1

month marked the end to the

organizational simplification we

announced in September. The

result is a cleaner, simpler

management structure that fully

aligns to and facilitates our

strategy. It will also help us

execute our Transformation,

progress as we retire multiple

legacy platforms, streamline

end-to-end processes, and

strengthen our risk and control

environment. This is necessary

to both meet the expectations

of our regulators and also to

serve our clients more

effectively.

With revenue up 8%, Services

continues to perform well and

generate very attractive returns.

Markets bounced back from a

good client activity in Equities

and Spread Products. The

rebound in Banking gained

speed where near-record levels

of investment grade debt

issuance helped increase

revenues by 49%. In Wealth, we

grew fees and gathered more

than an estimated $22 billion of

net new assets over the past 12

months. U.S. Personal Banking

had double-digit revenue

growth for the sixth straight

quarter, where we see

momentum across both our

card business and solid

engagement in our digital

payment offerings.

Our balance sheet is strong

across the board, an intentional

result of our high-quality assets,

robust capital and liquidity

positions, and rigorous risk

management. We returned $1.5

billion in capital to our common

shareholders while increasing

our CET1 ratio to 13.5%. With

the organizational simplification

behind us and a good quarter

under our belt, we have started

this critical year on the right

CEO COMMENTARY

For Immediate Release

Citigroup Inc. (NYSE: C)

April 12, 2024

FIRST QUARTER 2024 RESULTS AND KEY METRICS

RETURNED ~$1.5 BILLION IN THE FORM OF COMMON DIVIDENDS AND

REPURCHASES

PAYOUT RATIO OF 49%

(3)

BOOK VALUE PER SHARE OF $99.08

TANGIBLE BOOK VALUE PER SHARE OF $86.67

(4)

New York, April 12, 2024 Citigroup Inc. today reported net income for the first

quarter 2024 of $3.4 billion, or $1.58 per diluted share, on revenues of $21.1 billion.

This compares to net income of $4.6 billion, or $2.19 per diluted share, on revenues

of $21.4 billion for the first quarter 2023.

Revenues decreased 2% from the prior-year period, on a reported basis. Excluding

divestiture-related impacts of $1 billion, primarily consisting of the gain from the

sale of the India consumer business

(5)

in the prior-year period, revenues were up 3%

year over year. This increase in revenues was driven by growth across Banking, U.S.

Personal Banking (USPB) and Services, partially offset by declines in Markets and

Wealth.

Net income of $3.4 billion decreased from $4.6 billion in the prior-year period,

primarily driven by higher expenses, higher cost of credit and the lower revenues.

Earnings per share of $1.58 decreased from $2.19 per diluted share in the prior-year

period, reflecting the lower net income.

Percentage comparisons throughout this press release are calculated for the first

quarter 2024 versus the first quarter 2023, unless otherwise specified.

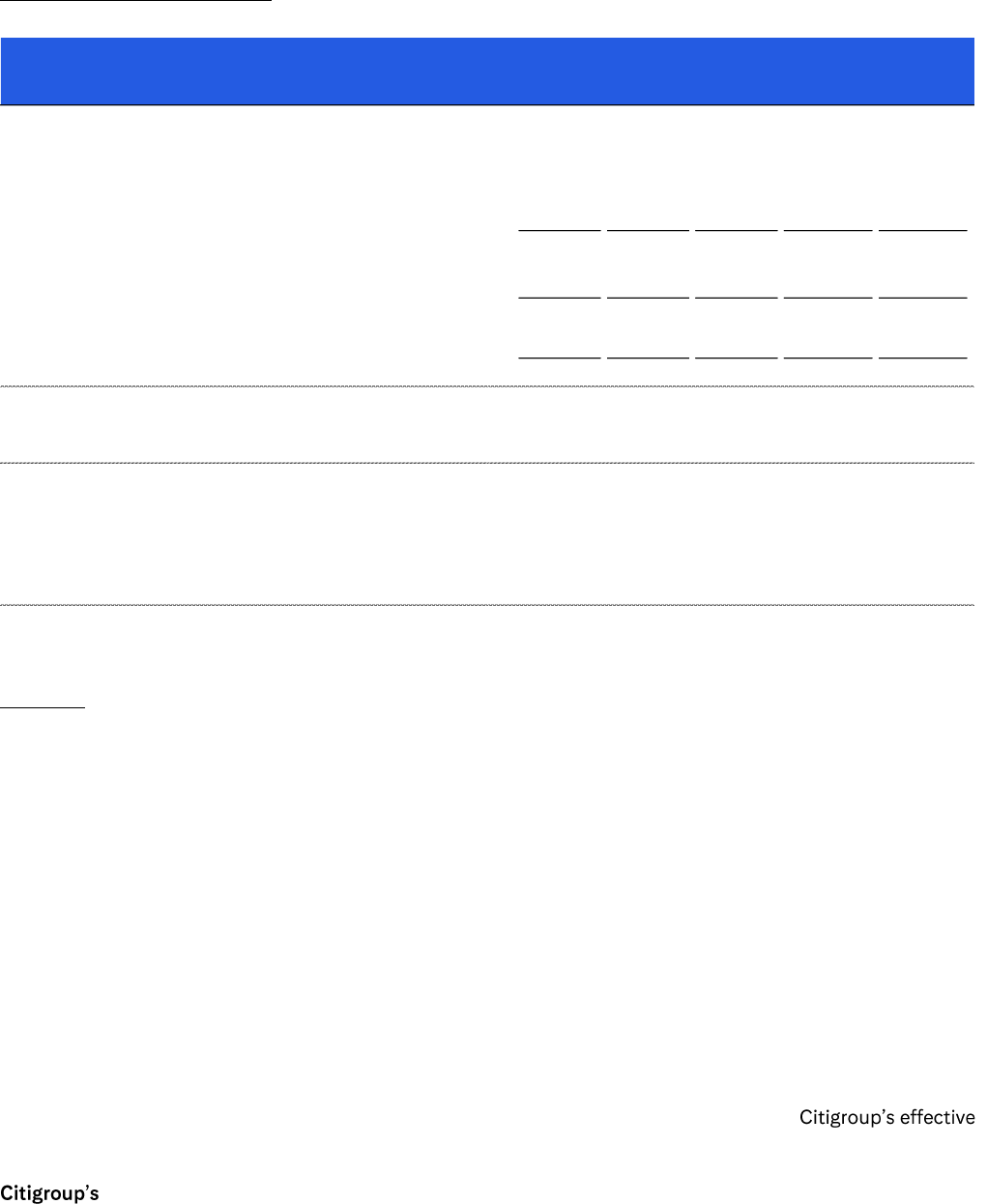

1Q

Revenues

$21.1B

1Q Net

Income

$3.4B

1Q

EPS

$1.58

1Q ROE

6.6%

1Q RoTCE

7.6%

(1)

CET1

Capital

Ratio

13.5%

(2)

2

First Quarter Financial Results

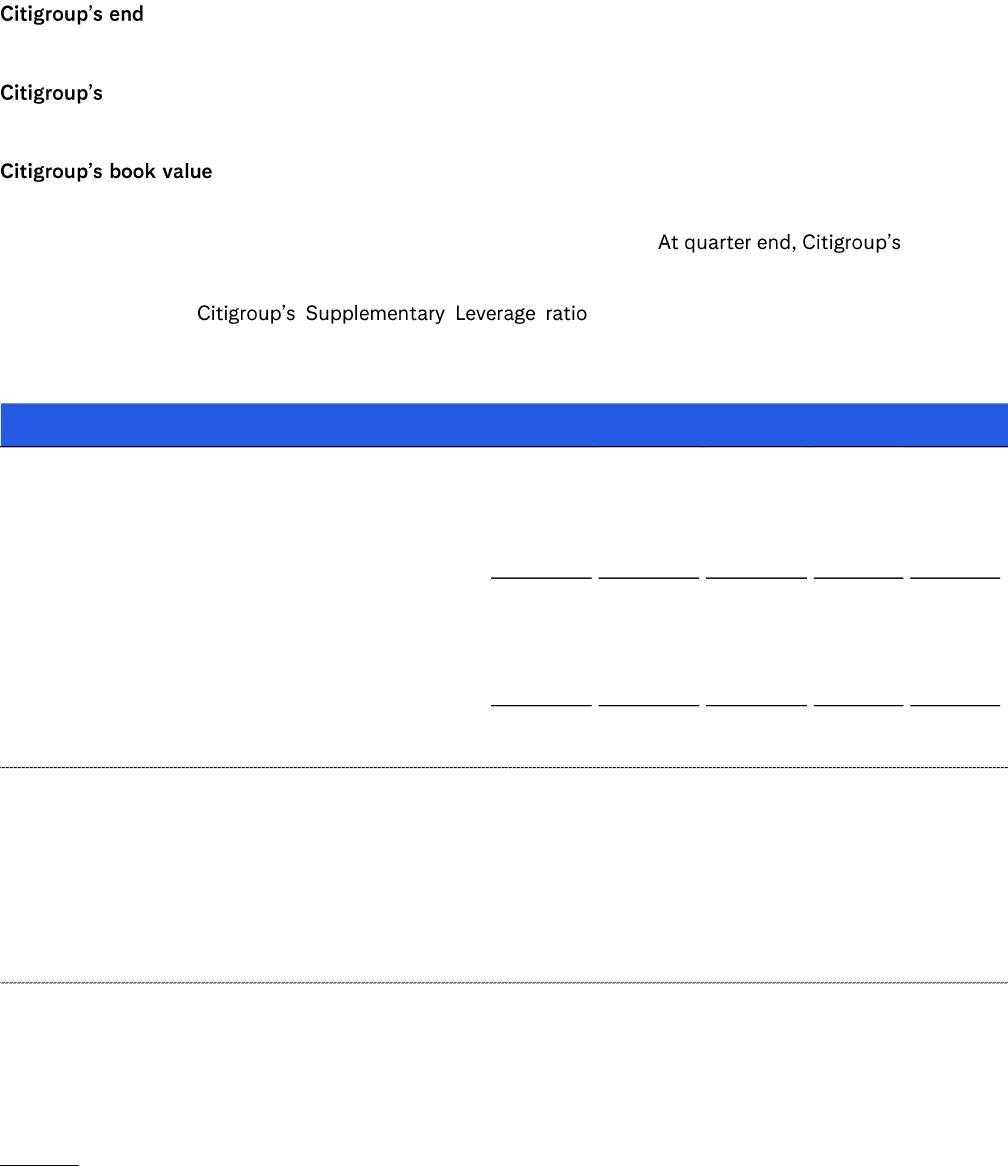

Citigroup

Citigroup revenues of $21.1 billion in the first quarter 2024 decreased 2%, on a reported basis. Excluding

divestiture-related impacts of $1 billion, primarily consisting of the gain from the sale of the India consumer

business, revenues were up 3% year over year. This increase in revenues was driven by growth across Banking,

USPB and Services, partially offset by declines in Markets and Wealth.

Citigroup operating expenses of $14.2 billion on a reported basis increased 7%, which included repositioning

costs of $258 million, an incremental FDIC special assessment

(6)

of $251 million and restructuring charges

(7)

of

$225 million. Excluding divestiture-related impacts

(5)

and the incremental FDIC special assessment, expenses

were up 5%. This increase in expenses was largely driven by inflation and volume-related expenses, partially offset

by productivity savings.

Citigroup cost of credit was approximately $2.4 billion in the first quarter 2024, compared to $2.0 billion in the

prior-year period, primarily driven by higher cards net credit losses, partially offset by a lower allowance for credit

losses (ACL) build.

Citigroup net income of $3.4 billion in the first quarter 2024, compared to net income of $4.6 billion in the prior-

year period, driven by the higher expenses, the higher cost of credit and the lower revenues.

tax rate of 25% was unchanged from the first quarter 2023.

total allowance for credit losses was approximately $21.8 billion at quarter end, compared to $19.8

billion at the end of the prior-year period. Total allowance for credit losses on loans was approximately $18.3

billion at quarter end, compared to $17.2 billion at the end of the prior-year period, with a reserve-to-funded loans

ratio of 2.75%, compared to 2.65% at the end of the prior-year period. Total non-accrual loans increased 6% from

the prior-year period to $2.8 billion. Corporate non-accrual loans increased 23% to $1.5 billion. Consumer non-

accrual loans decreased 8% from the prior-year period to $1.3 billion.

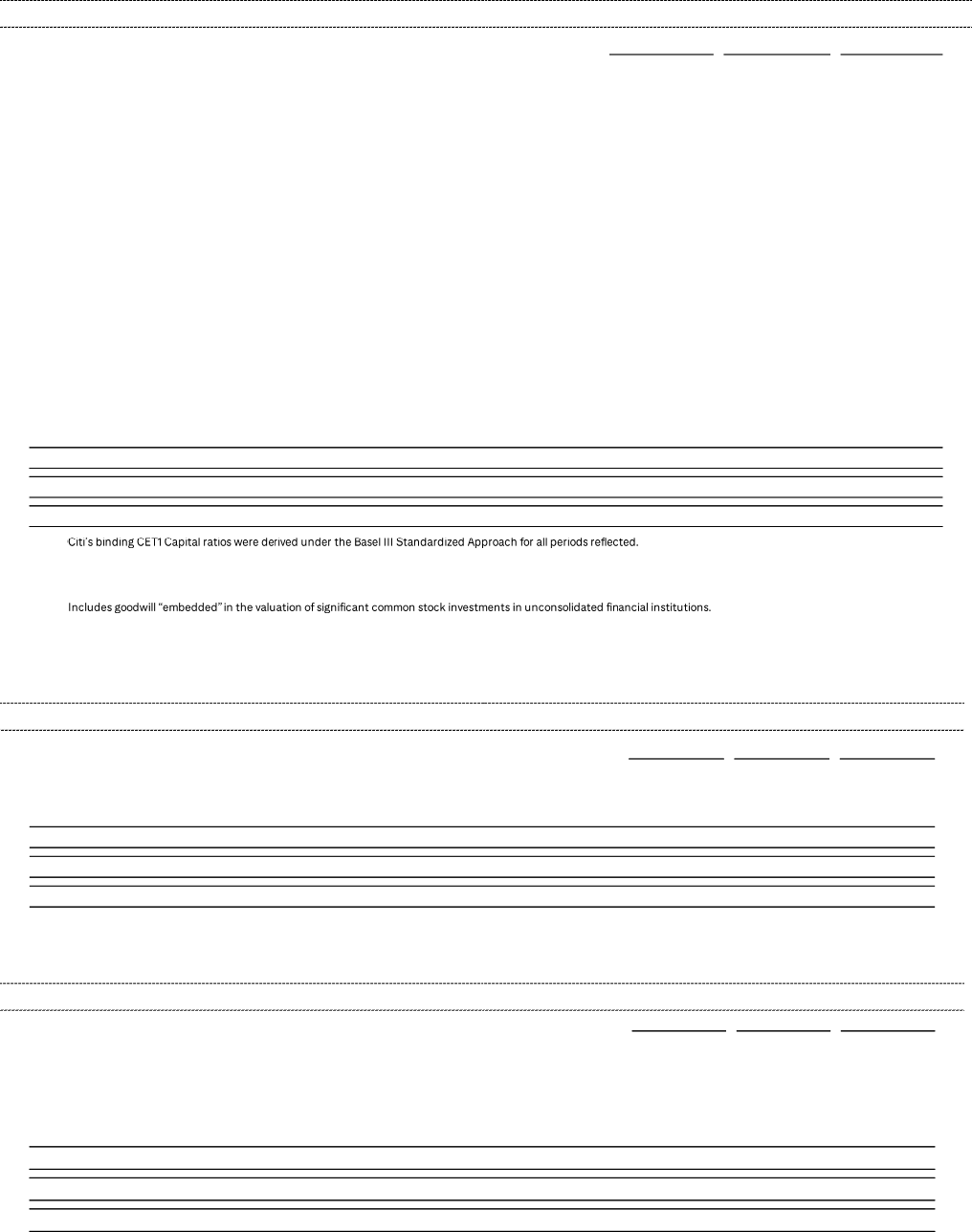

1Q'24 4Q'23 1Q'23 QoQ% YoY%

21,104 17,440 21,447 21% (2)%

14,195 15,996 13,289 (11)% 7%

Net credit losses 2,303 1,994 1,302 15% 77%

Net ACL build / (release)

(a)

21 397 241 (95)% (91)%

Other provisions

(b)

41 1,156 432 (96)% (91)%

2,365 3,547 1,975 (33)% 20%

4,544 (2,103) 6,183 NM (27)%

1,136 (296) 1,531 NM (26)%

3,408 (1,807) 4,652 NM (27)%

(1) (1) (1) - -

36 31 45 16% (20)%

$3,371 $(1,839) $4,606 NM (27)%

675 689 652 (2)% 3%

2,433 2,412 2,455 1% (1)%

1,307 1,309 1,330 - (2)%

$99.08 $98.71 $96.59 - 3%

$86.67 $86.19 $84.21 1% 3%

13.5% 13.4% 13.4%

5.8% 5.8% 6.0%

6.6% (4.5)% 9.5%

Return on average tangible common equity (RoTCE)

(1)

7.6% (5.1)% 10.9% NM (330) bps

Note: Please refer to the Appendices and Footnotes at the end of this press release for additional information.

(a) Includes credit reserve build / (release) for loans and provision for credit losses on unfunded lending commitments.

(b) Includes provisions on Other Assets, policyholder benefits and claims and HTM debt securities.

Return on average common equity (ROE)

Citigroup

($ in millions, except per share amounts and as otherwise noted)

Income (loss) from continuing operations

Book value per share

Total revenues, net of interest expense

Total operating expenses

Total cost of credit

Citigroup's net income (loss)

Provision (benefit) for income taxes

Income (loss) from discontinued operations, net of taxes

Net income attributable to non-controlling interest

EOP assets ($B)

EOP loans ($B)

EOP deposits ($B)

Income (loss) from continuing operations before taxes

Tangible book value per share

(4)

Common equity tier 1 (CET1) capital ratio

(2)

Supplementary leverage ratio (SLR)

(2)

3

-of-period loans were $675 billion at quarter end, up 3% versus the prior-year period, largely

reflecting growth in cards in USPB and higher loans in Markets.

end-of-period deposits were approximately $1.3 trillion at quarter end, down 2% versus the prior-

year period, largely due to a reduction in Services reflecting quantitative tightening.

per share of $99.08 and tangible book value per share of $86.67 at quarter end each

increased 3% versus the prior-year period. The increases were largely driven by net income and common share

repurchases, partially offset by the payment of common and preferred dividends and adverse movements in the

accumulated other comprehensive income (AOCI) component of equity. preliminary

CET1 Capital ratio was 13.5% versus 13.4% at the end of the prior quarter, driven by net income and lower risk-

weighted assets, partially offset by payment of common and preferred dividends, share repurchases and higher

deferred tax assets. (SLR) for the first quarter 2024 was 5.8%,

unchanged versus the prior quarter. During the quarter, Citigroup returned a total of $1.5 billion to common

shareholders in the form of dividends and share repurchases.

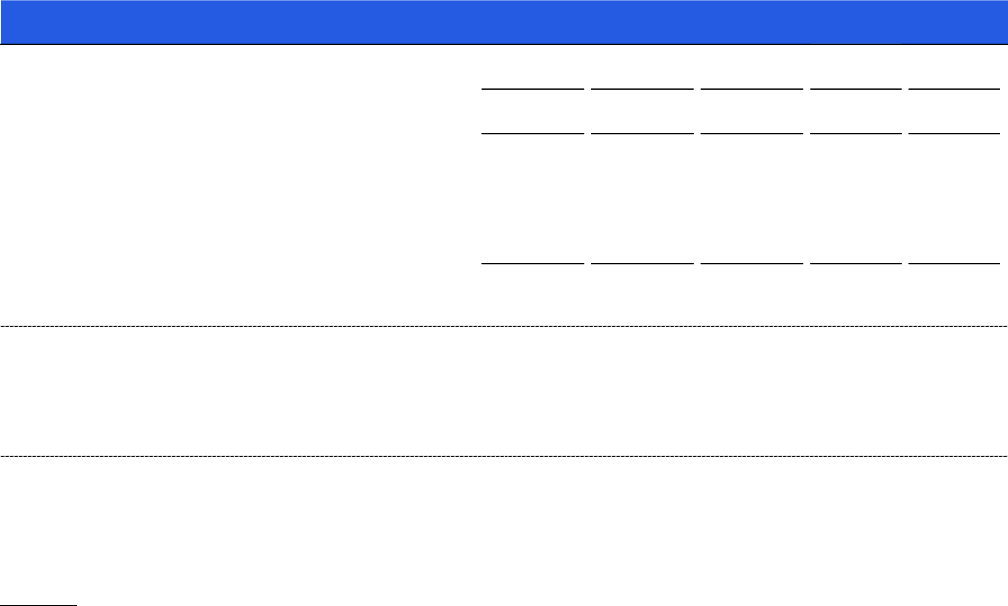

Services

Services revenues of $4.8 billion were up 8%, largely driven by continued momentum across both Treasury and

Trade Solutions and Securities Services. Net interest income increased 6%, driven by higher deposit and trade

loan spreads, and non-interest revenue increased 14%, largely driven by continued strength across underlying fee

drivers.

Treasury and Trade Solutions revenues of $3.5 billion increased 5%, driven by 4% growth in net interest income

and a 9% increase in non-interest revenues. The increase in net interest income was primarily driven by continued

1Q'24 4Q'23 1Q'23 QoQ% YoY%

Net interest income 2,723 2,887 2,612 (6)% 4%

Non-interest revenue 793 557 727 42% 9%

Treasury and Trade Solutions 3,516 3,444 3,339 2% 5%

Net interest income 594 555 514 7% 16%

Non-interest revenue 656 518 541 27% 21%

Securities Services 1,250 1,073 1,055 16% 18%

Total Services revenues 4,766 4,517 4,394 6% 8%

2,666 2,596 2,409 3% 11%

Net credit losses 6 (6) 6 NM -

Net ACL build / (release)

(a)

46 105 (65) (56)% NM

Other provisions

(b)

12 547 45 (98)% (73)%

64 646 (14) (90)% NM

$1,494 $785 $1,296 90% 15%

Allocated average TCE

(c)

25 23 23 8% 8%

RoTCE

(c)

24.1% 13.5% 22.9% 1,060 bps 120 bps

Average loans 82 83 79 (1)% 4%

Average deposits 808 803 830 1% (3)%

Cross border transaction value 91 99 83 (9)% 9%

US dollar clearing volume (#MM) 40 40 38 (1)% 3%

Commercial card spend volume 17 17 16 1% 5%

Assets under custody and/or administration (AUC/AUA) ($T)

(d)(e)

24 24 22 2% 11%

Note: Please refer to the Appendices and Footnotes at the end of this press release for additional information.

(a) Includes credit reserve build / (release) for loans and provision for credit losses on unfunded lending commitments.

(b) Includes provisions on Other Assets and for HTM debt securities.

(d) Reflects prior-period revisions for certain AUC North America accounts.

(e) Preliminary.

(c) TCE and RoTCE are non-GAAP financial measures. See Appendix H for a reconciliation of the summation of the segments' and component's average allocated TCE to

Citi's total average TCE and Citi's total average stockholders' equity.

Services

($ in millions, except as otherwise noted)

Total operating expenses

Total cost of credit

Net income (loss)

Services Key Statistics and Metrics ($B)

4

benefits from the rate environment. The increase in non-interest revenue was primarily driven by an increase in

cross-border volumes of 9%, U.S. Dollar clearing volumes of 3% and an increase in commercial card spend volume

of 5%.

Securities Services revenues of $1.3 billion increased 18%, driven by a 16% increase in net interest income on

higher deposit spreads and a 21% increase in non-interest revenue, driven by increases in assets under custody

and administration of an estimated 11%, benefiting from higher market valuations, as well as new client

onboarding.

Services operating expenses of $2.7 billion increased 11%, largely driven by continued investments in technology

and product innovation.

Services cost of credit was $64 million, compared to $(14) million in the prior-year period.

Services net income of approximately $1.5 billion increased 15%, largely driven by the higher revenues, partially

offset by the higher expenses.

Markets

Markets revenues of $5.4 billion decreased 7%, driven by lower Fixed Income revenues, partially offset by growth

in Equity revenues.

Fixed Income revenues of $4.2 billion decreased 10%, largely driven by rates and currencies on lower volatility and

a strong prior-year comparison, partially offset by strength in spread products and other fixed income, which was

up 26%, driven by an increase in client activity.

Equity revenues of $1.2 billion increased 5%, driven by growth across cash trading and equity derivatives.

Markets operating expenses of $3.4 billion increased 7%, largely driven by the absence of a legal reserve release

in the prior-year period.

1Q'24 4Q'23 1Q'23 QoQ% YoY%

Rates and currencies 2,799 1,736 3,551 61% (21)%

Spread products / other fixed income 1,352 833 1,072 62% 26%

Fixed Income markets 4,151 2,569 4,623 62% (10)%

Equity markets 1,227 819 1,167 50% 5%

5,378 3,388 5,790 59% (7)%

3,380 3,433 3,162 (2)% 7%

Net credit losses 78 30 4 NM NM

Net ACL build / (release)

(a)

119 53 60 NM 98%

Other provisions

(b)

3 126 19 (98)% (84)%

200 209 83 (4)% NM

$1,395 $(155) $1,848 NM (25)%

Allocated average TCE

(c)

54 53 53 2% 2%

RoTCE

(c)

10.4% (1.2)% 14.1% NM (370) bps

Average trading account assets 408 392 350 4% 17%

Average VaR 154 138 139 11% 11%

Note: Please refer to the Appendices and Footnotes at the end of this press release for additional information.

(a) Includes credit reserve build / (release) for loans and provision for credit losses on unfunded lending commitments.

(b) Includes provisions on Other Assets and HTM debt securities.

(c) TCE and RoTCE are non-GAAP financial measures. See Appendix H for a reconciliation of the summation of the segments' and component's average allocated TCE to

Citi's total average TCE and Citi's total average stockholders' equity.

Markets

($ in millions, except as otherwise noted)

Total operating expenses

Total cost of credit

Net income (loss)

Markets Key Statistics and Metrics ($B)

Total Markets revenues

5

Markets cost of credit was $200 million, compared to $83 million in the prior-year period, on net credit losses of

$78 million and an ACL build for loans and unfunded commitments of $119 million.

Markets net income of $1.4 billion decreased 25%, driven by the higher expenses, the lower revenues and the

higher cost of credit.

Banking

Banking revenues of $1.7 billion increased 49%, driven by growth in Investment Banking and Corporate Lending

and lower losses on loan hedges.

Investment Banking revenues of $903 million increased 35%, driven by Debt Capital Markets and Equity Capital

Markets, as improved market sentiment led to an increase in issuance activity. This increase in revenues was

partially offset by lower Advisory revenues, driven by the impact of lower merger activity announced in the second

half of 2023.

Corporate Lending revenues of $915 million, excluding mark-to-market on loan hedges,

(8)

increased 34% versus

the prior-year, largely driven by higher revenue share.

(9)

Banking operating expenses of $1.2 billion decreased 4%, primarily driven by benefits from repositioning actions

and other actions to lower the expense base, partially offset by business-led investments.

Banking cost of credit was a benefit of $129 million, compared to a benefit of $123 million in the prior-year period.

Banking net income of $536 million was driven by the higher revenues and the lower expenses.

1Q'24 4Q'23 1Q'23 QoQ% YoY%

Investment Banking 903 664 667 36% 35%

Corporate Lending

(a)

915 421 683 NM 34%

1,818 1,085 1,350 68% 35%

Gain / (loss) on loan hedges

(a)

(104) (131) (199) 21% 48%

1,714 954 1,151 80% 49%

Total operating expenses 1,184 1,165 1,236 2% (4)%

Net credit losses 66 71 12 (7)% NM

Net ACL build / (release)

(b)

(185) (226) (221) 18% 16%

Other provisions

(c)

(10) 339 86 NM NM

(129) 184 (123) NM (5)%

$536 $(324) $55 NM NM

Allocated average TCE

(d)

($B) 22 21 21 2% 2%

RoTCE

(d)

9.9% (6.0)% 1.0% NM 890 bps

Average loans ($B) 89 89 95 - (6)%

Advisory fees ($B)

Advisory 230 286 276 (20)% (17)%

Equity underwriting fees ($B)

Equity underwriting 171 110 109 55% 57%

Debt underwriting fees ($B)

Debt underwriting 576 310 355 86% 62%

Investment Banking fees 977 706 740 38% 32%

Note: Please refer to the Appendices and Footnotes at the end of this press release for additional information.

(a) Excludes gain / (loss) on credit derivatives as well as the mark-to-market on loans at fair value. For additional information, please refer to Footnote 8.

(b) Includes credit reserve build / (release) for loans and provision for credit losses on unfunded lending commitments.

(c) Includes provisions on Other Assets and HTM debt securities.

(d) TCE and RoTCE are non-GAAP financial measures. See Appendix H for a reconciliation of the summation of the segments' and component's average allocated TCE to

Citi's total average TCE and Citi's total average stockholders' equity.

Banking

($ in millions, except as otherwise noted)

Total Banking revenues including gain/(loss) on loan hedges

(a)

Total cost of credit

Net income (loss)

Banking Key Statistics and Metrics

Total Banking revenues

(a)

6

Wealth

Wealth revenues of $1.7 billion decreased 4%, driven by a 13% decrease in net interest income on lower deposit

spreads and higher mortgage funding costs, partially offset by an 11% increase in non-interest revenue, reflecting

higher investment fee revenues.

Private Bank revenues of $571 million increased 1%, primarily driven by improved deposit spreads and investment

fee revenues, partially offset by higher mortgage funding costs.

Wealth at Work revenues of $181 million decreased 6%, driven by deposit spread compression and higher

mortgage funding costs, partially offset by improved investment fee revenues.

Citigold revenues of $943 million decreased 6%, driven by deposit spread compression, partially offset by growth

in investment fee revenues and higher deposit volumes.

Wealth operating expenses of $1.7 billion increased 3%, driven by technology investments focused on risk and

controls, as well as platform enhancements, partially offset by benefits from repositioning and restructuring

actions.

Wealth cost of credit was a benefit of $170 million, compared to a benefit of $58 million in the prior-year period,

as net credit losses of $29 million were more than offset by an ACL release for loans and unfunded commitments

of $198 million.

Wealth net income of $150 million decreased 6%, primarily driven by the lower revenues and the higher expenses,

partially offset by lower cost of credit.

1Q'24 4Q'23 1Q'23 QoQ% YoY%

Private Bank 571 542 568 5% 1%

Wealth at Work 181 211 193 (14)% (6)%

Citigold 943 918 1,005 3% (6)%

1,695 1,671 1,766 1% (4)%

1,668 1,647 1,626 1% 3%

Net credit losses 29 31 20 (6)% 45%

Net ACL build / (release)

(a)

(198) (26) (75) NM NM

Other provisions

(b)

(1) (1) (3) - 67%

(170) 4 (58) NM NM

$150 $5 $159 NM (6)%

Allocated average TCE

(c)

13 13 13 (1)% (1)%

RoTCE

(c)

4.6% 0.1% 4.8% 450 bps (20) bps

Loans 149 152 150 (2)% (1)%

Deposits 323 323 322 - -

Estimated client investment assets

(d)

515 498 459 3% 12%

EOP client balances 987 973 931 1% 6%

Note: Please refer to the Appendices and Footnotes at the end of this press release for additional information.

(a) Includes credit reserve build / (release) for loans and provision for credit losses on unfunded lending commitments.

(b) Includes provisions on Other Assets and policyholder benefits and claims.

(d) Includes assets under management, and trust and custody assets. Client Investment Assets are estimated as of 1Q24.

Wealth Key Statistics and Metrics ($B)

Wealth

($ in millions, except as otherwise noted)

Total revenues, net of interest expense

Total operating expenses

Total cost of credit

Net income (loss)

(c) TCE and RoTCE are non-GAAP financial measures. See Appendix H for a reconciliation of the summation of the segments' and component's average allocated TCE

to Citi's total average TCE and Citi's total average stockholders' equity.

7

US Personal Banking (USPB)

USPB revenues of $5.2 billion increased 10%, driven by higher net interest income due to loan growth in cards

and lower partner payments.

Branded Cards revenues of $2.6 billion increased 7%, driven by interest-earning balance growth of 10%, as

payment rates continued to moderate, and spend volume growth of 4%.

Retail Services revenues of $1.9 billion increased 18%, primarily driven by the lower partner payments due to

higher net credit losses, as well as interest-earning balance growth of 9%.

Retail Banking revenues of $638 million increased 1%, driven by higher deposit spreads, loan growth and

improved mortgage margins.

USPB operating expenses of $2.5 billion were largely unchanged, due to lower compensation costs, including

repositioning impacts, offset by higher volume-related expenses.

USPB cost of credit was $2.2 billion, compared to $1.6 billion in the prior-year period. The increase was driven by

higher net credit losses reflecting continued maturation of the cards portfolio, partially offset by a lower ACL build.

USPB net income of $347 million decreased 14%, primarily driven by the higher cost of credit, partially offset by

the higher revenues.

1Q'24 4Q'23 1Q'23 QoQ% YoY%

Branded Cards 2,640 2,620 2,472 1% 7%

Retail Services 1,900 1,636 1,610 16% 18%

Retail Banking 638 684 629 (7)% 1%

5,178 4,940 4,711 5% 10%

2,519 2,594 2,529 (3)% -

Net credit losses 1,864 1,599 1,074 17% 74%

Net ACL build / (release)

(a)

337 472 576 (29)% (41)%

Other provisions

(b)

3 3 (1) - NM

2,204 2,074 1,649 6% 34%

$347 $201 $402 73% (14)%

Allocated average TCE

(c)

25 22 22 15% 15%

RoTCE

(c)

5.5% 3.6% 7.4% 190 bps (190) bps

Average loans 204 202 184 1% 11%

Average deposits 100 105 111 (5)% (10)%

US cards average loans 159 158 146 1% 9%

US credit card spend volume

(d)

141 156 137 (9)% 3%

Note: Please refer to the Appendices and Footnotes at the end of this press release for additional information.

(a) Includes credit reserve build / (release) for loans and provision for credit losses on unfunded lending commitments.

(b) Includes provisions on policholder benefits and claims and Other Assets.

(d) Credit card spend volume was previously referred to as card purchase sales.

USPB Key Statistics and Metrics ($B)

USPB

($ in millions, except as otherwise noted)

Total revenues, net of interest expense

Total operating expenses

Total cost of credit

Net income (loss)

(c) TCE and RoTCE are non-GAAP financial measures. See Appendix H for a reconciliation of the summation of the segments' and component's average allocated

TCE to Citi's total average TCE and Citi's total average stockholders' equity.

8

All Other (Managed Basis)

(10)

All Other (Managed Basis) revenues of $2.4 billion decreased 9%, driven by the closed exits and wind-downs, as

well as higher funding costs, partially offset by higher revenues in Mexico.

Legacy Franchises (Managed Basis)

(10)

revenues of $1.8 billion were largely unchanged, primarily driven by higher

volumes in Mexico and Mexican Peso appreciation, partially offset by the closed exits and wind-downs.

Corporate / Other revenues decreased to $571 million from $812 million in the prior-year period, largely driven by

the higher funding costs.

All Other (Managed Basis) expenses of $2.7 billion increased 18%, driven by the incremental FDIC special

assessment and the restructuring charges, partially offset by lower expenses from the closed exits and wind-

downs.

All Other (Managed Basis) cost of credit of $185 million decreased 59%, largely driven by the absence of a reserve

build in the prior year period, partially offset by higher net credit losses in Mexico Consumer.

All Other (Managed Basis) net loss of $457 million was driven by the higher expenses and the lower revenues,

partially offset by the lower cost of credit.

1Q'24 4Q'23 1Q'23 QoQ% YoY%

Legacy Franchises (Managed Basis) 1,814 1,708 1,805 6% -

Corporate / Other 571 324 812 76% (30)%

2,385 2,032 2,617 17% (9)%

2,668 4,455 2,254 (40)% 18%

Net credit losses 249 236 198 6% 26%

Net ACL build / (release)

(c)

(98) 82 (38) NM NM

Other provisions

(d)

34 142 286 (76)% (88)%

185 460 446 (60)% (59)%

$(457) $(2,240) $198 80% NM

Allocated average TCE

(e)

26 32 28 (21)% (10)%

(c) Includes credit reserve build / (release) for loans and provision for credit losses on unfunded lending commitments.

(d) Includes provisions on Other Assets and policyholder benefits and claims.

(e) TCE is a non-GAAP financial measure. See Appendix H for a reconciliation of the summation of the segments' and component's average allocated TCE.

All Other (Managed Basis)

(a)(b)

($ in millions, except as otherwise noted)

Total revenues

Total operating expenses

Total cost of credit

Net income (loss)

All Other Key Statistics and Metrics ($B)

Note: Please refer to the Appendices and Footnotes at the end of this press release for additional information.

(a) Includes Legacy Franchises and certain unallocated costs of global staff functions (including finance, risk, human resources, legal and compliance-related

costs), other corporate expenses, and unallocated global operations and technology expenses and income taxes, as well as Corporate Treasury investment

activities and discontinued operations.

(b) Reflects results on a managed basis, which excludes divestiture-related impacts related to Citi's divestitures of its Asia consumer banking businesses and the

planned divestiture of Mexico consumer banking, small business and middle-market banking within Legacy Franchises. For additional information, please refer to

Footnote 10.

9

Citigroup will host a conference call today at 11:00 AM (ET). A live webcast of the presentation, as well as

financial results and presentation materials, will be available at https://www.citigroup.com/global/investors.

The live webcast of the presentation can also be accessed at

https://www.veracast.com/webcasts/citigroup/webinars/Citi1Q24.cfm

Additional financial, statistical and business-related information, as well as business and segment trends, is

First Quarter 2024

Quarterly Financial Data Supplem www.citigroup.com.

Citi is a preeminent banking partner for institutions with cross-border needs, a global leader in wealth

management and a valued personal bank in its home market of the United States. Citi does business in nearly

160 countries and jurisdictions, providing corporations, governments, investors, institutions and individuals

with a broad range of financial products and services.

Additional information may be found at www.citigroup.com | X: @Citi | YouTube: www.youtube.com/citi | Blog:

http://blog.citigroup.com | Facebook: www.facebook.com/citi | LinkedIn: www.linkedin.com/company/citi

Certain statem -

subject to uncertainty and changes in circumstances. These statements are not guarantees of future results or

occurrences. Actual results and capital and other financial condition may differ materially from those included in

these statements due to a variety of factors. These factors include, among others:

objectives, including expense savings and revenue targets, from its transformation, simplification and other

strategic and other initiatives; (ii) the impacts from central bank interest rate policies, whether due to continued

elevated interest rates, or potential reductions in interest rates and a resulting decline in net interest income; (iii)

revisions to the U.S. Basel III rules, including the recently issued notice of proposed rulemaking, known as the

Basel III Endgame, and other proposed changes in regulatory capital rules; (iv) continued elevated levels of, or

any resurgence in, inflation and its impacts; (v) the various uncertainties and impacts related to or resulting from

the Middle East; and (vi) the precautionary statements included in this

-K. Any

forward-looking statements made by or on behalf of Citigroup speak only as to the date they are made, and Citi

does not undertake to update forward-looking statements to reflect the impact of circumstances or events that

arise after the date the forward-looking statements were made.

Contacts:

Investors: Jennifer Landis (212) 559-2718

Press: Danielle Romero-Apsilos (212) 816-2264

10

Appendix A

Citigroup

($ in millions)

1Q24 4Q23 1Q23

Net Income (Loss)

$3,371 $(1,839) $4,606

Less: Preferred Dividends

279 300 277

Net Income (Loss) to Common Shareholders

$3,092 $(2,139) $4,329

Average Common Equity

$188,001 $189,440 $184,107

Less: Average Goodwill and Intangibles

(23,335) (24,268) (23,057)

Average Tangible Common Equity (TCE)

$164,666 $165,172 $161,050

ROE 6.6% (4.5)% 9.5%

RoTCE 7.6% (5.1)% 10.9%

Appendix B

Citigroup

($ in millions)

Total Citigroup Revenue - As Reported $21,104 $21,447

(2)%

Less:

Total Divestiture-related Impact on Revenue (12) 1,018

Total Citigroup Revenue, Excluding Total Divestiture-related Impact $21,116 $20,429

3%

Total Citigroup Operating Expenses - As Reported $14,195 $13,289

7%

Less:

Incremental FDIC Special Assessment Impact on Operating Expenses 251 -

Total Divestiture-related Impact on Operating Expenses 110 73

Total Citigroup Operating Expenses, Excluding Total Divestiture-related Impact and Incremental FDIC Special Assessment $13,834 $13,216

5%

1Q'24

1Q'23

% Δ YoY

Appendix C

(a)

All Other

($ in millions)

All Other Revenues, Managed Basis $2,385 $2,032 $2,617 17% (9)%

Add:

All Other Divestiture-related Impact on Revenue

(b)

$(12) $(62) $1,018

All Other Revenues (U.S. GAAP) $2,373 $1,970 $3,635 20% (35)%

All Other Operating Expenses, Managed Basis $2,668 $4,455 $2,254 (40)% 18%

Add:

All Other Divestiture-related Impact on Operating Expenses

(c)(d)

$110 $106 $73

All Other Operating Expenses (U.S. GAAP) $2,778 $4,561 $2,327 (39)% 19%

All Other Cost of Credit, Managed Basis $185 $460 $446 (60)% (59)%

Add:

All Other Net credit losses 11 33 (12)

All Other Net ACL build / (release)

(e)

- (63) 4

All Other Other provisions

(f)

- - -

All Other Citigroup Cost of Credit (U.S. GAAP)

$196 $430 $438

(54)% (55)%

All Other Citigroup Net Income (Loss), Managed Basis $(457) $(2,240) $198 80% NM

Add:

All Other Divestiture-related Impact on Revenue

(b)

(12) (62) 1,018

All Other Divestiture-related Impact on Operating Expenses

(c)(d)

(110) (106) (73)

All Other Divestiture-related Impact on Cost of Credit (11) 30 8

All Other Divestiture-related Impact on Taxes

(b)

39 27 (305)

All Other Net Income (Loss) (U.S. GAAP) $(551) $(2,351) $846 77% NM

% Δ YoY

1Q'24

1Q'23

4Q'23

% Δ QoQ

(e) Includes credit reserve build / (release) for loans and provision for credit losses on unfunded lending commitments.

(f) Includes provisions for policyholder benefits and claims and other assets.

(c) 4Q23 includes approximately $106 million in operating expenses (approximately $75 million after-tax), primarily related to separation costs in Mexico and severance costs in the Asia exit

markets. For additional information, see Citi's Annual Report on Form 10-K for the year ended December 31, 2023.

(b) 1Q23 includes an approximate $1.059 billion gain on sale recorded in revenue (approximately $727 million after various taxes) related to Citi's sale of the India consumer banking business. For

additional information, see Citi's Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2023.

(d) 1Q24 includes approximately $110 million in operating expenses (approximately $77 million after-tax), primarily related to separation costs in Mexico and severance costs in the Asia exit markets.

11

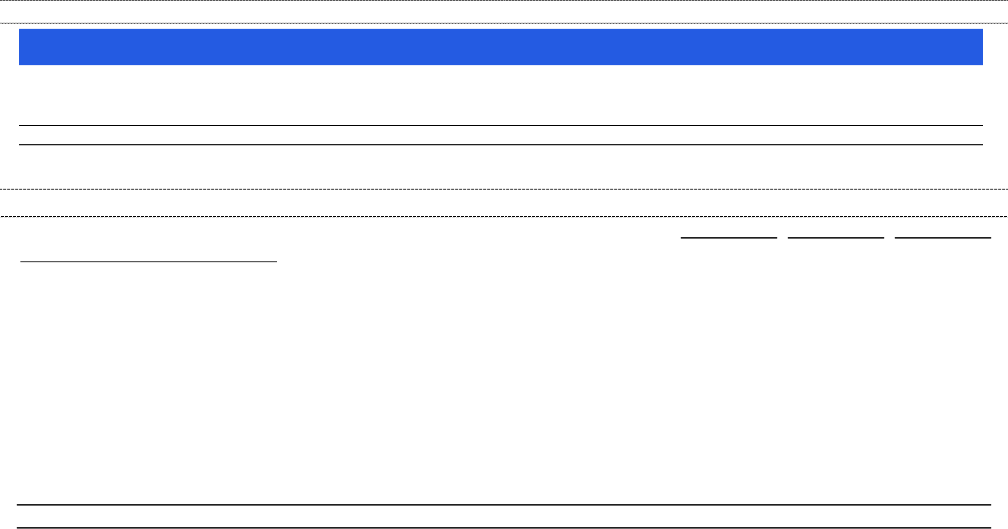

Appendix D

($ in millions)

1Q'24

(1)

4Q'23 1Q'23

$189,059 $187,937 $188,186

159 153 207

757 1,514 1,514

(914) (1,406) (2,161)

(1,031) (410) 1,037

18,647 18,778 18,844

3,258 3,349 3,607

1,386 1,317 1,999

11,936 12,075 11,783

3,551 2,306 1,045

Common Equity Tier 1 Capital (CET1)

$153,142 $153,595 $153,753

Risk-Weighted Assets (RWA)

(3)

$1,137,050 $1,148,608 $1,144,359

Common Equity Tier 1 Capital Ratio (CET1 / RWA)

(3)

13.5% 13.4% 13.4%

Note:

(1) Preliminary.

(2)

(3)

Please refer to Footnote 2 at the end of this press release for additional information.

(4)

(5)

(6)

Deferred tax assets (DTAs) arising from net operating loss, foreign tax credit

and general business credit carry-forwards

(5)

Defined benefit pension plan net assets; other

Accumulated net unrealized gains (losses) on cash flow hedges, net of tax

Cumulative unrealized net gain (loss) related to changes in fair value of financial

liabilities attributable to own creditworthiness, net of tax

Intangible Assets:

Goodwill,

net of related deferred tax liabilities (DTLs)

(4)

Identifiable intangible assets other than mortgage servicing rights (MSRs),

net of related DTLs

Citigroup Common Stockholders' Equity

(2)

Add: Qualifying noncontrolling interests

Regulatory Capital Adjustments and Deductions:

Add: CECL transition provision

(3)

Less:

Assets subject to 10% / 15% limitations include MSRs, DTAs arising from temporary differences and significant common stock investments in unconsolidated financial

institutions. For all periods presented, the deduction related only to DTAs arising from temporary differences that exceeded the 10% limitation.

Excess over 10% / 15% limitations for other DTAs, certain common stock

investments, and MSRs

(5)(6)

Excludes issuance costs related to outstanding preferred stock in accordance with Federal Reserve Board regulatory reporting requirements.

Represents deferred tax excludable from Basel III CET1 Capital, which includes net DTAs arising from net operating loss, foreign tax credit and general business credit tax

carry-forwards and DTAs arising from timing differences (future deductions) that are deducted from CET1 capital exceeding the 10% limitation.

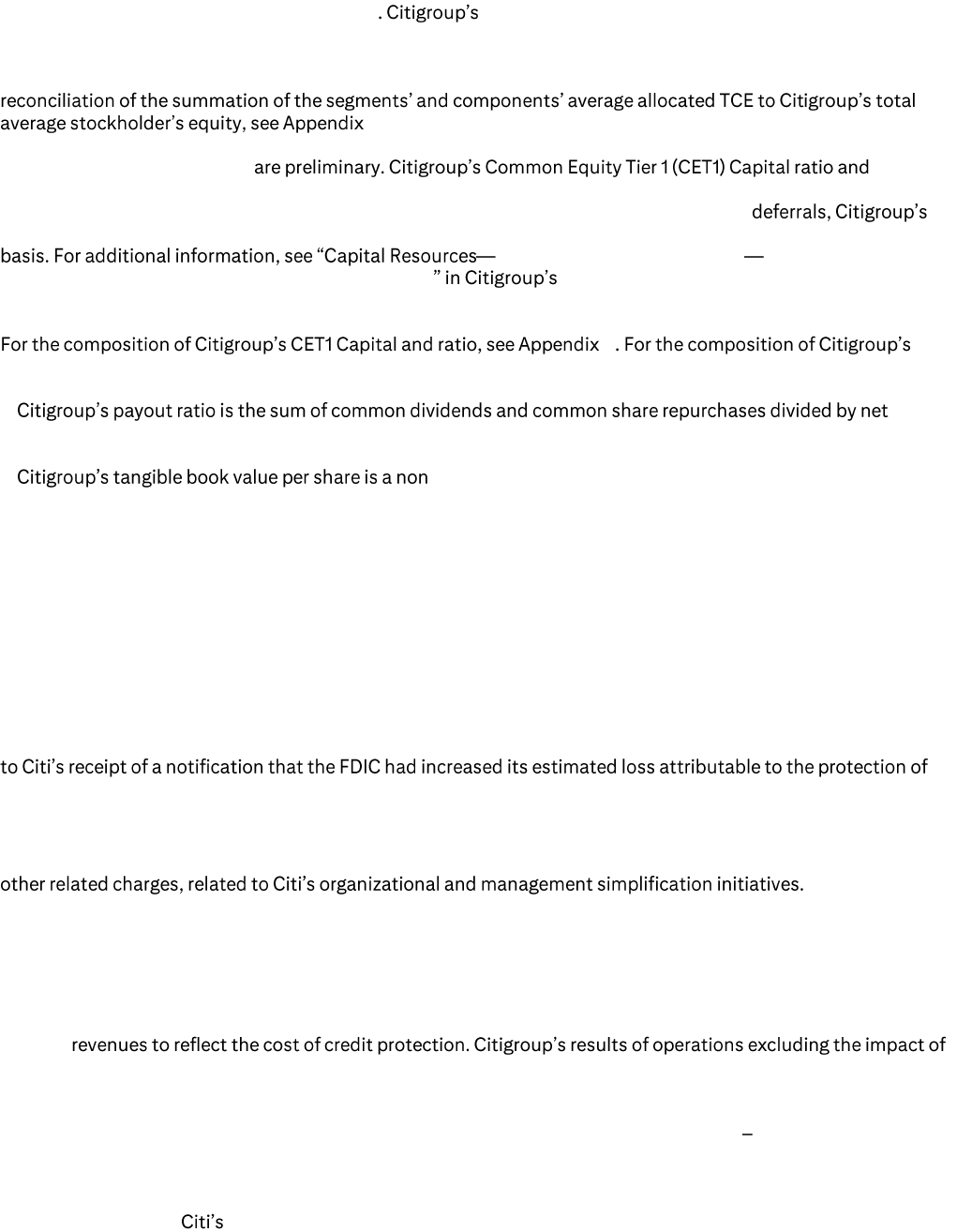

Appendix E

($ in millions)

1Q'24

(1)

4Q'23 1Q'23

Common Equity Tier 1 Capital (CET1)

(2)

$153,142 $153,595 $153,753

Additional Tier 1 Capital (AT1)

(3)

18,923 18,909 21,496

Total Tier 1 Capital (T1C) (CET1 + AT1)

$172,065 $172,504 $175,249

Total Leverage Exposure (TLE)

(2)

$2,949,960 $2,964,954 $2,939,744

Supplementary Leverage Ratio (T1C / TLE)

5.8% 5.8% 6.0%

(1) Preliminary.

(2) Please refer to Footnote 2 at the end of this press release for additional information.

(3) Additional Tier 1 Capital primarily includes qualifying noncumulative perpetual preferred stock and qualifying trust preferred securities.

Appendix F

($ and shares in millions)

1Q'24

(1)

4Q'23 1Q'23

Common Stockholders' Equity $188,985 $187,853 $188,050

Less:

Goodwill 20,042 20,098 19,882

Intangible Assets (other than MSRs) 3,636 3,730 3,974

Goodwill and Identifiable Intangible Assets (other than MSRs) Related to Assets Held-for-Sale - - 246

Tangible Common Equity (TCE) $165,307 $164,025 $163,948

Common Shares Outstanding (CSO) 1,907.4 1,903.1 1,946.8

Tangible Book Value Per Share $86.67 $86.19 $84.21

(1) Preliminary.

12

Appendix G

Banking

($ in millions)

Corporate Lending Revenues - As Reported $811 $290 $484

NM 68%

Less:

Gain/(loss) on loan hedges

(a)

$(104) $(131) $(199)

21% 48%

Corporate Lending Revenues - Excluding Gain/(loss) on loan hedges $915 $421 $683 NM 34%

(a) Please refer to Footnote 8 at the end of this press release for additional information.

% Δ YoY

1Q'24

4Q'23

1Q'23

% Δ QoQ

Appendix H

($ in billions)

1Q'24 4Q'23 1Q'23

Average Tangible Common Equity (TCE)

Services $24.9 $23.0 $23.0

Markets 54.0 53.1 53.1

Banking 21.8 21.4 21.4

USPB 25.2 21.9 21.9

Wealth 13.2 13.4 13.4

All Other 25.6 32.4 28.3

Total Citigroup Average TCE $164.7 $165.2 $161.1

Plus:

Average Goodwill 19.6 20.4 18.7

Average Intangible Assets (other than MSRs) 3.7 3.8 3.9

Average Goodwill and Identifiable Intangible Assets (other than MSRs) Related to Assets Held-for-Sale - - 0.4

Total Citigroup Average Common Stockholders' Equity $188.0 $189.4 $184.1

13

(1)

Ratios as of March 31, 2024 are preliminary allocated average tangible common equity (TCE) and

return on average tangible common equity (RoTCE) are non-GAAP financial measures. RoTCE represents

annualized net income available to common shareholders as a percentage of average TCE. For the components

of these calculations, see Appendix A. See Appendix F for a reconciliation of common equity to TCE. For a

H.

(2)

Ratios as of March 31, 2024

Supplementary Leverage ratio (SLR) reflect certain deferrals based on the modified regulatory capital transition

provision related to the Current Expected Credit Losses (CECL) standard. Excluding these

CET1 Capital ratio and SLR as of March 31, 2024 would be 13.4% and 5.8%, respectively, on a fully reflected

Regulatory Capital Treatment Modified Transition

of the Current Expected Credit Losses Methodology 2023 Annual Report on Form 10-K. Certain

prior period amounts have been revised to conform with enhancements made in the current period.

D

SLR, see Appendix E.

(3)

income available to common shareholders.

(4)

-GAAP financial measure. See Appendix F for a reconciliation

of common equity to tangible common equity and resulting calculation of tangible book value per share.

(5)

First quarter 2023 includes an approximate $1.059 billion gain on sale recorded in revenue (approximately

$727 million after various taxes) related to Citi's sale of the India consumer banking business.

First quarter 2024 includes approximately $110 million in operating expenses (approximately $77 million after-

tax), primarily related to separation costs in Mexico and severance costs in the Asia exit markets.

Results of operations excluding divestiture-related impacts are non-GAAP financial measures. For additional

information and a reconciliation to reported results, please refer to Appendix B.

(6)

Citi recorded a $251 million incremental pre-tax charge to operating expenses in the first quarter 2024 related

uninsured depositors at Silicon Valley Bank and Signature Bank. Results of operations excluding the impact of

this charge are non-GAAP financial measures. For a reconciliation to reported results, please refer to Appendix B.

(7)

Citi recorded $225 million in restructuring charges in the first quarter 2024, largely driven by severance and

(8)

Credit derivatives are used to economically hedge a portion of the Corporate Lending portfolio that includes

both accrual loans and loans at fair value. Gain / (loss) on loan hedges includes the mark-to-market on the

credit derivatives and the mark-to-market on the loans in the portfolio that are at fair value. In the first quarter

2024, gain / (loss) on loan hedges included $(104) million related to Corporate Lending, compared to $(199)

million in the prior-year period. The fixed premium costs of these hedges are netted against the Corporate

Lending

gain / (loss) on loan hedges are non-GAAP financial measures. For a reconciliation to reported results, please

refer to Appendix G.

(9)

Certain revenues earned by Citi are subject to a revenue sharing agreement to Banking Corporate Lending

from Investment Banking and certain Markets and Services products sold to clients.

(10)

All Other (Managed Basis) reflects results on a managed basis, which excludes divestiture-related impacts, for

all periods, related to divestitures of its Asia consumer banking businesses and the planned divestiture of

Mexico consumer banking and small business and middle market banking within Legacy Franchises. Certain of

the results of operations of All Other (Managed Basis) and Legacy Franchises (Managed Basis) that exclude

14

divestiture-related impacts are non-GAAP financial measures. For additional information and a reconciliation of

these results, please refer to Appendix C.