No.13‐2

The2010SurveyofConsumerPaymentChoice

KevinFoster,ScottSchuh,andHanbingZhang

Abstract:

In 2010, the number of consumer payments increased nearly 9 percent from 2009 as economic

activitybegan to rebound from the financial crisis and recession. Cash payments by consumers,

whichhadincreasedsharplyin2009,didnotfallbackbutrathergrewanother3percentin2010.

However,theshareofcashpayments,thedollaramountofcashwithdrawals,andcashholdings

by consumers decreased moderately in 2010. Credit card payments by consumers increased 15

percent, reversing more than halfthe 2009 decline, and the steady trend decline in paper chec k

paymentsbyconsumerscontinued.Debitcardsandcashcontinuedtoaccountforthetwolargest

sharesofconsumerpayments(31.1and28.6percent,respectively),andconsumeradoptionofall

types of prepaid cards (38.2 percent) increased notably in 2010. Mobile banking and mobile

payments by consumers continued to show moderate increases through the end of 2010,

consistent with early stages of technology adoption. The 2010 SCPC contains new results that

mayhelpresearchersandpolicymakersidentifypotentialindirecteffects ofRegulationII(Durbin

Amendment)onconsumersandmayhelptoinformtheFederalReserve’s newstrategicplanfor

thepaymentsystem.

JELClassifications:D12,D14,E42

K

evin Foster and Scott Schuh are members of the Consumer Payments Research Center in the research

departmentoftheFederalReserveBankofBoston.KevinFosterisasurveymethodologist.ScottSchuhis

the director of the Center and a senior economist andpolicyadvisor.Hanbing Zhang isa law studentat

YaleUniversityandaformerresearchassociatewiththeConsumerPaymentsResearchCenter.Theiremail

respectively.

This report, which may be revised, isavailable on the web site of the Federal Reserve Bank of Boston at

http://www.bostonfed.org/economic/rdr/index.htm.

Completeanddetailedacknowledgmentsappearonthefirstpageofthis report.Theprimaryauthorsare

responsibleforanyerrorsthatmayremain.

Theviewsexpressed inthispaperarethoseoftheauthorsandtheFederal ReserveBankof Boston.They

donotnecessarilyrepresenttheviewsoftheotherFederalRe

serveBanksortheBoardofGovernorsofthe

FederalReserveSystem.

Thisversion:November2013

1

Acknowledgments

The Survey of Consumer Payment Choice (SCPC) is produced by the Consumer Payments

Research Center (CPRC) in the research department at the Federal Reserve Bank of Boston.

Enthusiastic and generous support from the Bank’s senior management for many years is

acknowledged and greatly appreciated. Geoff Tootell and Robert Triest provided excellent

oversight ofthe CPRC and its data program. For more detailed acknowledgments and a brief

historyoftheSCPC,seeFoster,Meier,Schuh,andZabek(2009,2011).

Thefollowingindividualscontributeddirectlytotheproductionanddisseminationofthe2010

Survey of ConsumerPayment Choice. From the Boston Fed: Patricia

Allouise, Sean Connolly,

Marianne Crowe, Kevin Foster, Claire Greene, Marcin Hitczenko, Vikram Jambulapati, Nina

Johnson,TomLavelle,SuzanneLorant,WilliamMurdock,LaurenNyren,SarojiniRao,Heather

Roberts,ScottSchuh,OzShy,JoannaStavins,JoelWerkema,MichaelA.Zabek,JeffZhang,and

Chuanqi Zhu. From the RAND Corp.: Marco Angrisani, Sandy Chien,

Tim Colvin, Tania

Gutsche, Arie Kapteyn, Erik Meijer, Julie Newell, Matthias Schonlau, and Albert Weerman.

(SomeoftheRANDstaffnowworksfortheUniversityofSouthernCalifornia.)

The CPRC acknowledges and thanks the CPRC Board of Advisors who served during the

productionanddisseminationof the 2010 SCPC; see

SectionXII for a listofthe Advisors. Ray

GraberandTom Burke ofGraberAssociates provided publicrelationsand marketingservices

for the CPRC and SCPC during the production of the 2010 SCPC. Louise Roseman, Board of

Governors of the Federal Reserve System, provided very helpfulcomments onthe 2010

SCPC

questionnaire. Janet Estep, Jane Larimer, Colleen Morrison, and Scott Lang of NACHA (The

Electronic Payments Association) provided data and technical advice on consumer electronic

payments.

2

ContactList

Pleasecontactthefollowingindividualsforfurtherinformationabout theSurveyofConsumer

PaymentChoiceinthedesignatedareasofinterest.

FederalReserveBankofBoston

MediaandPublicRelations

ThomasLavelle,VicePresidentandPublicInformationOfficer

(617)973‐3647

ConsumerPaymentsResearchCenter(CPRC)

ClaireGreene,PaymentsAnalyst(publicinformationliaison)

(617)973‐3246

KevinFoster,SurveyMethodologist

(617)973‐3955

ScottSchuh,DirectorandEconomist

(617)973‐3941

RAND‐USCAmericanLifePanel

UniversityofSouthernCalifornia,CenterforSocialandEconomicResearch(CESR)

TaniaGutsche,ManagingDirector

(310)448‐0371

[email protected](alternate)

ArieKapteyn,Director

(310)448‐5383

[email protected](alternate)

RANDCorporation,LaborandPopulationDivision

JoyMoini,SeniorResearchDirector

(310)393‐0411x6045

3

TableofContents

I.Introduction.......................................................................................................................................4

II.ConceptsandContent......................................................................................................................8

III.ConsumerUseofPaymentInstruments......................................................................................15

IV.ConsumerAdoptionofPaymentInstruments............................................................................23

V.BankandOtherPaymentAccounts.............................................................................................33

VI.SelectedTopics................................................................................................................................35

VII.NewQuestionsin2010..................................................................................................................41

VIII.SurveyMethodologyand

Data.....................................................................................................51

IX.Conclusions......................................................................................................................................59

X.Definitionsandconcepts................................................................................................................60

XI.SCPCBoardofAdvisors.................................................................................................................68

XII.References........................................................................................................................................70

XIII.2010SCPCTables............................................................................................................................73

4

I. Introduction

The2010SurveyofConsumerPaymentChoice(SCPC)isthethirdinaseriesofannual

studies(2008–2010)conductedbytheFederalReserveBankofBostontogainacomprehensive

understanding of the cash and noncash payment behavior of U.S. consumers.

1

This report

contains 43 tables with detailed estimates of therates of adoption, shares of consumers using,

and number of payments made by consumers for nine common payment instruments—cash,

checks,moneyorders,traveler’schecks,debit cards,creditcards,prepaidcards,onlinebanking

bill payments (OBBP), and bank account number payments

(BANP)—plus payments made

directlyfromconsumers’incomesource.Thereportalsocontainsestimatesofconsumeractivity

related to banking, cash management, and other payment practices; consumer assessments of

paymentcharacteristics;andarichsetofconsumerandhouseholddemographiccharacteristics.

In2010,thenumberofconsumerpaymentsrebounded astheeconomy

begantoemerge

from the financial crisis and recession. The large increase in consumers’ use of cash in 2009,

documentedinFoster,Meier,Sch u h,andZabek(2011),generallywasnotreversedin2010.The

number of cash payments increased moderately, while the share of cash payments and most

measures of

cash holdings and withdrawals declined moderately. Consumers also increased

their use of credit card s and bank account numbers (BANP) to make payments in 2010, with

both methods recovering roughly half of their 2009 declines. Changes in other noncash

consumerpaymentswererelativelymodest,evenforprepaidcards,whichexperiencedalarge

increase in the rate of adoption by consumers. Debit cards remained one of the two most

popularconsumerpaymentmethods(31.1percentofallpayments;cashwas28.6percent),and

1

FordetailedreportsonearlierversionsoftheSCPC,seeFoster,Meier,Schuh,andZabek(2009,2011).

5

adoptionanduseofdebitcardsincreased.Consumerpaymentsbycheckcontinuedtheirlong‐

run trend decline. Mobile banking and mobile payments by consumers continued to increase

moderatelythrough2010,consistentwithearlystagesoftechnologydiffusionandconfirmedby

other,morerecentdata.

The 2010 SCPC provides results that may

help to inform the assessment of the 2010

Dodd‐Frank Act (DFA), which included new legislation pertaining to debit card interchange

fees and routing. The so‐called Durbin Amendment to DFA became Regulation II, which the

Federal Reserve approved in July 2011 and implemented in October 2011.

2

In response to this

development, the CPRC added new question s to the 2010 SCPC about consumer attitudes

towarddebitcardauthorizationmethodsandsecuritytohelpgaugethepotentialpolicyimpact

onconsumerbehavior.RegIIprimarilyaffectedfinancialinstitutions,paymentcardnetworks,

and merchants; most consumers likely were unaware

of the changes. However, consumers’

debit card behavior may have been affected indirectly by Reg II because of differences in

consumerattitudestowardauthorizationmethodsandsecurity.If so,thenewquestionsabout

these issues in 2010 (and subsequent surveys) may help researchers to identify any indirect

impact.

The SCPC of

2010 (and other survey years) may provide useful data for at least two

other recent proposed policies. One is the Federal Reserve’s new strategic focus for financial

servicesduringthenextdecade,whichwasannouncedinOctober2012bythepresidentofthe

FederalReserve BankofCleveland(Pianalto2012).

AnimportantelementoftheFed’splanisto

begin taking into account the preferences of end users, such as consumers, when making

decisions about the payment system. A second policy is the Advanced Notice of Proposed

Rulemaking on prepaid cards issued by the Consumer Financial Protection Bureau (CFPB) in

2

Seehttp://www.federalreserve.gov/paymentsystems/regii‐about.htm.

6

May 2012, which “seeks input on how to ensure that consumers’ funds on prepaid cards are

safeandthatcardtermsandfeesaretransparent.”

3

Todetermineconsumerpreferencestoward

prepaidcardsandotherpaymentinstruments,itisnecessarytohavedataonactual consumer

paymentchoicesaswellastheirattitudestowardpaymentinstrumentsandpractices,whichare

in the SCPC. Aparticular advantageof the SCPC data is the fact that it contains

estimates for

the same consumer over multiple years. This type of longitudinal panel of consumers’ data,

which now extends to three years (2008–2010), offers unique information for researchers and

policymakers.

As in prior years, the 2010 SCPC was developed by the Consumer Payments Research

Center (CPRC) of the Boston Fed and

implemented by the RAND Corporation as an online

survey, using RAND’s American Life Panel.

4

The 2010 SCPC had 2,102 respondents whose

responses were weighted to represent all U.S. consumers ages 18 years and older. Of these

respondents, 1,913 of them (91 percent) were also respondents to the 2009 SCPC, and 788 of

respondents completed all three surveys since 2008. Both groups form valuable longitudinal

panels for research on consumer payment choice. The survey was implemented in the fall of

2010,primarilyinOctober.AlsoinOctober2010,theCPRCteamedwithrepresentativesofthe

FederalReserveBanksofRichmondandSanFranciscotoimplementapilotstudyversionofa

consumerpaymentdiarytosupplement

theSCPC.

5

Theresultsofthe2010SCPCreflectfurthermodificationsinthequestionnaireandother

aspectsofsurveymethodology,introducedtoimprovetheoverallqualityandmeasurementof

3

See http://www.consumerfinance.gov/pressreleases/consumer‐financial‐protection‐bureau‐considers‐rules‐on‐

prepaid‐cards/.

4

In 2013, the American Life Panel became a joint venture between the RAND Corporation (Labor and Population

Division)andtheUniversityofSouthernCalifornia(DornsifeCenterforEconomicandSocialResearch).

5

The results of the pilot diary in 2010 and 2011 are not published because of their developmental stage and small

samplesizes.AnofficialversionoftheDiaryofConsumerPaymentChoice wasimplementedinOctober2012and

theresultsarebeingpreparedforpublication.

7

consumer payment choices. To this end, the following revisions were made to the survey

questionnaire:

Questions were modified and added to improve measurement of mobile banking

andmobilepayments;

Newquestionswereaddedaboutthesecurityandinitiationofdebitcardpayments;

Twoquestions about consumer assessmentsof

characteristics ofpayments that had

beendroppedin2009(recordkeepingandsetupcost)wererestored;

An improv ed methodology was introduced for detecting and reducing online

reportingerrors.

Releaseofthe2010SCPCresults,alongwithreviseddatafor2008–2009,wasdelayedby

complications associated with evaluating and cleaning

the responses across time. Previously,

thedata evaluationandcleaning process wasconducted on a year‐by‐year basis using largely

subjective judgments. With the addition of a third year of data in 2010, however, it became

possibletoenhancethedataanalysistoincludethetime‐seriespropertiesofthe

responsesand

develop more consistent, objective, rule‐based, multi‐year procedures for evaluating and

cleaning the survey‐response data. This task required extensive new research and innovation

andwasfurthercomplicatedbychangestothesurveyquestionnaire.Thoughthesechangesare

valuable improvements to the measurement of consumer payment activity,

the changes also

makeitmorechallengingtodrawcross‐yearcomparisons becauseofthedifficultiesinherentin

separating effects of changes in the survey from the effects of changes in economic behavior.

The investment in improving the analysis and cleaning the SCPC data in 2010 is expected to

reducethe

timeittakestoprocessandpublishSCPCresultsfor2011andbeyond.

All SCPC data are available free of charge to the public once the official results have

been published, along with complete technical documentation. As with previously published

results, the SCPC estimates for 2008–2010 reported here may be revised in the future due to

additional process improvement and insights from new data in 2011 and beyond. The 2008–

2010 estimates are not yet adjusted for seasonal variation, inflation, or item nonresponse

8

(missing values). The CPRC is conducting ongoing research to develop procedures for these

kindsofadjustmentsforpotentialinclusioninfuturedatareleases.

The remainder of this paper comprises three parts: 1) a written summary of the key

SCPCresults;2)asetofofficialtablescontainingmostoftheSCPC

results;and3)asetoftables

containingtheofficialdefinitionsofimportantsurveyconcepts.Mored e tailsareavailableina

separatetechnicalappendixbyAngrisani,Foster,andHitczenko(2013).

II. ConceptsandContent

The main objective of the SCPC program is to measure U.S. consumer payments

behavior.Broadlyspeaking,theSCPCasksconsumerswhatpaymentaccountsandinstruments

theyhaveandhow theyusetheseaccountsandinstruments. ThetwomaingoalsoftheSCPC

programare:1)toprovideaggregatedataontrends

inU.S.consumerpaymentchoices;and2)

toprovideaconsumer‐leveldatabasetosupportresearchonconsumerpaymentchoices.

KeyMeasurementConcepts

ThereportingunitoftheSCPCisanindividualconsumerintheU.S.,age18orolder.The

primaryreasonisthatitiscostliertoobtain

estimatesforallconsumersinahouseholdanditis

unlikelythataheadofhouseholdcanaccuratelytrackpaymentsofallmembers,especiallyfor

cash. Consequently, the SCPC does not provide comprehensive estimates of the payment

choicesofhouseholdunits.However,informationabouteachreportingconsumer’shouseholdis

collected in

the survey and can be used to tabulate consumer payment behavior by type of

9

household, and for research on the relationship between consumer payment choice and

householdcharacteristics.

6

ThecoremeasurementconceptoftheSCPCisapaymentinstrument,whichissomething

thatconsumersuseto initiateandauthorizepaymenttoanotherparty(seeDefinitionsTable2

for more detail). Payments are settled with some form of money, which economists most

commonlydefineasM1:

Currency,

or“cash”(coins,billsandnotes),

Funds in a bank demand deposit account (checking) or other checkable deposit

account,

Traveler’schecks.

Two forms of money, cash and traveler’s checks, are both money and payment instruments,

whileotherinstrumentsarenot.

7

Onerecent,complicatingexceptiontothisclassificationisthat

some traveler’s checks are now being issued as prepaid cards (see below). Four technologies

serveaspaymentinstrumentsthatcanaccessfundsincheckingandotherdepositaccounts:

Paperchecks,

Debitcards(alsocalledcheckcards),

Online banking

bill payments (OBBP), which consumers initiate from their bank’s

onlinebankingwebsite,

6

Thedecisionnottocollectpaymentinformationatthehouseholdlevelshouldnotaffectthestatisticalpropertiesof

theaggregateestimatesofconsumerpaymentbehavior,inexpectation.However,theSCPCsamplingweightsdonot

accountforhouseholdcharacteristics,andtheCPRCiscontinuingtostudythestatisticalandeconomicrelationships

betweenindividualconsumerpaymentsandhouseholdpaymentsinmulti‐consumerhouseholds.TheSCPCcontains

amodestnumberofrespondentswhoaremembersofthesamehousehold.

7

Formoredetailsaboutthedifferencebetween(“basic”)moneyandpaymentinstruments(“derivativemedia”),see

Tobin(2008).

10

Bank account number payments (BANP), which occur when consumers give their

bankroutingandaccountnumbers toathirdpartyotherthanthebanktoauthorize

payment.

Twootherpaymentinstrumentshaveuniqueproperties:

Credit cards authorize payments to be settled later and hence are based on debt

rather

thanmoney;

Prepaid cards (also called gift cards, stored‐value cards, or prepaid debit cards –

including some types of traveler’s checks) authorize payment from balances that

consumerspre‐fundwithsomekindofpaymentinstrument.

8

The SCPC also tracks payments made by consumers directly from their income source (for

example,fromtheirpaycheck).Althoughpaymentsmadedirectlyfromincomesourcesreplace

conventional payments, they are not counted as a payment instrument at this time. See

Definition Tables 1 and 2 for more details about banking

concepts and payment instruments.

Paymentinstrumentsalsohavevarioustypesofcharacteristics:acceptance,convenience,costof

use, cost of setup, recordkeeping, and security. For each payment instrument, the SCPC asks

consumerstorateeachofthesecharacteristicsasitappliestothatinstrumentona1to5scale

(with

5beingthehighestorbestrating).Presumably,consumersbasetheirratingsontheirown

objectiveknowledgeabouttheactualpaymentcharacteristicstheyface.However,theseratings

may contain measurement error due to incomplete information, memory loss, estimation, or

8

Depending on the type of prepaid card, including traveler’s checks, the consumer’s pre‐funded balances may or

maynotbeheldinabankaccountandcouldbepaidusingmanydifferentinstruments,includingcash,creditcard,

or BANP. In any case, the variety of sources of funds backing the

prepaid card, as well as the legal and financial

protectionsassociatedwiththem,maynotbeknownorunderstoodwellbyconsumers.Also,prepaidcardsfunded

byoneconsumermaybeaccessedandusedbyanotherconsumer.

11

even subjective perception. See Definition Table 7 for more information about payment

instrumentcharacteristics.

TheSCPCprimarilymeasurestwotypesofconsumerpaymentchoice.First,itmeasures

the adoption (or ownership) of payment accounts, payment instruments, and other payment

practicesbyaskingwhetherornotconsumershavetheitemand,

formanyitems,whetherthey

everhadit(iftheydidnothaveitatthetimeofthesurvey).Theproportionofconsumerswho

do not have an item now but did have it in the past reflects a minimum estimate of the

percentage of consumers who have discarded the

item. For some payment instrument, such as

cash and money orders, adoption and discarding occur naturally as part of their use so

ownershipoftheseinstrumentsisdefinedbytheiruseduring thepast12months.Second,the

SCPC also measures consumers’ use of payment instruments and other payment practices

in

twoways: theshare of consumers whouse them in a monthor year and thenumberof times

consumersusethem.Inprinciple,itwouldbeusefulfortheSCPCtomeasurethedollarvalueof

consumer payments in addition to the number of payments. However, the SCPC does

not

attempt to measure the dollar value of payments because the dollar values are larger, more

complicated numbers that are presumably more difficult for consumers to report.

9

See

DefinitionTables3and4formoredetailsaboutadoptionanduse.

TheSCPCalsomeasuresconsumerpaymentsbytypeoftransaction.Consumerpayment

transactions are broadly classified as bills or nonbills. A bill means a recurring payment—

typically monthly, but potentially any one of a variety of frequencies—that

is usually made

after a good or service is purchased (for example, loan repayments, utility payments,

subscription fees, membership dues, etc.).Nonbills are all other payments, which are broken

down further into two categories: retail goods and services and person‐to‐person (P2P)

9

Thedollarvaluesareincludedinthenew2012DiaryofConsumerPaymentChoice(forthcoming).

12

payments. Both nonbill payment categories can be further divided into two locations: online

andotherelectronicpayments(suchasthosemadeonmobilephones),andbymail,in‐person,

orbyphone.SeeDefinitionsTable5formoredetailsabouttransactions.

The SCPC employs a flexible reporting strategy to enhance recall

and maximize the

accuracyofitsestimatesofthenumber(use)ofpayments.First,respondentsareaskedtoreport

the number of payments for a typical period rather than a specific calendar period. Typical

periods are like an implicit average that ideally is consistent with consumers’ sense of their

regular

or trend behavior; typical periods also have the advantage of eliminating unusual

events that might affect high‐frequency payments and obscure longer‐run trends.

10

Second,

respondents are allowed to choose the frequency (week, month, or year) that best suits their

recollection of payments for eachcombination of payment instrumentandtype of transaction.

Third,respondentsareaskedtoreporttheirnumberofpaymentsatrelativelydetailedlevels—

foreachcombinationof10uniquelydefinedmeans

ofpayment(ninepaymentinstrumentsand

directdeductionfromincome)andsevenuniquelydefinedtransactiontypes:threetypesofbills

andfourtypesofnonbillpaymentsforgoodsandservices,includingpaymentstootherpeople

who are not merchants. Not all combinations of payment instrument andtransaction type are

possible

because not all instruments are accepted for all transactions. Thus, respondents may

report up to 41 categories of payments, depending on how many instruments they have

adopted.

SupplyandDemandPerspectives

Theconsumer‐orientedconcepts anddefinitions in theSCPC differ in somewaysfrom

the terminology and perspectives of the

supply side of the payment system, especially in the

10

Foracomparisonoftheeffectivenessofusingthetypicalperiodrelativetoaspecificcalendarperiodinasurveyof

consumerpaymentchoicewithrecall,seeAngrisani,Kapteyn,andSchuh(2012).

13

areaofelectronicpayments.

11

Thisdemand‐sideapproachtomeasuringpaymentactivityhelps

to fill a knowledge gap by complementing work on the supply‐side perspective of payment

services (banks, the Federal Reserve System, nonbank payment service providers, an d

consultants, and merchants who accept payment from consumers), which focuses on the

networksandprocesses

bywhich payments are settled.

12

In contrast, the SCPC measures how

consumersinitiateandauthorizepaymentsratherthanhowpaymentsclearandsettle.

The Federal Reserve’s new strategic focus for financial services (Pianalto 2012)

emphasizes the importance of developing an array of payment instruments that satisfy

consumer preferences. To accomplish this objective, it is first

important to obtain a better

understanding of the relationship between the supply and demand for payment instruments.

Then, to properly take into account consumer (end‐user) preferences, policymakers need to

understandtheinteractionbetweenthesupplyanddemandforpayments.Thesupply‐sidecost

ofprovidingpaymentservices is one important

aspect of understanding the optimal payment

system. However, there are distinct costs and especially benefits to consumers that affect the

optimalityofthemoneyandpaymentsystem.

TheSCPC,alongwithotherrelateddataprojectsfromtheConsumerPaymentsResearch

Center, can provide useful input for research and understanding of

consumer preferences.

Ultimately,however,itwouldbebesttohavedetaileddataonboththesupplyanddemandfor

11

TheBANPinstrumentisaprimeexampleofhowtheconsumerperspectiveonpaymentsdiffersfromthesupply‐

side perspective. BANP is an electronic payment in which a consumer gives his or her bank account and bank

routing numbers to a third party who then uses the numbers to obtain permission to debit the consumer’s bank

account for payment. Thus, it is like an electronic check. Consumer payments made by OBBP also work like an

electronic check, except that the consumer’s bank does not disclose the bank account number (or other personal

information)toathirdparty.Viewedfromthesupply

sideofpayments,bothOBBPandBANPconsumerpayments

settleontheAutomaticClearingHouse(ACH)networkandarebothclassifiedasan“ACHpayment”instrumentin

theFederalReservePaymentStudies(seeFederalReserveSystem2010).

12

Forexample,seethelatestFederalReservePaymentStudy(FederalReserveSystem2010).

14

money and payments, and how these interact for each consumer‐merchant payment

transaction, to be able to design an optimal money and payment sys t em with appropriate

governmentpolicies.

OfficialTablesandData

The official 2010 survey results appear in SCPC Tables 1–33 ofthis paper(a total of 43

tables).Thetablesareorganizedbroadlyintofoursections:

1. Adoption – Consumer adoption of bank accounts, nonbank payment accounts, and

paymentinstrumentsandpractices.[Tables1–12]

2. Use – Consumer use of their

adopted payment instruments to pay bills, purchase

goodsandservices,andmakeotherpayments.[Tables13–26]

3. Assessments – Consumer assessments of key characteristics of payment instruments

andpaymentpractices.[Tables28–29K]

4. Demographics and other – Information about consumer demographic characteristics

andfinancialstatus.[Tables30–33]

A complete set

of analogous tables containing estimates of the standard errors fo r the SCPC

results is available online.

13

The official definitions of survey concepts are found in Definition

Tables1–7.

TheSCPCtablescontainmost,butnotall,oftheresultsfromthe2010survey.The2010

SCPCpublic‐usemicrodatasetcontainstheconsumer‐levelSCPCresponsestoallofthesurvey

questions,includingthoseusedto

createtheofficialtables,andalsomanymoreresponsesthat

arenottabulatedor presented here.Acompletelistofvariablesinthe2010SCPC datasetcan

13

Toobtainthestandarderrortables,seehttp://www.bostonfed.org/economic/cprc/SCPC/index.htm

15

be obtained from the data codebook and questionnaire.

14

All SCPC data users are strongly

encouraged to read Section VIII, Survey Methodology and Data, and the technical appendix

(Angrisani, Foster, and Hitczenko 2013) for more details and instructions on how to use the

data.

III. ConsumerUseofPaymentInstruments

TotalPayments

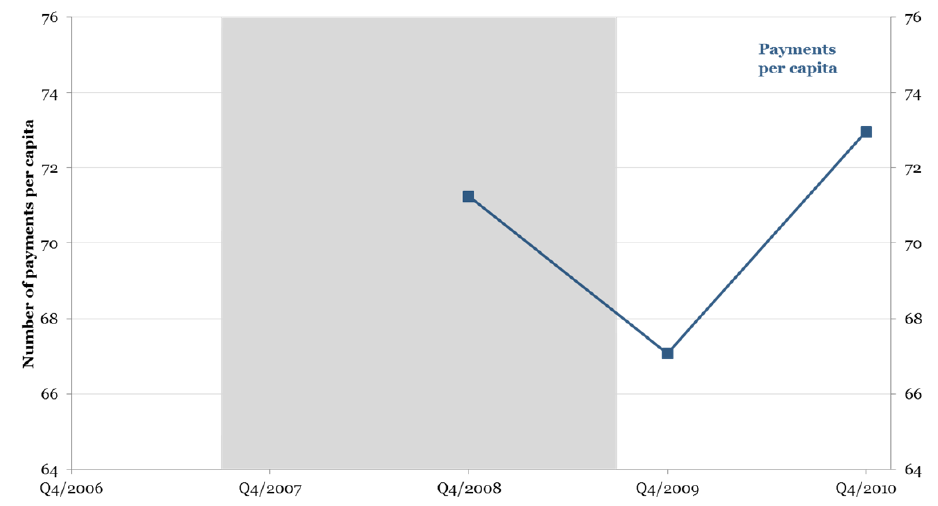

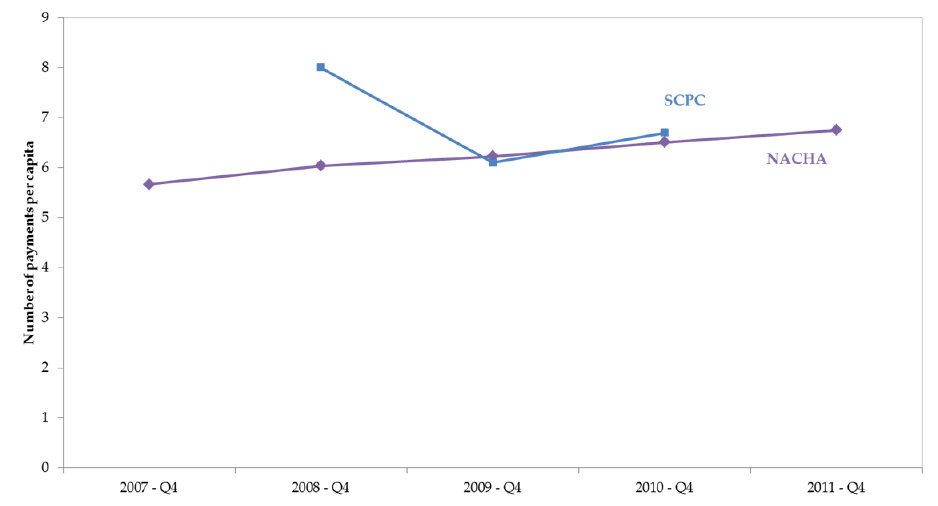

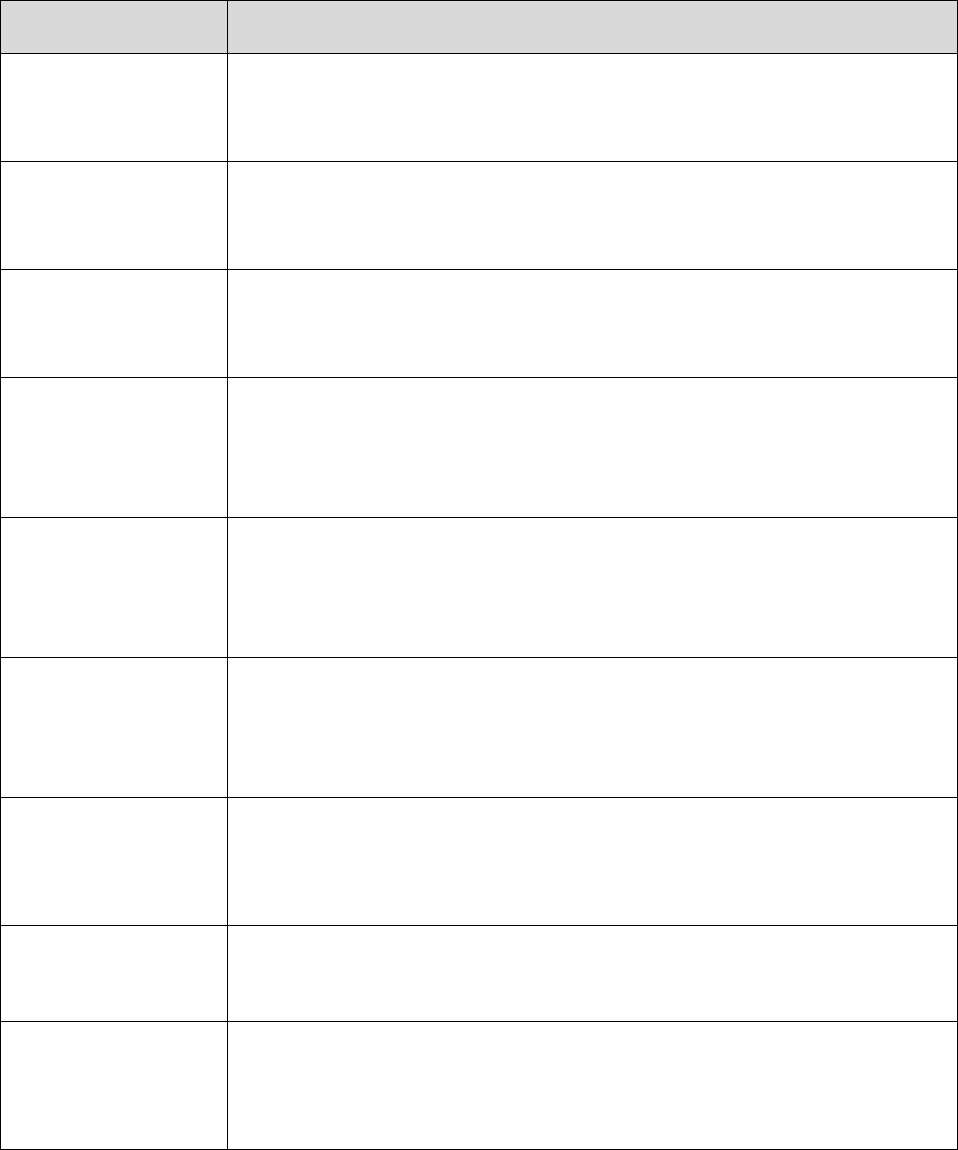

Total consumer payments per month rebounded in 2010, as shown in Figure 1. The average

numberofpaymentsmadebyconsumers(percapita)increased8.8percentin2010(Q4toQ4)to

73.0 in a typical month.

15

Consumer payments in the fourth quarter of 2010 were 2.5

16

percent

above their level in the same period of 2008, which was near the mid‐point of the previous

recessionasdefinedbytheNationalBureauofEconomicResearch(NBER)anddenotedbythe

shadedregionofFigure1.

14

Toobtainthe2010SCPCdataset,codebook,andquestionnaire,see

http://www.bostonfed.org/economic/cprc/SCPC/index.htm

15

The 2010 increase in total consumer payments per month is statistically significant at the 99 percent significance

level.

16

Allnumbersreportedinthetextarecopiedfromnumbersintheofficialtablesor,inthecaseoftransformations

suchasgrowthrates,calculatedusingthenumbersintheofficialtables,whichareroundedtointegersorasmall

numberofdecimals.SimilarcalculationsusingvariablesfromtheofficialSCPCdataset,whichhavemoreprecision,

mayproduceslightlydifferentestimatesinsomecasesduetothelackofrounding.

16

Figure1:Numberofconsumerpaymentspercapitapermonth

Source:2010SurveyofConsumerPaymentChoice,Table20.

Althoughthenumberofconsumerpaymentsin2008–2010appearstohavemovedprocyclically

during this unusually tumultuous time, with only three annual time series observations it is

simplytoosoontodeterminethe cyclical characterofthenumberof consumerpayments;that

willhavetowaituntiladditionalyearsof

databecomeavailable.Readersshouldalsobeaware

that the number of co nsumer payments is not the same as the National Income Account

measure of real consumption (per capita); Section VIII explains the relationship between the

twomeasures.

17

PaymentsbyInstrumentandTransactionType

In 2010, the SCPC tracked the number of payments made by consumers using 10 means of

payment(ninepaymentinstrumentsplusautomaticdeductionsfromincomesources )forseven

transactiontypes,asshowninTable1.Thetableshowstheaveragenumberofpaymentsmade

by consumers in a typical month for

each combination of instrument and transaction.

17

Blank

table entries indicate combinations for which the means of payment is assumed not to be

acceptedforthetransaction.Forexample,consumerscannotusecashtopayonline.

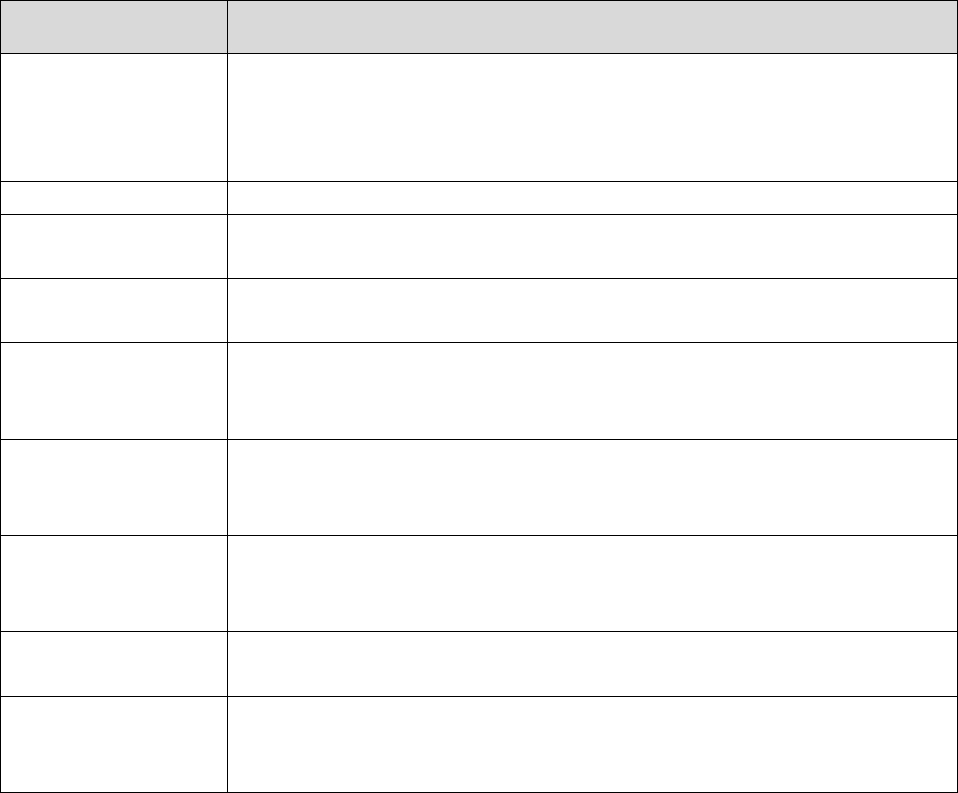

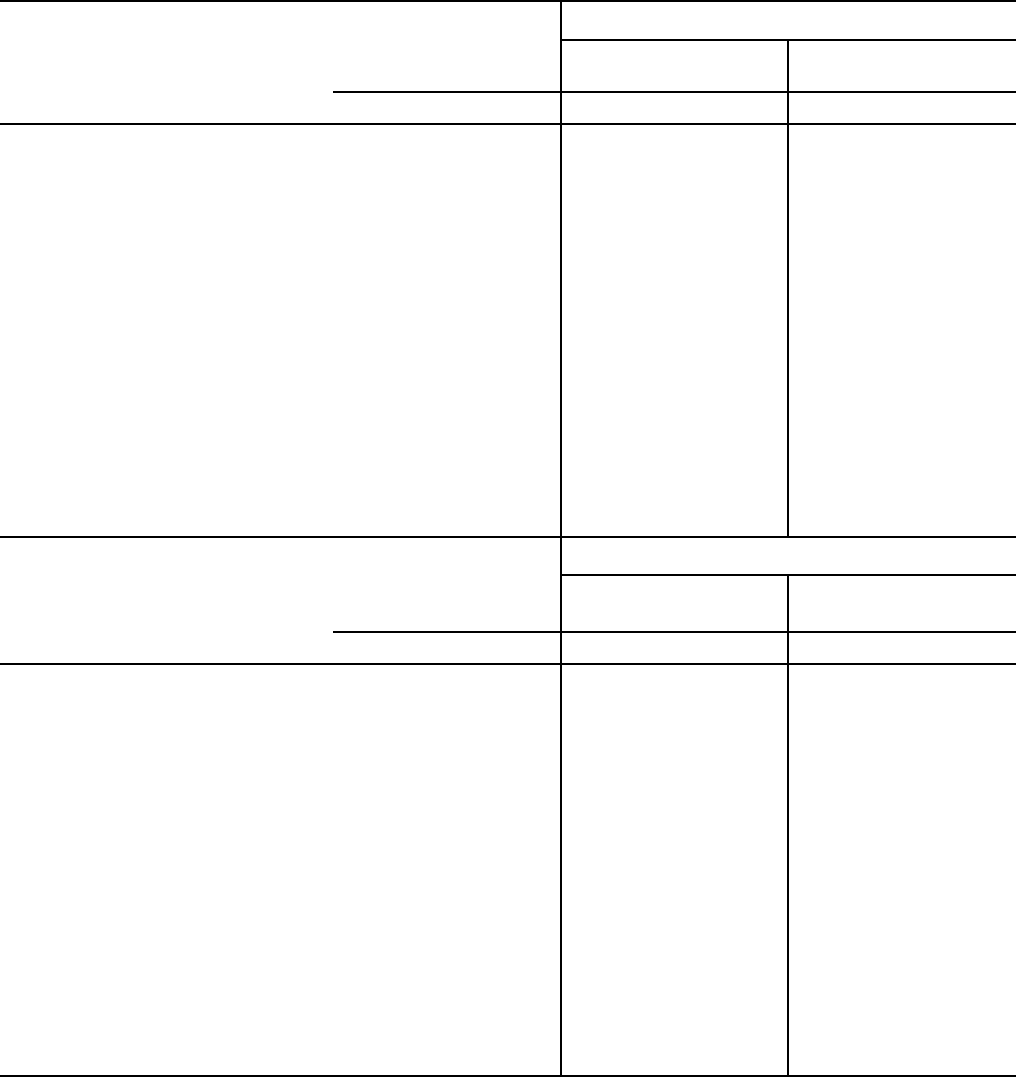

The largest number of consumer payments used cash (9.4 per month) and debit cards (9.2) to

pay for goods, followed by

payments for services using cash (7.1) and debit cards (6.0).

Consumersalsomade5.4creditcardpaymentsforgoodsand3.8forservices.Another2.7cash

payments were made by consumers to other consumers (or person‐to‐person, P2P) for

unspecified reasons. No other means of payment accounts for as many

as 2.0 payments for

nonbills.

Thelargestnumbersofbillpaymentsaremadebymail,phone,orinpersonusingcheck(3.3)or

cash (2.5). Among payment instruments, however, debit cards are used to make the most bill

payments:2.1automatic,2.0online,and2.3bymail,phone,orin

person,foratotalof6.3

18

bill

payments. Consumers make several automatic and online bill paym ents each month using

OBBPandBANPaswell.

19

17

TheaverageU.S.householdhadabouttwoconsumers(age18orolder)in2010,sodoublingthenumbersinTable1

yieldsanapproximateestimateofpaymentsperhousehold(excludingpaymentsbychildren).

18

Numbersdonotsumexactlyduetorounding.

19

The number of payments in each category may not necessarily reflect consumers’ preferred choices if there are

constraintsontheiradoptionanduseofpaymentinstruments,ifmerchantsvaryintheiracceptanceofpayments,or

if other factors influence consumer decisions. However, if these actual choices do reflect consumers’ preferred

paymentchoices,thenconsumerpreferencescanbeestimatedfromamodelofconsumerpaymentchoiceasshown

inKoulayev,Rysman,Schuh,andStavins(2012).

18

BillPayments NonbillPayments

Automatic Online

Mail,

phone,

in

person Online Goods

Services

&other

Person

to

person

Cash 2.5 9.4 7.1 2.7

Check 3.3 0.6 1.6 1.6 0.9

Moneyorder 0.3 0.1 0.1 0.1 0.1

Traveler’scheck*

Debitcard 2.1 2.0 2.3 1.3 9.2 6.0 0.5

Creditcard 1.2 0.9 1.2 0.8 5.4 3.8 0.2

Prepaidcard 0.1 0.1 0.2 0.1

OBBP 1.2 1.9 0.2

BANP 1.2 1.3 1.0 0.2

Incomededuction 0.6

Table1:Averagenumberofpaymentsmadeintypicalmonth,bytransactiontype

*Traveler’s checksare reportedin aseparate section,outsidethe paymentinstrument/transactiontype section,and

haveanaveragenumberof0.0paymentsafterrounding.

Source:2010SurveyofConsumerPaymentChoice,Tables23–25.

PaymentsbyTransaction

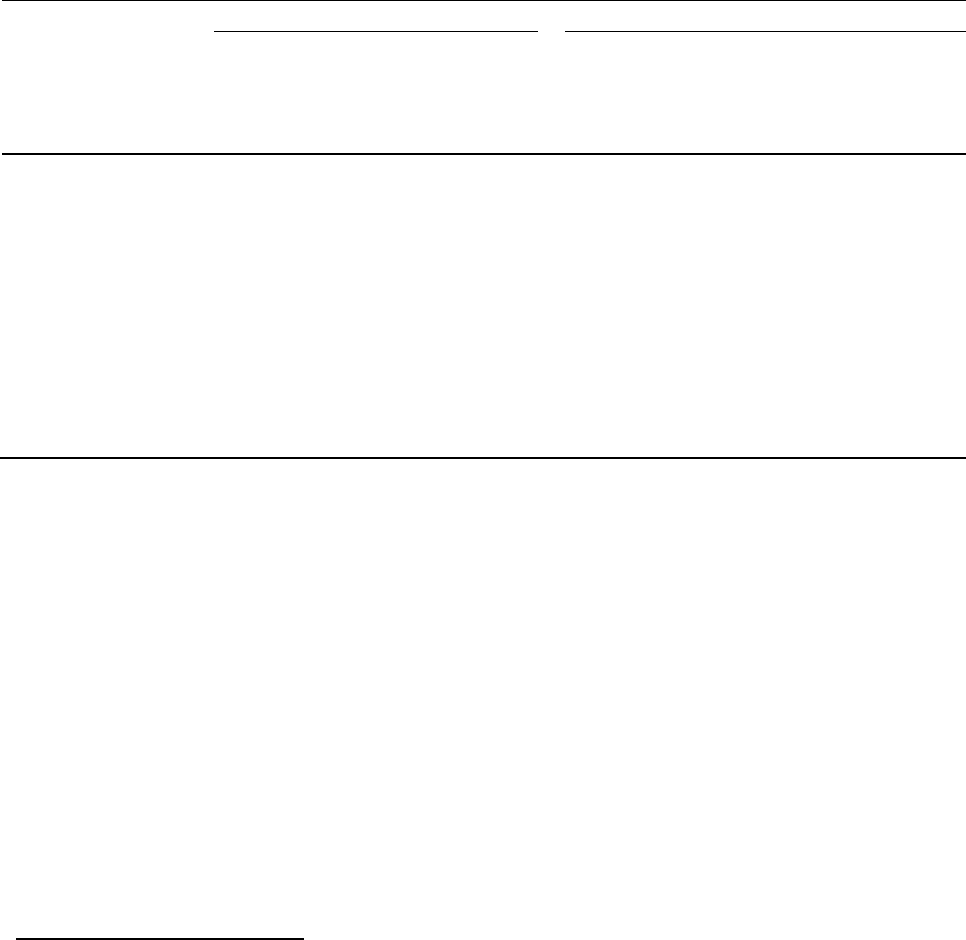

Oftheaverage73paymentsinatypicalmonthin2010,consumersmadeanaverageof21.2bill

payments(or29.2percentoftotalpayments)and51.4nonbillpayments(70.8percent),asshown

inFigure2.

20

Amongbills,themostcommonmethodofpaymentbyconsumerswasbymailor

in person (9.2 per month). Bill payments set up by consumers to be made automatically each

20

ThenumberofbillpaymentintheSCPCtendstobehigherthanotherindustryestimates.Potentialexplanations

are:1)theSCPCasksrespondentstoreportbillpaymentatamoredetailedleveloftypeandpaymentinstrument,

whichmayenhancerespondentrecall;2)theSCPCleavesthedefinitionofbills

opentorespondents’interpretation,

whichmayleadtoamoreinclusiveestimate;and3)theSCPCrespondentsareconsumersratherthanheadsof

households,whichmayleadtosomedouble‐countingofhouseholdbills.TheCPRCcontinuestostudythisissue.

19

month(6.1)andbillpaymentsmadeonlineattheconsumer’sdiscretionthroughoutthemonth

(5.9)wereaboutthesame.

Figure2:Numberofconsumerpaymentspermonthbytransaction

Source:2010SurveyofConsumerPaymentChoice,Table21.

Mostnonbillconsumerpaymentsweremadeinperson.Inatypicalmonth,consumersmadean

averageof25.1paymentsforretailgoodsand18.1paymentsforserviceswhileshoppingoffline,

plus another 4.5 payments directly to another person (person‐to‐person, or P2P). Consumers

madeanaverageof3.7nonbillonline

paymentspermonth.

20

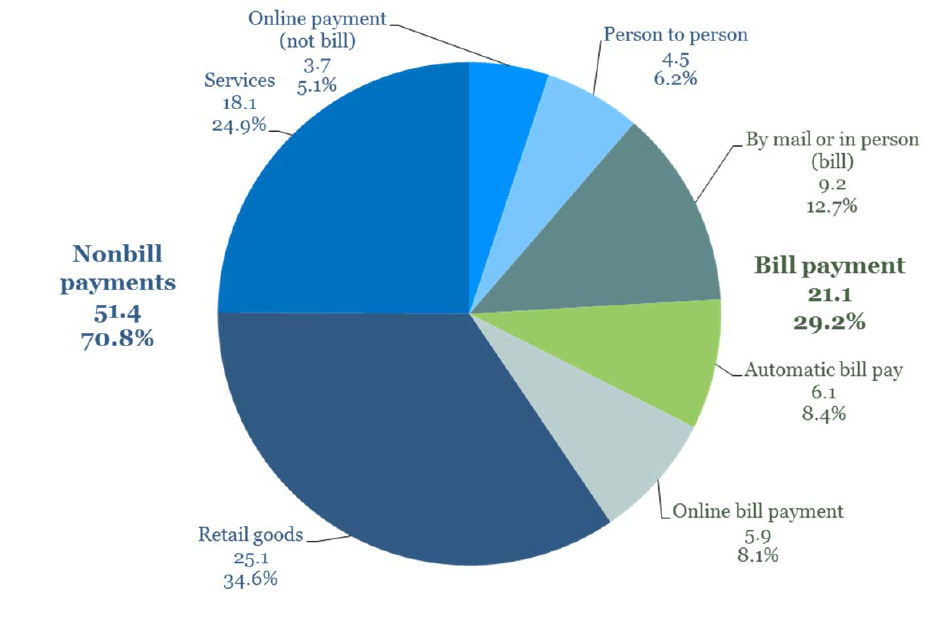

The average number of consumer payments by transaction type shifted primarily among

nonbill payments in 2010, as shown by the dark bars in Figure 3.

21

The share of consumer

payments for services made by mail, in‐person, or by phone increased 5.6 percentage points,

whiletheshareofpaymentsforretailgoodsmadeby mail,in‐person,orbyphonedecreased6.3

percentagepoints. The shareof consumer paymentsmadeonline for retail goods and

services

combineddeclined2.1percentagepoints,aboutthesamedeclineinthiscategoryasin2009(2.4

percentagepoints).Otherchangesinpaymentshareswerenotstatisticallysignificant.

Figure3:Changesinconsumerpaymentsbytransactiontype

Source:2010SurveyofConsumerPaymentChoice,Table21.

21

Thestatisticalhypothesisofnochangeinthemixoftransactionpaymentsbyconsumersin2010canberejectedat

the95percentsignificancelevel.

21

PaymentsbyInstrumentType

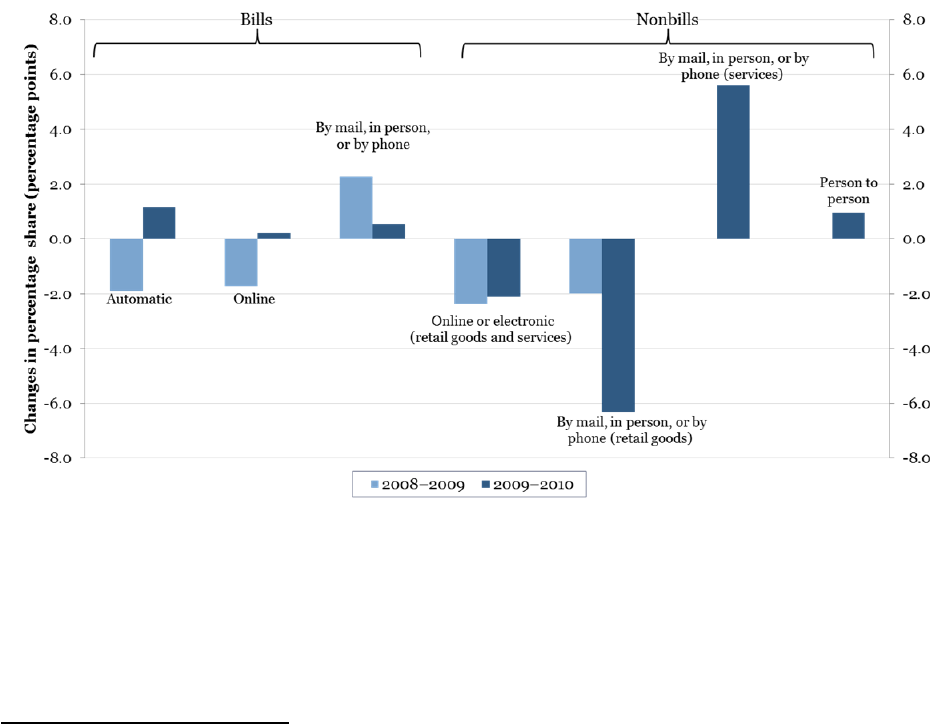

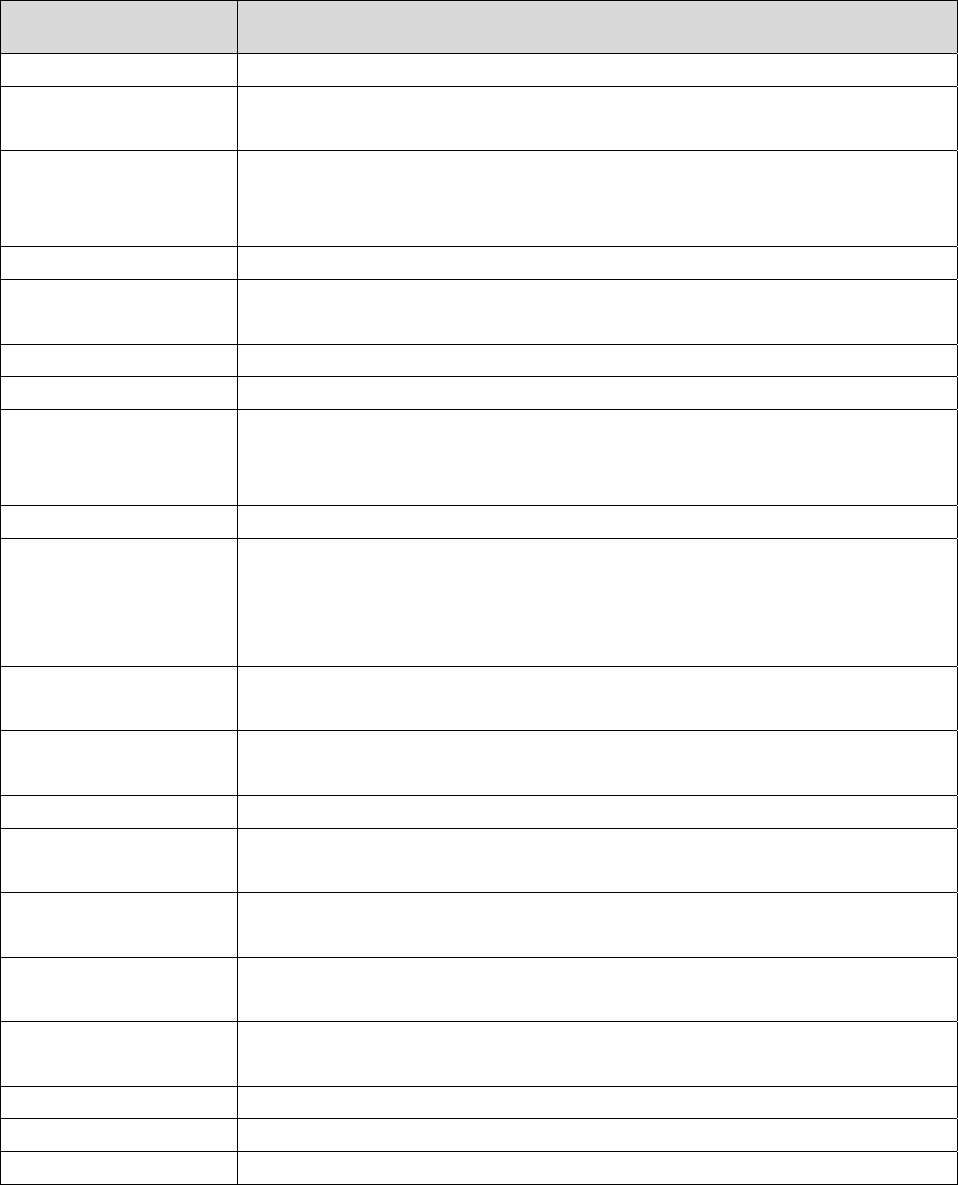

In2010,consumersmadeanaverageof36.4paymentsusingpaymentcards(or50.0percentof

totalpayments),29.0paymentsusingpaperinstruments(40.0percent),and6.7paymentsusing

electronic and other instruments (9.2 percent) in a typical month, as shownin Figure 4. Debit

cardsandcashcontinuedtobe

mostpopularamongconsumers.Consumersmadeanaverage

of22.7debitcardand21.1cashpaymentsinatypicalmonth,accountingfor about three‐fifths

of all consumer payments in a typical month (59.7 percent). The next most popular payments

instruments were credit cards (13.3 payments) and checks (7.7 payments).

All other payment

instrumentswereusedforanaverageof8.5paymentspermonth.

Figure4:Numberofconsumerpaymentsinatypicalmonth,bypaymentinstrument

Source:2010SurveyofConsumerPaymentChoice,Table20.

Note:Percentagesdonotsumto100duetorounding.

22

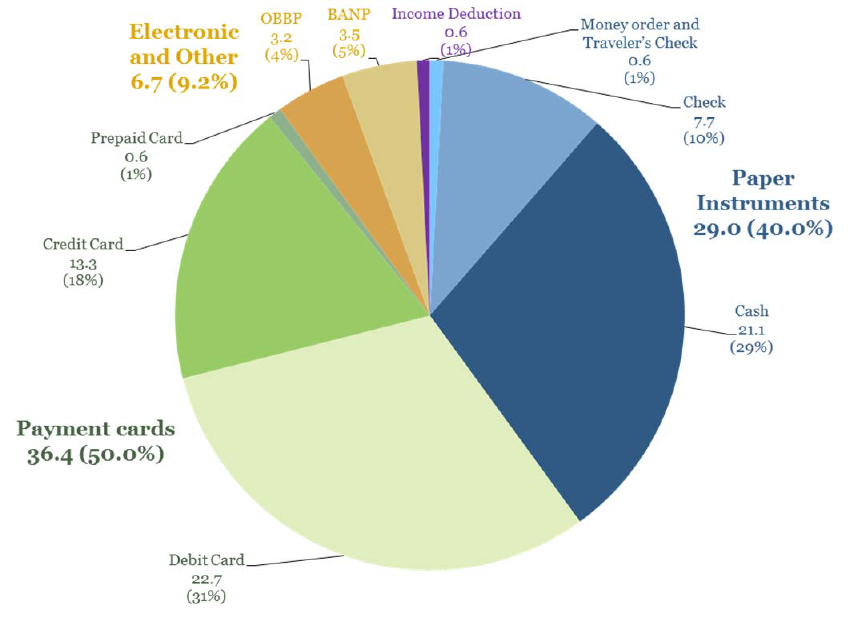

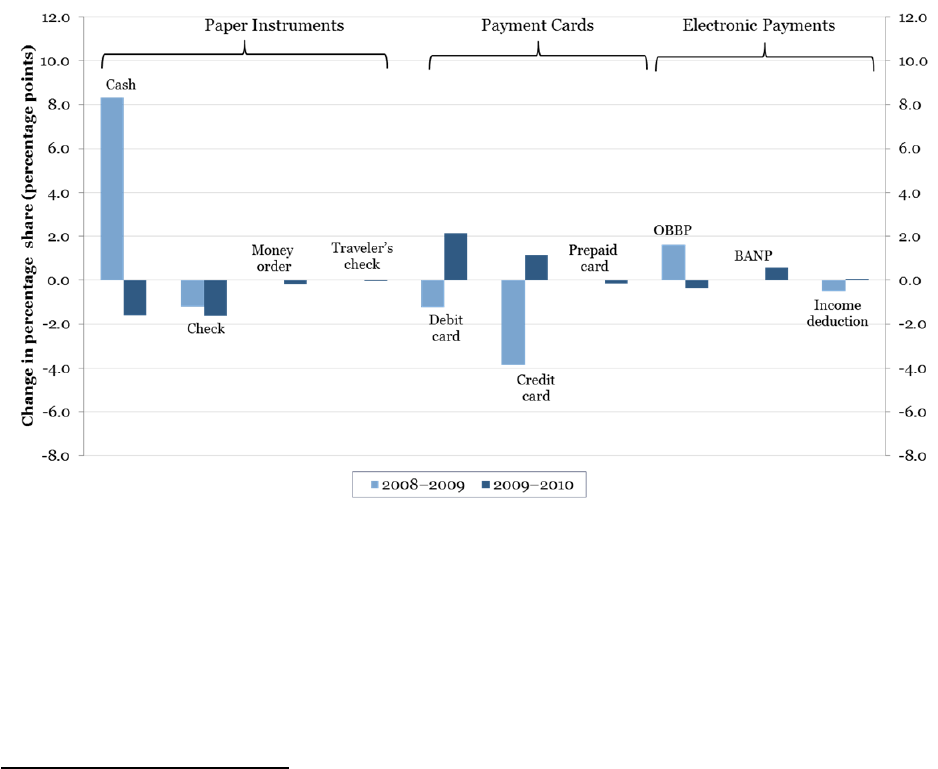

In 2010, consumers’ use of payment instruments shifted moderately from paper to cards, as

shownbythedarkbluebarsinFigure5.

22

Thesharesofconsumerpaymentsmadeusingdebit

cardsandcreditcardsincreased2.1and1.2percentagepoints,respectively.The2010increasein

thesharesofdebitandcreditcardpaymentspartiallyoffsetlargerdeclinesinthesharesofthese

same instruments as occurred in 2009 (the light blue bars)—most

notably the 3.9 percentage

pointdropincreditcarduse.

Figure5:Changeinconsumerpaymentsbyinstrumenttype

Source:2010SurveyofConsumerPaymentChoice,Table20.

Note:Missingbarsindicatedataforindicatedyearsarenotcomparable.

Incontrast,thesharesofconsumerpaymentsmadeusingeithercashorcheckin2010declined

1.6 and 1.7 percentage points, respectively. The 2010 decline in cash share was modest

22

Thestatisticalhypothesisofnochangeinthemixofpaymentinstrumentusebyconsumersin2010canberejected

atthe95percentsignificancelevel.

23

compared with the 8.4 percentage point increase in cash share in 2009, so the share of cash

paymentsbyconsumersremainedhigherthaninthemiddleoftherecession.The2010decrease

inchecksharewasconsistentwithalonger‐termtrenddeclineinconsumercheckuse.

23

Simulation results indicate that the shares of consumer use of all other payment instruments

had very low probabilities of having changed statistically significantly since 2009. Thus, the

shareofOBBPpayments,whichrose1.6percentagepoints in2009,waslikelytohaveremained

higher in 2010 than in 2009. Although

the share of BANP is estimated to have been lower in

2009than2008,thatchangemaynotbeanaccurateestimateofactualconsumerBANPbecause

ofalterationstothe2009surveyquestionnaire.Furthermore,asshowninSectionIV,therewere

much larger changes in the rate of adoption of

BANP.Section IV also provides additional

discussion about consumer electronic payments that provide context and perspective for the

SCPCresults.

IV. ConsumerAdoptionofPaymentInstruments

This section reports 2010 estimates of consumer adoption of payment instruments measured

three ways: 1) adoption rates of individual payment instruments; 2) number of payment

instruments adopted by consumers; and (3) portfolios of payment instruments adopted by

consumers.

IndividualInstruments

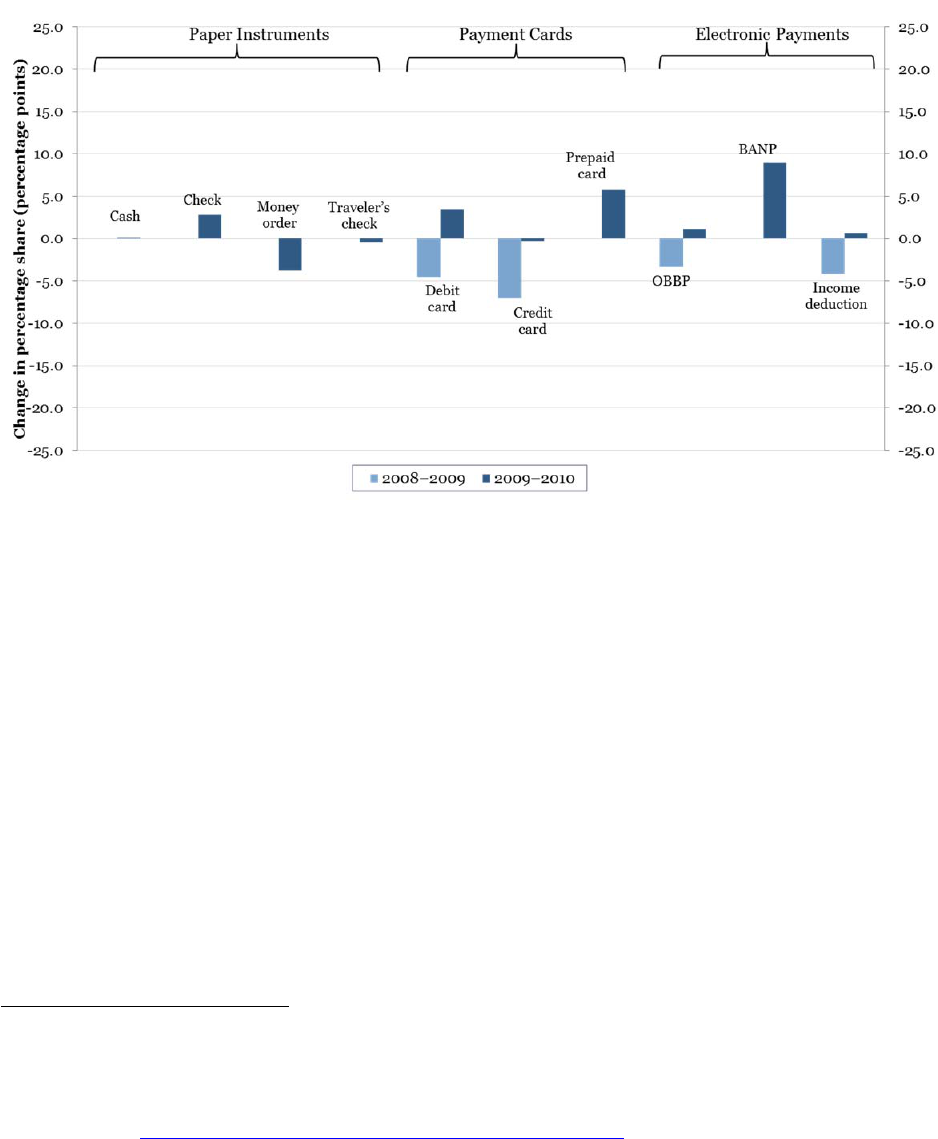

In2010,consumeradoptionofdebitcards,prepaidcards,andBANP

increased,asshownin

23

Intermsof growth rates, rather than changesinshares,the number of checkswrittenbyconsumers declined 8.5

percentperyearfrom2006to 2009, accordingto the Federal ReservePaymentStudies (see Federal ReserveSystem

2011),anddeclined 6.1percentfrom 2009 to2010, accordingtothe SCPC.

Through2009,theFRPS did notprovide

estimatesofconsumeruseofotherpaymentinstrumentssoitisnotpossibletocalculateshares,andtheirchanges,to

comparewiththeSCPC.

24

Figure6.

24

The biggest of these changesoccurred intheshareof consumershavingBANP,up

8.9 percentage points. The 2009 share of consumers having BANP is estimated to have been

muchlowerthanin2008,butthisdeclinemaynotrepresentactualconsumeradoptionofBANP

becauseofimprovementstothe

2009questionnaire.Amuchsmaller2010increaseinadoption

ofOBBPwasnotstatisticallysignificant.

More consumers held payment cards in 2010 than in 2009. The shares of consumers adopting

prepaidanddebitcardsincreased5.7and3.4percentagepoints,respectively,overtheprevious

year. Although smaller than the previous year,

the 2010 increase in prepaid card adoption

indicatedgrowingdisseminationofthesecardsamongconsumers.Incontrast,the2010increase

in adoption of debit cards reversed most of its decline in 2009. Credit card adoption was

essentiallyunchangeddespitetheincreaseinusedescribedearlier.

Moderately higher adoption of checks

and lower adoption of money orders in 2010 partially

offset opposite movements in 2009 in the shares of consumers adopting each of these paper

instruments.

24

The statistical hypothesis of no change in the adoption of payment instruments by consumers in 2010 can be

rejectedatthe95percentsignificancelevel.

25

Figure6:Changesinconsumeradoptionofpaymentinstruments

Source:2010SurveyofConsumerPaymentChoice,Table4.

Note:Missingbarsindicatedataforindicatedyearsarenotcomparable.

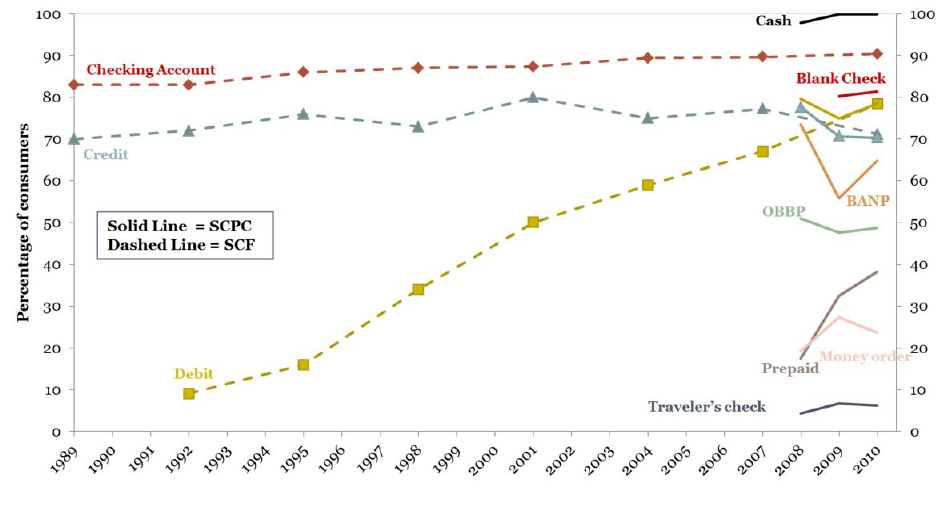

Figure7putstherecentchangesinconsumerholdingofpaymentinstrumentsintoperspective

byplottingadoptionratesovertime .

25

Asof2010,about two‐th irdsor moreofconsumers had

adopted the five most popular payment instruments: cash (100 percent), blank checks (87.0

percent),debitcards(78.4percent),creditcards(70.3percent),andBANP(64.8percent).About

halfofconsumershadadoptedOBBP(48.7percent),andwellmore than

one‐thirdhadadopted

prepaidcards(38.2percent).Morethanoneinfiveconsumershadadoptedmoneyorders(23.6

percent),andfewhadadoptedtraveler’schecks(6.2percent).

25

Figure 7 combines SCPC data on consumer adoption of payment instruments with similar data for households

fromtheSurveyof Consumer Finances (SCF), where available and comparable, toprovideaperspectiveon longer

termtrends.Seehttp://www.federalreserve.gov/econresdata/scf/scfindex.htmformoredetails.Exceptforcreditcard

spending,theSCFdoesnotcontaindataontheuseofpaymentinstrumentscomparabletodatafromtheSCPC.

26

Figure7:Consumeradoptionofpaymentinstruments

Source:2010SurveyofConsumerPaymentChoice,Table4;1983–2007SurveyofConsumerFinances.

Most shares of consumer adoption of payment instruments generally appear to be stabilizing

duringrecentyears.Thesharesofconsumersholdingcash,checks,andcreditcardshave been

relativelyhighandsteadyformanyyears.Afteralongtrendincrease,theshareof consumers

with debit cards appears to be

leveling off near 75–80 percent. The share of consumers with

OBBPhasfluctuatedlittleinthefewyearsforwhichdataareavailable.

In contrast, consumer adoption of prepaid cards shows evidence of a trend increase in recent

years as the share of consumersholding prepaid cards more than doubled from

2008to 2010.

The increase from 2008 to 2009 may have been partly due to improvements to the2009 SCPC

questionnaire. However, other data sources also show an increase in prepaid card adoption

duringthepastdecade(forexample,Pew2012).Furthermore,thetimeseriespatternofprepaid

cardadoption

isbroadlysimilartotheearly stagesofdebitcardadoption,bothmeasuresbeing

roughlyconsistentwiththeflatS‐curvepatternthattypifiesdiffusionofnewtechnologies.

27

Trendsinconsumerelectronicpaymentsaremoredifficulttodiscernbecausedata availability

is limited (three years) and, in the case of BANP, the year‐to‐year fluctuations are large.It is

possiblethat the sharpdecline in BANPin 2009 was partly due toimprovementsin the SCPC

questionnaire.Adoption

ofOBBP,whichdidnotchangedefinitionandhassimilaritiestoBANP

asanelectronicpayment,wasrelativelystableduringthesametime.ThelargeswingsinBANP

adoptionare difficulttoreconcilewiththerelativelymodestchangesinpaymentuseofBANP

described in the previous section. Furthermore, actual

transactions data from NACHA (The

ElectronicPaymentsAssociation)showalongerruntrendincreaseintotalconsumerelectronic

payments.

26

However, the OBBP and BANP definitions in the SCPC pertain only to certain

subcategoriesoftheNACHAconsumerelectronicpaymentsdata,anditisdifficulttomatchthe

twodatasourcesexactly,asdiscussedinSectionVIII.Inanycase,itnotpossibletodetermine

BANPtrendsdefinitivelyatthis

time.

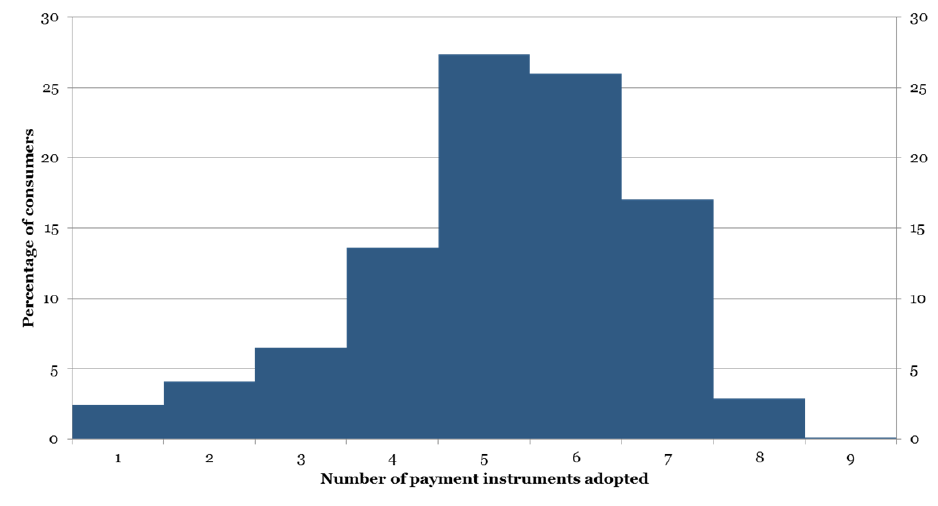

PortfoliosofInstruments

In2010,thenumberofpaymentinstrumentsheldbyconsumerswasessentiallyunchanged,as

shownin

Figure 8. On average, consumers held 5.2 instruments out of the nine common instruments

trackedbytheSCPC,upslightlyfrom2009(5.0)butnotmuchdifferentfromtheirholdings

in

2008(5.1).Fromasmallergroupoffourpaymentinstruments,includingonlyasubsetofBANP

(automatic ACH bill payments), consumers held 3.0 of them on average. This number is

approximately twice as many as in 1989, reflecting a trend increase in consumer holdings of

26

We thank NACHA CEO Janet Estep for bringing this issue to our attention. From 2008 to 2011, the NACHA

estimateoftotalconsumerelectronicpaymentsclosesttotheSCPCmeasuregrew5.4percentperyear inpercapita

terms.

28

paymentinstruments.However,averageholdingsinboththefour‐instrumentsetandthenine‐

instrumentsetappeartohavebeengrowingmoreslowlyinrecentyears.

Figure8:Averagenumberofpaymentinstrumentsadoptedbyconsumers

Source:2008–2010SurveyofConsumerPaymentChoice,authors’calculation;1983–2007SurveyofConsumer

Finances.

Another way to view consumer adoption of payment instruments is to look at individual

portfoliosof instruments held by consumers,as shown in Figure9. In 2 010, the mostcommon

number of instruments held by individual consumers was five (held by 27.4 percent of

consumers).Butalmostasmanyconsumers

(26.0percent)hadsixinstruments,andanother30.6

percentof consumershad fourorseveninstruments. Only about one ineight consumers (13.1

percent)heldfewerthanfourormorethansevenpaymentinstruments.

29

Figure9:Numberofpaymentinstrumentsadoptedbyindividualconsumers

Source:2010SurveyofConsumerPaymentChoice,authors’calculations.

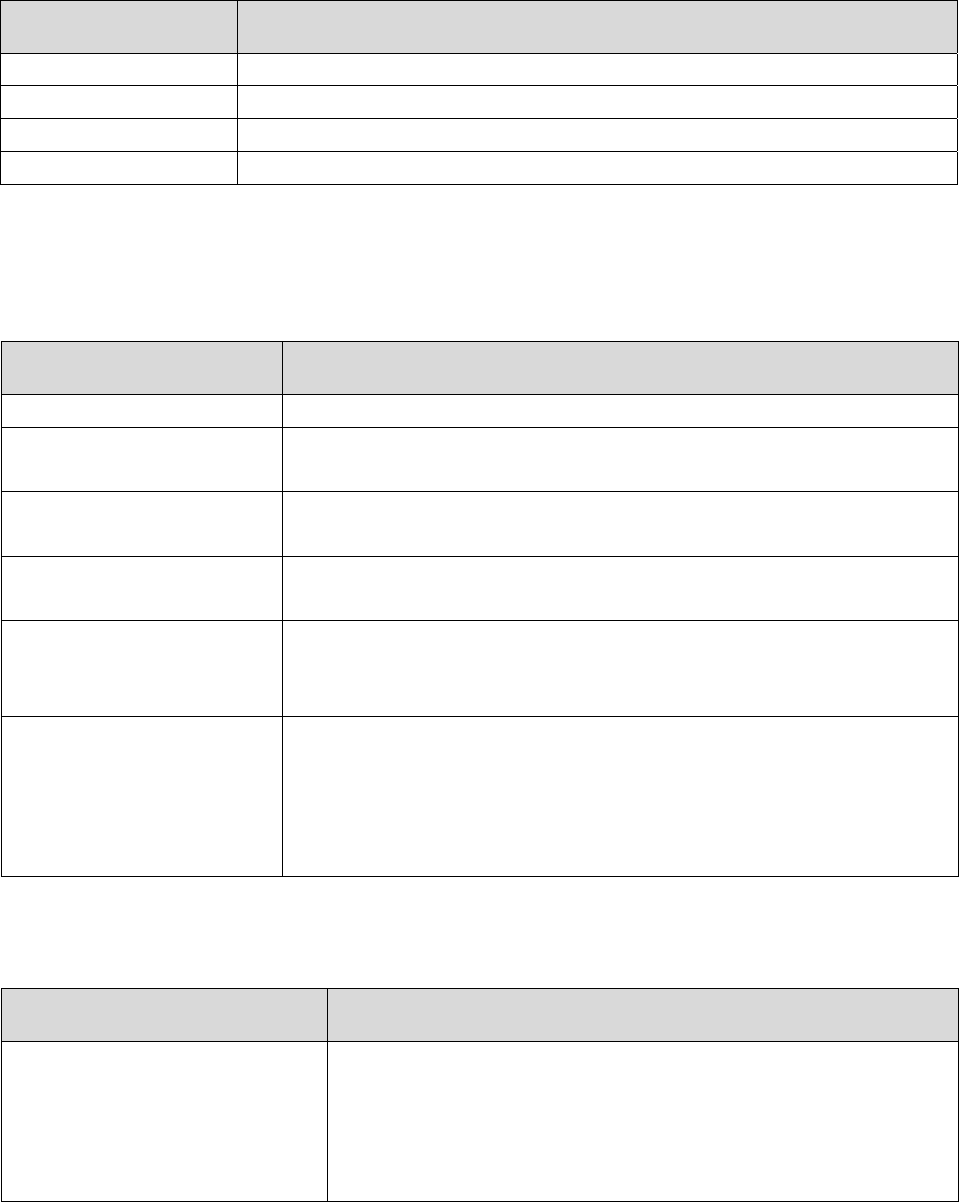

An even deeper look at individual portfolios of payment instrument reveals considerable

variety, as Table 2 shows. The most common portfolio of six instruments (two from each

categoryofpaper,cards,andelectronic:cashandcheck,debitandcreditcards,andOBBPand

BANP) was held by only 11.8 percent

of all consumers and the top five portfolios account for

only about one out of three consumers. These results demonstrate there is not one clear

representative consumer with reg ard to pay ment instrument holdings and highlight the

challenge of explaining the wide array of consumer payment choices. In fact, consumers held

135

uniqueportfolios(differentcombinationsofinstruments)in2010.

30

Number

of PI

Cash Check Traveler’s

Check

Money

Order

Credit

Card

Debit

Card

Prepaid

Card

OBBP BANP Percentage

of

Consumers

6 X X X X X X 11.9

7 X X X X X X X 9.1

5 X X X X X 7.2

5 X X X X X 3.9

5 X X X X X 3.8

Table2:Top5paymentinstrumentportfoliosadoptedbyindividualconsumers

Source:2010SurveyofConsumerPaymentChoice,authors’calculations.

CashManagement

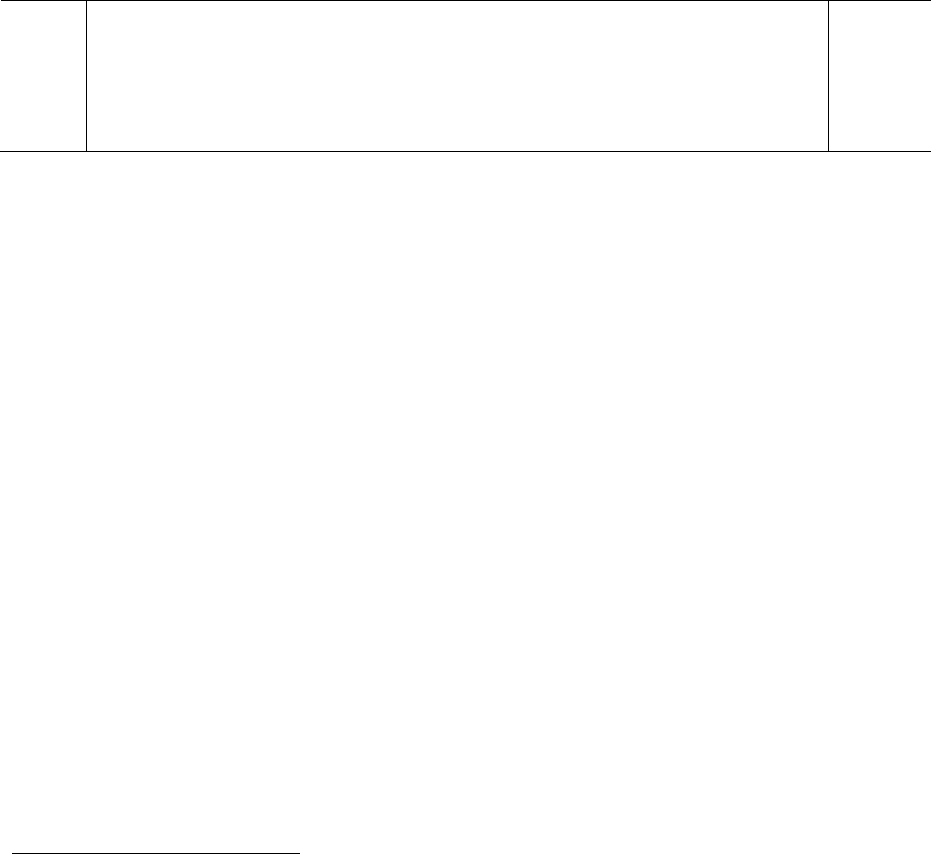

Total per‐capita domestic U.S. currency in circulation grew 3.3 percent in 2010 (Q4/Q4), after

growing7.5percentin2009,asshowninFigure10.Thisestimatereflectstotalcashholdingsby

all domestic U.S. agents (households, firms, nonprofit, and government) as well as balances

heldinbankvaults.

27

Forconsumersonly,theaverageamountofcurrencyheld declinedto$138

in the fourth quarter of 2010 from $147 four quarters prior; these amounts exclude unusual ly

large‐value cash holdings.

28

The 2010 decline in consumer cash holdings is relatively modest

and only marginally statistically significant. Note that dollar figures in this section are not

adjusted for inflation during the three‐year period from 2008 to 2010. During this time, the

annualpercentagechange(Q4/Q4)intheconsumerpriceindexwas

about1‐1/2percent.

27

TheestimateofdomesticcurrencyincirculationfollowsthemethodologydevelopedbytheBoardofGovernorsof

theFederalReserveSystemusingFlowofFundsdata(FederalReserveBoard2013c).ItexcludesU.S.currencyheld

inforeigncountries.

28

Average cash holding by consumers in Figure 10 excludes large‐value holdings of currency (that is, holdings

greaterthanthe95

th

percentile,whichisapproximately$1,200).ThisexclusionismotivatedbythefactthattheSCPC

obtains only a very small number of observations of very large cash holdings each year; hence fluctuations in the

compositionoflarge‐value cash holdings exertstatisticallyexcessive influenceonestimates of the average value of

totalcashholdings.SeeSection5.2,“CashValues,”inthetechnicalappendixformoreinformation.

31

Figure10:U.S.domesticcurrencyincirculation

Source:2010SurveyofConsumerPaymentChoice,Table9;HaverAnalytics.

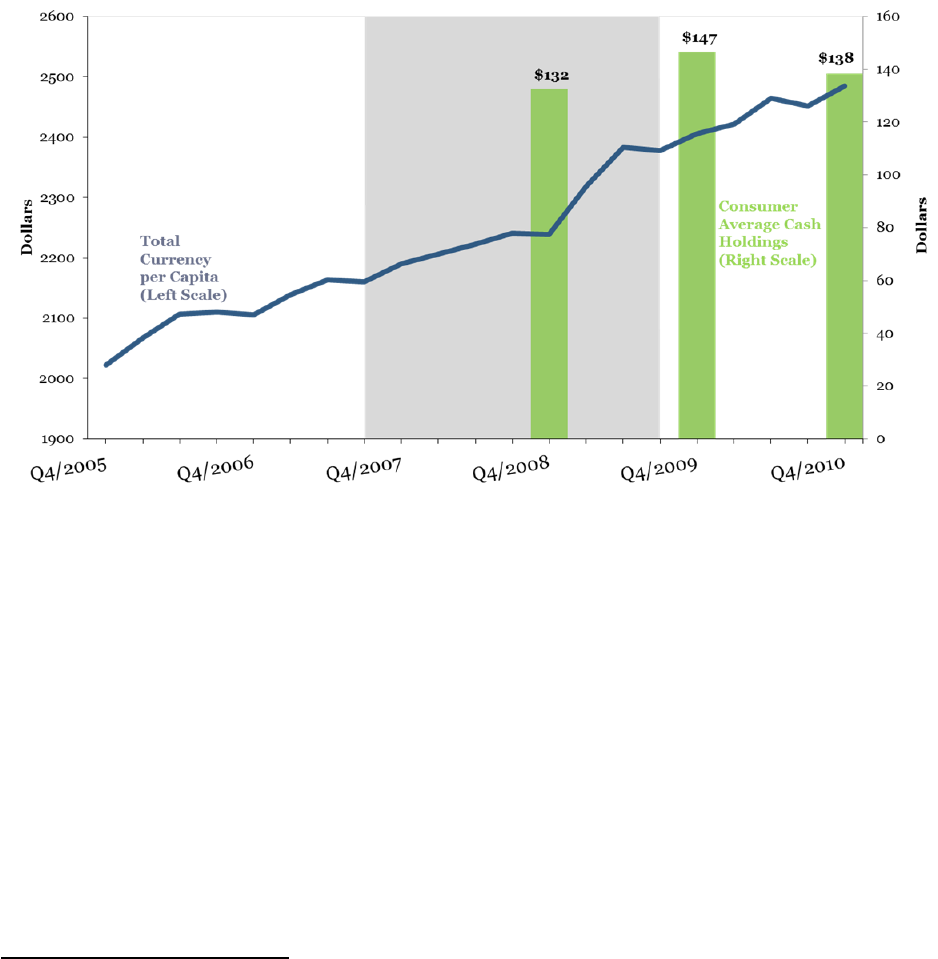

Given that consumer cash payments (Figure 4) and cash holdings (Figure 10) did not change

muchin2010,itisnotsurprisingthatcashwithdrawalswerelittlechangedaswell.Consumers

withdrew$502permonthonaveragein2010,upfrom$488permonthin2009,notastatistically

significant

change.Figure11showscashwithdrawalsbytheamountofwithdrawalmademost

oftenandthetypicalnumberofwithdrawalspermonth.

29

Theamountperwithdrawalandthe

numberof withdrawals aremeasuredat two sources:1)thelocation wheretheconsumergets

cashmostoften,and2)allotherlocationscombined.In2010,thetypicalamountofwithdrawal

29

Thenumberofwithdrawalsinatypicalperiodfollows themethodologyforthenumberofpayments.Theamount

of withdrawal made most often by a consumer may not be the same as the average amount of withdrawal by the

consumer.Statistically,“mostoften”correspondstothemodeofadistribution

ratherthanthemean.TheSCPCasks

for the most common amount to enhance consumer recall. If the mode and mean are not equal, this survey

methodologychoiceproducesbiasintheSCPCestimateoftotalwithdrawalamountinamonth.Thedirectionofbias

dependsonwhetherthemeanis

largerorsmallerthanthemode.

32

at the most frequented location was $133 and the amount at all other locations was $57.

Although both amounts were down slightly from 2009, neither decrease was statistically

significant. Also in 2010, the number of withdrawals per month was 3.9 at the most frequent

location and 2.1 at all other locations.

Both estimates of the number of withdrawals increased

significantlyfromtheir2009levels(whichwere3.6and1.6permonth,respectively).

Figure11:Amountofcashperwithdrawalandnumberofcashwithdrawalspermonth

Source:2010SurveyofConsumerPaymentChoice,Table9.

Note:Theleftpanelshowstheamountofcashperwithdrawalatthemostfrequentlocationcomparedtoallothers.

Therightpanelshowsthenumberofcashwithdrawalspermonthperconsumer.

33

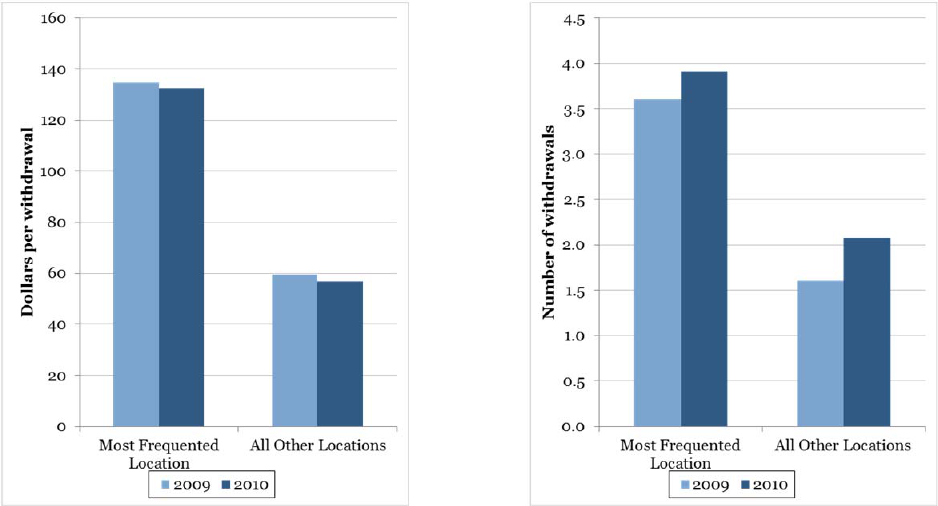

V. BankandOtherPaymentAccounts

Consumerownershipofbankandotherpaymentaccountswasessentiallyunchangedin

2010,as shown inFigure12.

30

In 2010,thepercentage of consumers with a checking orsaving

account at a bank was 92.7 percent, up just 0.9 percentage point from 2009. Consumer

ownership of checking accounts was 91.9, an increase of 1.8 percentage points, and consumer

ownershipofsavingaccountswas72.7percent,down1.6percentage

points.

Figure12:Consumerownershipofbankandotherpaymentaccounts

Source:2010SurveyofConsumerPaymentChoice,Table1.

Some consumers own nonbank deposit accounts to make payments, including those

held with PayPal, Google Wallet, Facebook, or other companies that are not depository

institutions.In2010,the shareofconsumers whoownednonbankpaymentaccountswas29.7,

essentially unchanged from 2009 (29.6). Due toresource limitations, theSCPC does not

collect

30

Noneofthechangesdiscussedinthissectionwerestatisticallysignificantatthe95percentsignificancelevel.

34

any other information about the nature or use of nonbank payment accounts other than

consumer adoption of the accounts, so it does not provide an estimate of the number of

paymentsbyinstrumentandaccount.

31

TheSCPCdoesnotcollectdataonthedollarvalueofdepositsheldinbankaccountsor

nonbankpaymentaccounts.Originally,thefocusoftheSCPCwasonmeasuringconsumeruse

of payment instruments, and checking account balances are not payment instruments per se.

However,checkingaccountbalancesaremoney

(anasset),likecash,andthedollaramountina

consumer’s checking account probably is correlated with a consumer’s cash management.

Therefore, it might be useful to collect data on checking account dollar amounts in future

versionsoftheSCPC.

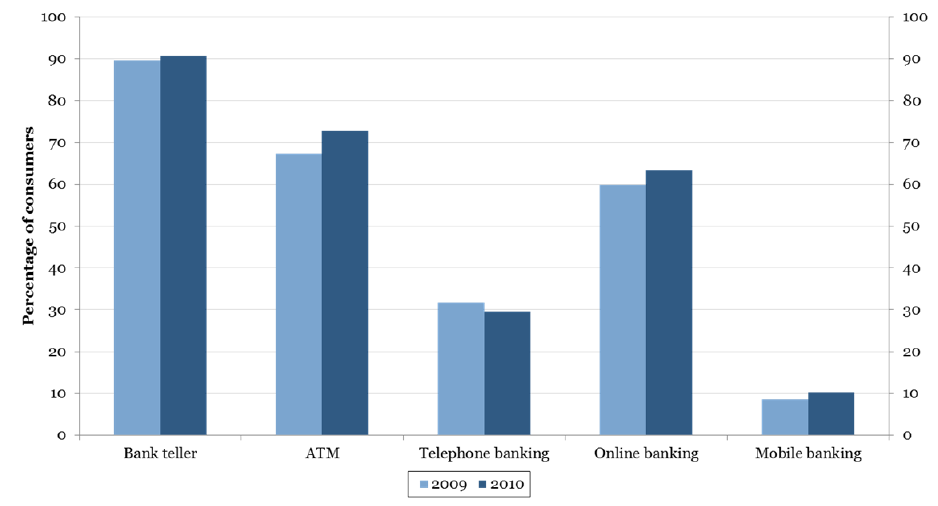

Moreconsumersaccessedtheirbankaccountsin2010thanin2009,

asshown in Figure

13. The share of consumers accessing their bank account through one of five methods (other

than a payment instrument) increased to 90.7 percent in 2010, up 1.0 percentage point from

2009.

32

Given that 92.7 percent of consumers have a bank account, the percentage of bank

accountadopterswhoaccessedtheiraccountduringthepastyearis97.8percent (90.7 percent

dividedby92.7percent).Comparedwith2009,moreconsumersaccessedtheirbankaccountsin

2010through ATMs (up 5.5 percentage points)

andonline banking (up 3.5 percentagepoints).

Changes in other methods of accessing bank and payment accounts were not statistically

significant,includingthe1.6percentagepointincreaseinmobilebanking.

31

Because the SCPC counts the number of payments initiated by consumers, it focuses on payment instruments

ratherthanon theaccounts,networks,platforms,orrelatedtechnologies throughwhichthesepaymentsoccur.For

example,thenumberofcreditcardpaymentsmadebyconsumersinatypicalmonth(13.3in2010)may

includesome

creditcardpaymentsmadeviaPayPal.Asimilarissuearisesformobilepaymentsdescribedinthenextsection.

32

Thestatisticalhypothesis of no changeinthe access of bank andpayment accountsbyconsumers in2010canbe

rejectedatthe95percentsignificancelevel.

35

Figure13:Consumeraccessofbankaccounts

Source:2010SurveyofConsumerPaymentChoice,Table13.

VI. SelectedTopics

This section briefly describes selected 2010 SCPC results pertaining to payment

instruments and practices that are changing rapidly, gaining notoriety, or in early stages of

diffusionandadoption.

PrepaidCards

Althoughprepaidcardshaveexistedfordecades,consumerprepaidactivityappearsto

have expanded notably in 2008‐2010. As indicated earlier

in Figure 7, the share of consumers

holdingprepaidcardsisestimatedintheSCPCtohavereached38.2percentbytheendof2010.

36

Other sources also indicate an increase in prepaid card activity (Hewitt 2013).

33

In addition,

governments are using prepaid cards to distribute benefits, and employers are using prepaid

cardsforpayroll.

34

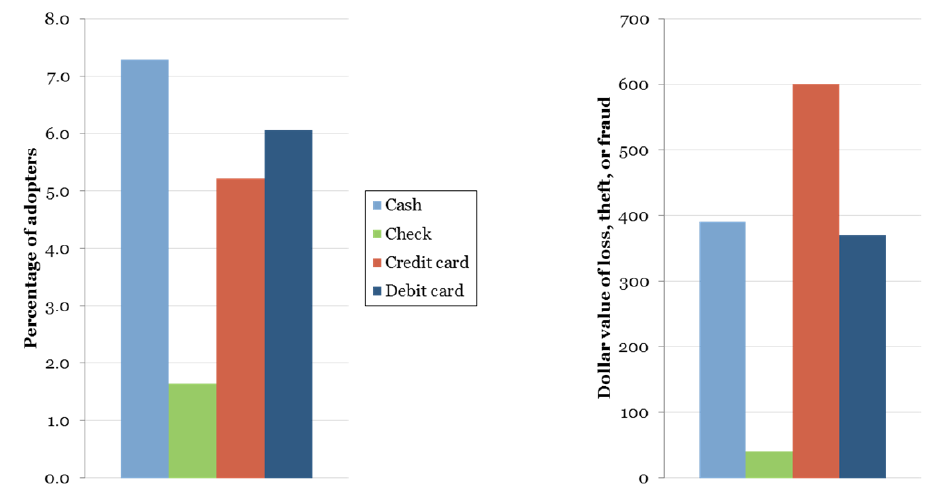

A deeper look at the SCPC data reveals a more nuanced view of developments in

consumerprepaidcard activitythrough2010.Table3 shows evidence suggesting that prepaid

card activity likely grew primarily on the extensive margin of use rather than the intensive

margin. Although a larger share of consumers

held prepaid cards in 2010 than in 2009, the

numberofprepaidcardsheldperadopterdeclinedto1.7in2010from2.4in2009,andtheshare

of prepaid card adopters using a prepaid card during the year fell more than 10 percentage

points to 32.1 percent in 2010.

35

Among prepaid card holders, the number of prepaid card

payments per consumer was 1.6 in 2010 but the change from 2009 was not significant. Taken

together, these results suggest that newer prepaid card holders tend to be less intensive users

thanconsumerswhoalreadyhadprepaidcards.

33

The Federal Reserve Payment Study reports that total payments made using prepaid cards (by all consumers,

businesses, and governments) increased 21.5 percent per year from 2006 to 2009 (Federal Reserve System 2011).

MercatorAdvisoryGroupestimatesthatthenumberofprepaidcardsincreasedfrom15millionin2007to52million

in2011,a24percentannualrateofgrowth(Hewitt2013).

34

Formoredetailsaboutprepaidcards,seeRhine,Jacob,Osaki,andTescher(2007)andWilshusen,Hunt,vanOpstel,

andSchneider(2012).

35

The hypothesis of no change in the number of prepaid cards per adopter can be rejected at the 99 percent

significancelevel.Thehypothesisofnochangeintheshareofprepaidcardadoptersusingaprepaidcardduringthe

yearcanberejectedatthe90percentsignificancelevel.

37

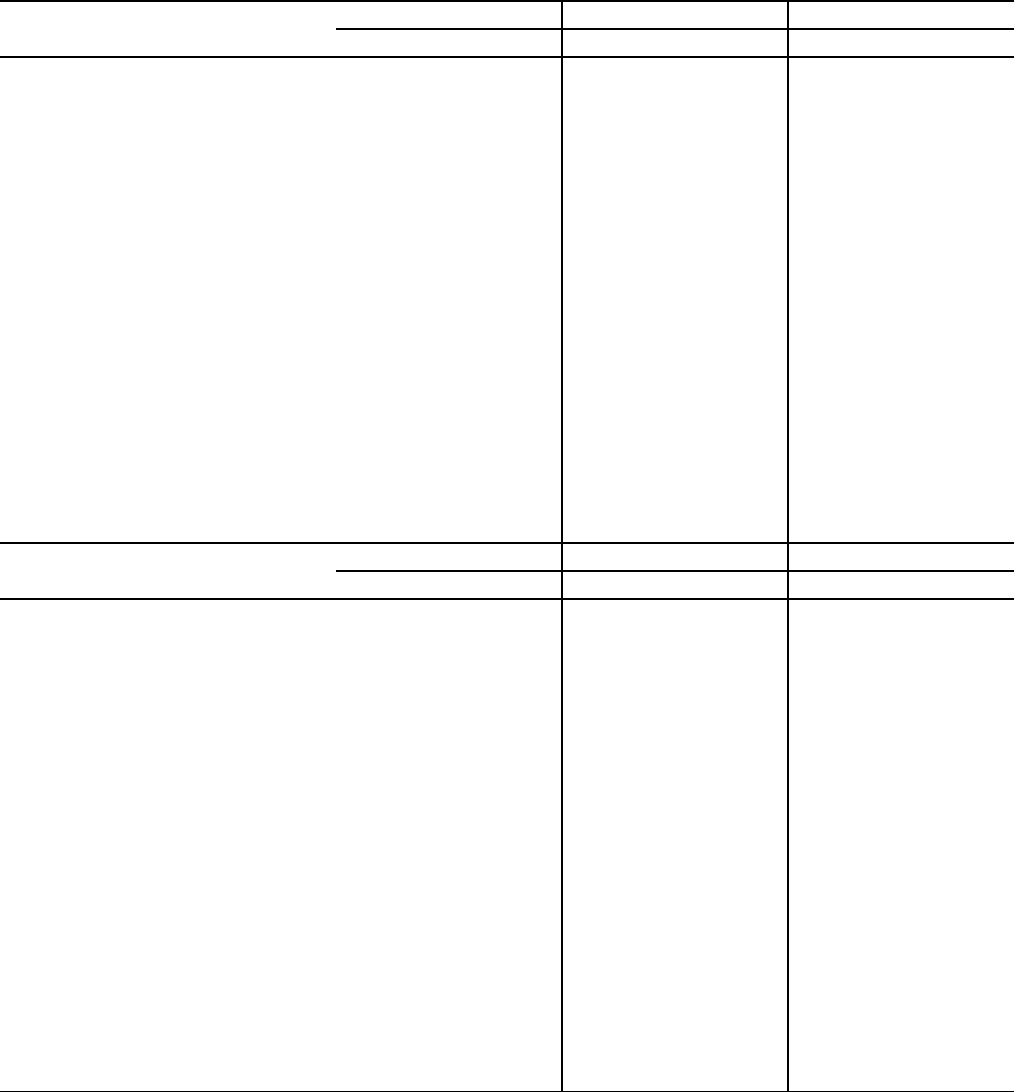

2009 2010

Number of prepaid cards per adopter 2.4 1.7

Number of prepaid card payments in a typical month per

adopter

2.1 1.6

Percentage of adopters using prepaid card in a given year 42.7 32.1

Percentage of prepaid card adopters who reloaded in the past

12 months

46.5 44.1

Number of reloads per month, reloaders only 1.7 2.0

Amount per prepaid reloading, reloaders only $146 $79

Table3:Consumerprepaidcardactivity

Source:2010SurveyofConsumerPaymentChoice,Tables7,9,14,20.

Forsomeprepaidcards,consumerscan“reload”thecards,meaningtheycanaddvalue

to the card using cash or another source of money or credit. The dollar amount loaded on

prepaid cards fell almost by half to $79 per reloading in 2010, and the share of consumers

reloadingtheir

cardsfellto44.1percent.

36

Thenumberofprepaidcardreloadingsperadopter

was 2.0 per month in 2010, but the change from 2009 was not significant. These reloading

resultsalsosuggestlessintensiveuseofprepaidcardsbyconsumersin2010.

MobileBankingandMobilePayments

Mobilebankingandmobilepaymentsarenewertechnologiesthathavebeenreceivinga

lotofattentionrecently.Although thesetechnologiesareincreasinglyfamiliartoconsumers,it

isimportant to define themcarefullyfor measurement in surveysanddata analysis.Thus, the

SCPCdefinitionsmaydifferfromthoseusedintheindustry,

media,orelsewhere.

36

Thehypothesisofnochangeinthesetwomeasurescanberejectedatthe90percentlevelofsignificance.Rhineet

al. (2007) found a higher reload average ($180) in data on general purposeprepaid cardfromcard processors. The

discrepancywiththeSCPCmaybeattributabletothefact

thattheSCPCincludesallprepaidcardsifgeneralpurpose

cardshavehigheraverageloads,orifconsumersonlyreporttheirownprepaidcardloadingifotherparties(suchas

governments,employers,etc.)tendtoloadhighervaluesthanconsumersdo.

38

IntheSCPC,mobilebankingisdefinedasthepracticeofaccessingabankaccountusinga

mobilephone.Asof2010,mobilebankingaccesscouldoccurinatleastoneofthreewaysona

mobile phone: 1) accessing a bank web site using a web browser; 2) using a

mobile banking

application (“app”) downloaded onto the phone; and 3) sending or receiving a text message.

Oncethebankaccountisaccessedviamobilephone,theconsumercancheckbalances,transfer

money,makepayments,andconductotherbankingbusiness.

IntheSCPC,a mobilepaymentisdefinedasthepractice

ofpayingforgoodsandservices

usinga mobile phone.Unlike mobilebanking,which usually istiedtoa specific bank, mobile

paymentscanoccurinavarietyofwaysusingdifferentpaymentinstrumentsandthereforethe

concept is more difficult to define. As of 2010, the SCPC measured only two

types of mobile

payments.

37

One is a contactless mobile payment, which make use of an NFC (near field

communication) device or QR (quick response) code that can communicate with a reader at a

pointofsale(POS).

38

Thisdefinitionisconsistentwithterminologyusedinthemobilepayments

industry.

However, the SCPC focuses on measuring all consumerpayments, andconsumers can

makemanyothertypesofpayments using amobile phone. Therefore, the SCPCalsoincludes

text/SMS mobile payment, such as messages sent to buy something or

to make a charitable

donation. For many of these types of payments, consumers authorize their cellular carrier to

make a payment to a third party, which the consumer repays later upon receipt of the cell

37

In2011and2012theSCPCincludedadditionaltypesofmobilepayments.

38

SeeCrowe,Rysman,andStavins (2010) for an analysis ofmobilepayments that focuses on contactlesspayments

usingNFCtechnology.MobilepaymentsbybarcodeorQRcodecanbemadeusingLevelUp,forexample,andare

addressedspecificallyinthe2011SCPCandbeyond.

39

phonebill.Inthiscase,theconsumerisauthorizingacreditpaymentinafashionsimilartothe

wayheorshewoulduseachargecardthatrequiresfullpaymentbytheendofthemonth.

39

In general, mobile payments are not different from all other payments tracked in the

SCPC; all of these payments are based on consumer initiation and authorization using a

payment instrument. Essentially all payments made by consumers on a mobile phone use a

standard payment instrument (except the text/SMS mobile payments,

of course). Thus,

consumer payments made using a mobile phone work quite similarly to the way consumer

payments made on a laptop computeror a ta blet device work; these are all “mobile” and use

eitherwirelessorcellulartechnologytotransmitpayments.Forexample,aconsumercoulduse

a credit card

to make a mobile payment by 1) using a contactless device in the phone at the

checkout counter; 2) entering the credit card number using a mobile browser at a store’s web

site;or3)enteringacreditcard number into a merchant’s app. Consequently,theSCPCtreats

mobile phones

as another device through which consumers make payments with instruments

as opposed to viewing mobile payments as being different from other consumer payments

(again,withtheexceptionoftext/SMSpayments).

Finally, beca usethe SCPC focuses on counting thenumber ofconsumer payments, the

definitions of mobile banking and mobile payments inherently

overlap. For example,

consumerswhoaccesstheironlinebankingwebsiteusing awebbrowserorapp (amethodof

mobile banking) and then pay a bill with OBBP (a type of mobile payment) have performed

39

For this reason, it might be reasonable to define mobile payments made by text/SMS sent to a cellularcarrier or

another nonbank as an official payment instrument that is analogous to, but different from, a credit/charge card

issuedbyabank.ThisclassificationisunderconsiderationbytheCPRC,but

thetechnologyandpracticeofmobile

payments are diverse, complex, and changing rapidly. For example, some large brick‐and‐mortar merchants have

mobile apps thatdonotuseNFC, bar codes,or QR codes but also do not usenonbanksor carrier billing. One gas

station chain uses text messages to

pay at the pump and ACH for settlement of payment, and a QSR chain uses a

prepaid‐based mobile app based on a six‐digit number that cashiers use to deduct money from the consumer’s

prepaidmobileapp.

40

bothmobileactivitiessimultaneouslyfromtheperspectiveoftheSCPC.Thisconcerndoesnot

ariseinthe2010SCPCbutdoesinlateryears.

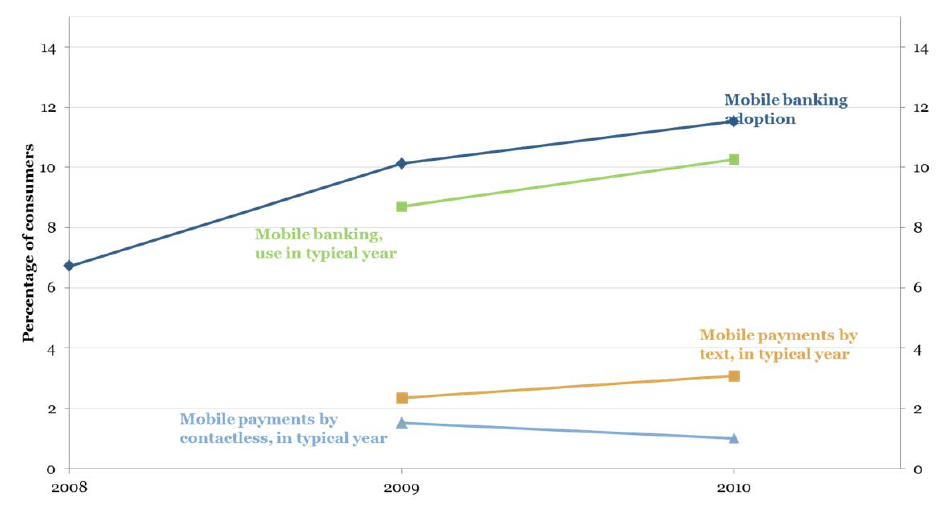

As of the fourth quarter of 2010, mobile banking and mobile payments were still

relativelyuncommonamongconsumers,asFigure14shows.In2010,92.2 percentof

consumers

hadamobilephonebutonly11.5percentof consumers had adoptedmobile banking and10.3

percent of consumers had used mobile banking in the pre vious 12 months. That is, about 90

percent(10.3percentdividedby11.5percent)ofmobilebankingadoptersusedtheservice.The

percentageof

consumerswhomadeatext/SMSmobilepaymentwas3.1percentin2010,butthe

percentageofconsumerswhomadeacontactless mobilepaymentin2010was1.0percent.The

smallchangesinbothoftheseestimatesfrom2009are notstatisticallysignificant.

Figure14:Mobilebankingandpayments

Source:2010SurveyofConsumerPaymentChoice,Tables1and13.

TherelativelylownumbersinFigure14areconsistentwiththeearlystagesofdiffusion

ofnewtechnologyandhaveincreasedsubstantiallyinsubsequentyears.Accordingtoamobile

payment survey in November 2012, the Federal Reserve Board (2013b) estimates that 48.9

41

percentofconsumershadadoptedmobilebankingbydownloadinganappand27.7percentof

consumers had used mobile banking. Both numbers represent large increases over the 2010

SCPCestimates,suggestingthatthesetechnologiesmayhaveenteredtherapidgrowthstageof

adoptionandusesince2010.

40

Diversity and rapid change in technology make it challenging to measure mobile

banking and mobile payments accurately and consistently in surveys over time. Because the

optionsforbothactivitiesarebecomingmorecomplexastechnologicalinnovationsexpand,the

SCPCmustaddmoredetailandcomplexitytocontinueobtainingunbiasedestimates.

Aspecial

measurement problem for surveys like the SCPC is that new technologies are unfamiliar to

consumersandchangerapidly,soitisdifficulttoaskquestionsthatwillbeunderstoodbyall

surveyrespondents.Also,intheearlystagesoftechnologicaldiffusion thesupplyoftechnology

tendstoleaddemand

for(adoptionof)technology.Becausesometechnologiesstarttodevelop

andthenfizzleoutduetoweakdemandorotherchallenges,itisriskytoinvestlimitedsurvey

resources in questions about them. By early 2013, the Federal Reserve Board’s estimates of

mobile banking and mobile payments suggest that these

technologies may have long‐run

stayingpower,sothedecisiontoincludethemintheSCPCstartingin2008seemstohavebeen

warranted.

VII. NewQuestionsin2010

Section 1075 of the Dodd‐Frank Wall Street Reform and Consumer Protection Act of

2010,“ReasonableFeesandRulesforPaymentCardTransactions,”containsamendmentstothe

40

The“ConsumersandMobileFinancialServices”(CMFS)surveywasconductedbytheDivisionofConsumerand

CommunityAffairs(DCCA) oftheBoardof Governorsof the FederalReserveinDecember2011/January2012 and

again in November 2012. The CMFS survey uses some of the same questions about mobile banking and mobile

paymentsasthe2011and2012SCPC,aswellasmanymore‐detailedquestionsonthesetechnologies.

42

ElectronicFundsActthataffectedpaymentmarketsinimportantways.

41

Thissectionofthelaw

eventually became Regulation II, written by the Board of Governors of the Federal Reserve,

approved in July 2011, and implemented on October 1, 2011. Most of the debate over Reg II

focusedontwochanges:1)cappingthedebitcardinterchangefeechargedbybanks

atalevel

belowtheprevailingmarketrateatthattime;and2)requiringdebitcardissuerstoofferatleast

twonetworksforthemerchanttoroutedebitcardpayments.

42

AstheDodd‐FrankActwasunfolding,newquestionswereaddedtothe2010 SCPCthat

may eventually help researchers and policy makers better understand the potential impact of

thenewregulationonconsumers.Thisendeavorisnoteasybecausemanydetailsofpayment

card systems are not well known

or understood by most consumers. For example, only 59

percentofconsumerswereevenawarethatpaymentcards involvedfeeschargedtomerchants

when a consumer paid with a card, and few would have known the ma gnitude of the fee on

theirparticularcardwhenevenmerchantswhoreceivedthecard

generallydidnotfullyknow

atthemomentofpayment.

43

Furthermore,theconceptofroutinga debitcardpaymentalonga

complex pa yment card network that involves merchants, processors, and banks is even more

arcaneandunfamiliartoconsumers.

Nevertheless, Reg II has the potential to affect consumers who choose debit card

payments,at leastindirectly, evenif they are

unawareof the connection. The mostlikely way

consumers could be affected indirectly is by the method they use to authorize debit card

payments—thatis,byusing a personalidentificationnumber(PIN) or a methodthatdoes not

requireaPIN.BecauseinterchangefeespriortoRegIIwerelowerfor

PINdebitcardpayments,

41

Originally,thissectionwascalledthe“DurbinAmendment”becauseitwasintroducedbySenatorRichardDurbin

(D‐Illinois) shortly before the Dodd‐Frank Act was approved. The entire law can be found online at

http://www.gpo.gov/fdsys/pkg/PLAW‐111publ203/html/PLAW‐111publ203.htm.

42

For information and evidence on the Reg II debit interchange fees, see Federal Reserve Board (2011, 2012b, and

2013a).Forresearchabouttheimpactoftheregulation,seeShy(2012,2013),Wang(2013),andHayashi(2013).

43

Formoreinformationaboutthisissue,seeSchuh,Shy,Stavins,andTriest(2011).

43

thepolicymayhavedifferentimplicationsforeachofthedebitcardauthorizationprocedures.

Thus,researchersmaybenefit fromknowinghowconsumersviewauthorizationmethodsand

locationsofdebitcardpayments.

A finer dis t inction, even more subtle to consumers, pertains to the security risks

associatedwithPINversusno‐PINauthorization.

RegIIallowsa1‐cent‐per‐transactionincrease

in debit interchange fees if the card‐issuing bank adheres to strong security standards. PIN

authorizations generally are considered more secure fo r the debit card payment system as a

whole.

44

Most of this information and perspective comes from the payment industry. Less is

known about the issue of payment security from the perspective of consumers and their

experiencewithloss,theft,andfraudassociatedwithpaymentinstruments.Therefore,the2010

SCPC includes new questions aboutconsumer experienceswith payment security

for selected

instruments.

The remainder of this section reports results of new questions about consumer

experiences with debit and other payment methods that may be related to policy‐induced

changes in thedebit card market. Before proceeding, however, it is important to reiterate that

the results do not provide a direct

assessment of the policy implications. The choice of consumer

authorizationofdebit cardpaymentsisnotalwaysleftentirelytothediscretionof consumers,

because merchants make decisions that affect the choice, such as whether to provide PIN

terminals (or not) at the point of sale. Furthermore, the Dodd‐Frank

Act and two subsequent

legal settlements have made it possible for merchants to steer consumers toward low‐cost

paymentmethodsusingdiscountingand,forthemoment,surcharging.

45

Itdoesnotappearthat

44

AccordingtoSullivan(2010),“Fraudratesondifferentpaymentcardsareunequal.UseofaPINcodetoidentifya

cardholderismoresecurethanusingasignature.CountriesthatrelymoreheavilyonPINcodesforcardpayments

willhavelesspaymentfraud.InAustralia,forexample,approximately90

percentofdebittransactionsin2006used

PINcodes,comparedtoonlyabout40percentintheUnitedStates.”

45

In2011,theDepartmentofJusticereachedasettlementwithVisaandMasterCardoverdiscountinganddisclosure

ofmerchantdiscount fees(http://www.justice.gov/atr/cases/f273100/273170.htm).In2012, merchants (plaintiffs)and

44

thesepracticeshavebecomewidespreadyet,butmeasuringthisactivityisdifficult(seeShyand

Stavins 2013). Any effort to identify the effects of debit‐card related policies on consumers

wouldrequirefurtherresearch.

DebitCardAuthorization

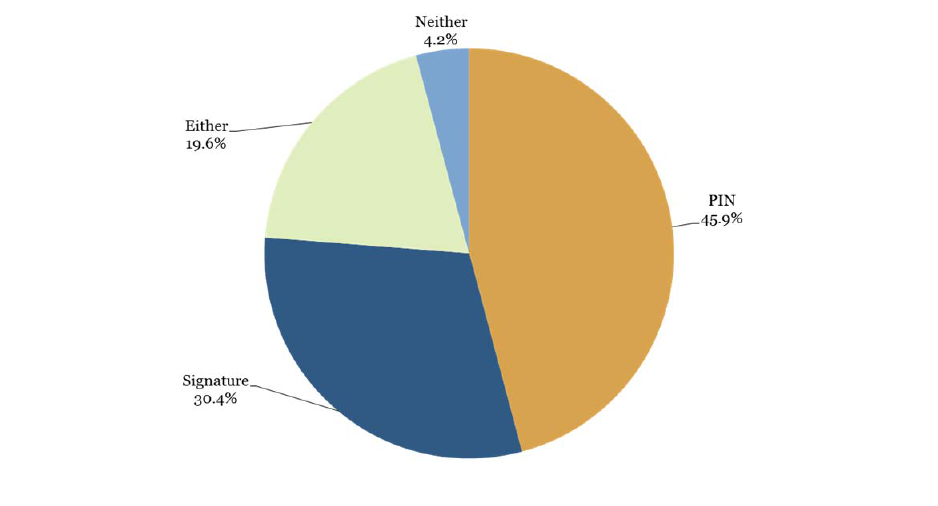

Asofthefourthquarterof2010,consumerspreferredPINdebitcardpayments.Figure

15showsconsumers’firstchoicefromamongfourmethodstoauthorizedebitcard payments:

1) entering a personal identification number (PIN); 2) signing the card ‐holder’s name

(signature); 3) indifference between PIN and signature (either); and 4) neither entering a PIN

nor signing.

46

Almost half of consumers (46 percent) preferred PIN debit authorization and

nearlyone‐third(30percent)preferredsignaturedebitauthorization.Oneinfiveconsumers(20

percent)wasindifferentbetweenenteringaPINandprovidingasignature.

Visa, MasterCard, and banks (defendants) reached a tentative settlement over interchange fees (see In re Payment

Card Interchange Fee and Merchant Discount Antitrust Litigation, No. 05‐MD‐1720, E.D. N.Y. for all documents),

whichhasnotreceivedfinalapprovaloftheU.S.DistrictCourtyetbutwouldallowsurchargingofcardpaymentsin

themeantime.Foradetailedanalysisoftheformersettlement,seeSchuh,Shy,Stavins,andTriest(2011).

46

Signatureauthorizationissometimescalled“credit”butisactuallystilladebitcardpaymentthatusesacreditcard

network such as Visa or MasterCard.The fourth category, neither PIN nor signature, includes at least two other

methods:1)usingthedebitcardnumberandCVCcode,usuallyonlineor

inothersituationswheretheconsumeris

notphysically present(card‐not‐present,orCNP);2)neithersignaturenorcard numberand CVCcodeisavailable,

usuallywhenthetransactionisforasufficientlysmalldollarvalue.

45

Figure15:Consumerpreferencesforauthorizingadebitcardpayment

Source:2010SurveyofConsumerPaymentChoice,Table29K

Note:Numbersmaynotsumexactlyduetoroundingormissingvalues.

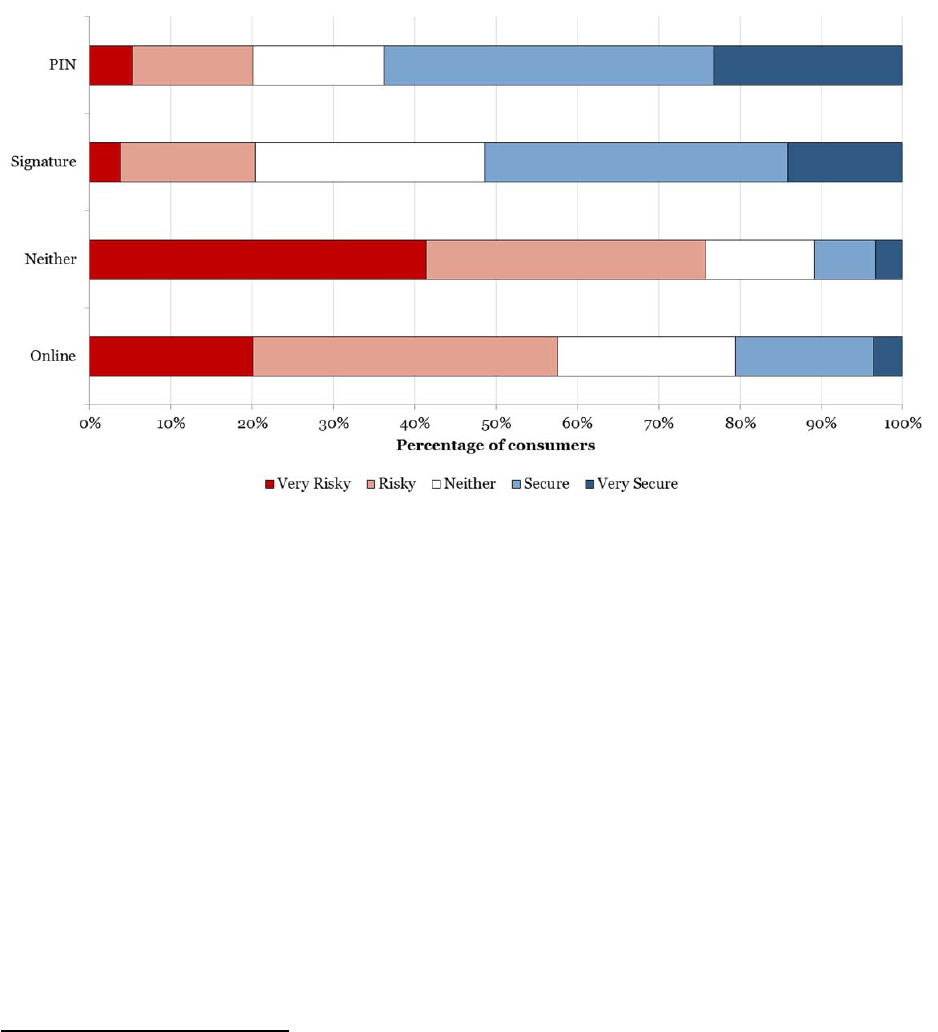

Themajorityofconsumerstrustthesecurityof PINdebit, asshown in thebluebarsof

Figure 16. Security is rated on a 1‐to‐5 scale from “very risky” (1) to “very secure” (5).

Consumers find either of the two primary authorization methods—PIN or signature—to be

relatively secure,

with 63.8 percent of consumers viewing PIN debit as secure or very secure

(blue bars) and 51.4 percent viewing signature debit as secure or very secure. From the

perspective of risk, about the same percentage of consumers (20 percent) view PIN and

signature debit as risky or very risky (red bars).

So, the main difference between these two

formsofauthorizingdebitcardsissimplythatmoreconsumersviewsignatureasneitherrisky

norsafe,whilemoreviewPINassafeorverysafe.Largemajoritiesofconsumersthinkthatthe

lack of authorization (neither PIN nor signature) and online authorization

are considerably

riskierthaneitherPINorsignaturedebit.

46

Figure16:Consumerassessmentsofdebitauthorizationmethod

Source:2010SurveyofConsumerPaymentChoice,Table29J.

PaymentSecuritybyLocation

Since 2008, the SCPC has included questions about consumers’ assessments of the

characteristicsofpaymentinstruments(see 2010SCPC Tables 29A through 29H). One of these

characteristics is the “security” of the payment instrument in terms of the potential loss of

moneyor personal informationwhen

the instrumentis lostor stolen.

47

Akey objective of the

new Federal Reserve strategic plan for payments is to improve the security of the payments

47

The questionnaire asks: “Suppose a payment method has been stolen, misused, or accessed without the owner’s

permission. Please rate the security of each method against permanent financial loss or unwanted disclosure of

personalinformation.”

47

system.Research shows that most consumer assessments ofcharacteristics are correlated with

consumeradoptionanduseofpaymentinstruments.

48

AdisadvantageoftheSCPCcharacteristicquestionsisthattheydonotallowconsumers

tovarytheirassessmentsofthesecurityofapaymentinstrumentoverthedifferentlocationsat

which they pay. Forexample, a consumermay have different views ofthe security ofa credit

cardswipedthrough

aterminalatastorecheckoutcountercomparedtoenteringthecreditcard

numberonlineatacompany’swebpage.Thus,thecharacteristicratingsmayimplicitlyreflecta

consumer’s payment patterns, meaningwhere he orshe most often uses a particularpayment

instrument. To fully address this shortcoming, it would be

necessary to ask the characteristic

questions for each payment instrument and payment location simultaneously. With so many

characteristics, instruments, and locations, it is not feasible to ask so many questions and still

keep the survey to a reasonable length tominimize respondent burden. To partly address the

shortcoming of the

security characteristics question, the 2010 SCPC included a new question

aboutconsumers’assessmentofsecurity,inwhichsubjectsareaskedtoratesecuritybylocation

ofpaymentona1‐to‐5scalefrom“veryrisky”to“verysecure.”

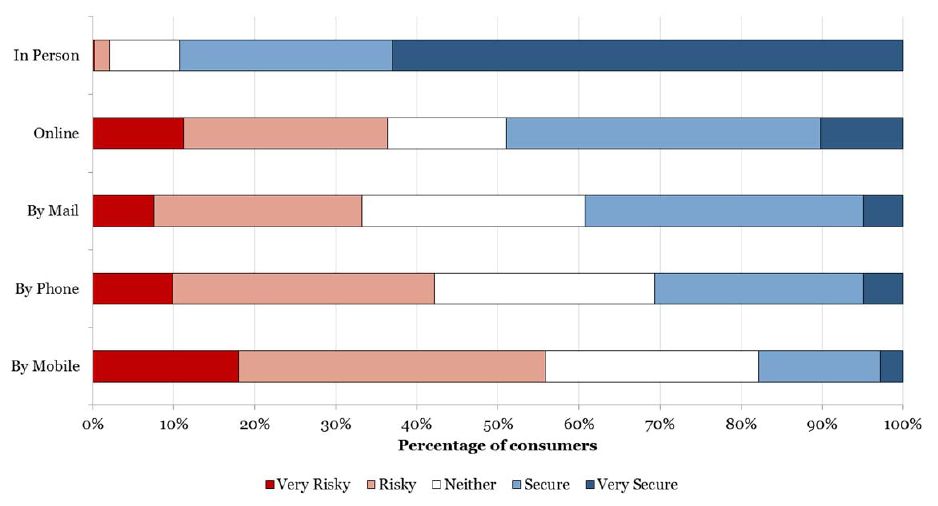

In 2010, consumers viewed payments made in person as the most secure

by far, as

shown in Figure 17. Nearly 90 percent of consumers thought payments made in person were

eithersecureorverysecure.Nootherlocationwasratedsosecurely.Thelocationwiththenext

bestsecurityratingwasonline,alocationthatalmosthalfofconsumersviewassecure

orvery