69

ECB

Monthly Bulletin

October 2013

Reference interest rates:

role, challenges and outlook

ARTICLES

Reference interest rates are frequently used interest rates that link payments in financial contracts

to standard money market interest rates. They serve as benchmarks for determining payments on

wholesale and retail loans, on floating rate notes and on derivatives contracts aimed at managing

interest rate risk. They are also entrenched in the global financial system via their usage in the

valuation of financial instruments and as a basis for performance measurement. This article

reviews the role traditionally played by reference rates, with a particular focus on the role that

EURIBOR plays in the monetary policy transmission mechanism in the euro area. Based on the

recent evidence of manipulation of reference interest rates and declining activity in the underlying

market, the article summarises the ECB’s views on the current debate on the possible options to

reform these reference rates, as well as the initiatives taken by the ECB to establish commonly

agreed principles that will strengthen the existing governance framework and to develop a next

generation of reference rates that are better anchored to observable transactions and more

representative of the underlying market conditions. It also presents some preliminary results of the

transaction data collection exercise that was carried out by EURIBOR-EBF and supported by the

ECB in order to assess the scope for a transaction-based reference rate that could act as a credible

substitute for EURIBOR. The article concludes that, while the reforms already implemented or to

be introduced represent significant progress in terms of strengthening the governance framework,

restoring credibility and reducing the risks of manipulation, further steps need to be taken to

explore alternative reference rates that are more transaction-based and that could be a potential

substitute for the current reference rates. The article also concludes that reference interest rates

reflecting banks’ unsecured funding costs will continue to play an important role, although they

will probably need to be complemented by alternative reference rates so that users can choose

reference rates that better match their needs.

1 INTRODUCTION

Reference interest rates (in particular TIBOR

1

, LIBOR

2

and EURIBOR

3

are interest rates that

link payments in a financial contract to standard money market interest rates. Given the growing

importance of these reference interest rates within the financial community over time, the

transmission of monetary policy is significantly influenced by the link between key reference

interest rates and the central banks’ key policy interest rate. Since the 1990s reference interest rates

based on unsecured interbank lending and borrowing have become dominant, as they facilitate the

management of banks’ funding risks owing to the role that banks play in credit channeling. This has

made reference rates an essential tool in the transmission of monetary policy decisions along the

yield curve, thereby affecting the investment decisions of many economic agents.

The allegations that have emerged since 2012 relating to the manipulation of key reference rates

such as TIBOR, LIBOR and EURIBOR have triggered a widespread debate on the appropriateness

of the process used to set reference interest rates. Yet this debate is supplemented by a more

fundamental question on the continuous representativeness of the interest rates used at present,

given the ongoing decline in the underlying market volumes and higher concentration. The ECB

believes that there is significant scope to reform these reference rates further. Taking into account

1 TIBOR stands for “Tokyo interbank offered rate”. Since 1995 it has been administered by the Japanese Bankers’ Association. For further

information, see http://www.zenginkyo.or.jp/en/tibor/the_jba_tibor/index.html

2 LIBOR stands for “London interbank offered rate”. It has thus far been administered by the British Bankers’ Association, but

its administration will be transferred to NYSE Euronext Rates Administration Limited by early 2014. For further information,

see http://www.bbalibor.com/news

3 EURIBOR stands for “euro interbank offered rate”. Since 1999 it has been administered by EURIBOR-EBF. For further information, see

www.euribor-ebf.eu

REFERENCE INTEREST RATES:

ROLE, CHALLENGES AND OUTLOOK

70

ECB

Monthly Bulletin

October 2013

the importance of these reference rates in the implementation and transmission of monetary policy,

any reform should distinguish between short-term, governance-enhancing measures aimed at

immediately increasing market confidence in these rates and more medium to long-term measures

aimed at making reference rates more transaction-based and more representative.

The aim of this article is thus threefold. First, to recall the purpose and role of reference interest

rates such as EURIBOR in the euro area and their importance from a monetary policy perspective

(see Section 2). Second, to explain the background behind the current debate on the appropriateness

and representativeness of the reference interest rates (see Section 3). Third, to present the various

initiatives taken by the official sector, including the Eurosystem, to enhance the integrity of

current reference interest rates and to encourage the adoption of more transaction-based ones

(see Section 4). In conclusion, the article draws some conclusions on what has been achieved thus

far and the tasks that lie ahead (see Section 5).

2 TRADITIONAL ROLE OF REFERENCE RATES

To understand the importance and social value of reference interest rates such as TIBOR, LIBOR

and EURIBOR, it is first essential to recapitulate the evolution of banks’ funding over time, which

in the 1990s gradually moved from a bank-based financial system towards a market-based financial

system. Reference interest rates, such as LIBOR or EURIBOR’s predecessors in the euro’s legacy

currencies, were initially created in the late 1980s in the context of syndicated loans as a more

transparent and cost-efficient way for banks to pass on their funding costs to their customers by

adding a spread to a reference rate representative of their marginal funding costs. The standardisation

of the pass-through rate in financial contracts also led to the emergence of derivatives, initially in

the form of forward rate agreements (FRAs) and then swaps. These derivatives allowed banks to

offer fixed rate loans while hedging their variable funding costs.

2.1 ROLE, NATURE AND CALCULATION OF REFERENCE RATES

Reference interest rates are snapshot assessments of certain market rates. Traditionally their role

has been to determine the pay-offs of standardised financial contracts by applying a formula to the

value of one or more underlying asset or price.

Based on the ESMA-EBA Principles for Benchmark-Setting Processes in the EU,

4

several different

roles in the rate-setting process can be identified. First, there is the so-called reference rate

administrator, which is the legal entity that sponsors the creation and operation of the reference rate.

It is also responsible for the calculation of the reference interest rate, as well as the methodologies

and governance of the rate-setting process. Second, there are the contributors, i.e. the legal entities

which contribute to the reference data used in the reference rate calculation process. Third, there is

the calculation agent, which is the legal entity that calculates the reference rate based on the data

submitted by the contributors. This entity may coincide with the administrator or be a third party

to which the administrator has assigned this role. Finally, there is the publisher, which is the legal

entity that makes the reference rate values available via publicly accessible media.

Based on the data used to calculate the reference interest rates, a distinction can be made between

transaction-based reference rates, which are based on the rates applied to actual transactions, and

4 For further information, see www.esma.europa.eu/system/files/2013-659_esma-eba_principles_for_benchmark-setting_processes_in_

the_eu.pdf

71

ECB

Monthly Bulletin

October 2013

Reference interest rates:

role, challenges and outlook

ARTICLES

quote-based reference interest rates, which are based on estimates of the rates at which transactions

can be executed. Depending on the data submitted, unsecured market reference rates can be further

differentiated between reference rates for lending and borrowing.

For example, in the specific case of the euro area and EURIBOR, EURIBOR-EBF

5

is the

benchmark administrator, while Thomson Reuters is the calculation agent and publisher that uses

data submitted by a panel of contributing banks. EURIBOR is a quote-based reference rate and is

calculated as a trimmed mean after the elimination of the top and bottom 15% of the contributions.

Contributions are based on the following definition: “EURIBOR

®

is the rate at which Euro interbank

term deposits are offered by one prime bank to another prime bank within the EMU zone, and is

published at 11:00 a.m. (CET) for spot value (T+2).”

6

It does not necessarily refer to the interbank

lending rates of the contributing bank, but rather to those at which euro interbank term deposits are

offered by one prime bank to another prime bank within the euro area.

7

TIBOR, administered by the Japanese Bankers Association, is based on quotes the panel of

contributing banks provide on the basis of what “they deem to be prevailing market rates, assuming

transactions between prime banks”.There are two types of TIBOR rate, namely the Japanese Yen

TIBOR and the Euroyen TIBOR, depending on whether the quotes provided refer to the Japanese

unsecured call market or the Japanese offshore market.

In contrast with EURIBOR and TIBOR, LIBOR, which has so far been administered by the British

Bankers’ Association (BBA)

8

and is calculated and published by Thomson Reuters, is based on the

answers provided by a panel of banks to the question: “At what rate could you borrow funds, were

you to do so by asking for and then accepting inter-bank offers in a reasonable market size just

prior to 11 a.m.?”. Therefore, submissions are based on the lowest perceived rate at which a bank

on a certain currency panel could access the interbank money market and obtain sizeable funding

for a given maturity. LIBOR refers to the estimated borrowing costs charged to contributing banks

and may therefore have a stronger signalling effect on the creditworthiness of these banks. Such

signalling effects may have increased the incentives to manipulate individual submissions during

the financial crisis.

The euro overnight index average (EONIA) is a transaction-based interest rate used for the euro

area overnight segment of the money market. It is calculated by the ECB, with EURIBOR-EBF as

the benchmark administrator and Thomson Reuters as the publisher, as a weighted average of the

interest rates on unsecured overnight lending transactions denominated in euro reported by a panel

of contributing banks. The ECB’s role as the calculating agent of EONIA stems from the high level

of confidentiality required for the handling of the submissions of individual bank transaction data,

as well as the need to ensure that the data are treated with the utmost confidentiality by an impartial

third party. The transaction-based nature of the submission minimises the extent of the subjectivity

implicit in quote-based systems, reduces the risk of manipulation – although it does not eliminate

it – and facilitates the ex post validation process.

5 EURIBOR-EBF is an international non-profit-making association that was founded in 1999 with the launch of the euro. Its members are

the national banking associations of those EU Member States that have adopted the euro.

6 See http://www.euribor-ebf.eu/euribor-org/about-euribor.html

7 The concept of a prime bank has recently been clarified in the Code of Conduct as “a credit institution of high creditworthiness for short-

term liabilities, which lends at competitive market related interest rates and is recognised as active in euro-denominated money market

instruments while having access to the Eurosystem’s (open) market operations.” The concept of an interbank deposits has also been

clarified in the Code of Conduct as “a cash deposit between two credit institutions, maturing by one year from inception.”

8 On 9 July 2013 the board of the BBA voted unanimously to approve the transfer of the administration of LIBOR to NYSE Euronext Rates

Administration Limited. The BBA will hand over the administration of LIBOR to that entity following approval by the United Kingdom’s

Financial Control Authority. The transition to the new administrator is expected to be completed in early 2014.

72

ECB

Monthly Bulletin

October 2013

2.2 RELEVANCE OF REFERENCE RATES FOR EURO AREA MARKETS

Through hedging activities (via swap and FRA contracts), there is a close link between cash (spot

and term) deposit interest rates and the derivatives segments of the money market. Transactions in

the cash and derivatives segments of the money market (in the euro area and other jurisdictions) are

conducted mainly over the counter (OTC), which makes it difficult to trace the rates and volumes

of the transactions made. This, in turn, increases the importance of having a reliable benchmark

reference on a term that is representative of the funding conditions for financial contracts (retail

loans, wholesale banking activities, syndicated loans) as well as OTC financial derivatives (FRAs,

short and long-term swaps, swaptions) and exchange-traded financial derivatives (futures contracts

and options on those futures contracts).

9

In the case of the euro area, EONIA is the usual reference interest rate for euro overnight indexed

swaps (OISs). EURIBOR serves as a pricing benchmark for variable rate loans and mortgages, and

is the reference rate for most interest rate swaps (IRSs) and other OTC-traded derivatives, such as

FRAs, and exchange-traded short-term interest rate futures contracts. The creation and trading of

these instruments has developed rapidly on account of their potential for leveraging and hedging

interest rate risk.

10

According to the latest data available from the BIS, at the end of 2012 the notional amount

11

outstanding of single-currency OTC interest rate derivatives (FRAs, swaps and options) was USD

489.7 trillion.

12

Of this total, the largest shares by currency were the notional amounts referenced to

euro interest rates (equivalent to USD 187.4 trillion, of which USD 137.6 trillion were IRSs, USD

25.6 trillion FRAs and USD 24.2 trillion interest rate options), which were greater than the amounts

referenced to US dollar rates (USD 148.7 trillion). There is broad consensus in the market that the

main reference rate underlying euro interest rates is EURIBOR, although there is no mention of this

in the BIS data. With regard to exchange-traded interest rate derivatives, data published by Euronext

show that the total notional amount of the three-month EURIBOR futures contracts traded on the

LIFFE exchange in London in 2012 amounted to €178.7 trillion and that of EURIBOR options on

futures was €70.7 trillion. These contracts are primarily, although not exclusively, used by banks

to hedge a significant part of their balance sheet against interest rate risk while performing their

maturity transformation function.

However, the traditional role of reference interest rates based on the unsecured interbank market is

currently being challenged by the developments that have occurred since the onset of the financial

crisis. First, the relationship between market reference rates and the individual cost of funding has

been significantly weakened, as the latter reflects more frequently country-specific or bank-specific

factors. Second, in terms of banks’ funding, there has been a gradual, albeit significant, shift from

the unsecured to the secured segment. In this regard, declining volumes and the higher concentration

have called into question the representativeness of reference interest rates.

13

These developments

may undermine the benefits of using reference rates or lead banks to charge higher spreads on

9 For a full description of the LIBOR-type fixings, see Gyntelberg, J. and Wooldridge, P.D., “Interbank rate fixings during the recent

turmoil”, Quarterly Review, BIS, March 2008.

10 Options now exist on both IRSs and futures contracts, which are the starting point of the price formation mechanism of market-implied

volatilities for euro interest rates.

11 The notional value is the nominal amount of the asset, reference rate or index underlying a derivative financial instrument. It is different

from the market value that results from the netting of the respective obligations of the buyer and of the seller of the contract, which

represents the replacement cost of a given contract transacted at a given price at any point in time.

12 BIS data covering the G10 countries since the end of June 1998, as well as Australia and Spain from December 2011.

13 See also the discussion in Brousseau, V., Chailloux, A. and Durré, A., “Fixing the Fixings: What Road to a More Representative Money

Market Benchmark?”, IMF Working Paper, No. 13/131, May 2013.

73

ECB

Monthly Bulletin

October 2013

Reference interest rates:

role, challenges and outlook

ARTICLES

market reference rates to compensate for adverse changes in their own refinancing costs and hedge

their basis risk.

The volatility of banks’ credit risk premia has also highlighted the credit risk component embedded

in these rates, making them less appropriate as a proxy for risk-free rates, as they used to be

perceived. In turn, the growing awareness of the credit risk component embedded in traditional

unsecured market reference interest rates has pushed up demand for reference interest rates, such

as OISs, to be as risk-free as possible and not to reflect the term, liquidity and credit risk premia

embedded in traditional unsecured market reference interest rates. In particular, such OIS rates

have increasingly been seen as more appropriate for evaluating centrally cleared standardised OTC

derivatives and OTC derivative positions based on comprehensive collateralisation arrangements.

2.3 IMPORTANCE OF REFERENCE INTEREST RATES FROM THE MONETARY POLICY PERSPECTIVE

From the ECB’s perspective, EURIBOR and EONIA are of crucial importance for the efficient

functioning of both the euro area and the international financial system. Their role has evolved over

time, together with their standardisation and the increased liquidity and availability of financial

instruments referring to them. Monetary policy decisions and market expectations of the future

path of policy rates are directly reflected in the interest rates that serve as a reference for highly

liquid and standardised derivative products, such as FRAs, futures and IRSs. In turn, these form the

basis for the pricing of various, usually less liquid, marketable debt instruments, thus influencing

financing and credit conditions.

Given the crucial role of EONIA and EURIBOR in the formation of both euro money market

interest rates and market expectations regarding the future values of short-term interest rates, they

also play an essential role in the interest rate channel, which transmits the monetary policy stance

along the yield curve. Over time, they have therefore gained a social function and are now a public

good. Both interest rates help to ensure a homogeneous pricing benchmark for the entire money

market yield curve across the euro area.

Today, the existing reference interest rates for the unsecured market are still used as a standard in

the financial industry, despite the decreasing turnover in the underlying market. As reported in the

table, almost 60% of total loans to non-financial corporations in the euro area were floating rate

loans at the end of March 2012; their interest rates were hence referenced mostly to EURIBOR. At

the same time, the proportion of floating rate loans in total loans to households was lower, at 40%,

although it had been rising over time. It is also interesting to note that these average figures for the

euro area conceal significant differences between countries.

Share of floating rate loans in total loans for the euro area

(data as of March 2012; percentages)

EA AT BE DE EE ES FI FR GR

Non-financial corporations

56 72 54 37 78 65 82 38 69

Households

40 63 19 11 89 89 93 16 52

IE IT LU MT NL PT SI SK CY

Non-financial corporations

61 77 69 82 60 76 82 75 52

Households

59 72 74 94 21 94 76 26 32

Source: MFI balance sheet item statistics.

Notes: Floating rate loans include short-term (less than one year) and long-term floating rate loans. All floating rate loans are pooled

together with no distinction of reference rates, such that the breakdown of these loans by reference rate is not known.

74

ECB

Monthly Bulletin

October 2013

Therefore, the social value of the pricing of reference interest rates appears even higher, since it

affects not only the relationships between financial investors at the very short end of the yield

curve, but also the relationships between banks and economic agents.

3 RECENT DEBATE ON REFERENCE INTEREST RATES

The evidence and allegations of manipulation of reference rates, as well as the structural market

changes that have occurred or have been gathering pace since the start of the financial crisis, have

highlighted the need to change current rules and practices with regard to the determination of

reference rates and move towards a more regulated approach, given that they are widely recognised

as a public good.

Given the role of reference interest rates in the monetary policy transmission mechanism, as

described in Section 2.3, it is also appropriate for the public sector to define which role it should

play in (i) the development of commonly agreed principles to strengthen governance frameworks

that enhance the reliability and integrity of reference interest rates; and (ii) the development of

reference interest rates that are more representative of market conditions and which better match

market participants’ individual needs.

3.1 GOVERNANCE ISSUES SURROUNDING THE RATE-SETTING PROCESS

A comprehensive review of all governance issues surrounding the rate-setting process has been

undertaken in various jurisdictions and in several fora. The UK Treasury’s Wheatley Review of

LIBOR, the ESMA-EBA’s Principles for Benchmark-Setting Processes in the EU, the IOSCO’s

Principles for Financial Benchmarks, the European Commission’s forthcoming proposals for the

regulation of benchmarks, as well its current proposals for a regulation on market abuse and for a

directive on criminal sanctions for market abuse,

14

are all examples of initiatives to address, inter

alia, the need to ensure that reference interest rates are adequately governed, administered and

regulated in order to appropriately guard against market abuse or systematic errors.

The principles embedded in these initiatives define a sound framework for the submission process

at the level of contributors, and, with regard to governance, minimise conflicts of interest within

rate administrator bodies, by retaining the expertise but reducing the influence of the banking

community through the involvement of other stakeholders. These principles also recommend

minimum standards for calculation agents, publishers and users, as well as a stricter sanctioning

regime. The timely, consistent and effective implementation of these principles should significantly

limit the opportunity for abuse and improve rate-setting practices. In this respect, EURIBOR-EBF

took steps to review the EURIBOR governance process and implement the recommendations set

out in the joint ESMA-EBA review. These include (i) enlarging the composition of the EURIBOR

Steering Committee to include non-bank stakeholders; (ii) consulting stakeholders on the number of

EURIBOR tenors, with a view to preserving only those with the highest utilisation and the highest

underlying transaction volume; and (iii) reviewing the key terms in the EURIBOR definition to

enhance clarity. While further work needs to be undertaken in order to implement the ESMA-EBA’s

recommendations, these governance-enhancing actions are a major step in the right direction.

14 See “Amended proposal for a Regulation of the European Parliament and of the Council on insider dealing and market manipulation

(market abuse) (submitted in accordance with Article 293(2) TFEU) (COM(2012) 421 final)”; and “Amended proposal for a Directive of

the European Parliament and of the Council on criminal sanctions for insider dealing and market manipulation (submitted in accordance

with Article 293(2) TFEU) (COM(2012) 420 final)”.

75

ECB

Monthly Bulletin

October 2013

Reference interest rates:

role, challenges and outlook

ARTICLES

3.2 REPRESENTATIVENESS OF REFERENCE

INTEREST RATES

However, in addition to the reform of the

governance framework for the rate-setting

process, there is the broader question as to

whether the dominance of reference interest

rates based on unsecured interbank markets

reflecting a common bank credit risk is still

appropriate today.

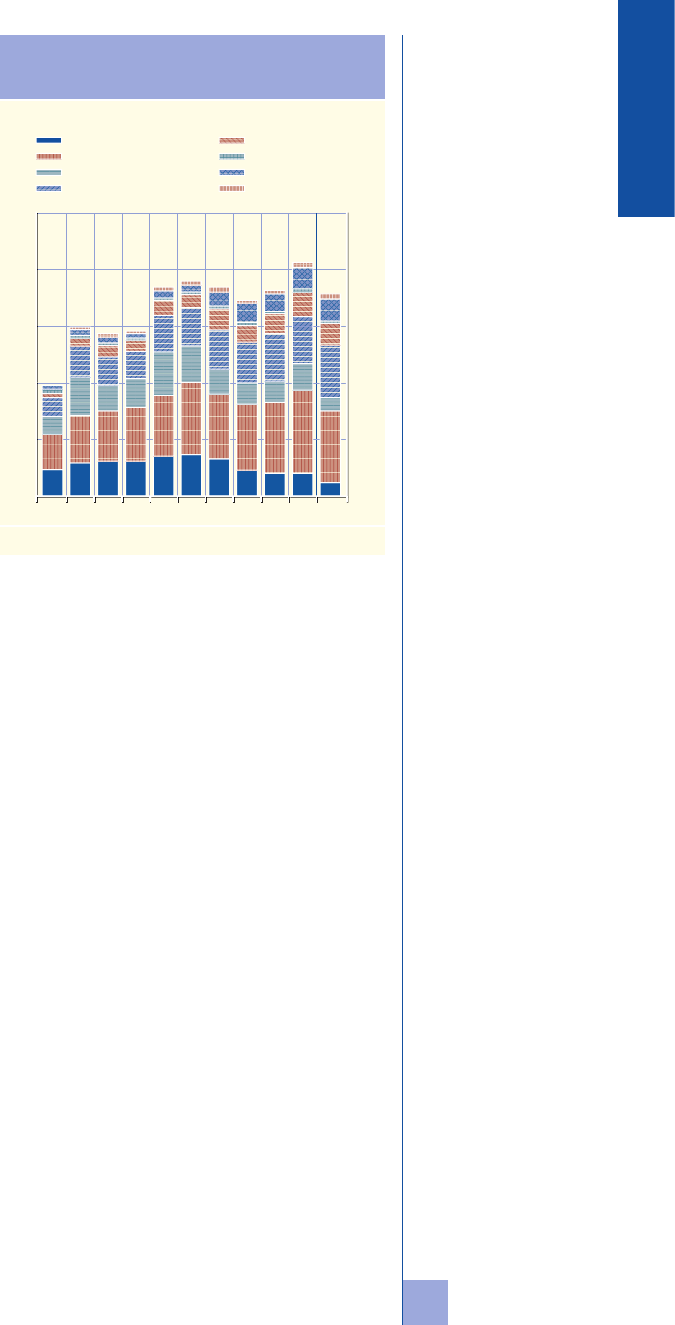

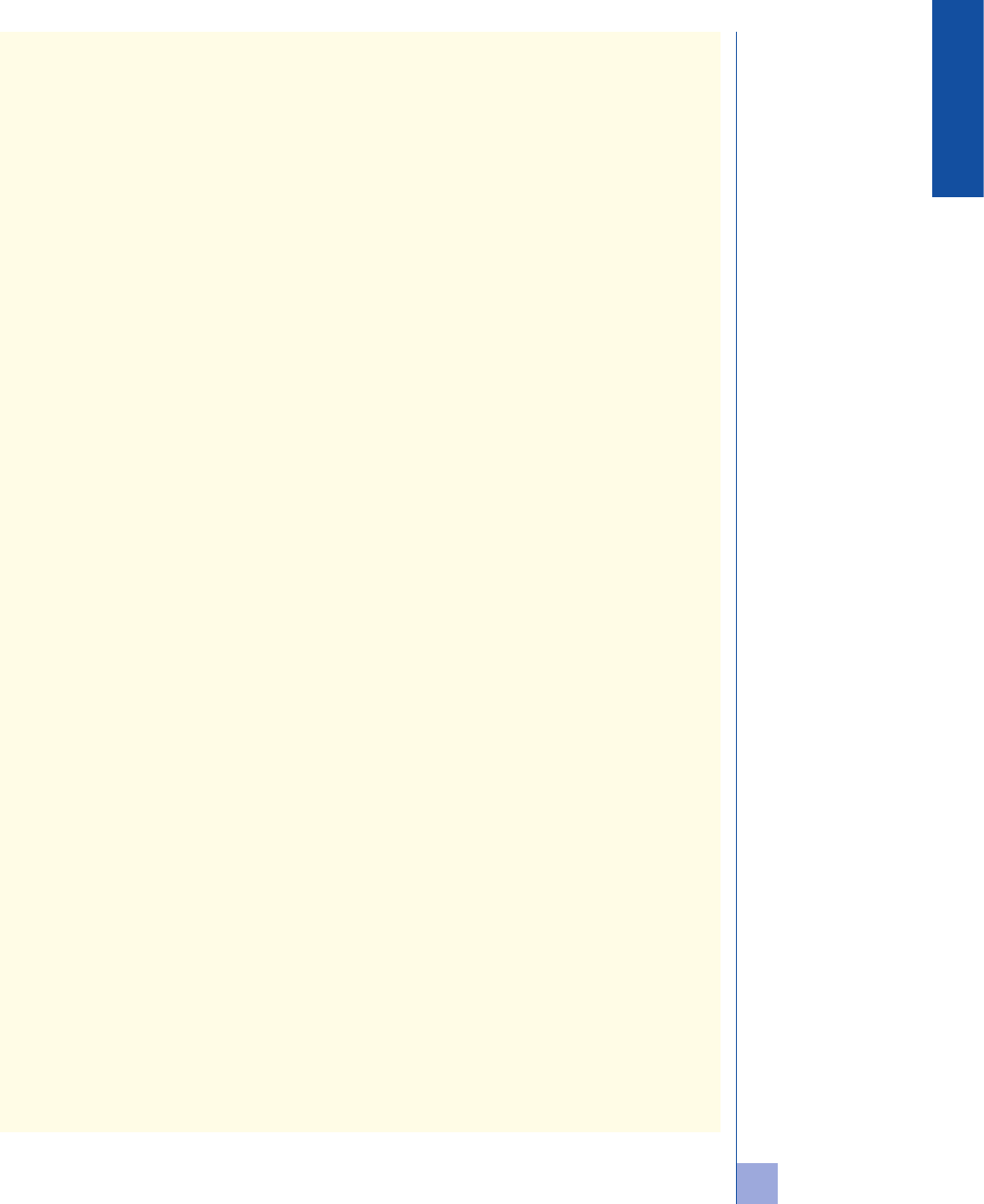

In this regard, it is interesting to note that the

shift from unsecured to secured interbank

borrowing and lending started even before the

onset of the financial crisis and accelerated

thereafter (see the chart).

Unsecured interbank markets have shrunk

considerably, particularly for longer maturities.

Therefore, the remaining market turnover is

currently concentrated only within the shortest

maturities, as confirmed by the results of the

data collection exercise undertaken by the ECB (see the box). Changes to the liquidity regulations,

such as the introduction of the Liquidity Coverage Ratio (LCR) and the Capital Requirements

Directive (CRD IV), which are aimed at reducing and better managing liquidity and counterparty

credit risks, provide further incentives to shift from unsecured to secured interbank markets and

to limit unsecured interbank activity to shorter maturities. Moreover, the dispersion of bank credit

risk has increased sharply, implying that the true refinancing costs of banks deviate from – and

are likely to be much more volatile than – the lending rates between prime banks referenced to

EURIBOR, which used to be seen as a proxy for a risk-free rate.

The contraction in volumes of unsecured interbank markets, as well as the other structural changes

described in Section 2.2, call into question the continuous representativeness of the current

reference interest rates for the segmented and heterogeneous borrowing conditions in the unsecured

interbank market. The challenge is to identify the necessary design changes to such unsecured

market reference rates in order to preserve and enhance their representativeness. In fact, in spite

of these developments, reference interest rates reflecting banks’ unsecured funding costs and

incorporating a generic bank credit risk premium are very likely to remain necessary for some users

as a benchmark of the “true” costs at which banks can obtain wholesale market liquidity and not –

as in the secured market – exchange cash for another asset. Another challenge is how to facilitate

greater diversity in the use of reference interest rates that better match users’ needs. This would

require a greater availability of reference rates that do not incorporate a bank credit risk premium,

but which instead are more similar to risk-free rates or reflect a sovereign risk premium.

15

15 An example of a reference rate that reflects a sovereign risk premium is the TEC 10 index ("Taux de l'échéance constant à 10 ans") in

France. The index value represents the yield to maturity of a fictitious OAT ("obligation assimilable du Trésor", namely French public

bond) with a constant maturity of precisely ten years. It is based on primary dealers’ quotes at 10 a.m. on the secondary market for two

OAT benchmark issues that are closest to ten-year maturity. The four highest prices and the four lowest prices are eliminated, and the

average of the remaining prices is converted into an equivalent yield to maturity for each OAT. The TEC 10 daily reference value is then

calculated by linear interpolation of the equivalent average yield of the two OATs.

Aggregated average daily turnover of the

euro money market

(index: aggregated average daily turnover volume in 2002 = 100)

250

200

150

100

2002 2004 2006 2008 2010 2012

50

0

250

200

150

100

50

0

unsecured lending

secured lending

overnight swap index

foreign exchange swaps

other IRSs

cross-currency swaps

FRAs

short-term securities

Source: Euro money market study, ECB, December 2012.

76

ECB

Monthly Bulletin

October 2013

3.3 ROLE OF PUBLIC AUTHORITIES AND CENTRAL BANKS

Given the importance of reference interest rates in the economy and their role as a public good,

the Economic Consultative Committee of the BIS established a working group

16

to study issues

relating to the use and production of reference interest rates from the perspective of central banks,

and encouraged public authorities and central banks to support the reliability, integrity, robustness

and representativeness of reference rates. In particular, it recommended that central banks become

involved in the reform of reference interest rates by (i) ensuring an appropriate governance

framework to uphold the reliability and integrity of reference rates; and (ii) facilitating market

choices in a changing financial system.

4 CONTRIBUTION OF THE ECB TO THE DEBATE

The ECB believes that the systemic relevance of reference rates justifies actively involving central

banks in the reform process. To uphold the reliability, integrity and representativeness of key euro

area reference interest rates, the ECB has actively participated in the consultations on reference

interest rates launched by the European Commission, the ESMA-EBA and the IOSCO.

17

These

initiatives complement each other: the ESMA-EBA and Commission’s initiatives are broader in

scope, although limited to the EU, while the IOSCO’s principles are narrower and focused on

financial market benchmarks, and apply at the international level. Notwithstanding this role of

central banks, the ECB believes that choosing reference rates that better reflect end-user needs is

ultimately the responsibility of the users themselves.

The ECB’s initiatives can be summarised as follows: (i) participation in public consultations of

regulators; (ii) public reminders to banks to act responsibly and assume collective responsibility

to safeguard the functioning of key reference rates, thus preventing potential disruption to the

functioning of financial markets while the regulatory framework is being refined; and (iii) acting

as a catalyst for private market initiatives to assess the options for reforming the current reference

rates, in particular EURIBOR.

The views of the ECB on the governance issues and options for reforming current reference

interest rates in order to preserve and enhance their representativeness are described in the next two

subsections.

4.1 OPTIONS FOR REGULATION AND GOVERNANCE REFORM

In its reply to the European Commission’s public consultation, the ECB recommended adequately

defining the principles and procedures for the four key processes surrounding the computation of

EURIBOR: (i) rate submission at the level of the panel bank to ensure that rates are accurate and

conflicts of interest are prevented; (ii) rate calculation with a better definition of the responsibilities

of the calculation agent and the legal responsibilities of all parties involved in case of suspect/

unusual quotes; (iii) benchmark administration to ensure the independence of the administrator

from the banking community and a greater diversity of its members with more clearly defined

16 See http://www.bis.org/publ/othp19.htm

17 See European Commission’s public consultation on the regulation of indices – Eurosystem’s response, ECB, Frankfurt am Main,

14 November 2012; Eurosystem’s response to IOSCO’s consultation report on financial benchmarks, ECB, Frankfurt am Main,

11 February 2013; and Eurosystem’s response to the EBA and ESMA’s public consultation on the principles for benchmark-setting

processes in the EU, ECB, Frankfurt am Main, 11 February 2013.

77

ECB

Monthly Bulletin

October 2013

Reference interest rates:

role, challenges and outlook

ARTICLES

responsibilities; and (iv) ex post validation by independent entities to validate the quality of the

contributions and of the rate submission process.

On 8 February 2013 the ECB also welcomed the European Commission’s intention to regulate

systemically important reference interest rates and to include in its forthcoming legislative proposal

the power to compel mandatory submissions for systemically important reference interest rates,

in order to ensure an appropriate level of bank participation.

18

In particular, the ECB believes that

it is crucial that banks remain in, or join, the EURIBOR and EONIA panels to prevent potential

disruptions to the functioning of the financial markets, as well as to ensure an appropriate level

of rate representativeness while the regulatory framework is being refined. In the same vein, the

ECB welcomed on 31 May 2013 EURIBOR-EBF’s decision to introduce separate EONIA and

EURIBOR panels with a view to encouraging banks to join or rejoin the respective panels according

to their level of activity and knowledge of market segments.

19

While supporting these initiatives and expressing the hope that they are adopted and enter into force

quickly, the ECB, in its responses to the IOSCO’s and the ESMA-EBA’s consultations, also laid

down certain criteria that the regulatory process and the governance reforms should meet.

Regulatory requirements and supervisory practices should be commensurate with the identified

risks to avoid placing unnecessary or excessive burdens on rate contributors. An appropriate balance

should be found between a sound production process with adequate controls and safeguards on the

one hand and cost efficiency on the other.

Practices across national jurisdictions should be harmonised. The ECB considers that LIBOR,

EURIBOR and other systemically important reference interest rates should be regulated, given

their role as a public good. However, in order to be both efficient and effective, regulation and

supervision needs to be based on principles introduced in a consistent manner at the international

level. Non-harmonised regulation, different interpretations of the same laws and principles

and unaligned actions by national supervisors could lead to an uneven playing field, decreasing

incentives for voluntary participation and potentially encouraging regulatory arbitrage.

Methodological changes should be appropriate and timely. The ECB welcomes the resolve to

strengthen the methodology for the production of reference rates through a more precise definition

of their constituent elements and through more representative and transparent data compilation

procedures. However, the choice of appropriate and detailed changes to the methodologies should

be left to private reference rate administrators and the timeline of any changes should be based on a

realistic time frame, also considering the current state of financial markets and the lack of obvious

alternatives to the current reference rates.

4.2 OPTIONS TO ENHANCE THE REPRESENTATIVENESS OF REFERENCE INTEREST RATES

The ECB believes that a shift towards a more transaction-based approach to calculating the

current reference interest rates would increase their representativeness, while also enhancing their

credibility and integrity. The merits of and the best method for shifting towards a more transaction

and market-based reference interest rate for an unsecured money market need careful consideration.

18 See ECB welcomes the European Commission’s intention to regulate systemically important reference rates, ECB, Frankfurt am Main,

8 February 2013.

19 See ECB welcomes the introduction of separate EONIA and EURIBOR panels and encourages banks’ participation, ECB, Frankfurt am

Main, 31 May 2013.

78

ECB

Monthly Bulletin

October 2013

Acting as a catalyst for private market initiatives, the ECB conducted a data collection exercise on

behalf of EURIBOR-EBF (see the box) in order to be able to better assess the feasibility of such

a shift and its modalities. The exercise confirmed that the significant structural and conjunctural

contraction in unsecured, interbank money market volumes is limiting unsecured turnover to

shorter maturities. While the turnover for these shorter maturities is limited and raises challenges

in terms of establishing a purely transaction-based reference rate, further measures could be taken

to increase the underlying turnover. These include a widening of the corridor around standard

tenors to capture non-standard transactions and the inclusion of further bank liabilities that play

an important role in banks’ overall wholesale funding costs. Such measures are currently being

investigated with the help of a further data collection exercise also being conducted by the ECB on

behalf of EURIBOR-EBF.

Furthermore, while there are significant differences between transaction-based rates and the quote-

based EURIBOR, the data collection exercise, although not aimed at assessing the accuracy of

EURIBOR, showed that past EURIBOR fixings were broadly in line with the results that could be

derived from transaction-based rate calculations.

Box

MAIN FINDINGS OF THE DATA COLLECTION EXERCISE AND THE DESIGN OF A NEW REFERENCE RATE

In February 2013, the ECB, in cooperation with EURIBOR-EBF, initiated a data collection

exercise aimed at assessing the feasibility of a transaction-based euro money market reference

rate and its modalities. As an impartial player in the money markets, the ECB offered to collect,

on behalf of EURIBOR-EBF, daily transaction data from participating banks and to undertake

an analysis that would form the basis of further assessment by EURIBOR-EBF and participating

banks. During the second quarter of 2013, the ECB collected data from 59 European banks

representing current and previous EURIBOR panel members. The scope of the data collection

was set deliberately wide to capture banks’ unsecured borrowing and lending volumes beyond

interbank transactions. On the borrowing side, the data collected included funding through

interbank deposits, deposits from other financial but not credit institutions, deposits from the

official sector and deposits from the issuance of short-term securities. On the lending side, data on

interbank lending and investment via the purchase of short-term securities issued by other banks

and non-financial corporations were collected. The reference period was from 3 January 2012 to

28 February 2013, which was considered long enough to be able to draw significant conclusions

while remaining cost-efficient. Among the participating banks, 50 are based in the euro area

while the remaining nine are based in other EU and EFTA countries. In terms of credit quality,

three-quarters of the banks are of medium and high credit quality (of a P-1 and P-2 investment

grade respectively, when using Moody’s short-term rating equivalents). The purpose of this box

is thus to recap the main findings of this data collection exercise conducted by the ECB on behalf

of EURIBOR-EBF.

The analysis was conducted taking into account the following five characteristics that the new

reference rate would need to have in order to meet the principles laid down by the International

Organization of Securities Commissions (IOSCO) and the Bank for International Settlements

(BIS). Each of these characteristics was further qualified to assess conformity with the above-

mentioned principles:

79

ECB

Monthly Bulletin

October 2013

Reference interest rates:

role, challenges and outlook

ARTICLES

(a) Robustness and resiliency: there should be an adequate daily volume and number of

contributors. If not, there should be a suitable and credible fall-back mechanism.

(b) Representativeness: the new rate needs to be representative of the market it intends to

measure – the wholesale senior unsecured bank credit market. The level and correlation of

the rate in relation to other relevant market rates, as well as the representativeness of the test

panel of the targeted market, are useful indicators.

(c) Usability: in order to be adopted by the market, a reference rate needs to be available on a

daily basis, have a simple computation mechanism, a relatively low volatility and predictable

behaviour in relation to the underlying credit.

(d) Reliability: the new reference rate should allow minimum scope for manipulation, both

through its governance and computational mechanism.

(e) Transparency: the determination of the rate needs to be sufficiently transparent in order to be

credible and meet governance standards.

Therefore, a sufficient transaction volume is considered a fundamental attribute of a robust

reference rate. In this respect, several observations can be drawn from the ECB’s data collection

as reported in Table A, which displays the average daily volume data at various maturities

(or tenors) and for both borrowing and lending transactions with different counterparty

sectors. First, the daily volumes for each type of transaction considered individually are small.

The volumes in the interbank market confirm the results of the ECB’s annual euro money market

survey, namely that interbank activity is concentrated within short tenors, with few volumes

beyond one week. The other most active tenors are one and three-month tenors, although volumes

are low on both the borrowing and lending sides, with average daily turnover below €300 million.

Second, interbank borrowing generally has the highest daily turnover among the wholesale

funding transaction types considered. Third, funding via the issuance of short-term fixed rate

securities plays an important role in unsecured bank term funding: beyond two months, the

average daily issuance of short-term securities exceeds the daily turnover in the other borrowing

types. Finally, even by aggregating all borrowing or lending transactions, the average daily

turnover remains low: if all borrowing transaction types are aggregated, volumes over the period

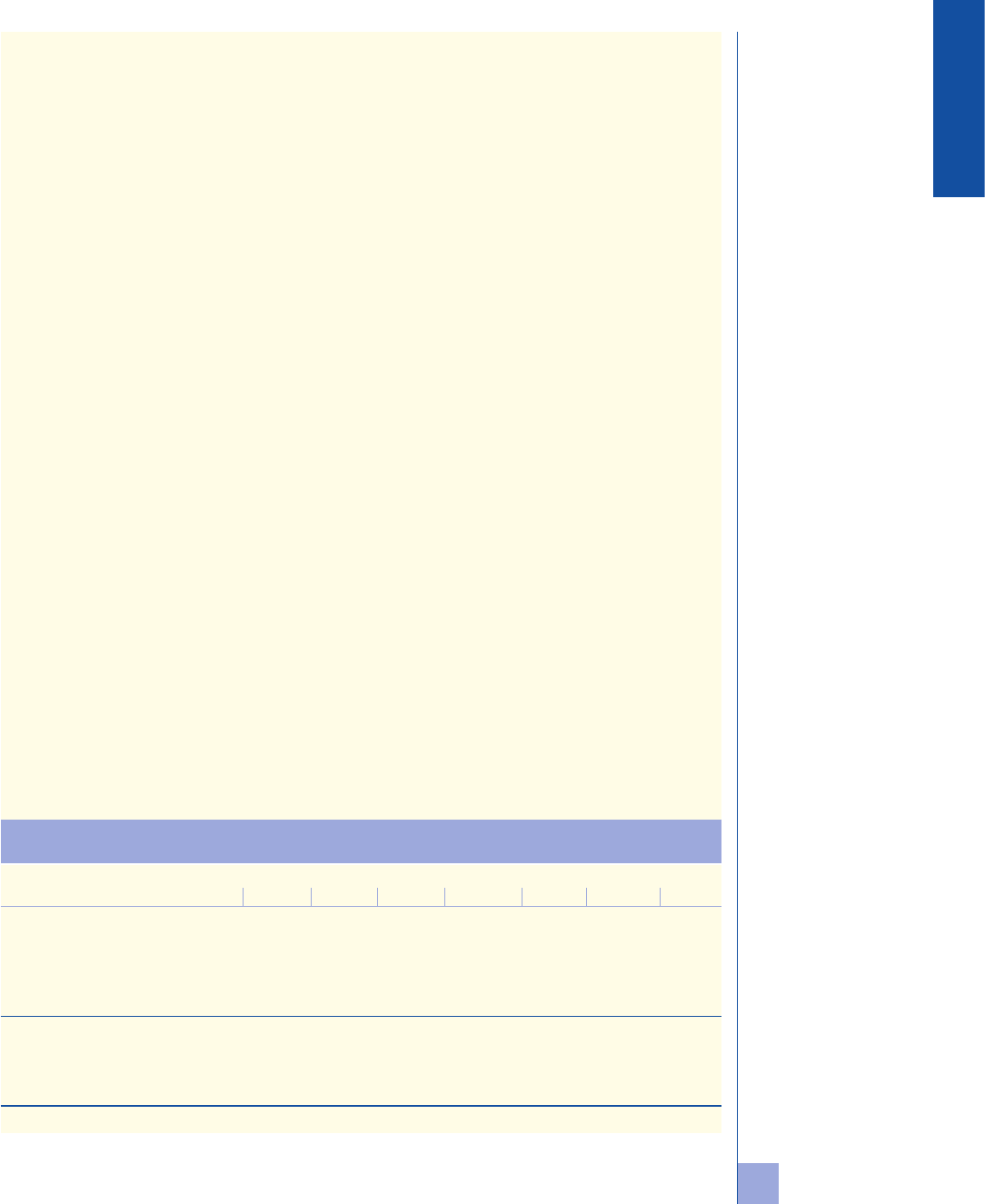

Table A Average daily volumes, January 2012 to February 2013

(EUR millions)

one-week one-month two-month three-month six-month nine-month one-year

Deposits from credit institutions 1,317 299 41 184 58 16 55

Deposits from other financials

1,153

217 50 117 33 25 25

Deposits from official sector

802 259 69 246 26 13 11

Short-term securities

314 217 148 545 119 41 81

All borrowing 3,527 939 230 1,083 210 37 142

Lending to banks (Deposits)

929

202 111 167 33 28 31

Lending to banks (Short-term paper)

30 108 46 69 24 84 106

Lending to non-financials (Short-term paper)

60 138 29 67 28 8 11

All lending 972 396 120 248 50 27 46

Note: Daily averages are calculated for the days with turnover activity and non-zero contributions.

80

ECB

Monthly Bulletin

October 2013

are around €3 billion for one-week transactions, €1 billion for one and three-month transactions

and less than €250 million for longer tenors; aggregated volumes on the lending side are even

lower.

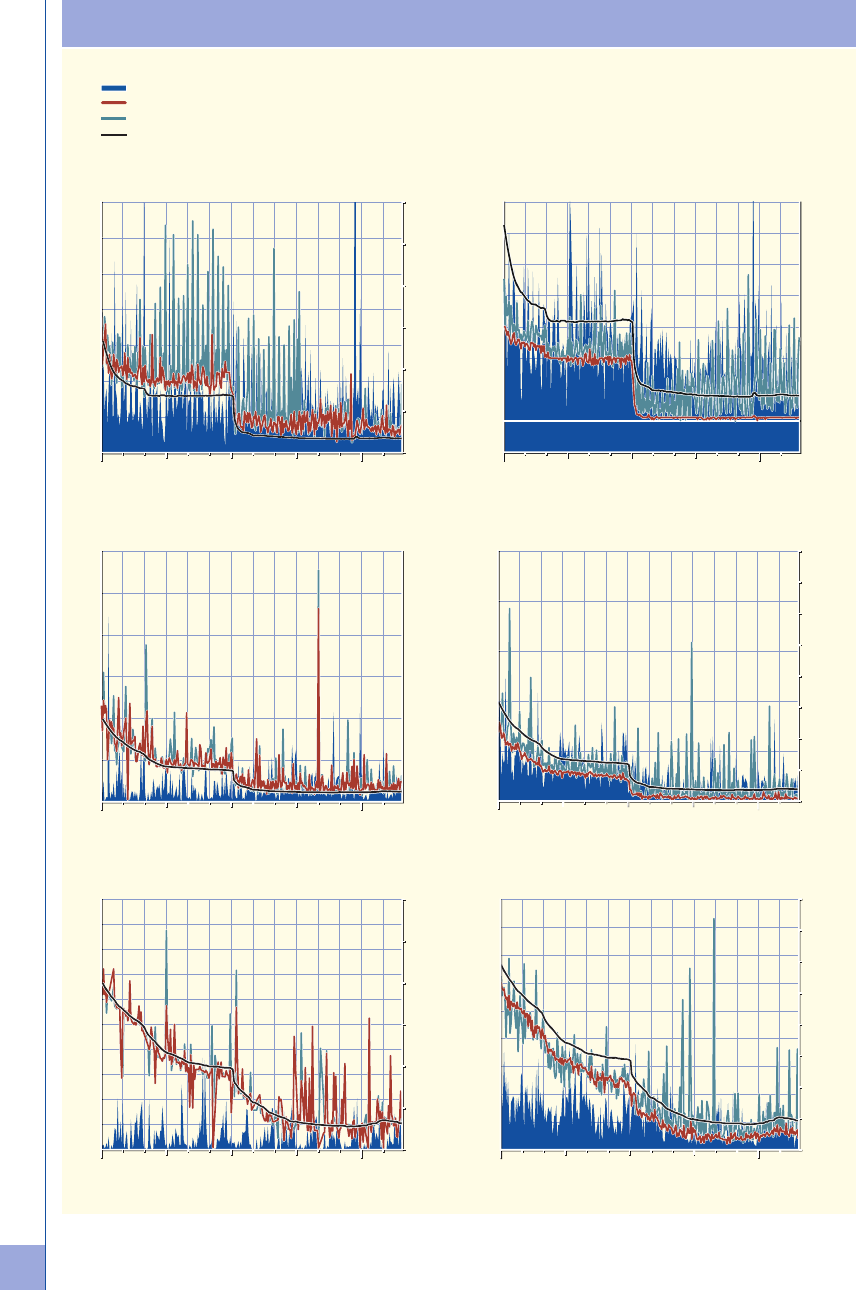

The evidence reported in both Table A and Chart A highlights the difficulty of building a

transaction-based reference rate that is a direct substitute for EURIBOR based on unsecured

interbank lending volumes alone and for all tenors. Chart A (a) illustrates that, while for one-

week maturities there is market activity every day, for the one and three-month tenors there

are no transactions on 2% and 13% of business days respectively (see Charts A (c) and (e)).

While there are important methodological differences between EURIBOR and the aggregate rate

computed on the basis of the lending data collected in this exercise, Chart A also shows that

EURIBOR rates broadly followed the evolution of average interbank lending rates (see Charts A

(a), (c) and (e)). This exercise also suggests that counterparty credit standing plays an important

role in the aggregate interbank lending levels. Indeed, while the levels of average interbank

lending rates with a maturity of less than three months are above those of EURIBOR, for longer

tenors they are below EURIBOR, as borrowers are likely to be of a higher credit quality.

Charts A (b), (d) and (f) show, in perspective, the volume and rate developments of the three

most active borrowing tenors and the relationship with EURIBOR during the period under

Table B Summary of the results of robustness tests for all borrowing transactions

Robustness/resiliency

(All borrowings)

Dimensions Tenors

January 2012 to

February 2013

July 2012 to

February 2013

Volume suffiency

(daily average)

one-week

€ 3.5 billion € 2.9 billion

one-month and three-month

€ 09-1.1 billion € 0.6-0.8 billion

Volume distribution

(% of days in which

daily volume

< a threshold)

one-week

1% of days daily volume

< € 1 billion 1% of days

daily volume

< € 0.25 billion

1% of days daily volume

< € 1 billion 1% of days

daily volume

< € 0.25 billion

one-month and three-month

~25%-30% of days daily

volume < 0.50 billion

10% of days

daily volume

< € 0.25 billion

~40%-50% of days daily

volume < 0.5 billion

~10%-15% of days

daily volume

< € 0.25 billion

Volume concentration

(% of days in which

one or two contributors

account for 80% or more

of the daily volume)

one-week <1% 1%

one-month and three-month

~15%-20% ~20%-30%

Contributor sufficiency

(daily average)

one-week 27 24

one-month and three-month

16-17 14

Contributor distribution

(% of days in which

number of contributors

< a threshold)

one-week

Number of contributors

equal or above

15 every day

Number of contributors

equal or above

15 every day

one-month and three-month

3%-5% of days

<10 contributors

~15%-20% of days

<15 contributors

5%-8% of days

<10 contributors

~30%-35% of days

<15 contributors

81

ECB

Monthly Bulletin

October 2013

Reference interest rates:

role, challenges and outlook

ARTICLES

review. The test results show that the aggregated borrowing rates are lower than EURIBOR

for all tenors. While there are differences between aggregated borrowing levels and EURIBOR,

Charts A (b), (d) and (f) show that aggregated borrowing levels mostly track EURIBOR rates.

They also show that some divergences occur in a fast-changing rate environment, for example at

the beginning of 2012, when, for the one-week tenor, borrowing rates adjusted downwards more

quickly than EURIBOR rates.

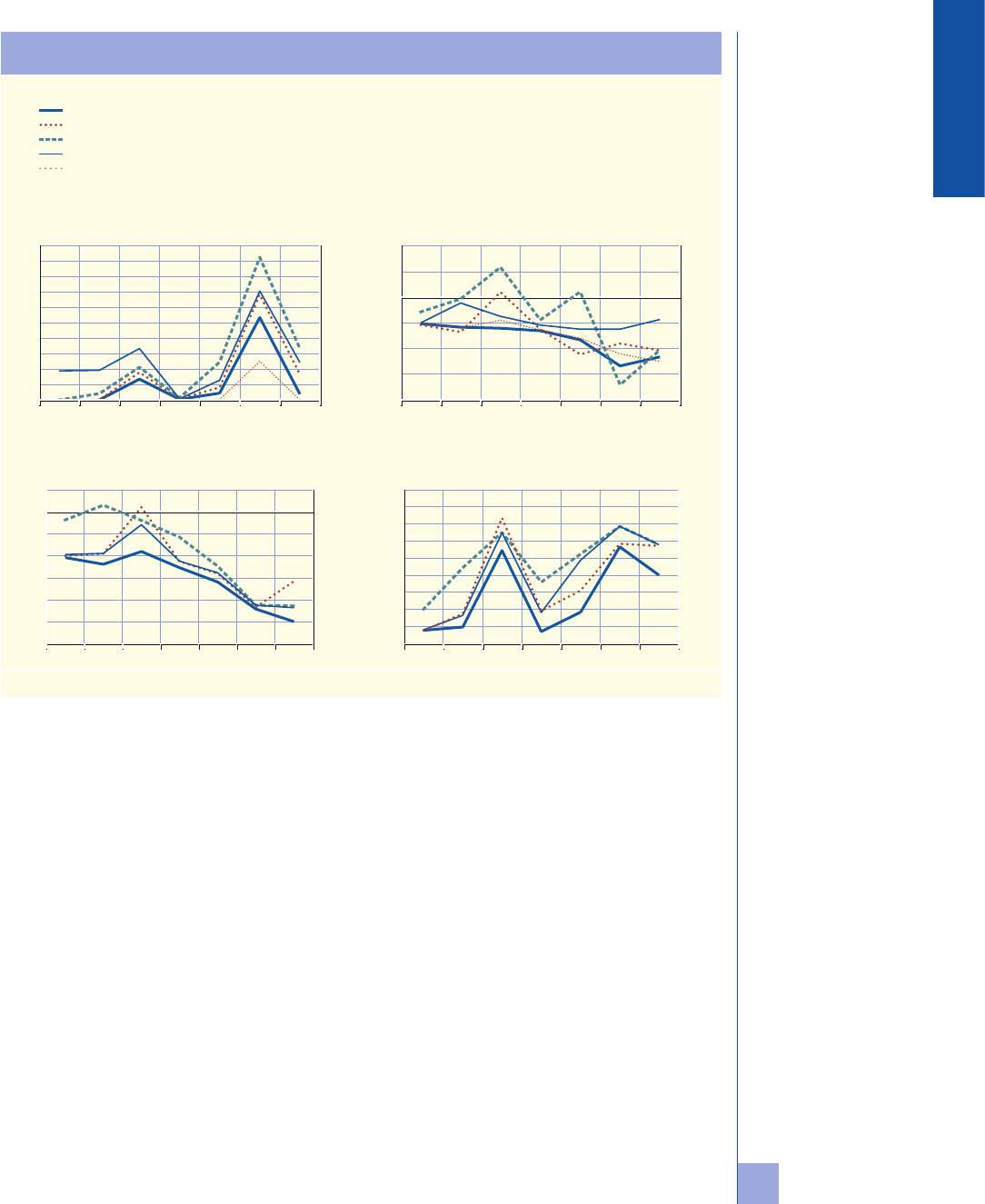

Chart B shows the computational results of the data collection exercise when aggregating the

daily turnover of various transactions on the borrowing side for various maturities. Several

observations can also be made. First, the percentage of zero transaction volumes mostly

occurred at longer maturities (or tenors), as reported in Chart B (a). Second, Charts B (b) and

(c) – illustrating the average rate (computed as a median) spread to EURIBOR – shows that the

average rates for the most active tenors were relatively close to each other and the spread to

EURIBOR was limited for most of the borrowing transaction types. Chart B (d) shows that, in

general, there is potential to aggregate borrowing data across different transaction types without

causing significant additional rate volatility. Such volatility could arise as a result of daily

changes in the sectoral composition if borrowing levels across different transaction types are

significantly different and, as is the case in the current transaction analysis, if some transaction

types are more represented than others in the daily rate computation.

Table B summarises the robustness characteristics of aggregated borrowing for the three most

active tenors. Several results can be highlighted. First, the daily turnover decreased by about

30% following the ECB’s deposit rate cut to zero in July 2012 (the second period of the test),

since banks attracted fewer deposits at the lower interest rate levels. For the one-week tenor,

these interest rate levels were close to zero or even negative in the case of higher rated banks.

Second, the daily volumes are frequently low for tenors beyond one week, dropping below

€0.5 billion for a significant number of days. This volume distribution deteriorates significantly

in the second period. Third, while in more than four out of five days the number of contributors

for the three tenors is higher than 15, in many cases a small number of contributors accounts for

most of the volume: for the one and three-month tenors, one or two contributors account for at

least 80% of the daily volume approximately 15%-20% of the time. The volume concentration

increases significantly in the second period.

The definition of the reference rate and the composition of the bank panel are key determinants

of rate characteristics, such as the level of the rate itself and its volatility. The differentiation of

credit profiles among panel banks results in different composite borrowing rates when different

rate computational methodologies are used. Charts B (c) and (d) show that, for all borrowing,

computing the rate as a median of individual contributions – as opposed to using other data

aggregation methodologies, such as the volume-weighted average (VWAR), the weighted

trimmed mean or the trimmed mean – results in lower rate levels and volatility of rate spread

relative to EURIBOR. This is explained by the fact that the median measures the borrowing

rate for the typical bank in the sample, which is predominantly higher rated. The test panel

heterogeneity has a greater impact for lower volume tenors (Chart B (d)), where daily rates are

at times more significantly impacted by contributions which are not necessarily representative

of the borrowing rates of most panel banks. Looking ahead, the trade-offs between the

representativeness of the rate according to its definition, usability and reliability could be further

considered in the reference rate design, together with measures that could increase the volume

while also addressing panel heterogeneity.

82

ECB

Monthly Bulletin

October 2013

Chart A Level of interest rates and daily turnover from the data collection exercise,

January 2012 to February 2013

(percentages; EUR millions)

daily turnover (right-hand scale)

median (left-hand scale)

weighted average rate (left-hand scale)

EURIBOR one-week (left-hand scale)

(a) Interbank lending — one-week maturity (b) All borrowing — one-week maturity

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

3,000

2,500

2,000

1,500

1,000

500

0

Jan. Mar. May July Sep. Nov. Jan.

2012 2013

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

-0.1

0.0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

Jan. Mar. May July Sep. Nov. Jan.

2012 2013

(c) Interbank lending — one-month maturity (d) All borrowing — one-month maturity

0.0

0.5

1.0

1.5

2.0

2.5

3.0 3,000

2,500

2,000

1,500

1,000

500

0

Jan. Mar. May July Sep. Nov. Jan.

2012 2013

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

Jan. Mar. May July Sep. Nov. Jan.

2012 2013

0.0

0.5

1.0

1.5

2.0

2.5

(e) Interbank lending — three-month maturity (f) All borrowing — three-month maturity

0.0

0.2

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

2.0

Jan. Mar. May July Sep. Nov. Jan.

2012 2013

3,000

2,500

2,000

1,500

1,000

500

0

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

0.2

0.0

0.4

0.6

0.8

1.0

1.2

1.4

1.6

1.8

Jan. Mar. May July Sep. Nov. Jan.

2012 2013

83

ECB

Monthly Bulletin

October 2013

Reference interest rates:

role, challenges and outlook

ARTICLES

The ECB also considers it desirable that market participants can choose from a range of reliable

and representative reference rates that reflect different needs and purposes. In the view of the ECB,

reference rates representing the OIS derivatives market, sovereign risk or the secured money market

segment, for example, could prove to be valid alternatives, coexist with EURIBOR and fulfil some

of the purposes for which EURIBOR is currently used by some users. However, it is unlikely that

these alternative reference rates would fully eliminate the need for reference rates that reflect banks’

unsecured cost of funding for all users. As long as unsecured funding (also in terms of the issuance

of short-term securities) still forms a significant part of a bank’s funding, there is likely to be a need

among some users for reference rates that allow banks to pass on their marginal borrowing costs.

5 CONCLUSIONS

The allegations and evidence of the manipulation of key reference interest rates have called

into question the adequacy of their current governance framework and methodology on which

they are based. In order to re-establish their credibility – while preserving their benchmark role

in the economy – the aim of the policy response that the ECB has strongly supported has been

Chart B Main findings of the data collection exercise, January 2012 to February 2013

(percentages)

interbank

other financials

official sector

short-term paper

all borrowing

W = week

M = month(s)

Y = year

(a) Frequency of zero volume/contributors (b) Average daily spread to EURIBOR (computed as

median)

1W 1M 2M 3M 6M 9M 1Y

00

100

90

80

70

60

50

40

30

20

10

100

90

80

70

60

50

40

30

20

10

1W 1M 2M 3M 6M 9M 1Y

0.2

0.1

0.0

-0.1

-0.2

-0.3

-0.4

0.2

0.1

0.0

-0.1

-0.2

-0.3

-0.4

(c) Average daily spread to EURIBOR, by computational

method

(d) Volatility (standard deviation) of the daily spread to

EURIBOR, by computational method

0.05

0.00

-0.05

-0.10

-0.15

-0.20

-0.25

-0.30

0.05

0.00

-0.05

-0.10

-0.15

-0.20

-0.25

-0.30

1W 1M 2M 3M 6M 9M 1Y

0.45

0.40

0.35

0.30

0.25

0.20

0.15

0.10

0.05

0.00

0.45

0.40

0.35

0.30

0.25

0.20

0.15

0.10

0.05

0.00

1W 1M 2M 3M 6M 9M 1Y

Source: ECB.

84

ECB

Monthly Bulletin

October 2013

to immediately restore the credibility of systemically important reference rates by addressing

significant deficiencies in their governance framework.

In the ECB’s view, such governance reforms are necessary short-term measures that need to be

complemented by further initiatives aimed at enhancing the reliability, representativeness and

resilience of reference rates in the medium term. The ECB, along with other central banks, is of the

view that reference interest rates reflecting banks’ unsecured funding costs will continue to play an

important role. Reference rates would continue to allow banks to pass on their wholesale unsecured

funding costs to customers and better manage their liquidity and asset and liability positions.

Therefore, the ECB strongly supports market initiatives aimed at identifying more transaction-

based reference rates that could viably complement or substitute for EURIBOR. The solutions are

not obvious and thus require careful assessment to take into account the structural changes taking

place in the money markets, as well as longer lead times. The collection of transaction data by

EURIBOR-EBF supported by the ECB is a valuable opportunity to assess the extent to which a

transaction-based rate could be calculated and, if so, what form it could take. The ECB also supports

facilitating market choices in a changing financial system so that users can choose reference

rates that better match their needs. Notwithstanding the role of public authorities in the reference

rate regulation process, and the interest that regulators and central banks have in upholding the

credibility, reliability and representativeness of reference rates, the choice of reference rates that

better reflect end-user needs is ultimately the responsibility of the users themselves.

The design of the new reference rate needs to take into account the sound principles for reference

rates put forward by the IOSCO and the ESMA-EBA. Reference rates need to be designed in a

manner that it is representative of the market they intend to measure. The design should also ensure

that the scope for manipulation is minimised or that any attempt at manipulation can be reliably

detected. Finally, the success of a new reference rate depends on the extent to which it is embraced

by users. Therefore, the ECB strongly encourages market participants to be actively involved in the

rate design process, in order to ensure that the resulting rate meets market needs.

Under these circumstances, it could be appropriate, from a policy perspective, to consider

encouraging the adoption of a more representative reference interest rate, reflecting active and

liquid transactions in the interbank market, which remains resilient in times of stress.

Systemically important reference interest rates such as EURIBOR and EONIA are of particular

importance in terms of credit provision to the euro area economy and for the implementation of the

single monetary policy. Therefore, it is crucial that their continuity is assured at all times, while more

long-term reform solutions aimed at making reference rates such as EURIBOR more transaction-

based are being assessed. This means, for EURIBOR and EONIA, that banks contributing to these

rates remain in their respective panels and, preferably, that more banks join them, including those

banks that recently left them. Furthermore, the public and private sectors should work together to

review the appropriateness of the current contingency arrangements and enhance them to prepare

for circumstances in which the provision of systemically important reference rates is destabilised.

Finally, the greater clarity that the ESMA-EBA’s principles and the forthcoming draft regulation of

the European Commission have introduced into the rate-setting process should make it easier for

banks to continue contributing to the rate-setting process by reducing risks and uncertainty while

options for more structural changes in the reference rate definition are further assessed. Transition

issues will need to be examined in detail, but this will be better dealt with once a consensus has

been reached on the design of more stable reference rates.