Dental Services Among Medicare Beneficiaries

Dental Services Among Medicare Beneficiaries:

Source of Payment and Out-of-Pocket Spending

Introduction

Oral health is an important aspect of general health and

wellbeing. Poor oral health is linked with respiratory

disease, cardiovascular disease, and diabetes.

(1)

The

relationship between poor dental health and disease is

especially relevant for vulnerable populations, such as

individuals with disabilities or the elderly.

(2, 3, 4)

Although Medicare does cover dental services that are

an essential part of a medical procedure such as jaw

surgery, routine dental services, including exams, check-

ups, and cleanings, are not covered by Medicare.

Beneficiaries must pay for these routine services

directly out-of-pocket (OOP), or rely on dental coverage

through private plans or Medicaid. This lack of dental

coverage can be a barrier to seeking dental care for

beneficiaries. More than half of all beneficiaries do not

use any dental services in a given year.

(5)

This data highlight examines sources of payment and

OOP spending for dental services among Medicare

beneficiaries for two time periods, 2002 and 2012, and

by select beneficiary characteristics. The analysis uses

the Medicare Current Beneficiary Survey (MCBS) which

has been widely used to study total Medicare costs and

health care utilization, but comparatively little research

has been done on the dental information collected in

the survey. The MCBS collects detailed self-reported

information on different sources of payment for a

dental event.

Source of Payment for Dental Services and Average

Dental Costs over Time

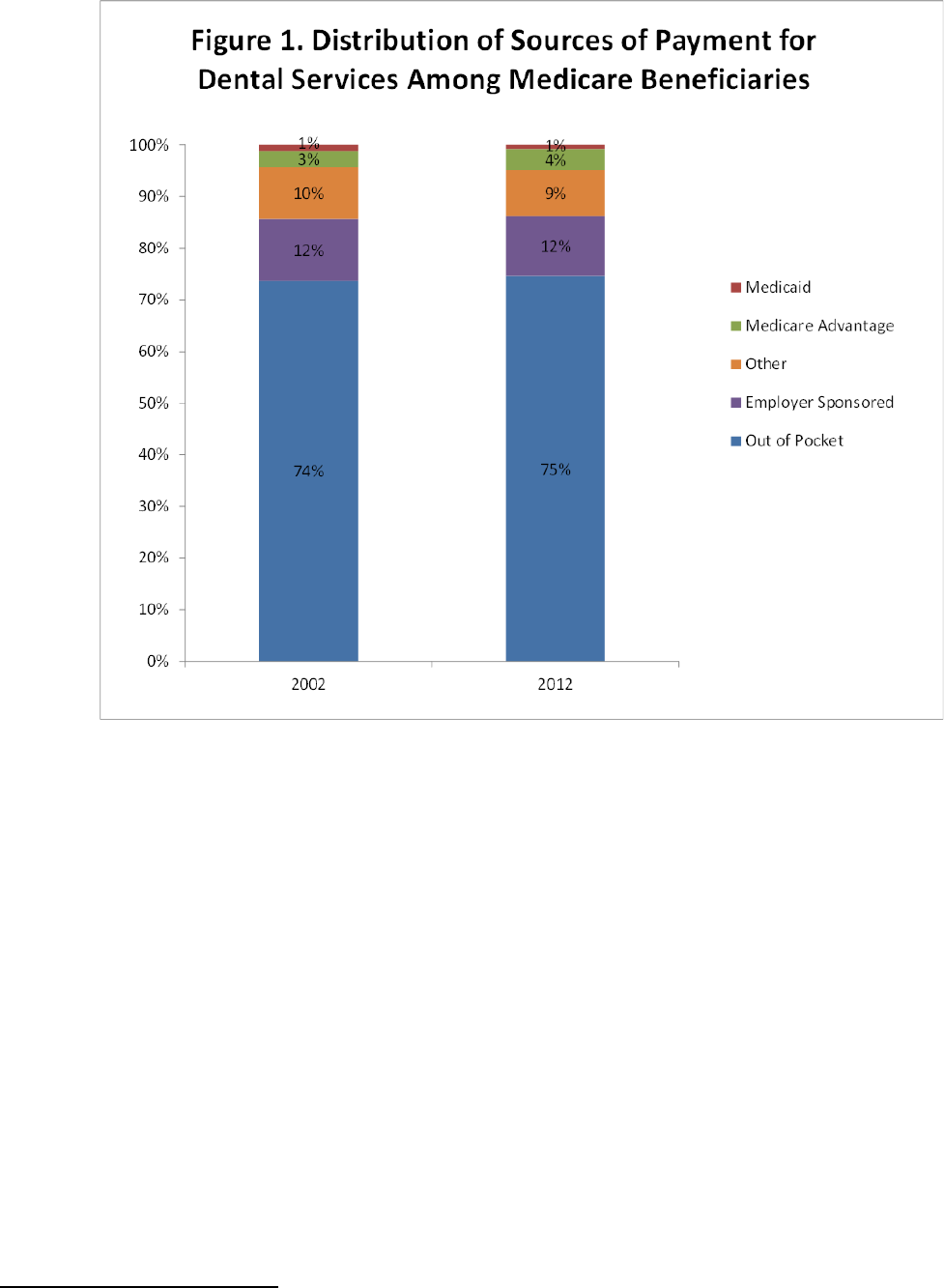

Figure 1 illustrates sources of payment for dental

services in 2002 and 2012 among Medicare

beneficiaries with at least one reported dental service.

The majority of dental costs were covered directly by

beneficiary OOP spending, at about 75%. Employer

sponsored insurance was the next largest payer, at 12%.

Other payers

1

combined paid about 10% of dental

costs.

1

The other payer category was determined by combining some of the

smallest sources of payment, which included Medicare Fee-for-

Service. A complete description of other payers can be found in the

technical notes.

KEY FINDINGS

Medicare beneficiaries paid out-of-pocket nearly

three-fourths of the costs of dental services.

The percentage of out-of-pocket spending on

dental services by all Medicare beneficiaries did

not change in 2012 compared to 2002.

Beneficiaires without supplemental insurance paid

a higher proportion of dental costs in 2012

compared to 2002.

Data Highlight March 2016

Data Highlight March 2016

Dental Services Among Medicare Beneficiaries

Medicare Advantage covered less than 5% of dental

costs, and Medicaid paid less than 1%.

Across sources of payment, the percentage of costs

covered by payers did not change between 2002 and

2012. Average dental costs per beneficiary increased

significantly from $798 in 2002 to $929 in 2012

2

.

Total Dental Costs and Medicare Beneficiary Out-of-

Pocket Spending

Although the percentage of beneficiary OOP spending

for dental services did not significantly vary over time

(~75%) in the Medicare population, we also examined

total dental costs and OOP spending by key beneficiary

characteristics for 2002 and 2012. From 2002 to 2012

there were no trends in the percentage of OOP

2

For more detailed numbers, including standard errors, please

reference Tables 1 and 2 in the Appendix.

spending on dental services over time for any of the

examined age groups, by gender, or by education

status. However, OOP spending on dental services did

differ between 2002 and 2012 by supplemental

insurance categories (Table 1).

Beneficiaries with no supplemental insurance (Fee-for-

Service (FFS) only) directly paid a significantly higher

portion of dental costs in 2012 (96.3%) than in 2002

(80.8%). Similarly, beneficiaries with only Medicaid

supplemental insurance (that is, FFS and Medicaid) paid

55.3% OOP in 2002, which increased to 75.0% in 2012.

Beneficiaries with only private health insurance and FFS

saw no change over the selected years, while those with

Medicare Advantage or another managed care plan

paid 70.3% OOP in 2002, increasing to 81.3% in 2012.

However, beneficiaries with multiple supplemental

insurance experienced no change in the percentage of

OOP spending.

Data Highlight March 2016

Dental Services Among Medicare Beneficiaries

Conclusion

On average, Medicare beneficiaries cover nearly three-

fourths of the costs of dental services. While inflation-

adjusted dental costs increased from 2002 to 2012, the

percentage of OOP spending on dental services by

Medicare beneficiaries remained the same and this

persisted when examining key socio-demographic

characteristics, such as age, gender, and education.

However, beneficiaries without supplemental insurance

paid a higher portion of dental costs in 2012, compared

to 2002. Similar trends were found for beneficiaries

with Medicaid or managed care supplemental

insurance. Beneficiaries with private health insurance

coverage or multiple supplemental insurance plans saw

no increase in their percentage of OOP spending.

Furthermore, beneficiaries with multiple supplemental

insurance paid the smallest percent of total costs OOP.

These findings highlight an important issue for Medicare

beneficiaries, particularly that beneficiaries pay the

majority of routine dental costs OOP, and most

beneficiaries do not have private or public plans to help

offset this cost. This has been consistent over time,

and may serve as a deterrent to dental care. Future

research should further examine the effects of

supplemental insurance, the burden of OOP spending in

relation to income, the association between insurance

coverage and service utilization, and the relationship

between oral health and quality of life. The MCBS is

uniquely suited to examine many of these issues.

Table 1. Mean Total Dental Costs and Out-of-Pocket Spending with Standard Errors for Medicare Beneficiaries With

At Least One Dental Service by Year and Beneficiary Characteristics, in 2012 Dollars

2002

2012

n

Mean Total

Dental Costs

(SE)

Mean OOP

Dental

Spending (SE)

Percent of OOP

Spending (SE) n

Mean Total

Dental Costs

(SE)

Mean OOP

Dental Spending

(SE)

Percent of OOP

Spending (SE)

Age

64 years old or younger

661

$717 (62)

$409 (46)

57.1% (3.86)

662

$821 (82)

$535 (68)

65.1% (4.06)

65 to 84 years old

3,757

$816 (25)

$613 (21)

75.1% (1.09)

3,614

$940 (32)

$707 (30)

75.2% (1.09)

85 years old or older

538

$730 (58)

$583 (49)

79.8% (2.29)

666

$980 (110)

$782 (106)

79.8% (2.62)

Sex

Male

2,227

$812 (32)

$588 (28)

72.4% (1.71)

2,197

$987 (42)

$744 (43)

75.3% (1.62)

Female

2,729

$787 (33)

$587 (27)

74.6% (1.26)

2,745

$883 (34)

$652 (38)

73.9% (1.35)

Education

Less than HS

930

$714 (50)

$509 (40)

71.4% (2.57)

586

$873 (92)

$675 (94)

77.4% (3.53)

High School

1,466

$734 (41)

$556 (32)

75.8% (1.86)

1,298

$727 (43)

$554 (40)

76.2% (2.06)

Any College

2,545

$863 (35)

$631 (29)

73.2% (1.49)

3,039

$1,016 (40)

$749 (37)

73.8% (1.29)

Supplemental Insurance

No Supplemental

278

$697 (83)

$563 (73)

80.8% (3.73)

208

$1,219 (199)

$1,174 (195)

96.3% (2.40)

Medicaid Only

383

$496 (59)

$275 (32)

55.3% (5.79)

344

$579 (70)

$434 (69)

75.0% (4.57)

Private Insurance only

2,984

$813 (29)

$635 (26)

78.1% (1.12)

1,937

$995 (40)

$754 (37)

75.8% (1.35)

HMO only

657

$809 (59)

$569 (47)

70.3% (2.58)

1,156

$814 (57)

$661 (55)

81.3% (1.95)

Multiple Supplemental

654

$897 (57)

$543 (40)

60.6% (2.59)

1,297

$957 (73)

$600 (62)

62.7% (2.50)

Data Highlight March 2016

Dental Services Among Medicare Beneficiaries

References

(1) Institute of Medicine and National Research Council. Improving access to oral health care for vulnerable and

underserved populations. Washington, DC: National Academies Press, 2011.

(2) Griffin SO, Jones JA, Brunson D, Griffin PM, and Bailey WD. “Burden of oral disease among older adults and

implications for public health priorities.” American Journal of Public Health. 2012; 102(3), 411-418.

(3) U.S. Department of Health and Human Services. Oral health in America: a report of the Surgeon General. Rockville,

MD: U.S. Department of Health and Human Services, National Institute of Dental and Craniofacial Research,

National Institutes of Health; 2000.

(4) Dolan TA and Atchison KA. “Implications of access, utilization and need for oral health care by the non-

institutionalized and institutionalized elderly on the dental delivery system.” Journal of Dental Education. 1993;

57(12), 876-887.

(5) Huang J, Saulsberry L, Damico A, Licata R, Neuman T. Oral Health and Medicare Beneficiaries: Coverage, Out-of-

Pocket Spending, and Unmet Need. Washington, DC: Kaiser Family Foundation. June 2012. Available at

<https://kaiserfamilyfoundation.files.wordpress.com/2013/01/8325.pdf>.

______________

This data brief was written by Jessie Parker at CMS, in partnership with Matthew DiFiore, Sukanya Kadam, Robert Kosarowich, and

Ida Chiang at Carnegie Mellon University (CMU), under the direction of CMU’s Dr. Martin Gaynor. Lisa Mirel and Kim Lochner at CMS

provided invaluable editorial feedback. For more information about the MCBS, visit www.cms.gov

. To purchase MCBS files, contact

the Research Data Assistance Center (ResDAC) at www.resdac.org or (888) 973-7322.

Data Highlight March 2016

Dental Services Among Medicare Beneficiaries

Technical Notes

The Medicare Current Beneficiary Survey (MCBS)

collects data from the total Medicare population,

whether aged or disabled, living in the community or a

facility, or served by managed care or traditional Fee-

for-Service (FFS). The MCBS is an in-person,

longitudinal panel survey. Respondents are interviewed

three times a year over a period of four years to form a

continuous profile of their health care experience. Two

types of interviews are conducted in the MCBS: a

community interview done in the home, and an

interview of knowledgeable staff on behalf of

beneficiaries in a facility setting.

This data highlight is based upon the 2002 and 2012

MCBS Cost and Use (CAU) research files, which

represent a full year of data captured in the Winter, Fall

and Summer interviews. The CAU research files include

demographic and health insurance data as well as

information on health care utilization and costs,

regardless of payer. In addition, the CAU files are

enhanced with available CMS administrative data and

Medicare claims data for survey participants who

received services through traditional FFS Medicare.

Special steps are taken to expand sample coverage in

the CAU files to include all beneficiaries who were

enrolled during the calendar year. This mix of

continuing enrollees, accretions (i.e., new enrollees),

and terminations is referred to as the “ever-enrolled”

population. The ever-enrolled population includes

everyone who was enrolled in Medicare for any period

during the year. These steps are necessary because

official Medicare program statistics cover all persons

entitled to Medicare during the year, and omitting part-

year enrollees and persons who died during the year

could substantially bias the results of these analyses. In

2002, 12,697 sampled beneficiaries represented an

ever-enrolled population of 41,808,000. In 2012,

11,299 sampled beneficiaries represented an ever-

enrolled population of 52,079,000.

Beneficiaries who reported that they received dental

care (or service) from a dentist, dental surgeon,

endodontist, periodontist, or dental hygienist were

subsequently asked about costs for that care and the

sources of payments to cover the costs. Any beneficiary

from the 2002 and 2012 MCBS CAU file that reported a

dental service and the associated cost was included in

this analysis. For this analysis source of payments

include Medicare Advantage, Medicaid, OOP, employer-

sponsored insurance, other payer. To create the ‘other’

category for source of payment in this analysis, the

existing ‘other’ category was combined with Medicare

FFS ( “Original Medicare”), Veteran’s Administration,

individually-purchased insurance, unknown private

insurance, private HMO, and uncollected liability.

In this data highlight, cost and source of payment

information is from the service summary dataset (RIC

SS). This dataset summarizes cost and utilization by

event type for all beneficiaries (e.g. there is a one

record per beneficiary for all the dental utilization for

the year).

Subgroup analyses included age, sex, education and

supplemental insurance. Age categories were defined

using the sampling age strata variable (D_STRAT) from

the Record Identification Code (RIC) 1 and were

grouped as: (1) disabled beneficiaries, who were under

age 65 and were entitled to Medicare benefits by either

receiving two years of Social Security or Railroad

Retirement Board benefits, or who had a qualifying

disability; (2) beneficiaries ages 65 to 84, who were

enrolled in Medicare, regardless of their original reason

for Medicare enrollment; and (3) beneficiaries ages 85

and older, who were enrolled in Medicare, regardless of

their original reason for Medicare enrollment. Sex was

determined using data from the administrative records

in the data file RIC A (variable name H_SEX). Education

was categorized based on the self-reported education

level found in RIC 1 (variable name SPDEGRCV).

Supplemental insurance categories were defined using

both self-reported and administrative data on insurance

status based on the annual summary variables for

Medicaid (D_CAID), Private Health Insurance (D_PHI),

Private Managed Care (D_PMC) and Medicare

Advantage (D_MA) found in RIC 4. For 2002, the annual

summary variable for Health Maintenance Organization

(D_HMO) was used to instead of D_PMC and D_MA

Data Highlight March 2016

Dental Services Among Medicare Beneficiaries

since earlier years of data on Medicare Advantage and

Private Managed Care were not available. Beneficiaries

with Medicare Advantage (MA) without other

supplemental insurance were categorized as “HMO

only” for all years. Beneficiaries with FFS without other

supplemental insurance were categorized as “No

Supplemental.” Beneficiaries with FFS and

supplemental private health insurance (PHI) were

categorized as “PHI only” but beneficiaries with MA and

PHI were categorized as “Multiple Supplemental.”

All costs are presented in 2012 dollars and are adjusted

for inflation using the Consumer Price Index available at

http://www.bls.gov/cpi/home.htm

The CAU files contain cross-sectional weights that

represent the “ever-enrolled” Medicare population. The

survey weights incorporate the selection probability of

each sample person, are post-stratified to control totals

based on when beneficiaries became eligible for

Medicare, age, sex, race, region, and metropolitan area

status and are adjusted to account for non-response.

Unweighted sample sizes (n’s) are displayed, but all

estimates presented in this data highlight were

calculated using the cross-sectional weights, and all

variance estimates were calculated using the balanced

repeated replicate weights with the Fay adjustment. A

two-sided p-value of less than 0.05 was used to assess

statistically significant differences between estimates.

No adjustments were made for multiple comparisons.

Appendix Tables

Appendix Table 1. (Figure 1) Distribution of Sources of

Payment for Dental Services Among Medicare

Beneficiaries, with Standard Errors

2002

2012

Estimate

SE

Estimate

SE

Sources of Payment

Out of Pocket

73.59%

1.11

74.57%

1.08

Employer Sponsored

11.98%

0.66

11.57%

0.75

Other

9.96%

0.73

8.98%

0.58

Medicare Advantage

3.17%

0.49

4.07%

0.47

Medicaid

1.16%

0.23

0.72%

0.15

Appendix Table 2. Average Total

Cost for Dental Services Among

Medicare Beneficiaries, with

Standard Errors

Estimate

SE

Year

2002

$798.14

22.39

2012

$928.76

31.14

Data Highlight March 2016