Case 22-0030-I 1 of 24

REPORT OF INVESTIGATION

DATE: January 18, 2024

TO: Mark Bialek

Inspector General

FROM: Stephen Carroll

Associate Inspector General for Investigations

SUBJECT: Report of Investigation on the Closing of 22-0030-I Reserve Bank Trading Activity

Executive Summary

On October 4, 2021, the Board of Governors of the Federal Reserve System requested that we “conduct

an independent review of whether the 2020 trading activities of Rob Kaplan, President of the Dallas

Federal Reserve Bank; Eric Rosengren, President of the Boston Federal Reserve Bank; and Rich Clarida,

Vice Chair of the Board of Governors of the Federal Reserve System violated the law or Federal Reserve

policies, whether the trading activities warrant further investigation by other authorities, and any other

related matters that you deem appropriate.”

In response, we initiated separate investigations of Board and Reserve Bank officials. Given public

reporting regarding Chair Jerome Powell’s December 2019 financial transactions, we included his trading

activities in our investigation of Board officials. On July 11, 2022, we concluded the investigation of Board

officials and publicly issued a closing memorandum.

1

This report details our investigation of Reserve Bank officials. Specifically, we reviewed whether former

Federal Reserve Bank of Dallas (FRB Dallas) President Robert Kaplan’s or former Federal Reserve Bank of

Boston (FRB Boston) President Eric Rosengren’s trading activities violated any of the following:

2

1

Office of Inspector General, OIG Closing of 22-0028-I Board Trading Activity, July 11, 2022. On January 18, 2024, we issued a

separate and more detailed report of this investigation, Report of Investigation on the Closing of 22-0028-I Board Trading Activity,

in which we reviewed the trading activities of Chair Jerome Powell and former Vice Chair Richard Clarida.

2

After consulting with government experts regarding potential violations of federal insider trading laws, including 18 U.S.C.

§ 1348 and section 10(b) of the Securities Exchange Act and Rule 10b-5 thereunder, we determined that there was insufficient

evidence to refer this matter for further law enforcement review.

Case 22-0030-I 2 of 24

• Federal Reserve Bank of Dallas Code of Conduct, section 9; Federal Reserve Bank of Boston Code

of Conduct, section 9;

3

and Federal Reserve Administrative Manual, section 2-026.1

4

(Reserve

Bank disclosure statements policies)

• Federal Reserve Bank of Dallas Code of Conduct, section 5.3; Federal Reserve Bank of Boston Code

of Conduct, section 5.3; and Federal Reserve Administrative Manual, section 2-026.1 (Reserve

Bank prohibited holdings policies)

• Federal Open Market Committee (FOMC), Program for Security of FOMC Information,

“Attachment 4: Financial Trading Blackout”

5

(FOMC blackout rule)

• Federal Conflict of Interest Statute (18 U.S.C. § 208) and U.S. Office of Government Ethics (OGE)

Conflicting Financial Interests (5 C.F.R. part 2635, subpart D) and Interpretation, Exemptions, and

Waiver Guidance Concerning 18 U.S.C. 208 (5 C.F.R. part 2640) (federal conflict of interest laws)

6

• Federal Reserve Bank of Dallas Code of Conduct, section 5.1, and Federal Reserve Bank of Boston

Code of Conduct, section 5.1 (Reserve Bank conflict of interest policy)

With regard to Mr. Kaplan, we did not find that his trading activities violated laws, rules, regulations, or

policies related to trading activities as investigated by our office. Mr. Kaplan’s 2020 Form A Federal

Reserve Bank Confidential Financial Disclosure Report (Form A), however, did not publicly disclose the

specific dates of his trading activities, nor did it specify transactions that involved the selling of stock

option contracts. This lack of information, in our opinion, did not support public confidence in the

impartiality and integrity of the policymakers and senior staff carrying out the public mission of the

FOMC’s work, especially during this critical time period when the Federal Reserve was taking monetary

policy actions to address the effects of the COVID-19 pandemic on the U.S. economy. These collective

facts, in our opinion, create an “appearance of acting on confidential FOMC information” under the

FOMC blackout rule and an “appearance of a conflict of interest” that could cause a reasonable person to

question Mr. Kaplan’s impartiality under FRB Dallas’s code of conduct.

With regard to Mr. Rosengren, we found that he did not report multiple trades on his 2020 Form A.

Additionally, we found multiple discrepancies between the transactions reflected in his brokerage

statements and trading data and what he reported on his 2020 Form A. Moreover, in our opinion,

Mr. Rosengren’s trading activities in real estate investment trusts (REITs) in 2020—during a time of

financial market volatility that prompted the Federal Reserve to authorize the purchase of agency

3

The Federal Reserve Bank of Dallas Code of Conduct and Federal Reserve Bank of Boston Code of Conduct in effect during the

scope of our review were “as revised November 2019.”

4

The Federal Reserve Administration Manual, section 2-026.1, in effect during the scope of our review was “adopted

November 18, 1970, and last amended in November 2017.”

5

We analyzed the Program for Security of FOMC Information in effect during the scope of our review.

6

The federal conflict of interest laws are also outlined in section 5.2 of the Federal Reserve Bank of Dallas Code of Conduct and

the Federal Reserve Bank of Boston Code of Conduct.

Case 22-0030-I 3 of 24

mortgage-backed securities (MBS)—create an “appearance of a conflict of interest” that could cause a

reasonable person to question Mr. Rosengren’s impartiality under FRB Boston’s code of conduct.

Finally, we note that the rules in effect during the scope of our review did not sufficiently support public

confidence in the impartiality and integrity of the policymakers and senior staff carrying out the public

mission of the FOMC’s work. In October 2021, the Board announced new rules governing investment and

trading activity for senior Board and Reserve Bank officials with the goal of supporting public confidence

in the impartiality and integrity of the FOMC’s work by guarding against even the appearance of any

conflict of interest. These new rules went into effect on May 1, 2022, and the requirements for advance

notice and preclearance of transactions took effect on July 1, 2022.

We completed an evaluation of the design and effectiveness of the Board’s new investment and trading

rules as well as the Board’s and the Reserve Banks’ approach to monitoring personal investment and

trading activities for possible conflicts of interest.

7

We posted this report to our public website on May 1,

2023.

Relevant Laws, Rules, and Policies

Reserve Bank Disclosure Statements Policies

The Reserve Bank disclosure statements policies require that Reserve Bank presidents annually file a

financial disclosure statement, or a Form A Federal Reserve Bank Confidential Financial Disclosure Report,

so that Reserve Banks can obtain information about circumstances that might constitute an actual or

potential conflict of interest or a violation of applicable Reserve Bank policy or law. The Form A includes

four reporting schedules: Schedule A—Assets and Income, Schedule B—Transactions and Gifts,

Schedule C—Liabilities and Agreements or Arrangements, and Schedule D—Positions Held Outside the

Federal Reserve Bank and Other Situations. In 2020, these forms were not required to be posted publicly.

However, FRB Dallas and FRB Boston made Form A disclosures available to members of the media or the

public upon request.

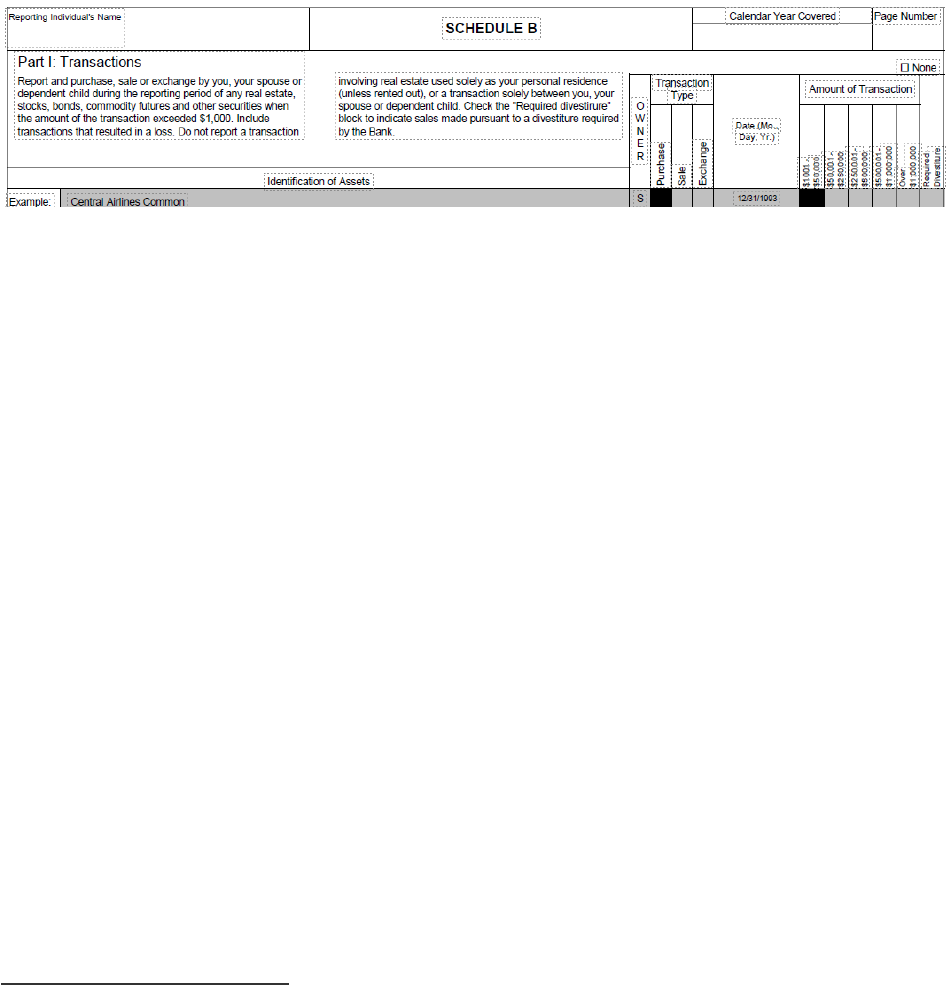

Form A, Schedule B, includes columns to identify transaction type (purchase, sale, or exchange), date of

transaction, and amount of transaction by dollar range ($1,001–$50,000; $50,001–$250,000; $250,001–

$500,000; $500,001–$1,000,000; and over $1,000,000) (see figure).

7

Office of Inspector General, The Board Can Further Enhance the Design and Effectiveness of the FOMC’s Investment and Trading

Rules, OIG Report 2023-SR-B-006, April 26, 2023.

Case 22-0030-I 4 of 24

Figure. Overview of Form A, Schedule B

Source: Form A Federal Reserve Bank Confidential Financial Disclosure Report in effect during the scope of our review.

Reserve Bank Prohibited Holdings Policies

Reserve Bank prohibited holdings policies state that an employee may not own or control, directly or

indirectly, any debt or equity interest in a depository institution or an affiliate of a depository institution.

8

An employee with regular and ongoing access to Class I FOMC information is also prohibited from owning

or controlling, directly or indirectly, any debt or equity interest in a primary government securities dealer

or an entity that directly or indirectly controls a primary dealer.

9

In addition, the Federal Reserve Administrative Manual, section 2-026.1, in effect in 2020, prohibited

Reserve Bank presidents from holding more than $50,000 in U.S. Treasury bonds or notes (including

shares of mutual funds whose investments are concentrated in such bonds or notes).

10

FOMC Blackout Rule

The FOMC’s Program for Security of FOMC Information states that an employee with knowledge of Class I

FOMC information should avoid engaging in any financial transaction the timing of which could create the

appearance of acting on inside information concerning Federal Reserve deliberations and actions:

In order to avoid even the appearance of acting on confidential FOMC information, an

FOMC staff officer or a [Federal Reserve] System employee who has knowledge of

information that is classified as “Class I FOMC—Restricted Controlled (FR)” and that is

related to the previous or upcoming FOMC meeting should not knowingly:

a. Purchase or sell any security (including any interest in the Thrift Plan for Employees of

the Federal Reserve System, but not including shares of a money market mutual fund)

during the period that begins at the start of the second Saturday (midnight) Eastern Time

8

Depository institution means a bank, a trust company, or any institution that accepts deposits, including a bank chartered under

the laws of a foreign country.

9

The employee is regarded as controlling any debt or equity interest held by the employee’s spouse or minor child.

10

We note that this provision became obsolete when the Federal Open Market Committee—Investment and Trading Policy for

FOMC Officials (adopted February 17, 2022; as reaffirmed effective January 31, 2023) was updated to prohibit FOMC officials

from holding U.S. Treasury bonds or notes.

Case 22-0030-I 5 of 24

before the beginning of the meeting and ends at Midnight Eastern time on the last day of

the meeting; or

b. Hold any security for less than 30 days, other than shares of a money market mutual

fund.

This purchase or sale restriction does not apply if the transaction is authorized before the period

described in section (a) above begins (for example, through directions given to a broker). The FOMC

blackout rule also states that an FOMC staff officer or a System employee with knowledge of information

that is classified as Class I FOMC—Restricted Controlled (FR) and that is related to the previous or

upcoming FOMC meeting also should make every effort to ensure that the trading activities of their

spouse and dependent children comply with these restrictions. In unusual circumstances, after

consultation with the ethics officer, the trading blackout restrictions may be waived.

In addition to the FOMC blackout rule, on March 23, 2020, the Board Ethics Program emailed the

following to Reserve Bank ethics officials about observing a blackout period:

After the issue was raised by some Reserve Bank presidents, there was a wide consensus

here that securities trading by FOMC members during these uncertain times raises

potential appearance issues. As a result, I sent the following message to Board members

and senior staff this afternoon:

All: As a reminder, System policy provides: “An employee with knowledge of Class I FOMC

information should avoid engaging in any financial transaction the timing of which could

create the appearance of acting on inside information concerning Federal Reserve

deliberations and actions.” In light of the rapidly developing nature of recent and likely

upcoming System actions, please consider observing a trading blackout and avoid making

unnecessary securities transactions for at least the next several months, or until FOMC

and Board policy actions return to their regularly scheduled timing. If you need to, for

example, redeem a 529 account in order to pay tuition, or make other necessary

transactions, please let me know in advance.

Please consider sending a similar message to your presidents, first V-Ps, research

directors and any others you deem appropriate.

We independently confirmed that the FRB Dallas Legal Department sent a similar message to senior staff

on March 24, 2020, and that the FRB Boston ethics official sent a similar message on March 25, 2020.

Board Ethics considered this voluntary blackout period to have ended on April 30, 2020, after the

regularly scheduled April 28–29, 2020, FOMC meeting. Accordingly, the FRB Dallas Legal Department sent

an email on April 30, 2020, to FRB Dallas officials, stating the following:

[W]e have been advised that the FOMC and Board of Governor’s [sic] policy actions have

returned to their regularly scheduled timing. As such, the blanket trading restriction . . .

is no longer in effect. . . . Also, if you are involved in work related to any of the Federal

Reserve’s emergency programs or other similar actions that (i) have not yet been

Case 22-0030-I 6 of 24

announced to the public and (ii) could affect markets, please consider avoid [sic] making

securities transactions until the full scope of the actions in which you are involved has

been publicly announced.

Similarly, on May 8, 2020, the FRB Boston Legal Department sent an email to FRB Boston officials, stating

the following:

Given the resumption of regularly scheduled FOMC meetings, the ongoing trading

blackout recommendation for staff with FOMC Class I information access has ended

following the last day of the most recent regular FOMC blackout period, on Thursday,

April 30. Going forward, we are back to the regularly scheduled blackout periods. I have

attached the year’s blackout calendar for your convenience.

As a reminder, all Bank employees, but particularly those with FOMC information access

and/or working on any of the new facilities, should maintain vigilance to avoid any

transaction that could give the appearance of trading on non-public information. In

particular, for those working on the Main Street program, additional investment guidance

will be forthcoming.

Federal Conflict of Interest Laws

The federal conflict of interest laws prohibit Reserve Bank employees from personally and substantially

participating in an official capacity in any particular matter which, to their knowledge, will have a direct

and predictable effect on their financial interests, which includes the financial interests of their spouses

and minor children.

11

Federal regulations clarify the statute as follows:

12

• Personal and substantial: To participate personally means to participate directly. To participate

substantially means that the employee’s involvement is of significance to the matter.

13

• Particular matter: A particular matter involves deliberation, decision, or action focused on the

interests of specific persons or a discrete and identifiable class of persons. The term particular

11

18 U.S.C. § 208; 5 C.F.R. part 2635, subpart D.

12

5 C.F.R. part 2635, subpart D. We note that the OGE has issued guidance on conflict of interest considerations for assets such

as REITs (last updated October 2021). The OGE clarifies that under 18 U.S.C. § 208, an employee who holds an interest in a REIT is

prohibited from participating personally and substantially in any particular matter that the employee knows would have a direct

and predictable effect on the financial interest of the REIT. However, an employee may participate in any particular matter of

general applicability, such as rulemaking, in which the disqualifying financial interest arises from the ownership by the employee

if the securities are publicly traded and the market value of which does not exceed (1) $25,000 in any one such entity; and

(2) $50,000 in all affected entities.

13

5 C.F.R. § 2635.402(b)(4). Participation may be substantial even though it is not determinative of the outcome of a particular

matter. While a series of peripheral involvements may be insubstantial, the single act of approving or participating in a critical

step may be substantial. Personal and substantial participation may occur when, for example, an employee participates through

decision, approval, disapproval, recommendation, investigation, or the rendering of advice in a particular matter.

Case 22-0030-I 7 of 24

matter does not extend to the consideration or adoption of broad policy options that are directed

to the interests of a large and diverse group of persons.

14

• Direct and predictable effect: A particular matter will have a direct effect on a financial interest if

there is a close causal link between any decision or action to be taken in the matter and any

expected effect of the matter on the financial interest.

15

A particular matter that has an effect on

a financial interest only as a consequence of its effects on the general economy does not have a

direct effect.

16

A particular matter will have a predictable effect if there is a real, as opposed to a

speculative, possibility that the matter will affect the financial interest.

Reserve Bank Conflict of Interest Policy

The Reserve Bank conflict of interest policy states that employees “should avoid any situation that might

give rise to an actual conflict of interest or even the appearance of a conflict of interest.” An employee

who routinely represents the Reserve Bank in dealing with the public must be particularly careful in this

regard. When the circumstances might cause a reasonable person to question the employee’s impartiality

in a matter or otherwise give rise to an appearance of a conflict of interest, the employee should not

participate in the matter unless the employee has informed the Reserve Bank of the situation and

received authorization from the Reserve Bank’s ethics official.

Investigative Methodology

We conducted a comprehensive review of relevant records, including Board and Reserve Bank email

accounts, Form As, brokerage statements, and trading data for all relevant trading accounts; FOMC

blackout dates; and other documentation. We also interviewed relevant individuals. To obtain a complete

understanding of Mr. Kaplan’s and Mr. Rosengren’s 2020 trading activities, the scope of our investigation

was January 2019 through December 2021.

Analysis of Former FRB Dallas President Robert Kaplan’s

2020 Trading Activities

Mr. Kaplan served as president and chief executive officer of FRB Dallas from September 8, 2015, to

October 8, 2021. Mr. Kaplan served as a voting member of the FOMC in 2020.

14

5 C.F.R. § 2635.402(b)(3), 2640.103(a)(1).

15

5 C.F.R. § 2640.103(b) defines financial interest as the potential for gain or loss to the employee (or other person specified in

18 U.S.C. § 208) as a result of governmental action on the particular matter. The disqualifying financial interest might arise from

ownership of certain financial instruments or investments such as stock, bonds, mutual funds, or real estate. A disqualifying

financial interest might also derive from a salary, indebtedness, job offer, or any similar interest that may be affected by the

matter.

16

5 C.F.R. § 2635.402(b)(1). An effect may be direct even though it does not occur immediately.

Case 22-0030-I 8 of 24

Reserve Bank Disclosure Statements Policies

We analyzed Mr. Kaplan’s 2020 Form A dated August 17, 2021 (covering calendar year 2020), brokerage

statements, and trading data to determine whether he properly disclosed his 2020 trading activities.

Mr. Kaplan filed a Form A for every year within the scope of our review.

We found that (1) Mr. Kaplan’s description of his trading activities in his 2020 Form A did not provide

relevant information that would have provided a more comprehensive understanding of his trading

activities and (2) Mr. Kaplan did not report two trades on his 2020 Form A supplemental list of

transactions dates.

17

Mr. Kaplan’s 2020 Form A Did Not Provide Relevant Information

Mr. Kaplan’s 2020 Form A identified neither the specific dates of his transactions nor his transactions that

were based on stock option contracts (and the resulting transactions based on these contracts). The then

FRB Dallas general counsel and Mr. Kaplan agreed to indicate “multiple” rather than specific transaction

dates on his Form A and determined that this approach was permissible because it was consistent with

Chair Powell’s reporting on his OGE Form 278e.

18

Mr. Kaplan stated that this had been his consistent

practice since the start of his tenure at FRB Dallas in 2015 and that no one had ever raised the issue of his

listing of “multiple” on his Form As.

We note that the Form A, Schedule B instructions state, “Report [any] purchase, sale or exchange by you,

your spouse or dependent child during the reporting period of any real estate, stocks, bonds, commodity

futures and other securities when the amount of the transaction exceeded $1,000. Include transactions

that resulted in a loss.” Unlike the OGE’s guidance for OGE Form 278e filers, the Form A instructions in

2020 were not detailed and did not distinguish between reporting excepted investment fund transactions

and other types of transactions.

17

Mr. Kaplan’s brokerage statements and trading data also reflect a December 9, 2020, purchase of GS Financial Square Treasury

Instruments, a money market mutual fund. We did not conduct further review of this transaction because money market mutual

funds are considered cash accounts, which are not required to be reported on Form As.

18

OGE’s guidance for OGE Form 278e filers permits combining multiple purchases or multiple sales of an excepted investment

fund, such as a mutual fund or an exchange traded fund (ETF), in a single entry, listing each date or providing a more general

description, such as “monthly” or “multiple.” We independently confirmed that Chair Powell’s listing of “multiple” on his

2020 OGE Form 278e was for mutual funds and an ETF; all other reported transactions included the transaction date.

Case 22-0030-I 9 of 24

In 2021, however, Board Ethics sent an email to the then FRB Dallas general counsel recommending that

Mr. Kaplan list the specific transaction dates.

19

Board Ethics acknowledged that Mr. Kaplan listed

“multiple” for his transactions in previous years but stated that it was now recommending including the

specific dates for several reasons. Specifically, the email from Board Ethics stated the following:

1) Earlier this year, the OGE advised us that we should not accept similar

transaction reporting (with “Multiple” as the listed date) from Board members.

They stated that omitting specific transaction dates and using “multiple” would

be acceptable only for mutual fund/ETF transactions, but even then, we should

consider whether using “multiple” as a date seems reasonable, particularly for

reports submitted by a high-level filer for whom there would be more public

interest in learning when transactions occurred.

2) Like our Board members, President Kaplan is a particularly high-level filer for

whom there would be a reasonable public interest in transaction dates. (I believe

that he also was a voting member of the FOMC last year.)

3) 2020 was a particularly turbulent year for the markets, and the Federal Reserve

played a key role in responding to events, so there is even more public interest in

listing transaction dates during this period.

4) Therefore, the Board members have listed their specific transaction dates, as

have other Reserve Bank Presidents. This preemptively answers potential

questions about whether they were trading during FOMC blackout periods and

so forth. (If a transaction occurred during a trading blackout period but was pre-

authorized and thus allowed under FOMC policy, other Reserve Bank presidents

have added an explanatory note in the comments section on the first page of the

form.)

In response to the Board’s request, on August 16, 2021, the then FRB Dallas general counsel responded in

a voicemail that she spoke to Mr. Kaplan, who stated that he wanted to keep his Form A as it was because

he did not have the time to complete the revisions by the due date. She further explained that Mr. Kaplan

19

As we found in our ethics evaluation, the Board has taken steps to adopt a more centralized approach to overseeing personal

investment and trading activities across the System. For example, the Board amended FRAM § 2-026, “Employee Conduct,” to

revise standards for reviewing and transmitting Reserve Bank presidents’ Form A financial disclosure reports and to formalize

escalation protocols through the Board’s designated agency ethics official (DAEO). Specifically, the Board amended FRAM § 2-026

to require the Reserve Bank ethics officers or their designees to transmit the Reserve Bank presidents’ Form A financial disclosure

reports to the Board’s DAEO and to consult with the Board’s DAEO as necessary. In addition, amendments to FRAM § 2-026

include a requirement that Reserve Bank ethics officers promptly refer ethics concerns about Reserve Bank presidents to the

Board’s DAEO. Reserve Bank ethics officers may also raise concerns about a Reserve Bank president with a Reserve Bank’s board

of directors. Moreover, the System has taken steps to align the standards for the Form A financial disclosure reports submitted

by Reserve Bank presidents with the standards for financial disclosure reports submitted by Board members, which are dictated

by OGE regulations. We recommended actions to address this finding, to which the Board concurred. See Office of Inspector

General, The Board Can Further Enhance the Design and Effectiveness of the FOMC’s Investment and Trading Rules, OIG Report

2023-SR-B-006, April 26, 2023.

Case 22-0030-I 10 of 24

had given her a list of his trade dates (see attachment); she reviewed them and confirmed that there

were no blackout violations. The then FRB Dallas general counsel stated that upon request, FRB Dallas

planned to release the Form A and would release the separate list of transaction dates upon request. She

also stated that starting in 2022, Mr. Kaplan would enter all his transaction dates directly on the Form A.

The then FRB Dallas general counsel acknowledged that it was not FRB Dallas’s practice to post the

Form As online; she explained in her interview with our office that she did not provide the supplemental

information to the Board because it could have been subject to public disclosure.

20

Mr. Kaplan Did Not Report Two Trades on His 2020 Form A Supplemental List of Transaction

Dates

We independently reviewed the supplemental list of Mr. Kaplan’s trading dates and cross-referenced

relevant brokerage statements and trading data. We found that the following transactions on

Mr. Kaplan’s brokerage statements and trading data were not reported on his 2020 Form A supplemental

list of transactions dates:

• June 9, 2020: two separate sales of General Electric Co. (GE), in which third parties exercised

previously established call options

Based on our review, Mr. Kaplan reported purchases and sales of GE stock on his 2020 Form A and listed

“multiple” as the transaction dates. Mr. Kaplan did not list the specific June 9, 2020, sales of GE in his

supplemental list of trading dates, but he did list a June 11, 2020, transaction of GE. We further note that

this supplemental list of trading dates did not indicate whether a transaction was a sale or purchase and

also did not identify transactions that were based on previously established option positions.

When asked about the difference between the brokerage statements and trading data and the dates

reported on his supplemental list, Mr. Kaplan, through his counsel, explained that the June 9, 2020, GE

call options settled on June 11, 2020. Additionally, on June 11, 2020, Mr. Kaplan separately purchased

additional shares of GE. Mr. Kaplan explained that these GE trades were referenced on the supplemental

list of trading dates as all having occurred on June 11, 2020, as a result of a clerical transcription error.

We independently confirmed that the June 9, 2020, GE call options settled on June 11, 2020.

Given the previously accepted reporting practices (meaning, Mr. Kaplan’s listing “multiple” on his Form A)

and the lack of clear instructions on the Form A regarding the permissibility of listing “multiple” for

transaction dates, we did not find that Mr. Kaplan violated a specific provision of the Reserve Bank

disclosure statement policies. However, as described below, we found that Mr. Kaplan’s description of his

trading activities on his 2020 Form A and his supplemental list of trading dates omitted relevant

information that would have provided a more comprehensive understanding of his trading activities.

20

We note that in February 2022, the FOMC’s Investment and Trading Policy was updated to require Reserve Banks to post

Form As to their public website annually.

Case 22-0030-I 11 of 24

Reserve Bank Prohibited Holdings Policies

We analyzed Mr. Kaplan’s 2020 Form A, brokerage statements, and trading data to determine whether

any of his 2020 trading activities violated the Reserve Bank prohibited holdings policies. Mr. Kaplan had

regular, ongoing access to Class I FOMC information and, therefore, was prohibited from owning or

controlling, directly or indirectly, any debt or equity interest in a depository institution or any of its

affiliates, or a primary government securities dealer or any of its affiliates (including bank stock, financial

services sector mutual funds, primary dealers, and savings and loan holding companies). In addition, he

was also prohibited from holding more than $50,000 in U.S. Treasury bonds or notes.

We determined that Mr. Kaplan did not own or control any prohibited holdings, nor did he hold any

U.S. Treasury bonds or notes. Therefore, we found that Mr. Kaplan did not violate the Reserve Bank

prohibited holdings policies.

FOMC Blackout Rule

We analyzed Mr. Kaplan’s 2020 Form A, brokerage statements, and trading data to determine whether he

engaged in any trading activity during the FOMC blackout period. We found that Mr. Kaplan’s 2020

trading activities did not violate the FOMC blackout rule. We reviewed and independently verified all of

Mr. Kaplan’s trading activities during 2020, which included reviewing all relevant brokerage statements

and cross-referencing each trade with all 2020 FOMC blackout dates.

We independently confirmed that Mr. Kaplan’s investment strategy primarily consisted of holding a large

amount of stock in single-name entities and selling put and call options against these shares. Under a call

option contract, a strike price is set for the underlying stock, and the call option buyer has the right to

purchase shares of the stock if the stock reaches or exceeds the strike price any time before the

expiration of the call option contract. The call option seller is legally required to sell the stock at the time

the buyer exercises the call option and has no discretion as to when this transaction occurs. Similarly,

under a put option contract, a strike price is set for the underlying stock, and the buyer of the put

contract has the right to sell shares of the underlying stock to the put option seller if the stock price is

lower than the strike price. The put option seller is legally required to buy the stock at the time the buyer

exercises the put option and has no discretion as to when this transaction occurs.

Mr. Kaplan’s brokerage statements and trading data reflected three transactions that occurred during an

FOMC blackout period:

21

• June 9, 2020: two separate sales of GE, in which third parties exercised previously established call

options

21

As noted earlier, Mr. Kaplan’s brokerage statements and trading data also reflect a December 9, 2020, purchase of GS Financial

Square Treasury Instruments, which is a money market mutual fund and as such, is explicitly excluded from the FOMC blackout

rule. The FOMC blackout rule states that a System employee who has knowledge of Class I FOMC information “should not

knowingly: purchase or sell any security . . . but not including shares of a money market mutual fund” during an FOMC blackout

period.

Case 22-0030-I 12 of 24

• December 9, 2020: one sale of GE, in which third parties exercised previously established call

options

These transactions, while executed during an FOMC blackout period, were the result of third parties

exercising a previously established option contract. The FOMC blackout rule does not apply if the

transaction is authorized before the blackout period. We therefore determined that these transactions,

which were based on previously established call options, did not violate the FOMC blackout rule.

Finally, through our review of brokerage statements and trading data, we found that Mr. Kaplan did not

engage in any trading activities from March 23, 2020 (the date of the Board Ethics email about observing

a voluntary blackout period), to April 30, 2020 (when the voluntary blackout period ended).

Federal Conflict of Interest Laws

We analyzed Mr. Kaplan’s 2020 trading activities to determine whether he violated the federal conflict of

interest laws. Specifically, we reviewed whether any of Mr. Kaplan’s 2020 trading activities as reported on

his 2020 Form A and his supplemental document created a conflict of interest, in light of the Federal

Reserve’s and the FOMC’s monetary policy actions in 2020.

By nature of his role as FRB Dallas president, Mr. Kaplan participated in setting national monetary policy

and served as a voting member of the FOMC. In March 2020, the Federal Reserve authorized the

establishment of several emergency lending facilities and authorized the purchase of agency MBS to

maintain the orderly function of financial markets in response to the COVID-19 pandemic. These

monetary policy actions focused on the adoption of broad policy options and were directed to the

interests of large and diverse groups of persons and were not focused on the interests of specific persons.

As such, in consultation with the OGE regarding the federal conflict of interest rules in effect at the time,

we found that the Federal Reserve’s actions were not a particular matter (as defined by the federal

conflict of interest laws), but rather were part of the Board’s broader monetary policy directed to address

the effects of the COVID-19 pandemic on the U.S. economy. Accordingly, we found that Mr. Kaplan’s

2020 trading activities did not create a conflict of interest.

Conclusion Regarding Mr. Kaplan

Mr. Kaplan’s 2020 trading activities did not violate the laws, rules, regulations, or policies related to

trading activities as investigated by our office. Mr. Kaplan’s 2020 Form A, however, did not publicly

disclose the specific dates of his trading activities, nor did it specify transactions that involved the selling

of stock option contracts. This lack of information, in our opinion, did not support public confidence in the

impartiality and integrity of the policymakers and senior staff carrying out the public mission of the

FOMC’s work, especially during this critical time period when the Federal Reserve was taking monetary

policy actions to address the effects of the COVID-19 pandemic on the U.S. economy.

These collective facts, in our opinion, create an “appearance of acting on confidential FOMC information”

under the FOMC blackout rule and an “appearance of a conflict of interest” that could cause a reasonable

person to question Mr. Kaplan’s impartiality under FRB Dallas’s code of conduct.

Case 22-0030-I 13 of 24

Analysis of Former FRB Boston President

Eric Rosengren’s 2020 Trading Activities

Mr. Rosengren served as president and chief executive officer of FRB Boston from July 20, 2007, to

September 30, 2021. Mr. Rosengren served as a voting member of the FOMC in 2019. Mr. Rosengren,

through his counsel, declined our request for an interview.

Reserve Bank Disclosure Statements Policies

We analyzed Mr. Rosengren’s 2020 Form A dated July 20, 2021 (covering calendar year 2020), brokerage

statements, and trading data to determine whether he properly disclosed his 2020 trading activities.

Mr. Rosengren filed a Form A for every year within the scope of our review.

Unreported Trades and Discrepancies on Mr. Rosengren’s 2020 Form A

We found that Mr. Rosengren did not report multiple trades on his 2020 Form A. Additionally, we found

discrepancies between the transactions reflected in his brokerage statements and trading data and what

he reported on his 2020 Form A.

22

• Mr. Rosengren reported a January 30, 2020, purchase of JingDong (JD) shares, with the amount

of the transaction reported in the $1,001–$50,000 range column; however, the trading data

reflect a sale of JD shares, the amount of transaction which should have been reported in the

$50,001–$250,000 range column.

• Mr. Rosengren reported a January 30, 2020, sale of Alibaba (BABA) shares, with the amount of

the transaction reported in the $1,001–$50,000 range column; however, the trading data reflect

that the sale of BABA shares was in an amount that should have been reported in the $50,001–

$250,000 range column.

Unreported REIT Trades on Mr. Rosengren’s 2020 Form A

Mr. Rosengren’s brokerage statements and trading data reflect the following REIT trades that he did not

report in his 2020 Form A:

• January 31, 2020, purchase of Annaly Capital (NLY)

23

in the amount of $1,001–$50,000

22

As we found in our ethics evaluation, because Board and most Reserve Bank ethics officers do not use brokerage statements to

review financial disclosure reports for accuracy, the Board and certain Reserve Banks are relying on a trust-based approach. As a

result, the Board and those Reserve Banks cannot be certain that a covered individual’s preclearance requests were accurate and

cannot detect instances in which a covered individual failed to preclear a transaction. We recommended actions to address this

finding, to which the Board concurred. See Office of Inspector General, The Board Can Further Enhance the Design and

Effectiveness of the FOMC’s Investment and Trading Rules, OIG Report 2023-SR-B-006, April 26, 2023.

23

NLY invests in agency MBS collateralized by residential mortgages, which are guaranteed by the Federal National Mortgage

Association (Fannie Mae), Federal Home Loan Mortgage Corporation (Freddie Mac), or the Government National Mortgage

Association (Ginnie Mae) and complementary investments within the agency market.

Case 22-0030-I 14 of 24

• February 5, 2020, purchase of NLY in the amount of $50,001–$250,000

• February 5, 2020, purchase of Invesco Mortgage Capital (IVR)

24

in the amount of $50,001–

$250,000

• February 20, 2020, purchase of IVR in the amount of $1,001–$50,000

• February 20, 2020, purchase of AGNC Investment (AGNC)

25

in the amount of $50,001–$250,000

26

• May 4, 2020, purchase of NLY in the amount of $1,001–$50,000

• May 5, 2020, purchase of AGNC in the amount of $1,001–$50,000

• June 12, 2020, purchase of AGNC in the amount of $1,001–$50,000

• June 16, 2020, purchase of AGNC in the amount of $1,001–$50,000

• June 26, 2020, purchase of AGNC in the amount of $1,001–$50,000

• August 3, 2020, purchase of IVR in the amount of $1,001–$50,000

• September 2, 2020, sale of Two Harbors (TWO)

27

in the amount of $1,001–$50,000

• November 24, 2020, purchase of IVR in the amount of $1,001–$50,000

• December 28, 2020, purchase of TWO in the amount of $1,001–$50,000

• December 29, 2020, purchase of NLY in the amount of $1,001–$50,000

REIT Trades on Mr. Rosengren’s 2020 Form A Not Reflected in His Brokerage Statements and

Trading Data

Mr. Rosengren’s 2020 Form A reports the following REIT trades that are not reflected in his brokerage

statements and trading data:

• September 20, 2020, sale of TWO in the amount of $1,001–$50,000

• December 20, 2020, purchase of TWO in the amount of $1,001–$50,000

24

IVR is a REIT. The company is primarily focused on investing in, financing, and managing residential and commercial MBS and

mortgage loans, which it collectively refers to as its target assets. The company’s target assets consist of agency residential

mortgage-backed securities (RMBS), where Ginnie Mae, Fannie Mae, or Freddie Mac guarantees payments of principal and

interest on the securities. Invesco’s agency RMBS investments include mortgage pass-through securities and may include

collateralized mortgage obligations.

25

AGNC invests predominately in agency RMBS on a leveraged basis, financed primarily through collateralized borrowings

structured as repurchase agreements.

26

Mr. Rosengren’s trading data reflect a February 20, 2020, purchase of AGNC in an amount between $1,001–$50,000.

27

TWO is an internally managed REIT focused on investing in, financing, and managing agency RMBS, mortgage servicing rights,

and other financial assets, which the firm collectively refers to as its target assets.

Case 22-0030-I 15 of 24

REIT Trade Discrepancies Between Mr. Rosengren’s 2020 Form A and His Brokerage Statements

and Trading Data

Mr. Rosengren’s 2020 Form A reports the following REIT trades, the amounts of which are different than

those reflected in his brokerage statements and trading data:

• February 5, 2020, purchase of TWO in the amount of $1,001–$50,000, but the brokerage

statements and the trading data reflect an amount greater than reported ($50,001–$250,000)

• May 15, 2020, purchase of NLY in the amount of $1,001–$50,000, but the brokerage statements

and the trading data reflect an amount less than the reportable threshold

• May 26, 2020, purchase of NLY in the amount of $1,001–$50,000, but the brokerage statements

and the trading data reflect an amount less than the reportable threshold

• December 29, 2020, sale of IVR in the amount of $1,001–$50,000, but the brokerage statements

and the trading data reflect an amount less than the reportable threshold

Reserve Bank Prohibited Holdings Policies

We analyzed Mr. Rosengren’s 2020 Form A, brokerage statements, and trading data to determine

whether any of his 2020 trading activities violated the Reserve Bank prohibited holdings policies.

Mr. Rosengren had regular, ongoing access to Class I FOMC information and, therefore, was prohibited

from owning or controlling, directly or indirectly, any debt or equity interest in a depository institution or

any of its affiliates, or a primary government securities dealer or any of its affiliates (including bank stock,

financial services sector mutual funds, primary dealers, and savings and loan holding companies). In

addition, he was prohibited from holding more than $50,000 in U.S. Treasury bonds or notes.

We determined that Mr. Rosengren did not own or control any prohibited holdings, nor did he hold any

U.S. Treasury bonds or notes. Therefore, we concluded that Mr. Rosengren did not violate the Reserve

Bank prohibited holdings policies.

FOMC Blackout Rule

We analyzed Mr. Rosengren’s 2020 Form A, brokerage statements, and trading data to determine

whether he engaged in any trading activity during the FOMC blackout period. We found that Mr.

Rosengren did not engage in such activity.

Through our analysis of brokerage statements and trading data, we found that Mr. Rosengren did not

engage in any trading activities from March 23, 2020 (the date of the Board Ethics email about observing

a voluntary blackout period), to April 30, 2020 (when the voluntary blackout period ended).

Federal Conflict of Interest Laws

We analyzed Mr. Rosengren’s 2020 trading activities to determine whether he violated the federal

conflict of interest laws. Specifically, we reviewed whether any of Mr. Rosengren’s 2020 trading activities

as reported on his 2020 Form A created a conflict of interest, in light of (1) the FOMC’s announcement

Case 22-0030-I 16 of 24

that it would increase its holdings of agency MBS in response to the emerging COVID-19 pandemic;

28

and

(2) Mr. Rosengren’s 2020 speeches addressing the economic effects of the COVID-19 pandemic, including

its effect on the REIT and MBS markets.

Mr. Rosengren’s REIT Holdings

Mr. Rosengren’s Form As reflect that he held and engaged in transactions involving mortgage REITs. REITs

are companies that manage a portfolio of real estate assets for the benefit of their shareholders. There

are two main types of REITs: equity REITs, which invest in and own properties, and mortgage REITs, which

have a stated policy of concentrating in agency securities, such as agency debt and agency MBS. REITs

invest in several different types of real estate, including residential, retail, office, industrial, health care,

hotel properties, and self-storage facilities. Specifically, in our analysis of Mr. Rosengren’s 2020 Form A,

brokerage statements, and trading data, we determined that he held and engaged in the following

reportable transactions of mortgage REITs:

• In 2017, $50,001–$250,000 holding in IVR

▪ November 14, 2017, purchase of $50,001–$250,000

• In 2018, $1,001–$50,000 holding in IVR

▪ January 3, 2018, sale of $50,001–$250,000

▪ June 18, 2018,

29

purchase of $1,001–$50,000

▪ June 22, 2018, purchase of $1,001–$50,000

• In 2019, $1,001–$50,000 holding in IVR

▪ May 9, 2019, sale of $50,001–$250,000

▪ July 5, 2019,

30

purchase of $1,001–$50,000

▪ October 2, 2019, purchase of $1,001–$50,000

In 2020, Mr. Rosengren’s holdings in REITs were greater, and he had more REIT transactions, than in prior

years. Specifically,

• Mr. Rosengren held $1,001–$50,000 of IVR and made the following transactions in that holding:

▪ January 30, 2020, purchase of $1,001–$50,000

28

On March 15, 2020, the FOMC announced that it would increase its holdings of Treasury securities by at least $500 billion and

its holdings of agency MBS by at least $200 billion; the FOMC also announced that it would reinvest all principal payments from

the Federal Reserve’s holdings of agency debt and agency MBS in agency MBS.

29

We note that the June 18, 2018, and June 22, 2018, trades were reflected in Mr. Rosengren’s brokerage statements and

trading data, but he did not report these trades in his 2018 Form A (dated June 6, 2019).

30

We note that the July 5, 2019, and October 2, 2019, trades were reflected in Mr. Rosengren’s brokerage statements and

trading data, but he did not report these trades in his 2019 Form A (dated August 28, 2020).

Case 22-0030-I 17 of 24

▪ February 5, 2020, purchase of $50,001–$250,000

▪ February 20, 2020, purchase of $1,001–$50,000

▪ August 3, 2020, purchase of $1,001–$50,000

▪ September 17, 2020, sale of $1,001–$50,000

▪ November 24, 2020, purchase of $1,001–$50,000

• Mr. Rosengren held $50,001–$250,000 of AGNC and made the following transactions in that

holding:

▪ February 20, 2020, purchase of $50,001–$250,000

▪ May 5, 2020, purchase of $1,001–$50,000

▪ May 8, 2020, purchase of $1,001–$50,000

▪ May 15, 2020, purchase of $1,001–$50,000

▪ May 26, 2020, purchase of $1,001–$50,000

▪ June 12, 2020, purchase of $1,001–$50,000

▪ June 16, 2020, purchase of $1,001–$50,000

▪ June 19, 2020, purchase of $1,001–$50,000

▪ June 22, 2020, purchase of $1,001–$50,000

▪ June 26, 2020, purchase of $1,001–$50,000

▪ August 21, 2020, purchase of $1,001–$50,000

▪ August 24, 2020, purchase of $1,001–$50,000

▪ September 30, 2020, purchase of $1,001–$50,000

▪ October 2, 2020, purchase of $1,001–$50,000

▪ October 23, 2020, purchase of $1,001–$50,000

▪ November 16, 2020, purchase of $1,001–$50,000

▪ December 4, 2020, purchase of $1,001–$50,000

• Mr. Rosengren held $50,001–$250,000 of NLY and made the following transactions in that

holding:

▪ January 2, 2020, purchase of $1,001–$50,000

▪ January 31, 2020, purchase of $1,001–$50,000

▪ February 5, 2020, purchase of $50,001–$250,000

▪ February 20, 2020, purchase of $1,001–$50,000

▪ May 4, 2020, purchase of $1,001–$50,000

Case 22-0030-I 18 of 24

▪ May 5, 2020, purchase of $1,001–$50,000

▪ May 8, 2020, purchase of $1,001–$50,000

▪ July 31, 2020, purchase of $1,001–$50,000

▪ August 24, 2020, purchase of $1,001–$50,000

▪ October 23, 2020, sale of $1,001–$50,000

▪ November 20, 2020, sale of $1,001–$50,000

▪ December 29, 2020, purchase of $1,001–$50,000

• Mr. Rosengren held $50,001–$250,000 of TWO and made the following transactions in that

holding:

▪ January 30, 2020, purchase of $1,001–$50,000

▪ February 5, 2020, purchase of $50,001–$250,000

▪ May 7, 2020, purchase of $1,001–$50,000

▪ July 31, 2020, purchase of $1,001–$50,000

▪ September 2, 2020, sale of $1,001–$50,000

▪ November 24, 2020, purchase of $1,001–$50,000

▪ December 28, 2020, purchase of $1,001–$50,000

Additionally, based on our independent analysis of Mr. Rosengren’s brokerage statements and trading

data, we note that Mr. Rosengren often employed a covered call strategy for his holdings in NLY and IVR,

which entails writing, or selling, call options while holding onto the REIT; once the market price of the

REIT hit or surpassed the strike price, he would have been obligated to sell the predetermined shares of

the REIT.

We found that the FRB Boston Legal Department’s analysis of Mr. Rosengren’s 2020 Form A focused on

whether he held investments in prohibited holdings and whether any transactions occurred during the

blackout periods. Moreover, we found in a July 12, 2021, email from the Board’s then designated agency

ethics official to the FRB Boston Legal Department that the Board acknowledged receipt of

Mr. Rosengren’s 2020 Form A and did not flag Mr. Rosengren’s REIT transactions as a concern.

Following public reporting on September 8, 2021, regarding Mr. Rosengren’s purchases and sales in

REITs, Board officials met with Mr. Rosengren on September 17, 2021, to obtain additional insight into his

REIT trading activities. We interviewed a Board official who stated that during this meeting between

Board officials and Mr. Rosengren, Mr. Rosengren characterized his trading in REITs during a time when

the Federal Reserve authorized the purchase of agency MBS as a “blind spot.”

By nature of his role as FRB Boston president, Mr. Rosengren participated in setting national monetary

policy. Accordingly, although not a voting member of the FOMC in 2020, we view his participation in the

FOMC’s policy decision regarding agency MBS as personal and substantial. However, in consultation with

Case 22-0030-I 19 of 24

the OGE regarding the federal conflict of interest rules in effect at the time, we determined the Federal

Reserve’s authorization to purchase agency MBS was part of its broader monetary policy directed to

address the effects of the COVID-19 pandemic on the U.S. economy. Accordingly, the establishment of

the MBS was not a particular matter (as defined by the federal conflict of interest laws) because it was

not focused on the interests of specific persons but rather a consideration and adoption of a broad policy

option directed to the interests of a large and diverse group of persons. Therefore, we determined that

Mr. Rosengren’s 2020 REIT holdings and transactions did not violate federal conflict of interest laws.

However, as discussed further below, in our opinion, Mr. Rosengren’s trading activities in REITs create an

appearance of a conflict of interest.

Mr. Rosengren’s 2020 Speeches

During 2020, Mr. Rosengren gave 14 public speeches and remarks in his role as Reserve Bank president,

some of which addressed REITs and MBS.

31

While FRB Boston officials reviewed Mr. Rosengren’s

speeches, they did not flag the content of his speeches as a concern.

Moreover, in consultation with the OGE, we determined that Mr. Rosengren’s 2020 speeches did not

create a conflict of interest because they are not particular matters. Mr. Rosengren’s speeches focused

on the broad effect of the COVID-19 pandemic on real estate markets, including REITs, rather than on

deliberations, decisions, or actions focused on the interests of specific persons or a discrete and

identifiable class of persons. Accordingly, we determined that Mr. Rosengren’s 2020 speeches on the

economic effect of the COVID-19 pandemic did not violate federal conflict of interest laws.

Conclusion Regarding Mr. Rosengren

In evaluating Mr. Rosengren’s 2020 Form A, we found the following:

• Mr. Rosengren did not report multiple trades on his 2020 Form A.

• Discrepancies exist between the transactions reflected in Mr. Rosengren’s brokerage statements

and trading data and what he reported on his 2020 Form A.

31

For example, in remarks to the Boston Economic Club on September 23, 2020, titled “The Economy’s Outlook, Challenges, and

Way Forward,” Mr. Rosengren stated, “A structural shock, like the pandemic, can result in a significant increase in the number of

nonperforming loans, eventually impinging the ability of banks and insurance companies to continue to make credit available to

borrowers. Hence, I am especially worried about a ‘second shoe dropping’ that will particularly affect small and medium-sized

banks, which provide a large share of commercial real estate loans and small business loans. A curtailment of credit resulting

from such problems has caused serious headwinds to recoveries in the past and may be a serious problem going forward.”

Additionally, during a lecture at the Marquette University Economics Department on October 8, 2020, in a speech titled

“Economic Fragility: Implications for Recovery from the Pandemic,” Mr. Rosengren stated, “While banking data do not yet reflect

significant problems in commercial real estate, given the forbearance I mentioned and the lagging nature of indicators, we can

obtain an approximation of likely problems from the recent equity performance of real estate investment trusts. These are

companies that seek exposure to specific sectors of the commercial real estate market . . . equity indices focused on two

commercial real estate sectors—retail real estate and hotel real estate are particularly depressed since the pandemic hit.”

Case 22-0030-I 20 of 24

• Mr. Rosengren’s holdings in REITs increased from one (IVR) to four (IVR, NLY, AGNC, TWO) REIT

holdings in 2020.

• Mr. Rosengren executed more trades within these four REIT holdings as compared with prior

years. Mr. Rosengren executed some of these transactions during a time of significant financial

market volatility, when the Federal Reserve had authorized the purchase of agency MBS.

These collective facts, in our opinion, create the “appearance of a conflict of interest” that could cause a

reasonable person to question Mr. Rosengren’s impartiality under FRB Boston’s code of conduct.

In a statement released to the media on September 9, 2021, Mr. Rosengren acknowledged the

appearance issue, stating the following:

While my personal saving and investment transactions have complied with the Federal

Reserve’s ethics rules, I have decided to address even the appearance of any conflict of

interest by taking the following steps. . . . For context, I made some personal investment

decisions last year that were permissible under Fed ethics rules for asset types and

timeframes for transactions. Regrettably, the appearance of such permissible personal

investment decisions has generated some questions, so I have made the decision to

divest these assets to underscore my commitment to Fed ethics guidelines. It is

extremely important to me to avoid even the appearance of a conflict of interest, and I

believe these steps will achieve that.

Conclusion

With regard to former Reserve Bank President Robert Kaplan, we did not find that his trading activities

violated laws, rules, regulations, or policies related to trading activities as investigated by our office.

Based on our findings, we are closing our investigation into the trading activities of Mr. Kaplan.

Mr. Kaplan’s 2020 Form A, however, did not publicly disclose the specific dates of his trading activities,

nor did it specify transactions that involved the selling of stock option contracts. This lack of information,

in our opinion, did not support public confidence in the impartiality and integrity of the policymakers and

senior staff carrying out the public mission of the FOMC’s work, especially during this critical time period

when the Federal Reserve was taking monetary policy actions to address the effects of the COVID-19

pandemic on the U.S. economy. These collective facts, in our opinion, create an “appearance of acting on

confidential FOMC information” under the FOMC blackout rule and an “appearance of a conflict of

interest” that could cause a reasonable person to question Mr. Kaplan’s impartiality under FRB Dallas’s

code of conduct.

With regard to former Reserve Bank President Eric Rosengren, we found that he did not report multiple

trades on his 2020 Form A. Additionally, we found multiple discrepancies between the transactions

reflected in his brokerage statements and trading data and what he reported on his 2020 Form A.

Moreover, in our opinion, Mr. Rosengren’s trading activities in REITs in 2020—during a time of financial

market volatility that prompted the Federal Reserve to authorize the purchase of agency MBS—create an

Case 22-0030-I 21 of 24

“appearance of a conflict of interest” that could cause a reasonable person to question Mr. Rosengren’s

impartiality under FRB Boston’s code of conduct. However, we determined that these findings did not rise

to the level of a violation of laws, rules, regulations, or policies related to trading activities as investigated

by our office. Based on our findings, we are closing our investigation into the trading activities of

Mr. Rosengren.

Finally, we note that the rules in effect during the scope of our review did not sufficiently support public

confidence in the impartiality and integrity of the policymakers and senior staff carrying out the public

mission of the FOMC’s work. In October 2021, the Board announced rules governing investment and

trading activity for senior Board and Reserve Bank officials with the goal of supporting public confidence

in the impartiality and integrity of the FOMC’s work by guarding against even the appearance of any

conflict of interest. These new rules went into effect on May 1, 2022 (except for the requirements for

advance notice and preclearance of transactions, which took effect on July 1, 2022).

We completed an evaluation of the design and effectiveness of the Board’s new investment and trading

rules as well as the Board’s and the Reserve Banks’ approach to monitoring personal investment and

trading activities for possible conflicts of interest.

32

We posted this report to our public website on May 1,

2023.

32

Office of Inspector General, The Board Can Further Enhance the Design and Effectiveness of the FOMC’s Investment and

Trading Rules, OIG Report 2023-SR-B-006, April 26, 2023.

Case 22-0030-I 22 of 24

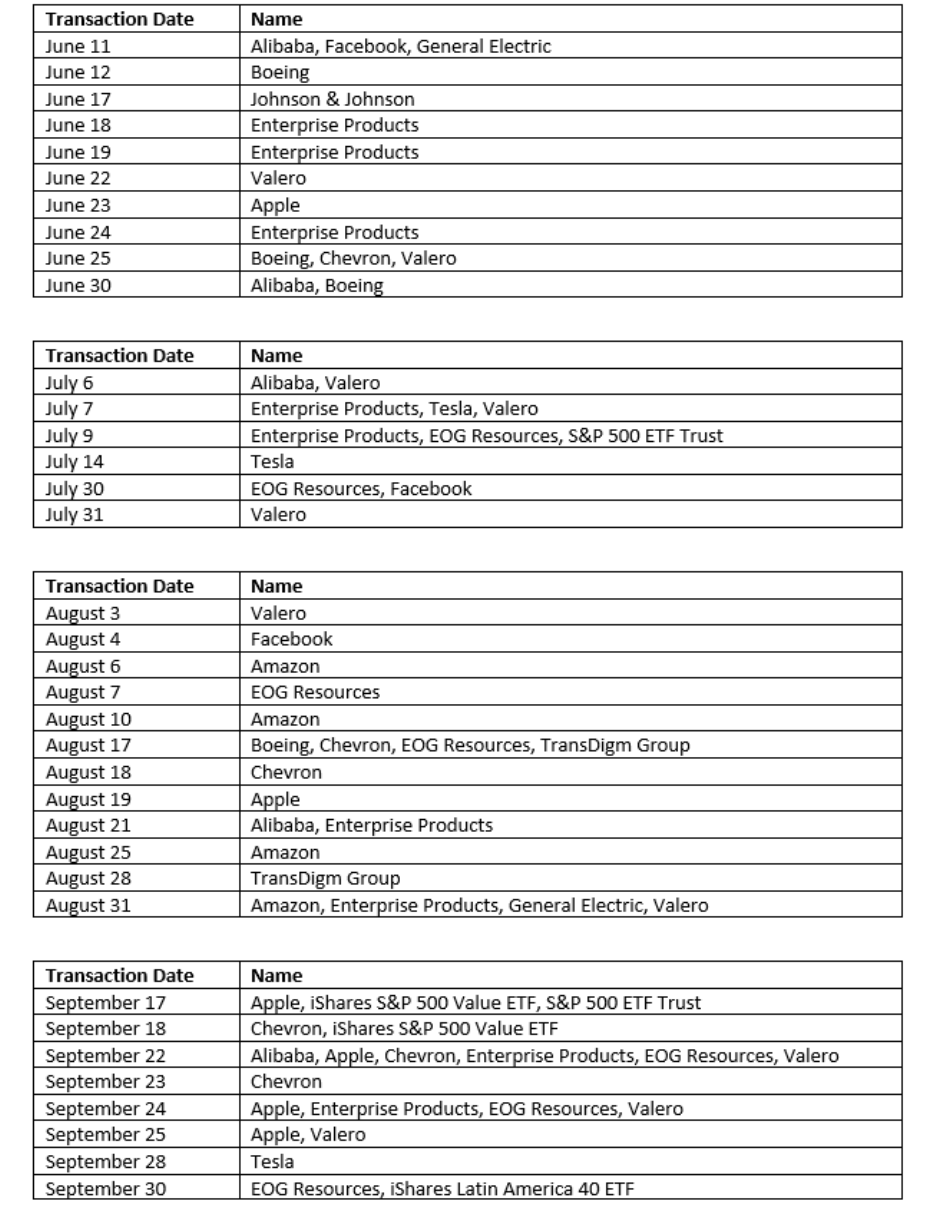

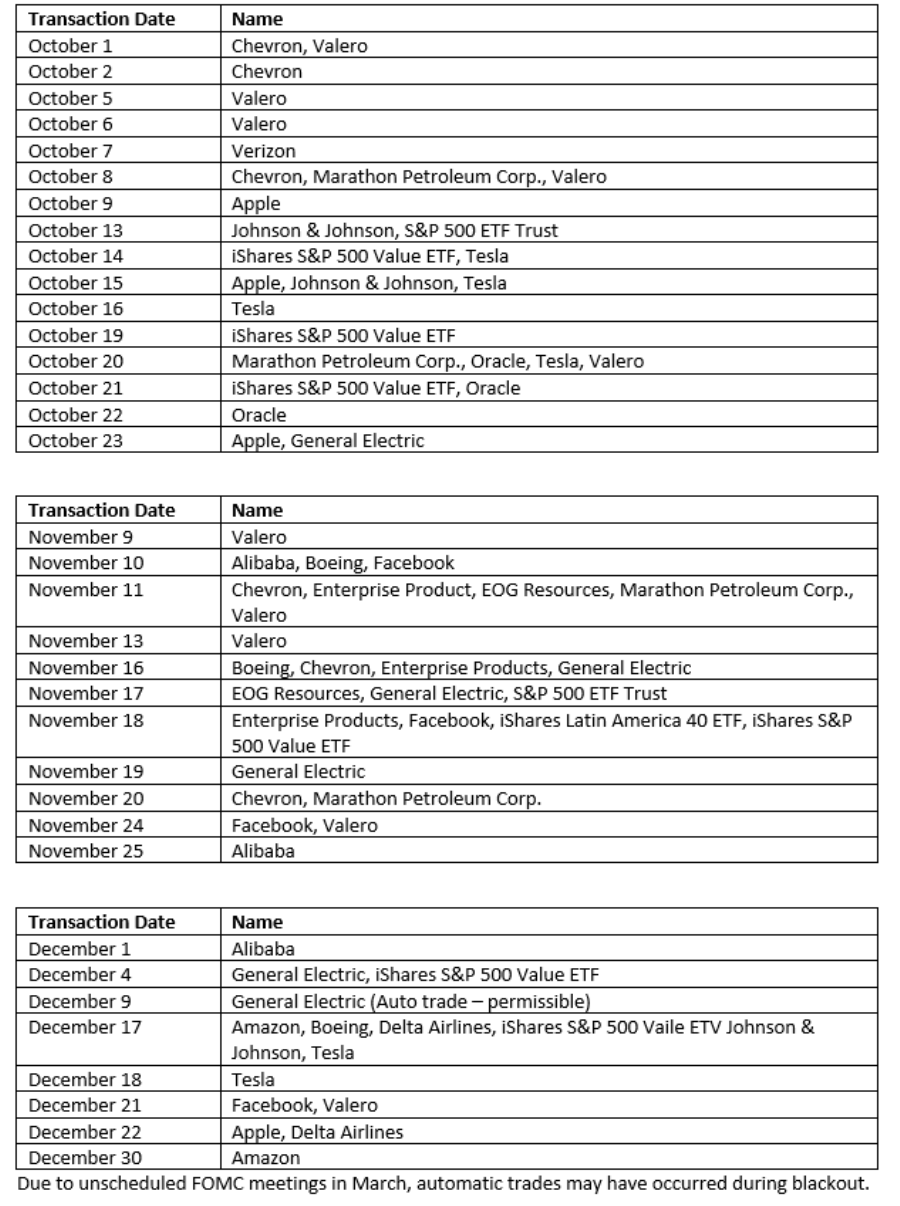

Attachment

Former FRB Dallas President Robert Kaplan 2020

Supplemental List of Trading Dates

Case 22-0030-I 23 of 24

Case 22-0030-I 24 of 24