Bank Funding Risk,

Reference Rates, and

Credit Supply

Harry Cooperman | Darrell Duffie | Stephan Luck |

Zachry Wang | Yilin (David) Yang

NO. 1042

DECEMBER 2022

REVISED

FEBRUARY 2023

Bank Funding Risk, Reference Rates, and Credit Supply

Harry Cooperman, Darrell Duffie, Stephan Luck, Zachry Wang, and Yilin (David) Yang

Federal Reserve Bank of New York Staff Reports, no. 1042

December 2022; revised February 2023

JEL classification: G00, G01, G02, G20, G21, E4, E43

Abstract

Corporate credit lines are drawn more heavily when funding markets are more stressed. This covariance

elevates expected bank funding costs. We show that credit supply is dampened by the associated debt-

overhang cost to bank shareholders. Until 2022, this impact was reduced by linking the interest paid on

lines to credit-sensitive reference rates such as LIBOR. We show that transition to risk-free reference

rates may exacerbate this friction. The adverse impact on credit supply is offset if drawdowns are

expected to be left on deposit at the same bank, which happened at some of the largest banks during the

COVID recession.

Key words: bank funding risk, credit supply, reference rates, credit lines, London Interbank Offered Rate

(LIBOR), Secured Overnight Financing Rate (SOFR)

_________________

Luck: Federal Reserve Bank of New York (email: [email protected]). Cooperman, Duffie, Wang:

authors thank discussants Anne Duquerroy, Dan Greenwald, David Glancy, Anil Kashyap, Elie Lewi,

Jose-Luis Peydro, and Peter Zimmermann, as well as Alena-Kang Landsberg for her excellent research

assistance. The authors are also grateful for conversations with Gara Afonso, Yacov Amihud, Leif

Andersen, Viral Acharya, Roc Armenter, Tom Baxter, Antje Berndt, Alastair Borthwick, Tim Bowler,

Laurent Clerc, Natalie Cox, Tom Deas, Fulvia Fringuelotti, Jason Granet, Vivien Lévy-Garboua, Andrei

Magasiner, John Marynowski, Bill Nelson, Peter Phelan, Michael Roberts, Richard Sandor, Gagan Singh,

Jeremy Stein, Jonathan Wallen, and Nathaniel Wuerffel, as well as seminar and conference participants at

the Federal Reserve Bank of New York, Stanford University, NYU Stern, Wharton, the Federal Reserve

Bank of San Francisco, the Financial Stability Conference at the Federal Reserve Bank of Cleveland,

System Committee on Financial Institutions, Regulation, and Markets held at the Federal Reserve Bank

of Kansas City, ES European Winter Meeting 2022, EFA 2022, AFA 2023 in New Orleans, Banque de

France, Symposium on Private Firms at University of Chicago, and Summer Finance Symposium at

London Business School. Duffie is an NBER research associate, a CDI research fellow, and a resident

scholar at the Federal Reserve Bank of

New York.

This paper presents preliminary findings and is being distributed to economists and other interested

readers solely to stimulate discussion and elicit comments. The views expressed in this paper are those of

the author(s) and do not necessarily reflect the position of the Federal Reserve Bank of New York or the

Federal Reserve System. Any errors or omissions are the responsibility of the author(s).

To view the authors’ disclosure statements, visit

https://www.newyorkfed.org/research/staff_reports/sr1042.html.

1 Introduction

In the US, most bank credit to corporate borrowers takes the form of revolving credit lines that

give borrowers the option to draw any amount of credit, up to an agreed line limit, at any time

before maturity and at committed pricing terms. Until 2022, the majority of US corporate loans,

including revolvers, had interest rates set to the London interbank offered rate (LIBOR) plus a

fixed spread.

1

In most of the world, however, banking has made a transition from credit-sensitive

interest rate benchmarks such as LIBOR to new “risk-free” benchmark reference rates such as the

secured overnight financing rate (SOFR). Credit-sensitive reference rates like LIBOR reduce borrowers’

incentives to draw on committed credit lines when the banks’ costs of funding drawdowns are high,

for example during the global financial crisis (GFC) and the COVID recession. Risk-free loan reference

rates, in contrast, typically fall when markets are stressed, encouraging borrowers to draw more

heavily on credit lines just when bank funding costs rise sharply. Because of this, a collection of

large US banks argued that transitioning to risk-free reference rates may reduce ex-ante incentives

for providing bank credit.

2

This paper shows how the choice of loan reference rate affects the supply of revolving credit lines.

We show that bank shareholders bear a disproportionate share of the interest expense for funding

line draws, a form of debt overhang. This debt-overhang wedge is priced ex-ante into the terms of

credit lines. The resulting adverse impact on credit provision is mitigated by using credit-sensitive

reference rates such as LIBOR that reduce borrowers’ incentives to draw on their lines when LIBOR

is high, which is most often when a bank’s funding spreads are high.

We show that the transition from LIBOR to SOFR will indeed lead to much heavier drawdowns

on credit lines when bank credit spreads rise sharply. Our calibrated representative bank prices this

behavior into the terms of new lines, increasing the expected cost of drawn credit by about 15 basis

points, reducing total line commitments by about 5%, and reducing the expected quantity of drawn

credit by about 3%. The corresponding welfare loss is about 3%. We also show that although these

results are quite sensitive to certain modeling assumptions, they are qualitatively robust.

Our analysis proceeds in three steps. First, we provide a simple equilibrium model of credit

1

We find that at the end of 2019, more than 70% of all US bank-firm lending referenced LIBOR as the underlying

floating interest rate.

2

See the letter of September 23, 2019 of banks in the Credit Sensitivity Group to Randall Quarles, vice chair of

supervision of the Board of Governors of the Federal Reserve System, Joseph Otting, Comptroller of the Currency, and

Jelena McWilliams, Chair Federal Deposit Insurance Corporation.

1

provision. We show that giving borrowers the option to draw funds at a pre-agreed fixed spread

over a floating reference rate induces a debt-overhang cost to bank shareholders that is roughly

equal to the covariance between the quantity of line draws and credit spreads on bank funding

transactions. This debt-overhang wedge inefficiently dampens banks’ incentives to offer committed

lines of credit. However, the adverse impact on the provision of credit lines is attenuated to the extent

that (1) reference rates are credit-sensitive, which reduces borrowers’ incentives to draw heavily

under stressed-market conditions and (2) drawn funds are expected to be left on deposit at the bank,

thus reducing the bank’s funding costs.

The second part of our analysis is an empirical evaluation of funding costs associated with the

provision of revolving credit. We use several data sources, including confidential bank-level data

from the Federal Reserve, such as reporting forms FR 2052a, FR Y-14Q, and FR 2420, which cover the

largest US bank holding companies (BHCs). The high granularity of the balance-sheet data collected

in the FR2052a dataset—designed to monitor the liquidity profile of large US BHCs—allows us to

pin down the composition and dynamics of bank funding costs for large US BHCs in much more

detail than was possible in prior work.

As of the end of 2019, for our main sample consisting of the 20 largest US BHCs, non-financial

firms borrowed more from large banks by utilizing credit lines ($544 billion) than with conventional

term loans and other forms of commercial and industrial (C&I) lending ($444 billion). Moreover, the

largest 20 BHCs alone had around $1.3 trillion of undrawn credit-line commitments, more than the

total utilized credit from term lending and revolving credit combined. Contractually, these lines can

be drawn at any time, including under stressed market conditions – times when wholesale bank

funding spreads, typified by the difference between LIBOR and overnight index swap (OIS) rates, are

elevated.

Consistent with the premise of our theoretical model, we find that banks were indeed subject

to substantial drawdowns on credit lines during recent stress episodes, such as the GFC (Ivashina

and Scharfstein, 2010) and the COVID recession (Acharya and Steffen, 2020; Greenwald, Krainer,

and Paul, 2020). However, we show that bank funding sources were much different across these

two episodes. During the GFC, most line draws were not left on deposit. Instead a large fraction of

the funds left the banking sector, causing banks to fund the drawdowns with other new borrowing

just when wholesale bank funding spreads were extremely high (Acharya and Mora, 2015). In

2

contrast, we show that during the COVID recession, drawdowns were generally of a “precautionary”

nature. That is, firms largely kept the drawn funds in their corporate deposit accounts. Given their

uncertainty regarding their own future credit quality over the course of the ensuing pandemic, many

firms plausibly chose to draw the cash on their lines before their banks might have invoked covenants

that could have blocked them from doing so. We estimate that for every dollar drawn, an average

of 89 cents was placed into low-interest-rate corporate deposit accounts at the same set of banks.

Moreover, rates on uninsured corporate deposits did not exhibit sensitivity to the LIBOR-OIS spread.

Banks raised the remaining needed funds with secured advances from the Federal Home Loan Bank

(FHLBs), which tended to be cheaper than unsecured wholesale funding. Unlike during the GFC,

the high fraction of line draws that were left on deposit during COVID significantly insulated bank

shareholders from the costs of funding the draws, on average across banks. Nevertheless, some large

regional banks funded a substantially larger part of their drawdowns with FHLB advances. Thus,

even during the COVID recession, elevated funding costs arising from committed credit lines did

materialize for this subset of banks.

Were it not for the debt-overhang cost to bank shareholders of funding line draws, the choice of

reference rate would merely determine how funding-cost risks are shared between banks and their

corporate borrowers. With risk-free reference rates, banks bear the majority of this risk, whereas

with credit-sensitive reference rates, corporate borrowers absorb the bulk of this risk. However, our

paper brings to light a funding-cost wedge that is not related to risk sharing: the ex-ante expected

debt-overhang cost to bank shareholders associated with funding committed credit to corporate

borrowers at a pre-agreed spread to a reference rate. This wedge, roughly equal to the covariance

between bank funding spreads and the quantity of drawn credit, is higher under new risk-free

reference rates than under legacy credit-sensitive reference rates. For the alternative of term lending,

transitioning to risk-free reference rates does not affect this wedge because the quantity of credit is

fixed, eliminating the covariance component of expected bank funding costs. Reference-rate transition

therefore has a negligible impact on the incentives of banks to supply term loans.

In the third and final part of our analysis, we combine our theoretical and empirical results into a

calibrated equilibrium model of credit-line provision and estimate the impact on credit supply of

the transition from the legacy credit-sensitive reference rate, LIBOR, to the risk-free reference rate,

SOFR. For our calibrated representative bank, we find that transition from LIBOR to SOFR implies a

3

moderate reduction in both aggregate credit-line commitments and expected line draws, 5% and

3%, respectively. However, our model predicts a dramatic change in line utilization across states

of the world. The transition from LIBOR to SOFR increases the amount drawn by borrowers when

LIBOR-OIS is high. Borrowers will exploit the opportunity to draw on SOFR-linked lines under

stressed market conditions, to a much greater extent than they would for LIBOR-linked lines. For

instance, we estimate that in a scenario in which wholesale bank funding spreads reach GFC levels,

draws on SOFR lines will be nearly 55% higher than they would be on LIBOR lines. Because of

this, in equilibrium, the fixed spread over SOFR offered to credit-line customers incorporates the

increased cost to bank shareholders of funding more line draws when LIBOR-OIS is elevated. As a

consequence, when bank funding spreads are at normal low levels, borrowers will draw less credit on

lines linked to SOFR than they would have on lines linked to LIBOR. For our representative calibrated

bank, we find that a welfare-maximizing reference rate has about 80% of the credit sensitivity of

LIBOR. The welfare-maximal reference rate is estimated to be much closer to SOFR, however, for

banks with much lower funding costs than our representative calibrated bank.

Our calibration also implies that the impact of LIBOR-SOFR transition on credit supply varies

markedly across types of banks. Banks that face less severe debt overhang—whether due to lower

wholesale funding spreads or higher expected deposit inflows from drawn credit—are less affected

by the transition, or may even increase overall credit provision. As we discuss in more detail in

Section 6, our analysis suggests that low-debt-overhang banks may gain market share and that the

aggregate impact on credit provision of the transition from LIBOR to SOFR is thus likely to be more

muted than would be suggested by our partial-equilibrium analysis, especially for a borrower with a

low cost of switching its banking relationship to a new bank. A broader equilibrium analysis that

incorporates the industrial organization of banking relationships is, however, beyond the scope of

this paper.

Our analysis helps explain why some US banks have argued that the transition to risk-free

reference rates will exacerbate bank funding shocks and reduce incentives for credit provision. In

September 2019, a collection of banks, predominantly large regional banks that we show are the most

affected by this transition,

3

wrote to bank regulators:

3

Our empirical analysis shows that regional banks experienced significantly less depositing of line draws during the

COVID recession than did the larger money-center banks, and that regional banks have historically had somewhat higher

funding spreads.

4

“Specifically, borrowers may find the availability of low cost credit in the form of SOFR-linked credit lines

committed prior to the market stress very attractive and borrowers may draw-down those lines to ‘hoard’

liquidity. The natural consequence of these forces will either be a reduction in the willingness of lenders to

provide credit in a SOFR-only environment, particularly during periods of economic stress, and/or an increase

in credit pricing through the cycle. In a SOFR-only environment, lenders may reduce lending even in a stable

economic environment, because of the inherent uncertainty regarding how to appropriately price lines of credit

committed in stable times that might be drawn during times of economic stress.”

Banking regulators responded by convening the Credit Sensitivity Group,

4

a group of these banks

that were invited to a series of meetings at the New York Fed to discuss this issue and eventually to

consider a “credit sensitive rate/spread that could be added to SOFR.”

Since January 2022, supervisory guidance provided in interagency statements has suggested that

US banks should not reference LIBOR in their loan contracts.

5

Banks have generally followed the

guidance of the Alternative Reference Rates Committee (ARRC) and now use primarily SOFR as

their loan reference rate. For example, ARRC reported that over 95% of US syndicated loans issued

in April 2022 referenced SOFR.

6

LIBOR is no longer acceptable as a reference rate because of the small number of wholesale

unsecured funding transactions at short maturities that are available to support a robust daily fixing

of LIBOR. The reporting of US dollar LIBOR is scheduled to end on June 30, 2023.

7

This does not

rule out the possibility that some banks may choose to link some of their corporate lending contracts

to other credit-sensitive reference rates.

8

Our work is the first to probe the implications of reference rate choice for incentives to provide

credit, and the first to quantify the impacts of reference rate transition on credit provision based on

detailed data on bank assets and liabilities.

The rest of the paper unfolds as follows. Section 2 relates our work to the most relevant prior

4

See Transition from LIBOR: Credit Sensitivity Group Workshops, Federal Reserve Bank of New York, February 04,

2021.

5

See, for instance, SR 20-27 which states: “Given consumer protection, litigation, and reputation risks, the agencies believe

entering into new contracts that use USD LIBOR as a reference rate after December 31, 2021, would create safety and soundness risks

and will examine bank practices accordingly.”

6

See Alternative Reference Rates Committee May 18 Meeting Readout, May 18, 2022.

7

See "Federal Reserve Board invites comment on proposal that provides default rules for certain contracts that use the

LIBOR reference rate, which will be discontinued next year," Press Release, Federal Reserve Board, July 19, 2023.

8

Alternative US dollar credit sensitive reference rates currently include Ameribor, BSBY, and AXI. One of the authors of

this paper, Duffie, is a co-author of the proposal for AXI (Berndt, Duffie, and Zhu, 2020), but has no related compensation

or affiliation with its commercialization.

5

research. Section 3 provides a simple equilibrium model of credit-line provision. Section 4 describes

our data. Our main empirical analysis, in Section 5, consists of mapping bank funding risk for

large US BHCs and quantifying the importance of reference rates in mitigating funding shocks. In

Section 6, we calibrate our theoretical model to key empirical moments and quantify the effects of

the LIBOR-SOFR transition on credit-line supply and welfare-maximal reference rates. Section 7

concludes.

2 Related Literature

Our paper is related to at least three strands of the literature. First, we contribute to the literature on

bank liquidity provision through revolving credit lines. Credit lines allow firms to access funds on

demand and can thus provide insurance against liquidity shocks (Holmström and Tirole, 1998). Banks

that are financed by deposits are naturally well positioned to provide this type of liquidity insurance

(Kashyap, Rajan, and Stein, 2002; Gatev and Strahan, 2006).

9

Existing work on the pricing of credit

lines typically emphasizes that drawdowns are more likely when a borrower’s financial condition

deteriorates (Thakor, Hong, and Greenbaum, 1981). Adverse selection with respect to borrower

credit quality thus creates incentives for banks to screen borrowers and to price credit lines with a

combination of spreads and fees (Thakor and Udell, 1987; Berg, Saunders, and Steffen, 2016). Our

paper focuses on a previously unstudied aspect of credit-line provision that stems from bank debt

overhang costs. We show that an extra source of debt overhang arises from the covariance between

bank funding spreads and the quantity of line draws. The associated cost to bank shareholders is

priced into line terms and inefficiently dampens the provision of revolving credit. We further show

that credit-sensitive reference rates mitigate the adverse impact of this debt-overhang wedge, relative

to risk-free reference rates.

Our paper also adds to prior work on elevated drawdowns during times of distress. During

the GFC, many non-financial firms drew on committed credit lines (see, for example, Ivashina and

Scharfstein, 2010; Campello, Giambona, Graham, and Harvey, 2011; Acharya and Mora, 2015).

10

9

Empirical evidence from Brown, Gustafson, and Ivanov (2021) and Santos and Viswanathan (2020) suggests that credit

lines indeed insure firms against liquidity shocks, although Chodorow-Reich, Darmouni, Luck, and Plosser (2021) find that

this insurance is only available to large firms but not to small firms. Other important work on credit lines includes Sufi

(2009), Acharya, Almeida, Ippolito, and Perez (2014), and Acharya, Almeida, Ippolito, and Orive (2020). Kiernan, Yankov,

and Zikes (2021) studies how interbank fronting networks mitigate bank funding risk in syndicated credit lines, from the

perspective of the borrower’s ability to quickly receive funds.

10

See also Berrospide, Meisenzahl, and Sullivan (2012), Acharya, Almeida, Ippolito, and Orive (2020), and Chodorow-

6

Drawdowns possibly resulted from concern by borrowers about their banks’ abilities to provide

credit in the future (Ivashina and Scharfstein, 2010; Ippolito, Peydró, Polo, and Sette, 2016). During

the COVID recession, firms drew on existing credit lines to an even larger extent than during the

GFC, with $300 billion to $500 billion drawn in March 2020 alone (Li, Strahan, and Zhang, 2020;

Acharya and Steffen, 2020) and these draws were accompanied by a large increase in deposits (Li

et al., 2020; Levine et al., 2021).

11

Using the novel FR 2052a data, we provide more detailed information on drawdowns and deposit

flows during the COVID recession. In contrast to the GFC, we show that drawing induced by COVID

was largely precautionary, in that borrowers left most of their drawn funds on deposit. Our evidence

bearing on the dynamics of bank balance sheets during the COVID recession thus emphasizes that

most banks did not need to raise costly external funding. However, heavy drawing on lines impinges

on bank capital requirements because drawn credit weighs more heavily on required capital than

unfunded commitments (Acharya, Engle, and Steffen, 2021; Greenwald, Krainer, and Paul, 2020;

Kapan and Minoiu, 2021).

Second, our paper adds to recent research concerning the transition from LIBOR to risk-free

reference rates.

12

Jermann (2019) shows that LIBOR-linked loan revenues act as a form of insurance

to banks against risks to their funding costs. Jermann (2021) shows, in effect, that SOFR is not as

effective as LIBOR for hedging his risk. Kirti (2022) models how reference rate choice affects loan

provision in a model with risk-averse banks and risk-averse borrowers. The risk-sharing properties of

alternative reference rates are not our concern. We focus instead on the implications of reference rate

choice for the equilibrium supply of credit lines. We calibrate an equilibrium model of credit line

provision and estimate the impact to both prices and quantities of switching from LIBOR to SOFR.

We find that the expected pricing of drawn credit is likely to be higher under SOFR, relative to LIBOR,

because banks adjust the terms of revolvers to reflect debt-overhang costs to their shareholders. By

Reich and Falato (2022).

11

After the 1998 Russian default, banks also experienced both credit-line drawdowns and transaction deposit inflows

(Gatev, Schuermann, and Strahan, 2007).

12

There is also work on LIBOR as a measure of bank funding costs, documenting historical divergences between

LIBOR and risk-free rates, such as SOFR or SOFR proxies. For example, Schrimpf and Sushko (2019) and Abate (2020)

document that the LIBOR-SOFR was extremely elevated for extended periods of time during past financial market stress

and recessions. Kuo, Skeie, and Vickery (2018) find that during the GFC, LIBOR broadly tracked alternative measures

of short-term bank funding costs but they also document a large dispersion in bank borrowing costs not captured by

LIBOR. However, Bowman, Scotti, and Vojtech (2020) question whether LIBOR is even a good measure of the marginal

funding costs of banks, noting that (1) wholesale unsecured funding is a tiny fraction of GSIB and non-GSIB liabilities and

(2) depending on time period and type of term SOFR (in arrears versus in advance), SOFR can be more correlated with

average funding costs than LIBOR.

7

contrast, our theory implies essentially no impact on term lending. This aligns with recent evidence

provided by Klingler and Syrstad (2022), who find only a small effect of reference rate transition on

the pricing of floating-rate bonds.

Third, we contribute to the theoretical literature on reference rates. Santomero (1983), Chang,

Rhee, and Pong (1995), and Kirti (2020) provide a rationale for floating-rate loans based on the

assumption that banks are risk averse. Ho and Saunders (1983) analyze hedging in the context of

fixed-rate unfunded loan commitments. Their model also highlights the importance of the covariance

between borrower draws and loan costs for pricing at origination. Risk aversion plays no role in

our analysis. In any case, only the credit-spread component of bank funding costs matters in our

analysis because uncertain changes in risk-free interest rates do not contribute to debt overhang in

this setting. By contrast, prior work that focuses on hedging total interest expense, including the

above cited work and Bowman, Scotti, and Vojtech (2020), applies even to banks that have no credit

spreads. In our model, banks maximize equity market value; they are not risk averse.

3 A Model of Credit Line Provision

This section provides a simple equilibrium model of credit lines that shows the degree to which

banks’ incentives to provide credit lines are affected by the choice of the floating reference rate. In

Section 6, we calibrate this model to the empirical experience with LIBOR credit lines originated by

large US banks, illustrating the potential impact of reference rate transition and the key economic

channels at work.

Credit lines are contracted at time 0, giving a borrower the option to draw on the line at time 1 at

an interest rate equal to a fixed contractual spread over the reference rate. We also analyze special

cases in which the reference rate

R

is either a credit-sensitive rate like LIBOR or the risk-free rate

r

.

These interest rates apply to loans funded at time 1 and maturing at time 2.

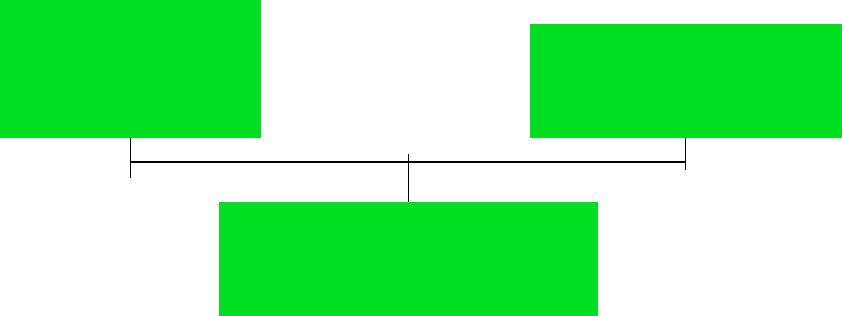

At time 0, as depicted in Figure 1, the bank offers the borrower a menu

{(L

,

s(L)) : L ≥

0

}

of

credit-line terms distinguished by the size

L

of the line and the associated fixed spread

s(L)

over

the variable loan benchmark rate

R

. The borrower selects its preferred choice

(L

,

s(L))

from this

menu. At time 1, information reveals the rates

R

,

r

, and the credit spread

S

of the bank for unsecured

wholesale funding maturing at time 2. By “wholesale," we mean that bank creditors break even in

market value by providing marginal quantities of new funding to the bank at the interest rate

r + S

.

8

0

Bank

and borrower

negotiate the line amount L

and the spread s over

the reference rate R.

1

The

reference rate R is realized.

Borrower draws q ≤ L and deposits d.

Bank funds q − d at wholesale rate r + S.

2

Borr

ower pays bank q(1 + R + s).

If the bank survives, it pays

(q − d)( 1 + r + S) + d(1 + r).

Figure 1:

Model timeline.

A credit-sensitive reference rate

R

such as LIBOR is of the form

r + W

, for some

credit-spread benchmark W. With a risk-free reference rate, for example SOFR, R = r.

At time 1, after observing

S

,

r

, and

R

, the borrower chooses the quantity

q ≤ L

of cash to draw

and leaves

d ≤ q

of the drawn funds on deposit at the same bank. In this basic version of the

model, the deposited fraction

ϕ = d/q

can be contingent on the state of the market at time 1 but

is exogenously chosen. In Appendix C, we endogenize

ϕ

based on the borrower’s fear that the

condition of the borrower or the bank may deteriorate so as to block drawing on the line at an

intermediate date before maturity.

As shown in Figure 1, the undeposited quantity

q − d

of drawn cash is funded by the bank at its

unsecured wholesale rate

r + S

. The interest rate offered to the borrower on the deposited amount

d

is assumed to be the risk-free rate

r

. (Empirically, we will later show that the interest rate paid

on corporate transaction deposits is near the risk-free rate.) At time 2, the bank’s total assets and

total liabilities are revealed and the bank is either solvent or not. For simplicity, the bank will not

default before time 2 because the bank has no liabilities maturing before time 2. If solvent at time

2, the bank pays back

( q − d)(

1

+ r + S) + d(

1

+ r)

on the funding that it obtained at time 1. The

corporate borrower repays

q(

1

+ R + s(L))

on the line, and receives

d(

1

+ r)

in interest, whether or

not the bank is solvent at time 2. For simplicity, our basic model assumes that the borrower will

not default on the credit line. Borrower default risk plays no significant role in the debt-overhang

channel that is central to our results. It remains to specify the preferences of the bank’s shareholders

and the borrower, and then solve for the equilibrium line size

L

, contractual spread

s(L)

, and amount

q drawn.

9

At time 1, the benefit to the borrower of access to

x

in cash

13

is

b(x

,

ψ)

, where

ψ

is a liquidity-

preference shock that is revealed at time 1 and

b

is a function in two non-negative variables such that

(i) for any

y

,

b(x

,

y)

is increasing, differentiable, and strictly concave with respect to

x

, and (ii), for

any x, the marginal benefit b

x

(x, y) of cash is at least 1 and is increasing in the outcome y of ψ.

At time 1, given the committed size

L

of the credit line and the borrower’s observations of

S

,

R

,

r

,

and

ψ

, the borrower chooses the amount

Q(L)

to draw that maximizes the benefit of receiving the

cash, net of the present value of the loan repayment less deposit proceeds. The net present value

to the borrower of giving up

qϕ

in deposited cash at time 1 and receiving the corresponding cash

payback

qϕ(

1

+ r)

at time 2 is

−qϕ + δqϕ(

1

+ r) =

0, where

δ =

1

/(

1

+ r)

, so we can ignore cash

deposit effects insofar as the borrower’s choice of

Q(L)

. The borrower’s liquidity benefit

b(q

,

ψ)

,

however, reflects the benefit of immediate access to both the deposited and undeposited cash amounts.

State by state, Q(L) thus solves

sup

q ≤ L

b(q, ψ) − qδ(1 + R + s(L)). (1)

In the event that

b

x

(

0,

ψ) ≤ δ(

1

+ R + s(L))

, the optimal cash draw

Q(L)

is zero. In the event

that

b

x

(L

,

ψ) ≥ δ(

1

+ R + s(L))

, the optimal cash draw

Q(L)

is

L

. Otherwise, from the first-order

condition for optimality,

Q(L) = B

(

δ(1 + R + s(L)), ψ

)

, (2)

where

B( ·

,

y)

is the inverse of

b

x

( ·

,

y)

, meaning that

b

x

(B(z

,

y)

,

y) = z

. At time 0, the borrower

chooses the size L

∗

of the credit line that achieves the maximal expected net benefit

sup

L

E

[

b(Q(L), ψ) − Q(L)δ(1 + R + s(L) )

]

− f L, (3)

where

f ≥

0 is the proportional line fee.

14

To simplify, we assume that the line fee

f L

compensates

bank shareholders for the cost of meeting any capital requirements associated with the committed

13

Our modeling of the liquidity benefit to the borrower is of a reduced form. Benefits from liquidity insurance can

be motivated, for instance, by a borrower’s ability to avoid liquidating otherwise profitable projects when obtaining an

amount of credit q when subject to a liquidity shock (see for example, Holmström and Tirole, 1998).

14

For notational simplicity, we vary from how revolver terms are stated in practice, with a proportional fee

f

on only the

undrawn amount

L − Q(L)

and a fixed spread

¯

s

over the reference rate

R

on the drawn amount. These contractual terms

are equivalent to those of our model, by taking

¯

s = s(L) − f

. The difference is purely notational. There are no implications

for drawn rates, line size, drawn amounts, or any other substantive equilibrium quantities.

10

line size

L

. There is also an equity capital requirement

CQ(L)

for the drawn

15

amount

Q(L)

, for

some constant capital ratio C.

From Theorem 1 of Andersen, Duffie, and Song (2019), the marginal increase

16

at time 1 in the

equity value of the bank associated with the given contractual credit line terms (L, s(L)) is

G(L) = p

1

π

L

− p

1

δ(1 + C)(1 − ϕ)Q(L)S, (4)

where p

1

is the conditional probability

17

at time 1 of bank solvency at time 2, and

π

L

= δQ(L)(1 + R + s(L)) − Q(L)

is the bank’s profit on the drawn line, which is the net present value of the loan cash flows. The first

term of

(4)

is the expectation at time 1 of credit-line profit going to bank shareholders, noting that

equity owners get paid at time 2 if and only if the bank is solvent. The second term of (4),

τ = p

1

δ(1 + C)(1 − ϕ)Q(L)S, (5)

is the debt-overhang cost to bank shareholders of funding

(

1

− ϕ)Q(L)

at the wholesale spread

S

.

For large US banks, the factor

δp

1

(

1

+ C)

is typically close to 1 and the majority of the debt-overhang

wedge is the product of the bank’s wholesale credit spread

S

and the quantity

(

1

− ϕ)Q(L)

of

required wholesale (non-deposit) funding.

When the credit line is contracted at time zero, the bank prices the expected debt-overhang wedge

E(τ)

into the terms of the line. This expected wedge includes the effect of covariance between the

15

The impacts of capital requirements on credit provision are widely discussed in the literature. For example, Favara,

Infante, and Rezende (2022) show how drawdowns during March 2020 reduced bank participation in Treasury markets.

16

The market value of the bank’s equity at time 1, for some incremental quantity

c

of credit-line customers, is

V(c) =

δE

1

[(X + cY)

+

]

, where

E

1

denotes conditional expectation at time 1,

X

is the payoff at time 2 of the bank’s legacy assets

net of its legacy liabilities, and

Y

is the cash flow at time 2 per unit of credit-line customers, net of the associated payback

on the associated funding. Under mild technical regularity conditions, the marginal value of a credit line customer at time

1 is shown in Andersen, Duffie, and Song (2019) to be

G(L)

, which is the right derivative

∂

+

V(

0

)/∂c

of the market value

V(c)

of the bank’s equity with respect to the incremental quantity

c

of customers contracting credit lines with the bank,

evaluated at

c =

0. A sufficient set of technical conditions is that the legacy bank liabilities total to a fixed constant and

that X and Y are integrable and have a joint probability density function.

17

Given the fractional loss

`

at default to the bank’s unsecured creditors, we can solve for the credit spread

S = (

1

− p

1

)`

,

and substitute

p

1

=

1

− S/`

into

(4)

. As shown by Andersen, Duffie, and Song (2019), for a borrower with default risk

that is positively correlated with the default risk of the bank, there is also a risk-shifting benefit to bank shareholders

of

δ cov

1

(

1

H

,

Y

L

)

, where 1

H

is the indicator of the event

H

of bank solvency and cov

1

denotes covariance conditional on

information available at time 1. This term is zero in our setting because the borrower is default free.

11

credit spread

S

and the required quantity

(

1

− ϕ)Q(L)

of wholesale funding. Section 5 explains

that, empirically, this covariance has been significantly positive for LIBOR credit lines because firms

have tended to draw heavily on their revolvers when bank credit spreads are sharply elevated. In

Section 6, we calibrate this model to empirical evidence for LIBOR-linked credit lines. With the

resulting calibrated model, we show that most corporate borrowers will draw even more heavily on

SOFR-linked lines when bank wholesale funding spreads spike, given the opportunity to borrow

at a drawn rate that is far below LIBOR. This increases the covariance between the bank’s required

amount wholesale funding per credit line and the bank’s wholesale funding spread, exacerbating the

debt-overhang wedge for the representative calibrated large bank.

18

We also show in Section 6 that the resulting potential adverse impact of reference-rate transition

on credit provision is mitigated for banks with low debt-overhang wedges, whether due to high

levels of capitalization (low S), or an expectation of a high fraction ϕ of depositing of line draws.

We assume that the bank maximizes the initial market value of its equity and Bertrand-competes

against other banks of the same credit quality for providing credit lines. At time 0, the bank therefore

offers the borrower, for any line size

L

, a fixed spread

s(L)

at which the bank’s shareholders break

even on marginal new credit lines, implying that

E[G(L)] =

0. This pins down the contractual spread

s(L) =

E[p

1

Q(L)(1 − δ (1 + R − (1 + C)(1 − ϕ)S) )]

E[δp

1

Q(L)]

. (6)

The borrower then solves

(3)

for the optimal line amount

L

∗

. An alternative would be to model

imperfect competition between banks, which would be more realistic with respect to the magnitudes

of profit markups, but would not alter the thrust of our characterization of the effect of reference

rate choice on incentives for loan provision. This is so because the rents associated with imperfect

competition are likely to be about the same for LIBOR-linked lines as for SOFR-linked lines.

In summary, in our setting, the switch from credit-sensitive reference rates like LIBOR to risk-free

reference rates could increase the expected pricing of credit obtained on committed lines because

borrowers will draw more credit when bank funding costs are sharply elevated. Section 6 shows,

18

As calibrated in Section 6 to empirical data for our sample of large banks, spanning 2015-2021, the borrower’s liquidity

shock

ψ

and the bank’s funding spread

S

are affiliated random variables. This is so because the calibrated model has

ψ = (K(S) + e)

+

, where

K

is strictly increasing and

e

is independent of

S

. The affiliation of

ψ

and

S

and the concavity

of the liquidity benefit function

b( ·

,

ψ)

imply that the drawn quantity

B

(

δ(1 + r + s(L))), ψ

)

and

S

are also affiliated for

the risk-free reference, and this covariance

cov(Q(L)

,

S)

is anticipated to be higher than for the case of a credit-sensitive

reference rate.

12

however, that this simple effect is sharply reduced, or even reversed, if corporate borrowers deposit a

sufficiently high fraction of their drawn credit. In Section 5 we therefore focus attention on the extent

to which corporate borrowers deposit their line draws under stressed market conditions, such as

during the COVID recession. We show that this propensity to deposit depends significantly on the

type of bank. We also show in Section 6 that the impact of reference rate choice on borrower welfare

has a somewhat different character, and also depends importantly on bank quality.

4 Data

Our empirical analysis builds mainly on two confidential data sets available at the Federal Reserve:

the FR 2052a and the FR Y-14Q. We use several additional sources such as the FR Y-9C, FR 2420,

FRED, RateWatch, Bloomberg, S&P Compustat, and Capital IQ. Here, we briefly describe these data.

A more detailed documentation of the data can be found in Appendix A.

Our primary data source is the FR 2052a data collection, which is designed to monitor the

liquidity profile of large US bank holding companies (BHCs). The respondent panel consists of

BHCs designated as global systemically important banks (G-SIBs) and foreign banking organizations

(FBOs) with US broker-dealer assets greater than $100 billion. The data collection was started in

December 2015 and expanded to a larger panel of banks in July 2017. This data source has two crucial

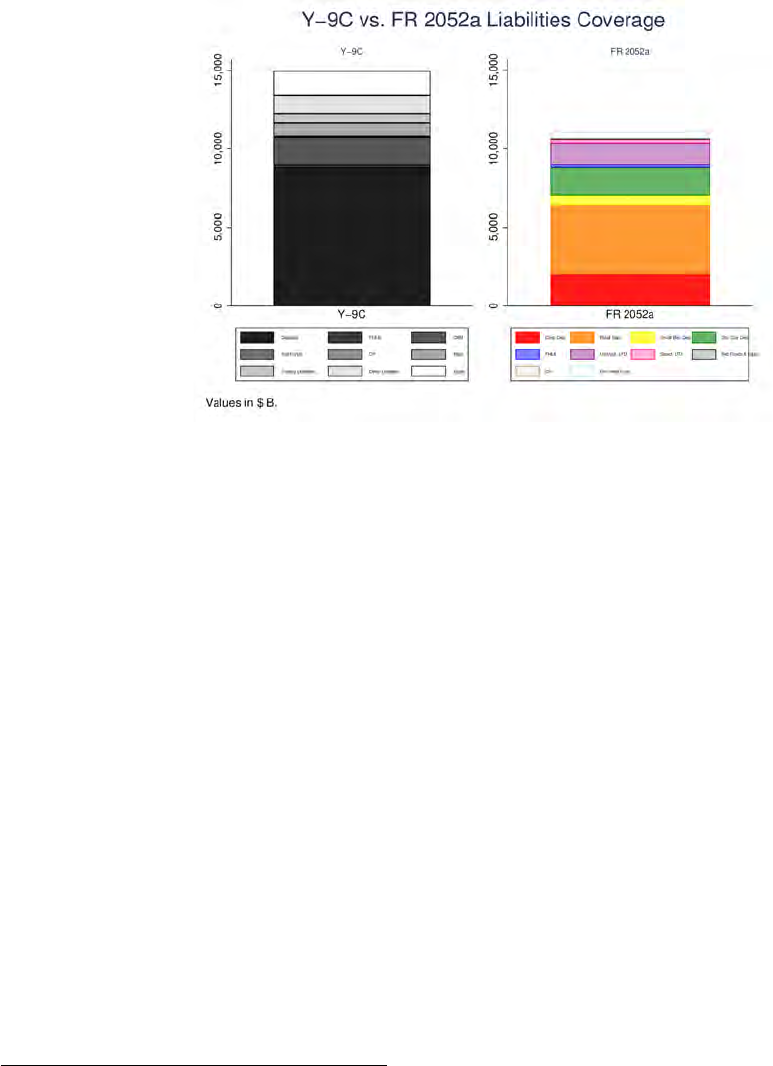

advantages over publicly available regulatory bank filings such as the FR Y-9C. First, the FR 2052a

data are more granular and report assets and liabilities by product type, maturity, collateral status,

and counterparty. This additional granularity allows us to establish several previously unreported

facts about US banks’ funding structures and exposures to variation in bank funding spreads. For

instance, Appendix Figure A.1 illustrates how the FR2052a data allow us to break down deposits and

wholesale funding by more detailed categories than would be possible from the publicly available

data in FR Y-9C. Second, the data are collected at a higher frequency. Firms with $700 billion or more

in total consolidated assets or $10 trillion or more in assets under custody must submit a report on

each business day. Firms with more than $50 billion but less than $700 billion in consolidated assets

report at the end of each month. These higher frequencies allow us to document how bank balance

sheets evolved during the COVID recession more precisely than was possible in previous work.

Our second main data source is the FR Y-14Q data collection, which is a supervisory data set

maintained by the Federal Reserve to support capital stress testing. The reporting institutions

13

comprise US BHCs, intermediate holding companies (IHCs) of foreign banking organizations, and

savings and loan holding companies with more than $100 billion in total consolidated assets. We

use the corporate loan schedule (H.1) and the commercial real estate schedule (H.2). Both schedules

contain loan-level information for commitments of at least $1 million. These data allow us to study

how reference rates are used in C&I and CRE lending. The corporate loan schedule (H.1) also

includes borrower reference information such as employer identification numbers (EINs), stock

tickers, and CUSIPs. We use these reference data to merge firm financials from S&P Compustat and

Capital IQ to analyze firm-level drawdowns and cash management during the COVID shock.

Combining the above data sets with publicly available information from the FR Y-9C and bank

call reports, our primary sample of banks consists of 24 of the largest US banks. We exclude the

US operations of foreign banks from the parts of our analysis that rely on the FR 2052a, as we do

not observe the full liability profile for these institutions. For our analysis, we distinguish between

different bank types: “universal” banks, “regional” banks, credit-card firms, trusts, and investment

banks. For some analyses, namely when using the FR Y-14Q to identify details on bank loan terms,

we restrict our sample further to a subset of 20 banks that reported Y-14Q data as of December 31,

2019. A list of all banks in our sample, their types, and the panels in which they report can be found

in Appendix Table A.1.

We also construct measures of bank funding rates using various sources. First, we use the FR

2420 to construct these measures for corporate deposits, interbank deposits, and other deposit and

wholesale funding rates. The FR 2420 is a transaction-based report that collects daily liability data on

federal funds purchased, certificates of deposits (CDs), and selected deposits by counterparty type,

allowing us to distinguish between rates paid by financial versus non-financial counterparties. The

reporting panel comprises US commercial banks and thrifts that have $18 billion or more in total

assets. Bank savings and checking deposit rates are taken from RateWatch. Additional information

on bank funding costs is sourced from FRED and Bloomberg, including term LIBOR, SOFR, and

BSBY rates. We also source data on fixed-rate advances provided by the Federal Home Loan Banks

(FHLBs) of Des Moines, Pittsburgh and Dallas.

14

5 Bank Funding Exposures and Revolving Credit at Large US Banks

In this section, we analyze the empirical implications of the provision of revolving credit for bank

funding risk. First, we provide a set of key facts about the composition of bank funding and document

the historical sensitivity of various bank funding rates to measures of bank funding spreads such

as the LIBOR-OIS spread. We measure LIBOR-OIS as the difference between three-month LIBOR

and three-month overnight index swap rates (OIS), for which the underlying rate is the effective fed

funds rate. Second, we investigate the extent to which revolving credit could pose bank funding risk

by studying the outstanding amounts of revolving credit for BHCs and the funding of drawdowns,

during both the COVID recession and the GFC.

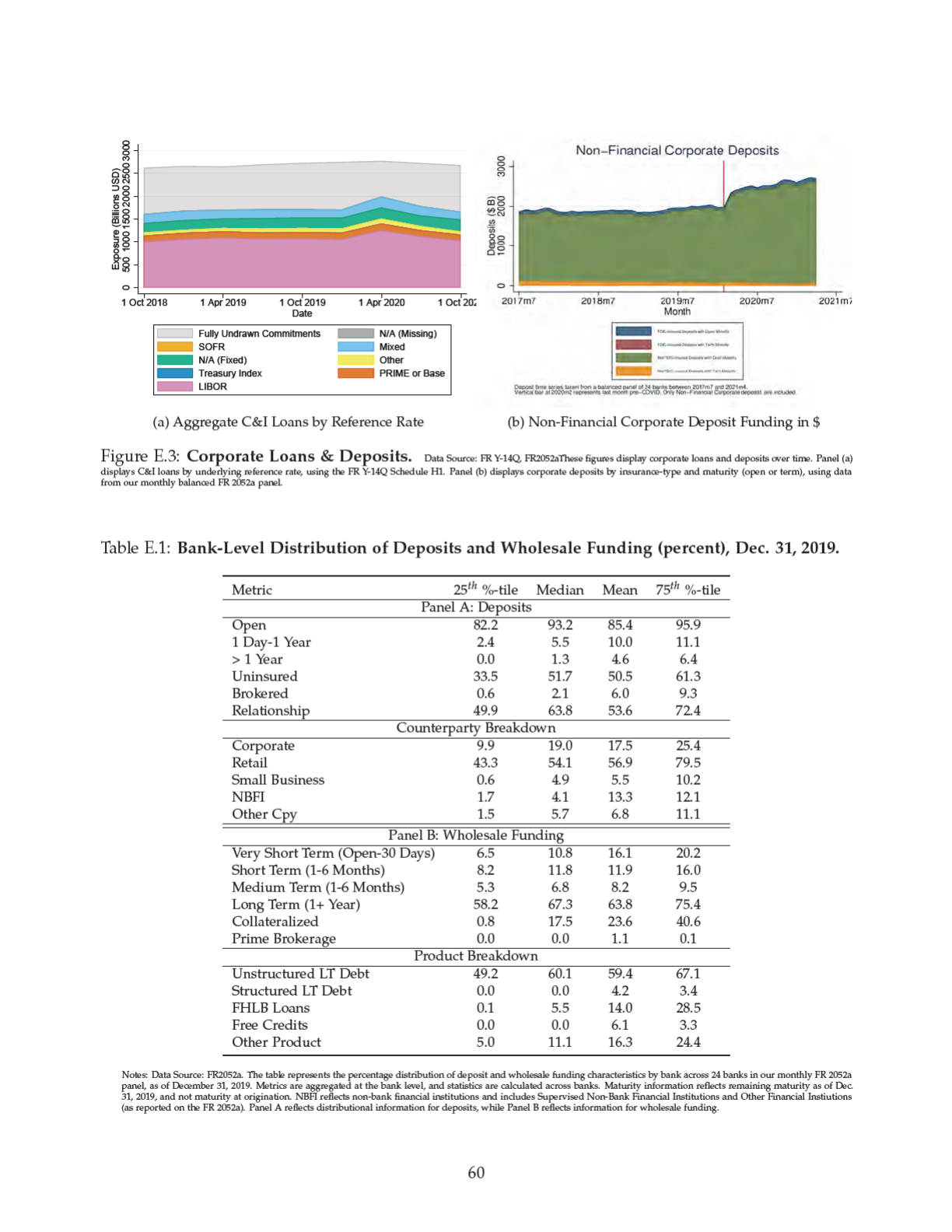

5.1 The Composition of Bank Deposit and Wholesale Funding

Table 1 provides evidence bearing on the composition of bank funding, as reported in the FR 2052a,

allowing us to establish several important novel facts about the composition of bank funding. In

Panel A of Table 1 we report deposits by counterparty, maturity, and type. The level of granularity

offered by the FR 2052a was not available for US banks before the recent introduction of the FR 2052a

dataset.

As of December 2019, deposits account for 59% of total bank assets. The largest providers of

bank deposits are retail customers, who provide around 50% of all deposit funding. The second most

important source of deposit funding is non-financial corporate deposits (23%) followed by deposits

from financial institutions (15%) and small businesses (7%). Most financial deposits are held by

non-bank financial institutions (NBFIs), around 11%.

19

Across all counterparty types, more than 91% of all deposits are without a specified maturity

date and available on demand—this form of deposit is referred to as “open.” Time deposits are

uncommon. The share of deposits with a fixed term is largest among retail depositors, at less than

14%. Retail and small-business deposits are mostly FDIC insured, in contrast to deposits from all

other counterparties, which are almost entirely uninsured. Further, most deposits – around 62% –

are considered stable, labeled as “relationship” accounts in Table 1, and are thus unlikely to cause an

19

There is also heterogeneity across banks, see for instance Table E.1 in the Appendix that shows cross-bank distributions.

While most banks predominantly rely on retail deposits, the reliance on these deposits varies, as the interquartile range

varies from 43% to 83%. Regional banks are slightly more reliant on retail and small business deposits than the rest of the

industry.

15

increase in banks’ funding costs under stressed market conditions.

20

Finally, only a small portion of

deposits (under 5%) are brokered deposits, which are less stable and more rate-sensitive.

We turn next to the composition of wholesale funding in Panel (B) of Table 1. Around 16% of

outstanding bank assets are financed by wholesale funding. Reflecting regulatory reforms after the

GFC, the majority of wholesale funding of large US BHCs is longer term. As of December 2019, less

than one-third of outstanding wholesale funding was expected to mature within 12 months and only

13% within one month (see also Anderson, Du, and Schlusche, 2021). Most wholesale funding is

provided through unstructured or structured long-term debt issues, which together account for 71%

of total wholesale funding

21

and are mostly at fixed interest rates.

22

The second most important type of wholesale funding is an advance from a Federal Home Loan

Bank (FHLB). Banks that join the FHLB system can obtain secured loans from FHLBs, which in turn

raise funds from money market funds (Gissler and Narajabad, 2017). FHLB advances are typically

secured by real estate mortgages and a “super lien” on other bank assets. The maturity of FHLB

advances can range from very short term (overnight) to very long term (30 years). Overall, FHLB

funding is an important source of bank funding and accounts for 8% of wholesale funding.

23

There is relatively little reliance on other forms of wholesale funding, especially types of funding

that have significant credit sensitivity. For instance, large US banks rely very little on unsecured fund-

ing sources such as wholesale certificates of deposits (2.4%) and commercial paper (1.2%). Instead,

banks more often use secured funding provided by conduits (such as asset-backed commercial paper),

which constitute around 6% of wholesale funding. Free credits (deposits placed at broker-dealers)

account for around 6% of wholesale funding, half of which come from prime-brokerage clients.

20

We use categories of funding as defined in the liquidity coverage ratio (LCR) rule to identify these types of deposits. For

retail and small business deposits, relationships accounts consist of transaction accounts (for example, demand deposits)

or non-transaction accounts (for example, savings accounts). For corporates and other counterparty types, relationship

accounts are operational deposits, defined as those used for cash management, clearing, or custody services.

21

Structured debt refers to debt instruments with original maturity greater than one year whose principal or interest

payments are linked to an underlying asset (for example, commodity-linked notes). Unstructured debt refers to vanilla

products with original maturity greater than one year, for instance floating rate notes linked to indexes like LIBOR or

effective fed funds or with standard embedded options (that is, call/put).

22

According to data obtained from Bloomberg, we find that most of long-term bank debt is fixed rate. Only 29% of

claims are floating rate, and of those 11% reference LIBOR, see Table E.2.

23

There is also cross-sectional variation in the types of wholesale funding used. For instance, regional banks rely more

on FHLB advances, which made up around 30% of their wholesale funding as of December 31, 2019. These regional

banks’ overall lending tends to have a larger share of C&I lending. They also rely relatively more on deposit funding

than the average bank, as 76% of all assets are financed by deposits and only around 11% by wholesale funding. The US

operations of FBOs also have a substantially different funding profile than the domestic U.S. banks. Nearly all deposits

are uninsured, and the US operations of FBOs rely primarily on corporate deposits and internal funding from overseas

branches (via deposits or wholesale funding). We exclude FBOs from our primary analyses because we do not observe the

full consolidated asset and liability profile of the institution – only that of their US operations.

16

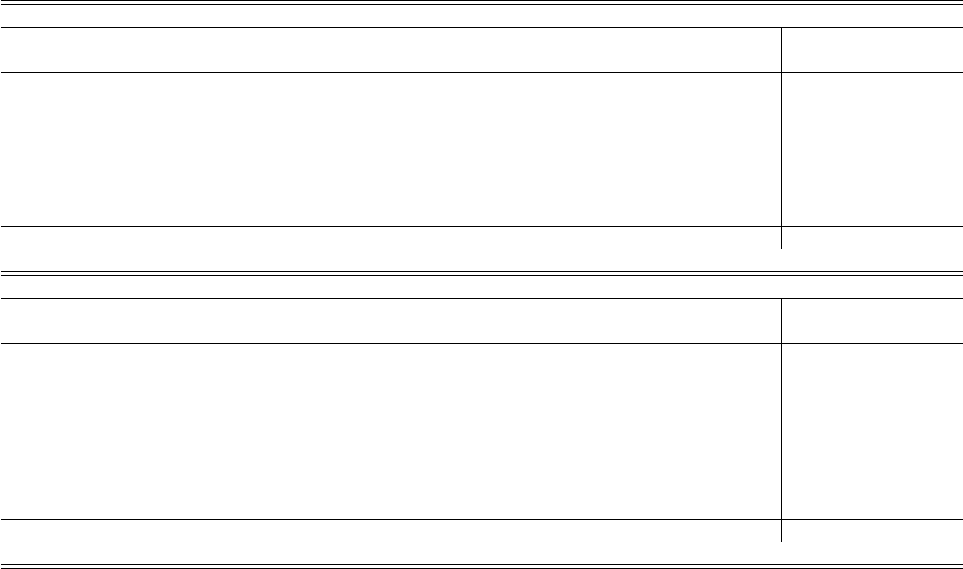

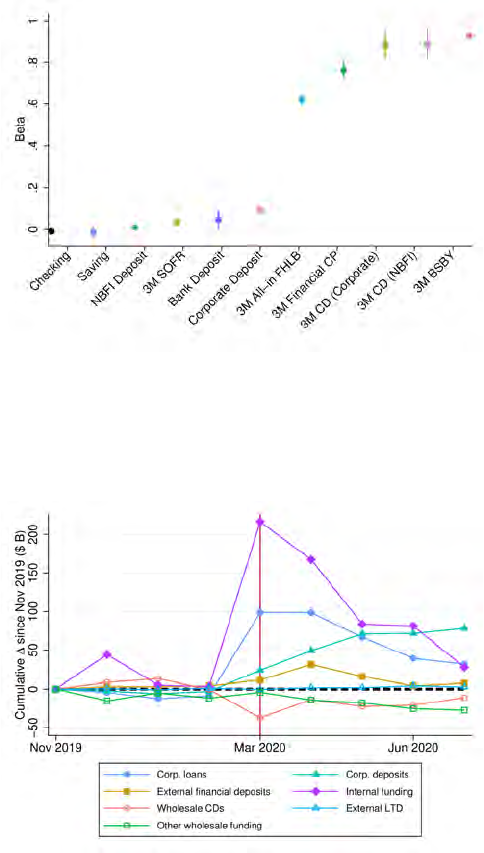

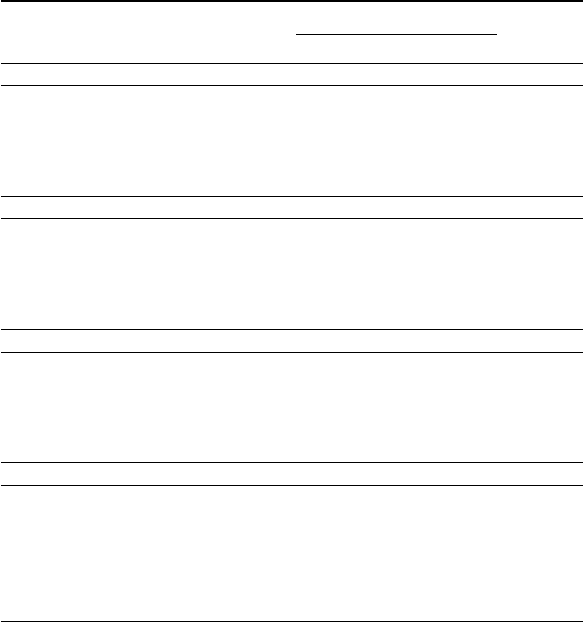

Table 1: Deposit and Wholesale Funding Breakdown as of December 31, 2019

Panel A: Deposit Funding by Counterparty (percent)

Counterparty Open 1 Day- 1 Year+ Uninsured Relation Brokered Total Total

1 Year -ship Deposits Assets

Retail 86.6 9.2 4.2 28.6 67.8 7.2 50.0 29.5

Non-Financial Corp. 96.5 3.3 0.1 96.1 45.2 1.0 23.3 13.7

NBFI 94.7 3.7 1.6 94.6 60.2 1.6 11.2 6.6

Small Business 98.0 1.9 0.1 45.8 80.5 6.0 6.6 3.9

Bank 96.7 2.8 0.5 97.3 65.4 0.1 4.2 2.5

Other Counterparty 90.1 8.9 1.0 95.6 59.1 0.1 2.5 1.5

Public Sector Entity 96.0 3.7 0.2 97.3 50.6 0.3 2.4 1.4

All Counterparties 91.3 6.3 2.4 59.0 61.8 4.4

Panel B: Wholesale Funding by Type (percent)

Product Open- 1-6 6 Months- Long- Collateral Prime Wholesale Total

30 Days Months 1-Year Term -ized Brokerage Funding Assets

Unstructured LTD 1.1 4.5 5.3 89.1 0.0 0.0 59.1 9.1

Structured LTD 3.1 8.4 9.3 79.2 0.0 0.0 12.4 1.9

FHLB 22.5 31.9 13.0 32.6 100.0 0.0 8.1 1.3

Conduit and SPV 13.9 23.3 8.3 54.5 99.4 0.0 6.5 1.0

Free Credits 100.0 0.0 0.0 0.0 0.0 50.7 6.3 1.0

Other Wholesale 55.7 30.8 10.5 3.1 0.0 0.0 4.0 0.6

Wholesale CDs 15.9 54.9 25.3 3.8 0.0 0.1 2.4 0.4

CP 27.8 64.9 7.3 0.0 0.0 0.0 1.2 0.2

All Products 13.0 11.2 7.0 68.9 14.6 3.2

Notes: Data Sources: FR2052a, FR Y-9C. Panel A represents the distribution of deposit characteristics by counterparty type across

24 banks in the monthly FR 2052a panel. Other Counterparty includes central banks, debt-issuing special purpose entities (SPEs),

GSEs, multilateral development banks, sovereigns, other supranationals, counterparties categorized as "other" and deposits with

missing information on counterparty type. Maturity information reflects remaining maturity as of Dec. 31, 2019, and not maturity at

origination. Relationship deposits reflect retail and small business deposits classified as transactional accounts (for example, demand

deposits) or non-transactional relationship accounts (e.g. savings accounts), and operational deposits at all other counterparties.

Panel B represents the distribution of wholesale funding characteristics by product type in the monthly FR 2052a panel across all

banks. Conduit and SPV financing includes asset-backed commercial paper, other asset-backed securities, collateralized CP, covered

bonds, and tender option bonds. Other Wholesale Funding includes banks’ draws on committed lines, government supported debt,

onshore and offshore borrowing (for example, fed funds), structured notes, and unsecured notes.

5.2 Sensitivity of Bank Funding Rates to the LIBOR-OIS Spread

To understand which types of funding sources are relatively more expensive to bank shareholders

when used to fund drawdowns, we next study the sensitivity of various types of bank funding rates

to changes in funding conditions. Given the variation in market power, riskiness, sophistication, or

opportunity costs across different counterparties and product types, the extent to which the various

types of short-term debt empirically correlate with LIBOR-OIS spreads may vary.

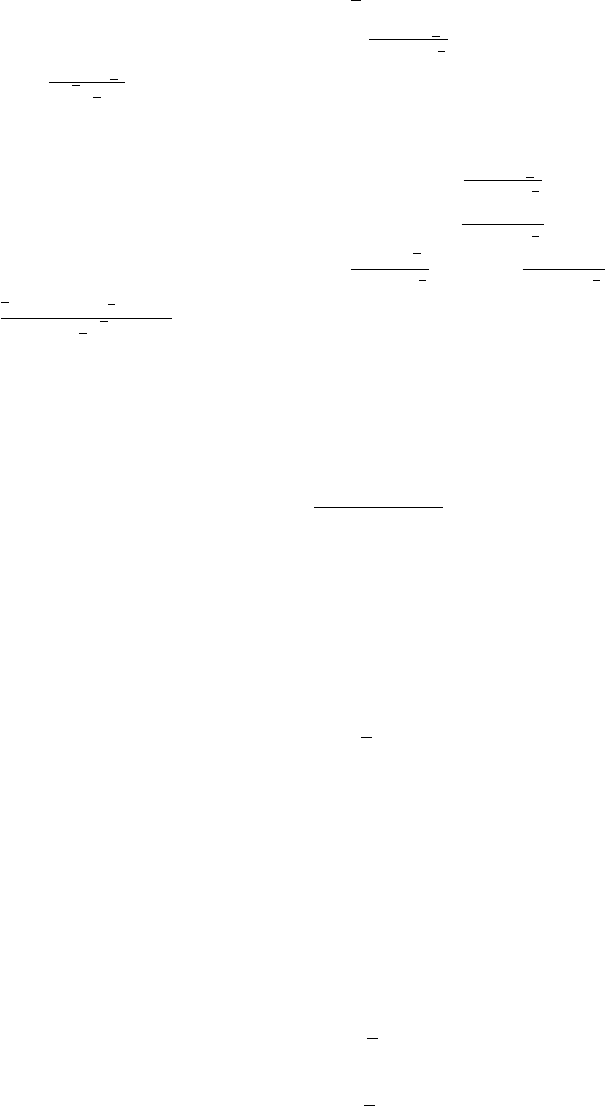

We thus study the historical sensitivity of bank funding rates that correspond to the different

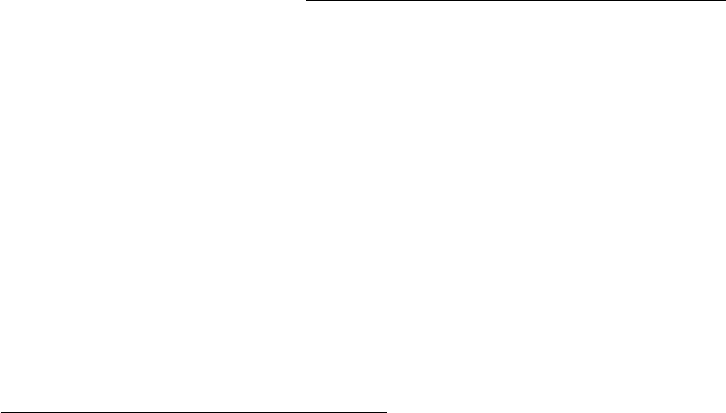

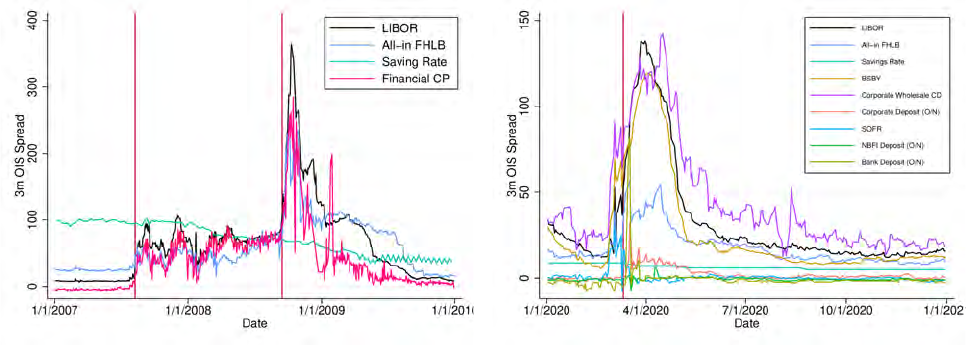

funding sources listed in Table 1 to LIBOR-OIS during periods of financial distress. Figure 2 shows

data bearing on some key funding rates during the GFC in Panel (a) and during the COVID recession

in Panel (b). During the GFC, LIBOR-OIS started to increase around August 2007, at the collapse of

17

the asset-backed commercial paper (ABCP) market (Covitz, Liang, and Suarez, 2013). Between the

summer of 2007 and September 2008, LIBOR-OIS remained elevated and just below 100bp. Reported

LIBOR rates, however, were downward biased by manipulative reporting (Duffie and Stein, 2015).

LIBOR-OIS returned toward normal levels near the end of the crisis.

Rates for retail deposits (proxied by savings and checking account rates from RateWatch) were

insensitive to movements in LIBOR-OIS spreads during the GFC. This is unsurprising. Most retail

deposits are insured and banks exhibit substantial market power over depositors, implying a low

sensitivity to changes in economic conditions (Driscoll and Judson, 2013; Drechsler, Savov, and

Schnabl, 2017). Rates on financial CP, however, rose sharply with increases in LIBOR-OIS, as shown

in Figure 2. As documented by Ashcraft, Bech, and Frame (2010), rates on “safer" borrowing—such

as collateralized advances from FHLBs—were significantly lower than LIBOR in the early stages of

the crisis, but rates on these somewhat lower-risk instruments also increased at the peak of the GFC.

(a) Global Financial Crisis (b) COVID-19 Recession

Figure 2:

Bank funding rates during financial distress

. Various wholesale and deposit funding rates are

shown for periods covering the GFC (Panel (a)), and COVID pandemic (Panel (b)). Data Sources: FR2420, FRED, Bloomberg,

FDIC, RateWatch, FHLB Des Moines Historical Rate File. “All-in” FHLB spreads are calculated similarly to Ashcraft, Bech,

and Frame (2010), with additional parameters to capture equity cost for FHLB stock. Appendix A provides details. In the

COVID figure, Corporate Wholesale CD and Bank, Corporate, and NBFI O/N deposit rates are calculated from bank-level

transactions in the FR 2420 report. 3M CD rates reflect issuances with maturities between 89 and 92 days. "O/N" refers to

overnight rates. We aggregate trades by date, calculating the median daily interest rate weighted by transaction amount.

We exclude dates with fewer than 10 transactions, and carry forward the prior date’s rate. We then calculate a rolling

average rate that averages the interest rates paid on the five most recent trading dates, to smooth our series.

A similar pattern holds for the COVID recession, as shown in Panel (b) of Figure 2. LIBOR-OIS

increased throughout March, especially once the World Health Organization announced on March 11

that COVID-19 had become a global pandemic. However, LIBOR-OIS reached a much lower peak

18

than it had during the GFC.

For the COVID episode, we have more precise measures for bank funding costs. For instance,

we can obtain the rates for overnight corporate deposits and rates on deposits held by other banks

or non-bank financial institutions (NBFIs). These rates, unlike retail deposit rates, are sensitive to

the effective fed funds rate. However, spreads of deposit rates over the effective federal funds rate

are relatively insensitive to LIBOR-OIS during the COVID episode.

24

We find that an increase in

LIBOR-OIS of 100 basis points is associated with a mere 10-basis-point increase in overnight corporate

deposit spreads, a 5-basis-point increase in bank deposit spreads, and a 1-basis-point increase in

NBFI deposit spreads, as illustrated in Appendix Figure E.1.

As expected, wholesale bank funding spreads, such as spreads of corporate wholesale CDs

over OIS, closely track LIBOR-OIS during the COVID recession. A recently introduced Bloomberg

credit-sensitive three-month bank funding rate index, BSBY, also closely tracks LIBOR during the

COVID pandemic. In line with patterns observed during the GFC, “All-in” FHLB spreads also rose,

but peaked at less than 40% of LIBOR-OIS.

Our analysis of funding rate sensitivity shows that deposits are a cheap source of funding for

banks. While this is less surprising for retail deposits, it also holds for corporate deposits and for

open deposits from financial institutions, which are sensitive to risk-free rates but not to LIBOR-

OIS. Wholesale funding is, in contrast, credit sensitive and more expensive. FHLB advances are

the cheapest form of wholesale funding while CDs and CP closely track LIBOR. Our analysis in

Section 5.1 shows that banks make little use of these more credit-sensitive forms of funding and,

to the extent they are used, the funding tends to be longer term and at fixed rates. Our analysis,

however, does not preclude the use of unsecured wholesale funding—which is expensive for bank

shareholders especially during times of distress—to fund drawdowns. We next study the potential

need to fund drawdowns, using the funding sources discussed above.

5.3 Undrawn Commitments

Our theoretical analysis in Section 3 emphasizes that BHCs expose themselves to funding risk when

providing revolving credit. Table 2 shows that this risk is economically large. For the 20 largest

BHC, overall commitments sum to more than $3.5 trillion—more than twice the $1.6 trillion in

24

We construct these spread by averaging across overnight deposits held by either non-financial corporates, banks or

NBFIs as reported in the FR 2420 and subtract the effective fed funds rate.

19

Table 2: Bank Credit by Loan Type for Large U.S BHCs as of December 31, 2019

Loan Type Util ($B) Comm ($B) % Utilized No. Banks

All Loans 1579.16 3551.52 44.46 21

Credit Line 543.76 1876.39 28.98 20

Term Loan 310.37 375.26 82.71 20

Other C&I 133.88 540.05 24.79 21

Commercial Real Estate 591.16 759.82 77.80 20

This table displays the distribution of utilized and committed credit across loan products. We source exposures from the

FR Y-14Q Schedule H1 B (corporate loans) and Schedule H2 (commercial real estate). Data are as of 2019q4. We include

only domestic C&I and CRE lending. US subsidiaries of foreign banks are excluded from our analysis. “Other” C&I

loans include non-revolving credit lines, capitalized lease obligations, standby letters of credit, other assets, fronting

exposures, commitments to commit, and exposures classified as “other.”

funded credit across C&I and CRE lending. The BHCs in our sample alone had around $1.3 trillion

of undrawn credit-line commitments, more than the total utilized credit from term lending and

revolving credit combined.

These unfunded commitments represent a substantial risk to bank liquidity if drawn during

times of stressed funding markets when bank credit spreads are elevated. Our theory suggests,

however, that linking lines to credit-sensitive reference rates has historically mitigated this funding

risk. Approximately 70% of these loans are indexed to LIBOR as of 2019 (Appendix Table E.4). Going

forward, this will not be the case. Our theoretical analysis implies that the funding risk associated

with credit lines may become much higher when LIBOR is replaced with a risk-free alternative such

as SOFR.

If borrowers draw on their lines in periods of distress, banks may need to pay expensive funding

costs in order to obtain the cash demanded by their borrowers.

25

As we show in Section 3, the

funding-spread component of these costs is borne by bank shareholders. However, as we have shown,

the manner in which banks fund these draws significantly influences the funding spreads. We have

shown empirically that corporate deposit rates exhibit almost no credit sensitivity. Thus, the funding

cost to shareholders is minimal if borrowers leave most of their drawn funds on deposit at the same

bank. If, however, banks are forced to obtain funding at more credit-sensitive rates, shareholders can

bear a substantial cost.

25

For revolving credit lines, borrowers can draw and repay funds at their discretion, at least “on paper.” In practice,

however, not all commitments can be drawn, because covenants (Sufi, 2009) or other loan terms can limit the ability or the

incentives of borrowers to draw (Chodorow-Reich, Darmouni, Luck, and Plosser, 2021). Nonetheless, the extent to which

credit line draws need to be funded is largely out of a bank’s control.

20

5.4 Dynamics of Assets and Liabilities During Times of Distress

Given the large outstanding unfunded credit commitments of banks and the high associated potential

funding cost to bank shareholders, we next ask: How have bank balance sheets historically evolved

during periods of market stress accompanied by elevated bank funding spreads? Is the covariance

between drawdowns and bank funding spreads—a key determinant of credit supply according to

our theory in Section 3—positive and large? And how are drawdowns actually funded?

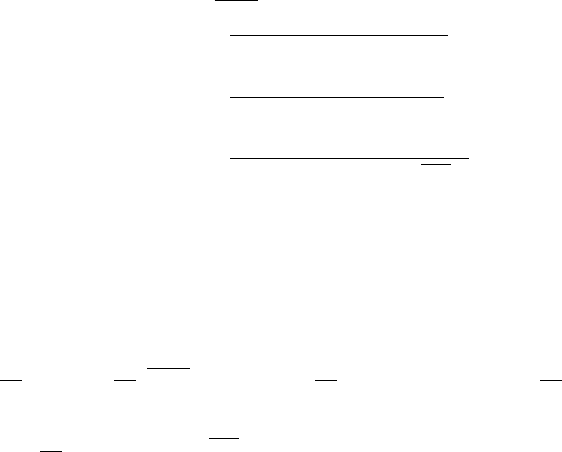

As descriptive evidence bearing on the evolution of bank balance sheets, Figure 3 shows cumu-

lative industry-level changes, in billions of dollars, of various balance sheet items in the periods

surrounding the COVID recession and the GFC. For the GFC, we rely on publicly available data

from the Federal Reserve H8 series, sourced via FRED. These data allow us to distinguish between

broad loan types (for example, C&I and home equity lines) on the asset side and, on the liability

side: deposits, interbank funding, and “other borrowing," which pools wholesale funding, FHLB

funding, and borrowing from the Federal Reserve. For the COVID recession, we use FR 2052a data,

which are more detailed. For instance, the FR 2052 gives us the ability to distinguish within the

categories of loans and deposits between counterparty types, allowing us to separate C&I lending to

large corporates and to small businesses. Figure 3 shows the dynamics of bank balance sheets, split

into assets and liabilities. Panels (a) and (b) show the dynamics for large US BHCs, which report

monthly in the FR2052a, around the COVID recession. Panels (c) and (d) show the dynamics for

large domestically chartered banks around the Lehman failure.

There is substantial growth in C&I lending following both shocks, partly or entirely driven by

credit line drawdowns, as shown in Panels (a) and (c) of Figure 3. During the COVID recession, we

observe for our sample of large banks that drawdowns on corporate credit lines increased by close to

$300 billion by April, which is an increase of almost 20% in total C&I lending (Li, Strahan, and Zhang,

2020; Acharya and Steffen, 2020). Most of these draws were from LIBOR-linked facilities

26

and were

driven by the largest firms (Greenwald, Krainer, and Paul, 2020; Chodorow-Reich, Darmouni, Luck,

and Plosser, 2021). Consistent with the presumption that firms drew on their lines to weather the

market turmoil, line draws were repaid quickly after the bond market started to recover (Darmouni

and Siani, 2022). Following Lehman’s failure, there was a $50 billion (6%) increase in C&I lending

overall, as large corporations drew on their lines in fear of future bank failures (Ivashina and

26

See Panel (a) of Figure E.3 in the Appendix.

21

(a) Loans During COVID Recession (b) Funding During COVID Recession

(c) Loans Around the Lehman Failure (d) Funding Around the Lehman Failure

Figure 3:

Industry Assets & Liabilities in Periods of Distress.

This figure shows the evolution of aggregate

assets and liabilities during the GFC (following Lehman’s collapse) and during the COVID pandemic (following the

declaration of the global pandemic in March 2020). Values represent cumulative growth/decreases compared to the starting

month in billions of dollars. Data from the GFC are sourced from the FRED series for large domestically chartered banks,

adjusted for large M&A based on public notes to H8 series. Data from COVID are sourced from the FR 2052a monthly

balanced panel of 24 banks. Due to balance reclassifications between business segments in the FR 2052a, we exclude one

bank from our aggregate series for: small business loans, small business deposits. We include a version of the COVID

graphs for U.S. Branches of FBOs in Appendix Figure E.2.

22

Scharfstein, 2010).

27

Altogether, the increase in C&I lending due to drawdowns during both episodes

suggests that the covariance between drawdowns and bank funding spreads is indeed large.

We next turn to the evolution of bank liabilities, shown in Panels (b) and (d) of Figure 3. In

contrast to corporate lending, which increased during both periods, the evolution of bank liabilities

varied more between the COVID pandemic and the Lehman failure. Starting with the COVID

pandemic, we notice that the increase in bank liabilities was driven by debt whose pricing exhibited

limited credit sensitivity. Both corporate and financial deposits increased by around $340 billion

(20%) in March 2020, almost entirely in open-maturity deposits (see Appendix Figure E.3). Rates

on these deposits largely tracked the federal funds rate during the COVID recession and were thus

far cheaper than unsecured wholesale funding (see Figure E.1). We also notice a striking increase

in FHLB advances—nearly $100 billion, or 40% of funding—in March 2020. The reliance on FHLB

advances in distress aligns with evidence from the GFC (Ashcraft, Bech, and Frame, 2010; Acharya

and Mora, 2015), as FHLBs provide cheaper funding than unsecured wholesale markets.

Retail deposits also rose significantly in March of 2020, by $200 billion, with steady increases in

subsequent months. The increase in retail deposits can be explained in part by government stimulus

checks and precautionary savings (Cox, Ganong, Noel, Vavra, Wong, Farrell, Greig, and Deadman,

2020). Small business deposits also increased starting in April-May, likely related to the disbursement

of PPP funds. We also see a decrease in more expensive sources of short-term wholesale funding,

such as commercial paper (CP), certificates of deposits (CDs), and funding from off-balance sheet

conduits. The sole increase in expensive funding was in the form of long-term debt issuance, starting

in April-May 2020, which may have been a response to reduced yields that came on the back of the

Fed’s announcement on March 23 that it would purchase corporate bonds.

28

Following Lehman’s failure, we see an increase of around $160 billion (approximately 15%) in

“other borrowing”—a broad category of liabilities that includes short-term unsecured wholesale

funding, as well as advances from FHLBs. Deposits grew by over $300 billion (about 9%), of which

27

There was also a sustained increase in C&I lending after the ABCP run in 2007, partly due to draws on corporate credit

lines (Berrospide, Meisenzahl, and Sullivan, 2012). Further, there was limited growth in other loans after the COVID shock.

Following the March 2020 pandemic declaration, there was a decrease in aggregate retail lending. Small business only

increased in April with the launch of the Paycheck Protection Program (PPP) (Granja, Makridis, Yannelis, and Zwick, 2022).

After Lehman’s collapse, there were continued draws on home equity lines and consumer loans (and, possibly, credit

cards), although both increases generally followed pre-Lehman growth trends.

28

See Federal Reserve announces extensive new measures to support the economy, Board of Governors of the Federal

Reserve System, March 23, 2021 as well as Boyarchenko, Kovner, and Shachar (2022). Further, note that most of these

aggregate trends for the COVID pandemic also hold true in the cross-section of banks.

23

a significant portion (by October 2008, nearly 50%) was in more expensive large time deposits. A

crucial difference between the GFC and the COVID recession is that the GFC saw a collapse of

interbank borrowing following Lehman’s failure (Afonso, Kovner, and Schoar, 2011), requiring some

banks to raise additional wholesale funds to make up for the lost interbank funding.

While both of these episodes saw significant credit line drawdowns, the composition of aggregate

bank funding tilts toward more expensive sources during the GFC than during the COVID recession.

During the COVID recession, cheap deposit funding increased and relatively expensive wholesale

funding decreased. In contrast, the evidence suggests that the increase of deposit funding during

the GFC was in the form of relatively more expensive time deposits, especially at weaker banks

(Acharya and Mora, 2015). Further, corporate drawdowns during the GFC were akin to a run on

some banks (Ivashina and Scharfstein, 2010), forcing some banks to turn to relatively expensive

wholesale funding.

5.5 How Credit-Line Drawdowns Are Funded

We next address how banks finance drawdowns. At the bank level, we can exploit the granularity

of FR 2052a data and use cross-sectional variation to tighten our empirical understanding of how

drawdowns are funded during the COVID recession. At the borrower level, we use data from FR

Y-14Q, Compustat, and Capital IQ to study the relationships between drawdowns and cash holdings

during both the COVID recession and the GFC.

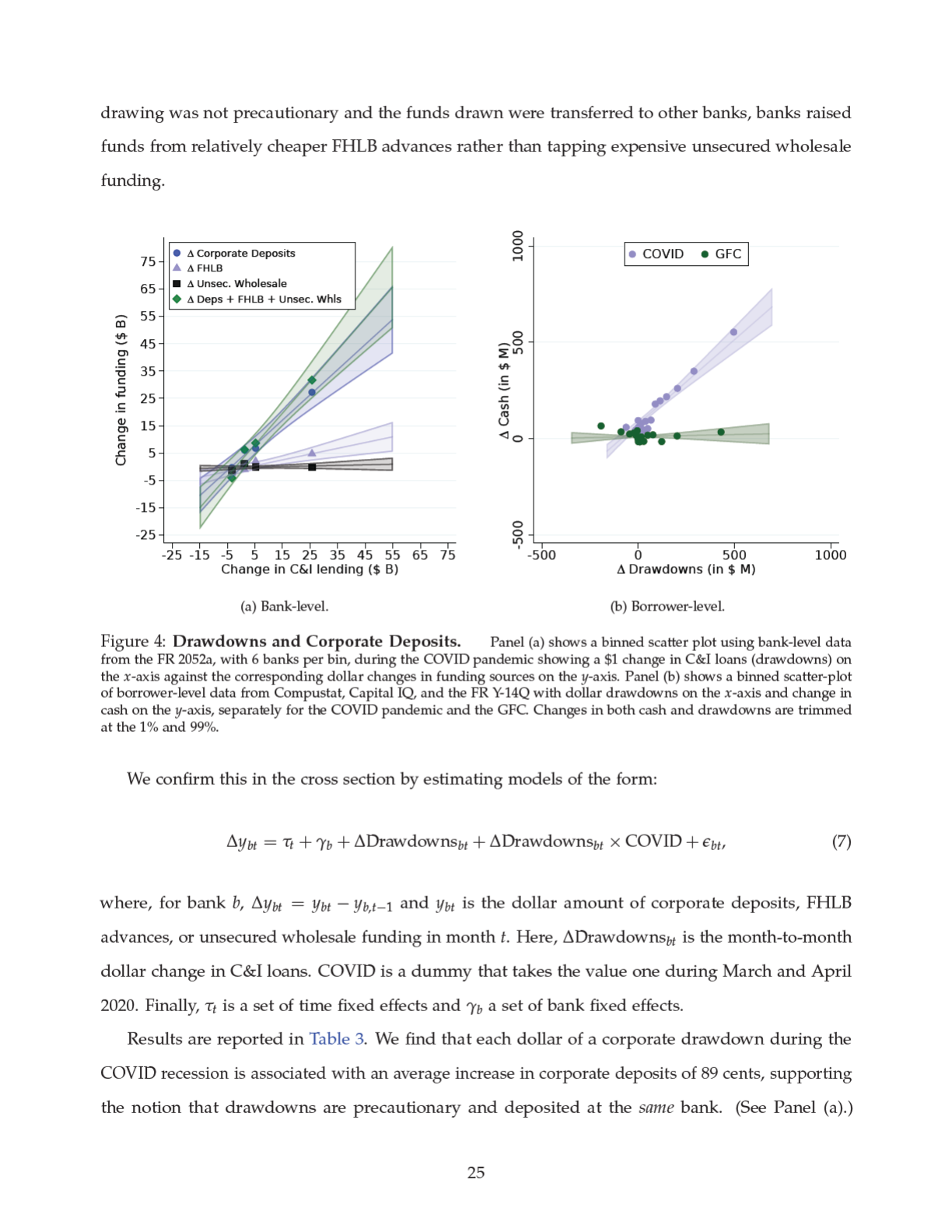

Bank-level Evidence.

We first study the raw data and correlate changes in outstanding utilized

C&I exposure from the end of February 2020 through end of April 2020 with changes in corporate

deposits, FHLB advances, and unsecured wholesale funding. The left panel of Figure 4 shows linear

fits. Here, for confidentiality reasons, we group BHCs into bins, with several BHCs per bin.

There is a strong correlation between an increase in C&I loans on the one hand and corporate

deposits and FHLB advances on the other, with the slope being much higher for the former. Thus,

our findings suggest that drawdowns in March and April 2020 were by and large for precautionary

purposes, with corporates drawing their credit lines but leaving the drawn amounts in their deposit

accounts. Firms plausibly chose to draw the cash on their lines before lenders might have invoked

covenants that could have blocked them from doing so at a later stage. Further, to the extent that this

24

However, this was mostly driven by the largest banks in our sample. For the regional banks in our

sample, captured in in Panel (b), only around 40% of drawdowns were deposited. The regional

banks instead relied on advances from FHLBs, which funded around 40% of additional draws.

29

Importantly, the banks in our sample did not require additional unsecured wholesale funding to fund

corporate draws, irrespective of their business model. In fact, the largest banks experienced deposit

growth significantly in excess of their drawdowns, as shown in column (5) of Panel (a).

30

This was

driven by a growth in deposits at non-bank financial institutions, possibly because of Federal Reserve

asset purchases and the concentration of reserve balances at larger banks. The simultaneous increase

in deposits and drawdowns is also consistent with the theoretical synergies of banks as liquidity

providers through both deposits and committed credit lines (Kashyap, Rajan, and Stein, 2002).

Borrower-level Evidence.

Our findings thus far indicate that, during the COVID shock, a

substantial portion of drawdowns were deposited. However, our bank-level data do not include

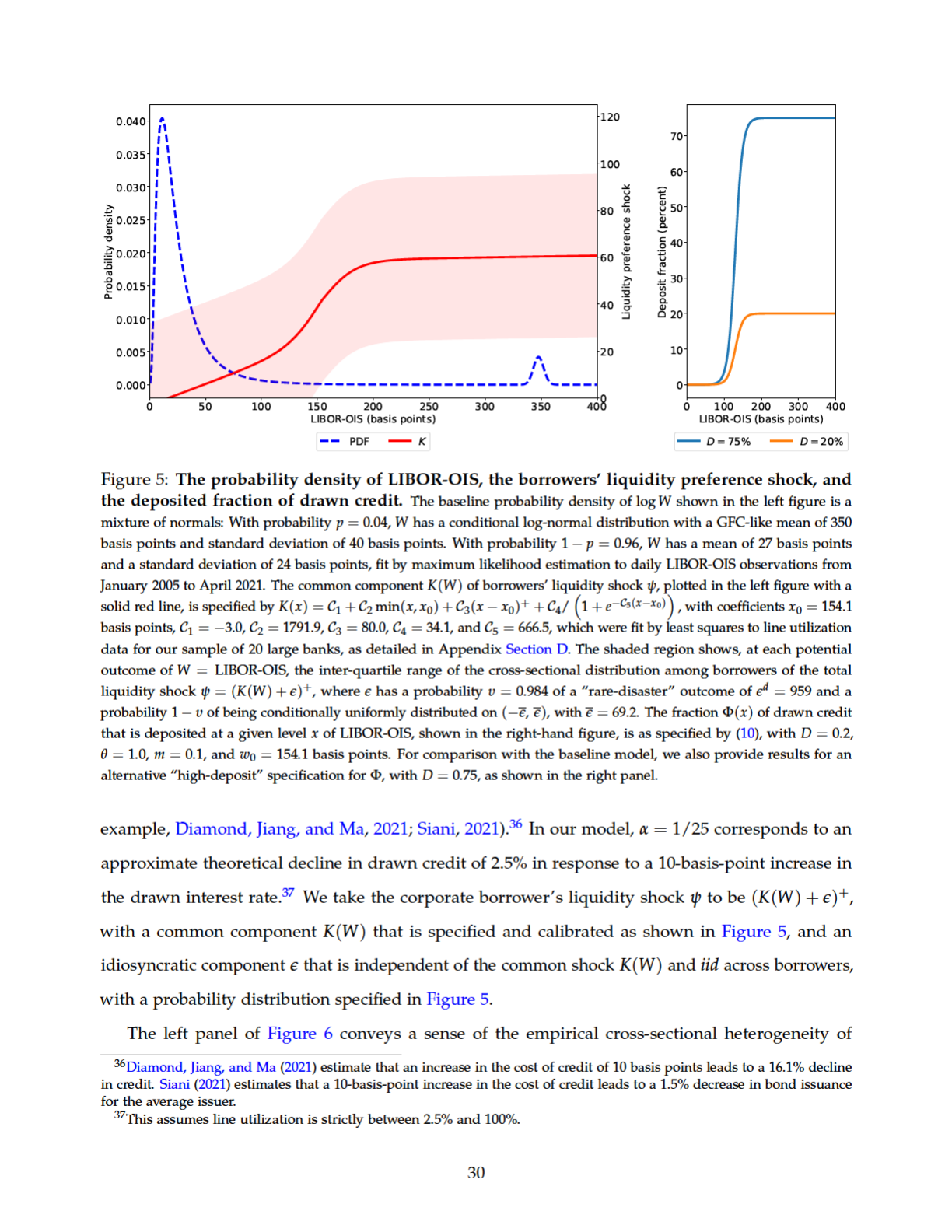

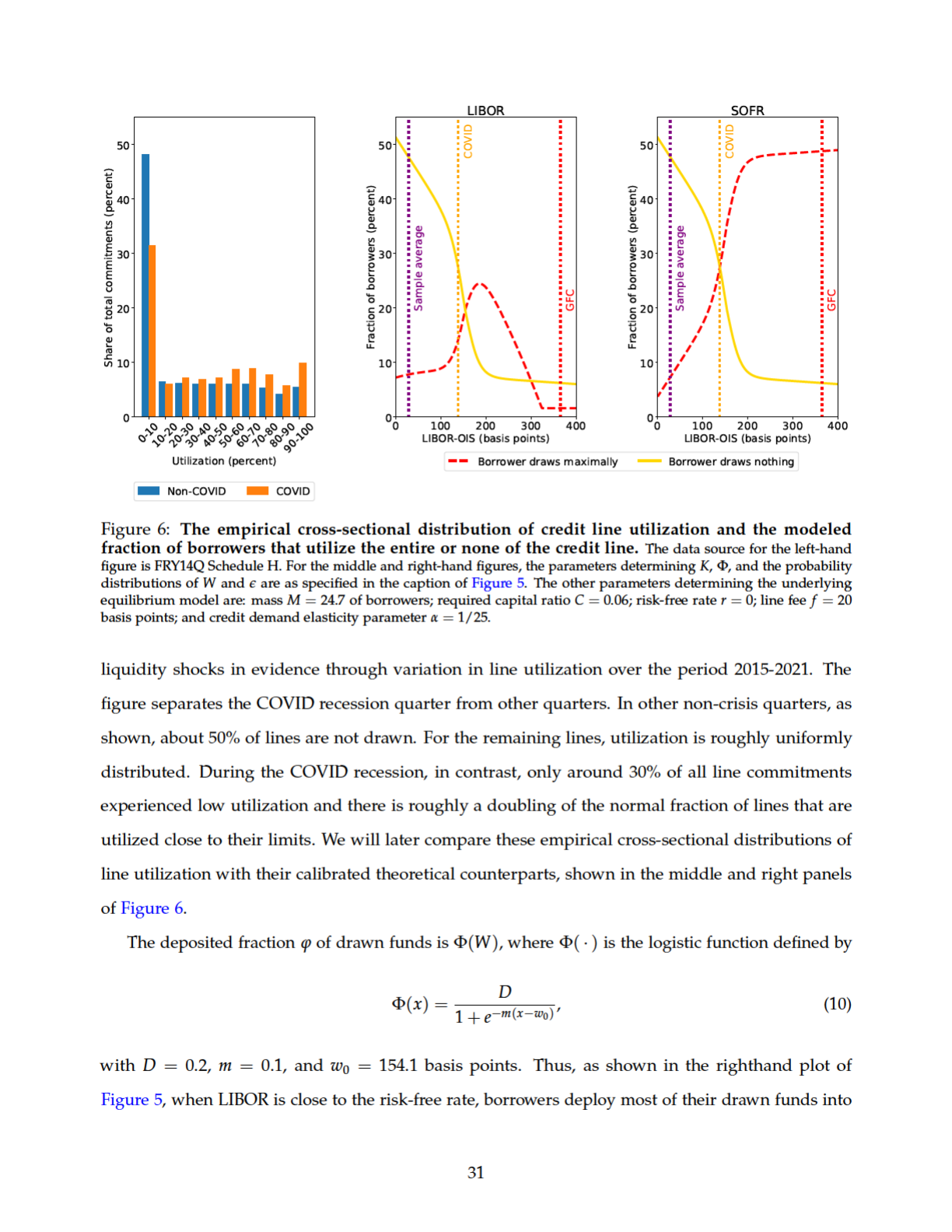

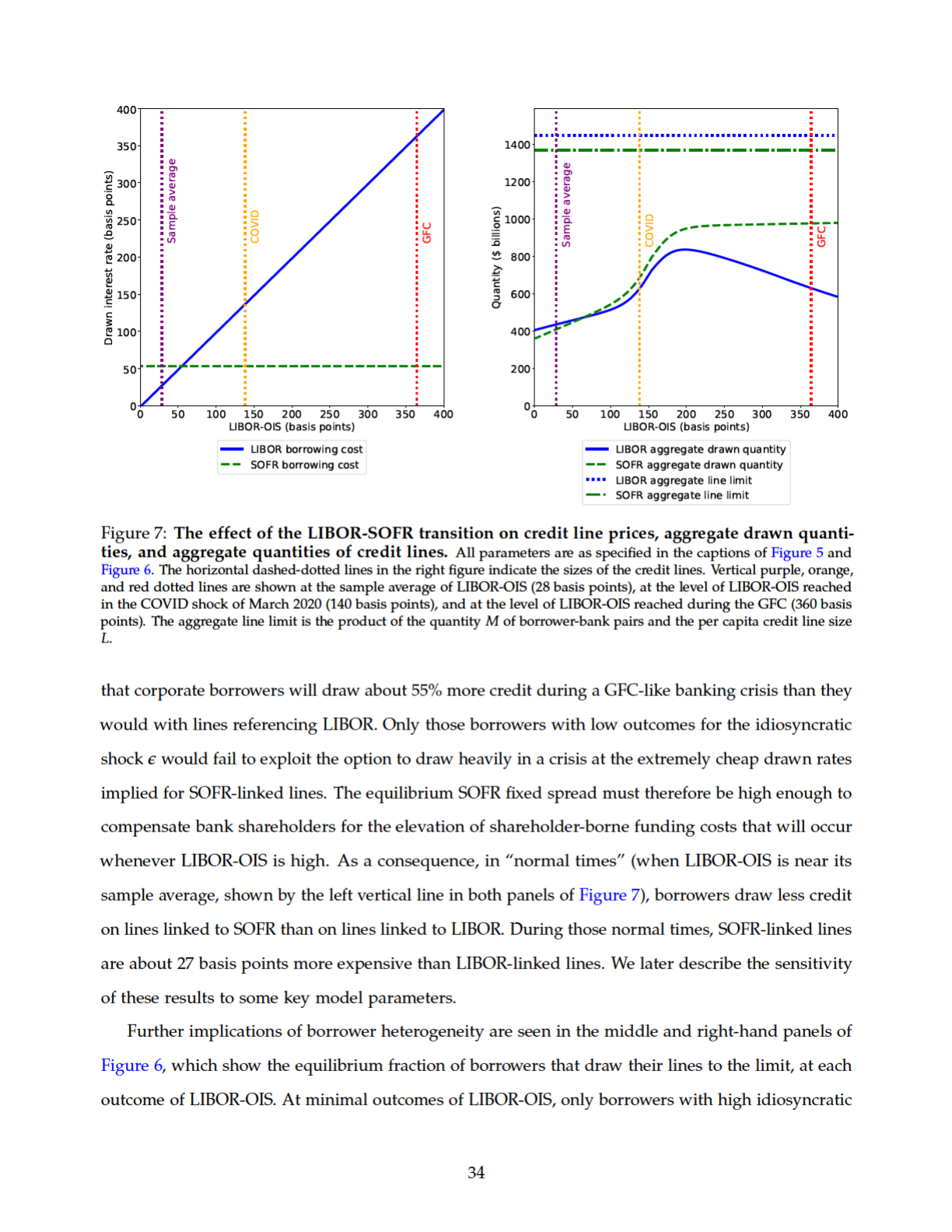

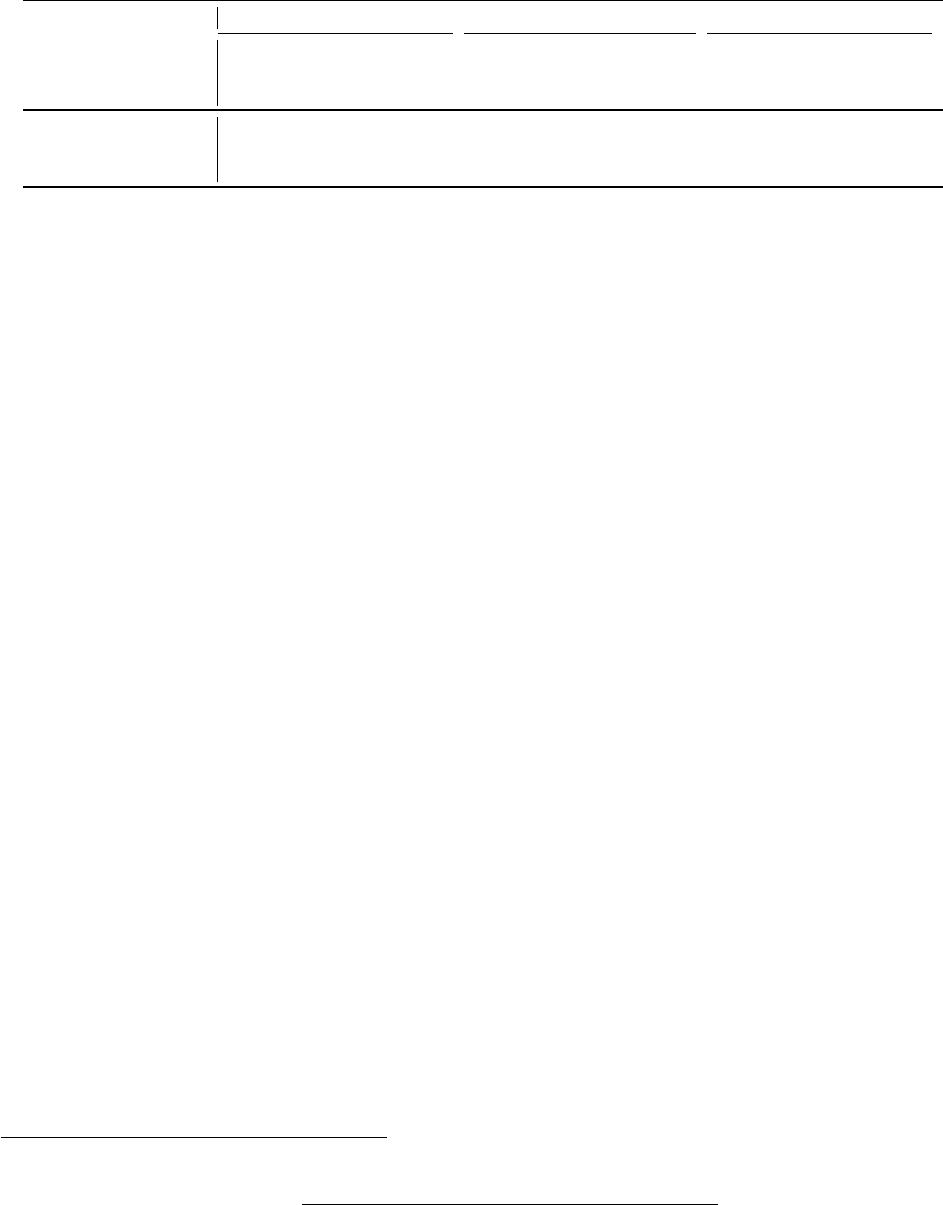

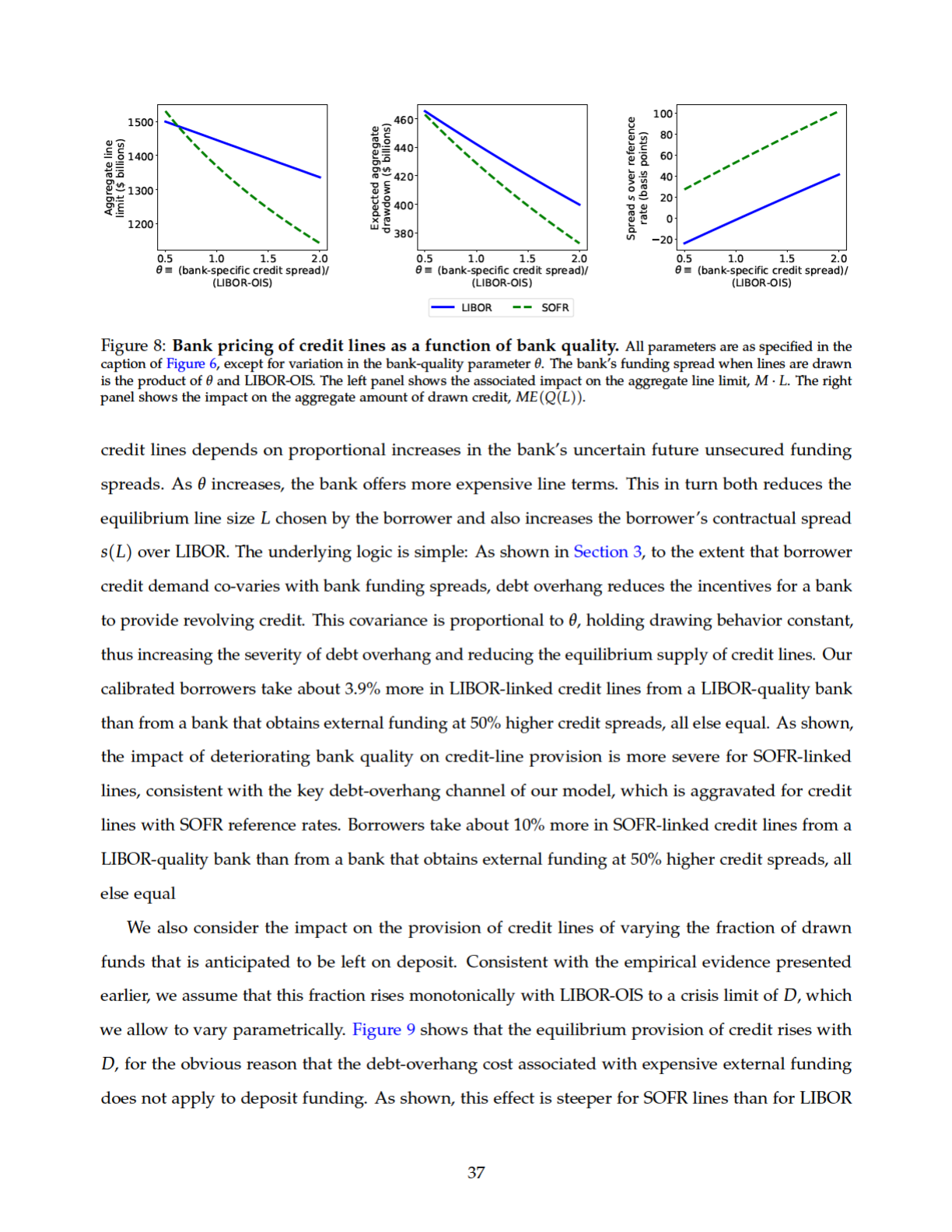

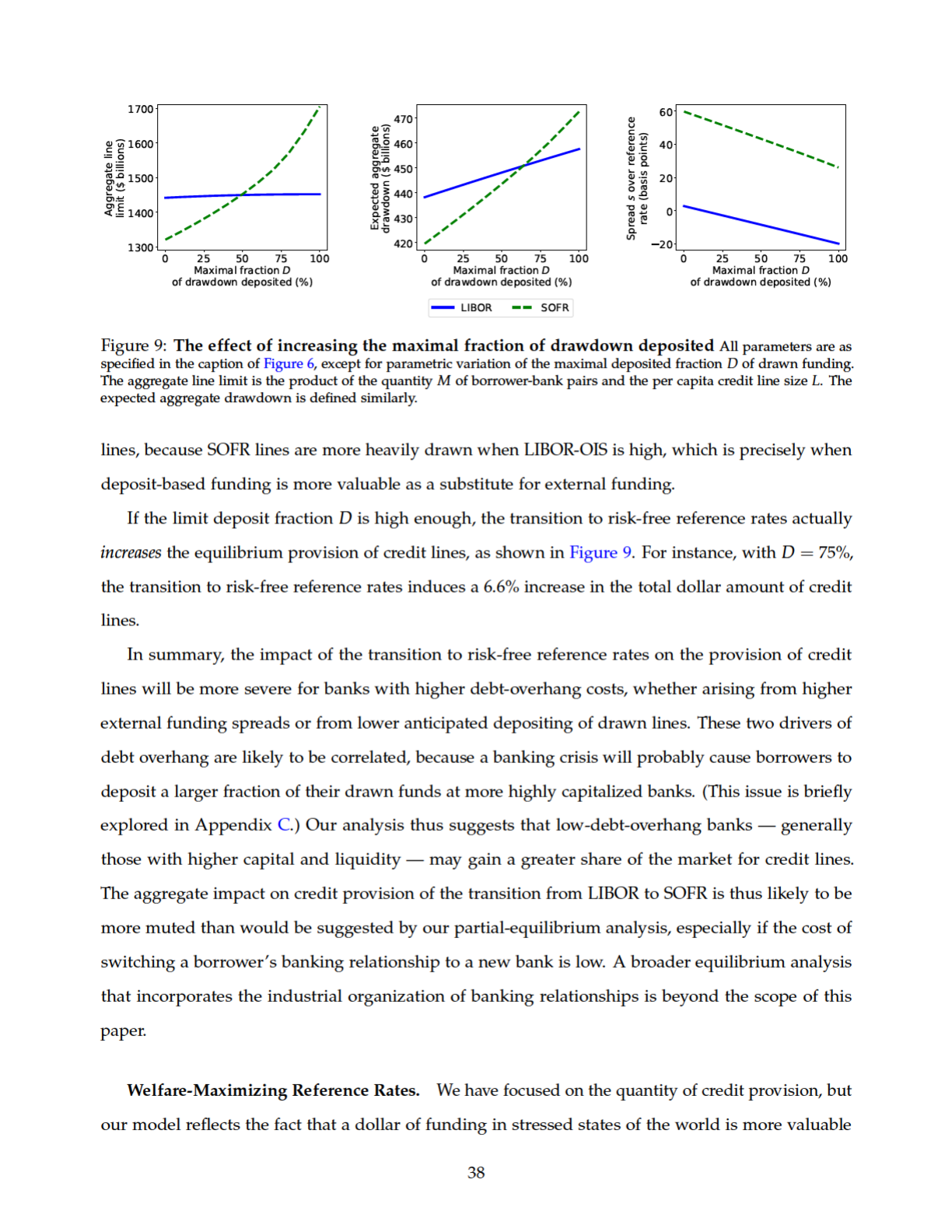

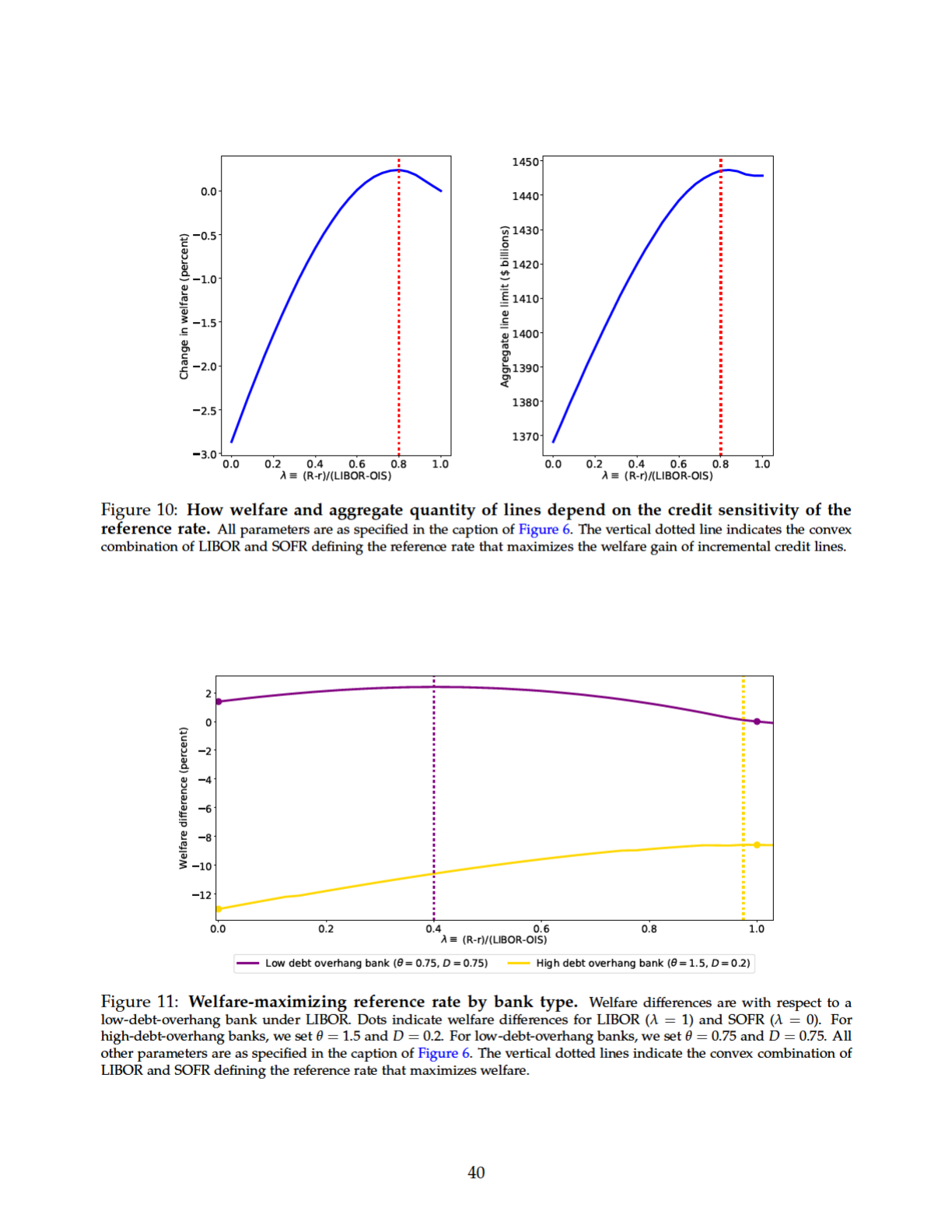

account-level deposit information, so we cannot establish a direct link between drawdowns and