When you ar e named ex ecutor

1

.

A guide to help you understand your responsibilities.

An estate account enables you to deposit income and pay any necessary expenses

that may be incurred during the administration of the estate. Use this account to

deposit proceeds from the sale of the deceased person's property, pay taxes, and pay

any outstanding balances.

This guide is designed to assist you in understanding

what duties you may have as an executor

1

, while ensuring

you’re aware of the option to enlist professional help with

any or all of your tasks throughout this process.

If you’ve been named executor

1

of a friend or loved one’s

estate, you may feel honoured to be entrusted with carrying

out their last wishes. You may also feel overwhelmed

and unsure of where to begin, or how to carry out your

duties. Fortunately, help is available — and the first step is

educating yourself about your role as executor

1

.

Performing the role of executor

1

requires more than just

trustworthiness and good intentions. An executor

1

’s duties

and responsibilities can require a great deal of time, eort

and expertise.

Typical duties that may fall to an executor

1

As an executor

1

, you are responsible for carrying out the

deceased’s wishes as stated in the Will. This often begins

with assisting with funeral arrangements and meeting the

immediate financial needs of the beneficiaries. It also

involves identifying, protecting and valuing the assets

the estate, paying the expenses and liabilities of the of

estate, filing tax returns and, finally, distributing the

remainder of the estate to the beneficiaries.

It can take 12 to 18 months to complete an average estate

settlement. In cases involving more complex estates,

settlement can sometimes take years — all while requiring

you to keep the beneficiaries informed and ensure proper

documentation is completed for each step of the process.

Careful considerations

When you need a helping hand…

There are many cir cumstances wher e an estate

professional can provide valuable support:

Time – Many executors

1

are unaware of the time

it can take to settle an estate. People with busy

lives can find it challenging to fulfill their executor

1

duties while still running their r egular lives.

Location – It can prove challenging to act as an

executor

1

when you live in another city, province

or country. You may need to be physically present

to fulfill some tasks, such as valuing estate assets

or distributing them to the beneficiaries.

Grief and family dynamics – Many people

feel overwhelmed by the thought of being

responsible for estate settlement at a time of

grief. Also, as executor

1

you need to communicate

with beneficiaries with potentially conflicting

inter ests. An unbiased thir d party can often be

an invaluable resource in managing these issues.

When you engage an estate professional, you

will continue to make all key decisions as they

relate to the estate, while the estate professional

ensur es that your duties are carried out in a

thor ough, timely manner . For mo re information

on how we can support you, please contact a

TD representative.

0

0

0

0

0

0

0

0

0

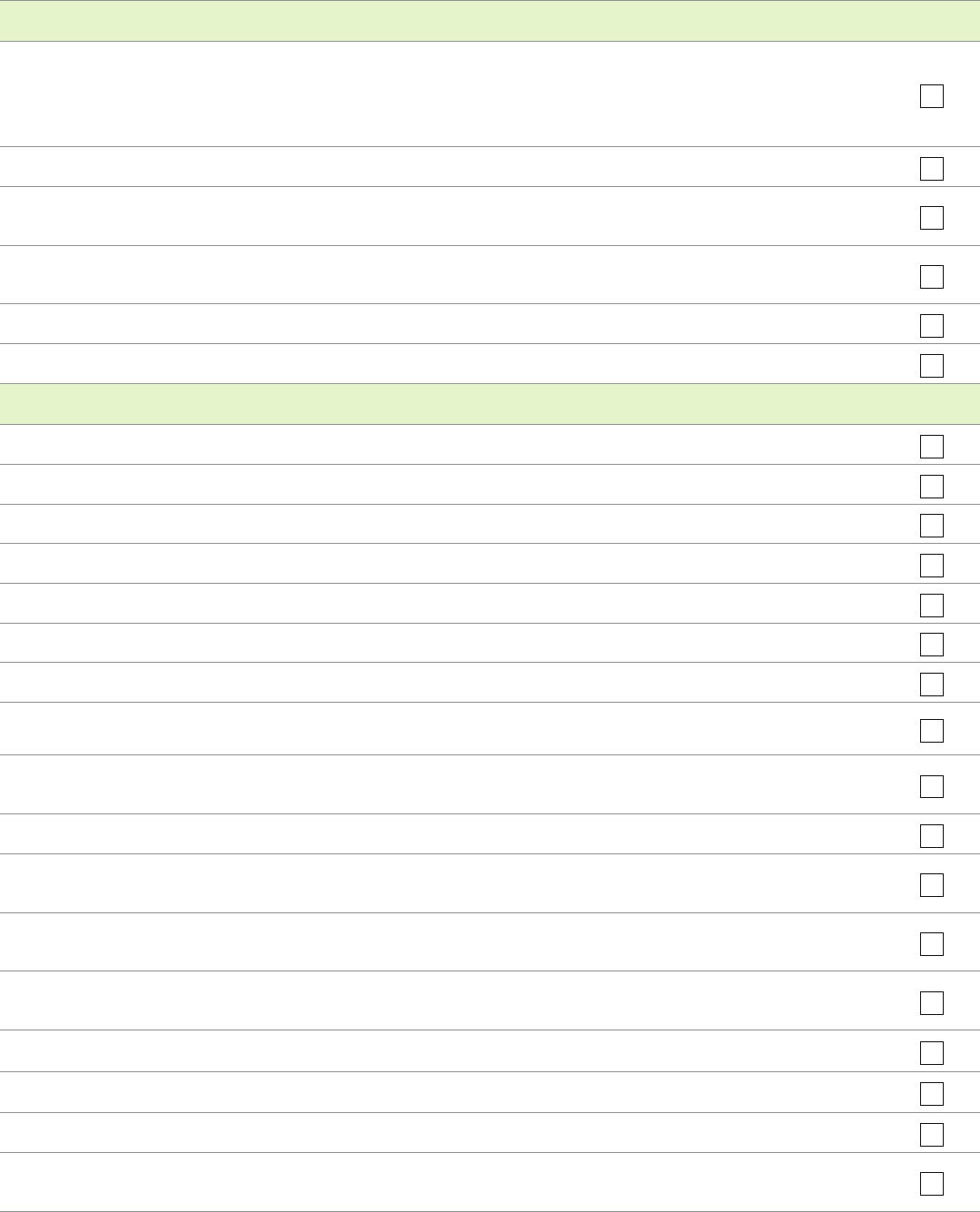

Where to begin

1. Locate the original last Will and review to determine whether there are any special funeral directions and to

understand the other terms of the Will. If there is no Will (legally known as dying “intestate”), a court may

have to appoint someone to administer the estate. TD Wealth Private Trust may also be able to assist you in

that situation.

2. Assist in making funeral arrangements, if necessary.

3. Determine the immediate financial needs of the beneficiaries and make arrangements to meet them,

if possible.

4. Obtain a funeral director’s statement of death or apply for a provincial death certificate. Begin gathering

other key documents related to the estate (see Appendix 1 for a list of documents to obtain).

5. Open an estate's bank account to deposit income and pay expenses, to transfer balances.

6. Arrange for Canada Post to redirect the deceased’s mail to your mailing address.

Identifying, valuing and protecting estate assets

7. Secure residence and contents (home, car, other property).

8. Continue or arrange for gardening and/or snow removal contracts.

9. Review and verify the adequacy of insurance coverage.

10. Notify financial institutions, insurance companies, brokers and employers of the deceased’s passing.

11. Confirm outstanding balances and cancel any credit cards.

12. Arrange for safe custody of any valuables.

13. Identify and list contents of safety deposit box(es).

14. Locate and obtain title documents for real property, mortgages, and any other physical or investment assets.

15. Investigate any jointly held accounts to determine if the deceased retained beneficial ownership and if the

account forms part of the estate.

16. Arrange valuations of real estate, personal property, and any vehicles.

17. Coordinate a review and valuation of the investment portfolio. A TD Canada Trust representative can help

refer you to an advisor who can complete the review for you.

18. Determine entitlement and apply for Canada Pension Plan Death Benefits, Survivor’s Benefits and

Child(ren)’s Benefits.

19. Notify the deceased’s previous employer and determine whether there are any survivor pension benefits,

insurance proceeds or other income owing.

20. Review and identify any digital assets (e.g. PayPal, online game currency) held by the deceased.

21. Locate any personal property held outside the home in storage or repair.

22. Identify any foreign assets and determine whether a foreign Will exists to administer them.

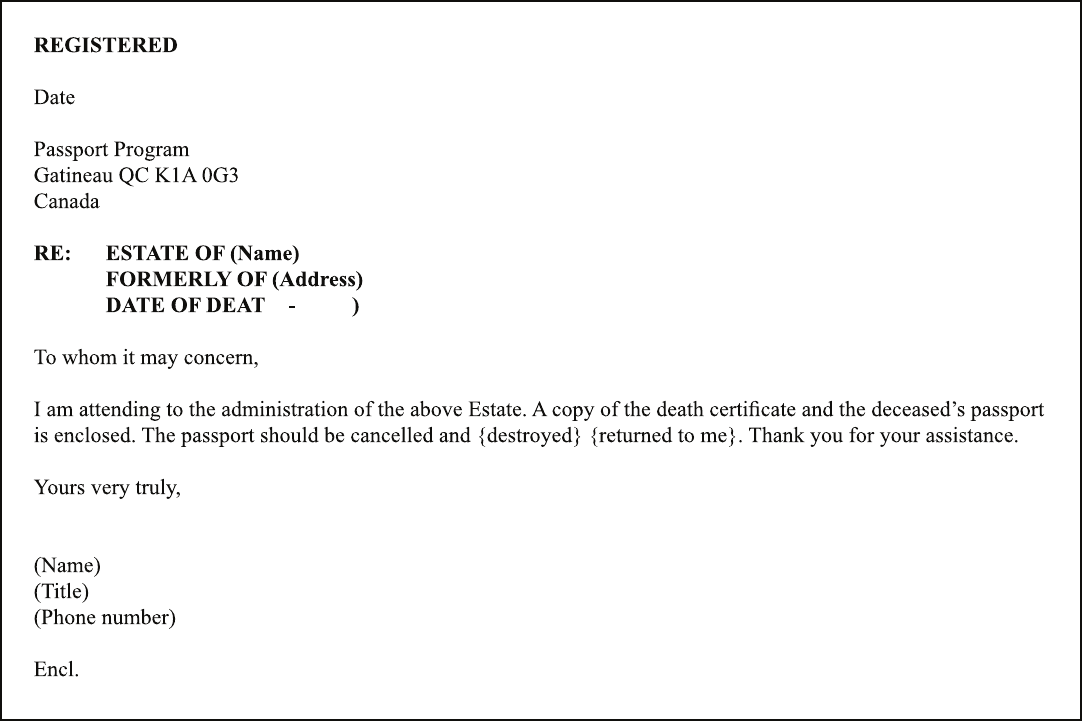

23. Cancel passport, driver’s license, any utilities, social media accounts, loyalty/points cards, subscriptions,

such as magazines, and request refunds, if applicable. (See Appendix 2 for a sample cancellation letter.)

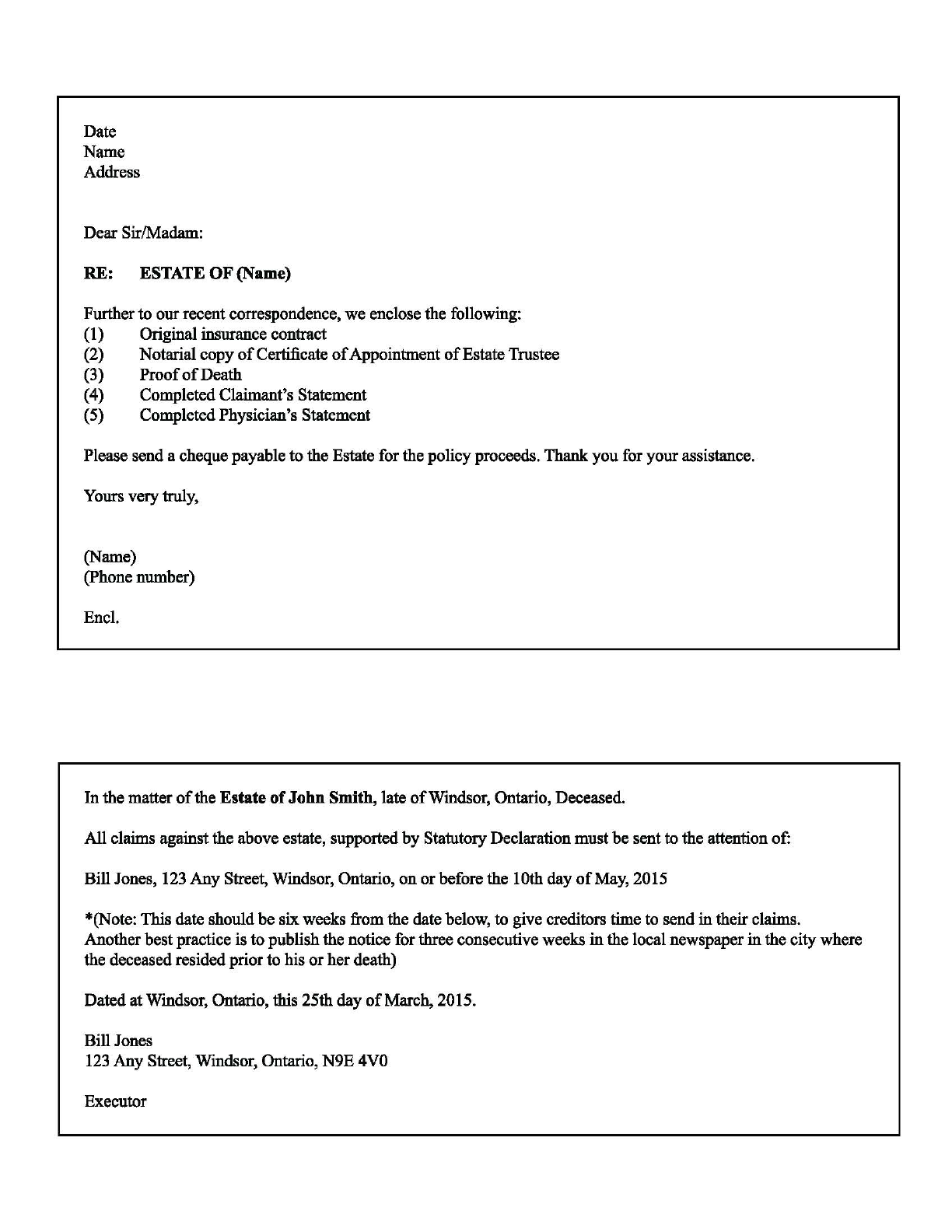

Administration of the Estate

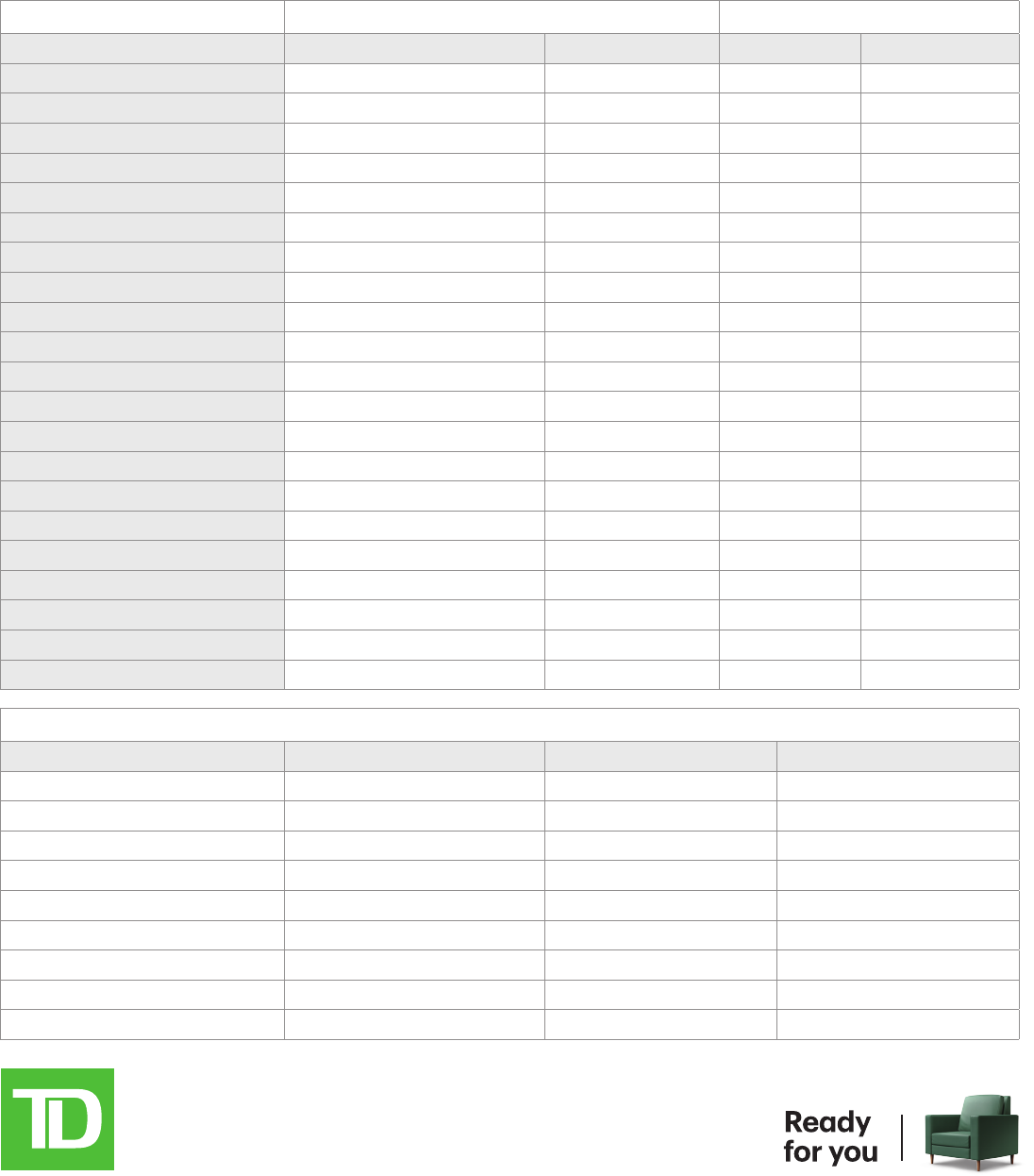

24. Prepare a complete summary of estate assets and liabilities. (See Appendix 3 for a template you can use to

complete this.)

25. Arrange with a lawyer for probate of the Will, if necessary. A probated Will is acknowledged by the

courts to be the deceased’s Last Will and Testament. It confirms the executor

1

and acknowledges his or

her authority to carry out the terms of the Will. Most financial institutions require probate before they will

release a deceased person’s assets because it assures the institution is transferring the assets to the person

lawfully entitled to receive them.

26. Prepare and file an Estate Information Return (required in Ontario) with the Ministry of Finance within

90 days of probate.

27. Apply for and collect any life insurance and other insurance benefits. (See Appendix 2 for a sample letter

to the insurance company.)

28. If the deceased was receiving a foreign pension, notify the foreign jurisdiction to cancel the entitlement

and make a claim for any death benefit, if applicable.

29. Cancel any automatic bank account deposits/withdrawals.

30. Close any bank accounts and transfer any balances to the estate bank account.

31. Remove contents of any safety deposit box after providing required estate documentation; return keys and

close safety deposit box.

32. Notify the federal government to cancel Old Age Security and Canada Pension Plan (CPP) payments, GST/

HST credits and child tax benefits. Note: CPP, Quebec Pension Plan (QPP) and Old Age Security benefits will

still be paid to the deceased for the month of death. If the deceased was receiving GST or HST quarterly

credits, the estate is entitled to them if the cheque was issued before the date of death. If the cheque was

issued after the date of death, the payment must be returned with notification of the date of death.

33. Cancel health insurance coverage, if necessary.

34. Terminate any lease, rental, or sublet arrangement.

35. Settle all claims and debts and arrange for publication of a Notice to Creditors prior to distribution of estate

assets, if necessary. (See Appendix 2 for a sample creditors’ notification.)

36. Review Will and determine the division of estate assets. Consult with beneficiaries regarding distribution

(e.g. in cash or in-kind), where appropriate.

37. Identify any time periods or restrictions imposed on the distribution of the estate (for example, family law

considerations or claims/litigations).

38. Pay all debts and settle any legitimate claims prior to final distribution of assets. Deliver personal eects,

securities and legacies to beneficiaries, obtaining receipts for each distribution.

39. Assist in establishing any trusts stipulated in the Will.

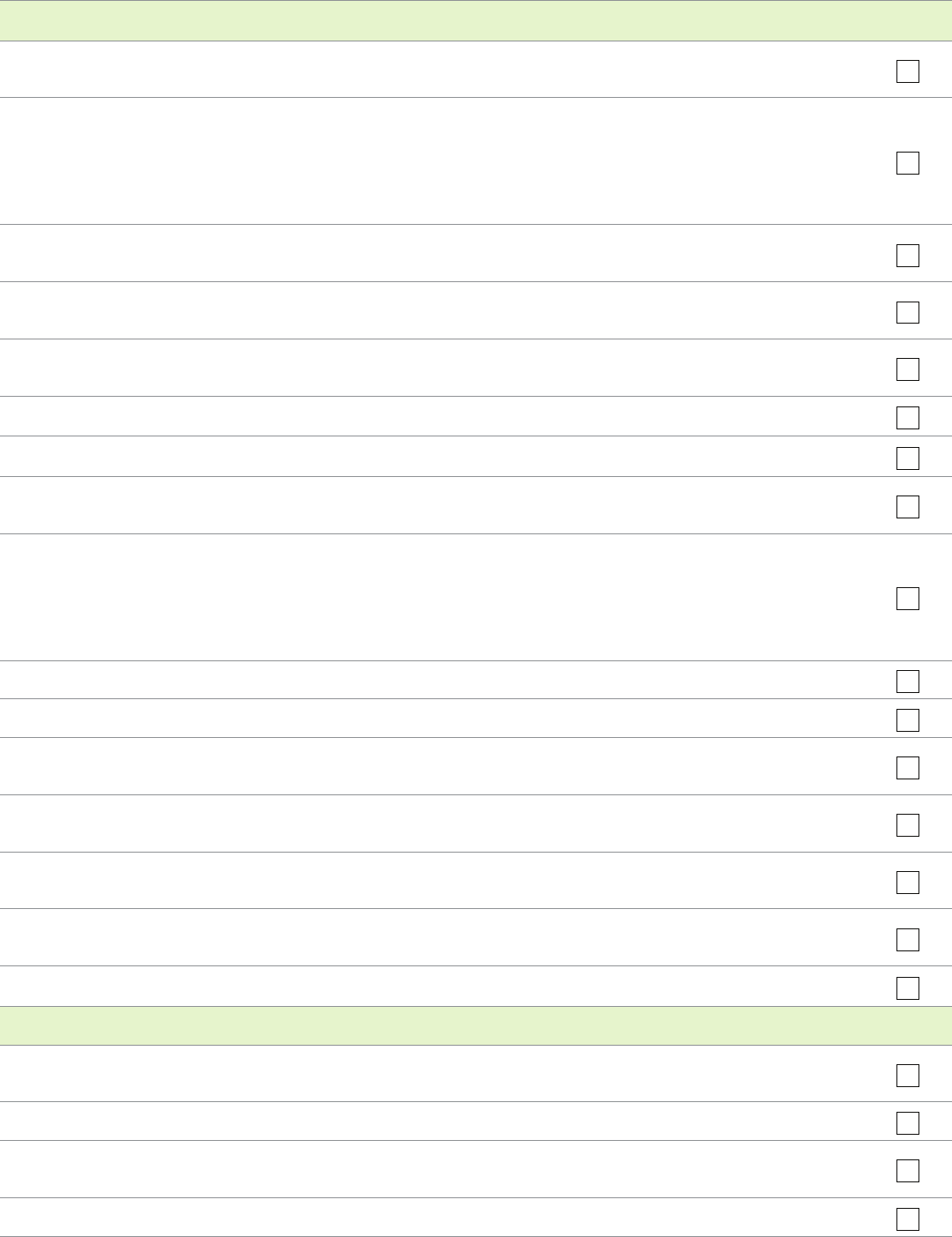

Communication with beneficiaries

40. Communicate directly with beneficiaries, gather information, and set expectations (this should happen

early in the process).

41. Send a copy of the Will to each beneficiary entitled to receive a copy.

42. Provide regular updates to beneficiaries regarding the status of administration to avoid any

misunderstandings and potential legal action on their part.

43. Provide each residual beneficiary with a copy of the estate summary document (see appendix 3).

Taxes

44. Obtain prior year(s) tax returns and determine whether any years are outstanding.

45. Forward a copy of the will and death certificate to Canada Revenue Agency (CRA) for their records and

update the mailing address on file.

46.

Contact CRA to cancel any future tax instalment payments, and determine if any tax instalments have been paid.

47. Obtain a disability tax certificate form for the deceased (if applicable), complete and file with CRA.

48.

Locate medical expenses, charitable donations, income receipts, deductible expenses and/or investment statements.

49. Prepare and file any outstanding prior year(s) tax returns and the final or terminal return(s) for the year of

death. Note: The final or terminal return for the deceased covers the period from January 1 of the year

of death to the date of death. If the date of death occurred between January 1 and October 31, the tax

return is due by April 30 of the following year. If the date of death was between November 1 and

December 31, the tax return is due six months after the date of death. Any taxes owing must be paid

at this time. If the taxes owing are not paid by the due date, interest will be added to the final tax bill.

If the return is filed late, penalties will also be charged.

50. In addition, once the terminal returns are filed, it may be advantageous to file an Estate T3 Trust Income Tax

and Information Return depending on the amount of income that has accumulated in the Estate after the

date of death. This T3 Trust Income Tax Return is due 90 days from the first anniversary of the date of death,

although an earlier year-end may be selected.

51. Obtain Tax Clearance Certificate(s) from the CRA (Revenue Quebec, if applicable) once all the Notice of

Assessment(s) are received, confirming that all tax liabilities have been settled.

Distribution

52. Arrange for a rollover or transfer of registered accounts (RRSP, TFSA), if necessary.

53. Initiate sale of assets to prepare for the estate’s distribution.

54. Begin distributing residual assets/cash to beneficiaries according to the terms of the will, obtaining receipts

from each beneficiary; ensure suicient funds are retained to pay outstanding debts and taxes.

55. Prepare accounts for passing or approval by beneficiaries. Prepare releases and obtain signed approval

from each beneficiary.

56. If beneficiaries approve accounts, confirm that all releases have been received.

57. If accounts are to be audited by the Court, contact a lawyer to prepare the application and all necessary notices.

58. Calculate and pay any executor

1

’s compensation once approval is received from the beneficiaries or the

Court. As executor

1

, you may be entitled to receive financial compensation. The fee may be stipulated in the

Will or agreed upon by the beneficiaries or approved by the court. At a minimum, you are entitled to

reimbursement of any expenses incurred while carrying out your duties.

59. Upon receipt of final clearance from CRA, make final distribution to beneficiaries.

60. Arrange for closing of the estate bank account after confirming all payments and cheques have cleared.

61. Prepare a final report to the beneficiaries in writing on all aspects of the administration.

Estate settlement practices and requirements may vary by province or territory. The information in this overview is for

informational purposes and intended only as a guide to assist you in better understanding what may need to be

considered when administering an estate. It should not be a considered complete list nor be considered as income,

tax, investment or legal advice.

If you have any questions about settling an estate, or any other aspect of estate planning, please speak to a TD

representative or call our One TD Estates Centre at 1-866-235-1974.

Appendix 1: List of documents to obtain

Obtain a copy of the death certificate

Will, Codicil, Memorandum (if any) and Afdavit of Execution

Life insurance policies, annuity contracts

Birth certicates of the deceased and the spouse

Bank passbooks or statements for the current year

Safety deposit box keys

Automobile registration and insurance policy

Property deeds, tax receipts, lease, etc.

Homeowner insurance policy

Income tax (last three years’ returns) and if possible 1994 income tax returns

Medical and charitable receipts

Outstanding bills

Credit and ATM cards

Social insurance and membership cards

Traveller’s cheques

Investment statements for the curr ent year (including RRIF & RRSP)

Canada Savings Bonds/Quebec Savings Bonds

Stock certicates

Valid passport

Addresses for all beneciaries

Address book

Mortgage statement

Domestic contracts, separation agreement/divorce decree

Citizenship documents

Foreign will and statements for foreign assets

Shareholders’ agreement

Business cards

Funeral director’s proof of death certicates for any beneciaries who are deceased

Appendix 2: Sample letters

Letter to cancel passport:

Letter to request insurance proceeds:

Date

Name

Address

Dear

Sir/Madam:

RE:

ESTATE

OF

(Name)

Further

to

our

recent correspondence,

we

enclose the following:

(1)

Original insurance contract

(2) Notarial

copy

of

Certificate

of

Appointment

of

Estate Trustee

(3)

Proof

of

Death

(4) Completed Claimant's Statement

(5) Completed Physician's Statement

Please send a cheque payable

to

the Estate for the policy proceeds. Thank

you

for

your

assistance.

Yours

very truly,

(Name)

(Phone number)

Encl.

Sample notice to creditors:

In

the

matter

of

the

Estate

of

John

Smith,

late

of

Windsor, Ontario, Deceased.

All claims against the above estate, supported

by

Statutory Declaration

must

be

sent to the attention of:

Bill Jones, 123

Any

Street, Windsor, Ontario,

on

or

before the 10th day

of

May, 2015

*(Note: This date should

be

six weeks from the date below,

to

give creditors time

to

send

in

their claims.

Another best practice is

to

publish the notice for three consecutive weeks

in

the local newspaper

in

the city where

the deceased resided prior to

his

or

her

death)

Dated

at

Windsor, Ontario, this 25th

day

of

March, 2015.

Bill Jones

123

Any

Street, Windsor, Ontario,

N9E

4VO

Executor

1

Liquidator in Quebec.

TD Wealth Private Trust services are oered by The Canada Trust Company.

®

The TD logo and other trade-marks are the property of The Toronto-Dominion Bank.

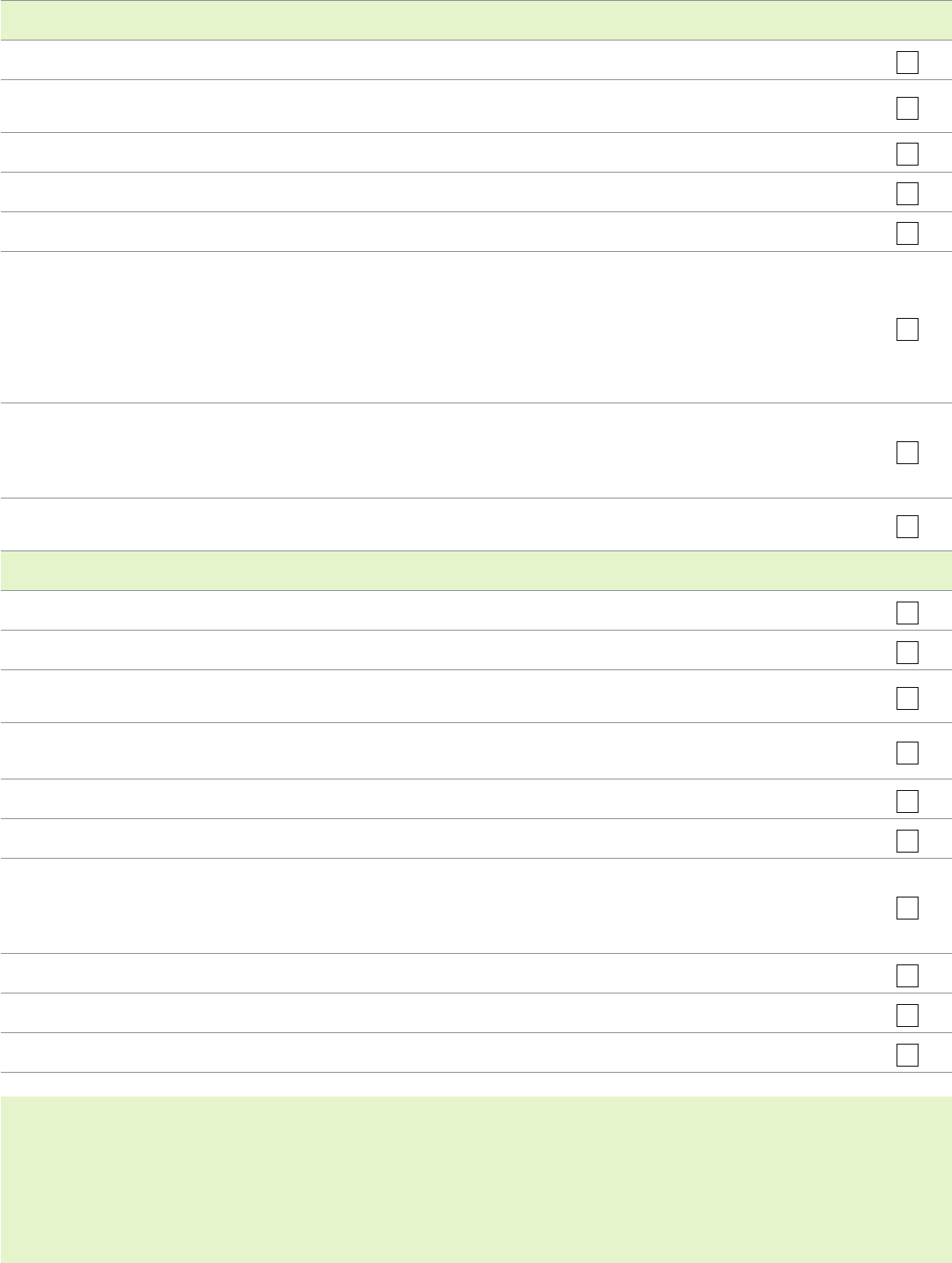

Ownership

Assets

Deceased only

Joint Named beneficiary

Bank accounts $$ $

Term deposits $$ $

Stocks, bonds, mutual funds $$ $

RSPs $$ $

RIFs $$ $

TFSAs $$ $

Annuities $$ $

Other investments $$ $

Life insurance $$ $

Company pension plan $$ $

Principal residence $$ $

Other real estate $$ $

Personal property $$ $

Other: $$ $

Other: $$ $

Total assets $

Liabilities

Deceased only

Joint

Mortgages $$

Loans $$

Credit cards $$

Other loans or debts $$

Income tax $$

Other: $$

Total liabilities: $

NET ESTATE $

Appendix 3: Assets and liabilities worksheet

Estate of the Late: (Deceased First name, Last name) ________________________________________________________________

Ownership Beneficiary

Assets

Sole/Tenants

in Common Joint Tenancy* Named In Will

Bank accounts

Investment accounts $ $

GICs/Term deposits $ $ n/a

Stocks, bonds, mutual funds $ $ n/a

RSPs $ n/a

RIFs $ n/a

RESPs $ n/a

TFSAs $ n/a

Annuities $ $

Other investments $ $ n/a

Life insurance $ $

Group life insurance $ $

Company pension plan $ $

Principal residence $ $ n/a

Other real estate $ $ n/a

Private business shares $ $ n/a

Other: $ $

Other: $ $

Other: $ $

Other: $ $

Total assets $

Ownership

Liabilities Sole/Tenants in Common Joint Tenancy* Insurance

Mortgages $ $ $

Loans/Lines of credit $ $ $

Credit cards $ $ $

Other loans or debts $ $ $

Income tax $ $ $

Other: $ $ $

Other: $ $ $

Total liabilities: $

NET ESTATE $

*Not applicable in Quebec.

1 Liquidator in Quebec.

TD Wealth Private Trust services are oered by The Canada Trust Company. ® The TD logo and other trade-marks are the property of The Toronto-

Dominion Bank.

M06482 (1218)

0.00

$0.00

0.00

$0.00

$0.00

0.00

$0.00

$0.00