“ONCE A BACKWATER OF THE

ENTERTAINMENT INDUSTRY,

BROADWAY IS NOW AT THE CENTER

OF AMERICAN POPULAR CULTURE.”

MICHAEL RIEDEL, VARIETY, MAY 2019

BROADWAY THEATERS:

AN ECONOMIC ENGINE FOR NEW YORK

The recently concluded 2018-19

Broadway season, which started

May 28, 2018 and ended May 26,

2019, was the highest-grossing and

best-attended season of all

time, according to the

Broadway League.

The Broadway

League represents

the interests of

show producers,

theater owners and

general managers.

During the 2018-

19 season, Broadway

productions grossed $1.83

billion in ticket sales, up 7.8% over

2017-18’s levels. In addition, total

attendance reached 14.8 million, up

7.1% over the prior season. To put

this latter statistic in perspective,

Broadway attendance for the 2018-

19 season topped the combined

attendance of the 10 professional

major league sports teams in

New York City and New Jersey.

It is important to note that the gross

sales and attendance figures

cited below do not reflect

any of the Broadway

shows currently

touring across

North America.

In this paper, we

define “Broadway,”

look at some recent

trends in Broadway’s

gross revenues and

attendance, and examine some

of the factors that contributed

to Broadway’s recent record-

breaking season. We also examine

some not-so-ancient history as

well as Broadway’s contribution

to New York City’s economy.

INTRODUCTION

$1.83

BILLION

1

NEW YORK CITY BROADWAY GROSS SALES ($MILLIONS)

WHAT EXACTLY IS MEANT BY “BROADWAY”?

“Broadway” is the heart of New York City’s Theater District. It refers to 41 theaters

located in Midtown Manhattan in an area running from 42nd to 53rd streets

between 6th and 8th avenues. The Theater District includes Times Square. The

Great White Way is the name given to the section of Broadway that runs through

the Theater District. Dozens of new musicals and long-running, beloved hits are

available every night of the week at numerous venues in the Theater District.

2

SOURCE: BROADWAY LEAGUE

RECENT TRENDS

Ticket sales to Broadway shows have, for the most

part, increased every year since the 2008-09

season, with a total increase of $809 million, or

79.3%. Similarly, attendance at Broadway shows has

increased in six of the last 10 seasons, for a total

increase of 2.9 million, or 24.2%. The graph above

shows the trend in ticket sales, which have increased

more than five-fold over the past quarter century.

The industry has not always been this prosperous.

Broadway attendance plummeted approximately

50% from nearly 10 million in 1968 to five million in

1972, a record low. A contemporary New York Times

article cited high ticket costs, poor productions

and the “fear of entering the midtown area” (Times

Square) as the main reasons behind the drop.

The redevelopment and rezoning of Times Square

in the 1990s helped to transform the area into the

tourist-friendly place we know today. Many of the

changes were due in large part to the actions of the

Disney Company, which bought and restored the

New Amsterdam Theater. As part of the transition

to a more family friendly destination, Madame

Tussauds and AMC Theaters moved to 42nd Street.

This, in turn, spurred the construction of new

oce towers, hotels and tourist attractions in the

area, such as ABC’s Times Square Studios and a

large number of chain restaurants, such as Ruby

Foo’s and the Bubba Gump Shrimp Company.

3

4

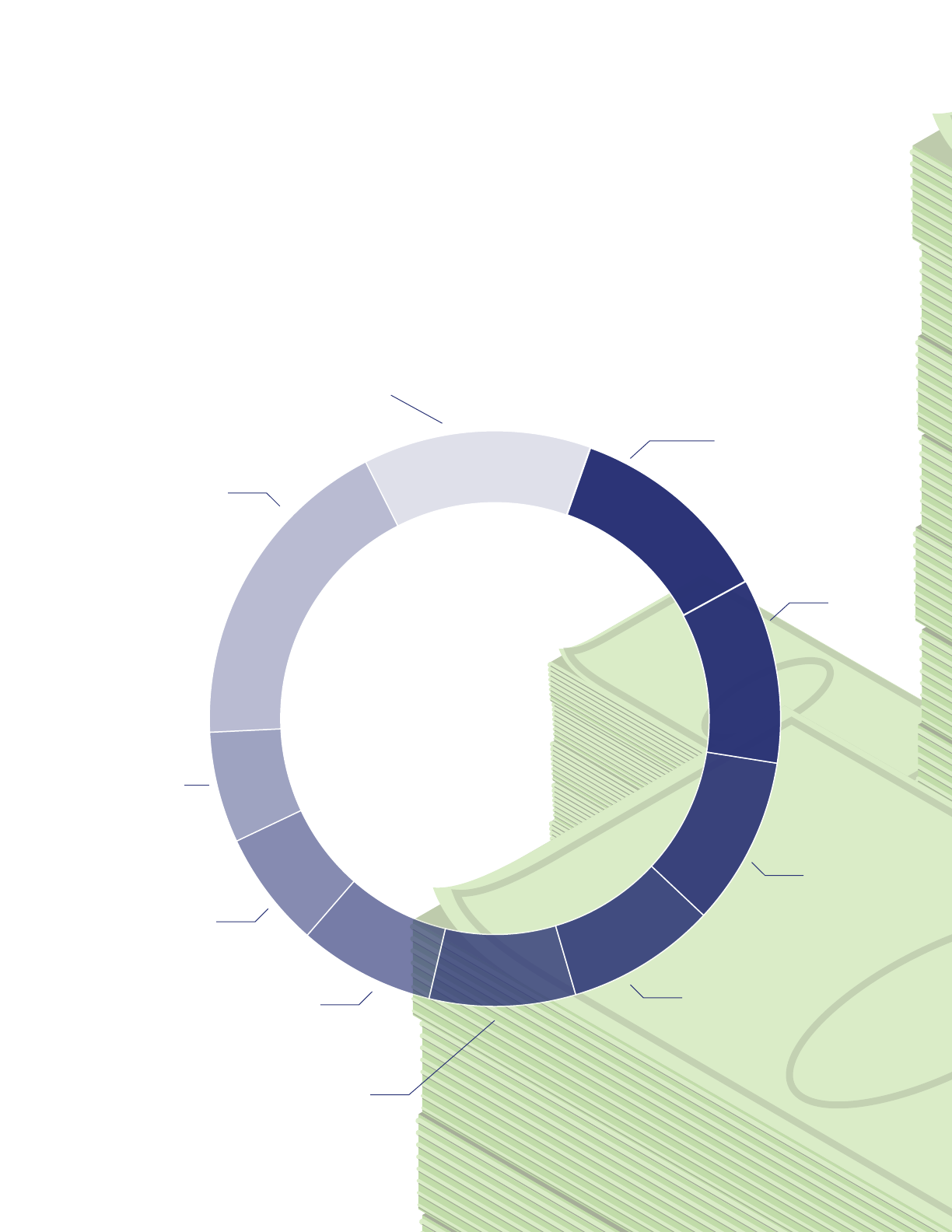

BROADWAY’S EMPLOYMENT

AND ECONOMIC IMPACT

According to a recent report from the Broadway League, Broadway theaters

of all sizes contributed over $12.6 billion on top of ticket sales to the New York

City economy. The same report found that Broadway supported more than

12,600 direct jobs and an estimated 74,500 indirect jobs in New York City.

All Broadway productions in New York City are unionized, and those who work

in the profession usually join one or more of the various theatrical unions. The

Broadway League negotiates contracts with multiple labor organizations on behalf

of its members. Of the 17 unions that are currently active, the three largest are:

International Alliance of

Theatrical Stage Employees

This union represents

technicians, artisans

and crafts people

employed backstage,

as well as ushers, ticket

collectors, press agents

and house managers.

Actors’ Equity Association

This union represents

professional actors

and stage managers,

including those in

Broadway productions

in New York City.

Associated Musicians

of Greater New York

This union represents

instrumentalists,

vocalists, arrangers,

conductors, librarians,

proofreaders, editors,

teachers and coaches.

5

$12.6

BILLION

$1.83

BILLION

TICKET SALES

87.1THOUSAND

12,600 DIRECT

74,500 INDIRECT

6

GROWING TOURISM

An increase in the number of tourists in New York City is a key contributor to Broadway’s

recent growth. As reported by NYC & Company, the city’s tourism promotion agency,

New York City welcomed a record 65.1 million visitors in 2018, the ninth consecutive

year of tourism growth. It is also likely that Broadway’s recent strength has served

to draw visitors to New York City, thereby bolstering local tourism levels.

Most visitors (79%) to the city are from the U.S., but the number of travelers from other

countries also continues to grow. In fact, New York City, with a 25.9% market share,

remains the #1 city destination for overseas visitors (i.e., excluding visitors from Mexico

and Canada) to the U.S., according to the U.S. Department of Commerce’s National

Travel & Tourism Oce. Its market share puts it well ahead of #2 Miami, which has a

13.1% market share. Rounding out the list of Top 5 city destinations for overseas visitors

to the U.S. are: #3 Los Angeles (12.3%); #4 Orlando (12.0%); and #5 San Francisco (8.9%).

KEYS TO A RECORD-BREAKING SEASON

Industry analysts cite several important factors that have helped boost Broadway

ticket sales in recent years. In this section, we briefly review them.

PRICING STRATEGIES

Innovative pricing strategies have also contributed to Broadway’s sales growth in

recent years. “Premium pricing” has found large numbers of people willing to pay

high prices for the best seats at the hottest shows. In fact, the average paid admission

to a Broadway show rose by 59% between the 2008-09 and 2018-19 seasons (i.e.,

from $78 in 2008-09 to $124 in 2018-19). Looked at another way, the average paid

admission to a Broadway show increased more than three times faster than the

Consumer Price Index (All Urban Consumers), which increased by about 18% over this

10-year timespan, according to data published by the U.S. Bureau of Labor Statistics.

Drawing from lessons learned from their counterparts in the hotel and airline industries,

the producers of some Broadway shows use “dynamic pricing” (aka “surge pricing”) to

adjust their ticket prices hourly, depending on demand. Although the overall average paid

admission is $124, price can vary greatly, depending on the show, seating, and day of the

week or month of the year. The price for the most popular musicals, like Hamilton, can go

as high as $850 for orchestra seating, even though it has been playing for over four years.

7

38

PRODUCTIONS

13 MUSICALS

4 SPECIAL EVENTS

21 PLAYS

SOURCE: BROADWAY LEAGUE

DIVERSE SHOW OFFERINGS

A wider array of shows has also

helped to boost ticket sales.

Spectators have a wide variety of

entertainment options to choose

from and can select based on

genre, age-appropriateness and

ticket price. The list of the 10 best-

selling shows from the recently

concluded season, which are

shown in the following table,

helps to illustrate their diversity.

During the 2018-19 season, 38

productions opened. New shows

included 13 musicals, 21 plays and

four special engagements. Some

of the new openings were short-

lived, like Gettin’ The Band Back

Together, while others are ongoing,

such as To Kill a Mockingbird.

8

SOURCE: BROADWAY LEAGUE

TOP 10 HIGHEST GROSSING

BROADWAY SHOWS

2018-19 SEASON

9

$900.5

MILLION

Gross Sales

HAMILTON

THE LION KING

WICKED

FROZEN

DEAR EVAN HANSEN

ALADDIN

MEAN GIRLS

THE BOOK

OF MORMON

COME FROM AWAY

HARRY POTTER

AND THE CURSED

CHILD, PARTS

ONE AND TWO

$56.2M

$164.7M

$116.1M

$105.1M

$93.5M

$85.5M

$76.3M

$59.2M

$69.4M

$74.5M

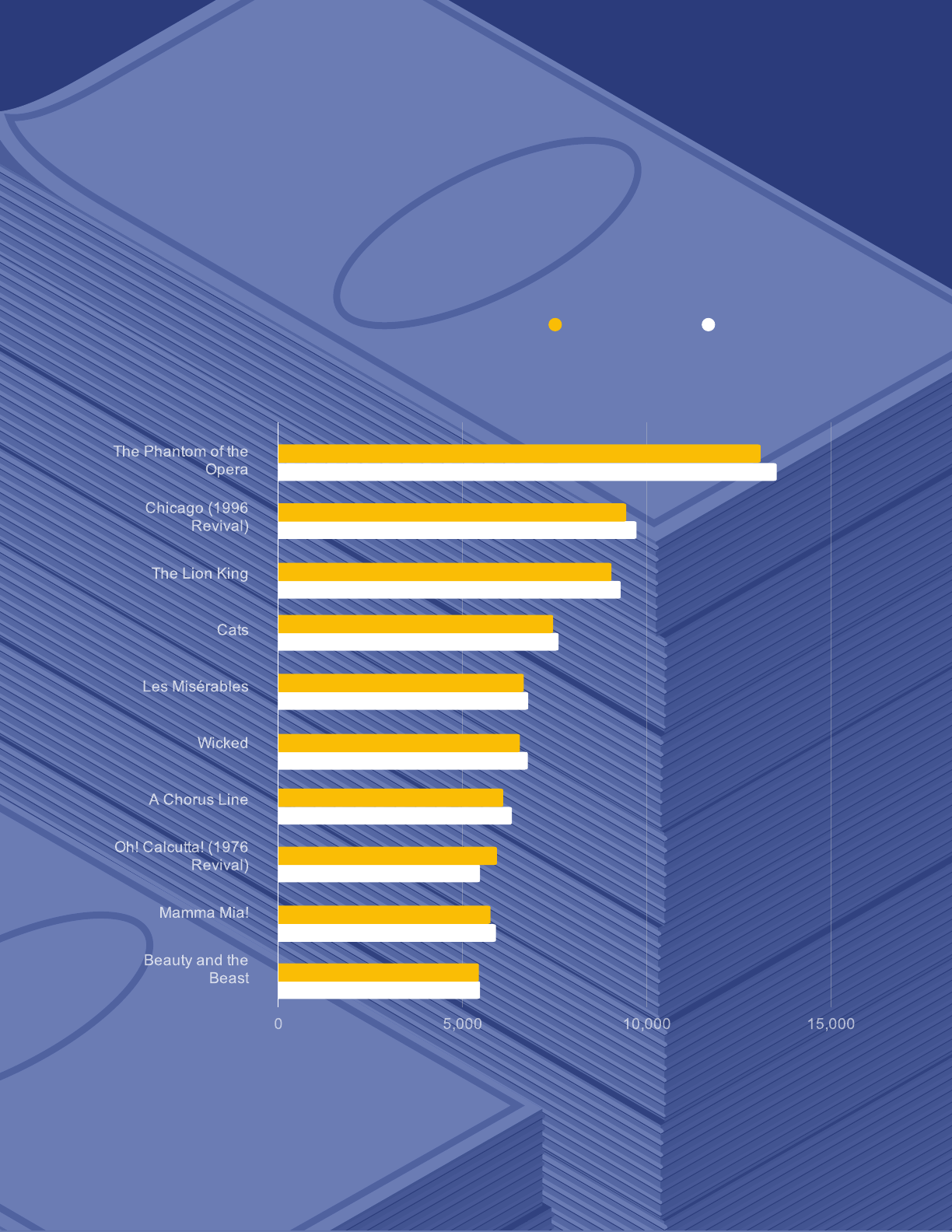

TOP 10 LONGEST RUNNING

BROADWAY SHOWS

YEARS SHOWING

AS OF 2019

32

YR

23YR

22YR

18YR

16YR

16YR

15YR

13YR

14YR

13YR

NUMBER OF

SHOWS

10

BROADWAY AUDIENCE

While tourists purchased two out of

every three Broadway tickets sold,

the share of the audience made

up of New York City area residents

continues to rise. Last season, 38%

of Broadway patrons were from the

greater New York metro area (i.e.,

the New York–Newark–Jersey City,

NY–NJ–PA Metropolitan Statistical

Area), including 20% from the five

boroughs of New York City. It is

important for theaters to attract

locals since they are more likely

than tourists to attend non-musical

plays. New York City residents also

help provide a stabilizing base for

Broadway during lull periods.

In another encouraging sign, the

average age of a typical theatergoer

last season – at a bit over 40 years

– hit its lowest mark since 2000.

Fifteen percent of all theatergoers

were under 18, which reflects the

large number of family-friendly

shows on Broadway last season.

This fall’s program, according to

an industry executive, will feature

17 shows that are acceptable for

16-year-olds. Just 10 years ago, that

number was approximately five.

11

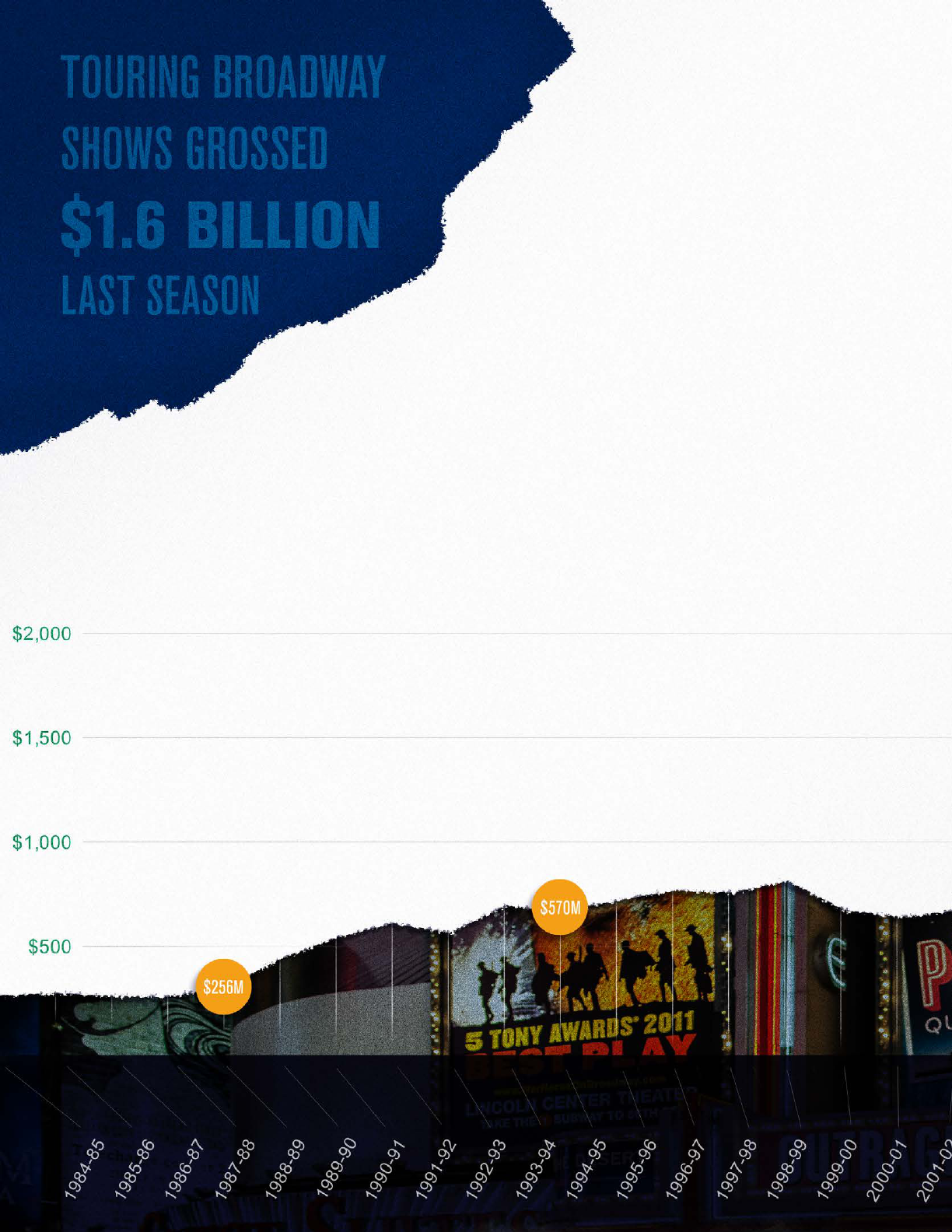

TOURING BROADWAY GROSS SALES ($MILLIONS)

SOURCE: BROADWAY LEAGUE

12

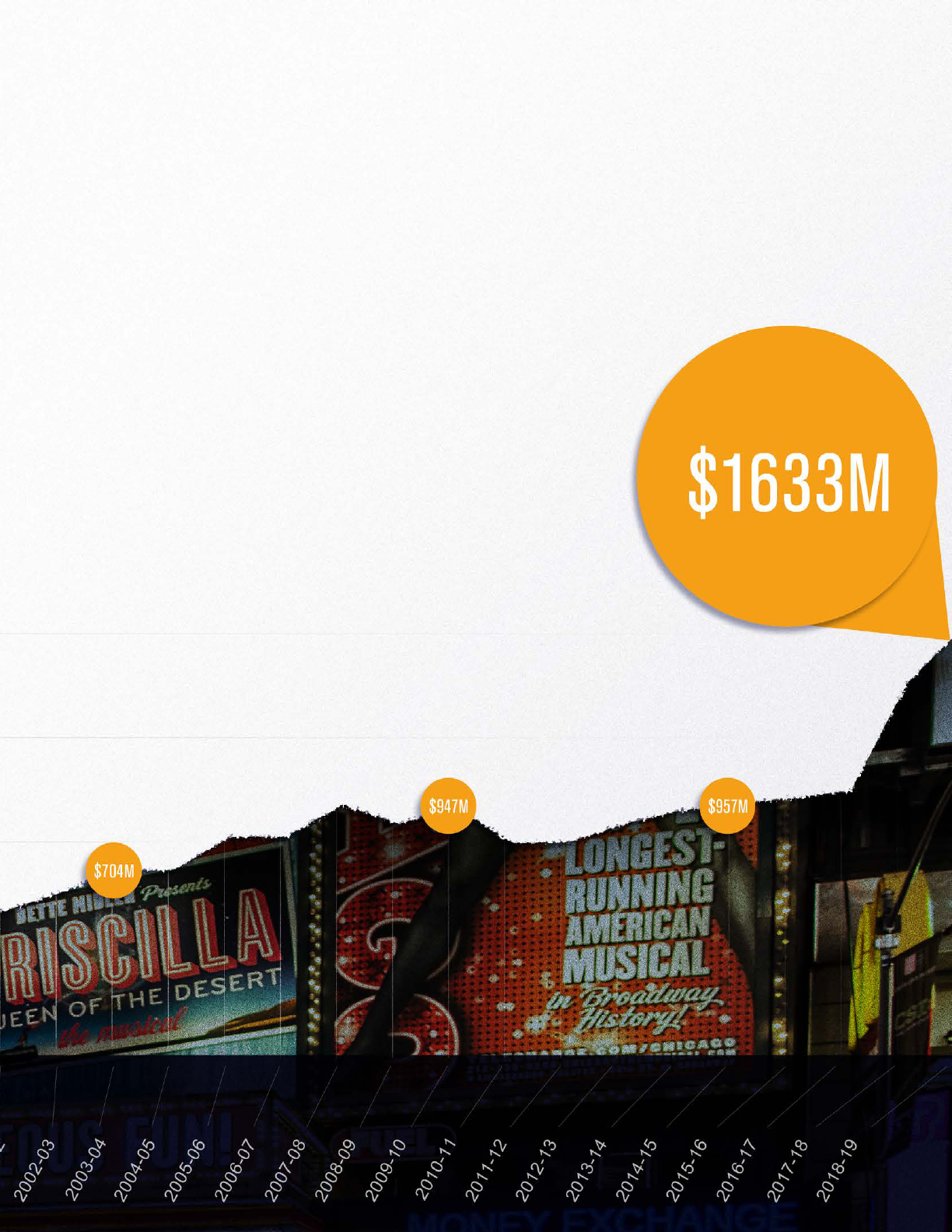

TOURING BROADWAY GROSS SALES ($MILLIONS)

SOURCE: BROADWAY LEAGUE

TOURING BROADWAY SHOWS

The statistics for the record-breaking

2018-19 Broadway season do not account

for touring Broadway shows. According

to the Broadway League, attendance

at touring shows across North America

during the 2018-19 season reached 18.5

million, or 25% more than the attendance

at Broadway shows. Touring shows visited

about 200 cities during the 2018-19

season. These statistics do not include

attendance at “o-Broadway” productions.

In addition, touring Broadway shows

grossed $1.6 billion last season. This is

about $230 million less than the total

gross revenues from “on Broadway” shows

during 2018-19. The greater attendance

levels and lower gross revenues at

touring Broadway shows compared to “on

Broadway” shows reflect, in large part,

overall ticket prices. More specifically,

the average paid admission at a touring

show in 2018-19 was about $88, or

roughly 30% less than the average price

for an “on Broadway” show ($124).

Over the past decade, ticket sales to

touring Broadway shows have increased by

a total of $752 million, or 85.4%. Similarly,

attendance at touring Broadway shows

has increased 4.2 million, or 29.4%, over

the same time frame.

According to the

Broadway League,

New York City-

based touring

Broadway shows

have a significant

economic impact

on their host

communities.

For example,

they contributed

a cumulative $3.8

billion to the metropolitan

areas that hosted the shows. In addition,

Broadway tours generate an economic

impact of 3.28 times the gross ticket sales

to a local metropolitan area’s economy.

13

SUMMARY

In 1995, City Journal magazine

asked the question, “Who

Killed Broadway?” That article

described live theater as

undergoing a crisis of relevance

in the world of more “lifelike”

entertainment and cost savings

brought by the movies and TV.

The industry still faces several

challenges to its survival. These

include rising production and

marketing expenses, concerns

about high ticket prices,

competition from more easily

accessible forms of entertainment

and an increasing reluctance

to buy tickets in advance.

But we can also say that Broadway

seems to be defying the cultural

odds: as an ancient art form in

the digital age, it is strengthening,

thanks to an ever-increasing

influx of tourists and a resurgent

enthusiasm for musical theater.

14

FOR FURTHER INFORMATION

Questions regarding this report

should be directed to Jerey

Sorensen, Chief of the Bureau

of Labor Market Information.

He can be reached via email at

Jerey.Sorensen@labor.ny.gov

or by phone at 518-457-3800.

This workforce product was

funded by a grant awarded by

the U.S. Department of Labor’s

Employment and Training

Administration. The product was

created by the recipient and does

not necessarily reflect the ocial

position of the U.S. Department of

Labor. The Department of Labor

makes no guarantees, warranties,

or assurances of any kind,

express or implied, with respect

to such information, including

any information on linked sites

and including, but not limited

to, accuracy of the information

or its completeness, timeliness,

usefulness, adequacy, continued

availability, or ownership. This

product is copyrighted by the

institution that created it. Internal

use by an organization and/or

personal use by an individual

for non-commercial purposes

is permissible. All other uses

require the prior authorization

of the copyright owner.

15

JULY 2019

DIVISION OF RESEARCH

AND STATISTIC S

THE NEW YORK STATE

DEPARTMENT OF LABOR