© 2016 American Dental Association All Rights Reserved. March 2016

The Per-Patient Cost of Dental Care, 2013:

A Look Under the Hood

Authors: Thomas Wall, M.A., M.B.A.; Albert Guay, D.M.D.

Introduction

Recent studies have shown that cost is the most significant barrier to receiving dental

services.

1

,

2

Studies have also reported that cost barriers to dental care are considerably

higher than for other types of health care services.

3

According to a recent study of non-

elderly adults with health insurance, dental care ranked number one among health care

services that people are skimping on because of cost.

4

This may seem surprising considering that in 2013, dental expenditures accounted for 4.5

percent of total health care spending, down from 8.5 percent in 1960.

5

According to another

study, average per-patient dental expenditures were $666 in 2011, an amount that would not

appear to qualify as a “budget buster” for most dental patients.

6

In this brief, we focus on the cost of dental care measured in terms of annual per-patient

dental expenditures. We look at expenditures for services provided by general practice (GP)

dentists and dental specialists. We also consider dental expenditures in the context of other

health care services, including the percentage of expenditures paid for out of pocket.

Key Messages

Average annual per-patient dental expenditures in the U.S. were $685 in 2013.

Average expenditures for patients in the 90th percentile were $1,624. Expenditures at

this level and above could represent a financial burden to dental patients.

Contributing to this burden are out-of-pocket expenditures which, as a percentage of the

total expenditure, are higher for dental services compared to other sectors of the health

care system.

Patients with high dental expenditures represent a relatively small percentage of the U.S.

population, and the services they receive are not usually required annually.

Research Brief

The Health Policy Institute (HPI)

is a thought leader and trusted

source for policy knowledge on

critical issues affecting the U.S.

dental care system. HPI strives

to generate, synthesize, and

disseminate innovative research

for policy makers, oral health

advocates, and dental care

providers.

Who We Are

HPI’s interdisciplinary team of

health economists, statisticians,

and analysts has extensive

expertise in health systems

policy research. HPI staff

routinely collaborates with

researchers in academia and

policy think tanks.

Contact Us

Contact the Health Policy

Institute for more information on

products and services at

call 312.440.2928.

2

Research Brief

Results

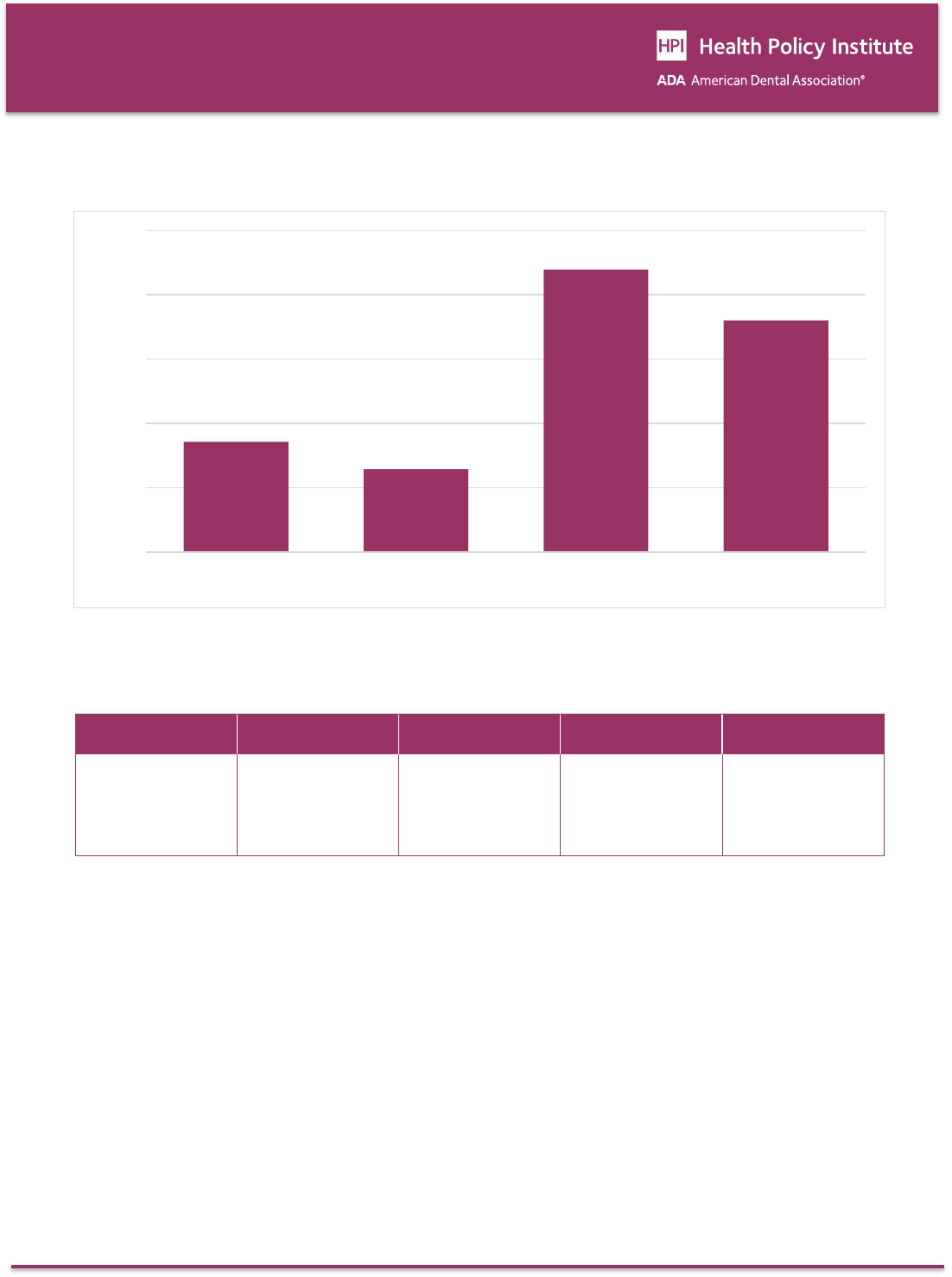

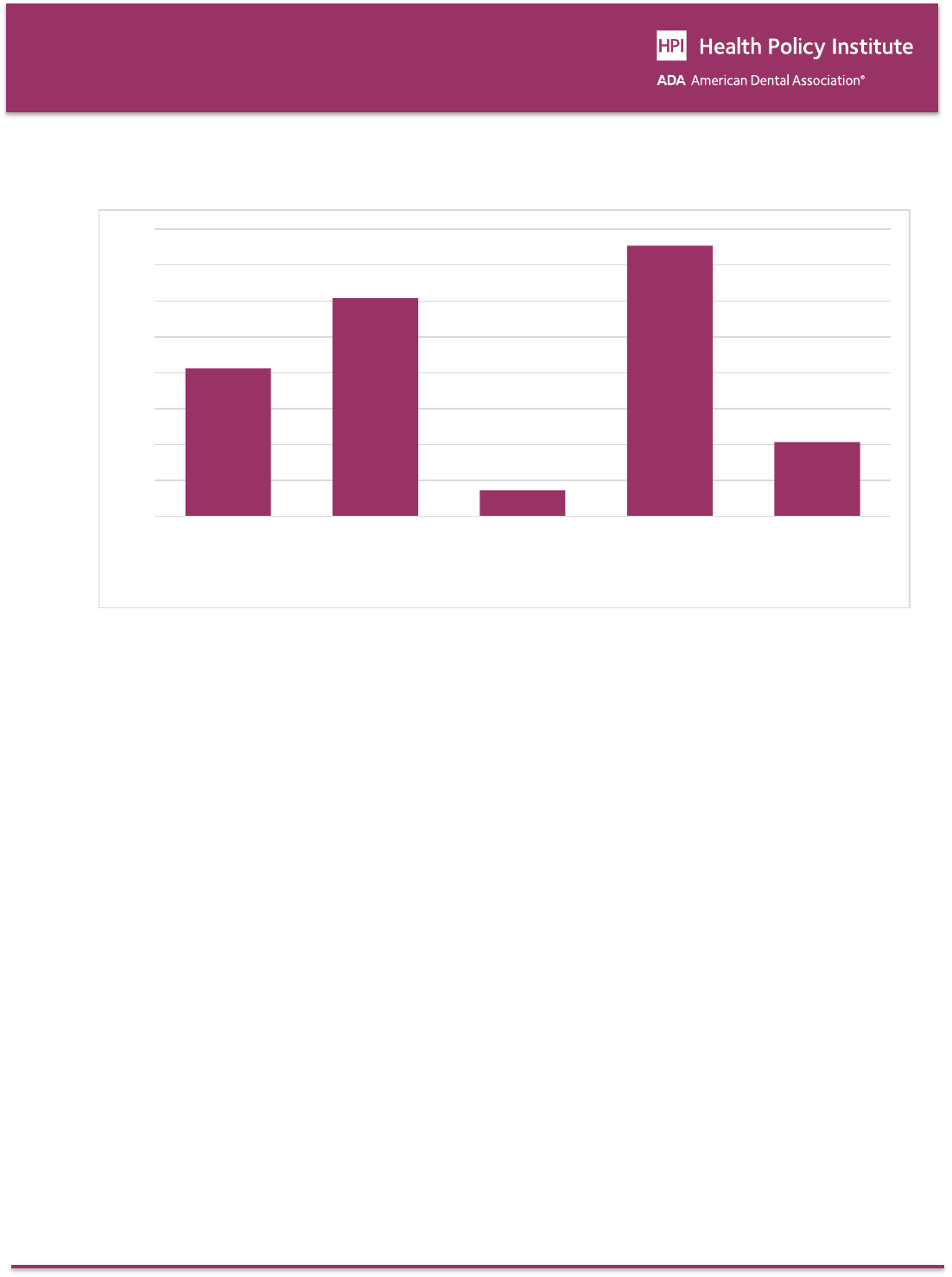

According to the Medical Expenditure Panel Survey

(MEPS), average annual dental expenditures among

those with a visit were $685 in 2013 (Figure 1). Among

those with a visit to a GP dentist, average expenditures

were $514. Among those with a visit to a dental

specialist, average dental expenditures were $1,755.

As an example of dental services provided by

specialists, average dental expenditures for services

provided by orthodontists were $1,440.

Table 1 shows the percentile distribution for annual

dental expenditures (i.e., all dentists) in 2013. The

lowest 10th percentile of dental patients reported

expenditures of $74 or less, while those in the 90th

percentile reported expenditures of $1,624. Patients at

the 50th percentile, or median, reported expenditures

of $254. Note that the mean ($685) is much higher

than the median ($254) because the distribution of

dental expenditures is positively skewed. Patients

falling into the 90th percentile and above represented

13.4 million persons, or 4.2 percent of the U.S.

population, in 2013.

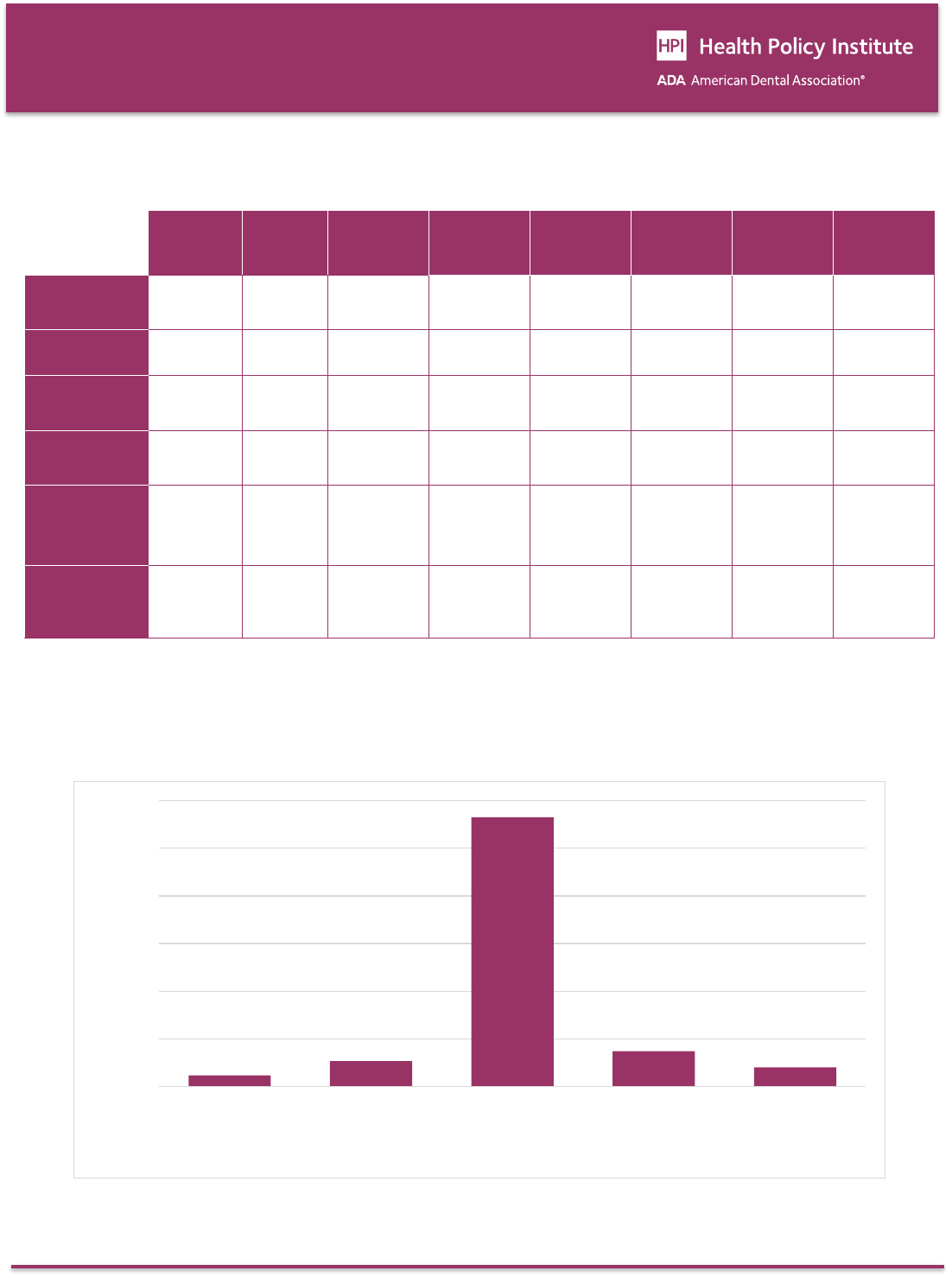

Table 2 shows total health care spending in 2013,

broken down by type of service. As shown in Figure 2,

mean dental spending per person with an expense was

$707.

7

However, as shown in Figure 3, the percentage

out of pocket was highest for dental (45.1 percent).

The percentage out of pocket was lowest for hospital

inpatients (3.2 percent), but due to very high per-

patient expenditures ($16,943), the amount out of

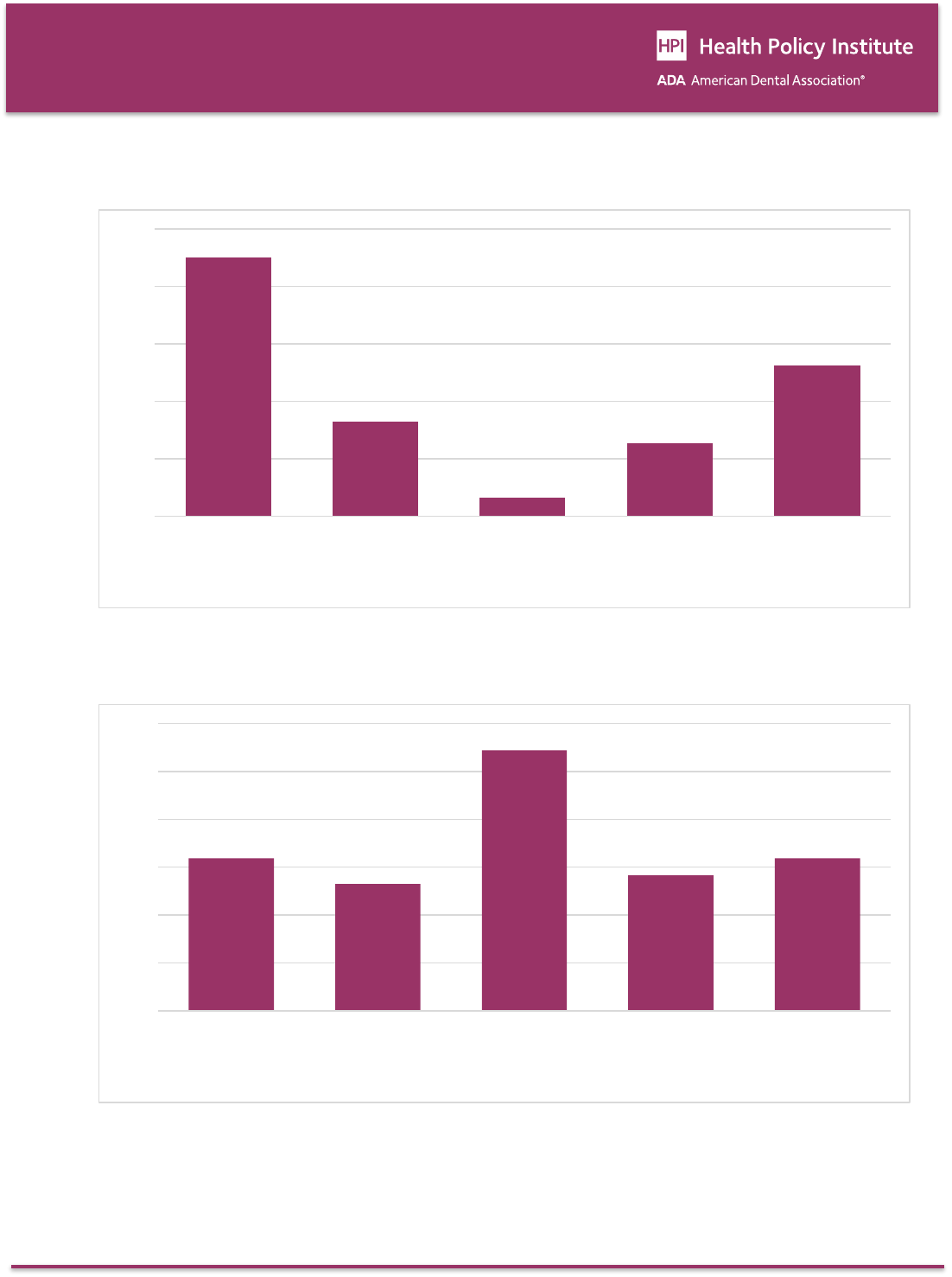

pocket was $544 (Figure 4). Finally, it is worth noting

that the percentage of the population reporting an

expense for hospital inpatient services (7.3 percent)

was much lower than the percentage with an expense

for dental services (41.2 percent). See Figure 5.

Discussion

We found that average per-patient dental costs were

$685 in 2013 and median (i.e., 50th percentile)

expenditures were $254. Expenditures for patients in

the 90th percentile were $1,624. Patients in the 90th

percentile and above represented 13.4 million persons,

or 4.2 percent of the U.S. population, in 2013.

Relatively high dental expenditures, like those in the

90th percentile or above, are likely to represent

services provided by dental specialists or high cost

restorative procedures performed by GP dentists (e.g.,

crowns, implants). Expenditures of this amount could

represent a financial burden even for those with private

dental insurance, and those without coverage are

required to pay the entire cost out of pocket. On the

other hand, high cost dental procedures are not usually

required annually. For example, most orthodontic

treatments can be completed in 18 to 24 months

without need for subsequent comprehensive treatment.

Contributing to this financial burden are higher out-of-

pocket expenditures as a percentage of total

expenditures for dental care compared to other health

care services. This is due, in part, to the relatively high

percentage of the U.S. population with no dental

benefits. For example, in employer-based insurance, a

smaller share of workers have access to dental

coverage through work than have access to health

coverage through work; 45 percent of workers in

private industry were offered dental benefits in 2012

compared with 70 percent who were offered health

benefits.

8

Also, those with private dental insurance are

subject to annual caps and copayments.

9

Dental

benefits are typically capped at $1,000 or $1,500 each

year, according to the National Association of Dental

Plans.

10

Regular office visits for cleanings and X-rays

are generally covered at 100 percent, while fillings and

other basic procedures are covered at 80 percent.

3

Research Brief

Plans typically pay just half of the cost of major

procedures such as crowns and inlays.

As mentioned in the introduction, recent studies have

shown that cost is the most significant barrier to

receiving dental services.

1,2

Although the percentage

of the U.S. population reporting cost barriers to dental

care declined each year from 2010 to 2013, cost

barriers for dental care remain significantly higher than

for other segments of the health care system.

3

However, we found that mean out-of-pocket

expenditures for hospital inpatient services were

considerably higher than mean out-of-pocket dental

expenditures.

Studies of the demand for health care services have

found that the demand for hospital care is among the

least price-responsive while the demand for dental

care is among the most price-responsive.

11

The

patterns of demand correspond to intuition about

“medical necessity” and urgency. This tendency of

patients to place a lower value on dental services than

other health care services may make them more

sensitive to out-of-pocket expenditures for dental

services and more likely to see the cost as a barrier to

care. Because of dental care’s greater sensitivity to

cost (elasticity), the imposition of out-of-pocket patient

costs for dental care can be employed by payers to

manage their financial risks by discouraging the

utilization of care.

12

On the other hand, for half of all dental patients, annual

costs were $254 or less, and those with private dental

insurance paid even less out of pocket. This reflects

improvements in the oral health of the U.S.

population

13

and the shift in the dental services mix

from relatively high cost restorative services to lower

cost diagnostic and preventive services.

14

In 2004,

approximately 73 percent of dental procedures were

either diagnostic (42.5 percent) or preventive (30.4

percent).

15

We have introduced “cost” into the discussion because

the out-of-pocket costs that patients pay for their care

are, in reality, the “price” patients must contend with.

This is regardless of the price providers charge for their

services because of the partial insulation from the true

price providers receive by the various subsidies

delivered by third party payers. The costs to patients

must include opportunity and acquisition costs, such as

transportation, child care, time lost from work, etc. In

other words, a price of zero would still leave costs to

patients when personal considerations are factored in.

On the surface, it appears to be incongruous that oral

health care consumes the smallest portion of health

care spending but dental patients pay the greatest

share of the costs for care out of pocket. The impact of

out-of-pocket spending on the amount of all health

spending is small; however, the impact on seeking

care by individual patients can be significant.

Meaningful reduction of the financial barriers to oral

health care must include moderating out-of-pocket

costs for patients and consideration of opportunity and

acquisition costs to patients beyond the price for

services.

4

Research Brief

Figure 1: Average Annual Expenditures Among Those with a Visit by Visit Type, 2013

Source: 2013 Medical Expenditure Panel Survey.

Table 1: Annual Expenditures for Dental Services Provided by All Dentists, 2013

10th percentile

25th percentile

50th percentile

75th percentile

90th percentile

$74

$127

$254

$595

$1,624

Source: 2013 Medical Expenditure Panel Survey.

$685

$514

$1,755

$1,440

$0

$400

$800

$1,200

$1,600

$2,000

All dental services Services provided by GP

dentists

Services provided by all

dental specialists

Services provided by

orthodontists

5

Research Brief

Table 2: Health Care Spending by Type of Service, 2013

Mean

(per person

with an

expense)

Percentage

with an

expense

Percentage

out of pocket

Mean

out of pocket

Total

out of pocket

(billions)

Percentage

of total out of

pocket

Total

expenditures

(billions)

Percentage

of total

expenditures

Dental

$706.73

41.2%

45.1%

$318.85

$41.4

21.5%

$91.8

6.6%

Prescription

Drugs

$1,606.63

60.7%

16.5%

$264.84

$50.7

26.3%

$307.8

22.0%

Hospital

Inpatient

$16,942.66

7.3%

3.2%

$544.18

$12.6

6.5%

$390.9

27.9%

Ambulatory

Services

$2,231.93

75.3%

12.7%

$283.39

$67.4

34.9%

$530.6

37.9%

Home Health

Care and

Other Medical

Services and

Equipment

$1,213.51

20.7%

26.3%

$318.50

$20.9

10.8%

$79.4

5.7%

Total Health

Care

$5,255.95

84.4%

13.8%

$724.07

$192.9

100.0%

$1,400.5

100.0%

Source: 2013 Medical Expenditure Panel Survey. Note: Expenditures include total direct payments from all sources to hospitals, physicians, home

health providers (agency and independent providers), dental providers, other types of health care providers (e.g., physical therapists, chiropractors,

optometrists, etc.), and pharmacies for services reported by respondents in the MEPS. Expenditures for hospital-based services include those for

both facility and separately billed physician services. Estimates are for the U.S. civilian non-institutionalized population.

Figure 2: Average Annual Expenditures Per Person With an Expense, 2013

Source: 2013 Medical Expenditure Panel Survey.

$707

$1,607

$16,943

$2,232

$1,214

$0

$3,000

$6,000

$9,000

$12,000

$15,000

$18,000

Dental Prescription Drugs Hospital Inpatient Ambulatory

Services

Home Health Care

and Other Medical

Services and

Equipment

6

Research Brief

Figure 3: Percentage of Annual Expenditure Paid for Out of Pocket, 2013

Source: 2013 Medical Expenditure Panel Survey.

Figure 4: Average Out-of-Pocket Expenditure, 2013

Source: 2013 Medical Expenditure Panel Survey.

45.1%

16.5%

3.2%

12.7%

26.3%

0%

10%

20%

30%

40%

50%

Dental Prescription Drugs Hospital Inpatient Ambulatory Services Home Health Care

and Other Medical

Services and

Equipment

$319

$265

$544

$283

$319

$0

$100

$200

$300

$400

$500

$600

Dental Prescription Drugs Hospital Inpatient Ambulatory Services Home Health Care

and Other Medical

Services and

Equipment

7

Research Brief

Figure 5: Percentage of the Population with an Expense, 2013

Source: 2013 Medical Expenditure Panel Survey.

Data & Methods

We analyzed data from the Medical Expenditure Panel

Survey (MEPS) that is managed by the Agency for

Healthcare Research and Quality (AHRQ). We focused

on the year 2013, the most recent year for which data

are available (data for 2013 were released in

September 2015). The MEPS provides nationally

representative estimates of health care use,

expenditures, sources of payment, and health

insurance coverage for the U.S. civilian non-

institutionalized population. Studies have documented

differences between the MEPS and National Health

Expenditure Accounts (NHEA) regarding health care

expenditure estimates.

16

We present annual dental expenditure estimates for all

dental services, dental services provided by general

practice (GP) dentists, and dental services provided by

dental specialists. Dental specialists include the

following categories in the MEPS: (1) dental surgeon,

(2) orthodontist, (3) endodontist, (4) periodontist and

(5) other dental specialist.

We also examine expenditures for dental care in the

context of other categories of health care expenditures

included in the MEPS, including prescription drugs,

hospital inpatient services, ambulatory services

(includes hospital out-patient visits, office-based

medical provider visits, and hospital ED visits), and

home health care and other medical services and

equipment. We include per-patient and total

expenditures as well as out-of-pocket expenditures as

a percentage of the total.

41.2%

60.7%

7.3%

75.3%

20.7%

0%

10%

20%

30%

40%

50%

60%

70%

80%

Dental Prescription Drugs Hospital Inpatient Ambulatory Services Home Health Care

and Other Medical

Services and

Equipment

9

Research Brief

References

1

Wall T, Nasseh K, Vujicic M. Most important barriers to dental care are financial, not supply related. Health Policy

Institute Research Brief. American Dental Association. October 2014. Available at:

http://www.ada.org/~/media/ADA/Science%20and%20Research/HPI/Files/HPIBrief_1014_2.ashx. Accessed February

26, 2016.

2

Yarbrough C, Nasseh K, Vujicic M. Why adults forgo dental care: evidence from a new national survey. Health Policy

Institute Research Brief. American Dental Association. November 2014. Available at:

http://www.ada.org/~/media/ADA/Science%20and%20Research/HPI/Files/HPIBrief_1114_1.ashx. Accessed February

26, 2016.

3

Nasseh K, Wall T, Vujicic M. Cost barriers to dental care continue to decline, particularly among young adults and the

poor. Health Policy Institute Research Brief. American Dental Association. October 2015. Available at:

http://www.ada.org/~/media/ADA/Science%20and%20Research/HPI/Files/HPIBrief_1015_2.ashx. Accessed February

26, 2016.

4

Urban Institute. Health Policy Center. QuickTake: the forgotten health care need: gaps in dental care for insured

adults remain under ACA. September 2015. Available at: http://hrms.urban.org/quicktakes/Gaps-in-Dental-Care-for-

Insured-Adults-Remain-under-ACA.html.

5

Centers for Medicare & Medicaid Services. National Health Expenditure Data. National Health Expenditures by type of

service and source of funds. Available at: https://www.cms.gov/Research-Statistics-Data-and-Systems/Statistics-

Trends-and-Reports/NationalHealthExpendData/NationalHealthAccountsHistorical.html.

6

Wall T, Nasseh K, Vujicic M. U.S. dental spending remains flat through 2012. Health Policy Institute Research Brief.

American Dental Association. January 2014. Available at:

http://www.ada.org/sections/professionalResources/pdfs/HPRCBrief_0114_1.pdf. Accessed February 26, 2016.

7

Mean per-patient dental expenditures in Table 2 are based on those patients in the MEPS with an expense. Mean per-

patient dental expenditures in Figure 1 are somewhat lower and include some patients in the MEPS with no

expenditures.

8

Wiatrowski WJ. 2013. Employment-based health benefits in small and large private establishments. Beyond the

Numbers. 2013;2(8). Washington, DC: Bureau of Labor Statistics.

9

Kaiser Health News. Adults with insurance often still have unmet dental needs, survey finds. October, 2015. Available

at: http://khn.org/news/adults-with-insurance-often-still-have-unmet-dental-needs-survey-

finds/?utm_campaign=KHN%3A+Daily+Health+Policy+Report&utm_source=hs_email&utm_medium=email&utm_conte

nt=22533884&_hsenc=p2ANqtz-8jWv6yFlEeg_QTT1JHQH4R-hbfjpxOOTOHArSwVUNCb_xzUfyW1Jfr2qgt9gjg-

PGYcK5LRTrozFU8phVIgVwEjset1g&_hsmi=22533884.

10

National Association of Dental Plans. What do dental plans normally cover? Available at:

http://www.nadp.org/Dental_Benefits_Basics/Dental_BB_3.aspx.

11

Phelps CE. Health Economics. Reading, MA: Addison Wesley Educational Publications, 1997.

12

Manning WG, Phelps CE. The demand for dental care. Bell Journal of Economics. 1979;10(2):503-525.

13

Dye BA, Tan S, Smith V, Lewis BG, Barker LK, Thornton-Evans G, et al. Trends in oral health status: United States,

1988–1994 and 1999–2004. National Center for Health Statistics. Vital Health Stat. 2007;11(248):1-92.

14

Eklund SA, Pittman JL, Smith RC. Trends in dental care among insured Americans, 1980 to 1995. JADA.

1997;128(2):171-78.

15

Manski, RJ, Brown E. Dental use, expenses, private dental coverage, and changes, 1996 and 2004. Agency for

Healthcare Research and Quality. 2007. MEPS Chartbook No. 17. Available at:

http://www.meps.ahrq.gov/mepsweb/data_files/publications/cb17/cb17.pdf.

16

Sing et al. Reconciling medical expenditure estimates from the MEPS and NHEA, 2002. Health Care Financing

Review. 2006;28(1):25-40.

10

Research Brief

Suggested Citation

Wall T, Guay A. The per-patient cost of dental care, 2013: a look under the hood. Health Policy Institute Research Brief.

American Dental Association. March 2016. Available from: https://www.ada.org/-/media/project/ada-

organization/ada/ada-org/files/resources/research/hpi/hpibrief_0316_4.pdf.