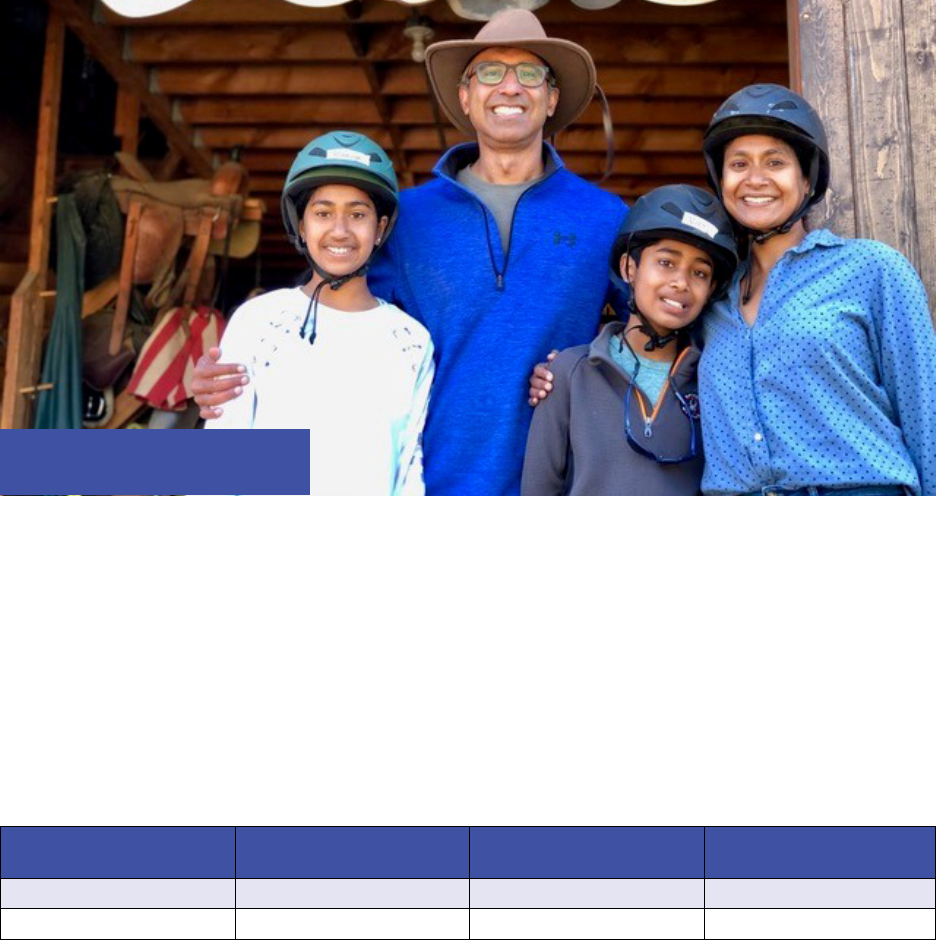

Credit: White Stallion Ranch

US Family Travel

Survey 2021

Family Travel Association

Dr. Lynn Minnaert

Jonathan M. Tisch Center of Hospitality

NYU School of Professional Studies

With generous support provided by:

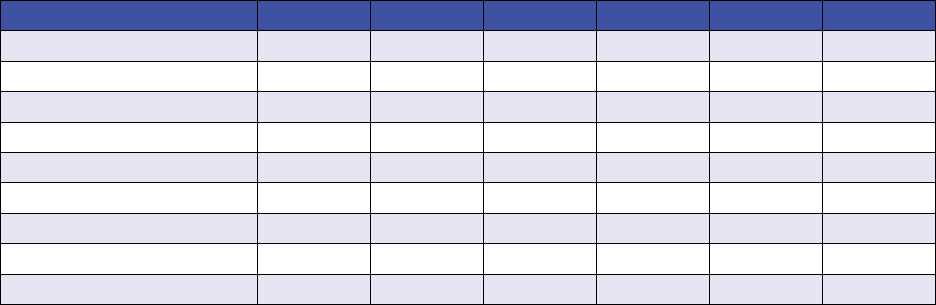

TABLE OF CONTENTS

Introduction .....................................................3

Study Highlights

.................................................5

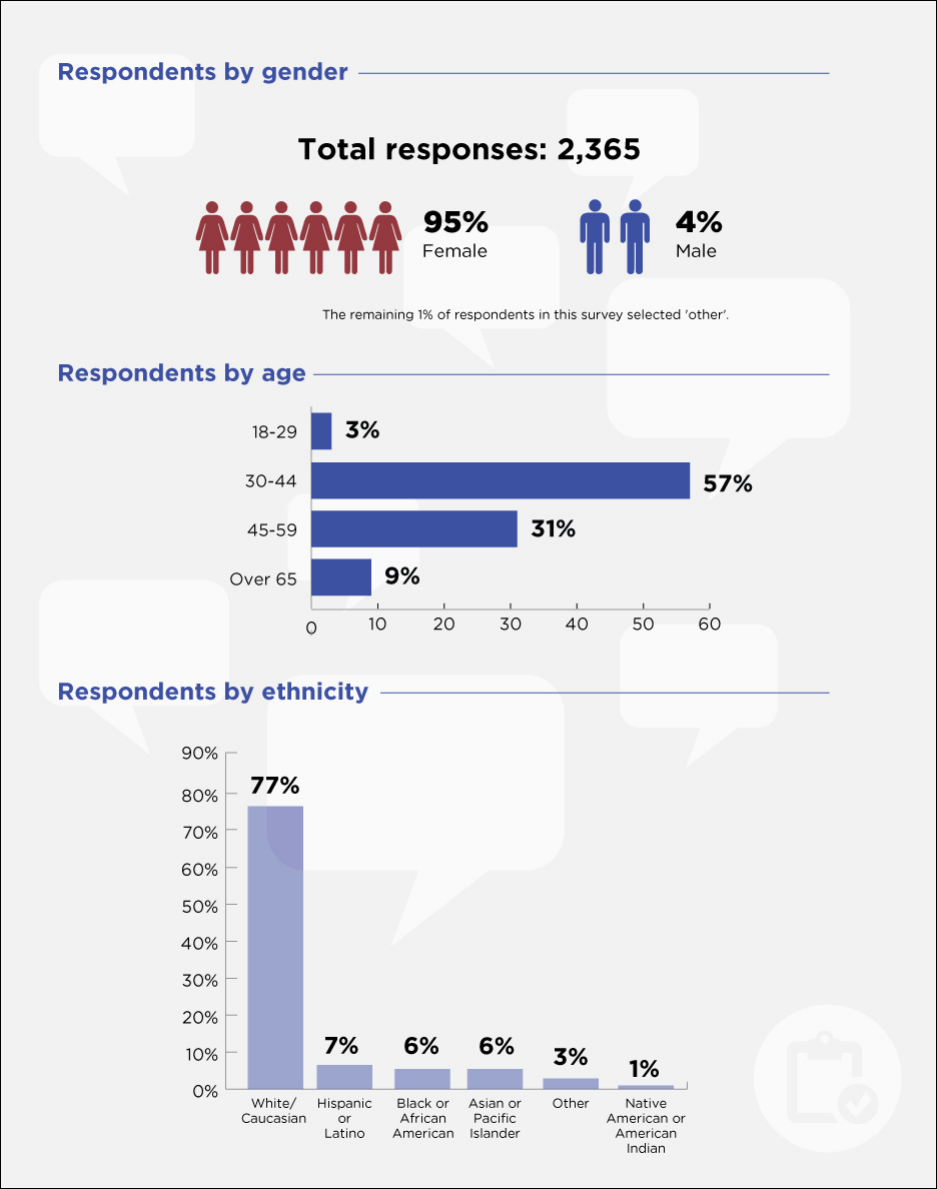

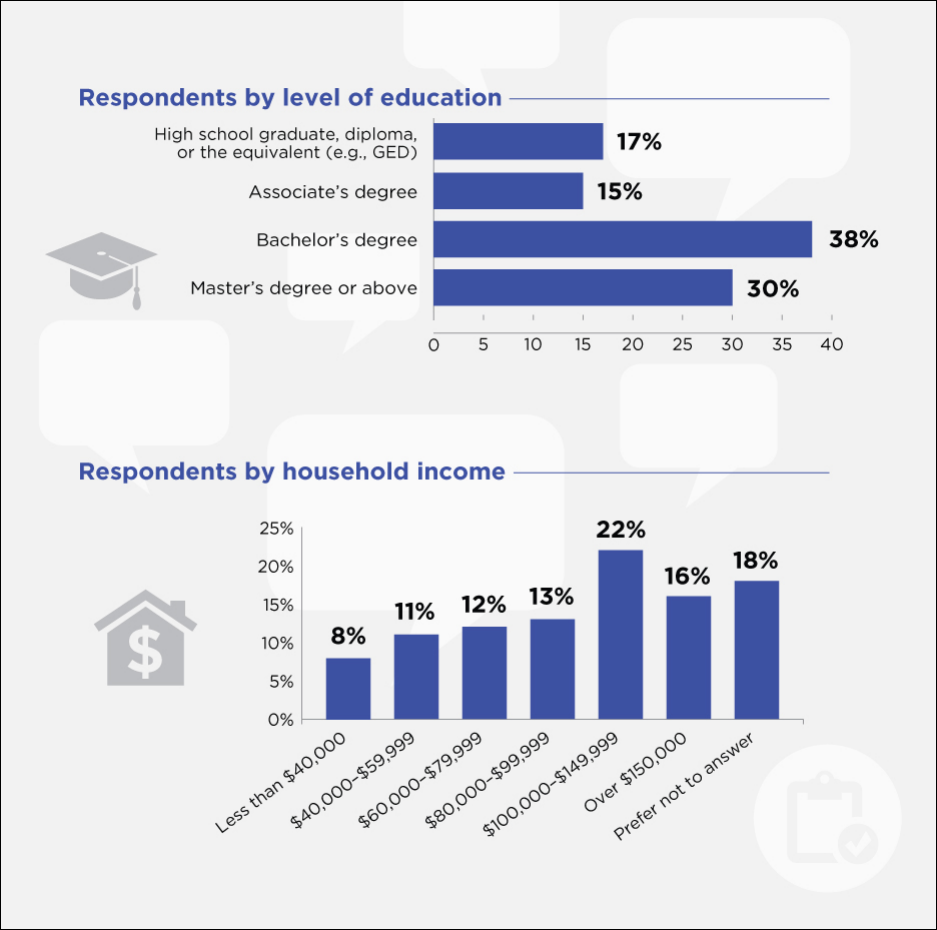

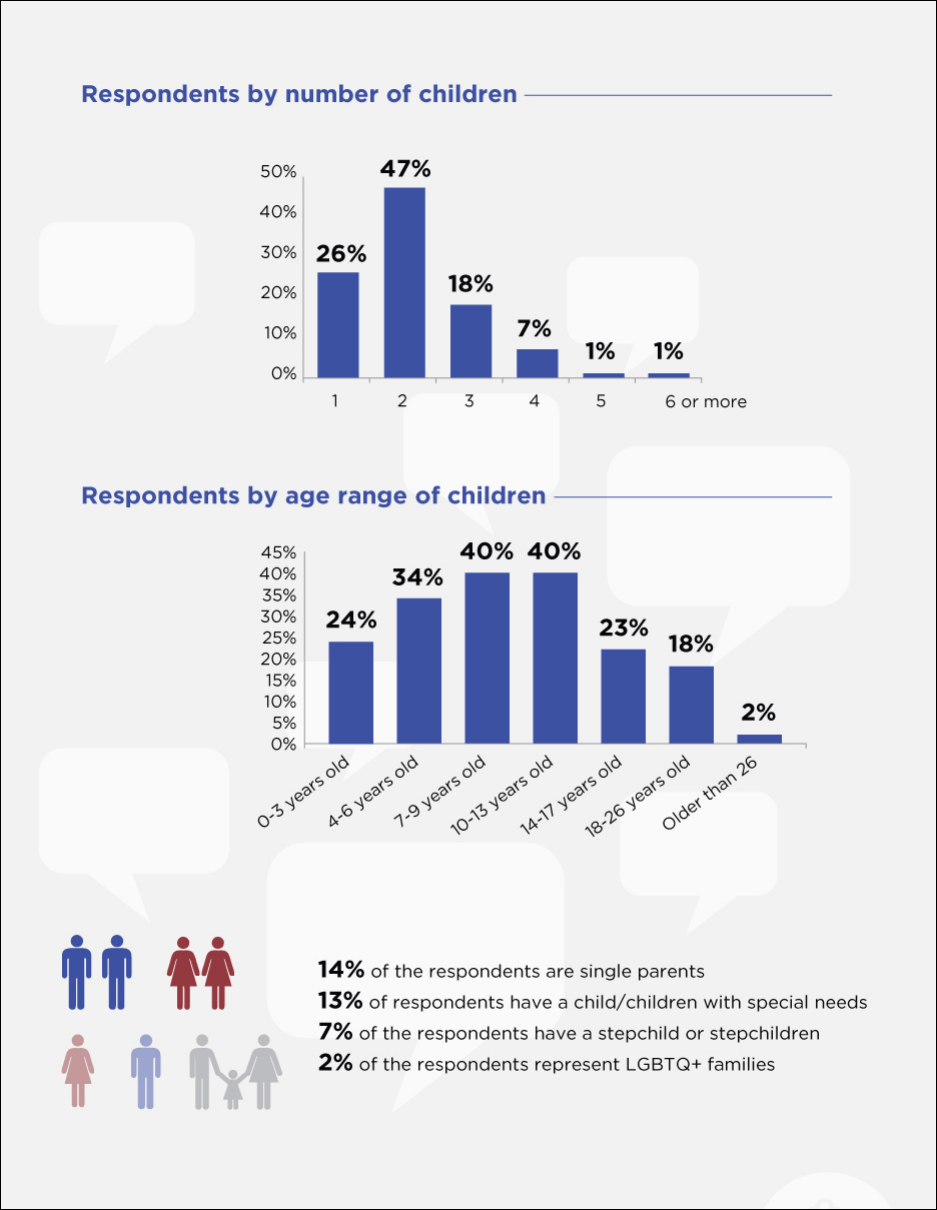

Survey Overview and Respondents

.................................8

Survey Design and Administration ....................................8

Survey Respondents

................................................9

Survey Findings ..................................................12

Intent to Travel .....................................................12

Impact of COVID-19 on Family Travel

..................................14

Impact on 2020 Travel ..................................................14

Family Vaccination Status

...............................................16

Impact on Future Family Travel

..........................................17

Travel Plans in the Next Year .........................................18

Trip Length ............................................................18

Trip Type

..............................................................18

Trip Season

...........................................................20

Travel Behavior .....................................................21

Air Travel .............................................................21

Accommodations

......................................................21

Travel Spending

.......................................................22

Use of Travel Advisers ............................................23

Travel Attitudes

..................................................25

Travel Sector Evaluation

...........................................29

About the NYU School of Professional Studies

........................31

About the NYUSPS Jonathan M. Tisch Center of Hospitality

............32

About the Family Travel Association

................................32

2

INTRODUCTION

By Rainer Jenss

Founder, Family Travel Association

You probably don’t need me or this survey to tell you that the COVID-19

global pandemic had a major impact on the travel industry during most of

2020 and 2021. In fact, the lingering eects of border closures, mask

mandates and vaccines will probably continue to play a major role in how

people plan, book, and travel for many months if not years to come.

Because of the pandemic, we felt conducting this annual survey in 2020

while the virus was wreaking havoc all around the world was somewhat

pointless. After all, since travel, and our businesses took such a major

hit, trying to figure out how our customer’s attitudes and behaviors were changing seemed

like an exercise in futility, especially given how rapidly conditions were changing. What was

happening one month proved at times to be almost completely irrelevant the next. With so

much fluctuation, how could we produce any meaningful and lasting research that would help

our members better plan how to serve traveling families?

But throughout all this, our members, the industry, and the travelers we serve hunkered down

and stayed patient, and now that vaccines are widely available and travel restrictions have

started to lift, it’s safe to say the travel industry’s recovery is finally underway.

That’s why I’m so excited to announce that with this report, the FTA is back on track in

producing this important annual industry survey—for the sixth time since 2015. Even though

each of our previous studies have helped us discover emerging trends, we would also drill

down more deeply into an area that our industry wanted to know more about. Whether

focusing on multigeneration travel, or learning more about why parents were not using all

their vacation time, our research always aimed to help our industry better serve the unique

needs and expectations of traveling families.

As we started preparing for what this year’s study should prioritize, there was little doubt

that the overriding issue would be on discovering how the COVID-19 pandemic has changed

families’ attitudes, expectations, and plans to travel now, and in the future. This report is

meant to reveal these findings in such a way that will help our members and the industry at

large better plan and prepare for the new travel landscape we find ourselves in.

3

What has not changed this or any other year, is our ongoing partnership with New York

University’s School of Professional Studies and Dr. Lynn Minnaert, Clinical Associate

Professor at the Jonathan M. Tisch Center of Hospitality. Our collective goal has always been

to learn more about American families, their travel habits and attitudes, and we feel this

study is arguably the most comprehensive. We so appreciate Lynn’s continued leadership

in this endeavor.

This year, we also want to thank Macaroni Kid by CertifiKid, for helping us capture the most

broad and diverse group of survey respondents possible. Finally, we want to thank Celebrity

Cruises and The White Stallion Ranch for their financial and promotional support and

partnership. They have made a serious commitment to serving families, and believe research

like this can help us all serve the consumer better.

So, take a deep dive into this year’s report and make sure to share with us your opinions and

insights. As a member of the FTA, you have complete access to all the data and we are happy

to provide a deeper analysis for you, if that would be helpful. After all, helping our members

better understand this market also is one of our top priorities.

Best regards,

Rainer Jenss

Founder

Family Travel Association

4

STUDY HIGHLIGHTS

By Dr. Lynn Minnaert

Clinical Associate Professor, NYUSPS Jonathan M. Tisch Center of Hospitality

In this sixth edition of the US Family Travel Survey, the Family Travel

Association (FTA) and the NYU School of Professional Studies Jonathan

M. Tisch Center of Hospitality examine family travel in the United States.

This year, the study focuses on the impact of the COVID-19 pandemic on

family travel behaviors, preferences and attitudes. With the support of

sponsor Celebrity Cruises and media sponsor MacaroniKid, 2,365

responses were collected between June 14 and July 26, 2021. The

following themes are featured in the 2021 US Family Travel Survey:

Travel Demand is Strong After a Steep Decline in 2020

• 88% of parents are likely or very likely to travel with their children in the next 12 months.

This means that travel demand from US families in 2021 is at the same level as it was in

2017. Travel intent in 2021 is higher than in 2019, when it was at 70%, and in 2018, when

it was at 79%. For families who do not intend to travel, aordability concerns trump

COVID concerns.

• In contrast, only 44% of respondents took a family trip in 2020. 80% of respondents

reported that they made changes to their travel plans due to the pandemic: 64%

cancelled or postponed domestic travel arrangement, and 23% cancelled or postponed

international travel arrangements.

While Domestic Demand Rebounds, International Demand is Weaker

• Respondents reported a median family travel spending of around $2,500 in 2019. We

asked whether they intended to spend more on less on family travel in the next 12

months, for domestic and international travel. 44% expect they will spend more on

domestic travel, whereas 43% expects to spend around the same amount. Only 13% of

respondents expect to spend less on domestic travel.

• The situation is however very dierent for international family travel: only 22% of

respondents expect to spend more on international trips, 36% expect their spending to

stay the same, and 42% expect to spend less.

While Many Family Travel Behaviors Remain Unchanged, the Pandemic Has Led

to Some Changes

• Many aspects of family travel have remained unchanged, despite the pandemic. Domestic

travel remains much more prevalent than international travel. In this survey, 83% of

respondents plan to take a multi-day vacation in the US, whereas only 19% plan to take a

multi-day international vacation. Families with higher annual household incomes are more

likely to plan international vacations.

5

• In terms of the types of trips respondents are planning to take, visiting family and friends

(62%) and beach vacations (61%) are the top two choices. Theme/water parks and state/

national parks are the following two choices, with 51% and 46% of respondents planning

to take these kinds of trips respectively. These preferences are in line with pre-pandemic

family travel behaviors we have reported in previous studies.

• Some trip types however are less popular with families now than before the pandemic. In

our 2019 survey, 68% of respondents reported they planned to visit a museum or cultural

attraction: that percentage has decreased to 36%. Events have decreased from 51-60% in

2019 to 23%. Cruises also decreased from 36% to 10%.

• Booking windows for family travel remain in line with those reported in the past. Most

respondents (38%) plan to book their trip 2 or 3 months prior to departure. 24% plan to

book 4 to 6 months prior to departure and 19% plan to book a month prior to departure.

• In terms of preferred accommodations for family travel, hotels were the most-selected

answer (74%

). Vacation rentals come in second at 54%, and resorts third at 45%. This

top three is similar to what this survey has previously found, however it is noticeable that

vacation rentals have steadily increased in popularity since the inception of this survey.

• A change induced by the pandemic is that families report they pay more attention to

cancellation policies (56%) and to health and safety considerations when choosing travel

destinations (55%). 80% of respondents either agree or agree strongly that they will only

book travel with companies that have flexible cancellation policies in place.

Travel Agents May Get Boost From Pandemic Travel Chaos

• 17% of respondents have booked travel with a travel adviser during the past two years.

However, a much larger share of 65% of respondents say they would consider using

a travel adviser for their family travel needs in the next two years. The respondents

who indicated that they would consider using a travel adviser, were asked whether the

pandemic had aected their answer: 31% said it had, and that they are more likely to

consider using a travel adviser after the disruptions caused by COVID.

COVID-19 Continues to Cause Travel Concerns

• When asked what makes family travel more dicult, aordability is identified as the

top challenge by 79% of respondents: it has been the top answer since the inception

of this survey in 2015. In contrast with previous years however, two COVID-19 related

concerns now appear in the top 5 of concerns: concerns about limitations on activities

and amenities (41%) and concerns about vaccination and health protocols adherence in

the destination (33%). Three further COVID-19 related challenges appear in the top 10:

concerns about vaccination and health protocols on our transportation providers (28%),

concerns about the sanitation and health protocols in hotels and restaurants (28%) and

dealing with potential cancellations (24%).

6

Health Protocols and Vaccine Passports Divide Respondents

• In our sample, 16% of respondents report that all family members are vaccinated,

67% that some family members are vaccinated and 17% that nobody in the family is

vaccinated. Children in particular are likely to be unvaccinated. At this time, children

under the age of 12 are not yet eligible for the vaccine, and 72% of respondents report

that none of the children have been vaccinated.

• Respondents were split on the question of vaccine passports: while 53% agree or strongly

agree with them, 28% disagree or strongly disagree. Respondents are equally split on the

questions about avoiding travel to destinations/states with low vaccination rates or few

health protocols. For 42% of the respondents, these are strong deterrents, whereas 58% have

either no strong opinion on the matter or disagree that they would avoid travel on this basis.

Unvaccinated families are most likely to say they disagree strongly with all three statements.

US Families Evaluate the Travel Sector: Travel Advisers and Vacation Rentals RankHighest

• US families give the travel sector a C+ for its handling of the shutdown, and the resulting

cancellations and refunds. 44% of respondents give a good (B – 32%) or excellent score

(A – 12%), and 49% think the sector did OK considering the circumstances (C).

• Respondents gave the sector a higher score of B- for its ability to provide safe travel

environments in 2021. 54% give a good to excellent score, 42% say the sector is doing OK

considering the circumstances.

• Travel agents and vacation rentals receive the highest score, a B+. Online booking

platforms, restaurants, hotels and tour operators all receive a B. Airlines and car rental

companies receive a B-, and cruise companies receive a C+.

Cleanliness, Clear Communications and Flexible Cancellations Top Family Wishlist

• Family travelers expect frequent, visible cleaning of common areas and often-touched

surfaces. Despite the recent criticism that some of this is ‘hygiene theatre’, this was one

of the most common requests families raised when asked how the travel sector could

serve them better.

• Family travelers also ask that travel companies provide them with an honest and clear

assessment of what they can expect at the destination in terms of amenities and health

protocols. While some look for reassurance that health protocols are being followed,

others want to know in advance if any amenities will be closed or have restricted access.

• Flexible cancellation and refund policies are seen as important considerations when

researching and booking family travel at this time.

Dr. Lynn Minnaert

Jonathan M. Tisch Center of Hospitality

NYU School of Professional Studies

7

SURVEY OVERVIEW AND RESPONDENTS

Survey Design and Administration

The study presented here includes the findings of a survey conducted with parents in 2021.

Only respondents who were over the age of 18 and who had children 26 years of age or

younger were eligible to take the survey. Respondents who were unlikely to travel with

their children in the coming year were filtered out at the end of the first question block. The

survey remained open for five weeks between June 14 and July 26, 2021. The total number of

respondents was 2,365.

The survey included seven question blocks: intent to travel, the impact of COVID-19 on

travel behavior, the types of trips planned in the coming year, travel behavior (including

transportation, accommodation preferences and spending), the use of travel advisers, travel

attitudes and an evaluation of how well the travel sector serves families.

The survey was circulated via the mailing list of MacaroniKid, a publishing platform that

provides local activity guides and news for more than 3,000,000 families in 4,000+

communities across the United States. We want to thank Celebrity Cruises and White Stallion

Ranch for their generous financial and promotional support in the facilitation of the survey.

8

Credit: OARS

Survey Respondents

9

10

11

SURVEY FINDINGS

Intent to Travel

In our sample, 88% of parents are likely or very likely to travel with their children in the next 12

months. Of the remaining 12%, 9% are undecided and 3% are unlikely or very unlikely to travel.

Comparing this finding to prior editions of the family travel survey, the data show that travel

demand from US families in 2021 is at the same level as it was in 2017. Travel intent in 2021

is higher than in 2019, when it was at 70%, and in 2018, when it was at 79%. It is lower than

the peak in 2015 and 2016, when 93% of parents were very likely or likely to travel with

their children.

The respondents who said they were unlikely to travel with their children in the next three

years were asked to select the reasons for their answer. Aordability emerged as the most

dominant factor, with 70% of the non-traveling respondents indicating they could not aord

to take a family vacation. The COVID-19 pandemic however also impacted intent to travel: 29%

of respondents is not planning to travel because not everyone in the family is vaccinated, 24%

report they do not feel safe because of the pandemic, and 21% feel that COVID restrictions

make travel less desirable.

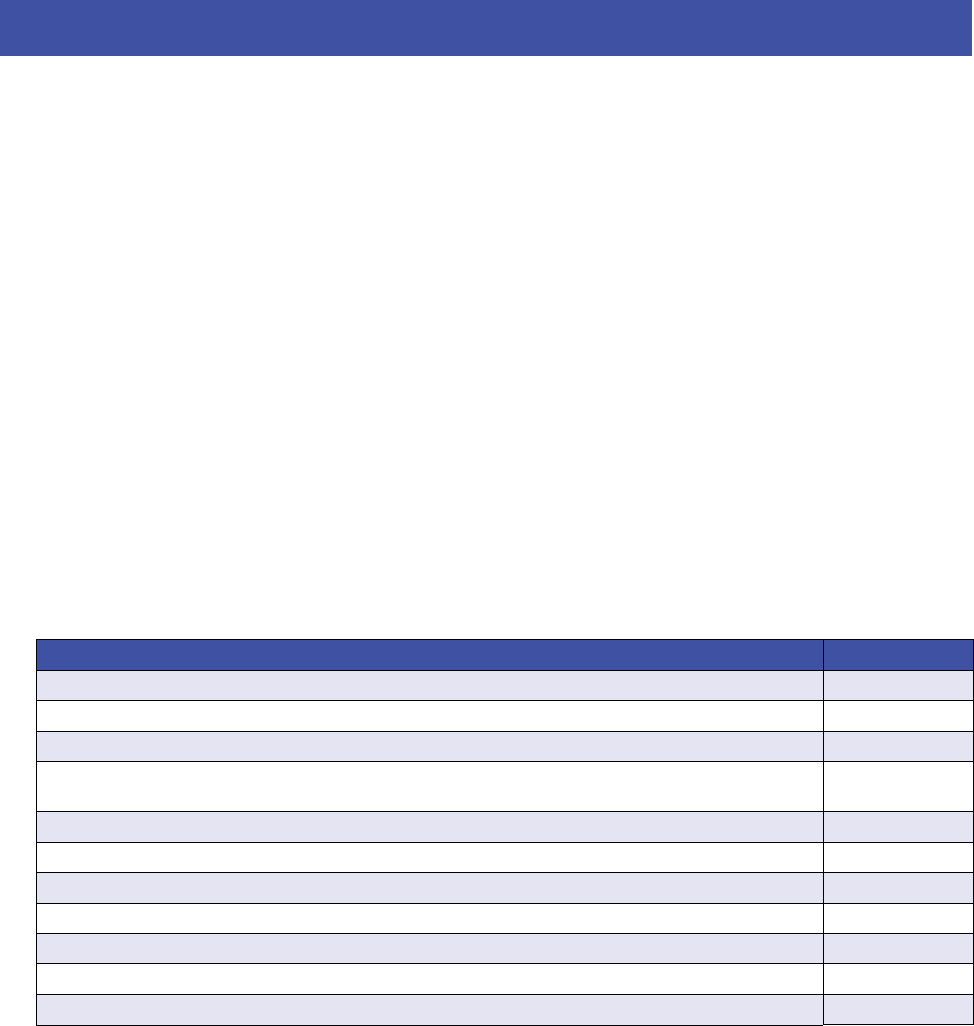

Table 1: Why are you unlikely to go on a family vacation with your children in the

next 12 months?

Answer Percentage

I/We cannot aord it 70%

Not everyone in our family is vaccinated against COVID 29%

We don’t feel safe traveling as a family because of the ongoing pandemic 24%

Travel, activity and/or dining restrictions created by the pandemic make travel

less desirable 21%

Traveling with children is not relaxing for me/us 14%

I/we don’t have any / enough vacation time 13%

Our children are too young 13%

It’s too dicult / time-consuming to plan 8%

Health problems or physical limitations 3%

Our children won’t like it, are too busy with other activities, or prefer staying at home 3%

I/we don’t think a family trip is worth the money 2%

12

In this edition of the US Family Travel Survey, we also asked parents about their intent to travel

with their older children, between the ages of 18 and 26. We added a focus on children in this

age bracket, as they are often still dependent on their parents, and may still be included in

family travel decisions. The respondents in this survey who have older children reported that:

• 76% have at least one child between 18 and 26 who lives at home

• 74% have at least one child between 18 and 26 who is financially dependent on them

• 67% have at least one child between 18 and 26 who is in school/college

• 29% have at least one child between 18 and 26 who returned to live at home due

to the pandemic

Survey results show that older children are part of the family travel plans of the respondents

at almost the same rates as younger children are: 84% of parents are likely or very likely to

travel with their older children in the next 12 months (compared to 88% of parents with only

younger children). Of the remaining 16%, 10% are undecided and 6% are unlikely or very

unlikely to travel.

When asked about why respondents were unlikely or very unlikely to travel with their older

children in the next 12 months, COVID considerations are much less common than for families

with younger children. Instead, 53% of respondents say that their older children cannot take

time o from their jobs at the same time as the planned family vacation, and 42% report that

their older children prefer to travel with their friends or partners.

Table 2: Why are your older children unlikely to join you on a family vacation in the

next 12 months?

Answer

Percentage

My older children cannot take time o from their jobs at the same time as we are

planning our family vacation 53%

My older children prefer to travel with their friends or partners 42%

My older children no longer want to take family vacations with us 21%

We cannot aord it 11%

I/we want our older children to be independent and no longer wish to cover their

travel expenses 5%

My older children cannot take time o from school/college at the same time as we are

planning our family vacation 5%

Coronavirus and global health concerns (e.g. cleanliness, sanitary conditions, medical

facilities) 0%

Not everyone in our family is vaccinated against COVID 0%

13

Impact of COVID-19 on Family Travel

Impact on 2020 Travel

This section of the survey examines how the COVID-19 pandemic impacted travel behavior in

2020, and continues to impact family travel in 2021.

Only 44% of respondents took a family trip in 2020. This is well below the 70% that were

projected to travel in 2019’s US Family Travel Survey.

80% of respondents reported that they made changes to their travel plans due to the

pandemic: 64% cancelled or postponed domestic travel arrangements, and 23% cancelled

or postponed international travel arrangements. The respondents who did still travel often

adjusted their trips: 36% picked a destination they could drive to instead of flying, 31%

adjusted their trip to the travel restrictions that were in place, and 28% picked a destination

where social distancing would be easier.

Table 3: Did you make any changes to your travel plans in 2020 due to the

COVID-19 health crisis?

Answer Percentage

We cancelled/postponed domestic travel arrangements we had made 64%

We picked a destination we could drive to instead of flying 36%

We adjusted our planned family trip to the travel and health restrictions that were in

place at the time 31%

We picked a destination where social distancing would be easier 28%

We cancelled/postponed international travel arrangements we had made 23%

Looking specifically at cancellations, while 45% of the respondents were unaected, 24%

reported that a theme park or attraction they planned to visit was closed. Airline cancellations

aected 17% of respondents, and accommodation reservations were cancelled for 15%. Cruise

and tour package cancellations aected fewer respondents, 9% and 3% of respondents

respectively: this reflects the fact that these vacation types are less commonly booked than

attractions, airlines and accommodations.

Table 4: Were any of your 2020 travel plans canceled due to the pandemic? Please select

all that apply.

Answer Percentage

None of these 45%

A theme park or attraction we had tickets for was closed 24%

An airline cancelled our flight(s) 17%

Our accommodations cancelled our stay 15%

Our cruise company cancelled our trip 9%

Other 7%

Our tour company cancelled our trip 3%

14

The respondents who reported having experienced cancellations, were then asked whether

they received full or partial refunds, and/or full or partial travel credit. 43% of respondents

received a full refund and 27% received full travel credit.

Table 5: Did you receive a refund or travel credit for your cancelled plans? You may have

received dierent outcomes for dierent components of a booked trip, so please select

all that apply.

Answer Percentage

Yes, we received a full refund 43%

Yes, we received a partial refund 8%

No, we did not receive a refund 9%

Yes, we received full travel credit 27%

Yes, we received partial travel credit 6%

No, we did not receive travel credit 3%

Not applicable 19%

15

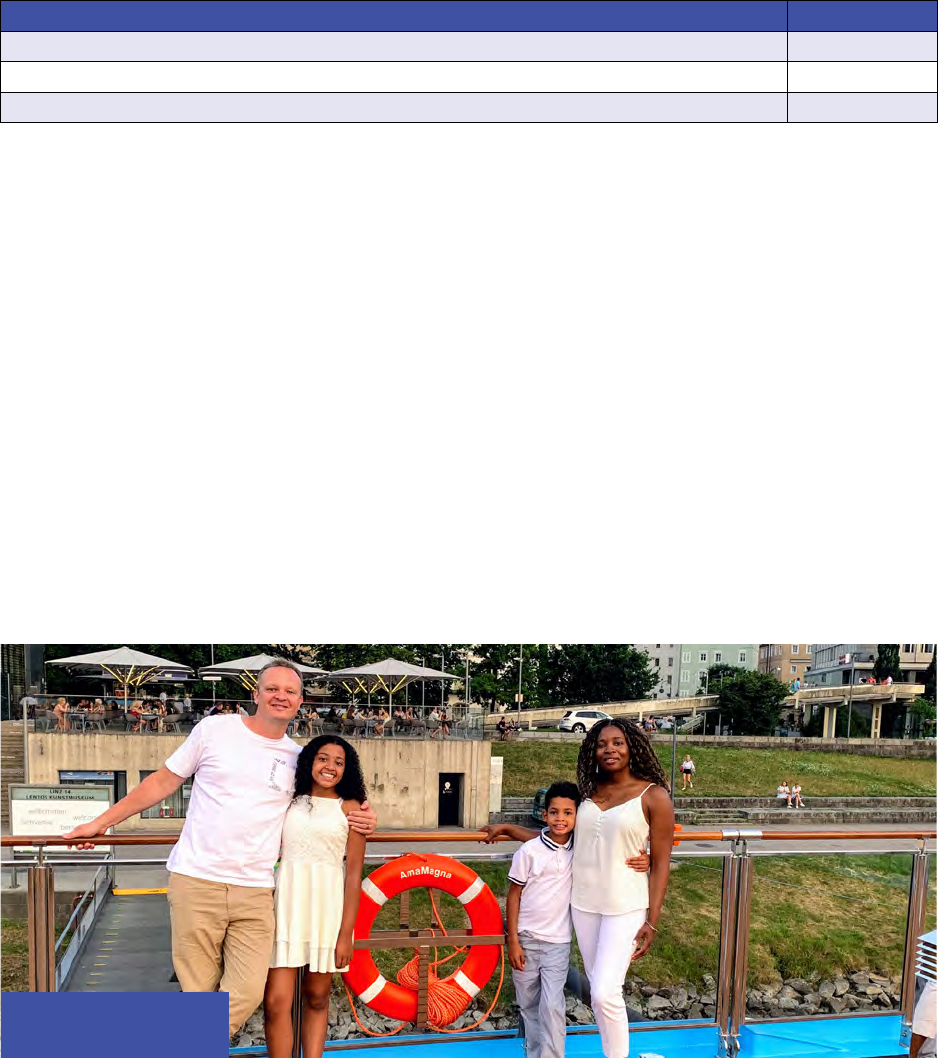

Credit: Celebrity Cruises

Family Vaccination Status

As the travel sector reopens in 2021, vaccinations are often central points of discussion.

Therefore, the survey asked about the respondents’ vaccination status in some detail.

In our sample, 16% of respondents report that all family members are vaccinated, 67% that

some family members are vaccinated and 17% that nobody in the family is vaccinated.

Table 6: What is the vaccination status of your family?

Answer Percentage

We are all vaccinated 16%

Some family members are vaccinated 67%

Nobody in the family has been vaccinated 17%

Respondents who report that nobody in the family has been vaccinated are more likely

to report a lower household income and level of education than respondents in the

other two groups.

At the time of writing, no COVID vaccines have been approved for children younger than 12,

which means that all families with children below that age will by default have unvaccinated

family members. Of the 67% of respondents who reported that some family members are

vaccinated, 2% report that all children have been vaccinated, 21% that some children have

been vaccinated, and 72% that none of the children have been vaccinated. (The remaining 5%

selected the ‘not applicable/don’t know’ option.) Of the 72% of respondents who say none

of the children have been vaccinated, 61% say they plan to have the children vaccinated, and

39% say they do not plan to.

The respondents who indicated that nobody in the family is vaccinated (17% of total sample)

were asked whether they and their families plan to get vaccinated. 73% of respondents in this

group say nobody in the family plans to get vaccinated, 19% say that some family members

plan to get vaccinated, and 2% say that they and their family will get vaccinated.

16

Credit: AMA Waterways

Impact on Future Family Travel

In the following question, we asked to which extent and how the pandemic had aected the

respondents’ attitudes towards future family travel. The two top responses are that families

pay more attention to cancellation policies (56%) and to health and safety considerations

when choosing travel destinations (55%). 40% of respondents report that they are now more

likely to travel using their own car, rather than opting for other forms of transportation. 26%

are more likely to buy travel insurance.

In terms of long-term attitudinal changes, fewer respondents indicate lasting concerns,

although 26% of respondents say they will be less likely to consider a cruise even after

COVID-19 has been contained. 15% of respondents say they will be less likely to consider

international travel even after COVID-19 has been contained. Respondents who indicate that

their family is fully or partially vaccinated are more likely to report these lasting concerns than

respondents with families where nobody has been vaccinated.

Table 7: Which of the following statements about future family travel apply to you? Please

select all that apply.

Answer Percentage

We pay more attention to cancellation policies now when making travel arrangements 56%

We pay more attention to health and safety now when choosing travel destinations 55%

We are more likely to travel using our own car/vehicle rather than in any other form of

transport (plane, train, cruise, bus) 40%

We are more likely to buy travel insurance now 26%

We are less likely to consider a cruise even after COVID 19 has been contained 26%

We will be hesitant to take a trip far away from home until we know that all virus-

related issues have been resolved 22%

We are more likely to take day trips instead of overnight trips now 17%

We are less likely to consider international travel even after COVID 19 has

been contained 15%

None of these statements apply to me 14%

17

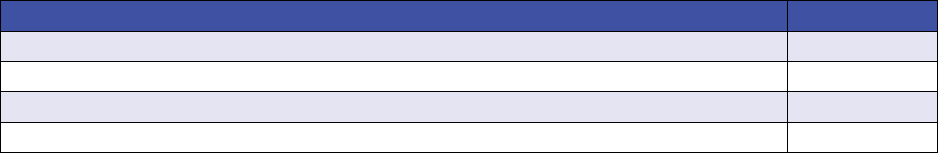

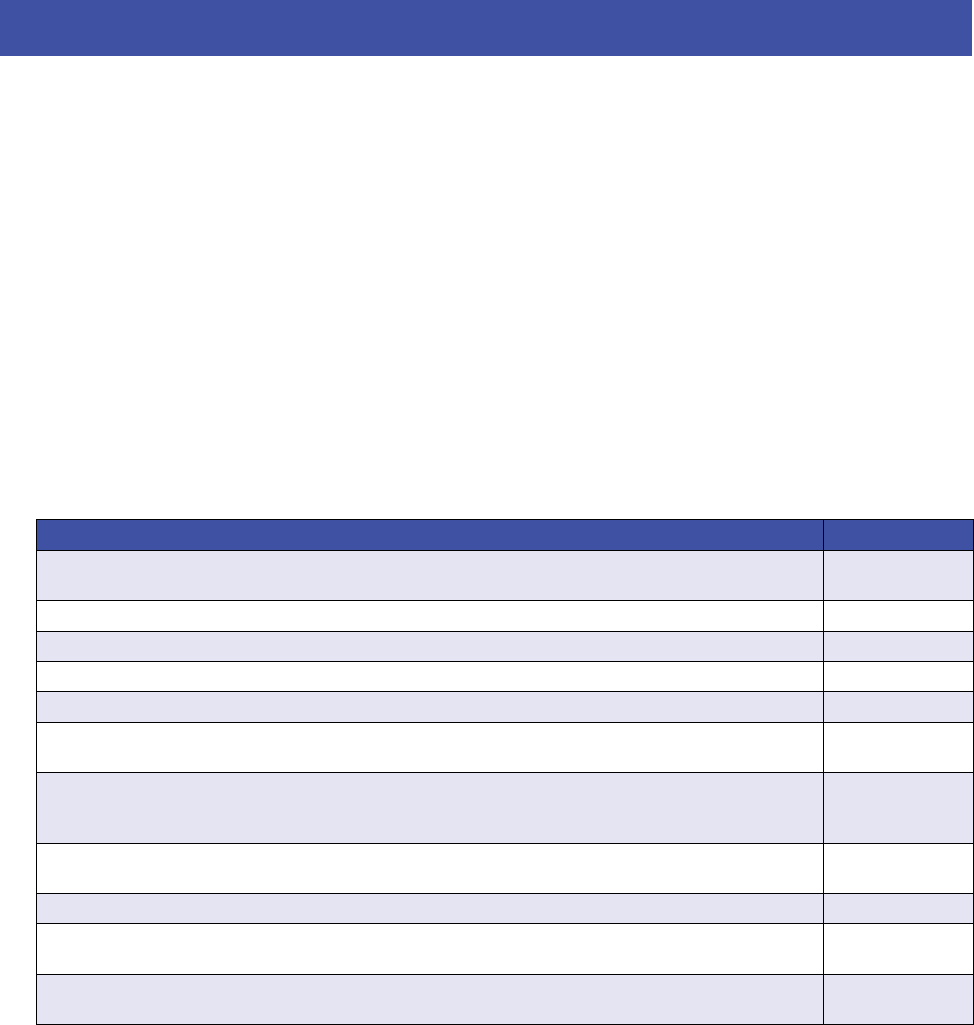

Credit: Karen Akpan

Travel Plans in the Next Year

Trip Length

In this section of the survey, we probed what our respondents’ family travel plans were for the

coming year. In the first question in this block, we asked about trips of dierent lengths, from

day trips to multi-day vacations. Multi-day vacations in the US are the most common trip type

the respondents plan to take (83%). Weekend getaways come in second (68%), followed by

day trips (57%). Multi-day international vacations are planned by 19% of respondents. Families

with higher annual household incomes are more likely to plan international vacations.

Table 8: We would like to know what types of trips you are planning to take with your

children in the coming year. Please select all that apply.

Answer Percentage

Day trip 57%

Weekend getaway 68%

Multi-day vacation in the US 83%

Multi-day international vacation 19%

When asked how long respondents were willing to drive for a weekend getaway, 47% of

respondents say they will drive between 2 and 4 hours. 27% of respondents is willing to drive

between 4 and 6 hours.

Trip Type

In terms of the types of trips respondents are planning to take, visiting family and friends

(62%) and beach vacations (61%) are the top two choices. Theme/water parks and state/

national parks are the following two choices, with 51% and 46% of respondents planning to

take these kinds of trips respectively. These preferences are in line with pre-pandemic family

travel behaviors we have reported in previous studies.

Some trip types however are less popular with families now than before the pandemic. In

our 2019 survey, 68% of respondents reported they planned to visit a museum or cultural

attraction: that percentage has decreased to 36%. Events have decreased from 51-60% in 2019

to 23%. Cruises also decreased from 36% to 10%.

While these travel plans are generally similar for families who are fully vaccinated, partially

vaccinated and unvaccinated, there is one trip type where there are dierences. 70% of

unvaccinated families plan to visit theme and water parks in the coming 12 months (making it

their joint top choice with beach vacations), compared to 59% of partially vaccinated families

and 50% of fully vaccinated families.

18

Table 9: Which of the following types of trips are you planning to take with your children in

the coming year? Please select all that apply.

Answer Percentage

Visiting friends and family 62%

Beach vacation 61%

Theme or water park 51%

National or State Parks 46%

Nature vacation excluding National Parks (e.g. lake, mountain) 37%

Museum or cultural attraction 36%

Active vacation (e.g. camping, hiking, biking, sports) 36%

City vacation 34%

All-inclusive resort 23%

Events (e.g. concerts, sport events, larger social events) 23%

Cruise 10%

A group tour through a tour operator (e.g., Adventures by Disney, Trafalgar,

safaris etc.) 7%

Dude ranch 5%

Next, respondents were asked whether they were planning to travel in larger family groups.

52% of respondents say they are planning a multi-generational trip, and 11% say that their

children will go on a skip-generational trip with their grandparents. 45% of respondents say

they are planning a trip with family members beyond parents and in-laws.

Table 10: Are you planning any of the following types of trips in the coming 12 months?

Answer Percentage

A multi-generational trip (travel that includes your parents/in laws and your children) 52%

A skip-generation trip (travel that includes your children and their grandparents

without you or your spouse/partner) 11%

A trip with extended members of your family beyond your parents/in laws (for

example, aunts or uncles, nieces or nephews, or travel with your siblings and

their children) 45%

19

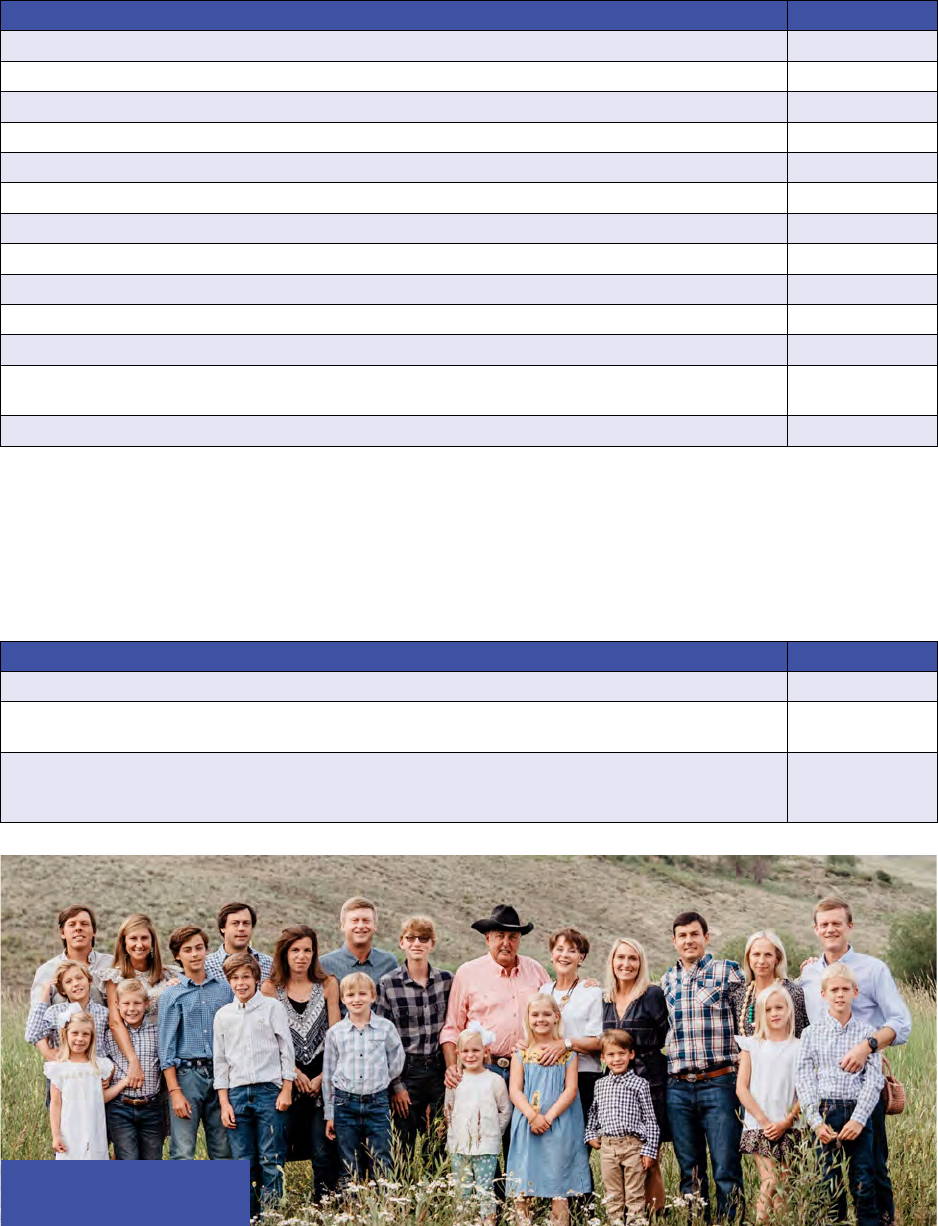

Credit: J. Lee Photography

Trip Season

In this section of the survey, respondents were asked when they plan to travel as a family in

2021 and 2022. The summer season is the most popular travel time: 64% of respondents plan

family travel in the summer of 2021, and 56% in the summer of 2022. The fall of 2021 and

the spring of 2022 are the next most popular options, with 35% or 32% of the respondents

planning trips then respectively.

Table 11: When are you planning to take a family vacation in 2021 and 2022? Please select

all that apply.

Answer Percentage

Summer 2021 64%

Summer 2022 56%

Fall 2021 (including Thanksgiving) 35%

Spring 2022 32%

Holidays 2021 29%

Winter 2022 18%

Holidays 2022 18%

Fall 2022 (including Thanksgiving) 17%

Most respondents (38%) plan to book their trip 2 or 3 months prior to departure. 24% plan to

book 4 to 6 months prior to departure and 19% plan to book a month prior to departure. The

pandemic has not substantially shortened booking windows compared to what this survey has

found in prior years.

Table 12: Approximately when do you plan to book travel in the coming 12 months? Please

select the answer that reflects your average booking period most accurately.

Answer Percentage

A week prior to departure 2%

Two weeks prior to departure 4%

A month prior to departure 19%

Two or three months prior to departure 38%

Four to six months prior to departure 24%

Six to twelve months prior to departure 11%

Over a year prior to departure 2%

20

Travel Behavior

Air Travel

Respondents were asked if they were willing to fly at the time of taking the survey. 72% of

respondents is willing to fly on a domestic trip, and 40% on an international trip. Only 15% of

respondents is unwilling to fly on an international trip, as 45% of respondents say they are not

planning international travel at this time.

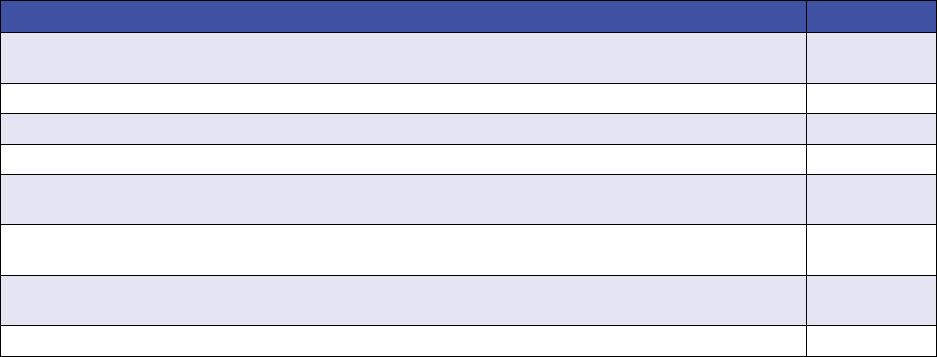

Table 13: At this time, are you willing to fly / take a plane for a family vacation? Please

indicate your answer for both domestic and international trips.

Trip Type

Not planning to take

this type of trip Yes, willing to fly No, not willing to fly

Domestic Trips 11% 72% 17%

International Trips 45% 40% 15%

Accommodations

When asked in which type of accommodations they planned to stay in the coming year, hotels

were the most-selected answer (74%). Vacation rentals come in second at 54%, and resorts

third at 45%. (For both vacation rentals and resorts, the probability that respondents plan to

stay in these accommodation type increases with income – higher income groups are more

likely to select these options than lower income groups).

The top 3 ranking of hotels, vacation rentals and resorts is similar to what this survey has

previously found, however it is noticeable that vacation rentals have steadily increased in

popularity since the inception of this survey. Motels in contrast have become less popular for

family travel: they were the third most common accommodation option in 2017, the sixth most

common in 2019, and have now dropped to 11th place.

21

Credit: Red Horse Mountain Ranch

Table 14: Do you plan to stay in each of the following types of accommodations on a family

vacation in the coming 12 months? Please select all that apply.

Answer Percentage

Hotel 74%

Vacation rental property (a home/condo, Airbnb, VRBO, etc.) 54%

Resort 45%

Homes belonging to friends/family members 38%

Cabin rental 25%

Campsite 24%

Bed and Breakfasts, small inns 11%

Cruise ship 11%

Timeshare 11%

RV / trailer 11%

Motel 8%

Your own vacation property 5%

Home exchange 1%

Other 1%

Travel Spending

Respondents reported a median family travel spending of around $2,500 in 2019. We asked

whether they intended to spend more on less on family travel in the next 12 months, for

domestic and international travel. 44% expect they will spend more on domestic travel,

whereas 43% expects to spend around the same amount. Only 13% of respondents expect to

spend less on domestic travel.

The situation is however very dierent for international family travel: only 22% of respondents

expect to spend more on international trips, 36% expect their spending to stay the same, and

42% expect to spend less.

Table 15: How much do you expect to spend on family travel in the coming 12 months,

compared to your spending on family travel in 2019, before the outbreak started?

Location

I expect to spend more

on family travel in the

next year

I expect to spend the

same amount on family

travel in the next year

I expect to spend less

on family travel in the

next year

Within the US 44% 43% 13%

Outside of the US 22% 36% 42%

22

USE OF TRAVEL ADVISERS

17% of respondents have used a travel adviser to book at least one family trip in the past two

years, 83% of respondents have not. Families with a household income higher than $100,000

per year are slightly more likely to have used a travel adviser (20%) than families in lower

income brackets.

For the respondents who have used a travel adviser for family travel in the past two years,

the biggest motivations were the expertise travel advisers have about certain destinations

or vacation types (48%) and their access to better rates and prices (43%). The pandemic

influenced the decision to use a travel adviser to some extent. For 26% of respondents, the

fact that travel advisers have the most up to date information about health protocols and

restrictions related to COVID-19 is an important motivator. For 25% of respondents also

highlight that the support travel advisers can oer in times if global crises is a factor in

deciding to use one.

Table 16: Why did you decide to use a travel adviser/agent to help plan/book at least one

family vacation in the past 2 years? Please select all that apply.

Answer Percentage

Travel advisers/agents have an in-depth understanding of the destination or vacation

type I was interested in 48%

Travel advisers/agents have access to better rates and prices 43%

Travel advisers/agents can best deliver the vacation experience we are looking for 38%

If something goes wrong, a travel adviser/agent is there to help 36%

Travel advisers/agents minimize the risk of problems on vacation 29%

Travel advisers/agents are better equipped to plan and book more complicated trips

(i.e., multi-generational trips, travel to o-the-beaten path destinations, etc.) 28%

Travel advisers/agents have the most up to date information about health and

vaccination protocols, rules and restrictions, and sanitation status of destinations we

are interested in visiting 26%

Travel agents/advisers are invaluable in cancelling/rescheduling travel plans aected

by global crises (e.g. Coronavirus) 25%

Planning and booking on my own is time-consuming 22%

Planning and booking on my own is too overwhelming/confusing as there are too

many options to choose from 21%

A travel adviser/agent gets to know me and my preferences and can tailor

recommendations for me 20%

Of the respondents who have not used a travel adviser for family travel in the past two years,

56% say that they can find all the information they need online, and 44% report that they

enjoy researching and planning family vacations themselves.

23

Table 17: Why did you decide not to use a travel adviser/agent in planning/booking your

family vacations in the past 2 years? Please select all that apply.

Answer Percentage

I can find all the information I need online 56%

I enjoy the process of researching, planning and booking a family vacation 44%

I trust myself more to find the right travel options for my family 39%

It would add to the cost of the vacation 37%

We tend to go to places we know very well 24%

I think the cost of using a travel adviser/agent would not pay back in terms of the

assistance received 17%

I don’t know how to select a travel adviser/agent 13%

I don’t know how travel advisers/agents work/what they do 13%

I don’t have time to visit or call a travel adviser/agent 11%

I have not found a travel adviser/agent that I can trust 6%

65% of all survey respondents say they would consider using a travel adviser for their family

travel needs in the next two years, 35% say they would not. The respondents who indicated

that they would consider using a travel adviser were asked whether the pandemic had

aected their answer: 31% said it had, and that they are more likely to consider using a travel

adviser after the disruptions caused by COVID.

24

Credit: White Stallion Ranch

TRAVEL ATTITUDES

In this section of the survey, respondents were first presented with a question about the value

they place on family vacations, especially since the pandemic heavily limited family travel in

2020. The question also probed whether families were planning to make up for lost travel time

by either traveling more or spending more on travel.

The table below show that US families place great value on the educational importance of

family travel (4.6/5), and that they agree with the statement that having to forego travel

during the pandemic has made them realize how valuable family vacations are (4.1/5).

However, the respondents were more ambivalent on the following two prompts. While 41% of

respondents agreed or agreed strongly that they saved up money during the pandemic that

they intend to use on travel, the mean response for this statement was 3.1/5. While 32% of

respondents say they plan to take more or longer trips to make up for canceled travel plans,

the mean response for this statement was 3.0/5

.

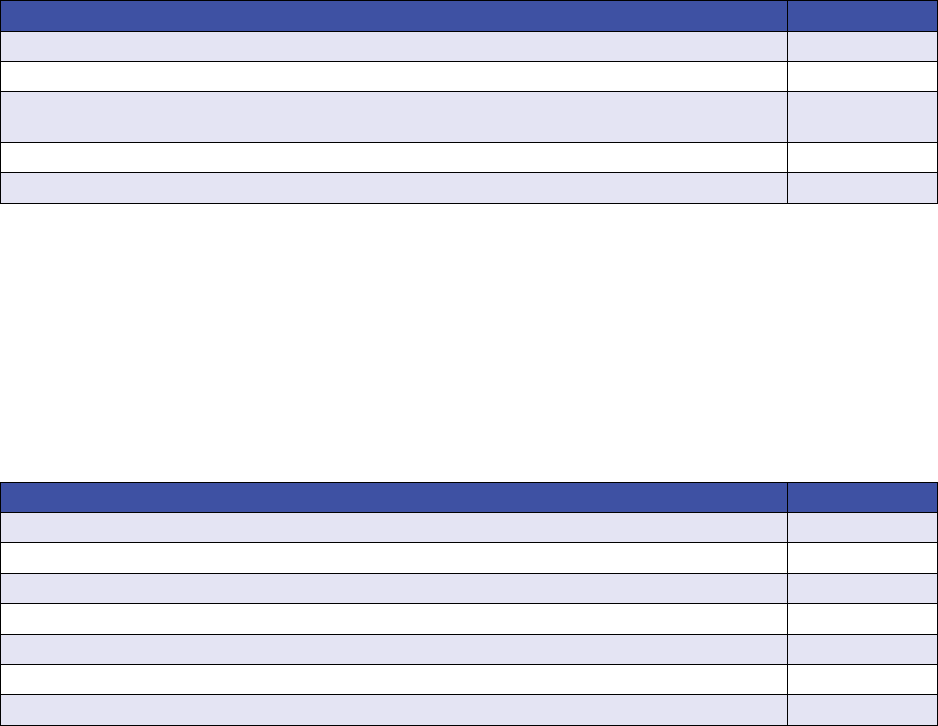

Table 18: How much do you agree with each of the following statements about family travel?

Statement

Disagree

strongly

(1)

Somewhat

disagree

(2)

Neither

agree nor

disagree

(3)

Somewhat

agree

(4)

Agree

strongly

(5) Mean

Family travel expands

my children’s

horizons/education 1% 1% 5% 23% 70%

4.6

Having to forego travel

during the pandemic

has made me realize

how valuable family

vacations are 2% 3% 20% 34% 41%

4.1

We saved up money

during the pandemic

that we intend to

spend on travel 13% 16% 30% 29% 12%

3.1

We are planning more or

longer trips to make up for

canceled travel plans 13% 17% 38% 22% 10%

3.0

25

Credit: Aidan Mullan

In the next question, we asked respondents about their comfort level with certain travel

practices, and the appeal of certain booking incentives.

Respondents report that they are generally comfortable with visiting indoor attractions

(4.0/5) and dining indoors (3.9/5). They also are generally fairly comfortable with traveling in

a group, although the mean score for this statement is lower at 3.6/5.

In terms of booking incentives, flexible cancellation and refund policies are of great

importance: 80% of respondents either agree or agree strongly that they will only book travel

with companies that have these policies in place (4.2/5). Discounts, while less important, also

hold appeal for 67% of respondents (3.8/5).

Respondents were split on the question of vaccine passports: while 53% agree or strongly

agree with them, 28% disagree or strongly disagree, and 19% has no strong opinion (3.3/5).

Respondents are equally split on the questions about avoiding travel to destinations/states

with low vaccination rates (3.1/5) or few health protocols (3.1/5). For 42% of the respondents,

these are strong deterrents, whereas 58% have either no strong opinion on the matter or

disagree that they would avoid travel on this basis. Unvaccinated families are most likely to

say they disagree strongly with all three statements.

Table 19: How much do you agree with each of the following statements about family travel?

Statement

Disagree

strongly

(1)

Somewhat

disagree

(2)

Neither

agree nor

disagree

(3)

Somewhat

agree

(4)

Agree

strongly

(5) Mean

We will only consider

booking travel with

companies that have

flexible cancellation and

refund policies 1% 3% 16% 41% 39%

4.2

We are comfortable

visiting indoor attractions

in our destination 3% 11% 11% 41% 35%

4.0

We are comfortable dining

indoors in restaurants in

our destination 5% 12% 9% 35% 40%

3.9

We will only consider

travel if we can find a

good deal or big discount 2% 8% 23% 43% 24%

3.8

We are comfortable

traveling in a group 6% 15% 18% 35% 25%

3.6

We support the use of

vaccine passports in travel 22% 6% 19% 22% 31%

3.3

We avoid travel to

destinations/states where

vaccination rates are low 17% 11% 30% 24% 18%

3.1

We avoid travel to

destinations/states where

there are few health and

safety restrictions in

place (e.g. masks, social

distancing) 16% 14% 27% 25% 17% 3.1

26

When asked who they trust for accurate travel advice, 69% of respondents indicate they trust

government agencies such as the CDC and state health departments. 44% trust friends and

family, and 35% trust fellow travelers they interact with via social media or word of mouth.

Travel companies are seen as trustworthy sources of information by 30% of the respondents,

and are trusted more than traditional news sources, which are only trusted by 23%. Travel

advisers/agents are trusted by 17% of the respondents, although this percentage increases to

43% for respondents who have used a travel agent in the past 2 years.

Table 20: Who do you trust for accurate travel advice at this time? Please select all that apply.

Answer Percentage

Government agencies, e.g. US CDC, state health departments 69%

Friends and family 44%

Fellow travelers (social media, word of mouth) 35%

Travel companies, e.g. airlines, destinations, tour operators, attractions 30%

Traditional news sources 23%

Travel advisers/agents 17%

None of the above 6%

There were marked dierences between the answers of respondents with dierent

vaccination status for this question. Respondents who reported that nobody in the family has

been vaccinated are much less likely to trust government agencies than respondents who

say everyone in the family has been vaccinated (34% vs. 78%). A similar dierence in trust

levels is noticeable when it comes to traditional news sources: these are trusted by 12% of

families where nobody has been vaccinated, and 31% of families where all members have been

vaccinated. Respondents who reported that nobody in the family has been vaccinated are

more likely to trust friends and family (50%) and fellow travelers (41%).

27

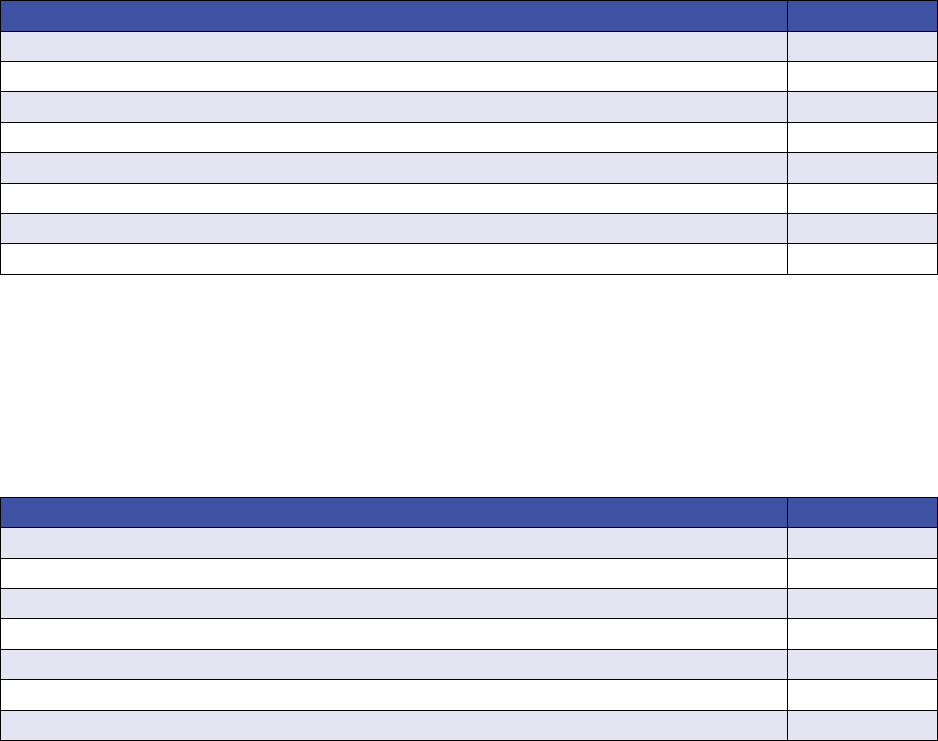

Credit: Kirsten Maxwell

Completing the section on travel attitudes, respondents were asked to identify up to five

factors that make family travel more dicult. Aordability is identified as the top challenge by

79% of respondents: it has been the top answer since the inception of this survey in 2015. In

contrast with previous years however, two COVID-19 related concerns now appear in the top 5

of concerns: concerns about limitations on activities and amenities (41%) and concerns about

vaccination and health protocols adherence in the destination (33%). Three further COVID-19

related challenges appear in the top 10: concerns about vaccination and health protocols on

our transportation providers (28%), concerns about the sanitation and health protocols in

hotels and restaurants (28%) and dealing with potential cancellations (24%

).

Table 21: We would now like to ask you about the factors that make family travel more

dicult. Which of the following factors listed below are the most challenging to you when

considering travel with your children? Please select your top 5 challenges.

Answer Percentage

Aordability 79%

Concerns about limitations on activities and amenities 41%

Timing of school breaks 39%

Concerns about vaccination and health protocols adherence in the destination 33%

Available vacation time 30%

Concerns about vaccination and health protocols on our transportation providers

(airplane, ship, train, etc.) 28%

Concerns about the sanitation and health protocols in hotels and restaurants 28%

Dealing with potential cancellations 24%

Finding a destination or activity everyone will enjoy 23%

Traveling by car with children 20%

Planning the trip 18%

Finding adult time while traveling with children 18%

Age(s) of my children 17%

Passport and visa requirements 13%

Dining out while traveling 10%

Health concerns other than Coronavirus 6%

Family members getting along 5%

28

Credit: AMA Waterways

TRAVEL SECTOR EVALUATION

In this section of the survey, we asked respondents to evaluate the travel sector on its

handling of the COVID-19 shutdown, and on its delivery of safe travel environments in 2021.

US families give the travel sector a C+ for its handling of the shutdown, and the resulting

cancellations and refunds. 44% of respondents give a good or excellent score, and 49% think

the sector did OK considering the circumstances.

Table 22: Overall, what grade would you give the travel industry for how it handled the

Coronavirus shutdown, refunds and cancellations?

Answer Percentage

A – Excellent 12%

B – Good 32%

C - OK, considering the circumstances 49%

D - Needed a lot of improvement 6%

F – Bad 1%

Respondents gave the sector a higher score of B- for its ability to provide safe travel

environments in 2021. 54% give a good to excellent score, 42% say the sector is doing OK

considering the circumstances.

Table 23: Overall, what grade would you give the travel industry for providing safe travel

environments in 2021?

Answer Percentage

A - Excellent 14%

B - Good 40%

C - OK, considering the circumstances 42%

D - Needed a lot of improvement 4%

F - Bad 0%

29

Credit: OARS

We then asked respondents to give dierent sub-sectors an individual score for how they

handled the pandemic. (If the respondents had no experience with a certain provider, they

were invited to select the ‘Not Applicable’ answer choice. These answers were excluded to

present the table below.)

Travel agents and vacation rentals receive the highest score, a B+. Online booking platforms,

restaurants, hotels and tour operators all receive a B. Airlines and car rental companies receive

a B-, and cruise companies receive a C+.

Table 24: More specifically, what grade would you give each of the following family travel

providers for how they handled the pandemic? If you have no experience with a certain

provider, please select ‘Not Applicable’ (N/A).

Travel Provider A B C D F Average

Travel agents 52% 30% 14% 3% 2% B+

Vacation rentals 47% 36% 14% 2% 1% B+

Online travel booking 44% 39% 12% 2% 2% B

Restaurants 41% 40% 16% 2% 1% B

Hotels 39% 43% 14% 2% 1% B

Tour operators 39% 35% 20% 4% 3% B

Airlines 30% 37% 21% 7% 4% B-

Car rental 30% 31% 21% 8% 10% B-

Cruise companies 25% 20% 23% 15% 16% C+

Finally, we asked respondents what they need or expect from the travel sector to make them

feel safe on their next trip. A text box was provided for respondents to type in their answers.

Common themes are:

• Cleanliness and hygiene: travelers expect frequent, visible cleaning of common areas and

often-touched surfaces. Despite the recent criticism that some of this is ‘hygiene theatre’,

this was one of the most common requests for this question.

• Clear and reliable communications: travelers ask that travel companies provide them with

an honest and clear assessment of what they can expect at the destination in terms of

amenities and health protocols.

• Flexible cancellation and refund policies are often mentioned as important considerations

for family travel.

• When it comes to masks and vaccines, respondents were split, as indicated earlier in this

survey. A large group of respondents advocate for vaccine and mask requirements, and

stronger consequences for non-compliance of health protocols. They express concerns

for their younger children who are unvaccinated. A smaller but still sizable group feel

strongly that vaccines and masks should not ne required, and that many existing health

protocols are too restrictive. Some comment that they explicitly choose destinations

where the health protocols are more relaxed. This amplifies the importance of the

prior point on clear communications: as travel businesses cannot satisfy both groups

simultaneously, it is vital that they are transparent in their expectations and requirements

prior to the traveler’s arrival.

30

ABOUT THE NYU SCHOOL OF PROFESSIONAL STUDIES

For 87 years, the NYU School of Professional Studies (NYU SPS) has been a deeply respected

institution of higher education that is grounded in applied learning. From its early years,

training returning World War II veterans to fulfill the nation’s urgent need for skilled technical

workers, it has evolved into a professional education powerhouse that oers 20 graduate

degrees, 14 bachelor’s degrees for traditional and post-traditional students, four associate’s

degrees, and a plethora of continuing education courses and credentials.

NYU SPS is a thought leader, and serves as an incubator for new ideas in industries that

are constantly changing, including real estate, real estate development, and construction

management; hospitality, tourism, travel, and event management; global aairs and global

security, conflict, and cybercrime; global sport and sports business; publishing; marketing;

public relations; project management; executive coaching and organizational consulting,

human resource management and development, and human capital analytics and technology;

management and systems; translation; and professional writing. It is focused on building skills

that open doors to opportunities in emerging fields and global markets. NYU SPS faculty

members are leading experts in their areas of discipline, with a hands-on approach that

encourages students to push beyond their limits and to break new ground.

Home to some of the largest and most prestigious industry conferences in the world,

including the Schack Institute of Real Estate’s Capital Markets Conference, REIT Symposium,

and National Symposium of Women in Real Estate; and the Jonathan M. Tisch Center’s

International Hospitality Industry Investment Conference, the School’s invaluable connections

to industry leaders is a truly distinguishing factor in the education that it provides. Through

career development services and resources provided by the NYU Wasserman Center for

Career Development at NYU SPS, guest lecturers, site visits, participation in numerous

conferences and events, and Global Field Intensives, students benefit from an NYU education

that will set them apart. In addition, they have the opportunity to learn from and network with

more than 39,000 NYU SPS alumni who live, work, and contribute to innovation in industry

around the world. To learn more about NYU SPS visit: sps.nyu.edu.

31

ABOUT THE NYUSPS JONATHAN M. TISCH CENTER OF HOSPITALITY

The NYU School of Professional Studies Jonathan M. Tisch Center of Hospitality, now

celebrating 25 years of academic excellence, is a leading center for the study of hospitality,

travel, and tourism. Founded in 1995, the Tisch Center was established in response to the

growing need for hospitality and tourism undergraduate and graduate education. Its cutting-

edge curricula attract bright, motivated students who seek to become leaders in their fields.

Through its undergraduate degree in hotel and tourism management, its graduate degrees

in hospitality industry studies, tourism management, and event management; a plethora of

Professional Pathways programs; and its world-renowned hospitality investment conference,

students gain the knowledge and the skill sets that enable them to manage change, to

communicate, to thrive in complex work environments, and to advance the businesses of

hospitality, travel, and tourism. The Tisch Center recently launched the Hospitality Innovation

Hub (HI Hub), which will foster entrepreneurship and creative solutions for the industries it

serves. The state-of-the-art facilities oer students, start-ups, established industry partners,

and investors opportunities to learn, discover, innovate, and invest.

For more information about the NYUSPS Jonathan M. Tisch Center of Hospitality, visit

sps.nyu.edu/tisch.

ABOUT THE FAMILY TRAVEL ASSOCIATION

The Family Travel Association was founded in 2014 to create a single and collective voice on

behalf of the travel industry and those companies that serve traveling families. As a coalition

of the leading family travel suppliers, resources, and experts, its mission is to inspire families

to travel—and travel more—while advocating travel be an essential part of every child’s

education. For additional information on the Family Travel Association, visit familytravel.org.

32