Eaton Vance Closed-End Funds

Eaton Vance manages eight closed-end funds that invest in common stocks and employ options strategies.

An overview of each fund’s investment objectives and investment program is included in the attached

Quick Reference Guide. Also included are key portfolio characteristics as of June 30, 2024.

Eaton Vance Equity Option Closed-End Funds

The Funds currently make distributions in accordance with a managed distribution plan. Distributions may include amounts characterized for federal income

tax purposes as ordinary dividends (including qualied dividends), capital gain distributions and nondividend distributions, also known as return of capital

distributions. A return of capital distribution may include, for example, a return of some or all of the money that an investor invested in Fund shares. With each

distribution, a Fund issues a notice to shareholders and a press release containing information about the amount and sources of the distribution and other related

information. Notices and press releases for the last 24 months are available on the Eaton Vance website (http://funds.eatonvance.com/19a-Fund-Distribution-

Notices.php). The amounts and sources of distributions reported in notices and press releases are only estimates and are not provided for tax reporting purposes.

Each Fund reports the character of distributions for federal income tax purposes for each calendar year on Form 1099-DIV. A Fund’s distributions in any period

may be more or less than the net return earned by the Fund on its investments, and therefore should not be used as a measure of performance or confused with

“yield” or “income.” Fund distribution rates are determined by its adviser based on its current assessment of long-term return potential. As portfolio and market

conditions change, the Fund distribution rate could change. Distributions in excess of Fund returns will cause its NAV to erode. Investors should not draw any

conclusions about a Fund’s investment performance from the amount of its distribution or from the terms of its managed distribution plan.

Equity Option Fund Categories

Eaton Vance offers equity option closed-end funds employing a variety of options strategies:

Covered Call Funds – sell call options on individual stocks held (EOI, EOS)

Buy-Write Funds – sell call options on one or more stock indices reective of the fund’s holdings (ETB, ETV, ETW)

Diversied Equity Income Funds – sell stock index call options; invest in higher-dividend-yielding stocks (ETY, EXG)

Collar Strategy Fund – buys index put options and sells index call options (ETJ)

Fund Highlights

Hedged equity exposure – seek equity market participation with less volatile returns

Regular monthly distributions – follow managed distribution plans

Managed for after-tax returns – seek to minimize and defer shareholder taxes (except covered call funds)

NOT FDIC INSURED | OFFER NO BANK GUARANTEE | MAY LOSE VALUE | NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY | NOT A DEPOSIT

Eaton Vance Closed-End Funds

Equity Option Fund Quick Reference Guide Current as of June 30, 2024

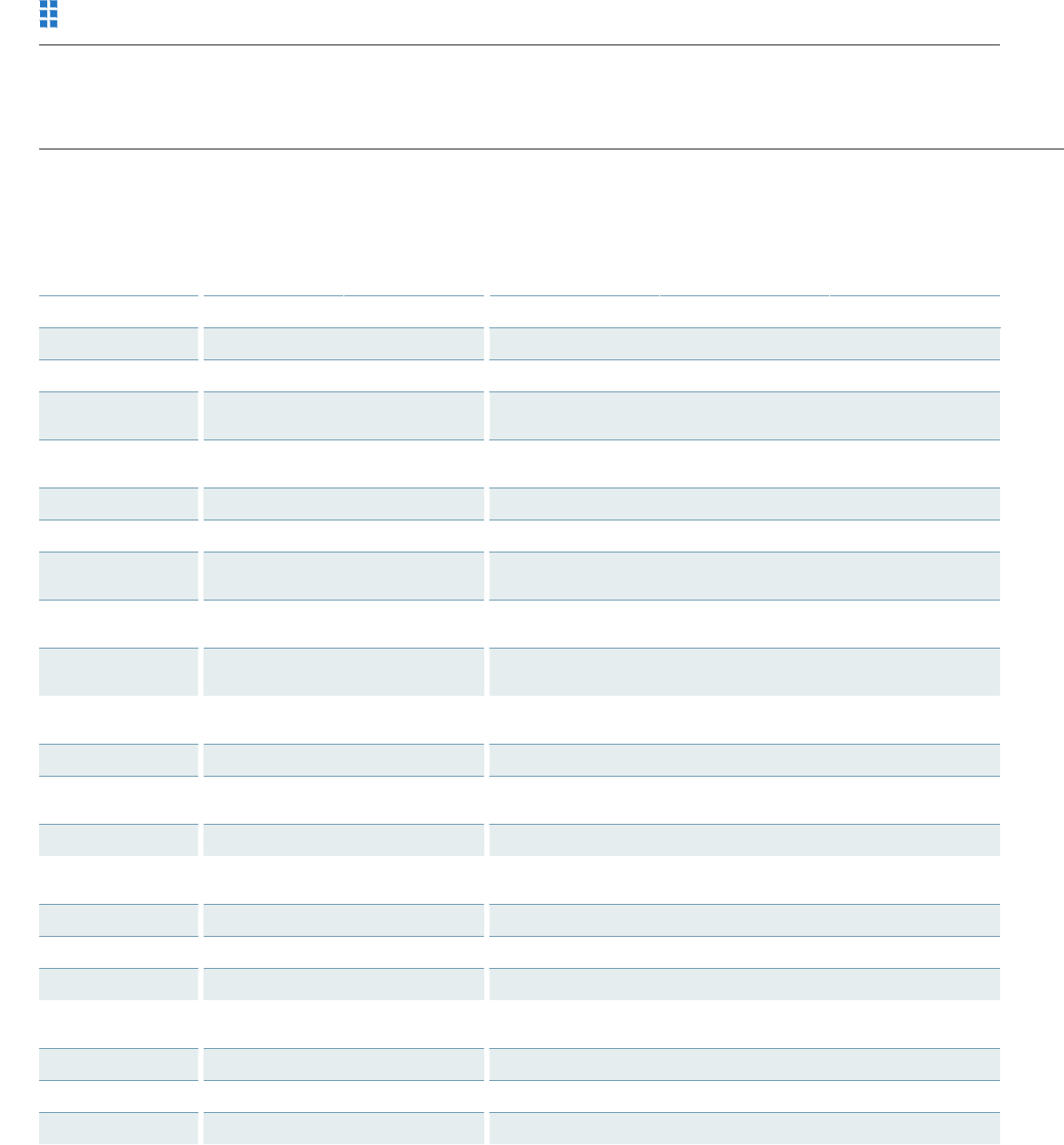

Covered Call Buy-Write Diversied Equity Income Collar Strategy

Name

Enhanced Equity

Income Fund

Enhanced Equity

Income Fund II

Tax-Managed

Buy-Write

Income Fund

Tax-Managed

Buy-Write

Opportunities Fund

1

Tax-Managed

Global Buy-Write

Opportunities Fund Name

Tax-Managed

Diversied Equity

Income Fund

Tax-Managed

Global Diversied

Equity Income Fund

Risk-Managed

Diversied Equity

Income Fund

Ticker EOI EOS ETB ETV ETW Ticker ETY EXG ETJ

Total Net Assets $790.36MM $1.18B $441.98MM $1.66B $1.02B Total Net Assets $2.30B $2.88B $638.15MM

Listing Exchange NYSE NYSE NYSE NYSE NYSE Listing Exchange NYSE NYSE NYSE

Primary Objective Current income Current income

Current income

and gains

Current income

and gains

Current income

and gains

Primary Objective

Current income

and gains

Current income

and gains

Current income

and gains

Secondary Objective

Capital

appreciation

Capital

appreciation

Capital appreciation

Capital

appreciation

Capital

appreciation

Secondary Objective

Capital

appreciation

Capital

appreciation

Capital

appreciation

Tax-Managed No No Yes Yes Yes Tax-Managed Yes Yes Yes

Distribution Frequency Monthly Monthly Monthly Monthly Monthly Distribution Frequency Monthly Monthly Monthly

Equity Benchmark

2

S&P 500

Russell 1000

Growth®

S&P 500

S&P 500

NASDAQ 100

S&P 500

MSCI Europe

Equity Benchmark

2

S&P 500 MSCI World S&P 500

Morningstar

Option-based Category

Option Writing Option Writing Option Writing Option Writing Option Writing

Morningstar

Option-based Category

Option Writing Option Writing Option Writing

Options Strategy

Write single stock

covered calls

Write single stock

covered calls

Write index covered

calls

Write index

covered calls

Write index

covered calls

Options Strategy

Write index covered

calls

Write index covered

calls

Write index covered

calls; buy index puts

Equity Portfolio Equity Portfolio

Positions Held 54 48 151 158 277 Positions Held 53 79 51

% US / Non-US

(% of Fund Net Assets)

97.6/2.4 99.1/0.9 99.8/0.2 99.4/0.7 57.5/42.5

% US / Non-US

(% of Fund Net Assets)

97.3/2.7 54.2/45.8 97.9/2.1

Avg. Mkt Cap 1.15T 1.44T 1.09T 1.23T 765.54B Avg. Mkt Cap 1.16T 735.56B 1.13T

Call Options Written Call Options Written

% of Stock Portfolio 48.0% 49.0% 96.0% 96.0% 95.0% % of Stock Portfolio 48.0% 48.0% 95.0%

Avg. Days to Expiration 24 Days 22 Days 15 Days 15 Days 16 Days Avg. Days to Expiration 15 Days 16 Days 15 Days

% Out of the Money** 5.00% 4.70% 0.40% 0.40% 0.80% % Out of the Money** 0.40% 1.00% 1.30%

Put Options Purchased Put Options Purchased

% of Stock Portfolio None None None None None % of Stock Portfolio None None 95.0%

Avg. Days to Expiration N/A N/A N/A N/A N/A Avg. Days to Expiration N/A N/A 15 Days

% Out of the Money** N/A N/A N/A N/A N/A % Out of the Money** N/A N/A 3.30%

1

Effective April 14, 2023, the Tax-Managed Buy-Write Strategy Fund (EXD) merged into Tax-Managed Buy-Write Opportunities Fund (ETV).

2

S&P 500 Index is

an unmanaged index of large-cap stocks commonly used as a measure of U.S. stock market performance. Russell 1000 Growth Index is an unmanaged index of

U.S. large-cap growth stocks. NASDAQ 100 Index includes 100 of the largest domestic and international securities (by market cap), excluding nancials, listed on

NASDAQ. Source: Nasdaq, Inc. The information is provided by Nasdaq (with its afliates, are referred to as the “Corporations”) and Nasdaq’s third party licensors

on an “as is” basis and the Corporations make no guarantees and bear no liability of any kind with respect to the information or the Fund. MSCI Europe Index is

an unmanaged index designed to measure the developed equity market performance of Europe. MSCI World Index is an unmanaged index of equity securities in

the developed markets. MSCI indices are net of foreign withholding taxes. Source: MSCI. MSCI data may not be reproduced or used for any other purpose. MSCI

provides no warranties, has not prepared or approved this report, and has no liability hereunder. Unless otherwise stated, index returns do not reect the effect

of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index.

**Negative value indicates “% In the Money”.

Eaton Vance Closed-End Funds

Equity Option Fund Quick Reference Guide Current as of June 30, 2024

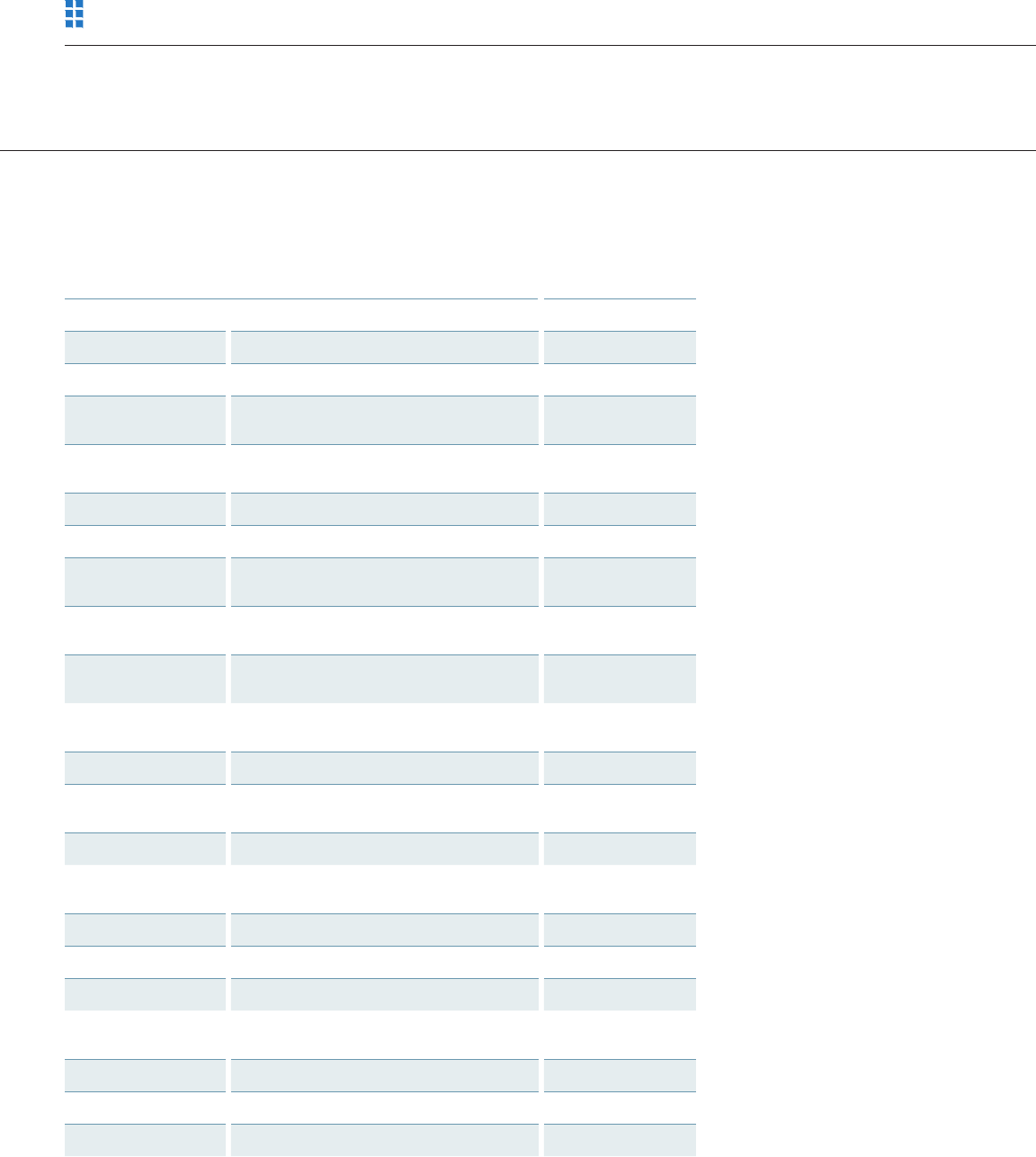

Covered Call Buy-Write Diversied Equity Income Collar Strategy

Name

Enhanced Equity

Income Fund

Enhanced Equity

Income Fund II

Tax-Managed

Buy-Write

Income Fund

Tax-Managed

Buy-Write

Opportunities Fund

1

Tax-Managed

Global Buy-Write

Opportunities Fund Name

Tax-Managed

Diversied Equity

Income Fund

Tax-Managed

Global Diversied

Equity Income Fund

Risk-Managed

Diversied Equity

Income Fund

Ticker EOI EOS ETB ETV ETW Ticker ETY EXG ETJ

Total Net Assets $790.36MM $1.18B $441.98MM $1.66B $1.02B Total Net Assets $2.30B $2.88B $638.15MM

Listing Exchange NYSE NYSE NYSE NYSE NYSE Listing Exchange NYSE NYSE NYSE

Primary Objective Current income Current income

Current income

and gains

Current income

and gains

Current income

and gains

Primary Objective

Current income

and gains

Current income

and gains

Current income

and gains

Secondary Objective

Capital

appreciation

Capital

appreciation

Capital appreciation

Capital

appreciation

Capital

appreciation

Secondary Objective

Capital

appreciation

Capital

appreciation

Capital

appreciation

Tax-Managed No No Yes Yes Yes Tax-Managed Yes Yes Yes

Distribution Frequency Monthly Monthly Monthly Monthly Monthly Distribution Frequency Monthly Monthly Monthly

Equity Benchmark

2

S&P 500

Russell 1000

Growth®

S&P 500

S&P 500

NASDAQ 100

S&P 500

MSCI Europe

Equity Benchmark

2

S&P 500 MSCI World S&P 500

Morningstar

Option-based Category

Option Writing Option Writing Option Writing Option Writing Option Writing

Morningstar

Option-based Category

Option Writing Option Writing Option Writing

Options Strategy

Write single stock

covered calls

Write single stock

covered calls

Write index covered

calls

Write index

covered calls

Write index

covered calls

Options Strategy

Write index covered

calls

Write index covered

calls

Write index covered

calls; buy index puts

Equity Portfolio Equity Portfolio

Positions Held 54 48 151 158 277 Positions Held 53 79 51

% US / Non-US

(% of Fund Net Assets)

97.6/2.4 99.1/0.9 99.8/0.2 99.4/0.7 57.5/42.5

% US / Non-US

(% of Fund Net Assets)

97.3/2.7 54.2/45.8 97.9/2.1

Avg. Mkt Cap 1.15T 1.44T 1.09T 1.23T 765.54B Avg. Mkt Cap 1.16T 735.56B 1.13T

Call Options Written Call Options Written

% of Stock Portfolio 48.0% 49.0% 96.0% 96.0% 95.0% % of Stock Portfolio 48.0% 48.0% 95.0%

Avg. Days to Expiration 24 Days 22 Days 15 Days 15 Days 16 Days Avg. Days to Expiration 15 Days 16 Days 15 Days

% Out of the Money** 5.00% 4.70% 0.40% 0.40% 0.80% % Out of the Money** 0.40% 1.00% 1.30%

Put Options Purchased Put Options Purchased

% of Stock Portfolio None None None None None % of Stock Portfolio None None 95.0%

Avg. Days to Expiration N/A N/A N/A N/A N/A Avg. Days to Expiration N/A N/A 15 Days

% Out of the Money** N/A N/A N/A N/A N/A % Out of the Money** N/A N/A 3.30%

Tax-Managed Investing

Other than the covered call Funds (EOI and

EOS), each Fund evaluates returns on an after-

tax basis and seeks to minimize and defer the

federal income taxes incurred by shareholders.

The Funds may employ a variety of techniques

and strategies in pursuit of this objective:

1. Investing in stocks that pay dividends that

currently qualify for federal income taxation

at rates applicable to long-term capital

gains and complying with the holding

period and other requirements for favorable

tax treatment.

2. Selling index call options that qualify for

treatment as “section 1256 contracts”

under the Code, on which capital gains

and losses are generally treated as 60%

long-term and 40% short-term,

regardless of holding period.

3

3. Limiting the overlap between a Fund’s stock

holdings (and any subset thereof) and each

index on which it has outstanding options

positions to less than 70% on an ongoing

basis so that the Fund’s stock holdings and

index call options are not subject to the

“straddle rules.”

3

4. Selling stocks that have declined in price

to realize capital losses that can be used to

offset realized capital gains.

5. Managing sales of appreciated stocks to

minimize each year’s net realized short-term

capital gains in excess of net realized long-

term capital losses. When an appreciated

security is sold, a Fund generally seeks to

select for sale the share lots resulting in the

most favorable tax treatment, normally those

with holding periods sufcient to qualify for

long-term capital gains treatment that have

the highest cost basis.

3

Applies to funds selling index call options.

Eaton Vance Closed-End Funds

© 2024 Morgan Stanley. All rights reserved. Eaton Vance Distributors, Inc. 6349 | 07.31.24

DEFINITIONS

Average Market Cap: The average market capitalization of the companies that have issued the common stocks owned by a Fund. Market Cap is determined by

multiplying the price of a share of a company’s common stock by the number of shares outstanding. Buy-Write Strategy: A strategy involving the ownership

of common stocks and writing call options on an index that is representative of the common stock portfolio. The index call options typically are written on a

substantial portion of the value of the common stock portfolio, generating current earnings from the option premium. Call Option: For a call option on a security,

the option buyer has the right to purchase, and the option seller (or writer) has the obligation to sell, a specied security at a specied price (exercise price or

strike price) on or before a specied date (option expiration date). For an index call option, the buyer has the right to receive from the seller (or writer) a cash

payment at the option expiration date equal to any positive difference between the value of the index at contract expiration and the exercise price. The buyer

of a call option makes a cash payment (premium) to the seller of the option upon entering into option contract. Covered Call: A call option in which the option

seller owns the stock on which the option is written. Covered Call Strategy: A strategy of owning a portfolio of common stocks and writing call options on all

or a portion of such stocks to generate current earnings from option premium. Collar Strategy: A strategy of owning a common stock portfolio and (i) selling

call options on a representative index at a higher exercise price and (ii) buying index put options on the same index at a lower exercise price. This strategy is

intended to limit exposure to price declines, but also limits upside participation. In the Money: For a call option on a common stock or an index, the extent to

which the current price of the stock or value of the index exceeds the exercise price of the option. For an index put option, the extent to which the exercise price

of the option exceeds the current value of the index. Out of the Money: For a call option on a common stock or an index, the extent to which the exercise price

of the option exceeds the current price of the stock or value of the index. For an index put option, the extent to which the current value of the index exceeds

the exercise price of the option. Index Put Option: Gives the option buyer the right to receive from the option seller (writer) a cash payment if the value of the

index exceeds a specied value (exercise price or strike price) on or before a specied date (option expiration date). The buyer makes a cash payment (premium)

to seller of the option upon entering into contract.

RISK CONSIDERATIONS

The following is a summary of the primary risks of investing in one or more of the Funds. Fund shares are subject to investment risk, including possible loss of

principal invested. There is no assurance that a Fund will meet its investment objective. Fund share values are sensitive to stock market volatility. In selling call

options, a Fund foregoes the opportunity to prot from increases in market value above the premium it received upon entering the option. In purchasing and/

or selling index options, a Fund is subject to the risk that the performance of its stock portfolio will vary from the performance of the underlying index and the

purpose of purchasing or selling the option will not be fully achieved. Investments in foreign instruments or currencies can involve greater risk and volatility

than U.S. investments because of adverse market, economic, political, regulatory, geopolitical, or other conditions. A Fund’s ability to utilize various tax-managed

techniques may be curtailed or eliminated in the future by tax legislation or regulation. The Funds may engage in other investment practices that may involve

additional risks. Shares of closed-end funds often trade at a discount from their net asset value. The market price of a Fund’s shares can be affected by factors

such as changing perceptions about the Fund, market conditions, uctuations in supply and demand for Fund shares, or changes in Fund distributions. Fund net

asset values and distribution rates will vary and may be affected by numerous factors, including changes in stock prices, dividend rates, option premiums and

other factors. The impact of the coronavirus on global markets could last for an extended period and could adversely affect the Funds performance. No Fund is

a complete investment program and you may lose money investing in a Fund. Investment in the Funds may not be appropriate for all investors.

The information contained herein is provided for informational purposes only and does not constitute a solicitation of an offer to buy or sell Fund shares.

Common shares of the Fund are only available for purchase and sale at current market price on a stock exchange. There is no assurance that the Fund will achieve

its investment objective. The Fund is subject to numerous risks, including investment risks. Shares of closed-end funds often trade at a discount from their net

asset value. The Fund is not a complete investment program and you may lose money investing in the Fund. An investment in the Fund may not be appropriate

for all investors. Investors should review and consider carefully the Fund’s investment objective, risks, charges and expenses.

This material is a general communication, which is not impartial and all information provided has been prepared solely for informational and educational purposes

and does not constitute an offer or a recommendation to buy or sell any particular security or to adopt any specic investment strategy. The information herein

has not been based on a consideration of any individual investor circumstances and is not investment advice, nor should it be construed in any way as tax,

accounting, legal or regulatory advice. To that end, investors should seek independent legal and nancial advice, including advice as to tax consequences, before

making any investment decision.

Please consider the investment objectives, risks, charges and expenses of the funds carefully before investing. The prospectuses contain this and other information

about the funds. To obtain a prospectus for the Eaton Vance Funds please download one at https://funds.eatonvance.com/open-end-mutual-fund-documents.php or

contact your nancial professional. Please read the prospectus carefully before investing.

Eaton Vance is part of Morgan Stanley Investment Management. Morgan Stanley Investment Management is the asset management division of Morgan Stanley.

The whole or any part of this material may not be directly or indirectly reproduced, copied, modied, used to create a derivative work, performed, displayed,

published, posted, licensed, framed, distributed or transmitted or any of its contents disclosed to third parties without MSIM’s express written consent. This

material may not be linked to unless such hyperlink is for personal and non-commercial use. All information contained herein is proprietary and is protected

under copyright and other applicable law.