Colorado

Sales Tax Guide

Colorado Sales Tax

1

Revised August 2021

Colorado imposes sales tax on retail sales of tangible

personal property. In general, the tax does not apply to

sales of services, except for those services specifically

taxed by law. However, in the case of a mixed

transaction that involves a bundled sale of both

tangible personal property and service (whether or not

such service is specifically taxed), the entire purchase

price may be taxable unless certain conditions exist.

The Colorado Department of Revenue administers not

only state sales tax, but also the sales taxes imposed by

a number of cities, counties, and special districts in

Colorado. However, the Department does not

administer and collect sales taxes imposed by certain

home-rule cities that instead administer their own sales

taxes. The information in this publication pertains only

to state and local sales taxes administered by the

Colorado Department of Revenue.

In general, any retailer making sales in Colorado is

required to collect the applicable state and state-

administered local sales taxes. The requirement to

collect tax applies whether the sale is made at a

retailer location in Colorado or delivered to the

customer at a location in Colorado. A retailer may be

required to collect tax even if it has no physical

presence in Colorado.

Any retailer that is required to collect Colorado sales

tax must obtain and maintain a Colorado sales tax

license. They must also file returns and remit collected

taxes at regular intervals, generally on a monthly basis.

Retailers must maintain all records necessary to

determine the correct amount of tax and provide these

records to the Department upon request.

This publication is designed to provide retailers with

general guidance regarding sales tax licensing,

collection, filing, remittance, and recordkeeping

requirements prescribed by law. Additional information

about license applications and renewals, filing options,

forms, and instructions can be found online at

Tax.Colorado.gov/sales-use-tax. Nothing in this

publication modifies or is intended to modify the

requirements of Colorado’s statutes and regulations.

Retailers are encouraged to consult their tax advisors

for guidance regarding specific situations.

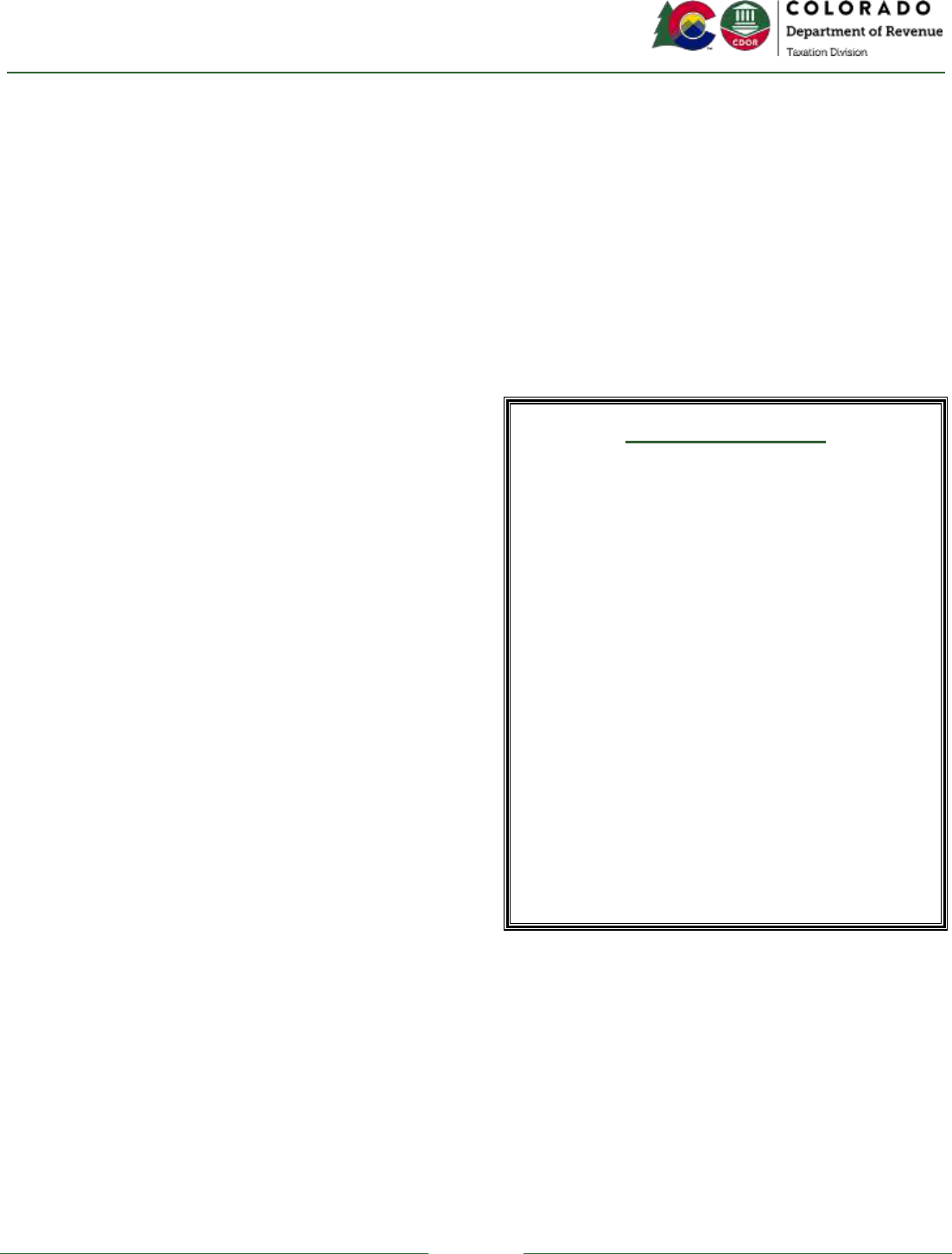

Table of Contents

Part 1: Retail Sales . . . . . . . . . . . . . . . . . . . 2

Part 2: Taxable Sales . . . . . . . . . . . . . . . . . 5

Part 3: Calculation of Tax . . . . . . . . . . . . . . . 9

Part 4: Retailers Who Must Collect Tax . . . . . . . . 11

Part 5: Sales Tax Licensing . . . . . . . . . . . . . 14

Part 6: Sales Tax Collection . . . . . . . . . . . . . 17

Part 7: Filing and Remittance . . . . . . . . . . . 20

Part 8: Local Sales Taxes . . . . . . . . . . . . . . . 24

Part 9: Recordkeeping Requirements . . . . . . . 27

Part 10: Refunds and Assessments . . . . . . . . . . . 29

Part 11: Buying or Selling a Retail Business . . . . . 31

Part 1: Retail Sales

2

Revised August 2021

Colorado imposes a sales tax on retail sales of tangible

personal property, prepared food and drink, and

certain services, as well as the furnishing of rooms and

accommodations. Wholesale sales are not subject to

sales tax. This Part 1 outlines criteria for determining

whether a particular transaction is a sale, whether a

particular sale is a retail sale, and whether a retail sale

is made in Colorado and therefore subject to Colorado

tax.

Sales

A sale is any transaction whereby a person, in exchange

for any consideration either:

1) transfers or agrees to transfer a full or partial

interest in any taxable property to any other

person; or

2) performs, furnishes, or agrees to perform or

furnish any taxable service for any other person.

Whether a transaction is absolute or conditional, it is

considered a sale if it transfers from a seller to a buyer

the title or possession of any tangible personal property

or service. The consideration exchanged in a sale may

include money in any form, property, the rendering of

a service, or the promise of any of these things. A

transaction involving taxable property is a sale whether

the seller acts on her own behalf or as the agent for

another party. A transaction involving a taxable service

is a sale whether the seller performs the service or

contracts with another party to perform or furnish the

service.

A bona fide gift of tangible personal property is not a

“sale”.

Retail & wholesale sales

Every sale that is not a wholesale sale is a retail sale. A

wholesale sale is a sale by a wholesaler or jobber to a

retail merchant, jobber, dealer, or other wholesaler for

the purpose of resale. Sales of ingredients or

component parts to manufacturers for incorporation

into a product for sale to an end user or consumer are

also regarded as wholesale sales (see Department

publication Sales & Use Tax Topics: Manufacturing for

additional information). A sale by a wholesaler or

jobber to an end user or consumer is a retail sale and

not a wholesale sale.

If a wholesaler or retailer makes a tax-free wholesale

purchase of an item for resale, but subsequently

withdraws that item from inventory for their own use,

they will owe use tax on that item. Please see the

Colorado Consumer Use Tax Guide for additional

information.

Leases

In general, leases of tangible personal property are

considered retail sales and are subject to Colorado

sales tax. However, a lease for a term of 36 months or

less is tax-exempt if the lessor has paid Colorado sales

or use tax on the acquisition of the leased property. A

lessor may submit a completed Lessor Registration for

Sales Tax Collection (DR 0440) to the Department to

request permission to acquire tangible personal

property tax-free on the condition that the lessor

agrees to collect sales tax on all lease payments

received on the property.

See Department publication Sales & Use Tax Topics:

Leases for additional information regarding the tax

treatment of leases.

Part 1: Retail Sales

3

Revised August 2021

Sourcing sales

Any retail sale that is made in Colorado is subject to

Colorado taxation. A retail sale is considered to be made

in Colorado if it is sourced to Colorado in accordance

with Colorado law. Generally, a retail sale is sourced to

the location where the purchaser takes possession of

the purchased property (“destination sourcing”). A

temporary exception from destination sourcing is

permitted for small retailers whose sales fall below

certain thresholds (“origin sourcing”).

The sourcing rules described in this section apply to

both state and state-administered local sales taxes. See

Part 4: Retailers Who Must Collect Tax and Part 8:

Local Sales Taxes for additional information regarding

state and local sales tax collection requirements.

General destination sourcing rules

In general, a retail sale is made at the location to which

it is sourced in accordance with the following rules:

1) If the purchaser takes possession of the purchased

property or first uses the purchased service at the

seller’s business location, the sale is sourced to

that business location.

2) If the property or service is delivered to the

purchaser at a location other than seller’s business

location, the sale is sourced to the location the

purchaser receives the purchased property or first

uses the purchased service.

3) If the purchaser requests delivery of the property or

service to another person, as a bona fide gift from

the purchaser, the sale is sourced to the location

that person takes possession of the purchased

property or first uses the purchased service.

If a sale cannot be sourced using the preceding rules,

section 39-26-104(3)(a), C.R.S., provides additional

guidelines for sourcing retail sales based upon the

seller’s records, the purchaser’s payment instrument, or

the location from which the property was shipped.

These sourcing rules do not apply to leased property.

See Department publication Sales & Use Tax Topics:

Leases for sourcing rules for lease payments.

Origin sourcing for small retailers

A temporary exception from destination sourcing is

allowed for retailers whose retail sales fall below the

small retailer threshold described below. Under this

exception, all of a small retailer’s sales will be sourced

to the retailer’s business location, except that any sale

delivered to a location outside of Colorado will not be

sourced to Colorado. This temporary exception will

expire on February 1, 2022. Beginning February 1, 2022

all sales will be sourced pursuant to the general

destination sourcing rules.

Small retailer threshold

A retailer will only qualify for origin sourcing if the

retailer’s total retail sales of tangible personal

property, commodities, and/or services in Colorado

during the previous calendar year were $100,000 or

less. If the retailer’s total retail sales in Colorado in the

previous calendar year exceeded $100,000, then all of

the retailer’s sales in the current calendar year must

be sourced in accordance with the general destination

sourcing rules.

A retailer who qualifies for origin sourcing based on

prior year sales will nonetheless transition to

destination sourcing if the retailer’s total retail sales in

Colorado in the current year exceed $100,000. If the

retailer’s retail sales in Colorado in the previous year

were less than $100,000, but exceed $100,000 in the

current year, the retailer’s sales will be sourced using

the general destination sourcing rules beginning with

the first day of the first month commencing at least 90

days after the retailer’s aggregate Colorado retail sales

in the current year exceed $100,000.

Part 1: Retail Sales

4

Revised August 2021

Examples

The following examples demonstrate the application of

the small retailer threshold for determining whether

origin or destination sourcing rules apply.

Example #1

During the previous calendar year, a retailer’s retail

sales in Colorado exceeded $100,000. As a result, all of

the retailer’s retail sales in the current year will be

sourced under the general destination sourcing rules.

Example #2

During the previous calendar year, a retailer’s retail

sales in Colorado were less than $100,000. As a result,

the retailer’s sales will be sourced under the origin

sourcing rules as the current year begins.

On June 15

th

of the current year, the retailer’s

cumulative retail sales in Colorado for the current year

exceed $100,000. Beginning with the first day of the

first month commencing at least 90 days after the

retailer’s aggregate Colorado sales in the current year

exceed $100,000, the retailer’s sales will be sourced

using the general destination sourcing rules.

Consequently, any retail sale the retailer makes on or

after October 1

st

of the current year will be sourced

using the general destination sourcing rules.

Since the retailer’s sales in Colorado in the current year

exceed $100,000, all of the retailer’s sales in the next

year will be sourced using the general destination

sourcing rules.

Example #3

During the previous calendar year, a retailer’s retail

sales in Colorado were less than $100,000. As a result,

the retailer’s sales will be sourced under the origin

sourcing rules as the current year begins.

On November 15

th

of the current year, the retailer’s

cumulative retail sales in Colorado for the current year

exceed $100,000. Since there are less than 90 days

remaining in the current year after the retailer’s

cumulative sales in Colorado exceeded $100,000, all of

the retailer’s sales in the current year will be sourced

using the origin sourcing rules.

However, since the retailer’s retail sales in Colorado in

the current year exceed $100,000, all of the retailer’s

sales will be sourced using the general destination

sourcing rules beginning January 1

st

of the next year.

Additional resources

The following is a list of statutes, regulations, forms,

and guidance pertaining to sales, retail sales, and the

sourcing of sales. This list is not, and is not intended to

be, an exhaustive list of authorities that govern the tax

treatment of every situation. Individuals and businesses

with specific questions should consult their tax advisors.

Statutes and regulations

➢ § 29-2-105, C.R.S. Contents of sales tax ordinances.

➢ § 39-26-102, C.R.S. Definitions.

➢ § 39-26-104, C.R.S. Property and service taxed.

➢ § 39-26-105, C.R.S. Vendor liable for tax.

➢ § 39-26-106, C.R.S. Schedule of sales tax.

➢ § 39-26-713, C.R.S. Tangible personal property.

➢ Rule 39-26-102(10).

➢ Rule 39-26-102(23).

➢ Rule 39-26-104-2. Sourcing Retail Sales.

➢ Rule 39-26-713-1.

Forms and guidance

➢ Tax.Colorado.gov/sales-use-tax

➢ Sales & Use Tax Topics: Leases

Part 2: Taxable Sales

5

Revised August 2021

Colorado imposes a sales tax on retail sales of tangible

personal property except when such sales qualify for an

exemption specifically authorized by law. Taxable sales

of tangible personal property include, but are not

limited to, the amount charged for mainframe

computer access, photocopying, and packing and

crating. Sales of services are generally not subject to

Colorado sales tax. However, sales of the following

services are specifically taxable under Colorado law:

➢ gas and electric service for commercial use and

➢ intrastate telephone and telegraph services.

Additionally, sales tax applies to prepared food and

drink sold by restaurants, bars, and other similar

establishments. Short-term rentals of rooms and

accommodations are also subject to Colorado sales tax.

This Part 2 discuss taxable sales and exemptions.

Tangible personal property

Tangible personal property subject to sales tax includes

all goods, wares, merchandise, products and

commodities, and all tangible or corporeal things and

substances that are dealt in and capable of being

possessed and exchanged. However, Colorado law

exempts several types of tangible personal property

from sales tax. Additional information regarding

exemptions can be found at the end of this Part 2.

Tangible personal property includes digital goods that

are delivered or stored by digital means, including, but

not limited to, video, music, or electronic books. The

method of delivery does not impact the taxability of a

sale of tangible personal property.

Colorado has specific rules regarding the taxability of

computer software. See Department publication Sales

& Use Tax Topics: Computer Software for additional

information.

Mainframe computer access

Mainframe computer access that is subject to Colorado

sales tax is the provision of access to computer

equipment for the purpose of storing or processing

data. However, sales tax does not apply under the

conditions described below.

Taxable mainframe computer access does not include

the provision of access to computer equipment for the

purpose of examining or acquiring data maintained by

the vendor.

Taxable mainframe computer access also does not

include the provision of access to computer equipment

incident to the electronic delivery of computer

software.

Additionally, taxable mainframe computer access does

not include the provision of computer access incident

to the use of computer software hosted by an

application service provider that retains custody over

or hosts computer software for use by third parties.

Packing and crating

Packing and crating that is subject to Colorado sales

tax is any tangible personal property furnished to

prepare tangible personal property purchased at retail

for delivery to a location designated by the purchaser.

Photocopying

Photocopying that is subject to Colorado sales tax is

the sale of a document rendered on paper or other

similar material by a machine that creates an accurate

reproduction of the original. Taxable photocopying

does not include the provision of a photocopy in

connection with services if the purchaser is not charged

separately for photocopying.

Part 2: Taxable Sales

6

Revised August 2021

Non-taxable property

Real property and intangible personal property are not

subject to Colorado sales tax. However, if intangible

personal property is included with tangible personal

property in a mixed transaction, the entire purchase

price of the transaction may be subject to sales tax.

Real property

Land and buildings are real property. Real property also

includes any tangible personal property that lost its

identity as tangible personal property when it was

incorporated into and became an integral and

inseparable part of real property and that is removable

only with substantial damage to the real property. If

some part of real property is severed and removed, it

once again becomes tangible personal property and

may be subject to sales tax if sold.

Intangible personal property

Intangible personal property constitutes mere rights of

action with no intrinsic value. Examples of intangible

personal property include the following:

➢ contracts,

➢ deeds,

➢ mortgages,

➢ stocks,

➢ bonds, or

➢ certificates of deposit.

Services

Colorado does not generally impose sales tax on

services. However, sales tax is imposed specifically on

intrastate telephone and telegraph services, as well as

gas and electric service for commercial consumption.

Additionally, otherwise nontaxable services may be

subject to sales tax if they are provided as part of a

transaction involving the sale of tangible personal

property. See Part 3: Calculation of Tax and Part 4:

Retailers Who Must Collect Tax for additional

information about service enterprises.

Telephone and telegraph service

Sales tax applies to all intrastate telephone and

telegraph service. Taxable telephone services include

mobile telecommunications services if the service is

provided to a customer whose place of primary use is

within Colorado, private line services, and Voice over

Internet Protocol (VoIP). The service provider must

charge and collect state and any applicable state-

administered local sales taxes.

Interstate telephone and telegraph services are not

subject to Colorado sales tax.

See Department publication FYI Sales 80: Telephone

and Telecommunications for additional information

regarding sales tax on telephone and telegraph service.

Part 2: Taxable Sales

7

Revised August 2021

Gas and electric service

Sales of gas and electric service for commercial

consumption and not for resale are taxable. Tax also

applies to sales of steam when consumed or used by

the purchaser and not resold in its original form. Sales

tax applies to such sales of steam and gas and electric

service regardless of whether the seller or provider is a

municipal, public, or private corporation or enterprise.

Colorado does not impose sales tax on sales of gas,

electricity, or steam for use in any of the following

activities:

➢ processing,

➢ manufacturing,

➢ mining,

➢ refining,

➢ irrigation,

➢ construction,

➢ telegraph communication,

➢ telephone communication,

➢ radio communication,

➢ street and railroad transportation services,

➢ all industrial uses, and

➢ all residential uses.

For additional information regarding sales tax on gas

and electric service, see:

➢ FYI Sales 66: Sales Tax Exemption on Residential

Energy Usage

➢ Retail Food Established Computation Worksheet for

Sales Tax Deduction For Gas and/or Electricity (DR 1465)

➢ Sales Tax Exempt Certificate Electricity & Gas for

Industrial Use (DR 1666)

Prepared food and drink

Colorado sales tax applies to the sale of food and drink

served or furnished in or by dining establishments and

other like places of business at which prepared food or

drink is regularly sold. Such establishments and

businesses include the following:

➢ restaurants,

➢ cafes,

➢ lunch counters,

➢ cafeterias,

➢ hotels,

➢ social clubs,

➢ nightclubs,

➢ cabarets,

➢ resorts,

➢ snack bars,

➢ caterers,

➢ carryout shops,

➢ pushcarts,

➢ motor vehicles, and

➢ other mobile facilities.

Cover charges are also subject to sales tax. However,

meals provided to employees of the establishments and

businesses listed above at no charge or at a reduced

charge are not subject to sales tax.

Please see Department publication Sales & Use Tax

Topics: Dining Establishments for additional information.

Rooms and accommodations

Colorado imposes sales tax on the entire amount

charged for rooms and accommodations. In general, the

tax applies to any charge paid for the use, possession,

or the right to use or possess any room in a hotel,

apartment hotel, inn, lodging house, motor hotel,

motel, guest house, guest ranch, dude ranch, trailer

coach, or mobile home and to any space in any camp

ground, auto camp, or trailer court and park. Under

certain circumstances, the rental of rooms and

accommodations to a permanent resident for a period

of at least 30 consecutive days is exempt from sales

tax. Please see Department publication Sales & Use Tax

Topics: Rooms & Accommodations for additional

information.

Part 2: Taxable Sales

8

Revised August 2021

Exemptions

Colorado exempts several types of property and sales

from sales tax. While retailers will not collect tax on

exempt sales, they must maintain appropriate records

and report exempt sales on the applicable lines of the

Colorado Retail Sales Tax Return (DR 0100) and

associated Schedule A and Schedule B.

Some of these exemptions apply automatically to state-

administered local sales taxes and are generally

reported on Schedule A. For others, reported on

Schedule B, each local jurisdiction may generally

choose whether to adopt the exemption. Information

about specific exemptions can be found in Colorado

Sales/Use Tax Rates (DR 1002) the Supplemental

Instructions for Form DR 0100, available online

atTax.Colorado.gov/sales-use-tax-forms.

Additional resources

The following is a list of statutes, regulations, forms,

and guidance pertaining to taxable sales. This list is

not, and is not intended to be, an exhaustive list of

authorities that govern the tax treatment of every

situation. Individuals and businesses with specific

questions should consult their tax advisors.

Statutes and regulations

➢ § 29-2-105, C.R.S. Contents of sales tax ordinances.

➢ § 39-26-102, C.R.S. Definitions.

➢ § 39-26-104, C.R.S. Property and service taxed.

➢ § 39-26-105, C.R.S. Vendor liable for tax.

➢ § 39-26-106, C.R.S. Schedule of sales tax.

➢ § 39-26-704, C.R.S. Miscellaneous sales tax

exemptions – hotel residents.

➢ § 39-26-713, C.R.S. Tangible personal property.

➢ § 39-26-715, C.R.S. Fuel and oil.

➢ Rule 39-26-102(10).

➢ Rule 39-26-102(11).

➢ Rule 39-26-102(15).

➢ Rule 39-26-102(23).

➢ Rule 39-26-713-1.

Forms and guidance

➢ Tax.Colorado.gov/sales-use-tax

➢ Tax.Colorado.gov/sales-use-tax-forms

➢ Tax.Colorado.gov/sales-use-tax-guidance-publications

➢ Colorado Retail Sales Tax Return (DR 0100)

➢ Colorado Sales/Use Tax Rates (DR 1002)

➢ Retail Food Established Computation Worksheet for

Sales Tax Deduction for Gas and/or Electricity (DR 1465)

➢ Sales Tax Exempt Certificate Electricity & Gas for

Industrial Use (DR 1666)

➢ Sales Tax Topics: Computer Software

➢ Sales & Use Tax Topics: Dining Establishments

➢ Sales & Use Tax Topics: Rooms & Accommodations

➢ FYI Sales 66: Sales Tax Exemption on Residential

Energy Usage

➢ FYI Sales 80: Telephone and Telecommunications

Part 3: Calculation of Tax

9

Revised August 2021

Colorado state sales tax is imposed at a rate of 2.9%.

Any sale made in Colorado may also be subject to

state-administered local sales taxes. Tax rate

information for state-administered local sales taxes is

available online at Tax.Colorado.gov/how-to-look-up-

sales-use-tax-rates.

This Part 3 discusses how the purchase price is

determined in order to calculate the tax on sales of

tangible personal property. The information in the

following sections does not apply to the calculation of

sales tax imposed on the following sales:

➢ gas and electric service,

➢ telephone and telegraph services,

➢ prepared food and drink, or

➢ rooms and accommodations.

Purchase price

For sales of tangible personal property, the sales tax is

calculated on the full purchase price. The purchase

price includes the full amount paid, or promised to be

paid, by the buyer at the time of purchase of the

property, excluding only the following taxes and fees

that may be imposed on the sale:

➢ any direct federal tax;

➢ any state and local sales tax; and

➢ any retail delivery fees and enterprise retail

delivery fees imposed by the state pursuant to

section 43-4-218, C.R.S.

The taxable purchase price includes the gross value of

all material, labor, and service, and the profit thereon

included in the price charged to the user or consumer.

Coupons

Retailers may accept coupons from their customers for

a reduction in the amount paid by the customer. For

tax purposes, coupons are classified as either

manufacturer's coupons or store coupons.

A manufacturer's coupon is issued by the manufacturer

and allows the customer a reduction in the sales price

of the product upon presentation of the coupon to the

retailer. Because the retailer is reimbursed by the

manufacturer for the amount of the reduction, sales

tax applies to the full selling price before the

deduction for the manufacturer's coupon.

A store coupon is issued by the retailer for a reduction in

the sales price when the coupon is presented to the

retailer by the customer. Because there is no

reimbursement to the retailer for such reduction, the

sales tax applies to the reduced selling price of the item.

Exchanged property

Under certain conditions, the fair market value of

tangible personal property exchanged by the purchaser

as part of a taxable sale is excluded from the taxable

purchase price. The fair market value of the tangible

personal property exchanged by the purchaser is

excluded from the taxable purchase price, if either:

➢ such exchanged property is to be sold thereafter in

the usual course of the retailer's business; or

➢ such exchanged property is a vehicle and is

exchanged for another vehicle and both vehicles

are subject to licensing, registration, or

certification under the laws of this state,

including, but not limited to, vehicles operating

upon public highways, off-highway recreation

vehicles, watercraft, and aircraft.

If the purchaser transfers intangible property or performs

services in exchange for tangible personal property, the

fair market value of the intangible property or service is

not excluded from the purchase price.

Part 3: Calculation of Tax

10

Revised August 2021

Associated service charges

With certain exceptions discussed below, the taxable

purchase price includes any service charges associated

with the sale of tangible personal property, such as

charges for installation or delivery, regardless of whether

the service is performed by the seller or a third party.

Associated service charges are subject to tax unless both

the service is separable from the sale of the property and

the service charge is separately stated from the price of

the property sold on the invoice or receipt.

An associated service is separable from the sale of the

property if the service is performed after the taxable

property is offered for sale and the purchaser has the

option not to purchase the associated service. For

example, if delivery is optional and the purchaser may

elect to pick up the property at the seller’s store,

without paying the delivery charge, the delivery charge

is separable.

An associated service charge is separately stated if it

appears as a distinct line item on a written sales

contract, retailer’s invoice, or other written document

issued in connection with the sale, apart from the price

of the property sold. However, the statement of a

charge as a separate line item does not necessarily

indicate that the charge is also separable.

A service charge that is overstated or intended to shift

cost and avoid the proper taxation of the property sold

is not excluded from the purchase price, even if the

service charge is both separable and separately stated.

Maintenance agreements and warranties

The taxability of maintenance agreements and warranties

sold along with tangible personal property is generally

determined under the same rules as other associated

service charges. If the charge for the maintenance

agreement or warranty is both separately stated and

separable, the charge is not subject to tax. Otherwise,

the charge for the maintenance agreement or warranty is

included in the taxable purchase price. See Department

publication Sales & Use Tax Topics: Leases for information

about maintenance services included in lease contracts.

Additional resources

The following is a list of statutes, regulations, forms,

and guidance pertaining to the calculation of tax on

sales of tangible personal property. This list is not, and

is not intended to be, an exhaustive list of authorities

that govern the tax treatment of every situation.

Individuals and businesses with specific questions

should consult their tax advisors.

Statutes and regulations

➢ § 39-26-102, C.R.S. Definitions.

➢ § 39-26-104, C.R.S. Property and service taxed.

➢ § 39-26-105, C.R.S. Vendor liable for tax.

➢ § 39-26-106, C.R.S. Schedule of sales tax.

➢ Rule 39-26-102(7)(a).

➢ Rule 39-26-102(12).

➢ Rule 39-26-104-3. Exchanged Tangible Personal

Property.

➢ Rule 39-26-105-4.

➢ Special Rule 11. Coupons.

➢ Special Rule 18. Transportation Charges.

Forms and guidance

➢ Tax.Colorado.gov/sales-use-tax

➢ Tax.Colorado.gov/how-to-look-up-sales-use-tax-rates

➢ Tax.Colorado.gov/sales-use-tax-forms

➢ Colorado Retail Sales Tax Return (DR 0100)

Part 4: Retailers Who Must Collect Tax

11

Revised August 2021

A retailer is required to obtain a sales tax license and

collect sales tax on any retail sale of tangible personal

property or taxable service made in Colorado if the

retailer is “doing business in Colorado,” as defined

below. See Part 1: Retail Sales for guidance in

determining whether a sale is made in Colorado. Sales

tax licensing and collection requirements apply not

only to for-profit businesses, but also to charitable

organizations and state and local governmental entities

that make retail sales of tangible personal property or

taxable services.

A retailer who makes sales only through a marketplace

may be exempt from sales tax licensing, collection, and

filing requirements if the marketplace facilitator

collects all applicable state and state-administered

local sales taxes on the retailer’s behalf. See

Department publication Sales & Use Tax Topics:

Marketplaces for additional information.

Any retailer that is subject to licensing and collection

requirements is liable and responsible for the

applicable sales tax, whether or not the retailer

actually collected such tax at the time of the sale.

Doing business in Colorado

In general, a retailer is doing business in Colorado if

the retailer sells, leases, or delivers tangible personal

property or taxable services in Colorado or engages in

any activity in Colorado in connection with the selling,

leasing, or delivering of tangible personal property or

taxable services for use, storage, distribution, or

consumption in Colorado. Whether a retailer is deemed

to be doing business in Colorado depends in part on

whether the retailer maintains a physical location in

Colorado and, if not, on the aggregate total of retail

sales the retailer makes into Colorado in the current

and previous calendar years.

Retailers with physical locations in Colorado

A retailer is doing business in Colorado and subject to

all sales tax licensing and collection requirements if

the retailer maintains any place of business in Colorado

directly, indirectly, or by a subsidiary. Such a place of

business may include an office, distribution facility,

salesroom, warehouse, storage place, or home office of

a Colorado resident employee.

A retailer who maintains a place of business in Colorado

is subject to all Colorado sales tax licensing and

collection requirements for as long as the retailer

maintains that place of business. If a retailer ceases to

maintain any place of business in Colorado, the retailer

may no longer be doing business in Colorado, depending

on its other activities within Colorado, as described

below in Retailers with no physical location in

Colorado.

A retailer that makes sales or takes orders at special

events located in Colorado is deemed to maintain a

place of business in Colorado at the location of the

special event for the duration of the special event.

Retailers with no physical location in Colorado

A retailer may be doing business in Colorado even if

that retailer maintains no physical location in the

state, but not if the retailer meets the small retailer

exception described below. A retailer is doing business

in Colorado if the retailer solicits business and receives

orders from Colorado residents by any means

whatsoever. Solicitation may be done by:

1) direct representatives, indirect representatives, or

manufacturers' agents;

2) distribution of catalogues or other advertising;

3) use of any communication media; or

4) use of the newspaper, radio, or television

advertising media.

Part 4: Retailers Who Must Collect Tax

12

Revised August 2021

Small retailer exception

Any retailer who does not maintain a physical location

in Colorado is exempted from state sales tax licensing

and collection requirements if the retail sales of

tangible personal property, commodities, and/or

services made annually by the retailer into Colorado in

both the current and previous calendar years are less

than $100,000. All retail sales are considered for the

purpose of the $100,000 threshold, regardless of

whether those sales would be subject to Colorado tax.

See Part 1: Retail Sales for rules for determining the

location of a sale.

If the retailer’s retail sales in Colorado in the previous

year were less than $100,000, then the retailer must

begin collecting sales tax if its retail sales into Colorado

during the current calendar year exceed $100,000. The

retailer must apply for and obtain a sales tax license and

begin collecting Colorado sales tax by the first day of the

first month commencing at least 90 days after the

retailer’s aggregate Colorado sales in the current year

exceed $100,000. If a retailer fails to obtain a sales tax

license and begin collecting sales tax within the

prescribed period of time, the retailer is nonetheless

liable for all applicable state and state-administered

sales taxes for any subsequent sale made into Colorado.

If the retailer’s Colorado sales in the previous year

exceed $100,000, the retailer is subject to Colorado

sales tax licensing and collection requirements for the

entire calendar year.

The following examples demonstrate the application of

the small retailer exception for retailers who maintain

no physical location in Colorado.

Example #1

A retailer maintains no physical location in Colorado.

During the previous calendar year, the retailer’s retail

sales in Colorado exceeded $100,000. As a result, the

retailer is doing business in Colorado and is required to

obtain a Colorado sales tax license and collect sales tax

on all sales made in Colorado during the entire current

calendar year.

Example #2

A retailer maintains no physical location in Colorado.

During the previous calendar year, the retailer’s retail

sales in Colorado were less than $100,000. As a result,

the retailer is not considered to be doing business in

Colorado and is not required to collect sales tax as the

current year begins.

On June 15

th

of the current year, the retailer’s

cumulative retail sales in Colorado for the current year

exceed $100,000. The retailer must apply for and

obtain a sales tax license and begin collecting Colorado

sales tax by the first day of the first month

commencing at least 90 days after the retailer’s

aggregate Colorado sales in the current year exceed

$100,000. Consequently, the retailer must obtain a

Colorado sales tax license and begin collecting sales tax

on any retail sale the retailer makes in Colorado no

later than October 1

st

of the current year.

Since the retailer’s sales in Colorado in the current

year exceed $100,000, the retailer will be required to

maintain a sales tax license and collect sales tax on all

sales made in Colorado in the following year.

Example #3

A retailer maintains no physical location in Colorado.

During the previous calendar year, the retailer’s retail

sales in Colorado were less than $100,000. As a result,

the retailer is not considered to be doing business in

Colorado and is not required to collect sales tax on

sales made in Colorado as the current year begins.

On November 15

th

of the current year, the retailer’s

cumulative retail sales in Colorado for the current year

exceed $100,000. Since there are less than 90 days

remaining in the current year after the retailer’s

cumulative sales in Colorado exceeded $100,000, the

retailer is not required to collect sales tax on any sale

made in Colorado during the current year.

However, since the retailer’s retail sales in Colorado in

the current year exceed $100,000, the retailer must

obtain a Colorado sales tax license before January 1 of

the following year and collect sales tax on all sales

made in Colorado during the following year.

Part 4: Retailers Who Must Collect Tax

13

Revised August 2021

Retailer agents

The Department may treat any salesperson or

representative as a retailer’s agent and hold that

person jointly liable with the retailer for the collection

and payment of sales tax if he or she:

1) operates under the retailer’s direction;

2) obtains tangible personal property from the

retailer to sell on the retailer’s behalf; or

3) solicits business on behalf of the retailer.

Service enterprises

Anyone engaged in the business of rendering services to

customers is generally considered the consumer, and

not the retailer, of any tangible personal property that

they use incidentally in rendering the service.

Consequently, service enterprises are generally

required to pay sales tax when they acquire such

tangible personal property and are not required to

collect sales tax from their customers. If, in addition to

rendering services, the service enterprise regularly

sells tangible personal property to consumers, then the

service enterprise is a retailer with respect to such

sales and must comply with the licensing, collection,

and filing requirements applicable to retailers.

Mobile food vendors

Mobile food vendors making food sales in Colorado from

pushcarts, motor vehicles, or other mobile facilities are

retailers, subject to sales tax licensing, collection, and

filing requirements. They must collect and remit all

state and state-administered local sales taxes

applicable to the point of sale for each taxable

transaction. Additional information regarding licensing

and filing requirements for mobile vendors can be

found online at Tax.Colorado.gov/sales-use-tax.

Flea markets and farmers markets

Anyone making sales at a flea market or farmers

market in Colorado is a retailer and is subject to sales

tax licensing, collection, and filing requirements with

respect to each market at which they make sales. See

Part 5: Sales Tax Licensing and Part 6: Sales Tax

Collection for additional information about licensing

and collection requirements.

Additional resources

The following is a list of statutes, regulations, forms,

and guidance relevant in evaluating a retailer’s

obligation to collect Colorado sales tax. This list is not,

and is not intended to be, an exhaustive list of

authorities that govern the tax treatment of every

situation. Individuals and businesses with specific

questions should consult their tax advisors.

Statutes and regulations

➢ § 39-21-112, C.R.S. Duties and powers of executive

director.

➢ § 39-26-102, C.R.S. Definitions.

➢ § 39-26-104, C.R.S. Property and service taxed.

➢ § 39-26-105, C.R.S. Vendor liable for tax.

➢ § 39-26-106, C.R.S. Schedule of sales tax.

➢ Rule 39-26-102(3). Doing Business in This State.

➢ Rule 39-26-103. Sales Tax Licensing.

➢ Rule 39-21-112(3.5). Notice and Reporting

Requirements for Non-Collecting Retailers.

Forms and guidance

➢ Tax.Colorado.gov/sales-use-tax

Part 5: Sales Tax Licensing

14

Revised August 2021

Any person or entity that will engage in the business of

selling at retail must first obtain a sales tax license,

unless that person or entity is specifically exempted

from licensing requirements. Licensing requirements

apply not only to traditional retailers, but also to

charitable organizations (with certain exceptions) and

individuals making regular sales out of their homes.

Information about license applications and renewals is

available online at Tax.Colorado.gov/sales-tax-

account-license.

Standard retail sales tax licenses

Any retailer that is required to collect sales tax, as

discussed in Part 4: Retailers Who Must Collect Tax,

must apply for and obtain a sales tax license prior to

making any sales. Licenses are non-transferable.

Anyone who starts a new retail business or purchases

an existing retail business must apply for and obtain a

new sales tax license. A retailer is not required to

obtain a license if the retailer is engaged exclusively in

the business of selling commodities that are exempt

from all otherwise applicable state and state-

administered local sales taxes.

Retailers must remit a license fee of $16, prorated

depending on the date of issuance, and a deposit of $50

at the time of application. The Department will refund

the deposit after the retailer has commenced

operations, filed the required sales tax return(s), paid

the applicable tax, and the state sales tax remitted, in

aggregate, exceeds $50. A retailer who sells only

products that are exempt from state tax, but subject

to state-administered local sales tax, may request a

waiver of the $50 deposit requirement.

Retailers must display the license in a conspicuous place

at their business locations. If a retailer maintains

multiple business locations in Colorado, a separate

license is required for each business location.

Licenses expire on December 31

st

of odd-numbered

years (e.g. 2019, 2021, 2023), unless revoked sooner by

the Department.

Wholesaler licenses

Any business operating exclusively as a wholesaler may

apply to the Department for a license to engage in the

business of selling at wholesale. A wholesaler is a

person or company conducting a regularly organized

wholesale or jobbing business, known within the trade

as a wholesaler, and selling to retail merchants,

jobbers, dealers, or other wholesalers, for the purpose

of resale.

Applicants for a wholesale license must pay a fee $16,

prorated depending on the date of issuance. Wholesale

licenses expire on December 31

st

of odd-numbered

years (e.g. 2019, 2021, 2023), unless revoked sooner by

the Department.

Charitable organizations

Charitable organizations that make retail sales are

subject to the same licensing requirements of other

retailers unless all of the organization’s sales are

exempt from taxation. Sales made by a charitable

organization are exempt from sales tax if all three of

the following conditions are met:

1) the funds raised through the sales are retained by

the organization to be used in the course of the

organization's charitable service;

2) the net proceeds from the charitable organization’s

otherwise taxable sales in the preceding calendar

year were less than $45,000; and

3) the net proceeds from the charitable organization’s

otherwise taxable sales in the current calendar year

are less than $45,000.

See Department publication Sales & Use Tax Topics:

Charitable Organizations for additional information

regarding sales made by charitable organizations.

Part 5: Sales Tax Licensing

15

Revised August 2021

Special event licenses

Anyone making retail sales at one or more special sales

events must obtain a special event license, unless the

event organizer has obtained a license to file returns

and remit tax on behalf of sellers participating in the

event. A special sales event is an event where retail

sales are made by more than three sellers at a location

other than their normal business location(s) and that

occurs no more than three times in any calendar year.

Special event license requirements apply to sellers

participating in the event regardless of whether such

sellers have been issued a standard retail sales tax

license for their regular business location.

Special event licenses apply only to retail sales made at

the special sales event by the seller to whom the

license is issued. The license does not apply to sales

made at the seller's regular business location or at any

other location.

Event organizers

Special event organizers bear various responsibilities in

relation to the special event. The organizer must

inform each seller participating in the event of the

various taxes and tax rates that apply to retail sales

made at the event. Additionally, the organizer must

provide a list of the sellers participating in the event to

the Department. The list must include the names,

addresses, and special sales event license number, if

any, of each seller participating in the event. The

organizer must submit such list to the Department

within ten days of the last day of the event.

A special event organizer may elect to obtain a special

event license in order to file and remit taxes on behalf

of some or all of the sellers participating in the event.

The license will only apply to the event for which it is

issued and cannot be used for any other event.

Any seller participating in the event must collect the

applicable state and state-administered local sales

taxes due, but may elect to remit such taxes to the

event organizer if the organizer has obtained a special

event license. A seller participating in the event may

make this election even if the seller has obtained a

special event license of their own.

Special event filing

Any seller participating in a special event must file a

return and remit payment of sales taxes for the event,

unless the seller has remitted the taxes to the event

organizer who has obtained a license as described

above. If the event organizer has obtained a license,

the organizer must file a return and remit payment for

all sellers that have elected to remit taxes to the

organizer. The seller’s or organizer’s return and

payment must be filed and remitted by the 20

th

day of

the month following the month in which the special

event began. If the 20

th

falls on a Saturday, Sunday, or

legal holiday, the return and tax remittance is due the

next business day.

A licensed organizer must maintain records regarding

all taxes remitted to the organizer. The records must

include, for each participating seller that has remitted

taxes to the organizer:

➢ the seller’s name and address;

➢ the amount of gross retail sales made by the seller

at the event; and

➢ the amount of sales tax collected by the seller at

the event.

Any retailer who makes sales as a participant in a

special event and also maintains a regular business

location cannot simply include their special event sales

in their sales tax return for their regular business

location. The retailer must either file a separate return

for their sales at the special event or remit the tax for

such sales to the event organizer, as described above.

Part 5: Sales Tax Licensing

16

Revised August 2021

Governmental entities

Any state or local government department, agency, or

institution that makes retail sales in Colorado is a retailer

subject to sales tax licensing and collection requirements.

See Department publication FYI Sales 86: Sales Tax

Exemption on School-Related Items for information about

sales made by schools and school organizations.

Additional resources

The following is a list of statutes, regulations, forms,

and guidance pertaining to Colorado sales tax licensing

requirements. This list is not, and is not intended to be,

an exhaustive list of authorities that govern the tax

treatment of every situation. Individuals and businesses

with specific questions should consult their tax advisors.

Statutes and regulations

➢ § 39-21-119, C.R.S. Filing with executive director –

when deemed to have been made

➢ § 39-26-102, C.R.S. Definitions

➢ § 39-26-103, C.R.S. Licenses

➢ § 39-26-718, C.R.S. Charitable organizations

➢ Rule 39-26-103. Sales Tax Licensing.

➢ Rule 39-26-718. Charitable and Other Exempt

Organizations.

Forms and guidance

➢ Tax.Colorado.gov/sales-use-tax

➢ Tax.Colorado.gov/sales-tax-account-license

➢ Tax.Colorado.gov/sales-use-tax-guidance-publications

➢ Sales & Use Tax Topics: Charitable Organizations

➢ FYI Sales 86: Sales Tax Exemption on School-

Related Items

Part 6: Sales Tax Collection

17

Revised August 2021

Retailers must add the state sales tax, along with any

state-administered local sales taxes, to the sale price

or charge for any taxable sale. If the purchased

property or taxable service is delivered to the

purchaser at a location in Colorado, the retailer must

collect all state and state-administered local sales

taxes applicable to the point of delivery. The tax due

constitutes a part of the price or charge and, until paid

by the purchaser to the retailer, is a debt from the

purchaser to the retailer that is legally recoverable in

the same manner as other debts.

All sums of money paid by the purchaser to the retailer

as sales taxes are and remain public money and the

property of the State of Colorado, or the appropriate

local jurisdiction, in the hands of such retailer. The

retailer must hold such monies in trust for the sole use

and benefit of the State of Colorado, or the

appropriate local jurisdiction, until remitted to the

Department. Failure to remit such taxes to the

Department is punishable as provided by law.

Tax disclosure requirements

It is illegal for any retailer to advertise, hold out, or

state to the public or to any customer, directly or

indirectly, that the sales tax due:

➢ will be assumed or absorbed by the retailer;

➢ will not be added to the selling price of the

property sold; or

➢ will be refunded to the purchaser, in full or in part.

The retailer must disclose the sales tax as a separate

and distinct item. The amount of tax must be separately

stated as a dollar amount. A statement of the tax rate

only is not sufficient. If the retailer issues the buyer a

receipt, invoice, or other document setting forth the

purchase price, the retailer must separately state the

tax on such document. If the retailer does not issue a

document that sets forth the purchase price, then the

retailer must disclose the tax of each item on signage

clearly visible to the purchaser.

Failure to collect

Retailers who fail to collect the required tax are

nonetheless liable for the full amount of tax due on all

sales, except for any sale that is tax-exempt. A retailer

is liable for the tax due even if the retailer has failed

or refused to obtain a Colorado sales tax license.

Direct pay permits

Purchasers who meet certain qualifications may apply

for a direct payment permit. A purchaser who holds a

direct payment permit (a “qualified purchaser”)

assumes responsibility for remitting all applicable sales

taxes directly to the Department and not to the

retailer. Retailers will not be liable for the collection

of sales taxes from a qualified purchaser if both of the

following conditions are met:

➢ the qualified purchaser presents their direct pay

permit at the time of the sale; and

➢ payment is made from the qualified purchaser’s

funds and not from the funds of any other party,

including the personal funds of any individual.

Direct pay permits issued by the Department have the

words “Direct Pay Permit” in the upper left corner. The

retailer must retain a copy of the qualified purchaser’s

direct pay permit.

Part 6: Sales Tax Collection

18

Revised August 2021

Exempt sales

A retailer must exercise due diligence with respect to

any sale for which the purchaser claims exemption

from sales tax. If evidence readily discernible to the

retailer at the time of the sale provides reason to

doubt the purchaser’s eligibility for the exemption

claimed, the retailer must either obtain and retain

sufficient information and documentation from the

purchaser to resolve the doubt or must collect the

applicable tax.

Exemption verification

If the purchaser is claiming exemption as a retailer,

wholesaler, or tax-exempt organization, or as a

contractor purchasing building materials for a tax-

exempt construction project, the retailer must verify

that the purchaser’s sales tax license or exemption

certificate is current and valid at the time of the sale

and can do so online at Colorado.gov/RevenueOnline.

Alternately, a retailer may inspect a physical copy of

the purchaser’s license or certificate, issued by the

Department or the comparable tax administration

agency of another state, to verify that it is current and

valid and retain a copy for their records. A retailer may

also accept from an out-of-state purchaser a fully

completed Standard Colorado Affidavit of Exempt Sale

(DR 5002), Sales Tax Exemption Certificate (DR 0563),

or Multistate Tax Commission Uniform Sales & Use Tax

Exemption/Resale Certificate. The retailer must retain

a copy of the completed exemption form.

Retailers must consider whether the nature of goods or

services sold is consistent with the purchaser’s claim

that the sale is exempt from sales tax. The retailer

must collect the tax if the retailer has reason to doubt

that a purchase is:

➢ made for resale;

➢ made in the conduct of exempt organization’s

charitable functions and activities;

➢ made in the governmental capacity of U.S. govern-

ment, the State of Colorado, or any of its depart-

ments, institutions, or political subdivisions; or

➢ otherwise exempt.

In the case of a sale to a tax-exempt organization or

governmental entity, the retailer must also verify that

the purchase is made directly from the funds of the

organization or entity claiming the exemption. This

requirement is satisfied if payment is made with a

credit card or check in the name of the tax-exempt

organization or governmental entity claiming

exemption. This requirement does not apply to

purchases made by charitable organizations for less

than $250.

Disputes about exemptions

Retailers bear the burden of proof for the proper

exemption of any sale upon which the retailer did not

collect sales tax. If there is disagreement between the

retailer and the purchaser about whether or not a sale

is exempt, the retailer must collect the tax and the

purchaser is obligated to pay it. In the case of such

disagreement, the retailer must issue to the purchaser

a receipt or certificate showing the names of the

retailer and purchaser, the item(s) purchased, the

date, price, amount of tax paid, and a brief statement

of the claim of exemption. The purchaser may request

a refund from the Department of the tax paid using the

applicable Department form.

Part 6: Sales Tax Collection

19

Revised August 2021

Additional resources

The following is a list of statutes, regulations, forms,

and guidance pertaining to sales tax collection. This list

is not, and is not intended to be, an exhaustive list of

authorities that govern the tax treatment of every

situation. Individuals and businesses with specific

questions should consult their tax advisors.

Statutes and regulations

➢ § 29-2-105, C.R.S. Contents of sales tax ord.

➢ § 29-2-106, C.R.S. Collection – administration.

➢ § 39-26-102, C.R.S. Definitions.

➢ § 39-26-103.5, C.R.S. Qualified purchaser – direct

pay permit.

➢ § 39-26-104, C.R.S. Property and services taxed.

➢ § 39-26-105, C.R.S. Vendor liable for tax.

➢ § 39-26-106, C.R.S. Schedule of sales tax.

➢ § 39-26-108, C.R.S. Tax cannot be absorbed.

➢ § 39-26-118, C.R.S. Recovery of taxes.

➢ § 39-26-703, C.R.S. Disputes and refunds.

➢ § 39-26-704, C.R.S. Miscellaneous sales tax

exemptions – governmental entities.

➢ Rule 39-26-102(9). Retail Sales.

➢ Rule 39-26-103. Sales Tax Licensing.

➢ Rule 39-26-103.5. Direct Payment Permit.

➢ Rule 39-26-105-3. Documenting Exempt Sales.

➢ Rule 39-26-106-1. Separately Stated Tax.

Forms and guidance

➢ Tax.Colorado.gov/sales-use-tax

➢ Tax.Colorado.gov/sales-use-tax-forms

➢ Colorado.gov/RevenueOnline

➢ Standard Colo. Affidavit of Exempt Sale (DR 5002)

➢ Sales Tax Exemption Certificate (DR 0563)

➢ Sales & Use Tax Topics: Governmental Entities

Part 7: Filing and Remittance

20

Revised August 2021

Retailers must file sales tax returns reporting all sales

made, whether taxable or exempt, at regular intervals

in accordance with prescribed filing schedules. If the

retailer maintains a physical location in the state from

which sales are made, but makes no retail sales during

the tax period, the retailer must nonetheless file a

return to report that no sales were made and no tax is

due. The retailer’s return must properly account not

only for all state sales tax, but also for all sales tax

collected and due for each applicable state-

administered local jurisdiction. Forms, filing

instructions, and electronic filing options are available

online at Tax.Colorado.gov/sales-tax-filing-

information.

Filing frequency and due dates

A retailer’s filing frequency is determined initially

when the retailer’s license is issued, but may be

subsequently adjusted by the Department or at the

retailer’s request. In general, retailers must file

monthly sales tax returns reporting and remitting all

tax due. If the retailer’s average or estimated monthly

state sales tax collection is less than $300, the retailer

will be required to file returns and remit tax on a

quarterly basis. If the retailer’s average or estimated

monthly sales tax collection is $15 or less, the

Department may grant the retailer permission to file on

an annual basis.

The Department will, on an annual basis, calculate the

retailer’s average monthly sales tax collection and

adjust the retailer’s filing schedule to increase the

retailer’s required filing frequency if necessary. Any

such adjustment will be made effective January 1. The

Department will not make any automatic adjustment to

a retailer’s filing schedule to decrease the frequency of

filing, but a retailer may, based upon reduced sales tax

collection, request a change to their filing schedule.

Regardless of the retailer’s filing frequency (monthly,

quarterly, or annually), the retailer must file its sales

tax return and remit all applicable tax by the 20

th

day

of the month following the close of the tax period. For

example, a monthly filer’s June return is due July 20

th

and a quarterly filer’s 3

rd

quarter return is due October

20

th

. If the 20

th

falls on a Saturday, Sunday, or legal

holiday, the retailer’s return and tax remittance is due

the next business day.

Seasonal businesses

If a retailer is engaged in a seasonal business (a

business that the retailer does not operate in Colorado

during certain months of the year), the retailer may

request permission to file returns and remit tax only for

the months of the year that the business operates. The

retailer may make such request with its license

application or by submitting such request to the

Department in writing. The retailer must immediately

notify the Department if the retailer operates its

business in any month outside of the previously

established period of seasonal operation.

Alternate filing schedules

If a retailer regularly employs accounting methods

involving reporting periods other than calendar months

(such as thirteen four-week periods over the course of

the year), the retailer may request permission to file

returns and remit tax on a filing schedule consistent

with such accounting methods. Any retailer requesting

such permission must make such request to the

Department in writing.

Wholesalers

Wholesalers that make no retail sales must file returns

on an annual basis to report their gross sales and

allowable subtractions. A wholesaler that makes retail

sales in addition to wholesale sales is subject to the

same filing requirements as retailers and must file

returns and remit tax monthly or quarterly, as

applicable, unless the wholesaler has received

permission to file less frequently.

Part 7: Filing and Remittance

21

Revised August 2021

Failure to file

If a retailer neglects or refuses to file a sales tax return

for any period for which the retailer has an open sales

tax account, the Department will estimate the tax due

based upon the best available information. The

Department will issue a notice of deficiency to the

retailer based upon this estimate. When such estimate

and notice of deficiency have been made, the retailer

may prepare and file a return for the tax period in

question or otherwise protest the notice of deficiency

as provided by law.

Remittance requirements

Retailers are liable and responsible for state sales tax

equal to 2.9% of their total taxable sales, regardless of

whether the retailer actually collected such tax, as

well as any tax collected in excess of this amount.

Retailers are required to remit, with the filing of each

return, all tax reported on such return, minus any

service fee allowed to the retailer. Any tax a retailer

fails to pay by the applicable due date is subject to

penalties and interest.

Retailer’s service fee

Unless a retailer is delinquent in remitting the tax due,

the retailer generally may deduct and retain a service

fee from the collected tax to cover the retailer’s

expenses in the collection and remittance of the tax.

For sales made on or after January 1, 2020, the service

fee is equal to 4% of the state sales tax due for the

period, but the total amount a retailer is allowed to

retain for any filing period is limited to $1,000. The

total service fee a retailer may retain for any filing

period may not exceed $1,000, even if the retailer has

multiple business locations or makes sales at different

locations in the state.

Beginning January 1, 2022, a retailer is not permitted

to retain any money to cover the retailer's expenses in

collecting and remitting tax in accordance with this

section for any filing period that the retailer's total

taxable sales were greater than one million dollars.

If the retailer is delinquent in remitting the tax due,

the retailer is not allowed to deduct and retain any

service fee. State-administered local jurisdictions may

also allow retailers to retain a service fee from the

collected local taxes, although service fee percentages

vary by jurisdiction. See Department publication

Colorado Sales/Use Tax Rates (DR 1002) for service fee

percentages for state-administered local sales taxes.

If a retailer has appropriately retained a service fee

and, subsequent to the applicable due date, owes

additional tax for the filing period as the result of an

amended return or an adjustment made by the

Department, the retailer is not allowed to retain a

service fee for the additional tax, but the retailer is

allowed to retain the service fee associated with the

original return, so long as the retailer filed the original

return in good faith.

Electronic funds transfer (EFT)

A retailer is required to remit all state and state-

administered local sales tax via electronic funds

transfer (EFT) if the retailer’s annual state sales tax

liability for the prior calendar year exceeded $75,000.

Any local sales taxes the retailer collected in the prior

year are not considered in determining whether the

retailer exceeded the $75,000 threshold. Retailers

whose prior year state sales tax collection did not

exceed the $75,000 threshold may nonetheless elect to

remit sales taxes via EFT.

Payments made by EFT must be made on or before

4:00 P.M. Mountain Time on the due date of the tax

payment in order to be treated as paid on that day.

Payments made after 4:00 P.M. Mountain Time are

considered to be made on the following day. Payments

made on a weekend or legal holiday are treated as paid

before 4:00 P.M. of the next business day.

Part 7: Filing and Remittance

22

Revised August 2021

Penalties and interest

A retailer will owe a penalty if they neglect or refuse to:

➢ file a return by the due date;

➢ pay the tax due by the due date; or

➢ correctly account, within their return, for all state

and state-administered local sales tax due.

The penalty is imposed at a rate of 10% of the unpaid

tax, plus an additional 0.5% for each month the tax

remains unpaid, not to exceed a total of 18%.

Additional penalties may be imposed for negligence or

fraud.

Interest accrues on any late payment of tax from the

original due date of the tax to the date the tax is paid.

The rate of interest accrual depends on the calendar

year(s) over which the deficiency continues.

Additionally, a discounted rate is allowed if:

➢ the retailer pays the tax in full prior to the

issuance of a notice of deficiency;

➢ the retailer pays the tax in full within 30 days of

the issuance of a notice of deficiency; or

➢ within 30 days of the issuance of a notice of

deficiency, the retailer enters into an agreement

to pay the tax in monthly installments.

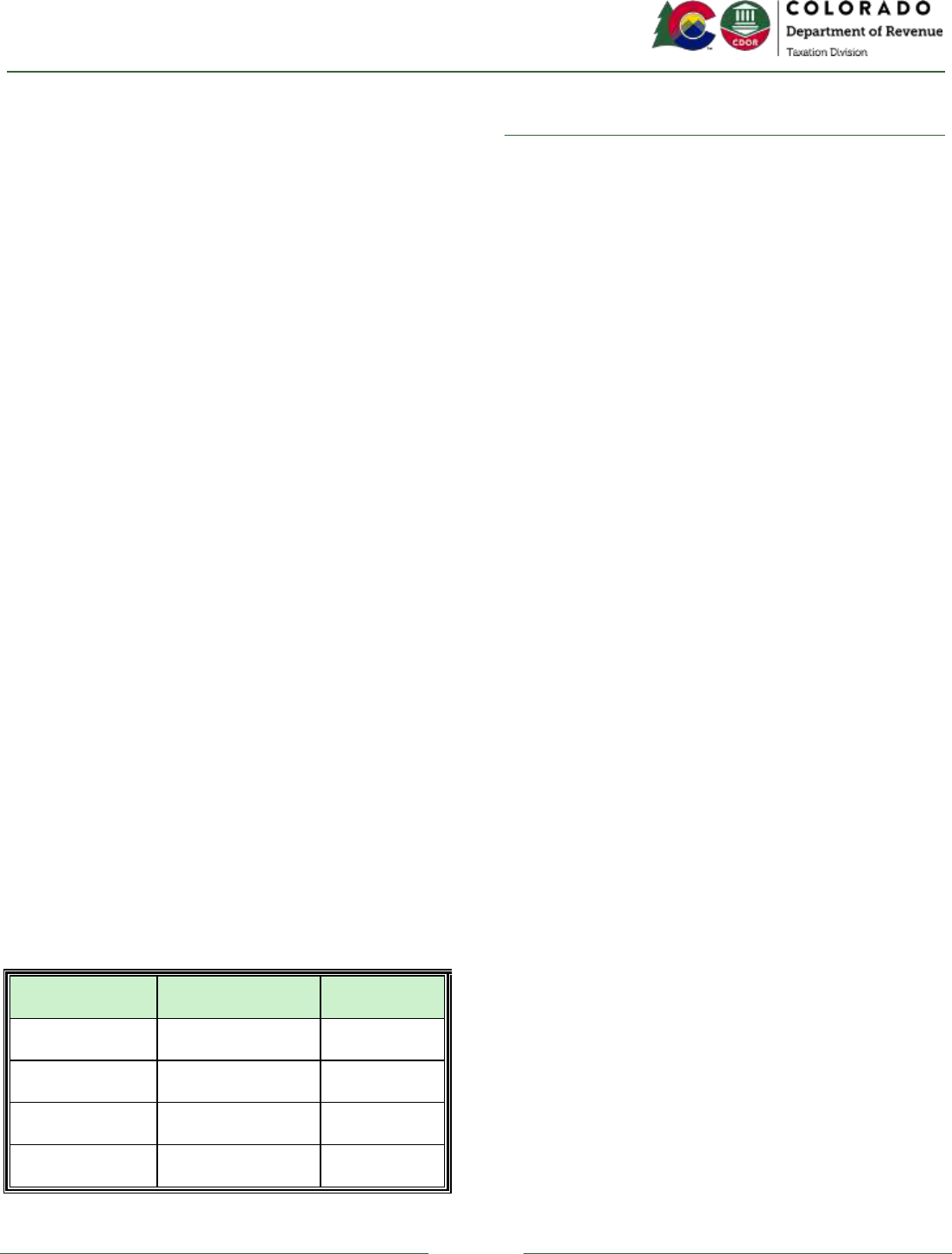

The discounted and non-discounted, regular interest

rates for recent years are listed in the following table.

Annual Interest Rates

Calendar year

Discounted rate

Regular rate

2018

4%

7%

2019

5%

8%

2020

6%

9%

2021

3%

6%

Items removed from inventory

If a wholesaler or retailer make a tax-free wholesale

purchase of an item for resale, but subsequently

withdraws that item from inventory for their own use,

they will owe use tax on that item. Please see the

Colorado Consumer Use Tax Guide for additional

information about filing and remittance requirements

for consumer use tax.

Part 7: Filing and Remittance

23

Revised August 2021

Additional resources

The following is a list of statutes, regulations, forms,

and guidance pertaining to sales tax filing and

remittance. This list is not, and is not intended to be,

an exhaustive list of authorities that govern the tax

treatment of every situation. Individuals and businesses

with specific questions should consult their tax

advisors.

Statutes and regulations

➢ § 39-21-103, C.R.S. Hearings.

➢ § 39-21-109, C.R.S. Interest on underpayment.

➢ § 39-21-110.5, C.R.S. Rate of interest.

➢ § 39-21-119, C.R.S. Filing with executive director –

when deemed to have been made.

➢ § 39-21-120, C.R.S. Signature and filing alternatives.

➢ § 39-26-105, C.R.S. Vendor liable for tax.

➢ § 39-26-105.5, C.R.S. Remittance of sales tax –

electronic funds transfer.

➢ § 39-26-109, C.R.S. Reports of vendor.

➢ § 39-26-112, C.R.S. Excess tax – remittance.

➢ § 39-26-115, C.R.S. Deficiency due to negligence.

➢ § 39-26-118, C.R.S. Recovery of taxes.

➢ § 39-26-122, C.R.S. Administration.

➢ Rule 39-26-105-1. Remittance of Sales Tax.

➢ Rule 39-26-106-1. Separately Stated Tax.

➢ Rule 39-26-109. Sales Tax Filing Schedules.

➢ Special Rule 1. Electronic Funds Transfer.

Forms and guidance

➢ Tax.Colorado.gov/sales-use-tax

➢ Tax.Colorado.gov/sales-tax-filing-information

➢ Tax.Colorado.gov/sales-use-tax-forms

➢ Colorado.gov/RevenueOnline

➢ Colorado Retail Sales Tax Return (DR 0100)

➢ Colorado Sales/Use Tax Rates (DR 1002)

➢ Colorado Department of Revenue Electronic Funds

Transferred (EFT) Program For Tax Payments

(DR 5782)

➢ Electronic Funds Transfer (EFT) Account Setup For

Tax Payments (DR 5785)

Part 8: Local Sales Taxes

24

Revised August 2021

Cities, counties, and special districts in Colorado can also

impose tax on sales made within their boundaries. The

Colorado Department of Revenue administers and

collects sales taxes imposed by many cities, most

counties, and a number of special districts. However, the

Department does not administer and collect sales taxes

imposed by certain home-rule cities, which instead

administer their own sales taxes. Department publication

Colorado Sales/Use Tax Rates (DR 1002) provides

detailed information about local sales taxes and

exemptions.

Retailers required to collect Colorado sales tax are also

required to collect any applicable state-administered

local sales taxes on any sales made at the retailer’s

location in Colorado, as well as on any sales delivered in

Colorado. The criteria for determining whether a sale

takes place within the boundaries of a particular state-

administered local taxing jurisdiction are the same as for

determining whether a sale takes place in Colorado. In

general, a sale takes place within a state-administered

local taxing jurisdiction if it is delivered to the purchaser

at a location within that jurisdiction. See Part 1: Retail

Sales for guidance in determining the location of a sale.

Local sales tax exemptions

In general, the local sales taxes administered by the

Department apply to the same sales of tangible personal

property and selected services as the state sales tax.

However, the sales tax exemptions allowed by the state

and state-administered local jurisdictions are not

entirely identical. The Supplemental Instructions for

Form DR 0100 and Department publication Colorado

Sales/Use Tax Rates (DR 1002), both available online at

Tax.Colorado.gov/sales-use-tax-forms, provide detailed

information about state-administered local sales tax

exemptions.

Geographic information system (GIS)

Retailers can use the geographic information system

(GIS) database, accessible through the Department’s

website, to determine the local taxing jurisdictions to

which taxes are owed and to calculate appropriate sales

and use tax rates for individual addresses. Additional

information about the GIS database can be found online

at Tax.Colorado.gov/GIS-info.

If a retailer properly uses the GIS database—a third-party

database that is verified to use the most recent information

provided by the GIS database—to determine the local

jurisdictions to which tax is owed for a given sale, the

retailer will not be held liable for any local sales tax the

retailer failed to properly collect solely as a result of an

error or omission in the database. In order to be relieved of

liability with respect to any particular sale, a retailer must

collect, retain, and produce, upon request, documentation

sufficient to demonstrate proper use of and reliance on a

certified database at the time of the sale. See Part 9:

Recordkeeping Requirements for information about

recordkeeping requirements related to the use of the GIS

database.

Filing and remitting local taxes

State-administered local sales taxes are reported and