Management’s Discussion and Analysis

and

Condensed Consolidated Financial Statements

December 31, 2015

(Unaudited)

Page 2

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

December 31, 2015

Contents

Page

I

Introduction ............................................................................................................................... 4

II Selected Financial Data and Financial Ratios .......................................................................... 4

III Overview of Financial Results .................................................................................................. 5

IV Client Services .......................................................................................................................... 7

V Liquid Assets .......................................................................................................................... 10

VI Funding Resources ................................................................................................................ 10

VII Results of Operations ............................................................................................................. 12

VIII Senior Management Changes ................................................................................................ 17

Page 3

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

LIST OF TABLES

Tables

Page

Table 1a:

Change in Income before Net Unrealized Gains and Losses on Non-trading

Financial Instruments accounted for at Fair Value, Grants to IDA and Net Gains

and Losses attributable to Non-controlling Interests FY16 YTD vs FY15 YTD ........................ 6

Table 1b: Change in Income before Net Unrealized Gains and Losses on Non-trading

Financial Instruments accounted for at Fair Value, Grants to IDA and Net Gains

and Losses attributable to Non-controlling Interests FY16 Q2 vs FY15 Q2 ............................ 6

Table 2: Activities of the Funds Managed by AMC FY16 YTD vs FY15 YTD ........................................ 8

Table 3: FY16 YTD and FY15 YTD Long-Term Finance and Core Mobilization ................................... 9

Table 4: IFC's Capital ........................................................................................................................... 11

Table 5: IFC's Retained Earnings ......................................................................................................... 11

Table 6: Main Elements of Net Income and Comprehensive Income .................................................. 12

Table 7: Change in Net Income FY16 YTD vs FY15 YTD ................................................................... 13

Table 8: FY16 YTD Change in Income from Loans and Guarantees, including Realized

Gains and Losses on Loans and Associated Derivatives ...................................................... 13

Table 9: Net Unrealized Gains and Losses on Non-Trading Financial Instruments FY16 YTD

vs FY15 YTD .......................................................................................................................... 15

Table 10: Change in Other Comprehensive Income - Unrealized Gains and Losses on Equity

Investments and Debt Securities FY16 YTD vs FY15 YTD ..................................................... 16

Page 4

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

I. INTRODUCTION

This document should be read in conjunction with the International Finance Corporation’s (IFC or the Corporation) consolidated financial

statements and management’s discussion and analysis issued for the year ended June 30, 2015 (FY15). IFC undertakes no obligation to

update any forward-looking statements.

BASIS OF PREPARATION OF IFC’S CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

The accounting and reporting policies of IFC conform to accounting principles generally accepted in the United States (GAAP). IFC’s

accounting policies are discussed in more detail in Note A to IFC’s Condensed Consolidated Financial Statements as of and for the three

and six months ended December 31, 2015 (FY16 YTD Financial Statements).

Management uses income available for designations (Allocable Income) (a non-GAAP measure) as a basis for designations of retained

earnings. Allocable Income generally comprises net income excluding net unrealized gains and losses on equity investments and net

unrealized gains and losses on non-trading financial instruments accounted for at fair value, income from consolidated entities other than

AMC, and expenses reported in net income related to prior year designations

.

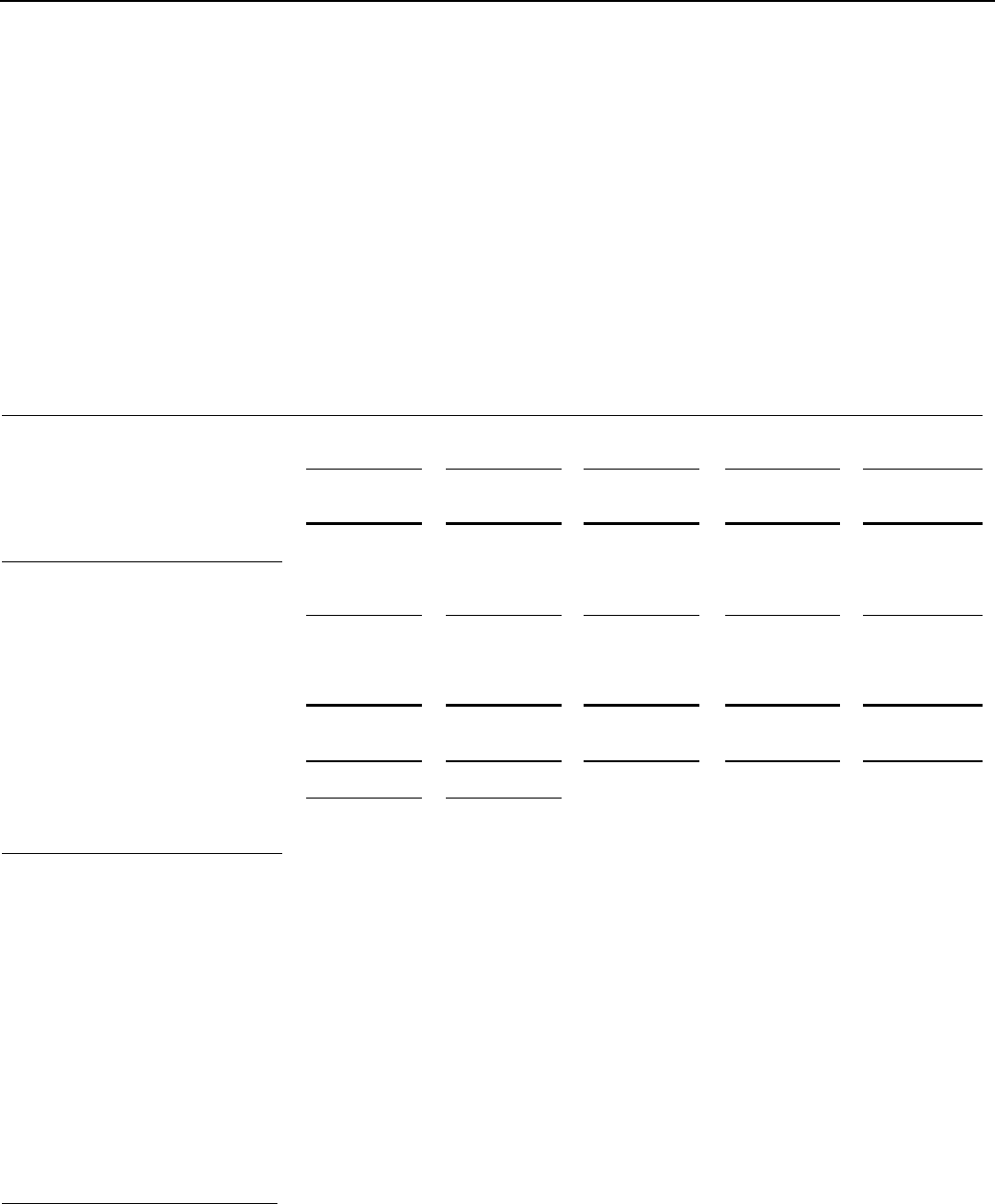

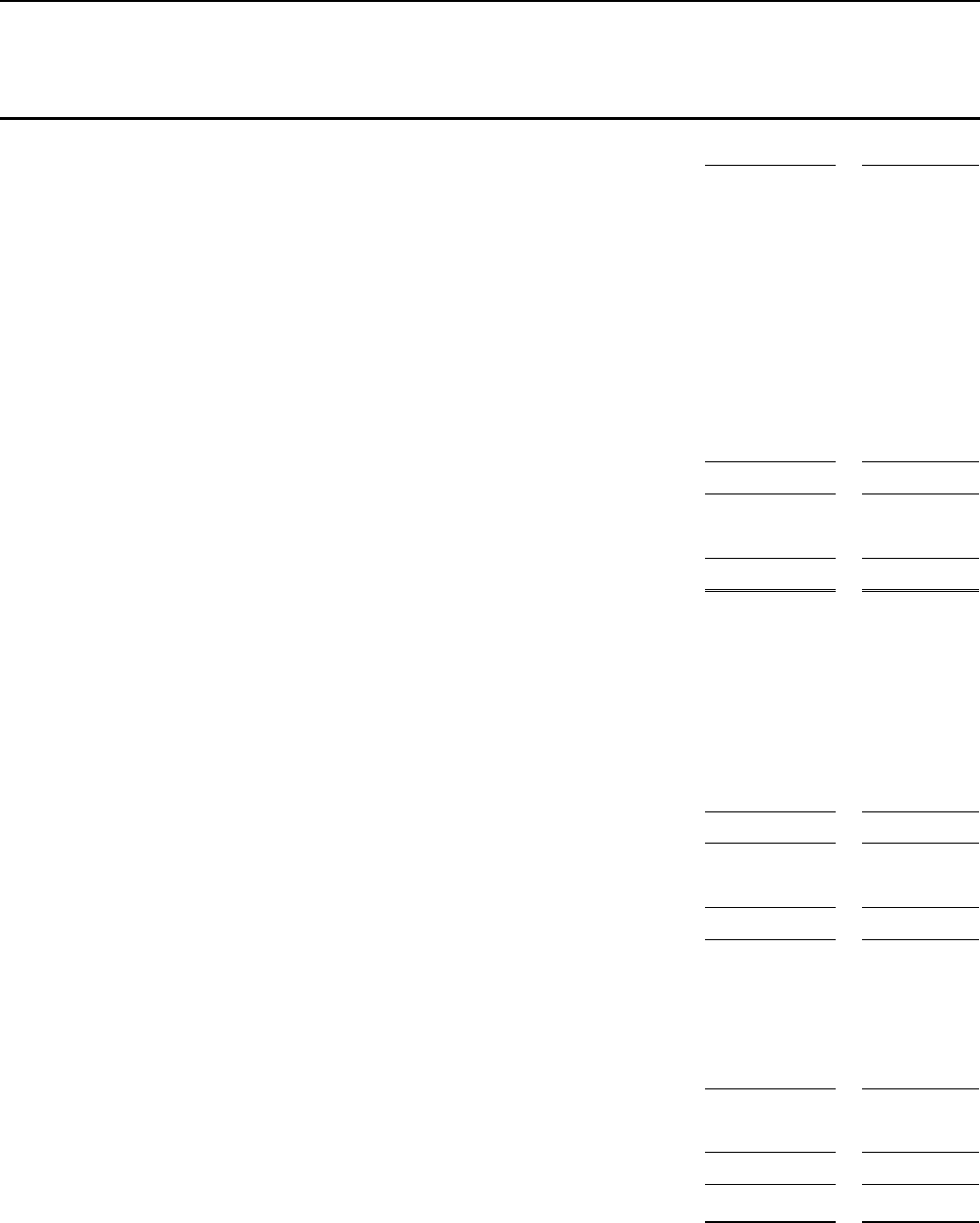

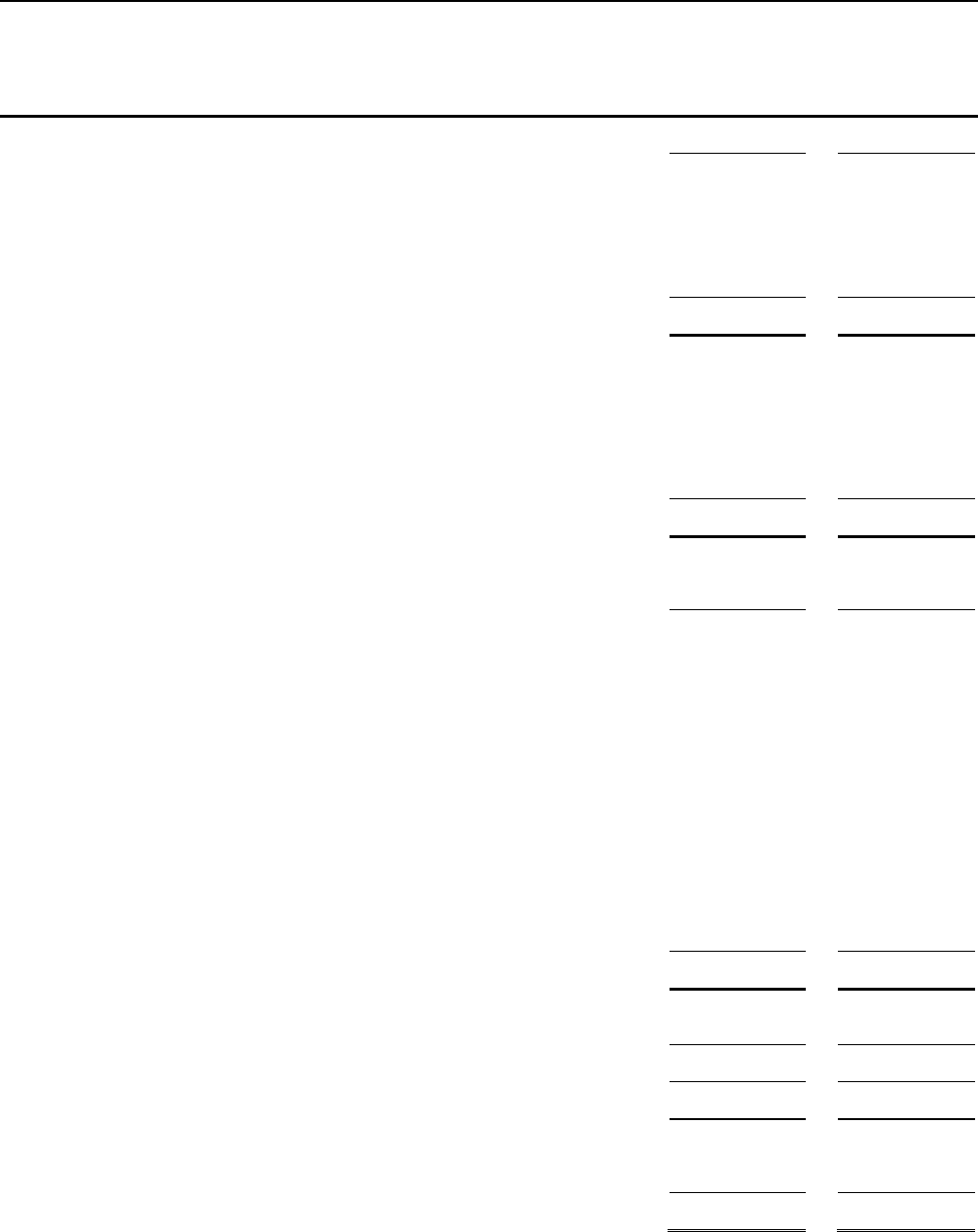

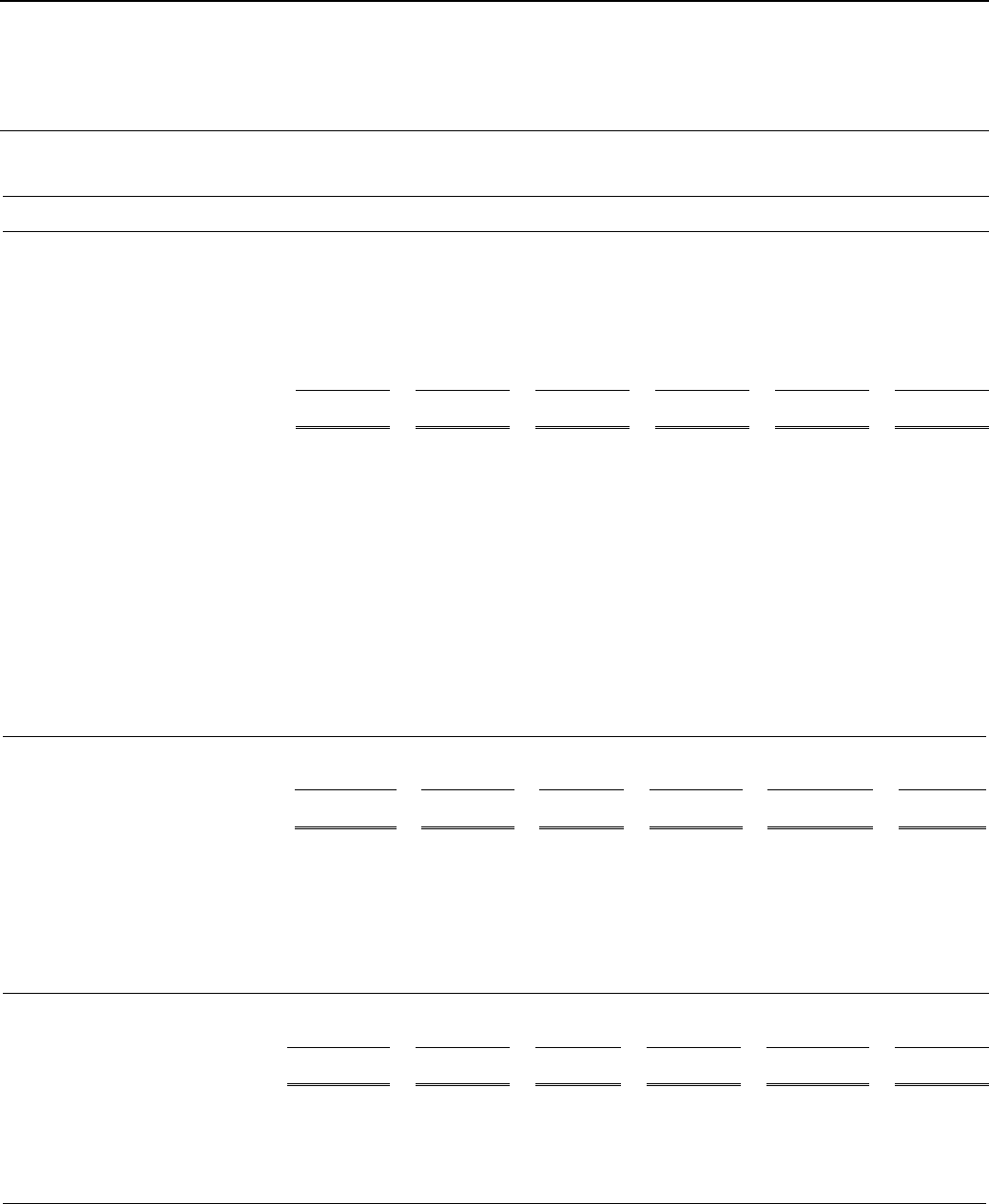

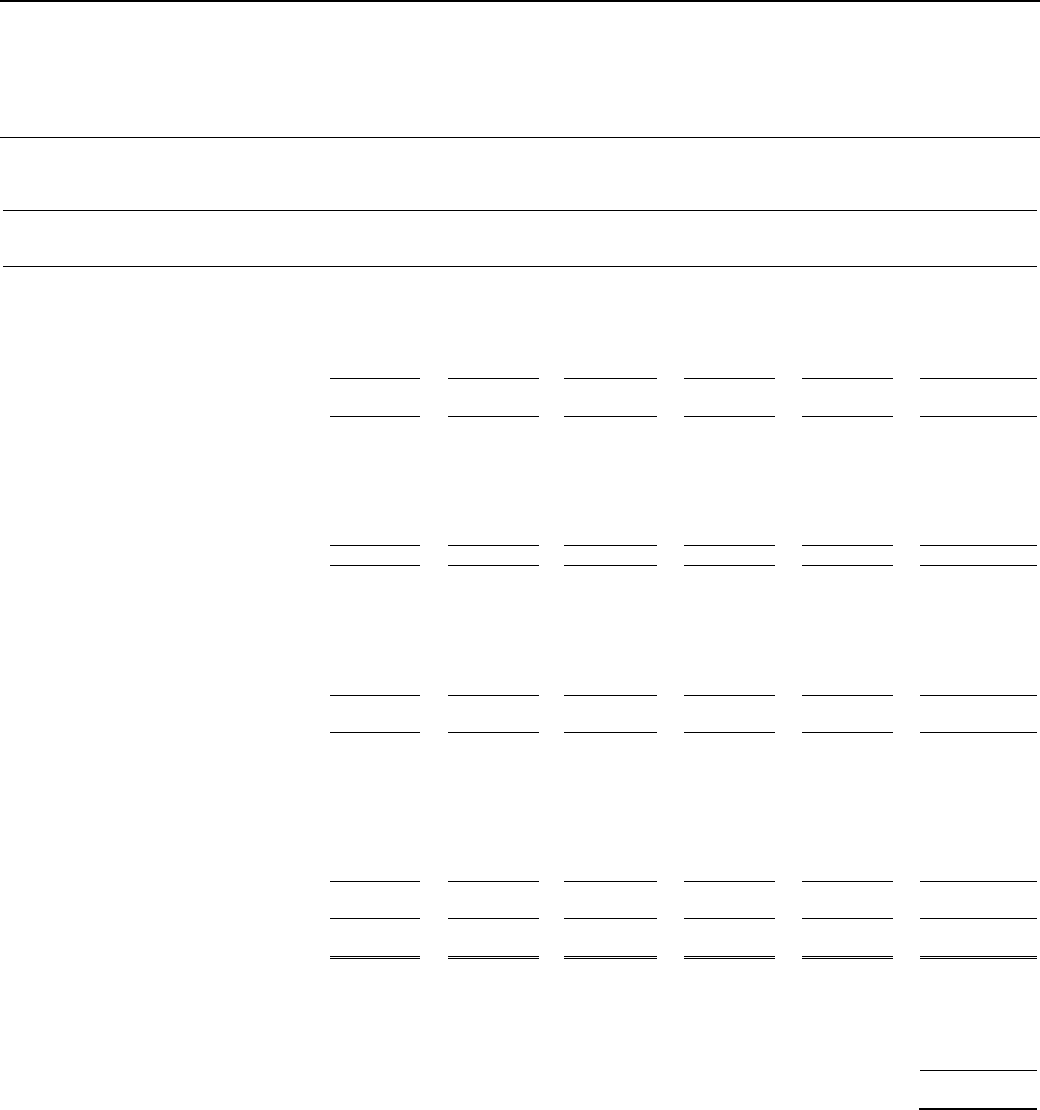

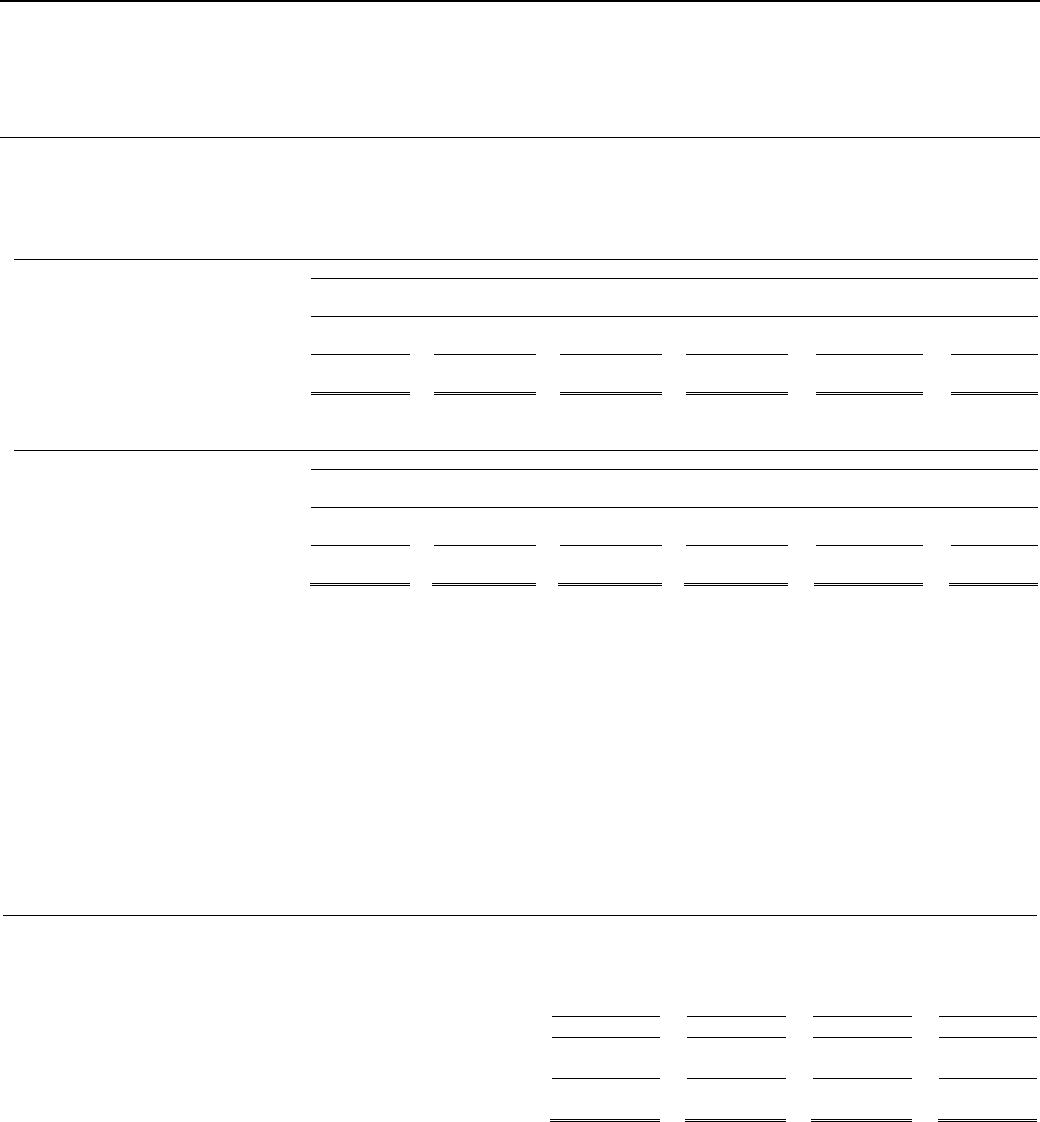

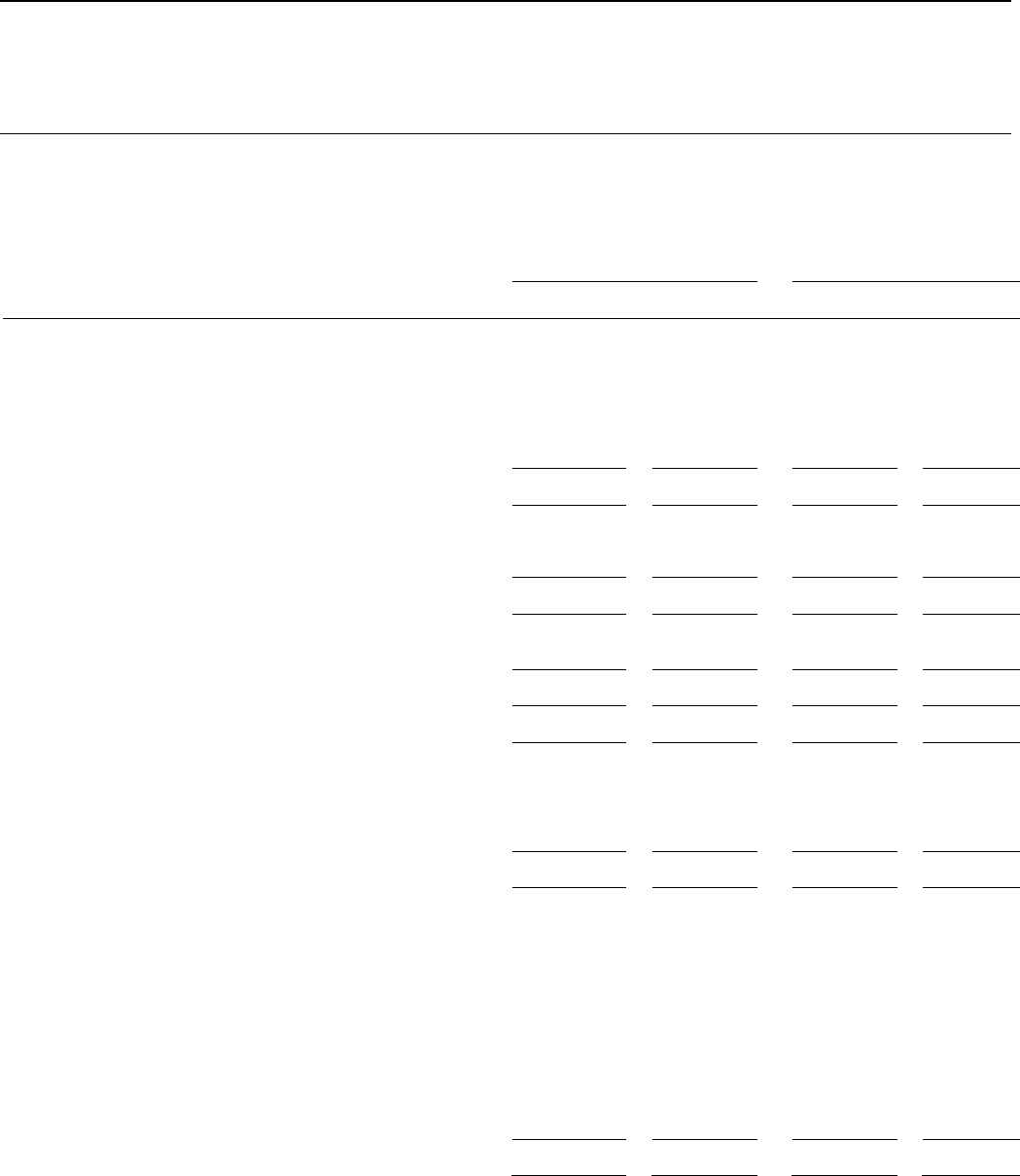

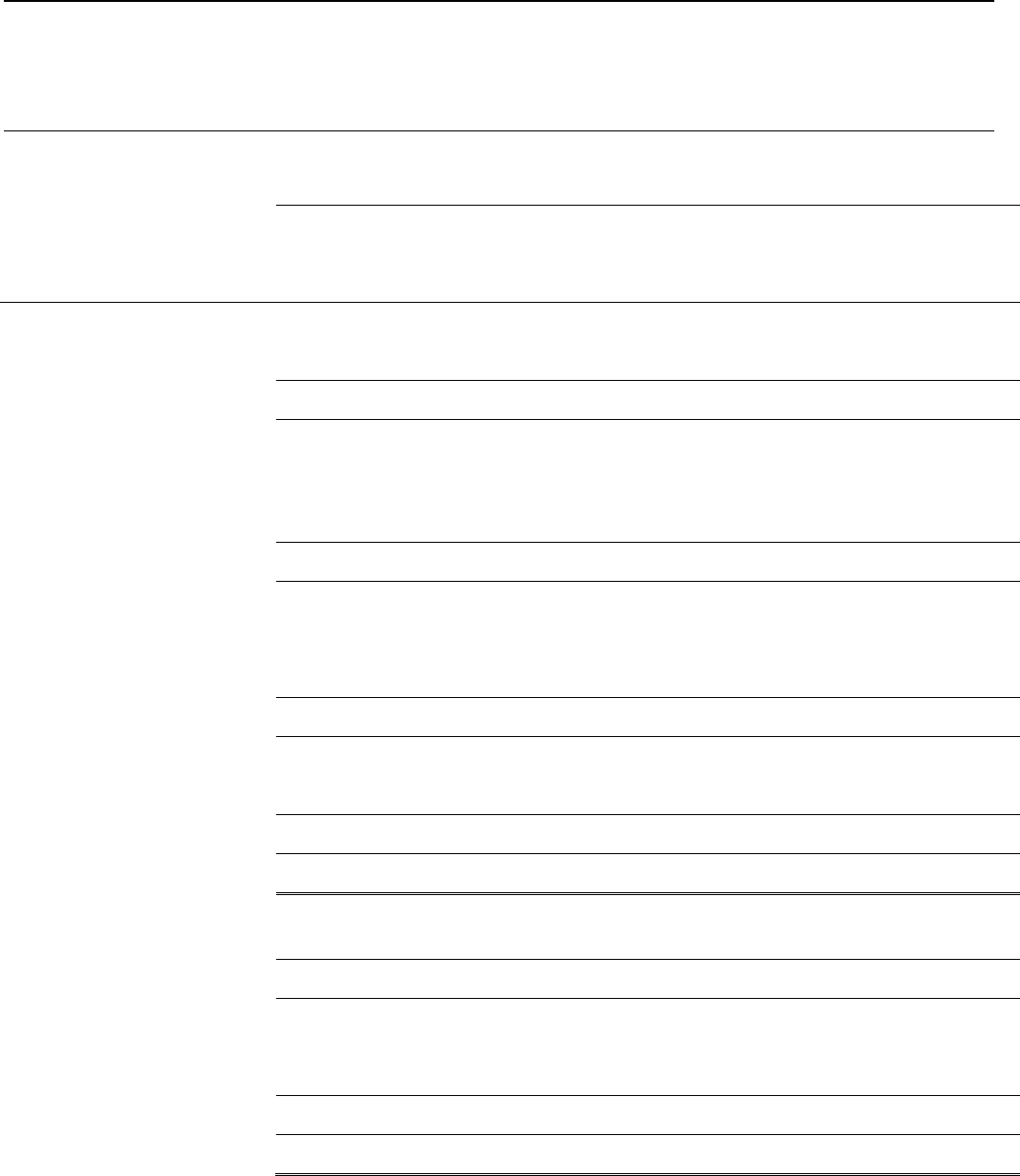

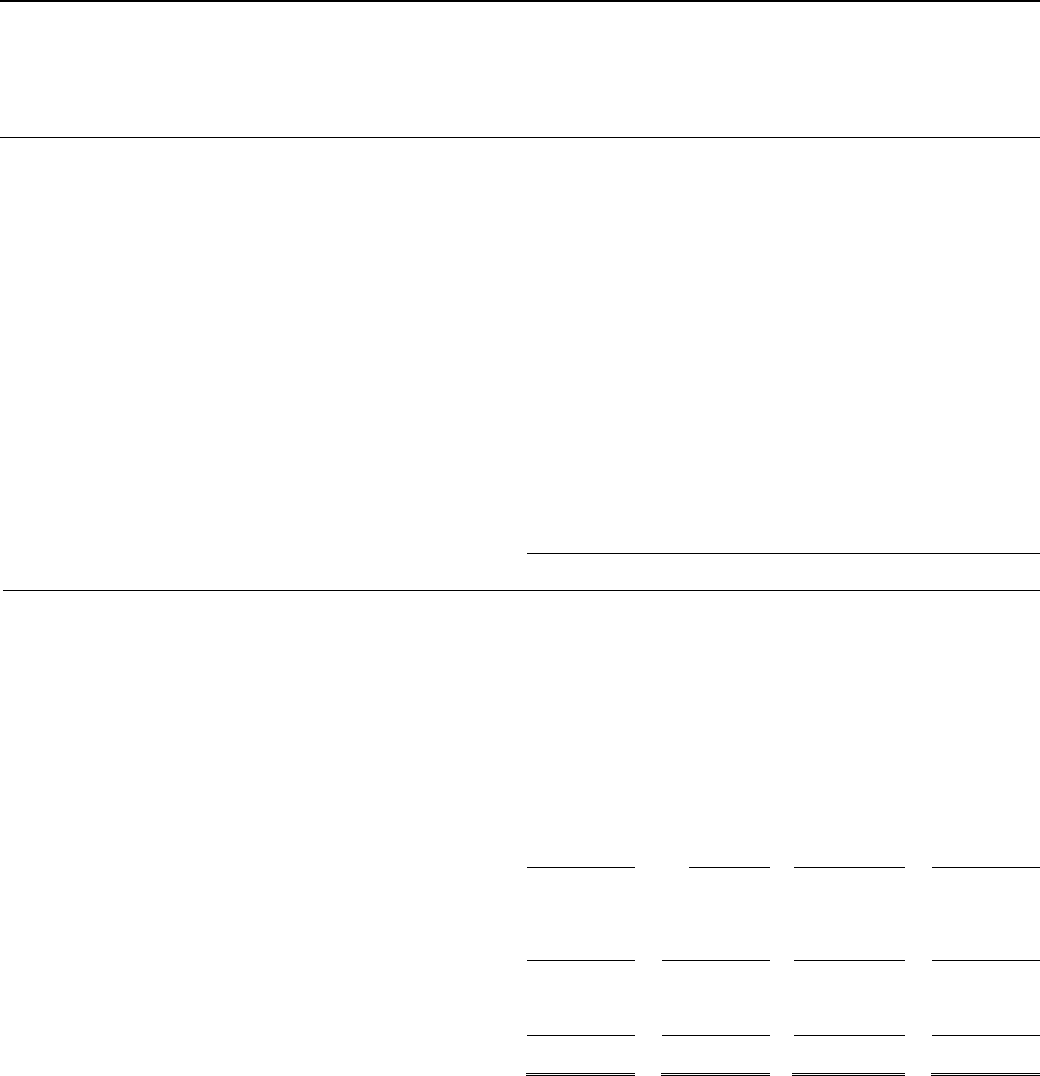

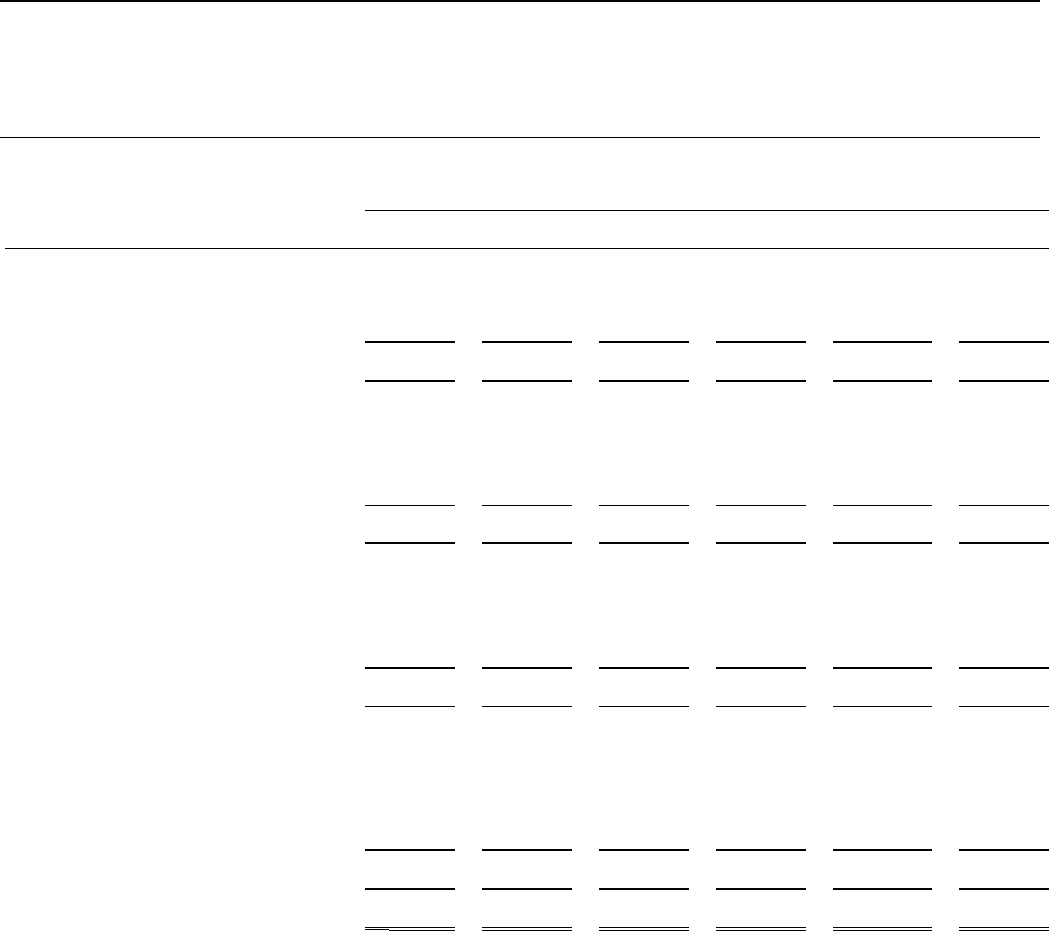

II. SELECTED FINANCIAL DATA AND FINANCIAL RATIOS

As of and for

the six months ended

As of and for

the three months ended

As of and

for the year

ended

Investment Program (US$ millions)

December

31

, 2015

December

31

, 2014

December

31, 2015

December

31, 2014

June 30,

2015

Long-Term Finance

$

4,896

$

5,049

$

3,293

$

2,812

$

10,539

Core Mobilization

2,730

3,890

2,072

2,488

7,133

Total commitments (Long-Term

Finance and Core Mobilization)

$

7,626

$

8,939

$

5,365

$

5,300

$

17,672

Income Statement (US$ millions)

Income before grants to IDA

$

163

$

397

$

16

$

(30)

$

749

Grants to IDA

-

-

-

-

(340)

Net income (loss)

$

163

$

397

$

16

$

(30)

$

409

Add: Net losses attributable to non-

controlling interests

5

30

3

20

36

Net income (loss) attributable to

IFC

$

168

$

427

$

19

$

(10)

$

445

Income available for designations

1

$

292

$

920

Financial Ratios

2

Deployable strategic capital (DSC) as

a percentage of Total Resources

Available (TRA)

7.4%

5.0%

5.4%

External funding liquidity level

559%

533%

494%

Cash and liquid investments as a

percentage of next three years’

estimated net cash requirements

80%

83%

81%

Debt to equity ratio

2.7:1

2.9:1

2.6:1

Return on average assets (GAAP-

basis)

0.8%

1.0%

0.5%

Return on average capital (GAAP-

basis)

2.8%

3.6%

1.8%

1

Income available for designations in the six months ended December 31, 2015 totaled $292 million ($920 million – six months ended December, 2014). Based on the

distribution policy approved by IFC’s Board of Directors, the maximum designation would be $28 million in respect of the six months ended December 31, 2015 ($206 million

– six months ended December 31, 2014). Actual designations in respect of the year ending June 30, 2016 will ultimately be dependent on full year financial results.

2

Returns on average assets are annualized.

Page 5

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

IFC’s DSC as a percentage of TRA was 7.4% at December 31, 2015, as compared with 5.4% at June 30, 2015. The increase in the DSC

in FY16 YTD is due to lower Total Resources Required (TRR) and higher TRA. TRR decreased due to a decline in the committed

investment portfolio as well as lower Treasury economic capital usage. The increase in TRA was supported by strong realized capital

gains on the equity portfolio offset by the $330 million designation to IDA, considered in advance for DSC purposes.

IFC’s debt-to-equity ratio was 2.7

:1

, well within the maximum of 4:1 required by policy approved by IFC’s Board of Directors. The externally

funded liquidity ratio was 559%, above the Board required minimum of 65% and IFC’s overall liquidity as a percentage of the next three

years' estimated net cash needs stood at 80%, above the minimum requirement of the Board of 45%.

III. OVERVIEW OF FINANCIAL RESULTS

IFC is the largest global development institution focused on the private sector in developing countries. Established in 1956, IFC is owned

by 184 member countries, a group that collectively determines its policies. IFC is a member of the World Bank Group (WBG)

3

but is a

legal entity separate and distinct from IBRD, IDA, MIGA, and ICSID, with its own Articles of Agreement, share capital, financial structure,

management and staff. Membership in IFC is open only to member countries of IBRD.

The WBG’s two goals, to be achieved by 2030, are to end extreme poverty by reducing the percentage of people living with less than

$1.90 per day to no more than 3% globally and to promote shared prosperity in a sustainable manner by fostering income growth for the

bottom 40% of the population in every developing country. In October 2015, the WBG raised its poverty line figure upwards, from $1.25 a

day to $1.90, to reflect the increase in prices worldwide based on updated purchasing-power-parity data.

IFC’s overall strategy remains focused on contributing to the WBG strategy and goals.

IFC helps developing countries achieve sustainable growth by financing private sector investment, mobilizing capital in international

financial markets, and providing advisory services to businesses and governments. IFC’s principal investment products are loans and

equity investments, with smaller debt securities and guarantee portfolios. IFC also plays an active and direct role in mobilizing additional

funding from other investors and lenders through a variety of means. Such means principally comprise: loan participations, parallel loans,

sales of loans, the non-IFC portion of structured finance transactions which meet core mobilization criteria, the non-IFC portion of

commitments in IFC’s initiatives, and the non-IFC investment portion of commitments in funds managed by IFC’s wholly owned subsidiary,

IFC Asset Management Company LLC (AMC), (collectively Core Mobilization). Unlike most other development institutions, IFC does not

accept host government guarantees of its exposures. IFC raises virtually all of the funds for its lending activities through the issuance of

debt obligations in the international capital markets, while maintaining a small borrowing window with IBRD. Equity investments are funded

from capital (net worth).

IFC’s capital base and its assets and liabilities, other than its equity investments, are primarily denominated in US Dollars ($ or US$) or

swapped into US Dollars but it has a growing portion of debt issuances denominated in currencies other than USD and which are invested

in such currencies. Overall, IFC seeks to minimize foreign exchange and interest rate risks arising from its loans and liquid assets funded

by the proceeds of market borrowings by closely matching the currency and rate bases of its assets in various currencies with liabilities

having the same characteristics. IFC generally manages non-equity investment related and certain lending related residual currency and

interest rate risks by utilizing currency and interest rate swaps and other derivative instruments.

The Management’s Discussion and Analysis contains forward looking statements which may be identified by such terms as “anticipates,”

“believes,” “expects,” “intends,” “plans” or words of similar meaning. Such statements involve a number of assumptions and estimates that

are based on current expectations, which are subject to risks and uncertainties beyond IFC’s control. Consequently, actual future results

could differ materially from those currently anticipated.

FINANCIAL PERFORMANCE SUMMARY

IFC’s net income is affected by a number of factors that can result in volatile financial performance.

Global equity markets in emerging economies have been volatile in recent years and in the six months ended December 31, 2015 (FY16

YTD) experienced significant deterioration with many emerging markets moving significantly lower in the three months ended September

30, 2015 (FY16 Q1). During FY16 Q2, there was continued intra-quarter volatility but overall such markets were essentially flat at

December 31, 2015 when compared to September 30, 2015. In addition, in FY16 YTD there was further depreciation of certain of IFC’s

major investment currencies against IFC’s reporting currency, the US$, particularly in the Latin America and Caribbean region, continuing

the trend experienced throughout much of FY15. FY16 YTD also saw a continuation of lower commodities prices. Collectively, these

factors negatively impacted the valuation of many of IFC’s investments.

The above factors, together with some adverse project-specific developments in a small but growing number of IFC’s loans, particularly

in the Europe and Central Asia and Middle East and North Africa regions, have also contributed to an increase in non-performing loans

and an increase in credit risk in the loan portfolio.

These factors have put downward pressure on IFC’s investment portfolio returns in FY16 YTD and has resulted in higher other-than-

temporary impairments on equity investments and debt securities and higher provisions for losses on loans in both FY16 YTD and FY16

Q2 alone. Partially offsetting these impacts on the investment portfolio, IFC was able to realize robust capital gains on a small number of

equity investments sales, largely in the East Asia and the Pacific region in FY16 Q1 with larger gains realized in FY16 Q1 compared to

FY16 Q2.

3

The other institutions of the World Bank Group are the International Bank for Reconstruction and Development (IBRD), the International Development Association

(IDA), the Multilateral Investment Guaranty Agency (MIGA), and the International Centre for Settlement of Investment Disputes (ICSID).

Page 6

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

IFC has also recorded significantly lower income from its liquid assets portfolio due in large part to credit spread widening and credit

downgrades.

SIX MONTHS ENDED DECEMBER 31, 2015

IFC reported income before net unrealized gains and losses on non-trading financial instruments accounted for at fair value and grants to

IDA of $124 million in FY16 YTD, as compared to $531 million in the six months ended December 31, 2014 (FY15 YTD). The $407 million

decrease in FY16 YTD when compared to FY15 YTD can be analyzed as follows:

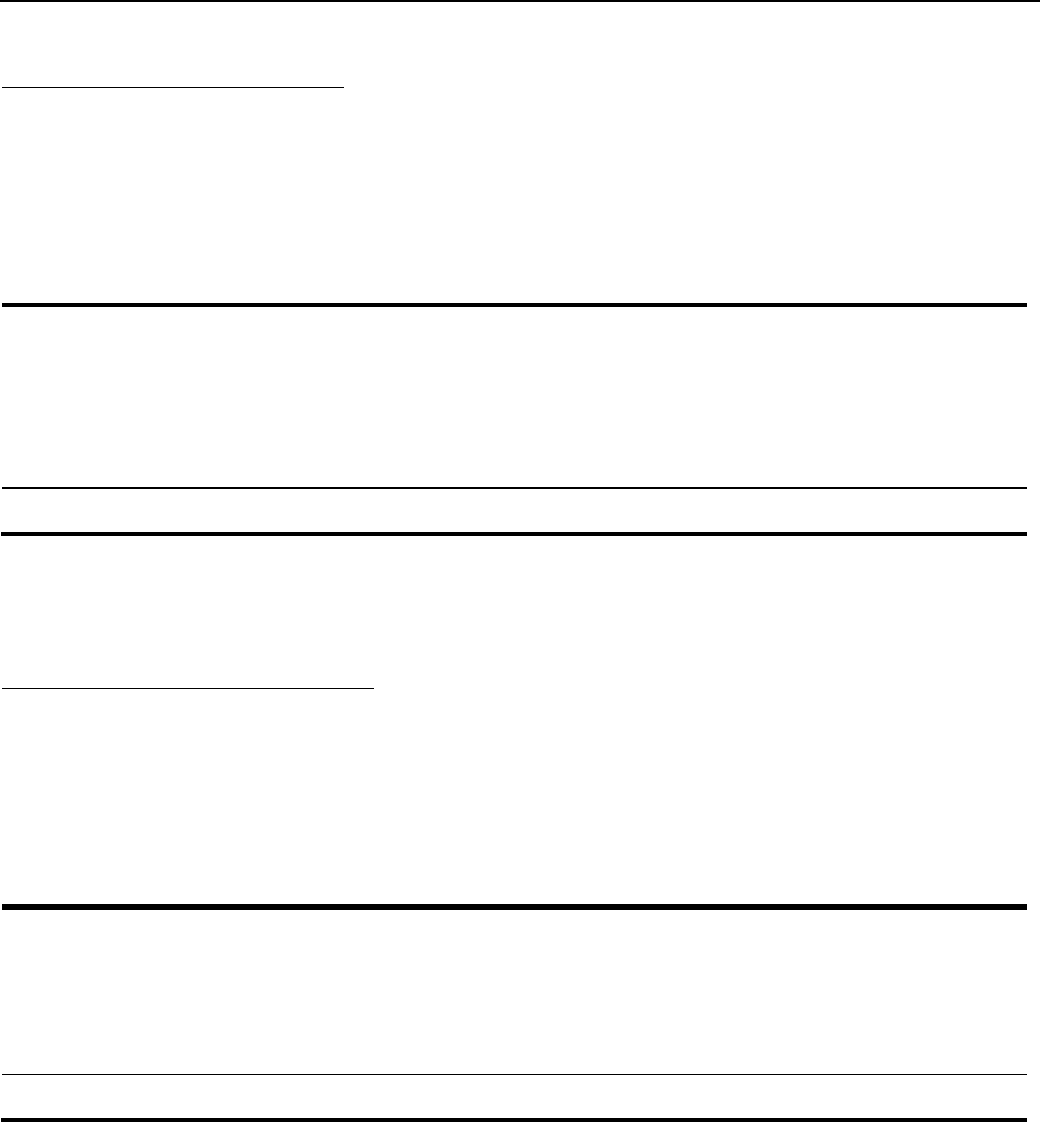

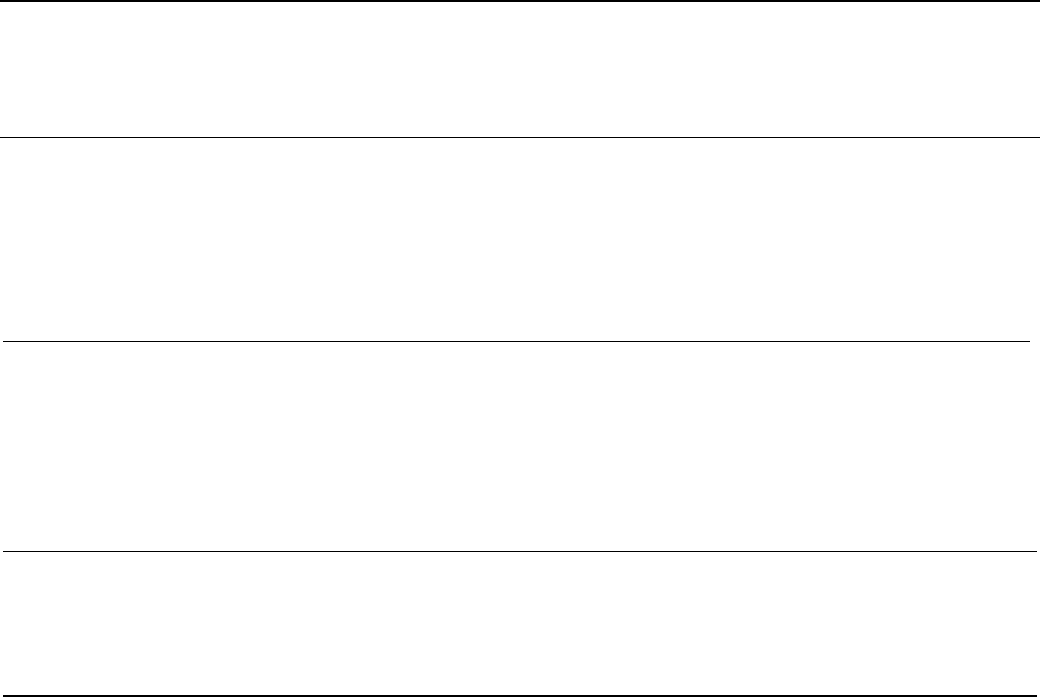

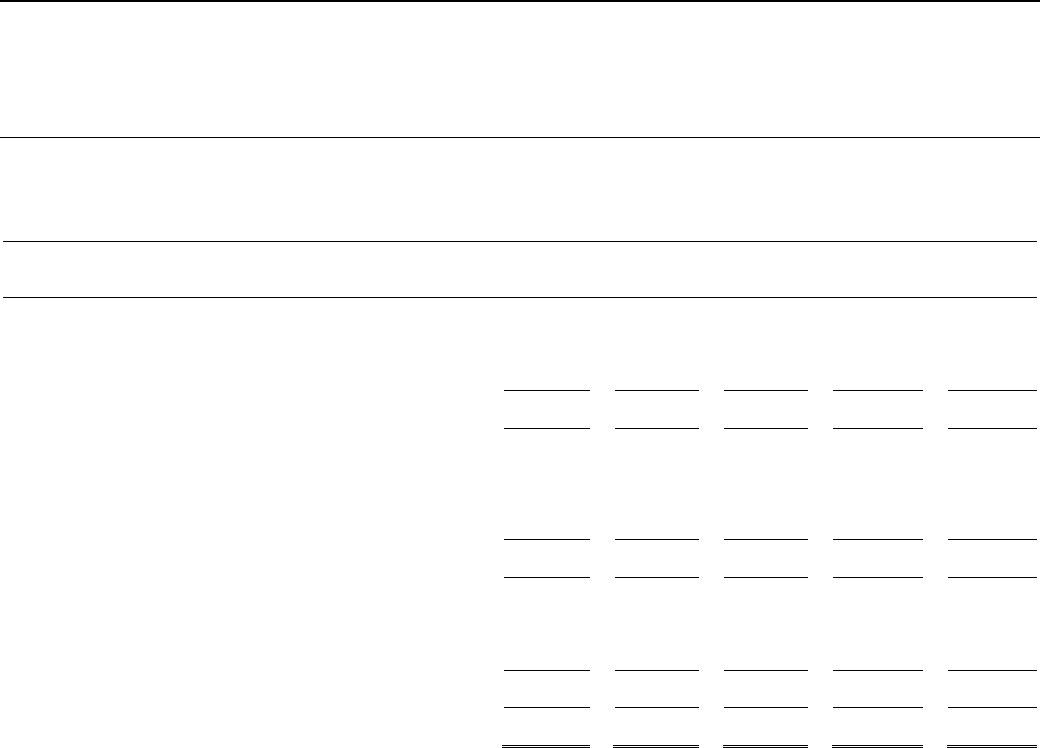

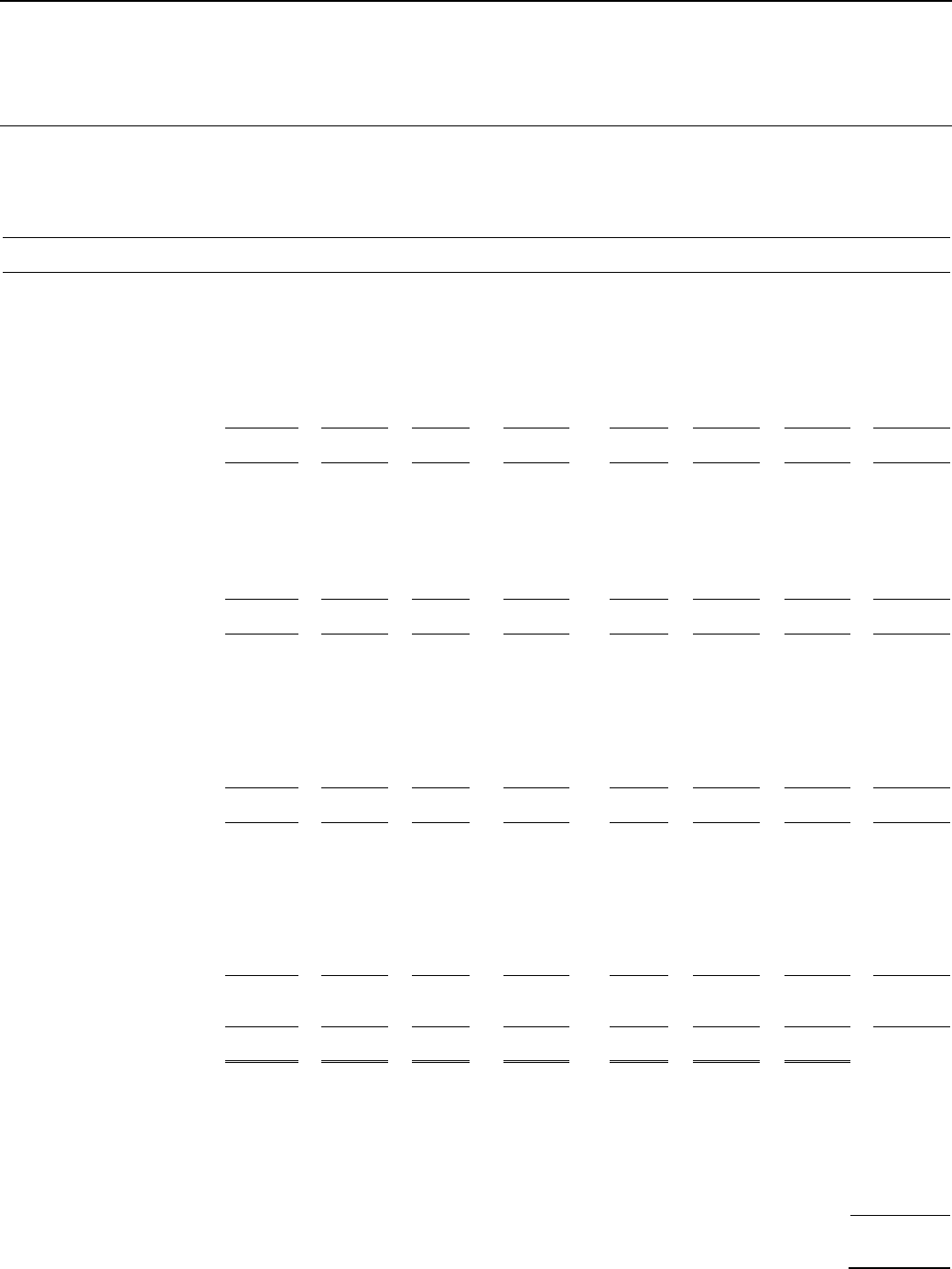

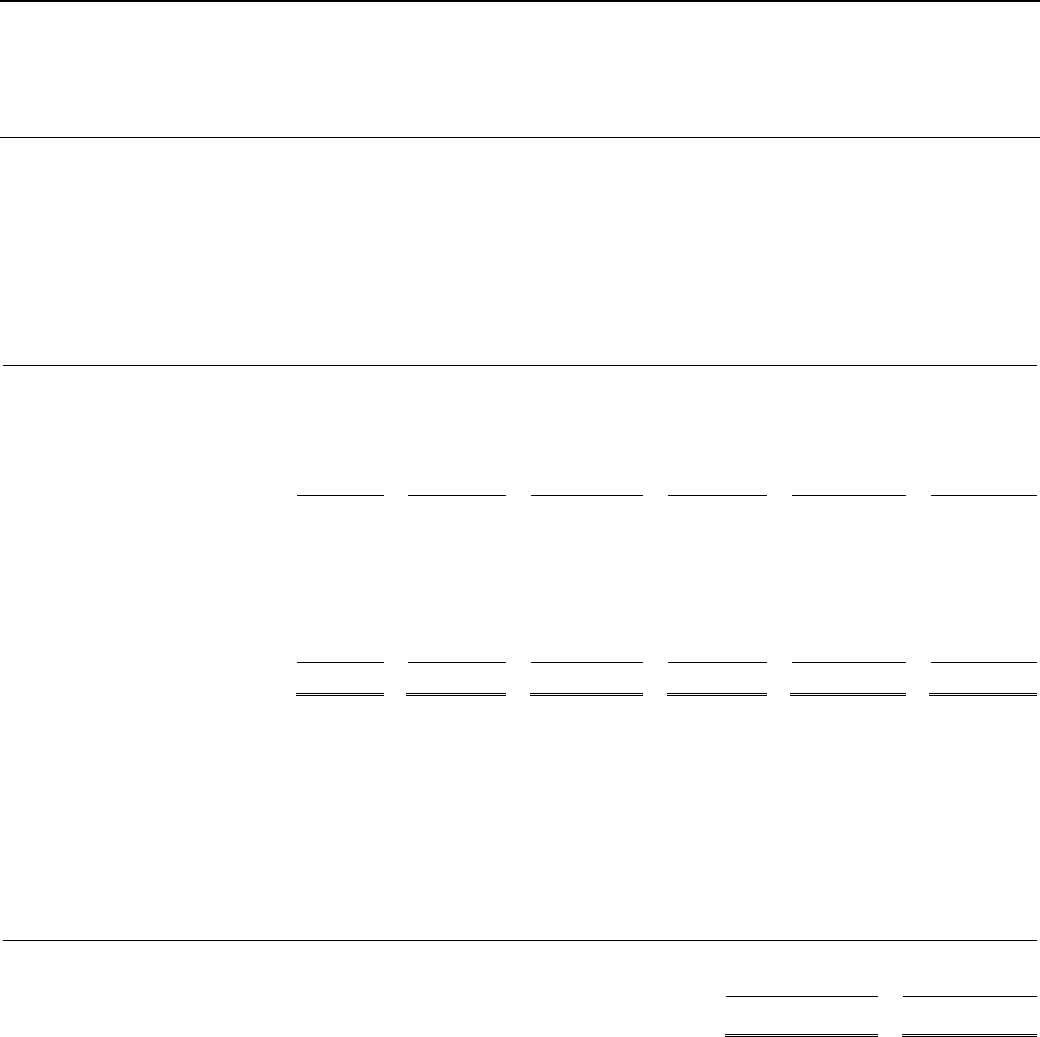

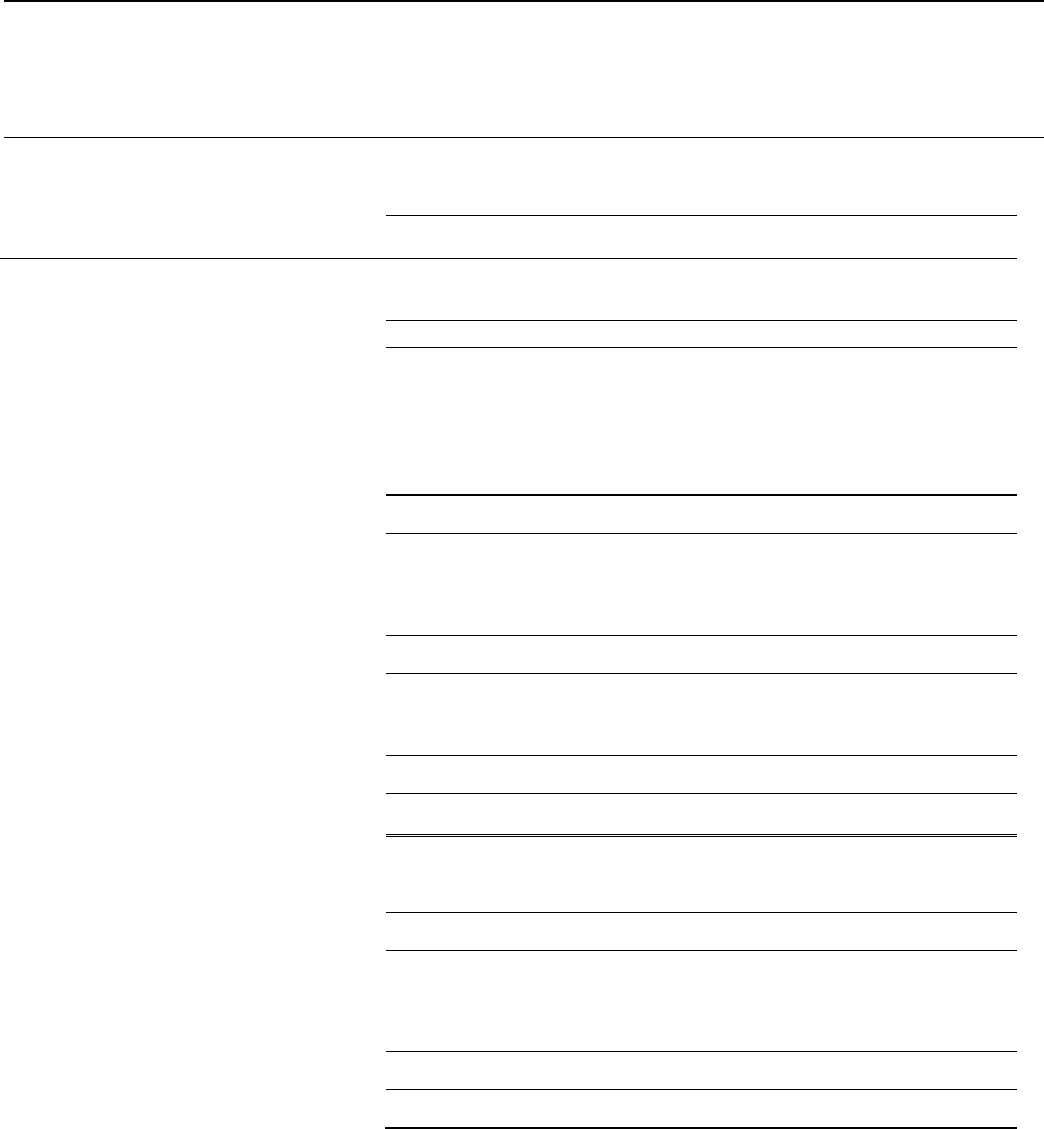

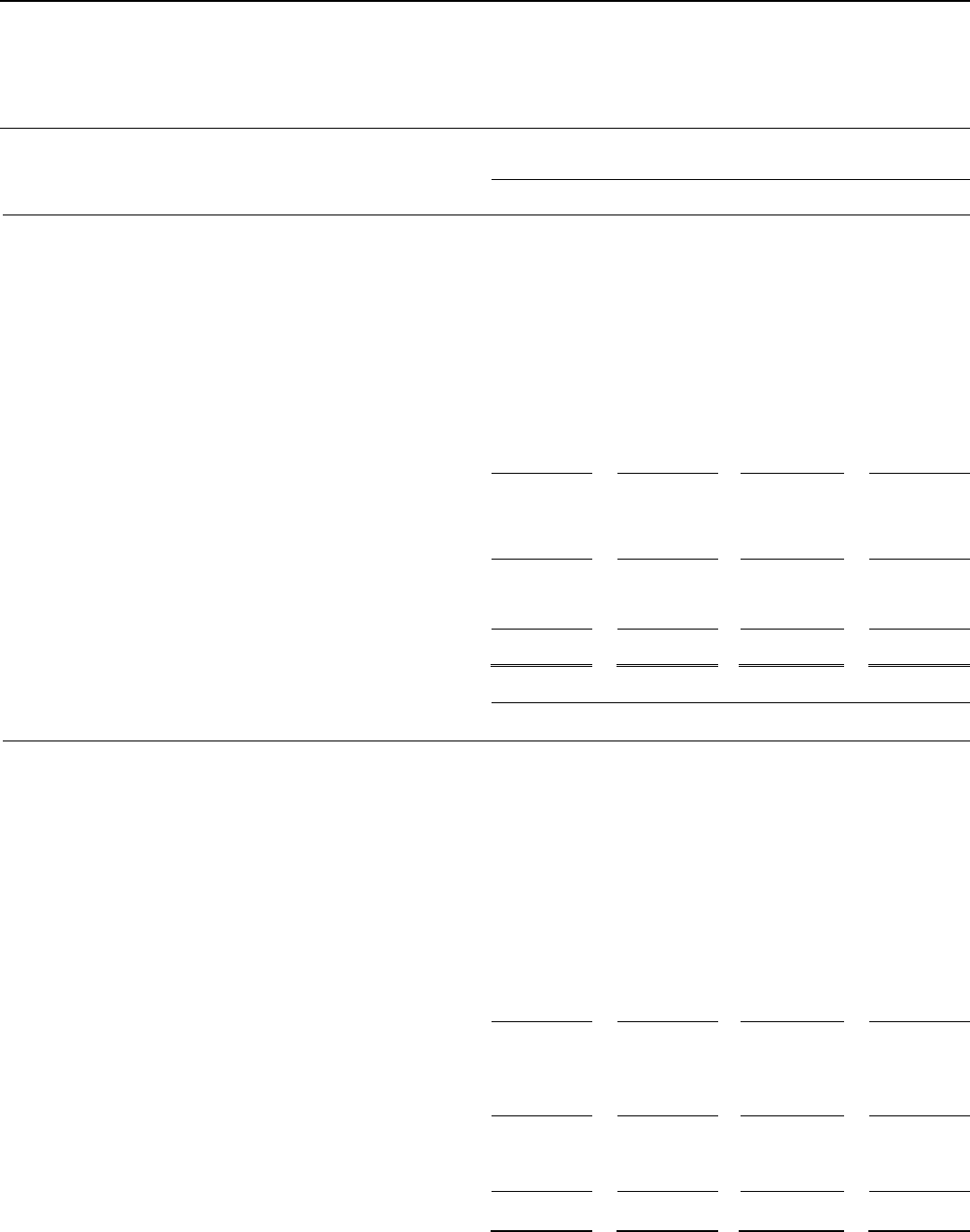

Table 1a: Change in Income before net unrealized gains and losses on non-trading financial instruments accounted for at fair

value, grants to IDA and net gains and losses attributable to non-controlling interests FY16 YTD vs FY15 YTD (US$ millions)

Increase

(decrease)

FY16 YTD vs

FY15 YTD

Higher provisions for losses on loans, guarantees and other receivables

$

(137)

Lower income from liquid asset trading activities

(91)

Higher charges on borrowings

(48)

Lower foreign currency transaction gains on non-trading activities

(32)

Lower income from loans and guarantees, including realized gains and losses on loans and associated

derivatives

(26)

Higher other-than-temporary impairments on equity investments and debt securities

(14)

Higher gains on equity investments and associated derivatives, net

16

Other, net

(75)

Change in income before net unrealized gains and losses on non-trading financial instruments accounted

for at fair value, grants to IDA and net gains and losses attributable to non-controlling interests

$

(407)

Net unrealized gains on non-trading financial instruments accounted for at fair value totaled $39 million in FY16 YTD (net unrealized losses

of $134 million in FY15 YTD) resulting in income before grants to IDA of $163 million in FY16 YTD, as compared to $397 million in FY15

YTD. There were no grants to IDA in FY16 YTD and FY15 YTD. Net losses attributable to non-controlling interests totaled $5 million in

FY16 YTD ($30 million in FY15 YTD).

Accordingly, net income attributable to IFC totaled $168 million in FY16 YTD, as compared with $427 million in FY15 YTD.

THREE MONTHS ENDED DECEMBER 31, 2015

IFC reported losses before net unrealized gains and losses on non-trading financial instruments accounted for at fair value and grants to

IDA of $25 million in the three months ended December 31, 2015 (FY16 Q2), as compared to income of $19 million in the three months

ended December 31, 2014 (FY15 Q2). The $44 million decrease in FY16 Q2 when compared to FY15 Q2 can be analyzed as follows:

Table 1b: Change in Income before net unrealized gains and losses on non-trading financial instruments accounted for at fair

value, grants to IDA and net gains and losses attributable to non-controlling interests FY16 Q2 vs FY15 Q2 (US$ millions)

Increase

(decrease)

FY16 Q2 vs

FY15 Q2

Higher provisions for losses on loans, guarantees and other receivables

$

(68)

Lower foreign currency transaction gains on non-trading activities

(46)

Higher charges on borrowings

(27)

Higher gains on equity investments and associated derivatives, net

23

Higher income from loans and guarantees, including realized gains and losses on loans and associated

derivatives

30

Lower other-than-temporary impairments on equity investments and debt securities

70

Other, net

(26)

Change in income before net unrealized gains and losses on non-trading financial instruments accounted

for at fair value, grants to IDA and net gains and losses attributable to non-controlling interests

$

(44)

Net unrealized gains on non-trading financial instruments accounted for at fair value totaled $41 million in FY16 Q2 (net unrealized losses

of $49 million in FY15 Q2) resulting in income before grants to IDA of $16 million in FY16 Q2, as compared to net loss of $30 million in

FY15 Q2. There were no grants to IDA in FY16 Q2 and FY15 Q2. Net losses attributable to non-controlling interests totaled $3 million in

FY16 Q2 ($20 million in FY15 Q2).

Accordingly, net income attributable to IFC totaled $19 million in FY16 Q2, as compared to net loss of $10 million in FY15 Q2.

IFC’s financial performance is detailed more fully in Section VII, Results of Operations.

Page 7

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

IV. CLIENT SERVICES

BUSINESS OVERVIEW

IFC fosters sustainable economic growth in developing countries by financing private sector investment, mobilizing capital in the

international financial markets, and providing advisory services to businesses and governments.

For all new investments, IFC articulates the expected impact on sustainable development, and, as the projects mature, IFC assesses the

quality of the development benefits realized.

IFC’s strategic focus areas are aligned to advance the World Bank Group’s global priorities.

INVESTMENT SERVICES

IFC’s investments are normally made in its developing member countries. The Articles of Agreement mandate that IFC shall invest in

productive private enterprise. The requirement for private ownership does not disqualify enterprises that are partly owned by the public

sector if such enterprises are organized under local commercial and corporate law, operate free of host government control in a market

context and according to profitability criteria, and/or are in the process of being totally or partially privatized.

IFC provides a range of financial products and services to its clients to promote sustainable enterprises, encourage entrepreneurship, and

mobilize resources that wouldn’t otherwise be available. IFC’s financing products are tailored to meet the needs of each project. Investment

services product lines include: loans, equity investments, trade finance, loan participations, structured finance, client risk management

services, and blended finance.

IFC carefully supervises its projects to monitor project performance and compliance with contractual obligations and with IFC’s internal

policies and procedures.

ADVISORY SERVICES

IFC’s Advisory Services (AS) strengthens the capacity and development impact of firms, helps governments design and implement public-

private partnership transactions (PPP), and helps governments and non-government institutions improve the enabling environment for

private investment. AS extends IFC’s footprint, especially in challenging markets. In these areas AS often leads the way for IFC, and is a

crucial part of its growth strategy.

ASSET MANAGEMENT COMPANY

IFC Asset Management Company, LLC (AMC), a wholly-owned subsidiary of IFC, invests third-party capital and IFC capital, enabling outside

investors to benefit from IFC’s expertise in achieving strong equity returns, as well as positive development impact in the countries in which

it invests in developing and frontier markets. Investors in funds managed by AMC include sovereign wealth funds, national pension funds,

multilateral and bilateral development institutions, national development agencies and international financial institutions. AMC helps IFC

mobilize additional capital resources for investment in productive private enterprise in developing countries.

At December 31, 2015, AMC managed eleven funds, with $8.7 billion total assets under management (ten funds; $8.5 billion at June 30,

2015):

• The IFC Capitalization (Equity) Fund, L.P. (Equity Capitalization Fund) and the Capitalization (Subordinated Debt) Fund, L.P.

(Sub-Debt Capitalization Fund), established in the year ended June 30, 2009, help strengthen systemically important banks in

emerging markets.

• The African, Latin American and Caribbean Fund, LP (ALAC Fund) was established in the year ended June 30, 2010 (FY10) and

invests in equity investments across a range of sectors in Sub-Saharan Africa, Latin America, and the Caribbean.

• The Africa Capitalization Fund, Ltd. (Africa Capitalization Fund) was established in FY10 to capitalize on systemically important

commercial banking institutions in northern and Sub-Saharan Africa.

• The Russian Bank Capitalization Fund, LP (Russian Bank Cap Fund) was established in the year ended June 30, 2012 to invest

in mid-sized commercial banks in Russia that are either: (i) privately owned and controlled; or (ii) state-owned; or (iii) controlled

and on a clear path to privatization.

• The Catalyst Fund, LP, IFC Catalyst Fund (UK), LP and IFC Catalyst Fund (Japan), LP (collectively, Catalyst Funds) were

established in the year ended June 30, 2013 (FY13) to make investments in selected climate- and resource efficiency-focused

private equity funds in emerging markets.

• The Global Infrastructure Fund, LP (Global Infrastructure Fund) was established in FY13 to focus on making equity and equity-

related investments in the infrastructure sector in global emerging markets.

• The China-Mexico Fund, LP (China-Mexico Fund) was established in FY15 to focus on making equity and equity-related

investments across all sectors in Mexico.

• The Financial Institutions Growth Fund, LP (FIG Fund) was established in FY15 to invest in equity and equity-related investments

in financial institutions in global emerging markets.

• The Global Emerging Markets Fund of Funds, LP and IFC Global Emerging Markets Fund of Funds (Japan Parallel), LP

(collectively, GEM Funds) were established in FY15 to primarily invest in a portfolio of investment funds in global emerging

markets.

•

The Middle East and North Africa Fund, LP (MENA Fund) was established in July 2015 to make equity and equity related

investments in the Middle East and North Africa region.

Page 8

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

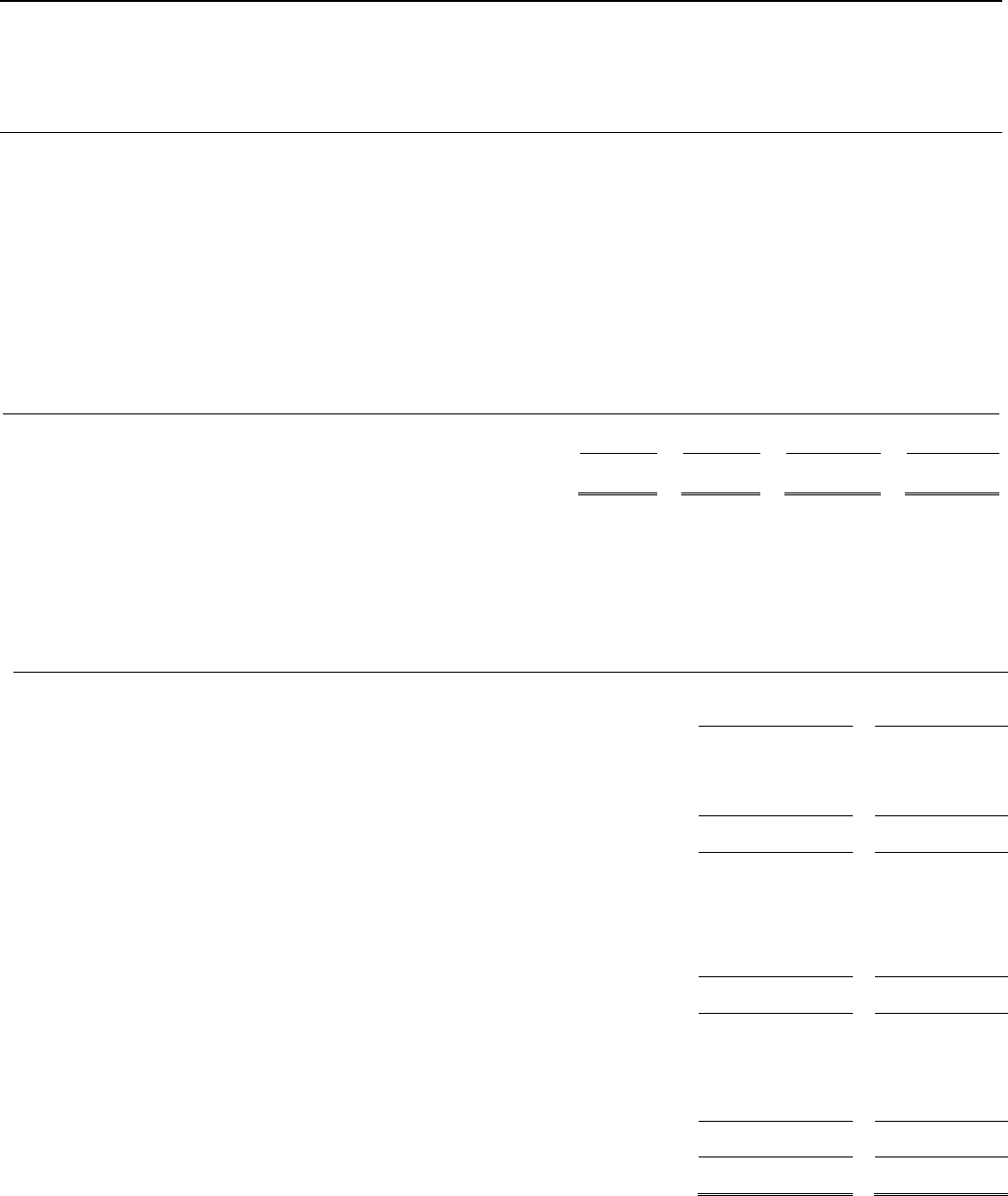

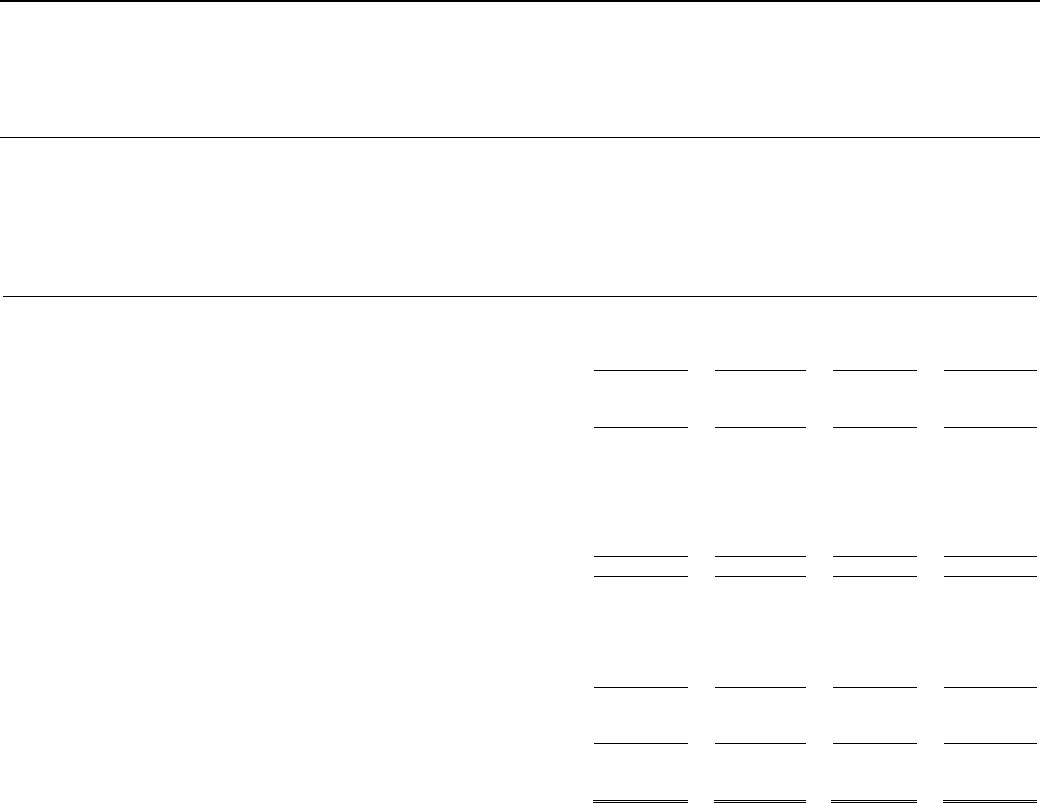

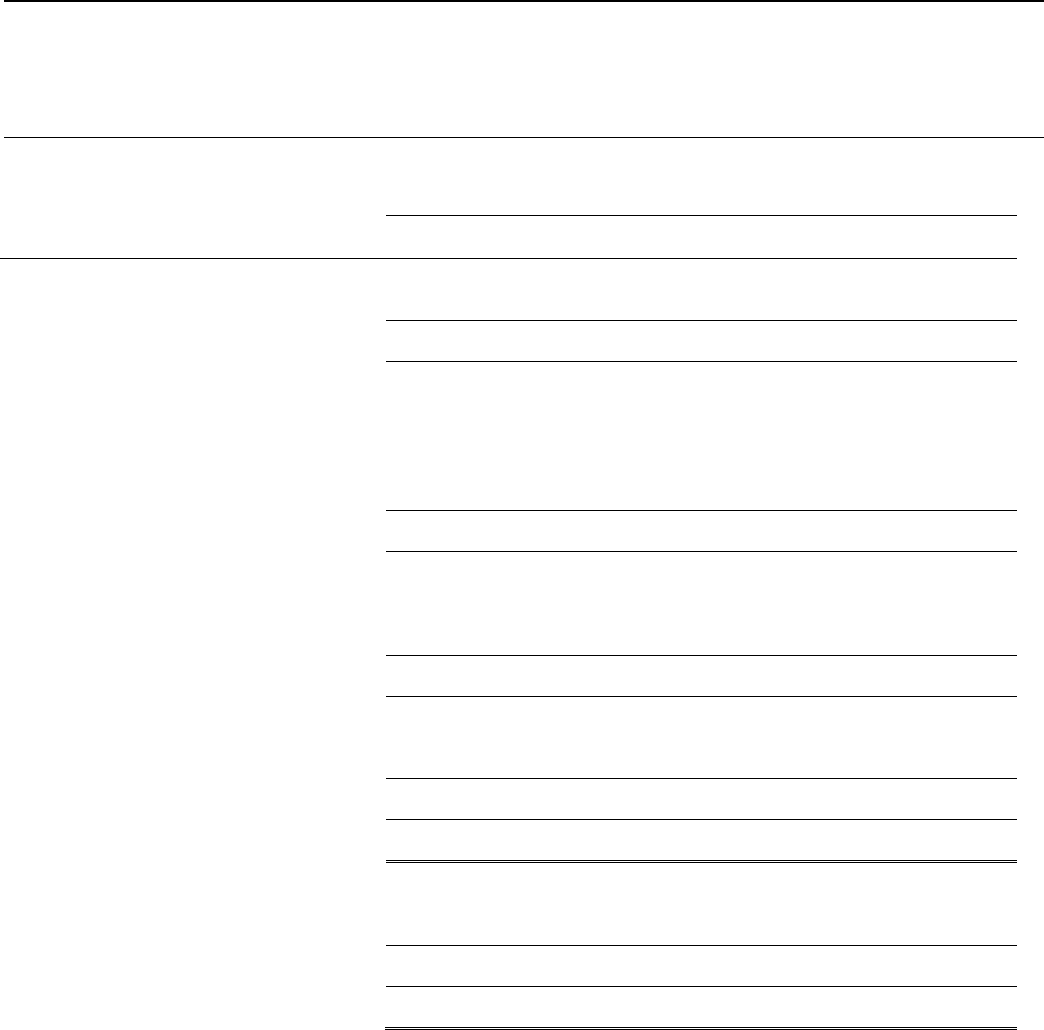

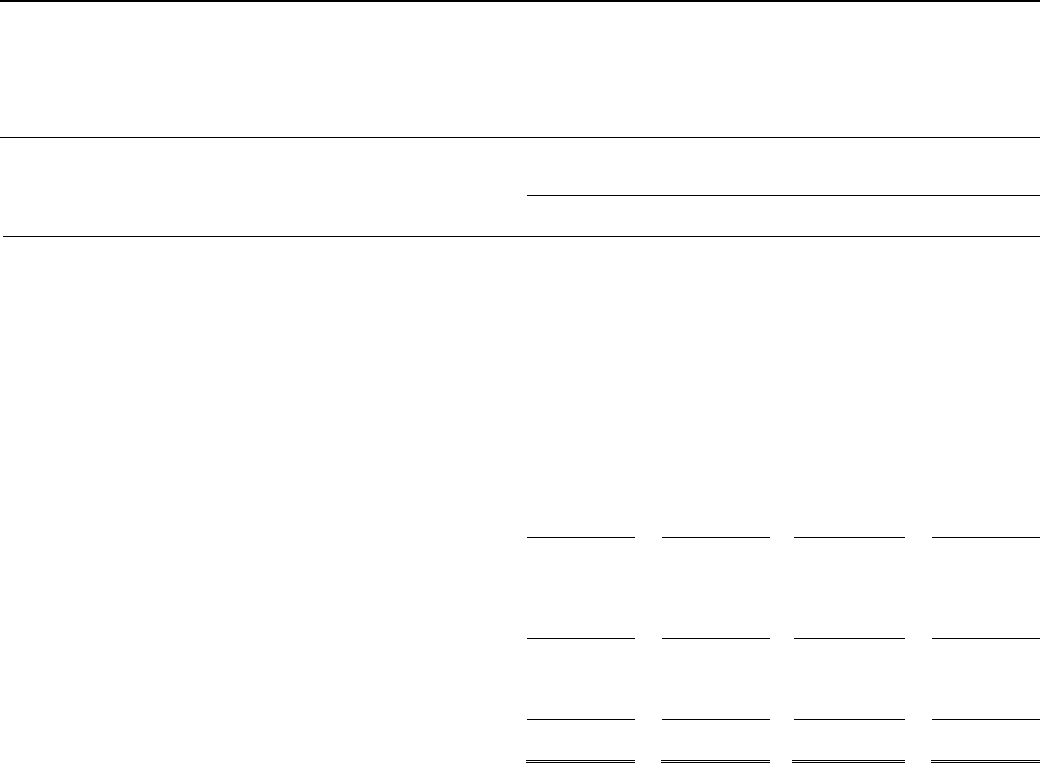

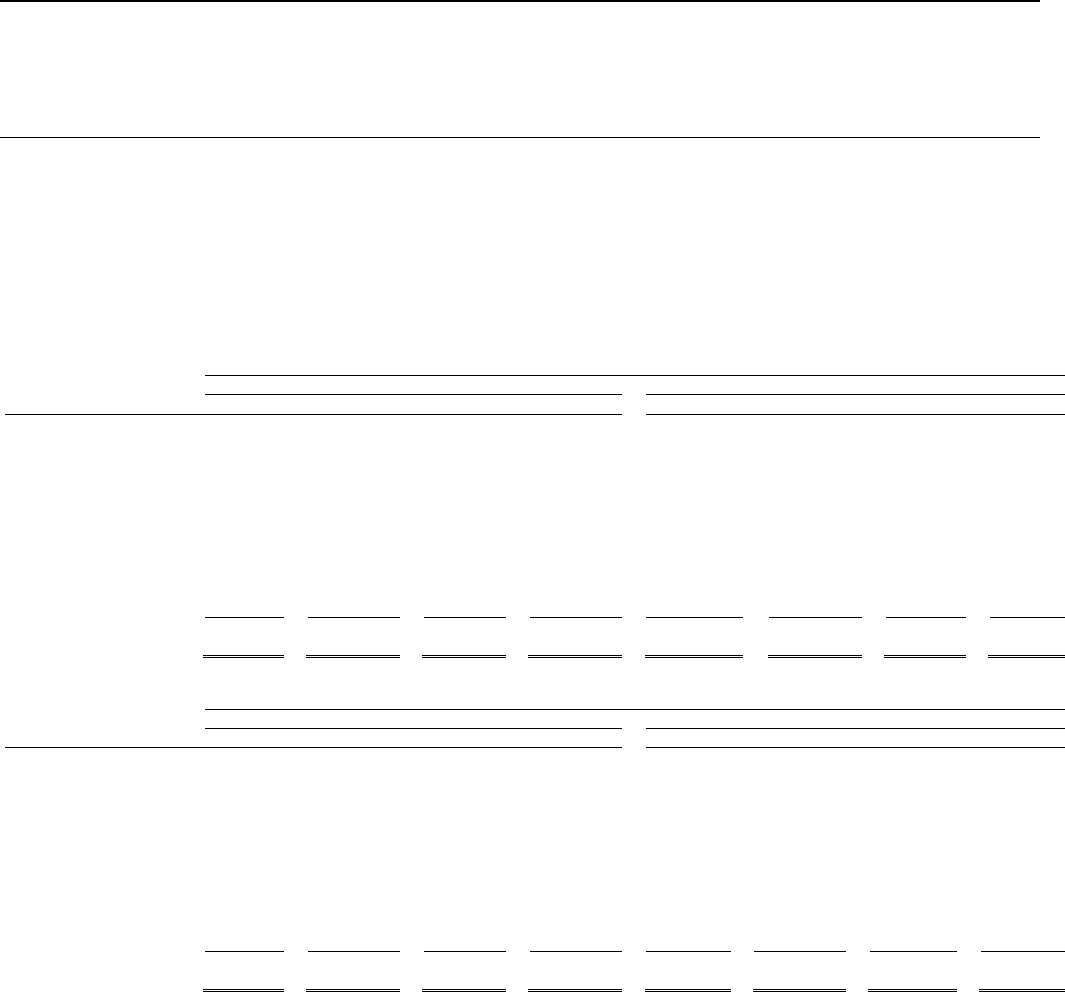

The activities of the funds managed by AMC as of and for the six months ended December 31, 2015 and 2014 can be summarized as follows:

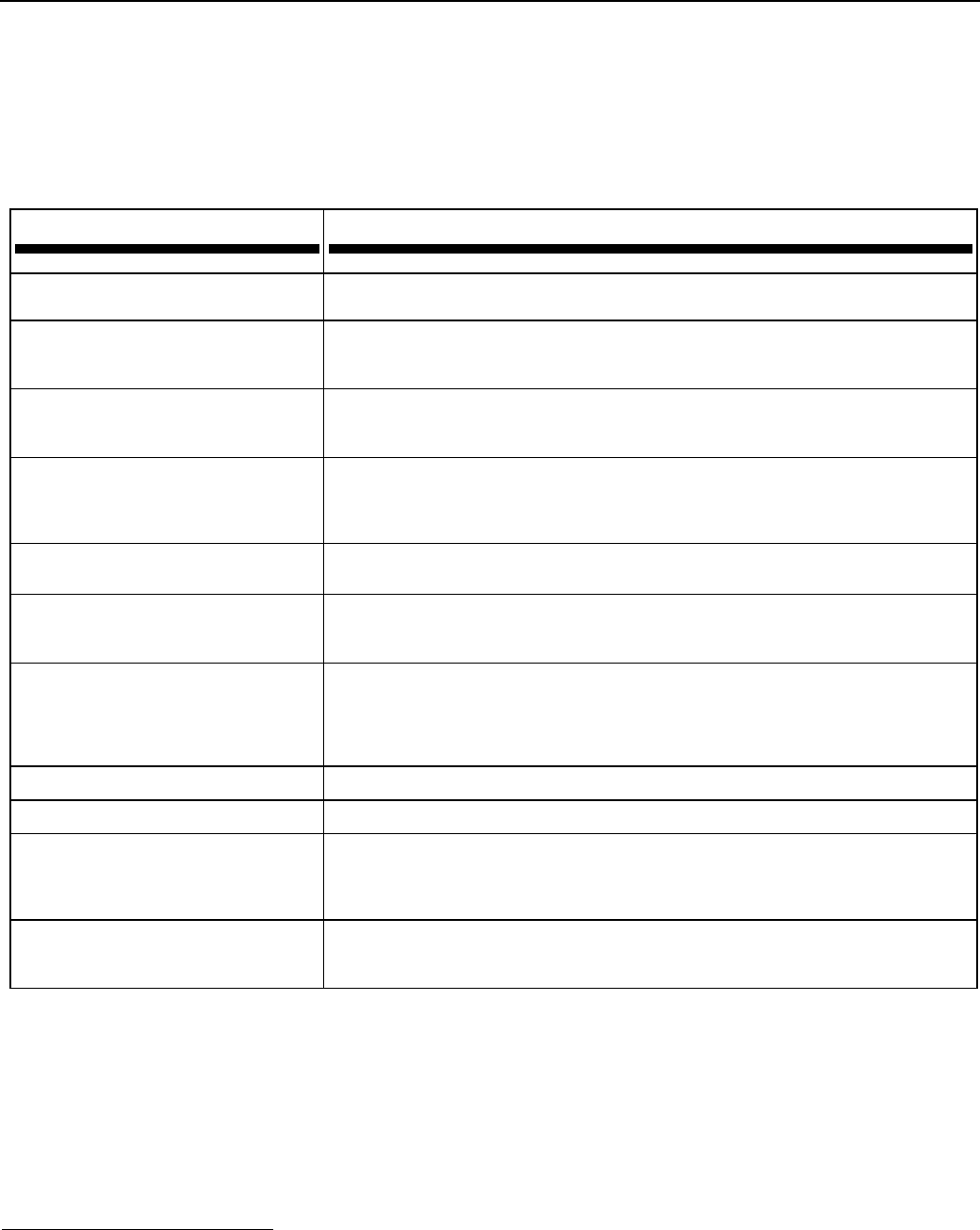

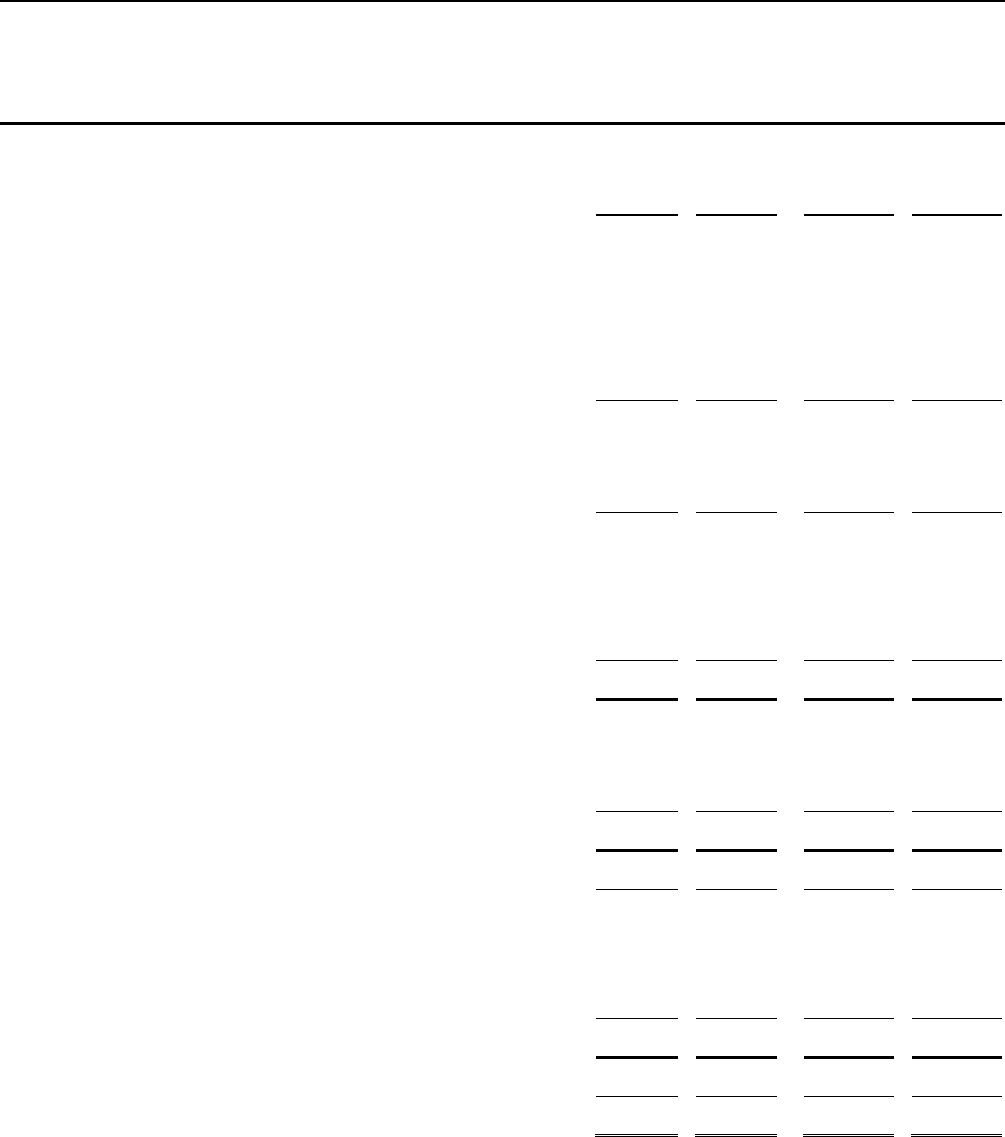

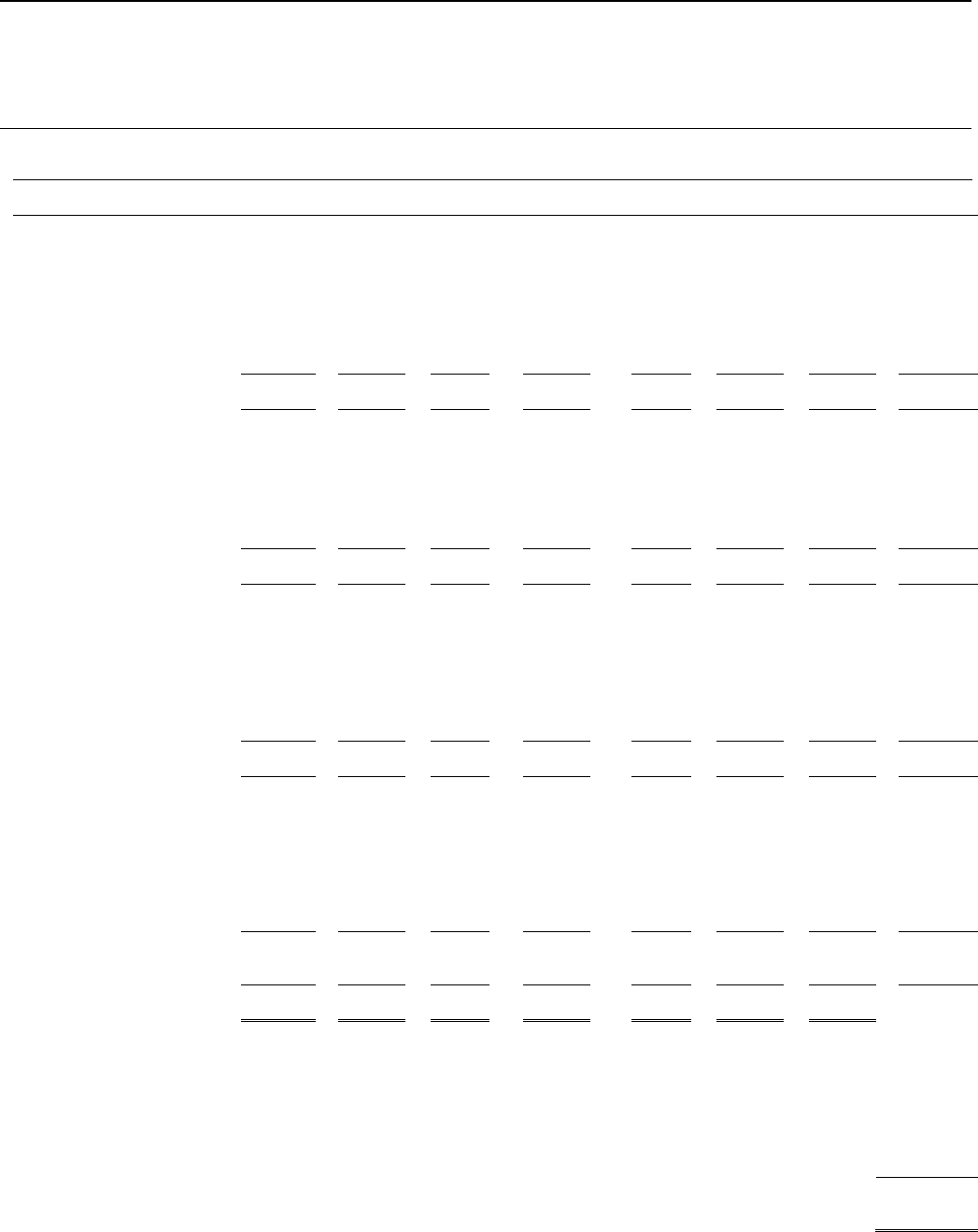

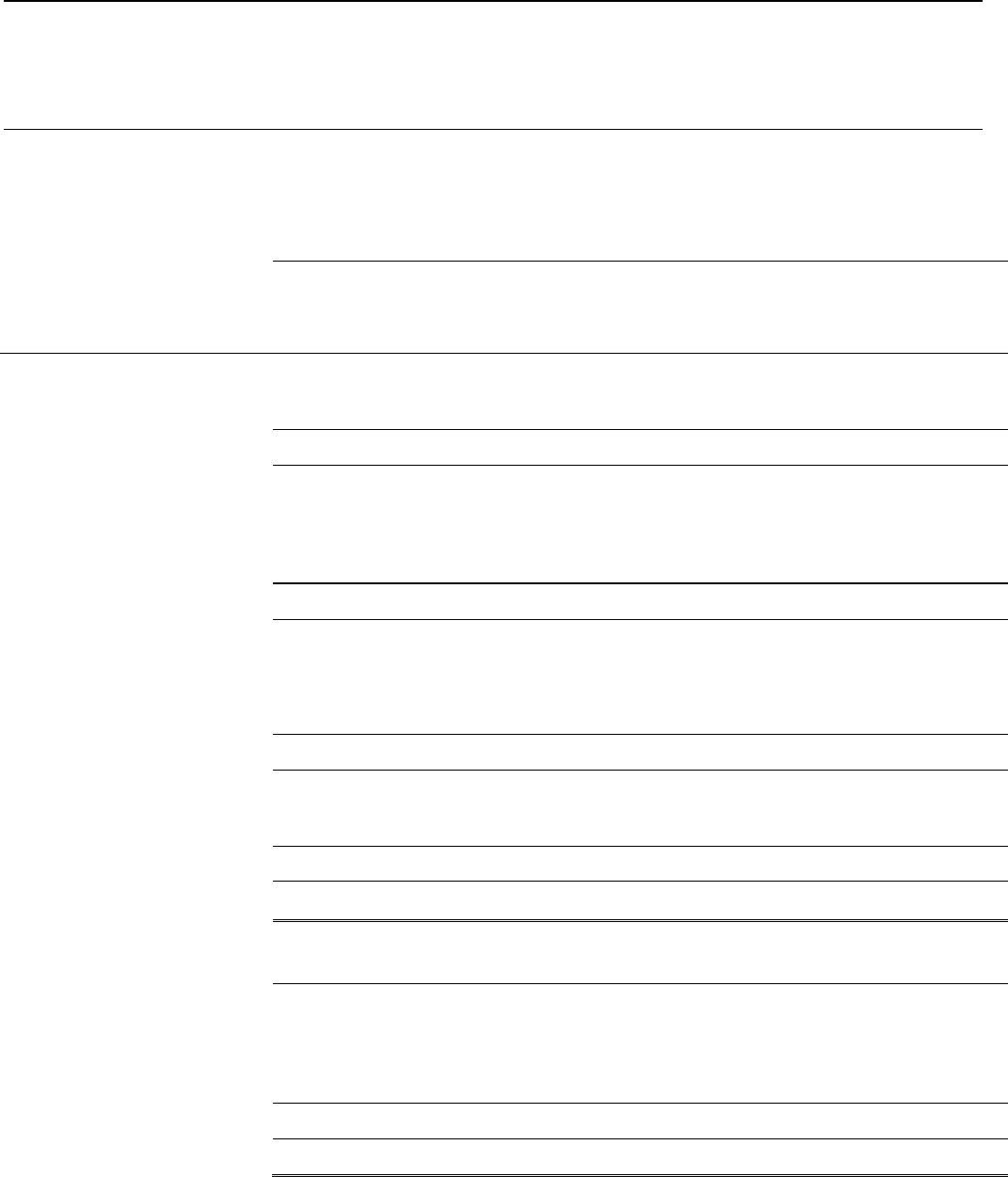

Table 2: Activities of the Funds Managed by AMC FY16 YTD vs FY15 YTD (US$ millions unless otherwise indicated)

As of December 31, 2015

For the six months ended December 31, 2015

Total assets under management

Disbursements to Fund

Disbursements

made by Fund

Disbursements

made by Fund

(number)*

Total

From IFC

From other

investors

From IFC

From other

investors

Equity Capitalization Fund

$ 1,275

$ 775

$ 500

$ 1

$ 1

$ -

-

Sub-Debt Capitalization Fund

1,725

225

1,500

-

1

-

-

ALAC Fund

1,000

200

800

4

21

12

4

Africa Capitalization Fund

182

-

182

-

24

6

1

Russian Bank Cap Fund

550

250

300

1

2

-

-

Catalyst Funds

418

75

343

7

28

26

52

Global Infrastructure Fund**

1,430

200

1,230

18

74

98

3

China-Mexico Funds

1,200

-

1,200

-

5

-

-

FIG Fund

406

150

256

2

4

-

-

GEM Funds

406

81

325

2

7

4

6

MENA Fund

125

60

65

7

8

12

1

Total

$ 8,717

$ 2,016

$ 6,701

$ 42

$ 175

$ 158

67

*

Number of disbursements may include multiple disbursements to a single investee company or fund.

** Includes co-investment fund managed by AMC on behalf of Fund LPs.

As of December 31, 2014

For the six months ended December 31, 2014

Total assets under management

Disbursements to Fund

Disbursements

made by Fund

Disbursements

made by Fund

(number)*

Total

From IFC

From other

investors

From IFC

From other

investors

Equity Capitalization Fund

$ 1,275

$

775

$ 500

$ 4

$

2 $ 9

1

Sub-Debt Capitalization Fund

1,725

225

1,500

28

188

254

4

ALAC Fund

1,000

200

800

11

43 44

3

Africa Capitalization Fund

182

-

182

-

1

-

-

Russian Bank Cap Fund

550

250

300

2

3 -

-

Catalyst Funds

418

75

343

5

24

19

17

Global Infrastructure Fund**

1,430

200

1,230

12

207 209

4

China-Mexico Funds

1,200

-

1,200

-

-

-

-

FIG Fund

-

-

-

-

- -

-

GEM Funds

-

-

-

-

-

-

-

MENA Fund

-

-

-

-

- -

-

Total

$ 7,780

$ 1,725

$ 6,055

$ 62

$ 468

$ 535

29

*

Number of disbursements may include multiple disbursements to a single investee company or fund.

** Includes co-investment fund managed by AMC on behalf of Fund LPs.

INVESTMENT PROGRAM

COMMITMENTS

In FY16 YTD, Long-Term Finance was $4,896 million, as compared to $5,049 million in FY15 YTD and Core Mobilization was $2,730

million, as compared to $3,890 million for FY15 YTD, a total decrease of 15% reflecting the less favorable investing climate in FY16 YTD.

In addition, the average outstanding balance for Short-Term Finance was $2,707 million at December 31, 2015, as compared to $2,837

million at June 30, 2015.

Page 9

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

CORE MOBILIZATION

Core Mobilization is financing from entities other than IFC that becomes available to clients due to IFC’s direct involvement in raising

resources. lFC finances only a portion, usually not more than 25%, of the cost of any project. All IFC-financed projects, therefore, require

other financial partners. IFC mobilizes such private sector finance from other entities through a number of means, as outlined in the Table

below.

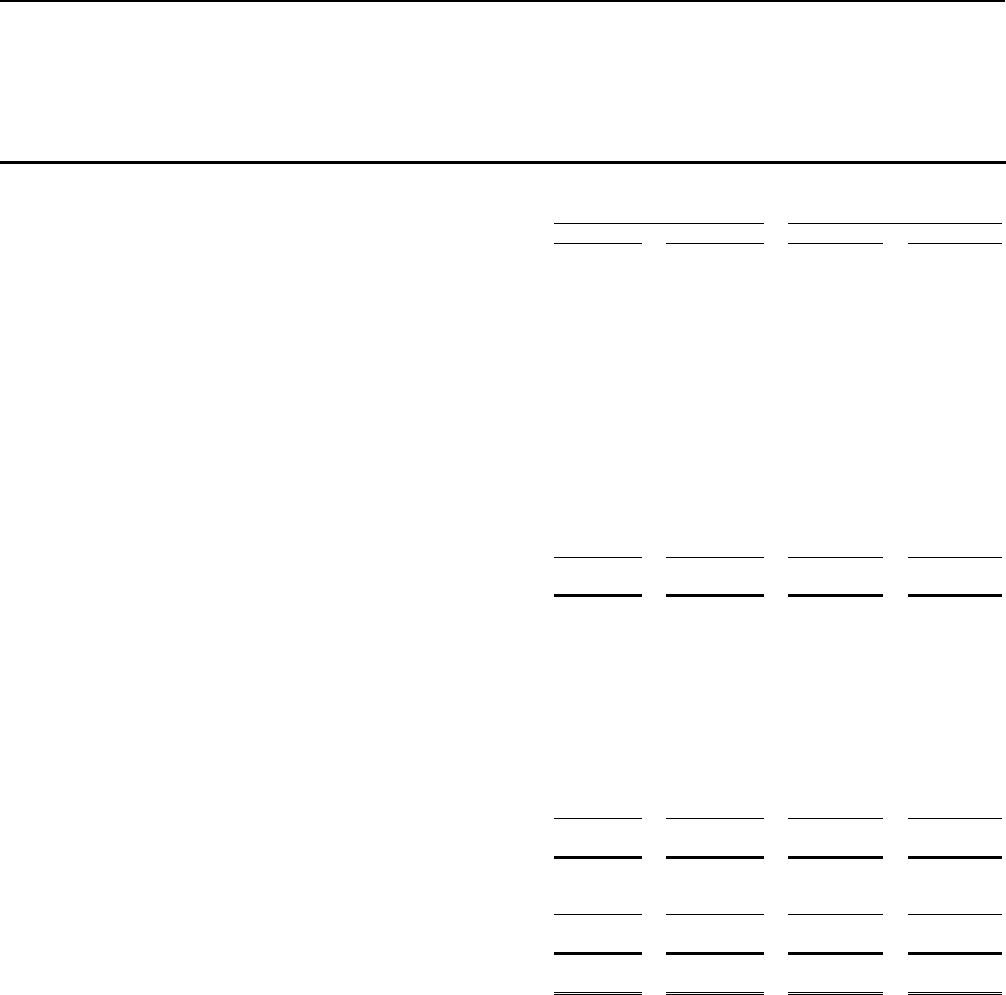

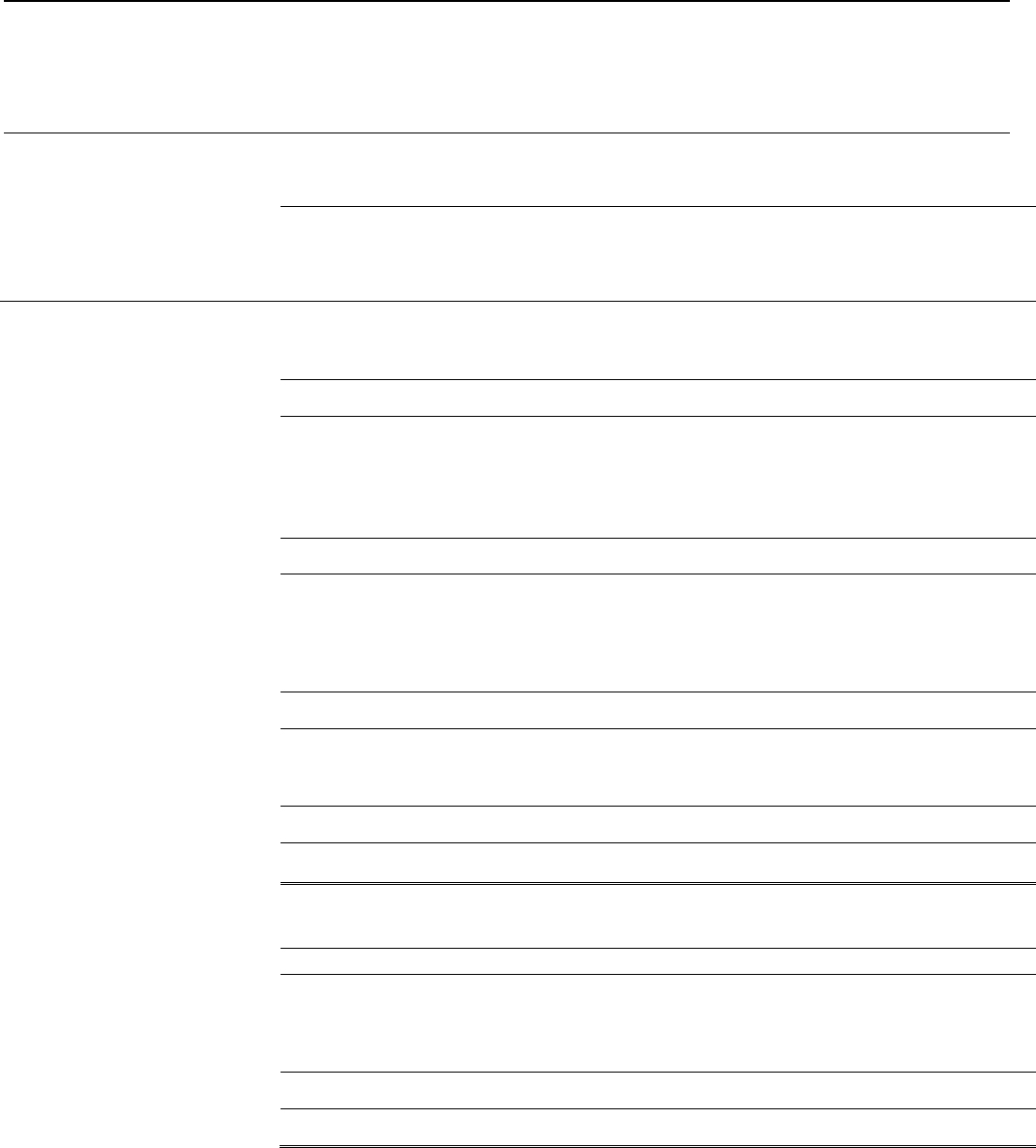

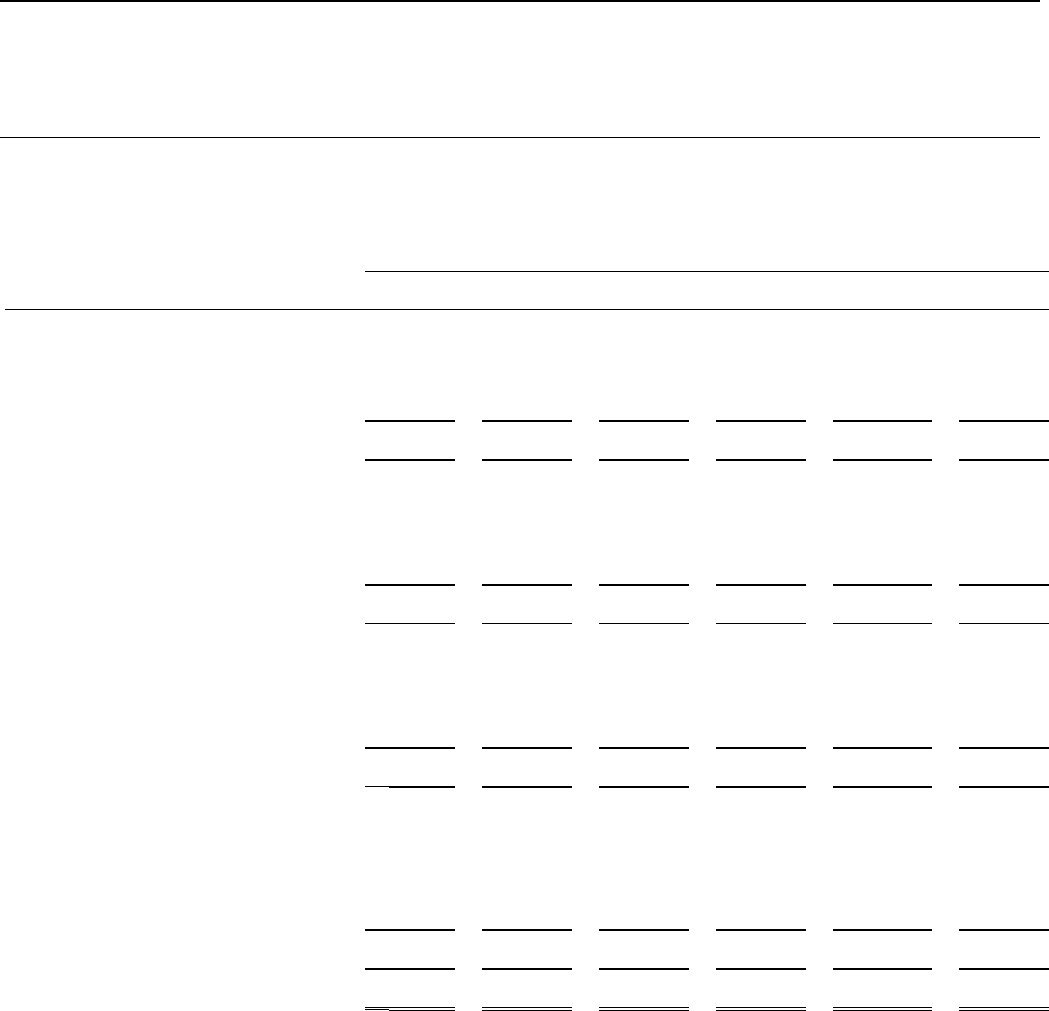

Table 3: FY16 YTD and FY15 YTD Long-Term Finance and Core Mobilization (US$ millions)

FY16

YTD

FY15

YTD

Total Long-Term Finance and Core Mobilization

4

$

7,626

$

8,939

Long-Term Finance

Loans

$

3,809

$

3,483

Equity investments

862

1,415

Guarantees

188

137

Client risk management

37

14

Total Long-Term Finance

$

4,896

$

5,049

Core Mobilization

Loan participations, parallel loans, and other mobilization

Loan participations

$

2,092

$

1,190

Managed Co-lending Portfolio Program

366

460

Parallel loans

65

994

Other Mobilization

111

300

Total loan participations, parallel loans and other mobilization

$

2,634

$

2,944

AMC

GEM Funds

40

-

Africa Capitalization Fund

$

23

$

-

Catalyst Funds

20

46

MENA Fund

6

-

ALAC Fund

5

76

Global Infrastructure Fund

2

121

Sub-debt Capitalization Fund

-

150

Equity Capitalization Fund

-

3

Total AMC

$

96

$

396

Other initiatives

Global Trade Liquidity Program and Critical Commodities Finance Program

$

-

$

150

Public Private Partnership

-

400

Total other initiatives

$

-

$

550

Total Core Mobilization

$

2,730

$

3,890

DISBURSEMENTS

IFC disbursed $4,990 million for its own account in FY16 YTD ($5,345 million in FY15 YTD): $3,497 million of loans ($3,671 million in

FY15 YTD), $1,125 million of equity investments ($1,244 million in FY15 YTD), and $368 million of debt securities ($430 million in FY15

YTD).

INVESTMENT PORTFOLIO

The carrying value of IFC’s investment portfolio was $36,735 million at December 31, 2015 ($37,578 million at June 30, 2015), comprising

the loan portfolio of $21,304 million ($21,336 million at June 30, 2015), the equity portfolio of $12,694 million ($13,503 million at June 30,

2015), and the debt security portfolio of $2,737 million ($2,739 million at June 30, 2015).

The carrying value of IFC’s investment portfolio comprises: (i) the disbursed investment portfolio; (ii) reserves against losses on loans;

(iii) unamortized deferred loan origination fees, net and other; (iv) disbursed amount allocated to a related financial instrument reported

separately in other assets or derivative assets; (v) unrealized gains and losses on equity investments held by consolidated variable interest

entities; (vi) unrealized gains and losses on investments accounted for at fair value as available-for-sale; and (vii) unrealized gains and

losses on investments.

4

Debt security commitments are included in loans and equity investments based on their predominant characteristics.

Page 10

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

GUARANTEES AND PARTIAL CREDIT GUARANTEES

IFC offers partial credit guarantees to clients covering, on a risk-sharing basis, client obligations on bonds and/or loans. IFC’s guarantee

is available for debt instruments and trade obligations of clients and covers commercial as well as noncommercial risks. IFC will provide

local currency guarantees, but when a guarantee is called, the client will generally be obligated to reimburse IFC in US dollar terms.

Guarantee fees are consistent with IFC’s loan pricing policies.

Guarantees of $3,242 million were outstanding (i.e., not called) at December 31, 2015 ($3,168 million at June 30, 2015).

V. LIQUID ASSETS

All liquid assets are managed according to an investment authority approved by the Board of Directors and liquid asset investment

guidelines approved by IFC’s Corporate Risk Committee, a subcommittee of IFC’s Management Team.

IFC funds its liquid assets from two sources, borrowings from market (funded liquidity) and capital (net worth). Liquid assets are managed

in a number of portfolios related to these sources.

IFC invests its liquid assets generally in highly rated fixed and floating rate instruments issued by, or unconditionally guaranteed by,

governments, government agencies and instrumentalities, multilateral organizations, and high quality corporate issuers; these include asset-

backed securities and mortgage-backed securities, time deposits, and other unconditional obligations of banks and financial institutions.

Diversification across multiple dimensions ensures a favorable risk return profile. IFC has a flexible approach to managing the liquid assets

portfolios by making investments on an aggregate portfolio basis against its benchmarks within specified risk parameters. In implementing

these portfolio management strategies, IFC utilizes derivative instruments, principally currency and interest rate swaps and futures and

options, and takes positions in various industry sectors and countries.

IFC’s liquid assets are accounted for as trading portfolios. The net asset value of the liquid assets portfolio was $41.3 billion at December 31,

2015 ($39.5 billion at June 30, 2015). The increase in FY16 YTD was principally due to additions to the portfolio from the investment of the

net proceeds of market borrowings, plus returns made on the investment portfolio partially offset by reductions due to investment

disbursements.

FUNDED LIQUIDITY

The primary funding source for liquid assets for IFC is borrowings from market sources. Proceeds of borrowings from market sources not

immediately disbursed for loans and loan-like debt securities (Funded Liquidity) are managed internally against money market

benchmarks. A small portion of Funded Liquidity is managed by third parties with the same benchmark as that managed internally.

MANAGED NET WORTH

The second funding source of liquid assets is that portion of IFC’s net worth not invested in equity and equity-like investments (Managed

Net Worth) which is managed against a U.S. Treasury benchmark. A portion of these assets is managed by third parties with the same

benchmark as that part managed internally.

For FY16 YTD, Income from liquid assets trading activities

5

from Funded Liquidity was $119 million while Managed Net Worth returned a

loss of $6 million.

VI. FUNDING RESOURCES

BORROWINGS

The major source of IFC’s borrowings is the international capital markets. Under the Articles of Agreement, IFC may borrow in the public

markets of a member country only with approvals from that member, together with the member in whose currency the borrowing is

denominated.

IFC’s new medium and long-term borrowings (after the effect of borrowing-related derivatives) totaled $6.8 billion during FY16 YTD ($10.0

billion, including $1.2 billion from IDA, in FY15 YTD).

IFC is increasingly using its borrowings issuances as a tool to promote capital markets development in emerging and frontier markets.

Proceeds of these issuances not disbursed into loans have primarily been invested in securities of the related sovereign and sovereign

instrumentalities in the currency of the issuances. As a result, borrowings from market sources at December 31, 2015 that have not been

swapped amounted to 5% of the total borrowings from market sources (6% at June 30, 2015 and 5% at June 30, 2014).

Market borrowings are generally swapped into floating-rate obligations denominated in US dollars. IFC’s mandate to help develop

domestic capital markets can result in raising local currency funds. As of December 31, 2015, $2.3 billion of non-US$ denominated market

borrowings were outstanding, denominated in Armenian drams, Chinese renminbi, Costa Rican colones, Dominican pesos, Georgian lari,

Indian rupees, Nigerian naira, Russian rubles, Rwandan francs and Zambian kwachas. Proceeds of these borrowings were invested in

corresponding local currencies, on lent to clients and/or partially swapped into US dollars.

5

Reported gross of borrowing costs and excluding foreign exchange gains and losses on local currency Funded Liquidity which are reported separately from income

from liquid assets trading activities in foreign currency gains and losses on non-trading activities and the effects of internal trades related to foregone swapping of

market borrowings and Funded Liquidity in certain currencies.

Page 11

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

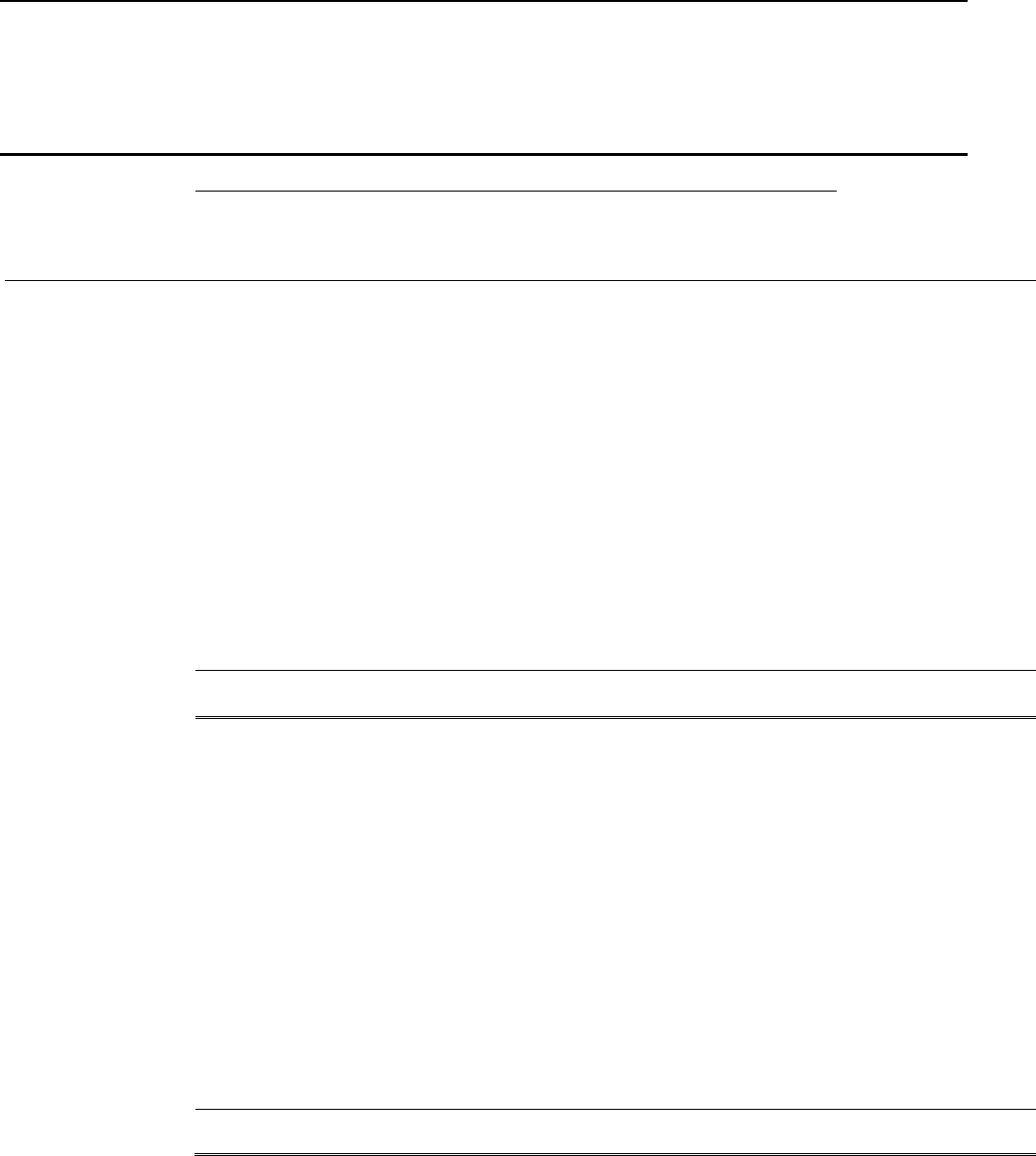

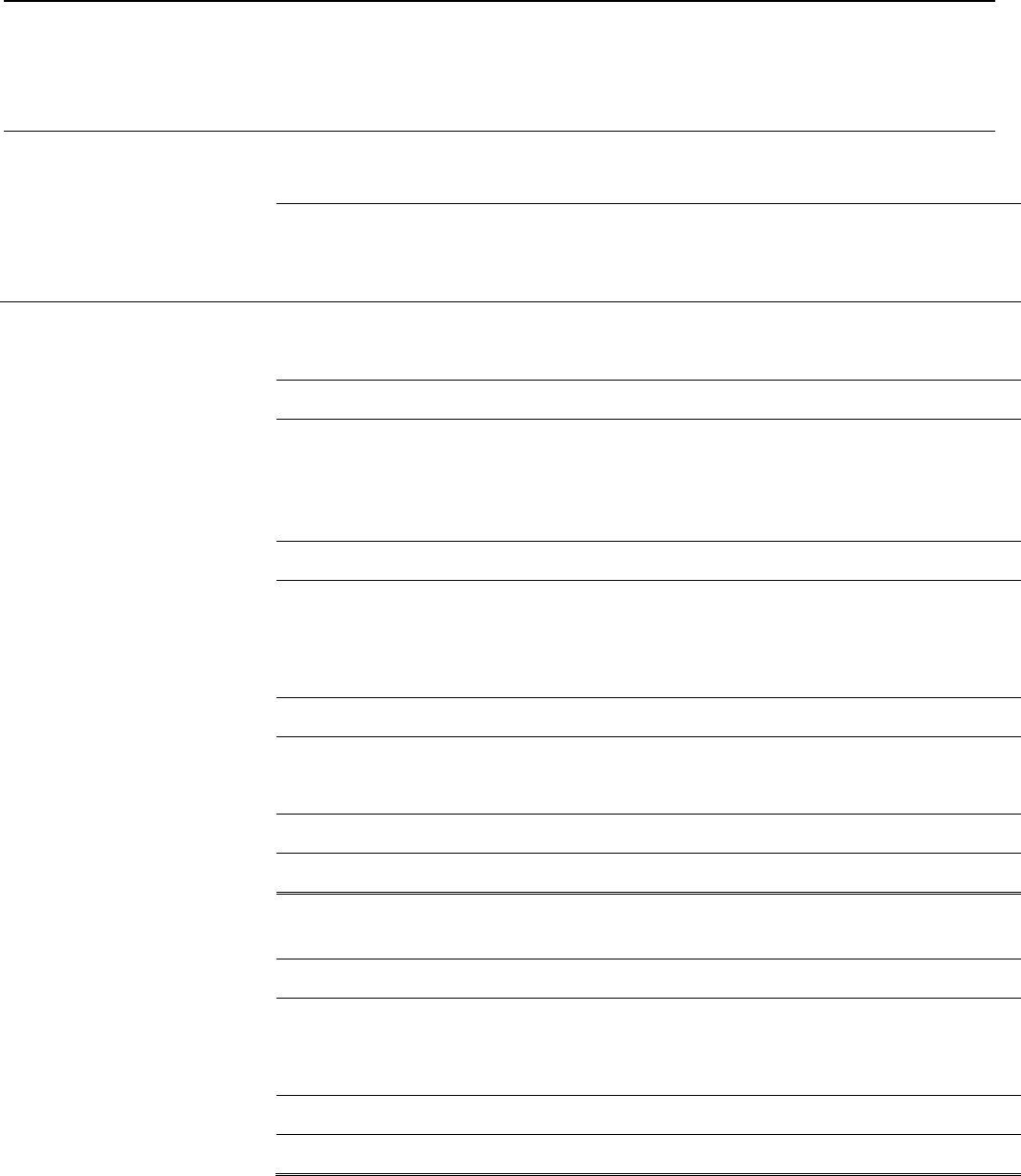

CAPITAL AND RETAINED EARNINGS

As of

December 31, 2015, IFC’s authorized capital was $2.58 billion ($2.58 billion - June 30, 2015), of which $2.57 billion was subscribed

and paid in at

December 31, 2015 ($2.57 billion at June 30, 2015).

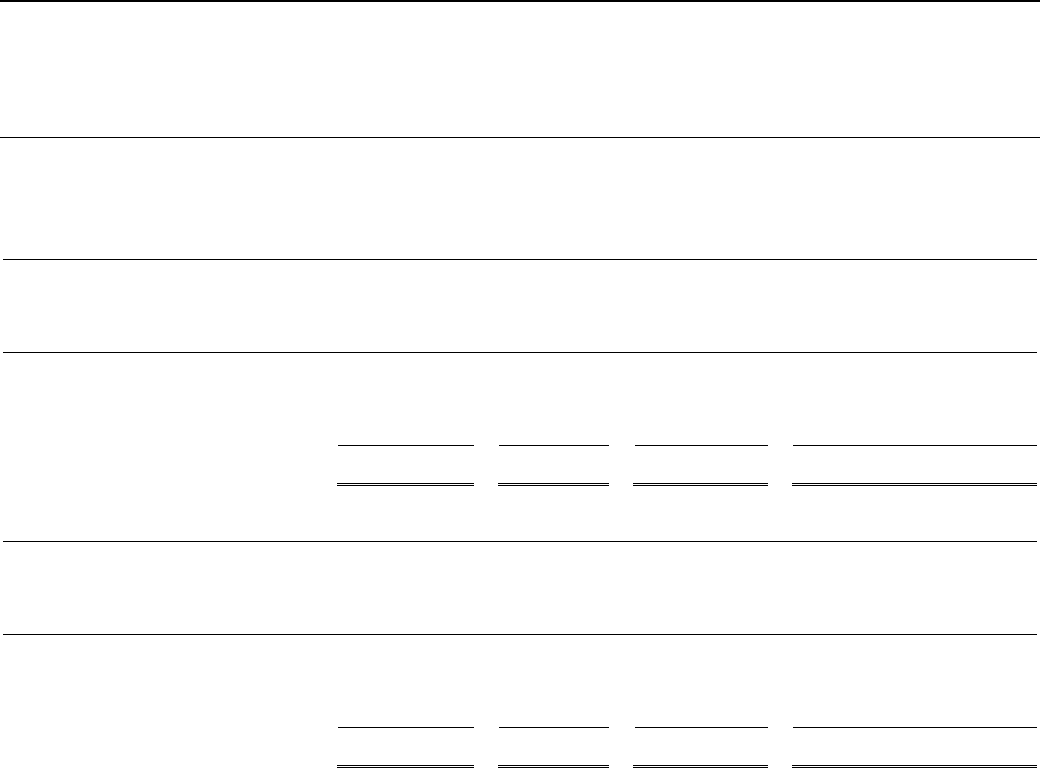

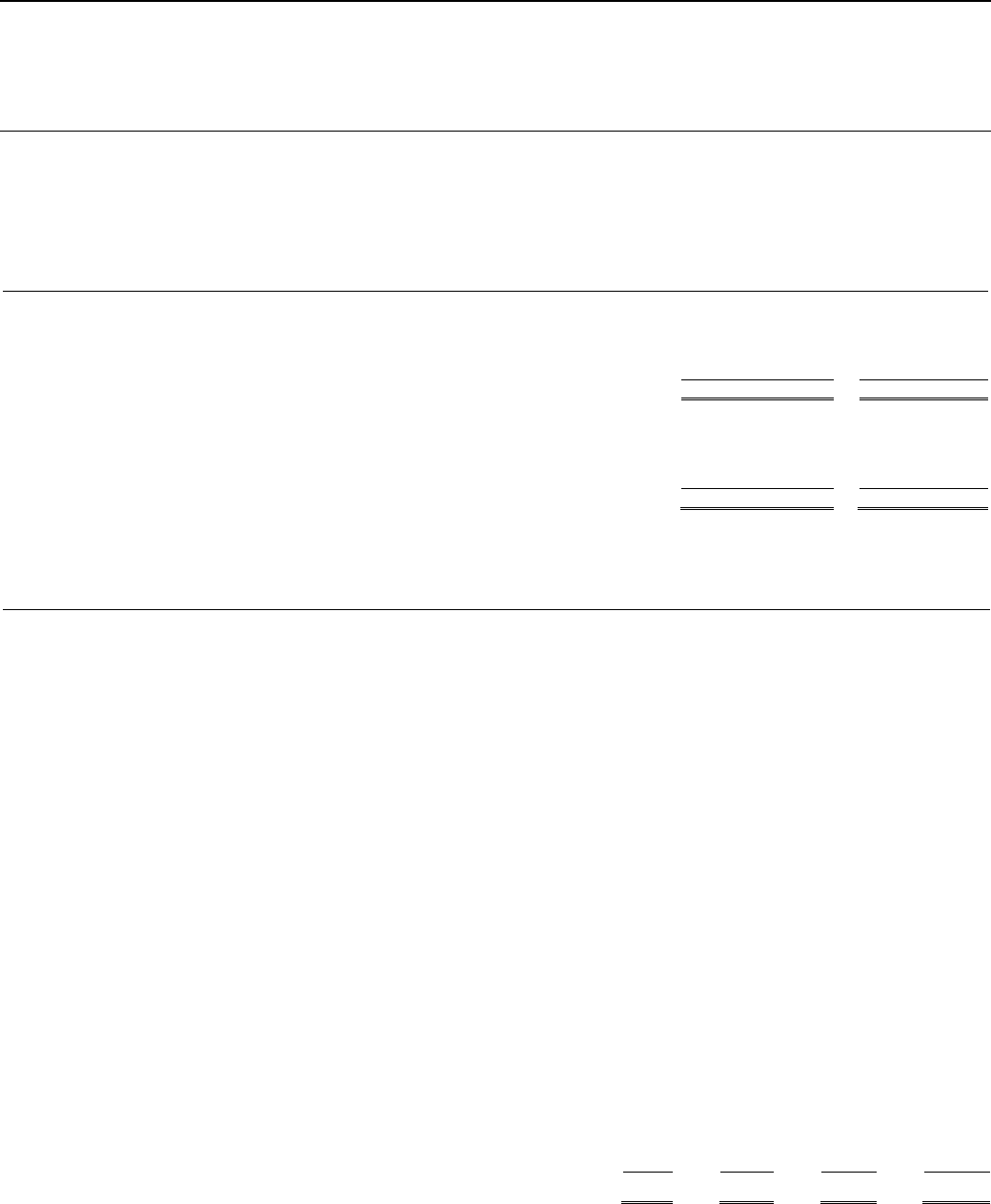

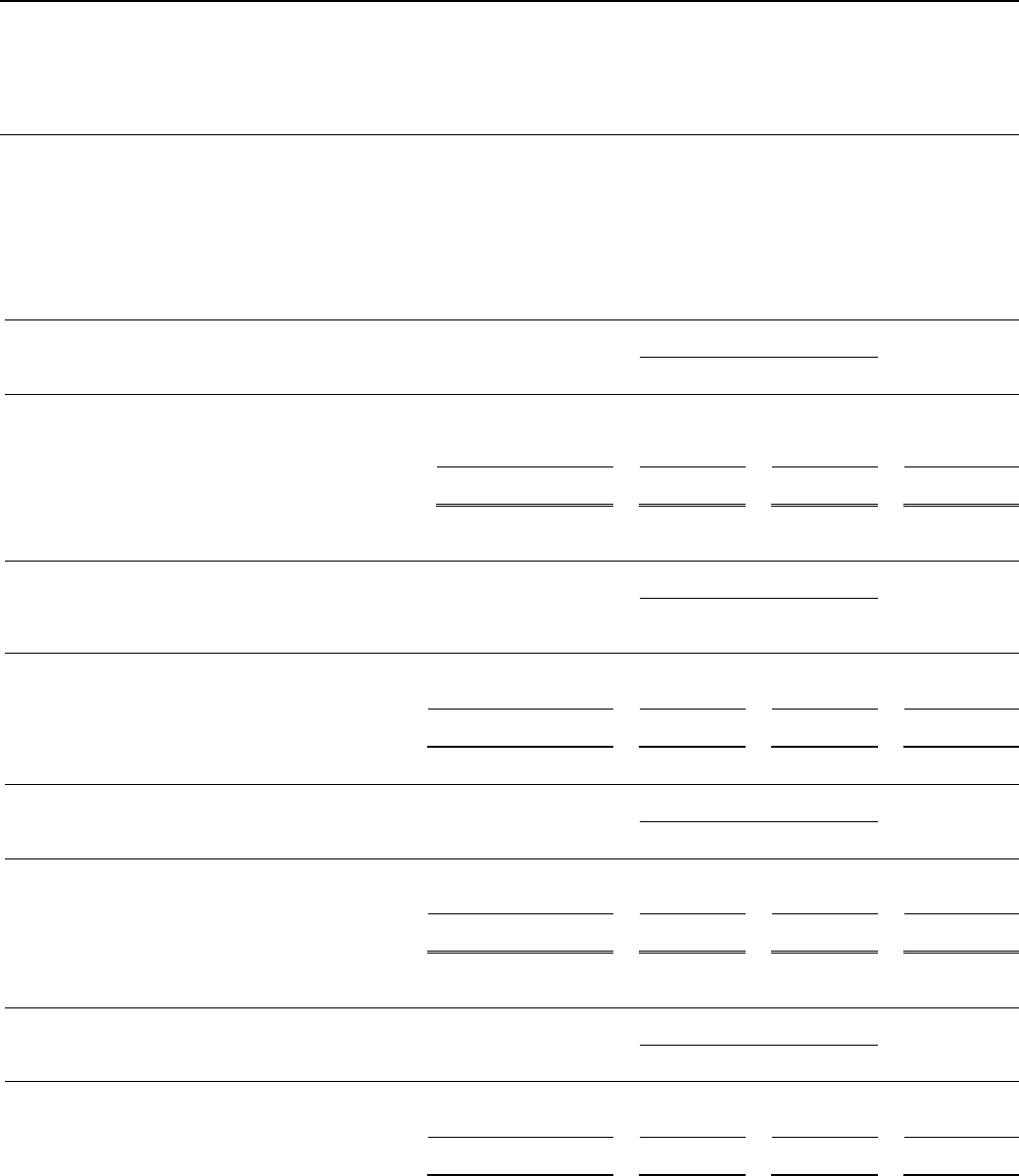

Table 4: IFC's Capital (US$ millions)

December 31,

2015

June 30,

2015

Capital

Capital stock, subscribed and paid-in

$

2,566

$

2,566

Accumulated other comprehensive income

262

1,197

Retained earnings

20,809

20,641

Total IFC capital

$

23,637

$

24,404

Non-controlling interests

19

22

Total capital

$

23,656

$

24,426

At December 31, 2015 and June 30, 2015, retained earnings comprised the following:

Table 5: IFC's Retained Earnings (US$ millions)

December 31,

2015

June 30,

2015

Undesignated retained earnings

$

20,305

$

20,457

Designated retained earnings:

Grants to IDA

330

-

Advisory services

132

137

Performance-based grants

15

16

IFC SME Ventures for IDA countries and Global Infrastructure Project Development Fund

27

31

Total designated retained earnings

$

504

$

184

Total retained earnings

$

20,809

$

20,641

SELECTIVE CAPITAL INCREASE (SCI)

On July 20, 2010, the IFC Board of Directors recommended that the IFC Board of Governors approve an increase of $130 million in the

authorized share capital of IFC to $2,580 million, through the issuance of $200 million in shares (including $70 million in unallocated

shares). The Board of Directors also recommended that the Board of Governors approve an increase in Basic Votes aimed at enhancing

the voice and participation of developing and transition countries which required an amendment to IFC’s Articles of Agreement.

The resolution recommended by the Board of Directors was adopted by the Board of Governors on March 9, 2012 (IFC Resolution no.

256 entitled "Amendment to the Articles of Agreement and 2010 Selective Capital Increase"). The amendment to the Articles of Agreement

and the increase in the authorized share capital became effective on June 27, 2012. As of the same date, eligible members were authorized

to subscribe to their allocated IFC shares.

As of June 30, 2015, IFC had received payments with respect to the SCI totaling $194.303 million and the balance of $5.697 million has

become part of IFC’s authorized and unallocated capital stock.

DESIGNATIONS OF RETAINED EARNINGS

Amounts available to be designated are determined based on a Board of Directors-approved income-based formula and, beginning in the

year ended June 30, 2008, on a principles-based Board of Directors-approved financial distribution policy, and are approved by the Board

of Directors.

IFC recognizes designations of retained earnings for advisory services when the Board of Directors approves it and recognizes designation

of retained earnings for grants to IDA when it is noted with approval by the Board of Governors. Expenditures for the various approved

designations are recorded as expenses in IFC’s condensed

consolidated income statement in the year in which they occur, and have the

effect of reducing retained earnings designated for this specific purpose.

On August 6, 2015, the Board of Directors approved a designation of $330 million of IFC’s retained earnings for grants to IDA and a designation

of $14 million of IFC’s retained earnings for Advisory Services. These designations were noted with approval by the Board of Governors on

October 9, 2015.

On January 15, 2016 IFC recognized grants to IDA of $330 million on the signing of a grant agreement between IDA and IFC concerning the

transfer to IDA and use of funds corresponding to the designation of retained earnings for grants to IDA approved by IFC’s Board of Directors

on August 6, 2015 and noted with approval by IFC’s Board of Governors on October 9, 2015. There were no grants to IDA recorded in FY16

YTD and FY15 YTD.

Page 12

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

Income available for designations in FY16 YTD (a non-GAAP measure)

6

totaled $292 million. Based on the distribution policy approved by

IFC’s Board of Directors the maximum amount available for designation would be $28 million - actual designations in respect of the year-

ending June 30, 2016 will ultimately be dependent on full year financial results.

VII. RESULTS OF OPERATIONS

OVERVIEW

The overall market environment has a significant influence on IFC’s financial performance. The main elements of IFC’s net income and

comprehensive income and influences on the level and variability of net income and comprehensive income from year to year are:

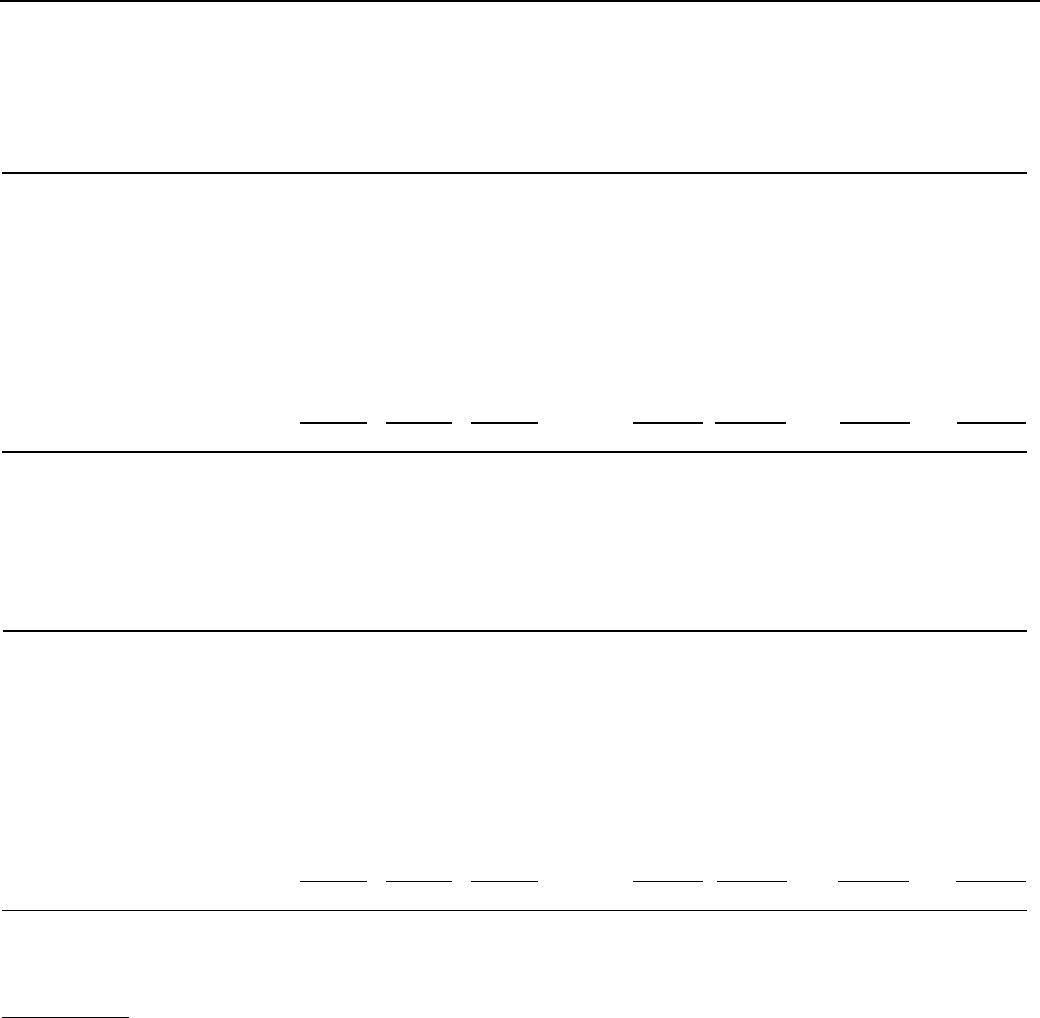

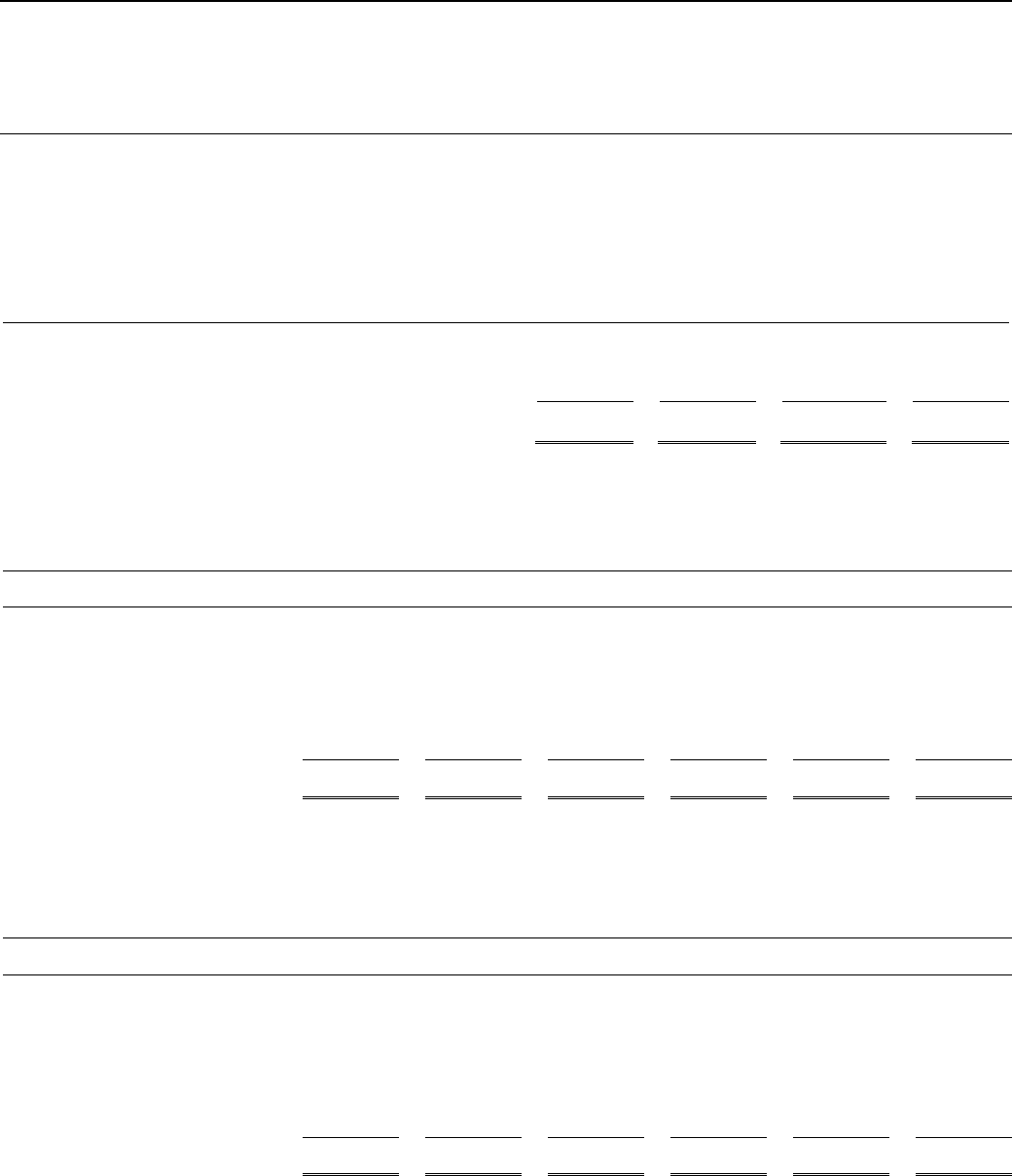

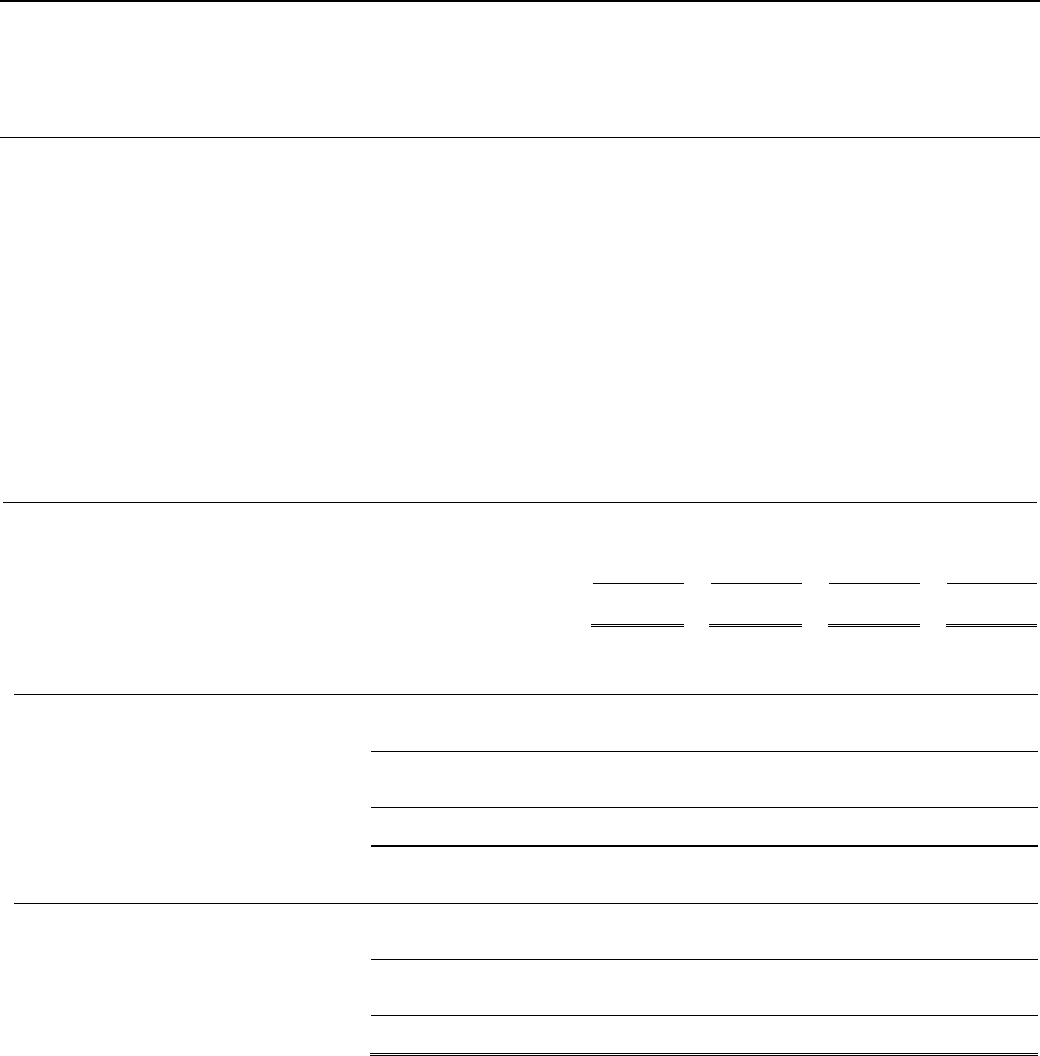

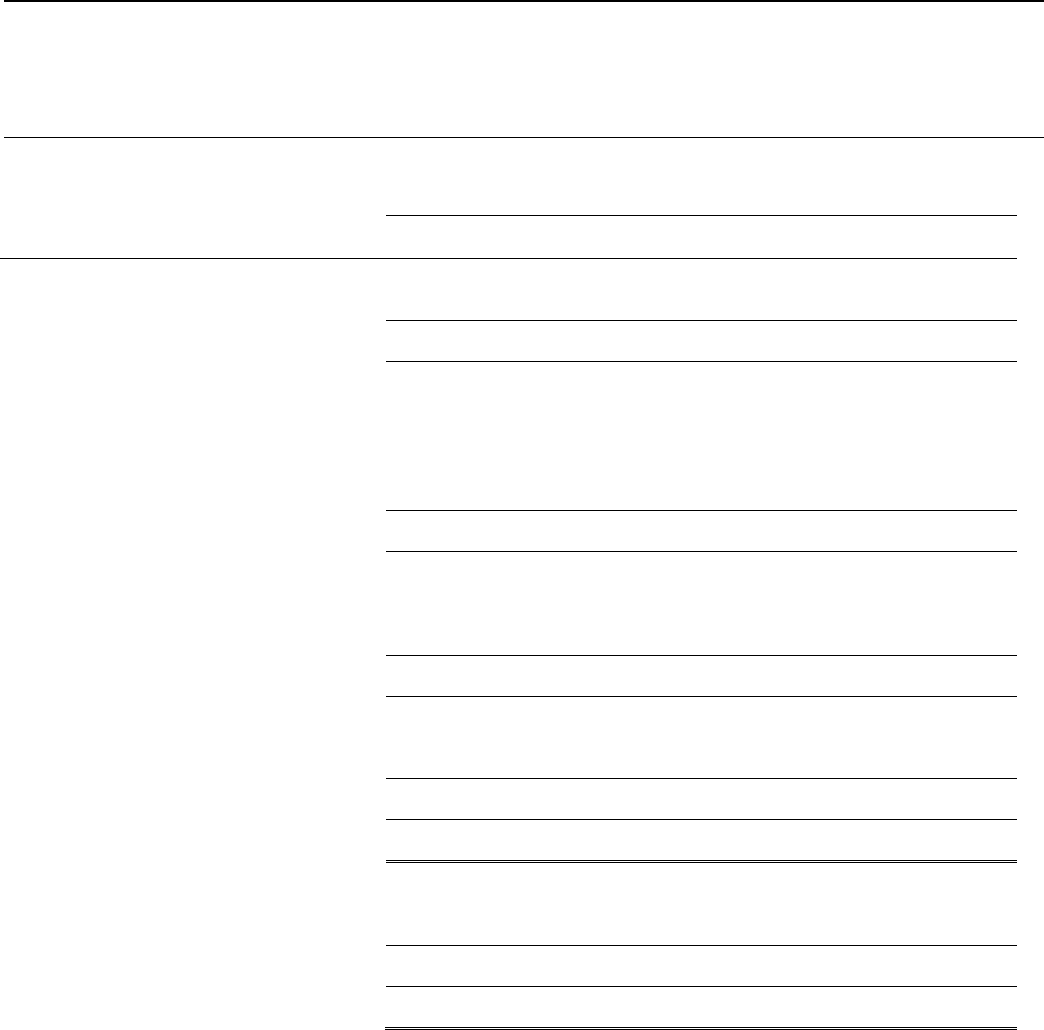

Table 6: Main Elements of Net Income and Comprehensive Income

ELEMENTS

SIGNIFICANT

INFLUENCES

Net income:

Yield on interest earning assets

Market conditions including spread levels and degree of competition. Nonaccruals and recoveries

of interest on loans formerly in nonaccrual status and income from participation notes on

individual loans are also included in income from loans.

Liquid asset income

Realized and unrealized gains and losses on the liquid asset portfolios, which are driven by

external factors such as: the interest rate environment; and liquidity of certain asset classes within

the liquid asset portfolio.

Income from the equity investment portfolio

Global climate for emerging markets equities, fluctuations in currency and commodity markets

and company-specific performance for equity investments. Performance of the equity portfolio

(principally realized capital gains, dividends, equity impairments, gains on non-monetary

exchanges and unrealized gains and losses on equity investments).

Provisions for losses on loans and

guarantees

Risk assessment of borrowers and probability of default and loss given default.

Other income and expenses

Level of advisory services provided by IFC to its clients, the level of expense from the staff

retirement and other benefits plans, and the approved and actual administrative expenses and

other budgets.

Gains and losses on other non-trading

financial instruments accounted for at fair

value

Principally, differences between changes in fair values of borrowings, including IFC’s credit

spread, and associated derivative instruments and unrealized gains or losses associated with the

investment portfolio including puts, warrants and stock options which in part are dependent on

the global climate for emerging markets. These securities are valued using internally developed

models or methodologies utilizing inputs that may be observable or non-observable.

Grants to IDA

Level of the Board of Governors-approved grants to IDA.

Other comprehensive income:

Unrealized gains and losses on listed

equity investments and debt securities

accounted for as available-for-sale

Global climate for emerging markets equities, fluctuations in currency and commodity markets

and company-specific performance. Such equity investments are valued using unadjusted

quoted market prices and debt securities are valued using internally developed models or

methodologies utilizing inputs that may be observable or non-observable.

Unrecognized net actuarial gains and

losses and unrecognized prior service

costs on benefit plans

Returns on pension plan assets and the key assumptions that underlay projected benefit

obligations, including financial market interest rates, staff expenses, past experience, and

management’s best estimate of future benefit cost changes and economic conditions.

The following paragraphs detail significant variances between FY16 YTD and FY15 YTD, covering the periods included in IFC’s FY16

YTD Condensed Consolidated Financial Statements. Certain amounts in FY15 YTD have been reclassified to conform to the current

year’s presentation. Such reclassifications had no effect on net income or total assets.

6

Income available for designations generally comprises net income excluding unrealized gains and losses on investments and unrealized gains and losses on other

non-trading financial instruments, income from consolidated VIEs, and expenses reported in net income related to prior year designations.

Page 13

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

NET INCOME

IFC reported income before net unrealized gains and losses on non-trading financial instruments accounted for at fair value, grants to IDA

and net gains and losses attributable to non-controlling interest of $124 million in FY16 YTD, as compared to $531 million in FY15 YTD.

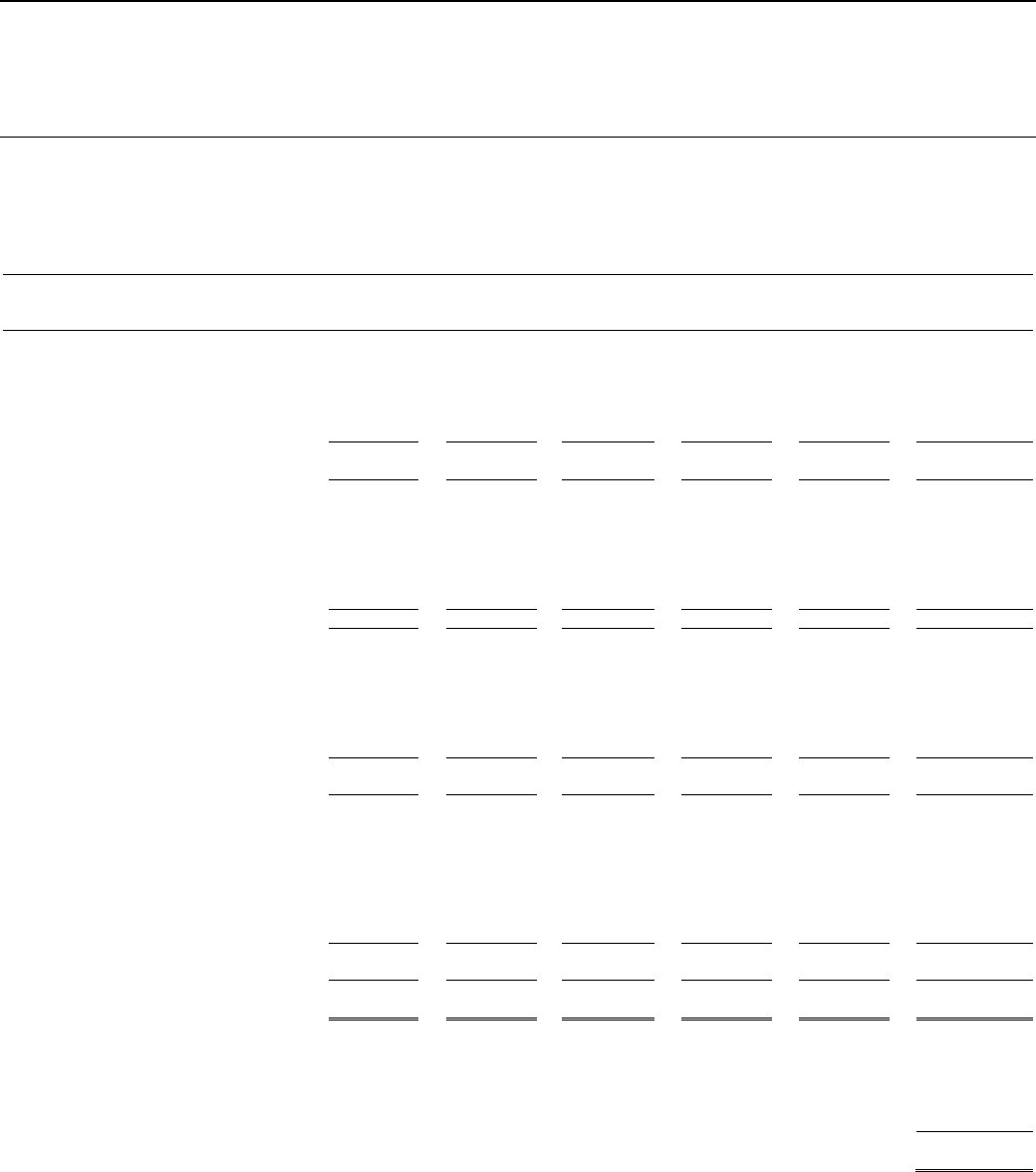

Table 7: Change in Net Income FY16 YTD vs FY15 YTD (US$ millions)

Increase

(decrease)

FY16 YTD vs

FY15 YTD

Higher provisions for losses on loans, guarantees and other receivables

$

(137)

Lower income from liquid asset trading activities

(91)

Higher charges on borrowings

(48)

Lower foreign currency transaction gains on non-trading activities

(32)

Lower Income from Loans and guarantees, including realized gains and losses on loans and associated

derivatives

(26)

Higher other-than-temporary impairments on equity investments and debt securities

(14)

Higher gains on equity investments and associated derivatives, net

16

Other, net

(75)

Change in income before net unrealized gains and losses on non-trading financial instruments accounted

for at fair value, grants to IDA and net gains and losses attributable to non-controlling interests

$

(407)

FY16

YTD

FY15

YTD

Income before net unrealized gains and losses on non-trading financial instruments

accounted for at fair value, grants to IDA and net gains and losses attributable to non-controlling

interests

$

124

$

531

Net unrealized gains and losses on non-trading financial instruments accounted for at fair value

39

(134)

Net income

163

397

Net losses attributable to non-controlling interests

5

30

Net income attributable to IFC

$

168

$

427

A more detailed analysis of the components of IFC’s net income follows.

INCOME FROM LOANS AND GUARANTEES, INCLUDING REALIZED GAINS AND LOSSES ON LOANS AND ASSOCIATED

DERIVATIVES

IFC’s primary interest earning asset is its loan portfolio. Income from loans and guarantees, including realized gains and losses on loans

and associated derivatives for FY16 YTD totaled $545 million, compared with $571 million in FY15 YTD, a decrease of $26 million.

The disbursed loan portfolio increased $178 million from $23,252 million at June 30, 2015 to $23,430 million at December 31, 2015.

The increase in the loan portfolio due to new disbursements exceeding repayments was significantly offset by the reduction in loans

outstanding due to currency exchange rate fluctuations ($410 million in FY16 YTD) as IFC’s reporting currency, the US Dollar appreciated

against most of IFC’s lending currencies.

The weighted average contractual interest rate on loans at December 31, 2015 was 5.0% (4.9% as of June 30, 2015), up from 4.6% at

December 31, 2014.

Table 8: FY16 YTD Change in Income from Loans and guarantees, including realized gains and losses on loans and associated

derivatives (US$ millions)

Income from loans and guarantees, including realized gains and losses on loans and associated derivatives in FY15

YTD

$

571

Decrease due to lower commitment and financial fees

(15)

Decrease due to lower realized gains on loans, guarantees and associated derivatives

(14)

Decrease due to lower recoveries of interest on non-accruing loans, net

(6)

Increase due to change in loan portfolio and interest rate environment

5

Increase due to higher income from participation notes and other income

4

Change in Income from loans and guarantees, including realized gains and losses on loans and associated

derivatives

$

(26)

Income from loans and guarantees, including realized gains and losses on loans and associated derivatives in

FY16 YTD

$

545

Page 14

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

INCOME FROM EQUITY INVESTMENTS AND ASSOCIATED DERIVATIVES

Income from the equity investment portfolio, including associated derivatives, decreased by $10 million from $276 million in FY15 YTD to

$266 million in FY16 YTD.

IFC sells equity investments where IFC’s developmental role was complete, where pre-determined sales trigger levels had been met and,

where applicable, lock ups have expired. Gains on equity investments and associated derivatives comprise realized and unrealized gains.

IFC recognized realized gains on equity investments and associated derivatives in the form of cash and non-monetary considerations for

FY16 YTD of $757 million, as compared with $963 million for FY15 YTD, a decrease of $206 million. Realized gains on equity investments

and associated derivatives are concentrated in a small number of investments. In FY16 YTD, there were six investments that generated

individual capital gains in excess of $20 million for a total of $568 million, or 75%, of the FY16 YTD realized gains, compared to seven

investments that generated individual capital gains in excess of $20 million for a total of $753 million, or 78%, of the FY15 YTD realized

gains.

Dividend income in FY16 YTD totaled $90 million, as compared with $120 million in FY15 YTD. Dividend income in FY16 YTD included

returns from two unincorporated joint venture (UJVs) in the oil, gas and mining sectors accounted for under the cost recovery method,

which totaled $7 million, as compared with $12 million from four such UJVs in FY15 YTD.

Other-than-temporary impairments on equity investments totaled $441 million in FY16 YTD, as compared with $444 million in FY15 YTD,

driven by the continued economic downturn across key emerging markets, foreign exchange deterioration, and the continuing low oil

prices. The largest amount of write-downs in FY16 YTD were from the Latin America and the Caribbean region, accounting for 29% of

the total write-offs, followed by Europe and Central Asia (18%) and East Asia and the Pacific (17%). There were also seven individual

equity write-downs in FY16 YTD greater than $10 million across all regions except South Asia.

Net unrealized losses on equity investments and associated derivatives totaled $143 million (Net unrealized losses of $365 million in FY15

YTD), reflecting a generally deteriorating macro environment in emerging market equities which has negatively impacted the value of

many of IFC’s equity investments accounted for at fair value in net income.

INCOME FROM DEBT SECURITIES AND REALIZED GAINS AND LOSSES ON DEBT SECURITIES AND ASSOCIATED DERIVATIVES

Income from debt securities and realized gains and losses on debt securities and associated derivatives decreased to $69 million in FY16

YTD from $90 million in FY15 YTD, a decrease of $21 million. The largest components of the decrease were higher other-than-temporary

impairments ($17 million) and lower realized gains on debt securities and associated derivatives ($8 million) in FY16 YTD when compared

with FY15 YTD.

PROVISION FOR LOSSES ON LOANS, GUARANTEES AND OTHER RECEIVABLES

The quality of the loan portfolio, as measured by average country risk ratings and average credit risk ratings, deteriorated in FY16 YTD.

Non-performing loans (NPLs)* increased by $266 million, from $1,578 million of the disbursed loan portfolio at June 30, 2015 to $1,844

million at December 31, 2015. The increase of $266 million comprised $364 million of loans and loan-like debt securities being placed in

NPL status, $48 million being removed from NPL status and a $50 million reduction due to repayments and currency translation

adjustments.

IFC recorded a net provision for losses on loans, guarantees and other receivables of $195 million in FY16 YTD ($179 million of specific

provisions on loans; $15 million of portfolio provisions on loans; less than $0.5 million provision on guarantees; and $1 million provision

on other receivables) as compared to a provision of $58 million in FY15 YTD ($83 million of specific provisions for losses on loans; $22

million release of portfolio provisions for losses on loans; and net $3 million of release of provision for losses on guarantees and other

receivables). Project-specific developments on five loans comprised $81 million of the specific provision for losses on loans in FY16

YTD.

At December 31, 2015, IFC’s total reserves against losses on loans were $1,901 million or 8.1% of the disbursed loan portfolio ($1,743

million; 7.5% at June 30, 2015), an increase of $158 million. The increase in reserves against losses on loans due to provisions of $194

million has been partially offset by foreign exchange gains related to reserves held against non-U.S. Dollar-denominated loans and the

strengthening of the U.S. Dollar against many of IFC’s lending currencies of $33 million and write-offs, net of recoveries, and other

adjustments of $3 million.

Specific reserves against losses on loans at December 31, 2015 of $1,116 million ($962 million at June 30, 2015) are held against impaired

loans of $1,807 million ($1,722 million at June 30, 2015), a coverage ratio of 62% (56% at June 30, 2015).

INCOME FROM LIQUID ASSET TRADING ACTIVITIES

The liquid assets portfolio, net of derivatives and securities lending activities, increased by $1.8 billion from $39.5 billion at June 30, 2015,

to $41.3 billion at December 31, 2015. Gross income from liquid asset trading activities totaled $113 million in FY16 YTD compared to

$204 million in FY15 YTD, a decrease of $91 million.

Interest income in FY16 YTD totaled $275 million, compared to $307 million in FY15 YTD. In addition, the portfolio of ABS and MBS

experienced fair value losses totaling $88 million in FY16 YTD. Holdings in other products, including US Treasuries, global government

bonds, high quality corporate bonds and derivatives generated $74 million of losses in FY16 YTD, a total loss of $162 million (realized

and unrealized). This compares to a total loss of $103 million in FY15 YTD.

* Includes $74 million reported as debt securities on the Balance Sheet as of December 31, 2015 ($44 million - June 30, 2015).

Page 15

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

In FY16 Q1, the liquid assets portfolios underperformed their benchmarks by $27 million. In FY16 Q1, the weaker performance reflected

mark-to-market losses on securitized products and high-quality credit spread securities as spreads widened throughout the quarter. The

portfolios funded by market borrowings suffered declines as a result. In FY16 YTD, the liquid assets portfolios outperformed their

benchmarks by $24 million. US Treasury yields rose, particularly in FY16 Q2 as the path of monetary policy became clearer. In December,

the US Federal Reserve Board raised its target range for the Fed Funds rate by 25 basis points. As a result, the portion of the liquid

assets portfolio funded by net worth and that is benchmarked to U.S. Treasuries suffered a decline. This was partially offset by favorable

performance from international securitized products and resiliency from emerging markets corporate bonds.

At December 31, 2015, trading securities with a fair value of $61 million are classified as Level 3 securities ($86 million on June 30, 2015).

CHARGES ON BORROWINGS

IFC’s charges on borrowings increased by $48 million, from $118 million in FY15 YTD (net of $1 million gain on extinguishment of

borrowings) to $166 million in FY16 YTD (net of $2 million gain on extinguishment of borrowings), largely reflecting increased interest

charges as pricing in the SSA (Sovereigns, Supranational and Agencies) market became more expensive due to USD swap curve

tightening and widening borrowing spreads vs. LIBOR.

OTHER INCOME

Other income of $211 million for FY16 YTD was $27 million lower than in FY15 YTD ($238 million). There were lower returns on the Post

Employment Benefit Plan (PEBP) assets which are partly invested in global equities and reflected the challenging market for equity

investments in FY16 YTD as compared to the same period in FY15. Fee income from mobilization activities was lower in FY16 YTD as

compared with FY15 YTD reflecting overall weaker mobilization.

Other income also includes management and other fees from IFC’s consolidated subsidiary, AMC of $33 million ($29 million in FY15 YTD)

and income from Advisory Services of $109 million ($112 million in FY15 YTD).

OTHER EXPENSES

Administrative expenses (the principal component of other expenses) increased by $26 million from $465 million in FY15 YTD to $491

million in FY16 YTD. Administrative expenses includes the grossing-up effect of certain revenues and expenses attributable to IFC’s

reimbursable program and expenses incurred in relation to workout situations ($12 million in both FY16 YTD and FY15 YTD). Salary

costs, the largest component of administrative expenses, have decreased due to head count reductions, but this is more than offset by

increases in depreciation and variable costs.

IFC recorded expenses from the Staff Retirement Plan (SRP), the Retired Staff Benefits Plan (RSPB), and the PEBP in FY16 YTD of $92

million, a decrease of $7 million from $99 million in FY15 YTD generally reflecting lower service cost and lower amortization of

unrecognized net loss, net of higher interest cost.

Advisory services expenses totaled $128 million in FY16 YTD ($134 million in FY15 YTD).

FOREIGN CURRENCY TRANSACTION GAINS AND LOSSES ON NON-TRADING ACTIVITIES

Foreign currency transaction gains reported in net income in FY16 YTD totaled $12 million ($44 million - FY15 YTD). Foreign currency

transaction losses on debt securities accounted for as available-for-sale in the amount of $71 million in FY16 YTD (losses of $76 million

– FY15 YTD) are reported in Other Comprehensive Income, while gains and losses on the derivatives economically hedging such debt

securities are reported in net income.

Largely due to IFC having a small population of unhedged non-U.S. Dollar-denominated loans and debt securities and the U.S. Dollar

strengthening against such currencies, IFC has recorded overall foreign exchange related losses in a combination of Net Income and

Other Comprehensive Income of $59 million in FY16 YTD (losses of $32 million – FY15 YTD).

NET UNREALIZED GAINS AND LOSSES ON NON-TRADING FINANCIAL INSTRUMENTS

IFC accounts for certain financial instruments at fair value with unrealized gains and losses on such financial instruments being reported

in net income, namely: (i) all market borrowings that are economically hedged with financial instruments that are accounted for at fair value

with changes therein reported in net income; (ii) unrealized gains and losses on certain loans, debt securities and associated derivatives;

and (iii) borrowings from IDA.

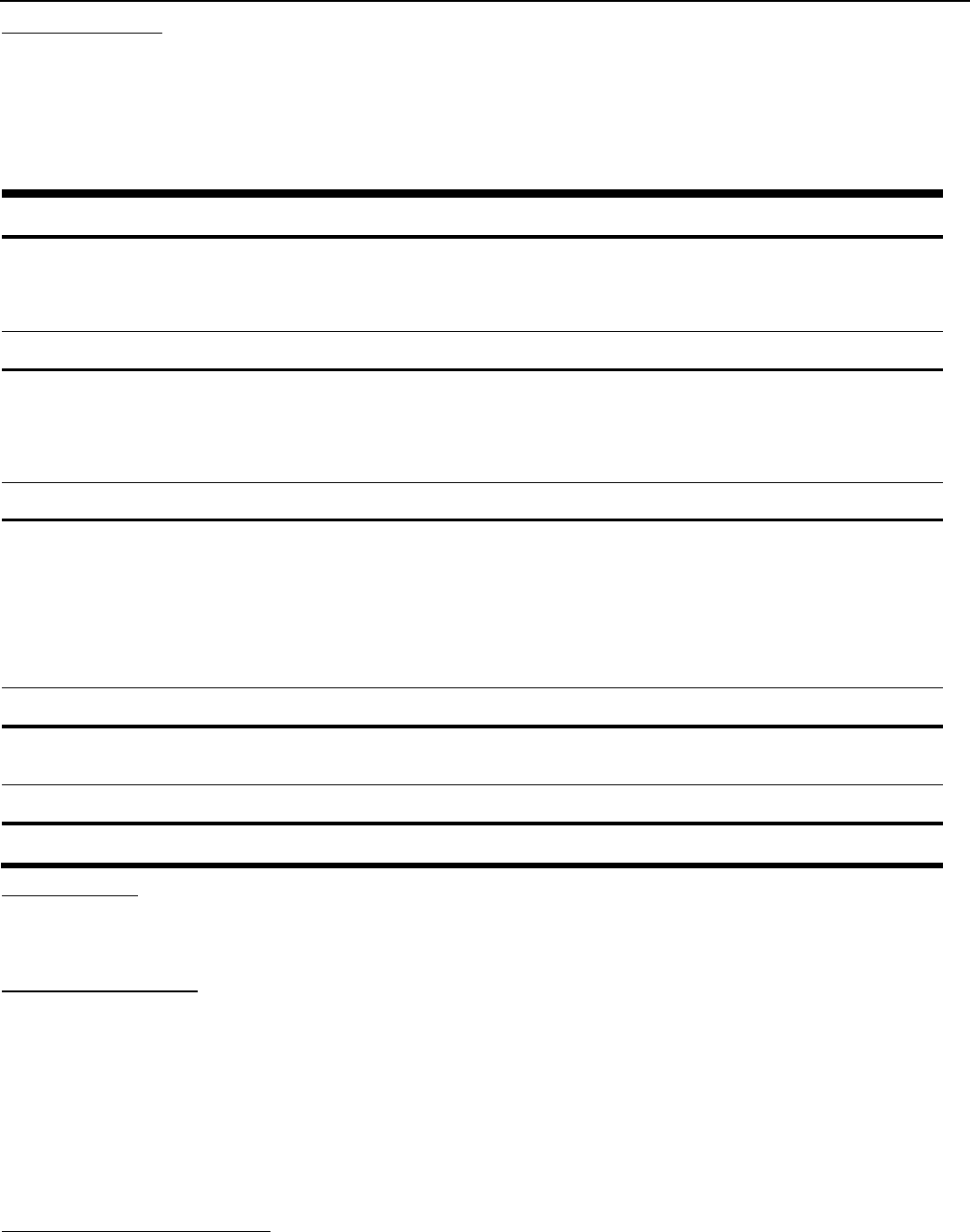

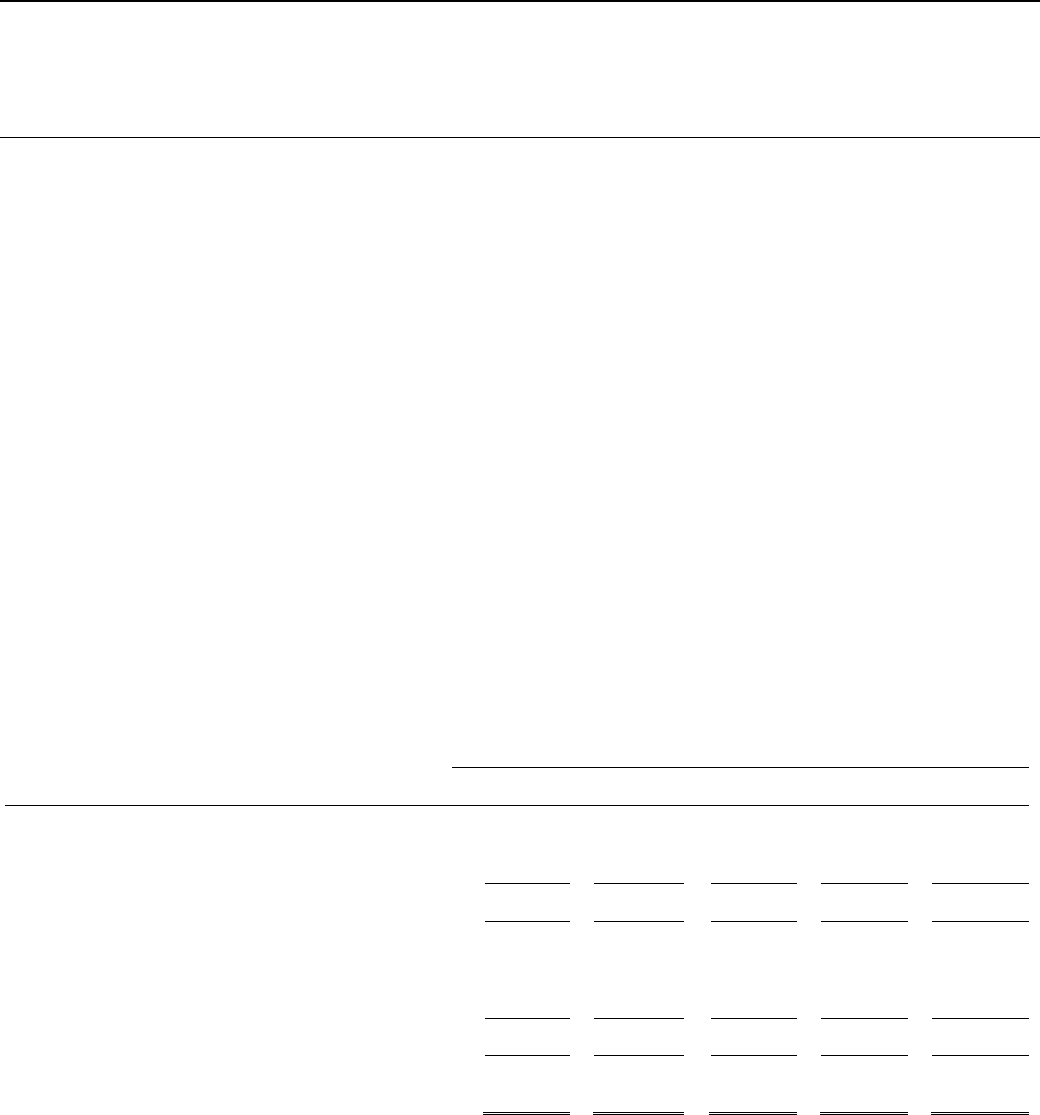

Table 9: Net Unrealized Gains and Losses on Non-Trading Financial Instruments FY16 YTD vs FY15 YTD (US$ millions)

FY16

YTD

FY15

YTD

Unrealized gains and losses on loans, debt securities and associated derivatives

$

(68)

$

(32)

Unrealized gains and losses on borrowings from market, IDA and associated derivatives

, net

107

(102)

Net unrealized gains and losses on non-trading financial instruments accounted for at fair value

$

39

$

(134)

Changes in the fair value of IFC’s borrowings from market, IDA and associated derivatives, net, includes the impact of changes in IFC’s

own credit spread when measured against US$ LIBOR. As credit spreads widen, unrealized gains are recorded and when credit spreads

narrow, unrealized losses are recorded (notwithstanding the impact of other factors, such as changes in risk-free interest and foreign

currency exchange rates). The magnitude and direction (gain or loss) can be volatile from period to period but do not alter the cash flows.

IFC’s policy is to generally match currency, amount and timing of cash flows on market borrowings with cash flows on associated

derivatives entered into contemporaneously.

Page 16

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

In FY16 YTD, higher market interest rates and a widening of the credit spreads for IFC bond issuances resulted in unrealized gains from

the valuation of IFC’s market borrowings that were only partially offset by losses on related hedging swaps. Widening credit spreads

produced afterswap valuation gains as bond liabilities were discounted relatively more than swap receivables. IFC reported net $107

million of unrealized gains on borrowings and associated derivatives in FY16 YTD (net $102 million of unrealized losses in FY15

YTD). Unrealized gains were incurred on market borrowings after swaps, on balance, across most major funding currency portfolios. The

cost of economically hedging borrowings in US, Australian and New Zealand dollars afterswaps was more expensive across all maturities

with respect to benchmarks at FY16 Q2 end as compared to FY15 end.

IFC reported net unrealized losses on loans, debt securities and associated derivatives of $68 million in FY16 YTD (net unrealized losses

of $32 million in FY15 YTD). In FY16 this comprised of unrealized losses of $69 million on the loan and debt securities portfolio carried

at fair value, concentrated in two projects, which provided $42 million of losses, unrealized gains of $11 million on client risk management

swaps, and unrealized losses of $10 million on other derivatives, mainly conversion features, warrants and interest rate and currency

swaps economically hedging the fixed rate and/or non-US$ loan portfolio.

OTHER COMPREHENSIVE INCOME (OCI)

UNREALIZED GAINS AND LOSSES ON EQUITY INVESTMENTS AND DEBT SECURITIES

IFC’s investments in debt securities and equity investments that are listed in markets that provide readily determinable fair values are

classified as available-for-sale, with unrealized gains and losses on these investments being reported in OCI until realized. When realized,

the gain or loss is transferred to net income. Changes in unrealized gains and losses on equity investments and debt securities reported

in OCI are significantly impacted by (i) the global environment for emerging markets; and (ii) the realization of gains on sales of such equity

investments and debt securities.

Table 10: Change in Other Comprehensive Income - Unrealized Gains and Losses on Equity Investments and Debt Securities

FY16 YTD vs FY15 YTD (US$ millions)

FY16

YTD

FY15

YTD

Net unrealized gains and losses on equity investments arising during the period:

Unrealized gains

$

104

$

717

Unrealized losses

(647)

(656)

Reclassification adjustment for realized gains and other-than-temporary impairments included in net income

(301)

(346)

Net unrealized gains and losses on equity investments

$

(844)

$

(285)

Net unrealized gains and losses on debt securities arising during the period:

Unrealized gains

$

44

$

61

Unrealized losses

(148)

(126)

Reclassification adjustment for realized gains, non-credit related portion of impairments which were

recognized in net income and other-than-temporary included in net income

(4)

(30)

Net unrealized gains and losses on debt securities

$

(108)

$

(95)

Total unrealized gains and losses on equity investments and debt securities

$

(952)

$

(380)

Net unrealized losses on equity investments arising in FY16 YTD totaled $844 million, mainly due to decreases in equity fair values

reflecting the volatile and overall significantly negative market conditions (equity, commodities and FX) in FY16 YTD. Unrealized losses

of $976 million were reported in FY16 Q1 and unrealized gains of $24 million were reported in FY16 Q2, reflecting the significantly weaker

emerging markets environment that existed in FY16 Q1 when compared to FY16 Q2 and larger realizations of gains on equity investments

accounted for as available for sale early in FY16 Q1.

Page 17

INTERNATIONAL FINANCE CORPORATION

Management’s Discussion and Analysis

VIII. SENIOR MANAGEMENT CHANGES SINCE JULY 1, 2015

The following changes became effective July 1, 2015:

Nena Stoiljkovic assumed the role of Vice President, Global Client Services. Jean Philippe Prosper left the position of Vice President,

Global Client Services and became an Adviser to IFC’s Executive Vice President and CEO. Karin Finkelston left the position of Vice

President, Global Partnerships to become Vice President and Chief Operating Officer of MIGA. Saran Kebet-Koulibaly assumed the role

of Vice President, Corporate Risk and Sustainability. The units that previously reported to the Co-Vice Presidents, Global Partnerships,

were realigned with synergistic functional areas in IFC.

James Scriven, Vice President, Corporate Risk and Sustainability on June 30, 2015 left IFC effective October 31, 2015.

The following is a list of the principal officers of IFC as of December 31, 2015.

President ……………………………………………………………………………………………………………….

Dr. Jim Yong Kim

Executive Vice President and CEO ..............................................................................................................

Jin-Yong Cai*

Vice President, Global Client Services .........................................................................................................

Dimitris Tsitsiragos

Vice President, Global Client Services .........................................................................................................

Nena Stoiljkovic

Vice President, Corporate Risk & Sustainability and General Counsel .........................................................

Ethiopis Tafara

Vice President, Corporate Risk & Sustainability ...........................................................................................

Saran Kebet-Koulibaly

Vice President, Treasury and Syndications…………………………………………………………………………

Jindong Hua

CEO, IFC Asset Management Company LLC (a wholly-owned subsidiary of IFC)…………………………….

Gavin E.R. Wilson

* Jin-Yong Cai left IFC effective January 8, 2016. IFC has announced that Philippe Le Houérou has been appointed Executive Vice

President and CEO effective March 1, 2016. Ethiopis Tafara, IFC’s Vice President and General Counsel is the acting Executive Vice

President and CEO effective until Mr. Le Houérou’s appointment becomes effective.

Mr. Tafara designated Fady Zeidan as Acting Vice

President for Corporate Risk & Sustainability and General Counsel for the period from January 9, 2016 until January 21, 2016; and David

Harris as Acting Vice President for Corporate Risk & Sustainability and General Counsel for the period from January 22, 2016 until

February 29, 2016.

Page 18

INTERNATIONAL FINANCE CORPORATION

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

December 31, 2015

Contents

Page

Condensed consolidated balance sheets ........................................................................................... 19

Condensed consolidated income statements ..................................................................................... 20

Condensed consolidated statements of comprehensive income ........................................................ 21

Condensed consolidated statements of changes in capital ................................................................ 22

Condensed consolidated statements of cash flows ............................................................................ 23

Notes to condensed consolidated financial statements ...................................................................... 25

Independent Auditors’ Report ............................................................................................................. 75

Page 19

INTERNATIONAL FINANCE CORPORATION

CONDENSED CONSOLIDATED BALANCE SHEETS

as of December 31, 2015 (unaudited) and June 30, 2015 (unaudited)

(US$ millions)

December 31

June 30

Assets

Cash and due from banks………………………………………………………………………………….

$

1,351

$

1,509

Time deposits…................................................................................................................................

10,975

7,509

Trading securities - Note K……………………….……………………………………………….............

32,260

34,731

Securities purchased under resale agreements and receivable

for cash collateral pledged - Note P….…………………………………...........................................

1,101

68

Investments - Notes B, D, E, F, K and M

Loans

($812 at December 31, 2015 and $784, June 30, 2015 at fair value;

net of reserve against losses of $1,901 at December 31, 2015, $1,743 at June 30, 2015)

- Notes D, E and K ...................................................................................................................

21,304

21,336

Equity investments

($9,435 at December 31, 2015, $10,253 at June 30, 2015 at fair value) - Notes B, D, G and K

12,694

13,503

Debt securities - Notes D, F and K ………………………………………………………………….….

2,737

2,739

Total investments ……………………………………………………………………………………...

36,735

37,578

Derivative assets - Notes J, K and P………………………………………………………………….....

3,518

3,255

Receivables and other assets……………………………………………………………………............

2,700

2,898

Total assets …………………………………………………………………………………………….

$

88,640

$

87,548

Liabilities and capital

Liabilities

Securities sold under repurchase agreements and payable

for cash collateral received - Note P..…………………………………………………………...........

$

4,262

$

4,695

Borrowings outstanding - Note K

From market and other sources at amortized cost ………………………………………………….

2,523

1,587

From market sources at fair value …………………………………………………………………….

49,271

48,329

From International Development Association at fair value …......…………………...………….….

1,110

1,136

From International Bank for Reconstruction and Development at amortized cost ………………

209

213

Total borrowings ……………………………………………………………………………………....

53,113

51,265

Derivative liabilities - Notes J, K and P……………………………………………………………..…...

4,622

4,225

Payables and other liabilities……………………………………………………………….…................

2,987

2,937

Total liabilities …………………………………………………………………………………….……..

64,984

63,122

Capital

Capital stock, authorized (2,580,000 at December 31, 2015 and June 30, 2015)

shares of $1,000 par value each

Subscribed and paid-in ………………………………………………………………………………..

2,566

2,566

Accumulated other comprehensive income - Note H …………………………………………………

262

1,197

Retained earnings - Note H ……………………………………………………………………………...

20,809

20,641

Total IFC capital ……………………………………………………………………………………….

23,637

24,404

Non-controlling interests …………………………………………………………………………………

19

22

Total capital …………………………………………………………………………………………….

23,656

24,426

Total liabilities and capital …………………………………………………………………………...

$

88,640

$

87,548

The notes to the Condensed Consolidated Financial Statements are an integral part of these statements.

Page 20

INTERNATIONAL FINANCE CORPORATION

CONDENSED CONSOLIDATED INCOME STATEMENTS

for each of the three and six months ended December 31, 2015 (unaudited) and December 31, 2014 (unaudited)

(US$ millions)

Three months ended

December 31,

Six months ended

December 31,

2015

2014

2015

2014

Income from investments

Income from loans and guarantees, including realized gains and losses

on loans and associated derivatives - Note E …..............................................

$

267

$

237

$

545

$

571

Provision for losses on loans, guarantees and other receivables - Note E...........

(107)

(39)

(195)

(58)

Income (loss) from equity investments and associated derivatives - Note G.......

27

(52)

266

276

Income from debt securities, including realized gains and losses on debt

securities and associated derivatives - Note F………………………………......

50

49

69

90

Total income from investments.....................................................................

237

195

685

879

Income from liquid asset trading activities - Note C.................................................

105

107

113

204

Charges on borrowings………………………………………………………................

(90)

(63)

(166)

(118)

Income from investments and liquid asset trading activities,

after charges on borrowings.........................................................................

252

239

632

965

Other income

Advisory services income.....................................................................................

64

62

109

112

Service fees..........................................................................................................

29

44

50

71

Other - Note B.......................................................................................................

40

34

52

55

Total other income..........................................................................................

133

140

211

238

Other expenses

Administrative expenses.......................................................................................

(246)

(243)

(491)

(465)

Advisory services expenses..................................................................................

(74)

(72)

(128)

(134)

Expense from pension and other postretirement benefit plans - Note O..............

(46)

(50)

(92)

(99)