Murray State's Digital Commons Murray State's Digital Commons

Honors College Theses Student Works

Spring 4-25-2024

Examination of the Top 10 Stocks in the S&P500 Examination of the Top 10 Stocks in the S&P500

Isaac Fulton

Follow this and additional works at: https://digitalcommons.murraystate.edu/honorstheses

Part of the Finance and Financial Management Commons

Recommended Citation Recommended Citation

Fulton, Isaac, "Examination of the Top 10 Stocks in the S&P500" (2024).

Honors College Theses

. 241.

https://digitalcommons.murraystate.edu/honorstheses/241

This Thesis is brought to you for free and open access by the Student Works at Murray State's Digital Commons. It

has been accepted for inclusion in Honors College Theses by an authorized administrator of Murray State's Digital

Commons. For more information, please contact [email protected].

Murray State University Honors College

HONORS THESIS

Cercate of Approval

Examinaon of the Top 10 Stocks in the S&P500

Isaac Fulton

April/2024

Approved to fulll the _____________________________

requirements of HON 437 Dr. David Durr

Finance

Approved to fulll the _____________________________

Honors Thesis requirement Dr. Warren Edminster, Execuve Director

of the Murray State Honors Diploma Honors College

Examinaon Approval Page

Author: Isaac Fulton

Project Title: Examinaon of the top 10 stocks in the S&P500 in relaon to the overall porolio

Department: Finance

Date of Defense: 4/25/2024

Approval by Examining Commiee:

________________________________________ ____________________

(Dr. David Durr, Advisor) (Date)

________________________________________ _____________________

(Professor Chistopher Wooldridge, Commiee Member) (Date)

________________________________________ ______________________

(Dr. Leiza Nochebuena-Evans, Commiee Member) (Date)

Examinaon of the Top 10 Stocks in the S&P500

Submied in paral fulllment

of the requirements

for the Murray State University Honors Diploma

Isaac Fulton

April / 2024

i

Abstract

The major goal of this research was to invesgate how the returns of a porolio

containing only the 10 largest stocks in the S&P500 index, based on market cap, would compare

to the overall index’s return and volality over mulple me frames. This project invesgated

whether a porolio of the 10 largest stocks in the S&P500, at the beginning of each year, would

be considered superior in terms of returns while not unproporonately increasing volality.

First, the SPDR S&P 500 ETF Trust, or SPY, was selected as the S&P500 index measure and was

used to evaluate the index’s returns. Second, the largest stocks in the index for each year

between 2016 and 2022 were selected and each of their market capitalizaons at the beginning

of that year were measured as a percentage of the total index’s. Returns for each stock, for each

month, were then sourced from a database provided by faculty at Murray State. Two dierent

test porolios were then generated containing the largest 10 stocks for each year, only diering

on how the ten largest stocks were weighed. Finally, the Invesco S&P 500 Top 50 ETF (XLG)’s

returns were also calculated to determine how a porolio containing the 50 largest stocks in the

index would perform compared to the index and the test porolios. Since the XLG is comprised

of only the 50 largest stocks in the S&P500, it may give us a good measure of how powerful the

ten largest stocks are, even in comparison to the other 40 largest rms. Once all the returns of

the four porolios had been collected, the index and test porolios’ return, betas, and standard

deviaons were calculated and compared to nd results. Aer comparing the test porolios

with the SPY, what was discovered was that during 2016 through 2022 a porolio containing the

10 largest stocks in the S&P500, as measured at the beginning of each year and weighed in

accordance with each stock’s index weight, would produce the best possible returns of any

ii

porolio analyzed, but would increase the porolio’s standard deviaon and beta. Aer running

a risk-adjusted analysis, what ulmately was discovered was that while the porolios containing

only the largest stocks did experience larger returns during the 7 years, that on a total risk-

adjusted basis, they produced less returns per unit of risk taken. This was concluded to be

because of the porolios’ lack of diversicaon, which no maer its larger returns, could not

outperform that of the market when accounng for its volality. Finally, to demonstrate that

there are sll benets to these types of porolios and the increased returns they can generate, I

ran a new scenario analysis, ending the study aer 2021.

iii

Table of Contents

Abstract………………………………………………………………………………………………………….….…i

Table of Contents……………………………………………………………………………………………..…..iii

List of Figures and Tables……………………………………………………………………………….……….iv

Introducon …………………………………………………………………………………………………………1

Goals of Research……………………………………………………………………………………………….…4

S&P500 Stock Weighng…………………………………………………………………………………………4

Analysis Methodology………………………………………………………………………………………..…..6

Test Porolios – Equally weighted and Index weighted…………………………………………………7

Market Players – Test Porolios Composion…………………………………………….…...10

Rebalancing the Porolios……………………………………………………………………….….12

Individual Stock Analysis………………………………………………………………………….…13

Monthly Return Comparison………………………………………………………………………………….15

Total Return Comparison………………………………………………………………………………………17

Yearly Return Comparison…………………………………………………………………………………….18

Standard Deviaon Comparison – Yearly and Monthly Basis……………………………………….19

Beta…………………………………………………………………………………………………………………..22

Invesng Scenarios……………………………………………………………………………………………...23

Analysis Limitaons……………………………………………………………………………………………..26

Risk-Adjusted Comparison………………………………………………………………………………......26

Sharpe……………………………………………………………………………………………………..27

Drawbacks of Sharpe Measure………………………………………………………………….….29

Treynor’s Measure………………………………………………………………………………….…..30

Jenson’s Alpha…………………………………………………………………………………….…….32

Risk-Adjusted Comparison Summary…………………………………………………….….….35

Alternave Analysis: What if the analysis ended aer 2021?............................................35

Research Findings Summary………………………………………………………………………………….37

References………………………………………………………………………………………………………….41

iv

List of Figures and Tables

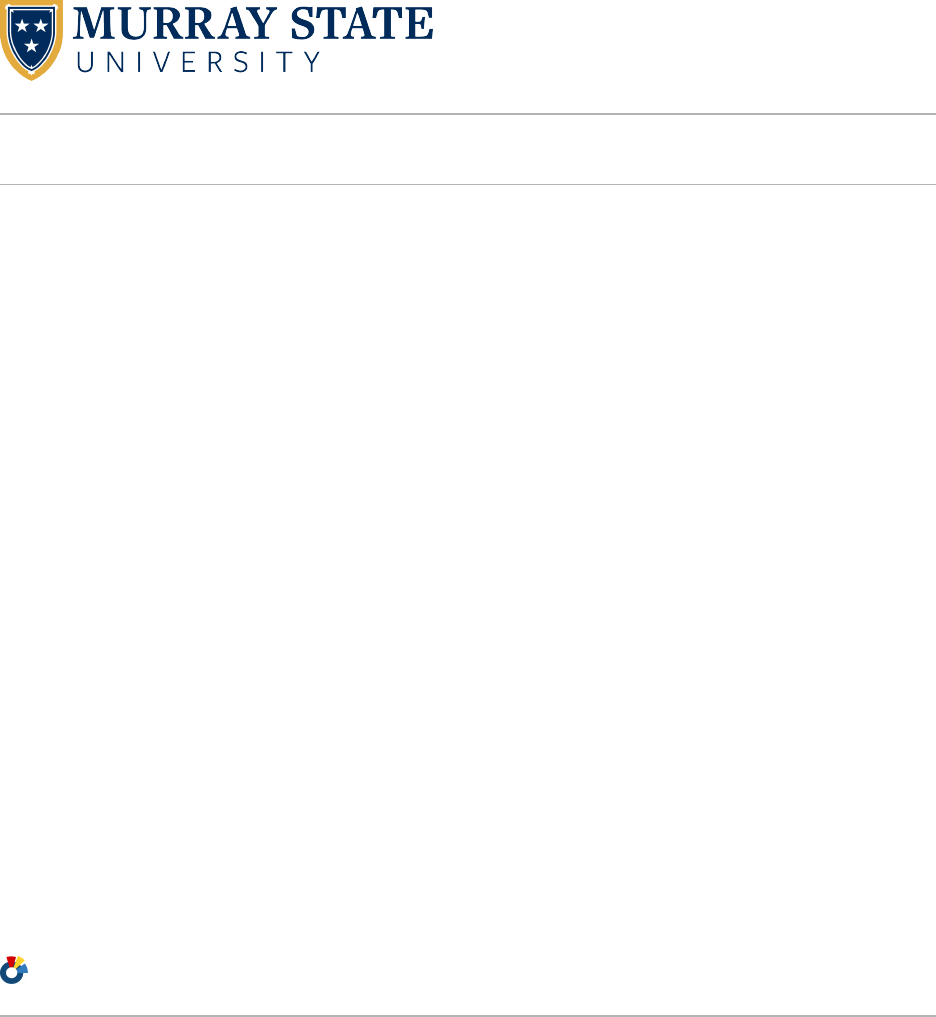

Figure 1- Invesng $1000 into the S&P500 in 2000 and leaving unl 2023 ……………………….3

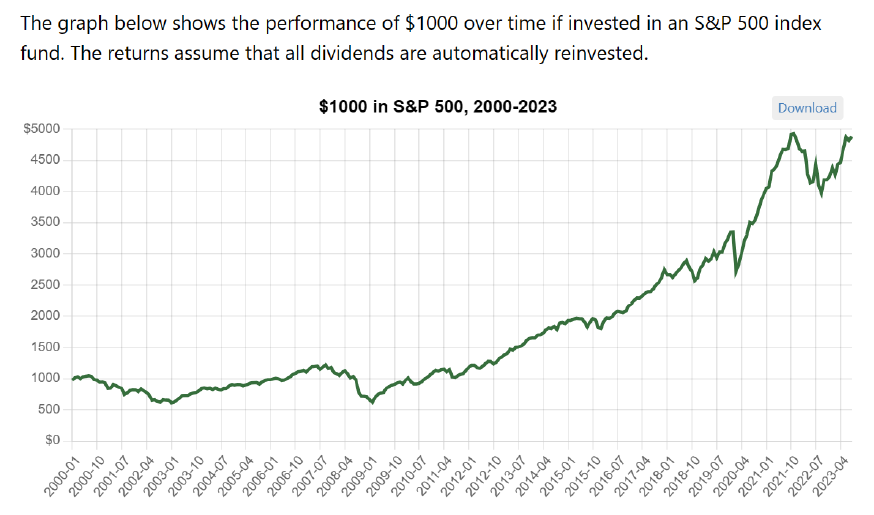

Figure 2- S&P 500 monthly returns (2000-2023)………………………………………………………….4

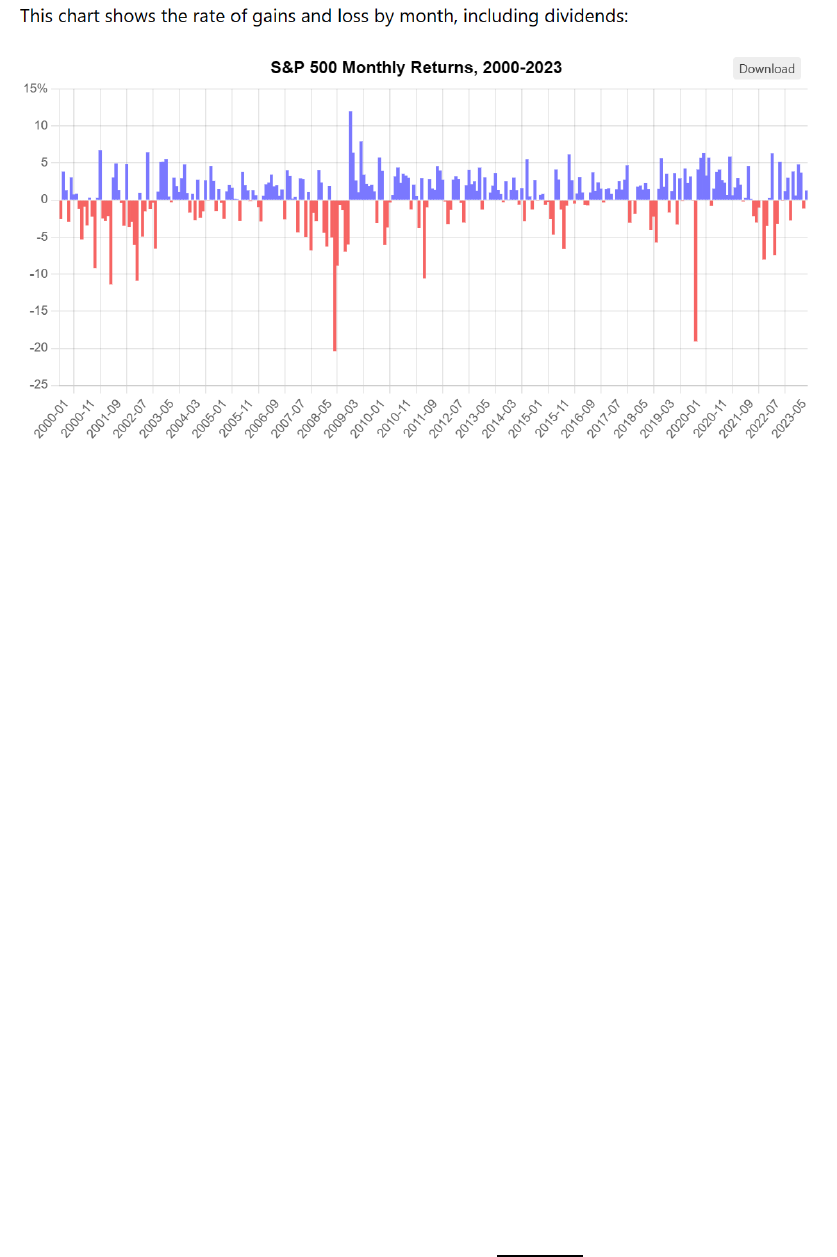

Figure 3 – Percentage of total Index market cap residing in the Largest 10 stocks in the S&P500

as of January 1st, 2024…………………………………………………………………………….….6

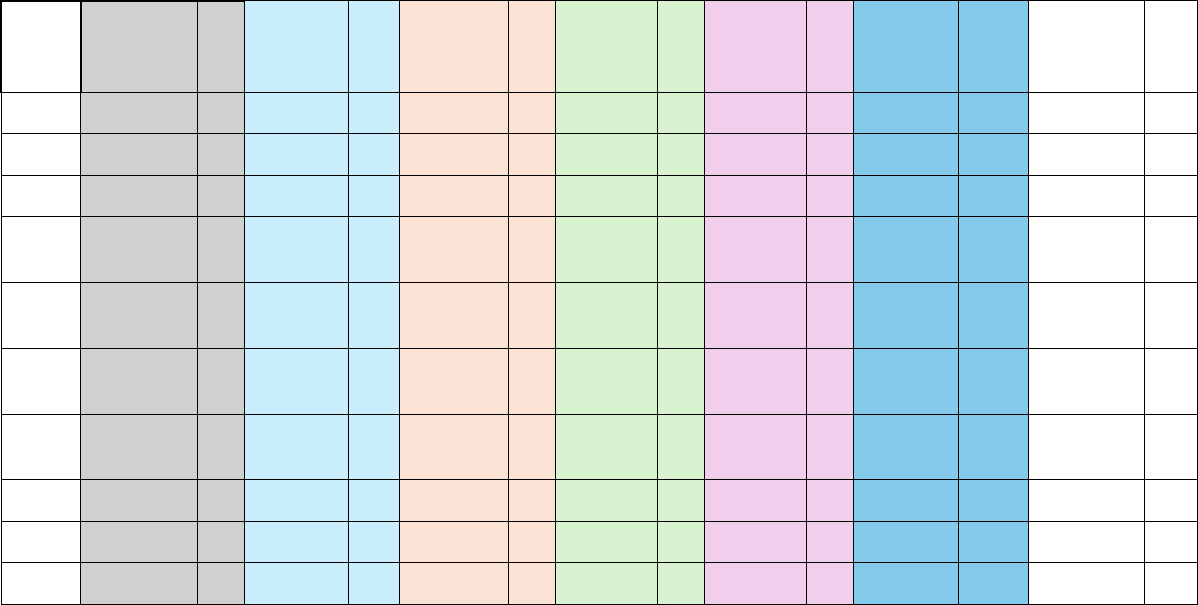

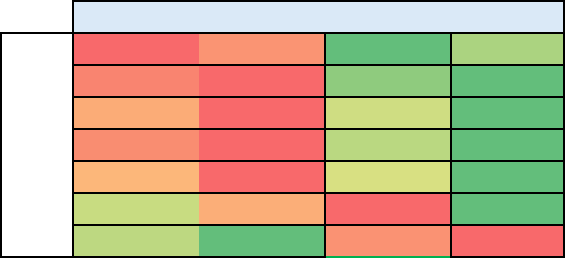

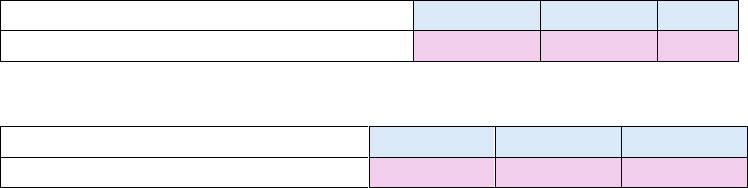

Figure 4 – Largest 10 stocks in the S&P500 and their index weights at the beginning of each year

between 2016 and 2022………………………………………………………………………………….11

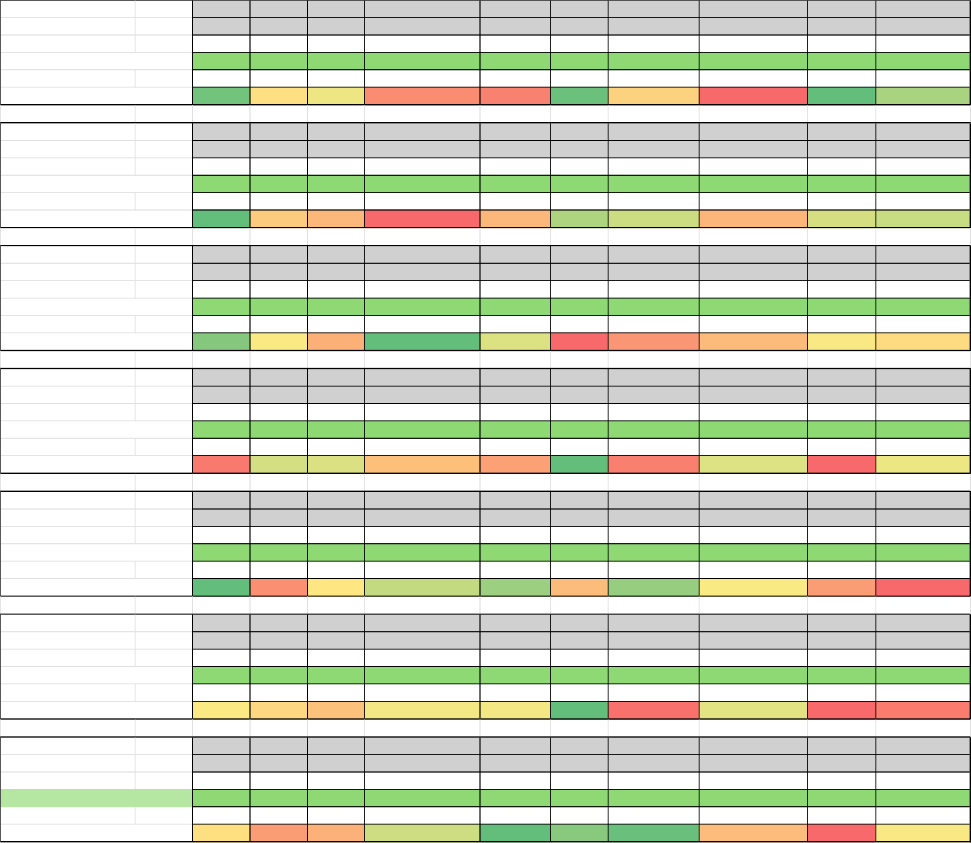

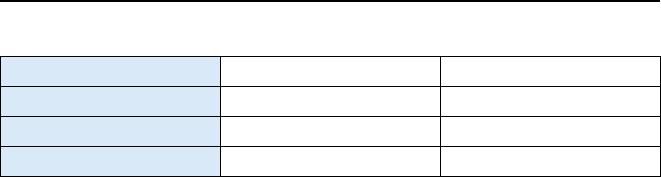

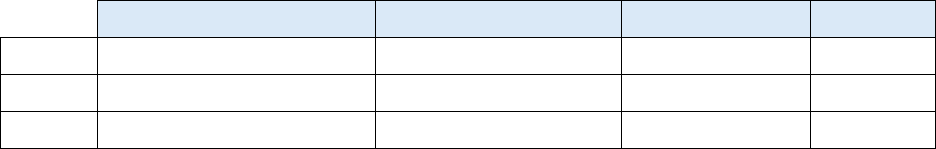

Figure 5 – Ten largest Stocks’ names, rankings, weights per test porolio, betas, and standard

deviaons of monthly returns from 2016 through 2022…………………………………15

Figure 6 – Number of Months the test porolios out/underperformed the SPY from 2016-

2022…………………………………………………………………………………………………………………..16

Figure 7 – Correlaon of our test porolios’ Monthly Returns to that of the SPY………………16

Figure 8 – Porolio Total Returns from 2016 through 2022…………………………………………..17

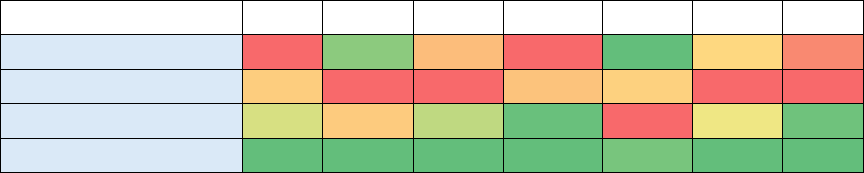

Figure – 9 Porolio’s yearly returns.…………………………………………………………………………18

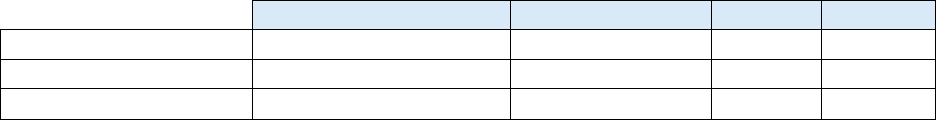

Figure 10 – Comparison of Porolio Standard deviaon…………………………………………..…20

Figure 11 – Porolio Monthly return standard deviaon for each year in study……………..…20

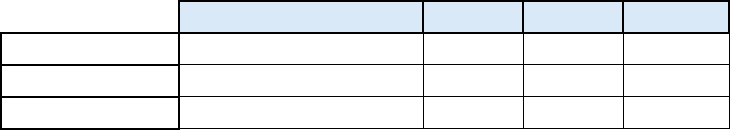

Figure 12 – Porolio Beta of each year – using Monthly returns for each year (2016-2022)..22

Figure 13 – Porolio Beta of enre period – Using Monthly Returns for enre period (2016-

2022)………………………………………………………………………………………………………………….22

Figure 14 – Porolio Beta of enre period – Using yearly Returns for enre period (2016-

2022)…………………………………………………………………………………………………………………22

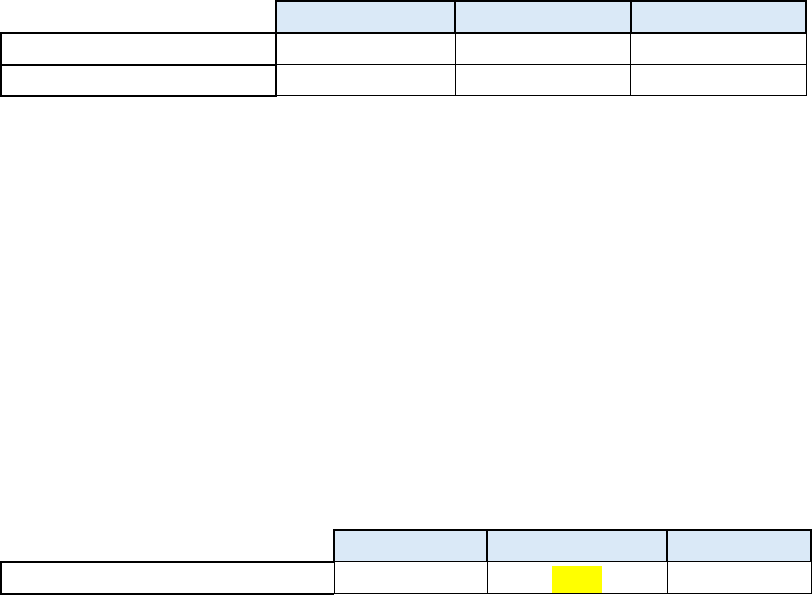

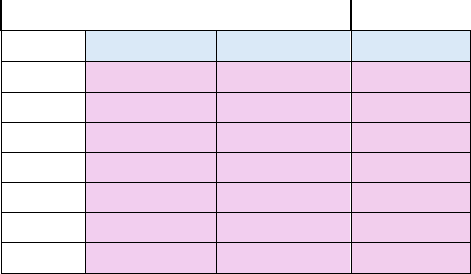

Figure 15 – Risk-Adjusted Rao Analysis Summary……………………………………………………27

Figure 16– Sharpe and Treynor Measure Component Informaon………………………………..30

Figure 17 – Treynor Measure Component Informaon………………………………………………..31

Figure 18– The SML on investments invested from 2016 through 2022………………………….34

Figure 19 – Porolios’ Yearly Compounded Returns from 2016-2022…………………………...36

Figure 20 – Alternave Analysis – Risk-Adjusted Analysis Summary…………………………..…37

Figure 21 – The SML on investments invested from 2016 through 2021…………………………37

1

Introducon

The S&P500 is one of the best-known equity indexes in the enre world and is

comprised of the ve-hundred largest companies traded on either the NYSE, Nasdaq, or CBOE.

The porolio technically includes over 500 separate stocks, as 3 of these companies have

mulple classes of stock, resulng in 503 tradable stocks in the index. The Index had a market

capitalizaon, as of January 1

st

, 2024, of over 40 trillion dollars, which comprises 80% of total US

business’s market capitalizaon. The S&P500 is preferred for instuonal investors over its

competors, such as the DOW JONEs index (Yahoo Finance, 2024), because of its inclusion of

more stocks across dierent sectors, and therefore is considered to be a more accurate

representaon of the US’s equies market (KENTON, 2023). The S&P500 index’s construcon

seeks to include stocks from all industries in an aempt to mimic how the overall economy is

moving. Through including many stocks from every sector, the index is thought to diversify out

unsystemac risk. This is why many investors use the S&P500 as a benchmark for the market

and many ETFs and Index funds have been created to mirror the composion of the index.

Currently, there are many ETFs and index funds that track the S&P500, all with their

slightly dierent goals. The oldest and most popular ETF mirroring the S&P500, was created in

1993 and is named the SPDR S&P 500 ETF Trust (SPY). SPY is a passively managed fund run by

State Street, with a goal of mirroring the S&P500. Another ETF tracking the S&P500, is the

Invesco S&P 500 Top 50 ETF (XLG), which only includes the 50 largest companies in the S&P500

and was created in 2005. Because both funds are passively managed, this means that both aim

to replicate the performance of the underlying index as closely as possible. Both ETFs oer

2

unique ways to compare porolios to the market and for this reason, I used both these ETFs as

market measures to compare my research’s porolios return and volality against.

Aside from ETFs, the three largest S&P500 index funds currently are the Fidelity 500

index fund, Schwab S&P 500 index fund, and the Vanguard 500 Index Admiral Fund (Reeves,

2024). While index funds and ETFs are very similar, they do have some dierences that can

result in dierent returns for the porolio. Index funds are generally considered safer than ETFs,

but they cannot be traded during the day and cannot be bought and sold on exchanges like

ETFs. This allows Index funds to provide more stable, long-term investment avenues, as they

primarily trade in securies via asset management companies and are therefore great for

paent investors. ETFs on the other hand oer more exibility, lower costs, and higher tax

eciency than Index funds, but are also more volale and garner more trading fees. While both

ETFs and index funds seek to match the performance of the market, ETFs have proven to be

beer for short-term investors and Index funds have shown to be beer for long-term investors.

Because this analysis only invesgates 7 years’ worth of data, and hence will be looking at a

relavely small-me frame, it will ulize both the SPY and XLG ETFs’ returns and volality to

compare to that of my test porolios.

Overall, the S&P500 is viewed as a safe investment by most analysts as it has

experienced a consistent history of long-term growth. In fact, if you invested $1000 in a

porolio mirroring the S&P500 index in 2000, by the end of 2023 you’d have $4,880.49, a return

of 388.05%, or 6.93% per year (Webster, 2024). A graphical depicon of this investment can be

seen in gure 1. Adjusng for inaon this would give the investor a 175.82% return over the 23

years. While the market does go through bull and bear markets, the S&P500 has proven over its

3

history that it will connue to grow and produce posive results in the long term. A graphic

depicon of the S&P500’s returns from 2000 to 2023 can be seen in gure 2. As we can see in

gure 2, while there have been plenty of negave months in terms of returns, they are

outnumbered by the posive returns that the index has generated. This history of long-term

growth is one of the reasons the S&P500 has become so popular as a measure of the market

and is why I used its measure as the benchmark for this analysis.

Figure 1- Invesng $1000 into the S&P500 in 2000 and leaving unl 2023. From Ocial Data, 2024., Retrieved from

hps://www.ocialdata.org/us/stocks/s-p-500/2000?amount=1000&endYear=2023. Copyright 2024 by Ian Webster.

4

Figure 2- S&P 500 monthly returns (2000-2023). From Slick Charts, 2024., Retrieved from

hps://www.slickcharts.com/sp500/returns. Copyright 2024 by Slick Charts.

Goals of Research

The goal of this paper ulmately is to discover whether a porolio containing the ten

largest stocks in the S&P500 index could potenally outperform the market, as measured by the

SPY, in terms of total returns as well as on a risk-adjusted basis. Addionally, a secondary goal of

this paper will be to get a sense of how much the ten largest stocks of any given year aect the

overall return and volality of the index. Through analyzing the SPY, I will seek to measure the

ten largest stocks impact on the overall market, and by analyzing the XLG, I will seek to view the

ten largest stocks impact compared to that of only the 50 largest stocks.

S&P500 Stock Weighng

The S&P500 index weighs its stocks based on their percentage of total market

capitalizaon, and therefore those stocks with more weight can aect the price more

dramacally. Recently, a real-life example of this would be Microso which, as of March 12

th

,

5

2024, was the largest stock in the S&P500 with an index weight of 6.98%. V.F. Corporaon as of

March 12

th

was the smallest stock in the S&P500 with an index weight of .01%. This meant that

at that me Microso, the largest stock, had 698 mes the weight of the smallest stock in the

index, demonstrang the sheer power that the largest stocks have in the index. Now while

obviously the largest stock might be much greater than the smallest stock, how would it

compare to the median stock, the 250

th

largest stock in the index? In this case, Electronic Arts

(EA), the 250th largest stock as of March 12

th

, had an index weight of .08%. Therefore, in this

case, Microso would sll possess 87.5 mes the weight of EA, demonstrang that this one

stock controls much more of the total return of the index than the enre boom half of the

index.

Through this paper’s analysis it was discovered that the S&P500 index is very top heavy,

as its largest 10 stocks in any given year between 2015 and 2023 accounted for, on average, 26%

of the total index’s market cap. This 26% is also not telling of the whole story either, as the top

ten stocks percentage increased throughout the 7-year period, with every year aer 2020

having a larger percentage than 26%. Figure 3 below depicts just this, as it shows the rankings of

the 10 largest stocks in the S&P500 as of January 1

st

, 2024, with these stocks collecvely holding

34.7% of the whole market cap of the index. This disparity between the top stocks in the index

can be seen even clearer when I also included the top 11-20 stocks. Between 2015 and the end

of 2023, on average, 36.9% of the index’s market cap resided within its top 20 stocks, with a

similar increasing percentage trend as seen with the top 10 stocks. This concentraon at the top

of the index leaves the remaining 480 or so stocks to have on average .13% of the index’s

market capitalizaon per stock. This disparity at the top is what led me to our queson in this

6

paper; would invesng in a porolio of only the top 10 largest stocks in the S&P500, over a

mul-year period, produce superior returns while not unproporonally increasing risk and

volality? Many believe that to achieve the best returns, a porolio or index must be well

diversied, but with the power that resides in the ten largest stocks of the S&P500, there is

room to queson whether that remains true.

Figure 3 – Percentage of total Index market cap residing in the Largest 10 stocks in the S&P500 as of January 1

st

, 2024.

Analysis Methodology

The 10 and even 20 largest stocks of the S&P500 index represent a massive poron of

the overall index’s market capitalizaon. To invesgate whether it is sll true that the other 490

or so stocks are sll necessary to diversify risk in a porolio and return the best possible returns,

an analysis and comparison of the returns of the top 10 stocks in the S&P500 over a 7-year

period was conducted.

The Ten Largest Stocks' Percentage of the Total

Index's Market Cap

34.7%

Apple

Microsoft

Alphabet

Amazon

NVIDIA

Meta/Facebook

Tesla

Berkshire Hathaway

Eli Lilly

Visa

7

To begin this analysis, rst the largest 10 stocks at the beginning of each year between

2016 and 2022 were ranked by their total market capitalizaon. Then the overall S&P500 index’s

market capitalizaon was found for each of these years. To test the performance of solely the

largest ten stocks in the index, two test porolios were created and compared to the index over

the 7 years. Aer the returns for each month, year, and total period were calculated for the test

porolios and SPY, each porolio’s beta and standard deviaon was calculated for the same

periods. To see how returns can dier depending on frequency, mulple invesng scenarios

were then examined to see how invesng $1000 in each porolio could dier over the 7-year

me in regards to compounding. Aer the returns and volality of the test porolios were

analyzed, a risk-adjusted review was completed, to determine whether these porolios could

outperform the market without increasing risk unproporonately. The results of the analysis are

shown in the following secons and gures in this paper.

Test Porolios – Equally weighted and Index weighted

To evaluate the eect of the ten largest stocks on the total return of the S&P500, this

analysis used two dierent test porolios comprised of the largest 10 stocks as of the beginning

of each year. The two test porolios were comprised of the same stocks each year and diered

only based upon how these stocks were weighed in the porolio. The rst test porolio equally

weighed each of the 10 largest stocks of the S&P500 each year, and therefore each stock’s

performance inuenced the porolio’s total return equally. The second test porolio weighed

each stock relave to its weight in the index. This second porolio allowed for the very largest

stocks to inuence the total porolio’s returns and volality more than the 9

th

or 10

th

largest

stocks and more accurately reects the power that each stock has in the index.

8

We will invesgate the results of both test porolios because each weighng method

brings its own benets and drawbacks to the analysis. To begin, the benets of the equally

weighted test porolio are that it removes the large cap bias of the index and returns results

that reect every stock’s performance equally. Market-cap weighted porolios on the other

hand, are overweight in companies that are currently outperforming the market and thus they

allow themselves to have a large concentraon of funds at the top of the porolio. Because of

this concentraon in overvalued stocks, market-cap weighted porolios are great for when the

largest companies are on a tear, but over the long-term, these porolios can be massively hurt

when the overpriced stocks inevitably fall back to their fair value. Therefore, market-cap

weighted porolios have long been viewed as a great tool for momentum invesng strategies,

as during good mes they can outperform the market, yet during contracons are oen le

desolated. Oppositely, Equal Weighted porolios are more resistant to drop os like these,

because of their beer diversicaon due to less concentraon in any one stock. Equally

weighted porolios are considered value-based invesng strategies, which means that this

approach favors undervalued stocks with the potenal to rise in price and return to their fair

value. A downside to this style of invesng, however, is that it will lead to more selling and

buying acvies and potenally larger tax consequences than a market-cap weighted porolio.

For example, when shares in Company A grow and become more highly valued, a poron will

have to be sold and deployed into the lower-priced Company B, C, and D to maintain the equal

weighng of all companies in the porolio. Therefore, while the equally weighted porolio may

have greater diversicaon and focus on the true value of the stocks, it too has its downsides,

as its higher management fees can eat into its returns. Ulmately then, the type of weight used

9

in porolios depends on the goals of the investor as each method can produce superior returns

and risk depending on investment strategy.

Because of the dierences in porolios and invesng strategies, this study will ulize

both equally and market-cap weighted porolios to determine which would have performed the

best from 2016-2022. Even though equally weighted porolios tend to require more

rebalancing, and therefore can generate larger fees, there is a generally accepted view that they

sll produce superior returns and risk to that of market-cap weighted porolios (Friedberg,

2018). While this may be held as true by many investors, this paper will seek to see if this

statement would hold true between 2016 and 2022, when the market was experiencing mainly

posive years. As a control for this research, the SPY was used as the benchmark for which I will

compare both porolios returns and volality to that of the market. The XLG will also be

compared to the test porolios and the market, to see how a porolio containing only the 50

largest stocks in the index would compare.

To begin the analysis, each of the largest stocks in the SPY, as of January 1st of each year,

were selected and weighed in accordance with their test porolio. Because the largest stocks in

the index changed market capitalizaon and therefore index weight throughout the 7-year

period, each year the manager would need to rebalance the porolio, removing companies who

had shrunk, and replacing them with the new largest companies. Once the ten largest

companies had been selected for each year in the study, each stocks’ monthly returns for that

year were collected, and the porolio’s monthly returns were then calculated based on the test

porolio’s stock weights. The SPY and XLG’s monthly returns for each year during the study

were then also calculated using data from Yahoo Finance. Once each porolios’ monthly returns

10

for the enre period were calculated, each year’s twelve-monthly returns were annualized to

nd the year’s total return. Likewise, once each year’s monthly returns were calculated using

the proper stocks and weights, the total 7 year holding period return was calculated.

A fault with the returns found using this method is that it does not include the

processing fees that would be incurred to rebalance each of the test porolios each year. What

this ulmately means is that less money would be invested each year as compared to my

calculaons, as some principal would be lost to these fees. These fees would not be apparent in

investments in the SPY, as it is a market-cap weighted ETF that would be fully passively invested

in. The SPY would only require fees when the money is ulmately pulled out at the end of the

period to realize a return. These calculaons also do not account for the equally weighted

porolios larger management fees in order to keep the porolio equal and therefore may not

accurately represent the dierence between equally weighted and market-cap weighted

porolios. Therefore, while these calculaons can oer insight into how these investments

could compare to the index, their returns may be slightly inated.

Market Players – Test Porolios Composion

When looking at the largest stocks throughout these seven years, it is apparent who the

largest players in the market have been. Apple has been the largest company almost every year

since 2016, only being usurped by Microso at the beginning of 2019. Between 2016 and 2019

Apple consistently comprised the largest weight of the index at approximately 3.5% of the

enre index’s market capitalizaon. However, starng in 2020, the company’s market

capitalizaon began to increase to around 7% of the total index weight. Unl the end of 2019,

11

no stock had been over 4% of the total index weight, but during 2020, the disparity between the

largest companies in the index and the smallest began to grow. By the beginning of 2022, four

dierent stocks had individual index weights greater than 4%, with Apple reaching its peak

index weight of 7.19%. Another notable trend during these 7 years is that many of the largest

stocks in the index stayed consistent. Stocks such as Apple, Microso, Alphabet, and Amazon

were among the ten largest every year during the study. While the largest ve stocks were

almost always the same, albeit shued, the sixth through tenth largest stocks in the index

would occasionally dier in composion. The largest stocks and their percentage of the total

Index market capitalizaon for 2016 through 2022 can be seen in gure 4 below.

Market Cap

Rank:

2022

% of

Total

S&P

2021

% of

Total

S&P

2020

% of

Total

S&P

2019

% of

Total

S&P

2018

% of

Total

S&P

2017

% of

Total

S&P

1/1/2016

% of

Total

S&P

1

Apple

7.19%

Apple

7.05%

Apple

4.81%

Microso

3.71%

Apple

3.77%

Apple

3.16%

Apple

3.26%

2

Microsoft

6.25%

Microsoft

5.30%

Microso

4.48%

Apple

3.55%

Alphabet

3.21%

Alphabet

2.83%

Alphabet

2.99%

3

Alphabet

4.75%

Amazon

5.17%

Alphabet

3.45%

Amazon

3.51%

Microso

2.89%

Microso

2.51%

Microso

2.46%

4

Amazon

4.20%

Alphabet

3.74%

Amazon

3.44%

Alphabet

3.46%

Amazon

2.47%

Berkshire

Hathaway

2.09%

Berkshire Hathaway

1.82%

5

Tesla

2.71%

Meta/Facebook

2.46%

Meta/Facebook

2.19%

Berkshire

Hathaway

2.39%

Meta/Facebook

2.25%

Exxon Mobil

1.94%

Exxon Mobil

1.81%

6

Meta/Facebook

2.28%

Tesla

2.14%

Berkshire Hathaway

2.06%

Meta/Facebook

1.78%

Berkshire

Hathaway

2.14%

Amazon

1.85%

Amazon

1.78%

7

NVIDIA

1.82%

Berkshire

Hathaway

1.70%

JPMorgan Chase

1.61%

Johnson &

Johnson

1.63%

Johnson & Johnson

1.64%

Meta/Facebook

1.72%

Meta/Facebook

1.66%

8

Berkshire Hathaway

1.64%

Visa

1.50%

Visa

1.53%

JPMorgan Chase

1.52%

JPMorgan Chase

1.63%

Johnson & Johnson

1.63%

Johnson & Johnson

1.59%

9

United Health

1.17%

Johnson & Johnson

1.31%

Johnson & Johnson

1.43%

Visa

1.40%

Exxon Mobil

1.55%

JPMorgan Chase

1.60%

Wells Fargo

1.55%

10

JPMorgan Chase

1.16%

Walmart

1.29%

Walmart

1.26%

Exxon Mobil

1.37%

Bank of America

1.35%

Wells Fargo

1.44%

JPMorgan Chase

1.35%

Figure 4 – Largest 10 stocks in the S&P500 and their index weights at the beginning of each year between 2016 and 2022.

Informaon was adapted from “Top 20 S&P 500 Companies by Market Cap (1990 – 2024)” (FINHACKER, 2024)

Rebalancing the Porolios

12

As can be seen in gure 4, each year the largest stocks in the SPY change and their

weight moves in accordance with their companies’ new market capitalizaon. Depending on

invesng schedule, even if funds invested in each of these test porolios were le for the enre

7-year period, the largest stocks in the SPY would change each year and would result in the

porolios needing to be rebalanced. Each year, the manager would calculate the largest ten

stocks in the SPY and then appropriately weigh the stocks based on the test porolio. For this

analysis, these calculated monthly returns of the SPY, XLG, and test porolios were used to

calculate the annualized yearly and 7-year returns.

The Ecient Market Hypothesis (EMH) demonstrates that no acve manager can beat

the market for long, as their success is only a maer of chance. Therefore, longer-term, passive

management has proven to deliver beer returns overme. My inial quesons for this paper

then were: how would a hybrid strategy perform where stocks are acvely selected and

rebalanced, but funds are le passively to grow? I try to answer this queson below, as well as:

would the ten largest stocks of the index, if acvely managed and rebalanced once a year,

provide superior returns without increasing the risk of the porolio unproporonately to that of

the index? The following secons of this paper seek to invesgate whether the two test

porolios would provide superior returns and measures of volality as compared to the market

between 2016 and 2022. The next part then seeks to compare the test porolios to the market

on a risk-adjusted basis.

Individual Stock Analysis

13

Throughout the 7-year period under analysis, the 10 largest stocks in the index remained

relavely stable. There were 6 dierent stocks who maintained top 10 status throughout the

enre period, with 13 dierent stocks in total being included at some point in the test

porolios. Each of these stocks played a role in determining the return and volality of the test

porolios as well as the SPY and XLG. To discover where volality came from during these years

under invesgaon, the standard deviaon, beta, and average stock rank were calculated for

each stock. A summary of the individual analysis of each company included in the index can be

found in gure 5.

As can be seen in gure 5, Apple was the largest company for all but one year of the

study. This means that throughout my analysis, Apple was the main driver of returns and

volality for all the porolios under analysis, except the equally weighted porolio. In fact, aer

analyzing the stocks who were included in my test porolios, 4 specic stocks, which were

present every year, stood out as drivers of returns and volality. These were, unsurprisingly,

Apple, Microso, Alphabet, and Amazon. These four stocks consistently ranked within the

largest 4 throughout the period and none of them even dropped below the 6

th

largest posion.

While these stocks were found to be the largest throughout the period, they were also found to

have experienced the largest standard deviaon during their me in the test porolios. This

leads to the idea that while the very largest stocks are responsible for generang the majority of

returns for even a porolio containing only the largest 10 stocks, they are also responsible for

generang the majority of volality for that porolio. In fact, every stock that ranked within the

10 largest every year of the study (7 mes) had a standard deviaon larger than that of the test

porolios. This means that while the largest returns of the test porolios are generated by the

14

largest stocks, the risk reducon of the test porolios comes from the boom half of the

porolio.

Another interesng thing discovered about these largest stocks was that, except for two

instances at the beginning of the study, the majority of stocks experienced betas of over 1.

Having a beta above 1 means these stocks are more volale and therefore riskier than the

market. What this ulmately means is that when the market reacts to changes, these stocks on

a whole will react more drascally than the market. This can be good for years when the market

is performing well, but as we can see when calculang yearly returns, when the market goes

south, the test porolios take even larger nose dives.

15

Figure 5 – Ten largest Stocks’ names, rankings, weights per test porolio, betas, and standard deviaons of monthly returns from

2016 through 2022.

Monthly Return Comparison

To perform my monthly return analysis, the returns of each of the ten largest stocks in

the SPY were calculated, for each month of the 7 years. Each stock’s monthly return would be

weighted according to the test porolio to calculate the porolios’ total return for each month.

To calculate the returns of the XLG and SPY, their historical prices were sourced from Yahoo

Finance, and the holding period formula was used to calculate their monthly returns.

Stock Size 1 2 3 4 5 6 7 8 9 10

Top 10 as of 1/1/16 Apple Alphabet Microsoft Berkshire Hathaway Exxon Mobil Amazon Meta/Facebook Johnson & Johnson Wells Fargo JPMorgan Chase

Equal Weight Portfolio

10% 10% 10% 10% 10% 10% 10% 10% 10% 10%

Index Weighted Portfolio

16.10% 14.75% 12.13% 8.98% 8.94% 8.78% 8.18% 7.84% 7.64% 6.67%

Stock Beta

1.54 1.04 1.10

0.67 0.29

1.50

-0.03 0.09

1.48 1.59

Standard Deviation (Monthly Ret)

7.52% 5.63% 6.06% 4.03% 3.80% 7.61% 5.36% 3.33% 7.70% 6.86%

Stock Size 1 2 3 4 5 6 7 8 9 10

Top 10 as of 1/1/17 Apple Alphabet Microsoft Berkshire Hathaway Exxon Mobil Amazon Meta/Facebook Johnson & Johnson

JPMorgan Chase

Wells Fargo

Equal Weight Portfolio

10% 10% 10% 10% 10% 10% 10% 10% 10% 10%

Index Weighted Portfolio

15.22% 13.65% 12.07% 10.04% 9.35% 8.90% 8.29% 7.83% 7.72% 6.92%

Stock Beta

1.90 1.02

0.61 0.88 -0.32

1.85 1.13

0.95 0.91 0.30

Standard Deviation (Monthly Ret)

6.16% 3.73% 3.42% 2.10% 3.41% 5.25% 4.89% 3.38% 4.77% 4.92%

Stock Size 1 2 3 4 5 6 7 8 9 10

Top 10 as of 1/1/18 Apple Alphabet Microsoft Amazon

Meta/Facebook

Berkshire Hathaway

Johnson & Johnson

JPMorgan Chase Exxon Mobil Bank of America

Equal Weight Portfolio

10% 10% 10% 10% 10% 10% 10% 10% 10% 10%

Index Weighted Portfolio

16.47% 14.00% 12.63% 10.78% 9.81% 9.36% 7.18% 7.10% 6.78% 5.89%

Stock Beta 0.83

1.25 1.25 2.12

0.75 0.93 0.73

1.06 1.14 1.17

Standard Deviation (Monthly Ret)

10.21% 6.62% 5.81% 11.25% 7.56% 5.00% 5.52% 5.93% 6.69% 6.28%

Stock Size 1 2 3 4 5 6 7 8 9 10

Top 10 as of 1/1/19 Microsoft Apple Amazon Alphabet

Berkshire Hathaway

Meta/Facebook

Johnson & Johnson

JPMorgan Chase Visa Exxon Mobil

Equal Weight Portfolio

10% 10% 10% 10% 10% 10% 10% 10% 10% 10%

Index Weighted Portfolio

15.26% 14.59% 14.42% 14.21% 9.83% 7.32% 6.72% 6.25% 5.75% 5.65%

Stock Beta 0.77

1.35 1.37

0.69 0.90

2.14

0.73

1.28

0.49

1.30

Standard Deviation (Monthly Ret)

4.12% 6.80% 6.58% 5.04% 4.63% 9.87% 4.20% 6.52% 3.91% 6.12%

Stock Size 1 2 3 4 5 6 7 8 9 10

Top 10 as of 1/1/20 Apple Microsoft Alphabet Amazon

Meta/Facebook

Berkshire Hathaway

JPMorgan ChaseVisa

Johnson & Johnson

Walmart

Equal Weight Portfolio

10% 10% 10% 10% 10% 10% 10% 10% 10% 10%

Index Weighted Portfolio

18.33% 17.07% 13.12% 13.09% 8.33% 7.86% 6.12% 5.83% 5.46% 4.80%

Stock Beta

1.23

0.64 0.98 0.83

1.22

0.88

1.24 1.05

0.71 0.35

Standard Deviation (Monthly Ret)

11.48% 6.73% 8.99% 10.01% 10.62% 7.92% 10.72% 9.19% 7.08% 5.75%

Stock Size 1 2 3 4 5 6 7 8 9 10

Top 10 as of 1/1/21 Apple Microsoft Amazon Alphabet

Meta/Facebook

Tesla

Berkshire Hathaway

Visa

Johnson & Johnson

Walmart

Equal Weight Portfolio

10% 10% 10% 10% 10% 10% 10% 10% 10% 10%

Index Weighted Portfolio

22.28% 16.75% 16.35% 11.81% 7.77% 6.76% 5.36% 4.73% 4.13% 4.07%

Stock Beta 0.84

1.39

0.71

1.65 1.19 1.36 1.03

0.99 0.62

1.08

Standard Deviation (Monthly Ret)

6.50% 6.01% 5.71% 6.92% 6.91% 14.96% 4.64% 7.83% 4.52% 4.78%

Stock Size 1 2 3 4 5 6 7 8 9 10

Top 10 as of 1/1/22 Apple Microsoft Alphabet Amazon Tesla

Meta/Facebook

NVIDIA

Berkshire Hathaway

United Health

JPMorgan Chase

Equal Weight Portfolio

10% 10% 10% 10% 10% 10% 10% 10% 10% 10%

Index Weighted Portfolio

21.67% 18.84% 14.32% 12.67% 8.16% 6.89% 5.49% 4.95% 3.53% 3.48%

Stock Beta

1.21

0.90 0.93

1.25 1.37

0.51

2.46 1.01

0.44

1.21

Standard Deviation (Monthly Ret)

9.50% 6.95% 7.72% 12.63% 18.39% 16.38% 18.14% 8.13% 4.94% 10.34%

16

When analyzing the four porolios’ returns, I began by comparing them on a monthly

basis. To do this, I started by lisng each porolio’s monthly returns for the enre 84-month

period. Then, each of the test porolio’s returns, as well as the XLG’s, were subtracted from the

SPY’s to see which performed beer during each month. Of the 84-month period analyzed, the

index weighted porolio outperformed the index 50 mes, which was far more than it lagged

behind. The equally weighted porolio performed similarly, outperforming the Index 48 mes.

Interesngly, the XLG, comprised of the 50 largest stocks in the SPY, outperformed the index the

exact same number of months as it underperformed it. The results of this analysis are shown

below in gure 6.

Equal

Index W

XLG

Months Outperformed

48

50

42

Months Underperformed

36

34

42

Figure 6 – Number of Months the test porolios out/underperformed the SPY from 2016-2022

The next step of analyzing the monthly returns of the porolios was to see how

correlated the 84 returns were to those of the index. Aer running an analysis, not surprisingly

all three delivered very high scores. What can be seen from these results is that just as the Index

weighted porolio outperformed the market in more months, it was also the least correlated of

the three. Similarly, the XLG with its higher correlaon was also the porolio that performed the

most similarly to the SPY on the monthly comparison.

Equal

Index W

XLG

Correlation of Monthly Returns

0.934

0.903

0.980

Figure 7 – Correlaon of our test porolios’ Monthly Returns to that of the SPY

Total Return Comparison

17

To calculate the total return of each test porolio, the annualized total return formula

was used to calculate the returns of each porolio. This total includes compounding monthly

returns and assumes the investor would leave investments for the enre 84-month period. For

each test porolio and the two index measures, their yearly and total 7-year holding period

returns were calculated for 2016-2022 using their monthly returns. As can be seen in gure 8

below, the SPY performed the worst throughout these 7 years, only experiencing a return of

113.04%. The XLG, with its less diversied holdings, experienced only a slightly higher 7-year

total return, experiencing a 113.31% total annualized return.

The equally weighted porolio was found to have experienced a 128.84% growth from

2016 to 2022, outperforming both the market and XLG in terms of total compounded returns.

The Index weighted test porolio experienced the largest total compounded return over the 7–

year period, realizing a 158.09% increase by the end of 2022. A summary of these total returns

is shown below in gure 8. An issue that arises with these returns is that they do not take into

account the fees required to rebalance the porolio each year, and therefore, the test

porolio’s return may be slightly inated. To get a beer understanding of how the test

porolios would perform on a year-by-year basis, in the next secon I calculated the yearly

returns for each porolio.

Total HPR (2016-2022)

SPY

113.04%

XLG

113.31%

Equal

128.84%

Index

158.09%

Figure 8 – Porolio Total Returns from 2016 through 2022.

Yearly Return Comparison

18

What if an investor did not want to leave their money in any of these porolios for the

enre 7-year period? If an investor were to invest $1000 in one of these porolios each year,

leaving their money passively compounding throughout the year, then withdrawing it at the end

of each year and realizing a return, how would the porolio’s returns compare? Figure 9 below

shows the yearly returns for each of my analyzed porolios.

XLG

SPY

EQUAL

INDEX

2016

11.28%

12.00%

16.17%

14.92%

2017

22.97%

21.80%

31.59%

33.27%

2018

-3.66%

-4.64%

-1.85%

0.16%

2019

32.32%

31.34%

37.32%

40.46%

2020

23.82%

18.41%

30.82%

40.99%

2021

30.60%

28.82%

27.80%

32.22%

2022

-24.37%

-18.26%

-33.56%

-35.74%

Figure – 9 Porolio’s yearly returns. (Dark Green Means Highest, Dark Red Means Lowest, Yellow means middle)

The equally weighted porolio consistently performed in between both the SPY and

Index weighted porolio from 2016 through 2022. The index weighted porolio outperformed

the SPY in every year but 2022, when the market turned south, and all 4 porolios felt large

losses. Not surprisingly, the index weighted porolio, as well as the equally weighted porolio,

appeared to follow a similar trend as the SPY in terms of yearly and monthly returns. The index

weighted porolio outperformed the index in 6 out of the 7 years, making a case for itself as the

smartest investment during this period. While the index weighted porolio did appear to

perform beer on a year-to-year comparison as well as overall, the drasc loss in 2022 cannot

be ignored. Since the largest stocks of the S&P500 have the largest eect on the returns of the

index, the other 490 stocks mainly aid the index by diversifying some of the largest stocks’

losses in bad years. As a result, while a porolio of the largest ten stocks in the S&P500 would

19

appear to produce superior returns in years when those companies did well, the lack of

diversicaon outside of those stocks, would lead to larger losses in years when these stocks did

not perform well. What can be seen by looking at the SPY, XLG, and index weighted porolios is

that as the porolio becomes less diversied in its holdings (500,50,10 stocks), the returns

appeared to become larger but change more drascally on a yearly basis.

It has long been taught that passively managed porolios outperform acvely managed

ones over the long-term. However, the superior returns of the test porolios do oer some

potenal that a combinaon of acvely managing the composion of the porolio while

passively invesng the money could outperform the market in the short-run and potenally

even in the long run. Whether or not these larger returns are accompanied by addional risk

will be invesgated next.

Standard Deviaon Comparison – Yearly and Monthly Basis

Now that I have invesgated the monthly, yearly and total returns for each of the

porolios, I shall look at the risk involved in each. To measure each porolios’ risk, the standard

deviaon of each porolio was rst calculated using the monthly returns. The standard

deviaon of a porolio includes both systemac (market) risk and unsystemac risk. The

standard deviaons of each porolio’s monthly returns as well as the standard deviaon of the

SPY and XLG, between 2016 and 2022, are shown in gure 10 below.

Monthly Return SD

(2016-2022)

Yearly Return SD

(2016-2022)

SPY

4.79%

14%

XLG

4.87%

21%

Equal Weighted

5.44%

25%

Index Weighted

5.71%

28%

20

Figure 10 – Comparison of Porolio Standard deviaon

We can see from the table above, as well as in Figure 11 below, that all the porolios

had similar risk structures. Each test porolio’s standard deviaons only varied above the

market’s by less than 1% each month. Yet when comparing the yearly return’s standard

deviaons, the increased variability that the test porolios experienced was made even more

evident. The porolios containing only the largest 10 stocks of the S&P500 would clearly have

more variability in their returns than that of more diverse porolios like the SPY or XLG.

Addionally, as I would expect, the equally weighted porolio, with its lower concentraon risk,

had a lower standard deviaon than the market-cap weighted porolio during every year.

STANDARD DEVIATION

2016

2017

2018

2019

2020

2021

2022

SPY

2.21%

1.85%

4.90%

3.25%

7.65%

3.81%

7.11%

XLG

2.66%

1.41%

4.61%

3.84%

7.51%

3.44%

6.90%

EQUAL WEIGHTED

2.92%

1.68%

5.21%

4.36%

7.24%

3.93%

8.38%

INDEX WEIGHTED

3.29%

1.88%

5.43%

4.37%

7.64%

4.45%

8.43%

Figure 11 – Porolio Monthly return standard deviaon for each year in study. (red means low, green means high, goes by year)

Beta

The beta of each stock is comprised of the market’s variance and the stock returns’

covariance. Variance measures how far apart the market’s data points spread out from their

average, while covariance measures how changes in a stock’s returns are related to changes in

the market’s returns. When the covariance of the stock is divided by the variance of the market,

the beta of the stock is produced. To calculate each porolio’s beta, I rst found the beta each

21

year, of the ten largest stocks. To determine the porolio beta for the year, these individual

stock betas were then weighed in accordance with their test porolio. The equally weighted

porolio would average the beta out evenly among the stocks, while the index weighted

porolio would allow for the largest stocks to inuence the beta more. Another way I found the

beta of the test porolios was to run the EXCEL slope funcon on the returns of the test

porolios and SPY, which unsurprisingly returned the same results as the previous method. The

beta of the test porolios was calculated using monthly and yearly returns and we will

invesgate the results in the secon below.

The monthly returns of the equally and index weighted porolios were found to have

had a 1.06 and 1.08 beta respecvely throughout the enre period. This means that the

monthly returns of both test porolios moved more dramacally in the face of market changes

than did the S&P500. While the monthly returns of the test porolios did experience a beta

above 1, there were mulple years where the betas were below 1. However, a beta of .90 is sll

considered very high and would indicate that the test porolios were only slightly less volale in

those years. Figure 12 through 14, below, depicts the betas for the test porolios on a yearly

basis as well as two dierent measures of the porolios’ beta during the enre period.

Beta of Monthly Returns

Equal W

Index W

XLG

2016

0.93

0.98

0.94

2017

0.92

0.99

1.00

2018

1.12

1.13

1.00

2019

1.10

1.09

1.00

2020

0.91

0.93

0.96

2021

1.09

1.09

0.99

2022

1.13

1.11

1.00

Figure 12 – Porolio Beta of each year – using Monthly returns for each year (2016-2022)

22

Equal W

Index W

XLG

Beta of Monthly Returns (84-Count)

1.06

1.08

.996

Figure 13 – Porolio Beta of enre period – Using Monthly Returns for enre period (2016-2022)

Equal W

Index W

XLG

Beta of Yearly Returns

1.34

1.46

1.13

Figure 14 – Porolio Beta of enre period – Using yearly Returns for enre period (2016-2022)

Since both the test porolios’ monthly returns experienced posive betas each year of

the study, the idea that the largest stocks could greatly outperform the market without adding

risk can be brought under serious queson. With the beta of the test porolios yearly returns

being found to be 1.34 and 1.46, this brings the idea even more under scruny. But all hope is

not lost. While these test porolios have indeed been proven to increase the volality of the

porolio, as their high betas represent, it is yet to be seen whether or not they sll produced

adequate returns for risk-averse investors to have chosen to accept their addional risk.

The benets of calculang the betas of these porolios using their monthly returns

included having a higher frequency of data points to give us a beer idea of short-term

uctuaons, as well as increased sensivity, as using monthly returns allows for a more granular

analysis of how a porolio reacts to market movements. The benets of using yearly returns, on

the other hand, is that yearly returns smooth out short-term uctuaons, giving us a beer

long-term perspecve. While each method has its benets and drawbacks, they both provide

valuable informaon about the volality of the porolios and give us some insight into how

returns will behave on a yearly and enre period basis.

Invesng Scenarios

23

To get a beer picture of how investors could ulize these test porolios, a couple

invesng scenarios were conducted. Each scenario assumed that an investor would invest

$1000 into one of the four porolios only diering in their investment frequency. To begin, my

rst scenario analysis assumed that an investor would invest $1000, starng on January 1

st

,

2016, into each of the porolios for each month and realize a return. The manager would then

reinvest $1000 into the porolio for the next month, keeping the weight the same as at the

beginning of the year, only changing stocks and weights at the beginning of the next year. These

monthly returns, added together throughout each year, provide us with the simplest form of

the investor’s total returns for the 7 years. In this scenario the index weighted, equally

weighted, XLG and SPY porolios would produce returns of 108.95%,95.62%, 85.97% and

83.76% respecvely. The benet of this invesng scenario is that it allows us to invesgate each

month’s returns separately, without the eect of compounding. What I discovered was that the

SPY experienced the most months with a posive return (58), the equally weighted porolio

was close behind with 57, and both the XLG and market-cap weighted porolios had posive

returns 55 mes. This means that the porolio with the lowest total return also had the most

posive monthly returns. This is because the SPY did have more months of growth, but the

other porolios, with their larger betas, produced larger returns during their good months that

ulmately made up for their addional few months of losses. Interesngly, while this scenario’s

yearly returns were obviously less than those that allowed for compounding in most years, this

scenario performed the best in 2018 for all four porolios. While every porolio felt a loss in

2018, this scenario’s porolios experienced the smallest loss, as losses too are not compounded

in this scenario. Ulmately, this scenario yet again depicts the larger variance of the test

24

porolios and demonstrates that this scenario’s returns would be much smaller than if an

investor were able to let their investment compound for the enre 7-year period.

The second invesng scenario assumed that the investor would invest $1000 into each

of the porolios at the beginning of each year and wait to fully realize and withdraw their gains

only aer that year ends. Aer rebalancing the porolios at the beginning of each year, the

investor would then only invest $1000 into each porolio at the start of the new year. This

scenario would garner some of the benets of compounding, and would produce returns of

126.27%, 108.28%, 92.94% and 83.41% for the index weighted, equally weighted, XLG and SPY,

respecvely. While this scenario would take some advantage of compounding returns, each year

the $1000 would only compound for 12 months. This scenario allows us to get a sense for how

these porolios dier depending on year and allows us to see trends in the long-term. While

this scenario takes advantage of compounding, there is sll one more scenario to maximize

investor returns.

In the third scenario, the investor would invest $1000 into each of the porolios on

January 1

st

, 2016, and leave the total value of the investment in the porolios for the enre 7-

years. This scenario diers from scenario two because while the investor would sll rebalance

his porolio yearly, choosing the new largest 10 stocks each year and weighing them

accordingly, they would reinvest their inial $1000 as well as any money they had made from

previous years. If investors let their money grow and were able to reap the full benets of

compounding returns, then the index weighted, equally weighted, XLG and SPY, would

experience returns of 158.09%,128.84%, 113.31% and 113.04%, respecvely. In this scenario,

25

both the equally weighted porolio (128.84%) and index weighted porolio (158.09%) would

vastly outperform the index in terms of total returns.

While analyzing the enre holding period return can be useful for comparing which

porolio would perform the best in the long run, it can vastly depend on starng and ending

points. As an example of this, if in this analysis I had placed the end date at the end of 2021, all

three porolios’ total returns would be higher, because up unl 2022, all four porolios had

experienced only posive, or near posive yearly returns. In 2022, however, both test porolios

compounded returns sharply fell by 142.57% and 115.62% respecvely. These large losses over

the nal year of the analysis vastly underperformed the index, which only felt a loss in its

compound returns of 47.61% in 2022. A summary of all the porolios compounded returns for

each year can be seen in gure 19, later in this paper.

While compounding returns are obviously benecial for every investor, what is yet to be

seen is whether these larger returns would sll be present if all three porolios were compared

on an equally risk-adjusted basis. To determine whether these porolios’ returns actually

provide superior results to that of the S&P500, a risk-adjusted analysis was completed to

determine how much return was added per percentage of risk for each porolio.

Analysis Limitaons

The limitaons to this research begin with only having access to returns from 2016 to

2022, and therefore this research may not reect the enre history of the S&P500 or accurately

predict its future. While this research can be useful for porolios that can be le and

rebalanced yearly, this may not work for some investors who are seeking to acvely trade their

26

stocks and rebalance their porolios daily, monthly, or quarterly. This research addionally has a

limitaon of only using the stocks and index weights of the ten largest market cap stocks in the

S&P500 index as of the beginning of each year. Therefore, while this analysis can give us a rough

esmate of how a porolio of the ten largest stocks would perform, it would not account for

changes in individual stock market capitalizaons and index weights throughout the year,

potenally vastly changing returns and variability.

Risk-Adjusted Comparison

To beer compare the returns of these porolios, a risk-adjusted analysis was completed

to decern which porolios performed the best when holding risk constant. A risk-adjusted

analysis is meant to discern how well porolios perform above the risk-free rate in relaon to

their volality. Therefore, to begin my analysis, the risk-free rate, as measured by 1-year T-bills,

for each month between January 2016 and December 2022 was collected. Then, the excess

returns of the equally weighted porolio, index weighted porolio, XLG, and SPY were

calculated, and their average monthly excess returns discovered. In this secon I computed the

Sharpe rao, Treynor rao, and Jenson’s Alpha to compare my three porolios on a risk-

adjusted basis. A summary of the results of this risk-adjusted analysis is shown below in gure

15.

Equally Weighted

Index Weighted

XLG

S&P500

Sharpe

12.61

13.24

13.25

13.73

Treynor

62.59%

67.98%

62.54%

63.48%

Alpha

0.0006

0.0020

0.0001

0

Figure 15 – Risk-Adjusted Rao Analysis Summary

Sharpe

27

To begin my risk-adjusted analysis, the Sharpe measure was rst calculated for each

porolio. To calculate the Sharpe rao, rst the risk-free rate was subtracted from each

porolio’s monthly returns. Then, each porolio’s total excess returns for the 7-year me period

were calculated, as well as the standard deviaon of the porolios’ raw returns. Once the

excess returns and standard deviaon for each porolio was calculated, each porolio’s excess

returns were divided by their standard deviaon. These raos resulted in Sharpe measures of

12.61, 13.24,13.25 and 13.73 for the equally weighted, index weighted, XLG and SPY,

respecvely.

The Sharpe rao is a mathemacal expression that considers the porolio’s excess

returns in relaon to its volality and risk over me. Essenally, the formula is used to quanfy

the total amount of excess returns earned above the risk-free rate, per unit of risk taken. The

Sharpe rao formula subtracts the risk-free rate on a 1-year T-bill, from the monthly historical

return of the porolio and divides the result by the porolio’s standard deviaon. The standard

deviaon of a porolio’s returns is a measure aimed at considering both the systemac and

unsystemac risk that the porolio contains. By dividing the excess returns of each porolio by

their standard deviaon, the Sharpe rao puts them all on the same risk-adjusted level, and by

doing so, aims to discover which porolio will produce superior returns when accounng for its

total risk. The porolio with the highest rao is the one that produced the largest excess returns

with the smallest level of total risk.

The excess returns of each of porolio can give us insight into their performance before I

even divide by their standard deviaon. The excess returns, standard deviaon, and beta, for

each porolio can be seen below in gure 16. What the ndings in gure 16 depict, is that while

28

the two test porolios clearly have larger excess returns, they also have larger standard

deviaons. The queson that the Sharpe rao answers then is, how much more risk is added to

those porolios to garner those larger returns? As well as is the risk added low enough to

warrant investment into those porolios rather than the S&P500?

A higher Sharpe measure is always desirable, as it means the porolio has garnered

larger returns relave to its risk and therefore it is a beer investment decision than lower

raoed porolios. Simply put, what a higher Sharpe rao directly means is that holding risk

constant for all porolios, the porolio with the highest rao will produce the largest returns. A

generally accepted benchmark for what is considered a “good Sharpe measure” would be

anything above 3, which all this study’s porolios fall far above.

What can be discovered by looking at the porolios’ Sharpe raos is that, while all the

porolios I evaluated performed well over the period, none outperformed the SPY on both a

systemac and unsystemac risk-adjusted comparison. What can be discerned from this

research is that, while the index weighted and equally weighted test porolios did perform

almost as well as the XLG, the much more diversied SPY remained the most resistant to

volality. The SPY, while producing smaller returns than the test porolios, would sll be the

best choice for a risk-adverse investor. While this rao can give us useful insights into which

porolio might be the best investment decision for investors, it does not give a complete picture

of the porolio return and risk relaonship.

Drawbacks of Sharpe’s Measure

29

There are a few drawbacks to the Sharpe Rao that can make it untrustworthy as a

standalone metric. To begin, the rao is calculated in an assumpon that investment returns are

normally distributed, which results in relevant interpretaons of the Sharpe rao potenally

being misleading. The rao’s eecveness can also vary based on the choice of the risk-free rate

and market benchmark. While for this analysis 1-year T-Bills and the SPY were selected as the

risk-free rate and market benchmark, other rates could have been selected. Another drawback

is that the risk-free and benchmark rates do not remain constant, meaning that while this

analysis’s ndings might be true for 2016-2022, the risk-free rate and benchmark are always

moving, causing this analysis to not necessarily reect future performance. The Sharpe rao

addionally, places relavely higher weight on short-term volality, which might not accurately

reect an investment’s long-term potenal. Despite these limitaons, the Sharpe rao remains

a valuable tool for assessing risk-adjusted returns.

Equally Weighted

Index Weighted

XLG

S&P500

Excess Return

68.65%

75.64%

64.51%

65.72%

Standard Deviation

5.44%

5.71%

4.87%

4.79%

Monthly Return Beta

1.06

1.08

.996

1

Figure 16– Sharpe and Treynor Measure Component Informaon

Treynor’s Measure

Treynor’s rao is another risk-adjusted measure that is similar to Sharpe’s rao in many

aspects. Both metrics aempt to measure the risk-return trade-o in porolio management by

dividing the excess returns of porolios by a measure of risk. While the Sharpe rao aims to

capture all elements of a porolio’s total risk (systemac and unsystemac) by dividing excess

returns by standard deviaon, the Treynor rao only captures the systemac component by

30

dividing the porolios excess returns by the porolio’s beta. By dividing the excess returns by

the beta, the Treynor rao only seeks to see how much systemic risk the porolio contains and

does not account for the unsystemac risk associated with the individual monthly returns. This

dierence in focus on systemac vs total risk is why most investors choose the Treynor rao

over the Sharpe rao for a well-diversied porolio. For this paper however, since the test

porolios are not well diversied, but the XLG and SPY are, I will ulize both measures to try to

get the most comprehensive insight possible.

Similarly to the Sharpe measure, the Treynor measure begins with compung the excess

return of the porolios relave to the risk-free rate. This me, instead of dividing by the

standard deviaon, I divided the excess returns by the porolio’s beta, which is a measure of

systemac risk. The Treynor measure, excess returns, and betas of the monthly returns for each

of the three porolios is shown below in gure 17. What we can see once the Treynor measures

are computed, is that while the SPY resulted in a posive 63.48% rao and outperformed both

the XLG and equally weighted porolios, the Index weighted test porolio outperformed the

market with a Treynor measure of 67.98%. This means that on a risk-adjusted basis, only

accounng for systemac risk, the index weighted porolio would outperform the market

during this period. This could be aributed to the index weighted porolio having the highest

beta and the market mainly experiencing only growth years during this study, with only the nal

year of the analysis seeing any real downturn. This could also be due to the rao only taking

into account systemac risk, as it does not include the unsystemac risk that the non-well-

diversied porolio could bring.

31

Equal W

Index W

XLG

SPY

Treynor

62.59%

67.98%

62.54%

63.48%

Excess Returns

68.651%

75.636%

64.505%

65.719%

Beta

1.06

1.08

0.996

1.00

Figure 17 – Treynor Measure Component Informaon

What these two measures tell us then, is that while the top 10-stock porolios do

outperform the S&P500 index in terms of total returns, and the index weighted porolio does

outperform the index on a systemac adjusted basis, all three test porolios underperform the

benchmark in terms of total risk-adjusted returns. Because all three of these porolios are not

as well diversied as the SPY, I would put more weight into the results of the Sharpe measure

and conclude that while the test porolios do garner larger returns, they do so at the sake of

adding unproporonately larger risk. As a result of the high unsystemac risk associated with

my two top-10 stock porolios, I can begin to condently say that while these two porolios

outperform the S&P500 in terms of total raw returns, they are not superior in terms of risk-

adjusted returns.

Jenson’s Alpha

The third risk-adjusted measure I will compute is Jenson’s alpha. Jenson’s alpha is a

measure that quanes the excess returns obtained by a porolio of investments above the

returns implied by the capital asset pricing model (CAPM). Alpha is dened as the incremental

returns from a porolio of investments, typically consisng of equies, above a certain

benchmark return (Jensen’s Measure, 2024). When using Jensen’s measure, the chosen

benchmark return is the Capital Asset Pricing Model, rather than the S&P500 market index.

Aer calculang the porolios return, risk-free rate, porolio beta, and expected market return,

32

I can calculate Jenson’s alpha. This analysis was done on Excel, so to begin, each porolio’s

excess returns were calculated, and a regression was done on the returns of each porolio.

Once the regression was completed, the intercept of the test porolio and SPY’s monthly

returns was found in the summary table and noted as the porolio’s alpha. The results of this

analysis can be seen in gure 15 back on page 27.

A good Jenson’s alpha measure is usually considered anything posive, as this posive

number indicates that the porolio outperformed the benchmark on a risk-adjusted basis over

the me period. When an investment has an alpha of one, it means that its return during the

specied me frame outperformed the overall market average by 1%. If the measure were to

come back as zero, the porolio would be said to be priced fairly, as it returned exactly what

was esmated by the CAPM. The S&P500, as represented by the SPY in this analysis, is an

example of a 0-alpha porolio, as it itself is the benchmark for which alphas are compared. If a

porolio’s result is negave, however, the porolio could be seen as underperforming its

expected return and could be viewed as a poor investment decision. In general, for return-

oriented investors, a posive, higher Alpha is always the desired outcome.

As we can see from the table above, all four of this study’s porolios had very low

alphas. This means that all four of the porolios were priced fairly for their experienced return

and risk throughout the period. This also means that all four of the porolios realized returns

would have compared favorably with the return associated with the level of expected risk. As

with many of this analysis’s other measures, the index weighted porolio had the largest alpha,

with equally weighted coming in second, and the XLG being barely above the market.

33

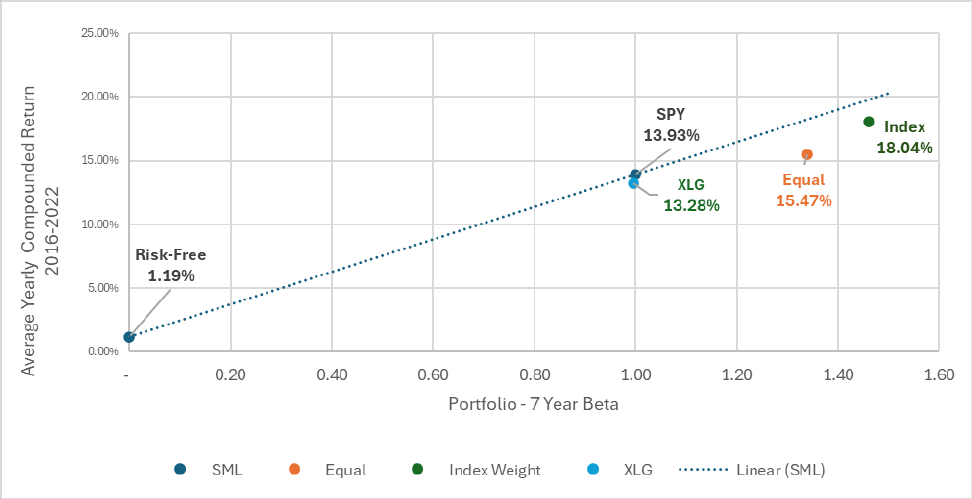

This relaonship can be easily seen on a graph, when the Security Market line is ploed,

and the porolio’s alpha’s shown in relaon. The graph will be set up with the X-Axis

represenng the beta of the porolio’s yearly returns and the Y-axis showing each porolio-

related yearly average return. To begin, a porolio only containing assets with the risk-free rate

is ploed. The average return of the risk-free rate during 2016-2022 was 1.19% and since an

asset with the risk-free rate has no systemac risk, its beta is 0. Aer the risk-free rate had been

marked, the S&P500, as measured by SPY, was ploed and the Security Market Line drawn

between them. What was found was, that during 2016 to 2022, the average return for the

S&P500 was 13.93%, which would mean a 12.74% market risk premium.

Figure 18– The SML on investments invested from 2016 through 2022.

The security Market Line above depicts dierent levels of systemac risk (or market risk)

for the dierent porolios. The line plots the porolios betas against the expected return of the

34

enre market at any given me. The SML can help analysts determine whether a porolio

would oer a favorable expected return compared to its level of risk. All stocks or porolios who

lie above the SML are considered undervalued because they oer larger returns compared to

their inherent risk. Porolios above the line are superior to those stocks or porolios with the

same or larger beta below the SML. Therefore, the two test porolios, while indeed producing

superior returns to that of the SPY and XLG, also lie below the SML. This means that the test

porolios would unproporonately add risk compared to their returns. Through my Jenson’s

alpha comparison then, the Equal weighed and Index weighted porolios would appear to

underperform the market in terms of proporonately adding risk for return. This does not make

the porolio useless, however, because for risk-neutral and risk-loving investors the added

returns that these test porolios produce could sll be worth the added risk that they would

have to accept.

Risk-Adjusted Comparison Summary

We can see through my risk-adjusted comparison of the four porolios that while the

two top-10 stock test porolios did underperform the market benchmark on a total risk-

adjusted basis (Sharpe measure), they did outperform the market when adjusted for only their

systemac risk (Treynor Measure). This is not surprising as the SPY is very well-diversied, with

over 500 or so stocks, but my two test porolios have much less ground to spread their

variability over. My risk-adjusted analysis indicates then that the test porolios did perform well

in terms of the systemac risk they contained, however, they also had high unsystemac risk

due to the fact that they only contained ten stocks. The small size of the test porolio means

even if only a few stocks have a bad month, then the whole porolio could be greatly aected.

35

Ulmately then, for investors interested in the high returns these test porolios can oer, they

must also be willing to accept the added unsystemac risk that comes with the simplicity of

these porolios.

Alternave Analysis: What if the analysis ended aer 2021?

If the analysis were to have ended at the end of 2021 the compounded returns of all

four of these porolios would have been much higher. When compung the compounded

returns of the porolios it is clear to see when would have been the ideal me to have

withdrawn our funds. Figure 19 below shows the compounded returns at the end of each year

of this study. Clearly, the end of 2021 would have been the ideal me to have withdrawn funds

invested in any of these porolios, but would the test porolios have performed any beer on a

risk-adjusted basis? To discover the answer to that queson, I performed the same analysis as

above, but only included data through the end of 2021.

Yearly Returns Compounded

2016

2017

2018

2019

2020

2021

2022

1 Year

Return

2 year

return

3 Year

Return

4 Year

Return

5 Year

Return

6 Year

Return

7 Year

Return

SPY

12.00%

36.42%

30.09%

70.87%

102.33%

160.65%

113.04%

Equal

16.17%

52.86%

50.04%

106.04%

169.53%

244.46%

128.84%

Index

14.92%

53.16%

53.41%

115.47%

203.78%

301.66%

158.09%

XLG

11%

37%

32%

74%

116%

182%

113%

Figure 19 – Porolios’ Yearly Compounded Returns from one to seven years (2016-2022)

As we can see, throughout the rst six years, the index and equally weighted porolios

vastly outperformed the market in terms of total compounded returns, with the XLG slowly

surpassing the market throughout the period. During the rst six years of this study the test

porolios also outperformed the market when adjusted for both total and only systemac risk,

most likely due to the sheer size of their returns. The Sharpe and Treynor measures, as well as

36

Jenson’s alpha for each of the porolios monthly returns from 2016-2021 are show below in

gure 20. Aer replong the porolios on a new graph, it was discovered that both test

porolios as well as the XLG, all appeared above the SML for the rst six years and

outperformed the market in terms of risk and return. This means that, at least for the rst six

years of this study, investors of all risk preferences would ideally have chosen my test porolios

or the XLG over invesng in the market.

Equally weighted

Index Weighted

XLG

S&P500

Sharpe

32.72

35.46

28.76

27.01

Treynor

148.43%

168.08%

126.12%

115.79%

Alpha

0.0041

0.0061

0.0014

0

Figure 20 – Alternave Analysis – Risk-Adjusted Analysis Summary

Figure 21 – The SML on investments invested from 2016 through 2021.

Research Findings Summary

This research’s test porolios were designed specically to invesgate how much weight

the ten largest stocks in the S&P500 carried, and whether a porolio of just those stocks could

SPY

17.96%

Risk-Free

1.23%

Equal

23.64%

Index

27.00%

XLG

19.55%

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

- 0.20 0.40 0.60 0.80 1.00 1.20 1.40 1.60

Average Yearly Compounded Return

2016-2022

Portfolio - 7 Year Beta

SML Equal Index Weight XLG Linear (SML)

37

outperform the market in terms of total, yearly, and monthly returns on a risk-adjusted basis.

What this analysis discovered was that monthly, the test porolios outperformed the market far

more oen than they underperformed it. On a yearly basis, the test porolios outperformed