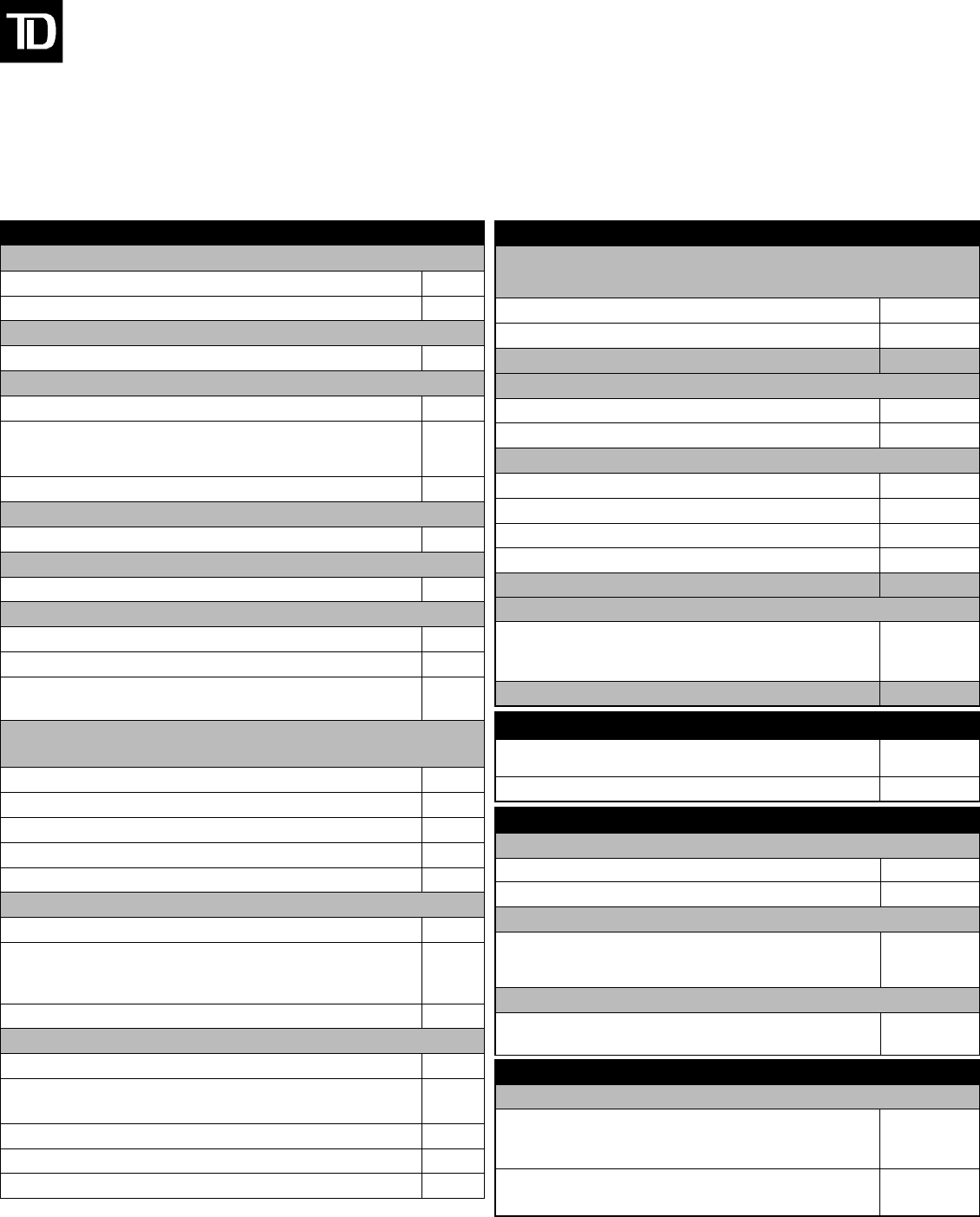

TD Canada Trust

Business Account Service Charges and Fees

520594 (1021) A

Transaction(s)

Fees

2

Deposits & Credits

• Fee per deposit/ credit

3

$1.25

• Fee per item deposited

4

$0.22

Currency Deposited

• Cash (paper currency and coin) deposited per $1,000

$2.50

Currency Supplied

• In-branch – paper currency supplied per $1,000

$2.00

• Direct Delivered - paper currency supplied per 100 notes

*

(

*

Requires the customer to contact and pay for a TD Canada Trust

approved armoured car delivery service.)

$0.50

• Coin supplied per roll

$0.12

Cheques & Debits

• Fee per debit

5

(MICR-encoded cheques and other debits)

$1.25

Withdrawals

• Fee per withdrawal

$1.25

Non-TD ATM

• Interac

®

$2.00

• PLUS

*

System

6

- Handling Fee within U.S. and Mexico

$3.00

• PLUS

*

System

6

- Handling Fee outside Canada, U.S. and

Mexico

$5.00

Funds Transfer

Transfer between a customer’s own TD Canada Trust accounts

• If requested by telephone, mail or facsimile

7

$5.00

• Green Machine

®

ATM

$1.25

• EasyLine

®

or EasyWeb

®,8

$1.25

• Corporate Transfer Service

$1.50

• Automated Transfer Service

$0.95

Interac e-Transfer

®

• Send Money

$1.50

• Request Money

If the request is accepted, the fee will be charged to the

account the money is deposited into

$1.50

• Cancel a Send Money Payment

$5.00

Bill Payments

• In-branch - Paid by cash or cheque (Handling Fee)

7

$1.00

• In-branch - Paid from a TD Canada Trust account

(Handling Fee)

7

$1.00

• Green Machine ATM

$1.25

• EasyLine or EasyWeb

8

$1.25

• Web Business Banking

$1.25

Drafts

Fees

2

Any Canadian, U.S., Foreign or International Draft

(foreign bank charges may apply)

$9.95

Request for refund or replacement of lost or stolen draft

$10.00

Searches / Notices

Fees

2

In Branch

• If processed within 90 days FREE

• If processed after 90 days – per request

$15.00

EasyWeb

• View Cheque Service - per cheque image

**

(

**

If you elect to have the paperless record keeping option, the

fee is waived.)

$1.50

Web Business Banking

• Cheque Image View via the Balance Reporting

Service – per image

$1.50

Account Handling

Fees

2

Record Keeping Options

• Per paper statement

***

- waived when the average daily

credit balance in any calendar month exceeds

8

: $2,500

(Canadian Accounts)

$5.00

• Per paper statement

***

- waived when the minimum

monthly credit balance exceeds

10

: $2,500 (U.S. Accounts)

$5.00

*** Fee waiver for average daily credit balance and minimum monthly credit balance does

not apply if you receive a monthly Summary of Cash Management, Deposit and Other Fees

and Services. If you elect to have the paperless record keeping option, the fee is waived.

Cheque Handling

Fees

2

Non-Sufficient Funds

(cheques, pre-authorized payments, post-dated bill payments, TD Canada Trust loan

payments, etc.)

• Returned

$48.00

• Paid (plus overdraft interest charges)

$5.00

Returned Item (includes mail advice to payee) $5.00

Cheque Certification

• Account holder

$10.00

• Non-account holder

$15.00

Stop Payments (cheque or pre-authorized payment)

• At a branch or through EasyLine

®

telephone banking

$25.00

• EasyWeb

$12.50

• Web Business Banking (with complete details)

$8.00

• Web Business Banking (with incomplete details)

$12.00

Cheque Not Written in Currency of Account

$20.00

Outgoing Cheque Collections

2, 9

Canadian Dollar, U.S. Dollar or

foreign currency cheques

payable outside of Canada

2

0.20%

min $30.00

max $150.00

Collection Item Returned Unpaid $15.00

Page 1 of 2

This schedule of business account service charges outlines our standard pricing of services commonly used by our commercial customers.

1

For more information on our business accounts and services and for charges not included in this schedule, simply visit any TD

Commercial Banking Centre, or visit our website at

www.tdcommercialbanking.com

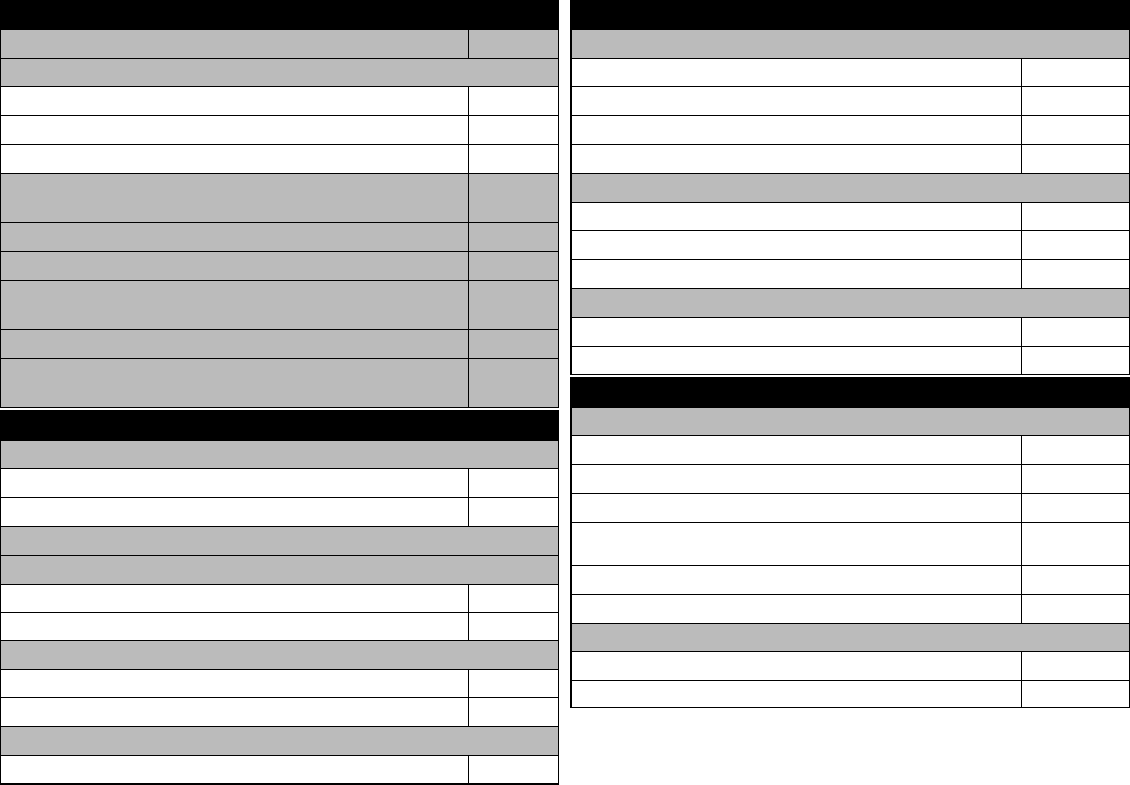

Account Handling (Continued)

Fees

2

Duplicate Statement

FREE

Interim Statement

• In-branch

FREE

• Updater/Green Machine ATM/EasyWeb

8

FREE

• EasyLine

7

via Fax – per page

$2.50

Holding a post-dated cheque to be deposited in branch (to

a TD Canada Trust account) – per cheque

$5.00

Bank Confirmation $25.00

Certificate of Balance FREE

Account Balance Transferred

to Another Financial Institution - per account

$15.00

Transfer Confirmation by Mail or Fax $2.00

Express Deposit Bags

See D+H

TM

Business ChequeSelector

®

Catalogue for pricing

N/A

Wire Payments

Fees

2, 9

Outgoing Wire Transfers

• $10,000 or less

$50.00

• $10,000.01 to $50,000

$50.00

• over $50,000

$50.00

• TD branch to branch

$16.00

Incoming Wire Transfers

• $100 or less

FREE

• Over $100

$17.50

• TD branch to branch

FREE

Wire Investigation Fee for Non-Bank Errors

• Per hour

$40.00

• Minimum

$25.00

1 This statement does not contain all of the charges for services provided by TD Commercial Banking in respect of deposit accounts with TD Commercial Banking other than personal deposit

accounts. For information regarding charges not included in this brochure, please contact your nearest TD Commercial Banking Centre. All features, fees, and rates are effective as of March

6, 2020 and are subject to change plus applicable taxes. If you have a Business Savings Account through Small Business Banking refer to the Small Business Accounts Service Plans and related

products brochure for pricing. If your accounts are on a Business Chequing Account Service Plan, refer to the Small Business Accounts Service Plans and related products brochure or your

Business Service Plan Letter (whichever is applicable) for pricing.

2

Amounts shown and service charges for Canadian Dollar transactions in Canadian Dollar Business Accounts are quoted

and/or payable in Canadian Dollars. Amounts shown and service charges for U.S. Dollar transactions and U.S. Dollar Business Accounts are quoted and or payable in U.S. Dollars, or their

Canadian equivalent, using the TD Canada Trust prevailing exchange rate at the time the service charge is applied. Fees and service charges for transactions in any foreign currency other

than U.S. Dollars are payable in Canadian Dollars at the Canadian Dollar equivalent using the TD Canada Trust prevailing exchange rate at the time the fee or service is charged.

3

Where a

deposit at a TD Canada Trust branch contains multiple deposit items, up to 250 such items will be considered as one transaction.

4

Deposit items are cheques (including cheque images

through TD Remote Deposit Capture and excluding cheques images through TD Mobile Deposit), money orders, drafts and all other clearing items.

5

If you make a purchase in foreign

currency with your TD Access Card (NYCE), the foreign currency amount is converted to Canadian dollars at an exchange rate that is calculated by adding 0.035 to the rate set by Acxsys

Corporation in effect on the date the transaction is posted to your account. For example: For a USD $10 purchase, where the rate set by Acxsys Corporation is 1.3 (USD $1.00 costs CAD

$1.30); Exchange rate = 1.3 + 0.035 = 1.335; Total withdrawal amount = USD $10 x 1.335 = CAD $13.35 (includes the fee in the amount of CAD $0.35).

6

If you make a foreign currency

withdrawal at an ATM outside Canada with your TD Access Card, the amount of: the foreign currency funds received at the ATM, and any fee charged by the ATM provider is converted to

Canadian dollars at the exchange rate set by Visa International in effect on the date the transaction is posted to your account. The amount withdrawn from your account will include a fee

equal to 3.5% of the amount of the foreign currency funds received at the ATM plus any fee charged by the ATM provider after conversion to Canadian dollars. For example: For a USD $10

cash withdrawal at an ATM in the United States, where the rate set by Visa International is 1.3 (USD $1.00 costs CAD $1.30); Amount received at ATM = USD $10; US ATM provided fee =

USD $2; Amount after conversion = USD $12 x 1.3 = CAD $15.60; Fee = CAD $15.60 x 3.5% = CAD $0.55; Total withdrawal amount = CAD $15.60 + CAD $0.55 = CAD $16.15. If this

withdrawal example occurred at a non-TD ATM in the United States, the $3 non TD ATM handling fee would also be withdrawn from your account.

7

This fee is in addition to any applicable

transaction fees.

8

Applies to Canadian Dollar operating accounts only.

9

Other bank charges and out-of-pocket expenses may apply.

10

Applies to US Dollar operating accounts only. All trade

marks are the property of their respective owners.

11

Some sizes not available at some branches.

®

The TD logo and other trademarks are the property of The Toronto-Dominion Bank or its

subsidiaries.

520594 (1021) A

Account Inquiries

Fees

2

Account Information (balance inquiries & account activity)

• In-branch (by telephone or in person) – per request

$5.00

• EasyLine or EasyWeb

7

FREE

Credit Inquiries

Inquiry in Canada, written

• Per hour

$40.00

• Minimum $18.50

Inquiry outside Canada, written

• Per hour

$40.00

• Minimum

$23.00

Third Party Credit Inquiry

• Per inquiry

$25.00

Safety Deposit Boxes

Fees

11

Size

• Small (1.0 to 9.0 sq. inches) – Annual Rental Fee

$60.00

• Medium (9.1 to 17.5 sq. inches) – Annual Rental Fee

$100.00

• Large (17.6 to 27.0 sq. inches) – Annual Rental Fee

$150.00

• X-Large/Super Large (27.1 sq. inches and greater) –

Annual Rental Fee

$5.00 per

square inch

Annual Billing Fee Notice

$5.00

Late Payment Fee

$5.00

Box Maintenance Fee

• Drilling Fee

$200.00

• Replacement Key $50.00

Page 2 of 2