NAIC Model Laws, Regulations, Guidelines and Other Resources—July 1999

© 1999 National Association of Insurance Commissioners 803-1

ASSUMPTION REINSURANCE MODEL ACT

Table of Contents

Section 1. Purpose

Section 2. Scope

Section 3. Definitions

Section 4. Notice Requirements

Section 5. Policyholder Rights

Section 6. Effect of Consent

Section 7. Commissioner’s Discretion

Section 8. Effective Date

Appendix A. Notice of Transfer

Section 1. Purpose

This Act provides for the regulation of the transfer and novation of contracts of insurance by way of assumption reinsurance.

It defines assumption reinsurance and establishes notice and disclosure requirements which protect and define the rights and

obligations of policyholders, regulators and the parties to assumption reinsurance agreements.

Section 2. Scope

A. This Act applies to any insurer authorized in this state which either assumes or transfers the obligations or

risks, or both, on contracts of insurance pursuant to an assumption reinsurance agreement.

Drafting Note: Certain other transactions may result in a substantive assumption or transfer of obligations or risks, or both, under contracts of insurance.

For example, some state statutes permit transactions in which affiliated insurers isolate certain obligations under existing insurance policies, in whole or in

part, from other insurance operations (so-called “division statutes”). States desiring to assure their jurisdiction over assumptions of this type should consider

including the following in their statutes:

1. Add “or other agreement, plan or arrangement whose effect on policyholder rights is substantially similar to an assumption reinsurance

agreement” after “assumption reinsurance agreement” in Section 2A.

2. Insert “, or other agreement, plan or arrangement” after “contract” in Section 3B.

3. Insert “, or” after “extinguished” in Section 3B(2).

4. Insert a new Paragraph (3) in Section 3B that would read as follows: “Whose effect on policyholder rights is substantially similar to transactions

meeting the conditions set forth in Paragraphs (1) and (2) of this subsection and that have not been specifically excluded from the application of

this Act by Section 2B.”

B. This Act does not apply to:

(1) Any reinsurance agreement or transaction in which the ceding insurer continues to remain directly

liable for its insurance obligations or risks, or both, under the contracts of insurance subject to the

reinsurance agreement;

(2) The substitution of one insurer for another upon the expiration of insurance coverage pursuant to

statutory or contractual requirements and the issuance of a new contract of insurance by another

insurer;

(3) The transfer of contracts of insurance pursuant to mergers or consolidations of two (2) or more

insurers to the extent that those transactions are regulated by statute;

(4) Any insurer subject to a judicial order of liquidation or rehabilitation;

Drafting Note: This section is intended to apply to any similar proceedings under court order.

(5) Any reinsurance agreement or transaction to which a state insurance guaranty association is a

party, provided that policyholders do not lose any rights or claims afforded under their original

policies pursuant to [cite applicable state guaranty fund laws]; or

Assumption Reinsurance Model Act

803-2

© 1999 National Association of Insurance Commissioners

(6) The transfer of liabilities from one insurer to another under a single group policy upon the request

of the group policyholder.

Section 3. Definitions

A. “Assuming insurer” means the insurer that acquires an insurance obligation or risk, or both, from the

transferring insurer pursuant to an assumption reinsurance agreement.

B. “Assumption reinsurance agreement” means any contract that both:

Drafting Note: See notes after Section 2A for suggested additional language.

(1) Transfers insurance obligations or risks, or both, of existing or in-force contracts of insurance from

a transferring insurer to an assuming insurer; and

(2) Is intended to effect a novation of the transferred contract of insurance with the result that the

assuming insurer becomes directly liable to the policyholders of the transferring insurer and the

transferring insurer’s insurance obligations or risks, or both, under the contracts are extinguished.

C. “Contract of insurance” means any written agreement between an insurer and policyholder pursuant to

which the insurer, in exchange for premium or other consideration, agrees to assume an obligation or risk,

or both, of the policyholder or to make payments on behalf of, or to, the policyholder or its beneficiaries; it

shall include all property, casualty, life, health, accident, surety, title and annuity business authorized to be

written pursuant to the insurance laws of this state.

Drafting Note: Individual states may cite specific sections of their insurance laws regarding lines, classes or types of insurance to which this Act is

applicable. If a state has a statutory definition of contract of insurance which is inconsistent with this definition, the state may want to consider using the

statutory definition.

D. “Home service business” means insurance business on which premiums are collected on a weekly or

monthly basis by an agent of the insurer.

E. “Notice of transfer” means the written notice to policyholders required by Section 4A.

F. “Policyholder” means any individual or entity which has the right to terminate or otherwise alter the terms

of a contract of insurance. It includes any certificateholder whose certificate is in force on the proposed

effective date of the assumption, if the certificateholder has the right to keep the certificate in force without

change in benefit following termination of the group policy.

The right to keep the certificate in force referred to in this section shall not include the right to elect

individual coverage under the Consolidated Omnibus Budget Reconciliation Act, (“COBRA”) Section 601,

et seq., of the Employee Retirement Income Security Act of 1974, as amended (29 U.S.C. 1161 et seq.).

G. “Transferring insurer” means the insurer which transfers an insurance obligation or risk, or both, to an

assuming insurer pursuant to an assumption reinsurance agreement.

Section 4. Notice Requirements

A. Notice to Policyholders, Agents and Brokers

(1) The transferring insurer shall provide or cause to be provided to each policyholder a notice of

transfer by first-class mail, addressed to the policyholder’s last known address or to the address to

which premium notices or other policy documents are sent or, with respect to home service

business, by personal delivery with acknowledged receipt. A notice of transfer shall also be sent to

the transferring insurer’s agents or brokers of record on the affected policies.

NAIC Model Laws, Regulations, Guidelines and Other Resources—July 1999

© 1999 National Association of Insurance Commissioners 803-3

(2) The notice of transfer shall state or provide:

(a) The date the transfer and novation of the policyholder’s contract of insurance is proposed

to take place;

(b) The name, address and telephone number of the assuming and transferring insurer;

(c) That the policyholder has the right to either consent to or reject the transfer and novation;

(d) The procedures and time limit for consenting to or rejecting the transfer and novation;

(e) A summary of any effect that consenting to or rejecting the transfer and novation will

have on the policyholder’s rights;

(f) A statement that the assuming insurer is licensed to write the type of business being

assumed in the state where the policyholder resides, or is otherwise authorized, as

provided herein, to assume such business;

(g) The name and address of the person at the transferring insurer to whom the policyholder

should send its written statement of acceptance or rejection of the transfer and novation;

and

(h) The address and phone number of the insurance department where the policyholder

resides so that the policyholder may write or call the insurance department for further

information regarding the financial condition of the assuming insurer.

(i) The following financial data for both companies:

(i) Ratings for the last five (5) years if available or for such lesser period as is

available from two (2) nationally recognized insurance rating services acceptable

to the commissioner including the rating service’s explanation of the meaning of

the ratings. If ratings are unavailable for any year of the five-year period, this

shall also be disclosed;

Drafting Note: Insert the title of the chief insurance regulatory official wherever the term “commissioner” appears.

(ii) A balance sheet as of December 31 for the previous three (3) years if available

or for such lesser period as is available and as of the date of the most recent

quarterly statement;

(iii) A copy of the Management’s Discussion and Analysis that was filed as a

supplement to the previous year’s annual statement; and

(iv) An explanation of the reason for the transfer.

(3) Notice in a form identical or substantially similar to Appendix A attached shall be deemed to

comply with the requirements of Section 4A(2).

(4) The notice of transfer shall include a pre-addressed, postage-paid response card which a

policyholder may return as its written statement of acceptance or rejection of the transfer and

novation.

(5) The notice of transfer shall be filed as part of the prior approval requirement set forth in Section

4B(1).

Assumption Reinsurance Model Act

803-4

© 1999 National Association of Insurance Commissioners

B. Notification and Prior Approval Requirements

(1) Prior approval by the commissioner is required for any transaction where an insurer domiciled in

this state assumes or transfers obligations and/or risks on contracts of insurance under an

assumption reinsurance agreement. No insurer licensed in this state shall transfer obligations

and/or risks on contracts of insurance issued to or owned by residents of this state to any insurer

that is not licensed in this state. An insurer domiciled in this state shall not assume obligations or

risks, or both, on contracts of insurance issued to or owned by policyholders residing in any other

state unless it is licensed in the other state, or the insurance regulatory official of that state has

approved the assumption.

(2) Any licensed foreign insurer that enters into an assumption reinsurance agreement which transfers

the obligations or risks, or both, on contracts of insurance issued to or owned by residents of this

state, shall file or cause to be filed with the commissioner of insurance of this state the assumption

certificate, a copy of the notice of transfer and an affidavit that the transaction is subject to

substantially similar requirements in the state of domicile of both the transferring and assuming

insurer. If no such requirements exist in the domicile of either the transferring or assuming

insurers, then the requirements of Section 4B(3) shall apply.

Drafting Note: It is anticipated that the insurance department will review the filing in a manner consistent with the policy form review process applicable

for the state which could include either prior approval or file and use.

(3) Any licensed foreign insurer that enters into an assumption reinsurance agreement which transfers

the obligations or risks, or both, on contracts of insurance issued to or owned by residents of this

state, shall obtain prior approval of the commissioner of insurance of this state and be subject to all

other requirements of this Act with respect to residents of this state, unless the transferring and

assuming insurers are subject to assumption reinsurance requirements adopted by statute or

regulation in the jurisdiction of their domicile which are substantially similar to those contained

herein.

(4) The following factors, along with such other factors as the commissioner deems appropriate under

the circumstances, shall be considered by the commissioner in reviewing a request for approval:

(a) The financial condition of the transferring and assuming insurers and the effect the

transaction will have on the financial condition of each company;

(b) The competence, experience and integrity of those persons who control the operation of

the assuming insurer;

(c) The plans or proposals the assuming party has with respect to the administration of the

policies subject to the proposed transfer;

(d) Whether the transfer is fair and reasonable to the policyholders of both companies; and

(e) Whether the notice of transfer to be provided by the insurer is fair, adequate and not

misleading.

Section 5. Policyholder Rights

A. Policyholders shall have the right to reject the transfer and novation of their contracts of insurance.

Policyholders electing to reject the assumption transaction shall return to the transferring insurer the pre-

addressed, postage-paid response card or other written notice and indicate thereon that the assumption is

rejected (collectively referred to as the “Response Card”).

NAIC Model Laws, Regulations, Guidelines and Other Resources—July 1999

© 1999 National Association of Insurance Commissioners 803-5

B. Payment of any premium to the assuming company during the twenty-four-month period after notice is

received shall be deemed to indicate the policyholder’s acceptance of the transfer to the assuming insurer

and a novation shall be deemed to have been effected, provided that the premium notice clearly states that

payment of the premium to the assuming insurer shall constitute acceptance of the transfer. However, the

premium notice shall also provide a method for the policyholder to pay the premium while reserving the

right to reject the transfer. With respect to any home service business or any other business not using

premium notices, the disclosures and procedural requirements of this subsection are to be set forth in the

Notice of Transfer required by Section 4 and in the assumption certificate.

C. After no fewer than twenty-four (24) months from the mailing of the initial notice of transfer required under

section 4A, if positive consent to, or rejection of, the transfer and assumption has not been received or

consent has not been deemed to have occurred under Subsection B of this section, the transferring company

shall send to the policyholder a second and final notice of transfer as specified in Section 4A. If the

policyholder does not accept or reject the transfer during the one month period immediately following the

date on which the transferring insurer mails the second and final notice of transfer, the policyholder’s

consent will be deemed to have occurred and novation of the contract will be effected. With respect to the

home service business, or any other business not using premium notices, the twenty-four and one month

periods shall be measured from the date of delivery of the Notice of Transfer pursuant to Section 4A(1).

D. The transferring insurer will be deemed to have received the Response Card on the date it is postmarked. A

policyholder may also send its Response Card by facsimile or other electronic transmission or by registered

mail, express delivery or courier service, in which case the Response Card shall be deemed to have been

received by the assuming insurer on the date of actual receipt by the transferring insurer.

Section 6. Effect of Consent

If a policyholder consents to the transfer pursuant to Section 5 or if the transfer is effected under Section 7, there shall be a

novation of the contract of insurance subject to the assumption reinsurance agreement with the result that the transferring

insurer shall thereby be relieved of all insurance obligations or risks, or both, transferred under the assumption reinsurance

agreement and the assuming insurer shall become directly and solely liable to the policyholder for those insurance obligations

or risks, or both.

Section 7. Commissioner’s Discretion

If an insurer domiciled in this state or in a jurisdiction having a substantially similar law is deemed by the domiciliary

commissioner to be in hazardous financial condition or an administrative proceeding has been instituted against it for the

purpose of reorganizing or conserving the insurer, and the transfer of the contracts of insurance is in the best interest of the

policyholders, as determined by the domiciliary commissioner, a transfer and novation may be effected notwithstanding the

provisions of this Act. This may include a form of implied consent and adequate notification to the policyholder of the

circumstances requiring the transfer as approved by the commissioner.

Drafting Note: States must amend their guaranty association law to specify that residents whose policies are transferred to an unlicensed insurer pursuant to

this section are entitled to continued guaranty association protection.

Section 8. Effective Date

This Act shall take effect six (6) months after the date it is enacted and shall apply to all assumption reinsurance agreements

entered into on or after that effective date.

_______________________________

Chronological Summary of Actions (all references are to the Proceedings of the NAIC).

1993 Proc. 3rd Quarter 7, 29, 650, 670-674 (adopted).

1999 Proc. 1

st

Quarter 8, 9, 755, 757-758 (amended).

Assumption Reinsurance Model Act

803-6

© 1999 National Association of Insurance Commissioners

Appendix A

NOTICE OF TRANSFER

IMPORTANT: THIS NOTICE AFFECTS YOUR CONTRACT RIGHTS. PLEASE READ IT CAREFULLY.

Transfer of Policy

The [ABC Insurance Company] has agreed to replace us as your insurer under [insert policy/certificate name and

number] effective [insert date]. The [ABC Insurance Company’s] principal place of business is [insert address] and certain

financial information concerning both companies is attached, including (1) ratings for the last five years, if available, or for

such lesser period as is available from two nationally recognized insurance rating services; (2) balance sheets for the previous

three years, if available, or for such lesser period as is available and as of the date of the most recent quarterly statement; (3) a

copy of the Management’s Discussion and Analysis that was filed as a supplement to the previous year’s annual statement;

and (4) an explanation of the reason for the transfer. You may obtain additional information concerning [ABC Insurance

Company] from reference materials in your local library or by contacting your Insurance Commissioner at [insert address and

phone number].

The [ABC Insurance Company] is licensed to write this coverage in your state. The Commissioner of Insurance in

your state has reviewed the potential effect of the proposed transaction, and has approved the transaction.

Your Rights

You may choose to consent to or reject the transfer of your policy to [ABC Insurance Company]. If you want your

policy transferred, you may notify us in writing by signing and returning the enclosed pre-addressed, postage-paid card or by

writing to us at:

[Insert name, address and facsimile number of contact person.]

Payment of your premium to the assuming company will also constitute acceptance of the transaction. However, a

method will be provided to allow you to pay the premium while reserving the right to reject the transfer.

If you reject the transfer, you may keep your policy with us or exercise any option under your policy. If we do not

receive a written rejection you will, as a matter of law, have consented to the transfer. However, before this consent is final

you will be provided a second notice of the transfer twenty-four months from now. After the second notice is provided, you

will have one month to reply. If you have paid your premium to the [ABC Insurance Company], without reserving your right

to reject the transfer, you will not receive a second notice.

Drafting Note: The second and final notice to the policyholders should include a date by which the policyholder should respond. The date should be one

month after the date on which the notice was mailed to the policyholder.

Effect of Transfer

If you accept this transfer, [ABC Insurance Company] will be your insurer. It will have direct responsibility to you

for the payment of all claims, benefits and for all other policy obligations. We will no longer have any obligations to you.

If you accept this transfer, you should make all premium payments and claims submissions to [ABC Insurance

Company] and direct all questions to [ABC Insurance Company].

If you have any further questions about this agreement, you may contact [XYZ Insurance] or [ABC Insurance].

Sincerely,

__________________________________________

NAIC Model Laws, Regulations, Guidelines and Other Resources—July 1999

© 1999 National Association of Insurance Commissioners 803-7

[XYZ Insurance Company [ABC Insurance Company

111 No Street 222 No Street

Smithville, USA Jonesville, USA

555/555-5555] 333/333-3333]

For your convenience, we have enclosed a pre-addressed postage-paid response card. Please take time now to read

the enclosed notice and complete and return the response card to us.

[Notice Date]

RESPONSE CARD

____ Yes, I accept the transfer of my policy from

[name of transferring company] to [name of

assuming company].

____ No, I reject the proposed transfer of my policy

from [name of transferring company] to [name of

assuming company] and wish to retain my policy

with [name of transferring company].

________________________ _______________________________________________________________

Date Signature

Name: _______________________________________________________________________________________

Street Address: ________________________________________________________________________________

City, State, Zip: _______________________________________________________________________________

Assumption Reinsurance Model Act

803-8

© 1999 National Association of Insurance Commissioners

This page is intentionally left blank

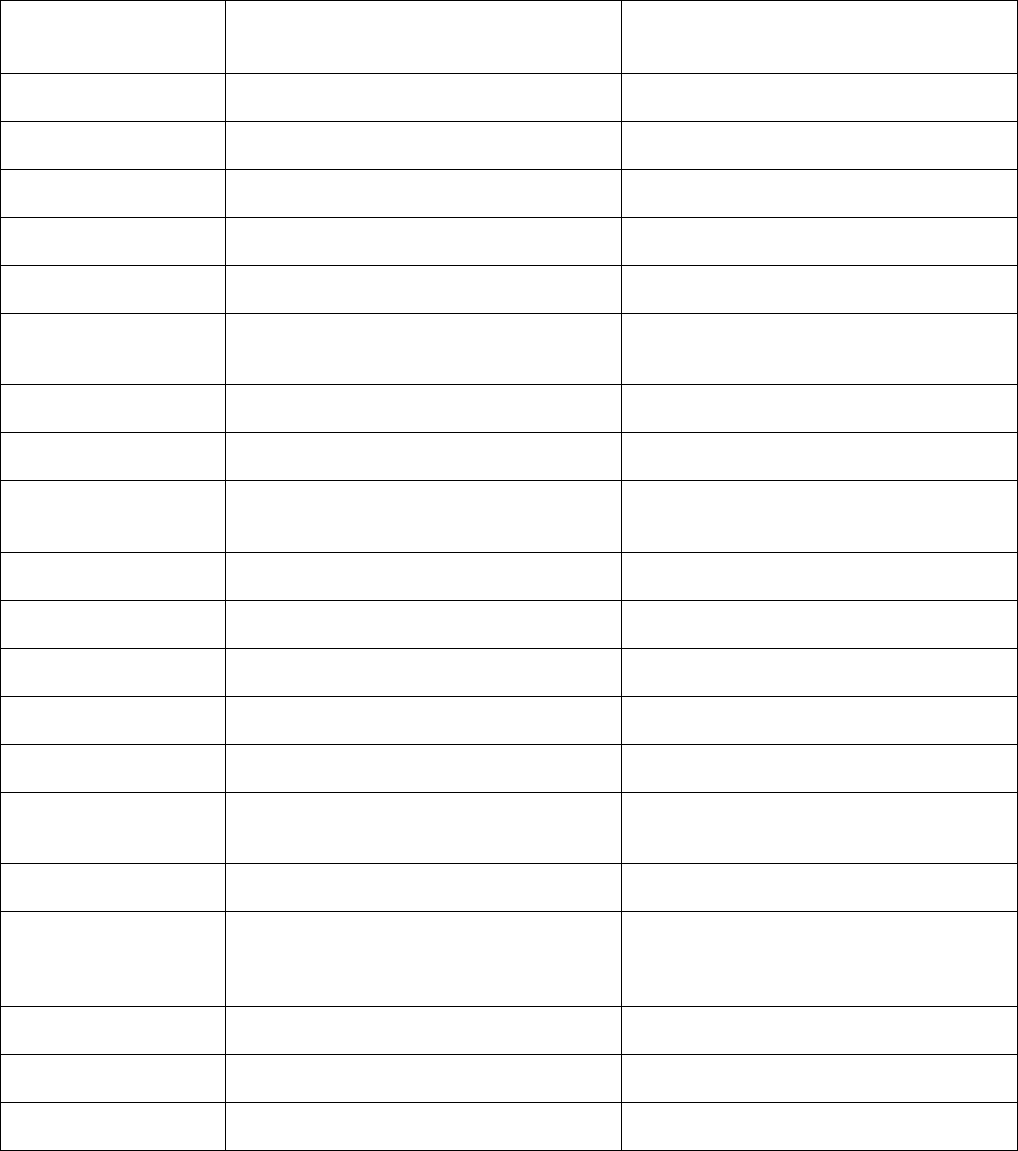

NAIC Model Laws, Regulations, Guidelines and Other Resources—July 2012

ASSUMPTION REINSURANCE MODEL ACT

© 2012 National Association of Insurance Commissioners ST-803-1

This chart is intended to provide readers with additional information to more easily access state statutes, regulations,

bulletins or administrative rulings related to the NAIC model. Such guidance provides readers with a starting point

from which they may review how each state has addressed the model and the topic being covered. The NAIC Legal

Division has reviewed each state’s activity in this area and has determined whether the citation most appropriately fits

in the Model Adoption column or Related State Activity column based on the definitions listed below. The NAIC’s

interpretation may or may not be shared by the individual states or by interested readers.

This chart does not constitute a formal legal opinion by the NAIC staff on the provisions of state law and should not

be relied upon as such. Nor does this state page reflect a determination as to whether a state meets any applicable

accreditation standards. Every effort has been made to provide correct and accurate summaries to assist readers in

locating useful information. Readers should consult state law for further details and for the most current information.

NAIC Model Laws, Regulations, Guidelines and Other Resources—July 2012

ASSUMPTION REINSURANCE MODEL ACT

ST-803-2

© 2012 National Association of Insurance Commissioners

This page is intentionally left blank

NAIC Model Laws, Regulations, Guidelines and Other Resources—July 2012

ASSUMPTION REINSURANCE MODEL ACT

© 2012 National Association of Insurance Commissioners ST-803-3

KEY:

MODEL ADOPTION: States that have citations identified in this column adopted the most recent version of the NAIC

model in a substantially similar manner. This requires states to adopt the model in its entirety but does allow for variations

in style and format. States that have adopted portions of the current NAIC model will be included in this column with an

explanatory note.

RELATED STATE ACTIVITY: Examples of Related State Activity include but are not limited to: older versions of the

NAIC model, statutes or regulations addressing the same subject matter, or other administrative guidance such as bulletins

and notices. States that have citations identified in this column only (and nothing listed in the Model Adoption column) have

not adopted the most recent version of the NAIC model in a substantially similar manner.

NO CURRENT ACTIVITY: No state activity on the topic as of the date of the most recent update. This includes states that

have repealed legislation as well as states that have never adopted legislation.

NAIC MEMBER

MODEL ADOPTION

RELATED STATE ACTIVITY

Alabama

NO CURRENT ACTIVITY

Alaska

A

LASKA

S

TAT

. § 21.12.025 (2004).

American Samoa

NO CURRENT ACTIVITY

Arizona

A

RIZ

.

R

EV

.

S

TAT

.

A

NN

. § 20-736 (1997).

Arkansas

A

RK

.

C

ODE

R.

§ 55 (1992).

California

NO CURRENT ACTIVITY

Colorado

3 C

OLO

.

C

ODE

R

EGS

. § 702-3:3-3-1

(1990/2012).

Connecticut

NO CURRENT ACTIVITY

Delaware

NO CURRENT ACTIVITY

District of Columbia

NO CURRENT ACTIVITY

Florida

NO CURRENT ACTIVITY

Georgia

G

A

.

C

ODE

A

NN

. §§ 33-52-1 to 33-52-6 (1992).

G

A

.

C

OMP

.

R.

&

R

EGS

.

120-2-62 (1995).

Guam

NO CURRENT ACTIVITY

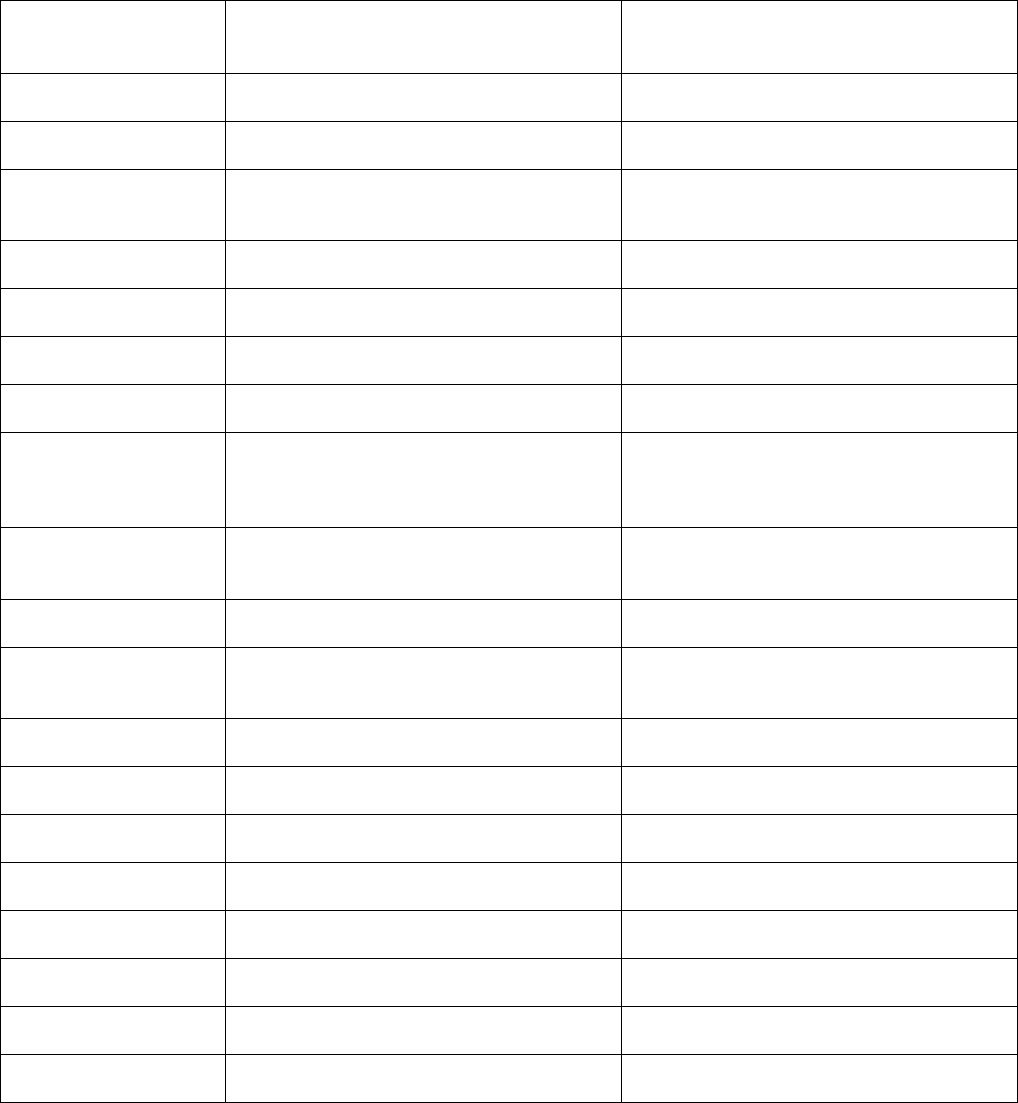

NAIC Model Laws, Regulations, Guidelines and Other Resources—July 2012

ASSUMPTION REINSURANCE MODEL ACT

ST-803-4

© 2012 National Association of Insurance Commissioners

NAIC MEMBER

MODEL ADOPTION

RELATED STATE ACTIVITY

Hawaii

NO CURRENT ACTIVITY

Idaho

NO CURRENT ACTIVITY

Illinois

NO CURRENT ACTIVITY

Indiana

NO CURRENT ACTIVITY

Iowa

I

OWA

C

ODE

§ 515.68A (1997).

Kansas

K

AN

.

S

TAT

.

A

NN

.

§§40-5201 to 40-5210

(2004).

BULLETIN 1993-21 (1993).

Kentucky

NO CURRENT ACTIVITY

Louisiana

NO CURRENT ACTIVITY

Maine

M

E

.

R

EV

.

S

TAT

.

A

NN

. tit. 24-A, §§ 761 to 766

(1994).

Maryland

NO CURRENT ACTIVITY

Massachusetts

NO CURRENT ACTIVITY

Michigan

NO CURRENT ACTIVITY

Minnesota

NO CURRENT ACTIVITY

Mississippi

NO CURRENT ACTIVITY

Missouri

M

O

.

R

EV

.

S

TAT

. §§ 375.1280 to 375.1295

(1993).

Montana

NO CURRENT ACTIVITY

Nebraska

N

EB

.

R

EV

.

S

TAT

. §§ 44-6201 to 44-6211

(1993); BULLETIN CB-85 (1993) (Appendix

of model).

Nevada

NO CURRENT ACTIVITY

New Hampshire

NO CURRENT ACTIVITY

New Jersey

NO CURRENT ACTIVITY

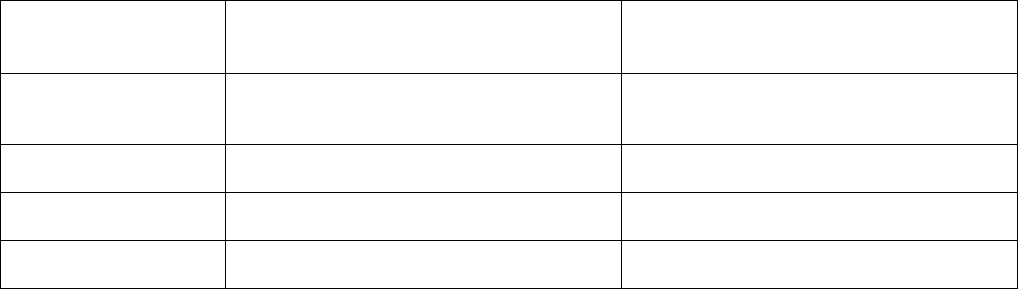

NAIC Model Laws, Regulations, Guidelines and Other Resources—July 2012

ASSUMPTION REINSURANCE MODEL ACT

© 2012 National Association of Insurance Commissioners ST-803-5

NAIC MEMBER

MODEL ADOPTION

RELATED STATE ACTIVITY

New Mexico

NO CURRENT ACTIVITY

New York

OGC Op. No. 08-07015 (2008).

North Carolina

N.C.

G

EN

.

S

TAT

. §§ 58-10-20 to 58-10-45

(1996).

North Dakota

NO CURRENT ACTIVITY

Northern Marianas

NO CURRENT ACTIVITY

Ohio

NO CURRENT ACTIVITY

Oklahoma

NO CURRENT ACTIVITY

Oregon

O

R

.

R

EV

.

S

TAT

. §§ 742.150 to 742.162

(1995); OR. ADMIN. R. 836-050-0000 to

836-050-0020 (1996/2006).

Pennsylvania

31 P

A

.

C

ODE

§§ 90i.1 to 90i.3 (1993)

(Statement of policy).

Puerto Rico

NO CURRENT ACTIVITY

Rhode Island

R.I.

G

EN

.

L

AWS

§§ 27-53.1 to 27-53.1-8

(1996).

South Carolina

NO CURRENT ACTIVITY

South Dakota

NO CURRENT ACTIVITY

Tennessee

NO CURRENT ACTIVITY

Texas

NO CURRENT ACTIVITY

Utah

NO CURRENT ACTIVITY

Vermont

V

T

.

S

TAT

.

A

NN

. tit. 8, §§ 8201 to 8208 (1994).

Virgin Islands

NO CURRENT ACTIVITY

Virginia

NO CURRENT ACTIVITY

NAIC Model Laws, Regulations, Guidelines and Other Resources—July 2012

ASSUMPTION REINSURANCE MODEL ACT

ST-803-6

© 2012 National Association of Insurance Commissioners

NAIC MEMBER

MODEL ADOPTION

RELATED STATE ACTIVITY

Washington

W

ASH

.

A

DMIN

.

C

ODE

284-95-010 to

284-95-080 (1991).

West Virginia

W. V

A

.

C

ODE

§ 33-4-15 (1957/2005).

Wisconsin

NO CURRENT ACTIVITY

Wyoming

NO CURRENT ACTIVITY

NAIC Model Laws, Regulations, Guidelines and Other Resources—April 2011

ASSUMPTION REINSURANCE MODEL ACT

Proceeding Citations

Cited to the Proceedings of the NAIC

© 2011 National Association of Insurance Commissioners PC-803-1

In June of 1990 the Reinsurance Issues Working Group recommended the establishment of a group to review the issue of

assumption reinsurance and the questions raised by these types of agreements. 1990 Proc. II 795.

Section 1. Purpose

In a memorandum announcing the organizational meeting, the chair said the proposed transfer of reinsurance on a permanent

basis (sometimes known as bulk or substitution reinsurance) had on occasion been effected without proper consent of the

policyholders. He said it was imperative to draft guidance for these transactions to provide clarification for regulators. 1991

Proc. IB 941-942.

Section 2. Scope

The chair of the working group considering the issue identified three basic contract transfers as examples for consideration.

These types are (1) a current contract which has premium payments being made, (2) a single premium payment policy such as

a single premium annuity contract, and (3) a policy that has no premiums currently being paid, but is in a payout or potential

payout mode. 1991 Proc. IB 942.

The chair was asked if the group would also consider in its study court-ordered assumptions in the case of impaired

companies, and the chair responded in the affirmative. 1991 Proc. IB 927.

In 1997 the NAIC adopted a white paper on liability-based restructuring. It contained a section on the impact of LBRs on the

Assumption Reinsurance Model Act. 1997 Proc. 2

nd

Quarter 217-218.

The LBR white paper was intended to be an informational document to aid regulators faced with reviewing, approving and

ongoing oversight of these types of transactions. The conclusions and recommendations section recommended revisions to

several NAIC models, including the Assumption Reinsurance Model Act. 1997 Proc. 2

nd

Quarter 205-206, 220.

A. The Executive Committee handed down a charge to consider whether the Assumption Reinsurance Model Act

should be amended to clarify that a division transaction was subject to all of the requirements of that model act. A regulator

suggested that the best way to approach the issue was to add a drafting note to the model. 1998 Proc. 2

nd

Quarter II 950.

A regulator suggested drafting language for a drafting note to Section 2 that would explicitly indicate that the Act’s provisions

were applicable to all transactions that effectively transfer policyholder obligations from the original insurer to another

insurer, regardless of the form or manner of the transaction. Another regulator opined that the language of Section 2 of the

model was probably broad enough to encompass division transactions, but that language for a drafting note ought to explicitly

reference transactions of that type. 1998 Proc. 3

rd

Quarter 830.

Another regulator opined that the drafting note should specifically exclude mergers and acquisitions and asked that the

committee recommend these transactions be excluded. A motion was passed recommending that consideration of merger and

acquisition transactions be contemplated in the drafting note. 1998 Proc. 3

rd

Quarter 830.

The first draft of revisions contained modifications to a portion of the model act, which could have the effect of creating

problems that would otherwise not exist, according to one regulator. Another regulator observed that the parent committee’s

intent had been to create fairly narrow language that focused specifically on division transactions, and not on other types of

reorganizations. 1998 Proc. 4

th

Quarter II 919.

Two states already had a law governing division transactions and a representative from one of those states said that a division

transaction was not in fact a transfer of policyholder obligations to another insurer, but rather a way that an existing entity

could divide itself into a number of successor entities, each of which would be a part of the original whole. In such a

transaction the assets and liabilities of the pre-division entity would be reallocated to the separate parts following the division.

Another regulator acknowledged that it might be possible to argue that policyholder obligations had not been transferred to

another insurer. 1998 Proc. 4

th

Quarter II 919.

NAIC Model Laws, Regulations, Guidelines and Other Resources—April 2011

ASSUMPTION REINSURANCE MODEL ACT

Proceeding Citations

Cited to the Proceedings of the NAIC

PC-803-2 © 2011 National Association of Insurance Commissioners

Section 2A (cont.)

A regulator noted that the liability-based restructuring white paper was not intended to address division transactions per se,

although it might have been cited as one method of restructuring. 1998 Proc. 4

th

Quarter II 919.

A regulator suggested adding language to the draft to focus more directly on the policyholder’s interest rather than on the

form of the transaction itself. Other regulators agreed that the proposal better expressed the regulatory intent underlying the

drafting note. The chair commented that one of the basic regulatory objectives was to ensure that companies could not do

indirectly anything potentially detrimental to the interests of policyholders that they would not be able to do directly. 1998

Proc. 4

th

Quarter II 916.

No further public comment was received on the draft and it was adopted as drafted. 1999 Proc. 1

st

Quarter 755.

B. Shortly before adoption of the model a new Paragraph (6) was added as a technical amendment to exempt from the

act transfers of liabilities under a single group contract from one insurer to another upon the request of the group

policyholder. 1993 Proc. 2

nd

Quarter 915.

Section 3. Definitions

C. After much discussion on the definition of “contract of insurance,” several persons suggested adding a drafting note

to indicate that a state may want to use its own statutory language to define the term. 1993 Proc. IB 1292.

Section 4. Notice Requirements

A. After the 1992 NAIC summer meeting several changes were made to the model draft. One of the changes was to

require that the notice of transfer contain ratings for both companies for the past five years. One regulator suggested the

addition of language requiring disclosure of the fact if either company had not been rated by any of the acceptable rating

services. 1993 Proc. IB 1313, 1316.

An industry spokesperson questioned the potential benefit to be derived from distributing rating agency information on the

assuming insurer to policyholders affected by a proposed assumption transaction. He also said distribution of the Management

Discussion and Analysis section from the company’s annual statement would be burdensome to the companies and of doubtful

value to the policyholders. The working group chair noted that the broader disclosure provisions had been introduced as a

consideration for agreeing to forego a requirement of positive written consent from policyholders before the novation could

be effected. 1993 Proc. IB 1296.

Consumer interest groups commended the NAIC for the draft changes, which they said were more protective of consumers. In

addition, representatives suggested the notices be provided in multiple languages where the need exists. They were concerned

that consumers might not understand the information on company ratings, and suggested an explanation of the ratings should

also be provided. 1993 Proc. IB 1291.

The working group concurred with a suggestion from an agents’ trade association for providing notice to agents of record on

the policies to be transferred. This was accomplished by adding agents and brokers to the heading so that Subsection A also

applied to them. 1993 Proc. IB 1251, 1253.

B. While soliciting comments on the draft, the working group heard from an individual who expressed concern over the

prior approval mandated in the model. He said he thought the current draft required unnecessary and laborious approval

methods that could lead to the demise of assumption reinsurance as a viable method of transfer. He suggested limiting

approval of the transaction to the two domiciliary states with a filing of the assumption certificate on a “file and use” basis in

all other states. 1992 Proc. IIB 983.

NAIC Model Laws, Regulations, Guidelines and Other Resources—April 2011

ASSUMPTION REINSURANCE MODEL ACT

Proceeding Citations

Cited to the Proceedings of the NAIC

© 2011 National Association of Insurance Commissioners PC-803-3

Section 4B (cont.)

Consumer interest groups supported the prohibition of transfers of policies to an insurer not licensed in the state. They

expressed concern about guaranty fund protection for policyholders should an insurer become insolvent. 1993 Proc. IB 1291.

A U.S. Senate Subcommittee held a hearing on assumption reinsurance, and the chair of that subcommittee reported that a

substantial number of policyholders were transferred to financially weaker insurers, and he found very little or no regulatory

scrutiny of the financial condition of the assuming and the transferring insurers. 1993 Proc. IB 1288-1289.

At one point the draft included a deemer provision allowing the assumption to take place if the commissioner had not

disapproved it within 30 days. 1993 Proc. IB 1254. The drafters felt the deemer provision contradicted the basic concept of

prior approval and it was deleted. 1993 Proc. 2nd Quarter 915.

Early drafts of Paragraph (1) required action on policies “issued to” residents of the state. This was later changed to “owned

by” because the policyowner was the party who should be given the right to accept or reject any proposed transfer. Still later

the wording was changed to include both the policyowner and the insured. 1993 Proc. IB 1249, 1954.

In response to a suggestion that the commissioner be required to find the transfer is fair and in the interests of the

policyholders, the working group established minimum standards that the commissioner should consider prior to approval.

The list drafted for Paragraph (4) remained unchanged and was included in the model adopted. 1993 Proc. IB 1251, 1254-

1255.

Section 5. Policyholder Rights

The first comments received on the project were concerns about how policyholder consent would be determined. One of the

working group members explained that in the absence of a response from the policyholder, the company can make a

presumption of acceptance if 60 days have passed. However, the policyholder would retain the right to reject the transfer by

his action at any time. The regulators were asked to take into account in their deliberations that very few policyholders were

likely to respond. 1991 Proc. IIB 1115.

The working group was asked for its reason for desiring positive consent. The chair responded that the primary objective was

to protect the policyholder’s contract rights in the case of a transfer. One attendee commented that protection of the

policyholder should take into account that, if the company intends to get out of a line of business, the policyholder may be

better served by a company that is dedicated to that kind of business. An academic in attendance asked the regulators to

consider three points he considered essential to effect an assumption: that the policyholders must provide prior positive

consent to the transfer, that the assuming company must be licensed in the policyholder’s state of residence, and that the

notice of proposed transfer be accompanied by adequate disclosure. To the argument that policyholders would not respond, he

suggested companies embark on a promotional campaign to solicit the consent of the policyholders. 1991 Proc. IIB 1115.

The first draft of the model law released for comment was similar in concept to a New York law, which was based on a

presumption of policyholder acceptance of the proposed transfer absent formal written rejection within the prescribed period

of time. 1991 Proc. IIB 1113.

One of the interested parties suggested that affirmative consent can be obtained from a substantial majority of policyholders

when the transfer is in the best interests of the policyholders and when the situation is accurately described in the notice. He

suggested that when the transfer is not in the best inserts of the policyholders, and when the situation is accurately described

in the notice, affirmative consent will not be obtained from a sufficient number of policyowners. 1993 Proc. IB 1246.

NAIC Model Laws, Regulations, Guidelines and Other Resources—April 2011

ASSUMPTION REINSURANCE MODEL ACT

Proceeding Citations

Cited to the Proceedings of the NAIC

PC-803-4 © 2011 National Association of Insurance Commissioners

Section 5 (cont.)

A consumer representative commented that while prior positive consent to any proposed assumption transaction remained a

desirable objective, it was recognized that it might be difficult to obtain this from policyholders. He suggested requiring a

specific recommendation from the domiciliary commissioner of the company that originally issued the policy be included in

the notice sent to the policyholder, which he felt would help consumers decide whether to accept the proposed transfer. He

also said his organization was not opposed to waiving prior approval requirements in cases where the original insurer was in

serious financial difficulty or had been found insolvent. 1993 Proc. IB 1230.

A. A United States Senator interested in the issue of assumption reinsurance expressed the opinion that, as a matter of

contract law, transfers between companies are attempted novations of existing contractual relationships. He said novations

should be accomplished only with the consent of the policyholder to whom the obligation was owed. 1993 Proc. IB 1289.

B. A meeting attendee suggested further examination of the language used in the Notice of Transfer, as he thought there

was some uncertainty regarding the ability of a policyholder to pay an anniversary premium while still reserving the right to

reject the proposed transfer within the time period provided for that purpose. 1993 Proc. IB 1296.

One regulator suggested that the language in the draft stipulate a specific method by which a policyholder might pay a

premium to the assuming insurer while reserving the right to eventually reject the proposed transfer. A member of the working

group said its intent had been to include a section for that purpose on the response card. 1993 Proc. IB 1249.

Language was drafted for inclusion in this subsection to indicate that payment of any premium during the period provided for

policyholder rejection could constitute consent to the transfer, provided that a satisfactory method allowing payments to be

made without forfeiting the right subsequently to reject the proposed transfer was also included. 1993 Proc. 2nd Quarter

915.

C. After the working group agreed to put in a time limit during which policyholders could reject a proposed assumption

transaction, the drafters settled on a three-year period. Twelve months after a first notice, a second notice was required, if a

response had not been received. Twelve months later a third notice was required. If no rejection was received during the next

twelve months, the policyholder’s consent was deemed to have occurred. 1992 Proc. IB 1323, 1334.

At the next meeting of the working group, an industry representative suggested a compromise time of one year to effect

novation. The working group did revise the draft to change to two notices at 30 and six months. 1992 Proc. IIB 981, 983.

The industry spokesperson again pointed out that the consensus of the industry was that the three years during which a

policyholder might formally reject a proposed assumption was entirely too long to be practical. 1992 Proc. IIB 971.

The next draft prepared by the working group provided for a second notice 12 months after the original notification, and a

two-month period to reply after the second notice. An advisory committee expressed concern that the 14-month period might

impede the timely conclusion of transactions that would be beneficiary to consumers as well as companies. 1993 Proc. IB

1296, 1314.

Consumer interest groups were opposed to this subsection and Subsection B because they felt it weakened the rights of the

policyholder in regard to a policy transfer. The amendments to Subsection C which reduced the notice period gave consumers

even less opportunity to reject the transfer before consent would be deemed to have occurred. The consumer representatives

expressed concern about consumers who were not as sophisticated as the insurer and might not understand the circumstances

and consequences. 1993 Proc. IB 1291.

NAIC Model Laws, Regulations, Guidelines and Other Resources—April 2011

ASSUMPTION REINSURANCE MODEL ACT

Proceeding Citations

Cited to the Proceedings of the NAIC

© 2011 National Association of Insurance Commissioners PC-803-5

Section 5C (cont.)

The working group engaged in extensive discussion of the concerns which had been expressed regarding the implied consent

provisions, and concluded the decision of whether to mandate express written consent was a public policy question which the

entire membership of the NAIC would have to make. The working group was of the opinion, however, that requiring express

written consent would effectively eliminate assumption reinsurance transactions. The group felt this would not be in the public

interest since the transactions served a legitimate, useful function. The group voted in favor of not recommending any changes

to the implied consent provisions. 1993 Proc. IB 1251.

The drafting committee called a meeting to concentrate on comments on that single issue of express versus implied consent.

The individual asked to summarize the industry position said that there often arose situations in which a company found itself

in the position where it could no longer efficiently and profitably market and service a product or class of business. The

industry needed a mechanism where it could transfer that business to another insurer that would be in a better position to

provide ongoing services to policyholders and to market the product more effectively. He indicated it was usually the original

insurer’s objective in such instances that the balance sheet not continue to be encumbered by liabilities associated with that

business, so conventional coinsurance with a service agreement would not suffice to achieve the company’s objective in this

regard. 1993 1st Quarter 401.

One regulator asked if any attempt to codify proper procedure via model legislation might not inadvertently supersede

existing common law protections, leaving the policyholders in a potentially less advantageous position. A meeting attendee

responded that common law protections would be expanded and enhanced via statutory provisions, which were intended to

afford greater clarity and consistency, and broader regulatory involvement. Another regulator commented that it was

ultimately a matter of finding a reasonably balanced approach which fairly reflected legitimate interests and concerns of all

parties. It was his opinion that consumer interests would be better served if the time period after which implied consent would

be deemed to have occurred was extended to at least three years. He also suggested this would make companies more

attentive to the long-term financial condition of any company to which they might consider transferring business. 1993 Proc.

1st Quarter 402.

Just before adoption of the draft the task force voted to change the 30-month period for rejection to 12 months again. The

chair explained that some committee members had favored the longer period in an attempt to ensure that the ceding insurer

maintained its interest in the transaction for the full 36 months. 1993 Proc. 2nd Quarter 866, 916.

After adoption by the task force, the parent committee reconsidered the issue of the amount of time for the consumer notice

period. The advantage of the three-year time period was better service to the consumers. The advantage of the one-year time

period was less cost and inconvenience to the ceding carrier. A regulator in favor of the shorter period questioned whether a

consumer would actually be better informed at the end of 36 months than at the end of 12 months. The committee voted to

adopt the model with a second notice 30 months after the initial notice, with consent deemed to have occurred six months

after the second notice. 1993 Proc. 3rd Quarter 650, 673.

When the model was considered by the Executive Committee, the period of time for notice was revised again. The period was

changed to 25 months, with the thought that policyholders would have at least two annual premium periods to take note of the

transfer. 1993 Proc. 3rd Quarter 29.

Section 6. Effect of Consent

The original draft released contained a provision that unless positive consent occurred, the policyholders would continue to

have the right to reject the transfer. One commentor said the issue of the original insurer’s contingent liability would require

further clarification. 1991 Proc. IIB 1114, 1118.

An industry representative said that the continuing liability and the continuing right to reject was not a workable solution.

Another suggested that the draft must contain a cut-off point for liability in order for assumption reinsurance to continue.

1992 Proc. IB 1337.

NAIC Model Laws, Regulations, Guidelines and Other Resources—April 2011

ASSUMPTION REINSURANCE MODEL ACT

Proceeding Citations

Cited to the Proceedings of the NAIC

PC-803-6 © 2011 National Association of Insurance Commissioners

Section 6 (cont.)

The first draft allowed an unlimited timeframe during which the policyholder who had not ratified the assumption transaction

could have his policy revert to the original carrier. The regulators drafted a revised proposal which limited the timeframe to

avoid potential problems caused by the indeterminate reversionary period. An industry representative suggested the time be

limited to less than one year to avoid or reduce any potential problems in reporting the contingent liability on the annual

statement. One regulator questioned the need to limit the time. He said that, by requiring the ceding company to remain

contingently liable, the regulators hoped to ensure that the ceding company would act responsibly in selecting an assuming

company. The ceding company would be more aware of the condition of the assuming insurer and more cautious about ceding

business to a company that may not be able to provide for the policyholders after the transaction. 1992 Proc. IB 1335-1336.

In a communication from consumer interest groups, the working group was urged to protect consumers in the event of a

transfer of policies by providing for residual liability in the absence of affirmative consent of the policyholder. The consumer

representatives recommended that the original insurer remain liable so that it took responsibility for the risks of a bad transfer.

The residual liability, they felt, would force transferring insurers to be more conscientious about with whom they enter into

transactions, knowing that they could be held accountable. 1993 Proc. 1B 1291.

At one point the task force considered an indemnity reinsurance contract involving 100 percent coinsurance together with a

service agreement instead of the novation. The president of a guaranty association organization responded with a number of

problems that this type of arrangement could cause. 1993 Proc. IB 1242, 1244, 1246.

An industry representative also spoke against a 100 percent indemnity coinsurance transaction as an alternative. He said these

transactions increased the cost of administration and forced the assuming company to set up a separate operation to handle the

reinsured block. 1993 Proc. IB 1243.

An insurance trade association representative said most assumption reinsurance transactions benefit the policyholder because

almost all transactions move the business from a weaker company to a stronger company. The association spokesperson also

said the practice is essential for the business of life insurance because of the long-term nature of the contracts. The association

spoke against 100 percent indemnity coinsurance because of the increased cost and complexity. 1993 Proc. 1st Quarter 399-

400.

A United States senator interested in the issue said that, because most policyholders do not consent, it was his opinion that as

a matter of law an involuntary transfer was ineffective to extinguish the transferring company’s obligation to the policyholder.

While the new company assumed the obligation and acquired the assets backing the policy, the previous company, if called

upon to perform its unextinguished obligation, will suffer a direct reduction in net worth. He said the NAIC’s effort at

correction did not remedy these problems, but just gave the policyholders less legal protection. 1993 Proc. IB 1289.

Correspondence received by the working group pointed out a recent court decision holding that notice of the transfer did not

extinguish the liability of the ceding company. The court said it would be persuaded only by evidence of clear and definite

intent of the policyowner to release the ceding company from liability. The correspondent suggested that the NAIC model as

drafted would reduce policyholder rights. He suggested the model should build upon the contractual rights and include

statutory protections in addition to those found in the common law. 1993 Proc. IB 1245.

An interested party commented upon a recent case where a company had transferred a block of policies, but had formally

guaranteed the performance of the assumed obligations. One regulator commented that his state would not permit any

arrangement where one insurer undertook to guaranty the obligations of another, nor would it permit the use of a cut-through

endorsement to create a direct obligation that might not otherwise exist. 1993 Proc. 1st Quarter 401.

NAIC Model Laws, Regulations, Guidelines and Other Resources—April 2011

ASSUMPTION REINSURANCE MODEL ACT

Proceeding Citations

Cited to the Proceedings of the NAIC

© 2011 National Association of Insurance Commissioners PC-803-7

Section 6 (cont.)

When questioned about the constitutionality of the current draft, the industry spokesperson pointed out that in none of the

cases where the courts held there was inadequate notification and preservation of policyholder rights had companies complied

with all the requirements contained in the draft the NAIC was considering. He expressed the view that full compliance with

these requirements would be sufficient to ensure that courts would not invalidate the assumption transaction. 1993 Proc. 1st

Quarter 402.

A committee of an accounting organization was asked to consider how a ceding company would account for an assumption

reinsurance agreement under the proposed model act. The response was that the preferred method would be to account for the

transaction as if the extinguishment of liability occurs only when express consent has been received or the rejection period has

expired. The ceding company could recognize a gain and remove the assets and liabilities from its financial statements only

when the novation occurs. 1993 Proc. 2nd Quarter 932-933.

Section 7. Commissioner’s Discretion

One regulator reacted to an early draft with the comment that Section 7 did not appear to grant the commissioner any

discretion if the company is in an administrative supervision or conservation rather than a court-ordered receivership. 1992

Proc. IB 1336.

While the working group was soliciting comments on the draft, one individual suggested consideration of a provision for

waiver of formal notice requirements. The chair pointed out that the draft language permitted waiver or modification of notice

requirements at the commissioner’s discretion in special circumstances. 1992 Proc. IB 1331.

The working group reviewed comments to determine whether a change should be made to Section 7. The suggestion was to

amend this section so that transfers would be allowed only to licensed insurer. This recommendation was the subject of

extensive discussion with recognition given to the goal of ensuring continued guaranty fund coverage, but also an appreciation

for the flexibility this section gives commissioners in a rehabilitation. The group decided to highlight this section as a public

policy matter that needed consideration by the entire task force. 1993 Proc. IB 1251.

Later the task force considered the issue of guaranty coverage and the chair suggesting adding language directing each state to

make revisions to its guaranty fund law as might be required to ensure continuity of protection for policyholders affected by a

transfer of their policies to an unlicensed company. Regulators from two states indicated that transfers to unlicensed

companies would not be approved. The next draft containing a drafting note to Section 7 suggesting that a state may want to

amend its guaranty association law. 1993 Proc. IB 1248, 1314.

Section 8. Effective Date

Appendix A

An advisory group suggested adding language that said “If you have paid your premium to the ABC Company, without

reserving your right to reject the transfer, you will not receive a second notice.” The working group agreed with the

clarification. 1993 Proc. IB 1293.

Revised language requiring provision of the commissioner’s telephone numbers was added at the end of the first paragraph,

along with a new final sentence stating that the proposed transfer had been reviewed and approved by the commissioner. 1993

Proc. 2nd Quarter 915.

NAIC Model Laws, Regulations, Guidelines and Other Resources—April 2011

ASSUMPTION REINSURANCE MODEL ACT

Proceeding Citations

Cited to the Proceedings of the NAIC

PC-803-8 © 2011 National Association of Insurance Commissioners

____________________________________

Chronological Summary of Actions

December 1993: Model Adopted.

June 1999: Amended Section 2 to add a drafting note regarding liability-based restructuring.