Executive Summary 2Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Executive Summary

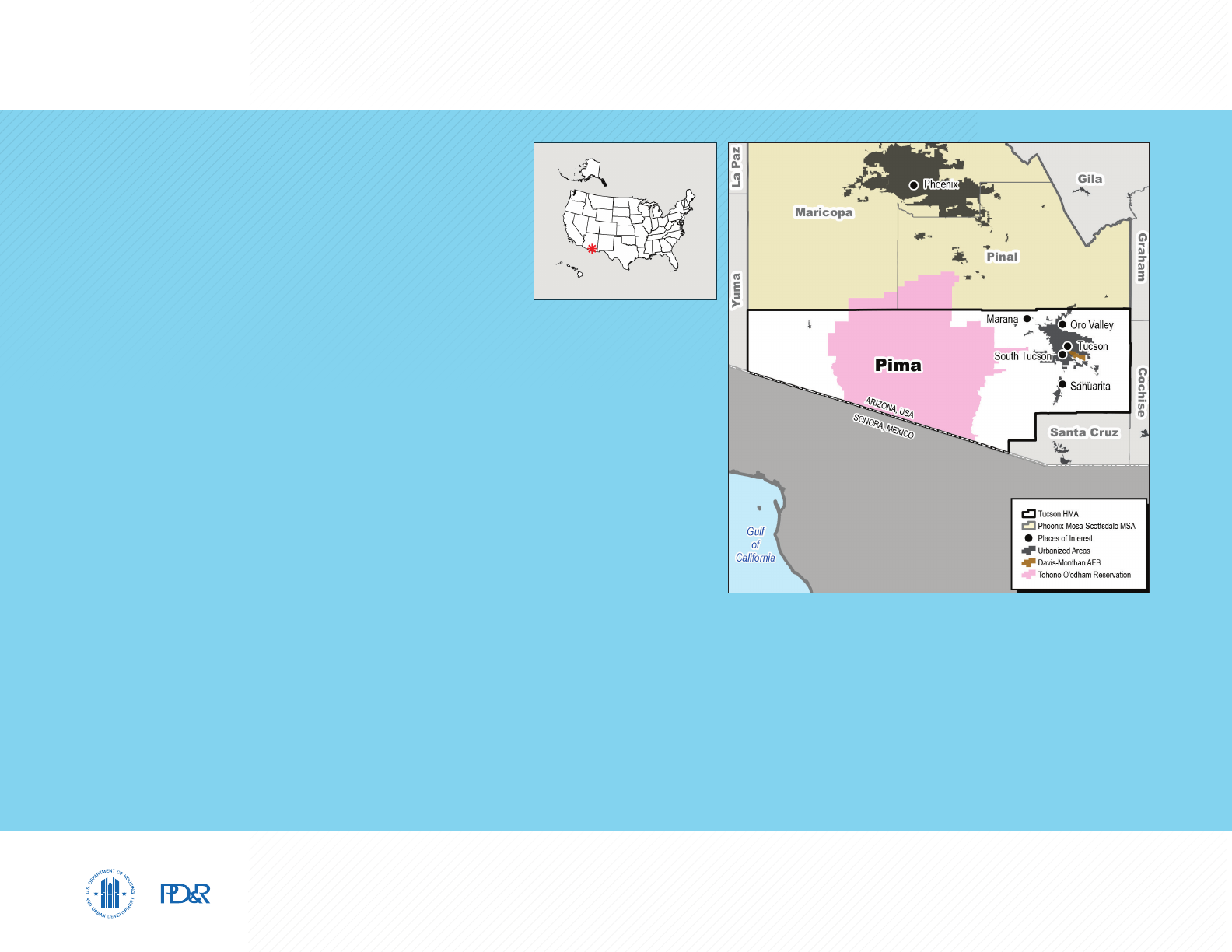

Housing Market Area Description

The Tucson, Arizona Housing Market Area (HMA) is

coterminous with the Tucson Metropolitan Statistical

Area (MSA), and Pima County. The city of Tucson

is the county seat and the largest city in the

HMA.

Incorporated towns include Marana, Oro Valley,

Sahuarita, and South Tucson.

The current population of the HMA is estimated at

1.06 million.

The Tucson HMA is along the United States–Mexico

border in the Sonoran Desert of Arizona, where a dry,

desert climate attracts vacationers and retirees. The

HMA is also home to the University of Arizona, the

Davis-Monthan Air Force Base, and two sovereign

nations, the Tohono O’odham Nation and the Pascua

Yaqui Tribe.

Tools and Resources

Find interim updates for this metropolitan area, and select geographies nationally, at PD&R’s

Market-at-a-Glance tool.

Additional data for the HMA can be found in this report’s supplemental tables.

For information on HUD-supported activity in this area, see the Community Assessment Reporting Tool.

Executive Summary 3Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Market Qualifiers

During the 12 months ending July 2022, nonfarm

payrolls in the Tucson HMA increased by 13,000

jobs, or 3.5 percent, to 387,400 jobs, compared

with a 4.4-percent increase nationwide. Before

the COVID-19 pandemic, the economy in the HMA

was stable, increasing by an average of 6,000

jobs, or 1.6 percent, annually from 2016 through

2019. During the 3-year forecast period, nonfarm

payroll growth is estimated to moderate and

average 1.5 percent annually, fully recovering the

jobs lost due to the pandemic in the first 2 years

of the forecast period.

The home sales vacancy rate is currently

estimated at 1.4 percent, down significantly from

2.9 percent in April 2010 when conditions were

soft. During the 12 months ending July 2022,

new and existing home sales in the HMA totaled

27,450, unchanged compared with a year earlier,

and the average sales price rose 15 percent

to $374,300 (Zonda, with adjustments by the

analyst). By comparison, sales and prices rose 17

and 19 percent, respectively, during the 12 months

ending July 2021. During the next 3 years, demand

is estimated for 10,550 new homes. The 2,700

homes currently under construction will satisfy

a portion of that demand.

Apartment market conditions are also balanced,

with a vacancy rate of 6.6 percent during the

second quarter of 2022, up from 4.6 percent

during the second quarter of 2021 when

conditions were tight (CoStar Group). The average

apartment rent in the HMA was $1,082 during

the second quarter of 2022, up 11 percent from

a year ago. During the next 3 years, demand is

estimated for 3,775 new rental units. The 1,650

units currently under construction will satisfy a

significant portion of that demand during the

forecast period.

Economy

Improving: Economic conditions in the

HMA improved during the past year,

following a year of nonfarm payroll

decline. By April 2022, the economy

had recovered 89 percent of the

45,900 nonfarm payroll jobs lost during

the recession of March and April 2020

(monthly data, not seasonally adjusted;

April is used as the latest monthly

comparison because of job seasonality

in the HMA).

Rental Market

Balanced: The estimated overall

rental vacancy rate is 7.0 percent,

down significantly from 11.3 percent

in April 2010, when rental market

conditions were soft.

Sales Market

Slightly Tight: As of July 2022, a

1.7-month supply of homes was

available for sale, up from 1.1 months

a year earlier and 1.4 months in July

2020 (Multiple Listing Service of

Southern Arizona).

TABLE OF CONTENTS

Economic Conditions 4

Population and Households 10

Home Sales Market 14

Rental Market 20

Terminology Definitions and Notes 24

3-Year Housing Demand Forecast

Sales Units Rental Units

Tucson HMA

Total Demand 10,550 3,775

Under Construction 2,700 1,650

Notes: Total demand represents estimated production necessary to achieve a balanced market at the end of the forecast period. Units under

construction as of August 1, 2022. The forecast period is August 1, 2022, to August 1, 2025.

Source: Estimates by the analyst

Economic Conditions 4Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Economic Conditions

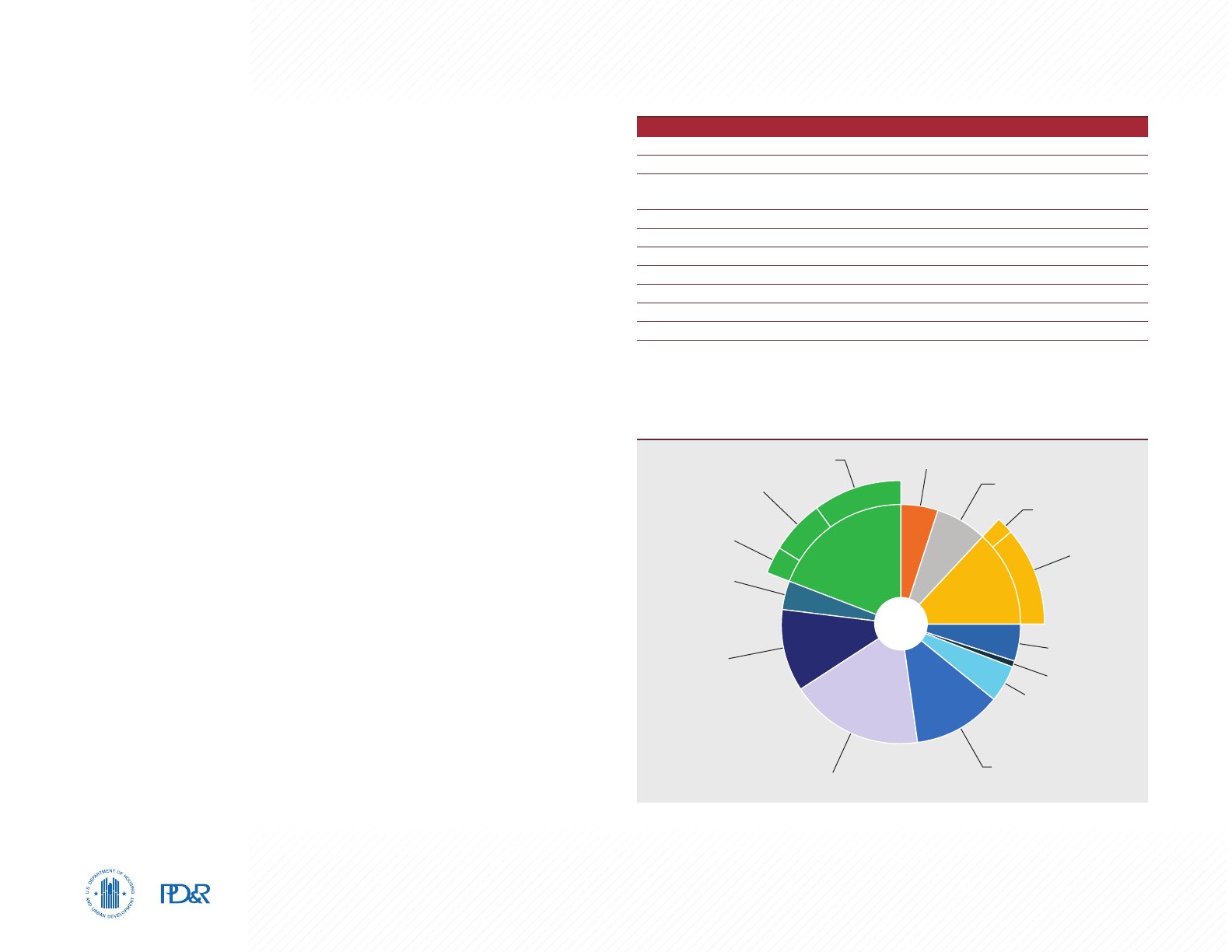

Largest Sector: Government

The government sector provides a stable base for the local

economy, with an average of 75,000 jobs during the 12 months

ending July 2022, or 19 percent of all nonfarm payrolls in the HMA.

Primary Local Economic Factors

Anchored by the presence of the University of Arizona (UA) and the Davis-

Monthan Air Force Base (AFB), the government sector is the largest nonfarm

payroll sector in the Tucson HMA. Approximately 32 percent of the jobs in the

sector are in the state government subsector, including UA, the second largest

employer in the HMA, with 12,500 employees (Table 1) and approximately

39,100 students on its main campus in the city of Tucson as of fall 2021

(University of Arizona). The federal government subsector constitutes nearly

17 percent of all government jobs in the HMA. Although active-duty military

personnel are not included in nonfarm payroll data, Davis-Monthan AFB, the

fourth largest employer in the HMA, employs approximately 8,400 military

personnel and civilians, with an estimated economic impact of $3.0 billion

in the HMA during 2017 (Economic Impact of Arizona’s Principal Military

Operations 2017, The Maguire Company). The presence of the AFB supports

the aerospace manufacturing and research industry through contracts with

Raytheon Missiles & Defense, the largest employer in the HMA and one of

the largest manufacturers of unmanned aircraft in the nation. Statewide, the

aerospace and defense industry was awarded $17.3 billion in Department of

Defense contracts during 2020 (Arizona Commerce Authority).

The education and health services sector accounted for 68,600 jobs, or

18 percent of nonfarm payrolls in the HMA, during the 12 months ending

July 2022 (Figure 1). The growing share of retirees in the HMA contributes

to continued growth in the education and health services sector. As such, the

Education & Health Services 18%

Mining, Logging, & Construction 5%

Manufacturing 7%

Transportation

& Utilities 5%

Information 1%

Financial Activities

5%

Professional & Business

Services 12%

Leisure &

Hospitality 11%

Other Services

4%

Federal 3%

State 6%

Local 10%

Total

387.4

Government

19%

Wholesale 2%

Retail 11%

Trade 13%

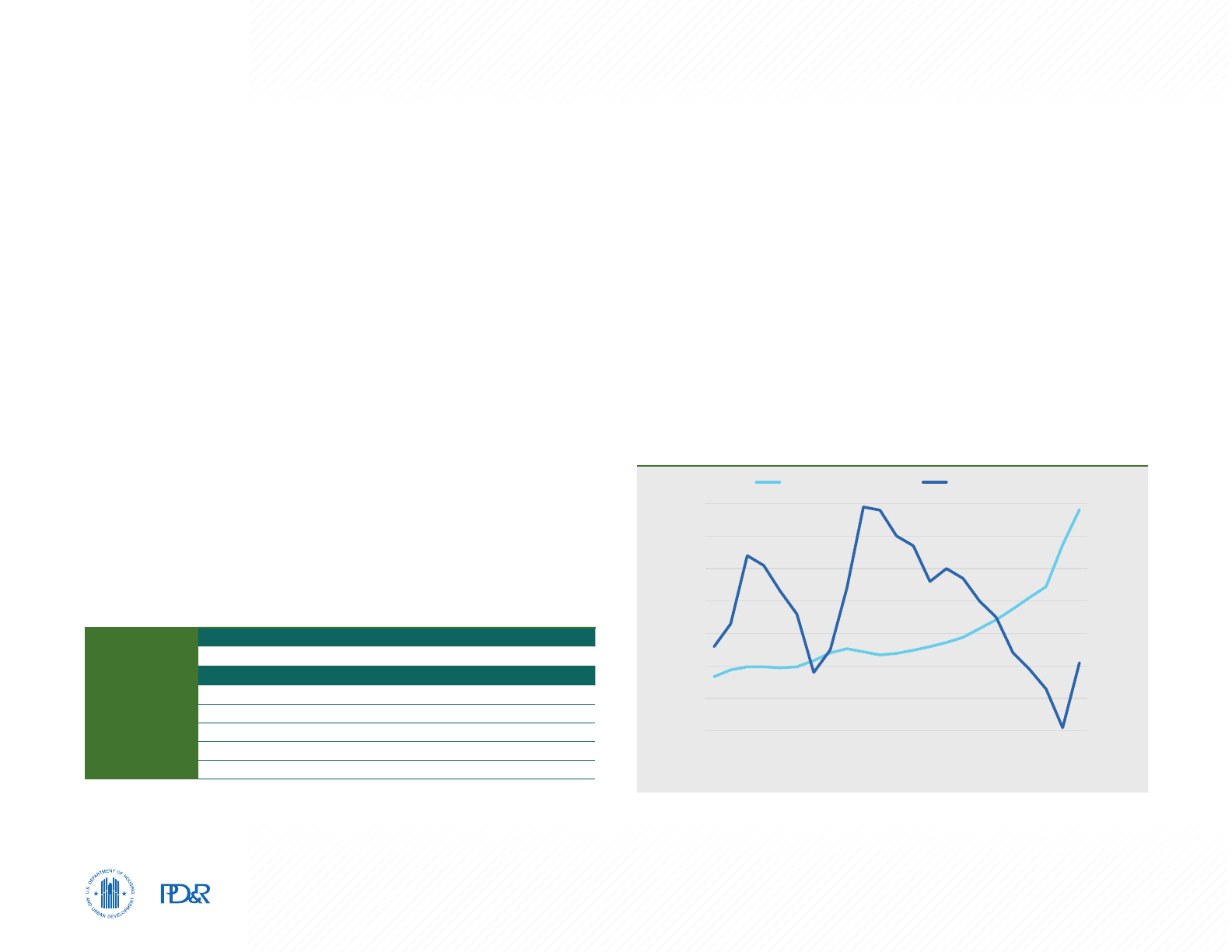

Figure 1. Share of Nonfarm Payroll Jobs in the Tucson HMA, by Sector

Notes: Total nonfarm payroll is in thousands. Percentages may not add to 100 percent due to rounding.

Based on 12-month averages through July 2022.

Source: U.S. Bureau of Labor Statistics

Table 1. Major Employers in the Tucson HMA

Name of Employer Nonfarm Payroll Sector Number of Employees

Raytheon Missiles & Defense Manufacturing 13,300

University of Arizona Government 12,500

Banner - University Medical

Center Tucson

Education & Health Services 7,700

Davis-Monthan Air Force Base Government 8,400

Pima County Government Government 7,400

U.S. Customs and Border Protection Government 5,750

Freeport-McMoRan Inc. Mining, Logging, & Construction 5,525

State of Arizona Government 4,825

Walmart Inc. Wholesale & Retail Trade 4,775

Tucson Medical Center Government 4,350

Notes: Excludes local school districts. Data for Davis-Monthan AFB include active duty military personnel

who are not included in nonfarm payrolls.

Sources: Pima County Annual Comprehensive Financial Report, 2021; City of Tucson Annual Comprehensive

Financial Report, 2021

Economic Conditions 5Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

education and health services sector has been the second fastest growing

sector in the HMA during the past 2 decades (Figure 2).

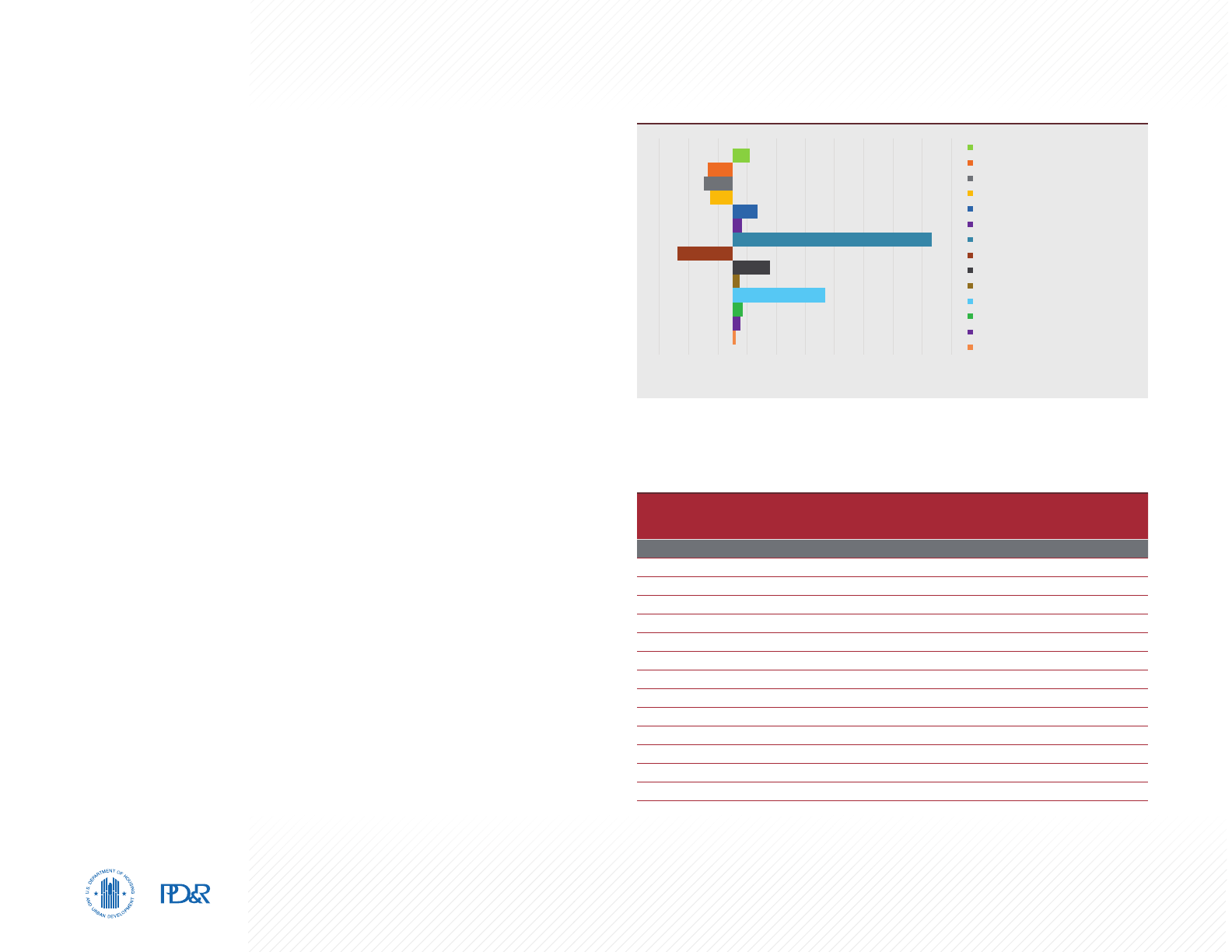

Since 2001, the transportation and utilities sector has led payroll growth in

the HMA in percentage terms. Growth has been particularly strong since 2018,

increasing at an average rate of 14.5 percent a year. Since opening its first

site in the HMA in 2018, Amazon.com, Inc. has expanded to a total of four

distribution sites and is estimated to currently employ more than 2,000 full-

time employees. The transportation and utilities sector, with 20,800 jobs,

or 5 percent of all nonfarm payroll jobs in the HMA, has increased with a

growing number of e-commerce, warehousing, and distribution centers near

the Port of Tucson. This active inland port between the United States and

Mexico also impacts the wholesale and retail trade sector with approximately

49,300 jobs, or 13 percent of all nonfarm payrolls in the HMA.

Current Conditions—Nonfarm Payrolls and

Impacts of COVID-19

The impacts of the COVID-19 pandemic were significant in the Tucson HMA,

and nonfarm payrolls have yet to return to the prepandemic high. During March

and April 2020, nonfarm payrolls declined by 45,900, or nearly 12 percent of

total nonfarm payrolls in the HMA (monthly basis, not seasonally adjusted).

By April 2022, the local economy recovered 40,900 jobs, or 89 percent, of

nonfarm pandemic losses (April is used as the latest monthly comparison

because of job seasonality in the HMA).

During the 12 months ending July 2022, nonfarm payrolls in the HMA increased

by 13,000, or 3.5 percent, to 387,400 jobs (Table 2), compared with a loss of

8,200 jobs, or 2.1 percent, a year earlier. Job growth occurred in 9 of 11 sectors

during the period, and the largest gains were in the leisure and hospitality

sector, which increased by 6,300, or 17.3 percent, to 42,700, compared with a

decrease of 9.7 percent a year earlier. Job losses in the HMA during March and

April 2020 were greatest in the leisure and hospitality sector, which declined by

19,300 jobs, or 42.3 percent, accounting for 47 percent of all job losses during

the period (monthly basis, not seasonally adjusted). Payrolls in this sector as

Total Nonfarm Payroll Jobs

Goods-Producing Sectors

Mining, Logging, & Construction

Manufacturing

Service-Providing Sectors

Wholesale & Retail Trade

Transportation & Utilities

Information

Financial Activities

Professional & Business Services

Education & Health Services

Leisure & Hospitality

Other Services

Government

-50 -30 -10 30 50 70 90 110 130 15010

Change in Jobs (%)

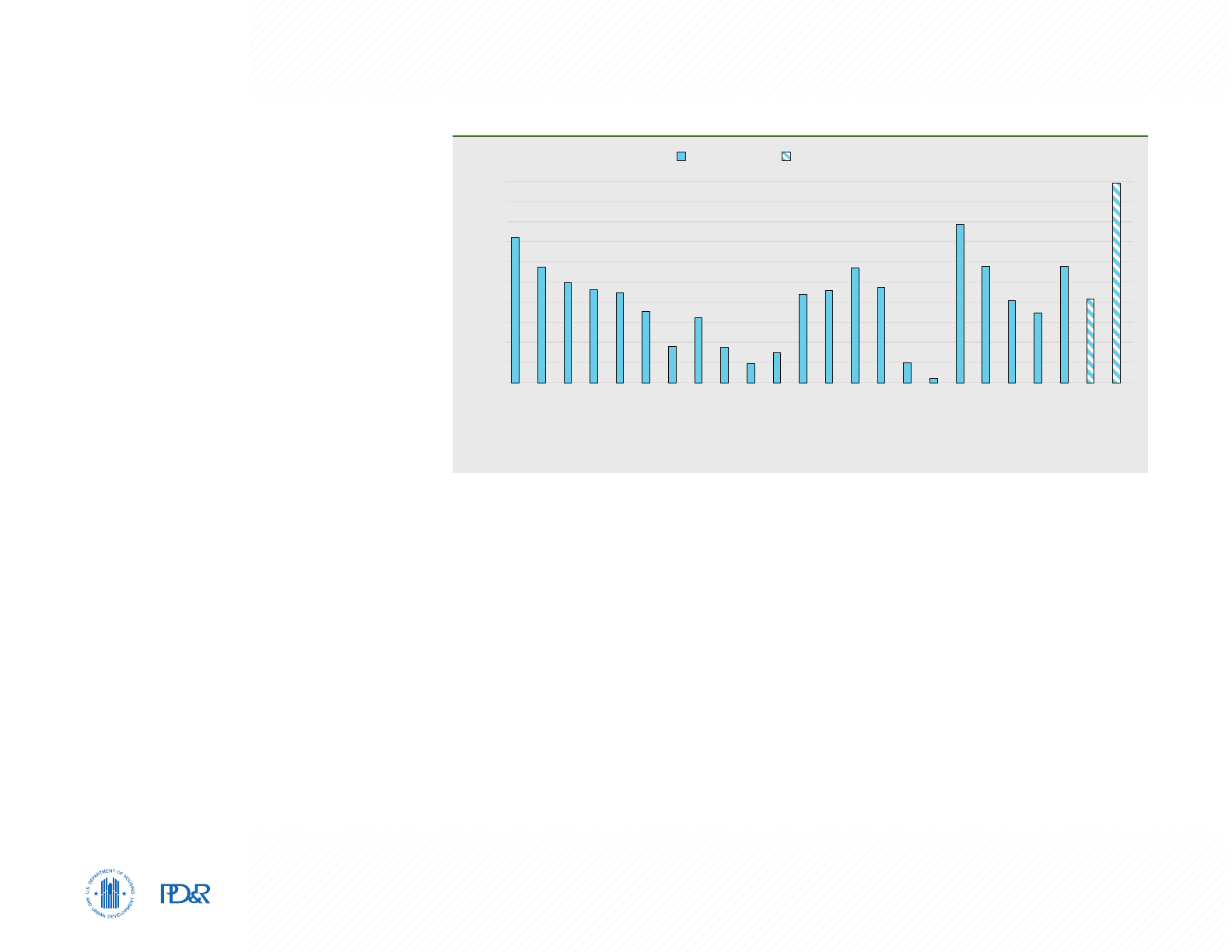

Figure 2. Sector Growth in the Tucson HMA, 2001 to Current

Note: Current data are based on the 12-month averages ending July 2022.

Source: U.S. Bureau of Labor Statistics

Table 2. 12-Month Average Nonfarm Payroll Jobs (1000s)

in the Tucson HMA, by Sector

12 Months

Ending

July 2021

12 Months

Ending

July 2022

Absolute

Change

Percentage

Change

Total Nonfarm Payroll Jobs 374.4 387.4 13.0 3.5

Goods-Producing Sectors 47.0 48.0 1.0 2.1

Mining, Logging, & Construction 19.7 19.9 0.2 1.0

Manufacturing 27.4 28.0 0.6 2.2

Service-Providing Sectors 327.4 339.4 12.0 3.7

Wholesale & Retail Trade 48.5 49.3 0.8 1.6

Transportation & Utilities 18.5 20.8 2.3 12.4

Information 4.9 5.1 0.2 4.1

Financial Activities 18.8 18.6 -0.2 -1.1

Professional & Business Services 47.2 45.5 -1.7 -3.6

Education & Health Services 66.7 68.6 1.9 2.8

Leisure & Hospitality 36.4 42.7 6.3 17.3

Other Services 12.6 13.7 1.1 8.7

Government 73.8 75.0 1.2 1.6

Notes: Based on 12-month averages through July 2021 and July 2022. Numbers may not add to totals due to

rounding. Data are in thousands.

Source: U.S. Bureau of Labor Statistics

Economic Conditions 6Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

of July 2022 are down 1,700 jobs, or 3.7 percent

below prepandemic levels (monthly data, not

seasonally adjusted).

Job growth was also strong in the transportation

and utilities sector, with jobs increasing by 2,300,

or 12.4 percent, to 20,800 during the 12 months

ending July 2022, compared with a gain of 3,400

jobs, or 22.3 percent, a year earlier. During March

and April 2020, the transportation and utilities

sector declined slightly, by 200 jobs, or 1.4 percent,

but as of July 2022, the sector surpassed the

prepandemic level of 14,800 by 6,000 jobs, or 41

percent, compared with February 2020 (monthly

basis, not seasonally adjusted). Recent gains in

the sector were supported by the increased use

of e-commerce platforms and delivery services.

During the 12 months ending July 2022, the

education and health services sector increased

by 1,900 jobs, or 2.8 percent, compared with a

decline of 1,300 jobs, or 1.9 percent, a year prior.

A new Northwest Healthcare hospital opened in

2022, adding approximately 600 jobs. The only

two sectors to lose jobs during the 12 months

ending July 2022 were the financial services and

the professional and business services sectors,

down by 200 and 1,700 jobs, or 1.1 and 3.6 percent,

respectively. The large decrease in the professional

and business services sector was due in large

part to declines in the administrative and support

and waste management and remediation services

industries as work from home continued after the pandemic. After declining 5.4 percent during the 12 months

ending July 2021, the government sector regained momentum during the 12 months ending July 2022,

increasing by 1,200 jobs, or 1.6 percent. All of the gains were in the state and local government subsectors,

which benefitted from enhanced federal aid and the resumption of normal operations, including in-person

learning at UA.

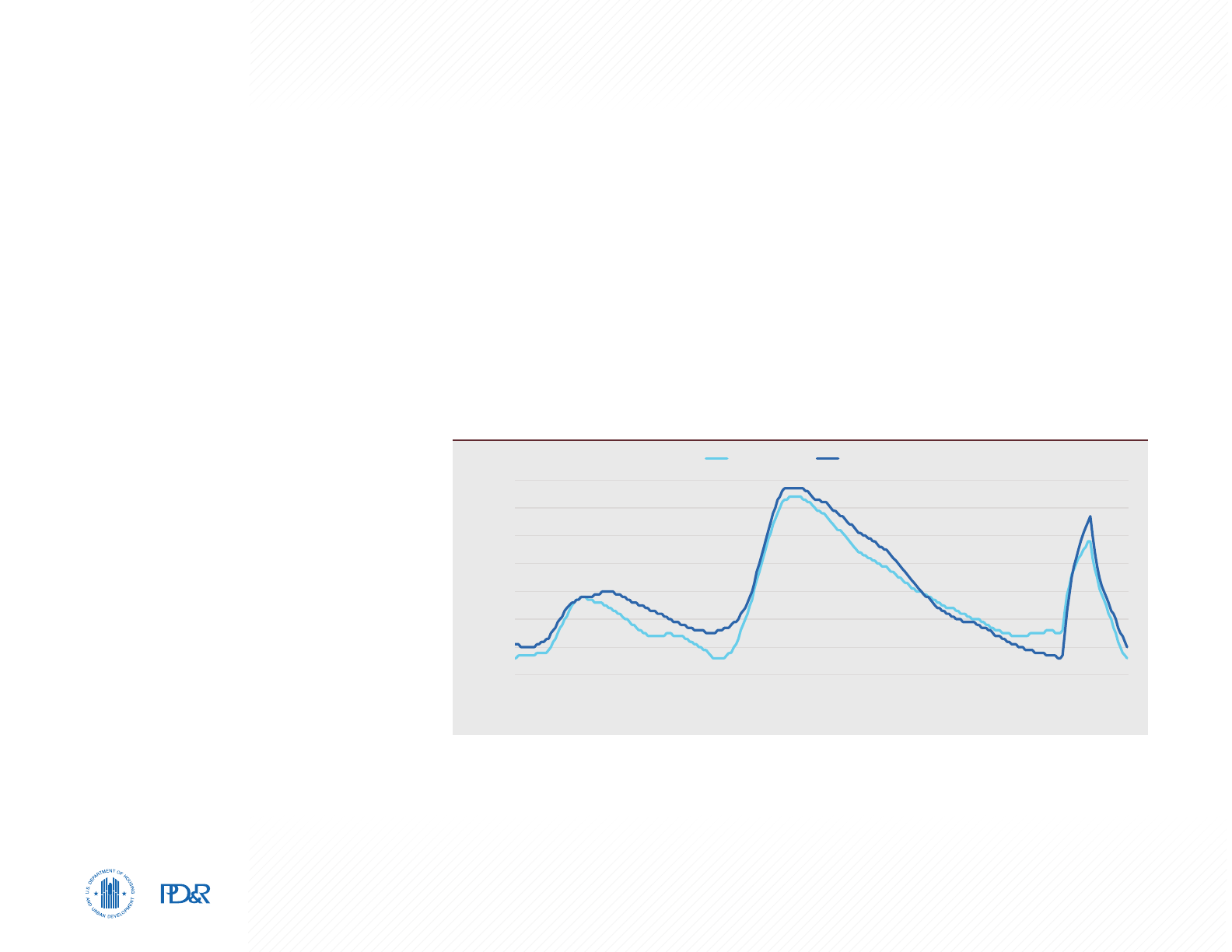

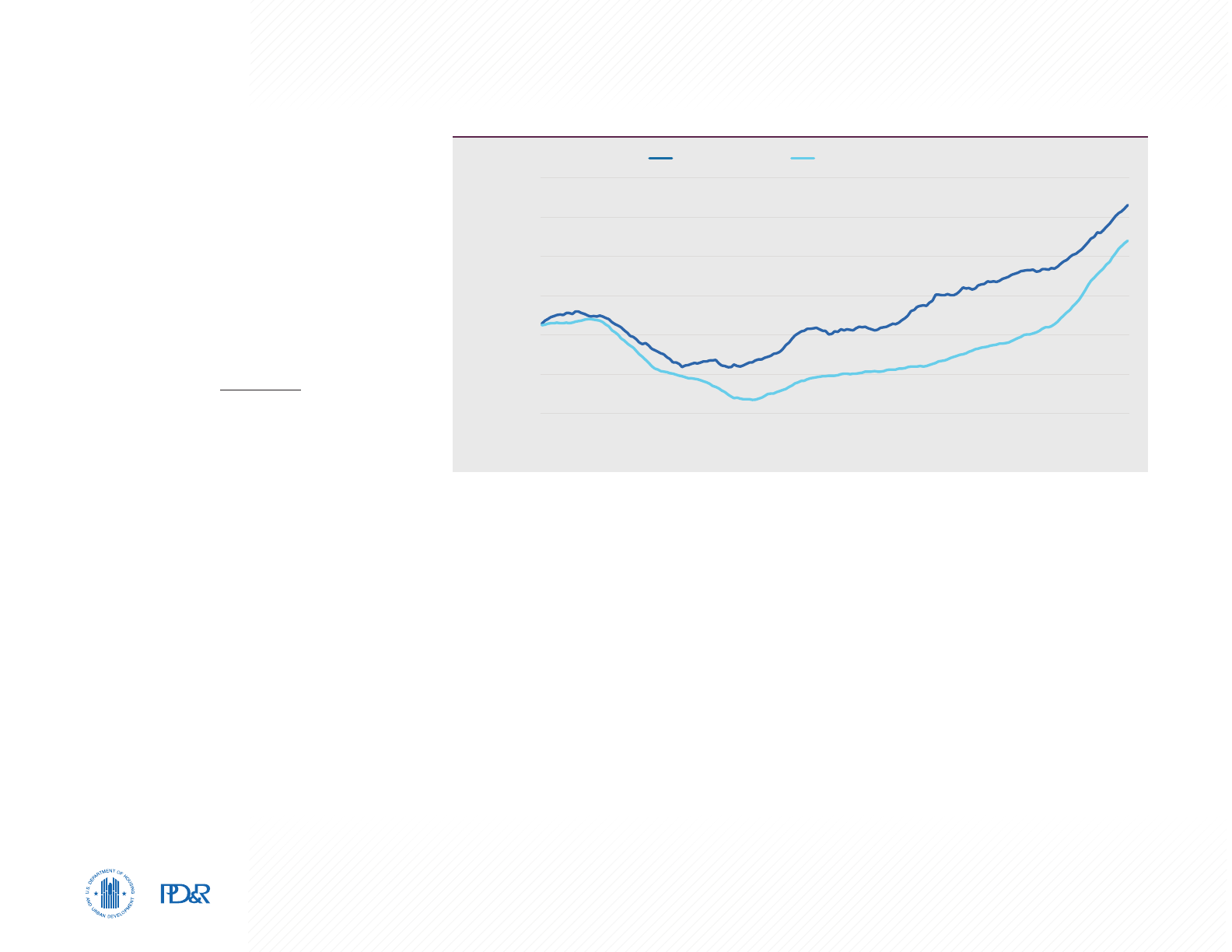

Current Conditions—Unemployment

Before the impact of the COVID-19 pandemic, the unemployment rate in the Tucson HMA declined from

a high of 9.3 percent in 2010 to a low of 4.4 percent in 2018. Strong resident employment growth in the

HMA during the 12 months ending July 2022 contributed to an average unemployment rate of 3.6 percent

(Figure 3). By comparison, the average rate was 6.1 percent a year earlier, and it recently peaked at 7.8

percent during the 12 months ending February 2021. The current unemployment rate in the HMA is below

the 3.7-percent rate for Arizona and the 4.0-percent national rate.

Tucson HMA Nation

10.0

9.0

8.0

7.0

6.0

5.0

4.0

3.0

Unemployment Rate (%)

Jul-00

Jul-01

Jul-02

Jul-03

Jul-04

Jul-05

Jul-06

Jul-07

Jul-08

Jul-09

Jul-10

Jul-11

Jul-12

Jul-13

Jul-14

Jul-15

Jul-16

Jul-17

Jul-18

Jul-19

Jul-20

Jul-21

Jul-22

Figure 3. 12-Month Average Unemployment Rate in the Tucson HMA and the Nation

Note: Based on the 12-month moving average.

Source: U.S. Bureau of Labor Statistics

Economic Conditions 7Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Economic Periods of Significance

2001 Through 2002

Following rapid expansion in the aerospace, teleservices, and optics industries

in the HMA, the dot-com recession combined with the September 11 attacks

during 2001 to negatively impact the local economy. During 2001 through

2002, nonfarm payrolls in the HMA decreased by an average of 2,000 jobs, or

0.6 percent, a year. By comparison, nonfarm payrolls in the nation decreased

by an average of 0.5 percent annually. The leisure and hospitality sector

led overall job losses in the HMA, decreasing by 1,300 jobs, or 3.3 percent,

annually. Manufacturing payrolls declined by an average of 1,200 jobs, or 3.5

percent, annually, partly because of a 550-job layoff at Bombardier Aerospace

in 2002—layoffs that resulted from the downturn in the aerospace industry

following September 11, 2001. Offsetting some of these losses were gains in

the government sector, which added an average of 800 jobs, or 1.1 percent,

annually. The local government subsector added an average of 900 jobs, or

2.1 percent, whereas the state subsector remained unchanged, and the federal

subsector declined by 100 jobs, or 0.5 percent, annually.

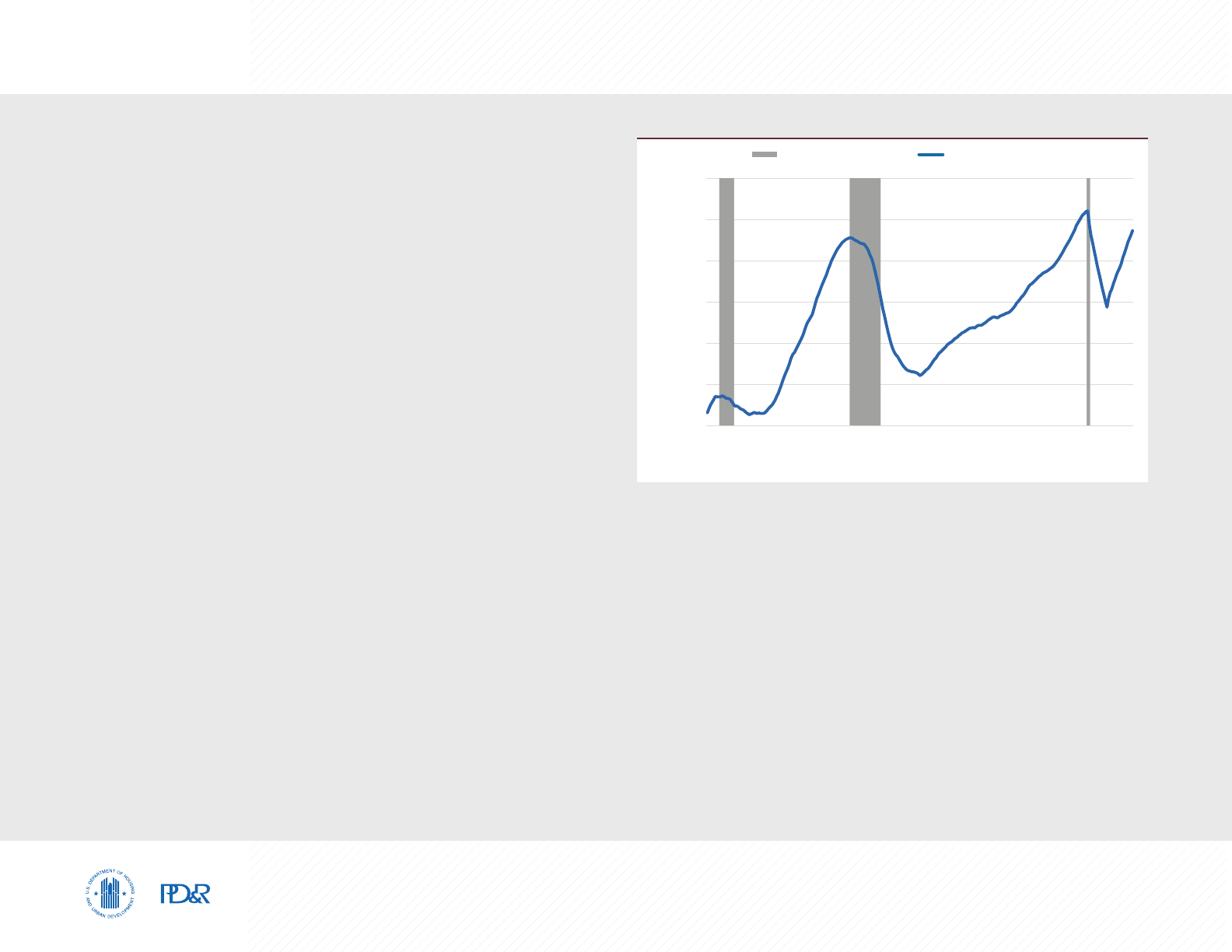

2003 Through 2007

Economic conditions in the HMA strengthened during the subsequent

5 years, and very strong population growth occurred during the period,

leading to continued growth in service-providing sectors. From 2003

through 2007, nonfarm payrolls increased by an average of 8,500 jobs, or

2.4 percent, annually, reaching a high of 385,600 jobs in 2007 (Figure 4). By

comparison, nonfarm payrolls in the nation increased by an average of 1.1

percent annually during this period. Economic expansion in the HMA during

the period was partly a result of significant growth in the professional and

business services sector, as the aerospace industry strengthened, and from

gains in the education and health services sector to meet the needs of the

growing population. From 2003 through 2007, these two sectors each added

an average of 2,200 jobs annually, or 4.9 and 4.7 percent, respectively.

Meanwhile, the government sector added an average of 600 jobs, or

National Recession Nonfarm Payrolls

400

390

380

370

360

350

340

Jul-00

Jul-01

Jul-02

Jul-03

Jul-04

Jul-05

Jul-06

Jul-07

Jul-08

Jul-09

Jul-10

Jul-11

Jul-12

Jul-13

Jul-14

Jul-15

Jul-16

Jul-17

Jul-18

Jul-19

Jul-20

Jul-21

Jul-22

Nonfarm Payrolls (in Thousands)

Note: 12-month moving average.

Sources: U.S. Bureau of Labor Statistics; National Bureau of Economic Research

Figure 4. 12-Month Average Nonfarm Payrolls in the Tucson HMA

0.8 percent, a year, with growth attributed to the federal and local government

subsectors, which had respective average annual increases of 300 and 500

jobs, or 2.7 percent and 1.1 percent, whereas the state government subsector

lost an average of 100 jobs, or 0.5 percent, annually. Growth in the government

sector was partly due to the establishment of the U.S. Department of Homeland

Security in March 2003 in response to the September 11 attacks.

2008 Through 2010

The HMA economy contracted from 2008 through 2010, in large part because

of the Great Recession and the national housing downturn. Nonfarm payrolls

in the HMA decreased by an average of 10,800 jobs, or 2.9 percent, annually

throughout the period. Payrolls in 9 of the 11 payroll sectors declined during

the period in the HMA. The mining, logging, and construction sector lost the

Economic Conditions 8Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

most jobs, down by an average of 3,800 jobs, or 15.8 percent, annually,

partly because the Freeport-McMoRan Inc. mining company laid off 1,500

workers throughout the state due to a decline in metal demand. Residential

construction declined in response to decreased population growth as many

residents sought jobs in larger employment centers, including the nearby

Phoenix-Mesa-Scottsdale metropolitan area (hereafter Phoenix metropolitan

area). During the 3-year downturn, the only two sectors to add jobs were the

education and health services and the government sectors, which increased

by an average of 1,200 and 100 jobs, or 2.1 and 0.1 percent, respectively. In

the government sector, the federal government subsector added an average

of 800 jobs, or 6.8 percent, offsetting losses of 100 and 600 jobs, or 0.1 and

1.5 percent, in the state and local government subsectors, respectively.

2011 Through 2015

The economy in the Tucson HMA began to improve in 2011, but economic

growth was relatively slow compared with the height of the early 2000s.

From 2011 through 2015, nonfarm payrolls rose by an average of 2,800

jobs, or 0.8 percent, annually. During the period, job gains in the HMA were

led by the education and health services and the leisure and hospitality

sectors, which each rose by a respective average of 900 jobs, or 1.4 and 2.3

percent, annually. Job losses in the manufacturing sector did occur, however,

averaging 200 jobs, or 0.9 percent, annually, as the collapse in demand for

durable goods during the Great Recession continued throughout the period.

A decline in oil prices in 2014 and a continued decline in copper prices since

2011 contributed to zero growth in the mining, logging, and construction

sector during the period. The government sector declined by an average

of 400, or 0.5 percent, annually, and the local government and federal

government subsectors declined by respective averages of 500 and 100 jobs,

or 1.3 and 0.6 percent. Offsetting losses were gains of 200, or 0.9 percent, in

the state government subsector.

2016 Through 2019

Economic growth in the Tucson HMA accelerated during 2016, and by 2018,

nonfarm payrolls surpassed the prerecession high of 2007. By comparison,

nationally, payrolls recovered to the prerecession high by 2014. From 2016

through 2019, nonfarm payrolls in the HMA increased by an average of

6,000 jobs, or 1.6 percent, annually. The education and health services

sector added the most jobs during the period, with an average annual

increase of 1,400 jobs, or 2.2 percent. In 2016, the UA Health Network

merged with Banner Health, one of the largest nonprofit healthcare systems

in the country, to form the private company Banner-University Medical

Center Tucson, the third largest employer in the HMA. The merger included

a $500 million investment, resulting in hospital expansions throughout the

period to meet the needs of residents. After a long period of decline, jobs

in the manufacturing sector began to increase, and from 2016 through 2019,

the sector had average gains of 1,100 jobs, or 4.2 percent, annually, due in

part to increases in the manufacturing of aerospace and renewable energy

products. Downtown revitalization projects throughout the period, including

several new businesses, hotels, and restaurants, contributed to the mining,

logging, and construction sector increasing by an average of 800 jobs, or

4.3 percent, annually. Job gains during the period were also supported by

Caterpillar Inc. completing construction of their $50 million, 150,000 square-

foot headquarters in 2019. Partly because of new Amazon.com, Inc. fulfillment

centers, the transportation and utilities sector increased the fastest throughout

the period, adding an average of 1,000 jobs, or 8.4 percent, annually. Partly

offsetting nonfarm payroll gains during the period, however, were losses in

the wholesale and retail trade sector, declining by an average of 300, or

0.5 percent, a year, partly because of a shift toward online shopping.

Economic Conditions 9Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Agriculture and Water

Agriculture in Pima County accounts for approximately 0.2 percent of private

employment with an economic impact of $64.5 million to the county (College

of Agriculture and Life Sciences, University of Arizona). According to the 2017

United States Department of Agriculture census of farms, there were 661 farms

in the HMA encompassing approximately 29,200 acres of cropland and over

2.5 million acres of pastureland with nursery, greenhouse, floriculture,

sod, cotton, and cattle as the major agricultural commodities in the county.

Approximately 28 percent of water usage in the county is attributed to

agricultural use (2015 United States Geological Survey). Amid the past two

decades of drought, the water levels of Lake Mead, which distributes Colorado

River water allocated to Arizona, California, Nevada, and Mexico, have

continued to decline. The U.S. Department of the Interior recently announced

the Colorado River had reached a Tier 2 shortage to start January 2023, further

reducing the amount of water that Arizona, Nevada, and Mexico can claim

from the river. Of the impacted states, Arizona will face the largest cuts of

approximately 21 percent of the state’s yearly allotment of river water. The most

recently announced cuts will disproportionately impact the agricultural sector.

Forecast

During the 3-year forecast period, economic recovery is expected to continue,

but moderate, in the HMA, with nonfarm payrolls increasing by an average of

1.5 percent annually. Jobs lost due to the pandemic are estimated to be fully

recovered in the first 2 years of the forecast period. Job growth is expected to be

strongest during the first year of the forecast, partly because of continued strong

gains in the transportation and utilities sector and continued use of e-commerce.

Amazon.com, Inc. is expected to open a new distribution site by the end of 2022

in the town of Marana, creating hundreds of new jobs. Steady growth is also

expected in the education and health services and the government sectors.

Population and Households 10Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Population and

Households

Current Population: 1.06 Million

Since 2020, population growth in the

Tucson HMA has slowed, in part because

of negative net natural change.

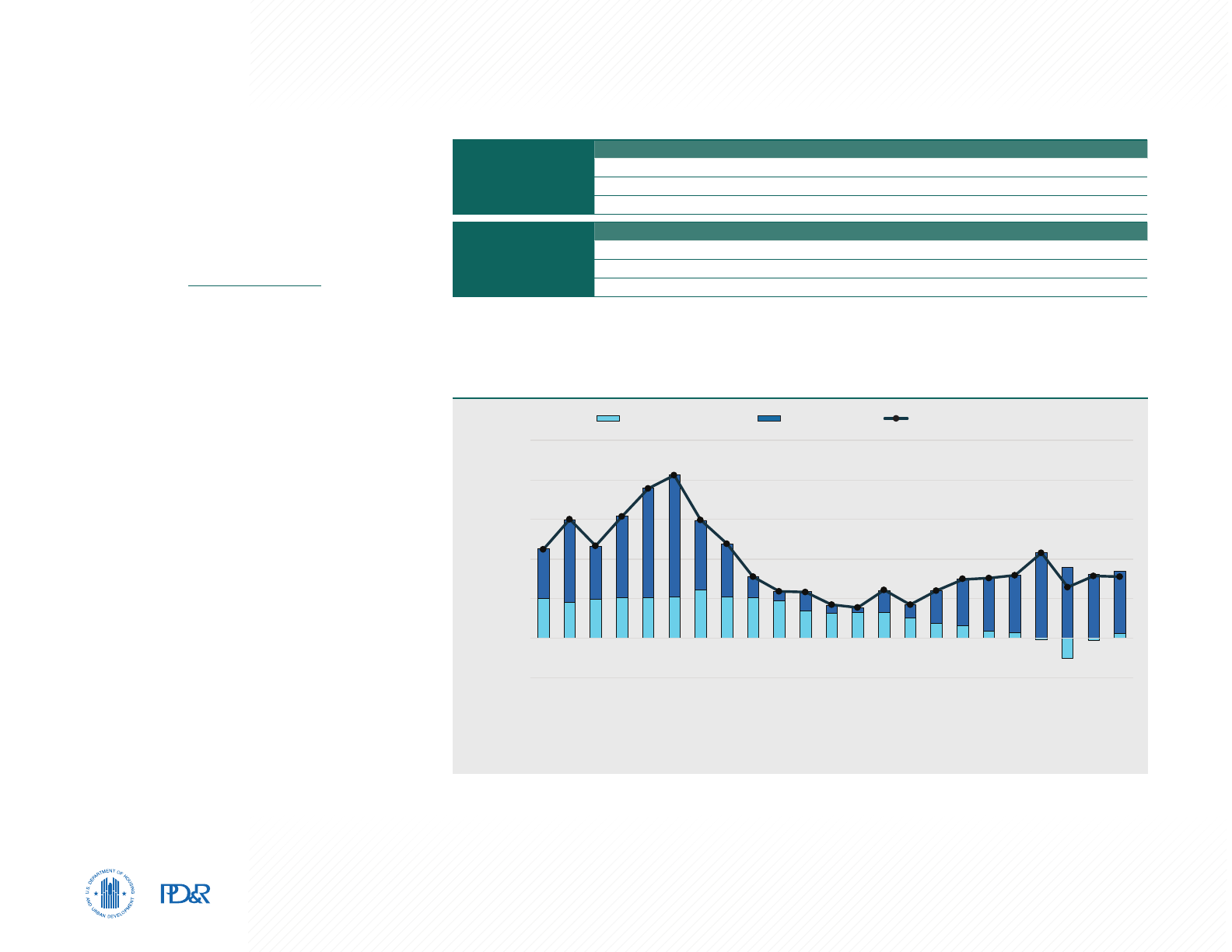

Population Trends

Population trends have generally mirrored

economic conditions in the Tucson HMA since

2000. The current population of the Tucson HMA

is estimated at 1.06 million, reflecting an average

increase of 6,525, or 0.6 percent, annually since

2010 (Table 3). From 2000 to 2007, a period

that included both an economic contraction and

expansion, the population of the HMA increased

by an average of 15,450, or 1.7 percent, annually

(U.S. Census Bureau decennial census count

and population estimates as of July 1; Figure 5).

During this period, the population grew rapidly,

largely the result of high levels of net in-migration,

propelled by strong economic growth following

the dot-com recession and robust net natural

change. Net in-migration averaged 10,300 people

a year from 2000 to 2007, and net natural change

averaged 5,150 people annually. Population

growth slowed significantly, however, with the

onset of the Great Recession in 2007, averaging

a gain of 7,875 people, or 0.8 percent, a year

from 2007 to 2011, because of a combination of

Table 3. Tucson HMA Population and Household Quick Facts

Population

Quick Facts

2010 Current Forecast

Population 980,263 1,061,000 1,086,000

Average Annual Change 13,650 6,525 8,425

Percentage Change 1.5 0.6 0.8

Household

Quick Facts

2010 Current Forecast

Households 388,660 435,900 448,600

Average Annual Change 5,625 3,825 4,225

Percentage Change 1.6 0.9 1.0

Notes: Average annual changes and percentage changes are based on averages from 2000 to 2010, 2010 to current, and current to forecast.

The forecast period is from the current date (August 1, 2022) to August 1, 2025.

Sources: 2000 and 2010—2000 Census and 2010 Census; current and forecast—estimates by the analyst

2000–2001

2001–2002

2002–2003

2003–2004

2004–2005

2005–2006

2006–2007

2007–2008

2008–2009

2009–2010

2010–2011

2011–2012

2012–2013

2013–2014

2014–2015

2015–2016

2016–2017

2017–2018

2018–2019

2019–2020

2020–2021

2021–Current

Current–Forecast

25,000

20,000

15,000

10,000

5,000

0

-5,000

Population Change

Net Natural Change Net Migration Population Growth

Figure 5. Components of Population Change in the Tucson HMA, 2000 Through the Forecast

Notes: Data displayed are average annual totals. The forecast period is from the current date August 1, 2022 to August 1, 2025.

Sources: U.S. Census Bureau; current to forecast—estimates by the analyst

Population and Households 11Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

decreased net natural change, averaging 4,650

people a year, and a significant reduction in net

in-migration, averaging 3,225 people annually.

From 2007 to 2011, there was a net out-migration

of approximately 1,700 Pima County residents

to nearby Pinal County, part of the Phoenix

metropolitan area, because historically low

housing prices attracted HMA residents who were

previously commuting to the county (County-

to-County Migration Flows, 5-year American

Community Survey [ACS] data; Arizona Office of

Employment). Both net natural change and net in-

migration continued to decline, and from 2011 to

2015, population growth averaged 4,600 people,

or 0.5 percent, annually. During the period, net

in-migration averaged 1,575 people annually, and

net natural change slowed to an average of 3,025

people a year. An increase in older residents over

65 years of age, combined with declining birth

rates, contributed to the overall slowing of net

natural change in the HMA. From 2015 to 2019,

net natural change slowed further, to an average

of 1,275 people a year, but population

growth

accelerated to an average of 7,275, or 0.7 percent,

a year, and net in-migration increased to an

average of 6,000 people annually. Migration

into the HMA from 2015 to 2019 was primarily

from the neighboring Phoenix metropolitan

area (Table 4) but also the result of business

relocations and expansions in the aerospace

and defense industries. Since 2019, the population

of the HMA has increased by an average of

Table 4. Metro-to-Metro Migration Flows in the Tucson HMA: 2015–2019

Into the HMA

Phoenix-Mesa-Chandler, AZ Metro Area 11,601

San Diego-Chula Vista-Carlsbad, CA Metro Area 1,063

Los Angeles-Long Beach-Anaheim, CA Metro Area 1,029

Austin-Round Rock-Georgetown, TX Metro Area 943

Sierra Vista-Douglas, AZ Metro Area 936

Out of the HMA

Phoenix-Mesa-Chandler, AZ Metro Area 11,191

Los Angeles-Long Beach-Anaheim, CA Metro Area 2,319

Sierra Vista-Douglas, AZ Metro Area 2,107

San Diego-Chula Vista-Carlsbad, CA Metro Area 1,603

Seattle-Tacoma-Bellevue, WA Metro Area 1,449

Source: U.S. Census Bureau Migration Flows, 2015–2019 American Community Survey 5-year data

8,375 people a year, or 0.8 percent, entirely the result of a surge in net in-migration, which averaged

9,275 people a year. During the same period, net natural decline averaged 900 people a year, mostly

because of a continued decrease in the number of births and an elevated number of deaths stemming

from the effects of COVID-19.

Population by Geography

The population of the HMA is generally concentrated in the eastern portion of the county, where the city

of Tucson is located. More than 543,200 residents, or approximately 52 percent of the HMA population,

resided in the city of Tucson as of July 1, 2021 (ACS 1-year estimates). From 2016 to 2021, the population of

the city of Tucson expanded by an average of 2,500, or 0.5 percent, a year, slower than respective averages

of 1.8, 4.2, and 4.6 percent, annually, in the towns of Oro Valley, Sahuarita, and Marana, the fastest growing

jurisdictions in the HMA (ACS 1-year supplemental estimates). The western portion of the HMA is generally

Native American Reservation land and covers approximately 42 percent of the land in Pima County.

Age Cohort Trends

In-migration of retirees and the declining number of those under 18 years of age are contributing to an

overall increase in the median age in the HMA. The median age in the Tucson HMA during 2021 was

Population and Households 12Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

39.1 years, up from 37.8 years in 2010 (2021 and 2010 ACS 1-year data).

By comparison, the median age in the nation during 2021 was 38.8 years,

up from 37.2 years in 2010. From 2010 through 2021, the retirement-age

portion of the population, generally defined as residents aged 65 and older,

increased by an average of 5,925, or 3.3 percent, annually in the HMA (ACS

1-year estimates). The rising share of residents in the over-65 age cohort,

which increased from less than 16 percent to more than 20 percent of the

total population during the period, has also contributed to slowing net natural

change (Figure 6). By comparison, the working-age population in the HMA,

generally those aged 18 to 64 years, increased by an average of 1,475 people,

or 0.2 percent, a year, and the population under 18 years old declined by an

average of 1,050 people, or 0.5 percent, a year throughout the period.

30%

25%

20%

15%

10%

5%

0%

Under 18

Years

18 to 24

Years

25 to 44

Years

45 to 64

Years

65 Years

and Over

2010 2021

Source: 2021 American Community Survey 1-year data

Figure 6. Population by Age Range in the Tucson HMA

65.0

64.8

64.6

64.4

64.2

64.0

63.8

63.6

63.4

63.2

63.0

450,000

400,000

350,000

300,000

250,000

200,000

150,000

100,000

50,000

0

2000 2010 Current

Homeownership Rate (%)

Households

RenterOwner Homeownership Rate

6 4.1

63.3

64.3

Figure 7. Households by Tenure and Homeownership Rate in the Tucson HMA

Note: The current date is August 1, 2022.

Sources: 2000 and 2010—2000 Census and 2010 Census; current—estimates by the analyst

Household Trends

Changing household composition, including smaller household sizes due in

part to the prevalence of older residents, has contributed to slightly faster

household growth than population growth in the HMA since 2000. As of

August 1, 2022, an estimated 435,900 households reside in the Tucson HMA,

reflecting an average annual increase of 3,825 households, or 0.9 percent,

since April 2010—a faster pace than the 0.6-percent population growth rate

in the HMA during the same period. The slightly faster pace in household

growth compared with population growth since 2010 was partly due to rapid

new household formation following the COVID-19 pandemic, particularly

smaller households. Currently, an estimated 63.3 percent of households are

homeowners, down from 64.1 percent in 2010 (Figure 7).

Population and Households 13Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Forecast

During the next 3 years, the population of the HMA is expected to increase

by an average of 8,425, or 0.8 percent, annually, to nearly 1.09 million. That

growth rate is higher than the estimated 2020-to-current rate of 7,200, or 0.7

percent, annually, as the HMA continues to recover from negative net natural

change associated with elevated deaths during the COVID-19 pandemic.

Most of the population growth will be due to continued net in-migration.

Household growth is expected to average 4,225, or 1.0 percent, annually,

reaching 448,600 households in the HMA by the end of the forecast period.

Home Sales Market 14Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Home Sales Market

Market Conditions: Slightly Tight

During the 3 months ending July 2022, home sales declined 14 percent,

and home sales prices rose 13 percent, compared with sales and prices

increasing 12 and 19 percent, respectively, during the 3 months ending

July 2021 (Zonda, with adjustments by the analyst).

Current Conditions

The sales housing market in the Tucson HMA is slightly tight, with an estimated

sales vacancy rate of 1.4 percent (Table 5), down significantly from 2.9 percent

in April 2010, when the market was soft. The HMA was significantly impacted

by the housing crisis, due in part to substantial building and lenient mortgage

lending standards during the mid-2000s. Increased job growth and net in-

migration during most years of the latter 2010s led to tighter housing market

conditions. As of July 2022, a 1.7-month supply of homes was available for

sale in the HMA, up from 1.1 months a year earlier and 1.4 months in July 2020

(Multiple Listing Service of Southern Arizona). By comparison, the supply of

homes available for sale was 3.6 months in 2011. During the 12 months ending

July 2022, home sales (including new and existing homes) totaled 27,450,

relatively unchanged from the previous 12 months (Zonda, with adjustments

by the analyst). Recently, however, the rising cost of homeownership resulted

in home sales declining 14 percent during the 3 months ending July 2022,

compared with the 3 months ending July 2021, when home sales market

conditions were tighter. During the 12 months ending July 2022, the average

home sales price increased approximately 15 percent to $374,300, compared

with a 19-percent increase a year earlier. More recently, however, home sales

prices rose 13 percent during the 3 months ending July 2022, compared with

a 19-percent increase a year ago. Figure 8 shows the share of home sales by

price range during the 12 months ending July 2022.

Table 5. Home Sales Quick Facts in the Tucson HMA

Home Sales

Quick Facts

Tucson HMA

Nation

Vacancy Rate 1.4% NA

Months of Inventory 1.7 1.9

Total Home Sales 27,450 7,030,000

1-Year Change 0% -9%

Existing Sales Price $370,000 $425,500

1-Year Change 16% 12%

New Sales Price $415,300 $471,500

1-Year Change 11% 14%

Mortgage Delinquency Rate 0.9% 1.4%

NA = data not available.

Notes: The vacancy rate is as of the current date; home sales and prices are for the 12 months ending

July 2022; and months of inventory and mortgage delinquency data are as of July 2022. The current date

is August 1, 2022.

Sources: Vacancy rate—estimates by the analyst; months of inventory and mortgage delinquency rate—

CoreLogic, Inc.; home sales and prices—Zonda

35

30

25

20

15

10

5

0

$0 to

$99k

$100k to

$199k

$200k to

$299k

$300k to

$399k

$400k to

$499k

$500k and

More

Share of Sales (%)

Existing Sales New Sales

Note: New and existing sales include single-family homes, townhomes, and condominium units.

Source: Zonda

Figure 8. Share of Overall Sales by Price Range During the

12 Months Ending July 2022 in the Tucson HMA

Home Sales Market 15Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Investor purchases, as a share of all residential

purchases in the HMA, increased from approximately

31 percent during the second quarter of 2021 to

nearly 39 percent during the second quarter of

2022 (John Burns Real Estate Consulting, LLC). By

comparison, during 2011, when investor purchases

peaked, approximately 55 percent of home sales

were investor purchases, before generally trending

downward to a low of 21 percent during 2020.

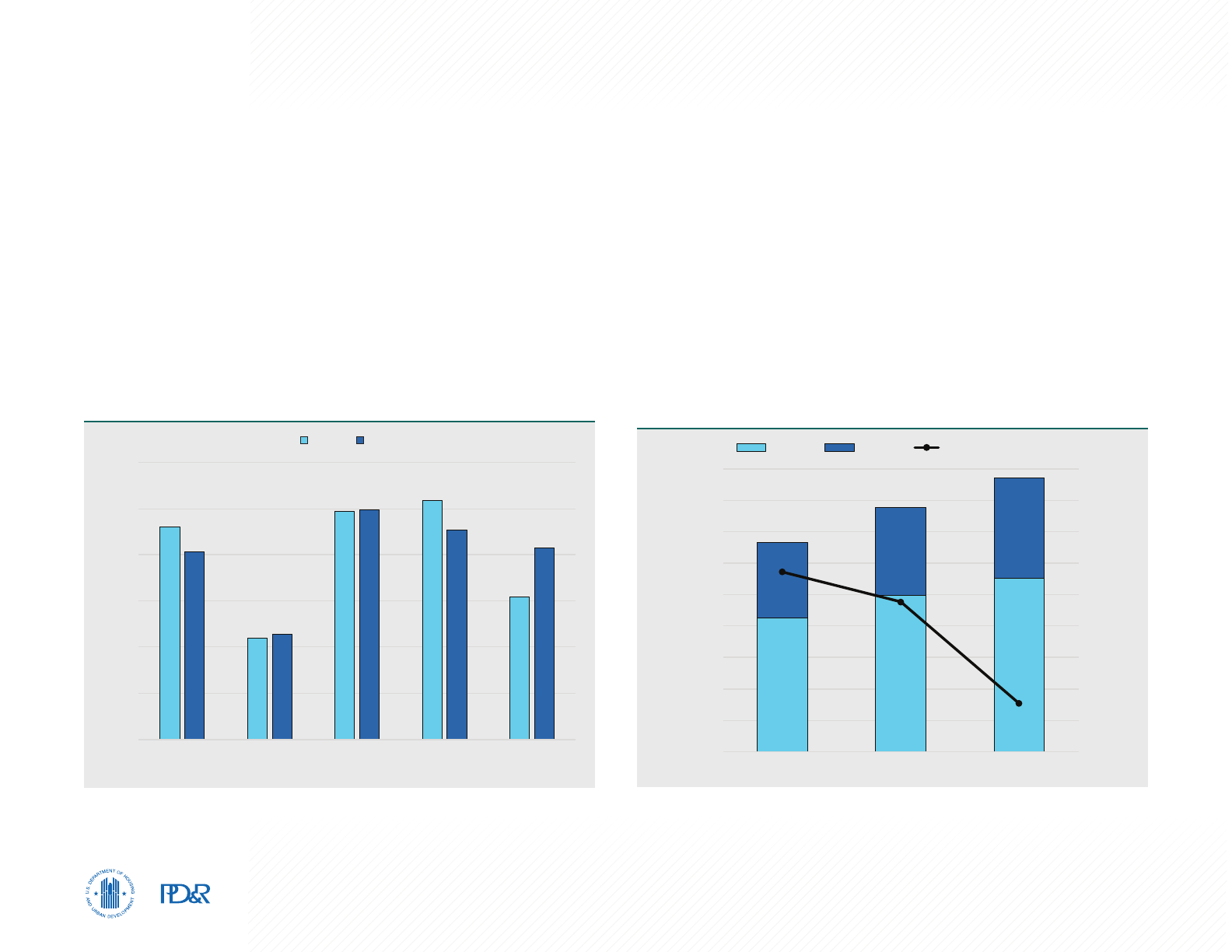

Existing Home Sales and Prices

The number of existing home sales, which

includes resale sales, real estate owned (REO)

home sales, and short sales, was generally high

during the early to mid-2000s. After a high of

25,100 existing sales in 2005, the number of

existing homes sold declined by an average of

18 percent a year from 2006 through 2008 to

a low of 13,950 existing sales in 2008 (Zonda;

Figure 9). Economic conditions in the HMA

weakened, and population growth declined

because of the national recession and housing

crisis. Existing home sales subsequently

increased an average of 5 percent a year from

2009 to 2013, to 17,550 sales, as many distressed

sales entered the market, but existing home sales

declined to 16,250 homes sold during 2014. As

population growth increased, so too did demand

for housing, and beginning in 2015, existing home

sales increased by an average of 930 homes, or

5 percent, annually, culminating in 20,900 homes

sold in 2019. The number of existing home sales

32,000

28,000

24,000

20,000

16,000

12,000

8,000

4,000

0

Sales Totals

Jul-06

Jul-07

Jul-08

Jul-09

Jul-10

Jul-11

Jul-12

Jul-13

Jul-14

Jul-15

Jul-16

Jul-17

Jul-18

Jul-19

Jul-20

Jul-21

Jul-22

Existing Sales New Sales

Figure 9. 12-Month Sales Totals by Type in the Tucson HMA

Source: Zonda, with adjustments by the analyst

increased further to 21,450 homes sold in 2020, largely in response to historically low mortgage interest

rates, especially in the latter part of 2020. During the 12 months ending July 2022, 24,900 existing homes

sold, up 2 percent from a year earlier. During the 3 months ending July 2022, however, the number of

existing home sales declined approximately 10 percent, compared with the 3 months ending July 2021,

as increased mortgage rates recently tempered housing demand.

Although the average existing home sales price in the HMA has increased each year since 2012, the

HMA was slow to recover existing home values after the housing market crash of 2008. During 2006

through 2007, before the local economic downturn, the average price for an existing home in the HMA

increased by an average of $12,050, or 5 percent, annually, to a high of $269,500 in 2007 (Figure 10).

From 2008 through 2011, the average price declined by an average of $25,100, or 11 percent, annually,

to a low of $169,000 in 2011. Lower demand for existing home sales in the HMA, stemming from local

job losses, contributed to a decrease in the average existing home sales price during the period. Even

as economic growth remained low compared with the early 2000s, existing housing prices remained

strong from 2012 through 2014, increasing an average of $10,500, or 6 percent, annually, in large part

Home Sales Market 16Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

because of heightened investor purchases

following the housing market crisis (John Burns

Real Estate Consulting, LLC). From 2015 through

2019, increased demand for existing home sales

continued because of stronger job growth,

despite a declining share of investor purchases.

The average price of an existing home increased

during the period, by an average of 5 percent a

year, to $252,500 in 2019. Demand for existing

homes increased, but a declining inventory of

existing homes available for sale during the

COVID-19 pandemic placed further upward

pressure on existing home prices. During 2020,

the average price of an existing home increased

by $29,650, or 12 percent, to $282,100. During

the 12 months ending July 2022, the average

price of an existing home increased 16 percent

to a new high of $370,000, compared with a

21-percent increase a year earlier. More recently,

however, existing home sales price growth

slowed to 14 percent during the 3 months ending

July 2022, compared with a 20-percent increase

during the same period a year ago.

New Home Sales and Prices

New home sales have not rebounded to the

number of new homes sold prior to the local

housing market downturn in the late 2000s, when

lending standards were more lenient and new

housing construction was more abundant. New

home sales peaked in 2006 at 9,350 new homes

sold. In response to the national recession and

the local impact of the housing crisis, the number

450,000

400,000

350,000

300,000

250,000

200,000

150,000

Jul-06

Jul-07

Jul-08

Jul-09

Jul-10

Jul-11

Jul-12

Jul-13

Jul-14

Jul-15

Jul-16

Jul-17

Jul-18

Jul-19

Jul-20

Jul-21

Jul-22

Average Sales Price ($)

New Sales Prices Existing Sales Prices

Figure 10. 12-Month Average Sales Price by Type of Sale in the Tucson HMA

Source: Zonda, with adjustments by the analyst

of new home sales declined during each of the 5 subsequent years by an average of 1,600, or 32 percent,

annually, to 1,350 new homes sold in 2011. New home sales rose slightly, to an average of 1,650 a year,

from 2012 through 2015. From 2016 through 2019, when economic and population growth increased, new

home sales generally increased, up 13 percent annually, to 3,050 new homes sold in 2019. The number of

new home sales increased another 4 percent during 2020, largely because of rising demand and the low

supply of existing homes available for sale during the COVID-19 pandemic. Rising mortgage rates, persistent

labor shortages, and ongoing supply chain challenges, however, constrained new home sales. During the

12 months ending July 2022, approximately 2,525 new homes sold, down nearly 18 percent from the 3,075

new homes sold during the previous 12 months. The decrease has been more severe recently, with new

home sales declining nearly 47 percent during the 3 months ending July 2022, compared with increasing

6 percent during the 3 months ending July 2021, when new home sales market conditions were tighter.

The average new home sales price in the HMA declined sharply during the housing crisis in the late

2000s, but new home sales prices recently increased significantly as the inventory of new homes has

generally trended downward since the highs of the early 2000s. After reaching a high of $275,700 in

Home Sales Market 17Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

2006, the average new home sales price declined as the market softened,

falling an average of 5 percent annually from 2007 through 2011 to a low

of $210,200 in 2011. With a stronger economy, prices rose an average of 11

percent a year during 2012 and 2013, before declining less than 1 percent in

2014, as slower economic growth occurred in the HMA. From 2015 through

2020, new home sales prices increased an average of 5 percent a year, to

$349,300 in 2020, as net in-migration increased each year during the 6-year

period. During the 12 months ending July 2022, the average sales price of a

new home increased by $42,100, or 11 percent, to $415,300, compared with an

average increase of 11 percent during the previous 12 months. More recently,

however, new home sales price growth has slowed to 8 percent during the

3 months ending July 2022, compared with a 10-percent increase a year ago.

REO Sales and Delinquent Mortgages

The housing crisis in the mid-to-late 2000s had a significant effect on loan

delinquencies in the HMA, but the market has improved since then. The

percentage of seriously delinquent mortgage loans and REO properties in the

HMA peaked at 7.7 percent in February 2010, 1 month after the peak rates for

Arizona and the nation of 12.0 and 8.6 percent (CoreLogic, Inc.), respectively.

The rate in the HMA generally declined to a low of 0.8 percent during

December 2019. The economic contraction caused by the impacts of the

COVID-19 pandemic contributed to an overall increase in the rate of seriously

delinquent and REO properties in the HMA as homeowners struggled to

make mortgage payments, reaching a high of 3.3 percent in September

2020, compared with a 3.0-percent rate statewide and a 4.3-percent rate

nationwide. The increase in the rate in the HMA from January to September

2020 was due to a 320 percent increase in the number of home loans that

were 90 or more days delinquent. During the same period, the number of

home loans that were in foreclosure declined 52 percent as many residents

took advantage of mortgage forbearance programs. As of July 2022, the rate

of seriously delinquent loans and REO properties in the HMA was 0.9 percent,

down from 2.2 percent a year ago; that proportion is below the 1.4 percent

rate for the nation but slightly above the 0.7-percent rate for Arizona.

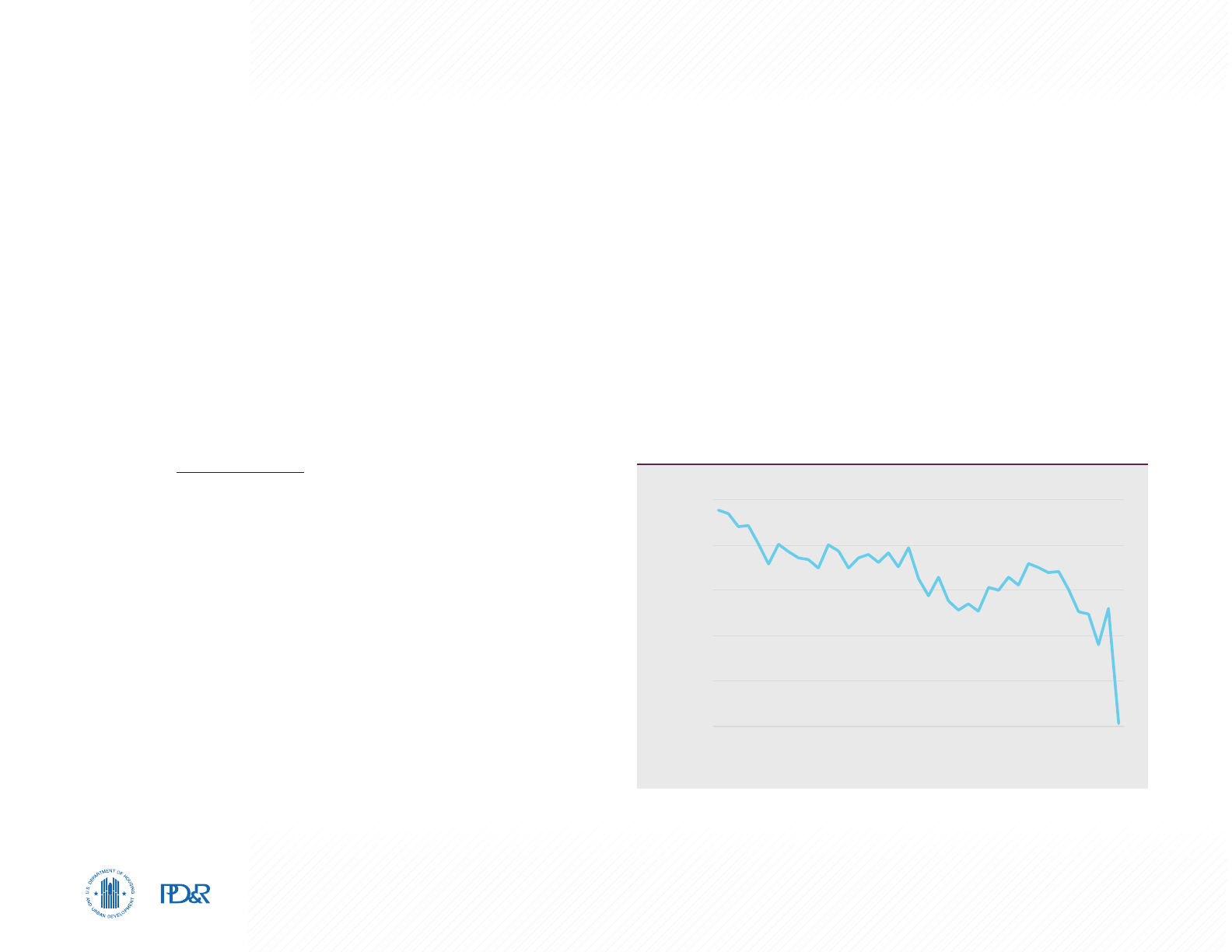

Housing Affordability

Affordability in the HMA declined significantly during the past year. The

affordability of homes in the Tucson HMA has generally trended downward

since the early 2010s as home price increases have exceeded income growth.

The National Association of Home Builders (NAHB)/Wells Fargo Housing

Opportunity Index (HOI), which represents the share of homes sold that would

have been affordable to a family earning the local median income,

was 40.6

for the HMA during the second quarter of 2022, down significantly

from 65.3

during the second quarter of 2021, as home prices increased significantly

since 2020 (Figure 11). The median prices for homes increased

over 24

percent, whereas median incomes rose 18 percent during the period

(NAHB).

By comparison, 42.8 percent of new and existing homes nationally were

considered affordable during the second quarter of 2022, down from 56.6

percent the previous year. The HOI has declined since reaching a high of 87.7

90

80

70

60

50

40

2012 Q2

2013 Q2

2014 Q2

2015 Q2

2016 Q2

2017 Q2

2018 Q2

2019 Q2

2020 Q2

2021 Q2

2022 Q2

NAHB/Wells Fargo Housing

Opportunity Index

Figure 11. Tucson HMA Housing Opportunity Index

NAHB = National Association of Home Builders. Q2 = second quarter.

Sources: NAHB; Wells Fargo

Home Sales Market 18Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

in the HMA during the second quarter of 2012.

The median home price in the MSA has increased

approximately 160 percent since the second

quarter of 2012, and the median income increased

30 percent (NAHB). Approximately 62 percent of

the 240 ranked metropolitan areas were more

affordable than the Tucson HMA during the

second quarter of 2022. Homeownership remains

relatively affordable in the HMA, however, when

compared with many nearby metropolitan areas,

including Los Angeles, Phoenix, and San Diego,

where the respective HOIs were 3.6, 22.3, and

6.9 during the second quarter of 2022.

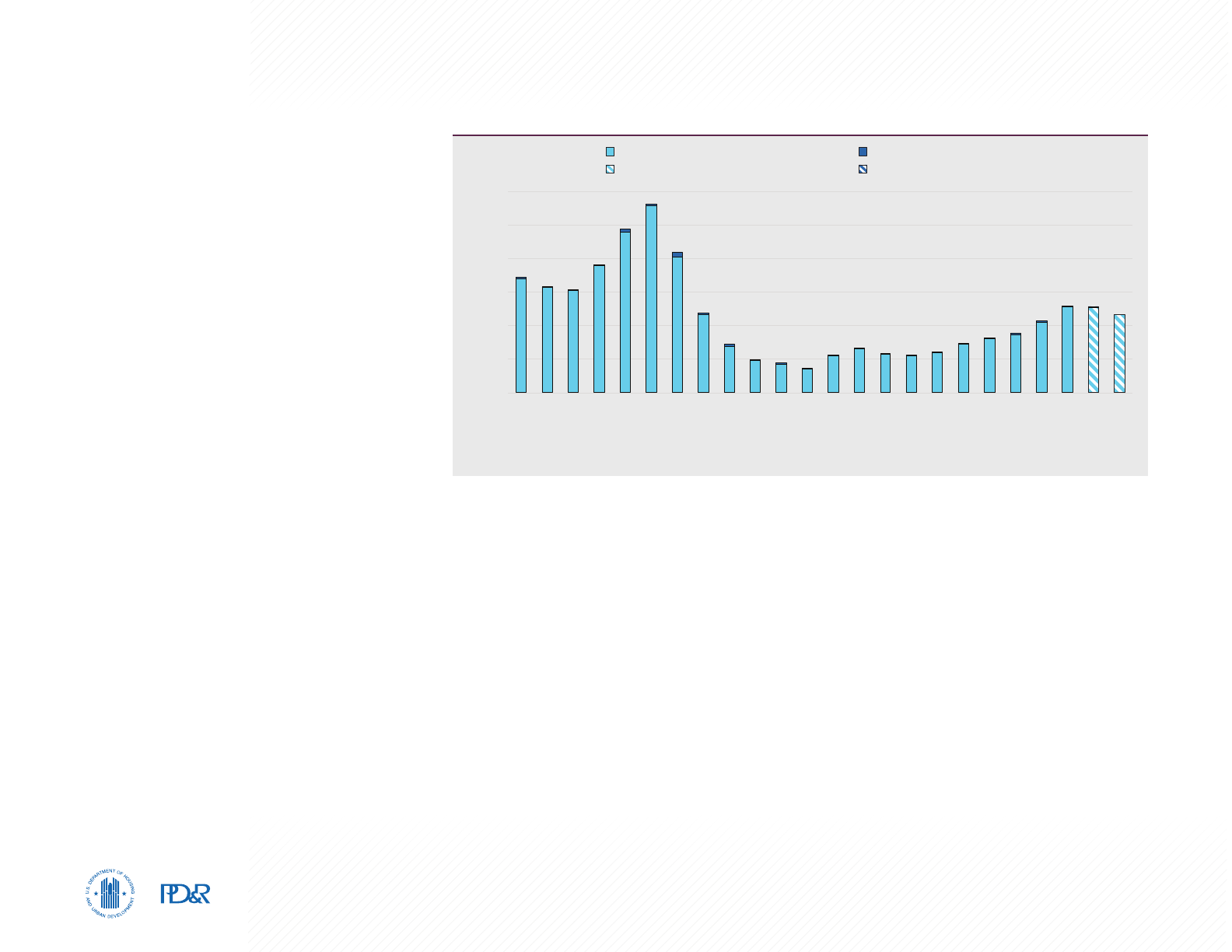

Sales Construction Trends

Sales construction activity in the HMA, as

measured by the number of single-family

homes, townhomes, and condominium units

permitted, has trended upwards since 2016.

Sales construction activity increased during the

most recent 12 months, but it is significantly

below the historically high levels reached during

the mid-2000s, when a peak of 11,300 homes

were permitted during 2005. Beginning in 2006,

sales construction activity fell by an average of

29 percent annually to a low of 1,400 homes

permitted in 2011, as builders responded to

declining home prices (Figure 12). From 2012

through 2015, an average of 2,350 homes

were permitted each year in response to rising

new home sales. Stronger home sales demand

stemming from an expanding local economy

12,000

10,000

8,000

6,000

4,000

2,000

0

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

12 ME Jul 2021

12 ME Jul 2022

Single-Family Homes/Townhomes

Single-Family Homes/Townhomes 12 ME

Condominiums

Condominiums 12 ME

Figure 12. Annual Sales Permitting Activity in the Tucson HMA

12 ME = 12 months ending.

Sources: U.S. Census Bureau, Building Permits Survey; 2000–21—final data and estimates by the analyst; past 24 months of data—preliminary data

and estimates by the analyst

and increased net in-migration contributed to an increase in homebuilding, and the number of homes

permitted increased an average of 14 percent annually from 2016 through 2020. During the 12 months

ending July 2022, 4,650 homes were permitted in the HMA, a 9-percent decrease from the previous

12 months (preliminary data and estimates by the analyst).

New Sales Construction

During the 12 months ending July 2022, more than 80 percent of home construction activity was

concentrated in the unincorporated areas of the HMA, in the town of Marana, and in the city of Tucson.

In the fast-growing town of Marana, approximately 20 miles northwest of the city of Tucson, a new

community, The Legends at Gladden Farms, is projected to open in September 2022. Construction began

at the master-planned community Gladden Farms in 2002 but stalled in 2009 during the housing crisis. New

owners acquired the property in 2013 and increased production during 2016, with multiple subdivisions

added on the 1,340 acres and 2,100 homes completed as of 2021. Approximately 4,000 homes are

Home Sales Market 19Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

expected at buildout. At The Legends subdivision, approximately 140 home

lots are available. Prices start in the low $300,000s for a three-bedroom

home and range in size from approximately 1,250 to 2,200 square feet.

Entrada La Coraza at Rancho Sahuarita, a single-family home community

under construction in the town of Sahuarita, is expected to have 144 homes

upon completion, with prices starting from $350,000.

Forecast

During the next 3 years, demand is expected for an estimated 10,550 new

homes in the HMA (Table 6). The estimated 2,700 homes currently under

construction are expected to satisfy a large portion of the estimated demand

during year 1 of the forecast period. Most of the demand will be for new homes

priced below $350,000. New development will be constrained to areas where an

assured 100-year water supply certificate exists or is approved from the Arizona

Department of Water Resources (ADWR).

Table 6. Demand for New Sales Units in the Tucson HMA

During the Forecast Period

Sales Units

Demand 10,550 Units

Under Construction 2,700 Units

Note: The forecast period is from August 1, 2022, to August 1, 2025.

Source: Estimates by the analyst

Rental Market 20Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Rental Market

Market Conditions: Balanced

Job growth and elevated net in-migration since 2015 have contributed

to currently balanced rental market conditions compared with soft

conditions in 2010.

Current Conditions and Recent Trends

The rental housing market in the Tucson HMA is balanced, with a current

overall rental vacancy rate estimated at 7.0 percent (Table 7). Rental market

conditions have improved since April 2010, when the rental vacancy rate was

11.3 percent and conditions were soft. The apartment market is also currently

balanced, having improved since 2010, when conditions were soft. The

average apartment vacancy rate during the second quarter of 2022 was 6.6

percent, up from 5.8 and 4.6 percent during the second quarters of 2020 and

2021, respectively, and well below the 11.3-percent rate during the second

quarter of 2010 (CoStar Group). Rental market conditions have improved since

2010 despite a significant increase in unsold homes that converted to the

rental market. Single-family homes represented approximately 29 percent

of renter-occupied units in 2000 and rose to 40 percent in 2010 (ACS 1-year

data). In 2019, renter-occupied single-family homes in the HMA accounted

for approximately 38 percent of the total number of occupied rental units.

Apartment Market Trends

Apartment market conditions in the HMA are balanced, with a vacancy rate of

6.6 percent during the second quarter of 2022, compared with 4.6 percent a

year ago, and the average asking rent increased 11 percent to $1,082 (CoStar

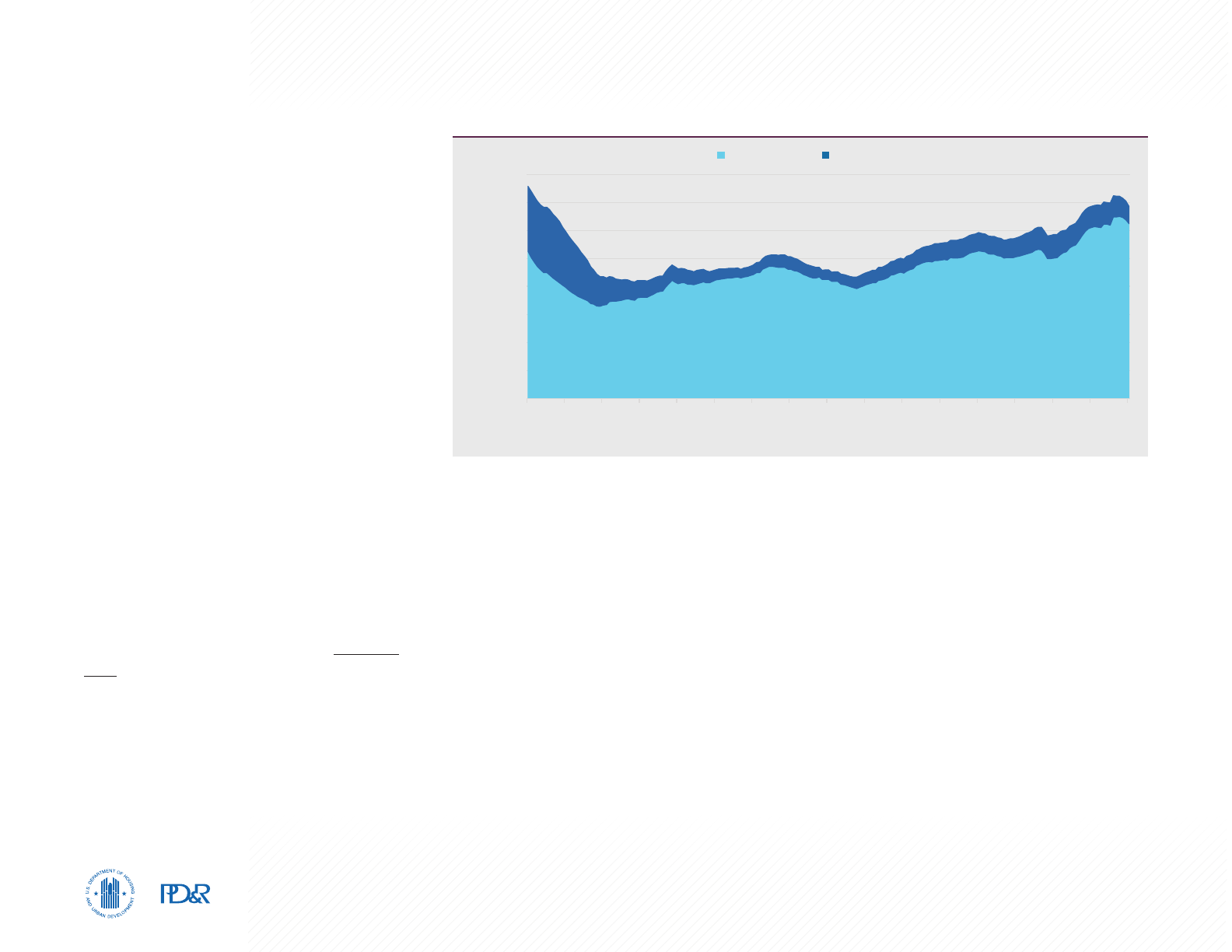

Group). Apartment market conditions in the HMA were generally soft during

most of the 2000s, with very modest rent growth and generally high vacancy

rates. During the second quarters of 2000 through 2002, vacancies increased

from 7.1 to 9.9 percent, and the average rent increased 3 percent to $598

(Figure 13). Between the second quarter of 2003 through the second quarter

of 2005, the apartment vacancy rate in the HMA declined to 8.1 percent, and

rent growth was flat. Overbuilding of apartments in the early 2000s, combined

with a strong competing home sales market, contributed to persistently high

average apartment vacancy rates throughout the period. By the second quarter

of 2006, the average apartment vacancy rate had decreased to 6.3 percent,

Rental Market

Quick Facts

2010 (%) Current (%)

Rental Vacancy Rate 11.3 7.0

2010 (%) 2019 (%)

Occupied Rental Units by Structure

Single-Family Attached & Detached 40 38

Multifamily (2–4 Units) 11 12

Multifamily (5+ Units) 43 45

Other (Including Mobile Homes) 6 5

Notes: The current date is August 1, 2022. Percentages may not add to 100 due to rounding.

Sources: 2010 vacancy rate—2010 Census; current vacancy rate—estimate by the analyst; occupied rental

units by structure—2010 and 2019 American Community Survey 1-year data; apartment data—CoStar Group

Table 7. Rental and Apartment Market Quick Facts in the Tucson HMA

Average Monthly Rent Vacancy Rate

11.5

10.5

9.5

8.5

7.5

6.5

5.5

4.5

1,100

1,000

900

800

700

600

500

400

2000 Q2

2001 Q2

2002 Q2

2003 Q2

2004 Q2

2005 Q2

2006 Q2

2007 Q2

2008 Q2

2009 Q2

2010 Q2

2011 Q2

2012 Q2

2013 Q2

2014 Q2

2015 Q2

2016 Q2

2017 Q2

2018 Q2

2019 Q2

2020 Q2

2021 Q2

2022 Q2

Vacancy Rate (%)

Average Monthly Rent ($)

Figure 13. Apartment Rents and Vacancy Rates in the Tucson HMA

Q2 = second quarter.

Source: CoStar Group

Rental Market 21Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

however, and rents increased 3 percent to $617. Demand for apartments

decreased during the Great Recession, and the apartment vacancy rate

increased from 7.0 percent during the second quarter of 2007 to 11.4 percent

by the second quarter of 2009, when the average rent for an apartment was

$644. By the second quarter of 2010, apartment rents declined to an average

of $634, and the average apartment vacancy rate was 11.3 percent. Vacancy

rates declined beginning in 2011, from 10.5 percent during the second quarter

of 2011 to 9.1 percent during the second quarter of 2013. Apartment rents

averaged $660 during the second quarter of 2013, an average annual increase

of 2 percent since the second quarter of 2011. Relatively slower household

growth, however, combined with more available single-family homes for rent,

kept apartment vacancies high. During the second quarter of 2014, the average

apartment vacancy rate was 9.5 percent, and apartment rents averaged $673.

Largely attributed to significantly increased net in-migration and declining

rental construction, particularly during 2015 through 2016, the apartment

vacancy rate declined as measured in the second quarter of each year from

2015 through 2021, reaching 4.6 percent by the second quarter of 2021. The

average rent for an apartment was $973 during the second quarter of 2021.

From the second quarter of 2015 through the second quarter of 2019, rent

growth in the HMA averaged 4 percent a year and then accelerated to an

average of 15 percent annually from the second quarter of 2020 through

the second quarter of 2021.

Student Housing

The University of Arizona has a significant effect on the rental market in

the HMA and the area surrounding the campus in downtown Tucson. From fall

2013 through fall 2021, total enrollment rose by an average of 1,125 students,

or 2.5 percent, a year. Of the 42,100 students enrolled at UA during fall

2021 (excluding online students), approximately 7,100 of the 31,100 students

located at the main campus in the city of Tucson were housed in on-campus

dormitories. The remaining 24,000 students account for approximately

6 percent of renter households in the HMA. Since 2013, approximately 7,000

student-centered apartment units have been added to the HMA. The average

vacancy rate for apartment properties in the CoStar Group-defined University

North market area has generally declined every year since 2013, from a high

of 10.9 percent during the second quarter of 2013 to 5.9 percent during the

second quarter of 2019. During the period, the average rent increased $20, or

nearly 3 percent, annually, to $842 during the second quarter of 2019. During

the second quarter of 2020, however, vacancies in the University North

market area increased to 9.4 percent as the onset of the COVID-19 pandemic

affected occupancy levels. Rents declined to $837 by the second quarter of

2020 before rebounding rapidly to $900, reflecting an increase of nearly

8 percent, by the second quarter of 2021 as heightened net in-migration to

the HMA increased overall rental demand. The apartment vacancy rate in the

University North submarket was 8.0 percent during the second quarter of

2022, up slightly from 7.9 percent during the same period a year earlier, and

the average apartment rent increased an average of 14 percent to $1,024.

Military Housing

Davis-Monthan AFB has a smaller but noteworthy effect on the rental market

in the HMA, and particularly in the area surrounding the AFB. As of 2021,

approximately 6,150 active-duty personnel were stationed at the Davis-

Monthan AFB. On-base housing capacity includes the 775-bed Unaccompanied

Housing option; other AFB housing choices include three privately-operated

neighborhoods with 1,175 two-to-five-bedroom single-family and duplex homes.

In the CoStar Group-defined Southeast submarket immediately surrounding

the AFB, the overall apartment vacancy rate during the second quarter of 2022

was 6.4 percent, up from 4.9 percent during the second quarter of 2021, but

down from a high of 9.9 percent during the second quarter of 2013. Rents

in the submarket area rose an average of 5 percent a year from the second

quarter of 2013 to the second quarter of 2020. The average apartment asking

rent in the Southeast submarket area during the second quarter of 2022 was

$1,035, an 18-percent increase from the second quarter of 2021.

Rental Market 22Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Rental Construction

Rental construction activity in the Tucson HMA, as

measured by the number of rental units permitted,

has fluctuated since 2000. Approximately 1,450

rental units were permitted in 2000; subsequently,

construction activity fell at an average annual rate

of 21 percent to a low of 360 units permitted in

2006 (Figure 14). In response to declining vacancy

rates, rental construction increased to 640 units

during 2007. During 2008 through 2010, rental

construction activity averaged 280 units annually,

partly because of an increase in the average

apartment vacancy rate. From 2011 through

2014, rental construction activity averaged 970

units built annually as builders responded to

declines in the average apartment vacancy rate

and local economic growth. The slowdown in

job growth during 2014 and an increase in the

average apartment vacancy rate contributed to

a decrease in rental construction activity during

2015 through 2016, when an average of 120 units

were permitted annually. During 2017, rental

construction activity increased to a decade-high

of 1,575 units as builders responded to stronger

demand for apartments. From 2018 through

2020, construction activity declined an average

of 24 percent annually to reach 700 units in

2020, despite a continued decline in the vacancy

rate, before increasing to 1,150 units during

2021. During the 12 months ending July 2022,

rental construction activity in the HMA more than

doubled to an estimated 1,975 units compared

2,000

1,800

1,600

1,400

1,200

1,000

800

600

400

200

0

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

12 ME Jul 2021

12 ME Jul 2022

Rental Units Rental Units 12 ME

Figure 14. Annual Rental Permitting Activity in the Tucson HMA

12 ME = 12 months ending.

Note: Includes apartments and units intended for rental occupancy.

Sources: U.S. Census Bureau, Building Permits Survey; 2000–21—final data and estimates by the analyst; past 24 months of data—preliminary

data and estimates by the analyst

with a year earlier (preliminary data, with adjustments by the analyst). Record high rent growth and a

decline in the average apartment vacancy rate contributed to the increase in rental construction activity

during the past year.

New Rental Construction Activity

Among the 1,650 units currently underway are those at Cabana Bridges, an apartment community on the

south side of the city of Tucson within the 350-acre The Bridges mixed-use development. Construction

began on the 288-unit complex in November 2021, with completion anticipated in early 2023. Average

rents are expected to start at $1,000 for 468-square-foot studios, 624-square-foot one-bedroom units,

and 828-square-foot two-bedroom units. Recent developments in the HMA include Encantada Rita Ranch,

located southeast of Tucson in Rita Ranch. Encantada Rita Ranch was completed during 2021, and rents

for one-, two-, and three-bedroom units start at $1,621, $1,849, and $2,201, respectively. Among the

Rental Market 23Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

recently completed student apartments is the Mark, an eight-story apartment

community with 154 units, or 475 bedrooms, approximately 1 mile from UA in

the city of Tucson. The development opened in late 2019, with an option to

rent per unit or per bedroom. Per bedroom rents for one-, two-, three-, and

four-bedroom units start at $1,600, $1,120, $1,075, and $840, respectively.

Forecast

During the 3-year forecast period, demand is expected for an additional 3,775

rental units (Table 8). The 1,650 units currently under construction will meet the

demand during the first year and part of the demand during the second year of

the forecast period. Rental demand is expected to increase in the second and

third years of the forecast period in response to continued household growth

and as homeownership becomes increasingly more expensive.

Note: The forecast period is August 1, 2022, to August 1, 2025.

Source: Estimates by the analyst

Rental Units

Demand 3,775 Units

Under Construction 1,650 Units

Table 8. Demand for New Rental Units in the Tucson HMA

During the Forecast Period

Terminology Definitions and Notes 24Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Terminology Definitions and Notes

A. Definitions

Building Permits

Building permits do not necessarily reflect all residential building activity that occurs in an HMA. Some units are constructed or created without a

building permit or are issued a different type of building permit. For example, some units classified as commercial structures are not reflected in the

residential building permits. As a result, the analyst, through diligent fieldwork, makes an estimate of this additional construction activity. Some of

these estimates are included in the discussions of single-family and multifamily building permits.

Demand

The demand estimates in the analysis are not a forecast of building activity. They are the estimates of the total housing production needed to achieve

a balanced market at the end of the 3-year forecast period given conditions on the as-of date of the analysis, growth, losses, and excess vacancies.

The estimates do not account for units currently under construction or units in the development pipeline.

Distressed Sales Short sales and real estate owned (REO) sales.

Existing Home

Sales

Includes regular resales and REO sales.

Forecast Period 8/1/2022–8/1/2025—Estimates by the analyst.

Home Sales/

Home Sales

Prices

Includes single-family home, townhome, and condominium sales.

Net Natural

Change

Resident births minus resident deaths.

Terminology Definitions and Notes 25Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Rental Market/

Rental Vacancy

Rate

Includes apartments and other rental units such as single-family, multifamily, and mobile homes.

Seriously

Delinquent

Mortgages

Mortgages 90+ days delinquent or in foreclosure.

B. Notes on Geography

1.

The metropolitan statistical area definition noted in this report is based on the delineations established by the Office of Management and Budget (OMB)

in the OMB Bulletin dated April 10, 2018.

2. Urbanized areas are defined using the U.S. Census Bureau 2010 Census Urban and Rural Classification and the Urban Area Criteria.

C. Additional Notes

1.

The NAHB Housing Opportunity Index represents the share of homes sold in the HMA that would have been affordable to a family earning the local

median income, based on standard mortgage underwriting criteria.

2.

This analysis has been prepared for the assistance and guidance of HUD in its operations. The factual information, findings, and conclusions may

also be useful to builders, mortgagees, and others concerned with local housing market conditions and trends. The analysis does not purport to

make determinations regarding the acceptability of any mortgage insurance proposals that may be under consideration by the Department.

3.

The factual framework for this analysis follows the guidelines and methods developed by the Economic and Market Analysis Division within HUD.

The analysis and findings are as thorough and current as possible based on information available on the as-of date from local and national sources.

As such, findings or conclusions may be modified by subsequent developments. HUD expresses its appreciation to those industry sources and state

and local government officials who provided data and information on local economic and housing market conditions.

Terminology Definitions and Notes 26Tucson, Arizona Comprehensive Housing Market Analysis as of August 1, 2022

Comprehensive Housing Market Analysis Tucson, Arizona

U.S. Department of Housing and Urban Development, Office of Policy Development and Research

Contact Information

Cameron N. Ehrlich, Economist