1

This panel intentionally left blank.

Table of Contents

Overview 1 ......................................................................

Business Banking Solution 2 ........................................

Business Savings Account 4 .........................................

Time Deposits – CDs 5 ..................................................

Other Account Fees and Services 6 ..............................

Other Account Information 10 .......................................

Frequently Asked Questions 11 .....................................

Preferred Rewards for Business Program

Rules 13 .........................................................................

Account Fees for Business

Deposit Accounts

This schedule applies to business deposit accounts.

Please read carefully. It is part of the binding contract

between you and us for your account and deposit

relationship.

This schedule lists account fees that may apply to you,

depending on which account you have, how you use your

account and what services you use. It also explains how

you can avoid some fees.

For information about interest rates, fees and other

services not covered in this schedule, please visit a

financial center, call us at the number on your statement

or 888.BUSINESS (888.287.4637). Please note that fees

for your account may be different than those listed in this

schedule based on your overall relationship with us.

We may change the accounts and services described

in this schedule at any time by adding new terms and

conditions or deleting or amending existing terms and

conditions. We may also add new accounts or services

and convert or discontinue existing accounts or services at

any time.

You can ordinarily open most accounts through all of our

channels – in our financial centers, through telephone

banking, mobile and online. However, some accounts may

not be available at all times, in all locations, or through

all channels. If your address is in a state where we do not

have a financial center, we may open the account as if you

opened it at a financial center in the state of Florida. In these

circumstances, the pricing and account terms will be those

applicable to accounts opened in the state of Florida.

Your account and deposit relationship are also governed

by the Deposit Agreement and Disclosures. Please read

that agreement carefully.

Account Services

All business checking accounts offer these optional

services and programs:

• Business Debit Card – lets you access Bank of America

ATMs to make deposits, withdrawals or transfers and

make purchases anywhere business debit cards are

accepted

• Business Employee Debit Card also available with access

and spending limits controlled by you

• Business Deposit Card for you or your employees

• Balance Connect

®

for overdraft protection is an optional

service which allows you to link up to five eligible backup

accounts (Balance Connect

®

is no

t available on savings

accounts). Please see the Deposit Agreement and

Disclosures for more information about eligibility and how

Balance Connect

®

t

ransfers work. Transfers from a linked

business credit card or business line of credit are subject

to interest charges.

• Preferred Rewards for Business provides a range of

benefits when you qualify for and enroll in the program

that increase as your business deposit and business

investment balances grow

Business Advantage Banking Accounts

• Business Advantage Fundamentals™ Banking

• Business Advantage Relationship Banking

Your Bank of America Business Advantage Banking Account offers you the ability to choose from and switch between two accounts.

Each account has a different set of features to offer you flexibility if your banking needs change.

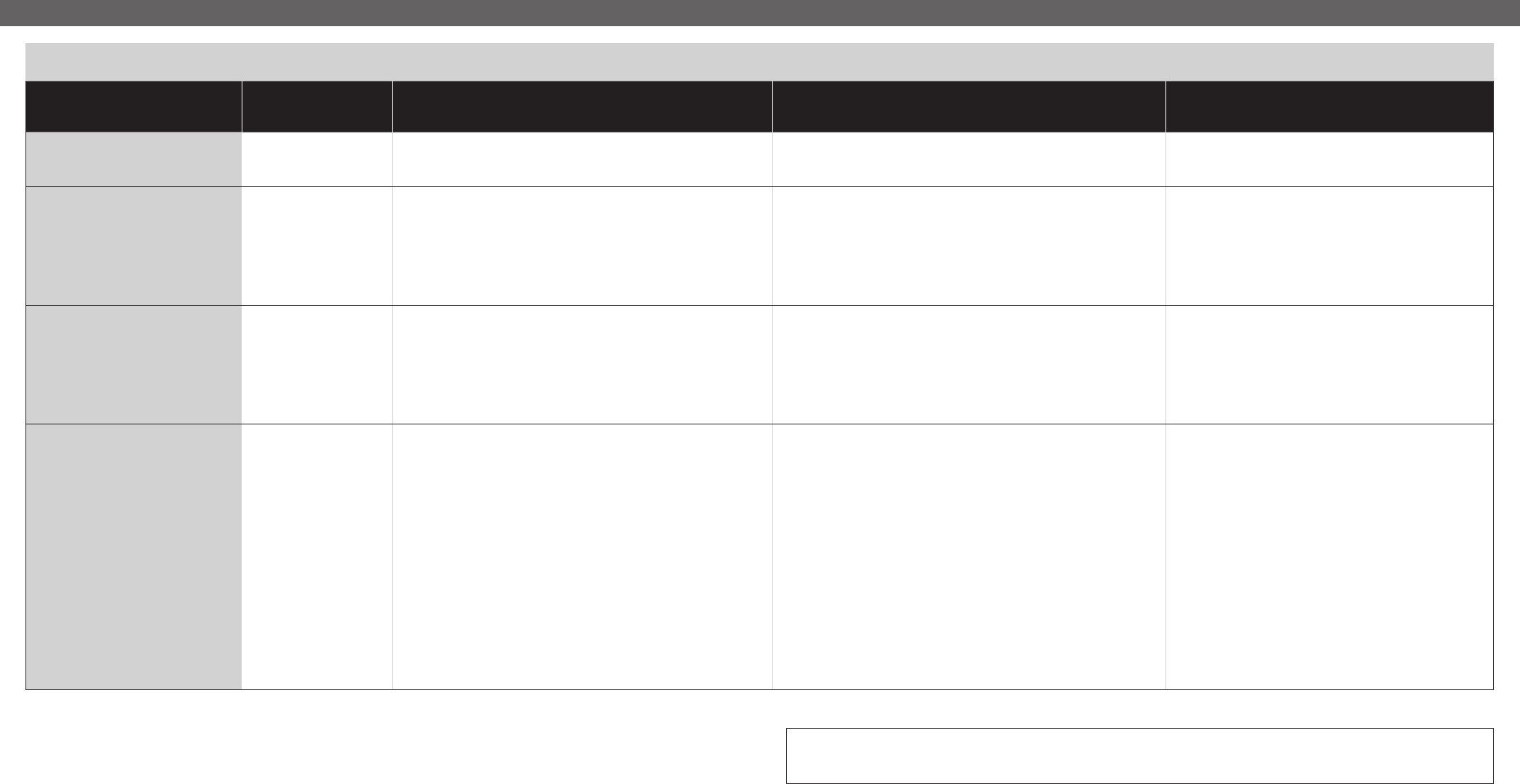

Account Monthly Fee and How to Avoid It Transaction Fees (per statement cycle) Other Important Account Information

Business Advantage

Fundamentals™ Banking

• This is a non-interest-bearing

account.

Monthly Fee for Business Advantage Fundamentals Banking - $16.00

To avoid the Monthly Fee, meet one of the following requirements during each banking

statement cycle:

• Maintain a $5,000 combined average monthly balance*.

OR

• Use your Bank of America business debit card to make at least $250 in new net qualified

purchases**.

Effective November 1, 2024, the Monthly Fee can be avoided when you use your

Bank of America business debit card to make at least $500 in new net qualified purchases.

OR

• Be a member of Preferred Rewards for Business (first 4 checking accounts per enrolled

business).

To allow time to establish your relationship, the Monthly Fee will not be assessed to your

account until your thirteenth statement cycle closes. To avoid this fee, you must meet one of

the above criteria.

Excess transactions (checks paid/other debits/

deposited items)

• No fee for first 200, then 45¢ per item

Effective November 1, 2024, there will be no fee for the

first 20 transactions, then 45¢ per item.

• No Excess Transaction Fee for debit card transactions,

electronic debits, and checks deposited through Mobile

Check Deposit, Bank of America ATM, or Remote

Deposit Online.

Deposit tickets

• No fee

Cash Deposit Processing Fee

• No fee for first $7,500 in cash deposited per

statement cycle at an ATM or Financial Center, then

30¢ per $100 deposited thereafter

Effective November 1, 2024, the Cash Deposit

Processing Fee will be no fee for first $5,000 in cash

deposited per statement cycle at an ATM or Financial

Center, then 30¢ per $100 deposited thereafter.

• See About the Cash Deposit Processing Fee under

the Other Account Information section for more detail

(see page 10).

• An account for businesses with lower transaction and cash

requirements.

• The Monthly Fee for banking and all linked and included accounts

will post after the cycle closes.

2

*

See Balance Information under the Other Account Information section for more detail.

**

Use a linked Bank of America business debit card to make at least $250 in new net purchases each statement cycle and Bank of America will

waive the Monthly Fee on your Business Advantage Fundamentals Banking account. In addition to the primary business debit, linked employee

business debit cards also count toward the monthly net purchases amount threshold.

The following transactions do not qualify: a) ATM transactions; b) refunds, returns or other adjustments; c) cash advances or purchases of cash-

like items, such as money orders, traveler’s cheques, foreign currency, cashier’s checks, gaming chips, and other similar instruments and things

of value; d) account funding transactions, including transfers to open or fund deposit, escrow or brokerage accounts and purchases of stored

value cards; e) pending (unposted) transactions.

NOTE: The waiver applies only when the owner of the Business Advantage Fundamentals Banking account and the owner of the linked product

share the same Taxpayer Identification Number (TIN).

3

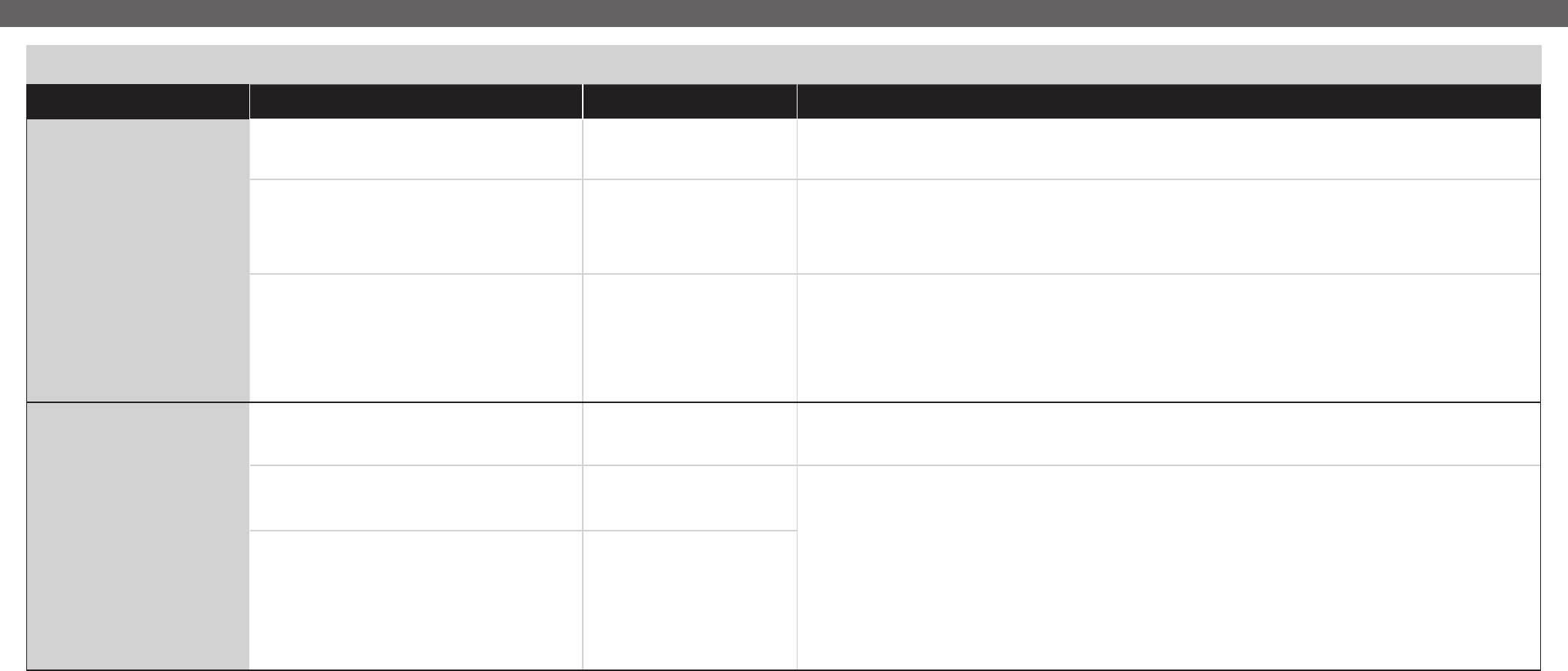

Business Advantage Banking Accounts (cont.)

Account Monthly Fee and How to Avoid It Transaction Fees (per statement cycle) Other Important Account Information

Business Advantage

Relationship Banking

• This is a non-interest-bearing

account.

Monthly Fee for Business Advantage Relationship Banking - $29.95

To avoid the Monthly Fee, meet one of the following requirements during each banking

statement cycle:

• Maintain a $15,000 combined average monthly balance*.

OR

• Be a member of Preferred Rewards for Business (first 4 checking accounts per enrolled

business).

To allow time to establish your relationship, the Monthly Fee will not be assessed to your

account until your third statement cycle closes. To avoid this fee, you must meet one of the

above criteria.

Transaction limits and fees are counted across the

primary account and the one included Business

Advantage Relationship Banking account.

Excess transactions (checks paid/other debits/

deposited items)

• No fee for first 500, then 45¢ per item

• No Excess Transaction Fee for debit card

transactions, electronic debits, and checks

deposited through Mobile Check Deposit,

Bank of America ATM, or Remote Deposit Online.

Deposit tickets

• No fee

Cash Deposit Processing Fee

• No fee for first $20,000 in cash deposited per

statement cycle at an ATM or Financial Center, then

30¢ per $100 deposited thereafter

• See About the Cash Deposit Processing Fee under

the Other Account Information section for more detail

(see page 10).

• An account for businesses with higher transaction and cash

requirements that includes additional services and the option to

include extra eligible accounts for no additional Monthly Fee.

• One extra Business Advantage Relationship Banking account and

one Business Advantage Savings account can be included for no

additional Monthly Fee.

• The Monthly Fee for banking and all linked and included accounts

will post after the cycle closes.

• You get the following services with all of your included accounts

in the Bank of America Business Advantage Relationship Banking

solution:

- No fee for introductory check package that includes checks,

deposit slips and an endorsement stamp (for the primary and one

included Business Advantage Relationship Banking account)

- No fee for stop payments

- No fee for incoming domestic and international wire transfers

- No fee for copies of checks

- No fee for copies of statements

- Preferred Rewards for Business members, or clients that ask for a

rush replacement ATM or Debit card due to a fraud event, qualify for

a waiver of the ATM or Debit Card Rush Replacement Fee.

Public Service Trust Account

Consider this account if you hold funds

in trust and interest must be paid to a

state program, such as an Interest On

Lawyer’s Trust Account (IOLTA) program.

Deducted from interest

• This account complies with the requirements of the IOLTA program

for the state where it is opened.

• Interest, less permissible fees, is paid to the state program.

• You are responsible for fees that are not deducted from the interest

paid to the state program.

*

See Balance Information under the Other Account Information section for more detail.

Business Savings Account

Account Monthly Fee and How to Avoid It Transaction Fees (per statement cycle) Other Important Account Information

Business Advantage Savings

• Interest bearing account

• Variable interest rate

• Potential for Preferred Rewards for

Business interest rate booster

feature

Monthly Fee - $10.00

To avoid the Monthly Fee, meet one of the following requirements during each savings

statement cycle:

• Maintain a $2,500 minimum daily balance.

OR

• Include one Business Advantage Savings account as part of your Business Advantage

Relationship Banking solution.

OR

• Be a member of Preferred Rewards for Business (first 4 savings accounts per

enrolled business).

To allow time to establish your relationship, the Monthly Fee will not be assessed to your

account until your third statement cycle closes. To avoid this fee, you must meet one of the

above criteria.

Deposited items

• No fee for first 25 items, then 45¢ per item

• The fee for deposited items will not apply to deposits

made using Mobile Check Deposit, Remote Deposit

Online or at a Bank of America ATM.

Deposit tickets

• No fee

Cash Deposit Processing Fee

• No fee for first $5,000 in cash deposited per state-

ment cycle at an ATM or Financial Center, then 30¢

per $100 deposited thereafter

• See About the Cash Deposit Processing Fee under

the Other Account Information section for more detail

(see page 10).

• You may not write checks on this account or use a debit card for

purchases (point-of-sale transactions).

• If you convert to this account from another account, please destroy

your checks.

• This account is not eligible to be enrolled in Balance Connect

®

as a

covered account, but can be linked as a backup account.

• Business ATM Card – lets you access Bank of America ATMs to make

deposits, withdrawals or transfers.

• Business Deposit Card – lets you or your employees make deposits

to your business banking or savings accounts at Bank of America

ATMs.

• Business Advantage Savings is eligible for the interest rate booster

feature of Preferred Rewards for Business, which may increase your

interest rate based on your Preferred Rewards for Business tier.

• This account is set to the Decline All Overdraft Setting. This means

that when we determine that you do not have sufficient available

funds in your account to cover an item, we will decline or return it

unpaid. You may be assessed a fee by a merchant if this happens.

4

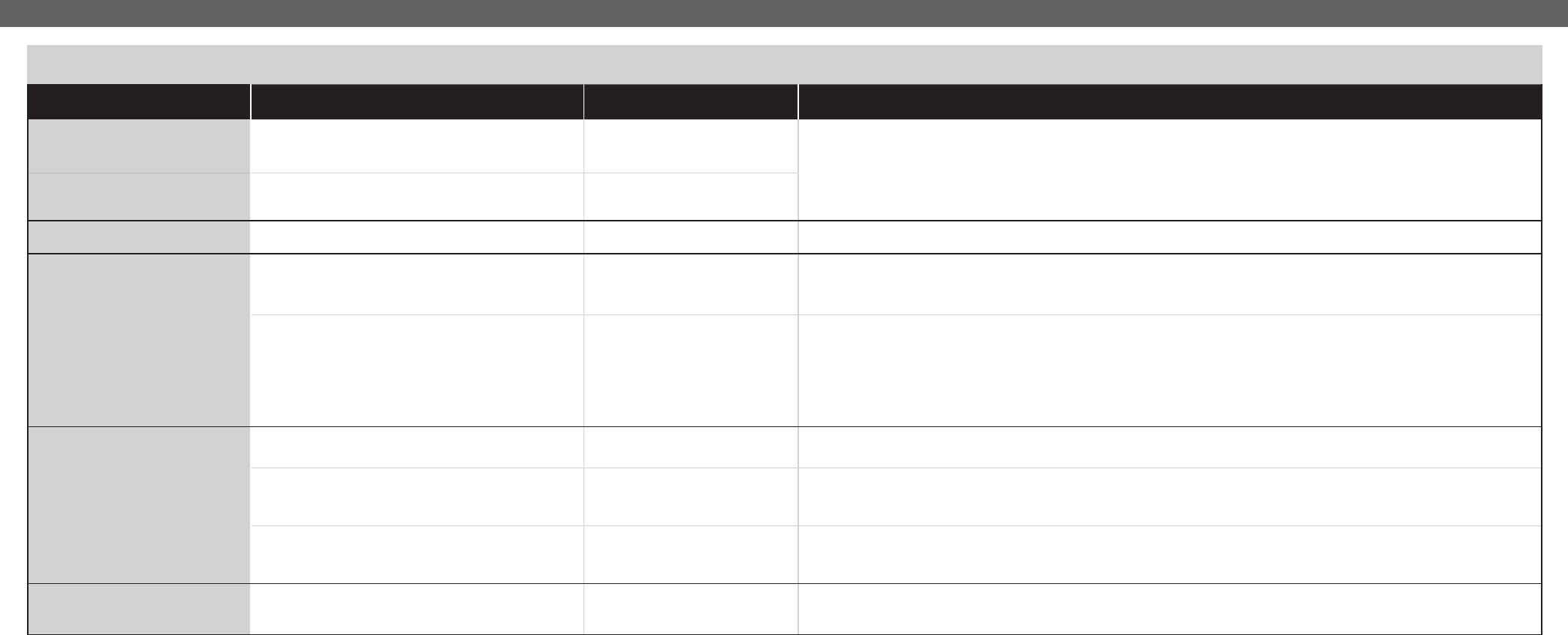

Time Deposits - CDs

Account Minimum Amount You

Need to Open Account

Account Features / Services Interest Rate Other Important Account Information

CD

Terms of 7 Days — 27 Days

$15,000

• No additional deposits until maturity.

• Automatically renews.

Fixed until maturity.

• A penalty is imposed for early withdrawal.

CD

Terms of 28 Days — 10 Years

$1,000

• No additional deposits until maturity.

• Automatically renews.

Fixed until maturity.

• A penalty is imposed for early withdrawal.

• For CDs with terms of 30 days or more, we send you a

maturity notice prior to renewal. Please read it carefully.

We may change the type, term or other features of your

CD by giving you notice. If we make a change, we tell

you about the change in the maturity notice.

Featured CD

See deposit rate sheet

for minimum opening

amount

• No additional deposits until maturity.

• Automatically renews.

• See deposit rate sheet for available terms.

Fixed until maturity.

• A penalty is imposed for early withdrawal.

• We send you a maturity notice prior to renewal. Please

read it carefully. We may change the type, term or other

features of your CD by giving you notice. If we make a

change, we tell you about the change in the maturity

notice.

Flexible CD

See deposit rate sheet

for minimum opening

amount

• No additional deposits until maturity.

• Automatically renews.

• See deposit rate sheet for available terms.

Fixed until maturity.

• A penalty of 7 days interest will be imposed for early

withdrawals within the first 6 days of the account

term (or within the first 6 days following any partial

withdrawal during the initial or any renewal term).

• If your account has not earned enough interest to cover

an early withdrawal penalty, we deduct any interest

first and take the remainder of the penalty from your

principal.

• See Deposit Agreement and Disclosures and deposit

rate sheet for additional detail.

• We send you a maturity notice prior to renewal. Please

read it carefully. We may change the type, term or other

features of your CD by giving you notice. If we make a

change, we tell you about the change in the maturity

notice.

5

Please also review Other Account Fees and Services section on the following pages. The Deposit Agreement and Disclosures

contains information about how we calculate interest, the early withdrawal penalty and other terms for CDs.

Other Account Fees and Services

Fee Category Fee Name/Description Fee Amount Other Important Information About This Fee

ATM Card and

Debit Card Fees

Rush Replacement ATM or Debit Card Fee $15.00 per card

• Fee for each requested rush delivery of a card or other debit access device.

• Preferred Rewards for Business members, or clients that ask for a rush replacement ATM or Debit card due to a fraud event, qualify

for a waiver of this fee.

Non-Bank of America Teller Withdrawal Fee For each transaction, the

greater of $5.00 OR

3% of the dollar amount of

the transaction, up to a

maximum of $10.00

• Fee applies when you authorize another financial institution to use your card or card number to conduct a transaction (such as a

withdrawal, transfer, or payment) and the other financial institution processes the transaction as a cash disbursement.

International Transaction Fee • International transaction in

a foreign currency: 3% of the

U.S. dollar amount

• International transaction in

U.S. dollar: $0

• Fee applies if you use your ATM or Debit card to purchase goods or services in a foreign currency (a “Foreign Transaction”).

Foreign Transactions include internet transactions made in the U.S. but with a merchant who processes the transaction in a

foreign currency.

• Fee also applies if you use your card to obtain foreign currency from an ATM. Visa

®

or Mastercard

®

converts the transaction into a

U.S. dollar amount, and the International Transaction Fee applies to that converted U.S. dollar amount. ATM fees may also apply

to ATM transactions. See ATM Fees section below.

• See disclosure information that accompanied your card for more information about this fee.

ATM Fees

Bank of America ATM Fee for:

Withdr

awals, deposits, transfers, payments and balance

inquiries at a Bank of America ATM

No ATM fee*

• Bank of America ATM — an ATM that prominently displays the Bank of America name and logo on the ATM.

• Deposits and payments may not be available at some ATMs.

*Transaction fees may apply to some accounts. See account descriptions in this schedule.

Non-Bank of America ATM Fee for:

Withdrawals and transfers at a

non-Bank of America ATM located in the U.S.

$2.50 each

• Non-Bank of America ATM — an ATM that does not prominently display the Bank of America name and logo on the ATM.

• When you use a non-Bank of America ATM, you may also be charged a fee by the ATM operator or any network used.

• The non-Bank of America ATM fees do not apply at some ATMs located outside the United States. Call us before you travel

internationally for current information about banks participating in the program.

• See the disclosure information that accompanied your card for other fees that may apply.

• Non-Bank of America ATM fees are in addition to other account fees that may apply to the transaction.

• Members in the Preferred Rewards for Business Platinum tier using a Bank of America Debit or ATM card are not charged the

non-Bank of America ATM fee for one withdrawal and one transfer per statement cycle from a non-Bank of America ATM in the U.S.,

and receive a refund of the ATM operator fee for one withdrawal and one transfer per statement cycle from a non-Bank of America

ATM in the U.S.

• Members in the Preferred Rewards for Business Platinum Honors tier using a Bank of America Debit or ATM card are not charged the

non-Bank of America ATM fee for withdrawals and transfers from non-Bank of America ATMs in the U.S., and receive a refund of the

ATM operator fee for withdrawals and transfers from non-Bank of America ATMs in the U.S.

Non-Bank of America ATM Fee for:

Withdrawals and transfers at a

non-Bank of America ATM located in a foreign country

$5.00 each

6

7

Other Account Fees and Services (cont.)

Fee Category Fee Name/Description Fee Amount Other Important Information About This Fee

Check Cashing

Bank of America customer

No fee

• A fee may be assessed to a payee presenting a check that you issued if the payee is not a Bank of America relationship customer.

A Bank of America relationship customer is an account owner of a deposit account (checking, savings, CD), Individual Retirement

Account (IRA), loan, credit card, mortgage, safe deposit box or a Merrill Investment account.

Nonrelationship customer Applies to checks drawn on Bank of America

business accounts

$8.00 per check

Certificate of Protest

Certificate of Protest No fee

• This service only applies to accounts in New York.

Check Safekeeping and

Check Image Services

Check Safekeeping Service No fee

• We store copies of cancelled checks for seven years and do not return them with your statement.

• Our Business Advantage 360 service (our Small Business Online Banking) allows you to view and print copies of checks that

posted to your account within the last 18 months.

Check Image Service No fee

• We provide images of the front and back of your cancelled checks in your digital statements.

• Each account statement includes images of checks (up to 5 per page) that posted to your account during the statement cycle.

• We do not return your cancelled checks.

• You can view and print copies of the front and back of checks posted within the last 18 months by signing in to Business

Advantage 360, or you can request check copies by visiting your nearest Bank of America financial center, or calling the customer

service number on your statement.

Copy Fee

Check Copy No fee

• Check copies available upon request through the Financial or Contact Center. You may also view and print checks in Business

Advantage 360. For information about what checks are available in Business Advantage 360, please review the Activity tab.

Deposit Slips and other Credit Items No fee

• Deposit Slip or other Credit Item copies are available upon request through the Financial or Contact Center. You may also view and

print Deposit Slips and other Credit Items in Business Advantage 360. For information about what Deposit Slips and other Credit

Items are available in Business Advantage 360, please review the Activity tab.

Statement Copy No fee

• Statement copies are available upon request through the Financial or Contact Center. You may also view and print statement

copies in Business Advantage 360. For information about what statements are available in Business Advantage 360, please

review the Statements and Documents tab.

Deposited Item Recleared

Deposited Item Recleared Fee

(Redeposit Fee)

$14.00 each item

• For information about the optional Deposited Item Recleared service, please call the number on your statement or visit your local

financial center.

8

Other Account Fees and Services (cont.)

Fee Category Fee Name/Description Fee Amount Other Important Information About This Fee

Overdraft Items

(an overdraft item)

Business Advantage Savings

accounts do not have

Overdraft Item Fees

Overdraft Item Fee $10.00 each item

• During nightly processing, when we determine that you do not have enough available funds in your account to cover an item, then we

either pay the item and overdraw your account (an overdraft item), or we return the item unpaid (a returned item).

• Some common examples of “items” are a check or other transaction made using your checking account number, an everyday

non-recurring debit card transaction, a recurring debit card transaction, an ATM withdrawal, an ACH submission, and an Online or

automatic bill payment. Please see the Deposit Agreement and Disclosures for more information about “items”, overdrafts, declined

or returned items and for information about how we process and post items.

• We charge an Overdraft Item Fee for each overdraft item, but will not charge this fee for more than 2 overdraft items per day.

• We do not charge an Overdraft Item Fee:

- When we return an item unpaid due to insufficient funds, but you may be charged a fee(s) by the payee for the returned item

- On ATM transactions

- On items that were authorized when your account had sufficient available funds

- On any item that is $1 or less or any item that overdraws your account by $1 or less

- On accounts with the Decline All Overdraft Setting, even if the account becomes overdrawn

- On any ACH submission labeled as a “RETRY PYMT” or “REDEPCHECK” in the data transmitted through the ACH network (see more

details below)

• Under the NACHA Operating Rules, a merchant or payee, or its financial institution is required to label an ACH submission that has

been resubmitted after the previous submission was returned for insufficient funds as a “RETRY PYMT” or “REDEPCHECK”. We do

not charge you an Overdraft Item Fee on any ACH submission labeled as a “RETRY PYMT” or “REDEPCHECK” in the data transmitted

through the ACH Network. For example, if you authorize your cable company to debit your account on a one-time or recurring basis or

through an electronic check and the resulting ACH submission is returned for insufficient funds, we will not charge you an Overdraft

Item Fee on a resubmission as long as the resubmission bears the “RETRY PYMT” or “REDEPCHECK” label. However, because we

cannot reliably identify ACH resubmissions that are not labeled “RETRY PYMT” or “REDEPCHECK” by the merchant or payee, or its

financial institution, if your cable company resubmits the ACH submission without the “RETRY PYMT” or “REDEPCHECK” label, you

may incur an additional and separate Overdraft Item Fee. We have no control over how merchants label their ACH submissions or

resubmissions. If you believe that a resubmitted electronic transfer was mislabeled and you were improperly charged an Overdraft

Item Fee, you must notify the Bank within the timeframes established by the Deposit Agreement and Disclosures and the Electronic

Fund Transfer Act. See Deposit Agreement and Disclosures sections titled Reporting Problems and Funds Transfer Services.

• To help you manage your account, we recommend that you use Business Advantage 360, Online Alerts and Balance Connect

®

for

overdraft protection from your linked Bank of America business deposit account, business credit card or business line of credit. As an

example, use low balance Alerts to notify you when your balance drops below an amount you set.

• For information about our Balance Connect

®

for overdraft protection service, overdraft practices and overdraft settings, please see

our Deposit Agreement and Disclosures.

Stop Payment

Stop Payment Fee $30.00 per request

• All accounts included in the Business Advantage Relationship Banking solution and members enrolled in Preferred Rewards for

Business qualify for a waiver of this fee.

9

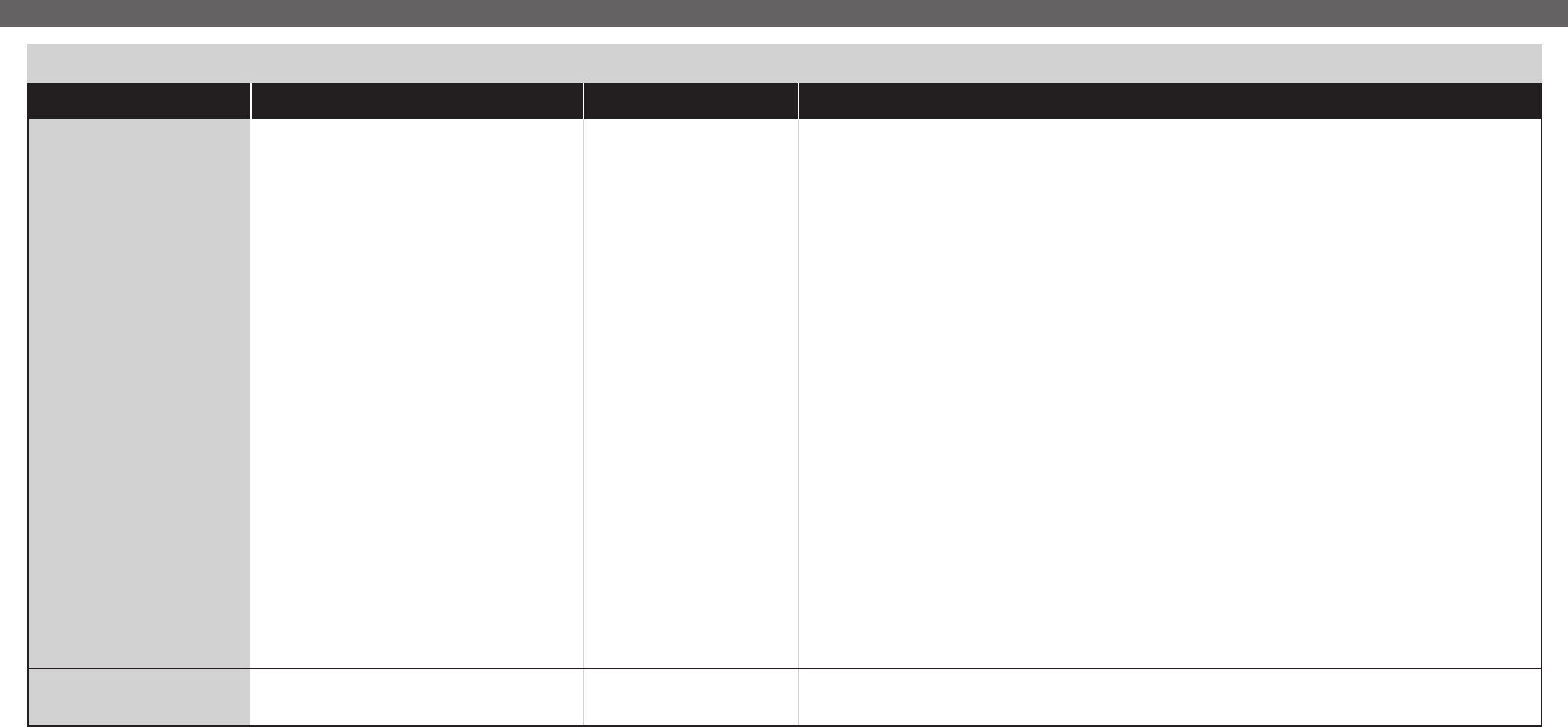

Other Account Fees and Services (cont.)

Fee Category Fee Name/Description Fee Amount Other Important Information About This Fee

Wire Transfers

Incoming or Outgoing Wire Transfers

(U.S. or International)

• Domestic outgoing wire: $30

• Domestic incoming wire:

$15

• International outgoing wire in

U.S. dollars: $45

• International outgoing wire in

foreign currency: $0

• International incoming wire:

$15

For international wire

transfers, other fees or

amounts may also apply,

including those charged by the

recipient’s financial institution,

foreign taxes, and other fees

that sometimes are part of the

wire transfer process.

Please note that you may

be able to transfer money

to or receive money from

third parties within the U.S.

without incurring a fee or with

a reduced fee, including by

using Zelle , depending on a

number of factors and the type

of service that you choose (see

the Online Banking Service

Agreement, available at

®

https://www.bankofamerica.

com/online-banking/service-

agreement.go).

• Business Advantage Relationship Banking accounts included in the solution qualify for a waiver of our standard wire fee for an

incoming domestic wire and incoming international wire transfer.

• Preferred Rewards for Business members qualify for a waiver of our standard wire fee for incoming domestic wire transfers. The

standard wire fee for incoming international wire transfers is only waived for Preferred Rewards for Business members in the Platinum

and Platinum Honors tiers.

• Only Preferred Rewards for Business members in the Platinum Honors tier qualify for a waiver of our standard wire fee for outbound

domestic and international wires sent in U.S. Dollars for the first four (4) wires sent per statement cycle through the online channel

(includes wires sent through Business Advantage 360 and Direct Payments). Wires sent via CashPro are not eligible for the fee waiver.

• We’re required by law to inform you of the exact fees you will incur for international wires, including fees from other banks. If we do

not have the exact fees from other banks, we will not be able to process the request.

Foreign Currency Exchange Fees and Rates

• Markups associated with the currency conversion are included in the Bank of America exchange rate.

• When deciding between sending in foreign currency or U.S. Dollars, you should consider factors that impact the total cost to send

or the amount available after transfer, such as exchange rates and other fees.

10

Other Account Information

This section covers some of the features and services that

may apply to your account, depending on which account

you have and how you use your account. Please see the

Deposit Agreement and Disclosures for more information.

Balance Information

The terms “Opening Balance,” “Minimum and Average

Balances,” “Minimum Daily Balance,” “Average Monthly

Balance,” “Combined Average Monthly Balance” and

“Eligible Balances” are explained below. Other balance terms

are explained in the Deposit Agreement and Disclosures.

Opening Balance. You can open most banking and

savings accounts with a deposit of $100 or more.

Minimum and Average Balances. With most banking and

savings accounts, you can avoid the monthly fee for each

statement cycle during which you maintain a specified

balance. If applicable, the balance requirements are

listed with the account description.

Minimum Daily Balance. The lowest balance that we

determine is in the business account during a statement

cycle.

Average Monthly Balance. For a statement cycle, we take

the balance that we determine is in the business account

for each day in the statement cycle, add those balances

together, and then divide that sum by the number of days

in the statement cycle.

Combined Average Monthly Balance. For a statement

cycle, we add the following balances together in your

linked business accounts to calculate the combined

average monthly balance:

• The average monthly balance in your banking account

and in each banking and savings account that is linked

to it.

• We determine the average monthly balance in a linked

account by using the beginning balance in the linked

account for each day of the primary banking statement

cycle.

And

• The current balance, as of the end of your primary

banking statement cycle in each CD that is linked to your

primary banking account.

See below for the eligible account types that may be linked

to meet the combined balance requirement for each

business banking product.

For Business Advantage Fundamentals Banking Eligible

Balances. For this banking solution, you may link Business

Economy Checking, Business Interest Checking, Business

Advantage Savings, Business Investment Account and

Business CD accounts.

For Business Advantage Relationship Banking Eligible

Balances. For this banking solution, you may link the one

extra Business Advantage Relationship Banking account

that can be included for no additional Monthly Fee with

your solution, Business Economy Checking, Business

Interest Checking, Business Advantage Savings, Business

Investment Account and Business CD accounts.

We use the balances in your linked accounts to calculate

the combined balances. A business banking solution

cannot be linked to another business banking solution

- for example, two Business Advantage Relationship

Banking solutions cannot be linked together. If you

have an existing Additional Checking, Business Interest

Checking or Business Investment Account linked to a

Business Advantage Fundamentals Banking solution or a

Business Advantage Relationship Banking solution prior

to February 19, 2021, your accounts will remain linked to

that solution.

Public service trust accounts, such as IOLTA accounts, and

certain other fiduciary accounts such as trusts and estate

accounts, are not eligible to be linked to non-fiduciary

accounts and are not counted toward the combined

balance requirement.

About the Cash Deposit Processing Fee

To determine the nearest $100 increment, less than

$50.00 is rounded down and $50.00 or more is

rounded up.

Please also see the Deposit Agreement and Disclosures.

This panel intentionally left blank.

Frequently Asked Questions about Business Banking

and Savings Accounts

What other agreements have terms that apply to

my deposit account?

In addition to the terms in this Schedule of Fees, the

terms in the Deposit Agreement and Disclosures, the

signature card for your account and the other account

opening documents govern your account and are part of

the binding contract between you and us for your account.

Please read these documents carefully.

What are paperless statements?

With the paperless statement option, you get your account

statement electronically through Business Advantage 360,

and you do not get a paper statement. You can enroll in

paperless statements at a financial center or through

Business Advantage 360. When you enroll at a financial

center, you’ll need to log into Business Advantage 360,

from your computer to confirm your choice.

How long is a statement cycle for a banking

account?

The normal statement cycle for a banking account can

range from 28 to 33 days. The beginning and end dates

may vary slightly from month to month and are listed on

the statement.

What are combined statements?

A combined statement is one statement that reports

activity for your primary banking account and any deposit

account linked to that primary account that you choose

to be included in the combined statement, instead of

separate statements for each account. You must do two

things in order to have a combined statement. First, you

must specifically request a combined statement. Second,

you must tell us which deposit accounts you want included

in the combined statement. Credit and charge card

accounts cannot be selected for the combined statement.

Since each linked deposit account is reported on the

combined statement, you understand and agree that each

owner of any linked account can review information about

all other linked accounts. You should not choose to include

any linked accounts in a combined statement that you do

not want others to see. Combined statements may not

be available in some states. Please read the information

about Combined Statements in the Deposit Agreement and

Disclosures.

What does variable rate mean?

Funds in an interest-bearing banking or savings

account earn a variable interest rate. This means

that your interest rate and annual percentage yield

may change after the account is opened. At our discretion,

we may change your interest rate and annual percentage

yield at any time.

What is the difference between “included accounts”

and “linked accounts”?

“Included accounts” refers to those accounts that are

included as part of a business banking solution for no

additional Monthly Fee. For the Business Advantage

Relationship Banking solution, your primary account is a

Business Advantage Relationship Banking account, and

you can choose to include another Business Advantage

Relationship Banking account and/or a Business Advantage

Savings account with no additional Monthly Fees. “Linkage”

or “linking” refers to the process by which a particular

account or service either gets included as part of a solution,

and/or counted as a way to avoid the Monthly Fee. “Linked

accounts” refers to those eligible products or services

whose balances can be combined, or usage counted, as

a way to qualify for a Monthly Fee waiver on a particular

solution. See Other Account Information for eligible account

balances. We do not ordinarily link your other accounts

unless you tell us to do so. You must visit a financial

center or call 888.BUSINESS (888.287.4637) and tell us

what accounts you would like to link to your solution. A

solution cannot be linked to another solution.

What happens when I link my debit card to a

Business Advantage Fundamentals Banking

account in the banking solution?

Business debit card purchases made on the primary banking

account or on additional Business Advantage Fundamentals

Banking accounts in the solution count towards the monthly

spend requirement to waive the Monthly Fee.

11

Are the statement cycles for linked accounts

the same?

If you use a combined statement for your banking and

savings accounts, the statement cycles for the linked

banking and savings accounts are generally the same.

Cycle dates may vary if you chose not to have a combined

statement.

When do Monthly Fees post?

For each statement cycle, the Monthly Fee for a banking

solution (and included accounts) will be applied to the

primary banking account if you did not meet any of the

specified ways to qualify for a waiver, and will post after

the statement cycle closes. For additional savings or

banking accounts linked to a solution, the Monthly Fees

for those accounts will also post after the statement cycle

closes, unless a balance qualifier is met.

When will the fee for cash deposit processing

post to my account? When will I see the fee on my

monthly banking statement?

The fee will not be posted in the month that the cash is

deposited. It will be posted and you will see the fee on

either your next monthly statement or the following one.

The Cash Deposit Processing Fee will be assessed at the

rate for your current account type when the fee posts to

your monthly statement.

What restrictions apply when linking deposit

accounts to a banking solution?

Some restrictions apply to which accounts can be linked

to a solution. Accounts located in different states cannot

always be linked. You may not link a banking solution

to another banking solution. To link additional accounts

to a banking solution, at least one of the owners of the

additional account must also be an owner of the primary

banking account in the solution. You may not link personal

and business accounts together.

Public service trust accounts, such as IOLTA accounts, and

certain other fiduciary accounts such as trusts and estate

accounts, are not eligible to be linked to non-fiduciary

accounts and are not counted toward the combined

balance requirement.

What happens if I change my Business Advantage

Fundamentals Banking solution to a Business

Advantage Relationship Banking solution?

If you upgrade your Business Advantage Fundamentals

Banking solution to a Business Advantage Relationship

Banking solution and you have existing Additional

Checking accounts included in your Business Advantage

Fundamentals Banking solution, when you upgrade your

solution you can include one Additional Checking account

in your Business Advantage Relationship Banking solution

for no additional Monthly Fee. However, this account will

be changed to a Business Advantage Relationship Banking

account and linked to the new Business Advantage

Relationship Banking solution. Any remaining Additional

Checking accounts will each form a new, separate

Business Advantage Relationship Banking solution. Fees

will change as will Monthly Fee waiver qualifications. See

the Business Advantage Relationship Banking solution

description on page 3. When you upgrade, accounts

linked to your Business Advantage Fundamentals Banking

solution may be delinked. You have the option of linking

accounts that were linked to your Business Advantage

Fundamentals Banking solution, for purposes of meeting

the balance or usage requirements to qualify for a Monthly

Fee waiver, to your new Business Advantage Relationship

Banking solution.

What happens if I change my Business Advantage

Relationship Banking solution to a Business

Advantage Fundamentals Banking solution?

If you downgrade your Business Advantage Relationship

Banking solution to a Business Advantage Fundamentals

Banking solution and you have existing Additional

Checking accounts included in your Business Advantage

Relationship Banking solution, when you downgrade

your solution the Additional Checking accounts will each

form a new, separate Business Advantage Fundamentals

Banking solution, subject to the fees and Monthly

Fee waiver qualifications for the Business Advantage

Frequently Asked Questions about Business Banking

and Savings Accounts (cont.)

Fundamentals Banking solution. See the Business

Advantage Fundamentals Banking solution description on

page 2. When you downgrade, accounts linked to your

Business Advantage Relationship Banking solution may

be delinked. You have the option of linking accounts

that were linked to your Business Advantage Relationship

Banking solution, for purposes of meeting the balance or

usage requirements to qualify for a Monthly Fee waiver,

to your new Business Advantage Fundamentals Banking

solution.

What happens if my primary checking account

is closed in a Business Advantage Relationship

Banking or Business Advantage Fundamentals

Banking solution?

Each banking solution has a primary checking account. If

your primary checking account is closed, then you must tell

us whether you want one of the other checking accounts

in the solution to become your new primary account. If

you do not select a new primary account, then we delink

all of the other checking accounts and each one becomes

a separate banking solution, subject to the Monthly Fee

for that type of banking solution. If you have Business

Interest Checking or Business Economy Checking accounts

linked to the solution, these accounts will also be delinked

and cannot be relinked. Business Economy Checking and

Business Interest Checking cannot become the primary

account in a checking solution.

12

This panel intentionally left blank. This panel intentionally left blank.

Preferred Rewards for Business Program Rules

Preferred Rewards for Business is only available to

Bank of America Small Business, Merrill Small Business,

and Bank of America Private Bank Small Business clients.

Other categories of clients, such as those commonly

referred to as Business Banking, Global Commercial

Banking, Global Corporate Investment Banking, or

Institutional clients are not eligible to participate in the

program.

You may enroll in Preferred Rewards for Business when

you:

(i)

have an active, eligible business checking account

with Bank of America (eligible checking accounts

are any Small Business checking account and the

following Analyzed checking accounts: Full Analysis

Business Checking or Analyzed Business Interest

Checking); and

(ii) maintain a combined average daily balance in

your qualifying Bank of America business deposit

accounts and/or your Merrill business investment

accounts (such as Working Capital Management

Accounts, Endowment Management Accounts,

International Cash Management Accounts, Business

Investor Accounts, Delaware Business Accounts).

You can satisfy the combined balance requirement for

enrollment with either:

(i) your average daily balance for a three calendar

month period; or

(ii) your current combined balance, provided that

you enroll at the time you open your first eligible

business checking account and satisfy the balance

requirement at the end of at least one day within

thirty days of opening that account.

Once you are eligible, you can enroll for program benefits.

Enrollment is generally available three or more business

days after the end of the calendar month in which you

satisfy the requirements. Bank of America Private Bank

Small Business clients are automatically enrolled in the

program.

Your benefits become effective within 30 days of your

enrollment, or for new accounts within 30 days of account

opening, unless we indicate otherwise. Some benefits

are automatically activated upon the effective date of

your enrollment and require no action on your part.

Some benefits may require you to open a new account

or take other action. Some benefits are available based

on balances and other requirements without the need to

enroll. Read carefully the terms of any offer to understand

the action required.

To receive Payroll benefits, the deposit account receiving

the benefit must be open at the time the benefit is paid.

You must be enrolled in Preferred Rewards for Business

at the time the benefit is paid. Any pending benefits are

forfeited upon account closure. The benefit will be based

on your Preferred Rewards for Business tier at the time the

benefit is paid.

To receive the merchant services benefit, your Merchant

Services processing account, and the Bank of America

business checking account where you are settling your

sales processing transactions, must be open and you

must be enrolled in Preferred Rewards for Business at the

time the benefit is paid. Any pending benefits forfeit upon

account closure. Your processing rate discount will be

based on your Preferred Rewards for Business tier at the

time the benefit is paid. Exclusions may apply based on the

merchant processing product. Subject to change.

Different benefits are available at different balance tiers.

The balance tiers are: Gold, for qualifying combined

balances at and above $20,000; Platinum, for

qualifying combined balances at and above $50,000; and

Platinum Honors, for qualifying combined balances at or

above $100,000. Bank of America Private Bank Small

Business clients are automatically enrolled in the program

at the Platinum Honors tier as long as you maintain your

Bank of America Private Bank relationship.

You will qualify for the next higher balance tier when your

three-month combined average daily balance meets or

exceeds the minimum amount for that balance tier. Once

you qualify for the next higher balance tier, you will be

moved to that balance tier starting in the month after

the month in which you satisfy the combined balance

requirement.

We will perform an annual review of your qualifying balance

in the month following the anniversary date of your initial

enrollment in the program. The annual review will calculate

your three-month combined average daily balance as of the

end of your anniversary month. If the result of the annual

review calculation would be to move you to a lower tier, you

will have a three month period from your anniversary month

to restore your qualifying balance before you are moved to

that lower balance tier. If you are moved to a lower balance

tier, your benefits may be changed to those of the balance

tier for which you qualify without further notice. Please note

that while you can be moved to a higher balance tier after

any month in which you satisfy the three-month combined

average daily balance requirement for that tier, you will only

be moved to a lower balance tier as a result of the annual

review.

At the annual review, we will also confirm that you still

have an active, eligible business checking account with

Bank of America. If as a result of the annual review you

do not qualify for any balance tier, or you no longer have

an eligible business checking account, and you do not

sufficiently restore your balances or open an eligible

business checking account in the three months after

your anniversary month, your program qualification will

discontinue. Your benefits may then be discontinued

immediately without further notice.

You or we may terminate your enrollment at any time. We may

change or terminate program benefits at any time, without

prior notice.

Only business accounts owned by the same business

entity, and that in our determination are in good standing,

count toward your balance requirements and receive

benefits. Accounts that we do not recognize as accounts

of the same business entity, due to inconsistent business

names or other identifying information, will not be counted

together to qualify for eligibility or benefits. Accounts on

which you are a signer but not an owner, or accounts

included in your periodic statement on which you are not

an owner, are not eligible. Personal accounts do not count

towards the checking account requirement or balance

requirements for the program, and will not be eligible to

receive program benefits. Bank of America has a separate

rewards program for personal accounts. Your personal

accounts can be used to qualify for that program.

Each business entity, including business entities with

common ownership, must qualify on its own to be eligible

for the program and must enroll in the program separately.

If at any time you become a Business Banking, Global

Commercial Banking, Global Corporate Investment

Banking, or Institutional client, and are no longer a Small

Business client, your qualification will discontinue. Your

benefits will then be discontinued without further notice.

Contact us at the phone number on your statement if you

have questions about your Bank relationship.

See the chart below for examples of accounts that do and

do not qualify for the combined balance calculation.

Qualify

Accounts owned by the business, including -

Bank of America business deposit accounts:

• Business Checking:

Business Advantage Relationship Banking, Business

Advantage Fundamentals™ Banking, Business Interest

Checking, Business Economy Checking, Analyzed Business

Interest Checking*, Full Analysis Business Checking*

• Business Savings:

Business Advantage Savings, Business Investment

Account, Analyzed Business Investment Account*, Full

Analysis Zero Investment Savings*

• Business CDs

• Merrill business investment accounts such as:

Working Capital Management Accounts (WCMA),

Endowment Management Accounts (EMA),

International Cash Management Accounts (ICMA),

Business Investor Accounts (BIA), Delaware Business

Accounts.

* While analyzed business accounts count towards the

checking account and balance requirements, these

accounts do not receive fee waiver benefits under the

program.

Do Not Qualify or Receive Program Benefits

• Accounts not owned by the business and accounts held by

the business in a fiduciary capacity. For example, accounts

on which the business is a/an Administrator, Beneficiary,

Custodian, Executor, Guardian, Power of Attorney,

Representative Payee, or Trustee

• All Trust accounts, including those designated as: Attorney

Trust, Estate, Escrow, Housing/Land Title, IRETA, Insurance

Agent/Broker Trust, IOLTA, IOTA, Landlord/Tenant, Lottery,

Public Service Trust, Political Action/Campaign Accounts,

State/Local Government, Trust and Living Trust, UTA (Under

Trust Agreement), or Representative Payee

• Uniform Transfers to Minor Act (UTMA) and Uniform Gifts to

Minors Act (UGMA) accounts

• Client Funds accounts

• Public Funds accounts

• Personal accounts

• Employee Benefit plans (such as 401(k) plans and

Health Care Savings Accounts) and retirement accounts

• Annuities

These account types also do not qualify for the Checking

Account Eligibility requirement or receive Program Benefits.

13

14

Not all products and services eligible for benefits under the

Preferred Rewards for Business program are available in all

locations. Please contact 888.BUSINESS (888.287.4637),

or if you are a Merrill Lynch Wealth Management or

Bank of America Private Bank client contact your advisor,

for details about which products and services are available

in your location.

Bank of America employees and retirees are subject to

standard program terms.

Merrill Lynch, Pierce, Fenner & Smith Incorporated (also

referred to as “MLPF&S” or “Merrill”) makes available

certain investment products sponsored, managed,

distributed or provided by companies that are affiliates of

Bank of America Corporation (“BofA Corp.”). MLPF&S is

a registered broker-dealer, registered investment advisor,

Member SIPC and a wholly owned subsidiary of

BofA Corp.

Banking, mortgage and home equity products are provided

by Bank of America, N.A., and affiliated banks, Members

FDIC and wholly owned subsidiaries of BofA Corp.

Bank of America, N.A. Equal Housing Lender.

Credit and collateral are subject to approval. Terms

and conditions apply. This is not a commitment to lend.

Programs, rates, terms and conditions are subject to

change without notice.

Investment products are provided by MLPF&S and:

Are Not FDIC

Insured

Are Not Bank

Guaranteed

May Lose Value

Bank of America Private Bank is a division of

Bank of America, N.A., Member FDIC, and a wholly owned

subsidiary of BofA Corp.

©2024

Bank of America Corporation

This panel intentionally left blank. This panel intentionally left blank.

This panel intentionally left blank. This panel intentionally left blank. This panel intentionally left blank. This panel intentionally left blank.

15

16

This panel intentionally left blank. This panel intentionally left blank.