1

ARIZONA

2019 Housing At-a-glance

2

e Arizona Department of Housing is pleased to provide

its 2019 Housing At-a-glance Report, with information

highlighting Arizona’s current housing market and its

aordability. is short document provides a summary view

of the market, with additional housing data, and information

specic to certain local communities in the state, available to

download from the Department’s website at azhousing.gov.

Housing is a market-driven industry, as it should be, and

as with other products and services, housing costs increase

and decrease based on supply and demand. Since the end

of the Great Recession, Arizona has, once again, taken o

in its growth as one of the country’s most desired relocation

destinations. As a result of this rapid growth and other

economic factors, the cost of housing – for both ownership

Arizona’s economy posted solid gains in 2018 and grew at a rate not seen since the Great Recession. e State’s gross domestic

product (GDP) increased by 4 percent in 2018 – outpacing the nation and making it one of the fastest growing states. Arizona was

ranked a top state for growth in population, employment, and personal income in 2018, and will continue to rank among the top

ve states in 2019. Between 2017 and 2018, Arizona’s population grew by more than 122,000 . . . and to put that in perspective,

a number that is greater than the populations of seven of Arizona’s 15 counties, nearly equaling the number of people living in

Cochise or Coconino Counties. Most of those who moved to Arizona during that period relocated to Maricopa County. Rapid

growth has put pressures on the housing supply, causing increases in housing costs and challenges for low-income residents in

locating available units that are modestly priced.

Arizona’s median household income grew by 21.5 percent over the last ve years, well above the U.S. average of 12.5 percent, and just

in the rst quarter of 2019, personal incomes in Arizona grew 5.5 percent over the nal quarter of 2018, again ahead of the national

average. From 2016-2017, more than 88,000 people lied themselves out of poverty in Arizona, an 8 percent decrease compared to

3.8 percent nationwide during that same time period. is is an optimistic sign that housing aordability concerns may trend in a

positive direction as household incomes are increasing.

e changes in generational needs and wants in housing has had an eect on the housing market and will continue to evolve as baby

boomers age and upcoming generations make housing decisions. e millenial generation’s preferences have resulted in changes

in how housing has been demanded and delivered in the last decade. Now with millenials and subsequent generations beginning

to think about homeownership opportunities, there will be additional demands for housing units for purchase. Nevertheless, it is

believed that the demand for rental units will continue to be higher than previous trends. e aordability of rental units is now

as important as with homes for purchase. A growing senior population, as the baby boomer generation retires, many with limited

retirement savings, will also strongly impact Arizona’s need for aordable, non-luxury rental products, as well as smaller single-

family homes.

Housing construction in the state remains a smaller share of the economy than it was before the Great Recession. In some ways it

is a good thing that the construction sector is not experiencing irrational exuberance, but with continued population growth, the

supply-driven aordable housing issues could continue to pose challenges for the State. Labor shortages and higher material costs

have resulted in increased production costs and slower delivery.

and rental opportunities – has been aected by growing

demand. While the majority of Arizona’s households are

happily housed, we know that despite a robust economy,

some residents of our state have found it increasingly dicult

to stretch their limited incomes to cover the rising cost of

housing and other necessary living expenses. For a number of

Arizona’s households, housing is their greatest single expense

each month. For those living on low, xed incomes, today’s

cost of housing may be as much or more than their entire

monthly income.

Few things are more important to the quality of our lives than

the place we make our homes, which emphasizes why the

availability, quality and sustainability of our housing stock is

so very important to the growth of the State and the well-

being of its citizens.

If you are reading this report, we know you share our concern

about Arizona’s ever-evolving housing landscape and hope

you nd this information helpful in understanding Arizona’s

current housing market and its challenges.

2019 Housing Market . . . Economic Considerations

3

Rental Housing

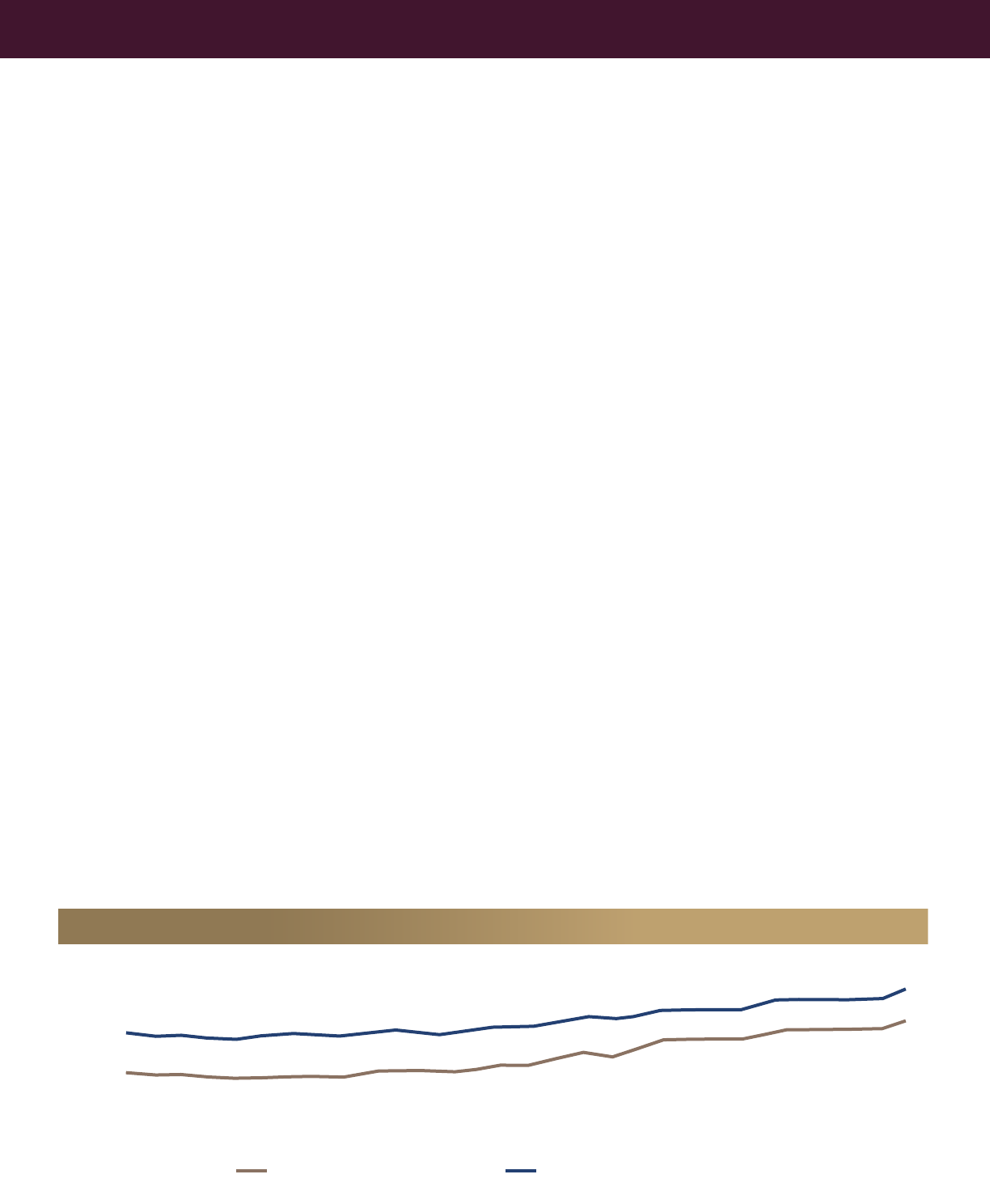

With rst-time homeownership opportunities becoming harder to achieve and state in-migration rates increasing, the demand for

rental units has expanded causing an increase in rents. Between 2017 and 2018, the median rent for multi-family housing rose 3.7

percent to $1,232 in Arizona. Similarly, the rental price of single-family homes in Arizona increased 4.1 percent over the same time

period to $1,398. ese higher prices are out of reach for many lower- and moderate-income households leaving them with fewer

options in a very tight market.

Housing aordability challenges, particularly for lower- and moderate-income households, is something that cannot be overlooked.

Cost-burdened households may struggle to aord other necessities such as food, clothing, transportation, and medical expenses, as

too much of their income is being used to pay for housing. Many rent-burdened households are one paycheck away from eviction.

According to the National Low Income Housing Coalition, Arizona has a shortgage of 153,331 aordable rentals available to

extremely low-income households.

Housing in Arizona

Over the past decade, a lag in the number of new single-family homes being built over prior boom periods, and a concerted eort

by investors to purchase existing single-family homes for rental purposes, has impacted the single-family entry level inventory in the

urban areas of the state. Luckily, over the past year or so, home builders in Arizona have realized that there is a strong demand for

housing in every category, including a pent up demand for entry-level housing. As a result, more eorts are being made by builders

to provide more entry-level product in their building eorts. It will; however, take some time before inventory can catch up with

demand. e increase in population, especially in the Phoenix-Metro area, will continue to impact the cost of housing as demand

still outstrips supply.

A signicant portion of the rental housing currently being built in Arizona’s urban areas has skewed to the luxury market, with some

formerly aordable properties lost during redevelopment. In fact, so many high-end rental units are currently under construction

in certain areas of the state, that the result of these units all becoming available at once could end up resulting in rent de-escalations

and stabilization and possible move-in concessions to attract renters. e actual eect of large numbers of these units leasing up

over the next few years remains to be seen. In the meantime, increased demand for rental housing has had the overall impact of

increasing the cost of rents statewide.

Market disrupters, where both single and multi-family housing is being utilized for short term vacation uses through convenient

internet reservation methods, have also had an impact on Arizona’s housing inventory. Today thousands of units which were once

available for permanent housing, are now only available for short-term rental uses around the state. is phenomena has taken

thousands of housing units o the market for permanent residents in urban areas, as well as an impactful number of units in a few

rural markets, especially those that cater to the tourism industry.

Changes in how homes may be bought and sold is also impacting Arizona’s housing market, as homeowners wishing to move

quickly may now sell their homes via the internet, virtually consummating a sale within days. Such homes are then marketed for

purchase via the internet. A number of companies working in this space have set up shop in Arizona, which is considered an ideal

proving ground for this type of venture.

$1,500

______________________________________________________________________________________________________________________________

$1,400

______________________________________________________________________________________________________________________________

$1,300

______________________________________________________________________________________________________________________________

$1,200

______________________________________________________________________________________________________________________________

$1,100

______________________________________________________________________________________________________________________________

$1,000

______________________________________________________________________________________________________________________________

$900

______________________________________________________________________________________________________________________________

$800

______________________________________________________________________________________________________________________________

Jan-11

Jul-11

Jan-12

Jul-12

Jan-13

Jul-13

Jan-14

Jul-14

Jan-15

Jul-15

Jan-16

Jul-16

Jan-17

Jul-17

Jan-18

Jul-18

Arizona Median Rental Rates

Multi-Family Rental Rate Single Family Rental Rate

Source: Zillow Research

4

New Home Construction and Homeownership

New home construction permits are on a steady, upwards trend. In 2018, 31,500 permits for single-family homes were approved.

is is a 14.6 percent increase from a year ago. Home builders remain constrained by rising material and labor costs, as well as a

shortage of available labor. e combination of strong population and employment growth should result in a continued near-term

upward trend in housing construction. Homebuilders in Arizona have realized that there is a strong demand for housing in every

category, including a pent up demand for entry-level housing, and as a result, over the past year, additional eorts were made by

builders to provide more entry-level products in their building eorts.

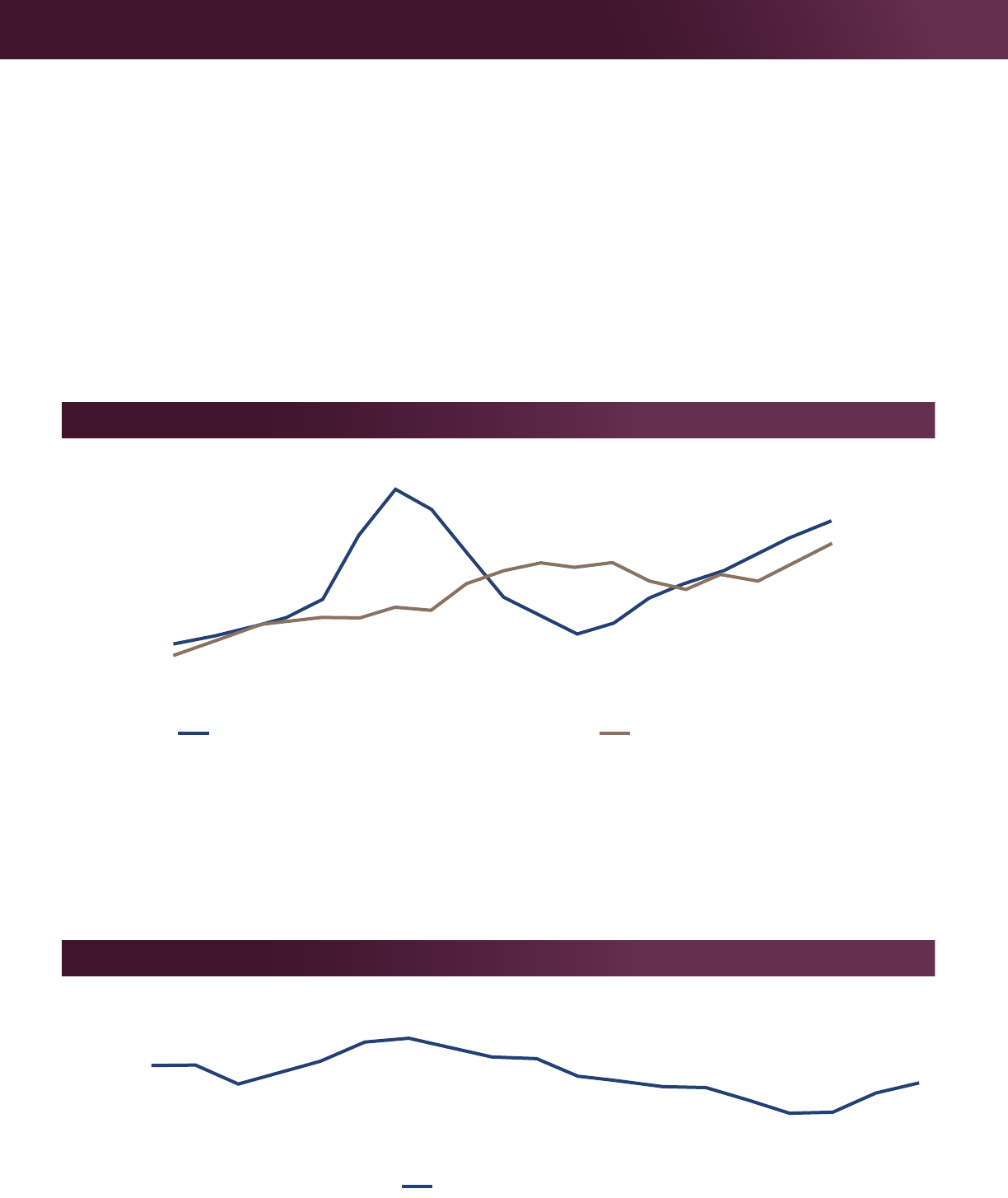

Median home values have continued to increase over the past year, but so have household incomes which have helped to bring

median family income closer in line with median housing costs. is analysis also indicates that there are many households who

must nd homes that are below the median value to make homeownership a viable option for them. Fortunately, mortgage rates

have remained low and have even decreased during 2019, which certainly helps with mortgage aordability in a market with

rising home prices.

$280,000

______________________________________________________________________________________________________

$75,000

$250,000

______________________________________________________________________________________________________

$70,000

$220,000

______________________________________________________________________________________________________

$65,000

$190,000

______________________________________________________________________________________________________

$60,000

$160,000

______________________________________________________________________________________________________

$55,000

$130,000

______________________________________________________________________________________________________

$50,000

$100,000

______________________________________________________________________________________________________

$45,000

Arizona Average Home Price vs. Arizona Family Median Income

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Arizona Average Home Price (Conventional Loans) Arizona Median Family Income

Home Price

Income

Source: U.S. Department of Housing and Urban Development; Zillow Research

ere are a variety of factors inuencing whether a household chooses to own or rent, so there is no ideal homeownership

rate. Between 2017 and 2018, Arizona’s current homeownership rate rose by 2 percent. At 65.7 percent, Arizona’s current

homeownership rate exceeds the national average of 64.4 percent. e homeownership rate in Arizona hit a peak in 2006 of

71.6 percent, at the height of the housing boom-and-bust cycle, when it fell to 61.7 percent in 2016. A continued increase in the

homeownership rate is also a good sign for the rental market, as it portends an increase in available rental units.

75.0%

______________________________________________________________________________________________________________________________

72.0%

_______________________________________________________________________________________________________________________________

69.0%

_______________________________________________________________________________________________________________________________

66.0%

_______________________________________________________________________________________________________________________________

63.0%

_______________________________________________________________________________________________________________________________

60.0%

_______________________________________________________________________________________________________________________________

Arizona Homeownership Rate

2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018

Homeownership Rate

Source: U.S. Census Bureau

5

Foreclosures

Foreclosures in Arizona have fallen to pre-recession levels, with foreclosure starts dropping in most major areas of Arizona, with

the exception of Pinal County, which is seeing a slight uptick. While foreclosures are considered signicant stressors for any

household experiencing foreclosure, today’s foreclosure levels are not considered to be at crises levels. Because housing prices have

increased over the past few years, homeowners with equity who cannot meet their current mortgages have more options available

to them than a few short years ago when the mortgage foreclosure crises resulted in serious negative equity issues for many

homeowners. For the largest part, Arizona’s housing market has gone from being one of the hardest hit by foreclosures, to having

one of the best recoveries with a low foreclosure rate.

Evictions

Evictions continue to be a signicant issue for households who have experienced a loss of income, or for other reasons have not

been able to meet all of their nancial needs, to include falling behind on their rents. Evictions for reasons other than nonpayment

are a small portion of evictions in Arizona. In 2018, Maricopa County’s court system issued 43,409 nancial judgements and

in Pima County, 12,409. Complete information on Arizona’s remaining rural counties was not available at the time of this

publication. Since the eviction process starts with the issuance of an Eviction Notice to a tenant, there are likely higher numbers

of households who have moved upon such notice, not waiting for the matter to go to court. Many households are not able to re-

house themselves aer an eviction without nancial assistance from family, friends, charity or public assistance, and can result in

homelessness since some landlords are reluctant to rent to households who have previously experienced an eviction.

Homelessness

Determining how many Arizonans experience homelessness is a complex issue. Many individuals and households who have lost

their housing are never reported as homeless, because they temporarily live with family or friends or otherwise nd short-term

accomodations.

To assess how many people are experiencing homelessness at any given day of the year, advocates rely on an annual Point in

Time (PIT) Count conducted by the State’s three Continuum of Care regions. Between 2018 and 2019, Arizona’s PIT homeless

population increased by approximately 142 individuals, an increase of 1.4 percent, from 9,865 in 2018 to 10,007 in 2019. e

increase in the state’s overall PIT count is attributed to a slight rise in Maricopa County’s unsheltered homeless numbers which

increased by 570 (5.8 percent), while Maricopa County’s sheltered homeless gures decreased. Homeless counts in Pima County

and rural Arizona also decreased. Based on information from the State’s Homeless Management Information System (HMIS),

we also know that Arizona’s homeless service providers interacted 32,234 times with people seeking assistance during federal

FY2018, which is 5,170 less interactions than occurred in 2017.

An in-depth review of homelessness in Arizona shows that the state’s homeless count has decreased by 32 percent in the past

decade, indicating that while unsheltered homelessness has increased in Maricopa County in the past few years, the overall

homeless situation in Arizona can be viewed as improving over the long term.

15,000

________________________________________________________________________________________________________________

10,000

________________________________________________________________________________________________________________

5,000

________________________________________________________________________________________________________________

Arizona Homeless Count

2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019

6

APPENDICES

Arizona Housing Price Increase or Decrease Ranking 7

Arizona Housing Permits 8

Median Home Price by Area - 2018 9

Housing Affordability in 2017 10

Employment Growth & Housing Affordability by Industry - 2018 11

Arizona Population and Employment 2000 - 2018 12

Arizona Mortgage Rates 1978 - 2018 13

Arizona Mortgage Rates: 30-Year Fixed, 15-Year Fixed, 5/1 Adjustable 14

Arizona Homeless Point-in-Time Counts 15

7

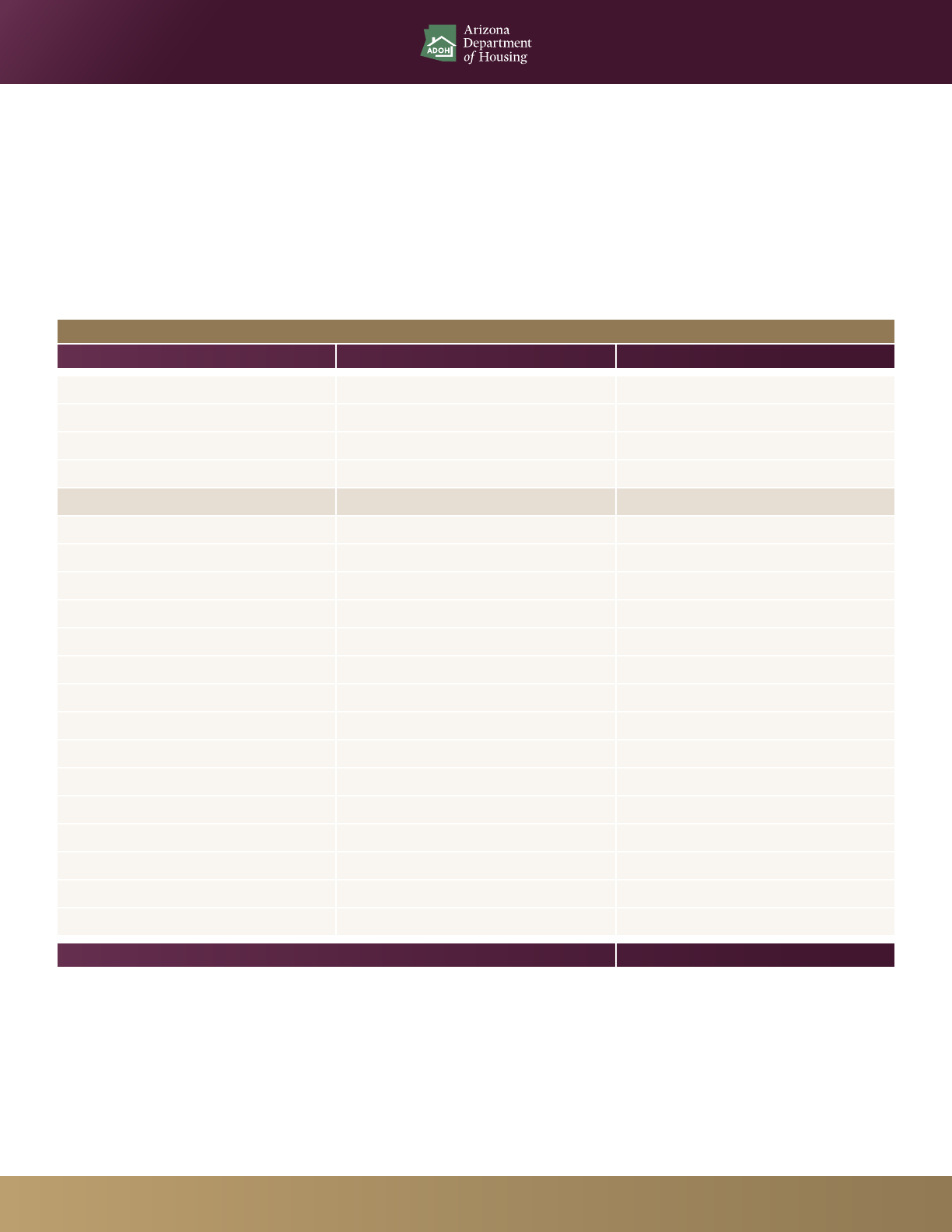

Arizona Housing Price Increase or Decrease Ranking

Based on the Housing Price Index (HPI) issued by the Federal Housing Finance Agency (FHFA), housing price appreciation

in Arizona was ranked number h nationally for the fourth quarter of 2018, where it has remained steadily over the past few

years. During the Great Recession, Arizona’s housing appreciation rate was ranked amongst the worst in the nation, so this

sustained improvement is a clear indication of the strength of Arizona’s recovery since the nancial crises.

Source: U.S. Federal Housing Finance Agency, Housing Price Index

Seasonally Adjusted, Purchase-Only HPI, 2018Q4, comes from the HPI Report

Q4 2018

State Rank Year-Over-Year %

Idaho 1 11.93

Nevada 2 11.20

Utah 3 9.80

Georgia 4 8.25

Arizona 5 8.17

Washington 6 7.94

Wisconsin 7 7.64

Montana 8 7.39

Michigan 9 7.35

Missouri 10 7.26

Mississippi 11 7.12

Tennessee 12 6.86

Kansas 13 6.86

Florida 14 6.79

New Hampshire 15 6.78

Colorado 16 6.74

North Carolina 17 6.73

South Carolina 18 6.71

Maine 19 6.62

Minnesota 20 6.50

U.S. Average 5.73

8

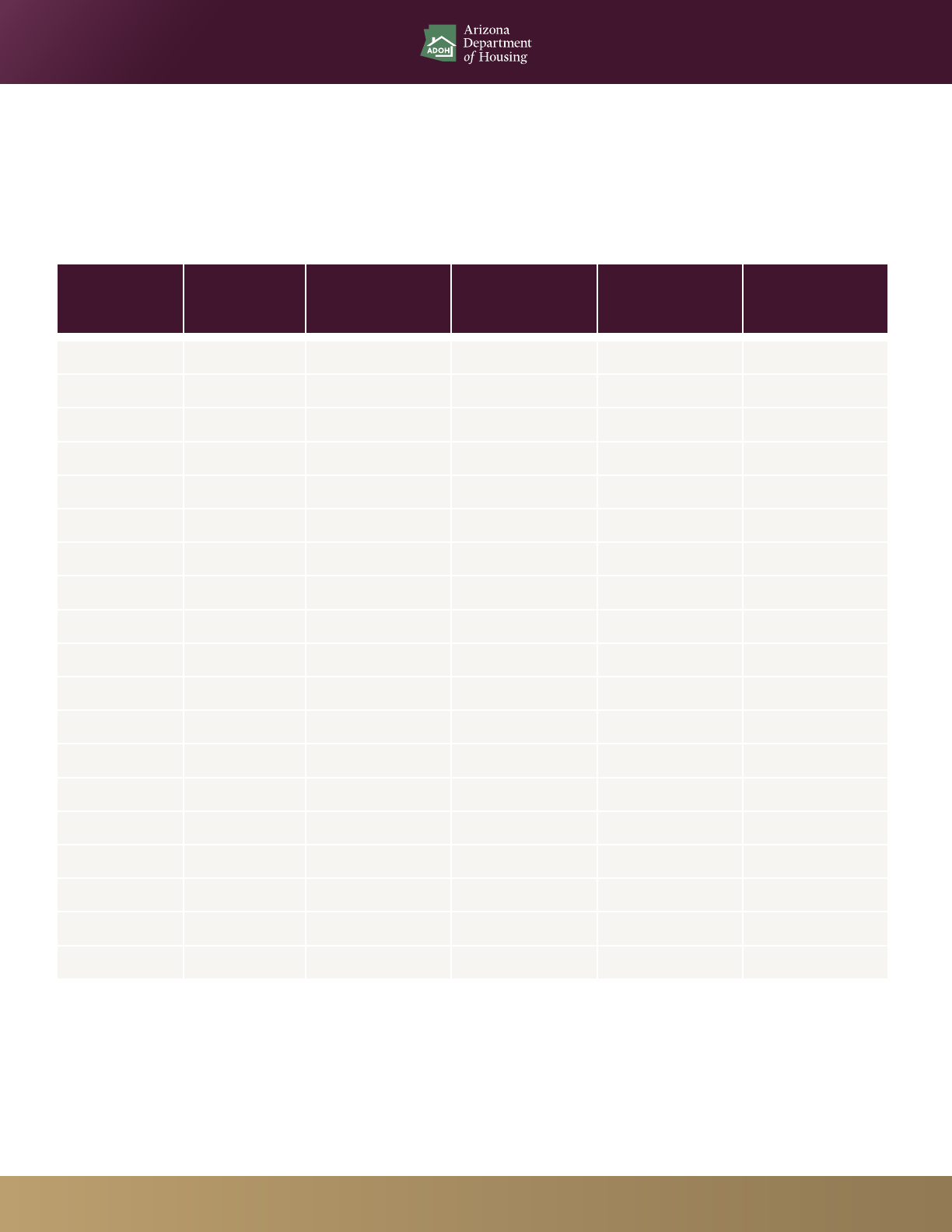

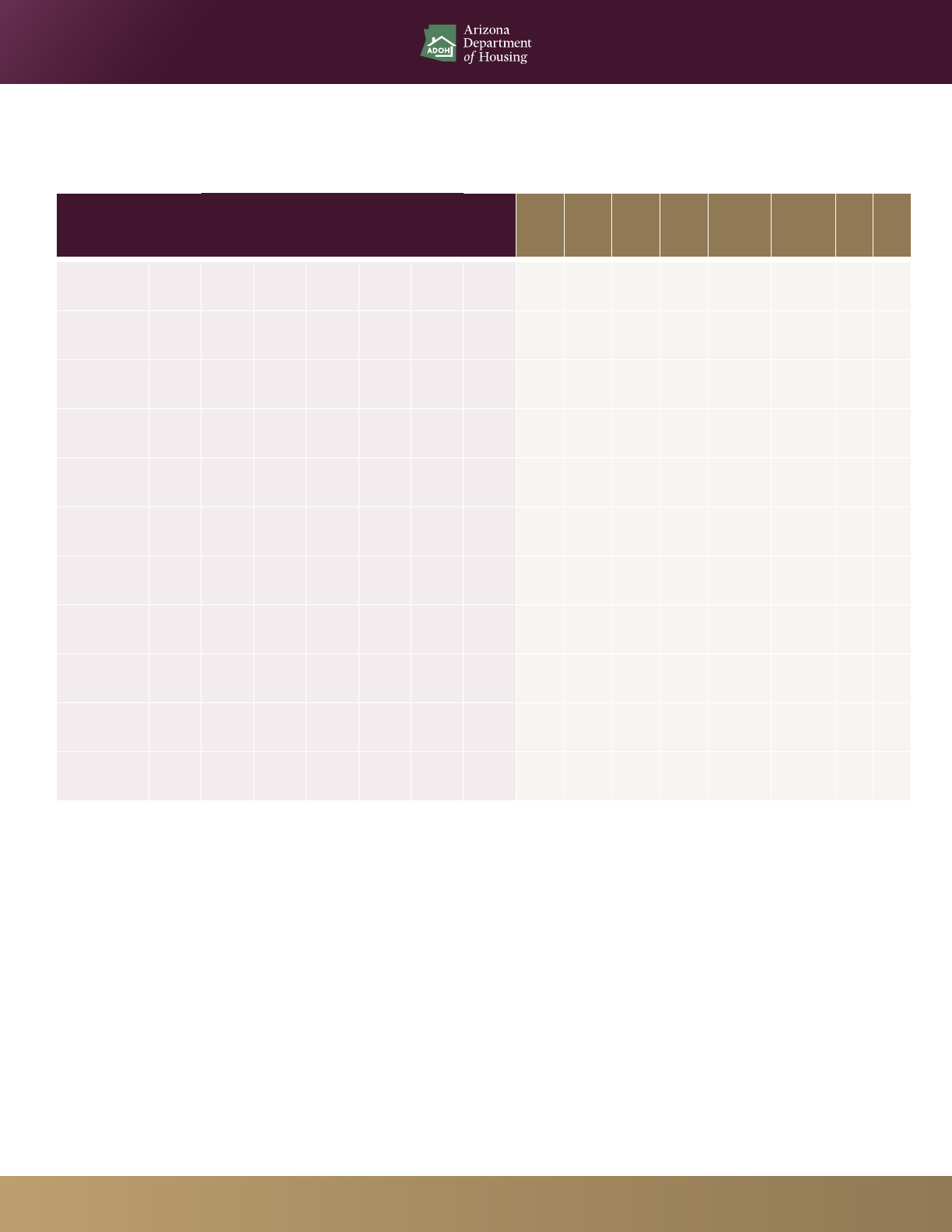

Annual Total Permits

1-Unit

Structure

2-Unit

Structures

3 and 4-Unit

Structures

5-Units or More

Structures

2000 59,765 47,415 350 833 11,167

2001 57,644 47,719 442 1,115 8,368

2002 63,897 54,894 598 537 7,868

2003 71,633 63,388 654 766 6,825

2004 85,613 76,651 778 1,422 6,762

2005 89,577 78,006 596 1,097 9,878

2006 64,746 54,882 566 1,674 7,624

2007 47,965 36,796 438 1,284 9,447

2008 24,790 17,687 212 543 6,348

2009 14,271 12,835 36 76 1,324

2010 12,641 10,972 66 93 1,510

2011 13,386 10,637 42 187 2,520

2012 21,519 16,023 234 224 5,038

2013 23,622 18,130 218 180 5,094

2014 27,863 17,555 238 93 9,977

2015 31,718 22,594 222 149 8,753

2016 35,620 24,244 398 190 10,788

2017 37,482 27,466 358 237 9,421

2018 41,469 31,464 568 242 9,195

Arizona Housing Permits

Aer the sharp drop o of permits in 2008 at the beginning of the Great Recession, housing construction continues its

steady rebound.

9

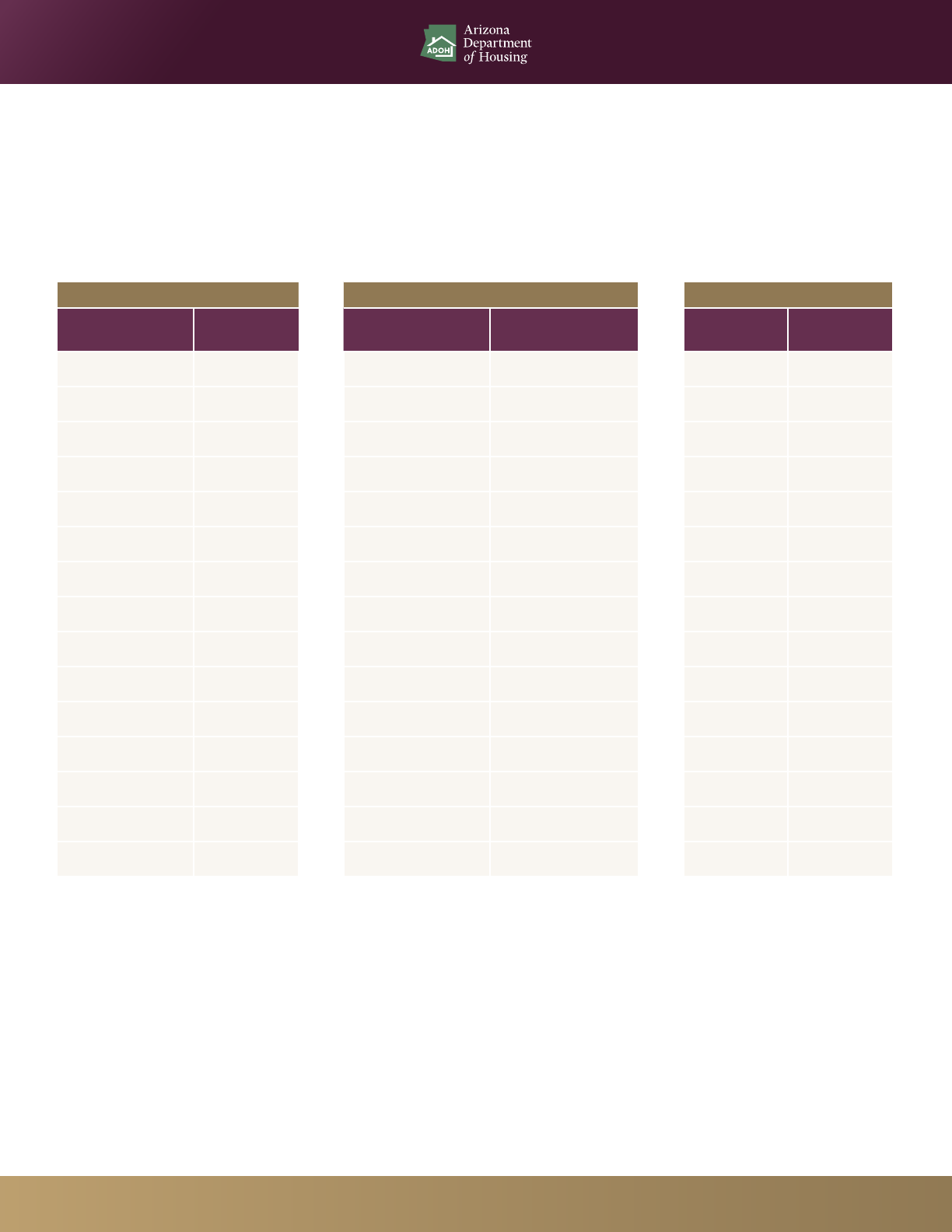

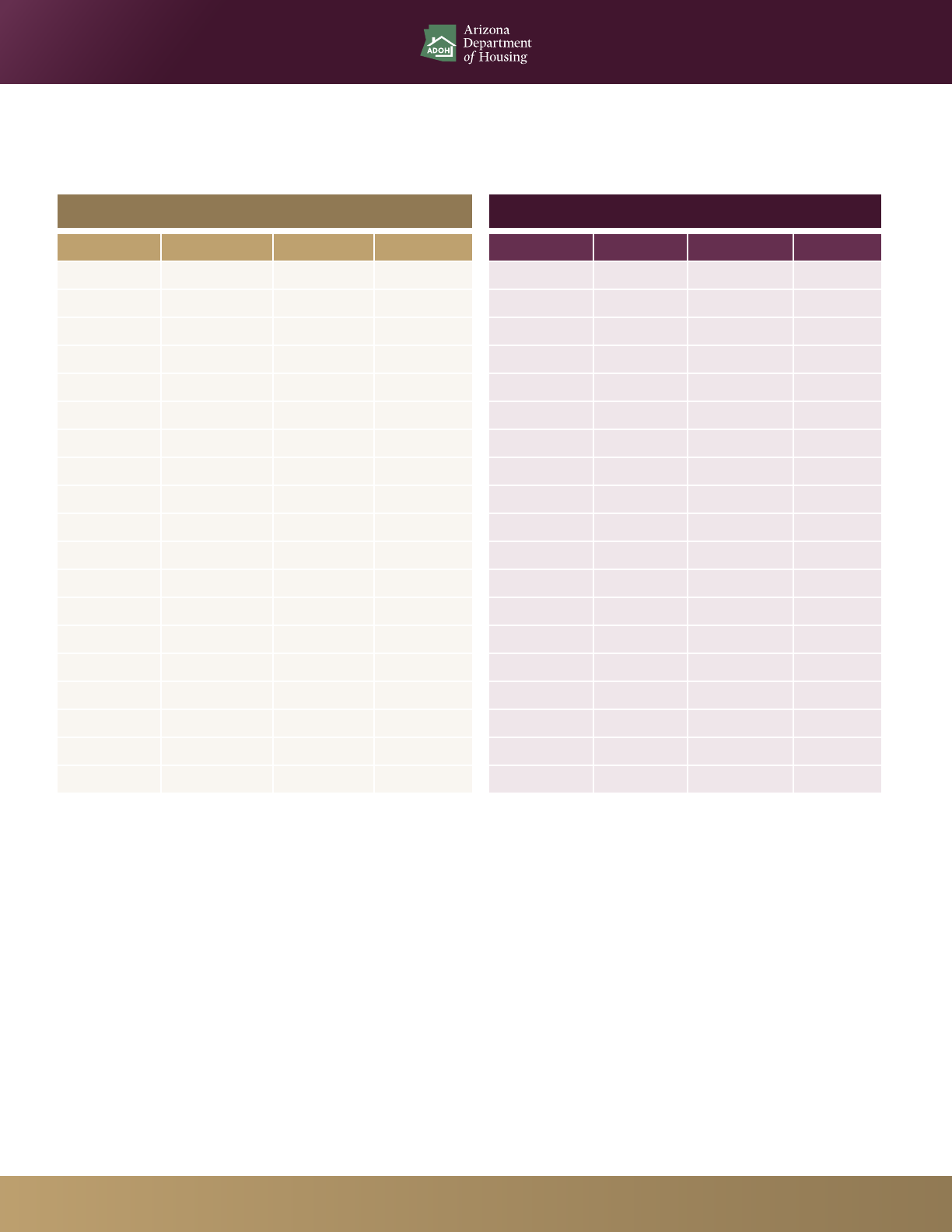

Median Home Price by Area - 2018

2018 median home sales prices in Arizona ranged from a low of $33K in Mammoth, to over $1.3 million in Paradise Valley.

Small rural communities were the most aordable, and as expected, the largest communities in the metro areas had some of

the highest priced homes.

Major Cities in Arizona High-Price Housing Areas Low-Price Housing Areas

City

Median Sales

Price (Trulia)

City

Median Sales Price

(Trulia)

City

Median Sales

Price (Trulia)

Scottsdale $445,000 Paradise Valley $1,387,500 Winslow $130,000

Flagsta $385,000 Carefree $568,230 Bullhead City $124,000

Prescott $343,100 Rio Verde $419,000 Wellton $146,500

Gilbert $325,000 Sedona $426,000 Benson $95,000

Chandler $295,500 Cave Creek $430,000 Douglas $63,250

Peoria $287,500 Scottsdale $445,000 Winkelman $86,000

Tempe $272,590 Fountain Hills $384,750 St. Johns $95,000

Mesa $239,500 Flagsta $385,000 Superior $91,000

Lake Havasu City $245,000 Queen Creek $354,250 Tombstone $45,000

Phoenix $239,500 Prescott $343,100 Willcox $66,500

Buckeye $235,000 Gilbert $325,000 Miami $94,600

Glendale $242,000 Chandler $295,500 Clion $55,000

Tucson $192,950 Anthem $304,950 Quartzsite $79,025

Sierra Vista $165,000 Peoria $287,500 Mammoth $33,000

Yuma $117,375 Tempe $272,590 Gila Bend $95,000

Source: Trulia

**Sales prices are updated quarterly, prices reect Dec’18-Mar’19

10

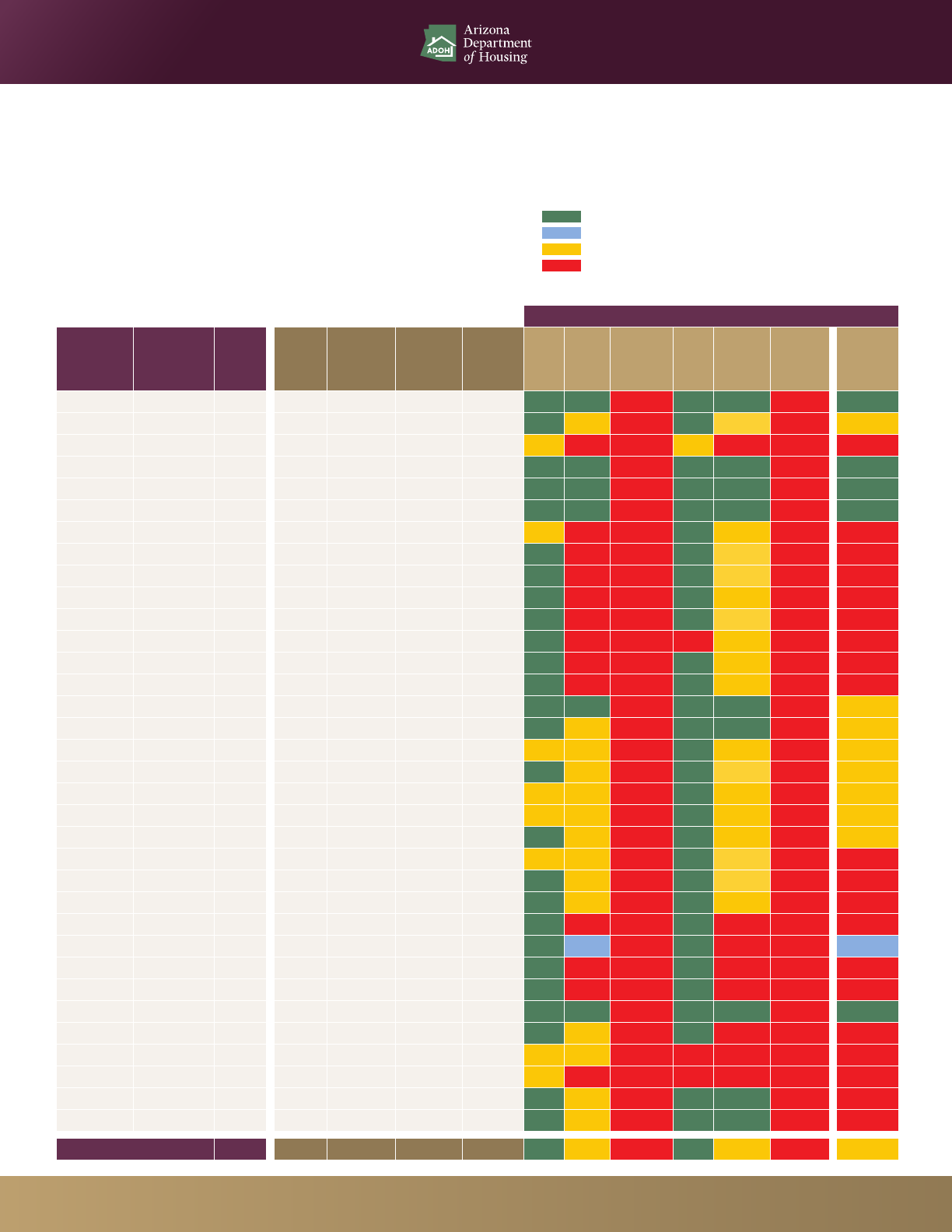

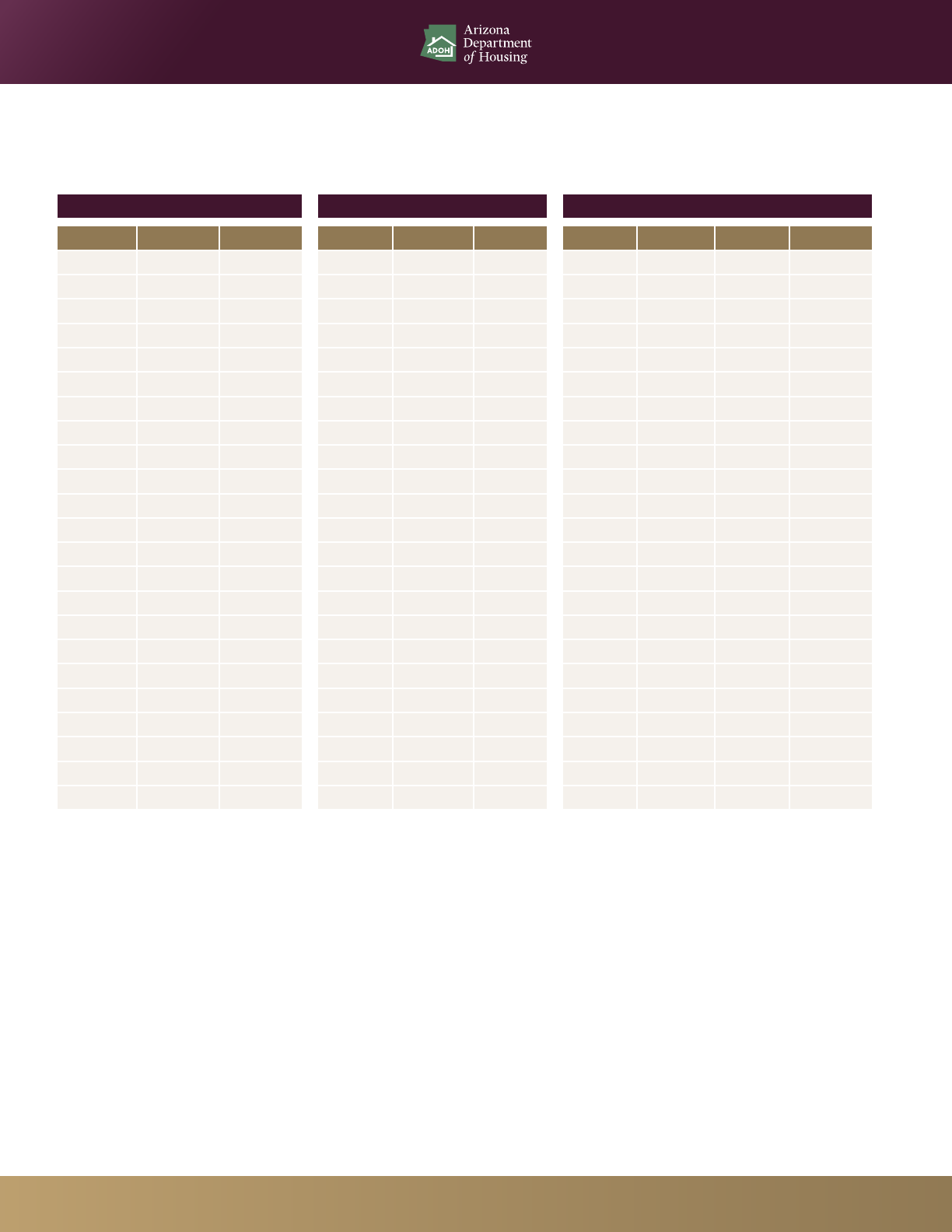

Housing Affordability: The Stoplight Chart depicts how affordable housing was for

home buyers and renters in common occupations around the state in 2018.

Mortgage Assumptions

Down Payment 5.00%

Interest Rate 4.86%

Loan Term in Years 30

Annual Property Tax 0.72%

Hourly Median Wage

City County

Median

Sales

Price

(2018)

Annual

Salary

Required

Hourly Wage

Required

(Buy)

2 Bedroom

Apartment

Monthly

Rent

Hourly

Wage

Required

(Rent)

Police

Ocer

Teacher

Retail

Worker

Nurse Fireghter Waitperson

Total of All

Occupations

Douglas Cochise $63,250 $16,008 $7.70 $823.00 $15.83 $25.29 $17.67 $11.41 $30.67 $18.63 $11.92 $17.39

Sierra Vista Cochise $165,000 $41,759 $20.08 $823.00 $15.83 $25.29 $17.67 $11.41 $30.67 $18.63 $11.92 $17.39

Flagsta Coconino $385,000 $97,438 $46.85 $1,237.00 $23.79 $26.46 $22.02 $11.84 $36.84 $18.41 $10.51 $16.18

Globe Gila $117,500 $29,738 $14.30 $889.00 $17.10 $24.66 $17.74 $11.54 $36.11 $18.23 $10.51 $17.52

Pine Gila $125,000 $31,636 $15.21 $889.00 $17.10 $24.66 $17.74 $11.54 $36.11 $18.23 $10.51 $17.52

Saord Graham $132,450 $33,521 $16.12 $840.00 $16.15 $24.18 $20.19 $11.49 $29.74 $21.67 $10.01 $17.95

Chandler Maricopa $295,500 $74,787 $35.96 $1,073.00 $20.63 $33.66 $20.16 $11.61 $37.04 $25.32 $11.37 $18.27

Glendale Maricopa $242,000 $61,247 $29.45 $1,073.00 $20.63 $33.66 $20.16 $11.61 $37.04 $25.32 $11.37 $18.27

Mesa Maricopa $239,500 $60,614 $29.14 $1,073.00 $20.63 $33.66 $20.16 $11.61 $37.04 $25.32 $11.37 $18.27

Peoria Maricopa $287,500 $72,762 $34.98 $1,073.00 $20.63 $33.66 $20.16 $11.61 $37.04 $25.32 $11.37 $18.27

Phoenix Maricopa $239,500 $60,614 $29.14 $1,073.00 $20.63 $33.66 $20.16 $11.61 $37.04 $25.32 $11.37 $18.27

Scottsdale Maricopa $445,000 $112,624 $54.15 $1,073.00 $20.63 $33.66 $20.16 $11.61 $37.04 $25.32 $11.37 $18.27

Surprise Maricopa $250,000 $63,272 $30.42 $1,073.00 $20.63 $33.66 $20.16 $11.61 $37.04 $25.32 $11.37 $18.27

Tempe Maricopa $272,590 $68,989 $33.17 $1,073.00 $20.63 $33.66 $20.16 $11.61 $37.04 $25.32 $11.37 $18.27

Bullhead City Mohave $124,000 $31,383 $15.09 $776.00 $14.92 $26.14 $16.39 $11.68 $34.54 $20.52 $10.51 $14.95

Kingman Mohave $145,000 $36,698 $17.64 $776.00 $14.92 $26.14 $16.39 $11.68 $34.54 $20.52 $10.51 $14.95

Lake Havasu City Mohave $245,000 $62,006 $29.81 $776.00 $14.92 $26.14 $16.39 $11.68 $34.54 $20.52 $10.51 $14.95

Lakeside Navajo $163,350 $41,342 $19.88 $796.00 $15.31 $24.53 $18.20 $11.64 $36.38 $17.04 $11.71 $16.71

Pinetop Navajo $235,000 $59,475 $28.59 $796.00 $15.31 $24.53 $18.20 $11.64 $36.38 $17.04 $11.71 $16.71

Show Low Navajo $212,000 $53,654 $25.80 $796.00 $15.31 $24.53 $18.20 $11.64 $36.38 $17.04 $11.71 $16.71

Snowake Navajo $155,000 $39,228 $18.86 $796.00 $15.31 $24.53 $18.20 $11.64 $36.38 $17.04 $11.71 $16.71

Marana Pima $244,000 $61,753 $29.69 $903.00 $17.37 $28.53 $19.05 $11.60 $35.26 $18.89 $11.79 $17.04

Sahuarita Pima $158,000 $39,988 $19.22 $903.00 $17.37 $28.53 $19.05 $11.60 $35.26 $18.89 $11.79 $17.04

Tucson Pima $192,950 $48,833 $23.48 $903.00 $17.37 $28.53 $19.05 $11.60 $35.26 $18.89 $11.79 $17.04

Casa Grande Pinal $175,000 $44,290 $21.29 $1,073.00 $20.63 $25.33 $18.89 $11.74 $35.94 $17.50 $12.35 $17.81

Coolidge Pinal $141,500 $35,812 $17.22 $1,073.00 $20.63 $25.33 $18.89 $11.74 $35.94 $17.50 $12.35 $17.81

Florence Pinal $176,500 $44,670 $21.48 $1,073.00 $20.63 $25.33 $18.89 $11.74 $35.94 $17.50 $12.35 $17.81

Maricopa Pinal $208,000 $52,642 $25.31 $1,073.00 $20.63 $25.33 $18.89 $11.74 $35.94 $17.50 $12.35 $17.81

Rio Rico Santa Cruz $112,900 $28,573 $13.74 $749.00 $14.40 $21.75 $18.16 $11.11 $32.84 $19.94 $10.01 $15.79

Chino Valley Yavapai $204,000 $51,630 $24.82 $958.00 $18.42 $25.54 $19.11 $11.87 $36.57 $17.36 $10.69 $16.20

Prescott Yavapai $343,100 $86,834 $41.75 $958.00 $18.42 $25.54 $19.11 $11.87 $36.57 $17.36 $10.69 $16.20

Sedona Yavapai/Coconino $426,000 $107,815 $51.83 $1,237.00 $23.79 $25.54 $20.57 $11.87 $36.57 $17.36 $10.69 $16.20

Somerton Yuma $169,900 $42,999 $20.67 $798.00 $15.35 $24.06 $17.21 $11.53 $35.23 $22.69 $10.95 $14.20

Yuma Yuma $117,375 $29,706 $14.28 $798.00 $15.35 $24.06 $17.21 $11.53 $35.23 $22.69 $10.95 $14.20

Arizona $235,800 $59,678 $28.69 $878.00 $16.88 $31.36 $19.63 $11.61 $36.43 $21.24 $11.24 $17.80

Source: Trulia; Zillow; Tax-Rates.org; Freddie Mac;

Arizona Oce of Economic Opportunity

Can afford to buy or rent

Can afford to buy

Can afford to rent

Cannot afford to buy or rent

11

Employment Growth & Housing Affordability by Industry (2018)

Industry 2007 2009 2011 2013 2015 2017 2018

Net

Change

(2007 to

2018)

Percent

Change

Average

Annual

Pay - AZ

(2018)

Average

Hourly

Wage

(2018)

Hourly Wage

Required

(Buy) (2018)

Hourly Wage

Required

(Rent)

(2018)

Aord

to

Buy

(Y/N)

Aord

to

Rent

(Y/N)

Total Private 2,258,400 2,009,600 2,004,100 2,110,900 2,226,800 2,359,300 2,441,725 183,325 7.5% $52,541 $25.63 $27.20 $16.88 No Yes

Goods Producing 418,100 293,500 272,800 292,100 298,700 321,400 342,017 -76,083 -22.2% $52,021 $25.97 $27.20 $16.88 No Yes

Private Service

Producing

1,840,300 1,716,100 1,731,300 1,818,800 1,928,100 2,037,900 2,099,708 259,408 12.4% $52,624 $25.57 $27.20 $16.88 No Yes

Construction 224,900 128,700 110,900 123,700 127,900 145,400 158,767 -66,133 -41.7% $53,539 $26.13 $27.20 $16.88 No Yes

Manufacturing 181,600 153,600 150,300 155,200 158,300 164,300 170,133 -11,467 -6.7% $50,190 $25.54 $27.20 $16.88 No Yes

Trade, Transportation,

and Utilities

527,700 478,400 473,000 481,200 506,500 524,200 534,800 7,100 1.3% $50,586 $24.78 $27.20 $16.88 No Yes

Financial Activities 186,600 170,100 171,400 184,900 194,800 213,900 220,975 34,375 15.6% $60,382 $29.94 $27.20 $16.88 Yes Yes

Professional and

Business Services

404,300 346,400 347,100 375,000 398,300 420,300 431,067 26,767 6.2% $57,346 $27.49 $27.20 $16.88 Yes Yes

Education and Health

Services

308,000 333,700 355,400 372,900 397,300 426,600 445,850 137,850 30.9% $54,954 $26.55 $27.20 $16.88 No Yes

Leisure and

Hospitality

273,000 256,000 259,300 275,900 299,200 319,200 326,917 53,917 16.5% $31,283 $15.85 $27.20 $16.88 No No

Other Services 99,200 93,400 87,900 87,100 87,500 88,500 92,792 -6,408 -6.9% $49,254 $22.58 $27.20 $16.88 No Yes

Source: Arizona Oce of Economic Opportunity

12

Arizona Population and Employment 2000 - 2018

Population Employment

Year Arizona Urban* Rural** Year Arizona Urban* Rural**

2000 5,175,581 3,941,302 1,234,279 2000

2001 5,287,510 4,038,920 1,248,590 2001 2,265,900 1,904,000 361,900

2002 5,411,164 4,142,733 1,268,431 2002 2,267,500 1,901,300 366,200

2003 5,554,235 4,251,713 1,302,521 2003 2,299,200 1,926,500 372,700

2004 5,725,610 4,380,603 1,345,008 2004 2,384,600 2,000,600 384,000

2005 5,924,476 4,517,078 1,407,398 2005 2,512,700 2,057,900 454,800

2006 6,116,409 4,623,389 1,493,020 2006 2,639,300 2,218,200 421,100

2007 6,274,981 4,730,671 1,544,311 2007 2,679,400 2,251,400 428,000

2008 6,368,649 4,792,861 1,575,787 2008 2,622,500 2,197,700 424,800

2009 6,389,081 4,805,410 1,583,672 2009 2,432,600 2,033,600 399,000

2010 6,401,569 4,805,226 1,596,343 2010 2,386,200 1,993,400 392,800

2011 6,438,178 4,829,451 1,608,727 2011 2,412,133 2,018,900 393,233

2012 6,498,569 4,875,085 1,623,484 2012 2,463,467 2,064,000 399,467

2013 6,581,054 4,940,905 1,640,149 2013 2,520,633 2,118,600 402,033

2014 6,667,241 5,015,813 1,651,428 2014 2,570,408 2,161,800 408,608

2015 6,758,251 5,085,809 1,672,442 2015 2,636,433 2,226,300 410,133

2016 6,835,518 5,150,179 1,685,339 2016 2,708,600 2,282,600 426,000

2017 6,965,897 5,247,783 1,718,114 2017 2,772,500 2,343,200 429,300

2018 7,076,199 5,328,661 1,747,538 2018 2,856,850 2,423,600 427,250

*Urban population and employment gures include Maricopa and Pima Counties only.

**Rural population and employment gures include AZ population less Maricopa and Pima Counties.

Source: Arizona Oce of Economic Opportunity

13

Arizona Mortgage Rates 1978 - 2018

Year

Contract Interest

Rate (%)

Initial Fees and

Charges (%)

Eective Interest

Rate (%)

Term to

Maturity

Purchase

Price ($000)

Loan-to-Price

Ration (%)

Adjustable-Rate

Loans (%)

1978 9.40 2.03 9.74 29.30 57.30 77.80 NA

1979 10.71 1.99 11.06 29.40 66.90 76.40 NA

1980 12.26 2.13 12.65 29.60 83.40 75.10 NA

1981 13.64 3.00 14.28 28.00 82.10 78.40 NA

1982 14.34 3.59 15.08 28.90 83.80 80.20 NA

1983 12.08 2.90 12.62 29.60 95.90 79.60 NA

1984 12.04 2.59 12.53 29.60 98.00 80.20 NA

1985 10.98 2.70 11.47 28.50 109.30 77.10 NA

1986 9.69 2.33 10.08 28.70 121.70 73.90 32

1987 8.85 2.25 9.22 28.90 126.10 75.80 46

1988 8.92 2.10 9.27 28.90 117.20 76.40 52

1989 9.82 2.32 10.21 28.50 123.50 73.90 25

1990 9.95 2.11 10.31 28.10 111.80 74.90 9

1991 9.18 1.56 9.44 27.90 118.40 75.80 15

1992 7.83 1.91 8.15 27.30 121.20 77.40 18

1993 6.98 1.63 7.23 27.30 119.40 74.40 11

1994 7.04 1.71 7.31 28.10 126.70 77.60 39

1995 7.29 0.87 7.42 28.60 128.60 79.00 46

1996 7.54 0.89 7.68 28.10 145.40 77.50 27

1997 7.56 1.09 7.74 27.10 158.70 78.50 16

1998 7.05 0.97 7.19 28.40 163.10 78.80 9

1999 7.24 0.94 7.38 28.70 167.80 79.30 17

2000 7.99 0.83 8.12 28.90 169.00 78.90 19

2001 7.00 0.68 7.10 28.20 175.80 80.10 12

2002 6.51 0.68 6.62 27.80 180.80 77.70 18

2003 5.72 0.52 5.80 27.10 193.60 74.80 19

2004 5.73 0.58 5.81 27.80 207.20 75.30 35

2005 5.86 0.39 5.92 28.57 280.48 72.91 39

2006 6.57 0.46 6.63 29.43 313.36 74.32 32

2007 6.46 0.65 6.56 29.91 302.83 77.56 15

2008 6.12 0.78 6.23 28.75 299.44 75.05 NA*

2009 5.15 0.92 5.28 28.59 252.15 73.66 3

2010 4.81 1.19 4.98 27.35 237.08 74.06 5

2011 4.63 1.49 4.85 28.30 232.40 75.96 NA*

2012 3.73 1.41 3.92 27.79 255.87 76.49 9

2013 3.85 1.41 4.04 27.81 277.12 77.83 NA

2014 4.18 1.52 4.40 28.13 300.88 76.83 NA

2015 3.91 1.53 4.12 28.25 334.35 76.74 NA

2016 3.76 1.45 3.96 28.50 350.94 78.09 NA

2017 4.03 1.42 4.23 28.78 341.95 79.32 NA

2018 4.66 1.38 4.86 28.64 327.86 77.96 NA

Source: U.S. Federal Housing Finance Agency, Monthly Interest Rate Survey

14

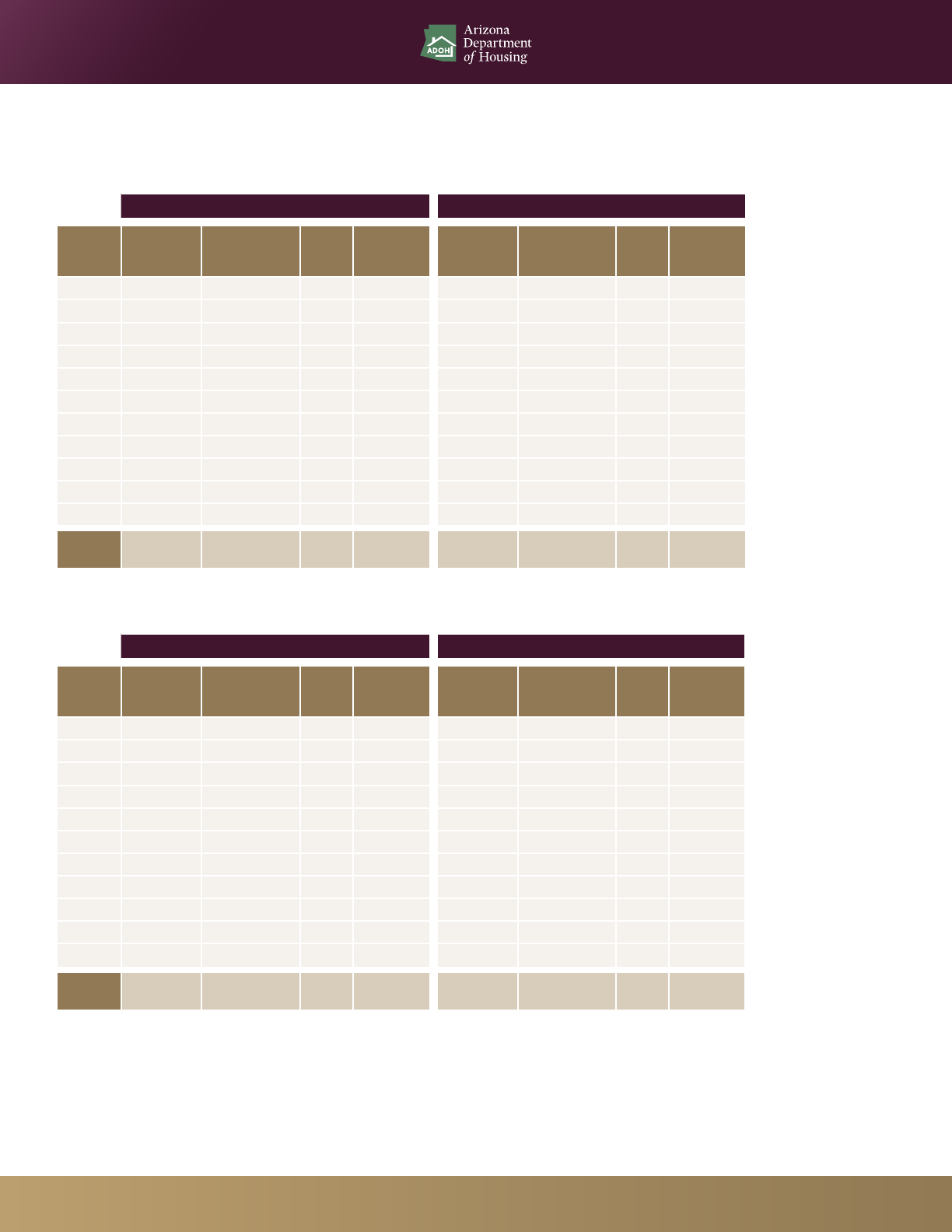

Arizona Mortgage Rates

30-Year Fixed Rate Mortgages 15-Year Fixed Rate Mortgages* 5/1 Hybrid Adjustable Rate Mortgages**

Yea r Rate Points Yea r Rate Points Year Rate Points Margin

2018 4.54 0.5 2018 4.00 0.4 2018 3.82 0.3 2.76

2017 3.99 0.5 2017 3.28 0.5 2017 3.20 0.4 2.74

2016 3.65 0.5 2016 2.93 0.5 2016 2.87 0.5 2.74

2015 3.85 0.6 2015 3.09 0.6 2015 2.94 0.5 2.74

2014 4.17 0.6 2014 3.29 0.6 2014 3.02 0.5 2.74

2013 3.98 0.7 2013 3.11 0.7 2013 2.88 0.5 2.75

2012 3.66 0.7 2012 2.93 0.7 2012 2.78 0.6 2.74

2011 4.45 0.7 2011 3.70 0.7 2011 3.31 0.6 2.74

2010 4.69 0.7 2010 4.10 0.7 2010 3.82 0.6 2.74

2009 5.04 0.7 2009 4.57 0.7 2009 4.75 0.6 2.74

2008 6.03 0.6 2008 5.62 0.6 2008 5.74 0.6 2.75

2007 6.34 0.4 2007 6.03 0.4 2007 6.07 0.5 2.76

2006 6.41 0.5 2006 6.07 0.5 2006 6.08 0.6 2.77

2005 5.87 0.6 2005 5.42 0.6 2005 5.32 0.6 2.78

2004 5.84 0.7 2004 5.21 0.6 2004 N/A N/A N/A

2003 5.83 0.6 2003 5.17 0.6 2003 N/A N/A N/A

2002 6.54 0.6 2002 5.98 0.6 2002 N/A N/A N/A

2001 6.97 0.9 2001 6.50 0.9 2001 N/A N/A N/A

2000 8.05 1.0 2000 7.72 1.0 2000 N/A N/A N/A

2003 5.83 0.6 2003 5.17 0.6 2003 N/A N/A N/A

2002 6.54 0.6 2002 5.98 0.6 2002 N/A N/A N/A

2001 6.97 0.9 2001 6.50 0.9 2001 N/A N/A N/A

2000 8.05 1.0 2000 7.72 1.0 2000 N/A N/A N/A

*Conventional, Conforming 15-Year Fixed-Rate Mortgages

**Conventional, Conforming, Treasury-Indexed 5/1 Hybrid Adjustable Rate Mortgages

Source: Freddie Mac

15

Arizona Homeless Point-in-Time Counts

Rural Arizona Maricopa County

Yea r Sheltered Unsheltered Total

Diff from

Previous

Yea r

Sheltered Unsheltered Tot a l

Diff from

Previous

Yea r

2019 1038 983 2021 -166 3426 3188 6614 316

2018 1102 1085 2187 419 3680 2618 6298 693

2017 1046 722 1768 -472 3546 2059 5605 -97

2016 1023 1217 2240 -162 4056 1646 5702 71

2015 1097 1305 2402 4 4342 1289 5631 -287

2014 1349 1049 2398 -37 4865 1053 5918 29

2013 1386 1049 2435 -16 4308 1581 5889 -596

2012 1722 729 2451 404 4736 1749 6485 654

2011 1318 729 2047 -1022 4082 1749 5831 -1168

2010 1005 2064 3069 -167 4270 2729 6999 -890

2009 1172 2064 3236 4971 2918 7889

Decade

Diff

(11.43) (52.37) (37.55) (1,215.00) (31.08) 9.25 (16.16) (1,275.00)

Sources: Annual Point in Time (PIT) Counts conducted by Arizona Department of Housing,

Maricopa Association of Governments, and Tucson Pima Collaboration to End Homelessness

Pima County Arizona Totals

Yea r Sheltered Unsheltered Total

Diff from

Previous

Yea r

Sheltered Unsheltered Tot a l

Diff from

Previous

Yea r

2019 1011 361 1372 -8 5475 4532 10007 142

2018 1017 363 1380 -194 5799 4066 9865 918

2017 1189 385 1574 -191 5781 3166 8947 -760

2016 1384 381 1765 -98 6463 3244 9707 -189

2015 1500 363 1863 -316 6939 2957 9896 -599

2014 1712 467 2179 -59 7926 2569 10495 -67

2013 1737 501 2238 -128 7431 3131 10562 -740

2012 1757 609 2366 -260 8215 3087 11302 798

2011 1902 724 2626 -1017 7302 3202 10504 -3207

2010 1939 1704 3643 47 7214 6497 13711 -1010

2009 2223 1373 3596 8366 6355 14721

Decade

Diff

(54.52) (73.71) (61.85) (2,224.00) (34.56) (28.69) (32.02) (4,714.00)

16

ARIZONA

2018 Housing At-a-glance

Housing is a market-driven industry, as it should be. Yet even in the best economies, market situations occur that

give rise to distress in certain housing markets. e goal of the Arizona Department of Housing is to help identify the

market conditions that cause distress to its citizens, so that the State and its partners working to address housing issues

can make the best investments with limited resources, and so that we are providng the best information in inuencing

policy directions in order to promote more housing choices for all Arizonans.

SOURCES

Arizona Department of Housing

Arizona Oce of Economic Opportunity

Bureau of Economic Analysis

Freddie Mac

Homeless Management Information System

Maricopa Association of Governments Point in Time Count

National Low Income Housing Coalition

Rounds Consulting Group

Tax-Rates.org

Trulia

Tucson Pima Collaboration to End Homelessness Point in Time Count

U.S. Bureau of Labor Statistics

U.S. Census Bureau

U.S. Department of Housing and Urban Development

U.S. Federal Housing Finance Agency

Zillow Research

Appendices providing additional charts and graphs depicting more detail on the

housing market may be downloaded from the Arizona Department of Housing website:

www.azhousing.gov/publications

Appendice sources notated within those

online documents

Title II of the Americans with

Disabilities Act prohibits discrimination

on the basis of disabiity in the programs

of a public agency. Individuals with

disabilities who need the information

contained in this publication in an

alternative format may contact the

Arizona Department of Housing at

(602) 771-1000 to make their needs

known. Requests should be made as soon

as possible to allow sucient time to

arrange for the accommodation.