1

Common Sense Institute

www.commonsenseinstituteaz.org

Arizona Housing Affordability Update:

August 2022

As expected, the U.S. and Arizona housing markets are changing rapidly in response to quickly rising

interest rates. For the first time since 2011, Phoenix-area home prices fell in July, and despite continued

increases in target interest rates average mortgage rates fell between June and August in response to

flagging demand.

Key Findings

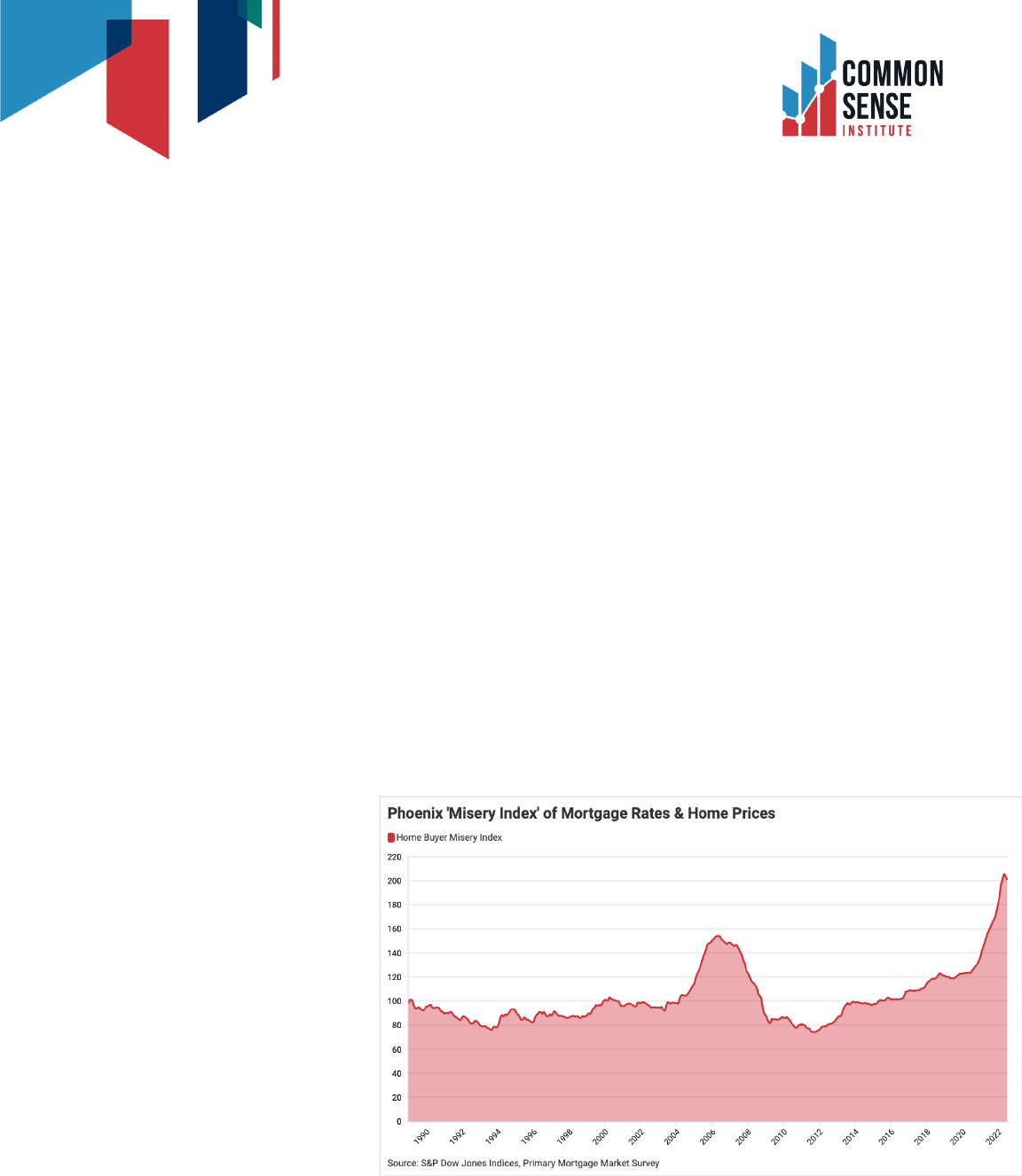

• The Phoenix Homebuyer Misery Index remains severely elevated, at 203.8 in July – nearly double

its long-run average level of 103.2.

• The Misery Index will likely fall to 200.7 in August, reflecting the ongoing cooling of the valleys

housing market. The last time the index fell for multiple consecutive periods was in early 2019.

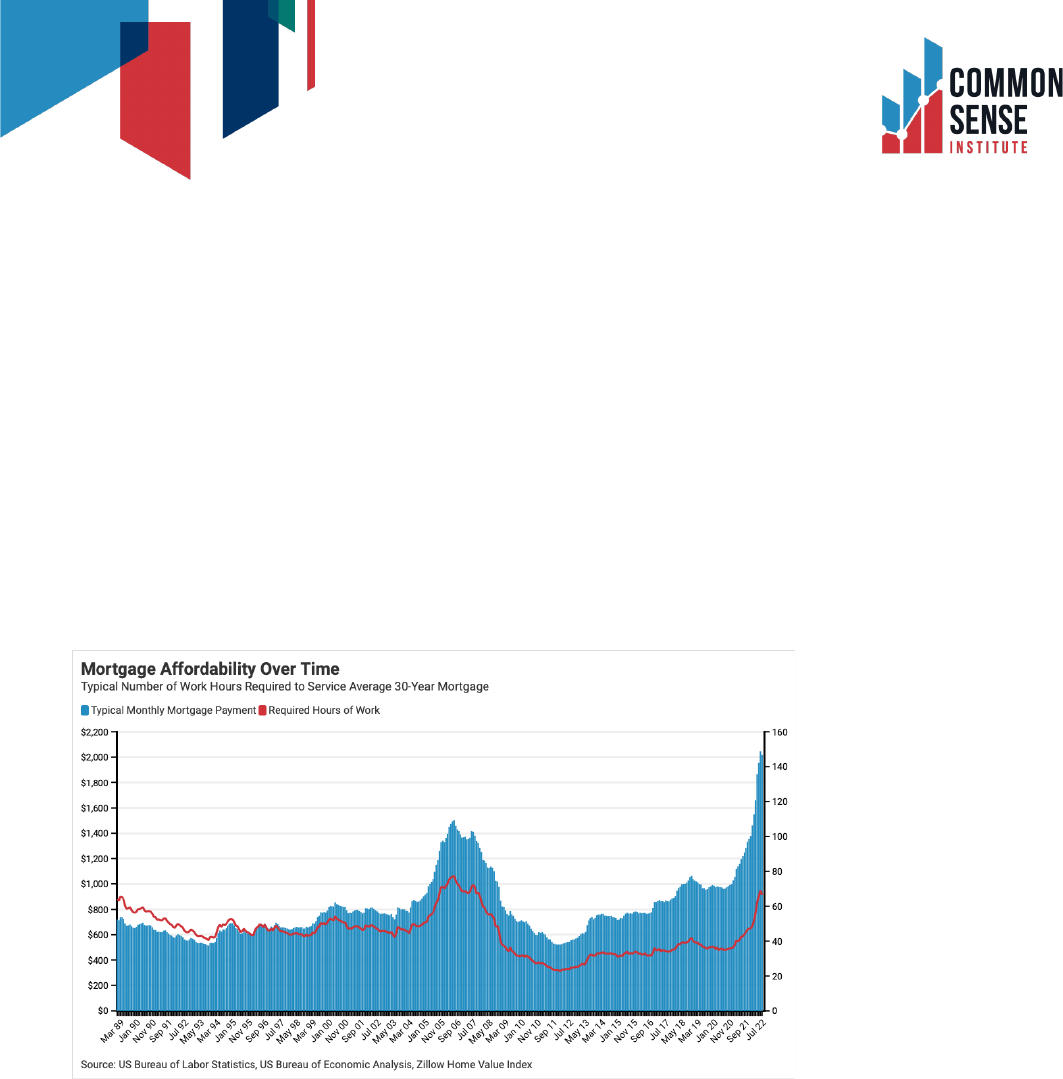

• At $2,016/month, the typical mortgage payment for an Arizona homebuyer remains extremely high

(though slightly below the all-time peak of $2,045 set in June). A typical household would have to

work 66.4 hours at the average hourly Arizona wage to make this payment.

• If mortgage rates rose to 7.0%, at current prices it would take over 77 hours of work to make a

monthly mortgage payment – tying 2006 for the highest level on record

Given the direction of interest rates and current economic conditions, Arizona’s housing market is likely to

continue cooling. Consider that the state’s nascent housing construction boom is slowing rapidly: monthly

permit applications slowed from nearly 7,000 in March to just over 5,000 in July

i

, suggesting forward-

looking home builders are growing less optimistic about real estate prospects in the next 12-18 months.

Phoenix Homebuyer Misery Index

After peaking at 205.1 in May –

an all-time high and reflecting

homebuying costs roughly

double their long-run average -

the Homebuyer Misery Index has

fallen (0.7%) to 203.8 in July. As

a reminder, the long-run average

index value is approximately

100.0. This is the first month-

over-month decline in the Index

since July 2020. The misery

index equally weights both

interest rates and nominal home

values since 1989; CSI has

considered various alternative

formulations that try to account

for the changing share of interest costs as a function of total housing purchase costs over time, but in

general, we believe a simple “equal weighting” formulation is reasonable and intuitive for consistent

2

Common Sense Institute

www.commonsenseinstituteaz.org

comparisons across time. This approach implies a homebuyer is equally sensitive to both changes in prices

and changes in interest rates.

After rising rapidly this year, 30-year average rates have stabilized in the low-5.0% range, even as the

Federal Reserve has continued increasing its interest rate targets. This suggests there is substantial

contemporary consumer and market resistance to rates significantly higher than 5.0%. As of August, the

average rate was 5.22%, down from a current-period peak of 5.52% in June. Prices in the Phoenix area

have begun to fall despite rate stabilization and will likely fall further in the coming months since the index

values tend to lag the market data. In July, prices fell (0.4%) according to Zillow

ii

– the first general

decline in month-over-month average valley home prices since August 2011. Based on preliminary market

data reviewed by CSI, we project that Phoenix prices will fall another (1.1%) in August, and that the

Index will decline (1.5%) to 200.7.

At current rates, interest costs are approximately half of total home purchase costs over a 30-year loan.

This means a homebuyer spending $450,000 on a home can expect to pay approximately $450,000 in

interest over 30 years.

Arizona Mortgage Affordability

After peaking at $2,045 in June,

the typical monthly mortgage

payment in Arizona fell (1.4%) in

July to $2,016. At the states

prevailing hourly wage one

would have to work 66.4 hours

to make this mortgage payment

– down from a current-period

peak of 68.6 hours in June. As a

reminder, since 1989 the hours

of work required to make a

typical mortgage payment in

Arizona averaged about 45.0 and

this measure reached an all-time

peak of 77.2 hours in July 2006.

A typical Arizona household likely works between 200 and 240 hours per month.

Assuming 1.5 (full-time) workers per homebuying household and lender parameters generally consistent

with the “28% Rule” (no more than 28% of gross monthly income should go to mortgage costs), a

reasonable rule of thumb is that mortgage service costs in terms of time cannot sustain above about 67

hours per month for an average-priced home and an average-rate loan. During the prior housing market

peak, costs remained above this level for exactly 24 months (between October 2005 and October 2007),

before falling precipitously through 2010. Since 1989 there is no other period during which mortgage costs

remained persistently above this threshold level.

If – as some analyst’s project

iii

– 30-year mortgage rates rise to 7.0% over the next 12 months, and

prevailing hourly wages rise only 2%, then home prices in Arizona would need to fall at least 13% to meet

the 67-hour target threshold. This should not be read as a formal forecast as markets may respond

3

Common Sense Institute

www.commonsenseinstituteaz.org

creatively to borrowing constraints. Interest rates could rise less than projected; households could

increase their hours worked in response to higher prices; sellers may hesitate to list homes in a declining-

price environment, constraining supply and keeping prices elevated while locking all but the most-qualified

buyers out of the market; etc. Instead, we present this as a hypothetical case study of the possible

implications of continued rapidly rising interest rates on the Arizona housing market.

CSI will continue monitoring local homebuying conditions over the coming months in order to provide

timely insights into the states’ (and particularly the Phoenix-area’s) rapidly changing market.

© 2022 Common Sense Institute

i

“Building Permits Survey”. U.S. Census Bureau. Retrieved on August 29, 2022.

ii

“Zillow Home Value Index”. Zillow. Retrieved on August 29, 2022.

iii

Stern, Gina. “Mortgage Rate Predictions for 2023”. PropertyOnion. July 18, 200.