“An Equal Opportunity Employer”

Dear Arkansas Employer:

It is a privilege for the Division of Workforce Services to provide this Employer Handbook. It

includes a brief explanation of the Division of Workforce Services Law, Regulations and

procedures as they relate to the administration of Arkansas’ Unemployment Insurance program.

This Handbook is intended to provide clear, concise information to help employers protect their

rights, fulfill their responsibilities and make the best possible use of services offered by the

Division.

References to the Arkansas Annotated Code are provided and easily accessed through the Lexis

Nexis website at no cost.

Arkansas employers are solely responsible for the funding of the UI program. The state

unemployment insurance tax is used exclusively for the payment of benefits to eligible

unemployed workers, while the annual federal unemployment or FUTA tax is used to fund the

administrative costs of the program.

Tax dollars can be saved by becoming familiar with the UI program. For example, FUTA taxes can

be reduced by paying state UI taxes on time. In addition, benefit payment accuracy can be

improved by responding to requests for information in a timely and precise manner.

While the Division encourages all employers to utilize this handbook it should be noted that it is

being provided as general information and should not be relied upon as a substitute for legal

advice.

2

Employer Handbook

Contents

DIRECTORY ......................................................................................................................................... 5

Administrative Directory ............................................................................................................... 5

Other Helpful Information Sources ............................................................................................... 5

Local Office Directory .................................................................................................................... 6

CONTRIBUTIONS ................................................................................................................................ 7

Employee ....................................................................................................................................... 7

Exempt Employment ..................................................................................................................... 8

Creating an Account ...................................................................................................................... 8

Successor Employer ....................................................................................................................... 9

Acquisition of an Entire Business .............................................................................................. 9

Acquisition of Part of a Business ............................................................................................... 9

SUTA Dumping ............................................................................................................................. 10

Joint Accounts ............................................................................................................................. 10

Multiple Accounts ....................................................................................................................... 10

Employee Leasing ........................................................................................................................ 11

Wages to Be Reported ................................................................................................................. 12

Payments Which Should Not Be Reported: ............................................................................ 12

Employees in More than One State ............................................................................................ 13

Unemployment Tax Calculation .................................................................................................. 13

Total Tax Rate .......................................................................................................................... 14

Advanced Interest Tax Rate..................................................................................................... 14

Extended Benefit Tax Rate ...................................................................................................... 14

Stabilization Tax Rate .............................................................................................................. 14

New Employer Tax Rate .......................................................................................................... 15

Base Tax Rate........................................................................................................................... 15

Reserve Ratio ........................................................................................................................... 15

Net Reserve ............................................................................................................................. 15

Contributions Credited ............................................................................................................ 16

Total Benefits Paid ................................................................................................................... 16

Payroll Factor ........................................................................................................................... 16

Deficit Rated Accounts ............................................................................................................ 16

Experience Rating Notices ....................................................................................................... 17

Voluntary Payment Option ...................................................................................................... 17

Federal Unemployment Tax Credit ............................................................................................. 17

Terminating Accounts ................................................................................................................. 18

Reimbursable Employers ............................................................................................................. 18

3

Employer Handbook

Factors That Should Be Considered Before Becoming Reimbursable .................................... 18

Reimbursable Payment Option ............................................................................................... 19

End of Year Balances ............................................................................................................... 19

RESPONSIBILITIES AS AN EMPLOYER ........................................................................................... 20

Filing Quarterly Wage Reports ................................................................................................ 20

Electronic Filing Requirement ..................................................................................................... 20

PENALTIES .................................................................................................................................... 20

Tax Rated Account Penalties ................................................................................................... 20

Reimbursable Penalties ........................................................................................................... 20

PAYING TAXES.............................................................................................................................. 21

Keeping Records .......................................................................................................................... 21

Reporting Changes to the Employer Account ............................................................................. 22

Providing Information to Employees .......................................................................................... 22

Providing Notice of Plant Closings or Mass Layoffs .................................................................... 23

Reporting Newly Hired and Returning Employees ...................................................................... 23

BENEFIT PAYMENTS ......................................................................................................................... 25

How Are Unemployment Benefit Amounts Determined? .......................................................... 25

1. Calculating the Base Period .......................................................................................... 25

2. Monetary Eligibility ....................................................................................................... 25

3. Calculating the Weekly and Maximum Benefit Amounts ............................................. 26

How Do Employers Know When a Claim has been Filed?........................................................... 26

When Are Benefit Payments Made? ........................................................................................... 27

The Reason for Separation from Last Employment ................................................................ 27

Continuing Eligibility Requirements ........................................................................................ 32

Multiple Base Period Employers and Benefit Charging .............................................................. 32

Quarterly Notice of Benefit Charges ........................................................................................... 32

Reimbursable Employer Billings .................................................................................................. 33

Detection and Prevention of Improper Payments ...................................................................... 33

Interstate and Combined Wages Claims ..................................................................................... 33

Federal-State Extended Benefits Program .................................................................................. 34

Shared Work — An Alternative to Total Unemployment ........................................................... 34

Trade Adjustment Assistance and Trade Readjustment Allowance ........................................... 34

Disaster Unemployment Assistance ............................................................................................ 35

How Can I Keep My Unemployment Costs Down? ..................................................................... 35

Stabilize Employment .............................................................................................................. 35

Minimize Charges .................................................................................................................... 35

4

Employer Handbook

Maintain a Good Tax Rate ....................................................................................................... 35

Report Fraud or Abuse ................................................................................................................ 36

APPEALS ........................................................................................................................................... 37

Notice of Claimant Eligibility ....................................................................................................... 37

5

Employer Handbook

DIRECTORY

Administrative Offices

The Division of Workforce Services Administrative Offices are located at #2 Capitol Mall, Little

Rock, Arkansas 72201.

Administrative Directory

Director ............................................................................................................

(501)

682-2121

Equal Opportunity ...........................................................................................

(501)

682-3106

Legal Counsel ...................................................................................................

(501)

682-3150

State New Hire Registry ...................................................................................

(501)

682-3798

Assistant Director for Unemployment Insurance ............................................

(501)

682-3200

Contributions Area Operations Chief ..............................................................

(501)

682-3253

Collections .......................................................................................................

(501)

682-3100

Employer Accounts ..........................................................................................

(501)

682-3798

Other Helpful Information Sources

Appeal Tribunal ...............................................................................................

(501)

682-1063

Board of Review ...............................................................................................

(501)

683-4300

Technical Assistance-Unemployment Insurance Benefits ..............................

(501)

628-3244

(General Inquiries Only--Questions regarding benefit payment issues involving specific

claimants should be addressed to [email protected] and your email

will be responded to as quickly as possible.

6

Employer Handbook

Local Office Directory

The Division of Workforce Services has local offices throughout the State to carry out

Unemployment and Employment Service functions.

Local Office

Physical Location

Zip Code

Telephone

Conway

1500 North Museum Rd, #111

72032

501-730-9897

El Dorado

708 West Faulkner St

71730

870-862-6456

Fayetteville

2153 E. Joyce Blvd, #201

72701

479-521-5730

Forrest City

EACC Campus, 1700 New Castle Rd

72235

870-633-2900

Fort Smith

616 Garrison Ave, Rm 101

72901

479-783-0231

Harrison

818 Highway 62-65

72601

PO Box 280 - 72602-0280

870-741-8236

Hope

205 Smith Road, Suite A

71801

870-777-3421

Hot Springs

201 Market St

70901

501-525-3450

Jonesboro

2311 East Nettleton Ave

72401

870-935-5594

Little Rock

5401 S University

72209

501-682-8030

Monticello

477 South Main St

71655

870-367-2476

Paragould

Black River Tech- 1 Black River Dr

72450

870-236-8512

Pine Bluff

1001 South Tennessee St

71601

870-534-1920

Russellville

104 South Rochester Ave

72801

479-968-2784

Searcy

501 West Arch Ave

72143

501-268-8601

West Memphis

ASU Mid-South-2003 W Broadway

72301

870-400-2269

7

Employer Handbook

CONTRIBUTIONS

Arkansas employers, except for certain IRS

approved nonprofit employers, and state and

local government entities, pay both Federal

and State unemployment insurance taxes to

finance Arkansas’ Unemployment Insurance

program. An employer can be an individual, a

partnership, a corporation, or any other

entity for which a worker performs services.

If a business meets one of the following

conditions, it is considered an “employer”

and required to pay unemployment taxes on

its employees' wages throughout the

calendar year.

1. Employ one or more workers for some portion of ten or more days during a calendar year.

2. Acquire the business or part of the business of an employer subject to unemployment

taxes.

3. Pay $1,000 or more cash wages in a calendar quarter to individuals employed in domestic

service.

4. Pay $20,000 or more cash wages in any calendar quarter to individuals employed in

agricultural labor or employ at least ten workers for some part of a day in each of twenty

different weeks in a calendar year.

5. Voluntarily elect to provide unemployment coverage to workers even though it is not

required. Such an election must include all employees in all of the employer’s places of

business and is binding for a minimum of two calendar years.

Reference: Arkansas Code § 11-10-208, §11-10-209 and, §11-10-210

Employee

The relationship between the employer and its workers determines if the workers are

employees covered by UI tax law. An employment relationship exists when a worker performs

services that are subject to the employer’s control, or right to control, whether or not that

control is exercised.

Generally, an employment relationship exists when the services performed are a regular part of

business. It is presumed that, in order to protect business interests, the manner in which workers

perform services is controlled.

The services may be performed on a full-time, part-time, temporary, seasonal, or probationary

basis. They may be performed on or off the premises or in employees own homes. Corporate

officers, including officers of closely-held corporations, are employees of the corporation

whether or not they receive wages.

In contrast, “independent contractors” are customarily engaged in an independent trade,

occupation, profession, or business. They usually advertise their services, are in a position to

realize a profit or suffer a loss as a result of their services, and usually have a significant

8

Employer Handbook

investment in the business.

Exempt Employment

Employees are covered by UI tax law, unless their services are specifically excluded. If a service

is excluded, it is not counted in determining the liability for taxes. Payments for those services

should not be included on the quarterly wage reports. Some of the more common types of

payments not reported are:

1. Service performed by an individual in the employ of his /her son, daughter, or spouse.

2. Service performed by a child under twenty-one years of age in the employ of his /her father

or mother.

3. Service performed as an insurance or real estate agent or solicitor if remuneration is solely

from commission.

4. Service performed in the delivery or distribution of newspapers or shopping news to

customers.

5. Service performed as a student nurse in the employ of a hospital or a nurses’ training

school; or interns in the employ of a hospital.

6. Service performed by students in regular attendance at the educational institution that

employs them.

7. Service performed in the employ of a church or convention or association of churches; or a

church organization operated exclusively for religious purposes.

8. Service performed by an individual for any political caucus, committee, or headquarters of

other groups of like nature not established on a permanent basis.

9. Service performed by an inmate of a penal institution.

10. Service performed by a qualified home and community based service provider.

Questions concerning coverage or exemption may be directed in writing to:

Division of Workforce Services

Employer Account Services

PO Box 8007

Little Rock, AR 72203

Or by calling (501) 682-3798.

All questions submitted in writing should include complete information regarding the nature of

the employment, along with the name, address, and telephone of the individual that can best

provide additional information, if such is needed.

Reference: Arkansas Code §11-10-210(a)(4)(A)-(F) and §11-10-210(f)(1)-(21)

Creating an Account

As soon as an entity meets the definition of employer, the Tax21 website can be utilized to

create an account for reporting purposes. The Employer Accounts Services section or any of

the District Field Tax Representatives shown in the Directory of this handbook is also available

to assist in the creating an account or answering any questions on the process. A “Report to

Determine Liability Under the Division of Workforce Services Law” (Form DWS-ARK-201) must

be completed and submitted no later than the last day of the second month in which the

9

Employer Handbook

employer/employing unit meets the definition. The information provided will be used to

determine the liability for unemployment taxes.

If an employer disagrees with a determination of liability it must notify the Division (Employer

Accounts Services) within twenty days of the mailing date of the notification of liability or an

account will be established and number assigned. The account number will consist of nine

digits and it is imperative that the number is included on all reports, remittances and other

correspondence to ensure reference to the correct account.

If there is a disagreement with the liability determination and the employer decides to appeal,

quarterly reports must be filed and all contributions, penalty, and interest due must be paid

during the appeal process.

Successor Employer

When all or part of a business covered by UI tax law is acquired, whether the acquisition is the

result of reorganization, purchase, inheritance, receivership or for any other cause, the

acquiring entity is considered a “successor” employer for unemployment tax purposes.

Successor employers are immediately liable for unemployment tax regardless of the amount of

wages paid or workers employed.

Acquisition of an Entire Business

When an entire business is acquired and its operation is continued, the tax rate and all

experience transfers to the successor employer. The experience includes the record of

contributions paid into and benefits paid out of the trust fund. Therefore, any unemployment

benefits awarded based on wages paid by the former owner will be charged to the successor

employer’s account. Additionally, the successor employer will be liable for taxes left unpaid by

the predecessor employer.

As a successor employer, take into account wages paid by the former owner in determining the

amount of wages that are taxable during the year the business is acquired. For example, if the

former owner has paid wages in excess of the taxable wage base to a worker whose

employment continues with the successor employer, taxes are not due on any additional wages

paid to this worker in the year that the business is acquired.

Reference: Arkansas Code §11-10-710

Acquisition of Part of a Business

If only a segregable and identifiable portion of a business is acquired and continues to operate,

the successor employer is not automatically assigned the tax rate and experience rating of the

When acquiring a business, consider whether any unemployment taxes remain

unpaid by the seller.

Take advantage of the taxable wages reported by the former owner.

10

Employer Handbook

former owner.

If a successor employer wants to obtain the partial experience of the predecessor employer a

“Petition for Partial Transfer of Experience” (Form DWS-ARK-201P) must be completed and

submitted no later than thirty days after the effective date of the acquisition.

Reference: Arkansas Code §11-10-710(b)(1)

SUTA Dumping

SUTA Dumping is the deliberate avoidance of UI taxes by manipulation of UI tax rates.

Businesses manipulate UI tax rates by purchasing or forming a new entity with a lower rate and

then moving employees and wage reporting to that entity.

UI tax law provides for criminal and civil penalties for employers and financial advisors that

engage in SUTA Dumping. Violations or attempted violations by employers can result in a 2%

rate increase in the year the violation occurs and in the three succeeding years, and a 10%

penalty on total UI taxes due. Advising other persons or entities to engage in SUTA Dumping

can result in penalties up to $5,000.00 plus 10% of tax due. In addition, any person who violates

or advises others to violate the SUTA Dumping provisions shall be guilty of a Class C felony.

Reference: Arkansas Code §11-10-723

For additional information regarding SUTA Dumping call (501) 537-6364.

Joint Accounts

Employers can make application to participate in a joint account with one or more other

employers. To make such an application, a completed “Petition for Joint Employer Tax

Account” (Form DWS-ARK-201J) must be submitted on or before December 1, prior to the year

the application is to become effective. If approved, the individual accounts are merged in a

joint account for experience rating purposes. Each employer assumes joint and several liability

for the debts of the others in the group. All joint accounts are maintained on a calendar year

basis and must be maintained for a minimum of two calendar years unless terminated sooner

by action of the Division.

Withdrawal from a joint account by any participating employer may be approved, if the request

for withdrawal is made in writing to the Division on or before September 30 of the year prior to

the year for which the withdrawal is to be effective. A “Request for Withdrawal from Joint

Account” (Form DWS-ARK-236J) must be completed and submitted to process the request. The

withdrawing employer will be treated as a new liable employer, and as such will not get the

benefit of the taxable wage base already paid on employees in former quarters.

Reference: Arkansas Code §11-10-208(3)-(12)

For additional information on joint accounts please contact the Employer Accounts Division at

(501)-682-3798.

Multiple Accounts

If an employer has multiple locations that require separation for its internal accounting

11

Employer Handbook

purposes, more than one account may be assigned, but the experience is combined in to one

rate.

Multiple accounts must file utilizing separate assigned account numbers. Once the account

numbers have been issued, we strongly urge all employers to use the Tax21 system to file all

quarterly reports. If paper reports are necessary separate “Employer’s Quarterly Wage and

Contribution Report” (Form DWS-ARK-209B, DWS-ARK-209BR-Reimbursable Employers Only or

DWS-ARK-209BS-Seasonal Industries Only) for each place of business.

Employee Leasing

The term “lessor employing unit” is defined as an independently established business entity

which engages in the business of providing leased employees to any other employer, individual,

organization, partnership, corporation, or other legal entity, referred to herein as a “client.”

Any legal entity determined to be engaged in the business of “outsourcing” shall be considered

a lessor employing unit. Additionally, the licensing requirements of the Arkansas PEO

Recognition and Licensing Act (Arkansas Code Annotated 23-92-401 et seq.), as administered

by the Arkansas Insurance Division, must be satisfied. Lessor employing units must also obtain

an employee leasing firm license from the Arkansas Department of Insurance, post a surety

bond in the amount required by them, and meet the other requirements of that licensing

department. (The surety bond required for licensing is in addition to the bond requirements of

the Division of Workforce Services.)

If, after three years all contributions have been paid in a timely manner, the bond held for a

bonded lessor employer may, upon request, be reduced from $100,000 to $35,000. Bonded

lessor employers must report wages for new clients on separate client accounts for three years;

after which time, the bonded lessor employer shall report all wages under its own account

number and federal ID number, using the assigned rate. Non-bonded lessor employers must

always report wages under its clients accounts.

In lieu of a surety bond, the lessor employing unit may deposit, in a depository designated by

the Director, securities with marketable value equivalent to the amount required for the surety

bond. The securities so deposited shall include authorization to the Director to sell any such

securities in an amount sufficient to pay any contributions which the lessor employing unit fails

to promptly pay when due.

Reference Arkansas Code Annotated, Section 11-10-717 (e) (2) (B).

The clients of lessor employing units must continue to report wages paid to their employees

and pay the contributions due on them until the lessor employing unit has complied with the

security bond requirements as stated above. In addition, the employee leasing company is

prohibited from moving the wages of a client from one lessor employing unit to another lessor

employing unit account with a lower rate.

A lessor employing unit, that has not posted a Surety Bond or provided other acceptable

collateral, must submit separate quarterly contribution and wage reports for each of its client

entities. When an employer enters into a contract with a lessor employing unit, which has not

posted a $100,000 surety bond, a new account number will be issued. If the client has an

existing account with DWS, it will be terminated, a new account number issued as a successor

account, and the experience rating transferred to the successor account. A new employer will

have a new DWS number issued. The lessor information on the account will be the lessor’s

12

Employer Handbook

Federal Identification Number, address, telephone number and contact person. Individual

client information will compose the remainder of the items.

If a client chooses to retain a portion of the employees, a multiple account will be generated

with the parent account unit belonging to the client and the secondary unit having joint and

several liabilities with the lessor employer.

For lessor accounts to be accurately maintained, a monthly list of clients added and deleted will

be sent to the Arkansas Insurance Department, with a copy to the Division of Workforce

Services. A Power of Attorney signed by the client’s representative should be submitted for

each lessor client.

The provisions, as outlined above are not applicable to private employment agencies that

provide their employees to employers on a temporary basis, provided that the private

employment agencies are liable as employers for the payment of contribution on wages paid to

temporary workers it employs. An example is a Temporary Help Firm, which is defined as a firm

that hires its own employees and assigns them to clients to support or supplement the client’s

workforce in work situations such as employees’ absences, temporary skill shortages, seasonal

workloads and special assignments/ projects.

Reference: Arkansas Code §11-10-717(e)1-5

Wages to Be Reported

“Wages” means all remuneration paid for personal services including, but not limited to,

salaries, commissions, bonuses, fees, fringe benefits, sick pay made directly to the employee or

his dependents, deferred compensation, tips received while performing services which

constitute employment and were reported by employees, and the cash value of payments in

any medium other than cash. Employer contributions (to the extent elected by the employee)

to 401 (k) plans are also wages.

Payments Which Should Not Be Reported:

1. Payments made to a plan or system which makes provision for employees and/or their

dependents for insurance or annuities involving retirement, sickness, or accident disability,

medical and hospitalization in connection with sickness or accident disability, worker’s

compensation, or death.

2. Payments made by an employer under a cafeteria plan, within the meaning of 26 U.S.C.A.

Section 125, if such payment would not be treated as wages without regard to such plan.

3. Fees paid to corporate directors.

4. A domestic employee’s share of the Federal Insurance Contribution Act (FICA).

Reference: Arkansas Code §11-10-215

Be aware of excluded payments for which taxes are not due.

13

Employer Handbook

Employees in More than One State

If employees are working in Arkansas and one or more other states, the following guidelines

will help correctly report their wages and pay unemployment taxes:

1. If an employee works only in Arkansas, report the wages and pay taxes to Arkansas,

whether or not the employer is located in Arkansas.

2. If an employee works only in another state, report the wages and pay taxes to that other

state, even if the employer is located in Arkansas.

3. If an employee works primarily in Arkansas and only occasionally in another state, report

the wages and pay taxes to Arkansas whether or not the employer is located in Arkansas.

4. If an employee works equally in two or more states, report the wages and pay taxes to the

state that contains the employer’s base of operations, or the state from which the services

are directed and controlled (usually the State in which the employer is located).

Localization of Work Provisions

When an employee permanently moves to Arkansas from another state, but remains employed

by the same employer, a credit against Arkansas’ $7,000 taxable wage base may be taken for UI

taxes paid in the former state of residence during the same calendar year.

For example:

If in the second quarter of the calendar year an employee moves to Arkansas from Missouri.

(Missouri’s taxable wage base is $13,000) In Missouri in the first quarter the employee was paid

$6,000 and in the second quarter in Arkansas the employee was paid $10,000. The second

quarter taxes will be as follows:

Arkansas taxable wage base: $ 7,000.00

1

st

quarter wages paid toward Missouri taxable base $ 6,000.00

Taxable wage base not yet met $1,000.00

2

nd

quarter wages for Arkansas $10,000.00

Taxable wages base not yet met $1,000.00

Excess Wages $9,000.00

Taxable Wages for Arkansas $1,000.00

Unemployment Tax Calculation

(The following information on calculating tax rates does not apply to certain nonprofit and

governmental employers that have chosen the reimbursement payment option—please see the

section on reimbursable employers for more information on this option).

Arkansas’ base UI tax rates range from 0.1% to 5.0% with deficit employer rates ranging from

6.0% to 10.0%. In addition to the base rates and deficit employer rates, additional taxes may

be in effect. The additional taxes are: Advanced Interest tax 0.2%, Extended Benefit tax 0.1%

and Administrative Assessment (formerly Stabilization 0.1% to 0.8%) 0.125% for 2023 third

quarter though 2024 second quarter; will reduce to 0.1% for 2024 third quarter forward.

Together the base/deficit rate and the additional taxes constitute the total tax rate. The

base/deficit rates and the additional taxes (when in effect) are due on the first $7,000 (taxable

-

-

14

Employer Handbook

wage base) of covered wages of each employee during the calendar year. The total tax amount

is calculated by multiplying the quarterly taxable wages by the total tax rate.

Total Tax Rate

To determine the amount of the tax that each individual employer pays; the advanced interest,

extended benefit, stabilization, and base rate are added.

For example:

Advanced Interest: 0.200%

Extended Benefit: 0.100%

Administrative Assessment (formerly stabilization): 0.125%

Example Employer’s Base Tax Rate: 1.900%

Total Tax Rate: 2.325%

Advanced Interest Tax Rate

The 0.20% Advanced Interest tax is imposed the quarter following the quarter in which an

outstanding Title XII advance begins to accrue interest.

Reference: Arkansas Code §11-10-708

Extended Benefit Tax Rate

The extended benefit tax is a 0.1% tax on taxable payrolls to finance the payment of extended

benefits. Whether the tax triggers on depends upon the trust fund balance.

Reference: Arkansas Code §11-10-540

Stabilization Tax Rate

Note: Stabilization tax was removed and replaces with Administrative Assessment effected July

1

st

, 2023.

The stabilization tax is a solvency tax which, depending on the relationship of the trust fund

balance to total payrolls, may range from – 0.1% to 0.8% of taxable wages. This tax is necessary

since individual employer reserves cannot be charged for all benefits paid from the trust fund.

Examples of these uncompensated benefit payments include:

1. Benefits paid to workers whose employer has gone out of business.

2. Benefits paid to workers whose employer’s tax rate is not sufficient to cover their benefit

charges.

3. Benefit payments that are non-charged.

Administrative Assessment

The administrative assessment is used for personal services necessary to the proper

administration of the Division of Workforce Service law.

Examples include:

1. Online filing systems for benefits and contributions

2. Fraud detection systems

3. IT enhancements

15

Employer Handbook

Reference: Arkansas Code §11-10-706

New Employer Tax Rate

New employers are assigned the new employer rate. The new employer rate is 1.9% plus any

additional taxes in effect effective January 1

st

, 2024. In prior years the new employer rate was

2.9% plus and additional taxes in effect. New employers keep the new employer rate until such

time as they have had three years of chargeable benefit experience.

Base Tax Rate

After an employer has been subject to three or more years of benefit experience the rate will

be assigned by the following chart based on the Reserve Ratio.

Contribution Base Rate

Reserve Ratio

0.1%

9.95% or more

0.3%

9.35% but less than 9.95%

0.5%

8.85% but less than 9.35%

0.8%

8.65% but less than 8.85%

1.2%

8.35% but less than 8.65%

1.6%

7.95% but less than 8.35%

2.0%

7.35% but less than 7.95%

2.4%

6.75% but less than 7.35%

2.8%

5.45% but less than 6.75%

3.2%

2.45% but less than 5.45%

4.0%

1.35% but less than 2.45%

5.0%

Less than 1.35% with a positive reserve balance

6.0%

Less than 0.00%

8.0%*

Less than 0.00% for four consecutive years

10.0%*

Less than 0.00% for eight consecutive years

12.0%* NA as of 1/1/2024

Less than 0.00% for six consecutive years

14.0%* NA as of 1/1/2024

Less than 0.00% for eight consecutive years

1.9%** as of 1/1/2024, previously 2.9%

New Employer Rate

Reference: Arkansas Code §11-10-705

Reserve Ratio

The reserve ratio is calculated by dividing the net reserve by the payroll factor.

Reserve Ratio = Net Reserve

Payroll Factor

Net Reserve

The net reserve is calculated by subtracting the total unemployment insurance benefits paid

from the total contributions credited.

Net Reserve = Contributions Credited – Total Benefits Paid

* See Deficit Account Rates section for additional information

** See New Employer Tax Rate section for additional information

16

Employer Handbook

Contributions Credited

Contributions credited is the amount of taxes paid on the account, excluding any advanced

interest, extended benefit, or stabilization taxes paid.

The rate calculation period is July 1 through June 30. However, contributions paid on or before

July 31 on wages paid on or before June 30 shall be included in the computation.

Total Benefits Paid

Unemployment benefits paid is the total amount of unemployment benefits paid to former

employees and charged to the account during the rate calculation period.

Payroll Factor

The payroll factor is determined by taking the lowest of the three or five year average taxable

payroll. Taxable payroll is the total of the first $7,000 paid to each employee in the calendar

year. DWS’ tax system will calculate and use the most advantageous payroll factor in the rate

calculation.

Example:

Year 5: $10,000

Year 4: $50,000

Year 3: $45,000

Year 2: $70,000

Year 1: $100,000

Option to Elect Last Year’s Payroll

An employer (other than one with the new employer rate) whose previous year’s total taxable

payroll is less than the three or five year average annual payroll may elect to use the previous

calendar year’s payroll as the payroll factor in computations of the experience rate.

Employers that wish to select this option must make their request in writing no later than July

31

st

immediately preceding the rate calculation year. Requests should be addressed to:

Division of Workforce Services

Employer Account Services

PO Box 8007

Little Rock, AR 72203

Deficit Rated Accounts

If, on the computation date, the total of all contributions credited to the employer for all

previous periods is less than the regular benefits charged to the employer’s account (negative

Net Reserve), the employer will be assigned a deficit rate.

Although many employers are assigned the maximum base rate, this does not cover the cost of

unemployment benefits chargeable to their accounts. As a result there are additional

assessments for deficit rated employers. Once an employer is assigned a 6.0% deficit rate for

four years an additional assessment of 2.0% is added raising the rate to 8.0%. If the account

remains deficit for eight years an additional assessment of 4.0% is added bringing the rate to

10.0%.

5 year average ($10,000 + $50,000 + $45,000 + $70,000 + $100,000)

divided by 5

$275,000/5 = $55,000

3 year average ($10,000 + $50,000 + $45,000) divided by 3

$105,000/3 = $35,000 lowest of the two averages = Payroll Factor

17

Employer Handbook

*Prior to the 2024 tax year, at six years deficit rating the additional assessment is 6.0% and the rate is 12.0% and starting in

2016 an account with a deficit rating for eight years or more receives an 8.0% additional assessment for a total rate of 14.0%.

Experience Rating Notices

On or before February 1 of each year an, “Experience Rating Notice” is sent to each liable

employer. This notice shows the rate the employer will use to compute the contribution due on

the taxable payroll for the current calendar year.

The total tax rate is identified as that portion of the tax applicable to the contributions tax,

stabilization tax, extended benefits tax, and advance interest tax, when in effect. The notice will

also show the various rate factors on the computation date which were used to determine the

assigned rate.

The notice should be inspected for accuracy. This notice is final and binding, unless written

application for review and redetermination is filed with the Division, within thirty days from the

date the notice was mailed.

Voluntary Payment Option

A voluntary payment may be an option to reduce the assigned base rate for an employer’s

account. Voluntary payments are used to increase the contributions credited rate calculation

factor and can result in a lower tax rate.

A voluntary payment schedule, if applicable to the employer’s account, is included with the

experience rating notice. Voluntary payments must be made by March 31. Upon receipt of the

voluntary payment, a new experience rate is calculated based on the updated reserve ratio and

a new experience rating notice will be mailed.

Such payment must be clearly identified as a voluntary payment, the amount being paid, and

the account(s) to which it is to be credited. No voluntary payment may be refunded after being

credited to an account. Payment may be made through the Tax21 system, or mailed to:

Division of Workforce Services

Attn: Voluntary Payments

PO Box 8007

Little Rock, AR 72203

For additional information on voluntary payments contact the Employer Accounts division at

(501)-682-3798.

Federal Unemployment Tax Credit

Most employers that pay Arkansas state unemployment tax are liable under the Federal

Unemployment Tax Act (FUTA). The annual tax paid under FUTA is used to fund the

administrative costs of the Unemployment Insurance program while Arkansas state

unemployment tax is used for the payment of benefits to eligible unemployed workers.

Each year consider a voluntary payment as a way to reduce tax rates.

Pay state unemployment taxes on time to receive full credit

against federal unemployment tax.

18

Employer Handbook

When state taxes are paid on time, a tax credit is given to reduce the FUTA tax regardless of the

Arkansas UI tax rate. In order to receive the full federal tax credit, state taxes must be paid

timely.

Reference IRS.gov/940-FUTA

Terminating Accounts

If an employer is going out of business or sells the business to a successor employer a “Report

to Terminate Account” (Form DWS-ARK-236) must be filed with the Division of Workforce

Services.

For additional information on terminating an account contact the Employer Accounts division

at (501)-682-3798.

Reimbursable Employers

A nonprofit organization, exempt from federal unemployment taxes under Section 501(a) of

the Internal Revenue Code of 1954, as amended, and state and local governmental entities,

including educational institutions, are offered an alternative method for paying state

unemployment taxes --the reimbursable payment option--a form of “self-insurance.” If an

employer opts for the reimbursable payment option, rather than pay quarterly taxes based on

a tax rate, it pays its pro rata share of the actual cost of any benefits paid to its former workers.

The reimbursement payment option must be chosen within thirty days of the date the

employer becomes liable under Arkansas’ unemployment tax law otherwise the account will be

set up to be tax rated. The required written notice of election should be mailed to:

Division of Workforce Services

Employer Accounts Services

PO Box 8007

Little Rock, AR 72203

Reference: Arkansas Code §11-10-713

Factors That Should Be Considered Before Becoming Reimbursable

1. This option is generally more advantageous for employers with stable employment; the tax-

rated basis is usually more advantageous for employers with high employee turnover.

2. Reimbursable payments will vary depending on the number of former employees receiving

unemployment benefits; however, with this option it is difficult to estimate costs. In

contrast, tax-rated employers can more accurately estimate unemployment costs because

their tax rates remain constant for a complete calendar year.

3. Employers that have elected the reimbursable payment option may not be relieved of

“charges” (benefit payments) for any reason. This includes cases where former employees

are paid benefits after a disqualification for quitting or discharge, or in cases where they are

paid benefits after subsequent employment and certain other circumstances. Although tax-

rated employers may be relieved of charges for specific individuals, the actual cost of the

benefits paid to those individuals is shared by all tax-rated employers.

19

Employer Handbook

Reimbursable Payment Option

1. Each quarter a report including all employees’ names, social security numbers, and total

gross wages must be completed using the Tax21 system. If that is not feasible for the

employer an “Employer’s Quarterly Contribution and Wage Report” (Form DWS-ARK-

209BR/CR) would be filed via mail. No payment is included with this report.

2. When former employees file for benefits, and if you were the claimant’s last employer a

notice will be provided for the opportunity to protest the employees’ receipt of benefits

based on the reason for separation.

3. When benefits are paid to former employees in a calendar quarter, a “Quarterly Listing of

Reimbursable Benefits Paid” (Form DWS-ARK-547) will be mailed following the end of the

quarter. This listing will contain the names and Social Security numbers of former

employees paid benefits in that quarter and the amount of the account's proportionate

share of charges.

4. In the event the extended benefits tax (see Extended Benefits) is in effect:

• Non-profit reimbursable employers must reimburse one half of the extended

benefits charged to the account.

• Governmental entities must reimburse the full amount of the extended benefits

charged to the account.

Administrative assessment, stabilization, and the advanced interest taxes do not apply to

reimbursable employers.

Advanced Payments

Employers that choose the reimbursable payment option must estimate the amount of benefits

that will be charged to them and make quarterly advance payments of those benefit charges.

The estimate is based on the total benefits charged to the account in the fiscal year ending on

June 30 of the immediately preceding calendar year.

Advance payments are due the tenth day of the first month of each calendar quarter:

• January 10

th

• April 10

th

• July 10

th

• Oct. 10

th

End of Year Balances

After the end of the calendar year, the Division will determine whether the total amount of

payments made for the year by the employer is less than, or in excess of, the total amount of

benefit payments chargeable to the employer. If the total advance payments were less than

the total benefit charges, the unpaid balance is due within thirty days after the mailing date of

the notice of the amount.

If the advance payments exceed the benefits charged, all or part of the excess may, at the

option of the employer, be refunded to the employer or retained as part payment against

future payments.

20

Employer Handbook

RESPONSIBILITIES AS AN EMPLOYER

Filing Quarterly Wage Reports

Employers are required by Law to file wage reports on a quarterly basis whether wages have

been paid in the quarter. Quarterly reports may be filed in the two following formats:

1. Online through the Tax21 system at

https://www.employment.arkansas.gov/Tax21/Home.aspx

2. Paper reports may be submitted utilizing the following forms (Form ARK-DWS-209B or

DWS-ARK-209BR Reimbursable Employers Only or DWS-ARK-209BS Seasonal Industries

Only).

Electronic Filing Requirement

If an employer has two hundred and fifty or more employees, it is a requirement to file via

electronic transmission using the Tax21 system. Failure to fully comply with the electronic

reporting requirements could result in the assessment of additional penalties.

For additional information contact Employer Accounts at (501)-682-3798.

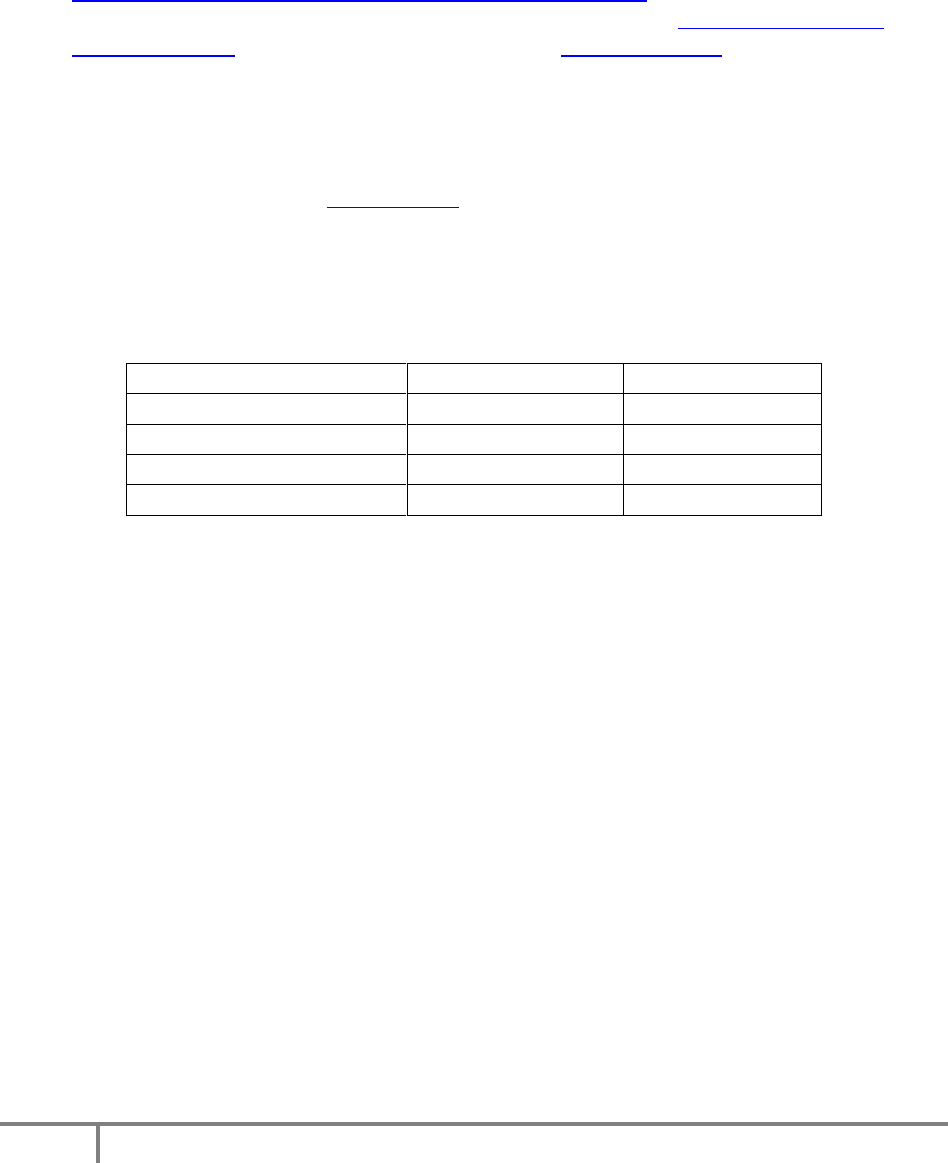

Report Due Dates

Quarterly wage reports are due quarterly on the following schedule:

For Wages Paid During

Calendar Qtr. Ends

Report Due By

Jan, Feb, Mar

March 31

April 30

Apr, May, Jun

June 30

July 31

Jul, Aug, Sep

September 30

October 31

Oct, Nov. Dec

December 31

January 31

PENALTIES

Tax Rated Account Penalties

Any liable employer whose report is filed or postmarked late will be assessed a penalty charge

as follows:

• $10.00 or 5% of tax due (whichever is greater) if the report is filed within twenty

days after the due date.

• $20.00 or 10% of tax due (whichever is greater) if the report is filed more than

twenty days after the due date.

• $30.00 or 15% of tax due (whichever is greater) if it is necessary to estimate the

wages, subpoena wage records, all information required is not supplied, including

but not limited to, employer wage information, employee Social Security numbers,

as well as, any non-compliance of electronic reporting.

Reimbursable Penalties

Any reimbursable employer whose report is filed or postmarked late will be assessed a penalty

charge as follows:

• $10.00, if the Quarterly Report is filed within twenty days after the due date.

21

Employer Handbook

• $20.00, if the Quarterly Report is filed more than twenty days after the due date.

PAYING TAXES

(This section does not apply to nonprofit and governmental employers that have chosen the

reimbursable payment option,

unless

otherwise noted.)

Employers must report total wages paid to all employees in the quarter, unless specifically

excluded by Law, but pay taxes on only the first $7,000 paid to each worker in the calendar

year. Subtract “excess wages,” (amounts over $7,000 paid to each worker) from total wages, to

determine taxable wages.

The unemployment tax payment is to be remitted with the quarterly report and is used solely

for the payment of unemployment benefits. Payments will be considered delinquent if not

postmarked or received by the Division of Workforce Services on or before the last day of the

month following the close of the calendar quarter. An interest charge of 1.5% per month is

assessed on delinquent payments.

(Note: Employing units which reimburse in lieu of taxes are subject to the same interest

charges as those for employers paying taxes).

A “Contribution Account Transaction” (Form DWS-ARK-213A) is sent to an employer when full

payment is not received by the date due.

The Director is authorized to impose a penalty of 10% of the face amount of the check, draft, or

order or $10.00, whichever is greater, when such form of payment is returned without having

been paid in full. This penalty is cumulative to any other penalties provided by Law.

A Contribution Account Transaction (Form DWS-ARK-213A) is also used to notify

employers of any credit due if an account is overpaid. The next Quarterly Report, and the

accompanying contribution payment due will be reduced by the amount of credit at that time. If

the overpayment is a substantial amount, or if it is not likely to be used within two quarters, a

refund may be preferred. To obtain a refund, mail (Form DWS-ARK-213A) to:

Division of Workforce Services

Employer Accounts Services

PO Box 8007

Little Rock, AR 72203

Keeping Records

Arkansas regulations require liable employers to preserve and make available for inspection,

employment records containing the following information for a period of five years from the

end of the month following the end of the calendar quarter to which such records pertain. The

records must contain:

1. Full name and Social Security number of each worker employed during any pay period.

Penalty may be assessed for failure to provide Social Security number.

2. Place of employment.

3. Amount of wages paid for each pay period, segregated as to cash payment and payment

made in other forms.

4. Amounts paid as allowance or reimbursement for traveling or other business expenses,

22

Employer Handbook

dates of payment, and amounts of such expenditures actually incurred and accounted

for by the employee.

5. Date each worker was hired, rehired, or returned to work after a temporary layoff.

6. Number of hours spent in covered employment and, if applicable, number of hours

spent in non-covered employment in each pay period.

All employers, in industries declared seasonal by the Director, must keep a separate record of

the wages paid for employment within a seasonal period and the wages paid outside a seasonal

period.

Field Tax Representatives conduct regular examinations of employer payroll records. The

purpose of these audits is to ensure that all employers understand and are complying with the

Division of Workforce Services Law and Regulations. There are civil and criminal penalties for

employers and individuals representing employers for willfully failing or refusing to produce or

permit the inspection of the required records.

Reporting Changes to the Employer Account

When an employer’s business changes it is the employer’s responsibility to notify DWS of these

changes. A delay in notification could result in additional costs later. Be sure to report changes

such as:

1. Discontinuing the business

2. Changing the address or other contact information

May be completed on the Tax21 system.

For the following changes:

3. Transferring or selling the business

4. Changing the name of the business

5. Changing the ownership of the business

6. Acquiring another business

All changes must be reported in writing via email within ten days to:

or mailed to:

Division of Workforce Services

Employer Accounts Services

PO Box 8007

Little Rock, AR 72203

Employer Accounts Services may be contacted at (501) 682-3798 to advise of a change and

request the necessary documents/forms.

Providing Information to Employees

Every employing unit which is, or becomes an employer, under the provisions of the Division of

Workforce Services Law is required to post, on a continuing basis, a printed notice informing

workers that the employer is covered under Arkansas unemployment law and that in the event

of unemployment, employees may file for unemployment insurance benefits. These notices

23

Employer Handbook

must be displayed in locations readily accessible to employees. A “Notice To Employees” (Form

DWS-ARK-237) is available on the DWS website that can be accessed at

www.arkansas.gov/esd/ working on updating form on the web. Employer Services, UI Employer

Forms.

Providing Notice of Plant Closings or Mass Layoffs

The Division of Workforce Services has been designated as Arkansas’ Dislocated Worker unit.

Should an employer be required to provide notice of plant closings or mass layoffs to this unit,

as provided for in the Worker Adjustment and Retraining Notification Act of 1988 (WARN, PL

100-379), the notice should be [email protected] or mailed to:

Arkansas Division of Workforce Services

PO Box 2981

Little Rock, Arkansas 72203

With the following information included:

1. The name and address of the employment site where the plant closing, or mass layoff will

occur.

2. The nature of the planned action, i.e., whether it is a plant closing or a mass layoff.

3. The expected date of the first separation, and the anticipated schedule for making

separations.

4. The job titles of positions to be affected, and the number of affected employees in each job

classification.

5. A statement as to the existence of any applicable bumping rights. Bumping rights provide for

an employee to displace another employee due to a layoff or other employment action as

defined in a collective bargaining agreement, employer policy, or other binding agreement.

6. The name of each union, along with the name and address of the chief elected officer of

each union.

7. The name, address, and telephone number of a company official to contact for further

information.

In addition, it is recommended that the notice include a statement of whether the planned

action is expected to be permanent or temporary, and if temporary, its expected duration.

Additional information may be obtained by contacting the DWS Dislocated Worker’s unit at

(501) 683-1412.

Reporting Newly Hired and Returning Employees

On October 1, 1997, the Division of the State New Hire Registry was created by Act 1276 of the

Arkansas General Assembly to compile an automated state registry of newly hired and

returning employees. State agencies will use this information to detect and prevent fraud in the

areas of unemployment insurance, worker’s compensation and other types of public

assistance. In addition, such information will be used to locate absent parents that owe child

support in Arkansas.

All Arkansas employers – private, nonprofit and government – must report all newly hired em-

ployees that live or work in Arkansas via the Tax21 system.

Out-of-state employers that hire employees that work in Arkansas must also report. The

24

Employer Handbook

employer must report any employee that fills out a W-4 form whether full-time, part-time or

student worker. The employee’s name, address, Social Security number, as well as the

employer’s name, address, and Federal Employer Identification Number (FEIN) must be

reported.

Employers must report a new hire within twenty days of hiring an employee in the Tax21

system.

For further information, call the Employer Accounts unit (501)-682-3798.

If you are a multi-state employer, newly hired employees may be reported to the state in which

they are working or select one State in which to report all new hires. If one State is chosen, new

hire reports must be submitted electronically. In addition, a letter must be submitted to the

U.S. Secretary of Health and Human Services which includes the FEIN, company name, address,

telephone number, state chosen to receive reports, list of states where employer has

employees and name of contact persons. The letter should be addressed to:

Office of Child Support Enforcement (OCSE)

Multi-State Employer Registration

PO Box 509

Randallstown, MD 21133

For more general information call (202) 401-9267.

25

Employer Handbook

BENEFIT PAYMENTS

Unemployment Insurance benefit payments are

made to workers (claimants) that are temporarily

unemployed through no fault of their own and are

attempting to reenter the labor force. UI taxes paid

by Arkansas employers fund the entire cost of UI

benefits paid. UI taxes cannot be withheld from

the wages paid to employees.

Since the amount of benefits charged to an employer’s account is one of the factors in

determining an employer’s UI tax rate, it is to an employer’s advantage to become familiar with

the UI benefit provisions of the Division of Workforce Services Law.

Before an individual can receive unemployment benefit payments, several basic requirements

must be met:

1. The worker must show a prior attachment to the labor force.

2. The worker must not have caused the unemployment.

3. Benefits are paid only to workers unemployed through no fault of their own.

4. The worker must maintain an attachment to the labor force while collecting benefits, by

making reasonable attempts to obtain gainful employment.

How Are Unemployment Benefit Amounts Determined?

Calculating the Base Period

Only wages paid during a twelve month period called the base period are used in establishing

unemployment benefit amounts. The traditional base period is the first four of the last five

completed calendar quarters prior to the date the claimant files for benefits. For example, a

claim filed on March 1, 2023, would have a base period of October 1, 2021 through September

30, 2022.

If a claimant cannot establish a claim using a traditional base period an “alternate base period”

is used. The alternate base period consists of the four quarters immediately preceding the

quarter in which the claim is filed. For example, a claim filed on March 1, 2023 would have an

alternate base period of January 1, 2022 through December 31, 2022. The alternate base

period is not an option for claimants and can only be selected by the agency only if the claimant

cannot set up a traditional base period claim due to insufficient base period wages.

Monetary Eligibility

To qualify monetarily a claimant must have covered wages (reported by an employer) in at least

two quarters of the base period and total base period wages must equal thirty-five times the

weekly benefit amount. For succeeding benefit year claims, a claimant must have had covered

work in a least two quarters of the base period and must have worked and been paid wages

equal to eight times the weekly benefit amount, since the filing date of the prior claim.

26

Employer Handbook

Calculating the Weekly and Maximum Benefit Amounts

The weekly benefit amount is calculated by dividing the claimant’s average base period wages

by 26 and then is limited by a minimum weekly benefit amount of $81 and a maximum weekly

benefit amount of $451. A claimant may collect a total of sixteen times (updated to twelve

times for claims filed after 01/01/2024) the weekly benefit amount in regular UI benefits or

one-third of the total base period wages, whichever is less.

How Do Employers Know When a Claim has been Filed?

Each time a new or additional claim is filed, a “Notice to Last Employer” (Form DWSARK-

501(3)), is mailed to the claimant’s last employer. These notices are mailed to the address of

the employer determined to be the claimant’s last employer immediately prior to filing the

claim.

Immediately upon receipt carefully review the Notice to Last Employer. To ensure that claims

for benefits are properly adjudicated and to establish non-charging rights, it is imperative that

the response be submitted within ten calendar days of the mailing date of the notice. If no

reply is made within the ten calendar day period DWS issues the determination based upon the

best available information. An employer that does not respond timely to the Notice to Last

Employer waives the right to protest charges resulting from the determination.

Each time an individual files a new claim for benefits, a “Notice to Base Period Employer” (Form

DWS-ARK-550) is sent to each base period employer (an employer that paid wages to the

claimant during the claimant’s base period). This notice is not sent to the last employer if the

employer is also a base period employer. As a base period employer, the worker’s reason for

separation from employment determines whether an account will be charged for its

proportionate share of any benefits paid to the claimant. To ensure proper charging and to

establish non-charging rights, it is imperative that the response is submitted within fifteen days

of the date the notice was mailed.

DWS has the capability to mail unemployment insurance claim forms to specific

locations/addresses that are different from an employer’s tax/payroll address. To set up a

special mailing address, a written request must be submitted. Employers may manage their

accounts via the Tax21 system. From this site employers can:

• Apply for a new ADWS Employer Account Number

• File and pay Employer’s Quarterly Contribution and Wage Report

• Request that Unemployment Insurance Benefit Claims documents be sent to a different

address than the tax documents.

• Respond to UI 901A Overpayment Wage Response System.

• Receive and Respond to Benefit Notices

• Report a Refusal of an Offer of Work

• Report a Failure to Submit to or Pass a Pre-Employment Drug Screen

To be eligible for non-charge rights employers must return the Notice to Last

Employer within ten calendar days of its mailing date.

27

Employer Handbook

When Are Benefit Payments Made?

After a claimant is determined monetarily eligible, two major factors determine whether

benefit payments will be made:

1. The reason for separation from last employment.

2. Maintaining continuing eligibility requirements.

The Reason for Separation from Last Employment

Each application for benefits requires the claimant to explain the reason for losing employment

from the last employer. Aside from the Notice to Last Employer the last employer generally is

also sent a questionnaire Form DWS-ARK- 525 to request verification of the reason for

unemployment and to obtain specifics about the separation.

When a claimant has been discharged it is the employer’s burden to establish that the reason

for the discharge was due to the claimant’s misconduct. It is not enough to respond by saying

that the claimant was discharged for disqualifying reasons. Rather, specific facts must be

provided to establish that the claimant’s behavior was such that it violated a known rule or

standard of behavior that employers have a right to expect of its workers. Accurate records of

dates of incidents or infractions leading to the dismissal, warnings, and disciplinary actions can

be used to establish misconduct.

On the other hand, when a worker voluntarily leaves or quits employment it is the worker’s

burden to establish that there were work related reasons for quitting and that there was no

choice but to quit.

After the initial information gathering phase is completed, both parties may be contacted for

additional information. Once the necessary facts are gathered DWS issues a “Notice of Agency

Determination” (Form DWS-ARK- 578).

Each Notice of Agency Determination contains a summary of the section of the law used to

decide the issue and presents a statement showing the facts which were considered in

adjudicating the issue. Instructions for filing an appeal are also found on each determination.

The following issues are the ones that most commonly affect an employer’s account when

benefits are paid:

Keep accurate records of employment agreements and employee performance.

Record dates of warnings and descriptions of incidents leading up

to the dismissal of an employee.

28

Employer Handbook

A Determination that the

Worker:

Effect on Worker

(Separation from Last

Employer)

Effect on Last Employer*

Voluntarily quit without good

cause in connection with the

work.

OR

Failed, without good cause, to

contact the Temporary Help

Firm for reassignment upon

completion of the assignment

provided the Temporary Help

Firm advised the temporary

employee at the time of hire

that he/she must report for

reassignment upon conclusion

of each assignment and that

unemployment benefits may

be denied for failure to do so.

Disqualified until subsequent

to filing claim, there have

been at least thirty days in

new covered employment.

Reference: Ark. Code Anno-

tated 11-10-513(3)

Account non-charged if Notice to

Last Employer returned timely.

Was laid off due to a lack of

work or reduction in force.

OR

Was discharged for reasons

other than misconduct.

OR

Voluntarily quit with good

cause in connection with the

work.

Eligible for unemployment

compensation if other eligibility

conditions are also met.

Account charged.

Was suspended for misconduct

in connection with the work.

Disqualified for the duration of

the suspension or eight (8)

weeks, whichever is the lesser.

Reference : Ark. Code Anno-

tated 11-10-512 and 11-10-

514(c)(1)-(2)

A charge decision is not

made since permanent

separation from

employment has not

occurred.

29

Employer Handbook

A Determination that the

Worker:

Effect on Worker

(Separation from Last

Employer)

Effect on Last Employer*

Was discharged for miscon-

duct in connection with the

work.

Disqualified until

subsequent to filing claim,

there have been at least

thirty days in new covered

employment.

If gross misconduct is

involved, the disqualification

shall be until the claimant

earns insured wages in two

quarters that total not less

than thirty five times the

weekly benefit amount.

Reference: Ark. Code

Annotated 11-10-512, 11-10-

514(a)(1)-(3), and 11-10-514(b)

Account non-charged if Notice

to Last Employer returned

timely.

Refuses an offer of suitable

work or fails to apply for or

to accept suitable work.

OR

Failed to appear for a quali-

fied Department of Transpor-

tation (D.O.T.) drug screening

after a bona fide offer of

suitable work.

OR

Failed to pass a qualified

D.O.T. drug screening after a

bona fide offer of suitable

work.

Disqualified until subsequent

to filing claim, there have been

at least thirty days in new

covered employment.

Disqualified until the claimant

earns insured wages in two

quarters that total not less

than thirty five times the

weekly benefit amount.

Reference: Ark. Code

Annotated Section 11-

10-512 and 11-10-

515(a)(1)-(2)

N/A

30

Employer Handbook

A Determination that the

Worker:

Effect on Worker

(Separation from Last

Employer)

Effect on Last Employer*

Received other remuneration

such as:

(a) Dismissal Payments

(b) Vacation Payments

(c) Bonus Payments

(d) Unemployment Insur-

ance from another state

or from the United

States Government.

(e) Retirement Pay

(f) Separation Pay

Treated as earnings

Reference: Ark. Code

Annotated Section 11-

10-517

Disqualified

Weekly benefits reduced by an

amount equal to the amount

of the pension reasonably

attributed to the week.

(Separation from Last

Employer)

Separation payments are

disqualifying for the number

of weeks following the date

of the separation that equals

the number of weeks of

wages received in the

separation payment.

Refuses while on layoff to

report for work within one

week after notice of recall to

the same job, or to a

suitable job similar to the

one from which he/she was

laid off, or, if while

unemployed, voluntarily

removes their name from a

recall list set forth in a

written contract of a base

period employer provided

the employer files a written

notice of the refusal of recall

or removal from a recall list

with the Agency within

seven days of such

occurrence.

Disqualification shall begin on

the date of receipt of the

written notice of refusal of

recall or removal from recall

list by the Agency and shall

continue until, subsequent to

filing a claim, the worker has

had at least thirty days of

employment covered by an

unemployment compen-

sation law of this state, or

another state of the United

States.

Reference: Ark. Code

Annotated Section 11-

10-516

N/A

N/A

31

Employer Handbook

Made false statements on a

continued claim in order to

obtain benefits to which

he/she is not entitled.

Disqualified for thirteen weeks of

unemployment plus an additional

three weeks for each week of

fraud, repayment of all benefits

obtained as a result of fraudulent

acts, total reduction of

subsequent benefits on the

current and possible prosecution

and, if conviction results, the

imposition of fines and

imprisonment.

Reference: Ark. Code Annotated

Section 11-10-519 (2)

The overpayment is created

and the account will be

credited for charges

assessed based on

erroneous benefit

payments.

For a Tax Rated account, the

credit will be applied to the

calendar quarter the

overpayment becomes final.

For a Reimbursable account,

the credit will be applied

during the quarter that

benefits are paid back.

A Determination that the

Worker:

Effect on Worker

(Separation from Last Employer)

Effect on Last

Employer*

Made false statements on an

initial or renewed claim in order

to obtain benefits to which

he/she is not entitled.

Disqualification from the date

of filing the claim until he/she

has had ten weeks of employ-

ment in each of which he/she

has earned wages equal to at

least the weekly benefit

amount.

Reference: Ark. Code Anno-