ALTERNATIVE REFERENCE RATES COMMITTEE

1

Frequently Asked Questions

Version: August 27, 2021

1

These Frequently Asked Questions were prepared by the Alternative Reference Rates Committee (ARRC) for use by

market participants and are current as of the version date noted above. This document will evolve as new developments

and questions arise. If you have a question to which you are seeking an answer, general ARRC inquiries can be

directed to the ARRC Secretariat at [email protected]. The ARRC will endeavor to incorporate those topics below.

Please also visit the ARRC’s website or sign up to receive alerts from the ARRC. Thank you.

ARRC

OVERVIEW

..........................................................................................................................................................................

2

1.

What is the ARRC and how have its key priorities evolved over time?

....................................................................................................

2

2. Which organizations are members of the ARRC? .........................................................................................................................................

3

SOFR OVERVIEW

..........................................................................................................................................................................

3

3.

What is SOFR, the ARRC’s recommended alternative to USD LIBOR?

.....................................................................................

3

4.

What was involved in the ARRC’s process for selecting SOFR?

...................................................................................................

3

5.

What makes SOFR the strongest alternative to USD LIBOR?

..................................................................................................................

4

6.

Who administers and produces SOFR and how is the rate production process reviewed?

..................................................................

7

7.

What sort of financial products can reference forms of overnight SOFR?

..............................................................................................

8

8.

Is it required that USD LIBOR-based products transition to SOFR specifically, and what tools are there to do so?

....................

8

9.

Who is being impacted by this transition from USD LIBOR to SOFR?

.................................................................................................

9

10.

How does SOFR compare to other “IBOR” alternatives selected in other countries?

.................................................................

9

11.

How practical is SOFR for use in financial contracts, in terms of its smoothness?

.............................................................................

10

SOFR TERM RATE

......................................................................................................................................................................

11

12.

What is the status of a forward-looking SOFR term rate?

..................................................................................................................

11

13.

Why did the ARRC publish recommendations related to the scope of use of the SOFR Term Rate?

.......................................

12

14.

The ARRC stated that it supported the use of SOFR Term Rate derivatives for end -user facing derivatives intended to

hedge cash products that reference the SOFR Term Rate. For these purposes, what constitutes an end-user facing derivative

hedging a SOFR Term Rate cash product?

.............................................................................................................................................................

13

15.

Does the ARRC’s recommendation of the SOFR Term Rate mean that it now

only

recommends use of SOFR Term Rates

in fallback language and does not recommend that other forms of SOFR be referenced as fallbacks in new or renegotiated

contracts referencing LIBOR? ...................................................................................................................................................................................

14

16.

What relation do these ARRC recommendations have to supervisory expectations or CME licensing agreements for the

SOFR Term Rate?

.......................................................................................................................................................................................................

14

CONTRACT

LANGUAGE

............................................................................................................................................................

15

17.

What is “fallback language”?

...................................................................................................................................................

15

18.

What should market participants do to strengthen fallbacks in cash products?

..............................................................................

16

19.

What should market participants do to strengthen fallback language in derivatives?

.....................................................................

16

20.

What is the purpose of spread adjustments, and what spread adjustments are recommended for cash products and

derivatives?

.....................................................................................................................................................................................................................

16

TRANSITION STATUS AND LATEST DEVELOPMENTS

....................................................................................................

17

21.

When will USD LIBOR stop publishing?

...............................................................................................................................................

17

22.

How will legacy contracts be impacted by the March 5, 2021 USD LIBOR endgame announcements, and what is the plan

for contracts that mature after mid-2023?

...............................................................................................................................................................

18

23.

How do the Q4 2020 announcements by regulators and IBA and the March 2021 announcements by the Federal Reserve

Board of Governors about USD LIBOR’s endgame impact the ARRC’s Recommended Best Practices?

..........................................

18

1

Updated on June 9, 2022 to reflect passage of federal LIBOR legislation.

ALTERNATIVE REFERENCE RATES COMMITTEE

2

ARRC OVERVIEW

1. What is the ARRC and how have its key priorities evolved over time?

The ARRC is a group of financial market participants convened to help ensure a successful

transition from U.S. dollar LIBOR to a more robust reference rate, its recommended

alternative, the Secured Overnight Financing Rate (SOFR). The ARRC is comprised of a

diverse set of private-sector entities, each with an important presence in markets affected by

U.S. dollar (USD) LIBOR, and a wide array of official-sector entities, including banking and

financial sector regulators, as ex-officio members.

The Federal Reserve Board and the New York Fed jointly convened the ARRC in 2014, in

response to recommendations and objectives set forth by the Financial Stability Board (FSB)

and the Financial Stability Oversight Council to address risks related to USD LIBOR. The

ARRC’s initial objectives were to identify risk-free alternative reference rates for USD

LIBOR, identify best practices for contract robustness, and create an implementation plan

with metrics of success and a timeline to support an orderly adoption. The ARRC

accomplished its first set of objectives, and in 2017, identified SOFR as the rate that

represents best practice for use in certain new USD derivatives and other financial contracts.

It also published its Paced Transition Plan, with specific steps and timelines designed to

encourage adoption of SOFR.

The ARRC was reconstituted in 2018 with an expanded membership to help ensure the

successful implementation of the Paced Transition Plan and address the risk of LIBOR not

being usable beyond 2021. It was reconstituted to serve as a forum to coordinate planning

across cash and derivatives products as well as market participants currently using USD

LIBOR.

The ARRC first published Recommended Best Practices in 2020. The Best Practices provide

timelines and interim milestones that the ARRC believes are appropriate for transitioning

away from USD LIBOR in a way that will minimize market disruption and support a

smooth transition.

The ARRC’s work complements parallel efforts in each of the other LIBOR currency

jurisdictions. After all, reference rate reform is an international effort, and the need to

transition away from LIBOR to alternative reference rates is not limited to USD LIBOR.

Most major currency jurisdictions have identified a need for reforming major interest rate

benchmarks, and committees similar to the ARRC have been formed in the other currencies

for which LIBOR is quoted. To the extent possible, the ARRC seeks to coordinate its plans

with these other groups.

For more details, see the ARRC’s Second Report. For more details on international efforts

for reference rate reform, see the working groups in the U.K., Switzerland, Japan, and the

euro area, and the Official Sector Steering Group (OSSG)

ALTERNATIVE REFERENCE RATES COMMITTEE

3

2. Which organizations are members of the ARRC?

The ARRC’s structure facilitates collaboration between the market and the official sector.

The full list of members and ex-officio members is here on the ARRC’s website.

The ARRC's membership is made up of a broad set of private-sector participants —

including banks, asset managers, insurers and industry trade organizations — and official

sector ex-officio members.

A minority of the ARRC membership are banks, or are associated with banks. This

membership allows the group to have diverse participation across financial services.

Participation in the ARRC has grown considerably since its inception in 2014. There are now

more than 300 member and nonmember institutions committed to a stable transition.

Additionally, working groups beyond ARRC members have also helped provide broad

coverage of applicable markets and required expertise and viewpoints, including non-

financial corporations and consumer advocacy groups.

SOFR OVERVIEW

3. What is SOFR, the ARRC’s recommended alternative to USD LIBOR?

SOFR is a fully-transaction based, nearly risk-free reference rate. It is a broad measure of the

cost of borrowing cash overnight collateralized by U.S. Treasury securities.

SOFR covers the most volume of transactions of any rate based on the U.S. Treasury

repurchase agreement (repo) market. It is based on transaction data from three segments of

the Treasury repo market: (i) tri-party repo, (ii) General Collateral Finance (GCF) repo, and

(iii) bilateral repo transactions cleared through the Fixed Income Clearing Corporation

(FICC). As a good representation of conditions in the overnight Treasury repo market,

SOFR reflects an economic cost of lending and borrowing by the wide array of market

participants active in the market.

The New York Fed publishes daily SOFR data available here. The New York Fed also

publishes a set of SOFR Averages and a SOFR Index, available here. The SOFR Averages

are compounded averages over rolling 30-, 90-, and 180-calendar day periods, and the SOFR

Index allows for the calculation of compounded average rates over custom time periods.

See FAQ 5 for more information on the significant depth and breadth of transactions underpinning SOFR,

which dwarfs the volume underlying LIBOR. See FAQ 11 for details on the use of SOFR Averages in

financial contracts and the smoothness of those averages.

4. What was involved in the ARRC’s process for selecting SOFR?

After more than two years of research and consultation, the ARRC identified SOFR as the

most suitable alternative reference rate for USD LIBOR.

ALTERNATIVE REFERENCE RATES COMMITTEE

4

In recommending SOFR as the alternative reference rate, the ARRC considered a variety of

factors, including the depth of the underlying market and its likely robustness over time; the

rate’s usefulness to market participants; and whether the rate’s construction and governance

would be consistent with the International Organization of Securities Commissions’

(IOSCO) Principles for Financial Benchmarks.

The ARRC considered the input of a wide range of market participants before selecting

SOFR to ensure that its recommendation reflected a wide consensus of market participants.

The ARRC received feedback from an Advisory Group it formed, consisting of a diverse set

of users of LIBOR-linked products active in a range of market sectors. In addition, the

ARRC published an Interim Report and Consultation laying out possible rate choices and

seeking market views as it moved to select a rate.

As part of its evaluation process, the ARRC considered a comprehensive list of potential

alternatives, including:

• Term unsecured rates

• Overnight unsecured rates like the Overnight Bank Funding Rate (OBFR)

• Term secured rates

• Overnight secured rates like SOFR

• Treasury bill and bond rates

The ARRC ultimately concluded that a term unsecured lending rate would not be robust

enough given the limited transactions, unstable samples of borrowers, and sensitivity to

market stress that term unsecured borrowing markets exhibit. Although term secured rates

were considered, it was determined that there is not sufficient trading to support such a rate.

After extensive discussion, the ARRC narrowed its list of potential alternatives to USD

LIBOR to two rates that it considered the be the strongest candidates: an overnight

unsecured rate (OBFR) and an overnight Treasury repo rate (SOFR).

In June 2017, the ARRC, with the support of a significant majority of its Advisory Group,

announced it had selected SOFR as its preferred alternative to USD LIBOR.

See FAQ 5 for the factors that make SOFR the strongest alternative to USD LIBOR.

5. What makes SOFR the strongest alternative to USD LIBOR?

The ARRC believes that SOFR is the most appropriate reference rate for widespread and

long-term adoption because, among other reasons, it is based on transactions in the Treasury

repo market, a market which features both exceptional depth and breadth.

When the ARRC was evaluating potential alternatives to USD LIBOR, it was clear that the

transaction volume underlying SOFR was far larger than volumes in other U.S. money

markets.

ALTERNATIVE REFERENCE RATES COMMITTEE

5

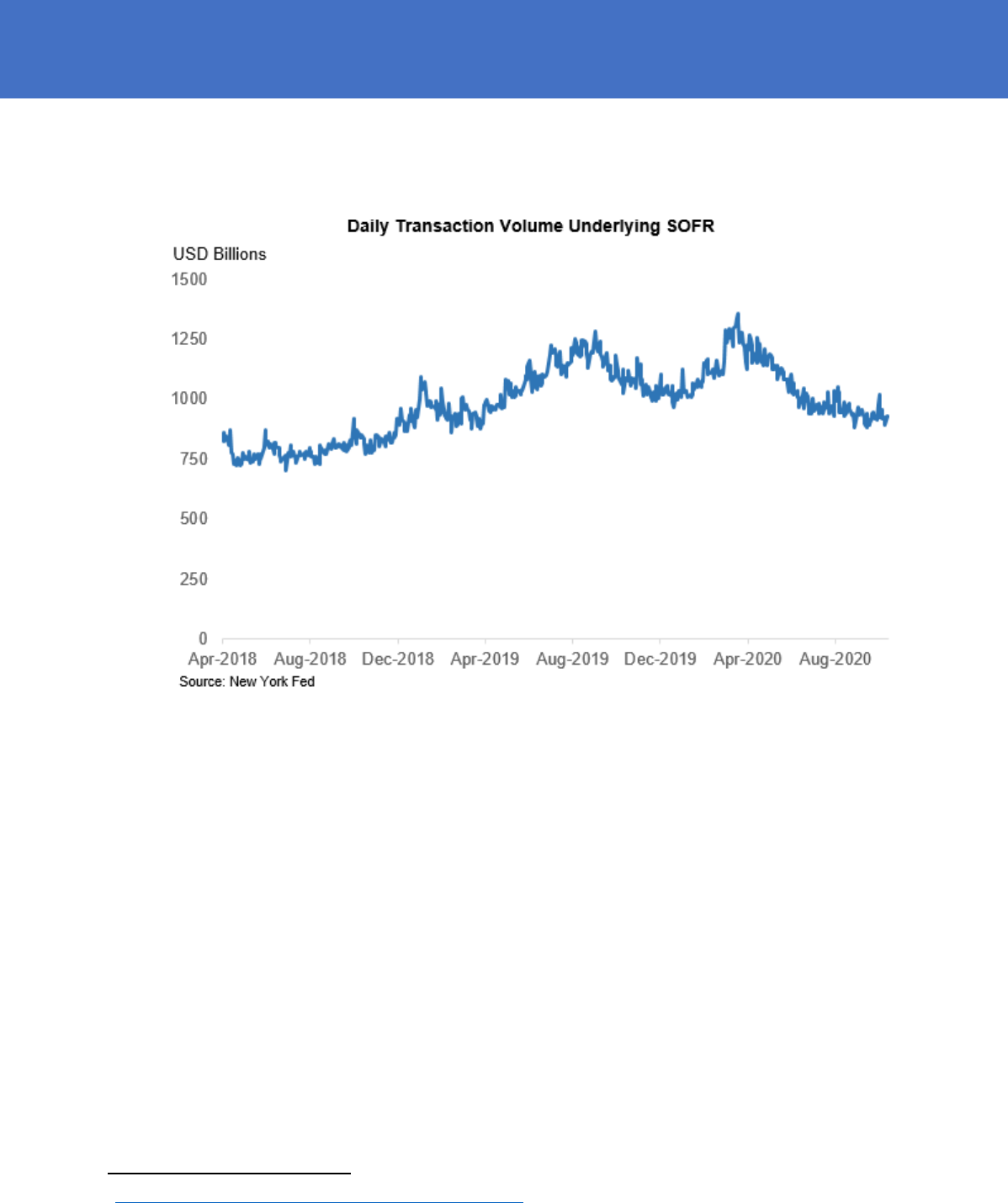

Since SOFR first was published in April 2018, daily transaction volume underlying SOFR

has averaged more than $980 billion. As shown in the chart below, the transaction volume

often has exceeded $1 trillion and it has never been less than $700 billion.

Not only does the overnight Treasury repo market have significant transaction volume, there

also are a wide range of financial market participants that regularly transact in, and have

access to it. As such, SOFR reflects activity undertaken by diverse types of institutions,

including asset managers, banks, corporate treasurers, insurance companies, money market

funds, pension funds, and more. This market reflects the best available measure of the

private sector’s near risk-free rate of borrowing relevant to a wide segment of market

participants.

The variety of borrowers and lenders active in the repo market underlying SOFR is evidence

of the market’s breadth:

• Data from the GCF Repo and FICC DVP markets, the two U.S. venues for inter-

dealer trading, demonstrate that a broad set of participants are active in the inter-

dealer market.

2

In both venues together, the top five largest cash-lenders and cash-borrowers

account for 44.2 and 40.2 percent of total activity, respectively. Furthermore,

the largest ten participants on the cash-lenders and cash-borrowers side

account for only 63.6 and 56.7 percent of total activity.

In FICC DVP alone, there are close to one hundred participants active on

each side of the market on a typical day. There, the top five largest cash-

2

Liberty Street Economics: How Competitive are U.S. Treasury Repo Markets?, Federal Reserve Bank of New York, February 18, 2021.

ALTERNATIVE REFERENCE RATES COMMITTEE

6

lenders and cash-borrowers account for an average of only 45.2 and 41.2

percent of total activity, respectively.

In contrast, the GCF Repo concentration statistics reflect some

concentration, with the top five largest cash-lenders and cash-borrowers

accounting for 77.2 and 80.7 percent of total activity, respectively, and the

top ten participants accounting for more than 95 percent of activity on both

sides of the market. These statistics are not surprising however, considering

there are only thirteen or fourteen active cash-lenders or cash-borrowers

active on a typical day.

• In the tri-party segment of the overnight Treasury repo market, representing a

portion of dealer-to-client trading, there typically are 40 to 50 different firms

borrowing cash each day, and roughly 120 firms lending.

3

• The top ten lenders in the market underlying SOFR account for only just over half

of all lending activity. The Herfindahl-Hirschman Index, a widely used measure of

market concentration, is below 600 for the market underlying SOFR—a value

consistent with a competitive market.

4

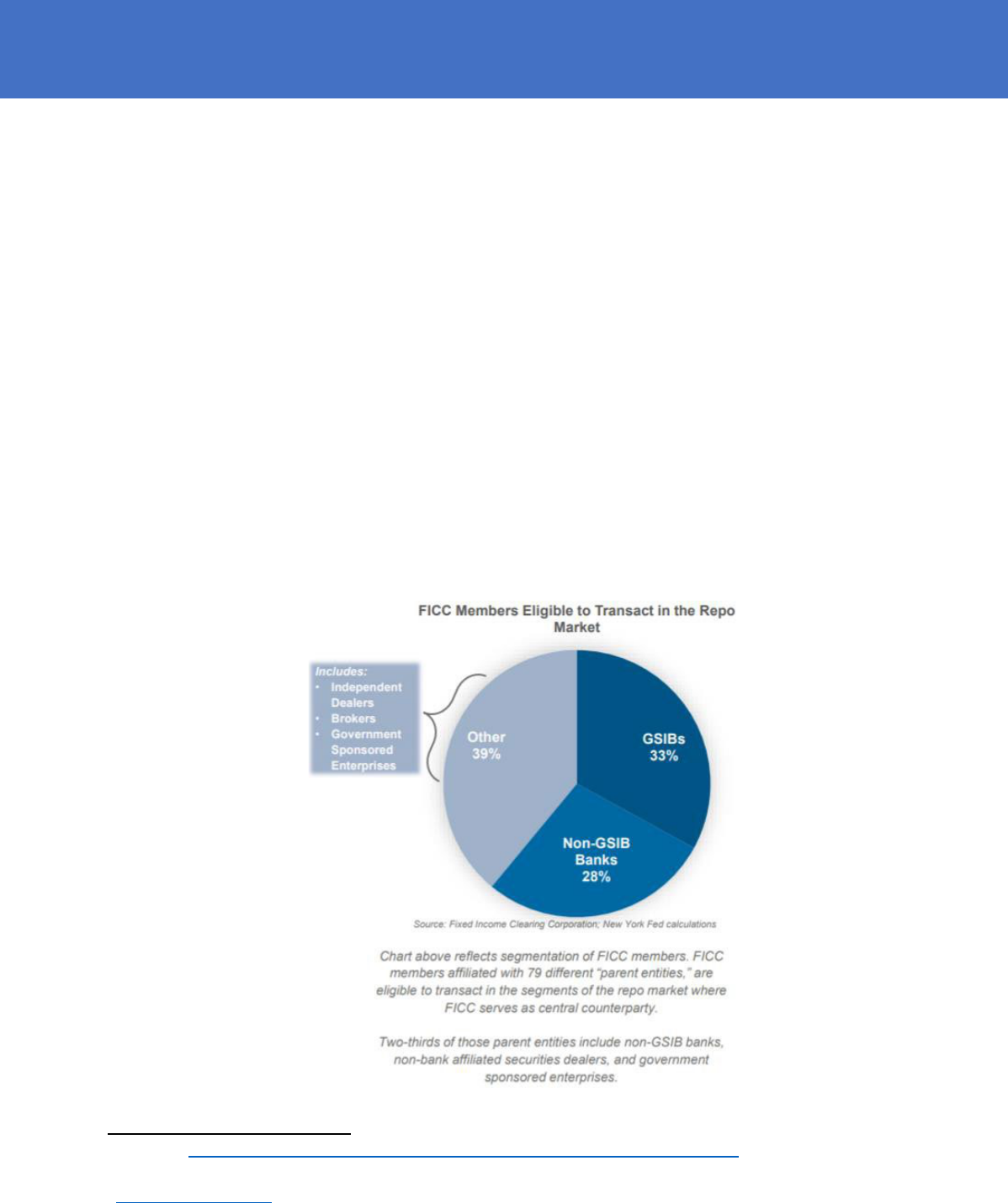

• In 2020, repo transactions cleared through the FICC have accounted for roughly

60% of daily transaction volume underlying SOFR. Within that segment of the

market alone, there are roughly 2,000 entities who are eligible to transact, either as

members of FICC or through its “sponsored membership” program.

5

3

Nate Wuerffel, Transitioning Away From LIBOR: Understanding SOFR’s Strengths and Considering the Path Forward, remarks before the Bank

Policy Institute, September 18, 2020.

4

Wuerffel, remarks.

5

SOFR Starter Kit: Factsheet 2, ARRC, August 7, 2020.

ALTERNATIVE REFERENCE RATES COMMITTEE

7

Beyond direct participation in the Treasury repo market, there are a significant number of

entities with indirect exposure to the market. For example, any investor in the $4.5 trillion

money market fund industry likely has exposure to the repo market. Similarly, pension funds

that serve millions of members typically lend cash in the repo market.

6

The breadth of this market is critical to enabling SOFR to accurately reflect market

conditions today. It also positions SOFR to adapt as the repo market evolves, so that it will

continue to reflect a deep, liquid, and broad market over time. After all, SOFR’s underlying

market is the largest rates market at a given maturity in the world, and SOFR encompasses

the widest coverage of the market available. For more information on these dynamics, please

see a February 2021 Liberty Street Economics blog post available here.

Finally, how SOFR is administered, produced, and publicly published also contribute to

making it such a strong alternative reference rate.

See FAQ 3 for more details on repo market segments underlying SOFR. See FAQ 6 for details on the

New York Fed’s approach to producing SOFR, including insuring it is produced in accordance with

internationally-accepted best practices.

6. Who administers and produces SOFR and how is the rate production process

reviewed?

The New York Fed is the administrator of SOFR and produces the rate in cooperation with

the Treasury Department’s Office of Financial Research (OFR). The New York Fed

publishes SOFR on a daily basis on its website at approximately 8:00 a.m. eastern time.

Additionally, the New York Fed publishes 30-, 90-, and 180-day SOFR Averages and a

SOFR Index to support a successful transition away from USD LIBOR.

An internal New York Fed Oversight Committee periodically reviews the rate production

process. The Oversight Committee consists of members from across the New York Fed’s

organizational structure who are not involved in the daily production of SOFR. It is chaired

by the New York Fed’s Chief Risk Officer and includes senior staff from various control

areas of the New York Fed, in addition to a representative from the OFR.

As mentioned in FAQ 5, SOFR is well-placed to adapt as the repo market evolves. The

depth of its underlying market and its ability to continue to accurately measure funding costs

in the U.S. Treasury repo market, means SOFR can be expected to remain robust over time.

The New York Fed has endeavored to adopt policies and procedures consistent with best

practices for financial benchmarks, including the IOSCO Principles for Financial

Benchmarks. Annually, the New York Fed assesses the compliance of the reference rates it

administers and produces with the IOSCO Principles and releases an IOSCO Statement of

Compliance online.

6

SOFR Starter Kit: Factsheet 2, ARRC.

ALTERNATIVE REFERENCE RATES COMMITTEE

8

For more information on the production of SOFR and the New York Fed’s other repo

reference rates, see here and here. For daily prints of SOFR, see here.

7. What sort of financial products can reference forms of overnight SOFR?

SOFR is a fully transaction-based, overnight near risk-free reference rate and is a good

representation of general funding conditions in the U.S. money markets. As such, SOFR is

suitable to be used across a broad range of financial products, including but not limited to,

derivatives (listed, cleared, and bilateral-OTC), and many variable rate cash products that

have historically referenced LIBOR. SOFR is also suitable as a reference rate to be used as a

general proxy for interest rates in a range of business processes (accounting, valuation, and

financial modeling). Issuers and lenders will face a technical choice between using a simple

or a compound average of SOFR as they seek to use SOFR in cash products. In the short-

term, using simple interest conventions may be easier since many systems are already set up

to accommodate it. However, compounded interest would more accurately reflect the time

value of money, which becomes a more important consideration as interest rates rise, and it

can allow for more accurate hedging and better market functioning. There are already many

tools for using forms of overnight SOFR now that can meet the needs of most investors,

borrowers, and lenders, including the New York Fed published SOFR averages available

here. The ARRC has also published a User’s Guide to SOFR, available here.

8. Is it required that USD LIBOR-based products transition to SOFR specifically, and

what tools are there to do so?

SOFR is the ARRC’s preferred alternative to USD LIBOR. The ARRC remains focused on

facilitating a smooth transition away from USD LIBOR, and believes that SOFR is the

strongest alternative rate. It’s a robust rate that can be used in a wide variety of products, and

it’s available now.

With that in mind, it is important to note that the ARRC supports a vibrant and innovative

market with reference rates that are robust, IOSCO compliant, and available for use before

the end of 2021. The ARRC’s recommendations have always been voluntary and it

recognizes that market participants may choose other rates, but any solutions must be

robust.

Although the adoption of SOFR is voluntary, the fact that LIBOR will become unusable

soon makes it essential that market participants consider moving to alternative rates such as

SOFR and that they have appropriate fallback language in existing contracts referencing

LIBOR.

The ARRC is making it as straightforward as possible for market participants to transition to

SOFR with tools like recommended fallback language for new cash products that continue

to reference LIBOR, recommended spread adjustment methodologies (here and here),

Recommended Best Practices, and conventions for using SOFR.

Additionally, in conjunction with producing overnight SOFR, the New York Fed produces

SOFR averages along with a SOFR Index. This provides consistently calculated SOFR

ALTERNATIVE REFERENCE RATES COMMITTEE

9

averages across various terms and an index to facilitate the calculation of averages over

custom periods, which should give all market participants the assurance that they can use

averages from the same reliable source.

9. Who is being impacted by this transition from USD LIBOR to SOFR?

Due to the broad use of USD LIBOR as a reference rate, all financial market participants

including retail customers, corporations, issuers, investors, asset managers, service providers

of financial products, and large financial institutions are impacted by the risks associated

with USD LIBOR.

The total exposure to USD LIBOR, as of Q4 2020, was $223 trillion. Although the notional

size of the derivatives markets accounts for a large majority of the outstanding gross notional

value of all financial products referencing USD LIBOR, it is also referenced in several

trillion dollars of corporate loans, floating-rate mortgages, floating rate notes, and securitized

products.

LIBOR is also extensively used across a range of business processes (for example,

accounting, valuation, and financial modeling) across many industries. So beyond financial

products and legal contracts, businesses that have exposure to USD LIBOR embedded in

their business processes are also likely to be impacted.

See FAQ 23 for more on the ARRC’s Recommended Best Practices, and FAQ 17 for more on the

ARRC’s fallback language.

10. How does SOFR compare to other “IBOR” alternatives selected in other countries?

The FSB identified its concerns on the vulnerability of LIBOR across currencies. As a

result, the need to transition away from LIBOR to alternative reference rates is not limited to

USD LIBOR. Most major currency jurisdictions have identified a need for reforming major

interest rate benchmarks. Public/private-sector working groups similar to the ARRC have

been formed in the other currencies for which LIBOR is quoted.

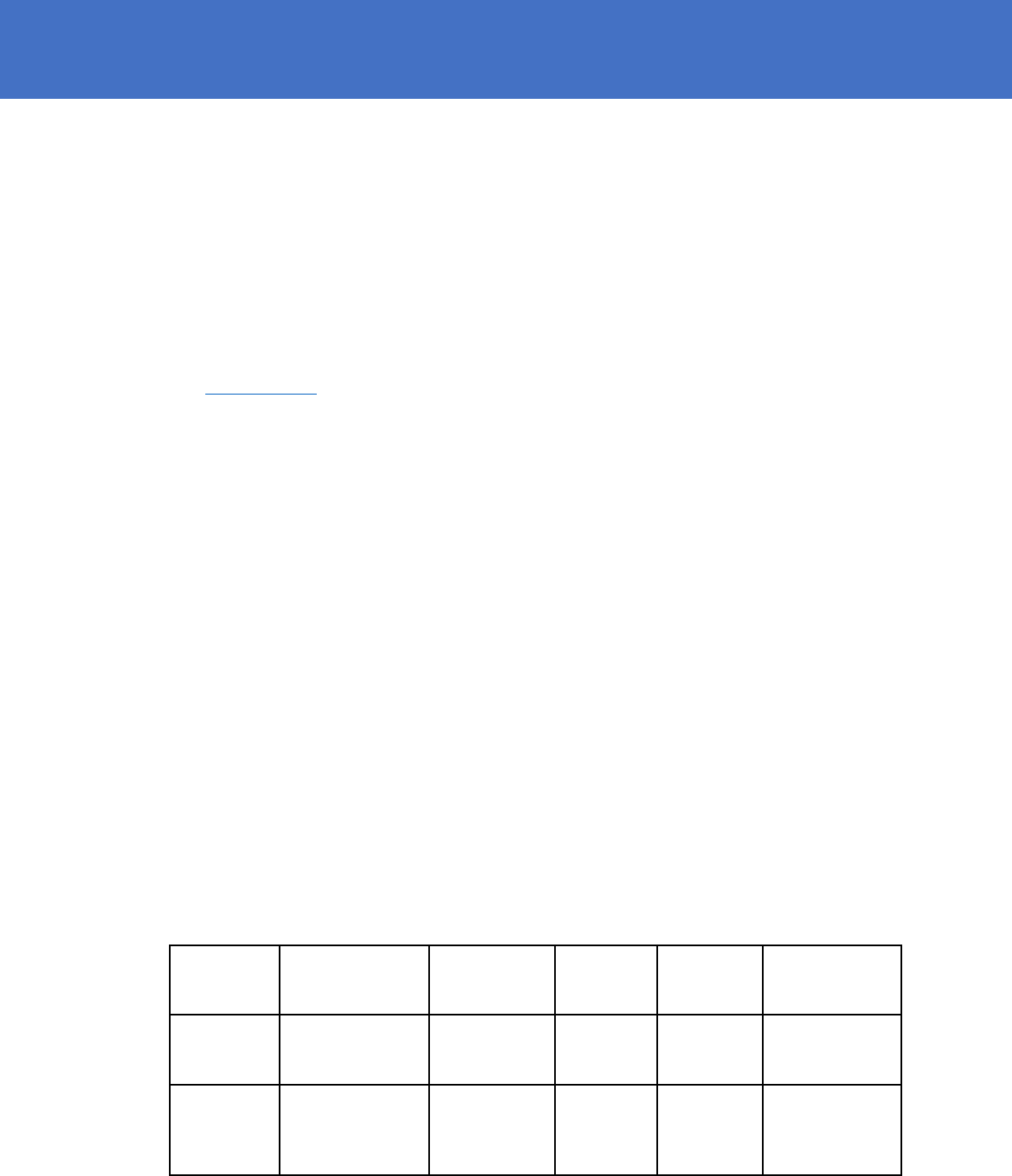

The alternative reference rates selected by the major currency areas are outlined in the table

below. Most have selected some form of overnight rate:

Jurisdiction

Working Group

Alternative

Rate

Secured

vs.

Unsecured

Overnight

vs. Term

Rate

Administration

U.S.

Alternative

Reference Rates

Committee

SOFR

Secured

Overnight

Federal

Reserve Bank

of New York

U.K.

Working Group

on Sterling

Risk-Free

Reference Rates

Reformed

Sterling

Overnight

Index

Unsecured

Overnight

Bank of

England

ALTERNATIVE REFERENCE RATES COMMITTEE

10

Average

(SONIA)

Switzerland

The National

Working Group

on Swiss Franc

Reference Rates

Swiss

Average Rate

Overnight

(SARON)

Secured

Overnight

SIX Swiss

Exchange

Japan

Study Group on

Risk-Free

Reference Rates

Tokyo

Overnight

Average Rate

(TONAR)

Unsecured

Overnight

Bank of Japan

Euro area

Working Group

on Risk-Free

Reference Rates

for the Euro

Area

Euro Short-

Term Rate

(€STR)

Unsecured

Overnight

ECB

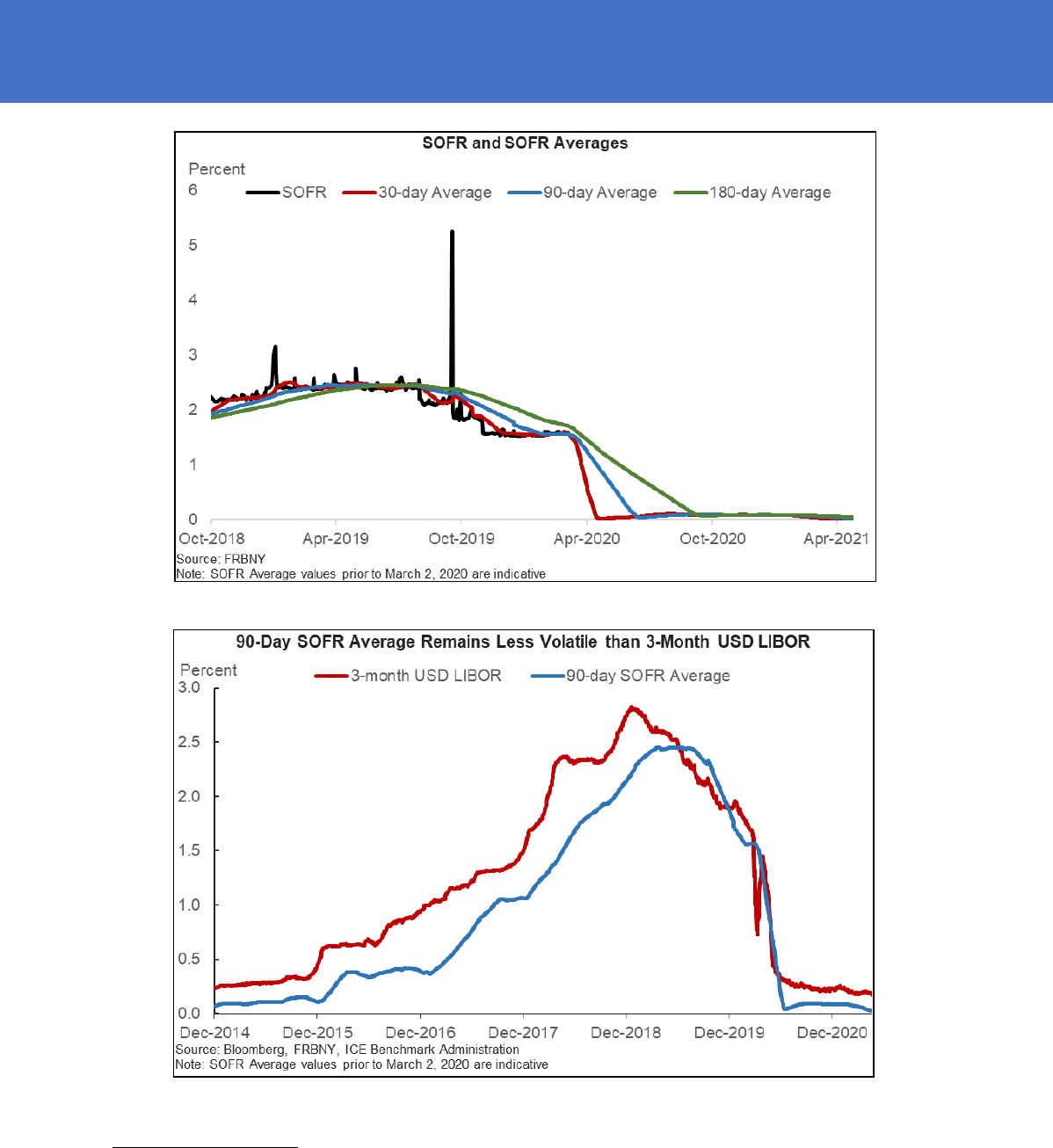

11. How practical is SOFR for use in financial contracts, in terms of its smoothness?

While SOFR and other overnight repo rates can be more volatile than term rates on a day-

to-day basis, it is important to remember that contracts referencing SOFR are based on

average of SOFR (see SOFR Averages and Index Data). SOFR futures and OIS, and the

many SOFR floating rate notes that have been issued all use an average of SOFR over a

fixed period of time as the floating rate paid under the terms of the contract, not a single

day’s realization of SOFR.

These averages of SOFR have been quite smooth and can be easily referenced in financial

contracts, as demonstrated by the growing use of SOFR in futures, swaps, and floating-rate

debt. The ARRC’s Second Report (Figure 5 of the report) emphasized this point, showing

that a 3-month average of overnight Treasury repo rates has historically been less volatile

than 3-month U.S. dollar LIBOR over a wide range of market conditions.

The charts below similarly make clear that this remains the case, even given the volatility

witnessed in repo markets in mid-September 2019, over year-end 2018 and during the

market turmoil of March 2020. The first chart below shows SOFR along with 30-, 90- and

180-day averages of SOFR. The volatility in SOFR is clearly visible, but it also can be seen to

have had negligible impact on the averages of SOFR. The second chart clearly demonstrates

that the point made in the ARRC’s Second Report remains true: a 90-day average of SOFR

is less volatile than 3-month LIBOR. For example, although SOFR rose sharply in mid-

September 2019 due to a number of factors, a 90-day average of SOFR only rose 2 basis

points relative to the week before those fluctuations, while 3-month LIBOR rose 4 basis

points.

ALTERNATIVE REFERENCE RATES COMMITTEE

11

SOFR TERM RATE

12. What is the status of a forward-looking SOFR term rate?

ALTERNATIVE REFERENCE RATES COMMITTEE

12

In late July, the ARRC announced that it was formally recommending CME Group’s

forward-looking SOFR term rates (SOFR Term Rate), following the completion of a key

change in interdealer trading conventions on July 26, 2021 under the SOFR First initiative.

The ARRC’s formal recommendation of SOFR Term Rate is a major milestone in the

transition away from USD LIBOR, providing market participants with an essential transition

tool and marking the completion of the Paced Transition Plan that the ARRC outlined in

2017 and has been working toward since. The successful SOFR First convention change,

along with the continued growth in SOFR cash and derivatives markets, allowed the ARRC

to recommend SOFR Term Rate, consistent with the principles and indicators it established

to do so.

Ahead of the formal recommendation of the SOFR Term Rate, the ARRC announced

conventions and best practices for use of how best to employ the SOFR Term Rate to

successfully transition away from USD LIBOR.

See FAQ 13 for more information about what is envisioned for use of the SOFR Term Rate.

13. Why did the ARRC publish recommendations related to the scope of use of the

SOFR Term Rate?

The ARRC published principles related to scope of use before finalizing a recommended

scope of use. One particular principle articulated why limits to scope of use were important

as follows:

“The rate should…have a limited scope of use, to avoid (i) use that is not in proportion to

the depth and transactions in the underlying derivatives market or (ii) use that materially

detracts from volumes in the underlying SOFR-linked derivatives transactions that are relied

upon to construct a term rate, making the term rate itself unstable over time.”

The ARRC’s recommendations related to scope of use of the SOFR Term rate are intended

to promote that objective.

Consistent with that objective, the ARRC continues to recommend SOFR for all products,

and as a general principle, recommends that market participants use overnight SOFR and

SOFR averages given their robustness, particularly in markets where we have seen that there

can be successful adoption of these rates. But the ARRC also recognizes that there could be

certain conditions where adapting to an overnight rate could be more difficult and it thus

developed its recommendations for the use of the SOFR Term Rate.

In its recommended best practices, the ARRC highlighted particular areas where use of the

SOFR Term Rate will be helpful to support a smooth transition away from USD LIBOR,

taking into account feedback from a broad set of stakeholders. The ARRC noted that SOFR

Term Rate will be especially helpful for the business loans market—particularly multi-lender

facilities, middle market loans, and trade finance loans—where transitioning from LIBOR to

an overnight rate has been difficult.

ALTERNATIVE REFERENCE RATES COMMITTEE

13

In addition, the ARRC recommended that “any use of SOFR Term Rate derivatives be

limited to end-user facing derivatives intended to hedge cash products that reference the

SOFR Term Rate. This limitation is intended to avoid use that is not in proportion to, or

materially detracts from, the depth of transactions in the underlying derivatives markets that

are essential to the construction of the SOFR Term Rate over time.”

See FAQ 14 for more information about what is envisioned for use of the SOFR Term Rate in end-user facing

derivatives.

14. The ARRC stated that it supported the use of SOFR Term Rate derivatives for end-

user facing derivatives intended to hedge cash products that reference the SOFR

Term Rate. For these purposes, what constitutes an end-user facing derivative

hedging a SOFR Term Rate cash product?

The ARRC recognizes that some end users may wish to hedge cash products that reference

the SOFR Term Rate with a SOFR Term Rate derivative to simplify their operations and

supports such use of SOFR Term Rate derivatives.

The ARRC, however, does not support the use of the SOFR Term Rate for the vast majority

of the derivatives markets. The ARRC does not recommend the trading of SOFR Term

Rate derivatives in the interdealer market because such activity could undermine trading

activity in the underlying overnight SOFR derivatives that are needed to construct the SOFR

term rate itself and could, thereby, compromise the robustness of the rate and its

corresponding utility to market participants. In general, the ARRC understands that dealers

offering SOFR Term Rate derivatives to end users can effectively warehouse the risk

associated with such offerings, including through the use of overnight SOFR

derivatives. The ARRC understands that most dealers regularly manage basis risks and the

ARRC believes that the basis risk between the use of derivatives based on overnight SOFR

and the SOFR Term Rate will typically be small and well within their capacity to manage

effectively.

• For the purposes of the ARRC’s derivatives recommendations, the ARRC considers

an end user to be a direct party or guarantor to a new SOFR Term Rate business

loan or securitization linked to SOFR Term Rate assets, or to a legacy LIBOR

product that has converted to the SOFR Term Rate through contractual fallback

language or legislation.

• Under the ARRC’s recommended use of SOFR Term Rate derivatives, an end user

(for example, either a lender or borrower who have entered in to a SOFR Term Rate

business loan), could enter in to a SOFR Term Rate swap, cap, swaption, or similar

derivatives contract to hedge that SOFR Term Rate cash product exposure, or a

portfolio of such exposures, and could adjust or unwind that hedge over time,

including through novations. A dealer counterparty to these hedges would not be

considered an end user under these recommendations, and the ARRC does not

recommend that the dealer seek to hedge its own resulting SOFR Term Rate

ALTERNATIVE REFERENCE RATES COMMITTEE

14

exposure with an additional SOFR Term Rate derivative.

7

However, the dealer

counterparty to these hedges could hedge its own exposure using derivatives linked

to forms of overnight SOFR, consistent with the ARRC’s recommendation that

overnight SOFR and SOFR averages be used in cases where a party wishes to hedge

in an efficient and transparent manner.

• The ARRC recognizes that some lending institutions are not structured to make

markets or warehouse the risk of offering derivatives products to end users but may

wish to enter in to a SOFR Term Rate swap, cap, swaption, or similar derivative as

part of their services to help a borrower hedge a SOFR Term Rate business loan. In

this instance, provided that the institution does not make two-way prices in interest

rate derivatives and is not a market maker in the interdealer market for such

derivatives in the regular course of its business, the ARRC considers that the use of

offsetting derivatives matching the derivatives exposure that the institution has

offered to its borrowers would fall under the ARRC’s recommended use of a SOFR

Term Rate derivative.

8

15. Does the ARRC’s recommendation of the SOFR Term Rate mean that it now

only

recommends use of SOFR Term Rates in fallback language and does not

recommend that other forms of SOFR be referenced as fallbacks in new or

renegotiated contracts referencing LIBOR?

As noted in the ARRC Best Practice Recommendations Related to Scope of Use of the

Term Rate, the ARRC continues to recommend use of overnight SOFR and SOFR averages

for all products. While the SOFR Term Rate is the first step of the waterfall in the ARRC’s

recommended hardwired fallback language for business loans, FRNs, and securitizations, the

ARRC believes it is appropriate to use of a daily SOFR rate as a bilaterally-negotiated

fallback where counterparties see this as feasible, have hedging requirements, and wish to

better align with ISDA fallbacks and current SOFR swap market conventions.

16. What relation do these ARRC recommendations have to supervisory expectations or

CME licensing agreements for the SOFR Term Rate?

Like all of the ARRC’s recommendations, whether and to what extent any market participant

decides to implement or adopt any benchmark rate, including the SOFR Term Rate,

overnight SOFR, or SOFR averages is voluntary. The ARRC is not a supervisory body, and

any supervisory expectations regarding SOFR Term Rates will determined by the relevant

regulatory agencies.

7

The ARRC recognizes that bank Treasury or lending desks may sometimes rely on an affiliated dealer to execute their derivatives hedges with third-

party swaps dealers in order to a hedge SOFR Term Rate cash product that the Treasury or lending desk is a direct party to. For clarity, the ARRC

views such arrangements as part of the bank’s hedging as the end user to an underlying cash Term SOFR position. In accordance with hedge

accounting standards, this derivative with the third-party swap dealer must remain outstanding for the duration of the hedge of the Term SOFR cash

products and may not be risk managed through compression/offsetting or other means by the affiliate dealer.

8

For purposes of clarity, the ARRC believes that any U.S. institution subject to CFTC regulation that is not a CFTC-registered swaps dealer would

meet these conditions, and that certain registered swaps dealers may also not make markets in the interdealer market or make two-way prices in interest

rate derivatives.

ALTERNATIVE REFERENCE RATES COMMITTEE

15

Whether and to what extent the CME elects to license the use of its SOFR Term Rate

consistent with the objective of ensuring a robust rate, or consistent with the ARRC’s

recommendations as to scope of use, will be determined solely by the CME itself. The

ARRC’s selection of the CME Group as the administrator of the ARRC-recommended

SOFR Term Rates was not conditioned on the CME adapting any of its restrictions on their

licensing of the SOFR Term rate for derivatives or otherwise. The ARRC identified CME

Group’s submission as the strongest proposal after a thorough evaluation of responses to a

public Request For Proposal (link). The ARRC evaluated proposals based on four specific

criteria: technical criteria, firm criteria, public policy criteria, and calculation methodology

criteria. The ARRC conclusively identified CME Group’s proposal as having most effectively

met those criteria. Most important to the ARRC was that the CME SOFR Term rate would

be robust, well-grounded in actual underlying transactions, and available at reasonable

commercial cost to all market participants to facilitate the transition away from USD

LIBOR.

CONTRACT LANGUAGE

17. What is “fallback language”?

In this context, “fallback language” refers to the legal provisions in a contract that apply if

the underlying reference rate in the product (e.g. LIBOR) is discontinued, non-representative

or unavailable. The OSSG recommended that market participants both understand their

contractual fallback arrangements and ensure that those arrangements are robust enough to

prevent potentially serious market disruptions in a LIBOR cessation event.

When USD LIBOR ceases or is non-representative, contracts that contain fallback

provisions will switch to a “fallback rate.” A “fallback rate” is the rate that a contract

indicates should be used if its base rate is not available.

Robust fallback language is needed to ensure market stability following the permanent

cessation of USD LIBOR. Following the confirmation of USD LIBOR’s endgame, the

ARRC, together with key U.S. regulators, has repeatedly stressed the danger of using USD

LIBOR in new contracts. If parties choose to reference LIBOR in those contracts, they

should incorporate robust fallback language.

The permanent cessation of USD LIBOR without viable fallback language would cause

uncertainties around the large gross flows of USD LIBOR–related payments and receipts

between many financial participants. It would also impair the normal functioning of a variety

of markets, including business and consumer lending.

Of note, on March 15, 2022, federal LIBOR legislation was signed into law as part of the

Consolidated Appropriations Act, 2022. The legislation provides a targeted solution for

financial contracts that mature after the cessation of LIBOR in mid-2023 and have no

effective means to replace LIBOR upon its cessation. It also provides a safe harbor to

lenders if they choose the SOFR fallback to be selected by the Federal Reserve as part of its

rulemaking under the legislation in contracts where a party has the discretion to select a

successor rate. The federal legislation supersedes the New York law that was enacted in

ALTERNATIVE REFERENCE RATES COMMITTEE

16

April 2021, as well as other similar state laws, with respect to the contracts covered by the

federal law.

See FAQ 20 for more on the ARRC’s recommended spread adjustment methodologies, and FAQ 19 for

more on steps market participants can take to strengthen fallback language in derivatives.

18. What should market participants do to strengthen fallbacks in cash products?

To protect against disruptions associated with LIBOR becoming unusable, the ARRC has

been working to deliver recommendations for addressing risks in cash product contract

language.

To date, the ARRC has released recommended fallback language for six different cash

products—for adjustable rate mortgages, bilateral business loans, floating rate notes,

securitizations, syndicated loans, and variable rate private student loans.. This language was

developed for market participants to voluntarily incorporate in new contracts that reference

USD LIBOR to ensure these contracts will continue to be effective in the event that LIBOR

is no longer usable.

19. What should market participants do to strengthen fallback language in derivatives?

Until recently, fallback provisions for LIBOR-based derivatives contracts were written under

the assumption that any interruptions in LIBOR publication would be temporary rather than

permanent (e.g. a computer glitch). Accordingly, in July 2016, the OSSG requested that the

International Swaps and Derivatives Association (ISDA), a derivatives industry trade group,

lead a cross-currency initiative to improve derivatives contract robustness to address risks of

discontinuance of widely-used interbank offered rates (IBORs), including LIBOR.

In light of the standardization of derivative contracts facilitated via ISDA, updating fallbacks

in LIBOR-based derivatives contracts is a relatively straightforward process.

Following a series of public consultations, ISDA launched its IBOR Fallbacks Protocol (the

Protocol) and IBOR Fallbacks Supplement (the Supplement) in October 2020. Together,

they focus on strengthening existing and new derivatives contracts with durable fallback

language. The Protocol and Supplement both took effect in January 2021.

The Protocol going into effect means that existing derivatives contracts will now

incorporate ISDA’s new fallbacks if both counterparties have adhered to the Protocol or

otherwise bilaterally agreed to include the new fallbacks in their contracts. The Supplement

going into effect means that new derivatives contracts that incorporate the 2006

ISDA Definitions and reference a relevant IBOR will also incorporate the new fallbacks.

20. What is the purpose of spread adjustments, and what spread adjustments are

recommended for cash products and derivatives?

ALTERNATIVE REFERENCE RATES COMMITTEE

17

The ARRC’s recommended fallbacks for USD LIBOR-based cash products and ISDA’s

latest fallbacks for USD-LIBOR based derivatives, would both fall back to forms of SOFR

plus a fixed spread adjustment at the point of transition for legacy contracts.

For USD LIBOR, the purpose of a spread adjustment is to reflect and adjust for the

historical differences between LIBOR and SOFR in order to make the spread -adjusted rate

comparable to LIBOR in a fair and reasonable way, thereby minimizing the impact to

borrowers and lenders.

The ARRC has stated its recommended spread adjustments for non-consumer and

consumer cash products will be the same as ISDA’s spread adjustments for USD LIBOR.

The ARRC will include a one-year transition period as part of its recommended spread

adjustments for consumer products. The ARRC specified that the starting point for the

transition period would be based on a 2-week average of the relevant LIBOR-SOFR spread

prior to the time of the Benchmark Replacement Date.

TRANSITION STATUS AND LATEST DEVELOPMENTS

21. When will USD LIBOR stop publishing?

The FCA and IBA announced on March 5, 2021 precisely when LIBOR panels will end. In

particular:

• FCA and IBA announced that the publication of LIBOR on a representative

basis will cease for the lesser-used USD LIBOR settings immediately after

December 31, 2021, and the remaining USD LIBOR settings immediately after

June 30, 2023.

This aligns directly with U.S. supervisory guidance released in late 2020 and which

encouraged banks to stop entering into new contracts that use USD LIBOR as a reference

rate as soon as practicable and in any event by December 31, 2021, in order to facilitate an

orderly transition. That guidance noted that entering into new contracts that reference

LIBOR after 2021 would create “safety and soundness risks.” It also makes clear that any

USD LIBOR issuance in 2021 should “either utilize a reference rate other than LIBOR or

have robust fallback language that includes a clearly defined alternative reference rate after

LIBOR’s discontinuation.”

The announcements by FCA and IBA served to fix the spread adjustments in the IBOR

Protocol offered by ISDA and, in conjunction with previous U.S. supervisory guidance

about stopping new U.S. dollar LIBOR issuances this year, should accelerate market

participants’ move away from USD LIBOR.

ALTERNATIVE REFERENCE RATES COMMITTEE

18

• As a result, ISDA spread adjustments are now fixed and will be applied to

derivatives when the panels for all USD LIBOR tenors cease in June 2023.

• And on March 9, 2021, the ARRC confirmed that the March 5, 2021

announcements by IBA and the FCA on future cessation and loss of

representativeness of the LIBOR benchmarks constitutes a “Benchmark

Transition Event” with respect to all USD LIBOR settings pursuant to the

ARRC recommendations regarding more robust fallback language for new

issuances or originations of LIBOR floating rate notes, securitizations, syndicated

business loans, and bilateral business loans. For additional information on that

development, see the ARRC FAQs Regarding the Occurrence of a Benchmark

Transition Event.

With these announcements and previous U.S. supervisory guidance, the path for when USD

LIBOR will end is now clear: market participants are being asked stop writing new USD

LIBOR contracts by the end of 2021. The extension of key USD LIBOR tenors will allow

many legacy contracts to mature before representative USD LIBOR stops.

22. How will legacy contracts be impacted by the March 5, 2021 USD LIBOR endgame

announcements, and what is the plan for contracts that mature after mid-2023?

As supervisory guidance notes, the June 30, 2023 cessation date for the frequently-used USD

LIBOR tenors “would allow most legacy USD LIBOR contracts to mature before LIBOR experiences

disruptions.” However, even though the majority of legacy USD LIBOR contracts will mature

by June 30, 2023, there will still be a significant minority of outstanding legacy LIBOR will

remain after that date.

While an estimated 67% of current LIBOR exposures will mature before June 2023, an

estimated $74 trillion will remain outstanding – a fact that underscores the importance of

finding solutions for legacy contracts. This includes legacy LIBOR contracts that have no

effective means to replace LIBOR upon its cessation.

Of note, on March 15, 2022, federal LIBOR legislation was signed into law as part of the

Consolidated Appropriations Act, 2022. The legislation provides a targeted solution for

financial contracts that mature after the cessation of LIBOR in mid-2023 and have no

effective means to replace LIBOR upon its cessation. It also provides a safe harbor to

lenders if they choose the SOFR fallback to be selected by the Federal Reserve as part of its

rulemaking under the legislation in contracts where a party has the discretion to select a

successor rate. The federal legislation supersedes the New York law that was enacted in

April 2021, as well as other similar state laws, with respect to the contracts covered by the

federal law.

23. How do the Q4 2020 announcements by regulators and IBA and the March 2021

announcements by the Federal Reserve Board of Governors about USD LIBOR’s

endgame impact the ARRC’s Recommended Best Practices?

ALTERNATIVE REFERENCE RATES COMMITTEE

19

As part of the November 30 announcements on USD LIBOR’s proposed endgame, U.S.

regulators (the Federal Reserve Board, Federal Deposit Insurance Corporation, and Office

of the Comptroller of the Currency) issued supervisory guidance noting that “the agencies

encourage banks to cease entering into new contracts that use USD LIBOR as a reference

rate as soon as practicable and in any event by December 31, 2021.” The guidance further

noted that entering into new contracts that reference LIBOR after December 31, 2021

would “create safety and soundness risks” for firms and for the financial system.

That November 30 supervisory guidance was later underscored by a March 9 Federal

Reserve Board of Governors Supervision and Regulation Letter. SR 21-7: Assessing

Supervised Institutions' Plans to Transition Away from the Use of the LIBOR was issued

“to assist examiners in assessing supervised firms’ progress in preparing for the transition”,

with examination work tailored to the size and complexity of the firms’ LIBOR exposure. It

noted that “examiners should consider issuing supervisory findings and other supervisory

actions if a firm is not ready to stop issuing LIBOR-based contracts by December 31, 2021.”

The ARRC believes that the ARRC’s Recommended Best Practices, which outline achievable

dates for stopping new use of LIBOR based on what is considered practicable ahead of end-

2021, are fully consistent with the supervisory guidance to stop new use of USD LIBOR “as

soon as practicable.”