Michelle.M.Weaver@morganstanley.com

M.Wilson@morganstanley.com

Andrew.Pauker@morganstanley.com

Qian.Ding@morganstanley.com

Nick.Lentini@morganstanley.com

MORGAN STANLEY & CO. LLC

Michelle M. Weaver, CFA

EQUITY STRATEGIST

+1 212 296-5254

Michael J Wilson

EQUITY STRATEGIST

+1 212 761-2532

Andrew B Pauker

EQUITY STRATEGIST

+1 212 761-1330

Diane Ding, Ph.D.

QUANTITATIVE STRATEGIST

+1 212 761-6758

Nicholas Lentini, CFA

RESEARCH ASSOCIATE

+1 212 761-5863

Alphabet

American Express

Blackstone

Cheniere Energy

Costco Wholesale

Eaton

Eli Lilly

Estee Lauder

Exxon Mobil

Hilton Worldwide

Intuitive Surgical

JPMorgan Chase

Liberty Formula One

Linde

Lululemon Athletica

MasterCard

Microsoft

Motorola Solutions

MSCI Inc.

NextEra Energy

Nike

Northrop Grumman

Old Dominion Freight Line

Prologis

Raytheon Technologies

Thermo Fisher Scientific

T-Mobile US

UnitedHealth Group

Visa

Yum! Brands

30 for 202530 for 2025 || North America North America

Quality Stocks for a Long-Term

Holding Period

As we contemplate the end of this bear market, we refresh a

cornerstone Morgan Stanley analysis, ‘30 for 2025’: Our best

long-term picks based on the sustainability and quality of the

business model, and opportunity to widen their competitive

advantage.

Our view remains that the current bear market is not over. We expect earnings

to drop well below consensus expectations, with our base case for 2023 at $195.

We believe this will be followed by a stronger earnings picture in 2024.

That said, we have also identified potential cyclical and secular drivers of the

next bull market in equities, including more accommodative monetary policy as

inflation slows; a more stable starting point for consumer balance sheets; pent-

up demand in investment / capex and in certain parts of consumer services; a

global growth recovery led by economies that have lagged since the pandemic;

the reemergence of positive operating leverage; Artificial Intelligence and its

diffusion across sectors; and reshoring.

So, which stocks should investors focus on as we contemplate an end to this

bear market? ‘30 for 2025’ identifies our best long-term picks. Our work has

long supported the view that quality outperforms in the long run. Accordingly,

we asked each of our US analysts to identify the highest-quality companies in

their sectors, the ones likely to strengthen their sustainable competitive

advantage. This report highlights 30 companies that look especially well

positioned.

The main criterion is sustainability — of competitive advantage, business model,

pricing power, cost efficiency, and growth. From more than 50 companies

singled out by our analysts, we narrowed our focus to those that stood out on

these criteria. We paid particular attention to RNOA, management’s strategy,

capital structure, and shareholder remuneration (dividends / buybacks). We also

examined each stock's scores in our Quant Strategy team’s stock selection

models. Additionally, we integrated Environmental, Social, and Governance (ESG)

factors into our decision process, and assessed key risks and opportunities for

each company.

We sought to identify the best franchises, not the most undervalued stocks.

There was no prerequisite that they be rated Overweight, and we were largely

agnostic about their valuations. Our guiding principle was to create a list of

companies whose business models and market positions would be increasingly

differentiated into 2025.

Morgan Stanley does and seeks to do business with

companies covered in Morgan Stanley Research. As a

result, investors should be aware that the firm may have a

conflict of interest that could affect the objectivity of

Morgan Stanley Research. Investors should consider

Morgan Stanley Research as only a single factor in making

their investment decision.

For analyst certification and other important disclosures,

refer to the Disclosure Section, located at the end of this

report.

1

March 21, 2023 04:01 AM GMT

Contributors

2

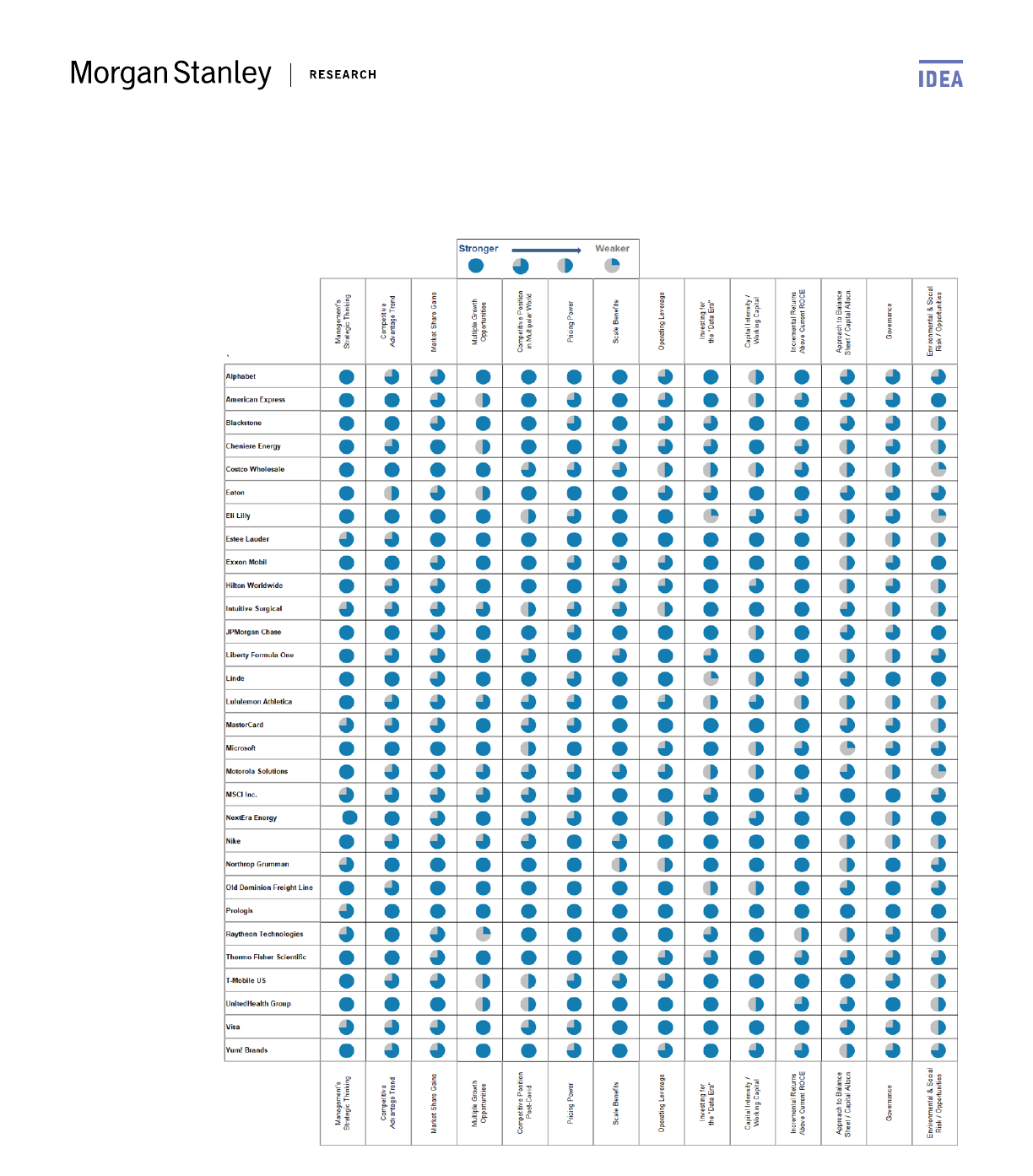

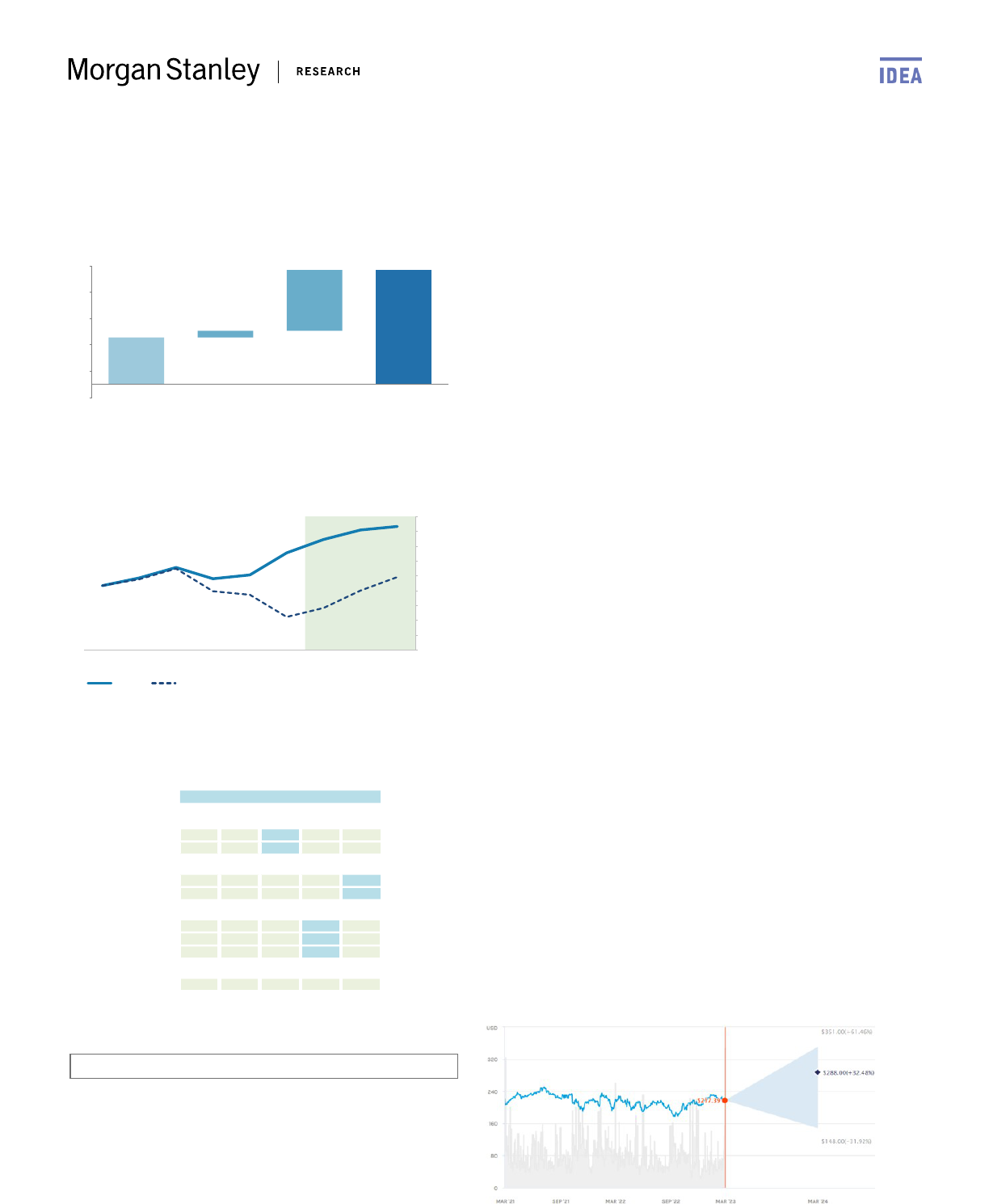

Our Analysts' Assessments

Source: Morgan Stanley Research

3

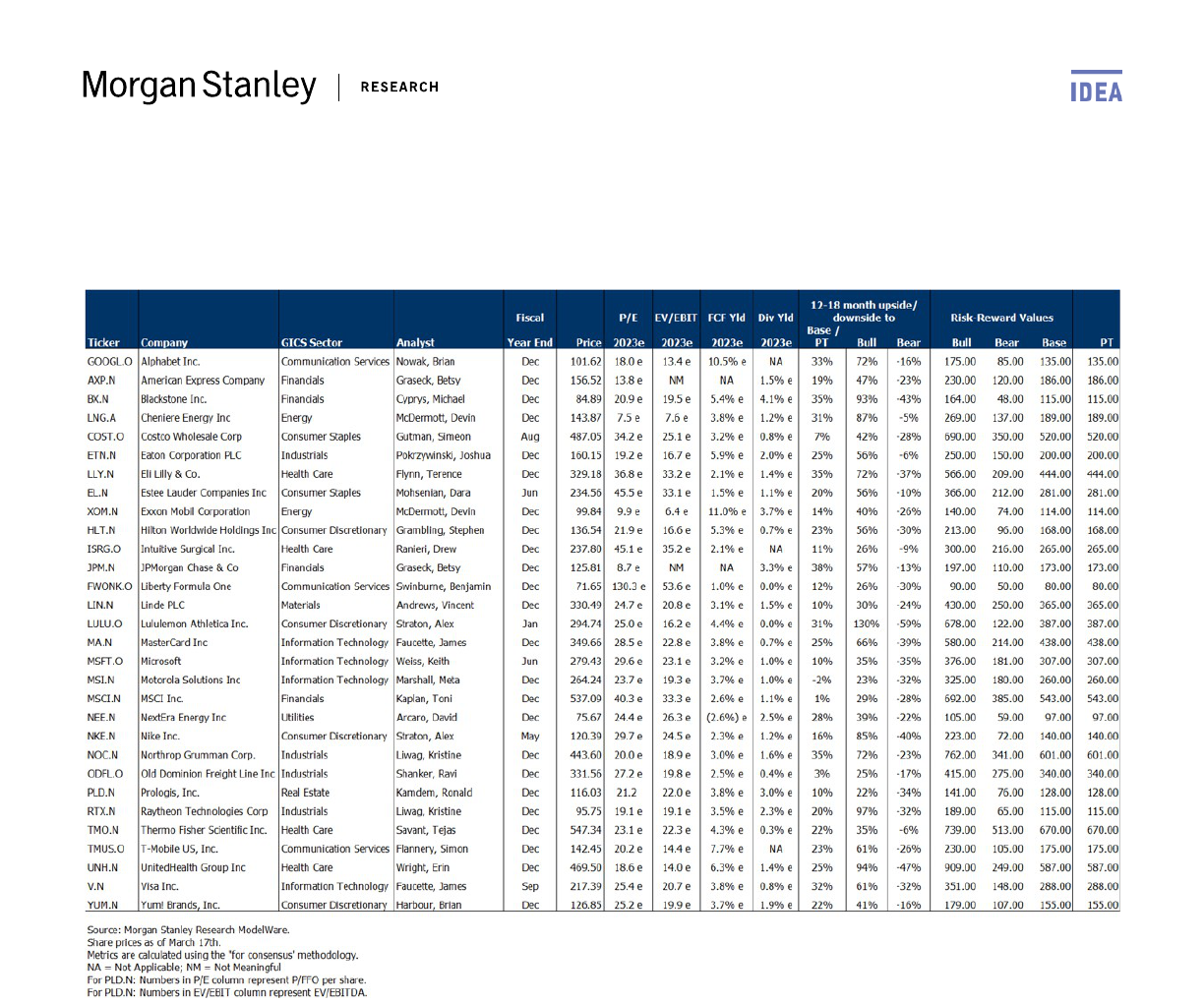

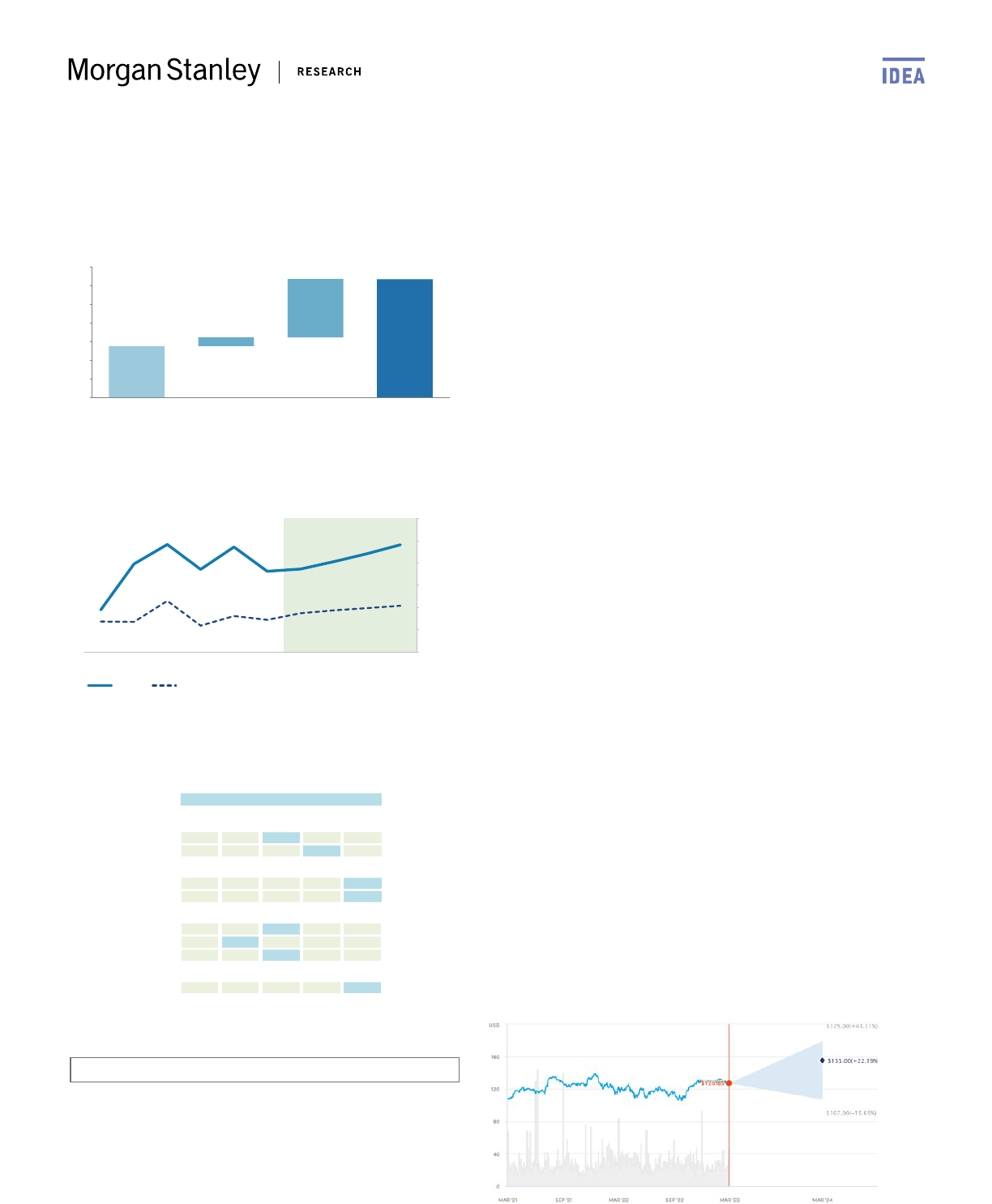

Financial Metrics

Exhibit 1: Financial Metrics

Ticker Company GICS Sector Analyst

Survey

Score

Market Cap

Revenue

5-Yr

CAGR

EPS

5-Yr

CAGR

Net Debt

/ EBITDA

Interest

Cover

('20-25e) ('20-25e) 2023e 2025e 2023e 2025e 2023e 2023e

GOOGL.O Alphabet Inc. Communication Services Nowak, Brian 49 1,306,460 17% 23% 27.4% e 28.5% e 54.3% e 61.7% e NM NM

AXP.N American Express Company Financials Graseck, Betsy 13 116,461 15% 32% NM NM 33.8% e 34.4% e NM NM

BX.N Blackstone Inc. Financials Cyprys, Michael 48 103,369 22% 22% 58.7% e 60.9% e 35.2% e 49.0% e 1.4 e 55.1x

LNG.A Cheniere Energy Inc Energy McDermott, Devin 44 35,062 19% 65% 36.9% e 28.7% e 26.5% e 22.1% e 2.2 e 5.1x

COST.O Costco Wholesale Corp Consumer Staples Gutman, Simeon 39 215,998 10% 14% 3.5% e 3.5% e 29.5% e 30.7% e NM NM

ETN.N Eaton Corporation PLC Industrials Pokrzywinski, Joshua 47 63,822 7% 16% 18.7% e 19.6% e 10.8% e 13.3% e 1.3 e 21.0x

LLY.N Eli Lilly & Co. Health Care Flynn, Terence 42 313,494 11% 15% 30.5% e 40.3% e 35.2% e 55.2% e 1.3 e 68.0x

EL.N Estee Lauder Companies Inc Consumer Staples Mohsenian, Dara 48 83,790 8% 17% 15.3% e 19.8% e 24.6% e 36.2% e 0.7 e 21.8x

XOM.N Exxon Mobil Corporation Energy McDermott, Devin 45 406,447 15% NM 15.6% e 10.5% e 23.5% e 15.8% e NM 91.2x

HLT.N Hilton Worldwide Holdings Inc Consumer Discretionary Grambling, Stephen 46 36,381 22% 141% 25.6% e 26.0% e 27.7% e 32.8% e 2.7 e 6.0x

ISRG.O Intuitive Surgical Inc. Health Care Ranieri, Drew 41 83,291 14% 15% 33.4% e 35.2% e 37.7% e 44.6% e NM NM

JPM.N JPMorgan Chase & Co Financials Graseck, Betsy 13 370,304 5% 12% NM NM 15.2% e 14.0% e NM NM

FWONK.O Liberty Formula One Communication Services Swinburne, Benjamin 47 17,388 28% NM 10.1% e 13.6% e 7.1% e 8.5% e 1.5 e 1.9x

LIN.N Linde PLC Materials Andrews, Vincent 47 162,654 6% 15% 25.3% e 27.6% e 11.9% e 13.5% e 1.3 e 42.5x

LULU.O Lululemon Athletica Inc. Consumer Discretionary Straton, Alex 39 37,609 22% 28% 23.1% e 24.0% e 65.9% e 77.5% e NM NM

MA.N MasterCard Inc Information Technology Faucette, James 47 333,311 16% 21% 58.1% e 59.1% e 78.9% e 128.4% e 0.1 e 36.0x

MSFT.O Microsoft Information Technology Weiss, Keith 46 2,080,022 14% 18% 41.5% e 43.8% e 64.7% e 65.8% e NM NM

MSI.N Motorola Solutions Inc Information Technology Marshall, Meta 39 44,194 8% 12% 27.1% e 29.4% e 40.5% e 46.4% e 1.4 e 11.5x

MSCI.N MSCI Inc. Financials Kaplan, Toni 48 43,001 13% 19% 55.1% e 57.2% e 46.0% e 63.5% e 2.4 e 8.5x

NEE.N NextEra Energy Inc Utilities Arcaro, David 48 150,394 11% 10% 32.2% e 35.0% e 6.5% e 6.7% e 5.1 e 3.2x

NKE.N Nike Inc. Consumer Discretionary Straton, Alex 45 186,672 9% 13% 13.1% e 16.3% e 38.4% e 40.6% e 0.0 e NM

NOC.N Northrop Grumman Corp. Industrials Liwag, Kristine 49 67,894 4% 5% 10.6% e 11.8% e 12.4% e 15.1% e 1.9 e 7.0x

ODFL.O Old Dominion Freight Line Inc Industrials Shanker, Ravi 50 36,480 12% 21% 29.0% e 30.0% e 38.1% e 37.1% e NM 920.5x

PLD.N Prologis, Inc. Real Estate Kamdem, Ronald 55 107,145 14% 10% 40.1% e 39.5% e 4.2% e 4.7% e 3.8 e 5.3x

RTX.N Raytheon Technologies Corp Industrials Liwag, Kristine 43 140,102 5% 17% 12.1% e 13.4% e 6.5% e 8.4% e 2.3 e 6.1x

TMO.N Thermo Fisher Scientific Inc. Health Care Savant, Tejas 50 210,961 10% 9% 23.9% e 24.9% e 13.6% e 16.0% e 1.9 e 22.5x

TMUS.O T-Mobile US, Inc. Communication Services Flannery, Simon 44 173,701 5% 35% 20.4% e 24.1% e 8.7% e 10.7% e 2.5 e 4.9x

UNH.N UnitedHealth Group Inc Health Care Wright, Erin 48 437,971 11% 14% 8.9% e 9.4% e 26.3% e 35.3% e 0.5 e 11.3x

V.N Visa Inc. Information Technology Faucette, James 47 447,433 13% 17% 67.9% e 69.2% e 37.2% e 41.6% e NM 145.0x

YUM.N Yum! Brands, Inc. Consumer Discretionary Harbour, Brian 47 35,532 8% 13% 32.8% e 34.2% e 74.4% e 88.1% e 4.9 e 4.3x

Source: Morgan Stanley Research ModelWare.

Share prices as of March 17th.

Metrics are calculated using the ''for consensus' methodology.

NA = Not Applicable; NM = Not Meaningful

For PLD.N: Numbers in EPS column represent FFO per share.

For BX.N, AXP.N, and JPM.N: Numbers in RNOA column represent ROE numbers.

RNOA (%)

EBIT Margin (%)

4

Valuation Metrics

Exhibit 2: Valuation Metrics

5

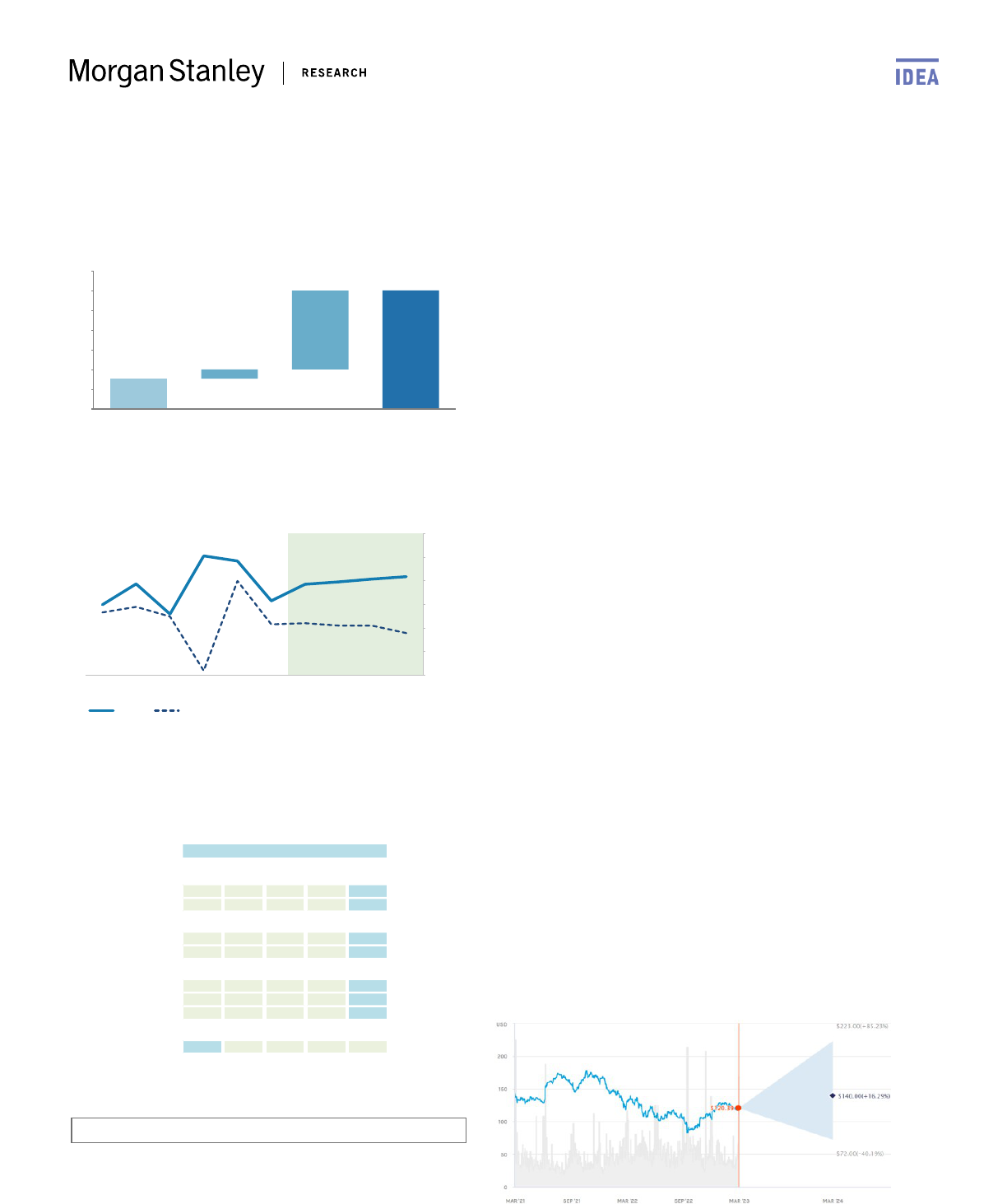

Alphabet (GOOGL)

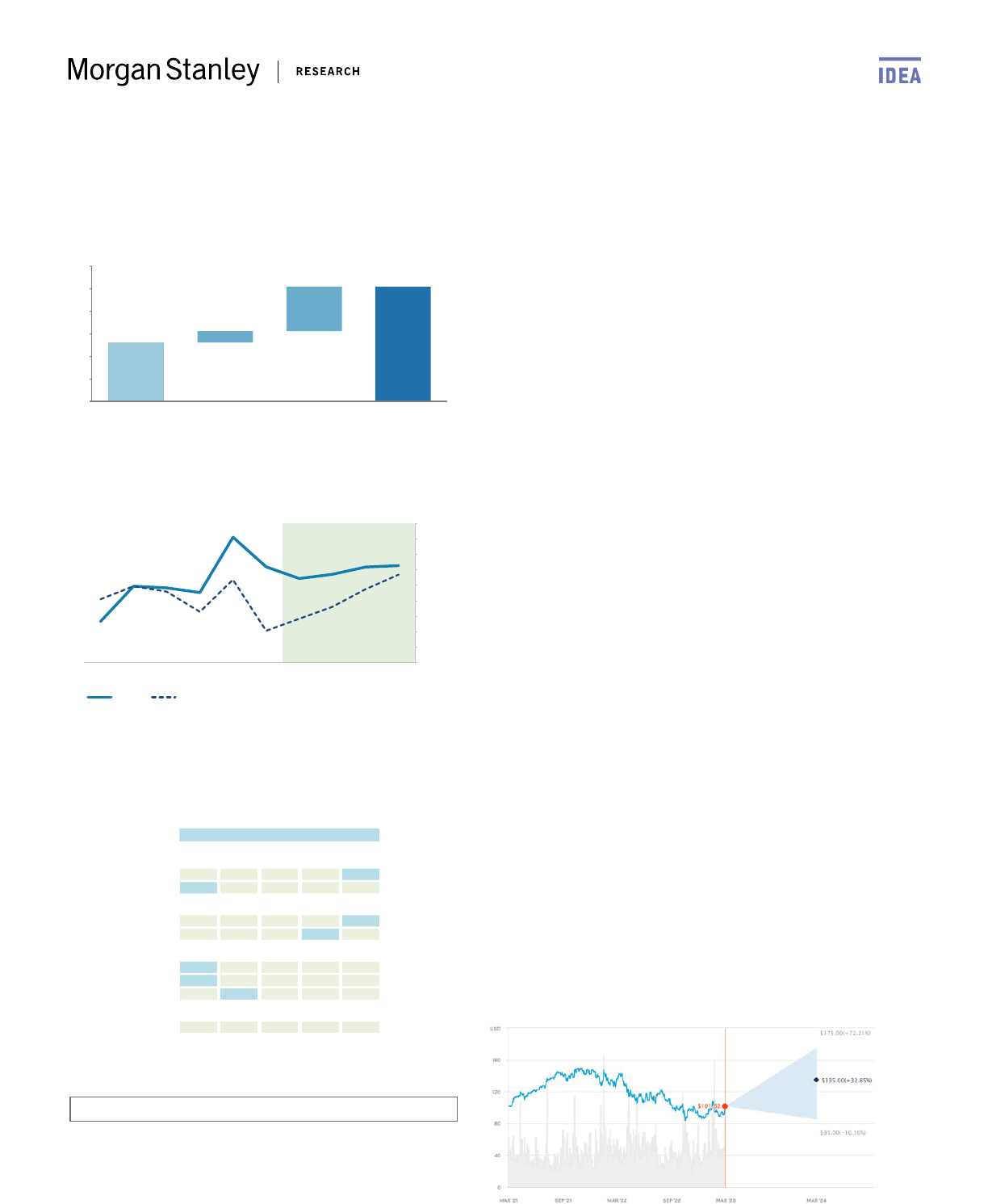

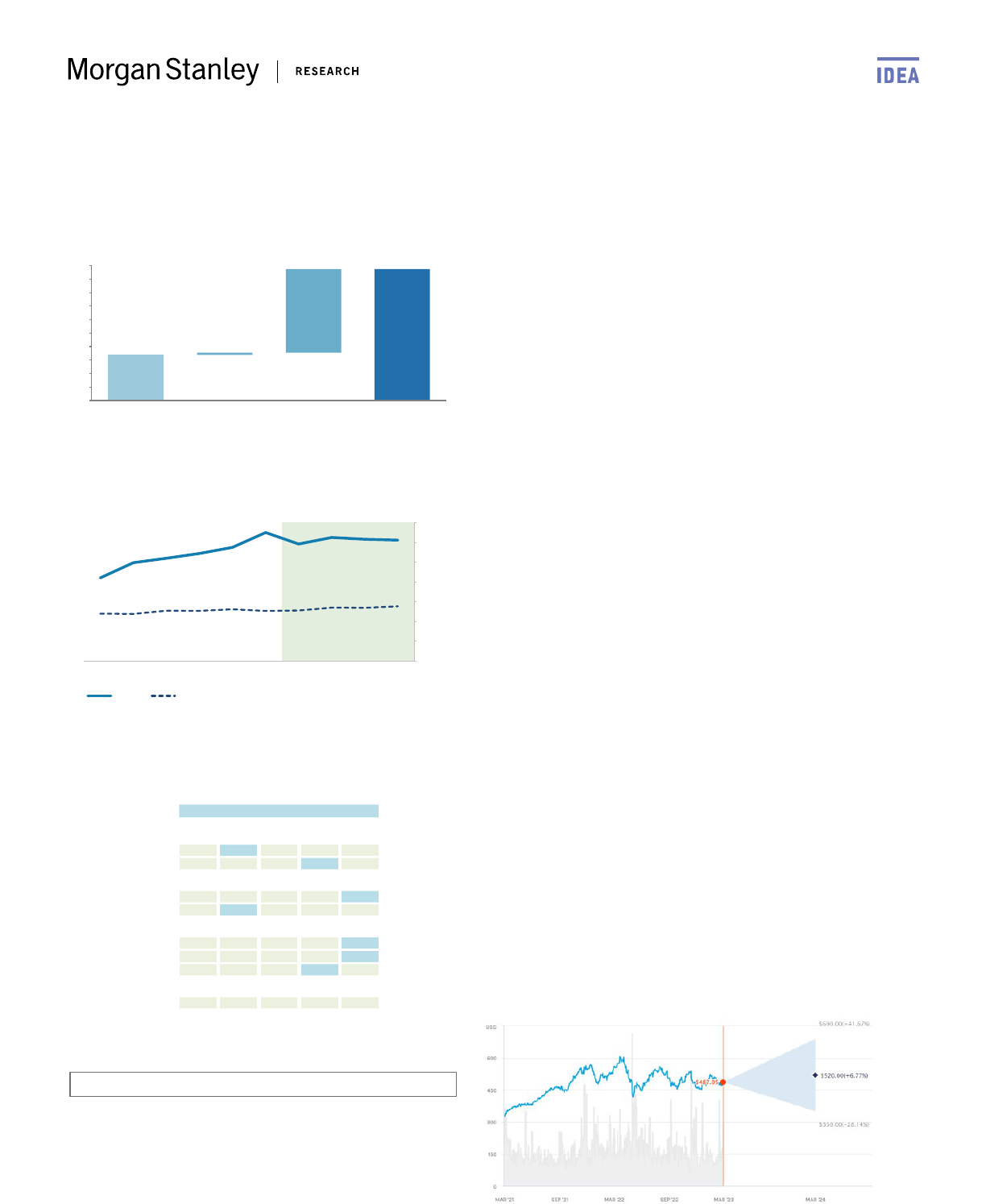

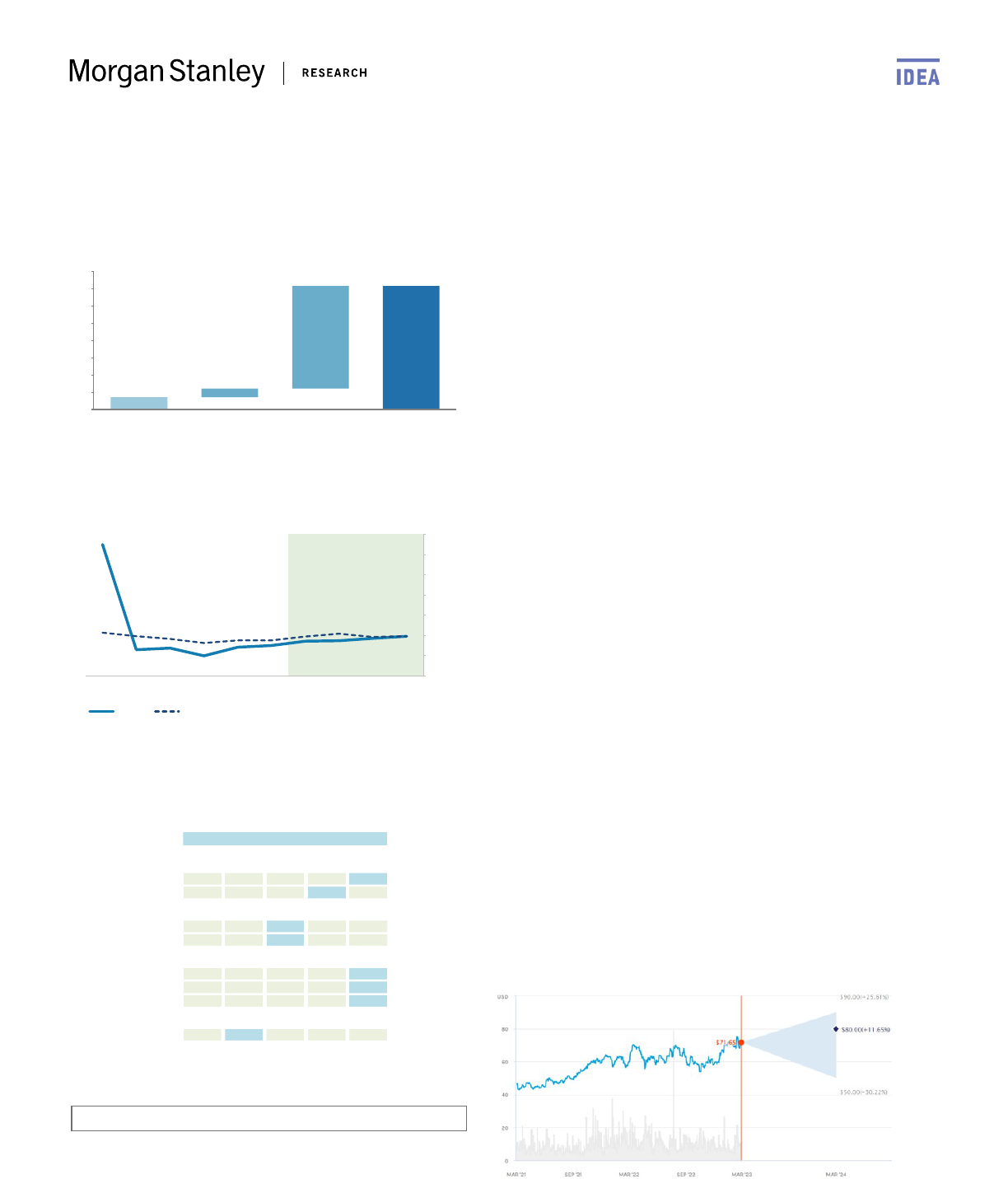

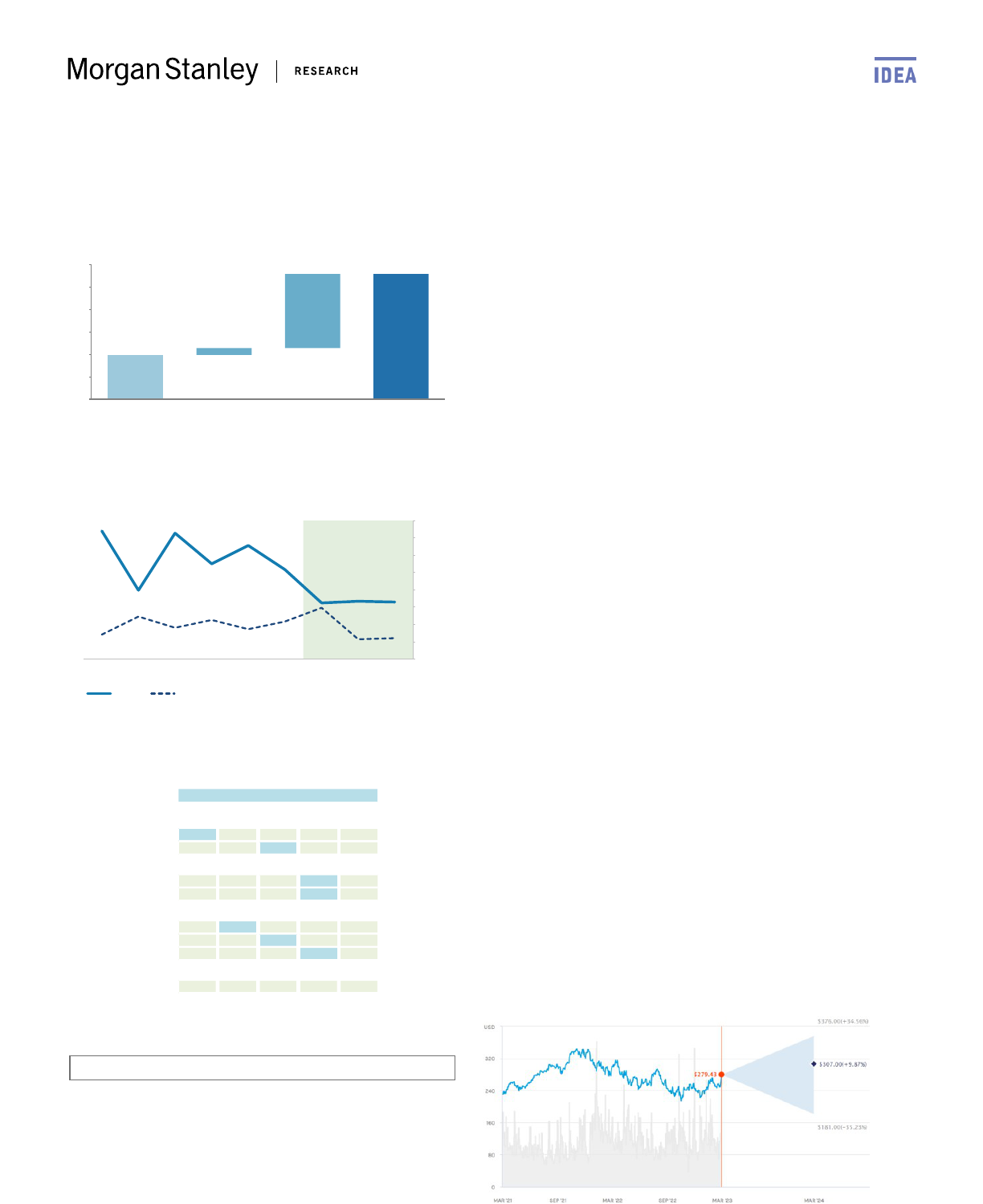

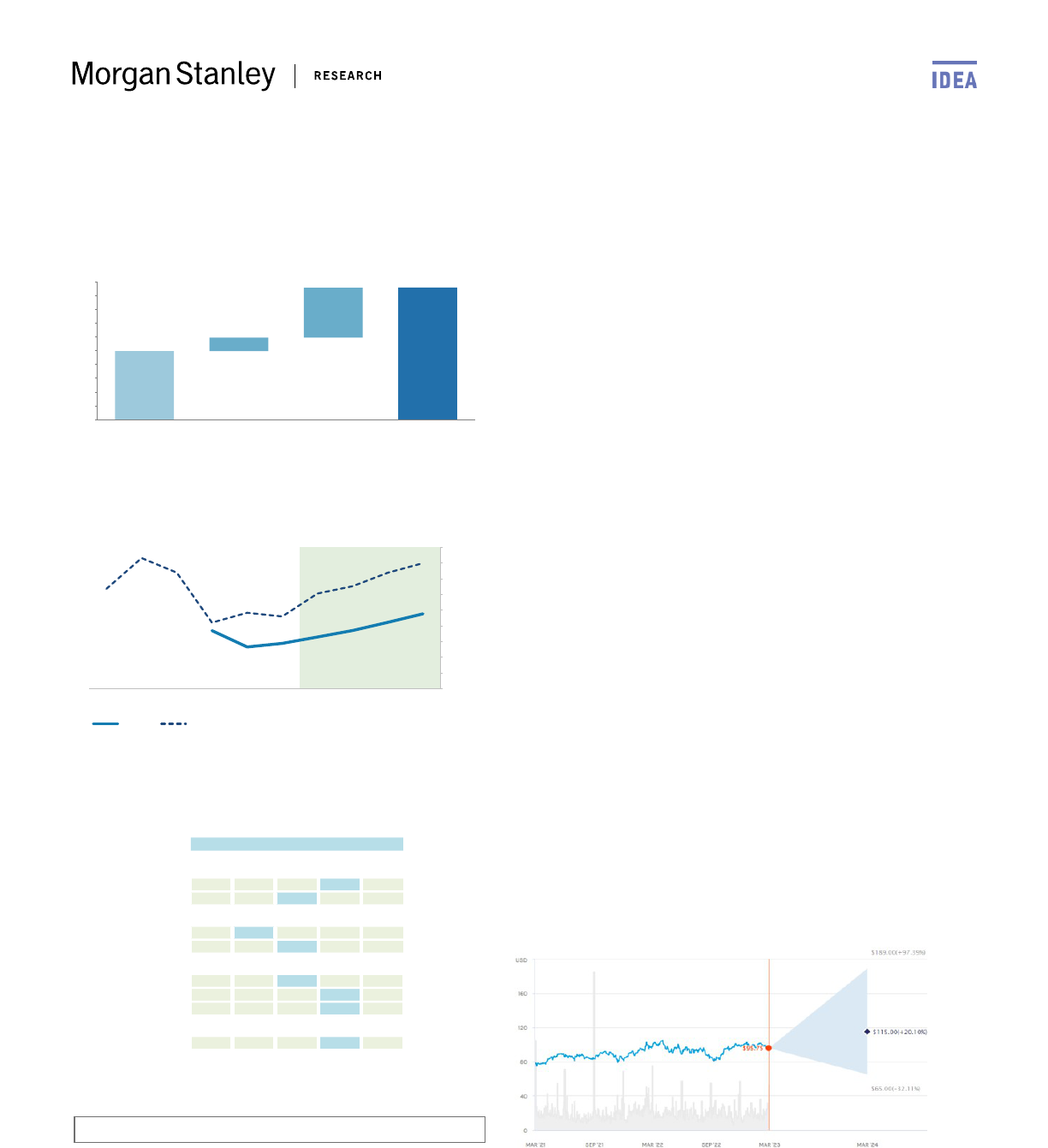

Value of Growth Analysis

52

102

+10

+39

0

20

40

60

80

100

120

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

Alphabet Inc. vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

21.0%

20.3%

Sales '23-'25 CAGR

14.6%

18.2%

Returns

RNOA

54.3%

28.2%

EBIT margin

27.4%

7.8%

Valuation

P/E

18.0x

18.3x

EV/EBIT

13.4x

16.9x

P/FCF

9.7x

23.5x

Leverage

Net Debt/EBITDA

Alphabet Inc.

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Internet Industry View: In-Line

Brian Nowak

The Digital Transformation continues to accelerate, AI is

the next internet opportunity, and there is still a large

addressable market… Behavior shifts seen throughout the

pandemic impacted the way consumers live and businesses

communicate with consumers and we continue to see an

acceleration of this digital transformation in the post-Covid

era. This, combined with the AI opportunity, highlights the

importance of some of GOOGL's key products and

investment areas.

… And GOOGL's product portfolio is well positioned to

benefit from key trends. We continue to see runway from

here for GOOGL's core product offering including Search,

YouTube and Cloud and highlight the significant

incremental Search revenue and share price potential as we

see next generations of AI-driven search leading to higher

relevancy/completeness, a further collapsing of the

shopping funnel (people effectively visiting fewer sites) and

higher user conversion. For YouTube, the platform

continues to evolve with Shorts and we see generative AI

(content creation tools) and improved algorithm matching &

advertising attribution as a potential tailwind to

engagement and revenue growth. Lastly, on Cloud, we see

next generation AI tools driving more durable multi-year

public cloud adoption.

We also remain confident GOOGL faces more manageable

incremental costs. We see management focused on durably

reengineering the cost base and see GOOGL working to

improve AI compute cost efficiency at the infrastructure,

model and application layer, which builds confidence that

margins won't compress over the long term.

Risk Reward: Overweight / Price Target $135

6

American Express (AXP)

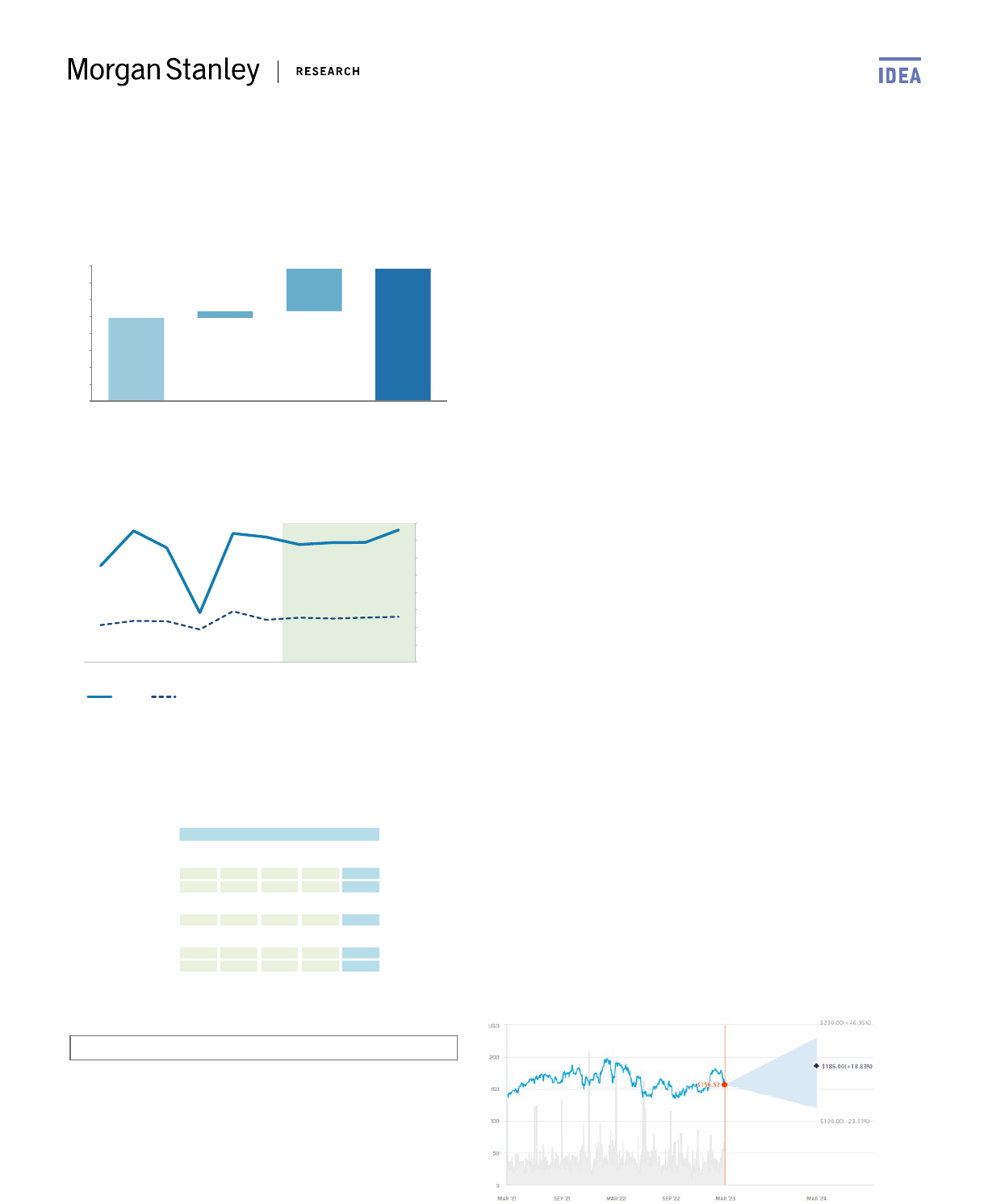

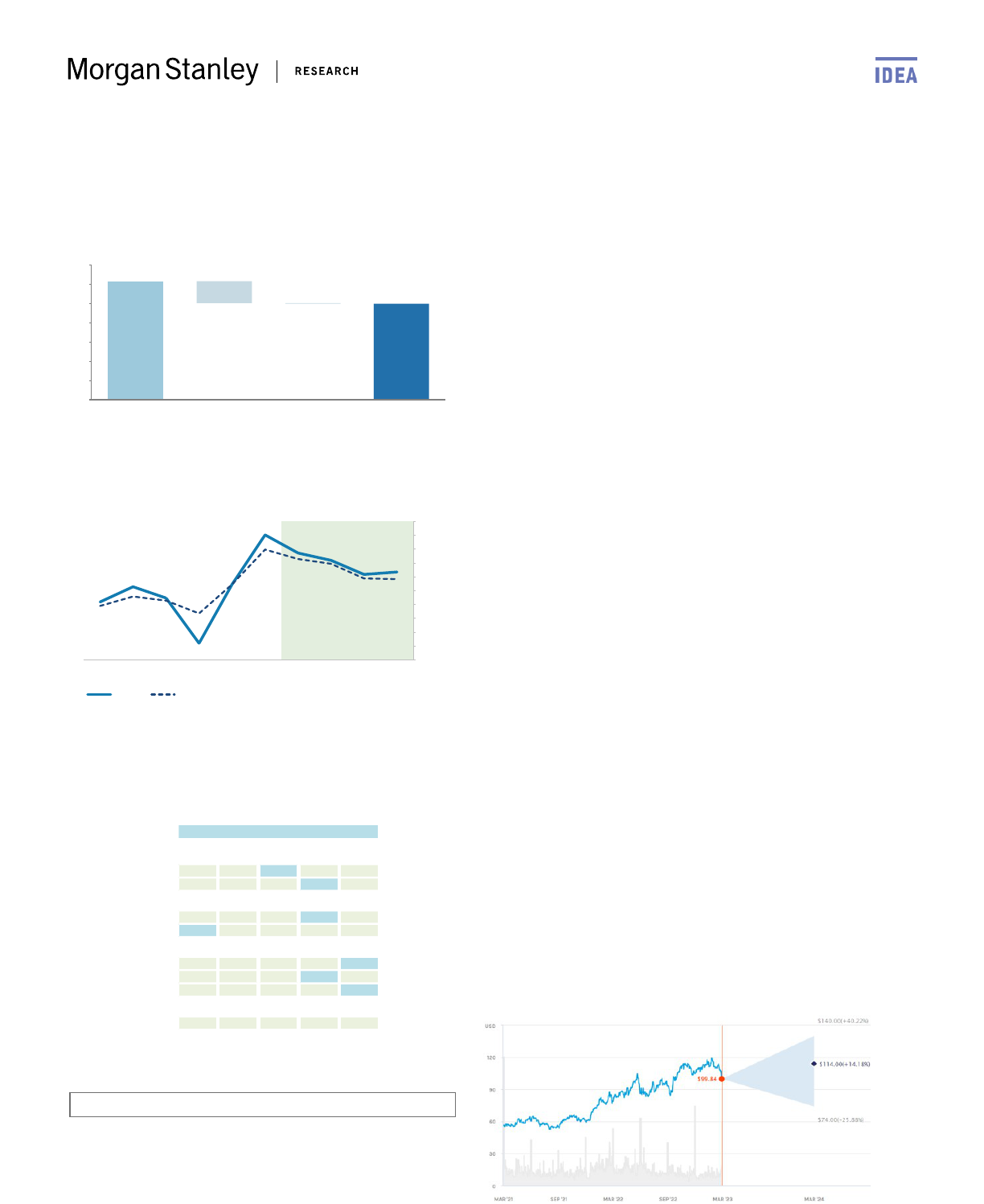

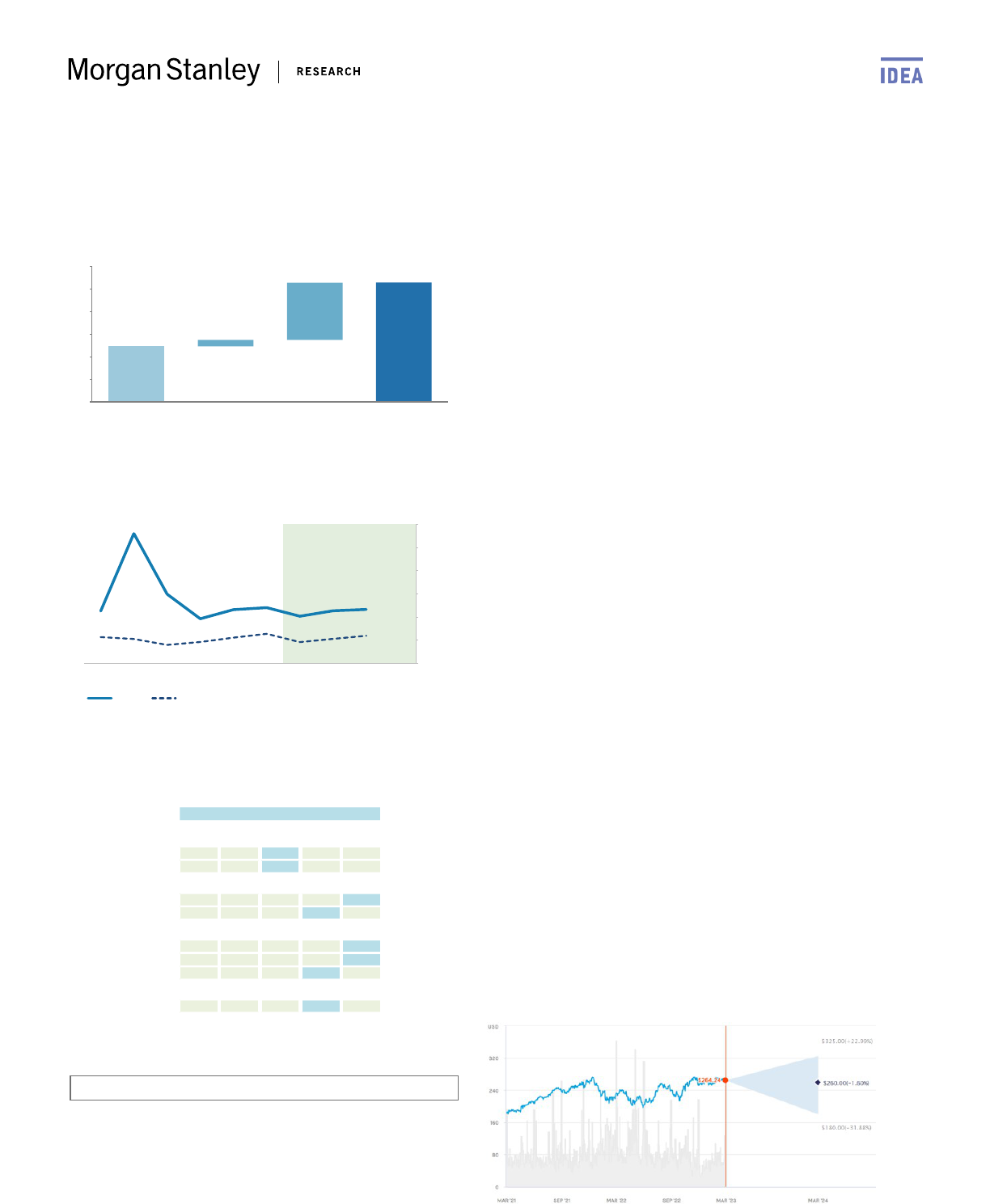

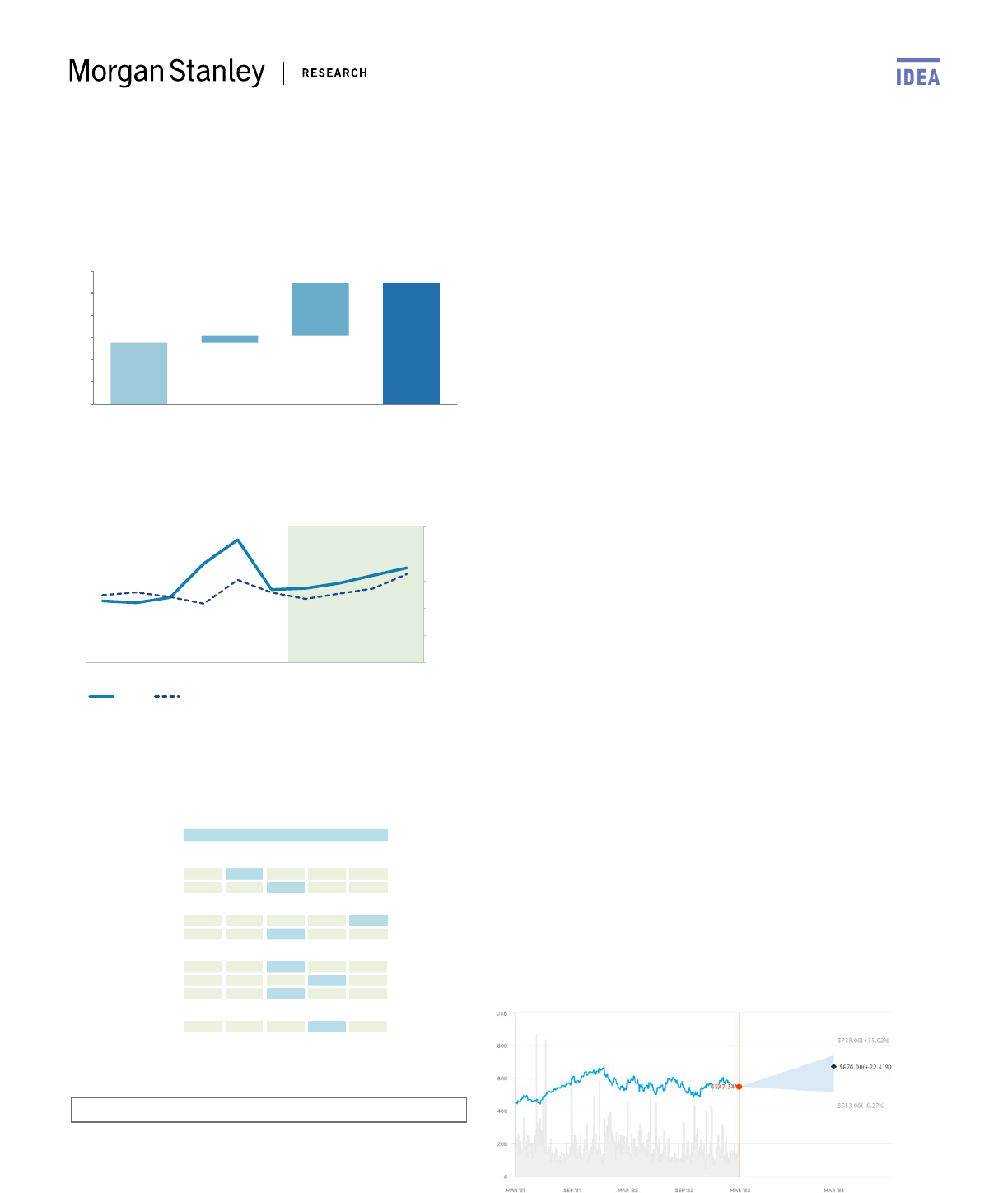

Value of Growth Analysis

99

157

+8

+50

0

20

40

60

80

100

120

140

160

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

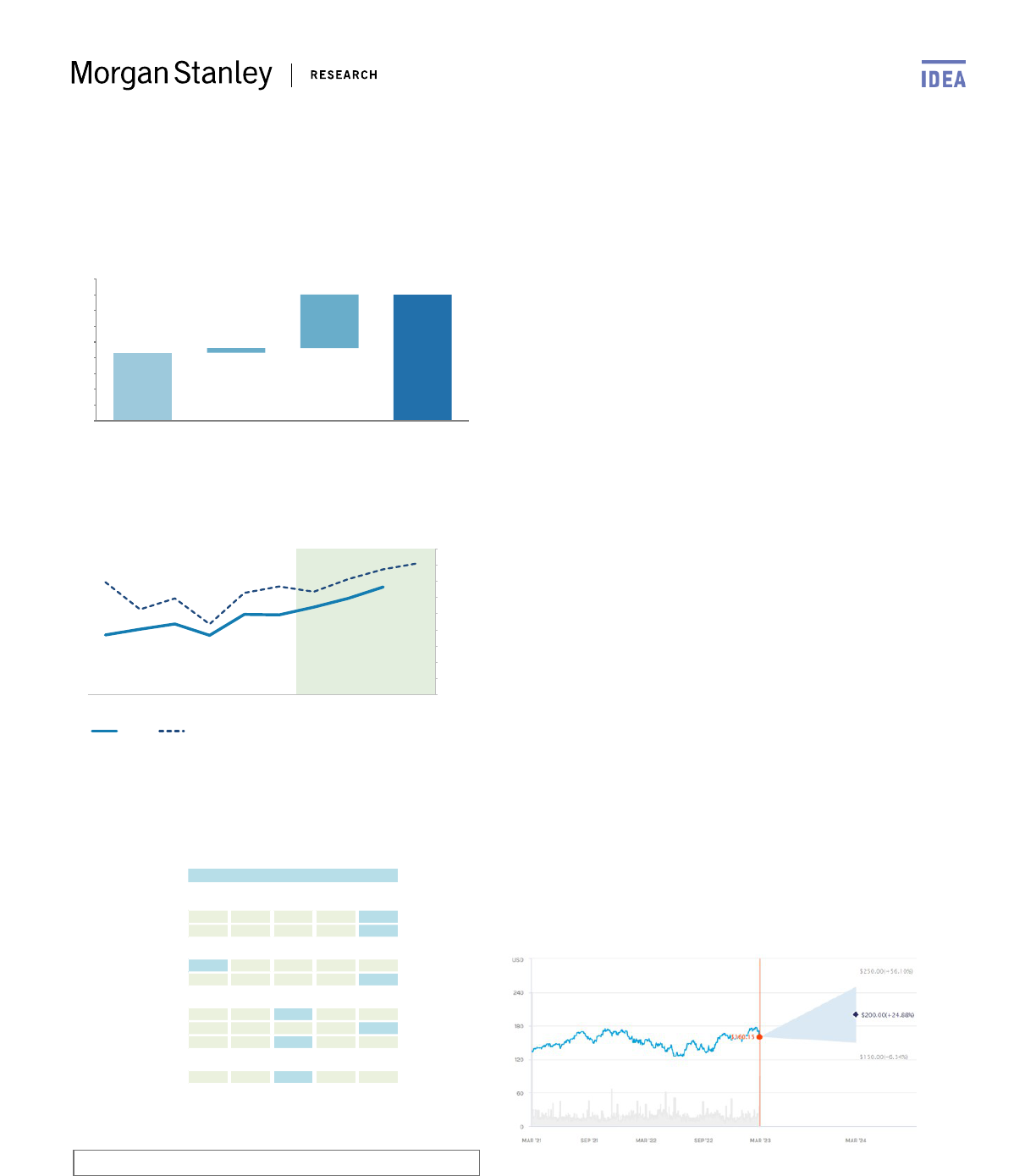

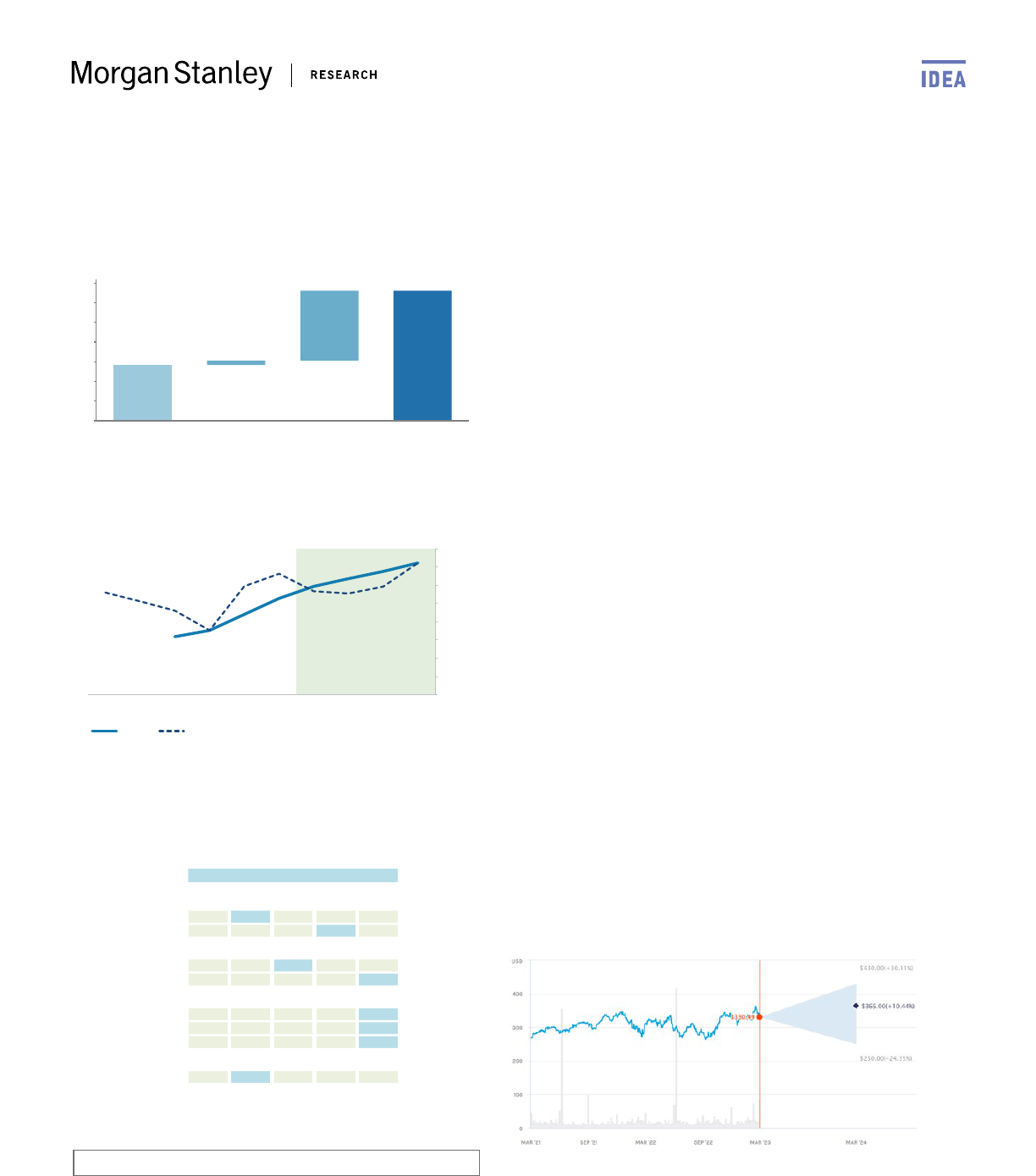

Return on Equity (ROE) Analysis

0%

5%

10%

15%

20%

25%

30%

35%

40%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

American Express Company vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

15.2%

8.0%

Sales '23-'25 CAGR

9.2%

3.8%

Returns

ROE

33.8%

12.7%

Valuation

P/E

13.8x

7.6x

P/B

4.3x

0.8x

American Express Company

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e. (P/B could be NM) Source: Morgan

Stanley Research

Consumer Finance Industry View: Cautious

Betsy Graseck

Higher credit-quality skew offers downside protection from

consumer credit deterioration. AXP's card book is high

quality, with subprime loans estimated to be 5-10% of loans.

We are more concerned about credit deterioration at more

heavily subprime-exposed card issuers, including

Underweight-rated COF (31%) and SYF (26%). As broader

consumer credit quality continues worsening from here

amid declining savings and high inflation, we expect AXP’s

card losses and delinquencies to only return to pre-Covid

levels by YE24, while card peers are expected to overshoot.

Post-Covid recovery tailwinds provide opportunity for

sustainable topline growth... AXP is well positioned to

benefit from ongoing recovery in corporate T&E spend - still

running 34% below 2019 levels. On the consumer end, we

think AXP's higher-income cardholders will have an easier

time managing this high-inflationary period. We see this card

spend resiliency translating to a ~16% 2022-2025 CAGR in

AXP's card fee income, and strong loan growth from its

customer base. We expect this to drive a ~11% 2022-2025

CAGR in total revenues.

...creating a path for positive operating leverage. Bears

typically point to Amex’s lack of operating leverage,

weighed down by high variable expenses (i.e. card member

rewards). Our forecast for slowing growth in marketing and

cardmember acquisition expenses should help drive ~430bp

operating leverage growth in 2023, its highest in over a

decade and a standout among card peers. We expect

positive operating leverage growth can continue into 2024

as well, even as top-line growth cools.

Risk Reward: Overweight / Price Target $186

7

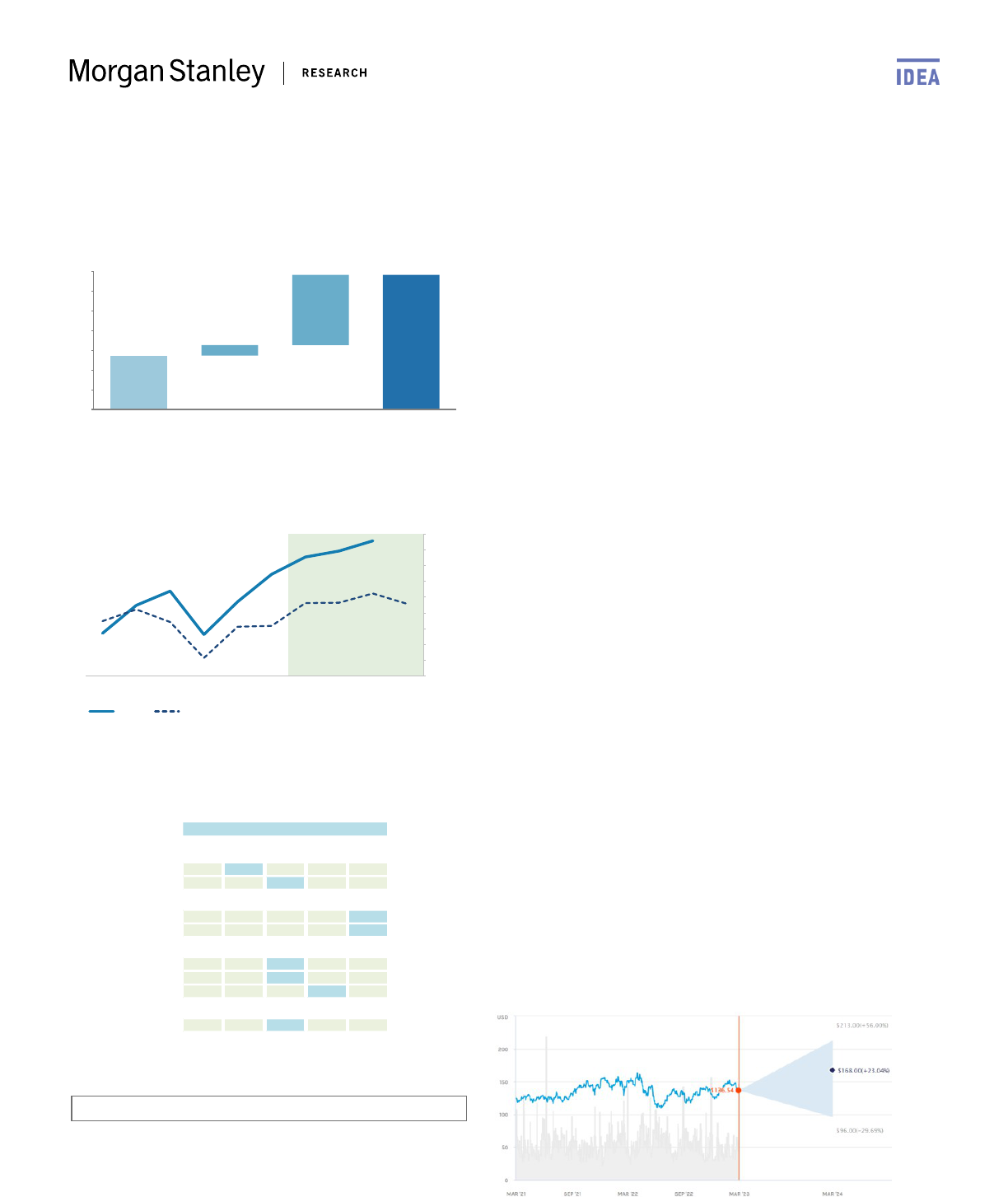

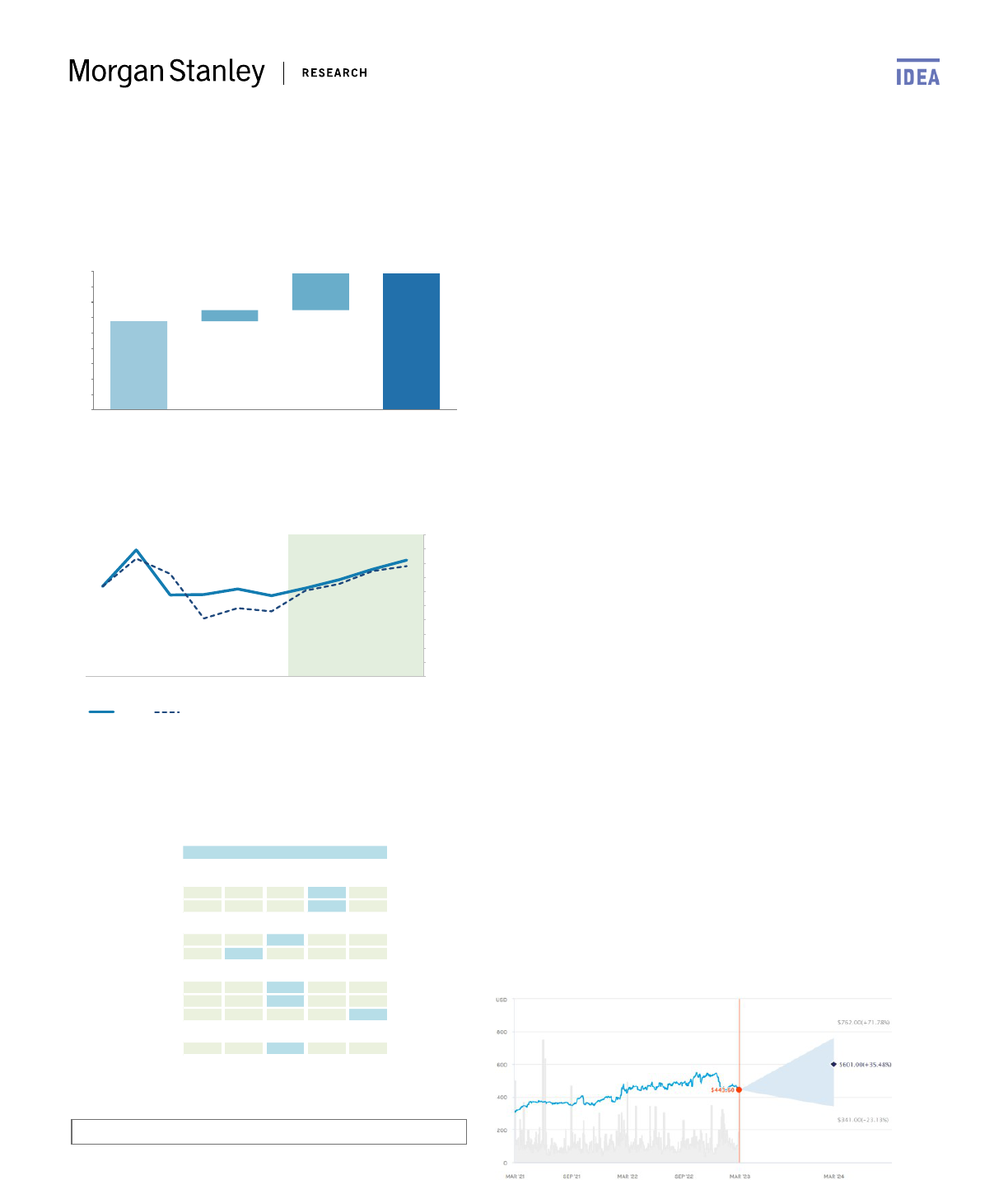

Blackstone (BX)

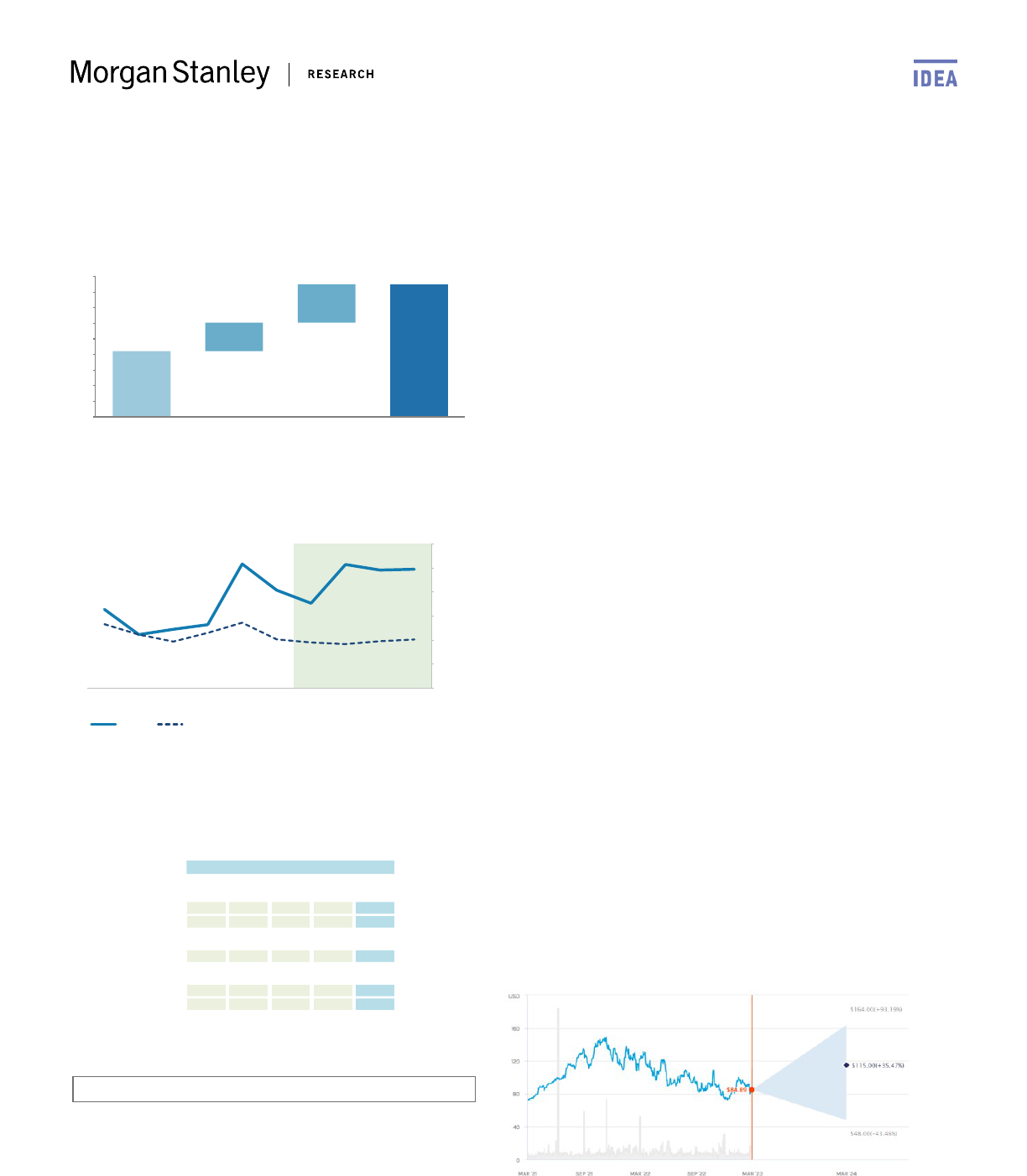

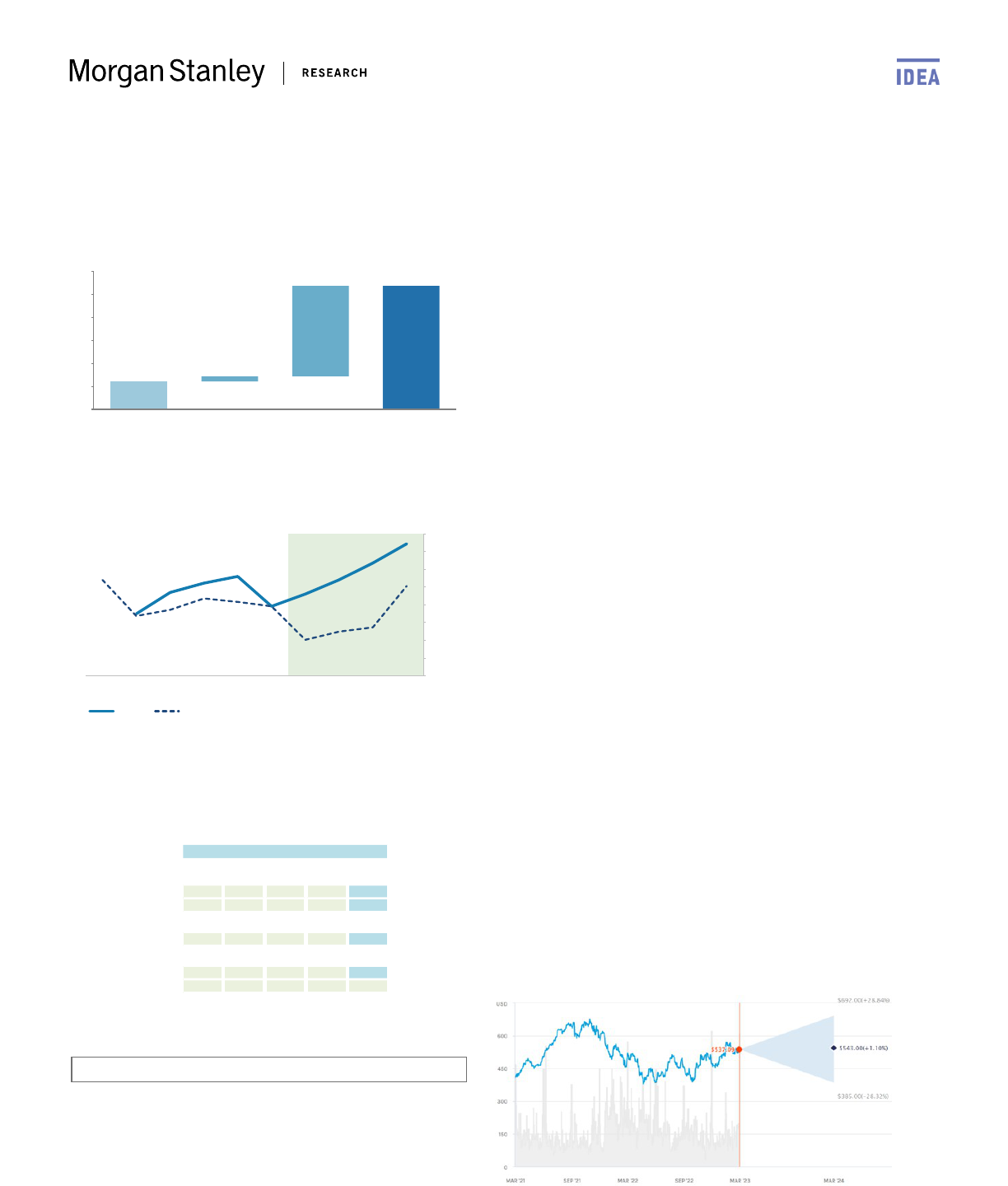

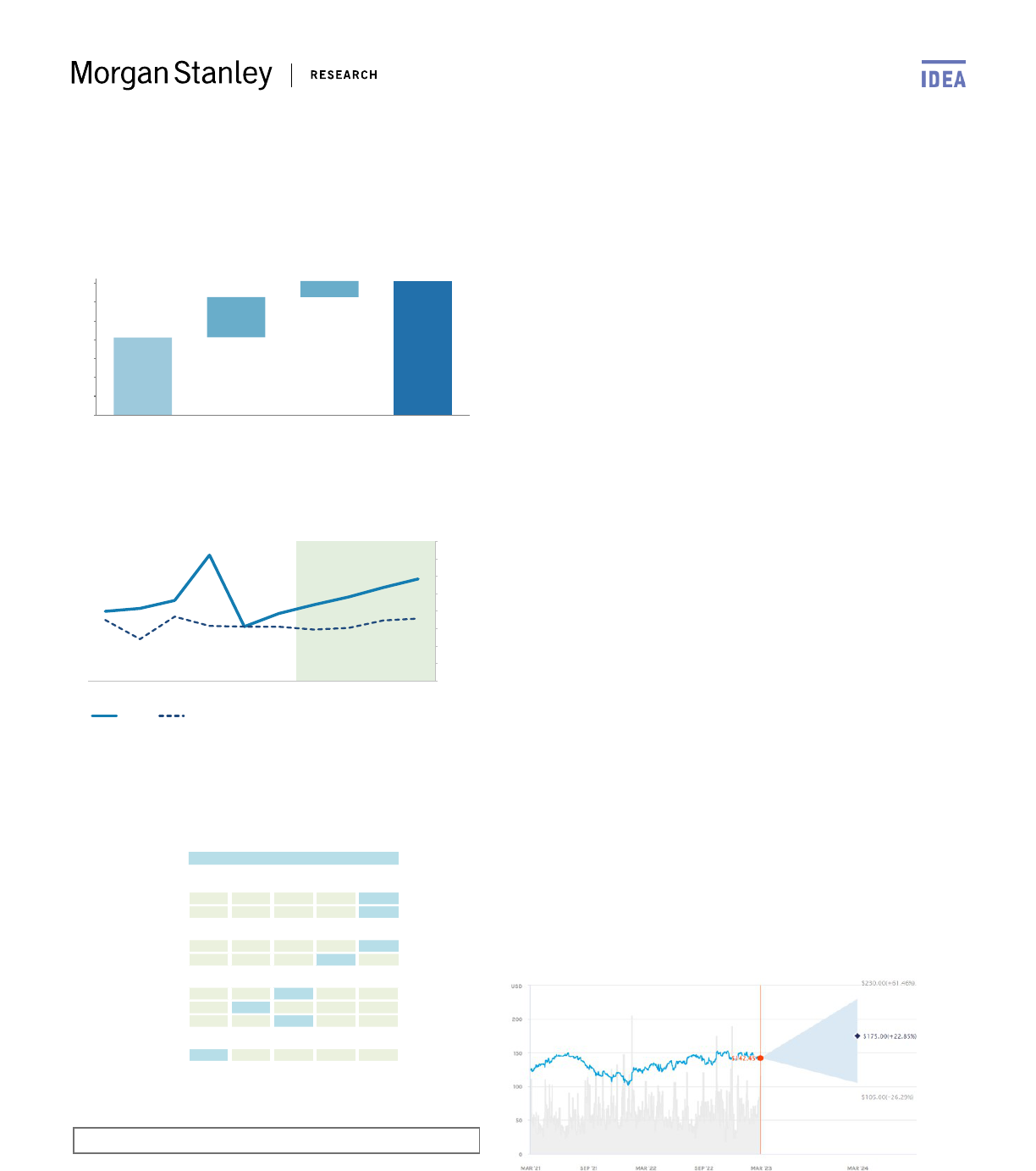

Value of Growth Analysis

42

85

+18

+24

0

10

20

30

40

50

60

70

80

90

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

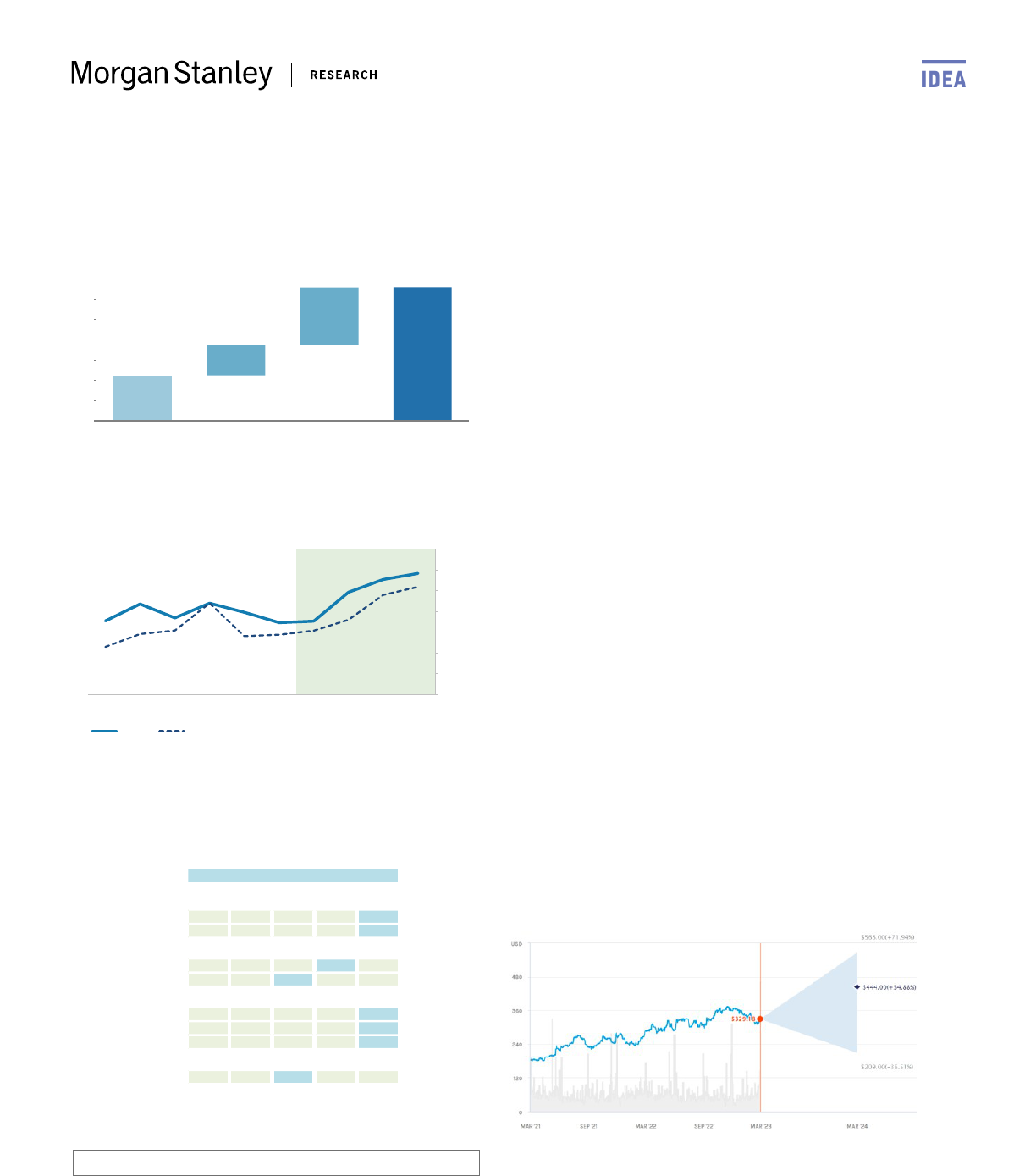

Return on Equity (ROE) Analysis

0%

10%

20%

30%

40%

50%

60%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

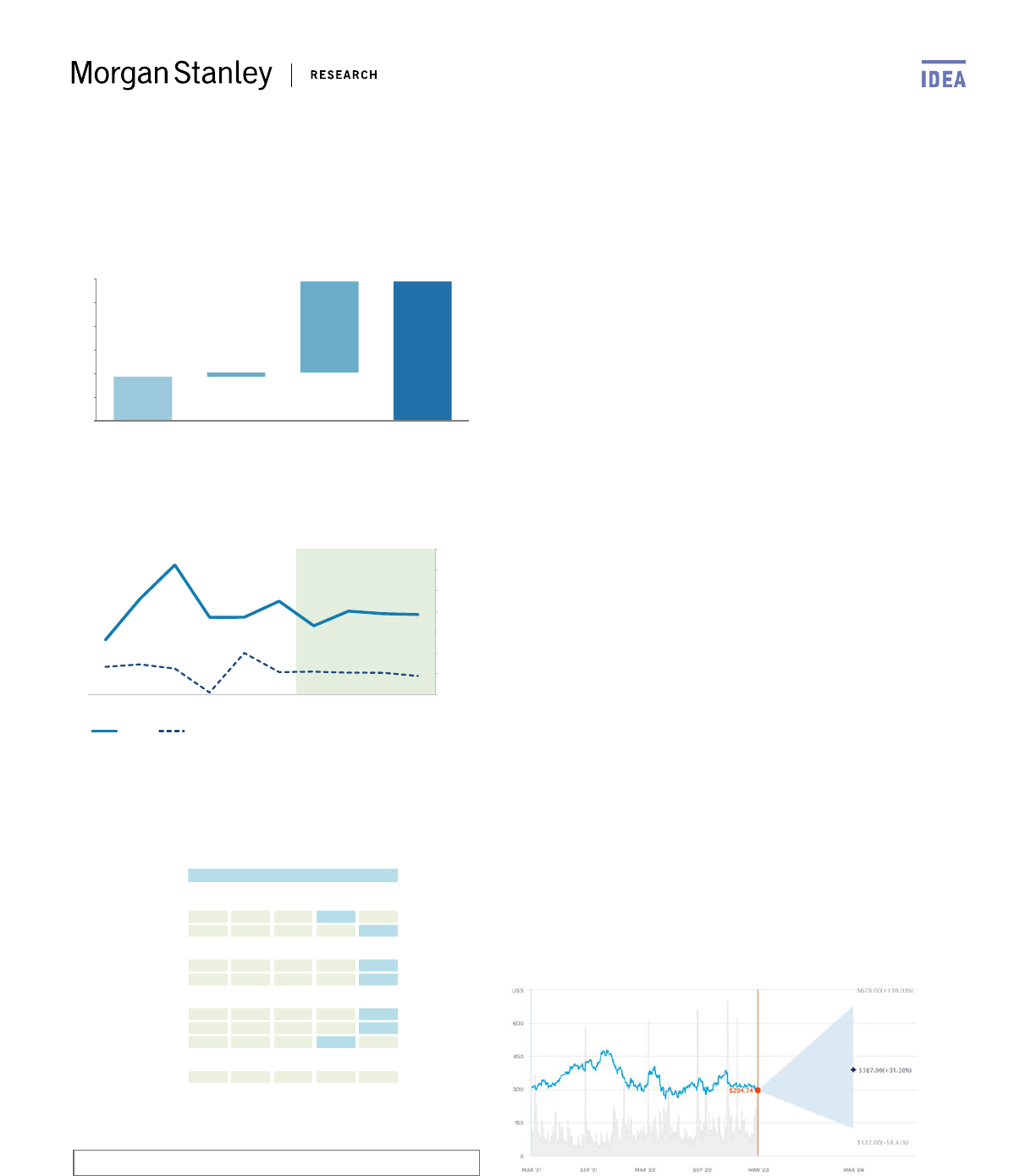

Sector Yardsticks

Sector Yardsticks

Blackstone Inc. vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

31.5%

14.0%

Sales '23-'25 CAGR

30.3%

9.1%

Returns

ROE

35.2%

18.9%

Valuation

P/E

20.9x

16.1x

P/B

11.4x

2.6x

Blackstone Inc.

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e. (P/B could be NM) Source: Morgan

Stanley Research

Brokers, Asset Managers & Exchanges Ind. View: In-Line

Michael Cyprys

Blackstone is a leading private markets franchise with a

best-in-class brand, unrivalled product capabilities, and

distribution breadth, in our view. BX is increasingly focused

on expanding its TAM, extending into new verticals, and

boosting margins. This should drive sustainable growth

higher than the market appreciates and support a premium

valuation.

Compelling secular grower at an attractive price. We see

powerful secular tailwinds driving increased allocations to

private markets including a ~$70tr retail TAM that's still in

early days of penetration, a large opportunity set of

investable assets, new growth engines, and private markets'

strong track record versus public markets through cycles.

Against this backdrop, we view BX as best positioned to

capture outsized share of a growing pie, particularly as

asset-owner clients and retail platforms target a narrower

set of managers with a breadth of offerings. In retail, BX is

furthest along with a first-mover advantage and industry-

leading distribution capabilities.

Focus on firepower and staying power. BX's long-duration

locked-up capital, ramping permanent capital initiatives, and

over $187b of dry powder should enable the company to

patiently wait for opportunities to time exits and

deployment. We believe this yields significant firepower and

staying power, which, combined with an enviable brand,

should enable BX to navigate through cycles and support

the next wave of growth.

Risk Reward: Overweight / Price Target $115

8

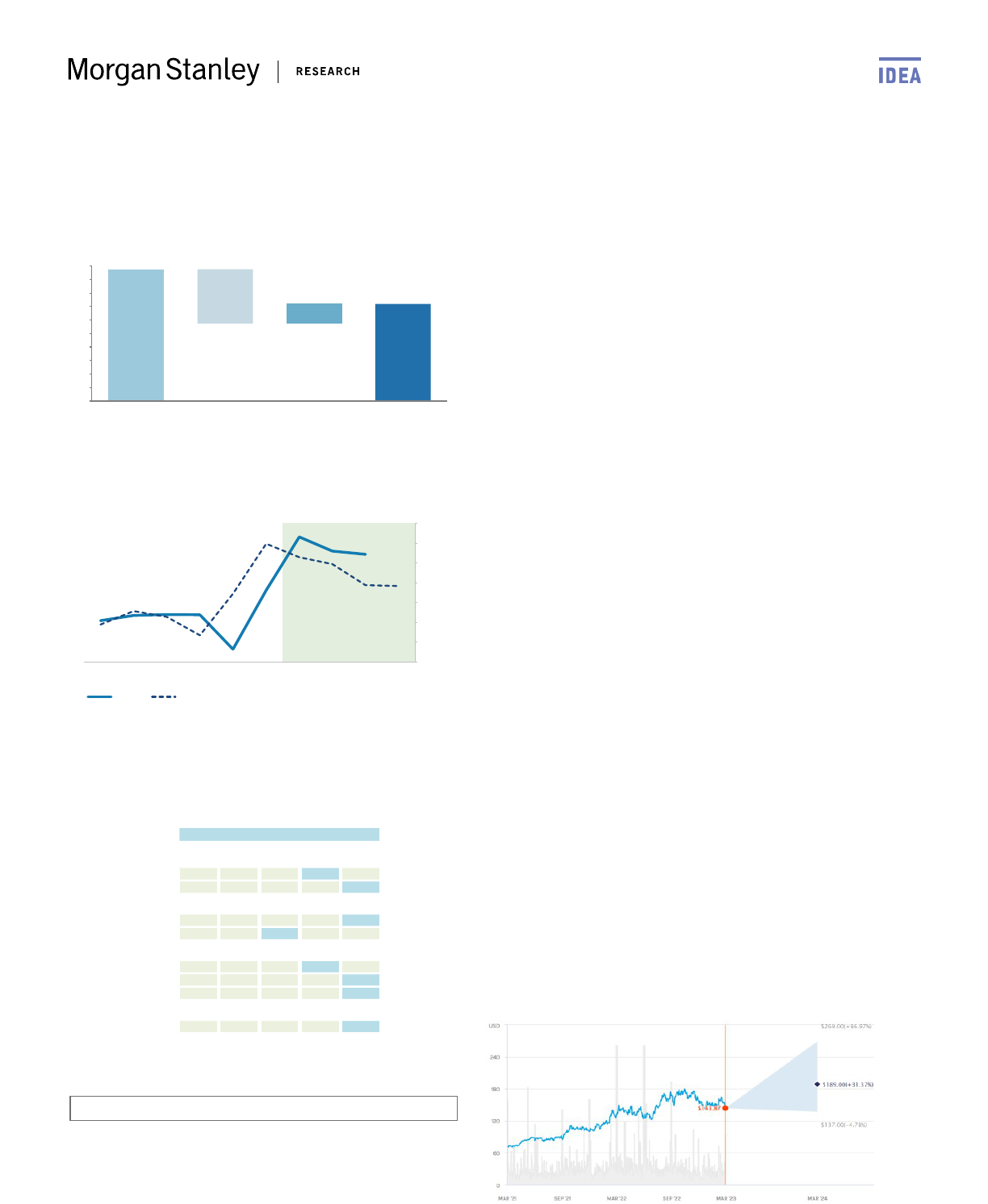

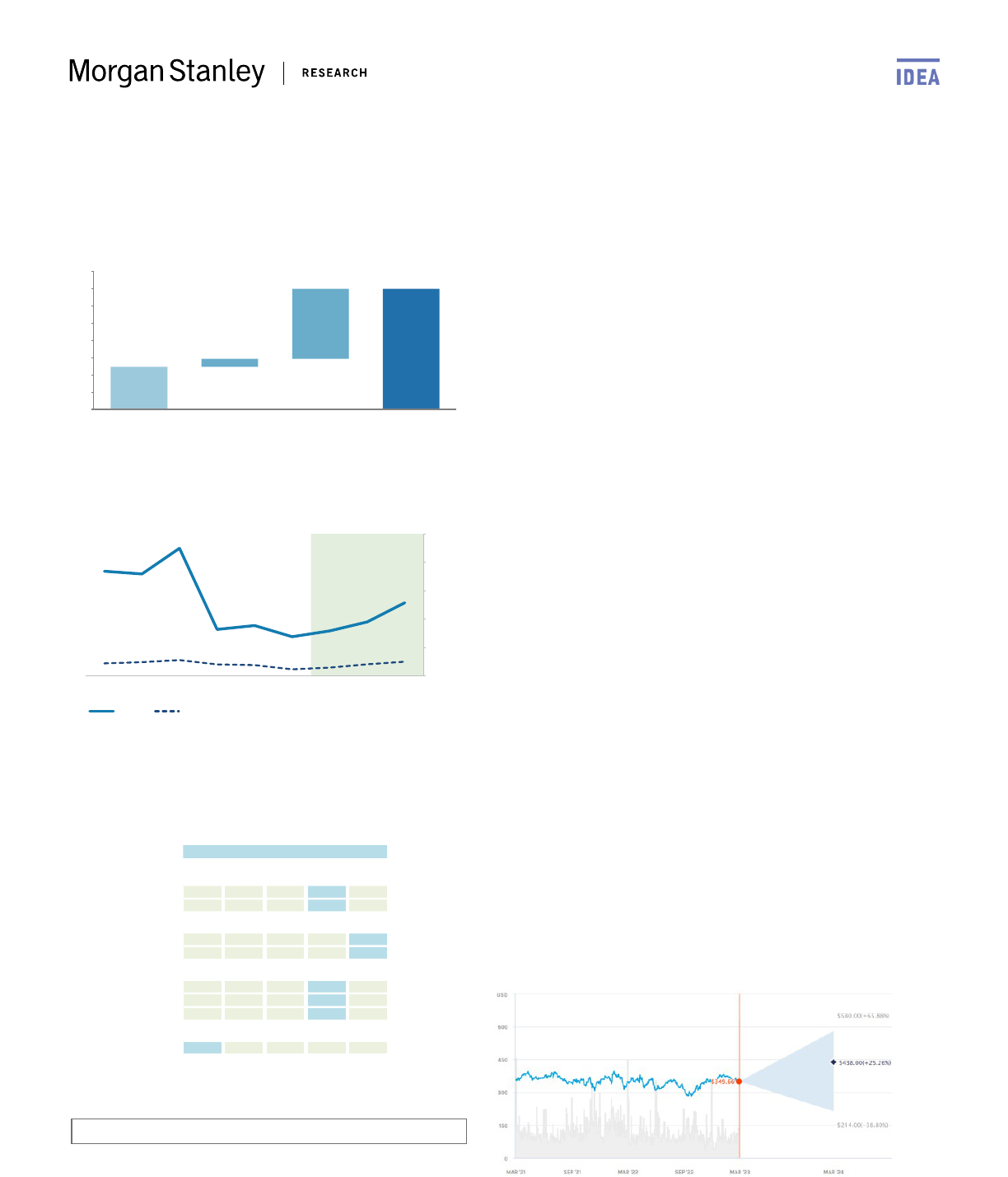

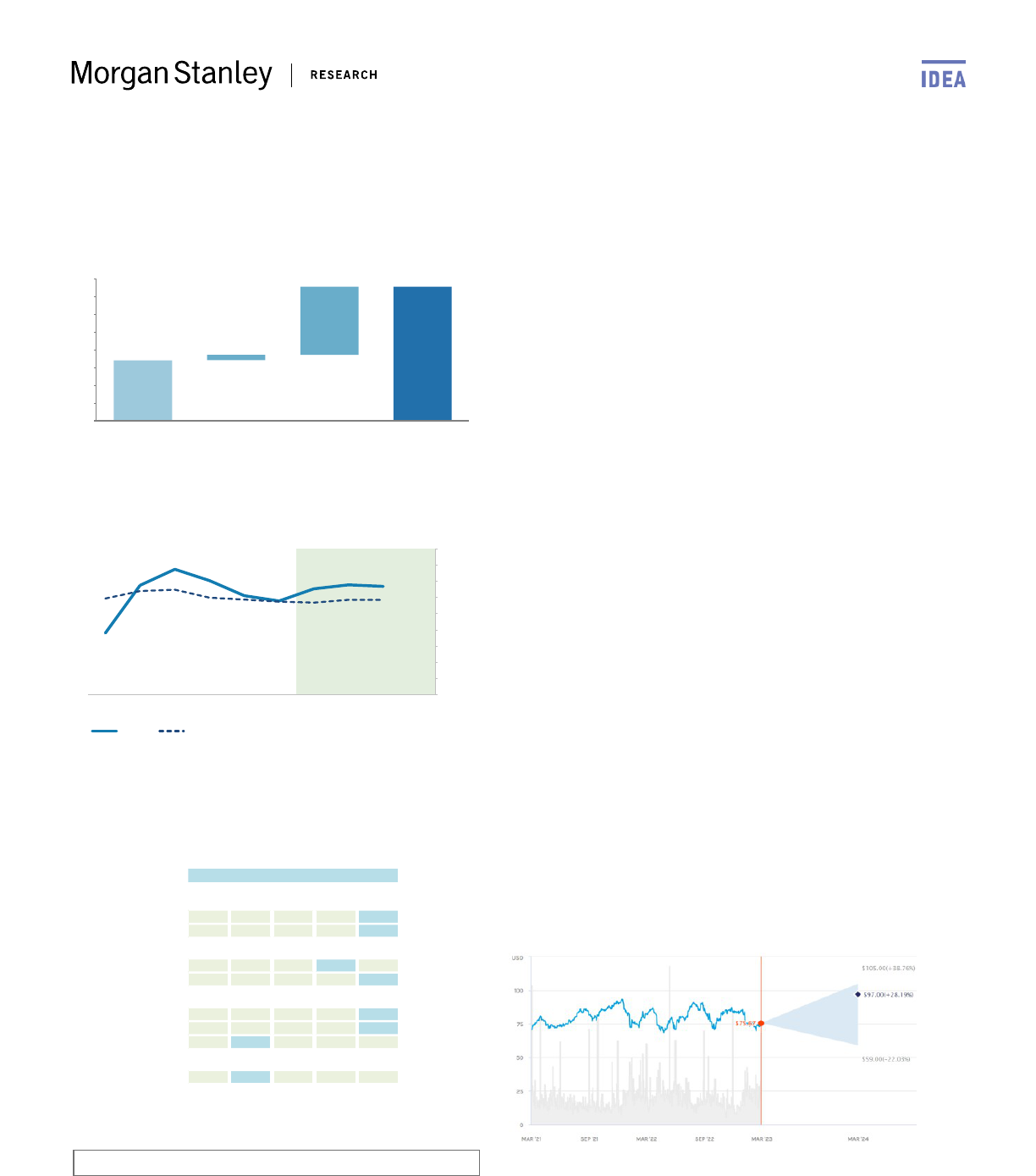

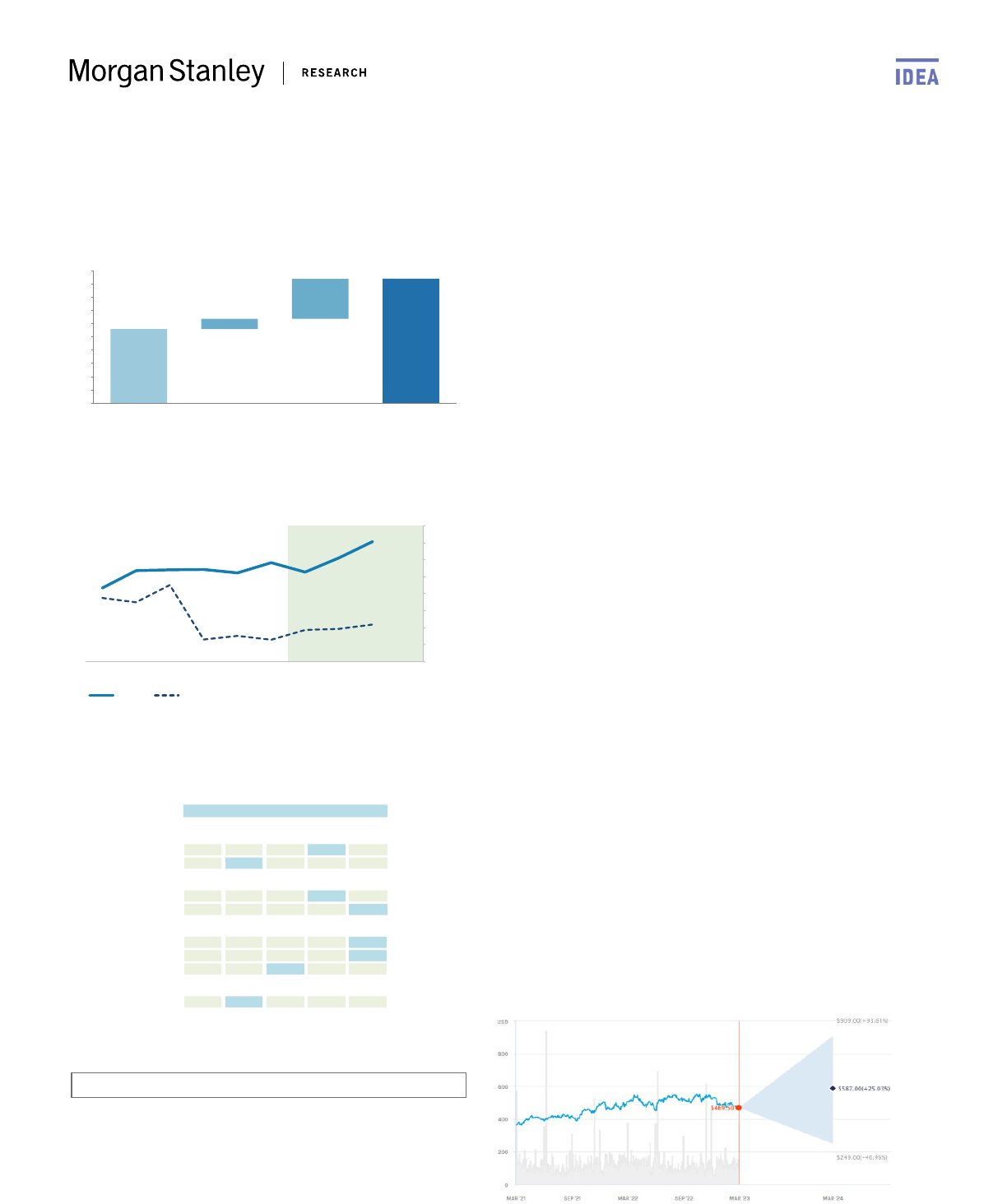

Cheniere Energy (LNG)

Value of Growth Analysis

195

144

-81

+29

0

20

40

60

80

100

120

140

160

180

200

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

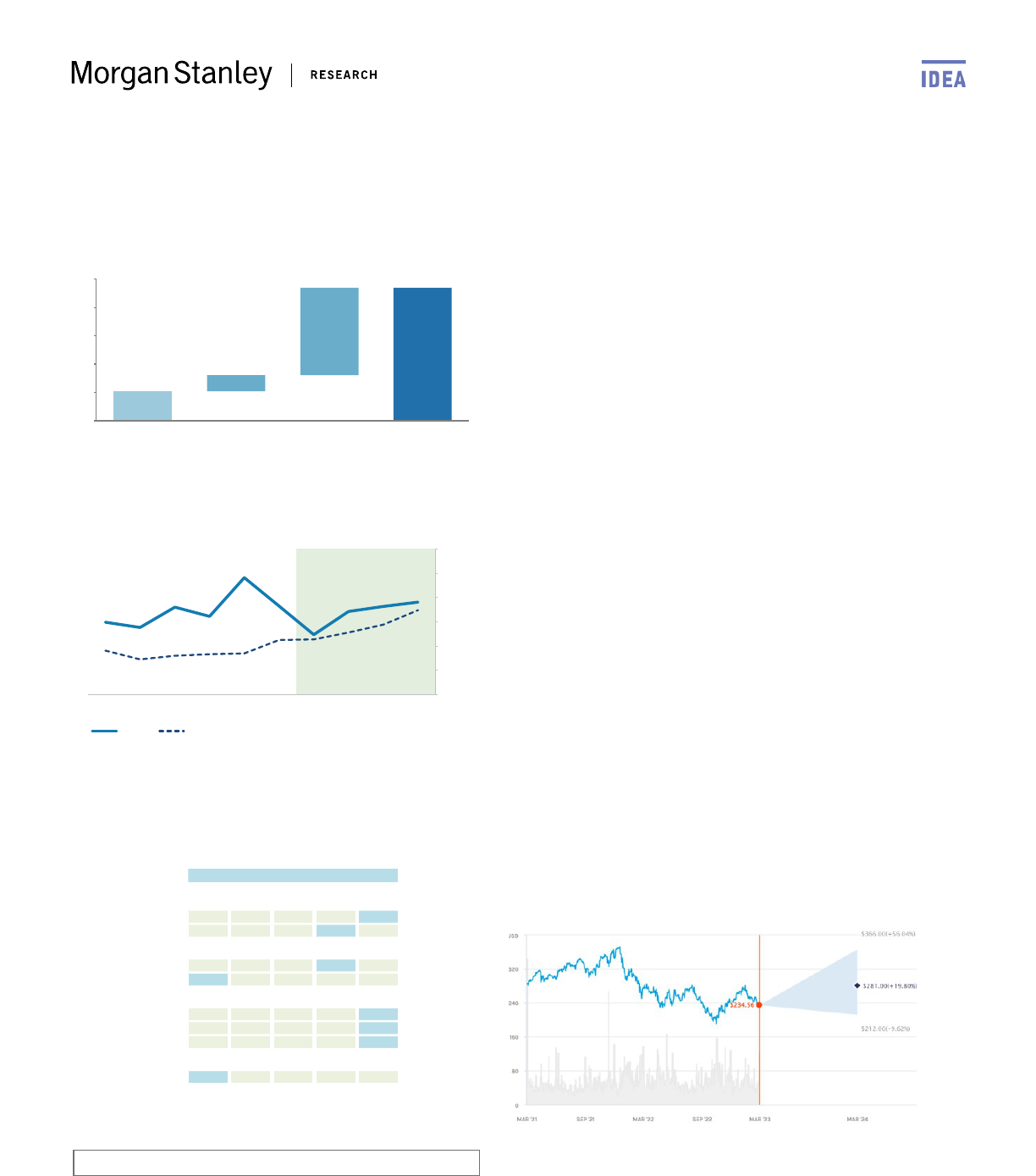

Return on Net Operating Assets (RNOA) Analysis

-5%

0%

5%

10%

15%

20%

25%

30%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

Cheniere Energy Inc vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

-9.3%

-15.2%

Sales '23-'25 CAGR

7.6%

-6.0%

Returns

RNOA

26.5%

21.4%

EBIT margin

36.9%

32.8%

Valuation

P/E

7.5x

6.6x

EV/EBIT

7.6x

5.3x

P/FCF

26.3x

6.8x

Leverage

Net Debt/EBITDA

2.2x

0.5x

Cheniere Energy Inc

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Diversified Natural Gas Industry View: In-Line

Devin McDermott

LNG market leader. Cheniere remains the dominant LNG

player in the US and in our view is structurally advantaged

compared to smaller, independent US peers given its scale,

low-cost expansion opportunities, and existing platform of

resilient cash flows backed by long-term contracts. ~95% of

the company’s liquefaction capacity is sold under fixed-price

sales agreements through 2030, supporting stable cash

flow regardless of where LNG prices go (weighted average

contract life of 17 years).

Pathways for growth. Cheniere is currently progressing its

brownfield expansion project at Corpus Christi Stage 3, set

to come online in late 2025. Longer term, the company

plans to formally file with FERC for Corpus Christi Midscale

Trains 8 & 9 by the end of 1Q and recently pre-filed for a

large 20+ mtpa expansion at Sabine Pass. Together with

additional growth projects, Cheniere sees the potential for

~90 mtpa of total liquefaction capacity (from 45 mtpa

today).

Attractive macro supports strong FCF and shareholder

returns. Cheniere is well-positioned to benefit from the

ongoing tightness in global gas markets through strong

marketing margins and additional growth opportunities. At

$10 JKM (Asia LNG), $3.25 Henry Hub, and conservative

$3.50 marketing margins, we forecast run-rate distributable

cash flow of ~$24/sh, a 16% yield on the current stock price.

Over the next several years, resilient FCF should support

declining leverage, growing dividends, and share

repurchases. Cheniere’s attractive shareholder returns

strategy includes 10% annual dividend growth and MSe $2B

of share buybacks in 2023.

Risk Reward: Overweight / Price Target $189

9

Costco Wholesale (COST)

Value of Growth Analysis

169

487

+8

+310

0

50

100

150

200

250

300

350

400

450

500

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

5%

10%

15%

20%

25%

30%

35%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

Costco Wholesale Corp vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

7.8%

9.3%

Sales '23-'25 CAGR

6.2%

4.1%

Returns

RNOA

29.5%

12.7%

EBIT margin

3.5%

4.0%

Valuation

P/E

34.2x

19.3x

EV/EBIT

25.1x

16.9x

P/FCF

31.7x

19.5x

Leverage

Net Debt/EBITDA 1.7x

Costco Wholesale Corp

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Hardline/Broadline/Food Retail Industry View: In-Line

Simeon Gutman

One of the best companies in all of Retail, in our view.

COST's differentiated value proposition and the stability of

the club model set it apart. In contrast to most retailers,

customers pay COST for the right to shop in their stores.

That this model continues to work is borne out by strong

membership renewal rates (average of ~89% over the past 5

years, and a record ~90.5% in the most recent quarter). We

believe Covid, inflationary pressures on the consumer, and

gas price volatility have strengthened COST's value

proposition , with likely higher membership stickiness and

spending consolidation at COST relative to past years.

Private label offers differentiation. We estimate COST's

private label brand, Kirkland Signature, has grown to >$75b

in revenue (~35% of total net sales in F22). This lifts COST's

margins (we estimate PL products carry a 1,000 bps gross

margin advantage over branded ones) and protects its

position as a retailer with products found nowhere else.

3 long-term drivers for the stock: (1) We model a a ~2.5%

CAGR in the club base through F25; we see room for at

least 100 more US warehouses (~10 years of domestic

growth), plus >50 potential international warehouses over

the long term. (2) SSS should continue to grow at a mid-

single digit rate, driven by merchandising, consumables, and

eComm. (3) Membership & fee income growth should

continue at ~3%/~8% respectively (their 5-yr averages) as

consumers look to access COST's unique value proposition;

we see potential upside as we believe a membership fee

increase likely in the next 12 months. Alongside

stable/steady EBIT margins, this algo drives our LT outlook

for mid- to- high-single-digit sales, EBIT, and EPS growth.

Risk Reward: Overweight / Price Target $520

10

Eaton (ETN)

Value of Growth Analysis

86

160

+6

+68

0

20

40

60

80

100

120

140

160

180

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

Eaton Corporation PLC vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

10.4%

9.7%

Sales '23-'25 CAGR

6.2%

4.6%

Returns

RNOA

10.8%

12.7%

EBIT margin

18.7%

17.2%

Valuation

P/E

19.2x

19.4x

EV/EBIT

16.7x

14.7x

P/FCF

17.2x

19.7x

Leverage

Net Debt/EBITDA

1.3x

1.3x

Eaton Corporation PLC

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Multi-Industry Industry View: In-Line

Joshua Pokrzywinski

We believe ETN is uniquely positioned with best-in-class

near-term visibility and long-term growth.

Backlog visibility isn't just high, it's exceptional. ETN's

backlog within its electrical businesses is running 2x higher

than "normal" levels, with close to 60% NTM revenue

coverage. We estimate that orders can decline by 20%+ and

still enter 2025 with above normal visibility / backlog

coverage. With attention turning to the cycle amid a

weakening macro backdrop, we expect ETN's backlog

coverage supports better near-term visibility than most

while also having some of the best long-term growth

drivers in our coverage.

The multiple vectors of energy transition go through

electrical equipment, which are key pieces of infrastructure

to enable electrification. ETN is ~70% electrical exposed

with leading positions in the US low- and medium-voltage

electrical market (~30%+ market share). This is a

consolidated industry with strong pricing power using

proven technology required to connect and control all

manner of electric sources, uses, and storage. Electrification

is already showing up in macro data with electrical growth

accelerating to MSD+ over the past two years and should

drive continued M-HSD growth through 2030. Stimulus,

nearshoring, and backlog conversion likely drive this closer

to HSD over the next few years.

Risk Reward: Overweight / Price Target $200

11

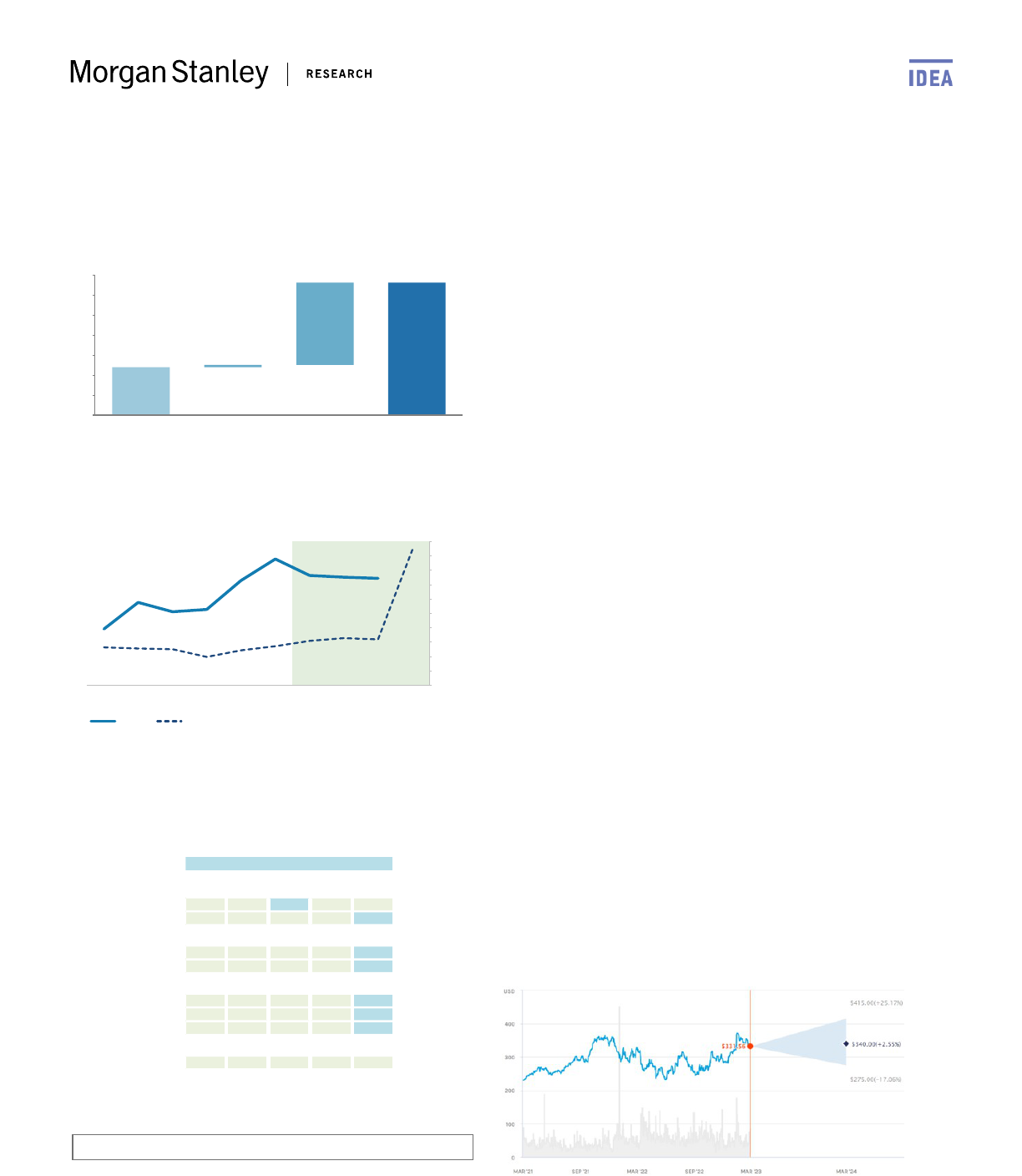

Eli Lilly (LLY)

Value of Growth Analysis

111

329

+76

+141

0

50

100

150

200

250

300

350

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

10%

20%

30%

40%

50%

60%

70%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

Eli Lilly & Co. vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

33.8%

0.1%

Sales '23-'25 CAGR

16.9%

2.9%

Returns

RNOA

35.2%

30.6%

EBIT margin

30.5%

30.3%

Valuation

P/E

36.8x

11.9x

EV/EBIT

33.2x

11.9x

P/FCF

47.7x

7.0x

Leverage

Net Debt/EBITDA

1.3x

1.2x

Eli Lilly & Co.

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Major Pharmaceuticals Industry View: In-Line

Terence Flynn

Robust new product cycles and limited exposure to loss of

exclusivity (LOE) favorably position LLY within US Pharma.

The company could potentially launch five new products

across four large therapeutic areas by the end of 2023,

including obesity. Trulicity goes off patent later this decade,

but the company should be able to transition the franchise

to Mounjaro.

We expect Mounjaro uptake in type-2 diabetes (T2D) and

expected approval in obesity to drive top-line growth and

margin expansion through the decade. LLY is positioned to

grow revenue at a 10% CAGR from '23-'30 which should

expand margins from 28% in 2022 to >40% in 2025+, driving

EPS growth of 18%, on our estimates. This compares

favorably to the rest of the peer group.

LLY is well positioned to capture significant share in a new

therapeutic TAM. LLY currently splits the GLP-1 injectable

T2D market with Novo (covered by Mark Purcell). Both

companies are competitively positioned to retain a duopoly

as this category of drugs moves into obesity, which we

project as a $50bn+ opportunity. Mounjaro's efficacy profile

in both T2D and obesity will make it a share gainer in the

expanding class. LLY is also developing additional drugs for

T2D and obesity, which position the company to remain

competitive in these areas longer term.

Risk Reward: Overweight / Price Target $444

12

Estée Lauder (EL)

Value of Growth Analysis

52

235

+28

+154

0

50

100

150

200

250

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

10%

20%

30%

40%

50%

60%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

Estee Lauder Companies Inc vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

31.1%

14.3%

Sales '23-'25 CAGR

10.5%

5.2%

Returns

RNOA

24.6%

22.7%

EBIT margin

15.3%

19.2%

Valuation

P/E

45.5x

29.1x

EV/EBIT

33.1x

21.1x

P/FCF

66.8x

31.4x

Leverage

Net Debt/EBITDA

0.7x

1.5x

Estee Lauder Companies Inc

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Household & Personal Care Industry View: In-Line

Dara Mohsenian

EL is well positioned in prestige beauty with strong

category and geographic growth trends and mix shifts,

opportunities for meaningful margin expansion, and best-

in-class management, in our view.

Post-Covid Beauty Rebound. We are confident in the

sustainability of the post-Covid beauty rebound, with long-

term prestige beauty category growth in the HSD% range,

with continued premiumization, a growing middle class

emerging in emerging markets, a larger pie post-Covid for

travel retail with Hainan development, and continued e-

commerce strength with technological advancements.

Growth and Margin Expansion Opportunity. EL has

benefited from a long-term mix shift to higher growth and

higher margin areas (China, travel retail, e-commerce, and

skin care) that have been artificially depressed by Covid and

should re-emerge as a key investment thesis recovering to

its LT growth algorithm.

Consensus Assumes L-MSD% Growth. Consensus only

forecasts 3-4% revenue CAGR's vs. a pre-Covid period

looking out over the next two years, seemingly too low if

China fully recovers relative to outsized MSD-HSD LT

prestige beauty category growth (to which EL is 100%

exposed).

Risk Reward: Overweight / Price Target $281

13

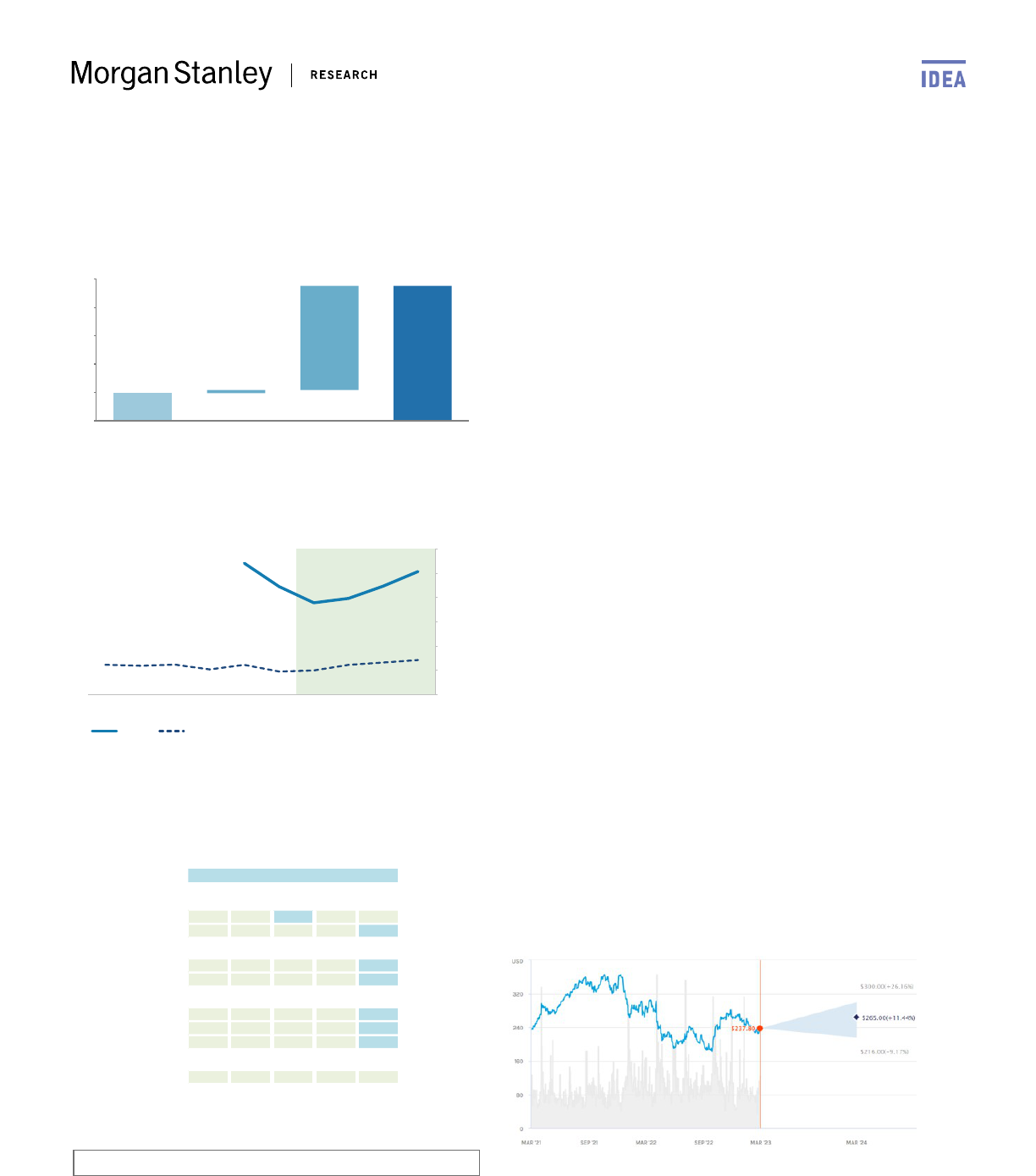

Exxon Mobil (XOM)

Value of Growth Analysis

123

100

-23

-1

0

20

40

60

80

100

120

140

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

-15%

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

35%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

Exxon Mobil Corporation vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

-15.6%

-15.2%

Sales '23-'25 CAGR

-3.4%

-6.0%

Returns

RNOA

23.5%

21.4%

EBIT margin

15.6%

32.8%

Valuation

P/E

9.9x

6.6x

EV/EBIT

6.4x

5.3x

P/FCF

9.3x

6.8x

Leverage

Net Debt/EBITDA 0.5x

Exxon Mobil Corporation

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Integrated Energy Industry View: Attractive

Devin McDermott

Competitive positioning. XOM’s strong FCF profile is

supported by an advantaged portfolio of high return

growth projects. These investments, coupled with ongoing

execution on >$9B of cost cuts ($6.9B to date with an

additional ~$2B through 2023), should allow the company

to double earnings capacity by 2027 (vs. 2019). Robust FCF

supports ~300% dividend cover in 2023 and ~$35B of share

repurchases across 2023-24. In total, XOM offers a ~8%

2023 shareholder return yield (~$85/bbl WTI), with the

potential for further upside.

Low-carbon opportunities. XOM is also an industry leader

in decarbonization, focusing on technologies that are

synergistic with core competencies including carbon capture

& storage (CCS), hydrogen, and renewable fuels. The

company has cumulatively captured more carbon than any

company (40% of the global total) and has a near-term

pipeline of ~20 CCS projects. Moreover, XOM is advancing a

blue hydrogen plant in the US Gulf Coast and targeting

~200 kbbl/d of lower-emission fuels production by 2030.

We forecast a 15% average return on capital will deliver

~$4B in low-carbon earnings by 2030 and ~$8B by 2035.

Sustainable long-term growth. XOM’s diversified business,

resilient FCF, and strong balance sheet support continued

investments in high return opportunities across the Energy

value chain. In addition to benefitting from what we expect

to be a multi-year period of strong oil & gas prices, XOM's

proactive (but still returns focused) decarbonization

strategy should help de-risk longer term cash flows and

mitigate terminal value uncertainty – offsetting the impact

of longer-term erosion in oil & gas demand.

Risk Reward: Overweight / Price Target $114

14

Hilton Worldwide (HLT)

Value of Growth Analysis

55

137

+11

+71

0

20

40

60

80

100

120

140

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

-10%

-5%

0%

5%

10%

15%

20%

25%

30%

35%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

Hilton Worldwide Holdings Inc vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

14.3%

17.9%

Sales '23-'25 CAGR

5.8%

6.2%

Returns

RNOA

27.7%

13.1%

EBIT margin

25.6%

16.4%

Valuation

P/E

21.9x

20.9x

EV/EBIT

16.6x

16.6x

P/FCF

20.2x

16.1x

Leverage

Net Debt/EBITDA

2.7x

2.7x

Hilton Worldwide Holdings Inc

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Gaming & Lodging Industry View: In-Line

Stephen Grambling, CFA

HLT is poised to benefit from secular growth of travel and

gain share all within a capital-light model with a best in-

class management team.

Beneficiary of long-term demand trends: We expect lodging

to continue to grow above GDP: (1) rising consumer incomes

= higher share of spend on travel; and (2) shifts from

industrial to service based economies = higher corporate

travel. HLT's scale also creates more efficient distribution

and higher revenue for hotel owners, enabling share gains

from independent and sub-scale peers.

HLT's asset light model limits volatility, maximizes ROIC.

HLT generates >85% of EBITDA from fees, which are largely

tied to the top line of hotels rather than profitability. When

combined with limited G&A and capex, HLT has highly visible

fundamentals. During the pandemic, EBITDA declined less

than revenue and FCF stayed positive.

FCF Compounder: With one of the highest in-construction

pipelines (18% growth vs. current), we expect the company

to deliver 5%+ growth over the next three years (with new

"Spark" brand offering potential for 6-7%). Therefore, even if

RevPAR growth is modest, room growth should propel EPS

at 20%+ and FCF 15%+ from 2022-24. Note the company's

growth and margins are understated in our metrics table

due to reimbursed revenue. Excluding these, HLT's 2020-

2025 revenue CAGR is 24% and 2023/2025 EBIT margins are

61%/64%, pushing the company even further up the

rankings.

Risk Reward: Overweight / Price Target $168

15

Intuitive Surgical (ISRG)

Value of Growth Analysis

49

238

+5

+184

0

50

100

150

200

250

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

10%

20%

30%

40%

50%

60%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

Intuitive Surgical Inc. vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

12.8%

12.8%

Sales '23-'25 CAGR

11.3%

6.2%

Returns

RNOA

37.7%

9.9%

EBIT margin

33.4%

24.2%

Valuation

P/E

45.1x

25.2x

EV/EBIT

35.2x

19.6x

P/FCF

47.9x

32.3x

Leverage

Net Debt/EBITDA 1.4x

Intuitive Surgical Inc.

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Medical Technology Industry View: In-Line

Drew Ranieri

One of the most innovative companies in Medical

Technology. We see Intuitive as a best-in-class enabler of

minimally invasive surgical innovation with a broad portfolio

of robotic surgery technology. Intuitive has the dominant

market position, though competitive systems are in early

innings. Still, we believe Intuitive's substantial global

installed base (>7,500 systems), large active (and trained)

surgeon base, and building ecosystem will entrench the

company's dominant position for years to come. We see

potentially open-ended opportunities to augment robotic

systems by developing digital capabilities and data insights,

which could further enhance Intuitive's offering and likely

provide stickier market share positioning.

A large and growing TAM that we think remains under-

penetrated. Worldwide robotics surgery penetration stands

at 5-6% after multiple decades on the market. Over 1.8mn

procedures were performed worldwide on Intuitive's da

Vinci systems in '22 ('17-'22 CAGR: 16%). Based on existing

clinical applications and geographies, the company has line

of sight to 6mn procedures, with opportunities to 4x the

market size with new technologies, indications and entry

into new geographies over time. Newer platforms (Ion and

SP) open access to additional markets and procedures.

Hospitals are increasingly establishing robotics programs,

and standardizing practices around Intuitive's technology

and building additional robotic procedure capacity.

Risk Reward: Overweight / Price Target $265

16

JPMorgan Chase & Co (JPM)

Value of Growth Analysis

131

126

+1

-6

100

105

110

115

120

125

130

135

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Equity (ROE) Analysis

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

JPMorgan Chase & Co vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

5.2%

8.0%

Sales '23-'25 CAGR

3.3%

3.8%

Returns

ROE

15.2%

12.7%

Valuation

P/E

8.7x

7.6x

P/B

1.3x

0.8x

JPMorgan Chase & Co

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e. (P/B could be NM) Source: Morgan

Stanley Research

Large Cap Banks Industry View: In-Line

Betsy Graseck

Positive operating leverage in 2023. We model JPM

delivering 400bps of positive operating leverage in 2023,

with revenues up 12% and expenses up 8% y/y. This is a

significant inflection from the last two years of negative

operating leverage at JPM (-510bps in 2021, -40bps in 2022).

In addition, while Jamie Dimon has made it clear that he

believes in investing through a cycle as reflected in JPM's

industry leading $14.1B tech budget, we think risks around

expenses skew positively. Areas to pull back on expenses

include low priority projects, market-related revenues in the

custody business, opportunities to flex on mortgage-related

expenses, and revenue-related comp in the Corporate &

Institutional Bank.

Consumer & Community Bank (CCB) is taking deposit

share. JPM is taking deposit share across the country with

median deposit share up 1.5% across the Top 50 US MSAs

over the last 5 years and median 3.1% across the Top 25 US

MSAs. This reflects JPM executing on 500 new branch

builds since 2017 including 300 branches in new markets

including Boston, DC, Philadelphia, Minneapolis, and

Baltimore, with the goal of becoming a scale player (we

think ~10% or greater share) in each of these markets. We

think JPM should continue to take share as 20% of its

branch network is <10 years old, significantly higher than

industry average of 12% and big bank average of mid-single

digits.

JPM de-rates less than peers in recessions. Looking at the

last four recessions (2001-02, 2008-10, 2016 recession

fears, 2020), JPM's NTM Consensus PE troughed at 7.5-9.2x,

above BAC's trough range of 6.1-9.2x and Citi's of 4.3-7.5x.

Risk Reward: Overweight / Price Target $173

17

Liberty Formula One (FWONK)

Value of Growth Analysis

7

72

+5

+60

0

10

20

30

40

50

60

70

80

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

-10%

0%

10%

20%

30%

40%

50%

60%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Liberty Formula One vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

69.2%

13.0%

Sales '23-'25 CAGR

6.6%

5.2%

Returns

RNOA

7.1%

9.4%

EBIT margin

10.1%

10.0%

Valuation

P/E

130.3x

17.6x

EV/EBIT

53.6x

18.2x

P/FCF

98.7x

14.2x

Leverage

Net Debt/EBITDA

1.5x

3.7x

Liberty Formula One

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Media & Entertainment Industry View: In-Line

Benjamin Swinburne

Investment Outlook: Our Overweight on FWONK reflects

(1) our bullish view on sports as an asset class, (2) F1's rising

global popularity and its ability to monetize that growth,

and (3) a preference for contracted revenues (defensive

growth) given the current macroeconomic uncertainty.

F1 continued to see its popularity rise in 2022, especially in

the US: The bull case on F1, in our view, includes

exponentially increasing its earnings in the world's largest

media market - the US - over the long term. Despite cord-

cutting lowering pay-TV distribution by 15-20% since 2017,

F1 linear ratings in the US were up ~15% on a CAGR basis

during this time frame and nearly 20% in '22 vs. '21. Globally,

F1 saw a cumulative TV audience of 1.54bn or 70mm per

race on average last year.

We see premium multiple on FWONK shares persisting: F1's

growth outlook (10-15% adjusted EBITDA CAGR through

2026, on our estimates), contracted nature of its business

model (its primary F1 revenues are almost entirely built on

multi-year contracts), and its high FCF conversion (~80% of

adjusted F1 OpCo EBITDA converted to FCF in '22) support a

premium multiple.

Las Vegas Grand Prix a potential catalyst for shares: As the

promoter in Las Vegas, F1's economics are different relative

to the rest of the calendar. While we do not see Liberty

pursuing a promoter position across the entire F1 race

calendar, we see both direct and indirect benefits to F1's

earnings power from success in Vegas.

Risk Reward: Overweight / Price Target $80

18

Linde (LIN)

Value of Growth Analysis

142

330

+11

+178

0

50

100

150

200

250

300

350

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

2%

4%

6%

8%

10%

12%

14%

16%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

Linde PLC vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

11.7%

14.1%

Sales '23-'25 CAGR

4.5%

3.3%

Returns

RNOA

11.9%

11.3%

EBIT margin

25.3%

15.8%

Valuation

P/E

24.7x

13.6x

EV/EBIT

20.8x

12.0x

P/FCF

32.2x

15.6x

Leverage

Net Debt/EBITDA

1.3x

1.7x

Linde PLC

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Chemicals Industry View: Attractive

Vincent Andrews

We view Linde as an underappreciated self-help story,

backstopped by visible EPS growth, pricing power, and

balance sheet flexibility. Linde stands to benefit from

regional margin parity, with an opportunity to close the

~200 bps margin gap between its APAC/EMEA and

Americas segments (see HERE for more details). While

parity is partially macro-dependent, Linde maintains control

over most key margin improvement initiatives, including

pricing and cost optimization. The company also continues

to see margin expansion in the Americas, thereby raising the

bar for APAC/EMEA parity. To that end, we believe self-help

is further supported by: (1) visible EPS growth tied to take-

or-pay capex; (2) through-the-cycle pricing power; and (3) an

under-levered balance sheet (2023e net debt-to-EBITDA of

1.2x) positioned for deployment into growth capex and/or

share repurchases.

Linde also screens as an attractive ESG ‘Rate of Change’

opportunity. In terms of green/blue hydrogen, Linde has

been less active to date compared to peer Air Products from

a large-scale project perspective. We believe this translates

to higher marginal utility for the next dollar of green/blue

capex announced at Linde versus Air Products. Likewise, we

expect any Linde project to come with a more traditional

industrial gas onsite structure (i.e., take or pay, automatic

cost pass through, et al.) as was the case in its $1.8B long-

term hydrogen/ASU agreement with OCI.

Risk Reward: Overweight / Price Target $365

19

Lululemon Athletica (LULU)

Value of Growth Analysis

93

295

+9

+192

0

50

100

150

200

250

300

350

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

93

295

+9

+192

0

50

100

150

200

250

300

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

20%

40%

60%

80%

100%

120%

140%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

0%

20%

40%

60%

80%

100%

120%

140%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

Lululemon Athletica Inc. vs. Sector Peers

Lululemon Athletica Inc. Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

16.1%

10.6%

Sales '23-'25 CAGR

13.1%

4.1%

Returns

RNOA

65.9%

21.9%

EBIT margin

23.1%

7.4%

Valuation

P/E

25.0x

12.3x

EV/EBIT

16.2x

9.0x

P/FCF

22.7x

16.2x

Leverage

Net Debt/EBITDA 1.2x

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Specialty Retail Industry View: In-Line

Alex Straton

LULU stands out for its balanced LT growth oppty, best-in-

class margin profile, higher-income customer exposure, &

thoughtful int’l strategy. 4 key attributes set LULU apart

from Softlines peers. (1) Consistent, outsized top-line &

market share growth potential fueled by global

geographical expansion, broader & deeper category

penetration, and best-in-class product innovation. (2)

Materially higher OM than peers (e.g., low-20s%+ vs. peer

avg. MSD-HSD%) due to higher prices, largely core

assortment mix, and low relative discounting activity. (3)

Greater higher-income customer skew, providing some

insulation from the turbulent macro. (4) Thoughtful

approach to int’l expansion (including localized assortments,

robust testing, & methodical store growth, among others).

Top-line growth should outpace already-strong athleisure

growth, & profitability should consistently improve over

time. The activewear market is expected to grow at a +MSD-

HSD CAGR thru ‘26e, above apparel at +LSD. Importantly,

not only is LULU likely to benefit from this industry growth,

we believe its unique & innovative product assortment &

category expansion is likely to generate ongoing market

share gains, enabling an above market-growth rate MT.

Further, we expect consistent EBIT dollar growth as LULU

scales across geographies & categories. Taken together,

LULU’s ability to take share in an attractive category,

coupled with EBIT dollar growth, likely enables consistent

EPS growth & pushes shares higher LT.

Risk Reward: Overweight / Price Target $387

20

MasterCard (MA)

Value of Growth Analysis

123

350

+23

+203

0

50

100

150

200

250

300

350

400

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

50%

100%

150%

200%

250%

2017 2018 2019 2020 2021 2022 2023 2024 2025

company sector peer median

Sector Yardsticks

Sector Yardsticks

MasterCard Inc vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

16.6%

14.6%

Sales '23-'25 CAGR

13.3%

11.0%

Returns

RNOA

78.9%

14.1%

EBIT margin

58.1%

19.0%

Valuation

P/E

28.5x

17.0x

EV/EBIT

22.8x

15.9x

P/FCF

26.7x

16.9x

Leverage

Net Debt/EBITDA

0.1x

1.3x

MasterCard Inc

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Payments and Processing Industry View: Attractive

James Faucette

One of the best business models we've seen: As the second-

largest global card network (behind Visa), MA looks well

positioned to benefit from market share gains in particular

regions and consumer spending trends, which have been

resilient even through economic cycles. Similar to V, MA

should benefit from the return of cross-border travel, which

is still below the pre-Covid trend-line and comes with

higher-than-average yields.

New fintech players are enabling, not disrupting, Networks:

Given MA's largely fixed cost base, it sees declining cost per

transaction and steady uplift in operating margins as

volume grows. This, along with its enhanced fraud

capabilities and stickiness of consumer behavior, makes the

threat of disruption from new entrants fairly low, in our

view. Many of the new payment players tend to partner

with MasterCard and operate on its rails, given

MasterCard’s competitive cost structure and moat. These

partnerships with newcomers should continue to expand

Mastercard's TAM in the P2P and B2B payment markets.

B2B supports longer term opportunity: MasterCard is likely

to be a key player in the evolution of B2B payments over

the next 3-10 years. Its solutions position it well to capture

the ~$40T of B2B flows (e.g. corporate cards, virtual cards,

cross-border, accounts payable) as 45% of B2B payments

are still made via checks. Many of these opportunities also

can use card products and solutions that exist today, and do

not require significant incremental investment.

Risk Reward: Overweight / Price Target $438

21

Microsoft (MSFT)

Value of Growth Analysis

99

279

+15

+165

0

50

100

150

200

250

300

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

20%

40%

60%

80%

100%

120%

140%

160%

2017 2018 2019 2020 2021 2022 2023 2024 2025

company sector peer median

Sector Yardsticks

Microsoft vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

18.4%

23.8%

Sales '23-'25 CAGR

14.6%

14.6%

Returns

RNOA

64.7%

59.0%

EBIT margin

41.5%

27.0%

Valuation

P/E

29.6x

30.1x

EV/EBIT

23.1x

23.1x

P/FCF

31.4x

29.7x

Leverage

Net Debt/EBITDA 1.5x

Microsoft

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Software Industry View: Attractive

Keith Weiss

Exceptional secular growth exposure… Durability of

Growth, Margin Expansion, and Capital Return. With over

70% of revenue derived from Commercial businesses and

over 95% of Commercial revenue being recurring in nature

(mostly ratable subscription revenue or term-based licenses

associated with multi-year Enterprise License Agreements),

growth is driven by strong commercial demand pools,

powered by strong secular tailwinds and accompanied by

attractive unit economics. According to our CIO Survey, CIOs

expect Microsoft to be the leading budget share gainer as

workloads shift to the cloud over the next 3 years. Strong

survey results are a reflection of Microsoft’s strong

positioning as a beneficiary of key secular trends and CIO

priorities across AI/ML, Cloud, Security, Analytics and Digital

Transformation. The accelerating pace of innovation around

adding AI-powered capabilities into the portfolio with

announcements including Microsoft 365 Copilot, Github

Copilot, New Bing, and more, support momentum across the

business and buttress durable growth.

…at an exceptional price. With a medium-term view,

double-digit top-line growth (supported by secular

tailwinds, easing compares, price increases, & waning FX

headwinds) outpaces COGS growth to deliver mid-teens

gross profit dollar growth. Prudent opex spend and focus

on efficiency at scale drives mid-to-high teens operating

income growth. Share repurchases and a dividend yield push

the total return profile to high-teens. With Microsoft on a

path to deliver 5 quarters of accelerating EPS growth from

the Q2 trough, we see an opportunity to accumulate MSFT

shares, which are significantly undervalued at current levels,

in our view.

Risk Reward: Overweight / Price Target $307

22

Motorola Solutions (MSI)

Value of Growth Analysis

123

264

+14

+127

0

50

100

150

200

250

300

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

20%

40%

60%

80%

100%

120%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

Motorola Solutions Inc vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

11.4%

11.6%

Sales '23-'25 CAGR

5.5%

5.3%

Returns

RNOA

40.5%

18.2%

EBIT margin

27.1%

17.8%

Valuation

P/E

23.7x

16.2x

EV/EBIT

19.3x

12.6x

P/FCF

27.7x

21.8x

Leverage

Net Debt/EBITDA

1.4x

1.3x

Motorola Solutions Inc

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Telecom & Networking Equip. Industry View: Cautious

Meta Marshall

Dominant radio market position. MSI has a dominant

market share in radios, a defensive exposure given the

segment's ties to government spending. Land mobile radio

(LMR) accounts for the vast majority of revenue (~77% in

2022) and MSI maintains ~40%+ share of this ~$11bn+

mission-critical TAM. With the LMR / push-to-talk market

expected to grow for several years and high barriers to

entry given LMR's mission-critical nature, we believe MSI has

an attractive competitive position in its core market. We also

favor MSI's ability to optimize around this market position

(i.e., consistently expanding operating margins Y/Y) and

generate cash to fund share repurchases / dividends.

TAM expansion opportunities bolster competitive

positioning. We see a path toward long-term re-rating via

MSI leveraging cash flow generation and its footprint in

LMR/command center into winning in next-generation public

safety tech, including video security. We estimate end

markets within Video are higher-growth than LMR and

should accelerate MSI's growth as the segment becomes

larger in the overall revenue mix (with tailwinds from

displacement of offerings from China). Advancements

within LMR (APX Next portfolio) should create holistic

secular tailwinds for growth. Overall, more investment in

security by schools, public places, and workplaces broaden

investment in MSI products.

Compelling longer-term software story offers additional

upside. MSI has invested in a more robust command center

software platform to build on its leading share in 911.

Increasing use of analytics software for video surveillance

use cases should support the software portfolio.

Risk Reward: Equal-Weight / Price Target $260

23

MSCI Inc. (MSCI)

Value of Growth Analysis

121

537

+22

+393

0

100

200

300

400

500

600

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

10%

20%

30%

40%

50%

60%

70%

80%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

MSCI Inc. vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

17.6%

13.7%

Sales '23-'25 CAGR

12.1%

7.0%

Returns

RNOA

46.0%

20.2%

Valuation

P/E

40.3x

31.7x

P/B 9.5x

MSCI Inc.

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e. (P/B could be NM) Source: Morgan

Stanley Research

Business & Education Services Industry View: In-Line

Toni Kaplan

Strong competitive advantages. MSCI is a leading provider

of benchmark indices, portfolio analytics, and ESG research

for investment institutions. MSCI has an attractive business

model with a scalable infrastructure, recurring revenue, and

a strong brand name. MSCI’s business model is extremely

scalable – once an index product is developed, little further

capital investment is required. As a result, MSCI has the

highest EBITDA margins within our subscription-based

Information Services coverage (60% vs. 43% avg), and we

expect margins to expand going forward driven by

operational leverage and strong expense management.

MSCI operates in the highly attractive index industry with

"must-have" data sets, pricing power, and operational

leverage. The index industry benefits from a network effect

and high switching costs. Once a fund manager selects an

MSCI index to use as a benchmark, it is disruptive to change

it, which promotes stickiness. Strong brand recognition,

large ecosystems surrounding flagship indices, and frictions

make it difficult or costly for asset managers to switch

benchmarks. Strong tailwinds in the index industry and

execution have led to the highest expected organic growth

rate in '24 within our coverage (12% vs. 7.5%)

MSCI is the leading provider of ESG/climate content and

indices with significant market share. MSCI benefits from

having a first mover advantage and continues to invest

heavily in the space to maintain its leading position. MSCI

has 55% share of US ESG ETFs vs. 13% for the next largest

competitor due to its significant head start.

Risk Reward: Overweight / Price Target $543

24

NextEra Energy (NEE)

Value of Growth Analysis

34

76

+3

+38

0

10

20

30

40

50

60

70

80

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

1%

2%

3%

4%

5%

6%

7%

8%

9%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

NextEra Energy Inc vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

9.2%

7.3%

Sales '23-'25 CAGR

6.7%

3.3%

Returns

RNOA

6.5%

5.7%

EBIT margin

32.2%

20.9%

Valuation

P/E

24.4x

17.4x

EV/EBIT

26.3x

19.6x

P/FCF

(38.1x)

(23.5x)

Leverage

Net Debt/EBITDA

5.1x

5.5x

NextEra Energy Inc

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Diversified Utilities / IPPs Industry View: Attractive

David Arcaro

Highly differentiated, sustainable competitive position in

the renewables market. This US developer of wind, solar,

and storage assets benefits from economies of scale that

offer the company buying power in the supply chain,

improved transmission interconnect positions, operating

cost efficiency, and robust access to debt and tax equity

capital. NEE has a very long track record in the industry,

building long-term customer relationships with repeat

buyers and a reputation for strong execution. The

company's large existing asset base offers improved market

and geographic knowledge of wind/solar resources. And the

next key area for differentiation is in software and analytics,

with internal software capabilities to integrate complex

storage assets, offer sophisticated predictive maintenance,

optimize site design and power output, and map out

customer generation portfolios and decarbonization targets

to better tailor products.

New growth opportunities with attractive returns and wide

moats stemming from the Inflation Reduction Act. Storage,

green hydrogen, and renewables repowering sre set to

benefit from new lucrative tax credits that unlock large

growth opportunities for new infrastructure. We see

prospects for NextEra to be among the leaders in building

out these new markets and capturing attractive low-risk

returns.

Risk Reward: Overweight / Price Target $97

25

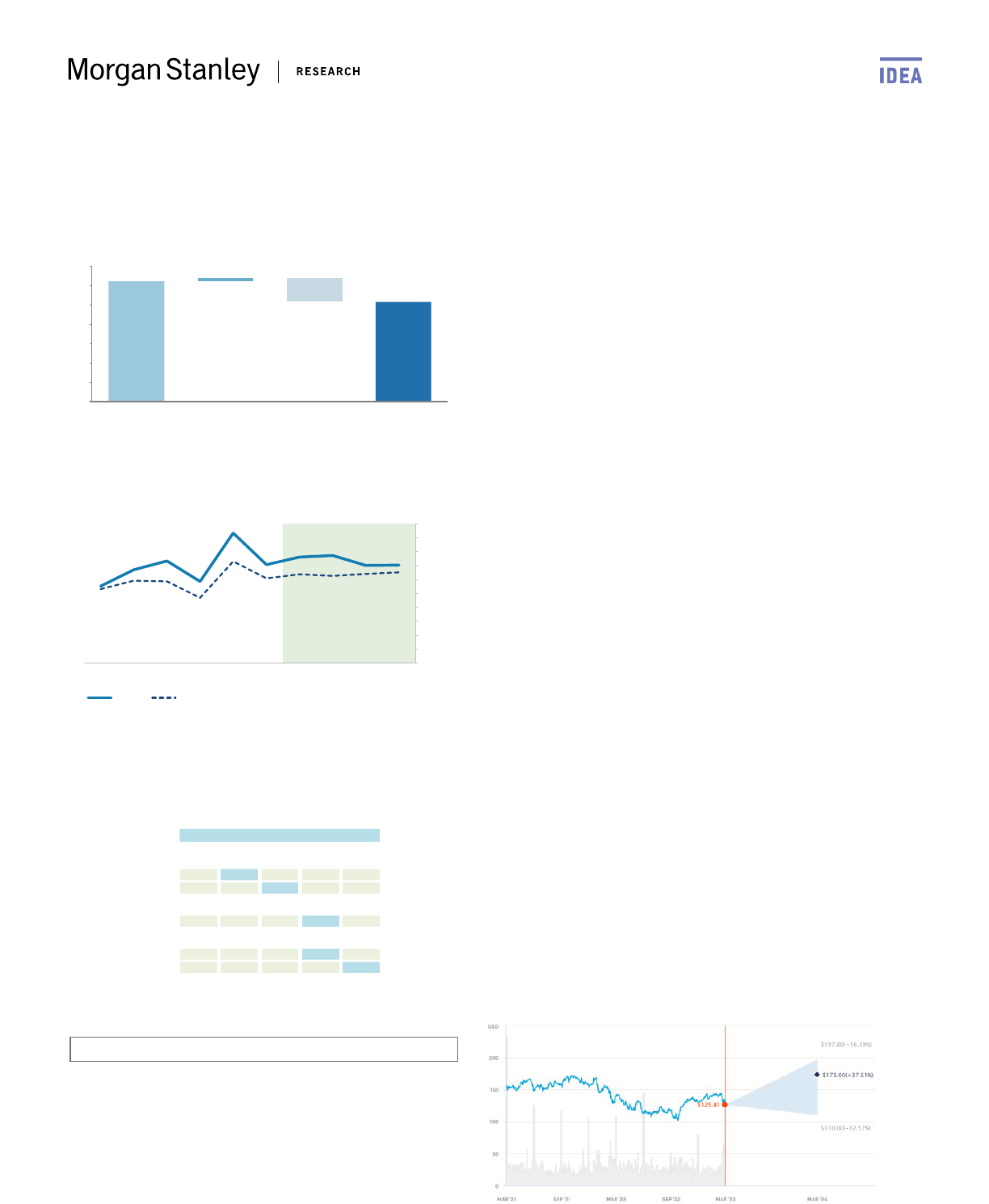

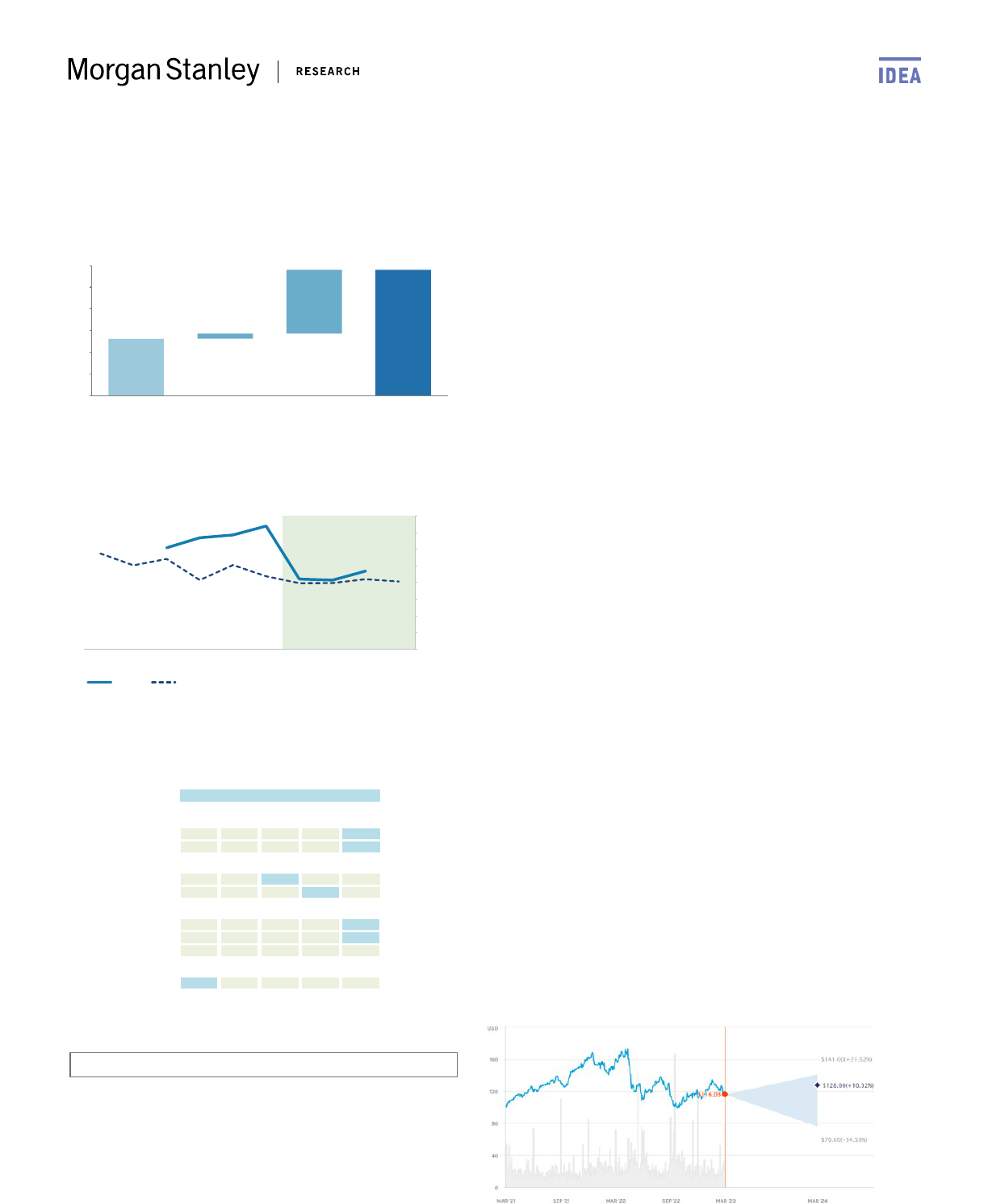

Nike (NKE)

Value of Growth Analysis

31

120

+9

+80

0

20

40

60

80

100

120

140

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

10%

20%

30%

40%

50%

60%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

Nike Inc. vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

28.1%

10.6%

Sales '23-'25 CAGR

11.1%

4.1%

Returns

RNOA

38.4%

21.9%

EBIT margin

13.1%

7.4%

Valuation

P/E

29.7x

12.3x

EV/EBIT

24.5x

9.0x

P/FCF

44.2x

16.2x

Leverage

Net Debt/EBITDA

0.0x

1.2x

Nike Inc.

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Branded Apparel & Footwear Industry View: In-Line

Alex Straton

NKE's DTC acceleration makes it one of the best-positioned

Softlines companies in the post-Covid era, in our view.

While we believe NKE remains in the early stages of its

transition from a traditional wholesaler to a digitally-led

direct to consumer (DTC) business, it has made impressive

progress so far, increasing DTC penetration by ~10 pts since

2019 (from 30% to ~40%). This DTC-first approach

enhances NKE’s LT market share, revenue, margin, & EPS

growth opportunity, making it one of the highest-growth

consumer names as well as one of the few to benefit from

the move to digital (~23% of ‘22 revenue vs. NKE’s ~40% LT

target).

The shift to DTC should materially improve NKE's financial

profile. Given its strong commitment to a DTC-first

approach, we expect NKE to continue to allocate its best

SKUs and focus its marketing efforts on DTC, leading the

most profitable customers to the channel. Therefore, not

only do we expect the DTC strategy to drive revenue

growth as NKE recognizes the full wholesale to retail

markup for itself, but it should also improve profitability.

We estimate a ~10 point uplift to GM, which mgmt. expects

to flow through to the operating profit line as the business

scales.

Strong activewear growth & favorable secular trends

should further support NKE's LT growth. Additionally,

trends such as (1) the activewear market outgrowing general

footwear & apparel, (2) increased consumer focus on health

& wellness, & (3) the ongoing casualization of fashion,

should further bolster NKE's LT growth opportunity.

Risk Reward: Overweight / Price Target $140

26

Northrop Grumman (NOC)

Value of Growth Analysis

288

444

+36

+119

0

50

100

150

200

250

300

350

400

450

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

2%

4%

6%

8%

10%

12%

14%

16%

18%

20%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

Northrop Grumman Corp. vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

17.3%

13.6%

Sales '23-'25 CAGR

8.7%

7.0%

Returns

RNOA

12.4%

12.1%

EBIT margin

10.6%

12.8%

Valuation

P/E

20.0x

20.0x

EV/EBIT

18.9x

18.2x

P/FCF

34.2x

24.7x

Leverage

Net Debt/EBITDA

1.9x

1.8x

Northrop Grumman Corp.

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Defense Industry View: Attractive

Kristine Liwag

A winning portfolio. Northrop Grumman (NOC) went from

Dark Horse of the Prime pack to the long-term Defense

name to own after winning two generational programs –

the B-21 bomber and Sentinel intercontinental ballistic

missile. These two franchises offer decades of earnings

visibility for NOC and will serve as the backbone of the US

nuclear deterrent. The 2018 acquisition of Orbital ATK also

helped NOC round out an end-to-end Space portfolio

(~35% of total revenue) that is unrivaled, in our view, by

peers. With its B-21 and Sentinel wins and continued

Pentagon investment in the Space domain (~20% YoY

growth in FY24 budget request / ~22% trailing 5-year CAGR),

we see NOC’s portfolio particularly well-aligned to current

and emerging Defense Department priorities (for more, see

Generational Investments in Defense). We see Defense in

the early inning of an upcycle fueled by a deteriorating

global security environment and pressing Pentagon

modernization requirements – both of which should provide

strong tailwinds for NOC’s business.

Peer-high growth. NOC’s strong portfolio alignment, in our

view, should drive peer-high growth through 2025 (~7.5%

CAGR 2022-25e). We also expect a ~29% FCF CAGR though

2025 as Section 174 headwinds ease and capex moderates

after an elevated investment period driven by significant

new program wins. NOC plans to return >100% of FCF to

shareholders in 2023 and we expect the management team

– which we view as best-in-class – to continue to run its

shareholder-friendly capital deployment playbook at least

through mid-decade.

Risk Reward: Overweight / Price Target $601

27

Old Dominion Freight Line (ODFL)

Value of Growth Analysis

120

332

+6

+206

0

50

100

150

200

250

300

350

Current Earnings Growth in Explicit Forecast

Period

Long-Term Growth Current Price

Return on Net Operating Assets (RNOA) Analysis

0%

5%

10%

15%

20%

25%

30%

35%

40%

45%

50%

2017 2018 2019 2020 2021 2022 2023 2024 2025 2026

company sector peer median

Sector Yardsticks

Sector Yardsticks

Old Dominion Freight Line Inc vs. Sector Peers

Peer

percentile range (vs. sector peers) median

Growth

0 20 40 60 80 100

EPS '23-'25 CAGR

9.4%

10.5%

Sales '23-'25 CAGR

6.5%

4.5%

Returns

RNOA

38.1%

15.4%

EBIT margin

29.0%

10.0%

Valuation

P/E

27.2x

14.8x

EV/EBIT

19.8x

12.2x

P/FCF

40.3x

14.6x

Leverage

Net Debt/EBITDA 1.7x

Old Dominion Freight Line Inc

Note: Sector Yardstick metrics - Returns: 2023e; Valuation: 2023e; Leverage 2023e. (Net Debt/EBITDA

and P/FCF could be NM) Source: Morgan Stanley Research

Freight Transportation Industry View: In-Line

Ravi Shanker

We view ODFL as a best-in-class franchise across Freight

Transportation, if not a wider sample set. Very few

companies can match ODFL’s 15+ year track record of

growing revenues at a 10%+ CAGR (4x+ GDP), while

improving margins 1500 bp (with op. margins now topping

30%) to drive EPS growth CAGR of 20%+. The stock has

been one of the best performing in the S&P 500 in that

period (up over 3,600% since 2008), as the company

solidifies its position amongst investors as a “core holding”.

The best house on a rapidly improving block. While the

cyclicality and industry dynamics of Trucking may initially

give some investors pause, we have been structurally

positive on Trucking for a while. A number of structural

catalysts including new regulations in the last 5 years (that

have introduced barriers to entry in the business for the

first time), share gains from other transportation modes

(supply chains getting shorter, faster, and tighter favors

Trucking), industry consolidation as well as long term

favorable structural shifts like nearshoring, electrification,

and autonomous trucking, are driving compounding earnings

growth in the space. As the best house on this block, ODFL

is very well positioned, in our view.

Deeply Entrenched Strengths. ODFL's key strengths include

being in the sweet spot of scale, owning more of their real

estate footprint than peers, investing in growth through the