Housing

Strategic Plan

FINAL REPORT Root Policy Research

5/22/2024 6740 E. Colfax Avenue, Denver, CO 80220

www.rootpolicy.com

970.880.1415

ARVADA HOUSING STRATEGIC PLAN

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 1

INTRODUCTION

This Housing Strategic Plan identifies, prioritizes, and

recommends housing goals, policies, programs and resources

to address housing needs in the City of Arvada. The Plan builds

on Arvada’s 2020 Housing Needs Assessment and Strategy,

accounting for changes in market trends, state resources, and

the progress made on the 2020 Housing Plan.

The goals and strategies outlined in this Plan were informed by

a Comprehensive Housing Needs Assessment (see Appendix A);

input from residents, in-commuters, and stakeholders (also in

Appendix A); as well as direction from City staff and the Housing

Advisory Committee (HAC). Strategic Actions are informed by

Root Policy Research’s expertise and experience in peer

communities and best practices in housing policy.

REPORT ORGANIZATION

Following a one-page executive summary, the Strategic Plan is

organized around the following sections:

Why Work to Address Housing Needs?

Summary of Housing Needs and Community Engagement (for

details, see Appendix A. Housing Needs Assessment, HNA).

Progress on Action Items in the 2020 Housing Strategy.

Housing Goals and Strategy Framework.

2024 Housing Strategies and Actions.

ACKNOWLEDGEMENTS

Special thanks to the City’s Housing Preservation and

Resources Division and the Arvada Housing Authority staff—

particularly Samantha Bradley and Carrie Espinosa—and to the

HAC for their continued work and input on development of the

Plan; and to the numerous residents and stakeholders who

participated in engagement opportunities to inform the

Housing Needs Assessment and Strategic Plan.

HUD AMI: Housing programs rely on income limits

published by the U.S. Department of Housing and Urban

Development (HUD) that are represented as percentages of the

area median family income (commonly abbreviated as “HUD

AMI” or simply “AMI”). Common programmatic income

qualifications occur at 30% AMI, 50% AMI, 60% AMI, and 80%

AMI. The 2023 AMI for a 2-person household in Arvada is

$99,300. See Appendix A (HNA) for additional details on how

AMI is determined and the current AMI thresholds in Arvada.

Housing Advisory Committee Members:

Paul Bunyard Tim Rogers

Andrew Heesacker Cmbr. Lisa Feret

Roger Jones Matthew Wedell

Mindy Mohr Harrison Wilterdink

Patrick Noonan

EXECUTIVE SUMMARY OF STRATEGIC PLAN

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 2

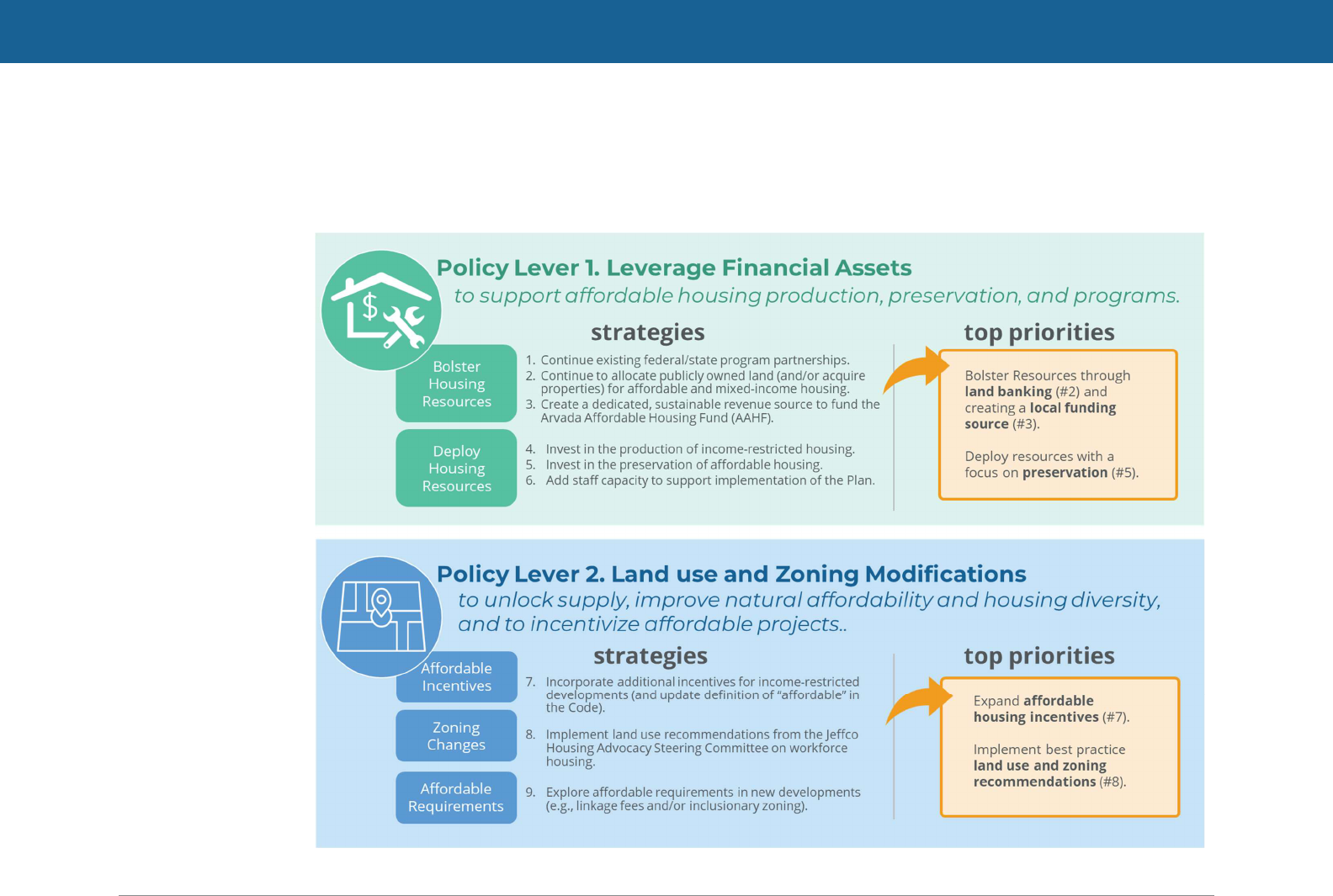

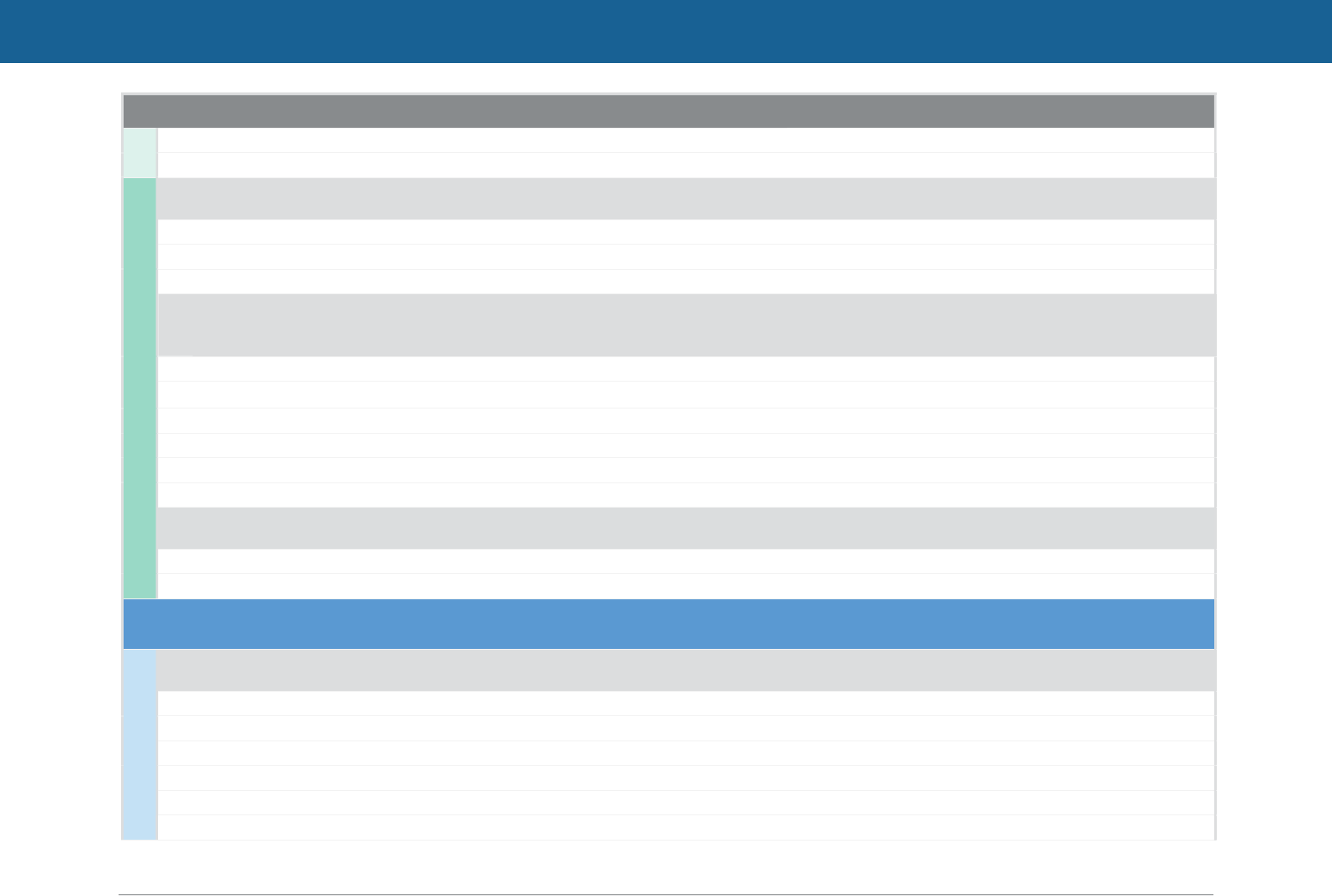

OVERVIEW OF RECOMMENDED STRATEGIES

The Arvada Housing Strategic Plan policy levers, strategies, and priorities are summarized below. Strategies and action items were

developed in conjunction with Arvada City staff, City Council, and the Arvada Housing Advisory Committee (HAC) and are grounded

in evidence-based

best practices, Root

Policy Research’s

expertise, and input

from Arvada

residents and

stakeholders as part

of the community

engagement

conducted in support

of the Housing Needs

Assessment and

Strategic Plan.

WHY WORK TO ADDRESS HOUSING NEEDS?

COMMUNITY INPUT

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 4

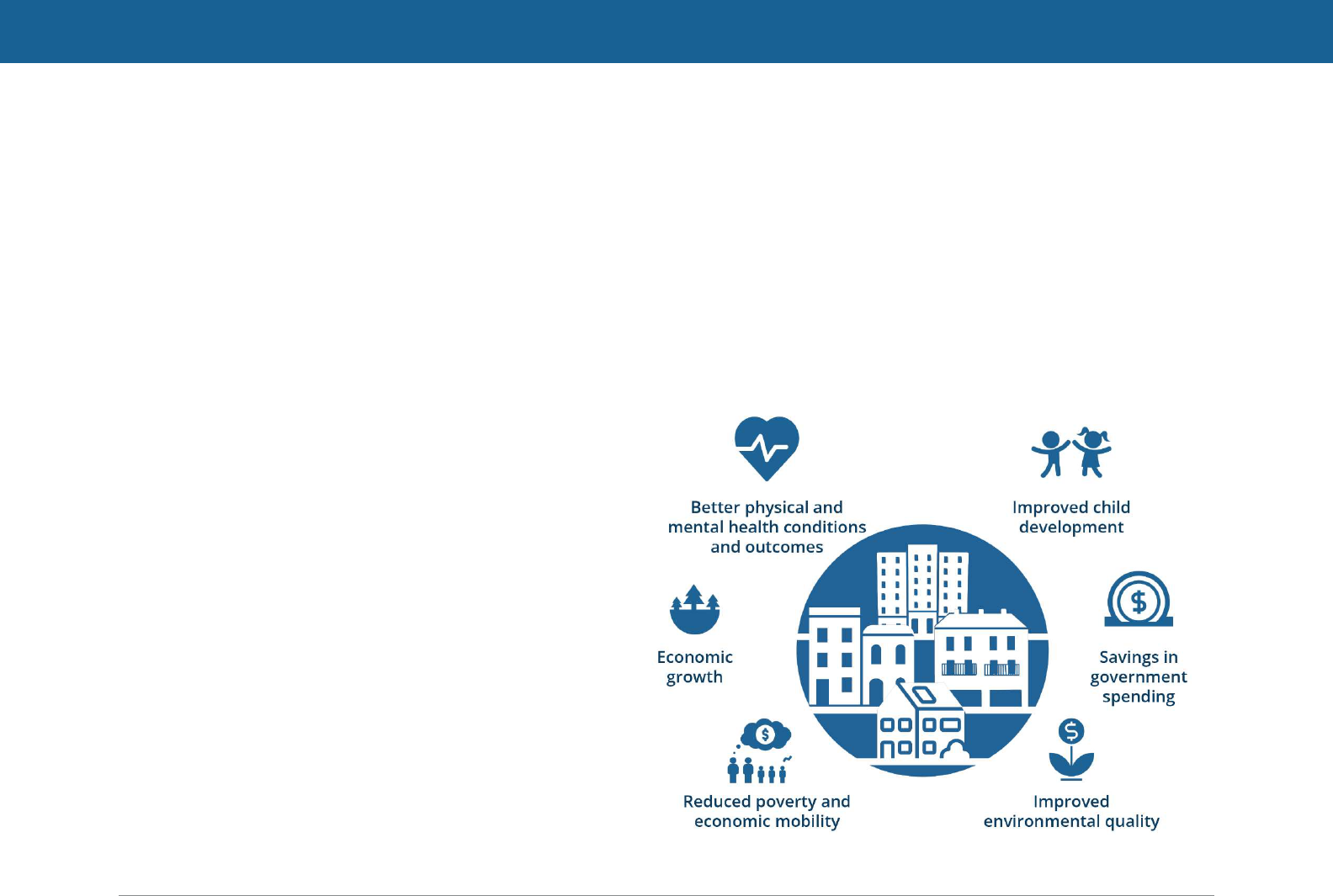

A balanced housing stock accommodates a full “life cycle community”—where there are affordable

housing options for each stage of life from career starters through centenarians—which in turn

supports the local economy and contributes to Arvada’s community culture.

Research consistently shows that a constrained housing

market negatively impacts economic growth while

stable and affordable housing are central to the health

of individuals, families, and communities.

Households living in stable housing are more likely to

spend their incomes in the local economy through

direct spending on goods and services.

Housing investments that allow workers to live near

their place of employment can reduce the impacts of

traffic and commuting, and attract new business by

increasing recruitment of talent, productivity and retention

of the talent that is recruited.

Affordable housing is key to providing high quality

public services as many essential workers (e.g., first

responders, medical professionals, and teachers) often

leave communities that do not have an adequate supply

of housing in their price range.

Affordable housing also plays a key role in preventing

and resolving homelessness.

Generational wealth from affordable home ownership

is a major contributor to positive outcomes for children.

As housing and equity are passed down, young adults

have the option to remain in the community and have families

of their own.

Housing investments and stable housing environments also

bolster local revenue, increase job readiness, help renters

transition to homeownership, lower public costs of eviction and

foreclosure, and increase the economic and educational

opportunities for children.

SUMMARY OF HOUSING NEEDS & COMMUNITY INPUT

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 4

This section summarizes the key findings of the comprehensive

Housing Needs Assessment (HNA) and associated community

engagement efforts. The full HNA is included in Appendix A and

includes a demographic and economic profile of Arvada,

housing market trends, a housing needs analysis and full

results from the resident and in-commuter survey along with

stakeholder interviews and focus groups.

SUPPLY AND MARKET TRENDS

Housing supply. Arvada’s housing supply did not quite

keep pace with household and population growth over the past

5 years. Arvada’s current housing stock is weighted toward

single-family detached products (71% of all units). Production

of “missing middle” types (e.g., townhomes, and du-/tri-/quad-

plexes) is increasing but still constitutes a small share of sales.

Rental market. Median rents in Arvada were around $1,600

in 2021, 56% higher than median rent in 2013. Rental units in

the city have increasingly shifted to higher price points over the

last decade, resulting in a sharp decline in units affordable to

low- and middle-income households. Limited supply and low

vacancy rates contribute to an extremely tight market.

Homeownership. 75% of households own their home in

Arvada; this is a similar proportion to Jefferson County overall.

However, recent data on mortgage applications in Arvada show

that buying a home is increasingly out of reach for low- and

even moderate-income households. Arvada households now

need an income of $199,000 to afford the median price of

$606,000. Condos offer the most affordable option with a

median price around $350,000, but account for a relatively

small proportion of total sales (8%).

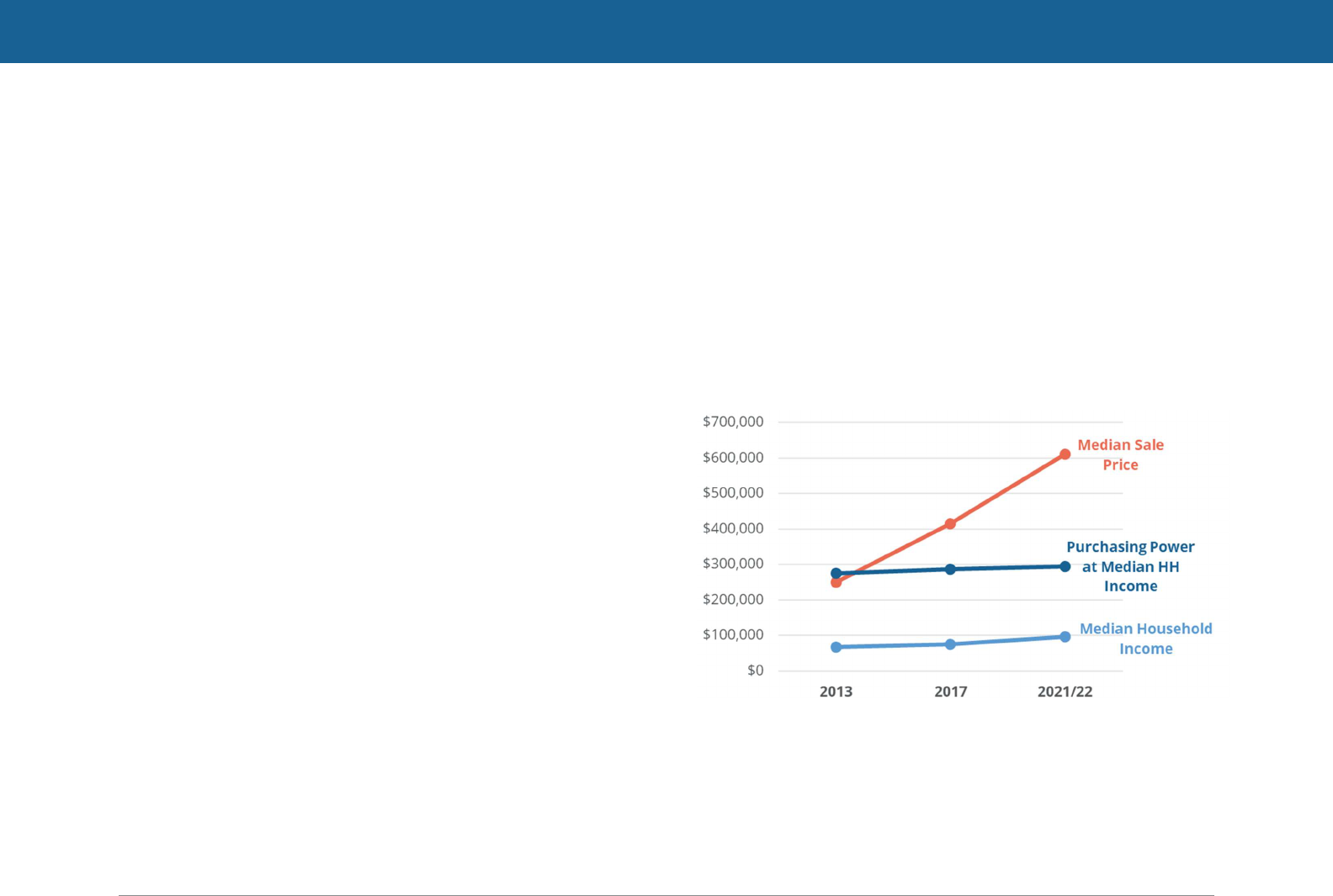

CHANGES IN AFFORDABILITY

The rise in home prices substantially outpaced incomes over

the past five years. These trends coupled with rising interest

rates are pushing homeownership further out of reach for

many current and potential future Arvada households, making

it difficult for renters to transition into home ownership, and for

those who work in Arvada to gain access to stable housing

For-Sale Market Affordability, Arvada, 2013-2021/22

Notes: Purchasing power assumes that buyers spend 30% of their income on housing and

have a 30-year mortgage with a 10% down payment. Ancillary costs (e.g., property taxes,

insurance, HOA payments) are assumed to collectively account for 30% of monthly housing costs.

Source: 2013, 2017, and 2021 ACS 5 year, Zonda Sales Data, and Root Policy Research.

The median home price rose 144% between 2013 and 2021, far

exceeding the change in median income (42%). Rising interest

rates exacerbate these changes and compress affordability

SUMMARY OF HOUSING NEEDS & COMMUNITY INPUT

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 5

further: the change in purchasing power associated with rising

incomes was only 7%, due to the sharp spike in interest rates

over the period.

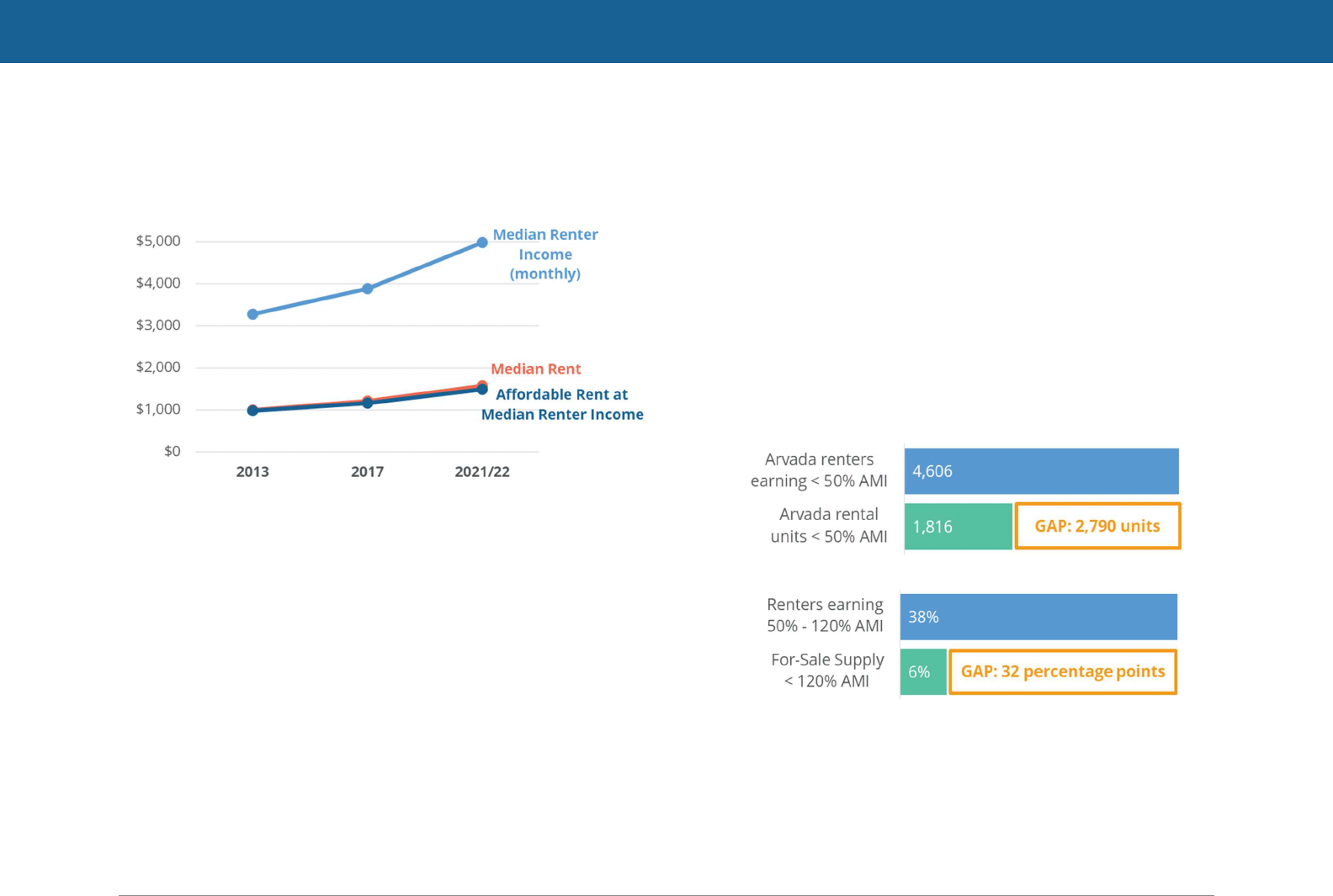

Rental Market Affordability, Arvada, 2013-2021/22

Source: 2013, 2017, and 2021 ACS 5 year , and Root Policy Research.

At the median, the increase in renter income and rental costs

were roughly proportional (52% rise in income and 56% rise in

rent). In other words—the median renter was almost able to

keep up with rising rents.

Even so, over half of Arvada’s renters are cost burdened

(spending 30% or more of gross income on housing). This leads

to housing instability, difficulties saving for a downpayment or

an emergency fund, and, overall, less disposable income

available to be spent at local businesses. Over the past 10 years,

cost burden has started to impact higher-income renters with

substantial increases in the proportion of renters earning

$35,000 to $75,000 that are cost burdened.

Affordable inventory. Income-restricted housing units play

an important role in providing affordable rents to Arvada

residents and workers with low to moderate household incomes.

Arvada currently has a total of 1,400 income restricted units across

24 properties, though some are at the end of their mandatory

affordability periods, with another 750 units in the pipeline.

Affordability Gaps—mismatches in supply and

demand by price-point. The affordability gaps analysis

indicates that affordability needs are concentrated below 50% AMI

in the rental market and below 120% AMI in the for-sale market

(though for-sale inventory needs do persist up to 150% AMI).

Rental Affordability Gap, Arvada

For-Sale Affordability Gap, Arvada

Source: 2013, 2017, and 2021 ACS 5 year , and Root Policy Research.

Collectively, there is an affordability shortage of 2,790 units for

renters earning less than 50% AMI (even after accounting for

the City’s affordable, income-restricted rental inventory). The

most acute affordability needs are for households earning less

than 30% of AMI.

SUMMARY OF HOUSING NEEDS & COMMUNITY INPUT

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 6

Thirty-eight percent (38%) of renters have incomes between

50% and 120% of AMI—a range that historically would have

placed them in consideration for first-time home purchase.

However, only 6% of homes sold in Arvada in 2022 were in an

attainable price-range for this group. Instead, potential buyers

do not see proportional affordability in the market unless they

have incomes over 150% AMI.

This creates affordability challenges for Arvada’s workers: only

8 of the 19 industries in Arvada have average wages high

enough to afford the median rent in Arvada and no industries

have average wages high enough to afford the median sale

price (even if they have 1.5 workers per household).

COMMUNITY PERSPECTIVES

Stakeholder interviews. A broad cross-section of

stakeholders, including social service providers, local employers,

community advocates, and real estate developers highlighted

growing housing needs in Arvada impacting economic

development, employee retention, and community well-being.

Social service providers emphasized the need for more

long-term programming to support low-income families

and residents experiencing (and at risk of) homelessness.

Real estate developers highlighted development barriers

including: high parking requirements; relatively high tap

fees and infrastructure costs; public opposition to multi-

family; requirements for conditional use permits in multi-

use zones; and slow approval processes. Addressing these

barriers and/or creating deeper affordability incentives

could boost housing production and affordability.

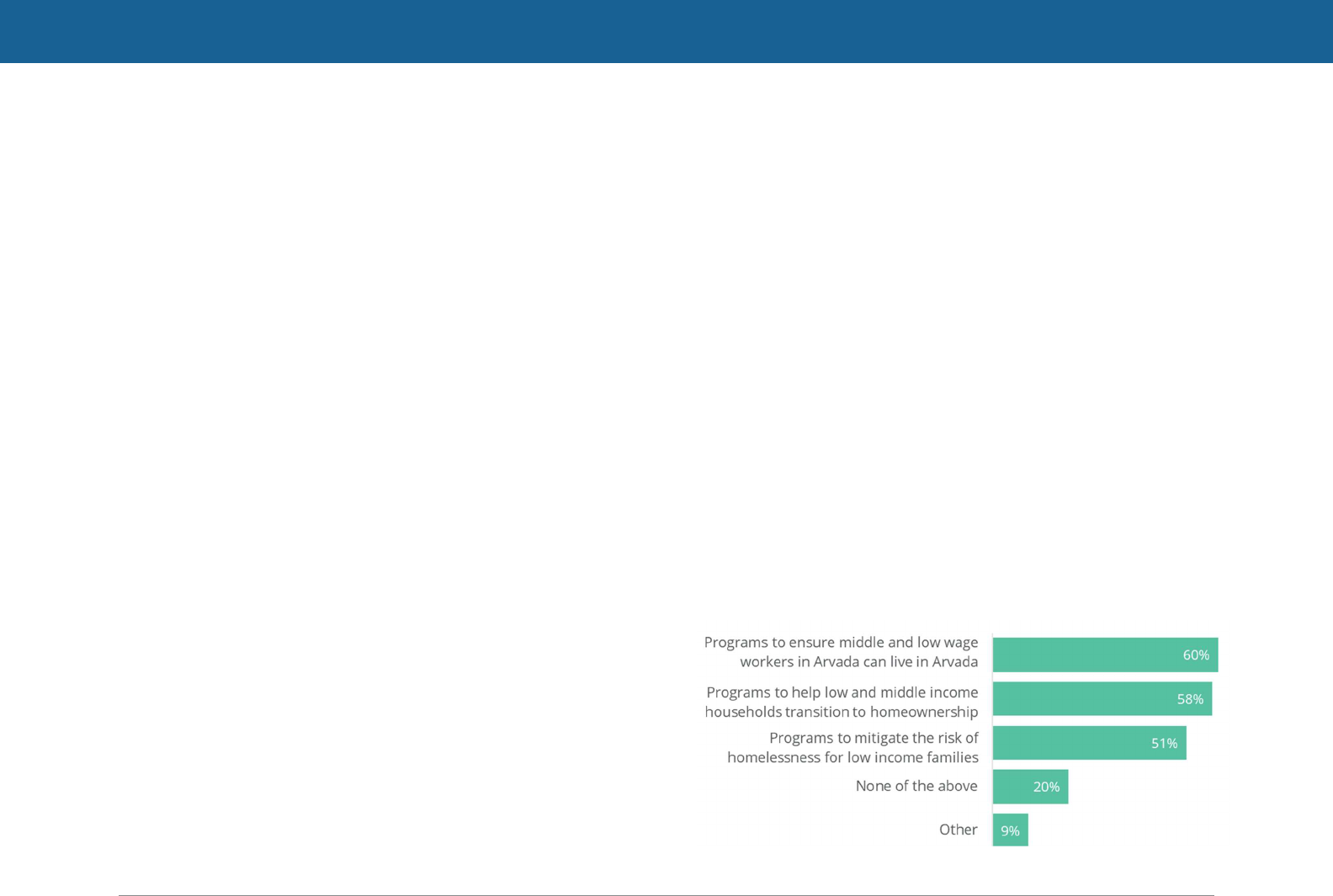

Resident survey. Arvada residents highly value housing

diversity/accessibility and affordability and a broad majority

(over 75% of surveyed residents) believe that housing forms

typically associated with affordability—such as duplexes,

townhomes, and apartments up to 3 stories along major

roads—are appropriate in Arvada.

Housing types rated most important to Arvada by survey

respondents are housing for middle class families;

affordable starter homes; accessible housing (e.g., no

stairs); and housing affordable to residents living on fixed

incomes and/or working in public service or retail.

Nearly half of residents think that duplexes and townhomes

specifically are appropriate in their own neighborhoods, with

support generally trending higher towards East Arvada.

Residents did express strong support for public investment in

housing—particularly for low and middle income workers as

well as programs to stabilize low-income families.

What types of housing programs should the City

of Arvada invest in over the next 5 years?

Source: Source: Root Policy Research from the 2023 Arvada Housing Survey.

PROGRESS TO DATE ON 2020 STRATEGIES

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 7

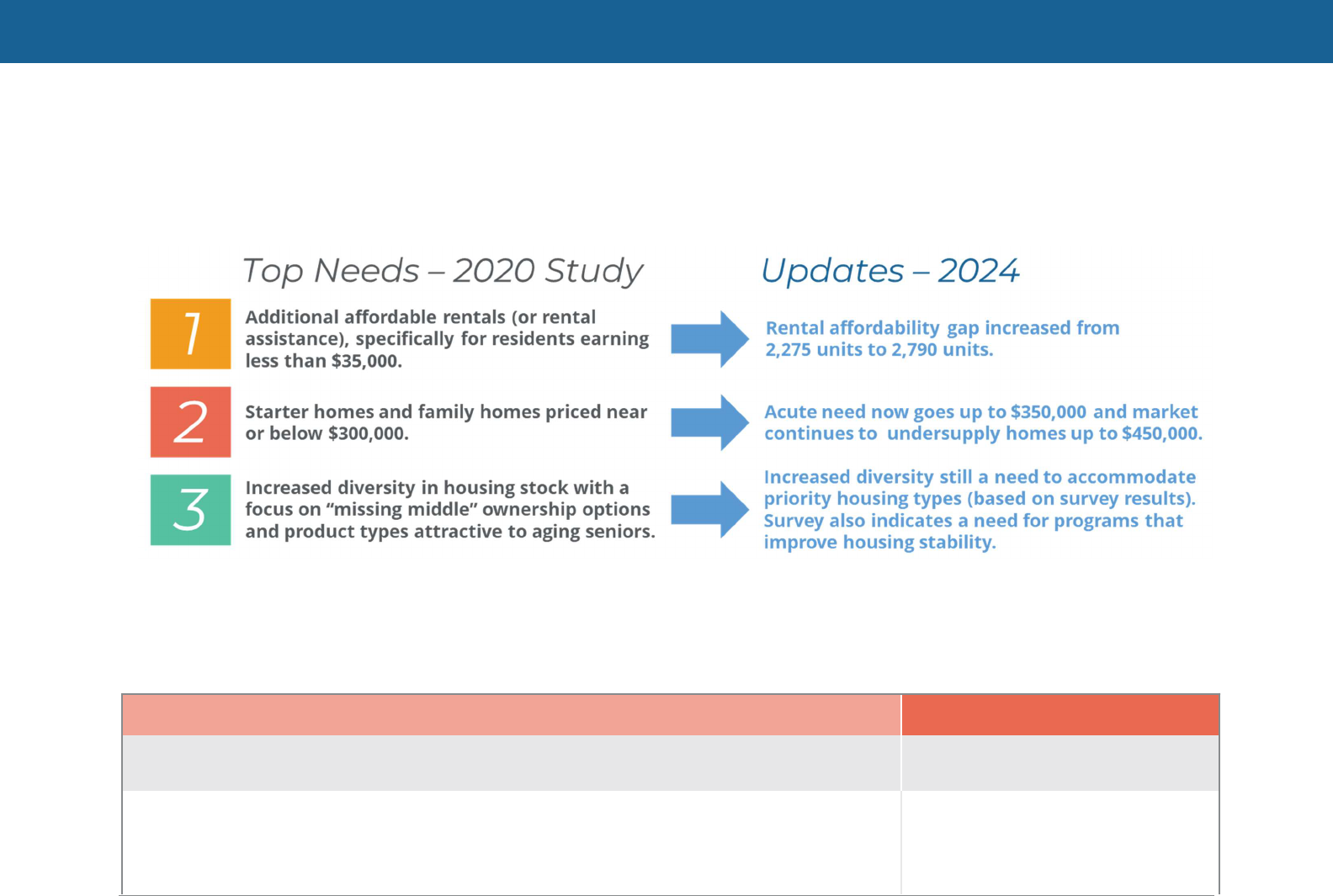

HAVE NEEDS CHANGED SINCE 2020?

The top needs identified in the 2020 Housing Needs Assessment are still present: affordable rental and ownership options and

increased housing diversity. Survey results also indicate a need for programs that improve housing stability coupled with support for

City investments in housing for low- and middle-income workers.

WHAT PROGRESS HAS BEEN MADE TO ADDRESS NEEDS SINCE 2020?

The 2020 Housing Needs Assessment and Strategy identified six priority strategies and related action steps to address the identified

needs at that time. The figure below shows the 2020 Strategy and Action Steps and summarizes the progress the City has made on

each strategy (as of March 2024).

2020 Strategy and Action Steps Progress to Date

1.

Establish a committee to implement the city’s affordable housing action plan and

support affordable housing development.

HAC was formed in 2023 and meets

quarterly.

2. Incorporate additional development incentives to the city’s land development code. Arvada’s code now includes height

bonus incentives and a reduced

parking requirement for LIHTC

developments. Parking incentives

Arvada recently updated its land development code (adopted by City Council on 5/18/20) to

include a height bonus, fast-track review, and modification opportunities for affordable

development. Additional incentives could include:

PROGRESS TO DATE ON 2020 STRATEGIES

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 8

2020 Strategy and Action Steps Progress to Date

Waive or reduce development fees (up to an amount) for affordable housing development.

have been utilized the most. The HAC

also established criteria for providing

gap financing to LIHTC as an

additional inventive.

Waive rezone requirements (or streamline process) for developments with deep affordability.

City to utilize CDBG, HODAG or other resources to fund off site infrastructure that a

development may need in return for affordable units.

3.

Allocate publicly owned land (and/or acquire vacant or underutilized properties) for

affordable and mixed-income housing.

The City has identified potential sites

and is actively meeting with partners.

Inventory existing public land (including land owned by the City, County, schools district, etc.)

and evaluate feasibility for residential development.

Establish partnership with local affordable developers and land trusts

Evaluate funding sources for land/property acquisition that could be utilized to create or

preserve affordable housing.

Actively watch for property and land to acquire to repurpose (could include vacant land,

underutilized commercial, and/or small naturally occurring affordable multifamily housing).

4. Implement a foreclosure/eviction prevention program.

Jefferson County administered

emergency assistance during the

pandemic but the program does not

have ongoing funding. Housing

counseling is currently available.

Identify potential non-profit partners to provide services.

Evaluate funding source options and feasibility of providing short-term emergency rent and

utilities assistance.

5. Establish a local funding source using commercial and/or residential linkage fees.

This was identified as a long-term

strategy in 2020 so action steps are

ongoing. There is still a need for

additional funding to support

affordable housing programs,

production, and preservation.

Evaluate political support for linkage fee option.

Consider and allocate staff resources for program compliance.

Conduct/contract a nexus study to investigate potential fee amounts and implement program.

6. Leverage existing resources to facilitate affordable housing development.

The City, in consultation with the HAC,

established procedures and priorities

for the Arvada Affordable Housing

Fund (AAHF). The City continues to

leverage state and federal resources

effectively and efficiently to serve low

and moderate income households.

Utilize current city resources for affordable housing development and preservation.

Analyze and configure current housing revenues.

Private Activity Bond procedures and priorities.

HOUSING GOALS & STRATEGY FRAMEWORK

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 9

HOUSING VISION

Arvada’s Comprehensive Plan (completed in 2014) outlines the

City’s vision for growth and change through 2034.

1

The Plan

includes the following goals for neighborhoods and housing:

Plan for a range of neighborhoods and accessible housing

of different tenure types to accommodate diverse incomes

and all ages and abilities.

Encourage development of Workforce, Affordable, and

assisted housing throughout Arvada.

Maintain and improve the quality of the existing housing

stock in Arvada and revitalize the physical and social fabric

of neighborhoods that are in decline.

Provide opportunities for special needs and senior housing

in Arvada.

HOUSING GOALS

In addition to the stated vision for housing in Arvada, the City

set the following goals to measure outcomes:

Increase Affordable Housing inventory by 3% per year—139

units annually from the current baseline—in compliance

with the City’s commitment with State Proposition 123

funding. (Affordable is defined a 60% of AMI for rental units

and 100% of AMI for for-sale units).

Increase production of housing that expands price-point

and product diversity in Arvada, including multifamily and

1

An update to the Comprehensive Plan is planned for 2025 (pending budget

allocation) and will incorporate the 2024 Housing Strategy.

“missing middle” products (e.g., du-/ tri-/quad-plexes and

townhomes) that tend to have more attainable price-points.

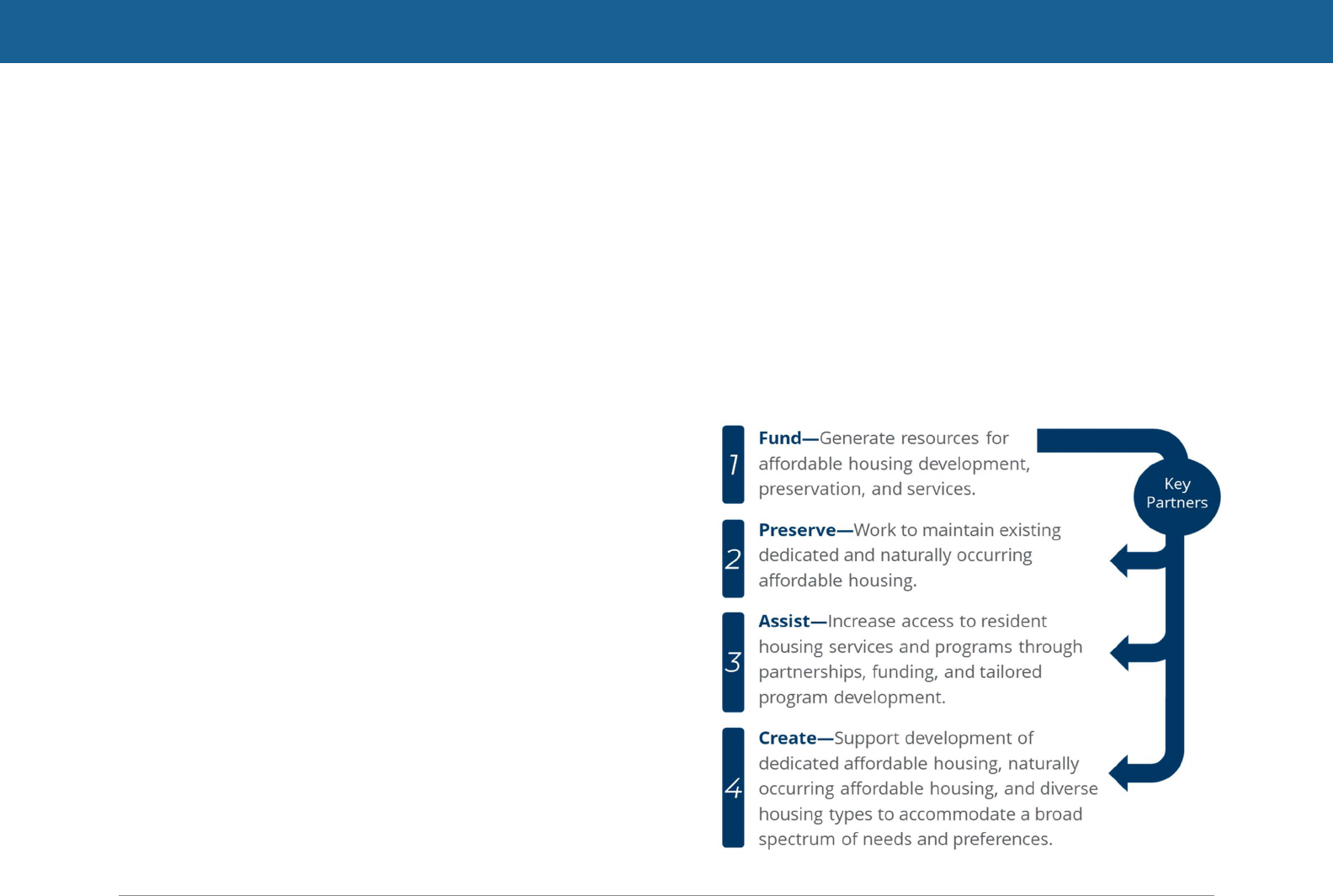

STRATEGY FRAMEWORK

There is no single strategy—or “silver bullet”—to resolve a

community’s housing challenges. Instead, it is important to

have a toolkit of strategies to effectively address needs and

respond to changing market and policy conditions.

An integrated approach that creates funding and leverages key

partners to create and preserve affordability as well as assist

low-income households will have the most success.

HOUSING GOALS & STRATEGY FRAMEWORK

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 10

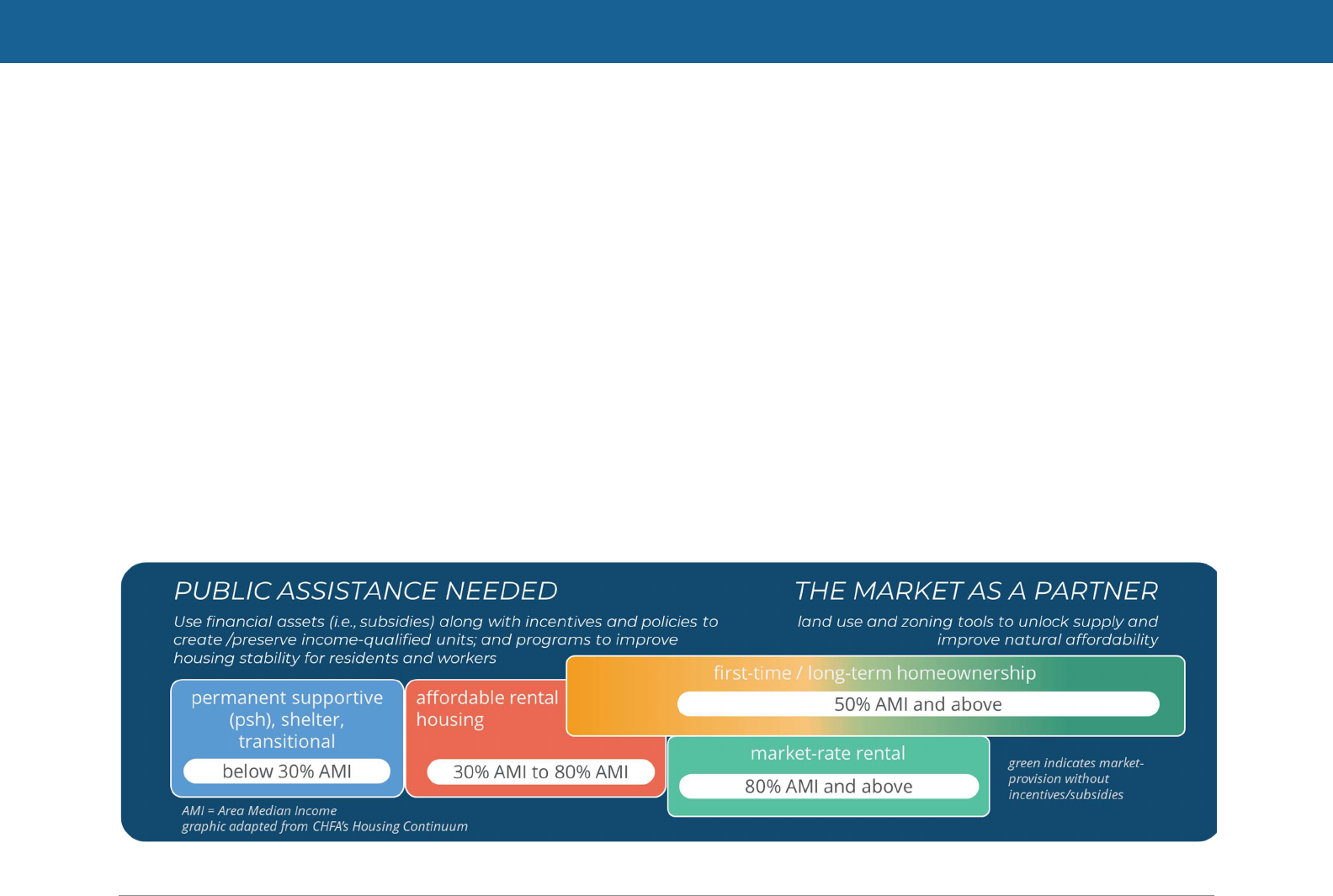

CITY OF ARVADA’S ROLE ACROSS THE HOUSING CONTINUUM

The graphic below shows the full spectrum of housing from

transitional/shelter housing up through market-rate

homeownership. Not surprisingly, the farther up the

income/price spectrum, the more likely it is that the private

market can provide housing without any subsidy or

intervention from public entities. However, at the most

affordable end (housing below 30% AMI), deep subsidies are

needed to produce and operate housing.

The City can leverage the market as a partner to develop

needed housing at the upper end by using land use and zoning

tools to unlock supply and increase natural affordability. (Land

use and zoning policies manage the type, volume, and location

of housing that can be constructed in a community, which

directly impacts product and price-point diversity).

Even with adequate zoning, the private market cannot

produce an adequate amount of affordable housing for

lower income households due to the high (and rising) cost of

new construction, land, and financing. Therefore, direct

subsidies (e.g., gap financing, LIHTC, land donations, etc.) are

needed to create affordable rental housing and to create access

to homeownership for low- and moderate-income households.

The two primary policy “levers” available to the City to

address needs across the housing continuum are:

1) Financial assets—funding and/or land assets—to

subsidize housing production, preservation, and programs.

2) Zoning tools to unlock supply, improve natural

affordability, and incentivize affordable/attainable projects.

Source: CHFA Housing Continuum graphic, adapted by Root Policy Research

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 11

RECOMMENDED STRATEGIES AND ACTIONS

Recommendations for the City of Arvada were developed in conjunction with Arvada City staff, City Council, and the Arvada Housing

Advisory Committee (HAC). Strategies and action items are grounded in evidence-based best practices, Root Policy Research’s

expertise (including working with peer communities), and input from Arvada residents and stakeholders as part of the community

engagement conducted in support of the Housing Needs Assessment and Strategic Plan.

The figure below summarizes the housing strategies recommended for Arvada along with action steps to facilitate implementation

and level of priority (based on feedback from the HAC and City staff). Additional details on each strategy follow. The recommended

strategies are intended to provide Arvada with a “roadmap” to meet affordability needs and goals. Given Colorado’s legislative housing

priorities, Arvada should monitor state legislation that may impact prospective land use and zoning opportunities, as well as

requirements related to housing and adjust the Strategic Plan if/as needed.

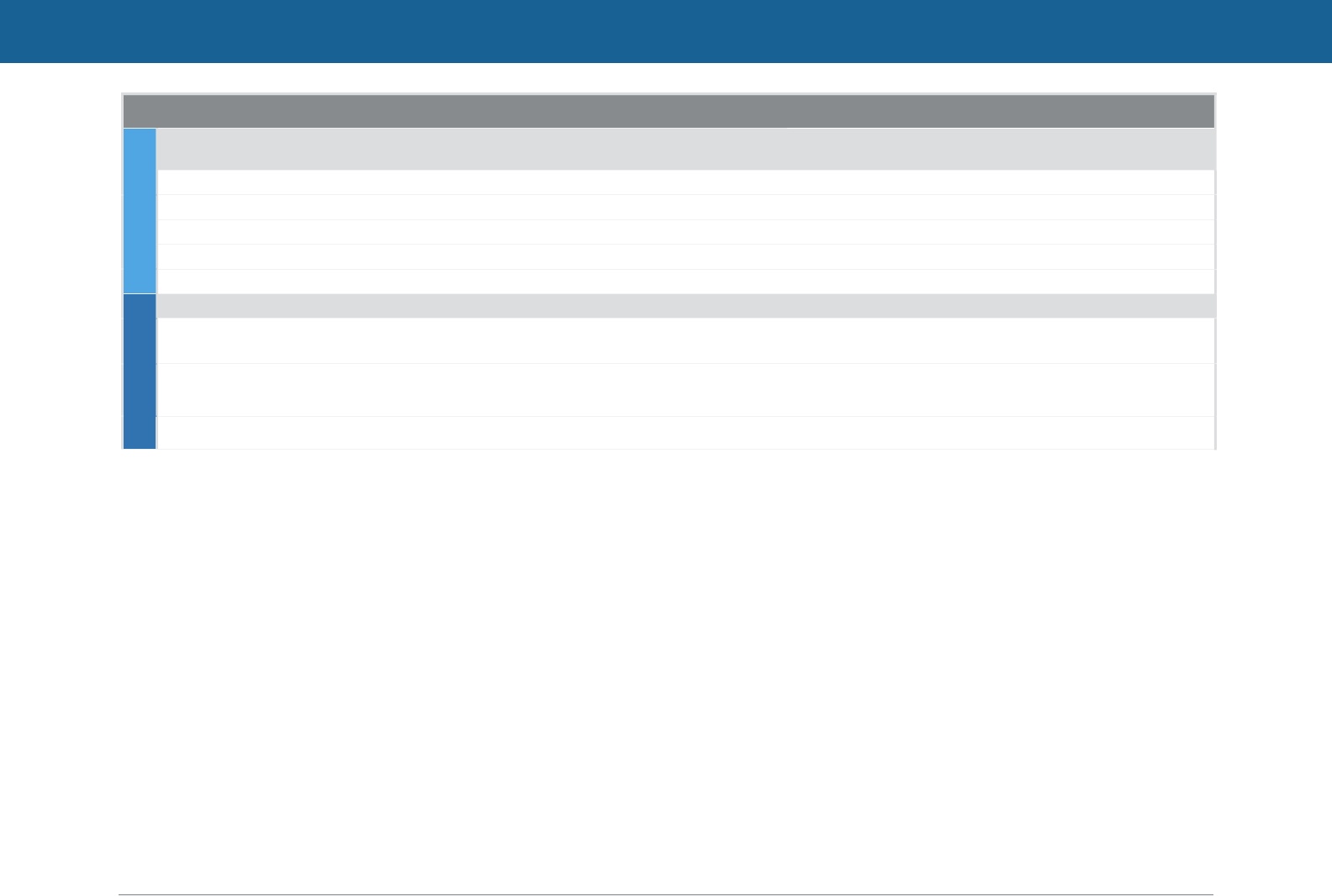

POLICY, STRATEGY, AND ACTION STATUS PRIORITY DIFFICULTY

IMPACT

Policy Lever 1. Leverage financial assets to support affordable housing production, preservation, and programs.

Bolster Resources

1.

Continue existing program funding supported by federal and state funds

and service delivery partnerships.

CONTINUE MODERATE LOW MODERATE

-

Continue to support housing, community development, and homeless prevention/intervention strategies with CDBG funds.

-

Continue to apply for state funding (e.g., Prop 123 programs) as opportunities arise.

-

Advocate for additional federal and state funds dedicated to housing.

-

Continue ongoing evaluation to determine which programs and service delivery partnerships can be expanded.

-

Continue to evaluate efficacy of programs and align funding priorities in consultation with the HAC.

2. Continue to allocate publicly owned land (and/or acquire properties) for

affordable and mixed-income housing.

EXPAND HIGH

LOW -

MODERATE

MODERATE

- HIGH

-

Inventory existing publicly available land and study the feasibility of residential development.

-

Define land bank program and strategies/priorities for disposition (e.g., donations, discounted sales, and/or long-term ground leases).

-

Establish partnerships with other mission-driven or community-oriented landowners.

-

Actively watch for property and land in Arvada and Jefferson County to acquire and redevelop (contingent on additional funding).

3.

Create a dedicated, sustainable revenue source to support the underfunded

Arvada Affordable Housing Fund (AAHF).

NEW HIGH HIGH HIGH

-

Consider the feasibility and impact of a small sales or property tax increase.

-

Task the HAC to study potential local funding tools and determine the most appropriate source of funds for the City (e.g., taxes, fees, TIF).

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 12

POLICY, STRATEGY, AND ACTION STATUS PRIORITY DIFFICULTY

IMPACT

-

Evaluate funding streams for housing projects in peer cities/communities.

-

Determine concrete priorities for the fund.

Deploy Resources

4.

Invest in the production of income-restricted housing, prioritizing projects

that meet identified housing needs.

EXPAND MODERATE MODERATE HIGH

-

Continue to set annual priorities through the HAC for funding criteria.

-

Contingent on Strategy 3, dedicate local funds for income-restricted projects that align with the housing needs.

-

Conduct regular data updates for the HNA to align affordable housing priorities with changing needs.

5.

Invest in the preservation of affordable housing, including naturally

occurring affordable housing (NOAH) and properties with expiring

affordability contracts.

NEW HIGH MODERATE MODERATE

-

Continue to maintain a database of Arvada’s affordable housing properties.

-

Establish partnerships to acquire expiring income-restricted properties and units.

-

Contingent on Strategy 3, dedicate local funds to support acquisition/rehabilitation that renews affordability contracts.

-

Include housing acquisition/rehabilitation of NOAH as an eligible activity for AAHF applications.

-

Determine geographic and housing priorities for acquisition and rehabilitation.

-

Work with peer communities to understand existing preservation programs and evaluate the feasibility in Arvada (e.g., Wheat Ridge).

6.

Bolster implementation and coordination capacity in support of the

Housing Strategic Plan

EXPAND MODERATE LOW MODERATE

-

Evaluate staffing needs for effective implementation of action items and add capacity accordingly.

-

Foster partnerships and advocacy to support housing outcomes.

Policy Lever 2. Implement land use and zoning modifications to unlock supply, improve natural affordability and housing

diversity, and to incentivize affordable projects.

Incentives

7.

Incorporate additional incentives for affordable (income restricted)

developments.

EXPAND HIGH LOW MODERATE

- Create “fast-track” process for affordable (already a requirement of Prop 123)

- Update the “Affordable” definition in in the LDC to include affordable for-sale

-

Consider deeper parking reductions for affordable multi-family and add parking reduction for affordable townhomes.

-

Consider administrative approval of affordable residential in mixed use zones (subject to ground-floor commercial space).

-

Consider design incentives/alternatives that reduce the impact of balcony and covered parking requirements.

-

Consider density bonuses for both multi-family and single-family Affordable projects

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 13

POLICY, STRATEGY, AND ACTION STATUS PRIORITY DIFFICULTY

IMPACT

Entitlements

8. Implement the Jeffco Housing Advocacy Steering Committee’s workforce

housing land use recommendations.

EXPAND HIGH MODERATE MODERATE

- Zone more land for multi-family.

- Allow more types of housing in single-family zones—especially duplexes.

- Lower minimum lot size for single-family.

- Increase lot coverage limits.

-

Allow conversion of commercial and office buildings to multi-family housing as appropriate.

Requirements

9.

Explore affordability requirements in new developments. NEW MODERATE HIGH HIGH

-

Continue HAC discussion of affordability requirement programs, evaluating their potential impact on housing needs as well as market

feasibility.

-

Monitor current and new inclusionary programs implemented throughout Colorado, particularly the Denver metro, and evaluate if

inclusionary requirements would be effective and appropriate in Arvada.

-

Consider a nexus study to investigate commercial and/or residential linkage fees as a dedicated source of funding.

Table Notes:

Status reflects whether the strategy is a continuation of prior efforts, an expansion of an existing program or policy, or a new approach to

address needs.

Priorities were determined by City staff and the HAC and are based on the expected impact of the strategy along with difficulty and cost of

implementation.

Difficulty reflects the level of challenge or cost associated with implementation. This could include financial cost, staffing cost and/or time,

and political cost or anticipated opposition.

Impact reflects the expected capacity of the strategy to address identified housing needs related to housing affordability, housing diversity,

and housing stability.

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 14

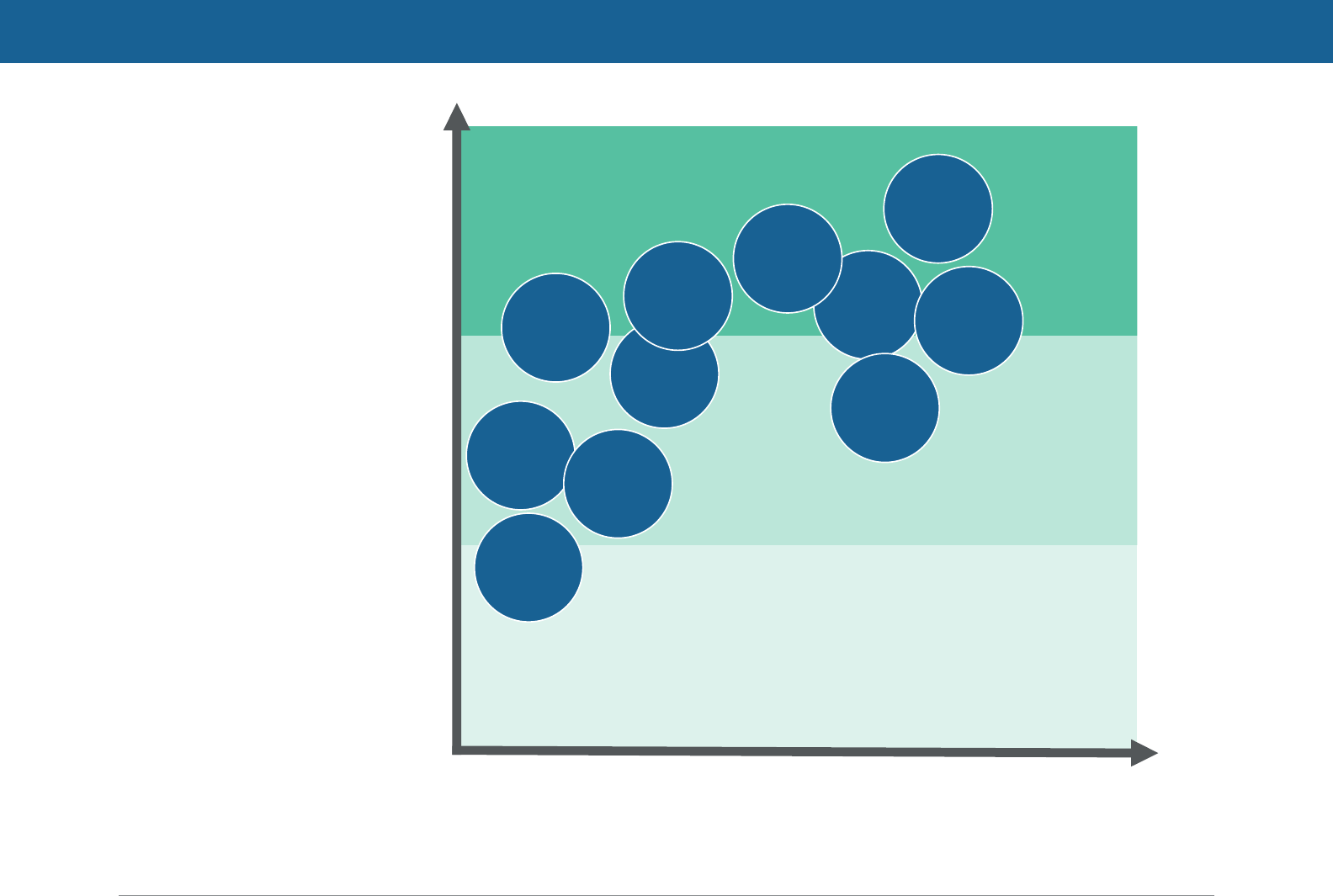

The figure at right plots

the recommended

strategies according to

their relative difficulty to

implement (i.e. financial

cost, political cost, or

staffing capacity/costs )

and anticipated impact on

housing affordability.

This matrix is intended as

a visual representation but

is not a perfectly precise

tool.

Note: *Impact of state legislation depends on the specific bill.

Source: Root Policy Research.

8. Land use

Changes

Difficulty (financial, political, and/or staffing cost)

Expected Impact (capacity to address needs)

1. Continue

Program

Funding

7.

Affordable

Incentives

2a. Public

Land

Donation

2b. Land

Acquisition

4. Produce

Affordable

9.

Affordability

Require-

ments

6. Bolster

Implement-

ation

Capacity

3. Fund the

AAHF

5. Preserve

NOAH &

Affordable

Monitor

State

legislation*

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 15

POLICY LEVER 1. LEVERAGE FINANCIAL ASSETS TO SUPPORT AFFORDABLE

HOUSING PRODUCTION, PRESERVATION, AND PROGRAMS

Financial assets (including funds and publicly owned land) are

commonly used by local governments to support affordable

housing production, preservation, and programs. Due to its

relatively low cashflow, and inability to leverage significant

permanent debt, income restricted housing almost always

requires some type of financial subsidy—either cash or in

kind—in order to be constructed. In high-cost markets, such as

the Denver Metro, federal subsidies alone are insufficient and

projects generally require local, state, or philanthropic funds.

Cities often leverage existing assets to subsidize affordable

housing projects, support existing programs and services, and

provide financial incentives in exchange for income-restricted

units. Communities can proactively address needs by

strategically planning for changing housing needs by identifying

additional financial resources and assets (for example, new

dedicated and sustainable revenue streams for projects).

Currently, financial resources to address housing affordability

needs in Arvada are drawn from federal and state sources, but

do not have a dedicated local revenue source such as a tax

dedication, linkage fee or a line item in the General Fund’s

budget. As it stands, these sources are insufficient to fully

address the housing needs identified in the 2024 HNA.

The City of Arvada receives about $450,000 annually in

Community Development Block Grants (CDBG) from the

HUD. Over the past five years, Arvada has used its CDBG

allocation to create mixed-income units, seniors-only

developments, affordable ownership housing, and

permanent supportive housing (PSH) units. The City has

also used CDBG funds to implement rehabilitation

programs for seniors and people with disabilities.

The Arvada Housing Authority administers federally funded

housing vouchers through the Housing Choice Voucher

Program and the Project Based Voucher Program.

The City may also apply for state-funded programs to

support affordable housing projects and services in

addition to (or combined with) federal funds. For example,

the City has also “opted in” to Proposition 123 programs,

which creates an opportunity for additional funds if

affordable production goals are met.

Arvada also receives Private Activity Bond allocations (PABs)

that can be used as a powerful financing tool for affordable

construction. PABs sufficient to cover 50% of a project’s

construction costs are federally required to unlock an

affordable project’s ability to access LIHTC. In these

projects, the credits can account for tens of millions of

dollars in the permanent Capital Stack. Because of the

pairing of PABs to LIHTC, affordable housing offers the

strongest leveraging for this financial resource.

At the local level, funds for affordable housing production

are limited though there are several opportunities for

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 16

Arvada to institute new dedicated funding streams for

housing (see Strategy 3). Currently, Arvada has no dedicated

local funding source to support the Arvada Affordable

Housing Fund (AAHF) and/or development projects.

Leveraging existing assets is critical to maintaining the ongoing

housing strategies of the City. Creating a dedicated and flexible

source of housing funds would substantially expand the City’s

ability to drive implementation of this Housing Strategic Plan

and make additional progress on the City’s housing goals.

Strategies 1 through 6, detailed below, outline actions the City

of Arvada can take to leverage financial assets to support

affordable housing production, preservation, and programs.

The first three strategies focus on stewarding and developing

assets while Strategies 4-6 focus on utilizing those assets.

STRATEGY 1. CONTINUE EXISTING

PROGRAM FUNDING SUPPORTED BY

FEDERAL AND STATE FUNDS AND

SERVICE DELIVERY PARTNERSHIPS.

Arvada allocates CDBG funds (and state funds as available) to

support housing programs, as well as nonprofits and service

agencies that provide housing, housing services, and/or

services to support low- and middle-income households. CDBG

Funds are allocated according to federal regulations. Any other

funding in Arvada flows through the Arvada Affordable Housing

Fund (AAHF), which is managed by the City, in consultation with

the HAC. In 2023, the HAC established procedures and priorities

for the Fund, which are revisited annually.

Program funds and partnerships are crucial for the City to

address residents’ current and future affordability needs. As

such, Arvada will need to continue existing program funding

(supported by federal/state funds) for programs and service

delivery partnerships to meet changing needs.

In addition to managing existing resources, the City could

advocate for additional federal and state funds dedicated to

housing. Advocacy could be a regional or countywide effort.

Service delivery partnerships can be maintained (and

strengthened) by participating in ad hoc meetings and

discussions and/or regional policy and action groups.

Recommended actions for Arvada:

Continue to support housing and community development

programs, homeless prevention/intervention strategies,

and other efforts to increase housing stability with the City’s

CDBG allocation.

Continue to apply for state funding (e.g., Prop 123

programs) as opportunities arise. Monitor new programs

and legislation that could create opportunities.

Advocate for additional state/federal housing funds and

explore opportunities to apply for state/federal allocations

(e.g., HOME funds).

Continue ongoing evaluation to determine which programs

and service delivery partnerships can be expanded.

Continue to evaluate efficacy of programs and align funding

priorities in consultation with the HAC.

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 17

STRATEGY 2. CONTINUE TO ALLOCATE

PUBLICLY OWNED LAND (AND/OR

ACQUIRE VACANT OR UNDERUTILIZED

PROPERTIES) FOR AFFORDABLE AND

MIXED-INCOME HOUSING.

Property acquisition costs are a central component of the cost

of developing affordable housing. Arvada and other public

entities (e.g., school district, RTD, and state entities) own

properties that could reduce costs and facilitate the production

of affordable and mixed-income units. Though much of this

property is already utilized for public facilities (or is

inappropriate for residential development), there are

opportunities for Arvada to create affordable and mixed-

income units through strategic utilization of publicly owned

property.

Many local governments donate, discount, or lease vacant land

or underutilized properties (e.g., closed schools, vacant or out-

of-date public sector offices) for residential mixed-income or

mixed-used developments through land bank/land donation

programs. Essentially, cities acquire properties which are held

in a “land bank” and redeveloped by nonprofit or private

developers. Land from the bank can be donated, discounted, or

offered on a land lease to the selected developer who agrees

to an affordability level or community benefit. This process is

typically started by creating an inventory of existing public land

that the City could use for future housing sites. Land banking

can also be used as a long-term preservation strategy, and a

mechanism to help develop additional financial assets for

future affordable housing needs.

Existing land inventory in Jefferson County presents a unique

opportunity for Arvada to reduce future development costs,

particularly given recent school closures across the county,

some of which could be redeveloped as housing.

Recommended actions for Arvada:

Inventory existing publicly available land (including land

owned by the City, County, Colorado, school districts, etc.)

and study the feasibility of residential development.

Implement a land bank/land donation program. (Banks can

vary in form from single parcels to scattered sites

properties to large tracts of land).

Establish partnerships with other mission-driven or

community-oriented landowners, such as school districts,

religious groups and churches, and nonprofit/affordable

developers.

Actively watch for property and land in Arvada and Jefferson

County to acquire and redevelop. This could include vacant

land, underutilized/vacant commercial, and/or small

naturally occurring affordable multi-family housing.

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 18

STRATEGY 3. CREATE A NEW DEDICATED,

SUSTAINABLE REVENUE SOURCE TO

SUPPORT THE AAHF.

Dedicated local funds for affordable housing production,

preservation, and programs (or a “Housing Trust Fund”) can

have a high impact on housing needs, especially in cities with

adopted housing plans, clear and measurable housing goals,

and/or additional development capacity. Revenue from local

sources vary widely but can include General Obligation Bonds,

commercial and/or residential linkage fees, sales tax, property

tax, general fund allocations, set-aside or cash-in-lieu from

inclusionary housing ordinances, and other taxes directly tied

to housing demand.

Local funds are particularly effective for affordable housing

development projects because they provide a sustainable and

flexible funding source without federal or state regulations. Fee

revenue can be used for gap financing of low-income housing

projects, land banking, development incentives or subsidies

(such as fee or tax rebates), and/or leveraging state and federal

funding that requires a local match.

In light of these benefits, the City recently created the Arvada

Affordable Housing Fund (“AAHF”) to support affordable

developers and provide gap financing for affordable and

attainable housing projects. Distribution of funds from the

AAHF are set annually by the HAC in alignment with this

Strategic Plan.

However, the AAHF is underfunded for its projected needs and

does not have a dedicated and sustainable revenue source.

Lack of revenue and funds make it increasingly difficult for

Arvada to meet its housing goals and address affordability

needs.

Recommended actions for Arvada:

Consider the feasibility and impact of a small sales or

property tax increase. (Over 25% of residents who

responded to the housing survey were supportive of a tax

increase up to $100/year to support the city’s affordable

housing fund).

Task the HAC to study potential local funding tools and

determine the most appropriate source of funds for the

City. Often, general fund allocations are the easiest way to

initiate housing trust funds but a dedicated stream is most

effective long-term. Options could include sales or property

taxes, linkage fees or inclusionary fees in lieu, tax increment

financing, or others.

Evaluate funding streams for housing projects in peer

cities/communities.

Determine concrete priorities for the fund—what programs

and policies should the fund support? Consider other

strategies and actions outlined in the Strategic Plan that

would require funding for maximum efficacy.

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 19

STRATEGY 4. INVEST IN THE PRODUCTION

OF INCOME-RESTRICTED HOUSING,

PRIORITIZING PROJECTS THAT MEET

IDENTIFIED HOUSING NEEDS.

Production of income-restricted (affordable) housing has

become increasingly important for many communities in

Colorado. As rents and home prices continue to rise, cities and

counties have strategically invested in the development of

income-restricted units for both renters and owners.

Investments are most effective in communities that have

recently completed housing needs assessments and/or

housing market analyses as these reports allow cities to

allocate their funds and resources in a manner that produces

maximum benefit for local communities.

In addition to data analyses, priority-setting is crucial for cities

to effectively address their community’s affordability needs.

Priorities should consider tenure (renter vs owner),

affordability levels (AMIs), geographic distribution (location in

the city as well as access to transportation, good schools, areas

of opportunity, etc.)

Recommended actions for Arvada:

Continue to set annual priorities through the HAC for

funding criteria (e.g., What renter/owner AMIs should be

targeted? Where should projects be sited? What financial

criteria must development projects meet for funding

eligibility?).

Contingent on Strategy 3, dedicate local funds from the

AAHF for income-restricted projects that align with the

housing needs detailed in Appendix A.

Conduct regular data updates for the Arvada Housing

Needs Assessment (every 3-5 years) to align affordable

housing priorities with changing needs.

STRATEGY 5. INVEST IN PRESERVATION

OF AFFORDABLE HOUSING, INCLUDING

NATURALLY OCCURRING AFFORDABLE

HOUSING AND PROPERITES WITH

EXPIRING AFFORDABILITY CONTRACTS.

There are two different submarkets of rental properties serving

low- and moderate-income households in Arvada: income-

restricted properties and naturally occurring affordable

housing, or NOAH. Preservation efforts are needed when the

affordability contracts on income-restricted units are set to

expire and when NOAH is under market pressure to raise rents

beyond what low-income households can afford.

Preservation is an attractive strategy because it utilizes existing

housing stock and is not bound by the timeline and cost of new

construction. However, preservation of NOAH, in particular, can

be a challenge because it is driven by market opportunities and

owned by private landlords—in other words, the City has no

control over the rents.

Expiring affordability contracts. Almost 400 rental units in

Arvada have federal subsidies contracts that will expire in the

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 20

next ten years and 1,200 units will expire in the next 15 years

(see Appendix A). This means that property owners will have

the option to convert units to market-rate housing. With rentals

in high demand, it is increasingly likely that affordability

contracts held by private companies (rather than non-profits)

will not be renewed after they expire—resulting in fewer

affordable units and more households vulnerable to

displacement/housing instability.

The most common form of preservation for expiring subsidies

is to provide funding to non-profits for acquisition (and

rehabilitation if needed) of the properties in exchange for long-

term affordability. Financial resources can be allocated for

activities including the identification of expiring properties,

outreach and education, and/or funds to incentivize

participation. The City does already institute a right-of-first-

offer on the sale of any property that previously received City

funding, putting them in an excellent position to preserve these

units as they “expire.”

Naturally occurring affordable housing. NOAH refers to

housing that does not have any income restriction but generally

serves lower- and middle-income households through

“naturally” affordable rents and home prices. It typically reflects

older apartments, smaller and attached for-sale homes, and/or

manufactured housing (i.e., mobile homes). This critical

segment of the market constitutes a large portion of the

housing stock but can be challenging to preserve through policy

tools because it is fully market-driven. NOAH preservation

strategies are typically designed to incentivize property owners

to institute long-term affordability periods by providing

financial assistance to make needed improvements to their

units and properties. Because these affordability restrictions

will reduce the overall market value of the property for the

duration of the restriction, the City must strike a balance

between short-term stabilization and long-term affordability

when considering the cost of these incentives.

Though they can be capital intensive depending on the context,

NOAH preservation strategies are flexible. For example, rental

properties can be maintained as rental or converted to

cooperative ownership; and ownership properties can be

resold to lower income families or leased as affordable rental

units. Programs can be structured as rehabilitation grants for

owners of existing multi-family developments (in exchange for

contractual affordability) and acquisition/rehabilitation

strategies can also support the conversion of hotels/motels into

affordable or transitional housing.

Preservation strategies—for both expiring affordability

contracts and NOAH—were recommended by the HAC as well

as key Arvada stakeholders. These efforts will not only prevent

housing instability and displacement among vulnerable

households but improve the condition of the city’s existing

housing stock and allow Arvada to adapt to changing housing

needs.

Recommended actions for Arvada:

Continue to maintain a database of Arvada’s income

restricted housing properties including affordability

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 21

periods, expiration timelines, ownership entities, and other

data to help City staff identify opportunities for

preservation programs.

Establish partnerships with local non-profits, housing

providers, affordable developers, and other entities who

could be able to acquire expiring income-restricted

properties and units.

Contingent on Strategy 3, dedicate local funds from the

AAHF to support acquisition/rehabilitation that renews

affordability contracts.

Include housing acquisition/rehabilitation of NOAH as an

eligible activity for AAHF applications (contingent on

imposing rent requirements).

Determine geographic and housing priorities for acquisition

and rehabilitation. For example, City staff could identify

which areas of Arvada require the most resources and/or

immediate intervention.

Work with the peer communities to understand existing

preservation programs (e.g., Wheat Ridge’s new program)

and evaluate the feasibility of a similar program in Arvada.

Continue to work across City departments to evaluate how

decisions in other areas may impact affordability of existing

housing stock (e.g., parks, fire, public works, etc.).

STRATEGY 6. BOLSTER IMPLEMENTATION

AND COORDINATION CAPACITY IN

SUPPORT OF THE STRATEGIC PLAN.

A number of the recommended strategies for Arvada include

expansion of existing policies or the addition of new

approaches to address housing needs. It goes without saying

that effective implementation will require staff resources to

manage policies and monitor progress. As specific policies are

implemented, the City should continue to monitor staffing

needs within the Housing Division and add capacity as needed.

Staff capacity and HAC engagement is also critical to continue

to foster partnerships with local service providers and

coordinate housing policy efforts with surrounding

communities, Jefferson County, and local foundations.

Recommended actions for Arvada:

Evaluate staffing needs for effective implementation of

action items and add capacity accordingly.

Foster partnerships and advocacy to support housing

outcomes.

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 22

POLICY LEVER 2. CONSIDER LAND USE AND ZONING MODIFICATIONS TO

UNLOCK SUPPLY, IMPROVE AFFORDABILITY AND HOUSING DIVERSITY, AND

INCENTIVIZE AFFORDABLE PROJECTS.

Land use and zoning reform (or modification) is a common

practice to increase housing supply, improve natural

affordability and housing diversity, and incentivize affordable

housing projects. While regulatory reforms cannot fully address

needs across the housing continuum, it is an important tool for

many local governments to increase production of income-

restricted units (through incentives or zoning mandates) while

also freeing the market to respond more effectively to product

and price-point demand.

Strategies specific to land use and zoning modifications are

detailed below and include:

Affordability incentives to increase income-restricted

production;

Land use recommendations that improve land use

efficiency and allow for more housing diversity in line with

market demand and housing needs; and

Exploration of requirements on new development to

contribute to the income-restricted housing supply through

unit production or impact fees.

A significant benefit of these types of regulatory reforms is

that they can typically be implemented without additional

financial resources—though they may require political

capital and/or staff capacity.

In addition to specific land use code modifications discussed in

the following strategies, Arvada also has an opportunity to

update its Comprehensive Plan, starting in 2025 (pending

budget allocation). The Comprehensive Plan should also

consider these recommendations in the context of the City’s

overall vision for growth and geographic priorities.

STRATEGY 7. INCORPORATE ADDITIONAL

INCENTIVES FOR AFFORDABLE (INCOME-

RESTRICTED) HOUSING DEVELOPMENTS.

In general, development incentives offer variances from

entitlement zoning (or relief from development fees) in

exchange for including affordable units in the development.

Incentives can take several forms:

Process-oriented development incentives, such as fast track

or administrative approvals, which indirectly lower

predevelopment costs by reducing risk, reducing redesigns,

and reducing the amount of time (and interest) a developer

will have to use bridge financing prior to closing.

Regulatory incentives that allow for more units to be built

than allowed by right by current zoning regulations (e.g.,

density or height bonuses), which improve land efficiency

and allow for more cost-efficient product.

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 23

Financial incentives, such as in-kind donations, fee

reductions/rebates or tax incentives for affordable

developments, which directly lower the cost of

construction.

Incentives can be used both to encourage market-rate

developers to include a small proportion of affordable units

and/or to improve the development economics and process for

projects with a large proportion of affordable units (e.g., LIHTC

developments). Most incentive policies mandate set asides of

between 10% and 30% of units affordable to 50% to 80% of the

AMI, depending on the City’s market. Affordability periods

range from 15 to 99 years (the average length of time for deed

restrictions is 30 years).

Arvada currently has some affordable incentives in place for

Low Income Housing Tax Credit (LIHTC) projects, including a 1-

story height bonus and parking reduction. However, there are

no codified incentives for affordable ownership projects or

projects funded through non-LIHTC sources.

Stakeholder outreach for the Housing Needs Assessment

identified some additional incentives that could help affordable

developers maximize their potential and that could stimulate

additional affordable development, outlined in the action steps

below.

Recommended actions for Arvada:

Create a “fast-track” development process for affordable

projects (a requirement of receiving funds from State

Proposition 123).

Update the “Affordable” definition to include an affordable

for-sale definition, defined by income-restrictions and AMIs

rather than LIHTC.

Consider deeper parking reductions for affordable multi-

family projects, including parking reductions for affordable

townhomes.

Consider administrative approvals for affordable

residential developments in mixed use zones, potentially

subject to ground-floor commercial spaces. (Often the

residents of the affordable development are the very

service workers needed by the onsite commercial space – a

true implementation of the live/work paradigm).

Consider design incentives or alternatives for affordable

projects that reduce the impact of balcony and covered

space requirements. For example, the City’s zoning code

could be modified to allow Juliette and/or faux balconies.

Consider density bonuses for both multi-family and single-

family affordable projects including (but not limited to) lot

size reductions, additional dwelling units per acre, and/or

incremental zoning (allowing the next increment of density).

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 24

STRATEGY 8. IMPLEMENT LAND USE

RECOMMENDATIONS FROM THE JEFFCO

HOUSING ADVOCACY STEERING

COMMITTEE ON WORKFORCE HOUSING.

The Colorado Gives Foundation, along with elected and

appointed officials, stakeholders, and other local actors formed

the Jefferson County Housing Advocacy Steering Committee to

develop workforce housing policy recommendations for local

jurisdictions throughout Jefferson County.

As part of this effort, committee members developed land use

and zoning reform recommendations to create more housing

price-point and/or product diversity in Jeffco cities. The Steering

Committee recommended all Jeffco communities:

Allow accessory dwelling units (ADUs) by right in

agricultural, single family, and two-family uses (subject to

lot and/or occupancy requirements).

Zone more land for multi-family.

Create opportunity for modular solutions through local

accommodations and state advocacy.

The Steering Committee recommended some communities

(depending on local context):

Allow more types of housing in single-family zones—

especially duplexes.

Allow medium density housing (10 dwellings per acre, or

du/a) in 10% of land area.

Allow administrative approvals of small multifamily or

affordable projects.

Lower minimum lot size for single-family.

Increase lot coverage limits.

Allow conversion of commercial and office buildings to

multi-family housing as appropriate.

Allow higher occupancy in each unit (accounting for multi-

generational households and expanding forms of

committed partnership and functional households).

Arvada already has some of these best practices in place,

including allowance of ADUs, reasonable occupancy limits, and

at least 10% of land zoned at 10 du/a or higher. However, there

are improvements the City can make to facilitate opportunities

for housing production that aligns with market demand and

improves natural affordability of market-rate products.

Recommended actions for Arvada:

Work with the Planning Department to draft and implement the

Jeffco Housing Advocacy Steering Committee’s

recommendations that are most applicable to the City of

Arvada, including:

Zone more land for multi-family;

Allow more housing types in single-family zones, especially

duplexes;

Lower minimum lot sizes for single-family homes;

Increase lot coverage limits;

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 25

Allow conversion of commercial and/or office buildings to

multi-family housing as appropriate; and

Regularly revisit ADU regulations and occupancy limits to

ensure the City is keeping with best practices.

STRATEGY 9. EVALUATE THE VIABILITY

AND IMPACT OF AFFORDABILITY

REQUIREMENTS IN NEW DEVELOPMENTS

SUCH AS INCLUSIONARY ZONING AND/OR

AFFORDABLE HOUSING LINKAGE FEES.

The primary policy tools used to mandate affordable housing

production in conjunction with new development are:

1. Mandatory inclusionary housing policies, which require

affordable production (or fees-in-lieu) in conjunction with

new residential development (note that these policies can

include incentives/offsets for compliance); and

2. Affordable housing linkage fees, which mandate an

impact fee on new development (residential, commercial,

or both) in proportion to its impact on affordable housing

needs.

Inclusionary ordinances are growing in popularity following

state legislation that enables these policies to apply to both

rental and for-sale developments. When structured well,

inclusionary zoning can generate a substantial number of units

at no direct cost to the city (other than enforcement and other

administrative costs). Inclusionary programs can include “off-

sets” and/or incentives for affordable housing provision, as well

as a fee “in lieu” option for developers. Cities that allow

developers to pay fees-in-lieu of developing income-restricted

units typically allocate revenue generated from the fees to

future affordable housing projects, but this is a challenging

strategy to maintain, given the high costs of land and

development.

Affordable housing linkage fees—similar to other impact fees—

are tied to quantifiable impacts of new development.

Implementation requires a nexus study to determine such

impacts before setting fees. Revenues from linkage fees must

be spent on affordable housing investments.

Since both inclusionary policies and linkage fees apply

exclusively to new development, they are most effective in

markets that are actively developing new housing and/or

commercial space and expect continued growth.

Recommended actions for Arvada:

Continue HAC discussion of potential affordability

requirement programs, evaluating their impact on housing

needs as well as market feasibility.

Monitor current and new inclusionary programs

implemented throughout Colorado, particularly the Denver

metro area, and evaluate if inclusionary requirements

would be effective and appropriate in Arvada.

Consider a nexus study to investigate commercial and/or

residential linkage fees as a dedicated source of funding.

2024 HOUSING STRATEGIES & ACTIONS

ROOT POLICY RESEARCH ARVADA HOUSING STRATEGIC PLAN, PAGE 26

MONITOR STATE LEGISLATION THAT MAY

IMPACT LAND USE AND ZONING

OPPORTUNITIES AND/OR REQUIREMENTS

RELATED TO HOUSING.

Given Colorado’s legislative housing priorities, Arvada (and

other communities in the Denver Metro area) should monitor

state legislation that may impact prospective land use and

zoning opportunities, as well as requirements related to

housing. Recent (2024) legislation proposed at the state level,

and applicable to the City of Arvada, includes: HB-1107, HB-

1304, and HB-1313 (among others).

As the 2024 legislative session closes—and after future

legislative sessions, City staff and the HAC should review the

Housing Strategic Plan in light of state legislative changes and

make adjustments if and as needed.