Buyingvs.RentingaHome:AFinancial

Analysis

Andrew Fraser

Markus Linke

Russ Reilly

Justin Rosales

Daniel Rossman

Abbey Staffnik

Mohammed Tarin

Berman Tijerino

Robert Wellman

Prepared in partial fulfillment requirements in CEE 300 – Engineering Business Practices

Dr. Thomas Seager, Instructor

Arizona State University

13 August, 2012

ExecutiveSummary

Salman Khan said, “The single most important video [series] anyone can watch” is his

presentation on renting vs. buying a home. Khan explains that, for a given year, it may be better

to rent than it is to buy, assuming the houses are similar. However, Khan further explains how

the decision to buy or rent could be dominated by the appreciation and depreciation in the value

of a house. The housing market is unpredictable without making a few assumptions. The

methods used to analyze buying vs. renting were to study a few key data sources. The US

Census Bureau publishes median home asking prices for four regions of the US at

www.census.gov. The S&P/Case-Shiller Home Price Index presents data on twenty different

metro home areas, including Phoenix, AZ. Lastly, www.zillow.com publishes sales data and

market estimates for individual houses. This study compares house prices in four different areas

in metropolitan Phoenix: central Phoenix, Tempe, Scottsdale, and West Phoenix/Glendale.

Using a spreadsheet downloadable from KhanAcademy.org to reduce expected cash flow

forecasts to net present value, this analysis recommends buying rather than renting, given an

assumed forecast of little to no price appreciation expected in the Phoenix housing market.

Table of Contents

Introduction………………………….………………………………………………………….....1

Problem Statement…………………………………………………………………………….......2

Assumptions……………................................................................................................................3

Methods…………………………….………………………………………………………...…...6

Discussion and Analysis………………………………...……………………………………….14

Recommendation..……………………………………………………………………………….18

References……………………………………………………………………………………….19

Appendix………………………………………………………………………………………...20

List of figures

Figure 1.0 – Cash flow diagram for buying a home….……………………………….……...…..2

Figure 1.1 – Cash flow diagram for renting a home ………...…………………….……...…...…3

Figure 2.0 – Median asking rents and sales prices.…………………………………….……...….5

Figure 3.0 – Trend of US home prices…………….…………………………………….……......6

Figure 4.0 – Median sales price of new US homes…………………....…………………..…...…7

Figure 5.0 – Phoenix S&P/Case-Shiller Home Price Index……………………………..……......7

Figure 6.0 – Average home value. ……………………………..……............................................8

Figure 6.1 – Average area of homes in studied areas……………………………..……................9

Figure 6.2 – Average payments……………………………..…….................................................9

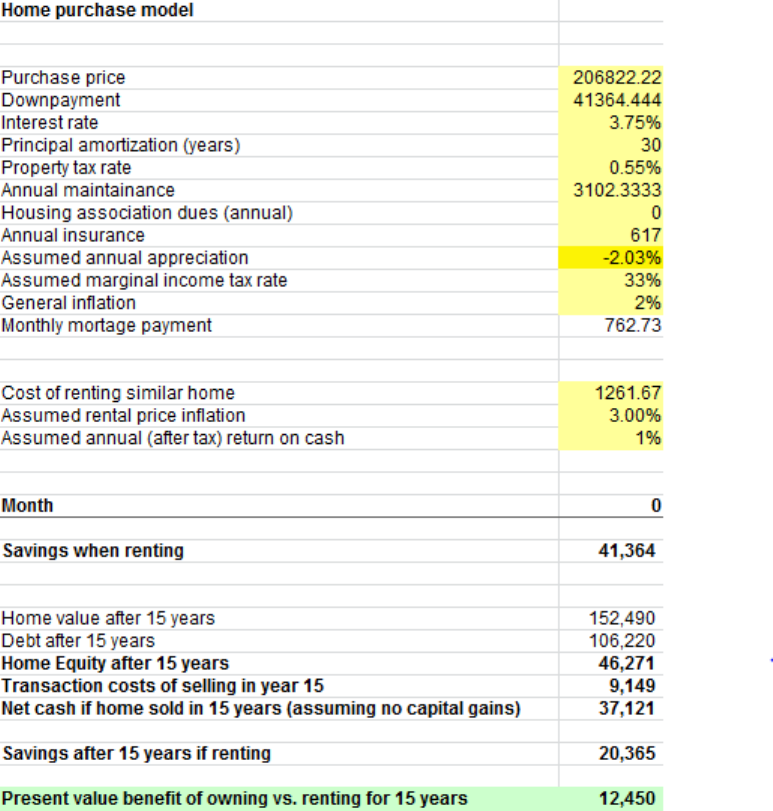

Figure 7.0 – Khan’s modified Excel spreadsheet………...……………………………..…….....13

Figure 8.0 – Buy vs. Rent in central Phoenix, 30 year mortgage……………………....……......15

Figure 8.1 – Buy vs. Rent in Scottsdale, 5/1 ARM…...……………………………..…..……....16

Figure 9.0 – Decision chart……..….…...……………………………..…..……...........................17

List of tables

Table 1.0 – Average mortgage rates……………………………………………………………...4

Table 2.0 – Home types and amount of homes studied..………………………………………....8

Table 3.0 – Variable list for sample calculations………………………………………………...11

Table A.CP – Central Phoenix homes….………………………………………………………..20

Table A.T – Tempe homes….………………………………..………………………………….20

Table A.S – Scottsdale homes….………………………………….…………………………….21

Table A.WP – West Phoenix/Glendale homes….………………………….……………………21

1

Introduction

The question asked for this report was “Which is cheaper—renting or buying?” Taking

into account the current market conditions of real estate in 2012 an in depth analysis was made

comparing rental properties to homes for sale in four metropolitan areas of Phoenix, Arizona.

The areas were as follows: central Phoenix, Tempe, Scottsdale and West Phoenix/Glendale.

Renters have landlords who charge a monthly fee for staying in their home. The rental

agreement is a binding contract between the renter and the landlord, so renters must make

periodic payments under the agreement to occupy the home. When renting, the landlord usually

carries the cost of maintenance and repair to the building and property, which can be substantial

when considering how much it would cost to replace an air conditioner. This is a great benefit to

the renter since it is unnecessary to set money aside for maintenance and repair. It is advisable to

carry renters insurance on the valuables in the home. Price of rent can fluctuate over time—they

can go up and down. Renters have no control over the rent or how much it can change over time.

Often times, rental agreements limit on how many changes or improvements are allowed to the

home. Usually a security deposit is required to rent a home to protect the landlord from having to

make improvements or repairs from damages the renter caused. This security deposit will be

returned to the renter upon leaving the home in acceptable shape. An advantage of renting vs.

buying is the flexibility of movement. If for whatever reason renters have to move, then renters

can simply pack up their belongings and move out without having to sell the home. Another

advantage is that renters do not have to worry about depreciation of the house.

If homeowners cannot buy the house outright, then they will most likely have a mortgage.

The mortgage is a loan secured by property that requires the borrower to make payments to

whoever holds the title of the home. This payment is most likely made up of four parts: the

interest on the outstanding loan, principal to pay down the balance of the loan, property taxes,

and homeowners insurance. Property taxes are what the responsible municipality charges based

on the assessed value of the property and dwelling. Homeowners insurance is required as part of

the loan agreement to ensure there is money to pay for replacement or repair in the case of loss.

The mortgage can be in the form of a fixed interest rate with payments spread over 15 to 40

years, depending on the signed agreement. Fixed rate loans are also known as conventional

loans. Another option is the Adjustable-Rate Mortgage (ARM), which was very popular during

the last housing boom. An ARM will start homeowners out with a lower initial interest rate than

a conventional loan but can be adjusted periodically depending if it is tied to the London

Interbank offered Rate, or LIBOR (“Definitions”). A Federal Housing Administration (FHA)

loan does not require as stringent credit qualification or as a large as a down payment when

compared to a conventional loan. As a homeowner with a fixed mortgage, the payments of

principal and interest will remain the same for the term of the loan; however the portion

2

consisting of property taxes and homeowners insurance can fluctuate with time (“What’s in a

Mortgage Payment?”).

A benefit of having a mortgage payment is that the paid interest is tax deductible

(“Renting vs. Buying a home”). This should only be small factor when deciding to buy a home.

The biggest benefit of homeownership is the possibility of the home’s appreciation, which means

the home is most likely worth more than the original purchase when homeowners decide to sell.

With the appreciation and the paying down of the principal, there should be a net gain over the

purchase price. The downfall is when the home’s value depreciates, which means the home is

worth less than what the original purchase. Homeowners are responsible for maintaining and

repairing the building and property, so important to have money in savings for unexpected

repairs.

ProblemStatement:Isitmoreeconomicaltobuyorrentahouseduring

the2012ThirdQuarter?

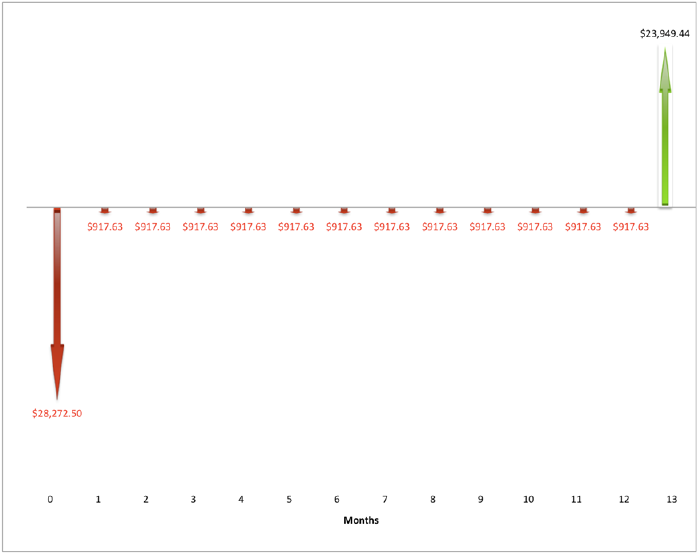

The following figures show cash flow diagrams for buying and renting a home.

Figure 1.0 – Simple cash flow diagram for buying a home.

Figure 1.0 reflects a one year ownership of a house with a purchase price of $131,500,

20% down payment, 15 year fixed mortgage rate at 3.09%, 0% appreciation, and assumes the

home is sold at the end of the year with a 6% of the sale going to the realtor.

3

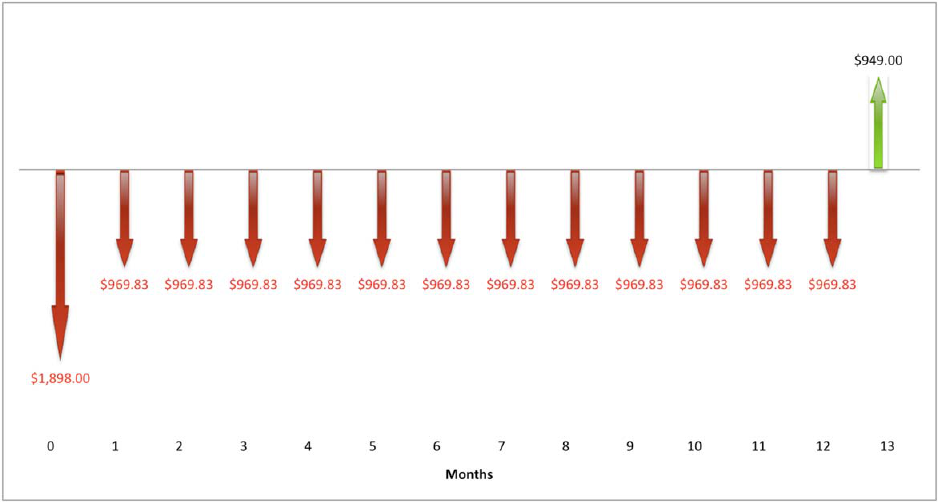

Figure 1.1 – Simple cash flow diagram for renting a home.

Figure 1.1 reflects a one year rental agreement with a monthly rent cost, which includes

renters insurance, of $949, a security deposit of $949, and assumes a full refund of the security

deposit at the end of the rental agreement.

Assumptions

In order to compare buying vs. renting a home a few assumptions must first be made

about the prospective buyer/renter. First and foremost, the client is looking for a place to live

and intends to live there for at least 5 years. This excludes any client looking at buying a house

as an investment rental property. Secondly, it is assumed that the client is in a position to buy a

home. That is to say, they have enough cash on hand for a 20% down payment and have a credit

score and debt situation that guarantees them a home loan. This client also has a steady stream of

income that would qualify them for a first mortgage. This analysis considers a client with secure

income, rather than a client that has reason to expect they may lost their job and face home

foreclosure due to an inability to make regular mortgage payments..

The report will only look at single-family detached homes. Apartments, duplexes,

condominiums, mobile homes, and loft spaces have all been excluded. The analysis will only

compare homes that are in move-in ready condition. For the sake of this report, move-in ready is

defined as a home that does not require any additional work for prospective buyer/renter. The

house does not have any structural deficiencies, does not require painting inside or out, the floors

and/or carpet are in good shape and do not need replacement, the appliances and plumbing are in

good working order, and the yard has been maintained. There are a number of homes on the

4

market that are available at a substantial discount but require additional improvements to make

the house livable. These have excluded because it is difficult to find rental equivalence and/or

estimate the cost of future renovations on these houses.

The report is specific to the greater Phoenix area, focusing on four areas: central Phoenix,

West Phoenix and Glendale, Scottsdale, and Tempe. In order to get a representation of each of

each of these areas, sale and rental properties have been analyzed using two, three and four

bedroom homes as the base categories provided they meet the move-in ready criteria listed

above.

There are additional costs associated with buying a home and those will be defined using

the following rates. Mortgage interest rate, maintenance, closing costs, property tax,

homeowners insurance, security deposits, renters insurance, appreciation, and depreciation.

While mortgage rates vary from place to place, however this report will use the average

rates posted by the Mortgage Bankers Association for August 2012, which is shown in Table 1.0.

Maintenance costs range from 1-2% of the home’s value, and this report will use an average

maintenance cost of 1.5% of the home’s value (“Budgeting for Home Maintenance and Repair

Costs”).

Table 1.0 – Average mortgage rates for August 2012

(http://www.mortgagenewsdaily.com/mortgage_rates/charts.asp?Y=2012&M=8)

30 Year Fixed 3.75%

15 Year Fixed 3.09%

5/1 ARM 2.73%

Closing costs also represent additional expenses typically paid by the purchaser. These

costs include “loan origination fees, discount points, appraisal fees, title searches, title insurance,

surveys, taxes, deed-recording fees, and credit report charges” among others (“Closing Costs”).

Based on research conducted in 2010, closing costs in Arizona average 1.5% of the

homes selling price. This number will be used for all calculations in this report and is paid at the

same time as the purchase of the home (“Closing costs averages comparison: Arizona”).

Property tax rates vary greatly depending on location. The tax rate used in this report is

based on the average rate for Maricopa County for a home’s estimated fair market value, which

is 0.55%. For this report, property taxes are paid at the end of the year (“Maricopa County

Average Property Tax”).

As of March 2012, the average Arizona homeowners insurance is $617.00 per year, or

$51.42 per month (“Arizona Homeowners Insurance Quotes”). The main components of

homeowners insurance are the dwelling, contents or personal property, and loss of use. Some

5

other components of homeowners insurance are other structures, such as garages or sheds, and

medical payments. The $51.42 per month cost is assumed throughout the analysis.

Security deposit is a refundable deposit paid buy a renter up front to cover any potential

damage to the home. These can vary depending on the house and landlord, but for this report

security deposits will be equal to one month’s rent, and the renter receives the entire security

deposit at the end of the agreement.

The average Arizona renters insurance is about $200.00 per year, or $16.67 per month

(“Arizona Renters Insurance”). Renters insurance can compensate for the replacement cost of

damaged personal property. The $16.67 per month cost is assumed throughout the analysis.

It is assumed that the prospective renters would be required to pay for all utilities on their

own. Therefore, monthly utility costs are the same for a renter or buyer, and thus have been

excluded from this report. Additionally, only 20% of homes in the United States belong to

homeowners associations and their fees vary greatly, so they have been excluded from this report

(“The Horror of Homeowners’ Associations”).

Another assumption made throughout this analysis is the homeowner sells the home after

a certain time. The time horizons assumed throughout ownership are one, three, five, ten,

fifteen, twenty, twenty-five, and thirty years. Unlike when the renter receives the entire security

deposit at the end of the agreement, the seller does not receive the entire down payment when the

home is sold because the realtor collects 6% commission (“3 ways to pay lower real-estate

commissions”).

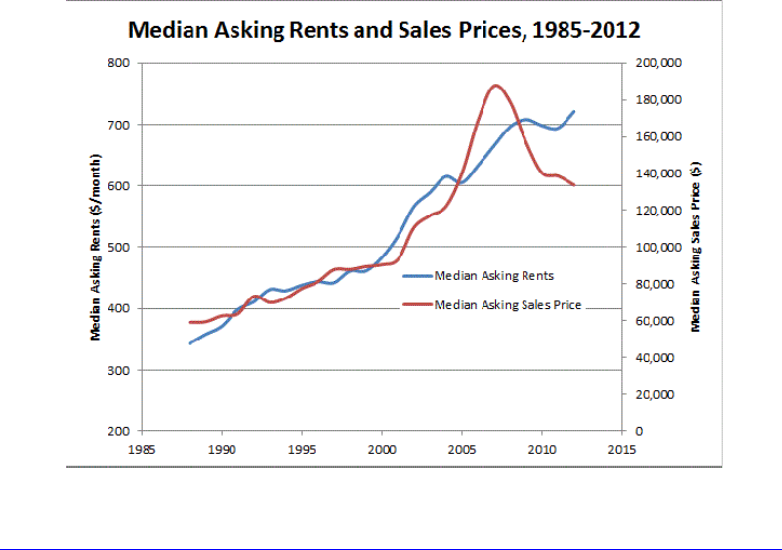

Figure 2.0 – Median asking rents and sales prices

(http://sustainableengineeringsystems.com/2012/07/24/renting-vs-buying-a-home/).

6

Figure 2.0 compares median renting price and median sales price of homes. The figure

shows a steady increase of renting price and a drop of home price in recent years. Since renting

and buying prices have been trending in opposite directions, the “Assumed rental inflation” will

be different from “Assumed annual appreciation” in the modified Khan spreadsheet. The

“Assumed rental inflation” will remain positive, while the “Assumed annual appreciation” will

fluctuate between positive and negative values, which represent appreciation and depreciation in

the housing market. Further detail of the modified Khan spreadsheet is given in the Methods

section.

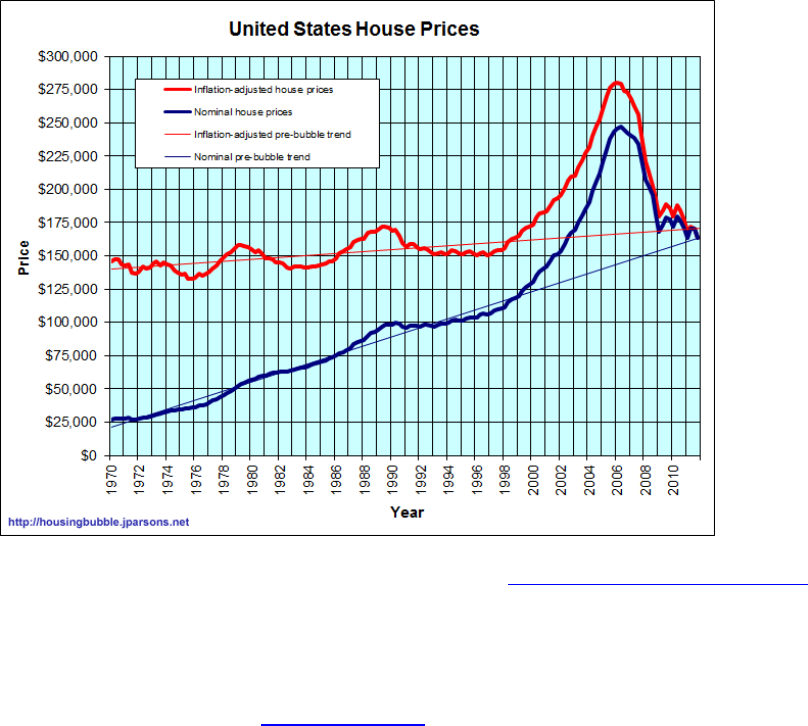

The crux of this study is the appreciation or depreciation of a home’s value. Figure 3.0

shows the trend of home prices in the United States. The positive trend lines indicate there is an

overall upward trend in home asking prices.

Figure 3.0 – Trend of United States house prices from 1970 to 2012 (http://jparsons.net/housingbubble/).

Methods

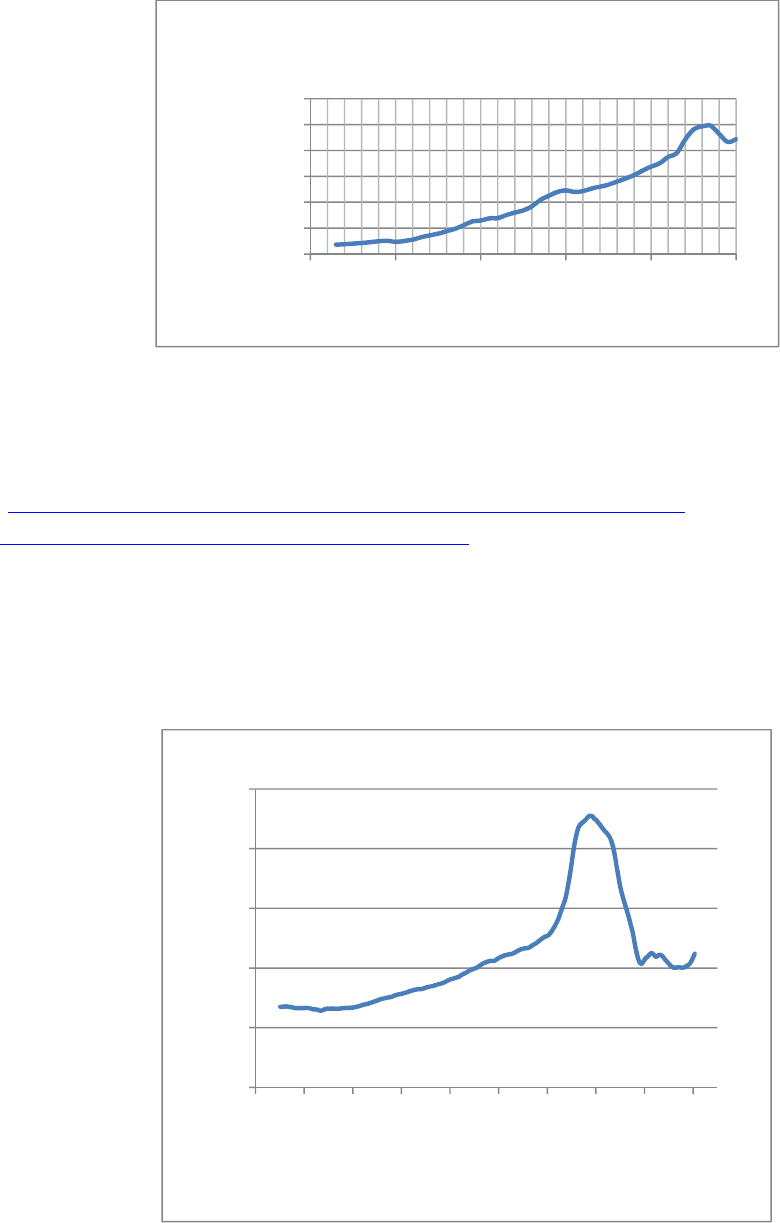

There were a few key data sources used throughout this study. The first key data source

was the United States Census Bureau (www.census.gov), which focuses on four regions—West,

Midwest, Northeast, and South. This analysis uses the US Census Bureau’s collected data on the

median price of new homes sold in the four regions. The median price was used to avoid

studying homes that were underpriced or overpriced. Figure 4.0 shows the median sale prices of

new homes from 1963 to 2010.

7

Figure 4.0 – The median sales price of new US homes in four regions (“Median and Average

Sales Prices of New Homes Sold in United States”).

Another website used was the S&P/Case-Shiller Home Price Index

(http://www.standardandpoors.com/indices/sp-case-shiller-home-price-

indices/en/us/?indexId=spusa-cashpidff--p-us----). The S&P/Case-Shiller Home Price Index

focused on twenty metro areas, which shrunk the housing market. Phoenix is one of the metro

areas, and Figure 5.0 shows the Home Price Index trend from 1989 to 2012. Higher Home Price

Indices suggest the affordability of homes. Homes are easier to purchase when the Home Price

Index is low and harder to purchase when the Home Price Index is high. From Figure 5.0,

homes are more affordable in the past few years, but were not as affordable during 2005 – 2007.

Figure 5.0 – The S&P/Case-Shiller Home Price Index from January 1989 to May 2012.

$0

$50,000

$100,000

$150,000

$200,000

$250,000

$300,000

1960 1970 1980 1990 2000 2010

Price($)

Year

MedianSalesPriceofNewUSHomesinfour

regions

0.00

50.00

100.00

150.00

200.00

250.00

8/11/1987

5/7/1990

1/31/1993

10/28/1995

7/24/1998

4/19/2001

1/14/2004

10/10/2006

7/6/2009

4/1/2012

HomePriceIndex

Date

PhoenixS&P/Case‐ShillerHomePriceIndex

8

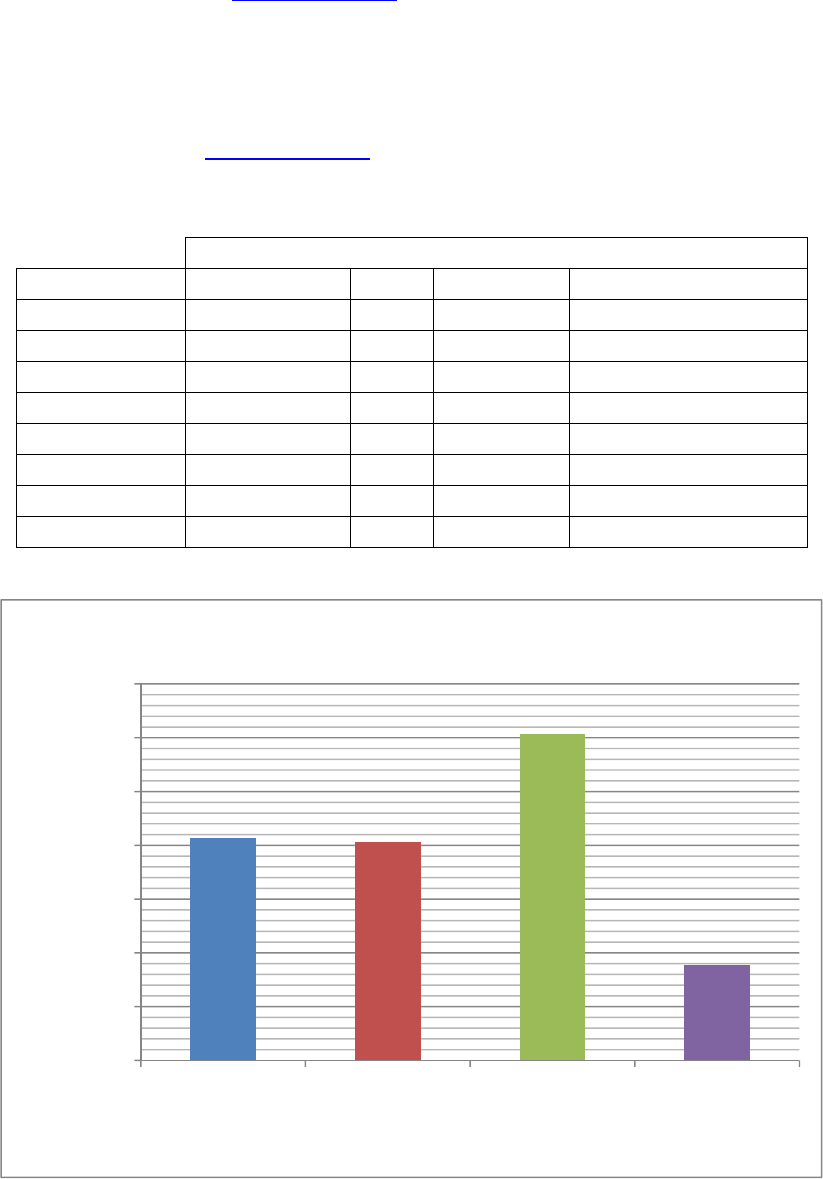

The final website was www.zillow.com, which allows anyone to look up the value of any

home in the United States. This website focused on individual homes in four different areas—

central Phoenix, Tempe, Scottsdale, and West Phoenix/Glendale. A range of home types

determined the search criteria in Zillow and information was gathered for three of each home

type. Table 2.0 shows the range of home types studied using Zillow. Figures 6.0 – 6.2 show the

information obtained from www.zillow.com in all four areas.

Table 2.0 – The home types and amount of homes studied in Zillow

Numberofhomesstudiedinarea

HomeType CentralPhoenix Tempe Scottsdale WestPhoenix/Glendale

2bed,1bath 3 3 0 3

2bed,2bath 0 0 2 0

2bed,2.5bath 0 0 1 0

3bed,2bath 3 3 3 3

4bed,2bath 0 2 0 1

4bed,2.5bath 3 1 0 2

4bed,3bath 0 0 2 0

4bed,3.5bath 0 0 1 0

Figure 6.0 – Average home value

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

CentralPhoenix Tempe Scottsdale West

Phoenix/Glendale

Value($)

Areastudied

Averagehomevalue

9

Figure 6.1 – Average area (ft

2

) of homes

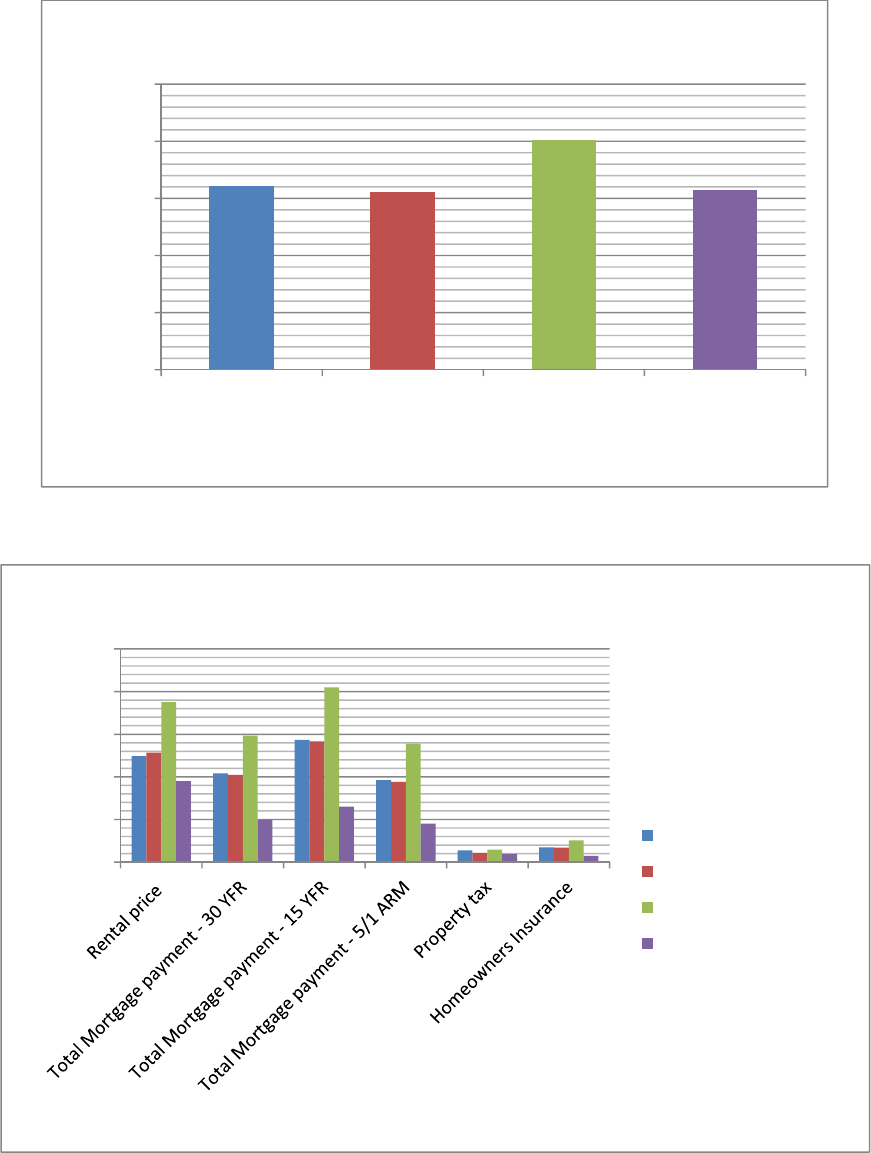

Figure 6.2– Average payments of homes

0

500

1,000

1,500

2,000

2,500

CentralPhoenix Tempe Scottsdale West

Phoenix/Glendale

Area(ft^2)

Areastudied

Averageareaofhomes

0

500

1,000

1,500

2,000

2,500

Payment($/month)

Paymenttype

Averagepaymentspermonth

CentralPhoenix

Tempe

Scottsdale

WestPhoenix/Glendale

10

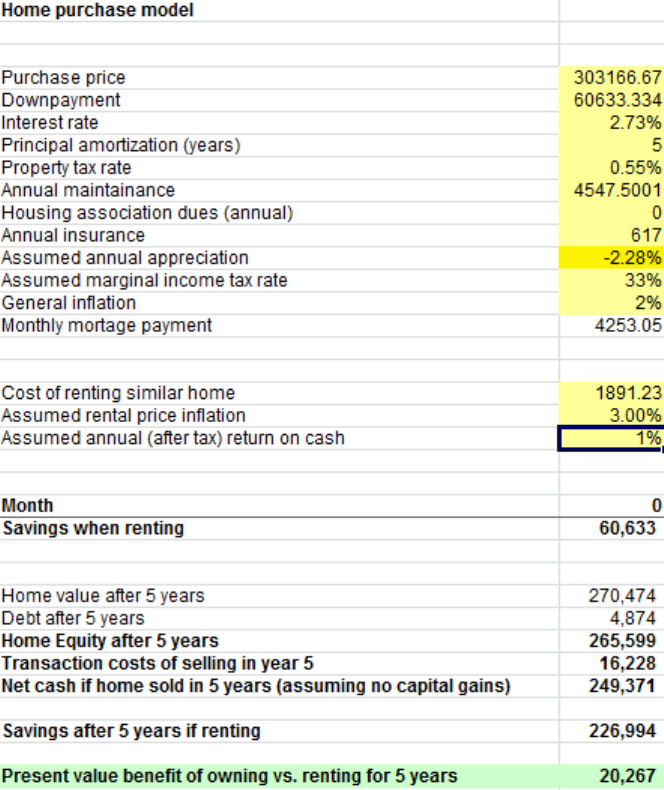

Salman Khan’s video series, “Renting vs. Buying a home,” includes an extremely useful

Excel spreadsheet that was used in this analysis. Figure 7.0 shows a screenshot of the modified

version of Khan’s “buyrent” spreadsheet with the calculated averages and assumptions taken

from Table A.CP – Central Phoenix homes, which is found in the Appendix section. The

highlighted values are the important ones in the spreadsheet, and these values were manipulated

to test different scenarios. In Figure 7.0, a 30 year fixed mortgage rate of 3.75% was used per

Table 1.0. The assumed property tax rate of 0.55%, annual homeowners and renters insurance,

annual maintenance costs of 1.5% of the home’s value, marginal income tax rate, annual cash

return due to money saved by renting, and negligible homeowners association fee were also

assumed from online research. In Khan’s video, he assumes a general inflation rate of 2%,

which is what Figure 7.0 shows.

The “Assumed annual appreciation” and “Assumed rental price inflation” are theoretical

values because it is impossible to predict whether homes will appreciate or depreciate. As

mentioned in the Assumptions section, these two values will be different based on Figure 2.0.

Negative values in those cells indicate depreciation, and positive values indicate appreciation.

Figure 7.0 shows negative values to indicate buying can still be better than renting even though

the home depreciates. The time horizon and mortgage rate are important factors that determine

when buying is no longer better than renting. Khan’s “buyrent” spreadsheet is available to

download at http://www.khanacademy.org/downloads/buyrent.xls, and individuals can follow

the same process outlined in Figure 7.0.

As was previously stated, there was a wide range of assumed housing and finance

variables that were used to complete the report. Assumptions that are in the form of numerical

values (i.e. interest rates, property taxes, inflation) are used to calculate important components

that help shape an answer to the rent versus buy question. Khan’s “buyrent” spreadsheet stores

and calculates these values so that they could be easily compared and analyzed. The following

analysis shows the equations and variables that were used to calculate a several components after

120 months for the $ 131,500 home located in central Phoenix, assuming a 30 year fixed

mortgage. The rest of the sample calculations can be found in the Appendix section.

11

Table 3.0 – Variable list for sample calculations.

Variable Description Units Assumed/Calculated/Given

P purchase price $ - US dollars given

P

down

down payment $ - US dollars calculated

P

maint.

annual maintenance payment $/year - US dollars per year assumed

P

insurance1

initial monthly insurance payment $/year - US dollars per year assumed

P

insurance2

current insurance payment,

adjusted for inflation $ - US dollars calculated

P

mort

g

a

g

e1

initial monthly mortgage payment $/month - US dollars per month assumed

P

mort

g

a

g

e2

current mortgage payment,

adjusted for inflation $ - US dollars calculated

P

p

ro

p

ert

y

monthly property tax payment $/month - US dollars per month calculated

r

down

required min. down payment rate % - percent assumed

r

p

ro

p

ert

y

property tax rate % - percent assumed

r

a

pp

./de

p

.

annual appreciation/depreciation

rate % - percent assumed

r

income

marginal income tax rate % - percent assumed

r

inflation

inflation rate % - percent assumed

r

rent

rate of rental price appreciation or

depreciation % - percent assumed

r

return

rate of return on cash (renting) % - percent assumed

V

home

value of home at time t $ - US dollars calculated

i interest rate % - percent assumed

t time years assumed

m

number of compunding

subperiods months given

Debt amount of debt in current month $ - US dollars calculated

D

p

revious

amount of debt in previous month $ - US dollars calculated

D

interest

portion of mortgage paid to

interest on debt $ - US dollars calculated

S

income

savings on income tax $ - US dollars calculated

C

inflow

renter cash inflow that can be

used on home expenses $ - US dollars calculated

P

rent1

initial amount of rent payment $/month - US dollars per month assumed

P

rent2

current rent payment adjusted for

appreciation or depreciation

$ - US dollars calculated

S

rent

savings when renting $ - US dollars calculated

PV present value $ - US dollars calculated

12

Down Payment

0.2131,500

$26,300

MonthlyMortgagePayment

1

1

1

131,50026,300

.

1

.

1

.

1

$487.20

HomeValue

1

.

131,500

1

0.0298

12

∗

$97,576

Debt

1

485

82,726

1

0.0375

12

485

$82,500

EquityinHome

97,57682,500

$15,076

InterestonDebt

82,726

0.0375

12

$258.52

PaidPrincipal

485258.52

$226.48

13

Figure 7.0 – Khan’s modified rent vs. buy Excel Spreadsheet

The lightly blue highlighted row on the bottom of Figure 7.0 indicates if buying or

renting a home is better. A positive value favors buying a home. A negative value is denoted in

Home purchase model

Data from Table 2.0 and References

Purchase price 206822.22 Home value ($)

Downpayment 41364.444 20% of Home value ($)

Interest rate 3.75% 30 Year Fixed Mortgage Rate

Principal amortization (years) 30 30 Year Fixed Mortgage Rate

Property tax rate 0.55% Assumed from "Maricopa County Average Property Tax"

Annual maintainance 3102.3333 Assumed from "Budgeting for Home Maintenance and Repair Costs"

Housing association dues (annual) 0 Assumed from "The Horrors of Homeowners' Associations"

Annual insurance 617 Assumed from "Arizona Homeowners Insurance Quotes"

Assumed annual appreciation -2.03% Theoretical value

Assumed marginal income tax rate 33% Assumed from "Federal Tax Brackets"

General inflation 2% Assumed from "Renting vs. Buying a home."

Monthly mortage payment 762.73 Assuming interest compounds monthly

Cost of renting similar home 1261.67 Rental price ($/month, including renters insurance)

Assumed rental price inflation -2.03% Theoretical value

Assumed annual (after tax) return on cash 1% Assumed from "Best Savings Accounts"

Month 012345

Buying scenario

Home Value 206,822 206,472 206,123 205,774 205,426 205,079

Debt 165,458 165,212 164,966 164,718 164,470 164,222

Equity in home 41,364 41,260 41,157 41,056 40,956 40,857

Interest on debt 517 516 516 515 514

Mortage payment 763 763 763 763 763

Paid principal 246 246 247 248 249

Insurance payment 51 52 52 52 52

Housing association dues - - - - -

Maintenance 259 259 259 260 260

Property tax 95 95 94 94 94

Income tax savings from interest deduction 202 202 201 201 201

Total cash outflow in buying scenario 966 966 967 968 968

Renting Scenario

Cashflow that could be spent on home-purchase/expesnes 966 966 967 968 968

Rent 1,262 1,259.54

1,257 1,255 1,253 1,251

Savings when renting 41,364 41,104.93 40,848 40,594 40,342 40,093

Home value after 10 years 168,795

Debt after 10 years 129,755

Home Equity after 10 years 39,040

Transaction costs of selling in year 10 10,128

Net cash if home sold in 10 years (assuming no capital gains) 28,912

Savings after 10 years if renting 28,813

Present value benefit of owning vs. renting for 10 years 82

14

parenthesis, and negative values favor renting a home. Another key assumption in Khan’s

“buyrent” spreadsheet is that the home is sold after a certain number of years. In Figure 7.0, the

home is sold after ten years of ownership.

DiscussionandAnalysis

From Figure 6.0, the home value will vary greatly depending on the area. Central

Phoenix and Tempe homes are comparable at $200,000.00, but Scottsdale homes are nearly

$100,000.00 more expensive and West Phoenix/Glendale homes are more than $100,000.00

cheaper than central Phoenix and Tempe homes. Similarly, renting central Phoenix and Tempe

homes are comparable at $1,200.00 per month, but Scottsdale homes are nearly $600.00 more

expensive per month and West Phoenix/Glendale homes are about $300.00 cheaper per month

than central Phoenix and Tempe homes.

After modifying Khan’s “buyrent” spreadsheet to fit the assumptions and averages

calculated throughout the report, buying a home in any of the four studied is better than renting a

home at a 30 year 3.75% fixed rate through fifteen years of ownership as long as there is little to

no appreciation. Even if there is some depreciation, buying a home in most of the areas is still

the cheaper option.

15

Figure 8.0 – Buy vs. rent in central Phoenix with 30 year fixed mortgage

Figure 8.0 shows the results of modifying Khan’s “buyrent” spreadsheet to show buying

a home in central Phoenix is better than renting after fifteen years of ownership, provided that

the home is sold at the end of the fifteenth year. Figure 8.0 also shows that the home

depreciations at a rate of 2.03%, but buying is still better than renting.

16

Figure 8.1 – Buy vs. rent in Scottsdale with 5/1 ARM

Figure 8.1 shows the results of modifying Khan’s “buyrent” spreadsheet to show buying

a home in Scottsdale at a 5/1 ARM is better than renting after five years of ownership, provided

that the home is sold at the end of the fifth year. The lightly blue highlighted cell indicates a net

present value of about +$20,267 when buying a home instead of renting. The home depreciates

at 2.28%, yet buying is still better.

17

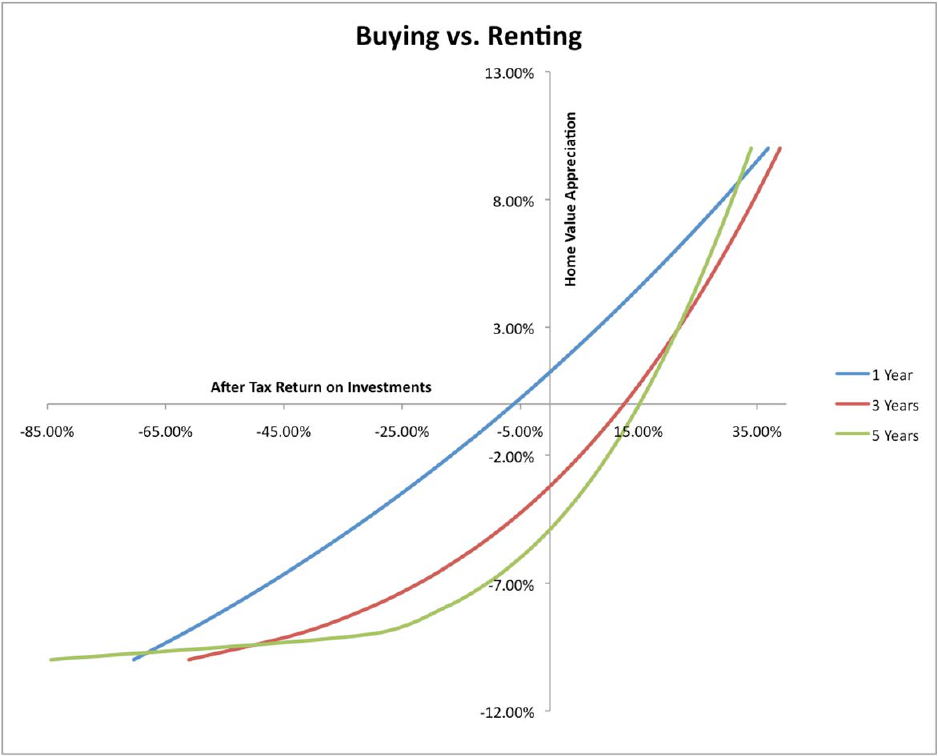

Figure 9.0 – Buy vs. rent decision chart

Figure 9.0 shows three lines representing prospective buying vs. renting years—one,

three, and five. If more prospective years, such as ten, fifteen, or thirty, were added then the

lines would continue to move right. The rates represented on the x and y axes are annual rates.

Any point above a line represents a buy scenario, and any point below represents a rent scenario.

Any point on the line is an even choice—either buy or rent and receive the same amount of

money when selling or moving out. For example, if an individual is considering buying a home

for five years, and the housing market is appreciating at 1%, then the individual should feel

confident in buying the home instead of renting because the point is above the five year line.

The large discrepancy between rental price and monthly mortgage payment accounts for the

good buying market.

18

Recommendation

Khan’s “buyrent” spreadsheet can be modified infinitely many times to fit infinite

situations, but ultimately individuals should feel confident about buying than renting a home,

provided the home is sold in after ownership and there is little to no appreciation. Figure 9.0

suggests buying is a much better option because if there is no after tax return on investments,

then owning a home that is depreciating at ~5% is more cost efficient than renting the same

home.

19

References

“3 ways to pay lower real-estate commissions.” MSN Real Estate, 2012. Web. 10 Aug. 2012.

<http://realestate.msn.com/article.aspx?cp-documentid=13108435>.

“Arizona Homeowners Insurance Quotes.” HomeInsurance.com, LLC., 2012. Web. 7 Aug. 2012.

<http://homeinsurance.com/Arizona/homeowners-insurance.php>.

“Arizona Renters Insurance.” InsureMyHouse.com, 2012. Web. 7 Aug. 2012.

<http://www.insuremyhouse.com/renters-insurance-arizona.html>.

“Best Savings Accounts.” MoneyRates.com, 2012. Web. 7 Aug. 2012. <http://www.money-

rates.com/savings.htm>.

“Budgeting for Home Maintenance and Repair Costs.” Intuit, Inc., 2012. Web. 6 Aug. 2012.

<http://www.mint.com/blog/goals/home-repair-02022011/>.

“Closing Costs.” Investopedia US, Inc., 2012. Web. 4 Aug. 2012.

<http://www.investopedia.com/terms/c/closingcosts.asp#axzz22jTBmOwo>.

“Closing costs comparison: Arizona.” Bankrate, Inc., 2012. Web. 4 Aug. 2012.

<http://www.bankrate.com/brm/news/mortgages/ccArizona.asp>.

“Definitions.” BBA Enterprises Ltd. and BBA LIBOR Ltd., 2012. Web. 7 Aug. 2012.

<http://www.bbalibor.com/bbalibor-explained/definitions>.

“Federal Tax Brackets.” Money Chimp, 2012. Web. 7 Aug. 2012.

<http://www.moneychimp.com/features/tax_brackets.htm>.

“Inflation-adjusted house prices.” JP’s Real Estate Charts, 2012. Web. 6 Aug. 2012.

<http://jparsons.net/housingbubble/>.

“Maricopa County Average Property Tax.” Tax-Rates.org, 2012. Web. 4 Aug 2012.

<http://www.tax-rates.org/arizona/maricopa_county_property_tax>.

“Renting vs. Buying a home.” Khan Academy, 2012. Web. 1 Aug. 2012.

<http://www.khanacademy.org/finance-economics/core-finance/v/renting-vs--buying-a-

home>.

“The Horror of Homeowners’ Associations.” Gawker Media, 2011. Web. 4 Aug. 2012.

<http://gawker.com/5830257/the-horror-of-homeowners-associations>.

“What’s in a Mortgage Payment?” Mortgage Bankers, Assn., 2012. Web. 7 Aug. 2012.

<http://www.homeloanlearningcenter.com/MortgageBasics/WhatsinaMortgagePayment.h

tm>.

20

Appendix

Table A.CP – Central Phoenix homes

Table A.T – Tempe homes

Hometype Area(ft

2

)Homevalue($)

Re nt al price

($/month)

Total

Mortga ge

pa yment

($/month)

30Year*

($/month)

15Ye ar*

($/month)

5/1ARM*

($/month)

Propertytax

($/month)

Homeowne rs

Insura nce

($/month)

2bed,1ba th 796 131500 949 703 466 715 415 128 110

2bed,1ba th 847 139900 954 741 496 761 442 128 117

2bed,1ba th 948 125000 874 614 443 680 395 67 104

3bed,2ba th 1440 170000 1222 887 603 925 537 142 142

3bed,2ba th 1458 142000 1167 743 504 773 449 121 118

3bed,2ba th 1815 2490 00 1169 1207 88 3 135 5 786 117 208

4bed,2.5bath 2274 385000 1983 1934 1365 2095 1216 248 321

4bed,2.5bath 2070 240000 1454 1199 85 1 1306 758 1 48 200

4bed,

2.5ba th 280 0 279000 1433 134 8 990 1519 883 126 233

Averages : 1605 206822 1245 1042 733 1125 653 136 172

TotalMortagePaym ent (30Year)=Loan+PropertyTaxes +HomeownersInsurance

Homeonwersins uarance1%ofvalue

*Bas edon20%down,excludestaxesandins

Hometype Area(ft

2

)Homevalue($)

Rentalpric e

($/month)

Total

Mortgage

pa yme nt

($/month)

30Yea r*

($/month)

15Year*

($/month)

5/1ARM*

($/month)

Propertytax

($/month)

Home owners

Ins ura nc e

($/month)

2bed,1bath 1,050 106,582 930 515 380 581 339 46 89

2bed,1bath 1,201 85,000 986 456 305 463 271 81 71

2bed,1bath 792 70,000 821 563 443 680 395 61 58

3bed,2bath 1,862 179,000 1,406 915 642 976 571 124 149

3bed,2bath 1,098 116,400 1,159 564 417 635 371 50 97

3bed,2bath 1,650 225,000 1,254 2,432 804 1,227 714 1,440 188

4bed,2bath 2,118 245,000 1,477 1,231 878 1,336 781 148 204

4bed,2bath 1,536 148,000 1,154 1,422 531 808 472 768 123

4bed,

2.5bath 2,659 649,900 2,373 3,141 2,322 3,544 2,061 278 542

Average s: 1,552 202,765 1,284 1,024 747 1,139 664 108 169

TotalMortagePayment(30Year)=Loan+PropertyTaxes +HomeownersInsurance

Home onwersins uarance1%ofvalue

*Bas edon20%down,excludestaxesand

21

Table A.S – Scottsdale homes

Table A.WP – West Phoenix/Glendale homes

Hometype Area (ft

2

)Homevalue($)

Rentalpric e

($/month)

Total

Mortgage

pa yment

($/month)

30Yea r*

($/month)

15Year*

($/month)

5/1ARM*

($/month)

Propertyta x

($/month)

Home owne rs

Insura nc e

($/month)

2bed,2bath 1,026 80,800 993 427 289 440 225 71 67

2bed,2ba th 1,335 154,900 1,351 794 554 844 849 111 129

2bed,2.5ba th 1,178 219,900 1,324 1,067 78 6 1,199 694 98 183

3bed,2bath 1,898 235,000 1,386 1 ,129 840 1,281 742 93 196

3bed,2bath 2,331 410,000 2,320 1 ,916 1,466 2,235 1,294 108 342

3bed,2bath 2,094 289,000 1,863 1 ,417 1,033 1,575 912 143 241

4bed,3bath 3,106 524,000 2,863 2 ,550 1,873 2,857 1,650 240 437

4bed,3.5ba th 2,242 364,900 1,991 1,774 1,304 1 ,989 1,149 166 304

4bed,

3bath 2,928 450,000 2,780 5 ,353 1,608 2 ,435 1,417 3,370 375

Averages : 2,015 303,167 1,875 1,482 1,084 1,651 992 146 253

Total MortagePaym ent(30Year)=Loan+PropertyTaxes+HomeownersInsurance

Homeonwersins uarance1%ofvalue

*Basedon20%down,excl udestaxesandins

Hometype Area(ft

2

)Homevalue($)

Rental price

($/month)

Total

Mortgage

pa yment

($/month)

30Yea r*

($/month)

15Year*

($/month)

5/1ARM*

($/month)

Prope rtytax

($/month)

Homeown ers

Ins uranc e

($/month)

2bed,1ba th 1,188 80,000 831 440 286 436 255 87 67

2bed,1ba th 520 40,000 759 246 143 218 127 70 33

2bed,1ba th 1,019 84,000 778 498 301 458 268 127 70

3bed,2ba th 1,710 124,900 988 658 447 680 399 107 104

3bed,2ba th 1,925 97,000 1,094 1,568 347 528 310 1,140 81

3bed,2ba th 1,882 144,900 1,071 754 518 789 462 115 121

4bed,2.5bath 2,099 70,000 1,026 391 250 381 223 83 58

4bed,2ba th 1,892 89,900 995 487 321 490 287 91 75

4bed,

2.5ba th 1,913 64,900 997 458 323 354 207 81 54

Average s: 1,572 88,400 949 495 326 482 282 95 74

TotalMortagePaym ent(30Year)=Loan+PropertyTaxes +HomeownersInsurance

Homeonwersins uarance1%ofvalue

*Basedon20%down,exc ludestaxesandins

22

InsurancePayment

1

617

12

1

0.02

12

$62.79

MaintenancePayment

1

1972.5

12

1

0.02

12

$200.73

PropertyTaxPayment

97,576

0.0055

12

$44.72

IncomeTaxSavings

0.28

44.72258.52

$84.91

TotalCashOutflow(Buying)

48562.79 200.7344.7284.91

708.33

23

RenterCashInflow

$708.33

Rent

1

965

1

0.0298

12

$716.06

SavingsWhenRenting

1

9,199

1

0.01

12

708.33716.06

$9,198

NetCashifHomeisSoldin10Years

15,0766,797

8,279

PresentValue

9,1988,279

$919