that are partly owned by the public

sector if such enterprises are organized under local commercial and corporate law, operate free of host government control in a market

context and according to profitability criteria, and/or are in the process of being totally or partially privatized.

IFC provides a range of financial products and services to its clients to promote sustainable enterprises, encourage entrepreneurship, and

mobilize resources that wouldn’t otherwise be available. IFC’s financing products are tailored to meet the needs of each project. Investment

services product lines include: loans, equity investments, trade finance, loan participations, structured finance, client risk management

services, and blended finance.

IFC’s investment project cycle can be divided into the following stages:

Business Development

Concept Review

Appraisal (Due Diligence)

Investment Review

Negotiations

Public Disclosure

Board of Directors Review and Approval

Commitment

Disbursement of funds

Project Supervision and Development Outcome Tracking

Evaluation

Closing

IFC comprehensively supervises its projects to monitor project performance and compliance with contractual obligations and with IFC’s

internal policies and procedures.

INVESTMENT PRODUCTS

Loans – IFC finances projects and companies through loans, typically for seven to twelve years. IFC also makes loans to intermediary

banks, leasing companies, and other financial institutions for on-lending. IFC provides long-term local-currency solutions and helps

companies access local capital markets through loans from IFC denominated in local currency, derivatives which allow clients to hedge

existing or new foreign currency denominated liabilities back in to the client’s local currency, and structured finance which enable clients

to borrow in local currency from other sources. While IFC’s loans have traditionally been dominated in the currencies of major industrial

nations, IFC has made it a priority to structure local-currency products based on client demand and on IFC’s ability to economically hedge

loans in these currencies through the use of cross currency swaps or forward contracts.

Loans generally have the following characteristics:

Term -

typically amortizing with final maturities generally for seven to twelve years, although some loans have been made for

tenors as long as 20 years

Currency -

primarily in major convertible currencies, principally US dollar, and to a lesser extent, Euro, but with a growing local-

currency loan portfolio

Interest rate -

typically variable (or fixed and swapped into variable)

Pricing -

reflects such factors as market conditions and country and project risks

Equity - IFC’s equity investments provide developmental support and long-term growth capital that private enterprises need. IFC invests

directly in companies’ equity, and also through private-equity funds. IFC generally invests between 5 and 20 percent of a company’s

equity. IFC’s equity investments are typically in the form of common or preferred stock which is not mandatorily redeemable by the issuer

or puttable to the issuer by IFC, and are usually denominated in the currency of the country in which the investment is made. IFC also

uses put and call options, profit participation features, conversion features, warrants and other types of instruments in managing its equity

investments.

Page 9

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

Debt Securities - Investments typically in the form of bonds and notes issued in bearer or registered form, securitized debt obligations

(e.g. asset-backed securities (ABS), mortgage-backed securities (MBS), and other collateralized debt obligations) and preferred shares

that are mandatorily redeemable by the issuer or puttable to the issuer by IFC.

Guarantees and Partial Credit Guarantees - IFC offers partial credit guarantees to clients covering, on a risk-sharing basis, client

obligations on bonds and/or loans. IFC’s guarantee is available for debt instruments and trade obligations of clients and covers commercial

as well as noncommercial risks. IFC will provide local currency guarantees, but when a guarantee is called, the client will generally be

obligated to reimburse IFC in US dollar terms.

Client Risk Management Services - IFC extends long-maturity risk management products to clients in developing countries.

IFC provides derivative products to its clients to allow them to hedge their interest rate, currency, or commodity-price exposures.

IFC intermediates between clients in developing countries and derivatives market makers to provide such clients with access to

risk-management products to bridge the credit gap between its clients and the market.

Loan Mobilization - IFC promotes development by mobilizing financing for the private sector in its developing member countries.

IFC mobilizes funds through loan participation programs, parallel loans and, beginning in FY14, a Managed Co-Lending Portfolio Program

(MCPP).

Loan Participations: Through its “B Loan Program”, IFC offers commercial banks and other financial institutions the opportunity to lend to

IFC-financed projects. These loans are a key part of IFC’s efforts to mobilize additional private sector financing in developing countries,

thereby broadening the Corporation’s developmental impact. Through the B Loan Program, financial institutions share fully in the

commercial credit risk of projects, while IFC remains the lender of record. When IFC participates a B Loan, it always maintains a portion

for its own account (an A Loan). An A Loan Participation (ALP) is an exposure management tool which IFC uses to reduce its risk

exposures to a client, country or sector. An ALP is created through the partial sale of an IFC A Loan to commercial banks or other financial

institutions and is governed in much the same way as a B Loan. IFC remains the lender of record and an ALP participant shares all project

risks with IFC.

Parallel Loans: IFC acts as an arranger (and can also act as an administrative agent) by using its existing mobilization platform,

deal-structuring expertise and global presence to identify investments, perform due diligence, and negotiate loan documents in cooperation

with parallel lenders.

MCPP: The MCPP allows institutional investors the opportunity to passively participate in IFC’s future loan portfolio. Investors provide

capital on a portfolio basis, which can be deployed by IFC in individual investments in accordance with IFC’s strategy and processes.

Through MCPP, IFC can expand its base of co-lending partners to include investors that do not have the capacity to invest on a “deal by

deal” basis.

Trade and Supply Chain Finance - IFC’s Global Trade Finance Program (GTFP) guarantees trade-related payment obligations of

approved financial institutions. Separately, the Global Trade Liquidity Program (GTLP) and Critical Commodities Finance Program (CCFP)

provides liquidity for trade in developing countries. IFC has also commenced a number of other Trade and Supply Chain Finance-related

programs, including Global Trade Supplier Finance (GTSF), Global Warehouse Finance Program, Working Capital and Systemic Solutions

and Global Trade Structured Trade.

Structured Finance - IFC uses structured and securitized products to provide forms of financing that may not otherwise be available to

clients to help clients diversify funding, extend maturities, and obtain financing in particular currencies. Products include partial credit

guarantees, structured liquidity facilities, portfolio risk transfer, securitizations, and Islamic finance.

Blended Finance - IFC combines concessional funds, typically from donor partners, with IFC’s resources to finance certain projects.

INVESTMENT PROGRAM

COMMITMENTS

In FY16, the Long-Term Finance program was $11,117 million, as compared to $10,539 million in FY15 and Core Mobilization was

$7,739 million, as compared to $7,133 million for FY15, a total increase of 7% reflecting the more favorable investing climate in FY16.

In addition, the average outstanding balance for Short-Term Finance was $2,807 million at June 30, 2016, as compared to $2,837 million

at June 30, 2015.

CORE MOBILIZATION

Core Mobilization is financing from entities other than IFC that becomes available to clients due to IFC’s direct involvement in raising

resources. lFC finances only a portion, usually not more than 25%, of the cost of any project. All IFC-financed projects, therefore, require

other financial partners. IFC mobilizes such private sector finance from other entities through a number of means, as outlined in the Table

on the following page.

Page 10

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

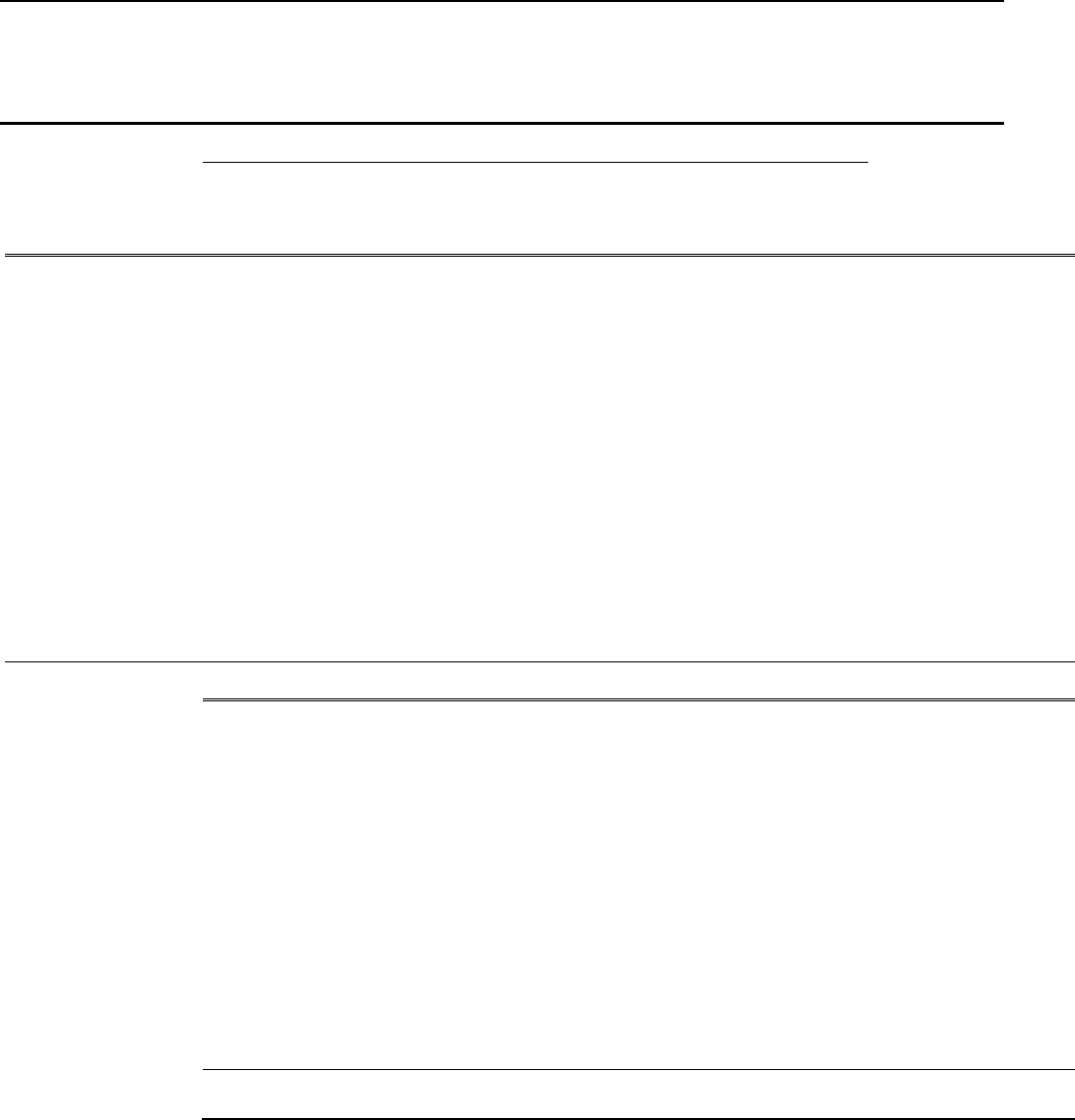

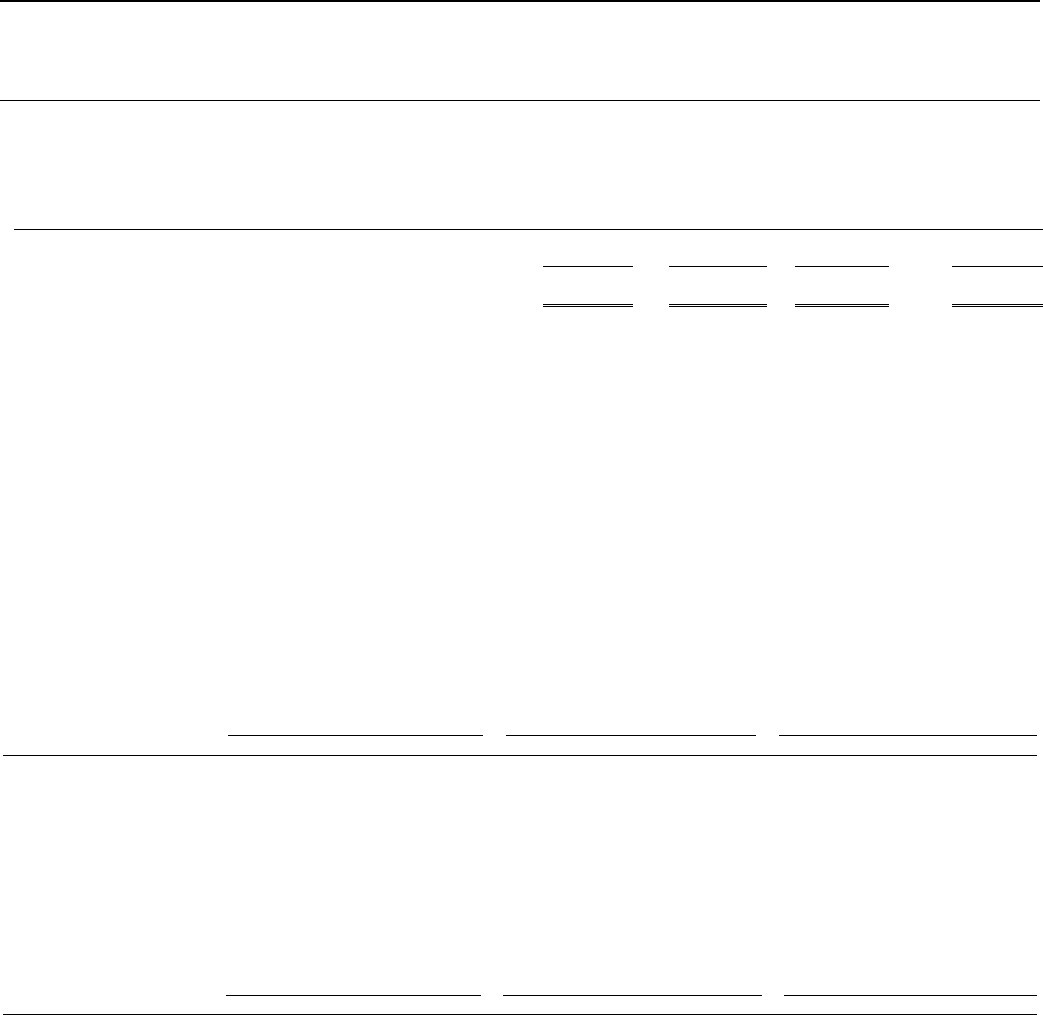

Table 5: FY16 and FY15 Long-Term Finance and Core Mobilization (US$ millions)

FY16

FY15

Total Long-Term Finance and Core Mobilization

3

$

18,856

$

17,672

Long-Term Finance

Loans

$

8,097

$

7,019

Equity investments

2,595

3,187

Guarantees

378

273

Client risk management

47

60

Total Long-Term Finance

$

11,117

$

10,539

Core Mobilization

Loan participations, parallel loans, and other mobilization

Loan participations

$

3,670

$

1,853

Parallel loans

1,205

1,522

Managed Co-lending Portfolio Program

541

818

Other Mobilization

554

881

Total loan participations, parallel loans and other mobilization

$

5,970

$

5,074

AMC (see definitions in Table 8)

China-Mexico Fund

$

140

$

-

GEM Funds

87

-

FIG Fund

82

-

Catalyst Funds

66

66

ALAC Fund

43

86

Africa Capitalization Fund

28

-

WED Fund

20

-

MENA Fund

8

-

Global Infrastructure Fund (GIF)

2

226

GIF Co-Investments

-

230

Sub-debt Capitalization Fund

-

150

Equity Capitalization Fund

-

3

Total AMC

$

476

$

761

Other initiatives

Public Private Partnership

$

793

$

548

Global Trade Liquidity Program and Critical Commodities Finance Program

500

750

Total other initiatives

$

1,293

$

1,298

Total Core Mobilization

$

7,739

$

7,133

INVESTMENT DISBURSEMENTS

IFC disbursed $9,952 million for its own account in FY16 ($9,258 million in FY15): $7,248 million of loans ($6,359 million in FY15),

$1,929 million of equity investments ($2,299 million in FY15), and $775 million of debt securities ($600 million in FY15).

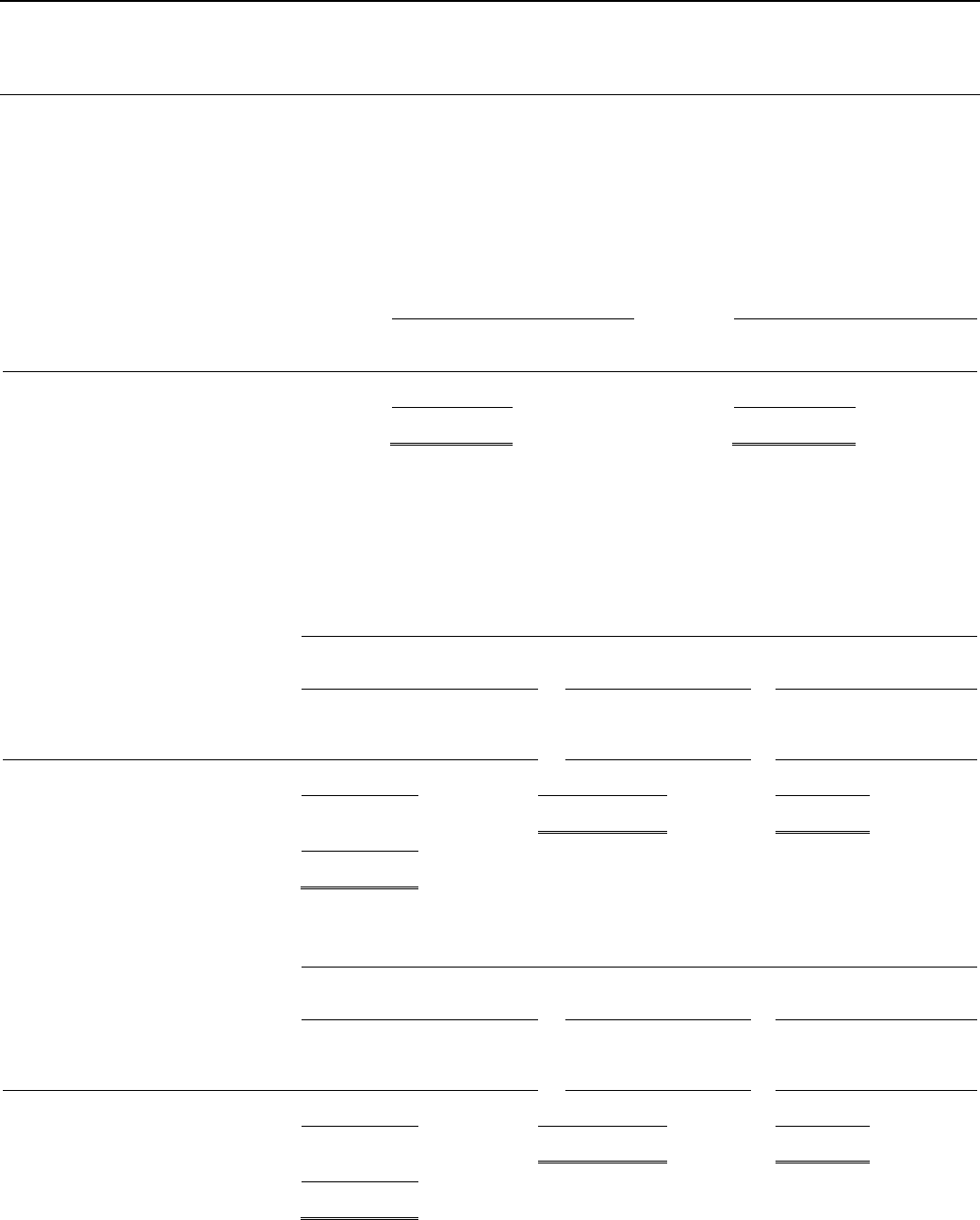

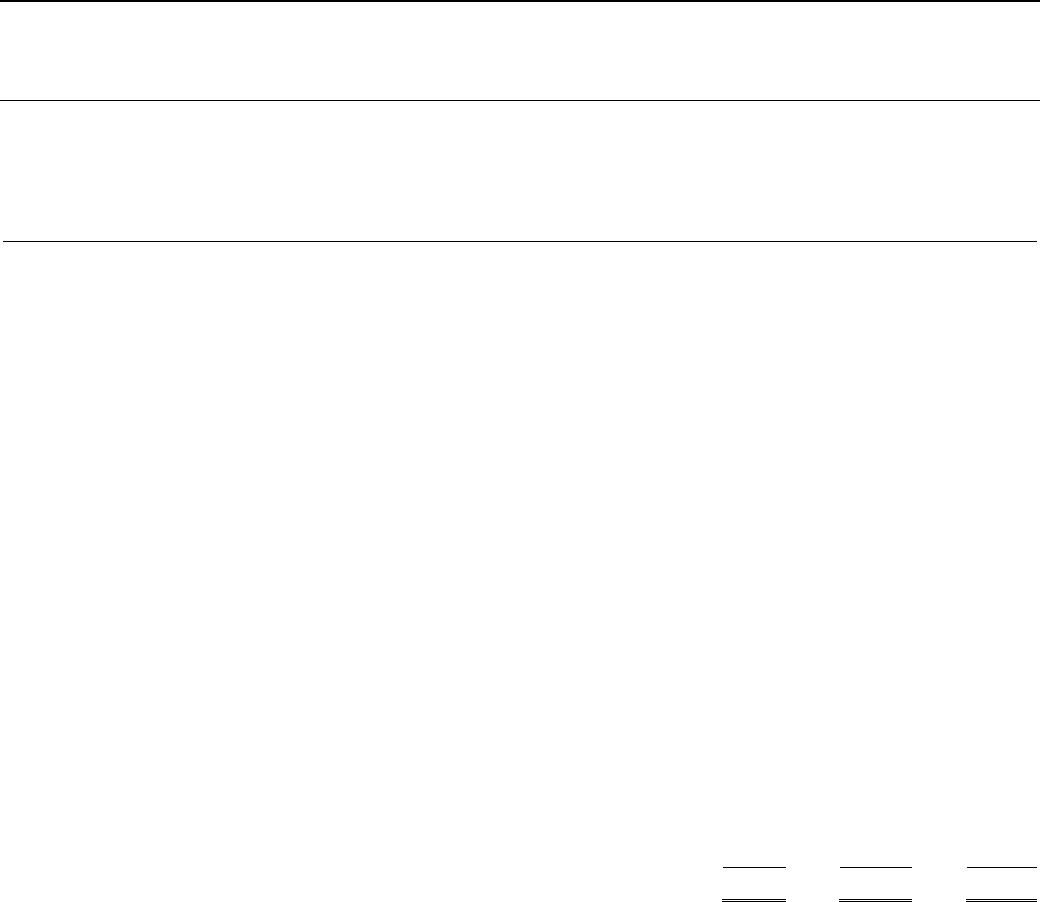

DISBURSED INVESTMENT PORTFOLIO

IFC’s total disbursed investment portfolio (a non-GAAP performance measure) was $37,554 million at June 30, 2016 ($36,401 million at

June 30, 2015), comprising the disbursed loan portfolio of $23,910 million ($23,252 million at June 30, 2015), the disbursed equity portfolio

of $10,793 million ($10,581 million at June 30, 2015), and the disbursed debt security portfolio of $2,851 million ($2,568 million at June

30, 2015).

3

Debt security commitments are included in loans and equity investments based on their predominant characteristics.

Page 11

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

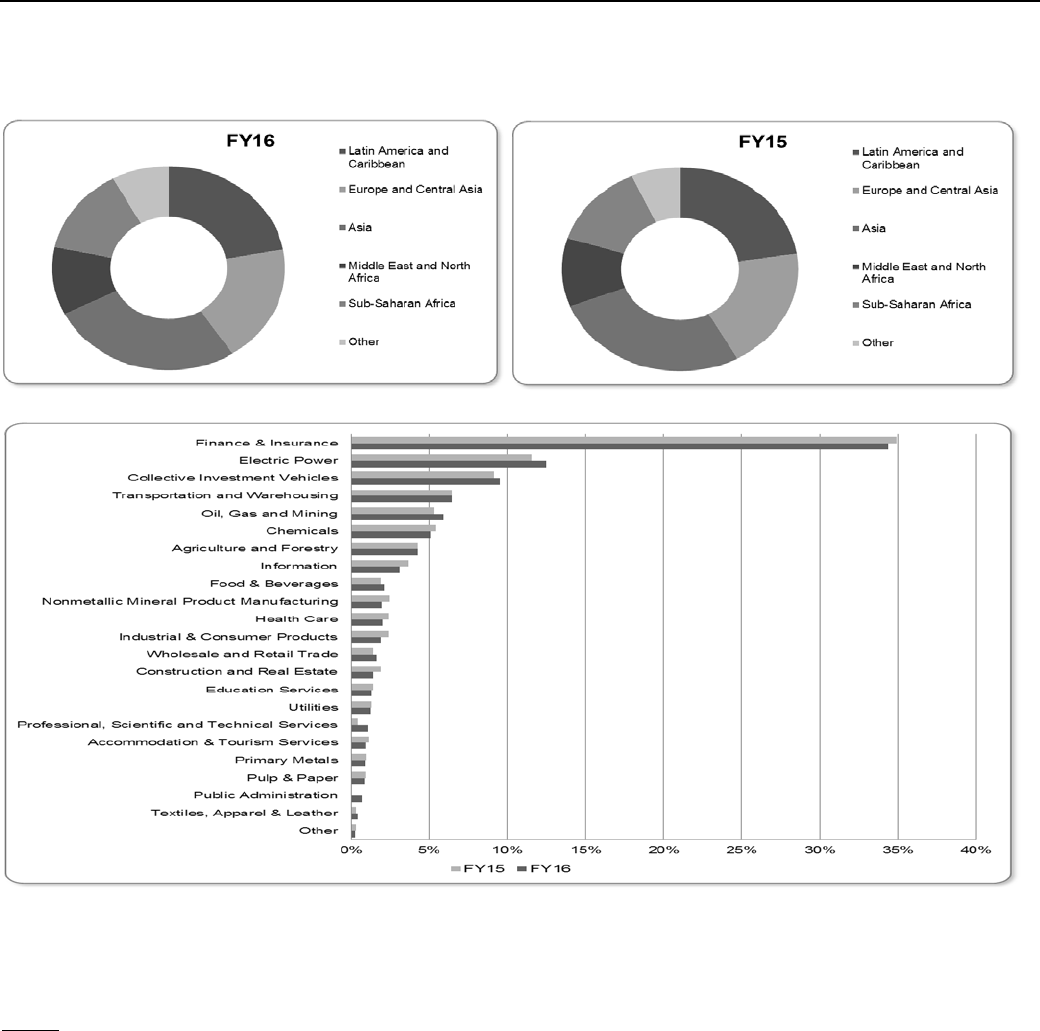

IFC’s disbursed investment portfolio is diversified by industry sector and geographic region.

The following charts show the distribution of the disbursed investment portfolio by geographical region and industry sector as of

June 30, 2016, and June 30, 2015:

Figure 1: Disbursed Investment Portfolio Distribution by Region

Fi

gure 2: Disbursed Investment Portfolio Distribution by Industry Sector

T

he carrying value of IFC’s investment portfolio comprises: (i) the disbursed investment portfolio; (ii) reserves against losses on loans;

(iii) unamortized deferred loan origination fees, net and other; (iv) disbursed amount allocated to a related financial instrument reported

separately in other assets or derivative assets; (v) unrealized gains and losses on equity investments held by consolidated variable interest

entities; (vi) unrealized gains and losses on investments accounted for at fair value as available-for-sale; and (vii) unrealized gains and

losses on investments.

LOANS

Loans comprise 64% of the disbursed investment portfolio as of June 30, 2016 (64% at June 30, 2015) and 58% of the carrying amount

of the investment portfolio as of June 30, 2016 (57% at June 30, 2015).

IFC’s disbursed loan portfolio totaled $23,910 million at June 30, 2016 ($23,252 million at June 30, 2015). The carrying amount of IFC’s

loan portfolio on IFC’s consolidated balance sheet (comprising the disbursed loan portfolio together with adjustments as detailed in Note

D to IFC’s FY16 Consolidated Financial Statements) grew 2.5% to $21,868 million at June 30, 2016 ($21,336 million at June 30, 2015).

Page 12

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

Loans traditionally have been denominated in the currencies of major industrial nations, but IFC has an extensive portfolio of local currency

products. IFC typically offers local currency products in other currencies where it can economically hedge the local currency loan cash

flows back into US dollars using swap markets or where it can fund itself in local bond markets. IFC’s disbursed loan portfolio at June 30,

2016 includes $2,458 million of currency products denominated in Brazilian reals, Indian rupees, Chinese renminbi, South African rands,

Philippine pesos, Colombian pesos, Mexican pesos, Indonesian rupiahs, Russian rubles, Peruvian nuevos soles, New Romanian Lei,

Hong Kong dollars and Dominican pesos ($3,026 million at June 30, 2015). The $568 million decline over FY16 in local currency loans

outstanding measured in US dollars was mainly due to repayments of loans denominated in Chinese renminbi, Mexican pesos, and

Indonesian rupiahs. IFC has also made loans in a number of frontier market currencies such as Tunisian dinar, Paraguayan guarani,

Rwandan franc, and Zambian kwacha. At June 30, 2016, 78% (75% at June 30, 2015) of IFC’s disbursed loan portfolio was US dollar-

denominated.

The currency position of the disbursed loan portfolio at June 30, 2016 and June 30, 2015 is shown below:

Figure 3: Currency position of the Disbursed Loan Portfolio (US$ millions)

EQUITY INVESTMENTS

IFC’s disbursed equity portfolio totaled $10,793 million at June 30, 2016 ($10,581 million at June 30, 2015), an increase of 2%.

Equity investments accounted for 29% of IFC’s disbursed investment portfolio at June 30, 2016, compared with 29% at June 30, 2015

and 34% of the carrying amount of the investment portfolio at June 30, 2016 (36% at June 30, 2015).

The carrying amount of IFC’s equity investment portfolio (comprising the disbursed equity portfolio, together with adjustments as detailed

in Note D to IFC’s FY16 Consolidated Financial Statements), fell 7% to $12,588 million at June 30, 2016 ($13,503 million at June 30, 2015).

While equity disbursements were robust in FY16, this was more than offset by sales, other than temporary impairments and unrealized

losses on equity investments accounted for at fair value, reflecting the tough overall environment for emerging markets equities in FY16.

The fair value of IFC’s equity portfolio

4

was $14,642 million at June 30, 2016 ($15,721 million at June 30, 2015).

DEBT SECURITIES

IFC’s disbursed debt securities portfolio totaled $2,851 million at June 30, 2016 ($2,568 million at June 30, 2015).

Debt securities accounted for 7% of IFC’s disbursed investment portfolio at June 30, 2016 (7% at June 30, 2015) and 8% of the carrying

amount of the investment portfolio at June 30, 2016 (7% at June 30, 2015).

The carrying amount of IFC’s debt securities portfolio (comprising the disbursed debt securities portfolio, together with adjustments as

detailed in Note D to IFC’s FY16 Consolidated Financial Statements), was $2,900 million at June 30, 2016 ($2,739 million at June 30,

2015).

Additional information on IFC’s investment portfolio as of and for the years ended June 30, 2016, and June 30, 2015, can be found in

Notes B, D, E, F, G, H, P and R to IFC’s FY16 Consolidated Financial Statements.

4

Including “equity-like” securities classified as debt securities in IFC’s consolidated balance sheet and equity-related options.

Page 13

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

GUARANTEES AND PARTIAL CREDIT GUARANTEES

IFC offers partial credit guarantees to clients covering, on a risk-sharing basis, client obligations on bonds and/or loans. IFC’s guarantee

is available for debt instruments and trade obligations of clients and covers commercial as well as noncommercial risks. IFC will provide

local currency guarantees, but when a guarantee is called, the client will generally be obligated to reimburse IFC in US dollar terms.

Guarantee fees are consistent with IFC’s loan pricing policies.

Guarantees of $3,478 million were outstanding (i.e., not called) at June 30, 2016 ($3,168 million at June 30, 2015).

ADVISORY SERVICES

It takes more than finance to achieve sustainable development. IFC’s experience shows the powerful role advice can play in unlocking

private sector investment and helping businesses expand and create jobs—thereby strengthening the World Bank Group’s efforts to end

poverty and boost shared prosperity.

That is why IFC continues to strengthen advisory work, which is now closely aligned with other areas of IFC and the World Bank, so that

IFC’s clients can benefit from the full range of capabilities available across the Bank Group. Advice is increasingly integrated into the wide

suite of solutions IFC provides to clients.

During FY16, IFC provided advice in a number of areas critical to development:

Financial Sector: IFC helps increase the availability and affordability of financial services for individuals and for micro, small, and medium

enterprises. IFC works with financial institutions to strengthen their risk management and diversify their product offering in areas such as

SMEs, housing finance, and sustainable energy. As part of an integrated World Bank Group team in the Finance & Markets Global

Practice, IFC also supports the development of financial markets—by promoting universal access to finance, strengthening capital

markets, and establishing credit bureaus and collateral registries that open up new avenues for companies to create jobs and grow

sustainably.

Investment Climate: As part of an integrated Work Bank Group team in the Trade & Competitiveness Global Practice, IFC helps national

and local governments implement reforms that improve the business environment and attract and retain investment—fostering growth,

competitive markets, and job creation.

Public-Private Partnerships: IFC helps governments design and implement public-private partnerships in infrastructure and basic public

services. IFC’s advice helps increase public access to electricity, water, health, and education.

Agribusiness: IFC helps clients improve productivity and standards in agribusiness. IFC’s efforts are focused on designing efficient value

chains and boosting food security—thereby providing valuable social, economic, and environmental benefits for all stakeholders.

Energy & Resource Efficiency: IFC helps clients develop clean, affordable, competitive, and high-quality energy solutions across the

value chain. IFC accelerates the development of commercial markets to increase renewable energy production and improve people's

access to modern energy services.

IFC also provides advisory solutions that can be deployed across several industries. This includes helping businesses improve corporate

governance and building the capacity of smaller businesses operating within the supply chains of larger companies, thereby increasing

local opportunities while helping clients make better use of local suppliers and resources. Central to IFC’s advisory work is helping clients

build robust and inclusive business performance by making them aware of, and invest in, the value women can bring either as a defined

consumer segment that can be better served, as employees, as business leaders or as entrepreneurs and suppliers.

The IFC Advisory Services Portfolio

5

as of June 30, 2016 totaled $1.3 billion ($1.2 billion at June 30, 2015). FY16 program expenditures

with clients was $221 million ($202 million -FY15) with a strong focus in strategic priority areas of IDA (62%) and FCS (21%) as of June

30, 2016 (65% and 20% at June 30, 2015). This emphasis is expected to continue in the coming years.

Table 6: IFC Advisory Services - Program Expenditures by Region for FY16 vs FY15

FY16

FY15

IFC Advisory Services program by region

US$ millions

%

US$ millions

%

Sub Saharan Africa

$

63

29

$

54

27

East Asia and the Pacific

39

18

38

19

Europe and Central Asia

34

15

34

17

South Asia

27

12

23

11

Latin America and the Caribbean

25

11

22

11

Middle East and North Africa

23

10

20

10

World region

10

5

11

5

Total expenditures

$

221

100

$

202

100

5

IFC Advisory Services Portfolio is the total of funds managed by IFC for active advisory projects.

Page 14

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

Table 7: IFC Advisory Services - Program Expenditures by area for FY16 vs FY15

FY16

FY15

IFC Advisory Services program by area

US$ millions

%

US$ millions

%

Financial Sector

$

67

30

$

64

32

Investment Climate

57

26

50

25

Cross-Industry Areas

34

15

28

14

Public-Private Partnerships

31

14

31

15

Energy & Resource Efficiency

19

9

17

8

Agribusiness

13

6

12

6

Total expenditures

$

221

100

$

202

100

Similar to FY15, the program results in FY16 were positive. Development effectiveness ratings of the projects reached 68% success rate

(77% in FY15) and client satisfaction was 91% (91% in FY15).

ASSET MANAGEMENT COMPANY

IFC Asset Management Company, LLC (AMC), a wholly-owned subsidiary of IFC, invests third-party capital and IFC capital, enabling outside

investors to benefit from IFC’s expertise in achieving strong equity returns, as well as positive development impact in the countries in which

it invests in developing and frontier markets. Investors in funds managed by AMC include sovereign wealth funds, national pension funds,

multilateral and bilateral development institutions, national development agencies and international financial institutions. AMC helps IFC

mobilize additional capital resources for investment in productive private enterprise in developing countries.

At June 30, 2016, AMC managed twelve funds, with $8.9 billion total assets under management (ten funds; $8.5 billion at June 30, 2015):

Table 8: List of Funds Managed by AMC at June 30, 2016

Fund Name

Established

Description

The IFC Capitalization

(Equity) Fund, L.P. (Equity

Capitalization Fund)

Year ended June

30, 2009 (FY09)

Help strengthen systemically important banks in emerging

markets

The Capitalization (Subordinated Debt) Fund, L.P.

(Sub-Debt Capitalization Fund)

FY09 Help strengthen systemically important banks in emerging

markets

The African, Latin American and Caribbean Fund,

LP (ALAC Fund)

Year ended June

30, 2010 (FY10)

Invest in equity investments across a range of sectors in

Sub-Saharan Africa, Latin America, and the Caribbean.

The Africa Capitalization Fund, Ltd. (Africa

Capitalization Fund)

FY10 Capitalize on systemically important commercial banking

institutions in northern and Sub-Saharan Africa

The Russian Bank Capitalization Fund, LP

(

Russian Bank Cap Fund)

Year ended June

30, 2012 (FY12)

Invest in mid-sized commercial banks in Russia that are either:

(i) privately owned and controlled; or (ii) state-

owned; or

(iii) controlled and on a clear path to privatization

The

Catalyst Fund, LP, IFC Catalyst Fund (UK),

LP and IFC Catalyst Fund (Japan), LP

(collectively, Catalyst Funds)

Year ended June

30, 2013 (FY13)

Make investments in selected climate-

and resource

efficiency-focused private equity funds in emerging markets

The Global Infrastructure Fund,

LP (Global

Infrastructure Fund)

The China

-Mexico Fund, LP (China-Mexico Fund)

FY13

FY1

5

Focus on making equity and equity-related investments in the

infrastructure sector in global emerging markets

Focus on making equity and equity-

related investments

across all sectors in Mexico

The

Financial Institutions Growth Fund, LP (FIG

Fund)

FY15 Invest in equity and equity-related investments in financial

institutions in global emerging markets

The Global Emerging Markets Fund of Funds, LP

and IFC Global Emerging Markets Fund of Funds

(Japan Parallel), LP (collectively, GEM Funds)

FY15 Primarily invest in a portfolio of investment funds in global

emerging markets.

The Middle East and North Africa Fund, LP

(MENA Fund)

FY16 Make equity and equity related investments in the Middle East

and North Africa region

Women Entrepreneurs Debt Fund

, LP (WED

Fund)

FY16 Focus on extending senior loans to commercial banks for

on-lending to women-owned small and medium enterprises in

emerging markets

Page 15

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

The activities of the funds managed by AMC at June 30, 2016 and 2015 can be summarized as follows:

Table 9: Activities of the Funds Managed by AMC FY16 vs FY15 (US$ millions unless otherwise indicated)

As of June 30, 2016 For the year ended June 30, 2016

Total assets under management

Disbursements to Fund

Disbursements

made by Fund

Disbursements

made by Fund

(number)*

Total

From IFC

From other

investors

From IFC

From other

investors

Equity Capitalization Fund

$ 1,275

$ 775

$ 500

$ 2

$ 1

$ -

-

Sub-Debt Capitalization Fund

1,725

225

1,500

-

2

-

-

ALAC Fund

1,000

200

800

19

80

81

8

Africa Capitalization Fund

182

-

182

-

56

29

2

Russian Bank Cap Fund

550

250

300

2

2

-

-

Catalyst Funds

418

75

343

9

38

48

96

Global Infrastructure Fund**

1,430

200

1,230

24

104

102

5

China-Mexico Funds

1,200

-

1,200

-

13

4

1

FIG Fund

464

150

314

45

63

96

3

GEM Funds

406

81

325

7

26

25

16

MENA Fund

162

60

102

6

11

12

1

WED Fund

90

30

60

9

17

10

1

Total

$ 8,902

$ 2,046

$ 6,856

$ 123

$ 413

$ 407

133

* Number of disbursements may include multiple disbursements to a single investee company or fund.

** Includes co-investment fund managed by AMC on behalf of Fund LPs.

As of June 30, 2015 For the year ended June 30, 2015

Total assets under management

Disbursements to Fund

Disbursements

made by Fund

Disbursements

made by Fund

(number)*

Total

From IFC

From other

investors

From IFC

From other

investors

Equity C

apitalization Fund

$ 1,275 $ 775

$ 500 $ 6

$ 4 $ 8 1

Sub-Debt Capitalization Fund

1,725

225

1,500

29

196

254

4

ALAC Fund

1,000 200

800 29

112 94 7

Africa Capitalization Fund

182

-

182

-

3

-

-

Russian Bank Cap Fund

550 250

300 5

5 - -

Catalyst Funds

418

75

343

9

41

36

46

Global Infrastructure Fund**

1,430 200

1,230 27

298 293 7

China-Mexico Funds

1,200

-

1,200

-

6

-

-

FIG

Fund 344 150

194 -

- - -

GEM Funds

406

81

325

-

-

-

-

MENA Fund

- -

- -

- - -

WED Fund

-

-

-

-

-

-

-

Total

$ 8,530

$ 1,956

$ 6,574

$ 105

$ 665

$ 685

65

* Number of disbursements may include multiple disbursements to a single investee company or fund.

** Includes co-investment fund managed by AMC on behalf of Fund LPs.

III. LIQUID ASSETS

All liquid assets are managed according to an investment authority approved by the Board of Directors and liquid asset investment

guidelines approved by IFC’s Corporate Risk Committee, a subcommittee of IFC’s Management Team.

IFC funds its liquid assets from two sources, borrowings from the market (funded liquidity) and capital (net worth). Liquid assets are

managed in a number of portfolios related to these sources.

IFC invests its liquid assets generally in highly rated fixed and floating rate instruments issued by, or unconditionally guaranteed by,

governments, government agencies and instrumentalities, multilateral organizations, and high quality corporate issuers; these include

asset-backed securities and mortgage-backed securities, time deposits, and other unconditional obligations of banks and financial institutions.

Diversification across multiple dimensions ensures a favorable risk return profile. IFC has a flexible approach to managing the liquid assets

portfolios by making investments on an aggregate portfolio basis against its benchmarks within specified risk parameters. In implementing

these portfolio management strategies, IFC utilizes derivative instruments, principally currency and interest rate swaps and futures and

options, and takes positions in various industry sectors and countries.

IFC’s liquid assets are accounted for as trading portfolios. The net asset value of the liquid assets portfolio was $41.4 billion at June 30, 2016

($39.5 billion at June 30, 2015). The increase in FY16 was principally due to additions to the portfolio from the investment of the net proceeds

of market borrowings, plus returns made on the investment portfolio partially offset by reductions due to investment disbursements.

Page 16

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

FUNDED LIQUIDITY

The primary funding source for liquid assets for IFC is borrowings from market sources. Proceeds of borrowings from market sources not

immediately disbursed for loans and loan-like debt securities (Funded Liquidity) are managed internally against money market

benchmarks. A small portion of Funded Liquidity is managed by third parties with the same benchmark as that managed internally.

MANAGED NET WORTH

The second funding source of liquid assets is that portion of IFC’s net worth not invested in equity and equity-like investments (Managed

Net Worth) which is managed against a U.S. Treasury benchmark. A portion of these assets are managed by third parties with the same

benchmark as that part managed internally.

Net income from liquid assets trading activities

6

from Funded Liquidity was $419 million and from Managed Net Worth totaled $85 million

in FY16.

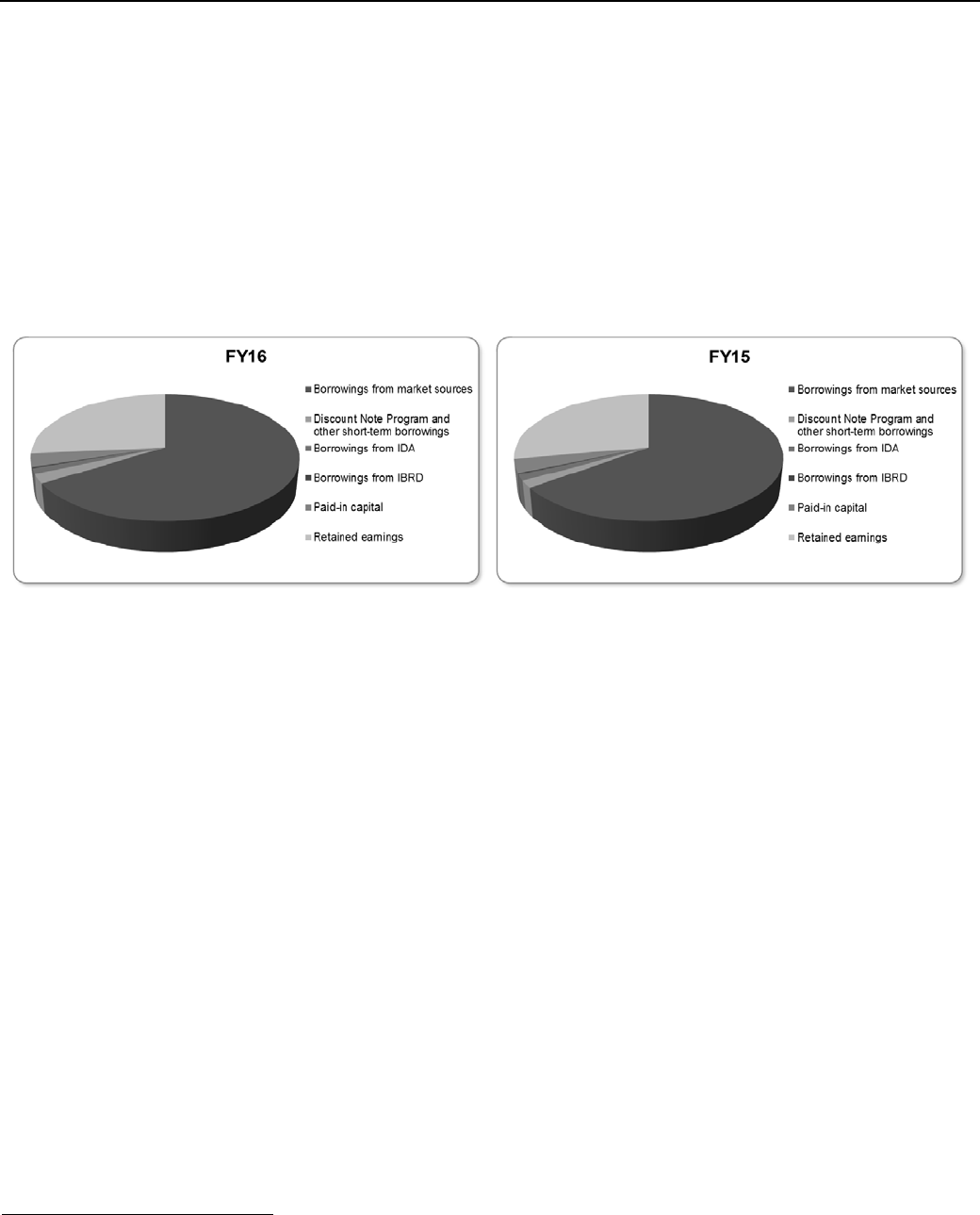

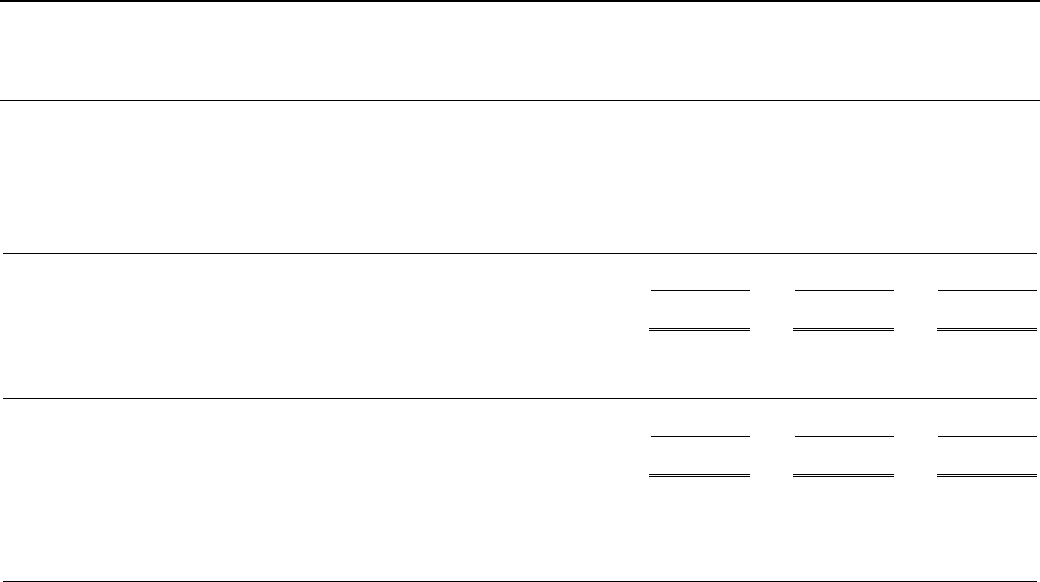

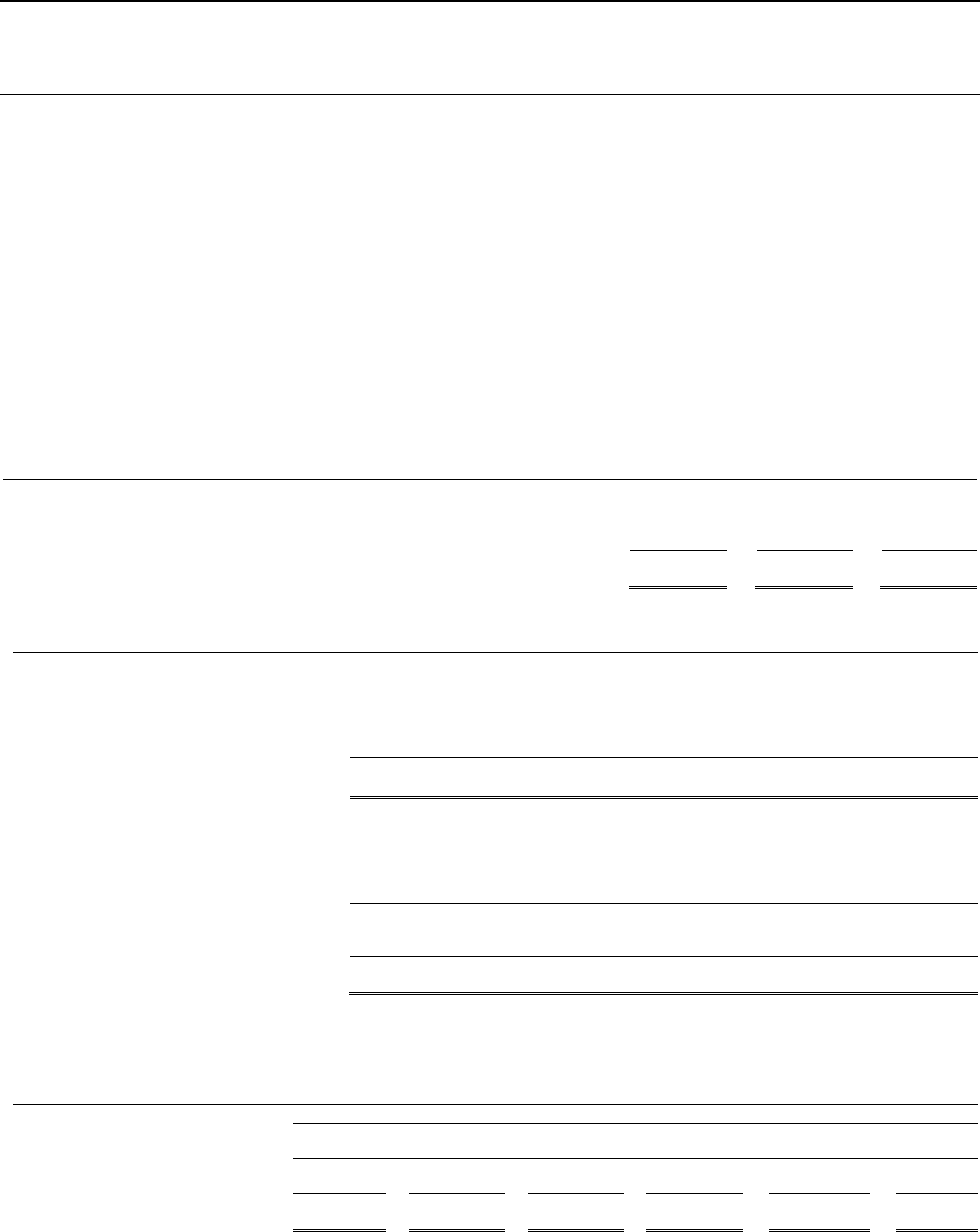

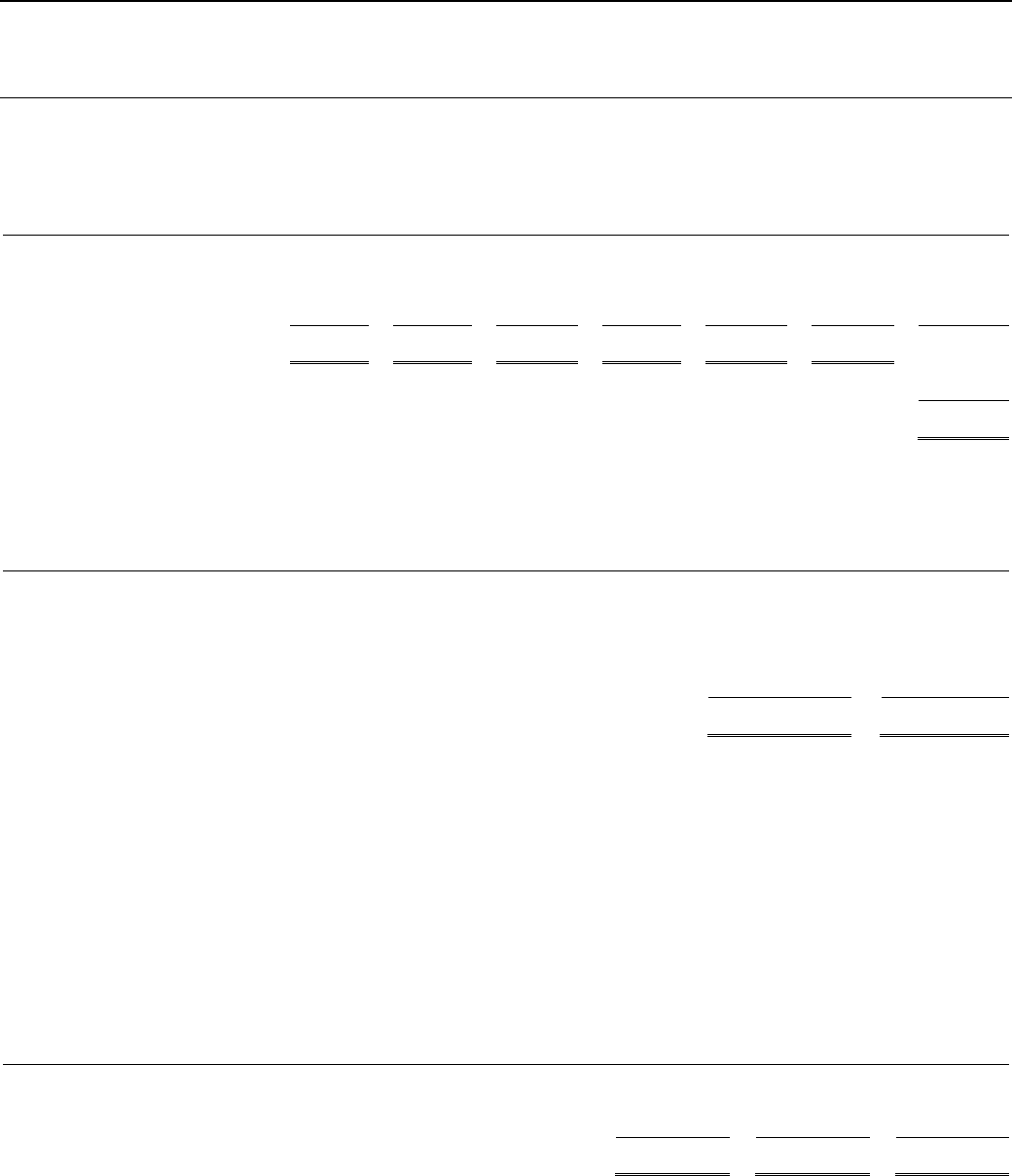

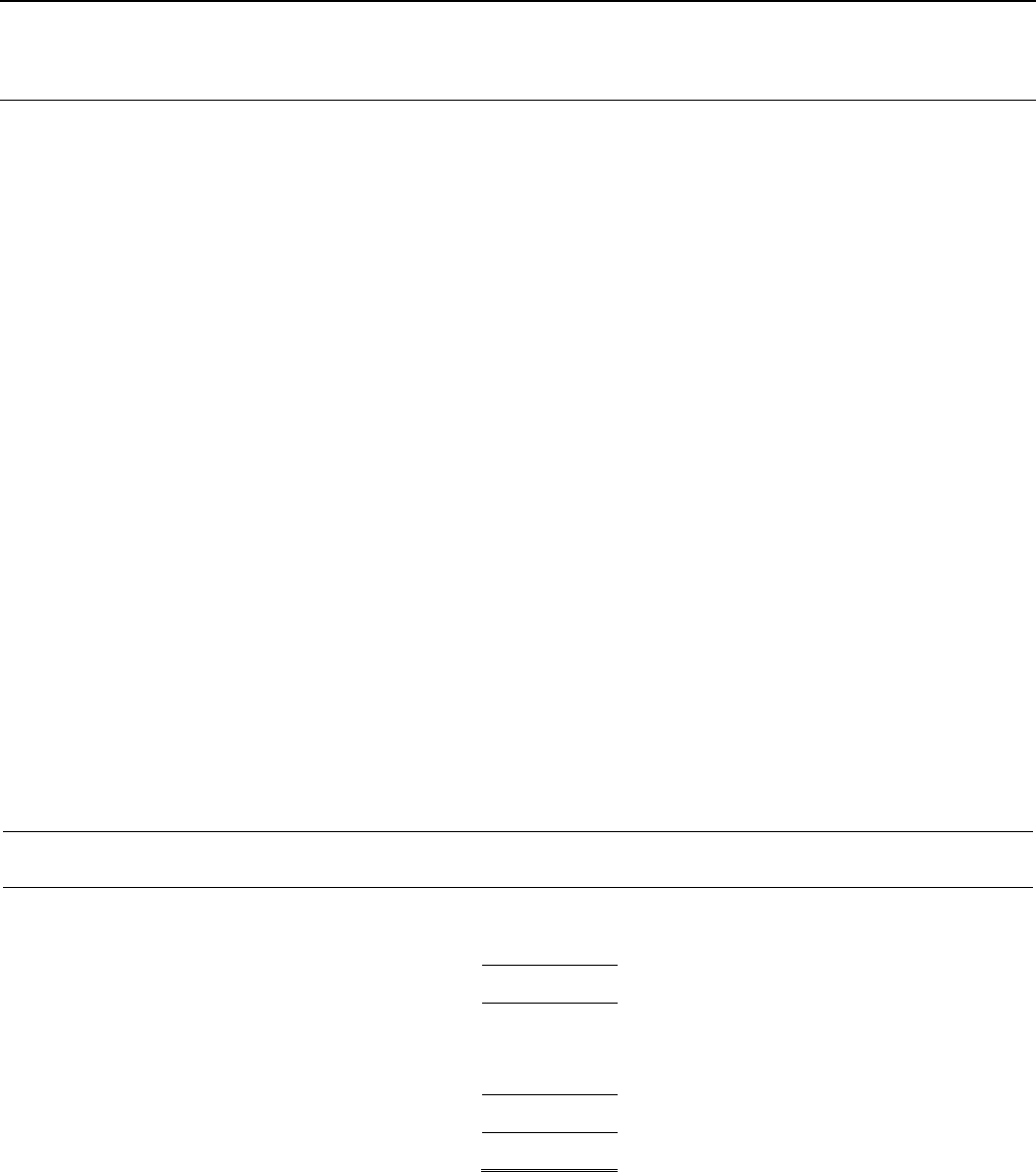

IV. FUNDING RESOURCES

IFC’s funding resources (comprising borrowings, capital and retained earnings) as of June 30, 2016 and June 30, 2015 are as follows:

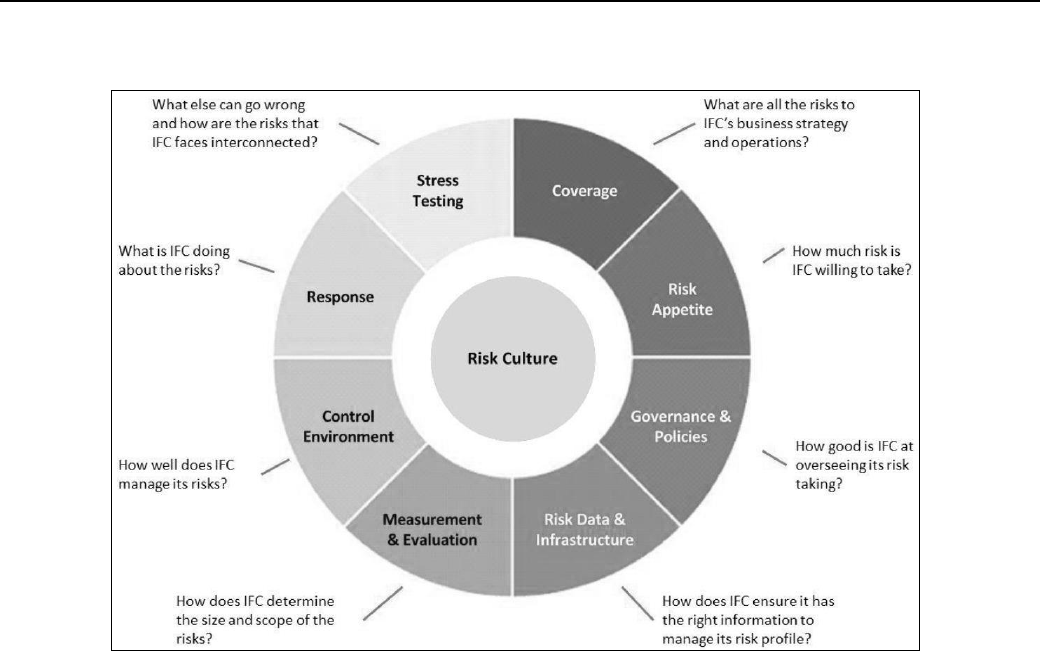

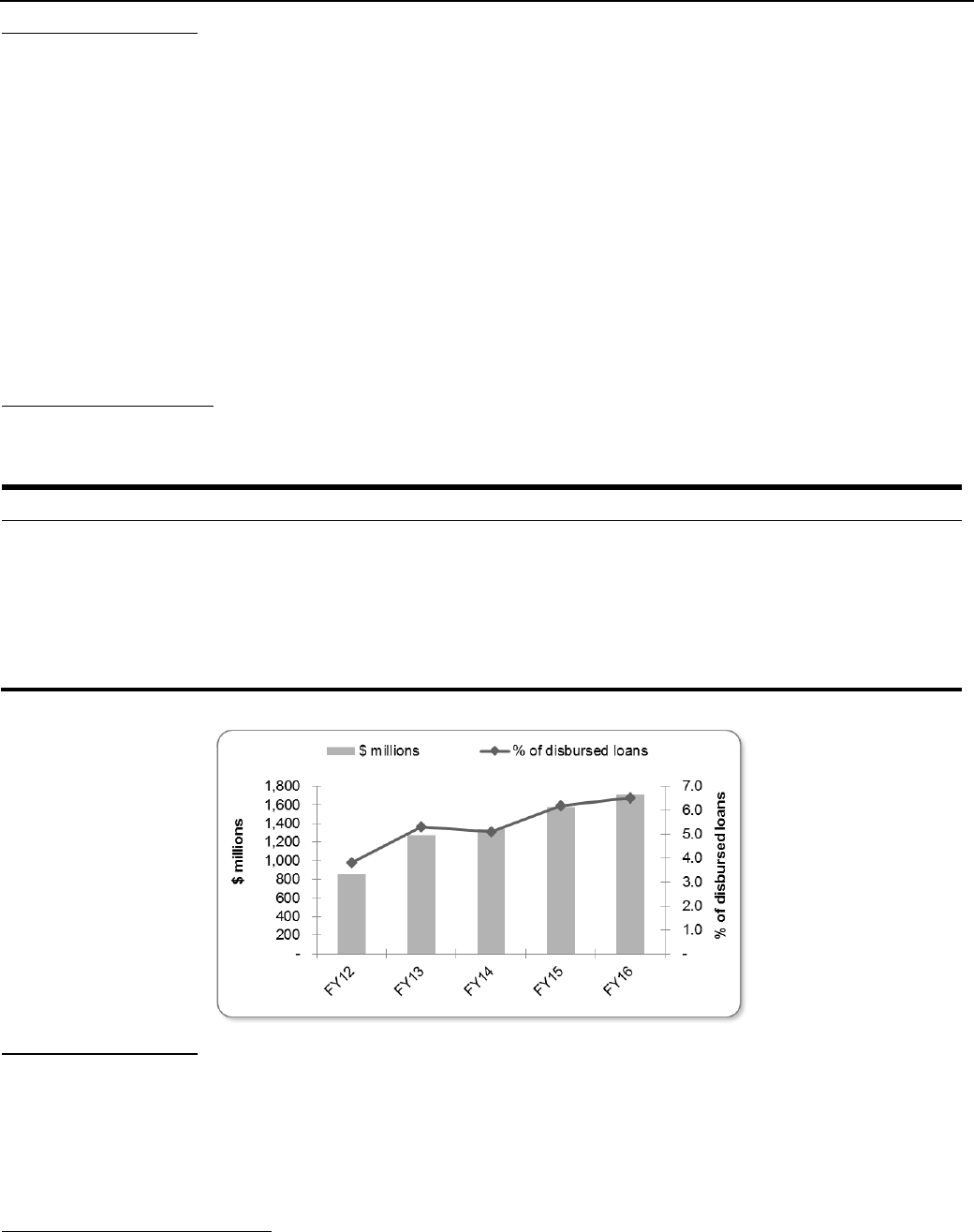

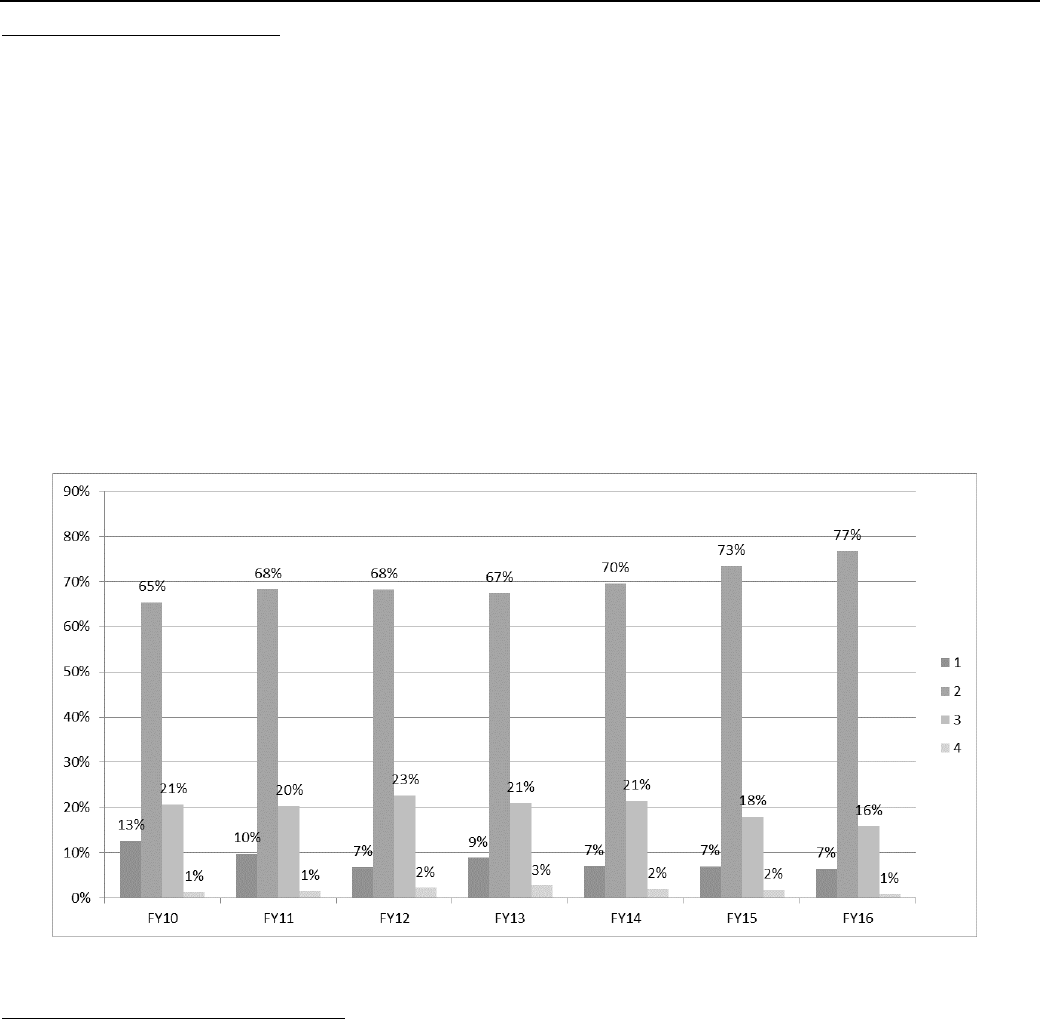

Figure 4: IFC's Funding Resources

BORROWINGS

The major source of IFC’s borrowings is the international capital markets. Under the Articles of Agreement, IFC may borrow in the public

markets of a member country only with approvals from that member, together with the member in whose currency the borrowing is

denominated.

Beginning July 1, 2014, IFC has a General Funding Authorization that authorizes IFC to borrow within the limits of its risk policies without

requiring annual authorizations from the Board of the Corporation as to the size of its borrowing program for the subsequent financial year.

IFC borrowed (after the effect of borrowing-related derivatives) $14.3 billion during FY16 ($14.8 billion in FY15 and $15.3 billion in FY14).

In addition, the Board of Directors has authorized the repurchase and/or redemption of debt obligations issued by IFC, which enhances

the liquidity of IFC’s borrowings. During FY16, IFC repurchased and retired $0.5 billion of outstanding debt ($1.4 billion in FY15 and

$1.4 billion in FY14), generating gains on buybacks of $6 million in FY16 ($2 million - FY15 and $3 million - FY14).

IFC uses its borrowings issuances as a tool to promote capital markets development in emerging and frontier markets. Proceeds of these

issuances not disbursed into loans have primarily been invested in securities of the related sovereign and sovereign instrumentalities in

the currency of the issuances. As a result, borrowings from market sources at June 30, 2016 that have not been swapped amounted

to 5% of the total borrowings from market sources (6% at June 30, 2015 and 5% at June 30, 2014).

IFC diversifies its borrowings by currency, country, source, and maturity to provide flexibility and cost-effectiveness. In FY16 IFC borrowed

in eighteen currencies and in final maturities ranging from one to 30 years. Remaining maturities have a weighted average remaining

contractual maturity of 4.1 years at June 30, 2016 (3.3 years at June 30, 2015). Actual maturities may differ from contractual maturities

due to the existence of call features in certain of IFC’s borrowings.

Market borrowings are generally swapped into floating-rate obligations denominated in US dollars. As of June 30, 2016, IFC had gross

payables from borrowing-related currency swaps of $19.9 billion ($19.6 billion at June 30, 2015) and from borrowing-related interest rate

swaps in the notional principal payable amount of $35.2 billion ($35.2 billion at June 30, 2015). After the effect of these derivative

instruments is taken into consideration, 95% of IFC’s market borrowings at June 30, 2016 were variable rate US dollar-denominated

(94% - June 30, 2015). The weighted average cost of market borrowings after currency and interest rate swap transactions was 1.1% at

June 30, 2016 (0.5% at June 30, 2015). This was mainly due to developments in USD funding, where compared to the prior year,

US$ six-month LIBOR rates were 0.5% higher and IFC’s credit spread widened by 0.1%.

6

Reported gross of borrowing costs and excluding foreign exchange gains and losses on local currency Funded Liquidity which are reported separately from income

from liquid assets trading activities in foreign currency gains and losses on non-trading activities and the effects of internal trades related to foregone swapping of

market borrowings and Funded Liquidity in certain currencies.

Page 17

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

IFC’s mandate to help develop domestic capital markets can result in raising local currency funds. As of June 30, 2016, $2.2 billion

($2.5 billion as of June 30, 2015) of such non-US$ denominated market borrowings were outstanding, denominated in Chinese Renminbi,

Dominican Pesos, Indian Rupees, Namibia dollar, New Zambian Kwacha, Nigerian Naira, Russian Ruble and Rwanda Francs. Proceeds

of such borrowings were invested in such local currencies, on-lent to clients and/or partially swapped into US dollars.

IFC has short term discount note programs in US$, Chinese renminbi and Turkish lira to provide an additional funding and liquidity

management tool for IFC in support of certain of IFC’s trade finance and supply chain initiatives and to expand the availability of short

term local currency finance.. The discount note programs provide for issuances with maturities ranging from overnight to one year. The

weighted average cost of discount note borrowing was at 0.33% at June 30, 2016. During FY16, IFC issued $11.5 billion of discount

notes and $1.8 billion were outstanding as of June 30, 2016 under the short-term discount note programs.

CAPITAL AND RETAINED EARNINGS

As of

June 30, 2016, IFC’s authorized capital was $2.58 billion ($2.58 billion - June 30, 2015), of which $2.57 billion was subscribed and

paid in at

June 30, 2016 ($2.57 billion at June 30, 2015).

Table 10: IFC's Capital (US$ millions)

June 30,

2016

June 30,

2015

Capital

Capital stock, subscribed and paid-in

$

2,566

$

2,566

Accumulated other comprehensive (loss) income

(431)

1,197

Retained earnings

20,608

20,641

Total IFC capital

$

22,743

$

24,404

Non-controlling interests

23

22

Total capital

$

22,766

$

24,426

At June 30, 2016 and June 30, 2015, retained earnings comprised the following:

Table 11: IFC's Retained Earnings (US$ millions)

June 30,

2016

June 30,

2015

Undesignated retained earnings

$

20,475

$

20,457

Designated retained earnings:

Advisory services

98

137

Performance-based grants

12

16

IFC SME Ventures for IDA countries and Global Infrastructure Project Development Fund

23

31

Total designated retained earnings

$

133

$

184

Total retained earnings

$

20,608

$

20,641

SELECTIVE CAPITAL INCREASE (SCI)

On July 20, 2010, the IFC Board of Directors recommended that the IFC Board of Governors approve an increase of $130 million in the

authorized share capital of IFC to $2,580 million, through the issuance of $200 million in shares (including $70 million in unallocated

shares). The Board of Directors also recommended that the Board of Governors approve an increase in Basic Votes aimed at enhancing

the voice and participation of developing and transition countries which required an amendment to IFC’s Articles of Agreement.

The resolution recommended by the Board of Directors was adopted by the Board of Governors on March 9, 2012 (IFC Resolution no.

256 entitled "Amendment to the Articles of Agreement and 2010 Selective Capital Increase"). The amendment to the Articles of Agreement

and the increase in the authorized share capital became effective on June 27, 2012. As of the same date, eligible members were authorized

to subscribe to their allocated IFC shares.

As of June 30, 2015, IFC had received payments with respect to the SCI totaling $194 million and the balance of $6 million has become

part of IFC’s authorized and unallocated capital stock.

DESIGNATIONS OF RETAINED EARNINGS

Beginning in the year ended June 30, 2004, IFC began a process of designating retained earnings to increase its support of advisory

services and, subsequently, for performance-based grants (PBG) (year ended June 30, 2005), grants to IDA (year ended June 30, 2006),

the Global Infrastructure Project Development Fund (year ended June 30, 2008 (FY08), and IFC SME Ventures for IDA Countries (FY08).

The levels and purposes of retained earnings designations are set based on the Board of Directors-approved principles, which are applied

each year to assess IFC’s financial capacity and to determine the maximum levels of retained earnings designations.

Amounts available to be designated are determined based on a Board of Directors-approved income-based formula and, beginning in the

year ended June 30, 2008, on a principles-based Board of Directors-approved financial distribution policy, and are approved by the Board

of Directors.

Page 18

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

IFC recognizes designations of retained earnings for advisory services when the Board of Directors approves it and recognizes designation

of retained earnings for grants to IDA when it is noted with approval by the Board of Governors. Expenditures for the various approved

designations are recorded as expenses in IFC’s consolidated income statement in the year in which they occur, and have the effect of

reducing retained earnings designated for this specific purpose.

FY15 DESIGNATIONS

On August 6, 2015, the Board of Directors approved a designation of $330 million of IFC’s retained earnings for grants to IDA and a designation

of $14 million of IFC’s retained earnings for Advisory Services. On October 9, 2015, IFC’s Board of Governors noted with approval these

designations. On January 15, 2016 IFC recognized expenditures against designations of retained earnings for grants to IDA of $330 million

pursuant to signing of a grant agreement between IDA and IFC.

FY16 DESIGNATIONS

Income available for designations in FY16 (a non-GAAP measure)

7

totaled $770 million. Based on the distribution policy approved by IFC’s

Board of Directors the maximum amount available for designation would be $161 million. On August 4, 2016, the Board of Directors approved

a designation of $101 million of IFC’s retained earnings for grants to IDA and a designation of $60 million of IFC’s retained earnings for

Advisory Services. These designations are expected to be noted with approval by the Board of Governors, and thereby concluded, in FY17.

DEPLOYABLE STRATEGIC CAPITAL

IFC’s deployable strategic capital (DSC) ratio was 4.4% at June 30, 2016, compared with 5.4% at June 30, 2015. Total Resources Available

(TRA) decreased to $22.5 billion at the end of FY16 from $22.6 billion at the end of FY15. Total Resources Required (TRR) was unchanged

at $19.2 billion at the end of FY16. The increase in capital required for the investment portfolio was offset by a decline in capital to support

the Treasury portfolio and for operational risk. The decrease in total resources available was heavily affected by the $0.8 billion increase in

the underfunded status of the pension plans - without this impact, the DSC ratio would have been 7.3%.

V. RISK MANAGEMENT

ENTERPRISE RISK MANAGEMENT

IFC provides long-term investments to the private sector in emerging markets, which includes expanding the investment frontier into the

most challenging markets. In doing so, IFC is exposed to a variety of financial and non-financial risks. Sound risk management is crucial

in fulfilling IFC’s mission.

The Corporate Risk and Sustainability Vice-Presidency combines all of IFC’s financial and non-financial risk functions to streamline and

enhance risk management at both corporate and project levels, as well as to improve support for IFC’s external clients.

ENTERPRISE RISK MANAGMENT FRAMEWORK

IFC’s enterprise risk management framework (ERM) is designed to enable the prudent management of financial and reputational impacts

that originate from the Corporation’s business activities. In this context, IFC’s risk management efforts are designed specifically to help

align the Corporation’s performance with its strategic direction. The ERM framework that IFC adopted in FY14 is aligned broadly with

industry standards and is designed to underpin IFC's response to risk by defining:

IFC's core risk management principles;

A common risk taxonomy for use across the organization, to help ensure that risk management efforts are coordinated and

aligned across the distinct parts of the organization that share responsibility for managing different aspects of risk;

A standard classification of roles and responsibilities for risk management, to differentiate and thereby clarify how different parts

of

the organization contribute towards the overall management of risk; and

The structures, processes and methods that are necessary to put active risk management into practice.

KEY RISK MANAGEMENT PRINCIPLES

The key principles that inform IFC’s ERM Framework are:

Maximizing development impact while maintaining financial sustainability;

Ensuring that business decisions are based on a thorough understanding of risks and that risks and rewards are balanced

appropriately;

Being selective in undertaking activities that could cause significant, adverse reputational impact; and

Sharing responsibility for risk management across the Corporation.

The ERM Framework comprises several components, each addressing a specific issue within the Framework. These components are

dynamic in nature and reflect the fact that IFC’s risk management evolution is a continual, iterative and interconnected effort.

7

Income available for designations generally comprises net income excluding unrealized gains and losses on investments and unrealized gains and losses on other

non-trading financial instruments, income from consolidated VIEs, and expenses reported in net income related to prior year designations.

Page 19

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

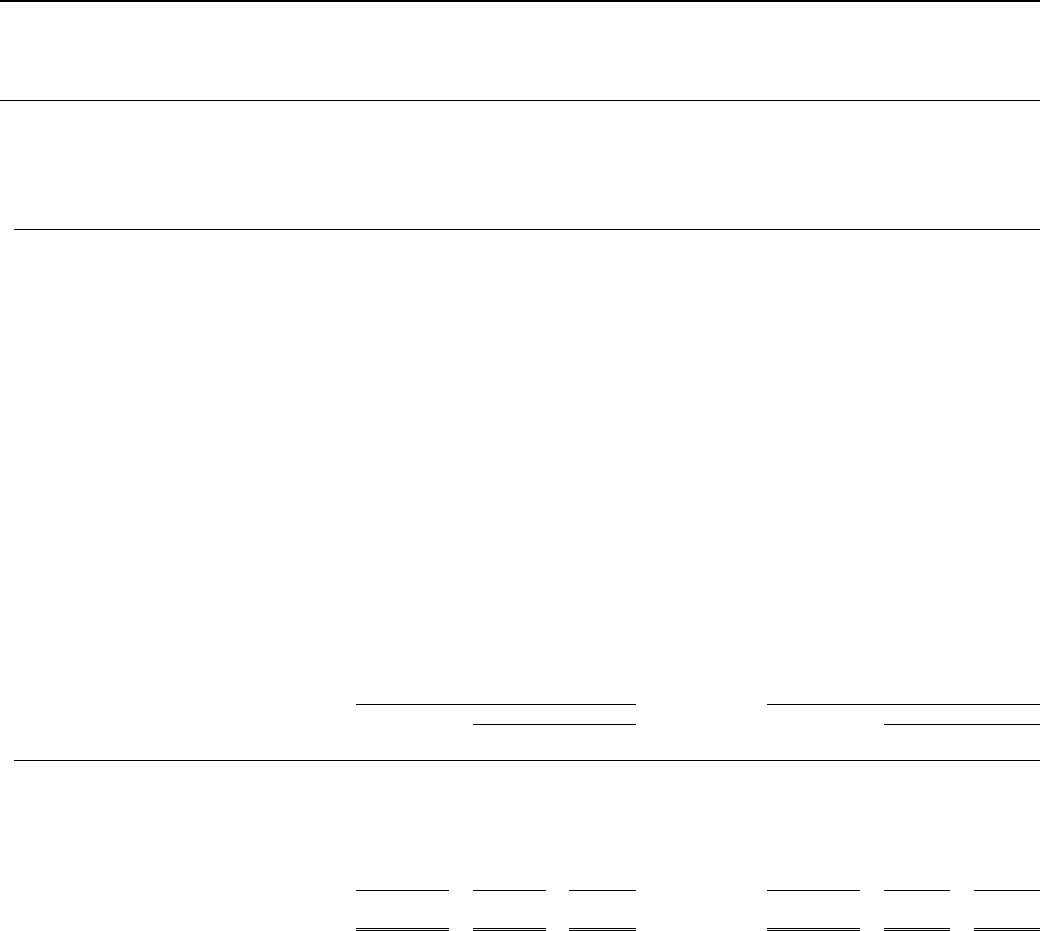

The Framework is depicted as follows:

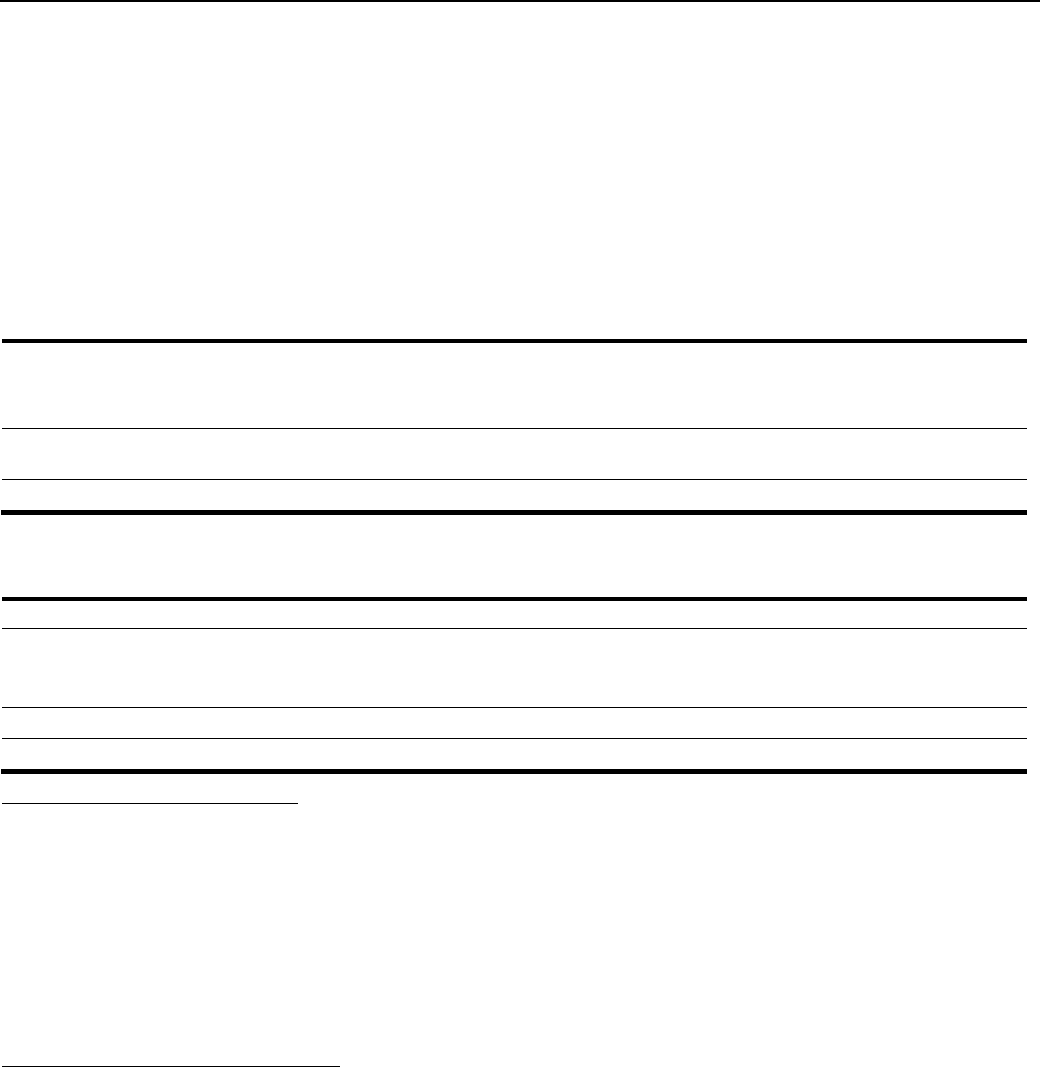

Figure 5: IFC's Enterprise Risk Management Framework

R

isk Culture

- Starting with IFC’s Management Team, building the right risk culture instills behaviors that are integral to the success of

ERM.

Risk Coverage

- IFC’s risk profile is categorized across five classes of risk, namely Credit, Market, Operational, Liquidity and Business

risks. Each of these is addressed in the following paragraphs.

Risk Appetite

- A comprehensive set of explicit risk appetite statements, with associated metrics, will provide a consistent and integrated

basis for making decisions that impact IFC’s risk profile, while monitoring IFC’s risk exposures, and taking action when risk tolerances are

exceeded.

Risk Governance and Policies

- IFC’s risk governance structure is based on the industry-standard principle of “three lines of defense”.

IFC’s first line of defense is line management, consisting of frontline decision makers on individual projects and transactions.

The second line of defense is, collectively, the Management Team, its committees and IFC’s independent risk management

functions. Independent oversight bodies, together with the Board of Directors, serve as the third line of defense. These

independent oversight bodies are:

o

The

Independent Evaluation Group

, which assesses the alignment between projected and realized outcomes of IFC’s

investment and advisory projects undertaken with its clients;

o

The

Compliance Advisor/Ombudsman

, which is the independent recourse mechanism for IFC’s stakeholders, responding

to complaints from project-affected communities with the goal of enhancing social and environmental outcomes on the

ground;

o

The

World Bank Group’s Internal Audit Vice Presidency

, which evaluates the effectiveness of the organization’s

governance, risk management, and control processes; and

o

The

Integrity Vice-Presidency

, which investigates and pursues sanctions related to allegations of fraud and corruption in

World Bank Group-financed activities.

IFC’s risk management policies define the types and amounts of risk that IFC’s Management Team is willing to assume, via

delegated authority from the Board.

Risk Data and Infrastructure

- Source data is collected, integrated and analyzed to support decision-making across the Corporation.

Measurement and Evaluation

- IFC uses a combination of quantitative and qualitative metrics to manage its risk profile. Key metrics for

each category of risk are discussed later in this document.

Control Environment

-

Management relies on internal controls, modelled on the COSO Framework, to reduce the level of inherent risk

to an acceptable level.

Page 20

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

Risk Response

-