NAHB Priced-Out Estimates for 2023

March 2023

Special Study for Housing Economics

Na Zhao, Ph.D.

Economics and Housing Policy

National Association of Home Builders

This article presents the NAHB’s “priced out estimates” for 2023, showing how higher prices

and interest rates affect housing affordability. The 2023 US estimates indicate that a $1,000

increase in the median new home price ($425,786

1

) would price 140,436 households out of the

market. As a benchmark, 96.5 million households are not able to afford a new median priced

new home. A $1,000 home price increase would make 140,436 more households disqualify for

the new home mortgage. Elevated mortgage interest rates, together with higher home prices,

create affordability challenges, particularly for first-time buyers.

Other NAHB estimates in this paper show that for 2023, 25 basis points added to the mortgage

rate at 30-year fixed rate of 6.25% would price out around 1.3 million households. In addition to

the national numbers, NAHB once again is providing priced out estimates for individual states

and more than 300 metropolitan areas.

The Priced-Out Methodology and Data

The NAHB priced-out model uses the ability to qualify a mortgage to measure housing

affordability, because most home buyers finance their new home purchase with conventional

loans, and because convenient underwriting standards for these loans apply. The standard

NAHB adopts for its priced-out estimates is that the sum of the mortgage payment (including the

principal amount, loan interest, property tax, homeowners’ property and private mortgage

insurance premiums (PITI), is no more than 28 percent of monthly gross household income.

As a result, the number of households that qualify for mortgages for a certain priced home

depends on the household income distribution in an area and the mortgage interest rate at that

1

The 2022 US median new home price is estimated by projecting the 2021 preliminary median new home price using the NAHB

forecast of the Case-Shiller Home Price Index.

time. The most recent detailed household income distributions for all states and metro areas are

from the 2021 American Community Survey (ACS). NAHB adjusts the income distributions to

reflect the income and population changes that may happen from 2021 to 2023. The income

distribution is adjusted for inflation using the 2022 median family income at the state

2

and

metro

3

levels and then extrapolated into 2023. The number of households in 2023 is projected by

the growth rate of households from 2019 to 2021.

Other assumptions of the priced-out calculation include a 10% down payment and a 30-year

fixed rate mortgage at an interest rate of 6.25% with zero points. For a loan with this down

payment, private mortgage insurance is required by lenders and thus included as part of PITI.

The typical private mortgage insurance annual premium is 73 basis points,

4

based on the

standard assumption of a national median credit score of 738

5

and 10% down payment and 30-

year fixed mortgage rate. Effective local property tax rates are calculated using data from the

2019 American Community Survey (ACS) summary files. Homeowner insurance rates are

constructed from the 2019 ACS Public Use Microdata Sample (PUMS)

6

. For the US as a whole,

the effective property tax rate is $10.7 per $1,000 of property value and typical homeowner

insurance is $3.6 per $1,000 of property value.

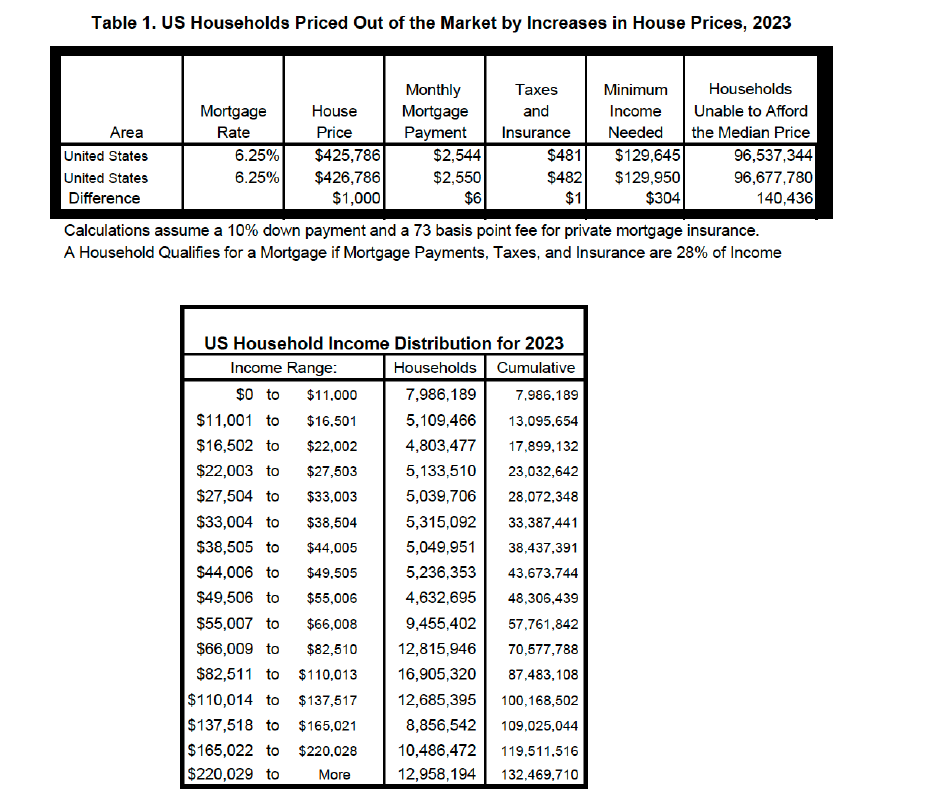

U.S. Priced-Out Estimates

Under these assumptions, 35.9 million of the 132.5 million US households could afford to buy a

new median priced home at $425,786 in 2023. A $1,000 home price increase will thus price

140,436 households out of the market for this home. These are the households that can qualify

for a mortgage before a $1,000 increase but not afterwards, as shown in Table 1 below.

2

The state median family income is published by Department of Housing and Urban Development (HUD).

3

The MSA median family income is calculated by HUD and published by Federal Financial Institutions Examination Council

(FFIEC).

4

Private mortgage insurance premium (PMI) is obtained from the PMI Cost Calculator( https://www.hsh.com/calc-pmionly.html)

5

Median credit score information is shown in the article “Four ways today’s high home prices affect the

larger economy” October 2018 Urban Institute https://www.urban.org/urban-wire/four-ways-todays-high-home-prices-affect-

larger-economy

6

Producing metro level estimates from the ACS PUMS involves aggregating Public Use Microdata Area (PUMA) level data

according to the latest definitions of metropolitan areas. Due to complexity of these procedures and since metro level insurance

rates tend to remain stable over time, NAHB revises these estimates only periodically.

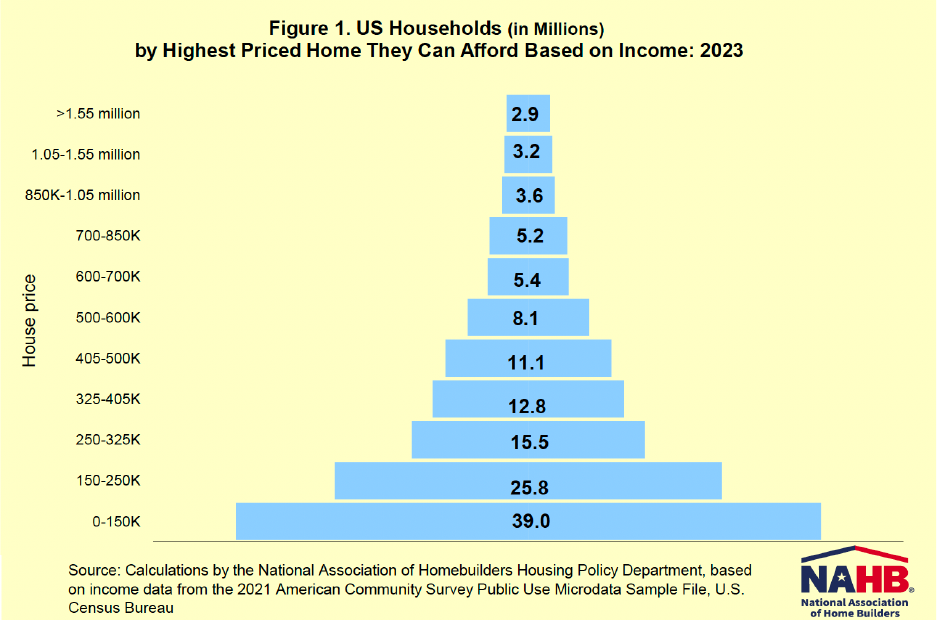

The U.S. housing affordability pyramid represents the number of households that could only

afford homes of no more than a certain price. Based on conventional assumptions and

underwriting standards, the minimum income required to purchase a $150,000 home at the

mortgage rate of 6.25% is $45,672.63. In 2023, about 39 million households in the U.S. are

estimated to have incomes no more than that threshold and, therefore, can only afford to buy

homes priced no more than $150,000. These 39 million households form the bottom step of the

pyramid (Figure 1). Of the remaining households who can afford a home priced at $150,000,

25.8 million can only afford to pay a top price of somewhere between $150,000 and $250,000

(the second step on the pyramid). Each step represents a maximum affordable price range for

fewer and fewer households. Housing affordability is a great concern for households with annual

income at the lower end of the distribution.

State and Local Estimates

The number of priced out households varies across both states and metropolitan areas, largely

affected by the sizes of local population and the affordability of new homes. The 2023 priced-out

estimates for all states and the District of Columbia are shown in Table 2, which presents the

projected 2023 median new home price estimates and the amount of income needed to qualify

the mortgage, the number and the percent of households who cannot afford the new homes, and

the number of households could be priced out if price goes up by $1,000. Among all the states,

Florida registered the largest number of households priced out of the market by a $1,000 increase

in the median-priced home in the state (9,573), followed by Texas (9,151), and California

(7,243), largely because these three states are the top three populous states.

Table 3 shows the 2023 priced-out estimates for over 300 metropolitan statistical areas and metro

divisions. The metropolitan area (or metro division) with the largest priced out effect, in terms of

absolute numbers, is Houston-The Woodlands-Sugar Land, TX, where 3,054 households will be

disqualified for a new median-priced home if price goes up by $1,000. The Atlanta-Sandy

Springs-Alpharetta, GA metro area registers the second largest number of priced-out households

(2,626), followed by Chicago-Naperville-Evanston, IL metro division (2,467) and New York-

Jersey City-White Plains, NY-NJ metro division (2,065). Different impacts of adding $1,000 to a

new home price are largely due to different sizes of metro population and the affordability of

new homes to begin with. The largest priced-out effect is in the Houston, TX metro area, where

2.1 million households are unable to afford the median-priced new home initially, and a $1,000

increase prices out an additional 3,054. Compared to the Houston metro area, the relatively larger

priced-out effect in the New York-Jersey City-White Plains, NY-NJ metro division is because of

the largest population size among all metro areas and metro divisions.

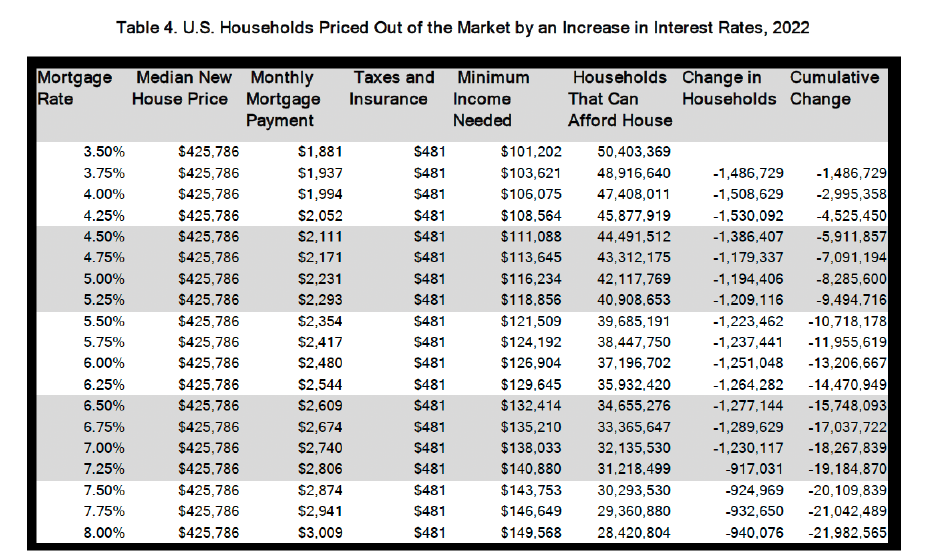

Interest Rates

The NAHB 2023 priced-out estimates also present how interest rates affect the number of

households that would be priced out of the new home market. If mortgage interest rate increase,

the monthly mortgage payments will rise as well and therefore higher household income

thresholds are needed to qualify for a mortgage loan. Table 4 shows the number of households

priced out of the market for a new median priced home at $ 425,786 by each 25 basis-point

increase in interest rate from 3.5% to 8%. When interest rates increase from 6.25% to 6.5%,

around 1.28 million households can no longer afford buying median-priced new homes. An

increase from 6.5% to 7% prices approximately 1.29 million households out of the market.

However, about 917,000 households would be squeezed out of the market if interest rate goes up

to 7.25% from 7%. This diminishing effect happens because only a few households at the

smaller end of household income distribution will be affected. In contrast, when interest rates are

relatively low, a 25 basis-point increase would affect a larger number of households at the larger

section of the income distribution.

United States 425,786 129,645 132,469,710 96,537,344 140,436

Alabama 322,953 94,014 2,040,123 1,423,521 2,681

Alaska 308,985 96,439 291,871 153,955 431

Arizona 492,558 140,214 2,973,128 2,402,986 2,304

Arkansas 240,411 71,794 1,204,048 710,298 2,167

California 601,917 173,080 13,705,842 10,457,556 7,243

Colorado 589,695 168,256 2,393,699 1,892,915 1,305

Connecticut 536,220 182,643 1,481,360 1,156,449 914

Delaware 470,721 134,632 416,075 288,787 391

District of Columbia 589,493 166,112 350,248 238,348 244

Florida 436,336 132,891 9,279,841 7,344,433 9,573

Georgia 383,391 115,618 4,155,220 2,981,340 4,260

Hawaii 925,231 252,090 516,181 472,851 261

Idaho 472,319 134,076 734,109 607,296 495

Illinois 387,157 133,323 5,120,520 3,626,384 6,158

Indiana 397,428 120,129 2,766,270 2,131,760 3,024

Iowa 398,201 130,910 1,313,849 1,061,560 1,111

Kansas 480,388 158,124 1,180,099 994,030 903

Kentucky 321,661 97,821 1,823,413 1,278,174 2,532

Louisiana 276,776 83,497 1,827,826 1,143,531 2,973

Maine 359,607 110,807 614,332 447,030 701

Maryland 415,455 125,572 2,491,997 1,490,359 2,842

Massachusetts 1,014,587 310,447 2,871,784 2,869,291 1,727

Michigan 375,352 119,817 4,135,406 3,080,557 4,521

Minnesota 440,104 136,303 2,341,036 1,703,640 2,272

Mississippi 271,597 83,919 1,159,778 818,099 1,651

Missouri 401,811 124,110 2,479,159 1,938,218 2,563

Montana 495,760 146,763 460,539 390,222 314

Nebraska 348,221 116,125 800,794 602,408 1,068

Nevada 497,365 140,129 1,241,203 954,118 1,129

New Hampshire 480,929 159,069 554,737 440,226 425

New Jersey 449,221 156,124 3,723,261 2,552,082 3,565

New Mexico 468,259 138,450 876,670 746,336 574

New York 762,735 246,870 7,864,210 7,030,080 3,850

North Carolina 408,684 121,187 4,317,306 3,287,850 4,230

North Dakota 420,455 130,016 321,506 238,218 341

Ohio 407,092 131,655 4,937,729 3,976,527 5,579

Oklahoma 463,362 145,961 1,602,649 1,344,578 1,478

Oregon 600,373 176,300 1,757,565 1,493,179 763

Pennsylvania 560,152 178,526 5,341,014 4,611,284 2,528

Rhode Island 718,404 228,588 475,840 442,221 241

South Carolina 404,514 118,055 2,126,805 1,597,965 1,908

South Dakota 372,224 116,922 360,002 272,637 437

Tennessee 346,540 101,407 2,891,092 2,023,759 4,004

Texas 439,581 147,125 11,673,258 9,145,956 9,159

Utah 522,301 147,701 1,185,031 914,731 1,000

Vermont 447,116 147,705 277,767 225,257 231

Virginia 401,764 117,877 3,477,182 2,208,502 3,924

Washington 635,131 186,757 3,114,782 2,527,592 1,737

West Virginia 208,300 61,247 716,276 400,187 1,516

Wisconsin 436,772 141,285 2,514,998 2,006,180 1,996

Wyoming 406,817 117,706 252,796 183,976 273

State

Median New

Home Price

Income

Needed to

Qualify

Table 2 Households Priced Out of the Market by a $1,000 Price Increase, 2023

Total

Households

Additional

Households Priced

Out by a $1,000

increase

Households

Unable to Afford

the Median

Price

Abilene, TX 255,297 84,621 72,298 36,962 177

Akron, OH 476,676 156,756 298,813 263,875 144

Albany, GA 234,253 74,854 61,892 48,105 150

Albany-Lebanon, OR 122,917 36,965 53,363 11,709 144

Albany-Schenectady-Troy, NY 378,852 128,524 394,699 276,520 512

Albuquerque, NM 460,702 138,801 400,228 335,705 310

Alexandria, LA 185,226 55,282 54,909 25,144 153

Allentown-Bethlehem-Easton, PA-NJ 539,102 179,196 352,961 297,547 171

Altoona, PA 347,060 108,607 47,232 37,529 48

Amarillo, TX 288,791 98,602 110,579 81,593 124

Ames, IA 446,598 145,765 49,157 43,392 25

Anchorage, AK 242,325 76,054 164,388 60,717 310

Ann Arbor, MI 637,659 205,521 156,978 131,216 75

Anniston-Oxford, AL 206,505 61,314 44,626 25,483 96

Appleton, WI 475,825 154,004 101,501 84,290 101

Asheville, NC 671,790 192,926 177,728 162,283 54

Athens-Clarke County, GA 565,354 171,108 92,128 86,526 47

Atlanta-Sandy Springs-Alpharetta, GA 442,012 133,070 2,369,222 1,683,117 2,626

Atlantic City-Hammonton, NJ 309,100 112,305 123,668 94,070 183

Auburn-Opelika, AL 370,287 107,287 70,399 45,325 95

Augusta-Richmond County, GA-SC 370,027 110,593 233,063 167,022 265

Austin-Round Rock-Georgetown, TX 447,001 146,130 1,115,314 817,808 1,166

Bakersfield, CA 444,360 134,608 293,410 232,964 274

Baltimore-Columbia-Towson, MD 535,157 162,569 1,174,925 845,730 967

Bangor, ME 276,351 87,614 66,814 43,233 91

Barnstable Town, MA 628,335 185,215 113,658 90,524 69

Baton Rouge, LA 273,480 82,239 353,980 174,670 474

Battle Creek, MI 303,039 98,785 53,139 38,533 68

Bay City, MI 367,617 138,969 46,095 40,676 25

Beaumont-Port Arthur, TX 175,869 59,685 155,127 71,852 382

Beckley, WV 312,125 92,652 43,611 31,475 61

Bellingham, WA 824,054 239,095 95,776 88,347 35

Bend, OR 782,373 223,594 91,682 81,780 42

Billings, MT 220,157 65,761 77,629 35,847

173

Binghamton, NY 226,801 83,773 112,117 72,660 213

Birmingham-Hoover, AL 427,339 124,239 444,712 339,700 410

Bismarck, ND 608,205 186,770 53,451 47,557 33

Blacksburg-Christiansburg, VA 269,333 78,995 72,167 46,892 91

Bloomington, IL 342,140 120,926 73,672 50,783 91

Bloomington, IN 279,328 83,582 68,607 43,347 112

Bloomsburg-Berwick, PA 353,865 111,661 33,256 24,227 43

Boise City, ID 342,213 96,948 315,585 202,457 526

Boston, MA Metro Division 879,346 265,956 825,038 729,240 497

Cambridge-Newton-Framingham, MA Metro Division 879,346 266,336 976,505 845,763 633

Rockingham County-Strafford County, NH Metro Division 879,346 286,604 185,254 200,357 164

Boulder, CO 725,593 204,563 139,467 119,853 99

Bowling Green, KY 297,007 89,298 78,015 56,431 140

Bremerton-Silverdale-Port Orchard, WA 904,759 264,726 105,285 104,415 62

Bridgeport-Stamford-Norwalk, CT 834,475 273,812 374,805 314,489 216

Brownsville-Harlingen, TX 337,171 118,994 142,480 125,671 98

Brunswick, GA 202,239 61,031 45,816

17,903 87

Buffalo-Cheektowaga, NY 579,922 201,294 519,193 473,873 244

Burlington, NC 249,121 73,237 74,763 37,917 146

Burlington-South Burlington, VT 442,437 143,672 96,852 70,679 68

Table 3 Households Priced Out of the Market by a $1,000 Price Increase, 2023

Additional

Households

Priced Out

by a $1,000

increase

Median New

Home Price

Income

Needed to

Qualify

Total

Households

Metro Area

Households

Unable to

Afford the

Median Price

Table 3 Households Priced Out of the Market by a $1,000 Price Increase, 2023

Additional

Households

Priced Out

by a $1,000

increase

Median New

Home Price

Income

Needed to

Qualify

Total

Households

Metro Area

Households

Unable to

Afford the

Median Price

California-Lexington Park, MD 380,766 114,607 43,913 29,147 74

Canton-Massillon, OH 379,697 121,525 170,987 137,580 191

Cape Coral-Fort Myers, FL 372,260 113,529 357,975 247,015 527

Cape Girardeau, MO-IL 262,102 79,894 37,769 23,231 91

Carbondale-Marion, IL 235,165 81,889 54,093 34,878 106

Carson City, NV 511,339 140,433 25,223 22,625 10

Casper, WY 339,298 98,872 33,363 23,676 56

Cedar Rapids, IA 256,291 85,087 112,563 64,591 204

Chambersburg-Waynesboro, PA 351,313 109,187 63,957 45,348 71

Champaign-Urbana, IL 414,300 144,134 93,450 77,942 80

Charleston, WV 202,261 60,648 103,258 55,006 216

Charleston-North Charleston, SC 499,699 145,375 329,286 250,659 239

Charlotte-Concord-Gastonia, NC-SC 469,445 138,191 1,119,126 847,316 845

Charlottesville, VA 536,117 156,785 89,417 70,010 50

Chattanooga, TN-GA 404,903 120,780 234,912 200,952 185

Cheyenne, WY 493,263 144,324 45,812 33,470 47

Chicago-Naperville-Evanston, IL Metro Division 503,364 172,518 2,918,910 2,275,906 2,467

Elgin, IL Metro Division 503,364 179,163 270,235 205,312 292

Gary, IN Metro Division 503,364 150,652 284,035 239,486 220

Lake County-Kenosha County, IL-WI Metro Division 503,364 179,180 333,628 250,904 209

Chico, CA 492,200 144,085 85,231 68,806 60

Cincinnati, OH-KY-IN 379,102 119,938 928,534 632,608 1,034

Clarksville, TN-KY 345,997 103,917 128,083 91,925 218

Cleveland, TN 316,118 92,291 53,768 39,034 81

Cleveland-Elyria, OH 417,609 139,995 907,934 748,509 710

Coeur d'Alene, ID 448,605 125,871 70,354 57,872 48

College Station-Bryan, TX 272,523 90,828 105,536 65,568 141

Colorado Springs, CO 683,121 195,351 315,164 276,966 164

Columbia, MO 310,376 95,148 90,055 67,227 99

Columbia, SC 262,421 77,707 351,465 186,359 590

Columbus, GA-AL 281,399 86,562 135,238 92,826 184

Columbus, IN 362,248 109,140 34,803 20,339 51

Columbus, OH 427,798 137,345 897,172 668,215 1,086

Corpus Christi, TX 256,892 90,204 153,172 82,641

267

Corvallis, OR 594,845 178,518 41,426 30,151 28

Crestview-Fort Walton Beach-Destin, FL 344,295 101,624 136,758 88,124 188

Cumberland, MD-WV 396,577 120,150 44,094 40,107 19

Dallas-Plano-Irving, TX Metro Division 483,393 163,741 2,070,202 1,639,096 1,212

Fort Worth-Arlington-Grapevine, TX Metro Division 483,393 162,837 984,037 798,973 839

Dalton, GA 129,616 38,902 50,895 17,205 162

Danville, IL 242,648 85,500 27,008 20,541 44

Daphne-Fairhope-Foley, AL 380,873 109,394 107,571 78,134 92

Davenport-Moline-Rock Island, IA-IL 242,112 82,485 162,967 87,594 281

Dayton-Kettering, OH 482,248 161,294 344,869 302,821 155

Decatur, AL 177,889 51,902 62,314 33,666 127

Decatur, IL 278,477 98,458 45,119 29,618 75

Deltona-Daytona Beach-Ormond Beach, FL 311,333 93,792 322,037 222,462 495

Denver-Aurora-Lakewood, CO 673,917 193,001 1,233,142 985,772 737

Des Moines-West Des Moines, IA 420,170 140,089 302,677 231,559 255

Detroit-Dearborn-Livonia, MI Metro Division 419,258 138,760 700,854 583,439 672

Warren-Troy-Farmington Hills, MI Metro Division 419,258 133,165 1,098,798

761,182 1,276

Dothan, AL 250,513 72,998 65,888 38,244 117

Dover, DE 350,994 99,645 72,379 51,244 134

Dubuque, IA 296,979 95,477 42,738 29,316 67

Table 3 Households Priced Out of the Market by a $1,000 Price Increase, 2023

Additional

Households

Priced Out

by a $1,000

increase

Median New

Home Price

Income

Needed to

Qualify

Total

Households

Metro Area

Households

Unable to

Afford the

Median Price

Duluth, MN-WI 428,083 134,246 125,079 100,673 142

Durham-Chapel Hill, NC 502,265 150,532 273,019 224,742 153

East Stroudsburg, PA 294,320 100,971 77,189 52,013 127

Eau Claire, WI 436,268 139,011 73,122 57,133 74

El Centro, CA 327,139 98,244 47,518 32,646 51

Elizabethtown-Fort Knox, KY 301,338 91,109 57,832 36,235 103

Elkhart-Goshen, IN 198,836 60,301 69,480 24,022 163

Elmira, NY 210,745 77,600 37,434 22,846 79

El Paso, TX 435,323 155,397 331,339 295,614 217

Enid, OK 334,726 106,376 22,368 14,236 30

Erie, PA 227,120 76,483 110,996 67,852 253

Eugene-Springfield, OR 622,241 183,871 164,748 148,221 47

Evansville, IN-KY 466,893 142,146 135,981 113,713 128

Fairbanks, AK 435,313 138,980 37,317 25,973 30

Fargo, ND-MN 441,959 140,492 116,231 87,950 103

Farmington, NM 223,292 66,193 39,196 24,299 74

Fayetteville, NC 338,872 105,034 202,276 162,879 208

Fayetteville-Springdale-Rogers, AR 249,875 73,783 217,252 107,690 470

Flagstaff, AZ 611,395 172,024 62,070 58,028 40

Flint, MI 220,634 72,301 166,554 100,240 333

Florence, SC 199,474 58,443 77,988 44,206 147

Florence-Muscle Shoals, AL 162,378 47,793 62,154 28,105 172

Fond du Lac, WI 548,767 178,779 42,913 37,354 27

Fort Collins, CO 435,313 124,096 157,813 104,239 171

Fort Smith, AR-OK 118,451 35,749 96,082 30,458 257

Fort Wayne, IN 373,818 113,457 177,641 134,869 197

Fresno, CA 595,510 174,945 329,459 286,587 152

Gadsden, AL 145,034 42,679 36,064 15,203 117

Gainesville, FL 272,523 84,211 143,688 88,276 240

Gainesville, GA 433,506 129,602 79,994 58,457 50

Gettysburg, PA 427,445 136,714 41,312 33,015 40

Glens Falls, NY 347,379 117,117 55,493 41,213 62

Goldsboro, NC 305,933 93,744 45,432 37,435 50

Grand Forks, ND-MN 284,219 89,001 41,767 23,342

60

Grand Island, NE 355,757 116,334 30,427 25,944 22

Grand Junction, CO 333,698 93,098 63,948 41,304 81

Grand Rapids-Kentwood, MI 405,948 125,711 424,533 324,476 549

Grants Pass, OR 662,752 187,995 38,372 35,660 11

Great Falls, MT 422,119 130,194 35,857 32,181 26

Greeley, CO 610,226 175,483 128,311 105,653 70

Green Bay, WI 301,551 96,246 139,370 88,284 226

Greensboro-High Point, NC 230,416 69,193 312,576 192,231 710

Greenville, NC 224,036 69,312 80,535 49,906 151

Greenville-Anderson, SC 282,624 81,724 398,342 224,612 746

Gulfport-Biloxi, MS 337,915 105,884 166,185 130,042 202

Hagerstown-Martinsburg, MD-WV 285,920 84,762 125,755 81,577 238

Hammond, LA 342,902 100,924 53,551 43,011 43

Hanford-Corcoran, CA 371,728 109,584 41,583 30,710 66

Harrisburg-Carlisle, PA 541,384 170,464 252,478 218,268 139

Harrisonburg, VA 333,237 95,858 54,101 39,596 69

Hartford-East Hartford-Middletown, CT 658,544 228,693 499,747

438,390 328

Hattiesburg, MS 189,479 58,971 75,148 46,672 176

Hickory-Lenoir-Morganton, NC 518,569 152,865 146,877 128,706 72

Hilton Head Island-Bluffton, SC 584,145 171,536 95,682 81,195 39

Table 3 Households Priced Out of the Market by a $1,000 Price Increase, 2023

Additional

Households

Priced Out

by a $1,000

increase

Median New

Home Price

Income

Needed to

Qualify

Total

Households

Metro Area

Households

Unable to

Afford the

Median Price

Hinesville, GA 202,877 62,886 28,623 13,941 67

Homosassa Springs, FL 224,036 67,409 72,317 40,979 118

Hot Springs, AR 214,254 63,509 42,414 28,093 83

Houma-Thibodaux, LA 122,811 37,215 87,630 31,343 246

Houston-The Woodlands-Sugar Land, TX 426,298 145,492 2,777,533 2,051,616 3,054

Huntington-Ashland, WV-KY-OH 269,893 81,460 152,512 104,256 195

Huntsville, AL 330,366 95,427 224,047 142,495 284

Idaho Falls, ID 414,366 118,495 57,744 41,213 57

Indianapolis-Carmel-Anderson, IN 437,327 132,495 877,392 654,687 907

Iowa City, IA 412,427 134,655 69,409 57,783 41

Ithaca, NY 315,055 108,548 49,043 35,635 49

Jackson, MI 313,181 100,464 62,476 39,158 82

Jackson, MS 194,796 59,923 237,531 113,172 466

Jackson, TN 292,651 89,062 72,562 54,945 113

Jacksonville, FL 381,298 114,946 711,658 500,843 813

Jacksonville, NC 303,310 92,936 84,062 69,039 95

Janesville-Beloit, WI 405,435 134,617 70,536 59,710 75

Jefferson City, MO 312,928 95,610 52,154 34,225 66

Johnson City, TN 294,334 86,539 84,570 55,067 124

Johnstown, PA 325,794 104,325 54,102 42,644 89

Jonesboro, AR 216,912 65,126 51,022 27,710 100

Joplin, MO 181,186 55,553 72,216 37,414 206

Kahului-Wailuku-Lahaina, HI 753,664 203,251 57,939 47,270 27

Kalamazoo-Portage, MI 429,146 138,706 108,146 87,848 80

Kankakee, IL 340,042 123,438 42,509 26,808 50

Kansas City, MO-KS 474,549 150,457 924,762 729,864 780

Kennewick-Richland, WA 774,079 228,665 110,005 107,264 62

Killeen-Temple, TX 298,361 100,277 193,838 129,941 286

Kingsport-Bristol, TN-VA 241,156 70,947 125,748 77,446 227

Kingston, NY 368,964 125,312 81,195 59,533 77

Knoxville, TN 417,556 120,932 375,906 290,190 418

Kokomo, IN 370,240 112,921 39,075 31,898 63

La Crosse-Onalaska, WI-MN 193,945 63,611 59,524 25,857 139

Lafayette, LA 238,816 72,120 191,072 105,232

313

Lafayette-West Lafayette, IN 450,306 134,704 88,058 77,602 47

Lake Charles, LA 338,703 102,188 66,562 46,938 98

Lake Havasu City-Kingman, AZ 245,940 70,210 115,103 69,789 188

Lakeland-Winter Haven, FL 284,963 87,169 320,309 220,162 487

Lancaster, PA 368,326 117,359 215,565 151,734 282

Lansing-East Lansing, MI 365,443 121,089 224,362 174,415 271

Laredo, TX 218,082 75,557 81,210 41,056 184

Las Cruces, NM 242,963 72,125 91,392 57,778 120

Las Vegas-Henderson-Paradise, NV 494,150 139,520 897,005 686,547 728

Lawrence, KS 469,642 151,070 51,042 39,855 35

Lawton, OK 326,630 104,907 49,881 39,489 67

Lebanon, PA 406,102 130,556 55,971 45,900 46

Lewiston, ID-WA 444,855 131,830 27,123 18,963 34

Lewiston-Auburn, ME 316,969 100,671 46,725 31,920 75

Lexington-Fayette, KY 364,604 110,033 225,769 161,116 221

Lima, OH 226,907 71,586 41,590 21,256 79

Lincoln, NE 580,028 193,688 141,486

130,955 70

Little Rock-North Little Rock-Conway, AR 304,103 91,942 329,675 210,539 427

Logan, UT-ID 413,835 119,325 51,535 39,593 67

Longview, TX 282,837 91,982 109,437 74,197 153

Table 3 Households Priced Out of the Market by a $1,000 Price Increase, 2023

Additional

Households

Priced Out

by a $1,000

increase

Median New

Home Price

Income

Needed to

Qualify

Total

Households

Metro Area

Households

Unable to

Afford the

Median Price

Longview, WA 586,207 173,358 43,622 41,116 19

Anaheim-Santa Ana-Irvine, CA Metro Division 617,207 176,296 1,111,143 791,248 716

Los Angeles-Long Beach-Glendale, CA Metro Division 617,207 177,022 3,423,445 2,753,888 1,685

Louisville/Jefferson County, KY-IN 369,602 111,879 552,143 388,061 776

Lubbock, TX 443,286 154,074 136,778 115,961 69

Lynchburg, VA 556,529 160,146 104,919 90,627 57

Macon-Bibb County, GA 224,462 70,689 85,656 51,762 190

Madera, CA 370,133 108,790 43,712 30,344 38

Madison, WI 382,042 124,776 307,517 201,627 338

Manchester-Nashua, NH 464,341 153,642 173,383 124,126 206

Manhattan, KS 443,948 145,798 55,944 48,714 41

Mankato, MN 298,574 93,485 41,660 23,986 63

Mansfield, OH 232,224 74,574 49,262 30,749 105

McAllen-Edinburg-Mission, TX 142,056 49,480 291,443 148,625 719

Medford, OR 585,524 170,656 93,938 84,032 29

Memphis, TN-MS-AR 409,697 125,649 536,031 407,804 454

Merced, CA 401,394 115,981 89,521 59,928 77

Fort Lauderdale-Pompano Beach-Sunrise, FL Metro Division 668,465 208,612 792,487 713,326 294

Miami-Miami Beach-Kendall, FL Metro Division 668,465 205,280 1,016,962 928,369 366

West Palm Beach-Boca Raton-Boynton Beach, FL Metro Divisio

n

668,465 207,324 623,216 546,759 268

Michigan City-La Porte, IN 264,548 81,049 43,793 24,384 89

Midland, MI 357,905 118,894 36,591 24,161 48

Midland, TX 254,553 82,025 75,700 25,804 100

Milwaukee-Waukesha, WI 569,537 183,484 663,561 566,196 285

Minneapolis-St. Paul-Bloomington, MN-WI 520,802 161,417 1,513,133 1,114,015 1,414

Missoula, MT 508,149 152,782 53,085 47,139 28

Mobile, AL 302,543 91,458 177,111 127,026 213

Modesto, CA 512,934 149,243 173,721 149,272 88

Monroe, LA 204,047 60,629 83,602 50,073 173

Monroe, MI 342,732 108,190 62,281 44,027 97

Montgomery, AL 340,361 98,405 156,969 101,673 182

Morgantown, WV 346,366 100,332 59,068 35,955 89

Morristown, TN 204,791 59,523 52,044 24,324 98

Mount Vernon-Anacortes, WA 297,829 87,770 55,074 32,188 93

Muncie, IN 170,234 52,505 46,316 19,759 109

Muskegon, MI 305,982 97,140 69,303 47,473 108

Myrtle Beach-Conway-North Myrtle Beach, SC-NC 356,523 103,795 223,427 153,204 301

Napa, CA 261,039 75,276 51,924 18,283 69

Naples-Marco Island, FL 704,221 208,226 191,191 155,198 67

Nashville-Davidson--Murfreesboro--Franklin, TN 489,541 141,541 859,961 644,144 883

New Bern, NC 204,897 62,285 49,730 24,023 92

New Haven-Milford, CT 567,492 197,940 370,398 326,769 242

New Orleans-Metairie, LA 316,437 96,836 531,781 337,357 592

Nassau County-Suffolk County, NY Metro Division 809,594 266,528 993,767 863,942 831

Newark, NJ-PA Metro Division 809,594 279,915 909,680 847,887 586

New Brunswick-Lakewood, NJ Metro Division 809,594 272,206 988,282 901,032 702

New York-Jersey City-White Plains, NY-NJ Metro Division 809,594 250,888 4,711,379 4,011,912 2,065

Niles, MI 316,862 98,302 69,972 52,321 76

North Port-Sarasota-Bradenton, FL 493,157 148,630 406,168 328,555 301

Norwich-New London, CT 395,652 132,132 112,161 78,397 158

Ocala, FL 334,913 101,579 170,018 131,136 251

Ocean City, NJ 344,402 109,289 58,314 34,594 107

Odessa, TX 182,887 59,796 77,465 16,631

115

Ogden-Clearfield, UT 541,537 153,858 242,607 192,424 241

Table 3 Households Priced Out of the Market by a $1,000 Price Increase, 2023

Additional

Households

Priced Out

by a $1,000

increase

Median New

Home Price

Income

Needed to

Qualify

Total

Households

Metro Area

Households

Unable to

Afford the

Median Price

Oklahoma City, OK 339,191 109,103 609,969 402,676 832

Olympia-Lacey-Tumwater, WA 581,517 172,904 121,625 93,093 93

Omaha-Council Bluffs, NE-IA 416,387 141,014 404,864 330,775 435

Orlando-Kissimmee-Sanford, FL 433,556 131,009 1,102,569 852,494 1,101

Oshkosh-Neenah, WI 417,781 138,900 74,384 64,105 56

Owensboro, KY 208,831 64,770 48,729 27,994 97

Oxnard-Thousand Oaks-Ventura, CA 661,961 190,462 290,234 227,188 184

Palm Bay-Melbourne-Titusville, FL 383,212 116,648 281,146 205,230 324

Panama City, FL 322,923 96,279 91,413 57,737 91

Parkersburg-Vienna, WV 310,651 91,757 38,380 29,919 58

Pensacola-Ferry Pass-Brent, FL 381,298 114,390 211,357 151,500 216

Peoria, IL 176,401 62,690 180,496 78,324 439

Camden, NJ Metro Division 486,139 178,706 515,820 402,006 394

Montgomery County-Bucks County-Chester County, PA Metro D

i

486,139 155,042 821,119 542,688 864

Philadelphia, PA Metro Division 486,139 148,737 932,434 779,230 673

Wilmington, DE-MD-NJ Metro Division 486,139 145,691 299,460 214,596 315

Phoenix-Mesa-Chandler, AZ 491,895 139,216 1,966,703 1,543,518 1,691

Pine Bluff, AR 245,783 74,419 26,408 20,072 45

Pittsburgh, PA 438,716 140,911 1,022,967 805,029 821

Pittsfield, MA 733,568 233,752 62,031 57,216 27

Pocatello, ID 427,764 125,058 38,440 34,136 38

Portland-South Portland, ME 506,129 153,884 247,934 193,426 210

Portland-Vancouver-Hillsboro, OR-WA 650,950 192,207 1,040,866 866,291 571

Port St. Lucie, FL 400,317 124,798 221,987 161,696 294

Poughkeepsie-Newburgh-Middletown, NY 527,714 181,596 270,308 206,003 178

Prescott Valley-Prescott, AZ 628,302 177,225 122,206 107,794 71

Providence-Warwick, RI-MA 702,307 221,051 723,071 661,032 379

Provo-Orem, UT 601,507 168,313 214,277 175,055 117

Pueblo, CO 434,888 126,923 72,178 64,479 61

Punta Gorda, FL 318,457 98,912 103,394 68,708 158

Racine, WI 510,934 169,771 79,231 67,760 66

Raleigh-Cary, NC 441,799 130,530 579,404 373,717 635

Rapid City, SD 393,207 122,868 58,629 40,404 74

Reading, PA 204,791 68,116 174,526 75,502 380

Redding, CA 511,977 150,203 70,318 54,270 54

Reno, NV 495,397 138,441 207,306 155,891 175

Richmond, VA 397,354 116,985 551,974 370,592 623

Riverside-San Bernardino-Ontario, CA 617,456 181,176 1,506,275 1,289,136 716

Roanoke, VA 229,566 68,112 136,131 68,713 212

Rochester, MN 629,152 197,129 89,649 76,023 41

Rochester, NY 378,640 138,893 471,433 374,093 419

Rockford, IL 255,297 92,434 134,480 83,941 221

Rocky Mount, NC 327,601 101,044 55,198 47,939 42

Rome, GA 262,422 80,916 35,391 24,253 50

Sacramento-Roseville-Folsom, CA 668,601 195,104 905,768 772,716 508

Saginaw, MI 316,940 105,371 81,257 59,375 119

St. Cloud, MN 296,979 92,459 81,799 50,951

126

St. George, UT 471,465 131,301 73,423 59,330 102

St. Joseph, MO-KS 345,890 105,941 46,639 37,415 44

St. Louis, MO-IL 416,387 133,660 1,142,641 828,376 1,245

Salem, OR 589,161 174,636 164,228 137,504 115

Salinas, CA 306,123 87,349 138,416 71,265 230

Salisbury, MD-DE 259,533 74,141 187,790 89,311 314

Salt Lake City, UT 521,334 148,117 485,134 355,961 393

Table 3 Households Priced Out of the Market by a $1,000 Price Increase, 2023

Additional

Households

Priced Out

by a $1,000

increase

Median New

Home Price

Income

Needed to

Qualify

Total

Households

Metro Area

Households

Unable to

Afford the

Median Price

San Angelo, TX 401,809 132,867 48,636 34,182 63

San Antonio-New Braunfels, TX 315,480 105,818 1,083,181 712,019 1,675

San Diego-Chula Vista-Carlsbad, CA 862,014 248,229 1,194,177 1,105,801 723

Oakland-Berkeley-Livermore, CA Metro Division 888,915 256,138 1,016,294 807,436 616

San Francisco-San Mateo-Redwood City, CA Metro Division 888,915 251,823 599,410 432,265 329

San Rafael, CA Metro Division 888,915 256,088 101,493 81,030 63

San Jose-Sunnyvale-Santa Clara, CA 1,186,851 338,381 679,056 627,466 439

San Luis Obispo-Paso Robles, CA 734,206 210,343 108,641 89,759 49

Santa Cruz-Watsonville, CA 674,661 192,214 96,997 74,040 53

Santa Fe, NM 357,161 100,991 79,144 56,291 71

Santa Maria-Santa Barbara, CA 384,593 110,008 154,748 89,777 147

Santa Rosa-Petaluma, CA 827,989 238,345 190,483 179,361 135

Savannah, GA 412,842 127,785 181,047 141,160 174

Scranton--Wilkes-Barre, PA 326,645 107,629 236,782 189,958 316

Seattle-Bellevue-Kent, WA Metro Division 805,128 235,795 1,267,391 1,055,105 856

Tacoma-Lakewood, WA Metro Division 805,128 238,470 362,267 352,084 245

Sebastian-Vero Beach, FL 367,156 111,072 76,605 50,814 84

Sebring-Avon Park, FL 369,512 113,078 49,164 41,071 52

Sheboygan, WI 457,729 148,549 50,152 44,372 23

Sherman-Denison, TX 397,446 131,158 63,980 48,996 63

Shreveport-Bossier City, LA 249,024 74,483 157,899 98,275 251

Sierra Vista-Douglas, AZ 242,027 71,773 48,001 32,639 94

Sioux City, IA-NE-SD 432,445 142,881 58,781 45,177 66

Sioux Falls, SD 326,858 102,891 122,954 83,323 188

South Bend-Mishawaka, IN-MI 460,269 141,269 131,264 114,592 106

Spartanburg, SC 274,862 80,643 136,043 82,521 292

Spokane-Spokane Valley, WA 682,211 201,963 244,390 226,736 92

Springfield, IL 298,893 104,608 90,296 56,426 146

Springfield, MA 398,204 129,058 280,765 202,315 300

Springfield, MO 449,774 136,841 192,539 175,335 71

Springfield, OH 375,228 122,182 59,745 53,339 46

State College, PA 451,369 138,353 56,108 46,786 31

Staunton, VA 389,166 112,235 52,471 40,235 66

Stockton, CA 708,261 208,164 253,855 243,893

168

Sumter, SC 258,079 77,058 52,936 35,787 69

Syracuse, NY 231,799 84,382 285,678 154,691 634

Tallahassee, FL 249,981 76,015 159,264 98,604 236

Tampa-St. Petersburg-Clearwater, FL 420,528 128,186 1,396,105 1,093,219 1,526

Terre Haute, IN 266,955 81,981 73,149 53,785 133

Texarkana, TX-AR 307,109 99,574 55,330 39,378 71

The Villages, FL 433,355 130,343 79,591 66,164 89

Toledo, OH 509,000 168,484 278,337 254,315 95

Topeka, KS 252,001 84,932 96,426 59,709 167

Trenton-Princeton, NJ 424,999 152,685 158,404 113,922 173

Tucson, AZ 387,678 114,321 457,152 333,814 427

Tulsa, OK 443,912 140,038 419,542 333,792 415

Tuscaloosa, AL 158,537 45,740 114,112 47,644 278

Twin Falls, ID 356,310 103,118 46,425 32,806 66

Tyler, TX 193,626 63,104 83,834 35,919 184

Urban Honolulu, HI 783,391 213,520 361,209 306,195 206

Utica-Rome, NY 237,540 83,273 121,181

69,536 258

Valdosta, GA 303,305 95,372 56,146 42,856 62

Vallejo, CA 624,799 182,159 165,188 130,725 88

Victoria, TX 229,459 77,873 51,612 24,312 120

Table 3 Households Priced Out of the Market by a $1,000 Price Increase, 2023

Additional

Households

Priced Out

by a $1,000

increase

Median New

Home Price

Income

Needed to

Qualify

Total

Households

Metro Area

Households

Unable to

Afford the

Median Price

Vineland-Bridgeton, NJ 266,143 97,402 56,530 36,678 75

Virginia Beach-Norfolk-Newport News, VA-NC 402,399 121,445 770,233 536,571 961

Visalia, CA 522,078 153,749 142,975 119,191 77

Waco, TX 227,108 76,422 105,435 67,078 167

Walla Walla, WA 569,347 170,815 23,724 20,861 11

Warner Robins, GA 329,761 101,468 71,917 47,915 126

Frederick-Gaithersburg-Rockville, MD Metro Division 623,198 184,721 523,367 351,963 359

Washington-Arlington-Alexandria, DC-VA-MD-WV Metro Divis

i

623,198 185,489 2,003,568 1,408,013 1,445

Waterloo-Cedar Falls, IA 597,679 199,364 69,848 64,525 16

Watertown-Fort Drum, NY 295,171 97,290 57,376 41,736 95

Wausau-Weston, WI 364,332 119,763 72,536 57,299 114

Weirton-Steubenville, WV-OH 339,298 104,489 48,242 37,875 64

Wenatchee, WA 582,155 170,609 50,853 41,321 36

Wheeling, WV-OH 191,712 58,146 58,910 31,149 114

Wichita, KS 327,835 109,201 253,500 167,814 339

Wichita Falls, TX 654,140 224,417 57,020 54,370 20

Williamsport, PA 432,655 140,383 49,308 40,716 40

Wilmington, NC 330,685 98,513 132,692 87,893 187

Winchester, VA-WV 428,423 123,365 56,002 36,880 70

Winston-Salem, NC 445,035 132,797 277,602 231,416 258

Worcester, MA-CT 410,858 129,604 395,844 262,740 496

Yakima, WA 553,066 165,036 90,099 81,828 56

York-Hanover, PA 276,032 91,062 182,423 98,193 315

Youngstown-Warren-Boardman, OH-PA 265,824 86,920 230,429 170,395 358

Yuba City, CA 537,184 158,704 63,378 52,401 32

Yuma, AZ 185,545 54,517 75,932 42,607 214