Kentucky Tax Registration Application

and Instructions

www.revenue.ky.gov

COMMONWEALTH OF KENTUCKY

DEPARTMENT OF REVENUE

FRANKFORT, KENTUCKY 40620

10A100(P) (11-23)

Employer’s Withholding Tax Account

Sales and Use Tax Account/Permit

Transient Room Tax Account

Motor Vehicle Tire Fee Account

Commercial Mobile Radio Service (CMRS) Prepaid Service Charge Account

Utility Gross Receipts License Tax Account

Telecommunications Tax Account

Consumer’s Use Tax Account

Corporation Income Tax Account

Limited Liability Entity Tax Account

Kentucky Nonresident Income Tax Withholding on Distributive Share Income Tax Account

Coal Severance and Processing Tax Account

Coal Seller/Purchaser Certicate ID Number

10A100(P)(11-23)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

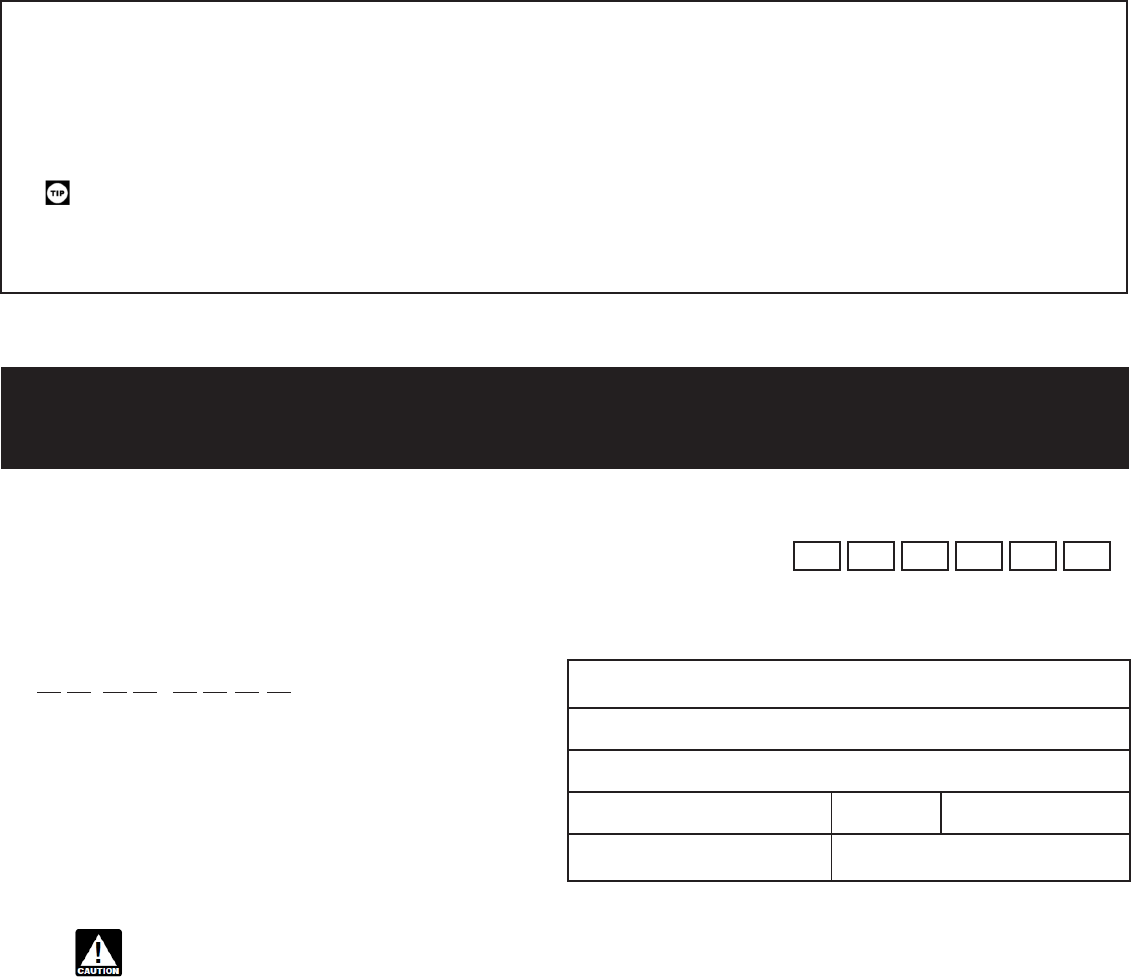

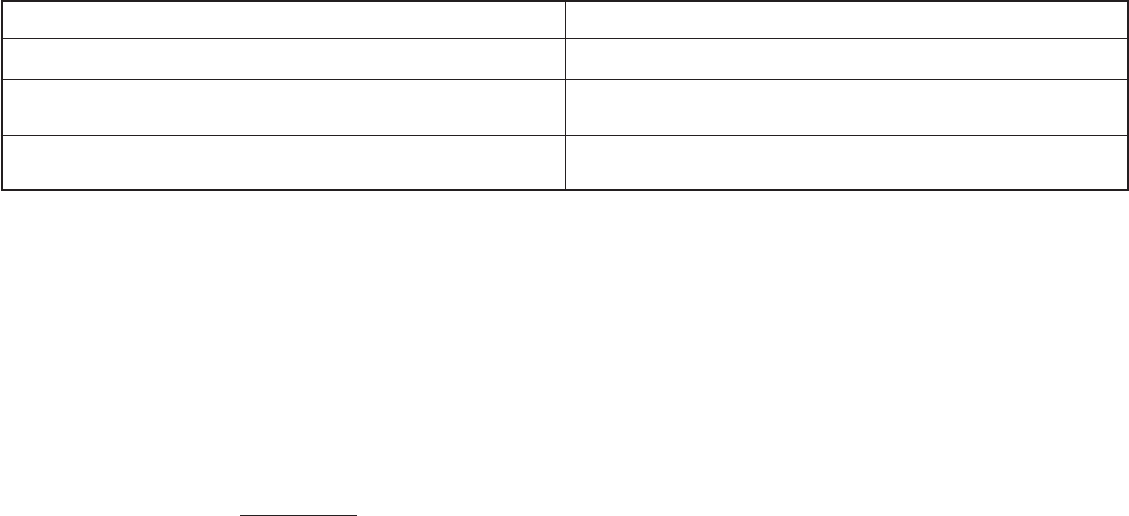

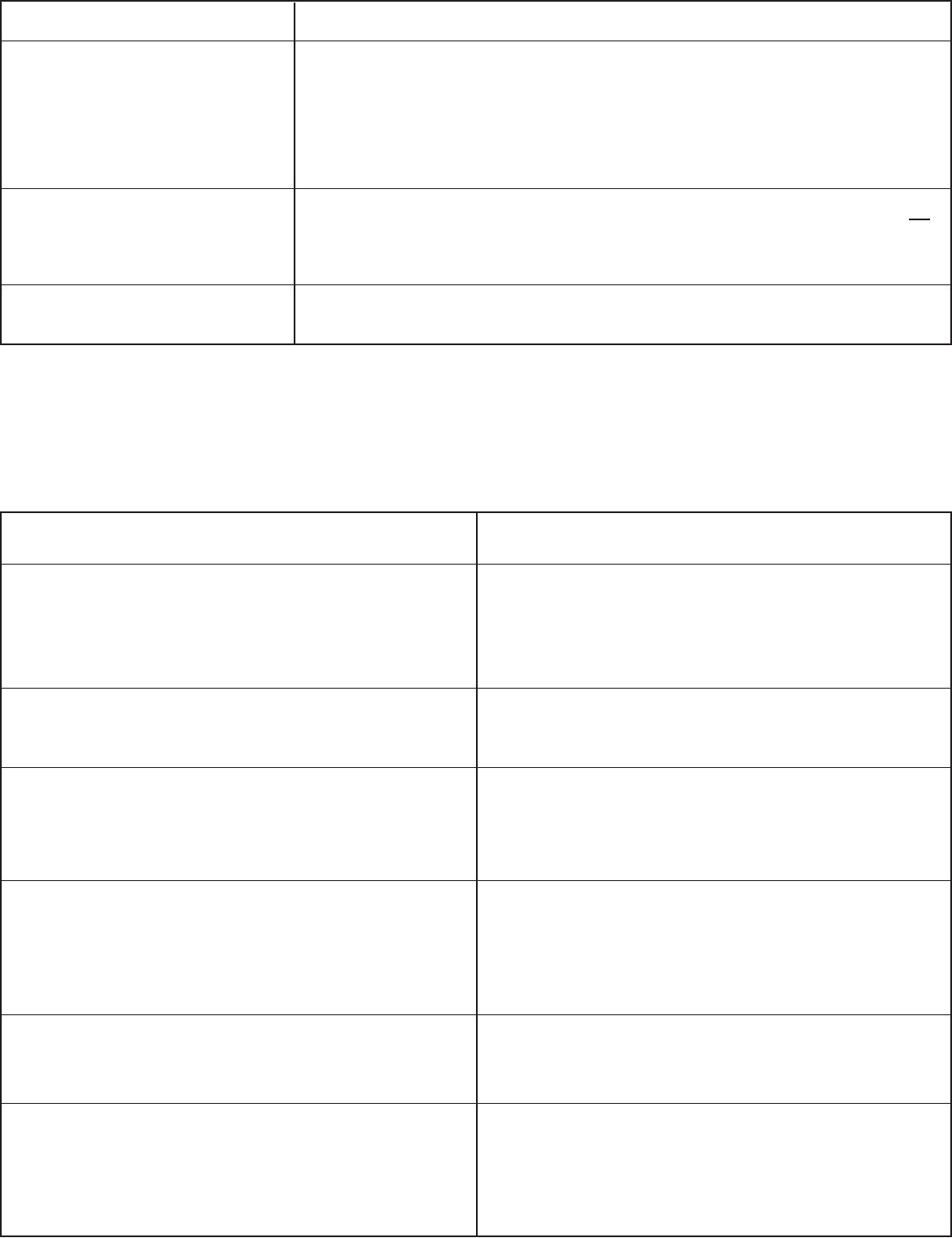

FOR OFFICE USE ONLY

CBI #

FEIN

CRIS #

RCS Flag

NAICS

Coded/Date Coded

Data Entry/Data Entered

WH SU TEL CU CT CP NRWH

TR UTL CID LL

TF

CMRS

SECTION A REASON FOR COMPLETING THIS APPLICATION (Must Be Completed)

SECTION B BUSINESS / RESPONSIBLE PARTY / CONTACT INFORMATION (Must Be Completed)

4. Legal Business Name

5. Doing Business As (DBA) Name (See instructions)

6. Federal Employer Identication Number (FEIN)

(Required, complete prior to submitting)

7. Kentucky Commonwealth Business Identier

(if already assigned)

8. Secretary of State Information (if applicable)

Kentucky Secretary of State Organization Number

/ /

Date of Incorporation/Organization State of Incorporation/Organization

/ /

If you are an Out-of-State Entity, Date of

Qualication with the Kentucky Secretary of

State’s Oce

—

1. Eective Date 3. Previous Account Numbers (If applicable)

Opened new business/Began activity in Kentucky

Resumption of business

Hired employees working outside KY who have a KY residence

Applying for other accounts/Began a new taxable activity

Bidding for state government contract (State Vendor or Aliates)

Purchased an existing business (See instructions)

Purchased business assets from previous owner

Yes No

Business structure change or conversion

(Specify previous type; See instructions)

Change of Federal Identication Number (FEIN), Kentucky

Secretary of State Organization Number, or Commonwealth

Business Identier (CBI)

Other (Specify)

/ /

Kentucky Employer’s Withholding Tax __________________

Kentucky Sales and Use Tax __________________

Kentucky Telecommunications Tax __________________

Kentucky Utilities Gross Receipts License Tax __________________

Kentucky Consumer’s Use Tax __________________

Kentucky Corporation Income Tax and/or

Limited Liability Entity Tax __________________

Kentucky Coal Severance & Processing Tax __________________

Kentucky Pass-Through Non-Resident Withholding __________________

Federal ID Number (FEIN) __________________

Kentucky Secretary of State Organization Number __________________

Commonwealth Business Identier (CBI) __________________

Incomplete or illegible applications will delay processing and will be returned.

See instructions for questions regarding completion of the application.

Need Help? Call (502) 564-3306 or

Email DOR.Registration@ky.gov

KENTUCKY TAX REGISTRATION APPLICATION

For faster service, apply online at

http://onestop.ky.gov

To update information for your existing account(s) or report opening a new location of your current business,

use Form 10A104, Update or Cancellation of Kentucky Tax Account(s).

2. A. Did you receive correspondence from the Division of Registration requesting registration of this business?

Yes No

B. If Yes, enter the File Number(s) located at the

top of the letter you received.

File Number File Number

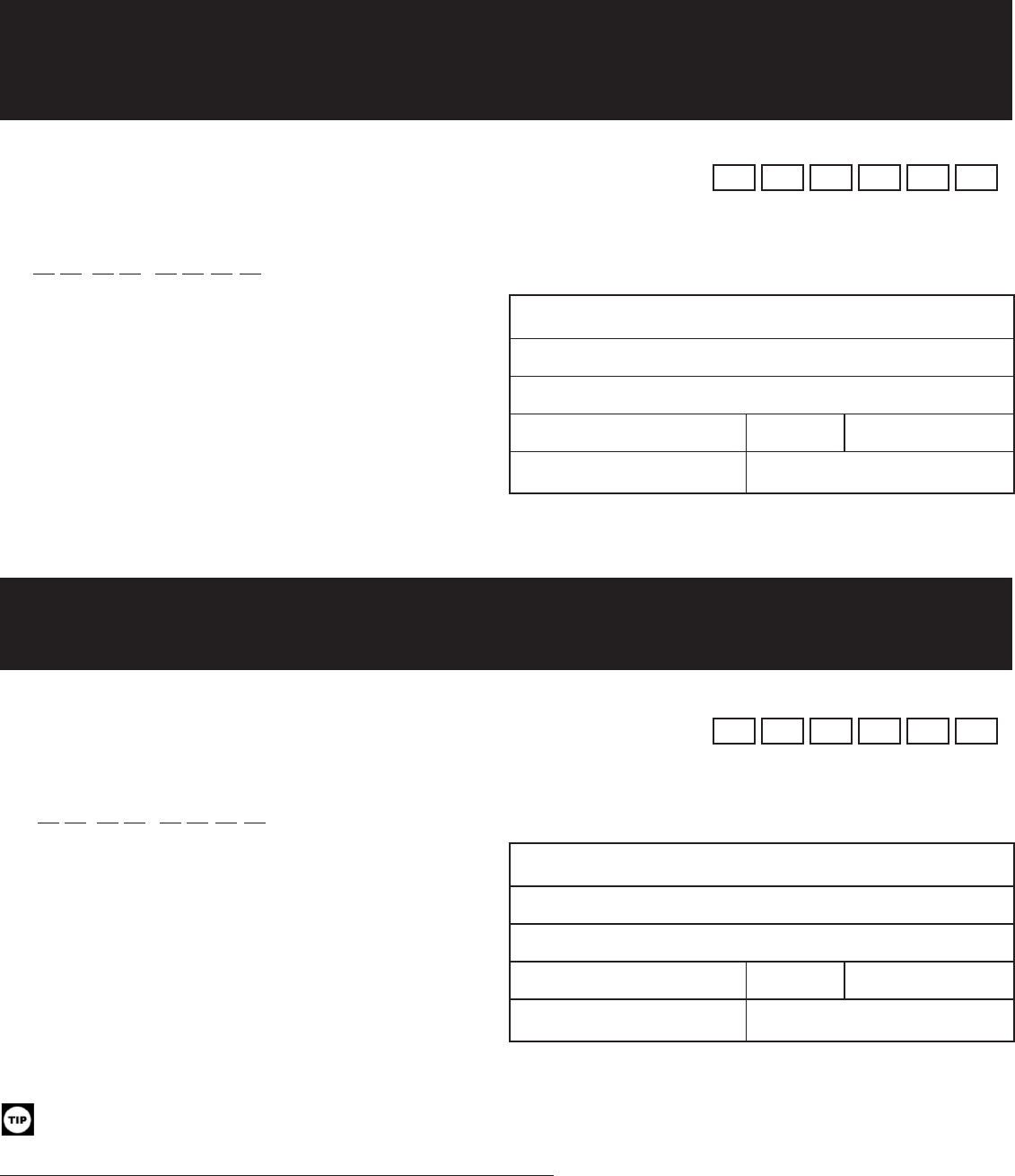

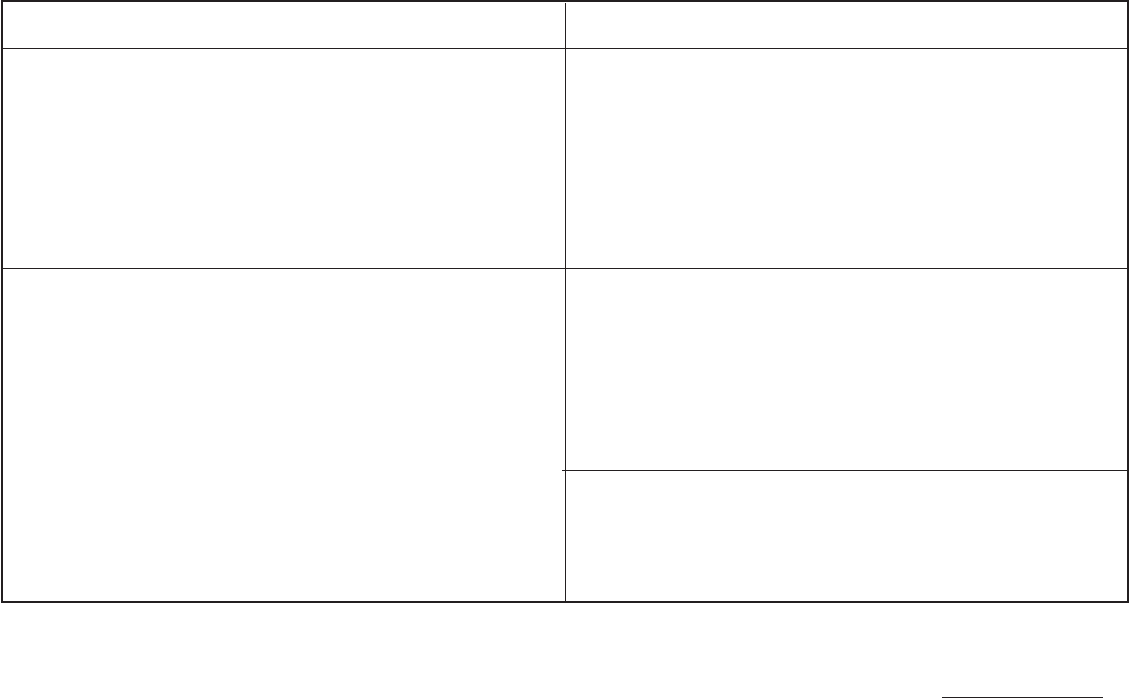

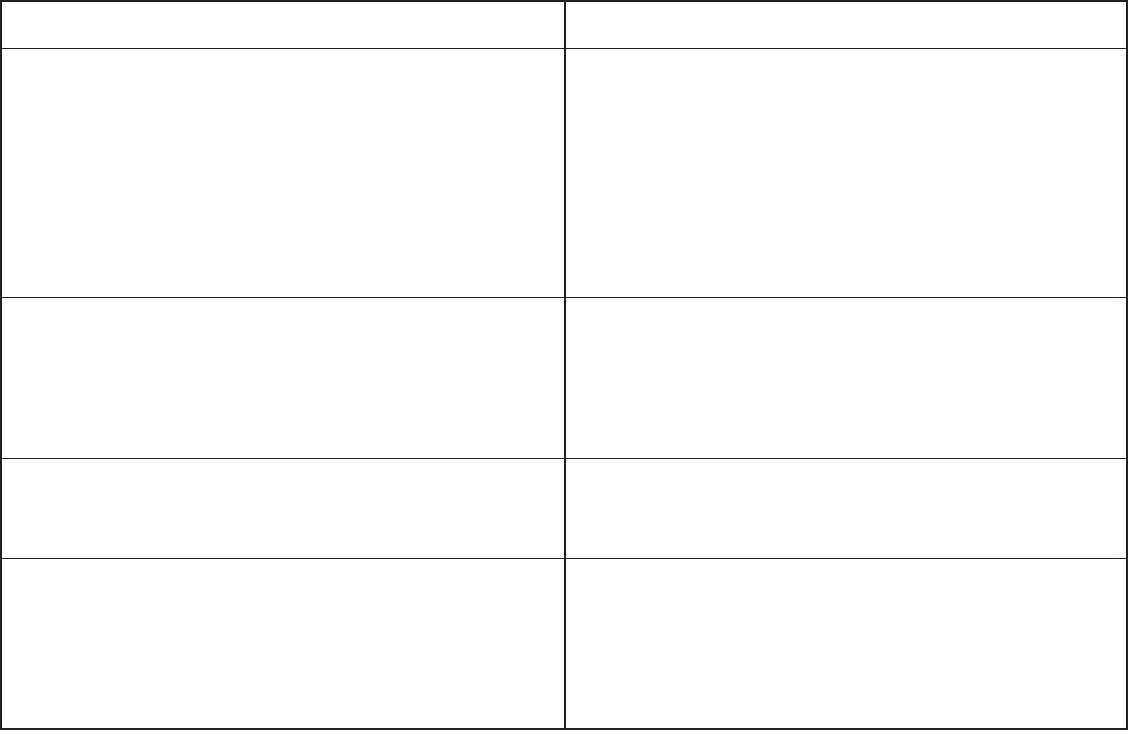

13. Business Structure

14. How Will You be Taxed for Federal Purposes?

(Sole Proprietorships, HCSRs, Qualied Joint Ventures, Estates, Governments, and Unincorporated Non-Prots SKIP question 14)

15–16. OWNERSHIP DISCLOSURE–RESPONSIBLE PARTIES (REQUIRED FOR ALL BUSINESS STRUCTURES)

Prot Limited Liability

Company (LLC)

Non-Prot Limited Liability

Company (LLC)

Professional Limited Liability

Company (PLLC)

Series of a Limited Liability

Company

Prot Corporation

Non-Prot Corporation

Professional Service

Corporation (PSC)

Cooperative Corporation

Limited Cooperative

Association

Association

Statutory Trust

Series of a Statutory Trust

Business Trust

Trust (Non-statutory)

Limited Partnership (LP)

Limited Liability Partnership

(LLP)

Limited Liability Limited Partnership

(LLLP)

Series of a Partnership

General Partnership

Joint Venture

Estate

Government

Unincorporated Non-prot

Association

Sole Proprietorship

Home Care Service

Recipient (HCSR)

Qualied Joint Venture

(Married Couple)

Public Benet Corporation

Other (Specify)

Single Member Disregarded Entity

Partnership

Corporation

S-Corporation

Cooperative

Trust

Check below how the Member will be taxed federally

Individual Sole Proprietorship

General Partnership/Joint Venture

Estate

Trust (Non-statutory)/Business Trust

Other (Specify how the Member is federally taxed)

10A100(P)(11-23) Page 2

Full Legal Name (First Middle Last)

Social Security Number (REQUIRED) FEIN (if Responsible Party is another business)

Driver’s License Number (if applicable) Driver’s License State of Issuance

Business Title Eective Date of Title

Residence Address

City State Zip Code

Telephone Number County (if in Kentucky)

( ) –

/ /

Full Legal Name (First Middle Last)

Social Security Number (REQUIRED) FEIN (if Responsible Party is another business)

Driver’s License Number (if applicable) Driver’s License State of Issuance

Business Title Eective Date of Title

Residence Address

City State Zip Code

Telephone Number County (if in Kentucky)

( ) –

/ /

9. Primary Business Location 11. Accounting Period

( ) –

Calendar Year: Year Ending December 31

st

Fiscal Year: Year Ending ___ ___ /___ ___ (mm/dd)

52/53 Week Calendar Year: _______________________________

(Month and Day of Week Year Ends)

52/53 Week Fiscal Year: _______________________________

(Month and Day of Week Year Ends)

12. Accounting Method

Cash Accrual

Street Address (DO NOT List a PO Box)

City State Zip Code

Telephone Number County (if in Kentucky)

10. Business Operations are Primarily

Home Based Web Based Oce/Store Based Transient

See instructions regarding required responsible parties for your business structure

SECTION C TELL US ABOUT YOUR BUSINESS OR ORGANIZATION (Must Be Completed)

10A100(P)(11-23) Page 3

Name (First Middle Last) Title Daytime Telephone Extension

E-mail: (By supplying your e-mail address you grant the Department of Revenue permission to contact you via e-mail.)

( ) –

17. Person to contact about this application:

18a. Describe the nature of your business activity in Kentucky, including any services provided.

_________________________________________________________________________________________________________________________

18b. List products sold in Kentucky.

_________________________________________________________________________________________________________________________

18c. Please list the NAICS (North American Industry Classication System) Code used to classify your business, if known. _____________________

The following questions will determine your need for a Sales and Use Tax Account,

the schedules you may need to le,

and/or your need for a

Transient Room Tax Account,

Motor Vehicle Tire Fee Account,

Commercial Mobile Radio Service (CMRS) Prepaid Service Charge Account,

Utility Gross Receipts License Tax Account, and/or

Telecommunications Tax Account.

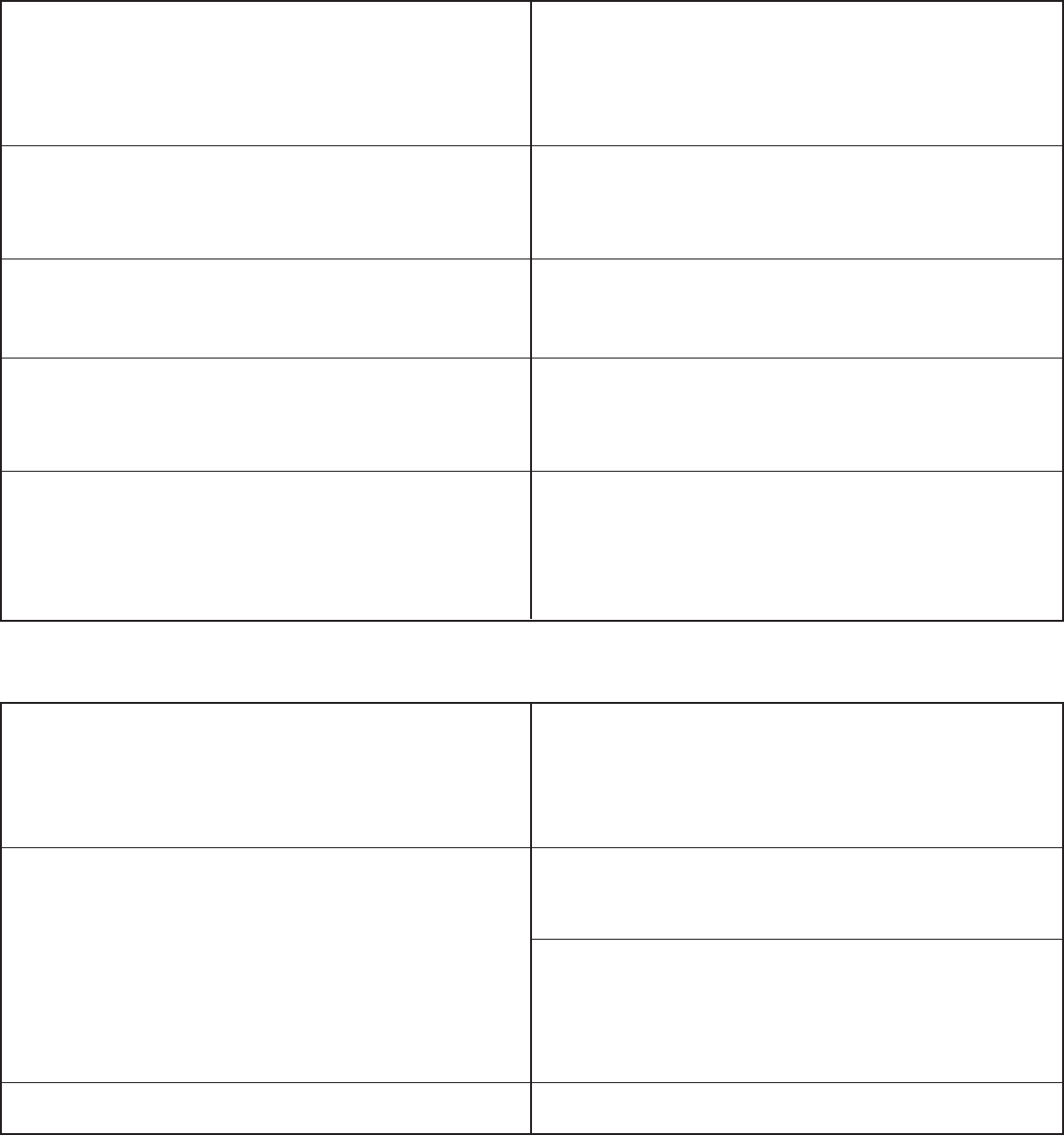

CONTINUE

Sales and Use Tax Account

Yes No

23. Will you make retail and/or wholesale sales of tangible or digital property in Kentucky? .................................................................................

Examples: prepared food, internet sales, downloaded music and books. (See instructions for more.)

24. Will you install replacement parts for the repair or recondition of tangible property? .......................................................................................

Examples: automotive repairs, computer or electronics repair, furniture repair. (See instructions for more.)

25. Will you produce, fabricate, process, print or imprint tangible property? ..........................................................................................................

Examples: sign making, window tinting, embroidery, screen printing, engraving. (See instructions for more.)

26.

Will you charge for labor or services rendered in installing or applying tangible personal property, digital property, or service sold?

...............

CONTINUED ON NEXT PAGE

The following questions will determine your need for an Employer’s Withholding Tax Account.

Yes No

19. Do you have or will you hire employees to work in Kentucky within the next six (6) months? .........................................................................

An employee is anyone to whom you pay wages, including part-time help and family members. Kentucky corporate

ocers receiving compensation other than dividends are also considered employees.

20. Do you wish to voluntarily withhold on Kentucky residents who work outside Kentucky? ...............................................................................

21.

Do you wish to voluntarily withhold on pension and retirement payments? .....................................................................................................

22. Will your business be registered to make charitable or other lawful gaming payouts in Kentucky and be required to withhold

federal tax from those payouts? .......................................................................................................................................................................

If you answered Yes to any of questions 19 through 22, you must complete SECTION D.

10A100(P)(11-23) Page 4

Yes No

A. Landscaping services

B. Janitorial services

C. Small animal veterinary services

D. Pet care services

E. Industrial laundry services

F. Non-coin operated laundry and dry

cleaning services

G. Linen supply services

H. Indoor skin tanning services

I. Non-medical diet and weight reducing

services

J. Photography and photo nishing

services

K. Telemarketing services

L. Public opinion and research polling services

M. Lobbying services

N. Executive employee recruitment services

O. Website design and development services

P. Website hosting services

Q. Private mailroom services (including

presorting, bar coding, tracking delivery

to postal service, and private mailbox rentals)

R. Bodyguard services

S. Residential and non-residential security

system monitoring services

T. Private investigation services

U. Process Server Services

V. Repossession of tangible personal property

services

W. Personal Background Check services

X. Parking services (including valet services and

the use of parking lots and parking structures,

excluding any parking at an educational

institution)

Y. Road and travel services provided by

automobile clubs

Z. Condominium time-share exchange services

Yes No

AA. Rental of space for meetings, conventions,

short-term business uses, entertainment

events, weddings, banquets, parties, and

other short-term social events

AB. Social event planning and coordination

services

AC. Leisure, recreational, and athletic instructional

services

AD. Recreational camp tuition and fees

AE. Personal tness training services

AF. Massage services, unless medically

necessary

AG. Cosmetic surgery services

AH. Body modication services that are not

necessary for medical or dental health,

such as tattooing, etc.

AI. Laboratory testing services, except for medical,

educational, or veterinary reasons

AJ. Interior decorating and design services

AK. Household moving services

AL. Specialized design services, including the

design of clothing, costumes, fashion, furs,

jewelry, shoes, textiles, and lighting

AM. Lapidary services, including cutting, polishing,

and engraving precious stones

AN. Labor and services to repair or maintain

commercial refrigeration equipment or systems

AO. Labor to repair or alter apparel, footwear,

watches, or jewelry

AP. Pre-written computer software access services

27. Will you provide any of the following services? (See instructions for more.)

CONTINUED ON NEXT PAGE

10A100(P)(11-23) Page 5

Yes No

A. Sewer services

B. Water utilities

C. Natural, articial, or mixed gas utilities

D. Electricity

Yes No

E. Communications services

F. Multichannel video programming services *(see instructions)

G. Video streaming services *(see instructions)

H. Direct broadcast satellite services *(see instructions)

If you answered Yes to any of questions 23 through 45 E, you must complete SECTION E.

If you answered Yes to any of questions 44 or 45 B through 45 G, you must complete SECTION F.

If you answered Yes to any of questions 45 E through 45 H, you must complete SECTION G.

Transient Room Tax Account

41. Will you rent temporary lodging (less than 30 continuous days) to others? .....................................................................................................

Examples: hotel, motel, inn, campground, or RV park (See instructions for more.)

Motor Vehicle Tire Fee Account

42. Will you sell new tires for motor vehicles or semi-trailers? ...............................................................................................................................

Commercial Mobile Radio Service (CMRS) Prepaid Service Charge Account

43. Will you sell cellular phones with preloaded minutes, prepaid cellular phone cards, or recharge cellular phones and cards

with minutes? ...................................................................................................................................................................................................

Utility Gross Receipts License Tax Account and/or Telecommunications Tax Account

44. Were you approved for an Energy Direct Pay Authorization with a Utility Gross Receipts License Tax Exemption? ......................................

Attach a copy of your ocial UGRLT Exemption Authorization.

45. Will you sell any of the following?

Yes No

46a. Will your company purchase any of the utility types listed above in question 45 B through G from

a provider outside of Kentucky? .......................................................................................................................................................................

46b. If yes, please list the provider’s name and utility type: _____________________________________________________________________

CONTINUE

Yes No

28. Will you sell extended warranties? ...................................................................................................................................................................

29. Will you rent or lease tangible or digital property to others, including related companies? ..............................................................................

30. Will you charge admissions, including initiation fees, monthly fees or membership fees for the use of a facility or participating

in an event or activity? (Non-prot organizations selling admissions other than golf admissions, check NO. (See instructions

for additional information.) ............................................................................................................................................................................

31. Are you a remote retailer selling tangible personal property or digital property delivered or transferred electronically to a

purchaser in Kentucky? (See instructions for additional information.) .......................................................................................................

32. Are you a manufacturer’s agent soliciting orders for a nonresident seller not registered in Kentucky? ...........................................................

33a. Are you a marketplace provider or retailer? (See instructions for additional information.) ........................................................................

33b. Do you facilitate sales by third party retailers? (See KRS 139.450. A marketplace provider may register for two Kentucky sales

tax account numbers. See instructions for additional information.) ...........................................................................................................

33c. Are you applying for separate accounts for your own sales and for your facilitated sales? (See instructions for additional

information.) ...................................................................................................................................................................................................

34. Are you a manufacturing fee processor or a contract miner operating in Kentucky? .......................................................................................

35. Are you bidding on a contract with Kentucky state government? .....................................................................................................................

36. Are you an aliate of a company who has been awarded a Kentucky state government contract? ...............................................................

37. Will you rent campsites at campgrounds or recreational vehicle parks? ..........................................................................................................

Sales and Use Tax Account Schedules

38. Will you receive receipts from the breeding of a stallion to a mare in Kentucky? ............................................................................................

39. Will you make sales of aviation jet fuel? ...........................................................................................................................................................

40a. Will you make sales of motor vehicles to residents of Arizona, California, Florida, Indiana, Massachusetts, Michigan, South

Carolina, or Washington? .................................................................................................................................................................................

40b. Will you make sales of recreational vehicles to customers that are residents of Arizona, California, Florida, Hawaii, Massachusetts,

Michigan, North Carolina, South Carolina, and Wisconsin? .............................................................................................................................

The following questions will determine your need for a

Kentucky Nonresident Income Tax Withholding on Distributive Share Income Tax Account.

Yes No

55. Is this business considered a pass-through entity as dened in KRS 141.010(22)? .......................................................................................

56. Does your pass-through entity have nonresident:

Yes No

A. Individual partner(s), shareholder(s), or member(s) receiving Kentucky distributive share income from your

pass-through entity? .................................................................................................................................................................................

“Individual" includes estates and trusts.

B. Corporate partner(s) or member(s) receiving Kentucky distributive share income from your pass-through entity? ................................

If you answered Yes to question 56 A and/or 56 B, you must complete SECTION J.

If you answered Yes to question 55, you must answer questions 56 A and 56 B.

CONTINUE

CONTINUE

CONTINUE

The following questions will determine your need for a

Corporation Income Tax Account and/or a Limited Liability Entity Tax Account.

If you answered Yes to any of questions 48 through 54, you must complete SECTION I.

If your answer to questions 13 and 14 was NOT

Sole Proprietorship, HCSR, Qualied Joint Venture, Estate, Government,

General Partnership taxed as a Partnership, or Joint Venture taxed as a Partnership,

you must complete questions 48 through 54.

Yes No

48. Are you organized under the laws of Kentucky with the Kentucky Secretary of State’s Oce? ......................................................................

49. Will your business have its commercial domicile in Kentucky? ........................................................................................................................

50. Will your business own or lease any real or tangible property in Kentucky? ....................................................................................................

51. Will your business have one or more individuals performing services in Kentucky? .......................................................................................

52. Will your business maintain an interest in a pass-through entity or derive income from Kentucky sources? ..................................................

53. Will you direct activities toward Kentucky customers for the purpose of selling them goods and/or services? ...............................................

54. Will your business own/lease any intangible property or receive payments from a related member as dened in KRS 141.205(1)(g)

or an unrelated party for the use of intangible property in Kentucky such as royalties, franchise agreements, patents, trademarks,

etc.? .................................................................................................................................................................................................................

The following question will determine your need for a Consumer’s Use Tax Account.

Skip question 47 if you must complete Section E.

If you answered Yes to question 47, you must complete SECTION H.

Yes No

47. Will your business make purchases from out-of-state vendors and not pay Kentucky Sales or Use Tax to the seller on those purchases? ..

If you are a PROFESSIONAL SERVICE business or if your business will make a one-time purchase only, please see

instructions for important additional details.

10A100(P)(11-23) Page 6

The following questions will determine your need for a

Coal Severance/Processing Tax Account and/or a Coal Seller Purchaser Certicate ID#.

If you answered Yes to any of questions 57 through 59, you must complete SECTION K and SECTION E.

Yes No

57. Will you mine coal to which you own or possess the mineral rights? ...............................................................................................................

58. Will you purchase coal for the purpose of processing and resale, or do you process refuse coal? .................................................................

Processing means cleaning, breaking, sizing, dust allaying, treating to prevent freezing, or loading or unloading for any purpose.

59. Will you purchase and sell coal as a coal broker? ...........................................................................................................................................

10A100(P)(11-23) Page 7

SECTION D EMPLOYER’S WITHHOLDING TAX ACCOUNT

Must be completed if you answered Yes to any of questions 19 through 22.

60. A. Has a Kentucky Employer’s Withholding Tax Account already been assigned to this business? Yes No

B. If Yes, list the Employer’s Withholding Tax Account Number

61. Number of Kentucky employees ______________________________

62. Date wages/pensions rst paid or will be paid (REQUIRED)

63 Estimated total annual tax withheld in Kentucky:

$0.00–$399.99 $2,000.00–$49,999.99

$400.00–$1,999.99 $50,000.00 or more

64. A. Is the withholding for your employees reported by a Common Paymaster or a Common Pay Agent? Yes No

Most payroll processors do NOT operate as Common Paymasters/Pay Agents. If using a payroll processor, check with them to

determine if you should answer yes to the question above.

B. If Yes, attach a separate sheet listing which you use, Common Paymaster or Common Pay Agent, and provide their Business Name, FEIN, and

Kentucky Employer’s Withholding Tax Account Number.

/ /

c/o or Attn.

Address

City State Zip Code

Mailing Telephone Number County (if in Kentucky)

( ) –

65. Employer’s Withholding Tax mailing address:

Use the same address as your location address

Use the same address as ______________________ Tax Account

10A100(P)(11-23) Page 8

SECTION E SALES AND USE TAX ACCOUNT

TRANSIENT ROOM TAX ACCOUNT

MOTOR VEHICLE TIRE FEE ACCOUNT

COMMERCIAL MOBILE RADIO SERVICE (CMRS) PREPAID SERVICE CHARGE ACCOUNT

Must be completed if you answered Yes to any of questions 23 through 45 E or any of questions 57 through 59.

67. Date sales began or will begin (REQUIRED)

68. Estimated gross monthly sales tax collected in Kentucky:

$0.00–$1,199.99 $1,200.00 or more

69. A. Does this business have additional locations in Kentucky other

than the Primary Business Location? Yes No

B. If Yes, attach a listing of all additional Kentucky locations. For each

location, the attachment should include: doing business as (DBA)

name, physical location address, phone number, date location was

opened, and a description of the location’s business activity.

/ /

c/o or Attn.

Address

City State Zip Code

Mailing Telephone Number County (if in Kentucky)

( ) –

c/o or Attn.

Address

City State Zip Code

Mailing Telephone Number County (if in Kentucky)

( ) –

66. A. Has a Kentucky Sales and Use Tax Account already been assigned to this business? Yes No

B. If Yes, list the Sales and Use Tax Account Number

70. Sales and Use Tax mailing address:

Use the same address as your location address

Use the same address as _______________________ Tax Account

74. Utility Gross Receipts License Tax mailing address:

Use the same address as your location address

Use the same address as _______________________ Tax Account

SECTION F UTILITY GROSS RECEIPTS LICENSE TAX ACCOUNT

Must be completed if you answered Yes to any of questions 44 or 45 B through 45 G.

71. A. Has a Kentucky Utility Gross Receipts License Tax Account already been assigned to this business? Yes No

B. If Yes, list the Utility Gross Receipts License Tax Account Number

72. Date sales or purchases of utilities began or will begin (REQUIRED)

73. Telephone Number

/ /

(__________) __________ – ____________________

Once the account for Utility Gross Receipts License Tax is assigned,

use the website below to set up account for e-le.

http://revenue.ky.gov/Business/Utility-Gross-Receipts-License-Tax/Pages/default.aspx

10A100(P)(11-23) Page 9

82. Date purchases began or will begin

(REQUIRED)

/ /

c/o or Attn.

Address

City State Zip Code

Mailing Telephone Number County (if in Kentucky)

( ) –

81. A. Has a Consumer’s Use Tax Account already been assigned to this business? Yes No

B. If Yes, list the Consumer’s Use Tax Account Number

83. Consumer’s Use Tax mailing address:

Use the same address as your location address

Use the same address as _______________________ Tax Account

SECTION H CONSUMER’S USE TAX ACCOUNT

Must be completed if you answered Yes to question 47.

SECTION G TELECOMMUNICATIONS TAX ACCOUNT

Must be completed if you answered Yes to any of questions 45 E through 45 H.

75. A. Has a Kentucky Telecommunications Tax Account already been assigned to this business? Yes No

B. If Yes, list the Telecommunications Tax Account Number

76. Does your organization have tangible personal property located within the Commonwealth of Kentucky? Yes No

77. Select company type:

Municipal Entity Other Provider Consumer

78. Date sales of services began or will begin in Kentucky (REQUIRED)

79. Telephone Number

/ /

(__________) __________ – ____________________

Once the account for Telecommunications Tax is assigned, use

the website below to set up account for e-le.

http://revenue.ky.gov/Business/Telecommunications-Tax/Pages/default.aspx

c/o or Attn.

Address

City State Zip Code

Mailing Telephone Number County (if in Kentucky)

( ) –

80. Telecommunications Tax mailing address:

Use the same address as your location address

Use the same address as _______________________ Tax Account

10A100(P)(11-23) Page 10

SECTION J KENTUCKY NONRESIDENT INCOME TAX WITHHOLDING ON DISTRIBUTIVE SHARE

INCOME TAX ACCOUNT

Must be completed if you answered Yes to question 56 A and/or B.

90. A. Has a Kentucky Nonresident Income Tax Withholding on Distributive Share Income Tax Account already been assigned to this business?

Yes No

B. If Yes, list the Kentucky Nonresident Income Tax Withholding on Distributive Share Income Tax Account Number

91.

Date rst nonresident corporation or individual became a

partner, member, or shareholder (REQUIRED)

92. A. Is your entity exempt from Kentucky Nonresident Income Tax

Withholding on Distributive Share Income Tax under Kentucky

law? Yes No

B. If Yes, see Exemption Table 2 in the instructions to provide the

code for your Exemption Type.

__________________________________________________

/ /

c/o or Attn.

Address

City State Zip Code

Mailing Telephone Number County (if in Kentucky)

( ) –

93. Nonresident Distributive Share Withholding Tax mailing address:

Use the same address as your location address

Use the same address as _______________________ Tax Account

89. Corporation Income and/or Limited Liability Entity Tax mailing address:

Use the same address as your location address

Use the same address as _______________________ Tax Account

/ /

SECTION I CORPORATION INCOME AND/OR LIMITED LIABILITY ENTITY TAX ACCOUNT

Must be completed if you answered Yes to any of questions 48 through 54.

c/o or Attn.

Address

City State Zip Code

Mailing Telephone Number County (if in Kentucky)

( ) –

84. A. Has a Corporation Income and/or Limited Liability Entity Tax Account already been assigned to this business? Yes No

B. If Yes, list the Corporation Income or Limited Liability Entity Tax Account Number

85. A. Is this entity treated federally as a division of a parent company

and not separately taxed as its own entity? Yes No

B. If Yes, select the division type below:

Qualied Subchapter S-corporation Subsidiary (QSUB)

Qualied Real Estate Investment Trust Subsidiary (QRS)

86. If an out-of-state entity, is your Kentucky activity limited to the mere

solicitation of the sale of tangible personal property and exempt from

Corporation Income tax due to Public Law 86-272? Yes No

87. If an out-of-state entity, date activity or receipt of pass through income

began or will begin in Kentucky

88.

A. Is your entity exempt from Corporation Income Tax and/or Limited Liability Entity Tax under Kentucky law? Yes No

B. If Yes, see Exemption Table 1 in the instructions to provide the code for your Exemption Type. __________________________________________

C. If Political Organization selected above, are you required to le federal Form 1120-POL? Yes No

✔

10A100(P)(11-23) Page 11

The Kentucky Department of Revenue does not discriminate on the basis of race, color, national origin,

sex, age, religion, disability, sexual orientation, gender identity, veteran status, genetic information or

ancestry in employment or the provision of services.

For assistance in completing the application, please call the Division of Registration at (502) 564–3306, Monday through Friday between the hours of

8:00 a.m. and 5:00 p.m., Eastern Time, or you may use the Telecommunications Device for the Deaf at (502) 564-3058.

SEND completed application to: KENTUCKY DEPARTMENT OF REVENUE

DIVISION OF REGISTRATION

501 HIGH STREET, STATION 20

FRANKFORT, KENTUCKY 40602-0299

FAX: 502–227–0772

E-MAIL: DOR.Registration@ky.gov

If you would like to register for Electronic Funds Transfer (EFT), visit the Kentucky Department of Revenue website at http://revenue.ky.gov .

This form does not include registration with the Secretary of State, Unemployment Insurance, or Workers’ Compensation Insurance. For assistance,

please contact those oces at the telephone numbers below.

Secretary of State (502) 564–3490 Unemployment Insurance (502) 564–2272 Workers’ Compensation (502) 564–5550

IRS—FEIN (800) 829–4933

For assistance with other questions about starting a business in Kentucky, including special licensing and permitting requirements, business structure registration,

employer responsibilities, and business development resources, call the Business Information Clearinghouse at 1–800–626–2250 or visit the Kentucky Business

One Stop website at http://onestop.ky.gov .

SECTION K COAL SEVERANCE/PROCESSING TAX ACCOUNT and/or COAL SELLER/PURCHASER CERTIFICATE ID #

Must be completed if you answered Yes to any of questions 56 through 58.

95.

Date mining/processing or coal brokering operations began

or will begin (REQUIRED)

/ /

c/o or Attn.

Address

City State Zip Code

Mailing Telephone Number County (if in Kentucky)

( ) –

94. A. Has a Coal Severance Tax Account and/or a Coal Seller/Purchaser Certicate ID # already been assigned to this business? Yes No

B. If Yes, list the Coal Severance Tax Account Number

C. If Yes, list the Coal Seller/Purchaser Certicate ID Number

96.

Coal Severance & Processing Tax mailing address:

Use the same address as your location address

Use the same address as _______________________ Tax Account

The statements contained in this application and any accompanying schedules are hereby certied to be correct to the best knowledge and belief of the

undersigned who is duly authorized to sign this application.

Signature: __________________________________________________ Printed Name: _______________________________________________

Phone Number: ______________________________________________ Title: ______________________ Date: ____/____/______

(mm/dd/yyyy)

IMPORTANT: THIS APPLICATION MUST BE SIGNED BELOW:

INSTRUCTIONS

INSTRUCTIONS

KENTUCKY TAX REGISTRATION APPLICATION

10A100(P)(11-23)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

WHAT IS THE PURPOSE OF THE KENTUCKY TAX REGISTRATION APPLICATION?

This application is used to apply for any of the following: Employer’s Withholding Tax Account, Sales and Use Tax Account/Permit,Transient Room Tax Account,

Motor Vehicle Tire Fee Account, Commercial Mobile Radio Service (CMRS) Prepaid Service Charge Account, Telecommunications Tax Account, Utility Gross

Receipts License Tax Account, Consumer’s Use Tax Account, Corporation Income Tax Account, Limited Liability Entity Tax Account, Kentucky Nonresident Income

Tax Withholding on Distributive Share Income Tax Account, Coal Severance and Processing Tax Account, and/or Coal Seller/Purchaser Certicate ID Number.

DO I HAVE ANY OTHER DEPARTMENT OF REVENUE TAX REGISTRATION REQUIREMENTS?

Depending on the product or service your business provides, there may be other state taxes that apply to your business. Most of these require that you le a

special application/registration. To register for Tobacco Tax, Minerals or Natural Gas Severance Tax, Motor Fuels Tax, or any other miscellaneous taxes

or fees administered by the Department of Revenue, visit the Department’s website at www.revenue.ky.gov .

I ALREADY HAVE TAX ACCOUNTS, HOW DO I UPDATE MY ACCOUNT INFORMATION?

Complete FORM 10A104, UPDATE OR CANCELLATION OF KENTUCKY TAX ACCOUNT(S), to update information; such as business name, location or mailing

addresses, phone numbers, accounting period, responsible party information, and to report a taxing election change with the Internal Revenue Service (IRS) or

to request cancellation of your accounts. Visit www.revenue.ky.gov to obtain the form.

You may also update certain business and tax account information for the Department of Revenue and the Kentucky Secretary of State’s Oce online. If you do

not already have online access to your business, follow the steps below.

1. Go to onestop.ky.gov .

2. Click on the Dashboard Login at the top right of the page.

Note: The One Stop Business Services login page provides information on creating a user account, as well as portal security. You will also nd overview

information for the services the portal currently provides. This information is updated regularly to reect new services and notify you when additional agencies

join the portal.

3. Welcome to the Kentucky Online Gateway. Select that you are a citizen or business partner and click Create Account.

4. Complete your Kentucky Online Gateway user account. Once a user account has been created, an e-mail will be sent to you with further instructions to

activate the account and login. You must use the activation link in the e-mail prior to logging in to your account.

5. Once logged in, launch the Kentucky Business One Stop App.

6. Go to the Link My Business option. Click on the link provided within that webpage to obtain the Commonwealth Business Identier (CBI) and the Security

Token for the business.

Note: You will be able to provide information to gain immediate access to the business or request a letter be mailed, which contains your CBI and Security

Token. To gain secure access to the portal, each business has been assigned a unique Security Token, which is an enhanced security feature of the portal.

7. Once you have the CBI and Security Token for the business, the Link My Business option will require you to name at least one “One-Stop Portal Business

Administrator.” (This should be the business owner or a representative from the business.)

Note: The administrator can then delegate access to other individuals—for example, an attorney, accountant or manager. The administrator also determines

the appropriate authority level for delegates to make changes—this could include changes such as ling annual reports with the Secretary of State’s Oce,

changing the business address, or ling and paying taxes. Only the One Stop business administrator(s) can grant, approve, withdraw or revoke access to

the business.

For more information about registering and using the portal, visit onestop.ky.gov . For questions, please call the Kentucky Business One Stop Help Line at

(502) 564-5053.

WHO CAN I CALL WITH QUESTIONS ABOUT REGISTRATION?

For help completing the application, please call the Division of Registration at (502) 564-3306, Monday through Friday between the hours of 8:00

a.m. and 5:00 p.m., Eastern Time.

You may also use the Telecommunications Device for the Deaf, (502) 564-3058.

The Department of Revenue has an Ombudsman who serves as your advocate and is available to make sure your rights are protected. You may contact the

Ombudsman at (502) 564-7822.

WHEN SHOULD I FILE MY APPLICATION?

You are required to complete the application and le it with the Kentucky Department of Revenue at least 30 days before engaging in an activity that requires

the establishment of the following:

n Employer’s Withholding Tax Account (KRS 141.310) n Consumer’s Use Tax Account (KRS 139.310)

n Sales and Use Tax Account (KRS 139.200, 139.240) n Utility Gross Receipts License Tax Account (KRS 160.613)

n Transient Room Tax Account (KRS 142.400) n Telecommunications Tax Account (KRS 136.614 and 136.616)

n Motor Vehicle Tire Fee Account (KRS 224.50-868) n Coal Seller/Purchaser Certicate ID Number (KRS 143.037)

n Commercial Mobile Radio Service Prepaid Service Charge Account (KRS 65.7634)

10A100(P)(11-23) Page 2

Pass-Through Entities must complete the application to establish a Kentucky Nonresident Income Tax Withholding on Distributive Share Income Tax Account

(KRS 141.206) within 30 days of obtaining a Kentucky non-resident individual or corporate partner, member, or shareholder.

Corporations and Limited Liability Entities must complete the application to establish a Corporation Income Tax Account and/or a Limited Liability Entity Tax

Account (KRS 141.040, 141.0401):

IS MY APPLICATION COMPLETE?

Your application will not be considered complete unless it includes all required information specied on the form. This includes, but is not limited to, a Federal

Employer Identication Number and accurate Social Security Number(s), as appropriate. You are required to provide your Social Security Number on tax forms

per Section 405, Title 42, of the United States Code. This information will be used to establish your identity for tax purposes.

WHAT PENALTIES APPLY?

Failure to complete and le the required application in the specied time frames listed above shall subject you to applicable penalties as provided in

KRS 131.180.

HOW LONG WILL IT TAKE FOR MY ACCOUNT NUMBERS TO BE ASSIGNED?

Fully completed paper applications will be processed, barring seasonal workload increases, within 5 to 10 business days. Applications with missing or unclear

information requiring additional research may take longer. Those with extensive amounts of missing information will be returned by mail for further completion.

For faster service, apply online at onestop.ky.gov .

Note: If your business structure is not available as a selection online, you must submit a completed Kentucky Tax Registration Application by mail, fax, or e-mail.

LINE BY LINE APPLICATION INSTRUCTIONS

SECTION A—REASON FOR COMPLETING THIS APPLICATION

1. Eective Date—Enter the eective date of the reason you are completing this application. Check the box which corresponds to why the application is

being completed.

• Opened New Business, Began Activity in Kentucky, Resumption of Business, Hired Employees Working Outside Kentucky Who Have a

Kentucky Residence—Complete Sections A, B, and C to determine the accounts for which you are required to apply. For Resumption of Business, list

your previous account numbers in Section A, question 3.

• Applying for Other Accounts, Began a New Taxable Activity—If you require an account type that is not currently assigned to your business, complete

Sections A, B, and C to determine the additional accounts for which you are required to apply. If the questions in Section C lead you to complete a

Section for an account type you already have, write your current account number in the eld provided within the Section you are completing.

• Bidding for State Government Contract (State Vendor or Aliates)—Any vendor who contracts to sell, install, or provide services to the Commonwealth

of Kentucky or one of its agencies, or any aliate of a company who contracts to sell, install, or provide services to the Commonwealth, is required to

register for Kentucky Sales and Use Tax per KRS Chapter 45A, and collect and remit the Sales and Use Tax imposed by KRS Chapter 139. Complete

Sections A, B, and C to determine the accounts for which you are required to apply.

• Purchased an Existing Business—(This will include a business previously owned by a family member.)

If you are...

Kentucky formed

Formed out-of-state and you have obtained a Certicate of Authority to

transact business in Kentucky from the Kentucky Secretary of State

Formed out-of-state and you have NOT obtained a Certicate of Authority

to transact business in Kentucky from the Kentucky Secretary of State

Then your application should be led...

Within 30 days of formation with the Kentucky Secretary of State’s Oce

Within 30 days of obtaining a certicate of authority, provided that you

are treated as doing business in Kentucky under KRS Chapter 141

Within 30 days of rst engaging in activities that result in you being

treated as doing business in Kentucky under KRS Chapter 141

Note to persons buying a business: Any person buying a business may incur a sales tax liability on the purchase of the business assets or become personally

liable for the prior sales tax liability of the seller. It may be necessary for the purchaser to withhold a part of the sales price until verication has been furnished

by the seller that tax liabilities have been paid or do not exist. Therefore, it is important that anyone purchasing a business obtain a copy of Kentucky Revised

Statutes 139.670 and 139.680 to determine the tax consequences and potential liability in such transactions. Copies are available at www.revenue.ky.gov, by

writing the Oce of Sales and Excise Taxes, Department of Revenue, P.O. Box 181, Station 67, Frankfort, Kentucky 40602-0181, or by calling (502) 564-5170.

• Business Structure Change or Conversion, Change in Federal Identication Number (FEIN), Change in Kentucky Secretary of State Organization

Number, or Change in Commonwealth Business Identier (CBI)—A business may change its taxing election with the Internal Revenue Service

(IRS) and retain the same Kentucky tax account numbers. However, any change to an entity’s business structure, Federal Identication Number (FEIN),

Kentucky Secretary of State Organization Number, or Commonwealth Business Identier (CBI) requires that new accounts be applied for with the

Department of Revenue.

To change a taxing election, use Form 10A104, Update or Cancellation of Kentucky Tax Account(s), to provide the updated business and responsible

party information.

For all other business structure changes or conversions, for receiving a new Federal Identication Number (FEIN), for receiving a new Kentucky

Secretary of State Organization Number, or for receiving a new Commonwealth Business Identier (CBI), you must apply for new Kentucky tax

account numbers. List your old account numbers in Section A, question 3, and complete Sections A, B and C to determine the account(s) for which

you are required to re-apply.

Examples of conversions requiring a business apply for new accounts are:

n A Sole Proprietorship converting to a General Partnership and vice versa,

n A Corporation converting to a Limited Liability Company (LLC) and vice versa,

n A Limited Liability Company (LLC) converting to a Statutory Trust and vice versa, or

n Any ownership type converting to a Limited Liability Company (LLC) and vice versa.

2. Did you receive correspondence from the Division of Registration and Data Integrity—If you received a letter(s) requesting registration, check Yes and

list the File Number(s) from the letter in B. If No, leave B blank.

3. Previous Kentucky Account Numbers—If you have purchased an existing business, list the previous owner’s accounts, if available. If your current business

has changed business structures, received a new Federal Identication Number (FEIN), received a new Kentucky Secretary of State Organization Number, or

a new Commonwealth Business Identier (CBI) and your company must apply for new accounts or you have resumed an old business, list your old accounts

in Section A, question 3. A request in writing from the previous owner is required to cancel previous accounts.

10A100(P)(11-23) Page 3

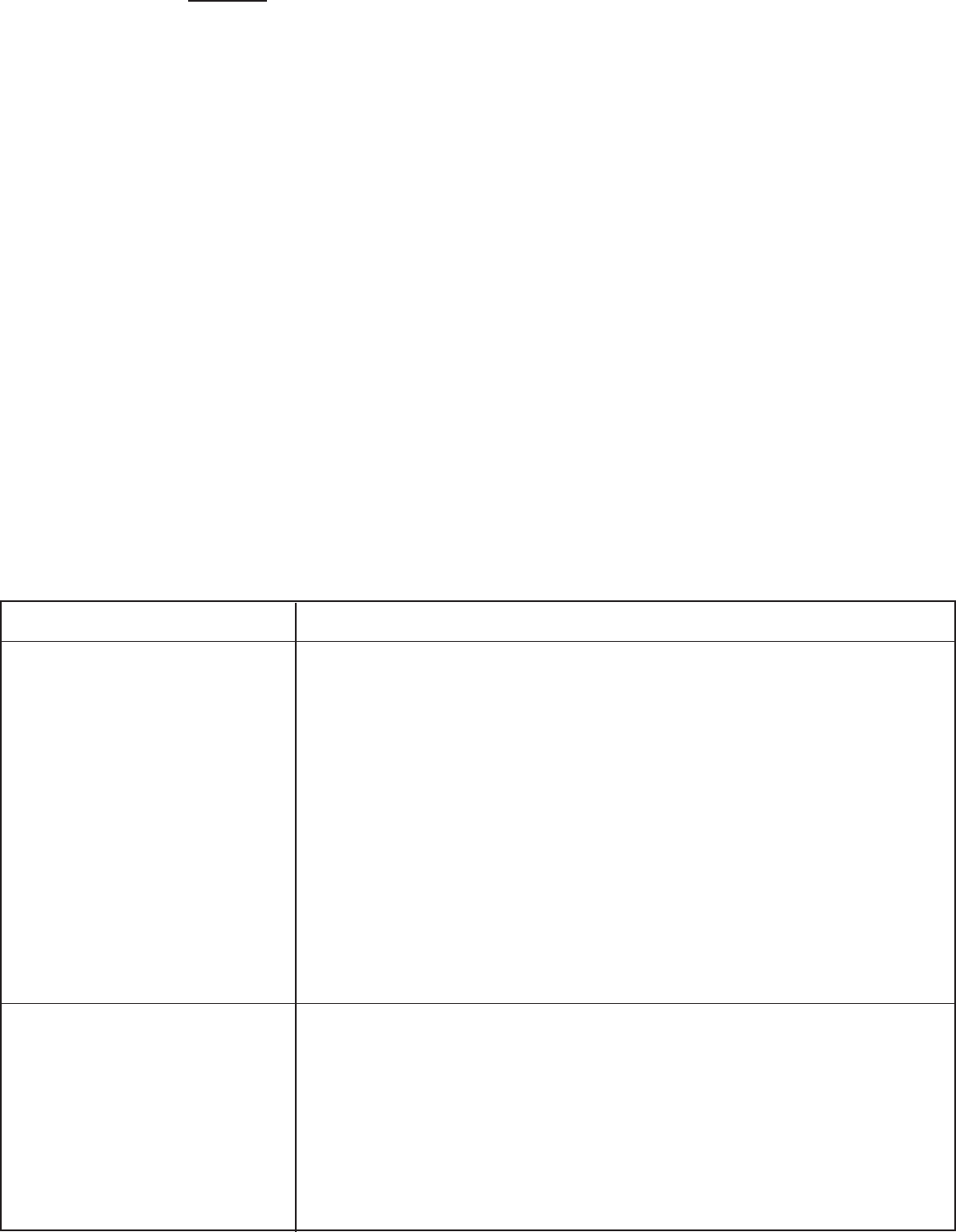

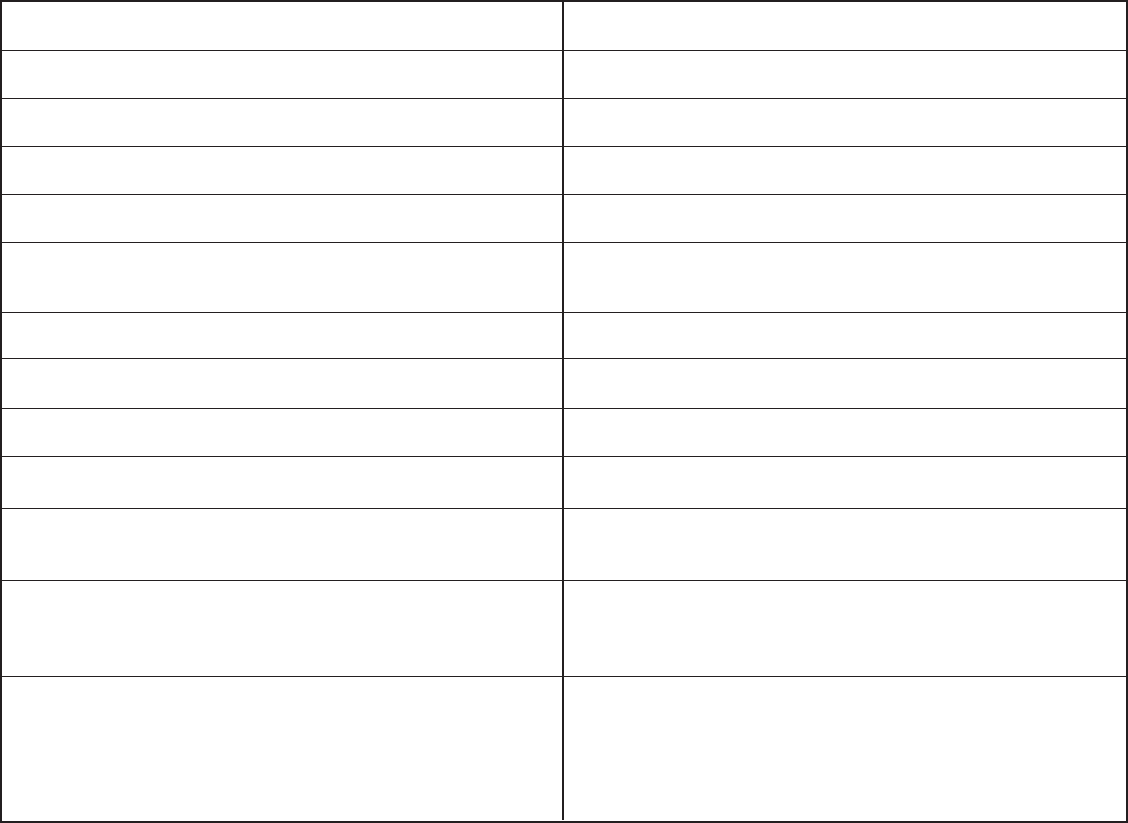

If the business you purchased was a... Then...

n

Sole Proprietorship

n Joint Venture

n Qualied Joint Venture

n General Partnership

n Series of a Statutory Trust

n Limited Partnership (LP)

n Limited Liability Partnership (LLP)

n Limited Liability Limited Partnership (LLLP)

n Series of a Partnership

n Series of a Limited Liability Company (LLC)

n Protected Cell Company (PCC)

n Prot Corporation

n Prot Limited Liability Company (LLC)

n Professional Service Corporation (PSC)

n Professional Limited Liability Company (PLLC)

n Public Benet Corporation

n Association

n Cooperative Corporation

n Limited Cooperative Association

n Statutory Trust

n Business Trust

n Trust (non-statutory)

n Non-Prot Corporation

n Non-Prot Limited Liability Company (LLC)

n Unincorporated Non-Prot Association

You will need to apply for new accounts. List the previous owner’s

accounts in Section A, question 3, and complete Sections B and C to

determine the account(s) for which you are required to re-apply.

If the business structure, Federal Identi cation Number (FEIN), Secretar y

of State Organization Number, and Commonwealth Business Identier

(CBI) will all stay the same, DO NOT use the Kentucky Tax Registration

Application. Use Form 10A104, Update or Cancellation of Kentucky

Tax Account(s), to provide the updated business and responsible party

information or update your information online.

If:

–you are converting the purchased business to a new business structure,

or

–the Federal Identication Number (FEIN) has changed, or

–the Secretary of State Organization Number has changed, or

–the Commonwealth Business Identier (CBI) has changed,

you will need to apply for new accounts. List the previous owner’s

accounts in Section A, question 3, and complete Sections B and C to

determine the account(s) for which you are required to re-apply.

SECTION B—BUSINESS / RESPONSIBLE PARTY / CONTACT INFORMATION

4. Legal Business Name—Enter the complete legal business name for your business or organization.

Note: If the business is a Sole Proprietorship, do not include your personal name unless it is a part of the business name or you do not have a business

name. For example: John Smith’s Plumbing.

If the business is a Home Care Service Recipient (HCSR), the name of the business should be the rst, middle and last name of the disabled or elderly

individual with the acronym “HCSR” added to the end of the name. For example: “John Q Public HCSR”.

5. Doing Business As (DBA)—If your business or organization has a “doing business as” name, enter the name.

6. Federal Employer Identication Number (FEIN)—Enter the FEIN assigned to your business or organization by the Internal Revenue Service. If you are a

disregarded entity that is operating under your parent’s FEIN, DO NOT list your parent’s/member’s FEIN.

10A100(P)(11-23) Page 4

Business Structure Basic Denition

Prot Corporation

Non-Prot Corporation

Professional Service Corporation (PSC)

Public Benet Corporation

An organization chartered by law and recognized as having a legal existence as an entity separate from

its owners. It operates under the direction of duly elected ocers.

A Non-Prot Corporation is a special type of corporation formed for educational, charitable, social, religious,

civic, or humanitarian purposes.

A PSC is a special type of corporation formed to engage in specic types of licensed professional services

such as law, medicine, architecture, accounting, engineering, etc.

Prot Limited Liability Company (LLC)

Non-Prot Limited Liability Company

(LLC)

Professional Limited Liability Company

(PLLC)

Series of a Limited Liability Company

An organization of individuals chartered by law and operating under the direction of members or managers.

For US federal taxation purposes an LLC can be taxed as a single member disregarded entity, partnership,

or a corporation.

A Non-Prot LLC is a special type of LLC formed for educational, charitable, social, religious, civic or

humanitarian purposes.

A PLLC is a special type of LLC formed to engage in specic types of licensed professional services such

as law, medicine, architecture, accounting, engineering, etc.

Some states’ laws allow for the formation of Series underneath a main or master LLC, which has separate

rights, powers, or duties, or has a separate purpose or investment objective.

Each LLC which has a Series should register each of its separate Series which do business in Kentucky

with the Kentucky Secretary of State’s Oce as an assumed name.

For Kentucky Department of Revenue purposes, each Series within an LLC must register for its own

separate Corporation Income Tax and/or Limited Liability Entity Tax Account, unless it has chosen a

disregarded status.

Apply for a FEIN online at www.irs.gov or contact the IRS at (800) 829-4933. Sole Proprietorships and Disregarded Entities that do not have employees or

le certain federal excise tax returns may not be required to hold a FEIN for federal purposes. However, all businesses applying for Kentucky tax accounts

are encouraged to obtain a FEIN. A FEIN helps distinguish a business from others with similar names, and for certain documents, may be an alternative to

using a personal Social Security Number.

7. Kentucky Commonwealth Business Identier (CBI)—If your business has already been assigned a CBI, enter that 10-digit number. This number is used

to uniquely identify your business for the Kentucky One Stop Portal across all state agencies that utilize the portal.

8. Secretary of State Information—Sole Proprietorships, Estates, HCSRs, Governments, Unincorporated Non-Prot Associations, Unincorporated Associations,

Qualied Joint Ventures, and Non-statutory Trusts are not required to register with the Kentucky Secretary of State. General Partnerships or Joint Ventures

who do not operate using a DBA or Assumed Name are not required to register with the Kentucky Secretary of State.

For all remaining entities, enter the Organization Number assigned to your entity by the Kentucky Secretary of State’s Oce. Enter your date of incorporation/

organization and list the state in which you incorporated/organized. If an out-of-state entity, list the date you qualied with the Kentucky Secretary of State’s

Oce to do business in Kentucky.

9. Primary Business Location—List the street address, city, state and ZIP Code for the location for which you are requesting registration. Do not list a P.O.

Box for a business location address. For out-of-state businesses that do not have a Kentucky location, use the principal location address in your home state.

If your location is in Kentucky, enter county name. If out-of-state, leave county blank. Enter the telephone number for the listed location; include the area

code.

10. Business Operations are Primarily—Check the box where your business is primarily operated.

11. Accounting Period—Check the box that corresponds to when your business or organization’s accounting period ends. If you choose the scal year ling

box, enter the month and day when your year ends. If you choose the 52/53 week calendar year box, enter the month and day of the week your year ends.

If you choose the 52/53 week scal year box, enter the month and day of the week your year ends.

Note: Most businesses operate under a calendar year basis (year end December 31).

12. Accounting Method—Check the box corresponding to the accounting method your company uses.

Cash Basis—The business elects to report receipts in the accounting period that payment is actually or constructively received from the customer, even

though the customer may take possession of the product before actually paying for it.

Accrual Basis—The business elects to report receipts in the accounting period that the sale actually occurs, regardless of when the customer makes payment

for such purchases.

13. Business Structure—Check the box for the organizational structure type you have selected for your business. If “Other” selected, enter the structure type

on the blank provided.

A Public Benet Corporation is a special type of corporation created to perform a specic function for the

benet of the public.

Business Structure Basic Denition

Sole Proprietorship

One single person owning and/or operating a business, solely responsible for all debts and liabilities

incurred by the business.

General Partnership

Two or more individuals owning and/or operating a business. All partners jointly share prots and losses

and are individually responsible for debts incurred.

Joint Venture

A business entity that is generally short lived, frequently common to construction related activities,

where two or more individuals or businesses come together temporarily to participate in a prot making

activity. Usually, each partner specializes in a specic eld of expertise or has resources not available

to the other partner(s).

Estate

The total property, real and personal, that was owned by an individual, now deceased, before distribution

through a trust or will.

Government

City, county, state, and federal agencies.

Unincorporated Non-Prot

Association

An unincorporated informal group of members who come together to perform some social good conducted

for nonprot purposes. Per KRS 273A.005(6), “Nonprot purposes” means any one (1) or more of

the following purposes: charitable, benevolent eleemosynary, educational, civic, patriotic, political,

governmental, religious, social, recreational, fraternal, literary, cultural, athletic, scientic, agricultural,

horticultural, animal husbandry, and professional commercial, industrial, or trade association, but shall

not include labor unions, cooperative organizations, and organizations subject to any of the provisions

of the insurance laws or banking laws of this state which may not be organized under this chapter.

Trust (Non-statutory)

Business Trust

Statutory Trust

Series of a Statutory Trust

A legal entity that acts as duciary, agent or trustee on behalf of a person or business entity for the purpose

of administration, management and the eventual transfer of assets to a benecial party.

A Statutory Trust must register as such with the Kentucky Secretary of State’s Oce.

A Series of a Statutory Trust is a Series established by a Statutory Trust, which has separate rights, powers,

or duties, or has a separate purpose or investment objective. Each Statutory Trust should register each of

its separate Series with the Kentucky Secretary of State’s Oce as an assumed name. (KRS 386A.4-010)

For Kentucky purposes, Statutory Trusts and Series of Statutory Trusts are subject to the Limited Liability

Entity Tax.

For Kentucky Department of Revenue purposes, each Series within a Statutory Trust must register for its

own separate Limited Liability Entity Tax Account, unless it has chosen a disregarded status.

Limited Partnership (LP)

Limited Liability Partnership (LLP)

Limited Liability Limited Partnership

(LLLP)

Series of a Partnership

A partnership formed by two or more persons having one or more general partners and one or more

limited partners. The limited partner(s) have restricted liability for the business debts, while the general

partner(s) are fully liable. Limited liability will only be recognized for partnerships registered as a limited

partnership through a state’s Secretary of State’s Oce.

Some states’ laws allow for the formation of Series underneath the main or master Partnership, which

has separate rights, powers, or duties, or has a separate purpose or investment objective.

Each Partnership which has a Series should register each of its separate Series which do business in

Kentucky with the Kentucky Secretary of State’s Oce as an assumed name.

For Kentucky Department of Revenue purposes, each Series within a Partnership must register for its

own separate Limited Liability Entity Tax Account, unless it has chosen a disregarded status.

10A100(P)(11-23) Page 5

Association

An association is an unincorporated group joined together for a common purpose. However, associations

may be treated as corporations for Kentucky tax purposes.

Cooperative Corporation

Limited Cooperative Association

A group of individuals known as patrons who have supplied their own capital at their own risk, who

democratically direct and manage the enterprise, and who themselves receive the fruits of their

cooperative endeavors, through the allocation of the excess among themselves. In general, Cooperatives

are treated as corporations for Kentucky tax purposes.

Limited C ooperative Assoc iations must register as such with the Kentuc ky Secretar y of State’s O ce. This

business structure allows for investor members in addition to patron members. For Kentucky purposes,

Limited Cooperative Associations are also subject to the Limited Liability Entity Tax.

Business Structure Basic Denition

Qualied Joint Venture

A business jointly owned and operated by a married couple who are electing to have the business not

treated as a general partnership for federal tax purposes. Spouses electing qualied joint venture status

are treated as sole proprietors for federal tax purposes.

Other

Any ownership not elsewhere classied.

14. How will You be Taxed for Federal Purposes? Indicate how this business will be treated for federal purposes. If “Single Member Disregarded Entity, Other”

is selected, list what type of entity the single member is and how it is taxed.

10A100(P)(11-23) Page 6

15-16.

Ownership Disclosure—Responsible Parties—Enter the full legal name, Social Security Number (required if responsible party is an individual), FEIN

(if responsible party is another business), driver’s license number, driver’s license state of issuance, residence address, city, state, ZIP Code, telephone

number, county (if in Kentucky), business title and the date for when the title became eective for the information that corresponds to your business structure.

Note: Social Security Numbers for responsible parties are required (KRS 131.180(3)). Also, you are required to provide your Social Security Number

on tax forms per Section 405, Title 42, of the United States Code. This information will be used to establish your identity for tax purposes.

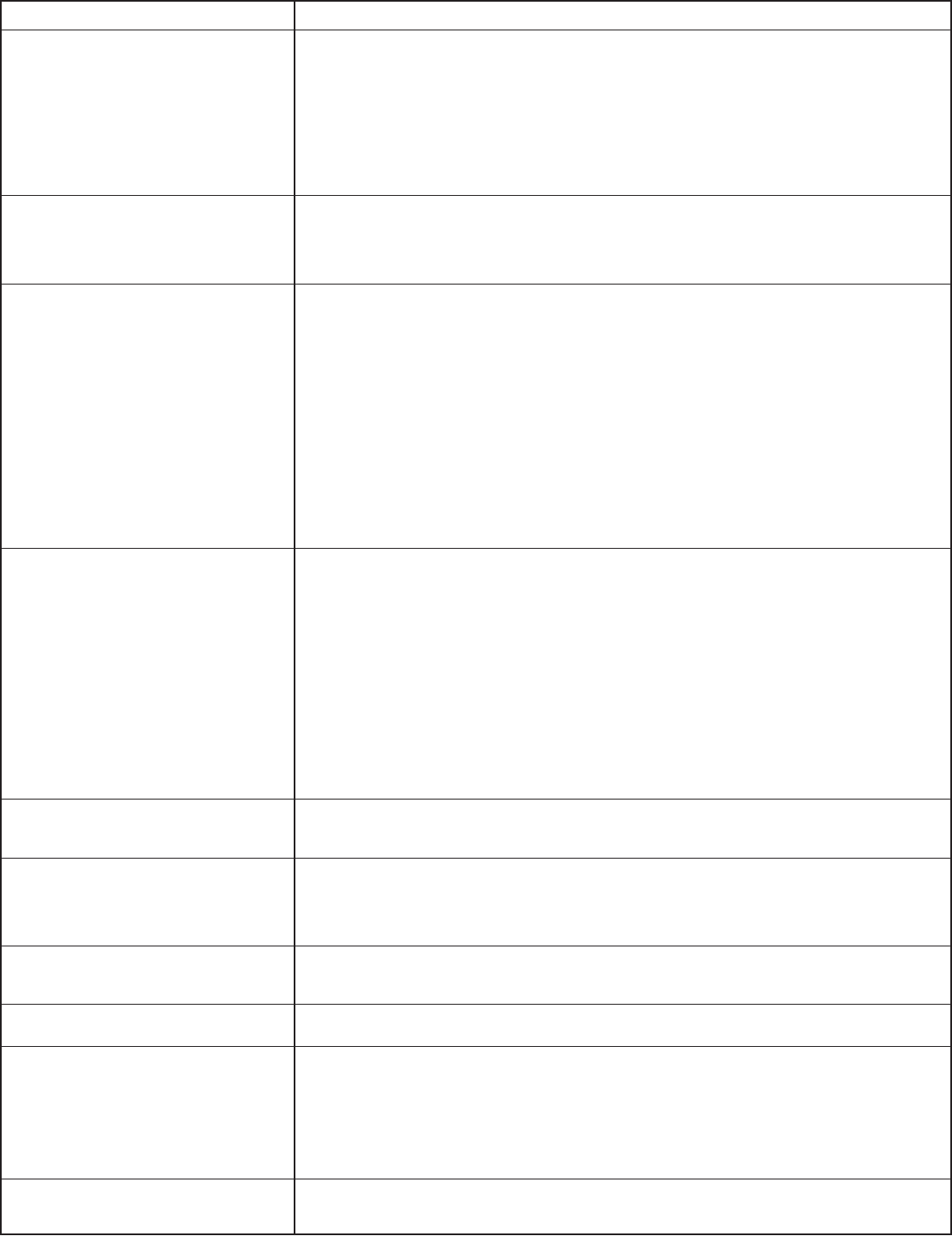

If your Business Structure is... Then the required Ownership/Responsible Party disclosure is...

n

Sole Proprietorship

n Prot Limited Liability Company (LLC) for Federal Purposes Taxed as

an Individual Sole Proprietorship

n Professional Limited Liability Company (PLLC) for Federal Purposes

Taxed as an Individual Sole Proprietorship

n Non-Prot Limited Liability Company (LLC) for Federal Purposes

Taxed as an Individual Sole Proprietorship

Enter owner’s individual information, including Social Security Number, in

question 15.

Do not use name abbreviations or nicknames.

n

Prot Limited Liability Company (LLC) for Federal Purposes Taxed as

a Single Member Disregarded Entity

n Professional Limited Liability Company (PLLC) for Federal Purposes

Taxed as a Single Member Disregarded Entity

n Non-Prot Limited Liability Company (LLC) for Federal Purposes

Taxed as a Single Member Disregarded Entity

Enter the single member’s company information, including FEIN, in question

15.

If the LLC has managers, their full individual information can be entered in

question 16. Attach a separate sheet for more LLC managers.

n

Qualied Joint Venture

Enter the information for the married couple, including Social Security

Numbers, in question 15 and 16.

Do not use name abbreviations or nicknames.

n

Unincorporated Non-Prot Association

Enter the members’/managers’ information in questions 15 and 16. If

members/managers are individuals, provide their Social Security Numbers.

If members/managers are other businesses, provide their FEINs.

If more than two members/managers, attach a separate sheet.

n

Prot Corporation

n Professional Service Corporation (PSC)

n Public Benet Corporation

n Association

n Cooperative Corporation

n Limited Cooperative Association

n Non-Prot Corporation

n Government

Enter the officers’ information, including Social Security Numbers in

questions 15 and 16. If more than two ocers, attach a separate sheet.

Note: Information for the President is required. The information for an Ocer

must be for an individual and not another business.

n

Statutory Trust

n Series of a Statutory Trust

n Business Trust

n Trust (non-statutory)

Enter the trustee information in questions 15 and 16. If trustees are

individuals, provide their Social Security Numbers. If trustees are other

businesses, provide their FEINs. If more than two trustees, attach a

separate sheet.

For a Series of a Statutory Trust, also provide the information for the master

Statutory Trust under which it was formed, including the FEIN for the master

Statutory Trust.

Home Care Service Recipient (HCSR)

A disabled or elderly individual participating in an in-home domestic services program administered by

a state or local agency where all or part of the services received are paid for with funds supplied by the

federal, state, or local government.

A Federal Identication Number (FEIN) is issued in the name of the disabled or elderly individual (Service

Recipient) as the employer. The Service Recipient or their family designates an agent to report, le, and

pay employment taxes on the Service Recipient’s behalf.

10A100(P)(11-23) Page 7

If your Business Structure is... Then the required Ownership/Responsible Party disclosure is...

n

Estate

Enter the information for the estate administrator, including Social Security

Number, in question 15.

n

Home Care Service Recipient (HCSR)

Enter the information, including FEIN, for the agent that has been designated

to report, le, and pay employment taxes on the Service Recipient’s behalf

in question 15. The business title for the agent should be listed as “HCSR

Agent”.

HCSR Agents are not liable for debts of the HCSR business and are

processing agents only.

17. Person to contact about this application— Enter the name, title, daytime telephone number, extension, and e-mail address for the person to contact with

questions about this application.

Enter the information for the master Partnership or master Limited Liability

Company, including FEIN, in question 15.

If the Series of the LLC has managers, their full individual information can

be entered in question 16. Attach a separate sheet for more LLC managers

of the Series.

n

Series of a Partnership

n Series of a Limited Liability Company

SECTION C—TELL US ABOUT YOUR BUSINESS OR ORGANIZATION—Answer questions 18 through 58 to determine accounts for which your business

or organization is required to apply.

18a. Business Activity Description—Give a description of the nature of your Kentucky business activity, including a description of any services provided.

18b. Products Sold in Kentucky—List any products sold in Kentucky.

18c. Current list of NAICS codes can be found at https://www.census.gov/naics

19. An employee is anyone to whom you pay wages, including part-time help and family members (KRS 141.010, 103 KAR 18:010 and 103 KAR 18:070).

Kentucky corporate ocers who receive compensation, other than dividends, are legally considered employees for withholding purposes (KRS 141.010).

20. Kentucky withholding is not required from wages of Kentucky residents that work entirely outside the state, but your business may choose to voluntarily

register to withhold.

21. Kentucky withholding is not required from payments of pensions/retirements, but your business may choose to voluntarily register to withhold.

22. If your business is required to withhold federal tax on gaming payouts made to Kentucky residents, then it will also be required to withhold Kentucky tax.

The business is required to obtain an Employer’s Withholding Tax Account for reporting and paying the Kentucky withholding.

23. All businesses or organizations making regular and continuous sales of Tangible Property or Digital Property within Kentucky, including those via Internet

and at ea markets or antique malls, are required to register for a Sales and Use Tax Account.

Tangible Personal Property (KRS 139.010(46)) “means personal property which may be seen, weighed, measured, felt or touched, or which is in any

way or manner perceptible to the senses, and includes natural, articial, and mixed gas, electricity, water, steam, and prewritten computer software.”

Digital Property (KRS 139.010(11)) “means any of the following which is transferred electronically: digital audio works, digital books, nished artwork,

digital photographs, periodicals, newspapers, magazines, video greeting cards, audio greeting cards, video games, electronic games, or any digital code

related to this property. Digital Property does not include audio-visual works or satellite radio programming.”

n

Joint Venture

n General Partnership

n Limited Partnership (LP)

n Limited Liability Partnership (LLP)

n Limited Liability Limited Partnership (LLLP)

n Limited Liability Company (LLC) for Federal Purposes Taxed as Other

Than Disregarded

n Professional Limited Liability Company (PLLC) for Federal Purposes

Taxed as Other Than Disregarded

n Non-Prot Limited Liability Company (LLC) for Federal Purposes

Taxed as Other Than Disregarded

Enter the partners’/members’ information in questions 15 and 16. If partners/

members are individuals, provide their Social Security Numbers. If partners/

members are other businesses, provide their FEINs.

If more than two partners/members, attach a separate sheet.

Note:

For any entity taxed as a partnership at least two partners/members

must be listed.

10A100(P)(11-23) Page 8

24. A repairer or reconditioner of tangible property is a retailer of parts and materials furnished in connection with repair work and as such must collect Sales

and Use Tax (103 KAR 27:150).

25. Charges, including labor charges, for producing, fabricating, processing, printing, or imprinting tangible property are subject to Sales and Use Tax (103 KAR

27:130 and 103 KAR 28:030).

26. Beginning July 1, 2018, the amount charged for labor or services rendered in installing or applying the tangible personal property, digital property, or service

sold is subject to Sales and Use Tax (KRS 139.010(17)(a)(6)).

27a. Beginning July 1, 2018, the collection of Sales and Use Tax is required on the following services (KRS 139.200(2)(g-o)).

Landscaping services, including but not limited to:

n Lawn care and maintenance services

n Tree trimming, pruning or removal services

n Landscape design and installation services

n Landscape care and maintenance services

n Snow plowing or removal services

Janitorial services, including but not limited to:

n Residential and commercial cleaning services

n Carpet, upholstery, and window cleaning services

Small animal veterinary services, excluding veterinary services for equine,

cattle, poultry, swine, sheep, goats, llamas, alpacas, ratite birds, bualo,

and cervids.

Pet care services, including but not limited to:

n

Grooming and boarding services

n Pet sitting services

n Pet obedience or training services

Industrial laundry services, including but not limited to:

n Industrial uniform supply services

n Protective apparel supply services

n Industrial mat and rug supply services

Linen supply services, including but not limited to:

n Table and bed linen supply services

n Non-industrial uniform supply services

Indoor skin tanning services, including but not limited to:

n Tanning booth or tanning bed services

n Spray tanning services

Non-medical diet and weight reducing services

Non-coin operated laundry and dry cleaning services

Photography and photo nishing services

n Taking, developing, or printing of an original photograph

n Image editing, composite image creation, formatting, watermarking

printing, and delivery of an original photograph in the form of tangible

personal property, digital property, or other media

n Excludes services necessary for medical or dental health

Private mailroom services

n Presorting mail and packages by postal code

n Address bar coding

n Tracking

n Delivery to postal services

n Private mailbox rentals

Public opinion and research polling services

Telemarketing services

n Services provided via telephone, facsimile, electronic mail, text

messages, or other modes of communications to another person, which

are unsolicited by that person, for the purposes of promoting products

or services, taking orders, providing information or assistance regarding

the products or services, or soliciting contributions

Rental of space for meetings, conventions, short-term business uses,

entertainment events, weddings, banquets, parties, and other short-term

social events

Leisure, recreational and athletic instructional services

Social event planning and coordination services

27b. Beginning January 1, 2023, the collection of Sales and Use Tax is required on the following services (KRS 139.200 (2) (q) – (ax)).

28. Beginning July 1, 2018, the sale of an extended warranty on tangible or digital property is subject to Sales and Use Tax (KRS 139.200((2)(p)).

Beginning July 1, 2019, extended warranty services do not include the sale of a service contract agreement for tangible personal property to be used by a

small telephone utility or a Tier III CMRS provider (KRS 139.010(15)(b)).

Beginning January 1, 2023, the denition for extended warranty services includes extended warranty contracts for real property and all extended warranty

contracts for tangible personal property and digital property regardless of whether the property itself is taxable or exempt.

29. Rental of tangible property or digital property is a taxable activity. Additionally, if you have formed a separate business to hold title to equipment, machinery, or

other tangible property or digital property for lease back to another business you own, you will be required to charge Sales and Use Tax on those transactions

(103 KAR 28:051).

30. Beginning July 1, 2018, admissions paid for the right of entrance to an entertainment or amusement event or venue are subject to Sales and Use Tax, except

admission to racetracks taxed under KRS 138.480, admission to historical sites exempt under KRS 139.482, admission taxed under KRS 229.031, unarmed

combat show not licensed under KRS 229.061. Initiation fees, monthly fees, and membership fees paid for the use of a facility or participating in an event or

activity, regardless of whether the fee is paid per use or in any other form, are subject to Sales and Use Tax (KRS139.010 (1)).

Beginning March 26, 2019, admissions charged by nonprot educational, charitable, religious institutions, non-prot civic, government or other non-prot

organizations are exempt from Sales and Use Tax (KRS 139.200(2)(c)).

Beginning July 1, 2019, admissions paid to enter or participate in a shing tournament, and any fee paid for the use of a boat ramp for the purposes of allowing

boats to be launched into or hauled out from water are exempt from Sales and Use Tax (KRS 139.010(1)(b)).

Beginning August 1, 2020, all golf course admissions are subject to sales tax whether sold by a for-prot or a non-prot entity, unless for fundraising event

by a non-prot entity (KRS 139.498).