We are at a pivotal moment in the energy

transition—balancing the need to address climate

change while securing energy independence and

ensuring national security.

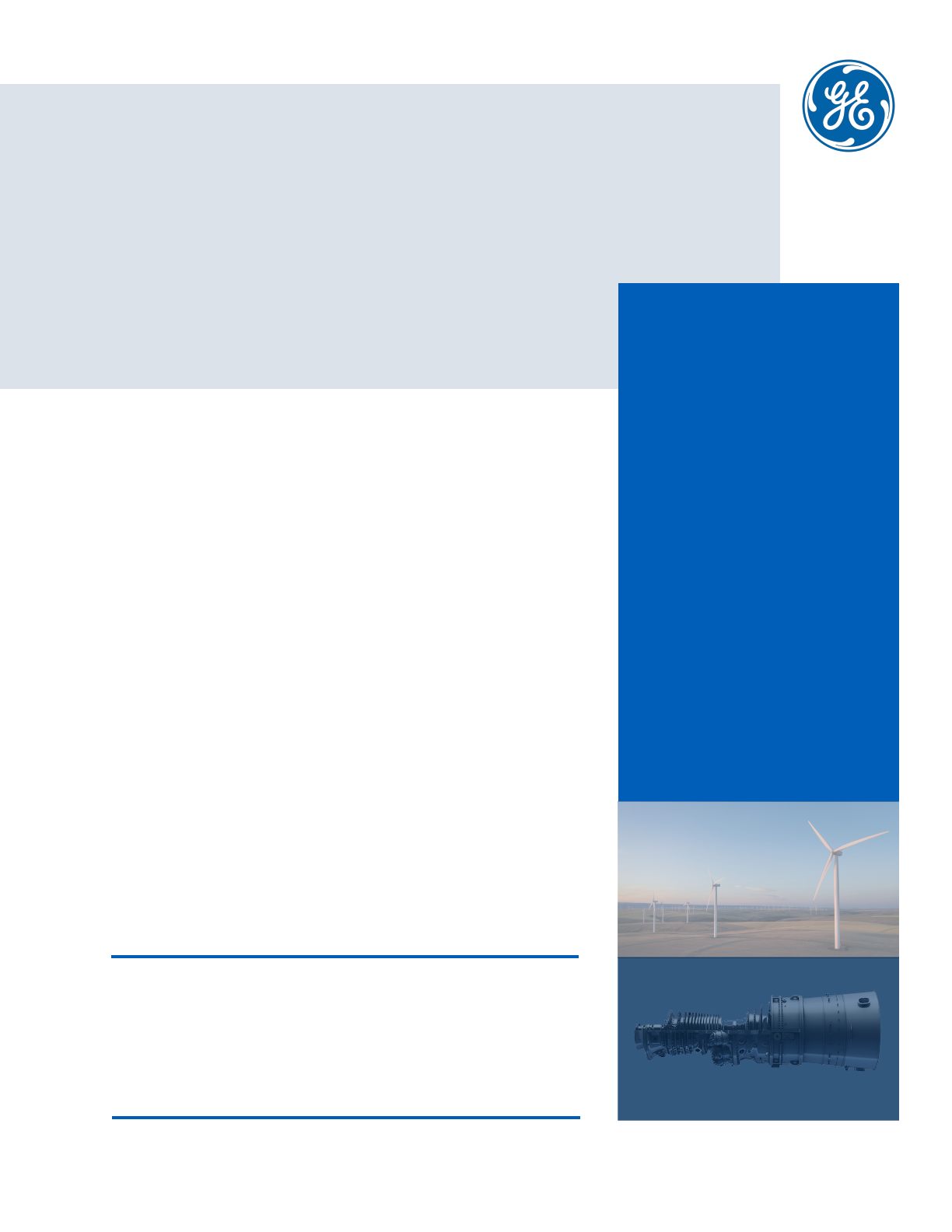

Together with our customers, GE provides one-third of the world’s

electricity. As the only U.S. company with expertise across wind, gas,

hydro, grid, and nuclear, GE supports clean energy tax credits to ensure

success in decarbonization efforts and continued U.S. leadership in

energy manufacturing and jobs – both today and in the future.

Investing in

American Energy

Key to our success is the urgent enactment of strong

policies that complement the private sector’s efforts to

innovate and build a clean, energy-independent future

for the country – restoring the wind production tax

credit and enhancing the tax credit for carbon

sequestration.

Strengthen national security by

bolstering reliable energy in the U.S.

Reinforce U.S. energy independence

by providing support to a variety of

energy resources

Build a strong domestic supply

chain to lead the energy transition

globally

Ensure continued U.S. leadership in

manufacturing and breakthrough

technologies critical to meeting our

decarbonization targets

Create domestic jobs

Securing long-term

clean energy tax

credits will help:

An all-inclusive approach across the energy industry avoids the

arbitrary selection of winners and losers and gives room for markets to

work. In addition to the wind production tax credit (PTC) and 45Q tax

credit for carbon sequestration detailed below, a comprehensive

package of clean energy tax credits would support diverse generation

sources, such as wind, solar, and nuclear, while creating new incentives

for storage (including pumped hydro storage), hydrogen, and

transmission, as well as manufacturing credits.

We can, and should, achieve these goals together. The geopolitical

effects of the crisis in Ukraine only strengthen the urgency to achieve

energy independence and resilience.

Wind PTC

45Q

“I think there's a bipartisan consensus… that we need to do

something not only with respect to wind and the production

tax credit, but frankly a range of other incentives, including

45Q… We just need to have that policy certainty.”

- GE CEO Larry Culp at theMilken Institute Global Conference

Carbon management is a critical component of an

effective climate strategy and represents an

opportunity for the U.S. to lead the development of

breakthrough technologies. These technologies will

enable a diverse, reliable, and affordable mix of

power generation, including natural gas and

hydrogen, sustaining jobs and creating new

economic opportunity. They will play a key role in

meeting our climate goals as one of several

solutions to tackle emissions from the industrial and

power sectors, according to the International

Energy Agency.

Proposed enhancements to the Section 45Q tax

credit complement important carbon management

demonstration programs led by the U.S. Department

of Energy. These updates to the tax code will

mobilize and sustain the necessary private capital to

propel this innovative sector forward, and drive

wider, scalable deployment of commercially viable

projects that deliver substantial emission reductions.

This will enable continued investments in the

technologies needed to achieve energy

independence, strengthen national security,

create jobs and technologies here at home,

ensure our competitiveness with foreign

manufacturers, and make our climate targets

achievable.

Enhancing the Tax Credit

for Carbon Sequestration

The wind PTC has been critical to accelerating decarbonization,

building a strong domestic supply chain, and ensuring U.S.

leadership in the industry; however, the PTC expired for all renewable

energy technologies commencing construction after December 31,

2021, significantly slowing new U.S. wind projects and investments.

Already, the wind industry is feeling the effects of a lack of policy

certainty around the PTC that has resulted in decision-making on

projects being deferred. According to a leading market expert, the U.S.

market will decline from 18 gigawatts of wind installations in 2020 to a

forecast number of 11 gigawatts for 2022.¹ The potential employment

fallout from failing to support the U.S. wind industry is clear.

Restoring the Wind

Production Tax Credit (PTC)

A look at the economic potential of the

wind industry shows:

GE urges Congress and the

Biden administration to

work together to enact

these policies as soon as

possible to provide the U.S.

energy industry with

certainty and support.

For more information on GE’s perspective on the

energy transition and expertise across energy sources,

please visit: ge.com/about-us/energy-transition.

Wind technician is the

The wind sector supported more than

more than $291 billion in domestic

investments in wind.⁴

second-fastest growing job

in America, with employment of wind turbine

technicians projected to grow 68% from 2020-30

compared to the 8% nationwide average.²

115,000 jobs in 2020.³

Accelerating the rate of clean energy deployment to account

for 70% of electricity generation by 2030 would result in

The global effects of this slowdown in the U.S. wind industry are

readily apparent. As a recentBloomberg article states,

"aslowdown in U.S. turbine manufacturing risks further weakening

the country’s energy independence. ... Now, Chinese competitors

see opportunity in the wind market. Companies including Xinjiang

Goldwind Science & Technology Co., Envision Group and Ming

Yang Smart Energy Group Ltd. plan to invest in factories abroad to

take market share."

¹ Wood Mackenzie Q1 2022 Global Wind Power Market Outlook Update

² U.S. Bureau of Labor Statistics

³ American Clean Power Association’s 2021 Clean Energy Labor Supply

⁴Ibid.