Japan’s

Insurance

Sector

post-COVID

Where to From Here?

CONTRIBUTORS AND CONTACTS

Mukund Rajan

Mukund Rajan is a Partner with PwC Strategy& based in Tokyo. He works closely with multi-national insurers and

wealth managers to advise them on growth and distribution strategies, customer centricity, and operating model trans-

formations. Over the last 15+ years he has worked with clients across Japan, Australia, S.E. Asia and the US, and has

authored extensively on issues relevant to the Japanese and Australian insurers. He holds a BA in Economics (Honors)

from the University of Texas at Austin.

Toshiya Tsutsumi

Toshiya Tsutsumi is an advisor to executives in the nancial industry for PwC Strategy&. He has more than 15 years of

professional experience in strategy consulting and alternative investments. He has advised nancial service com panies

in the UK, Middle East, and Japan, including life insurance companies, asset management companies, and private as

well as Islamic banks. His expertise is in distribution strategy and company-wide cost transformation projects.

Daisuke Yabuki

Daisuke Yabuki is an advisor to executives in nancial industry for PwC Strategy&. Based in Tokyo, he is a Partner

with PwC Consulting LLC. He has over 15 years of extensive experience in growth strategy, marketing strategy, digital

transformation, M&A, global expansion, organization and operation transformation with focus on nancial industry and

business. In recent years, he has been involved in various large-scale projects for business strategy and operation/

organization transformation programs preparing for the structural change of industry.

Koichi Uzuka

Koichi Uzuka is a Partner leader of the Insurance industry with PwC Alata. He has been involved in the corporate acqui-

sitions (due diligence, post-merger integration support), risk-related operations, support of the governance system

and the ORSA /ERM systems conguration, various regulatory compliance/FRS support operations focusing on both

Japanese and foreign life insurance companies and non-life insurance companies. Currently he leads the Insurance

Advisory Group of the Second Financial Department, specializing in advisory services to insurance companies.

Akira Yamane

Akira Yamane is a Partner with PwC Consulting LLC in Banking & Capital Market Asset Management team of Financial

Service consulting practice. As the lead partner of the practice, he has been involved in account development and

delivery of strategic transformation engagements for the rm’s Japanese and multinational clients, with focus on

strategy development, operational excellence, post-merger integration (PMI), regulatory compliance, and technology-

enabled business transformation.

Hiroyuki Koga

Hiroyuki Koga has about 20 years of consulting experience to nancial Institutions. He specializes in supporting

nan cial institutions’ business process transformation in business management/management accounting as well as

managing large-scale system Implementation projects. Since joining PwC Japan, he held various positions in nancial

services division such as Insurance Industry leader and Accounting solution leader. He now leads various projects for

nancial institutions.

Jonathan Sharp

Jonathan Sharp is Partner with PwC Strategy& with a focus on technology strategy. Based in Tokyo, he has more than

20 years of global technology consulting experience working in Japan, Australia, South East Asia, and other parts of

the world. His main industry focus is in Financial Services including Banking, Insurance and Wealth Management, and

has lead major technology transformation eorts in other industries as well. Jonathan’s expertise is in designing and

executing technology strategies, architectures and solutions that build business capability.

Katsuya Ide

Manager of PwC Consulting, Strategy&. Engaged in the organizational restructuring, optimization of cost structure,

operation design, PMI for the nancial service industry.

Takumi Maeomote

Xiying Zhang

Strategy& | デジタルイノベ ーション戦 略 ガイド2

As of May 2020, Japanese insurers have mobilized rapidly in response to the COVID-19

pandemic. The sudden decrease in global interest rates and signicant restrictions on

people’s movement are necessitating changes to product portfolios, distribution models,

and business operations.

However, business continuity and crisis management are only half the story; while there is

a pressing need to react quickly to fast-moving events, insurers must also reassess their

long-term strategy. The need for establishing customer trust and supporting them through

a time of need has rarely been greater.

We expect the market to be signicantly dierent over the longer term and here is what

insurers should focus on:

• Evolve product portfolios to reect lower interest rates and changes to underlying risks—

this extends to optimizing underlying investments (to achieve the desired yield) as well as

extending into adjacencies to capture new revenue streams

• Become digitally enabled across customer interactions, distribution (including agents/

banca partners), core operations, and back-end processing to support new ways of

working and evolved risk proles

• Integrate more tightly with suppliers to support their customer promise—in the short run,

this means working with them to creatively support their businesses.

• Rethink the operating model—beyond organization structures and processes, successful

insurers will critically rethink their workforce strategies, cost structures, physical

presence, and organizational culture to build resilience and adaptability.

The successful insurer of the Post-COVID era will be the ones that take a holistic approach

to rethinking their business (beyond just reacting to market dynamics).

Insurers can move in this direction by calibrating their mid- and long-term strategies around

six key areas: strategy & brand, distribution, nance & liquidity, workforce, operations &

supply chain, and being proactive about the regulatory agenda. In short, insurers must

watch the immediate situa tion, but with a rm focus on the emerging future to deliver on

customer promises and stakeholder expectations.

EXECUTIVE SUMMARY

Strategy& | Japan�s Insurance Sector post-COVID: Where to From Here? 3

*1: Insurance Journal, 2020. “Hong Kong Insurers Say Sales Have Fallen to ‘Almost Nothing’ Due to Coronavirus”, Accessed June 30, 2020.

https://www.insurancejournal.com/news/international/2020/02/06/557700.htm.

Global Data., 2020. “South Korea’s life insurance business to decline in 2020 due to Covid-19, says GlobalData”, Accessed June 30, 2020.

https://www.globaldata.com/south-koreas-life-insurance-business-to-decline-in-2020-due-to-covid-19-says-globaldata/

*2: Top 5 Japanese insurer announcement

Impact of COVID-19 on Japan

As of May 2020, Japanese insurers have mobilized rapidly in response to the COVID-19

pandemic. For insurers who have predominantly relied on face-to-face (F2F) distribution

and people-intensive operations, the battleground extends to all fronts: mass customer

acquisition, running the business, and delivering on claims.

Domestic sales have declined signicantly because insurance agents are unable to meet

with customers and reduced discretionary spending given the possibility of unemployment.

While the impact to date on general insurers is less pronounced, few expect this trend to

continue. If the experience of other regional markets is any indication*

1

, Japanese insurers

should expect a double-digit decline in new businesses in the initial months of the restrictions

and a low, single-digit reduction in annualized premium income thereafter. Several insurers

have started making regular compensatory payments to their agents*

2

, further impacting

protability and liquidity. Market volatility and declining interest rates have challenged

investment portfolios and overseas business interests further.

Yet, a relentless focus on business continuity will only get you so far—insurers need to have

one eye on the future to emerge strong and capture the signicant market opportunities

that emerge. In this context, we see three broad scenarios developing over the next ~12–18

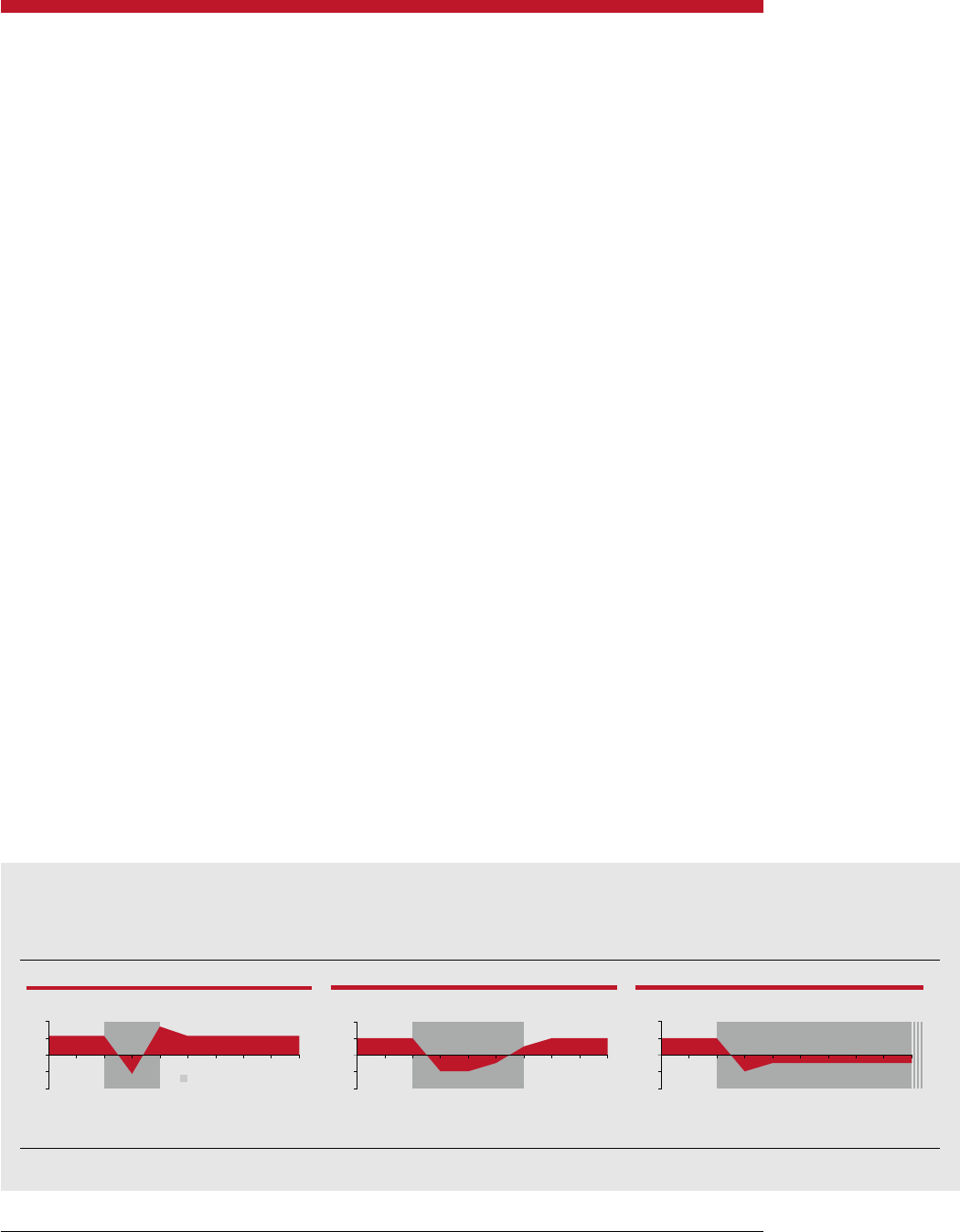

months, both globally and in Japan outlined in the gure below (Exhibit 1).

Our house view is that scenarios U and L are most credible and insurers will need to adapt

accordingly. After crisis management, as national governments gradually pull societies out

of hibernation, opportunities will arise for insurers who act now to position themselves to

emerge stronger in the post-COVID times. To respond eectively, Japanese insurers need to

cater to four Japan-specic issues:

• A signicant shift toward remote working

• Regional variances in COVID related economic impacts

• A higher degree of manual operations vis-à-vis global peers

• Improve governance of their global portfolios

Strategy& | Japan�s Insurance Sector post-COVID: Where to From Here?4

L Scenario—Continued re-emergence of COVID-19

Drastic impact on economic performance and prolonged recession with

acute threats to the monetary and nancial system

U Scenario—Flattened curve of COVID-19

V Scenario—Early peak of COVID-19

Sustained recession with return to previous GDP level over several quarters

leading to postponed and, in part, sustained restricted consumption

Shock impact on the economy as a whole followed by swift and complete

recovery; insurers face postponement of investment and consumption

EXHIBIT 1

COVID-19 crisis: overview of possible economic scenarios

GDP Change (quarterly) through crisis, recovery and beyond

Source: PwC Strategy&

= crisis and recovery period

0%

2%

–2%

4%

–4%

0%

2%

–2%

4%

–4%

0%

2%

–

2%

4%

–

4%

= crisis and recovery period

0%

2%

–2%

4%

–4%

0%

2%

–

2%

4%

–

4%

0%

2%

–2%

4%

–4%

= crisis and recovery period

0%

2%

–

2%

4%

–4%

0%

2%

–2%

4%

–4%

0%

2%

–2%

4%

–4%

• A substantive, sustained shift toward remote working by employers and employees.

The medical requirements for social distancing necessitates a high proportion of sta

work from home (Exhibit 2), and companies (and sta) are investing to do so; for example,

the purchase of remote working equipment has risen sharply this year (Exhibit 3). Some

changes may likely remain post COVID, with profound implications for how insurers

manage their workforce, real-estate, and product portfolios (i.e., as underlying risk

evolves).

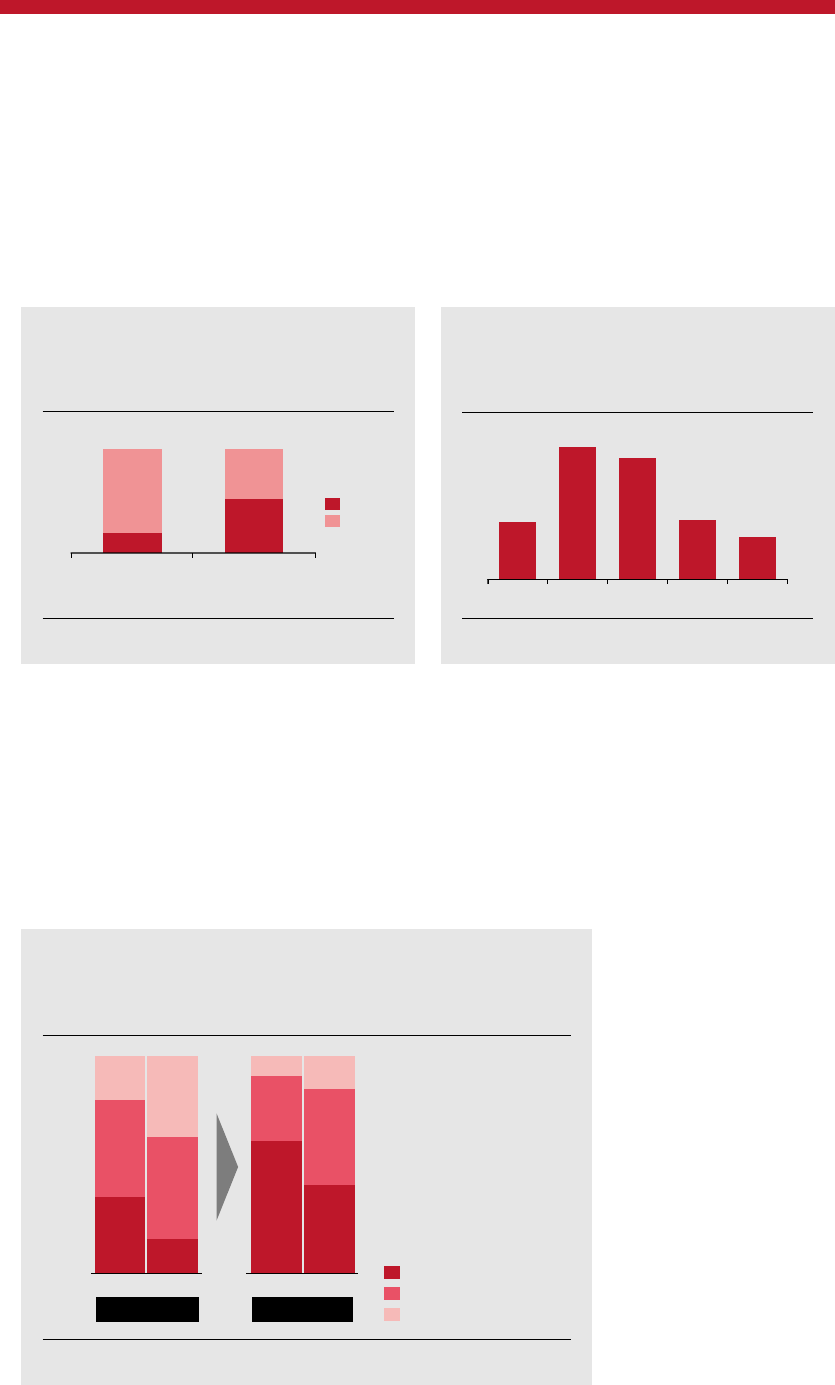

EXHIBIT 2

% of companies adopting remote

working

Source: PwC Strategy&

EXHIBIT 3

Sales of Tele-Working Equipment

(16 Feb–15 Mar 2020, YoY, %)

SSDWeb cam

111%

107%

Headset Display Note PC

246%

226%

80%

Source: PwC Strategy&

EXHIBIT 4

Insurers Willingness to Invest in Digital Technologies—

Pre-COVID

35%

16%

61%

41%

45%

47%

30%

44%

20%

37%

9%

15%

JapanWorld Japan World

2017

Future Plan

Pre-COVID

Small-scale/no investment

Medium-scale

Large-scale

Source: PwC Strategy&

• A higher degree of manual operations vis a vis global peers has left Japanese insur-

ers facing additional challenges in responding to the current operating environment.

There are constraints associated with physically getting sta to locations to execute man-

ual, paper-based processes. In parallel, the signicant volume of non-digital records has

posed business continuity and risk management challenges that are dicult to resolve in

the short term. Local insurers who have typically underinvested in digitization compared to

global peers are already revisiting these plans (Exhibit 4), but will need to accelerate them

as business stabilizes.

Strategy& | Japan�s Insurance Sector post-COVID: Where to From Here? 5

19%

81%

52%

48%

2018 Mar-20

Yes

No

n=2106 n=2835

• Disparities in the impact of COVID-19. By sheer size, the largest impact (based on

population) will be in Kanto, Kinki, and Tokai. In the rest of Japan, 65%+ of the working

population is employed in small- and medium-sized enterprises (SMEs), who face lower

employment security (Exhibit 5).

The immediate impact will be on new businesses as customers reduce the amount and

types of cover they hold. While there is an urgent need to support SMEs and freelancers

with working capital solutions in the near term, over the mid to long term, we envisage a

slight decline in SME-oriented products and propositions. Beyond evolving distribution

models, insurers will need to think about the types of products that can cater to the

diverse workforce—now and in post-COVID times.

• Management of global portfolios by Holding Companies. Over the last decade,

Japanese insurers have nurtured global portfolios to tap into attractive markets and

investment opportunities—the economic upside and yield arbitrage opportunities more

than oset the cost of integrating and governing global businesses. However, with the

precipitous decline in interest rates and a declining global economic outlook, this arbitrage

opportunity has also diminished. Additionally, the nature of these portfolios may require

incremental capital contributions (e.g., to cover increased income protection claims).

While not a direct issue for Japan operations, we expect this to be an area of signicant

interest for top management in holding companies.

Strategy& | Japan�s Insurance Sector post-COVID: Where to From Here?6

EXHIBIT 5

Employment by employer size & region

38%

South

Kanto

7%

8% 60%

Chugoku

31%

Kinki

1,871

59%

Tokai

24%11%

156

334

Kyushu

25%

63%9%

Hokkaido

55%

65%22%12%Tohoku

65%25%

23%

23

%

65%

66%

387

12%

11%

10%

10%

Shikoku

65%

15% 18%

728

437

246Hokuriku

North

Kanto

29%

65%

8%

62

33%

Okinawa

232

67%

<500 employeesGovernment >500 employees

In many

regions, more

than 60% of

people are

employed by

small and

medium sized

companies

556

933

Source: PwC Strategy&

As an initial response, many insurers are evolving their business practices. Several have

signicantly curtailed agent and sta sales visits, closed physical locations, reduced working

hours, and established A/B teams (Exhibit 6). Others have increased website use, with

many substantively shifting to digital channels (Exhibit 7). However, these are only near-

term measures; tackling longer-term impacts will require deep examination across four main

dimensions:

• Product portfolio and value chain participation

• Workforce and real-estate management

• Operational resilience and agility

• Role as stable, long term Institutional Investors

EXHIBIT 6

Company A

*3

# of consultation by type

(2020)

18

March April

151

0%

10%

20%

30%

40%

50%

60%

70%

80%

0

50

100

150

200

250

300

350

400

Visit

Store

Online

Online

(

%

)

*3: Large Japanese Insurance Distributer

*4: Major Japanese Direct Insurer

*5: Top 10 European Insurer in Japan

EXHIBIT 7

Sales trend for online insurance

(# of contract, 2020 vs 2019)

Online insurers

Online

insurance store

March

February

Company B*

4

Company C*

5

Company A*

3

182%

122%

116%

127%

150%

N/A

Source: PwC Strategy&

Source: PwC Strategy&

Strategy& | Japan�s Insurance Sector post-COVID: Where to From Here? 7

Longer Term Impact on Japanese Insurers

From disrupted value chains to workforce anxiety, all business aspects are being impacted.

Japan’s scal stimulus package is one of the world’s largest*

6

, and its interplay with health

data pertaining to the local progression of COVID-19 should underpin scenario planning.

While acute in the short term, the combinatorial impacts of these aspects will have more

substantive impacts across the product portfolio over the longer term (Exhibit 8).

*6: Japan’s scal stimulus in response to the COVID-19 pandemic is pegged at ~20% of GDP, which is on par with Germany and the UK and

ahead of Australia and Singapore.

Strategy& | Japan�s Insurance Sector post-COVID: Where to From Here?8

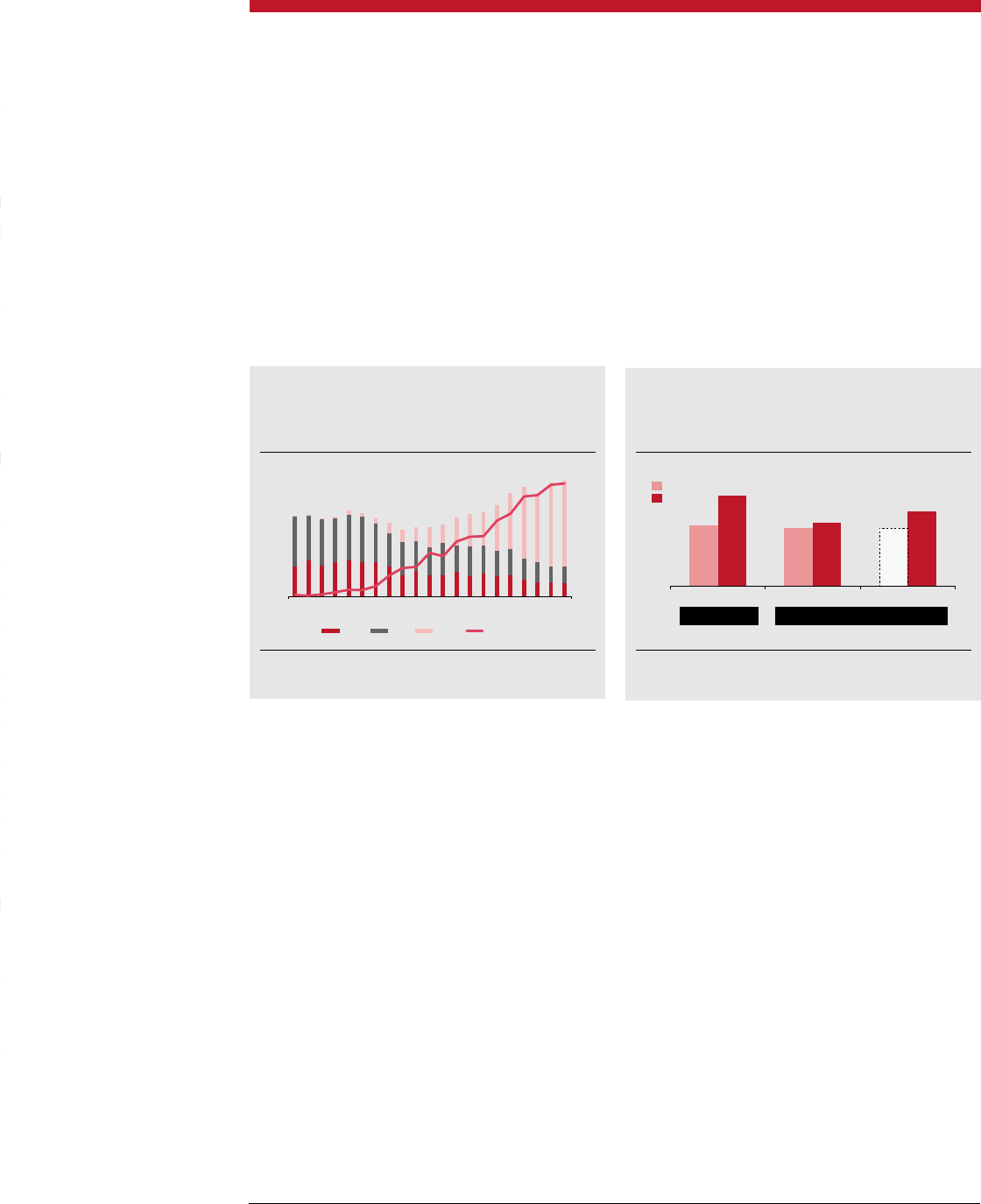

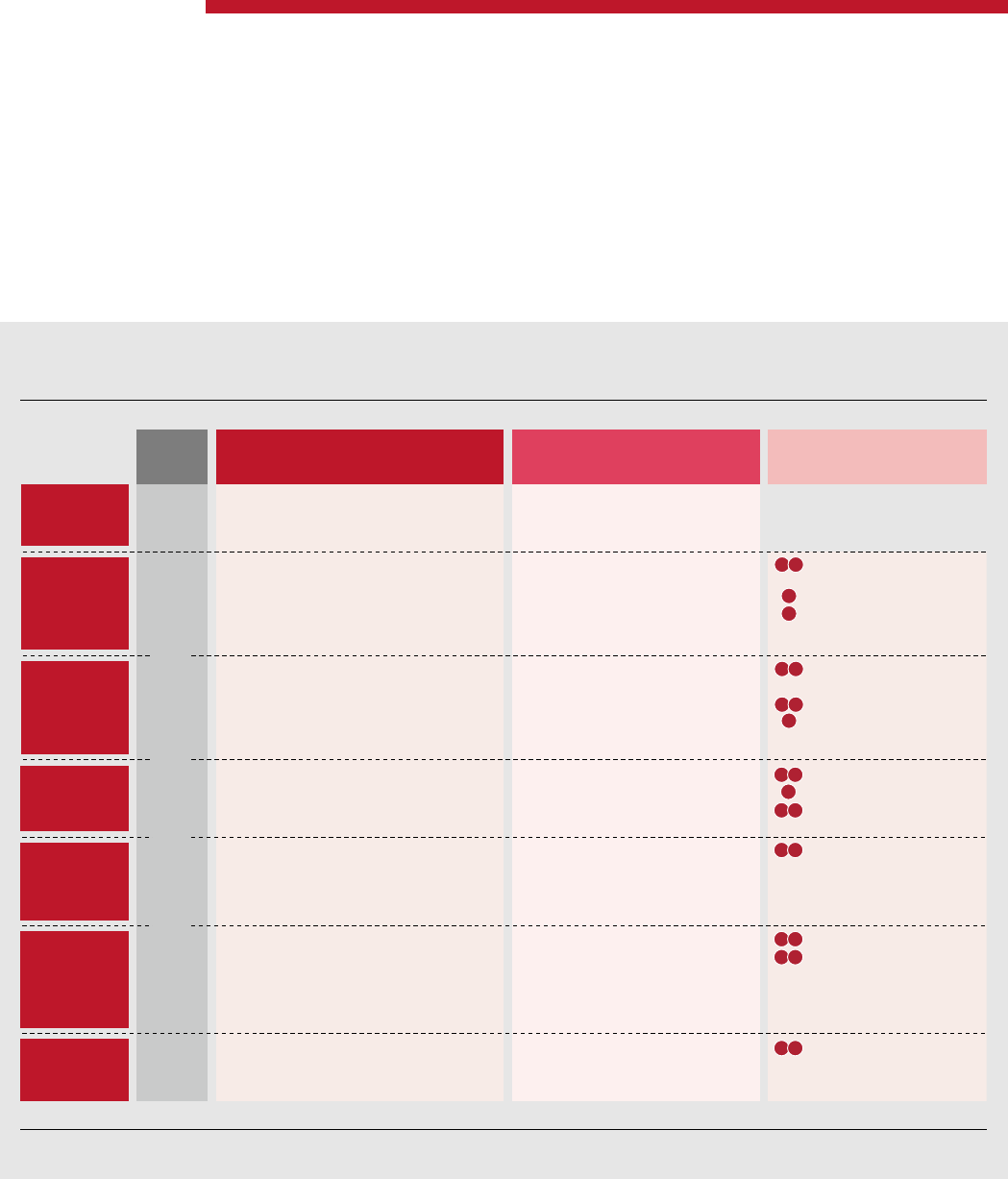

EXHIBIT 8

Impact on Insurers Products & Business

Premium Loss Ratio Long Term COVID Impacts

Property & Casualty

Fire & Marine

Compulsory

Auto Liability

Voluntary

Automobile

Personal

Accident

Other Personal

(Pet, Travel, etc.)

Property & Misc.

Casualty

Life

Whole / Term

Endowments &

Annuities

Hospitalization &

Surgery

(3

rd

Sector)

Group Insurance

Neutral UnknownDeterioratingImproving

More businesses closing but

shipping likely to increase—

unclear if two will balance out

Reduced vehicle demand and

customers choosing to drive

at non-peak periods

Reduced vehicle demand,

changed driving conditions,

and customers saving money

Slight reduction driven by

reduction in short and long

term travel

Underpinned by spending on

discretionary items subject to

customers’ belt tightening

Ownership and occupancy

unchanged—but some shift

to cheaper policies

Usage patterns of surviving

businesses remain largely

unchanged

Changed driving frequency

and behavior improve loss

ratio assumptions

Changed driving frequency

and behavior improves loss

ratio assumptions

Usage patterns may be

“safer” but volume loss

could increase unit cost

Changes in usage pattern

unclear

Usage patterns largely

unchanged

Largely unchanged as businesses re-emerge

—but will trend with overall population/

economy of Japan profile

Economic slowdown, continued travel

restrictions and declining car ownership rates

will reduce premiums

Mixed impact on loss ratio—likely lower in the

short term but higher in the long term as driving

increases to maintain social distancing

Demand likely to remain stable and likely to

follow broader market/societal trends

Less requirement for travel

Increase in other personal items insufficient to

offset loss

will trend with broader Japan population and

economic profile (e.g., people seek lower cost

housing)

Few discretionary purchases

by customers and likely for

lower ticket amounts

Base mortality and morbidity

largely unchanged—assumes

COVID will be controlled in

next ~12–18 months

Sustained shift in acceptance of remote work-

ing resulting in changes to underlying risk profile

assumes COVID will be controlled over the next

~12–18 months

Flight to preserve cash or

substituting into other

traditional policies

Increased cost of generating

returns and hedging in a

low-rate, volatile environment

Shift toward larger ticket sizes—lower rates

for foreseeable future will necessitate (pricier)

high grade real assets to generate returns

Increased demand for health

cover and services—if you

can reach the customer

Changes in usage patterns

and mix uncertain

Increased demand for health related policies

(and services) as customers continue to

become more health conscious

Longer term contracts with

expectations of employers to

provide cover

Base mortality and morbidity

unchanged

Sustained shift in acceptance of remote work-

ing resulting in change to underlying risk profile

?

?

?

?

Source: PwC Strategy&

Strategy& | Japan�s Insurance Sector post-COVID: Where to From Here? 9

Once in a generation shifts in customer behavior will profoundly impact market

dynamics. A drive to frugality will see customers purchasing fewer and lower ticket whole /

term policies, but potentially more on supplemental health cover. Substantive and long lasting

shifts in real estate usage, travel and socialization patterns, and personal asset ownership

will impact longer term risk proles. First, we expect a shift in product portfolios—especially

for life insurers—away from capital intensive products as savings oriented products will

have to work much harder to generate returns. Products like unit linked ones might appear

attractive but their capital eciency should be stress tested given solvency requirements.

Second, core operations need to be a lot more digitized—not only to provide exibility

in business operations, but to respond to and remain relevant to long term changes in

customer behavior. Given the expected decline in volumes in some parts of the portfolio,

reducing the expense ratio (through digitization) will be critical to maintaining protability.

Third, digitization will extend to distribution models—not to replace agents and partners, but

to support them with more time to spend with customers. Several tools are available from

ntech-type providers, and there is an opportunity for insurers to accelerate eorts by buying

capability. Fourth, insurers should integrate better with suppliers (e.g., repairers, hospitals,

other service providers), distribution partners (e.g., agents, banks, etc.), and for the Group

business, with large corporates (e.g., to put in place programs to manage safety and mental

health whilst working from home).

A second major change will be around workforce and real-estate management.

The high degree of manual and paper-intensive processes among Japanese insurers has

necessitated large workforces, oces and branches. COVID-19 has forced insurers and

sales forces to work remotely and challenge existing norms; as we emerge from this crisis,

successful insurers will rethink how and where they organize their people and activity.

Managing this requires a greater focus on organizing the workforce (including for continued

remote work) and investing in a base level of digital/remote working skills for all sta.

From a real-estate perspective, this is an opportunity to re-examine the scale of corporate

headquarters/operational centers and rethink the format of sales branches. Done correctly,

there is a real opportunity to redeploy savings from the former to the latter.

A third area, which Japanese insurers will have to develop is building resilience and

agility within their businesses. This will require more than just training sta; specically,

there needs to be a deeper focus on the interconnectivity between people, processes, and

governance. First, governance structures and controls should be updated for a changed

environment. Second, customer and non-customer facing processes need to be redesigned

to focus on digitization and distributed execution, that is, “one process, distributed

execution.” This means greater standardization and “designing- in” controls (vs. traditional

model of relying on human oversight). Lastly, all managers must be trained on how to

lead distributed teams on a regular basis. The benets of achieving this include increased

workforce exibility, better customer customers; improved employee value proposition; and

increased operational capacity.

A fourth longer-term impact is the role of insurers as large institutional investors.

Portfolios/allocations of large institutional investors will shift due to lower global interest

rates and structural changes in asset valuations (e.g., commercial real estate). In addition to

ALM requirements, insurers will need to seek yields for savings-oriented products that have

already been sold and redesign future savings—oriented products. There are fewer highly

rated investments, and longer tenured (e.g., infrastructure) investments come with liquidity

constraints. Insurers should revisit their investment strategies and the products that can be

supported through those strategies.

Strategy& | Japan�s Insurance Sector post-COVID: Where to From Here?10

EXHIBIT 9

Future Positioning of Insurers - Typical Archetypes

Scale

Provides access to capital and resources to

sustain and then recalibrate the business

Portfolio Breadth

In-built resilience within the portfolio

Low High

Low High

Suited for Survival

Product

Differentiators

Potential Stars

Challenged Future

1

34

Opportunity to leverage core

products to re-position

business by digitizing, and

building scale

Strong business model …

must start acting now to

capture opportunity before

others

Sub-scale and challenged

products

…preserve value

for possible merger/exit

Ability to leverage scale into

digitizing the business or

expanding product portfolio

2

Source: PwC Strategy&

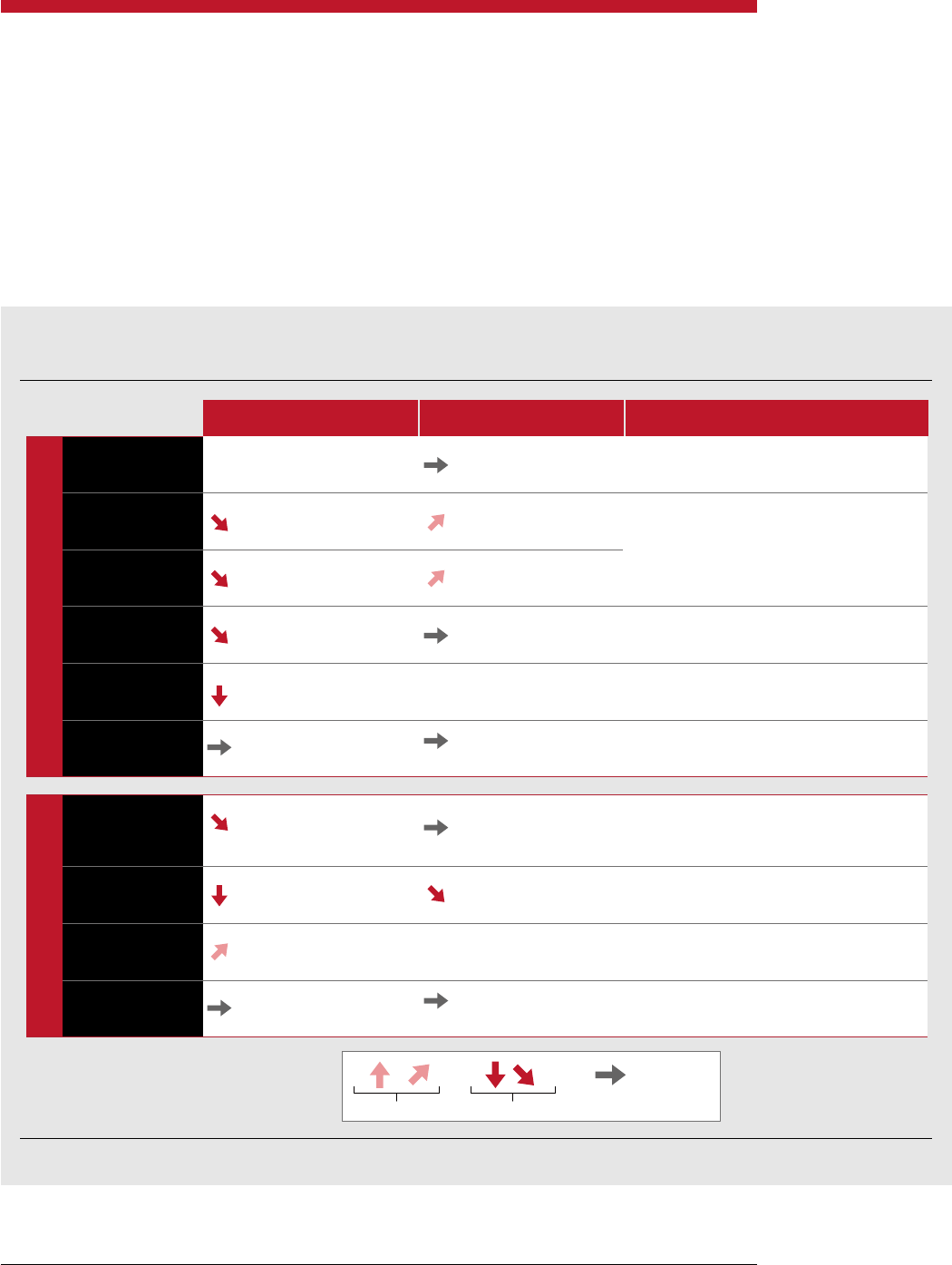

Actions for Insurers

The fast spread of COVID-19 pushed most businesses to uncharted territory. It is tempting

to become internally focused, but insurers’ response to customers and society in the present

times will dictate their future public perception. The rst steps should be directed toward

customers; reiterating your value propositions, providing a clear way for customers to get

help, and developing solutions to operational challenges with customers in mind (even if

the solution is not perfect). For example, in China, an insurer has fast-tracked claims (and

accepted the risk of a higher loss ratio) and waived deductibles. Only then, should insurers

start thinking about their longer-term business response.

There is no doubt the insurance landscape will be signicantly altered over the long term

from customer, employee, and product perspectives. It is also possible that some of these

changes will be acute enough to force market consolidation providing opportunities for

stronger players. The actions available to insurers will be inuenced or constrained by their

archetype which are presented in the Exhibit 9 alongside. These are based on the current

scale and portfolio breadth of insurers (i.e. structural factors that enable or constrain their

businesses).

Strategy& | Japan�s Insurance Sector post-COVID: Where to From Here? 11

EXHIBIT 10

Actions Insurers Can Take to Emerge Stronger

Crisis

Management

& Response

Workforce

Operations

& Supply

Chain

Finance &

Liquidity

Distribution

Tax, Trade &

Regulatory

Strategy &

Brand

Mobilize

Stabilize

(Start now to execute over the medium term)

Strategize

(Think now to guide long term choices)

Archetype Specific Options

(Start thinking now)

Ongoing scenario planning and stress testing

of financial, operational and reputational risk

Customer charter—demonstrate how

you will support for future crises

Be clear on your purpose

Liquidity solutions for Small and Medium

Enterprises (SME) (and other) for other

Strengthen customer loyalty by capitalizing

on minimized risk (e.g., motor, value added

services)

Reprioritize and rationalize project portfolio

Review product portfolio mix and

compare with client needs

Recovery + growth strategy

Fit for purpose operating model

!

1

1

2

3

Strategic M&A—of other

insurers and capabilities

Global portfolio optimization

Build distribution partner-

ships

Extending credit/ working capital to business

partners

Re-insurance strategies

Recalibrating capital/ valuation models

Make better use of existing sales related

assets—lead trackers, savings calculators,

etc… i.e. drive adoption

Design and deploy digital sales support tools

in the hands of agents and drive adoption

Better link direct and F2F sales channels

Closed block/ legacy portfolio strategy

Lapse management

Accurate valuation on illiquid

investments & overseas portfolios

Rethink agent/ banca sales experience

—and retrain/hire to deliver on that

experience

Redesign branch/ agent office formats

and rethink location strategies

!

1

4

2

2 4

Partial Sale of back-books

Divestments

Capital/Liquidity

Management

!

3

1 2

1 2

Redesign sales process to

make it digital centric

Invest in direct distribution

and customer engagement

!

1 2

Captive re-insurance to

better access global capital

markets

Workforce stabilization and planning

Base level of digital & remote leadership

training for staff and agents/partners (inc.

adoption of existing tools)

Personal development & personal projects

Workforce strategy & digital upskilling

Improved agent value proposition

Real estate location strategy

!

1 2

Targeted recruiting

campaigns to capture

candidates from others

Ensuring continuity of supply chain through

targeted investments and working capital

solutions

Digital tools to agents—chat, VC, shared

screens, etc.

Digitization and automation of core processes

Design-in cyber security and data

privacy—before digitizing processes

IT Infrastructure & end of life strategy

!

1 3

!

1 2

Tactical sales campaigns

Digital adoption campaigns

of existing tools and systems

Financial reporting and disclosures

Replan & recalibrate regulatory programs

currently underway—IFRS, LDTI

Global governance models (for those

with multi-national portfolios)

Immediate crisis management and business continuity planning

efforts largely completed—now at monitoring stage

Source: PwC Strategy&

Estimates suggest that the global economy will take at least ~12–18 months to return to

something resembling “normal” conditions—but what exactly it looks like is still unclear. It

is also clear that we have to get used to emergencies like COVID-19 in a world of growing

uncertainty, instability, and interconnectedness. We are familiar with some systemic threats

like climate change and cyber-attacks and are already adapting to them—a similar approach

is required for the post-COVID environment. Insurers need not wait; irrespective of their

archetype, there are actions insurers can start now to position themselves (Exhibit 10).

Strategy& | Japan�s Insurance Sector post-COVID: Where to From Here?12

So, the actions that you, as insurers, take now will build resilience and adaptability in

your organization, starting with the following:

• Test, Test, Test: To loosely paraphrase the advice of WHO Director General Dr. Tedros

Adhanom, companies must adopt a “Test! Test! Test!” policy by taking a scenario-based

approach to business planning. Insurers have historically run sophisticated nancial

scenario tests (e.g., solvency), but they now need to expand this to customer- and

employee-facing processes and develop market approaches, product portfolios, and

physical infrastructure.

• Assessing Resilience in Product Portfolios: The rapid decrease in global interest rates

has wreaked havoc on investment portfolios; for life insurers, this has markedly increased

the cost of capital (especially in legacy portfolios). It is unlikely that rates will increase

for some time. Stress testing your current and legacy products including using health

analytics will enable you to better negotiate with re-insurers (near term) and optimize your

post-COVID portfolio (long term).

• Digitize the Customer Interaction: Profound changes in customer behavior brought

about by COVID19 means insurers should rethink customer interactions - the need to

digitize sales, customer management, and claims management has never been higher.

Contrary to dogma, digital eorts need not replace agents and sta - it can actually

give them back more time to spend on higher value activities (e.g., spending time with

customers) and support better risk management. The time to start acting on this is now.

• Revisiting Governance and Controls: Current (local and global) governance models and

controls must be redesigned for an operating environment in which risks rapidly translate

across national boundaries and one where much work may be conducted remotely

(even in post-COVID times). As you design these controls, ask the following question:

“Why can we not do this remotely”? (e.g., using physical vs. electronic signatures for

supplier contracts) and design in this digital governance for customer facing and internal

processes.

• Rethinking the Workforce: Near-term eorts have necessarily focused on sta safety,

tactical resource management, and team splitting. To position for the future, insurers

must start thinking about their workforce strategy including the mix of required skills,

where employees need to be (physically) located, incorporating a comprehensive digital

upskilling program, instilling remote team leadership skills for all managers, and rethinking

career pathways.

• Redesigning the Operating Model: Without a doubt, successful insurers will be more

digitized, more adaptable, more resilient, and potentially more dispersed post COVID.

Beyond organizational structures, you need to dene how parts of your company work

together and the requisite collaboration, information ows, and infrastructure delity.

So to from here? Japanese insurers have already successfully mobilized in the face of

COVID-19. The next step is to stabilize operations, and then re-strategize for the future. This

should necessarily focus on business models and organizational change. Insurers who can

align their COVID-19 response with their long-term strategy will be able to emerge stronger.

We encourage you to explore your scenarios and stress-test them and, in doing so, focus on

the implications to your strategy over the coming weeks and months.

© 2020 PwC. All rights reserved. PwC refers to the PwC network and/or one or more of its member rms, each of which is a separate legal entity.

Please see www.pwc.com/structure for further details. Mentions of Strategy& refer to the global team of practical strategists that is integrated

within the PwC network of rms. For more about Strategy&, see www.strategyand.pwc.com. No reproduction is permitted in whole or part without

written permission of PwC. Disclaimer: This content is for general purposes only, and should not be used as a substitute for consultation with

professional advisors.

Issue: July, 2020

www.strategyand.pwc.com/jpwww.strategyand.pwc.com/jp

Strategy&

Strategy& is a global strategy consulting business uniquely positioned to help deliver your

best future: one that is built on dierentiation from the inside out and tailored exactly to you.

As part of PwC, every day we’re building the winning systems that are at the heart of growth.

We combine our powerful foresight with this tangible know-how, technology, and scale to

help you create a better, more transformative strategy from day one.

As the only at-scale strategy business that’s part of a global professional services network,

we embed our strategy capabilities with frontline teams across PwC to show you where you

need to go, the choices you’ll need to make to get there, and how to get it right.

The result is an authentic strategy process powerful enough to capture possibility, while

pragmatic enough to ensure eective delivery. It’s the strategy that gets an organization

through the changes of today and drives results that redene tomorrow. It’s the strategy

that turns vision into reality. It’s strategy, made real.