Page 1 of 7 CBP Form 3461 – Instructions (2/16)

DEPARTMENT OF HOMELAND SECURITY

U.S. Customs and Border Protection

CBP Form 3461 – Instructions

HEADER INFORMATION:

BLOCK 1 – PORT OF ENTRY

Record the U.S. port of entry code utilizing the Schedule D, Port Codes, listed in Annex C of the

Harmonized Tariff Schedule of the United States (HTS). The port is where the merchandise is released

under an immediate delivery permit. Use the following format: DDPP (no spaces or hyphens).

BLOCK 2 – BOND TYPE

Select the Bond Type from the available options: Singe Transaction Bond, Continuous Bond, or No Bond

Required.

BLOCK 3 – IMPORTER NUMBER

Check the appropriate box for IRS, SSN, or CBP Assigned number of the importer of record. Record the

number in the space provided.

BLOCK 4 – IMPORTER NAME AND ADDRESS

Record the name and address of the importer of record.

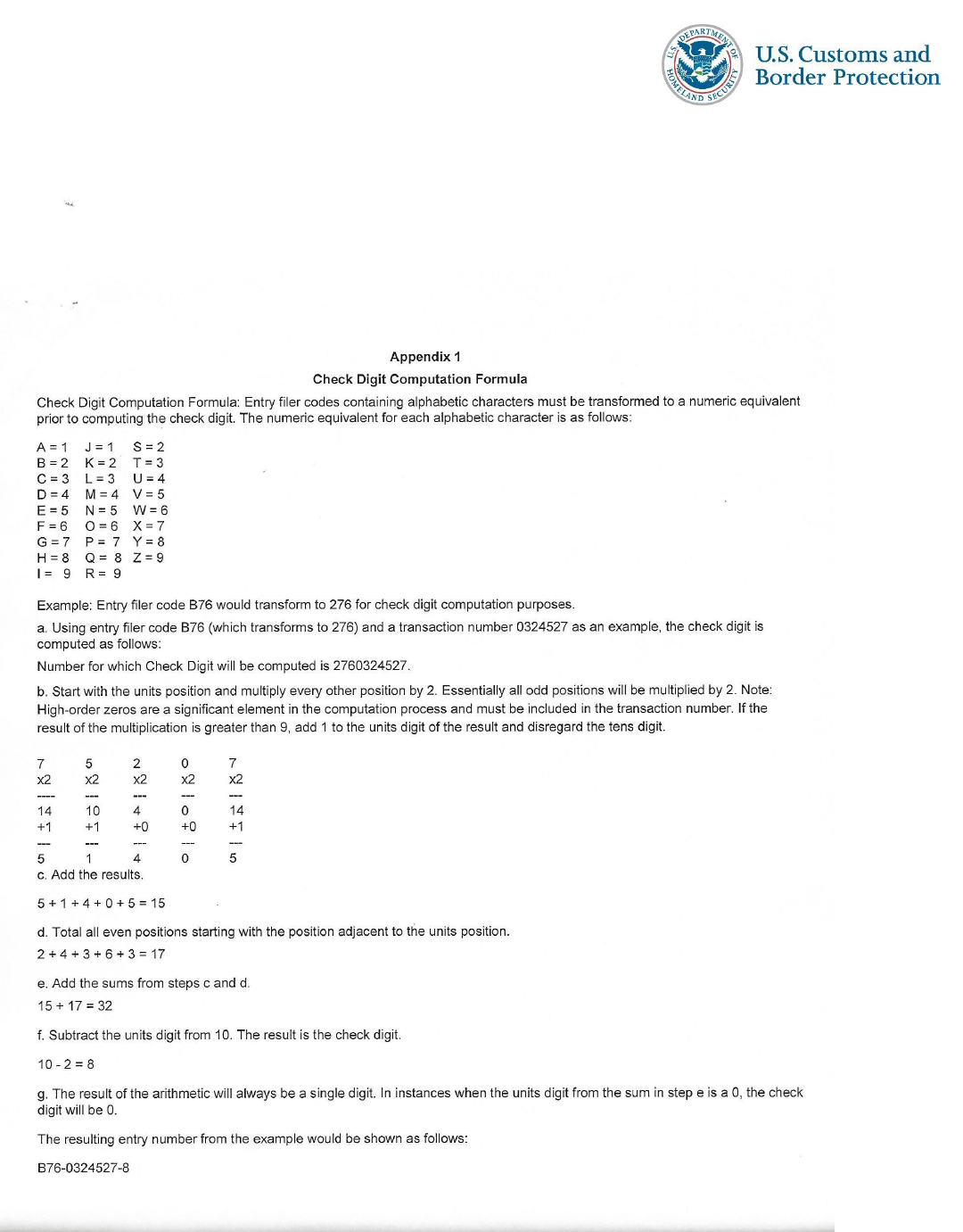

BLOCK 5 – ENTRY NUMBER

Record the 11 digit alphanumeric code. The entry number is comprised of the three-digit filer code,

followed by the seven-digit entry number, and completed with the one-digit check digit. The Entry Filer

Code represents the three-character alphanumeric filer code assigned to the filer or importer by CBP.

The Entry Number represents the seven-digit number assigned by the filer. The number may be assigned

in any manner convenient, provided that the same number is not assigned to more than one CBP Form

3461. Leading zeros must be shown. The check digit is computed on the previous 10 characters. The

formula for calculating the check digit can be found in Appendix 1.

BLOCK 6 – BOND VALUE

Provide the value of the bond in U.S. dollars, rounded off to the nearest whole dollar.

BLOCK 7 – ENTRY VALUE

Provide the value of the entry in U.S. dollars, rounded off to the nearest whole dollar.

BLOCK 8 – CES (Centralized Examination Site)

Provide the Facilities Information and Resources Management (FIRMS) Code of the desired devanning or

centralized exam site in case this shipment is subject to an intensive exam. If there is only one site, this

information is not required.

Page 2 of 7 CBP Form 3461 – Instructions (2/16)

BLOCK 9 - ENTRY TYPE

Record the appropriate entry type code by selecting the two-digit code for the type of entry summary

being filed. The first digit of the code identifies the general category of the entry (i.e., consumption = 0,

informal = 1). The second digit further defines the specific processing type within the entry category.

The following codes shall be used:

Consumption Entries

Free and Dutiable 01

Quota/Visa 02

Antidumping/Countervailing Duty (AD/CVD) 03

Foreign Trade Zone Consumption 06

Quota/Visa and AD/CVD combinations 07

Informal Entries

Free and Dutiable 11

Quota Other than textiles 12

Other Entries

Warehouse Entries 21

Re-Warehouse Entries 22

Temporary Importation Bond 23

Government Entries

Defense Contract Management Command (DCMAO NY) Military Only (P99 filer) 51

Any U.S. Federal Government agency (other than DCMAO NY) 52

Note: When the importer of record of emergency war materials is not a government

agency, entry type codes 01, 02, 03, etc., as appropriate, are to be used.

BLOCK 10 – ORIGINATING WAREHOUSE ENTRY NUMBER

Record the entry number of the originating warehouse entry.

BLOCK 11 – SURETY CODE

Provide the surety code. The surety code identifies the surety company, authorized by the Department

of the Treasury, for the bond.

BLOCK 12 – PORT OF UNLADING

Record the U.S. port code where the merchandise was unlade from the importing vessel, aircraft or

train. Do not provide the name of the port instead of the numeric code. For merchandise arriving in the

U.S. by means of transportation other than vessel, rail or air, leave blank. For merchandise arriving in the

customs territory from a U.S. FTZ, leave blank.

BLOCK 13 – MODE OF TRANSPORTATION

Select the Mode of Transportation from the available options: Air, Ocean, Rail, Truck, Hand Carry,

Pipeline, or Other.

Page 3 of 7 CBP Form 3461 – Instructions (2/16)

BLOCK 14 – LOCATION OF GOODS

Record the Facilities Information and Resources Management (FIRMS) codes where the goods are

available for examination. Where the FIRMS Code is not available, record the name and physical location

of the goods.

BLOCK 15 – G.O. NUMBER

If the shipment has been placed in a general order warehouse, enter the G.O. number (e.g., 2016--

0638).

BLOCK 16 – CONVEYANCE NAME OR FTZ ZONE ID

For entry type 06, list the Foreign Trade Zone ID. Enter the FTZ project number (2 digits); Subzone

number or General Purpose Zone Acreage Site number (3 characters); Subzone Site number (2 digits) as

applicable, in one of the following format(s), including any needed leading zeros:

FTZ0260A01 - FTZ 26, Subzone A, Subzone Site 01

FTZ02610 - FTZ 26, General Purpose Zone Acreage Site 10

HEADER REFERENCE INFORMATION – FILER DEFINED:

BLOCK 17 – REFERENCE ID CODE

Provide the Reference ID Code.

BLOCK 18 – REFERENCE ID NUMBER

Provide the Reference ID Number up to 50 characters.

HEADER PARTIES:

BLOCK 19 – HEADER PARTY TYPE

Select the Header Party Type from the available options. Use a separate line for each Header Party

Type. Note: The Header Parties must apply to the entire entry. If not, skip to line information (Block

24).

BLOCK 20 – HEADER PARTY TYPE NAME/ADDRESS

Provide the name and address of the selected Header Party.

BLOCK 21 – HEADER ID NUMBER, IF APPLICABLE

Check the appropriate box to indicate if you are providing an IRS, SSN, or CBP Assigned number and

record the number in the space provided.

CERTIFICATION:

BLOCK 22 – CERTIFICATION

Record the name, job title, and signature of the applicant (i.e. owner, purchaser, or agent). Record the

month, day, and year (MM/DD/YYYY) the application is signed. When the entry/immediate delivery

consists of more than one page, the signature, job title and date must be recorded on the first page.

Facsimile signatures are acceptable. Certification is the electronic equivalent of a signature for data

transmitted through ABI.

Page 4 of 7 CBP Form 3461 – Instructions (2/16)

BLOCK 23 - CBP USE ONLY

LINE INFORMATION:

BLOCK 24 – LINE INFORMATION

Provide the following information for each line.

HTS CODE

Provide the 10-digit Harmonized Tariff Schedule of the U.S. (HTS) Number. If more than one HTS

number is required, follow the reporting instructions in the statistical head note in the appropriate HTS

section or chapter. If the Entry type is 23 (TIB), at least two HTS codes must be provided per line.

HTS/COMMERCIAL/DESCRIPTION

If HTS code is known, check the HTS box and provide the HTS code. If the HTS code is not known, check

the Commercial/Invoice box and provide a description of the merchandise.

LINE ITEM QUANTITY

For Entry type 06, enter the quantity in units of this HTS Line to be removed from the FTZ and entered

into the Commerce of the U.S. Quantity entered must be a whole number and greater than zero. For all

other entry types leave blank.

FTZ FILING DATE

For Entry type 06, enter the date the merchandise was granted Privileged Foreign Status by CBP. For all

other entry types leave blank.

VALUE

Provide the value of the line in U.S. dollars, rounded off to the nearest whole dollar. A value must be

provided for each HTS code entered.

COUNTRY OF ORIGIN

Record the country of origin utilizing the International Organization for Standardization (ISO) country

code located in Annex B of the HTS. The country of origin is the country of manufacture, production, or

growth of any article. If the article consists of material produced, derived from, or processed in more

than one foreign territory or country, or insular possession of the U.S., it shall be considered a product

of that foreign territory or country, or insular possession, where it last underwent a substantial

transformation. When merchandise is invoiced in or exported from a country other than that in which it

originated, the actual country of origin shall be specified rather than the country of invoice or

exportation.

SPECIAL NOTE FOR GOODS OF CANADIAN ORIGIN: The ISO country code “CA” for Canada for goods of

Canadian Origin will no longer be reported as a country of origin. As of May 15, 1997, the Canadian

Province codes will replace the code “CA.” The following conditions in which the “CA” is acceptable, in

addition to the Province Codes:

1. Withdrawals of goods from warehouses for consumption.

2. Entries of goods from Foreign Trade Zones into the Commerce of the U.S.

3. Informal entries.

4. Imports of Canadian origin arriving from countries other than Canada.

Page 5 of 7 CBP Form 3461 – Instructions (2/16)

5. Cargo selectivity entries not certified from entry summary, i.e. full

cargo selectivity entries provided with entry data only or border cargo selectivity entries.

Data elements intended specifically for other government agencies, e.g. FDA, DOT, and EPA

which only allow “CA” to be used as the origin code. Additional information related to reporting

the correct ISO country code for goods of Canadian origin can be found in CSMS#97-000267 and

02-000071.

ZONE STATUS

For Entry type 06, select P for Privileged Foreign or N for Non-privileged Foreign. For all other entry

types leave blank.

LINE PARTY TYPE

Select the Line Party Type from the available options. Use a separate line for each Line Party Type.

LINE NAME/ADDRESS

Provide the name and address of the selected Line Party.

LINE ID NUMBER, IF APPLICABLE

Check the appropriate box to indicate if you are providing an IRS, SSN, or CBP Assigned number and

record the number in the space provided.

BILL OF LADING INFORMATION:

BLOCK 25 – NON-AMS

Check the box to indicate if the Bill of Lading is not automated.

BLOCK 26 – SPLIT BILL

Check the box to indicate if the bill is a split bill.

BLOCK 27 – BOL TYPE

Select the Bill of Lading type from the available options: In-Bond, Master, House, or Regular/Simple.

BLOCK 28 – SCAC/CARRIER ID

For merchandise arriving in the U.S. by air, record the two digit IATA alpha code corresponding to the

name of the airline which transported the merchandise from the last airport of foreign lading to the first

U.S. airport of unlading. If the carrier file does not contain a specific air carrier’s code, write the

designation “*C” for Canadian airlines, “*F” for other foreign airlines, and “*U” for U.S. airlines. These

designations should be used only for unknown charter and private aircraft. When a private aircraft is

being entered under its own power (ferried), the designation “**” will be used. For merchandise arriving

in the U.S. by means of transportation other than vessel or air, leave blank. Do not record the name of a

domestic carrier transporting merchandise after initial unlading in the U.S. For merchandise arriving in

the customs territory from a Foreign Trade Zone (FTZ), insert “FTZ” followed by the FTZ number. Use

the following format: FTZ NNNN.

BLOCK 29 – IN-BOND NUMBER

Provide the in-bond number.

BLOCK 30 – BOL NUMBER

Page 6 of 7 CBP Form 3461 – Instructions (2/16)

Record the number listed on the manifest of the importing carrier. Provide

the Bill of Lading number.

BLOCK 31 – ENTERED QUANTITY

Report the entered quantity for each IT/BL/AWB covered by this entry. The quantity reported should be

at the most detailed level of the shipment being reported. (The quantity being reported is the smallest

exterior packaging unit.) If the entry covers the entire bill of lading, AWB, or in-bond shipment, the

quantity reported will be the total quantity. If the entry is for a house bill, both the master bill and house

bill will be shown in Block 29, but the only quantity reported will be the house bill quantity.

BLOCK 32 – UNIT OF MEASURE

Provide the unit of measure code.

BLOCK 33 – VOYAGE/FLIGHT/TRIP

Provide the voyage number if arrival by vessel, the flight number if arrival by air, and the trip number if

arrival by land of the importing carrier which brought the merchandise into the United States.

BLOCK 34 – CONVEYANCE NAME

Provide the name of the vessel, airline, truck or rail.

BLOCK 35 – ARRIVAL DATE

Provide the month, day, year (MM/DD/YYYY) the merchandise arrived at a U.S. port of entry. For pre-

filed entries, use the scheduled date of arrival. For merchandise arriving by vessel, the arrival date is the

date the vessel enters the port limits with the intent to unlade. For merchandise arriving by air, the

arrival date is the date the air carrier landed within the port. For merchandise arriving by truck or rail,

the arrival date is the date the conveyance entered the Customs territory of the United States. For

merchandise arriving by in-bond, the date to be used is the estimated date of arrival at the port of

destination.

NOTE: For additional HTS lines, In-Bonds, and/or BOLs please use CBP Form 3461C.

Page 7 of 7 CBP Form 3461 – Instructions (2/16)