MILLIMAN CLIENT REPORT

Average annual beneficiary

health care costs for various

Medicare coverage options 2023

Commissioned by UnitedHealth Group (UHG)

September 2023

David Mike, FSA, MAAA

Philip Nelson, FSA, CERA, MAAA

Brad Schliesmann, ASA, MAAA, JD

MILLIMAN CLIENT REPORT

Table of contents

1. EXECUTIVE SUMMARY ........................................................................................................................................ 1

2. BACKGROUND ..................................................................................................................................................... 4

3. NATIONWIDE COMPARISON OF THE COVERAGE VALUE TO MEDICARE BENEFICIARIES ....................... 7

Nationwide comparison of annual health care costs for an average aged Medicare enrollee ......................... 8

Average lifetime cost differential for 65-year-old Medicare beneficiary ............................................................ 9

Annual health care costs for specific age groupings ...................................................................................... 10

Considerations for beneficiaries who incur high health care costs ................................................................. 12

Additional considerations not measured by annual health care costs ............................................................ 12

Demographic information ............................................................................................................................... 15

4. STATE-LEVEL RESULTS ................................................................................................................................... 16

5. METHODOLOGY ................................................................................................................................................. 20

6. CAVEATS AND LIMITATIONS ............................................................................................................................ 21

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 1 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

1. EXECUTIVE SUMMARY

UnitedHealth Group (UHG) commissioned Milliman to compare the beneficiary costs of the Medicare Advantage (MA)

program relative to other public and private health insurance options available to Medicare-eligible seniors. This

report is an update to our 2020 analysis

1

comparing average annual health care costs

2

paid by seniors across various

popular coverage options. We compared an integrated Medicare Advantage and Prescription Drug (MA-PD) plan, the

most popular type of MA plan,

3

to Traditional Medicare Fee-for-Service (FFS) and Medigap Plan G, which are

supplemented by standalone Medicare Prescription Drug Plans (PDPs), the most popular drug coverage option for

seniors choosing FFS and Medigap.

As of 2023, approximately 59.8 million people were enrolled in Medicare Parts A and B, of which over 86% are

seniors eligible for Medicare due to age.

4

Approximately 31 million seniors chose an individual MA plan for coverage,

while over 14 million chose Medigap plans.

5

,

6

Approximately two-thirds of people who purchased a Medigap plan

between 2019 and 2021 purchased Plan G.

7

Additionally, many Medicare beneficiaries receive supplemental

coverage through Medicaid or their employers (employer coverage may be provided through MA plans, Medigap

plans, or other employer-sponsored health plans). The most recent published information shows that of the 51.6

million non-institutionalized Medicare beneficiaries, approximately 4.6 million, or 8.9%, have no supplemental

coverage.

8

Most Medicare beneficiaries are on fixed incomes, with half having annual incomes below $29,650 as of

2019,

9

,

10

rendering average annual health care costs a significant portion of income for many Medicare beneficiaries

and a key determinant in the choice of health care coverage for Medicare beneficiaries.

This analysis considers average annual health care costs borne by seniors of average age and health status, not

eligible to receive income-based assistance with medical costs, and eligible for the Medicare program due to age

rather than disability.

RESULTS

For 2023, we estimate that such a beneficiary (one not eligible to receive income-based assistance with medical

costs and eligible for the Medicare program due to age) will incur approximately $3,396 in health care costs annually

under MA-PD, about $5,597 annually under FFS and PDP, and about $6,200 under the most popular Medigap plan

option currently available to new enrollees, Plan G. Please note that these cost estimates represent averages.

Individual beneficiaries will experience actual out-of-pocket (OOP) costs that vary from averages. We highlight

considerations for beneficiaries with annual OOP costs that differ significantly from averages in a special section of

this report dedicated to high-cost beneficiaries.

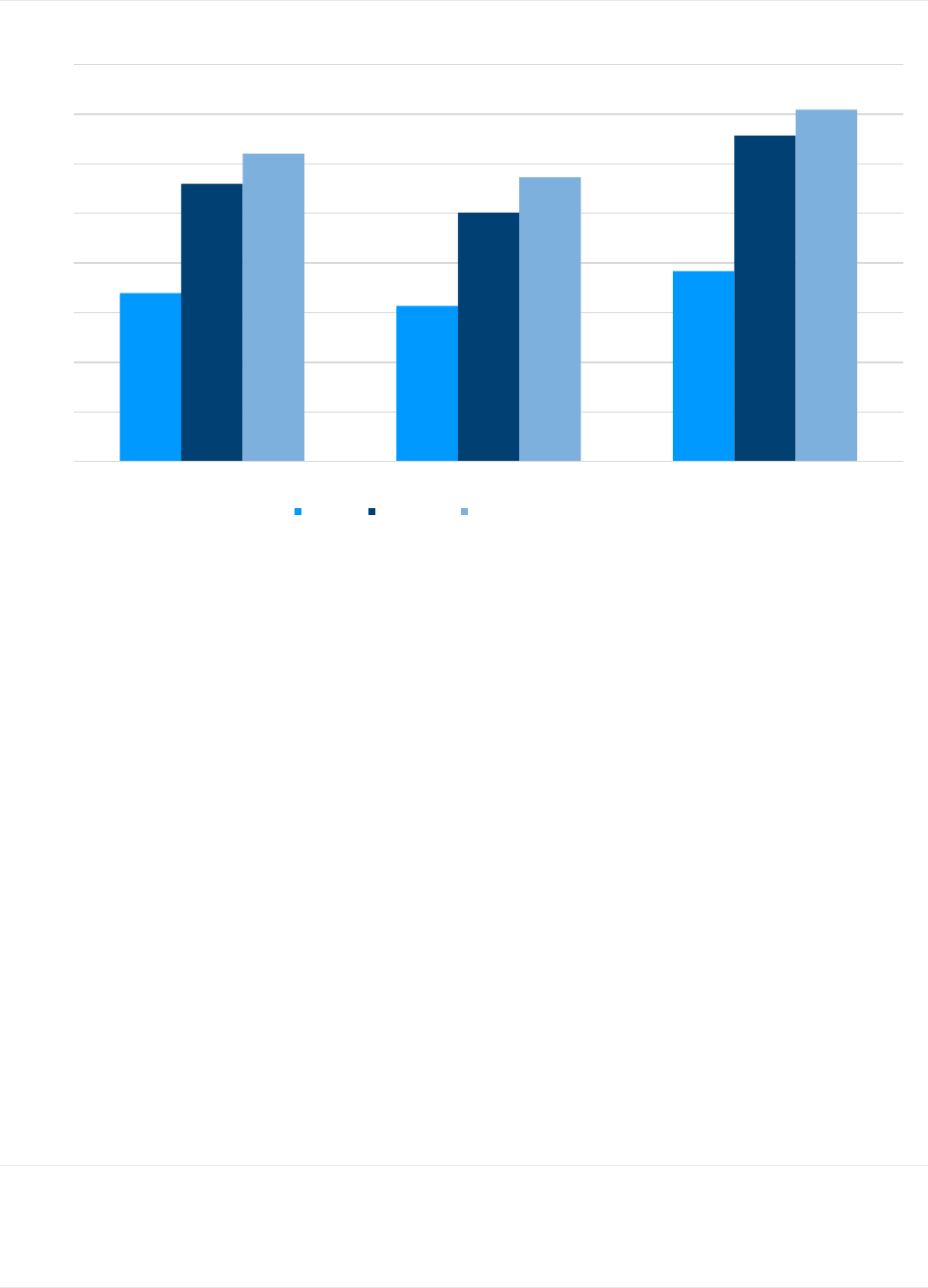

We performed this analysis for hypothetical average 65-year-old and 85-year-old Medicare beneficiaries under the

same coverage options—these results are adjusted for differences in the underlying health status. Results are

summarized in Figure 1.

1

Mike, D. & Yilmaz, G. (April 2021). Average annual beneficiary health care costs for various Medicare coverage options 2021. Retrieved February 1,

2023 from https://us.milliman.com/en/insight/average-annual-beneficiary-health-care-costs-for-various-medicare-coverage-options-2021 .

2

Annual health care costs represent total health care-related spending by an individual beneficiary, including premiums and out-of-pocket (OOP) costs

on deductibles, coinsurances, and copays for medical, drug, and ancillary services.

3

Not all MA plans cover prescription drug costs. Those that do are known as MA-PD plans. The majority of MA plans do cover prescription drug costs,

but some plans, which are less common, are known as MA-only plans and do not cover Part D. MA-PD plans are the focus of this report.

4

MedPAC July 2023 Data Book: Health Care Spending and the Medicare Program, Section 2: Medicare beneficiary demographics. Retrieved August

18, 2023, from https://www.medpac.gov/wp-content/uploads/2023/07/July2023_MedPAC_DataBook_SEC.pdf.

5

Freed M. et al., Kaiser Family Foundation (August 2023) Medicare Advantage in 2023: Enrollment Update and Key Trends. Retrieved August 18,

2023, from https://www.kff.org/medicare/issue-brief/medicare-advantage-in-2023-enrollment-update-and-key-trends/.

6

American Association of Medicare Supplement Insurance, Medicare Insurance Statistics 2022 – Medicare Advantage – Medigap – Data – Costs –

Facts & More. Retrieved February 1, 2023, from https://medicaresupp.org/medicare-insurance-statistics-2022/#enrollment-2022.

7

Mark Farrah Associates 2021 Med Supp Database. Retrieved April 1, 2023.

8

MedPAC July 2023 Data Book: Health Care Spending and the Medicare Program, Section 3: Medicare beneficiary and other payer financial liability.

Retrieved August 18, 2023, from https://www.medpac.gov/wp-content/uploads/2023/07/July2023_MedPAC_DataBook_SEC.pdf.

9

Kaiser Family Foundation (April 2020). Medicare Beneficiaries’ Financial Security Before the Coronavirus Pandemic. Retrieved February 1, 2023,

from https://www.kff.org/medicare/issue-brief/medicare-beneficiaries-financial-security-before-the-coronavirus-pandemic/.

10

All dollar amounts in this report reflect the nominal dollar amount. Reported amounts are not adjusted for inflation.

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 2 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

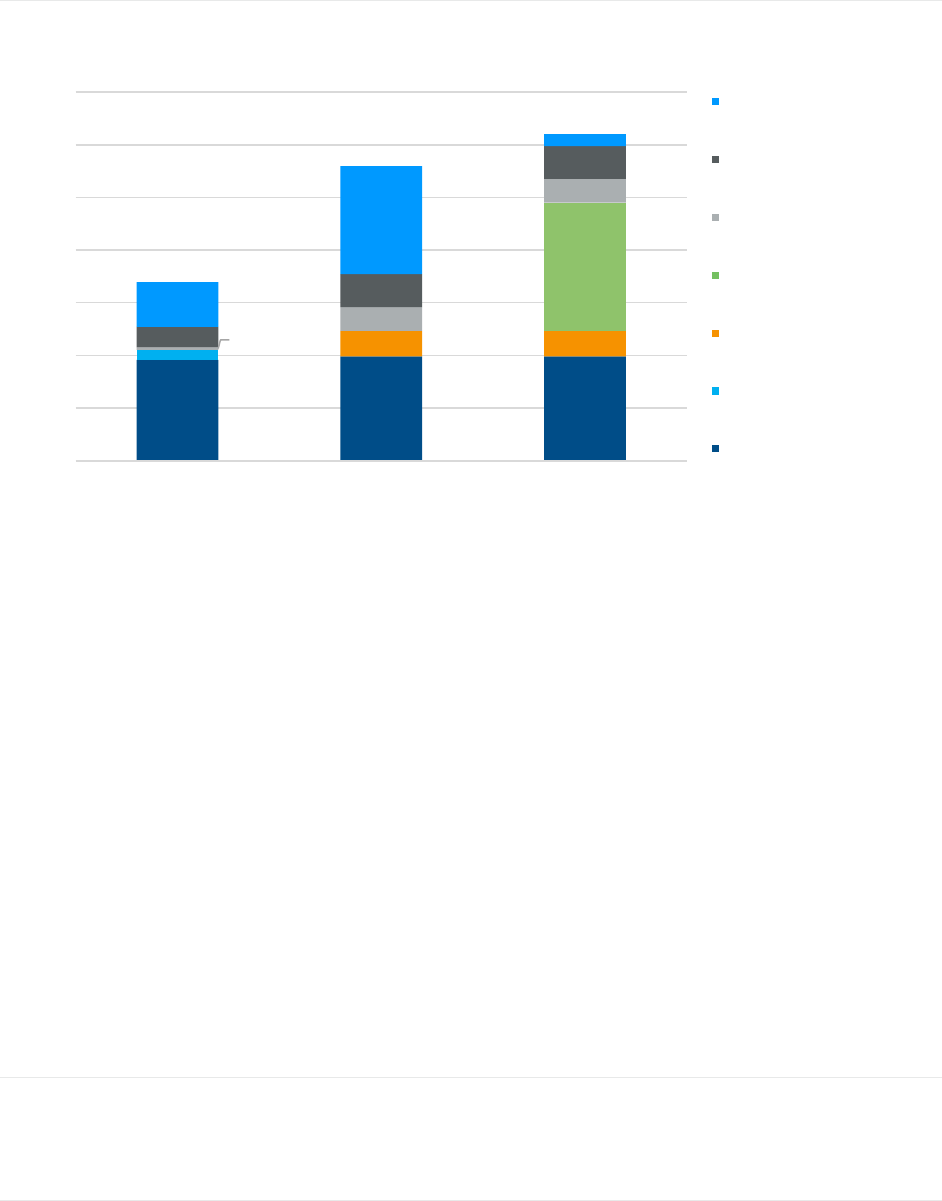

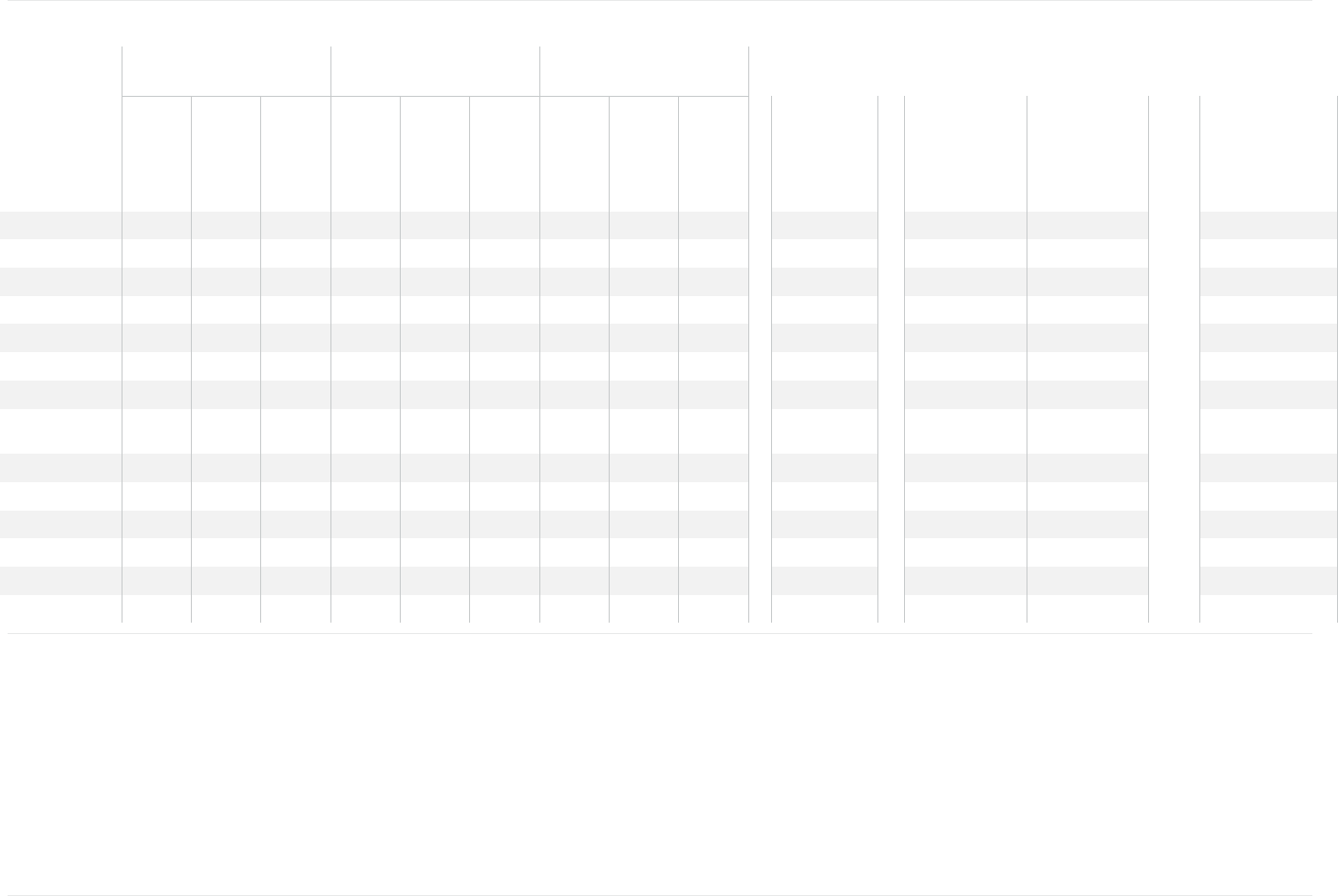

FIGURE 1: ESTIMATED ANNUAL BENEFICIARY HEALTH CARE COSTS BY COVERAGE OPTION AND AGE

These beneficiary health care cost estimates include premiums (total member premium, that is, including the Part B

premium, as well as the member premium for the MA-PD, PDP, and/or Medigap plan) and cost sharing for medical

services, pharmacy services, and ancillary services, such as dental, vision, and hearing. While premium is the most

visible cost to prospective beneficiaries when deciding what coverage to purchase, total health care costs, which are

generally less understood by beneficiaries shopping for coverage, ultimately determine whether a coverage option is

the best option financially. Results are outlined in greater detail in the Nationwide Comparison of the Coverage Value

to Medicare Beneficiaries section below.

A key design feature required to be included in all MA plans is an annual maximum out-of-pocket (MOOP) limit; the

average in-network MOOP is approximately $4,680 in 2023.

11

Fee-for-Service Medicare has no cap on total annual

OOP costs. Most Medigap plan designs do not offer an explicit cap on total OOP costs, but significantly limit

beneficiary cost sharing. Care management programs and provider networks included in MA plans are designed, in

part, to generate savings, though they may be viewed by beneficiaries as limiting choice or creating administrative

barriers.

12

Medigap plans, while relatively more expensive, do offer an option to Medicare beneficiaries for maximizing provider

choice and minimizing variability in OOP costs. These plans tend to offer premiums in excess of the reduction in

expected OOP costs they provide, but with a hard cap on beneficiary costs for Medicare-covered services. In the

case of Plan G, this cap is $226 in 2023, which is the Part B deductible. Medigap plans, however, do not offer

protection for services not traditionally covered by Medicare FFS, such as drugs, vision, and dental.

KEY FINDINGS RELATIVE TO 2020 REPORT

Relative to our prior report, which outlined beneficiary estimated annual health care costs for 2020, we expect that a

beneficiary’s total annual health care costs for those enrolled in MA-PD plans will decrease by about $160 in 2023

relative to 2020, despite the Part B premium increasing in that timeframe. We expect beneficiaries in FFS and with a

PDP, whether they purchase a Medigap plan to supplement coverage under Part A and Part B or not, will face higher

11

By regulation, an MA plan’s in-network maximum out-of-pocket limit (MOOP) may not exceed $8,300 in 2023.

12

O'Connor, J.T. & Spector, J.M. (July 2, 2014). High-Value Healthcare Provider Networks. Milliman Report. Retrieved September 12, 2019, from

https://www.ahip.org/wp-content/uploads/2016/02/High-Value-Provider-Networks-Issue-Paper-2014_07_01.final-pdf.pdf.

$3,396

$3,138

$3,837

$5,597

$5,021

$6,573

$6,200

$5,726

$7,092

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

Average Medicare Beneficiary 65-Year Old Medicare Beneficiary 85-Year Old Medicare Beneficiary

MA-PD FFS, PDP FFS, PDP, Medigap Plan G

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 3 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

annual health care costs in 2023 relative to 2020. Note that the 2020 costs from our prior report did not include the

impact of the COVID-19 pandemic.

Medical OOP costs for Medicare-covered services remain flat for the average MA-PD beneficiary relative to 2020,

offsetting medical cost trends, which generally exceed overall inflation. Out-of-pocket costs for these same core

services will be higher, relative to 2020, for beneficiaries choosing FFS, and Medigap premiums increase

correspondingly, mirroring the increase in OOP costs for FFS beneficiaries. On the pharmacy side, Part D OOP costs

for MA-PD beneficiaries decreased approximately $80 relative to 2020, while corresponding Part D OOP costs for

PDP, for FFS and Medigap beneficiaries, decreased approximately $40 in the same period.

A portion of total annual health care costs is attributable to premiums. All beneficiaries pay the Part B premium,

unless eligible for income-related subsidies. Beneficiaries who enroll in MA and Medigap plans pay additional

premiums for these coverage options, though some MA plans are offered with no additional premium. The average

member premium for MA-PD plans decreased relative to 2020 from $300 per member per year to $189 in 2023. This

is due to a large increase in the number of plans offering $0 premiums and beneficiaries choosing to enroll in those

plans. Nearly three-quarters of all members enrolled in MA-PD plans in 2023 will be in a $0 premium plan, up from

60% of members in 2020. Annual Part B premiums increased $244 between 2020 and 2023; however, some MA-PD

plans offer a Part B premium “buydown,” offsetting Part B premiums. The value of the Part B buydown benefit for MA-

PD beneficiaries has increased by $40 since 2020, resulting in a lower effective Part B premium increase for MA-PD

beneficiaries relative to FFS and Medigap beneficiaries.

FIGURE 2: CHANGES IN ANNUAL BENEFICIARY COSTS BETWEEN 2020 AND 2023 FOR A SENIOR OF AVERAGE AGE

Category

2020

2023

Change

Annual Premiums

MA-PD beneficiaries

$2,013

$2,106

$93

FFS and PDP beneficiaries

$2,186

$2,470

$284

FFS, PDP, and Medigap beneficiaries

$4,393

$4,901

$509

Medical OOP costs for Medicare-covered services

MA-PD beneficiaries

$857

$854

($3)

FFS and PDP beneficiaries

$1,773

$2,053

$280

FFS, PDP, and Medigap beneficiaries

$198

$226

$28

Drug OOP costs

MA-PD beneficiaries

$471

$388

($83)

FFS and PDP beneficiaries

$659

$622

($38)

FFS, PDP, and Medigap beneficiaries

$659

$622

($38)

Dental, Vision, & Hearing OOP costs

MA-PD beneficiaries

$217

$48

($169)

FFS and PDP beneficiaries

$742

$452

($291)

FFS, PDP, and Medigap beneficiaries

$742

$452

($291)

Total annual health care costs

MA-PD beneficiaries

$3,558

$3,396

($162)

FFS and PDP beneficiaries

$5,361

$5,597

$236

FFS, PDP, and Medigap beneficiaries

$5,992

$6,200

$208

Note: The sum of individual components in this figure may not equal totals due to rounding.

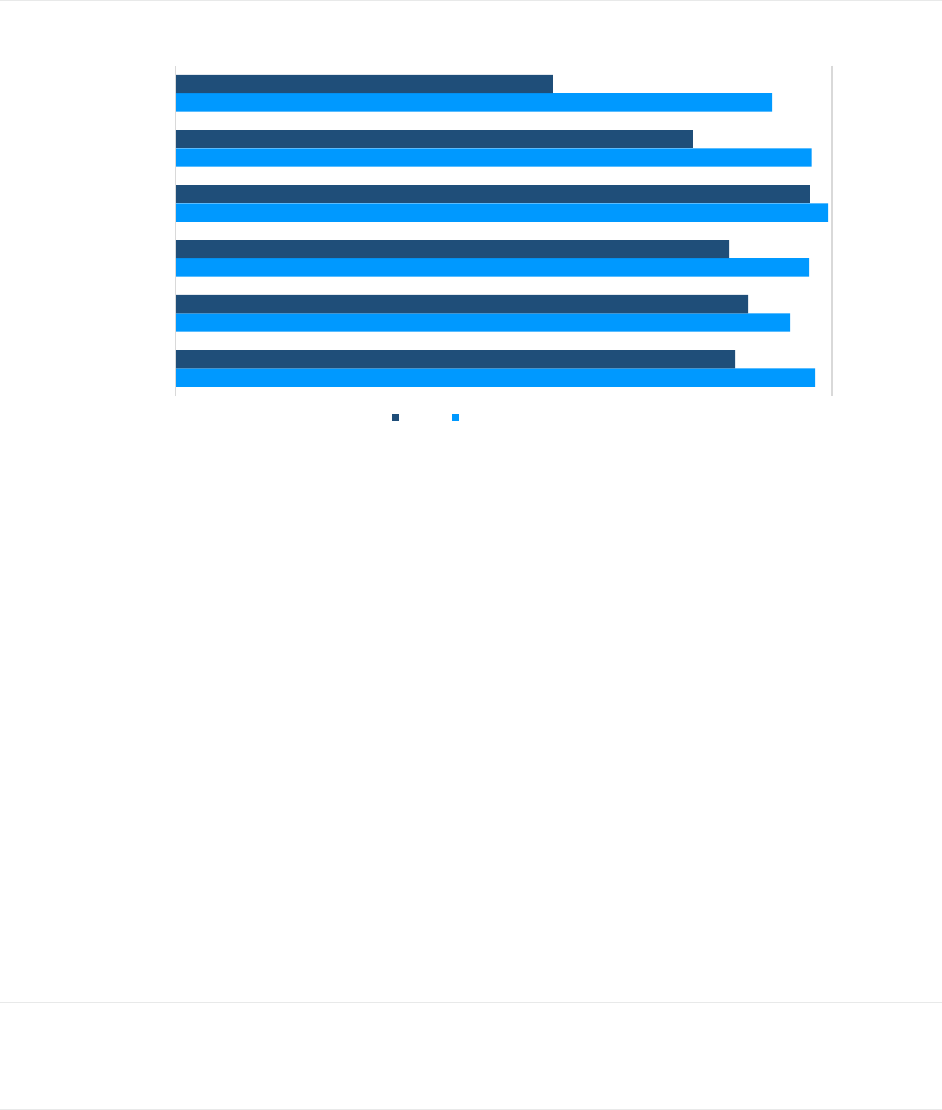

For the remainder of this report, we will refer to the dental, vision, and hearing non-Medicare covered services as

“supplemental benefits.” These costs have decreased about $170 annually for MA-PD members, partly driven by a

substantial increase in the number of MA-PD beneficiaries enrolled in plans newly offering these services relative to

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 4 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

2020. In the absence of these benefits, we estimate that Medicare beneficiaries will pay $452 OOP annually in 2023

for these services. The decrease in the supplemental benefit cost estimate relative to our 2020 report is primarily

driven by a refinement in our dental modeling. As substantially more MA plans have offered dental benefits since

2020, we made refinements to more accurately reflect expected Medicare beneficiary dental costs. The percentage of

non-SNP MA beneficiaries receiving these supplemental benefits in 2020 and 2023 is shown in Figure 3.

13

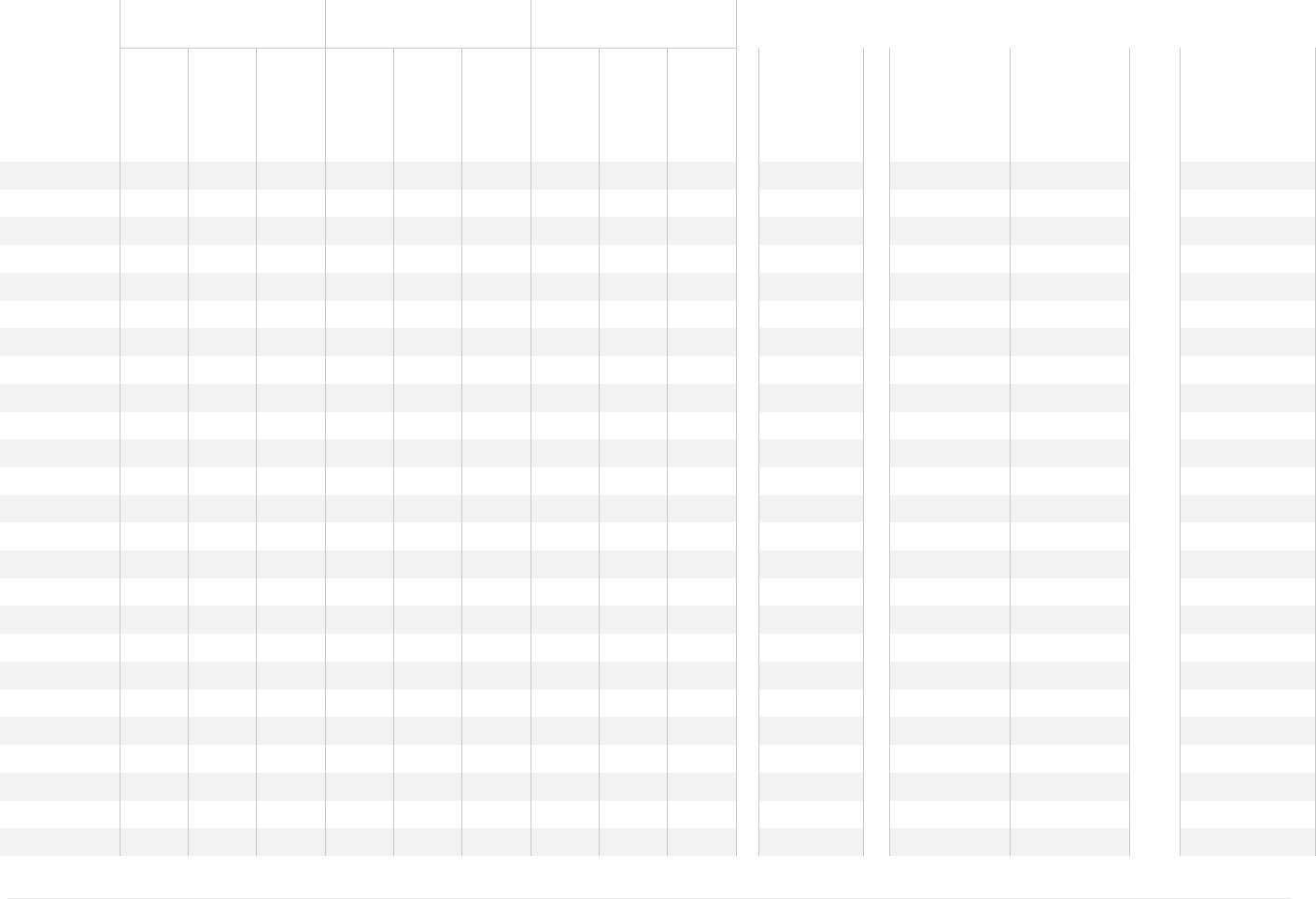

FIGURE 3: PERCENT OF BENEFICIARIES ENROLLED IN PLANS OFFERING SELECT SUPPLEMENTAL BENEFITS

2. BACKGROUND

UnitedHealth Group (UHG) commissioned Milliman to compare the beneficiary costs of the Medicare Advantage (MA)

program relative to other public and private health insurance options available to seniors. In this report, we highlight

differences in average annual beneficiary health care costs (i.e., premiums and cost sharing) among Medicare

coverage options. We also describe several qualitative differences among the options.

The options analyzed, described in detail below, include Medicare Advantage (MA), Traditional Medicare Fee-For-

Service (FFS), Prescription Drug Plans (PDPs), and Medicare Supplement policies (Medigap). We do not analyze

options subsidized by employers for active or retired employees, nor do we analyze options for Medicare

beneficiaries receiving financial assistance from Medicaid or other programs due to income.

▪ Medicare Advantage: Medicare Advantage Organizations (MAOs) contract with the Centers for Medicare and

Medicaid Services (CMS) to offer privately managed insurance plans covering Part A, Part B, and frequently

Part D (prescription drug) services—they are known as Medicare Advantage and Prescription Drug (MA-PD)

plans. The MA program is an alternative to FFS, and beneficiary premiums for MA-PD coverage vary from $0

to over $3,600 per year in 2023, with an average of $189 in addition to the standard Medicare Part B premium

($1,979 per year in 2023). In many cases, additional health care services not covered by FFS are offered by

MAOs, known as ancillary or supplemental benefits. These types of services vary widely by MA plan and

include benefits such as hearing, vision, dental, over-the-counter (OTC) drug cards, and non-emergency

medical transportation (NEMT). MAOs, through capitated payments from CMS, are incentivized to manage and

coordinate the care of the beneficiaries enrolling in their plans.

13

Laktas J., Yeh, M., & Friedman, J. (March 2023) Prevalence of Supplemental Benefits in the general enrollment Medicare Advantage marketplace:

2019 to 2023. Retrieved March 21, 2023, from https://www.milliman.com/en/insight/prevalence-supplemental-benefits-general-enrollment-ma-

marketplace-2023.

97%

94%

96%

99%

97%

91%

85%

87%

84%

97%

79%

57%

0% 100%

Hearing Hardware

Hearing Exams

Vision Hardware

Vision Exams

Preventive Dental

Comprehensive Dental

2020 2023

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 5 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

▪ Traditional Medicare FFS (FFS): Only Part A (facility services) and Part B (ambulatory services) services are

covered by FFS, so beneficiaries opting for FFS must select a PDP plan or have some alternative drug

coverage, such as Veterans Administration coverage or employer-provided insurance, if they would like

coverage for pharmacy costs. All FFS beneficiaries pay a premium for Part B services, which is $1,979 per

year in 2023. Higher-income beneficiaries may pay higher Part B premiums than the standard amount. Those

who are enrolled in FFS can go to any doctor or hospital that accepts Medicare.

▪ Prescription Drug Plans (PDP): While Part D benefits are typically bundled with MA-PD coverage, PDP

organizations contract with CMS to provide Part D plans that cover only prescription drug benefits—mainly for

FFS beneficiaries (including those who enroll in Medigap plans). Premiums for PDP plans in 2023 range from

just under $24 to over $2,400 per year, with an average of about $491 per year. If a beneficiary is not enrolled

in an MA-PD plan that provides both medical and drug coverage, they must enroll in a PDP plan to avoid facing

penalties from CMS.

14

▪ Medigap: Those in FFS can purchase private supplemental “wraparound” insurance known as Medigap

15

,

16

for

a premium, in addition to the standard Part B premium paid by Medicare beneficiaries. Medigap plans, such as

Plan G,

17

are purchased from private insurance companies. Plan G is currently the most comprehensive and

most popular Medigap plan actively sold on the market and, therefore, commands high premiums. The

premiums are exchanged for certainty in OOP costs; Plan G covers all OOP costs for Medicare covered

services but the Part B deductible. The high premiums are driven by the need for an administrative cost and

profit load, as well as what some argue to be induced utilization due to lack of beneficiary cost sharing,

18

and

the lack of tools to control underlying cost and utilization of medical services.

19

Less generous Medigap plans

are available, with lower premiums to reflect leaner benefits. Medigap plans do not offer coverage for services

not otherwise covered by FFS, including prescription drug coverage, so any coverage for services not covered

by FFS must be obtained separately. Beneficiaries who choose MA are not eligible to purchase Medigap plans.

Most Medicare beneficiaries are on a fixed income, with half having annual incomes below $29,650 as of 2019.

20

In

order to mitigate the unexpected OOP costs associated with FFS coverage, and because FFS does not have a

maximum limit on a beneficiary’s annual OOP costs, many beneficiaries choose MA-PD plans or Medigap plans to

replace or supplement their FFS coverage, respectively. Additionally, MA plans offer supplemental benefits beyond

those offered by FFS or Medigap plans, such as integrated prescription drug coverage, hearing, dental, and vision.

Approximately 22% of non-institutionalized Medicare beneficiaries choose Medigap, while 45% choose Medicare

Advantage, and 9% choose Medicare FFS only

21

,

22

. The remainder obtain supplemental coverage via their employer,

Medicaid, or other public sector programs, such as the VA. In this report, we provide estimates of beneficiary health

care costs associated with each of these programs for an average aged beneficiary (that is, the average of all

Medicare beneficiaries ages 65 and older), as well as a new entrant into Medicare (age 65) and an older Medicare

enrollee (age 85). We also review plan features that beneficiaries may consider when selecting a type of coverage.

14

Note, members who enroll in MA-only plans are not the focus of this paper because they typically have their pharmacy needs covered under

something other than Part D, like creditable coverage from an employer or the Veterans Administration. Beneficiaries in MA-only plans are restricted

from buying PDP coverage except in very limited circumstances.

15

Medigap is also known as Medicare Supplement.

16

Medigap is not technically health insurance. It is insurance against the potential of very high cost sharing under FFS—that is, it provides financial

indemnification for cost sharing associated with health events where the primary insurance is FFS.

17

There are 10 standardized Medigap plan designs, designated by letters A through N. Three states, Massachusetts, Minnesota, and Wisconsin, have

different standardized plans through federal waivers.

18

Induced utilization is the expected increased use of a benefit or service when a person is protected from its financial consequences, e.g., by

insurance.

19

Medigap plans lack the traditional tools used by health insurers to contain costs, such as care management and negotiation with providers.

20

Kaiser Family Foundation, Medicare Beneficiaries’ Financial Security Before the Coronavirus Pandemic, 2019, op cit.

21

MedPAC July 2023 Data Book: Health Care Spending and the Medicare Program, Section 3: Medicare beneficiary and other payer financial liability.

Retrieved August 18, 2023, from https://www.medpac.gov/wp-content/uploads/2023/07/July2023_MedPAC_DataBook_SEC.pdf.

22

The July 2023 MedPAC Data Book uses 51.6 million non-institutionalized Medicare beneficiaries and the Medicare Current Beneficiary Survey

(MCBS) from 2020 as the basis for their supplemental coverage analysis. In other parts of this report, we use all 59.8 million Medicare beneficiaries

enrolled in Medicare Part A and Part B, subject to limitations outlined, as the basis of our analyses.

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 6 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

The demographic makeup of seniors choosing various coverage options differs; however, we adjust for this in our

analysis using publicly available cost data and Milliman proprietary benchmark claim data. Over half of Medicare

beneficiaries are female, with the mix differing between MA (56%), FFS (50%), and Medigap (57%). Beneficiaries

over the age of 75 are more prevalent in both MA (39%) and Medigap (45%) than in FFS (31%). Around half of

beneficiaries in MA (48%) and in FFS (48%) have incomes less than twice the federal poverty level, while about one-

quarter of the Medigap members have an income less than twice the federal poverty level. This report focuses on

beneficiaries not eligible for government subsidies due to income, as discussed above.

23

This report provides results specific to average annual health care costs (premium and cost sharing) borne by

beneficiaries in the above age groups. Results exclude beneficiaries receiving additional assistance from Medicaid,

beneficiaries obtaining active employee or retiree coverage through an employer, beneficiaries in MA Special Needs

Plans (SNPs), and institutionalized beneficiaries (i.e., beneficiaries residing in nursing homes or other long-term care

facilities). We assume that the sample beneficiaries analyzed in the report obtain coverage for pharmacy costs

through either an MA-PD plan or a PDP plan.

23

MedPAC July 2023 Data Book: Health Care Spending and the Medicare Program, Section 3: Medicare beneficiary and other payer financial liability.

Retrieved August 18, 2023, from https://www.medpac.gov/wp-content/uploads/2023/07/July2023_MedPAC_DataBook_SEC.pdf.

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 7 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

3. NATIONWIDE COMPARISON OF THE COVERAGE VALUE TO

MEDICARE BENEFICIARIES

We estimated average annual health care costs for Medicare beneficiaries under three different coverage options, using

publicly available premium, enrollment, and benefit data, as well as proprietary Milliman MA-PD pricing models. We

analyzed these coverage options for three groupings of Medicare beneficiaries intended to represent beneficiaries of

average health status at various ages: average age non-dual beneficiaries eligible for Medicare due to age,

24

average 65-

year-old newly eligible Medicare beneficiaries, and average older Medicare beneficiaries, with an average age of 85. For

each coverage option and average beneficiary age grouping, we examine average annual OOP costs for cost sharing (i.e.,

copays, deductibles, and coinsurance), insurance premiums, and other OOP costs for health-related products and services

on a calendar year (CY) 2023 basis.

The three coverage options are as follows:

Medicare Advantage coverage: This scenario reviews the medical, pharmacy, and ancillary benefit OOP

costs, as well as total premiums paid by the member—MA-PD premium and Part B premium—under the MA

program. This coverage option assumes that all members choose to obtain Part D coverage under an MA-

PD plan, and that supplemental benefits (like dental, vision, and hearing) are partly covered by the MA-PD

plan.

Traditional Medicare FFS and PDP coverage: This scenario reviews the medical OOP costs for Medicare-

covered services under FFS and pharmacy OOP costs under a PDP plan and the premiums for Part B and

PDP coverage, as well as the expected costs of additional supplemental benefits that are not covered under

FFS.

Traditional Medicare FFS, PDP, and Plan G Medigap coverage: This scenario assumes that, in addition

to FFS and PDP coverage, all members purchase the richest available Medigap plan on the market—Plan

G. Average PDP and Part B premiums are included in this scenario as well. Results would be different for

enrollees that choose leaner Medigap plans, which have lower premiums but cover fewer OOP costs for

beneficiaries. Also, we consider the expected OOP costs for the Part B deductible (not covered by Plan G);

for additional core supplemental benefits, defined in our analysis as dental, vision, and hearing, that are not

covered under FFS; and for drugs under the PDP plan, which are not covered by Medigap plans.

24

The average Medicare beneficiary in our analysis is approximately 73 years old and of average health for a beneficiary eligible for Medicare due to

age. We exclude beneficiaries dually-eligible for Medicare and Medicaid, as well as those eligible for Medicare due to disability and/or end-stage

renal disease (ESRD). Both groups are known to have extremely different cost profiles and they are also limited in their coverage options,

particularly under Medigap.

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 8 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

Nationwide comparison of annual health care costs for an average aged Medicare enrollee

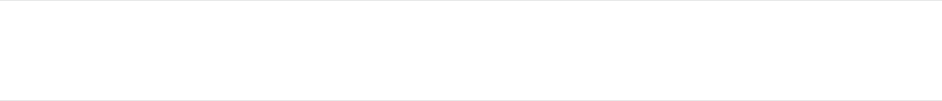

Figure 4 illustrates our estimates of average annual health care costs for an average aged Medicare beneficiary, split

by type of cost to the beneficiary.

FIGURE 4: ESTIMATED ANNUAL HEALTH CARE COSTS FOR AVERAGE AGED BENEFICIARY, BY TYPE OF COST

Note: The sum of individual components in this figure may not equal totals due to rounding.

MA-PD plan coverage has the lowest overall average total annual health care costs for beneficiaries, followed by FFS

with PDP coverage. The Medigap coverage option analyzed has a higher average total annual cost than either the

MA-PD or FFS with PDP options, though Medigap enrollees generally exchange higher premiums for limited

variability in annual OOP costs and expanded provider availability.

The average annual costs for a beneficiary who chooses Medigap Plan G are $604 higher annually than an average

beneficiary who forgoes Medigap coverage and only has Medicare FFS and PDP coverage, and they are about

$2,805 higher than for an average beneficiary who chooses to purchase an MA-PD plan. These costs are intended to

represent the average, and an individual beneficiary will experience different costs based on that person's own

circumstances.

These differences in OOP costs also indicate that the estimated actuarial value for the MA-PD coverage is 91.3%,

while the actuarial value for the FFS coverage options is 83.9%.

25

Said another way, for every dollar of health care

cost, MA-PD plans pay 91.3 cents and the member cost sharing is 8.7 cents. Similarly, under each of the two FFS

coverage options, FFS pays 83.9 cents of every dollar of health care costs, while the member pays the remaining

16.1 cents through cost sharing.

25

We define actuarial value as the percentage of total Medicare-covered claim costs that are covered by each coverage option, i.e., (Payer Liability /

[Payer Liability + Member Cost Sharing]). Claim costs are for core Medicare-covered benefits plus pharmacy claims, and exclude ancillary benefits,

such as dental, vision, and hearing. Pharmacy claims exclude the impact of federal subsidies and rebates.

$1,917

$1,979 $1,979

$189

$491 $491

$2,431

$48

$452

$452

$388

$622

$622

$854

$2,053

$226

$3,396

$5,597

$6,200

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

MA-PD FFS, PDP FFS, PDP, Medigap Plan G

Medicare Covered Medical OOP

Part D OOP

Supplemental OOP

Medigap Premium

PDP Premium

MA-PD Premium

Part B Premium

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 9 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

Some drivers of the differences in annual health care costs across coverage options are as follows:

MA-PD plans: MAOs attract and retain members by offering lower cost sharing, which is required to be at

least equivalent to, but is generally better than, FFS cost sharing, at a competitive premium. Based on our

analysis, shown in Figure 4, the average annual health care costs for an MA-PD member are lower than

those of FFS and Medigap members for reasons that include the following:

− MA plans provide care management and coordination for their members, including directing members to

specific services and providers to manage their health care, as well as disease management programs

aimed at improving health outcomes. Utilization management typically generates cost savings but can

be viewed as a limitation by some beneficiaries, as they may be required to obtain prior authorization,

use specific providers, or try alternative treatments during the course of care.

− Furthermore, MA plans typically provide a selection of supplemental benefits for no additional premium,

often with no or low cost sharing, to attract membership, as well as to assist in care management. In our

estimates listed above, we included only dental, vision and hearing cost sharing under each coverage

option. We estimate the average MA-PD member pays approximately $48 annually OOP for dental,

vision and hearing supplemental benefits in 2023, compared to $452 for beneficiaries choosing FFS

with or without Medigap, a $404 difference in OOP costs. MA plans also usually offer additional

supplemental benefits that members may choose to forgo without coverage, such as cards to subsidize

OTC drugs, NEMT, or fitness benefits. On average, MA-PD plans offer additional supplemental benefits

worth $190 in 2023. These benefits vary significantly by plan.

− MA plans may also implement provider networks, some of which limit coverage to a specific subset of

providers. Medicare Health Maintenance Organization (HMO) plans offer lower cost sharing to

beneficiaries by limiting the network to a defined set of preferred providers. Preferred Provider

Organization (PPO) and point-of-service (POS) plans may offer lower cost sharing to members if they

choose providers specified by the MA plan, but still allow the member the option of going outside the

network.

− MA plans implement an in-network maximum out-of-pocket (MOOP) cost limit for beneficiaries. While

the regulatory in-network annual maximum is $8,300 in 2023,

26

many MA-PD plans offer lower MOOP

limits—in 2023, the average MOOP in MA-PD plans is just under $4,680. FFS has no such limit on a

beneficiary’s OOP medical costs, making the MOOP particularly important for those members who are

likely to incur high medical costs.

PDP plans: PDP plans generally offer leaner Part D benefits, in the form of higher cost sharing and a more

restrictive formulary, than MA-PD plans, which results in higher drug-related health care costs for FFS and

Medigap members relative to MA-PD members.

Medigap plans: While the magnitude of OOP costs for FFS members may not be known in advance, it is

generally assumed that beneficiaries choosing Plan G knowingly do so to “lock-in” OOP costs for Medicare-

covered services. As a result, the premiums for Plan G significantly exceed average Medicare-covered health

care costs under FFS (approximately $2,400 vs. $2,000) in order to cover administrative costs, profit, and risk

loads inherent in Medigap premiums, as well as what some argue to be induced utilization caused by the lack

of beneficiary cost sharing—that is, beneficiaries are able to obtain covered care without limits or any utilization

management controls.

27

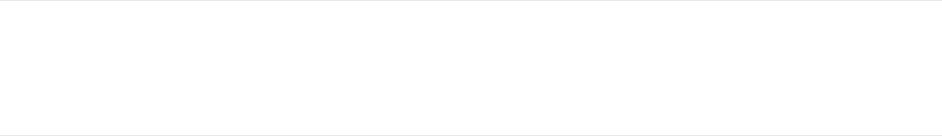

Average lifetime cost differential for 65-year-old Medicare beneficiary

A typical 65-year-old will live for an average of about 21 more years, or through age 85.

28

,

29

We projected the annual

health care costs of each Medicare coverage option for the average 65-year-old using assumptions for medical cost

inflation and cost increases due to age, and then summed these costs over the average expected lifetime to

26

The regulatory in-network maximum was raised to $8,300 in 2023 by CMS.

27

Induced utilization is a term used by actuaries to describe increased use in health care services due to moral hazard.

Moral Hazard in Health Insurance: What We Know and How We Know it. Retrieved December 1 2020, from

https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6128379.

28

https://www.ssa.gov/planners/lifeexpectancy.html

29

The Social Security Administration website calculates different life expectancies for male and female, which are both slightly different than 21 years.

However, we used 21 years for this lifetime calculation because the male and female life expectancies average to approximately 21 years.

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 10 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

demonstrate the total expected financial outlay over that same timeframe. FFS, PDP and Plan G represent

approximately $111,889 more in health care costs compared to MA-PD, while FFS and PDP represent $77,582 more

than MA-PD over the same 21-year time horizon.

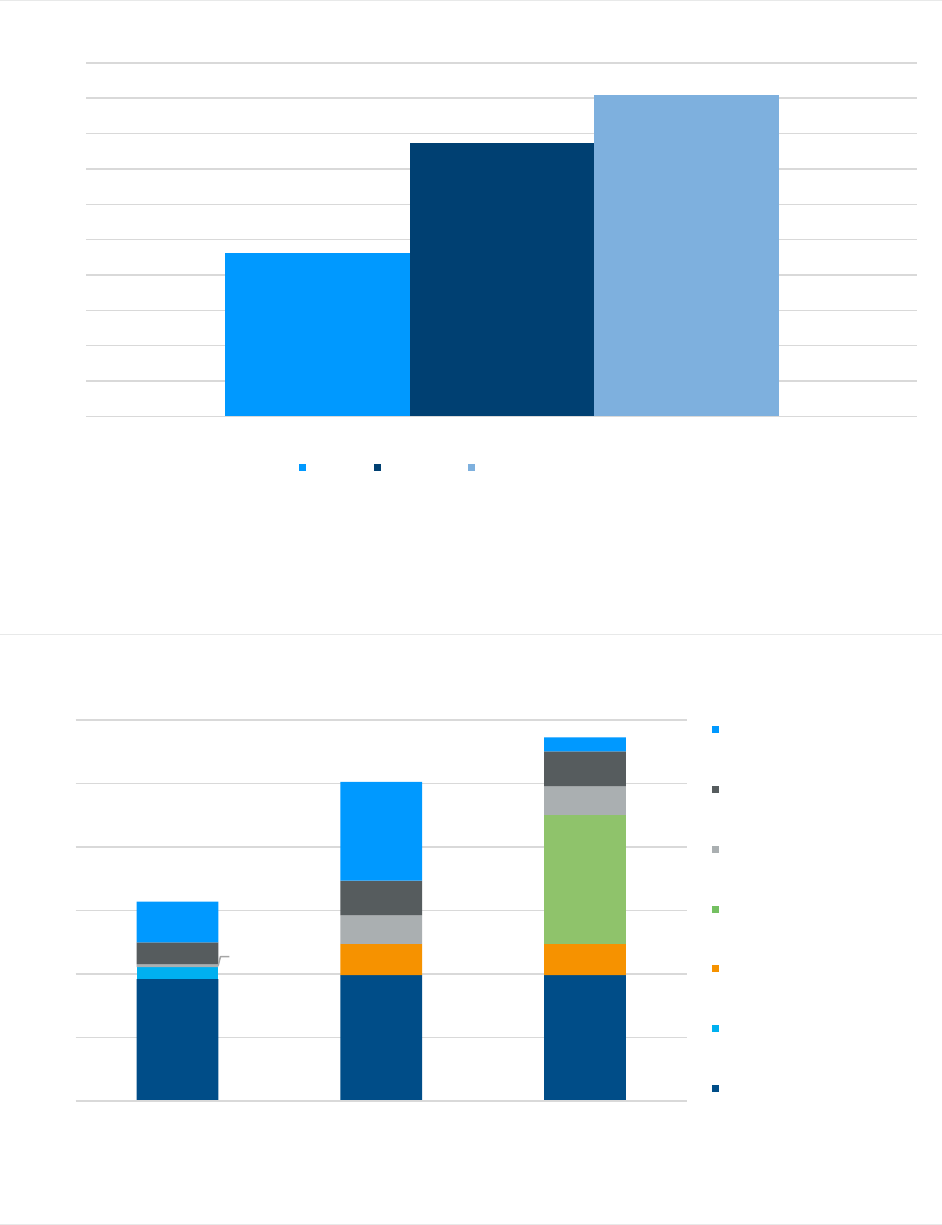

FIGURE 5: ESTIMATED FUTURE LIFETIME HEALTH CARE COSTS FOR AVERAGE 65-YEAR-OLD BENEFICIARY, BY COVERAGE OPTION

Annual health care costs for specific age groupings

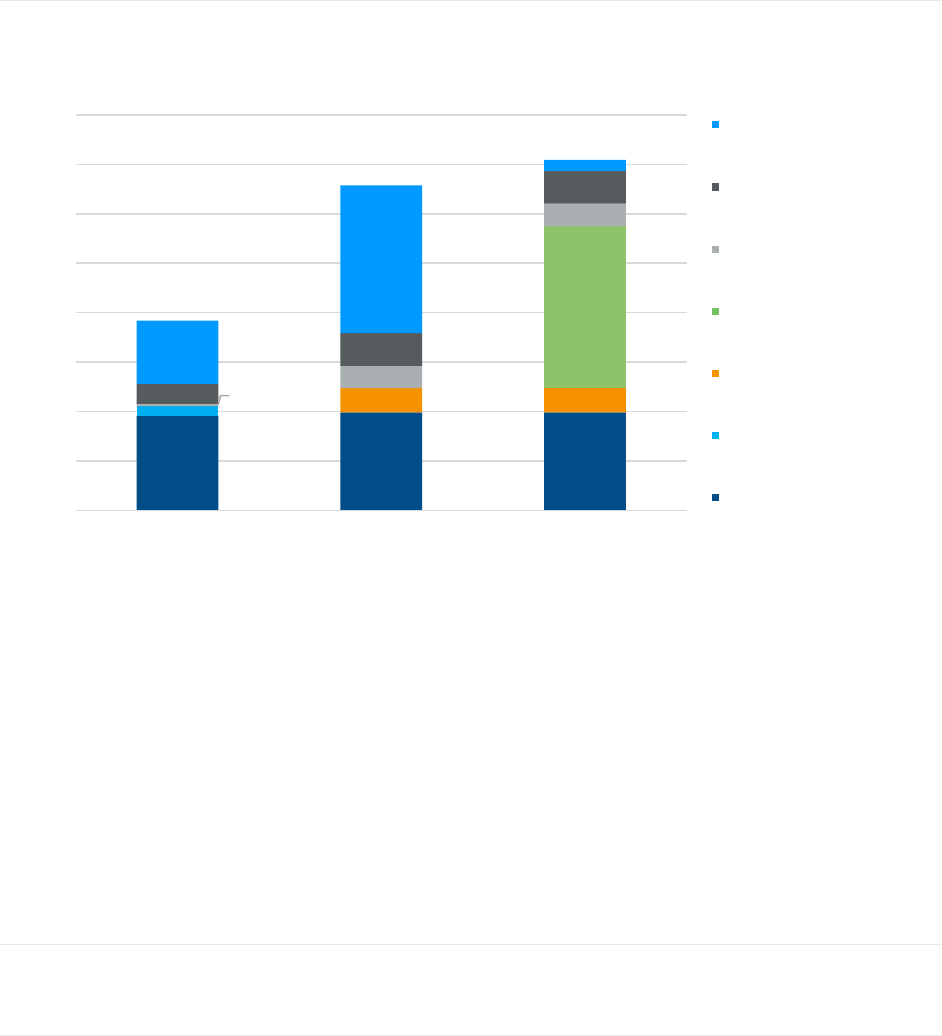

The differences in costs between coverage options for the average beneficiary, shown in Figure 4, holds for an

average 65-year-old newly eligible Medicare beneficiary, as well as for older Medicare beneficiaries. Figure 6

illustrates our estimates of average annual health care costs for an average 65-year-old Medicare beneficiary, split by

type of cost to the beneficiary.

FIGURE 6: ESTIMATED ANNUAL HEALTH CARE COSTS FOR AVERAGE 65-YEAR-OLD BENEFICIARY, BY TYPE OF COST

Note: The sum of individual components in this figure may not equal totals due to rounding.

$115,451

$193,033

$227,340

$0

$25,000

$50,000

$75,000

$100,000

$125,000

$150,000

$175,000

$200,000

$225,000

$250,000

Total Lifetime Expenditures

MA-PD FFS, PDP FFS, PDP, Medigap Plan G

$1,917

$1,979 $1,979

$189

$491 $491

$2,033

$48

$452

$452

$345

$546

$546

$639

$1,554

$226

$3,138

$5,021

$5,726

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

MA-PD FFS, PDP FFS, PDP, Medigap Plan G

Medicare Covered Medical OOP

Part D OOP

Supplemental OOP

Medigap Premium

PDP Premium

MA-PD Premium

Part B Premium

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 11 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

Similar to the average beneficiary results, an average 65-year-old new entrant to Medicare can expect to incur lower

annual health care costs under an MA-PD plan than under the combinations of FFS and PDP, with or without

Medigap coverage ($1,884 to $2,588 lower). This differential is smaller than for the average beneficiary ($2,201 to

$2,805 lower). The primary driver of the difference in annual health care costs between options at age 65 relative to

the average Medicare beneficiary is the Medigap premium, which varies by age in most states. The 65-year-old

Medigap member will have lower premiums than the average Medigap member. MA-PD plans, in contrast, are

community-rated i.e., the rates do not vary by age, gender, or health status. As such, the MA-PD premium is the

same for a 65-year-old as it is for a beneficiary at any other age. These costs are intended to represent the average

for a 65-year-old. Individual beneficiaries will experience different costs based on that person’s own circumstances.

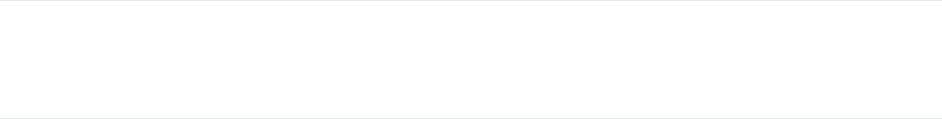

Figure 7 illustrates our estimates of average annual health care costs for an average 85-year-old Medicare

beneficiary, split by type of cost to the beneficiary.

FIGURE 7: ESTIMATED ANNUAL HEALTH CARE COSTS FOR AVERAGE 85-YEAR-OLD BENEFICIARY, BY TYPE OF COST

Note: The sum of individual components in this figure may not equal totals due to rounding.

Similar to the previous two examples, an average 85-year-old Medicare beneficiary can expect to incur lower annual

health care costs under an MA-PD plan than under the combinations of FFS and PDP, with or without Medigap

coverage (about $2,737 to $3,256 lower), though the differential between FFS and PDP with and without Medigap

narrows at this age, as Medigap premiums align more closely to FFS costs at higher ages.

30

The estimated annual

Medigap premiums in this scenario are much higher than in the previous average age beneficiary and average age

65-year-old scenarios. We also expect that medical and drug OOP costs will be higher in this scenario given the

morbidity of this population. These costs are intended to represent the average for an 85-year-old, and an individual

beneficiary will experience different costs based on that person’s own circumstances.

30

The narrower differential between FFS and PDP-only and FFS and PDP with Medigap Plan G at age 85 relative to the differential for the age 65 and

for the average age cohorts may, in part, be due to higher up-front administrative costs and commissions associated with Medigap plans.

$1,917

$1,979 $1,979

$189

$491 $491

$3,283

$48

$452

$452

$402

$662

$662

$1,280

$2,990

$226

$3,837

$6,573

$7,092

$0

$1,000

$2,000

$3,000

$4,000

$5,000

$6,000

$7,000

$8,000

MA-PD FFS, PDP FFS, PDP, Medigap Plan G

Medicare Covered Medical OOP

Part D OOP

Supplemental OOP

Medigap Premium

PDP Premium

MA-PD Premium

Part B Premium

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 12 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

Considerations for beneficiaries who incur high health care costs

While our report focuses on averages within groupings of beneficiaries, for a beneficiary expecting to incur

significantly greater than average health care costs (for example, for Part B infusion medications), both Medigap

policies and MA plans (including MA-PD plans) offer financial protections in the form of a hard cap on OOP costs not

offered by FFS on its own. While all MA plans have an in-network MOOP of $8,300 or less as of 2023, most Medigap

plans limit total annual health care costs to significantly less than $8,300. To better understand which enrollees would

benefit from theses financial protections, we studied FFS claim data for enrollees with more than $8,300 in annual

OOP costs (i.e., cost sharing expenses) for Medicare-covered services.

Figure 8 demonstrates that only about 2.5% of FFS enrollees exceed $8,300 in annual OOP costs, with average

OOP costs of approximately $15,000 for those exceeding this amount. These beneficiaries incur approximately

$100,000 in annual claims and may incur lower OOP costs by choosing an MA-PD plan or a Medigap plan than FFS

coverage alone.

Further, beneficiaries who expect to have over $2,700 annually in OOP costs (the approximate average annual Plan

G premium plus the annual Part B deductible in 2023) for copays, coinsurance, and deductibles for Part A and Part B

services over a multiyear time horizon may incur lower OOP costs with a Medigap plan than with an MA-PD plan, as

beneficiaries in MA-PD plans may continue to accrue cost sharing up to $8,300, while a Plan G enrollee will not

accrue Medicare-covered costs beyond the Medigap premium and the Part B premium and deductible. However,

depending on MA plans available in a beneficiary’s geography, they may be able to purchase a Medicare Advantage

plan with a low MOOP to protect themselves against high OOP costs. In some instances, a beneficiary could enroll in

an MA-PD plan with a lower combined premium plus MOOP than the available Medigap Plan G premium plus the

annual Part B deducible. By purchasing an MA-PD plan, most of these beneficiaries are also able to access the

additional supplemental benefits offered by MA-PD plans but not covered by FFS or Medigap plans.

Average premiums for Plan G by year are included below for comparison with OOP costs for this high-cost

population.

Our analysis is based on 2023 benefits and premiums. Note that the COVID-19 pandemic affected 2020 medical

costs. Nonetheless, we include 2020 results from the CMS 5% Sample, as the values align with 2017 through 2019

amounts.

FIGURE 8: FFS ENROLLEES EXCEEDING $8,300 IN ANNUAL MEDICAL (PART A AND PART B) OUT-OF-POCKET COSTS

YEAR

SHARE OF FFS

ENROLLEES

AVERAGE ANNUAL

TOTAL CLAIMS

AVERAGE ANNUAL

MEMBER OOP COSTS

AVERAGE PLAN G

PREMIUM

2017

2.4%

$96,851

$14,191

$1,557

2018

2.6%

$98,022

$14,439

$1,530

2019

2.7%

$99,989

$14,671

$1,860

2020

2.5%

$101,424

$15,111

$2,206

Note: Results are based on 2017 to 2020 data from the CMS 5% Sample, and are limited to non-Dual, non-ESRD, and non-Hospice members from these

data sets, including those enrolled in FFS regardless of PDP or Medigap enrollment.

Additional considerations not measured by annual health care costs

The previous sections outlined the estimated annual health care costs for a Medicare beneficiary under various

coverage options. In addition to beneficiary costs, there are many additional considerations when a prospective

beneficiary is deciding what type of coverage is best for them. These additional considerations include, in no

particular order:

▪ Care management: Most MA plans provide care management and coordination. Many plan sponsors

incorporate programs to direct members to the specific services and sites of service in order to improve

access to preventive care and to coordinate the total care spectrum for members with numerous and

complex conditions. As such, members with complex health profiles may benefit from the coordinated and

holistic approach to their health care needs. In recent years, CMS has implemented a series of value-based

care programs (such as the Medicare Shared Savings Program), which encourage providers to coordinate

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 13 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

care delivery to benefit high acuity and complex members. However, these programs, if implemented

improperly, may burden the member due to administrative hurdles.

▪ Availability of supplemental benefits in Medicare Advantage: Many MA-PD plans offer ancillary

benefits, including but not limited to routine dental, vision, hearing, meals, NEMT, nutritional therapy, OTC

drugs, and gym memberships. In recent years, CMS has allowed greater flexibility for MA plans to offer

supplemental benefits, including provision of benefits that address social determinants of health. Relative to

our prior report, more MA-PD plans are offering benefits that address social determinants of health and

more beneficiaries are enrolled in plans offering such benefits.

Relative to our prior report, combo benefits (which allow plans to group together multiple supplemental

benefits under a single benefit limit) and reduction in cost sharing (RICS)

31

offerings are available to more

beneficiaries under recent benefit flexibilities available to MA plans. In 2023, approximately one-fourth of

beneficiaries enrolled in a non-SNP plan will be enrolled in a plan that offers a combined benefit with a

single limit covering multiple supplemental service categories.

32

Also, based on research from the 2023

Milliman MACVAT

®

, approximately one in 10 MA beneficiaries enrolled in a non-SNP plan will be enrolled in

a plan that offers a RICS benefit.

In contrast, FFS and Medigap policies do not include any supplemental benefits, and a member would have

to buy standalone plans or pay full OOP costs to receive these benefits or services. According to the 2017

Medicare Current Beneficiary Survey, the most frequently self-identified chronic condition is related to vision

(99.6% of respondents self-reporting as having vision issues).

33

Additionally, many Medicare beneficiaries

use OTC drugs. Many MA-PD plans offer an OTC drug benefit, which is valued at approximately $65 in

2023. Therefore, supplemental benefits are likely a significant source of OOP savings for MA-PD members

who need and utilize these supplemental services and benefits that are not covered under FFS.

▪ Existence of Special Needs Plans in Medicare Advantage: There are several types of SNPs in the MA

program, listed below. These plans may offer targeted ancillary benefits, which are not available in FFS, for

members who qualify based on their health conditions or income-based characteristics to address their

specific conditions or characteristics, such as maintenance drugs for members with diabetes and meals

benefits for low-income members in a dual eligible SNP.

− Chronic SNP (C-SNP): Plans for members with specified chronic conditions (e.g., diabetes, chronic heart

failure)

− Institutionalized SNP (I-SNP): Plans for members who are institutionalized in a nursing home, or

functionally impaired seniors living in the community

− Dual eligible SNP (D-SNP): Plans for members who are eligible for both Medicare and Medicaid

− ESRD SNP: Plans for members with ESRD

Special supplemental benefits for the chronically ill, uniformity flexibility, and value-based insurance

design benefits in Medicare Advantage: CMS encourages MAOs to offer coordinated care through these

various options to personalize the experience and to reduce health care costs for specific individuals who

need more intensive therapies. As of CY 2020 for special supplemental benefits for the chronically ill

(SSCBI), CY 2019 for uniformity flexibility (UF), and CY 2017 for value-based insurance design (VBID),

MAOs are allowed to design benefits that target a specific population, and these benefits may be offered

non-uniformly to members in plans with these offerings.

31

RICS benefits allow an MA-PD plan to reimburse any beneficiary in that plan for OOP costs up to a specific dollar amount for a defined set of

services. For example, a plan could offer a $500 RICS allowance on dental, vision, and hearing benefits. A particular member could incur OOP costs

for glasses, hearing aid, etc. and then be reimbursed by the plan for those OOP costs up to $500.

32

Friedman, J., Yeh, M. & Yen, I. (January 2023). 2023 Combined Benefits in Medicare Advantage: Tracking Benefit Strategy and Options. Retrieved

February 1, 2023 from https://us.milliman.com/en/insight/2023-combined-benefits-in-medicare-advantage-tracking-benefit-strategy

33

Milliman analysis of CMS-provided Medicare Current Beneficiary Survey Chartbook 2017, accessed November 19, 2020 from

https://www.cms.gov/research-statistics-data-and-systemsresearchmcbsdata-tables/2017-medicare-current-beneficiary-survey-annual-chartbook-

and-slides.

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 14 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

Part D financial penalties: A beneficiary who goes without Part D or other creditable drug coverage after

their initial Medicare enrollment period will generally be liable for a late enrollment penalty on future PDPs, if

and when the beneficiary eventually enrolls.

34

Therefore, beneficiaries who actively choose to not enroll in

Part D for their lifetime may see potential premium savings; but if those same beneficiaries choose to enroll

in Part D later in life, they could face steep financial costs depending on the length of time they have gone

without Part D or other creditable drug coverage.

Guaranteed issue and premium protections in Medicare Advantage: General enrollment MA plans

(i.e., non-SNP) are guaranteed issue, with no underwriting. The only restriction to guaranteed issue in MA is

that potential SNP beneficiaries need to prove they are eligible for those MA-PD plan types. The same

premium is charged to each member, regardless of health status. Premiums may vary due to subsidies

available to low-income beneficiaries, but not due to age or health conditions. While MA plans can increase

their member premiums each year, there are strict filing restrictions around allowable premium increases. In

contrast, while Medigap policies are guaranteed issue at age 65, many Medigap policies allow underwriting

by age, health status, geography, and tobacco use, though some states only allow community rating.

Therefore, premiums typically vary widely for an individual depending on their demographic, geographic,

and/or health characteristics. In addition, many Medigap policies’ premiums increase as the member ages. It

is worth noting that Medigap premiums frequently increase with age, and future premiums are generally not

known by beneficiaries with certainty at the time they first enroll in their Medigap plans.

Beneficiary access to providers (e.g., network access): MA plans rely on provider networks to

coordinate care, implement programs, and reduce plan cost through preferred network rates. In an HMO, a

member going outside the network would not receive any insurance benefit and would be obligated to pay

all billed charges OOP. In a PPO, a member would pay the predetermined out-of-network benefit cost

sharing, which is typically less generous than in-network benefit cost sharing. As a trade-off for including

out-of-network access, many PPOs charge higher premiums. In contrast, FFS and Medigap policies typically

do not offer any restrictions on provider access and members would not need to verify that their physicians

and providers are in-network before receiving care or worry about unexpected bills for out-of-network labs or

procedures. Medigap “select” plans are an exception because they do have a preferred provider network for

Part A services, and, frequently, lower premiums as a trade-off for the network restriction.

Medigap plan offerings: Plan G is currently the most popular Medigap option because it covers all OOP

costs for Part A and Part B services except the Part B deductible for FFS beneficiaries, making it easy for

beneficiaries to plan their annual expected health care costs for that year. In 2023, the annual Part B

deductible is $226, the Part B Premium is $1,979, and the Plan G premium is approximately $2,430.

Because the Part B deductible is the only beneficiary cost sharing for Medicare-covered services under Plan

G, beneficiaries purchasing this plan will have a comprehensive Medigap option ensuring predictable annual

health care costs for Medicare-covered services in 2023.

Predictable medical costs in the future: Many seniors are on a fixed income each year. By enrolling in a

comprehensive Medigap plan like Plan G, they have more predictable medical OOP spending each year,

without dealing with the uncertainty of high cost sharing due to a long hospitalization or coverage of Part B

infusion medications under FFS and a PDP. The peace of mind for a beneficiary of having predictable OOP

costs each year without network restrictions is in some cases worth more to them than the actual higher

lifetime health care costs under Medigap. Additionally, as most Medigap policies allow underwriting, it is

advantageous to the beneficiary to purchase the coverage prior to a health event that may preclude them

from obtaining Medigap coverage.

34

This penalty is calculated as a percentage of the nationwide base beneficiary premium each year, which is $32.74 in 2023. The percentage

increases with the length of time between when a beneficiary first gains Medicare eligibility or their last period of creditable drug coverage, whichever

is later.

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 15 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

Demographic information

The demographic makeup of beneficiaries selecting various coverage options differs across several measures,

including gender, age, income, and geography. Figure 9 outlines several demographic measures across coverage

options for 2020. These metrics are calculated based on Medicare enrollment distributions from the MedPAC July

2023 Databook.

35

FIGURE 9: DEMOGRAPHIC INFORMATION FOR 2020

CATEGORY

MEDICARE ADVANTAGE

FFS EXCLUDING

MEDIGAP

MEDIGAP

ALL MEDICARE

BENEFICIARIES

GENDER

Male

44%

50%

43%

45%

Female

56%

50%

57%

55%

AGE GROUP

Younger than 65 Years

13%

21%

2%

13%

65 to 69 Years

23%

22%

26%

22%

70 to 75 Years

26%

25%

28%

25%

75 to 79 Years

17%

14%

21%

18%

80 to 84 Years

11%

9%

12%

11%

85 Years and Older

11%

8%

11%

11%

GEOGRAPHIC LOCATION

Urban

87%

75%

77%

82%

Rural

13%

25%

23%

18%

INCOME-TO-POVERTY RATIO

<1.0

17%

11%

4%

15%

1.0 to 1.2

9%

9%

4%

7%

1.2 to 1.35

9%

11%

5%

7%

1.35 to 2.0

14%

17%

11%

12%

>2.0

52%

52%

76%

59%

Note: The percentages in this table may not sum to 100 percent due to rounding.

35

MedPAC July 2023 Data Book: Health Care Spending and the Medicare Program, Section 3: Medicare beneficiary and other payer financial liability.

Retrieved August 18, 2023, from https://www.medpac.gov/wp-content/uploads/2023/07/July2023_MedPAC_DataBook_SEC.pdf.

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 16 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

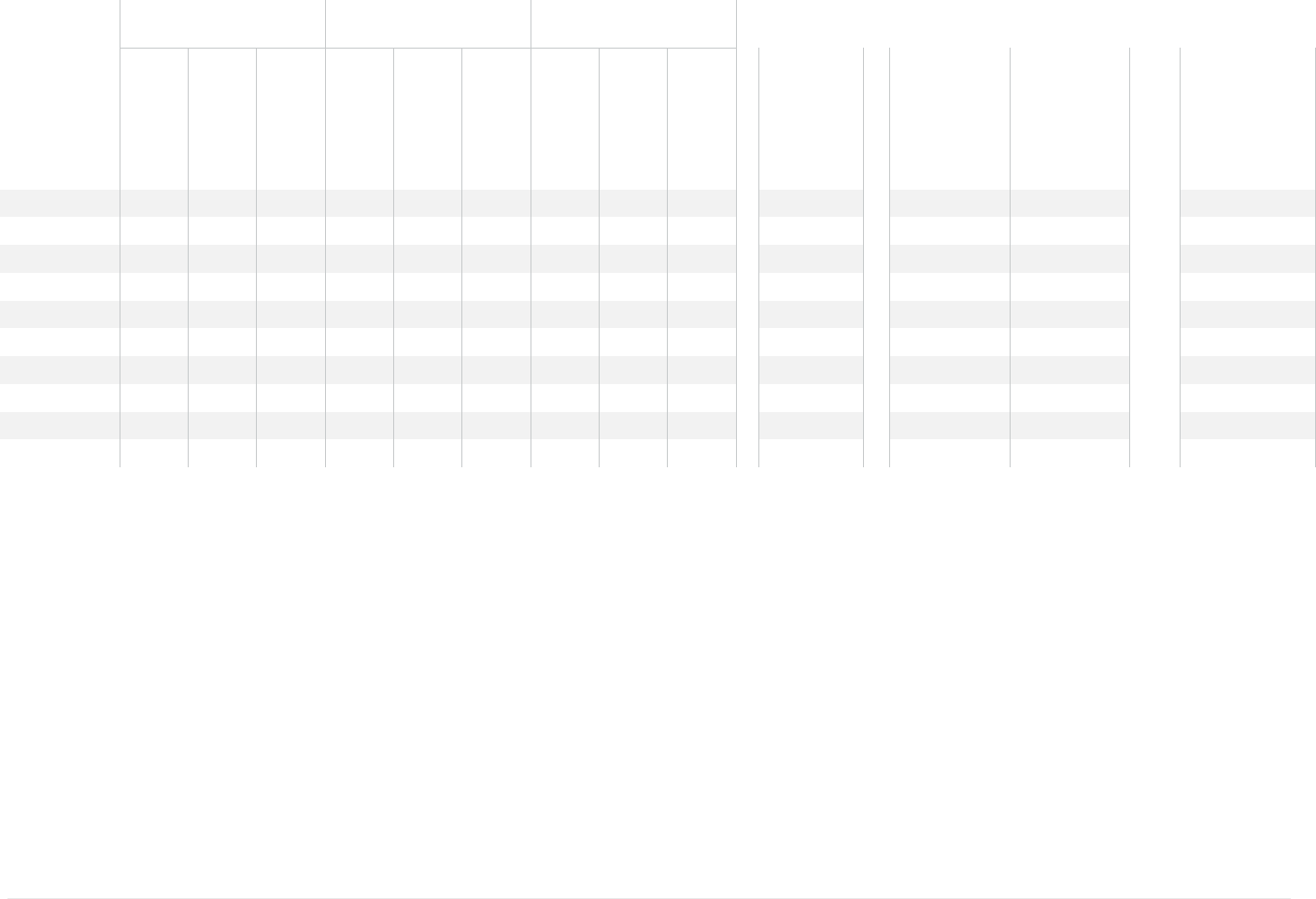

4. STATE-LEVEL RESULTS

Figure 10 details our analysis by state for each of the enrollment options discussed above, for an average Medicare

beneficiary. There is expected variation across each state and coverage option due to differences in cost and

utilization patterns, differences in MA-PD and PDP plan offerings, and Medigap premiums.

We excluded Alaska from the state level summary due to a lack of MA-PD plan offerings. We excluded all U.S.

territories due to the unique nature of the Medicare program in US territories.

Since Medigap is a product largely regulated at a state level, there are some differences in the structure of the rates

for beneficiaries of different ages. For example, states like Arkansas, Connecticut, Massachusetts, Maine, Minnesota,

New York, Vermont, and Washington do not allow age-issue underwriting, which means that rates are the same,

regardless of the age of a beneficiary when they choose to enroll. Three states—Massachusetts, Wisconsin and

Minnesota—do not offer standardized benefits. For these three states, we included rates for each set of state-level

Medigap products that correspond most closely to Plan G.

36

There is significant variation in MA-PD premiums across states. While the Part B premium is the same for all

beneficiaries, the MA-PD premium offered by health plans varies significantly by product type, geography, and plan

offerings. Notably, in Florida the premium is much lower due to the prevalence of $0 MA-PD premium plans and

plans offering Part B premium reductions. Conversely, in states such as North Dakota, South Dakota and Wyoming,

the MA-PD premiums are higher due to the low number of MA-PD plans, or plans are designed to mimic high-

premium Medicare Cost or Medigap plans, which are currently more prevalent in these less densely populated states.

36

The equivalent plans in these three states were determined to be: MA1 Supplement 1 for Massachusetts; Minnesota Basic Coverage with the Usual

and Customary Rider for Minnesota; Wisconsin Basic Coverage with the following riders: Part A Deductible Rider, Additional Home Health Rider,

Part B Excess Charges Rider, and Foreign Travel Rider.

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 17 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

FIGURE 10 2023 OUT-OF-POCKET AND PREMIUM COSTS BY STATE (CONTINUED ON PAGES 19 AND 20)

MA-PD

FFS and PDP

FFS, PDP and

Medigap Plan G

State

Total

OOP

Cost

37

Total

Premium

38

Total

Cost

Total

OOP

Cost

39

Total

Premium

40

Total

Cost

Total

OOP

Cost

41

Total

Premium

42

Total

Cost

MA-PD Value

of

Supplemental

Benefits

43

FFS

and PDP

compared

to MA-PD

FFS, PDP, and

Medigap Plan G

Compared

to MA-PD

FFS, PDP, and

Medigap Plan G

Compared to FFS

and PDP Only

Alabama

44

$1,368

$2,028

$3,396

$3,176

$2,494

$5,669

$1,353

$4,587

$5,940

$154

167%

175%

105%

Arizona

$1,119

$1,997

$3,115

$3,037

$2,462

$5,499

$1,229

$4,744

$5,973

$209

177%

192%

109%

Arkansas

$1,439

$2,028

$3,467

$3,174

$2,424

$5,598

$1,361

$4,381

$5,741

$194

161%

166%

103%

California

$740

$2,081

$2,821

$3,058

$2,478

$5,536

$1,268

$5,114

$6,381

$192

196%

226%

115%

Colorado

$1,051

$2,090

$3,141

$2,932

$2,443

$5,376

$1,248

$4,651

$5,899

$205

171%

188%

110%

Connecticut

$1,906

$2,113

$4,019

$3,242

$2,490

$5,732

$1,275

$5,399

$6,673

$173

143%

166%

116%

Delaware

$1,325

$2,077

$3,401

$3,216

$2,500

$5,716

$1,292

$4,796

$6,088

$190

168%

179%

107%

District of

Columbia

$1,330

$2,271

$3,602

$2,856

$2,500

$5,356

$1,292

$4,914

$6,206

$172

149%

172%

116%

Florida

$1,048

$1,694

$2,742

$3,539

$2,528

$6,067

$1,310

$5,869

$7,180

$204

221%

262%

118%

Georgia

$1,473

$1,986

$3,459

$3,080

$2,479

$5,559

$1,328

$4,501

$5,828

$187

161%

169%

105%

Hawaii

$1,294

$2,574

$3,868

$2,384

$2,434

$4,818

$1,210

$4,526

$5,736

$128

125%

148%

119%

Idaho

$1,311

$2,211

$3,522

$2,856

$2,421

$5,277

$1,290

$4,743

$6,033

$185

150%

171%

114%

Illinois

$1,193

$2,105

$3,298

$3,212

$2,436

$5,647

$1,300

$4,707

$6,007

$205

171%

182%

106%

Indiana

$1,405

$2,042

$3,446

$3,116

$2,401

$5,517

$1,333

$4,426

$5,760

$201

160%

167%

104%

37

Milliman analysis of medical OOP costs, drug OOP costs, estimated OOP for dental, vision, and hearing supplemental benefits, based on plan design and described in the Methodology section.

38

Includes average Part C plan premium by state, in addition to Part B premium, reduced by the average state Part B Buydown.

39

Milliman analysis of Medicare FFS medical OOP costs, drug OOP costs for the average PDP, estimated OOP costs for dental, vision, and hearing supplemental benefits, assuming other or no coverage.

40

Includes Part B premium, as well as the average PDP premium.

41

Milliman analysis of medical OOP costs, accounting for Plan G plan design, drug OOP costs for the average PDP, estimated OOP for dental, vision, and hearing supplemental benefits, assuming other or no coverage.

42

This premium reflects average Medigap premium for Plan G in each state, in addition to Part B premium, and average PDP premium.

43

Dental, vision, and hearing OOP costs are excluded from this column because they are included in the Total OOP Cost.

44

The Alabama Medigap market has historically had a higher share of Medicare Select Medigap plans, offered by Blue Cross and Blue Shield of Alabama. We excluded Medicare Select products nationwide due to low

overall prevalence and the network requirement as a trade-off for lower premiums.

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 18 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

MA-PD

FFS and PDP

FFS, PDP and

Medigap Plan G

State

Total

OOP

Cost

37

Total

Premium

38

Total

Cost

Total

OOP

Cost

39

Total

Premium

40

Total

Cost

Total

OOP

Cost

41

Total

Premium

42

Total

Cost

MA-PD Value

of

Supplemental

Benefits

43

FFS

and PDP

compared

to MA-PD

FFS, PDP, and

Medigap Plan G

Compared

to MA-PD

FFS, PDP, and

Medigap Plan G

Compared to FFS

and PDP Only

Iowa

$1,327

$2,021

$3,348

$3,059

$2,386

$5,445

$1,324

$4,558

$5,882

$171

163%

176%

108%

Kansas

$1,330

$2,024

$3,354

$3,181

$2,363

$5,544

$1,344

$4,662

$6,006

$177

165%

179%

108%

Kentucky

$1,531

$2,014

$3,545

$3,134

$2,401

$5,535

$1,333

$4,581

$5,914

$224

156%

167%

107%

Louisiana

$1,293

$1,967

$3,260

$3,165

$2,470

$5,635

$1,365

$4,549

$5,915

$168

173%

181%

105%

Maine

$1,441

$2,078

$3,519

$2,933

$2,485

$5,419

$1,229

$5,297

$6,526

$169

154%

185%

120%

Maryland

$1,641

$2,424

$4,064

$3,384

$2,500

$5,884

$1,292

$5,122

$6,414

$172

145%

158%

109%

Massachusetts

$1,449

$2,556

$4,005

$3,139

$2,490

$5,629

$1,275

$5,372

$6,646

$170

141%

166%

118%

Michigan

$1,416

$2,229

$3,645

$3,045

$2,445

$5,489

$1,248

$4,729

$5,977

$221

151%

164%

109%

Minnesota

$1,231

$2,959

$4,190

$3,080

$2,386

$5,466

$1,324

$4,958

$6,282

$163

130%

150%

115%

Mississippi

$1,481

$2,095

$3,576

$3,219

$2,425

$5,644

$1,369

$4,237

$5,606

$170

158%

157%

99%

Missouri

$1,262

$2,011

$3,273

$3,196

$2,442

$5,638

$1,351

$5,154

$6,506

$191

172%

199%

115%

Montana

$1,530

$2,296

$3,826

$2,953

$2,386

$5,339

$1,324

$4,418

$5,741

$164

140%

150%

108%

Nebraska

$1,350

$2,063

$3,413

$3,147

$2,386

$5,532

$1,324

$4,485

$5,809

$175

162%

170%

105%

Nevada

$795

$1,960

$2,756

$3,074

$2,468

$5,542

$1,263

$4,759

$6,022

$229

201%

219%

109%

New Hampshire

$1,695

$2,148

$3,843

$3,005

$2,485

$5,491

$1,229

$5,177

$6,406

$158

143%

167%

117%

New Jersey

$1,583

$2,087

$3,671

$3,445

$2,516

$5,961

$1,325

$4,936

$6,262

$155

162%

171%

105%

New Mexico

$1,237

$2,049

$3,286

$2,574

$2,458

$5,032

$1,227

$4,438

$5,665

$193

153%

172%

113%

New York

$1,704

$2,190

$3,894

$3,144

$2,581

$5,725

$1,294

$6,215

$7,509

$163

147%

193%

131%

North Carolina

$1,331

$2,017

$3,348

$3,072

$2,515

$5,587

$1,316

$4,481

$5,797

$192

167%

173%

104%

North Dakota

$1,475

$2,462

$3,937

$3,065

$2,386

$5,451

$1,324

$4,532

$5,856

$177

138%

149%

107%

Ohio

$1,433

$2,104

$3,538

$3,074

$2,434

$5,508

$1,286

$4,488

$5,774

$220

156%

163%

105%

Oklahoma

$1,359

$2,098

$3,456

$3,288

$2,447

$5,735

$1,423

$4,439

$5,862

$181

166%

170%

102%

Oregon

$1,289

$2,402

$3,691

$2,701

$2,452

$5,153

$1,214

$5,107

$6,321

$161

140%

171%

123%

Pennsylvania

$1,412

$2,307

$3,719

$3,039

$2,482

$5,521

$1,290

$4,596

$5,886

$202

148%

158%

107%

Rhode Island

$1,257

$2,306

$3,563

$3,040

$2,490

$5,530

$1,275

$4,944

$6,219

$276

155%

175%

112%

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 19 September 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

MA-PD

FFS and PDP

FFS, PDP and

Medigap Plan G

State

Total

OOP

Cost

37

Total

Premium

38

Total

Cost

Total

OOP

Cost

39

Total

Premium

40

Total

Cost

Total

OOP

Cost

41

Total

Premium

42

Total

Cost

MA-PD Value

of

Supplemental

Benefits

43

FFS

and PDP

compared

to MA-PD

FFS, PDP, and

Medigap Plan G

Compared

to MA-PD

FFS, PDP, and

Medigap Plan G

Compared to FFS

and PDP Only

South Carolina

$1,410

$1,954

$3,364

$3,036

$2,495

$5,531

$1,316

$4,714

$6,030

$181

164%

179%

109%

South Dakota

$1,443

$2,213

$3,656

$3,078

$2,386

$5,464

$1,324

$5,129

$6,453

$173

149%

176%

118%

Tennessee

$1,284

$2,136

$3,420

$3,103

$2,494

$5,597

$1,353

$4,435

$5,788

$192

164%

169%

103%

Texas

$1,256

$1,987

$3,243

$3,202

$2,431

$5,633

$1,321

$4,442

$5,762

$190

174%

178%

102%

Utah

$1,228

$2,102

$3,330

$2,991

$2,421

$5,412

$1,290

$4,554

$5,844

$194

163%

176%

108%

Vermont

$1,692

$2,179

$3,871

$2,881

$2,490

$5,370

$1,275

$5,723

$6,997

$149

139%

181%

130%

Virginia

$1,330

$2,067

$3,398

$3,024

$2,460

$5,485

$1,295

$4,371

$5,666

$201

161%

167%

103%

Washington

$1,333

$2,331

$3,664

$2,803

$2,452

$5,256

$1,214

$5,053

$6,266

$172

143%

171%

119%

West Virginia

$1,550

$2,156

$3,706

$3,029

$2,482

$5,511

$1,290

$4,631

$5,921

$197

149%

160%

107%

Wisconsin

$1,343

$2,305

$3,648

$2,954

$2,425

$5,379

$1,344

$5,007

$6,351

$184

147%

174%

118%

Wyoming

$1,347

$2,373

$3,721

$2,954

$2,386

$5,340

$1,324

$4,609

$5,932

$150

144%

159%

111%

MILLIMAN CLIENT REPORT

UnitedHealth Group Page 20 August 2023

Average annual beneficiary health care

costs for various Medicare coverage options 2023

5. METHODOLOGY

We used detailed publicly available benefit design, premium, and plan information, and county-level enrollment

information, for all 2023 MA plans provided by CMS. We used this information, along with proprietary Milliman MA-PD

pricing models, to calculate the value of the medical cost sharing in the MA-PD program for all calendar year 2023

non-SNP MA-PD plans under the current MA payment methodology in each county. We also calculated the value of

medical cost sharing under the FFS program at the county level. We summarized the premium paid for MA-PD plans

and any Part B premium reductions in the MA-PD program. We applied a similar exercise to calculate the value of

cost sharing under the Part D portion of an MA-PD plan and of PDP plans for FFS members, and also captured the

PDP premium paid.

Medical costs are calculated for a non-disabled average age Medicare beneficiary not receiving income-based

assistance with medical costs. Part D costs are calibrated to published CMS values, for a non-low income (NLI)

population. We adjusted for the cost impact of geography and average CMS HCC (Part A and Part B) and RxHCC

(Part D) payment risk scores when developing medical cost estimates and other assumptions. In calculating expected

lifetime costs for an average 65-year-old, we assumed an annual inflation rate of 4.3% and an average remaining life

span of approximately 21 years. We also included the impact of aging in our medical and pharmacy cost trends,

which is in addition to the 4.3% annual trend. We include the impact of aging in the lifetime cost projections because

we expect OOP costs to increase as beneficiaries age. We projected the costs based on these assumptions for each

of those 21 years and summed them to demonstrate the lifetime costs for an average 65-year-old.

45

,

46

The annual

inflation rate of 4.3% is commensurate with the long-term trend rate as measured in the 2022 Medicare Trustees

Report and includes all components of trend that are applicable to costs outlined in this report. We did not consider